UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07538

LORD ABBETT SECURITIES TRUST

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

Thomas R. Phillips, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2013

| Item 1: | Report(s) to Shareholders. |

2 0 1 3

L O R D A B B E T T

A N N U A L

R E P O R T

Lord Abbett

Alpha Strategy Fund

Fundamental Equity Fund

Growth Leaders Fund

International Core Equity Fund

International Dividend Income Fund

International Opportunities Fund

Value Opportunities Fund

For the fiscal year ended October 31, 2013

Lord Abbett Securities Trust

Lord Abbett Alpha Strategy Fund, Lord Abbett Fundamental Equity Fund, Lord Abbett Growth Leaders Fund, Lord Abbett International Core Equity Fund, Lord Abbett International Dividend Income Fund, Lord Abbett International Opportunities Fund, and Lord Abbett Value Opportunities Fund

Annual Report

For the fiscal year ended October 31, 2013

Daria L. Foster, Trustee, President and Chief Executive Officer of the Lord Abbett Funds, and E. Thayer Bigelow, Independent Chairman of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Funds for the fiscal year ended October 31, 2013. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and more timely information about the Funds, please visit our Website at www.lordabbett.com, where you also can access the quarterly commentaries that provide updates on each Fund’s performance and other portfolio related updates.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Daria L. Foster

Trustee, President and Chief Executive Officer

1

Alpha Strategy Fund

For the fiscal year ended October 31, 2013, the Fund returned 37.98%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the combined 85% Russell 2000® Index1 / 15% S&P Developed Ex-U.S. SmallCap® Index,2 which returned 35.17% over the same period.

Global equity markets rose during the 12-month period amid an ongoing housing recovery in the Unites States, rising corporate profits, accommodative monetary policy, and economic stabilization in Europe. The equity market advance came in the face of a series of disruptive congressional showdowns, a two-week government shutdown, and concerns about growth in the largest emerging market economies. Domestic small cap equity markets (as represented by the Russell 2000® Index) outperformed foreign small cap equity markets (as represented by the S&P Developed Ex-U.S. SmallCap® Index). Within the U.S. small cap market, growth stocks (as represented by the Russell 2000® Growth Index3) outperformed value stocks (as represented by the Russell 2000® Value Index4), while micro cap stocks (as represented by the Russell Microcap® Index5) outperformed small cap stocks (as represented by the Russell 2000® Index) for the period.

The Fund’s exposure to domestic micro cap growth and small cap growth equities benefited relative performance, as each of these investment strategies significantly outperformed Alpha Strategy Fund’s index and the underlying investment strategy’s index. Within each of these underlying strategies, stock selection in the information technology and health care sectors contributed positively to performance relative to the underlying index.

Detracting from the Fund’s relative performance was the Fund’s exposure to domestic micro cap value equities, as this investment strategy underperformed Alpha Strategy Fund’s index and its underlying index. Within this asset class, stock selection in the industrials and consumer discretionary sectors detracted from performance relative to the underlying index. Also detracting from the Fund’s relative performance was exposure to the domestic small cap blend asset class. Stock selection within the materials and consumer discretionary sectors caused this investment strategy to underperform its underlying index.

Fundamental Equity Fund

For the fiscal year ended October 31, 2013, the Fund returned 31.11%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to the Russell 1000® Value Index,6 which returned 28.29% over the same period.

The 12-month period began and ended with the incessant U.S. budget debate which ultimately led to a temporary partial government shutdown and the postponement of a resolution until early 2014. Investors appeared to be most

2

concerned with the possibility that the Federal Reserve may begin tapering its bond purchases. The broad market declined in June when Fed chairman Ben Bernanke alluded that tapering may occur by the end of 2013. Despite these obstacles, the broad market continued to move higher, reaching an all-time high near the end of the period. Positive indicators, such as strengthening U.S. employment reports, an improving U.S. housing market, and better than expected corporate earnings, continue to support the gradual economic recovery.

The Fund’s relative performance benefited from strong stock selection within the health care and energy sectors. Within the health care sector, shares of Celgene Corp., a biotechnology firm that develops and markets therapies for the treatment of hematologic malignancies, rose after reporting strong sales for its Revlimid and Pomalyst drugs as well as the anticipation of successful product launches in the pipeline. Shares of Actavis, Inc., an integrated global pharmaceutical company engaged in the development and distribution of generic and proprietary drugs, rallied following the announcement of a definitive agreement to acquire Warner Chilcott, a pharmaceutical company focused on women’s health. The merger is expected to benefit Actavis with operational synergies, and is consistent with management’s plans to build out its brand presence and lower its tax structure. Within the energy sector, shares of Halliburton Co., a provider of services and products for the exploration, development, and production of oil and natural gas, appreciated as the company continued to return capital back to shareholders through share repurchase programs as well as increasing dividends. Shares of Anadarko Petroleum Corporation, a large cap exploration and production company, appreciated as the firm benefited from offshore exploration and drilling.

Stock selection within the information technology sector was the largest detractor from the Fund’s relative performance during the period. Shares of Broadcom Corp., a provider of semiconductor chips used in mobility and broadband communication devices and infrastructure, fell after the firm released lower than expected revenue guidance in July amid slowing growth in the smartphone market. Shares of Ecommerce company, eBay Inc., underperformed within the sector as the company faced some challenges with weakening demand in Europe. In addition, stock selection within the financials sector detracted from relative performance. Health care real estate investment trust, Ventas, Inc., declined as investors’ concern increased about the negative affect of rising interest rates. Shares of Capital One Financial Group, a diversified financial services holding company, underperformed its sector as the company’s announcement that it would not be enacting a share buyback in 2013 disappointed investors. Investors also reacted negatively to the announced sale of the Best Buy private

3

label and co-branded credit card accounts. This announcement was a reversal of the company’s efforts to grow in private label credit cards.

Growth Leaders Fund

For the fiscal year ended October 31, 2013, the Fund returned 42.20%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index,7 which returned 28.29% over the same period.

Equity markets made considerable gains in the trailing 12-month period. Following the conclusion of the U.S. presidential election in November, and the last-minute resolution of the “fiscal cliff” in December, equity markets shook off challenges and marched significantly higher. By the end of the period in October, broad market equity indexes had recently hit all-time highs.

We were pleased with the Fund’s outperformance during the period, which we attribute to our fundamentally driven process focusing on sound business models, capable management, competitive advantages, and favorable industry conditions.

Security selection within the information technology sector contributed the most to relative Fund performance during the period. Shares of the world’s leading online social network, Facebook, Inc., were among the largest contributors. The company had a strong second quarter, posting a 41% increase in mobile advertisement revenue. Global technology company Google, Inc. also contributed to relative Fund performance within the sector. Revenue and earnings for the third quarter were particularly strong, beating Street expectations. The beat was the first in eight quarters for the company, and provided support for much of the run-up in the share price over the last 12 months.

Both security selection and a slight overweight to the consumer discretionary sector also contributed to relative Fund performance during the period. Shares of Tesla Motors, Inc., a manufacturer of high-end electric vehicles, rose significantly. Investors cheered midyear following a quarterly earnings report in which the company reported its first-ever profit. Starbucks Corporation, which owns coffee and tea shops in more than 60 countries, also saw its shares rise steadily throughout the period. The company benefited from an expanding digital platform, lower coffee costs, and significant growth opportunities domestically and abroad.

Security selection within the health care sector detracted from relative Fund performance during the period. Express Scripts, a provider of healthcare management and administration services, was among the most notable detractors within the sector. Shares of the company have been volatile over the period due to uncertainty surrounding the new health care law and what impact private exchanges would have on current customers. Onyx Pharmaceuticals, Inc., a biopharmaceutical company that develops

4

cancer fighting therapies, also detracted from relative performance. Shares of the company pulled back in June 2013, having more than doubled from the year prior.

Both security selection and a slight underweight to the energy sector also detracted from relative Fund performance during the period. Halliburton Company, a provider of services and products used in the production of oil and natural gas, detracted from relative performance. Shares declined after they were added to the Fund in February 2013, following a run-up of nearly 40% since the beginning of the period. The Fund’s position in CARBO Ceramics, Inc., a supplier of ceramic proppants and the resin-coated sand used to extract natural gas from shale, also detracted from relative performance during the period. CARBO’s shares declined notably in the 2013 second quarter after a disappointing earnings report tied to competitive pricing pressure from lower-quality importers.

International Core Equity Fund

For the fiscal year ended October 31, 2013, the Fund returned 24.99%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the MSCI EAFE Index with Gross Dividends,8 which returned 27.40% over the same period.

Global growth appeared to be broadening beyond the United States over the 12-month period, with numerable markets returning over 20%, many from Europe. Austria, Belgium, Finland, France, Germany, the Netherlands, Sweden, and Switzerland, for example, all posted returns greater than the United States’ 27.58% return, as measured by the MSCI All Country World Index – Gross Dividends. The United Kingdom also saw a return greater than 20%. After years marked by austerity, struggling eurozone members Italy, Spain, Ireland, and Greece were among the top performing markets: Italy posted a return just shy of 30%, while Greece topped the list at nearly 77%. In the Asia/Pacific region, Japan led a group of markets with double-digit positive returns that included Australia, Hong Kong, Korea, New Zealand, the Philippines, and Taiwan. India, Malaysia, Singapore, and Thailand posted single-digit returns, while Indonesia was the laggard, ending the period with a loss. Emerging markets, especially in South America, saw the weakest returns; Brazil, Chile, Colombia, and Peru all ended the period with negative returns.

Based on an analysis of stocks and sectors represented in the portfolio, stock selection within the energy and materials sectors was the primary reason for the Fund’s underperformance. A main detractor from the Fund’s performance from the energy sector was United Kingdom-based oil and gas exploration company Tullow Oil plc. After struggling early in 2013, shares of Tullow became increasingly scrutinized when a series of disappointing exploration results served only to worsen market sentiment, and we

5

exited the position. Another detractor from the energy sector was Japan-based oil and gas exploration company Inpex Corp. In the first quarter of 2013, it was ascertained that the approximate enterprise value of Inpex’s Australian Ichthys liquid natural gas project was roughly 20% lower than forecasted. Also, the rumor that Japan’s new government could merge Inpex with its smaller national competitor, Japex, moved investors toward Japex, which would see greater benefit from a merger. A notable detractor from the materials sector was Kinross Gold Corp., a Canadian gold mining company. Given the continued outflow of investors away from precious metals and back into the higher-returning equity market, Kinross’s share price has been on a downward trend over the last 12 months. Kinross faced two analyst price-target reductions in February and April, which coincided with two substantial drops in the value of gold.

Contributing to Fund performance was stock selection in the health care and consumer staples sectors. Contributing from the health care sector was Switzerland-based Roche Holding Ltd. The Swiss drug maker started off the year with strong first quarter sales. Demand for its flu drug, Tamiflu, saw a spike in the United States, while sales of its cancer treatment medications lifted overall first quarter sales by 5% over estimates. Roche’s success continued in June, when the European Medicines Agency gave the green light on Roche’s injectable breast cancer treatment drug, Herceptin, which cuts treatment time from 30–90 minutes down to about five minutes. Another contributor from the health care sector was Germany-based biotechnology company Morphosys AG. Shares continued to climb as the company entered into a partnership with Celgene, in which Celgene agreed to market and sell the cancer fighting MOR202 antibody that was developed by Morphosys. In return, Morphosys received an upfront fee as well as additional revenue based on defined sales milestones. On top of the potential revenues, Celgene will likely invest additional money by way of a capital increase. From consumer staples, the Netherlands-based supermarket operator Koninklijke Ahold NV was a notable contributor to the portfolio. After fourth quarter 2012’s results beat expectations, Ahold announced a dividend that topped the previous year’s by 10% and stated that it would begin a 12-month share buyback program totaling €500 million. In addition, it completed its sale of Swedish retail company ICA, the proceeds of which might either be used to benefit shareholders immediately through another share buy-back program or reinvested through M&A for longer-term growth.

International Dividend Income Fund

For the fiscal year ended October 31, 2013, the Fund returned 21.54%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions

6

reinvested, compared to its benchmark, the MSCI All Country World Ex-U.S. Value Index with Gross Dividends,9 which returned 21.40% over the same period.

Global growth appeared to be broadening beyond the United States over the 12-month period, with numerable markets returning over 20%, many from Europe. Austria, Belgium, Finland, France, Germany, the Netherlands, Sweden, and Switzerland, for example, all posted returns greater than the United States’ 27.58% return, as measured by the MSCI All Country World Index – Gross Dividends. The United Kingdom also saw a return greater than 20%. After years marked by austerity, struggling eurozone members Italy, Spain, Ireland, and Greece were among the top performing markets: Italy posted a return just shy of 30%, while Greece topped the list at nearly 77%. In the Asia/Pacific region, Japan led a group of markets with double-digit positive returns that included Australia, Hong Kong, Korea, New Zealand, the Philippines, and Taiwan. India, Malaysia, Singapore, and Thailand posted single-digit returns, while Indonesia was the laggard, ending the period with a loss. Emerging markets, especially in South America, saw the weakest returns; Brazil, Chile, Colombia, and Peru all ended the period with negative returns.

Strong stock selection, particularly in the consumer discretionary and telecommunication services sectors, was partially responsible for the Fund’s outperformance versus its benchmark index. One of the notable contributors from the consumer discretionary sector was Japan-based automaker Toyota Motor Corp. Demand for autos, particularly in the United States, has had a strong turn upward. In the United States, Toyota has surpassed Ford as the number two in auto sales for the first time since March 2010. In China, the opportunity to surpass German auto sales in China for premium cars has helped bolster Toyota’s share price. Another contributing automaker was Germany-based Daimler AG. A plan to reduce production costs and the introduction of new compact and SUV models to meet global demand are believed to put Daimler in the position to increase its return on sales in both segments over the course of its next fiscal year. A leading contributor from the telecommunication services sector was Israel-based Bezeq-Israeli Telecommunication Corp. Ltd. Increasing weakness in its competition, maintaining a stable average revenue per user, reduction in costs, and the announcement of the disbursement of 100% of its net income from the first half of 2013 to shareholders via dividend, has kept Bezeq’s share price on an upward trend.

Detracting from the Fund’s performance was stock selection in the financials and utilities sectors. From the financials sector, Stockland Trust Group, a residential and retail real estate developer, saw its shares fall in the middle of 2013. Deteriorating margins in residential real estate, a challenging environment for retail, and uncertainty at the management

7

level adversely affected the stock. Another weak performer from the financials sector was Aozora Bank Ltd., a Japan-based bank. Investors in Aozora reacted poorly when the U.S. investment fund Cerberus Capital announced it would be boosting its stake in another Japanese financial firm, Seibu Holdings, by relinquishing its controlling stake in Aozora. Cerberus also announced plans to poach Aozora’s director, Yuji Shirakawa, to aid in a change in management at Seibu. From the utilities sector, CEZ, a.s., a Czech Republic-based producer and distributor of electricity, detracted from the Fund’s performance. Despite an attractive dividend yield, shares fell during the period as CEZ faced declining forward prices of electricity thanks to declining costs in coal, expanding renewable energy sources, and overall weak demand for electricity across Europe.

International Opportunities Fund

For the fiscal year ended October 31, 2013, the Fund returned 30.26%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the S&P Developed Ex-U.S. SmallCap® Index,10 which returned 28.67% over the same period.

Global growth appeared to be broadening beyond the United States over the 12-month period, with numerable equity markets returning over 20%, many from Europe. Austria, Belgium, Finland, France, Germany, the Netherlands, Sweden, and Switzerland, for example, all posted returns greater than the United States’ 27.58% return, as measured by the MSCI All Country World Index – Gross Dividends. The United Kingdom also saw a return greater than 20%. After years marked by austerity, struggling eurozone members Italy, Spain, Ireland, and Greece were among the top performing markets: Italy posted a return just shy of 30%, while Greece topped the list at nearly 77%. In the Asia/Pacific region, Japan led a group of markets with double-digit positive returns that included Australia, Hong Kong, Korea, New Zealand, the Philippines, and Taiwan. India, Malaysia, Singapore, and Thailand posted single-digit returns, while Indonesia was the laggard, ending the period with a loss. Emerging markets, especially in South America, saw the weakest returns; Brazil, Chile, Colombia, and Peru all ended the period with negative returns.

The Fund’s pro-cyclical approach resulted in strong allocation in the top two contributing sectors to the Fund’s performance for the period. An overweight position in the consumer discretionary sector helped Fund performance, as it was the best performing sector for the period. Also contributing was an underweight position in the materials sector, the weakest performing sector for the period. In addition, contributing to the Fund’s performance was strong stock selection in the industrials sector. Shares of Ashtead Group plc benefited over the period thanks to its growing presence in the U.S. equipment rental market. Ashtead has been steadily gaining market share from its

8

larger rival, United Rentals, over the last three years.

Detracting from Fund performance was an overweight in the consumer staples sector as it was one of the weaker performing sectors for the period. In addition, stock selection in the financials sector also detracted from the Fund’s performance. A significant detractor was Indonesia-based Bank of Tabungan Negara Persero. Its shares remained depressed for most of 2013, as three straight quarters of underwhelming earnings paired with macro-economic concerns including a depreciating currency in Indonesia have created an uncertain outlook for investors. Another financials holding that detracted was India-based real estate and infrastructure developer Housing Development & Infrastructure Ltd. (HDIL). Early in 2013, investors reacted poorly to the announcement that HDIL’s vice chairman and managing director sold more than half of his stake in the company. In addition, high levels of debt and a nonconvertible debenture rating downgrade, from ‘BBB+’ to ‘D,’ were among the issues that harmed HDIL’s stock performance for the period.

Value Opportunities Fund

For the fiscal year ended October 31, 2013, the Fund returned 34.08%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, Russell 2500™ Value Index,11 which returned 33.35% over the same period.

In a period marred by a series of congressional showdowns culminating in a two-week governmental shutdown, an escalating Syrian civil war, fears of a slowing Asian economy, and an ongoing European debt crisis, domestic equity markets could have very easily experienced lackluster returns. Instead, positive investor sentiment driven by a continuation of global accommodative monetary policy and a rebounding U.S. housing market led to a significant broad market rally for the trailing 12-month period. Meanwhile, in an anemic economic recovery, investors favored small capitalization companies over large and within the small to mid-cap space, growth companies over value.

During the period, stock selection was the prevailing factor of the Fund’s relative outperformance, most notably in consumer discretionary holding Red Robin Gourmet Burgers, Inc. Management’s efforts to revitalize the brand through an upgraded menu and promotional offerings drew people back to the casual dining restaurant, boosting same-store-sales and customer traffic. In addition, a focus on cost discipline led to margin expansion as the company continued to outperform its peers.

Other notable contributors included health care holding Actavis plc and industrials holding Jacobs Engineering Group, Inc. A series of transformational acquisitions by Actavis was lauded by investors as the integrated specialty pharmaceutical company continued to grow its generic business and expand into branded

9

pharmaceuticals. Potential synergies from these acquisitions along with strong management execution led to positive price action in shares of the firm. For shares of Jacobs Engineering, an engineering and construction company, positive price momentum can be attributed to consistent backlog growth throughout the period as the firm experienced bookings strength in the chemicals and oil and gas sectors.

Conversely, the Fund’s biggest detractor of relative performance was industrials holding Atlas Worldwide Holdings, Inc. A weak global airfreight environment resulted in a muted outlook for the provider of air cargo services, leading to relatively weak stock performance. Due to secular concerns with the industry, the position was liquidated in April 2013.

Also detracting from the Fund’s relative performance was information technology holding Nuance Communications, Inc. and materials holding Axiall Corp. Following two negative guidance revisions, shares of Nuance communications skidded lower as the provider of voice and language solutions experienced weakness across multiple business segments. Due to continued fundamental disappointments and concerns with the company’s medical division, the position was exited in May 2013. Axiall Corp. struggled with rising ethylene costs, deterioration in caustic soda and chlorine prices, and weaker-than-expected PVC piping demand, leading to lower investor confidence and a woeful stock performance. Due to fundamental concerns in the integrated chemicals and building products company, the position was exited in October 2013.

Each Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

1 The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000 Index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

2 The S&P Developed Ex-U.S. SmallCap® Index captures the bottom 15% of companies domiciled in the developed markets excluding the United States within the S&P Global BMI with a float-adjusted market capitalization of at least US$100 million and a minimum annual trading liquidity of US$50 million.

3 The Russell 2000® Growth Index measures the performance of those Russell 2000 companies with higher price-to-book ratios and higher forecasted growth values.

4 The Russell 2000® Value Index measures the performance of those Russell 2000 companies with lower price-to-book ratios and lower forecasted growth values.

5 The Russell Microcap® Index measures performance of the micro-cap segment, representing less than 3% of the U.S. equity market. The Russell Microcap Index includes the smallest 1,000 securities in the small cap Russell 2000 Index plus the next smaller 1,000 securities.

6 The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

7 The Russell 1000® Growth Index measures the performance of large cap companies with higher price-to-book ratios and higher forecasted growth values.

8 The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US

10

& Canada. The MSCI EAFE Index consists of the following 22 developed market country indexes: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Greece, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, and the United Kingdom.

The MSCI EAFE Index with Gross Dividends approximates the maximum possible dividend reinvestment. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits.

9 The MSCI ACWI (All Country World Index) ex-U.S. Value Index is a subset of the MSCI ACWI ex-U.S Index. The index is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets excluding the United States from a value perspective

The MSCI Global Value indexes cover the full range of developed, emerging, and All Country MSCI International Equity indexes across all size segmentations. MSCI uses a two-dimensional framework for style segmentation in which value and growth securities are categorized using a multi-factor approach, which uses three variables to define the value investment style characteristics and five variables to define the growth investment style characteristics, including forward looking variables. The objective of the index design is to divide constituents of an underlying MSCI Equity Index into respective value indexes, each targeting 50% of the free float-adjusted market capitalization of the underlying market index.

10 The S&P Developed Ex-U.S. SmallCap®Index captures the bottom 15% of companies domiciled in the developed markets excluding the United States within the S&P Global BMI with a float-adjusted market capitalization of at least US$100 million and a value traded of at least US$50 million for the past 12-months at the time of the annual reconstitution. Stocks are excluded if their market capitalization falls below US$75 million, or if the value traded is less than US$35 million at the time of reconstitution.

11 The Russell 2500™ Value Index measures the performance of those Russell 2500 companies with lower price-to-book ratios and lower forecasted growth values.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in each Fund will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. Each Fund offers classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see a Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place for Alpha Strategy Fund, Growth Leaders Fund, International Core Equity Fund and International Dividend Income Fund. Without such expense waivers and reimbursements, each of the Fund’s returns would have been lower.

The annual commentary above discusses the views of the Funds’ management and various portfolio holdings of the Funds as of October 31, 2013. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because the Funds’ portfolios are actively managed and may change significantly, the Funds may no longer own the securities described above or may have otherwise changed their positions in the securities. For more recent information about the Funds’ portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see each Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

11

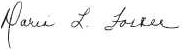

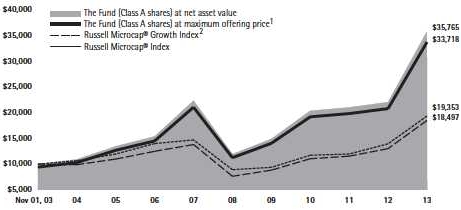

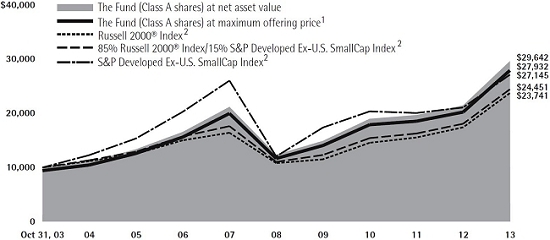

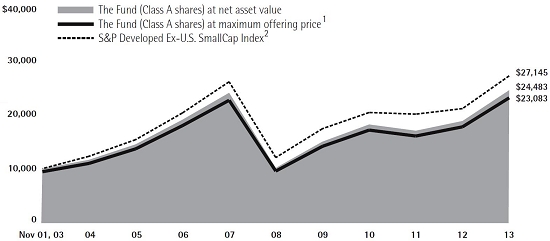

Alpha Strategy Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 2000® Index, 85% Russell 2000® Index/15% S&P Developed Ex-U.S. SmallCap Index, and the S&P Developed Ex-U.S. SmallCap Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A3 | | 30.04% | | 17.69% | | 10.82% | | — |

| Class B4 | | 31.93% | | 18.06% | | 10.90% | | — |

| Class C5 | | 35.97% | | 18.26% | | 10.74% | | — |

| Class F6 | | 38.19% | | 19.34% | | — | | 6.69% |

| Class I7 | | 38.32% | | 19.45% | | — | | 12.12% |

| Class R28 | | 37.49% | | 18.74% | | — | | 6.15% |

| Class R39 | | 37.60% | | 18.85% | | — | | 6.26% |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2013, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years, and 0% for 10 years. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations on October 19, 2004. Performance is at net asset value.

8 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

9 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

12

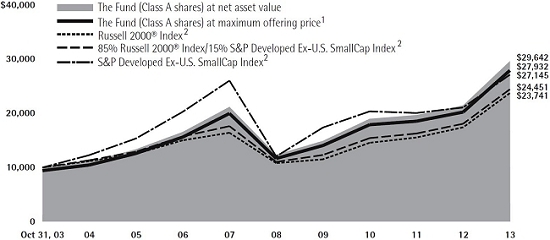

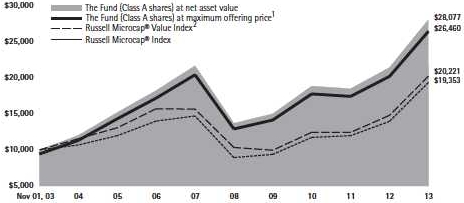

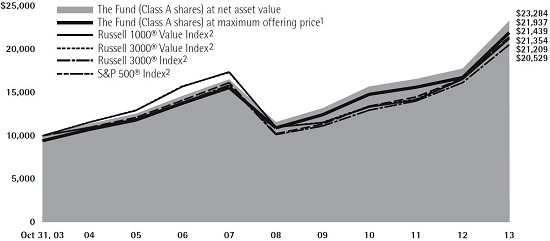

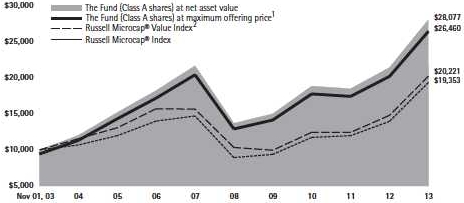

Fundamental Equity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 1000® Value Index, Russell 3000® Value Index, Russell 3000® Index, and S&P 500® Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A3 | | 23.56% | | 13.63% | | 8.17% | | — |

| Class B4 | | 25.32% | | 14.00% | | 8.25% | | — |

| Class C5 | | 29.30% | | 14.22% | | 8.12% | | — |

| Class F6 | | 31.49% | | 15.25% | | — | | 6.15% |

| Class I7 | | 31.66% | | 15.37% | | 9.21% | | — |

| Class P8 | | 31.08% | | 14.86% | | 8.72% | | — |

| Class R29 | | 30.87% | | 14.69% | | — | | 5.64% |

| Class R310 | | 31.04% | | 14.81% | | — | | 5.73% |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2013, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years, and 0% for 10 years. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations on March 31, 2003. Performance is at net asset value.

8 Class P shares commenced operations on August 15, 2001. Performance is at net asset value.

9 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

13

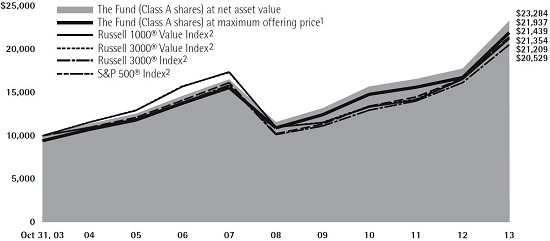

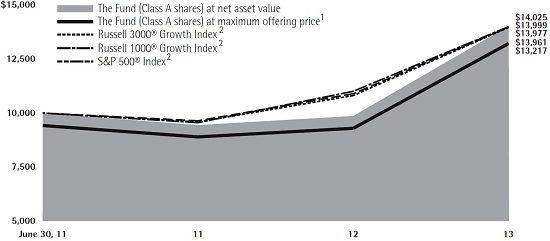

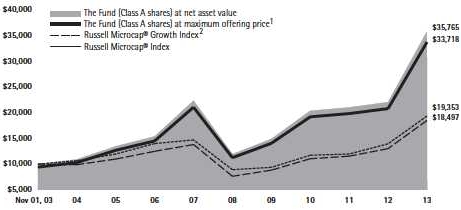

Growth Leaders Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 3000® Growth Index, Russell 1000® Growth Index, and S&P 500® Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2013

| | | 1 Year | | Life of Class |

| Class A3 | | 34.06% | | 12.67% |

| Class B4 | | N/A | | 24.05% |

| Class C5 | | 40.24% | | 14.82% |

| Class F6 | | 42.51% | | 15.82% |

| Class I6 | | 42.67% | | 15.96% |

| Class R26 | | 42.62% | | 15.85% |

| Class R36 | | 41.98% | | 15.53% |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance for each index begins on June 30, 2011.

3 Class A shares commenced operations on June 21, 2011 and performance for the Class began on June 30, 2011. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2013, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations and performance for the Class began on February 11, 2013. Performance reflects the deduction of a CDSC of 5% for 1 year.

5 Class C shares commenced operations on June 24, 2011 and performance for the Class began on June 30, 2011. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Commenced operations on June 24, 2011 and performance for the Class began on June 30, 2011. Performance is at net asset value.

14

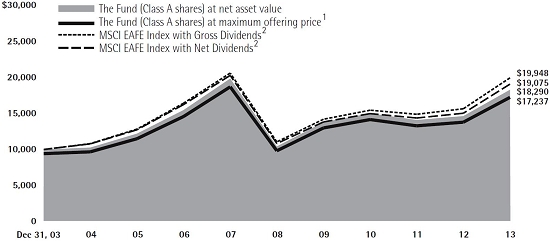

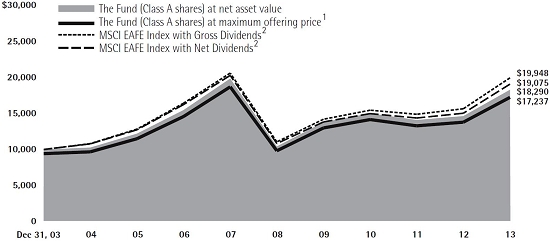

International Core Equity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International Europe, Australasia, Far East Index (“MSCI EAFE® Index”) with Gross Dividends and the MSCI EAFE® Index with Net Dividends assuming reinvestment of all dividends and distributions. The MSCI EAFE Index with Net Dividends reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI EAFE Index. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2013

| | | 1 Year | | 5 Years | | Life of Class |

| Class A3 | | 17.78% | | 10.59% | | 5.69% |

| Class B4 | | 19.18% | | 10.92% | | 5.77% |

| Class C5 | | 23.26% | | 11.21% | | 5.65% |

| Class F6 | | 25.35% | | 12.20% | | -0.46% |

| Class I7 | | 25.37% | | 12.31% | | 6.70% |

| Class P8 | | 24.91% | | 11.81% | | 6.22% |

| Class R29 | | 24.65% | | 11.79% | | -0.73% |

| Class R310 | | 24.80% | | 11.78% | | -0.83% |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of each index begins on December 31, 2003.

3 Class A shares commenced operations on December 15, 2003 and performance for the Class began on December 31, 2003. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2013, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on December 15, 2003 and performance for the Class began on December 31, 2003. Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years and 0% for the Life of the Class. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 Class C shares commenced operations on December 15, 2003 and performance for the Class began on December 31, 2003. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations on December 15, 2003 and performance for the Class began on December 31, 2003. Performance is at net asset value.

8 Class P shares commenced operations on December 15, 2003 and performance for the Class began on December 31, 2003. Performance is at net asset value.

9 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

15

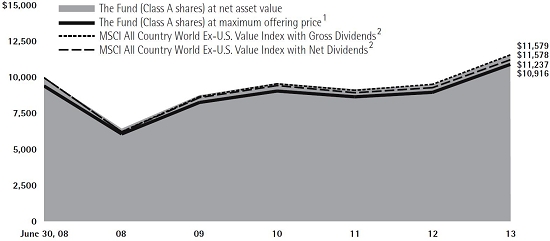

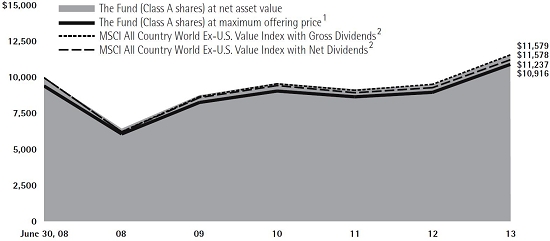

International Dividend Income Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International (MSCI) All Country World Ex-U.S. Value Index with Gross Dividends and the MSCI All Country World Ex-U.S. Value Index with Net Dividends, assuming reinvestment of all dividends and distributions. The MSCI All Country World Ex-U.S. Value Index with Net Dividends reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI All Country World Ex-U.S. Value Index. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursements of expense, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2013

| | | 1 Year | | 5 Years | | Life of Class |

| Class A3 | | 14.49% | | 11.06% | | 1.66% |

| Class C4 | | 19.70% | | 11.64% | | 2.12% |

| Class F5 | | 21.80% | | 12.65% | | 3.02% |

| Class I6 | | 21.86% | | 12.78% | | 3.14% |

| Class R27 | | 21.13% | | 12.44% | | 2.85% |

| Class R38 | | 21.30% | | 12.30% | | 2.74% |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of each index begins on June 30, 2008.

3 Class A shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2013, is calculated using the SEC-required uniform method to compute such return.

4 Class C shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Class F shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Performance is at net asset value.

6 Class I shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Performance is at net asset value.

7 Class R2 shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Performance is at net asset value.

8 Class R3 shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Performance is at net asset value.

16

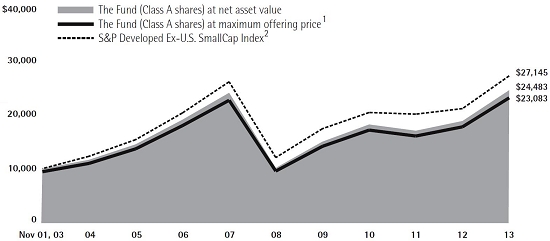

International Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P Developed Ex-U.S. SmallCap Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2013

| | | 1 Year | | 5 Years | | 10 Years | | Life of Class |

| Class A3 | | 22.80% | | 17.92% | | 8.73% | | — |

| Class B4 | | 24.39% | | 18.34% | | 8.80% | | — |

| Class C5 | | 28.43% | | 18.57% | | 8.68% | | — |

| Class F6 | | 30.63% | | 19.61% | | — | | 1.42% |

| Class I7 | | 30.74% | | 19.72% | | 9.75% | | — |

| Class P7 | | 30.19% | | 19.21% | | 9.31% | | — |

| Class R28 | | 29.97% | | 19.03% | | — | | 0.93% |

| Class R39 | | 30.14% | | 19.18% | | — | | 1.09% |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2013, is calculated using the SEC-required uniform method to compute such return.

4 Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years, and 0% for 10 years. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Performance is at net asset value.

8 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

9 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

17

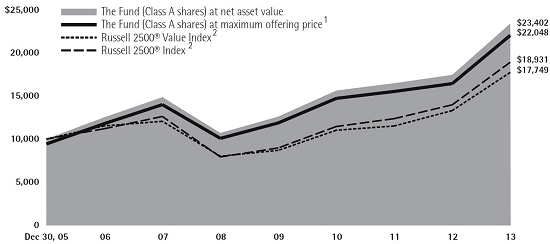

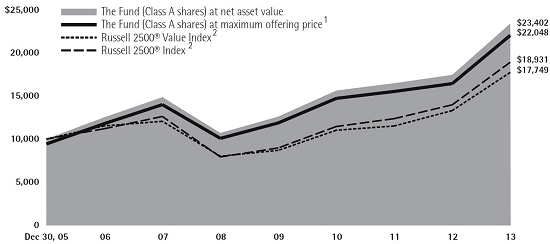

Value Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 2500® Value Index and the Russell 2500® Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2013

| | | 1 Year | | 5 Years | | Life of Class |

| Class A3 | | 26.34% | | 15.58% | | 10.62% |

| Class B4 | | 28.29% | | 15.95% | | 10.76% |

| Class C5 | | 32.29% | | 16.20% | | 10.76% |

| Class F6 | | 34.54% | | 17.25% | | 8.14% |

| Class I7 | | 34.63% | | 17.36% | | 11.85% |

| Class P8 | | 34.09% | | 16.84% | | 11.36% |

| Class R29 | | 33.82% | | 16.66% | | 7.60% |

| Class R310 | | 33.92% | | 16.79% | | 7.71% |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance for each index begins on December 30, 2005.

3 Class A shares commenced operations on December 20, 2005 and performance for the Class began on December 30, 2005. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2013, is calculated using the SEC-required uniform method to compute such return.

4 Class B shares commenced operations on December 20, 2005 and performance for the Class began on December 30, 2005. Performance reflects the deduction of a CDSC of 5% for 1 year, 2% for 5 years, and 0% for Life of the Class. Class B shares automatically convert to Class A shares after approximately 8 years. (There is no initial sales charge for automatic conversions.) All returns for periods greater than 8 years reflect this conversion.

5 Class C shares commenced operations on December 20, 2005 and performance for the Class began on December 30, 2005. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Class F shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

7 Class I shares commenced operations on December 20, 2005 and performance for the Class began on December 30, 2005. Performance is at net asset value.

8 Class P shares commenced operations on December 20, 2005 and performance for the Class began on December 30, 2005. Performance is at net asset value.

9 Class R2 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

10 Class R3 shares commenced operations and performance for the Class began on September 28, 2007. Performance is at net asset value.

18

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2013 through October 31, 2013).

Actual Expenses

For each class of each Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 5/1/13 – 10/31/13” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

19

Alpha Strategy Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period†# |

| | | 5/1/13 | | 10/31/13 | | 5/1/13 -

10/31/13 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,191.30 | | $1.38 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,023.95 | | $1.28 |

| Class B | | | | | | |

| Actual | | $1,000.00 | | $1,186.90 | | $5.51 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.18 | | $5.09 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,187.10 | | $5.51 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.20 | | $5.09 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,192.50 | | $0.55 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,024.70 | | $0.51 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,193.00 | | $0.00 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,025.21 | | $0.00 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,189.10 | | $3.31 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,022.18 | | $3.06 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,189.60 | | $2.76 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,022.71 | | $2.55 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.25% for Class A, 1.00% for Classes B and C, 0.10% for Class F, 0.00% for Class I, 0.60% for Class R2 and 0.50% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

| # | Does not include expenses of Underlying Funds in which Alpha Strategy Fund invests. |

Portfolio Holdings Presented by Portfolio Allocation

October 31, 2013

| Underlying Fund Name | %* | |

| Lord Abbett Developing Growth Fund, Inc. - Class I | 20.30 | % |

| Lord Abbett Securities Trust - International Opportunities Fund - Class I | 19.84 | % |

| Lord Abbett Securities Trust - Micro-Cap Growth Fund - Class I | 10.66 | % |

| Lord Abbett Securities Trust - Micro-Cap Value Fund - Class I | 9.67 | % |

| Lord Abbett Research Fund, Inc. - Small-Cap Value Fund - Class I | 19.71 | % |

| Lord Abbett Securities Trust - Value Opportunities Fund - Class I | 19.78 | % |

| Repurchase Agreement | 0.04 | % |

| Total | 100.00 | % |

| * | Represents percent of total investments. |

20

Fundamental Equity Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 5/1/13 | | 10/31/13 | | 5/1/13 -

10/31/13 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,110.20 | | $5.64 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.88 | | $5.40 |

| Class B | | | | | | |

| Actual | | $1,000.00 | | $1,106.40 | | $9.08 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,016.61 | | $8.69 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,106.20 | | $9.08 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,016.61 | | $8.69 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,111.30 | | $4.31 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.14 | | $4.13 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,111.60 | | $3.78 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.64 | | $3.62 |

| Class P | | | | | | |

| Actual | | $1,000.00 | | $1,109.30 | | $6.17 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.37 | | $5.90 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,109.10 | | $6.96 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.62 | | $6.67 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,109.90 | | $6.43 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.13 | | $6.16 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.06% for Class A, 1.71% for Classes B and C, 0.81% for Class F, 0.71% for Class I, 1.16% for Class P, 1.31% for Class R2 and 1.21% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

October 31, 2013

| Sector* | %** | |

| Consumer Discretionary | 14.01 | % |

| Consumer Staples | 5.02 | % |

| Energy | 13.79 | % |

| Financials | 22.85 | % |

| Health Care | 18.70 | % |

| Industrials | 7.09 | % |

| Sector* | %** | |

| Information Technology | 8.56 | % |

| Materials | 3.57 | % |

| Telecommunication Services | 2.42 | % |

| Utilities | 3.13 | % |

| Repurchase Agreement | 0.86 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

21

Growth Leaders Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 5/1/13 | | 10/31/13 | | 5/1/13 -

10/31/13 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,231.70 | | $4.78 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.96 | | $4.33 |

| Class B | | | | | | |

| Actual | | $1,000.00 | | $1,227.50 | | $8.42 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.69 | | $7.63 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,228.00 | | $8.09 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.94 | | $7.32 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,232.50 | | $3.26 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,022.26 | | $2.96 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,233.50 | | $2.81 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,022.69 | | $2.55 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,233.30 | | $3.55 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,022.05 | | $3.21 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,230.20 | | $5.62 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.18 | | $5.09 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.85% for Class A, 1.50% for Class B, 1.44% for Class C, 0.58% for Class F, 0.50% for Class I, 0.63% for Class R2 and 1.00% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

October 31, 2013

| Sector* | %** | |

| Consumer Discretionary | 23.77 | % |

| Consumer Staples | 8.30 | % |

| Energy | 4.51 | % |

| Financials | 6.91 | % |

| Health Care | 13.53 | % |

| Industrials | 13.47 | % |

| Sector* | %** | |

| Information Technology | 24.40 | % |

| Materials | 1.32 | % |

| Telecommunication Services | 0.95 | % |

| Repurchase Agreement | 2.84 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

22

International Core Equity Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 5/1/13 | | 10/31/13 | | 5/1/13 -

10/31/13 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,090.60 | | $5.90 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.56 | | $5.70 |

| Class B | | | | | | |

| Actual | | $1,000.00 | | $1,086.90 | | $9.31 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,016.29 | | $9.00 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,086.80 | | $9.20 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,016.40 | | $8.89 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,092.00 | | $4.59 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.82 | | $4.43 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,092.40 | | $4.06 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.33 | | $3.92 |

| Class P | | | | | | |

| Actual | | $1,000.00 | | $1,089.90 | | $6.43 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.06 | | $6.21 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,089.20 | | $7.21 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.30 | | $6.97 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,089.40 | | $6.69 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.82 | | $6.46 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.12% for Class A, 1.77% for Class B, 1.75% for Class C, 0.87% for Class F, 0.77% for Class I, 1.22% for Class P, 1.37% for Class R2 and 1.27% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

October 31, 2013

| Sector* | %** | |

| Consumer Discretionary | 13.69 | % |

| Consumer Staples | 7.18 | % |

| Energy | 6.01 | % |

| Financials | 24.95 | % |

| Health Care | 6.81 | % |

| Industrials | 16.64 | % |

| Sector* | %** | |

| Information Technology | 7.09 | % |

| Materials | 8.45 | % |

| Telecommunication Services | 4.15 | % |

| Utilities | 1.50 | % |

| Repurchase Agreement | 3.53 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

23

International Dividend Income Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 5/1/13 | | 10/31/13 | | 5/1/13 -

10/31/13 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,062.20 | | $5.82 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.56 | | $5.70 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,058.20 | | $9.18 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,016.30 | | $9.00 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,063.40 | | $4.52 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.82 | | $4.43 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,063.80 | | $4.01 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,021.32 | | $3.92 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,061.00 | | $7.12 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.31 | | $6.97 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,060.80 | | $6.65 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.76 | | $6.51 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.12% for Class A, 1.77% for Class C, 0.87% for Class F, 0.77% for Class I, 1.37% for Class R2 and 1.28% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

October 31, 2013

| Sector* | %** | |

| Consumer Discretionary | 11.76 | % |

| Consumer Staples | 6.12 | % |

| Energy | 10.72 | % |

| Financials | 22.76 | % |

| Health Care | 5.67 | % |

| Industrials | 10.42 | % |

| Information Technology | 2.34 | % |

| Materials | 5.37 | % |

| Telecommunication Services | 12.09 | % |

| Utilities | 9.57 | % |

| Repurchase Agreement | 3.18 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

24

International Opportunities Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 5/1/13 | | 10/31/13 | | 5/1/13 -

10/31/13 |

| Class A | | | | | | |

| Actual | | $1,000.00 | | $1,105.10 | | $7.80 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.80 | | $7.48 |

| Class B | | | | | | |

| Actual | | $1,000.00 | | $1,102.20 | | $11.18 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,014.55 | | $10.71 |

| Class C | | | | | | |

| Actual | | $1,000.00 | | $1,102.30 | | $11.07 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,014.65 | | $10.61 |

| Class F | | | | | | |

| Actual | | $1,000.00 | | $1,107.20 | | $6.48 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.04 | | $6.21 |

| Class I | | | | | | |

| Actual | | $1,000.00 | | $1,107.20 | | $5.95 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,019.56 | | $5.70 |

| Class P | | | | | | |

| Actual | | $1,000.00 | | $1,105.50 | | $8.33 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.29 | | $7.98 |

| Class R2 | | | | | | |

| Actual | | $1,000.00 | | $1,104.60 | | $9.12 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,016.54 | | $8.74 |

| Class R3 | | | | | | |

| Actual | | $1,000.00 | | $1,105.30 | | $8.54 |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.09 | | $8.19 |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.47% for Class A, 2.11% for Class B, 2.09% for Class C, 1.22% for Class F, 1.12% for Class I, 1.57% for Class P, 1.72% for Class R2 and 1.61% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

October 31, 2013

| Sector* | %** | |

| Consumer Discretionary | 19.64 | % |

| Consumer Staples | 6.13 | % |

| Energy | 5.99 | % |

| Financials | 19.50 | % |

| Health Care | 5.97 | % |

| Industrials | 21.02 | % |

| Sector* | %** | |

| Information Technology | 10.74 | % |

| Materials | 4.76 | % |

| Telecommunication Services | 0.67 | % |

| Utilities | 1.48 | % |

| Repurchase Agreement | 4.10 | % |

| Total | 100.00 | % |

| * | A sector may comprise several industries. |

| ** | Represents percent of total investments. |

25

Value Opportunities Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period† |

| | | 5/1/13 | | 10/31/13 | | 5/1/13 -

10/31/13 |

| Class A | | | | | | | | | |

| Actual | | $1,000.00 | | $1,135.00 | | | $ | 6.83 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.80 | | | $ | 6.46 | |

| Class B | | | | | | | | | |

| Actual | | $1,000.00 | | $1,131.30 | | | $ | 10.31 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,015.53 | | | $ | 9.75 | |

| Class C | | | | | | | | | |

| Actual | | $1,000.00 | | $1,131.30 | | | $ | 10.31 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,015.53 | | | $ | 9.75 | |

| Class F | | | | | | | | | |

| Actual | | $1,000.00 | | $1,136.70 | | | $ | 5.49 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.06 | | | $ | 5.19 | |

| Class I | | | | | | | | | |

| Actual | | $1,000.00 | | $1,136.80 | | | $ | 4.96 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,020.56 | | | $ | 4.69 | |

| Class P | | | | | | | | | |

| Actual | | $1,000.00 | | $1,134.60 | | | $ | 7.37 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.29 | | | $ | 6.97 | |

| Class R2 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,133.60 | | | $ | 8.17 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,017.54 | | | $ | 7.73 | |

| Class R3 | | | | | | | | | |

| Actual | | $1,000.00 | | $1,134.30 | | | $ | 7.64 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $1,018.04 | | | $ | 7.22 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (1.27% for Class A, 1.92% for Classes B and C, 1.02% for Class F, 0.92% for Class I, 1.37% for Class P, 1.52% for Class R2 and 1.42% for Class R3) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

Portfolio Holdings Presented by Sector

October 31, 2013

| Sector* | %** | |

| Consumer Discretionary | 14.15 | % |

| Consumer Staples | 3.44 | % |

| Energy | 8.05 | % |

| Financials | 26.47 | % |

| Health Care | 8.91 | % |

| Industrials | 9.70 | % |

| Sector* | %** | |

| Information Technology | 11.71 | % |

| Materials | 7.28 | % |

| Utilities | 6.58 | % |

| Repurchase Agreement | 3.71 | % |

| Total | 100.00 | % |