UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-7762 |

|

First Eagle Funds |

(Exact name of registrant as specified in charter) |

|

1345 Avenue of the Americas

New York, NY | | 10105 |

(Address of principal executive offices) | | (Zip code) |

|

Suzan Afifi

First Eagle Funds

1345 Avenue of the Americas

New York, NY 10105 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | 1-212-632-2700 | |

|

Date of fiscal year end: | October 31 | |

|

Date of reporting period: | April 30, 2018 | |

| | | | | | | | |

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

First Eagle Global Fund

First Eagle Overseas Fund

First Eagle U.S. Value Fund

First Eagle Gold Fund

First Eagle Global Income Builder Fund

First Eagle High Yield Fund

First Eagle Fund of America

Advised by First Eagle Investment Management, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seem", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

First Eagle Funds | Semi-Annual Report | April 30, 2018

2

Table of Contents

Letter from the President | | | 4 | | |

Management's Discussion of Fund Performance | | | 6 | | |

Performance Chart | | | 11 | | |

First Eagle Global Fund: | |

Fund Overview | | | 18 | | |

Consolidated Schedule of Investments | | | 20 | | |

First Eagle Overseas Fund: | |

Fund Overview | | | 38 | | |

Consolidated Schedule of Investments | | | 40 | | |

First Eagle U.S. Value Fund: | |

Fund Overview | | | 56 | | |

Consolidated Schedule of Investments | | | 58 | | |

First Eagle Gold Fund: | |

Fund Overview | | | 66 | | |

Consolidated Schedule of Investments | | | 68 | | |

First Eagle Global Income Builder Fund: | |

Fund Overview | | | 72 | | |

Schedule of Investments | | | 74 | | |

First Eagle High Yield Fund: | |

Fund Overview | | | 88 | | |

Schedule of Investments | | | 90 | | |

First Eagle Fund of America: | |

Fund Overview | | | 98 | | |

Schedule of Investments | | | 100 | | |

Statements of Assets and Liabilities | | | 106 | | |

Statements of Operations | | | 114 | | |

Statements of Changes in Net Assets | | | 118 | | |

Financial Highlights | | | 130 | | |

Notes to Financial Statements | | | 146 | | |

Fund Expenses | | | 173 | | |

General Information | | | 179 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

3

Letter from the President

Dear Fellow Shareholders,

When I wrote six months ago, investment markets were generally buoyant and the CBOE Volatility Index (VIX) had progressively reached record lows over the course of 2017. This pattern continued into January 2018 but changed abruptly in February, and 2018 has been marked by market swings of wider amplitude than investors have been used to in recent months. Although volatility only reverted to levels consistent with history, the impact on investor sentiment was dramatic when it happened—an indication, I believe, of just how sanguine investors have been.

Although an economic crisis may not be imminent, we have to question the widespread assumption that synchronized global economic growth will continue into the indefinite future and at a sufficient pace to justify current valuations. There is ample evidence to the contrary. Economic activity in the eurozone appears to be slowing despite maximally stimulative monetary policy. Equity and fixed income asset prices have softened in emerging markets coincident with a strengthening of the US dollar—a development that may indicate greater fragility in these economies than investors generally recognize.

In the United States, economic growth has been reasonable in our view, but it has taken unprecedented levels of monetary and fiscal stimulus to get there. US labor markets are tight, but the majority of workers are spending more than they are earning, i.e., they have a negative savings rate, which is unsustainable. At whatever pace the Federal Reserve ("Fed") unwinds quantitative easing and normalizes interest rates, we are entering a period where the pressure on rates appears higher rather than lower. It is difficult to imagine benign markets and further appreciation in asset valuations as the stimulus fades.

In addition, geopolitical events during the November-April period reinforced our sense that risks are elevated. Most striking to us was the Chinese government's decision in March to abolish presidential term limits. We are inclined to interpret this as a sign that China's leaders believe their country needs strong centralized authority to address daunting economic and other challenges in the years ahead. We have serious concerns about debt levels not just in China but around the world. Meanwhile, Italy's general election, also in March, brought to the fore populist candidates who

First Eagle Funds | Semi-Annual Report | April 30, 2018

4

Letter from the President

want to rewrite the EU's policies on monetary union and immigration. These developments, among others, convince us that this remains a time for prudence, and we believe that our teams and products are positioned appropriately.

Global Value Team

The Global Value team maintained a cautious posture, holding approximately 30% of the Global, Overseas and U.S. Value funds in cash, cash equivalents, bonds, gold and gold-related investments, and 12% of the Global Income Builder Fund in cash, cash equivalents and gold. In the volatile markets of March and April, some share prices fell to attractive levels, and the team was able to enlarge existing positions in companies in diverse sectors, including consumer staples, consumer discretionary, health care, real estate, energy and materials.

High Yield Team

Like the equity market, the fixed-income market saw a resurgence of volatility during this period. Yields of ten-year Treasuries rose (and prices fell) as the market began to transition to more normal monetary policy from a period of unprecedented accommodation. The high yield team continued its efforts to minimize exposure to risks for which the market was not providing adequate compensation. It kept duration short and emphasized bonds that were relatively high in credit quality, including a sizable allocation to investment-grade bonds. It avoided smaller issues that could, potentially, be subject to liquidity constraints. It also maintained a substantial allocation to cash.

Fund of America Team

In an environment changed by the removal of Fed accommodation, a lack of spare capacity due to full employment and a reassessment of trading relationships with leading counterparties, the Fund of America team reminded itself that the market climbs a wall of worry. It focused on areas where it expected change catalysts to be robust, such as stories of management change or impending spinoffs. It also sought companies that could deploy a large amount of financial self-help to take advantage of market volatility.

Thank you for your confidence in our stewardship of your assets.

Sincerely,

Mehdi Mahmud

President

June 2018

First Eagle Funds | Semi-Annual Report | April 30, 2018

5

Management's Discussion of Fund Performance*

First Eagle Global Fund

The net asset value ("NAV") of the Fund's Class A shares increased 1.16% for the six months ending April 30, 2018 while the MSCI World Index increased 3.40%. The Fund's cash and cash equivalents position was 18.0% as of April 30, 2018.

The five largest contributors to the performance of First Eagle Global Fund over the period were Microsoft Corp. (software, US), gold bullion, ConocoPhillips (oil, gas & consumable fuels, US), TechnipFMC plc (energy equipment & services, UK), Teradata Corp. (IT services, US) collectively accounting for 1.04% points of this period's performance.

The five largest detractors were Oracle Corp. (software, US), 3M Co. (industrial conglomerates, US), Comcast Corp. (media, US), Nutrien Ltd. (chemicals, Canada) and Sanofi (pharmaceuticals, France). Their combined negative performance over the six months subtracted 0.83% points from performance.

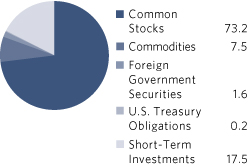

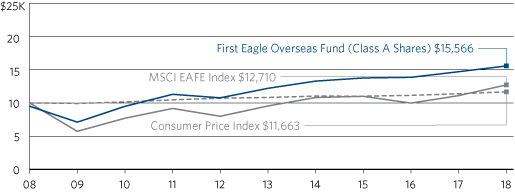

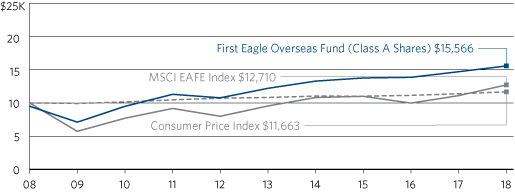

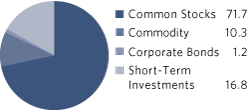

First Eagle Overseas Fund

The NAV of the Fund's Class A shares increased 0.45% for the six months ending April 30, 2018 while the MSCI EAFE Index increased 3.41%. The Fund's cash and cash equivalents position was 17.5% as of April 30, 2018.

The five largest contributors to the performance of First Eagle Overseas Fund over the period were TechnipFMC plc (energy equipment & services, UK), gold bullion, Haw Par Corp. Ltd. (pharmaceuticals, Singapore), Keyence Corp. (electronic equipment, instruments & components, Japan) and Robertet SA (chemicals, France) collectively accounting for 1.14% points of this period's performance.

The five largest detractors were Nutrien Ltd. (chemicals, Canada), Sanofi (pharmaceuticals, France), Sodexo SA (hotels, restaurants & leisure, France), FANUC Corp. (machinery, Japan) and Grupo Televisa (media, Mexico). Their combined negative performance over the six months subtracted 1.00% points from performance.

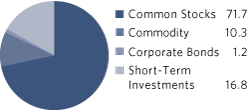

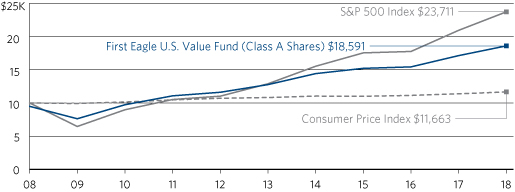

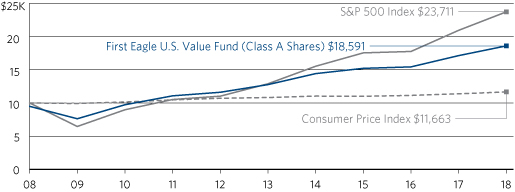

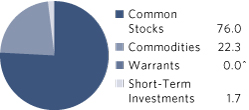

First Eagle U.S. Value Fund

The NAV of the Fund's Class A shares increased 2.77% for the six months ending April 30, 2018 while the S&P 500 Index increased 3.82%. The Fund's cash and cash equivalents position was 16.8% as of April 30, 2018.

* Performance information for Class A Shares is without the effect of sales charges and assumes all distributions have been reinvested. If a sales charge was included values would be lower.

First Eagle Funds | Semi-Annual Report | April 30, 2018

6

Management's Discussion of Fund Performance

The five largest contributors to the performance of First Eagle U.S. Value Fund over the period were Microsoft Corp. (software, US), Teradata Corp. (IT services, US), gold bullion, ConocoPhillips (oil, gas & consumable fuels, US) and Union Pacific Corp. (road & rail, US) collectively accounting for 1.80% points of this period's performance.

The five largest detractors were Oracle Corp. (software, US), Comcast Corp. (media, US), 3M Co. (industrial conglomerates, US), Nutrien Ltd. (chemicals, Canada), Xilinx, Inc. (semiconductors & semiconductor equipment, US). Their combined negative performance subtracted 1.37% points from performance.

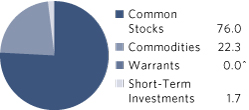

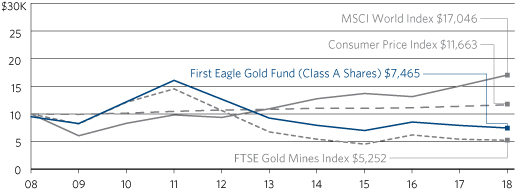

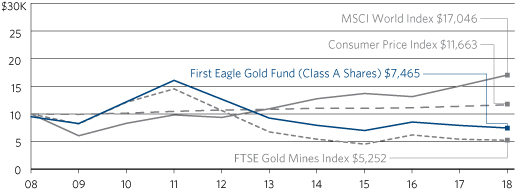

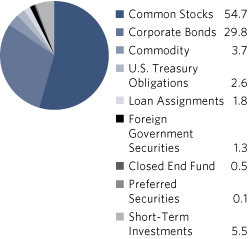

First Eagle Gold Fund

The NAV of the Fund's Class A shares decreased 3.52% for the six months ending April 30, 2018 while the FTSE Gold Mines Index decreased 0.82%. The Fund's cash and cash equivalents position was 1.7% as of April 30, 2018.

The five largest contributors to the performance of First Eagle Gold Fund over the period were gold bullion, Newmont Mining Corp. (metals & mining, US), Royal Gold, Inc. (metals & mining, US), Novagold Resources Inc. (metals & mining, Canada) and B2Gold Corp. (metals & mining, Canada) collectively accounting for 1.89% points of this period's performance.

The five largest detractors were Detour Gold Corp. (metals & mining, Canada), Osisko Gold Royalties Ltd. (metals & mining, Canada), New Gold, Inc. (metals & mining, Canada), Randgold Resources Ltd. (metals & mining, Africa) and Newcrest Mining Ltd. (metals & mining, Australia). Their combined negative performance subtracted 4.02% points from performance.

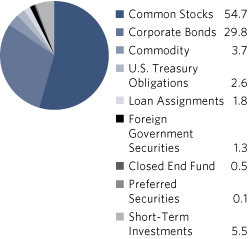

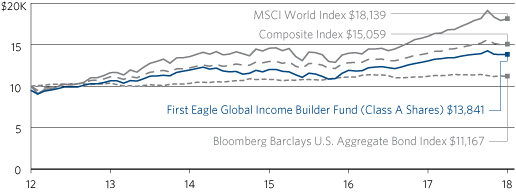

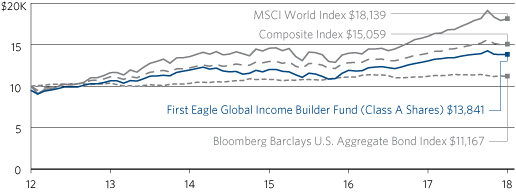

First Eagle Global Income Builder Fund

The NAV of the Fund's Class A shares increased 0.59% for the six months ending April 30, 2018 while the composite index1 increased 1.34%. The Bloomberg Barclays US Aggregate Bond Index decreased 1.87% while the MSCI World Index increased 3.40%. The Fund's cash and cash equivalents position was 5.5% as of April 30, 2018.

The five largest contributors to the performance of First Eagle Global Income Builder Fund over the period were Microsoft Corp. (software, US), ConocoPhillips (oil, gas & consumable fuels, US), GlaxoSmithKline plc (pharmaceuticals, UK), Berkeley Group Holdings plc (household durables, UK) and gold bullion collectively accounting for 0.84% points of this period's performance.

1 The composite index consists of 60% of the MSCI World Index and 40% of the Bloomberg Barclays U.S. Aggregate Bond Index.

First Eagle Funds | Semi-Annual Report | April 30, 2018

7

Management's Discussion of Fund Performance

The five largest detractors were Sanofi (pharmaceuticals, France), Nutrien Ltd. (chemicals, Canada), British American Tobacco plc (tobacco, UK), 3M Co. (industrial conglomerates, US), Sodexo SA (hotels, restaurants & leisure, France). Their combined negative performance subtracted 0.71% points from performance.

First Eagle High Yield Fund

The NAV of the Fund's Class I shares increased 1.22% for the six months ending April 30, 2018 while the Bloomberg Barclays U.S. Corporate High Yield Index decreased 0.17%. The Fund's cash and cash equivalents position was 6.1% as of April 30, 2018.

The five largest contributors to the performance of First Eagle High Yield Fund over the period were BI-LO LLC 8.63% due 09/15/2018 (food & staples retailing, US), EnQuest plc 7.00% due 04/15/2022 (oil, gas & consumable fuels, UK), BI-LO LLC 9.25% due 02/15/2019 (food & staples retailing, US), California Resources Corp. 8.00% due 12/15/2022 (oil, gas & consumable fuels, US) and Caelus Energy Alaska LLC Term Loan 8.82% due 04/15/2020 (oil, gas & consumable fuels, US) collectively accounting for 2.51% points of this period's performance.

The five largest detractors were Jupiter Resources, Inc. 8.50% due 10/01/2022 (oil, gas & consumable fuels, US), Ultra Resources, Inc. 7.13% due 04/15/2025 (oil, gas & consumable fuels, US), Payless LLC (specialty retail, US), B&G Foods, Inc. 5.25% due 04/01/2025 (food products, US), Virgin Media Secured Finance plc 5.50% due 01/15/2025 (diversified telecommunication services, US). Their combined negative performance subtracted 0.64% points from performance.

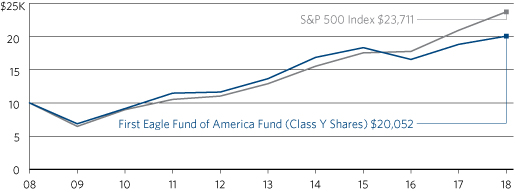

First Eagle Fund of America

The NAV of the Fund's Class A shares decreased 1.12% for the six months ending April 30, 2018 while the S&P 500 Index increased 3.82%. The Fund's cash and cash equivalents position was 1.0% as of April 30, 2018.

The five largest contributors to the performance of Fund of America over the period were KLX, Inc. (aerospace & defense, US), Marathon Petroleum Corp. (oil, gas & consumable fuels, US), Halozyme Therapeutics, Inc. (biotechnology, US), Chipotle Mexican Grill, Inc. (hotels, restaurants & leisure, US) and La Quinta Holdings, Inc. (hotels, restaurants & leisure, US) collectively accounting for 2.88% points of this period's performance.

The five largest detractors were Albemarle Corp. (chemicals, US), Adient plc (auto components, US), Martin Marietta Materials, Inc. (construction materials, US), Olin Corp. (chemicals, US) and Western Digital Corp. (technology hardware, storage & peripherals, US). Their combined negative performance subtracted 3.00% points from performance.

First Eagle Funds | Semi-Annual Report | April 30, 2018

8

Management's Discussion of Fund Performance

| |

| |

Matthew McLennan

Head of the Global Value Team

Portfolio Manager

Global, Overseas,

U.S. Value and Gold Funds | | T. Kimball Brooker, Jr.

Portfolio Manager

Global, Overseas,

U.S. Value and

Global Income Builder Funds | |

| |

| |

Matt Lamphier

Portfolio Manager

U.S. Value Fund

| | Edward Meigs

Portfolio Manager

Global Income Builder and

High Yield Funds | |

| |

| |

Sean Slein

Portfolio Manager

Global Income Builder and

High Yield Funds | | Thomas Kertsos

Portfolio Manager

Gold Fund

| |

| |

| |

Harold Levy

Portfolio Manager

Fund of America | | Eric Stone

Portfolio Manager

Fund of America | |

| | | |

Lukasz Thieme

Portfolio Manager

Fund of America | | | |

June 2018 | | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

9

Management's Discussion of Fund Performance

The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact a fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at feim.com or by calling 800.334.2143.

The commentary represents the opinion of Mehdi Mahmud and the Portfolio Management Teams as of June 2018 and is subject to change based on market and other conditions. These materials are provided for informational purposes only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

First Eagle Funds | Semi-Annual Report | April 30, 2018

10

Performance Chart1 (unaudited)

| | | One-

Year | | Three-

Years | | Five-

Years | | Ten-

Years | | Since

Inception | | Inception Date | |

First Eagle Global Fund | |

Class A (SGENX)

without sales charge | | | 6.74 | % | | | 5.85 | % | | | 6.55 | % | | | 6.38 | % | | | 13.15 | % | | 01/01/792 | |

with sales charge | | | 1.39 | % | | | 4.05 | % | | | 5.46 | % | | | 5.84 | % | | | 13.04 | % | | 01/01/792 | |

| Class C (FESGX) | | | 4.94 | % | | | 5.06 | % | | | 5.75 | % | | | 5.59 | % | | | 9.87 | % | | 06/05/00 | |

| Class I (SGIIX) | | | 7.00 | % | | | 6.13 | % | | | 6.82 | % | | | 6.65 | % | | | 10.72 | % | | 07/31/98 | |

| Class R4 (EAGRX) | | | — | | | | — | | | | — | | | | — | | | | -4.30 | % | | 01/17/18 | |

| Class R6 (FEGRX) | | | 7.08 | % | | | — | | | | — | | | | — | | | | 6.50 | % | | 03/01/17 | |

MSCI World Index3 | | | 13.22 | % | | | 7.55 | % | | | 9.28 | % | | | 5.48 | % | | | 9.67 | % | | 01/01/79 | |

First Eagle Overseas Fund4 | |

Class A (SGOVX)

without sales charge | | | 5.88 | % | | | 4.20 | % | | | 4.99 | % | | | 5.06 | % | | | 10.51 | % | | 08/31/93 | |

with sales charge | | | 0.60 | % | | | 2.44 | % | | | 3.92 | % | | | 4.53 | % | | | 10.34 | % | | 08/31/93 | |

| Class C (FESOX) | | | 4.11 | % | | | 3.42 | % | | | 4.22 | % | | | 4.28 | % | | | 9.23 | % | | 06/05/00 | |

| Class I (SGOIX) | | | 6.15 | % | | | 4.48 | % | | | 5.28 | % | | | 5.33 | % | | | 10.51 | % | | 07/31/98 | |

| Class R4 (FIORX) | | | — | | | | — | | | | — | | | | — | | | | -3.86 | % | | 01/17/18 | |

| Class R6 (FEORX) | | | 6.26 | % | | | — | | | | — | | | | — | | | | 7.46 | % | | 03/01/17 | |

MSCI EAFE Index5 | | | 14.51 | % | | | 4.94 | % | | | 5.90 | % | | | 2.43 | % | | | 5.30 | % | | 08/31/93 | |

First Eagle U.S. Value Fund | |

Class A (FEVAX)

without sales charge | | | 8.54 | % | | | 6.91 | % | | | 7.81 | % | | | 6.94 | % | | | 8.99 | % | | 09/04/01 | |

with sales charge | | | 3.11 | % | | | 5.10 | % | | | 6.71 | % | | | 6.39 | % | | | 8.65 | % | | 09/04/01 | |

| Class C (FEVCX) | | | 6.78 | % | | | 6.11 | % | | | 7.00 | % | | | 6.15 | % | | | 8.17 | % | | 09/04/01 | |

| Class I (FEVIX) | | | 8.84 | % | | | 7.20 | % | | | 8.10 | % | | | 7.22 | % | | | 9.26 | % | | 09/04/01 | |

| Class R6 (FEVRX) | | | 8.83 | % | | | — | | | | — | | | | — | | | | 6.55 | % | | 03/01/17 | |

S&P 500 Index6 | | | 13.27 | % | | | 10.57 | % | | | 12.96 | % | | | 9.02 | % | | | 7.35 | % | | 09/04/01 | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

11

Performance Chart (unaudited)

| | | One-

Year | | Three-

Years | | Five-

Years | | Ten-

Years | | Since

Inception | | Inception Date | |

First Eagle Gold Fund | |

Class A (SGGDX)

without sales charge | | | -5.80 | % | | | 2.12 | % | | | -4.20 | % | | | -2.38 | % | | | 4.95 | % | | 08/31/93 | |

with sales charge | | | -10.51 | % | | | 0.38 | % | | | -5.18 | % | | | -2.88 | % | | | 4.79 | % | | 08/31/93 | |

| Class C (FEGOX) | | | -7.45 | % | | | 1.30 | % | | | -4.95 | % | | | -3.13 | % | | | 4.12 | % | | 05/15/03 | |

| Class I (FEGIX) | | | -5.55 | % | | | 2.42 | % | | | -3.94 | % | | | -2.13 | % | | | 5.18 | % | | 05/15/03 | |

| Class R6 (FEURX) | | | -5.44 | % | | | — | | | | — | | | | — | | | | -6.13 | % | | 03/01/17 | |

FTSE Gold

Mines Index7 | | | -3.30 | % | | | 4.90 | % | | | -4.90 | % | | | -6.24 | % | | | -1.06 | % | | 08/31/93 | |

MSCI World Index3 | | | 13.22 | % | | | 7.55 | % | | | 9.28 | % | | | 5.48 | % | | | 7.02 | % | | 08/31/93 | |

First Eagle Global Income Builder | |

Class A (FEBAX)

without sales charge | | | 6.07 | % | | | 4.82 | % | | | 5.36 | % | | | — | | | | 6.48 | % | | 05/01/12 | |

with sales charge | | | 0.76 | % | | | 3.03 | % | | | 4.29 | % | | | — | | | | 5.56 | % | | 05/01/12 | |

| Class C (FEBCX) | | | 4.31 | % | | | 4.03 | % | | | 4.58 | % | | | — | | | | 5.68 | % | | 05/01/12 | |

| Class I (FEBIX) | | | 6.36 | % | | | 5.09 | % | | | 5.64 | % | | | — | | | | 6.74 | % | | 05/01/12 | |

| Class R6 (FEBRX) | | | 6.32 | % | | | — | | | | — | | | | — | | | | 7.24 | % | | 03/01/17 | |

Composite Index8 | | | 7.71 | % | | | 5.06 | % | | | 6.23 | % | | | — | | | | 7.09 | % | | 05/01/12 | |

MSCI World Index3 | | | 13.22 | % | | | 7.55 | % | | | 9.28 | % | | | — | | | | 10.41 | % | | 05/01/12 | |

Bloomberg Barclays

U.S. Aggregate

Bond Index9 | | | -0.32 | % | | | 1.07 | % | | | 1.47 | % | | | — | | | | 1.85 | % | | 05/01/12 | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

12

Performance Chart (unaudited)

| | | One-

Year | | Three-

Years | | Five-

Years | | Ten-

Years | | Since

Inception | | Inception Date | |

First Eagle High Yield | |

Class A (FEHAX)

without sales charge | | | 2.92 | % | | | 3.09 | % | | | 3.13 | % | | | — | | | | 5.17 | % | | 01/03/12 | |

with sales charge | | | -1.72 | % | | | 1.50 | % | | | 2.19 | % | | | — | | | | 4.41 | % | | 01/03/12 | |

| Class C (FEHCX) | | | 1.20 | % | | | 2.37 | % | | | 2.39 | % | | | — | | | | 4.39 | % | | 01/03/12 | |

| Class I (FEHIX) | | | 3.23 | % | | | 3.42 | % | | | 3.45 | % | | | 8.66 | % | | | 8.35 | % | | 11/19/0710 | |

| Class R6 (FEHRX) | | | 3.21 | % | | | — | | | | — | | | | — | | | | 3.63 | % | | 03/01/17 | |

Bloomberg Barclays

U.S. Corporate

High Yield Index11 | | | 3.26 | % | | | 4.98 | % | | | 4.75 | % | | | 7.88 | % | | | 7.72 | % | | 11/19/07 | |

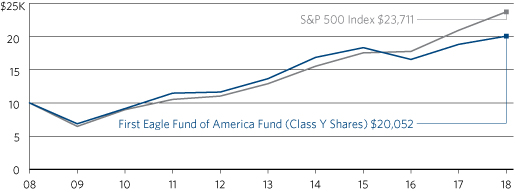

First Eagle Fund of America | |

Class A (FEFAX)

without sales charge | | | 6.58 | % | | | 3.06 | % | | | 8.01 | % | | | 7.21 | % | | | 8.34 | % | | 11/20/98 | |

with sales charge | | | 1.26 | % | | | 1.31 | % | | | 6.90 | % | | | 6.66 | % | | | 8.05 | % | | 11/20/98 | |

| Class C (FEAMX) | | | 4.88 | % | | | 2.29 | % | | | 7.20 | % | | | 6.41 | % | | | 7.55 | % | | 03/02/98 | |

| Class I (FEAIX) | | | 6.91 | % | | | 3.36 | % | | | 8.30 | % | | | — | | | | 8.43 | % | | 03/08/13 | |

| Class Y (FEAFX)12 | | | 6.57 | % | | | 3.05 | % | | | 8.00 | % | | | 7.21 | % | | | 11.39 | % | | 04/10/87 | |

| Class R6 (FEFRX) | | | 6.91 | % | | | — | | | | — | | | | — | | | | 8.03 | % | | 03/01/17 | |

S&P 500 Index6 | | | 13.27 | % | | | 10.57 | % | | | 12.96 | % | | | 9.02 | % | | | 9.79 | % | | 04/10/87 | |

1 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at feim.com or by calling 800.334.2143. The average annual returns for Class A Shares "with sales charge" of First Eagle Global, Overseas, U.S. Value, Gold, Fund of America, and Global Income Builder give effect to the deduction of the maximum sales charge of 5.00%. The average annual returns for Class A Shares "with sales charge" of First Eagle High Yield gives effect to the deduction of the maximum sales charge of 4.50%.

The average annual returns for Class C Shares reflect the contingent deferred sales charge (CDSC) of 1.00% which pertains to the first year or less of investment only.

A contingent deferred sales charge of 1.00% may apply on redemptions of Class A shares made within 18 months following a purchase of $1,000,000 or more without an initial sales charge.

First Eagle Funds | Semi-Annual Report | April 30, 2018

13

Performance Chart (unaudited)

Class I Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Yield Fund, and First Eagle Fund of America require $1 million minimum investment and are offered without a sales charge.

Class Y Shares of First Eagle Fund of America are offered without a sales charge.

Class R4 Shares of First Eagle Global Fund and First Eagle Overseas Fund are offered without a sales charge.

Class R6 Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Yield Fund, and First Eagle Fund of America are offered without a sales charge.

2 The Fund commenced operation April 28, 1970. Performance for periods prior to January 1, 2000 occurred while a prior portfolio manager of the fund was affiliated with another firm. Inception date shown is when this prior portfolio manager assumed portfolio management responsibilities.

3 The MSCI World Index is a widely followed, unmanaged group of stocks from 23 developed international markets. The index provides total returns in U.S. dollars with net dividends reinvested. One cannot invest directly in an index.

4 Effective May 9, 2014, the First Eagle Overseas Fund is closed to certain investors. Please see prospectus for more information.

5 The MSCI EAFE Index is an unmanaged total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of approximately 1,100 companies from 21 developed market countries. One cannot invest directly in an index.

6 The S&P 500 Index is a widely recognized unmanaged index including a representative sample of 500 leading companies in leading sectors of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 80% coverage of U.S. equities, it is also considered a proxy for the total market. The S&P 500 Index includes dividends reinvested. One cannot invest directly in an index.

7 The FTSE Gold Mines Index is designed to reflect the performance of the worldwide market in the shares of companies whose principal activity is the mining of gold. The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable, attributable gold production of at least 300,000 ounces a year and that derive 51% or more of their revenue from mined gold. The Index is unmanaged, and includes dividends reinvested. One cannot invest directly in an index.

8 The composite index consists of 60% of the MSCI World Index and 40% of the Bloomberg Barclays U.S. Aggregate Bond Index.

9 The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. One cannot invest directly in an index.

10 First Eagle High Yield Fund commenced operations in its present form on December 30, 2011, and is successor to another mutual fund pursuant to a reorganization on December 30, 2011. Information prior to December 30, 2011 is for this predecessor fund. Immediately after the reorganization, changes in net asset value of the Class I shares were partially impacted by differences in how the Fund and the predecessor fund price portfolio securities.

11 The Bloomberg Barclays U.S. Corporate High Yield Index is composed of fixed-rate, publicly issued, noninvestment grade debt and is unmanaged, with dividends reinvested. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations. One cannot invest directly in an index.

First Eagle Funds | Semi-Annual Report | April 30, 2018

14

Performance Chart (unaudited)

12 As of September 1, 2005 First Eagle Fund of America Class Y is closed to new accounts.

Expense Ratios As Stated In The Most Recent Prospectus16

Class A | | Class C | | Class I | | Class Y | | Class R413 | | Class R6 | |

| First Eagle Global Fund 1.11% | | | 1.85 | % | | | 0.84 | % | | | — | | | | 1.04 | % | | | 0.78 | % | |

| First Eagle Overseas Fund 1.15 | | | 1.88 | | | | 0.87 | | | | — | | | | 1.05 | | | | 0.79 | | |

| First Eagle U.S. Value Fund14,15 1.14 | | | 1.89 | | | | 0.86 | | | | — | | | | N/A | | | | 0.85 | | |

| First Eagle Gold Fund 1.26 | | | 2.04 | | | | 0.99 | | | | — | | | | N/A | | | | 0.90 | | |

First Eagle Global Income

Builder Fund 1.19 | | | 1.94 | | | | 0.93 | | | | — | | | | N/A | | | | 0.89 | | |

| First Eagle High Yield Fund14,15 1.21 | | | 1.95 | | | | 0.91 | | | | — | | | | N/A | | | | 0.92 | | |

| First Eagle Fund of America 1.31 | | | 2.06 | | | | 1.01 | | | | 1.31 | % | | | N/A | | | | 1.00 | | |

13 Class R4 Shares commenced investment operations on January 17, 2018 for the First Eagle Global and Overseas Funds. The percentages shown above are based on anticipated expenses of Class R4 for the first fiscal year. However, the rate at which expenses are accrued during the fiscal year may not be constant and, at any particular point, may be greater or less than the stated average percentage.

14 For the First Eagle U.S. Value Fund and High Yield Funds, had fees not been waived and/or expenses reimbursed, returns would have been lower.

15 These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to waive its management fee at an annual rate in the amount of 0.05% of the average daily value of the Fund's net assets for the period through February 28, 2019. This waiver has the effect of reducing the management fee for the term of the waiver from 0.75% to 0.70% on First Eagle U.S. Value Fund and from 0.70% to 0.65% on First Eagle High Yield Fund.

16 Certain other share classes were newly organized during the period but did not yet have assets or expenses during the period.

These expense ratios are presented as of March 1, 2018 and may differ from corresponding ratios shown elsewhere in this report because of differing time periods (and/or, if applicable, because these expense ratios do not include expense credits or waivers).

There are risks associated with investing in funds that invest in securities of foreign countries, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. These risks may be more pronounced with respect to investments in emerging markets. Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of risk than funds whose investments are diversified and may not be suitable for all investors.

All securities may be subject to adverse market trends. The value of a Fund's portfolio holdings may fluctuate in response to events specific to the companies or stock or bond markets in which a Fund invests, as well as economic, political, or social events in the United States or abroad. This may cause a Fund's portfolio to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer or the market as a whole. As a result, a portfolio of such securities may underperform the market as a whole.

In addition to investments in larger companies, each Fund may invest in small and medium-size companies, which historically have been more volatile in price than larger company securities, especially over the short term. Positions in smaller companies, especially when the Fund is a large holder of a small company's securities, also may be more difficult or expensive to trade. Among the reasons for the greater price volatility are the less certain growth prospects of smaller companies, the lower degree of liquidity in the markets for such securities and the greater sensitivity of smaller companies to changing

First Eagle Funds | Semi-Annual Report | April 30, 2018

15

Performance Chart (unaudited)

economic conditions. In addition, smaller companies may lack depth of management, they may be unable to generate funds necessary for growth or development, or they may be developing or marketing new products or services for which markets are not yet established and may never become established. The Funds consider small companies to be companies with market capitalizations of less than $1 billion and medium-size companies to have market capitalizations of less than $10 billion.

Holding illiquid securities restricts or otherwise limits the ability for a Fund to freely dispose of its investments for specific periods of time. A Fund might not be able to sell illiquid securities at its desired price or time. Changes in the markets or in regulations governing the trading of illiquid instruments can cause rapid changes in the price or ability to sell an illiquid security. The market for lower-quality debt instruments, including junk bonds and leveraged loans, is generally less liquid than the market for higher-quality debt instruments.

Investment in gold and gold-related investments present certain risks, including political and economic risks affecting the price of gold and other precious metals like changes in U.S. or foreign regulatory policies, tax, currency or mining laws, increased environmental costs, international monetary and political policies, economic conditions within an individual country, trade imbalances, and trade or currency restrictions between countries. The price of gold, in turn, is likely to affect the market prices of securities of companies mining or processing gold, and accordingly, the value of investments in such securities may also be affected. Gold-related investments as a group have not performed as well as the stock market in general during periods when the U.S. dollar is strong, inflation is low and general economic conditions are stable. In addition, returns on gold-related investments have traditionally been more volatile than investments in broader equity or debt markets.

The event-driven investment style of the First Eagle Fund of America carries the additional risk that the event anticipated occurs later than expected, does not occur at all, or does not have the desired effect on the market price of the securities.

First Eagle High Yield and Global Income Builder Funds invest in high yield instruments (commonly known as "junk bonds") which may be subject to greater levels of interest rate, credit (including issuer default) and liquidity risk than investment grade instruments and may experience extreme price fluctuations. The securities of such companies may be considered speculative and the ability of such companies to pay their debts on schedule may be uncertain.

First Eagle High Yield and Global Income Builder Funds invest in bank loans. These investments potentially expose a fund to the credit risk of the underlying borrower, and in certain cases, of the financial institution. The fund's ability to receive payments in connection with the loan depends primarily on the financial condition of the borrower. The market for bank loans may be illiquid and the fund may have difficulty selling them, especially in the case of leveraged loans, which can be difficult to value. In addition, bank loans often have contractual restrictions on resale, which can delay the sale and adversely impact the sale price. At times, a fund may decline to receive non-public information relating to loans, which could disadvantage the fund relative to other investors.

Funds that invest in bonds are subject to credit and interest rate risk. The value of a fund's portfolio may fluctuate in response to the risk that the issuer of a bond or other instrument will not be able to make payments of interest and principal when due. In addition, fluctuations in interest rates can affect the value of debt instruments held by a fund. An increase in interest rates tends to reduce the market value of debt instruments, while a decline in interest rates tends to increase their values. Longer duration instruments tend to be more sensitive to interest rate changes than those with shorter durations.

Income generation and dividends are not guaranteed. If dividend paying stocks in the fund's portfolio stop paying or reduce dividends the fund's ability to generate income will be adversely affected.

An investment made at a perceived "margin of safety" or "discount to intrinsic or fundamental value" can trade at prices substantially lower than when an investment is made, so that any perceived "margin of safety" or "discount to value" is no guarantee against loss.

All investments involve the risk of loss.

First Eagle Funds | Semi-Annual Report | April 30, 2018

16

This page was intentionally left blank.

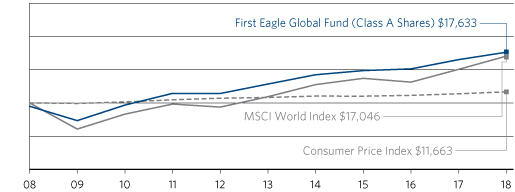

Data as of April 30, 2018 (unaudited)

Investment Objective

The First Eagle Global Fund seeks long-term growth of capital by investing in a range of asset classes from markets in the United States and throughout the world. This truly global fund is managed with a highly disciplined, bottom-up, value-oriented style.

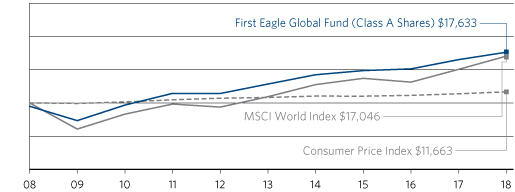

Average Annual Returns (%) | | | | | | One-Year | | Five-Years | | Ten-Years | |

First Eagle Global Fund | | Class A | | without sales load | | | 6.74 | | | | 6.55 | | | | 6.38 | | |

| | | | with sales load | | | 1.39 | | | | 5.46 | | | | 5.84 | | |

MSCI World Index | | | | | | | 13.22 | | | | 9.28 | | | | 5.48 | | |

Consumer Price Index | | | | | | | 2.46 | | | | 1.51 | | | | 1.55 | | |

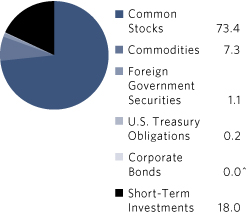

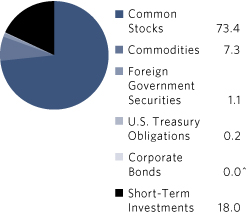

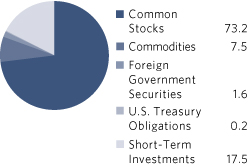

Sectors* (%) | |

Financials | | | 13.5 | | |

Industrials | | | 12.1 | | |

Information Technology | | | 10.0 | | |

Materials | | | 7.6 | | |

Energy | | | 7.4 | | |

Commodities | | | 7.3 | | |

Consumer Discretionary | | | 7.1 | | |

Consumer Staples | | | 5.3 | | |

Health Care | | | 4.2 | | |

Real Estate | | | 3.5 | | |

Telecommunication Services | | | 2.3 | | |

Foreign Government Securities | | | 1.1 | | |

Utilities | | | 0.4 | | |

U.S. Treasury Obligations | | | 0.2 | | |

Short-Term Investments | | | 18.0 | | |

Countries*~ (%)

United States | | | 43.3 | | |

Japan | | | 12.2 | | |

France | | | 5.1 | | |

United Kingdom | | | 4.3 | | |

Canada | | | 4.2 | | |

Hong Kong | | | 2.0 | | |

South Korea | | | 1.7 | | |

Switzerland | | | 1.7 | | |

Germany | | | 1.6 | | |

Mexico | | | 1.3 | | |

Sweden | | | 0.7 | | |

Australia | | | 0.6 | | |

Belgium | | | 0.6 | | |

Thailand | | | 0.6 | | |

Brazil | | | 0.5 | | |

Singapore | | | 0.4 | | |

Ireland | | | 0.3 | | |

Denmark | | | 0.2 | | |

Poland | | | 0.2 | | |

Russia | | | 0.1 | | |

Israel | | | 0.1 | | |

Italy | | | 0.1 | | |

Africa | | | 0.1 | | |

Indonesia | | | 0.1 | | |

Norway | | | 0.0 | ^ | |

Malaysia | | | 0.0 | ^ | |

Venezuela | | | — | | |

Short-Term Investments | | | 18.0 | | |

^ Less than 0.05%

* Asset Allocation, Sector and Countries percentages are based on total investments in the portfolio.

~ Country allocations reflect country of risk (not currency of issue). Bonds of non-U.S. issuers may be U.S. dollar denominated.

The Fund's portfolio composition is subject to change at any time.

First Eagle Funds | Semi-Annual Report | April 30, 2018

18

First Eagle Global Fund | Fund Overview

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

The average annual returns for Class A Shares give effect to the deduction of the maximum sales charge of 5.00%.

The MSCI World Index is a widely followed, unmanaged group of stocks from 23 developed international markets. The index provides total returns in U.S. dollars with net dividends reinvested. One cannot invest directly in an index. The Consumer Price Index (CPI) represents the change in price of all goods and services purchased for consumption by urban households.

Top 10 Holdings* (%)

Gold bullion** (Precious Metal) | | | 7.3 | | |

Oracle Corp. (Software, United States) | | | 2.2 | | |

FANUC Corp. (Machinery, Japan) | | | 1.6 | | |

Exxon Mobil Corp. (Oil, Gas & Consumable Fuels, United States) | | | 1.6 | | |

American Express Co. (Consumer Finance, United States) | | | 1.6 | | |

Weyerhaeuser Co. (Equity Real Estate Investment Trusts (REITs), United States) | | | 1.6 | | |

Schlumberger Ltd. (Energy Equipment & Services, United States) | | | 1.5 | | |

KDDI Corp. (Wireless Telecommunication Services, Japan) | | | 1.5 | | |

Microsoft Corp. (Software, United States) | | | 1.5 | | |

Omnicom Group, Inc. (Media, United States) | | | 1.3 | | |

Total | | | 21.7 | | |

* Holdings in cash, commercial paper and other short-term cash equivalents have been excluded.

**The Fund invests in gold and precious metals through investment in a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the "Subsidiary"). Gold Bullion and commodities include the Fund's investment in the Subsidiary.

Percentages are based on total net assets.

First Eagle Funds | Semi-Annual Report | April 30, 2018

19

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Shares | | Value ($) | |

Common Stocks — 73.3% | |

Africa — 0.1% | |

Randgold Resources Ltd., ADR | | | 413,501 | | | | 33,534,931 | | |

Australia — 0.6% | |

Newcrest Mining Ltd. | | | 22,277,117 | | | | 353,091,424 | | |

Belgium — 0.6% | |

Groupe Bruxelles Lambert SA | | | 2,788,865 | | | | 318,786,707 | | |

Brazil — 0.5% | |

Cielo SA | | | 50,066,318 | | | | 274,398,637 | | |

Canada — 4.1% | |

Agnico Eagle Mines Ltd. | | | 5,969,324 | | | | 251,195,589 | | |

Barrick Gold Corp. | | | 20,378,638 | | | | 274,500,254 | | |

Canadian Natural Resources Ltd. | | | 2,388,401 | | | | 86,164,363 | | |

Cenovus Energy, Inc. | | | 15,294,201 | | | | 153,400,836 | | |

Franco-Nevada Corp. | | | 2,615,497 | | | | 185,516,034 | | |

Goldcorp, Inc. | | | 14,579,998 | | | | 193,768,174 | | |

Imperial Oil Ltd. | | | 9,729,552 | | | | 302,582,664 | | |

Nutrien Ltd. | | | 12,347,604 | | | | 562,186,410 | | |

Suncor Energy, Inc. | | | 1,054,556 | | | | 40,327,660 | | |

Wheaton Precious Metals Corp. | | | 13,305,261 | | | | 276,616,376 | | |

| | | | 2,326,258,360 | | |

Denmark — 0.2% | |

ISS A/S | | | 3,009,360 | | | | 104,948,872 | | |

France — 5.1% | |

Bouygues SA | | | 5,688,713 | | | | 290,153,605 | | |

Carrefour SA | | | 5,993,157 | | | | 122,964,097 | | |

Cie de Saint-Gobain | | | 7,208,725 | | | | 377,168,140 | | |

Danone SA | | | 8,040,001 | | | | 651,286,817 | | |

Legrand SA | | | 1,401,821 | | | | 109,079,848 | | |

LVMH Moet Hennessy Louis Vuitton SE | | | 404,478 | | | | 140,763,257 | | |

Neopost SA | | | 152,262 | | | | 4,108,528 | | |

NSC Groupe (a) | | | 64,717 | | | | 6,408,485 | | |

Rexel SA | | | 11,789,132 | | | | 182,752,389 | | |

Robertet SA | | | 157,260 | | | | 94,573,774 | | |

Robertet SA CI (non-voting)‡ (b) | | | 42,252 | | | | 17,786,797 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

20

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Shares | | Value ($) | |

France — 5.1% (continued) | |

Sabeton SA (a) | | | 385,000 | | | | 11,437,180 | | |

Sanofi | | | 5,286,679 | | | | 417,977,124 | | |

Sodexo SA | | | 3,369,352 | | | | 333,661,664 | | |

Wendel SA | | | 851,019 | | | | 128,531,821 | | |

| | | | 2,888,653,526 | | |

Germany — 1.6% | |

HeidelbergCement AG | | | 5,883,039 | | | | 575,285,747 | | |

Hornbach Baumarkt AG | | | 29,871 | | | | 1,004,611 | | |

Hornbach Holding AG & Co. KGaA (a) | | | 1,181,422 | | | | 94,934,984 | | |

Linde AG* | | | 938,751 | | | | 207,966,636 | | |

| | | | 879,191,978 | | |

Hong Kong — 2.0% | |

CK Asset Holdings Ltd. | | | 10,174,468 | | | | 87,835,842 | | |

Guoco Group Ltd. | | | 12,693,580 | | | | 168,318,042 | | |

Hang Lung Properties Ltd. | | | 125,232,969 | | | | 296,373,120 | | |

Hysan Development Co. Ltd. | | | 23,163,348 | | | | 134,814,696 | | |

Jardine Matheson Holdings Ltd. | | | 6,864,471 | | | | 415,669,330 | | |

Jardine Strategic Holdings Ltd. | | | 520,800 | | | | 19,709,861 | | |

| | | | 1,122,720,891 | | |

Ireland — 0.3% | |

CRH plc | | | 4,704,407 | | | | 166,964,514 | | |

Israel — 0.1% | |

Israel Chemicals Ltd. | | | 12,448,757 | | | | 55,631,733 | | |

Italy — 0.1% | |

Italmobiliare SpA | | | 1,889,410 | | | | 51,223,077 | | |

Japan — 12.3% | |

Astellas Pharma, Inc. | | | 14,011,000 | | | | 204,928,168 | | |

Chofu Seisakusho Co. Ltd. (a) | | | 3,351,250 | | | | 79,597,527 | | |

FANUC Corp. | | | 4,251,100 | | | | 910,630,836 | | |

Hirose Electric Co. Ltd. (a) | | | 2,564,415 | | | | 360,872,936 | | |

Hoya Corp. | | | 8,345,640 | | | | 445,864,549 | | |

KDDI Corp. | | | 31,838,200 | | | | 854,652,067 | | |

Keyence Corp. | | | 1,008,100 | | | | 614,718,831 | | |

Mitsubishi Estate Co. Ltd. | | | 30,826,080 | | | | 563,271,105 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

21

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Shares | | Value ($) | |

Japan — 12.3% (continued) | |

MS&AD Insurance Group Holdings, Inc. | | | 9,086,420 | | | | 306,178,186 | | |

Nissin Foods Holdings Co. Ltd. | | | 2,006,030 | | | | 147,712,402 | | |

NTT DOCOMO, Inc. | | | 16,534,400 | | | | 427,149,857 | | |

Secom Co. Ltd. | | | 9,186,430 | | | | 689,200,782 | | |

Shimano, Inc. | | | 1,892,590 | | | | 251,655,255 | | |

SMC Corp. | | | 698,556 | | | | 265,446,355 | | |

Sompo Holdings, Inc. | | | 17,037,000 | | | | 713,341,181 | | |

T Hasegawa Co. Ltd. (a) | | | 3,061,300 | | | | 65,803,955 | | |

| | | | 6,901,023,992 | | |

Mexico — 0.8% | |

Fresnillo plc | | | 18,230,274 | | | | 319,978,090 | | |

Industrias Penoles SAB de CV | | | 6,401,020 | | | | 134,351,924 | | |

| | | | 454,330,014 | | |

Norway — 0.0% (c) | |

Orkla ASA | | | 2,000,066 | | | | 18,510,990 | | |

Russia — 0.1% | |

Gazprom PJSC, ADR | | | 15,687,012 | | | | 72,387,623 | | |

South Korea — 1.7% | |

Hyundai Mobis Co. Ltd. | | | 795,007 | | | | 184,110,591 | | |

Kia Motors Corp. | | | 8,545,697 | | | | 263,845,747 | | |

KT&G Corp. | | | 4,321,898 | | | | 395,204,450 | | |

Lotte Confectionery Co. Ltd. | | | 153,688 | | | | 27,278,437 | | |

Lotte Corp.* | | | 913,277 | | | | 55,488,257 | | |

Namyang Dairy Products Co. Ltd. (a) | | | 39,989 | | | | 25,385,087 | | |

| | | | 951,312,569 | | |

Sweden — 0.7% | |

Investor AB, Class A | | | 5,939,940 | | | | 254,218,136 | | |

Investor AB, Class B | | | 3,394,798 | | | | 147,789,153 | | |

| | | | 402,007,289 | | |

Switzerland — 1.7% | |

Cie Financiere Richemont SA (Registered) | | | 550,340 | | | | 52,314,629 | | |

Nestle SA (Registered) | | | 6,313,950 | | | | 489,142,293 | | |

Pargesa Holding SA | | | 4,327,670 | | | | 405,025,395 | | |

| | | | 946,482,317 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

22

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Shares | | Value ($) | |

Thailand — 0.6% | |

Bangkok Bank PCL, NVDR | | | 51,812,900 | | | | 315,468,606 | | |

Bangkok Bank PCL | | | 36,500 | | | | 232,465 | | |

| | | | 315,701,071 | | |

United Kingdom — 4.3% | |

Berkeley Group Holdings plc (a) | | | 6,719,082 | | | | 376,161,072 | | |

British American Tobacco plc | | | 6,527,406 | | | | 358,011,966 | | |

BT Group plc | | | 495,434 | | | | 1,700,499 | | |

Diageo plc | | | 8,034,220 | | | | 286,618,317 | | |

GlaxoSmithKline plc | | | 14,471,132 | | | | 290,249,910 | | |

Liberty Global plc, Class C* | | | 5,645,208 | | | | 164,275,553 | | |

Lloyds Banking Group plc | | | 273,586,862 | | | | 242,657,109 | | |

TechnipFMC plc | | | 15,536,847 | | | | 512,094,477 | | |

Unilever NV, CVA | | | 865,611 | | | | 49,624,256 | | |

WPP plc | | | 6,155,655 | | | | 105,631,834 | | |

| | | | 2,387,024,993 | | |

United States — 35.8% | |

3M Co. | | | 2,815,173 | | | | 547,241,480 | | |

Alleghany Corp. | | | 418,350 | | | | 240,413,194 | | |

Alphabet, Inc., Class A* | | | 134,718 | | | | 137,221,060 | | |

Alphabet, Inc., Class C* | | | 163,012 | | | | 165,836,998 | | |

American Express Co. | | | 8,849,838 | | | | 873,921,503 | | |

Analog Devices, Inc. | | | 2,275,357 | | | | 198,752,434 | | |

Anthem, Inc. | | | 1,884,793 | | | | 444,792,300 | | |

Automatic Data Processing, Inc. | | | 1,027,905 | | | | 121,375,022 | | |

Bank of New York Mellon Corp. (The) | | | 13,360,022 | | | | 728,254,799 | | |

BB&T Corp. | | | 10,500,485 | | | | 554,425,608 | | |

Berkshire Hathaway, Inc., Class A* | | | 1,088 | | | | 316,227,200 | | |

Brown & Brown, Inc. | | | 9,778,706 | | | | 266,274,164 | | |

CH Robinson Worldwide, Inc. | | | 4,158,442 | | | | 382,701,417 | | |

Cincinnati Financial Corp. | | | 1,900,903 | | | | 133,709,517 | | |

Cintas Corp. | | | 1,059,896 | | | | 180,500,289 | | |

Colgate-Palmolive Co. | | | 5,506,298 | | | | 359,175,819 | | |

Comcast Corp., Class A | | | 22,106,304 | | | | 693,916,883 | | |

ConocoPhillips | | | 6,618,073 | | | | 433,483,782 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

23

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Shares | | Value ($) | |

United States — 35.8% (continued) | |

Cummins, Inc. | | | 1,378,153 | | | | 220,311,539 | | |

Deere & Co. | | | 3,176,107 | | | | 429,822,560 | | |

Devon Energy Corp. | | | 3,449,156 | | | | 125,307,837 | | |

Exxon Mobil Corp. | | | 11,628,713 | | | | 904,132,436 | | |

Facebook, Inc., Class A* | | | 930,632 | | | | 160,068,704 | | |

Flowserve Corp. (a) | | | 8,414,508 | | | | 373,688,300 | | |

H&R Block, Inc. | | | 3,992,318 | | | | 110,387,593 | | |

HCA Healthcare, Inc. | | | 1,327,633 | | | | 127,107,583 | | |

JG Boswell Co. | | | 2,485 | | | | 1,694,770 | | |

Mastercard, Inc., Class A | | | 1,133,715 | | | | 202,107,373 | | |

Microsoft Corp. | | | 8,977,773 | | | | 839,601,331 | | |

Mills Music Trust (a) | | | 31,592 | | | | 714,295 | | |

National Oilwell Varco, Inc. | | | 17,895,308 | | | | 692,011,560 | | |

Newmont Mining Corp. | | | 4,534,880 | | | | 178,175,435 | | |

NOW, Inc.* (a) | | | 5,851,664 | | | | 70,980,684 | | |

Omnicom Group, Inc. | | | 10,111,773 | | | | 744,833,199 | | |

Oracle Corp. | | | 27,002,083 | | | | 1,233,185,131 | | |

Orbital ATK, Inc. (a) | | | 3,694,106 | | | | 489,025,752 | | |

Praxair, Inc. | | | 1,061,412 | | | | 161,886,558 | | |

Royal Gold, Inc. | | | 1,260,596 | | | | 111,940,925 | | |

San Juan Basin Royalty Trust (a) | | | 3,908,035 | | | | 26,887,281 | | |

Schlumberger Ltd. | | | 12,656,668 | | | | 867,741,158 | | |

Scotts Miracle-Gro Co. (The) | | | 1,614,331 | | | | 134,925,785 | | |

Synchrony Financial | | | 11,102,151 | | | | 368,258,349 | | |

Teradata Corp.* (a) | | | 12,190,179 | | | | 498,822,125 | | |

Texas Instruments, Inc. | | | 2,158,760 | | | | 218,963,027 | | |

Tiffany & Co. | | | 2,478,615 | | | | 254,875,980 | | |

Travelers Cos., Inc. (The) | | | 332,055 | | | | 43,698,438 | | |

UGI Corp. | | | 4,874,044 | | | | 235,854,989 | | |

Union Pacific Corp. | | | 4,056,411 | | | | 542,058,202 | | |

Universal Health Services, Inc., Class B | | | 357,823 | | | | 40,863,387 | | |

US Bancorp | | | 7,819,459 | | | | 394,491,707 | | |

Varex Imaging Corp.* | | | 1,256,253 | | | | 45,212,545 | | |

Varian Medical Systems, Inc.* | | | 3,140,634 | | | | 363,025,884 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

24

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Shares | | Value ($) | |

United States — 35.8% (continued) | |

Visa, Inc., Class A | | | 1,265,285 | | | | 160,539,361 | | |

Vista Outdoor, Inc.* (a) | | | 3,252,457 | | | | 54,478,655 | | |

Weyerhaeuser Co., REIT | | | 23,709,923 | | | | 872,050,968 | | |

Willis Towers Watson plc | | | 2,058,297 | | | | 305,677,687 | | |

WR Berkley Corp. | | | 4,386,051 | | | | 327,023,963 | | |

Xilinx, Inc. | | | 6,088,374 | | | | 391,117,146 | | |

| | | | 20,101,773,671 | | |

Total Common Stocks

(Cost $28,107,859,689) | | | 41,125,959,179 | | |

| | | Ounces | | | |

Commodities — 7.3% | |

Gold bullion*

(Cost $3,289,770,460) | | | 3,110,306 | | | | 4,088,715,166 | | |

| | | Principal Amount ($) | | | |

Foreign Government Securities — 1.1% | |

Indonesia — 0.0% (c) | |

Indonesia Treasury Bond

8.25%, 7/15/2021 | | IDR | 345,617,000,000 | | | | 26,084,302 | | |

Malaysia — 0.0% (c) | |

Malaysia Government Bond

3.66%, 10/15/2020 | | MYR | 54,021,000 | | | | 13,767,555 | | |

Mexico — 0.5% | |

Mexican Bonos

4.75%, 6/14/2018 | | MXN | 2,559,090,000 | | | | 136,212,134 | | |

5.00%, 12/11/2019 | | MXN | 764,192,000 | | | | 39,425,942 | | |

6.50%, 6/10/2021 | | MXN | 1,813,760,000 | | | | 94,628,131 | | |

| | | | 270,266,207 | | |

Poland — 0.2% | |

Poland Government Bond

3.25%, 7/25/2019 | | PLN | 306,347,000 | | | | 89,289,565 | | |

Singapore — 0.4% | |

Singapore Government Bond

3.25%, 9/1/2020 | | SGD | 119,604,000 | | | | 92,826,414 | | |

2.25%, 6/1/2021 | | SGD | 147,741,000 | | | | 111,986,787 | | |

| | | | 204,813,201 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

25

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Venezuela, Bolivarian Republic of — 0.0% | |

Venezuela Government Bond

(Oil-Linked Payment Obligation)

Zero Coupon, 4/15/2020‡ (b)(d)(i) | | | 53,230 | | | | — | | |

Total Foreign Government Securities

(Cost $632,665,031) | | | 604,220,830 | | |

U.S. Treasury Obligations — 0.2% | |

U.S. Treasury Notes

1.13%, 1/15/2019 (e)

(Cost $113,462,290) | | | 114,023,000 | | | | 113,176,735 | | |

Corporate Bonds — 0.0% (c) | |

United States — 0.0% (c) | |

Bausch & Lomb, Inc.

7.13%, 8/1/2028

(Cost $4,918,586) | | | 5,467,000 | | | | 5,425,998 | | |

Short-Term Investments — 18.0% | |

Commercial Paper — 18.0% | |

American Honda Finance Corp.

1.69%, 5/4/2018 (f) | | | 40,458,000 | | | | 40,450,174 | | |

2.01%, 6/6/2018 (f) | | | 48,214,000 | | | | 48,120,890 | | |

2.01%, 6/13/2018 (f) | | | 87,461,000 | | | | 87,258,216 | | |

2.01%, 6/18/2018 (f) | | | 81,683,000 | | | | 81,470,536 | | |

2.06%, 6/19/2018 (f) | | | 63,501,000 | | | | 63,332,282 | | |

2.16%, 7/6/2018 (f) | | | 78,799,000 | | | | 78,510,679 | | |

2.18%, 7/10/2018 (f) | | | 21,395,000 | | | | 21,311,452 | | |

Apple, Inc.

1.61%, 5/2/2018 (f)(g) | | | 63,540,000 | | | | 63,533,900 | | |

1.62%, 5/7/2018 (f)(g) | | | 100,000,000 | | | | 99,966,167 | | |

1.64%, 5/8/2018 (f)(g) | | | 57,265,000 | | | | 57,242,820 | | |

1.62%, 5/10/2018 (f)(g) | | | 76,523,000 | | | | 76,485,865 | | |

1.70%, 5/21/2018 (f)(g) | | | 34,111,000 | | | | 34,075,581 | | |

1.66%, 5/22/2018 (f)(g) | | | 25,435,000 | | | | 25,407,286 | | |

1.75%, 5/23/2018 (f)(g) | | | 61,666,000 | | | | 61,595,597 | | |

1.88%, 6/5/2018 (f)(g) | | | 62,025,000 | | | | 61,911,742 | | |

1.86%, 6/11/2018 (f)(g) | | | 100,000,000 | | | | 99,785,100 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

26

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Commercial Paper — 18.0% (continued) | |

1.90%, 6/12/2018 (f)(g) | | | 37,025,000 | | | | 36,943,406 | | |

1.93%, 6/18/2018 (f)(g) | | | 25,000,000 | | | | 24,936,674 | | |

1.92%, 6/20/2018 (f)(g) | | | 18,183,000 | | | | 18,134,933 | | |

1.96%, 7/13/2018 (f)(g) | | | 78,531,000 | | | | 78,217,675 | | |

AstraZeneca Pharmaceuticals LP

2.33%, 6/14/2018 (f) | | | 37,411,000 | | | | 37,319,109 | | |

AstraZeneca plc

2.03%, 5/1/2018 (f) | | | 3,069,000 | | | | 3,068,852 | | |

2.22%, 5/10/2018 (f) | | | 34,607,000 | | | | 34,589,802 | | |

2.21%, 6/5/2018 (f) | | | 35,114,000 | | | | 35,046,581 | | |

2.21%, 6/6/2018 (f) | | | 66,117,000 | | | | 65,986,190 | | |

2.27%, 6/8/2018 (f) | | | 78,123,000 | | | | 77,959,235 | | |

2.24%, 6/11/2018 (f) | | | 57,835,000 | | | | 57,703,425 | | |

2.37%, 6/19/2018 (f) | | | 35,426,000 | | | | 35,328,086 | | |

2.47%, 7/19/2018 (f) | | | 33,543,000 | | | | 33,381,025 | | |

BASF SE

1.98%, 6/1/2018 (f) | | | 35,842,000 | | | | 35,782,582 | | |

1.99%, 6/12/2018 (f) | | | 43,431,000 | | | | 43,332,695 | | |

1.99%, 6/13/2018 (f) | | | 43,431,000 | | | | 43,330,303 | | |

BP Capital Markets plc | |

2.21%, 7/12/2018 (f) | | | 38,552,000 | | | | 38,377,592 | | |

2.21%, 7/19/2018 (f) | | | 33,032,000 | | | | 32,865,959 | | |

2.21%, 7/23/2018 (f) | | | 33,543,000 | | | | 33,364,629 | | |

Campbell Soup Co.

1.88%, 5/15/2018 (f) | | | 40,000,000 | | | | 39,962,500 | | |

CenterPoint Energy, Inc.

2.10%, 5/1/2018 (f) | | | 1,162,000 | | | | 1,161,930 | | |

Chevron Corp.

1.73%, 5/25/2018 (f) | | | 82,221,000 | | | | 82,118,738 | | |

Coca-Cola Co. (The)

1.62%, 5/1/2018 (f) | | | 61,238,000 | | | | 61,235,071 | | |

1.63%, 5/3/2018 (f) | | | 96,240,000 | | | | 96,226,086 | | |

1.72%, 5/14/2018 (f) | | | 37,202,000 | | | | 37,175,900 | | |

1.76%, 5/17/2018 (f) | | | 25,394,000 | | | | 25,372,211 | | |

1.75%, 5/18/2018 (f) | | | 115,000,000 | | | | 114,895,350 | | |

1.96%, 6/21/2018 (f) | | | 25,200,000 | | | | 25,130,148 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

27

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Commercial Paper — 18.0% (continued) | |

1.95%, 6/22/2018 (f) | | | 117,793,000 | | | | 117,459,865 | | |

2.03%, 6/25/2018 (f) | | | 55,537,000 | | | | 55,370,352 | | |

1.96%, 6/26/2018 (f) | | | 31,634,000 | | | | 31,537,232 | | |

1.95%, 6/27/2018 (f) | | | 42,249,000 | | | | 42,117,289 | | |

2.07%, 7/11/2018 (f) | | | 88,000,000 | | | | 87,650,816 | | |

2.04%, 7/16/2018 (f) | | | 51,910,000 | | | | 51,687,718 | | |

Diageo Capital plc

2.21%, 6/1/2018 (f) | | | 66,117,000 | | | | 65,979,477 | | |

2.21%, 6/5/2018 (f) | | | 27,740,000 | | | | 27,674,534 | | |

2.41%, 6/11/2018 (f) | | | 55,144,000 | | | | 54,990,240 | | |

2.52%, 6/14/2018 (f) | | | 50,541,000 | | | | 50,389,061 | | |

Eli Lilly & Co.

1.80%, 5/11/2018 (f) | | | 43,431,000 | | | | 43,407,577 | | |

1.80%, 5/14/2018 (f) | | | 43,431,000 | | | | 43,400,869 | | |

Engie SA

1.65%, 5/2/2018 (f) | | | 33,092,000 | | | | 33,088,803 | | |

1.66%, 5/9/2018 (f) | | | 39,027,000 | | | | 39,009,614 | | |

1.69%, 5/10/2018 (f) | | | 42,158,000 | | | | 42,137,050 | | |

1.70%, 5/30/2018 (f) | | | 41,111,000 | | | | 41,046,250 | | |

1.87%, 6/15/2018 (f) | | | 30,000,000 | | | | 29,924,483 | | |

2.16%, 7/16/2018 (f) | | | 62,290,000 | | | | 62,000,888 | | |

2.14%, 7/19/2018 (f) | | | 84,267,000 | | | | 83,856,339 | | |

Eni Finance USA, Inc.

2.19%, 5/1/2018 (f) | | | 1,151,000 | | | | 1,150,937 | | |

Erste Abwicklungsanstalt

1.76%, 5/2/2018 (f)(g) | | | 31,455,000 | | | | 31,451,996 | | |

Essilor International SA

1.86%, 5/29/2018 (f) | | | 45,000,000 | | | | 44,931,669 | | |

Export Development Corp.

1.66%, 5/18/2018 (f) | | | 52,101,000 | | | | 52,054,109 | | |

1.99%, 6/28/2018 (f) | | | 35,114,000 | | | | 35,003,681 | | |

Henkel of America, Inc.

1.95%, 5/9/2018 (f) | | | 86,850,000 | | | | 86,811,308 | | |

2.09%, 7/18/2018 (f) | | | 27,386,000 | | | | 27,255,770 | | |

HP, Inc.

2.67%, 6/8/2018 (f) | | | 36,100,000 | | | | 36,026,320 | | |

2.72%, 6/15/2018 (f) | | | 74,543,000 | | | | 74,361,740 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

28

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Commercial Paper — 18.0% (continued) | |

Intel Corp.

1.96%, 6/21/2018 (f) | | | 74,049,000 | | | | 73,845,884 | | |

John Deere Financial Ltd.

1.82%, 5/11/2018 (f) | | | 44,139,000 | | | | 44,114,926 | | |

1.93%, 5/17/2018 (f) | | | 54,712,000 | | | | 54,665,055 | | |

2.08%, 6/12/2018 (f) | | | 35,426,000 | | | | 35,345,814 | | |

Kreditanstalt fuer Wiederaufbau

1.70%, 5/8/2018 (f) | | | 70,045,000 | | | | 70,019,146 | | |

2.02%, 6/7/2018 (f) | | | 59,465,000 | | | | 59,348,878 | | |

2.19%, 7/5/2018 (f) | | | 60,995,000 | | | | 60,773,476 | | |

2.11%, 7/11/2018 (f) | | | 91,993,000 | | | | 91,619,692 | | |

LVMH Moet Hennessy Louis Vuitton, Inc.

1.86%, 5/15/2018 (f) | | | 35,269,000 | | | | 35,241,666 | | |

1.86%, 5/17/2018 (f) | | | 59,054,000 | | | | 59,001,936 | | |

MetLife Short Term Funding LLC

1.64%, 5/1/2018 (f) | | | 82,938,000 | | | | 82,934,176 | | |

1.66%, 5/7/2018 (f) | | | 5,222,000 | | | | 5,220,254 | | |

1.91%, 5/22/2018 (f) | | | 54,883,000 | | | | 54,820,918 | | |

2.05%, 6/1/2018 (f) | | | 68,266,000 | | | | 68,147,976 | | |

2.01%, 6/5/2018 (f) | | | 4,376,000 | | | | 4,367,449 | | |

2.13%, 6/11/2018 (f) | | | 28,268,000 | | | | 28,203,097 | | |

2.12%, 6/12/2018 (f) | | | 75,000,000 | | | | 74,823,520 | | |

2.15%, 6/14/2018 (f) | | | 87,663,000 | | | | 87,446,582 | | |

2.14%, 6/15/2018 (f) | | | 34,459,000 | | | | 34,371,819 | | |

2.17%, 6/18/2018 (f) | | | 86,729,000 | | | | 86,493,494 | | |

2.21%, 6/21/2018 (f) | | | 64,823,000 | | | | 64,634,797 | | |

2.25%, 7/11/2018 (f) | | | 79,024,000 | | | | 78,682,300 | | |

Mitsubishi International Corp.

1.94%, 6/1/2018 (f) | | | 62,460,000 | | | | 62,354,123 | | |

2.07%, 6/14/2018 (f) | | | 64,323,000 | | | | 64,166,213 | | |

2.24%, 6/29/2018 (f) | | | 37,025,000 | | | | 36,901,584 | | |

Mitsui & Co. USA, Inc.

1.83%, 5/1/2018 (f) | | | 1,220,000 | | | | 1,219,933 | | |

Nestle Capital Corp.

1.73%, 5/10/2018 (f) | | | 19,420,000 | | | | 19,410,781 | | |

1.76%, 5/15/2018 (f) | | | 39,013,000 | | | | 38,984,716 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

29

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Commercial Paper — 18.0% (continued) | |

1.78%, 5/16/2018 (f) | | | 44,503,000 | | | | 44,468,545 | | |

1.83%, 6/4/2018 (f) | | | 88,277,000 | | | | 88,124,832 | | |

2.01%, 6/15/2018 (f) | | | 37,411,000 | | | | 37,324,811 | | |

2.00%, 6/18/2018 (f) | | | 7,220,000 | | | | 7,202,203 | | |

Novartis Finance Corp.

1.93%, 5/16/2018 (f) | | | 40,000,000 | | | | 39,968,124 | | |

1.94%, 5/21/2018 (f) | | | 40,000,000 | | | | 39,957,767 | | |

NRW Bank

1.76%, 5/3/2018 (f) | | | 31,455,000 | | | | 31,450,712 | | |

1.81%, 5/10/2018 (f) | | | 31,722,000 | | | | 31,707,073 | | |

2.09%, 7/9/2018 (f) | | | 68,859,000 | | | | 68,573,943 | | |

2.14%, 7/12/2018 (f) | | | 41,527,000 | | | | 41,347,217 | | |

2.14%, 7/13/2018 (f) | | | 39,266,000 | | | | 39,093,515 | | |

2.14%, 7/18/2018 (f) | | | 63,201,000 | | | | 62,903,091 | | |

2.14%, 7/19/2018 (f) | | | 44,555,000 | | | | 44,342,126 | | |

2.14%, 7/20/2018 (f) | | | 67,086,000 | | | | 66,761,170 | | |

2.14%, 7/23/2018 (f) | | | 77,549,000 | | | | 77,158,515 | | |

2.14%, 7/24/2018 (f) | | | 77,549,000 | | | | 77,153,500 | | |

Ontario Teachers' Finance Trust

1.87%, 7/25/2018 (f)(g) | | | 72,918,000 | | | | 72,527,285 | | |

1.85%, 7/27/2018 (f)(g) | | | 69,662,000 | | | | 69,277,667 | | |

Pfizer, Inc.

1.86%, 6/4/2018 (f) | | | 31,634,000 | | | | 31,577,010 | | |

1.89%, 6/12/2018 (f) | | | 91,890,000 | | | | 91,684,205 | | |

1.91%, 6/13/2018 (f) | | | 91,890,000 | | | | 91,679,194 | | |

1.91%, 6/14/2018 (f) | | | 21,660,000 | | | | 21,609,099 | | |

2.01%, 7/2/2018 (f) | | | 20,658,000 | | | | 20,588,192 | | |

2.02%, 7/12/2018 (f) | | | 54,478,000 | | | | 54,260,596 | | |

2.02%, 7/13/2018 (f) | | | 61,815,000 | | | | 61,564,557 | | |

Philip Morris International, Inc.

1.83%, 5/11/2018 (f) | | | 43,339,000 | | | | 43,315,561 | | |

Procter & Gamble Co. (The)

1.64%, 5/3/2018 (f) | | | 89,372,000 | | | | 89,359,227 | | |

1.67%, 5/4/2018 (f) | | | 55,803,000 | | | | 55,792,329 | | |

1.67%, 5/7/2018 (f) | | | 30,321,000 | | | | 30,310,742 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

30

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Commercial Paper — 18.0% (continued) | |

Province of Quebec Canada

1.96%, 7/3/2018 (f) | | | 60,995,000 | | | | 60,785,177 | | |

1.95%, 7/5/2018 (f) | | | 64,694,000 | | | | 64,463,668 | | |

1.96%, 7/6/2018 (f) | | | 20,747,000 | | | | 20,671,860 | | |

1.96%, 7/10/2018 (f) | | | 52,884,000 | | | | 52,679,574 | | |

1.99%, 7/16/2018 (f) | | | 65,405,000 | | | | 65,127,730 | | |

1.97%, 7/17/2018 (f) | | | 107,281,000 | | | | 106,819,370 | | |

2.00%, 7/19/2018 (f) | | | 25,591,000 | | | | 25,477,660 | | |

2.00%, 7/20/2018 (f) | | | 77,549,000 | | | | 77,200,553 | | |

1.99%, 7/23/2018 (f) | | | 31,485,000 | | | | 31,337,482 | | |

2.00%, 7/24/2018 (f) | | | 23,379,000 | | | | 23,267,937 | | |

PSP Capital, Inc.

1.64%, 5/2/2018 (f)(g) | | | 25,949,000 | | | | 25,946,522 | | |

1.75%, 5/11/2018 (f)(g) | | | 31,718,000 | | | | 31,700,797 | | |

1.75%, 5/14/2018 (f)(g) | | | 31,718,000 | | | | 31,695,871 | | |

1.70%, 5/22/2018 (f)(g) | | | 27,395,000 | | | | 27,364,313 | | |

2.06%, 6/19/2018 (f)(g) | | | 67,383,000 | | | | 67,198,633 | | |

2.00%, 6/20/2018 (f)(g) | | | 112,050,000 | | | | 111,736,493 | | |

2.06%, 7/9/2018 (f)(g) | | | 68,859,000 | | | | 68,579,566 | | |

2.11%, 7/16/2018 (f)(g) | | | 30,627,000 | | | | 30,487,272 | | |

QUALCOMM, Inc.

1.65%, 5/8/2018 (f) | | | 83,790,000 | | | | 83,756,931 | | |

1.73%, 5/15/2018 (f) | | | 56,719,000 | | | | 56,675,988 | | |

1.96%, 5/16/2018 (f) | | | 135,131,000 | | | | 135,021,394 | | |

2.16%, 6/5/2018 (f) | | | 75,000,000 | | | | 74,856,000 | | |

2.26%, 6/6/2018 (f) | | | 40,325,000 | | | | 40,245,218 | | |

2.23%, 6/8/2018 (f) | | | 54,712,000 | | | | 54,597,310 | | |

Roche Holdings, Inc.

1.83%, 5/14/2018 (f) | | | 47,279,000 | | | | 47,246,199 | | |

Sanofi

1.80%, 5/3/2018 (f) | | | 49,360,000 | | | | 49,352,945 | | |

1.76%, 5/4/2018 (f) | | | 107,648,000 | | | | 107,627,416 | | |

1.78%, 5/7/2018 (f) | | | 133,688,000 | | | | 133,642,769 | | |

1.74%, 5/11/2018 (f) | | | 44,783,000 | | | | 44,758,848 | | |

1.87%, 6/8/2018 (f) | | | 74,404,000 | | | | 74,251,336 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

31

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Commercial Paper — 18.0% (continued) | |

Schlumberger Holdings Corp.

1.91%, 5/1/2018 (f) | | | 27,681,000 | | | | 27,679,476 | | |

2.11%, 5/14/2018 (f) | | | 44,139,000 | | | | 44,103,571 | | |

2.31%, 6/4/2018 (f) | | | 52,671,000 | | | | 52,560,135 | | |

Suncor Energy, Inc.

2.04%, 5/14/2018 (f) | | | 25,282,000 | | | | 25,259,937 | | |

Total Capital Canada Ltd.

1.74%, 5/9/2018 (f) | | | 111,958,000 | | | | 111,908,263 | | |

1.99%, 6/7/2018 (f) | | | 142,557,000 | | | | 142,258,905 | | |

2.11%, 7/6/2018 (f) | | | 119,702,000 | | | | 119,246,195 | | |

2.13%, 7/10/2018 (f) | | | 52,735,000 | | | | 52,521,165 | | |

2.13%, 7/18/2018 (f) | | | 136,238,000 | | | | 135,617,943 | | |

Unilever Capital Corp.

1.84%, 5/24/2018 (f) | | | 88,277,000 | | | | 88,168,713 | | |

2.00%, 6/4/2018 (f) | | | 54,660,000 | | | | 54,560,466 | | |

1.98%, 6/5/2018 (f) | | | 28,930,000 | | | | 28,875,727 | | |

2.06%, 7/17/2018 (f) | | | 44,645,000 | | | | 44,450,958 | | |

2.06%, 7/20/2018 (f) | | | 39,512,000 | | | | 39,332,685 | | |

UnitedHealth Group, Inc.

1.86%, 5/2/2018 (f) | | | 61,666,000 | | | | 61,659,186 | | |

1.93%, 5/18/2018 (f) | | | 76,353,000 | | | | 76,273,440 | | |

2.06%, 6/6/2018 (f) | | | 79,286,000 | | | | 79,108,762 | | |

2.16%, 6/13/2018 (f) | | | 65,747,000 | | | | 65,569,410 | | |

2.20%, 6/15/2018 (f) | | | 107,627,000 | | | | 107,321,698 | | |

VW Credit, Inc.

2.02%, 5/1/2018 (f) | | | 67,062,000 | | | | 67,057,972 | | |

Walmart, Inc.

1.92%, 5/21/2018 (f) | | | 28,485,000 | | | | 28,454,260 | | |

Walt Disney Co. (The)

1.66%, 5/15/2018 (f) | | | 43,539,000 | | | | 43,506,164 | | |

1.76%, 5/31/2018 (f) | | | 40,300,000 | | | | 40,235,349 | | |

2.06%, 7/20/2018 (f) | | | 11,974,000 | | | | 11,919,659 | | |

2.19%, 7/30/2018 (f) | | | 39,788,000 | | | | 39,581,218 | | |

2.19%, 7/31/2018 (f) | | | 39,788,000 | | | | 39,578,233 | | |

Total Commercial Paper

(Cost $10,100,936,507) | | | 10,100,806,296 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

32

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Investments | | Principal Amount ($) | | Value ($) | |

Investment Companies — 0.0% (c) | |

JP Morgan U.S. Government Money Market Fund,

Agency Shares 1.52% (h)

(Cost $238,452) | | | 238,452 | | | | 238,452 | | |

Total Short-Term Investments

(Cost $10,101,174,959) | | | 10,101,044,748 | | |

Total Investments — 99.9%

(Cost $42,249,851,015) | | | 56,038,542,656 | | |

Other Assets Less Liabilities — 0.1% | | | 79,194,743 | | |

Net Assets — 100.0% | | | 56,117,737,399 | | |

* Non-income producing security.

‡ Value determined using significant unobservable inputs.

(a) Affiliated company as defined under the Investment Company Act of 1940.

(b) Security fair valued as of April 30, 2018 in accordance with procedures approved by the Board of Trustees. Total value of all such securities at April 30, 2018 amounted to $17,786,797, which represents approximately 0.03% of net assets of the Fund.

(c) Represents less than 0.05% of net assets.

(d) Variable or floating rate security, linked to the referenced benchmark. The interest rate shown is the rate in effect as of April 30, 2018.

(e) All or a portion of this security is pledged with the custodian for current or potential holdings of forward foreign currency exchange contracts.

(f) The rate shown was the current yield as of April 30, 2018.

(g) Securities exempt from registration under Rule 144A or section 4(2), of the Securities Act of 1933. Under procedures approved by the Board of Trustees, such securities have been determined to be liquid by the investment adviser and may be resold, normally to qualified institutional buyers in transactions exempt from registration.

(h) Represents 7-day effective yield as of April 30, 2018.

(i) Defaulted security.

As of April 30, 2018, the gross unrealized appreciation (depreciation) of investments based on the aggregate cost of investment securities and derivative instruments, if applicable, for federal income tax purposes was as follows:

Aggregate gross unrealized appreciation | | $ | 15,282,065,465 | | |

Aggregate gross unrealized depreciation | | | (1,453,603,761 | ) | |

Net unrealized appreciation | | $ | 13,828,461,704 | | |

Federal income tax cost | | $ | 42,249,851,015 | | |

Forward Foreign Currency Exchange Contracts outstanding as of April 30, 2018:

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation

(Depreciation) | |

USD | 33,820,757 | | | GBP | 24,132,000 | | | Bank of New York Mellon | | 5/16/2018 | | $ | 576,493 | | |

USD | 194,005,565 | | | JPY | 21,056,491,000 | | | Bank of New York Mellon | | 5/16/2018 | | | 1,211,070 | | |

First Eagle Funds | Semi-Annual Report | April 30, 2018

33

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2018 (unaudited)

Forward Foreign Currency Exchange Contracts outstanding as of April 30, 2018 (continued)

Currency

Purchased | | Currency Sold | | Counterparty | | Settlement

Date | | Unrealized

Appreciation

(Depreciation) | |

USD | 443,519,763 | | | EUR | 365,592,000 | | | Goldman Sachs | | 6/13/2018 | | $ | 587,141 | | |

USD | 31,803,918 | | | GBP | 22,532,000 | | | Goldman Sachs | | 6/13/2018 | | | 719,628 | | |

USD | 194,230,154 | | | JPY | 21,056,491,000 | | | Goldman Sachs | | 6/13/2018 | | | 1,048,830 | | |

USD | 180,052,128 | | | EUR | 144,924,000 | | | JPMorgan Chase Bank | | 7/18/2018 | | | 3,971,475 | | |

USD | 62,165,690 | | | GBP | 44,576,000 | | | JPMorgan Chase Bank | | 7/18/2018 | | | 561,926 | | |

USD | 422,808,611 | | | JPY | 45,088,604,000 | | | JPMorgan Chase Bank | | 7/18/2018 | | | 8,101,531 | | |

USD | 38,937,415 | | | EUR | 30,974,000 | | | UBS AG | | 8/15/2018 | | | 1,217,098 | | |