QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrantý

|

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

GTC BIOTHERAPEUTICS, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

175 Crossing Boulevard

Framingham, Massachusetts 01702

(508) 620-9700

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 26, 2004

The 2004 Annual Meeting of Stockholders of GTC Biotherapeutics, Inc., or GTC, will be held in the State Street Bank Board Room, 33rd Floor, 225 Franklin Street, Boston, Massachusetts, at 2:00 p.m. on Wednesday, May 26, 2004 for the following purposes:

- 1.

- To elect two directors to serve until the 2007 Annual Meeting of Stockholders.

- 2.

- To approve GTC's Amended and Restated 2002 Equity Incentive Plan.

- 3.

- To transact such other business as may properly come before the meeting or any adjournments thereof.

Only stockholders of record at the close of business on April 2, 2004 are entitled to notice of and to vote at the annual meeting or at any adjournment.

It is important that your shares be represented at the meeting.Therefore, whether or not you plan to attend the meeting, please complete your proxy card and return it in the enclosed envelope, which requires no postage if mailed in the United States. If you attend the meeting and wish to vote in person, your proxy will not be used.

| | | By order of the Board of Directors, |

|

|

Nathaniel S. Gardiner

Clerk |

April 21, 2004 |

|

|

TABLE OF CONTENTS

| | Page

|

|---|

| GENERAL INFORMATION | | 1 |

| | Who can vote | | 1 |

| | How to vote your shares | | 1 |

| | Proposals to be considered at the annual meeting | | 1 |

| | Quorum | | 1 |

| | Number of votes required | | 1 |

| | Abstentions and broker non-votes | | 1 |

| | Discretionary voting by proxies on other matters | | 2 |

| | How you may revoke your proxy | | 2 |

| | Expenses of solicitation | | 2 |

| | Security Ownership of Certain Beneficial Owners and Management | | 2 |

| PROPOSAL 1: ELECTION OF DIRECTORS | | 4 |

| BOARD OF DIRECTORS AND COMMITTEE MATTERS | | 7 |

| | Independence | | 7 |

| | Board Meetings and Committees | | 7 |

| | Shareholder Communications | | 7 |

| | Audit Committee | | 7 |

| | Compensation Committee | | 8 |

| | Nominating and Corporate Governance Committee | | 8 |

| | Director Compensation | | 9 |

| | Certain Relationships and Related Transactions | | 10 |

| | Compensation Committee Interlocks and Insider Participation | | 11 |

| PROPOSAL 2: APPROVAL OF OUR AMENDED AND RESTATED 2002 EQUITY INCENTIVE PLAN | | 12 |

| | The Current Plan | | 12 |

| | Summary of Proposed Changes | | 12 |

| | Reasons for the Changes | | 13 |

| | Description of Awards | | 14 |

| | Shares Available for Issuance under the 2002 Plan | | 15 |

| | Amendment and Term of the 2002 Plan | | 16 |

| | U.S. Federal Income Tax Consequences Relating to Awards | | 16 |

| | Option Grants and Outstanding Options | | 19 |

| | Securities Authorized for Issuance Under Equity Compensation Plans | | 20 |

| EXECUTIVE COMPENSATION | | 21 |

| | Summary Compensation Table | | 21 |

| | Option Grant Table | | 22 |

| | Fiscal Year-End Option Table | | 23 |

| | Executive Employment Agreements | | 23 |

| | Compensation Committee Report on Executive Compensation | | 24 |

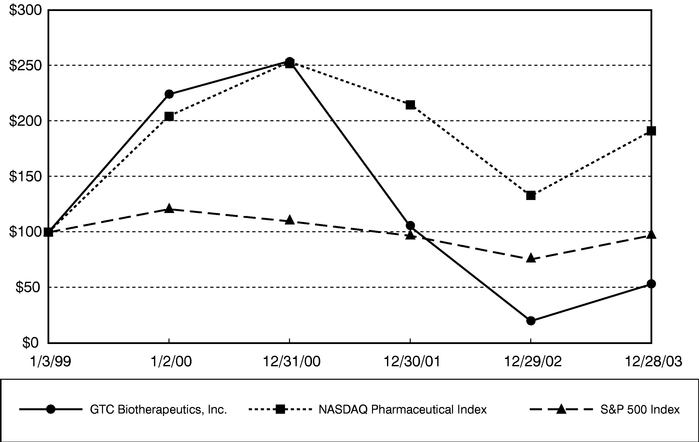

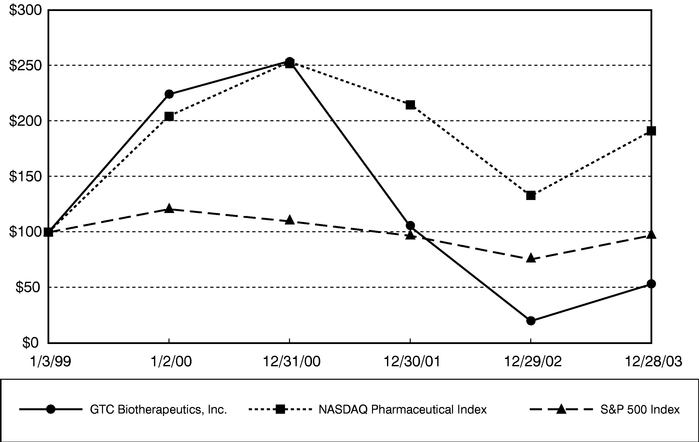

| STOCK PERFORMANCE GRAPH | | 27 |

| INFORMATION ABOUT OUR AUDITORS | | 28 |

| | Report of the Audit Committee | | 28 |

| | Independent Auditors' Fees and Other Matters | | 28 |

| ADDITIONAL INFORMATION | | 29 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 29 |

| | Deadline for Stockholder Proposals and Director Nominations | | 29 |

| | Householding of Annual Meeting Materials | | 30 |

| APPENDIX A AUDIT COMMITTEE CHARTER | | A-1 |

| APPENDIX B AMENDED AND RESTATED 2002 EQUITY INCENTIVE PLAN | | B-1 |

PROXYSTATEMENT

Our Board of Directors is soliciting the enclosed proxy card for use at the 2004 Annual Meeting of Stockholders to be held on Wednesday, May 26, 2004 and at any adjournment. This proxy statement and the accompanying proxy card are first being provided to stockholders of GTC on or about April 21, 2004.

GENERAL INFORMATION

Who can vote. You may vote your shares of GTC common stock at the annual meeting if you were a stockholder of record at the close of business on April 2, 2004. On that date, there were 38,470,889 shares of common stock outstanding. You are entitled to one vote for each share of common stock that you held on the record date.

How to vote your shares. You may vote your shares either by proxy or by attending the meeting and voting in person. If you choose to vote by proxy, please complete, date, sign and return the proxy card in the enclosed postage prepaid envelope. The proxies named in the proxy card will vote your shares as you have instructed. If you sign and return the proxy card without indicating how your vote should be cast, the proxies will vote your shares in favor of the proposals contained in this proxy statement, as recommended by our Board of Directors. Even if you plan to attend the meeting, please complete and mail your proxy card to ensure that your shares are represented at the meeting. If you attend the meeting, you can still revoke your proxy by voting in person.

Proposals to be considered at the annual meeting. The principal business expected to be transacted at the meeting, as more fully described below, will be the election of two directors and approval of our Amended and Restated 2002 Equity Incentive Plan.

Quorum. A quorum of stockholders is required to transact business at the meeting. A majority in interest of the outstanding shares of common stock entitled to vote, represented at the meeting in person or by proxy, constitutes a quorum for the transaction of business.

Number of votes required. The number of votes required to approve the proposals that are scheduled to be presented at the meeting is as follows.

Proposal

| | Required Vote for Approval

|

|---|

| • | | Election of a nominee as director. | | • | | Affirmative votes representing a plurality of the votes cast for or against the nominee. |

| • | | Approval of Amended and Restated 2002 Equity Incentive Plan. | | • | | Affirmative votes representing a majority of the shares of common stock present or represented at the meeting. |

Abstentions and broker non-votes. Abstentions and broker non-votes will be counted in determining a quorum for the transaction of business at the Annual Meeting. A broker non-vote on a proposal results from a proxy submitted by a broker that does not indicate a vote for one or more

proposals because the broker does not have discretionary voting authority and the customer did not send the broker instructions on how to vote on the proposal. If the broker does not have instructions on certain matters, and the broker is barred by law or NASDAQ regulations from exercising its discretionary voting authority in the particular matter, then the shares will not be voted on the matter. In voting on the proposal to elect two directors, abstentions, any votes withheld and broker non-votes will be disregarded and not treated as votes cast and, therefore, will not affect the outcome of the election. In voting on the proposal to approve the Amended and Restated 2002 Equity Incentive Plan, abstentions will count as votes against the proposal and broker non-votes will not be counted as votes against or as shares present or represented at the meeting.

Discretionary voting by proxies on other matters. Aside from the proposals for the election of directors and approval of our Amended and Restated 2002 Equity Incentive Plan, we do not know of any other proposals that may be presented at the 2004 Annual Meeting. If another matter is properly presented for consideration at the meeting, the persons named in the accompanying proxy card will exercise their discretion in voting on the matter.

How you may revoke your proxy. You may revoke the authority granted by your executed proxy card at any time before we exercise it by filing with GTC, Attention: Nathaniel S. Gardiner, our corporate clerk, a written revocation or a duly executed proxy card bearing a later date, or voting in person at the meeting. If your shares are held in a brokerage account, you must make arrangements with your broker or bank to vote your shares in person or to revoke your proxy.

Expenses of solicitation. We will bear all costs of soliciting proxies. We have hired a proxy solicitation firm, The Altman Group, to assist us in soliciting proxies. We will pay The Altman Group a fee of $8,000, plus its reasonable out-of-pocket expenses. We will, upon request, reimburse brokers, custodians and fiduciaries for out-of-pocket expenses incurred in forwarding proxy solicitation materials to the beneficial owners of our common stock held in their names. In addition to solicitations by mail, our directors, officers and employees may solicit proxies from stockholders in person or by other means of communication, including telephone, facsimile and e-mail, without additional remuneration.

Security Ownership of Certain Beneficial Owners and Management

The following table and footnotes show the amount of our common stock beneficially owned as of April 2, 2004 by (i) persons known by us to be beneficial owners of more than 5% of our common stock, (ii) the Chief Executive Officer and the five other most highly compensated executive officers who were serving as executive officers as of the end of fiscal year 2003, whom we refer to collectively as the "Named Executive Officers," (iii) our directors and (iv) all of our current executive officers and directors as a group.

The number of shares beneficially owned by each person listed below includes any shares over which the person has sole or shared voting or investment power as well as shares which the person has the right to acquire on or before May 31, 2004 by exercising a stock option or other right to acquire shares. Unless otherwise noted, each person has sole investment and voting power (or shares that power with his or her spouse) over the shares listed in the table. The percentage ownership of each person listed in the table was calculated using the total number of shares outstanding on April 2, 2004,

2

plus any shares that person could acquire upon the exercise of any options or other rights exercisable on or before May 31, 2004.

5% Stockholders, Directors and

Named Executive Officers

| | Number of

Outstanding

Shares

| | Number of Shares

Subject to Options,

Warrants or

Other Rights

| | Total Number

of Shares

Beneficially

Owned

| | Percent of

Class

| |

|---|

| Genzyme Corporation (1) | | 4,924,919 | | 518,324 | | 5,443,243 | | 13.96 | % |

| Intrinsic Value Asset Management, Inc. (2) | | 1,131,100 | | — | | 1,131,100 | | 2.94 | % |

| Geoffrey F. Cox (3) | | 68,744 | | 335,000 | | 403,744 | | 1.04 | % |

| Robert W. Baldridge | | 5,075 | | 72,500 | | 77,575 | | * | |

| Francis J. Bullock | | 1,000 | | 71,500 | | 72,500 | | * | |

| James A. Geraghty | | 51,791 | | 157,103 | | 208,894 | | * | |

| Pamela W. McNamara | | 3,800 | | 22,500 | | 26,300 | | * | |

| Marvin L. Miller | | — | | 22,500 | | 22,500 | | * | |

| Alan W. Tuck | | 6,000 | | 49,000 | | 55,000 | | * | |

| John B. Green (4) | | 50,124 | | 205,121 | | 255,245 | | * | |

| Paul K. Horan (5) | | 60,067 | | 50,000 | | 110,067 | | * | |

| Gregory F. Liposky (6) | | 15,779 | | 109,500 | | 125,279 | | * | |

| Harry M. Meade (7) | | 52,528 | | 163,996 | | 216,524 | | * | |

| Daniel S. Woloshen (8) | | 36,580 | | 95,900 | | 132,480 | | * | |

| All executive officers and directors as a group (12 persons) | | 351,488 | | 1,354,620 | | 1,706,108 | | 4.28 | % |

- *

- Less than 1%.

- (1)

- Includes four common stock purchase warrants exercisable for 145,000, 288,000, 55,833 and 29,491 shares of GTC common stock at prices of $2.84, $4.88, $6.30 and $6.30 per share, respectively. The address of Genzyme Corporation is 500 Kendall Street, Cambridge, Massachusetts 02142.

- (2)

- Based on the Schedule 13G/A filed with the Securities and Exchange Commission on March 1, 2004. The address of Intrinsic Value Asset Management, Inc. is 522 Wilshire Blvd., Suite D, Santa Monica, California 90401.

- (3)

- Includes 62,536 shares owned directly by Dr. Cox, 1,000 shares owned jointly with grandson and 5,208 shares beneficially owned by Dr. Cox and held in GTC's 401(k) plan.

- (4)

- Includes 35,129 shares owned directly by Mr. Green and 14,995 shares beneficially owned by Mr. Green and held in GTC's 401(k) plan.

- (5)

- Dr. Horan left GTC in January 2004.

- (6)

- Includes 6,961 shares owned directly by Mr. Liposky and 8,818 shares beneficially owned by Mr. Liposky and held in GTC's 401(k) plan.

- (7)

- Includes 41,103 shares owned directly by Dr. Meade, 10,486 shares beneficially owned by Dr. Meade and held in GTC's 401(k) plan, and 939 shares held by Dr. Meade's adult son. Dr. Meade disclaims beneficial ownership of the shares held by his son.

- (8)

- Includes 27,935 shares owned directly by Mr. Woloshen and 8,645 shares beneficially owned by Mr. Woloshen and held in GTC's 401(k) plan.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors has currently fixed the number of directors at seven. Under our Articles of Organization, as amended, our Board is divided into three classes with staggered three year terms, with each class being as nearly equal in number of directors as possible. The directors in each class serve a term of three years each until their successors are elected at the next annual stockholders meeting. At the upcoming annual meeting, two directors, Robert W. Baldridge and James A. Geraghty, have each been nominated to serve a term of office of three years and until a successor is elected and qualified. Each has consented to such nomination and is expected to stand for election. However, if any nominee is unable to serve, proxies will be voted for any replacement candidate nominated by our Board.

Under our by-laws, directors must be elected by a plurality of votes cast. Abstentions, votes withheld and broker non-votes will not be treated as votes cast and, therefore, will not affect the outcome of the election.

The following table contains biographical information about the nominees for director and current directors whose term of office will continue after the meeting.

Name and Age

| | Business Experience

and Other Directorships

| | Director

Since

| | Present

Term

Expires

|

|---|

*Robert W. Baldridge

Age: 69 |

|

Mr. Baldridge has served as a director since 1994. Mr. Baldridge provided consulting services to GTC from October 1994 to October 2000 and has served as an independent business consultant since June 1988. |

|

1994 |

|

2004 |

*James A. Geraghty

Age: 49 |

|

Mr. Geraghty has served as a director since February 1993, and held the role of Chairman of the Board of Directors of GTC from January 1998 to July 2001. Mr. Geraghty has served as Senior Vice President, International Development of Genzyme since January 2001 and, prior to that served as President of Genzyme Europe from July 1998 to December 2000. Mr. Geraghty was the President and Chief Executive Officer of GTC from its incorporation in February 1993 until July 1998. |

|

1993 |

|

2004 |

Francis J. Bullock

Age: 67 |

|

Dr. Bullock has served as a director since 1994. Dr. Bullock is an independent consultant. Prior to that he was a senior consultant with Arthur D. Little, Inc. and with Strategic Decisions Group from September 1993 to March 2003, and a Senior Vice President, Research Operations at Schering-Plough Research Institute from 1981 until August 1993. Dr. Bullock is also a director of Array Biopharma, Inc., a chemical drug discovery services company. |

|

1994 |

|

2005 |

| | | | | | | |

4

Alan W. Tuck

Age: 55 |

|

Mr. Tuck has served as a director since 1993. Mr. Tuck is a partner of The Bridgespan Group, a nonprofit consulting organization where he has worked since April 2001. Mr. Tuck retired in June 2000 as Chief Strategic Officer of Organogenesis Inc., a tissue engineering firm where he had been since July 1997. From September 1996 until July 1997, Mr. Tuck was Executive Vice President and Chief Strategic Officer of Biocode, Inc., a privately-held biotechnology company focused on brand protection technology and, from September 1996 until March 1997, was Chief Strategic Officer of Immulogic Pharmaceutical Corporation, a biotechnology company focused on diseases of the immune system. From February 1992 through May 1996, Mr. Tuck was President and Chief Executive Officer of T Cell Sciences, Inc. Mr. Tuck is also a director of Apogee Technology, Inc., a developer of digital amplifier chip sets. |

|

1993 |

|

2005 |

Geoffrey F. Cox

Age: 60 |

|

Dr. Cox has served as Chairman of the Board, Chief Executive Officer and President of GTC since July 2001, after being elected a director in May 2001. From 1997 to June 2001, Dr. Cox was Chairman and Chief Executive Officer of Aronex Pharmaceuticals, Inc, a biotechnology company. In 1984, Dr. Cox joined Genzyme Corporation in the U.K., and in 1988, became Senior Vice President of Operations in the United States. Subsequently, Dr. Cox was promoted to Executive Vice President of Genzyme, responsible for operations and the pharmaceutical, diagnostic and genetics business units until 1997. Prior to joining Genzyme, Dr. Cox was General Manager of U.K. manufacturing operations for Gist-Brocades. Dr. Cox also serves as a director of Nabi Biopharmaceuticals and a member of the Emerging Companies Section Governing Body of the Biotechnology Industry Organization. |

|

2001 |

|

2006 |

| | | | | | | |

5

Pamela W. McNamara

Age: 46 |

|

Ms. McNamara has served as a director since July 2002. Since October 2003, Ms. McNamara has been Chief Executive Officer of CRF, Inc., a clinical trial data management and mobile technology company. Prior to that, Ms. McNamara was a private consultant. Ms. McNamara was appointed Chief Executive Officer of Arthur D. Little, Inc., a global management and technology firm, from 2001 to February 2002, to develop plans to restructure, reorganize or divest the firm's viable business units. In February 2002, Arthur D. Little filed a voluntary petition for reorganization under Chapter 11 of the United States Bankruptcy Code to provide a framework under which these plans could be executed. Ms. McNamara served as Managing Director of Arthur D. Little from 1997 to 2001, and had been a partner since 1992, focusing on the pharmaceutical and biotechnology industries. |

|

2002 |

|

2006 |

Marvin L. Miller

Age: 67 |

|

Mr. Miller has served as a director since October 2002. Mr. Miller has been Executive Chairman of Onconova Therapeutics, Inc. since 2002. Mr. Miller retired in 2002 as President and Chief Executive Officer of Nextran, a subsidiary of Baxter Healthcare Corporation. Before joining Nextran in 1995, Mr. Miller served as Vice President of Biotechnology Licensing for the Pharmaceutical and Agricultural Divisions of American Cyanamid Company since 1987. Previously, Mr. Miller was a Vice President of Johnson & Johnson International from 1983 to 1986. |

|

2002 |

|

2006 |

- *

- Indicates a nominee for election as director.

6

BOARD OF DIRECTORS AND COMMITTEE MATTERS

The Board of Directors has responsibility for establishing broad corporate policies and reviewing our overall performance rather than day-to-day operations. The Board's primary responsibility is to oversee the management of the Company and, in so doing, to serve the best interests of the Company and its stockholders. The Board reviews and approves corporate objectives and strategies, and evaluates significant policies and proposed major commitments of corporate resources. It participates in decisions that have a potential major economic impact on GTC. Management keeps the directors informed of company activity through regular written reports and presentations at Board and committee meetings.

Independence

Our Board of Directors has determined that Messrs. Baldridge, Geraghty, Bullock, Tuck, Miller and Ms. McNamara are "independent directors" under the applicable listing standards of the NASDAQ National Market governing the independence of directors.

Board Meetings and Committees

Our Board of Directors held nine meetings during 2003. Each of the directors then in office attended at least 75% of the aggregate of all meetings of the Board and all meetings of the committees of the Board on which such director then served. Directors are asked to attend each Annual Meeting of Stockholders, barring significant commitments or special circumstances. All directors attended our 2003 Annual Meeting.

Shareholder Communications

Any shareholder wishing to communicate with our Board of Directors, a particular director or any committee of the Board may do so by sending written correspondence to our principal executive offices, c/o Vice President, Corporate Communications. All such communications will be delivered to the Board or the applicable director or committee chair.

Our Board has three standing committees: the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. The members of all our standing committees are non-employee directors.

Audit Committee

The Audit Committee has authority to select and engage our independent auditors and is responsible for reviewing our audited financial statements, accounting processes and reporting systems and discusses the adequacy of our internal financial controls with our management and our auditors. The Audit Committee also reviews the performance of the independent auditors in the annual audit and in assignments unrelated to the audit, assesses the independence of the auditors, and reviews their fees. The current members of this committee are Messrs. Tuck (Chair) and Baldridge and Ms. McNamara. Our Board of Directors has considered and determined that each of the members of the Audit Committee satisfies the independence and financial literacy requirements under the applicable listing standards of the NASDAQ National Market governing the qualifications of Audit Committee members. The Board has also determined that Mr. Tuck, who has an M.B.A. degree and has served as the chief executive officer of a biotechnology company, qualifies as an "audit committee

7

financial expert" as defined under the rules of the Securities and Exchange Commission. The Board also noted that Mr. Baldridge has substantial experience in investment banking and consulting and has served as the chief executive officer of a biotechnology company, and Ms. McNamara has served as the chief executive officer of an international consulting firm and currently serves as the chief executive officer of a clinical trial data management and mobile technology company.

The Audit Committee held eight meetings during fiscal year 2003. The Audit Committee operates under a written charter adopted by the Board, which is attached to this proxy statement asAppendix Aand is also available on our web site at www.gtc-bio.com. For more information about the Audit Committee, see "Audit Committee Report" in this proxy statement.

Compensation Committee

Our Compensation Committee is responsible for establishing cash compensation policies with respect to our executive officers, employees, directors and consultants, determining the compensation to be paid to our executive officers and administering our equity incentive and stock purchase plans. The current members of the Compensation Committee are Messrs. Bullock (Chair), Miller and Tuck. The Compensation Committee held four meetings during fiscal year 2003. This committee operates under a written charter, which is available on our website at www.gtc-bio.com. Our Board has determined that all of the Compensation Committee members meet the independence requirements under the listing standards of the NASDAQ National Market governing the independence of directors.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee identifies individuals qualified to become Board members and recommends to the Board the director nominees for the next annual meeting of stockholders and candidates to fill vacancies on the Board. Additionally, the committee recommends to the Board the directors to be appointed to Board committees. The Nominating and Corporate Governance Committee also develops and recommends to the Board a set of corporate governance guidelines applicable to the Board and to the Company and oversees the effectiveness of our corporate governance in accordance with those guidelines. This committee currently consists of the six non-management directors (i.e. those other than Dr. Cox), each of whom the Board has determined meets the independence requirements under the applicable listing standards of the NASDAQ National Market governing the independence of directors. This committee held one meeting during fiscal 2003, in addition to two executive sessions conducted in conjunction with regular meetings of the Board. The Nominating and Corporate Governance Committee operates pursuant to a written charter, which is available on our web site at www.gtc-bio.com.

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by its members and other Board members. Additionally, in selecting nominees for directors, the Nominating and Corporate Governance Committee will review candidates recommended by stockholders in the same manner and using the same general criteria as candidates recruited by the committee and/or recommended by the Board. The Nominating and Corporate Governance Committee will also consider whether to nominate any person nominated by a shareholder in accordance with the provisions of the Company's by-laws relating to shareholder nominations as described in "Deadline for Stockholder Proposals and Director Nominations" below.

8

Once the Nominating and Corporate Governance Committee has identified a prospective nominee, a subcommittee of the Nominating and Corporate Governance Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on the information provided to the subcommittee with the recommendation of the prospective candidate, as well as the subcommittee's own knowledge of the prospective candidate, which may be supplemented by inquiries of the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. Based on the recommendation of the subcommittee, the full committee then evaluates the prospective nominee against the standards and qualifications set out in our Corporate Governance Guidelines, which include among others:

- •

- whether the prospective nominee meets the independence requirements defined under the applicable listing standards of the NASDAQ National Market and audit committee financial expert requirements defined under applicable Securities and Exchange Commission rules and regulations;

- •

- the extent to which the prospective nominee's skills, experience and perspective add to the range of talent appropriate for the Board and whether such attributes are relevant to our industry;

- •

- the prospective nominee's ability to dedicate the time and resources sufficient for the diligent performance of Board duties; and

- •

- the extent to which the prospective nominee holds any position that would conflict with responsibilities to GTC.

If the Nominating and Corporate Governance Committee's internal evaluation is positive, the subcommittee and possibly others will interview the candidate. Upon completion of this evaluation and interview process, the Nominating and Corporate Governance Committee makes a recommendation and report to the full Board as to whether the candidate should be nominated by the Board and the Board determines whether to approve the nominee after considering this recommendation and report.

Director Compensation

Director Fees. Our directors who are not employees of GTC receive compensation for their services as directors in the form of an annual retainer of $12,000, payable in quarterly installments. Directors who are GTC employees do not receive compensation for their service as directors. Members of standing committees also receive an annual retainer of $2,000, payable quarterly, and the Chair of each standing committee receives an annual retainer of $3,000, payable quarterly. In addition, each non-employee director receives $500 for attendance in person (or $250 for participation by conference call) for each Board meeting and each standing committee meeting other than a standing committee meeting held in conjunction with a Board meeting, plus reimbursement of reasonable expenses incurred in attending or otherwise participating in such meetings.

Stock Options. All non-employee directors of GTC are currently eligible to participate in our 2002 Equity Incentive Plan. Under our 2002 Equity Incentive Plan, options are automatically granted once a year, on the date of the Annual Meeting of Stockholders, to eligible non-employee directors elected or reelected at the meeting. Each eligible director receives an option to purchase 7,500 shares of common

9

stock for each year of the term of office to which the director is elected (normally 22,500 shares for election to a three-year term of office). Upon an eligible director's election other than at an annual meeting, the director is automatically granted an option to purchase 7,500 shares, for each year or portion of a year of the term of office to which he or she is elected. Options vest as to 7,500 shares on the date the option is granted and on the date of each subsequent Annual Meeting of Stockholders, so long as the optionholder is still a director. The options have a term of ten years and an exercise price, payable in cash or common stock, equal to the opening price of our common stock on the date of grant, as reported on the NASDAQ National Market. If GTC were to have a non-employee Chairperson of the Board, which it does not currently have, the numbers of option shares for the Chairperson would be based on 15,000 shares per year instead of 7,500.

During fiscal year 2003, Dr. Cox, Ms. McNamara and Mr. Miller all stood for reelection as a director at our 2003 Annual Meeting and, accordingly, Ms. McNamara and Mr. Miller each received an option to purchase 22,500 shares vesting over a three year period. As an employee director, Dr. Cox did not receive such an option.

Certain Relationships and Related Transactions

Since our initial public offering in 1993, we have entered into several agreements with Genzyme which are summarized below. In fiscal year 2003, we paid Genzyme an aggregate of approximately $3.5 million under the research and development agreement, the services agreement and the lease agreement described below. In addition, Mr. Geraghty is an executive employed by Genzyme.

Equity Position. Genzyme is our largest single stockholder, holding 4,924,919 shares of common stock as of April 2, 2004, which represents approximately 13% of our then outstanding common stock. Genzyme also holds four common stock purchase warrants exercisable for 145,000, 288,000, 55,833 and 29,491 shares of common stock at prices of $2.84, $4.88, $6.30 and $6.30 per share, respectively, which were the market prices of the common stock at the time the respective Genzyme warrants were issued. The expiration dates of these warrants range from July 2005 through November 2009. All of the shares held by Genzyme (including shares issuable on exercise of Genzyme warrants) are entitled to registration rights. Genzyme owns approximately 14% of our common stock on a fully diluted basis.

Stock Buyback. On April 4, 2002, we repurchased 2.82 million shares of our common stock directly from Genzyme which was recorded as treasury stock. We bought the shares for an aggregate consideration of approximately $9.6 million, consisting of approximately $4.8 million in cash and a promissory note to Genzyme for the remaining $4.8 million. Our common stock was valued at $3.385 per share in this transaction, using the simple average of the high and low transaction prices quoted on the NASDAQ National Market on the previous trading day. Genzyme agreed to a 24-month lock-up provision on their remaining 4.92 million shares of common stock, which was released on April 4, 2004. The $4.8 million promissory note bears interest at the LIBOR plus 1% (LIBOR was at 1.17% at December 28, 2003). The principal is payable in two installments: 50% on April 3, 2005 and the remaining 50% on April 3, 2006. This note is collateralized by a subordinated lien on all our assets except intellectual property.

Research and Development Agreement. Under our Research and Development Agreement dated May 1, 1993, we and Genzyme each agreed to provide to the other research and development services relating, in the case of GTC, to transgenic production of recombinant proteins and, in the case of

10

Genzyme, to the purification of such proteins. Each company receives payments from the other equal to the performing party's fully allocated cost of such services, which can be no less than 80% of the annual budgets established by the parties under the agreement on a month-to-month basis, plus, in most cases, a fee equal to 10% of such costs. The agreement expired on December 31, 1998 and the parties are continuing under this agreement on a month-to-month basis. On July 31, 2001, we entered into a services agreement with Genzyme under which Genzyme may perform manufacturing, research and development and regulatory services for our ATryn® program on a cost plus 5% basis. In fiscal year 2003, we purchased $2,934,000 under this arrangement. In June of 2003, we entered into another services agreement under which we provide certain services to Genzyme for which Genzyme pays us monthly, based on a rate of $250,000 for each full time equivalent employee on an annual basis. Services to be performed under this June 2003 agreement will continue until December 31, 2004, unless earlier terminated.

Services Agreement. Under the Services Agreement, we receive certain basic laboratory and administrative support services in exchange for a fixed monthly payment ($12,000 per month from January through June 2003 and $3,000 per month from August through December 2003). The monthly fee is adjusted annually based on the services to be provided and changes in Genzyme's cost of providing the services. If we request additional services from Genzyme, we have agreed to pay Genzyme fully allocated costs of those services. This Services Agreement is automatically renewed each year unless terminated by either party not less than ninety days prior to the end of any annual period. We have made payments of $101,000 for the fiscal year ended December 28, 2003.

Lease. Under the Sublease Agreement, we lease certain laboratory, research and office space from Genzyme in exchange for fixed monthly rent payments which approximate the estimated current rental value for such space. In addition, we reimburse Genzyme for our pro rata share of appropriate facilities' operating costs such as maintenance, cleaning, utilities and real estate taxes. The sublease is automatically renewed each year and renewals are subject to earlier termination of the sublease by either party after the initial five-year term. Under the Sublease Agreement, we made payments for the fiscal year 2003 of $356,000.

Compensation Committee Interlocks and Insider Participation

No person serving on the Compensation Committee at any time during fiscal year 2003 was a present or former officer or employee of GTC or any of our subsidiaries during that year. During 2003, no executive officer of GTC served as a member of the board of directors or compensation committee (or other board committee performing equivalent functions) of any other entity that had an executive officer serving on our Board of Directors or Compensation Committee.

11

PROPOSAL 2

APPROVAL OF OUR AMENDED AND RESTATED 2002 EQUITY INCENTIVE PLAN

The Board of Directors is seeking stockholder approval of changes to our 2002 Equity Incentive Plan (the "2002 Plan") that are intended to provide a reserve of additional shares for future awards, permit equity compensation awards to be more effectively linked to Company and individual performance, reduce the expense of equity compensation reported on our financial statements should equity compensation expensing become mandatory, permit improved tax treatment for employees who receive equity compensation and help us continue to attract highly-qualified directors.

The Current Plan

We have relied on the 2002 Plan as an important tool to attract and retain key employees, directors and consultants, to provide an incentive for them to achieve long-range performance goals, and to enable them to participate in the long-term growth of the Company. Approximately 31 key employees and 6 non-employee (or outside) directors are participating in the 2002 Plan, which is currently administered by the Compensation Committee of the Board.

Summary of Proposed Changes

The following are the material changes to the 2002 Plan approved by the Board:

- •

- The Compensation Committee will be explicitly authorized to set performance goals to be satisfied before options become exercisable or other awards earned. To the extent that an award is made to any of the five highest-paid executive officers, the Compensation Committee may subject the award to performance conditions based upon the list of business criteria specified under "U.S. Federal Income Tax Consequences Relating to Awards" below for purposes of preserving our tax deduction associated with such awards.

- •

- The types of awards available under the 2002 Plan will be expanded to include restricted stock units, which are described under "Description of Awards" below.

- •

- When the 2002 Plan was approved by stockholders in 2002 to permit 2,500,000 shares to be issued for awards, we did not seek to include in the 2002 Plan's authorized limit any of shares that the been previously granted under our 1993 Equity Incentive Plan ("1993 Plan") but which would subsequently expire or terminate unexercised. We are now seeking in this proposal to add to the shares under the 2002 Plan all shares that are now or subsequently become available upon termination of forfeited or expired options under the 1993 Plan.

- •

- The number of shares reserved for issuance under the 2002 Plan will be increased by 2,000,000 shares, including 382,724 shares previously reserved under the 1993 Plan that were subject to options that have terminated as of April 2, 2004. This will result in a total increase of 2,000,000 in the number of shares currently subject to outstanding options or reserved and available under our equity plans.

- •

- The 2002 Plan currently provides that no more than 20% of the total number of shares received for issuance under the 2002 Plan may be granted to any one participant in any fiscal year of the Company, except that in the case of a new hire the number of shares may be up to 30% of the

12

total number of shares reserved. The 2002 Plan as amended sets forth the annual limits as fixed numbers, namely 400,000 shares for any current participant, and 600,000 shares for any new hire, in each case subject to adjustment for changes in the Company's capitalization.

- •

- Common stock awards under the 2002 Plan are limited in the aggregate to 10% of the maximum number of shares available for issuance under the 2002 Plan unless the award is for consideration of at least 100% of the fair market value of the common stock on the date of grant. The 2002 Plan as amended clarifies that the exclusion for fair market value consideration includes stock paid in lieu of cash bonuses that would be consistent with past bonus practices. The 2002 Plan as amended also excludes from the 10% limitation awards that are subject to vesting only if performance criteria are satisfied.

- •

- The 2002 Plan currently provides for automatic grant to non-employee directors upon election or reelection of a non-statutory stock option to purchase 7,500 shares (15,000 in the case of the Chairman of the Board) for each year of their term. These options become exercisable at the rate of 7,500 for year of service as a director (15,000 per year in the case of the Chairman) but are immediately exercisable in full in the event of a change in control of the Company. Once vested, the options remain exercisable for the balance of their ten year term. Under the 2002 Plan as amended, the Board will be able to exercise its discretion as to the size, type, and exercisability of awards to non-employee directors.

- •

- Loans to executive officers and directors for the exercise of options or the purchase of shares will be prohibited.

- •

- The repricing of stock options will be prohibited without further stockholder approval.

- •

- The 2002 Plan will have a term of ten years unless extended by stockholder approval or terminated earlier by the Board.

- •

- No options will have a term that can exceed ten years.

- •

- Awards will be subject to a minimum three-year vesting schedule with exceptions in the discretion of the Compensation Committee for retirement, death, disability, termination by the Company, change of control, grants to consultants, directors or new hires, awards in lieu of cash compensation and performance vesting.

A copy of the 2002 Plan as amended and restated, is included asAppendix B to this proxy statement. The foregoing summary description is subject in its entirety to actual provisions of the 2002 Plan as amended and restated.

Reasons for the Changes

The Board recommends that our stockholders approve the amendments to the 2002 Plan for the following reasons:

- •

- The Board believes that it is important to provide the Compensation Committee with flexibility to set performance goals for options to become exercisable or other awards to be earned so that the Compensation Committee has another tool to effectively tie employee rewards to stockholder benefits.

13

- •

- Stockholder approval of the business criteria upon which objective performance goals may be established by the Compensation Committee would permit us to take tax deductions under Section 162(m) of the Internal Revenue Code for performance-based awards to certain executive-level employees.

- •

- The rules for accounting for the expense of equity compensation are expected to change in 2005, making it more advantageous to us to use awards other than stock options with time-based vesting.

- •

- Employees and directors may be better served from a tax perspective by the grant of restricted stock units.

- •

- The Board believes that it is important to have a sufficient number of shares available for grant to continue to motivate the existing work force and attract qualified new hires while simultaneously preserving cash for other corporate needs.

- •

- The Board believes that we will be better able to attract prospective outside directors and retain current directors if the Board has the same authority for these awards as it has for others. However, the Compensation Committee and the Board intend to continue the practice of using the same equity awards for all outside directors and not using any type or level of award for one outside director that is different from those for other outside directors.

Description of Awards

The amended 2002 Plan provides for the following five basic types of awards:

Stock Options. The Compensation Committee may grant options to purchase shares of common stock that are either incentive stock options (ISOs) eligible for the special tax treatment described below or nonstatutory stock options. No option may have an exercise price that is less than the fair market value of the common stock on the date of grant or a term of more than ten years. An option may be exercised by the payment of the option price in cash or with such other lawful consideration as the Compensation Committee may determine, including by delivery or attestation of ownership of shares of common stock valued at their fair market value on the date of delivery, and for consideration received by us under a broker-assisted cashless exercise program.

Restricted Stock. The Compensation Committee may grant shares of common stock that are only earned if specified conditions, such as a completing a term of employment or satisfying pre-established performance goals, are met and that are otherwise subject to forfeiture.

Restricted Stock Units. The Compensation Committee may grant the right to receive shares of common stock in the future, also based on meeting specified conditions and subject to forfeiture. These awards are to be made in the form of "units," with each unit representing the equivalent of one share of common stock, although they may be settled in either cash or stock. Restricted stock unit awards would represent an unfunded and unsecured obligation of the Company. In the discretion of the Compensation Committee, units may be awarded with rights to the payment of dividend equivalents.

Unrestricted Stock. The Compensation Committee may grant shares of common stock that are not subject to restrictions or forfeiture. It is expected that such awards will generally be made only when shares are awarded in lieu of an otherwise earned cash bonus.

14

Stock Appreciation Rights. The Compensation Committee may grant stock appreciation rights (SARs), where the participant receives cash, shares of common stock, or other property, or a combination thereof, as determined by the Compensation Committee, equal in value to the difference between the exercise price of the SAR and the fair market value of the common stock on the date of exercise. SARs may be granted in tandem with options (at or after award of the option) or alone and unrelated to an option. SARs in tandem with an option terminate to the extent that the related option is exercised, and the related option terminates to the extent that the tandem SAR is exercised. The exercise price of a SAR may not be less than the fair market value of the common stock on the date of grant or in the case of a tandem SAR, the exercise price of the related option.

Awards under the 2002 Plan may contain such terms and conditions consistent with the 2002 Plan as the Compensation Committee in its discretion approves. In setting the terms of each award, except as noted above, the Compensation Committee has full discretion to determine the number of shares or units subject to the award, the exercise price or other consideration, if any, to be paid by the participant, the term and exercise period of each option granted, the conditions under which and the time or times at which an option becomes exercisable or under which the option, shares or units may be forfeited to us, and the other terms and conditions of the award. The Compensation Committee may provide, at the time an award is made or at any time thereafter, for the acceleration of a participant's rights or cash settlement upon a change in control of the Company. The terms and conditions of awards need not be the same for each participant. In general, the Compensation Committee has discretion to administer the 2002 Plan in the manner that it determines, from time to time, is in our best interest.

The Compensation Committee has not granted any SARs, restricted stock, or restricted stock units under the 2002 Plan. On February 13, 2004, the Compensation Committee granted 111,102 shares of unrestricted stock to 35 employees (together with $264,329 in cash to be used for tax withholding purposes) in lieu of cash bonuses for the 2003 fiscal year.

The maximum aggregate number of shares that may be granted to a Plan participant in any fiscal year is 400,000 (600,000 in the case of a new hire) shares, subject to adjustment for changes in capitalization. Incorporation of these limits are intended to qualify awards as performance-based compensation that is not subject to the $1 million limit on the Federal income tax deduction we may take for compensation paid to certain senior officers.

Shares Available for Issuance under the 2002 Plan

Our stockholders have authorized a total of 2,500,000 shares of common stock for issuance under the 2002 Plan. As of April 2, 2004, we have granted options to purchase 2,089,745 shares, of which options to purchase 170,245 shares have been subsequently cancelled on termination of employment or otherwise and returned to the 2002 Plan. There remain 580,500 shares available for awards in the 2002 Plan. The number and kind of shares that may be issued under the 2002 Plan are subject to adjustment to reflect stock dividends, recapitalizations, or other changes affecting the common stock. If any award expires, or is terminated unexercised, or is forfeited or settled in cash or in a manner that results in fewer shares outstanding than were initially awarded, the shares that would have been issuable will again be available for award under the 2002 Plan.

15

As of April 2, 2004, there are outstanding under the 1993 Plan options to purchase 2,178,388 shares at prices ranging from $2.16 to $37.75 with expiration dates that range from 2004 to 2012, and options to purchase 382,724 shares have been cancelled on termination of employment or otherwise as of April 2, 2004. Under the proposal, all of the 382,724 cancelled shares would become immediately available for awards under the 2002 Plan, and the shares under any of the options currently outstanding that expire or terminate unexercised or are forfeited or otherwise settled on or after April 2, 2004 shall also become available under the 2002 Plan in the event of any such expiration, termination, forfeiture or settlement.

Amendment and Term of the 2002 Plan

The Board may amend the 2002 Plan subject to any stockholder approval as the Board determines to be necessary or advisable. Subject to the special limitations on the repricing of stock options, the Compensation Committee has authority to amend outstanding awards, including changing the date of exercise and converting an incentive stock option to a nonstatutory stock option, if the Compensation Committee determines that such action would not materially and adversely affect the participant, the award is canceled and the participant receives the net value in cash or other property, the change reduces the benefit of a performance-based vesting award, or the Compensation Committee determines that such action is reasonably necessary to comply with any regulatory, accounting, or stock market listing requirement.

Unless terminated earlier by the Board or extended by approval of our stockholders, the term of the 2002 Plan will expire on May 26, 2014 if approved at the 2004 Annual Meeting.

U.S. Federal Income Tax Consequences Relating to Awards

Incentive Stock Options. An optionee does not realize taxable income for regular tax purposes upon the grant or exercise of an ISO under the 2002 Plan. If no disposition of shares issued to an optionee pursuant to the exercise of an ISO is made by the optionee within two years from the date of grant or within one year from the date of exercise, then (a) upon sale of such shares, any amount realized in excess of the option price (the amount paid for the shares) is taxed to the optionee as long-term capital gain and any loss sustained will be a long-term capital loss, and (b) no deduction is allowed to us for Federal income tax purposes. The exercise of ISOs gives rise to an adjustment in computing alternative minimum taxable income that may result in alternative minimum tax liability for the optionee in the year of option exercise. Under current tax laws, the optionee would pay the greater of the regular tax liability or the alternative minimum tax liability. In certain circumstances, optionees may recover all or substantially all of the alternative minimum tax liability created due to the exercise of an ISO in later tax years, including the year of sale of the shares. If shares of common stock acquired upon the exercise of an ISO are disposed of before the expiration of the two-year and one-year holding periods described above (a "disqualifying disposition"), then (a) the optionee realizes ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares at exercise (or, if less, the amount realized on a sale of such shares) over the option price thereof, and (b) we are entitled to deduct such amount. Any further gain realized is taxed as a short or long-term capital gain and does not result in any deduction to us. A disqualifying disposition in the year of exercise will generally avoid the alternative minimum tax consequences of the exercise of an ISO.

16

Nonstatutory Stock Options. No income is realized by the optionee at the time a nonstatutory option is granted. Upon exercise, (a) ordinary income is realized by the optionee in an amount equal to the difference between the option price and the fair market value of the shares on the date of exercise, and (b) we receive a tax deduction for the same amount. Upon disposition of the shares, appreciation or depreciation after the date of exercise is treated as a short or long-term capital gain or loss and will not result in any further deduction by us.

Restricted Stock. Generally, a recipient will be taxed at the time the conditions to earning the award are met. The excess of the fair market value of the shares at that time over the amount paid, if any, by the recipient for the shares will be treated as ordinary income. The recipient may instead elect at the time of grant to be taxed (as ordinary income) on the excess of the then fair market value of the shares over the amount paid, if any, for the shares. In either case, we receive a tax deduction for the amount reported as ordinary income to the recipient, subject to the limitations of Internal Revenue Code Section 162(m) discussed below. Upon disposition of the shares, any appreciation or depreciation after the taxable event is treated as a short or long-term capital gain or loss and will not result in any further deduction by us.

Unrestricted Stock. Generally, a recipient will be taxed at the time of the grant of the award. The fair market value of the shares at that time will be treated as ordinary income. We receive a tax deduction for the amount reported as ordinary income to the recipient subject to the limitations of Internal Revenue Code Section 162(m). Upon disposition of the shares, any appreciation or depreciation after the taxable event is treated as short or long-term capital gain or loss and will not result in any further deduction by us.

Restricted Stock Units. A recipient does not realize taxable income upon the grant or vesting of a restricted stock unit. The recipient must include as ordinary income when an award is settled an amount equal to the excess of the fair market value of the shares (or the amount of cash) distributed to settle the award. Subject to the limitations of Internal Revenue Code Section 162(m), we receive a corresponding tax deduction at the time of settlement. If the award is settled in shares, then any subsequent appreciation or depreciation is treated as short or long-term capital gain or loss and will not result in any further deduction by us.

Internal Revenue Code Section 162(m). United States tax laws generally do not allow publicly-held companies to obtain tax deductions for compensation of more than $1 million paid in any year to any of the chief executive officer and the next four highest paid executive officers (each, a "covered employee") unless the compensation is "performance-based" as defined in Internal Revenue Code Section 162(m). Stock options and SARs granted under an equity compensation plan are performance-based compensation if (a) stockholders approve a maximum aggregate per person limit on the number of shares that may be granted each year, (b) any stock options or SARs are granted by a committee consisting solely of outside directors, and (c) the stock options or SARs have an exercise price that is not less than the fair value of common stock on the date of grant.

The Compensation Committee has designed the 2002 Plan with the intention of satisfying Section 162(m) with respect to stock options and SARs granted to covered employees.

In the case of restricted stock and restricted stock units, Section 162(m) requires that the general business criteria of any performance goals that are established by the Compensation Committee be

17

approved and periodically reapproved by stockholders (generally, every five years) in order for such awards to be considered performance-based and deductible by the employer. Generally, the performance goals must be established before the beginning of the relevant performance period. Furthermore, satisfaction of any performance goals during the relevant performance period must be certified by the Compensation Committee.

The Compensation Committee has approved the following list of business criteria upon which it may establish performance goals for deductible performance-based awards made to covered persons: (a) increases in the price of the common stock, (b) product or service sales or market share, (c) revenues, (d) return on equity, assets, or capital, (e) economic profit (economic value added), (f) total shareholder return, (g) costs, (h) expenses, (i) margins, (j) earnings or earnings per share, (k) cash flow, (l) cash balances, (m) customer satisfaction, (n) operating profit, (o) research and development progress, (p) clinical trial progress, (q) licensing, (r) product development, (s) manufacturing, or (t) any combination of the foregoing, including without limitation goals based on any of such measures relative to appropriate peer groups or market indices. Performance goals may be particular to a participant or may be based, in whole or in part, on the performance of the division, department, line of business, subsidiary, or other business unit in which the participant works, or on the performance of the Company generally. The Compensation Committee has the authority to reduce (but not to increase) the amount payable at any given level of performance to take into account factors that the Compensation Committee may deem relevant.

In connection with the approval of the 2002 Plan as amended and restated, we are seeking stockholder approval of the Compensation Committee's right to develop performance goals based upon the above business criteria for future awards to covered employees. Stockholder approval of these business criteria will enable us to realize a full income tax deduction for awards under the 2002 Plan where the deduction would otherwise be restricted by Internal Revenue Code Section 162(m).

18

Option Grants and Outstanding Options

Under the 2002 Plan, we have granted stock options to purchase shares of common stock to the following individuals and groups in the following amounts as of April 2, 2004:

| | Number of Shares of Common Stock Underlying 1993 Plan Options (1)

| | Number of Shares of Common Stock Underlying 2002 Plan Options

| |

|---|

| Named executive officers | | | | | |

| | Geoffrey F. Cox

Chairman, Chief Executive Officer and President | | 425,000 | | 215,000 | |

| | John B. Green

Senior Vice President, Chief Financial Officer and Treasurer | | 274,120 | | 75,000 | |

| | Gregory F. Liposky

Senior Vice President, Operations | | 65,000 | | 130,000 | |

| | Harry M. Meade

Senior Vice President, Research and Development | | 264,720 | | 70,000 | |

| | Daniel S. Woloshen

Senior Vice President and General Counsel | | 58,000 | | 105,000 | |

| | Paul K. Horan

Former Senior Vice President, Corporate Development | | 50,000 | | 45,000 | (2) |

| All current executive officers as a group (5 persons) | | 1,086,840 | | 595,000 | |

| All current directors who are not executive officers as a group (6 persons) | | 522,353 | | 105,000 | |

| Each nominee for election as a director | | | | | |

| | Robert W. Baldridge | | 117,500 | | — | |

| | James A. Geraghty | | 314,353 | | — | |

| Other employees as a group (including current officers who are not executive officers) | | 4,369,137 | | 1,344,745 | |

| Total Awards to Date | | 6,028,330 | | 2,089,745 | |

- (1)

- While not required, the 1993 Plan numbers are provided as additional information.

- (2)

- Dr. Horan exercised these options on January 26, 2004.

No person has received more than five percent of the options granted under the 2002 Plan.

19

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets out the status of securities authorized for issuance under our equity compensation plans at December 28, 2003:

Equity Compensation Plan Information

| | (a)

| | (b)

| | (c)

|

|---|

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding outstanding options, warrants and rights

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))(3)(4)

|

|---|

| Equity compensation plans/arrangements approved by the stockholders (1) | | 3,782,208(2 | ) | 5.7322 | | 1,684,529 |

| Equity compensation plans/arrangements not approved by the stockholders | | 0 | | — | | 0 |

| | |

| |

| |

|

| Total | | 3,782,208 | | 5.7322 | | 1,684,529 |

| | |

| |

| |

|

- (1)

- Includes the 1993 Plan, the 2002 Plan and the 2003 Employee Stock Purchase Plan.

- (2)

- Does not include purchase rights accruing under the 2003 Employee Stock Purchase Plan because the purchase price (and therefore the number of shares to be purchased) will not be determined until the end of the purchase period.

- (3)

- Includes 734,614 shares issuable under the 2003 Employee Stock Purchase Plan and 949,915 shares issuable under the 2002 Plan.

- (4)

- Up to 10% of the awards under the 2002 Plan may be issued as restricted or unrestricted stock awards. For purposes of this limitation, awards subject to performance vesting and awards granted in lieu of cash bonuses are disregarded.

Vote Required

Approval of the amendment and restatement of the 2002 Plan will require the affirmative vote of a majority of the shares of common stock present or represented and entitled to vote at the annual meeting. Broker non-votes will not be counted as present or represented for this purpose and, accordingly, will have no effect on the outcome. Abstentions will be counted as present and entitled to vote and, accordingly, will have the effect of negative votes.

THE DIRECTORS RECOMMEND A VOTE FOR THIS PROPOSAL.

20

EXECUTIVE COMPENSATION

The following tables contain information regarding our Named Executive Officers' compensation during the fiscal year 2003:

Summary Compensation Table

| | Annual Compensation

| | Long-Term Compensation Awards

| |

| |

|---|

Name and Position

| | Year

| | Salary

| | Bonus

| | Securities

Underlying Options

| | All Other

Compensation (1)

| |

|---|

Geoffrey F. Cox

Chairman, Chief Executive Officer and President | | 2003

2002

2001 |

(3) | $

| 420,056

420,055

168,813 | | $

| 110,000

112,420

76,000 | | 125,000

140,000

300,000 | | $

| 6,000

152,434

13,098 |

(2)

(4) |

John B. Green

Senior Vice President, Chief Financial Officer and Treasurer |

|

2003

2002

2001 |

|

|

267,255

257,005

239,114 |

|

|

48,519

50,321

53,254 |

|

50,000

50,000

35,000 |

|

|

6,000

6,000

5,100 |

|

Gregory F. Liposky(5)

Senior Vice President, Operations |

|

2003

2002 |

|

|

227,894

220,022 |

|

|

44,643

41,976 |

|

45,000

50,000 |

|

|

6,000

6,000 |

|

Harry M. Meade

Senior Vice President, Research and Development |

|

2003

2002

2001 |

|

|

260,784

249,482

212,698 |

|

|

44,105

47,068

47,700 |

|

45,000

50,000

20,000 |

|

|

6,000

6,000

5,100 |

|

Daniel S. Woloshen(5)

Senior Vice President and General Counsel |

|

2003

2002 |

|

|

229,000

219,023 |

|

|

42,800

41,347 |

|

45,000

35,000 |

|

|

6,000

6,000 |

|

Paul K. Horan(5)(6)

Former Senior Vice President, Corporate Development |

|

2003

2002 |

|

|

271,543

260,000 |

|

|

25,421

28,340 |

|

45,000

50,000 |

|

|

6,000

4,000 |

|

- (1)

- Unless otherwise noted, the amounts in this column represent our contributions to GTC's 401(k) plan on behalf of the Named Executive Officer.

- (2)

- Includes reimbursement of $149,434 for relocation expenses.

- (3)

- For period beginning in July 2001 when Dr. Cox became an executive employee.

- (4)

- Includes reimbursement of $5,698 for relocation expenses and $4,000 as compensation for serving as a non-employee director from May 2001 until July 2001.

- (5)

- First became an executive officer during 2002. Information provided includes compensation received during the entire year 2002.

- (6)

- In January 2004, Dr. Horan resigned from his position with the Company.

21

Option Grant Table

Option Grants in 2003 Fiscal Year

| | Individual Grants

| |

| |

|

|---|

| |

| | Percent

of Total

Options

Granted to

Employees in

Fiscal Year

| |

| |

| | Potential Realizable Value at

Assumed Annual Rates of

Stock Price Appreciation

for Option Term (2)

|

|---|

| | Number of

Securities

Underlying

Options

Granted (1)

| |

| |

|

|---|

Name

| | Exercise

Price per

Share

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| Geoffrey F. Cox | | 125,000 | | 13.94 | % | $ | 1.45 | | 2/14/2013 | | $ | 113,987 | | $ | 288,866 |

| John B. Green | | 50,000 | | 5.58 | | | 1.45 | | 2/14/2013 | | | 45,595 | | | 115,546 |

| Gregory F. Liposky | | 45,000 | | 5.02 | | | 1.45 | | 2/14/2013 | | | 41,035 | | | 103,992 |

| Harry M. Meade | | 45,000 | | 5.02 | | | 1.45 | | 2/14/2013 | | | 41,035 | | | 103,992 |

| Daniel S. Woloshen | | 45,000 | | 5.02 | | | 1.45 | | 2/14/2013 | | | 41,035 | | | 103,992 |

| Paul K. Horan | | 45,000 | | 5.02 | | | 1.45 | | 2/14/2013 | | | 41,035 | | | 103,992 |

- (1)

- The options listed in this column were granted on February 14, 2003 under our 2002 Equity Incentive Plan and became exercisable with respect to 20% of the shares on the grant date. The remaining 80% of the underlying shares will vest in four equal installments on the first four anniversaries of the grant date.

- (2)

- The values in this column are given for illustrative purposes only. They do not reflect our estimate or projection of our future stock price. The values are based on an assumption that our common stock's market price will appreciate at the stated rate, compounded annually, from the date of the option grant until the end of the option's term. Actual gains, if any, on stock option exercises will depend upon future performance of our common stock's price, which will benefit all stockholders proportionately. In order to realize the potential values set forth in the 5% and 10% columns of this table at the end of a typical ten-year option term, the per share price of our common stock would have to be approximately 63% and 159%, respectively, above the total weighted average exercise price of all options described above ($1.45). The potential value to all our stockholders if our price appreciates at rates of 5% and 10% over ten years would be $35,081,496 and $88,903,399, respectively, assuming a purchase of common stock in 2003 at $1.45 per share and 38,470,889 shares outstanding.

22

Fiscal Year-End Option Table

The following table provides information on the total number of exercisable and unexercisable stock options held at December 28, 2003 by the Named Executive Officers. None of the Named Executive Officers exercised any options during fiscal year 2003.

| | Number of Securities

Underlying Unexercised

Options at Fiscal Year-End

| | Value of Unexercised

In-the-Money Options

at Fiscal Year-End(1)

|

|---|

Name

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| Geoffrey F. Cox | | 267,000 | | 298,000 | | $ | 45,410 | | $ | 162,054 |

| John B. Green | | 166,521 | | 90,600 | | | 15,500 | | | 62,000 |

| Gregory F. Liposky | | 76,000 | | 81,000 | | | 13,950 | | | 55,800 |

| Harry M. Meade | | 129,326 | | 80,600 | | | 13,950 | | | 55,800 |

| Daniel S. Woloshen | | 68,800 | | 69,200 | | | 13,950 | | | 55,800 |

| Paul K. Horan | | 29,000 | | 66,000 | | | 13,950 | | | 55,800 |

- (1)

- Based on the difference between the option's exercise price and a closing price of $3.00 for the underlying common stock on December 26, 2003 (our last business day of fiscal year 2003) as reported by the NASDAQ National Market.

Executive Employment Agreements

Geoffrey F. Cox. Under the terms of Dr. Cox's employment agreement entered into in July 2001, he is entitled to a minimum base salary of $31,667 per month ($380,000 on an annualized basis), and is eligible to receive performance and incentive bonuses of not less than 40% of his base salary. In calendar year 2003, Dr. Cox received a base salary of $420,000.

John B. Green. Under Mr. Green's employment agreement entered into in August 1997, Mr. Green is entitled to a minimum base salary of $150,000 per year, plus performance and incentive bonuses as determined by the Compensation Committee. In calendar year 2003, Mr. Green received a base salary of $270,000.

Harry M. Meade. Under Dr. Meade's employment agreement, he is entitled to a minimum base salary of $126,000 per year, plus performance and incentive bonuses as determined by the Compensation Committee. In calendar year 2003, Dr. Meade received a base salary of $263,000.

Each of these agreements will remain in effect until terminated according to its terms. In the event that we terminate any of these executive officers without cause or if any of them terminates his agreement for "good reason" after a "change of control" of GTC, as those terms are defined in their respective employment agreements, the executive will immediately be paid the maximum annual bonus for the year he is terminated, prorated for the portion of the year completed, and his then current base salary for a specified severance period, together in one lump sum. In the case of Dr. Cox, the severance period is two years. In the case of Mr. Green, the severance period in the event of a "change of control" is two years and otherwise is one year. In the case of Dr. Meade, the severance period is one year. If Dr. Meade terminates his agreement upon a change of control, his severance payments will be reduced by any income that he derives from a subsequent employer during the severance period. In addition, upon a change of control of GTC, any unvested stock options held by these executive officers would become immediately exercisable in full. In the case of Dr. Cox, such options will remain

23

exercisable for a period of two years. In the case of Mr. Green and Dr. Meade, such options will remain exercisable for the duration of the term of such options as if the termination had not occurred.

Messrs. Liposky and Woloshen. Messrs. Liposky and Woloshen entered into Management Agreements in June 2000 and May 1999, respectively. The Management Agreements provide that the executive will receive benefits and severance payments for a one year period at his then-current base salary if GTC terminates the executive's employment without cause, or in Mr. Woloshen's case, without cause including change of control.

Paul K. Horan. Dr. Horan entered into an employment agreement when he joined GTC in February 2002. Dr. Horan then resigned from GTC in January 2004. As a result of his departure, under this agreement, Dr. Horan will receive any unpaid amount of his base salary, plus credit for any vacation earned but not taken, and any bonus awarded for the past fiscal year that was not previously paid. In addition, as of the date of his resignation, Dr. Horan's stock options became fully vested and exercisable for a period of eighteen months.

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Board of Directors determines the compensation to be paid to GTC's executive officers, including its Chief Executive Officer. The Committee also administers GTC's employee stock purchase and equity incentive plans, including grants of stock options and other awards. The Committee is currently composed of Messrs. Bullock (Chairman), Miller and Tuck. This report is submitted by the Committee and addresses the compensation policies for fiscal year 2003.

GTC's executive compensation policy is designed to attract, retain and reward executive officers who contribute to GTC's long-term success by maintaining a competitive salary structure as compared with other biotechnology companies. The compensation program seeks to align compensation with the achievement of business objectives and individual and corporate performance. Bonuses are included to encourage effective individual performance relative to GTC's current plans and objectives. Stock option grants are key components of the executive compensation program and are intended to provide executives with an equity interest in GTC to link a meaningful portion of the executive's compensation with the performance of GTC's common stock.