UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-7762

First Eagle Funds

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas

New York, NY 10105

(Address of principal executive offices) (Zip code)

Sheelyn Michael

First Eagle Funds

1345 Avenue of the Americas

New York, NY 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-632-2700

Date of fiscal year end: October 31

Date of reporting period: April 30, 2022

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Stockholders. |

Semiannual Report

April 30, 2022

First Eagle Global Fund

First Eagle Overseas Fund

First Eagle U.S. Value Fund

First Eagle Gold Fund

First Eagle Global Income Builder Fund

First Eagle High Income Fund

First Eagle Fund of America

First Eagle Small Cap Opportunity Fund

First Eagle Global Real Assets Fund

Advised by First Eagle Investment Management, LLC

Forward-Looking Statement Disclosure

One of our most important responsibilities as mutual fund managers is to communicate with shareholders in an open and direct manner. Some of our comments in our letters to shareholders are based on current management expectations and are considered "forward-looking statements". Actual future results, however, may prove to be different from our expectations. You can identify forward-looking statements by words such as "may", "will", "believe", "attempt", "seek", "think", "ought", "try" and other similar terms. We cannot promise future returns. Our opinions are a reflection of our best judgment at the time this report is compiled, and we disclaim any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

First Eagle Funds | Semiannual Report | April 30, 2022

2

Table of Contents

Letter from the President | | | 6 | | |

Management's Discussion of Fund Performance | | | 9 | | |

Performance Chart | | | 16 | | |

First Eagle Global Fund | |

Fund Overview | | | 26 | | |

Consolidated Schedule of Investments | | | 28 | | |

First Eagle Overseas Fund | |

Fund Overview | | | 42 | | |

Consolidated Schedule of Investments | | | 44 | | |

First Eagle U.S. Value Fund | |

Fund Overview | | | 56 | | |

Consolidated Schedule of Investments | | | 58 | | |

First Eagle Gold Fund | |

Fund Overview | | | 64 | | |

Consolidated Schedule of Investments | | | 66 | | |

First Eagle Global Income Builder Fund | |

Fund Overview | | | 70 | | |

Schedule of Investments | | | 72 | | |

First Eagle High Income Fund | |

Fund Overview | | | 86 | | |

Schedule of Investments | | | 88 | | |

First Eagle Fund of America | |

Fund Overview | | | 98 | | |

Schedule of Investments | | | 100 | | |

First Eagle Small Cap Opportunity Fund | |

Fund Overview | | | 104 | | |

Schedule of Investments | | | 106 | | |

First Eagle Global Real Assets Fund | |

Fund Overview | | | 118 | | |

Consolidated Schedule of Investments | | | 120 | | |

First Eagle Funds | Semiannual Report | April 30, 2022

3

Statements of Assets and Liabilities | | | 124 | | |

Statements of Operations | | | 134 | | |

Statements of Changes in Net Assets | | | 144 | | |

Financial Highlights | | | 158 | | |

Notes to Financial Statements | | | 186 | | |

Fund Expenses | | | 219 | | |

General Information | | | 225 | | |

Board Considerations for Approval of Advisory Agreement | | | 226 | | |

First Eagle Funds | Semiannual Report | April 30, 2022

4

This page was intentionally left blank.

Letter from the President (unaudited)

Dear Fellow Shareholders,

Since my last letter to you, war has been added to the litany of geopolitical and macroeconomic challenges already facing world economies and markets, including inflation, shifting monetary policy, recession fears and the ongoing supply and demand impacts of Covid-19. Though Russia's invasion of Ukraine in late February was widely anticipated, the sharp repricing of equities and other risk assets that followed suggested the market may have been caught off guard by its scale and investors have been left with few places to hide thus far in 2022.

I've written previously of our concerns about the markets' apparent complacence in the face of mounting risks, not the least of which was the impact of Covid-19 on economic and market dynamics. The massive fiscal and policy response to the initial outbreak of the virus in early 2020 produced distortions in the fortunes of companies and industries, as businesses representative of the "new economy" capitalized on the forced virtualization of global activity while more traditional organizations struggled under the weight of pandemic-related restrictions. As a result, we saw a sharp but bifurcated comeback in risk assets, as the predominantly growth-oriented stocks representative of the new economy were priced as if their Covid tailwinds would persist indefinitely, while old-line names typical of value stocks traded at levels suggesting their business models were becoming obsolete.

It has been our view that neither of these scenarios was likely to be true and that the normalization of economic activity would bring asset valuations closer to long-term equilibrium. This journey toward equilibrium began to emerge in late 2021 and picked up steam in the period; though both are down through the end of May, the MSCI World Value Index has outperformed the MSCI World Growth Index by more than 1,000 basis points during this period.1 Tightening financial conditions appear to be among the primary drivers of this move. With inflation at 40-year highs and showing no sign of abating, the Federal Reserve embarked upon a new tightening cycle in March; the central bank has raised its federal funds rate by 75 basis points through its May meeting and has foreshadowed an aggressive bias going forward. High-valuation stocks—including the growth-oriented, tech-related names that had been market darlings since the Covid swoon and for much of the post-global financial crisis era in general—suffered the most, as their future cash flows appeared less attractive to investors when discounted against higher

1 Source: FactSet; data as of May 31, 2022.

First Eagle Funds | Semiannual Report | April 30, 2022

6

Letter from the President (unaudited)

prevailing interest rates. Higher interest rates also weighed on fixed income assets, particularly those with longer durations; notably, investment grade bonds fell more than they have in four decades.2

We are living in uncertain macroeconomic times. Some observers think recession is inevitable, especially in Europe, which still relies on Russian oil and natural gas for a major share of its energy needs. Sanctions have already been imposed on Russian exports, and additional sanctions are under discussion, further pressuring consumers and businesses straining under the weight of inflation. In the United States, where the Federal Reserve is unwinding years of highly accommodative policy, many doubt it can engineer a soft landing, given its spotty track record. On the other hand, employment remains strong in the United States, and consumers still have savings that they are willing to spend—factors that might help prevent or moderate a recession. China's zero-Covid approach has led to draconian lockdowns in a number of areas vital to global supply chains and slowed its economy, but policymakers in China have been rolling out targeted stimulus measures.

Volatility in both the equity and fixed income markets, which had been creeping higher since the fall, spiked in response to Russia's invasion of Ukraine and has trended higher since. Volatility can rattle investors and trigger fearful reactions but selling into a falling market has the potential to inflict serious damage on long-term investment returns by permanently impairing investor capital.

At First Eagle, we seek to counter this inclination through a focus on generating absolute returns across market cycles. We take a selective, valuation-sensitive approach to portfolio construction, in many cases complemented by cash and cash equivalents as a form of deferred purchasing power and gold and gold-related securities as an important source of ballast. Though targeting different asset classes, the strategies across our platform are united by a shared dedication to First Eagle's long-held investment principles, including a commitment to in-depth fundamental analysis, a flexible, benchmark-agnostic approach, a focus on absolute returns, and an ongoing effort to avoid the permanent impairment of capital. The end result is a lineup of strategies we believe have the potential to mitigate the impact of tumultuous markets.

Global Value Team

After finishing 2021 on a high note, global equities staggered out of the gates in 2022 in the face of the myriad risks discussed above. Some Global Value team funds that delivered negative absolute returns in the six-month period covered in this report substantially outpaced their benchmarks and index-based peers thanks to strong stock selection. The energy sector in particular, buoyed by rising oil

2 Source: Callan; data as of April 15, 2022.

First Eagle Funds | Semiannual Report | April 30, 2022

7

Letter from the President (unaudited)

prices, contributed strongly to fund performance. Gold and gold-related equities, which many of our funds hold as a potential hedge against left-tail risk and market turbulence, played their part effectively.

High Income Team

Though high yield bonds had been resilient in the face of the pressures dragging down investment grade bonds, performance began to unravel in 2022. With borrowers given pause by higher rates and investors seeking to preserve liquidity, high yield new issuance has been off sharply this year, while secondary-market spreads have widened considerably. In this uncertain investment environment, we continued to focus on minimizing downside risk, looking to allocate capital countercyclically as opportunities emerged. The team sought to maintain good credit quality and to attach relatively high in companies' capital structures, with a focus on businesses with the pricing power to pass along rising input costs to their customers.

Small Cap Team

Although smaller companies are often seen as especially vulnerable to volatility, the Small Cap team seeks to leverage such conditions to uncover stocks whose market price has become disconnected from its normalized value, especially once-larger companies whose shrinking market capitalizations have pushed them into the team's investment universe. Even well-managed companies can lose ground in a falling market, but company-specific growth drivers or catalysts, such as a new management team or product innovation, can pave a more economically resilient path to operational success regardless of macroeconomic conditions.

As always, I want to thank you for entrusting your assets to our stewardship.

Mehdi Mahmud

President

June 2022

First Eagle Funds | Semiannual Report | April 30, 2022

8

Management's Discussion of Fund

Performance (unaudited)

First Eagle Global Fund

The net asset value ("NAV") of the fund's Class A shares* decreased 4.60% for the six months ended April 30, 2022, while the net return of the MSCI World Index decreased 11.30%. The fund's short-term investments, including cash and cash equivalents, were 8.5% as of April 30, 2022.

The five largest contributors to the performance of First Eagle Global Fund over the period were Exxon Mobil Corp. (oil, gas & consumable fuels, United States), gold bullion, Imperial Oil Limited (oil, gas & consumable fuels, Canada), Newmont Corporation (metals & mining, United States) and British American Tobacco plc (tobacco, United Kingdom). Collectively, they accounted for 2.28% of this period's performance.

The five largest detractors during the first quarter were Oracle Corporation (software, United States), Meta Platforms Inc. Class A (interactive media & services, United States), Comcast Corporation Class A (media, United States), Bank of New York Mellon Corp (capital markets, United States) and Salesforce, Inc. (software, United States). Their combined negative performance over the period subtracted 2.53% from fund performance.

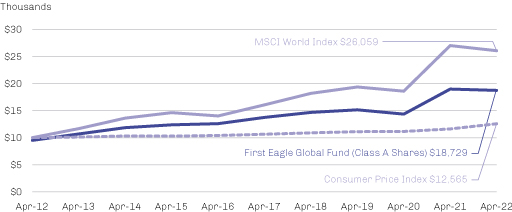

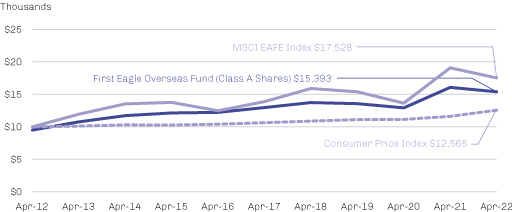

First Eagle Overseas Fund

The NAV of the fund's Class A shares* decreased 5.26% for the six months ended April 30, 2022 while the MSCI EAFE Index decreased 11.80%. The fund's short-term investments, including cash and cash equivalents, were 4.3% as of April 30, 2022.

The five largest contributors to the performance of First Eagle Overseas Fund over the period were Imperial Oil Limited (oil, gas & consumable fuels, Canada), gold bullion, Nutrien Ltd. (chemicals, Canada), Newmont Corporation (metals & mining, United States) and British American Tobacco plc (tobacco, United Kingdom). Collectively, they accounted for 2.97% of this period's performance.

The five largest detractors were Shimano Inc. (leisure products, Japan), Groupe Bruxelles Lambert SA (diversified financial services, Belgium), Prosus N.V. Class N (internet & direct marketing retail, China), Fanuc Corporation (machinery, Japan) and Taiwan Semiconductor Manufacturing Co. Ltd. Sponsored ADR (semiconductors & semiconductor equipment, Taiwan). Their combined negative performance over the period subtracted 2.08% from fund performance.

First Eagle U.S. Value Fund

The NAV of the fund's Class A shares* decreased 3.64% for the six months ended April 30, 2022, while the S&P 500 Index decreased 9.65%. The fund's short-term investments, including cash and cash equivalents, were 8.6% as of April 30, 2022.

* Reflects performance for Class A shares without the effect of sales charges and assumes all distributions have been reinvested; if sales charges were included, values would be lower.

First Eagle Funds | Semiannual Report | April 30, 2022

9

Management's Discussion of Fund Performance (unaudited)

The five largest contributors to the performance of First Eagle U.S. Value Fund over the period were Exxon Mobil Corp. (oil, gas & consumable fuels, United States), gold bullion, Newmont Corporation (metals & mining, United States), Nutrien Ltd. (chemicals, Canada) and Anthem, Inc. (health care providers & services, United States). Collectively, they accounted for 2.74% of this period's performance.

The five largest detractors during the first quarter were Meta Platforms Inc. Class A (interactive media & services, United States), Oracle Corporation (software, United States), Comcast Corporation Class A (media, United States), Bank of New York Mellon Corp. (capital markets, United States) and Salesforce, Inc. (software, United States). Their combined negative performance over the period subtracted 4.43% from fund performance.

First Eagle Gold Fund

The NAV of the fund's Class A shares* increased 6.69% for the six months ended April 30, 2022, while the FTSE Gold Mines Index increased 13.02%. The fund's short-term investments, including cash and cash equivalents, were 7.8% as of April 30, 2022.

The five largest contributors to the performance of First Eagle Gold Fund over the period were Newmont Corp. (metals & mining, United States), Barrick Gold Corporation (metals & mining, Canada), Royal Gold Inc. (metals & mining, United States), Agnico Eagle Mines Limited (metals & mining, Canada) and gold bullion. Collectively, they accounted for 8.51% of this period's performance.

The five largest detractors were MAG Sliver Corp. (metals & mining, Canada), Novagold Resources Inc. (metals & mining, Canada), Fresnillo plc (metals & mining, Mexico), Dundee Precious Metals (metals & mining, Canada) and Kirkland Lake Gold Ltd. (metals & mining, Canada). Their combined negative performance over the period subtracted 2.55% from fund performance.

First Eagle Global Income Builder Fund

The NAV of the fund's Class A shares* decreased 2.30% for the six months ended April 30, 2022, while the MSCI World Index decreased 11.30% and the Bloomberg U.S. Aggregate Bond Index was down 9.47%. The composite index3 decreased 10.47% over the same time period. The fund's short-term investments, including cash and cash equivalents, were 1.9% as of April 30, 2022.

The five largest contributors to the performance of First Eagle Global Income Builder Fund over the period were Exxon Mobil Corporation (oil, gas & consumable fuels, United States), British American Tobacco plc (tobacco, United Kingdom), gold bullion, Imperial Oil Limited (oil, gas & consumable fuels, Canada) and Enterprise Products Partners LP (oil, gas & consumable fuels, United States). Collectively, they accounted for 4.34% of this period's performance.

The five largest detractors were Groupe Bruxelles Lambert SA (diversified financial services, Belgium), Bank of New York Mellon Corp. (capital markets, United States),

3 The composite index consists of 60% of the MSCI World Index and 40% of the Bloomberg US Aggregate Bond Index.

First Eagle Funds | Semiannual Report | April 30, 2022

10

Management's Discussion of Fund Performance (unaudited)

Unilever plc (personal products, United Kingdom), Fuchs Petrolub SE Preferred (chemicals, Germany) and Wells Fargo & Company 7.5% Non-Cumulative Perpetual Convertible Preferred Registered Shares A Series L (diversified banks, United States). Their combined negative performance over the period subtracted 1.57% from fund performance.

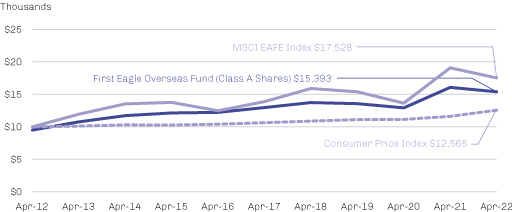

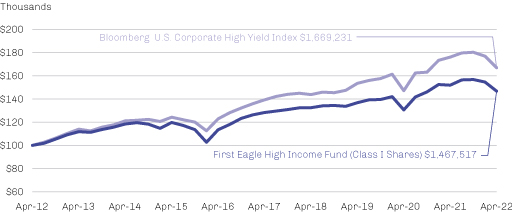

First Eagle High Income Fund

The NAV of the fund's Class I shares decreased 6.38% for the six months ended April 30, 2022 while the Bloomberg US Corporate High Yield Index decreased 7.41%. The fund's short-term investments, including cash and cash equivalents, were 3.0% as of April 30, 2022.

The five largest contributors to the performance of First Eagle High Income Fund over the period were EnQuest plc 7.00%, 10/15/2023 (oil, gas & consumable fuels, United Kingdom); Intertape Polymer Group Inc. 4.375%, 4/15/2029 (containers & packaging, Canada); Pearl Merger Sub, Inc. 6.75%, 10/1/28 (paper & forest products, United States); G-III Apparel Group, Ltd. 7.875%, 8/15/2025 (textiles, apparel & luxury goods, United States); and Avation Capital SA 8.25%, 10/31/2026 (consumer finance, Singapore). Collectively, they accounted for 0.20% points of this period's performance.

The five largest detractors were Glatfelter Corporation 4.75%, 11/15/2029 (paper & forest products, United States); Valvoline, Inc. 3.625%, 6/15/2031 (chemicals, United States); Mexico Remittances Funding Fiduciary Estate Sarl 4.875%, 1/15/2028 (diversified financial services, Mexico); Lumen Technologies, Inc. 4.5%, 1/15/2029 (diversified telecommunication services, United States); and Triton Water Holdings, Inc. 6.25%, 4/1/2029 (beverages, United States). Their combined negative performance over the period subtracted 0.79% from fund performance.

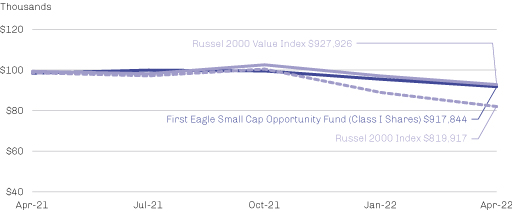

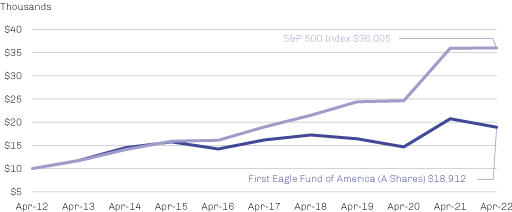

First Eagle Fund of America

The NAV of the fund's Class A shares decreased 15.06% for the six months ended April 30, 2022, while the S&P 500 Index decreased 9.65%. The fund's short-term investments, including cash and cash equivalents, were 1.3% as of April 30, 2022.

The five largest contributors to the performance of First Eagle Fund of America over the period were UnitedHealth Group (health care providers & services, United States), C.H Robinson Worldwide, Inc. (air freight & logistics, United States), PepsiCo, Inc. (beverages, United States), Becton, Dickinson and Company (health care equipment & supplies, United States) and Visa Inc. Class A (IT services, United States). Collectively, they accounted for 1.34% of this period's performance.

The five largest detractors were Meta Platforms Inc. Class A (interactive media & services, United States), Oracle Corporation (software, United States), Alphabet Inc. Class A (interactive media & services, United States), Comcast Corporation Class A (media, United States) and Taiwan Semiconductor Manufacturing Co. Ltd. Sponsored ADR (semiconductors & semiconductor equipment, Taiwan). Their combined negative performance over the period subtracted 8.59% from fund performance.

First Eagle Funds | Semiannual Report | April 30, 2022

11

Management's Discussion of Fund Performance (unaudited)

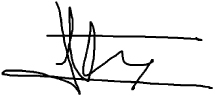

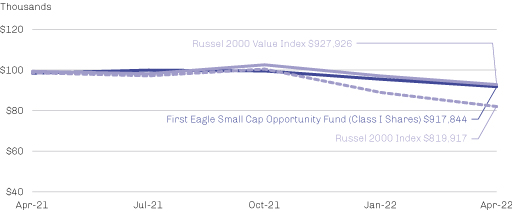

First Eagle Small Cap Opportunity Fund

The NAV of the fund's Class I shares decreased 7.78% for the six months ended April 30, 2022, while the Russell 2000 Value Index decreased 9.50%. The fund's short-term investments, including cash and cash equivalents, were 10.0% as of April 30, 2022.

The five largest contributors to the performance of First Eagle Small Cap Opportunity Fund over the period were PBF Energy, Inc. Class A (oil, gas & consumable fuels, United States), RPC Inc. (energy equipment & services, United States), Helmerich & Payne, Inc. (energy equipment & services, United States), U.S. Silica Holdings (energy equipment & services, United States) and Allegheny Technologies Incorporated (metals & mining, United States). Collectively, they accounted for 1.96% of this period's performance.

The five largest detractors were Sientra, Inc. (health care equipment & supplies, United States), Kirkland's Inc. (specialty retail, United States), DMC Global Inc. (energy equipment & services, United States), Community Health Systems, Inc. (health care providers & services, United States) and CarParts.com Inc (interactive media & services, United States). Their combined negative performance over the period subtracted 1.71% from fund performance.

First Eagle Global Real Assets Fund

The NAV of the fund's Class I shares increased 3.90% from its November 30, 2021, inception through April 30, 2022, while the MSCI World Index decreased 1.10%. The fund's short-term investments, including cash and cash equivalents, were 2.0% as of April 30, 2022.

The five largest contributors to the performance of First Eagle Global Real Assets Fund over the period were NOV Inc. (energy equipment & services, United States), Chevron Corporation (oil, gas & consumable fuels, United States), Exxon Mobil Corporation (oil, gas & consumable fuels, United States), Imperial Oil Limited (oil, gas & consumable fuels, Canada) and gold bullion. Collectively, they accounted for 4.03% of this period's performance.

The five largest detractors were Alrosa PJSC (metals & mining, Russia), Home Depot, Inc. (specialty retail, United States), Charter Communications, Inc. Class A (media, United States), Fuchs Petrolub SE Preferred (chemicals, Germany) and UGI Corporation (gas utilities, United States). Their combined negative performance over the period subtracted 2.69% from fund performance.

First Eagle Funds | Semiannual Report | April 30, 2022

12

Management's Discussion of Fund Performance (unaudited)

| |

| |

Matthew McLennan

Co-Head of the Global Value Team

Portfolio Manager

Global, Overseas,

U.S. Value and Gold Funds

| | T. Kimball Brooker, Jr.

Co-Head of the Global Value Team

Portfolio Manager

Global, Overseas,

U.S. Value and

Global Income Builder Funds | |

| |

| |

Matt Lamphier

Portfolio Manager

U.S. Value Fund

| | Edward Meigs

Portfolio Manager

Global Income Builder and

High Income Funds | |

| |

| |

Sean Slein

Portfolio Manager

Global Income Builder and

High Income Funds | | Thomas Kertsos

Portfolio Manager

Gold Fund

| |

| |

| |

Manish Gupta

Portfolio Manager

Global Fund and

Fund of America | | Christian Heck

Portfolio Manager

Overseas Fund and

Fund of America | |

First Eagle Funds | Semiannual Report | April 30, 2022

13

Management's Discussion of Fund Performance (unaudited)

| |

| |

Julien Albertini

Portfolio Manager

Global Fund,

Global Income Builder Fund and

Fund of America | | Alan Barr

Portfolio Manager

Overseas Fund

| |

| |

| |

Mark Wright

Portfolio Manager

U.S. Value Fund

| | Idanna Appio

Portfolio Manager

Global Income

Builder Fund | |

| |

| |

Bill Hench

Portfolio Manager

Small Cap Opportunity Fund | | Benjamin Bahr

Portfolio Manager

Global Real Assets Fund | |

| |

| |

John Masi

Portfolio Manager

Global Real Assets Fund | | George Ross

Portfolio Manager

Global Real Assets Fund | |

First Eagle Funds | Semiannual Report | April 30, 2022

14

Management's Discussion of Fund Performance (unaudited)

| | | |

David Wang

Portfolio Manager

Global Real Assets Fund | | | | | |

The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact a fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month- end is available at www.firsteagle.com or by calling 800.334.2143.

The commentary represents the opinion of Mehdi Mahmud and the Portfolio Management teams as of June 2022 and is subject to change based on market and other conditions. These materials are provided for informational purposes only. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice. The views expressed herein may change at any time subsequent to the date of issue hereof. The information provided is not to be construed as a recommendation or an offer to buy or sell or the solicitation of an offer to buy or sell any fund or security.

First Eagle Funds | Semiannual Report | April 30, 2022

15

Performance Chart1 (unaudited)

| | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception | | Inception Date | |

First Eagle Global Fund | |

Class A (SGENX)

without sales charge | | | -1.30 | % | | | 7.34 | % | | | 6.39 | % | | | 7.03 | % | | | 12.50 | % | | 01/01/792 | |

with sales charge | | | -6.23 | % | | | 5.53 | % | | | 5.31 | % | | | 6.48 | % | | | 12.36 | % | | 01/01/792 | |

| Class C (FESGX) | | | -2.97 | % | | | 6.53 | % | | | 5.60 | % | | | 6.23 | % | | | 9.06 | % | | 06/05/00 | |

| Class I (SGIIX) | | | -1.05 | % | | | 7.62 | % | | | 6.67 | % | | | 7.31 | % | | | 10.01 | % | | 07/31/98 | |

| Class R3 (EARGX) | | | -1.90 | % | | | 7.02 | % | | | — | | | | — | | | | 6.05 | % | | 05/01/18 | |

| Class R4 (EAGRX) | | | -1.28 | % | | | 7.45 | % | | | — | | | | — | | | | 4.91 | % | | 01/17/18 | |

| Class R5 (FRGLX) | | | -1.33 | % | | | — | | | | — | | | | — | | | | 6.22 | % | | 07/29/19 | |

| Class R6 (FEGRX) | | | -0.97 | % | | | 7.70 | % | | | 6.75 | % | | | — | | | | 6.62 | % | | 03/01/17 | |

MSCI World Index3 | | | -3.52 | % | | | 10.41 | % | | | 10.17 | % | | | 10.05 | % | | | 9.65 | % | | 01/01/79 | |

First Eagle Overseas Fund | |

Class A (SGOVX)

without sales charge | | | -4.22 | % | | | 4.30 | % | | | 3.48 | % | | | 4.94 | % | | | 9.41 | % | | 08/31/93 | |

with sales charge | | | -9.01 | % | | | 2.53 | % | | | 2.43 | % | | | 4.40 | % | | | 9.22 | % | | 08/31/93 | |

| Class C (FESOX) | | | -5.84 | % | | | 3.53 | % | | | 2.72 | % | | | 4.17 | % | | | 7.90 | % | | 06/05/00 | |

| Class I (SGOIX) | | | -3.94 | % | | | 4.60 | % | | | 3.78 | % | | | 5.23 | % | | | 9.25 | % | | 07/31/98 | |

| Class R3 (EAROX) | | | -4.43 | % | | | 4.07 | % | | | — | | | | — | | | | 2.77 | % | | 05/01/18 | |

| Class R4 (FIORX) | | | -4.41 | % | | | 4.43 | % | | | — | | | | — | | | | 1.88 | % | | 01/17/18 | |

| Class R5 (FEROX) | | | -4.24 | % | | | 4.23 | % | | | — | | | | — | | | | 5.08 | % | | 03/11/19 | |

| Class R6 (FEORX) | | | -3.85 | % | | | 4.68 | % | | | 3.86 | % | | | — | | | | 4.20 | % | | 03/01/17 | |

MSCI EAFE Index4 | | | -8.15 | % | | | 4.44 | % | | | 4.77 | % | | | 5.77 | % | | | 4.90 | % | | 08/31/93 | |

First Eagle Funds | Semiannual Report | April 30, 2022

16

Performance Chart1 (unaudited)

| | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception | | Inception Date | |

First Eagle U.S. Value Fund | |

Class A (FEVAX)

without sales charge | | | 1.23 | % | | | 8.56 | % | | | 8.16 | % | | | 8.12 | % | | | 8.81 | % | | 09/04/01 | |

with sales charge | | | -3.81 | % | | | 6.73 | % | | | 7.06 | % | | | 7.57 | % | | | 8.54 | % | | 09/04/01 | |

| Class C (FEVCX) | | | -0.45 | % | | | 7.74 | % | | | 7.34 | % | | | 7.30 | % | | | 7.99 | % | | 09/04/01 | |

| Class I (FEVIX) | | | 1.54 | % | | | 8.87 | % | | | 8.46 | % | | | 8.41 | % | | | 9.09 | % | | 09/04/01 | |

| Class R3 (EARVX) | | | 1.12 | % | | | 8.39 | % | | | — | | | | — | | | | 7.91 | % | | 05/01/18 | |

| Class R4 (FIVRX) | | | 1.18 | % | | | — | | | | — | | | | — | | | | 8.05 | % | | 07/29/19 | |

| Class R5 (FERVX) | | | 1.32 | % | | | — | | | | — | | | | — | | | | 8.22 | % | | 07/29/19 | |

| Class R6 (FEVRX) | | | 1.54 | % | | | 8.90 | % | | | 8.49 | % | | | — | | | | 7.98 | % | | 03/01/17 | |

S&P 500 Index5 | | | 0.21 | % | | | 13.85 | % | | | 13.66 | % | | | 13.67 | % | | | 8.57 | % | | 09/04/01 | |

First Eagle Gold Fund | |

Class A (SGGDX)

without sales charge | | | 1.85 | % | | | 19.79 | % | | | 7.96 | % | | | -0.86 | % | | | 5.87 | % | | 08/31/93 | |

with sales charge | | | -3.23 | % | | | 17.75 | % | | | 6.86 | % | | | -1.36 | % | | | 5.68 | % | | 08/31/93 | |

| Class C (FEGOX) | | | 0.12 | % | | | 18.89 | % | | | 7.15 | % | | | -1.62 | % | | | 5.51 | % | | 05/15/03 | |

| Class I (FEGIX) | | | 2.14 | % | | | 20.11 | % | | | 8.26 | % | | | -0.58 | % | | | 6.59 | % | | 05/15/03 | |

| Class R3 (EAURX) | | | 1.68 | % | | | 19.70 | % | | | — | | | | — | | | | 11.67 | % | | 05/01/18 | |

| Class R4 (FIURX) | | | 1.95 | % | | | — | | | | — | | | | — | | | | 12.59 | % | | 07/29/19 | |

| Class R5 (FERUX) | | | 2.02 | % | | | — | | | | — | | | | — | | | | 12.58 | % | | 07/29/19 | |

| Class R6 (FEURX) | | | 2.22 | % | | | 20.19 | % | | | 8.35 | % | | | — | | | | 7.70 | % | | 03/01/17 | |

FTSE Gold Mines

Index6 | | | 1.36 | % | | | 18.45 | % | | | 8.34 | % | | | -2.68 | % | | | 0.59 | % | | 08/31/93 | |

MSCI World Index3 | | | -3.52 | % | | | 10.41 | % | | | 10.17 | % | | | 10.05 | % | | | 7.35 | % | | 08/31/93 | |

First Eagle Funds | Semiannual Report | April 30, 2022

17

Performance Chart1 (unaudited)

| | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception | | Inception Date | |

First Eagle Global Income Builder Fund | |

Class A (FEBAX)

without sales charge | | | 0.08 | % | | | 5.51 | % | | | 4.98 | % | | | — | | | | 5.76 | % | | 05/01/12 | |

with sales charge | | | -4.91 | % | | | 3.72 | % | | | 3.91 | % | | | — | | | | 5.22 | % | | 05/01/12 | |

| Class C (FEBCX) | | | -1.61 | % | | | 4.69 | % | | | 4.18 | % | | | — | | | | 4.97 | % | | 05/01/12 | |

| Class I (FEBIX) | | | 0.32 | % | | | 5.75 | % | | | 5.25 | % | | | — | | | | 6.03 | % | | 05/01/12 | |

| Class R3 (FBRRX) | | | -0.06 | % | | | 5.28 | % | | | — | | | | — | | | | 4.56 | % | | 05/01/18 | |

| Class R4 (FIBRX) | | | -0.03 | % | | | — | | | | — | | | | — | | | | 5.17 | % | | 07/29/19 | |

| Class R5 (EABRX) | | | 0.06 | % | | | — | | | | — | | | | — | | | | 5.28 | % | | 07/29/19 | |

| Class R6 (FEBRX) | | | 0.40 | % | | | 5.79 | % | | | 5.28 | % | | | — | | | | 5.52 | % | | 03/01/17 | |

Composite Index7 | | | -5.38 | % | | | 6.69 | % | | | 6.81 | % | | | — | | | | 6.92 | % | | 05/01/12 | |

MSCI World Index3 | | | -3.52 | % | | | 10.41 | % | | | 10.17 | % | | | — | | | | 10.02 | % | | 05/01/12 | |

Bloomberg

U.S. Aggregate

Bond Index8 | | | -8.51 | % | | | 0.38 | % | | | 1.20 | % | | | — | | | | 1.73 | % | | 05/01/12 | |

First Eagle High Income Fund | |

Class A (FEHAX)

without sales charge | | | -3.62 | % | | | 2.13 | % | | | 2.47 | % | | | 3.61 | % | | | 4.07 | % | | 01/03/12 | |

with sales charge | | | -7.98 | % | | | 0.58 | % | | | 1.52 | % | | | 3.13 | % | | | 3.61 | % | | 01/03/12 | |

| Class C (FEHCX) | | | -5.30 | % | | | 1.31 | % | | | 1.67 | % | | | 2.83 | % | | | 3.28 | % | | 01/03/12 | |

| Class I (FEHIX) | | | -3.37 | % | | | 2.37 | % | | | 2.73 | % | | | 3.91 | % | | | 6.73 | % | | 11/19/079 | |

| Class R3 (EARHX) | | | -3.85 | % | | | 1.96 | % | | | — | | | | — | | | | 2.21 | % | | 05/01/18 | |

| Class R4 (FIHRX) | | | -4.23 | % | | | — | | | | — | | | | — | | | | 1.14 | % | | 07/29/19 | |

| Class R5 (FERHX) | | | -3.62 | % | | | — | | | | — | | | | — | | | | 1.63 | % | | 07/29/19 | |

| Class R6 (FEHRX) | | | -3.31 | % | | | 2.39 | % | | | 2.73 | % | | | — | | | | 2.84 | % | | 03/01/17 | |

Bloomberg

U.S. Corporate

High Yield Index10 | | | -5.22 | % | | | 2.84 | % | | | 3.69 | % | | | 5.26 | % | | | 6.41 | % | | 11/19/07 | |

First Eagle Funds | Semiannual Report | April 30, 2022

18

Performance Chart1 (unaudited)

| | | One

Year | | Three

Years | | Five

Years | | Ten

Years | | Since

Inception | | Inception Date | |

First Eagle Fund of America11 | |

Class A (FEFAX)

without sales charge | | | -8.76 | % | | | 4.84 | % | | | 3.18 | % | | | 6.58 | % | | | 7.29 | % | | 11/20/98 | |

with sales charge | | | -13.32 | % | | | 3.06 | % | | | 2.12 | % | | | 6.03 | % | | | 7.06 | % | | 11/20/98 | |

| Class C (FEAMX) | | | -10.20 | % | | | 4.07 | % | | | 2.41 | % | | | 5.78 | % | | | 6.54 | % | | 03/02/98 | |

| Class I (FEAIX) | | | -8.54 | % | | | 5.15 | % | | | 3.48 | % | | | — | | | | 5.86 | % | | 03/08/13 | |

| Class R3 (EARFX) | | | -8.89 | % | | | 4.70 | % | | | — | | | | — | | | | 2.26 | % | | 05/01/18 | |

| Class R4 (EAFRX) | | | -8.63 | % | | | — | | | | — | | | | — | | | | 4.22 | % | | 07/29/19 | |

| Class R5 (FERFX) | | | -8.54 | % | | | — | | | | — | | | | — | | | | 4.33 | % | | 07/29/19 | |

| Class R6 (FEFRX) | | | -8.58 | % | | | 5.13 | % | | | 3.49 | % | | | — | | | | 3.84 | % | | 03/01/17 | |

S&P 500 Index5 | | | 0.21 | % | | | 13.85 | % | | | 13.66 | % | | | 13.67 | % | | | 7.80 | % | | 04/10/87 | |

First Eagle Small Cap Opportunity Fund | |

Class A (FESAX)

without sales charge | | | — | | | | — | | | | — | | | | — | | | | -11.17 | % | | 07/01/21 | |

with sales charge | | | — | | | | — | | | | — | | | | — | | | | -15.59 | % | | 07/01/21 | |

| Class I (FESCX) | | | -6.72 | % | | | — | | | | — | | | | — | | | | -8.15 | % | | 04/27/21 | |

| Class R6 (FESRX) | | | — | | | | — | | | | — | | | | — | | | | -10.97 | % | | 07/01/21 | |

Russell 2000

Value Index12 | | | -6.59 | % | | | — | | | | — | | | | — | | | | -7.10 | % | | 04/27/21 | |

Russell 2000 Index13 | | | -16.87 | % | | | — | | | | — | | | | — | | | | -17.76 | % | | 04/27/21 | |

First Eagle Global Real Assets Fund | |

Class A (FERAX)

without sales charge | | | — | | | | — | | | | — | | | | — | | | | 3.80 | % | | 11/30/21 | |

with sales charge | | | — | | | | — | | | | — | | | | — | | | | -1.42 | % | | 11/30/21 | |

| Class I (FEREX) | | | — | | | | — | | | | — | | | | — | | | | 3.90 | % | | 11/30/21 | |

| Class R6 (FERRX) | | | — | | | | — | | | | — | | | | — | | | | 3.90 | % | | 11/30/21 | |

MSCI World Index3 | | | — | | | | — | | | | — | | | | — | | | | -9.32 | % | | 11/30/21 | |

Consumer Price

Index +400bps | | | — | | | | — | | | | — | | | | — | | | | 3.70 | % | | 11/30/21 | |

First Eagle Funds | Semiannual Report | April 30, 2022

19

Performance Chart1 (unaudited)

1 The performance data quoted herein represents past performance and does not guarantee future results. Market volatility can dramatically impact the fund's short-term performance. Current performance may be lower or higher than figures shown. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. Past performance data through the most recent month end is available at www.firsteagle.com or by calling 800.334.2143. The average annual returns for Class A Shares "with sales charge" of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle Fund of America, First Eagle Small Cap Opportunity Fund and First Eagle Global Real Assets Fund give effect to the deduction of the maximum sales charge of 5.00%. The average annual returns for Class A Shares "with sales charge" of First Eagle High Income Fund gives effect to the deduction of the maximum sales charge of 4.50%.

The average annual returns for Class C Shares reflect the maximum contingent deferred sales charge (CDSC), which is charged on the lesser of the original purchase price or the current market value at the time of sale. This pertains to the shares sold or redeemed with the first year of purchase.

For First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Fund of America, First Eagle Small Cap Opportunity Fund and First Eagle Global Real Assets Fund, a CDSC of 1.00% may apply on redemptions of Class A shares made within 18 months following a purchase of $1 million or more without an initial sales charge.

With respect to the First Eagle Global Income Builder Fund and the First Eagle High Income Fund, a CDSC of 1.00% may apply on certain redemptions of Class A shares made within 18 months following a purchase of $250,000 or more without an initial sales charge.

Class I Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Income Fund, First Eagle Fund of America, First Eagle Small Cap Opportunity Fund and First Eagle Global Real Assets Fund require $1 million minimum investment and are offered without a sales charge.

Class R3 Shares, Class R4 Shares, Class R5 Shares and Class R6 Shares of First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund, First Eagle Global Income Builder Fund, First Eagle High Income Fund and First Eagle Fund of America are offered without a sales charge.

Class R6 Shares of First Eagle Small Cap Opportunity Fund and First Eagle Global Real Assets Fund are offered without a sales charge.

2 The Fund commenced operations on April 28, 1970. Performance for periods prior to January 1, 2000, occurred while a prior portfolio manager of the fund was affiliated with another firm. Inception date shown is when this prior portfolio manager assumed portfolio management responsibilities.

3 The MSCI World Index is a widely followed, unmanaged group of stocks from 23 developed market countries. The index provides total returns in U.S. dollars with net dividends reinvested. One cannot invest directly in an index.

4 The MSCI EAFE Index is an unmanaged total return index, reported in U.S. dollars, based on share prices and reinvested net dividends of companies from 21 developed market countries, excluding the United States and Canada. One cannot invest directly in an index.

5 The S&P 500 Index is a widely recognized unmanaged index including a representative sample of 500 leading companies in leading sectors of the U.S. economy. Although the S&P 500 Index focuses on the large-cap segment of the market, with approximately 80% coverage of U.S. equities, it is also considered a proxy for the total market. The S&P 500 Index includes dividends reinvested. One cannot invest directly in an index.

6 The FTSE Gold Mines Index is designed to reflect the performance of the worldwide market in the shares of companies whose principal activity is the mining of gold. The FTSE Gold Mines Index encompasses all gold mining companies that have a sustainable, attributable gold production of at least 300,000 ounces a year and that derive 51% or more of their revenue from mined gold. The Index is unmanaged, and includes dividends reinvested. One cannot invest directly in an index.

First Eagle Funds | Semiannual Report | April 30, 2022

20

Performance Chart1 (unaudited)

7 The composite index consists of 60% of the MSCI World Index and 40% of the Bloomberg U.S. Aggregate Bond Index.

8 The Bloomberg U.S. Aggregate Bond Index is an unmanaged broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, MBS (agency fixed-rate and hybrid ARM passthroughs), ABS, and CMBS. One cannot invest directly in an index.

9 First Eagle High Income Fund commenced operations in its present form on December 30, 2011, and is successor to another mutual fund pursuant to a reorganization on December 30, 2011. Information prior to December 30, 2011 is for this predecessor fund. Immediately after the reorganization, changes in net asset value of the Class I shares were partially impacted by differences in how the Fund and the predecessor fund price portfolio securities.

10 The Bloomberg U.S. Corporate High Yield Index is composed of fixed-rate, publicly issued, non-investment grade debt and is unmanaged, with dividends reinvested. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility, and Finance, which include both U.S. and non-U.S. corporations. One cannot invest directly in an index.

11 Effective on August 14, 2020, Fund of America is managed by a portfolio management team at First Eagle Investment Management, LLC. Prior to that date, the Fund was managed by a third-party subadviser.

12 The Russell 2000® Value Index is a widely followed, unmanaged index that measures the performance of small-cap value segment of the U.S. equity universe. It includes those Russell 2000® companies with lower price-to-book ratios and lower forecasted growth values. The Russell 2000® Value Index is completely reconstituted annually. One cannot invest directly in an index.

13 The Russell 2000® Index is a widely followed, unmanaged index that measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000® Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership. The Russell 2000® Index is completely reconstituted annually. One cannot invest directly in an index.

Expense ratios as stated in the most recent prospectus

| | | Class A | | Class C | | Class I | | Class R3 | | Class R4 | | Class R5 | | Class R6 | |

First Eagle Global Fund | | | 1.11 | % | | | 1.87 | % | | | 0.86 | % | | | 1.51 | % | | | 1.10 | % | | | 1.11 | % | | | 0.78 | % | |

First Eagle Overseas Fund | | | 1.16 | | | | 1.89 | | | | 0.88 | | | | 1.34 | | | | 1.06 | | | | 1.20 | | | | 0.79 | | |

First Eagle U.S. Value Fund14,15 | | | 1.16 | | | | 1.95 | | | | 0.89 | | | | 1.31 | | | | 1.21 | | | | 1.13 | | | | 0.84 | | |

First Eagle Gold Fund | | | 1.22 | | | | 1.95 | | | | 0.96 | | | | 1.34 | | | | 1.11 | | | | 1.03 | | | | 0.85 | | |

First Eagle Global Income

Builder Fund | | | 1.17 | | | | 1.94 | | | | 0.93 | | | | 1.32 | | | | 1.17 | | | | 1.16 | | | | 0.87 | | |

First Eagle High Income Fund | | | 1.06 | | | | 1.84 | | | | 0.80 | | | | 1.23 | | | | 1.49 | | | | 1.03 | | | | 0.75 | | |

First Eagle Fund of America14,16 | | | 1.04 | | | | 1.79 | | | | 0.70 | | | | 1.12 | | | | 1.08 | | | | 1.35 | | | | 0.67 | | |

First Eagle Small Cap

Opportunity Fund14,17 | | | 1.31 | | | | — | | | | 1.06 | | | | — | | | | — | | | | — | | | | 1.07 | | |

First Eagle Global Real

Assets Fund14,18 | | | 6.91 | | | | — | | | | 6.66 | | | | — | | | | — | | | | — | | | | 6.66 | | |

14 For the First Eagle U.S. Value Fund, First Eagle Fund of America, First Eagle Small Cap Opportunity Fund and First Eagle Global Real Assets Fund, had fees not been waived and/or expenses reimbursed, returns would have been lower.

First Eagle Funds | Semiannual Report | April 30, 2022

21

Performance Chart1 (unaudited)

15 These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to waive its management fee at an annual rate in the amount of 0.05% of the average daily value of the Fund's net assets for the period through February 28, 2023. This waiver has the effect of reducing the management fee for the term of the waiver from 0.75% to 0.70% on First Eagle U.S. Value Fund.

16 These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to waive and/or reimburse certain fees and expenses of Classes A, C, I, R3, R4, R5 and R6 so that the total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses relating to short sales, and extraordinary expenses, if any) ("annual operating expenses") of each class are limited to 0.90%, 1.65%, 0.65%, 1.00%, 0.75%, 0.65% and 0.65% of average net assets, respectively. Each of these undertakings lasts until February 28, 2023 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that each of Classes A, C, I, R3, R4, R5 and R6 will repay the Adviser for fees and expenses waived or reimbursed for the class provided that repayment does not cause annual operating expenses (after the repayment is taken into account) to exceed either: (1) 0.90%, 1.65%, 0.65%, 1.00%, 0.75%, 0.65% and 0.65% of the class' average net assets, respectively; or (2) if applicable, the then-current expense limitations. Any such repayment must be made within three years after the year in which the Adviser incurred the expense.

17 These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to waive and/or reimburse certain fees and expenses of Classes A, I, and R6 so that the total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses relating to short sales, and extraordinary expenses, if any) ("annual operating expenses") of each class are limited to 1.25%, 1.00% and 1.00% of average net assets, respectively. Each of these undertakings lasts until February 28, 2023 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that each of Classes A, I and R6 will repay the Adviser for fees and expenses waived or reimbursed for the class provided that repayment does not cause annual operating expenses (after the repayment is taken into account) to exceed either: (1) 1.25%, 1.00% and 1.00% of the class' average net assets, respectively; or (2) if applicable, the then-current expense limitations. Any such repayment must be made within three years after the year in which the Adviser incurred the expense.

18 These are the actual fund operating expenses prior to the application of fee waivers and/or expense reimbursements. The Adviser has contractually agreed to waive and/ or reimburse certain fees and expenses of Classes A, I and R6 so that the total annual operating expenses (excluding interest, taxes, brokerage commissions, acquired fund fees and expenses, dividend and interest expenses relating to short sales, and extraordinary expenses, if any) ("annual operating expenses") of each class are limited to 1.10%, 0.85% and 0.85% of average net assets, respectively. Each of these undertakings lasts until February 28, 2023 and may not be terminated during its term without the consent of the Board of Trustees. The Fund has agreed that each of Classes A, I and R6 will repay the Adviser for fees and expenses waived or reimbursed for the class provided that repayment does not cause annual operating expenses (after the repayment is taken into account) to exceed either: (1) 1.10%, 0.85% and 0.85% of the class' average net assets, respectively; or (2) if applicable, the then-current expense limitations. Any such repayment must be made within three years after the year in which the Adviser incurred the expense.

These expense ratios are presented as of March 1, 2022 and may differ from corresponding ratios shown elsewhere in this report because of differing time periods (and/or, if applicable, because these expense ratios do not include expense credits or waivers).

There are risks associated with investing in funds that invest in securities of foreign companies, such as erratic market conditions, economic and political instability and fluctuations in currency exchange rates. These risks may be more pronounced with respect to investments in emerging markets. Funds whose investments are concentrated in a specific industry or sector may be subject to a higher degree of risk than funds whose investments are diversified and may not be suitable for all investors.

First Eagle Funds | Semiannual Report | April 30, 2022

22

Performance Chart1 (unaudited)

All securities may be subject to adverse market trends. The value and liquidity of a Fund's portfolio holdings may fluctuate in response to events specific to the companies or stock or bond markets in which a Fund invests, as well as economic, political, or social events in the United States or abroad. Markets can be volatile, and values of individual securities and other investments at times may decline significantly and rapidly. This may cause a Fund's portfolio to be worth less than the price originally paid for it, or less than it was worth at an earlier time. Market risk may affect a single issuer or the market as a whole. As a result, a portfolio of such securities may underperform the market as a whole. Recent market conditions and events, including a global public health crisis and actions taken by governments in response, may exacerbate volatility. Rapid changes in value or liquidity, which often are not anticipated and can relate to events not connected to particular investments, may limit the ability of the Fund to dispose of its assets at the value or time of its choosing and can result in losses.

The outbreak of COVID-19 has resulted in, among other things, closing borders, quarantines, disruptions to supply chains and customer activity, as well as general concern and uncertainty. The impact of COVID-19, and other epidemics and pandemics that may arise in the future, has affected and may continue to affect the economies of many nations, individual companies and the global markets, including their liquidity, in ways that cannot necessarily be foreseen at the present time.

To the extent a Fund invests a significant portion of its assets in the securities of companies of a single country or region, it is more likely to be impacted by events or conditions affecting that country or region. For example, political and economic conditions and changes in regulatory, tax, or economic policy in a country could significantly affect the market in that country and in surrounding or related countries and have a negative impact on a Fund's performance. Currency developments or restrictions, political and social instability, and changing economic conditions have resulted in significant market volatility. Currently, a substantial portion of the companies in which the First Eagle Gold Fund invests are domiciled in Canada, although the mining operations of such companies may take place in other countries. Currently, a substantial portion of the companies in which the First Eagle Global Fund and First Eagle Overseas Fund invest are domiciled in Japan, although the operations of such companies may take place in other countries.

Canada is a significant exporter of natural resources, such as oil, natural gas and agricultural products. As a result, the Canadian economy is susceptible to adverse changes in certain commodities markets. It is also heavily dependent on trading with key partners, including the United States, Mexico, and China. Any reduction in trading with these key partners may adversely affect the Canadian economy. Canada's dependency on the economy of the United States, in particular, makes Canada's economy vulnerable to political and regulatory changes affecting the United States economy. These and other factors could negatively affect a Fund's performance.

A Fund's investments may subject it to the risks associated with investing in the European markets, including the risks associated with the United Kingdom's ("UK") exit from the European Union ("Brexit"). Investments in a single region, even though representing a number of different countries within the region, may be affected by common economic forces and other factors. Further, political or economic disruptions in European countries, even in countries in which a Fund is not invested, may adversely affect security values and thus a Fund's holdings.

The Japanese economy is heavily dependent upon international trade and may be subject to considerable degrees of economic, political and social instability, which could negatively affect a Fund. Japan has also experienced natural disasters, such as earthquakes and tidal waves, of varying degrees of severity, which also could negatively affect a Fund.

The value of a Fund's portfolio holdings may fluctuate in response to the risk that the prices of equity securities, including common stock, rise and fall daily. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. In addition, equity markets tend to move in cycles, which may cause stock prices to fall over short or extended periods of time. Equity securities generally have greater price volatility than debt securities.

By investing in its Subsidiary, each of the First Eagle Global Fund, First Eagle Overseas Fund, First Eagle U.S. Value Fund, First Eagle Gold Fund and First Eagle Global Real Assets Fund are indirectly exposed to

First Eagle Funds | Semiannual Report | April 30, 2022

23

Performance Chart1 (unaudited)

the risks associated with that Subsidiary's investments. The Subsidiaries are not registered under the 1940 Act and are not subject to all of the investor protections of the 1940 Act. Changes in the laws of the United States and/or the Cayman Islands could result in the inability of a Fund and/or a Subsidiary to operate as expected and could adversely affect the Fund.

In addition to investments in larger companies, each Fund (and First Eagle Small Cap Opportunity Fund generally will) may invest in small and medium-size companies, which historically have been more volatile in price than larger company securities, especially over the short term. Positions in smaller companies, especially when a Fund is a large holder of a small company's securities, also may be more difficult or expensive to trade. Among the reasons for the greater price volatility are the less certain growth prospects of smaller companies, the lower degree of liquidity in the markets for such securities and the greater sensitivity of smaller companies to changing economic conditions. In addition, smaller companies may lack depth of management, they may be unable to generate funds necessary for growth or development, or they may be developing or marketing new products or services for which markets are not yet established and may never become established. Each Fund (except First Eagle Small Cap Opportunity Fund) considers small companies to be companies with market capitalizations of less than $1 billion and medium-size companies to have market capitalizations of less than $10 billion. Larger, more established companies may be unable to respond quickly to new competitive challenges like changes in consumer tastes or innovative smaller competitors. First Eagle Small Cap Opportunity Fund considers small companies to be companies with market capitalizations not greater than that of the largest company in the Russell 2000 Index at the time of investment. Larger companies are sometimes unable to attain the high growth rates of successful, smaller companies, especially during extended periods of economic expansion. The Funds generally consider large companies to be companies with market capitalizations of $10 billion or greater.

Holding illiquid securities restricts or otherwise limits the ability for a Fund to freely dispose of its investments for specific periods of time. A Fund might not be able to sell illiquid securities at its desired price or time. Changes in the markets or in regulations governing the trading of illiquid instruments can cause rapid changes in the price or ability to sell an illiquid security. The market for lower-quality debt instruments, including junk bonds and leveraged loans, is generally less liquid than the market for higher-quality debt instruments.

Investment in gold and gold-related investments present certain risks, including political and economic risks affecting the price of gold and other precious metals including specific changes in U.S. and foreign regulatory policies, tax, currency or mining laws, increased environmental costs, international monetary and political policies, economic conditions within an individual country, trade imbalances, and trade or currency restrictions between countries. The price of gold, in turn, is likely to affect the market prices of securities of companies mining or processing gold, and accordingly, the value of investments in such securities may also be affected. Gold-related investments as a group have not performed as well as the stock market in general during periods when the U.S. dollar is strong, inflation is low and general economic conditions are stable. In addition, returns on gold-related investments have traditionally been more volatile than investments in broader equity or debt markets.

If one or more investors in a Fund initiate significant redemptions, it may be necessary to dispose of assets to meet the redemption request. This can make ordinary portfolio management and rebalancing decisions more complicated to implement and can result in a Fund's current expenses being allocated over a smaller asset base, which generally results in an increase in a Fund's expense ratio. The impact of these transactions is likely to be greater in highly volatile markets or less liquid markets when a significant investor purchases, redeems or owns a substantial portion of a Fund's shares.

First Eagle High Income and First Eagle Global Income Builder Funds will invest in high yield instruments (commonly known as "high yield" or "junk" bonds) which may be subject to greater levels of interest rate, credit (including issuer default) and liquidity risk than investment grade securities and may experience extreme price fluctuations. The securities of such companies may be considered speculative and the ability of such companies to pay their debts on schedule may be uncertain.

First Eagle High Income and First Eagle Global Income Builder Funds invest in bank loans. These investments potentially expose a Fund to the credit risk of the underlying borrower, and in certain cases,

First Eagle Funds | Semiannual Report | April 30, 2022

24

Performance Chart1 (unaudited)

of the financial institution. A Fund's ability to receive payments in connection with the loan depends primarily on the financial condition of the borrower. The market for bank loans may be illiquid and a Fund may have difficulty selling them, especially in the case of leveraged loans, which can be difficult to value. In addition, bank loans often have contractual restrictions on resale, which can delay the sale and adversely impact the sale price. At times, a Fund may decline to receive non-public information relating to loans, which could disadvantage the Fund relative to other investors.

First Eagle Global Real Assets Fund will invest in companies operating in various industries related to real assets. To the extent there is a downturn in one or more of these industries, there would be a larger impact on the Fund than if the Fund's portfolio were more broadly diversified. Factors that may affect these industries include, but are not limited to, government regulation or deregulation, energy conservation and supply/demand, raw material prices, commodities regulation, cost of transport, cost of labor, interest rates, and broad economic developments such as growth or contraction in different markets, currency valuation changes and central bank movements.

Funds that invest in bonds are subject to credit and interest rate risk. The value of a Fund's portfolio may fluctuate in response to the risk that the issuer of a bond or other instrument will not be able to make payments of interest and principal when due. In addition, fluctuations in interest rates can affect the value of debt instruments held by a Fund. An increase in interest rates tends to reduce the market value of debt instruments, while a decline in interest rates tends to increase their values. A debt instrument's "duration" is a way of measuring a debt instrument's sensitivity to a potential change in interest rates. Longer duration instruments tend to be more sensitive to interest rate changes than those with shorter durations. Generally, debt instruments with long maturities and low coupons have the longest durations. Recent market conditions and events, including a global public health crisis and actions taken by governments in response, may exacerbate the risk that borrowers will not be able to make payments of interest and principal when due. In addition, there is risk of significant future rate moves and related economic and markets impact.

Income generation and dividends are not guaranteed. If dividend paying stocks in the Fund's portfolio stop paying or reduce dividends a Fund's ability to generate income will be adversely affected.

An investment strategy that employs a "value" approach may pose a risk to a Fund that such investment strategy may not be successfully achieved. In any Fund, an investment made at a perceived "margin of safety" or "discount to intrinsic or fundamental value" can trade at prices substantially lower than when an investment is made, so that any perceived "margin of safety" or "discount to value" is no guarantee against loss. "Value" investments, as a category, or entire industries or sectors associated with such investments, may lose favor with investors as compared to those that are more "growth" oriented. In such an event, a Fund's investment returns would be expected to lag relative to returns associated with more growth-oriented strategies.

All investments involve the risk of loss.

First Eagle Funds | Semiannual Report | April 30, 2022

25

Data as of April 30, 2022 (unaudited)

Investment Objective

The First Eagle Global Fund seeks long-term growth of capital by investing in a range of asset classes from markets in the United States and throughout the world. This truly global fund is managed with a highly disciplined, bottom-up, value-oriented style.

Average Annual Returns (%) | | | | | | One-Year | | Five-Years | | Ten-Years | |

First Eagle Global Fund | | Class A | | without sales load | | | -1.30 | | | | 6.39 | | | | 7.03 | | |

| | | | with sales load | | | -6.23 | | | | 5.31 | | | | 6.48 | | |

MSCI World Index | | | | | | | -3.52 | | | | 10.17 | | | | 10.05 | | |

Consumer Price Index | | | | | | | 8.26 | | | | 3.41 | | | | 2.31 | | |

Sectors* (%) | |

Financials | | | 13.7 | | |

Consumer Staples | | | 11.8 | | |

Commodities | | | 11.4 | | |

Industrials | | | 10.3 | | |

Information Technology | | | 9.5 | | |

Energy | | | 6.8 | | |

Health Care | | | 6.3 | | |

Materials | | | 5.9 | | |

Consumer Discretionary | | | 5.1 | | |

Communication Services | | | 4.9 | | |

Real Estate | | | 4.1 | | |

Foreign Government Securities | | | 1.3 | | |

Utilities | | | 0.4 | | |

Short-Term Investments | | | 8.5 | | |

Countries*~ (%)

United States | | | 54.8 | | |

Japan | | | 7.3 | | |

United Kingdom | | | 5.3 | | |

Canada | | | 3.8 | | |

France | | | 3.7 | | |

Switzerland | | | 2.6 | | |

Hong Kong | | | 2.1 | | |

Brazil | | | 1.9 | | |

South Korea | | | 1.8 | | |

Belgium | | | 1.3 | | |

China | | | 1.2 | | |

Mexico | | | 1.2 | | |

Sweden | | | 1.0 | | |

Taiwan | | | 0.9 | | |

Germany | | | 0.7 | | |

Thailand | | | 0.4 | | |

Australia | | | 0.4 | | |

Ireland | | | 0.3 | | |

Norway | | | 0.2 | | |

Colombia | | | 0.2 | | |

Malaysia | | | 0.2 | | |

Indonesia | | | 0.1 | | |

Peru | | | 0.1 | | |

Short-Term Investments | | | 8.5 | | |

^ Less than 0.05%.

* Asset Allocation, Sector and Countries percentages are based on total investments in the portfolio.

** Includes short-term commercial paper (4.2% of total investments) that settles in 90 days or less, long-term commercial paper (4.3% of total investments) that settles in 91 days or greater and other short-term investments (0.0% of total investments), such as U.S treasury bills or money market funds.

~ Country allocations reflect country of risk (not currency of issue). Bonds of non-U.S. issuers may be U.S. dollar denominated.

The Fund's portfolio composition is subject to change at any time.

First Eagle Funds | Semiannual Report | April 30, 2022

26

First Eagle Global Fund | Fund Overview

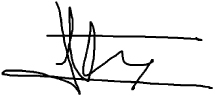

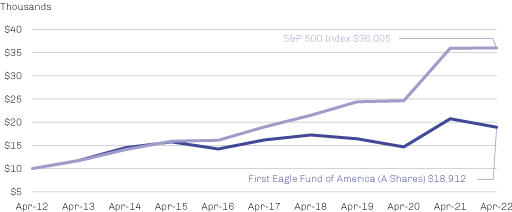

Growth of a $10,000 Initial Investment

Performance data quoted herein represents past performance and should not be considered indicative of future results. Performance data quoted herein does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the sale of Fund shares. The average annual returns shown above are historical and reflect changes in share price, reinvested dividends and are net of expenses.

The average annual returns for Class A shares give effect to the deduction of the maximum sales charge of 5.00%.

The MSCI World Index is a widely followed, unmanaged group of stocks from 23 developed market countries. The index provides total returns in U.S. dollars with net dividends reinvested. One cannot invest directly in an index. The Consumer Price Index (CPI) represents the change in price of all goods and services purchased for consumption by urban households.

Top 10 Holdings* (%)

Gold bullion** (Precious Metal) | | | 11.4 | | |

Exxon Mobil Corp. (Oil, Gas & Consumable Fuels, United States) | | | 3.1 | | |

Oracle Corp. (Software, United States) | | | 2.9 | | |

Comcast Corp. (Media, United States) | | | 1.8 | | |

British American Tobacco plc (Tobacco, United Kingdom) | | | 1.7 | | |

CH Robinson Worldwide, Inc. (Air Freight & Logistics, United States) | | | 1.7 | | |

Meta Platforms, Inc. (Interactive Media & Services, United States) | | | 1.6 | | |

Philip Morris International, Inc. (Tobacco, United States) | | | 1.6 | | |

Schlumberger NV (Energy Equipment & Services, United States) | | | 1.6 | | |

Anthem, Inc. (Health Care Providers & Services, United States) | | | 1.5 | | |

Total | | | 28.9 | | |

* Holdings in cash, commercial paper and other short-term cash equivalents have been excluded.

** The Fund invests in gold and precious metals through investment in a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the "Subsidiary"). Gold Bullion and commodities include the Fund's investment in the Subsidiary.

Percentages are based on total net assets

First Eagle Funds | Semiannual Report | April 30, 2022

27

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2022 (unaudited)

Investments | | Shares | | Value ($) | |

Common Stocks — 78.5% | |

Australia — 0.4% | |

Newcrest Mining Ltd. | | | 9,296,442 | | | | 174,581,183 | | |

Belgium — 1.3% | |

Groupe Bruxelles Lambert SA | | | 6,469,396 | | | | 610,455,355 | | |

Brazil — 1.9% | |

Ambev SA, ADR | | | 133,221,957 | | | | 387,675,895 | | |

Itausa SA (Preference) | | | 102,984,133 | | | | 191,847,382 | | |

Wheaton Precious Metals Corp. | | | 7,523,631 | | | | 337,510,087 | | |

| | | | 917,033,364 | | |

Canada — 3.8% | |

Agnico Eagle Mines Ltd. | | | 2,298,700 | | | | 133,808,264 | | |

Barrick Gold Corp. | | | 11,518,361 | | | | 256,974,634 | | |

Franco-Nevada Corp. | | | 769,497 | | | | 116,372,457 | | |

Imperial Oil Ltd. | | | 10,896,401 | | | | 548,615,745 | | |

Nutrien Ltd. | | | 4,138,319 | | | | 406,589,842 | | |

Power Corp. of Canada | | | 11,884,483 | | | | 349,693,268 | | |

| | | | 1,812,054,210 | | |

China — 1.2% | |

Alibaba Group Holding Ltd.* | | | 25,252,192 | | | | 308,018,394 | | |

Prosus NV* | | | 5,387,539 | | | | 259,833,808 | | |

| | | | 567,852,202 | | |

France — 3.7% | |

Danone SA | | | 10,211,219 | | | | 617,485,036 | | |

Legrand SA | | | 1,954,335 | | | | 173,181,796 | | |

LVMH Moet Hennessy Louis Vuitton SE | | | 185,038 | | | | 119,744,625 | | |

Sanofi | | | 4,031,951 | | | | 426,156,791 | | |

Sodexo SA | | | 3,827,240 | | | | 287,906,279 | | |

Wendel SE | | | 1,067,994 | | | | 106,408,707 | | |

| | | | 1,730,883,234 | | |

Germany — 0.7% | |

Brenntag SE | | | 1,126,149 | | | | 86,897,550 | | |

Henkel AG & Co. KGaA (Preference) | | | 4,137,100 | | | | 265,648,631 | | |

| | | | 352,546,181 | | |

First Eagle Funds | Semiannual Report | April 30, 2022

28

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2022 (unaudited)

Investments | | Shares | | Value ($) | |

Hong Kong — 2.1% | |

CK Asset Holdings Ltd. | | | 37,986,500 | | | | 257,515,848 | | |

Guoco Group Ltd. | | | 12,748,580 | | | | 133,420,260 | | |

Hongkong Land Holdings Ltd. | | | 31,759,300 | | | | 148,156,001 | | |

Hysan Development Co. Ltd. | | | 23,322,348 | | | | 68,804,939 | | |

Jardine Matheson Holdings Ltd. | | | 6,979,771 | | | | 370,835,233 | | |

| | | | 978,732,281 | | |

Ireland — 0.3% | |

CRH plc | | | 3,284,015 | | | | 129,800,250 | | |

Japan — 7.3% | |

Chofu Seisakusho Co. Ltd. (a) | | | 3,224,200 | | | | 47,469,994 | | |

FANUC Corp. | | | 2,442,000 | | | | 374,182,900 | | |

Hirose Electric Co. Ltd. | | | 1,555,415 | | | | 197,341,627 | | |

Hoshizaki Corp. | | | 2,252,900 | | | | 142,703,986 | | |

Hoya Corp. | | | 513,870 | | | | 50,997,558 | | |

Keyence Corp. | | | 466,500 | | | | 187,534,979 | | |

Komatsu Ltd. | | | 6,756,000 | | | | 152,053,802 | | |

Mitsubishi Electric Corp. | | | 24,592,300 | | | | 257,586,915 | | |

Mitsubishi Estate Co. Ltd. | | | 24,622,380 | | | | 358,663,879 | | |

MS&AD Insurance Group Holdings, Inc. | | | 11,209,120 | | | | 333,664,851 | | |

Olympus Corp. | | | 2,001,224 | | | | 35,223,799 | | |

Secom Co. Ltd. | | | 6,337,130 | | | | 445,845,541 | | |

Shimano, Inc. | | | 1,517,390 | | | | 268,857,924 | | |

SMC Corp. | | | 442,156 | | | | 214,100,957 | | |

Sompo Holdings, Inc. | | | 7,663,700 | | | | 311,989,193 | | |

T Hasegawa Co. Ltd. (a) | | | 3,002,800 | | | | 58,477,284 | | |

USS Co. Ltd. | | | 1,298,600 | | | | 21,619,159 | | |

| | | | 3,458,314,348 | | |

Mexico — 0.8% | |

Fomento Economico Mexicano SAB de CV, ADR | | | 3,414,770 | | | | 255,219,910 | | |

Fresnillo plc | | | 5,590,827 | | | | 54,097,963 | | |

Industrias Penoles SAB de CV | | | 6,401,020 | | | | 70,486,031 | | |

| | | | 379,803,904 | | |

First Eagle Funds | Semiannual Report | April 30, 2022

29

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2022 (unaudited)

Investments | | Shares | | Value ($) | |

Norway — 0.2% | |

Orkla ASA | | | 14,016,004 | | | | 113,734,898 | | |

South Korea — 1.6% | |

Hyundai Mobis Co. Ltd. | | | 999,985 | | | | 162,684,680 | | |

KT&G Corp. | | | 5,242,098 | | | | 344,242,537 | | |

Lotte Confectionery Co. Ltd. | | | 161,797 | | | | 15,965,583 | | |

Lotte Corp. | | | 913,277 | | | | 24,638,596 | | |

Namyang Dairy Products Co. Ltd. | | | 7,644 | | | | 2,470,911 | | |

NAVER Corp. | | | 304,531 | | | | 67,837,034 | | |

Samsung Electronics Co. Ltd. (Preference) | | | 3,025,981 | | | | 141,868,996 | | |

| | | | 759,708,337 | | |

Sweden — 0.9% | |

Investor AB, Class A | | | 4,970,940 | | | | 103,825,630 | | |

Investor AB, Class B | | | 11,255,824 | | | | 216,594,742 | | |

Svenska Handelsbanken AB, Class A | | | 12,783,537 | | | | 128,938,835 | | |

| | | | 449,359,207 | | |

Switzerland — 2.5% | |

Cie Financiere Richemont SA (Registered) | | | 5,271,939 | | | | 612,550,452 | | |

Nestle SA (Registered) | | | 3,276,025 | | | | 422,915,462 | | |

Schindler Holding AG | | | 877,406 | | | | 168,572,178 | | |

| | | | 1,204,038,092 | | |

Taiwan — 0.9% | |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR | | | 4,606,256 | | | | 428,059,370 | | |

Thailand — 0.4% | |

Bangkok Bank PCL, NVDR | | | 47,278,400 | | | | 178,324,352 | | |

United Kingdom — 5.3% | |

BAE Systems plc | | | 30,239,911 | | | | 279,315,697 | | |

Berkeley Group Holdings plc* (a) | | | 5,667,123 | | | | 287,416,641 | | |

British American Tobacco plc | | | 19,154,797 | | | | 802,822,392 | | |

Lloyds Banking Group plc | | | 437,703,164 | | | | 248,599,515 | | |

Reckitt Benckiser Group plc | | | 4,483,021 | | | | 349,611,090 | | |

Unilever plc | | | 11,446,490 | | | | 531,278,193 | | |

| | | | 2,499,043,528 | | |

First Eagle Funds | Semiannual Report | April 30, 2022

30

First Eagle Global Fund | Consolidated Schedule of Investments | April 30, 2022 (unaudited)

Investments | | Shares | | Value ($) | |

United States — 43.2% | |

Alleghany Corp.* | | | 309,855 | | | | 259,193,708 | | |

Alphabet, Inc., Class A* | | | 134,718 | | | | 307,452,072 | | |

Alphabet, Inc., Class C* | | | 161,179 | | | | 370,603,710 | | |

American Express Co. | | | 2,387,850 | | | | 417,181,274 | | |

Analog Devices, Inc. | | | 2,347,969 | | | | 362,479,454 | | |

Anthem, Inc. | | | 1,418,918 | | | | 712,197,512 | | |

Bank of New York Mellon Corp. (The) | | | 10,867,969 | | | | 457,106,776 | | |

Becton Dickinson and Co. | | | 1,130,197 | | | | 279,373,396 | | |

Berkshire Hathaway, Inc., Class A* | | | 728 | | | | 352,599,520 | | |

Boston Properties, Inc., REIT | | | 1,627,005 | | | | 191,335,788 | | |

Brown & Brown, Inc. | | | 4,415,934 | | | | 273,699,589 | | |

CH Robinson Worldwide, Inc. (a) | | | 7,426,526 | | | | 788,325,735 | | |

Charles Schwab Corp. (The) | | | 2,951,646 | | | | 195,782,679 | | |

Colgate-Palmolive Co. | | | 7,521,578 | | | | 579,537,585 | | |

Comcast Corp., Class A | | | 20,976,453 | | | | 834,023,771 | | |

Cummins, Inc. | | | 1,379,077 | | | | 260,907,578 | | |

Deere & Co. | | | 725,504 | | | | 273,914,035 | | |

DENTSPLY SIRONA, Inc. | | | 6,187,890 | | | | 247,453,721 | | |

Douglas Emmett, Inc., REIT | | | 5,349,427 | | | | 157,594,119 | | |

Embecta Corp.* | | | 226,039 | | | | 6,878,367 | | |

Equity Residential, REIT | | | 3,778,751 | | | | 307,968,207 | | |

Expeditors International of Washington, Inc. | | | 1,672,498 | | | | 165,694,377 | | |

Exxon Mobil Corp. | | | 17,012,219 | | | | 1,450,291,670 | | |

Fidelity National Information Services, Inc. | | | 1,235,403 | | | | 122,490,208 | | |

Flowserve Corp. (a) | | | 7,892,216 | | | | 258,154,385 | | |

GlaxoSmithKline plc | | | 14,146,132 | | | | 318,890,270 | | |

HCA Healthcare, Inc. | | | 2,361,860 | | | | 506,737,063 | | |

IPG Photonics Corp.* | | | 2,380,173 | | | | 224,878,745 | | |

J G Boswell Co. | | | 2,485 | | | | 2,485,000 | | |

Kraft Heinz Co. (The) | | | 4,471,740 | | | | 190,630,276 | | |

Meta Platforms, Inc., Class A* | | | 3,855,034 | | | | 772,818,666 | | |

Microsoft Corp. | | | 1,716,838 | | | | 476,456,882 | | |

Mills Music Trust (a) | | | 31,592 | | | | 1,579,600 | | |