LETTER TO SHAREHOLDERS —

KEELEY SMALL CAP VALUE FUND (KSCVX) |

Dear Shareholder,

During the past six months from March 31, 2007 through September 30, 2007, the Fund’s net assets grew from $4,188,378,061 to $5,591,784,929 and the number of shareholders grew from 185,280 to 252,414. For the six month period ending September 30, 2007, the portfolio turnover was 7.51% and the expense ratio was 1.33%. The Fund’s portfolio is widely diversified with investments in 174 equities. As of September 30, 2007, the Keeley family beneficially owned 0.30% of the Fund’s outstanding shares.

As of this date, the KEELEY Small Cap Value Fund was rated five stars («««««) by Morningstar among 157 Small Blend funds for the 10-year period. The Fund also received five stars («««««) for the five year period among 397 funds and five stars («««««) for the three year period among 507 funds. Morningstar ratings reflect historical risk adjusted performance as of September 30, 2007 and are subject to change every month*. As of this date, the Fund rated as a Lipper Leader in the Overall Total Return, Overall Consistent Return, and Overall Tax Efficiency among 574, 571, and 574 funds, respectively. Lipper ratings for Overall Total Return and Overall Consistent Return reflect the Fund’s historical total return performance relative to peers. The Overall rating is calculated monthly, based upon an equal-weighted average of percentile ranks for each measure over three, five, and ten-year periods (if applicable).

For the quarter ended September 30, 2007, the Fund’s total return was -1.90% versus a return of -3.09% for the Russell 2000 Index. For the six month period ended September 30, 2007, the Fund’s return was 6.63% versus 1.19% for the Russell 2000 Index. For the one year period the Fund’s return was 24.30% versus 12.34% for the Russell 2000 Index. For the five-year period, the Fund’s average annual return was 24.00% versus 18.75% for the Russell 2000 Index. For the ten year period, the Fund’s average annual return was 13.66% versus 7.22% for the Russell 2000 Index. Since its inception, October 1, 1993, the Fund’s average annual return was 16.04% versus 10.07% for the Russell 2000 Index. Performance Data does not reflect the deduction of the sales load or fee, and, if reflected, the load or fee would reduce the performance quoted.

Performance Data Including 4.5% Maximum Up-Front Sales Charge

For the quarter ended September 30, 2007, the Fund’s return was -6.31% versus a return of -3.09% for the Russell 2000 Index. For the six month period ended September 30, 2007, the Fund’s return was 1.83% versus 1.19% for the Russell 2000 Index. For the one year period, the Fund’s return was 18.71% versus 12.34% for the Russell 2000 Index. For the five year period, the Fund’s average annual return was 22.86% versus 18.75% for the Russell 2000 Index. For the ten year period, the Fund’s average annual return was 13.14% versus 7.22% for the Russell 2000 Index. Since inception, October 1, 1993, the Fund’s average annual return was 15.66% versus 10.07% for the Russell 2000 Index.

1

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and the current performance may be lower or higher than the performance data quoted. You may call toll-free at 888-933-5391, or visit our website at www.keeleyfunds.com to obtain performance data current to the most recent month end.

For the third quarter ended September 30, 2007, the KEELEY Small Cap Value Fund (KSCVX) fell -1.90%, outperforming its benchmark, the Russell 2000 Index, which fell -3.09% during the third quarter. The Fund also outperformed the Russell 2000 Value Index, which fell -6.26% in the third quarter. Year-to-date, the portfolio rose 11.00% compared to a 3.16% rise for the Russell 2000 Index, and a -2.70% drop for the Russell 2000 Value Index. For the past several years, we have favored and overweighted the industrial and energy sectors while underweighting financial services. These sector weightings have made a positive contribution to investment results and have been a key factor in the excess return that we have generated for the portfolio over this period of time. During the most recent quarter, the portfolio continued to benefit from exposure in the industrial sector, as the Fund’s holdings in this area contributed 58 basis points of performance to the Fund. Other sectors that contributed positively to results were the materials and utilities sectors. Returns in the financials, energy, and consumer discretionary sectors were the largest detractors during the third quarter. The top two performing names in the Fund came from the industrials sector during the third quarter. Layne Christensen (LAYN) was the top performer, rising over 35% and contributing 35 basis points of return to the Fund. The drilling and construction services company grew second quarter earnings by 33%, driven by strong revenue growth in their energy, mineral exploration, and water infrastructure divisions. McDermott International (MDR) continued its impressive performance in 2007, rising over 30% and contributing 33 basis points of return to the portfolio in the third quarter. The energy services provider has now risen over 110% for the year, and with strong order backlogs and upward earnings revisions, the outlook remains positive. The materials sector also contributed positively to results in the third quarter. AMCOL International (ACO) was the best performer, rising over 21% and contributing 19 basis points of return to the Fund. The maker of specialty minerals is experiencing stronger sales and expanding margins in their environmental and oilfield services divisions.

While it is not our intention to have companies within the portfolio acquired, takeovers are a natural by-product of our investment philosophy. Since many opportunities within the corporate restructuring process are “pure-plays” on a single industry, our companies are inherently takeover prone. In 2006, we had 17 companies acquired at a premium price, and so far in 2007, 11 companies have been acquired or agreed to an acquisition. Recently, announced buyouts of savings bank TierOne (TONE) and laundry equipment maker Coinmach Service (DRA) helped boost returns in 2007. From a macroeconomic standpoint, volatility plagued the markets throughout the third quarter as tightening credit sent stocks sharply lower in July and August. In times of higher volatility, thoughtful stock selection becomes a critical aspect of producing strong returns and fortunately, there is a wealth of activity within our primary investment themes. Our research team continues to

2

be presented with an abundance of restructuring opportunities for our portfolios. We will continue to employ our unique investment process to identify compelling opportunities that we believe will unlock shareholder value.

Thank you for your continued commitment to the Fund.

| Sincerely, |

| |

|

| John L. Keeley, Jr. |

| President |

There are risks associated with investing in small-cap mutual funds, such as smaller product lines and market shares, including limited available information. You should consider objectives, risks and charges and expenses of a fund carefully before investing. Additional information regarding such risks, including information on fees is located in the Fund’s prospectus. Please read the Fund’s prospectus carefully before investing.

____________________

| * | | Morningstar ratings are based on a risk adjusted return measure that accounts for variation in a Fund’s monthly performance (including the effects of sales charges and redemption fees), placing more emphasis on downward variations and rewarding consistent performance. The overall rating is a weighted average of the three-, five-, and ten-year returns. The top 10% of funds are labeled five stars; the next 22.5% are labeled four stars, the next 35% are labeled three stars; the next 22.5% are labeled two stars and the bottom 10% one star. ©2005 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. |

3

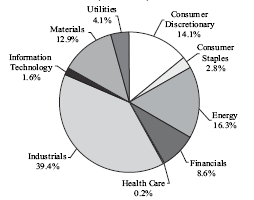

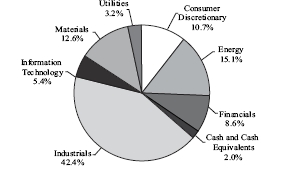

Investments by Sector

As a Percentage of Investments

As of 9/30/2007

(Unaudited)

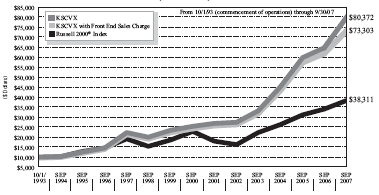

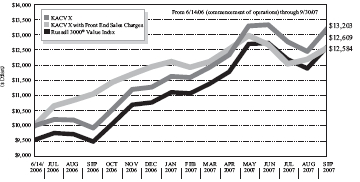

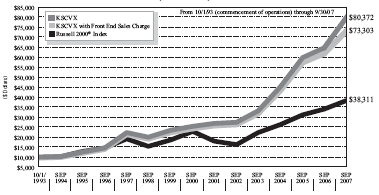

Index Comparison

Comparison of a Hypothetical $10,000 Investment

In KSCVX and Russell 2000® Index*

(Unaudited)

Average annual total returns **

For the periods ended September 30, 2007

| | | | | | | | | Since Commencement |

| | | | | | | | | of Operations |

| | | 1-Year | | 5-Years | | 10-Years | | (10/1/1993) |

| KSCVX | | +24.30% | | +24.00% | | +13.66% | | +16.04% |

| KSCVX (includes max | | | | | | | | |

| 4.50% front-end load) | | +18.71% | | +22.86% | | +13.14% | | +15.66% |

| Russell 2000® Index | | +12.34% | | +18.75% | | +7.22% | | +10.07% |

| * | | The Russell 2000® Index is comprised of the smallest 2,000 companies in the Russell 3000® Index.

The Russell 3000® Index is comprised of the 3,000 largest U.S. companies based on market capitalization. The Russell 2000® Index is unmanaged and returns include reinvested dividends. |

| ** | | PERFORMANCE DATA quoted represents past performance, which is not predictive of future performance. The investment return and principal value of shares will fluctuate and when redeemed, may be worth more or less than their original cost. Returns shown include the reinvestment of all dividends. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

4

KEELEY Small Cap Value Fund, Inc.

Expense Example

For the Six Month Period Ended September 30, 2007

(Unaudited)

As a shareholder of the KEELEY Small Cap Value Fund (the “Fund”), you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2007 to September 30, 2007 (the “period”).

Actual Expenses

The first line of the table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

Hypothetical Example for Comparison Purposes

The second line of the table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the second line of the table is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

Expenses Paid During the Period

| | | Beginning | | Ending | | Expenses paid during |

| | | account value | | account value | | the period ended |

| | | April 1, 2007 | | September 30, 2007 | | September 30, 2007* |

| Actual | | $1,000.00 | | $1,066.30 | | $6.89 |

| Hypothetical (5% return | | | | | | |

| before expenses) | | 1,000.00 | | 1,018.40 | | 6.73 |

| * | | Expenses are equal to the Fund’s expense ratio of 1.33% for the six month period, multiplied by the average account value over the period, multiplied by 183/365 (to reflect one-half year period). |

5

KEELEY Small Cap Value Fund

SCHEDULE OF INVESTMENTS

September 30, 2007

| Shares | | | Value |

| | COMMON STOCKS – 100.15% | | |

| | Aerospace & Defense – 3.28% | | |

| 1,195,000 | | GenCorp, Inc. (a) | $ | 14,292,200 |

| 2,170,000 | | Hexcel Corp. (a) | | 49,280,700 |

| 340,000 | | Kaman Corp. | | 11,750,400 |

| 880,000 | | Ladish, Inc. (a) (b) | | 48,822,400 |

| 1,110,000 | | Teledyne Technologies, Inc. (a) | | 59,262,900 |

| | | | | 183,408,600 |

| | | Air Freight & Logistics – 0.48% | | |

| 515,000 | | Atlas Air Worldwide Holdings, Inc. (a) | | 26,589,450 |

| | | Auto Components – 1.53% | | |

| 1,500,000 | | LKQ Corp. (a) | | 52,215,000 |

| 1,270,000 | | Midas, Inc. (a) (b) | | 23,964,900 |

| 361,000 | | Sauer-Danfoss, Inc. | | 9,631,480 |

| | | | | 85,811,380 |

| | | Capital Markets – 3.42% | | |

| 745,000 | | Cowen Group, Inc. (a) (b) | | 10,295,900 |

| 998,000 | | Epoch Holding Corp. (a) (b) | | 14,051,840 |

| 765,000 | | Greenhill & Co., Inc. | | 46,703,250 |

| 1,190,000 | | Investment Technology Group, Inc. (a) | | 51,146,200 |

| 490,000 | | Piper Jaffray Companies (a) | | 26,264,000 |

| 1,350,000 | | SWS Group, Inc. | | 23,881,500 |

| 1,285,000 | | Thomas Weisel Partners Group, Inc. (a) (b) | | 18,645,350 |

| | | | | 190,988,040 |

| | | Chemicals – 2.53% | | |

| 715,000 | | Arch Chemicals, Inc. | | 33,519,200 |

| 1,405,000 | | Koppers Holdings, Inc. (b) | | 54,247,050 |

| 455,000 | | Sensient Technologies Corp. | | 13,135,850 |

| 1,515,000 | | W.R. Grace & Co. (a) | | 40,692,900 |

| | | | | 141,595,000 |

| | | Commercial Banks – 2.35% | | |

| 610,000 | | BankFinancial Corp. | | 9,650,200 |

| 1,625,000 | | Boston Private Financial Holdings, Inc. | | 45,240,000 |

| 435,000 | | MB Financial Corp. | | 15,029,250 |

| 1,097,500 | | PrivateBancorp, Inc. | | 38,236,900 |

| 550,000 | | Wintrust Financial Corp. | | 23,479,500 |

| | | | | 131,635,850 |

| | | Commercial Services & Supplies – 3.58% | | |

| 1,205,000 | | ACCO Brands Corp. (a) | 27,040,200 |

| 1,470,000 | | Cenveo, Inc. (a) | | 31,796,100 |

| 765,000 | | GP Strategies Corp. (a) | | 8,491,500 |

| 1,255,000 | | Layne Christensen Co. (a) (b) | | 69,627,400 |

| 600,000 | | Mac-Gray Corp. (a) | | 7,728,000 |

| 1,660,000 | | PHH Corp. (a) | | 43,624,800 |

| 305,000 | | Standard Parking Corp. (a) | | 12,135,950 |

| | | | | 200,443,950 |

| | | Construction & Engineering – 7.06% | | |

| 1,345,000 | | AECOM Technology Corp. (a) | 46,980,850 |

| 1,020,000 | | Chicago Bridge & Iron Co. | 43,921,200 |

| 632,000 | | Foster Wheeler Ltd. (a) | | 82,968,960 |

| 790,000 | | Granite Construction, Inc. | | 41,885,800 |

| 657,500 | | Integrated Electrical Services, Inc. (a) | | 16,838,575 |

| 1,412,500 | | McDermott International, Inc. (a) | | 76,388,000 |

| 1,335,000 | | Quanta Services, Inc. (a) | | 35,310,750 |

| 867,500 | | The Shaw Group, Inc. (a) | | 50,401,750 |

| | | | | 394,695,885 |

| | | Construction Materials – 0.93% | | |

| 660,000 | | Texas Industries, Inc. | | 51,810,000 |

The accompanying notes are an integral part of these financial statements.

6

KEELEY Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2007

| Shares | | | | Value |

| | | Consumer Finance – 0.74% | | | |

| 1,830,000 | | Moneygram International, Inc. | | $ | 41,339,700 |

| | | Diversified Financial Services – 1.02% | | | |

| 847,500 | | GATX Corp. | | | 36,230,625 |

| 1,395,000 | | MarketAxess Holdings, Inc. (a) | | | 20,925,000 |

| | | | | | 57,155,625 |

| | | Electric Utilities – 3.08% | | | |

| 762,500 | | Black Hills Corp. | | | 31,277,750 |

| 1,220,000 | | Cleco Corp. | | | 30,829,400 |

| 870,000 | | ITC Holdings Corp. | | | 43,108,500 |

| 1,725,000 | | Portland General Electric Co. | | | 47,955,000 |

| 785,000 | | Westar Energy, Inc. | | | 19,279,600 |

| | | | | | 172,450,250 |

| | | Electrical Equipment – 2.81% | | | |

| 535,000 | | AZZ, Inc. (a) | | | 18,703,600 |

| 797,500 | | General Cable Corp. (a) | | | 53,528,200 |

| 835,000 | | Regal-Beloit Corp. | | | 39,988,150 |

| 1,197,500 | | Superior Essex, Inc. (a) (b) | | | 44,642,800 |

| | | | | | 156,862,750 |

| | | Energy Equipment & Services – 6.49% | | | |

| 1,585,000 | | Allis-Chalmers Energy, Inc. (a) | | | 30,019,900 |

| 995,000 | | Basic Energy Services, Inc. (a) | | | 20,914,900 |

| 1,215,000 | | Bronco Drilling Co., Inc. (a) | | | 17,982,000 |

| 1,105,000 | | Dresser-Rand Group, Inc. (a) | | | 47,194,550 |

| 325,000 | | Key Energy Services, Inc. (a) | | | 5,525,000 |

| 549,000 | | Lufkin Industries, Inc. | | | 30,205,980 |

| 1,457,500 | | Natural Gas Services Group, Inc. (a) (b) | | | 25,083,575 |

| 2,325,000 | | Parker Drilling Co. (a) | | | 18,879,000 |

| 2,550,000 | | Pioneer Drilling Co. (a) (b) | | | 31,059,000 |

| 2,045,000 | | RPC, Inc. | | | 29,059,450 |

| 1,187,500 | | Superior Well Services, Inc. (a) (b) | | | 26,991,875 |

| 1,302,500 | | Tesco Corp. (a) | | | 35,362,875 |

| 1,312,500 | | Willbros Group, Inc. (a) | | | 44,625,000 |

| | | | | | 362,903,105 |

| | | Food Products – 2.51% | | | |

| 1,545,000 | | Flowers Foods, Inc. | | | 33,681,000 |

| 1,475,000 | | Lance, Inc. | | | 33,954,500 |

| 658,000 | | Ralcorp Holdings, Inc. (a) | | | 36,729,560 |

| 1,325,000 | | TreeHouse Foods, Inc. (a) | | | 35,841,250 |

| | | | | | 140,206,310 |

| | | Gas Utilities – 0.69% | | | |

| 1,110,000 | | South Jersey Industries, Inc. | | | 38,628,000 |

| | | Health Care Providers & Services – 0.17% | | | |

| 342,000 | | Emeritus Corp. (a) | | | 9,268,200 |

| | | Hotels Restaurants & Leisure – 0.68% | | | |

| 1,185,000 | | AFC Enterprises, Inc (a) | | | 17,834,250 |

| 5,030,000 | | Denny’s Corp. (a) (b) | | | 20,120,000 |

| | | | | | 37,954,250 |

| | | Hotels, Restaurants & Leisure – 6.38% | | | |

| 2,055,000 | | CKE Restaurants, Inc. | | | 33,311,550 |

| 940,000 | | Gaylord Entertainment Co. (a) | | | 50,026,800 |

| 707,000 | | IHOP Corp. | | | 44,774,310 |

| 2,015,000 | | Interstate Hotels & Resorts, Inc. (a) (b) | | | 9,168,250 |

| 1,530,000 | | Marcus Corp. (b) | | | 29,376,000 |

| 950,000 | | Orient-Express Hotels Ltd. | | | 48,706,500 |

The accompanying notes are an integral part of these financial statements.

7

KEELEY Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2007

| Shares | | | Value |

| | | Hotels, Restaurants & Leisure (continued) | | |

| 1,440,000 | | Red Lion Hotels Corp. (a) (b) | $ | 14,832,000 |

| 1,275,000 | | The Steak N Shake Co. (a) | | 19,137,750 |

| 54,000 | | Triarc Companies, Inc. - Class A | | 675,540 |

| 1,357,500 | | Triarc Companies, Inc. - Class B | | 16,683,675 |

| 907,500 | | Vail Resorts, Inc. (a) | | 56,528,175 |

| 1,030,000 | | Wyndham Worldwide Corp. | | 33,742,800 |

| | | | | 356,963,350 |

| | | Industrial Conglomerates – 0.86% | | |

| 1,785,000 | | Walter Industries, Inc. | | 48,016,500 |

| | | Insurance – 1.33% | | |

| 700,000 | | Conseco, Inc. (a) | | 11,200,000 |

| 1,077,500 | | Covanta Holding Corp. (a) | | 26,409,525 |

| 1,355,000 | | Meadowbrook Insurance Group, Inc. (a) | | 12,208,550 |

| 1,747,500 | | Phoenix Companies, Inc. | | 24,657,225 |

| | | | | 74,475,300 |

| | | IT Services – 0.82% | | |

| 1,252,500 | | Wright Express Corp. (a) | | 45,703,725 |

| | | Machinery – 18.30% | | |

| 845,000 | | Actuant Corp. - Class A | | 54,899,650 |

| 990,000 | | Albany International Corp. | | 37,115,100 |

| 1,550,000 | | Altra Holdings, Inc. (a) (b) | | 25,838,500 |

| 830,000 | | American Railcar Industries, Inc. | | 18,276,600 |

| 780,000 | | Ampco-Pittsburgh Corp. (b) | | 30,716,400 |

| 584,000 | | Bucyrus International, Inc. - Class A | | 42,591,120 |

| 945,000 | | CIRCOR International, Inc. (b) | | 42,912,450 |

| 730,000 | | EnPro Industries, Inc. (a) | | 29,638,000 |

| 2,265,000 | | Federal Signal Corp. | | 34,790,400 |

| 535,000 | | Flowserve Corp. | | 40,756,300 |

| 1,100,000 | | Gardner Denver, Inc. (a) | | 42,900,000 |

| 1,622,500 | | Greenbrier Companies, Inc. (b) | | 43,336,975 |

| 582,500 | | Joy Global, Inc. | | 29,625,950 |

| 975,000 | | Kaydon Corp. | | 50,690,250 |

| 1,085,000 | | L B Foster Co. (a) (b) | | 47,154,100 |

| 910,000 | | Lindsay Manufacturing Co. (b) | | 39,839,800 |

| 1,075,000 | | Manitowoc Co. | | 47,601,000 |

| 1,360,000 | | Mueller Water Products, Inc. - Class A | | 16,850,400 |

| 1,547,500 | | Mueller Water Products, Inc. - Class B | | 17,022,500 |

| 900,000 | | RBC Bearings, Inc. (a) | | 34,515,000 |

| 615,000 | | Sun Hydraulics, Inc. | | 19,557,000 |

| 580,000 | | Tennant Co. | | 28,246,000 |

| 667,000 | | Terex Corp. (a) | | 59,376,340 |

| 555,000 | | Titan International, Inc. | | 17,715,600 |

| 917,500 | | Trinity Industries, Inc. | | 34,442,950 |

| 715,000 | | Valmont Industries, Inc. | | 60,667,750 |

| 950,000 | | Watts Water Technologies, Inc. - Class A | | 29,165,000 |

| 1,255,000 | | Westinghouse Air Brake Technologies Corp. | | 47,012,300 |

| | | | | 1,023,253,435 |

| | | Media – 1.29% | | |

| 1,112,500 | | Carmike Cinemas, Inc. (b) | | 20,436,625 |

| 2,940,000 | | Gray Television, Inc. (b) | | 24,960,600 |

| 857,500 | | Idearc, Inc. | | 26,985,525 |

| | | | | 72,382,750 |

| | | Metals & Mining – 9.73% | | |

| 235,000 | | Allegheny Technologies, Inc. | | 25,838,250 |

| 1,742,500 | | Alpha Natural Resources, Inc. (a) | | 40,478,275 |

The accompanying notes are an integral part of these financial statements.

8

KEELEY Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2007

| Shares | | | Value |

| Metals & Mining (continued) | | |

| 1,210,000 | | AM Castle & Co. (b) | $ | 39,446,000 |

| 1,705,000 | | AMCOL International Corp. (b) | | 56,418,450 |

| 960,000 | | Brush Engineered Materials, Inc. (a) | | 49,814,400 |

| 945,000 | | Century Aluminum Co. (a) | | 49,754,250 |

| 1,050,000 | | Commercial Metals Co. | | 33,232,500 |

| 1,085,000 | | Compass Minerals International, Inc. | | 36,933,400 |

| 1,297,500 | | Foundation Coal Holdings, Inc. | | 50,862,000 |

| 570,000 | | Haynes International, Inc. (a) | | 48,660,900 |

| 705,000 | | Kaiser Aluminum Corp. | | 49,751,850 |

| 1,015,000 | | Ryerson, Inc. | | 34,246,100 |

| 720,000 | | Universal Stainless & Alloy (a) (b) | | 28,648,800 |

| | | | | 544,085,175 |

| | | Multiline Retail – 0.83% | | |

| 2,030,000 | | Retail Ventures, Inc. (a) | | 21,132,300 |

| 1,490,000 | | Saks, Inc. | | 25,553,500 |

| | | | | 46,685,800 |

| | | Multi-Utilities – 0.30% | | |

| 3,620,000 | | Aquila, Inc. (a) | | 14,516,200 |

| 173,000 | | Florida Public Utilities Co. | | 2,041,400 |

| | | | | 16,557,600 |

| | | Oil, Gas & Consumable Fuels – 8.17% | | |

| 1,560,000 | | Bois d’Arc Energy, Inc. (a) | | 29,905,200 |

| 992,500 | | Carrizo Oil & Gas, Inc. (a) | | 44,523,550 |

| 1,125,000 | | Comstock Resources, Inc. (a) | | 34,695,000 |

| 997,500 | | Encore Acquisition Co. (a) | | 31,570,875 |

| 2,382,500 | | EXCO Resources, Inc. (a) | | 39,406,550 |

| 1,425,000 | | Goodrich Petroleum Corp. (a) (b) | | 45,172,500 |

| 1,290,000 | | Penn Virginia Corp. (b) | | 56,734,200 |

| 2,250,000 | | PetroHawk Energy Corp. (a) | 36,945,000 |

| 670,000 | | Quicksilver Resources, Inc. (a) | | 31,523,500 |

| 807,500 | | Range Resources Corp. | | 32,832,950 |

| 830,000 | | Western Refining, Inc. | | 33,681,400 |

| 895,000 | | Whiting Petroleum Corp. (a) | | 39,782,750 |

| | | | | 456,773,475 |

| | | Paper & Forest Products – 1.37% | | |

| 402,000 | | Deltic Timber Corp. | | 22,881,840 |

| 1,107,500 | | Neenah Paper, Inc. (b) | | 36,647,175 |

| 1,520,000 | | Wausau Paper Corp. | | 16,948,000 |

| | | | | 76,477,015 |

| | | Road & Rail – 2.03% | | |

| 392,000 | | Amerco, Inc. (a) | | 24,876,320 |

| 1,765,000 | | Genesee & Wyoming, Inc. (a) | | 50,902,600 |

| 1,072,500 | | Kansas City Southern (a) | 34,502,325 |

| 190,000 | | Providence & Worcester Railroad Co. | | 3,439,000 |

| | | | | 113,720,245 |

| | | Specialty Retail – 2.45% | |

| 2,117,500 | | Maidenform Brands, Inc. (a) (b) | | 33,625,900 |

| 2,340,000 | | PEP Boys-Manny, Moe & Jack | | 32,830,200 |

| 1,675,300 | | Prestige Brands Holdings, Inc. (a) | | 18,394,794 |

| 3,025,000 | | Sally Beauty Holdings, Inc. (a) | | 25,561,250 |

| 1,457,500 | | Stage Stores, Inc. | | 26,570,225 |

| | | | | 136,982,369 |

The accompanying notes are an integral part of these financial statements.

9

KEELEY Small Cap Value Fund

SCHEDULE OF INVESTMENTS (Continued)

September 30, 2007

| Shares | | | Value |

| | | Textiles, Apparel & Luxury Goods – 1.31% | | |

| 1,082,500 | | Hanesbrands, Inc. (a) | $ | 30,374,950 |

| 1,345,000 | | Movado Group, Inc. (b) | | 42,932,400 |

| | | | | 73,307,350 |

| | | Thrifts & Mortgage Finance – 1.63% | | |

| 1,870,000 | | BankAtlantic Bancorp, Inc. | | 16,212,900 |

| 310,000 | | Citizens First Bancorp, Inc. | | 5,564,500 |

| 475,000 | | First Niagara Financial Group, Inc. | | 6,721,250 |

| 540,000 | | Home Federal Bancorp, Inc. | | 7,187,400 |

| 1,785,000 | | NewAlliance Bancshares, Inc. | | 26,203,800 |

| 735,000 | | Provident Financial Services, Inc. | | 12,031,950 |

| 1,770,000 | | Westfield Financial, Inc. (b) | | 17,186,700 |

| | | | | 91,108,500 |

| |

| | | Total Common Stocks | | |

| | | (Cost $4,696,122,599) | $ | 5,600,238,934 |

| Principal | | | | | |

| Amount | | | Value | |

| | | SHORT TERM INVESTMENTS – 0.05% | | | |

| | | Investment Companies – 0.05% | | | |

| 2,885,700 | | Fidelity Institutional Money Market Portfolio | $ | 2,885,700 | |

| | | Total Short Term Investments | | | |

| | | (Cost $2,885,700) | $ | 2,885,700 | |

| | | Total Investments – 100.20% | | | |

| | | (Cost $4,699,008,299) | $ | 5,603,124,634 | |

| | | Liabilities in Excess of Other Assets – (0.20)% | | (11,339,705 | ) |

| | | TOTAL NET ASSETS – 100.00% | $ | 5,591,784,929 | |

| | | | | |

| | Percentages are stated as a percent of net assets. | | | |

| | (a) | | Non Income Producing. |

| |

| (b) | | Affliated issuer. See Note 10 in Notes to the Financial Statements |

The accompanying notes are an integral part of these financial statements.

10

KEELEY Small Cap Value Fund, Inc.

STATEMENT OF ASSETS AND LIABILITIES

September 30, 2007

| ASSETS: | | |

| Investments, at value | | |

| Unaffiliated issuers (cost $3,734,929,237) | $ | 4,530,188,719 |

| Affiliated issuers (cost $964,079,062) | | 1,072,935,915 |

| Total Investments | | 5,603,124,634 |

| Cash | | 33,788 |

| Receivable for investments sold | | 2,252,235 |

| Receivable for shares issued | | 37,108,324 |

| Dividends and interest receivable | | 2,581,568 |

| Prepaid expenses and other assets | | 153,598 |

| Total Assets | | 5,645,254,147 |

| | | |

| LIABILITIES: | | |

| Payable for investments purchased | | 33,232,504 |

| Payable for shares redeemed | | 13,620,952 |

| Payable to Adviser | | 4,051,703 |

| Payable to Directors | | 33,999 |

| Accrued 12b-1 fees | | 944,882 |

| Other accrued expenses | | 1,585,178 |

| Total Liabilities | | 53,469,218 |

| NET ASSETS | $ | 5,591,784,929 |

| | | |

| NET ASSETS CONSIST OF: | | |

| Capital stock | $ | 4,568,070,178 |

| Accumulated undistributed net realized gain on investments | | 119,598,416 |

| Net unrealized appreciation on investments | | 904,116,335 |

| NET ASSETS | $ | 5,591,784,929 |

| | | |

| CAPITAL STOCK, $0.01 par value | | |

| Authorized | | 500,000,000 |

| Issued and outstanding | | 193,147,278 |

| | | |

| NET ASSET VALUE AND REDEMPTION PRICE PER SHARE | $ | 28.95 |

| | | |

| MAXIMUM OFFERING PRICE | $ | 30.32 |

KEELEY Small Cap Value Fund, Inc.

STATEMENT OF OPERATIONS

For the Year Ended

September 30, 2007

| INVESTMENT INCOME: | | | |

| Dividend income | | | |

| Affiliated issuers | $ | 3,798,497 | |

| Unaffiliated issuers (Net of $27,823 of foreign witholding taxes) | | 26,003,548 | |

| Interest income | | 2,067,370 | |

| Total Investment Income | | 31,869,415 | |

| | | | |

| EXPENSES: | | | |

| Investment advisory fees | | 39,483,939 | |

| 12b-1 fees | | 10,689,983 | |

| Transfer agent fees and expenses | | 3,639,624 | |

| Administration and accounting fees | | 957,573 | |

| Federal and state registration fees | | 316,832 | |

| Custody fees | | 392,624 | |

| Audit Fees | | 70,034 | |

| Reports to shareholders | | 492,299 | |

| Directors’ fees | | 149,955 | |

| Other | | 407,049 | |

| Total Expenses | | 56,599,912 | |

| NET INVESTMENT LOSS | | (24,730,497 | ) |

| | | | |

| REALIZED AND UNREALIZED GAIN ON INVESTMENTS: | | | |

| Net realized gain/(loss) on investments | | | |

| Unaffiliated issuers | | 153,751,407 | |

| Affiliated issuers | | (3,840,991 | ) |

| Change in net unrealized | | | |

| appreciation on investments | | 658,857,690 | |

| Net Gain on Investments | | 808,768,106 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 784,037,609 | |

The accompanying notes are an integral part of these financial statements.

11

KEELEY Small Cap Value Fund, Inc.

STATEMENTS OF CHANGES IN NET ASSETS

| | Year Ended | | Year Ended |

| | September 30, 2007 | | September 30, 2006 |

| OPERATIONS: | | | | | | | |

| Net investment loss | $ | (24,730,497 | ) | | $ | (8,265,612 | ) |

| Net realized gain (loss) on investments | | 149,910,416 | | | | (28,875,466 | ) |

| Change in net unrealized appreciation | | | | | | | |

| on investments | | 658,857,690 | | | | 69,833,055 | |

| Net increase in net assets resulting | | | | | | | |

| from operations | | 784,037,609 | | | | 32,691,977 | |

| | | | | | | | |

| DISTRIBUTIONS: | | | | | | | |

| Net realized gains | | (34,902 | ) | | | (9,190,330 | ) |

| | | | | | | | |

| CAPITAL STOCK TRANSACTIONS: | | | | | | | |

| Proceeds from 106,925,545 and 114,139,817(1) | | | | | | | |

| shares issued, respectively | | 2,920,915,219 | | | | 2,245,147,049 | |

| Proceeds from 1,216 and 399,186(1) shares of | | | | | | | |

| distributions reinvested, respectively | | 32,024 | | | | 8,263,222 | |

| Cost of 32,004,504 and 15,875,067(1) shares | | | | | | | |

| redeemed, respectively | | (867,004,922 | ) | | | (373,255,960 | ) |

| Net increase from capital stock transactions | | 2,053,942,321 | | | | 1,880,154,311 | |

| TOTAL INCREASE IN NET ASSETS | | 2,837,945,028 | | | | 1,903,655,958 | |

| | | | | | | | |

| NET ASSETS: | | | | | | | |

| Beginning of period | | 2,753,839,901 | | | | 850,183,943 | |

| End of period | $ | 5,591,784,929 | | | $ | 2,753,839,901 | |

| Accumulated undistributed net investment loss | $ | — | | | $ | — | |

| (1) | | On July 10, 2006, the Board of Directors declared a 2 for 1 stock split. As a result of the split, each share was converted into two shares on that date. The number of shares in capital stock transactions for the period October 1, 2005 through July 10, 2006 reflect the impact of the split. |

The accompanying notes are an integral part of these financial statements.

12

KEELEY Small Cap Value Fund, Inc.

FINANCIAL HIGHLIGHTS

| | Year Ended September 30, |

| | 2007 | | 2006 | | 2005 | | 2004 | | 2003 |

| PER SHARE DATA (1) | | | | | | | | | | | | | | | | | | | |

| Net asset value, beginning of period | $ | 23.29 | | | $ | 21.73 | | | $ | 16.98 | | | $ | 12.44 | | | $ | 10.95 | |

| Income from investment operations: | | | | | | | | | | | | | | | | | | | |

| Net investment loss | | (0.13 | ) | | | (0.07 | ) | | | (0.06 | ) | | | (0.06 | ) | | | (0.08 | ) |

| Net realized and unrealized gains on | | | | | | | | | | | | | | | | | | | |

| investments | | 5.79 | | | | 2.04 | | | | 5.41 | | | | 4.60 | | | | 2.23 | |

| Total from investment operations | | 5.66 | | | | 1.97 | | | | 5.35 | | | | 4.54 | | | | 2.15 | |

| | | | | | | | | | | | | | | | | | | | |

| Less distributions: | | | | | | | | | | | | | | | | | | | |

| Net realized gains | | — | (2) | | | (0.41 | ) | | | (0.60 | ) | | | — | | | | (0.66 | ) |

| Net asset value, end of period | $ | 28.95 | | | $ | 23.29 | | | $ | 21.73 | | | $ | 16.98 | | | $ | 12.44 | |

| |

| Total return (3) | | 24.30 | % | | | 8.25 | % | | | 32.37 | % | | | 36.45 | % | | | 20.61 | % |

| | | | | | | | | | | | | | | | | | | | |

| Supplemental data and ratios: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in 000’s) | $ | 5,591,785 | | | $ | 2,753,840 | | | $ | 850,184 | | | $ | 206,976 | | | $ | 90,471 | |

| Ratio of expenses to average net assets | | 1.33 | % | | | 1.39 | % | | | 1.52 | % | | | 1.64 | % | | | 1.75 | % |

| Ratio of net investment loss to average | | | | | | | | | | | | | | | | | | | |

| net assets | | (0.58 | )% | | | (0.47 | )% | | | (0.50 | )% | | | (0.57 | )% | | | (0.68 | )% |

| Portfolio turnover rate | | 29.60 | % | | | 17.58 | % | | | 22.93 | % | | | 29.63 | % | | | 38.83 | % |

| (1) | | Per share data is for a share outstanding during the period. On July 10, 2006, the Board of Directors declared a 2 for 1 stock split. As a result of the split, each share was converted into two shares on that date. Per share data for all five years is for a share outstanding throughout the period reflecting the impact of the stock split. |

| (2) | | Amount calculated is less than $0.005 per share. |

| (3) | | The total return calculation does not reflect the sales load imposed on the purchase of shares (see Note 7). |

The accompanying notes are an integral part of these financial statements.

13

KEELEY Small Cap Value Fund, Inc.

NOTES TO THE FINANCIAL STATEMENTS

September 30, 2007

| 1. | | ORGANIZATION |

| | |

| | The KEELEY Small Cap Value Fund, Inc. ( the “Fund”) was incorporated on May 17, 1993 as a Maryland corporation and is registered as a diversified open-end investment company under the Investment Company Act of 1940 (the “1940 Act”). |

| | | |

| 2. | | SIGNIFICANT ACCOUNTING POLICIES |

| | |

| | The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“GAAP”) The presentation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates and assumptions. |

| | |

| | a) Investment Valuation – Securities which are traded on a recognized stock exchange are valued at the last sale price each day on the securities exchange on which such securities are primarily traded or at the last sale price on a national securities exchange. Exchange-traded securities for which there were no transactions are valued at the current bid prices. Securities traded on only over-the-counter markets are valued on the basis of last sale price, or closing over-the-counter bid prices when there is no last sale price available. Debt securities (other than short-term obligations) are valued by a service that uses electronic data processing methods, avoiding exclusive reliance on exchange or over-the-counter prices. Debt securities purchased within 60 days of their stated maturity date are valued at amortized cost, which approximates fair value. Securities for which quotations are not readily available are valued at fair value as determined in good faith by the Board of Directors. For each investment that is fair valued, if any, the Board of Directors considers, to the extent applicable, various factors including, but not limited to, the financial condition of the company, comparable companies in the public market, the nature and duration of the cause for a quotation not being readily available and other relevant factors. |

| | |

| | In September 2006, the Financial Accounting Standards Board issued its new Standard No. 157, “Fair Value Measurements” (“FAS 157”). FAS 157 is designed to unify guidance for the measurement of fair value of all types of assets, including financial instruments, and certain liabilities, throughout a number of accounting standards. FAS 157 also establishes a hierarchy for measuring fair value in generally accepted accounting principles and expands financial statement disclosures about fair value measurements that are relevant to mutual funds. FAS 157 is effective for financial statements issued for fiscal years beginning after November 15, 2007, and earlier adoption is permitted. At this time, management believes the adoption of FAS 157 will have no material impact on the financial statements of the Fund. |

14

KEELEY Small Cap Value Fund, Inc.

NOTES TO THE FINANCIAL STATEMENTS (Continued)

September 30, 2007

| | | b) Federal Income and Excise Taxes – It is the Fund’s policy to meet the requirements of Subtitle A, Chapter 1, Subchapter M of the Internal Revenue Code, as amended, applicable to regulated investment companies and to distribute substantially all investment company net taxable income and net capital gains to shareholders in a manner which results in no tax cost to the Fund. Therefore, no federal income or excise tax provision is required. On July 13, 2006, the Financial Accounting Standards Board (“FASB”) released FASB Interpretation No. 48 “Accounting for Uncertainty in Income Taxes” (“FIN 48”). FIN 48 provides guidance for how uncertain tax positions should be recognized, measured, presented and disclosed in the financial statements. FIN 48 requires the evaluation of tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions are “more-likely-than-not” of being sustained by the applicable tax authority. Tax positions not deemed to meet the more-likely-than-not threshold would be recorded as a tax benefit or expense in the current year. Adoption of FIN 48 is required as of the date of the last net asset value calculation in the first required financial statement reporting period for fiscal years beginning after December 15, 2006 and is to be applied to all open tax years as of the effective date. At this time, management is evaluating the implications of FIN 48 to the Fund and its impact in the financial statements has not yet been determined. c) Distributions to Shareholders – Dividends from net investment income, if any, will be declared and paid annually. Distributions of net realized gains, if any, will be declared and paid annually. Distributions to shareholders are recorded on the ex-dividend date. The Fund may periodically make reclassifications among certain of its capital accounts as a result of the characterization of certain income and realized gains determined annually in accordance with federal tax regulations that may differ from generally accepted accounting principles. For the year ended September 30, 2007, the Fund increased undistributed net investment income by $24,730,497, increased accumulated net realized gain by $27,846 and decreased paid in capital by $24,758,343. These reclassifications between capital accounts were made for only those differences that are permanent in nature. d) Other – Investment transactions are recorded on the trade date. The Fund determines the gain or loss realized from investment transactions by comparing the identified original cost of the security lot sold with the net sale proceeds. Dividend income is recognized on the ex-dividend date and interest income is recognized on an accrual basis, including amortization/accretion of premiums or discounts using the effective interest method. e) Guarantees and Indemnifications – In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims against the Fund that have not yet occurred. Based on experience, the Fund expects the risk of loss to be remote. |

15

KEELEY Small Cap Value Fund, Inc.

NOTES TO THE FINANCIAL STATEMENTS (Continued)

September 30, 2007

| 3. | | INVESTMENT ADVISORY AGREEMENT |

| |

| | | The Fund has an agreement with Keeley Asset Management Corp. (the “Adviser”), with whom certain officers and directors of the Fund are affiliated, to furnish investment advisory services to the Fund (the “Investment Advisory Agreement”). Under the terms of this agreement, the Fund pays the Adviser a monthly fee at the annual rate of 1.00% of the Fund’s first $1 billion and 0.90% in excess of $1 billion of the Fund’s average daily net assets. Under the Investment Advisory Agreement, if the aggregate annual operating expenses (excluding interest, taxes, brokerage commissions and other costs incurred in connection with the purchase or sale of portfolio securities, and extraordinary items) exceed 2.50% of the Fund’s average daily net assets, the Adviser will reimburse the Fund for the amount of such excess expenses. Because the aggregate annual operating expenses did not exceed 2.50% of the Fund’s average daily net assets, the Adviser has not reimbursed the Fund in the current fiscal year, nor the prior three fiscal years. |

| |

| 4. | | DISTRIBUTION PLAN |

| |

| | | The Fund has adopted a Distribution Plan (the “Plan”) pursuant to Rule 12b-1 under the 1940 Act. The Plan is designed to reimburse Keeley Investment Corp. (the “Distributor”), with whom certain officers and directors of the Fund are affiliated, for certain promotional and other sales related costs and to permit the Fund to compensate other dealers of its shares. Unreimbursed amounts may be carried forward and paid in a subsequent year, to the extent that total expenses under the plan do not exceed 0.25% of the average daily net assets of the Fund. The Fund paid to the Distributor and each dealer a monthly fee at the annual rate of 0.25% of the average daily net assets of Fund shares beneficially owned by the Distributor’s and each dealer’s existing brokerage clients. For the period from October 1, 2006 to September 30, 2007, the Fund paid $10,689,983 in distribution fees, of which $624,757 was paid to the Distributor. |

| |

| 5. | | INVESTMENT TRANSACTIONS |

| |

| | | The aggregate purchases and sales of securities, excluding short-term investments, for the Fund for the period from October 1, 2006 to September 30, 2007, were $3,361,229,474 and $1,251,267,376, respectively. For the period from October 1, 2006 to September 30, 2007, the Fund paid $8,151,376 in brokerage commissions on trades of securities to the Distributor. |

| |

| 6. | | FEDERAL INCOME TAX INFORMATION |

| |

| | | At September 30, 2007, gross unrealized appreciation and depreciation of investments, based on cost for federal income tax purposes were as follows: |

| | Cost of Investments | | $ | 4,700,606,522 | |

| Gross Unrealized Appreciation | | $ | 1,142,875,163 | |

| Gross Unrealized Depreciation | | | (240,357,051 | ) |

| Net Unrealized Appreciation | | | | |

| on Investments | | $ | 902,518,112 | |

16

KEELEY Small Cap Value Fund, Inc.

NOTES TO THE FINANCIAL STATEMENTS (Continued)

September 30, 2007

| | The difference between cost amounts for financial statement and federal income tax purposes is due primarily to timing differences resulting from wash sale transactions during the year. |

| |

| At September 30, 2007, the Fund had no realized Post-October capital losses for federal income tax purposes from transactions between November 1, 2006 and September 30, 2007. |

| |

| | The tax character of distributions paid during the fiscal years ended September 30, 2007 and 2006 were as follows: |

| | | 2007 | | | 2006 |

| | Long-Term Capital Gains | $ | 34,902 | | $ | 9,190,330 |

| | As of September 30, 2007 the components of accumulated earnings on a tax basis were as follows: | | |

| | | |

| | Undistributed Long-term Capital Gains | $ | 121,196,639 |

| | Unrealized Appreciation on Investments | | 902,518,112 |

| | Total Accumulated Earnings | $ | 1,023,714,751 |

| 7. | | OFFERING PRICE PER SHARE |

| |

| | | The public offering price is the net asset value plus a sales charge, which varies in accordance with the amount of the purchase up to a maximum of 4.5%. |

| |

| | | The Distributor retains the entire sales charge when it makes sales directly to the public. Otherwise, when sales are made through dealers, the Distributor receives a portion of the related sales charge. For the period from October 1, 2006 to September 30, 2007, the Distributor received $1,700,092 of sales charges. Sales charges are not an expense of the Fund and are not reflected in the financial statements of the Fund. |

| |

| | | As specified in the Fund’s Prospectus, reduced sales charges are available through a right of accumulation and certain sales of Fund shares can be made at net asset value per share. |

| |

| 8. | | LINE OF CREDIT ARRANGEMENT |

| |

| | | The Fund is party to an uncommitted line of credit with U.S. Bank, N.A., expiring March 1st, 2008, under which the Fund may borrow up to the lesser of (a) $300 million or (b) 10% of the market value of the assets of the Fund. Interest is charged on borrowings at the prevailing Prime Rate. The Fund has borrowed under these agreements from time to time to increase the efficiency of cash flow management. For the year ended September 30, 2007, the Fund made interest payments of $28,287 in connection with the use of this line of credit, and had average daily borrowings of $327,784. |

| |

| 9. | | RELATED PARTY TRANSACTION |

| |

| | | As of September 30, 2007, one affiliated director beneficially owned 583,505 shares of the Fund, which represents 0.30% of the Fund’s outstanding shares. |

| |

17

KEELEY Small Cap Value Fund, Inc.

NOTES TO THE FINANCIAL STATEMENTS (Continued)

September 30, 2007

| 10. | | TRANSACTIONS WITH AFFILIATES |

| |

| | | The following issuers are affiliated with the Fund; that is, the Fund held 5% or more of the outstanding voting securities during the period from October 1, 2006 through September 30, 2007. As defined in Section (2)(a)(3) of the 1940 Act, such issuers are: |

| |

| | | Share Balance | | | | | | Share Balance | | | | Value At |

| | | At October 1, | | | | | | At September 30, | | Dividend | | September 30, |

| Issuer Name | | 2006 | | Additions | | Reductions | | 2007 | | Income | | 2007 |

| Altra Holdings, Inc. | | — | | 1,550,000 | | | — | | | 1,550,000 | | $ | — | | $ | 25,838,500 |

| AM Castle & Co. | | 597,500 | | 612,500 | | | — | | | 1,210,000 | | | 199,200 | | | 39,446,000 |

| AMCOL International Corp. | | — | | 1,705,000 | | | — | | | 1,705,000 | | | 449,800 | | | 56,418,450 |

| Ampco-Pittsburgh Corp. | | — | | 780,000 | | | — | | | 780,000 | | | 140,985 | | | 30,716,400 |

| Carmike Cinemas, Inc. | | — | | 1,112,500 | | | — | | | 1,112,500 | | | 286,738 | | | 20,436,625 |

| CIRCOR International, Inc. | | 600,000 | | 345,000 | | | — | | | 945,000 | | | 118,406 | | | 42,912,450 |

| Cowen Group, Inc. | | 150,000 | | 595,000 | | | — | | | 745,000 | | | — | | | 10,295,900 |

| Denny’s Corp. | | 3,874,500 | | 1,155,500 | | | — | | | 5,030,000 | | | — | | | 20,120,000 |

| Epoch Holding Corp. | | 945,714 | | 52,286 | | | — | | | 998,000 | | | — | | | 14,051,840 |

| Goodrich Petroleum Corp. | | 647,500 | | 777,500 | | | — | | | 1,425,000 | | | — | | | 45,172,500 |

| Gray Television, Inc. | | — | | 2,940,000 | | | — | | | 2,940,000 | | | 219,600 | | | 24,960,600 |

| Greenbrier Companies, Inc. | | 760,000 | | 862,500 | | | — | | | 1,622,500 | | | 378,400 | | | 43,336,975 |

| Interstate Hotels & Resorts, Inc. | | 1,310,000 | | 725,000 | | | (20,000 | ) | | 2,015,000 | | | — | | | 9,168,250 |

| Koppers Holdings, Inc. | | — | | 1,405,000 | | | — | | | 1,405,000 | | | 482,256 | | | 54,247,050 |

| L B Foster Co. | | 830,000 | | 255,000 | | | — | | | 1,085,000 | | | — | | | 47,154,100 |

| Ladish, Inc. | | 632,500 | | 247,500 | | | — | | | 880,000 | | | — | | | 48,822,400 |

| Layne Christensen Co. | | — | | 1,255,000 | | | — | | | 1,255,000 | | | — | | | 69,627,400 |

| Lindsay Manufacturing Co. | | 415,000 | | 495,000 | | | — | | | 910,000 | | | 174,000 | | | 39,839,800 |

| Maidenform Brands, Inc. | | — | | 2,117,500 | | | — | | | 2,117,500 | | | — | | | 33,625,900 |

| Marcus Corp. | | 867,500 | | 662,500 | | | — | | | 1,530,000 | | | 369,500 | | | 29,376,000 |

| Midas, Inc. | | 780,000 | | 490,000 | | | — | | | 1,270,000 | | | — | | | 23,964,900 |

| Movado Group, Inc. | | 775,000 | | 570,000 | | | — | | | 1,345,000 | | | 283,800 | | | 42,932,400 |

| Natural Gas Services | | | | | | | | | | | | | | | | |

| Group, Inc. | | 655,000 | | 802,500 | | | — | | | 1,457,500 | | | — | | | 25,083,575 |

| Neenah Paper, Inc. | | 500,000 | | 607,500 | | | — | | | 1,107,500 | | | 335,250 | | | 36,647,175 |

| NU Horizons Electronics Corp. | | 617,000 | | 768,000 | | | (1,385,000 | ) | | — | | | — | | | — |

| Penn Virginia Corp. | | — | | 675,000 | * | | — | | | 1,290,000 | | | 146,812 | | | 56,734,200 |

| Pioneer Drilling Co. | | 950,000 | | 1,600,000 | | | — | | | 2,550,000 | | | — | | | 31,059,000 |

| Ready Mix, Inc. | | 297,500 | | — | | | (297,500 | ) | | — | | | — | | | — |

| Red Lion Hotels Corp. | | 1,380,000 | | 60,000 | | | — | | | 1,440,000 | | | — | | | 14,832,000 |

| Superior Essex, Inc. | | 625,000 | | 572,500 | | | — | | | 1,197,500 | | | — | | | 44,642,800 |

| Superior Well Services, Inc. | | 595,000 | | 592,500 | | | — | | | 1,187,500 | | | — | | | 26,991,875 |

| Thomas Weisel Partners | | | | | | | | | | | | | | | | |

| Group, Inc. | | 55,000 | | 1,295,000 | | | (65,000 | ) | | 1,285,000 | | | — | | | 18,645,350 |

| Universal Stainless & Alloy | | — | | 720,000 | | | — | | | 720,000 | | | — | | | 28,648,800 |

| Westfeild Financial, Inc. | | — | | 1,770,000 | | | — | | | 1,770,000 | | | 213,750 | | | 17,186,700 |

| | | | | | | | | | | | | $ | 3,798,497 | | $ | 1,072,935,915 |

| * | The Fund purchased 615,000 shares prior to a 2 for 1 stock split in the company on June 20, 2007. 60,000 shares were purchased post-split. The total share balance as of September 30, 2007 represents the split-adjusted amount. |

18

KEELEY Small Cap Value Fund, Inc.

NOTES TO THE FINANCIAL STATEMENTS (Continued)

September 30, 2007

| 11. | SUBSEQUENT EVENTS |

| |

| | On August 14, 2007, the Board of Directors of KEELEY Funds, Inc. unanimously approved a plan of reorganization of KEELEY Small Cap Value Fund, Inc. into a newly created series of KEELEY Funds, Inc., designated “KEELEY Small Cap Value Fund,” effective as of December 31, 2007. |

| |

19

| LETTER TO SHAREHOLDERS — |

| KEELEY MID CAP VALUE FUND (KMCVX) |

Dear Shareholder,

During the past six months from March 31, 2007 through September 30, 2007, the Fund’s net assets grew from $64,761,421 to $108,571,966 and the number of shareholders grew from 2,632 to 4,278. For the six month period ending September 30, 2007, the portfolio turnover was 18.96% and the expense ratio was 1.47%. On August 15, 2007 Keeley Asset Management Corp. (the “Adviser”) contractually agreed, effective October 1, 2007 to waive a portion of its fee or reimburse the Fund to the extent that the total ordinary operating expenses exceed 1.39%. This waiver will be in effect until September 30, 2008. The Fund’s portfolio is diversified with investments in 53 equities. As of September 30, 2007, the Keeley family beneficially owned 11.76% of the Fund’s outstanding shares.

For the quarter ended September 30, 2007, the Fund’s return was 1.22% versus a return of -3.55% for the Russell Mid Cap Value Index. For the six month period ended September 30, 2007, the Fund’s return was 14.31% versus -0.03% for the Russell Mid Cap Value Index. For the one year period ended September 30, 2007, the Fund’s return was 33.40% versus 13.75% for the Russell Mid Cap Value Index. Since inception, August 15, 2005, the Fund’s average annual return was 17.70% versus 12.82% for the Russell Mid Cap Value Index. Performance data does not reflect the deduction of the sales load or fee, and, if reflected, the load or fee would reduce the performance quoted.

Performance Data Including 4.5% Maximum Up-Front Sales Charge

For the quarter ended September 30, 2007, the Fund’s return was -3.34% versus a return of -3.55% for the Russell Mid Cap Value Index. For the six month period ended September 30, 2007, the Fund’s return was 9.16% versus -0.03% for the Russell Mid Cap Value Index. For the one year period ended September 30, 2007, the Fund’s return was 27.39% versus 13.75% for the Russell Mid Cap Value Index. Since inception, August 15, 2005, the Fund’s average annual return was 15.15% versus 12.82% for the Russell Mid Cap Value Index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and the current performance my be lower or higher than the performance data quoted. You may call toll-free at 888-933-5391, or visit our website at www.keeleyfunds.com to obtain performance data current to the most recent month end.

The KEELEY Mid Cap Value Fund (KMCVX) outperformed its benchmark, the Russell Mid Cap Value Index, for the quarter ended September 30, 2007. The portfolio rose 1.22% compared to a -3.55% decline for the benchmark. Year-to-date, the Fund has substantially outperformed its benchmark, rising 21.17% compared to a 4.83% increase for the Russell Mid Cap Value Index. The portfolio continued to benefit from exposure in the industrial sector, as the Fund’s holdings in this area were very strong, contributing 282 basis points of performance. Other sectors that contributed positively to results were the financials

20

and energy sectors. Returns in the materials and consumer discretionary sectors were the largest detractors during the third quarter. A number of the portfolio’s best stocks in the third quarter came from the industrial sector. The top performing position in the Fund was KBR Inc. (KBR), which rose 47% and contributed 86 basis points of return to the fund. The engineering and construction services company, which was spun-off from Halliburton in April, benefited from the sale of its stake in a British dockyard, and second quarter earnings rose 52%. McDermott International (MDR) was the second best performing industrial name as it continued its impressive performance in 2007, rising over 30% and contributing 74 basis points of return to the portfolio in the third quarter. The energy services provider has now risen over 110% for the year, and with strong order backlogs and upward earnings revisions, the outlook remains positive.

From a macroeconomic standpoint, volatility plagued the markets throughout the third quarter as tightening credit sent stocks sharply lower in July and August. In times of higher volatility, thoughtful stock selection becomes a critical aspect of producing strong returns and fortunately, there is a wealth of activity within our primary investment themes. Our research team continues to be presented with an abundance of restructuring opportunities for our portfolios. We will continue to employ our unique investment process to identify compelling opportunities that we believe will unlock shareholder value.

Thank you for your continued commitment to the Fund.

| Sincerely, |

|

| John L. Keeley, Jr. |

| President |

There are risks associated with investing in small-cap mutual funds, such as smaller product lines and market shares, including limited available information. You should consider objectives, risks and charges and expenses of a fund carefully before investing. Additional information regarding such risks, including information on fees is located in the Fund’s prospectus. Please read the Fund’s prospectus carefully before investing.

21

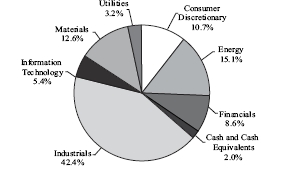

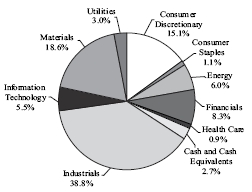

Investments by Sector

As a Percentage of Investments

As of 9/30/07

(Unaudited)

Index Comparison

Comparison of a Hypothetical $10,000 Investment

In KMCVX and Russell Midcap® Value Index*

(Unaudited)

Average annual total returns **

For the periods ended September 30, 2007

| | | | Since Commencement |

| | | | of Operations |

| | 1-Year | | (8/12/2005)(1) |

| KMCVX | +33.40% | | +17.70% |

| KMCVX (includes max | | | |

| 4.50% front-end load) | +27.39% | | +15.15% |

| Russell Midcap® Value Index | +13.75% | | +12.82% |

| * | | The Russell Midcap® Value Index of common is an unmananged index of common stock prices that measures the performance of those Russell Midcap® companies with lower price-to-book ratios and lower forecasted growth values. These Index figures do not reflect any deduction for fees, expenses or taxes, and are not available for investment. |

| ** | | PERFORMANCE DATA quoted represents past performance which is not predictive of future performance. The investment return and principal value of shares will fluctuate and when redeemed, may be worth more or less than their original cost. Returns shown include the reinvestment of all dividends. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

| (1) | | Not annualized. |

22

LETTER TO SHAREHOLDERS —

KEELEY ALL CAP VALUE FUND (KACVX) |

Dear Shareholder,

The KEELEY All Cap Value Fund commenced operations on June 14, 2006. During the past six months from March 31, 2007 through September 30, 2007, the Fund’s net assets grew from $34,153,522 to $76,989,943 and the number of shareholders grew from 1,151 to 2,785. For the six month period ending September 30, 2007, the portfolio turnover was 21.64% and the expense ratio was capped by Keeley Asset Management Corp. (the “Adviser”) at 1.49%. On August 15, 2007 the Adviser contractually agreed, effective October 1, 2007 to waive a portion of its fee or reimburse the Fund to the extent that the total ordinary operating expenses exceed 1.39%. This waiver will be in effect until September 30, 2008. The Fund’s portfolio is widely diversified with investments in 97 equities. As of September 30th, 2007, the Keeley family beneficially owned 15.38% of the Fund’s outstanding shares.

For the quarter ended September 30, 2007, the Fund’s return was -0.90% versus a return of -0.75% for the Russell 3000 Value Index. For the six month period ended September 30, 2007, the Fund’s return was 10.74% versus 3.90% for the Russell 3000 Value Index. For the one year period ended September 30, 2007, the Fund’s return was 32.97% versus 13.73% for the Russell 3000 Value Index. Since inception, June 14, 2006, the Fund’s return was 23.92% versus 19.32% for the Russell 3000 Value Index. Performance Data does not reflect the deduction of the sales load or fee, and, if reflected, the load or fee would reduce the performance quoted.

Performance Data Including 4.5% Maximum Up-Front Sales Charge

For the quarter ended September 30, 2007, the Fund’s total return was -5.36% versus a return of -0.75% for the Russell 3000 Value Index. For the six month period ended September 30, 2007, the Fund’s return was 5.76% versus 3.90% for the Russell 3000 Value Index. For the one year period ended September 30th, 2007, the Fund’s return was 26.98% versus 13.73% for the Russell 3000 Value Index. Since inception, June 14, 2006, the Fund’s average annual return was 19.55% versus 19.32% for the Russell 3000 Value Index.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and the current performance my be lower or higher than the performance data quoted. You may call toll-free at 888-933-5391, or visit our website at www.keeleyfunds.com to obtain performance data current to the most recent month end.

The KEELEY All Cap Value Fund (KACVX) slightly underperformed its benchmark, the Russell 3000 Value Index, for the quarter ended September 30, 2007. The portfolio declined -0.90% versus a -0.75% drop for the benchmark. Year-to-date, the Fund has substantially outperformed its benchmark, rising 17.13% compared to a 5.21% increase for the Russell 3000 Value Index. The portfolio continued to benefit from exposure in the industrial

23

sector, as the Fund’s holdings in this area contributed 140 basis points of performance to the portfolio. While stock selection was strong in the consumer discretionary sector, returns in that area were the largest detractor from the Fund’s performance in the third quarter. Returns from the industrial sector had the greatest positive impact on performance during the third quarter. L.B. Foster (FSTR) was the top performer, rising over 51% and adding 57 basis points of return to the Fund. Shares of the maker of rail and construction products rose sharply after second-quarter profit more than doubled. The firm also benefited from the announcement that the Canadian Pacific Railway reached an agreement to acquire the Dakota Minnesota and Eastern Railroad (“DM&E”) in which L.B. Foster holds a minority equity interest. KBR Inc. (KBR) was the second best performing industrial name, rising over 47% and contributing 46 basis points to the Fund. The engineering and construction services company, which was spun-off from Halliburton in April, benefited from the sale of its stake in a British dockyard, and second quarter earnings rose 52%. As mentioned previously, the largest detractor from performance during the third quarter was the consumer discretionary sector. However, stock selection in the sector was strong, and the single largest contributor to performance, Las Vegas Sands (LVS), came from this area. Dillard’s (DDS) was the weakest performing stock in the sector, falling 39% and detracting 48 basis points of performance from the Fund. The retailer saw same-store sales drop 5% in August and 7% in September. Houston Wire & Cable (HWCC) was the second largest detractor in the sector, dropping 31% and detracting 40 basis points of return from the portfolio. Although second quarter profits and sales rose, results for the cable and wire distributor were below Wall Street analysts’ expectations.

From a macroeconomic standpoint, volatility plagued the markets throughout the third quarter as tightening credit sent stocks sharply lower in July and August. In times of higher volatility, thoughtful stock selection becomes a critical aspect of producing strong returns and fortunately, there is a wealth of activity within our primary investment themes. Our research team continues to be presented with an abundance of restructuring opportunities for our portfolios. We will continue to employ our unique investment process to identify compelling opportunities that we believe will unlock shareholder value.

| Sincerely, | |

| |

| John L. Keeley, Jr. | |

| President | |

There are risks associated with investing in small-cap mutual funds, such as smaller product lines and market shares, including limited available information. You should consider objectives, risks and charges and expenses of a fund carefully before investing. Additional information regarding such risks, including information on fees is located in Fund’s prospectus. Please read the Fund’s prospectus carefully before investing.

24

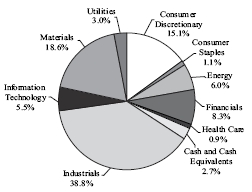

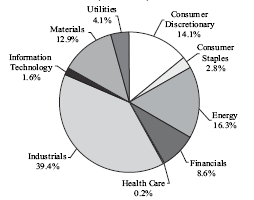

Investments by Sector

As a Percentage of Investments

As of 9/30/07

(Unaudited)

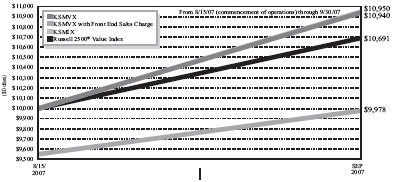

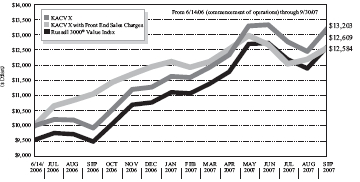

Index Comparison

Comparison of a Hypothetical $10,000 Investment

In KACVX and Russell 3000® Value Index*

(Unaudited)

Total returns **

For the periods ended September 30, 2007

| | | | Since Commencement |

| | | | of Operations(1) |

| | 1 year | | (6/14/2006) |

| KACVX | +32.97% | | +23.92% |

| KACVX (includes max | | | |

| 4.50% front-end load) | +26.98% | | +19.55% |

| Russell 3000® Value Index | +13.73% | | +19.32% |

| * | | The Russell 3000® Value Index measures the performance of those Russell 3000® Index companies with lower price-to-book ratios and lower forecasted growth values. The stocks in this index are also members of either the Russell 1000® Value or the Russell 2000® Value indexes. |

| ** | | PERFORMANCE DATA quoted represents past performance which is not predictive of future performance. The investment return and principal value of shares will not fluctuate and when redeemed, may be worth more or less than their original cost. Returns shown include the reinvestment of all dividends. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

| (1) | | Not annualized. |

25

| LETTER TO SHAREHOLDERS — |

| KEELEY SMALL-MID CAP VALUE FUND (KSMVX AND KSMIX) |

Dear Shareholder,

The KEELEY Small-Mid Cap Value Fund commenced operations on August 15, 2007. As of September 30, 2007, the Fund’s net assets were $4,780,416 and the fund had 93 shareholders. For the period ending September 30, 2007, the portfolio turnover was 0.91%. On August 15, 2007 Keeley Asset Management Corp. (the “Adviser”) contractually agreed to waive a portion of its fee or reimburse the Fund to the extent that the total ordinary operating expenses exceed 1.39% for the Class A shares and 1.14% for the Class I shares. This waiver will be in effect until September 30, 2009. The Fund’s portfolio is widely diversified with investments in 77 equities. As of September 30, 2007, the Keeley family beneficially owned 55.81% of the Fund’s Class A outstanding shares and 100% of the Fund’s Class I outstanding shares. In the first full month of its history, the Class A shares rose 6.42% and the Class I shares rose 6.31%, outperforming its benchmark, the Russell 2500 Value Index, which climbed 1.04% in September. Performance Data does not reflect the deduction of the sales load or fee, and that, if reflected, the load or fee would reduce the performance quoted.

Performance Data Including 4.5% Maximum Up-Front Sales Charge

In the first full month of its history, the Class A shares rose 1.63%, outperforming its benchmark, the Russell 2500 Value Index, which climbed 1.04% in September. The Fund does not charge up-front sales charges for investments in Class I shares.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost and the current performance my be lower or higher than the performance data quoted. You may call toll-free at 888-933-5391, or visit our website at www.keeleyfunds.com to obtain performance data current to the most recent month end.

The Small-Mid Cap Value Fund is the natural evolution of our highly successful KEELEY Small Cap Value Fund. With our patient, long-term approach to stock selection, we believe the added flexibility in market capitalization will be a strong complement to our other product offerings, specifically the Small Cap Value Fund. The Fund will be managed using the same corporate restructuring investment discipline as the firm’s highly-rated flagship product, the KEELEY Small Cap Value Fund (KSCVX), as well as the KEELEY Mid

26

Cap Value Fund (KMCVX) and KEELEY All Cap Value Fund (KACVX). The Fund will not concentrate on any specific sector or industry and primarily invest in small and mid-cap stocks with market capitalizations of $7.5 billion or less at the time of investment.

| Sincerely, | |

| |

| John L. Keeley, Jr. | |

| President | |

There are risks associated with investing in small-cap mutual funds, such as smaller product lines and market shares, including limited available information. You should consider objectives, risks and charges and expenses of a fund carefully before investing. Additional information regarding such risks, including information on fees is located in Fund’s prospectus. Please read the Fund’s prospectus carefully before investing.

27

Investments by Sector

As a Percentage of Investments

As of 9/30/07

(Unaudited)

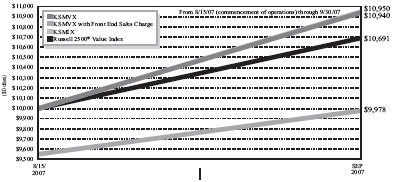

Index Comparison

Comparison of a Hypothetical $10,000 Investment

In KSMVX and KSMIX and Russell 2500® Value Index*

(Unaudited)

Total returns **

For the periods ended September 30, 2007

| | | | Since Commencement |

| | 1 month ended | | of Operations(1) |

| | 9/30/2007(1) | | (8/15/2007) |

| KSMVX | +6.42% | | +9.40% |

| KSMVX (includes max 4.50% front-end load) | +1.63% | | +4.48% |

| KSMIX | +6.31% | | +9.50% |

| Russell 2500® Value Index | +1.04% | | +6.91% |

| * | | The Russell 2500® Value Index measures the performance of those Russell 2500® Index companies with lower price-to-book ratios and lower forecasted growth values. The stocks in this index are also members of either the Russell 1000® Value or the Russell 2000® Value indexes. |

| ** | | PERFORMANCE DATA quoted represents past performance which is not predictive of future performance. The investment return and principal value of shares will not fluctuate and when redeemed, may be worth more or less than their original cost. Returns shown include the reinvestment of all dividends. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of shares. |

| (1) | | Not annualized. |

28

KEELEY Funds, Inc.

Expense Example

For the Six Month Period Ended September 30, 2007

(Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from April 1, 2007 to September 30, 2007 (the “period”) for the Mid Cap Value Fund and the All Cap Value Fund, and from August 15, 2007 (commencement of operations) to September 30, 2007 for the Small-Mid Cap Value Fund.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 equals 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during the period.

| | | | | | CLASS A(1) | | | CLASS I |

| | | | | | | | | | Expenses | | | | | | | Expenses |

| | | Beginning | | | Ending | | Six-Month | | paid | | | Ending | | Six-Month | | paid |

| | | account | | | account | | Expense | | during | | | account | | Expense | | during |

| | | value | | | value | | Ratio | | period* | | | value | | Ratio | | period* |

| Mid Cap Value Fund | | $1,000.00 | | | $1,143.10 | | 1.42% | | $7.63 | | | N/A | | N/A | | N/A |

| All Cap Value Fund | | 1,000.00 | | | 1,107.40 | | 1.48% | | 7.82 | | | N/A | | N/A | | N/A |

| Small-Mid Cap Value Fund | | 1,000.00 | | | 1,094.00 | | 1.39% | | 1.87 | | | $1,095.00 | | 1.14% | | $1.54 |

| * | | Expenses are equal to the Funds’ expense ratio for the six-month period, multiplied by the average account value over the period, multiplied by 183/365 for the Mid Cap Value and All Cap Value Funds (to reflect the one-half year period) and multiplied by 47/365 for the Small-Mid Cap Value Fund (to reflect the period since commencement). |

| (1) | | The Small-Mid Cap Value Fund is the only series of Keeley Funds, Inc. that has two distinct share classes: Class A and Class I. The Mid Cap Value Fund and All Cap Value Fund have a single common share class which has the same characteristics of the Small-Mid Cap Value Fund – Class A shares. |

29

KEELEY Funds, Inc.

Expense Example (Continued)

For the Six Month Period Ended September 30, 2007

(Unaudited)

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund s’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads). Therefore, the table below is useful in comparing the ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs could have been higher.

| | | | | | CLASS A(1) | | | CLASS I |

| | | | | | | | | | Expenses | | | | | | | Expenses |

| | | Beginning | | | Ending | | Six-Month | | paid | | | Ending | | Six-Month | | paid |

| | | account | | | account | | Expense | | during | | | account | | Expense | | during |

| | | value | | | value | | Ratio | | period* | | | value | | Ratio | | period* |

| Mid Cap Value Fund | | $1,000.00 | | | $1,017.75 | | 1.42% | | $7.18 | | | N/A | | N/A | | N/A |

| All Cap Value Fund | | 1,000.00 | | | 1,017.60 | | 1.48% | | 7.49 | | | N/A | | N/A | | N/A |

| Small-Mid Cap Value Fund | | 1,000.00 | | | 1,004.65 | | 1.39% | | 1.79 | | | $1,004.97 | | 1.14% | | $1.47 |

| * | | Expenses are equal to the Funds’ expense ratio for the six-month period, multiplied by the average account value over the period, multiplied by 183/365 for the Mid Cap Value and All Cap Value Funds (to reflect the one-half year period and multiplied by 47/365 for the Small-Mid Cap Value Fund (to reflect the period since commencement). |

| (1) | | The Small-Mid Cap Value Fund is the only series of Keeley Funds, Inc. that has two distinct share classes: Class A and Class I. The Mid Cap Value Fund and All Cap Value Fund have a single common share class which has the same characteristics of the Small-Mid Cap Value Fund – Class A shares. |

30

KEELEY Mid Cap Value Fund

SCHEDULE OF INVESTMENTS

September 30, 2007

| Shares | | | | Value |

| COMMON STOCKS – 97.85% |

| Aerospace & Defense – 4.27% |

| 66,400 | | KBR, Inc. (a) | | $ 2,574,328 |

| 53,000 | | Spirit Aerosystems Holdings, Inc. (a) | | 2,063,820 |

| | | | | 4,638,148 |

| | | Auto Components – 1.79% | | |

| 41,500 | | Wabco Holdings, Inc. (a) | | 1,940,125 |

| | | Capital Markets – 3.75% | | |