UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-7440

DIMENSIONAL EMERGING MARKETS VALUE FUND

(Exact name of registrant as specified in charter)

6300 Bee Cave Road, Building One, Austin, TX 78746

(Address of principal executive offices) (Zip code)

Catherine L. Newell, Esquire, Vice President and Secretary

Dimensional Emerging Markets Value Fund,

6300 Bee Cave Road, Building One, Austin, TX 78746

(Name and address of agent for service)

Registrant’s telephone number, including area code: 512-306-7400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2009

| ITEM 1. | REPORTS TO STOCKHOLDERS. |

Dimensional Fund Advisors

6300 Bee Cave Road, Building One

Austin, TX 78746

December 2009

Dear Fellow Shareholder,

After sinking to ten-year lows, stock prices around the world rebounded sharply in March 2009 and posted steady gains in the seven months between March and September. March and April were among the best-return months in the life of Dimensional’s equity Funds.

The unexpected turns in the financial markets this year offered some valuable lessons. We were reminded that stock prices are unpredictable. We saw once again the benefits of staying disciplined in the market as it inevitably moves up and down. And I believe these markets showed very clearly why diversification is so important to long-term investment success.

Although diversification can’t prevent losses, it can help investors avoid the extreme outcomes that can result from concentrating investments in individual stocks or market segments. We believe that successful investing is about both increasing wealth and being able to sleep well at night. Investors who understand how markets work and have a realistic understanding of their own tolerance for risk are most likely to have a good overall experience.

More than $10 billion in net long-term assets flowed into Dimensional’s Funds during the first 10 months of 2009, a reflection of the trust our shareholders around the world have placed in us. We are grateful for that trust and want you to know that we take our responsibility as the steward of your investments in Dimensional’s Funds very seriously. We hope to have the opportunity to continue serving your needs for many years to come.

|

Sincerely, |

|

|

|

David G. Booth |

Chairman and Chief Executive Officer |

[THIS PAGE INTENTIONALLY LEFT BLANK]

ANNUAL REPORT

Table of Contents

This report is submitted for the information of the Fund’s shareholders. It is not authorized for distribution to prospective investors unless preceded or accompanied by an effective prospectus.

i

[THIS PAGE INTENTIONALLY LEFT BLANK]

DFA INVESTMENT DIMENSIONS GROUP INC.

DIMENSIONAL EMERGING MARKETS VALUE FUND

DEFINITIONS OF ABBREVIATIONS AND FOOTNOTES

Statement of Assets and Liabilities/Summary Schedule of Portfolio Holdings

| | |

Investment Abbreviations |

ADR | | American Depositary Receipt |

FNMA | | Federal National Mortgage Association |

|

Investment Footnotes |

† | | See Note B to Financial Statements. |

†† | | Securities have generally been fair valued. See Note B to Financial Statements. |

** | | Calculated as a percentage of total net assets. Percentages shown parenthetically next to the category headings have been calculated as a percentage of total investments. “Other Securities” are those securities that are not among the top 50 holdings of the fund or do not represent more than 1.0% of the net assets of the fund. Some of the individual securities within this category may include Total or Partial Securities on Loan and/or Non-Income Producing Securities. |

* | | Non-Income Producing Securities. |

# | | Total or Partial Securities on Loan. |

@ | | Security purchased with cash proceeds from Securities on Loan. |

§ | | Affiliated Fund. |

|

Financial Highlights |

| |

(A) | | Computed using average shares outstanding. |

(B) | | Annualized |

(C) | | Non-Annualized |

(D) | | Represents the combined ratios for the respective portfolio and its respective pro-rata share of its Master Fund Series. |

(E) | | Because of commencement of operations and related preliminary transaction costs, these ratios are not necessarily indicative of future ratios. |

|

All Statements and Schedules |

| |

— | | Amounts designated as — are either zero or rounded to zero. |

SEC | | Securities and Exchange Commission |

(a) | | Commencement of Operations. |

1

DFA INVESTMENT DIMENSIONS GROUP INC.

PERFORMANCE CHARTS

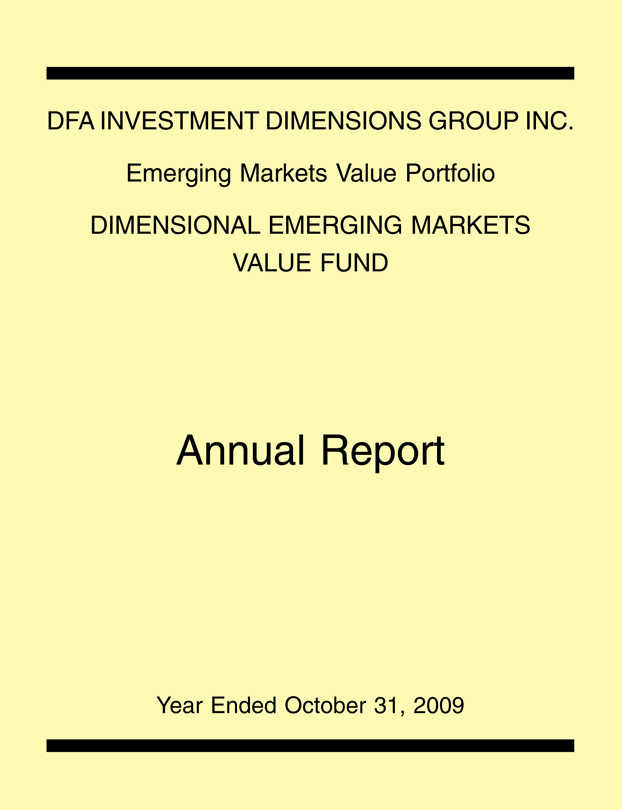

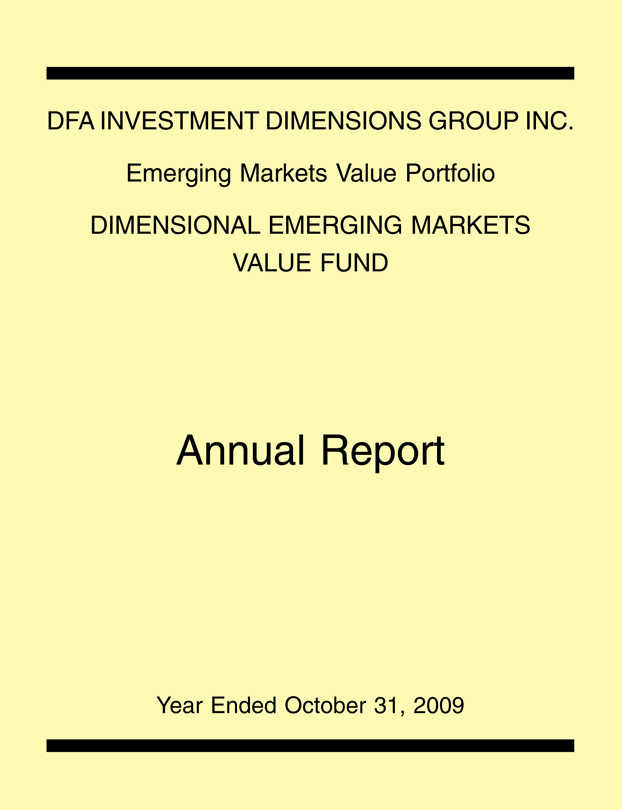

Emerging Markets Value Portfolio Institutional Class vs.

MSCI Emerging Markets Index (net dividends)

October 31, 1999-October 31, 2009

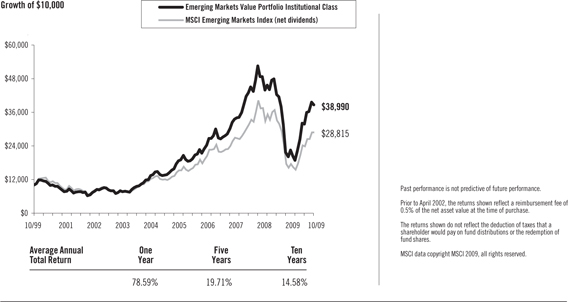

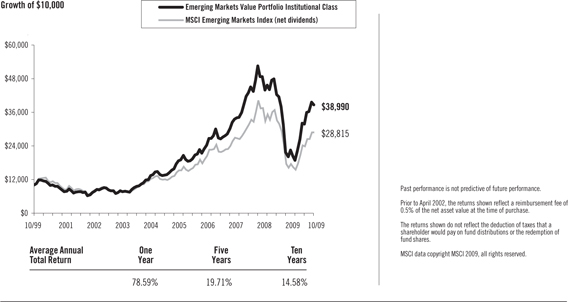

Emerging Markets Value Portfolio Class R2 vs.

MSCI Emerging Markets Index (net dividends)

January 29, 2008-October 31, 2009

2

DFA INVESTMENT DIMENSIONS GROUP INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS

| | |

| International Equity Market Review | | 12 Months Ended October 31, 2009 |

The one-year period ending October 31, 2009, was characterized by unprecedented volatility in non-US developed markets. Non-US developed markets lost 18.87% from November 2008 through February 2009, as measured by the MSCI World ex USA Index (net dividends). From March through October 2009 these same markets gained 57.56%. In April 2009, the Index had its largest-ever monthly gain (12.90%) since October 1990.

From November 2008 through February 2009, developed markets returns were negative across all asset classes. The US dollar rallied against most currencies, reversing a general trend of depreciation dating back to 2006. From March through October 2009 the market reversed course, with small cap and value stocks strongly outperforming large cap and growth stocks. The US dollar depreciated against most major currencies. The rally drove strong positive returns for the 12-month period, with small cap stocks significantly outperforming large cap stocks and value stocks outperforming growth stocks, as measured by the MSCI indexes.

12 Months Ended October 31, 2009

| | | | |

Ten Largest Foreign Developed Markets by Market Cap (BB) | | Local

Currency

Return | | U.S. Dollar

Return |

Japan ($2,432) | | 6.03% | | 15.20% |

United Kingdom ($2,328) | | 23.19% | | 25.68% |

France ($1,106) | | 10.09% | | 28.10% |

Canada ($1,060) | | 17.46% | | 32.58% |

Australia ($912) | | 21.91% | | 66.97% |

Germany ($843) | | 6.37% | | 23.77% |

Switzerland ($821) | | 5.78% | | 20.63% |

Spain ($488) | | 33.27% | | 55.06% |

Italy ($388) | | 7.57% | | 25.17% |

Netherlands ($277) | | 20.17% | | 39.83% |

Country market capitalizations (in parentheses) are in USD billions. Source: Returns are of MSCI indices net of foreign withholding taxes on dividends. Country market capitalizations are based on country carve-outs of the MSCI All-Country World Investable Market Index. MSCI data copyright MSCI 2009, all rights reserved.

Small company stocks were the best-performing asset class in international markets, while growth stocks had the worst relative results.

12 Months Ended October 31, 2009

| | |

| | | U.S. Dollar

Return |

MSCI World ex USA Small Cap Index | | 50.01% |

MSCI World ex USA Value Index | | 31.71% |

MSCI World ex USA Index | | 27.83% |

MSCI World ex USA Growth Index | | 24.03% |

Source: MSCI indices are net of foreign withholding taxes on dividends, copyright MSCI 2009, all rights reserved.

Gains in emerging markets were better, on average, than in developed markets, although results varied widely among the individual emerging markets countries. For the 12 month period, returns in U.S. dollars were 64.13% for the MSCI Emerging Markets Index (net dividends) and 27.83% for the MSCI World ex USA Index (net dividends).

3

12 Months Ended October 31, 2009

| | |

Country | | U.S. Dollar

Return |

Argentina | | 53.21% |

Brazil | | 91.55% |

Chile | | 61.68% |

China | | 82.16% |

Czech Republic | | 26.83% |

Hungary | | 63.54% |

India | | 77.12% |

Indonesia | | 127.39% |

Israel | | 31.43% |

Malaysia | | 56.99% |

Mexico | | 39.79% |

Philippines | | 50.71% |

Poland | | 23.09% |

South Africa | | 61.69% |

South Korea | | 56.17% |

Taiwan | | 48.86% |

Thailand | | 78.58% |

Turkey | | 68.21% |

Source: Returns are of MSCI indices net of foreign withholding taxes on dividends, copyright MSCI 2009, all rights reserved.

Master-Feeder Structure

The Emerging Markets Value Portfolio described below, called a “Feeder Fund,” does not buy individual securities directly; instead, the Portfolio invests in a corresponding fund called a “Master Fund“. The Master Fund, in turn, purchases stocks and/or other securities.

Emerging Markets Value Portfolio

The Emerging Markets Value Portfolio seeks to capture the returns of value stocks in selected emerging markets by purchasing shares of the Dimensional Emerging Markets Value Fund, which invests in such stocks. The investment strategy employs a disciplined, quantitative approach, emphasizing broad diversification and consistent exposure to emerging markets value stocks, but does not attempt to track closely a specific equity index. As of October 31, 2009, the Master Fund held 1,944 stocks across 18 emerging markets countries and was mostly invested in equities throughout the year: the average non-equitized cash level for the period was less than 1% of the Master Fund’s assets. The Master Fund’s target country weights are capped at a ceiling set by the manager in order to limit single-country risk exposure.

As a result of the Master Fund’s diversified investment approach, performance was generally determined by broad structural trends in emerging country stock markets, rather than the behavior of a limited number of stocks. For the 12 months ended October 31, 2009, total returns were 78.59% for the Institutional Class share of the Portfolio, 78.29% for the Class R2 shares of the Portfolio and 64.13% for the MSCI Emerging Markets Index (net dividends). The Master Fund targets large and small cap value stocks while the Index primarily targets large cap stocks. The Master Fund’s greater allocation than the Index to value stocks added approximately 11.9% to relative performance. The Master Fund’s greater allocation to small cap stocks added approximately 3.3% to the relative performance.

4

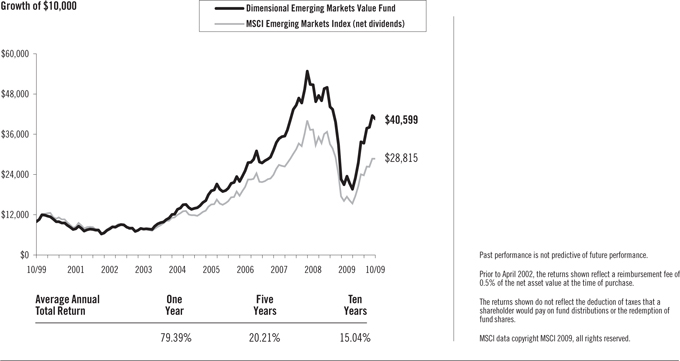

Dimensional Emerging Markets Value Fund

The Dimensional Emerging Markets Value Fund seeks to capture the returns of value stocks in selected emerging markets. The investment strategy employs a disciplined, quantitative approach, emphasizing broad diversification and consistent exposure to emerging markets value stocks, but does not attempt to closely track a specific equity index. As of October 31, 2009, the Fund held 1,944 stocks in 18 emerging markets countries and was mostly invested in equities throughout the year: the average non-equitized cash level for the period was less than 1% of the Fund’s assets. The Fund’s target country weights are capped at a ceiling set by the manager in order to limit single-country risk exposure.

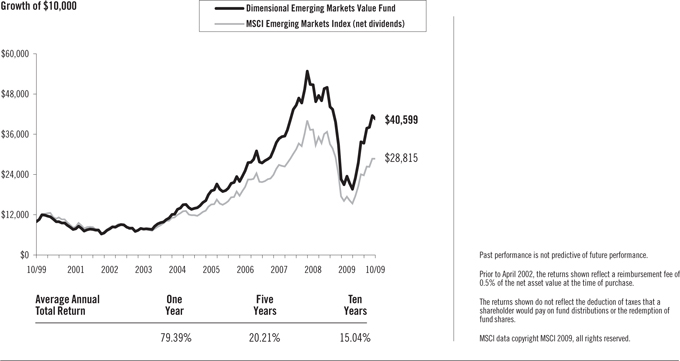

As a result of the Fund’s diversified investment approach, performance was generally determined by broad structural trends in emerging country stock markets, rather than the behavior of a limited number of stocks. For the 12 months ended October 31, 2009, total returns were 79.39% for the Fund and 64.13% for the MSCI Emerging Markets Index (net dividends). The Fund targets large and small cap value stocks while the Index primarily targets large cap stocks. The Fund’s greater allocation than the Index to value stocks added approximately 11.9% to relative performance. The Fund’s greater allocation to small cap stocks added approximately 3.3% to the relative performance.

5

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

DISCLOSURE OF FUND EXPENSES

(Unaudited)

The following Expense Table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. Operating expenses, legal and audit services, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs, in dollars, of investing in the fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your fund’s costs in two ways.

Actual Fund Return

This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return and “Expenses Paid During Period” reflect the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, a $7,500 account value divided by $1,000 = 7.5), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

This section is intended to help you compare your fund’s costs with those of other mutual funds. The hypothetical “Ending Account Value” and “Expenses Paid During Period” are derived from the fund’s actual expense ratio and an assumed 5% annual return before expenses. In this case, because the return used is not the fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% annual return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs, if applicable. The “Annualized Expense Ratio” represents the actual expenses for the six-month period indicated.

| | | | | | | | |

| EXPENSE TABLE | | Six Months Ended October 31, 2009 |

| | | | |

| | | Beginning

Account

Value

05/01/09 | | Ending

Account

Value

10/31/09 | | Annualized

Expense

Ratio* | | Expenses

Paid

During

Period* |

Actual Fund Return | | | | | | | | |

Class R2 Shares | | $1,000.00 | | $1,471.60 | | 0.90% | | $5.61 |

Institutional Class Shares | | $1,000.00 | | $1,474.10 | | 0.62% | | $3.87 |

Hypothetical 5% Annual Return | | | | | | | | |

Class R2 Shares | | $1,000.00 | | $1,020.67 | | 0.90% | | $4.58 |

Institutional Class Shares | | $1,000.00 | | $1,022.08 | | 0.62% | | $3.16 |

| * | Expenses are equal to the fund’s annualized expense ratio for the six-month period, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the year (365) to reflect the six-month period. The Portfolio is a Feeder Fund. The expenses shown reflect the direct expenses of the Feeder Fund and the indirect payment of the Feeder Fund’s portion of the expenses of its Master Fund. | |

6

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

DISCLOSURE OF PORTFOLIO HOLDINGS

(Unaudited)

The SEC requires that all Funds file a complete Schedule of Investments with the SEC for their first and third fiscal quarters on Form N-Q. For DFA Investment Dimensions Group Inc., this would be for the fiscal quarters ending January 31 and July 31. The Form N-Q filing must be made within 60 days of the end of the quarter. DFA Investment Dimensions Group Inc. filed its most recent Form N-Q with the SEC on September 29, 2009. It is available upon request, without charge, by calling collect: (512) 306-7400 or by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, Texas 78746, or by visiting the SEC’s website at http://www.sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the Public Reference Room).

PORTFOLIO HOLDINGS

The SEC requires that all Funds present their categories of portfolio holdings in a table, chart or graph format in their annual and semi-annual shareholder reports, whether or not a Schedule of Investments is utilized. The following table, which presents portfolio holdings as a percent of total investments before short-term investments and collateral for loaned securities, is provided in compliance with such requirement.

The categories of industry classification for the Affiliated Investment Company is represented in the Disclosure of Portfolio Holdings, which is included elsewhere within the report. Refer to the Summary Schedule of Portfolio Holdings for the underlying Master Fund’s holdings which reflects the investments by country.

| | | |

Affiliated Investment Company | | 100.0 | % |

7

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

STATEMENT OF ASSETS AND LIABILITIES

OCTOBER 31, 2009

(Amounts in thousands, except share and per share amounts)

| | | |

ASSETS: | | | |

Investment in Dimensional Emerging Markets Value Fund (Affiliated Investment Company) at Value† | | $ | 7,409,209 |

Receivables: | | | |

Investment Securities Sold | | | 16,385 |

Fund Shares Sold | | | 9,155 |

Prepaid Expenses and Other Assets | | | 49 |

| | | |

Total Assets | | | 7,434,798 |

| | | |

LIABILITIES: | | | |

Payables: | | | |

Affiliated Investment Company Shares Purchased | | | 4,044 |

Fund Shares Redeemed | | | 21,496 |

Due to Advisor | | | 2,594 |

Accrued Expenses and Other Liabilities | | | 316 |

| | | |

Total Liabilities | | | 28,450 |

| | | |

NET ASSETS | | $ | 7,406,348 |

| | | |

NET ASSET VALUE, OFFERING AND REDEMPTION PRICE PER SHARE: | | | |

Class R2 Shares - based on net assets of $5,082 and shares outstanding of 2,034,960 | | $ | 2.50 |

| | | |

NUMBER OF SHARES AUTHORIZED | | | 100,000,000 |

| | | |

Institutional Class Shares - based on net assets of $7,401,266 and shares outstanding of 256,115,623 | | $ | 28.90 |

| | | |

NUMBER OF SHARES AUTHORIZED | | | 1,500,000,000 |

| | | |

Investments in Affiliated Investment Company at Cost | | $ | 5,504,485 |

| | | |

NET ASSETS CONSIST OF: | | | |

Paid-In Capital | | $ | 5,930,966 |

Undistributed Net Investment Income (Distributions in Excess of Net Investment Income) | | | 12,574 |

Accumulated Net Realized Gain (Loss) | | | 182,234 |

Net Unrealized Appreciation (Depreciation) | | | 1,280,574 |

| | | |

NET ASSETS | | $ | 7,406,348 |

| | | |

See accompanying Notes to Financial Statements.

8

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

STATEMENT OF OPERATIONS

FOR THE YEAR ENDED OCTOBER 31, 2009

(Amounts in thousands)

| | | | |

Investment Income | | | | |

Dividends | | $ | 109,045 | |

Interest | | | 277 | |

Income from Securities Lending | | | 11,962 | |

Expenses Allocated from Affiliated Investment Company | | | (10,541 | ) |

| | | | |

Total Investment Income | | | 110,743 | |

| | | | |

Expenses | | | | |

Administrative Services Fees | | | 20,346 | |

Accounting & Transfer Agent Fees | | | 109 | |

Filing Fees | | | 208 | |

Shareholder Servicing Fees — Class R2 Shares | | | 9 | |

Shareholders’ Reports | | | 125 | |

Directors’/Trustees’ Fees & Expenses | | | 87 | |

Professional Fees | | | 70 | |

Other | | | 57 | |

| | | | |

Total Expenses | | | 21,011 | |

| | | | |

Net Investment Income (Loss) | | | 89,732 | |

| | | | |

Realized and Unrealized Gain (Loss) | | | | |

Net Realized Gain (Loss) on Investment Securities Sold | | | 76,523 | |

Change in Unrealized Appreciation (Depreciation) of Investment Securities and Foreign Currency | | | 2,867,814 | |

| | | | |

Net Realized and Unrealized Gain (Loss) | | | 2,944,337 | |

| | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 3,034,069 | |

| | | | |

See accompanying Notes to Financial Statements.

9

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

STATEMENTS OF CHANGES IN NET ASSETS

(Amounts in thousands)

| | | | | | | | | | | | |

| | | Year

Ended

Oct. 31,

2009 | | | Period

Dec. 1, 2007

to

Oct. 31, 2008 | | | Year

Ended

Nov. 30,

2007 | |

Increase (Decrease) in Net Assets | | | | | | | | | | | | |

Operations: | | | | | | | | | | | | |

Net Investment Income (Loss) | | $ | 89,732 | | | $ | 179,045 | | | $ | 119,722 | |

Net Realized Gain (Loss) on Investment Securities Sold | | | 76,523 | | | | 603,223 | † | | | 170,231 | † |

Change in Unrealized Appreciation (Depreciation) of Investment Securities and Foreign Currency | | | 2,867,814 | | | | (5,398,482 | )† | | | 2,117,791 | † |

| | | | | | | | | | | | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 3,034,069 | | | | (4,616,214 | ) | | | 2,407,744 | |

| | | | | | | | | | | | |

Distributions From: | | | | | | | | | | | | |

Net Investment Income: | | | | | | | | | | | | |

Class R2 Shares | | | (427 | ) | | | (115 | ) | | | — | |

Institutional Class Shares | | | (77,134 | ) | | | (181,885 | ) | | | (96,479 | ) |

Net Short-Term Gains: | | | | | | | | | | | | |

Class R2 Shares | | | (76 | ) | | | — | | | | — | |

Institutional Class Shares | | | (36,974 | ) | | | (13,134 | ) | | | (8,058 | ) |

Net Long-Term Gains: | | | | | | | | | | | | |

Class R2 Shares | | | (1,070 | ) | | | — | | | | — | |

Institutional Class Shares | | | (517,440 | ) | | | (155,738 | ) | | | (44,751 | ) |

| | | | | | | | | | | | |

Total Distributions | | | (633,121 | ) | | | (350,872 | ) | | | (149,288 | ) |

| | | | | | | | | | | | |

Capital Share Transactions: | | | | | | | | | | | | |

Shares Issued | | | 1,980,752 | | | | 2,280,870 | | | | 1,777,388 | |

Shares Issued in Lieu of Cash Distributions | | | 576,478 | | | | 306,474 | | | | 124,212 | |

Shares Redeemed | | | (1,289,209 | ) | | | (1,368,681 | ) | | | (957,950 | ) |

| | | | | | | | | | | | |

Net Increase (Decrease) from Capital Share Transactions | | | 1,268,021 | | | | 1,218,663 | | | | 943,650 | |

| | | | | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | 3,668,969 | | | | (3,748,423 | ) | | | 3,202,106 | |

Net Assets | | | | | | | | | | | | |

Beginning of Period | | | 3,737,379 | | | | 7,485,802 | | | | 4,283,696 | |

| | | | | | | | | | | | |

End of Period | | $ | 7,406,348 | | | $ | 3,737,379 | | | $ | 7,485,802 | |

| | | | | | | | | | | | |

Undistributed Net Investment Income (Distributions in Excess of Net Investment Income) | | $ | 12,574 | | | $ | 6,472 | | | $ | 22,447 | |

| † | See Note A in the Notes to Financial Statements. |

See accompanying Notes to Financial Statements.

10

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

FINANCIAL HIGHLIGHTS

(for a share outstanding throughout the period)

| | | | | | | | |

| | | Class R2 Shares | |

| | | Year

Ended

Oct. 31,

2009 | | | Period

Jan. 29, 2008(a)

to Oct. 31, 2008 | |

Net Asset Value, Beginning of Period | | $ | 4.56 | | | $ | 10.00 | |

| | | | | | | | |

| | |

Income from Investment Operations | | | | | | | | |

Net Investment Income (Loss) | | | 0.03 | (A) | | | 0.21 | (A) |

Net Gains (Losses) on Securities

(Realized and Unrealized) | | | 1.14 | | | | (4.93 | ) |

| | | | | | | | |

Total from Investment Operations | | | 1.17 | | | | (4.72 | ) |

| | |

| | |

Less Distributions | | | | | | | | |

Net Investment Income | | | (0.32 | ) | | | (0.72 | ) |

Net Realized Gains | | | (2.91 | ) | | | — | |

| | | | | | | | |

Total Distributions | | | (3.23 | ) | | | (0.72 | ) |

| | |

Net Asset Value, End of Period | | $ | 2.50 | | | $ | 4.56 | |

| | |

Total Return | | | 78.29 | % | | | (50.51 | )%(C) |

| | |

Net Assets, End of Period (thousands) | | | $5,082 | | | $ | 1,799 | |

Ratio of Expenses to Average Net Assets (D) | | | 0.90 | % | | | 0.92 | %(B)(E) |

Ratio of Net Investment Income to Average Net Assets | | | 1.39 | % | | | 3.35 | %(B)(E) |

| | |

See page 1 for the Definitions of Abbreviations and Footnotes.

See accompanying Notes to Financial Statements.

11

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

FINANCIAL HIGHLIGHTS

(for a share outstanding throughout each period)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Institutional Class Shares | |

| | | Year Ended

Oct. 31, 2009 | | | Period

Dec. 1, 2007

to Oct. 31, 2008 | | | Year Ended

Nov. 30,

2007 | | | Year Ended

Nov. 30,

2006 | | | Year Ended

Nov. 30,

2005 | | | Year

Ended

Nov. 30,

2004 | |

Net Asset Value, Beginning of Period | | $ | 19.36 | | | $ | 45.85 | | | $ | 31.26 | | | $ | 22.86 | | | $ | 17.93 | | | $ | 12.53 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

Income from Investment Operations | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) | | | 0.38 | (A) | | | 0.98 | (A) | | | 0.78 | (A) | | | 0.60 | (A) | | | 0.50 | | | | 0.21 | |

Net Gains (Losses) on Securities

(Realized and Unrealized) | | | 12.41 | | | | (25.48 | ) | | | 14.82 | | | | 8.65 | | | | 4.96 | | | | 5.54 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total from Investment Operations | | | 12.79 | | | | (24.50 | ) | | | 15.60 | | | | 9.25 | | | | 5.46 | | | | 5.75 | |

| | |

| | | | | | |

Less Distributions | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income | | | (0.34 | ) | | | (1.00 | ) | | | (0.63 | ) | | | (0.60 | ) | | | (0.44 | ) | | | (0.35 | ) |

Net Realized Gains | | | (2.91 | ) | | | (0.99 | ) | | | (0.38 | ) | | | (0.25 | ) | | | (0.09 | ) | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Distributions | | | (3.25 | ) | | | (1.99 | ) | | | (1.01 | ) | | | (0.85 | ) | | | (0.53 | ) | | | (0.35 | ) |

| | |

Net Asset Value, End of Period | | $ | 28.90 | | | $ | 19.36 | | | $ | 45.85 | | | $ | 31.26 | | | $ | 22.86 | | | $ | 17.93 | |

| | |

| | |

Total Return | | | 78.59 | % | | | (55.65 | )%(C) | | | 50.98 | % | | | 41.55 | % | | | 31.06 | % | | | 46.76 | % |

| | |

Net Assets, End of Period (thousands) | | $ | 7,401,266 | | | $ | 3,735,580 | | | $ | 7,485,802 | | | $ | 4,283,696 | | | $ | 2,077,480 | | | $ | 895,313 | |

Ratio of Expenses to Average Net Assets (D) | | | 0.62 | % | | | 0.60 | %(B) | | | 0.60 | % | | | 0.63 | % | | | 0.70 | % | | | 0.77 | % |

Ratio of Net Investment

Income to Average Net Assets | | | 1.76 | % | | | 2.82 | %(B) | | | 2.00 | % | | | 2.22 | % | | | 2.45 | % | | | 1.37 | % |

| | |

See page 1 for the Definitions of Abbreviations and Footnotes.

See accompanying Notes to Financial Statements.

12

DFA INVESTMENT DIMENSIONS GROUP INC.

EMERGING MARKETS VALUE PORTFOLIO

NOTES TO FINANCIAL STATEMENTS

A. Organization:

DFA Investment Dimensions Group Inc. (the “Group”) is an open-end management investment company whose shares are offered, without a sales charge, generally to institutional investors and clients of registered investment advisors. The Group offers fifty-seven operational portfolios, one of which, the Emerging Markets Value Portfolio (the “Portfolio”) is included in this report. The remaining fifty-six portfolios are presented in separate reports.

The Portfolio primarily invests all of its assets in the Dimensional Emerging Markets Value Fund (the “Fund”, formerly, the Dimensional Emerging Markets Value Fund Inc.). At October 31, 2009, the Portfolio owned 93% of the Fund. The financial statements of the Fund are included elsewhere in this report and should be read in conjunction with the financial statements of the Portfolio.

Effective November 1, 2009, Dimensional Emerging Markets Value Fund (“DEM II”), a master fund in a master-feeder structure, elected with the consent of its Holder(s) to change its U.S. federal income tax classification from that of an association taxable as a corporation to a partnership pursuant to Treasury Regulation §301.7701-3. The change in capital structure and retroactive reclassification of the statement of changes in net assets and financial highlights for the Fund is a result of the treatment of a partnership for book purposes. DEM II and the Portfolio will maintain their books and records and present their financial statements in accordance with generally accepted accounting principles for investment partnerships.

On January 29, 2008, Class R2 shares commenced operations. As of October 31, 2009, Class R1 has 100,000,000 authorized shares and has not commenced operations.

At a regular meeting of the Board of Directors/Trustees (the “Board”) on September 16, 2008, the Board voted to change the fiscal and tax year ends of the Portfolio from November 30 to October 31.

B. Significant Accounting Policies:

The following significant accounting policies are in conformity with accounting principles generally accepted in the United States of America. Such policies are consistently followed by the Group in preparation of its financial statements. The preparation of financial statements in accordance with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates and those differences could be material.

1. Security Valuation: The Portfolio’s investment reflects its proportionate interest in the net assets of the Fund.

The Portfolio utilizes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three broad levels described below:

• Level 1 – quoted prices in active markets for identical securities

• Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Portfolio’s own assumptions in determining the fair value of investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. A summary of the inputs used to value the Portfolio’s net assets as of October 31, 2009 is listed below (in thousands).

13

| | | | | | | | | | |

| | | Valuation Inputs |

| | | Investments in

Securities

(Market Value) |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Emerging Markets Value Portfolio | | $ | 7,409,209 | | — | | — | | $ | 7,409,209 |

2. Deferred Compensation Plan: Each eligible Director of the Group may elect participation in the Deferred Compensation Plan (the “Plan”). Under the Plan, effective January 1, 2002, such Directors may defer payment of all or a portion of their total fees earned as a Director. These deferred amounts may be treated as though such amounts had been invested in shares of the following funds: U.S. Large Cap Value Portfolio; U.S. Core Equity 1 Portfolio; U.S. Core Equity 2 Portfolio; U.S. Vector Equity Portfolio; U.S. Micro Cap Portfolio; DFA International Value Portfolio; International Core Equity Portfolio; Emerging Markets Portfolio; Emerging Markets Core Equity Portfolio; and/or DFA Two-Year Global Fixed Income Portfolio. Contributions made under the Plan and the change in unrealized appreciation (depreciation) and income, are included in Directors’/Trustees’ Fees & Expenses. At October 31, 2009, the total liability for deferred compensation to Directors is included in Accrued Expenses and Other Liabilities on the Statement of Assets and Liabilities in the amount of $145 (in thousands).

Each Director has the option to receive their distribution of proceeds in one of the following methods upon one year’s notice: lump sum; annual installments over a period of agreed upon years; or semi-annual installments over a period of agreed upon years. As of October 31, 2009, none of the Directors have requested distribution of proceeds.

3. Other: The portfolio recognizes its pro-rata share, on a daily basis, of net investment income and realized and unrealized gains and losses of investment securities and foreign currency from the Fund, which is treated as a partnership for federal income tax purposes. Dividend income and distributions to shareholders are recorded on the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments or as a realized gain, respectively. The Portfolio estimates the character of distributions received that may be considered return of capital distributions. Expenses directly attributable to the Portfolio are directly charged. Common expenses of the Fund are allocated using methods approved by the Board of Directors/Trustees, generally based on average net assets.

C. Investment Advisor:

Dimensional Fund Advisors LP (“Dimensional” or the “Advisor”) provides administrative services to the Portfolio, including supervision of services provided by others, providing information to the shareholders and the Board of Directors/Trustees, and other administrative services. The Advisor provides investment advisory services to the Fund. For the year ended October 31, 2009, the Portfolio’s administrative services fees were accrued daily and paid monthly to the Advisor based on an effective annual rate of 0.40% of average daily net assets.

Pursuant to the Expense Assumption Agreement for the Class R2 Shares of the Emerging Markets Value Portfolio, the Advisor has contractually agreed to assume the Portfolio’s direct expenses (excluding management fees and custodian fees) to the extent necessary to limit the expenses of the Class R2 Shares of the Portfolio to 0.96% of its average net assets on an annualized basis. At any time that the annualized expenses of the Portfolio are less than 0.96% of its average net assets on an annualized basis, the Advisor retains the right to recover any fees previously waived and/or expenses previously assumed to the extent that such recovery will not cause the annualized expenses to exceed 0.96% of its average net assets on an annualized basis. The Portfolio is not obligated to reimburse the Advisor for fees previously waived or expenses previously assumed by the Advisor more than thirty-six months before the date of such recovery. The Expense Assumption Agreement will remain in effect until March 1, 2010, and shall continue in effect from year to year thereafter, unless terminated by the Group or the Advisor. At October 31, 2009, there were no fees subject to future recovery by the Advisor.

14

Fees Paid to Officers and Directors/Trustees:

Certain Officers and Directors/Trustees of the Advisor are also Officers and Directors/Trustees of the Group; however, such Officers and Directors/Trustees (with the exception of the Chief Compliance Officer (“CCO”)) receive no compensation from the Group. For the year ended October 31, 2009, the total related amounts paid by the Group to the CCO were $197 (in thousands). The total related amount paid by the Portfolio is included in Other Expenses on the Statement of Operations.

D. Federal Income Taxes:

The Portfolio has qualified and intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code for federal income tax purposes and to distribute substantially all of its taxable income and net capital gains to shareholders. Accordingly, no provision has been made for federal income taxes.

Distributions from net investment income and net realized capital gains are determined in accordance with U.S. federal income tax regulations, which may differ from those amounts determined under accounting principles generally accepted in the United States of America. These book/tax differences are either temporary or permanent in nature. To the extent these differences are permanent, they are charged or credited to paid-in capital, undistributed net investment income or accumulated net realized gains, as appropriate, in the period that the differences arise. Accordingly, the following permanent differences as of October 31, 2009, primarily attributable to the utilization of accumulated earnings and profits distributed to shareholders on redemptions of shares as part of the dividends paid deduction for income tax purposes, were reclassified to the following accounts. These reclassifications had no effect on net assets or net asset value per share (amounts in thousands):

| | | | |

Increase

(Decrease)

Paid-In Capital | | Increase

(Decrease)

Undistributed

Net Investment Income | | Increase

(Decrease)

Accumulated

Net Realized

Gains (Losses) |

$(76,651) | | $(6,069) | | $82,720 |

The tax character of dividends and distributions declared and paid during the year ended November 30, 2007, the period December 1, 2007 to October 31,2008 and the year ended October 31, 2009 were as follows (amounts in thousands):

| | | | | | | | | |

| | | Net Investment

Income and

Short-Term

Capital Gains | | Long-Term

Capital Gains | | Total |

2007 | | | $110,158 | | $ | 51,893 | | $ | 162,051 |

2008 | | | 210,872 | | | 193,750 | | | 404,622 |

2009 | | | 114,611 | | | 518,510 | | | 633,121 |

At October 31, 2009, the following net investment income and short-term capital gains and long-term capital gains distributions designated for federal income tax purposes are due to the utilization of accumulated earnings and profits distributed to shareholders upon redemption of shares (amounts in thousands):

| | | | |

Net Investment

Income and

Short-Term

Capital Gains | | Long-Term

Capital Gains | | Total |

$11,386 | | $8,867 | | $20,253 |

15

At October 31, 2009, the components of distributable earnings/(accumulated losses) were as follows (amounts in thousands):

| | | | |

Undistributed

Net Investment

Income and

Short-Term

Capital Gains | | Undistributed

Long-Term

Capital Gains | | Total Net

Distributable

Earnings

(Accumulated

Losses) |

$78,548 | | $116,405 | | $194,953 |

For federal income tax purposes, the Portfolio measures its capital loss carryforwards annually at October 31, 2009, its fiscal year end. Capital loss carryforwards may be carried forward and applied against future capital gains. As of October 31, 2009, the Portfolio had no capital loss carryforwards available to offset future realized capital gains.

At October 31, 2009, the total cost and aggregate gross unrealized appreciation and (depreciation) of securities for federal income tax purposes were different from amounts reported for financial reporting purposes (amounts in thousands):

| | | | | | |

Federal

Tax Cost | | Unrealized

Appreciation | | Unrealized

(Depreciation) | | Net

Unrealized

Appreciation

(Depreciation) |

$6,117,186 | | $2,018,873 | | $(726,850) | | $1,292,023 |

Accounting for Uncertainty in Income Taxes sets forth a minimum threshold for financial statement recognition of the benefit of a tax position taken or expected to be taken in a tax return. Management has analyzed each Portfolios’ tax positions and has concluded that no provision for income tax is required in any Portfolios’ financial statements. No Portfolio is aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Each of the Portfolios’ federal tax returns for the prior three fiscal years remains subject to examination by the Internal Revenue Service.

E. Capital Share Transactions:

The capital share transactions by class were as follows (amounts in thousands):

| | | | | | | | | | | | | | | | | | | | | |

| | | Year

Ended

Oct. 31, 2009 | | | Period

Dec. 1, 2007

to

Oct. 31, 2008* | | | Year

Ended

Nov. 30, 2007 | |

| | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | |

Class R2 Shares* | | | | | | | | | | | | | | | | | | | | | |

Shares Issued | | $ | 2,967 | | | 1,723 | | | $ | 2,856 | | | 408 | | | | N/A | | | N/A | |

Shares Issued in Lieu of Cash Distributions | | | 1,574 | | | 942 | | | | 115 | | | 14 | | | | N/A | | | N/A | |

Shares Redeemed | | | (2,169 | ) | | (1,024 | ) | | | (175 | ) | | (28 | ) | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | |

Net Increase (Decrease) — Class R2 Shares | | $ | 2,372 | | | 1,641 | | | $ | 2,796 | | | 394 | | | | N/A | | | N/A | |

| | | | | | | | | | | | | | | | | | | | | |

Institutional Class Shares | | | | | | | | | | | | | | | | | | | | | |

Shares Issued | | $ | 1,977,785 | | | 91,360 | | | $ | 2,278,014 | | | 60,725 | | | $ | 1,777,388 | | | 46,560 | |

Shares Issued in Lieu of Cash Distributions | | | 574,904 | | | 34,181 | | | | 306,359 | | | 7,710 | | | | 124,212 | | | 3,560 | |

Shares Redeemed | | | (1,287,040 | ) | | (62,335 | ) | | | (1,368,506 | ) | | (38,791 | ) | | | (957,950 | ) | | (23,900 | ) |

| | | | | | | | | | | | | | | | | | | | | |

Net Increase (Decrease) — Institutional Class Shares | | $ | 1,265,649 | | | 63,206 | | | $ | 1,215,867 | | | 29,644 | | | $ | 943,650 | | | 26,220 | |

| | | | | | | | | | | | | | | | | | | | | |

| *Class | R2 Shares commenced operations on January 29, 2008. |

16

F. Line of Credit:

The Portfolio, together with other Dimensional-advised portfolios, has entered into an amended and restated $250 million unsecured discretionary line of credit effective July 8, 2009 with an affiliate of its domestic custodian bank. Each portfolio is permitted to borrow, subject to its investment limitations, up to a maximum of $250 million, as long as total borrowings under the line of credit do not exceed $250 million in the aggregate. Borrowings under the line of credit are charged interest at the then current Federal Funds Rate plus 1%. Each portfolio is individually, and not jointly, liable for its particular advances under the line of credit. There is no commitment fee on the unused portion of the line of credit. The agreement for the discretionary line of credit may be terminated by either party at any time. The line of credit is scheduled to expire on June 22, 2010. There were no borrowings by the Portfolio under this line of credit during the year ended October 31, 2009.

The Portfolio, together with other Dimensional-advised portfolios, has also entered into an additional $500 million unsecured line of credit effective January 15, 2009 with its international custodian bank. Each portfolio is permitted to borrow, subject to its investment limitations, up to a maximum of $500 million, as long as total borrowings under the line of credit do not exceed $500 million in the aggregate. Each portfolio is individually, and not jointly, liable for its particular advances under the line of credit. Borrowings under the line of credit are charged interest at rates agreed to by the parties at the time of borrowing. There is no commitment fee on the unused portion of the line of credit. The agreement for the line of credit expires on January 15, 2010. There were no borrowings by the Portfolio under this line credit during the year ended October 31, 2009.

G. Shareholder Servicing Fees:

The Class R2 Shares pay a shareholder servicing fee in the amount of 0.25% of their annual average net assets to compensate service agents that provide shareholder servicing, record keeping, account maintenance and other services to investors in the Emerging Markets Value Portfolio Class R2 Shares.

H. Indemnitees; Contractual Obligations:

Under the Group’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the Group.

In the normal course of business, the Group enters into contracts that contain a variety of representations and warranties which provide general indemnification. The Group’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Group and/or its affiliates that have not yet occurred. However, based on experience, the Group expects the risk of loss to be remote.

I. Other:

At October 31, 2009, three shareholders held approximately 97% of the outstanding shares of Class R2 Shares and two shareholder held 28% of the outstanding shares of the Institutional Class Shares of the Portfolio. One or more of the shareholders of the Institutional Class Shares is an omnibus account, which typically holds shares for the benefit of several other underlying investors.

J. Subsequent Event Note:

Effective November 1, 2009, Dimensional Emerging Markets Value Fund (“DEM II”), a master fund in a master-feeder structure with one RIC feeder (the Emerging Markets Value Portfolio) and other direct client investors, made a “Check-the-Box” election for federal income tax purposes pursuant to Treasury Regulation §301.7701-3, to change their federal entity classifications from a corporation taxable as a regulated investment company to a partnership. DEM II and the Portfolio will maintain their books and records and present their financial statements in accordance with generally accepted accounting principals for investment partnerships. As a result of this election, the master fund is deemed to have distributed all of its assets and liabilities on October 31, 2009 to its shareholders in liquidation of the master fund. Since the master fund has a shareholder owning 80% or more of the fund’s shares, and also has shareholders owning less than 80%, the transaction creates a non-taxable transaction, pursuant to Internal Revenue

17

Code §332, for those owning more than 80%, and a taxable transaction, pursuant to Internal Revenue Code §331, for those shareholders owning less than 80%. Immediately after the deemed liquidation, the shareholders contributed all of the distributed assets and liabilities to a newly formed partnership. The final tax year end of the master fund was October 31, 2009.

For federal income tax purposes, pursuant to Code §336(a), the master fund recognizes gain or loss relative to the investment of the less than 80% shareholders as if the master’s investment securities were sold to those shareholders and, pursuant to Code §331, each of those shareholders recognizes gain or loss as if it liquidated its investment in the master. Pursuant to Code §334(a), each of these shareholders will take a fair market value basis in the securities deemed received by them and a new holding period for those securities commences on the deemed liquidation date. In regards to the shareholder owning 80% or more of the master fund, pursuant to Code §332(a), the shareholder will not recognize any gain or loss on the deemed liquidation. However, pursuant to Code §332(c), a portion of the deemed distribution, which otherwise would have been tax-free as discussed above, since it is utilized by the master fund to satisfy its dividends paid deduction for the tax year, must be recognized and treated as a dividend by the 80% or greater shareholder. Pursuant to Code §334(b)(1) and §1223, the 80% or greater shareholder’s basis and holding period in the securities received in liquidation is the same as it was in the possession of the master.

The master fund had book/tax differences upon its deemed liquidation. The following summary of permanent differences occurred as of the respective effective “Check the Box” election date.

| | | | | | |

Increase

(Decrease)

Paid-in Capital | | Unrealized

Appreciation

(Depreciation)

Investment

Securities | | Increase

(Decrease)

Undistributed

Net Investment

Income | | Increase

(Decrease)

Accumulated

Net Realized

Gains (Losses) |

$1,370,229,576 | | $(1,383,011,838) | | $1,404,500 | | $11,377,762 |

As a result of the transaction, the Dimensional Emerging Markets Value Fund recognized a $104,402,506 and ($16,523) capital gain and currency loss respectively, for the tax year ended October 31, 2009.

The Emerging Markets Value Portfolio which was impacted by the “Check the Box” election also had a permanent book/tax difference resulting from the transaction. For financial statement purposes, this adjustment did not result in any changes to the Portfolio’s net assets or net asset value per share. The following summary of permanent differences occurred as of the effective “Check the Box” election date.

| | | | |

Increase

(Decrease)

Paid-in Capital | | Unrealized

Appreciation

(Depreciation)

Investment

Securities | | Increase

(Decrease)

Accumulated

Net Realized

Gains (Losses) |

$(154,596,409) | | $(82,593,386) | | $237,189,795 |

For financial reporting purposes, this transaction had no impact on the net assets of the respective funds.

K. Subsequent Event Evaluations:

Management has evaluated the impact of all subsequent events on the Portfolios through December 23, 2009, the date the financial statements were available for issuance, and has determined that there are no subsequent events requiring recognition or disclosure in the financial statements.

18

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders of Emerging Markets Value Portfolio and

Board of Directors of DFA Investment Dimensions Group Inc.:

In our opinion, the accompanying statement of assets and liabilities, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Emerging Markets Value Portfolio (one of the portfolios constituting DFA Investment Dimensions Group Inc., hereafter referred to as the “Portfolio”) at October 31, 2009, the results of its operations for the year then ended, the changes in its net assets and the financial highlights for each of the periods indicated, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Portfolio’s management; our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at October 31, 2009 by correspondence with the transfer agent of the investee fund, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

Philadelphia, Pennsylvania

December 23, 2009

19

RESULTS OF THE SHAREHOLDER MEETING

On June 2, 2009 and July 8, 2009, DFA Investment Dimensions Group Inc. (“DFAIDG”) held a Special Joint Meeting of Shareholders for the purpose of voting on several proposals affecting DFAIDG and the Portfolio, including, among other items, the election of Directors, the amendment of certain fundamental investment limitations, and the elimination of certain fundamental investment limitations. The shareholders of the Portfolio approved each of the applicable proposals for DFAIDG and the Portfolio presented at the Meeting. Listed below are the voting results from the Meeting. Please note that not all Proposals presented at the Meeting were voted on by the Portfolio. Additionally, the Proposal numbers reflected below correlate to the Proposal numbers presented for vote at the Meeting.

DFAIDG

| | | | | | | | | | | | | | | | | | | | |

| | | | | Shares Voted | | Percent of Outstanding Shares Voted |

| | | | | For | | % | | Against | | % | | Abstain/WithHold | | % | | For | | Against | | Abstain / WithHold |

Proposal 1: Election of Directors for DFAIDG* | | | | | | | | | | | | | | | | | | |

| 1a | | David G. Booth | | 5,100,343,281 | | 93.94% | | — | | 0.00% | | 328,971,623 | | 6.06% | | 81.55% | | 0.00% | | 5.26% |

| 1b | | George M. Constantinides | | 5,105,280,301 | | 94.03% | | — | | 0.00% | | 324,034,602 | | 5.97% | | 81.63% | | 0.00% | | 5.18% |

| 1c | | John P. Gould | | 5,100,584,112 | | 93.95% | | — | | 0.00% | | 328,730,791 | | 6.05% | | 81.55% | | 0.00% | | 5.26% |

| 1d | | Roger G. Ibbotson | | 5,105,426,112 | | 94.03% | | — | | 0.00% | | 323,888,792 | | 5.97% | | 81.63% | | 0.00% | | 5.18% |

| 1e | | Robert C. Merton | | 5,107,268,900 | | 94.07% | | — | | 0.00% | | 322,046,003 | | 5.93% | | 81.66% | | 0.00% | | 5.15% |

| 1f | | Myron S. Scholes | | 5,104,997,961 | | 94.03% | | — | | 0.00% | | 324,316,942 | | 5.97% | | 81.62% | | 0.00% | | 5.19% |

| 1g | | Eduardo A. Repetto | | 5,094,783,848 | | 93.84% | | — | | 0.00% | | 334,531,055 | | 6.16% | | 81.46% | | 0.00% | | 5.35% |

| 1h | | Abbie J. Smith | | 5,100,861,923 | | 93.95% | | — | | 0.00% | | 328,452,981 | | 6.05% | | 81.55% | | 0.00% | | 5.25% |

| | | |

| | | | | Shares Voted | | Percent of Outstanding Shares Voted |

| | | | | For | | % | | Against | | % | | Abstain/WithHold | | % | | For | | Against | | Abstain / WithHold |

Proposal 2: To approve Articles of Amendment and Restatement for DFAIDG* | | 3,385,698,613 | | 93.83% | | 43,557,844 | | 1.21% | | 179,189,489 | | 4.97% | | 54.13% | | 0.70% | | 4.97% |

* Results are for all Portfolios within DFAIDG

Emerging Markets Value Portfolio

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Shares Voted | | Percent of Outstanding Shares Voted |

| | | | | For | | % | | Against | | % | | Abstain/WithHold | | % | | NonVote | | % | | For | | Against | | Abstain / WithHold |

Proposals: | | | | | | | | | | | | | | | | | | | | | | |

5 | | To approve amendments to certain fundamental investment restrictions |

5a | | Borrowing Money | | 132,322,989 | | 75.20% | | 7,586,186 | | 4.31% | | 843,802 | | 0.48% | | 35,211,160 | | 20.01% | | 50.10% | | 2.87% | | 0.32% |

5b | | Making Loans | | 132,110,921 | | 75.08% | | 7,737,859 | | 4.40% | | 904,198 | | 0.51% | | 35,211,160 | | 20.01% | | 50.02% | | 2.93% | | 0.34% |

5c | | Investments in Real Estate | | 130,422,103 | | 74.12% | | 9,486,023 | | 5.39% | | 844,852 | | 0.48% | | 35,211,160 | | 20.01% | | 49.38% | | 3.59% | | 0.32% |

5d | | Investments in Commodities | | 132,227,173 | | 75.14% | | 7,682,935 | | 4.37% | | 842,869 | | 0.48% | | 35,211,160 | | 20.01% | | 50.07% | | 2.91% | | 0.32% |

5e | | Diversification of Investments | | 132,295,453 | | 75.18% | | 7,607,042 | | 4.32% | | 850,482 | | 0.48% | | 35,211,160 | | 20.01% | | 50.09% | | 2.88% | | 0.32% |

6 | | To approve the elimination of certain fundamental investment restrictions |

6b | | Purchasing Securities on Margin | | 131,696,395 | | 74.84% | | 8,154,685 | | 4.63% | | 901,898 | | 0.51% | | 35,211,160 | | 20.01% | | 49.87% | | 3.09% | | 0.34% |

6d | | Investing for the Purpose of Exercising Control | | 132,128,548 | | 75.09% | | 7,767,248 | | 4.41% | | 857,181 | | 0.49% | | 35,211,160 | | 20.01% | | 50.03% | | 2.94% | | 0.32% |

6e | | Investing in Other Investment Companies | | 131,992,254 | | 75.01% | | 7,915,625 | | 4.50% | | 845,099 | | 0.48% | | 35,211,160 | | 20.01% | | 49.98% | | 3.00% | | 0.32% |

6h | | Investing in Securities of Unseasoned Issuers | | 132,041,608 | | 75.04% | | 7,866,456 | | 4.47% | | 844,913 | | 0.48% | | 35,211,160 | | 20.01% | | 50.00% | | 2.98% | | 0.32% |

8 | | Approval of Investment Advisory Agreement between Dimensional Fund Advisors LP and the Company | | 135,285,853 | | 76.88% | | 620,557 | | 0.35% | | 4,846,568 | | 2.75% | | 35,211,160 | | 20.01% | | 51.22% | | 0.23% | | 1.84% |

20

DIMENSIONAL EMERGING MARKETS VALUE FUND

PERFORMANCE CHART

Dimensional Emerging Markets Value Fund vs.

MSCI Emerging Markets Index (net dividends)

October 31, 1999-October 31, 2009

21

DIMENSIONAL EMERGING MARKETS VALUE FUND

DISCLOSURE OF FUND EXPENSES

(Unaudited)

The following Expense Table is shown so that you can understand the impact of fees on your investment. All mutual funds have operating expenses. As a shareholder of the fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports, among others. Operating expenses, legal and audit services, which are deducted from a fund’s gross income, directly reduce the investment return of the fund. A fund’s expenses are expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs, in dollars, of investing in the fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your fund’s costs in two ways.

Actual Fund Return

This section helps you to estimate the actual expenses after fee waivers that you paid over the period. The “Ending Account Value” shown is derived from the fund’s actual return and “Expenses Paid During Period” reflect the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, a $7,500 account value divided by $1,000 = 7.5), then multiply the result by the number given for your fund under the heading “Expenses Paid During Period.”

Hypothetical Example for Comparison Purposes

This section is intended to help you compare your fund’s costs with those of other mutual funds. The hypothetical “Ending Account Value” and “Expenses Paid During Period” are derived from the fund’s actual expense ratio and an assumed 5% annual return before expenses. In this case, because the return used is not the fund’s actual return, the results do not apply to your investment. The example is useful in making comparisons because the SEC requires all mutual funds to calculate expenses based on a 5% annual return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight and help you compare ongoing costs only and do not reflect any transactional costs, if applicable. The “Annualized Expense Ratio” represents the actual expenses for the six-month period indicated.

Six Months Ended October 31, 2009

EXPENSE TABLE

| | | | | | | | | | |

| | | | |

| | | Beginning

Account

Value

05/01/09 | | Ending

Account

Value

10/31/09 | | Annualized

Expense

Ratio* | | Expenses

Paid

During

Period* |

Actual Fund Return | | $ | 1,000.00 | | $ | 1,477.20 | | 0.22% | | $1.37 |

Hypothetical 5% Annual Return | | $ | 1,000.00 | | $ | 1,024.10 | | 0.22% | | $1.12 |

| * | Expenses are equal to the fund’s annualized expense ratio for the six-month period, multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period (184), then divided by the number of days in the year (365) to reflect the six-month period. |

22

DIMENSIONAL EMERGING MARKETS VALUE FUND

DISCLOSURE OF PORTFOLIO HOLDINGS

(Unaudited)

The SEC requires that all Funds file a complete Schedule of Investments with the SEC for their first and third fiscal quarters on Form N-Q. For Dimensional Emerging Markets Value Fund, this would be for the fiscal quarters ending January 31 and July 31. The Form N-Q filing must be made within 60 days of the end of the quarter. Dimensional Emerging Markets Value Fund filed its most recent Form N-Q with the SEC on September 29, 2009. It is available upon request without charge, by calling collect: (512) 306-7400 or by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, Texas 78746, or by visiting the SEC’s website at http://www.sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the Public Reference Room).

SEC regulations permit a fund to include in its reports to shareholders a “Summary Schedule of Portfolio Holdings” in lieu of a full Schedule of Investments. The Summary Schedule of Portfolio Holdings reports the fund’s 50 largest holdings in unaffiliated issuers and any investments that exceed one percent of the fund’s net assets at the end of the reporting period. The amendments also require that the Summary Schedule of Portfolio Holdings identify each category of investments that are held.

The fund is required to file a complete Schedule of Investments with the SEC on Form N-CSR within ten days after mailing the annual and semi-annual reports to shareholders. It will be available upon request, without charge, by calling collect: (512) 306-7400 or by mailing a request to Dimensional Fund Advisors LP, 6300 Bee Cave Road, Building One, Austin, Texas 78746, or by visiting the SEC’s website at http://www.sec.gov, or they may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the Public Reference Room).

PORTFOLIO HOLDINGS

The SEC requires that all Funds present their categories of portfolio holdings in a table, chart or graph format in their annual and semi-annual shareholder reports, whether or not a Schedule of Investments is utilized. The following table, which presents portfolio holdings as a percent of total investments before short-term investments and collateral for loaned securities, is provided in compliance with such requirement. The categories shown below represent broad industry sectors. Each industry sector consists of one or more specific industry classifications.

| | | |

| Dimensional Emerging Markets Value Fund | |

Consumer Discretionary | | 10.8 | % |

Consumer Staples | | 6.4 | % |

Energy | | 7.8 | % |

Financials | | 29.7 | % |

Health Care | | 1.3 | % |

Industrials | | 11.6 | % |

Information Technology | | 7.1 | % |

Materials | | 21.6 | % |

Other | | 0.1 | % |

Real Estate Investment Trusts | | — | |

Telecommunication Services | | 2.0 | % |

Utilities | | 1.6 | % |

| | | |

| | 100.0 | % |

23

DIMENSIONAL EMERGING MARKETS VALUE FUND

SUMMARY SCHEDULE OF PORTFOLIO HOLDINGS

October 31, 2009

| | | | | | | | |

| | | Shares | | Value†† | | Percentage

of Net Assets** | |

COMMON STOCKS — (85.6%) | | | | | | | | |

BRAZIL — (5.5%) | | | | | | | | |

BM&F Bovespa SA | | 13,089,600 | | $ | 84,336,376 | | 1.1 | % |

Other Securities | | | | | 399,678,193 | | 5.0 | % |

| | | | | | | | |

TOTAL BRAZIL | | | | | 484,014,569 | | 6.1 | % |

| | | | | | | | |

| | | |

CHILE — (2.4%) | | | | | | | | |

Empresas CMPC SA | | 1,375,219 | | | 49,245,765 | | 0.6 | % |

Enersis SA Sponsored ADR | | 2,873,037 | | | 50,795,294 | | 0.6 | % |

Other Securities | | | | | 107,796,717 | | 1.4 | % |

| | | | | | | | |

TOTAL CHILE | | | | | 207,837,776 | | 2.6 | % |

| | | | | | | | |

| | | |

CHINA — (12.0%) | | | | | | | | |

Bank of China, Ltd. | | 180,881,000 | | | 104,011,089 | | 1.3 | % |

Beijing Enterprises Holdings, Ltd. | | 5,599,500 | | | 33,375,390 | | 0.4 | % |

China Construction Bank Corp. | | 41,385,000 | | | 35,679,319 | | 0.5 | % |

#China Unicom Hong Kong, Ltd. ADR | | 3,936,592 | | | 49,797,889 | | 0.6 | % |

CNPC Hong Kong, Ltd. | | 40,880,000 | | | 42,741,026 | | 0.5 | % |

Denway Motors, Ltd. | | 57,266,000 | | | 27,411,466 | | 0.4 | % |

Dongfeng Motor Corp. | | 28,888,000 | | | 34,382,337 | | 0.4 | % |

Shanghai Industrial Holdings, Ltd. | | 7,759,000 | | | 36,449,823 | | 0.5 | % |

Other Securities | | | | | 687,073,216 | | 8.6 | % |

| | | | | | | | |

| | | |

TOTAL CHINA | | | | | 1,050,921,555 | | 13.2 | % |

| | | | | | | | |

| | | |

CZECH REPUBLIC — (0.4%) | | | | | | | | |

Other Securities | | | | | 32,531,377 | | 0.4 | % |

| | | | | | | | |

| | | |

HUNGARY — (2.2%) | | | | | | | | |

#*MOLHungarian Oil & Gas NYRT | | 818,138 | | | 68,350,657 | | 0.8 | % |

#*OTPBank NYRT | | 3,901,786 | | | 109,716,230 | | 1.4 | % |

Other Securities | | | | | 16,594,742 | | 0.2 | % |

| | | | | | | | |

TOTAL HUNGARY | | | | | 194,661,629 | | 2.4 | % |

| | | | | | | | |

| | | |

INDIA — (10.7%) | | | | | | | | |

ICICI Bank, Ltd. Sponsored ADR | | 3,310,395 | | | 104,111,923 | | 1.3 | % |

*Reliance Industries, Ltd. | | 4,193,665 | | | 169,675,160 | | 2.1 | % |

Other Securities | | | | | 666,095,691 | | 8.4 | % |

| | | | | | | | |

TOTAL INDIA | | | | | 939,882,774 | | 11.8 | % |

| | | | | | | | |

| | | |

INDONESIA — (2.7%) | | | | | | | | |

PT Astra International Tbk | | 9,546,400 | | | 30,713,599 | | 0.4 | % |

PT Bumi Resources Tbk | | 158,328,500 | | | 38,115,617 | | 0.5 | % |

Other Securities | | | | | 163,519,727 | | 2.0 | % |

| | | | | | | | |

TOTAL INDONESIA | | | | | 232,348,943 | | 2.9 | % |

| | | | | | | | |

| | | |

ISRAEL — (2.6%) | | | | | | | | |

*Bank Hapoalim B.M. | | 13,175,469 | | | 48,100,324 | | 0.6 | % |

*Bank Leumi Le-Israel B.M. | | 12,465,728 | | | 48,684,714 | | 0.6 | % |

Other Securities | | | | | 133,709,213 | | 1.7 | % |

| | | | | | | | |

TOTAL ISRAEL | | | | | 230,494,251 | | 2.9 | % |

| | | | | | | | |

| | | |

MALAYSIA — (3.6%) | | | | | | | | |

AMMB Holdings Berhad | | 21,831,262 | | | 30,016,248 | | 0.4 | % |

PPB Group Berhad | | 6,759,566 | | | 29,850,799 | | 0.4 | % |

Other Securities | | | | | 257,290,043 | | 3.2 | % |

| | | | | | | | |

TOTAL MALAYSIA | | | | | 317,157,090 | | 4.0 | % |

| | | | | | | | |

24

DIMENSIONAL EMERGING MARKETS VALUE FUND

CONTINUED

| | | | | | | |

| | | Shares | | Value†† | | Percentage

of Net Assets** |

MEXICO — (6.3%) | | | | | | | |

*Cemex S.A.B. de C.V. Sponsored ADR | | 9,390,579 | | $ | 97,474,207 | | 1.2% |

#Fomento Economico Mexicano S.A.B. de C.V. Sponsored ADR | | 1,402,758 | | | 60,753,449 | | 0.8% |

#Grupo Carso S.A.B. de C.V. Series A-1 | | 10,578,093 | | | 31,244,580 | | 0.4% |

#*Grupo Financiero Banorte S.A.B. de C.V. | | 9,775,260 | | | 31,242,334 | | 0.4% |

*Grupo Mexico S.A.B. de C.V. Series B | | 37,630,484 | | | 75,239,593 | | 0.9% |

#*Organizacion Soriana S.A.B. de C.V. Series B | | 14,451,500 | | | 31,970,335 | | 0.4% |

Other Securities | | | | | 224,409,268 | | 2.8% |

| | | | | | | |

TOTAL MEXICO | | | | | 552,333,766 | | 6.9% |

| | | | | | | |

| | | |

PHILIPPINES — (0.7%) | | | | | | | |

Other Securities | | | | | 59,406,031 | | 0.7% |

| | | | | | | |

| | | |

POLAND — (2.1%) | | | | | | | |

KGHM Polska Miedz SA | | 1,076,971 | | | 36,251,556 | | 0.5% |

*Polski Koncern Naftowy Orlen SA | | 5,310,008 | | | 55,270,438 | | 0.7% |

Other Securities | | | | | 89,333,418 | | 1.1% |

| | | | | | | |

TOTAL POLAND | | | | | 180,855,412 | | 2.3% |

| | | | | | | |

| | | |

RUSSIA — (0.8%) | | | | | | | |

*Gazprom OAO Sponsored ADR | | 2,755,161 | | | 66,074,426 | | 0.8% |

Other Securities | | | | | 2,469,848 | | 0.1% |

| | | | | | | |

TOTAL RUSSIA | | | | | 68,544,274 | | 0.9% |

| | | | | | | |

| | | |

SOUTH AFRICA — (8.7%) | | | | | | | |

#ABSA Group, Ltd. | | 2,880,669 | | | 46,348,396 | | 0.6% |

#Gold Fields, Ltd. Sponsored ADR | | 5,353,350 | | | 68,255,212 | | 0.9% |

Harmony Gold Mining Co., Ltd. | | 2,923,251 | | | 29,227,650 | | 0.4% |

#Nedbank Group, Ltd. | | 2,693,900 | | | 41,601,279 | | 0.5% |

Sanlam, Ltd. | | 28,700,406 | | | 78,760,640 | | 1.0% |

Steinhoff International Holdings, Ltd. | | 11,472,572 | | | 27,724,247 | | 0.3% |

Other Securities | | | | | 469,775,616 | | 5.9% |

| | | | | | | |

TOTAL SOUTH AFRICA | | | | | 761,693,040 | | 9.6% |

| | | | | | | |

| | | |

SOUTH KOREA — (10.3%) | | | | | | | |

Hana Financial Group, Inc. | | 1,078,133 | | | 31,974,873 | | 0.4% |

Hyundai Motor Co., Ltd. | | 895,824 | | | 81,255,253 | | 1.0% |

#*KB Financial Group, Inc. ADR | | 1,770,753 | | | 84,004,522 | | 1.1% |

#POSCO ADR | | 1,041,585 | | | 106,366,660 | | 1.4% |

#Shinhan Financial Group Co., Ltd. ADR | | 663,280 | | | 50,177,132 | | 0.6% |

Other Securities | | | | | 552,386,684 | | 6.9% |

| | | | | | | |

TOTAL SOUTH KOREA | | | | | 906,165,124 | | 11.4% |

| | | | | | | |

| | | |

TAIWAN — (10.6%) | | | | | | | |

#AU Optronics Corp. Sponsored ADR | | 5,821,675 | | | 51,405,388 | | 0.7% |

Chinatrust Financial Holdings Co., Ltd. | | 53,481,946 | | | 32,125,168 | | 0.4% |

*Fubon Financial Holding Co., Ltd. | | 29,313,000 | | | 32,526,620 | | 0.4% |

Mega Financial Holding Co., Ltd. | | 69,737,000 | | | 38,835,040 | | 0.5% |

*United Microelectronics Corp. | | 106,490,069 | | | 51,191,211 | | 0.6% |

Other Securities | | | | | 721,886,417 | | 9.1% |

| | | | | | | |

TOTAL TAIWAN | | | | | 927,969,844 | | 11.7% |

| | | | | | | |

| | | |

THAILAND — (1.8%) | | | | | | | |

Other Securities | | | | | 161,733,191 | | 2.0% |

| | | | | | | |

| | | |

TURKEY — (2.2%) | | | | | | | |

Other Securities | | | | | 190,785,580 | | 2.4% |

| | | | | | | |

TOTAL COMMON STOCKS | | | | | 7,499,336,226 | | 94.2% |

| | | | | | | |

25

DIMENSIONAL EMERGING MARKETS VALUE FUND

CONTINUED

| | | | | | | |

| | | Shares | | Value†† | | Percentage

of Net Assets** |

PREFERRED STOCKS — (5.3%) | | | | | | | |

BRAZIL — (5.3%) | | | | | | | |

Gerdau SA | | 2,445,084 | | $ | 36,851,147 | | 0.5% |

#Gerdau SA Sponsored ADR | | 4,348,258 | | | 65,658,696 | | 0.8% |

Metalurgica Gerdau SA | | 4,022,600 | | | 73,870,975 | | 0.9% |

Usinas Siderurgicas de Minas Gerais SA Series A | | 3,546,355 | | | 92,604,638 | | 1.2% |

Other Securities | | | | | 192,949,483 | | 2.4% |

| | | | | | | |

TOTAL BRAZIL | | | | | 461,934,939 | | 5.8% |

| | | | | | | |

| | | |

CHILE — (0.0%) | | | | | | | |

Other Securities | | | | | 1,719,902 | | 0.0% |

| | | | | | | |

| | | |

INDIA — (0.0%) | | | | | | | |

Other Securities | | | | | 97,463 | | 0.0% |

| | | | | | | |

| | | |

MALAYSIA — (0.0%) | | | | | | | |

Other Securities | | | | | 178,880 | | 0.0% |

| | | | | | | |

| | | |

TOTAL PREFERRED STOCKS | | | | | 463,931,184 | | 5.8% |

| | | | | | | |

| | | |

RIGHTS/WARRANTS — (0.0%) | | | | | | | |

BRAZIL — (0.0%) | | | | | | | |

Other Securities | | | | | 144,019 | | 0.0% |

| | | | | | | |

| | | |

CHINA — (0.0%) | | | | | | | |

Other Securities | | | | | 202,026 | | 0.0% |

| | | | | | | |

| | | |

MALAYSIA — (0.0%) | | | | | | | |

Other Securities | | | | | 38,923 | | 0.0% |

| | | | | | | |

| | | |

PHILIPPINES — (0.0%) | | | | | | | |

Other Securities | | | | | 379,437 | | 0.0% |

| | | | | | | |

| | | |

SOUTH KOREA — (0.0%) | | | | | | | |

Other Securities | | | | | 178 | | 0.0% |

| | | | | | | |

| | | |

TAIWAN — (0.0%) | | | | | | | |

Other Securities | | | | | 68,030 | | 0.0% |

| | | | | | | |

| | | |

THAILAND — (0.0%) | | | | | | | |

Other Securities | | | | | 80,775 | | 0.0% |

| | | | | | | |

| | | |

TOTAL RIGHTS/WARRANTS | | | | | 913,388 | | 0.0% |

| | | | | | | |

| | | Face

Amount | | Value† | | |

| | | (000) | | | | |

TEMPORARY CASH INVESTMENTS — (0.0%) | | | | | | | |

Repurchase Agreement, PNC Capital Markets, Inc. 0.19%, 11/02/09 (Collateralized by $1,245,000 FNMA 5.00%, 06/01/35, valued at $766,237) to be repurchased at $753,012 | | $753 | | | 753,000 | | 0.0% |

| | | | | | | |

26

DIMENSIONAL EMERGING MARKETS VALUE FUND

CONTINUED

| | | | | | | |

| | | Shares/

Face

Amount | | Value† | | Percentage

of Net Assets** |

| | | (000) | | | | |

SECURITIES LENDING COLLATERAL — (9.1%) | | | | | | | |

§@DFA Short Term Investment Fund LP | | 792,322,880 | | $ | 792,322,880 | | 10.0% |

@Repurchase Agreement, Deutsche Bank Securities 0.07%, 11/02/09 (Collateralized by various corporate obligations, ranging in par value from $4,247,617 to $16,429,280, rates ranging from 5.000% to 7.000%, maturities ranging from 03/01/37 to 10/01/39, valued at $584,280) to be repurchased at $572,827 | | $573 | | | 572,824 | | 0.0% |

| | | | | | | |

TOTAL SECURITIES LENDING COLLATERAL | | | | | 792,895,704 | | 10.0% |

| | | | | | | |

TOTAL INVESTMENTS — (100.0%)

(Cost $7,369,005,537) | | | | $ | 8,757,829,502 | | 110.0% |

| | | | | | | |

Summary of inputs used to value the Fund’s net assets as of October 31, 2009 is as follows (See Security Valuation Note):

| | | | | | | | | | | |

| | | Valuation Inputs |

| |

| | | Investment in Securities (Market Value) |

| | | Level 1 | | Level 2 | | Level 3 | | Total |

Common Stocks | | | | | | | | | | | |

Brazil | | $ | 484,014,569 | | | — | | — | | $ | 484,014,569 |

Chile | | | 207,837,776 | | | — | | — | | | 207,837,776 |

China | | | 104,254,493 | | $ | 946,667,062 | | — | | | 1,050,921,555 |

Czech Republic | | | — | | | 32,531,377 | | — | | | 32,531,377 |

Hungary | | | — | | | 194,661,629 | | — | | | 194,661,629 |

India | | | 116,902,770 | | | 822,980,004 | | — | | | 939,882,774 |

Indonesia | | | 4,151,498 | | | 228,197,445 | | — | | | 232,348,943 |

Israel | | | 18,804,680 | | | 211,689,571 | | — | | | 230,494,251 |

Malaysia | | | 445,014 | | | 316,712,076 | | — | | | 317,157,090 |

Mexico | | | 549,997,197 | | | 2,336,569 | | — | | | 552,333,766 |

Philippines | | | 1,729,383 | | | 57,676,648 | | — | | | 59,406,031 |

Poland | | | — | | | 180,855,412 | | — | | | 180,855,412 |

Russia | | | 754,724 | | | 67,789,550 | | — | | | 68,544,274 |

South Africa | | | 106,113,394 | | | 655,579,646 | | — | | | 761,693,040 |

South Korea | | | 252,962,556 | | | 653,202,568 | | — | | | 906,165,124 |

Taiwan | | | 51,416,015 | | | 876,553,829 | | — | | | 927,969,844 |

Thailand | | | 161,733,191 | | | — | | — | | | 161,733,191 |

Turkey | | | — | | | 190,785,580 | | — | | | 190,785,580 |

Preferred Stocks | | | | | | | | | | | |

Brazil | | | 461,934,939 | | | — | | — | | | 461,934,939 |

Chile | | | 1,719,902 | | | — | | — | | | 1,719,902 |

India | | | — | | | 97,463 | | — | | | 97,463 |

Malaysia | | | 178,880 | | | — | | — | | | 178,880 |

Rights/Warrants | | | | | | | | | | | |

Brazil | | | 144,019 | | | — | | — | | | 144,019 |

China | | | 202,026 | | | — | | — | | | 202,026 |

Malaysia | | | 38,923 | | | — | | — | | | 38,923 |