QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

|

Dyax Corp. |

(Name of Registrant as Specified in Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required. |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

DYAX CORP.

300 TECHNOLOGY SQUARE

CAMBRIDGE, MA 02139

(617) 225-2500

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 15, 2003

The 2003 Annual Meeting of Stockholders of Dyax Corp., a Delaware corporation ("Dyax"), will be held at the offices of Dyax Corp., 300 Technology Square, Cambridge, Massachusetts, at 2:00 p.m. on Thursday, May 15, 2003, for the following purposes:

- 1.

- To elect three Class III directors to serve until the 2006 Annual Meeting of Stockholders.

- 2.

- To vote on a proposed amendment to Dyax's 1998 Employee Stock Purchase Plan (the "Purchase Plan") that would increase the number of shares of Common Stock issuable under the plan by 200,000 shares from 200,000 to 400,000 shares.

- 3.

- To transact any other business that may properly come before the meeting or any adjournment of the meeting.

Only stockholders of record at the close of business on April 3, 2003 will be entitled to vote at the meeting or any adjournment of the meeting.

It is important that your shares be represented at the meeting.Therefore, whether or not you plan to attend the meeting, please complete your proxy and return it in the enclosed envelope, which requires no postage if mailed in the United States. If you attend the meeting and wish to vote in person, your proxy will not be used.

| | | By order of the Board of Directors, |

|

|

Nathaniel S. Gardiner

Secretary |

April 15, 2003

DYAX CORP.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

MAY 15, 2003

Our Board of Directors is soliciting your proxy with the enclosed proxy card for use at the 2003 Annual Meeting of Stockholders of Dyax Corp. to be held at our offices at 300 Technology Square, Cambridge, Massachusetts at 2:00 p.m. on Thursday, May 15, 2003, and at any adjournments of the meeting. The approximate date on which this proxy statement and accompanying proxy are first being sent or given to stockholders is April 15, 2003.

General Information About Voting

Who can vote. You will be entitled to vote your shares of Dyax Common Stock at the annual meeting if you were a stockholder of record at the close of business on April 3, 2003. As of that date, 24,562,067 shares of Common Stock were outstanding. You are entitled to one vote for each share of Common Stock that you held at that date.

How to vote your shares. You can vote your shares either by attending the annual meeting and voting in person or by voting by proxy. If you choose to vote by proxy, please complete, sign, date and return the enclosed proxy card. The proxies named in the enclosed proxy card will vote your shares as you have instructed. If you sign and return the proxy card without indicating how you wish your shares to be voted, the proxies will vote your shares in favor of the proposals contained in this proxy statement, as recommended by our Board of Directors. Even if you plan to attend the meeting, please complete and mail your proxy card to ensure that your shares are represented at the meeting. If you attend the meeting, you can still revoke your proxy by voting in person.

How you may revoke your proxy. You may revoke the authority granted by your executed proxy at any time before its exercise by filing with Dyax, Attention: Nathaniel S. Gardiner, Secretary, a written revocation or a duly executed proxy bearing a later date, or by voting in person at the meeting.

Quorum. A quorum of stockholders is required in order to transact business at the annual meeting. A majority of the outstanding shares of Common Stock entitled to vote must be present at the meeting, represented either in person or by proxy, to constitute a quorum for the transaction of business. If your shares are held in a brokerage account, you must make arrangements with your broker or bank to vote your shares in person or to revoke your proxy.

Abstentions and broker non-votes. "Broker non-votes" are proxies submitted by brokers that do not indicate a vote for one or more proposals because the brokers do not have discretionary voting authority and have not received instructions from the beneficial owners on how to vote on these proposals. Abstentions and broker non-votes will be considered present for purposes of determining a quorum for a matter.

Householding of Annual Meeting Materials. Some banks, brokers and other nominee record holders may be "householding" our proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to stockholders may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you call or write us at our principal executive offices, 300 Technology Square, Cambridge, Massachusetts 02139, Attn: Secretary, telephone: (617) 225-2500. If you want to receive separate copies of the proxy statement or annual report to stockholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and telephone number.

1

Share Ownership

The following table and footnotes set forth certain information regarding the beneficial ownership of our Common Stock as of March 25, 2003 by (i) persons known by us to be beneficial owners of more than 5% of our Common Stock, (ii) our current executive officers and our named executive officers, (iii) our directors and (iv) all our current executive officers and directors as a group.

| | Number of Shares Beneficially Owned

| |

|---|

Beneficial Owner

| |

|---|

| | Shares(1)

| | Percent

| |

|---|

HealthCare Ventures V, L.P. and certain related entities(2)

44 Nassau Street

Princeton, NJ 08542 | | 1,651,376 | | 6.75 | % |

Francis H. and Margrit A. Kelly(3)

1 Voltastrasse

8044 Zurich, Switzerland | | 1,623,750 | | 6.64 | % |

Thomas L. Kempner(4)

c/o Loeb Partners Corporation

61 Broadway

New York, NY 10006 | | 1,546,415 | | 6.32 | % |

Lancet Capital Health Ventures, L.P.(5)

124 Mount Auburn Street, Suite 200N

Cambridge, MA 02138 | | 1,344,087 | | 5.50 | % |

Alta Partners and certain related entities(6)

One Embarcadero Center, 4050

San Francisco, CA 94111 | | 1,336,147 | | 5.46 | % |

Dimensional Fund Advisors Inc.(7)

1299 Ocean Avenue, 11th Floor

Santa Monica, CA 90401 | | 1,245,800 | | 5.09 | % |

| Henry E. Blair(8) | | 863,737 | | 3.53 | % |

| Constantine Anagnostopoulos(9) | | 54,645 | | * | |

| James W. Fordyce(10) | | 638,871 | | 2.61 | % |

| Henry R. Lewis(11) | | 84,407 | | * | |

| John W. Littlechild(12) | | 1,672,876 | | 6.84 | % |

| Alix Marduel(13) | | 1,363,647 | | 5.58 | % |

| David J. McLachlan(14) | | 36,700 | | * | |

| Gregory D. Phelps(15) | | 244,083 | | 1.00 | % |

| Lynn G. Baird, Ph.D.(16) | | 29,583 | | * | |

| Scott C. Chappel(17) | | 167,325 | | * | |

| Stephen S. Galliker(18) | | 220,441 | | * | |

| Jack H. Morgan(19) | | 51,422 | | * | |

| David B. Patteson(20) | | 112,077 | | * | |

| Anthony Williams, M.D.(21) | | 41,041 | | * | |

| All Current Directors and Executive Officers as a Group (14 Persons)(22) | | 7,127,270 | | 29.14 | % |

- *

- Less than 1%

- (1)

- The persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned by them, except as noted below.

2

- (2)

- Based on the Schedule 13G filed by HealthCare Ventures V, L.P. with the SEC on February 11, 2002, HealthCare Partners V, L.P. is the general partner of HeatlhCare Ventures V, L.P. The natural persons who control the 1,651,376 shares owned by HealthCare Ventures V., L.P. are John W. Littlechild, William Crouse, Harold R. Werner, Christopher Mirabelli, Ph.D., Augustine Lawlor, and James H. Cavanaugh, Ph.D.

- (3)

- Based on the Schedule 13D/A filed by Francis H. and Margrit A. Kelly with the SEC on April 9, 2003, Mr. and Mrs. Kelly share beneficial ownership of 1,623,750 shares, as joint tenants. Mr. and Mrs. Kelly also share voting and dispositive control over 985,450 shares. Mr. Kelly has sole voting and dispositive control over 1,000 shares and Mrs. Kelly has sole voting and dispositive control over 637,300 shares.

- (4)

- Includes (i) 1,441,048 shares of Common Stock held in trusts for the benefit of Mr. Kempner's brother, Mr. Kempner's brother's children, Mr. Kempner's children, and Mr. Kempner, of which Mr. Kempner is a trustee (ii) 11,792 shares held by Pinpoint Partners Corporation, of which Mr. Kempner is President, and (iii) 53,764 shares owned by Loeb Investors Co. IX, of which Mr. Kempner is the Managing Partner. Also includes 32,563 shares of Common Stock issuable to Mr. Kempner upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (5)

- Based on the Schedule 13G filed by Lancet Capital Health Ventures, L.P. with the SEC on April 8, 2003, Lancet Capital Health Ventures, L.P. ("Lancet Capital L.P.") is the record owner of these shares of common stock. Lancet Capital Health Ventures, G.P., LLC ("Lancet Capital G.P."), in its capacity as general partner of Lancet Capital L.P., has the power to vote and dispose of the common stock held by Lancet Capital L.P. William J. Golden and George L. Sing are the managing directors of Lancet Capital G.P. As such, they each have the power to direct the voting control of Lancet Capital G.P. While neither Mr. Golden nor Mr. Sing own of record any shares of common stock, as a result of their positions, both of them may be deemed to be beneficial owners of and to have the power to exercise or to direct the exercise of voting and/or dispositive power with respect to these shares. Messrs. Golden and Sing disclaim beneficial ownership over any of these securities which they may be deemed to beneficially own.

- (6)

- Based on the Schedule 13G filed by Alta Partners with the SEC on February 5, 2003, consists of (i) 830,530 shares held by Alta BioPharma Partners, L.P., (ii) 31,305 shares held by Alta Embarcadero BioPharma Partners, LLC, and (iii) 474,312 shares held by Dyax Chase Partners, LLC. As general partners and managing members of these entities, the principals of Alta Partners exercise control over voting and investment decisions with respect to these shares. The principals of Alta Partners are Jean Deleage, Garrett Gruener, Daniel Janney, Alix Marduel and Guy Nohra.

- (7)

- Based on the Schedule 13G filed by Dimensional Fund Advisors Inc. ("Dimensional") with the SEC on February 11, 2003, Dimensional, an investment advisor registered under Section 203 of the Investment Advisors Act of 1940, furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other commingled group trusts and separate accounts. These investment companies, trusts and accounts are referred to as the "Dimensional Funds." In its role as investment advisor or manager, Dimensional possesses voting and/or investment power over the securities of Dyax described in its Schedule 13G that are owned by the Dimensional Funds, and may be deemed to be the beneficial owner of the shares of Dyax held by the Dimensional Funds. However, all securities reported in its Schedule 13G are owned by the Dimensional Funds. Dimensional disclaims beneficial ownership of such securities.

- (8)

- Includes (i) 114,100 shares which are held in trust for the benefit of Mr. Blair's spouse and child, as to which Mr. Blair disclaims beneficial ownership, and (ii) 192,716 shares of Common Stock issuable to Mr. Blair upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

3

- (9)

- Includes 41,060 shares of Common Stock issuable to Dr. Anagnostopoulos upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (10)

- Includes 588,031 shares held by Prince Venture Partners IV Limited Partnership. Mr. Fordyce is a general partner of Prince Ventures Limited Partnership, the general partner of Prince Venture Partners IV Limited Partnership. Mr. Fordyce disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest in these entities. Also includes 32,299 shares of Common Stock issuable to Mr. Fordyce upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (11)

- Includes 44,049 shares of Common Stock issuable to Dr. Lewis upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (12)

- Includes 1,651,376 shares held by HealthCare Ventures V, L.P. Mr. Littlechild is the general partner of HealthCare Partners, LP, which is the general partner of HealthCare Ventures V, L.P. Mr. Littlechild disclaims beneficial ownership of these shares except to the extent of his pecuniary interest in the limited partnerships. Also includes 21,500 shares of Common Stock issuable to Mr. Littlechild upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (13)

- Includes (i) 830,530 shares held by Alta BioPharma Partners, L.P., (ii) 31,305 shares held by Alta Embarcadero BioPharma Partners, LLC, and (iii) 474,312 shares held by Dyax Chase Partners, LLC. The principals of Alta Partners exercise control over voting and investment decisions with respect to these securities. See Note (4) above. Dr. Marduel is a general partner of Alta Partners. She disclaims beneficial ownership of these shares, except to the extent of her pecuniary interest in the entities. Also includes 27,500 shares of Common Stock issuable to Dr. Marduel upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (14)

- Includes 31,500 shares of Common Stock issuable to Mr. McLachlan upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (15)

- Includes 174,770 shares of Common Stock issuable to Mr. Phelps upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (16)

- Consists entirely of shares of Common Stock issuable to Dr. Baird upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (17)

- Includes 130,384 shares of Common Stock issuable to Dr. Chappel upon exercise of outstanding options exercisable on or before May 7, 2003.

- (18)

- Includes 162,299 shares of Common Stock issuable to Mr. Galliker upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (19)

- Includes 50,833 shares of Common Stock issuable to Mr. Morgan upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (20)

- Consists entirely of shares of Common Stock issuable to Mr. Patteson upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (21)

- Consists entirely of shares of Common Stock issuable to Dr. Williams upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

- (22)

- See Notes 2, 8 through 16 and 18 through 21. Includes 993,790 shares of Common Stock issuable upon exercise of outstanding options exercisable within the 60-day period following March 25, 2003.

Section 16(a) Beneficial Ownership Reporting Compliance

Our executive officers and directors and persons who own beneficially more than ten percent of our equity securities are required under Section 16(a) of the Securities Exchange Act of 1934 to file reports of ownership and changes in their ownership of our securities with the Securities and Exchange Commission. They must also furnish copies of these reports to us. Based solely on a review of the copies of reports furnished to us and written representations that no other reports were required, we believe that for 2002 our executive officers, directors and 10% beneficial owners complied with all applicable Section 16(a) filing requirements, except that a Form 3 report was filed late on behalf of Mr. Morgan after he was first designated an executive officer.

4

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors has fixed the number of directors at nine (9) for the coming year. Under our charter, our Board is divided into three classes, with each class having as nearly equal number of directors as possible. The term of one class expires, with their successors being subsequently elected to a three-year term, at each annual meeting of stockholders. At the 2003 Annual Meeting three Class III Directors will be elected to hold office for three years until their successors are elected and qualified. Our Board of Directors has nominated Constantine E. Anagnostopoulos, Henry R. Lewis and David J. McLachlan for election as Class III Directors at the upcoming annual meeting. Each has consented to serve, if elected. If any nominee is unable to serve, proxies will be voted for any replacement candidate nominated by our Board of Directors.

Votes Required

Directors will be elected by a plurality of the votes cast by the stockholders entitled to vote on this proposal at the meeting. Abstentions, broker non-votes and votes withheld will not be treated as votes cast for this purpose and, therefore, will not affect the outcome of the election.

The following table contains certain information as of March 31, 2003 about the nominees for Class III Director and current directors whose term of office will continue after the annual meeting.

Name and Age

| | Business Experience During Past Five Years

and Other Directorships

| | Director Since

|

|---|

| | | Class III Directors

(present term expires in 2003) | | |

Constantine E. Anagnostopoulos

Age: 80 |

|

Constantine E. Anagnostopoulos, Ph.D.has been a director of Dyax since 1991. He has been a Managing General Partner of Gateway Associates L.P., a venture capital management firm, since 1987. Dr. Anagnostopoulos is a retired corporate officer of Monsanto Company. He is also a director of a number of other biotechnology companies, including Genzyme Corporation and Deltagen, Inc. |

|

1991 |

Henry R. Lewis

Age: 77 |

|

Henry R. Lewis, Ph.D. has been a director of Dyax since August 1995, and previously was a director of Protein Engineering Corporation before its merger with Dyax. Dr. Lewis is a consultant to several companies. From 1986 to February 1991, Dr. Lewis was the Vice Chairman of the board of directors of Dennison Manufacturing Company, a manufacturer and distributor of products for the stationery, technical paper and industrial and retail systems markets. From 1982 to 1986, he was a Senior Vice President of Dennison Manufacturing Company. Dr. Lewis was also a director of Genzyme Corporation, a biotechnology company, from 1986 until 2000. |

|

1995 |

|

|

|

|

|

5

David J. McLachlan

Age: 64 |

|

David J. McLachlan has been a director of Dyax since May 1999. Since June 1999, Mr. McLachlan has been a Senior Advisor to Genzyme Corporation, where he held the position of Executive Vice President and Chief Financial Officer from 1989 through 1999. Mr. McLachlan currently serves on the board of directors of: HearUSA Inc., a hearing care company; Skyworks Solutions, Inc., a wireless semiconductor company; and Peptimmune, Inc., a private biotechnology company. He is also a director of the Massachusetts Biotechnology Council. |

|

1999 |

|

|

Class I Directors

(present term expires in 2004) |

|

|

Henry E. Blair

Age: 59 |

|

Henry E. Blairhas served as Chairman of the Board and President of Dyax Corp. since its merger with Protein Engineering Corporation in August 1995, and as acting Chief Executive Officer from August 1995 until his appointment as Chief Executive Officer in April 1997. He has been a director and officer of the Company since co-founding it in 1989. Mr. Blair is a director of Genzyme Corporation, a biotechnology company he co-founded in 1981. He is also a director of Esperion Therapeutics, Inc., a biotechnology company, a trustee of the Center for Blood Research, and a member of the Board of Overseers at Tufts University School of Medicine and at Lahey Hitchcock Clinic. |

|

1989 |

John W. Littlechild

Age: 51 |

|

John W. Littlechild has been a director of Dyax since 1998. Mr. Littlechild is a general partner of HealthCare Partners V, L.P. which is the general partner of HealthCare Ventures V, L.P. He also serves in a similar capacity with other related entities. Mr. Littlechild is also a member of HealthCare Ventures LLC, a venture management company that, among other things, provides management services to HealthCare Ventures V, L.P., and its related entities. From 1984 to 1991, Mr. Littlechild was a Senior Vice President of Advent International Corporation, a venture capital company in Boston and London. Prior to working at Advent in Boston, Mr. Littlechild was involved in establishing Advent in the United Kingdom. Mr. Littlechild serves on the board of directors of various health care and biotechnology companies, including Diacrin, Inc., a biotechnology company, and Orthofix International N.V., a medical device company. |

|

1998 |

|

|

|

|

|

6

Gregory D. Phelps

Age: 54 |

|

Gregory D. Phelpshas been a director of Dyax since 1998. He has been the Chief Executive Officer and a director of Ardais Corporation since December 2002. Prior to that, he was Vice Chairman of Dyax. Mr. Phelps was an executive officer of Genzyme Corporation, a biotechnology company, from 1991 to 1997, and was Executive Vice President at his departure. |

|

1998 |

|

|

Class II Directors

(present term expires 2005) |

|

|

James W. Fordyce

Age: 60 |

|

James W. Fordyce has been a director of Dyax since August 1995. Since 1981, he has served as a general partner of Prince Ventures Limited Partnership, a venture capital management firm, and its affiliated partnerships. Prince Venture Partners IV Limited Partnership is a venture capital limited partnership, managed by Prince Ventures Limited Partnership, which specializes in early stage investments in companies involved in the medical and life science areas. Mr. Fordyce has also served as Managing Member of Fordyce & Gabrielson LLC, a private investment management firm, since 1998. In addition, he is Chairman of the Albert and Mary Lasker Foundation. |

|

1995 |

Thomas L. Kempner

Age: 75 |

|

Thomas L. Kempner has been a director of Dyax since August 1995, and previously was a director of Protein Engineering Corporation before its merger with Dyax. Mr. Kempner is the Chairman and Chief Executive Officer of Loeb Partners Corporation, an investment banking, registered broker/dealer and registered investment advisory firm. He is also President of Pinpoint Partners Corporation, the general partner of the Loeb Investment Partnerships. Mr. Kempner is a director of Alcide Corporation, CCC Information Services Group, Inc., FuelCell Energy, IGENE BioTechnology, Inc., Insight Communications Company, Inc., and Intermagnetics General Corporation. Mr. Kempner also serves as a director emeritus of Northwest Airlines, Inc., an airline company. |

|

1995 |

|

|

|

|

|

7

Alix Marduel

Age: 45 |

|

Alix Marduel, M.D. has been a director of Dyax since October 1998. She is a managing director of Alta Partners, a venture capital firm investing in life sciences and information technology companies. Prior to joining Alta Partners in 1997, Dr. Marduel was a partner at Sofinnova, Inc., a venture capital management firm, which she joined in 1990. Dr. Marduel holds a medical doctorate from the University of Paris, is licensed to practice medicine in Europe and has passed U.S. equivalency exams. Dr. Marduel has conducted post-doctoral research in immunology at the University of California at San Francisco and at Stanford University. Prior to moving to the United States in 1986, she was employed by the pharmaceutical company ICI-Pharma, where she organized clinical trials in England and France. |

|

1998 |

Board and Committee Meetings

Our Board of Directors held nine (9) meetings during 2002. Each of the directors then in office attended at least 75% of the aggregate of all meetings of the Board of Directors and all meetings of the committees of the Board of Directors on which such director then served, except that Dr. Anagnostopoulos attended 57% of such meetings. Our Board of Directors has standing Audit and Compensation Committees, but does not have a Nominating Committee.

Audit Committee. The Audit Committee evaluates our independent auditors, reviews our audited financial statements, accounting processes and reporting systems and discusses the adequacy of our internal financial controls with our management and our auditors. The Audit Committee also is responsible for the appointment of our independent auditors. The members of the Audit Committee are David McLachlan (Chair), Henry Lewis, and Thomas Kempner, each of whom is independent as defined by applicable Nasdaq National Market standards governing the qualifications of Audit Committee members. The Audit Committee held six (6) meetings during fiscal 2002. The Audit Committee operates under a written charter adopted by the Board. For more information about the Audit Committee, See "Audit Committee Report" in this proxy statement.

8

Compensation Committee. Our Compensation Committee is responsible for establishing cash compensation policies with respect to our executive officers, employees, directors and consultants, determining the compensation to be paid to our executive officers and administering our equity incentive and stock purchase plans. The members of the Compensation Committee are James Fordyce (Chair), Constantine Anagnostopoulos, and Henry Lewis. The Compensation Committee held five (5) meetings during fiscal 2002.

Director Compensation

Director Fees. Our directors who are not employees of Dyax receive compensation for their services as directors in the form of a retainer of $12,000, payable in quarterly installments, and a fee of $750 for each meeting attended ($375 for attendance by conference call), plus reimbursement for travel expenses. We pay non-employee directors who serve as the chairman of a committee of the Board of Directors an additional $3,000 per year. All other non-employee directors who serve on a committee of the Board of Directors receive $1,000 per year. Directors who are also our employees receive no additional compensation for serving as directors.

Stock Options. In addition, in 2002 all of our non-employee Class III and Class II directors automatically received stock options under our Amended and Restated 1995 Equity Incentive Plan to purchase 9,000 shares of our Common Stock for each year of their remaining terms of office and also received stock options to purchase 1,500 shares of our Common Stock for each remaining year of their present terms of office. Our non-employee directors elected at the 2002 Annual Meeting automatically received stock options to purchase 9,000 shares of our Common Stock for each year of their three-year term, as will non-employee directors elected at the 2003 Annual Meeting.

Certain Relationships and Related Transactions

In October 1998, we loaned $1,300,000 to Henry Blair, our Chairman and Chief Executive Officer, in connection with a purchase of real property. This loan is secured by Mr. Blair's interest in the real property and by his shares of our capital stock. Interest accrues on the unpaid principal balance at the rate of one and a half percent less than the base rate of Fleet National Bank, provided that the interest rate will not be less than the minimum rate required to avoid imputed interest for federal income tax purposes. This loan is due and payable on October 30, 2003; provided, however, that it may be accelerated at any time at the discretion of the Board of Directors, including upon (i) termination of Mr. Blair's service as our Chairman and Chief Executive Officer, or (ii) if our cash and marketable investments total less than $10,000,000. As of March 1, 2003, $1,256,000 in principal amount remained outstanding under this loan.

Mr. Blair serves as an outside director of Genzyme Corporation. Mr. Anagnostopoulos is also a director of Genzyme and Mr. McLachlan is a Senior Advisor to Genzyme. We subleased a portion of our research facilities in Cambridge, Massachusetts, from Genzyme at a rate of $40 per square foot for a total of 16,183 square feet, pursuant to a lease arrangement that expired in April 2002. Prior to the expiration of this lease, we moved our research facility to our new headquarters located at 300 Technology Square, Cambridge.

In October 1998, we entered into a collaboration and commercialization agreement with Genzyme for one of our proprietary therapeutic compounds for the treatment of chronic inflammatory diseases, with initial development to be focused on the treatment of hereditary angioedema. On May 31, 2002, we amended our collaboration agreement with Genzyme. We are now funding the development of DX-88 for the treatment of HAE and expect to complete the first Phase II clinical trial for HAE, referred to as the Initial Program, early in the second quarter of 2003. Genzyme has an option to acquire a 50% interest in the DX-88 program upon our completion of the Initial Program, and will have a period of 60 days after review of the clinical trial data to exercise its option. If Genzyme

9

exercises its option, it will be responsible for 50% of the development costs incurred subsequent to completion of the Initial Program. Genzyme will also be obligated to pay us, upon dosing of the first patient in a clinical trial of DX-88 for HAE, one-half of the development costs in excess of $6.0 million that we incurred through completion of the Initial Program. Through December 31, 2002, we had incurred approximately $11.0 million of development costs for the Initial Program.

On May 31, 2002, we entered into a senior secured promissory note and security agreement with Genzyme, under which Genzyme agreed to loan us up to $7.0 million. Under the note and the security agreement, we pledged certain tangible and intangible personal property relating to or arising out of the DX-88 program. As of March 1, 2003, we had borrowed the full $7.0 million available under the loan. In addition, under our collaboration agreement with Genzyme, as of March 31, 2003, we exercised our option to purchase Genzyme's interest in the application of DX-88 for the prevention of blood loss and other systemic inflammatory responses in cardiopulmonary bypass and other surgery, which will require us to pay Genzyme $1.0 million in the second quarter of 2003. The terms of the security agreement require Genzyme to release its security interest in the portion of the DX-88 program relating to this indication and that we pledge a percentage of our interest in our wholly owned subsidiary, Biotage, Inc., as additional collateral for the Genzyme loan. As of March 1, 2003, Genzyme owns approximately 2.7% of our outstanding Common Stock.

Compensation Committee Interlocks And Insider Participation

Our Compensation Committee determines salaries, incentives and other compensation for our directors and officers. The Compensation Committee also administers our equity incentive and stock purchase plans. The Compensation Committee currently consists of Drs. Anagnostopoulos and Lewis, and Mr. Fordyce. For more information regarding the relationship of Dr. Anagnostopoulos with Genzyme Corporation and its relationships with Dyax, see the sections of this proxy statement entitled "Share Ownership", "Election of Directors" and "Certain Relationships and Related Transactions".

PROPOSAL 2

AMENDMENT OF THE 1998 EMPLOYEE STOCK PURCHASE PLAN

Summary of the 1998 Employee Stock Purchase Plan

General. In April 2003, upon recommendation of the Compensation Committee, the Board of Directors approved several technical amendments to the 1998 Employee Stock Purchase Plan, referred to as the Purchase Plan, primarily to limit the total number of shares that may be purchased in any exercise period and also to limit the number of shares that any participant may purchase. Having made these amendments, the Board of Directors approved submission to our stockholders for approval a further amendment to increase the number of shares reserved under the Purchase Plan by 200,000 shares. The description below summarizes the material provisions of the Purchase Plan, as amended by the Board of Directors. This summary is qualified in its entirety by reference to the full text of the Purchase Plan, attached asAppendix Bto this Proxy Statement.

Purpose. The Purchase Plan provides our full-time U.S. employees the opportunity to purchase shares of our common stock at periodic intervals on tax-advantaged terms. Under the Purchase Plan, only 146,085 shares remain available for issuance, and we anticipate that there will not be sufficient shares remaining in June 2004 to fulfill all options exercisable on that purchase date under the next offering that will commence on January 1, 2004. We believe that continuing to provide the benefits available under the Purchase Plan to our employees will help us attract and retain top quality personnel, motivate them to acquire an equity stake in Dyax and provide an incentive for them to achieve long-range performance goals to the extent they retain the shares purchased under the

10

Purchase Plan. Our Board of Directors strongly believes that continuing to offer a program in which our employees can purchase shares of our common stock is an important component of our compensation program. The Purchase Plan is intended to qualify as an "employee stock purchase plan" under Section 423 of the Internal Revenue Code.

Administration. By action of Dyax's Compensation Committee on February 15, 2001, Mr. Blair, in his capacity as the Chairman, President and Chief Executive Officer of Dyax, was delegated the authority to grant the rights to purchase shares of our common stock under the Purchase Plan, at his discretion. Mr. Blair determines the frequency and duration of individual offerings under the Purchase Plan and the date(s) when stock may be purchased.

Authorized Shares. Currently, a maximum of 200,000 of our authorized but unissued shares of common stock may be issued under the Purchase Plan, subject to appropriate adjustment in the event of any stock dividend, stock split, merger, consolidation, reorganization, recapitalization or similar change in our capital structure. If the proposed amendment is approved, the maximum number of shares reserved for issuance under the Purchase Plan will be increased to 400,000 shares. If any purchase right expires or terminates, the shares subject to the unexercised portion of such purchase right will again be available for issuance under the Plan. The maximum number of shares that may be sold under the Plan during any single exercise period is 25,000 shares multiplied by the number of full calendar quarters included in that exercise period. This effectively limits the number of shares that may be sold under the Purchase Plan to 100,000 per year. If the number of shares available is insufficient to cover shares offered during an offering period or on any day the shares are purchased ("Purchase Date"), the Compensation Committee may authorize an equitable pro rata allocation of shares among all participants and either continue or terminate all offerings then in effect.

Eligibility. All employees of Dyax or any U.S. subsidiary designated by the Compensation Committee, who work at least twenty hours per week and are employed for at least five months, are eligible to participate in the Purchase Plan. As of April 7, 2003, 197 employees were eligible to participate in the Purchase Plan.

Offerings. Dyax may make one or more offerings to employees to purchase shares of Dyax common stock, as determined by the Compensation Committee. No offering period may exceed 27 months in duration.

Purchase Price. The purchase price per share in an offering is 85% of the lower of the fair market value of common stock on the first day of an offering period (the "Offering Date") or the Purchase Date and may be paid through regular payroll deductions, lump sum cash payments, by delivery of shares of Dyax common stock, or some combination thereof, as determined by the Compensation Committee. The closing price of our common stock on April 3, 2003, as reported by the NASDAQ National Market, was $1.94

Participation and Withdrawal. Participation in the Purchase Plan is voluntary, and a participant may withdraw from an offering before stock is purchased. No employee will be eligible to participate in more than one offering at a time. Directors who are not employees of Dyax are not eligible to participate in the Purchase Plan. Participation in the Purchase Plan terminates automatically upon termination of employment for any reason. Given that the number of shares that may be purchased under the Purchase Plan is determined, in part, on any common stock's market value on the first and last day of the enrollment period and given that participation in the Purchase Plan is voluntary on the part of employees, the actual number of shares that may be purchased by any individual is not determinable.

Purchase Limitations. The maximum number of shares of common stock that a participant may purchase on a Purchase Date is limited to 875 shares multiplied by the number of full calendar

11

quarters since the prior Purchase Date in the offering. This effectively limits each employee to a maximum of 3,500 shares that may be purchased per year. As required by Section 423 of the Internal Revenue Code, an employee's purchases under the Purchase Plan and all other Dyax employee stock purchase plans intended to qualify under Section 423 of the Code may not accrue at a rate which exceeds $25,000 per calendar year (based upon the fair market value of the stock determined as of the Offering Date), or such lower amount as may be determined by Dyax's Compensation Committee. In addition, no employee may contribute more than 15% of the employee's annual rate of compensation (or such lesser percentage as the Compensation Committee may fix). Furthermore, an employee may not subscribe for shares under the Purchase Plan if, immediately after having subscribed, the employee would own 5% or more of the voting power or value of all classes of our stock, including stock which may be purchased through subscriptions under the Purchase Plan or any other plans.

Merger or Change in Control. In the event of a sale of all or substantially all of our assets or a merger, consolidation or other reorganization in which our stockholders immediately prior to the transaction own less than 50% of the voting stock of Dyax or our successor, each right under the Purchase Plan shall be assumed or an equivalent right shall be substituted by such successor corporation or a parent or subsidiary of such successor corporation. In the event the successor corporation refuses to assume or substitute for the rights, or if the Compensation Committee determines otherwise to do so, the Compensation Committee shall shorten any purchase periods and offering then in progress by setting a new Purchase Date and any offering shall end on the new Purchase Date, which shall be on or before the date of consummation of the change in control transaction.

Termination or Amendment. The Compensation Committee may at any time terminate or amend the Purchase Plan, or terminate any offering. However, the Compensation Committee may not amend the Purchase Plan without the approval of Dyax stockholders if stockholder approval is required by Section 423 of the Internal Revenue Code or by applicable law, regulation, or stock exchange rule. No rights will be granted under the Purchase Plan after January 30, 2008.

Federal Income Tax Consequences

A participant does not realize taxable income at the commencement of an offering or at the time shares are purchased under the Purchase Plan.

If a participant does not dispose of shares purchased under the Purchase Plan for at least:

- •

- two years from the Offering Date, and

- •

- one year from the Purchase Date,

then upon sale of the shares, the lesser of 15% of the fair market value of the stock (determined as of Offering Date) or the amount realized on sale of such shares in excess of the purchase price, is taxed to the participant as ordinary income, with any additional gain taxed as long-term capital gain and any loss taxed as long-term capital loss. No deduction will be allowed to Dyax for Federal income tax purposes.

If a participant disposes of shares of common stock purchased under the Purchase Plan before the expiration of the prescribed holding periods, then the participant realizes ordinary income in the year of disposition in an amount equal to the excess of the fair market value of the shares on the date of purchase over the purchase price thereof, and Dyax is entitled to deduct this amount. Any further gain or loss is treated as a short-term or long-term capital gain or loss and will not result in any deduction for Dyax.

12

Vote Required

The affirmative vote by the holders of a majority of the shares present, or represented by proxy, and entitled to vote at the meeting is required to approve the Purchase Plan. Broker non-votes will not be counted as present or represented for this purpose. Abstentions will be counted as present and entitled to vote and, accordingly, will have the effect of a negative vote.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFOR THIS PROPOSAL.

Equity Compensation Plan Information

The following table provides information about the securities authorized for issuance under the Company's equity compensation plans as of December 31, 2002:

Plan Category

| | Number of securities

to be issued

upon exercise of

outstanding options,

warrants and rights

(a)

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

(b)

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

(c)

|

|---|

| Equity compensation plans approved by security holders:(1) | | 4,306,313(2) | | $6.94 | | 1,906,131(3) |

| Equity compensation plans not approved by security holders: | | — | | — | | — |

| | |

| |

| |

|

| | Totals: | | 4,306,313(2) | | $6.94 | | 1,906,131(3) |

| | |

| |

| |

|

- (1)

- Consists of the Amended and Restated 1995 Equity Incentive Plan and the 1998 Employee Stock Purchase Plan.

- (2)

- Does not include purchase rights accruing under the 1998 Employee Stock Purchase Plan because the purchase price (and therefore the number of shares to be purchased) will not be determined until the end of the purchase period.

- (3)

- Includes 146,085 shares issuable under the 1998 Employee Stock Purchase Plan, of which up to 146,085 are issuable in connection with the current offering period which ends on June 30, 2003. The remaining shares consist of 1,760,046 issuable under the Amended and Restated 1995 Equity Incentive Plan, which amount reflects the automatic increase of 1,207,872 shares that occurred on January 1, 2003 under the terms of the Plan. Under the 1995 Amended and Restated Equity Incentive Plan, effective date July 13, 1995, the number of shares issuable is automatically increased every January 1 by an amount equal to the lesser of (i) 1,250,000 shares, (ii) 5% of the fully diluted outstanding shares of Common Stock of the Company on such date or (iii) such lesser amount as may be determined by resolution of the Board of Directors at any date before or within 90 days after January 1 of the respective year; provided, however, that the maximum aggregate number of shares received since inception under the plan shall not exceed 10,250,000 shares. No incentive stock options may be granted under the plan more than ten years after the effective date. The plan may be amended, suspended, or terminated by the Compensation Committee of the Board of Directors at any time, subject to any stockholder approval.

13

EXECUTIVE OFFICERS AND KEY EMPLOYEES

The following contains certain information as of March 31, 2003 about the current executive officers and key employees of Dyax:

Name

| | Age

| | Position

|

|---|

| Henry E. Blair* | | 59 | | Chairman of the Board, President and Chief Executive Officer |

Stephen S. Galliker* |

|

56 |

|

Executive Vice President, Finance and Administration, and Chief Financial Officer |

David B. Patteson* |

|

47 |

|

Executive Vice President, President of Biotage, Inc. |

Lynn G. Baird, Ph.D.* |

|

55 |

|

Senior Vice President, Development |

Robert Charles Ladner, Ph.D. |

|

58 |

|

Senior Vice President and Chief Scientific Officer |

Jack H. Morgan* |

|

51 |

|

Senior Vice President, Corporate Development and Business Operations |

Anthony H. Williams, M.D.* |

|

47 |

|

Senior Vice President, Medical Affairs and Clinical Operations |

- *

- Executive officer

Henry E. Blair has served as Chairman of the Board and President of Dyax Corp. since its merger with Protein Engineering Corporation in August 1995, and as acting Chief Executive Officer from August 1995 until his appointment as Chief Executive Officer in April 1997. He has been a director and officer of the Company since co-founding it in 1989. Mr. Blair is a director of Genzyme Corporation, a biotechnology company he co-founded in 1981. He is also a director of Esperion Therapeutics, Inc., a biotechnology company, a trustee of the Center for Blood Research, and a member of the Board of Overseers at Tufts University School of Medicine and at Lahey Hitchcock Clinic.

Stephen S. Galliker has served Dyax as Executive Vice President, Finance and Administration, and Chief Financial Officer since September 1999. He was Chief Financial Officer of Excel Switching Corporation, a developer and manufacturer of open switching platforms for telecommunications networks, from July 1996 to September 1999 and was Excel's Vice President, Finance and Administration from September 1997. Mr. Galliker was employed by Ultracision, Inc., a developer and manufacturer of ultrasonically powered surgical instruments from September 1992 to June 1996. At Ultracision, Inc., Mr. Galliker was Chief Financial Officer and Vice President of Finance until November 1995 and Chief Operating Officer from December 1995 to June 1996.

David B. Patteson has served as President of Biotage, Inc., a wholly owned subsidiary of Dyax, since Biotage was formed in October 2000. He is also an Executive Vice President of Dyax, a role he has held since March 2001. Mr. Patteson joined Dyax in November 1998 as Senior Vice President and President of the Separations Division of Biotage Products. From 1994 until he joined Dyax, Mr. Patteson was an executive at Siebe plc, a diversified engineering and electronics company, most recently as Vice President and General Manager, Siebe Measurement and Controls Division. Prior to joining Siebe, Mr. Patteson was President of Perstorp Analytical, Inc., a laboratory and process analytical instruments company.

Lynn G. Baird, Ph.D.has served as Senior Vice President of Development for Dyax since March 2002. She joined the company in October 2001 as Senior Vice President of Preclinical and Regulatory Affairs. From 1998 to 2001, she held the title of Vice President at Reprogenesis, Inc. and its

14

successor Curis, Inc., a biotechnology company. Her responsibilities at various times during her tenure included Regulatory Affairs, Quality, Clinical Development and Preclinical Development. Prior to Reprogenesis, Dr. Baird was at CytoTherapeutics, Inc., a biotechnology company, from 1995 to 1998 and was Vice President of Regulatory, Quality and Clinical Development at her departure. Prior to that she held positions of increasing responsibility at Johnson and Johnson, a pharmaceutical company, from 1990 to 1995 and at Creative BioMolecules, a biotechnology company, from 1985 to 1990.

Robert Charles Ladner, Ph.D. became Senior Vice President and Chief Science Officer of Dyax in August 1995. He was a co-founder of Protein Engineering Corporation where he was an inventor of our fundamental phage display technology and served as Senior Vice President and Scientific Director from 1987 until its merger with Dyax in August 1995. Previously, Dr. Ladner served as Senior Scientist of Genex Corp., where he was an inventor of single chain antibodies.

Jack H. Morgan has been Senior Vice President, Corporate Development and Business Operations since joining Dyax in May 2001. Mr. Morgan served as a consultant to Syntonix Pharmaceuticals, Inc., a pharmaceutical company, from January to May 2001, to PerkinElmer, Inc., a technology company, and to Caremark Inc., a pharmaceutical services company, from July 1999 to April 2000. From May to December 2000, Mr. Morgan served as the transitional President and Chief Executive Officer of Admetric Biochem Inc., an early stage drug discovery technology company. On October 30, 2001, Admetric BioChem Inc. filed a voluntary petition pursuant to Chapter 7 of the U.S. Bankruptcy Code, which was completed early in 2002. From 1991 to 1999, Mr. Morgan was an executive with Genetics Institute, a biotechnology company, where he headed Corporate Development from October 1993 to February 1998 and was Vice President & General Manager, responsible for commercial operations in North America, from March 1998 to June 1999. Mr. Morgan held various positions at Baxter Healthcare Corporation from 1978 to 1990, including Vice President—Corporate Planning, Vice President—Global Marketing, Planning, and Finance, Renal Therapy Division, Vice President—Finance and Planning, Home Therapy Group, and Vice President—Marketing U.S. Dialysis Division.

Anthony H. Williams, M.D. has served as Dyax's Senior Vice President, Medical Affairs and Clinical Operations since September 2001. Prior to this, Dr. Williams was the Chief Medical Officer for Aronex Pharmaceuticals, Inc. from April 2000 to September 2001, where he was responsible for the implementation of pre-existing clinical development programs and product safety. Dr. Williams graduated from the University of London, England in 1980, with a degree in medicine. He had previously obtained a Master of Arts degree from the University of Cambridge in England. Dr. Williams specialized in infectious diseases and oncology during his hospital training in London. In 1985, he joined the pharmaceutical industry and since that time has held a number of positions with companies such as Merrell Dow Pharmaceuticals, Inc., GlaxoSmithKline, Medeva plc and Aronex Pharmaceuticals, Inc.

EXECUTIVE COMPENSATION

Compensation Committee Report on Executive Compensation

The Compensation Committee of our Board of Directors determines the compensation to be paid to Dyax's executive officers, including the Chief Executive Officer. The Committee also administers Dyax's 1995 Equity Plan, including the grant of stock options and other awards under that plan, as well as our Purchase Plan. The Committee is currently composed of Mr. Fordyce (Chair), and Drs. Anagnostopoulos and Lewis. This report is submitted by the Committee and addresses the compensation policies for fiscal year 2002 as they affected Mr. Blair, as Chairman, President and Chief Executive Officer, and Dyax's other executive officers, including the individuals other than Mr. Blair who are named in the Summary Compensation Table.

15

Compensation Philosophy

Dyax's executive compensation policy is designed to attract, retain and reward executive officers who contribute to Dyax's long-term success and to maintain a competitive salary structure as compared with other biotechnology companies. The compensation program seeks to align compensation with the achievement of business objectives and individual and corporate performance. Bonuses are included to encourage effective individual performance relative to Dyax's current plans and objectives. Stock option grants are key components of the executive compensation program and are intended to provide executives with an equity interest in Dyax in order to link a meaningful portion of the executive's compensation with the performance of Dyax's Common Stock.

In executing its compensation policy, Dyax seeks to reward each executive's achievement of designated objectives relating to Dyax's annual and long-term performance and individual fulfillment of responsibilities. While compensation survey data are useful guides for comparative purposes, Dyax believes that a successful compensation program also requires the application of judgment and subjective determinations of individual performance, and to that extent the Compensation Committee applies its judgment in reconciling the program's objectives with the realities of retaining valued employees.

Executive Compensation Program

Dyax's executive compensation package for the Chief Executive Officer and the other named executive officers is composed of three elements:

- •

- base salary;

- •

- annual incentive bonuses based on individual performance; and

- •

- initial, annual and other periodic grants of stock options under the 1995 Equity Plan.

Named Executive Officers. Each of the named executive officers, other than our Chief Executive Officer, has entered into an employment agreement with Dyax. The minimum annual base salary provided for in each agreement was fixed based upon the executive's salary history and internal and external equity considerations. Near the beginning of each fiscal year, the Compensation Committee then reviews the base salaries paid to the named executive officers. The annual base salary for 2002 for each named executive officer was adjusted in light of the executive's prior performance, tenure and responsibility, as well as independent compensation data.

For fiscal 2002, the Committee established a maximum bonus opportunity for each of the senior officers, expressed as a percentage of base salary, ranging from 30% to 40%. Bonuses were tied to the Committee's judgment regarding individual performance and the contribution of the executive to Dyax's performance. In March 2003, the Compensation Committee reviewed with Mr. Blair the performance of each named executive officer and determined the bonuses to be paid to them based on their achievement of their performance goals for 2002. The Committee also directed that a portion of each executive officer's bonus for 2003 be based on corporate performance. In the case of Mr. Phelps, who resigned in December 2002 to become the Chief Executive Officer of Ardais Corporation, the Committee determined in lieu of any bonus for 2002 to extend the period of exercisability of his outstanding vested options so as to permit him to exercise those options until the tenth anniversary of their respective dates of grant.

Executive officer compensation also includes long-term incentives afforded by options to purchase Common Stock. The purposes of the stock option grant program are to reinforce the mutuality of long-term interests between Dyax's employees and stockholders, and to assist in the attraction and retention of important key executives, managers and individual contributors who are essential to Dyax's growth and development.

16

In October 2002, the Committee approved annual option grants of 50,000 shares to Mr. Morgan, 35,000 shares to Mr. Galliker and 45,000 to Mr. Patteson, as shown in the Summary Compensation Table.

Chief Executive Officer. The Compensation Committee established a compensation package for Mr. Blair based on an analysis of compensation data for comparable executive positions gathered from surveys prepared by independent compensation consultants.

The Committee established a 2002 base salary of $450,000 for Mr. Blair and a target bonus opportunity of 33% of his base salary. The increase in Mr. Blair's 2002 base salary from his 2001 base compensation resulted from the Committee's determination that an increase was merited based on performance as well as to maintain Mr. Blair's salary at the midpoint of a range of chief executive officer salaries in comparable companies reviewed by the Committee.

Mr. Blair's target bonus percentage was fixed at 33% of his base salary. Mr. Blair's target bonus opportunity was based on the Committee's qualitative evaluation of his performance. In March 2003, the Committee awarded Mr. Blair a bonus of $89,100, representing 60% of his target bonus opportunity for 2002. In addition, in October 2002, the Committee awarded Mr. Blair options to purchase 30,000 shares of Common Stock. In each case the awards were based on the Committee's positive evaluation of Mr. Blair's individual performance in advancing Dyax's business in 2002, but were also tempered by the performance of the Company's Common Stock during the period.

Compensation Deductibility

Section 162(m) of the Internal Revenue Code denies a tax deduction to a public corporation for annual compensation in excess of one million dollars paid to its chief executive officer and its four other highest compensated officers. This provision excludes certain types of "performance based compensation" from the compensation subject to the limit. Although Dyax currently does not expect to have compensation exceeding this one million dollar limit, the 1995 Equity Plan contains an individual annual limit on the number of stock options and stock appreciation rights that may be granted under the plan so that the awards will qualify for the exclusion from the limitation on deductibility for performance-based compensation. The Committee will continue to assess the impact of Section 162(m) on its compensation practices and determine what further action, if any, is appropriate.

17

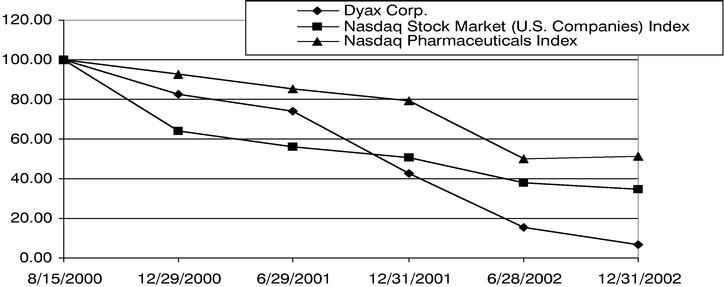

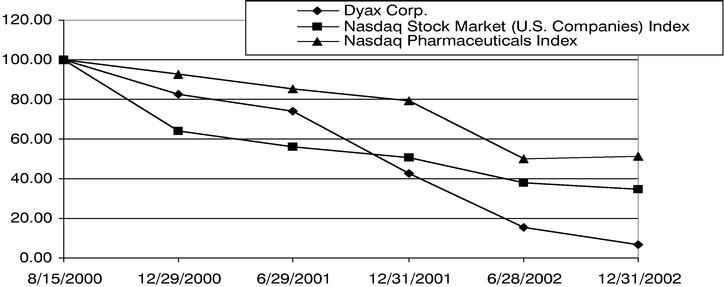

Stock Performance Graph

The following graph shows a comparison of the cumulative total stockholder returns on our Common Stock over the period from August 15, 2000 (the first trading day of our Common Stock) to December 31, 2002 as compared with that of the Nasdaq Stock Market (U.S. Companies) Index and Nasdaq Pharmaceuticals Index, based on an initial investment of $100 in each on August 15, 2000. Total stockholder return is measured by dividing share price change plus dividends, if any, for each period by the share price at the beginning of the respective period, assuming reinvestment of any dividends.

Comparison of Cumulative Total Return of Dyax Corp.,

Nasdaq Stock Market (U.S. Companies) Index and Nasdaq Pharmaceuticals Index

| | 8/15/00

| | 12/29/00

| | 6/29/01

| | 12/31/01

| | 6/28/2002

| | 12/31/2002

|

|---|

| Dyax Corp. | | 100 | | 82.34 | | 73.79 | | 42.60 | | 15.15 | | 6.99 |

| Nasdaq Stock Market (U.S. Companies) Index | | 100 | | 63.71 | | 56.05 | | 50.56 | | 38.18 | | 34.94 |

| Nasdaq Pharmaceuticals Index | | 100 | | 92.90 | | 85.47 | | 79.18 | | 50.22 | | 51.15 |

18

Summary Compensation Table

The following table sets forth certain compensation information for our Chief Executive Officer, each of the other four most highly compensated executive officers whose salary and bonus for the year ended December 31, 2002 exceeded $100,000, and one additional individual who would have been one of the four most highly compensated executive officers but for the fact that he was not an executive officer at December 31, 2002. We refer to these persons as the named executive officers.

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation Awards

| |

| |

|---|

| | Annual Compensation

| |

| |

|---|

Name and Principal Position

| | Shares Of Common Stock

Underlying Options(#)

| | All Other

Compensation($)(a)

| |

|---|

| | Year

| | Salary($)

| | Bonus($)

| |

|---|

Henry E. Blair

President and Chief Executive Officer | | 2002

2001

2000 | | 448,846

418,269

375,047 | | 89,100

124,740

150,000 | | 30,000

100,000

90,000 | | 7,786

6,003

1,161 | (b)

(c)

|

David B. Patteson

Executive Vice President, Separations Division, President of Biotage, Inc. |

|

2002

2001

2000 |

|

234,423

219,231

199,484 |

|

94,000

66,000

52,000 |

|

45,000

35,000

39,178 |

|

4,047

3,901

5,664 |

(d)

(e)

(f) |

Stephen S. Galliker

Executive Vice President, Finance and Administration, and Chief Financial Officer |

|

2002

2001

2000 |

|

253,995

230,193

209,232 |

|

55,020

62,370

75,000 |

|

35,000

40,000

39,178 |

|

14,803

21,026

15,621 |

(b)(g)

(h)(i)

(i) |

Jack H. Morgan(j)

Senior Vice President, Corporate Development and Business Operations |

|

2002

2001 |

|

229,616

126,923 |

|

64,400

57,529(l |

) |

60,000

85,000 |

|

5,932

3,029 |

(k)

(m) |

Scott C. Chappel, Ph.D.(n)

Executive Vice President of Research and Technology |

|

2002

2001

2000 |

|

246,827

249,231

230,621 |

|

—

60,000

50,000 |

|

35,000

155,000

39,178 |

|

27,027

31,036

29,246 |

(o)

(p)

(q) |

Gregory D. Phelps

Vice Chairman of the Board(r) |

|

2002

2001

2000 |

|

273,654

320,192

277,451 |

|

—

96,300

90,000 |

|

—

90,000

92,000 |

|

6,826

5573

621 |

(b)

(s)

|

- (a)

- Unless otherwise noted, this amount represents premiums paid by Dyax for group term life insurance.

- (b)

- Includes $6,000 in 401(k) matching paid by Dyax.

- (c)

- Includes $5,100 in 401(k) matching paid by Dyax.

- (d)

- Includes $3,732 in 401(k) matching paid by Dyax.

- (e)

- Includes $3,586 in 401(k) matching paid by Dyax.

- (f)

- Includes $5,259 in relocation expenses reimbursed to Mr. Patteson in 2000.

- (g)

- Includes $6,923 paid to Mr. Galliker as a housing allowance.

- (h)

- Includes $5,088 in 401(k) matching paid by Dyax.

19

- (i)

- Includes $15,000 paid to Mr. Galliker as a housing allowance.

- (j)

- Mr. Morgan joined us in May 2001.

- (k)

- Includes $5,000 paid in 401(k) matching paid by Dyax.

- (l)

- Includes $15,000 paid to Mr. Morgan as a signing bonus at the commencement of his employment with Dyax.

- (m)

- Includes $2,750 in 401(k) matching paid by Dyax.

- (n)

- Dr. Chappel resigned in February 2003.

- (o)

- Includes $6,000 in 401(k) matching paid by Dyax and $25,964 in principal and accrued interest that was forgiven by Dyax in 2002 on a 1999 loan to Dr. Chappel.

- (p)

- Includes $5,100 in 401(k) matching paid by Dyax and $25,453 in principal and accrued interest that was forgiven by Dyax in 2001 on a 1999 loan to Dr. Chappel.

- (q)

- Includes $28,625 in principal and accrued interest that was forgiven by Dyax in 2000 on a 1999 loan to Dr. Chappel.

- (r)

- Mr. Phelps resigned as Vice Chairman of the Board in December 2002.

- (s)

- Includes $5,090 in 401(k) matching paid by Dyax.

Option Grants and Potential Realizable Values Table

The following table sets forth certain information concerning option grants made to the named executive officers through December 31, 2002.

Option Grants In Last Fiscal Year

| | Individual Grants

| |

| |

| |

|

|---|

| |

| | Potential Realizable Value at

Assumed Annual Rates of Stock Price Appreciation For Option Term(b)

|

|---|

| | Number Of Securities Underlying Options Granted (#)(a)

| | Percent Of Total

Options Granted

To Employees In

Fiscal Year

| |

| |

|

|---|

Name(a)

| | Exercise or Base Price

($/Sh)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Henry E. Blair | | 30,000 | | 2.2 | | 1.36 | | 10/10/12 | | 25,659 | | 65,025 |

| David B. Patteson | | 45,000 | | 3.3 | | 1.36 | | 10/10/12 | | 38,488 | | 97,537 |

| Stephen S. Galliker | | 35,000 | | 2.6 | | 1.36 | | 10/10/12 | | 29,935 | | 75,862 |

| Jack H. Morgan | | 10,000(c) | | 0.7 | | 3.80 | | 5/16/12 | | 23,898 | | 60,562 |

| | | 50,000(d) | | 3.7 | | 1.36 | | 10/10/12 | | 42,765 | | 108,374 |

| Scott C. Chappel, Ph.D. | | 35,000 | | 2.6 | | 1.36 | | 10/10/12 | | 29,935 | | 75,862 |

| Gregory D. Phelps | | — | | — | | — | | — | | — | | — |

- (a)

- All options reported are Incentive Stock Options, except as noted. These options vest as to 1/48th of the total shares per month beginning on the date of grant.

- (b)

- The values in this column are given for illustrative purposes; they do not reflect our estimate or projection of future stock prices. The values are based on an assumption that our Common Stock's market price will appreciate at the stated rate, compounded annually, from the date of the option grant until the end of the option's 10-year term. Actual gains, if any, on stock option exercises will depend upon the future performance of our Common Stock's price, which will benefit all stockholders proportionately.

- (c)

- Includes 6,455 nonstatutory stock options.

- (d)

- Includes 27,077 nonstatutory stock options.

20

Option Exercises and Year-End Values Table

The following table sets forth certain information concerning exercisable and unexercisable stock options held by the named executive officers as of December 31, 2002.

Aggregated Option Exercises In Last Fiscal Year And

Fiscal Year-End Option Value

Name

| | Shares Acquired on Exercise(#)

| | Value Realized($)

| | Number of Securities Underlying Unexercised Options at Fiscal Year-End(#)

Exercisable/Unexercisable

| | Value of Unexercised

in-the-Money Options at Fiscal Year-End($)

Exercisable/Unexercisable(a)

|

|---|

| Henry E. Blair | | — | | — | | 167,300 / 155,000 | | 13,321 / 12,650 |

| David B. Patteson | | — | | — | | 97,101 / 128,577 | | 825 / 18,975 |

| Stephen S. Galliker | | — | | — | | 141,761 / 99,275 | | 642 / 14,759 |

| Jack H. Morgan | | — | | — | | 35,729 / 109,271 | | 917 / 21,084 |

| Scott C. Chappel, Ph.D. | | — | | — | | 123,736 / 168,025 | | 642 / 14,759 |

| Gregory D. Phelps | | — | | — | | 162,062 / 64,125 | | -/ - |

- (a)

- Based on the difference between the exercise price of the option and the $1.80 closing price of the underlying Common Stock on December 31, 2002.

Executive Employment Agreements

Under his 1998 employment agreement, Mr. Galliker is entitled to receive a minimum base salary of $185,000 under his employment agreement. We also pay Mr. Galliker a housing allowance of no more than $15,000 a year. If we terminate Mr. Galliker without cause, we must continue to pay him at his current salary for six months, reduced by any compensation that Mr. Galliker earns for other work performed during this six-month period. The agreement also provides that 50% of Mr. Galliker's options will become immediately exercisable following a change in control of the company if he is terminated or quits because the terms of his employment have been adversely changed.

Mr. Patteson has an agreement with us under which he is entitled to certain benefits under particular conditions if he is terminated in connection with a change in control of Biotage, Inc. Under the agreement, for a period of 24 months following a change in control, Mr. Patteson is entitled to receive, as severance, his base salary for a period of 24 months if his employment is terminated without cause, or if he resigns for good reason due to a the material diminution of his duties, a reduction in his base salary, or a relocation of his place of business that is more than 50 miles from his prior place of business. Additionally, following such a termination, all of Mr. Patteson's outstanding unvested options will be fully accelerated. He is also entitled to receive full benefits during that time, as well as outplacement services. In addition, Mr. Patteson is entitled to these benefits if we terminate his employment within 180 days prior to a change in control, where his termination was a condition to the change in control transaction.

Mr. Morgan has an agreement with us under which we must continue to pay him at his current salary and benefits for up to twelve months if he is terminated without cause or he resigns after his compensation or responsibilities are decreased, or in the case of a change of control, dependent in part upon whether he finds other employment providing comparable compensation during that period.

Mr. Phelps and Dr. Chappel had employment agreements with us, but both agreements terminated upon their respective resignations.

21

Report of the Audit Committee

Audit Committee Report

In the course of its oversight of our financial reporting process, the Audit Committee of the Board of Directors has:

- •

- reviewed and discussed with management and PricewaterhouseCoopers LLP, Dyax's independent auditor, Dyax's audited financial statements for the fiscal year ended December 31, 2002;

- •

- discussed with the auditor the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees;

- •

- received the written disclosures and the letter from the auditor required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees;

- •

- reviewed with management and the auditor Dyax's critical accounting policies;

- •

- discussed with management and the auditor the quality and adequacy of Dyax's internal controls;

- •

- discussed with the auditor any relationships that may impact their objectivity and independence; and

- •

- considered whether the provision of non-audit services by the auditor is compatible with maintaining the auditor's independence.

Based on the foregoing review and discussions, the Committee recommended to the Board of Directors that the audited financial statements be included in Dyax's Annual Report on Form 10-K for the year ended December 31, 2002 for filing with the Securities and Exchange Commission.

The Committee has also reviewed and recommended to the Board of Directors a revision of the Audit Committee Charter, the current form of which is attached to this proxy statement asAppendix A.

| | | By the Audit Committee, |

|

|

David J. McLachlan (Chair)

Henry R. Lewis

Thomas L. Kempner |

Information Concerning Our Auditors

The firm of PricewaterhouseCoopers LLP, independent accountants, examined our financial statements for the year ended December 31, 2002. The Audit Committee has appointed PricewaterhouseCoopers LLP to serve as our independent auditors for its fiscal year ending December 31, 2003. Representatives of PricewaterhouseCoopers LLP are expected to attend the annual meeting to respond to appropriate questions, and will have the opportunity to make a statement if they desire.

The fees for services provided to us by PricewaterhouseCoopers LLP in 2002 were as follows:

| Audit Fees | | $ | 327,000 |

| All Other Fees | | $ | 44,000 |

Other Matters

The Board of Directors does not know of any business to come before the meeting other than the matters described in the notice. If other business is properly presented for consideration at the meeting, the enclosed proxy authorizes the persons named therein to vote the shares in their discretion.

22

Deadline for Stockholder Proposals

In order for a stockholder proposal to be considered for inclusion in Dyax's proxy materials for the 2004 Annual Meeting of Stockholders, it must be received by Dyax at 300 Technology Square, Cambridge, Massachusetts 02139 (or such other address as is listed as Dyax's primary executive offices in its periodic reports under the Securities Exchange Act of 1934) no later than December 16, 2003.

In addition, Dyax's Bylaws require a stockholder who wishes to bring business before or propose director nominations at an annual meeting to give advance written notice to Dyax's Secretary between March 14, 2004 and March 29, 2004 (assuming the 2004 annual meeting of stockholders is held on May 13, 2004).

Expenses of Solicitation

We will bear the cost of the solicitation of proxies, including the charges and expenses of brokerage firms and others of forwarding solicitation material to beneficial owners of Common Stock. In addition to the use of mails, proxies may be solicited by officers and any of our regular employees in person or by telephone, facsimile and e-mail.

23

Appendix A

DYAX CORP.

Audit Committee Charter

Purpose

The principal purpose of the Audit Committee (the "Committee") is to assist the Board of Directors (the "Board") in fulfilling its responsibility to oversee the Company's accounting and financial reporting processes and audits of the Company's financial statements, including by reviewing the financial reports and other financial information provided by the Company, the Company's disclosure controls and procedures and internal accounting and financial controls, and the annual independent audit process.

In discharging its oversight role, the Committee is granted the authority to investigate any matter brought to its attention with full access to all books, records, facilities and personnel of the Company and the authority to engage independent counsel and other advisers, as it determines necessary to carry out its duties.

The outside auditor is ultimately accountable to the Board and the Committee, as representatives of the stockholders. In this connection, the Committee, as a committee of the Board, shall be directly responsible for the appointment (and where appropriate, replacement), compensation and oversight of the work of the outside auditor in preparing or issuing an audit report or related work, including resolving any disagreements between management and the outside auditor regarding financial reporting. The Committee shall receive direct reports from the outside auditor. The Committee shall be responsible for overseeing the independence of the outside auditor and for approving all auditing services and permitted non-audit services provided by the outside auditor.

This Charter shall be reviewed for adequacy on an annual basis by the Committee.

Membership

The Committee shall be comprised of not less than three members of the Board, and the Committee's composition will meet the Nasdaq Audit Committee requirements. Accordingly, all of the members will be directors:

- •