QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

VISION-SCIENCES, INC. |

(Name of Registrant as Specified In Its Charter) |

Not Applicable |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

VISION-SCIENCES, INC.

Nine Strathmore Road

Natick, Massachusetts 01760

Notice of Annual Meeting of Stockholders

To be Held on Thursday, July 24, 2003

The Annual Meeting of Stockholders of Vision-Sciences, Inc. (the "Company") will be held at the offices of Hale and Dorr LLP, 26th Floor, 60 State Street, Boston, Massachusetts on Thursday, July 24, 2003 at 10:00 a.m., local time, to consider and act upon the following matters:

(1) To elect Kenneth W. Anstey and Gerald B. Lichtenberger, Ph.D., as Class III Directors, each to serve for a three-year term;

(2) To approve the 2003 Director Stock Option Plan;

(3) To ratify the selection of BDO Seidman LLP as the Company's independent auditors for the current fiscal year; and

(4) To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on June 13, 2003 will be entitled to notice of and to vote at the meeting or any adjournment thereof.

| | | By Order of the Board of Directors, |

|

|

|

|

|

Katsumi Oneda, Chairman |

Natick, Massachusetts

July 7, 2003

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEED BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

VISION-SCIENCES, INC.

Nine Strathmore Road

Natick, Massachusetts 01760

PROXY STATEMENT

For the Annual Meeting of Stockholders

To Be Held on July 24, 2003

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Vision-Sciences, Inc. (the "Company") for use at the Annual Meeting of Stockholders to be held on July 24, 2003 at 10:00 a.m. at the offices of Hale and Dorr LLP, 60 State Street, Boston, Massachusetts and at any adjournment of that meeting. All proxies will be voted in accordance with the stockholders' instructions, and if no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before its exercise by delivery of written revocation or a subsequently dated proxy to the Secretary of the Company or by voting in person at the Annual Meeting.

This proxy statement was mailed to stockholders on or about July 7, 2003.

Voting Securities and Votes Required

At the close of business on June 13, 2003, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 30,112,378 shares of Common Stock of the Company, $.01 par value per share ("Common Stock"), constituting all of the voting stock of the Company. Holders of Common Stock are entitled to one vote per share.

The holders of a majority of the shares of Common Stock outstanding and entitled to vote at the Annual Meeting shall constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares that abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum exists at the Annual Meeting.

The affirmative vote of the holders of a plurality of the shares of Common Stock voting on the matter is required for the election of directors.

Shares held by stockholders who abstain from voting as to a particular matter, and shares held in "street name" by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and also will not be counted as shares voting on such matter. Accordingly, abstentions and "broker non-votes" will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the shares voting on the matter, including the election of directors (Proposal 1), the approval of the 2003 Director Stock Option Plan (Proposal 2) and the ratification of the Company's independent auditors (Proposal 3).

Stock Ownership of Certain Beneficial Owners and Managers

The following table sets forth the beneficial ownership of the Company's Common Stock as of March 31, 2003 (i) by each person who is known by the Company to beneficially own more than 5% of the outstanding shares of Common Stock, (ii) by each current director or nominee for director, (iii) by each of the executive officers named in the Summary Compensation Table set forth under the caption "Executive Compensation" below and (iv) by all current directors and executive officers as a group:

Name of Beneficial Owner

| | Number of Shares

Beneficially Owned(1)

| | Percentage of Outstanding

Common Stock

Beneficially Owned(2)

| |

|---|

Katsumi Oneda(3)

c/o Vision-Sciences, Inc.

Nine Strathmore Road

Natick, MA 01760 | | 7,978,614 | | 26.9 | % |

Lewis C. Pell(4)

c/o Machida Incorporated

40 Ramland Road South

Orangeburg, NY 10962 | | 7,824,739 | | 26.4 | % |

Pentax Corporation(5)

2-36-9, Maeno-cho

Itabashi-Ku

Tokyo 174-8639 Japan | | 2,000,000 | | 6.8 | % |

| Ron Hadani(6) | | 100,000 | | * | |

| Gerald B. Lichtenberger, Ph.D.(7) | | 309,500 | | 1.0 | % |

| Kenneth W. Anstey(8) | | 209,290 | | * | |

| William F. Doyle(9) | | 8,000 | | * | |

| John J. Wallace(10) | | 12,000 | | * | |

| Isao Fujimoto(11) | | 200,000 | | * | |

| James A. Tracy(12) | | 181,500 | | * | |

| Thomas M. Olmstead(13) | | 25,000 | | * | |

| All current directors and executive officers as a group (12 persons)(14) | | 17,104,893 | | 55.8 | % |

- *

- Less than 1% of the shares of Common Stock outstanding

- (1)

- Each person has sole investment and voting power with respect to the shares indicated, except as otherwise noted. The number of shares of Common Stock beneficially owned by each director, nominee for director or executive officer is determined under the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. The inclusion herein of any shares as beneficially owned does not constitute an admission of beneficial ownership.

- (2)

- The number of shares deemed outstanding includes 29,588,280 shares outstanding as of March 31, 2003 and any shares subject to stock options held by the person or entity in question that are currently exercisable or exercisable within 60 days after March 31, 2003.

- (3)

- Includes 125,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (4)

- Includes 50,000 shares and 42,500 shares held of record and beneficially owned by Mr. Pell's wife and child, respectively. Mr. Pell disclaims beneficial ownership of these shares.

2

- (5)

- Based on information provided by Pentax Corporation. Pentax was formerly Asahi Optical Company Limited.

- (6)

- Comprised of 100,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (7)

- Comprised of (a) 153,500 shares owned by Dr. Lichtenberger, (b) an aggregate of 6,000 shares held of record and beneficially owned by Dr. Lichtenberger's two children and (c) 150,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003. Dr. Lichtenberger disclaims beneficial ownership of the shares held by his children.

- (8)

- Includes 48,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (9)

- Comprised of 8,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (10)

- Comprised of 12,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (11)

- Includes 175,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (12)

- Includes 180,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (13)

- Comprised of 25,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2003.

- (14)

- Includes, as to all directors and executive officers as a group, 1,070,500 shares subject to stock options that are currently exercisable or exercisable within 60 days after March 31, 2003. Also includes shares for which certain individuals have disclaimed beneficial ownership, as set forth in the above footnotes.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Board of Directors is divided into three classes, with members of each class holding office for staggered three-year terms. There are currently three Class I Directors, whose terms expire at the 2004 Annual Meeting of Stockholders, two Class II Directors, whose terms expire at the 2005 Annual Meeting of Stockholders, and two Class III Directors, whose terms expire at the 2003 Annual Meeting of Stockholders (in all cases subject to the election of their successors and to their earlier death, resignation or removal).

The persons named in the enclosed proxy will vote to elect Kenneth W. Anstey and Gerald B. Lichtenberger, Ph.D., as Class III Directors, unless authority to vote for the election of Mr. Anstey or Dr. Lichtenberger is withheld by marking the proxy to that effect. Mr. Anstey and Dr. Lichtenberger are currently Class III Directors of the Company. Mr. Anstey and Dr. Lichtenberger have indicated willingness to serve, if elected, but if either is unable or unwilling to stand for election, proxies may be voted for a substitute nominee or nominees designated by the Board of Directors.

3

Set forth below is the name and certain information with respect to each director of the Company, including the nominees for Class III Directors.

Name

| | Class of

Director

| | Age

| | First

Became a

Director

|

|---|

| William F. Doyle(1)(2) | | I | | 41 | | 2002 |

| Lewis C. Pell(3) | | I | | 60 | | 1987 |

| John J. Wallace (1) | | I | | 49 | | 2001 |

| Ron Hadani | | II | | 47 | | 2003 |

| Katsumi Oneda(3) | | II | | 65 | | 1987 |

| Kenneth W. Anstey(1)(2) | | III | | 57 | | 1993 |

| Gerald B. Lichtenberger, Ph.D. | | III | | 58 | | 1997 |

- (1)

- member of Audit Committee

- (2)

- member of Compensation Committee

- (3)

- member of Executive Committee

William F. Doyle has been a managing director of WFD Ventures LLC since October 2002. He served as a managing director of Insight Venture Partners from December 1999 through October 2002 and as Vice President, Licensing and Acquisitions, for Johnson & Johnson from October 1995 through November 1999. Mr. Doyle is a director of I-many, Inc., a publicly traded provider of contract management software and solutions.

Lewis C. Pell, a co-founder of the Company, has been Vice-Chairman of the Board of Directors of the Company since May 1992. Mr. Pell is a founder or co-founder and director of a number of other privately held medical device companies.

John J. Wallace has served as Chief Operating Officer of Nova Biomedical Corporation, a medical device company, since October 1991.

Ron Hadani has served as President and Chief Executive Officer of the Company since February 2003. From November 2001 to February 2003, Mr. Hadani was a self-employed business development consultant. Mr. Hadani served as President of Kontron Medical LLC, an ultrasound equipment company, from April 1999 through October 2001 and served as Division Vice President of U.S. Surgical, a surgical devices unit of Tyco Healthcare Group LP, from September 1997 through April 1999.

Katsumi Oneda, a co-founder of the Company, has been Chairman of the Board of Directors of the Company since October 1993. From October 1993 through January 2003 he also served as President and Chief Executive Officer of the Company. He served as Vice-Chairman of the Board of Directors of the Company from May 1992 to October 1993, as Honorary Chairman of the Board of Directors from October 1991 to October 1993 and as Chairman of the Board of Directors from September 1990 to October 1991. Mr. Oneda is a director of several private companies.

Kenneth W. Anstey has served as President and Chief Executive Officer of Coapt Systems, Inc., a developer of bioabsorbable implants, since December 2002 and served as President and Chief Executive Officer of Oratec Interventions Inc., a publicly traded medical device company, from July 1997 through May 2002.

Gerald B. Lichtenberger, Ph.D., has served as Vice President, Business Development of the Company since 1997. Dr. Lichtenberger served as Executive Vice President, Chief Operating Officer and Secretary of the Company from December 1996 to December 1998. From June 1990 to

4

December 1996, Dr. Lichtenberger served as President and as a director of iSight, Inc., a developer and manufacturer of digital video cameras and components.

Executive officers of the Company are generally elected by the Board of Directors on an annual basis and serve at the Board's discretion. No family relationship exists among any of the executive officers or directors of the Company.

Board and Committee Meetings

The Company has a standing Audit Committee of the Board of Directors, which reviews the Company's independent auditors' performance in the annual audit, reviews auditors' fees, discusses the Company's internal accounting control policies and procedures and considers and appoints the Company's independent auditors. The Audit Committee met eight times during the fiscal year ended March 31, 2003. The current members of the Audit Committee are Messrs. Anstey, Doyle and Wallace.

The Company has a standing Compensation Committee of the Board of Directors, which sets the compensation levels of executive officers of the Company (subject to review by the Board of Directors), provides recommendations to the Board regarding compensation programs of the Company, administers the Company's 1990 Stock Option Plan and 2000 Stock Incentive Plan (the "2000 Incentive Plan") and authorizes option grants under the 2000 Incentive Plan to all employees of the Company. The Compensation Committee met three times during the fiscal year ended March 31, 2003. The current members of the Compensation Committee are Messrs. Anstey and Doyle.

The Company does not have a standing Nominating Committee or a committee that performs functions similar to those of a nominating committee.

The Board of Directors met four times during the fiscal year ended March 31, 2003. Each incumbent director attended at least 75% of the aggregate of the number of Board meetings and the number of meetings held by all committees on which he then served.

Director Compensation

The Company's outside directors (currently, Messrs. Anstey, Doyle and Wallace) receive an annual director's fee in the amount of $10,000 payable quarterly. Directors are reimbursed for certain Company-related travel expenses. In addition, members of the Audit Committee receive $500 for each Audit Committee meeting attended.

Pursuant to the Company's 1993 Director Option Plan (the "1993 Director Plan"), a non-statutory stock option to purchase 20,000 shares of the Company's Common Stock at an exercise price equal to fair market value of the Common Stock on the date of grant was, or shall be, as the case may be, granted (i) on August 16, 1993, to each person who was an outside director on such date and who did not have a consulting agreement with the Company at that time, and (ii) on the date of initial election to the board, to any outside director elected subsequent to August 16, 1993. In each case, the option becomes exercisable over a four-year period from the date of grant with one-fifth of the option being exercisable on the date of grant and an additional one-fifth becoming exercisable on each of the first, second, third and fourth anniversaries of the date of grant. In addition to the grants described above, on the date that all of a director's options, as described above, become fully vested, such director shall be granted an additional option to purchase 20,000 shares of the Company's Common Stock at a price equal to the fair market value at the time of grant, which option shall become exercisable over a four-year period from the date of grant as set forth above.

The 1993 Director Plan will expire in accordance with its terms on August 16, 2003. Proposal 3 to be considered at the Annual Meeting is to approve the 2003 Director Stock Option Plan, which, if approved by the stockholders, will become effective as of the date of the Annual Meeting.

5

Executive Compensation

The following table sets forth certain information concerning the compensation, for the fiscal years indicated, for each person who served as the Company's Chief Executive Officer and each of the Company's four most highly compensated executive officers during the fiscal year ended March 31, 2003 (the "Named Executive Officers").

Summary Compensation Table

| |

| | Annual Compensation(2)

| | Long-Term

Compensation

| |

|

|---|

Name and

Principal Position(1)

| | Year

| | Salary

| | Bonus

| | Securities

Underlying

Options

| | All Other

Compensation(3)

|

|---|

Ron Hadani(4)

President and Chief Executive Officer | | 2003

2002

2001 | | $

| 26,789

—

— | | —

—

— | | 400,000

—

— | | $

| —

—

— |

Katsumi Oneda(5)

Chairman of the Board of Directors; former President and Chief Executive Officer | | 2003

2002

2001 | | $

$

$ | 109,200

109,200

109,200 | | —

—

— | | —

—

— | | | —

—

— |

Gerald B. Lichtenberger

Vice President, Business Development | | 2003

2002

2001 | | $

$

$ | 140,000

138,958

85,800 | | —

—

— | | —

—

50,000 | | | —

—

— |

Thomas M. Olmstead(6)

Vice President, Sales and Marketing | | 2003

2002

2001 | | $

$

| 130,000

57,692

— | | —

—

— | | 50,000

100,000

— | | | —

—

— |

Isao Fujimoto

Vice President, Manufacturing and Engineering, Industrial Segment | | 2003

2002

2001 | | $

$

$ | 128,610

122,513

121,937 | | —

—

— | | 30,000

—

40,000 | | $

$

$ | 1,720

1,804

1,713 |

James A. Tracy

Vice President, Finance; Treasurer; Chief Financial Officer and Controller | | 2003

2002

2001 | | $

$

$ | 124,800

119,714

103,810 | | —

—

— | | 50,000

—

90,000 | | $

$

$ | 1,790

1,552

1,419 |

- (1)

- The rules of the SEC require that this table, the stock option grant table and the stock option exercise table which follow, present information concerning the Company's Chief Executive Officer as of March 31, 2003, the Company's fiscal year-end, any other person who served as the Company's Chief Executive Officer at any time during the fiscal year ended March 31, 2003, up to four of the Company's other most highly compensated executive officers (determined by reference to total annual salary and bonus earned by such officers) whose total salary and bonus exceeded $100,000 for the fiscal year ended March 31, 2003, and up to two individuals who would have been one of the four most highly compensated executive officers but for the fact that such individuals no longer served as executive officers of the Company on March 31, 2003.

- (2)

- In accordance with the rules of the SEC, other compensation in the form of perquisites and other personal benefits has been omitted because such perquisites and other personal benefits constituted less than 10% of the total annual salary and bonus for each Named Executive Officer.

- (3)

- Consists of Company contributions to the Company's 401(k) Plan.

6

- (4)

- Mr. Hadani began serving as President and Chief Executive Officer of the Company on February 1, 2003.

- (5)

- All of Mr. Oneda's 2001 salary has been accrued and will be paid to Mr. Oneda at such time as the Company generates a positive cash flow. Beginning in January 2002, Mr. Oneda resumed receiving his salary in cash.

- (6)

- Mr. Olmstead joined the Company in October 2001.

Option Grants on Last Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for

Option Term(1)

|

|---|

| | Securities

Underlying

Options

Granted

(#)(2)

| |

| |

| |

|

|---|

| | Percent of Total

Options Granted

To Employees

in Fiscal Year

| |

| |

|

|---|

| | Exercise or Base

Price ($/Share)

| | Expiration Date

|

|---|

Name

| | 5%($)

| | 10%($)

|

|---|

| Ron Hadani | | 400,000 | | 54 | % | $ | 1.05 | | 02/01/13 | | $ | 264,136 | | $ | 669,372 |

| Katsumi Oneda | | 0 | | 0 | % | | — | | — | | | — | | | — |

| Gerald B. Lichtenberger | | 0 | | 0 | % | | — | | — | | | — | | | — |

| Thomas Olmstead | | 50,000 | | 7 | % | $ | 0.89 | | 12/17/12 | | $ | 27,986 | | $ | 70,922 |

| Isao Fujimoto | | 30,000 | | 4 | % | $ | 0.89 | | 12/17/12 | | $ | 16,791 | | $ | 42,553 |

| James A. Tracy | | 50,000 | | 7 | % | $ | 0.89 | | 12/17/12 | | $ | 27,986 | | $ | 70,922 |

- (1)

- Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. Actual gains, if any, on stock option exercises will depend on the future performance of the Common Stock and the date on which the options are exercised.

- (2)

- Except for the options granted to Mr. Hadani, these options vest over a four year period as follows: 25% on each of the first, second, third and fourth anniversaries of the date of grant. Mr. Hadani's option was vested with respect to 25% of the underlying stock upon grant and vests with respect to an additional 25% on each of the first three anniversaries of the date of grant.

7

The following table sets forth certain information concerning stock options held as of March 31, 2003 by each of the Named Executive Officers. None of the Named Executive Officers exercised options in the fiscal year ended March 31, 2003.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

| | Number of Shares of

Common Stock Underlying

Unexercised Options at

Fiscal Year-End

| | Value of Unexercised In-the-Money

Options at Fiscal Year End(1)

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Ron Hadani | | 100,000 | | 300,000 | | $ | 0 | | $ | 0 |

| Katsumi Oneda | | 125,000 | | 0 | | $ | 0 | | $ | 0 |

| Gerald B. Lichtenberger | | 150,000 | | 0 | | $ | 0 | | $ | 0 |

| Thomas M. Olmstead | | 25,000 | | 125,000 | | $ | 0 | | $ | 5,000 |

| Isao Fujimoto | | 175,000 | | 30,000 | | $ | 0 | | $ | 3,000 |

| James A. Tracy | | 180,000 | | 50,000 | | $ | 0 | | $ | 5,000 |

- (1)

- Based on the fair market value of the Common Stock on March 31, 2003 ($.99 per share), less the option exercise price.

Agreements with Named Executive Officers

The Company and Mr. Hadani entered a letter agreement on January 24, 2003 with respect to the terms of Mr. Hadani's employment as Chief Executive Officer of the Company. Under the agreement, Mr. Hadani's annual base salary was initially set at $190,000, subject to annual review. In addition, the Company agreed to grant to Mr. Hadani an option to purchase 400,000 shares of the Company's Common Stock at an exercise price equal to the closing price of the Common Stock on the date of grant. The option was 25% vested on grant with the balance to vest in three equal installments over a three-year period.

Under the terms of a letter agreement dated September 20, 2001 between the Company and Mr. Olmstead, the Company's Vice President of Sales and Marketing, Mr. Olmstead's annual base salary was initially set at $120,000. In addition, the Company agreed to grant Mr. Olmstead an option to purchase 100,000 shares of the Company's Common Stock at an exercise price equal to the closing price of the Common Stock on October 1, 2001. This option was vested as to 25% of the underlying shares on October 1, 2002 and vests as to an additional 25% annually over the following three-year period.

Under the terms of a letter agreement dated July 18, 1997 between the Company and Mr. Tracy, the Company's Vice President of Finance and Chief Financial Officer, Mr. Tracy was granted an option to purchase 50,000 shares of the Company's Common Stock at an exercise price equal to the closing price of the Common Stock on the date of the letter agreement. This option has since vested in full in accordance with its terms. The letter agreement also provides that, in the event of a termination other than for cause, Mr. Tracy will receive a lump sum severance payment equal to three months' salary and continue to receive all benefits for a period of three months following termination.

Mr. Oneda has agreed to grant the Company an option to purchase certain securities held by him, as discussed immediately below.

Certain Relationships and Related Transactions

On April 5, 2002, the non-interested members of the Board of Directors authorized the Company to enter into an agreement with Messrs. Oneda and Pell, who are officers and directors of the Company, whereby the Company would have an option to assume convertible capital notes (the

8

"Notes") held by Messrs. Oneda and Pell in the aggregate principal amounts of $976,397 and $992,090, respectively. The Notes are convertible into capital stock of 3DV Systems, Ltd., an Israeli corporation of which the Company held, as of May 31, 2003, approximately 21% of the outstanding shares. The Company may exercise its option to assume the Notes at its sole discretion, in exchange for payment of the respective principal amounts of the Notes.

In the fiscal year ended March 31, 2003, the Company purchased approximately $833,000 of flexible endoscope components from a subsidiary of Pentax Corporation (f/k/a Asahi Optical Co., Ltd.) ("Pentax"), pursuant to a March 16, 1992 supply agreement between the Company and Pentax. Pentax is the record and beneficial holder of 7% of the Company's outstanding Common Stock.

On March 31, 2003, the Company sold 1,192,784 shares of restricted Common Stock to each of Messrs. Oneda and Pell. In April 2003 the Company sold an additional 524,098 shares of Common Stock to unaffiliated accredited investors. All of these shares were sold at a price per share of $.6707, which represented 67% of the average closing price of the Common Stock over the five trading days ended March 21, 2003, the day on which the Board of Directors of the Company unanimously approved the transaction.

The Company believes that the terms of the foregoing transactions are at least as favorable to the Company as could have been obtained from unaffiliated third parties.

The Company has a policy that transactions, if any, between the Company and its officers, directors or other affiliates must (a) be on terms no less favorable to the Company than could be obtained from unaffiliated third parties, (b) be approved by a majority of the members of the Board of Directors and (c) be approved by a majority of the disinterested members of the Board of Directors.

Compensation Committee Report on Executive Compensation

The Company's executive compensation program is administered by the Compensation Committee, which is currently comprised of Kenneth W. Anstey and William F. Doyle. From the beginning of the last fiscal year through December 31, 2002, the Compensation Committee comprised of Mr. Anstey and Fred E. Silverstein, M.D. The Compensation Committee is responsible for determining the compensation package of each executive officer and recommending it to the Board of Directors and for awarding stock options under the Company's 2000 Incentive Plan. In the fiscal year ended March 31, 2003, the Board of Directors did not modify or reject in any material way any action or recommendation of the Compensation Committee. In making decisions regarding executive compensation, the Compensation Committee considers the input of the Company's other directors, including the input of the Chief Executive Officer of the Company, with respect to the compensation of the Company's other executive officers.

The Company's executive compensation program is structured and administered to achieve three broad goals in a manner consistent with stockholder interests. First, the Compensation Committee structures executive compensation programs and decisions regarding individual compensation in a manner that the Compensation Committee believes will enable the Company to attract and retain key executives. Second, the Compensation Committee establishes compensation programs that are designed to reward executives for the achievement of specified business objectives of the Company, which are often targeted to the individual executive's particular business unit. Finally, the Compensation Committee designs the Company's executive compensation programs to provide executives with long-term ownership opportunities in the Company in an attempt to align executive and stockholder interests.

The Company has not to date generated significant revenues from the sales of its new products that incorporate its disposable EndoSheath technology. Accordingly, in evaluating both individual and corporate performance for purposes of determining salary levels and stock option grants, the

9

Compensation Committee currently places significant emphasis on the progress and success of the Company with respect to matters such as product development, including product design and manufacturing, and enhancement of the Company's patent and licensing position as well as on the Company's overall financial performance and sales by product line.

The compensation programs for the Company's executives established by the Compensation Committee consist of two elements based upon the foregoing objectives: (i) base salary and benefits competitive with the marketplace; and (ii) stock-based equity incentives in the form of participation in the 2000 Incentive Plan. The Compensation Committee believes that providing base salaries and benefits to its executive officers that are competitive with the marketplace enables the Company to attract and retain key executives. The Compensation Committee generally provides executive officers discretionary stock option awards to reward them for achieving specified business objectives and to provide them with long-term ownership opportunities. In evaluating the salary level and equity incentives to award to each current executive officer, the Compensation Committee examines the progress that the Company has made in areas under the particular executive officer's supervision, such as manufacturing or sales, and the overall performance of the Company. The Compensation Committee does not establish specific goals or milestones that automatically trigger additional compensation for the executive officers but rather decides on each executive officer's compensation after taking into account actions by such officer to accomplish established Company goals.

In determining the salary of each executive officer, including the Named Executive Officers, the Compensation Committee and the Board of Directors consider numerous factors such as (i) the individual's performance, including the expected contribution of the executive officer to the Company's goals, (ii) the Company's long-term needs and goals, including attracting and retaining key management personnel and (iii) the Company's competitive position, including data on the payment of executive officers at comparable companies that are familiar to members of the Compensation Committee. The companies described under the caption "Comparative Stock Performance" below constitute a much broader group of companies at various stages of development than those considered by the Compensation Committee to compare compensation levels of the Company's executive officers. Rather, the companies used by the Compensation Committee to compare executive compensation are companies of which the members of the Compensation Committee have specific knowledge and are considered as of the time those companies were at similar stages of development as the Company. To the extent determined to be appropriate, the Compensation Committee also considers general economic conditions and the historic compensation levels of the individual. The Compensation Committee believes that the salary levels of the Company's executive officers are in the middle third when compared to the compensation levels of companies at similar stages of development as the Company.

The compensation philosophy applied by the Committee in establishing the compensation for the Company's Chief Executive Officer is the same as for the other senior management of the Company—to provide a competitive compensation opportunity that rewards performance.

Mr. Oneda served as President and Chief Executive Officer of the Company during the fiscal year ended March 31, 2003 through January 2003. He has served as Chairman of the Board of Directors since October 1993. In the fiscal year ended March 31, 1999, the Compensation Committee accepted Mr. Oneda's offer that his salary be reduced to $109,200, which was lower than the salaries of other officers of the Company. The Compensation Committee considers this to be in the lower third of the compensation of Chief Executive Officers at other publicly-traded companies at the same stage of development as the Company. From October 1995 through December 2001, all of Mr. Oneda's salary

10

was accrued, and will be paid to Mr. Oneda at such time as the Company generates a positive cash flow. Beginning in January 2002, Mr. Oneda resumed receiving his salary in cash.

Mr. Hadani has served as Chief Executive Officer since February 2003. The Compensation Committee approved a salary of $190,000 for Mr. Hadani, an annual car allowance of $9,000 and an incentive stock option to purchase 400,000 shares of Company Common Stock. The Compensation Committee believes Mr. Hadani's salary to be in the middle third when compared to compensation levels of chief executive officers of companies at a similar stage of development as the Company. The Compensation Committee intends to review Mr. Hadani's compensation during the current fiscal year.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a federal income tax deduction to a public company for certain compensation in excess of $1,000,000 paid to the company's Chief Executive Officer and four other most highly compensated executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. Although the Company has not paid any of its executive officers annual compensation over $1,000,000 and has no current plan to do so, it currently intends to structure all future performance-based compensation of its executive officers in a manner that complies with this statute.

Compensation Committee Interlocks and Insider Participation

Mr. Anstey, Mr. Doyle and Fred E. Silverstein, M.D. served as members of the Compensation Committee during the fiscal year ended March 31, 2003. No member of the Compensation Committee was at any time during the fiscal year ended March 31, 2003, an officer or employee of the Company nor has any member of the Compensation Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Securities Exchange Act of 1934.

None of the Company's executive officers has served as a director or member of the Compensation Committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director of or member of the Compensation Committee.

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Company's Board of Directors is composed of three members and acts under a written charter first adopted and approved in March 2000. The members of the Audit Committee are independent directors, as defined by its charter and the rules of the Nasdaq Stock Market. The current members of the Audit Committee are Kenneth W. Anstey, William F. Doyle and John J. Wallace. From the beginning of the last fiscal year through December 31, 2002, the members of the Audit Committee were Fred E. Silverstein, M.D., and Messrs. Anstey and Wallace.

The Audit Committee reviewed the Company's audited financial statements for the fiscal year ended March 31, 2003 and discussed these financial statements with the Company's management. Management is responsible for the Company's internal controls and the financial reporting process. The Company's independent accountants are responsible for performing an independent audit of the Company's financial statements in accordance with generally accepted accounting principles and to issue a report on those financial statements. As appropriate, the Audit Committee reviews and

11

evaluates, and discusses with the Company's management, internal accounting and financial personnel and the independent auditors, the following:

- •

- the plan for, and the independent auditors' report on, each audit of the Company's financial statements;

- •

- the Company's financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to shareholders;

- •

- changes in the Company's accounting practices, principles, controls or methodologies;

- •

- significant developments or changes in accounting rules applicable to the Company; and

- •

- the adequacy of the Company's internal controls and financial personnel.

Management represented to the Audit Committee that the Company's financial statements had been prepared in accordance with generally accepted accounting principles.

The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards ("SAS") 61,Communications with Audit Committees with BDO Seidman LLP, the Company's independent auditors. SAS 61 requires the Company's independent auditors to discuss with the Company's Audit Committee, among other things, the following:

- •

- methods to account for significant or unusual transactions;

- •

- the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus;

- •

- the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors' conclusions regarding the reasonableness of those estimates; and

- •

- disagreements with management over the application of accounting principles, the basis for management's accounting estimates and the disclosures in the financial statements.

The Company's independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditor's professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. The Audit Committee discussed with the independent auditors the matters disclosed in this letter and their independence from the Company. The Audit Committee also considered whether the independent auditors' provision of the other, non-audit related services to the Company that are referred to in "Independent Auditors Fees and Other Matters" is compatible with maintaining such auditors' independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company's Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended March 31, 2003.

12

COMPARATIVE STOCK PERFORMANCE

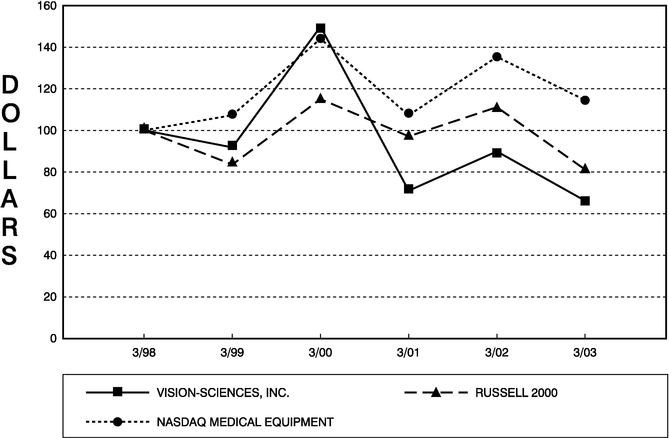

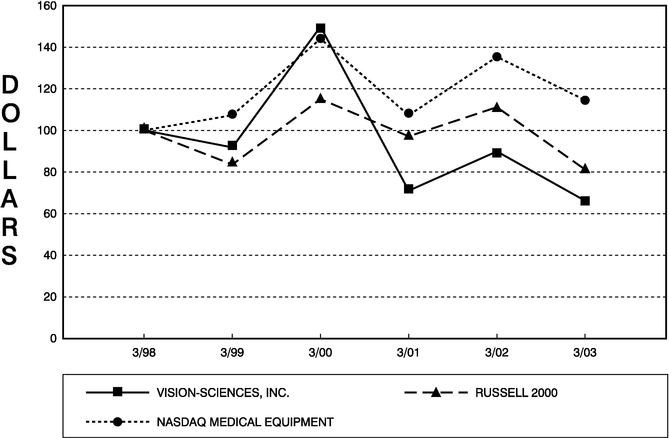

The following graph compares the cumulative total stockholder return on the Common Stock of the Company between March 31, 1998 and March 31, 2003 (the end of fiscal 2003) with the cumulative total return of (i) the Russell 2000 Index and (ii) the Nasdaq Medical Equipment Index. This graph assumes the investment of $100 on March 31, 1998 in the Company's Common Stock, the Russell 2000 Index and the Nasdaq Medical Equipment Index Index, and assumes dividends are reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN

Among Vision-Sciences, Inc., the Russell 2000 Index

and the Nasdaq Medical Equipment Index

| | Cumulative Total Return

|

|---|

| | 3/98

| | 3/99

| | 3/00

| | 3/01

| | 3/02

| | 3/03

|

|---|

| Vision-Sciences, Inc. | | $ | 100.00 | | $ | 91.67 | | $ | 150.00 | | $ | 70.87 | | $ | 90.00 | | $ | 66.00 |

| Russell 2000 | | | 100.00 | | | 83.74 | | | 114.98 | | | 97.35 | | | 110.97 | | | 81.04 |

| Nasdaq Medical Equipment | | | 100.00 | | | 107.44 | | | 144.01 | | | 107.14 | | | 135.52 | | | 114.51 |

13

PROPOSAL 2: APPROVAL OF 2003 DIRECTOR STOCK OPTION PLAN

On July 2, 2003, the Board of Directors of the Company adopted, subject to stockholder approval, the 2003 Director Stock Option Plan (the "2003 Director Plan"). Up to 200,000 shares of Common Stock (subject to adjustment in the event of stock splits and other similar events) may be issued pursuant to options granted under the 2003 Director Plan.

The 2003 Director Plan is intended to replace the 1993 Director Plan, which expires by its terms on August 16, 2003. As of May 31, 2003, options to purchase 100,000 shares of Common Stock were outstanding under the 1993 Director Plan and an additional 100,000 shares were reserved for future option grants. Upon the expiration date of the 1993 Director Plan on August 16, 2003, all then outstanding options will remain in effect, but no additional option grants may be made under the 1993 Director Plan.

The Board of Directors believes that the future success of the Company depends, in large part, upon the ability of the Company to attract and retain outside directors.Accordingly, the Board of Directors believes adoption of the 2003 Director Plan is in the best interests of the Company and its stockholders and recommends a vote FOR this proposal.

Summary of the 2003 Director Plan

The following is a brief summary of the 2003 Director Plan. You should refer to the full text of the 2003 Director Plan, which is an exhibit to the Company's Schedule 14A filed with the SEC in June 2003. The Company's SEC filings may be found online at the SEC's EDGAR website at http://www.sec.gov/edgar/searchedgar/webusers.htm.

The 2003 Plan provides for the grant of nonstatutory stock options (collectively "Director Options") to directors of the Company who are not employees of the Company or any subsidiary of the Company (collectively "Outside Directors"). No discretionary options or other awards can be granted under the 2003 Director Plan; rather, Director Options to purchase 4,000 shares of Common Stock (subject to adjustment for stock splits, reverse stock splits, stock dividends, recapitalizations or other similar changes in capitalization) will be granted automatically (i) to each person who becomes an Outside Director after the date the Plan is approved by the stockholders of the Company and (ii) to each Outside Director on each date on which an annual meeting of the stockholders of the Company is held, provided that such Outside Director does not then hold any options under the 1993 Director Plan that have not vested as of such date.

The exercise price per share of any Director Option will be the fair market value of one share of Common Stock on the date of grant. While the Company's stock is listed on a national securities exchange or other nationally recognized trading system such as the Nasdaq SmallCap Market, this will be the closing price per share of the Company's Common Stock on the trading day immediately preceding the date of grant.

Each Director Option shall be fully vested and exercisable in full on the date of grant. Director Options are exercisable until the tenth anniversary of the date of grant.

A maximum of 200,000 shares of Common Stock (subject to adjustment for stock splits, reverse stock splits, stock dividends, recapitalizations or other similar changes in capitalization) may be issued under the 2003 Director Plan. If any Director Option expires or is terminated, surrendered, canceled or forfeited, the unused shares of Common Stock covered by such Director Option will again be available for grant under the 2003 Director Plan.

14

All Outside Directors are eligible to participate in the 2003 Director Plan. As of May 31, 2003, three persons were eligible to receive Director Options under the 2003 Director Plan.

The following table sets forth the options that will be received by or allocated to each of the following under the 2003 Director Plan:

2003 DIRECTOR PLAN BENEFITS

Name and Position

| | Dollar Value($)

| | Number of Options

| |

|---|

Katsumi Oneda

Director and Chairman of the Board | | $ | 0 | | 0 | |

Ron Hadani

Director, President and Chief Executive Officer | | $ | 0 | | 0 | |

Gerald B. Lichtenberger, Ph.D.

Director, Vice President, Business Development, and Secretary | | $ | 0 | | 0 | |

Isao Fujimoto

Vice President, Manufacturing and Engineering, industrial segment | | $ | 0 | | 0 | |

James A. Tracy

Vice President, Finance, Chief Financial Officer and Treasurer | | $ | 0 | | 0 | |

Thomas M. Olmstead

Vice President, Sales and Marketing | | $ | 0 | | 0 | |

| Executive Group | | $ | 0 | | 0 | |

| Non-Executive Director Group(1) | | | | (2) | 104,000 | (2) |

| Non-Executive Officer Employee Group | | $ | 0 | | 0 | |

- (1)

- Currently consists of Messrs. Anstey, Doyle and Wallace.

- (2)

- Options granted under the 2003 Director Plan will be granted at a price equal to 100% of the fair market value of a share of Common Stock on the date of grant.

- (3)

- The Company had three Outside Directors as of May 31, 2003. Mr. Anstey would receive a Director Option to purchase 4,000 shares of Common Stock each year from 2005 through 2013, Mr. Doyle would receive a Director Option to purchase 4,000 shares of Common Stock each year from 2006 through 2013 and Mr. Wallace would receive a Director Option to purchase 4,000 shares of Common Stock each year from 2005 through 2013 (assuming, in each case, that such Outside Director remains on the Board for such period). This number may be higher or lower depending on the number of Outside Directors on the Board of Directors each year during the term of the 2003 Director Plan.

On May 30, 2003, the last reported sale price of the Company Common Stock on the Nasdaq SmallCap Market was $1.39.

As discussed above under "Description of Options", the amount and nature of Director Options to be granted under the 2003 Director Plan will be automatic and non-discretionary in accordance with the terms of the 2003 Director Plan. However, the 2003 Director Plan will be supervised and administered by the Board of Directors, which will have the authority to correct any defect, supply any omission or reconcile any inconsistency in the 2003 Director Plan or any option granted thereunder in the manner and to the extent the Board of Directors shall deem expedient to carry the 2003 Director Plan into effect.

15

The Board of Directors is required to make appropriate adjustments in connection with the 2003 Director Plan and any outstanding Director Options to reflect stock dividends, stock splits and certain other events. In the event of a merger, liquidation or other Reorganization Event (as defined in the 2003 Director Plan), the Board of Directors is authorized to provide that any successor corporation shall either assume all outstanding Director Options or substitute equivalent options for such Director Options. In the event of a Reorganization Event that also constitutes a Change of Control (as defined in the 2003 Director Plan), all such assumed or substituted options shall become immediately exercisable in full.

No Director Option may be granted under the 2003 Director Plan after the tenth anniversary of the date on which it is approved by the stockholders of the Company, but Director Options previously granted may extend beyond that date. The Board of Directors may at any time amend, suspend or terminate the 2003 Director Plan, except that no amendment shall (i) change the number of shares subject to the 2003 Director Plan, (ii) change the number of shares underlying the automatic grants of Director Options, (iii) change the designation of the class of directors eligible to receive Director Options or (iv) materially increase the benefits accruing to Outside Directors under the 2003 Director Plan, in each case unless and until such amendment shall have been approved by the Company's stockholders.

The following generally summarizes the United States federal income tax consequences that generally will arise with respect to Director Options granted under the 2003 Director Plan. This summary is based on the tax laws in effect as of the date of this proxy statement. Changes to these laws could alter the tax consequences described below.

Outside Directors. An Outside Director will not have income upon the grant of a Director Option. An Outside Director will have compensation income upon the exercise of a Director Option equal to the value of the stock on the day the Outside Director exercised the Director Option less the exercise price. Upon sale of the stock, the Outside Director will have capital gain or loss equal to the difference between the sales proceeds and the value of the stock on the day the Director Option was exercised. This capital gain or loss will be long-term if the Outside Director has held the stock for more than one year and otherwise will be short-term.

Tax Consequences to the Company. There will be no tax consequences to the Company in connection with the 2003 Director Plan.

16

Securities Authorized for Issuance Under Equity Compensation Plans

The following table provides information about the securities authorized for issuance under the Company's equity compensation plans as of March 31, 2003:

Equity Compensation Plan Information

| | (a)

| | (b)

| | (c)

| |

|---|

Plan category

| | Number of securities

to be issued upon

exercise of

outstanding options,

warrants and

rights(1)

| | Weighted-

average exercise

price of

outstanding

options, warrants

and rights

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))(1)

| |

|---|

| Equity compensation plans approved by security holders | | 4,051,082 | | $ | 1.64 | | 2,654,358 | (2) |

| Equity compensation plans not approved by security holders (3) | | 0 | | $ | 0 | | 0 | |

| | |

| |

| |

| |

| Total | | 4,051,082 | | $ | 1.64 | | 2,654,358 | (2) |

- (1)

- In addition to being available for future issuance upon exercise of options that may be granted after March 31, 2003, shares issuable under the 2000 Incentive Plan may instead be issued in the form of restricted stock, unrestricted stock, stock appreciation rights, performance shares or other equity-based awards.

- (2)

- Does not include any shares of Common Stock that would be issuable pursuant to the 2003 Director Plan if it is approved by the stockholders.

- (3)

- All of the Company's equity compensation plans have been approved by the stockholders.

PROPOSAL 3: RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee has selected the firm of BDO Seidman, LLP ("BDO Seidman") as the Company's independent auditors for the current fiscal year. BDO Seidman has served as the Company's independent auditors beginning in the fiscal year ended March 31, 2003. Although stockholder approval of the Board of Directors' selection of BDO Seidman is not required by law, the Board of Directors believes that it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Board of Directors may reconsider its selection.

Representatives of BDO Seidman are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from stockholders.

Independent Auditors Fees and Other Matters

Audit Fees. BDO Seidman billed the Company an aggregate of $57,355 in fees for professional services rendered in connection with the audit of the Company's financial statements for the most recent fiscal year and the reviews of the financial statements included in each of the Company's Quarterly Reports on Form 10-Q during the fiscal year ended March 31, 2003.

Financial Information Systems Design and Implementation Fees. BDO Seidman did not bill the Company for any professional services rendered to the Company and its affiliates for the fiscal year

17

ended March 31, 2003 in connection with financial information systems design or implementation, the operation of the Company's information system or the management of its local area network.

All Other Fees. BDO Seidman billed the Company an aggregate of $11,575 in fees for tax planning, compliance and advisory services rendered to the Company and its affiliates for the fiscal year ended March 31, 2002.

Change in Accountants

Upon the recommendation of the Audit Committee, on July 1, 2002, the Board of Directors of the Company decided to change the principal accountants for the Company from Arthur Andersen LLP ("Arthur Andersen") to BDO Seidman. The Company subsequently engaged BDO Seidman on July 30, 2002.

During the Company's fiscal year ended March 31, 2002 and the subsequent interim period preceding the decision to change principal accountants, there were no disagreements with Arthur Andersen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of Arthur Andersen, would have caused it to make reference to the subject matter of the disagreement in connection with its report. Arthur Andersen's reports on the Company's financial statements for the past two years did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the Company's fiscal year ended March 31, 2002 and the subsequent interim period preceding the decision to change principal accountants, there were no reportable events as defined in Regulation S-K Item 304(a)(1)(v).

During the Company's fiscal year ended March 31, 2002 and the subsequent interim period prior to engaging BDO Seidman, neither the Company nor anyone on its behalf consulted with BDO Seidman regarding the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company by BDO Seidman that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely on its review of copies of reports filed by persons required to file such reports pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended ("Reporting Persons"), the Company believes that all filings required to be made by Reporting Persons of the Company were timely made in accordance with the requirements of the Exchange Act.

OTHER MATTERS

The Board of Directors does not know of any other matters that may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

Solicitation of Proxies

This solicitation of proxies is made on behalf of the Company and the Company will bear all costs of solicitation. In addition to solicitations by mail, the Company's directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews, and the Company reserves the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the

18

owners of stock held in their names, and the Company will reimburse them for their out-of-pocket expenses in this connection.

Householding of Annual Proxy Materials

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of the Company's proxy statement or annual report may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document to you if you call or write the Company at the following address or phone number: Vision-Sciences, Inc., Nine Strathmore Road, Natick, Massachusetts 01760, Telephone: (508) 650-9971, Attention: James A. Tracy. If you want to receive separate copies of the annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact the Company at the above address and phone number.

Stockholder Proposals

Proposals of stockholders intended to be presented at the 2004 Annual Meeting of Stockholders must be received by the Company at its principal office in Natick, Massachusetts not later than March 9, 2004 for inclusion in the proxy statement for that meeting.

If a stockholder of the Company wishes to present a proposal before the 2004 Annual Meeting of Stockholders, but does not wish to have the proposal considered for inclusion in the Company's proxy statement and proxy card, such stockholder must give written notice to the Company at its principal office in Natick, Massachusetts not later than May 23, 2004. If the stockholder fails to provide timely notice of a proposal to be presented at the 2004 Annual Meeting, the proxies designated by the Board of Directors of the Company will have discretionary authority to vote on any such proposal.

| By Order of the Board of Directors, | | |

|

|

|

Katsumi Oneda, Chairman |

|

|

July 7, 2003

THE BOARD OF DIRECTORS HOPES THAT STOCKHOLDERS WILL ATTEND THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE MEETING AND YOUR COOPERATION WILL BE APPRECIATED. STOCKHOLDERS WHO ATTEND THE MEETING MAY VOTE THEIR STOCK PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXIES.

19

Vision-Sciences, Inc.

2003 DIRECTOR OPTION PLAN

1. Purpose

The purpose of this 2003 Director Option Plan (the "Plan") of Vision-Sciences, Inc., a Delaware corporation (the "Company"), is to advance the interests of the Company's stockholders by enhancing the Company's ability to attract and retain outside directors by providing such directors with equity ownership opportunities and incentives and thereby better aligning the interests of such directors with those of the Company's stockholders. Except where the context otherwise requires, the term "Company" shall include any of the Company's present or future subsidiary corporations as defined in Section 424(f) of the Internal Revenue Code of 1986, as amended, and any regulations promulgated thereunder (the "Code").

2. Eligibility

Directors of the Company who are not employees of the Company or any subsidiary of the Company (each, an "Outside Director" and collectively, the "Outside Directors") shall be eligible to participate in the Plan.

3. Administration and Delegation

The Plan will be supervised and administered by the Board of Directors of the Company (the "Board"). The amount and nature of the Options (as defined in Section 5(a)) to be granted shall be automatic and non-discretionary in accordance with Section 5. However, the Board may correct any defect, supply any omission or reconcile any inconsistency in the Plan or any Option in the manner and to the extent it shall deem expedient to carry the Plan into effect and the Board shall be the sole and final judge of such expediency. All decisions by the Board shall be made in the Board's sole discretion and shall be final and binding on all persons having or claiming any interest in the Plan or in any Option.

4. Stock Available for Options

The maximum number of shares of common stock, $.01 par value per share, of the Company (the "Common Stock") issuable under the Plan shall be 200,000, subject to adjustment in accordance with Section 6. If any Option expires or is terminated, surrendered or canceled without having been fully exercised or is forfeited in whole or in part or results in any Common Stock not being issued, the unused Common Stock covered by such Option shall again be available for the grant of Options under the Plan. Options shall be non-statutory stock options not entitled to treatment as incentive stock options under the Code.

5. Terms, Conditions and Form of Options

(a) Automatic Grant. An Option (an "Option" and collectively, "Options") to purchase 4,000 shares of Common Stock (subject to adjustment as provided in Section 6) shall be granted automatically (i) to each person who becomes an Outside Director after the date the Plan is approved by the stockholders of the Company upon his or her election of the Board and (ii) to each Outside Director on each date on which an annual meeting of the stockholders of the Company is held, provided that such Outside Director does not hold on such date any outstanding options to purchase Common Stock pursuant to the Company's 1993 Director Stock Option Plan, which options are not fully exercisable.

-1-

(b) Exercise Price. The exercise price per share of any Option shall be the Fair Market Value of one share of Common Stock on the date of grant of such Option. "Fair Market Value" shall mean: (i) if the Common Stock is listed on a national securities exchange, the Nasdaq National Market or the Nasdaq SmallCap Market as of such date, the closing price per share of the Company's Common Stock on the trading day immediately preceding such date, as published inThe Wall Street Journal, (ii) if the Common Stock is traded or quoted on the OTC Bulletin Board or similar over-the-counter market or quotation system, the average of the closing bid and asked prices per share of the Company's Common Stock on the trading day immediately preceding such date, as published by such over-the-counter market or quotation system and (iii) if the Common Stock is not as of such date listed on or quoted by an exchange or quotation service described in clauses (i) or (ii) above, the price per share determined by the Board in good faith to represent the fair market value per share of the Common Stock.

(c) Vesting. Except as otherwise provided in the Plan, each Option shall be exercisable in full on the date of grant.

(d) Exercise Period. The right of exercise shall be cumulative so that to the extent an Option is not exercised in any period to the maximum extent permissible it shall continue to be exercisable, in whole or in part, with respect to all shares for which it is vested until the earlier of the tenth anniversary of the date of grant of such Option or the earlier termination of the Option under Section 5(e) or Section 6. Notwithstanding the foregoing, if any Outside Director ceases to be a director of the Company for any reason, then, except as provided in Section 5(e), the right to exercise his or her Options shall terminate 90 days after such cessation (but in no event after the tenth anniversary of the date of grant of such Options),provided that any Option shall be exercisable only to the extent that the Outside Director was entitled to exercise such Option on the date of such cessation.

�� (e) Exercise Period Upon Death or Disability. If an Outside Director dies or becomes disabled (within the meaning of Section 22(e)(3) of the Code) prior to the tenth anniversary of the date of grant of an Option and while he or she is a director of the Company, such Option shall be exercisable, within the period of one year following the date of death or disability of the Outside Director, by the Outside Director (or in the case of death by an authorized transferee), provided that the Option shall be exercisable only to the extent that such Option was exercisable by the Outside Director on the date of his or her death or disability, and further provided that the Option shall not be exercisable after the tenth anniversary of the date of grant of such Option.

(f) Exercise Procedure. Options may be exercised by delivery to the Company of a written notice of exercise signed by the proper person or by any other form of notice (including electronic notice) approved by the Board together with payment in full for the number of shares for which the Option is exercised, such payment to be made as follows, in each caseprovided that such method of payment is then permitted under applicable law:

(1) in cash or by check, payable to the order of the Company;

(2) by (i) delivery of an irrevocable and unconditional undertaking by a creditworthy broker to deliver promptly to the Company sufficient funds to pay the exercise price and any required tax withholding or (ii) delivery by the Outside Director to the Company of a copy of irrevocable and unconditional instructions to a creditworthy broker to deliver promptly to the Company cash or a check sufficient to pay the exercise price and any required tax withholding;

(3) when the Common Stock is registered under the Securities Exchange Act of 1934 (the "Exchange Act"), by delivery of shares of Common Stock owned by the Outside Director valued at their Fair Market Value, provided that such Common Stock, if acquired directly from the Company was owned by the Outside Director at least six months prior to such delivery; or

(4) by any combination of the above permitted forms of payment.

-2-

6. Adjustments for Changes in Common Stock and Certain Other Events

(a) Changes in Capitalization. In the event of any stock split, reverse stock split, stock dividend, recapitalization, combination of shares, reclassification of shares, spin-off or other similar change in capitalization or event, or any distribution to holders of Common Stock other than a normal cash dividend, (i) the number and class of securities available under this Plan, (ii) the number of shares underlying each Option to be granted pursuant to Section 5(a) and (iii) the number and class of securities and exercise price per share subject to each outstanding Option shall be appropriately adjusted by the Company (or substituted options may be made, if applicable) to the extent the Board shall determine, in good faith, that such an adjustment (or substitution) is necessary and appropriate. If this Section 6(a) applies and Section 6(c) also applies to any event, Section 6(c) shall be applicable to such event, and this Section 6(a) shall not be applicable.

(b) Liquidation or Dissolution. In the event of a proposed liquidation or dissolution of the Company, the Board may take either or both of the following actions with respect to all then unexercised and outstanding Options: (i) provide that all such Options will become exercisable in full as of a specified time at least 10 business days prior to the effective date of such liquidation or dissolution and (ii) provide that all such Options will terminate effective upon such liquidation or dissolution, except to the extent exercised before such effective date.

(c) Reorganization and Change in Control Events

(1) Definitions

- (a)

- A "Reorganization Event" shall mean:

- (i)

- any merger or consolidation of the Company with or into another entity as a result of which all of the Common Stock of the Company is converted into or exchanged for the right to receive cash, securities or other property; or

- (ii)

- any exchange of all of the Common Stock of the Company for cash, securities or other property pursuant to a share exchange transaction.

- (b)

- A "Change in Control Event" shall mean:

- (i)

- the acquisition by an individual, entity or group (within the meaning of Section 13(d)(3) or 14(d)(2) of the Exchange Act) (a "Person") of beneficial ownership of any capital stock of the Company if, after such acquisition, such Person beneficially owns (within the meaning of Rule 13d-3 promulgated under the Exchange Act) 20% or more of either (x) the then outstanding shares of Common Stock of the Company (the "Outstanding Company Common Stock") or (y) the combined voting power of the then outstanding securities of the Company entitled to vote generally in the election of directors (the "Outstanding Company Voting Securities");provided, however, that for purposes of this subsection (i), the following acquisitions shall not constitute a Change in Control Event: (A) any acquisition directly from the Company (excluding an acquisition pursuant to the exercise, conversion or exchange of any security exercisable for, convertible into or exchangeable for Common Stock or voting securities of the Company, unless the Person exercising, converting or exchanging such security acquired such security directly from the Company or an underwriter or agent of the Company), (B) any acquisition by any employee benefit plan (or related trust) sponsored or maintained by the Company or any corporation controlled by the Company, (C) any acquisition by any corporation pursuant to a Business Combination (as defined below) which complies with clauses (x) and (y) of subsection (iii) of this definition, (D) any acquisition by Katsumi Oneda or

-3-

Lewis C. Pell, or any affiliate thereof (within the meaning of Rule 405 promulgated under the Securities Act of 1933, as amended) (or their respective spouses and minor children or by a trust for the benefit of any of such persons) (each party is referred to herein as an "Exempt Person") of any shares of Common Stock; provided that, after such acquisition, such Exempt Person does not beneficially own more than 40% of either (i) the Outstanding Company Common Stock of (ii) the Outstanding Company Voting Securities; or

- (ii)

- such time as the Continuing Directors (as defined below) do not constitute a majority of the Board (or, if applicable, the board of directors of a successor corporation to the Company), where the term "Continuing Director" means, at any date, a member of the Board (x) who was a member of the Board on the date of the initial adoption of this Plan by the Board or (y) who was nominated or elected subsequent to such date by at least a majority of the directors who were Continuing Directors at the time of such nomination or election or whose election to the Board was recommended or endorsed by at least a majority of the directors who were Continuing Directors at the time of such nomination or election;provided,however, that there shall be excluded from this clause (y) any individual whose initial assumption of office occurred as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents, by or on behalf of a person other than the Board; or

- (iii)

- the consummation of a merger, consolidation, reorganization, recapitalization or share exchange involving the Company or a sale or other disposition of all or substantially all of the assets of the Company (a "Business Combination"), unless, immediately following such Business Combination, each of the following two conditions is satisfied: (x) all or substantially all of the individuals and entities who were the beneficial owners of the Outstanding Company Common Stock and Outstanding Company Voting Securities immediately prior to such Business Combination beneficially own, directly or indirectly, more than 50% of the then outstanding shares of Common Stock and the combined voting power of the then outstanding securities entitled to vote generally in the election of directors, respectively, of the resulting or acquiring corporation in such Business Combination (which shall include, without limitation, a corporation which as a result of such transaction owns the Company or substantially all of the Company's assets either directly or through one or more subsidiaries) (such resulting or acquiring corporation is referred to herein as the "Acquiring Corporation") in substantially the same proportions as their ownership of the Outstanding Company Common Stock and Outstanding Company Voting Securities, respectively, immediately prior to such Business Combination and (y) no Person (excluding any Exempt Person, the Acquiring Corporation or any employee benefit plan (or related trust) maintained or sponsored by the Company or by the Acquiring Corporation) beneficially owns, directly or indirectly, 20% or more of the then outstanding shares of common stock of the Acquiring Corporation, or of the combined voting power of the then outstanding securities of such corporation entitled to vote generally in the election of directors (except to the extent that such ownership existed prior to the Business Combination).

-4-

(2) Effect on Options

- (a)