QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| /x/ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12

|

GENZYME TRANSGENICS CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

175 Crossing Boulevard

Framingham, Massachusetts 01701-9322

(508) 620-9700

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 22, 2002

The 2002 Annual Meeting of Stockholders of Genzyme Transgenics Corporation, or GTC, will be held in the State Street Bank Board Room, 33rd Floor, 225 Franklin Street, Boston, Massachusetts, at 2:00 p.m. on Wednesday, May 22, 2002 for the following purposes:

- 1.

- To elect two directors to serve until the 2005 Annual Meeting of Stockholders.

- 2.

- To approve an amendment of Genzyme Transgenics Corporation's Articles of Organization to change Genzyme Transgenics Corporation's name to "GTC Biotherapeutics, Inc."

- 3.

- To approve the 2002 Equity Incentive Plan of GTC.

- 4.

- To approve the 2002 Employee Stock Purchase Plan of GTC as an amendment and restatement of the existing 1993 Employee Stock Purchase Plan.

- 5.

- To transact such other business as may properly come before the meeting or any adjournment thereof.

Only stockholders of record at the close of business on April 1, 2002 are entitled to notice of and to vote at the annual meeting or at any adjournment.

It is important that your shares be represented at the meeting.Therefore, whether or not you plan to attend the meeting, please complete your proxy card and return it in the enclosed envelope,which requires no postage if mailed in the United States. If you attend the meeting and wish to vote in person, your proxy will not be used.

April 17, 2002

TABLE OF CONTENTS

| | Page

|

|---|

| General Information About Voting | | 1 |

| SHARE OWNERSHIP | | 3 |

| PROPOSAL 1: ELECTION OF DIRECTORS | | 4 |

| Board of Directors and Committee Meetings | | 6 |

| Director Compensation | | 7 |

| PROPOSAL 2: AMENDMENT TO OUR ARTICLES OF ORGANIZATION | | 8 |

| PROPOSAL 3: APPROVAL OF THE 2002 EQUITY INCENTIVE PLAN | | 8 |

| PROPOSAL 4: APPROVAL OF THE 2002 EMPLOYEE STOCK PURCHASE PLAN AS AN AMENDMENT AND RESTATEMENT OF THE 1993 EMPLOYEE STOCK PURCHASE PLAN | | 11 |

| EXECUTIVE COMPENSATION | | 14 |

| Summary Compensation Tables | | 17 |

| Fiscal Year-End Option Table | | 19 |

| STOCK PERFORMANCE GRAPH | | 23 |

| TRANSACTIONS WITH RELATED PARTIES | | 24 |

| SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | 24 |

| INFORMATION CONCERNING INDEPENDENT ACCOUNTANTS | | 24 |

| AUDIT COMMITTEE REPORT | | 25 |

| APPENDIX A, AUDIT COMMITTEE CHARTER | | A-1 |

| APPENDIX B, 2002 EQUITY INCENTIVE PLAN | | B-1 |

| APPENDIX C, 2002 EMPLOYEE STOCK PURCHASE PLAN | | C-1 |

PROXYSTATEMENT

Our board of directors is soliciting the enclosed proxy card for use at the 2002 Annual Meeting of Stockholders to be held on Wednesday, May 22, 2002 and at any adjournment. This proxy statement and the accompanying proxy card are first being provided to stockholders of GTC on or about April 19, 2002.

General Information About Voting

Who can vote. You may vote your shares of GTC common stock at the annual meeting if you were a stockholder of record at the close of business on April 1, 2002. On that date, there were 30,273,373 shares of common stock outstanding. You are entitled to one vote for each share of common stock that you held on the record date.

How to vote your shares. You may vote your shares either by proxy or by attending the meeting and voting in person. If you choose to vote by proxy, please complete, date, sign and return the proxy card in the enclosed postage prepaid envelope. The proxies named in the proxy card will vote your shares as you have instructed. If you sign and return the proxy card without indicating how your vote should be cast, the proxies will vote your shares in favor of the proposals contained in this proxy statement, as recommended by our board of directors. Even if you plan to attend the meeting, please complete and mail your proxy card to ensure that your shares are represented at the meeting. If you attend the meeting, you can still revoke your proxy by voting in person.

Proposal to be considered at the annual meeting. The principal business expected to be transacted at the meeting, as more fully described below, will be the election of two directors, a vote to amend our charter to change our name to "GTC Biotherapeutics, Inc.," a vote to adopt the 2002 Equity Incentive Plan and a vote to adopt the 2002 Employee Stock Purchase Plan.

Quorum. A quorum of stockholders is required to transact business at the meeting. A majority in interest of the outstanding shares of common stock entitled to vote, represented at the meeting in person or by proxy, constitutes a quorum for the transaction of business.

Number of votes required. The number of votes required to approve the proposals that are scheduled to be presented at the meeting is as follows.

Proposal

| | Required Vote for Approval

|

|---|

| • | | Election of a nominee as director. | | • | | Affirmative votes representing a plurality of the votes cast for or against the nominee. |

| • | | Amendment of charter to change name to "GTC Biotherapeutics, Inc." | | • | | Affirmative votes representing a majority of the outstanding shares of our common stock. |

| • | | Adoption of the 2002 Equity Incentive Plan. | | • | | Affirmative votes representing a majority of the shares of common stock present or represented at the meeting. |

| • | | Adoption of the 2002 Employee Stock Purchase Plan as an amendment and restatement of the 1993 Employee Stock Purchase Plan. | | • | | Affirmative votes representing a majority of the shares of common stock present or represented at the meeting. |

Abstentions and broker non-votes. A broker non-vote on a proposal results from a proxy submitted by a broker that does not indicate a vote for one or more proposals because the broker does not have discretionary voting authority and the customer did not send the broker instructions on how to vote on the proposal. If the broker does not have instructions on certain matters, and it is barred by law or Nasdaq regulations from exercising its discretionary voting authority in the particular matter, then the shares will not be voted on the matter. Abstentions and broker non-votes will be counted in determining a quorum for a matter.

Discretionary voting by proxies on other matters. Aside from the proposals for the election of directors, the change of the Company's name and adoption of the 2002 Equity Incentive Plan and the 2002 Employee Stock Purchase Plan, we do not know of any other proposals that may be presented at the 2002 Annual Meeting. If another matter is properly presented for consideration at the meeting, the persons named in the accompanying proxy card will exercise their discretion in voting on the matter.

How you may revoke your proxy. You may revoke the authority granted by your executed proxy card at any time before we exercise it by filing with GTC, Attention: Nathaniel S. Gardiner, our corporate clerk, a written revocation or a duly executed proxy card bearing a later date, or voting in person at the meeting. If your shares are held in a brokerage account, you must make arrangements with your broker or bank to vote your shares in person or to revoke your proxy.

Expenses of solicitation. We will bear all costs of soliciting proxies. We have hired a proxy solicitation firm, Georgeson Shareholder, to assist us in soliciting proxies. We will pay Georgeson Shareholder a fee of $6,000 plus their expenses. We will, upon request, reimburse brokers, custodians and fiduciaries for out-of-pocket expenses incurred in forwarding proxy solicitation materials to the beneficial owners of GTC common stock held in their names. In addition to solicitations by mail, our directors, officers and employees may solicit proxies from stockholders in person or by other means of communication, including telephone, facsimile and e-mail, without additional remuneration.

2

SHARE OWNERSHIP

The following table and footnotes show the amount of our common stock beneficially owned as of April 5, 2002 by (i) persons known by us to be beneficial owners of more than 5% of our common stock, (ii) our executive officers named in the Summary Compensation Table, (iii) our directors and (iv) all of our current executive officers and directors as a group.

The number of shares beneficially owned by each person listed below includes any shares over which the person has sole or shared voting or investment power as well as shares which the person has the right to acquire on or before June 4, 2002 by exercising a stock option or other right. Unless otherwise noted, each person has sole investment and voting power (or shares that power with his or her spouse) over the shares listed in the table. The percentage ownership of each person listed in the table was calculated using the total number of shares outstanding on April 5, 2002, plus any shares that person could acquire upon the exercise of any options or other rights exercisable on or before June 4, 2002.

Beneficial Owner

| | Shares

Owned as of

April 5, 2002

| | Options or Warrants

Exercisable

as of

June 4, 2002

| | Total Number

of Shares

Beneficially

Owned

| | Percent of

Class

| |

|---|

Genzyme Corporation

One Kendall Square

Cambridge, MA 02139 | | 4,924,919 | | 518,324 | | 5,443,243 | | 17.7 | % |

Pictet Global Sector Fund—Biotech

c/o Banque Pictet S.A.

1 Boulevard Royal Luxembourg L-2016 | | 1,837,100 | | 0 | | 1,837,100 | | 6.1 | |

| Geoffrey F. Cox | | 10,589 | (1) | 97,000 | | 107,859 | (1) | * | |

| Robert W. Baldridge | | 5,075 | | 105,000 | | 110,075 | | * | |

| Henry E. Blair | | 1,000 | | 32,500 | | 33,500 | | * | |

| Francis J. Bullock | | 1,000 | | 49,000 | | 50,000 | | * | |

| James A. Geraghty | | 45,791 | | 142,103 | | 187,894 | | * | |

| Alan W. Tuck | | 1,000 | | 32,500 | | 33,500 | | * | |

| John B. Green | | 26,312 | (2) | 134,521 | | 160,833 | (2) | * | |

| Harry M. Meade | | 8,920 | (3) | 113,483 | | 122,403 | (3) | * | |

| Sandra Nusinoff Lehrman | | 12,031 | (4) | 100,000 | | 112,031 | (4) | * | |

| Michael W. Young | | 0 | | 0 | | 0 | | * | |

| All executive officers and directors as a group (8 persons) | | 99,687 | (5) | 706,107 | (5) | 805,794 | (5) | 2.6 | |

- *

- Indicates less than 1%.

- (1)

- Includes 589 shares beneficially owned by Dr. Cox held in GTC's 401(k) plan.

- (2)

- Includes 7,675 shares beneficially owned by Mr. Green held in GTC's 401(k) plan.

- (3)

- Includes 3,166 shares beneficially owned by Dr. Meade held in GTC's 401(k) plan.

- (4)

- Includes 1,435 shares beneficially owned by Dr. Lehrman held in GTC's 401(k) plan.

- (5)

- Excludes shares or options beneficially owned by Dr. Lehrman or Mr. Young, who are no longer executive officers of GTC.

3

PROPOSAL 1: ELECTION OF DIRECTORS

Our board of directors has fixed the number of directors at seven for the coming year. Under our charter, our board is divided into three classes, with each class being as nearly equal in number of directors as possible. The directors in each class serve a staggered term of three years each until their successors are elected at the next annual stockholders meeting. At the upcoming annual meeting, two directors, Francis J. Bullock and Alan W. Tuck, have each been nominated to serve a term of office of three years and until the director's successor is elected and qualified. Each of the board's nominees has consented to serve, if elected. However, if either nominee is unable to serve, proxies will be voted for any replacement candidate nominated by our board of directors. In connection with our repurchase of GTC shares from Genzyme Corporation (see description on page 18), one of our directors, Henri Termeer, Chairman, CEO and President of Genzyme Corporation, recently resigned from our board, and Henry E. Blair, at the request of Genzyme Corporation, of which he is also a director, will not stand for re-election to our board when his term concludes at the upcoming annual meeting. We are currently searching for appropriate candidates for appointment to fill the resulting vacancies on the board.

Under our by-laws, directors must be elected by a plurality of votes cast. Abstentions, votes withheld and broker non-votes will not be treated as votes cast and, therefore, will not affect the outcome of the election.

The following table contains biographical information about the nominees for director and current directors whose term of office will continue after the meeting.

Name and Age

| | Business Experience

and Other Directorships

| | Director

Since

| | Present

Term

Expires

|

|---|

*Francis J. Bullock

Age: 65 |

|

Dr. Bullock is a senior consultant with Strategic Decisions Group. Prior to that he was a senior consultant with Arthur D. Little, Inc. from September 1993 to March 2002 and a Senior Vice President, Research Operations at Schering-Plough Research Institute from 1981 until August 1993. Dr. Bullock is also a director of Array Biopharma, Inc., a chemical drug discovery services company. |

|

1994 |

|

2002 |

4

*Alan W. Tuck

Age: 53 |

|

Mr. Tuck has been a principal of The Bridgespan Group, a non-profit consulting organization, since April 2001. Mr. Tuck retired in June 2000 as Chief Strategic Officer of Organogenesis Inc., a tissue engineering firm where he had been since July 1997. From September 1996 until July 1997, Mr. Tuck was Executive Vice President and Chief Strategic Officer of Biocode Inc., a privately-held biotechnology company focused on covert product marking and, from September 1996 until March 1997, was Chief Strategic Officer of Immulogic Pharmaceutical Corporation, a biotechnology company focused on diseases of the immune system. From February 1992 through May 1996, Mr. Tuck was President and Chief Executive Officer of T Cell Sciences, Inc. Mr. Tuck is also a director of Apogee Technology, Inc. |

|

1993 |

|

2002 |

Geoffrey F. Cox

Age: 58 |

|

Dr. Cox has been a director of GTC since May 2001 and was appointed Chairman of the Board, Chief Executive Officer and President of GTC in July 2001. Before joining GTC, Dr. Cox was Chairman and Chief Executive Officer of Aronex Pharmaceuticals, Inc., a biotechnology company, from 1997 to July 2001. In 1984, Dr. Cox joined Genzyme Corporation in the United Kingdom and, in 1988, became Senior Vice President of Operations in the United States. Subsequently, he was promoted to Executive Vice President of Genzyme Corporation, responsible for operations and pharmaceutical, diagnostic and genetics business units. Prior to joining Genzyme Corporation, Dr. Cox was General Manager of the United Kingdom manufacturing operations for Gist-Brocades in the United Kingdom. |

|

2002 |

|

2003 |

Robert W. Baldridge

Age: 67 |

|

Mr. Baldridge has served as an independent business consultant since June 1988 and provided consulting services to GTC from October 1994 to October 2000. |

|

1994 |

|

2004 |

|

|

|

|

|

|

|

5

James A. Geraghty

Age: 47 |

|

Mr. Geraghty has served as Senior Vice President, International Development of Genzyme Corporation since January 2001 and from July 1998 to December 2000, was President of Genzyme Europe. Mr. Geraghty served as Chairman of the Board of Directors of GTC from January 1998 to July 2001 and has been a director since February 1993. Mr. Geraghty was the President and Chief Executive Officer of GTC from its incorporation in February 1993 until July 1998. |

|

1993 |

|

2004 |

- *

- Indicates a nominee for election as director.

Board of Directors and Committee Meetings

Our board of directors held eight meetings during 2001. Our board has standing Audit and Compensation Committees but does not have a Nominating Committee.

Audit Committee. The Audit Committee selects and evaluates our independent auditors, reviews the audited financial statements and discusses the adequacy of our internal controls with management and the auditors. The Audit Committee, which met six times during 2001, is currently composed of three directors, Messrs. Tuck (Chair), Baldridge and Blair. Because Mr. Blair is not standing for re-election, we are searching for an appropriate candidate to fill the resulting vacancy on the Audit Committee. Messrs. Tuck and Blair are each "independent directors" as defined by the current rules of the Nasdaq Stock Market. Under these Nasdaq rules, Mr. Baldridge would not technically be considered independent due to his past consulting arrangement with GTC. However, the board of directors has determined that Mr. Baldridge's past consulting activities do not interfere with his ability to carry out his responsibilities as a member on the Audit Committee, and given his unique knowledge and background on financial matters, his continued membership is in the best interests of GTC and its stockholders. The Audit Committee operates under a written charter adopted by the board, a copy of which is included as Appendix A to this proxy statement. For more information about the Audit Committee, see the "Audit Committee Report" in this proxy statement.

Compensation Committee. The Compensation Committee determines the compensation to be paid to our executive officers and also administers our equity incentive plans and employee stock purchase plans. The members of the Compensation Committee are currently Messrs. Bullock (Chair), Blair and Tuck. Because Mr. Blair is not standing for re-election, we are searching for an appropriate candidate to fill the resulting vacancy on the Compensation Committee. The Committee held three meetings in 2001. For more information about the Compensation Committee, see the "Compensation Committee Report on Executive Compensation" included in this proxy statement.

6

Director Compensation

Director Fees. All directors who are not employees of GTC or Genzyme Corporation receive an annual retainer of $12,000, payable in quarterly installments. Directors who are GTC employees do not receive compensation for their service as directors.

Equity Incentive Plans. All non-employee directors of GTC are currently eligible to participate in our 2002 Equity Incentive Plan. Under this 2002 Equity Plan, options are automatically granted once a year, on the date of the annual meeting of stockholders, to eligible directors elected or re-elected at the meeting. Each eligible director, other than the Chairman of the Board, receives an option to purchase 7,500 shares of common stock for each year of the term of office to which the director is elected (normally 22,500 shares for election to a three-year term of office). A non-employee Chairman of the Board would receive an option to purchase 15,000 shares for each year of the term of office to which the Chairman is elected (normally 45,000 shares for a three-year term of office). Upon an eligible director's election other than at an annual meeting, the director is automatically granted an option to purchase 7,500 shares (or 15,000 shares in the case of a non-employee Chairman), for each year or portion of a year of the term of office to which he or she is elected. Options vest as to 7,500 shares (or 15,000 shares in the case of a non-employee Chairman), on the date the option is granted and on the date of each subsequent annual meeting of stockholders, so long as the optionee is still a director. The options have a term of ten years and an exercise price, payable in cash or common stock, equal to the opening price of our common stock on the date of grant, as reported on the Nasdaq National Market System.

One-Time Option Grants. In March 2001, the board of directors amended the 1993 Equity Plan to increase the number of options granted to directors, beginning with the annual grants at the 2001 annual stockholders meeting, from 5,000 shares per year served to the 7,500 shares discussed above. In order to equitably compensate directors then serving on the board, but not due for re-election at the then upcoming 2001 annual meeting, the amendment included a one-time option grant, effective on the date of the 2001 annual stockholders meeting. Accordingly, under the amended plan, Messrs. Blair and Tuck and Dr. Bullock each received an option to purchase 2,500 shares of common stock that was immediately exercisable. In addition, in December 2001, the board of directors awarded Dr. Bullock options to purchase 22,500 shares of common stock as compensation for his participation on the interim executive committee managing GTC during May to July 2001.

Geraghty Consulting Arrangement. Mr. Geraghty provided part-time consulting services to GTC under a consulting agreement that expired on June 30, 2000. Although the written agreement was not renewed, he continued to provide services until April 2002 under the same terms. Under that arrangement, Mr. Geraghty received a consulting fee of $1,200 per day for three days per month. Accordingly, in 2001, Mr. Geraghty received $43,200 in consulting fees.

7

PROPOSAL 2: AMENDMENT TO OUR ARTICLES OF ORGANIZATION

Our board of directors has adopted an amendment, subject to shareholder approval, of Article I of our Articles of Organization to change the Company's name to "GTC Biotherapeutics, Inc."

The new name highlights the familiar initials by which the Company is already known and confirms our status as an independent business. It also includes the broader field of biotherapeutics in which we operate.

Vote Required

The affirmative vote of holders of a majority of the shares of common stock outstanding and entitled to vote at the meeting is required to approve the proposed amendment to our charter. Abstentions and broker non-votes will be treated as a vote against the proposal.

The board of directors recommends a vote FOR this proposal.

PROPOSAL 3: APPROVAL OF THE 2002 EQUITY INCENTIVE PLAN

General

In February 2002, our board of directors adopted the 2002 Equity Incentive Plan. The 2002 Equity Plan is intended to supplement and replace the 1993 Equity Plan, which expires in 2003. Upon stockholder approval, a total of 2,500,000 shares will be available for issuance under the 2002 Plan. The closing price of our common stock on April 5, 2002, as reported by the Nasdaq, was $3.45. A copy of the 2002 Equity Plan is attached as Appendix A to this proxy statement.

The 2002 Equity Plan will enable us and our affiliates to offer competitive compensation to attract and retain key employees. As of March 1, 2002, 172 employees were eligible to participate in the plan. Non-employee directors also receive awards under the plan, which allows us to attract and retain qualified persons, to serve as directors and to encourage stock ownership in GTC by those directors so as to provide additional incentives to promote our success. All five of our non-employee directors are eligible to participate in the plan. Stock options granted under the 2002 Equity Plan will be a significant element of our compensation package, as they are in the biotechnology industry generally. In 2001 for example, we granted options to approximately 95% of our employees. Competition for top scientists, researchers, and other skilled employees has become more intense as biotechnology companies proliferate at a rapid pace. Our board of directors strongly believes that, in this highly competitive environment, we need to provide meaningful stock option grants to retain and motivate our employees. The board considers our ongoing program of granting stock options broadly across the employee base to be very important to our ability to compete for top talent and a significant incentive to promote our success and, therefore, in the best interests of our stockholders. Equity incentives are equally common and important among our competitors and throughout the biotechnology industry. Therefore, we continue to consider it crucial that we have in place appropriate arrangements for granting equity compensation.

8

Principal Terms of the 2002 Equity Plan

The 2002 Equity Plan permits us to grant awards to our and our affiliates' employees and consultants, including incentive and nonstatutory stock options, stock appreciation rights, performance shares, dividend equivalents, restricted stock and stock units. To date, we have not granted any awards other than stock options. Any options we grant under the 2002 Equity Plan upon assuming or substituting for outstanding grants of an acquired company will not reduce the number of shares available under the plan.

The 2002 Equity Plan is administered by the Compensation Committee of the board of directors. Awards under the plan are granted at the discretion of the Compensation Committee, which determines the recipients and establishes the terms and conditions of each award, including the exercise price, the form of payment of the exercise price, the number of shares subject to options or other equity rights and the time at which options become exercisable. The Compensation Committee may delegate to one or more officers the power to make awards to employees who are not executive officers of GTC subject to the reporting requirements of Section 16 of the Securities Exchange Act of 1934, as amended.

Although the Compensation Committee has discretion in granting awards, the exercise price of any incentive stock option, or ISO, may not be less than 100% of the fair market value of our common stock on the date of the grant. Nonstatutory options also are generally granted at fair market value. The term of any ISO granted under the 2002 Equity Plan may not exceed ten years, and no ISO may be granted under the 2002 Equity Plan more than ten years from the 2002 Equity Plan's adoption. When a participant's employment is terminated, vested options are generally cancelled if not exercised within a specified time. The aggregate number of shares that we may issue under the 2002 Equity Plan subject to ISOs, as well as those subject to outstanding ISO awards, which number is subject to appropriate adjustment in the event of a stock split or other recapitalization is 2,500,000. An option holder may not transfer an ISO granted under the 2002 Equity Plan other than by will or the laws of descent and distribution. Other awards are transferable to the extent provided by the Compensation Committee.

The maximum number of shares subject to stock options and stock appreciation rights that may be granted to any participant within any fiscal year shall not exceed 20% of the total number of shares reserved for issuance, except for grants to new hires during the fiscal year of hiring, which shall not exceed 30% of the total number of shares reserved.

The Compensation Committee has adopted guidelines for the number of annual and new hire options awarded to our employees, other than employees who are subject to Section 16 of the Exchange Act. These guidelines are based on the salary grade of the employee and provide for the grant of ISOs at fair market value on the date of grant. The Compensation Committee has delegated to our CEO the power to make awards under the 2002 Equity Plan, in amounts consistent with the guidelines, to employees that are not subject to Section 16 of the Exchange Act. The Compensation Committee may change the guidelines at any time.

All of our non-employee directors are eligible to participate in the 2002 Equity Plan. Options are granted automatically once a year, at the annual meeting of stockholders, to eligible directors elected or re-elected at the meeting. Each eligible director, other than the Chairman of the Board, receives an option to purchase 7,500 shares of common stock for each year of the term of office to which the

9

director is elected (normally 22,500 shares for election to a three-year term of office). A non-employee Chairman of the Board would receive an option to purchase 15,000 shares for each year of the term of office to which the Chairman is elected (normally 45,000 shares for a three-year term of office). Upon an eligible director's election other than at an annual meeting, the director is automatically granted an option to purchase 7,500 shares in the case of a non-Chairman and 15,000 shares in the case of a non-employee Chairman, for each year or portion of a year of the term of office to which he or she is elected. Options vest as to 7,500 shares in the case of a non-Chairman and 15,000 shares in the case of a non-employee Chairman, on the date the option is granted and on the date of each subsequent annual meeting of stockholders, so long as the optionee is still a director. The options have a term of ten years and an exercise price, payable in cash or common stock, equal to the opening price of our common stock on the date of grant, as reported on Nasdaq.

Federal Income Tax Consequences Relating to Stock Options

Incentive Stock Options. An optionee does not realize taxable income upon the grant or exercise of an ISO under the 2002 Equity Plan. If an optionee does not dispose of shares received upon exercise of an ISO for at least:

- •

- two years from the date of grant, and

- •

- one year from the date of exercise,

then upon sale of the shares, any amount realized in excess of the exercise price is taxed to the optionee as long-term capital gain and any loss sustained will be a long-term capital loss. In that event, we may not take a deduction for federal income tax purposes. The exercise of an ISO gives rise to an adjustment in computing alternative minimum taxable income that may result in alternative minimum tax liability for the optionee.

If the optionee disposes of shares of common stock acquired upon the exercise of an ISO before the end of either of the prescribed holding periods (a "disqualifying disposition") then the optionee realizes ordinary income in the year of disposition in an amount that the fair market value of the shares on the date of exercise exceeds the exercise price, and we would be entitled to deduct that amount. Any further gain realized by the optionee would be taxed as a short-term or long-term capital gain and would not result in any deduction for us. A disqualifying disposition in the year of exercise will generally avoid the alternative minimum tax consequences of the exercise.

Nonstatutory Stock Options. An optionee does not realize income at the time a nonstatutory option is granted. Upon exercise of the option, the optionee realizes ordinary income in an amount equal to the difference between the exercise price and the fair market value of the shares on the date of exercise. We would receive a tax deduction for the same amount. Upon disposition of the shares, appreciation or depreciation after the date of exercise is treated as a short-term or long-term capital gain or loss and will not result in any deduction for us.

An optionee who receives any accelerated vesting or exercise of options or stock appreciation rights or accelerated lapse of restrictions on restricted stock in connection with a change in control might be deemed to have received an "excess parachute payment" under federal tax law. In this case, the optionee may be subject to an excise tax, and we may be denied a tax deduction.

10

Vote Required

The affirmative vote by the holders of a majority of the shares present, or represented by proxy, and entitled to vote at the meeting is required to approve the 2002 Equity Plan. Broker non-votes will not be counted as present or represented for this purpose. Abstentions will be counted as present and entitled to vote and, accordingly, will have the effect of a negative vote.

PROPOSAL 4: APPROVAL OF THE 2002 EMPLOYEE STOCK PURCHASE PLAN AS AN AMENDMENT AND RESTATEMENT OF THE 1993 EMPLOYEE STOCK PURCHASE PLAN

General

In February 2002, the board of directors amended and restated the 1993 Employee Stock Purchase Plan and renamed it the 2002 Employee Stock Purchase Plan, which is referred to here as the 2002 Purchase Plan. This amendment and restatement will qualify as a new plan for the purpose of Section 423 of the Internal Revenue Code if approved by our stockholders and will be consolidated with the existing plan to provide for coordinated administration of this benefit to our employees. The amendment and restatement of the plan reserves an additional 600,000 shares of common stock for issuance under the plan in addition to the 103,435 shares of common stock currently remaining available for issuance. If the 2002 Purchase Plan is approved, there will be a total of 703,435 shares reserved for issuance under the 2002 Purchase Plan. As of April 5, 2002, 172 employees were eligible to participate in the plan. The closing price of our common stock on April 5, 2002, as reported by the Nasdaq, was $3.45. A copy of the 2002 Purchase Plan is attached as Appendix B to this proxy statement.

The 2002 Purchase Plan will provide our full-time employees the opportunity to purchase shares of our common stock by automatic payroll deduction on favorable terms. Upon stockholder approval, the first offering under the terms of the plan as amended and restated will commence in July 2002. All offerings still open under the terms of the plan prior to the amendment and restatement shall continue to be governed by the terms of the plan as in effect immediately prior to the amendment and restatement. Like the 2002 Equity Plan, the 2002 Purchase Plan will help us attract and retain top quality personnel, motivate them to acquire an equity stake in GTC and provide an incentive for them to achieve long-range performance goals. Our board of directors strongly believes that the ongoing program of allowing employees to purchase stock under the 2002 Purchase Plan is very important to our ability to compete for top talent.

11

Principal Terms of the Purchase Plan

The 2002 Purchase Plan is intended to qualify as an "employee stock purchase plan" under Section 423 of the Internal Revenue Code. The rights to purchase shares of common stock under the 2002 Purchase Plan are granted by our board of directors, at its discretion. A plan administrator appointed by our board, currently the CEO, determines the frequency and duration of individual offerings under the plan and the date(s) when stock may be purchased. All employees of GTC or any subsidiary designated by the board of directors, who work at least 20 hours per week and are employed for at least 5 months, are eligible to participate in the 2002 Purchase Plan. The plan may be amended or terminated at any time by the board of directors, subject to any necessary approval by stockholders. In particular, any amendment that would increase the number of shares offered under the plan would require stockholder approval. The 2002 Purchase Plan is scheduled to terminate on February 1, 2012.

Participation in the plan is voluntary, and a participant may withdraw from an offering at any time before stock is purchased. Participation terminates automatically upon termination of employment for any reason. The purchase price per share in an offering is 85% of the lower of the fair market value of common stock on the first day of an offering period or the purchase date and may be paid through regular payroll deductions, lump sum cash payments or a combination of both, as determined by the board of directors.

As required by Section 423 of the Internal Revenue Code, all of an employee's purchases in a calendar year are limited to the lesser of $25,000 worth of stock, determined by the fair market value of the common stock at the time the offering begins, or 15% of the employee's annual rate of compensation (or such lesser percentage as the board of directors may fix). In addition, an employee may not subscribe for shares under the plan if, immediately after having subscribed, the employee would own 5% or more of the voting power or value of all classes of our stock, including stock which may be purchased through subscriptions under the 2002 Purchase Plan or any other plans.

Federal Income Tax Consequences Relating to the Purchase Plan

A participant does not realize taxable income at the commencement of an offering or at the time shares are purchased under the 2002 Purchase Plan. If a participant does not dispose of shares purchased under the plan for at least:

- •

- two years from the offering commencement date, and

- •

- one year from the purchase date,

then upon sale of the shares, 15% of the fair market value of the stock at the commencement of the offering period (or, if less, the amount realized on sale of such shares in excess of the purchase price) is taxed to the participant as ordinary income, with any additional gain taxed as long-term capital gain and any loss sustained taxed as long-term capital loss. No deduction will be allowed to us for Federal income tax purposes. However, if the participant sells the shares before either of the prescribed periods, he or she will be treated as having received taxable compensation income upon the sale equal to the excess of the fair market value of the stock on the date of purchase over the actual purchase price, and we will be allowed to deduct that amount. In either case, any difference over or under the participant's tax cost (the purchase price plus the amount of taxable compensation income that the participant recognizes upon sale of the shares) will be treated as capital gain or loss.

12

If a participant disposes of shares of common stock purchased under the 2002 Purchase Plan before the expiration of the prescribed holding periods, then the participant realizes ordinary income in the year of disposition in an amount equal to the excess of the fair market value of the shares on the date of purchase over the purchase price thereof, and we are entitled to deduct this amount. Any further gain or loss is treated as a short-term or long-term capital gain or loss and will not result in any deduction for us.

If the participant dies at any time while owning shares purchased under the 2002 Purchase Plan, then 15% of the fair market value of the stock at the commencement of the offering period (or, if less, the fair market value of such shares on the date of death in excess of the purchase price) is taxed to the participant as ordinary income in the year of death, and we would not be allowed a deduction for Federal income tax purposes.

Vote Required

The affirmative vote by the holders of a majority of the shares present, or represented by proxy, and entitled to vote at the meeting is required to approve the 2002 Purchase Plan. Broker non-votes will not be counted as present or represented for this purpose. Abstentions will be counted as present and entitled to vote and, accordingly, will have the effect of a negative vote.

The board of directors recommends a vote FOR this proposal.

13

EXECUTIVE COMPENSATION

Compensation Committee Report on Executive Compensation

The Compensation Committee of the board of directors determines the compensation to be paid to GTC's executive officers, including the Chief Executive Officer. The Committee also administers GTC's equity plans, including the grant of stock options and other awards under the 2002 Equity Plan. The Committee is currently composed of Messrs. Bullock (Chairman), Blair and Tuck. Because Mr. Blair is not standing for re-election, GTC is searching for an appropriate candidate to fill the resulting vacancy on the Committee. This report is submitted by the Committee and addresses the compensation policies for fiscal year 2001.

GTC's executive compensation policy is designed to attract, retain and reward executive officers who contribute to GTC's long-term success by maintaining a competitive salary structure as compared with other biotechnology companies. The compensation program seeks to align compensation with the achievement of business objectives and individual and corporate performance. Bonuses are included to encourage effective individual performance relative to GTC's current plans and objectives. Stock option grants are key components of the executive compensation program and are intended to provide executives with an equity interest in GTC to link a meaningful portion of the executive's compensation with the performance of GTC's common stock.

In executing its compensation policy, GTC seeks to relate compensation with GTC's financial performance and business objectives as well as to reward each executive's achievement of designated targets relating to GTC's annual and long-term performance and individual fulfillment of responsibilities. While compensation survey data are useful guides for comparative purposes, GTC believes that a successful compensation program also requires the application of judgment and subjective determinations of individual performance. To that extent, the Committee applies its judgment in reconciling the program's objectives with the realities of retaining valued employees.

The Company's executive compensation package for the CEO and the other executive officers is composed of three elements:

- •

- base salary;

- •

- annual incentive bonuses based on corporate and individual performance; and

- •

- initial, annual and other periodic grants of stock options under the equity plans.

Named Executive Officers

Base Salary. The two most highly paid current executive officers other than the CEO, Messrs. Green and Meade, have employment agreements with GTC that each set a minimum annual base salary based upon that executive's salary history and internal and external equity considerations. At the beginning of fiscal year 2001, the Compensation Committee reviewed the base salaries actually paid to all executive officers during the prior year. Effective January 1, 2001, those annual base salaries were adjusted in light of the executives' prior performance, tenure and responsibility, as well as independent compensation data.

14

Incentive Bonus. In fiscal year 2001, the Committee established a target bonus opportunity for each executive officer. Under that 2001 Executive Bonus Program, bonus amounts were to be recommended by the Chief Executive Officer and tied to GTC's financial performance and the executive's contribution to that performance. The bonuses for 2001 were determined by the Committee in consultation with the CEO based on GTC's performance against budget and management's subjective judgment regarding each executive's individual contributions to GTC's performance in 2001.

Mr. Green and Dr. Meade received a significant proportion of their target bonuses. In addition, the Committee awarded Mr. Green a one-time $25,000 bonus in recognition of his contribution to GTC's sale of Primedica Corporation in February 2001.

Stock Options. Executive officer compensation also includes long-term incentives through GTC's stock option grant program, the purpose of which is to:

- •

- highlight and reinforce the mutual, long-term interests between employees and the stockholders; and

- •

- to assist in the attraction and retention of important key executives, managers and individual contributors who are essential to GTC's growth and development.

In May 2001, the Committee approved annual option grants of 35,000 and 20,000 shares to Mr. Green and Dr. Meade, respectively, as shown in the Summary Compensation Table in this proxy statement.

Upon Dr. Cox becoming Chairman, CEO and President in July 2001, the Committee established a 2001 base salary of $380,000 per annum for Dr. Cox as well as a target bonus opportunity. The Committee determined that Dr. Cox's base salary should fall at the midpoint within a range of chief executive officer salaries of comparable companies reviewed by the Committee and be equal to Dr. Lehrman's base salary at the time of her departure. The Committee also approved an initial hire option grant to Dr. Cox with respect to 285,000 shares of common stock at an exercise price equal to the fair market value on the date of grant, exercisable as to 20% of such shares on the date of grant and on each of the first four anniversaries of the date of grant.

Sandra Nusinoff Lehrman served as CEO and President of the Company until May 2001, with an annual base salary established by the Committee of $380,000. In addition, in early 2001 Dr. Lehrman received options to purchase 150,000 shares of GTC common stock at an exercise price equal to the fair market value of the common stock on the date of grant. In connection with the settlement of Dr. Lehrman's employment contract with GTC at the time of her departure, the Committee granted her a new option with respect to 100,000 shares of common stock, which is exercisable until May 2004 at an exercise price of $6.70 per share.

Section 162(m) of the Internal Revenue Code denies a tax deduction to a public corporation for annual compensation in excess of one million dollars paid to its CEO and its four other highest compensated officers. This provision excludes certain types of "performance based compensation." Currently, GTC does not expect to pay compensation exceeding this one million dollar limit.

15

Furthermore, the 1993 and 2002 Equity Plans contain a limit on the number of stock options and stock appreciation rights that may be granted annually under the plan to any individual so that such awards will qualify for such exclusionary treatment. The Committee will continue to assess the impact of Section 162(m) on its compensation practices and determine what further action, if any, is appropriate.

16

SUMMARY COMPENSATION TABLES

The following tables contain information regarding our executive officers' compensation during the fiscal year 2001.

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation

Awards

| |

| |

|---|

| | Annual Compensation

| |

| |

|---|

Name and Position

| | Securities

Underlying

Options

| | All Other

Compensation (1)

| |

|---|

| | Year

| | Salary

| | Bonus

| |

|---|

Geoffrey F. Cox

Current Chairman of the Board, President and Chief Executive Officer | | 2001 | | $ | 168,813 | | $ | 76,000 | | 300,000 | | $ | 13,098 | (2) |

John B. Green

Senior Vice President, Chief Financial Officer, Treasurer and Assistant Clerk |

|

2001

2000

1999 |

|

$

$

$ |

239,114

206,393

184,169 |

|

$

$

$ |

53,254

80,000

45,249 |

|

35,000

33,000

33,000 |

|

$

$

$ |

5,100

4,765

4,286 |

|

Harry M. Meade

Senior Vice President,

Transgenics Research |

|

2001

2000

1999 |

|

$

$

$ |

212,698

194,638

180,959 |

|

$

$

$ |

47,068

37,000

40,747 |

|

20,000

33,000

33,000 |

|

$

$

$ |

5,100

3,183

3,000 |

|

Sandra Nusinoff Lehrman

Former President and Chief Executive Officer |

|

2001

2000

1999 |

|

$

$

$ |

164,325

303,264

275,400 |

|

$

$

$ |

0

121,400

112,310 |

|

250,000

85,000

85,000 |

(3)

|

$

$

$ |

257,336

4,151

31,367 |

(4)

(5) |

Michael W. Young

Former Vice President,

Commercial Development |

|

2001

2000

1999 |

|

$

$

$ |

107,789

193,713

172,760 |

|

$

$

$ |

0

49,500

40,207 |

|

35,000

33,000

33,000 |

|

$

$

$ |

0

3,985

3,631 |

|

- (1)

- Unless otherwise noted, the amounts in this column represent our contributions to the Genzyme Transgenics Corporation 401(k) Plan on behalf of the employee.

- (2)

- For the period beginning in July 2002 when Dr. Cox became an executive employee. Includes reimbursement of $5,698 for relocation expenses and $4,000 as compensation for serving as a non-employee director from May 2002 until July 2002.

- (3)

- Includes an option to purchase 150,000 shares, only 36,000 of which vested prior to Dr. Lehrman's departure, and an option to purchase 100,000 shares granted in May 2001.

- (4)

- Includes amounts paid to Dr. Lehrman pursuant to her separation agreement.

- (5)

- Includes reimbursement of $27,293 for relocation expenses.

17

Option Grant Table

The following table provides information on stock options granted during fiscal year 2001 to the executive officers named in the Summary Compensation Table.

Option Grants in 2001 Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| |

| | Percentage

of Total

Options

Granted to

Employees in

Fiscal Year

| |

| |

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation during Option Term (2)

|

|---|

| | Number of

Securities

Underlying

Options

Granted (1)

| |

| |

|

|---|

Name

| | Exercise

Price per

Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Geoffrey F. Cox | | 15,000 | (3) | 1.49 | % | $ | 8.8100 | | 5/23/2011 | | $ | 83,108 | | $ | 210,613 |

| | | 285,000 | (4) | 28.38 | % | $ | 8.0000 | | 7/17/2011 | | $ | 1,433,880 | | $ | 3,633,733 |

John B. Green |

|

35,000 |

|

3.48 |

% |

$ |

5.0313 |

|

3/14/2011 |

|

$ |

110,746 |

|

$ |

280,651 |

Harry M. Meade |

|

20,000 |

|

1.99 |

% |

$ |

5.0313 |

|

3/14/2011 |

|

$ |

63,283 |

|

$ |

160,372 |

Sandra Nusinoff Lehrman |

|

150,000 |

(5) |

14.94 |

% |

$ |

5.0313 |

|

3/14/2011 |

|

$ |

474,624 |

|

$ |

1,202,789 |

| | | 100,000 | (6) | 9.96 | % | $ | 6.7000 | | 5/16/2004 | | $ | 105,609 | | $ | 221,770 |

Michael W. Young |

|

35,000 |

(7) |

3.48 |

% |

$ |

5.0313 |

|

3/14/2011 |

|

$ |

110,746 |

|

$ |

280,651 |

- (1)

- Except where noted, the options listed in this column were granted on March 14, 2001 under our 1993 Equity Plan and became exercisable with respect to 20% of the shares on the grant date. The remaining 80% of the underlying shares will vest in four equal installments on the first four anniversaries of the grant date.

- (2)

- The values in this column are given for illustrative purposes only. They do not reflect our estimate or projection of our future stock price. The values are based on an assumption that our common stock's market price will appreciate at the stated rate, compounded annually, from the date of the option grant until the end of the option's term. Actual gains, if any, on stock option exercises will depend upon the future performance of our common stock's price, which will benefit all stockholders proportionately. In order to realize the potential values set forth in the 5% and 10% columns of this table at the end of a typical ten-year option term, the per share price of our common stock would have to be approximately 63% and 159% above the total weighted average exercise price of all options described above ($6.7026). The potential value to all of our stockholders if our price appreciates at rates of 5% and 10% over ten years would be $127,177,024 and $322,291,549, respectively, assuming a purchase of common stock in 2001 at $6.7026 per share and 30,170,859 shares outstanding.

- (3)

- This option was granted on May 23, 2001 under our 1993 Equity Plan and was immediately exercisable with respect to 7,500 shares and will become exercisable for the remaining 7,500 shares on May 23, 2002.

- (4)

- This option was granted on July 17, 2001 under our 1993 Equity Plan and was immediately exercisable with respect to 20% of the shares and will become exercisable for the remaining 80% in four equal installments on the first four anniversaries of the grant date.

- (5)

- This option was granted on March 14, 2001 under our 1993 Equity Plan and was exercised with respect to 30,000 shares prior to its expiration three months following Dr. Lehrman's departure from GTC in May 2001.

- (6)

- This option was granted on May 16, 2001 and was immediately exercisable in full.

- (7)

- This option was granted on March 14, 2001 under our 1993 Equity Plan and was exercised with respect to 7,000 shares prior to its expiration three months following Mr. Young's departure from GTC in June 2001.

18

FISCAL YEAR-END OPTION TABLE

The following table provides information on the total number of exercisable and unexercisable stock options held at December 30, 2001 by the executive officers named in the Summary Compensation Table.

Fiscal Year-End Option Values

| |

| |

| | Number of Securities Underlying

Unexercised Options at

Fiscal Year-End

| | Value of Unexercised

In-the-Money Options

at Fiscal Year-End

|

|---|

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable(1)

|

|---|

| Geoffrey F. Cox | | 0 | | $ | 0 | | 64,500 | | 235,500 | | $ | 0 | | $ | 0 |

| John B. Green | | 0 | | $ | 0 | | 99,321 | | 66,000 | | $ | 22,121 | | $ | 38,683 |

| Harry M. Meade | | 0 | | $ | 0 | | 81,283 | | 54,000 | | $ | 24,639 | | $ | 29,218 |

| Sandra Nusinoff Lehrman | | 137,000 | | $ | 187,024 | | 100,000 | | 0 | | $ | 0 | | $ | 0 |

| Michael W. Young | | 16,800 | | $ | 5,238 | | 0 | | 0 | | $ | 0 | | $ | 0 |

- (1)

- Based on the difference between the option's exercise price and a closing price of $5.82 for the underlying common stock on December 28, 2001 as reported by Nasdaq.

Executive Employment Agreements

Geoffrey F. Cox. Under the terms of Dr. Cox's employment agreement entered into in July 2001, he is entitled to a minimum base salary of $31,667 per month ($380,000 on an annualized basis), and is eligible to receive performance and incentive bonuses of not less than 40% of his base salary. For the 2002 calendar year, Dr. Cox's annual base salary has been set at $420,000 with a bonus opportunity of 40% of such base salary.

Sandra Nusinoff Lehrman. Under Dr. Lehrman's separation agreement entered into in May 2001, she is entitled to 24 months of her former $380,000 annual base salary plus a bonus equal to $60,384, which payments will be made in substantially equal installments over a 24-month period.

John B. Green. Under Mr. Green's employment agreement entered into in August 1997, Mr. Green is entitled to a minimum base salary of $150,000 per year, plus performance and incentive bonuses as determined by the Compensation Committee. For the 2002 calendar year, Mr. Green's annual base salary has been set at $257,000, with a maximum bonus opportunity of 30% of such base salary.

Harry M. Meade. Under Dr. Meade's employment agreement, he is entitled to a minimum base salary of $126,000 per year, plus performance and incentive bonuses as determined by the Compensation Committee. For the 2002 calendar year, Dr. Meade's annual base salary has been set at $250,000, with a maximum bonus opportunity of 30% of such base salary.

19

Each of these agreements will remain in effect until terminated according to its terms. In the event that we terminate any of these executive officers without cause or if any of them terminates his agreement upon a "change of control" of GTC, as that term is defined in the employment agreement, the executive will immediately be paid the maximum annual bonus for the year he is terminated, prorated for the portion of the year completed, and his then current base salary for a specified severance period, together in one lump sum. In the case of Dr. Cox, the severance period is two years. In the case of Mr. Green, the severance period in the event of a "change of control" is two years and otherwise is one year. In the case of Dr. Meade, the severance period is one year. If Dr. Meade terminates his agreement upon a change of control, his severance payments will be reduced by any income that he derives during the severance period from a subsequent employer.

In addition, upon a change of control of GTC, any unvested stock options held by these executive officers would become immediately exercisable in full.

Compensation Committee Interlocks And Insider Participation

During fiscal year 2001, the Compensation Committee of the board of directors consisted of Dr. Bullock and Messrs. Blair and Tuck. Mr. Blair is President, CEO and Chairman of the Board of Dyax and Mr. Tuck is a strategic advisor to Dyax. We have an agreement with Dyax under which Dyax is developing a purification media for some of our products. Dr. Bullock was a senior consultant with Arthur D. Little, Inc. through March 2002. In November 2000, we entered into a consulting agreement with Arthur D. Little for strategic and technical assessment and due diligence within the ordinary course of business.

Two of our current board members hold positions with Genzyme Corporation. Mr. Blair, who is not standing for re-election to our board at the 2002 Annual Meeting, is a Genzyme Corporation director and Mr. Geraghty is an officer of Genzyme Corporation. Each of these directors owns equity in GTC and Genzyme Corporation. In addition, until April 2002 Henri Termeer, Chairman, CEO and President of Genzyme Corporation, was also a director of GTC.

In connection with our initial public offering in 1993, we entered into several agreements with Genzyme Corporation that are summarized below. In 2001, we paid Genzyme Corporation an aggregate of $1,316,000 under the research and development agreement, the services agreement and the lease agreement described below. In April 2002, we repurchased from Genzyme Corporation 2,282,000 shares of our common stock on the terms described below.

Equity Position. Genzyme Corporation is the largest single stockholder of the Company, holding 5,443,243 shares of common stock as of April 5, 2002 (including shares issuable upon exercise of warrants), which represents approximately 17.7% of the outstanding GTC common stock. Genzyme Corporation also holds four common stock purchase warrants exercisable for 145,000, 288,000, 55,833 and 29,491 shares of GTC common stock at prices of $2.84, $4.88, $6.30 and $6.30 per share, respectively, which were the market prices of the common stock at the time the respective Genzyme Corporation warrants were issued. All of the shares held by Genzyme Corporation (including shares issuable on exercise of Genzyme Corporation warrants) are entitled to registration rights. On April 4, 2002, we repurchased from Genzyme Corporation 2,820,000 shares of our common stock for $4,722,850

20

in cash and a promissory note for an additional $4,722,850 at an annual interest rate of LIBOR plus 1%. The note is secured by a subordinated lien on all of our assets except our intellectual property and is to be repaid 50% on April 3, 2005 and the remaining 50% on April 3, 2006. We also granted Genzyme Corporation an option to convert their remaining 4.9 million shares of our common stock into a class of preferred stock, which shall have identical terms and rights as the common stock except that it shall be non-voting. Genzyme Corporation agreed to a 24-month lock-up on all of its remaining 4.9 million shares of our common stock, releasable if the average price of the stock trades above $12 per share for twenty consecutive trading days. In connection with the stock repurchase, Mr. Termeer resigned his position on our board and Mr. Blair, at the request of Genzyme Corporation, is not standing for re-election.

Technology Transfer Agreement. Under the Technology Transfer Agreement dated May 1, 1993, Genzyme Corporation transferred substantially all of its transgenic assets and liabilities to us, assigned its relevant contracts and licensed to us technology owned or controlled by it and relating to the field of recombinant proteins in the milk of transgenic animals and the purification of proteins produced in that manner. The license is worldwide and royalty free as to Genzyme Corporation, although we are obligated to Genzyme Corporation's licensors for any royalties due them. As long as Genzyme Corporation owns less than 50% of GTC, Genzyme Corporation may use the transferred technology, or any other technology it subsequently acquires relating to the field, for internal purposes only without any royalty obligation to us.

R&D Agreement. Under a Research and Development Agreement dated May 1, 1993, we and Genzyme Corporation each agreed to provide to the other research and development services relating, in the case of GTC, to transgenic production of recombinant proteins and, in the case of Genzyme Corporation, to the purification of such proteins. Each company receives payments from the other equal to the performing party's fully allocated cost of such services, which can be no less than 80% of the annual budgets established by the parties under the agreement on a month-to-month basis, plus, in most cases, a fee equal to 10% of such costs. The agreement expired on December 31, 1998 and the parties are continuing under this agreement on a month-to-month basis.

ATIII Collaboration. In January 1998, we entered into a collaboration agreement for the development of rhATIII with Genzyme Corporation forming the ATIII LLC joint venture. Under the terms of the agreement, Genzyme Corporation funded 70% of the development costs of rhATIII up to a maximum of $33 million. We funded the remaining 30% of these costs. Development costs in excess of these amounts were to be funded equally by the partners. The $33 million funding level was achieved by Genzyme Corporation in 2000.

In late 2000, we announced that we expected to re-acquire from Genzyme Corporation the rights to rhATIII that we did not already own. In early 2001, the ATIII LLC met with the FDA to discuss the status of the clinical development program for the rhATIII in the treatment of heparin-resistant patients undergoing cardiopulmonary bypass surgery. The ATIII LLC decided to discontinue development of this indication based on the level of additional data that would have been required to address the clinical development issues raised during the meeting with the FDA. In 2001, we reacquired Genzyme Corporation's ownership interest the ATIII LLC in consideration of 4% of future product revenue, three years after approval, up to a total of $30 million.

21

Services Agreement. Under a services agreement with Genzyme Corporation, we pay Genzyme Corporation a fixed monthly fee for basic laboratory and administrative support services. The monthly fee is adjusted annually, based on the services to be provided and changes in Genzyme Corporation's cost of providing the services. The services agreement is self-renewing annually and may be terminated upon 90 days notice by either party.

Credit Line Guaranty, Term Loan Guaranty, and Lien. Genzyme Corporation guaranteed a credit line and term loan that we had with a commercial bank up to $24.6 million, which was extended until March 28, 2002. In return for Genzyme Corporation's guaranty, we issued to Genzyme Corporation warrants to purchase 145,000 and 288,000 shares of our common stock at prices per share of $2.84 and $4.88, respectively, which are fully exercisable and expire in July 2005 and December 2008, respectively. The credit line and term loan were fully satisfied on March 28, 2002, and the guarantee was released.

Lease. We lease a portion of Genzyme Corporation's Framingham, Massachusetts facility for which we paid $368,000 to Genzyme Corporation in 2001.

22

STOCK PERFORMANCE GRAPH

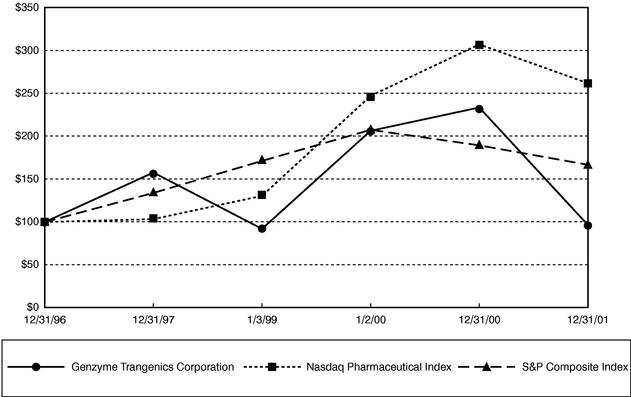

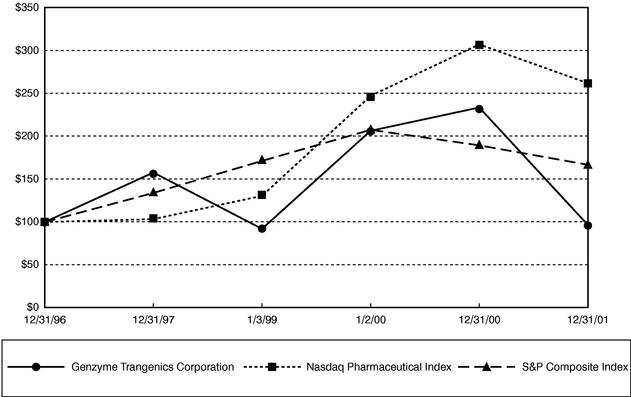

The following graph compares the cumulative total shareholder return on our common stock with the cumulative total return of the S&P 500 Composite Index and the Nasdaq Pharmaceutical Index during the period from December 31, 1996 to December 30, 2001. The Nasdaq Pharmaceutical Index is comprised of pharmaceutical and biotechnology companies with the SIC Code 283 (Division/ Manufacturing, Major Group/Chemical and Allied Products, Industry Group/Drugs) whose securities are traded on the Nasdaq National Market. We believe the Nasdaq Pharmaceutical Index is representative of peer biotechnology companies.

This graph assumes an initial investment of $100 on December 31, 1996 in our common stock, the S&P 500 Composite Index and the Nasdaq Pharmaceutical Index, with all dividends, if any, being reinvested. The total stockholder return is measured by dividing the share price change of the respective securities plus dividends, if any, for each fiscal year shown by the share price at the end of the particular fiscal year.

Comparison of the Cumulative Total Shareholder Return

Among Genzyme Transgenics Corporation,

the S&P 500 Composite Index and the Nasdaq Pharmaceutical Index

| | 12/31/96

| | 12/31/97

| | 1/3/99

| | 1/2/00

| | 12/31/00

| | 12/30/01

|

|---|

| Genzyme Transgenics Corporation | | 100.00 | | 157.14 | | 91.84 | | 206.12 | | 233.68 | | 96.49 |

| Nasdaq Pharmaceutical Index | | 100.00 | | 103.06 | | 130.81 | | 246.55 | | 307.50 | | 261.22 |

| S&P 500 Composite Index | | 100.00 | | 133.36 | | 171.47 | | 207.56 | | 188.66 | | 166.24 |

23

TRANSACTIONS WITH RELATED PARTIES

Mr. Blair, who will not be standing for re-election, is an executive officer of Dyax and a director of Genzyme Corporation. Mr. Geraghty is an executive officer of Genzyme Corporation, and Mr. Termeer, who served as a director of GTC until April 2002, is an executive officer and a director of Genzyme Corporation. Mr. Bullock was a senior consultant with Arthur D. Little, Inc. through March 2002. We are involved in various financial and business transactions with Dyax, Genzyme Corporation and Arthur D. Little. See "Compensation Committee Interlocks and Insider Participation" in this proxy statement.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors, executive officers and persons owning more than 10% of our registered equity securities, to file with the SEC reports of their initial ownership and of changes in their ownership of our common stock and to provide us with copies of those reports.

To our knowledge, based solely on our review of copies of reports furnished to us and written representations that no other reports were required during the 2001 fiscal year, we believe that during the 2001 fiscal year, our directors, officers, and 10% stockholders complied with all Section 16(a) filing requirements.

INFORMATION CONCERNING INDEPENDENT ACCOUNTANTS

The firm of PricewaterhouseCoopers LLP, independent accountants, has audited our financial statements for the year ended December 30, 2001. The board of directors has appointed PricewaterhouseCoopers LLP to serve as our auditors for the year end audit and to review the quarterly financial reports for the filing with the Securities and Exchange Commission during fiscal year 2002. Representatives of PricewaterhouseCoopers LLP are expected to attend the annual meeting and be available to respond to appropriate questions. They will also have the opportunity to make a statement if they desire.

Audit Fees. Total fees for professional services rendered by PricewaterhouseCoopers LLP in connection with their audit of our consolidated financial statements, our annual report on Form 10-K for 2000 and reviews of the consolidated financial statements included in our quarterly reports on Form 10-Q for fiscal year 2001 were $169,000.

Financial Information Systems Design and Implementation Fees. No fees were billed by PricewaterhouseCoopers LLP for fiscal year 2001 related to financial information systems design and implementation services.

All Other Fees. Total fees for all other services rendered by PricewaterhouseCoopers LLP for fiscal year 2001 were $171,000 (primarily consisting of tax compliance and advisory services, accounting and advisory services, and 401K benefit plan audit).

24

AUDIT COMMITTEE REPORT

In the course of its oversight of GTC's financial reporting process, the Audit Committee of the board of directors has:

- •

- reviewed and discussed with management and PricewaterhouseCoopers LLP, GTC's independent auditor, GTC's audited financial statements for the fiscal year ended December 30, 2001;

- •

- discussed with the auditor the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees;

- •

- received the written disclosures and the letter from the auditor required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees;

- •

- reviewed with management and the auditor GTC's critical accounting policies;

- •

- discussed independently with the auditor the quality and adequacy of GTC's internal controls;

- •

- discussed with PricewaterhouseCoopers LLP any relationships that may impact their objectivity and independence; and

- •

- considered whether the provision of non-audit services by the auditor is compatible with maintaining the auditor's independence.

Based on the foregoing review and discussions, the Committee recommended to the board of directors that the audited financial statements be included in GTC's Annual Report on Form 10-K for the year ended December 30, 2001 for filing with the Securities and Exchange Commission.

DEADLINE FOR STOCKHOLDER PROPOSALS

Assuming the 2003 stockholders annual meeting is not held before April 22, 2003 or after June 21, 2003, if you wish to bring business before or propose director nominations at the 2003 annual meeting, you must give written notice to GTC by March 8, 2003 (the date 75 days before the anniversary of the 2002 annual meeting).

If you intend to bring such a proposal or nomination at the 2003 annual meeting, and you would like us to consider the inclusion of your proposal or nomination in our proxy statement for the meeting, you must provide written notice to GTC of such proposal or nomination prior to December 17, 2002.

Notices of stockholder proposals and nominations shall be given in writing to Geoffrey F. Cox, Chairman, President and Chief Executive Officer, Genzyme Transgenics Corporation, 175 Crossing Boulevard, Framingham, Massachusetts 01701.

25

Appendix A

GENZYME TRANSGENICS CORPORATION

Audit Committee Charter

Purpose

The principal purpose of the Audit Committee is to assist the Board of Directors in fulfilling its responsibility to oversee management's conduct of the Company's financial reporting process, including by reviewing the financial reports and other financial information provided by the Company, the Company's systems of internal accounting and financial controls, and the annual independent audit process.

In discharging its oversight role, the Committee is granted the power to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company and the power to retain outside counsel, auditors or other experts for this purpose.

The outside auditor is ultimately accountable to the Board and the Committee, as representatives of the stockholders. The Board and the Committee shall have the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the outside auditor. The Committee shall be responsible for overseeing the independence of the outside auditor.

This Charter shall be reviewed for adequacy on an annual basis by the Board.

Membership

The Committee shall be comprised of not less than three members of the Board, and the Committee's composition will meet the requirements of the Nasdaq Audit Committee Requirements. Accordingly, all of the members will be directors:

- •

- Who have no relationship to the Company or the outside auditor that may interfere with the exercise of their independence from management and the Company; and

- •

- Who are financially literate or who become financially literate within a reasonable period of time after appointment to the Committee.

In addition, at least one member of the Committee will have accounting or related financial management expertise.

Key Responsibilities

The Committee's role is one of oversight, and it is recognized that the Company's management is responsible for preparing the Company's financial statements and that the outside auditor is responsible for auditing those financial statements.

The following functions shall be the common recurring activities of the Committee in carrying out its oversight role. The functions are set forth as a guide and may be varied from time to time as appropriate under the circumstances.

A-1

- •

- The Committee shall review with management and the outside auditor the audited financial statements to be included in the Company's Annual Report on Form 10-K and the Annual Report to Stockholders, and shall review and consider with the outside auditor the matters required to be discussed by Statement on Auditing Standards No. 61.

- •

- As a whole, or through the Committee chair, the Committee shall review with the outside auditor, prior to filing with the Securities and Exchange Commission, the Company's interim financial information to be included in the Company's Quarterly Reports on Form 10-Q and the matters required to be discussed by SAS No. 61.

- •

- The Committee shall periodically discuss with management and the outside auditor the quality and adequacy of the Company's internal controls and discuss with the outside auditor how the Company's financial systems and controls compare with industry practices.

- •

- The Committee shall periodically review with management and the outside auditor the quality, as well as the acceptability, of the Company's accounting policies and discuss with the outside auditor how the Company's accounting policies compare with industry practices.

- •

- The Committee shall review with management and the outside auditor the Company's accounting policies which may be viewed as critical.

- •

- The Committee shall request from the outside auditor annually a formal written statement delineating all relationships between the auditor and the Company consistent with Independence Standards Board Standard No. 1, discuss with the outside auditor any such disclosed relationships and their impact on the outside auditor's independence, and take or recommend that the Board take appropriate action regarding the independence of the outside auditor.

- •

- The Committee shall be consulted regarding retention of the outside auditor to perform any significant non-audit services for the Company and the effect of such retention on the outside auditor's independence.

- •

- The Committee, subject to any action that may be taken by the Board, shall have the ultimate authority and responsibility to select (or nominate for stockholder approval), evaluate and, where appropriate, replace the outside auditor.

- •