UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-07820 |

| | |

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 03-31 |

| | |

| Date of reporting period: | 03-31-2016 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| | |

| | Annual Report |

| | |

| | March 31, 2016 |

| | |

| | Equity Income Fund |

|

| | |

| President’s Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

|

| |

| Dear Investor:

Thank you for reviewing this annual report for the 12 months ended March 31, 2016. It provides investment performance and portfolio information for the reporting period, plus longer-term historical performance data.

Annual reports help convey information about fund performance, including market and economic factors that affected returns during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

|

| Jonathan Thomas |

Divergence in Economic Growth and Monetary Policies, Combined With China Turmoil, Triggered Market Volatility

Divergence between the U.S. and the rest of the world—along with China’s struggles, plunging commodity prices, capital market volatility, and risk-off trading—were dominant themes during the reporting period. Global divergence described not only the relatively stronger economic growth enjoyed by the U.S. compared with most of the world, but also the related contrast between the U.S. Federal Reserve’s (the Fed’s) unwinding of monetary stimulus versus the continuation and expansion of stimulus by other major central banks.

Two months in particular captured the volatility and risk-off trading of the 12-month period. Last August, China’s economic slowdown (which rippled across the global economy) triggered Chinese stock market volatility, increasingly stimulative Chinese central bank monetary policy, and currency devaluations. Burdened further with oil market volatility, equity and higher-risk bond markets declined globally. Five months later, in January, investor sentiment plunged again as global economic growth decelerated, China devalued its currency again, and oil prices dropped below $30 a barrel. In addition, the Fed, in December, executed its first rate hike since 2006. Central bank policies showed less divergence thereafter, with the Bank of Japan suddenly resorting to negative interest rates, the Fed holding rates steady while reducing its rate hike projections, and the European Central Bank announcing significant additional stimulus.

Bonds (and more bond-like stock sectors, such as utilities and REITs) generally outperformed the broad stock market for the reporting period. In terms of stock style and size, growth generally outperformed value, and large cap generally outperformed small cap. In the bond market, higher quality (investment-grade) generally outperformed lower quality (high-yield). We expect continued economic and monetary policy divergence between the U.S. and non-U.S. economies in 2016, accompanied by further market volatility. This could present both challenges and opportunities for active investment managers. Looking ahead, we continue to believe in a disciplined, diversified, risk-aware investment approach, using professionally managed portfolios to meet financial goals. We appreciate your trust in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | | |

| Total Returns as of March 31, 2016 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| Investor Class | TWEIX | 6.78% | 9.84% | 6.96% | — | 8/1/94 |

| Russell 3000 Value Index | — | -2.05% | 9.94% | 5.60% | — | — |

| S&P 500 Index | — | 1.78% | 11.57% | 7.00% | — | — |

| Institutional Class | ACIIX | 7.11% | 10.05% | 7.18% | — | 7/8/98 |

| A Class | TWEAX | | | | | 3/7/97 |

| No sales charge | | 6.51% | 9.57% | 6.70% | — | |

| With sales charge | | 0.40% | 8.29% | 6.07% | — | |

| C Class | AEYIX | 5.72% | 8.73% | 5.91% | — | 7/13/01 |

| R Class | AEURX | 6.27% | 9.30% | 6.45% | — | 8/29/03 |

| R6 Class | AEUDX | 7.14% | — | — | 8.78% | 7/26/13 |

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Average annual returns since inception are presented when ten years of performance history is not available.

Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

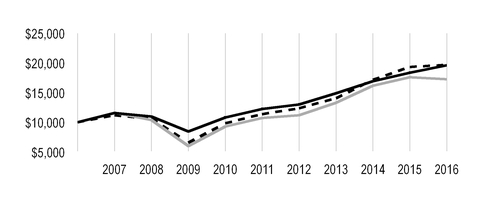

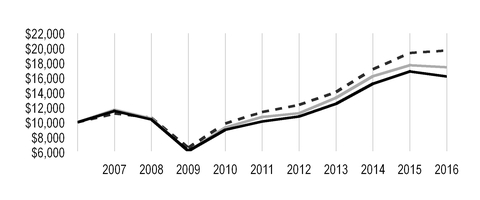

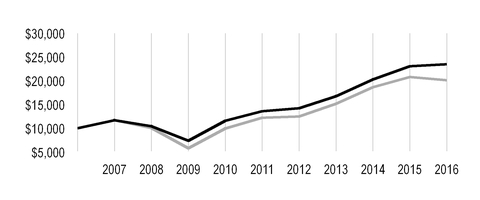

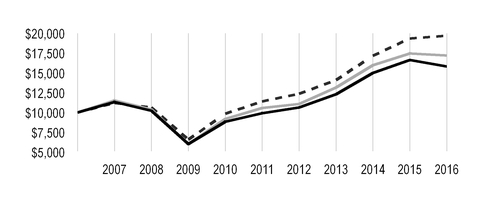

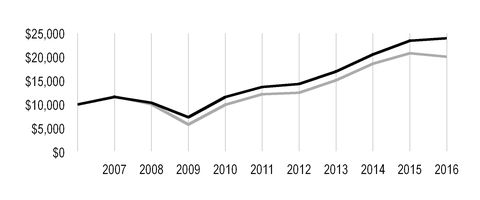

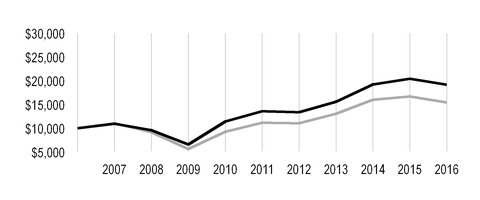

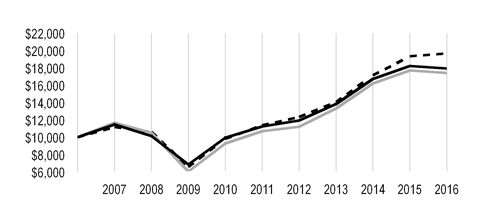

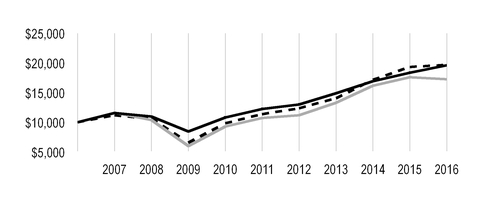

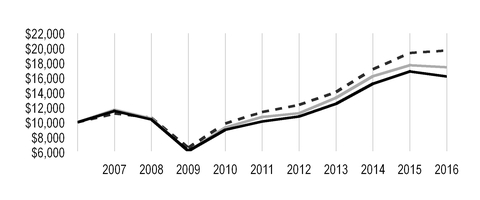

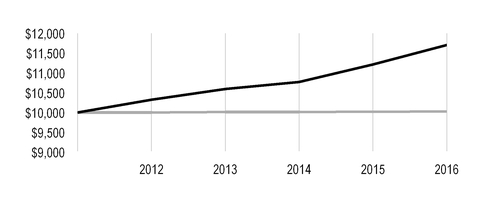

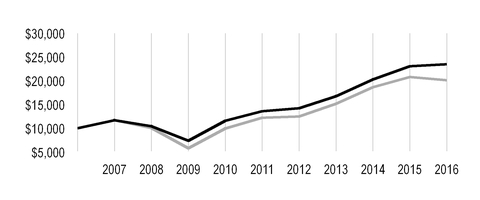

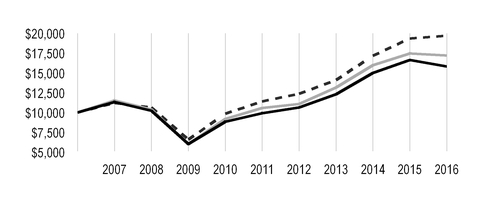

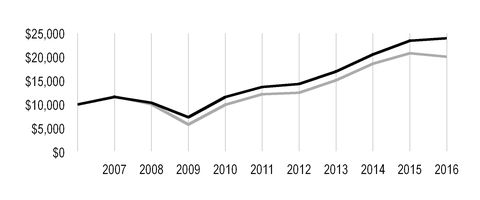

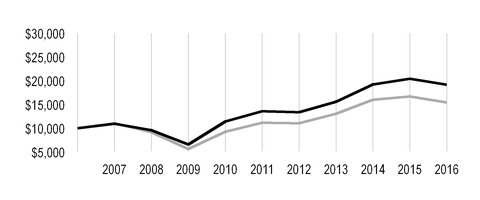

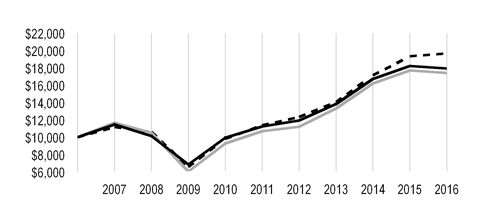

| Growth of $10,000 Over 10 Years |

| $10,000 investment made March 31, 2006 |

Performance for other share classes will vary due to differences in fee structure.

|

|

| |

| Value on March 31, 2016 |

| | Investor Class — $19,615 |

| |

| | Russell 3000 Value Index — $17,249 |

| |

| | S&P 500 Index — $19,687 |

| |

|

| | | | | |

| Total Annual Fund Operating Expenses | | |

| Investor Class | Institutional Class | A Class | C Class | R Class | R6 Class |

| 0.93% | 0.73% | 1.18% | 1.93% | 1.43% | 0.58% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Phil Davidson, Kevin Toney, Michael Liss, and Dan Gruemmer

In February 2016, portfolio manager Dan Gruemmer joined the Equity Income management team.

Performance Summary

Equity Income returned 6.78%* for the 12 months ended March 31, 2016. By comparison, its benchmark, the Russell 3000 Value Index, declined -2.05%. The fund’s return reflects operating expenses, while index returns do not.

Volatility reigned over much of the 12-month period. Economic growth in the U.S. continued at a moderate pace, and the domestic employment market continued to post encouraging gains. Yet, continued weakness in oil prices and Chinese economic activity worried investors, spurring a significant pullback in stocks in the third quarter of 2015. Facing market anxiety, the Federal Reserve (Fed) delayed the first interest rate increase. The market rallied in the fourth quarter, with sufficient strength that the Fed finally enacted the first rate increase in nine years.

The first quarter of 2016 was a shorter version of the same cycle, with stocks pulling back alongside falling oil prices, then recovering when the Fed announced a slower pace for interest rate increases. The energy sector continued to struggle; worries about souring loans to the sector spilled over to the financials sector as well. Growth stocks outperformed value stocks among large caps; among small and mid caps, the trend was reversed. Among value stocks, large caps outperformed mid caps, while small caps posted the biggest declines.

Equity Income outperformed its benchmark, primarily because of its positioning in financials, utilities and energy stocks. Holdings in industrials and consumer discretionary stocks also boosted relative performance. Stock selection across the portfolio was particularly strong, although sector allocation also contributed to relative performance. The portfolio’s stance in telecommunication services and materials detracted slightly from relative returns.

Financials Boosted Performance

Stock selection and an underweight to the financials sector both contributed to relative performance. Selection in banks, where the portfolio is overweight, was especially strong; convertible holdings in Bank of America and Wells Fargo added to relative returns. We have used select convertible positions of banks that have unique terms which skew the risk-reward to our favor. The portfolio also benefited from avoiding the common stocks of Citigroup and Wells Fargo. Some large-cap banks struggled as the pace of interest rate increases stalled over the last 12 months, lowering earnings expectations for banks. Credit exposure to the energy sector was also a growing concern over the period, as oil prices generally continued to fall.

Utilities Contributed to Outperformance

Overall selection also had a positive effect in utilities, as did the portfolio’s overweight allocation to the sector, which was one of the top performers in the benchmark over the 12-month period. The portfolio’s overweight to gas utilities added to relative performance, as did selection in the industry. Gas utility ONE Gas was the top contributor; the company continued to exceed expectations, raising its dividend and long-term outlook in the period.

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund's benchmark, other share classes may not. See page 3 for returns for all share classes.

Energy Added to Relative Performance

Selection in the struggling energy sector also contributed to the portfolio’s outperformance, though a slight overweight in the sector detracted marginally from returns. Selection in the oil, gas and consumable fuels industry added to performance, due to the avoidance of a number of energy companies that underperformed, including Kinder Morgan, ConocoPhillips and Anadarko Petroleum. Relative performance was also boosted by the portfolio’s selection in energy equipment and services, as well as by an underweight to the industry.

Telecommunication Services and Materials Weighed on Results

Selection and an underweight allocation in the telecommunication services sector weighed slightly on relative performance. The sector was the top performer in the benchmark over the 12-month period; the portfolio’s avoidance of benchmark name AT&T hindered results. Telecommunications services performed well as investors sought stability during periodic market volatility. Selection in the materials sector also detracted a bit from overall performance. Chemicals manufacturer Potash Corp. of Saskatchewan weighed on results. Potash suffered lower pricing power from oversupply and weakening demand, particularly in China.

Outlook

We will continue to follow our disciplined, bottom-up investment process, selecting companies one at a time for the portfolio. The portfolio continues to be notably overweight in consumer staples companies. A position in beverage maker PepsiCo was recently trimmed, after the stock held up well on a relative basis during the market decline in the first quarter of 2016. We also trimmed food distributor Sysco as the stock outperformed, and the company announced an acquisition that will materially increase leverage. The portfolio moved from a slight underweight in information technology to a moderate overweight following purchases over the year. We added to a position in Cisco Systems due to a significantly larger-than-expected dividend increase and share repurchase authorization signaling improving capital allocation.

In the financials sector, the portfolio maintains an underweight position, particularly in real estate investment trusts (REITs) and insurance companies. The portfolio maintains an overweight in banks, which we believe are attractively valued. We prefer banks with safe dividends.

|

| |

| MARCH 31, 2016 |

| Top Ten Holdings | % of net assets |

| iShares Russell 1000 Value ETF | 5.0% |

| Wells Fargo & Co. (Convertible) | 4.0% |

| Bank of America Corp. (Convertible) | 3.8% |

| Procter & Gamble Co. (The) | 3.0% |

| Pfizer, Inc. | 3.0% |

| Intel Corp. (Convertible) | 3.0% |

| Schlumberger Ltd. | 2.7% |

| Microchip Technology, Inc. (Convertible) | 2.7% |

| Cisco Systems, Inc. | 2.6% |

| PNC Financial Services Group, Inc. (The) | 2.5% |

| | |

| Top Five Industries | % of net assets |

| Banks | 14.1% |

| Oil, Gas and Consumable Fuels | 7.8% |

| Semiconductors and Semiconductor Equipment | 7.7% |

| Pharmaceuticals | 6.3% |

| Electric Utilities | 4.7% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 70.0% |

| Convertible Preferred Stocks | 9.0% |

| Convertible Bonds | 8.0% |

| Exchange-Traded Funds | 6.5% |

| Preferred Stocks | 3.4% |

| Total Equity Exposure | 96.9% |

| Temporary Cash Investments | 3.1% |

| Other Assets and Liabilities | —* |

*Category is less than 0.05% of total net assets.

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2015 to March 31, 2016.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

10/1/15 | Ending

Account Value

3/31/16 | Expenses Paid

During Period(1)10/1/15 - 3/31/16 |

Annualized

Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $1,129.50 | $5.00 | 0.94% |

| Institutional Class | $1,000 | $1,130.50 | $3.94 | 0.74% |

| A Class | $1,000 | $1,128.00 | $6.33 | 1.19% |

| C Class | $1,000 | $1,123.90 | $10.30 | 1.94% |

| R Class | $1,000 | $1,127.00 | $7.66 | 1.44% |

| R6 Class | $1,000 | $1,131.30 | $3.14 | 0.59% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,020.30 | $4.75 | 0.94% |

| Institutional Class | $1,000 | $1,021.30 | $3.74 | 0.74% |

| A Class | $1,000 | $1,019.05 | $6.01 | 1.19% |

| C Class | $1,000 | $1,015.30 | $9.77 | 1.94% |

| R Class | $1,000 | $1,017.80 | $7.26 | 1.44% |

| R6 Class | $1,000 | $1,022.05 | $2.98 | 0.59% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. |

MARCH 31, 2016

|

| | | | | | |

| | Shares/Principal Amount | Value |

| COMMON STOCKS — 70.0% | | |

| Air Freight and Logistics — 0.3% | | |

| United Parcel Service, Inc., Class B | 268,118 |

| $ | 28,278,405 |

|

| Automobiles — 0.1% | | |

| Honda Motor Co., Ltd. | 399,400 |

| 10,951,605 |

|

| Banks — 5.4% | | |

| Comerica, Inc. | 1,437,200 |

| 54,426,764 |

|

| Commerce Bancshares, Inc. | 1,894,572 |

| 85,161,011 |

|

| JPMorgan Chase & Co. | 860,397 |

| 50,952,710 |

|

| PNC Financial Services Group, Inc. (The) | 2,799,012 |

| 236,712,445 |

|

| SunTrust Banks, Inc. | 2,446,530 |

| 88,270,803 |

|

| | | 515,523,733 |

|

| Beverages — 1.7% | | |

| PepsiCo, Inc. | 1,564,099 |

| 160,288,865 |

|

| Capital Markets — 1.6% | | |

| AllianceBernstein Holding LP | 1,743,778 |

| 40,856,718 |

|

| Ameriprise Financial, Inc. | 389,673 |

| 36,633,159 |

|

| Northern Trust Corp. | 1,089,240 |

| 70,985,771 |

|

| | | 148,475,648 |

|

| Chemicals — 1.7% | | |

| Air Products & Chemicals, Inc. | 1,069,637 |

| 154,081,210 |

|

| Potash Corp. of Saskatchewan, Inc. | 553,085 |

| 9,413,507 |

|

| | | 163,494,717 |

|

| Commercial Services and Supplies — 2.2% | | |

| Republic Services, Inc. | 3,192,461 |

| 152,120,766 |

|

| Tyco International plc | 886,804 |

| 32,554,575 |

|

| Waste Management, Inc. | 339,700 |

| 20,042,300 |

|

| | | 204,717,641 |

|

| Communications Equipment — 2.6% | | |

| Cisco Systems, Inc. | 8,598,991 |

| 244,813,274 |

|

| Containers and Packaging — 0.5% | | |

| International Paper Co. | 1,099,427 |

| 45,120,484 |

|

| Distributors — 1.8% | | |

| Genuine Parts Co. | 1,738,751 |

| 172,762,299 |

|

| Diversified Telecommunication Services — 1.1% | | |

| Verizon Communications, Inc. | 1,868,237 |

| 101,034,257 |

|

| Electric Utilities — 4.7% | | |

| Edison International | 1,799,599 |

| 129,373,172 |

|

| PG&E Corp. | 2,599,237 |

| 155,226,434 |

|

| Westar Energy, Inc. | 3,321,169 |

| 164,763,194 |

|

| | | 449,362,800 |

|

| Electrical Equipment — 1.1% | | |

| Eaton Corp. plc | 843,252 |

| 52,753,845 |

|

| Rockwell Automation, Inc. | 469,200 |

| 53,371,500 |

|

| | | 106,125,345 |

|

| | | |

|

| | | | | | |

| | Shares/Principal Amount | Value |

| Energy Equipment and Services — 2.7% | | |

| Schlumberger Ltd. | 3,529,200 |

| $ | 260,278,500 |

|

| Food and Staples Retailing — 3.6% | | |

| Sysco Corp. | 2,548,919 |

| 119,110,985 |

|

| Wal-Mart Stores, Inc. | 3,239,983 |

| 221,906,436 |

|

| | | 341,017,421 |

|

| Food Products — 2.8% | | |

| General Mills, Inc. | 1,794,666 |

| 113,692,091 |

|

| Mead Johnson Nutrition Co. | 1,827,071 |

| 155,246,223 |

|

| | | 268,938,314 |

|

| Gas Utilities — 3.7% | | |

| Atmos Energy Corp. | 499,000 |

| 37,055,740 |

|

ONE Gas, Inc.(1) | 3,580,293 |

| 218,755,902 |

|

| WGL Holdings, Inc. | 1,289,921 |

| 93,351,583 |

|

| | | 349,163,225 |

|

| Health Care Equipment and Supplies — 1.9% | | |

| Medtronic plc | 2,350,903 |

| 176,317,725 |

|

| Health Care Providers and Services — 1.3% | | |

| Quest Diagnostics, Inc. | 1,748,458 |

| 124,927,324 |

|

| Hotels, Restaurants and Leisure — 0.4% | | |

| McDonald's Corp. | 328,763 |

| 41,318,934 |

|

| Household Durables — 0.6% | | |

| Tupperware Brands Corp. | 411,219 |

| 23,842,478 |

|

| Whirlpool Corp. | 198,900 |

| 35,869,626 |

|

| | | 59,712,104 |

|

| Household Products — 3.0% | | |

| Procter & Gamble Co. (The) | 3,462,159 |

| 284,970,307 |

|

| Industrial Conglomerates — 2.3% | | |

| 3M Co. | 1,038,600 |

| 173,061,918 |

|

| General Electric Co. | 1,383,195 |

| 43,971,769 |

|

| | | 217,033,687 |

|

| Insurance — 1.7% | | |

| Marsh & McLennan Cos., Inc. | 1,960,105 |

| 119,154,783 |

|

| MetLife, Inc. | 980,029 |

| 43,062,474 |

|

| | | 162,217,257 |

|

| Life Sciences Tools and Services — 0.3% | | |

| Agilent Technologies, Inc. | 599,500 |

| 23,890,075 |

|

| Machinery — 1.0% | | |

| Stanley Black & Decker, Inc. | 880,681 |

| 92,656,448 |

|

| Oil, Gas and Consumable Fuels — 7.6% | | |

| Chevron Corp. | 190,016 |

| 18,127,527 |

|

| Exxon Mobil Corp. | 2,740,478 |

| 229,076,556 |

|

| Imperial Oil Ltd. | 122,800 |

| 4,102,631 |

|

| Occidental Petroleum Corp. | 2,299,477 |

| 157,353,211 |

|

| Spectra Energy Partners LP | 2,154,169 |

| 103,658,612 |

|

| TOTAL SA | 4,616,561 |

| 210,442,545 |

|

| | | 722,761,082 |

|

| Pharmaceuticals — 5.5% | | |

| Johnson & Johnson | 1,735,421 |

| 187,772,552 |

|

| Merck & Co., Inc. | 869,701 |

| 46,015,880 |

|

|

| | | | | | |

| | Shares/Principal Amount | Value |

| Pfizer, Inc. | 9,599,470 |

| $ | 284,528,291 |

|

| | | 518,316,723 |

|

| Real Estate Investment Trusts (REITs) — 0.6% | | |

| Weyerhaeuser Co. | 1,859,400 |

| 57,604,212 |

|

| Road and Rail — 0.4% | | |

| Norfolk Southern Corp. | 409,183 |

| 34,064,485 |

|

| Semiconductors and Semiconductor Equipment — 2.0% | | |

| Applied Materials, Inc. | 6,382,603 |

| 135,183,532 |

|

| Maxim Integrated Products, Inc. | 1,506,100 |

| 55,394,358 |

|

| | | 190,577,890 |

|

| Software — 1.5% | | |

| Microsoft Corp. | 1,924,336 |

| 106,281,077 |

|

| Oracle Corp. | 882,800 |

| 36,115,348 |

|

| | | 142,396,425 |

|

| Technology Hardware, Storage and Peripherals — 0.6% | | |

| Apple, Inc. | 521,800 |

| 56,870,982 |

|

| Thrifts and Mortgage Finance — 1.7% | | |

Capitol Federal Financial, Inc.(1) | 12,074,379 |

| 160,106,266 |

|

TOTAL COMMON STOCKS (Cost $5,292,410,860) | | 6,636,088,459 |

|

| CONVERTIBLE PREFERRED STOCKS — 9.0% | | |

| Banks — 7.8% | | |

| Bank of America Corp., 7.25% | 311,569 |

| 354,565,522 |

|

| Wells Fargo & Co., 7.50% | 313,977 |

| 378,345,425 |

|

| | | 732,910,947 |

|

| Gas Utilities — 0.4% | | |

| Laclede Group, Inc. (The), 6.75%, 4/1/17 | 667,497 |

| 40,310,144 |

|

| Pharmaceuticals — 0.8% | | |

| Teva Pharmaceutical Industries Ltd., 7.00%, 12/15/18 | 87,611 |

| 77,442,867 |

|

TOTAL CONVERTIBLE PREFERRED STOCKS (Cost $790,304,651) | | 850,663,958 |

|

| CONVERTIBLE BONDS — 8.0% | | |

| Food Products — 0.6% | | |

Credit Suisse AG, (convertible into Mondelez International, Inc.), 3.10%, 9/22/16(2)(3) | $ | 447,900 |

| 18,067,508 |

|

Goldman Sachs International, (convertible into Mondelez International, Inc.), 5.75%, 8/10/16(2)(3) | 1,013,600 |

| 40,615,485 |

|

| | | 58,682,993 |

|

| Health Care Equipment and Supplies — 0.2% | | |

Credit Suisse AG, (convertible into Baxter International, Inc.), 3.25%, 4/15/16(2)(3) | 449,500 |

| 16,432,991 |

|

| Oil, Gas and Consumable Fuels — 0.2% | | |

Morgan Stanley BV, (convertible into EQT Corp.), 10.30%, 8/9/16(2)(3) | 351,600 |

| 22,147,072 |

|

| Semiconductors and Semiconductor Equipment — 5.7% | | |

| Intel Corp., 2.95%, 12/15/35 | 220,901,000 |

| 281,234,586 |

|

| Microchip Technology, Inc., 1.625%, 2/15/25 | 245,980,000 |

| 254,281,825 |

|

| | | 535,516,411 |

|

| Specialty Retail — 0.7% | | |

Merrill Lynch International & Co. CV, (convertible into Advance Auto Parts, Inc.), 5.50%, 5/18/16(2)(3) | 224,400 |

| 35,935,603 |

|

|

| | | | | | |

| | Shares/Principal Amount | Value |

UBS AG, (convertible into Advance Auto Parts, Inc.), 3.60%, 5/19/16(2)(3) | $ | 166,300 |

| $ | 26,625,832 |

|

| | | 62,561,435 |

|

| Technology Hardware, Storage and Peripherals — 0.6% | | |

| SanDisk Corp., 0.50%, 10/15/20 | 55,975,000 |

| 58,388,922 |

|

TOTAL CONVERTIBLE BONDS (Cost $711,337,537) | | 753,729,824 |

|

| EXCHANGE-TRADED FUNDS — 6.5% | | |

| iShares Russell 1000 Value ETF | 4,758,472 |

| 470,184,618 |

|

| SPDR S&P 500 ETF Trust | 715,100 |

| 146,995,956 |

|

TOTAL EXCHANGE-TRADED FUNDS (Cost $597,055,122) | | 617,180,574 |

|

| PREFERRED STOCKS — 3.4% | | |

| Banks — 0.9% | | |

| U.S. Bancorp, 6.00% | 3,231,982 |

| 85,033,447 |

|

| Diversified Financial Services — 2.5% | | |

| Citigroup, Inc., 5.95% | 95,856,000 |

| 92,471,037 |

|

| General Electric Co., 5.00% | 144,180,000 |

| 148,685,625 |

|

| | | 241,156,662 |

|

TOTAL PREFERRED STOCKS (Cost $307,177,451) | | 326,190,109 |

|

| TEMPORARY CASH INVESTMENTS — 3.1% | | |

Federal Home Loan Bank Discount Notes, 0.08%, 4/1/16(4) | $ | 52,707,000 |

| 52,707,000 |

|

| Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S.Treasury obligations, 3.625% - 3.75%, 8/15/43 - 11/15/43, valued at $149,365,169), at 0.10%, dated 3/31/16, due 4/1/16 (Delivery value $146,428,407) | | 146,428,000 |

|

| State Street Institutional Liquid Reserves Fund, Premier Class | 95,617,177 |

| 95,617,177 |

|

TOTAL TEMPORARY CASH INVESTMENTS (Cost $294,752,177) | | 294,752,177 |

|

TOTAL INVESTMENT SECURITIES — 100.0% (Cost $7,993,037,798) | | 9,478,605,101 |

|

OTHER ASSETS AND LIABILITIES† | | 53,733 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 9,478,658,834 |

|

|

| | | | | | | | | | |

| FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS |

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) |

| CAD | 1,194,085 |

| USD | 902,163 |

| Morgan Stanley | 6/30/16 | $ | 17,316 |

|

| CAD | 1,056,538 |

| USD | 801,555 |

| Morgan Stanley | 6/30/16 | 12,008 |

|

| CAD | 419,561 |

| USD | 323,351 |

| Morgan Stanley | 6/30/16 | (278 | ) |

| USD | 13,067,547 |

| CAD | 17,246,418 |

| Morgan Stanley | 6/30/16 | (212,674 | ) |

| USD | 166,377,469 |

| EUR | 148,545,343 |

| UBS AG | 6/30/16 | (3,109,283 | ) |

| USD | 8,700,887 |

| JPY | 977,092,160 |

| Credit Suisse AG | 6/30/16 | (3,740 | ) |

| | | | | | | $ | (3,296,651 | ) |

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| CAD | - | Canadian Dollar |

| EUR | - | Euro |

| JPY | - | Japanese Yen |

| USD | - | United States Dollar |

| |

| † | Category is less than 0.05% of total net assets. |

| |

| (1) | Affiliated Company: the fund’s holding represents ownership of 5% or more of the voting securities of the company; therefore, the company is affiliated as defined in the Investment Company Act of 1940. |

| |

| (2) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration, normally to qualified institutional investors. The aggregate value of these securities at the period end was $159,824,491, which represented 1.7% of total net assets. |

| |

| (3) | Equity-linked debt security. The aggregated value of these securities at the period end was $159,824,491, which represented 1.7% of total net assets. |

| |

| (4) | The rate indicated is the yield to maturity at purchase. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| MARCH 31, 2016 | |

| Assets | |

| Investment securities - unaffiliated, at value (cost of $7,725,921,460) | $ | 9,099,742,933 |

|

| Investment securities - affiliated, at value (cost of $267,116,338) | 378,862,168 |

|

| Total investment securities, at value (cost of $7,993,037,798) | 9,478,605,101 |

|

| Foreign currency holdings, at value (cost of $151,658) | 158,177 |

|

| Receivable for investments sold | 70,539,965 |

|

| Receivable for capital shares sold | 13,577,515 |

|

| Unrealized appreciation on forward foreign currency exchange contracts | 29,324 |

|

| Dividends and interest receivable | 31,871,492 |

|

| | 9,594,781,574 |

|

| | |

| Liabilities | |

| Payable for investments purchased | 95,162,847 |

|

| Payable for capital shares redeemed | 9,764,579 |

|

| Unrealized depreciation on forward foreign currency exchange contracts | 3,325,975 |

|

| Accrued management fees | 6,959,760 |

|

| Distribution and service fees payable | 909,579 |

|

| | 116,122,740 |

|

| | |

| Net Assets | $ | 9,478,658,834 |

|

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 7,889,774,000 |

|

| Undistributed net investment income | 4,293,572 |

|

| Undistributed net realized gain | 102,282,812 |

|

| Net unrealized appreciation | 1,482,308,450 |

|

| | $ | 9,478,658,834 |

|

|

| | | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class, $0.01 Par Value |

| $5,399,701,918 |

| 641,896,431 |

| $8.41 |

| Institutional Class, $0.01 Par Value |

| $1,229,940,051 |

| 146,125,043 |

| $8.42 |

| A Class, $0.01 Par Value |

| $1,934,680,707 |

| 230,002,924 |

| $8.41* |

| C Class, $0.01 Par Value |

| $562,723,213 |

| 66,909,171 |

| $8.41 |

| R Class, $0.01 Par Value |

| $105,462,430 |

| 12,575,573 |

| $8.39 |

| R6 Class, $0.01 Par Value |

| $246,150,515 |

| 29,218,351 |

| $8.42 |

*Maximum offering price $8.92 (net asset value divided by 0.9425).

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED MARCH 31, 2016 |

| Investment Income (Loss) | |

| Income: | |

| Dividends (including $14,099,199 from affiliates and net of foreign taxes withheld of $2,726,155) | $ | 277,355,199 |

|

| Interest | 28,395,174 |

|

| | 305,750,373 |

|

| | |

| Expenses: | |

| Management fees | 81,296,915 |

|

| Distribution and service fees: | |

| A Class | 4,906,952 |

|

| B Class | 27,483 |

|

| C Class | 5,316,529 |

|

| R Class | 560,355 |

|

| Directors' fees and expenses | 319,350 |

|

| Other expenses | 7,083 |

|

| | 92,434,667 |

|

| | |

| Net investment income (loss) | 213,315,706 |

|

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions (including $482,400 from affiliates) | 486,727,568 |

|

| Foreign currency transactions | 4,952,571 |

|

| | 491,680,139 |

|

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (119,022,588 | ) |

| Translation of assets and liabilities in foreign currencies | (7,574,658 | ) |

| | (126,597,246 | ) |

| | |

| Net realized and unrealized gain (loss) | 365,082,893 |

|

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 578,398,599 |

|

See Notes to Financial Statements.

|

|

| Statement of Changes in Net Assets |

|

| | | | | | |

| YEARS ENDED MARCH 31, 2016 AND MARCH 31, 2015 |

| Increase (Decrease) in Net Assets | March 31, 2016 | March 31, 2015 |

| Operations | | |

| Net investment income (loss) | $ | 213,315,706 |

| $ | 224,478,215 |

|

| Net realized gain (loss) | 491,680,139 |

| 923,209,519 |

|

| Change in net unrealized appreciation (depreciation) | (126,597,246 | ) | (325,925,104 | ) |

| Net increase (decrease) in net assets resulting from operations | 578,398,599 |

| 821,762,630 |

|

| | | |

| Distributions to Shareholders | | |

| From net investment income: | | |

| Investor Class | (123,019,058 | ) | (133,181,145 | ) |

| Institutional Class | (30,526,067 | ) | (39,559,169 | ) |

| A Class | (42,382,590 | ) | (52,200,356 | ) |

| B Class | (37,483 | ) | (92,083 | ) |

| C Class | (7,534,907 | ) | (7,582,993 | ) |

| R Class | (2,144,133 | ) | (3,003,425 | ) |

| R6 Class | (4,870,941 | ) | (1,830,727 | ) |

| From net realized gains: | | |

| Investor Class | (363,605,047 | ) | (395,701,675 | ) |

| Institutional Class | (77,411,532 | ) | (110,691,649 | ) |

| A Class | (139,778,814 | ) | (157,867,418 | ) |

| B Class | — |

| (427,312 | ) |

| C Class | (38,422,267 | ) | (38,104,526 | ) |

| R Class | (7,738,439 | ) | (10,698,515 | ) |

| R6 Class | (15,271,252 | ) | (4,882,125 | ) |

| Decrease in net assets from distributions | (852,742,530 | ) | (955,823,118 | ) |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (995,331 | ) | (389,000,119 | ) |

| | | |

| Net increase (decrease) in net assets | (275,339,262 | ) | (523,060,607 | ) |

| | | |

| Net Assets | | |

| Beginning of period | 9,753,998,096 |

| 10,277,058,703 |

|

| End of period | $ | 9,478,658,834 |

| $ | 9,753,998,096 |

|

| | | |

| Undistributed net investment income | $ | 4,293,572 |

| $ | 7,112,583 |

|

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

MARCH 31, 2016

1. Organization

American Century Capital Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Equity Income Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek current income. Capital appreciation is a secondary objective.

The fund offers the Investor Class, the Institutional Class, the A Class, the C Class, the R Class and the R6 Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class and R6 Class shareholders do not require the same level of shareholder and administrative services from American Century Investment Management, Inc. (ACIM) (the investment advisor) as shareholders of other classes. In addition, financial intermediaries do not receive any service, distribution or administrative fees for the R6 Class. As a result, the Institutional Class and R6 Class are charged lower unified management fees. On October 16, 2015, all outstanding B Class shares were converted to A Class shares and the fund discontinued offering the B Class.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Fixed income securities are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Corporate and convertible bonds are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value. Forward foreign currency exchange contracts are valued at the mean of the appropriate forward exchange rate at the close of the NYSE as provided by an independent pricing service.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not

limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. If significant fluctuations in foreign markets are identified, the fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Equity-Linked Debt and Linked-Equity Securities — The fund may invest in hybrid equity securities, which usually convert into common stock at a date predetermined by the issuer. These securities generally offer a higher dividend yield than that of the common stock to which the security is linked. These instruments are issued by a company other than the one to which the security is linked and carry the credit of the issuer, not that of the underlying common stock. The securities’ appreciation is limited based on a predetermined final cap price at the date of the conversion. Risks of investing in these securities include, but are not limited to, a set time to capture the yield advantage, limited appreciation potential, decline in value of the underlying stock, and failure of the issuer to pay dividends or to deliver common stock at maturity.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that ACIM has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three

years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as well as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule ranges from 0.80% to 1.00% for the Investor Class, A Class, B Class, C Class and R Class. The annual management fee schedule ranges from 0.60% to 0.80% for the Institutional Class and 0.45% to 0.65% for the R6 Class. The effective annual management fee for each class for the year ended March 31, 2016 was 0.93% for the Investor Class, A Class, C Class and R Class, 0.73% for the Institutional Class and 0.58% for the R6 Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, B Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the B Class and C Class will each pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended March 31, 2016 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended March 31, 2016 were $7,622,418,671 and $8,399,209,443, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

|

| | | | | | | | | | |

| | Year ended

March 31, 2016 | Year ended

March 31, 2015 |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 3,690,000,000 |

| | 3,000,000,000 |

| |

| Sold | 114,466,871 |

| $ | 941,691,955 |

| 110,372,179 |

| $ | 992,156,979 |

|

| Issued in reinvestment of distributions | 56,859,660 |

| 457,471,867 |

| 55,640,804 |

| 491,422,481 |

|

| Redeemed | (156,737,452 | ) | (1,310,805,748 | ) | (150,064,474 | ) | (1,346,501,750 | ) |

| | 14,589,079 |

| 88,358,074 |

| 15,948,509 |

| 137,077,710 |

|

| Institutional Class/Shares Authorized | 900,000,000 |

| | 800,000,000 |

| |

| Sold | 43,236,265 |

| 355,337,764 |

| 45,244,697 |

| 411,339,947 |

|

| Issued in reinvestment of distributions | 12,080,239 |

| 97,419,785 |

| 15,432,164 |

| 136,422,405 |

|

| Redeemed | (60,463,997 | ) | (509,934,591 | ) | (70,206,105 | ) | (626,531,762 | ) |

| | (5,147,493 | ) | (57,177,042 | ) | (9,529,244 | ) | (78,769,410 | ) |

| A Class/Shares Authorized | 1,450,000,000 |

| | 1,200,000,000 |

| |

| Sold | 33,772,941 |

| 281,467,687 |

| 42,413,027 |

| 380,034,934 |

|

| Issued in reinvestment of distributions | 22,158,796 |

| 178,188,273 |

| 23,166,897 |

| 204,705,243 |

|

| Redeemed | (75,339,830 | ) | (629,711,265 | ) | (124,063,217 | ) | (1,118,733,276 | ) |

| | (19,408,093 | ) | (170,055,305 | ) | (58,483,293 | ) | (533,993,099 | ) |

| B Class/Shares Authorized | N/A |

| | 5,000,000 |

| |

| Sold | 1,773 |

| 15,470 |

| 9,982 |

| 88,368 |

|

| Issued in reinvestment of distributions | 4,126 |

| 34,715 |

| 51,900 |

| 457,829 |

|

| Redeemed | (640,096 | ) | (5,462,542 | ) | (235,376 | ) | (2,129,994 | ) |

| | (634,197 | ) | (5,412,357 | ) | (173,494 | ) | (1,583,797 | ) |

| C Class/Shares Authorized | 380,000,000 |

| | 250,000,000 |

| |

| Sold | 10,920,834 |

| 90,266,957 |

| 9,067,836 |

| 80,952,738 |

|

| Issued in reinvestment of distributions | 4,821,802 |

| 38,594,526 |

| 4,237,094 |

| 37,309,528 |

|

| Redeemed | (11,886,580 | ) | (99,349,090 | ) | (9,244,873 | ) | (82,980,488 | ) |

| | 3,856,056 |

| 29,512,393 |

| 4,060,057 |

| 35,281,778 |

|

| R Class/Shares Authorized | 70,000,000 |

| | 70,000,000 |

| |

| Sold | 1,999,195 |

| 16,610,134 |

| 2,337,223 |

| 20,958,591 |

|

| Issued in reinvestment of distributions | 1,206,549 |

| 9,662,979 |

| 1,523,932 |

| 13,415,731 |

|

| Redeemed | (5,355,482 | ) | (44,926,763 | ) | (8,390,547 | ) | (75,033,538 | ) |

| | (2,149,738 | ) | (18,653,650 | ) | (4,529,392 | ) | (40,659,216 | ) |

| R6 Class/Shares Authorized | 180,000,000 |

| | 40,000,000 |

| |

| Sold | 19,314,185 |

| 162,369,985 |

| 11,586,359 |

| 103,570,127 |

|

| Issued in reinvestment of distributions | 2,424,776 |

| 19,519,689 |

| 759,719 |

| 6,712,852 |

|

| Redeemed | (6,008,060 | ) | (49,457,118 | ) | (1,858,023 | ) | (16,637,064 | ) |

| | 15,730,901 |

| 132,432,556 |

| 10,488,055 |

| 93,645,915 |

|

| Net increase (decrease) | 6,836,515 |

| $ | (995,331 | ) | (42,218,802 | ) | $ | (389,000,119 | ) |

6. Affiliated Company Transactions

If a fund's holding represents ownership of 5% or more of the voting securities of a company, the company is affiliated as defined in the 1940 Act. A summary of transactions for each company which is or was an affiliate at or during the year ended March 31, 2016 follows:

|

| | | | | | | | | | | | | | | | | | |

| Company | Beginning Value | Purchase

Cost | Sales Cost | Realized

Gain (Loss) | Dividend

Income | Ending Value |

| Capitol Federal Financial, Inc. | $ | 124,997,237 |

| $ | 25,263,812 |

| — |

| — |

| $ | 9,592,113 |

| $ | 160,106,266 |

|

| ONE Gas, Inc. | 155,480,715 |

| 2,076,160 |

| $ | 2,815,763 |

| $ | 482,400 |

| 4,507,086 |

| 218,755,902 |

|

| | $ | 280,477,952 |

| $ | 27,339,972 |

| $ | 2,815,763 |

| $ | 482,400 |

| $ | 14,099,199 |

| $ | 378,862,168 |

|

7. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| |

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars. |

| |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments. There were no significant transfers between levels during the period.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

|

| | | | | | | | |

| | Level 1 | Level 2 | Level 3 |

| Assets | | | |

| Investment Securities | | | |

| Common Stocks | $ | 6,410,591,678 |

| $ | 225,496,781 |

| — |

|

| Convertible Preferred Stocks | — |

| 850,663,958 |

| — |

|

| Convertible Bonds | — |

| 753,729,824 |

| — |

|

| Exchange-Traded Funds | 617,180,574 |

| — |

| — |

|

| Preferred Stocks | 85,033,447 |

| 241,156,662 |

| — |

|

| Temporary Cash Investments | 95,617,177 |

| 199,135,000 |

| — |

|

| | $ | 7,208,422,876 |

| $ | 2,270,182,225 |

| — |

|

| Other Financial Instruments | | | |

| Forward Foreign Currency Exchange Contracts | — |

| $ | 29,324 |

| — |

|

| | | | |

| Liabilities | | | |

| Other Financial Instruments | | | |

| Forward Foreign Currency Exchange Contracts | — |

| $ | 3,325,975 |

| — |

|

8. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund's exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The fund's average U.S. dollar exposure to foreign currency risk derivative instruments held during the period was $285,550,560.

The value of foreign currency risk derivative instruments as of March 31, 2016, is disclosed on the Statement of Assets and Liabilities as an asset of $29,324 in unrealized appreciation on forward foreign currency exchange contracts and a liability of $3,325,975 in unrealized depreciation on forward foreign currency exchange contracts. For the year ended March 31, 2016, the effect of foreign currency risk derivative instruments on the Statement of Operations was $5,020,126 in net realized gain (loss) on foreign currency transactions and $(7,769,393) in change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies.

9. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2016 and March 31, 2015 were as follows:

|

| | | | | | |

| | 2016 | 2015 |

| Distributions Paid From | | |

| Ordinary income | $ | 252,510,096 |

| $ | 359,095,721 |

|

| Long-term capital gains | $ | 600,232,434 |

| $ | 596,727,397 |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of March 31, 2016, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

|

| | | |

| Federal tax cost of investments | $ | 8,138,858,940 |

|

| Gross tax appreciation of investments | $ | 1,377,187,993 |

|

| Gross tax depreciation of investments | (37,441,832 | ) |

| Net tax appreciation (depreciation) of investments | 1,339,746,161 |

|

| Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | 37,798 |

|

| Net tax appreciation (depreciation) | $ | 1,339,783,959 |

|

| Undistributed ordinary income | $ | 18,219,253 |

|

| Accumulated long-term gains | $ | 230,881,622 |

|

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

|

| | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | | |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| Investor Class | | | | | | | | | | | | |

| 2016 | $8.71 | 0.21 | 0.32 | 0.53 | (0.20) | (0.63) | (0.83) | $8.41 | 6.78% | 0.94% | 2.44% | 88% |

| $5,399,702 |

|

| 2015 | $8.84 | 0.21 | 0.54 | 0.75 | (0.22) | (0.66) | (0.88) | $8.71 | 8.54% | 0.93% | 2.30% | 56% |

| $5,463,566 |

|

| 2014 | $8.47 | 0.20 | 0.92 | 1.12 | (0.20) | (0.55) | (0.75) | $8.84 | 13.64% | 0.93% | 2.31% | 57% |

| $5,406,362 |

|

| 2013 | $7.69 | 0.21 | 0.86 | 1.07 | (0.21) | (0.08) | (0.29) | $8.47 | 14.33% | 0.93% | 2.63% | 83% |

| $5,504,359 |

|

| 2012 | $7.43 | 0.20 | 0.25 | 0.45 | (0.19) | — | (0.19) | $7.69 | 6.24% | 0.95% | 2.69% | 115% |

| $5,363,783 |

|

| Institutional Class | | | | | | | | | | | | |

| 2016 | $8.71 | 0.22 | 0.34 | 0.56 | (0.22) | (0.63) | (0.85) | $8.42 | 7.11% | 0.74% | 2.64% | 88% |

| $1,229,940 |

|

| 2015 | $8.85 | 0.22 | 0.54 | 0.76 | (0.24) | (0.66) | (0.90) | $8.71 | 8.63% | 0.73% | 2.50% | 56% |

| $1,318,193 |

|

| 2014 | $8.47 | 0.22 | 0.92 | 1.14 | (0.21) | (0.55) | (0.76) | $8.85 | 13.85% | 0.73% | 2.51% | 57% |

| $1,422,725 |

|

| 2013 | $7.69 | 0.22 | 0.87 | 1.09 | (0.23) | (0.08) | (0.31) | $8.47 | 14.69% | 0.73% | 2.83% | 83% |

| $1,527,723 |

|

| 2012 | $7.44 | 0.21 | 0.24 | 0.45 | (0.20) | — | (0.20) | $7.69 | 6.31% | 0.75% | 2.89% | 115% |

| $1,316,758 |

|

|

| | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | | |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| A Class | | | | | | | | | | | | | |

| 2016 | $8.71 | 0.18 | 0.33 | 0.51 | (0.18) | (0.63) | (0.81) | $8.41 | 6.51% | 1.19% | 2.19% | 88% |

| $1,934,681 |

|

| 2015 | $8.84 | 0.18 | 0.55 | 0.73 | (0.20) | (0.66) | (0.86) | $8.71 | 8.27% | 1.18% | 2.05% | 56% |

| $2,172,105 |

|

| 2014 | $8.47 | 0.18 | 0.91 | 1.09 | (0.17) | (0.55) | (0.72) | $8.84 | 13.36% | 1.18% | 2.06% | 57% |

| $2,722,731 |

|

| 2013 | $7.69 | 0.19 | 0.86 | 1.05 | (0.19) | (0.08) | (0.27) | $8.47 | 14.05% | 1.18% | 2.38% | 83% |

| $2,631,737 |

|

| 2012 | $7.43 | 0.18 | 0.25 | 0.43 | (0.17) | — | (0.17) | $7.69 | 5.98% | 1.20% | 2.44% | 115% |

| $2,512,840 |

|

| C Class | | | | | | | | | | | | | |

| 2016 | $8.71 | 0.12 | 0.33 | 0.45 | (0.12) | (0.63) | (0.75) | $8.41 | 5.72% | 1.94% | 1.44% | 88% |

| $562,723 |

|

| 2015 | $8.84 | 0.12 | 0.54 | 0.66 | (0.13) | (0.66) | (0.79) | $8.71 | 7.47% | 1.93% | 1.30% | 56% |

| $549,088 |

|

| 2014 | $8.47 | 0.12 | 0.91 | 1.03 | (0.11) | (0.55) | (0.66) | $8.84 | 12.53% | 1.93% | 1.31% | 57% |

| $521,688 |

|

| 2013 | $7.69 | 0.13 | 0.86 | 0.99 | (0.13) | (0.08) | (0.21) | $8.47 | 13.21% | 1.93% | 1.63% | 83% |

| $467,913 |

|

| 2012 | $7.44 | 0.12 | 0.25 | 0.37 | (0.12) | — | (0.12) | $7.69 | 5.05% | 1.95% | 1.69% | 115% |

| $469,355 |

|

|

| | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | | |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| R Class | | | | | | | | | | | | | |

| 2016 | $8.69 | 0.16 | 0.33 | 0.49 | (0.16) | (0.63) | (0.79) | $8.39 | 6.27% | 1.44% | 1.94% | 88% |

| $105,462 |

|

| 2015 | $8.82 | 0.16 | 0.54 | 0.70 | (0.17) | (0.66) | (0.83) | $8.69 | 8.03% | 1.43% | 1.80% | 56% |

| $127,897 |

|

| 2014 | $8.45 | 0.16 | 0.91 | 1.07 | (0.15) | (0.55) | (0.70) | $8.82 | 13.12% | 1.43% | 1.81% | 57% |

| $169,852 |

|

| 2013 | $7.67 | 0.17 | 0.86 | 1.03 | (0.17) | (0.08) | (0.25) | $8.45 | 13.81% | 1.43% | 2.13% | 83% |

| $179,855 |

|

| 2012 | $7.42 | 0.16 | 0.24 | 0.40 | (0.15) | — | (0.15) | $7.67 | 5.59% | 1.45% | 2.19% | 115% |

| $177,061 |

|

| R6 Class | | | | | | | | | | | | | |

| 2016 | $8.72 | 0.24 | 0.32 | 0.56 | (0.23) | (0.63) | (0.86) | $8.42 | 7.14% | 0.59% | 2.79% | 88% |

| $246,151 |

|

| 2015 | $8.85 | 0.25 | 0.53 | 0.78 | (0.25) | (0.66) | (0.91) | $8.72 | 8.90% | 0.58% | 2.65% | 56% |

| $117,620 |

|

2014(3) | $8.94 | 0.17 | 0.46 | 0.63 | (0.17) | (0.55) | (0.72) | $8.85 | 7.41% | 0.58%(4) | 2.93%(4) | 57%(5) |

| $26,550 |

|

|

| | | | |

| Notes to Financial Highlights | | |

| |

| (1) | Computed using average shares outstanding throughout the period. |

| |

| (2) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized. |

| |

| (3) | July 26, 2013 (commencement of sale) through March 31, 2014. |

| |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended March 31, 2014. |

See Notes to Financial Statements.

|

|

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of American Century Capital Portfolios, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Equity Income Fund (the “Fund”), one of the funds constituting American Century Capital Portfolios, Inc., as of March 31, 2016, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of March 31, 2016, by correspondence with the custodian and brokers; when replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Equity Income Fund of American Century Capital Portfolios, Inc. as of March 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Kansas City, Missouri May 17, 2016

The Board of Directors

The individuals listed below serve as directors of the funds. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The board has adopted a mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors). Independent directors shall retire by December 31 of the year in which they reach their 75th birthday.