UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07538

LORD ABBETT SECURITIES TRUST

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302

(Address of principal executive offices) (Zip code)

John T. Fitzgerald, Esq., Vice President & Assistant Secretary

90 Hudson Street, Jersey City, NJ 07302

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 522-2388

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2020

| Item 1: | Report(s) to Shareholders. |

LORD ABBETT

ANNUAL REPORT

Lord Abbett

| Alpha Strategy Fund | Growth Leaders Fund |

| | |

| Durable Growth Fund | Health Care Fund |

| | |

| Focused Growth Fund | International Equity Fund |

| | |

| Focused Large Cap Value Fund | International Opportunities Fund |

| | |

| Focused Small Cap Value Fund | International Value Fund |

| | |

| Fundamental Equity Fund | Value Opportunities Fund |

| | |

| Global Equity Research Fund | |

For the fiscal year ended October 31, 2020

Important Information on Paperless Delivery

Beginning in February 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer, investment advisor or bank. Instead, the reports will be made available on Lord Abbett’s website and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Shareholders who hold accounts directly with a Fund may elect to receive shareholder reports and other communications from the Fund electronically by signing into your Lord Abbett online account at lordabbett.com and selecting “Log In.” For further information, you may also contact the Funds at (800) 821-5129. Shareholders who hold accounts through a financial intermediary should contact them directly.

You may elect to receive all future reports in paper free of charge by contacting a Fund at (800) 821-5129. Your election to receive reports in paper will apply to all funds held with Lord Abbett. If your fund shares are held through a financial intermediary please contact them directly. Your election applies to all funds held with that intermediary.

Table of Contents

Lord Abbett Securities Trust

Lord Abbett Alpha Strategy Fund, Lord Abbett Durable Growth Fund, Lord Abbett Focused Growth Fund, Lord Abbett Focused Large Cap Value Fund, Lord Abbett Focused Small Cap Value Fund, Lord Abbett Fundamental Equity Fund, Lord Abbett Global Equity Research Fund, Lord Abbett Growth Leaders Fund, Lord Abbett Health Care Fund, Lord Abbett International Equity Fund, Lord Abbett International Opportunities Fund, Lord Abbett International Value Fund, and Lord Abbett Value Opportunities Fund

Annual Report

For the fiscal year ended October 31, 2020

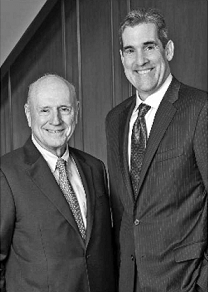

From left to right: James L.L. Tullis, Independent Chairman of the Lord Abbett Funds and Douglas B. Sieg, Trustee, President, and Chief Executive Officer of the Lord Abbett Funds.

Dear Shareholders: We are pleased to provide you with this overview of the performance of the Funds for the fiscal year ended October 31, 2020. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and timely information about the Funds, please visit our website at www.lordabbett.com, where you can also access the quarterly commentaries that provide updates on each Fund’s performance and other portfolio related updates.

Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come.

Best regards,

Douglas B. Sieg

Trustee, President, and Chief Executive Officer

1

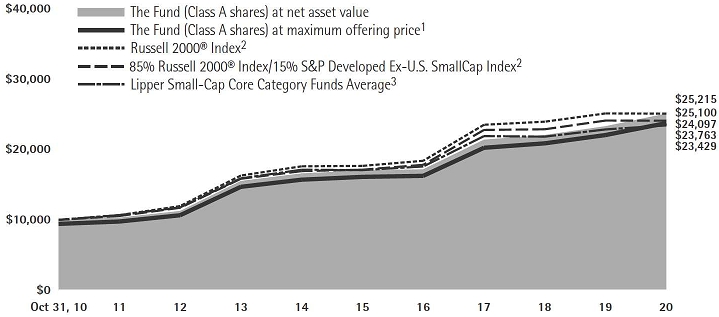

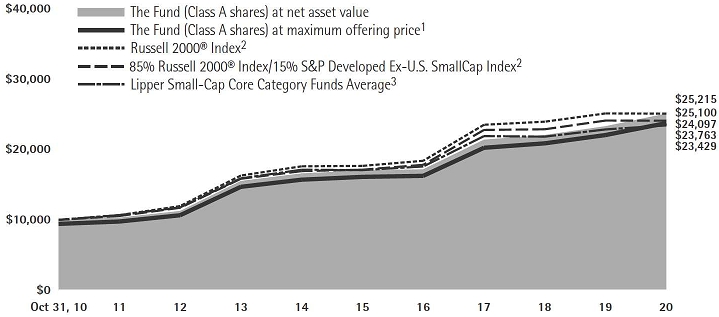

Lord Abbett Alpha Strategy Fund

For the fiscal year ended October 31, 2020, the Fund returned 7.72%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 2000® Index,1 which returned -0.14% over the same period.

The trailing twelve-month period was characterized by several market-moving events. After trade tensions continued to ebb and flow in the final four months of 2019, U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. As the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500 Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with

a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. Next, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September 2020 meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.”

Risk assets began to stage a recovery in April and May 2020 on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors

2

listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments, as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election, and worries about stalled fiscal stimulus talks in Washington.

The Fund is a “fund of funds” that invests in affiliated mutual funds managed by Lord Abbett. Under normal conditions, through the underlying funds, the Fund indirectly invests in the equity securities of U.S. and foreign micro-cap, small, and mid-sized companies. The Fund uses a “blend” strategy to gain exposure to both growth and value stocks.

The portfolio’s weightings in domestic small- and micro-cap stocks within the Lord Abbett Micro Cap Growth Fund and the Lord Abbett Developing Growth Fund were the largest contributors to relative performance over the period, as innovation-oriented stocks outperformed cyclical industries throughout both the severe bear market in March 2020 and the subsequent recovery. The portfolio’s exposure to mid-cap stocks within the Lord Abbett Value Opportunities Fund also contributed to relative performance, as larger cap stocks outperformed smaller cap stocks over the period.

The portfolio’s weightings in domestic small- and micro-cap value stocks within the Lord Abbett Small Cap Value Fund and Lord Abbett Focused Small Cap Value Fund were the largest detractors from relative performance over the period, as the global pandemic caused smaller capitalization stocks within cyclical industries to struggle relative to the Russell 2000® Index. In addition, the portfolio’s allocation to international small-cap stocks within the Lord Abbett International Opportunities Fund was also a modest detractor from relative performance, as domestic equities outperformed international equities over the period.

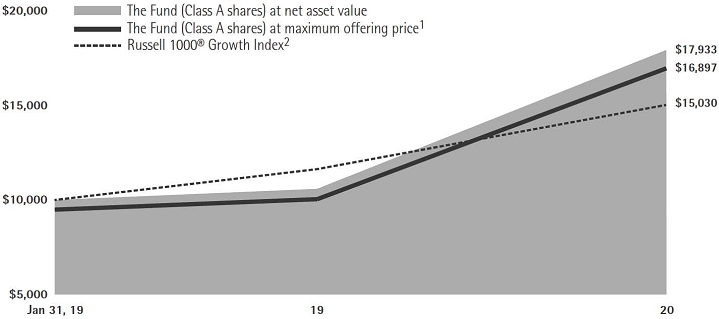

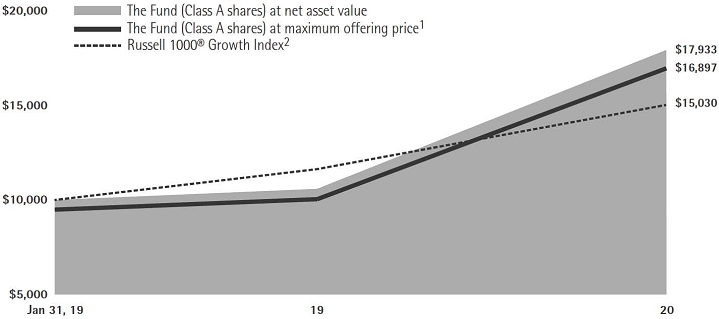

Lord Abbett Durable Growth Fund

From November 4th, 2019 through the fiscal year ended October 31, 2020, the Fund returned 28.16% reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index,3 which returned 28.12% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending,

3

individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. As the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500® Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. Next, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers

from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.”

Risk assets began to stage a recovery in April and May 2020 on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election, and worries about stalled fiscal stimulus talks in Washington.

Security selection within the health care and industrials sectors contributed to relative performance. Within the health care sector, Danaher Corp., a medical device company, was the largest contributor to relative performance. Shares of Danaher rose as the company received Federal Drug Administration approval for its rapid COVID-19 test, which was

4

expected to provide substantially faster results than existing tests. Additionally, the Fund’s allocation to Immunomedics, Inc., a developer and manufacturer of biopharmaceutical products, contributed to relative performance as Gilead Sciences announced it would acquire the company for a large premium.

Within the industrials sector, the Fund’s holding in Old Dominion Freight Line Inc., contributed to relative performance over the period. Shares of the less-than-load (LTL) trucking company rose throughout the period, most notably after tonnage trends started to improve in the beginning of the summer as a result of a surge in eCommerce demand and inventory restocking.

Conversely, stock selection within the consumer discretionary and energy sectors detracted from relative performance during the period. The Fund’s underweight position in Tesla Inc., a designer and manufacturer of electric vehicles and energy storage systems, detracted from relative performance as the company announced a stock split and expectations for strong demand out of China helped buoy the share price, despite lofty valuations. Aramark Holdings Corp., a provider of food, facilities, and uniform services, also detracted from relative performance. Aramark’s core business was severely impacted by the spread of COVID-19 to North America, which forced the cancellation of events and the closure of venues.

Within the energy sector, shares of Pioneer Natural Resources Co., an independent oil and gas exploration and

production company, detracted from relative performance during the period. We believe Pioneer executed well during the period with good relative positioning via its assets in the Permian Basin and lower breakeven oil costs; however, this was overshadowed by falling energy prices and declining demand.

Lord Abbett Focused Growth Fund

For the fiscal year ended October 31, 2020, the Fund returned 69.40%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index,3 which returned 29.22% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. Furthermore, as the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During

5

the month of March, the S&P 500® Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. During the second half of March, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.”

Risk assets began to stage a recovery in April and May 2020 on the back of progress

with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election, and worries about stalled fiscal stimulus talks in Washington.

Security selection within the information technology and consumer discretionary sectors contributed to relative performance. Within the information technology sector, Zoom Video Communications, Inc., a provider of a video communications platform, was the largest contributor to relative performance. Zoom Video Communications was a huge beneficiary of the disruption to traditional business and social interactions caused by the spread of COVID-19. Adoption of Zoom’s services rose rapidly throughout the period, with a torrent of new customers signing up, and existing customers increasing their utilization, which we believe led to the company’s

6

sales and earnings growth accelerating rapidly. Additionally, the Fund’s allocation to Square, Inc., a provider of payment processing solutions, also contributed to relative performance. Shares of Square appreciated as the company’s earnings report demonstrated key upside in important metrics. Most importantly, the company’s “Cash App” application saw revenue growth accelerate, while its products continued to resonate within its market.

Within the consumer discretionary sector, Tesla, Inc., a designer and manufacturer of electric vehicles and energy storage systems, contributed to relative performance. Shares of Tesla rose rapidly as the company’s execution, capital expenditure discipline, and strong orders drove the advance in the stock price. Furthermore, the announcement of a stock split and expectations for strong demand out of China helped buoy the share price.

Conversely, stock selection within the communication services sector detracted from relative performance during the period. The Fund’s underweight position in Facebook, Inc., the world’s leading social network, detracted from relative performance as, in our view, the company continued to execute well despite regulatory pressure. Live Nation Entertainment Corp., an entertainment marketing company, also detracted from relative performance. Live Nation’s core business was severely impacted by the spread of COVID-19 to North America, which forced the cancellation of events and the closure of venues.

Another detractor from relative performance within the Fund was Chipotle Mexican Grill, Inc., a restaurant operator. Chipotle was severely impacted by the spread of COVID-19, as restaurants were forced to close and demand waned.

Lord Abbett Focused Large Cap Value Fund

For the fiscal year ended October 31, 2020, the Fund returned -11.74%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Value Index,4 which returned -7.57% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. As the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500 Index2 experienced its fastest bear market since 1987 and the

7

longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. Next, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September 2020 meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.”

Risk assets began to stage a recovery in April and May on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in

April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments, as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election and worries about stalled fiscal stimulus talks in Washington.

During the 12-month period ending October 31, 2020, Wells Fargo & Company, a diversified, community-based financial services company, detracted most from relative performance. Shares of Wells Fargo fell throughout the period, but dropped significantly in June 2020 following an announcement that net interest income was down more than 11% for the year. Delta Air Lines, Inc., an air transportation company, also detracted from relative performance, as the company faced significant headwinds as the pandemic limited travel. Specifically, shares dropped after reporting third quarter earnings where revenue was below expectations and management pushed out its cash flow break-even assumption from year-end 2020 to Spring 2021. The Fund’s position in Universal Health Services, Inc., a health

8

care management company, also detracted from relative performance. Shares came under significant pressure in April after the firm missed earnings, which was attributed to significant slowdown in patient volumes in March 2020, in both the acute care and behavioral health units. Additionally, the stock was hurt by the firm’s inability to provide guidance for the year amid the uncertainty of the COVID-19 pandemic.

Conversely, the largest contributor to relative performance during the 12-month period ending October 31, 2020, was the Fund’s position in Thor Industries, Inc., a manufacturer of recreational vehicles (RVs). Shares of Thor increased as the demand for the RVs quickly rebounded as consumers looked for alternative ways to vacation during the pandemic. The Fund’s position in Discover Financial Services, a direct banking and payment services company, also contributed to relative performance. Shares of Discover rose as credit and spending trends improved quicker-than-expected during the second quarter, aided by the government stimulus package and enhanced unemployment benefits. The Fund’s position in Ameriprise Financial, Inc., a financial planning, asset management, and insurance services provider, also contributed to relative performance. Shares of Ameriprise rose following a better-than-expected first quarter, despite possible headwinds related to market volatility in March. The company’s first quarter performance was partially driven by an accelerated improvement in the advice and wealth management segment and

outperformance in the asset management segment.

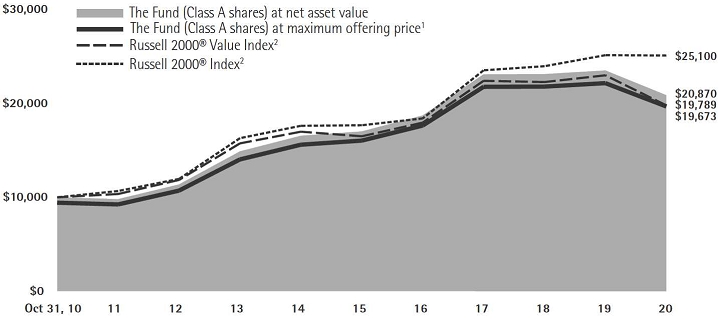

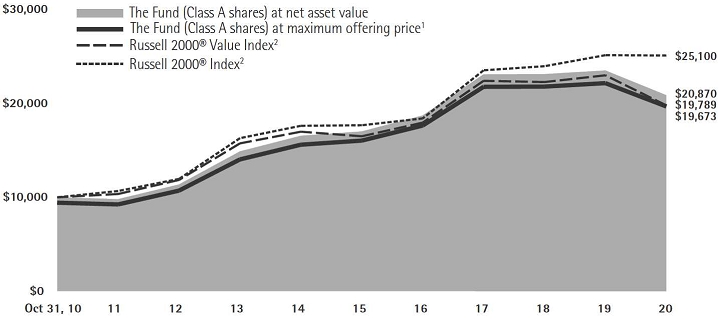

Lord Abbett Focused Small Cap Value Fund

For the fiscal year ended October 31, 2020, the Fund returned -11.21%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 2000® Value Index,5 which returned -13.92% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. As the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500 Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with

9

a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. Next, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September 2020 meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.”

Risk assets began to stage a recovery in April and May on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors

listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments, as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election and worries about stalled fiscal stimulus talks in Washington.

The largest contributor to relative performance during the 12-month period ending October 31, 2020, was the Fund’s position in Masonite International Corporation. Shares of the door manufacturer rose after the company reported first quarter adjusted earnings per share (EPS) of more than double consensus estimates due to better-than-expected results in the North American residential segment. In September, shares of Masonite continued to rally when, following better-than-expected demand for the North American residential segment, management raised its third quarter outlook, stating that they expected year-over-year sales growth to be up mid-single digits, versus their prior guidance which was flat. The Fund’s position in Thor Industries, Inc., a manufacturer of recreational vehicles (RVs), also contributed to relative performance. Shares of Thor increased as demand for RVs quickly rebounded as consumers looked for alternative ways to vacation during the

10

pandemic. The Fund’s position in Brightsphere Investment Group, an asset management firm, also contributed to relative performance. The stock of Brightsphere rose after it was reported on June 26, 2020 that Generali, an Italian insurance and financial manager, had approached the company about a potential takeover.

Conversely, the Fund’s position in Triumph Group, Inc., a manufacturer of aerospace and defense systems and equipment for the aviation industry, detracted from relative performance. Shares of Triumph fell throughout the period, but dropped significantly in March, as travel restrictions grounded flights worldwide in response to the pandemic. Natus Medical Inc., a medical device company, also detracted from relative performance as the company’s shares fell after it reported second quarter earnings in which revenues were down 32.4% versus the second quarter of 2019. The decrease in revenues over the year was due to the impact of COVID-19. Specifically, Natus’ Neuro products and services segment was impacted by the decline in spending at many hospitals and the hearing and balance segment was hindered by the reduced activity in audiologists’ offices and retail hearing centers. The Fund’s position in Avnet Inc., an electronic components distributor, also detracted from relative performance. Throughout the year, Avnet continued to face significant headwinds relating to the COVID-19 pandemic causing sales to decline 11% year-over-year. Specifically, within the

electronic components segment, which makes up 93% of Avnet’s total sales, revenue was down 11% year-over-year due to sluggish semiconductor sales. The stock experienced further pressure when the revenue forecast provided by management for the third quarter was lower than other semiconductor suppliers.

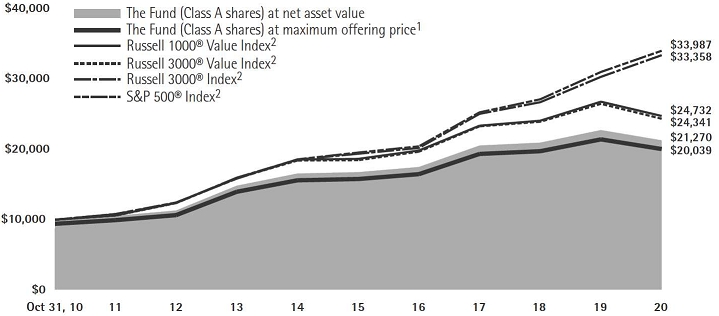

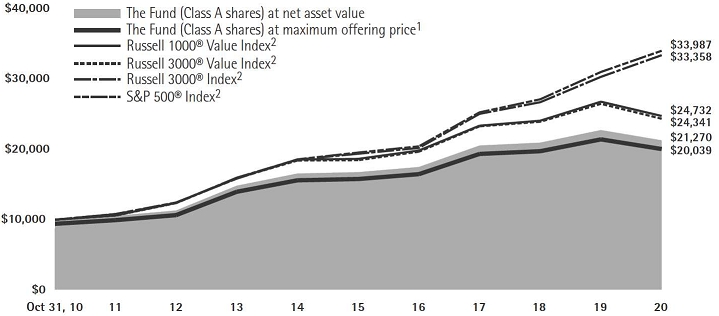

Lord Abbett Fundamental Equity Fund

For the fiscal year ended October 31, 2020, the Fund returned -6.39%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Value Index,4 which returned -7.57% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. As the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of

11

March, the S&P 500 Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. Next, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September 2020 meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.”

Risk assets began to stage a recovery in April and May on the back of progress with respect to COVID-19 treatments and

vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments, as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election and worries about stalled fiscal stimulus talks in Washington.

The largest contributor to relative performance during the 12-month period ending October 31, 2020, was the Fund’s position in Apple, Inc., a smartphone and personal electronics manufacturer. Shares of Apple rose throughout the year on the back of strong year-over-year revenue growth for iPhones and increased growth for Macs and iPads due to remote working and learning. The Fund’s position in E-Trade, Inc. also contributed to relative performance. Shares of the online brokerage firm rose after Morgan Stanley announced that it had reached an agreement to acquire the company in an all-stock deal valued at approximately $13B, a premium of 31%. The Fund’s position in Cummins, Inc., a manufacturer

12

of diesel and natural gas engines, also contributed to relative performance. The stock rose after the company reported better-than-expected second quarter earnings driven by the firm’s exposure to China and its cost reduction incentives, which led to better-than-expected margins.

Conversely, during the 12-month period ending October 31, 2020 the Fund’s position in Wells Fargo & Company, a diversified, community-based financial services company, detracted most from relative performance. Shares fell throughout the period but dropped significantly in June following an announcement that net interest income was down more than 11% for the year. Citigroup Inc., a financial products and services company, also detracted from relative performance. Citi’s stock price fell after the Federal Open Markets Committee announced on June 10th that it would keep the federal funds rate at 0%-0.25%. Bank stocks fell due to expectations that this would likely lower net interest income in the medium-term. Shares of Citi came under further pressure in September, as several news articles suggested regulators could take action over the bank’s deficiencies in risk and control functions. The Fund’s position in Universal Health Services, Inc., a healthcare management company, also detracted from relative performance. Shares came under significant pressure in April after the firm missed earnings, which was attributed to the significant slowdown in March in patient volumes in both the Acute Care

and Behavioral Health units. Additionally, the stock was hurt due to the firm’s inability to provide guidance for the year amid the uncertainty of the COVID-19 pandemic.

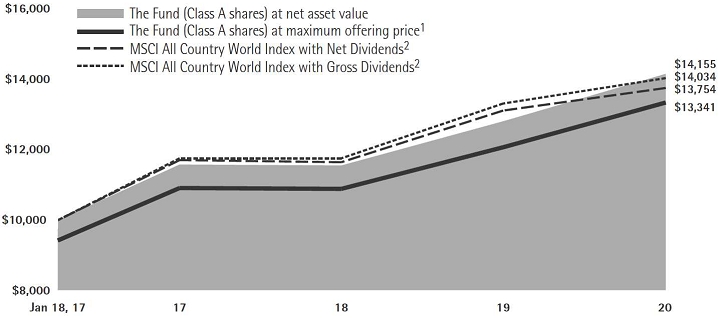

Lord Abbett Global Equity Research Fund

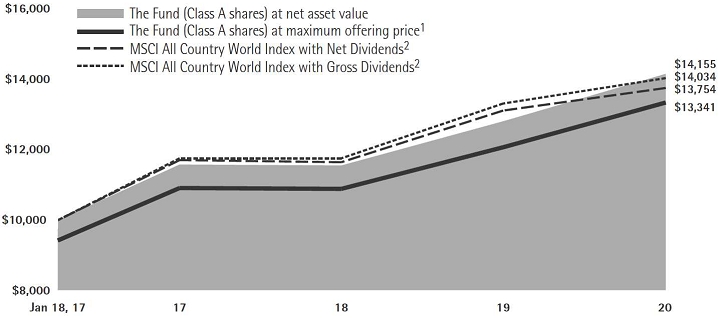

For the fiscal year ended October 31, 2020, the Fund returned 10.52%, reflecting performance at the net asset value (NAV) of Class A Shares with all distributions reinvested, compared to its benchmark, the MSCI All Country World Index with Net Dividends,6 which returned 4.89% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. Furthermore, as the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500 Index2 experienced its fastest bear market since

13

1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. In the latter half of March, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September 2020 meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.” The European Central Bank (ECB) maintained interest rates at 0% as new President Christine Lagarde took over the responsibility on November 1st, 2019. Since the COVID-19 pandemic roiled global markets during her tenure, the

ECB introduced and expanded its pandemic emergency purchase program (PEPP) and extended it to at least June 2021. The ECB also continued net purchases under the asset purchase program (APP) at a monthly pace of 20 billion euros, together with the purchase under the additional 120-billion-euro temporary envelope until the end of the year. Additionally, officials signaled readiness to adjust all of its instruments to ensure that inflation moved towards its aim in a sustained manner, including by slashing interest rates deeper into negative territory and changing the conditions of the targeted longer-term refinancing operations. Similar to other global central banks, The Bank of Japan (BoJ) introduced several measures to combat the pressures from COVID-19, including aggressive purchases of corporate debt and a new lending facility to funnel money to smaller firms via financial institutions. The BoJ also maintained its stimulative monetary policy at its October 2020 meeting, as short-term interest rates remained unchanged at -0.1%, and the bank kept its 10-year government bond yield target at around 0%.

Risk assets began to stage a recovery in April and May on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in

14

earnings revisions as well as further progress in COVID-19 treatments as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election, and worries about stalled fiscal stimulus talking in Washington. Sentiment overseas moved largely in line with that of the U.S., and international equity markets staged a recovery from April through October 2020. Chinese equities rallied as the country’s economy gained control over the COVID-19 pandemic, and China’s economy managed to grow 4.9% year-on-year in the third quarter. In the Eurozone, equities rebounded as well, but in a less robust way, as a second wave of the COVID-19 pandemic materialized, and as second quarter GDP numbers from Germany, France, and the Eurozone weighed on investor sentiment. Germany’s economy contracted by 9.7%, France’s by 13.80%, and the Eurozone’s by 11.80% in the quarter.

In its latest October report, the International Monetary Fund estimated global growth at -4.4% for 2020, a less severe contraction than forecast in the June 2020 World Economic Outlook. “The revision reflects better-than anticipated second quarter GDP outturns, mostly in advanced economies, where activity began to improve sooner than expected after lockdowns were scaled back in May and June, as well as indicators of a stronger recovery in the third

quarter.” The International Monetary Fund projects growth to pick up to 5.2% in 2021, “reflecting the more moderate downturn projected for 2020 and consistent with expectations of persistent social distancing”.

During the period, the Fund’s outperformance relative to the benchmark was driven by stock selection within the information technology and communication services sectors. Within the information technology sector, holdings in The Trade Desk, Inc. contributed to relative performance. Shares of the U.S.-based advertising technology platform company rose as management showed strong execution and initiated quarterly guidance in its television advertising business, revealing that the company’s competitive moat had widened. An overweight position in NVIDIA Corp. also contributed to relative performance as the company’s stock rose throughout the year. The American manufacturer of computer graphics processors and chipsets benefitted from strong underlying gaming demand driven by the COVID-19 pandemic, as well as from positive sentiment around its announced acquisition of Arm Limited from Softbank Group, Corp.

Within the communication services sector, an overweight position in Tencent Holdings Limited contributed to relative performance. The Chinese multinational technology conglomerate’s stock rose as it navigated the pandemic successfully, utilizing its platforms and technologies to help users adapt to the ‘new normal’ via online tools and digital content, resulting

15

in mobile games revenue surging 62% year-over-year.

Conversely, stock selection within the consumer staples and energy sectors detracted from relative performance. Within the consumer staples sector, shares of Sysco Corp. detracted from performance. The food products distribution company’s stock fell as the COVID-19 pandemic proved to have a lasting negative effect on foodservice businesses through weaker demand. Additionally, Shiseido Company, Limited, a Japanese cosmetics company, detracted from relative performance. Shares fell over the period as the company’s plans for margin improvements were hit by drops in inbound tourism and by the COVID-19 pandemic. Investor sentiment shifted negatively given limited details about how a margin recovery would materialize.

Within the energy sector, holdings of Oneok, Inc. detracted from relative performance. The natural gas midstream services company’s stock fell as gas volumes across their system showed deep declines driven by COVID-19 and the drop in commodity prices.

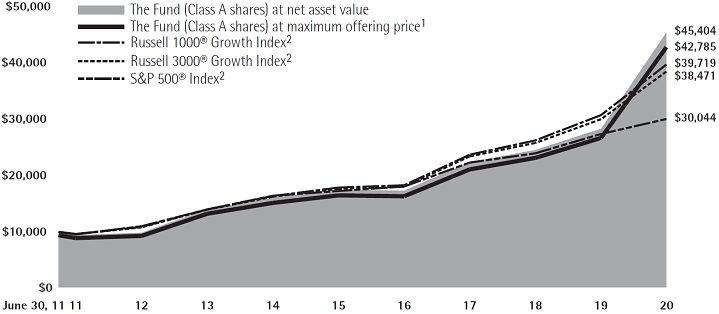

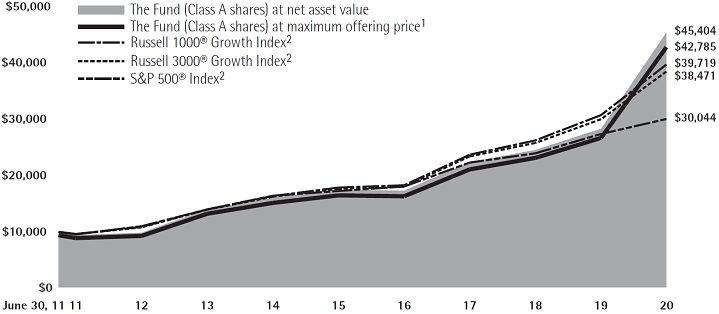

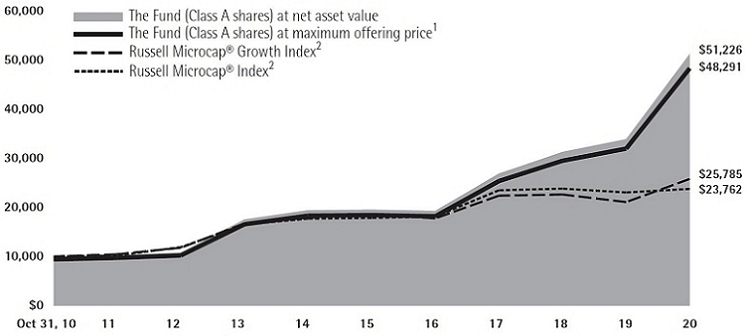

Lord Abbett Growth Leaders Fund

For the fiscal year ended October 31, 2020, the Fund returned 60.35%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index,3 which returned 29.22% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. Furthermore, as the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500® Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. During the second half of March, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business

16

lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.”

Risk assets began to stage a recovery in April and May 2020 on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened

uncertainty leading up to the U.S. Presidential election, and worries about stalled fiscal stimulus talks in Washington.

Security selection within the information technology and consumer discretionary sectors contributed to relative performance. Within the information technology sector, Zoom Video Communications, Inc., a provider of a video communications platform, was the largest contributor to relative performance. Zoom Video Communications was a huge beneficiary of the disruption to traditional business and social interactions caused by the spread of COVID-19. Adoption of Zoom’s services rose rapidly throughout the period, with a torrent of new customers signing up, and existing customers increasing their utilization, which we believe led to the company’s sales and earnings growth accelerating rapidly. Additionally, the Fund’s allocation to Square, Inc., a provider of payment processing solutions, also contributed to relative performance. Shares of Square appreciated as the company’s earnings report demonstrated key upside in important metrics. Most importantly, the company’s “Cash App” application saw revenue growth accelerate, while its products continued to resonate within its market.

Within the consumer discretionary sector, Tesla, Inc., a designer and manufacturer of electric vehicles and energy storage systems, contributed to relative performance. Shares of Tesla rose rapidly as the company’s execution, capital expenditure discipline, and strong orders

17

drove the advance in the stock price. Furthermore, the announcement of a stock split and expectations for strong demand out of China helped buoy the share price.

Conversely, stock selection within the communication services sector detracted from relative performance during the period. The Fund’s underweight position in Facebook, Inc., the world’s leading social network, detracted from relative performance as, in our view, the company continued to execute well despite regulatory pressure. Live Nation Entertainment Corp., an entertainment marketing company, also detracted from relative performance. Live Nation’s core business was severely impacted by the spread of COVID-19 to North America, which forced the cancellation of events and the closure of venues.

The Fund’s underweight to Apple, Inc., a designer of a variety of technology-related products and services, detracted from relative performance, as the company made progress in moderating product delays caused by the global pandemic.

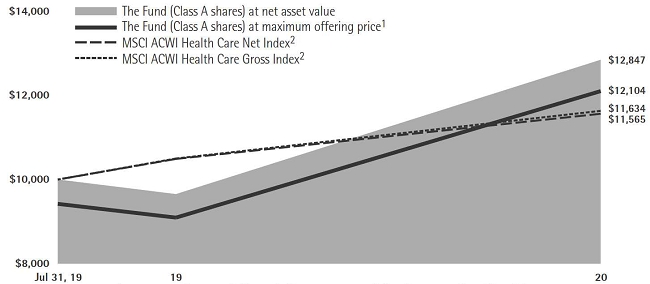

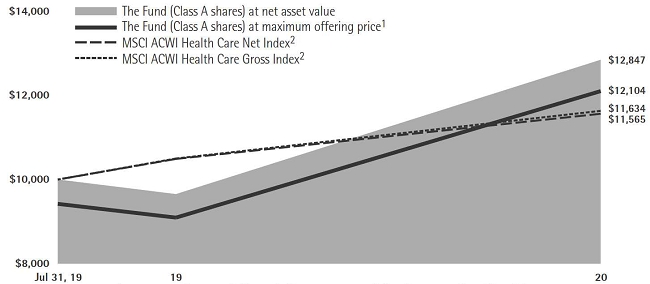

Lord Abbett Health Care Fund

For the fiscal year ended October 31, 2020, the Fund returned 33.08%, reflecting performance at the net asset value (NAV) of Class A Shares with all distributions reinvested, compared to its benchmark, the MSCI ACWI Health Care Index with Net Dividends,7 which returned 10.24% over the same period.

Politics remained an overhang for the health care sector in the U.S. throughout the period, especially as the 2020 elections approached. The prospects for Medicare-for-All increased, concerns that regulatory burdens would increase in the future lingered, and the potential for the Texas Affordable Care Act case to move to the U.S. Supreme Court in 2020 became an ongoing debate. However, in our view, regulatory and policy concerns were somewhat offset by the substantial innovation within the health care industry that was highlighted during the period.

The tide turned abruptly in February and March. The outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, and consumer confidence, resulting in recessionary and deflationary pressures, triggered a severe sell-off. The U.S. Federal Reserve responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. Similarly, the European Central Bank maintained an accommodative stance keeping interest rates at 0% and introduced and expanded its pandemic emergency purchase program. Despite a challenging global macroeconomic environment which continued to be driven by the COVID-19 pandemic, the broad markets rallied based on further stimulus and positive data on COVID treatments. Risk assets began to stage a recovery in April and May on the back of progress with respect to COVID-19 treatments and

18

vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. By the end of July, following Phase 1-2 clinical trial data from Moderna, Pfizer/BioNTech, and Astra Zeneca/Oxford, it was clear timelines for a vaccine were being accelerated, suggesting a vaccine might be available before the end of the year.

Sentiment overseas moved largely in line with that of the U.S., as international equity markets staged a recovery from April through October. In its October 2020 report, the International Monetary Fund estimated global growth at -4.4% for 2020, “reflecting the more moderate downturn projected for 2020 and consistent with expectations of persistent social distancing.” This was a less severe contraction than forecast in the June 2020 World Economic Outlook.

Security selection within the biotechnology industry was the largest contributor to relative performance during the period. Twist Bioscience Corp., a developer of proprietary DNA manufacturing processes, was the largest contributor to relative performance. Shares of Twist rose as the company’s proprietary platform drove scale, product development, and lowered costs for synthetic DNA fragments, which are key for antibody drug discovery. Additionally, the Fund’s allocation to Immunomedics, Inc., a developer and manufacturer of biopharmaceutical products, contributed to relative performance, as Gilead Sciences,

Inc. announced it would acquire the company for a large premium.

Conversely, the Fund’s positioning within the health care providers and services industry detracted from relative performance. Specifically, the Fund’s underweight allocation to UnitedHealth Group, Inc., a provider of a variety of health care services, detracted from relative performance as the company executed well throughout the period, despite a myriad of industry and regulatory headwinds. The Fund’s position in Constellation Pharmaceuticals, Inc., a clinical-stage biopharmaceutical company, also detracted from relative performance during the period. At the European Hematology Medical meeting, Constellation presented what we believe to be compelling updated Phase 2 clinical trial data which indicated the company’s therapy had potential in treating myelofibrosis. However, there were some concern that lower risk patients were driving the strong efficacy in the study, which hurt the share price.

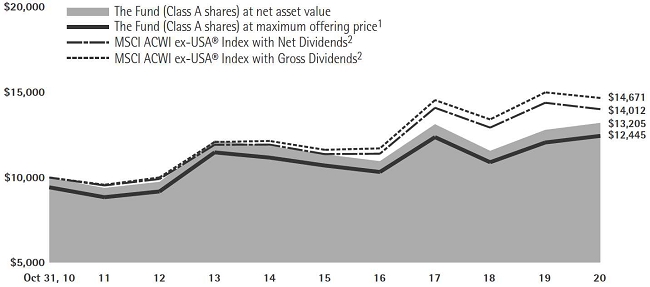

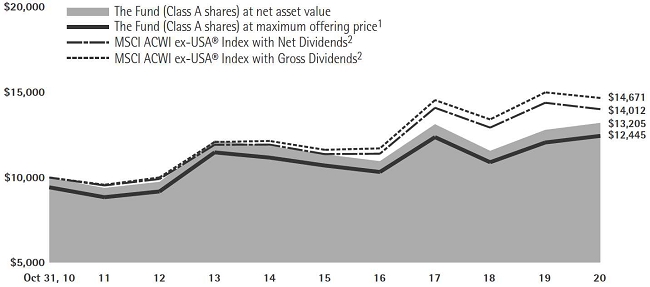

Lord Abbett International Equity Fund

For the fiscal year ended October 31, 2020, the Fund returned 3.23%, reflecting performance at the net asset value (NAV) of Class A Shares with all distributions reinvested, compared to its benchmark, the MSCI ACWI ex-U.S. Index with Net Dividends8, which returned -2.61% over the same period.

19

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. Furthermore, as the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500 Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. In the latter half of March, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central

bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September 2020 meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.” The European Central Bank (ECB) maintained interest rates at 0% as new President Christine Lagarde took over the responsibility on November 1st, 2019. Since the COVID-19 pandemic roiled global markets during her tenure, the ECB introduced and expanded its pandemic emergency purchase program (PEPP) and extended it to at least June 2021. The ECB also continued net purchases under the asset purchase program (APP) at a monthly pace of 20 billion euros, together with the purchase under the additional 120-billion-euro temporary envelope until the end of the year. Additionally, officials signaled readiness to adjust all of its instruments to ensure that inflation moved towards its aim in a sustained manner, including by slashing interest rates deeper into negative territory and changing the conditions of the targeted longer-term refinancing operations. Similar to other global central banks, The Bank of

20

Japan (BoJ) introduced several measures to combat the pressures from COVID-19, including aggressive purchases of corporate debt and a new lending facility to funnel money to smaller firms via financial institutions. The BoJ also maintained its stimulative monetary policy at its October 2020 meeting, as short-term interest rates remained unchanged at -0.1%, and the bank kept its 10-year government bond yield target at around 0%.

Risk assets began to stage a recovery in April and May on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election, and worries about stalled fiscal stimulus talking in Washington. Sentiment overseas moved largely in line with that of the U.S., and international equity markets staged a recovery from April through October 2020. Chinese equities rallied as the country’s economy gained

control over the COVID-19 pandemic, and China’s economy managed to grow 4.9% year-on-year in the third quarter. In the Eurozone, equities rebounded as well, but in a less robust way, as a second wave of the COVID-19 pandemic materialized, and as second quarter GDP numbers from Germany, France, and the Eurozone weighed on investor sentiment. Germany’s economy contracted by 9.7%, France’s by 13.80%, and the Eurozone’s by 11.80% in the quarter.

In its latest October report, the International Monetary Fund estimated global growth at -4.4% for 2020, a less severe contraction than forecast in the June 2020 World Economic Outlook. “The revision reflects better-than anticipated second quarter GDP outturns, mostly in advanced economies, where activity began to improve sooner than expected after lockdowns were scaled back in May and June, as well as indicators of a stronger recovery in the third quarter.” The International Monetary Fund projects growth to pick up to 5.2% in 2021, “reflecting the more moderate downturn projected for 2020 and consistent with expectations of persistent social distancing”.

During the period, the Fund’s outperformance relative to the benchmark was driven by stock selection within the health care and industrials sectors. Within the health sector, holdings in Lonza Group AG, a Swiss pharmaceutical, health care, and life science products company, contributed to relative performance. Shares rose as Lonza was categorized as “essential” during the COVID-19 pandemic and its license to operate remained intact

21

in all markets, without any major disruptions in its supply chain. An overweight position in Genmab A/S also contributed to relative performance, as the Denmark-based biotechnology company benefited from strong momentum and positive investors sentiment, driven by the expected strength of the company’s announced collaboration with AbbVie, Inc.

Security selection in the industrials sector also contributed to relative performance. Specifically, overweight position in Airtac International Group contributed to relative performance. Shares of the Taiwan-based pneumatic equipment manufacturing company rose after the company reported better-than-expected 2Q20 results, with management reaffirming an industry upcycle and strong 5G-related and new infrastructure demand.

Conversely, stock selection within the energy and consumer staples sectors detracted from relative performance over the period. Within the energy sector, shares of Royal Dutch Shell PLC detracted from relative performance, as the global oil and gas production company’s stock fell due to surprisingly weak 2Q20 earnings results, elevated debt, and uncertainty around financial priorities and free cash flow outlook.

Within the consumer staples sector, shares of Shiseido Company Limited, a Japanese cosmetics company, detracted from relative performance. Shares fell over the period as the company’s plans for margin improvements were hit by drops in inbound tourism and by the COVID-19

pandemic. Investor sentiment shifted negatively, given limited details about how a margin recovery would materialize. An overweight position in Asahi Group Holdings, Ltd., a Japanese food and beverages company, also detracted from relative performance. The company’s stock fell after it booked a 43% year-over-year decline in consolidated core operating profit in the second quarter of 2020, due in part to restaurant closures and lower demand from Japanese pubs resulting from the increased prevalence of telecommuting.

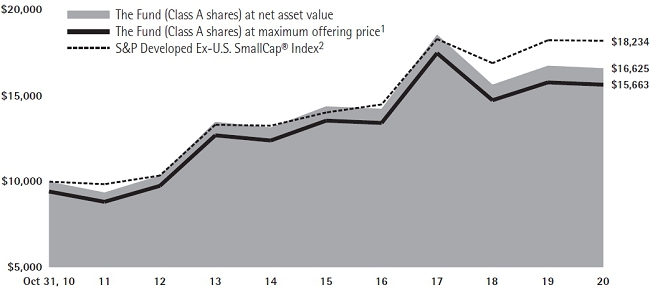

Lord Abbett International Opportunities Fund

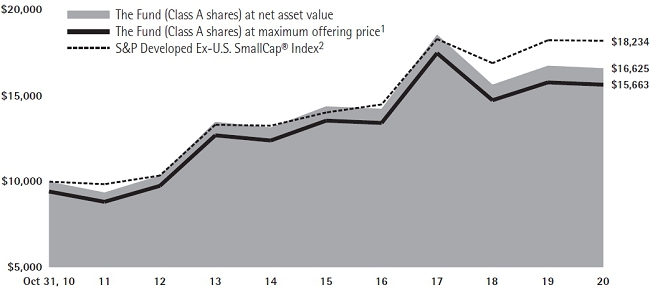

For the fiscal year ended October 31, 2020, the Fund returned -0.84%, reflecting performance at the net asset value (NAV) of Class A Shares with all distributions reinvested, compared to its benchmark, the S&P Developed Ex-U.S. SmallCap® Index9, which returned -0.13% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January and markets priced in a likelihood of two more interest rate cuts in 2020. The tide turned abruptly in February and March, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. Furthermore, as the COVID-19 pandemic fueled fears of

22

slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500 Index2 experienced its fastest bear market since 1987 and the longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. In the back half of March, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 related lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged

until “inflation has risen to 2% and is on track to moderately exceed 2% for some time”. The European Central Bank (ECB) maintained interest rates at 0% as new President Christine Lagarde took over the responsibility on November 1st, 2019. Since the COVID-19 pandemic roiled global markets during her tenure, the ECB introduced and expanded its pandemic emergency purchase program (PEPP) and extended it to at least June 2021. The ECB also continued net purchases under the asset purchase program (APP) at a monthly pace of 20 billion euros, together with purchases under the additional 120-billion-euro temporary envelope until the end of the year. Additionally, officials signaled readiness to adjust all of the ECB’s instruments to ensure that inflation moved towards its aim in a sustained manner, including by slashing interest rates deeper into negative territory and changing the conditions of the targeted longer-term refinancing operations. Similar to other global central banks, The Bank of Japan (BoJ) introduced several measures to combat the pressures from COVID-19, including aggressive purchases of corporate debt and a new lending facility to funnel money to smaller firms via financial institutions. The BoJ also maintained its stimulative monetary policy at its October 2020 meeting, as short-term interest rates remained unchanged at -0.1%, and the bank kept its 10-year government bond yield target at around 0%.

Risk assets began to stage a recovery in April and May on the back of progress with

23

respect to coronavirus treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in earnings revisions as well as further progress in COVID-19 treatments as evidenced by multiple drugs reaching Phase III trials. In September, however, market sentiment soured amid political volatility related to the Supreme Court of the United States vacancy, heightened COVID-19 concerns in Europe as global deaths topped one million, heightened uncertainty leading up to the U.S. Presidential election, and worries about stalled fiscal stimulus talks in Washington. Sentiment overseas moved largely in line with that of the U.S., and international equity markets staged a recovery from April through October. Chinese equities rallied as the country’s economy gained control over the coronavirus pandemic, and China’s economy managed to grow 4.9% year-on-year in the third quarter. In the Eurozone, equities rebounded as well, but in a less robust way, as a second wave of the COVID-19 pandemic materialized, and as second quarter GDP numbers from Germany, France, and the Eurozone weighed on investor sentiment. Germany’s economy contracted by 9.7%, France’s by 13.80%, and the Eurozone’s by 11.80% in the second quarter.

In its latest October report, the International Monetary Fund estimated global growth at -4.4% for 2020, a less severe contraction than forecast in the June 2020 World Economic Outlook. “[t]he revision reflects better-than-anticipated second quarter GDP outturns, mostly in advanced economies, where activity began to improve sooner than expected after lockdowns were scaled back in May and June, as well as indicators of a stronger recovery in the third quarter.” The International Monetary Fund projects growth to pick up to 5.2% in 2021, “reflecting the more moderate downturn projected for 2020 and consistent with expectations of persistent social distancing”.

Stock selection, most notably in the industrials and health care sectors, was the primary driver of relative underperformance during the period. Within the industrials sector, shares of Senior PLC detracted from relative performance. Shares of the U.K.-based aerospace components and systems manufacturing company fell as the demand outlook across the company’s aerospace and industrial end-markets deteriorated as a result of the COVID-19 pandemic. In addition, shares of Loomis AB detracted from relative performance. The Swedish cash handling company’s stock fell as the global pandemic accelerated fears of the move away from cash transactions.

Within the health care sector, shares of Korian SA detracted from relative performance over the period. Shares of the European leader in dependent care, which operates nursing homes, assisted living

24

facilities, home-care networks and clinics, fell despite the company’s relatively resilient earnings results, as the market misunderstood the impact of COVID-19 on Korian relative to other dependent care operators - particularly in light of Korian’s 30% exposure to Germany, a country which experienced limited pressure from COVID-19.

Conversely, stock selection in the real estate and communication services sectors contributed to relative performance. Within the real estate sector, shares of Nippon Prologis REIT, Inc. contributed to relative performance. Shares of the Japanese real estate investment trust rose as property management remained steady despite the COVID-19 pandemic, with only about 0.1% of overall rental income getting deferred and portfolio occupancy averaging 99.2% throughout the company’s properties. In addition, holdings of Patrizia AG contributed to relative performance during the period. Shares of the Germany-based real estate investment company rose after it managed to sign transaction volumes in the second quarter of 2020 in the same amount as in the first quarter, notwithstanding that the lockdowns in Europe had a severe impact on activity in the European real estate markets.

Within the communication services sector, an overweight position in Capcom Co., Ltd. contributed to relative performance, as shares of the company rose throughout the period. The Japanese video game manufacturing company benefited from an accelerated shift to digital entertainment in the leisure

industry, partly as a result of the COVID-19 pandemic. Additionally, the company was able to bolster sales with a growing library of content and a flexible pricing strategy.

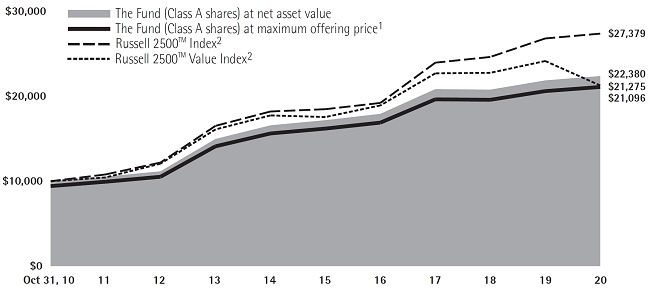

Lord Abbett International Value Fund

For the fiscal year ended October 31, 2020, the Fund returned -11.89%, reflecting performance at the net asset value (NAV) of Class A Shares with all distributions reinvested, compared to its benchmark, the MSCI EAFE Value Index with Net Dividends,10 which returned -18.42% over the same period.

The trailing twelve-month period was characterized by several market-moving events. U.S. President Donald Trump signed a “phase one” trade deal with China on the 15th of January 2020 and markets priced in a likelihood of two more rate cuts in 2020. The tide turned abruptly in February and March 2020, as the outbreak of the COVID-19 pandemic and the expected economic damage resulting from a sudden slowdown in corporate spending, individual spending, consumer confidence, and thus recessionary and deflationary pressures, triggered a severe sell-off. Furthermore, as the COVID-19 pandemic fueled fears of slowing global growth, oil prices fell precipitously, with the primary U.S. oil contract closing in negative territory for the first time in history, although it has since rebounded. During the month of March, the S&P 500 Index2 experienced its fastest bear market since 1987 and the

25

longest U.S. economic expansion in history ended at 128 months.

The U.S. Federal Reserve (Fed) responded to the COVID-19 outbreak with a breadth of policy measures which lifted investors’ confidence in the markets. The Fed launched a $700 billion quantitative easing program, decreased the reserve requirements to zero for thousands of banks, and cut the federal funds rate to the current target range of 0-0.25%. In the latter half of March, the Fed announced additional stimulus programs, including open-ended asset purchases, purchases of corporate debt, and a commitment to a new small business lending program. Additionally, the central bank announced $2.3 trillion of additional credit support by expanding the Primary Market Corporate Credit Facility (PMCCF), the Secondary Market Corporate Credit Facility (SMCCF), and the Term Asset-Backed Securities Loan Facility (TALF). Most notably, the expanded measures included the purchase of select fallen angels. During its latest September 2020 meeting, the Fed voted to keep interest rates in a range of 0-0.25% to support the U.S. economy as it recovers from the deep impact of the COVID-19 lockdowns. In its September statement, the Fed noted that it expects to keep rates unchanged until “inflation has risen to 2% and is on track to moderately exceed 2% for some time.” The European Central Bank (ECB) maintained interest rates at 0% as new President Christine Lagarde took over the responsibility on November 1st, 2019. Since the COVID-19 pandemic roiled global markets during her tenure, the

ECB introduced and expanded its pandemic emergency purchase program (PEPP) and extended it to at least June 2021. The ECB also continued net purchases under the asset purchase program (APP) at a monthly pace of 20 billion euros, together with the purchase under the additional 120-billion-euro temporary envelope until the end of the year. Additionally, officials signaled readiness to adjust all of its instruments to ensure that inflation moved towards its aim in a sustained manner, including by slashing interest rates deeper into negative territory and changing the conditions of the targeted longer-term refinancing operations. Similar to other global central banks, The Bank of Japan (BoJ) introduced several measures to combat the pressures from COVID-19, including aggressive purchases of corporate debt and a new lending facility to funnel money to smaller firms via financial institutions. The BoJ also maintained its stimulative monetary policy at its October 2020 meeting, as short-term interest rates remained unchanged at -0.1%, and the bank kept its 10-year government bond yield target at around 0%.

Risk assets began to stage a recovery in April and May on the back of progress with respect to COVID-19 treatments and vaccines, commentary from several corporations that indicated stabilization in April and May, and massive monetary and fiscal policy globally. Positive market sentiment continued into the third quarter of 2020 as well. In addition to the factors listed above, tailwinds for the continued rally in risk assets included a rebound in

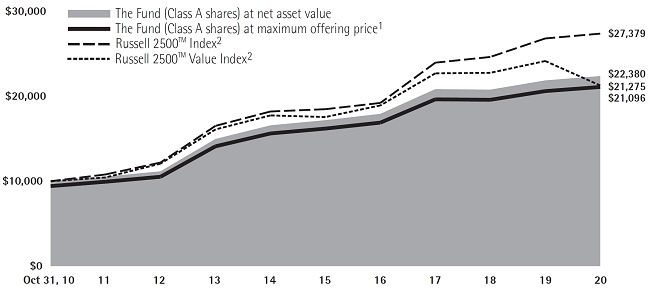

26