QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

VISION-SCIENCES, INC. |

(Name of Registrant as Specified In Its Charter) |

Not Applicable |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

VISION-SCIENCES, INC.

Nine Strathmore Road

Natick, Massachusetts 01760

Notice of Annual Meeting of Stockholders

To be Held on Wednesday, July 21, 2004

The Annual Meeting of Stockholders of Vision-Sciences, Inc. (the "Company") will be held at the offices of Proskauer Rose LLP, 1585 Broadway, New York, New York on Wednesday, July 21, 2004 at 11:00 a.m., local time, to consider and act upon the following matters:

(1) To elect William F. Doyle, Lewis C. Pell and John J. Wallace, as Class I Directors, each to serve for a three-year term;

(2) To ratify the selection of BDO Seidman LLP as the Company's independent auditors for the current fiscal year; and

(3) To transact such other business as may properly come before the meeting or any adjournment thereof.

Stockholders of record at the close of business on June 11, 2004 will be entitled to notice of and to vote at the meeting or any adjournment thereof.

| | | By Order of the Board of Directors, |

|

|

|

|

|

Katsumi Oneda, Chairman |

Natick, Massachusetts

July 1, 2004

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY AND MAIL IT PROMPTLY IN THE ENCLOSED ENVELOPE IN ORDER TO ENSURE REPRESENTATION OF YOUR SHARES. NO POSTAGE NEEDS TO BE AFFIXED IF THE PROXY IS MAILED IN THE UNITED STATES.

VISION-SCIENCES, INC.

Nine Strathmore Road

Natick, Massachusetts 01760

PROXY STATEMENT

For the Annual Meeting of Stockholders

To Be Held on July 21, 2004

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of Vision-Sciences, Inc. (the "Company") for use at the Annual Meeting of Stockholders to be held on July 21, 2004 at 11:00 a.m. at the offices of Proskauer Rose LLP, 1585 Broadway, New York, New York and at any adjournment of that meeting. All proxies will be voted in accordance with the stockholders' instructions, and if no choice is specified, the proxies will be voted in favor of the matters set forth in the accompanying Notice of Meeting. Any proxy may be revoked by a stockholder at any time before its exercise by delivery of written revocation or a subsequently dated proxy to the Secretary of the Company or by voting in person at the Annual Meeting.

This proxy statement was mailed to stockholders on or about July 1, 2004.

Voting Securities and Votes Required

At the close of business on June 11, 2004, the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting, there were outstanding and entitled to vote an aggregate of 30,873,213 shares of Common Stock of the Company, $.01 par value per share ("Common Stock"), constituting all of the voting stock of the Company. Holders of Common Stock are entitled to one vote per share.

The holders of a majority of the shares of Common Stock outstanding and entitled to vote at the Annual Meeting shall constitute a quorum for the transaction of business at the Annual Meeting. Shares of Common Stock represented in person or by proxy (including shares that abstain or do not vote with respect to one or more of the matters presented for stockholder approval) will be counted for purposes of determining whether a quorum exists at the Annual Meeting.

The affirmative vote of the holders of a plurality of the shares of Common Stock voting on the matter is required for the election of directors.

Shares held by stockholders who abstain from voting as to a particular matter, and shares held in "street name" by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will not be counted as votes in favor of such matter, and also will not be counted as shares voting on such matter. Accordingly, abstentions and "broker non-votes" will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the shares voting on the matter, such as the election of directors (Proposal 1).

Stock Ownership of Certain Beneficial Owners and Managers

The following table sets forth the beneficial ownership of the Company's Common Stock as of March 31, 2004 (i) by each person who is known by the Company to beneficially own more than 5% of

the outstanding shares of Common Stock, (ii) by each current director or nominee for director, (iii) by each of the executive officers named in the Summary Compensation Table set forth under the caption "Executive Compensation" below and (iv) by all current directors and executive officers as a group:

Name of Beneficial Owner

| | Number of Shares

Beneficially Owned(1)

| | Percentage of Outstanding

Common Stock

Beneficially Owned(2)

| |

|---|

Katsumi Oneda

c/o Vision-Sciences, Inc.

Nine Strathmore Road

Natick, MA 01760 | | 7,853,614 | | 25.6 | % |

Lewis C. Pell(3)

c/o Machida Incorporated

40 Ramland Road South

Orangeburg, NY 10962 | | 7,849,739 | | 25.6 | % |

Pentax Corporation(4)

2-36-9, Maeno-cho

Itabashi-Ku

Tokyo 174-8639 Japan | | 2,000,000 | | 6.5 | % |

| Ron Hadani(5) | | 440,000 | | 1.4 | % |

| Gerald B. Lichtenberger, Ph.D.(6) | | 313,250 | | 1.0 | % |

| Kenneth W. Anstey(7) | | 193,290 | | * | |

| William F. Doyle(8) | | 12,000 | | * | |

| John J. Wallace(9) | | 16,000 | | * | |

| Isao Fujimoto(10) | | 201,250 | | * | |

| Mark S. Landman(11) | | 167,625 | | * | |

| James A. Tracy(12) | | 147,750 | | * | |

| Thomas M. Olmstead(13) | | 40,000 | | * | |

| All current directors and executive officers as a group (11 persons)(14) | | | | 53.5 | % |

- *

- Less than 1% of the shares of Common Stock outstanding

- (1)

- Each person has sole investment and voting power with respect to the shares indicated, except as otherwise noted. The number of shares of Common Stock beneficially owned by each director, nominee for director or executive officer is determined under the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any other purpose. The inclusion herein of any shares as beneficially owned does not constitute an admission of beneficial ownership.

- (2)

- The number of shares deemed outstanding includes 30,687,963 shares outstanding as of March 31, 2004 and any shares subject to stock options held by the person or entity in question that are currently exercisable or exercisable within 60 days after March 31, 2004.

- (3)

- Includes 50,000 shares and 42,500 shares held of record and beneficially owned by Mr. Pell's wife and child, respectively. Mr. Pell disclaims beneficial ownership of these shares.

- (4)

- Based on information provided by Pentax Corporation. Pentax was formerly Asahi Optical Company Limited.

2

- (5)

- Comprised of 440,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004.

- (6)

- Comprised of (a) 153,500 shares owned by Dr. Lichtenberger, (b) an aggregate of 6,000 shares held of record and beneficially owned by Dr. Lichtenberger's two children and (c) 153,750 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004. Dr. Lichtenberger disclaims beneficial ownership of the shares held by his children. Dr. Lichtenberger resigned from his position as director of the Company effective December 31, 2003.

- (7)

- Includes 32,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004.

- (8)

- Comprised of 12,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004.

- (9)

- Comprised of 16,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004.

- (10)

- Includes 176,250 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004.

- (11)

- Includes 167,625 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004

- (12)

- Includes 146,250 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004.

- (13)

- Comprised of 40,000 shares subject to stock options currently exercisable or exercisable within 60 days after March 31, 2004.

- (14)

- Includes, as to all directors and executive officers as a group, 1,120,750 shares subject to stock options that are currently exercisable or exercisable within 60 days after March 31, 2004. Also includes shares for which certain individuals have disclaimed beneficial ownership, as set forth in the above footnotes.

PROPOSAL 1: ELECTION OF DIRECTORS

The Company's Board of Directors is divided into three classes, with members of each class holding office for staggered three-year terms. There are currently three Class I Directors, whose terms expire at the 2004 Annual Meeting of Stockholders, two Class II Directors, whose terms expire at the 2005 Annual Meeting of Stockholders, and one Class III Director, whose terms expire at the 2006 Annual Meeting of Stockholders (in all cases subject to the election of their successors and to their earlier death, resignation or removal).

The persons named in the enclosed proxy will vote to elect William F. Doyle, Lewis C. Pell and John J. Wallace, as Class I Directors, unless authority to vote for the election of Messrs. Doyle, Pell and Wallace is withheld by marking the proxy to that effect. Messrs. Doyle, Pell and Wallace are currently Class I Directors of the Company. Messrs. Doyle, Pell and Wallace have indicated willingness to serve, if elected, but if any are unable or unwilling to stand for election, proxies may be voted for a substitute nominee or nominees designated by the Board of Directors.

3

Set forth below is the name and certain information with respect to each director of the Company, including the nominees for Class I Directors.

Name

| | Class of

Director

| | Age

| | First

Became a

Director

|

|---|

| William F. Doyle(1)(2)(4) | | I | | 42 | | 2002 |

| Lewis C. Pell(3) | | I | | 61 | | 1987 |

| John J. Wallace(1)(4) | | I | | 50 | | 2001 |

| Ron Hadani | | II | | 48 | | 2003 |

| Katsumi Oneda(3) | | II | | 66 | | 1987 |

| Kenneth W. Anstey(1)(2)(4) | | III | | 58 | | 1993 |

- (1)

- member of Audit Committee

- (2)

- member of Compensation Committee

- (3)

- member of Executive Committee

- (4)

- member of Nominating Committee

William F. Doyle has been a managing director of WFD Ventures LLC since October 2002. He served as a managing director of Insight Venture Partners from December 1999 through October 2002 and as Vice President, Licensing and Acquisitions, for Johnson & Johnson from October 1995 through November 1999. Mr. Doyle is a director of I-many, Inc., a publicly traded provider of contract management software and solutions.

Lewis C. Pell, a co-founder of the Company, has been Vice-Chairman of the Board of Directors of the Company since May 1992. Mr. Pell is a founder or co-founder and director of a number of other privately held medical device companies.

John J. Wallace has served as Chief Operating Officer of Nova Biomedical Corporation, a medical device company, since October 1997.

Ron Hadani has served as President and Chief Executive Officer of the Company since February 2003. From November 2001 to February 2003, Mr. Hadani was a self-employed business development consultant. Mr. Hadani served as President of Kontron Medical LLC, an ultrasound equipment company, from April 1999 through October 2001 and served as Division Vice President of U.S. Surgical, a surgical devices unit of Tyco Healthcare Group LP, from September 1997 through April 1999.

Katsumi Oneda, a co-founder of the Company, has been Chairman of the Board of Directors of the Company since October 1993. From October 1993 through January 2003 he also served as President and Chief Executive Officer of the Company. He served as Vice-Chairman of the Board of Directors of the Company from May 1992 to October 1993, as Honorary Chairman of the Board of Directors from October 1991 to October 1993 and as Chairman of the Board of Directors from September 1990 to October 1991. Mr. Oneda is a director of several private companies.

Kenneth W. Anstey has served as President and Chief Executive Officer of Coapt Systems, Inc., a developer of bioabsorbable implants, since December 2002 and served as President and Chief Executive Officer of Oratec Interventions Inc., a publicly traded medical device company, from July 1997 through May 2002.

Executive officers of the Company are generally elected by the Board of Directors on an annual basis and serve at the Board's discretion. No family relationship exists among any of the executive officers or directors of the Company.

4

Board and Committee Meetings

The Company has a standing Audit Committee of the Board of Directors, which reviews the Company's independent auditors' performance in the annual audit, reviews auditors' fees, discusses the Company's internal accounting control policies and procedures and considers and appoints the Company's independent auditors. The Audit Committee met five times during the fiscal year ended March 31, 2004. The current members of the Audit Committee are Messrs. Anstey, Doyle and Wallace and each member is "independent" under the listing standards of The Nasdaq National Market. A copy of the Company's Audit Committee Charter is attached to this Proxy Statement as Appendix A.

The Company has a standing Compensation Committee of the Board of Directors, which sets the compensation levels of executive officers of the Company (subject to review by the Board of Directors), provides recommendations to the Board regarding compensation programs of the Company, administers the Company's 1990 Stock Option Plan and 2000 Stock Incentive Plan (the "2000 Incentive Plan") and authorizes option grants under the 2000 Incentive Plan to all employees of the Company. The Compensation Committee met twice during the fiscal year ended March 31, 2004. The current members of the Compensation Committee are Messrs. Anstey and Doyle.

In April 2004, the Company established a Nominating Committee of the Board of Directors, which is currently composed of three directors, Messrs. Anstey, Doyle and Wallace. The Nominating Committee assists the Board by identifying individuals qualified to become Board members and recommends to the Board potential candidates for election as a director and nominees for each committee of the Board (other than the Nominating Committee). Each member of the Nominating Committee is "independent" under the listing standards of The NASDAQ National Market. The Nominating Committee did not meet during the fiscal year ended March 31, 2004.

The Nominating Committee strives to select individuals as director nominees who have the highest personal and professional integrity, who have demonstrated exceptional ability and judgment and who will be the most effective, in conjunction with the other director nominees, in collectively serving the long-term interests of the stockholders. To this end, the Nominating Committee seeks director nominees with the highest professional and personal ethics and values, an understanding of the Company's business and industry, diversity of business experience and expertise, a high level of education and broad-based business acumen. The Nominating Committee also will consider any other factor which it deems relevant in selecting individuals as director nominees. The Nominating Committee does not use different standards to evaluate nominees depending on whether they are proposed by the Company's directors and management or by the Company stockholders.

The Company does not currently have a written policy with regard to stockholder recommendations. The absence of such a policy does not mean, however, that a stockholder recommendation would not be considered if received. Stockholders may recommend qualified candidates for the Board by writing Vision Sciences, Inc., Attn: Secretary, Nine Strathmore Road, Natick, Massachusetts 01760. All stockholder communications that are received will be submitted to the Nominating Committee for review and consideration. Nominations of directors by stockholders will be reviewed by the Nominating Committee, who will determine whether these nominations should be presented to the Board.

The Board has adopted the Company's Nominating Committee Charter. A copy of the Nominating Committee Charter is attached to this Proxy Statement as Appendix B.

The Board of Directors met two times during the fiscal year ended March 31, 2004. Each incumbent director attended at least 75% of the aggregate of the number of Board meetings and the number of meetings held by all committees on which he then served.

Stockholders may send communications to the Board or to specified individual directors at any time. Stockholders should direct their communication to the Board or to specified individual directors,

5

in care of the Secretary of the Company at the Company's principal offices, Nine Strathmore Road, Natick, Massachusetts 01760. Any stockholder communications that are addressed to the Board or specified individual directors will be delivered by the Secretary of the Company to the Board or such specified individual directors.

Director Compensation

The Company's outside directors (currently, Messrs. Anstey, Doyle and Wallace) receive an annual director's fee in the amount of $10,000 payable quarterly. Directors are reimbursed for certain Company-related travel expenses. In addition, members of the Audit Committee receive $500 for each Audit Committee meeting attended.

The 2003 Director Stock Option Plan (the "2003 Director Plan") provides for the grant of non-statutory stock options (collectively "Director Options") to directors of the Company who are not employees of the Company or any subsidiary of the Company (collectively "Outside Directors"). No discretionary options or other awards can be granted under the 2003 Director Plan; rather, Director Options to purchase 4,000 shares of Common Stock (subject to adjustment for stock splits, reverse stock splits, stock dividends, recapitalizations or other similar changes in capitalization) will be granted automatically (i) to each person who becomes an Outside Director after the date the Plan was approved by the stockholders of the Company and (ii) to each Outside Director on each date on which an annual meeting of the stockholders of the Company is held, provided that such Outside Director does not then hold any options under the 1993 Director Option Plan that have not vested as of such date. The exercise price per share of any Director Option will be the fair market value of one share of Common Stock on the date of grant. While the Company's stock is listed on a national securities exchange or other nationally recognized trading system such as the Nasdaq SmallCap Market, this will be the closing price per share of the Company's Common Stock on the trading day immediately preceding the date of grant. Each Director Option shall be fully vested and exercisable in full on the date of grant. Director Options are exercisable until the tenth anniversary of the date of grant.

Executive Compensation

The following table sets forth certain information concerning the compensation, for the fiscal years indicated, for each person who served as the Company's Chief Executive Officer and each of the Company's four most highly compensated executive officers during the fiscal year ended March 31, 2004 (the "Named Executive Officers").

6

Summary Compensation Table

| |

| | Annual Compensation(2)

| | Long-Term

Compensation

| |

|

|---|

Name and

Principal Position(1)

| | Year

| | Salary

| | Bonus

| | Securities

Underlying

Options

| | All Other Compensation(3)

|

|---|

Ron Hadani(4)

President and Chief Executive Officer | | 2004

2003

2002 | | $

$

| 194,731

25,289

— | | | —

—

— | | 1,200,000

400,000

— | | | —

—

— |

Isao Fujimoto

Vice President, Manufacturing and Engineering, Industrial Segment | | 2004

2003

2002 | | $

$

$ | 126,287

122,610

116,513 | | | —

—

— | | 15,000

30,000

— | | $

$

$ | 1,806

1,720

1,804 |

Mark S. Landman

Vice President Operations, Medical Segment | | 2004

2003

2002 | | $

$

$ | 128,544

123,600

119,717 | | | —

—

— | | 15,000

58,750

— | | $

$

$ | 1,821

1,768

1,503 |

Thomas M. Olmstead

Vice President, Sales and Marketing, Medical Segment | | 2004

2003

2002 | | $

$

$ | 120,462

130,000

57,692 | | $

| 31,500

—

— | (5)

| —

50,000

100,000 | | $

| 615

—

— |

James A. Tracy

Vice President, Finance; Treasurer; Chief Financial Officer and Controller | | 2004

2003

2002 | | $

$

$ | 129,792

124,800

119,714 | | | —

—

— | | 15,000

50,000

— | | $

$

$ | 1,866

1,790

1,552 |

Gerald B. Lichtenberger

Vice President Business Development(6) | | 2004

2003

2002 | | $

$

$ | 145,362

140,000

138,958 | | | —

—

— | | 15,000

—

— | | $

| 954

—

— |

- (1)

- The rules of the SEC require that this table, the stock option grant table and the stock option exercise table which follow, present information concerning the Company's Chief Executive Officer as of March 31, 2004, the Company's fiscal year-end, any other person who served as the Company's Chief Executive Officer at any time during the fiscal year ended March 31, 2004, up to four of the Company's other most highly compensated executive officers (determined by reference to total annual salary and bonus earned by such officers) whose total salary and bonus exceeded $100,000 for the fiscal year ended March 31, 2004, and up to two individuals who would have been one of the four most highly compensated executive officers but for the fact that such individuals no longer served as executive officers of the Company on March 31, 2004.

- (2)

- In accordance with the rules of the SEC, other compensation in the form of perquisites and other personal benefits has been omitted because such perquisites and other personal benefits constituted less than 10% of the total annual salary and bonus for each Named Executive Officer.

- (3)

- Consists of Company contributions to the Company's 401(k) Plan.

- (4)

- Mr. Hadani began serving as President and Chief Executive Officer of the Company on February 1, 2003.

- (5)

- Mr. Olmstead received $15,000 in bonus during the year ended March 31, 2004, and received $16,500 in bonus in April 2004.

- (6)

- Dr. Lichtenberger resigned from his position as director of the Company effective December 30, 2003.

7

Option Grants on Last Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| | Potential Realizable Value at

Assumed Annual Rates of Stock

Price Appreciation for

Option Term(1)

|

|---|

| | Securities

Underlying

Options

Granted

(#)(2)

| | Percent of

Total Options

Granted To

Employees in

Fiscal Year

| |

| |

|

|---|

| | Exercise or Base

Price ($/Share)

| | Expiration Date

|

|---|

Name

| | 5%($)

| | 10%($)

|

|---|

| Ron Hadani | | 1,200,000 | | 88 | | $ | 1.04 | | 6/6/2013 | | $ | 784,860 | | $ | 1,988,991 |

| Isao Fujimoto | | 15,000 | | 1 | | $ | 1.04 | | 6/6/2013 | | $ | 9,811 | | $ | 24,862 |

| Mark S. Landman | | 15,000 | | 1 | | $ | 1.04 | | 6/6/2013 | | $ | 9,811 | | $ | 24,862 |

| Thomas Olmstead | | — | | — | | | — | | — | | | — | | | — |

| James A. Tracy | | 15,000 | | 1 | | $ | 1.04 | | 6/6/2013 | | $ | 9,811 | | $ | 24,862 |

| Gerald B. Lichtenberger(3) | | 15,000 | | 1 | | $ | 1.04 | | 6/6/2013 | | $ | 9,811 | | $ | 24,862 |

- (1)

- Amounts represent hypothetical gains that could be achieved for the respective options if exercised at the end of the option term. These gains are based on assumed rates of stock appreciation of 5% and 10% compounded annually from the date the respective options were granted to their expiration date. Actual gains, if any, on stock option exercises will depend on the future performance of the Common Stock and the date on which the options are exercised.

- (2)

- Except for the options granted to Mr. Hadani, these options vest over a four year period as follows: 25% on each of December 31 2003, 2004, 2005 and 2006. Mr. Hadani's option vests with respect to 20% on each December 31, 2003, 2004, 2005, 2006 and 2007.

- (3)

- Dr. Lichtenberger resigned from his position as director of the Company effective December 30, 2003.

The following table sets forth certain information concerning stock options held as of March 31, 2004 by each of the Named Executive Officers. Mr. Landman, Mr. Olmstead and Mr. Tracy exercised options in the fiscal year ended March 31, 2004.

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

| | Number of Shares of

Common Stock Underlying

Unexercised Options at

Fiscal Year-End

| | Value of Unexercised In-the-Money

Options at Fiscal Year End(1)

|

|---|

Name

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Ron Hadani | | 440,000 | | 1,160,000 | | $ | 1,164,000 | | $ | 3,072,000 |

| Isao Fujimoto | | 176,250 | | 33,750 | | $ | 434,515 | | $ | 92,813 |

| Mark S. Landman | | 167,625 | | 48,125 | | $ | 421,155 | | $ | 134,500 |

| Thomas M. Olmstead | | 40,000 | | 87,500 | | $ | 105,600 | | $ | 237,000 |

| James A. Tracy | | 146,250 | | 48,750 | | $ | 356,588 | | $ | 134,813 |

| Gerald B. Lichtenberger(2) | | 153,750 | | 11,250 | | $ | 391,538 | | $ | 29,813 |

- (1)

- Based on the fair market value of the Common Stock on March 31, 2004 ($3.69 per share), less the option exercise price.

- (2)

- Dr. Lichtenberger resigned from his position as director of the Company effective December 30, 2003.

8

Agreements with Named Executive Officers

The Company and Mr. Hadani entered a letter agreement on January 24, 2003 with respect to the terms of Mr. Hadani's employment as Chief Executive Officer of the Company. Under the agreement, Mr. Hadani's annual base salary was initially set at $190,000, subject to annual review. In addition, the Company agreed to grant to Mr. Hadani an option to purchase 400,000 shares of the Company's Common Stock at an exercise price equal to the closing price of the Common Stock on the date of grant. The option was 25% vested on grant with the balance to vest in three equal installments over a three-year period.

Under the terms of a letter agreement dated September 20, 2001 between the Company and Mr. Olmstead, the Company's Vice President of Sales and Marketing, Mr. Olmstead's annual base salary was initially set at $120,000. In addition, the Company agreed to grant Mr. Olmstead an option to purchase 100,000 shares of the Company's Common Stock at an exercise price equal to the closing price of the Common Stock on October 1, 2001. This option was vested as to 25% of the underlying shares on October 1, 2002 and vests as to an additional 25% annually over the following three-year period.

Under the terms of a letter agreement dated July 18, 1997 between the Company and Mr. Tracy, the Company's Vice President of Finance and Chief Financial Officer, Mr. Tracy was granted an option to purchase 50,000 shares of the Company's Common Stock at an exercise price equal to the closing price of the Common Stock on the date of the letter agreement. This option has since vested in full in accordance with its terms. The letter agreement also provides that, in the event of a termination other than for cause, Mr. Tracy will receive a lump sum severance payment equal to three months' salary and continue to receive all benefits for a period of three months following termination.

Mr. Lichtenberger resigned his positions as Vice President Business Development and member of the Board of Directors of the Company, effective December 30, 2003. As part of his resignation, Dr. Lichtenberger received thirteen weeks salary. In addition, from December 30, 2003 through March 31, 2005, Dr. Lichtenberger entered into a consulting arrangement with the Company. As part of that arrangement, the Company agreed to pay Dr. Lichtenberger $25,000.

Certain Relationships and Related Transactions

On April 5, 2002, the non-interested members of the Board of Directors authorized the Company to enter into an agreement with Messrs. Oneda and Pell, who are officers and directors of the Company, whereby the Company would have an option to assume convertible capital notes (the "Notes") held by Messrs. Oneda and Pell in the aggregate principal amounts of $976,397 and $992,090, respectively. The Notes were convertible into capital stock of 3DV Systems, Ltd., an Israeli corporation. In January 2004, Messrs. Oneda and Pell sold their Notes, and the Company sold its shares, to certain other shareholders of 3DV in exchange for an option to purchase shares in a successor corporation to 3DV.

In the fiscal year ended March 31, 2004, the Company purchased approximately $1,476,748 of flexible endoscope components from a subsidiary of Pentax Corporation (f/k/a Asahi Optical Co., Ltd.) ("Pentax"), pursuant to a March 16, 1992 supply agreement between the Company and Pentax. Pentax is the record and beneficial holder of 6.5% of the Company's outstanding Common Stock.

On March 31, 2003, the Company sold 1,192,784 shares of restricted Common Stock to each of Messrs. Oneda and Pell. In April 2003 the Company sold an additional 524,098 shares of Common Stock to unaffiliated accredited investors. All of these shares were sold at a price per share of $.6707, which represented 67% of the average closing price of the Common Stock over the five trading days ended March 21, 2003, the day on which the Board of Directors of the Company unanimously approved the transaction.

9

The Company believes that the terms of the foregoing transactions were at least as favorable to the Company as could have been obtained from unaffiliated third parties.

The Company has a policy that transactions, if any, between the Company and its officers, directors or other affiliates must (a) be on terms no less favorable to the Company than could be obtained from unaffiliated third parties, (b) be approved by a majority of the members of the Board of Directors and (c) be approved by a majority of the disinterested members of the Board of Directors.

Compensation Committee Report on Executive Compensation

The Company's executive compensation program is administered by the Compensation Committee, which is currently comprised of Kenneth W. Anstey and William F. Doyle. The Compensation Committee is responsible for determining the compensation package of each executive officer and recommending it to the Board of Directors and for awarding stock options under the Company's 2000 Incentive Plan. In the fiscal year ended March 31, 2004, the Board of Directors did not modify or reject in any material way any action or recommendation of the Compensation Committee. In making decisions regarding executive compensation, the Compensation Committee considers the input of the Company's other directors, including the input of the Chief Executive Officer of the Company, with respect to the compensation of the Company's other executive officers.

The Company's executive compensation program is structured and administered to achieve three broad goals in a manner consistent with stockholder interests. First, the Compensation Committee structures executive compensation programs and decisions regarding individual compensation in a manner that the Compensation Committee believes will enable the Company to attract and retain key executives. Second, the Compensation Committee establishes compensation programs that are designed to reward executives for the achievement of specified business objectives of the Company, which are often targeted to the individual executive's particular business unit. Finally, the Compensation Committee designs the Company's executive compensation programs to provide executives with long-term ownership opportunities in the Company in an attempt to align executive and stockholder interests.

The Company has not to date generated significant revenues from the sales of its new products that incorporate its disposable EndoSheath technology. Accordingly, in evaluating both individual and corporate performance for purposes of determining salary levels and stock option grants, the Compensation Committee currently places significant emphasis on the progress and success of the Company with respect to matters such as product development, including product design and manufacturing, and enhancement of the Company's patent and licensing position as well as on the Company's overall financial performance and sales by product line.

The compensation programs for the Company's executives established by the Compensation Committee consist of two elements based upon the foregoing objectives: (i) base salary, bonus and benefits competitive with the marketplace; and (ii) stock-based equity incentives in the form of participation in the 2000 Incentive Plan. The Compensation Committee believes that providing base salaries and benefits to its executive officers that are competitive with the marketplace enables the Company to attract and retain key executives. The Compensation Committee generally provides executive officers discretionary stock option awards to reward them for achieving specified business objectives and to provide them with long-term ownership opportunities. In evaluating the salary level and equity incentives to award to each current executive officer, the Compensation Committee examines the progress that the Company has made in areas under the particular executive officer's

10

supervision, such as manufacturing or sales, and the overall performance of the Company. The Compensation Committee does not establish specific goals or milestones that automatically trigger additional compensation for the executive officers but rather decides on each executive officer's compensation after taking into account actions by such officer to accomplish established Company goals.

In determining the salary of each executive officer, including the Named Executive Officers, the Compensation Committee and the Board of Directors consider numerous factors such as (i) the individual's performance, including the expected contribution of the executive officer to the Company's goals, (ii) the Company's long-term needs and goals, including attracting and retaining key management personnel and (iii) the Company's competitive position, including data on the payment of executive officers at comparable companies that are familiar to members of the Compensation Committee. The companies described under the caption "Comparative Stock Performance" below constitute a much broader group of companies at various stages of development than those considered by the Compensation Committee to compare compensation levels of the Company's executive officers. Rather, the companies used by the Compensation Committee to compare executive compensation are companies of which the members of the Compensation Committee have specific knowledge and are considered as of the time those companies were at similar stages of development as the Company. To the extent determined to be appropriate, the Compensation Committee also considers general economic conditions and the historic compensation levels of the individual. The Compensation Committee believes that the salary levels of the Company's executive officers are in the middle third when compared to the compensation levels of companies at similar stages of development as the Company.

The compensation philosophy applied by the Committee in establishing the compensation for the Company's Chief Executive Officer is the same as for the other senior management of the Company—to provide a competitive compensation opportunity that rewards performance.

Mr. Hadani has served as Chief Executive Officer since February 2003. In Fiscal 2004, the Compensation Committee approved a salary of $250,000 for Mr. Hadani, an annual car allowance of $9,000 and an incentive stock option to purchase 1,200,000 shares of Company Common Stock. The Compensation Committee believes Mr. Hadani's salary to be in the middle third when compared to compensation levels of chief executive officers of companies at a similar stage of development as the Company. The Compensation Committee intends to review Mr. Hadani's compensation during the current fiscal year.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a federal income tax deduction to a public company for certain compensation in excess of $1,000,000 paid to the company's Chief Executive Officer and four other most highly compensated executive officers. Qualifying performance-based compensation will not be subject to the deduction limit if certain requirements are met. Although the Company has not paid any of its executive officers annual compensation over $1,000,000 and has no current plan to do so, it currently intends to structure all future performance-based compensation of its executive officers in a manner that complies with this statute.

11

Compensation Committee Interlocks and Insider Participation

Messrs. Anstey and Doyle served as members of the Compensation Committee during the fiscal year ended March 31, 2004. No member of the Compensation Committee was at any time during the fiscal year ended March 31, 2004, an officer or employee of the Company nor has any member of the Compensation Committee had any relationship with the Company requiring disclosure under Item 404 of Regulation S-K under the Securities Exchange Act of 1934.

None of the Company's executive officers has served as a director or member of the Compensation Committee (or other committee serving an equivalent function) of any other entity, one of whose executive officers served as a director of or member of the Compensation Committee.

Report of the Audit Committee of the Board of Directors

The Audit Committee of the Company's Board of Directors is composed of three members and acts under a written charter first adopted and approved in March 2000. The members of the Audit Committee are independent directors, as defined by its charter and the rules of the Nasdaq Stock Market. The current members of the Audit Committee are Kenneth W. Anstey, William F. Doyle and John J. Wallace. The Company's Board of Directors has determined that Mr. Wallace is an "audit committee financial expert" and independent within the meaning of the rules of the Securities and Exchange Commission.

The Audit Committee reviewed the Company's audited financial statements for the fiscal year ended March 31, 2004 and discussed these financial statements with the Company's management. Management is responsible for the Company's internal controls and the financial reporting process. The Company's independent accountants are responsible for performing an independent audit of the Company's financial statements in accordance with generally accepted accounting principles and to issue a report on those financial statements. As appropriate, the Audit Committee reviews and evaluates, and discusses with the Company's management, internal accounting and financial personnel and the independent auditors, the following:

- •

- the plan for, and the independent auditors' report on, each audit of the Company's financial statements;

- •

- the Company's financial disclosure documents, including all financial statements and reports filed with the Securities and Exchange Commission or sent to shareholders;

- •

- changes in the Company's accounting practices, principles, controls or methodologies;

- •

- significant developments or changes in accounting rules applicable to the Company; and

- •

- the adequacy of the Company's internal controls and financial personnel.

Management represented to the Audit Committee that the Company's financial statements had been prepared in accordance with generally accepted accounting principles.

The Audit Committee also reviewed and discussed the audited financial statements and the matters required by Statement on Auditing Standards ("SAS") 61,Communications with Audit Committees with BDO Seidman LLP, the Company's independent auditors. SAS 61 requires the Company's independent auditors to discuss with the Company's Audit Committee, among other things, the following:

- •

- methods to account for significant or unusual transactions;

- •

- the effect of significant accounting policies in controversial or emerging areas for which there is a lack of authoritative guidance or consensus;

12

- •

- the process used by management in formulating particularly sensitive accounting estimates and the basis for the auditors' conclusions regarding the reasonableness of those estimates; and

- •

- disagreements with management over the application of accounting principles, the basis for management's accounting estimates and the disclosures in the financial statements.

The Company's independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees. Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditor's professional opinion may reasonably be thought to bear on independence, confirm their perceived independence and engage in a discussion of independence. The Audit Committee discussed with the independent auditors the matters disclosed in this letter and their independence from the Company. The Audit Committee also considered whether the independent auditors' provision of the other, non-audit related services to the Company that are referred to in "Independent Auditors Fees and Other Matters" is compatible with maintaining such auditors' independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company's Board of Directors that the audited financial statements be included in the Company's Annual Report on Form 10-K for the year ended March 31, 2004.

13

Fees and Services

The table below summarizes the audit fees paid by the Company and its consolidated subsidiaries during each of the Company's two most recent fiscal years.

| | Year Ended March 31, 2003

| | Year Ended March 31, 2004

| |

|---|

| | Amount

| | Percentage

| | Amount

| | Percentage

| |

|---|

| | (in thousands, except percentage)

| |

|---|

| Audit Fees | | $ | 55,000 | | 79 | % | $ | 57,300 | | 76 | % |

| Audit-Related Fees(1) | | | 0 | | 0 | | | 2,500 | | 3 | |

| Tax Fees(2) | | | 15,000 | | 21 | | | 15,500 | | 21 | |

| All Other Fees | | | 0 | | 0 | | | 0 | | 0 | |

| | |

| |

| |

| |

| |

| Total | | $ | 70,000 | | 100 | % | $ | 75,300 | | 100 | % |

| | |

| |

| |

| |

| |

- (1)

- "Audit-related fees" are fees related to due diligence investigations and to other assignments relating to internal accounting functions and procedures.

- (2)

- "Tax fees" are fees for professional services rendered by the Company's auditors for tax compliance, tax advice on actual or contemplated transactions, tax consulting associated with international transfer prices and employee tax services.

The Audit Committee of the Company's board of directors chooses and engages the Company's independent auditors to audit the Company's financial statements. In April 2004, the Company's Audit Committee adopted a policy requiring management to obtain the audit committee's approval before engaging the Company's independent auditors to provide any audit or permitted non-audit services to the Company or its subsidiaries. This policy, which is designed to assure that such engagements do not impair the independence or the Company's auditors, requires the Audit Committee to pre-approve annually various audit and non-audit services that may be performed by the Company's auditors. In addition, the Audit Committee limited the aggregate amount of fees the Company's auditors may receive during 2004 for non-audit services in certain categories.

The Company's Chief Financial Officer reviews all management requests to engage the Company's auditors to provide services and approves the request if the requested services are of the type pre-approved by the Audit Committee. The Company informs the Audit Committee of these approvals at least quarterly. Services of the type not pre-approved by the Audit Committee require pre-approval by the Audit Committee on a case-by-case basis. The Audit Committee is not permitted to approve the engagement of the Company's auditors for any services that fall into a category of services that is not permitted by applicable law or if the services would be inconsistent with maintaining the auditor's independence.

Code of Ethics

In 2004, the Board adopted a Code of Ethics that is intended to serve as a set of guiding principles to promote integrity and compliance with the law in the conduct of the Company's business. The Code of Ethics applies to all directors, officers and employees, including the Company's Chief Executive Officer and Chief Financial Officer. The code of ethics may be obtained free of charge by writing Vision Sciences, Inc., Attn: Chief Financial Officer, Nine Strathmore Road, Natick, Massachusetts 01760.

14

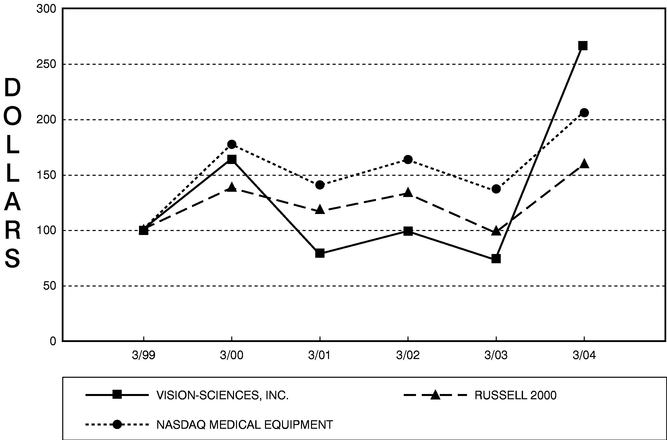

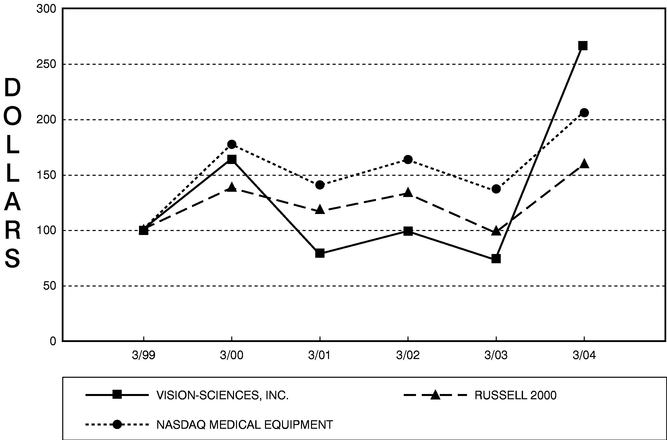

COMPARATIVE STOCK PERFORMANCE

The following graph compares the cumulative total stockholder return on the Common Stock of the Company between March 31, 1999 and March 31, 2004 (the end of fiscal 2004) with the cumulative total return of (i) the Russell 2000 Index and (ii) the Nasdaq Medical Equipment Index. This graph assumes the investment of $100 on March 31, 1998 in the Company's Common Stock, the Russell 2000 Index and the Nasdaq Medical Equipment Index Index, and assumes dividends are reinvested.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Vision-Sciences, Inc., the Russell 2000 Index

and the Nasdaq Medical Equipment Index

| | Cumulative Total Return

|

|---|

| | 3/99

| | 3/00

| | 3/01

| | 3/02

| | 3/03

| | 3/04

|

|---|

| Vision-Sciences, Inc. | | $ | 100.00 | | $ | 163.64 | | $ | 77.31 | | $ | 98.18 | | $ | 72.00 | | $ | 268.36 |

| Russell 2000 | | | 100.00 | | | 137.29 | | | 116.25 | | | 132.51 | | | 96.78 | | | 158.55 |

| Nasdaq Medical Equipment | | | 100.00 | | | 177.25 | | | 139.71 | | | 163.09 | | | 134.64 | | | 205.95 |

15

PROPOSAL 2: RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee has selected the firm of BDO Seidman LLP ("BDO Seidman") as the Company's independent auditors for the current fiscal year. BDO Seidman has served as the Company's independent auditors beginning in the fiscal year ended March 31, 2003. Although stockholder approval of the Board of Directors' selection of BDO Seidman is not required by law, the Board of Directors believes that it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Board of Directors may reconsider its selection.

Representatives of BDO Seidman are expected to be present at the Annual Meeting, will have the opportunity to make a statement if they desire to do so and will also be available to respond to appropriate questions from stockholders.

Change in Accountants

Upon the recommendation of the Audit Committee, on July 1, 2002, the Board of Directors of the Company decided to change the principal accountants for the Company from Arthur Andersen LLP ("Arthur Andersen") to BDO Seidman. The Company subsequently engaged BDO Seidman on July 30, 2002.

During the Company's fiscal year ended March 31, 2002 and the subsequent interim period preceding the decision to change principal accountants, there were no disagreements with Arthur Andersen on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which, if not resolved to the satisfaction of Arthur Andersen, would have caused it to make reference to the subject matter of the disagreement in connection with its report. Arthur Andersen's reports on the Company's financial statements for the two years preceding their dismissal did not contain an adverse opinion or a disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope or accounting principles. During the Company's fiscal year ended March 31, 2002 and the subsequent interim period preceding the decision to change principal accountants, there were no reportable events as defined in Regulation S-K Item 304(a)(1)(v).

During the Company's fiscal year ended March 31, 2002 and the subsequent interim period prior to engaging BDO Seidman, neither the Company nor anyone on its behalf consulted with BDO Seidman regarding the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided to the Company by BDO Seidman that was an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue.

Section 16(a) Beneficial Ownership Reporting Compliance

Based solely on its review of copies of reports filed by persons required to file such reports pursuant to Section 16(a) of the Securities Exchange Act of 1934, as amended ("Reporting Persons"), the Company believes that all filings required to be made by Reporting Persons of the Company were timely made in accordance with the requirements of the Exchange Act.

OTHER MATTERS

The Board of Directors does not know of any other matters that may come before the Annual Meeting. However, if any other matters are properly presented to the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote, or otherwise act, in accordance with their judgment on such matters.

16

Solicitation of Proxies

This solicitation of proxies is made on behalf of the Company and the Company will bear all costs of solicitation. In addition to solicitations by mail, the Company's directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and personal interviews, and the Company reserves the right to retain outside agencies for the purpose of soliciting proxies. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and the Company will reimburse them for their out-of-pocket expenses in this connection.

Householding of Annual Proxy Materials

Some banks, brokers and other nominee record holders may be participating in the practice of "householding" proxy statements and annual reports. This means that only one copy of the Company's proxy statement or annual report may have been sent to multiple stockholders in your household. The Company will promptly deliver a separate copy of either document to you if you call or write the Company at the following address or phone number: Vision-Sciences, Inc., Nine Strathmore Road, Natick, Massachusetts 01760, Telephone: (508) 650-9971, Attention: James A. Tracy. If you want to receive separate copies of the annual report and proxy statement in the future, or if you are receiving multiple copies and would like to receive only one copy for your household, you should contact your bank, broker or other nominee record holder, or you may contact the Company at the above address and phone number.

Stockholder Proposals

Proposals of stockholders intended to be presented at the 2005 Annual Meeting of Stockholders must be received by the Company at its principal office in Natick, Massachusetts not later than March 21, 2005 for inclusion in the proxy statement for that meeting.

If a stockholder of the Company wishes to present a proposal before the 2005 Annual Meeting of Stockholders, but does not wish to have the proposal considered for inclusion in the Company's proxy statement and proxy card, such stockholder must give written notice to the Company at its principal office in Natick, Massachusetts not later than May 23, 2005. If the stockholder fails to provide timely notice of a proposal to be presented at the 2005 Annual Meeting, the proxies designated by the Board of Directors of the Company will have discretionary authority to vote on any such proposal.

| By Order of the Board of Directors, | | |

|

|

|

Katsumi Oneda, Chairman |

|

|

July 1, 2004

THE BOARD OF DIRECTORS HOPES THAT STOCKHOLDERS WILL ATTEND THE MEETING. WHETHER OR NOT YOU PLAN TO ATTEND, YOU ARE URGED TO COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE. PROMPT RESPONSE WILL GREATLY FACILITATE ARRANGEMENTS FOR THE MEETING AND YOUR COOPERATION WILL BE APPRECIATED. STOCKHOLDERS WHO ATTEND THE MEETING MAY VOTE THEIR STOCK PERSONALLY EVEN THOUGH THEY HAVE SENT IN THEIR PROXIES.

17

APPENDIX A

VISION—SCIENCES, INC.

AUDIT COMMITTEE CHARTER

| I. | | Purpose |

|

|

The primary function of the Audit Committee is to assist the board of directors in monitoring (1) the quality and integrity of the financial statements of the Company, (2) the Company's compliance with legal and regulatory requirements, (3) the independent auditor's qualifications and independence, and (4) the performance of the Company's internal audit function (if any) and independent auditors. |

|

|

The Audit Committee shall prepare the report required by the rules of the Securities and Exchange Commission (the "SEC") to be included in the Company's proxy statement for its annual meeting of stockholders. |

II. |

|

Membership |

|

|

A. |

|

The Audit Committee shall consist of at least three members of the board of directors. Each member of the Audit Committee shall satisfy the independence and experience requirements of The Nasdaq Stock Market, Section 10A(m)(3) of the Securities Exchange Act of 1934 (as amended, the "Exchange Act") and all rules and regulations promulgated by the SEC. |

|

|

|

|

Each member of the Audit Committee must be able to read and understand fundamental financial statements, including the Company's balance sheet, income statement, and cash flow statement, or become able to do so within a reasonable period of time after his or her appointment to the Audit Committee. In addition, at least one member of the Audit Committee shall have past employment experience in finance or accounting, professional certification in accounting, or other comparable experience or background which results in the member having financial sophistication (such as being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities), all as determined by the board of directors in its business judgment, and at least one member of the Audit Committee (who may be the same person) shall be a "financial expert" (as defined by the SEC). |

|

|

|

|

Under exceptional and limited circumstances, one director who has a relationship making him or her not independent, and who is not a Company officer or employee or an immediate family member of a Company officer or employee, may serve on the Audit Committee if the board of directors determines that the director's membership on the Audit Committee is required by the best interests of the Company and its shareholders, and discloses in the next annual proxy statement after such determination the nature of the relationship that makes such individual not independent and the reasons for the determination. |

|

|

B. |

|

Chairman. Unless a Chairman is elected by the board of directors, the Audit Committee shall elect a Chairman by majority vote. |

III. |

|

Committee Rules of Procedure |

|

|

The Audit Committee shall meet as often as it determines, but not less frequently than quarterly. Special meetings may be convened as the Audit Committee deems necessary or appropriate. |

| | | | | | | |

|

|

A majority of the members of the Audit Committee shall constitute a quorum to transact business. Members of the Audit Committee may participate in a meeting of the Committee by means of telephone conference call or similar communications equipment by means of which all persons participating in the meeting can hear each other. Except in extraordinary circumstances as determined by the Chairperson of the Audit Committee, notice shall be delivered to all Committee members at least 24 hours in advance of the scheduled meeting. Minutes of each meeting will be kept and distributed to the entire board of directors. |

|

|

The affirmative vote of a majority of the members of the Audit Committee present at the time of such vote will be required to approve any action of the Committee. Subject to the requirements of any applicable law, regulation or Nasdaq Stock Market rule, any action required or permitted to be taken at a meeting of the Audit Committee may be taken without a meeting if a consent in writing, setting forth the action so taken, is signed by all of the members of the Committee. Such written consent shall have the same force as a unanimous vote of the Audit Committee. |

IV. |

|

Responsibilities and Authority of the Audit Committee |

|

|

The Audit Committee shall be directly responsible for the appointment, compensation, oversight, termination and replacement of the Company's independent auditor (subject, if applicable, to stockholder ratification), and shall have the sole authority to approve all audit engagement fees and terms and all non-audit engagements with the independent auditors. |

|

|

The Audit Committee shall approve all audit and non-audit engagements of the Company's independent auditors in advance. The Audit Committee may delegate to one or more of its members who are independent directors on the board of directors the authority to approve the performance of audit and non-audit services by the Company's independent auditors (a "Sub-Committee"). Any decision by a Sub-Committee shall be presented to the full Audit Committee at its next scheduled meeting. Neither the Audit Committee nor any Sub-Committee shall approve any engagements of the Company's outside auditors with respect to those services set forth in Section 10A(g)(1) through (9) of the Exchange Act. In the event the Audit Committee or any Sub-Committee approves any non-audit services by the Company's independent auditors, such approval shall be disclosed in periodic reports required by Section 13(a) of the Exchange Act. The pre-approval requirement is not applicable with respect to the provision of non-audit services by the Company's outside auditors where (i) such services were not recognized by the Company at the time of the engagement to be non-audit services, (ii) the aggregate amount of all such non-audit services provided to the Company constitutes not more than 5% of the total amount paid by the Company to the Company's independent auditors during the fiscal year in which the non-audit services are provided and (iii) such services are promptly brought to the attention of the Audit Committee and approved prior to the completion of the audit by the Committee or a Sub-Committee. |

|

|

The Audit Committee shall have the authority, to the extent it deems necessary or appropriate to carry out its responsibilities, to retain at the expense of the Company special legal, accounting or other consultants to advise the Committee. The Audit Committee shall have the sole authority to approve all fees and terms of engagement of such advisors. |

|

|

The Audit Committee may designate any member of the Committee to execute documents on its behalf as it deems necessary or appropriate to carry out its responsibilities hereunder. Except as provided above with regard to the independent auditor, the Audit Committee may form and delegate authority to subcommittees to the extent the Committee deems necessary or appropriate. |

| | | | | | | |

A-2

|

|

The Audit Committee may request any officer or employee of the Company or the Company's outside counsel or independent auditor to attend a meeting of the Committee or to meet with any member of, or consultants to, the Committee. The Audit Committee shall meet with management, the internal auditors (or other personnel responsible for the internal audit function), if any, and the independent auditor in separate executive sessions as often as the Committee determines. The Audit Committee may also, to the extent the Committee deems necessary or appropriate, meet with the Company's investment bankers or any financial analysts who follow the Company. |

|

|

The Audit Committee shall make regular reports to the board of directors and shall review with the board of directors any issues that arise with respect to (i) the quality or integrity of the Company's financial statements, (ii) the Company's compliance with legal or regulatory requirements that may have a material impact on the Company's financial statements, (iii) the performance and independence of the Company's independent auditors or (iv) the performance of the internal audit function, if any. In addition, the Audit Committee annually shall review its own performance. |

|

|

The Audit Committee shall review and reassess the adequacy of this Charter annually and recommend any proposed change to the board of directors for its approval. This Charter is in all respects subject and subordinate to the Company's Certificate of Incorporation and by-laws and the applicable provisions of the General Corporation Law of the State of Delaware. |

|

|

In addition to the foregoing, the Audit Committee, to the extent it deems necessary or appropriate, shall: |

|

|

A. |

|

Review and discuss with management and the independent auditor the Company's annual audited financial statements, including the disclosures made under "Management's Discussion and Analysis of Financial Condition and Results of Operation," and determine whether to recommend to the board of directors that the audited financial statements should be included in the Company's Annual Report on Form 10-K. |

|

|

B. |

|

Review and discuss with management and the independent auditor the Company's quarterly financial statements, including the results of the independent auditor's review of the quarterly financial statements. |

|

|

C. |

|

Discuss with management and the independent auditor, and resolve any disagreements between management and the independent auditor with respect to, significant financial reporting issues and judgments made in connection with the preparation of the Company's financial statements. |

|

|

D. |

|

Review and discuss with management and the independent auditor any report of the independent auditor regarding (a) all critical accounting policies and practices to be used by management, (b) alternative treatments of financial information within generally accepted accounting principles ("GAAP") that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor, or (c) any other material written communications between the independent auditor and management, including any management letter or schedule of unadjusted differences. |

| | | | | | | |

A-3

|

|

E. |

|

Review and discuss with management and the independent auditor (a) major issues regarding accounting principles and financial statement presentations, including any significant changes in the Company's selection of application of accounting principles, and major issues as to the adequacy of the Company's internal controls and any special audit steps adopted in light of material control deficiencies, (b) analyses prepared by management and/or the independent auditor setting forth significant financial reporting issues and judgments made in connection with the preparation of the Company's financial statements, including analyses of the effect of alternative GAAP methods on the financial statements, (c) the types of information to be disclosed and the types of presentation to be made relating to earnings press releases, as well as other financial information and earnings guidance provided to analysts and rating agencies, and (d) the effect of regulatory and accounting initiatives, as well as off-balance sheet structures, on the Company's financial statements. |

|

|

F. |

|

Discuss with management the Company's major financial risk exposures and the steps management has taken to monitor and control such exposures, including the guidelines and policies to govern the process by which risk assessment and risk management are undertaken. |

|

|

G. |

|

Review legal and regulatory matters that may have a material impact on the Company's financial statements, and all related compliance policies and programs. Discuss with management and the independent auditor any correspondence with regulators or governmental agencies and any employee complaints or published reports which raise material issues regarding the Company's financial statements or accounting policies. Discuss with the Company's counsel any legal matters that may have a material impact on the Company's financial statements. Assist the board of directors and any applicable committee thereof in monitoring the compliance by the Company with other legal and regulatory requirements. |

|

|

H. |

|

Discuss with the independent auditor the matters required to be discussed by Statement on Auditing Standards No. 61 relating to the conduct of the audit. In particular, discuss: |

|

|

|

|

1. |

|

the adoption of, or changes to, the Company's significant auditing and accounting principles and practices as suggest by the independent auditor, internal auditors, if any, or management; |

|

|

|

|

2. |

|

the management letter (or comments, if no letter is written) provided by the independent auditor and the Company's response to that letter; and |

|

|

|

|

3. |

|

any audit problems or difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or on access to requested information. |

|

|

I. |

|

Review the annual internal control report (if any) prepared or issued by the Company's management, and the independent auditor's attestation of such report, and report to the board of directors any concerns about management's internal control report, or its inclusion in the Company's Annual Report on Form 10-K. |

|

|

J. |

|

Review and evaluate the experience and qualifications of the lead partner of the independent auditor team. |

| | | | | | | |

A-4

|

|

K. |

|

Obtain and review a report from the independent auditor at least annually regarding (a) the firm's internal quality-control procedures, (b) any material issues raised by the most recent quality-control review, or peer review, of the firm, or by any inquiry or investigation by governmental or professional authorities within the preceding five years, respecting one or more independent audits carried out by the firm, (c) all relationships between the independent auditor and its related entities and the Company and its related entities, and (c) any steps taken to deal with any such issues. The Audit Committee shall require the independent auditor to confirm that the report in all respects satisfies the requirements of Independence Standards Board Standard No. 1, discuss the report with the independent auditor, and evaluate the qualifications, performance and independence of the independent auditor, including considering whether the auditor's quality controls are adequate and the provision of non-audit services is compatible with maintaining the auditor's independence, and taking into account the opinions of management and the internal auditor, if any. The Audit Committee shall present its conclusions to the board of directors and if so determined by the Audit Committee, recommend that the board of directors take additional action to satisfy itself of the qualifications, performance and independence of the auditor. |

|

|

L. |

|

Consider when, in order to comply with Section 10A(j) of the Exchange Act and to assure continuing auditor independence, to rotate the lead audit partner, the audit partner responsible for reviewing the audit or the independent auditing firm itself. |

|

|

M. |

|

Establish policies for the Company's hiring of employees or former employees of the independent auditor who were engaged on the Company's account. Review the experience and qualifications of the senior management of the Company to ensure that none of them has a relationship with the independent auditor that would compromise the auditor's independence or otherwise cause the Company or the independent auditor to be in violation of Section 10A(l) of the Exchange Act. |

|

|

N. |

|

Obtain assurance from the independent auditor that each audit of the Company's financial statements has complied with the requirements of Section 10A of the Exchange Act. |

|

|

O. |

|

Discuss with the national office of the independent auditor issues on which they were consulted by the Company's audit team and matters of audit quality and consistency. |

|

|

P. |

|

Discuss with the independent auditor the planning and staffing of the audit. |

|

|

Q. |

|

If the Company determines to maintain an internal audit function, review the appointment and replacement of the senior internal auditing executive or selection and retention of the person or entity (other than the Company's independent auditor) to which the internal auditing function is out-sourced. |

|

|

R. |

|

If the Company determines to maintain an internal audit function, review the significant reports to management prepared by the internal auditing department and management's responses. |

|

|

S. |

|

If the Company determines to maintain an internal audit function, discuss with the independent auditor the Company's internal audit department (or contracted internal auditor) responsibilities, budget and staffing and any recommended changes in the planned scope of any internal audit. |

|

|

T. |

|

Establish and review periodically procedures for (a) the receipt, retention and treatment of complaints received by the Company regarding accounting, internal accounting controls or auditing matters and (b) the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters. |

|

|

U. |

|

Approve the Company's transactions with directors, executive officers, major stockholders and firms that employ directors, as well as any other material related party transactions, that are identified by the Company in a periodic review of such transactions. |

| | | | | | | |

A-5

|

|

In addition to the activities described above, the Audit Committee will perform such other functions as are necessary or appropriate in its opinion under applicable law, the Company's Certificate of Incorporation and by-laws, and the resolutions and other directives of the board of directors. This Charter may be amended from time to time by the Board. |

V. |

|

Limitation of Audit Committee Role |

|

|

While the Audit Committee has the responsibilities and powers set forth in this Charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company's financial statements and disclosures are complete and accurate, fairly present the information shown or are in accordance with GAAP and applicable rules and regulations. These are the responsibilities of management and the independent auditor. Nor is it the duty of the Audit Committee to conduct investigations or to assure compliance with any law, regulation or Nasdaq Stock Market rule, or the Company's Code of Ethics for the Chief Executive Officer and Senior Financial Officers and other similar policies. |

A-6

APPENDIX B

VISION-SCIENCES, INC.

NOMINATING COMMITTEE CHARTER

| I. | | Purpose |

|

|

The Nominating Committee is appointed by the Company's Board of Directors (the "Board") (1) to assist the Board by identifying individuals qualified to become Board members, and to recommend for selection by the Board the Director nominees to stand for election at the next annual meeting of the Company's shareholders; and (2) to recommend to the Board Director nominees for each committee of the Board (other than this Committee). |

II. |

|

Membership |

|

|

The Nominating Committee shall consist of no fewer than three members. Each member of the Nominating Committee shall be a member of the Board and shall meet the independence requirements of The Nasdaq Stock Market ("Nasdaq"). |

|

|

The members of the Nominating Committee shall be appointed and replaced by the Board. The Board shall designate one member of the Nominating Committee to serve as the Committee's Chairperson. |

III. |

|

Committee Rules of Procedure |

|

|

The Nominating Committee shall meet at least once annually, or more frequently as circumstances dictate. Special meetings may be convened as the Nominating Committee deems necessary or appropriate. |

|

|

A majority of the members of the Nominating Committee shall constitute a quorum to transact business. Members of the Nominating Committee may participate in a meeting of the Committee by means of telephone conference call or similar communications equipment by means of which all persons participating in the meeting can hear each other. Except in extraordinary circumstances as determined by the Chairperson of the Nominating Committee, notice shall be delivered to all Committee members at least 24 hours in advance of the scheduled meeting. Minutes of each meeting will be kept and distributed to the entire Board. |

|

|