UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7762 |

|

First Eagle Funds |

(Exact name of registrant as specified in charter) |

|

1345 Avenue of the Americas

New York, NY | | 10105 |

(Address of principal executive offices) | | (Zip code) |

|

Suzan Afifi

First Eagle Funds

1345 Avenue of the Americas

New York, NY 10105 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-212-632-2700 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | April 30, 2017 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

First Eagle Global Fund

First Eagle Overseas Fund

First Eagle U.S. Value Fund

First Eagle Gold Fund

First Eagle Global Income Builder Fund

First Eagle High Yield Fund

First Eagle Fund of America

Advised by First Eagle Investment Management, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seem", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

First Eagle Funds | Semi-Annual Report | April 30, 2017

2

Table of Contents

Letter from the President | | | 4 | | |

Management's Discussion of Fund Performance | | | 7 | | |

Performance Chart | | | 12 | | |

First Eagle Global Fund: | |

Fund Overview | | | 18 | | |

Consolidated Schedule of Investments | | | 20 | | |

First Eagle Overseas Fund: | |

Fund Overview | | | 46 | | |

Consolidated Schedule of Investments | | | 48 | | |

First Eagle U.S. Value Fund: | |

Fund Overview | | | 72 | | |

Consolidated Schedule of Investments | | | 74 | | |

First Eagle Gold Fund: | |

Fund Overview | | | 84 | | |

Consolidated Schedule of Investments | | | 86 | | |

First Eagle Global Income Builder Fund: | |

Fund Overview | | | 90 | | |

Schedule of Investments | | | 92 | | |

First Eagle High Yield Fund: | |

Fund Overview | | | 106 | | |

Schedule of Investments | | | 108 | | |

First Eagle Fund of America: | |

Fund Overview | | | 120 | | |

Schedule of Investments | | | 122 | | |

Statements of Assets and Liabilities | | | 128 | | |

Statements of Operations | | | 136 | | |

Statements of Changes in Net Assets | | | 140 | | |

Financial Highlights | | | 144 | | |

Notes to Financial Statements | | | 164 | | |

Fund Expenses | | | 202 | | |

General Information | | | 208 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

3

Letter from the President

Dear Fellow Shareholders,

For the period from November 1, 2016 through April 30, 2017, the S&P 500 Index was up 13.32%, the MSCI World Index rose 12.12% and the MSCI EAFE Index increased 11.47%. France's CAC 40 Index was up 16.81%, Germany's DAX Index climbed 16.62% and Japan's Nikkei 225 Index rose 10.17% during the period. The price of WTI crude oil rose from $46.83 a barrel on November 1 to $49.31 a barrel on April 30. During this same period, the dollar strengthened 0.66% versus the euro and strengthened 5.73% versus the yen. The price of gold declined from $1,277.00 an ounce on November 1 to $1,267.70 an ounce on April 30.

During this period, the Bloomberg Barclays U.S. High Yield Corporate Index returned 5.30% and the Bloomberg Barclays U.S. Aggregate Index returned -0.67%.

In the six months since my last letter, stocks generally advanced strongly around the globe. The economic backdrop was generally favorable, and growth resumed in many parts of the world. The CBOE Volatility Index (VIX), which is sometimes called the uncertainty index, was low through most of the period. In short, the financial markets behaved as if there were little risk on the horizon.

We do not share this sanguine view. Markets are said to like certainty, but as we survey the world, certainty is hard to find. In the US equity market, the Trump rally seems to be driven by a widespread belief that tax reform and infrastructure spending will spur growth at US companies. While this is, indeed, possible, we think the fate of these initiatives in Congress is far from certain. In China, the world's second-largest economy, high levels of debt are a long-term concern. In Europe, extreme populist candidates were defeated in French and Dutch national elections, which reduced the immediate threat to the EU's survival. Nonetheless, the region still has large hurdles to overcome, including the need to recapitalize major banks.

Meanwhile, on the geopolitical front, North Korea, Russia and China all present challenges, and peace in the Middle East remains elusive.

Despite these conditions, money continued to pour into equity ETFs and index funds, generally driving up the share prices of companies that are included in major

First Eagle Funds | Semi-Annual Report | April 30, 2017

4

Letter from the President

indexes. Investors appeared to be more interested in gaining broad exposure to equity assets than they were in discriminating among individual companies. In this environment, momentum can beget more momentum, and valuation may play little role in determining the price of a company's shares.

At First Eagle, we strive to preserve the purchasing power of our investors' capital. While we aim to be prudent in all market environments, we believe that present conditions call for an added measure of caution.

Global Value Team

In the period from November 2016 through April 2017, the Global Value team did not share the apparent enthusiasm of other equity investors. Strengthening stock markets took overall valuation levels to territory that made it difficult to find exciting new opportunities. The portfolio managers trimmed or eliminated positions where prices had approached their estimates of intrinsic value. As a result, levels of cash and cash equivalents in the portfolios were at the higher end of their range.

Acknowledging that they did not know whether global stock markets would rise or fall over the next quarter or year, portfolio managers on the Global Value team remained true to their value investment philosophy and their active, disciplined, bottom-up approach. They focused on buying and holding stocks they believed offered a "margin of safety"—a discount to their estimates of intrinsic value. They sought to avoid companies with high leverage or with leaders who did not allocate capital effectively. They found opportunities in energy stocks driven lower by the decline in oil prices, in the sovereign debt of some peripheral issuers, and in a company with new management. On weakness in the gold price, they also made a small addition to their position in gold.

High Yield Team

The High Yield team suspected that credit risk, duration risk and liquidity risk were all mispriced during this period. Although leverage increased in the high yield market, spreads generally compressed—an indication that investors were reaching for yield by going lower in the credit spectrum and accepting less compensation for the incremental risk.

Duration, historically, has been secondary to credit as a risk factor in the high yield market, but today, there's a distinct possibility that yields will increase and that a duration-induced drop in value will ensue. Nevertheless, there were few signs that the market was focusing on the management of duration.

Liquidity risk has increased because of constraints introduced in the Dodd-Frank Act and the Volcker Rule. Banks and brokerage houses are no longer willing to maintain large inventories of high yield bonds. In the past—for a price—they served

First Eagle Funds | Semi-Annual Report | April 30, 2017

5

Letter from the President

as shock absorbers in risk-off markets. In the absence of these players, the market seems to be mispricing liquidity risk. The team believes that liquidity was overpriced a year ago and that it is underpriced today.

In this environment of perceived mispriced risks, the High Yield team elected to move up in credit quality while at the same keeping duration relatively short to reduce the portfolio's sensitivity to rising interest rates. It also retained cash and cash equivalents to help manage its duration exposure and prepare itself to take advantage of situations where it can provide liquidity at an attractive price.

Fund of America Team

The Fund of America team was encouraged to see a rebound in stocks that it believed were unfairly punished in the fourth quarter of 2016 following the US election. Within the US economy, data were mixed: Consumer confidence was high and job growth was good, but auto sales showed signs of slowing.

The team does not expect economic growth to accelerate in the United States. Instead, it anticipates a continuation of the slow and unsteady progress we have witnessed for the last several years. Even at this late stage of the US bull market, the Fund of America team continued to identify many new stock-specific opportunities. Recognizing the benefits of broader diversification, it created a portfolio containing more names than a year ago.

Although the US stock market may look fully valued, the strategic levers that good management teams can pull have the potential to unlock shareholder value. The Fund of America team believes that this environment may be suitable for its style of investing.

This is my last letter to you as president of First Eagle Funds, and as I transition from this role, I want to thank you for your confidence and support over the years. Mehdi Mahmud, CEO of First Eagle Investment Management, has been elected as the new president of First Eagle Funds, effective July 1, 2017. I am confident that under his stewardship, you will continue to benefit from the careful and disciplined management of your assets.

Sincerely,

John P. Arnhold

President

June 2017

First Eagle Funds | Semi-Annual Report | April 30, 2017

6

Management's Discussion of Fund Performance

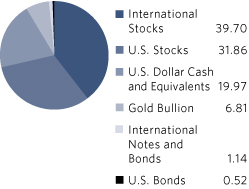

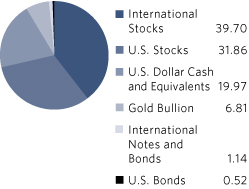

First Eagle Global Fund

The net asset value ("NAV") of the Fund's Class A shares increased 6.48% for the six months ending April 30, 2017 while the MSCI World Index increased 12.12%. The Fund's cash and cash equivalents position was 19.97% as of April 30, 2017.

The five largest contributors to the performance of First Eagle Global Fund over the period were Comcast Corporation (cable and satellite, US), Oracle Corporation (systems software, US), American Express Company (consumer finance, US), Microsoft Corporation (systems software, US) and Anthem, Inc. (managed health care, US). These investments collectively accounted for 1.71% points of this period's performance.

The five largest detractors were KDDI Corporation (wireless telecommunication services, Japan), Vista Outdoor, Inc. (leisure products, US), Cenovus Energy, Inc. (integrated oil & gas, Canada), TechnipFMC PLC (oil & gas equipment & services, UK) and gold bullion. Their combined negative performance over the six months subtracted 0.65% points from performance.

First Eagle Overseas Fund

The NAV of the Fund's Class A shares increased 4.34% for the six months ending April 30, 2017 while the MSCI EAFE Index increased 11.47%. The Fund's cash and cash equivalents position was 19.95% as of April 30, 2017.

The five largest contributors to the performance of First Eagle Overseas Fund over the period were Berkeley Group Holdings PLC (homebuilding, UK), Bouygues SA (construction & engineering, France), Sompo Holdings, Inc. (property & casualty insurance, Japan), Fanuc Corporation (industrial machinery, Japan) and Cie de Saint-Gobain (building products, France). These investments collectively accounted for 1.53% points of this period's performance.

The five largest detractors were KDDI Corporation (wireless telecommunication services, Japan), Cenovus Energy, Inc. (integrated oil & gas, Canada), Emin Leydier SA (consumer finance, France), Carrefour SA (hypermarkets & super centers, France) and Shimano, Inc. (leisure products, Japan). Their combined negative performance over the six months subtracted 0.90% points from performance.

Performance information for Class A Shares is without the effect of sales charges and assumes all distributions have been reinvested. If a sales charge was included values would be lower.

First Eagle Funds | Semi-Annual Report | April 30, 2017

7

Management's Discussion of Fund Performance

First Eagle U.S. Value Fund

The NAV of the Fund's Class A shares increased 8.84% for the six months ending April 30, 2017 while the S&P 500 Index increased 13.32%. The Fund's cash and cash equivalents position was 20.23% as of April 30, 2017.

The five largest contributors to the performance of First Eagle U.S. Value Fund over the period were Comcast Corporation (cable & satellite), Oracle Corporation (systems software), Microsoft Corporation (systems software), Orbital ATK, Inc. (aerospace & defense) and American Express Company (consumer finance). These investments collectively accounted for 3.04% points of this period's performance.

The five largest detractors were Vista Outdoor, Inc. (leisure products), TechnipFMC PLC (oil & gas equipment & services, UK), Schlumberger (oil & gas equipment & services), gold bullion and Newcrest Mining Limited (mining, Australia). Their combined negative performance subtracted 0.80% points from performance.

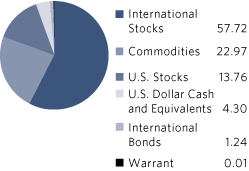

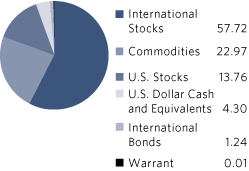

First Eagle Gold Fund

The NAV of the Fund's Class A shares decreased 6.06% for the six months ending April 30, 2017 while the FTSE Gold Mines Index decreased 7.50%. The Fund's cash and cash equivalents position was 4.30% as of April 30, 2017.

The five largest contributors to the performance of First Eagle Gold Fund over the period were Eldorado Gold Corporation (Canada), Franco-Nevada Corporation (Canada), Randgold Resources Limited (Africa), Osisko Gold Royalties Limited (Canada) and Royal Gold, Inc. (US). These investments collectively accounted for 1.36% of this period's performance.

The five largest detractors were Tahoe Resources, Inc. (US), New Gold, Inc. (Canada), Newcrest Mining Limited (Australia), Detour Gold Corporation (Canada) and gold bullion. Their combined negative performance subtracted 4.40% points from performance.

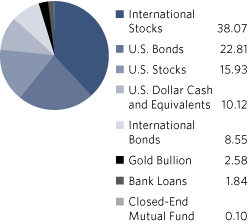

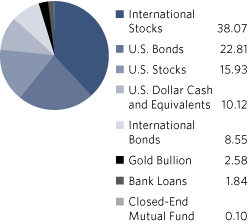

First Eagle Global Income Builder Fund

The NAV of the Fund's Class A shares increased 6.56% for the six months ending April 30, 2017 while the composite index1 increased 6.86%. The Bloomberg Barclays US Aggregate Bond Index returned -0.67% while the MSCI World Index increased 12.12%. The Fund's cash and cash equivalents position was 10.12% as of April 30, 2017.

1 The composite index consists of 60% of the MSCI World Index and 40% of the Bloomberg Barclays U.S. Aggregate Bond Index.

First Eagle Funds | Semi-Annual Report | April 30, 2017

8

Management's Discussion of Fund Performance

The five largest contributors to the performance of First Eagle Global Income Builder Fund over the period were Berkeley Group Holdings PLC (homebuilding, UK), Bouygues SA (construction & engineering, France), Microsoft Corporation (systems software, US), Xilinx, Inc. (semiconductors, US) and Anthem, Inc. (managed health care, US). These investments collectively accounted for 1.38% points of this period's performance.

The five largest detractors were Asian Pay Television Trust (Pay-TV business trust, Singapore), KDDI Corporation (wireless telecommunication services, Japan), Cenovus Energy, Inc. (integrated oil & gas, Canada), Carrefour SA (hypermarkets & super centers, France) and Goldcorp, Inc. (mining, Canada). Their combined negative performance subtracted 0.54% points from performance.

First Eagle High Yield Fund

The NAV of the Fund's Class I shares increased 4.07% for the six months ending April 30, 2017 while the Bloomberg Barclays U.S. Corporate High Yield Index increased 5.30%. The Fund's cash and cash equivalents position was 10.78% as of April 30, 2017.

The five largest contributors to the performance of First Eagle High Yield Fund over the period were Enquest PLC 7.00% due 04/15/2022 (oil company-exploration & production, UK), Caelus Energy Alaska 03 LLC Second Lien Term Loan 8.75% due 04/15/2020 (oil company-exploration & production, US), Osum Productions Corporation Term Loan B 6.50% due 07/31/2020 (oil & gas exploration & production, US), Cloud Peak Energy Resources LLC 12.00% due 11/01/2021 (coal, US) and EP Energy Corporation 9.375% due 05/01/2020 (oil company-exploration & production, US). These investments collectively accounted for 1.44% points of this period's performance.

The five largest detractors were Bi-Lo Holdings LLC 8.625% due 09/15/2018 (food-retail, US), Payless, Inc. First Lien Term Loan 5.03% due 03/11/2021 (apparel retail, US), Rex Energy Corporation 1.00% due 10/01/2020 (oil & gas exploration & production, US), Vista Outdoor, Inc. 5.875% due 10/01/2023 (leisure products, US) and True Religion Apparel, Inc. First Lien Term Loan 6.02% due 07/30/2019 (apparel, accessories & luxury goods, US). Their combined negative performance subtracted 0.64% points from performance.

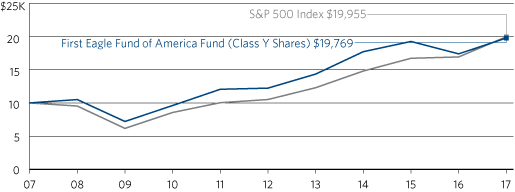

First Eagle Fund of America

The NAV of the Fund's Class A shares increased 14.63% for the six months ending April 30, 2017 while the S&P 500 Index increased 13.32%. The Fund's cash and cash equivalents position was 2.92% as of April 30, 2017.

First Eagle Funds | Semi-Annual Report | April 30, 2017

9

Management's Discussion of Fund Performance

The five largest contributors to the performance of Fund of America over the period were Wyndham Worldwide Corporation (hotels, resorts and cruise lines), Halozyme Therapeutics, Inc. (biotechnology), General Dynamics Corporation (aerospace & defense), Martin Marietta Materials, Inc. (construction materials) and Packaging Corporation of America (paper packaging). These investments collectively accounted for 7.73% points of this period's performance.

The five largest detractors were Pitney Bowes, Inc. (offices services & supplies), Tyson Foods, Inc. (packaged foods & meats), Hertz Global Holdings, Inc. (trucking), Intrexon Corporation (biotechnology) and SemGroup Corporation (oil & gas storages & transportation). Their combined negative performance subtracted 2.45% points from performance.

| |

| |

Matthew McLennan

Head of the Global Value Team

Portfolio Manager

Global, Overseas,

U.S. Value and Gold Funds | | T. Kimball Brooker, Jr.

Portfolio Manager

Global, Overseas,

U.S. Value and

Global Income Builder Funds | |

| |

| |

Matt Lamphier

Portfolio Manager

U.S. Value Fund

| | Edward Meigs

Portfolio Manager

Global Income Builder and

High Yield Funds | |

| |

| |

Sean Slein

Portfolio Manager

Global Income Builder and

High Yield Funds | | Harold Levy

Portfolio Manager

Fund of America

| |

First Eagle Funds | Semi-Annual Report | April 30, 2017

10

Management's Discussion of Fund Performance

| |

| |

Eric Stone

Portfolio Manager

Fund of America | | Thomas Kertsos

Portfolio Manager

Gold Fund | |

June 2017 | | | |

The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact a fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at feim.com or by calling 800.334.2143.

The commentary represents the opinion of John Arnhold and the Portfolio Management Teams as of June 2017 and is subject to change based on market and other conditions. These materials are provided for informational purposes only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

First Eagle Funds | Semi-Annual Report | April 30, 2017

11

Performance Chart1 (unaudited)

| | | One-

Year | | Three-

Years | | Five-

Years | | Ten-

Years | | Since

Inception | | Inception Date | |

First Eagle Global Fund | |

Class A (SGENX)

without sales charge | | | 9.21 | % | | | 5.07 | % | | | 7.66 | % | | | 6.28 | % | | | 13.32 | % | | 01/01/792 | |

with sales charge | | | 3.75 | % | | | 3.29 | % | | | 6.56 | % | | | 5.73 | % | | | 13.21 | % | | 01/01/792 | |

| Class C (FESGX) | | | 7.40 | % | | | 4.28 | % | | | 6.86 | % | | | 5.48 | % | | | 10.10 | % | | 06/05/00 | |

| Class I (SGIIX) | | | 9.52 | % | | | 5.35 | % | | | 7.94 | % | | | 6.55 | % | | | 10.92 | % | | 07/31/98 | |

| Class R6 (FEGRX) | | | — | | | | — | | | | — | | | | — | | | | 0.49 | % | | 03/01/17 | |

MSCI World Index3 | | | 14.65 | % | | | 5.68 | % | | | 9.94 | % | | | 3.92 | % | | | 9.58 | % | | 01/01/79 | |

First Eagle Overseas Fund4 | |

Class A (SGOVX)

without sales charge | | | 6.08 | % | | | 3.43 | % | | | 6.42 | % | | | 4.69 | % | | | 10.71 | % | | 08/31/93 | |

with sales charge | | | 0.75 | % | | | 1.68 | % | | | 5.33 | % | | | 4.15 | % | | | 10.53 | % | | 08/31/93 | |

| Class C (FESOX) | | | 4.26 | % | | | 2.67 | % | | | 5.63 | % | | | 3.91 | % | | | 9.48 | % | | 06/05/00 | |

| Class I (SGOIX) | | | 6.37 | % | | | 3.71 | % | | | 6.70 | % | | | 4.96 | % | | | 10.75 | % | | 07/31/98 | |

| Class R6 (FEORX) | | | — | | | | — | | | | — | | | | — | | | | 2.33 | % | | 03/01/17 | |

MSCI EAFE Index5 | | | 11.29 | % | | | 0.86 | % | | | 6.78 | % | | | 0.87 | % | | | 4.93 | % | | 08/31/93 | |

First Eagle U.S. Value Fund | |

Class A (FEVAX)

without sales charge | | | 10.99 | % | | | 5.91 | % | | | 8.08 | % | | | 6.61 | % | | | 9.02 | % | | 09/04/01 | |

with sales charge | | | 5.42 | % | | | 4.11 | % | | | 6.97 | % | | | 6.07 | % | | | 8.66 | % | | 09/04/01 | |

| Class C (FEVCX) | | | 9.09 | % | | | 5.10 | % | | | 7.26 | % | | | 5.80 | % | | | 8.20 | % | | 09/04/01 | |

| Class I (FEVIX) | | | 11.27 | % | | | 6.19 | % | | | 8.36 | % | | | 6.88 | % | | | 9.29 | % | | 09/04/01 | |

| Class R6 (FEVRX) | | | — | | | | — | | | | — | | | | — | | | | -1.06 | % | | 03/01/17 | |

S&P 500 Index6 | | | 17.92 | % | | | 10.47 | % | | | 13.68 | % | | | 7.15 | % | | | 6.99 | % | | 09/04/01 | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

12

Performance Chart (unaudited)

| | | One-

Year | | Three-

Years | | Five-

Years | | Ten-

Years | | Since

Inception | | Inception Date | |

First Eagle Gold Fund | |

Class A (SGGDX)

without sales charge | | | -7.19 | % | | | -0.08 | % | | | -8.95 | % | | | 0.07 | % | | | 5.43 | % | | 08/31/93 | |

with sales charge | | | -11.84 | % | | | -1.77 | % | | | -9.88 | % | | | -0.44 | % | | | 5.26 | % | | 08/31/93 | |

| Class C (FEGOX) | | | -8.85 | % | | | -0.87 | % | | | -9.67 | % | | | -0.70 | % | | | 4.92 | % | | 05/15/03 | |

| Class I (FEGIX) | | | -6.89 | % | | | 0.21 | % | | | -8.70 | % | | | 0.33 | % | | | 5.99 | % | | 05/15/03 | |

| Class R6 (FEURX) | | | — | | | | — | | | | — | | | | — | | | | -1.76 | % | | 03/01/17 | |

FTSE Gold

Mines Index7 | | | -12.47 | % | | | -0.07 | % | | | -12.57 | % | | | -4.27 | % | | | -0.97 | % | | 08/31/93 | |

MSCI World Index3 | | | 14.65 | % | | | 5.68 | % | | | 9.94 | % | | | 3.92 | % | | | 6.77 | % | | 08/31/93 | |

First Eagle Global Income Builder | |

Class A (FEBAX)

without sales charge | | | 9.45 | % | | | 2.96 | % | | | — | | | | — | | | | 6.56 | % | | 05/01/12 | |

with sales charge | | | 4.00 | % | | | 1.22 | % | | | — | | | | — | | | | 5.46 | % | | 05/01/12 | |

| Class C (FEBCX) | | | 7.65 | % | | | 2.18 | % | | | — | | | | — | | | | 5.76 | % | | 05/01/12 | |

| Class I (FEBIX) | | | 9.65 | % | | | 3.21 | % | | | — | | | | — | | | | 6.82 | % | | 05/01/12 | |

| Class R6 (FEBRX) | | | — | | | | — | | | | — | | | | — | | | | 2.03 | % | | 03/01/17 | |

Composite Index8 | | | 8.98 | % | | | 4.61 | % | | | — | | | | — | | | | 6.97 | % | | 05/01/12 | |

MSCI World Index3 | | | 14.65 | % | | | 5.68 | % | | | — | | | | — | | | | 9.86 | % | | 05/01/12 | |

Bloomberg Barclays

U.S. Aggregate

Bond Index9 | | | 0.83 | % | | | 2.66 | % | | | — | | | | — | | | | 2.29 | % | | 05/01/12 | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

13

Performance Chart (unaudited)

| | | One-

Year | | Three-

Years | | Five-

Years | | Ten-

Years | | Since

Inception | | Inception Date | |

First Eagle High Yield | |

Class A (FEHAX)

without sales charge | | | 12.61 | % | | | 2.37 | % | | | 4.76 | % | | | — | | | | 5.59 | % | | 01/03/12 | |

with sales charge | | | 7.56 | % | | | 0.82 | % | | | 3.80 | % | | | — | | | | 4.69 | % | | 01/03/12 | |

| Class C (FEHCX) | | | 10.92 | % | | | 1.65 | % | | | 4.01 | % | | | — | | | | 4.81 | % | | 01/03/12 | |

| Class I (FEHIX) | | | 13.07 | % | | | 2.70 | % | | | 5.11 | % | | | — | | | | 8.90 | % | | 11/19/0710 | |

| Class R6 (FEHRX) | | | — | | | | — | | | | — | | | | — | | | | 1.00 | % | | 03/01/17 | |

Bloomberg Barclays

U.S. Corporate

High Yield Index11 | | | 13.30 | % | | | 4.74 | % | | | 6.84 | % | | | — | | | | 8.21 | % | | 11/19/07 | |

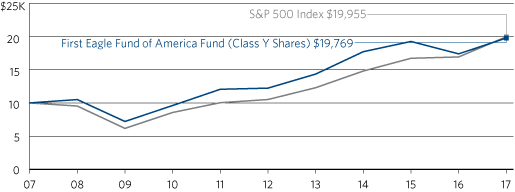

First Eagle Fund of America | |

Class A (FEFAX)

without sales charge | | | 13.69 | % | | | 3.74 | % | | | 10.09 | % | | | 7.06 | % | | | 8.43 | % | | 11/20/98 | |

with sales charge | | | 8.00 | % | | | 1.98 | % | | | 8.97 | % | | | 6.51 | % | | | 8.13 | % | | 11/20/98 | |

| Class C (FEAMX) | | | 11.84 | % | | | 2.95 | % | | | 9.26 | % | | | 6.25 | % | | | 7.64 | % | | 03/02/98 | |

| Class I (FEAIX) | | | 14.01 | % | | | 4.04 | % | | | — | | | | — | | | | 8.80 | % | | 03/08/13 | |

| Class Y (FEAFX)12 | | | 13.71 | % | | | 3.73 | % | | | 10.08 | % | | | 7.05 | % | | | 11.55 | % | | 04/10/87 | |

| Class R6 (FEFRX) | | | — | | | | — | | | | — | | | | — | | | | 2.34 | % | | 03/01/17 | |

S&Ps 500 Index6 | | | 17.92 | % | | | 10.47 | % | | | 13.68 | % | | | 7.15 | % | | | 9.68 | % | | 04/10/87 | |

1 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at feim.com or by calling 800.334.2143. The average annual returns for Class A Shares "with sales charge" of First Eagle Global, Overseas, U.S. Value, Gold, Fund of America, and Global Income Builder give effect to the deduction of the maximum sales charge of 5.00%. The average annual returns for Class A Shares "with sales charge" of First Eagle High Yield gives effect to the deduction of the maximum sales charge of 4.50%.

The average annual returns for Class C Shares reflect the contingent deferred sales charge (CDSC) of 1.00% which pertains to the first year or less of investment only.

A contingent deferred sales charge of 1.00% may apply on redemptions of Class A shares made within 18 months following a purchase of $1,000,000 or more without an initial sales charge.

First Eagle Funds | Semi-Annual Report | April 30, 2017

14

Performance Chart (unaudited)

Class I Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Yield Fund, and First Eagle Fund of America require $1 million minimum investment and are offered without a sales charge.

Class Y Shares of First Eagle Fund of America are offered without a sales charge.

Class R6 Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Yield Fund, and First Eagle Fund of America are offered without a sales charge.

2 The Fund commenced operation April 28, 1970. Performance for periods prior to January 1, 2000 occurred while a prior portfolio manager of the fund was affiliated with another firm. Inception date shown is when this prior portfolio manager assumed portfolio management responsibilities.

3 The MSCI World Index is a widely followed, unmanaged group of stocks from 23 developed international markets. The index provides total returns in U.S. dollars with net dividends reinvested. One cannot invest directly in an index.

4 Effective May 9, 2014, the First Eagle Overseas Fund is closed to certain investors. Please see prospectus for more information.

5 The MSCI EAFE Index is an unmanaged total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 1,100 companies from 21 developed market countries. One cannot invest directly in an index.

6 The S&P 500 Index is a widely recognized unmanaged index including a representative sample of 500 leading companies in leading sectors of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 80% coverage of U.S. equities, it is also considered a proxy for the total market. The S&P 500 Index includes dividends reinvested. One cannot invest directly in an index.

7 The FTSE Gold Mines Index Series is designed to reflect the performance of the worldwide market in the shares of companies whose principal activity is the mining of gold. The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable, attributable gold production of at least 300,000 ounces a year and that derive 51% or more of their revenue from mined gold. The Index is unmanaged, and includes dividends reinvested. One cannot invest directly in an index.

8 The composite index consists of 60% of the MSCI World Index and 40% of the Bloomberg Barclays U.S. Aggregate Bond Index.

9 The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. One cannot invest directly in an index.

10 First Eagle High Yield Fund commenced operations in its present form on December 30, 2011, and is successor to another mutual fund pursuant to a reorganization on December 30, 2011. Information prior to December 30, 2011 is for this predecessor fund. Immediately after the reorganization, changes in net asset value of the Class I shares were partially impacted by differences in how the Fund and the predecessor fund price portfolio securities.

11 The Bloomberg Barclays U.S. Corporate High Yield Index is composed of fixed-rate, publicly issued, noninvestment grade debt and is unmanaged, with dividends reinvested. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations. One cannot invest directly in an index.

First Eagle Funds | Semi-Annual Report | April 30, 2017

15

Performance Chart (unaudited)

12 As of September 1, 2005 First Eagle Fund of America Class Y is closed to new accounts.

Expense Ratios As Stated In The Most Recent Prospectus16

Total Annual Gross Operating Expense Ratios

| | | Class A | | Class C | | Class I | | Class Y | | Class R613 | |

First Eagle Global Fund | | | 1.10 | % | | | 1.86 | % | | | 0.84 | % | | | — | | | | 0.80 | % | |

First Eagle Overseas Fund | | | 1.14 | | | | 1.89 | | | | 0.87 | | | | — | | | | 0.81 | | |

First Eagle U.S. Value Fund14,15 | | | 1.14 | | | | 1.90 | | | | 0.87 | | | | — | | | | 0.82 | | |

First Eagle Gold Fund | | | 1.27 | | | | 2.04 | | | | 0.98 | | | | — | | | | 0.86 | | |

First Eagle Global Income

Builder Fund | | | 1.18 | | | | 1.94 | | | | 0.92 | | | | — | | | | 0.88 | | |

First Eagle High Yield Fund14,15 | | | 1.20 | | | | 1.94 | | | | 0.91 | | | | — | | | | 0.86 | | |

First Eagle Fund of America | | | 1.30 | | | | 2.06 | | | | 1.01 | | | | 1.31 | % | | | 0.96 | | |

13 The Fund's Class R6 Shares commenced investment operations on March 1, 2017. The percentages shown above are based on anticipated expenses of Class R6 for the first fiscal year. However, the rate at which expenses are accrued during the fiscal year may not be constant and, at any particular point, may be greater or less than the stated average percentage.

14 For the First Eagle U.S. Value Fund and High Yield Funds, had fees not been waived and/or expenses reimbursed, returns would have been lower.

15 These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to waive its management fee at an annual rate in the amount of 0.05% of the average daily value of the Fund's net assets for the period through February 28, 2018. This waiver has the effect of reducing the management fee for the term of the waiver from 0.75% to 0.70% on First Eagle U.S. Value Fund and from 0.70% to 0.65% on First Eagle High Yield Fund.

16 Certain other share classes were newly organized during the period but did not yet have assets or expenses during the period.

These expense ratios are presented as of October 31, 2016 and may differ from corresponding ratios shown elsewhere in this report because of differing time periods (and/or, if applicable, because these expense ratios do not include expense credits or waivers).

There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. These risks may be more pronounced with respect to investments in emerging markets. Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of risk than funds whose investments are diversified and may not be suitable for all investors.

All securities may be subject to adverse market trends. The value of a Fund's portfolio holdings may fluctuate in response to events specific to the companies or stock or bond markets in which a Fund invests, as well as economic, political, or social events in the United States or abroad. This may cause a Fund's portfolio to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer or the market as a whole. As a result, a portfolio of such securities may underperform the market as a whole.

First Eagle Funds | Semi-Annual Report | April 30, 2017

16

Performance Chart (unaudited)

In addition to investments in larger companies, each Fund may invest in smaller and medium-size companies, which historically have been more volatile in price than larger company securities, especially over the short term. Positions in smaller companies, especially when the Fund is a large holder of a small company's securities, also may be more difficult or expensive to trade. Among the reasons for the greater price volatility are the less certain growth prospects of smaller companies, the lower degree of liquidity in the markets for such securities and the greater sensitivity of smaller companies to changing economic conditions. In addition, smaller companies may lack depth of management, they may be unable to generate funds necessary for growth or development, or they may be developing or marketing new products or services for which markets are not yet established and may never become established. The Funds consider small companies to be companies with market capitalizations of less than $1 billion and medium-size companies to have market capitalizations of less than $10 billion.

Holding illiquid securities restricts or otherwise limits the ability for a Fund to freely dispose of its investments for specific periods of time. A Fund might not be able to sell illiquid securities at its desired price or time. Changes in the markets or in regulations governing the trading of illiquid instruments can cause rapid changes in the price or ability to sell an illiquid security. The market for lower-quality debt instruments, including junk bonds and leveraged loans, is generally less liquid than the market for higher-quality debt instruments.

Investment in gold and gold related investments present certain risks, including political and economic risks affecting the price of gold and other precious metals like changes in U.S. or foreign regulatory policies, tax, currency or mining laws, increased environmental costs, international monetary and political policies, economic conditions within an individual country, trade imbalances, and trade or currency restrictions between countries. The price of gold, in turn, is likely to affect the market prices of securities of companies mining or processing gold, and accordingly, the value of investments in such securities may also be affected. Gold related investments as a group have not performed as well as the stock market in general during periods when the U.S. dollar is strong, inflation is low and general economic conditions are stable. In addition, returns on gold related investments have traditionally been more volatile than investments in broader equity or debt markets.

The event-driven investment style used by First Eagle Fund of America carries the additional risk that the event anticipated occurs later than expected, does not occur at all or does not have the desired effect on the market price of the securities.

First Eagle High Yield and Global Income Builder Funds invest in high yield securities that are non-investment grade. High yield securities are rated lower than investment-grade securities because there is a greater possibility that the issuer may be unable to make interest and principal payments on those securities. High yield securities involve greater risk than higher rated securities and portfolios that invest in them may be subject to greater levels of credit and liquidity risk than portfolios that do not.

For the First Eagle High Yield and Global Income Builder Funds, bank loans are often less liquid than other types of debt instruments. There is no assurance that the liquidation of any collateral from a secured bank loan would satisfy the borrower's obligation or that such collateral could be liquidated.

Funds that invest in bonds are subject to interest-rate risk and can lose principal value when interest rates rise. Bonds are also subject to credit risk, in which the bond issuer may fail to pay interest and principal in a timely manner, or that negative perception of the issuer's ability to make such payments may cause the price of that bond to decline.

Income generation and dividends are not guaranteed. If dividend paying stocks in the fund's portfolio stop paying or reduce dividends the fund's ability to generate income will be adversely affected.

An investment made at a perceived "margin of safety" or "discount to intrinsic or fundamental value" can trade at prices substantially lower than when an investment is made, so that any perceived "margin or safety" or "discount to value" is no guarantee against loss.

All investments involve the risk of loss.

First Eagle Funds | Semi-Annual Report | April 30, 2017

17

Data as of April 30, 2017 (unaudited)

Investment Objective

The First Eagle Global Fund seeks long-term growth of capital by investing in a range of asset classes from markets in the United States and throughout the world. This truly global fund is managed with a highly disciplined, bottom-up, value oriented style.

Average Annual Returns (%) | | | | | | One-Year | | Five-Years | | Ten-Years | |

First Eagle Global Fund | | Class A | | without sales load | | | 9.21 | | | | 7.66 | | | | 6.28 | | |

| | | | | with sales load | | | 3.75 | | | | 6.56 | | | | 5.73 | | |

MSCI World Index | | | | | | | 14.65 | | | | 9.94 | | | | 3.92 | | |

Consumer Price Index | | | | | | | 2.21 | | | | 1.23 | | | | 1.70 | | |

Countries** (%)

United States | | | 39.19 | | |

Japan | | | 13.15 | | |

France | | | 5.94 | | |

United Kingdom | | | 3.81 | | |

Canada | | | 3.54 | | |

Mexico | | | 2.23 | | |

Germany | | | 1.76 | | |

Switzerland | | | 1.54 | | |

South Korea | | | 1.31 | | |

Curacao | | | 1.11 | | |

Hong Kong | | | 1.08 | | |

Bermuda | | | 0.82 | | |

Australia | | | 0.82 | | |

Sweden | | | 0.79 | | |

Thailand | | | 0.50 | | |

Belgium | | | 0.50 | | |

Singapore | | | 0.37 | | |

Brazil | | | 0.35 | | |

Ireland | | | 0.32 | | |

Denmark | | | 0.23 | | |

Poland | | | 0.15 | | |

Russia | | | 0.14 | | |

Italy | | | 0.13 | | |

Israel | | | 0.10 | | |

Africa | | | 0.07 | | |

Indonesia | | | 0.05 | | |

Norway | | | 0.03 | | |

* Asset Allocation and Countries percentages are based on total investments in the portfolio.

**Country allocations reflect country of the issuer (not currency of issue) and exclude short-term investments. Bonds of non-U.S. issuers may be U.S. dollar denominated.

The Fund's portfolio composition is subject to change at any time.

First Eagle Funds | Semi-Annual Report | April 30, 2017

18

First Eagle Global Fund | Fund Overview

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

The average annual returns for Class A Shares give effect to the deduction of the maximum sales charge of 5.00%.

The MSCI World Index is a widely followed, unmanaged group of stocks from 23 developed international markets. The index provides total returns in U.S. dollars with net dividends reinvested. One cannot invest directly in an index. The Consumer Price Index (CPI) represents the change in price of all goods and services purchased for consumption by urban households.

Top 10 Holdings* (%)

Gold Bullion** (precious metal) | | | 6.80 | | |

Oracle Corporation (U.S. Systems Software) | | | 2.26 | | |

Microsoft Corporation (U.S. Systems Software) | | | 2.09 | | |

Fanuc Corporation (Japanese Industrial Machinery) | | | 1.74 | | |

American Express Company (U.S. Consumer Finance) | | | 1.67 | | |

Comcast Corporation Class 'A' (U.S. Cable & Satellite) | | | 1.61 | | |

KDDI Corporation (Japanese Wireless Telecommunication Services) | | | 1.57 | | |

Weyerhaeuser Company REIT (U.S. Specialized REIT's) | | | 1.49 | | |

Omnicom Group, Inc. (U.S. Advertising) | | | 1.36 | | |

Secom Company Limited (Japanese Security & Alarm Services) | | | 1.24 | | |

Total | | | 21.83 | | |

* Holdings in cash, commercial paper and other short-term cash equivalents have been excluded.

**The Fund invests in gold and precious metals through investment in a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the "Subsidiary"). Gold Bullion and commodities include the Fund's investment in the Subsidiary.

Percentages are based on total net assets.

First Eagle Funds | Semi-Annual Report | April 30, 2017

19

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Shares | | Description | | Cost (Note 1) | | Value (Note 1) | |

Common Stocks — 71.56% | | | |

International Common Stocks — 39.70% | | | |

Africa — 0.07% | | | |

| | 413,501 | | | Randgold Resources Limited, ADR | | $ | 24,650,966 | | | $ | 36,383,953 | | |

Australia — 0.82% | | | |

| | 27,660,364 | | | Newcrest Mining Limited | | | 382,007,728 | | | | 438,267,653 | | |

Belgium — 0.50% | | | |

| | 2,788,865 | | | Groupe Bruxelles Lambert SA | | | 234,732,253 | | | | 267,366,442 | | |

Bermuda — 0.82% | | | |

| | 6,516,471 | | | Jardine Matheson Holdings Limited | | | 333,620,326 | | | | 420,507,874 | | |

| | 520,800 | | | Jardine Strategic Holdings Limited | | | 15,162,023 | | | | 22,014,216 | | |

| | | | 348,782,349 | | | | 442,522,090 | | |

Brazil — 0.35% | | | |

| | 25,075,440 | | | Cielo SA | | | 184,361,184 | | | | 190,393,379 | | |

Canada — 3.54% | | | |

| | 20,266,923 |

| | Potash Corporation of Saskatchewan,

Inc. | | | 519,454,273

| | | | 342,105,660

| | |

| | 20,378,638 | | | Barrick Gold Corporation | | | 242,892,480 | | | | 340,730,827 | | |

| | 6,554,822 | | | Agnico-Eagle Mines Limited | | | 201,782,165 | | | | 313,323,421 | | |

| | 3,490,459 | | | Franco-Nevada Corporation | | | 148,910,524 | | | | 237,393,659 | | |

| | 14,579,998 | | | Goldcorp, Inc. | | | 339,599,943 | | | | 203,536,772 | | |

| | 15,294,201 | | | Cenovus Energy, Inc. | | | 360,056,268 | | | | 152,636,126 | | |

| | 4,363,660 | | | Imperial Oil Limited | | | 135,710,968 | | | | 126,941,093 | | |

| | 3,570,888 | | | Suncor Energy, Inc. | | | 89,457,482 | | | | 111,909,885 | | |

| | 2,388,401 | | | Canadian Natural Resources Limited | | | 66,793,714 | | | | 76,076,096 | | |

| | | | 2,104,657,817 | | | | 1,904,653,539 | | |

Curacao — 1.11% | | | |

| | 8,241,660 | | | Schlumberger Limited | | | 644,067,330 | | | | 598,262,099 | | |

Denmark — 0.23% | | | |

| | 2,987,524 | | | ISS A/S | | | 94,568,138 | | | | 123,906,828 | | |

France — 5.88% | | | |

| | 7,836,484 | | | Danone SA | | | 525,476,283 | | | | 547,858,429 | | |

| | 7,208,725 | | | Cie de Saint-Gobain | | | 311,259,631 | | | | 389,089,491 | | |

| | 4,014,366 | | | Sanofi | | | 309,476,282 | | | | 378,732,338 | | |

| | 8,746,568 | | | Bouygues SA | | | 289,358,751 | | | | 367,719,030 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

20

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Shares | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Common Stocks — 39.70% (continued) | | | |

France — 5.88% (continued) | | | |

| | 2,173,169 | | | Sodexo SA | | $ | 56,283,339 | | | $ | 276,256,014 | | |

| | 11,307,383 | | | Carrefour SA | | | 413,289,236 | | | | 266,357,913 | | |

| | 11,789,132 | | | Rexel SA | | | 172,974,551 | | | | 210,607,126 | | |

| | 4,050,575 | | | Total SA | | | 194,246,569 | | | | 208,127,726 | | |

| | 851,019 | | | Wendel SA | | | 19,376,060 | | | | 119,260,447 | | |

| | 404,478 |

| | LVMH Moet Hennessy Louis

Vuitton SE | | | 59,813,051

| | | | 99,795,394

| | |

| | 1,401,821 | | | Legrand SA | | | 47,735,245 | | | | 90,749,800 | | |

| | 1,654,366 | | | Neopost SA | | | 144,309,033 | | | | 67,092,197 | | |

| | 157,260 | | | Robertet SA | | | 20,623,058 | | | | 60,298,751 | | |

| | 12,000,000 | | | Emin Leydier SA (a)(b)(c)(d)(e) | | | — | | | | 44,966,292 | | |

| | 42,252 | | | Robertet SA CI (d)(f) | | | 800,508 | | | | 11,340,582 | | |

| | 385,000 | | | Sabeton SA (b) | | | 4,841,233 | | | | 8,928,608 | | |

| | 104,457 | | | Gaumont SA | | | 6,087,824 | | | | 8,494,049 | | |

| | 66,717 | | | NSC Groupe (b) | | | 11,738,587 | | | | 5,690,437 | | |

| | | | 2,587,689,241 | | | | 3,161,364,624 | | |

Germany — 1.76% | | | |

| | 7,002,523 | | | HeidelbergCement AG | | | 381,894,065 | | | | 648,366,927 | | |

| | 938,751 | | | Linde AG | | | 126,181,611 | | | | 168,674,766 | | |

| | 1,339,934 |

| | Hornbach Holding AG & Company

KGaA (b) | | | 41,310,978

| | | | 103,616,273

| | |

| | 339,758 | | | Fraport AG | | | 11,433,424 | | | | 26,721,096 | | |

| | 29,871 | | | Hornbach Baumarkt AG | | | 560,239 | | | | 975,992 | | |

| | | | 561,380,317 | | | | 948,355,054 | | |

Hong Kong — 1.08% | | | |

| | 125,232,969 | | | Hang Lung Properties Limited | | | 293,629,183 | | | | 328,444,023 | | |

| | 12,693,580 | | | Guoco Group Limited | | | 115,086,260 | | | | 145,729,711 | | |

| | 23,163,348 |

| | Hysan Development Company

Limited | | | 104,471,981

| | | | 109,289,871

| | |

| | | | 513,187,424 | | | | 583,463,605 | | |

Ireland — 0.32% | | | |

| | 4,704,407 | | | CRH PLC | | | 78,654,390 | | | | 171,765,736 | | |

Israel — 0.10% | | | |

| | 12,448,757 | | | Israel Chemicals Limited | | | 122,246,849 | | | | 53,791,774 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

21

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Shares | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Common Stocks — 39.70% (continued) | | | |

Italy — 0.13% | | | |

| | 1,194,634 | | | Italmobiliare S.p.A. (b) | | $ | 147,127,183 | | | $ | 66,887,563 | | |

Japan — 13.14% | | | |

| | 4,599,600 | | | Fanuc Corporation | | | 503,468,534 | | | | 934,774,057 | | |

| | 31,838,200 | | | KDDI Corporation | | | 370,490,177 | | | | 844,115,722 | | |

| | 9,186,430 | | | Secom Company Limited | | | 405,509,768 | | | | 666,350,957 | | |

| | 17,037,000 | | | Sompo Holdings, Inc. | | | 474,055,672 | | | | 642,813,384 | | |

| | 2,129,156 | | | SMC Corporation | | | 265,808,258 | | | | 599,544,354 | | |

| | 30,826,080 | | | Mitsubishi Estate Company Limited | | | 557,670,697 | | | | 589,006,956 | | |

| | 11,414,440 | | | Hoya Corporation | | | 260,204,655 | | | | 545,148,944 | | |

| | 1,263,800 | | | Keyence Corporation | | | 121,430,285 | | | | 507,900,785 | | |

| | 2,442,300 | | | Hirose Electric Company Limited (b) | | | 245,404,954 | | | | 327,976,955 | | |

| | 9,739,320 |

| | MS&AD Insurance Group Holdings,

Inc. | | | 208,696,055

| | | | 317,319,670

| | |

| | 12,265,900 | | | NTT DoCoMo, Inc. | | | 291,476,975 | | | | 295,768,013 | | |

| | 1,892,590 | | | Shimano, Inc. | | | 23,499,497 | | | | 289,130,367 | | |

| | 15,895,900 | | | Astellas Pharma, Inc. | | | 117,606,337 | | | | 209,331,072 | | |

| | 2,006,030 |

| | Nissin Foods Holdings Company

Limited | | | 70,165,113

| | | | 114,810,239

| | |

| | 3,485,880 |

| | Chofu Seisakusho Company

Limited (b) | | | 63,365,956

| | | | 83,367,177

| | |

| | 4,060,600 | | | T. Hasegawa Company Limited (b) | | | 61,362,863 | | | | 78,826,090 | | |

| | 1,036,100 | | | Komatsu Limited | | | 18,231,597 | | | | 27,623,137 | | |

| | | | 4,058,447,393 | | | | 7,073,807,879 | | |

Mexico — 1.73% | | | |

| | 17,765,033 | | | Grupo Televisa S.A.B., ADR | | | 356,198,593 | | | | 431,690,302 | | |

| | 18,230,274 | | | Fresnillo PLC | | | 243,897,991 | | | | 342,843,867 | | |

| | 6,401,020 | | | Industrias Peñoles S.A.B. de C.V. | | | 7,339,323 | | | | 156,478,634 | | |

| | | | 607,435,907 | | | | 931,012,803 | | |

Norway — 0.03% | | | |

| | 2,000,066 | | | Orkla ASA | | | 13,269,921 | | | | 18,111,476 | | |

Russia — 0.14% | | | |

| | 15,687,012 | | | Gazprom PJSC, ADR | | | 83,302,846 | | | | 74,513,307 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

22

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Shares | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Common Stocks — 39.70% (continued) | | | |

South Korea — 1.31% | | | |

| | 3,628,820 | | | KT&G Corporation | | $ | 206,993,270 | | | $ | 323,688,575 | | |

| | 8,365,611 | | | Kia Motors Corporation | | | 374,300,528 | | | | 256,210,162 | | |

| | 519,000 |

| | Lotte Confectionery Company

Limited | | | 21,157,499

| | | | 93,501,186

| | |

| | 39,989 |

| | Namyang Dairy Products Company

Limited (b) | | | 7,325,466

| | | | 30,468,814

| | |

| | | | 609,776,763 | | | | 703,868,737 | | |

Sweden — 0.79% | | | |

| | 5,939,940 | | | Investor AB, Class 'A' | | | 116,378,542 | | | | 268,921,222 | | |

| | 3,394,798 | | | Investor AB, Class 'B' | | | 63,888,333 | | | | 155,188,795 | | |

| | | | 180,266,875 | | | | 424,110,017 | | |

Switzerland — 1.54% | | | |

| | 5,963,365 | | | Nestlé SA | | | 208,278,355 | | | | 459,388,872 | | |

| | 4,327,670 | | | Pargesa Holding SA | | | 272,881,781 | | | | 323,379,160 | | |

| | 550,340 | | | Cie Financiere Richemont SA | | | 33,677,058 | | | | 45,990,725 | | |

| | | | 514,837,194 | | | | 828,758,757 | | |

Thailand — 0.50% | | | |

| | 51,812,900 | | | Bangkok Bank PCL, NVDR | | | 214,262,825 | | | | 268,875,847 | | |

| | 36,500 | | | Bangkok Bank PCL | | | 154,243 | | | | 197,326 | | |

| | | | 214,417,068 | | | | 269,073,173 | | |

United Kingdom — 3.81% | | | |

| | 11,666,240 | | | TechnipFMC PLC (a) | | | 402,139,938 | | | | 351,503,811 | | |

| | 4,778,582 | | | British American Tobacco PLC | | | 257,800,241 | | | | 322,767,596 | | |

| | 9,095,881 | | | Liberty Global PLC, Series 'C' (a) | | | 298,498,837 | | | | 314,808,442 | | |

| | 7,383,566 | | | Berkeley Group Holdings PLC (b) | | | 96,480,082 | | | | 311,568,694 | | |

| | 2,058,297 | | | Willis Towers Watson PLC | | | 167,146,585 | | | | 272,971,348 | | |

| | 12,196,447 | | | GlaxoSmithKline PLC | | | 243,907,853 | | | | 244,850,843 | | |

| | 8,034,220 | | | Diageo PLC | | | 217,243,861 | | | | 233,768,890 | | |

| | | | 1,683,217,397 | | | | 2,052,239,624 | | |

Total International Common Stocks | | | 15,993,084,533 | | | | 21,362,880,112 | | |

U.S. Common Stocks — 31.86% | | | |

Consumer Discretionary — 3.74% | | | |

| | 22,106,304 | | | Comcast Corporation, Class 'A' | | | 172,422,581 | | | | 866,346,054 | | |

| | 8,915,482 | | | Omnicom Group, Inc. | | | 382,904,586 | | | | 732,139,382 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

23

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Shares | | Description | | Cost (Note 1) | | Value (Note 1) | |

U.S. Common Stocks — 31.86% (continued) | | | |

Consumer Discretionary — 3.74% (continued) | | | |

| | 2,715,849 | | | Tiffany & Company | | $ | 163,749,956 | | | $ | 248,907,561 | | |

| | 3,992,318 | | | H&R Block, Inc. | | | 67,554,206 | | | | 98,969,563 | | |

| | 3,252,457 | | | Vista Outdoor, Inc. (a)(b) | | | 60,840,739 | | | | 63,618,059 | | |

| | 2,485 | | | JG Boswell Company | | | 573,840 | | | | 1,722,105 | | |

| | 31,592 | | | Mills Music Trust (b) | | | 930,198 | | | | 695,024 | | |

| | | | 848,976,106 | | | | 2,012,397,748 | | |

Consumer Staples — 0.44% | | | |

| | 3,258,980 | | | Colgate-Palmolive Company | | | 125,309,063 | | | | 234,776,919 | | |

Energy — 2.35% | | | |

| | 17,895,308 | | | National Oilwell Varco, Inc. | | | 852,431,598 | | | | 625,798,921 | | |

| | 6,916,659 | | | ConocoPhillips | | | 258,633,895 | | | | 331,377,133 | | |

| | 3,449,156 | | | Devon Energy Corporation | | | 175,660,555 | | | | 136,207,170 | | |

| | 892,800 | | | Exxon Mobil Corporation | | | 72,418,089 | | | | 72,897,120 | | |

| | 867,954 | | | Phillips 66 | | | 68,629,773 | | | | 69,054,420 | | |

| | 3,908,035 | | | San Juan Basin Royalty Trust (b) | | | 138,744,051 | | | | 27,668,888 | | |

| | | | 1,566,517,961 | | | | 1,263,003,652 | | |

Financials — 9.29% | | | |

| | 11,313,401 | | | American Express Company | | | 633,566,347 | | | | 896,587,029 | | |

| | 23,709,923 | | | Weyerhaeuser Company, REIT | | | 483,947,523 | | | | 803,055,092 | | |

| | 13,790,619 | | | Bank of New York Mellon Corporation | | | 333,503,194 | | | | 648,986,530 | | |

| | 10,500,485 | | | BB&T Corporation | | | 271,359,274 | | | | 453,410,942 | | |

| | 7,819,459 | | | U.S. Bancorp | | | 192,949,644 | | | | 400,981,858 | | |

| | 11,559,557 | | | Synchrony Financial | | | 335,221,813 | | | | 321,355,685 | | |

| | 4,386,051 | | | WR Berkley Corporation | | | 117,583,057 | | | | 298,163,747 | | |

| | 1,088 | | | Berkshire Hathaway, Inc., Class 'A' (a) | | | 78,430,920 | | | | 269,584,640 | | |

| | 4,260,484 | | | American International Group, Inc. | | | 218,865,690 | | | | 259,506,080 | | |

| | 418,350 | | | Alleghany Corporation (a) | | | 173,611,138 | | | | 255,486,345 | | |

| | 4,889,353 | | | Brown & Brown, Inc. | | | 152,411,545 | | | | 209,753,244 | | |

| | 1,964,386 | | | Cincinnati Financial Corporation | | | 46,752,733 | | | | 141,612,587 | | |

| | 332,055 | | | The Travelers Companies, Inc. | | | 39,177,929 | | | | 40,397,811 | | |

| | | | 3,077,380,807 | | | | 4,998,881,590 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

24

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Shares | | Description | | Cost (Note 1) | | Value (Note 1) | |

U.S. Common Stocks — 31.86% (continued) | | | |

Health Care — 1.26% | | | |

| | 1,980,790 | | | Anthem, Inc. | | $ | 167,592,499 | | | $ | 352,362,733 | | |

| | 3,140,634 | | | Varian Medical Systems, Inc. (a) | | | 215,574,657 | | | | 284,981,129 | | |

| | 1,256,253 | | | Varex Imaging Corporation (a) | | | 27,620,059 | | | | 42,159,851 | | |

| | | | 410,787,215 | | | | 679,503,713 | | |

Industrials — 5.64% | | | |

| | 3,015,674 | | | 3M Company | | | 262,447,187 | | | | 590,559,439 | | |

| | 4,423,114 | | | Deere & Company | | | 357,858,692 | | | | 493,663,753 | | |

| | 4,056,411 | | | Union Pacific Corporation | | | 332,054,346 | | | | 454,155,776 | | |

| | 8,414,508 | | | Flowserve Corporation (b) | | | 398,851,749 | | | | 428,046,022 | | |

| | 3,694,106 | | | Orbital ATK, Inc. (b) | | | 187,772,271 | | | | 365,716,494 | | |

| | 2,806,745 | | | Cintas Corporation | | | 69,946,918 | | | | 343,742,060 | | |

| | 1,378,153 | | | Cummins, Inc. | | | 122,205,129 | | | | 208,018,414 | | |

| | 5,851,664 | | | NOW, Inc. (a)(b) | | | 178,684,330 | | | | 99,536,805 | | |

| | 679,237 | | | CH Robinson Worldwide, Inc. | | | 49,449,700 | | | | 49,380,530 | | |

| | | | 1,959,270,322 | | | | 3,032,819,293 | | |

Information Technology — 7.88% | | | |

| | 27,002,083 | | | Oracle Corporation | | | 856,422,677 | | | | 1,214,013,652 | | |

| | 16,419,091 | | | Microsoft Corporation | | | 402,143,883 | | | | 1,124,050,970 | | |

| | 8,166,351 | | | Xilinx, Inc. | | | 329,367,112 | | | | 515,378,412 | | |

| | 12,190,179 | | | Teradata Corporation (a)(b) | | | 444,225,494 | | | | 355,709,423 | | |

| | 2,530,508 | | | Texas Instruments, Inc. | | | 119,204,422 | | | | 200,365,623 | | |

| | 2,275,357 | | | Analog Devices, Inc. | | | 188,740,863 | | | | 173,382,203 | | |

| | 163,012 | | | Alphabet, Inc., Class 'C' (a) | | | 39,031,290 | | | | 147,682,352 | | |

| | 1,222,123 | | | Mastercard, Inc., Class 'A' | | | 24,535,794 | | | | 142,157,347 | | |

| | 1,517,758 | | | Visa, Inc., Class 'A' | | | 27,354,307 | | | | 138,449,885 | | |

| | 134,718 | | | Alphabet, Inc., Class 'A' (a) | | | 75,360,379 | | | | 124,549,485 | | |

| | 1,027,905 | | | Automatic Data Processing, Inc. | | | 31,952,626 | | | | 107,405,794 | | |

| | | | 2,538,338,847 | | | | 4,243,145,146 | | |

Materials — 0.81% | | | |

| | 2,235,507 | | | Scotts Miracle-Gro Company, Class 'A' | | | 94,363,118 | | | | 215,949,976 | | |

| | 1,061,412 | | | Praxair, Inc. | | | 109,485,246 | | | | 132,655,272 | | |

| | 1,260,596 | | | Royal Gold, Inc. | | | 75,321,955 | | | | 89,098,925 | | |

| | | | 279,170,319 | | | | 437,704,173 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

25

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Shares | | Description | | Cost (Note 1) | | Value (Note 1) | |

U.S. Common Stocks — 31.86% (continued) | | | |

Utilities — 0.45% | | | |

| | 4,874,044 | | | UGI Corporation | | $ | 161,805,549 | | | $ | 244,482,047 | | |

Total U.S. Common Stocks | | | 10,967,556,189 | | | | 17,146,714,281 | | |

Total Common Stocks | | | 26,960,640,722 | | | | 38,509,594,393 | | |

Investment Company — 0.00*% | | | |

| 250,970

| | | State Street Institutional

U.S. Government Money Market

Fund, Premier Class | | | 250,970

| | | | 250,970

| | |

| Ounces | | | | | | | |

Commodity — 6.80% | | | |

| | 2,886,886 | | | Gold bullion (a) | | | 3,010,610,020 | | | | 3,662,188,350 | | |

| Principal | | | | | | | |

Notes and Bonds — 1.66% | | | |

U.S. Bonds — 0.52% | | | |

Government Obligations — 0.51% | | | |

$ | 27,414,000

| | | Federal Home Loan Bank

0.00% due 05/23/17 | | | 27,401,603

| | | | 27,401,609

| | |

| | 250,000,000 |

| | U.S. Treasury Note

0.875% due 01/15/18 (g) | | | 249,717,505

| | | | 249,658,250

| | |

| | | | 277,119,108 | | | | 277,059,859 | | |

U.S. Corporate Bond — 0.01% | | | |

| | 5,467,000 |

| | Bausch & Lomb, Inc.

7.125% due 08/01/28 | | | 4,886,171

| | | | 5,173,149

| | |

Total U.S. Bonds | | | 282,005,279 | | | | 282,233,008 | | |

International Notes and Bonds — 1.14% | | | |

International Corporate Notes and Bonds — 0.07% | | | |

France — 0.07% | | | |

| | 6,000,000 | | | Emin Leydier SA FRN

EUR7.779% due 11/30/20 (c)(d)(h) | | | 7,238,074

| | | | 6,535,798

| | |

| | 15,000,000 | | | Emin Leydier SA FRN

EUR7.779% due 11/30/20 (c)(d)(h) | | | 21,341,293

| | | | 16,339,496

| | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

26

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Principal | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Corporate Notes and Bonds — 0.07% (continued) | | | |

France — 0.07% (continued) | | | |

| | 12,050,000 | | | Wendel SA | | $ | 16,043,090 | | | $ | 13,277,536 | | |

| | | EUR4.375% due 08/09/17 | | | | | | | | | |

Total International Corporate Notes and Bonds | | | 44,622,457 | | | | 36,152,830 | | |

International Government Bonds — 1.07% | | | |

Indonesia — 0.05% | | | |

| | 345,617,000,000 | | | Indonesia Treasury Bond

IDR8.25% due 07/15/21 | | | 26,379,853

| | | | 27,291,012

| | |

Mexico — 0.50% | | | |

| | 2,559,090,000 | | | Mexican Bonos

MXN4.75% due 06/14/18 | | | 160,969,063

| | | | 133,171,508

| | |

| | 764,192,000 | | | Mexican Bonos

MXN5.00% due 12/11/19 | | | 56,116,618

| | | | 38,842,764

| | |

| | 1,813,760,000 | | | Mexican Bonos

MXN6.50% due 06/10/21 | | | 97,460,890

| | | | 94,453,971

| | |

| | | | 314,546,571 | | | | 266,468,243 | | |

Poland — 0.15% | | | |

| | 306,347,000 | | | Republic of Poland Government Bond

PLN3.25% due 07/25/19 | | | 78,811,716

| | | | 80,922,296

| | |

Singapore — 0.37% | | | |

| | 154,398,000 | | | Singapore Government Bond

SGD0.50% due 04/01/18 | | | 117,587,100

| | | | 109,967,755

| | |

| | 119,604,000 | | | Singapore Government Bond

SGD3.25% due 09/01/20 | | | 91,542,981

| | | | 90,767,721

| | |

| | | | 209,130,081 | | | | 200,735,476 | | |

Total International Government Bonds | | | 628,868,221 | | | | 575,417,027 | | |

Total International Notes and Bonds | | | 673,490,678 | | | | 611,569,857 | | |

Total Notes and Bonds | | | 955,495,957 | | | | 893,802,865 | | |

Commercial Paper — 19.97% | | | |

International Commercial Paper — 6.54% | | | |

Australia — 0.36% | | | |

| | 39,046,000 | | | Telstra Corporation Limited

USD1.00% due 05/17/17 | | | 39,028,646

| | | | 39,024,259

| | |

| | 39,046,000 | | | Telstra Corporation Limited

USD1.00% due 05/18/17 | | | 39,027,562

| | | | 39,023,071

| | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

27

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Principal | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Commercial Paper — 6.54% (continued) | | | |

Australia — 0.36% (continued) | | | |

| | 35,298,000 | | | Telstra Corporation Limited

USD1.05% due 06/06/17 | | $ | 35,260,937

| | | $ | 35,256,510

| | |

| | 35,298,000 | | | Telstra Corporation Limited

USD1.05% due 06/08/17 | | | 35,258,878

| | | | 35,254,262

| | |

| | 45,000,000 | | | Telstra Corporation Limited

USD1.10% due 06/08/17 | | | 44,947,750

| | | | 44,944,240

| | |

Canada — 1.34% | | | |

| | 77,089,000 | | | PSP Capital, Inc.

USD0.99% due 06/05/17 | | | 77,016,301

| | | | 77,019,590

| | |

| | 30,670,000 | | | PSP Capital, Inc.

USD1.00% due 06/28/17 | | | 30,620,587

| | | | 30,623,644

| | |

| | 1,633,000 | | | PSP Capital, Inc.

USD1.00% due 07/05/17 | | | 1,630,052

| | | | 1,630,196

| | |

| | 31,592,000 | | | PSP Capital, Inc.

USD1.06% due 07/20/17 | | | 31,517,583

| | | | 31,523,242

| | |

| | 16,337,000 | | | Suncor Energy, Inc.

USD1.23% due 06/07/17 | | | 16,316,347

| | | | 16,314,546

| | |

| | 109,245,000 | | | Total Capital Limited

USD0.94% due 05/17/17 | | | 109,200,330

| | | | 109,194,435

| | |

| | 100,176,000 | | | Total Capital Limited

USD0.95% due 05/15/17 | | | 100,139,770

| | | | 100,134,702

| | |

| | 51,797,000 | | | Total Capital Limited

USD1.02% due 06/20/17 | | | 51,723,621

| | | | 51,727,378

| | |

| | 66,334,000 | | | Total Capital Limited

USD1.02% due 07/05/17 | | | 66,211,835

| | | | 66,216,095

| | |

| | 40,611,000 | | | Total Capital Limited

USD1.02% due 07/11/17 | | | 40,529,304

| | | | 40,531,111

| | |

| | 33,663,000 | | | Total Capital Limited

USD1.02% due 07/12/17 | | | 33,594,327

| | | | 33,595,674

| | |

| | 31,937,000 | | | Total Capital Limited

USD1.02% due 07/14/17 | | | 31,870,039

| | | | 31,871,081

| | |

| | 52,231,000 | | | Total Capital Limited

USD1.03% due 07/18/17 | | | 52,114,438

| | | | 52,116,301

| | |

| | 24,788,000 | | | Total Capital Limited

USD1.03% due 07/20/17 | | | 24,731,263

| | | | 24,731,936

| | |

| | 55,846,000 | | | Total Capital Limited

USD1.04% due 07/20/17 | | | 55,716,934

| | | | 55,719,690

| | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

28

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Principal | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Commercial Paper — 6.54% (continued) | | | |

France — 0.69% | | | |

| | 52,946,000 | | | Engie

USD0.88% due 06/15/17 | | $ | 52,888,421

| | | $ | 52,882,465

| | |

| | 44,463,000 | | | Engie

USD0.90% due 06/06/17 | | | 44,423,428

| | | | 44,420,371

| | |

| | 25,881,000 | | | Engie

USD0.91% due 05/09/17 | | | 25,875,881

| | | | 25,874,318

| | |

| | 32,914,000 | | | Engie

USD0.95% due 06/14/17 | | | 32,876,588

| | | | 32,875,412

| | |

| | 24,506,000 | | | Essilor International

USD1.00% due 06/05/17 | | | 24,482,175

| | | | 24,483,159

| | |

| | 14,210,000 | | | Essilor International

USD1.00% due 06/19/17 | | | 14,190,659

| | | | 14,191,383

| | |

| | 9,983,000 | | | Essilor International

USD1.00% due 06/23/17 | | | 9,968,303

| | | | 9,968,822

| | |

| | 28,942,000 | | | Essilor International

USD1.05% due 07/12/17 | | | 28,881,222

| | | | 28,884,418

| | |

| | 15,282,000 | | | Essilor International

USD1.05% due 07/13/17 | | | 15,249,462

| | | | 15,251,125

| | |

| | 31,592,000 | | | Essilor International

USD1.05% due 07/20/17 | | | 31,518,285

| | | | 31,521,057

| | |

| | 46,882,000 | | | L'Oreal USA, Inc.

USD0.92% due 06/08/17 | | | 46,837,462

| | | | 46,836,188

| | |

| | 46,882,000 | | | L'Oreal USA, Inc.

USD0.92% due 06/09/17 | | | 46,836,290

| | | | 46,834,962

| | |

Germany — 0.33% | | | |

| | 32,877,000 | | | BASF AG

USD1.00% due 06/27/17 | | | 32,825,986

| | | | 32,826,589

| | |

| | 41,818,000 | | | Henkel Corporation

USD0.81% due 05/01/17 | | | 41,818,000

| | | | 41,815,090

| | |

| | 41,818,000 | | | Henkel Corporation

USD0.81% due 05/02/17 | | | 41,817,071

| | | | 41,814,115

| | |

| | 4,548,000 | | | Henkel Corporation

USD1.08% due 07/07/17 | | | 4,538,858

| | | | 4,539,661

| | |

| | 55,846,000 | | | Henkel Corporation

USD1.08% due 07/17/17 | | | 55,716,996

| | | | 55,725,993

| | |

Italy — 0.01% | | | |

| | 3,140,000 | | | Eni S.p.A.

USD1.13% due 05/01/17 | | | 3,140,000

| | | | 3,139,729

| | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

29

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Principal | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Commercial Paper — 6.54% (continued) | | | |

Japan — 0.82% | | | |

| | 4,655,000 | | | Hitachi Limited

USD1.11% due 05/01/17 | | $ | 4,655,000

| | | $ | 4,654,571

| | |

| | 87,470,000 | | | Honda Corporation

USD0.95% due 06/16/17 | | | 87,366,056

| | | | 87,367,731

| | |

| | 17,609,000 | | | Honda Corporation

USD0.97% due 07/24/17 | | | 17,569,967

| | | | 17,568,913

| | |

| | 51,853,000 | | | Honda Corporation

USD1.02% due 07/06/17 | | | 51,756,035

| | | | 51,764,150

| | |

| | 49,871,000 | | | Honda Corporation

USD1.03% due 07/05/17 | | | 49,778,254

| | | | 49,787,067

| | |

| | 43,418,000 | | | Honda Corporation

USD1.04% due 07/18/17 | | | 43,320,165

| | | | 43,327,539

| | |

| | 59,195,000 | | | Honda Corporation

USD1.05% due 07/24/17 | | | 59,049,972

| | | | 59,060,243

| | |

| | 32,559,000 | | | Honda Corporation

USD1.06% due 07/21/17 | | | 32,481,347

| | | | 32,488,043

| | |

| | 57,720,000 | | | Mitsubishi Company

USD0.83% due 05/05/17 | | | 57,714,741

| | | | 57,709,876

| | |

| | 25,148,000 | | | Mitsubishi Company

USD1.07% due 06/29/17 | | | 25,103,900

| | | | 25,104,776

| | |

| | 12,637,000 | | | Mitsui & Company Limited

USD1.14% due 06/19/17 | | | 12,617,391

| | | | 12,615,881

| | |

Switzerland — 2.58% | | | |

| | 58,603,000 | | | Nestlé SA

USD0.68% due 05/09/17 | | | 58,594,275

| | | | 58,588,908

| | |

| | 32,351,000 | | | Nestlé SA

USD0.69% due 05/08/17 | | | 32,346,722

| | | | 32,343,945

| | |

| | 36,187,000 | | | Nestlé SA

USD0.73% due 05/10/17 | | | 36,180,486

| | | | 36,177,495

| | |

| | 35,592,000 | | | Nestlé SA

USD0.73% due 05/22/17 | | | 35,577,051

| | | | 35,572,923

| | |

| | 33,516,000 | | | Nestlé SA

USD0.74% due 06/02/17 | | | 33,494,252

| | | | 33,489,313

| | |

| | 71,535,000 | | | Nestlé SA

USD0.76% due 06/08/17 | | | 71,478,368

| | | | 71,467,624

| | |

| | 21,811,000 | | | Nestlé SA

USD0.77% due 06/06/17 | | | 21,794,423

| | | | 21,791,530

| | |

| | 22,202,000 | | | Nestlé SA

USD0.79% due 06/14/17 | | | 22,180,834

| | | | 22,177,797

| | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

30

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Principal | | Description | | Cost (Note 1) | | Value (Note 1) | |

International Commercial Paper — 6.54% (continued) | | | |

Switzerland — 2.58% (continued) | | | |

| | 50,000,000 | | | Nestlé SA

USD0.84% due 06/19/17 | | $ | 49,943,514

| | | $ | 49,939,261

| | |

| | 21,293,000 | | | Nestlé SA

USD0.86% due 06/05/17 | | | 21,275,404

| | | | 21,274,502

| | |

| | 31,112,000 | | | Nestlé SA

USD0.91% due 07/18/17 | | | 31,052,006

| | | | 31,050,398

| | |

| | 52,121,000 | | | Nestlé SA

USD0.92% due 06/14/17 | | | 52,063,667

| | | | 52,064,181

| | |

| | 42,889,000 | | | Nestlé SA

USD0.93% due 06/30/17 | | | 42,823,952

| | | | 42,824,752

| | |

| | 46,520,000 | | | Nestlé SA

USD0.93% due 07/20/17 | | | 46,425,926

| | | | 46,425,294

| | |

| | 79,688,000 | | | Nestlé SA

USD0.94% due 06/19/17 | | | 79,588,213

| | | | 79,591,197

| | |

| | 26,403,000 | | | Nestlé SA

USD0.97% due 07/14/17 | | | 26,351,441

| | | | 26,353,586

| | |

| | 63,003,000 | | | Nestlé SA

USD0.97% due 07/19/17 | | | 62,871,656

| | | | 62,876,571

| | |

| | 44,385,000 | | | Nestlé SA

USD0.99% due 07/06/17 | | | 44,306,069

| | | | 44,311,498

| | |

| | 31,592,000 | | | Nestlé SA

USD1.00% due 07/18/17 | | | 31,524,920

| | | | 31,529,448

| | |

| | 31,592,000 | | | Nestlé SA

USD1.00% due 07/19/17 | | | 31,524,060

| | | | 31,528,604

| | |

| | 21,230,000 | | | Novartis International AG

USD0.92% due 07/03/17 | | | 21,196,191

| | | | 21,194,815

| | |

| | 58,369,000 | | | Roche Holdings, Inc.

USD0.68% due 05/01/17 | | | 58,369,000

| | | | 58,365,085

| | |

| | 45,608,000 | | | Roche Holdings, Inc.

USD0.68% due 05/02/17 | | | 45,607,151

| | | | 45,603,915

| | |

| | 28,041,000 | | | Roche Holdings, Inc.

USD0.68% due 05/08/17 | | | 28,037,347

| | | | 28,034,660

| | |

| | 39,908,000 | | | Roche Holdings, Inc.

USD0.69% due 05/10/17 | | | 39,901,216

| | | | 39,897,145

| | |

| | 62,726,000 | | | Roche Holdings, Inc.

USD0.69% due 05/11/17 | | | 62,714,152

| | | | 62,707,494

| | |

| | 29,199,000 | | | Roche Holdings, Inc.

USD0.70% due 05/02/17 | | | 29,198,440

| | | | 29,196,385

| | |

First Eagle Funds | Semi-Annual Report | April 30, 2017

31

First Eagle Global Fund | Consolidated Schedule of Investments | Six-Month Period Ended April 30, 2017 (unaudited)

| Principal | | Description | | Cost (Note 1) | | Value (Note 1) | |