UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811- 07584

Rydex Series Funds

(Exact name of registrant as specified in charter)

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Address of principal executive offices) (Zip code)

Amy J. Lee

Rydex Series Funds

702 King Farm Boulevard, Suite 200

Rockville, Maryland 20850

(Name and address of agent for service)

Registrant's telephone number, including area code: 1-301-296-5100

Date of fiscal year end: December 31

Date of reporting period: January 1, 2021 - December 31, 2021

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The registrant’s annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “Investment Company Act”), is as follows:

12.31.2021

Guggenheim Funds Annual Report

Guggenheim Alternative Fund |

Guggenheim Multi-Hedge Strategies Fund | | |

Rydex Commodities Fund |

Rydex Commodities Strategy Fund | | |

GuggenheimInvestments.com | RDXSGIALT-ANN-1221x1222 |

| | |

DEAR SHAREHOLDER | 2 |

ECONOMIC AND MARKET OVERVIEW | 4 |

ABOUT SHAREHOLDERS’ FUND EXPENSES | 6 |

ALTERNATIVE FUND | |

MULTI-HEDGE STRATEGIES FUND | 9 |

COMMODITIES FUND | |

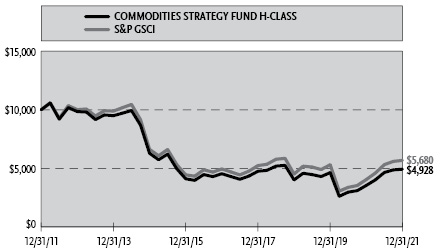

COMMODITIES STRATEGY FUND | 49 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | 63 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 89 |

OTHER INFORMATION | 91 |

INFORMATION ON BOARD OF TRUSTEES AND OFFICERS | 93 |

GUGGENHEIM INVESTMENTS PRIVACY NOTICE | 101 |

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 1 |

Dear Shareholder:

Security Investors, LLC (the “Investment Adviser”) is pleased to present the annual shareholder report for two alternative strategy funds that are part of the Rydex Series Funds (each a “Fund”). This report covers performance of the Funds for the annual period ended December 31, 2021.

The Investment Adviser is a part of Guggenheim Investments, which represents the investment management businesses of Guggenheim Partners, LLC (“Guggenheim”), a global, diversified financial services firm.

Guggenheim Funds Distributors, LLC is the distributor of the Funds. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim and the Investment Adviser.

We encourage you to read the Economic and Market Overview section of the report, which follows this letter, and then the Performance Report and Fund Profile for each Fund.

We are committed to providing innovative investment solutions and appreciate the trust you place in us.

Sincerely,

Security Investors, LLC

January 31, 2022

Read a prospectus and summary prospectus (if available) carefully before investing. It contains the investment objectives, risks, charges, expenses and other information, which should be considered carefully before investing. Obtain a prospectus and summary prospectus (if available) at guggenheiminvestments.com or call 800.820.0888.

This material is not intended as a recommendation or as investment advice of any kind, including in connection with rollovers, transfers, and distributions. Such material is not provided in a fiduciary capacity, may not be relied upon for or in connection with the making of investment decisions, and does not constitute a solicitation of an offer to buy or sell securities. All content has been provided for informational or educational purposes only and is not intended to be and should not be construed as legal or tax advice and/or a legal opinion. Always consult a financial, tax and/or legal professional regarding your specific situation.

COVID-19 The outbreak of COVID-19 and the recovery response causes at times disruption to consumer demand, economic output, and supply chains. There are still travel restrictions, quarantines, and disparate global vaccine distributions. As with other serious economic disruptions, governmental authorities and regulators have responded to this situation with significant fiscal and monetary policy changes. These include providing direct capital infusions into companies, introducing new monetary programs, and considerably lowering interest rates. In some cases, these responses resulted in negative interest rates and higher inflation. Recently, the U.S. and other governments have also made investments and engaged in infrastructure modernization projects that have also increased public debt and spending. These actions, including their possible unexpected or sudden reversal or potential ineffectiveness, could further increase volatility in securities and other financial markets, reduce market liquidity, continue to cause higher inflation, heighten investor uncertainty, and adversely affect the value of the Funds’ investments and the performance of the Funds. These actions also contribute to a risk that asset prices have a higher degree of correlation than historically seen across markets and asset classes. The duration and extent of COVID-19 over the long term cannot be reasonably estimated at

2 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

this time. The ultimate impact of COVID-19 and the extent to which COVID-19 impacts the Funds will depend on future developments, which are highly uncertain and difficult to predict. Management continues to monitor and evaluate this situation.

The Multi-Hedge Strategies Fund is subject to a number of risks and may not be suitable for all investors. ● The Fund’s use of derivatives such as futures, options and swap agreements may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities underlying those derivatives. ● The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund’s use of short selling involves increased risks and costs. The Fund risks paying more for a security than it received from its sale. ● The Fund’s investments in high yield securities and unrated securities of similar credit quality (“junk bonds”) may be subject to greater levels of interest rate, credit and liquidity risk than funds that do not invest in such securities. ● The Fund’s fixed income investments will change in value in response to interest rate changes and other factors. ● The Fund’s exposure to the commodity and currency markets may subject the Fund to greater volatility as commodity- and currency-linked derivative investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry, commodity or currency—such as droughts, floods, weather, livestock disease, embargoes, tariffs and international economic, political and regulatory developments. The Fund may also incur transaction costs with the conversion between various currencies. ● The Fund’s exposure to foreign currencies subjects the Fund to the risk that those currencies will decline in value relative to the U.S. dollar, or, in the case of short positions, that the U.S. dollar will decline in value relative to the currency being hedged. ● These risks may cause the Fund to experience higher losses and/or volatility than a fund that does not invest in derivatives, use leverage or short sales or have exposure to high yield/fixed income securities, foreign currencies and/or securities. ● Please read the prospectus for more detailed information regarding these and other risks.

The Commodities Strategy Fund is subject to a number of risks and may not be suitable for all investors. ● The Fund’s exposure to the commodity markets may subject the Fund to greater volatility as commodity-linked investments may be affected by changes in overall market movements, commodity index volatility, changes in interest rates or factors affecting a particular industry or commodity—such as droughts, floods, weather, embargos, tariffs and international economic, political and regulatory developments. ● To the extent that the Fund’s investments are concentrated in energy-related commodities, the Fund is subject to the risk that this sector will underperform the market as a whole. ● The Fund’s use of derivatives, such as futures, options, structured notes and swap agreements, may expose the Fund to additional risks that it would not be subject to if it invested directly in the securities or investments underlying those derivatives. ● The more the Fund invests in leveraged instruments, the more the leverage will magnify any gains or losses on those investments. ● The Fund is subject to tracking error risks, which may cause the Fund’s performance not to match that of or be lower than the Fund’s underlying benchmark. ● The Fund’s investments in other investment companies subjects the Fund to those risks affecting the investment company, including the possibility that the value of the underlying securities held by the investment company could decrease. Moreover, the Fund will incur its pro rata share of the expenses of the underlying investment companies’ expenses. ●This Fund is considered non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund. As a result, changes in the market value of a single security could cause greater fluctuations in the value of Fund shares than would occur in a more diversified fund. ● Please read the prospectus for more detailed information regarding these and other risks.

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 3 |

ECONOMIC AND MARKET OVERVIEW (Unaudited) | December 31, 2021 |

During the 12-month period ended December 31, 2021, the S&P 500 Index reached all-time highs as investors largely brushed off concerns about new COVID-19 variants, global supply chain disruptions, inflationary fears, and other worrying factors that resulted in little more than brief selloffs before the index resumed its upward march.

The economic recovery made considerable progress in 2021 with the help of COVID-19 vaccines and enormous policy stimulus. We expect policymakers, led by the Federal Reserve (the “Fed”), will begin to scale back their support in 2022. However, because of their dovish policy framework, the Fed is deliberately “behind the curve.” As such, we expect real interest rates could remain negative in the near term, supporting above-potential economic growth and risk asset returns. Eventually an overheated economy will require that the Fed apply the brakes more firmly, but we believe that will be a greater concern in 2023.

U.S. real gross domestic product (“GDP”) slowed to 2.3% in the third quarter of 2021, but output has now fully recovered and now exceeds its supply side potential. We believe growth could bounce back to a robust 6–7% in the fourth quarter and remain well above potential in 2022, which would ensure a continued rapid decline in the unemployment rate.

A rapidly tightening labor market will put further pressure on wages, which are already surging. The Employment Cost Index, which is a measure of wage growth given that it controls for compositional changes (e.g. low paid industries losing jobs disproportionately), saw the largest quarterly gain in over 30 years in the third quarter reading. The share of businesses reporting plans to raise wages is also spiking, which suggests that further wage gains are in the pipeline.

As a result, the inflation narrative is evolving from a focus on the series of “transitory” shocks of 2021 to a focus on accelerating wage growth and housing inflation. While we believe that overall inflation will slow in 2022 as durable goods prices recede, core inflation should remain meaningfully above the Fed’s 2.0% target. We therefore expect that the Fed will deliver four rate increases in 2022, starting in March, and begin the process of quantitative tightening.

A key risk to our positive outlook is China, where massive property and credit imbalances threaten to unravel. Real GDP growth in 2021 slowed to a pace of just 4.0%, the weakest in the modern era excluding the first half of 2020. However, Chinese policymakers appear ready to step in to support faster growth. Separately, while the Omicron variant of COVID-19 has produced record cases, reduced severity and vaccines/treatments may portend only a modest drag on growth.

For the 12-month period ended December 31, 2021, the S&P 500® Index* returned 28.71%. The MSCI Europe-Australasia-Far East (“EAFE”) Index* returned 11.26%. The return of the MSCI Emerging Markets Index* was -2.54%.

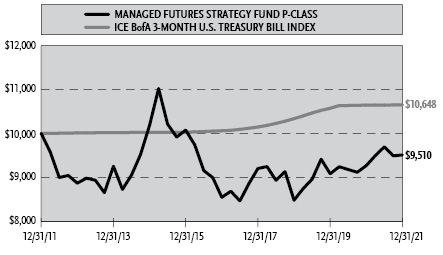

In the bond market, the Bloomberg U.S. Aggregate Bond Index* posted a -1.54% return for the 12-month period, while the Bloomberg U.S. Corporate High Yield Index* returned 5.28%. The return of the ICE Bank of America (“BofA”) 3-Month U.S. Treasury Bill Index* was 0.05% for the 12-month period.

4 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

ECONOMIC AND MARKET OVERVIEW (Unaudited)(concluded) | December 31, 2021 |

The opinions and forecasts expressed may not actually come to pass. This information is subject to change at any time, based on market and other conditions, and should not be construed as a recommendation of any specific security or strategy.

*Index Definitions:

The following indices are referenced throughout this report. Indices are unmanaged and not available for direct investment. Index performance does not reflect transaction costs, fees, or expenses.

Bloomberg U.S. Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including U.S. Treasuries, government-related and corporate securities, mortgage-backed securities or “MBS” (agency fixed-rate and hybrid adjustable-rate mortgage, or “ARM”, pass-throughs), asset-backed securities (“ABS”), and commercial mortgage-backed securities (“CMBS”) (agency and non-agency).

Bloomberg U.S. Corporate High Yield Index measures the U.S. dollar-denominated, high yield, fixed-rate corporate bond market. Securities are classified as high yield if the middle rating of Moody’s, Fitch, and S&P is Ba1/BB +/BB + or below.

HFRX Global Hedge Fund Index is designed to be representative of the overall composition of the hedge fund universe. It is comprised of all eligible hedge fund strategies, including, but not limited to, convertible arbitrage, distressed securities, equity hedge, equity market neutral, event driven, macro, merger arbitrage and relative-value arbitrage. The strategies are asset weighted based on the distribution of assets in the hedge fund industry.

ICE BofA 3-Month U.S. Treasury Bill Index is an unmanaged market Index of U.S. Treasury securities maturing in 90 days that assumes reinvestment of all income.

MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the U.S. & Canada.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market performance in the global emerging markets.

S&P 500® Index is a broad-based index, the performance of which is based on the performance of 500 widely held common stocks chosen for market size, liquidity, and industry group representation.

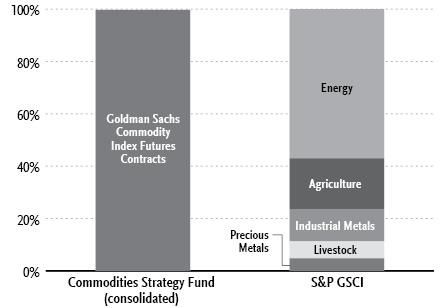

S&P Goldman Sachs Commodity Index (S&P GSCI®), a benchmark for investment performance in the commodity markets, measures investable commodity price movements and inflation in the world economy. The index is calculated primarily on a world production weighted basis and is comprised of the principal physical commodities that are the subject of active, liquid futures markets.

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 5 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited) |

All mutual funds have operating expenses, and it is important for our shareholders to understand the impact of costs on their investments. Shareholders of a fund incur two types of costs: (i) transaction costs, including sales charges (loads) on purchase payments, reinvested dividends, other distributions, and exchange fees, and (ii) ongoing costs, including management fees, administrative services, and shareholder reports, among others. These ongoing costs, or operating expenses, are deducted from a fund’s gross income and reduce the investment return of the fund.

A fund’s expenses are expressed as a percentage of its average net assets, which is known as the expense ratio. The following examples are intended to help investors understand the ongoing costs (in dollars) of investing in a fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The examples are based on an investment of $1,000 made at the beginning of the period and held for the entire six-month period beginning June 30, 2021 and ending December 31, 2021.

The following tables illustrate the Funds’ costs in two ways:

Table 1. Based on actual Fund return: This section helps investors estimate the actual expenses paid over the period. The “Ending Account Value” shown is derived from the Fund’s actual return, and the fifth column shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. Investors may use the information here, together with the amount invested, to estimate the expenses paid over the period. Simply divide the Fund’s account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number provided under the heading “Expenses Paid During Period.”

Table 2. Based on hypothetical 5% return: This section is intended to help investors compare a fund’s cost with those of other mutual funds. The table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses paid during the period. The example is useful in making comparisons because the U.S. Securities and Exchange Commission (the “SEC”) requires all mutual funds to calculate expenses based on the 5% return. Investors can assess a fund’s costs by comparing this hypothetical example with the hypothetical examples that appear in shareholder reports of other funds.

The calculations illustrated above assume no shares were bought or sold during the period. Actual costs may have been higher or lower, depending on the amount of investment and the timing of any purchases or redemptions.

6 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(continued) |

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) on purchase payments, and contingent deferred sales charges (“CDSC”) on redemptions, if any. Therefore, the second table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

More information about the Funds’ expenses, including annual expense ratios for periods up to five years (subject to the Fund’s inception date), can be found in the Financial Highlights section of this report. For additional information on operating expenses and other shareholder costs, please refer to the appropriate Fund prospectus.

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 7 |

ABOUT SHAREHOLDERS’ FUND EXPENSES (Unaudited)(concluded) |

| Expense

Ratio1 | Fund

Return | Beginning

Account Value

June 30,

2021 | Ending

Account Value

December 31,

2021 | Expenses

Paid During

Period2 |

Table 1. Based on actual Fund return3 |

Multi-Hedge Strategies Fund |

A-Class | 2.17% | (2.10%) | $ 1,000.00 | $ 979.00 | $ 10.82 |

C-Class | 2.97% | (2.43%) | 1,000.00 | 975.70 | 14.79 |

P-Class | 2.16% | (2.08%) | 1,000.00 | 979.20 | 10.78 |

Institutional Class | 1.91% | (1.93%) | 1,000.00 | 980.70 | 9.54 |

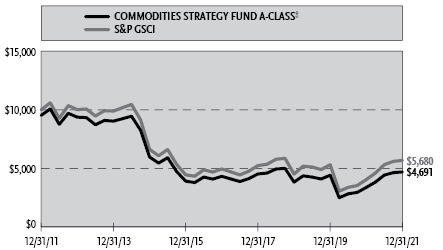

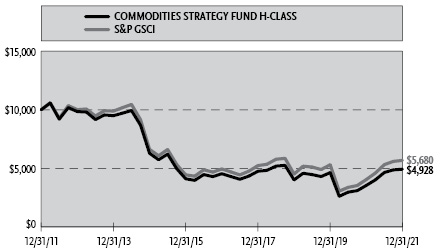

Commodities Strategy Fund |

A-Class | 1.67% | 5.96% | 1,000.00 | 1,059.60 | 8.67 |

C-Class | 2.41% | 5.59% | 1,000.00 | 1,055.90 | 12.49 |

H-Class | 1.65% | 5.99% | 1,000.00 | 1,059.90 | 8.57 |

|

Table 2. Based on hypothetical 5% return (before expenses) |

Multi-Hedge Strategies Fund |

A-Class | 2.17% | 5.00% | $ 1,000.00 | $ 1,014.27 | $ 11.02 |

C-Class | 2.97% | 5.00% | 1,000.00 | 1,010.23 | 15.05 |

P-Class | 2.16% | 5.00% | 1,000.00 | 1,014.32 | 10.97 |

Institutional Class | 1.91% | 5.00% | 1,000.00 | 1,015.58 | 9.70 |

Commodities Strategy Fund |

A-Class | 1.67% | 5.00% | 1,000.00 | 1,016.79 | 8.49 |

C-Class | 2.41% | 5.00% | 1,000.00 | 1,013.06 | 12.23 |

H-Class | 1.65% | 5.00% | 1,000.00 | 1,016.89 | 8.39 |

1 | Annualized and excludes expenses of the underlying funds in which the Funds invest. This ratio represents net expenses which includes dividends on short sales and prime broker interest expenses. Excluding these expenses, the net expense ratio of the Multi-Hedge Strategies Fund would be 1.42%, 2.19%, 1.42% and 1.17% for the A-Class, C-Class, P-Class and Institutional Class, respectively. |

2 | Expenses are equal to the Fund’s annualized expense ratio, net of any applicable fee waivers, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period). |

3 | Actual cumulative return at net asset value for the period June 30, 2021 to December 31, 2021. |

8 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND

OBJECTIVE: Seeks to provide long-term capital appreciation with less risk than traditional equity funds.

The Fund seeks capital appreciation with low correlation to equity and fixed income markets, while doing so with low risk*–typically in the 5% to 8% range.

For the one-year period ended December 31, 2021, the Institutional Class shares of the Fund produced a return of 7.43%.

The Fund succeeded in maintaining low correlation with stock and bond indices, as its correlation with the S&P 500 Index and the Bloomberg U.S. Aggregate Bond Index came in at 49% and -16%, respectively. During the period the Fund experienced 6.5% risk, as measured by annualized daily return standard deviation.

The Fund outperformed the HFRX Global Hedge Fund Index, which returned 3.65% for the year. The HFRX Global Hedge Fund Index had a correlation of 71% with the S&P 500 Index and a -18% correlation to the Bloomberg U.S. Aggregate Bond Index in 2021.

Three hedge fund strategies used within the Fund contributed positively to Fund returns in 2021. Specifically, Equity Market Neutral, Merger Arbitrage, and Long/Short Equity strategies were positive contributors for the year. Global Macro was the only strategy to detract from performance this year.

The Fund held derivatives for a number of reasons, including liquidity, leverage, speculation, duration management, index exposure, and hedging. Derivatives were liquid and allowed the Fund to gain leveraged access to markets in order to express investment views and to hedge exposures. During the year, derivatives were used within the Global Macro, Long/Short Equity, and Equity Market Neutral strategies and to a limited extent in the Merger Arbitrage strategy. Overall, the use of derivatives had a positive contribution to Fund performance for the year.

Guggenheim Ultra Short Duration Fund and Guggenheim Strategy Funds were utilized within the Fund to achieve higher yields than what would otherwise be achieved through overnight repurchase agreements or short-term investments.

Performance displayed represents past performance which is no guarantee of future results.

* | Risk is measured by standard deviation, a statistic of the historical volatility of an investment, usually computed using the most recent 36-monthly returns and then annualized. More generally, it is a measure of the extent to which numbers are spread around their average. The higher the number, the more volatility is to be expected. |

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 9 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(continued) | December 31, 2021 |

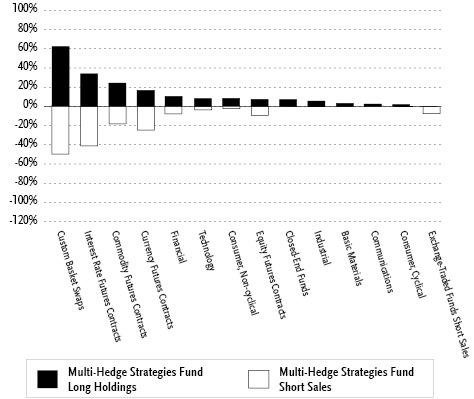

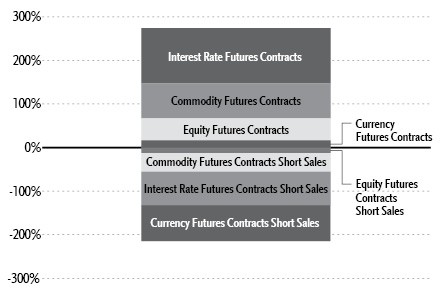

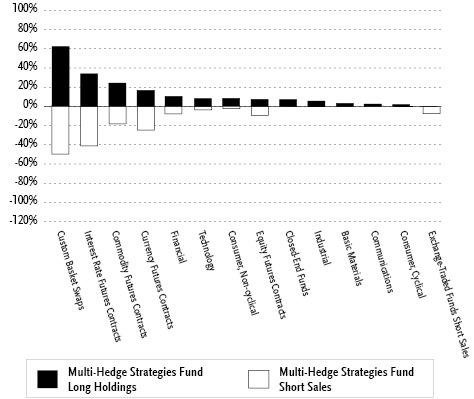

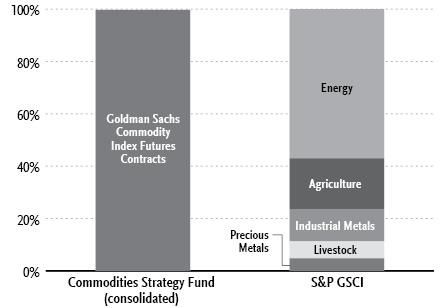

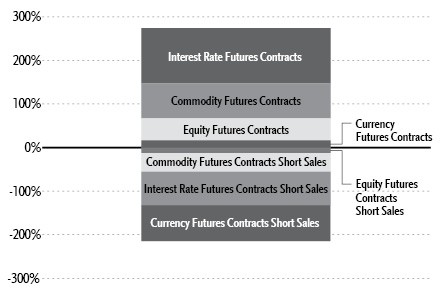

Consolidated Holdings Diversification (Market Exposure as % of Net Assets)

“Consolidated Holdings Diversification (Market Exposure as % of Net Assets)” excludes any temporary cash investments, investments in Guggenheim Strategy Funds Trust mutual funds, or investments in Guggenheim Ultra Short Duration Fund. Investments in those Funds do not provide “market exposure” to meet the Fund’s investment objective, but will significantly increase the portfolio’s exposure to certain other asset categories (and their associated risks), which may cause the Fund to deviate from its principal investment strategy, including: (i) high yield, high risk debt securities rated below the top four long-term rating categories by a nationally recognized statistical rating organization (also known as “junk bonds”); (ii) securities issued by the U.S. government or its agencies and instrumentalities; (iii) CLOs and similar investments; and (iv) other short-term fixed income securities.

10 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(continued) | December 31, 2021 |

Inception Dates: |

Institutional Class | May 3, 2010 |

A-Class | September 19, 2005 |

C-Class | September 19, 2005 |

P-Class | September 19, 2005 |

Ten Largest Holdings (% of Total Net Assets) |

Guggenheim Strategy Fund II | 7.4% |

Guggenheim Ultra Short Duration Fund — Institutional Class | 5.2% |

Xilinx, Inc. | 2.8% |

IHS Markit Ltd. | 2.5% |

Nuance Communications, Inc. | 2.4% |

Magellan Health, Inc. | 1.5% |

Guggenheim Strategy Fund III | 1.4% |

Athene Holding Ltd. — Class A | 1.3% |

Coherent, Inc. | 1.3% |

Ferro Corp. | 1.2% |

Top Ten Total | 27.0% |

| | |

“Ten Largest Holdings” excludes any temporary cash or derivative investments. |

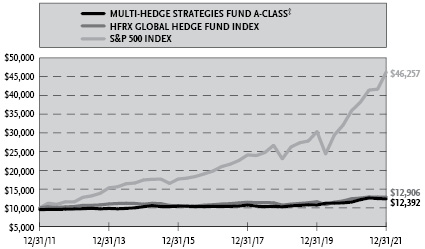

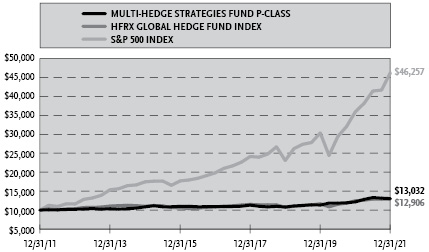

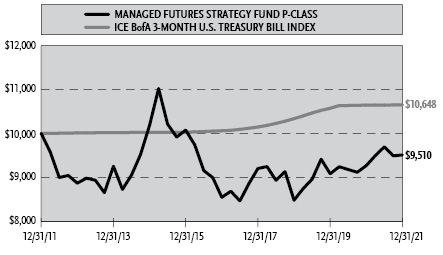

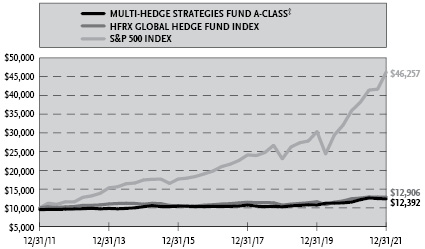

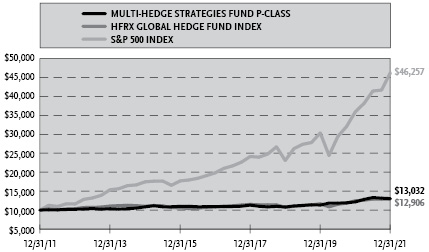

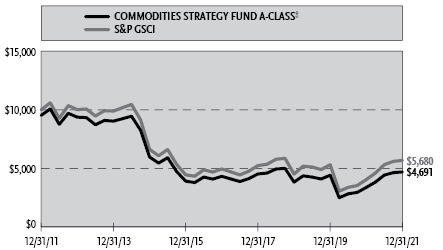

Cumulative Fund Performance*

| | THE GUGGENHEIM FUNDS ANNUAL REPORT | 11 |

PERFORMANCE REPORT AND FUND PROFILE (Unaudited)(concluded) | December 31, 2021 |

Average Annual Returns*

Periods Ended December 31, 2021

| 1 Year | 5 Year | 10 Year |

A-Class Shares | 7.17% | 3.54% | 2.67% |

A-Class Shares with sales charge‡ | 2.08% | 2.54% | 2.17% |

C-Class Shares | 6.32% | 2.80% | 1.91% |

C-Class Shares with CDSC§ | 5.32% | 2.80% | 1.91% |

P-Class Shares | 7.16% | 3.58% | 2.68% |

Institutional Class Shares | 7.43% | 3.80% | 2.93% |

S&P 500 Index | 28.71% | 18.47% | 16.55% |

HFRX Global Hedge Fund Index | 3.65% | 3.52% | 2.58% |

* | The performance data above represents past performance that is not predictive of future results. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns are historical and include changes in principal and reinvested dividends and capital gains and do not reflect the effect of taxes. The S&P 500 Index and HFRX Global Hedge Fund Index are unmanaged indices and, unlike the Fund, have no management fees or operating expenses to reduce their reported returns. The graphs are based on A-Class share and P-Class shares only; performance for C-Class and Institutional Class shares will vary due to differences in fee structures. |

‡ | Fund returns are calculated using the maximum sales charge of 4.75%. |

§ | Fund returns include a CDSC of 1% if redeemed within 12 months of purchase. |

12 | THE GUGGENHEIM FUNDS ANNUAL REPORT | |

CONSOLIDATED SCHEDULE OF INVESTMENTS | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Value | |

COMMON STOCKS† - 39.4% |

| | | | | | | | | |

Financial - 10.6% |

Athene Holding Ltd. — Class A* | | | 11,013 | | | $ | 917,713 | |

People’s United Financial, Inc. | | | 48,387 | | | | 862,256 | |

Monmouth Real Estate Investment Corp. REIT | | | 40,114 | | | | 842,795 | |

CyrusOne, Inc. REIT | | | 9,392 | | | | 842,650 | |

MGM Growth Properties LLC — Class A REIT | | | 16,551 | | | | 676,108 | |

CIT Group, Inc. | | | 10,573 | | | | 542,818 | |

Investors Bancorp, Inc. | | | 31,211 | | | | 472,847 | |

Flagstar Bancorp, Inc. | | | 9,355 | | | | 448,479 | |

TriState Capital Holdings, Inc.* | | | 13,971 | | | | 422,762 | |

CorePoint Lodging, Inc. REIT* | | | 26,565 | | | | 417,071 | |

Great Western Bancorp, Inc. | | | 10,324 | | | | 350,603 | |

Sterling Bancorp | | | 13,158 | | | | 339,345 | |

State Auto Financial Corp. | | | 6,307 | | | | 326,009 | |

Total Financial | | | 7,461,456 | |

| | | | | | | | | |

Technology - 8.1% |

Xilinx, Inc. | | | 9,242 | | | | 1,959,581 | |

Nuance Communications, Inc.* | | | 30,874 | | | | 1,707,950 | |

PAE, Inc.* | | | 85,495 | | | | 848,965 | |

Change Healthcare, Inc.* | | | 36,682 | | | | 784,261 | |

Cerner Corp. | | | 4,553 | | | | 422,837 | |

Total Technology | | | 5,723,594 | |

| | | | | | | | | |

Consumer, Non-cyclical - 8.0% |

IHS Markit Ltd. | | | 13,091 | | | | 1,740,056 | |

Magellan Health, Inc.* | | | 11,030 | | | | 1,047,740 | |

Sanderson Farms, Inc. | | | 3,900 | | | | 745,212 | |

GreenSky, Inc. — Class A* | | | 65,037 | | | | 738,820 | |

Intersect ENT, Inc.* | | | 23,678 | | | | 646,646 | |

Arena Pharmaceuticals, Inc.* | | | 4,606 | | | | 428,082 | |

RR Donnelley & Sons Co.* | | | 29,423 | | | | 331,303 | |

Total Consumer, Non-cyclical | | | 5,677,859 | |

| | | | | | | | | |

Industrial - 5.4% |

Coherent, Inc.* | | | 3,364 | | | | 896,664 | |

Forterra, Inc.* | | | 31,588 | | | | 751,162 | |

Welbilt, Inc.* | | | 28,767 | | | | 683,792 | |

Teekay LNG Partners, LP | | | 37,040 | | | | 627,087 | |

Aerojet Rocketdyne Holdings, Inc. | | | 13,359 | | | | 624,667 | |

SPX FLOW, Inc. | | | 2,340 | | | | 202,363 | |

Total Industrial | | | 3,785,735 | |

| | | | | | | | | |

Basic Materials - 3.1% |

Ferro Corp.* | | | 40,498 | | | | 884,071 | |

Kraton Corp.* | | | 9,514 | | | | 440,689 | |

Atotech Ltd.* | | | 17,259 | | | | 440,450 | |

Rogers Corp.* | | | 1,562 | | | | 426,426 | |

Total Basic Materials | | | 2,191,636 | |

| | | | | | | | | |

Communications - 2.4% |

Mimecast Ltd.* | | | 8,007 | | | | 637,117 | |

Vonage Holdings Corp.* | | | 30,603 | | | | 636,236 | |

NeoPhotonics Corp.* | | | 26,811 | | | | 412,085 | |

Total Communications | | | 1,685,438 | |

| | | | | | | | | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 13 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Value | |

Consumer, Cyclical - 1.8% |

Veoneer, Inc.* | | | 18,045 | | | $ | 640,241 | |

Casper Sleep, Inc.* | | | 61,814 | | | | 412,917 | |

Golden Nugget Online Gaming, Inc.* | | | 23,257 | | | | 231,407 | |

Total Consumer, Cyclical | | | 1,284,565 | |

| | | | | | | | | |

Total Common Stocks |

(Cost $26,062,455) | | | | | | | 27,810,283 | |

| | | | | | | | | |

RIGHTS††† - 0.0% |

Consumer, Non-cyclical - 0.0% |

Lantheus Holdings, Inc.* | | | 42,000 | | | | — | |

Alexion Pharmaceuticals, Inc.* | | | 34,843 | | | | — | |

Total Consumer, Non-cyclical | | | — | |

| | | | | | | | | |

Total Rights |

(Cost $—) | | | | | | | — | |

| | | | | | | | | |

MUTUAL FUNDS† - 14.0% |

Guggenheim Strategy Fund II1 | | | 209,304 | | | | 5,207,495 | |

Guggenheim Ultra Short Duration Fund — Institutional Class1 | | | 372,043 | | | | 3,690,666 | |

Guggenheim Strategy Fund III1 | | | 39,063 | | | | 977,752 | |

Total Mutual Funds |

(Cost $9,886,814) | | | | | | | 9,875,913 | |

| | | | | | | | | |

CLOSED-END FUNDS† - 7.0% |

Aberdeen Global Premier Properties Fund | | | 29,937 | | | | 204,769 | |

Nuveen Real Estate Income Fund | | | 15,935 | | | | 204,287 | |

CBRE Global Real Estate Income Fund | | | 20,822 | | | | 203,847 | |

Royce Value Trust, Inc.2 | | | 10,123 | | | | 198,309 | |

Aberdeen Total Dynamic Dividend Fund | | | 19,359 | | | | 197,849 | |

General American Investors Company, Inc. | | | 4,423 | | | | 195,497 | |

Gabelli Dividend & Income Trust | | | 7,204 | | | | 194,508 | |

LMP Capital and Income Fund, Inc. | | | 12,687 | | | | 192,842 | |

Adams Diversified Equity Fund, Inc. | | | 9,906 | | | | 192,276 | |

Royce Micro-Capital Trust, Inc. | | | 16,531 | | | | 190,933 | |

Virtus AllianzGI Convertible & Income Fund | | | 32,720 | | | | 190,758 | |

BlackRock California Municipal Income Trust | | | 13,066 | | | | 190,110 | |

PGIM Global High Yield Fund, Inc. | | | 12,573 | | | | 189,727 | |

Nuveen New York AMT-Free Quality Municipal Income Fund | | | 13,746 | | | | 189,557 | |

Saba Capital Income & Opportunities Fund | | | 41,689 | | | | 188,434 | |

Virtus AllianzGI Convertible & Income Fund II | | | 36,770 | | | | 187,527 | |

Tri-Continental Corp.2 | | | 5,399 | | | | 179,193 | |

Miller/Howard High Dividend Fund | | | 15,368 | | | | 158,598 | |

Nuveen New York Quality Municipal Income Fund | | | 9,472 | | | | 140,091 | |

Gabelli Healthcare & WellnessRx Trust | | | 8,447 | | | | 114,626 | |

14 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Value | |

Invesco Trust for Investment Grade New York Municipals | | | 8,536 | | | $ | 114,553 | |

Western Asset Managed Municipals Fund, Inc. | | | 8,660 | | | | 113,273 | |

Invesco Dynamic Credit Opportunities Fund* | | | 9,072 | | | | 112,765 | |

Invesco Pennsylvania Value Municipal Income Trust | | | 7,747 | | | | 108,226 | |

Nuveen New Jersey Quality Municipal Income Fund | | | 6,826 | | | | 104,984 | |

Delaware Ivy High Income Opportunities Fund | | | 6,594 | | | | 91,854 | |

Sprott Focus Trust, Inc. | | | 10,508 | | | | 90,365 | |

Aberdeen Japan Equity Fund, Inc. | | | 8,046 | | | | 65,414 | |

Morgan Stanley Emerging Markets Debt Fund, Inc. | | | 7,039 | | | | 63,421 | |

Swiss Helvetia Fund, Inc. | | | 5,667 | | | | 56,330 | |

Nuveen Ohio Quality Municipal Income Fund | | | 3,413 | | | | 54,506 | |

Source Capital, Inc. | | | 986 | | | | 42,605 | |

Tortoise Power and Energy Infrastructure Fund, Inc. | | | 2,552 | | | | 34,758 | |

Neuberger Berman New York Municipal Fund, Inc. | | | 2,630 | | | | 34,190 | |

Gabelli Global Small and Mid Capital Value Trust | | | 2,095 | | | | 33,310 | |

Delaware Investments Minnesota Municipal Income Fund II, Inc. | | | 2,289 | | | | 32,298 | |

Western Asset Municipal Partners Fund, Inc. | | | 1,937 | | | | 30,140 | |

MFS Investment Grade Municipal Trust | | | 2,215 | | | | 22,836 | |

Western Asset Intermediate Muni Fund, Inc. | | | 1,928 | | | | 18,586 | |

Herzfeld Caribbean Basin Fund, Inc. | | | 3,326 | | | | 18,562 | |

Royce Global Value Trust, Inc. | | | 1,032 | | | | 13,540 | |

Delaware Investments National Municipal Income Fund | | | 937 | | | | 13,230 | |

New Ireland Fund, Inc. | | | 905 | | | | 10,100 | |

Total Closed-End Funds |

(Cost $4,790,725) | | | | | | | 4,983,584 | |

| | | | | | | | | |

| | | Face

Amount | | | | | |

U.S. TREASURY BILLS†† - 12.8% |

U.S. Treasury Bills |

0.02% due 01/18/223,4 | | $ | 5,800,000 | | | | 5,799,964 | |

0.04% due 01/06/224,5 | | | 3,286,000 | | | | 3,285,999 | |

Total U.S. Treasury Bills |

(Cost $9,085,920) | | | | | | | 9,085,963 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 15 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Face

Amount | | | Value | |

REPURCHASE AGREEMENTS††,6 - 22.5% |

J.P. Morgan Securities LLC

issued 12/31/21 at 0.05%

due 01/03/22 | | $ | 8,866,539 | | | $ | 8,866,539 | |

Barclays Capital, Inc.

issued 12/31/21 at 0.01%

due 01/03/22 | | | 3,666,936 | | | | 3,666,936 | |

BofA Securities, Inc.

issued 12/31/21 at 0.02%

due 01/03/22 | | | 3,333,578 | | | | 3,333,578 | |

Total Repurchase Agreements |

(Cost $15,867,053) | | | | | | | 15,867,053 | |

| | | | | | | | | |

| | | Shares | | | | | |

SECURITIES LENDING COLLATERAL†,7 - 0.4% |

Money Market Fund |

First American Government Obligations Fund — Class Z, 0.02%8 | | | 281,926 | | | | 281,926 | |

Total Securities Lending Collateral |

(Cost $281,926) | | | | | | | 281,926 | |

| | | | | | | | | |

Total Investments - 96.1% |

(Cost $65,974,893) | | $ | 67,904,722 | |

| | | | | | | | | |

COMMON STOCKS SOLD SHORT† - (14.7)% |

Industrial - (0.3)% |

II-VI, Inc.* | | | 3,061 | | | | (209,158 | ) |

| | | | | | | | | |

Consumer, Cyclical - (0.3)% |

DraftKings, Inc. — Class A* | | | 8,489 | | | | (233,193 | ) |

| | | | | | | | | |

Consumer, Non-cyclical - (2.5)% |

S&P Global, Inc. | | | 3,715 | | | | (1,753,220 | ) |

Technology - (3.5)% |

MKS Instruments, Inc. | | | 953 | | | | (165,984 | ) |

Advanced Micro Devices, Inc.* | | | 15,928 | | | | (2,292,039 | ) |

Total Technology | | | (2,458,023 | ) |

| | | | | | | | | |

Financial - (8.1)% |

Webster Financial Corp. | | | 6,104 | | | | (340,847 | ) |

Raymond James Financial, Inc. | | | 3,493 | | | | (350,697 | ) |

First Interstate BancSystem, Inc. — Class A | | | 8,698 | | | | (353,748 | ) |

Citizens Financial Group, Inc. | | | 9,270 | | | | (438,007 | ) |

New York Community Bancorp, Inc. | | | 37,561 | | | | (458,620 | ) |

First Citizens BancShares, Inc. — Class A | | | 656 | | | | (544,375 | ) |

VICI Properties, Inc. | | | 22,609 | | | | (680,757 | ) |

Goldman Sachs Group, Inc. | | | 1,951 | | | | (746,355 | ) |

M&T Bank Corp. | | | 5,710 | | | | (876,942 | ) |

Apollo Asset Management, Inc. | | | 12,654 | | | | (916,529 | ) |

Total Financial | | | (5,706,877 | ) |

| | | | | | | | | |

Total Common Stocks Sold Short |

(Proceeds $8,650,335) | | | (10,360,471 | ) |

| | | | | | | | | |

16 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Value | |

EXCHANGE-TRADED FUNDS SOLD SHORT† - (7.5)% |

iShares Preferred & Income Securities ETF | | | 65 | | | $ | (2,563 | ) |

SPDR Gold Shares — Class D* | | | 41 | | | | (7,009 | ) |

iShares Mortgage Real Estate ETF | | | 259 | | | | (8,938 | ) |

iShares 7-10 Year Treasury Bond ETF | | | 92 | | | | (10,580 | ) |

VanEck Gold Miners ETF | | | 350 | | | | (11,210 | ) |

Energy Select Sector SPDR Fund | | | 313 | | | | (17,372 | ) |

iShares Core High Dividend ETF | | | 193 | | | | (19,491 | ) |

iShares iBoxx $ Investment Grade Corporate Bond ETF | | | 240 | | | | (31,805 | ) |

iShares Floating Rate Bond ETF | | | 1,541 | | | | (78,175 | ) |

Health Care Select Sector SPDR Fund | | | 614 | | | | (86,506 | ) |

iShares Russell 1000 Growth ETF | | | 296 | | | | (90,455 | ) |

VanEck High Yield Muni ETF | | | 2,545 | | | | (158,884 | ) |

Invesco Senior Loan ETF | | | 11,557 | | | | (255,410 | ) |

SPDR Bloomberg Convertible Securities ETF | | | 3,293 | | | | (273,187 | ) |

iShares National Muni Bond ETF | | | 2,800 | | | | (325,584 | ) |

iShares U.S. Real Estate ETF | | | 4,950 | | | | (574,893 | ) |

iShares iBoxx High Yield Corporate Bond ETF | | | 6,661 | | | | (579,574 | ) |

iShares Russell 2000 Index ETF | | | 2,637 | | | | (586,600 | ) |

iShares Russell 1000 Value ETF | | | 3,712 | | | | (623,356 | ) |

SPDR Nuveen Bloomberg Municipal Bond ETF | | | 14,980 | | | | (774,916 | ) |

SPDR S&P 500 ETF Trust | | | 1,682 | | | | (798,883 | ) |

Total Exchange-Traded Funds Sold Short |

(Proceeds $5,180,420) | | | (5,315,391 | ) |

| | | | | | | | | |

Total Securities Sold Short - (22.2)% |

(Proceeds $13,830,755) | | $ | (15,675,862 | ) |

Other Assets & Liabilities, net - 26.1% | | | 18,412,704 | |

Total Net Assets - 100.0% | | $ | 70,641,564 | |

Futures Contracts |

Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation)** | |

Commodity Futures Contracts Purchased† |

Gasoline RBOB Futures Contracts | | | 32 | | | | Jan 2022 | | | $ | 2,986,234 | | | $ | 83,032 | |

Cotton #2 Futures Contracts | | | 38 | | | | Jul 2022 | | | | 2,046,870 | | | | 82,602 | |

Live Cattle Futures Contracts | | | 105 | | | | Jun 2022 | | | | 5,842,200 | | | | 18,727 | |

Live Cattle Futures Contracts | | | 15 | | | | Feb 2022 | | | | 837,900 | | | | 15,754 | |

NY Harbor ULSD Futures Contracts | | | 3 | | | | Jan 2022 | | | | 293,366 | | | | 14,029 | |

Soybean Oil Futures Contracts | | | 7 | | | | Mar 2022 | | | | 237,594 | | | | 12,831 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 17 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

Futures Contracts (continued) |

Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation)** | |

Commodity Futures Contracts Purchased† (continued) | | | | | | | | | | | | | | | | |

Brent Crude Futures Contracts | | | 3 | | | | Jan 2022 | | | $ | 233,820 | | | $ | 12,475 | |

LME Zinc Futures Contracts | | | 2 | | | | Feb 2022 | | | | 178,132 | | | | 12,239 | |

Soybean Futures Contracts | | | 5 | | | | Mar 2022 | | | | 334,937 | | | | 11,572 | |

WTI Crude Futures Contracts | | | 3 | | | | Jan 2022 | | | | 226,350 | | | | 11,186 | |

LME Primary Aluminum Futures Contracts | | | 2 | | | | Feb 2022 | | | | 140,250 | | | | 8,994 | |

Low Sulphur Gas Oil Futures Contracts | | | 4 | | | | Feb 2022 | | | | 266,400 | | | | 8,079 | |

Corn Futures Contracts | | | 19 | | | | Mar 2022 | | | | 562,875 | | | | 6,768 | |

LME Nickel Futures Contracts | | | 1 | | | | Feb 2022 | | | | 125,001 | | | | 3,383 | |

Copper Futures Contracts | | | 1 | | | | Mar 2022 | | | | 111,413 | | | | 2,659 | |

LME Lead Futures Contracts | | | 3 | | | | Feb 2022 | | | | 173,963 | | | | 385 | |

Soybean Meal Futures Contracts | | | 7 | | | | Mar 2022 | | | | 279,930 | | | | (31 | ) |

Sugar #11 Futures Contracts | | | 16 | | | | Feb 2022 | | | | 337,075 | | | | (8,114 | ) |

Coffee ‘C’ Futures Contracts | | | 3 | | | | Mar 2022 | | | | 253,969 | | | | (21,216 | ) |

Natural Gas Futures Contracts | | | 45 | | | | Feb 2022 | | | | 1,616,400 | | | | (54,565 | ) |

| | | | | | | | | | | $ | 17,084,679 | | | $ | 220,789 | |

Currency Futures Contracts Purchased† |

British Pound Futures Contracts | | | 33 | | | | Mar 2022 | | | $ | 2,788,500 | | | $ | 57,538 | |

New Zealand Dollar Futures Contracts | | | 59 | | | | Mar 2022 | | | | 4,032,650 | | | | 51,978 | |

Canadian Dollar Futures Contracts | | | 18 | | | | Mar 2022 | | | | 1,423,170 | | | | 10,951 | |

Euro FX Futures Contracts | | | 1 | | | | Mar 2022 | | | | 142,400 | | | | 1,171 | |

Japanese Yen Futures Contracts | | | 32 | | | | Mar 2022 | | | | 3,477,200 | | | | (38,090 | ) |

| | | | | | | | | | | $ | 11,863,920 | | | $ | 83,548 | |

Equity Futures Contracts Purchased† |

NASDAQ-100 Index Mini Futures Contracts | | | 1 | | | | Mar 2022 | | | $ | 326,505 | | | $ | 14,094 | |

Nikkei 225 (OSE) Index Futures Contracts†† | | | 1 | | | | Mar 2022 | | | | 250,677 | | | | 11,593 | |

Tokyo Stock Price Index Futures Contracts†† | | | 1 | | | | Mar 2022 | | | | 173,291 | | | | 7,014 | |

Russell 2000 Index Mini Futures Contracts | | | 1 | | | | Mar 2022 | | | | 112,125 | | | | 5,346 | |

OMX Stockholm 30 Index Futures Contracts†† | | | 8 | | | | Jan 2022 | | | | 212,929 | | | | 4,974 | |

SPI 200 Index Futures Contracts†† | | | 3 | | | | Mar 2022 | | | | 403,819 | | | | 4,295 | |

CAC 40 10 Euro Index Futures Contracts†† | | | 2 | | | | Jan 2022 | | | | 162,318 | | | | 3,024 | |

FTSE MIB Index Futures Contracts†† | | | 1 | | | | Mar 2022 | | | | 154,266 | | | | 2,183 | |

S&P/TSX 60 IX Index Futures Contracts | | | 1 | | | | Mar 2022 | | | | 202,606 | | | | 1,932 | |

Amsterdam Index Futures Contracts†† | | | 1 | | | | Jan 2022 | | | | 181,418 | | | | 1,805 | |

Euro STOXX 50 Index Futures Contracts†† | | | 3 | | | | Mar 2022 | | | | 145,772 | | | | (668 | ) |

S&P 500 Index Mini Futures Contracts | | | 1 | | | | Mar 2022 | | | | 237,975 | | | | (814 | ) |

FTSE 100 Index Futures Contracts†† | | | 3 | | | | Mar 2022 | | | | 296,654 | | | | (1,520 | ) |

CBOE Volatility Index Futures Contracts | | | 60 | | | | Feb 2022 | | | | 1,317,000 | | | | (10,195 | ) |

CBOE Volatility Index Futures Contracts | | | 49 | | | | Jan 2022 | | | | 966,280 | | | | (100,778 | ) |

| | | | | | | | | | | $ | 5,143,635 | | | $ | (57,715 | ) |

18 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

Futures Contracts (continued) |

Description | | Number of

Contracts | | | Expiration

Date | | | Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation)** | |

Interest Rate Futures Contracts Purchased† |

U.S. Treasury 10 Year Note Futures Contracts | | | 28 | | | | Mar 2022 | | | $ | 3,649,187 | | | $ | 27,450 | |

U.S. Treasury Ultra Long Bond Futures Contracts | | | 3 | | | | Mar 2022 | | | | 588,281 | | | | 5,091 | |

U.S. Treasury Long Bond Futures Contracts | | | 5 | | | | Mar 2022 | | | | 799,687 | | | | 2,341 | |

Euro - 30 year Bond Futures Contracts†† | | | 3 | | | | Mar 2022 | | | | 705,772 | | | | (1,492 | ) |

Euro - OATS Futures Contracts†† | | | 47 | | | | Mar 2022 | | | | 8,725,285 | | | | (76,508 | ) |

Euro - BTP Italian Government Bond Futures Contracts†† | | | 57 | | | | Mar 2022 | | | | 9,533,743 | | | | (95,924 | ) |

| | | | | | | | | | | $ | 24,001,955 | | | $ | (139,042 | ) |

Equity Futures Contracts Sold Short† |

CBOE Volatility Index Futures Contracts | | | 145 | | | | May 2022 | | | $ | 3,658,350 | | | $ | 130,099 | |

CBOE Volatility Index Futures Contracts | | | 119 | | | | Jun 2022 | | | | 3,042,830 | | | | 22,294 | |

| | | | | | | | | | | $ | 6,701,180 | | | $ | 152,393 | |

Interest Rate Futures Contracts Sold Short†† |

Long Gilt Futures Contracts | | | 48 | | | | Mar 2022 | | | $ | 8,101,805 | | | $ | 54,916 | |

Euro - Bund Futures Contracts | | | 21 | | | | Mar 2022 | | | | 4,095,765 | | | | 15,149 | |

Australian Government 10 Year Bond Futures Contracts | | | 51 | | | | Mar 2022 | | | | 5,178,940 | | | | (19,178 | ) |

Canadian Government 10 Year Bond Futures Contracts | | | 105 | | | | Mar 2022 | | | | 11,830,389 | | | | (85,870 | ) |

| | | | | | | | | | | $ | 29,206,899 | | | $ | (34,983 | ) |

Commodity Futures Contracts Sold Short† |

Natural Gas Futures Contracts | | | 48 | | | | Mar 2022 | | | $ | 1,697,280 | | | $ | 47,398 | |

Wheat Futures Contracts | | | 4 | | | | Mar 2022 | | | | 154,050 | | | | 6,188 | |

Silver Futures Contracts | | | 1 | | | | Mar 2022 | | | | 116,600 | | | | 4,977 | |

Hard Red Winter Wheat Futures Contracts | | | 3 | | | | Mar 2022 | | | | 120,075 | | | | 3,589 | |

Natural Gas Futures Contracts | | | 2 | | | | Jan 2022 | | | | 75,300 | | | | (344 | ) |

Lean Hogs Futures Contracts | | | 1 | | | | Feb 2022 | | | | 32,520 | | | | (1,103 | ) |

Cocoa Futures Contracts | | | 4 | | | | Mar 2022 | | | | 101,560 | | | | (2,008 | ) |

Cattle Feeder Futures Contracts | | | 2 | | | | Mar 2022 | | | | 170,000 | | | | (5,119 | ) |

Live Cattle Futures Contracts | | | 105 | | | | Apr 2022 | | | | 6,080,550 | | | | (48,943 | ) |

Cotton #2 Futures Contracts | | | 30 | | | | Mar 2022 | | | | 1,689,750 | | | | (64,912 | ) |

Gasoline RBOB Futures Contracts | | | 29 | | | | Mar 2022 | | | | 2,839,402 | | | | (138,804 | ) |

| | | | | | | | | | | $ | 13,077,087 | | | $ | (199,081 | ) |

Currency Futures Contracts Sold Short† |

Australian Dollar Futures Contracts | | | 33 | | | | Mar 2022 | | | $ | 2,398,275 | | | $ | (47,282 | ) |

Swiss Franc Futures Contracts | | | 110 | | | | Mar 2022 | | | | 15,098,875 | | | | (216,605 | ) |

| | | | | | | | | | | $ | 17,497,150 | | | $ | (263,887 | ) |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 19 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

Custom Basket Swap Agreements |

Counterparty | Reference

Obligation | Type | Financing

Rate | | Payment

Frequency | | | Maturity

Date | | | Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

OTC Custom Basket Swap Agreements†† |

Morgan Stanley Capital Services LLC | MS Equity Market Neutral Custom Basket | Pay | 0.48% (Federal Funds Rate + 0.40%) | | | At Maturity | | | | 08/31/23 | | | $ | 13,017,639 | | | $ | 2,087,083 | |

Goldman Sachs International | GS Equity Market Neutral Custom Basket | Pay | 0.53% (Federal Funds Rate + 0.45%) | | | At Maturity | | | | 05/06/24 | | | | 13,017,650 | | | | 2,044,462 | |

Goldman Sachs International | GS Long/Short Equity Custom Basket | Pay | 0.53% (Federal Funds Rate + 0.45%) | | | At Maturity | | | | 05/06/24 | | | | 9,009,748 | | | | 902,053 | |

Morgan Stanley Capital Services LLC | MS Long/Short Equity Custom Basket | Pay | 0.48% (Federal Funds Rate + 0.40%) | | | At Maturity | | | | 08/31/23 | | | | 9,009,793 | | | | 900,851 | |

| | | | | | | | | | | | | | $ | 44,054,830 | | | $ | 5,934,449 | |

OTC Custom Basket Swap Agreements Sold Short†† |

Morgan Stanley Capital Services LLC | MS Long/Short Equity Custom Basket | Pay | (0.22)% (Federal Funds Rate - 0.30%) | | | At Maturity | | | | 08/31/23 | | | $ | 4,919,821 | | | $ | (24,704 | ) |

Goldman Sachs International | GS Long/Short Equity Custom Basket | Pay | (0.12)% (Federal Funds Rate - 0.20%) | | | At Maturity | | | | 05/06/24 | | | | 4,919,750 | | | | (26,733 | ) |

Morgan Stanley Capital Services LLC | MS Equity Market Neutral Custom Basket | Pay | (0.23)% (Federal Funds Rate - 0.31%) | | | At Maturity | | | | 08/31/23 | | | | 12,984,844 | | | | (948,917 | ) |

Goldman Sachs International | GS Equity Market Neutral Custom Basket | Pay | (0.15)% (Federal Funds Rate - 0.23%) | | | At Maturity | | | | 05/06/24 | | | | 12,997,199 | | | | (954,993 | ) |

| | | | | | | | | | | | | | $ | 35,821,614 | | | $ | (1,955,347 | ) |

20 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage

Notional

Amount | | |

Value and

Unrealized

Appreciation

| |

MS LONG/SHORT EQUITY LONG CUSTOM BASKET |

Utilities |

UGI Corp. | | | 2,046 | | | | 1.03 | % | | $ | 22,713 | |

IDACORP, Inc. | | | 825 | | | | 1.04 | % | | | 18,084 | |

National Fuel Gas Co. | | | 1,476 | | | | 1.05 | % | | | 16,965 | |

Chesapeake Utilities Corp. | | | 654 | | | | 1.06 | % | | | 16,763 | |

American States Water Co. | | | 610 | | | | 0.70 | % | | | 13,077 | |

Southern Co. | | | 1,115 | | | | 0.85 | % | | | 12,884 | |

MGE Energy, Inc. | | | 1,095 | | | | 1.00 | % | | | 6,672 | |

Portland General Electric Co. | | | 1,750 | | | | 1.03 | % | | | 5,211 | |

WEC Energy Group, Inc. | | | 935 | | | | 1.01 | % | | | 2,953 | |

PPL Corp. | | | 3,119 | | | | 1.04 | % | | | 1,212 | |

CMS Energy Corp. | | | 281 | | | | 0.20 | % | | | 1 | |

Total Utilities | | | 116,535 | |

| | | | | | | | | | | | | |

Consumer, Non-cyclical |

United Therapeutics Corp. | | | 181 | | | | 0.43 | % | | | 22,413 | |

Prestige Consumer Healthcare, Inc. | | | 770 | | | | 0.52 | % | | | 18,673 | |

Innoviva, Inc. | | | 4,224 | | | | 0.81 | % | | | 17,734 | |

Quest Diagnostics, Inc. | | | 449 | | | | 0.86 | % | | | 16,389 | |

Gilead Sciences, Inc. | | | 1,271 | | | | 1.02 | % | | | 12,931 | |

Eagle Pharmaceuticals, Inc. | | | 970 | | | | 0.55 | % | | | 10,161 | |

AbbVie, Inc. | | | 467 | | | | 0.70 | % | | | 9,065 | |

Molson Coors Beverage Co. — Class B | | | 681 | | | | 0.35 | % | | | 8,748 | |

| | | | | | | | | | | | | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

John B Sanfilippo & Son, Inc. | | | 992 | | | | 0.99 | % | | $ | 8,074 | |

Regeneron Pharmaceuticals, Inc. | | | 96 | | | | 0.67 | % | | | 7,735 | |

Hologic, Inc. | | | 847 | | | | 0.72 | % | | | 6,827 | |

Amgen, Inc. | | | 413 | | | | 1.03 | % | | | 6,695 | |

Amphastar Pharmaceuticals, Inc. | | | 1,785 | | | | 0.46 | % | | | 5,965 | |

PerkinElmer, Inc. | | | 107 | | | | 0.24 | % | | | 5,851 | |

Johnson & Johnson | | | 531 | | | | 1.01 | % | | | 5,710 | |

Vertex Pharmaceuticals, Inc. | | | 161 | | | | 0.39 | % | | | 4,721 | |

Perdoceo Education Corp. | | | 4,774 | | | | 0.62 | % | | | 4,489 | |

Vector Group Ltd. | | | 1,570 | | | | 0.20 | % | | | 4,211 | |

EVERTEC, Inc. | | | 939 | | | | 0.52 | % | | | 3,438 | |

Waters Corp. | | | 95 | | | | 0.39 | % | | | 2,079 | |

Coherus Biosciences, Inc. | | | 1,170 | | | | 0.21 | % | | | 1,910 | |

Laboratory Corporation of America Holdings | | | 102 | | | | 0.36 | % | | | 1,765 | |

USANA Health Sciences, Inc. | | | 567 | | | | 0.64 | % | | | 1,504 | |

Bio-Rad Laboratories, Inc. — Class A | | | 65 | | | | 0.55 | % | | | 1,221 | |

Halozyme Therapeutics, Inc. | | | 516 | | | | 0.23 | % | | | 1,155 | |

Royalty Pharma plc — Class A | | | 784 | | | | 0.35 | % | | | 919 | |

Merck & Company, Inc. | | | 471 | | | | 0.40 | % | | | 830 | |

Pfizer, Inc. | | | 503 | | | | 0.33 | % | | | (425 | ) |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 21 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Bristol-Myers Squibb Co. | | | 1,479 | | | | 1.02 | % | | $ | (1,161 | ) |

Incyte Corp. | | | 588 | | | | 0.48 | % | | | (2,137 | ) |

Vanda Pharmaceuticals, Inc. | | | 2,556 | | | | 0.45 | % | | | (2,507 | ) |

Exelixis, Inc. | | | 1,043 | | | | 0.21 | % | | | (3,223 | ) |

Total Consumer, Non-cyclical | | | 181,760 | |

| | | | | | | | | | | | | |

Technology |

NetApp, Inc. | | | 537 | | | | 0.55 | % | | | 24,600 | |

CSG Systems International, Inc. | | | 1,630 | | | | 1.04 | % | | | 20,440 | |

Rambus, Inc. | | | 2,056 | | | | 0.67 | % | | | 19,573 | |

HP, Inc. | | | 690 | | | | 0.29 | % | | | 15,318 | |

Cirrus Logic, Inc. | | | 362 | | | | 0.37 | % | | | 10,070 | |

ExlService Holdings, Inc. | | | 182 | | | | 0.29 | % | | | 7,243 | |

Lumentum Holdings, Inc. | | | 212 | | | | 0.25 | % | | | 5,309 | |

International Business Machines Corp. | | | 428 | | | | 0.63 | % | | | 2,344 | |

Progress Software Corp. | | | 684 | | | | 0.37 | % | | | 1,055 | |

Intel Corp. | | | 608 | | | | 0.35 | % | | | 459 | |

Microsoft Corp. | | | 91 | | | | 0.34 | % | | | 369 | |

Texas Instruments, Inc. | | | 141 | | | | 0.29 | % | | | 149 | |

Xperi Holding Corp. | | | 1,750 | | | | 0.37 | % | | | (3,411 | ) |

CommVault Systems, Inc. | | | 281 | | | | 0.21 | % | | | (3,512 | ) |

Total Technology | | | 100,006 | |

| | | | | | | | | | | | | |

Consumer, Cyclical |

AutoZone, Inc. | | | 45 | | | | 1.05 | % | | | 39,390 | |

Gentex Corp. | | | 2,700 | | | | 1.04 | % | | | 23,030 | |

Gentherm, Inc. | | | 347 | | | | 0.33 | % | | | 18,007 | |

Brunswick Corp. | | | 485 | | | | 0.54 | % | | | 16,640 | |

AutoNation, Inc. | | | 311 | | | | 0.40 | % | | | 16,135 | |

| | | | | | | | | | | | | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

NVR, Inc. | | | 12 | | | | 0.79 | % | | $ | 12,459 | |

Cummins, Inc. | | | 360 | | | | 0.87 | % | | | 8,527 | |

O’Reilly Automotive, Inc. | | | 132 | | | | 1.03 | % | | | 7,857 | |

Dolby Laboratories, Inc. — Class A | | | 476 | | | | 0.50 | % | | | 7,362 | |

Tri Pointe Homes, Inc. | | | 1,096 | | | | 0.34 | % | | | 6,365 | |

LKQ Corp. | | | 1,622 | | | | 1.08 | % | | | 6,307 | |

Zumiez, Inc. | | | 791 | | | | 0.42 | % | | | 5,865 | |

Autoliv, Inc. | | | 302 | | | | 0.35 | % | | | 4,516 | |

Dick’s Sporting Goods, Inc. | | | 301 | | | | 0.38 | % | | | 4,463 | |

Methode Electronics, Inc. | | | 637 | | | | 0.35 | % | | | 4,317 | |

MarineMax, Inc. | | | 396 | | | | 0.26 | % | | | 4,028 | |

Ethan Allen Interiors, Inc. | | | 1,690 | | | | 0.49 | % | | | 3,866 | |

Lennar Corp. — Class A | | | 312 | | | | 0.40 | % | | | 3,108 | |

Acushnet Holdings Corp. | | | 966 | | | | 0.57 | % | | | 2,825 | |

Buckle, Inc. | | | 1,058 | | | | 0.50 | % | | | 2,627 | |

Whirlpool Corp. | | | 262 | | | | 0.68 | % | | | 2,309 | |

PulteGroup, Inc. | | | 485 | | | | 0.31 | % | | | 1,917 | |

Kontoor Brands, Inc. | | | 390 | | | | 0.22 | % | | | 1,403 | |

Oxford Industries, Inc. | | | 228 | | | | 0.26 | % | | | 1,100 | |

Shoe Carnival, Inc. | | | 489 | | | | 0.21 | % | | | 753 | |

Tapestry, Inc. | | | 730 | | | | 0.33 | % | | | (615 | ) |

Allison Transmission Holdings, Inc. | | | 1,573 | | | | 0.63 | % | | | (878 | ) |

Haverty Furniture Companies, Inc. | | | 573 | | | | 0.19 | % | | | (2,000 | ) |

Polaris, Inc. | | | 285 | | | | 0.35 | % | | | (2,805 | ) |

Foot Locker, Inc. | | | 570 | | | | 0.28 | % | | | (5,328 | ) |

22 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Jack in the Box, Inc. | | | 315 | | | | 0.31 | % | | $ | (6,856 | ) |

Hibbett, Inc. | | | 305 | | | | 0.24 | % | | | (7,948 | ) |

Total Consumer, Cyclical | | | 178,746 | |

| | | | | | | | | | | | | |

Industrial |

Mueller Industries, Inc. | | | 1,480 | | | | 0.98 | % | | | 24,942 | |

Encore Wire Corp. | | | 489 | | | | 0.78 | % | | | 21,170 | |

Snap-on, Inc. | | | 374 | | | | 0.89 | % | | | 20,181 | |

Knowles Corp. | | | 4,172 | | | | 1.08 | % | | | 18,957 | |

Vishay Intertechnology, Inc. | | | 2,902 | | | | 0.70 | % | | | 17,304 | |

Owens Corning | | | 446 | | | | 0.45 | % | | | 17,146 | |

Keysight Technologies, Inc. | | | 349 | | | | 0.80 | % | | | 16,923 | |

Louisiana-Pacific Corp. | | | 459 | | | | 0.40 | % | | | 7,726 | |

Hillenbrand, Inc. | | | 1,115 | | | | 0.64 | % | | | 7,124 | |

Boise Cascade Co. | | | 577 | | | | 0.46 | % | | | 6,229 | |

Atkore, Inc. | | | 193 | | | | 0.24 | % | | | 4,831 | |

Eagle Materials, Inc. | | | 231 | | | | 0.43 | % | | | 3,638 | |

Sanmina Corp. | | | 1,741 | | | | 0.80 | % | | | 3,608 | |

Albany International Corp. — Class A | | | 302 | | | | 0.30 | % | | | 3,344 | |

Crane Co. | | | 436 | | | | 0.49 | % | | | 3,060 | |

TTM Technologies, Inc. | | | 3,700 | | | | 0.61 | % | | | 2,670 | |

Simpson Manufacturing Company, Inc. | | | 139 | | | | 0.21 | % | | | 2,595 | |

Oshkosh Corp. | | | 440 | | | | 0.55 | % | | | 1,503 | |

Packaging Corporation of America | | | 433 | | | | 0.65 | % | | | 1,444 | |

Textron, Inc. | | | 405 | | | | 0.35 | % | | | 1,177 | |

| | | | | | | | | | | | | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

3M Co. | | | 446 | | | | 0.88 | % | | $ | 879 | |

Insteel Industries, Inc. | | | 542 | | | | 0.24 | % | | | 404 | |

Dorian LPG Ltd. | | | 1,887 | | | | 0.27 | % | | | (22 | ) |

Worthington Industries, Inc. | | | 626 | | | | 0.38 | % | | | (320 | ) |

Garmin Ltd. | | | 684 | | | | 1.03 | % | | | (1,205 | ) |

Donaldson Company, Inc. | | | 863 | | | | 0.57 | % | | | (1,761 | ) |

OSI Systems, Inc. | | | 513 | | | | 0.53 | % | | | (2,474 | ) |

MDU Resources Group, Inc. | | | 1,631 | | | | 0.56 | % | | | (3,921 | ) |

Toro Co. | | | 866 | | | | 0.96 | % | | | (4,752 | ) |

Vontier Corp. | | | 1,839 | | | | 0.63 | % | | | (5,225 | ) |

Huntington Ingalls Industries, Inc. | | | 309 | | | | 0.64 | % | | | (5,295 | ) |

Sturm Ruger & Company, Inc. | | | 862 | | | | 0.65 | % | | | (6,720 | ) |

Total Industrial | | | 155,160 | |

| | | | | | | | | | | | | |

Financial |

Stewart Information Services Corp. | | | 1,132 | | | | 1.00 | % | | | 21,439 | |

Raymond James Financial, Inc. | | | 930 | | | | 1.04 | % | | | 12,236 | |

Piper Sandler Cos. | | | 353 | | | | 0.70 | % | | | 12,217 | |

Synchrony Financial | | | 545 | | | | 0.28 | % | | | 12,094 | |

Interactive Brokers Group, Inc. — Class A | | | 643 | | | | 0.57 | % | | | 9,291 | |

Arch Capital Group Ltd. | | | 1,931 | | | | 0.95 | % | | | 8,335 | |

First American Financial Corp. | | | 623 | | | | 0.54 | % | | | 6,441 | |

Enstar Group Ltd. | | | 361 | | | | 0.99 | % | | | 6,402 | |

Safety Insurance Group, Inc. | | | 1,064 | | | | 1.00 | % | | | 5,544 | |

Preferred Bank/Los Angeles CA | | | 1,330 | | | | 1.06 | % | | | 5,129 | |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 23 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Douglas Elliman, Inc. | | | 785 | | | | 0.10 | % | | $ | 4,452 | |

HomeStreet, Inc. | | | 1,042 | | | | 0.60 | % | | | 2,754 | |

United Bankshares, Inc. | | | 1,702 | | | | 0.69 | % | | | 2,568 | |

Janus Henderson Group plc | | | 756 | | | | 0.35 | % | | | 2,210 | |

Citigroup, Inc. | | | 1,505 | | | | 1.01 | % | | | 1,578 | |

National Bank Holdings Corp. — Class A | | | 1,685 | | | | 0.82 | % | | | 1,308 | |

Fulton Financial Corp. | | | 1,568 | | | | 0.30 | % | | | 1,085 | |

Everest Re Group Ltd. | | | 180 | | | | 0.55 | % | | | 863 | |

Markel Corp. | | | 23 | | | | 0.32 | % | | | 674 | |

Affiliated Managers Group, Inc. | | | 133 | | | | 0.24 | % | | | 465 | |

Western Union Co. | | | 1,816 | | | | 0.36 | % | | | (80 | ) |

Ameris Bancorp | | | 376 | | | | 0.21 | % | | | (832 | ) |

BankUnited, Inc. | | | 1,212 | | | | 0.57 | % | | | (1,447 | ) |

Essent Group Ltd. | | | 892 | | | | 0.45 | % | | | (1,487 | ) |

MGIC Investment Corp. | | | 4,128 | | | | 0.66 | % | | | (1,739 | ) |

Evercore, Inc. — Class A | | | 520 | | | | 0.78 | % | | | (1,840 | ) |

Meta Financial Group, Inc. | | | 701 | | | | 0.46 | % | | | (3,597 | ) |

Hilltop Holdings, Inc. | | | 1,198 | | | | 0.47 | % | | | (3,669 | ) |

Old Republic International Corp. | | | 3,423 | | | | 0.93 | % | | | (4,456 | ) |

Radian Group, Inc. | | | 2,751 | | | | 0.65 | % | | | (4,591 | ) |

OneMain Holdings, Inc. | | | 677 | | | | 0.38 | % | | | (4,617 | ) |

AMERISAFE, Inc. | | | 1,252 | | | | 0.75 | % | | | (4,953 | ) |

| | | | | | | | | | | | | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Mercury General Corp. | | | 1,593 | | | | 0.94 | % | | $ | (10,178 | ) |

Total Financial | | | 73,599 | |

| | | | | | | | | | | | | |

Communications |

Viavi Solutions, Inc. | | | 5,550 | | | | 1.09 | % | | | 32,719 | |

Cisco Systems, Inc. | | | 1,524 | | | | 1.07 | % | | | 27,102 | |

Juniper Networks, Inc. | | | 1,101 | | | | 0.44 | % | | | 14,974 | |

Omnicom Group, Inc. | | | 1,119 | | | | 0.91 | % | | | 11,430 | |

F5, Inc. | | | 78 | | | | 0.21 | % | | | 4,134 | |

InterDigital, Inc. | | | 527 | | | | 0.42 | % | | | 3,758 | |

Shenandoah Telecommunications | | | | | | | | |

Co. | | | 1,151 | | | | 0.33 | % | | | (751 | ) |

Yelp, Inc. — Class A | | | 535 | | | | 0.22 | % | | | (786 | ) |

T-Mobile US, Inc. | | | 160 | | | | 0.21 | % | | | (1,248 | ) |

Cogent Communications Holdings, Inc. | | | 425 | | | | 0.35 | % | | | (1,451 | ) |

Verizon Communications, Inc. | | | 1,394 | | | | 0.80 | % | | | (2,985 | ) |

Telephone & Data Systems, Inc. | | | 1,513 | | | | 0.34 | % | | | (3,658 | ) |

Total Communications | | | 83,238 | |

| | | | | | | | | | | | | |

Basic Materials |

Westlake Chemical Corp. | | | 696 | | | | 0.75 | % | | | 3,259 | |

Celanese Corp. — Class A | | | 351 | | | | 0.65 | % | | | 2,625 | |

LyondellBasell Industries N.V. — Class A | | | 572 | | | | 0.59 | % | | | 1,959 | |

AdvanSix, Inc. | | | 479 | | | | 0.25 | % | | | 1,786 | |

Dow, Inc. | | | 660 | | | | 0.42 | % | | | 1,424 | |

Newmont Corp. | | | 380 | | | | 0.26 | % | | | 791 | |

Nucor Corp. | | | 315 | | | | 0.40 | % | | | (222 | ) |

24 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Steel Dynamics, Inc. | | | 523 | | | | 0.36 | % | | $ | (222 | ) |

Total Basic Materials | | | 11,400 | |

| | | | | | | | | | | | | |

Energy |

Equitrans Midstream Corp. | | | 1,850 | | | | 0.21 | % | | | 1,967 | |

Kinder Morgan, Inc. | | | 1,159 | | | | 0.20 | % | | | 176 | |

Antero Midstream Corp. | | | 1,944 | | | | 0.21 | % | | | (1,736 | ) |

Total Energy | | | 407 | |

Total MS Long/Short Equity Long Custom Basket | | $ | 900,851 | |

| | | | | | | | | |

MS LONG/SHORT EQUITY SHORT CUSTOM BASKET |

Consumer, Non-cyclical |

Teladoc Health, Inc. | | | 397 | | | | (0.77 | )% | | $ | 12,558 | |

Guardant Health, Inc. | | | 375 | | | | (0.76 | )% | | | 11,707 | |

CoStar Group, Inc. | | | 791 | | | | (1.27 | )% | | | 7,286 | |

Viad Corp. | | | 848 | | | | (0.74 | )% | | | 3,589 | |

US Foods Holding Corp. | | | 772 | | | | (0.55 | )% | | | 827 | |

ASGN, Inc. | | | 330 | | | | (0.83 | )% | | | 686 | |

Brink’s Co. | | | 289 | | | | (0.39 | )% | | | 41 | |

Verisk Analytics, Inc. — Class A | | | 196 | | | | (0.91 | )% | | | (669 | ) |

Equifax, Inc. | | | 134 | | | | (0.80 | )% | | | (1,523 | ) |

TransUnion | | | 296 | | | | (0.71 | )% | | | (1,579 | ) |

Rollins, Inc. | | | 1,330 | | | | (0.92 | )% | | | (1,584 | ) |

Sysco Corp. | | | 627 | | | | (1.00 | )% | | | (3,253 | ) |

Dun & Bradstreet Holdings, Inc. | | | 2,301 | | | | (0.96 | )% | | | (3,440 | ) |

Cintas Corp. | | | 176 | | | | (1.59 | )% | | | (4,094 | ) |

Driven Brands Holdings, Inc. | | | 2,217 | | | | (1.52 | )% | | | (11,832 | ) |

Total Consumer, Non-cyclical | | | 8,720 | |

| | | | | | | | | | | | | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Technology |

Coupa Software, Inc. | | | 152 | | | | (0.49 | )% | | $ | 16,483 | |

Twilio, Inc. — Class A | | | 93 | | | | (0.50 | )% | | | 9,230 | |

Clarivate plc | | | 962 | | | | (0.46 | )% | | | 5,102 | |

Avalara, Inc. | | | 93 | | | | (0.24 | )% | | | 3,369 | |

Zscaler, Inc. | | | 42 | | | | (0.27 | )% | | | 1,018 | |

Smartsheet, Inc. — Class A | | | 173 | | | | (0.27 | )% | | | 882 | |

Allscripts Healthcare Solutions, Inc. | | | 1,444 | | | | (0.54 | )% | | | 286 | |

Leidos Holdings, Inc. | | | 284 | | | | (0.51 | )% | | | (352 | ) |

Snowflake, Inc. — Class A | | | 82 | | | | (0.56 | )% | | | (2,655 | ) |

Ceridian HCM Holding, Inc. | | | 303 | | | | (0.64 | )% | | | (4,359 | ) |

KBR, Inc. | | | 1,756 | | | | (1.70 | )% | | | (11,985 | ) |

Total Technology | | | 17,019 | |

| | | | | | | | | | | | | |

Industrial |

Stericycle, Inc. | | | 1,067 | | | | (1.29 | )% | | | 15,523 | |

Boeing Co. | | | 380 | | | | (1.55 | )% | | | 9,286 | |

US Ecology, Inc. | | | 1,401 | | | | (0.91 | )% | | | 7,562 | |

TransDigm Group, Inc. | | | 43 | | | | (0.56 | )% | | | 532 | |

Jacobs Engineering Group, Inc. | | | 666 | | | | (1.88 | )% | | | 509 | |

Howmet Aerospace, Inc. | | | 1,449 | | | | (0.94 | )% | | | (2,781 | ) |

Waste Management, Inc. | | | 355 | | | | (1.20 | )% | | | (9,983 | ) |

Tetra Tech, Inc. | | | 312 | | | | (1.08 | )% | | | (10,256 | ) |

Republic Services, Inc. — Class A | | | 490 | | | | (1.39 | )% | | | (14,755 | ) |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 25 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Casella Waste Systems, Inc. — Class A | | | 843 | | | | (1.46 | )% | | $ | (17,856 | ) |

Total Industrial | | | (22,219 | ) |

| | | | | | | | | | | | | |

Consumer, Cyclical |

United Airlines Holdings, Inc. | | | 1,991 | | | | (1.77 | )% | | | 20,500 | |

Freshpet, Inc. | | | 250 | | | | (0.48 | )% | | | 18,002 | |

Delta Air Lines, Inc. | | | 2,227 | | | | (1.77 | )% | | | 13,047 | |

Spirit Airlines, Inc. | | | 1,580 | | | | (0.70 | )% | | | 6,208 | |

Frontier Group Holdings, Inc. | | | 1,785 | | | | (0.49 | )% | | | 5,685 | |

Tesla, Inc. | | | 24 | | | | (0.52 | )% | | | 2,907 | |

American Airlines Group, Inc. | | | 4,556 | | | | (1.66 | )% | | | 748 | |

Royal Caribbean Cruises Ltd. | | | 508 | | | | (0.79 | )% | | | (402 | ) |

Wynn Resorts Ltd. | | | 226 | | | | (0.39 | )% | | | (769 | ) |

Las Vegas Sands Corp. | | | 533 | | | | (0.41 | )% | | | (1,303 | ) |

IAA, Inc. | | | 914 | | | | (0.94 | )% | | | (1,797 | ) |

Carnival Corp. | | | 2,022 | | | | (0.83 | )% | | | (3,682 | ) |

Madison Square Garden Sports Corp. — Class A | | | 446 | | | | (1.57 | )% | | | (4,491 | ) |

Copart, Inc. | | | 310 | | | | (0.96 | )% | | | (4,969 | ) |

Total Consumer, Cyclical | | | 49,684 | |

| | | | | | | | | | | | | |

Financial |

Americold Realty Trust | | | 1,356 | | | | (0.90 | )% | | | 8,402 | |

Park Hotels & Resorts, Inc. | | | 4,179 | | | | (1.60 | )% | | | 1,466 | |

RLJ Lodging Trust | | | 5,158 | | | | (1.46 | )% | | | 1,136 | |

Welltower, Inc. | | | 805 | | | | (1.40 | )% | | | 635 | |

DiamondRock Hospitality Co. | | | 4,576 | | | | (0.89 | )% | | | 546 | |

Safehold, Inc. | | | 941 | | | | (1.53 | )% | | | 544 | |

| | | | | | | | | | | | | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Lincoln National Corp. | | | 720 | | | | (1.00 | )% | | $ | (85 | ) |

Sunstone Hotel Investors, Inc. | | | 5,316 | | | | (1.27 | )% | | | (264 | ) |

Sun Communities, Inc. | | | 176 | | | | (0.75 | )% | | | (1,425 | ) |

Wells Fargo & Co. | | | 1,308 | | | | (1.28 | )% | | | (1,766 | ) |

Xenia Hotels & Resorts, Inc. | | | 2,410 | | | | (0.89 | )% | | | (2,137 | ) |

Pebblebrook Hotel Trust | | | 2,934 | | | | (1.33 | )% | | | (2,810 | ) |

Northern Trust Corp. | | | 329 | | | | (0.80 | )% | | | (2,962 | ) |

Equitable Holdings, Inc. | | | 2,036 | | | | (1.36 | )% | | | (3,357 | ) |

Equinix, Inc. | | | 83 | | | | (1.43 | )% | | | (3,445 | ) |

Host Hotels & Resorts, Inc. | | | 4,756 | | | | (1.68 | )% | | | (3,468 | ) |

Signature Bank | | | 147 | | | | (0.97 | )% | | | (3,702 | ) |

Bank of New York Mellon Corp. | | | 986 | | | | (1.16 | )% | | | (3,778 | ) |

Ryman Hospitality Properties, Inc. | | | 780 | | | | (1.46 | )% | | | (3,932 | ) |

Kennedy-Wilson Holdings, Inc. | | | 3,733 | | | | (1.81 | )% | | | (4,775 | ) |

Outfront Media, Inc. | | | 2,208 | | | | (1.20 | )% | | | (5,434 | ) |

State Street Corp. | | | 912 | | | | (1.72 | )% | | | (5,859 | ) |

Apartment Income REIT Corp. | | | 1,621 | | | | (1.80 | )% | | | (5,998 | ) |

Western Alliance Bancorporation | | | 685 | | | | (1.50 | )% | | | (6,395 | ) |

Comerica, Inc. | | | 1,056 | | | | (1.87 | )% | | | (7,999 | ) |

Howard Hughes Corp. | | | 679 | | | | (1.40 | )% | | | (8,046 | ) |

Total Financial | | | (64,908 | ) |

| | | | | | | | | | | | | |

26 | THE GUGGENHEIM FUNDS ANNUAL REPORT | SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage

Notional

Amount | | | Value and

Unrealized

Appreciation

(Depreciation) | |

Communications |

Uber Technologies, Inc. | | | 1,426 | | | | (1.22 | )% | | $ | 8,007 | |

Okta, Inc. | | | 159 | | | | (0.72 | )% | | | 7,932 | |

Airbnb, Inc. — Class A | | | 148 | | | | (0.50 | )% | | | 3,871 | |

Zillow Group, Inc. — Class C | | | 373 | | | | (0.48 | )% | | | (719 | ) |

Opendoor Technologies, Inc. | | | 1,589 | | | | (0.47 | )% | | | (1,051 | ) |

Lyft, Inc. — Class A | | | 1,383 | | | | (1.20 | )% | | | (1,664 | ) |

Total Communications | | | 16,376 | |

| | | | | | | | | | | | | |

Energy |

Plug Power, Inc. | | | 414 | | | | (0.24 | )% | | | 4,443 | |

NOV, Inc. | | | 2,222 | | | | (0.61 | )% | | | 808 | |

Denbury, Inc. | | | 346 | | | | (0.54 | )% | | | (593 | ) |

Range Resources Corp. | | | 1,182 | | | | (0.43 | )% | | | (673 | ) |

Marathon Petroleum Corp. | | | 567 | | | | (0.74 | )% | | | (702 | ) |

| | | | | | | | | | | | | |

| | Shares | | | Percentage

Notional

Amount | | |

Value and

Unrealized

Depreciation

| |

Hess Corp. | | | 525 | | | | (0.79 | )% | | $ | (1,468 | ) |

Schlumberger N.V. | | | 2,180 | | | | (1.33 | )% | | | (1,531 | ) |

Halliburton Co. | | | 3,347 | | | | (1.56 | )% | | | (2,001 | ) |

Pioneer Natural Resources Co. | | | 315 | | | | (1.16 | )% | | | (2,670 | ) |

Patterson-UTI Energy, Inc. | | | 4,062 | | | | (0.70 | )% | | | (2,799 | ) |

Total Energy | | | (7,186 | ) |

| | | | | | | | | | | | | |

Utilities |

ONE Gas, Inc. | | | 1,223 | | | | (1.93 | )% | | | (253 | ) |

Atmos Energy Corp. | | | 916 | | | | (1.95 | )% | | | (3,063 | ) |

CenterPoint Energy, Inc. | | | 2,903 | | | | (1.65 | )% | | | (5,044 | ) |

Edison International | | | 1,354 | | | | (1.88 | )% | | | (13,830 | ) |

Total Utilities | | | (22,190 | ) |

Total MS Long/Short Equity Short Custom Basket | | $ | (24,704 | ) |

SEE NOTES TO CONSOLIDATED FINANCIAL STATEMENTS. | THE GUGGENHEIM FUNDS ANNUAL REPORT | 27 |

CONSOLIDATED SCHEDULE OF INVESTMENTS (continued) | December 31, 2021 |

MULTI-HEDGE STRATEGIES FUND | |

| | Shares | | | Percentage