UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number:811-07704

Schwab Capital Trust – Target Index Funds

(Exact name of registrant as specified in charter)

211 Main Street, San Francisco, California 94105

(Address of principal executive offices) (Zip code)

Jonathan de St. Paer

Schwab Capital Trust

211 Main Street, San Francisco, California 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (415)636-7000

Date of fiscal year end: March 31

Date of reporting period: March 31, 2019

Item 1: Report(s) to Shareholders.

Annual Report | March 31, 2019

Schwab Target Index Funds

Schwab Target 2010 Index Fund

Schwab Target 2015 Index Fund

Schwab Target 2020 Index Fund

Schwab Target 2025 Index Fund

Schwab Target 2030 Index Fund

Schwab Target 2035 Index Fund

Schwab Target 2040 Index Fund

Schwab Target 2045 Index Fund

Schwab Target 2050 Index Fund

Schwab Target 2055 Index Fund

Schwab Target 2060 Index Fund

| New Notice Regarding Shareholder Report Delivery Options |

| Beginning on January 1, 2021, paper copies of a fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from a fund or from your financial intermediary (such as a bank or broker-dealer). Instead, the reports will be made available on a fund’s websitewww.schwabfunds.com/schwabfunds_prospectus, and you will be notified by mail each time a report is posted and the mailing will provide a website link to access the report. You will continue to receive other fund regulatory documents (such as prospectuses or supplements) in paper unless you have elected to receive all fund documents electronically as described below. |

| If you would like to continue to receive a fund’s future shareholder reports in paper free of charge after January 1, 2021, you can make that request: (1) by contacting your financial intermediary, if you invest through a financial intermediary; or (2) if you invest directly with a fund, by calling 1-800-407-0256. |

| If you already receive shareholder reports and other fund documents electronically, you will not be affected by this change and you need not take any action. If you do not receive shareholder reports and other fund documents electronically but would like to do so, contact your financial intermediary or, if you invest directly with the funds, call 1-800-407-0256. |

This page is intentionally left blank.

Schwab Target Index Funds

Fund investment adviser: Charles Schwab Investment Management, Inc. (CSIM)

Distributor: Charles Schwab & Co., Inc. (Schwab)

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

| Total Returns For the 12 Months Ended March 31, 2019 |

| Schwab Target 2010 Index Fund (Ticker Symbol: SWYAX) | 4.81% |

| Target 2010 Passive Composite Index | 4.82% |

| Fund Category: Morningstar Target-Date 2000-20101 | 3.36% |

| Performance Details | pages 9-11 |

| |

| Schwab Target 2015 Index Fund (Ticker Symbol: SWYBX) | 4.74% |

| Target 2015 Passive Composite Index | 4.85% |

| Fund Category: Morningstar Target-Date 20151 | 3.48% |

| Performance Details | pages 12-14 |

| |

| Schwab Target 2020 Index Fund (Ticker Symbol: SWYLX) | 4.73% |

| Target 2020 Passive Composite Index | 4.81% |

| Fund Category: Morningstar Target-Date 20201 | 3.38% |

| Performance Details | pages 15-17 |

| |

| Schwab Target 2025 Index Fund (Ticker Symbol: SWYDX) | 4.79% |

| Target 2025 Passive Composite Index | 4.95% |

| Fund Category: Morningstar Target-Date 20251 | 3.38% |

| Performance Details | pages 18-20 |

| |

| Schwab Target 2030 Index Fund (Ticker Symbol: SWYEX) | 4.76% |

| Target 2030 Passive Composite Index | 4.96% |

| Fund Category: Morningstar Target-Date 20301 | 3.31% |

| Performance Details | pages 21-23 |

| |

| Schwab Target 2035 Index Fund (Ticker Symbol: SWYFX) | 4.68% |

| Target 2035 Passive Composite Index | 4.89% |

| Fund Category: Morningstar Target-Date 20351 | 3.17% |

| Performance Details | pages 24-26 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The components that make up each of the composite indices may vary over time. For index definitions, please see the Glossary.

Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, a fund’s total return would have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

| 1 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| | |

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

Performance at a Glance(continued)

| Total Returns For the 12 Months Ended March 31, 2019 |

| Schwab Target 2040 Index Fund (Ticker Symbol: SWYGX) | 4.49% |

| Target 2040 Passive Composite Index | 4.77% |

| Fund Category: Morningstar Target-Date 20401 | 3.04% |

| Performance Details | pages 27-29 |

| |

| Schwab Target 2045 Index Fund (Ticker Symbol: SWYHX) | 4.33% |

| Target 2045 Passive Composite Index | 4.67% |

| Fund Category: Morningstar Target-Date 20451 | 2.94% |

| Performance Details | pages 30-32 |

| |

| Schwab Target 2050 Index Fund (Ticker Symbol: SWYMX) | 4.23% |

| Target 2050 Passive Composite Index | 4.60% |

| Fund Category: Morningstar Target-Date 20501 | 2.87% |

| Performance Details | pages 33-35 |

| |

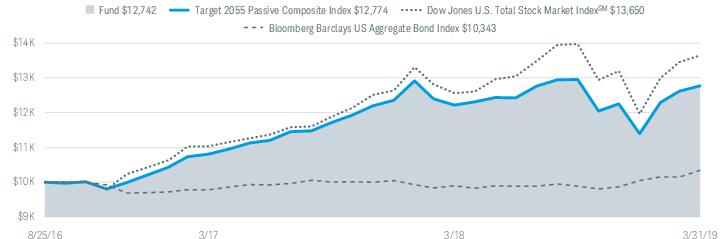

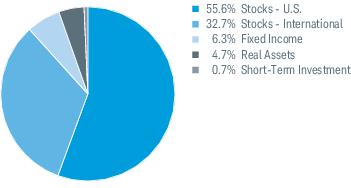

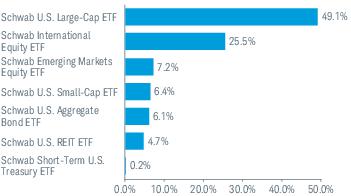

| Schwab Target 2055 Index Fund (Ticker Symbol: SWYJX) | 4.15% |

| Target 2055 Passive Composite Index | 4.53% |

| Fund Category: Morningstar Target-Date 20551 | 2.84% |

| Performance Details | pages 36-38 |

| |

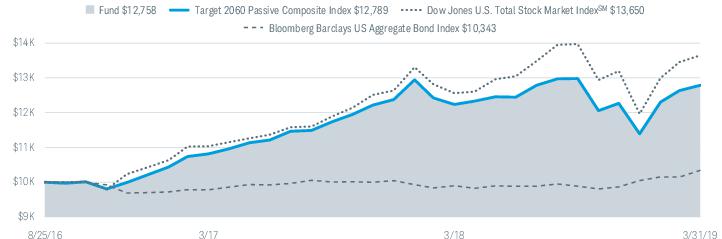

| Schwab Target 2060 Index Fund (Ticker Symbol: SWYNX) | 4.23% |

| Target 2060 Passive Composite Index | 4.50% |

| Fund Category: Morningstar Target-Date 2060+1 | 2.99% |

| Performance Details | pages 39-41 |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The components that make up each of the composite indices may vary over time. For index definitions, please see the Glossary.

Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, a fund’s total return would have been lower. Performance does not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption of fund shares.

| 1 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

Jonathan de St. Paer

President and CEO of

Charles Schwab Investment

Management, Inc. and the

funds covered in this report.

Dear Shareholder,

Recent months provided a stark reminder that market trends can reverse quickly. The declines in stocks that dominated headlines in the late stages of 2018 became a backstory this year to a broad-based recovery that saw most equity positions not only make up lost ground, but deliver solid returns over the 12 months ended March 31, 2019. Similarly, fixed income lost value in September and October but then rallied in November as expectations on interest rates shifted, and many bond investments also ended the period with positive returns.

At Charles Schwab Investment Management, we often talk about the importance of diversification, creating a long-term investing plan, and sticking to it. This is because trying to time the markets can be a losing strategy for most investors. However, we also recognize it can be tempting to veer from that plan when markets fluctuate. We believe that for most investors it is better to hold a portfolio that’s diversified and rebalanced regularly so that they can stay focused on their long-term financial goals. That’s why we seek to provide straightforward products that can help you keep that focus and weather the market volatility that may come along the way.

The Schwab Target Index Funds play an important role in fulfilling this objective. With their mix of domestic and international equities, fixed income, real estate, and cash, the funds provide an all-in-one portfolio solution. They incorporate the diversification and regular rebalancing that can help cushion a portfolio from market turbulence. This provides investors an opportunity for better results, and potentially less volatility, as compared with a self-directed asset allocation.

The asset weights in the Schwab Target Index Funds are shifted to become more conservative over time, adjusting your portfolio mix as you get closer to retirement. This asset allocation approach creates greater opportunity for growth when your target retirement date is far in the future, and shifts toward income and capital preservation as it gets closer. This provides investors with a straightforward way to stay aligned with their long-term goals—and not be distracted by any sudden turns in the markets.

Charles Schwab Investment Management has become one of the largest and most experienced asset managers in the industry not by offering more choices than our competitors, but by providing carefully developed products, like the Schwab Target Index Funds, that can help simplify decision-making. This is a cornerstone of our investing philosophy—and will continue to be.

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

From the President(continued)

“On April 1, 2019, I transitioned into the role of Chief Executive Officer of Charles Schwab Investment Management, replacing Marie Chandoha upon her retirement.”

On April 1, 2019, I transitioned into the role of Chief Executive Officer of Charles Schwab Investment Management, replacing Marie Chandoha upon her retirement. Looking back at how Charles Schwab Investment Management has grown into the market leader it is today, I believe Marie deserves particular credit. As CEO for over eight years, Marie provided the vision and leadership that has helped us stay focused on the goal of providing cost-effective funds to support investors in meeting their investment objectives. It’s been my privilege to be part of the great team Marie built.

I look forward to furthering our organization’s important mission. As we encounter ups and downs in the investment environment, it becomes even more important to serve our investors to the best of our ability. At Charles Schwab Investment Management we seek to offer products that help investors build portfolios that serve their needs, even during the more difficult stretches in the market.

Thank you for investing with Charles Schwab Investment Management. For more information about the Schwab Target Index Funds, please continue reading this report. In addition, you can find further details about these funds by visiting our website at www.schwabfunds.com. We are also happy to hear from you at 1-877-824-5615.

Sincerely,

Diversification and asset allocation strategies do not ensure a profit and cannot protect against losses in a declining market.

Management views may have changed since the report date.

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

The Investment Environment

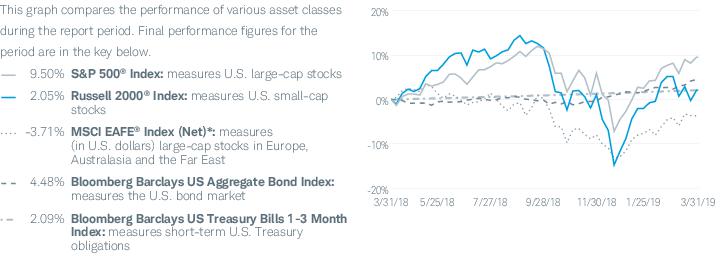

For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains and driving major indices to near–bear market territory as investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. However, as the Federal Reserve (Fed) put interest rate hikes on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. Over the period, the U.S. dollar strengthened against a basket of foreign currencies, generally reducing the returns on overseas investments in U.S. dollar terms. In this environment, the S&P 500® Index, a bellwether for the overall U.S. stock market, returned 9.50% for the reporting period. U.S. large-cap-cap stocks outperformed small-caps, with the Russell RAFI™ US Large Company Index and the Russell 2000® Index returning 7.10% and 2.05%, respectively. The MSCI EAFE® Index (Net)*, a broad measure of developed international equity performance, returned -3.71%, and the MSCI Emerging Markets Index (Net)* returned -7.41%. The Bloomberg Barclays US Aggregate Bond Index, representing the broad U.S. fixed-income market, returned 4.48%.

The U.S. economy exhibited stable growth for much of the reporting period as it entered its tenth year of expansion, buoyed by a combination of tax reform early in the reporting period, strong corporate earnings, and still-positive financial conditions. Toward the end of 2018 the U.S. economy showed signs of slowing. U.S. gross domestic product (GDP) grew at an annual rate of 2.2% in the fourth quarter of 2018, down from 4.2% and 3.4% in the second and third quarters, respectively. Seasonally adjusted nonfarm payrolls were steady, and unemployment remained low. Even amid a tight labor market and growing economy, inflation fell during the period, primarily due to lower energy prices, and wage growth remained in check. Consumer confidence, which hit an 18-year high in October, the highest since 2000,

Asset Class Performance Comparison % returns during the 12 months ended March 31, 2019

Index figures assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized. Past performance is not an indication of future results.

For index definitions, please see the Glossary.

Data source: Index provider websites and CSIM.

Nothing in this report represents a recommendation of a security by the investment adviser.

Management views may have changed since the report date.

| * | The net version of the index reflects reinvested dividends net of withholding taxes, but reflects no deductions for expenses or other taxes. |

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

The Investment Environment(continued)

fell for the subsequent three months before rebounding in February and March against the backdrop of the market’s rally and the end of the 35-day partial government shutdown that began in late December and extended through late January.

Outside the U.S., conditions continued to soften. After reaching a nearly three-year high in October, global oil prices fell precipitously over the last three months of 2018, ending the year down 25% amid concerns of economic slowing and a global oil glut. Prices rebounded somewhat in the first quarter of 2019 as major exporters sought to curb supply and central banks took steps to ease growth-related fears. In the final quarter of 2018, the eurozone economy expanded by 0.2%, down from 0.7% a year earlier, subdued by political tensions as well as a sharp decline in the manufacturing sector’s new export orders. Japan’s economy contracted in the third quarter of 2018 but grew in the second and fourth quarters. The United Kingdom’s economy grew modestly in the second and third quarters of 2018 but contracted in the fourth quarter amid ongoing Brexit-related economic and political uncertainty as well as rapidly growing wage pressures. Several Asian economies, including China and India, also exhibited signs of slowing but still outpaced many developed economies. During much of the period, trade issues dominated headlines—particularly between the U.S. and China. Following the implementation of a series of tariffs on goods and services from both sides, as of the end of the period, negotiations are underway between the two countries to resolve the underlying issues.

Monetary policy measures remained generally accommodative during the reporting period. In the U.S., despite continuing low levels of inflation, the Fed raised the federal funds rate by 0.25% three times over the reporting period—in June, September, and December. At its January and March meetings, the Fed left rates unchanged and dialed back its projections for further rate hikes in 2019 as growth slowed and inflation remained in check. Fed interest rates ended the reporting period in a target range of 2.25% to 2.50%. Over the reporting period, the Fed continued its program to reduce the size of its balance sheet, although in March it indicated its intention to slow the reduction. As of the end of the reporting period, the Fed’s balance sheet stood at just under $4 trillion, down from $4.5 trillion when the program was announced in June 2017.

Outside the U.S., most central banks maintained accommodative monetary policies or, in some cases, in the face of signs of rising inflation, tightened their policies. The European Central Bank has held interest rates unchanged since early 2016 and in March announced that it would likely maintain those rates at least through the end of 2019, but ended its monthly asset purchase program in December. Also in March, the Bank of Japan upheld its short-term interest rate target of –0.1%, also unchanged since 2016, and maintained its pledge to keep interest rates extremely low for an extended period. After raising its key official bank rate in August amid rising inflation projections and higher energy and import prices, the Bank of England maintained its rate of 0.75% during the reporting period despite ongoing uncertainties over the United Kingdom economy’s wider direction and intensifying uncertainties surrounding the impact of Brexit. Central banks in several emerging market economies—including India, Indonesia, Mexico, and Turkey—raised policy rates during the reporting period in response to inflation and exchange-rate pressures. In February, however, India subsequently lowered its policy rate and in December, the People’s Bank of China maintained its prudent, but no longer neutral, policy stance, indicating it would place a greater focus on flexibility as its economy faces continued headwinds.

Over the reporting period, the U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations. In May and again in September, 10-year yields pushed above 3.00%, relieving some pressure on the yield curve, but as equity markets tumbled at the end of 2018 and signs of slowing economic growth intensified, investors flocked to longer-term bonds, driving prices higher and yields lower for most of the remainder of the period. (Bond yields and bond prices move in opposite directions). In late March, parts of the yield curve inverted for several days, raising recession concerns for some, but it quickly reverted as the likelihood of an imminent recession appeared low. The 2-year Treasury yield began and ended the reporting period at 2.27% and the 10-year Treasury yield ended the period at 2.41%, down from 2.74% at the beginning of the period.

Schwab Target Index Funds | Annual Report

Schwab Target Index Funds

| Zifan Tang, Ph.D., CFA, Senior Portfolio Manager, is responsible for the co-management of the funds. She has served as portfolio manager of the funds since August 2016. Prior to joining CSIM in 2012, Ms. Tang was a product manager at Thomson Reuters and, from 1997 to 2009, worked as a portfolio manager at Barclays Global Investors, which was subsequently acquired by BlackRock. |

| Patrick Kwok, CFA, Portfolio Manager, is responsible for the co-management of the funds. He has served as portfolio manager of the funds since July 2018. Prior to joining CSIM in 2008, Mr. Kwok spent two years as an asset operations specialist at Charles Schwab Trust Company. He also previously worked for one year at State Street Bank & Trust as a portfolio accountant and pricing specialist. |

Schwab Target Index Funds | Annual Report

Schwab Target 2010 Index Fundas of March 31, 2019

The Schwab Target 2010 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab Funds and Laudus Funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the last annual adjustment at the end of January 2019, the fund’s asset allocation was approximately 35.9% equity securities, 56.8% fixed-income securities, and 7.3% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, however, investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. Volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains. However, as the Federal Reserve put interest rates on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. The U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations.

Performance. For the 12-month reporting period ended March 31, 2019, the fund returned 4.81%. The fund’s internally calculated comparative index, the Target 2010 Passive Composite Index (the composite index), returned 4.82% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s overall fixed-income allocation provided the greatest contribution to total return. The Schwab U.S. Aggregate Bond ETF, the fund’s intermediate-term bond component, returned approximately 4.6%, while the Schwab Short-Term U.S. Treasury ETF returned approximately 2.7% and slightly underperformed the fund’s short-term bond comparative index, the Bloomberg Barclays US Treasury 1-3 Year Index. The fund’s U.S. TIPS fixed-income exposure also contributed to total return, with the Schwab U.S. TIPS ETF returning approximately 2.8%.

The fund’s equity exposure also contributed to total return, particularly the fund’s U.S. large-cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF, which returned approximately 9.3%. The fund’s U.S. small-cap holding, the Schwab U.S. Small-Cap ETF, also contributed slightly, returning approximately 2.5%. The international equity component, however, was the only detractor from total return. The Schwab International Equity ETF returned approximately -4.4%.

The fund’s real estate allocation contributed to the fund’s total return. The Schwab U.S. REIT ETF returned approximately 19.7%, tracking its comparative index, the Dow Jones U.S. Select REIT Index.

Management views and portfolio holdings may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2010 Index Fund

Performance and Fund Factsas of March 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

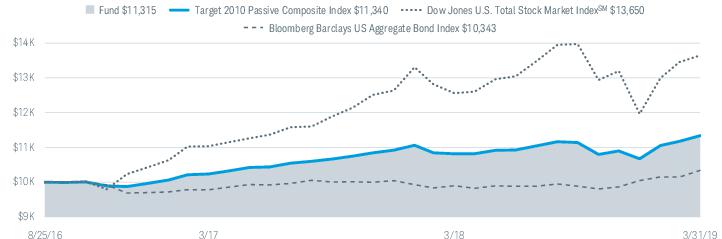

Performance of Hypothetical $10,000 Investment (August 25, 2016 – March 31, 2019)1,2

Average Annual Total Returns1,2

| Fund and Inception Date | 1 Year | Since Inception |

| Schwab Target 2010 Index Fund (8/25/16) | 4.81% | 4.87% |

| Target 2010 Passive Composite Index | 4.82% | 4.97% |

| Dow Jones U.S. Total Stock Market IndexSM | 8.66% | 12.74% |

| Bloomberg Barclays US Aggregate Bond Index | 4.48% | 1.31% |

| Fund Category: Morningstar Target-Date 2000-20103 | 3.36% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Share class and Institutional Share class of the fund were consolidated into a single class of shares of the fund. The performance and financial history of the fund is that of the fund’s former Institutional Shares. Accordingly, the past performance shown is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2010 Index Fund

Performance and Fund Factsas of March 31, 2019 (continued)

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 30% |

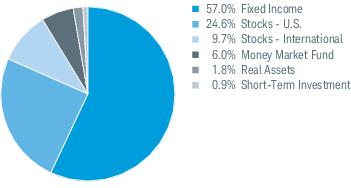

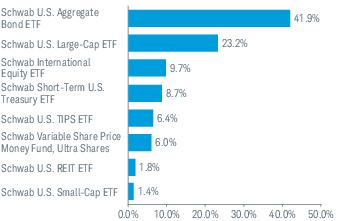

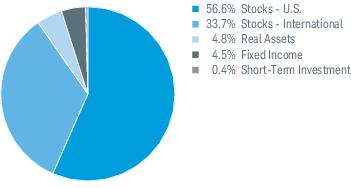

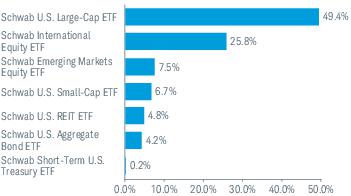

Asset Class Weightings % of Investments1,2

Top Holdings % of Net Assets3,4

Portfolio holdings may have changed since the report date.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2015 Index Fundas of March 31, 2019

The Schwab Target 2015 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab Funds and Laudus Funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the last annual adjustment at the end of January 2019, the fund’s asset allocation was approximately 38.5% equity securities, 54.7% fixed-income securities, and 6.8% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, however, investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. Volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains. However, as the Federal Reserve put interest rates on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. The U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations.

Performance. For the 12-month reporting period ended March 31, 2019, the fund returned 4.74%. The fund’s internally calculated comparative index, the Target 2015 Passive Composite Index (the composite index), returned 4.85% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were broadly in line with those of the composite index over the reporting period.

The fund’s overall fixed-income allocation provided the greatest contribution to total return. The Schwab U.S. Aggregate Bond ETF, the fund’s intermediate-term bond component, returned approximately 4.6%, while the Schwab Short-Term U.S. Treasury ETF returned approximately 2.7% and slightly underperformed the fund’s short-term bond comparative index, the Bloomberg Barclays US Treasury 1-3 Year Index. The fund’s U.S. TIPS fixed-income exposure also contributed to total return, with the Schwab U.S. TIPS ETF returning approximately 2.8%.

The fund’s equity exposure also contributed to total return, particularly the fund’s U.S. large-cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF, which returned approximately 9.3%. The fund’s U.S. small-cap holding, the Schwab U.S. Small-Cap ETF, also contributed slightly, returning approximately 2.5%. The international equity component, however, was the only detractor from total return. The Schwab International Equity ETF returned approximately -4.4%.

The fund’s real estate allocation contributed to the fund’s total return. The Schwab U.S. REIT ETF returned approximately 19.7%, tracking its comparative index, the Dow Jones U.S. Select REIT Index.

Management views and portfolio holdings may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2015 Index Fund

Performance and Fund Factsas of March 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

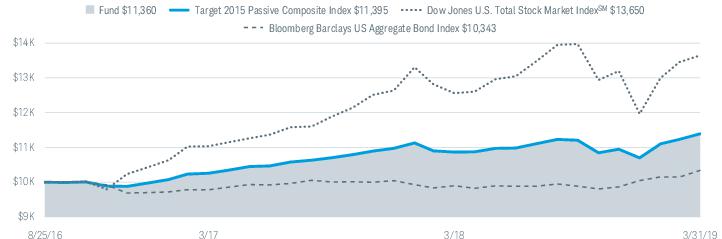

Performance of Hypothetical $10,000 Investment (August 25, 2016 – March 31, 2019)1,2

Average Annual Total Returns1,2

| Fund and Inception Date | 1 Year | Since Inception |

| Schwab Target 2015 Index Fund (8/25/16) | 4.74% | 5.03% |

| Target 2015 Passive Composite Index | 4.85% | 5.16% |

| Dow Jones U.S. Total Stock Market IndexSM | 8.66% | 12.74% |

| Bloomberg Barclays US Aggregate Bond Index | 4.48% | 1.31% |

| Fund Category: Morningstar Target-Date 20153 | 3.48% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Share class and Institutional Share class of the fund were consolidated into a single class of shares of the fund. The performance and financial history of the fund is that of the fund’s former Institutional Shares. Accordingly, the past performance shown is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2015 Index Fund

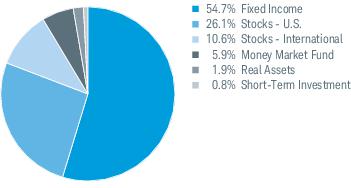

Performance and Fund Factsas of March 31, 2019 (continued)

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 29% |

Asset Class Weightings % of Investments1,2

Top Holdings % of Net Assets3,4

Portfolio holdings may have changed since the report date.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2020 Index Fundas of March 31, 2019

The Schwab Target 2020 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab Funds and Laudus Funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the last annual adjustment at the end of January 2019, the fund’s asset allocation was approximately 43.3% equity securities, 50.6% fixed-income securities, and 6.1% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, however, investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. Volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains. However, as the Federal Reserve put interest rates on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. The U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations.

Performance. For the 12-month reporting period ended March 31, 2019, the fund returned 4.73%. The fund’s internally calculated comparative index, the Target 2020 Passive Composite Index (the composite index), returned 4.81% for the same period.

Positioning and Strategies.1 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s equity exposure provided the greatest contribution to total return, particularly the fund’s U.S. large-cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF, which returned approximately 9.3%. The fund’s U.S. small-cap holding, the Schwab U.S. Small-Cap ETF, also contributed slightly, returning approximately 2.5%. The international equity and emerging markets components, however, detracted from total return. The Schwab International Equity ETF and Schwab Emerging Markets Equity ETF returned approximately -4.4% and -7.0%, respectively.

The fund’s overall fixed-income allocation also contributed to total return. The Schwab U.S. Aggregate Bond ETF, the fund’s intermediate-term bond component, returned approximately 4.6%, while the Schwab Short-Term U.S. Treasury ETF returned approximately 2.7% and slightly underperformed the fund’s short-term bond comparative index, the Bloomberg Barclays US Treasury 1-3 Year Index. The fund’s U.S. TIPS fixed-income exposure also contributed to total return, with the Schwab U.S. TIPS ETF returning approximately 2.8%.

The fund’s real estate allocation contributed to the fund’s total return. The Schwab U.S. REIT ETF returned approximately 19.7%, tracking its comparative index, the Dow Jones U.S. Select REIT Index.

Management views and portfolio holdings may have changed since the report date.

| 1 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2020 Index Fund

Performance and Fund Factsas of March 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

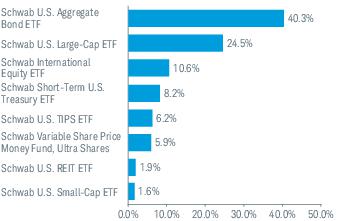

Performance of Hypothetical $10,000 Investment (August 25, 2016 – March 31, 2019)1,2

Average Annual Total Returns1,2

| Fund and Inception Date | 1 Year | Since Inception |

| Schwab Target 2020 Index Fund (8/25/16) | 4.73% | 6.07% |

| Target 2020 Passive Composite Index | 4.81% | 6.15% |

| Dow Jones U.S. Total Stock Market IndexSM | 8.66% | 12.74% |

| Bloomberg Barclays US Aggregate Bond Index | 4.48% | 1.31% |

| Fund Category: Morningstar Target-Date 20203 | 3.38% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.13% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Share class and Institutional Share class of the fund were consolidated into a single class of shares of the fund. The performance and financial history of the fund is that of the fund’s former Institutional Shares. Accordingly, the past performance shown is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.05% of acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2020 Index Fund

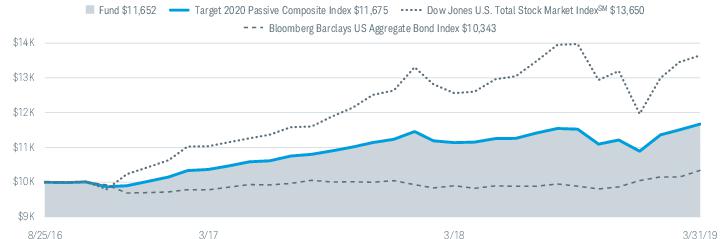

Performance and Fund Factsas of March 31, 2019 (continued)

| Number of Holdings | 12 |

| Portfolio Turnover Rate | 13% |

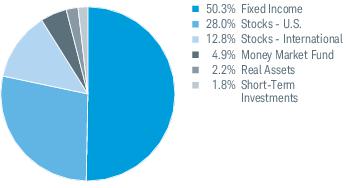

Asset Class Weightings % of Investments1,2

Top Holdings % of Net Assets3,4

Portfolio holdings may have changed since the report date.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2025 Index Fundas of March 31, 2019

The Schwab Target 2025 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab Funds and Laudus Funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the last annual adjustment at the end of January 2019, the fund’s asset allocation was approximately 56.8% equity securities, 38.7% fixed-income securities, and 4.4% cash and cash equivalents (including money market funds).1 (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, however, investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. Volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains. However, as the Federal Reserve put interest rates on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. The U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations.

Performance. For the 12-month reporting period ended March 31, 2019, the fund returned 4.79%. The fund’s internally calculated comparative index, the Target 2025 Passive Composite Index (the composite index), returned 4.95% for the same period.

Positioning and Strategies.2 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s equity exposure provided the greatest contribution to total return, particularly the fund’s U.S. large-cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF, which returned approximately 9.3%. The fund’s U.S. small-cap holding, the Schwab U.S. Small-Cap ETF, also contributed slightly, returning approximately 2.5%. The international equity and emerging markets components, however, detracted from total return. The Schwab International Equity ETF and Schwab Emerging Markets Equity ETF returned approximately -4.4% and -7.0%, respectively.

The fund’s overall fixed-income allocation also contributed to total return. The Schwab U.S. Aggregate Bond ETF, the fund’s intermediate-term bond component, returned approximately 4.6%, while the Schwab Short-Term U.S. Treasury ETF returned approximately 2.7% and slightly underperformed the fund’s short-term bond comparative index, the Bloomberg Barclays US Treasury 1-3 Year Index. The fund’s U.S. TIPS fixed-income exposure also contributed to total return, with the Schwab U.S. TIPS ETF returning approximately 2.8%.

The fund’s real estate allocation contributed to the fund’s total return. The Schwab U.S. REIT ETF returned approximately 19.7%, tracking its comparative index, the Dow Jones U.S. Select REIT Index.

Management views and portfolio holdings may have changed since the report date.

| 1 | Percentages may not add up to 100% due to rounding. |

| 2 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2025 Index Fund

Performance and Fund Factsas of March 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

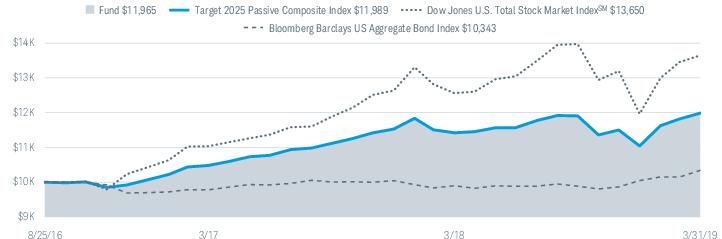

Performance of Hypothetical $10,000 Investment (August 25, 2016 – March 31, 2019)1,2

Average Annual Total Returns1,2

| Fund and Inception Date | 1 Year | Since Inception |

| Schwab Target 2025 Index Fund (8/25/16) | 4.79% | 7.15% |

| Target 2025 Passive Composite Index | 4.95% | 7.24% |

| Dow Jones U.S. Total Stock Market IndexSM | 8.66% | 12.74% |

| Bloomberg Barclays US Aggregate Bond Index | 4.48% | 1.31% |

| Fund Category: Morningstar Target-Date 20253 | 3.38% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Share class and Institutional Share class of the fund were consolidated into a single class of shares of the fund. The performance and financial history of the fund is that of the fund’s former Institutional Shares. Accordingly, the past performance shown is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2025 Index Fund

Performance and Fund Factsas of March 31, 2019 (continued)

| Number of Holdings | 10 |

| Portfolio Turnover Rate | 13% |

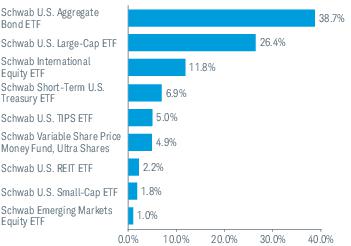

Asset Class Weightings % of Investments1,2

Top Holdings % of Net Assets3,4

Portfolio holdings may have changed since the report date.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2030 Index Fundas of March 31, 2019

The Schwab Target 2030 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab Funds and Laudus Funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the last annual adjustment at the end of January 2019, the fund’s asset allocation was approximately 66.7% equity securities, 29.9% fixed-income securities, and 3.3% cash and cash equivalents (including money market funds).1 (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, however, investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. Volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains. However, as the Federal Reserve put interest rates on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. The U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations.

Performance. For the 12-month reporting period ended March 31, 2019, the fund returned 4.76%. The fund’s internally calculated comparative index, the Target 2030 Passive Composite Index (the composite index), returned 4.96% for the same period.

Positioning and Strategies.2 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s equity exposure provided the greatest contribution to total return, particularly the fund’s U.S. large-cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF, which returned approximately 9.3%. The fund’s U.S. small-cap holding, the Schwab U.S. Small-Cap ETF, also contributed slightly, returning approximately 2.5%. The international equity and emerging markets components, however, detracted from total return. The Schwab International Equity ETF and Schwab Emerging Markets Equity ETF returned approximately -4.4% and -7.0%, respectively.

The fund’s overall fixed-income allocation also contributed to total return. The Schwab U.S. Aggregate Bond ETF, the fund’s intermediate-term bond component, returned approximately 4.6%, while the Schwab Short-Term U.S. Treasury ETF returned approximately 2.7% and slightly underperformed the fund’s short-term bond comparative index, the Bloomberg Barclays US Treasury 1-3 Year Index.

The fund’s real estate allocation contributed to the fund’s total return. The Schwab U.S. REIT ETF returned approximately 19.7%, tracking its comparative index, the Dow Jones U.S. Select REIT Index.

Management views and portfolio holdings may have changed since the report date.

| 1 | Percentages may not add up to 100% due to rounding. |

| 2 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2030 Index Fund

Performance and Fund Factsas of March 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

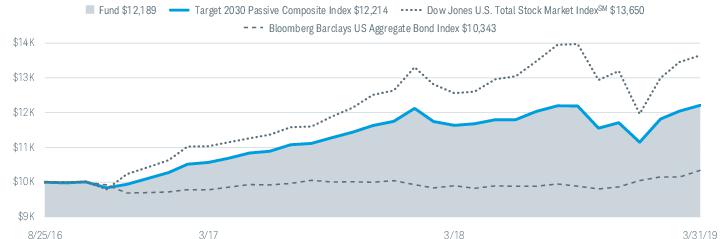

Performance of Hypothetical $10,000 Investment (August 25, 2016 – March 31, 2019)1,2

Average Annual Total Returns1,2

| Fund and Inception Date | 1 Year | Since Inception |

| Schwab Target 2030 Index Fund (8/25/16) | 4.76% | 7.92% |

| Target 2030 Passive Composite Index | 4.96% | 8.01% |

| Dow Jones U.S. Total Stock Market IndexSM | 8.66% | 12.74% |

| Bloomberg Barclays US Aggregate Bond Index | 4.48% | 1.31% |

| Fund Category: Morningstar Target-Date 20303 | 3.31% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Share class and Institutional Share class of the fund were consolidated into a single class of shares of the fund. The performance and financial history of the fund is that of the fund’s former Institutional Shares. Accordingly, the past performance shown is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2030 Index Fund

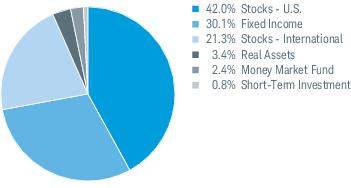

Performance and Fund Factsas of March 31, 2019 (continued)

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 8% |

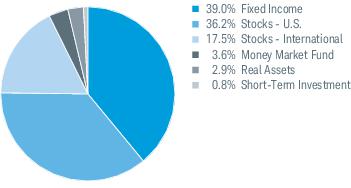

Asset Class Weightings % of Investments1,2

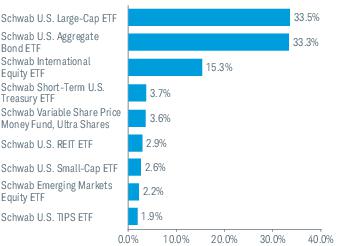

Top Holdings % of Net Assets3,4

Portfolio holdings may have changed since the report date.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

Schwab Target 2035 Index Fundas of March 31, 2019

The Schwab Target 2035 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab Funds and Laudus Funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the last annual adjustment at the end of January 2019, the fund’s asset allocation was approximately 74.6% equity securities, 22.8% fixed-income securities, and 2.5% cash and cash equivalents (including money market funds).1 (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

Market Highlights. For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, however, investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. Volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains. However, as the Federal Reserve put interest rates on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. The U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations.

Performance. For the 12-month reporting period ended March 31, 2019, the fund returned 4.68%. The fund’s internally calculated comparative index, the Target 2035 Passive Composite Index (the composite index), returned 4.89% for the same period.

Positioning and Strategies.2 The fund’s asset allocations were generally in line with those of the composite index over the reporting period.

The fund’s equity exposure provided the greatest contribution to total return, particularly the fund’s U.S. large-cap holding. The top contributor to the total return of the fund was the Schwab U.S. Large-Cap ETF, which returned approximately 9.3%. The fund’s U.S. small-cap holding, the Schwab U.S. Small-Cap ETF, also contributed slightly, returning approximately 2.5%. The international equity and emerging markets components, however, detracted from total return. The Schwab International Equity ETF and Schwab Emerging Markets Equity ETF returned approximately -4.4% and -7.0%, respectively.

The fund’s overall fixed-income allocation also contributed to total return. The Schwab U.S. Aggregate Bond ETF, the fund’s intermediate-term bond component, returned approximately 4.6%, while the Schwab Short-Term U.S. Treasury ETF returned approximately 2.7% and slightly underperformed the fund’s short-term bond comparative index, the Bloomberg Barclays US Treasury 1-3 Year Index.

The fund’s real estate allocation contributed to the fund’s total return. The Schwab U.S. REIT ETF returned approximately 19.7%, tracking its comparative index, the Dow Jones U.S. Select REIT Index.

Management views and portfolio holdings may have changed since the report date.

| 1 | Percentages may not add up to 100% due to rounding. |

| 2 | ETF performance can be expressed on a market price or NAV basis. The returns cited in this section are Market Price Returns. The ETF’s per share NAV is the value of one share of the ETF. NAV is calculated by taking the ETF’s total assets (including the market value of securities owned), subtracting liabilities, and dividing by the number of shares outstanding. The NAV Return is based on the NAV of the ETF, and the Market Price Return is based on the market price per share of the ETF. The price used to calculate market return (Market Price) is determined using the Official Closing Price on the primary stock exchange (generally, 4:00 p.m. Eastern time). NAV is used as a proxy for purposes of calculating Market Price Return on inception date. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the ETF at Market Price and NAV, respectively. |

Schwab Target Index Funds | Annual Report

Schwab Target 2035 Index Fund

Performance and Fund Factsas of March 31, 2019

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment returns and principal value of an investment will fluctuate so that an investor’s shares may be worth more or less than their original cost. Current performance may be lower or higher than performance data quoted. To obtain performance information current to the most recent month end, please visitwww.schwabfunds.com/schwabfunds_prospectus.

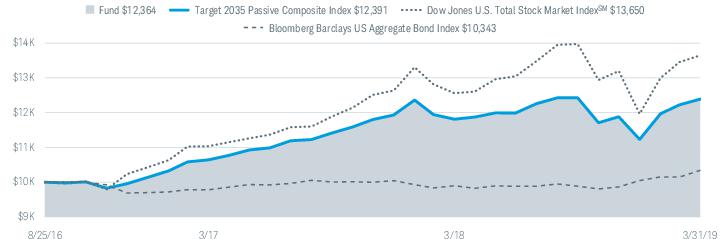

Performance of Hypothetical $10,000 Investment (August 25, 2016 – March 31, 2019)1,2

Average Annual Total Returns1,2

| Fund and Inception Date | 1 Year | Since Inception |

| Schwab Target 2035 Index Fund (8/25/16) | 4.68% | 8.51% |

| Target 2035 Passive Composite Index | 4.89% | 8.61% |

| Dow Jones U.S. Total Stock Market IndexSM | 8.66% | 12.74% |

| Bloomberg Barclays US Aggregate Bond Index | 4.48% | 1.31% |

| Fund Category: Morningstar Target-Date 20353 | 3.17% | N/A |

| Fund Expense Ratios4: Net 0.08%; Gross 0.12% |

All total returns on this page assume dividends and distributions were reinvested. Index figures do not include trading and management costs, which would lower performance. Indices are unmanaged and cannot be invested in directly. Performance results less than one year are not annualized.

The first index listed for the fund is the fund’s primary benchmark, as shown in the prospectus. Additional indices shown are provided for comparative purposes.

For index definitions, please see the Glossary.

| 1 | Fund expenses may have been partially absorbed by CSIM and its affiliates. Without these reductions, the fund’s returns would have been lower. These returns do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| 2 | On July 24, 2017, the Investor Share class and Institutional Share class of the fund were consolidated into a single class of shares of the fund. The performance and financial history of the fund is that of the fund’s former Institutional Shares. Accordingly, the past performance shown is that of the fund’s former Institutional Shares. |

| 3 | Source for category information: Morningstar, Inc. The Morningstar Category return represents all active and index mutual funds within the category as of the report date. |

| 4 | As stated in the prospectus. Includes 0.04% of acquired fund fees and expenses, which are indirect expenses incurred by the fund through its investments in the underlying funds. Net Expense: Expenses reduced by a contractual fee waiver in effect for so long as CSIM serves as the investment adviser to the fund. Gross Expense: Does not reflect the effect of contractual fee waivers. For actual ratios during the period, refer to the financial highlights section of the financial statements. |

Schwab Target Index Funds | Annual Report

Schwab Target 2035 Index Fund

Performance and Fund Factsas of March 31, 2019 (continued)

| Number of Holdings | 9 |

| Portfolio Turnover Rate | 6% |

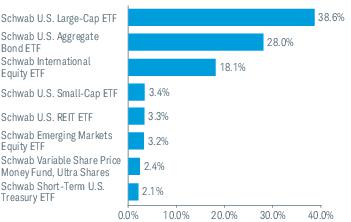

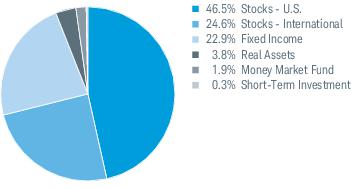

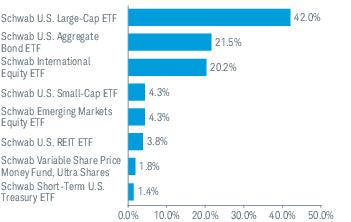

Asset Class Weightings % of Investments1,2

Top Holdings % of Net Assets3,4

Portfolio holdings may have changed since the report date.

| 1 | The percentage may differ from the Portfolio Holdings because the above calculation is based on a percentage of total investments, whereas the calculation in the Portfolio Holdings is based on a percentage of net assets. |

| 2 | The fund intends to primarily invest in affiliated Schwab ETFs and may also invest in affiliated Schwab and Laudus mutual funds and unaffiliated third party ETFs and mutual funds (all such ETFs and mutual funds referred to as “underlying funds”). |

| 3 | This list is not a recommendation of any security by the investment adviser. |

| 4 | The holdings listed exclude any temporary liquidity investments. |

Schwab Target Index Funds | Annual Report

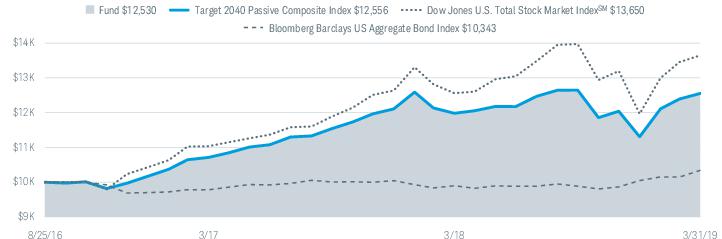

Schwab Target 2040 Index Fundas of March 31, 2019

The Schwab Target 2040 Index Fund (the fund) seeks to provide capital appreciation and income consistent with its current asset allocation, and seeks to achieve its investment objective by investing primarily in affiliated Schwab exchange-traded funds (ETFs). The fund may also invest in affiliated Schwab Funds and Laudus Funds and unaffiliated third party ETFs and mutual funds. The target asset allocation is adjusted annually based on the adviser’s asset allocation strategy; as of the last annual adjustment at the end of January 2019, the fund’s asset allocation was approximately 81.6% equity securities, 16.6% fixed-income securities, and 1.8% cash and cash equivalents (including money market funds). (For portfolio allocations as of the end of this reporting period, please see the fund’s Portfolio Holdings included in this report.)

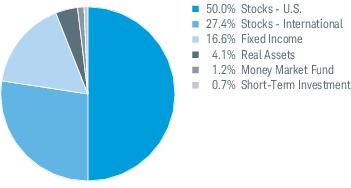

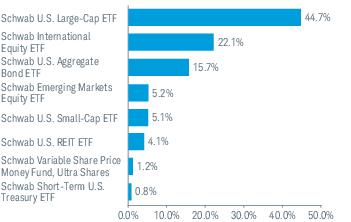

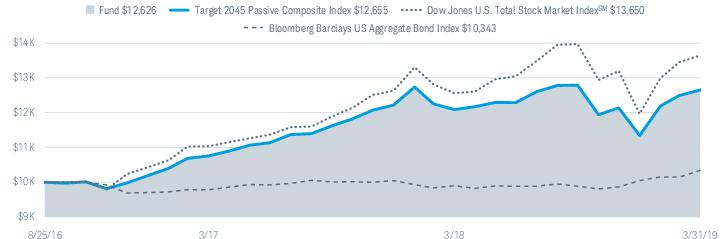

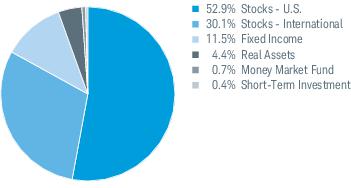

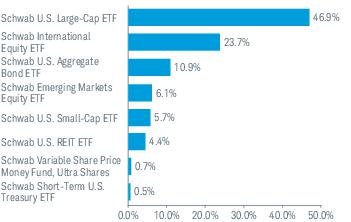

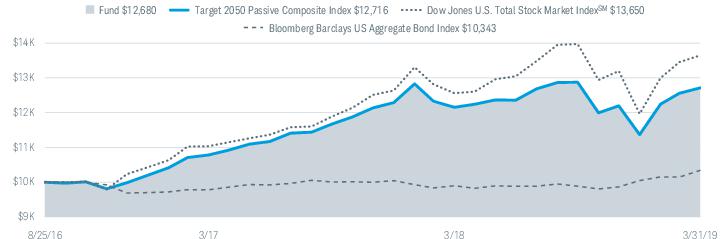

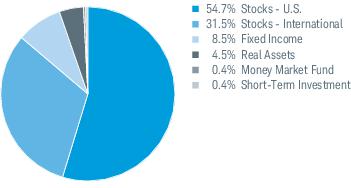

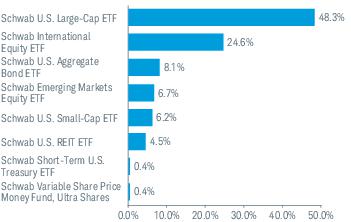

Market Highlights. For the 12-month reporting period ended March 31, 2019, global equity markets were mixed. In the U.S., stable economic growth, solid corporate earnings, and robust consumer spending helped propel U.S. stock markets to record highs in late September and early October, despite escalating trade tensions and rising interest rates. During the fourth quarter of 2018, however, investor anxiety rose amid concerns about the pace of future interest rate hikes despite low inflation, falling oil prices, slowing international growth, and concerns about trade negotiations with China. Volatility spiked and stocks fell steeply, particularly in December, more than erasing the period’s earlier gains. However, as the Federal Reserve put interest rates on hold, a strong rebound in the first quarter of 2019 brought U.S. stocks back above their early-December levels, albeit below their previous October highs. Outside the U.S., equity markets were notably weaker as economic momentum slowed due to uncertainties from several fronts, including trade, inflation, and geopolitical concerns. The U.S. Treasury yield curve slope (the spread between rates on 2-year and 10-year Treasuries) generally flattened, as short-term yields, which typically respond to changes in the federal funds rate, rose more quickly than longer-term yields, which are influenced more by economic growth and inflation expectations.