UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07538

LORD ABBETT SECURITIES TRUST

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

John T. Fitzgerald, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 201-6984

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2018

| Item 1: | Report(s) to Shareholders. |

LORD ABBETT

ANNUAL REPORT

Lord Abbett

Alpha Strategy Fund

Fundamental Equity Fund

Global Equity Research Fund*

Global Select Equity Fund

Growth Leaders Fund

International Equity Fund

International Opportunities Fund

International Value Fund**

Value Opportunities Fund

For the fiscal year ended October 31, 2018

*Formerly Global Core Equity Fund

**Formerly International Dividend Income Fund

Lord Abbett Securities Trust

Lord Abbett Alpha Strategy Fund, Lord Abbett Fundamental Equity Fund, Lord Abbett Global Equity Research Fund, Lord Abbett Global Select Equity Fund, Lord Abbett Growth Leaders Fund, Lord Abbett International Equity Fund, Lord Abbett International Opportunities Fund, Lord Abbett International Value Fund, and Lord Abbett Value Opportunities Fund Annual Report

For the fiscal year ended October 31, 2018

From left to right: James L.L. Tullis, Independent Chairman of the Lord Abbett Funds and Douglas B. Sieg, Trustee, President, and Chief Executive Officer of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Funds for the fiscal year ended October 31, 2018. On the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and timely information about the Funds, please visit our website at www.lordabbett.com, where you can also access the quarterly commentaries that provide updates on each Fund’s performance and other portfolio related updates.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Douglas B. Sieg

Trustee, President and Chief Executive Officer

1

Lord Abbett Alpha Strategy Fund

For the fiscal year ended October 31, 2018, the Fund returned 3.11%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark Russell 2000® Index1 which returned 1.85% over the same period.

Domestic equity returns were positive over the past year, with large cap stocks, as represented by the S&P 500® Index,2 rising 7.35% during the period, while small cap stocks, as represented by the Russell 2000® Index,1 were up 1.85%. During the period, there were several market-moving events. Notably, in December 2017, Congress passed the largest rewrite of the U.S. tax code in decades. The tax bill reduced the corporate tax rate from 35% to 21% and allowed for a one-time repatriation tax of 15.5%, rather than the standard repatriation tax rate of 35%. In June 2018, the White House announced its intent to impose additional tariffs on $200 billion worth of Chinese goods, on top of the $50 billion previously announced. The aggressive U.S. trade posture continued into September with trade tensions mounting between the U.S. and China. While the impact has yet to fully be realized, many corporations anticipate that the retaliatory tariffs will weigh on profits. Trade discussions between Mexico, Canada, and the U.S., however, took a more favorable turn as the negotiations resulted in a revised version of the North American

Free Trade Agreement (NAFTA) called the U.S.–Mexico–Canada Agreement. In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each of its March, June and September meetings, raising the target range to 2.00%-2.25%. Amid rising concerns surrounding escalating trade tensions, slowing growth, and increasing interest rates, the Nasdaq experienced the largest monthly drop since 2008 in October. Despite the sell-off, the U.S. economy continued to expand by more than 2% during each quarter of the trailing 12-month period, with domestic GDP growth ranging between 2.2% to 4.2% from the third quarter of 2017 to the third quarter of 2018. The 4.2% GDP growth in the second quarter marked the strongest growth rate since the third quarter of 2014.

The Fund’s allocation to domestic small and micro cap growth equities contributed to performance, as these investment strategies outperformed the Russell 2000® Index. Within these strategies, stock selection in the health care and information technology sectors contributed to the performance relative to the underlying indexes.

The Fund’s allocation to international small cap equities as well as domestic small and mid (“smid”) and micro cap value equities detracted from relative performance, as each of these investment

2

strategies underperformed the Russell 2000® Index. Within the international small cap allocation, security selection in the financials and health care sectors detracted from performance relative to the underlying index. Within the domestic smid cap value equity allocation, security selection in the financials and information technology sectors detracted from performance relative to the underlying index. Stock selection in the industrials and communication services sectors in the domestic micro cap value strategy detracted from performance.

Lord Abbett Fundamental Equity Fund

For the fiscal year ended October 31, 2018, the Fund returned 1.99%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Russell 1000® Value Index,3 which returned 3.03% over the same period.

Domestic equity returns were positive over the past year, with large cap stocks, as represented by the S&P 500® Index,2 rising 7.35% during the period, while small cap stocks, as represented by the Russell 2000® Index,1 were up 1.85%. During the period, there were several market-moving events. Notably, in December 2017, Congress passed the largest rewrite of the U.S. tax code in decades. The tax bill reduced the corporate tax rate from 35% to 21% and allowed for a one-time repatriation tax of 15.5%, rather than the standard repatriation tax rate of

35%. In June 2018, the White House announced its intent to impose additional tariffs on $200 billion worth of Chinese goods, on top of the $50 billion previously announced. The aggressive U.S. trade posture continued into September with trade tensions mounting between the U.S. and China. While the impact has yet to fully be realized, many corporations anticipate that the retaliatory tariffs will weigh on profits. Trade discussions between Mexico, Canada, and the U.S., however, took a more favorable turn as the negotiations resulted in a revised version of the North American Free Trade Agreement (NAFTA) called the U.S.–Mexico–Canada Agreement. In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each of its March, June and September meetings, raising the target range to 2.00%-2.25%. Amid rising concerns surrounding escalating trade tensions, slowing growth, and increasing interest rates, the Nasdaq experienced the largest monthly drop since 2008 in October. Despite the sell-off, the U.S. economy continued to expand by more than 2% during each quarter of the trailing 12-month period, with domestic GDP growth ranging between 2.2% to 4.2% from the third quarter of 2017 to the third quarter of 2018. The 4.2% GDP growth in the second quarter marked the strongest growth rate since the third quarter of 2014.

3

The Fund underperformed its index for the period. During the trailing 12-month period, the largest detractors from relative performance were the materials and financials sectors. Within the materials sector, shares of DowDuPont, Inc., an American multinational chemical corporation, detracted from relative performance. Shares of DowDuPont came under downward pressure after announcing a $4.6 billion non-cash impairment charge related to its agricultural business. Within the materials sector, shares of Nucor Corporation, a steel manufacturer, also detracted from relative performance. While the import tariffs imposed by President Trump were intended to lift the share prices of domestic steel manufacturers, share prices of many steel manufacturers, including Nucor, came under pressure as investors appeared to question the longevity of the protectionist policies. Within the financials sector, shares of ACE Limited, an insurance firm, detracted most from relative performance. The company’s shares fell following the announcement of a preliminary net catastrophe loss estimate of $450 million pre-tax in the firm’s third quarter. The losses were attributable to an array of weather events, including Hurricane Florence and wildfires in California. An overweight to Hartford Financial Group also detracted from performance. The investment and insurance company’s shares declined after the company announced an acquisition to purchase

Navigators Group, Inc. We believe shareholders were disappointed by the announcement as many were likely hopeful for capital return.

The largest contributors to relative performance during the trailing 12-month period were the industrials and the information technology sectors. Within the industrials sector, the Fund’s holding of General Electric (“GE”), a digital industrial company, contributed most to relative performance. While GE’s shares came under pressure after cutting its dividend as well as facing a downgrade from Moody’s, the Fund benefited because it maintained an underweight position in the stock relative to its benchmark. An overweight to CSX Corporation, a rail and transportation company, also positively contributed to relative performance. Shares of CSX rose after significantly beating consensus estimates for top and bottom line. Within the information technology sector, Microsoft Corporation contributed most to relative performance. Shares of the software and technology manufacturer rose on the back of solid fourth quarter earnings. The company closed out the year with impressive revenue growth, with upside driven in part by acceleration in intelligent cloud growth. An overweight to Cisco Systems, Inc., a company that sells Internet Protocol based networking, also positively contributed to relative performance. Shares of Cisco Systems advanced after the company announced the acquisition of Duo Security, Inc., a cyber security company. We

4

believe the acquisition signaled Cisco Systems’ willingness to move into a high growth space that was outside of their core business.

Lord Abbett Global Equity Research Fund

For the fiscal year ended October 31, 2018, the Fund returned -0.22%, reflecting performance at the net asset value (NAV) of Class A Shares, with all distributions reinvested, compared to its benchmark, the MSCI ACWI Index,4 which returned -0.52% over the same period.

Over the period, global equity markets experienced significant negative performance outside the United States, despite most central banks remaining accommodative, interest rates remaining low, and unemployment steadily declining. In addition, corporate earnings continued to grow, while global economic growth has showed signs of peaking and plateauing. Overall, European markets (as measured by the Euro Stoxx 50 Index®)5 fell roughly 15.5% in U.S. dollars for the period, while Japan’s Nikkei 2256 rose 0.14%.

In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each of its March, June and September meetings, raising the target range to 2.00%-2.25%. Meanwhile, other central banks have continued their

accommodative policies. The European Central Bank (ECB) kept its benchmark refinancing rate unchanged at 0%, since March 2016, and at its October 2018 meeting, the ECB said it will continue to make net asset purchases at the new monthly pace of €15 billion until the end of December 2018. The Bank of Japan (BoJ) also maintained its stimulative monetary policy as short term interest rates remained unchanged, at -0.1%, at its October 2018 meeting, and the bank kept its 10-year government bond yield target at around 0%. The BoJ also reduced its inflation forecast again, saying that the momentum toward achieving the price stability target of 2% is not sufficiently firm.

The International Monetary Fund lowered global growth estimates by 0.2 percentage points to 3.7% for both 2018 and 2019, reflecting “surprises that suppressed activity in early 2018 in some major advanced economies, the negative effects of the trade measures implemented or approved between April and mid-September, as well as a weaker outlook for some key emerging markets and developing economies arising from country-specific factors, tighter financial conditions, geopolitical tensions, and higher oil import bills”. Unemployment steadily declined in most developed countries, falling to 8.1% in the euro area, 3.7% in the United States, 2.3% in Japan, and 3.8% in China, all multiyear lows. GDP growth has remained positive in most developed countries, while inflation

5

remained subdued, allowing central banks to continue their stimulative monetary policies with global stock markets as the beneficiaries.

Volatility, as measured by the VIX index, has crept back up this year after remaining near all-time low levels for most of 2017. We believe that sources of tension throughout the year have come from aggressive U.S. trade posture with trade tensions mounting between the U.S. and China, remaining uncertainty regarding a potential hard “Brexit” outcome, as well as the gradual and continuous rise of rates by the Fed.

During the period, the Fund’s outperformance relative to the benchmark was driven by the health care and consumer discretionary sectors. Within the health care sector, holdings of Ascendis Pharma A/S contributed to relative performance. Shares of the Danish pharmaceutical company rose, as investors continue to see upside in the company’s meaningful drug pipeline. An overweight position in Illumina, Inc. also contributed to relative performance as the company’s stock rose throughout the year. The human genome testing company’s stock advanced as its dominant competitive position and strong product momentum continued to sustain growth acceleration.

Within the consumer discretionary sector, an overweight position in TJX Companies, Inc. contributed to relative performance. The off-price apparel and home fashion retailer’s stock rose as the

company benefitted from healthy customer traffic, merchandise margin increases, and a sector that continues to gain market share.

Conversely, stock selection within the information technology and materials sectors negatively contributed to relative performance. Within the information technology sector, shares of Universal Display, Corp. detracted from performance as the company’s stock fell. The OLED research and manufacturing company’s stock fell as continued weakness in flagship smartphones and inventory buildup at its biggest customer disappointed investors. Additionally, shares of Tencent Holdings Limited also contributed negatively to performance. The China-based e-commerce conglomerate’s stock fell as a result of a lingering regulatory setback in video game releases.

Within the materials sector, holdings of Lundin Mining Corp. contributed negatively to relative performance. The Canadian metals mining company suffered as the Zinc Expansion Project ramp-up was further delayed and costs continued to increase.

Lord Abbett Growth Leaders Fund

For the fiscal year ended October 31, 2018, the Fund returned 9.68%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index,7 which returned 10.71% over the same period.

6

Domestic equity returns were positive over the past year, with large cap stocks, as represented by the S&P 500® Index2, rising 7.35% during the period, while small cap stocks, as represented by the Russell 2000® Index,1 were up 1.85%. During the period, there were several market-moving events. Notably, in December 2017, Congress passed the largest rewrite of the U.S. tax code in decades. The tax bill reduced the corporate tax rate from 35% to 21% and allowed for a one-time repatriation tax of 15.5%, rather than the standard repatriation tax rate of 35%. In June 2018, the White House announced its intent to impose additional tariffs on $200 billion worth of Chinese goods, on top of the $50 billion previously announced. The aggressive U.S. trade posture continued into September with trade tensions mounting between the U.S. and China. While the impact has yet to fully be realized, many corporations anticipate that the retaliatory tariffs will weigh on profits. Trade discussions between Mexico, Canada, and the U.S., however, took a more favorable turn as the negotiations resulted in a revised version of the North American Free Trade Agreement (NAFTA) called the U.S.–Mexico–Canada Agreement. In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each of its March, June and September meetings,

raising the target range to 2.00%-2.25%. Amid rising concerns surrounding escalating trade tensions, slowing growth, and increasing interest rates, the Nasdaq experienced the largest monthly drop since 2008 in October 2018. Despite the sell-off, the U.S. economy continued to expand by more than 2% during each quarter of the trailing 12-month period, with domestic GDP growth ranging between 2.2% to 4.2% from the third quarter of 2017 to the third quarter of 2018. The 4.2% GDP growth in the second quarter marked the strongest growth rate since the third quarter of 2014.

Security selection and positioning within the information technology and industrials sectors detracted from the Fund’s relative performance during the 12-month period. Within the information technology sector, shares of Apple, Inc., a designer and manufacturer of mobile communication devices, detracted from the Fund’s relative performance during the period. Despite some concerns that iPhone unit growth would wane, shares of Apple appreciated as average selling prices increased and demand for new product launches remained resilient. The Fund held an underweight position in Apple relative to its benchmark throughout the period. Shares of NVIDIA Corp., a developer of computer graphics processing chips and multimedia software, also detracted from relative performance. Shares of NVIDIA were impacted by volatility in crypto currencies, game title delays coming out of China, and the macro concerns that drove

7

investors to sell market leading secular growth stocks in October of 2018.

Within the industrials sector, shares of AeroVironment, Inc., a designer and developer of unmanned aircraft and transportation solutions, detracted from the Fund’s performance relative to its benchmark. Shares of AeroVironment declined over the period as a broker’s research report called in to question the company’s ability to innovate and develop successful new products.

Security selection in the consumer discretionary and health care sectors detracted from the Fund’s performance relative to its benchmark. Within the consumer discretionary sector, shares of World Wrestling Entertainment, Inc., a producer and developer of televised and live events, contributed to relative performance. Shares of World Wrestling Entertainment surged throughout the period as investors awaited the announcement of a new TV deal agreement with major U.S. networks for its Raw and SmackDown programs. The deal eventually was cemented at a higher rate than many expected. Shares of Lululemon Athletica, Inc., a designer and retailer of athletic apparel and accessories, also contributed to relative performance during the period. Lululemon displayed exceptional growth as e-commerce and strong demand across all categories and regions drove robust top-line momentum.

Within the health care sector, the Fund’s position in Illumina, Inc., a

developer of genetic sequencing analysis tools, contributed to relative performance as robust sequencing consumables trends and strong product innovation helped the company to rapidly become the dominant gene sequencing company in the industry and accelerate revenue growth.

Lord Abbett International Equity Fund

For the fiscal year ended October 31, 2018, the Fund returned -11.91%, reflecting performance at the net asset value (NAV) of Class A Shares, with all distributions reinvested, compared to its benchmark, the MSCI ACWI ex-U.S. Index,8 which returned -8.24% over the same period.

Over the period, global equity markets experienced significant negative performance outside the United States, despite most central banks remaining accommodative, interest rates remaining low, and unemployment steadily declining. In addition, corporate earnings continued to grow, while global economic growth has showed signs of peaking and plateauing. Overall, European markets (as measured by the Euro Stoxx 50 Index®)5 fell roughly 15.5% in U.S. dollars for the period, while Japan’s Nikkei 2256 rose 0.14%.

In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each

8

of its March, June and September meetings, raising the target range to 2.00%-2.25%. Meanwhile, other central banks have continued their accommodative policies. The European Central Bank (ECB) kept its benchmark refinancing rate unchanged at 0%, since March 2016, and at its October 2018 meeting, the ECB said it will continue to make net asset purchases at the new monthly pace of €15 billion until the end of December 2018. The Bank of Japan (BoJ) also maintained its stimulative monetary policy as short term interest rates remained unchanged, at -0.1%, at its October 2018 meeting, and the bank kept its 10-year government bond yield target at around 0%. The BoJ also reduced its inflation forecast again, saying that the momentum toward achieving the price stability target of 2% is not sufficiently firm.

The International Monetary Fund lowered global growth estimates by 0.2 percentage points to 3.7% for both 2018 and 2019, reflecting “surprises that suppressed activity in early 2018 in some major advanced economies, the negative effects of the trade measures implemented or approved between April and mid-September, as well as a weaker outlook for some key emerging markets and developing economies arising from country-specific factors, tighter financial conditions, geopolitical tensions, and higher oil import bills”. Unemployment steadily declined in most developed countries, falling to 8.1% in the euro area, 3.7% in the United States, 2.3% in Japan, and 3.8% in China, all

multiyear lows. GDP growth has remained positive in most developed countries, while inflation remained subdued, allowing central banks to continue their stimulative monetary policies with global stock markets as the beneficiaries.

Volatility, as measured by the VIX index, has crept back up this year after remaining near all-time low levels for most of 2017. We believe that sources of tension throughout the year have come from aggressive U.S. trade posture with trade tensions mounting between the U.S. and China, remaining uncertainty regarding a potential hard “Brexit” outcome, as well as the gradual and continuous rise of rates by the Fed.

During the period, the Fund’s underperformance relative to its benchmark was driven by stock selection, particularly within the industrials and consumer staples sectors. Within the industrials sector, an overweight position in Loomis AB detracted from relative performance. Shares of the Swedish armored car services company fell as the long-term structural decline in the usage of cash in society put a damper on the valuation. Additionally, shares of En-Japan, Inc. also detracted from relative performance. Shares of the Japanese internet-based recruiting solutions company declined amid structural concerns around Japan’s declining working-age population and general labor shortages.

Security selection in the consumer staples sector also detracted from relative

9

performance. Within the consumer staples sector, an overweight position in Pola Orbis Holdings Inc. detracted from relative performance. Shares of the Japanese cosmetic products company fell as a tourism growth slump weighed on Japanese cosmetics and consumer good stocks.

Conversely, stock selection within the consumer discretionary and real estate sectors contributed to relative performance over the period. Within the consumer discretionary sector, shares of Sony Corp. contributed to relative performance. The global consumer electronics company’s shares rose as it signaled a new phase of expansion driven by innovation and sustained growth in established businesses. Wynn Macau, Limited, a Macau-based destination casino resort company, also contributed to relative performance. The company benefited in the first half of 2018 amid a sustained and genuine demand recovery that had grown to new highs.

Within the real estate sector, shares of Aroundtown SA, a Luxembourg-based real estate company, contributed to performance. The company has continued to benefit from its focus in regions with solid economic fundamentals and from the improvement of rental and occupancy levels in the German office property markets.

Lord Abbett International Opportunities Fund

For the fiscal year ended October 31, 2018, the Fund returned -15.72%,

reflecting performance at the net asset value (NAV) of Class A Shares, with all distributions reinvested, compared to its benchmark, the S&P Developed Ex-U.S. SmallCap® Index,9 which returned -7.70% over the same period.

Over the period, global equity markets experienced significant negative performance outside the United States, despite most central banks remaining accommodative, interest rates remaining low, and unemployment steadily declining. In addition, corporate earnings continued to grow, while global economic growth has showed signs of peaking and plateauing. Overall, European markets (as measured by the Euro Stoxx 50)5 fell roughly 15.5% in U.S. dollars for the period, while Japan’s Nikkei 2256 rose 0.14% in U.S. dollars for the period.

In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each of its March, June and September meetings, raising the target range to 2.00%-2.25%. Meanwhile, other central banks have continued their accommodative policies. The European Central Bank (ECB) kept its benchmark refinancing rate unchanged at 0%, since March 2016, and at its October 2018 meeting, the ECB said it will continue to make net asset purchases at the new monthly pace of €15 billion until the end

10

of December 2018. The Bank of Japan (BoJ) also maintained its stimulative monetary policy as short term interest rates remained unchanged, at -0.1%, at its October 2018 meeting, and the bank kept its 10-year government bond yield target at around 0%. The BoJ also reduced its inflation forecast again, saying that the momentum toward achieving the price stability target of 2% is not sufficiently firm.

The International Monetary Fund lowered global growth estimates by 0.2 percentage points to 3.7% for both 2018 and 2019, reflecting “surprises that suppressed activity in early 2018 in some major advanced economies, the negative effects of the trade measures implemented or approved between April and mid-September, as well as a weaker outlook for some key emerging markets and developing economies arising from country-specific factors, tighter financial conditions, geopolitical tensions, and higher oil import bills”. Unemployment steadily declined in most developed countries, falling to 8.1% in the Euro area, 3.7% in the United States, 2.3% in Japan, and 3.8% in China, all multiyear lows. GDP growth has remained positive in most developed countries, while inflation remained subdued, allowing central banks to continue their stimulative monetary policies with global stock markets as the beneficiaries.

Volatility, as measured by the VIX index, has crept back up this year after remaining near all-time low levels for most of 2017.

Sources of tension throughout the year have come from aggressive U.S. trade posture with trade tensions mounting between the U.S. and China, remaining uncertainty regarding a potential hard “Brexit” outcome, as well as the gradual and continuous rise of rates by the Fed.

Stock selection, most notably in the financials and health care sectors, was the primary driver of relative under-performance during the period. Within the financials sector, shares of Arrow Global Group Plc detracted from relative performance. Shares of the British debt management solutions company fell as margins continued to be pressured and as low money multiples at this stage in the cycle translate into lower returns. In addition, shares of TP ICAP Plc detracted from relative performance. The British financial markets brokering services company’s stock fell after the company fired its CEO and warned that returns will be lower than expected this year.

Within the health care sector, shares of United Drug plc detracted from relative performance over the period. Shares of the Ireland based provider of commercialization solutions for health care companies retreated throughout the year as underlying growth, margin, cash flow, and quality of earnings weakened.

Conversely, stock selection in the consumer discretionary and communication services sectors contributed to relative performance. Within the consumer discretionary sector, shares of Moncler SpA

11

contributed to relative performance. Shares of the Italian luxury apparel company rose as first half 2018 earnings results demonstrated accelerating momentum and incremental support from its Fragment Genius launch. In addition, holdings of Basic-Fit N.V. also contributed to relative performance during the period. Shares of the Dutch health and fitness club company rose, as it increased previous guidance and expects to open more clubs in 2018.

Within the communication services sector, an overweight position to Okinawa Cellular contributed to relative performance, as shares of the company rose during the year. The Japanese cellular and car phone services company benefited as the company’s half-year results showed double digit profit growth from a year earlier.

Lord Abbett International Value Fund

For the fiscal year ended October 31, 2018, the Fund returned -9.05%, reflecting performance at the net asset value (NAV) of Class A Shares, with all distributions reinvested, compared to its benchmark, the MSCI EAFE Value Index,10 which returned -7.69% over the same period.

Over the period, global equity markets experienced significant negative performance outside the United States, despite most central banks remaining accommodative, interest rates remaining low, and unemployment steadily declining. In addition, corporate earnings continued to grow, while global economic growth has

showed signs of peaking and plateauing. Overall, European markets (as measured by the Euro Stoxx 50 Index®)5 fell roughly 15.5% in U.S. dollars for the period, while Japan’s Nikkei 2256 rose 0.14%.

In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each of its March, June and September meetings, raising the target range to 2.00%-2.25%. Meanwhile, other central banks have continued their accommodative policies. The European Central Bank (ECB) kept its benchmark refinancing rate unchanged at 0%, since March 2016, and at its October 2018 meeting, the ECB said it will continue to make net asset purchases at the new monthly pace of €15 billion until the end of December 2018. The Bank of Japan (BoJ) also maintained its stimulative monetary policy as short term interest rates remained unchanged, at -0.1%, at its October 2018 meeting, and the bank kept its 10-year government bond yield target at around 0%. The BoJ also reduced its inflation forecast again, saying that the momentum toward achieving the price stability target of 2% is not sufficiently firm.

The International Monetary Fund lowered global growth estimates by 0.2 percentage points to 3.7% for both 2018 and 2019, reflecting “surprises that suppressed activity in early 2018 in some

12

major advanced economies, the negative effects of the trade measures implemented or approved between April and mid-September, as well as a weaker outlook for some key emerging markets and developing economies arising from country-specific factors, tighter financial conditions, geopolitical tensions, and higher oil import bills”. Unemployment steadily declined in most developed countries, falling to 8.1% in the euro area, 3.7% in the United States, 2.3% in Japan, and 3.8% in China, all multiyear lows. GDP growth has remained positive in most developed countries, while inflation remained subdued, allowing central banks to continue their stimulative monetary policies with global stock markets as the beneficiaries.

Volatility, as measured by the VIX index, has crept back up this year after remaining near all-time low levels for most of 2017. We believe that sources of tension throughout the year have come from aggressive U.S. trade posture with trade tensions mounting between the U.S. and China, remaining uncertainty regarding a potential hard “Brexit” outcome, as well as the gradual and continuous rise of rates by the Fed.

During the period, the Fund’s underperformance relative to the benchmark was driven by its stock selection within the industrials and consumer staples sectors. Within the industrials sector, shares of China Everbright International Ltd., an investment company that provides

environmental solutions, fell after the company issued a surprise rights offering that raised investor concerns about the company’s corporate governance. Additionally, an overweight position in BAE Systems plc also detracted from relative performance throughout the year. The company’s stock declined as its massive deals with Saudi Arabia seemed unlikely to happen in the near term amid the political crisis surrounding journalist Jamal Khashoggi’s death.

Within the consumer staples sector, shares of Anheuser-Busch InBev SA/NV, a global alcoholic beverage manufacturer, detracted from relative performance. The company’s stock declined as the devaluation of currencies across the globe against the U.S. dollar delivered a large incremental hit to sales.

Conversely, stock selection within the financials and real estate sectors contributed to relative performance. Within the financials sector, shares of ASR Nederland N.V., a Netherlands-based insurance company, rose as it posted very strong earnings results for the first half of 2018, overcoming storm losses from earlier this year. Additionally, DBS Group Holdings Ltd, a South Asia bank and financial services provider, also contributed to relative performance. The company’s stock rose as net interest margins benefited from higher interest rates due to carryover from the U.S.

Within the real estate sector, shares of Aroundtown SA, a Luxembourg-based real estate company, contributed to

13

performance. We believe the company has continued to benefit from its focus in regions with solid economic fundamentals and from the improvement of rental and occupancy levels in the German office property markets.

Lord Abbett Value Opportunities Fund

For the fiscal year ended October 31, 2018, the Fund returned -0.28%, reflecting performance at the net asset value (NAV) of Class A shares, with all distributions reinvested, compared to its benchmark, the Russell 2500™ Index,11 which returned 2.80% over the same period.

Domestic equity returns were positive over the past year, with large cap stocks, as represented by the S&P 500® Index,2 rising 7.35% during the period, while small cap stocks, as represented by the Russell 2000® Index1 were up 1.85%. During the period, there were several market-moving events. Notably, in December 2017, Congress passed the largest rewrite of the U.S. tax code in decades. The tax bill reduced the corporate tax rate from 35% to 21% and allowed for a one-time repatriation tax of 15.5%, rather than the standard repatriation tax rate of 35%. In June 2018, the White House announced its intent to impose additional tariffs on $200 billion worth of Chinese goods on top of the $50 billion previously announced. The aggressive U.S. trade posture continued into September with trade tensions mounting between the U.S. and China.

While the impact has yet to fully be realized, many corporations anticipate that the retaliatory tariffs will weigh on profits. Trade discussions between Mexico, Canada, and the U.S., however, took a more favorable turn as the negotiations resulted in a revised version of the North American Free Trade Agreement (NAFTA) called the U.S.–Mexico–Canada Agreement. In December 2017, the Federal Reserve (the “Fed”) raised its target for short-term interest rates by 0.25%, to a range of 1.25%-1.50%, and indicated that it was targeting three rate hikes in 2018. The Fed followed with rate hikes of 0.25% at each of its March, June and September meetings, raising the target range to 2.00%-2.25%. Amid rising concerns surrounding escalating trade tensions, slowing growth, and increasing interest rates, the Nasdaq experienced the largest monthly drop since 2008 in October 2018. Despite the sell-off, the U.S. economy continued to expand by more than 2% during each quarter of the trailing 12-month period, with domestic GDP growth ranging between 2.2% to 4.2% from the third quarter of 2017 to the third quarter of 2018. The 4.2% GDP growth in the second quarter marked the strongest growth rate since the third quarter of 2014.

Security selection within the financials and information technology sectors were detractors from the Fund’s relative performance during the period. Within the financials sector, shares of Western Alliance Bancorporation, a multi-bank holding company, detracted from relative

14

performance. Shares of Western Alliance fell following its third quarter financial results. Despite surpassing analyst estimates on earnings, revenues were below consensus estimates and forward guidance was lowered as a result. Additionally, the Fund’s holding of Arch Capital Group Ltd., which offers life, health, and property insurance and reinsurance products as well as mortgage services, was a detractor from relative performance. Shares of Arch Capital Group came under pressure in October, as Hurricane Michael made landfall on the Florida panhandle as a Category 4 storm, and a sizeable portion of the company’s revenues come from the reinsurance industry. Within the information technology sector, the Fund’s holding of MACOM Technology Solutions Holdings Inc., a provider of analog semiconductor solutions, detracted from relative performance. MACOM was challenged in February, as competitive pricing pressures caused gross margins to decline leading MACOM to report both revenue and earnings for the first quarter that failed to meet consensus estimates.

Conversely, security selection in the consumer discretionary and industrials sectors were contributors to the Fund’s relative performance during the period. Within the consumer discretionary sector, the Fund’s position in Lululemon Athletica Inc., a designer and retailer of athletic clothing products, contributed to relative

performance. Lululemon reported strong first quarter comparable sales that exceeded estimates, which led to an increase in full year earnings per share guidance. Additionally, Lululemon posted strong second quarter financial results, beating analyst estimates on both revenue and earnings per share, boosted by e-commerce sales growth, which led management to raise earnings per share and sales guidance for the full year once again. Shares of Advance Auto Parts, an automotive aftermarket parts provider, also contributed to relative performance due to strong second quarter financial results, which included raised 2018 guidance. Due to improved free cash flow expectations, management also expressed its intent to repurchase $600 million of shares. Within the industrials sector, shares of XPO logistics Inc., a provider of logistical services, was a contributor to relative performance. The stock rose following rumors of a potential acquisition by Home Depot in December.

Each Fund’s portfolio is actively managed and, therefore, its holdings and the weightings of a particular issuer or particular sector as a percentage of portfolio assets are subject to change. Sectors may include many industries.

15

1 The Russell 2000® Index measures the performance of the 2,000 smallest companies in the Russell 3000® Index, which represents approximately 10% of the total market capitalization of the Russell 3000® Index.

2 The S&P 500® Index is widely regarded as the standard for measuring large cap U.S. stock market performance and includes a representative sample of leading companies in leading industries.

3 The Russell 1000® Value Index measures the performance of those Russell 1000 companies with lower price-to-book ratios and lower forecasted growth values.

4 The MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI consists of 46 country indices comprising 23 developed and 23 emerging market country indices. The developed market country indices included are: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom and the United States. The emerging market country indices included are: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

5 The EURO STOXX 50® Index represents the performance of the 50 largest companies among the 19 supersectors in terms of free-float market cap in 12 eurozone countries. These countries include Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. The index has a fixed number of components and is part of the STOXX blue-chip index family. The index captures about 60% of the free-float market cap of the EURO STOXX Total Market Index (TMI).

6 The Nikkei Stock Average, the Nikkei 225 is used around the globe as the premier index of Japanese stocks. Because of the prominent nature of the index, many financial products linked to the Nikkei 225 that have been created are traded worldwide while the index has been sufficiently used as the indicator of the movement of Japanese stock markets. The Nikkei 225 is a price-weighted equity index, which consists of 225 stocks in the 1st section of the Tokyo Stock Exchange.

7 The Russell 1000® Growth Index measures the performance of those Russell 1000® Index companies with higher price-to-book ratios and higher forecasted growth values.

8 The MSCI ACWI (All Country World Index) ex U.S.A. Index is a subset of the MSCI ACWI Index. The MSCI ACWI (All Country World Index) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI ACWI Ex-U.S. Index with Gross Dividends approximates the maximum possible dividend reinvestment. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits. The MSCI ACWI Ex-U.S. Index with Net Dividends approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates.

9 The S&P Developed Ex-U.S. SmallCap® Index captures the bottom 15% of companies domiciled in the developed markets (excluding the United States) within the S&P Global BMI with a float-adjusted market capitalization of at least US$100 million and a value traded of at least US$50 million for the past 12 months at the time of the annual reconstitution. Stocks are excluded if their market capitalization falls below US$75 million, or if the value traded is less than US$35 million at the time of reconstitution.

10 The MSCI EAFE Value Index captures large and mid-cap securities exhibiting overall value style characteristics across Developed Markets countries around the world, excluding the U.S. and Canada. Gross Dividends approximates the maximum possible dividend reinvestment. The amount reinvested is the entire dividend distributed to individuals resident in the country of the company, but does not include tax credits. Net Dividends approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate to non-resident individuals who do not benefit from double taxation treaties. MSCI uses withholding tax rates applicable to Luxembourg holding companies, as Luxembourg applies the highest rates.

16

11 The Russell 2500™ Index is a market cap weighted index that includes the smallest 2,500 companies covered in the Russell 3000® Index universe of United States-based listed equities.

Unless otherwise specified, indexes reflect total return, with all dividends reinvested. Indexes are unmanaged, do not reflect the deduction of fees or expenses, and are not available for direct investment.

Important Performance and Other Information

Performance data quoted in the following pages reflect past performance and are no guarantee of future results. Current performance may be higher or lower than the performance quoted. The investment return and principal value of an investment in the Funds will fluctuate so that shares, on any given day or when redeemed, may be worth more or less than their original cost. You can obtain performance data current to the most recent month end by calling Lord Abbett at 888-522-2388 or referring to www.lordabbett.com.

Except where noted, comparative Fund performance does not account for the deduction of sales charges and would be different if sales charges were included. Each Fund offers classes of shares with distinct pricing options. For a full description of the differences in pricing alternatives, please see each Fund’s prospectus.

During certain periods shown, expense waivers and reimbursements were in place for Alpha Strategy Fund, Global Equity Research Fund, Growth Leaders Fund, International Equity Fund and International Value Fund. Without such expense reimbursements, each Fund’s returns would have been lower.

The annual commentary above discusses the views of the Funds’ management and various portfolio holdings of the Funds as of October 31, 2018. These views and portfolio holdings may have changed after this date. Information provided in the commentary is not a recommendation to buy or sell securities. Because each Fund’s portfolio is actively managed and may change significantly, the Funds may no longer own the securities described above or may have otherwise changed their positions in the securities. For more recent information about the Funds’ portfolio holdings, please visit www.lordabbett.com.

A Note about Risk: See Notes to Financial Statements for a discussion of investment risks. For a more detailed discussion of the risks associated with each Fund, please see each Fund’s prospectus.

Mutual funds are not insured by the FDIC, are not deposits or other obligations of, or guaranteed by, banks, and are subject to investment risks including possible loss of principal amount invested.

17

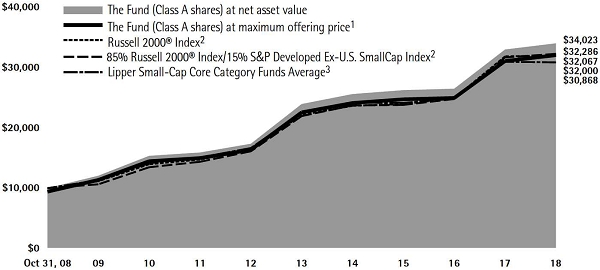

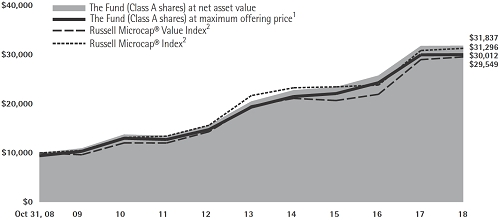

Alpha Strategy Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 2000® Index, the 85% Russell 2000® Index/15% S&P Developed Ex-U.S. SmallCap Index and the Lipper Small-Cap Core Category Funds Average, assuming reinvestment of all dividends and distributions. The Fund has adopted the Russell 2000® Index, a more broad-based index, as its primary benchmark index. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | 5 Years | | | 10 Years | | | Life of Class | |

| Class A4 | | | –2.80 | % | | | 6.01% | | | | 12.36% | | | | – | |

| Class C5 | | | 1.42 | % | | | 6.47% | | | | 12.21% | | | | – | |

| Class F6 | | | 3.25 | % | | | 7.43% | | | | 13.23% | | | | – | |

| Class F37 | | | 3.42 | % | | | – | | | | – | | | | 10.33% | |

| Class I6 | | | 3.38 | % | | | 7.54% | | | | 13.34% | | | | – | |

| Class R26 | | | 2.75 | % | | | 6.90% | | | | 12.66% | | | | – | |

| Class R36 | | | 2.84 | % | | | 7.01% | | | | 12.77% | | | | – | |

| Class R48 | | | 3.12 | % | | | – | | | | – | | | | 5.93% | |

| Class R58 | | | 3.34 | % | | | – | | | | – | | | | 6.20% | |

| Class R68 | | | 3.45 | % | | | – | | | | – | | | | 6.24% | |

18

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Source: Lipper Inc. The performance of the average is not necessarily representative of the Fund’s performance.

4 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and

distributions reinvested for the periods shown ended October 31, 2018, is calculated using the SEC-required uniform method to compute such return.

5 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

6 Performance is at net asset value.

7 Commenced operations and performance for the Class began on April 4, 2017. Performance is at its net asset value.

8 Commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

19

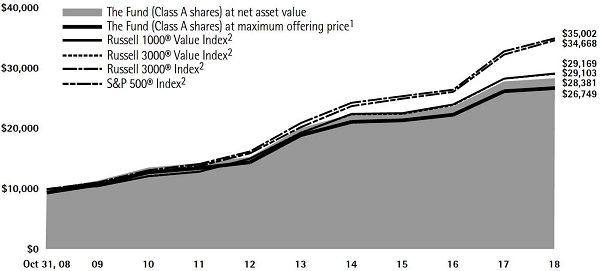

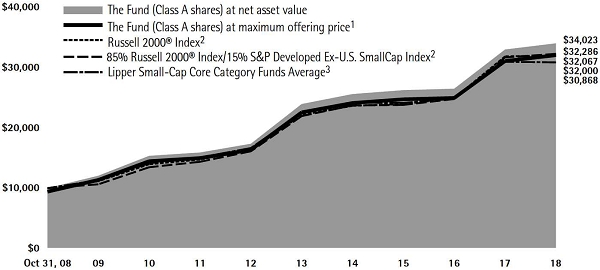

Fundamental Equity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 1000® Value Index, Russell 3000® Value Index, Russell 3000® Index, and S&P 500® Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | 5 Years | | | 10 Years | | | Life of Class | |

| Class A3 | | | –3.86 | % | | | 5.88% | | | | 10.34% | | | | – | |

| Class C4 | | | 0.32 | % | | | 6.37% | | | | 10.22% | | | | – | |

| Class F5 | | | 2.17 | % | | | 7.33% | | | | 11.22% | | | | – | |

| Class F36 | | | 2.36 | % | | | – | | | | – | | | | 5.72% | |

| Class I5 | | | 2.19 | % | | | 7.43% | | | | 11.33% | | | | – | |

| Class P5 | | | 1.77 | % | | | 6.95% | | | | 10.84% | | | | – | |

| Class R25 | | | 1.64 | % | | | 6.79% | | | | 10.67% | | | | – | |

| Class R35 | | | 1.66 | % | | | 6.89% | | | | 10.78% | | | | – | |

| Class R47 | | | 2.00 | % | | | – | | | | – | | | | 6.45% | |

| Class R57 | | | 2.28 | % | | | – | | | | – | | | | 6.72% | |

| Class R67 | | | 2.36 | % | | | – | | | | – | | | | 6.84% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2018, is calculated using the SEC-required uniform method to compute such return.

4 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Performance is at net asset value.

6 Commenced operations and performance for the Class began on April 4, 2017. Performance is at net asset value.

7 Commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

20

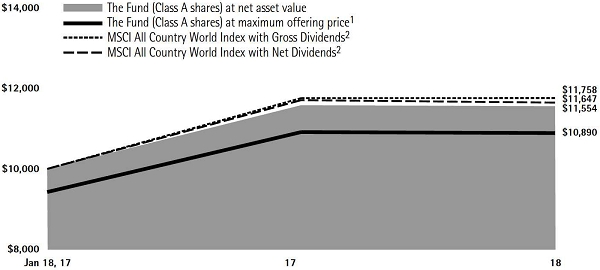

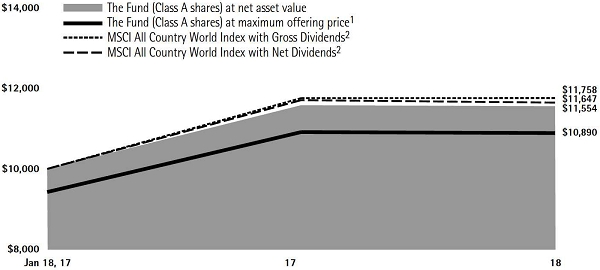

Global Equity Research Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International (MSCI) All Country World Index with Gross Dividends and the MSCI All Country World Index with Net Dividends, assuming reinvestment of all dividends and distributions. The MSCI All Country World Index with Net Dividends reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI All Country World Index. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursements of expense, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | Life of Class | |

| Class A3 | | | –5.99 | % | | | 4.90% | |

| Class C4 | | | –2.01 | % | | | 7.61% | |

| Class F5 | | | –0.19 | % | | | 8.56% | |

| Class F36 | | | 0.01 | % | | | 8.03% | |

| Class I5 | | | –0.10 | % | | | 8.67% | |

| Class R25 | | | –0.66 | % | | | 8.01% | |

| Class R35 | | | –0.56 | % | | | 8.12% | |

| Class R45 | | | –0.24 | % | | | 8.43% | |

| Class R55 | | | –0.10 | % | | | 8.67% | |

| Class R65 | | | 0.01 | % | | | 8.73% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of each index begins on January 18, 2017.

3 Class A shares commenced operations on January 17, 2017 and performance for the Class began on January 18, 2017. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2018, is calculated using the SEC-required uniform method to compute such return.

4 Class C shares commenced operations on January 17, 2017 and performance for the Class began on January 18, 2017. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Commenced operations on January 17, 2017 and performance for the Class began on January 18, 2017. Performance is at net asset value.

6 Commenced operations and performance for the class began on April 4, 2017. Performance is at net asset value.

21

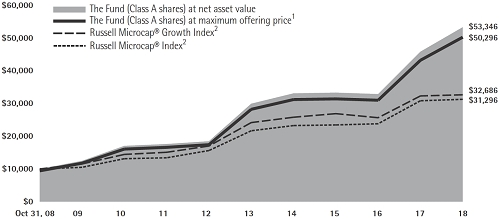

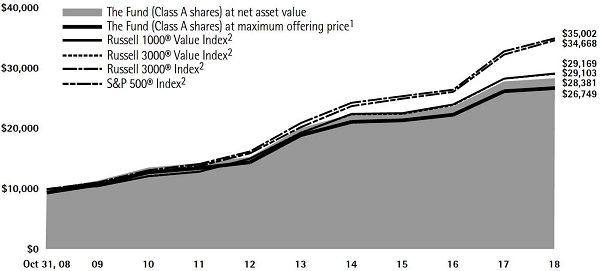

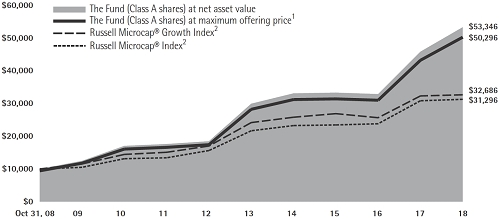

Growth Leaders Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 1000® Growth Index, Russell 3000® Growth Index, and S&P 500® Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | 5 Years | | | Life of Class | |

| Class A3 | | | 3.37 | % | | | 10.53% | | | | 12.11 | % | |

| Class C4 | | | 7.87 | % | | | 11.04% | | | | 12.23 | % | |

| Class F5 | | | 9.94 | % | | | 12.07% | | | | 13.25 | % | |

| Class F36 | | | 10.01 | % | | | – | | | | 18.49 | % | |

| Class I5 | | | 9.96 | % | | | 12.14% | | | | 13.34 | % | |

| Class R25 | | | 9.31 | % | | | 11.47% | | | | 12.85 | % | |

| Class R35 | | | 9.41 | % | | | 11.58% | | | | 12.82 | % | |

| Class R47 | | | 9.68 | % | | | – | | | | 11.13 | % | |

| Class R57 | | | 9.96 | % | | | – | | | | 11.44 | % | |

| Class R67 | | | 10.01 | % | | | – | | | | 11.51 | % | |

22

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance for each index begins on June 30, 2011.

3 Class A shares commenced operations on June 24, 2011 and performance for the Class began on June 30, 2011. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2018, is calculated using the SEC-required uniform method to compute such return.

4 Class C shares commenced operations on June 24, 2011 and performance for the Class began on June 30, 2011. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Commenced operations on June 24, 2011 and performance for the Class began on June 30, 2011. Performance is at net asset value.

6 Commenced operations and performance for the Class began on April 4, 2017. Performance is at net asset value.

7 Commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

23

International Equity Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) ex-USA® Index with Gross Dividends and the MSCI ACWI ex-USA Index with Net Dividends, assuming reinvestment of all dividends and distributions. The MSCI ACWI ex-USA Index with Net Dividends reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI ACWI ex-USA Index. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | 5 Years | | | 10 Years | | | Life of Class | |

| Class A3 | | | –16.97 | % | | | –2.19% | | | | 4.62% | | | | – | |

| Class C4 | | | –13.46 | % | | | –1.73% | | | | 4.54% | | | | – | |

| Class F5 | | | –11.77 | % | | | –0.80% | | | | 5.50% | | | | – | |

| Class F36 | | | –11.62 | % | | | – | | | | – | | | | 1.30% | |

| Class I5 | | | –11.65 | % | | | –0.68% | | | | 5.61% | | | | – | |

| Class P5 | | | –12.14 | % | | | –1.21% | | | | 5.10% | | | | – | |

| Class R25 | | | –12.28 | % | | | –1.36% | | | | 5.01% | | | | – | |

| Class R35 | | | –12.18 | % | | | –1.24% | | | | 5.06% | | | | – | |

| Class R47 | | | –11.96 | % | | | – | | | | – | | | | –0.46% | |

| Class R57 | | | –11.68 | % | | | – | | | | – | | | | –0.22% | |

| Class R67 | | | –11.62 | % | | | – | | | | – | | | | –0.06% | |

24

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2018, is calculated using the SEC-required uniform method to compute such return.

4 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Performance is at net asset value.

6 Commenced operations and performance for the Class began on April 4, 2017. Performance is at net asset value.

7 Commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

25

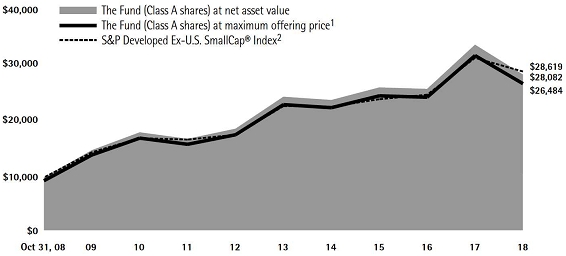

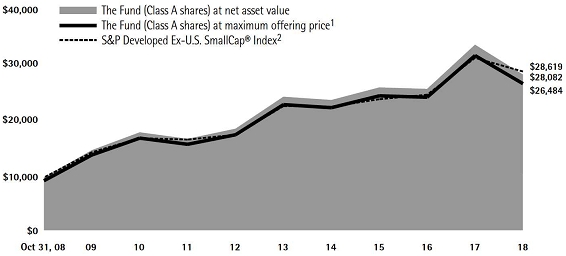

International Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the S&P Developed Ex-U.S. SmallCap® Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | 5 Years | | | 10 Years | | | Life of Class | |

| Class A3 | | | –20.55 | % | | | 1.82% | | | | 10.23% | | | | – | |

| Class C4 | | | –17.14 | % | | | 2.28% | | | | 10.13% | | | | – | |

| Class F5 | | | –15.58 | % | | | 3.20% | | | | 11.10% | | | | – | |

| Class F36 | | | –15.46 | % | | | – | | | | – | | | | 1.52% | |

| Class I5 | | | –15.46 | % | | | 3.31% | | | | 11.21% | | | | – | |

| Class P5 | | | –15.87 | % | | | 2.84% | | | | 10.72% | | | | – | |

| Class R25 | | | –16.00 | % | | | 2.68% | | | | 10.56% | | | | – | |

| Class R35 | | | –15.87 | % | | | 2.81% | | | | 10.69% | | | | – | |

| Class R47 | | | –15.70 | % | | | – | | | | – | | | | 1.72% | |

| Class R57 | | | –15.47 | % | | | – | | | | – | | | | 1.96% | |

| Class R67 | | | –15.41 | % | | | – | | | | – | | | | 2.10% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for the unmanaged index does not reflect any fees or expenses. The performance of the index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2018, is calculated using the SEC-required uniform method to compute such return.

4 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance is at net asset value.

5 Performance is at net asset value.

6 Commenced operations and performance for the Class began on April 4, 2017. Performance is at net asset value.

7 Commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

26

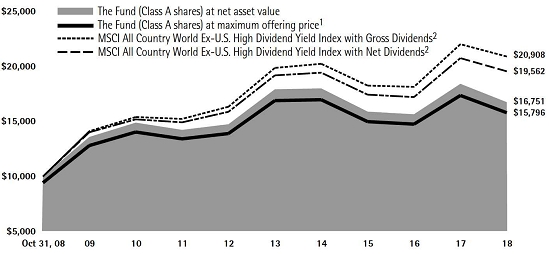

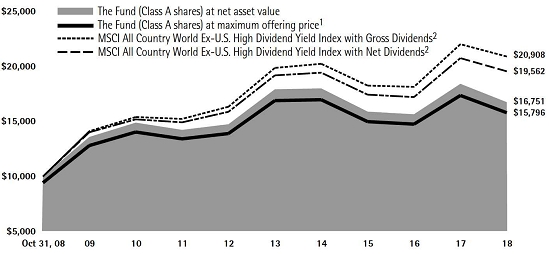

International Value Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Morgan Stanley Capital International (MSCI) All Country World Ex-U.S. High Dividend Yield Index with Gross Dividends and the MSCI All Country World Ex-U.S. High Dividend Yield Index with Net Dividends, assuming reinvestment of all dividends and distributions. The MSCI All Country World Ex-U.S. High Dividend Yield Index with Net Dividends reflects a reduction in dividends after taking into account withholding of taxes by certain foreign countries represented in the MSCI All Country World Ex-U.S. High Dividend Yield Index. The performance of other classes will be greater than or less than the performance shown in the graph due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursements of expense, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | 5 Years | | | 10 Years | | | Life of Class | |

| Class A3 | | | –14.32 | % | | | –2.51% | | | | 4.68% | | | | – | |

| Class C4 | | | –10.59 | % | | | –2.05% | | | | 4.57% | | | | – | |

| Class F5 | | | –8.87 | % | | | –1.10% | | | | 5.55% | | | | – | |

| Class F36 | | | –8.76 | % | | | – | | | | – | | | | 0.90% | |

| Class I5 | | | –8.89 | % | | | –1.03% | | | | 5.65% | | | | – | |

| Class R25 | | | –9.44 | % | | | –1.66% | | | | 5.15% | | | | – | |

| Class R35 | | | –9.35 | % | | | –1.55% | | | | 5.15% | | | | – | |

| Class R47 | | | –9.06 | % | | | – | | | | – | | | | –1.11% | |

| Class R57 | | | –8.78 | % | | | – | | | | – | | | | –0.84% | |

| Class R67 | | | –8.76 | % | | | – | | | | – | | | | –0.79% | |

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance. Performance of each index begins on June 30, 2008.

3 Class A shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31,

2018, is calculated using the SEC-required uniform method to compute such return.

4 Class C shares commenced operations on June 23, 2008 and performance for the Class began on June 30, 2008. The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Performance is at net asset value.

6 Commenced operations and performance for the Class began on April 4, 2017. Performance is at net asset value.

7 Commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

27

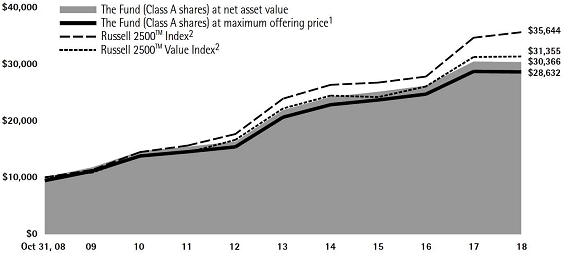

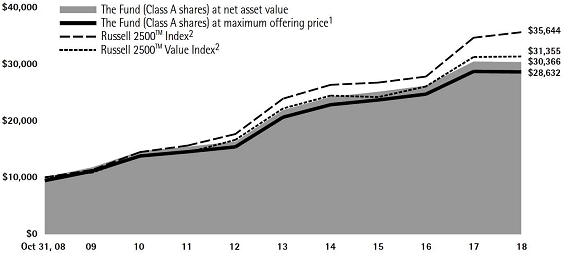

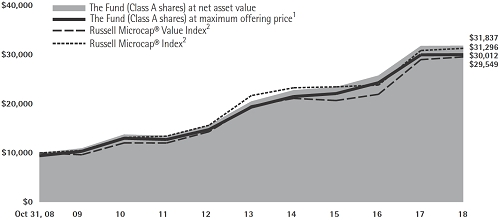

Value Opportunities Fund

Investment Comparison

Below is a comparison of a $10,000 investment in Class A shares with the same investment in the Russell 2500TM Index and the Russell 2500TM Value Index, assuming reinvestment of all dividends and distributions. The performance of other classes will be greater than or less than the performance shown in the graph below due to different sales loads and expenses applicable to such classes. The graph and performance table below do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. During certain periods, expenses of the Fund have been waived or reimbursed by Lord Abbett; without such waiver or reimbursement of expenses, the Fund’s returns would have been lower. Past performance is no guarantee of future results.

Average Annual Total Returns at Maximum Applicable

Sales Charge for the Periods Ended October 31, 2018

| | | 1 Year | | 5 Years | | | 10 Years | | | Life of Class | |

| Class A3 | | | –6.02 | % | | | 5.52% | | | | 11.09% | | | | – | |

| Class C4 | | | –1.97 | % | | | 6.00% | | | | 10.98% | | | | – | |

| Class F5 | | | –0.03 | % | | | 6.96% | | | | 11.99% | | | | – | |

| Class F36 | | | 0.13 | % | | | – | | | | – | | | | 4.42% | |

| Class I5 | | | –0.02 | % | | | 7.06% | | | | 12.09% | | | | – | |

| Class P5 | | | –0.49 | % | | | 6.57% | | | | 11.59% | | | | – | |

| Class R25 | | | –0.50 | % | | | 6.44% | | | | 11.43% | | | | – | |

| Class R35 | | | –0.45 | % | | | 6.54% | | | | 11.55% | | | | – | |

| Class R47 | | | –0.30 | % | | | – | | | | – | | | | 4.65% | |

| Class R57 | | | –0.01 | % | | | – | | | | – | | | | 4.91% | |

| Class R67 | | | 0.08 | % | | | – | | | | – | | | | 5.02% | |

28

1 Reflects the deduction of the maximum initial sales charge of 5.75%.

2 Performance for each unmanaged index does not reflect any fees or expenses. The performance of each index is not necessarily representative of the Fund’s performance.

3 Total return, which is the percentage change in net asset value, after deduction of the maximum initial sales charge of 5.75% applicable to Class A shares, with all dividends and distributions reinvested for the periods shown ended October 31, 2018, is calculated using the SEC-required uniform method to compute such return.

4 The 1% CDSC for Class C shares normally applies before the first anniversary of the purchase date. Performance for other periods is at net asset value.

5 Performance is at net asset value.

6 Commenced operations and performance for the Class began on April 4, 2017. Performance is at net asset value.

7 Commenced operations and performance for the classes began on June 30, 2015. Performance is at net asset value.

29

Expense Example

As a shareholder of a Fund, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments (these charges vary among the share classes); and (2) ongoing costs, including management fees; distribution and service (12b-1) fees (these charges vary among the share classes); and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in each Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period (May 1, 2018 through October 31, 2018).

Actual Expenses

For each class of each Fund, the first line of the table on the following page provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading titled “Expenses Paid During Period 5/1/18 – 10/31/18” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

For each class of each Fund, the second line of the table on the following page provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in each Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

30

Alpha Strategy Fund

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | Beginning

Account

Value | | Ending

Account

Value | | Expenses

Paid During

Period†# | |

| | | 5/1/18 | | 10/31/18 | | 5/1/18 –

10/31/18 | |

| Class A | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 985.90 | | | $2.05 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,023.14 | | | $2.09 | |

| Class C | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 982.00 | | | $5.80 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,019.36 | | | $5.90 | |

| Class F | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 986.40 | | | $1.30 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,023.89 | | | $1.33 | |

| Class F3 | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 987.40 | | | $0.40 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,024.80 | | | $0.41 | |

| Class I | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 987.00 | | | $0.80 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,024.00 | | | $0.82 | |

| Class R2 | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 983.90 | | | $3.80 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.37 | | | $3.87 | |

| Class R3 | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 984.40 | | | $3.30 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,021.88 | | | $3.36 | |

| Class R4 | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 985.90 | | | $2.05 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,023.14 | | | $2.09 | |

| Class R5 | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 987.00 | | | $0.80 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,024.40 | | | $0.82 | |

| Class R6 | | | | | | | | | |

| Actual | | $1,000.00 | | $ | 987.40 | | | $0.40 | |

| Hypothetical (5% Return Before Expenses) | | $1,000.00 | | $ | 1,024.80 | | | $0.41 | |

| † | For each class of the Fund, net expenses are equal to the annualized expense ratio for such class (0.41% for Class A, 1.16% for Class C, 0.26% for Class F, 0.08% for Class F3, 0.16% for Class I, 0.76% for Class R2, 0.66% for Class R3, 0.41% for Class R4, 0.16% for Class R5 and 0.08% for Class R6) multiplied by the average account value over the period, multiplied by 184/365 (to reflect one-half year period). |

| # | Does not include expenses of Underlying Funds in which Alpha Strategy Fund invests. |

31

Portfolio Holdings Presented by Portfolio Allocation

October 31, 2018

| Portfolio Allocation | | %* |