QuickLinks -- Click here to rapidly navigate through this documentUNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12

|

Dyax Corp. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

|

|

|

|

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

DYAX CORP.

300 TECHNOLOGY SQUARE

CAMBRIDGE, MA 02139

(617) 250-5500

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 19, 2005

The 2005 Annual Meeting of Stockholders of Dyax Corp., a Delaware corporation ("Dyax"), will be held at the offices of Dyax Corp., 300 Technology Square, Cambridge, Massachusetts, at 2:00 p.m. on Thursday, May 19, 2005, for the following purposes:

- 1.

- To elect three Class II directors to serve until the 2008 Annual Meeting of Stockholders.

- 2.

- To approve an amendment to Dyax's Amended and Restated 1995 Equity Incentive Plan to extend the period in which incentive stock options may be granted to eligible employees under the plan.

- 3.

- To transact any other business that may properly come before the meeting or any adjournment of the meeting.

Only stockholders of record at the close of business on April 4, 2005 will be entitled to vote at the meeting or any adjournment of the meeting.

It is important that your shares be represented at the meeting.Therefore, whether or not you plan to attend the meeting, please complete your proxy and return it in the enclosed envelope, which requires no postage if mailed in the United States. If you attend the meeting and wish to vote in person, your proxy will not be used.

| | | By order of the Board of Directors, |

|

|

Nathaniel S. Gardiner

Secretary |

April 18, 2005

DYAX CORP.

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD

MAY 19, 2005

Our Board of Directors is soliciting your proxy with the enclosed proxy card for use at our 2005 Annual Meeting of Stockholders to be held at our offices at 300 Technology Square, Cambridge, Massachusetts at 2:00 p.m. on Thursday, May 19, 2005, and at any adjournments of the meeting. The approximate date on which this proxy statement and accompanying proxy are first being sent or given to stockholders is April 18, 2005.

General Information About Voting

Who can vote. You will be entitled to vote your shares of Dyax Common Stock at the annual meeting if you were a stockholder of record at the close of business on April 4, 2005. As of that date, 31,579,992 shares of Common Stock were outstanding. You are entitled to one vote for each share of Common Stock that you held at that date.

How to vote your shares. You can vote your shares either by attending the annual meeting and voting in person or by voting by proxy. If you choose to vote by proxy, please complete, sign, date and return the enclosed proxy card. The proxies named in the enclosed proxy card will vote your shares as you have instructed. If you sign and return the proxy card without indicating how you wish your shares to be voted, the proxies will vote your shares in favor of the proposals contained in this proxy statement, as recommended by our Board of Directors. Even if you plan to attend the meeting, please complete and mail your proxy card to ensure that your shares are represented at the meeting. If you attend the meeting, you can still revoke your proxy by voting in person.

How you may revoke your proxy. You may revoke the authority granted by your executed proxy at any time before its exercise by filing with Dyax, Attention: Nathaniel S. Gardiner, Secretary, a written revocation or a duly executed proxy bearing a later date, or by voting in person at the meeting.

Quorum. A quorum of stockholders is required in order to transact business at the annual meeting. A majority of the outstanding shares of Common Stock entitled to vote must be present at the meeting, represented either in person or by proxy, to constitute a quorum for the transaction of business. If your shares are held in a brokerage account, you must make arrangements with your broker or bank to vote your shares in person or to revoke your proxy.

Abstentions and broker non-votes. "Broker non-votes" are proxies submitted by brokers that do not indicate a vote for one or more proposals because the brokers do not have discretionary voting authority and have not received instructions from the beneficial owners on how to vote on these proposals. Abstentions and broker non-votes will be considered present for purposes of determining a quorum for a matter.

Householding of Annual Meeting Materials. Some banks, brokers and other nominee record holders may be "householding" our proxy statements and annual reports. This means that only one copy of our proxy statement and annual report to stockholders may have been sent to multiple stockholders in your household. We will promptly deliver a separate copy of either document to you if you call or write us at our principal executive offices, 300 Technology Square, Cambridge, Massachusetts 02139, Attn: Investor Relations, telephone: (617) 225-2500. If you want to receive

1

separate copies of the proxy statement or annual report to stockholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and telephone number.

Share Ownership

The following table and footnotes set forth certain information regarding the beneficial ownership of our Common Stock as of March 15, 2005 by (i) persons known by us to be beneficial owners of more than 5% of our Common Stock, (ii) our current executive officers and our named executive officers, (iii) our directors and (iv) all our current executive officers and directors as a group.

| | Number of Shares

Beneficially Owned

| |

|---|

Beneficial Owner

| |

|---|

| | Shares(1)

| | Percent

| |

|---|

Federated Investors, Inc. and certain related entities(2)

Federated Investors Tower

Pittsburgh, PA 15222-3779 | | 2,996,300 | | 9.49 | % |

Francis H. and Margrit A. Kelly(3)

1 Voltastrasse

8044 Zurich, Switzerland |

|

1,623,750 |

|

5.14 |

% |

Thomas L. Kempner(4)

c/o Loeb Partners Corporation

61 Broadway

New York, NY 10006 |

|

1,111,103 |

|

3.51 |

% |

Henry E. Blair(5) |

|

1,021,343 |

|

3.20 |

% |

| Constantine E. Anagnostopoulos(6) | | 71,895 | | * | |

| Susan B. Bayh(7) | | 15,750 | | * | |

| James W. Fordyce(8) | | 70,090 | | * | |

| Mary Ann Gray(9) | | 18,000 | | * | |

| Henry R. Lewis(10) | | 101,657 | | * | |

| David J. McLachlan(11) | | 53,950 | | * | |

| Lynn G. Baird, Ph.D.(12) | | 114,218 | | * | |

| Stephen S. Galliker(13) | | 303,604 | | * | |

| Ivana Magovcevic-Liebisch, Ph.D., J.D.(14) | | 94,417 | | * | |

| Clive R. Wood, Ph.D.(15) | | 37,500 | | * | |

| All Current Directors and Executive Officers as a Group (12 Persons)(16) | | 3,013,527 | | 9.21 | % |

- *

- Less than 1%

- (1)

- The persons and entities named in the table have sole voting and investment power with respect to all shares beneficially owned by them, except as noted below.

- (2)

- Based on the Schedule 13G filed by Federated Investors, Inc. with the SEC on February 14, 2005, Federated Investors, Inc. is the parent holding company of Federated Investment Management Company, Federated Investment Counseling, and Federated Global Investment Management Corp. (the "Investment Advisers"), which act as investment advisers to registered investment companies and separate accounts that own shares of common stock in us. The Investment Advisers are wholly owned subsidiaries of FII Holdings, Inc., which is a wholly owned subsidiary of Federated Investors, Inc. All of Federated Investors' outstanding voting stock is held in the Voting Shares Irrevocable Trust for which John F. Donahue, Rhodora J. Donahue and J. Christopher Donahue act as trustees.

2

- (3)

- Based on the Schedule 13D/A filed by Francis H. and Margrit A. Kelly with the SEC on April 9, 2003, Mr. and Mrs. Kelly share beneficial ownership of 1,623,750 shares, as joint tenants. Mr. and Mrs. Kelly also share voting and dispositive control over 985,450 shares. Mr. Kelly has sole voting and dispositive control over 1,000 shares and Mrs. Kelly has sole voting and dispositive control over 637,300 shares.

- (4)

- Includes (i) 979,486 shares of Common Stock held in trusts for the benefit of Mr. Kempner's brother's children, Mr. Kempner's children and Mr. Kempner, of which Mr. Kempner is a trustee (ii) 11,792 shares held by Pinpoint Partners Corporation, of which Mr. Kempner is President, and (iii) 53,764 shares owned by Loeb Investors Co. IX, of which Mr. Kempner is the Managing Partner. Also includes 58,813 shares of Common Stock issuable to Mr. Kempner upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (5)

- Includes (i) 114,100 shares which are held in trust for the benefit of Mr. Blair's spouse and child, as to which Mr. Blair disclaims beneficial ownership, and (ii) 350,322 shares of Common Stock issuable to Mr. Blair upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (6)

- Includes 58,310 shares of Common Stock issuable to Dr. Anagnostopoulos upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (7)

- Consists entirely of shares of Common Stock issuable to Ms. Bayh upon the exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (8)

- Includes 51,549 shares of Common Stock issuable to Mr. Fordyce upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (9)

- Consists entirely of shares of Common Stock issuable to Ms. Gray upon the exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (10)

- Includes 58,310 shares of Common Stock issuable to Dr. Lewis upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (11)

- Includes 48,750 shares of Common Stock issuable to Mr. McLachlan upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (12)

- Consists entirely of shares of Common Stock issuable to Dr. Baird upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (13)

- Includes 250,462 shares of Common Stock issuable to Mr. Galliker upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (14)

- Includes 78,009 shares of Common Stock issuable to Dr. Magovcevic-Liebisch upon the exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

- (15)

- Consists entirely of shares of Common Stock issuable to Dr. Wood upon the exercise of outstanding options exercisable with the 60-day period following March 15, 2005.

- (16)

- See Notes 4 through 15. Includes 1,139,993 shares of Common Stock issuable upon exercise of outstanding options exercisable within the 60-day period following March 15, 2005.

Section 16(a) Beneficial Ownership Reporting Compliance

Our executive officers and directors and persons who own beneficially more than ten percent of our equity securities are required under Section 16(a) of the Securities Exchange Act of 1934 to file reports of ownership and changes in their ownership of our securities with the Securities and Exchange Commission. They must also furnish copies of these reports to us. Based solely on a review of the copies of reports furnished to us and written representations that no other reports were required, we believe that for 2004 our executive officers, directors and 10% beneficial owners complied with all applicable Section 16(a) filing requirements, except that a Form 4 that covered a grant of stock options was filed late on behalf of Mr. Fordyce.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Our Board of Directors has fixed the number of directors at eight (8) for the coming year. Under our charter, our Board is divided into three classes, with each class having as nearly equal number of directors as possible. The term of one class expires, with their successors being subsequently elected to a three-year term, at each annual meeting of stockholders. At the 2005 Annual Meeting three Class II Directors will be elected to hold office for three years until their successors are elected and qualified. Our Board of Directors has nominated James W. Fordyce, Thomas L. Kempner and Mary Ann Gray for re-election as Class II Directors at the upcoming annual meeting. Each has consented to serve, if elected. If any nominee is unable to serve, proxies will be voted for any replacement candidate nominated by our Board of Directors.

Votes Required

Directors will be elected by a plurality of the votes cast by the stockholders entitled to vote on this proposal at the meeting. Abstentions, broker non-votes and votes withheld will not be treated as votes cast for this purpose and, therefore, will not affect the outcome of the election.

Nominees for Director

The following table contains certain information as of March 15, 2005 about the nominees for Class II Director and current directors whose term of office will continue after the annual meeting.

Name and Age

| | Business Experience During Past Five Years

and Other Directorships

| | Director Since

|

|---|

| | | Class II Directors

(present term expires 2005) | | |

James W. Fordyce

Age: 62 |

|

James W. Fordycehas been a director of Dyax since 1995. Mr. Fordyce is currently Managing Partner of MEDNA Partners LLC, a private advisory firm. From 1981 to 2004 he was a general partner of Prince Ventures LP, a venture capital management firm focused on investments in medicine and the life sciences. From 1998 to 2004, Mr. Fordyce also served as the Managing Member of Fordyce & Gabrielson LLC, a private investment management firm. He is currently Chairman of the Board of Directors of the Albert and Mary Lasker Foundation. |

|

1995 |

| | | | | |

4

Mary Ann Gray

Age: 52 |

|

Mary Ann Gray, Ph.D.has been a director of Dyax since February 2004. Dr. Gray established Gray Strategic Advisors, LLC in August, 2003 to provide strategic advice to both public and private biotechnology companies. From 1999 to July 2003, she served as a Senior Analyst and Portfolio Manager of the Federated Kaufmann Fund, focusing on both public and private healthcare investments. Prior to joining the Kaufmann Fund, Dr. Gray was a sell-side biotechnology analyst with Kidder Peabody from 1992 to 1995, and held similar positions with Warburg Dillon Read from 1996 to 1998 and with Raymond James & Associates from 1998 to 1999. Additionally, Dr. Gray has over twelve years of experience as a scientist in academia and industry. She held scientific positions at Schering Plough Corporation and NeoRx Corporation, and early in her career Dr. Gray managed pre-clinical toxicology studies for the National Cancer Institute through Battelle Memorial Institute. She is also a director of Telik, Inc., a biotechnology company. |

|

2004 |

Thomas L. Kempner

Age: 77 |

|

Thomas L. Kempnerhas been a director of Dyax since 1995, and previously was a director of Protein Engineering Corporation before its merger with Dyax. Mr. Kempner has been Chairman and Chief Executive Officer of Loeb Partners Corporation, an investment banking firm, and its predecessors since 1978. He is also President of Pinpoint Partners Corporation, the general partner of the Loeb Investment Partnerships. Mr. Kempner is a director of CCC Information Services Group, Inc., FuelCell Energy, IGENE BioTechnology, Inc., Insight Communications Company, Inc., Intermagnetics General Corporation, and Intersections, Inc. Mr. Kempner also serves as a director emeritus of Northwest Airlines, Inc. |

|

1995 |

|

|

Class III Directors

(present term expires in 2006) |

|

|

Constantine E. Anagnostopoulos

Age: 82 |

|

Constantine E. Anagnostopoulos, Ph.D.has been a director of Dyax since 1991. He has been a Managing General Partner of Gateway Associates L.P., a venture capital management firm, since 1987. Dr. Anagnostopoulos is a retired corporate officer of Monsanto Company. He is also a director of a number of other biotechnology companies, including Genzyme Corporation and Metaphore Pharmaceuticals, Inc. |

|

1991 |

| | | | | |

5

Henry R. Lewis

Age: 79 |

|

Henry R. Lewis, Ph.D.has been a director of Dyax since 1995, and previously was a director of Protein Engineering Corporation before its merger with Dyax. Dr. Lewis is a consultant to several companies. From 1986 to 1991, Dr. Lewis was the Vice Chairman of the board of directors of Dennison Manufacturing Company. From 1982 to 1986, he also served as a Senior Vice President at Dennison. Dr. Lewis was also a director of Genzyme Corporation, from 1986 until 2000. |

|

1995 |

David J. McLachlan

Age: 66 |

|

David J. McLachlanhas been a director of Dyax since 1999. He was the Executive Vice President and Chief Financial Officer of Genzyme Corporation from 1989 to 1999 and a senior advisor to Genzyme's chairman and chief executive officer through June 2004. Prior to joining Genzyme, Mr. McLachlan served as Chief Financial Officer and Vice President of Adams-Russell Company, an electronic component supplier and cable television operator. Mr. McLachlan currently serves on the Board of Directors of HearUSA Inc., a hearing care company, and Skyworks Solutions, Inc., a manufacturer of analog, mixed signal and digital semiconductors for mobile communications. |

|

1999 |

|

|

Class I Directors

(present term expires in 2007) |

|

|

Susan B. Bayh

Age: 45 |

|

Susan B. Bayhhas been a director of Dyax since 2003. Ms. Bayh has served as the Commissioner of the International Commission between the U.S. and Canada since 1994, overseeing compliance with environmental and water level treaties for the United States-Canadian border. From 1994 to 2001, Ms. Bayh served as a Distinguished Visiting Professor at the College of Business Administration at Butler University. From 1989 to 1994, Ms. Bayh was an attorney in the Pharmaceutical Division of Eli Lilly and Company, where she focused on marketed products, clinical trials and regulatory issues. Previously, she practiced law, specializing in litigation, utility, corporate and antitrust law. Currently, Ms. Bayh serves as a director of Wellpoint, Inc., Dendreon Corporation, Curis, Inc., Emmis Communications Corporation, Novavax, Inc. and Golden State Foods. |

|

2003 |

| | | | | |

6

Henry E. Blair

Age: 61 |

|

Henry E. Blairhas served as Chairman of the Board and President of Dyax Corp. since its merger with Protein Engineering Corporation in 1995, and as acting Chief Executive Officer from 1995 until his appointment as Chief Executive Officer in 1997. He has been a director and officer of the Company since co-founding it in 1989. Mr. Blair is a director of Genzyme Corporation, a company he co-founded in 1981. He was also a co-founder of Biocode, Inc., and GelTex Pharmaceuticals, Inc. Mr. Blair was a director of Esperion Therapeutics, Inc., prior to its acquisition by Pfizer, Inc. in February 2004. |

|

1989 |

Board and Committee Matters

Independence. Our Board of Directors has determined that each of the current directors, as well as those standing for re-election, are independent directors as defined by applicable NASDAQ Stock Market standards governing the independence of directors, except for Henry E. Blair, our Chairman, President and Chief Executive Officer

Board Meetings and Committees. Our Board of Directors held nine (9) meetings during 2004. In addition to the five (5) meetings of the Nominating and Governance Committee, the independent directors held executive sessions at two (2) meetings of the Board. During 2004, each of the directors then in office attended at least 75% of the aggregate of all meetings of the Board of Directors and all meetings of the committees of the Board of Directors on which such director then served. In 2004, eight (8) directors attended the annual meeting of shareholders. Continuing directors and nominees for election as directors in a given year are required to attend the annual meeting of shareholders barring significant commitments or special circumstances.

Shareholder Communications. Any shareholder wishing to communicate with our Board of Directors, a particular director or the chair of any committee of the Board of Directors may do so by sending written correspondence to our principal executive offices, c/o Senior Vice President, Legal Affairs. All such communications will be delivered to the Board of Directors or the applicable director or committee chair.

Our Board of Directors has three standing committees: Audit Committee, Compensation Committee and Nominating and Governance Committee.

Audit Committee. The Audit Committee has authority to select and engage our independent registered public accounting firm and is responsible for reviewing our audited financial statements, accounting processes and reporting systems. The Audit Committee also discusses the adequacy of our internal financial controls with our management and our independent registered public accounting firm. In addition, the Audit Committee is responsible for overseeing the independence of, and approving all types of services provided by, our independent registered public accounting firm.

The members of the Audit Committee are David McLachlan (Chair), Mary Ann Gray, Thomas Kempner and Henry Lewis. Our Board of Directors has considered and concluded that each of the members of the Audit Committee satisfies the independence and financial literacy and expertise requirements as defined by applicable NASDAQ Stock Market standards governing the qualifications of Audit Committee members. Additionally, our Board of Directors has determined that Mr. McLachlan qualifies as an audit committee financial expert under the rules of the SEC.

7

The Audit Committee held seven (7) meetings during 2004. The Audit Committee operates under a written charter adopted by the Board. The Audit Committee reviewed the charter in March 2004 and March 2005, and in each case it was amended by the Board pursuant to the Committee's recommendation. The charter, as amended, is attached to this proxy statement as Appendix A. For more information about the Audit Committee, including its audit services pre-approval procedures, see "Report of the Audit Committee" and "Information Concerning Our Auditors" in this proxy statement.

Compensation Committee. Our Compensation Committee is responsible for establishing cash compensation policies with respect to our executive officers, directors and consultants, determining the compensation to be paid to our executive officers and administering our equity incentive and stock purchase plans. The members of the Compensation Committee are James Fordyce (Chair), Constantine Anagnostopoulos, Susan Bayh and Henry Lewis. The Compensation Committee held four (4) meetings during 2004.

Nominating and Governance Committee. Our Nominating and Governance Committee identifies individuals qualified to become Board members and recommends to the Board the director nominees for the next annual meeting of shareholders and candidates to fill vacancies on the Board. Additionally, the Committee recommends to the Board the directors to be appointed to Board committees. The Committee also develops and recommends to the Board a set of corporate governance guidelines applicable to the Board and to the Company and oversees the effectiveness of our corporate governance in accordance with those guidelines. The Nominating and Governance Committee currently consists of all the independent directors serving on the Board, namely Henry Lewis (Chair), Constantine Anagnostopoulos, Thomas Kempner, James Fordyce, Susan Bayh, David McLachlan and Mary Ann Gray, each of whom the Board has determined meets the independence requirements as defined by applicable NASDAQ Stock Market standards governing the independence of directors. The committee held five (5) meetings during 2004. The Nominating and Governance Committee operates pursuant to a written charter, which is available on our website—www.dyax.com.

The Nominating and Governance Committee considers candidates for Board membership suggested by its members and other Board members. Additionally, in selecting nominees for directors, the Nominating and Governance Committee will review candidates recommended by stockholders in the same manner and using the same general criteria as candidates recruited by the Committee and/or recommended by the Board. Any stockholder who wishes to recommend a candidate for consideration by the Committee as a nominee for director should follow the procedures set forth in "Shareholder Recommendations for Director Nominations" below. The Nominating and Governance Committee will also consider whether to nominate any person proposed by a shareholder in accordance with the provisions of our bylaws relating to shareholder nominations as described in "Deadline for Stockholder Proposals and Director Nominations" below.

Once the Nominating and Governance Committee has identified a prospective nominee, the Committee makes an initial determination as to whether to conduct a full evaluation of the candidate. This initial determination is based on the information provided to the Committee with the recommendation of the prospective candidate, as well as the Committee's own knowledge of the prospective candidate, which may be supplemented by inquiries of the person making the recommendation or others. The preliminary determination is based primarily on the need for additional Board members to fill vacancies or expand the size of the Board and the likelihood that the prospective nominee can satisfy the evaluation factors described below. The Committee then evaluates the prospective nominee against the standards and qualifications set out in our Corporate Governance Guidelines, which include among others:

- •

- whether the prospective nominee meets the independence requirements and audit committee qualifications defined under applicable NASDAQ Stock Market standards and audit committee financial expert requirements defined under applicable SEC rules and regulations;

8

- •

- the extent to which the prospective nominee's skills, experience and perspective add to the range of talent appropriate for the Board and whether such attributes are relevant to our business and industry;

- •

- the prospective nominee's ability to dedicate the time and resources sufficient for the diligent performance of Board duties; and

- •

- the extent to which the prospective nominee holds any position that would conflict with a directors responsibilities to Dyax.

If the Committee's internal evaluation is positive, a sub-group of the committee will interview the candidate. Upon completion of this evaluation and interview process, the committee makes a recommendation to the full Board as to whether the candidate should be nominated by the Board and the Board determines the whether to approve the nominee after considering the recommendation and report of the Committee.

Director Compensation

Director Fees. Our directors who are not employees of Dyax receive compensation for their services as directors in the form of an annual retainer of $15,000, payable in quarterly installments, a fee of $2,000 for each Board meeting attended ($1,000 for attendance by conference call), and a fee of $1,000 for each committee meeting attended ($500 for attendance by conference call), other than meetings of the Nominating and Governance Committee held in conjunction with a Board meeting, plus reimbursement for travel expenses. We pay non-employee directors who serve as the chairman of a committee of the Board of Directors an additional $5,000 per year. All other non-employee directors who serve on a committee of the Board of Directors receive an additional $1,000 per year. Directors who are also our employees receive no additional compensation for serving as directors.

Stock Options. In addition, our non-employee directors elected at the 2004 Annual Meeting automatically received stock options under our Amended and Restated 1995 Equity Incentive Plan to purchase 9,000 shares of our Common Stock for each year of their three-year term, as will non-employee directors elected at the 2005 Annual Meeting. Non-employee directors elected between annual meetings automatically receive options to purchase 9,000 shares of our Common Stock for each year or portion of a year remaining in the three-year term of the class of directors to which they have been elected.

Certain Relationships and Related Transactions.

Mr. Blair serves as an outside director of Genzyme Corporation and was a consultant to Genzyme until 2001. Dr. Anagnostopoulos also serves as a director of Genzyme and Mr. McLachlan served as a senior advisor to Genzyme's Chief Executive Officer until 2004 and as an officer of Genzyme from 1989 to 1999.

In 2004, we employed the spouse of our former executive officer Anthony H. Williams, M.D. as a technical writing consultant to our Clinical Operations department for which she received $78,000 in aggregate compensation.

9

We have a collaboration agreement with Genzyme Corporation for the development and commercialization of DX-88. Under this agreement, we have established a joint venture, Dyax-Genzyme LLC (formerly known as Kallikrein LLC), which now owns the rights to DX-88 for the treatment of hereditary angioedema (HAE). Dyax and Genzyme are each responsible for 50% of ongoing costs incurred in connection with the development and commercialization of DX-88 for HAE and each will be entitled to receive approximately 50% of any profits realized as a result. In addition, we are entitled to receive potential milestone payments from Genzyme in connection with the development of DX-88. The first such milestone payment, approximately $3.0 million, is due upon dosing the first patient in a pivotal clinical trial of DX-88 for HAE. In addition, we will be entitled to receive potential milestone payments of $10.0 million for the first FDA-approved product derived from DX-88, and up to $15.0 million for additional therapeutic indications for DX-88 developed under the collaboration.

The term of the joint venture is perpetual unless terminated by either party with prior written notice, upon a material breach by the other party or immediately upon a change of control or bankruptcy of the other party. We currently anticipate that this collaboration will not terminate until the parties determine that no commercial products will result from the collaboration or, if commercial products are eventually sold, until the sale of those products is no longer profitable. Because the drug discovery and approval process is lengthy and uncertain, we do not expect to be able to determine whether any commercial products will result from this collaboration until completion of clinical trials for at least one indication.

When we first amended the collaboration agreement in May 2002, we also executed a senior secured promissory note and security agreement under which Genzyme agreed to loan us up to $7.0 million and we agreed to grant Genzyme a continuing security interest in certain tangible and intangible personal property arising out of the DX-88 program. In addition, under the terms of the security agreement, once we exercised our option to purchase Genzyme's interest in the application of DX-88 in on-pump, open-heart surgery and other surgical indications, we were required to pledge additional collateral to Genzyme. Under an amendment to the security agreement executed on October 15, 2003, we have granted Genzyme a continuing security interest in our rights to revenues from licenses of our fundamental phage display patent portfolio known as the Ladner patents. The security agreement, as amended, contains certain financial covenants under which we must (i) maintain at least $20.0 million in cash, cash equivalents and short-term marketable securities based on our quarterly consolidated financial statements and (ii) continue to satisfy at least one standard for continued listing of our securities on the NASDAQ National Market. As of December 31, 2004, we had borrowed the full $7.0 million available under the note.

Compensation Committee Interlocks And Insider Participation

Our Compensation Committee determines salaries, incentives and other compensation for our directors and officers. The Compensation Committee also administers our equity incentive and stock purchase plans. The Compensation Committee currently consists of Ms. Bayh and Mr. Fordyce, Drs. Anagnostopoulos and Lewis. For more information regarding the relationship of Dr. Anagnostopoulos with Genzyme Corporation and its relationships with Dyax, see the sections of this proxy statement entitled "Share Ownership," "Election of Directors" and "Certain Relationships and Related Transactions."

10

PROPOSAL 2

AMENDMENT OF THE AMENDED AND RESTATED 1995 EQUITY INCENTIVE PLAN

We are asking stockholders to approve an amendment to Dyax's Amended and Restated 1995 Equity Incentive Plan, referred to herein as the 1995 Equity Plan. The 1995 Equity Plan is an important part of our compensation program and we believe it is essential to our ability to attract and retain highly qualified employees in an extremely competitive environment in which employees view equity incentives as an important component of their compensation. The proposed amendment to the 1995 Equity Plan is necessary to allow us to continue to award incentive stock options (ISOs) to all eligible employees to the full extent allowable under the Internal Revenue Code of 1986, as amended, (the "Code"). Under the current terms of the 1995 Equity Plan, we will not be able to grant incentive stock options to employees after July 13, 2005, the tenth anniversary of the effective date of the 1995 Equity Plan.

The closing price of Dyax's Common Stock on the NASDAQ National Market on March 15, 2005 was $4.48 per share. The material terms of the 1995 Equity Plan and a more detailed description of the proposed amendment are set forth below.

General Description of 1995 Equity Plan

The purpose of the 1995 Equity Plan is to attract and retain employees, directors and consultants and to provide an incentive for these persons to achieve long-range performance goals. The 1995 Equity Plan permits us to grant equity awards to our employees, directors and consultants, including incentive and non-statutory stock options, stock appreciation rights, performance shares, restricted stock and stock units. To date, we have granted only incentive stock options, non-statutory stock options and restricted stock under the 1995 Equity Plan. As of March 15, 2005, 131 employees were eligible to participate in the 1995 Equity Plan. As of March 15, 2005, 3,712,763 shares of Common Stock have been issued pursuant to awards under the 1995 Equity Plan, and 6,305,139 shares are reserved for issuance, of which 2,592,376 shares remain available for future awards. Outstanding options have exercise prices ranging from $0.30 to $48.69. The weighted average exercise price of all outstanding options is $7.58 per share. All options granted have a term of ten years. In addition to options, 239,840 shares of our Common Stock have been issued as restricted stock under the 1995 Equity Plan, none of which have been cancelled. As the amount of any awards under the 1995 Equity Plan is within the Compensation Committee's discretion, total awards that may be granted for a fiscal year are not determinable until completion of the year.

11

The following table sets forth shares underlying awards granted under the 1995 Equity Plan through March 15, 2005:

Total Awards Under the 1995 Equity Incentive Plan

| | Number of Shares of

Common Stock

Underlying Options

|

|---|

| Current executive officers: | | |

| | Henry E. Blair, Chief Executive Officer | | 642,253 |

| | Stephen S. Galliker, Chief Financial Officer | | 401,678 |

| | Lynn G. Baird, Ph.D., Senior VP, Development | | 250,000 |

| | Ivana Magovcevic-Liebisch, Ph.D., J.D., Senior VP Legal Affairs and Chief Patent Counsel | | 234,300 |

| | Clive R. Wood, Ph.D., Senior VP Discovery & Research | | 150,000 |

| | |

|

| Current executive officers as a group (5 persons) | | 1,678,231 |

| Current directors who are not executive officers as a group (7 persons) | | 459,941 |

| Other Dyax employees as a group (including current officers who are not executive officers) | | 7,452,329 |

| | |

|

| Total Awards through March 15, 2004 | | 9,590,501 |

| | |

|

The following summary of the 1995 Equity Plan's principal features is qualified in its entirety by reference to the full text of the plan, which has been filed with the SEC and will be made available upon written request to our Secretary.

Administration and Eligibility

Awards are made by the Compensation Committee, which has been designated by our Board of Directors to administer the 1995 Equity Plan. Subject to certain limitations, the Compensation Committee may delegate to one or more of our executive officers the power to make awards to participants who are not subject to Section 16 of the Securities Exchange Act of 1934 or "covered employees" for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended. The Committee has authorized our Chairman and President to make Awards to non-executive employees within parameters approved by the Committee.

The Compensation Committee administers the 1995 Equity Plan and determines the terms and conditions of each award to our executive officers and directors, including the exercise price, the form of payment of the exercise price, the number of shares subject to the award and the time at which such options become exercisable. The exercise price of any incentive stock option granted under the 1995 Equity Plan may not, however, be less than the fair market value of the Common Stock on the date of grant and the term of any such option cannot be greater than 10 years. The exercise price of any non-statutory stock option is determined by the Compensation Committee.

Federal Income Tax Consequences Relating to Stock Options and Restricted Stock

Incentive Stock Options. An optionee does not realize taxable income upon the grant or exercise of an incentive stock option, known as an ISO, under the 1995 Equity Plan. If no disposition of shares issued to an optionee pursuant to the exercise of an ISO is made by the optionee within two years from the date of grant or within one year from the date of exercise, then (a) upon sale of such shares,

12

any amount realized in excess of the option price (the amount paid for the shares) is taxed to the optionee as a capital gain and any loss sustained will be a capital loss and (b) no deduction is allowed to Dyax for Federal income tax purposes. The exercise of ISOs gives rise to an adjustment in computing alternative minimum taxable income that may result in alternative minimum tax liability for the optionee.

If shares of Common Stock acquired upon the exercise of an ISO are disposed of prior to the expiration of the two-year and one-year holding periods described above, referred to as a disqualifying disposition, then (a) the optionee realizes ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares at exercise (or, if less, the amount realized on a sale of such shares) over the option price thereof and (b) Dyax is entitled to deduct this amount. Any further gain realized is taxed as a capital gain and does not result in any deduction to us. A disqualifying disposition in the year of exercise will generally avoid the alternative minimum tax consequences of the exercise of an ISO.

Non-statutory Stock Options. No income is realized by the optionee at the time a non-statutory option is granted. Upon exercise, (a) ordinary income is realized by the optionee in an amount equal to the difference between the option price and the fair market value of the shares on the date of exercise and (b) we receive a tax deduction for the same amount. Upon disposition of the shares, appreciation or depreciation after the date of exercise is treated as a capital gain or loss and will not result in any deduction by Dyax.

�� Restricted Stock. Awards of restricted stock that are non-transferable and subject to forfeiture are generally not taxable to the recipient until the shares vest. When the shares vest, the recipient realizes compensation income equal to the difference between the amount paid for the shares and their fair market value at the time of the vesting, and we are entitled to a corresponding deduction. Appreciation in the value of the shares during the vesting period therefore increases the income subject to tax at ordinary income rates at the time of vesting as well as the corresponding deduction we are entitled to take at that time. The tax is payable for the year in which the vesting occurs, regardless of whether the shares are sold at that time. If the recipient is an employee, we are required to withhold income and social security taxes from the compensation income (by withholding from shares, from other income of the employee or from a cash payment made by the employee to us to cover the withholding taxes).

Instead of being taxed when the shares vest, a recipient may elect to be taxed in the year the shares are awarded by filing a "Section 83(b) election" with the Internal Revenue Service within 30 days after issuance of the restricted shares. The recipient then realizes compensation income in the year of the award equal to the difference between the amount paid for the shares and their fair market value at the time of issuance, and we are entitled to a corresponding deduction at that time.

13

Equity Compensation Plan Information

The following table provides information about the securities authorized for issuance under the Company's equity compensation plans as of December 31, 2004:

Equity Compensation Plan Information

Plan Category

| | Number of securities

to be issued

upon exercise of

outstanding options,

warrants and rights

| | Weighted-average

exercise price of

outstanding options,

warrants and rights

| | Number of securities

remaining available for

future issuance under

equity compensation plans

(excluding securities

reflected in column (a))

| |

|---|

| | (a)

| | (b)

| | (c)

| |

|---|

| Equity compensation plans approved by security holders(1) | | 3,845,785 | | $ | 7.39 | | 3,954,658 | |

| Equity compensation plans not approved by security holders: | | — | | | — | | — | |

| | |

| |

| |

| |

| | Totals: | | 3,845,785 | (2) | $ | 7.39 | | 3,954,658 | (3) |

- (1)

- Consists of the Amended and Restated 1995 Equity Incentive Plan and the 1998 Employee Stock Purchase Plan.

- (2)

- Does not include purchase rights currently accruing under the 1998 Employee Stock Purchase Plan, because the purchase price (and therefore the number of shares to be purchased) will not be determined until the end of the purchase period, which is June 30, 2005.

- (3)

- Includes 209,240 shares issuable under the 1998 Employee Stock Purchase Plan, of which up to 50,000 are issuable in connection with the current offering period which ends on June 30, 2005. The remaining shares consist of 3,745,418 under the 1995 Amended and Restated Equity Incentive Plan, which amount reflects the automatic increase of 1,250,000 shares that occurred on January 1, 2005 under the terms of the Plan. Under the 1995 Amended and Restated Equity Incentive Plan, the number of shares issuable is automatically increased every January 1 by an amount equal to the lesser of (i) 1,250,000 shares, (ii) 5% of the fully diluted outstanding shares of Common Stock of the Company on such date or (iii) such lesser amount as may be determined by resolution of the board of directors at any date before or within 90 days after January 1 of the respective year; provided, however, that the maximum aggregate number of shares received since inception under the plan shall not exceed 10,250,000 shares. No incentive stock options may be granted under the plan more than ten years after the plan's July 13, 1995 effective date. The plan may be amended, suspended, or terminated by the Compensation Committee of the Board of Directors at any time, subject to any required stockholder approval.

Proposed Amendment to the 1995 Equity Plan

On March 2, 2005, our Board of Directors voted, subject to stockholder approval, to amend the 1995 Equity Plan to provide that ISOs may be granted for the ten-year period beginning on the last date that the plan was approved by stockholders for purposes of Section 422 of the Code, which sets forth the requirements for a plan under which ISOs may be granted. The plan currently prohibits the grant of ISOs after July 12, 2005. The proposed amendment would allow us to continue to grant ISOs until at least May 16, 2012 (ten years from the date that our stockholders approved an amendment to the plan that is an amendment for purposes of Section 422 of the Code). In addition, this ten year period would recommence upon any future approval of the plan or an amendment thereto by our stockholders that constitutes approval for the purposes of Section 422 of the Code (e.g., approval of an amendment to increase the number of shares available for issuance under the plan). We believe that

14

the ability to grant ISOs under the 1995 Equity Plan is an important feature of the plan and affects our ability to attract and retain highly qualified employees in an extremely competitive hiring environment.

Votes Required

The affirmative vote of a majority of the shares represented in person or by proxy at the annual meeting and entitled to vote on this proposal will constitute the approval of the proposed amendment to the 1995 Equity Plan. Abstentions will count as votes against the amendment and broker non-votes will not be counted.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR THIS PROPOSAL.

EXECUTIVE OFFICERS AND KEY EMPLOYEES

The following contains certain information as of March 15, 2005 about the current executive officers and key employees of Dyax:

Name

| | Age

| | Position

|

|---|

| Henry E. Blair* | | 61 | | Chairman of the Board, President and Chief Executive Officer |

| Stephen S. Galliker* | | 58 | | Executive Vice President, Finance and Administration, and Chief Financial Officer |

| Ivana Magovcevic-Liebisch, Ph.D., J.D.* | | 37 | | Senior Vice President Legal Affairs and Chief Patent Counsel |

| Lynn G. Baird, Ph.D.* | | 57 | | Senior Vice President, Development |

| Clive R. Wood, Ph.D.* | | 44 | | Senior Vice President Discovery Research & Chief Science Officer |

| Robert Charles Ladner, Ph.D. | | 60 | | Senior Vice President and Chief Technology Officer |

| E. Fayelle Whelihan, Ph.D. | | 41 | | Senior Vice President Discovery Research and General Manager, Dyax S.A. |

- *

- Executive officer

Henry E. Blair has served as our Chairman of the Board and President since our merger with Protein Engineering Corporation in August 1995, and as acting Chief Executive Officer from August 1995 until his appointment as Chief Executive Officer in April 1997. He has been a director and officer of Dyax since co-founding it in 1989. Mr. Blair is a director of Genzyme Corporation, a biotechnology company he co-founded in 1981, as well as being a co-founder of Biocode, Inc. and GelTex Pharmaceuticals, Inc, both also biotechnology companies. Mr. Blair was a director of Esperion Therapeutics, Inc., prior to its acquisition by Pfizer, Inc. in February 2004.

Stephen S. Galliker has served as our Executive Vice President, Finance and Administration, and Chief Financial Officer since 1999. From 1996 to 1999, Mr. Galliker was the Chief Financial Officer of Excel Switching Corporation, a developer and manufacturer of open switching platforms for telecommunications networks, and was Excel's Vice President, Finance and Administration from 1997 to 1999. From 1992 to 1996, Mr. Galliker was employed by Ultracision, Inc. a developer and manufacturer of ultrasonically powered surgical instruments, where he served as Chief Financial Officer and Vice President of Finance until 1995, when he became Ultracision's Chief Operating Officer. Mr. Galliker is also a director of Osteotech, Inc., a medical device company.

Ivana Magovcevic-Liebisch, Ph.D., J.D. has served as our Senior Vice President of Legal Affairs and Chief Patent Counsel since February 2004. She heads our Legal and Investor Relations & Corporate Communications departments and also serves as our Assistant Secretary. She joined Dyax in April of 2001 as Vice President of Intellectual Property. Previously, Dr. Magovcevic-Liebisch was Director of

15

Intellectual Property and Patent Counsel for Transkaryotic Therapies, Inc. from 1998 to 2001. Before that she served as a patent agent at Fish and Richardson and Lahive & Cockfield, two Boston patent law firms. Dr. Magovcevic-Liebisch holds a doctorate in genetics from Harvard University and a law degree from Suffolk University.

Lynn G. Baird, Ph.D. has served as our Senior Vice President of Development since March 2002. She joined Dyax in October 2001 as Senior Vice President of Preclinical and Regulatory Affairs. From 1998 to 2001, she held the title of Vice President at Reprogenesis, Inc. and its successor Curis, Inc., a biotechnology company. Her responsibilities at various times during her tenure included Regulatory Affairs, Quality, Clinical Development and Preclinical Development. Prior to her service at Reprogenesis, Dr. Baird was employed at CytoTherapeutics, Inc., a biotechnology company, from 1995 to 1998 and was Vice President of Regulatory, Quality and Clinical Development at her departure. Prior to that she held positions at Johnson and Johnson, a pharmaceutical company, from 1990 to 1995 and at Creative BioMolecules, a biotechnology company, from 1985 to 1990.

Clive R. Wood, Ph.D. has served as our Senior Vice President, Research Discovery and Chief Scientific Officer since August 2003. Prior to this, Dr. Wood spent 17 years at Genetics Institute (GI) and its successor, Wyeth Research, where he held a number of drug discovery research positions of increasing scope and responsibility. Most recently, Dr. Wood held the position of Senior Director and Acting Head of Inflammation Discovery Research at Wyeth Research in Cambridge, MA. At GI and Wyeth, Mr. Wood focused on respiratory diseases, transplantation, immunology, hematopoiesis and antibody technologies. Prior to joining GI in 1986, Dr. Wood worked for four years at Celltech Ltd. and contributed to the first work on the production of recombinant antibodies. Dr Wood also serves as an Adjunct Professor in the Department of Pharmacology and Experimental Therapeutics of Boston University School of Medicine, and received his Biochemistry B.Sc. as well as his Ph.D. from the University of London in 1982 and 1986, respectively.

Robert Charles Ladner, Ph.D. became Senior Vice President of Dyax in August 1995 and served as our Chief Scientific Officer from 1995 to 2003. He was a co-founder of Protein Engineering Corporation where he was an inventor of our fundamental phage display technology and served as Senior Vice President and Scientific Director from 1987 until its merger with Dyax in August 1995. Previously, Dr. Ladner served as Senior Scientist of Genex Corp., where he was an inventor of single chain antibodies.

E. Fayelle Whelihan, Ph.D. has been with Dyax since 1996 in various positions, including Director of Research from 1999 to 2001 and VP of Research from 2001 to 2003. She has held her current position as the General Manager of Dyax S.A. and our Senior Vice President, Discovery Research since 2003. Prior to joining Dyax, Dr. Whelihan was an American Cancer Society Fellow at MIT with Dr. Paul Schimmel. She holds a Ph.D. in Synthetic Organic Chemistry from UCLA, where she conducted polymer chemistry research at IBM (San Jose) and cancer research at the University of Arizona, College of Medicine.

EXECUTIVE COMPENSATION

Compensation Committee Report on Executive Compensation

The Compensation Committee of the Dyax Board of Directors determines the compensation to be paid to Dyax's executive officers, including the Chief Executive Officer. The Committee also administers Dyax's equity incentive plan and its employee stock purchase plan, including the grant of stock options and other awards under those plans. This report is submitted by the Committee and addresses the compensation policies for fiscal year 2004 as they affected Mr. Blair, as Chairman, President and Chief Executive Officer, and Dyax's four other executive officers, who are named in this year's Summary Compensation Table.

16

Compensation Philosophy

Dyax's executive compensation policy is designed to attract, retain and reward executive officers who contribute to Dyax's long-term success and to maintain a competitive salary structure as compared with other biotechnology companies. The compensation program seeks to align compensation with the achievement of business objectives and individual and corporate performance. Bonuses are included to encourage effective individual performance relative to Dyax's current plans and objectives. Stock option grants are key components of the executive compensation program and are intended to provide executives with an equity interest in Dyax in order to link a meaningful portion of the executive's compensation with the performance of Dyax's Common Stock.

In executing its compensation policy, the Committee seeks to reward each executive's achievement of designated objectives relating to Dyax's annual and long-term performance and individual fulfillment of responsibilities. While compensation survey data are useful guides for comparative purposes, the Committee believes that a successful compensation program also requires the application of judgment and subjective determinations of individual performance, and to that extent the Committee applies its judgment in reconciling the program's objectives with the realities of retaining valued employees.

Executive Compensation Program

Dyax's executive compensation package for the Chief Executive Officer or CEO, and the other named executive officers is composed of three elements:

- •

- base salary;

- •

- annual incentive bonuses based on corporate and individual performance; and

- •

- initial, annual and other periodic grants of stock options under the Amended and Restated 1995 Equity Incentive Plan.

Named Executive Officers. The Compensation Committee reviews with our Chief Executive Officer his evaluation of the performance of each of our named executive officers and his recommendations for each element of their compensation based upon the executive's salary history and internal and external equity considerations. Based on this review the Compensation Committee each year make the final determination of the base salaries provided for each of the named executive officers. The annual base salary for 2004 for each named executive officer was adjusted in light of the executive's prior performance, tenure and responsibilities, as well as independent compensation data for executives in comparable positions in other biotechnology companies.

For fiscal 2004, the Committee established a target bonus opportunity for each of the senior executives, other than Mr. Blair, expressed as a percentage of base salary. The target bonus opportunity, which ranged from 25% to 30% for these senior executives, could be exceeded by up to 20% of the target for exceptional performance. For example, an executive with a target bonus of 30% who had outstanding performance could receive a bonus of as much as 36% of base salary. One half of each 2004 bonus was tied to Dyax's corporate performance and one half was tied to the Committee's judgment regarding individual performance against objectives determined by Mr. Blair. In February 2004, the Compensation Committee reviewed with Mr. Blair the performance of each named executive officer and determined the bonus to be paid to each of them based on company performance against a number of corporate objectives and the achievement of individual's performance goals for 2004. The portion of bonuses based on corporate objectives included subjective assessment of a number of objectives in the areas of Dyax's clinical development of product candidates, advancement of Dyax's research pipeline, cash receipts, use of cash, and recruitment and training of employees, among other factors agreed upon among the Committee and Mr. Blair.

Executive officer compensation also includes long-term incentives through awards of options to purchase Common Stock. The purposes of the stock option grant program are to reinforce the

17

mutuality of long-term interests between Dyax's employees and stockholders, and to assist in the attraction and retention of important key executives, managers and individual contributors who are essential to Dyax's growth and development.

When the Committee reviewed recommended equity grants for executive officers in June 2004, the Committee followed a similar procedure to that used for base salaries and bonuses. After review of our CEO's recommendations and comparative data, the Committee approved option grants of 75,000 shares to Mr. Galliker, 60,000 shares to Dr. Magovcevic-Liebisch, 75,000 shares to Dr. Baird and 75,000 shares to Dr. Wood, as shown in the Summary Compensation Table.

Chief Executive Officer. The Compensation Committee established a 2004 compensation package for Mr. Blair based on an analysis of compensation data for chief executive officers in comparable companies gathered from the AON Radford survey.

In determining Mr. Blair's 2004 base salary, the Committee took note of the fact that his salary had not been increased since 2002. Based on this fact, corporate performance in 2003 and a review of the range of chief executive officer salaries in publicly-traded biopharmaceutical companies of similar size, the Committee established a 2004 base salary of $500,000 for Mr. Blair.

Mr. Blair's target bonus percentage for 2004 was fixed at 33% of his base salary and was based entirely on the Committee's assessment of Dyax's performance against corporate goals. In February 2005, the Committee awarded Mr. Blair a bonus of $102,300, representing 62% of his target bonus opportunity for 2004. In addition, in June 2004, the Committee awarded Mr. Blair an option to purchase 140,000 shares of Common Stock based on equity awards reflected in the survey data and the performance of Dyax during the preceding twelve months.

Compensation Deductibility

Section 162(m) of the Internal Revenue Code denies a tax deduction to a public corporation for annual compensation in excess of one million dollars paid to its Chief Executive Officer and its four other highest compensated officers. This provision excludes certain types of "performance based compensation" from the compensation subject to the limit. The Committee does not expect to pay any one covered employee salary and bonus for 2005 that could exceed $1,000,000. In addition, the Amended and Restated 1995 Equity Incentive Plan contains an individual annual limit on the number of stock options and stock appreciation rights that may be granted under the plan so that such awards will qualify for the exclusion from the limitation on deductibility for performance-based compensation. In light of pending changes by the Financial Accounting Standard Board (FASB) to the accounting standards governing the treatment of equity-based compensation, the Company is also expected to seek shareholder approval next year of general business criteria upon which other types of cash and equity incentive awards may be made in the future on a fully-deductible basis. The Committee believes, however, that in some circumstances factors other than tax deductibility are more important in determining the forms and levels of executive compensation most appropriate and in the best interests of the Company and its shareholders. Given our industry and business, as well as the competitive market for outstanding executives, we believe that it is important for the Committee to retain the flexibility to design compensation programs consistent with its executive compensation philosophy for the Company, even if some executive compensation is not fully deductible. Accordingly, the Committee may from time to time approve elements of compensation for certain executives that are not fully deductible.

By the Compensation Committee,

James W. Fordyce (Chair)

Constantine E. Anagnostopoulos

Susan B. Bayh

Henry R. Lewis

18

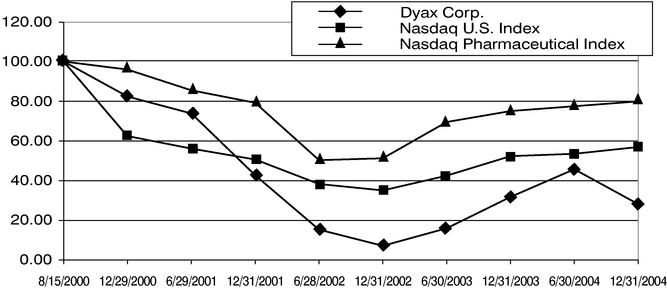

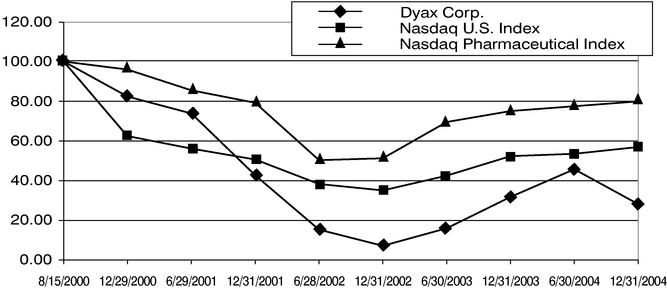

Stock Performance Graph

The following graph shows a comparison of the cumulative total stockholder returns on our Common Stock over the period from August 15, 2000 (the first trading day of our Common Stock) to December 31, 2004 as compared with that of the NASDAQ US Index and NASDAQ Pharmaceutical Index, based on an initial investment of $100 on August 15, 2000 in the Dyax's Common Stock and in each such index. Total stockholder return is measured by dividing share price change plus dividends, if any, for each period by the share price at the beginning of the respective period, assuming reinvestment of any dividends.

Comparison of Cumulative Return of Dyax Corp.,

NASDAQ US Index and NASDAQ Pharmaceuticals Index

| | 8/15/2000

| | 12/29/2000

| | 6/29/2001

| | 12/31/2001

| | 6/28/2002

| | 12/31/2002

| | 6/30/2003

| | 12/31/2003

| | 6/30/2004

| | 12/31/2004

|

|---|

| Dyax Corp. (DYAX) | | 100.00 | | 82.33 | | 73.79 | | 42.60 | | 15.15 | | 6.99 | | 15.84 | | 31.65 | | 45.63 | | 28.04 |

| NASDAQ US Index | | 100.00 | | 63.73 | | 56.05 | | 50.55 | | 38.18 | | 34.95 | | 42.39 | | 52.25 | | 53.43 | | 56.86 |

| NASDAQ Pharmaceutical Index | | 100.00 | | 95.94 | | 85.47 | | 79.18 | | 50.22 | | 51.16 | | 69.47 | | 75.00 | | 77.44 | | 79.88 |

19

Summary Compensation Table

The following table sets forth certain compensation information for our Chief Executive Officer and each of our four other executive officers whose salary and bonus for the year ended December 31, 2004 exceeded $100,000. We refer to these persons as the named executive officers.

Summary Compensation Table

| |

| |

| |

| | Long-Term

Compensation Awards

| |

| |

|---|

| | Annual Compensation

| |

| |

|---|

Name and Principal Position

| | Shares Of Common Stock

Underlying Options(#)

| | All Other

Compensation($)(b)

| |

|---|

| | Year

| | Salary($)(a)

| | Bonus($)

| |

|---|

Henry E. Blair

President and Chief Executive Officer | | 2004

2003

2002 | | 500,000

450,000

450,000 | | 102,300

165,000

89,100 | | 140,000

55,000

30,000 | | 9,714

9,701

7,786 | (c)

(d)

(d) |

Stephen S. Galliker

Executive Vice President, Finance and Administration, and Chief Financial Officer |

|

2004

2003

2002 |

|

273,250

262,000

255,219 |

|

74,597

85,956

55,020 |

|

75,000

27,500

35,000 |

|

22,318

23,412

14,803 |

(e)

(f)

(g) |

Ivana Magovcevic-Liebisch, Ph.D., J.D.

Senior Vice President, Legal Affairs and Chief Patent Counsel |

|

2004

2003

2002 |

|

275,000

230,000

210,767 |

|

59,125

64,429

43,000 |

|

60,000

62,500

55,000 |

|

6,633

6,425

5,837 |

(h)

(i)

(j) |

Lynn G. Baird, Ph.D.

Senior Vice President, Development |

|

2004

2003

2002 |

|

255,000

228,000

224,030 |

|

51,638

63,014

45,600 |

|

75,000

32,500

60,000 |

|

8,455

8,163

7,703 |

(k)

(l)

(m) |

Clive R. Wood, Ph.D(n)

Senior Vice President, Discovery Research and Chief Scientific Officer |

|

2004

2003

2002 |

|

250,000

88,151

— |

|

56,875

25,770

— |

|

75,000

75,000

— |

|

4,690

2,002

— |

(o)

(p)

|

- (a)

- Salary amounts reflect amounts earned during the fiscal year rather than amounts paid during the fiscal year. The amount earned during the fiscal year can differ from the amount paid due to Dyax's standard bi-weekly payroll system. The 2003 and 2002 amounts, to the extent previously reported, have been adjusted to reflect the amount earned during the fiscal year so that salary amounts are reported on a consistent basis in this table.

- (b)

- Unless otherwise noted, this amount represents premiums paid by Dyax for group term life insurance.

- (c)

- Includes $6,150 in 401(k) matching paid by Dyax.

- (d)

- Includes $6,000 in 401(k) matching paid by Dyax.

- (e)

- Includes $6,150 in 401(k) matching paid by Dyax and $13,846 paid to Mr. Galliker as a housing allowance.

- (f)

- Includes $6,000 in 401(k) matching paid by Dyax and $15,000 paid to Mr. Galliker as a housing allowance.

- (g)

- Includes $6,000 in 401(k) matching paid by Dyax and $6,923 paid to Mr. Galliker as a housing allowance.

- (h)

- Includes $6,150 in 401(k) matching paid by Dyax.

- (i)

- Includes $5,992 in 401(k) matching paid by Dyax.

- (j)

- Includes $5,500 in 401(k) matching paid by Dyax.

20

- (k)

- Includes $6,150 in 401(k) matching paid by Dyax.

- (l)

- Includes $5,998 in 401(k) matching paid by Dyax.

- (m)

- Includes $6,000 in 401(k) matching paid by Dyax.

- (n)

- Dr. Wood joined us in August 2003.

- (o)

- Includes $4,154 in 401(k) matching paid by Dyax.

- (p)

- Includes $1,817 in 401(k) matching paid by Dyax.

Option Grants and Potential Realizable Values Table

The following table sets forth certain information concerning option grants made to the named executive officers through December 31, 2004.

Option Grants In Last Fiscal Year

| | Individual Grants

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation For Option Term(b)

|

|---|

| |

| | Percent Of Total

Options Granted

To Employees In

Fiscal Year

| |

| |

|

|---|

Name(a)

| | Number of

Securities

Underlying Options Granted (#)(a)

| | Exercise or

Base Price

(Per Share)

| | Expiration

Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Henry E. Blair | | 140,000 | (c) | 11.18 | % | $ | 11.41 | | 6/27/2014 | | 1,004,596 | | 2,545,844 |

| Stephen S. Galliker | | 75,000 | (d) | 5.99 | % | $ | 11.41 | | 6/27/2014 | | 538,177 | | 1,363,845 |

| Ivana Magovcevic-Liebisch, Ph.D., J.D. | | 60,000 | (e) | 4.79 | % | $ | 11.41 | | 6/27/2014 | | 430,541 | | 1,091,076 |

| Lynn G. Baird, Ph.D. | | 75,000 | (f) | 5.99 | % | $ | 11.41 | | 6/27/2014 | | 538,177 | | 1,363,845 |

| Clive R. Wood, Ph.D. | | 75,000 | (g) | 5.99 | % | $ | 11.41 | | 6/27/2014 | | 538,177 | | 1,363,845 |

- (a)

- All options reported are Incentive Stock Options, except as noted. These options vest as to 1/48th of the total shares per month beginning on the first monthly anniversary of the date of grant.

- (b)

- The values in this column are given for illustrative purposes; they do not reflect our estimate or projection of future stock prices. The values are based on an assumption that our Common Stock's market price will appreciate at the stated rate, compounded annually, from the date of the option grant until the end of the option's 10-year term. Actual gains, if any, on stock option exercises will depend upon the future performance of our Common Stock's price, which will benefit all stockholders proportionately.

- (c)

- Includes 117,114 nonstatutory stock options.

- (d)

- Includes 44,108 nonstatutory stock options.

- (e)

- Includes 49,742 nonstatutory stock options.

- (f)

- Includes 54,086 nonstatutory stock options.

- (g)

- Includes 57,520 nonstatutory stock options.

21

Option Exercises and Year-End Values Table

The following table sets forth certain information concerning exercisable and unexercisable stock options held by the named executive officers as of December 31, 2004.

Aggregated Option Exercises In Last Fiscal Year And

Fiscal Year-End Option Value

Name

| | Shares

Acquired on

Exercise

| | Value

Realized

| | Number of Securities Underlying

Unexercised Options

at Fiscal Year-End(#)

Exercisable/

Unexercisable

| | Value of Unexercised

in-the-Money Options at

Fiscal Year-End($)

Exercisable/

Unexercisable(a)

|

|---|

| Henry E. Blair | | — | | | — | | 320,529 / 196,771 | | $726,651 / $217,686 |

| Stephen S. Galliker | | — | | | — | | 234,109 / 109,427 | | $810,889 / $162,560 |

| Ivana Magovcevic-Liebisch, Ph.D., J.D. | | 26,407 | | $ | 307,807 | | 60,147 / 122,746 | | $67,537 / $191,205 |

| Lynn G. Baird, Ph.D. | | — | | | — | | 94,011 / 123,489 | | $225,225 / $227,424 |

| Clive R. Wood, Ph.D. | | 9,375 | | $ | 100,059 | | 23,959 / 116,666 | | $33,470 / $147,998 |

- (a)

- Based on the difference between the exercise price of the option and the $7.22 closing price of the underlying Common Stock on December 31, 2004.

Executive Employment Agreements

Mr. Galliker and Drs. Magovcevic-Liebisch, Baird and Wood each has an agreement with us under which they are entitled to certain benefits under particular conditions if they are terminated in connection with, or within twelve months after, a change in control of Dyax. Under the agreements, each officer is entitled to receive, as severance, his or her base salary for a period of six months if they are terminated without cause, or if they resign for good reason due to a the material diminution of their duties, a reduction in their base salary, or a relocation of their place of business that is more than 50 miles from their prior place of business. Additionally, following the termination of any of these officers' employment, that officer's outstanding unvested options will be fully accelerated and he or she will also be entitled to receive full benefits during that six-month period, as well as outplacement services. In addition, each of the officers is entitled to these benefits if we terminate their employment within 90 days prior to a change in control, if their termination was a condition to the change in control transaction.

Under his 1999 employment agreement, Mr. Galliker is entitled to receive a minimum base salary of $185,000. We also pay Mr. Galliker a housing allowance of no more than $15,000 a year. If we terminate Mr. Galliker without cause, we must continue to pay him at his current salary for six months, reduced by any compensation that Mr. Galliker earns for other work performed during this six-month period.

Under her 2001 employment agreement, Dr. Magovcevic-Liebisch is entitled to receive a base salary of $168,000, which is subject to annual review.

Under her 2001 employment agreement, Dr. Baird is entitled to receive a base salary of $205,000, which is subject to annual review. If we terminate Dr. Baird without cause or, following a change in control of the Company, she is terminated or quits because the terms of her employment have been adversely changed, we must continue to pay her at her then current salary for six months.

Under his 2003 employment agreement, Dr. Wood is entitled to receive a minimum base salary of $225,000, which is subject to annual review. If we terminate Dr. Wood without cause, we must continue to pay him at his then current salary for six months.

22

Report of the Audit Committee

The following is the report of the Audit Committee with respect to Dyax's audited financial statements for the year ended December 31, 2004.

The purpose of the Audit Committee is to assist the Board in fulfilling its responsibility to oversee Dyax's accounting and financial reporting, internal controls and audit functions. The Audit Committee Charter describes in greater detail the full responsibilities of the committee and is included in this proxy statement asAppendix A. The Audit Committee is comprised entirely of independent directors as defined by applicable NASDAQ Stock Market standards.

Management is responsible for our internal controls and the financial reporting process. The Independent Registered Public Accounting Firm is responsible for performing an independent audit of our consolidated financial statements and internal control over financial reporting in accordance with the standards established by the Public Company Accounting and Oversight Board (United States) and issuing a report thereon. The committee's responsibility is to monitor these processes. The Audit Committee has reviewed and discussed the consolidated financial statements with management and PricewaterhouseCoopers LLP, our independent registered public accounting firm.

In the course of its oversight of Dyax's financial reporting process, the Audit Committee of the Board of Directors has:

- •

- reviewed and discussed with management and PricewaterhouseCoopers LLP Dyax's audited financial statements for the fiscal year ended December 31, 2004;

- •

- discussed with PricewaterhouseCoopers LLP the matters required to be discussed by Statement on Auditing Standards No. 61,Communication with Audit Committees;

- •

- received the written disclosures and the letter from PricewaterhouseCoopers LLP required by Independence Standards Board Standard No. 1,Independence Discussions with Audit Committees;

- •

- reviewed with management and PricewaterhouseCoopers LLP Dyax's critical accounting policies;

- •

- discussed with management the quality and adequacy of Dyax's internal controls;

- •

- discussed with PricewaterhouseCoopers LLP any relationships that may impact their objectivity and independence; and

- •

- considered whether the provision of non-audit services by PricewaterhouseCoopers LLP is compatible with maintaining independence.

Based on the foregoing review and discussions, the Committee recommended to the Board of Directors that the audited financial statements be included in Dyax's Annual Report on Form 10-K for the year ended December 31, 2004 for filing with the Securities and Exchange Commission.