UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-07538

LORD ABBETT SECURITIES TRUST

(Exact name of Registrant as specified in charter)

90 Hudson Street, Jersey City, NJ 07302-3973

(Address of principal executive offices) (Zip code)

Lawrence B. Stoller, Esq.

Vice President, Secretary, and Chief Legal Officer

90 Hudson Street, Jersey City, New Jersey 07302-3973

(Name and address of agent for service)

Registrant’s telephone number, including area code: (888) 522-2388

Date of fiscal year end: 10/31

Date of reporting period: 10/31/2022

| Item 1: | Report(s) to Shareholders. |

LORD ABBETT

ANNUAL REPORT

| Lord Abbett | |

| Alpha Strategy Fund | Health Care Fund |

| Focused Growth Fund | International Equity Fund |

| Focused Large Cap Value Fund | International Opportunities Fund |

| Focused Small Cap Value Fund | International Value Fund |

| Fundamental Equity Fund | Micro Cap Growth Fund |

| Global Equity Fund | Value Opportunities Fund |

| Growth Leaders Fund | |

For the fiscal year ended October 31, 2022

Table of Contents

Lord Abbett Securities Trust

Lord Abbett Alpha Strategy Fund, Lord Abbett Focused Growth Fund, Lord Abbett Focused Large Cap Value Fund, Lord Abbett Focused Small Cap Value Fund, Lord Abbett Fundamental Equity Fund, Lord Abbett Global Equity Fund, Lord Abbett Growth Leaders Fund, Lord Abbett Health Care Fund, Lord Abbett International Equity Fund, Lord Abbett International Opportunities Fund, Lord Abbett International Value Fund, Lord Abbett Micro Cap Growth Fund, and Lord Abbett Value Opportunities Fund

Annual Report

For the fiscal year ended October 31, 2022

From left to right: James L.L. Tullis, Independent Chairman of the Lord Abbett Funds and Douglas B. Sieg, Trustee, President and Chief Executive Officer of the Lord Abbett Funds. | | Dear Shareholders: We are pleased to provide you with this overview of the performance of the Funds for the fiscal year ended October 31, 2022. On this page and the following pages, we discuss the major factors that influenced fiscal year performance. For detailed and timely information about the Funds, please visit our website at www.lordabbett.com, where you can also access the quarterly commentaries that provide updates on each Fund’s performance and other portfolio related updates. Thank you for investing in Lord Abbett mutual funds. We value the trust that you place in us and look forward to serving your investment needs in the years to come. Best regards,

Douglas B. Sieg

Trustee, President and Chief Executive Officer |

| | | |

1

Lord Abbett Alpha Strategy Fund

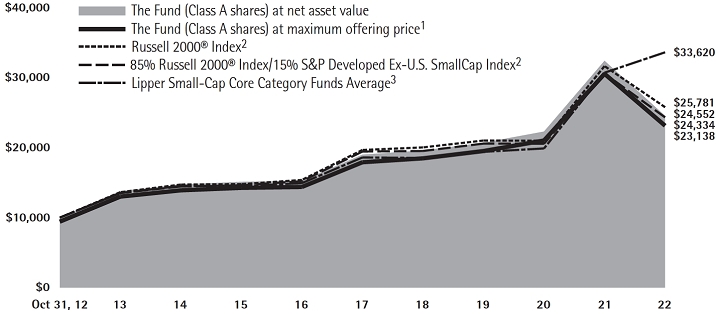

For the fiscal year ended October 31, 2022, the Fund returned -24.25%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 2000® Index,1 which returned -18.54% over the same period.

U.S. markets faced many challenges throughout the twelve-month period ending October 31, 2022, including the emergence of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial Average and S&P 500® Index fell -6.74% and -14.61%, respectively, while the tech-heavy Nasdaq Composite lost -28.56%. Value stocks2 significantly outperformed growth stocks3 (-7.25% vs -24.67%), while large cap stocks4 outperformed small cap stocks5 (-16.38% vs -18.54%).

The period began with global markets grappling with the emergence of the newly discovered Omicron variant. In November 2021 the World Health Organization designated the mutation as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases on the last week of the month and more than doubling the previous record high. Yet, the negative sentiment

regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. There was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 before becoming a dominant headline throughout the period. Headline core consumer price index readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. However, this debate was intensified by November’s headline consumer price index rising 6.8% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to an imbalance between supply and demand dynamics across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June.

Energy costs were the primary driver of inflation for the period, rising more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction with Russia’s invasion of Ukraine. Investors were concerned about the secondary effects of the war, particularly from a commodity and supply chain standpoint. Russia has been a large global exporter of

2

oil and certain minerals, and the various sanctions set on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market as of the end of the fiscal year. Bond yields shot up in anticipation of this aggressive policy, leading to a bearish curve flattening trend and ultimately periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd. Tensions remained elevated for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear

warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by U.S. President Joe Biden to defend the democratically governed island.

Key macroeconomic indicators mostly continued to trend lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries among investors that a recession was pending continued to grow, which ultimately led consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as measured by The University of Michigan’s index of consumer sentiment.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one of the most positive developments seemed to be the traction behind the peak inflation narrative, which included a 99 day stretch of declines in U.S. gasoline prices. In addition, apartment rents fell for the first time in nearly two years in July and lumber prices were off more than 70% from their March peak late in the third quarter, back to pre-COVID levels. Second quarter earnings season also generated many “better-than-feared” takeaways, including plenty of commentary about relatively

3

stable demand and pricing power continuing to protect margins. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply chain constraints. The U.S. labor market also remained strong over the period, with the national unemployment rate at 3.7% as of the end of October.

The Fund is a “fund of funds” that invests in affiliated mutual funds managed by Lord Abbett. Under normal conditions, through the underlying funds, the Fund indirectly invests in the equity securities of U.S. and foreign micro-cap, small, and mid-sized companies. The Fund uses a “blend” strategy to gain exposure to both growth and value stocks.

The Fund’s exposure to domestic small-cap growth stocks within the Lord Abbett Developing Growth Fund was the largest detractor from relative performance over the period. As a result of supply chain dislocations, labor shortages, inflationary pressures, restrictive fiscal and monetary policy, and geopolitical tensions surrounding Russia’s invasion of Ukraine, high innovation small and midcap companies, particularly those aggressively reinvesting in R&D to drive future revenues and earnings, underperformed lower growth, lower valuation names within the index as the market has largely expressed a technical preference for companies with positive earnings today, compared to larger growth potential in the future.

In addition, the Fund’s allocation to international small-cap stocks within the Lord Abbett International Opportunities

Fund was a notable detractor from relative performance, as international equity markets were less resilient against the aforementioned headwinds relative to domestic equities.

The Fund’s weightings in domestic small-cap value stocks within the Lord Abbett Focused Small Cap Value Fund and the Lord Abbett Small Cap Value Fund were the largest contributors to relative performance over the period. Both Funds employ a fundamental, bottom-up individual stock selection strategy that focuses on quality companies with compelling valuation over a long-term horizon. As such, the relative outperformance over the period was largely a result of the market expressing technical preference for higher quality, lower valuation names within the broader index.

Lord Abbett Focused Growth Fund

For the fiscal year ended October 31, 2022, the Fund returned -36.92%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index,6 which returned -24.60% over the same period.

U.S. markets faced many challenges throughout the twelve-month period ending October 31, 2022, including the emergence of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial

4

Average and S&P 500® Index fell -6.74% and -14.61%, respectively, while the tech-heavy Nasdaq Composite lost -28.56%. Value stocks2 significantly outperformed growth stocks3 (-7.25% vs -24.67%), while large cap stocks4 outperformed small cap stocks5 (-16.38% vs -18.54%).

The period began with global markets grappling with the emergence of the newly discovered Omicron variant. In November 2021 the World Health Organization designated the mutation as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases on the last week of the month and more than doubling the previous record high. Yet, the negative sentiment regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. There was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 before becoming a dominant headline throughout the period. Headline core consumer price index readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. However, this debate was intensified by November’s headline consumer price index

rising 6.8% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to an imbalance between supply and demand dynamics across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June.

Energy costs were the primary driver of inflation for the period, rising more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction with Russia’s invasion of Ukraine. Investors were concerned about the secondary effects of the war, particularly from a commodity and supply chain standpoint. Russia has been a large global exporter of oil and certain minerals, and the various sanctions set on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike

5

in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market as of the end of the fiscal year. Bond yields shot up in anticipation of this aggressive policy, leading to a bearish curve flattening trend and ultimately periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd. Tensions remained elevated for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by U.S. President Joe Biden to defend the democratically governed island.

Key macroeconomic indicators mostly continued to trend lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries among

investors that a recession was pending continued to grow, which ultimately led consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as measured by The University of Michigan’s index of consumer sentiment.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one of the most positive developments seemed to be the traction behind the peak inflation narrative, which included a 99 day stretch of declines in U.S. gasoline prices. In addition, apartment rents fell for the first time in nearly two years in July and lumber prices were off more than 70% from their March peak late in the third quarter, back to pre-COVID levels. Second quarter earnings season also generated a lot of “better-than-feared” takeaways, including plenty of commentary about relatively stable demand and pricing power continuing to protect margins. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply chain constraints. The U.S. labor market also remained strong over the period, with the national unemployment rate at 3.7% as of the end of October.

From an industry standpoint, the portfolio’s allocation to stocks within the software industry was a primary drag on performance over the period. For example, the portfolio’s position in Atlassian Corporation, a developer of products for software developers, project managers and other software

6

development teams, was a notable detractor as many stocks within the industry suffered significant valuation compression as a result of supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and heightened recessionary fears. That said, we view this largely as a price correction as many of these companies continue to exhibit strong operating momentum and possess bright futures.

The portfolio’s position in EPAM Systems, Inc., a developer of software products and digital platform engineering services, was the largest detractor from relative performance over the period. After sustained stock price appreciation since the beginning of the pandemic, EPAM stock quickly moved into a period of consolidation in the first quarter of 2022 as the high-growth and richly valued technology stock was adversely impacted by the rotation away from growth to value. Additionally, EPAM was also negatively impacted by the Russian invasion of Ukraine, as a large percentage of its workforce is based in Ukraine, Russia, and Belarus. We exited the position shortly after the invasion.

Conversely, not owning Meta Platforms, Inc., a technology company that engages in the development of social media applications, had the largest contribution to the portfolio’s relative performance over the period. The portfolio has maintained a zero weight in Meta stock since December 2021 as it has not aligned with our investment process. In regard to our decision to exit the position, we have been concerned about the

company’s inability to manage data privacy and controversial speech on its sites. The company has also acknowledged issues regarding Apple’s iOS privacy changes and advertiser challenges - citing supply chain and other macro issues as prominent headwinds. Lastly, we considered Facebook’s name change to Meta Platforms and quick pivot to the metaverse, a new and uncertain area, as a red flag, as we questioned the need for such a shift and concluded that the company must be concerned about the growth prospects of its existing business.

The portfolio’s position in Enphase Energy, Inc., an energy technology company that develops and manufactures solar micro-inverters, battery energy storage, and electric vehicle charging stations, was also a prominent contributor to relative performance over the period. Enphase has benefited greatly from increased demand for solar solutions in Europe as a result of persistent energy shortages. In the company’s most recent quarterly earnings report, management reported top- and bottom-line earnings results that exceeded consensus expectations. Notably, Enphase reported strong revenue growth driven by growth in microinverter and IQ Battery shipments. As of the end of the fiscal year, Enphase is one of the portfolio’s top active overweights.

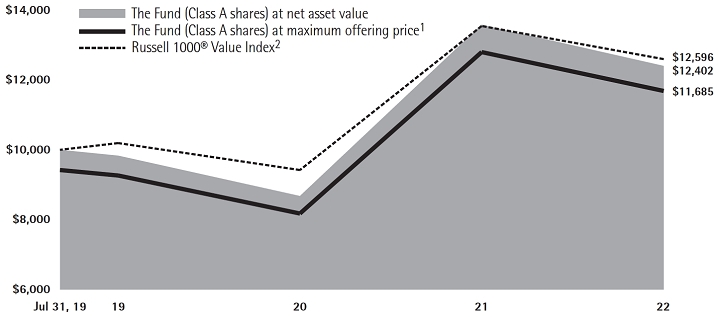

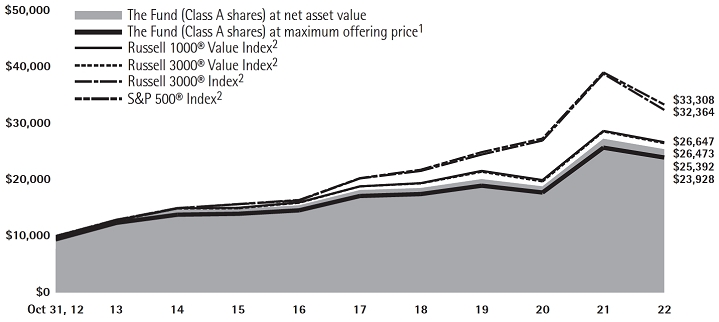

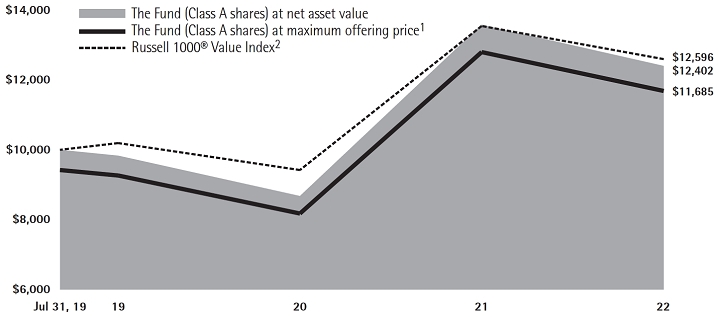

Lord Abbett Focused Large Cap Fund

For the fiscal year ended October 31, 2022, the Fund returned -8.69%, reflecting performance at the net asset value (“NAV”) of Class A shares with all distributions

7

reinvested, compared to its benchmark, the Russell 1000® Value Index7, which returned -7.00% over the same period.

U.S. markets faced many challenges throughout the twelve-month period ending October 31, 2022, including the emergence of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial Average and S&P 500® Index fell -6.74% and -14.61%, respectively, while the tech-heavy Nasdaq Composite lost -28.56%. Value stocks2 significantly outperformed growth stocks3 (-7.25% vs -24.67%), while large cap stocks4 outperformed small cap stocks5 (-16.38% vs -18.54%).

The period began with global markets grappling with the emergence of the newly discovered Omicron variant. In November 2021 the World Health Organization designated the mutation as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases on the last week of the month and more than doubling the previous record high. Yet, the negative sentiment regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. There was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 before becoming a dominant headline throughout the period. Headline core consumer price index readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. However, this debate was intensified by November’s headline consumer price index rising 6.8% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to an imbalance between supply and demand dynamics across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June.

Energy costs were the primary driver of inflation for the period, rising more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction with Russia’s invasion of Ukraine. Investors were concerned about the secondary effects of the war, particularly from a commodity and supply chain standpoint. Russia has been a large global exporter of oil and certain minerals, and the various sanctions set on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive

8

approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market as of the end of the fiscal year. Bond yields shot up in anticipation of this aggressive policy, leading to a bearish curve flattening trend and ultimately periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd. Tensions remained elevated for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by U.S. President Joe Biden to defend the democratically governed island.

Key macroeconomic indicators mostly continued to trend lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries among investors that a recession was pending continued to grow, which ultimately led consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as measured by The University of Michigan’s index of consumer sentiment.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one of the most positive developments seemed to be the traction behind the peak inflation narrative, which included a 99 day stretch of declines in U.S. gasoline prices. In addition, apartment rents fell for the first time in nearly two years in July and lumber prices were off more than 70% from their March peak late in the third quarter, back to pre-COVID levels. Second quarter earnings season also generated many “better-than-feared” takeaways, including plenty of commentary about relatively stable demand and pricing power continuing to protect margins. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply chain constraints. The U.S. labor market also remained strong over the period, with the national unemployment rate at 3.7% as of the end of October.

9

During the 12-month period ending October 31, 2022, the Fund’s position in Caesars Entertainment, a casino management company, detracted most from relative performance. Shares fell after the company reported that revenue was short of expectations in the first quarter. The company faced headwinds throughout the period as it had notable financial leverage. We believe the company should benefit from both the reduction of their overall leverage as well as the resumption of international travel. The Fund’s position in Organon & Co, a science-based global pharmaceutical company, also detracted from relative performance. Shares fell after the company lowered fiscal year guidance, including a reduction in adjusted EBITDA margin guidance. While shares have lagged over the last year, their legacy business has done better than expected following the spin-off from Merck & Co., Inc. We also believe the expansion of their women’s health business will be a significant opportunity for the company as they look to migrate the business to a higher growth segment which will in turn increase margins over time. The Fund’s position in KKR & Co., Inc, a leading alternatives investment firm, also detracted from relative performance. Amid the flattening of the yield curve, rate volatility, and skepticism around global growth prospects, the Financials sector came under pressure. In addition to the sector headwinds, shares of KKR & Co. were negatively impacted by its failure to close its acquisition of Telecom Italia. The company stands to benefit from increasing allocations to alternatives by

retail and institutional investors as well as a rising proportion of fee-related income.

Conversely, the largest contributor to relative performance during the 12-month period ending October 31, 2022, was T-Mobile US, Inc., an American wireless network operator. Shares of T-Mobile increased over the period as the company reported second quarter earnings that came in above expectations and simultaneously increased fiscal year guidance. The Fund’s position in Lockheed Martin Corp., a global security and aerospace company, also contributed to relative performance. The ongoing tensions between Russia and Ukraine have built up momentum in the defense sector and the U.S. government is Lockheed Martin’s largest customer. We believe the U.S. national defense budget could be larger than most are predicting, and the company should benefit from this. The Fund’s position in AbbVie, Inc., a research-based biopharmaceutical company, also contributed to relative performance. Shares rallied in the first half of the year, up almost 50% at the peak in early April. This was supported by the company reporting strong fourth quarter earnings and issuing fiscal year guidance above expectations.

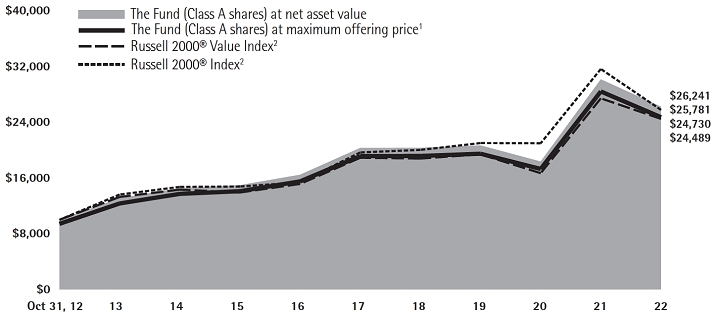

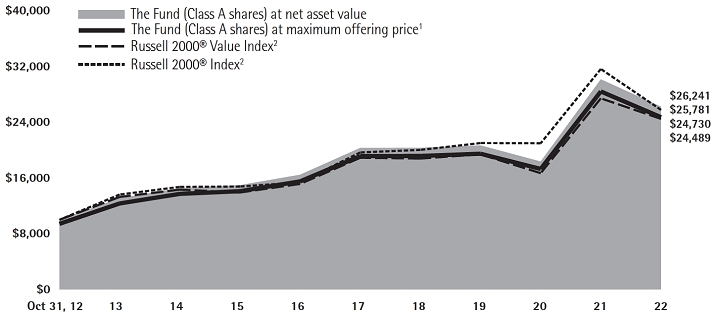

Lord Abbett Focused Small Cap Value Fund

For the fiscal year ended October 31, 2022, the Fund returned -12.99%, reflecting performance at the net asset value (“NAV”) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 2000® Value Index8, which returned -10.73% over the same period.

10

U.S. markets faced many challenges throughout the twelve-month period ending October 31, 2022, including the emergence of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial Average and S&P 500® Index fell -6.74% and -14.61%, respectively, while the tech-heavy Nasdaq Composite lost -28.56%. Value stocks2 significantly outperformed growth stocks3 (-7.25% vs -24.67%), while large cap stocks4 outperformed small cap stocks5 (-16.38% vs -18.54%).

The period began with global markets grappling with the emergence of the newly discovered Omicron variant. In November 2021 the World Health Organization designated the mutation as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases on the last week of the month and more than doubling the previous record high. Yet, the negative sentiment regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. There was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 before becoming a dominant headline throughout the period. Headline core consumer price index readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. However, this debate was intensified by November’s headline consumer price index rising 6.8% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to an imbalance between supply and demand dynamics across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June.

Energy costs were the primary driver of inflation for the period, rising more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction with Russia’s invasion of Ukraine. Investors were concerned about the secondary effects of the war, particularly from a commodity and supply chain standpoint. Russia has been a large global exporter of oil and certain minerals, and the various sanctions set on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive

11

approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market as of the end of the fiscal year. Bond yields shot up in anticipation of this aggressive policy, leading to a bearish curve flattening trend and ultimately periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd. Tensions remained elevated for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by

U.S. President Joe Biden to defend the democratically governed island.

Key macroeconomic indicators mostly continued to trend lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries among investors that a recession was pending continued to grow, which ultimately led consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as measured by The University of Michigan’s index of consumer sentiment.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one of the most positive developments seemed to be the traction behind the peak inflation narrative, which included a 99 day stretch of declines in U.S. gasoline prices. In addition, apartment rents fell for the first time in nearly two years in July and lumber prices were off more than 70% from their March peak late in the third quarter, back to pre-COVID levels. Second quarter earnings season also generated many “better-than-feared” takeaways, including plenty of commentary about relatively stable demand and pricing power continuing to protect margins. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply chain constraints. The U.S. labor market also remained strong over the

12

period, with the national unemployment rate at 3.7% as of the end of October.

During the 12-month period ending October 31, 2022, the Fund’s position in Spectrum Brands Holdings, Inc., a consumer products and home essentials company, detracted from relative performance. Shares fell after Assa Abloy, which engages in the provision of intelligent lock and security solutions, issued a statement regarding the U.S. DOJ’s blocking of Assa Abloys’s proposed acquisition of the hardware and home improvement division of Spectrum Brands. The Fund’s position in Masonite International Corp., a manufacturer of residential interior doors, also detracted from relative performance. Shares fell at the end of 2021 after the company lowered fiscal year guidance. Howard Heckes, President and CEO, stated “While our team has worked extremely hard to deliver continued growth in the face of a difficult operating environment, we expect the fourth quarter will continue to be affected by a tight labor market and logistics challenges and have updated our outlook to reflect their impact.” Despite the aforementioned headwinds, the company has been exhibiting pricing power and improving normalized returns as a result. The Fund’s position in Century Aluminum Co., a producer of aluminum and operator of aluminum reduction facilities, or smelters, in the United States and Iceland, detracted from relative performance. Shares fell as power costs increased early in the year, with the expectation that higher prices would continue through the summer. Electricity prices typically comprise approximately 1/3

of smelter costs. In addition to this, it became evident there was a much smaller global aluminum supply deficit than anticipated, largely due to weaker China demand and excess supply.

Conversely, the largest contributor to relative performance during the 12-month period ending October 31, 2022 was International Money Express, Inc, a leading money remittance services company. Shares rallied after the company reported fourth quarter earnings above expectations, followed by another strong first quarter earnings report. The company subsequently increased second quarter guidance. We believe their valuation remains attractive and they are well positioned for further growth. The Fund’s position in Cars.com, Inc., a leading automotive marketplace platform, contributed to relative performance. Shares rallied after the company reported strong second quarter earnings where revenue and adjusted EBITDA beat expectations. Subsequently, the company issued third quarter guidance stating they expect revenue growth to accelerate and projects growth of 6-8% year-over-year in the second half of 2022. The Fund’s position in Silicon Motion Technology, which engages in the development, manufacturing, and supply of semiconductor products for the electronics market, was the largest contributor within the sector. Silicon Motion Technology was a significant outperformer in the first half of the year. Shares rallied following the announcement that MaxLinear, which provides highly integrated radio-frequency

13

analog and mixed-signal semiconductor products for broadband communications applications, would acquire Silicon Motion Technology.

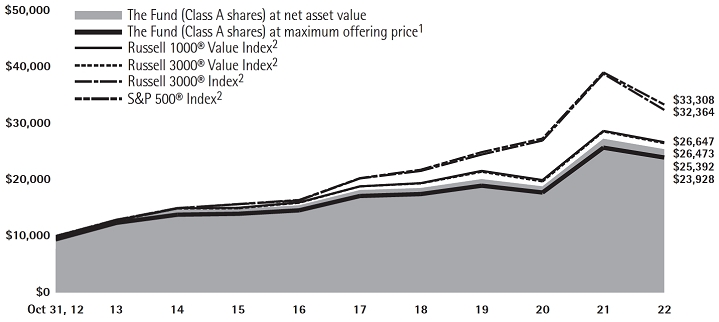

Lord Abbett Fundamental Equity Fund

For the fiscal year ended October 31, 2022, the Fund returned -6.81%, reflecting performance at the net asset value (“NAV”) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Value Index7, which returned -7.00% over the same period.

U.S. markets faced many challenges throughout the twelve-month period ending October 31, 2022, including the emergence of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial Average and S&P 500® Index fell -6.74% and -14.61%, respectively, while the tech-heavy Nasdaq Composite lost -28.56%. Value stocks2 significantly outperformed growth stocks3 (-7.25% vs -24.67%), while large cap stocks4 outperformed small cap stocks5 (-16.38% vs -18.54%).

The period began with global markets grappling with the emergence of the newly discovered Omicron variant. In November 2021 the World Health Organization designated the mutation as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of

infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases on the last week of the month and more than doubling the previous record high. Yet, the negative sentiment regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. There was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 before becoming a dominant headline throughout the period. Headline core consumer price index readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. However, this debate was intensified by November’s headline consumer price index rising 6.8% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to an imbalance between supply and demand dynamics across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June.

Energy costs were the primary driver of inflation for the period, rising more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction

14

with Russia’s invasion of Ukraine. Investors were concerned about the secondary effects of the war, particularly from a commodity and supply chain standpoint. Russia has been a large global exporter of oil and certain minerals, and the various sanctions set on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market as of the end of the fiscal year. Bond yields shot up in anticipation of this aggressive policy, leading to a bearish curve flattening trend and ultimately periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd.

Tensions remained elevated for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by U.S. President Joe Biden to defend the democratically governed island.

Key macroeconomic indicators mostly continued to trend lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries among investors that a recession was pending continued to grow, which ultimately led consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as measured by The University of Michigan’s index of consumer sentiment.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one of the most positive developments seemed to be the traction behind the peak inflation narrative, which included a 99 day stretch of declines in U.S. gasoline prices. In addition, apartment rents fell for the first time in nearly two years in July and lumber prices were off more than 70% from their March peak late in the third quarter, back

15

to pre-COVID levels. Second quarter earnings season also generated many “better-than-feared” takeaways, including plenty of commentary about relatively stable demand and pricing power continuing to protect margins. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply chain constraints. The U.S. labor market also remained strong over the period, with the national unemployment rate at 3.7% as of the end of October.

During the 12-month period ending October 31, 2022, the Fund’s position in Caesars Entertainment, a casino management company, detracted most from relative performance. Shares fell after the company reported that revenue was short of expectations in the first quarter. The company faced headwinds throughout the period as it had notable financial leverage. We believe the company should benefit from both the reduction of their overall leverage as well as the resumption of international travel. The Fund’s position in Organon & Co, a science-based global pharmaceutical company, also detracted from relative performance. Shares fell after the company lowered fiscal year guidance, including a reduction in adjusted EBITDA margin guidance. While shares have lagged over the last year, their legacy business has done better than expected following the spin-off from Merck & Co., Inc. We also believe the expansion of their women’s health business will be a significant opportunity for the company as they look to migrate the business to a higher growth

segment which will in turn increase margins over time. The Fund’s position in Signature Bank, a commercial banking company, also detracted from relative performance. Banks were under pressure as the yield curve flattened and the possibility of slowing economic growth became evident. The 5-year and 30-year U.S. Treasury spread inverted for the first time since 2006, and the 2-year and 10-year Treasury spread inverted for the first time since 2019.

Conversely, the largest contributor to relative performance during the 12-month period ending October 31, 2022, was T-Mobile US, Inc, an American wireless network operator. Shares of T-Mobile increased over the period as the company reported strong second quarter earnings above expectations and simultaneously increased fiscal year guidance. The Fund’s position in Lockheed Martin Corp., a global security and aerospace company, also contributed to relative performance. The ongoing tensions between Russia and Ukraine have built up momentum in the defense sector and the U.S. government is Lockheed Martin’s largest customer. We believe the U.S. national defense budget could be larger than most are predicting, and the company should subsequently benefit from this. The Fund’s position in UnitedHealth Group, Inc., a health care coverage provider, also contributed to relative performance. Managed care companies such as UnitedHealth Group continued to see strong performance at the beginning of the year as investors expected that medical cost trends would remain subdued as the pandemic continued to

16

delay procedures. Shares of the company rose after reporting fourth quarter earnings, with revenue above expectations. Shares continued to rally after it was announced that LHC Group would be acquired by UnitedHealth for $5.4B cash.

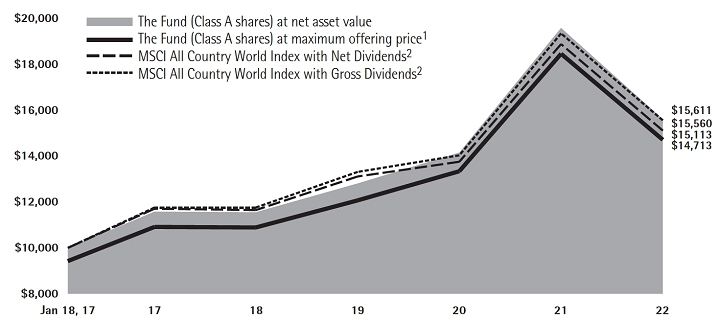

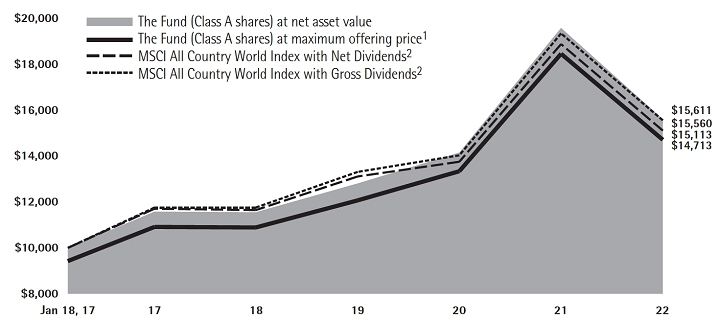

Lord Abbett Global Equity Fund

For the fiscal year ended October 31, 2022, the Fund returned -20.30%, reflecting performance at the net asset value (“NAV”) of Class A Shares with all distributions reinvested, compared to its benchmark, the MSCI All Country World Index with Net Dividends,9 which returned -19.96% over the same period.

Global equities finished lower for the trailing twelve-month period as bearish sentiment overwhelmed markets. Looking closer, the fiscal year was defined by two distinct periods of economic activity. In the second half of 2021, U.S. markets were supported by continued central bank liquidity and corporate earnings surprises. Continued vaccine progress against the COVID-19 virus and momentum surrounding economic reopening in developed markets also provided a tailwind. Specifically, the U.S. economy showed signs of meaningful growth, with gross domestic product (GDP) growing 7.0% in the fourth quarter of 2021. Meanwhile, GDP growth in the Eurozone and China was 0.5% and 1.3%, respectively over the same period.

However, global markets were met with increasing headwinds towards the end of 2021, including the emergence of the newly discovered Omicron variant. In

November 2021 the World Health Organization designated the newly discovered mutation as a “variant of concern”, leading to one of the largest selloffs and worst one-day performance of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases in the last week of the month and more than doubling the previous record high. Yet, the negative sentiment regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. In the U.S., there was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Moving into 2022, investor risk appetite shifted lower due primarily to a combination of higher and more persistent inflation. Inflationary pressures had built up in the fourth quarter of 2021 by an imbalance between supply and demand dynamics across multiple industries, exacerbated by COVID-19 labor issues. This became evident with the headline U.S. consumer price index (CPI) rising 6.8% year-on-year in November 2021, the fastest pace since 1982. Prices continued increasing throughout the first half of 2022, led by energy, food, and used cars. This surge in prices culminated in June 2022 as headline inflation came in at 9.1% year-on-year, the fastest annual increase in over 40 years. Meanwhile, inflation data outside the U.S. was also high, with

17

October 2022 inflation readings for Canada, the U.K., and Eurozone coming in at 6.9%, 11.1%, and 10.6%, respectively.

There were a number of developments indicating an increasing possibility of an approaching recession for global economies. The U.S. reported negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries of a pending recession continued to grow, causing consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as measured by The University of Michigan’s index of consumer sentiment. There was a flurry of high-profile hiring freezes and layoff announcements. Second quarter earnings also provided some cautious takeaways, including lower guidance from retailers on general merchandise softness as a result of inflation, tech companies pointing to a continued deterioration in digital advertising and consumer electronics, and home builders commenting on a slowdown in housing demand.

In Europe, market sentiment deteriorated throughout the year, with the prospects of a recession increasing, in our view. Most economic data pointed to a slowdown in Europe, such as the euro area composite Purchasing Managers Index (PMI) business survey, which fell into contractionary territory and closed the twelve-month period with six straight months of falling private sector activity. Euro area consumer confidence dropped to an all-time low in September, as measured

by the European Commission’s consumer confidence indicator, in part due to the reduction in gas supplies coming from Russia, which drove prices up significantly and raised fears of outright shortages and rationing. Russia completely halted gas flows through the key Nord Stream 1 pipeline in September, which exacerbated many of those fears. This sparked officials to announce plans to tackle the energy crisis towards the end of the period, which included the first version of a price cap and a common purchases system. Germany also launched a jumbo fiscal package of €200bn to support households and firms.

Emerging markets equities meaningfully underperformed their developed market peers, as a strong U.S. dollar and rising oil prices proved to be major headwinds. Chinese equities were a notable underperformer, as the country continued to grapple the COVID-zero strategy, a moderation in exports, and a persistent property crisis. These headwinds led to consumer confidence, as measured by the National Bureau of Statistics of China, to fall to an all-time low in April and continue to hover in that range for the remainder of the fiscal year. As such, in September, the Asian Development Bank downgraded its growth estimate for China to 3.3% this year from a prior 4.0% estimate. It also forecasted that China’s economic growth would lag that of developing Asia for the first time in more than three decades.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd. Tensions remained elevated

18

for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by U.S. President Joe Biden to defend the democratically governed island.

The surge in prices forced global central banks into a more aggressive approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the U.S. Federal Reserve (Fed) to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market. Bond yields shot up in reaction to this shift in policy, exhibiting a bearish curve flattening trend and ultimately leading to periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields. This trend was reflected in the 5-year and

30-year U.S. Treasury spread inverting for the first time since 2006, and the 2-year and 10-year Treasury spread inverting for the first time since 2019.

The European Central Bank (ECB) raised its three key interest rates by 50bp during its July 2022 meeting in an attempt to reduce inflationary pressures, ending eight years of negative rates with its first increase since 2011. The ECB then followed up with two 75bp rate hikes in September and October, bringing borrowing costs to the highest level since early 2009. Inflation in the Euro Area continued to march higher and break record rates, reaching double digits by October, and showing no signs of peaking. In total, ninety central banks globally have raised rates thus far in 2022, creating the most widespread rate rise in over two decades. That said, the Bank of Japan (BoJ) appeared undeterred and maintained its key short-term interest rate at -0.1% during its October meeting but raised its 2022 inflation forecast to 2.9% from the 2.3% made in July, citing surging prices of energy, food, and durable goods. The BoJ reiterated it will take extra easing measures if needed while continuing to buy unlimited amounts of bonds, as it has been doing since April. The People’s Bank of China also maintained accommodative monetary policy over the year amid subdued headline inflation and a rapid decline in the yuan.

In terms of Fund performance, stock selection within the information technology sector was a primary driver of relative underperformance over the period. Specifically, shares of NVIDIA Corporation,

19

a U.S.-based designer of graphics processing units that enhance the experience on computing platforms, slumped for most of the period amid declining demand for its gaming graphic processing units (GPUs). Management noted during the company’s most recent earnings report that as macroeconomic challenges started to affect consumers, the demand for high-quality gaming GPUs started to fall.

Within consumer discretionary, shares of Alibaba Group Holding Ltd., a Chinese online and mobile marketplace in retail and wholesale trade, fell meaningfully throughout the year. Entering the fiscal year, the company was already facing pressure of increased regulation from the State Administration for Market Regulation. In August 2021, the Chinese agency issued a comprehensive list of rules that forbade tech giants from illegally capturing and using customer data, as well as using technology to bar access to competitors’ products. Shares of Alibaba were also under pressure as a result of renewed fears of further COVID containment driven lockdowns in China. Previously strict lockdowns have reduced social engagement, which in turn has presented challenges in many areas of consumption.

Conversely, stock selection within the industrials and financials sectors contributed to relative performance during the period. Within industrials, the Fund’s position in Rheinmetall AG, a German defense equipment manufacturer, was the largest individual

contributor to relative performance. After Russia’s invasion of Ukraine, the German government enlisted Rheinmetall to improve the equipment of the armed forces of the Federal Republic of Germany, sending shares of the stock soaring.

Stock selection within the energy sector was also a primary contributor to relative performance during the period. Leading the way was the Fund’s position in Marathon Petroleum as they largely benefitted from higher oil and gas prices. Marathon refines crude oil and other feedstocks at its refineries in the Gulf Coast and Midwest regions of the U.S., with the former currently particularly advantaged in the current environment. European refining capacity has been disadvantaged by high gas prices, while US Gulf Coast refineries have enjoyed significant cost advantages due to cheaper input costs.

Within the heath care sector, the Fund’s position in Vertex Pharmaceuticals, Inc., a manufacturer of small molecule drugs for patients with serious diseases, also contributed to relative performance. Shares of the stock largely benefited throughout the year due to positive results for its drug, VX- 548, which treats acute pain. Most recently, in July, the company announced positive results from two Phase 2 proof-of-concept studies. As of the end of the fiscal year, Vertex is among the Fund’s top active overweights relative to the MSCI All Country World Index with Net Dividends.

20

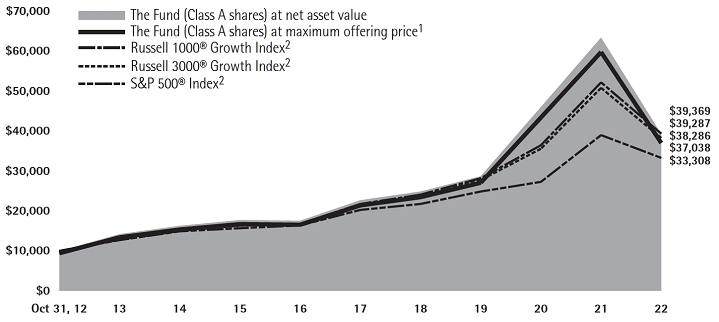

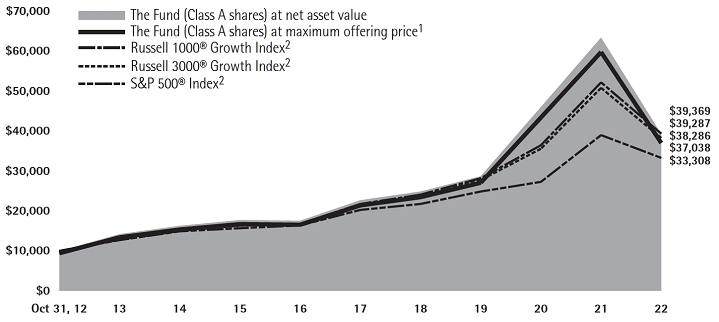

Lord Abbett Growth Leaders Fund

For the fiscal year ended October 31, 2022, the Fund returned -38.05%, reflecting performance at the net asset value (NAV) of Class A shares with all distributions reinvested, compared to its benchmark, the Russell 1000® Growth Index,6 which returned -24.60% over the same period.

U.S. markets faced many challenges throughout the twelve-month period ending October 31, 2022, including the emergence of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial Average and S&P 500® Index fell -6.74% and -14.61%, respectively, while the tech-heavy Nasdaq Composite lost -28.56%. Value stocks2 significantly outperformed growth stocks3 (-7.25% vs -24.67%), while large cap stocks4 outperformed small cap stocks5 (-16.38% vs -18.54%).

The period began with global markets grappling with the emergence of the newly discovered Omicron variant. In November 2021 the World Health Organization designated the mutation as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases

on the last week of the month and more than doubling the previous record high. Yet, the negative sentiment regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. There was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 before becoming a dominant headline throughout the period. Headline core consumer price index readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. However, this debate was intensified by November’s headline consumer price index rising 6.8% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to an imbalance between supply and demand dynamics across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June.

Energy costs were the primary driver of inflation for the period, rising more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction with Russia’s invasion of Ukraine. Investors were concerned about the secondary

21

effects of the war, particularly from a commodity and supply chain standpoint. Russia has been a large global exporter of oil and certain minerals, and the various sanctions set on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market as of the end of the fiscal year. Bond yields shot up in anticipation of this aggressive policy, leading to a bearish curve flattening trend and ultimately periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd. Tensions remained elevated

for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by U.S. President Joe Biden to defend the democratically governed island.

Key macroeconomic indicators mostly continued to trend lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries among investors that a recession was pending continued to grow, which ultimately led consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as measured by The University of Michigan’s index of consumer sentiment.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one of the most positive developments seemed to be the traction behind the peak inflation narrative, which included a 99 day stretch of declines in U.S. gasoline prices. In addition, apartment rents fell for the first time in nearly two years in July and lumber prices were off more than 70% from their March peak late in the third quarter, back

22

to pre-COVID levels. Second quarter earnings season also generated a lot of “better-than-feared” takeaways, including plenty of commentary about relatively stable demand and pricing power continuing to protect margins. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply chain constraints. The U.S. labor market also remained strong over the period, with the national unemployment rate at 3.7% as of the end of October.

From an industry standpoint, the portfolio’s allocation to companies within the software industry was a primary drag on performance over the period. For example, the portfolio’s position in Atlassian Corporation, a developer of products for software developers, project managers and other software development teams, was a notable detractor as many stocks within the industry, and other industries, suffered significant valuation compression as a result of supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and heightened recessionary fears. That said, we view this largely as a price correction as many of these companies continue to exhibit strong operating momentum and possess bright futures.

The portfolio’s position in EPAM Systems, Inc., a developer of software products and digital platform engineering services, was the largest detractor from relative performance over the period. After sustained stock price appreciation since

the beginning of the pandemic, EPAM stock quickly moved into a period of consolidation in the first quarter of 2022 as the high-growth and richly valued technology stock was adversely impacted by the rotation away from growth to value. Additionally, EPAM was negatively impacted by the Russian invasion of Ukraine, as a large percentage of its workforce is based in Ukraine, Russia, and Belarus. We exited the position shortly after the invasion.

Conversely, not owning Meta Platforms, Inc., a technology company that engages in the development of social media applications, had the largest contribution to the portfolio’s relative performance over the period. The portfolio has maintained a zero weight in Meta stock since December 2021 as it has not aligned with our investment process. In regard to our decision to exit the position, we have been concerned about the company’s inability to manage data privacy and controversial speech on its sites. The company has also acknowledged issues regarding Apple’s iOS privacy changes and advertiser challenges - citing supply chain and other macro issues as prominent headwinds. Lastly, we considered Facebook’s name change to Meta Platforms and quick pivot to the metaverse, a new and uncertain area, as a red flag, as we questioned the need for such a shift and concluded that the company must be concerned about the growth prospects of its existing business.

The portfolio’s position in in Enphase Energy, Inc., an energy technology company that develops and manufactures solar micro-inverters, battery energy

23

storage, and electric vehicle charging stations, was also a prominent contributor to relative performance over the period. Enphase has benefited greatly from increased demand for solar solutions in Europe as a result of persistent energy shortages. In the company’s most recent quarterly earnings report, management reported top- and bottom-line earnings results that exceeded consensus expectations. Notably, Enphase’s reported strong revenue growth driven by growth in microinverter and IQ Battery shipments. As of the end of the fiscal year, Enphase is one of the portfolio’s top active overweights.

Lord Abbett Health Care Fund

For the fiscal year ended October 31, 2022, the Fund returned -16.29%, reflecting performance at the net asset value (NAV) of Class A Shares with all distributions reinvested, compared to its benchmark, the MSCI ACWI Health Care Index with Net Dividends,10 which returned -7.61% over the same period.

U.S. markets faced many challenges throughout the twelve-month period ending October 31, 2022, including the emergence of the Omicron variant of COVID-19, supply chain dislocations, labor shortages, inflationary pressures, less accommodative fiscal and monetary policy, and Russia’s invasion of Ukraine. The Dow Jones Industrial Average and S&P 500® Index fell -6.74% and -14.61%, respectively, while the tech-heavy Nasdaq Composite lost -28.56%. Value stocks2 significantly outperformed growth stocks3

(-7.25% vs -24.67%), while large cap stocks4 outperformed small cap stocks5 (-16.38% vs -18.54%).

The period began with global markets grappling with the emergence of the newly discovered Omicron variant. In November 2021 the World Health Organization designated the mutation as a “variant of concern”, leading to one of the largest selloffs of U.S. risk assets since the start of the pandemic, as fears that the world would succumb to a new wave of infections emerged. U.S. cases hit the highest levels of the pandemic in December, rising above 580,000 new cases on the last week of the month and more than doubling the previous record high. Yet, the negative sentiment regarding Omicron quickly reversed as cases proved to be generally less severe than prior strains. There was also increased positive market sentiment after the Center for Disease Control shortened its suggested isolation policy for those infected from 10 days to five.

Inflationary concerns began to take focus towards the end of 2021 before becoming a dominant headline throughout the period. Headline core consumer price index readings had hovered a little above 5% year-over-year for most of 2021, which led investors to question whether this period of rising prices would be more persistent than originally thought. However, this debate was intensified by November’s headline consumer price index rising 6.8% year-over-year, the fastest pace since 1982. The sharp increase in prices was generally due to an imbalance

24

between supply and demand dynamics across multiple industries, led initially by energy, food, and used cars. Inflation readings continued to climb throughout the first half of 2022, peaking at 9.1% year-over-year in June.

Energy costs were the primary driver of inflation for the period, rising more than 30% year-over-year by the end of June. The energy sector, which had been subject to rising consumer demand as global economies reopened from lockdowns induced by COVID-19, faced added friction with Russia’s invasion of Ukraine. Investors were concerned about the secondary effects of the war, particularly from a commodity and supply chain standpoint. Russia has been a large global exporter of oil and certain minerals, and the various sanctions set on Russia from Western nations led to a surge in commodity prices, with crude oil reaching over $100 per barrel for the first time since 2014.

The surge in prices forced the U.S. Federal Reserve (Fed) into a more aggressive approach to combating inflation. After remaining mostly consistent in its messaging around expectations that price pressures would be transitory, elevated and more persistent inflation pressures caused the Fed to move the target federal funds rate into more restrictive territory. This resulted in a 25-basis point (bps) hike in the federal funds rate at the March Federal Open Market Committee meeting, the first hike in more than three years. Five additional rate hikes of 50 bps, 75 bps, 75 bps, 75 bps, and 75 bps, respectively, followed in the succeeding months as inflation prints continued to

come in hotter than expected, resulting in a federal funds rate of 4.00% by November 2, 2022, which was widely anticipated by the market as of the end of the fiscal year. Bond yields shot up in anticipation of this aggressive policy, leading to a bearish curve flattening trend and ultimately periods of brief yield curve inversion, as shorter-term yields moved higher than longer-term yields.

Separately, global markets were faced with increased geopolitical tensions due to the Russian invasion of Ukraine on February 23rd. Tensions remained elevated for the remainder of the twelve-month period, as Russia continued to weaponize energy flows, annexed four Ukrainian regions, and ratcheted up its nuclear warnings. In addition, the rhetoric between the U.S. and China over Taiwan further heated up after U.S. House of Representatives Speaker Nancy Pelosi visited Taiwan in August. China responded to the trip with large-scale military drills, which led to a pledge by U.S. President Joe Biden to defend the democratically governed island.

Key macroeconomic indicators mostly continued to trend lower throughout the period, with the U.S. reporting negative gross domestic product of -1.6% in the first quarter of 2022 and -0.9% in the second quarter before returning to growth in the third quarter. Worries among investors that a recession was pending continued to grow, which ultimately led consumer sentiment to drop to levels worse than during the COVID-19 pandemic and the global financial crisis of 2008, as

25

measured by The University of Michigan’s index of consumer sentiment.

Despite rising recessionary signs, select bright spots in the U.S. economy supported the idea that a potential recession would be shallow. For example, one of the most positive developments seemed to be the traction behind the peak inflation narrative, which included a 99 day stretch of declines in U.S. gasoline prices. In addition, apartment rents fell for the first time in nearly two years in July and lumber prices were off more than 70% from their March peak late in the third quarter, back to pre-COVID levels. Second quarter earnings season also generated many “better-than-feared” takeaways, including plenty of commentary about relatively stable demand and pricing power continuing to protect margins. Capital return and capital expenditures were also mentioned as relative bright spots as companies flagged easing labor shortages and supply chain constraints. The U.S. labor market also remained strong over the period, with the national unemployment rate at 3.7% as of the end of October.

In terms of Fund performance, an overweight to and security selection within the biotechnology industry was a primary detractor from relative performance during the period. Biotechnology faced a number of headwinds throughout the fiscal year after a strong 2020 and start to 2021. Many clinical trials experienced delays, largely as a result of the U.S. Food and Drug Administration (FDA) being constrained as they were forced to redirect resources to help combat the pandemic. Additionally,

the industry was negatively impacted by the general shift from investors into reopening stocks after COVID vaccines were approved. With that said, biotech showed some signs of life throughout the third quarter of 2022 as a string of high-profile clinical trial successes were announced, as well as several high-profile products that have already been launched continuing to do well.

The portfolio’s position in Natera, Inc., a clinical genetic testing company that primarily focuses on women’s health, was the largest individual detractor from relative performance over the period. Shares of the stock fell dramatically in the first quarter of 2022 after Hindenburg Research published a report that alleged that Natera has deceptive sales and billing practices. However, despite the slide, we maintain conviction in the stock as we believe the company is the leader in diagnostics with a first mover advantage in minimal residual disease testing. The company is expanding payor coverage in new cancer and transplant indications and increasing screening efforts which will drive long term value. Additionally, we see the potential for insurance reimbursement of the company’s microdeletions tests, which would provide a big revenue boost in the future.