UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-07704

Schwab Capital Trust – Schwab Fundamental Global Real Estate Index Fund

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415)636-7000

Date of fiscal year end: February 28

Date of reporting period: February 28, 2019

| Item 1: | Report(s) to Shareholders. |

Annual Report | February 28, 2019

Schwab Fundamental Global Real Estate Index Fund

| New Notice Regarding Shareholder Report Delivery Options |

| Beginning on January 1, 2021, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a fund or from your financial intermediary (such as a bank or broker-dealer). Instead, the reports will be made available on a fund’s websitewww.schwabfunds.com/schwabfunds_prospectus, and you will be notified by mail each time a report is posted and the mailing will provide a website link to access the report. You will continue to receive other fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all fund documents electronically as described below. |

| If you would like to continue to receive a fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request: (1) by contacting your financial intermediary, if you invest through a financial intermediary; or (2) if you invest directly with a fund, by calling 1-800-407-0256. |

| If you already receive shareholder reports and other fund documents electronically, you will not be affected by this change and you need not take any action. If you do not receive shareholder reports and other fund documents electronically but would like to do so, contact your financial intermediary or, if you invest directly with the funds, call 1-800-407-0256. |

This page is intentionally left blank.

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM)

Distributor: Charles Schwab & Co., Inc. (Schwab)

The Sector/Industry classifications in this report use the Global Industry Classification Standard (GICS), which was developed by and is the exclusive property of MSCI Inc. (MSCI) and Standard & Poor’s (S&P). GICS is a service mark of MSCI and S&P and has been licensed for use by Schwab.

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

| Total Returns for the 12 Months Ended February 28, 2019 |

| Schwab Fundamental Global Real Estate Index Fund (Ticker Symbol: SFREX) | 6.91%1 |

| Russell RAFITM Global Select Real Estate Index (Net)2 | 6.35% |

| FTSE EPRA Nareit Global Index (Net)2 | 9.53% |

| Fund Category: Morningstar Global Real Estate3 | 8.22% |

| Performance Details | pages 8-10 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

Index ownership – The Schwab Fundamental Global Real Estate Index Fund is not in any way sponsored, endorsed, sold or promoted by Frank Russell Company (Russell), by the London Stock Exchange Group companies (LSEG), or by Research Affiliates LLC (RA) (collectively the Licensor Parties), and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the Russell RAFI™ Global Select Real Estate Index (the Index) or otherwise. The Index is compiled and calculated by Russell in conjunction with RA. None of the Licensor Parties shall be liable (whether in negligence or otherwise) to any person for any error in the Index and none of the Licensor Parties shall be under any obligation to advise any person of any error therein. “Russell®” is a trademark of Russell. The trade names “Research Affiliates®”, “Fundamental Index®” and “RAFI®” are registered trademarks of RA. CSIM has obtained full license from Russell to use the Index. For full disclaimer please see the fund’s statement of additional information.

| 1 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 2 | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Jonathan de St. Paer

President and CEO of

Charles Schwab Investment

Management, Inc. and the

fund covered in this report.

Dear Shareholder,

In a period that was not easy for most investors, global real estate securities provided a relative bright spot during the 12 months ended February 28, 2019, outpacing broader equity markets and generating positive returns. A generally stable global economy, as well as steady office leasing activity and increases in rental values, supported the overall real estate market. Global monetary policy also remained mostly accommodative despite the Federal Reserve raising interest rates four times during the period. While U.S. and international stocks experienced significant turbulence during the period, global real estate securities generally performed better, demonstrating how different asset classes don’t always move in lockstep—a key reason why it’s important to hold a mix of investments in your portfolio.

At Charles Schwab Investment Management, we often talk about the importance of diversification. But, we also recognize that maintaining a long-term perspective and setting emotions aside can be tough when overall market conditions become challenging. We seek to provide the products that investors can use to achieve their long-term financial goals—and to help weather the market volatility that may come along the way.

The Schwab Fundamental Global Real Estate Index Fund is an important part of that approach. Since real estate values tend to be influenced by a different combination of factors than stocks and bonds, the fund offers the potential for differentiated performance and a convenient way to capture the performance of the global real estate market. Also, by weighting fund holdings based on objective financial measures of company size, Fundamental Index strategies tend to have different risk exposures than traditional market-cap index products that use market capitalization to weight the same set of securities—providing investors the added potential for more attractive risk-adjusted returns across various market cycles.

Recently, the fund gained recognition for its performance relative to its peers. In March, we were honored to receive three Lipper Fund Awards. One was for the Schwab Fundamental Global Real Estate Index Fund, which was recognized for consistent investment returns over the three-year period ended November 30, 2018. The fund was named best-in-class among 41 global real estate funds over that time.1

| 1 | The Thomson Reuters Lipper Fund Awards, granted annually, highlight funds and fund companies that have excelled in delivering consistently strong risk-adjusted performance relative to their peers. The Lipper Fund Awards are based on the Lipper Leader for Consistent Return rating, which is a risk-adjusted performance measure calculated over 36, 60 and 120 months. The fund with the highest Lipper Leader for Consistent Return (Effective Return) value in each eligible classification wins the Lipper Fund Award. For more information, see www.lipperfundawards.com. Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

From the President(continued)

“In March, we were honored to receive three Lipper Fund Awards. One was for the Schwab Fundamental Global Real Estate Index Fund, which was recognized for consistent investment returns over the three-year period ended November 30, 2018.”

On April 1, 2019, I transitioned into the role of Chief Executive Officer of Charles Schwab Investment Management, replacing Marie Chandoha upon her retirement. Looking back at how Charles Schwab Investment Management has grown into the market leader it is today, I believe Marie deserves particular credit. As Chief Executive Officer for over eight years, Marie provided the vision and leadership that has helped us stay focused on the goal of providing cost-effective funds to support investors in meeting their investment objectives. It’s been my privilege to be part of the great team Marie built.

I look forward to furthering our organization’s important mission. As we encounter ups and downs in the investment environment, it becomes even more important to serve our investors to the best of our ability. At Charles Schwab Investment Management, we seek to offer high quality products that help investors build portfolios that serve their needs, even during the more difficult stretches in the market.

Thank you for investing with Charles Schwab Investment Management. For more information about the Schwab Fundamental Global Real Estate Index Fund, please continue reading this report. In addition, you can find further details about this fund by visiting our website at www.schwabfunds.com. We are also happy to hear from you at 1-877-824-5615.

Sincerely,

Fundamental Index is a registered trademark of Research Affiliates LLC.

Past performance cannot guarantee future results.

Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

Management views may have changed since the report date.

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

The Investment Environment

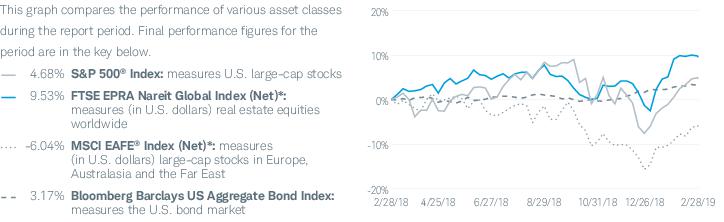

For the 12-month reporting period ended February 28, 2019, global real estate securities generated positive returns. Despite signs of slower growth, a generally stable global economy supported the overall real estate market, as did mostly flexible monetary policies and solid fundamentals such as stable office leasing activity and steady increases in rental values. U.S. real estate securities were particularly strong, with double-digit positive results coming from all sub-industries. Global real estate securities also outpaced the broader equity markets, primarily due to steep equity declines during the third quarter of 2018 and strong performance of real estate securities in January and February. In this environment, the FTSE EPRA Nareit Global Index (Net)*, representing general trends in eligible real estate securities worldwide, returned 9.53% for the reporting period, while U.S. REITs, represented by the Dow Jones U.S. Select REIT IndexTM, returned 20.90%. The overall U.S. stock market, as measured by the S&P 500® Index, returned 4.68%. Outside the U.S., the MSCI EAFE® Index (Net)*, a broad measure of developed international equity performance, and the MSCI Emerging Markets Index (Net)*, returned –6.04% and –9.89%, respectively.

The U.S. economy exhibited stable growth for most of the reporting period as it entered its tenth year of expansion, buoyed by a combination of tax reform early in the reporting period, strong corporate earnings, and still-positive financial conditions, but toward the end of 2018 showed signs of slowing. U.S. gross domestic product (GDP) grew at an annual rate of 2.2% in the fourth quarter of 2018, down from 4.2% and 3.4% in the second and third quarters, respectively. Even amid a tight labor market and growing economy, inflation remained in check, while pressure on wage growth began to rise toward the end of 2018. Consumer confidence, which hit an 18-year high in October, the highest since 2000, fell for the subsequent three months before rebounding in February against the backdrop of the market’s rally and the end of the 35-day partial government shutdown that began in late December and extended through late January.

In the U.S., despite continuing low levels of inflation, the Federal Reserve (Fed) raised the federal funds rate by 0.25% four times over the reporting period—in March, June, September and December. Fed rates ended the reporting period in a target range of 2.25% to 2.50%, bringing them closer to what the Fed considers a neutral level, according to Fed Chairman Jerome Powell. In January, he stated that “the case for raising rates has weakened somewhat,” and that the Fed had “the luxury of patience” regarding possible future rate hikes, easing investors’ concerns about the likelihood and pace of future rate hikes.

Asset Class Performance Comparison % returns during the 12 months ended February 28, 2019

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not an indication of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and CSIM.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

The Investment Environment(continued)

Outside the U.S., most central banks maintained accommodative monetary policies or, in some cases, in the face of signs of rising inflation, tightened their policies. The European Central Bank has held interest rates unchanged since March 2016 and in December reiterated that it would likely maintain those rates through the summer of 2019, but ended its monthly asset purchase program in December. In January, the Bank of Japan upheld its short-term interest rate target of –0.1%, also unchanged since 2016, and maintained its pledge to keep interest rates extremely low for an extended period. After raising its key official bank rate in August amid rising inflation projections and higher energy and import prices, the Bank of England maintained its rate of 0.75% during the reporting period despite ongoing uncertainties over the United Kingdom economy’s wider direction and intensifying uncertainties surrounding the impact of Brexit. Central banks in key emerging market economies—including India, Indonesia, Mexico, Turkey, and Russia—raised their policy rates during the reporting period in response to inflation and exchange-rate pressures. In February, however, India subsequently lowered its policy rate, and in December, the People’s Bank of China (PBOC) maintained its prudent, but no longer neutral, policy stance, indicating it would place a greater focus on flexibility as its economy faces continued headwinds.

Throughout most of the reporting period, the environment for real estate investment trusts (REITs) was mostly solid, with both demand and supply drivers favorable, and the Fed’s change in stance regarding the pace of future rate hikes eased investor concerns about continued interest rate hikes. After a lackluster beginning to 2018, the U.S. REIT industry rebounded in March and continued its positive trend until December, when the stock market experienced its steepest slide in nearly a decade. Although U.S. REITs declined along with other equities, their relative strength earlier in the reporting period, along with their subsequent strong recovery in January and February, helped them outperform other equities for the reporting period.

Real estate markets outside the U.S. were mixed amid slowing economic growth in several regions. On a country basis, REITs in Sweden were among the strongest performers as investors sought investments in countries with lower perceived risk. REITs in Canada performed well, driven by strong residential and industrial demand. Returns among most Asian REITs were weaker but still positive, reflecting declining growth across many emerging markets. Japan’s real estate market turned positive by the end of the period after having lost ground earlier in the period. REITs in China and India posted negative returns, reflective of the slowing growth in those countries along with trade-related concerns. Turkey’s real estate market posted the weakest return, down 53%, reflecting the country’s economic woes relating primarily to its troubled currency and runaway inflation.

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

| Christopher Bliss, CFA, Vice President and Head of the Passive Equity Team, leads the portfolio management team for Schwab’s passive equity mutual funds and ETFs. He also has overall responsibility for all aspects of the management of the fund. Prior to joining CSIM in 2016, Mr. Bliss spent 12 years at BlackRock (formerly Barclays Global Investors) managing and leading institutional index teams, most recently as a Managing Director and Head of Americas Institutional Index team. Prior to BlackRock, he worked as an equity analyst and portfolio manager for Harris Bretall and before that, as a research analyst for JP Morgan. |

| Chuck Craig, CFA, Senior Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2012, Mr. Craig worked at Guggenheim Funds (formerly Claymore Group), where he spent more than five years as a managing director of portfolio management and supervision, and three years as vice president of product research and development. Prior to that, he worked as an equity research analyst at First Trust Portfolios (formerly Niké Securities), and a trader and analyst at PMA Securities, Inc. |

| Jane Qin, Portfolio Manager, is responsible for the day-to-day co-management of the fund. Prior to joining CSIM in 2012, Ms. Qin spent more than four years at The Bank of New York Mellon Corporation. During that time, Ms. Qin spent more than two years as an associate equity portfolio manager and nearly two years as a performance analyst. She also worked at Wells Fargo Funds Management as a mutual fund analyst and at CIGNA Reinsurance in the Risk Management group as a risk analyst. |

| David Rios, Portfolio Manager, is responsible for the day-to-day co-management of the fund. He joined CSIM in 2008 and became a Portfolio Manager in 2014. Prior to this role, Mr. Rios served as an Associate Portfolio Manager on the Schwab Equity Index Strategies team for four years. His first role with CSIM was as a trade operation specialist. He also previously worked as a senior fund accountant at Investors Bank & Trust (subsequently acquired by State Street Corporation). |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fundas of February 28, 2019

The Schwab Fundamental Global Real Estate Index Fund (the fund) seeks investment results that correspond generally (before fees and expenses) to the total return of the Russell RAFITM Global Select Real Estate Index (Net) (the index). The index measures the performance of real estate companies, including real estate investment trusts (REITs), in U.S. and non-U.S. markets, including developed and emerging markets. To pursue its investment objective, the fund invests in a representative sample of the securities included in the index which, when taken together, are expected to perform similarly to the index as a whole. Due to the use of sampling techniques, the fund may not hold all of the securities in the index. For more information concerning the fund’s investment objective, strategies, and risks, please see the fund’s prospectus.

Market Highlights. Global real estate securities generated positive returns for the reporting period. U.S. real estate securities were particularly strong, with double-digit positive results coming from all sub-industries. Although U.S. REITs declined along with other equities in December, their relative strength earlier in the reporting period, along with their subsequent strong recovery in January and February, helped them outperform other equities for the reporting period. Real estate markets outside the U.S. were mixed amid slowing economic growth in several regions.

Performance. The fund closely tracked the index for the 12-month reporting period ended February 28, 2019. The fund returned 6.91%,1 while the index returned 6.35%2 for the reporting period. Fair valuation of the fund’s holdings and income, primarily due to tax rate differences between the fund and the index, contributed to the fund’s performance.

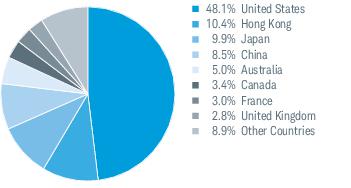

Contributors and Detractors. Real estate securities from the U.S. were the biggest contributor to the total return of both the index and the fund. U.S. securities represented an average weight of approximately 47% of the fund’s investments and had a return of approximately 19% for the reporting period. One example from this market is Welltower, Inc., a REIT that invests mostly in seniors housing, assisted living communities, and medical office buildings. The fund’s holdings of Welltower, Inc. returned approximately 49% for the reporting period.

Real estate securities in Hong Kong also contributed to the index and the fund, representing an average weight of approximately 13% of the fund’s investments and returning approximately 4% in U.S. dollar terms for the reporting period.

Real estate securities from the Netherlands were among the largest detractors from the total return of the index and the fund. Real estate securities from the Netherlands represented an average weight of approximately 1.6% of the fund’s investments and returned approximately -23% in U.S. dollar terms for the reporting period. One example from this market is Unibail-Rodamco-Westfield, a commercial real estate company. The fund’s holdings of Unibail-Rodamco-Westfield returned approximately -28% for the reporting period.

Real estate securities from Japan also detracted from the total return of the index and the fund. Japanese real estate securities represented an average weight of approximately 11% of the fund’s investments and returned approximately -5% in U.S. dollar terms for the reporting period.

Management views and portfolio holdings may have changed since the report date.

| 1 | Total return for the report period above differs from the return in the Financial Highlights. The total return presented above is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 2 | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Performance and Fund Factsas of February 28, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

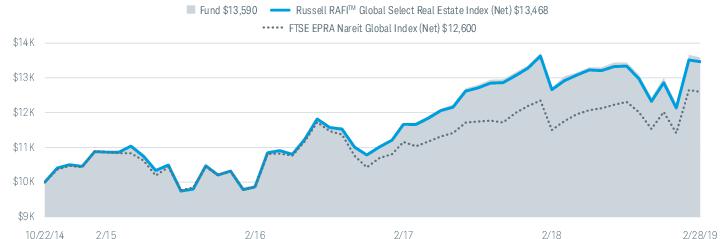

Performance of Hypothetical $10,000 Investment (October 22, 2014 – February 28, 2019)1

Average Annual Total Returns1

| Fund and Inception Date | 1 Year | 3 Years | Since Inception |

| Fund: Schwab Fundamental Global Real Estate Index Fund (10/22/14) | 6.91%2 | 11.22% | 7.30% |

| Russell RAFITM Global Select Real Estate Index (Net)3 | 6.35% | 10.93% | 7.07% |

| FTSE EPRA Nareit Global Index (Net)3 | 9.53% | 8.55% | 5.45% |

| Fund Category: Morningstar Global Real Estate4 | 8.22% | 8.15% | N/A |

| Fund Expense Ratio5: 0.39% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

The fund’s performance relative to the index may be affected by fair value pricing, see financial note 2 for more information.

Small-company stocks are subject to greater volatility than many other asset classes.

International investing may involve risk of capital loss from unfavorable fluctuations in currency values, from differences in generally accepted accounting principles, or from economic or political instability in other nations. Investing in emerging markets may accentuate these risks.

The fund is subject to risks associated with the direct ownership of real estate securities and an investment in the fund will be closely linked to the performance of the real estate markets.

Index ownership – The Schwab Fundamental Global Real Estate Index Fund is not in any way sponsored, endorsed, sold or promoted by Frank Russell Company (Russell), by the London Stock Exchange Group companies (LSEG), or by Research Affiliates LLC (RA) (collectively the Licensor Parties), and none of the Licensor Parties make any warranty or representation whatsoever, expressly or impliedly, either as to the results to be obtained from the use of the Russell RAFITM Global Select Real Estate Index (the Index) or otherwise. The Index is compiled and calculated by Russell in conjunction with RA. None of the Licensor Parties shall be liable (whether in negligence or otherwise) to any person for any error in the Index and none of the Licensor Parties shall be under any obligation to advise any person of any error therein. “Russell®” is a trademark of Russell. The trade names “Research Affiliates®”, “Fundamental Index®” and “RAFI®” are registered trademarks of RA. CSIM has obtained full license from Russell to use the Index. For full disclaimer please see the fund’s statement of additional information.

| 1 | Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares. |

| 2 | Total return for the report period presented in the table differs from the return in the Financial Highlights. The total return presented in the above table is calculated based on the net asset value (NAV) at which shareholder transactions were processed. The total return presented in the Financial Highlights section of the report is calculated in the same manner, but also takes into account certain adjustments that are necessary under generally accepted accounting principles required in the annual and semiannual reports. |

| 3 | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

| 4 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 5 | As stated in the prospectus. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Performance and Fund Factsas of February 28, 2019 (continued)

| Number of Holdings | 315 |

| Weighted Average Market Cap (millions) | $16,407 |

| Price/Earnings Ratio (P/E) | 13.0 |

| Price/Book Ratio (P/B) | 1.3 |

| Portfolio Turnover Rate | 16% |

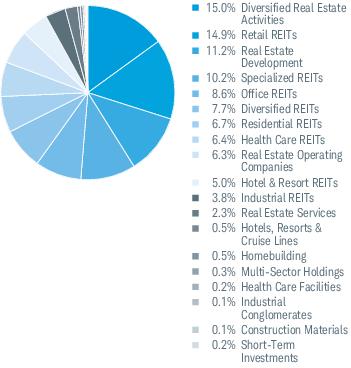

Industry Weightings % of Investments1

Top Holdings % of Net Assets2

Country Weightings % of Investments3

Portfolio holdings may have changed since the report date.

An index is a statistical composite of a specified financial market or sector. Unlike the fund, an index does not actually hold a portfolio of securities and its return is not inclusive of trading and management costs incurred by the fund.

Source of Sector Classification: S&P and MSCI.

| 1 | Excludes derivatives. |

| 2 | This list is not a recommendation of any security by the investment adviser. |

| 3 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, excluding derivatives, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Examples for a $1,000 Investment

As a fund shareholder, you may incur two types of costs: (1) transaction costs; and (2) ongoing costs, including management fees.

The expense examples below are intended to help you understand your ongoing cost (in dollars) of investing in the fund and to compare this cost with the ongoing cost of investing in other mutual funds. These examples are based on an investment of $1,000 invested for six months beginning September 1, 2018 and held through February 28, 2019.

Actual Return line in the table below provides information about actual account values and actual expenses. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period. To do so, simply divide your account value by $1,000 (for example, an $8,600 account value ÷ $1,000 = 8.6), then multiply the result by the number given for your fund under the heading entitled “Expenses Paid During Period.”

Hypothetical Return line in the table below provides information about hypothetical account values and hypothetical expenses based on the fund’s actual expense ratio and an assumed return of 5% per year before expenses. Because the return used is not an actual return, it may not be used to estimate the actual ending account value or expenses you paid for the period.

You may use this information to compare the ongoing costs of investing in the fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only, and do not reflect any transactional costs. Therefore, the hypothetical return lines of the table are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | Expense Ratio

(Annualized)1 | Beginning

Account Value

at 9/1/18 | Ending

Account Value

(Net of Expenses)

at 2/28/19 | Expenses Paid

During Period

9/1/18-2/28/192 |

| Schwab Fundamental Global Real Estate Index Fund | | | | |

| Actual Return | 0.39% | $1,000.00 | $1,011.90 | $1.95 |

| Hypothetical 5% Return | 0.39% | $1,000.00 | $1,022.87 | $1.96 |

| 1 | Based on the most recent six-month expense ratio; may differ from the expense ratio provided in the Financial Highlights which covers a 12-month period. |

| 2 | Expenses for the fund are equal to its annualized expense ratio, multiplied by the average account value over the period, multiplied by the 181 days of the period, and divided by the 365 days of the fiscal year. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Statements

Financial Highlights

| | 3/1/18–

2/28/19 | 3/1/17–

2/28/18 | 3/1/16–

2/28/17 | 3/1/15–

2/29/16 | 10/22/141–

2/28/15 | |

| Per-Share Data |

| Net asset value at beginning of period | $11.24 | $10.73 | $9.53 | $10.74 | $10.00 | |

| Income (loss) from investment operations: | | | | | | |

| Net investment income (loss)2 | 0.37 | 0.34 | 0.29 | 0.27 | 0.10 | |

| Net realized and unrealized gains (losses) | 0.38 | 0.59 | 1.42 | (1.21) | 0.75 | |

| Total from investment operations | 0.75 | 0.93 | 1.71 | (0.94) | 0.85 | |

| Less distributions: | | | | | | |

| Distributions from net investment income | (0.44) | (0.39) | (0.43) | (0.27) | (0.11) | |

| Distributions from net realized gains | (0.12) | (0.03) | (0.08) | — | (0.00)3 | |

| Total distributions | (0.56) | (0.42) | (0.51) | (0.27) | (0.11) | |

| Net asset value at end of period | $11.43 | $11.24 | $10.73 | $9.53 | $10.74 | |

| Total return | 7.00% | 8.69% | 18.26% | (8.91%) | 8.57%4 | |

| Ratios/Supplemental Data |

| Ratios to average net assets: | | | | | | |

| Total expenses | 0.39% | 0.43%5 | 0.91% | 0.89% | 2.58%6 | |

| Net operating expenses | N/A7 | 0.41%5 | 0.49% | 0.50%8 | 0.13%6,9 | |

| Net investment income (loss) | 3.32% | 3.01% | 2.72% | 2.65% | 2.62%6 | |

| Portfolio turnover rate | 16% | 13% | 23% | 26% | 4%4 | |

| Net assets, end of period (x 1,000,000) | $190 | $158 | $93 | $84 | $105 | |

| |

1

Commencement of operations.

2

Calculated based on the average shares outstanding during the period.

3

Per-share amount was less than $0.005.

4

Not annualized.

5

Effective June 1, 2017, the annual operating expense ratio was reduced. The ratio presented for the period ended 2/28/18 is a blended ratio.

6

Annualized (except for offering costs on the gross operating expenses ratio).

7

Effective June 1, 2017, the fund instituted a new fee structure and the contractual expense limitation was terminated.

8

The ratio of net operating expenses would have been 0.49%, if certain non-routine expenses had not been incurred.

9

The ratio presented for period ended 2/28/15 is a blended ratio.

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of February 28, 2019

This section shows all the securities in the fund’s portfolio and their values as of the report date.

The fund files its complete schedule of portfolio holdings with the U.S. Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Form N-Q is available on the SEC’s website atwww.sec.gov. The fund also makes available its complete schedule of portfolio holdings 15 to 20 days after the end of the month on the fund’s website atwww.schwabfunds.com/schwabfunds_prospectus.

| Security | Number

of Shares | Value ($) |

| Common Stock99.5% of net assets |

| |

| Australia 4.9% |

| Charter Hall Retail REIT | 46,717 | 150,773 |

| Cromwell Property Group | 220,872 | 173,277 |

| Dexus | 93,794 | 800,621 |

| Goodman Group | 121,724 | 1,107,159 |

| LendLease Group | 162,889 | 1,488,815 |

| Mirvac Group | 684,453 | 1,250,879 |

| Scentre Group | 651,898 | 1,792,995 |

| Stockland | 542,234 | 1,348,564 |

| The GPT Group | 169,576 | 704,227 |

| Vicinity Centres | 306,580 | 535,692 |

| | | 9,353,002 |

| |

| Austria 0.4% |

| CA Immobilien Anlagen AG | 5,765 | 194,624 |

| IMMOFINANZ AG * | 14,083 | 348,961 |

| S IMMO AG | 9,030 | 170,891 |

| | | 714,476 |

| |

| Belgium 0.3% |

| Befimmo S.A. | 2,782 | 151,242 |

| Cofinimmo S.A. | 2,782 | 361,373 |

| | | 512,615 |

| |

| Brazil 0.5% |

| BR Malls Participacoes S.A. | 132,022 | 470,635 |

| Cyrela Brazil Realty S.A. Empreendimentos e Participacoes | 118,989 | 541,701 |

| | | 1,012,336 |

| |

| Canada 3.4% |

| Allied Properties Real Estate Investment Trust | 8,050 | 293,689 |

| Artis Real Estate Investment Trust | 40,353 | 326,577 |

| Boardwalk Real Estate Investment Trust | 8,280 | 259,043 |

| Canadian Apartment Properties REIT | 11,241 | 429,241 |

| Chartwell Retirement Residences | 25,600 | 291,804 |

| Choice Properties Real Estate Investment Trust | 14,100 | 144,756 |

| Colliers International Group, Inc. | 2,369 | 161,858 |

| Cominar Real Estate Investment Trust | 52,893 | 481,521 |

| Crombie Real Estate Investment Trust | 21,300 | 224,824 |

| Dream Global Real Estate Investment Trust | 15,977 | 164,511 |

| Dream Office Real Estate Investment Trust | 28,469 | 537,600 |

| First Capital Realty, Inc. | 21,385 | 348,088 |

| FirstService Corp. | 2,500 | 217,049 |

| Granite Real Estate Investment Trust | 4,748 | 222,436 |

| H&R Real Estate Investment Trust | 53,171 | 917,598 |

| Northview Apartment Real Estate Investment Trust | 5,900 | 124,416 |

| Security | Number

of Shares | Value ($) |

| RioCan Real Estate Investment Trust | 47,449 | 906,469 |

| SmartCentres Real Estate Investment Trust | 18,289 | 469,195 |

| | | 6,520,675 |

| |

| China 8.4% |

| Agile Group Holdings Ltd. | 473,000 | 591,066 |

| BBMG Corp., Class H | 461,000 | 169,221 |

| Beijing Capital Land Ltd., Class H | 246,000 | 103,080 |

| China Aoyuan Property Group Ltd. | 185,000 | 145,278 |

| China Evergrande Group | 364,000 | 1,123,054 |

| China Jinmao Holdings Group Ltd. | 1,214,000 | 589,124 |

| China Overseas Grand Oceans Group Ltd. | 284,000 | 111,679 |

| China Overseas Land & Investment Ltd. | 726,000 | 2,674,684 |

| China Resources Land Ltd. | 462,000 | 1,723,528 |

| China SCE Group Holdings Ltd. | 279,000 | 109,833 |

| China South City Holdings Ltd. | 1,194,000 | 199,140 |

| China Vanke Co., Ltd., Class H | 191,100 | 724,717 |

| CIFI Holdings Group Co., Ltd. | 470,000 | 306,198 |

| Country Garden Holdings Co., Ltd. | 696,000 | 915,579 |

| Country Garden Services Holdings Co., Ltd. * | 31,264 | 51,358 |

| Fantasia Holdings Group Co., Ltd. | 726,000 | 113,627 |

| Future Land Development Holdings Ltd. | 230,000 | 197,831 |

| Greentown China Holdings Ltd. | 320,000 | 272,033 |

| Guangzhou R&F Properties Co., Ltd., Class H | 397,800 | 743,787 |

| Hopson Development Holdings Ltd. | 172,000 | 159,039 |

| KWG Property Holdings Ltd. * | 244,500 | 229,941 |

| Logan Property Holdings Co., Ltd. | 116,000 | 164,853 |

| Longfor Group Holdings Ltd. | 220,500 | 653,644 |

| Poly Property Group Co., Ltd. | 867,000 | 326,701 |

| Powerlong Real Estate Holdings Ltd. | 447,000 | 208,598 |

| Shenzhen Investment Ltd. | 1,032,000 | 385,060 |

| Shimao Property Holdings Ltd. | 363,000 | 857,304 |

| Sino-Ocean Group Holding Ltd. | 1,156,500 | 540,816 |

| SOHO China Ltd. * | 978,000 | 417,711 |

| Sunac China Holdings Ltd. | 125,000 | 522,057 |

| Yuexiu Property Co., Ltd. | 2,392,000 | 551,303 |

| Yuzhou Properties Co., Ltd. | 327,503 | 159,872 |

| | | 16,041,716 |

| |

| France 3.0% |

| Covivio | 5,122 | 518,515 |

| Gecina S.A. | 3,554 | 526,291 |

| ICADE | 6,194 | 527,346 |

| Klepierre S.A. | 24,620 | 858,882 |

| Mercialys S.A. | 11,908 | 173,841 |

| Nexity S.A. | 9,530 | 464,815 |

| Unibail-Rodamco-Westfield | 16,542 | 2,663,329 |

| | | 5,733,019 |

| |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of February 28, 2019 (continued)

| Security | Number

of Shares | Value ($) |

| Germany 1.8% |

| Deutsche Euroshop AG | 4,498 | 133,342 |

| Deutsche Wohnen SE | 15,469 | 719,886 |

| LEG Immobilien AG | 5,003 | 557,815 |

| TAG Immobilien AG | 13,686 | 318,270 |

| TLG Immobilien AG | 5,421 | 157,355 |

| Vonovia SE | 32,708 | 1,583,113 |

| | | 3,469,781 |

| |

| Hong Kong 10.4% |

| CK Asset Holdings Ltd. | 297,500 | 2,468,371 |

| Great Eagle Holdings Ltd. | 52,493 | 260,233 |

| Hang Lung Group Ltd. | 210,000 | 659,899 |

| Hang Lung Properties Ltd. | 325,000 | 767,336 |

| Henderson Land Development Co., Ltd. | 126,697 | 716,352 |

| Hongkong Land Holdings Ltd. | 129,741 | 930,574 |

| Hopewell Holdings Ltd. | 46,000 | 211,562 |

| Hysan Development Co., Ltd. | 51,500 | 271,957 |

| K Wah International Holdings Ltd. | 311,000 | 167,537 |

| Kerry Properties Ltd. | 152,000 | 635,026 |

| Link REIT | 120,500 | 1,362,996 |

| New World Development Co., Ltd. | 1,466,842 | 2,341,909 |

| Road King Infrastructure Ltd. | 67,000 | 128,079 |

| Shui On Land Ltd. | 875,000 | 218,535 |

| Sino Land Co., Ltd. | 426,063 | 793,205 |

| Sun Hung Kai Properties Ltd. | 250,000 | 4,144,938 |

| Swire Properties Ltd. | 104,000 | 417,474 |

| The Wharf Holdings Ltd. | 426,000 | 1,332,612 |

| Wharf Real Estate Investment Co., Ltd. | 98,200 | 689,483 |

| Wheelock & Co., Ltd. | 181,000 | 1,226,537 |

| | | 19,744,615 |

| |

| Japan 9.8% |

| Activia Properties, Inc. | 37 | 154,189 |

| Advance Residence Investment Corp. | 96 | 266,995 |

| Aeon Mall Co., Ltd. | 23,400 | 381,547 |

| Daito Trust Construction Co., Ltd. | 15,980 | 2,214,608 |

| Daiwa House REIT Investment Corp. | 48 | 107,009 |

| Frontier Real Estate Investment Corp. | 40 | 165,110 |

| GLP J-REIT | 173 | 180,587 |

| Hulic Co., Ltd. | 29,000 | 267,051 |

| Japan Excellent, Inc. | 127 | 175,547 |

| Japan Hotel REIT Investment Corp. | 157 | 121,214 |

| Japan Prime Realty Investment Corp. | 68 | 266,840 |

| Japan Real Estate Investment Corp. | 102 | 590,601 |

| Japan Retail Fund Investment Corp. | 303 | 611,226 |

| Kenedix Office Investment Corp. | 37 | 246,916 |

| Leopalace21 Corp. | 132,700 | 287,677 |

| Mitsubishi Estate Co., Ltd. | 148,400 | 2,549,257 |

| Mitsui Fudosan Co., Ltd. | 152,500 | 3,618,955 |

| Nippon Accommodations Fund, Inc. | 39 | 193,917 |

| Nippon Building Fund, Inc. | 109 | 709,740 |

| Nippon Prologis REIT, Inc. | 97 | 206,305 |

| Nomura Real Estate Holdings, Inc. | 36,100 | 684,148 |

| Nomura Real Estate Master Fund, Inc. | 236 | 323,304 |

| Open House Co., Ltd. | 2,300 | 81,402 |

| Orix JREIT, Inc. | 144 | 236,042 |

| Relo Group, Inc. | 7,200 | 188,508 |

| Starts Corp., Inc. | 7,800 | 170,188 |

| Sumitomo Realty & Development Co., Ltd. | 54,500 | 2,039,942 |

| Tokyo Tatemono Co., Ltd. | 38,700 | 449,846 |

| Security | Number

of Shares | Value ($) |

| Tokyu Fudosan Holdings Corp. | 145,000 | 802,530 |

| United Urban Investment Corp. | 230 | 356,733 |

| | | 18,647,934 |

| |

| Netherlands 0.3% |

| Eurocommercial Properties N.V. CVA | 6,968 | 203,533 |

| NSI N.V. | 3,684 | 153,577 |

| Wereldhave N.V. | 6,465 | 188,433 |

| | | 545,543 |

| |

| Philippines 0.4% |

| Ayala Land, Inc. | 481,100 | 409,215 |

| SM Prime Holdings, Inc. | 453,600 | 335,990 |

| | | 745,205 |

| |

| Singapore 1.9% |

| Ascendas Real Estate Investment Trust | 226,900 | 469,511 |

| CapitaLand Commercial Trust | 122,700 | 175,962 |

| CapitaLand Ltd. | 392,700 | 991,993 |

| CapitaLand Mall Trust | 233,400 | 414,172 |

| Fortune Real Estate Investment Trust | 135,400 | 168,954 |

| Mapletree Commercial Trust | 91,900 | 120,193 |

| Mapletree Industrial Trust | 118,305 | 175,094 |

| Mapletree Logistics Trust | 183,640 | 187,391 |

| Mapletree North Asia Commercial Trust | 194,600 | 179,648 |

| Suntec Real Estate Investment Trust | 128,100 | 182,447 |

| UOL Group Ltd. | 66,080 | 323,640 |

| Yanlord Land Group Ltd. | 233,500 | 239,612 |

| | | 3,628,617 |

| |

| South Africa 0.6% |

| Growthpoint Properties Ltd. | 345,738 | 598,300 |

| Redefine Properties Ltd. | 591,258 | 406,533 |

| Vukile Property Fund Ltd. | 99,434 | 141,950 |

| | | 1,146,783 |

| |

| Sweden 0.9% |

| Castellum AB | 23,670 | 431,025 |

| Fabege AB | 18,835 | 252,879 |

| Hemfosa Fastigheter AB | 16,368 | 139,794 |

| Kungsleden AB | 15,481 | 115,613 |

| LE Lundbergfortagen AB, B Shares | 19,899 | 613,390 |

| Nyfosa AB * | 16,248 | 93,818 |

| Wihlborgs Fastigheter AB | 14,852 | 197,005 |

| | | 1,843,524 |

| |

| Switzerland 0.9% |

| Allreal Holding AG * | 2,321 | 372,930 |

| Mobimo Holding AG | 934 | 221,813 |

| PSP Swiss Property AG | 3,039 | 309,122 |

| Swiss Prime Site AG | 9,294 | 783,460 |

| | | 1,687,325 |

| |

| Taiwan 0.5% |

| Farglory Land Development Co., Ltd. | 134,000 | 160,264 |

| Highwealth Construction Corp. | 266,700 | 412,672 |

| Huaku Development Co., Ltd. | 68,000 | 153,668 |

| Ruentex Development Co., Ltd. | 116,280 | 182,842 |

| | | 909,446 |

| |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of February 28, 2019 (continued)

| Security | Number

of Shares | Value ($) |

| United Arab Emirates 0.3% |

| Aldar Properties PJSC | 388,974 | 188,322 |

| Emaar Properties PJSC | 262,080 | 350,111 |

| | | 538,433 |

| |

| United Kingdom 2.8% |

| Derwent London plc | 6,415 | 277,996 |

| Etalon Group plc | 63,697 | 140,133 |

| Grainger plc | 57,197 | 187,382 |

| Great Portland Estates plc | 12,976 | 130,986 |

| Hammerson plc | 89,916 | 455,504 |

| Hansteen Holdings plc | 79,493 | 103,327 |

| Intu Properties plc | 270,880 | 411,171 |

| Land Securities Group plc | 109,063 | 1,302,491 |

| McCarthy & Stone plc | 132,731 | 217,595 |

| Savills plc | 31,557 | 372,174 |

| Segro plc | 60,879 | 533,927 |

| St. Modwen Properties plc | 29,979 | 162,327 |

| The British Land Co., plc | 97,731 | 782,185 |

| The Unite Group plc | 17,187 | 208,644 |

| | | 5,285,842 |

| |

| United States 48.0% |

| Acadia Realty Trust | 6,577 | 187,379 |

| Alexander & Baldwin, Inc. * | 5,763 | 132,146 |

| Alexandria Real Estate Equities, Inc. | 5,332 | 724,565 |

| American Campus Communities, Inc. | 14,934 | 672,926 |

| American Homes 4 Rent, Class A | 9,049 | 197,630 |

| American Tower Corp. | 18,390 | 3,239,398 |

| Apartment Investment & Management Co., Class A | 15,739 | 770,109 |

| Apple Hospitality REIT, Inc. | 34,854 | 574,394 |

| Ashford Hospitality Trust, Inc. | 47,512 | 254,664 |

| AvalonBay Communities, Inc. | 9,522 | 1,853,267 |

| Boston Properties, Inc. | 17,352 | 2,302,437 |

| Brandywine Realty Trust | 28,688 | 450,975 |

| Brixmor Property Group, Inc. | 57,684 | 1,007,163 |

| Camden Property Trust | 8,769 | 860,151 |

| CBL & Associates Properties, Inc. | 156,479 | 334,865 |

| CBRE Group, Inc., Class A * | 29,952 | 1,490,412 |

| Chesapeake Lodging Trust | 9,300 | 280,116 |

| Colony Capital, Inc. | 22,918 | 127,424 |

| Columbia Property Trust, Inc. | 24,748 | 535,299 |

| CoreCivic, Inc. | 49,548 | 1,049,427 |

| CorePoint Lodging, Inc. | 4,617 | 64,499 |

| Corporate Office Properties Trust | 14,886 | 386,887 |

| Cousins Properties, Inc. | 14,560 | 138,611 |

| Crown Castle International Corp. | 22,507 | 2,672,706 |

| CubeSmart | 11,238 | 344,332 |

| CyrusOne, Inc. | 4,151 | 206,886 |

| DiamondRock Hospitality Co. | 38,895 | 415,788 |

| Digital Realty Trust, Inc. | 13,814 | 1,562,640 |

| Douglas Emmett, Inc. | 11,944 | 461,038 |

| Duke Realty Corp. | 31,842 | 941,568 |

| EastGroup Properties, Inc. | 2,270 | 239,848 |

| EPR Properties | 5,770 | 423,980 |

| Equinix, Inc. | 3,172 | 1,343,342 |

| Equity Commonwealth | 14,571 | 475,743 |

| Equity LifeStyle Properties, Inc. | 5,365 | 582,854 |

| Equity Residential | 36,589 | 2,696,243 |

| Essex Property Trust, Inc. | 3,695 | 1,034,009 |

| Extra Space Storage, Inc. | 6,476 | 621,307 |

| Federal Realty Investment Trust | 5,374 | 717,913 |

| First Industrial Realty Trust, Inc. | 7,745 | 259,612 |

| Franklin Street Properties Corp. | 26,510 | 191,932 |

| Security | Number

of Shares | Value ($) |

| Gaming & Leisure Properties, Inc. | 13,640 | 496,223 |

| HCP, Inc. | 77,054 | 2,370,952 |

| Healthcare Realty Trust, Inc. | 12,205 | 386,288 |

| Healthcare Trust of America, Inc., Class A | 13,590 | 387,179 |

| Hersha Hospitality Trust | 9,359 | 176,417 |

| Highwoods Properties, Inc. | 11,783 | 545,671 |

| Hospitality Properties Trust | 42,375 | 1,147,091 |

| Host Hotels & Resorts, Inc. | 138,686 | 2,719,632 |

| Hudson Pacific Properties, Inc. | 6,755 | 224,401 |

| Investors Real Estate Trust | 3,215 | 194,122 |

| Invitation Homes, Inc. | 6,461 | 148,603 |

| Iron Mountain, Inc. | 55,718 | 1,973,532 |

| Jones Lang LaSalle, Inc. | 7,158 | 1,181,929 |

| Kennedy-Wilson Holdings, Inc. | 6,196 | 128,753 |

| Kilroy Realty Corp. | 6,367 | 469,312 |

| Kimco Realty Corp. | 60,291 | 1,060,519 |

| Kite Realty Group Trust | 12,757 | 200,795 |

| Lamar Advertising Co., Class A | 9,361 | 726,133 |

| Lexington Realty Trust | 42,082 | 390,942 |

| Liberty Property Trust | 16,595 | 785,441 |

| Life Storage, Inc. | 3,549 | 346,382 |

| Mack-Cali Realty Corp. | 22,009 | 462,409 |

| Medical Properties Trust, Inc. | 22,685 | 413,548 |

| Mid-America Apartment Communities, Inc. | 7,738 | 801,502 |

| National Health Investors, Inc. | 2,193 | 171,120 |

| National Retail Properties, Inc. | 10,012 | 521,625 |

| New Senior Investment Group, Inc. | 30,725 | 158,541 |

| Office Properties Income Trust | 7,385 | 225,316 |

| Omega Healthcare Investors, Inc. | 17,705 | 635,610 |

| Outfront Media, Inc. | 37,875 | 849,915 |

| Paramount Group, Inc. | 22,825 | 327,767 |

| Park Hotels & Resorts, Inc. | 23,122 | 722,331 |

| Pebblebrook Hotel Trust | 22,476 | 719,457 |

| Pennsylvania Real Estate Investment Trust | 23,426 | 144,070 |

| Piedmont Office Realty Trust, Inc., Class A | 30,362 | 621,510 |

| Prologis, Inc. | 36,253 | 2,539,885 |

| PS Business Parks, Inc. | 1,681 | 247,393 |

| Public Storage | 9,130 | 1,930,904 |

| QTS Realty Trust, Inc., Class A | 2,986 | 124,606 |

| Realogy Holdings Corp. | 44,182 | 600,875 |

| Realty Income Corp. | 15,269 | 1,056,004 |

| Regency Centers Corp. | 7,792 | 508,428 |

| Retail Opportunity Investments Corp. | 5,890 | 101,131 |

| Retail Properties of America, Inc., Class A | 45,013 | 560,862 |

| Retail Value, Inc. | 4,049 | 126,045 |

| RLJ Lodging Trust | 29,119 | 540,740 |

| RPT Realty | 14,459 | 183,340 |

| Ryman Hospitality Properties, Inc. | 5,440 | 440,586 |

| Sabra Health Care REIT, Inc. | 12,394 | 224,579 |

| SBA Communications Corp. * | 3,640 | 657,238 |

| Senior Housing Properties Trust | 52,744 | 683,035 |

| Seritage Growth Properties, Class A | 2,627 | 115,982 |

| Simon Property Group, Inc. | 26,076 | 4,723,928 |

| SITE Centers Corp. | 40,285 | 537,805 |

| SL Green Realty Corp. | 10,731 | 973,516 |

| Spirit MTA REIT | 5,526 | 40,616 |

| Spirit Realty Capital, Inc. | 11,972 | 462,598 |

| STAG Industrial, Inc. | 4,386 | 121,404 |

| STORE Capital Corp. | 6,697 | 217,452 |

| Summit Hotel Properties, Inc. | 12,886 | 146,772 |

| Sun Communities, Inc. | 4,202 | 477,221 |

| Sunstone Hotel Investors, Inc. | 36,564 | 550,288 |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of February 28, 2019 (continued)

| Security | Number

of Shares | Value ($) |

| Tanger Factory Outlet Centers, Inc. | 14,852 | 320,655 |

| Taubman Centers, Inc. | 9,978 | 532,626 |

| The GEO Group, Inc. | 26,281 | 597,104 |

| The Howard Hughes Corp. * | 1,291 | 143,792 |

| The Macerich Co. | 18,101 | 789,204 |

| Tier REIT, Inc. | 8,140 | 197,395 |

| UDR, Inc. | 21,170 | 940,371 |

| Uniti Group, Inc. | 23,876 | 230,165 |

| Urban Edge Properties | 9,597 | 186,374 |

| Ventas, Inc. | 47,649 | 2,989,975 |

| VEREIT, Inc. | 119,992 | 956,336 |

| Vornado Realty Trust | 20,826 | 1,401,798 |

| Washington Prime Group, Inc. | 99,979 | 577,879 |

| Washington Real Estate Investment Trust | 10,289 | 272,556 |

| Weingarten Realty Investors | 16,474 | 474,616 |

| Welltower, Inc. | 51,341 | 3,815,150 |

| WP Carey, Inc. | 10,491 | 774,970 |

| Wyndham Destinations, Inc. | 22,573 | 1,016,462 |

| Xenia Hotels & Resorts, Inc. | 27,234 | 531,880 |

| | | 91,304,064 |

| Total Common Stock |

| (Cost $176,336,661) | | 189,384,951 |

|

| Rights0.0% of net assets |

| |

| China 0.0% |

China Aoyuan Group Ltd.

expires 03/04/19 *(a) | 2,176 | — |

| Total Rights |

| (Cost $—) | | — |

Security

Rate, Maturity Date | Face Amount

Local Currency | Value ($) |

| Short-Term Investments0.2% of net assets |

| |

| Time Deposits 0.2% |

| BNP Paribas |

| Euro | | |

| (0.57%), 03/01/19(b) | 17,085 | 19,433 |

| Brown Brothers Harriman |

| Australian Dollar | | |

| 0.76%, 03/01/19(b) | 118,002 | 83,705 |

| Canadian Dollar | | |

| 0.82%, 03/01/19(b) | 7,493 | 5,694 |

Security

Rate, Maturity Date | Face Amount

Local Currency | Value ($) |

| Hong Kong Dollar | | |

| 0.36%, 03/01/19(b) | 66,995 | 8,535 |

| Pound Sterling | | |

| 0.36%, 03/01/19(b) | 67 | 88 |

| Singapore Dollar | | |

| 0.80%, 03/01/19(b) | 13,539 | 10,014 |

| South African Rand | | |

| 5.14%, 03/01/19(b) | 198,259 | 14,067 |

| Swedish Krona | | |

| (0.55%), 03/01/19(b) | 1,612 | 175 |

| Swiss Franc | | |

| (1.44%), 03/01/19(b) | 215 | 215 |

| JPMorgan Chase Bank |

| U.S. Dollar | | |

| 1.75%, 03/01/19(b) | 32,414 | 32,414 |

| Sumitomo Mitsui Banking Corp. |

| Japanese Yen | | |

| (0.27%), 03/01/19(b) | 20,899,633 | 187,500 |

| Total Short-Term Investments |

| (Cost $361,840) | | 361,840 |

| | Number of

Contracts | Notional

Amount

($) | Current Value/

Unrealized

Appreciation

(Depreciation)

($) |

| Futures Contracts | |

| Long | |

| S&P 500 Index, e-mini, expires 03/15/19 | 2 | 278,470 | 744 |

| MSCI Emerging Markets Index, expires 03/15/19 | 4 | 209,340 | (4,628) |

| MSCI EAFE Index, expires 03/15/19 | 2 | 186,900 | (484) |

| Net Unrealized Depreciation | (4,368) |

| * | Non-income producing security. |

| (a) | Fair-valued by management using significant unobservable inputs in accordance with procedures approved by fund’s Board of Trustees. |

| (b) | The rate shown is the current daily overnight rate. |

| | |

| CVA — | Dutch Certificate |

| REIT — | Real Estate Investment Trust |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Portfolio Holdings as of February 28, 2019 (continued)

The following is a summary of the inputs used to value the fund’s investments as of February 28, 2019 (see financial note 2(a) for additional information):

| Description | Quoted Prices in

Active Markets for

Identical Assets

(Level 1) | Other Significant

Observable Inputs

(Level 2) | Significant

Unobservable Inputs

(Level 3) | Total | |

| Assets | | | | | |

| Common Stock1 | $98,837,075 | $— | $— | $98,837,075 | |

| Australia | — | 9,353,002 | — | 9,353,002 | |

| Austria | 194,624 | 519,852 | — | 714,476 | |

| Belgium | 361,373 | 151,242 | — | 512,615 | |

| China | — | 16,041,716 | — | 16,041,716 | |

| France | 518,515 | 5,214,504 | — | 5,733,019 | |

| Germany | — | 3,469,781 | — | 3,469,781 | |

| Hong Kong | — | 19,744,615 | — | 19,744,615 | |

| Japan | — | 18,647,934 | — | 18,647,934 | |

| Netherlands | 357,110 | 188,433 | — | 545,543 | |

| Philippines | — | 745,205 | — | 745,205 | |

| Singapore | 168,954 | 3,459,663 | — | 3,628,617 | |

| South Africa | 141,950 | 1,004,833 | — | 1,146,783 | |

| Sweden | 93,818 | 1,749,706 | — | 1,843,524 | |

| Switzerland | — | 1,687,325 | — | 1,687,325 | |

| Taiwan | — | 909,446 | — | 909,446 | |

| United Arab Emirates | — | 538,433 | — | 538,433 | |

| United Kingdom | 648,437 | 4,637,405 | — | 5,285,842 | |

| Rights1 | | | | | |

| China | — | — | —* | — | |

| Short-Term Investments1 | — | 361,840 | — | 361,840 | |

| Futures Contracts2 | 744 | — | — | 744 | |

| Liabilities | | | | | |

| Futures Contracts2 | (5,112) | — | — | (5,112) | |

| Total | $101,317,488 | $88,424,935 | $— | $189,742,423 | |

| * | Level 3 amount shown includes securities determined to have no value at February 28, 2019. |

| 1 | As categorized in Portfolio Holdings. |

| 2 | Futures contracts are valued at unrealized appreciation or depreciation. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Statement of Assets and Liabilities

As of February 28, 2019

| Assets |

| Investments in unaffiliated issuers, at value (cost $176,698,501) | | $189,746,791 |

| Foreign currency, at value (cost $34,422) | | 34,411 |

| Deposit with broker for futures contracts | | 85,600 |

| Receivables: | | |

| Investments sold | | 333,064 |

| Dividends | | 211,942 |

| Fund shares sold | | 183,701 |

| Foreign tax reclaims | | 35,011 |

| Prepaid expenses | + | 16,151 |

| Total assets | | 190,646,671 |

| Liabilities |

| Payables: | | |

| Investments bought | | 259,536 |

| Investment adviser fees | | 56,814 |

| Fund shares redeemed | | 91,087 |

| Variation margin on futures contracts | + | 5,161 |

| Total liabilities | | 412,598 |

| Net Assets |

| Total assets | | 190,646,671 |

| Total liabilities | – | 412,598 |

| Net assets | | $190,234,073 |

| Net Assets by Source | | |

| Capital received from investors | | 180,714,808 |

| Total distributable earnings1 | | 9,519,265 |

| Net Asset Value (NAV) |

| Net Assets | ÷ | Shares

Outstanding | = | NAV |

| $190,234,073 | | 16,649,287 | | $11.43 |

| | | | | |

| 1 | The SEC eliminated the requirement to disclose total distributable earnings (loss) by each of its components as previously disclosed as the previous presentation did not provide insight into the tax implications of distributions (see financial note 9 for additional information). |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Statement of Operations

For the period March 1, 2018 through February 28, 2019

| Investment Income |

| Dividends (net of foreign withholding tax of $296,229) | | $6,534,478 |

| Interest | + | 9,661 |

| Total investment income | | 6,544,139 |

| Expenses |

| Investment adviser fees | | 687,810 |

| Total expenses | – | 687,810 |

| Net investment income | | 5,856,329 |

| Realized and Unrealized Gains (Losses) |

| Net realized losses on investments | | (434,962) |

| Net realized losses on futures contracts | | (11,693) |

| Net realized losses on foreign currency transactions | + | (12,230) |

| Net realized losses | | (458,885) |

| Net change in unrealized appreciation (depreciation) on investments (net of change in foreign capital gains tax of ($1,371)) | | 5,774,127 |

| Net change in unrealized appreciation (depreciation) on futures contracts | | 12,506 |

| Net change in unrealized appreciation (depreciation) on foreign currency translations | + | (7,551) |

| Net change in unrealized appreciation (depreciation) | + | 5,779,082 |

| Net realized and unrealized gains | | 5,320,197 |

| Increase in net assets resulting from operations | | $11,176,526 |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Statement of Changes in Net Assets

For the current and prior report periods

| Operations | |

| | 3/1/18-2/28/19 | 3/1/17-2/28/18 |

| Net investment income | | $5,856,329 | $3,420,714 |

| Net realized gains (losses) | | (458,885) | 2,056,339 |

| Net change in unrealized appreciation (depreciation) | + | 5,779,082 | 2,023,137 |

| Increase in net assets from operations | | 11,176,526 | 7,500,190 |

| Distributions to Shareholders1 | |

| Total distributions | | ($8,781,234) | ($4,174,000) |

| Transactions in Fund Shares | | | |

| | | 3/1/18-2/28/19 | 3/1/17-2/28/18 |

| | | SHARES | VALUE | SHARES | VALUE |

| Shares sold | | 6,151,264 | $69,415,729 | 7,075,682 | $80,763,586 |

| Shares reinvested | | 630,628 | 6,879,385 | 280,696 | 3,217,737 |

| Shares redeemed | + | (4,222,676) | (46,815,739) | (1,899,092) | (21,552,849) |

| Net transactions in fund shares | | 2,559,216 | $29,479,375 | 5,457,286 | $62,428,474 |

| Shares Outstanding and Net Assets | | | |

| | | 3/1/18-2/28/19 | 3/1/17-2/28/18 |

| | | SHARES | NET ASSETS | SHARES | NET ASSETS |

| Beginning of period | | 14,090,071 | $158,359,406 | 8,632,785 | $92,604,742 |

| Total increase | + | 2,559,216 | 31,874,667 | 5,457,286 | 65,754,664 |

| End of period2 | | 16,649,287 | $190,234,073 | 14,090,071 | $158,359,406 |

| 1 | For the period ended February 28, 2018, the fund distributed to shareholders $3,812,190 from net investment income and $361,810 from net realized gains. The SEC eliminated the requirement to disclose distributions to shareholders from net investment income and from net realized gains in 2018 (see financial note 9 for additional information). |

| 2 | End of period - Net assets include distributions in excess of net investment income of ($1,056,494) at February 28, 2018. The SEC eliminated the requirement to disclose undistributed net investment income in 2018. |

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

1. Business Structure of the Fund:

Schwab Fundamental Global Real Estate Index Fund is a series of Schwab Capital Trust (the trust), a no-load, open-end management investment company. The trust is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended (the 1940 Act). The list below shows all the funds in the trust as of the end of the period, including the fund discussed in this report, which is highlighted:

| SCHWAB CAPITAL TRUST (ORGANIZED MAY 7, 1993) |

| Schwab Fundamental Global Real Estate Index Fund | Schwab Target 2010 Fund |

| Schwab Fundamental US Large Company Index Fund | Schwab Target 2015 Fund |

| Schwab Fundamental US Small Company Index Fund | Schwab Target 2020 Fund |

| Schwab Fundamental International Large Company Index Fund | Schwab Target 2025 Fund |

| Schwab Fundamental International Small Company Index Fund | Schwab Target 2030 Fund |

| Schwab Fundamental Emerging Markets Large Company Index Fund | Schwab Target 2035 Fund |

| Schwab S&P 500 Index Fund | Schwab Target 2040 Fund |

| Schwab Small-Cap Index Fund | Schwab Target 2045 Fund |

| Schwab Total Stock Market Index Fund | Schwab Target 2050 Fund |

| Schwab U.S. Large-Cap Growth Index Fund | Schwab Target 2055 Fund |

| Schwab U.S. Large-Cap Value Index Fund | Schwab Target 2060 Fund |

| Schwab U.S. Mid-Cap Index Fund | Schwab Monthly Income Fund — Moderate Payout |

| Schwab International Index Fund | Schwab Monthly Income Fund — Enhanced Payout |

| Schwab MarketTrack All Equity Portfolio™ | Schwab Monthly Income Fund — Maximum Payout |

| Schwab MarketTrack Growth Portfolio™ | Schwab Target 2010 Index Fund |

| Schwab MarketTrack Balanced Portfolio™ | Schwab Target 2015 Index Fund |

| Schwab MarketTrack Conservative Portfolio™ | Schwab Target 2020 Index Fund |

| Laudus International MarketMasters Fund™ | Schwab Target 2025 Index Fund |

| Schwab Balanced Fund | Schwab Target 2030 Index Fund |

| Schwab Core Equity Fund | Schwab Target 2035 Index Fund |

| Schwab Dividend Equity Fund | Schwab Target 2040 Index Fund |

| Schwab Large-Cap Growth Fund | Schwab Target 2045 Index Fund |

| Schwab Small-Cap Equity Fund | Schwab Target 2050 Index Fund |

| Schwab Hedged Equity Fund | Schwab Target 2055 Index Fund |

| Schwab Health Care Fund | Schwab Target 2060 Index Fund |

| Schwab International Core Equity Fund | |

Schwab Fundamental Global Real Estate Index Fund offers one share class. Shares are bought and sold at closing net asset value per share (NAV), which is the price for all outstanding shares of the fund. Each share has a par value of 1/1,000 of a cent, and the fund’s Board of Trustees (the Board) may authorize the issuance of as many shares as necessary.

The fund maintains its own account for purposes of holding assets and accounting, and is considered a separate entity for tax purposes. Within its account, the fund may also keep certain assets in segregated accounts, as required by securities law.

2. Significant Accounting Policies:

The following is a summary of the significant accounting policies the fund uses in its preparation of financial statements. The fund follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (FASB) Accounting Standard CodificationTopic 946 Financial Services — Investment Companies. The accounting policies are in conformity with accounting principles generally accepted in the United States of America (GAAP).

The fund may invest in certain other investment companies (underlying funds). For more information about the underlying funds’ operations and policies, please refer to those funds’ semiannual and annual reports, which are filed with the U.S. Securities and Exchange Commission (SEC).

Effective November 5, 2018, the fund adopted SEC Regulation S-X disclosure requirement changes. The adopted changes are reflected throughout this report.

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Notes(continued)

2. Significant Accounting Policies (continued):

(a) Security Valuation:

Under procedures approved by the Board, the investment adviser has formed a Pricing Committee to administer the pricing and valuation of portfolio securities and other assets and to ensure that prices used for internal purposes or provided by third parties reasonably reflect fair market value. Among other things, these procedures allow the fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

The fund values the securities in its portfolio every business day. The fund uses the following policies to value various types of securities:

• Securities traded on an exchange or over-the-counter:Traded securities are valued at the closing value for the day, or, on days when no closing value has been reported, at the mean of the most recent bid and ask quotes. Securities that are primarily traded on foreign exchanges are valued at the official closing price or the last sales price on the exchange where the securities are principally traded with these values then translated into U.S. dollars at the current exchange rate, unless these securities are fair valued as discussed below.

• Securities for which no quoted value is available:The Board has adopted procedures to fair value the fund’s securities when market prices are not “readily available” or are unreliable. For example, the fund may fair value a security when it is de-listed or its trading is halted or suspended; when a security’s primary pricing source is unable or unwilling to provide a price; or when a security’s primary trading market is closed during regular market hours. The fund makes fair value determinations in good faith in accordance with the fund’s valuation procedures. The Pricing Committee considers a number of factors, including unobservable market inputs when arriving at fair value. The Pricing Committee may employ techniques such as the review of related or comparable assets or liabilities, related market activities, recent transactions, market multiples, book values, transactional back-testing, disposition analysis and other relevant information. The Pricing Committee regularly reviews these inputs and assumptions to calibrate the valuations. Due to the subjective and variable nature of fair value pricing, there can be no assurance that the fund could obtain the fair value assigned to the security upon the sale of such security. The Board convenes on a regular basis to review fair value determinations made by the fund pursuant to the valuation procedures.

• Foreign equity security fair valuation:The Board has adopted procedures to fair value foreign equity securities that are traded in markets that close prior to the fund valuing its holdings. By fair valuing securities whose prices may have been affected by events occurring after the close of trading, the fund seeks to establish prices that investors might expect to realize upon the current sales of these securities. This methodology is designed to deter “arbitrage” market timers, who seek to exploit delays between the change in the value of the fund’s portfolio holdings and the NAV of the fund’s shares, and seeks to help ensure that the prices at which the fund’s shares are purchased and redeemed are fair and do not result in dilution of shareholder interest or other harm to shareholders. When fair value pricing is used at the open or close of a reporting period, it may cause a temporary divergence between the return of the fund and that of its comparative index or benchmark. The Board regularly reviews fair value determinations made by the fund pursuant to these procedures.

• Futures contracts:Futures contracts are valued at their settlement prices as of the close of their exchanges.

In accordance with the authoritative guidance on fair value measurements and disclosures under GAAP, the fund discloses the fair value of its investments in a hierarchy that prioritizes the significant inputs to valuation techniques used to measure the fair value. The hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation (Level 3 measurements). If inputs used to measure the financial instruments fall within different levels of the hierarchy, the categorization is based on the lowest level input that is significant to the valuation. If the fund determines that either the volume and/or level of activity for an asset or liability has significantly decreased (from normal conditions for that asset or liability) or price quotations or observable inputs are not associated with orderly transactions, increased analysis and management judgment will be required to estimate fair value.

The three levels of the fair value hierarchy are as follows:

• Level 1—quoted prices in active markets for identical securities—Investments whose values are based on quoted market prices in active markets, and whose values are therefore classified as Level 1 prices, include active listed equities and futures contracts.

• Level 2—other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.)—Investments that trade in markets that are not considered to be active, but whose values are based on quoted market prices, dealer quotations or valuations provided by alternative pricing sources supported by observable inputs are classified as Level 2 prices. These generally include U.S. government and sovereign obligations, most government agency

Schwab Fundamental Global Real Estate Index Fund | Annual Report

Schwab Fundamental Global Real Estate Index Fund

Financial Notes(continued)

2. Significant Accounting Policies (continued):

securities, investment-grade corporate bonds, certain mortgage products, less liquid listed equities, and state, municipal and provincial obligations. In addition, international securities whose markets close hours before the fund values its holdings may require fair valuations due to significant movement in the U.S. markets occurring after the daily close of the foreign markets. The Board has approved a vendor that calculates fair valuations of international equity securities based on a number of factors that appear to correlate to the movements in the U.S. markets.

• Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments)—Investments whose values are classified as Level 3 prices have significant unobservable inputs, as they may trade infrequently or not at all. When observable prices are not available for these securities, the fund uses one or more valuation techniques for which sufficient and reliable data is available. The inputs used by the fund in estimating the value of Level 3 prices may include the original transaction price, quoted prices for similar securities or assets in active markets, completed or pending third-party transactions in the underlying investment or comparable issuers, and changes in financial ratios or cash flows. Level 3 prices may also be adjusted to reflect illiquidity and/or non-transferability, with the amount of such discount estimated by the fund in the absence of market information. Assumptions used by the fund due to the lack of observable inputs may significantly impact the resulting fair value and therefore the fund’s results of operations.

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The levels associated with valuing the fund’s investments as of February 28, 2019 are disclosed in the Portfolio Holdings.

(b) Accounting Policies for certain Portfolio Investments (if held):

Futures Contracts: Futures contracts are instruments that represent an agreement between two parties that obligates one party to buy, and the other party to sell, specific instruments at an agreed upon price on a stipulated future date. The fund must give the broker a deposit of cash and/or securities (initial margin) whenever it enters into a futures contract. The amount of the deposit may vary from one contract to another. Subsequent payments (variation margin) are made or received by the fund depending on the daily fluctuations in the value of the futures contract and are accounted for as unrealized appreciation or depreciation until the contract is closed, at which time the gains or losses are realized. Futures contracts are traded publicly on exchanges, and their market value may change daily.