UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-07820 |

| | |

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 03-31 |

| | |

| Date of reporting period: | 03-31-2017 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| | |

| | Annual Report |

| | |

| | March 31, 2017 |

| | |

| | Equity Income Fund |

|

| | |

| President’s Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2017. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Risk-On Rebound From Global Economic Concerns of Early 2016

Stocks, high-yield bonds, and commodities rebounded from severe downturns in early 2016 that were triggered by China’s economic slowdown. Since then, growth conditions in China and the rest of the world have generally improved. For the reporting period, the S&P 500 Index, the Bloomberg Barclays U.S. Corporate High-Yield Bond Index, and the S&P Goldman Sachs Commodities Index returned 17.17%, 16.39%, and 8.45%, respectively. This risk-on rebound also drove government bond yields higher, resulting in declines for indices such as the Bloomberg Barclays U.S. Treasury Bond Index (-1.44%). The broader taxable investment-grade U.S. bond market performed better, but still significantly underperformed stocks; the Bloomberg Barclays U.S. Aggregate Bond Index returned 0.44%.

Investors could thank the world’s major central banks and the “Trump Trade” for the risk-on rebound, which occurred with a backdrop of landmark political events, including Brexit (the U.K. vote to leave the European Union) and Donald Trump’s U.S. presidential election victory. Central bank stimulus helped to propel the markets past China- and Brexit-related volatility, followed by Trump victory-inspired optimism about U.S. growth that further boosted higher-risk markets.

But the Trump Trade could prove to be double edged—investor optimism faded as health care reform stalled in Congress and other U.S. fiscal policy proposals looked like they’d face significant hurdles. Meanwhile, the Federal Reserve raised its interest rate target during the reporting period, and suggested that it might raise rates again and start gradually reducing its balance sheet by the end of 2017. These factors, plus rising inflation and continuing geopolitical risks, could impede further risk-on sentiment. In this unsettled environment, we believe in remaining focused on investment goals, using disciplined, actively managed, risk-aware strategies. We appreciate your continued trust in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | | |

| Total Returns as of March 31, 2017 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| Investor Class | TWEIX | 17.14% | 12.01% | 7.09% | — | 8/1/94 |

| Russell 3000 Value Index | — | 19.97% | 13.07% | 5.93% | — | — |

| S&P 500 Index | — | 17.17% | 13.29% | 7.50% | — | — |

| Institutional Class | ACIIX | 17.36% | 12.25% | 7.31% | — | 7/8/98 |

| A Class | TWEAX | | | | | 3/7/97 |

| No sales charge | | 16.85% | 11.74% | 6.82% | — | |

| With sales charge | | 10.17% | 10.42% | 6.19% | — | |

| C Class | AEYIX | 15.97% | 10.91% | 6.03% | — | 7/13/01 |

| R Class | AEURX | 16.48% | 11.47% | 6.56% | — | 8/29/03 |

| R6 Class | AEUDX | 17.66% | — | — | 11.12% | 7/26/13 |

Average annual returns since inception are presented when ten years of performance history is not available.

Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

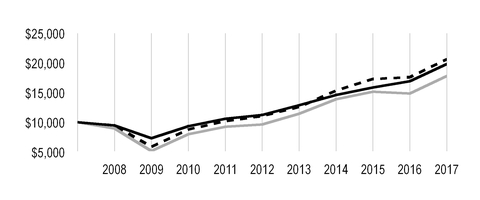

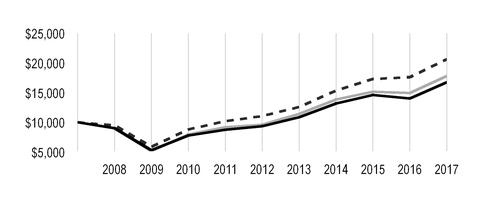

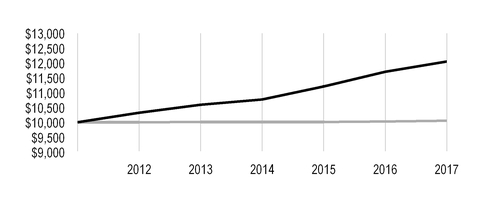

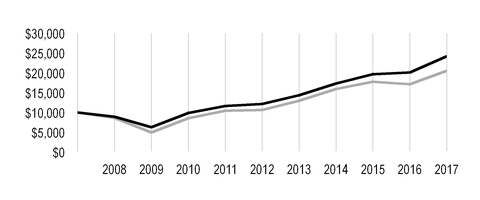

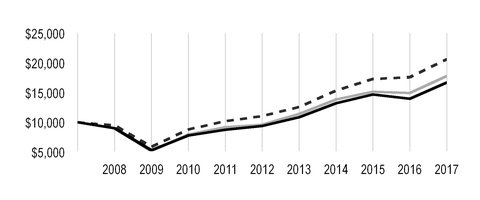

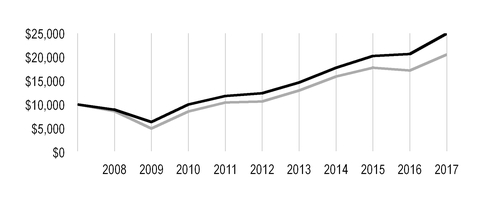

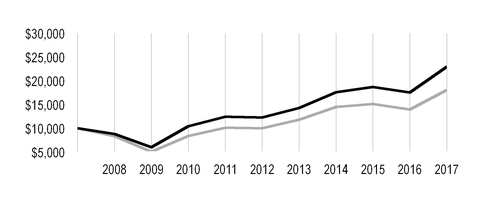

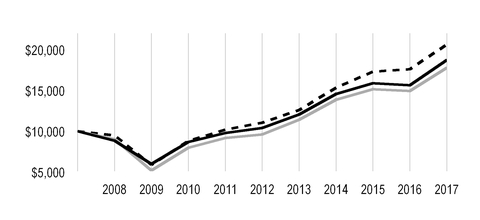

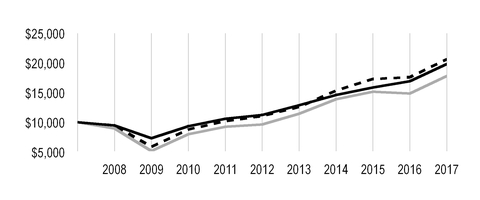

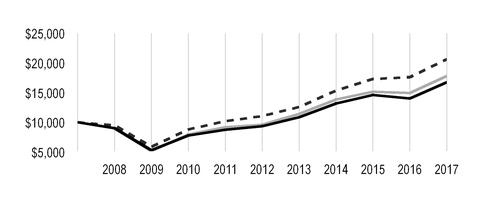

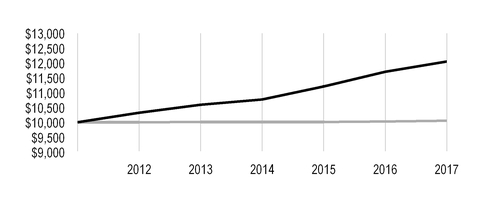

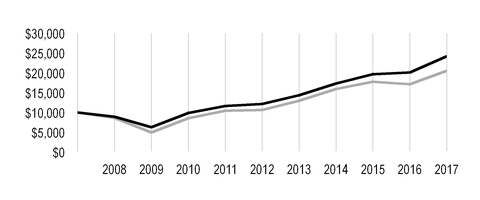

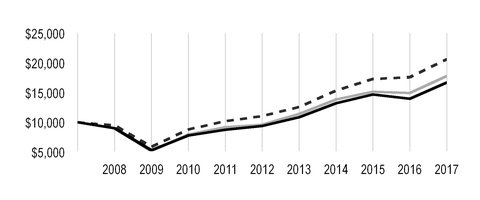

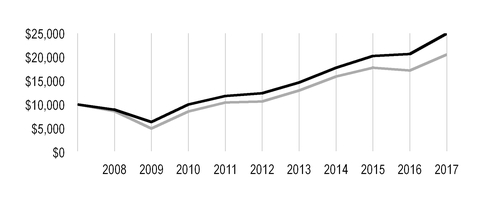

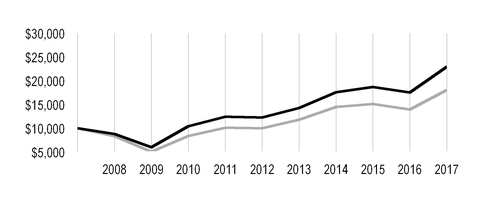

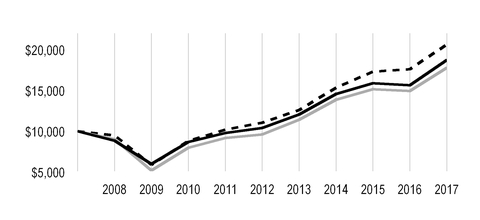

| Growth of $10,000 Over 10 Years |

| $10,000 investment made March 31, 2007 |

Performance for other share classes will vary due to differences in fee structure.

|

|

| |

| Value on March 31, 2017 |

| | Investor Class — $19,844 |

| |

| | Russell 3000 Value Index — $17,805 |

| |

| | S&P 500 Index — $20,627 |

| |

|

| | | | | |

| Total Annual Fund Operating Expenses | | |

| Investor Class | Institutional Class | A Class | C Class | R Class | R6 Class |

| 0.94% | 0.74% | 1.19% | 1.94% | 1.44% | 0.59% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Phil Davidson, Kevin Toney, Michael Liss, and Dan Gruemmer

Performance Summary

Equity Income returned 17.14%* for the fiscal year ended March 31, 2017, underperforming the Russell 3000 Value Index, which returned 19.97%. Stock selection in financials, energy, and consumer staples detracted from performance relative to the benchmark, while an underweight position in financials and overweights in energy and consumer staples also hurt relative results. A portfolio underweight and stock selection in real estate, combined with stock selection in health care and utilities, contributed to relative performance.

Stock Choices in Financials, Energy, and Consumer Staples Detracted

More conservative positioning in the financials industry weighed on relative returns, especially in the fourth quarter of 2016, when the portfolio’s higher-quality, lower-beta banking stocks and convertible positions lagged many of the index’s lower-quality, higher-beta constituents. Lack of exposure to the common stock of Bank of America also detracted from performance. Bank stocks such as Bank of America rose strongly in the fourth quarter of 2016 as interest rates rose, the yield curve steepened, and investors anticipated potential tax cuts and deregulation under President Trump. The portfolio holds convertible preferred stock issued by Bank of America. While the portfolio is overweight in banks, an underweight in the financial services sector overall also dampened relative performance.

Energy stocks remained under pressure through most of the period due to high fuel stocks and weak prices, and stock selection combined with a portfolio overweight in energy subtracted from relative performance. Occidental Petroleum was a notable detractor, as the energy sector downturn created concerns about the sustainability of its dividend payment. In our view, the dividend is sustainable, due to the company’s healthy balance sheet and underappreciated asset quality, and we believe the stock’s risk/reward profile appears attractive.

Stock selection and a portfolio overweight in consumer staples also hampered relative performance. General Mills was a notable detractor. The food company’s stock declined sharply in September on news of disappointing third-quarter earnings, and trended lower into the first quarter of 2017 after the company reduced fiscal-year guidance to reflect weakness in yogurt sales.

Real Estate, Health Care, Utilities, and Information Technology Contributed

Real estate remains a portfolio underweight, as we believe REITs have been generally overvalued for some time. This underweight position assisted relative performance, as higher interest rates weighed on sector performance. Stock selection in real estate was also beneficial, due in part to an investment in American Tower, a REIT that owns and operates wireless communications towers. The stock benefited from positive revisions to earnings guidance and from expectations for more traffic to the company’s towers as wireless telecommunications services companies offer more unlimited data plans.

* All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund's benchmark, other share classes may not. See page 3 for returns for all share classes.

Stock selection in health care and utilities also aided relative performance. In health care, Quest Diagnostics benefited from pricing and volume tailwinds, as well as legislation that delayed price cuts until 2018. The team reduced the position as the stock’s risk/reward profile became less attractive due to valuation. In the utilities sector, Westar Energy was a top contributor. Westar Energy’s stock price surged higher in May on the news that it would be acquired by Great Plains Energy, and we sold our investment, taking our profits. Relative performance in the information technology sector was assisted by overweight investments in several semiconductor technology companies, including Applied Materials, that are benefiting from strong orders, low inventories, and high demand for chips to power computing equipment and technology-driven features in automobiles.

Portfolio Positioning

The portfolio ended the period with the largest sector overweights in energy and consumer staples. We added to the energy weighting in the first quarter of 2017 as stocks declined and valuations become more attractive. Additionally, we continue to find many stocks in the consumer staples sector that fit our process due to their high returns on invested capital, stability, attractive relative yields, and strong balance sheets. Financials was the largest underweight in the portfolio, due in part to a lack of exposure to Berkshire Hathaway, which doesn’t pay a dividend, and to the consumer finance industry. The portfolio is also underweight in consumer discretionary, as that sector includes fewer attractively valued, higher-quality companies that meet our investment criteria.

|

| |

| MARCH 31, 2017 |

| Top Ten Holdings | % of net assets |

| Johnson & Johnson | 4.8% |

| Procter & Gamble Co. (The) | 4.6% |

| TOTAL SA | 3.2% |

| General Mills, Inc. | 2.6% |

| General Electric Co. | 2.5% |

| Republic Services, Inc. | 2.4% |

| Schlumberger Ltd. | 2.4% |

| Exxon Mobil Corp. | 2.3% |

| Chevron Corp. | 2.2% |

| 3M Co. | 2.1% |

| | |

| Top Five Industries | % of net assets |

| Oil, Gas and Consumable Fuels | 12.9% |

| Banks | 12.6% |

| Pharmaceuticals | 8.1% |

| Semiconductors and Semiconductor Equipment | 6.2% |

| Household Products | 5.4% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Domestic Common Stocks | 73.7% |

| Foreign Common Stocks* | 5.1% |

| Convertible Bonds | 6.0% |

| Preferred Stocks | 5.4% |

| Convertible Preferred Stocks | 4.1% |

| Exchange-Traded Funds | 2.5% |

| Total Equity Exposure | 96.8% |

| Temporary Cash Investments | 2.4% |

| Other Assets and Liabilities | 0.8% |

*Includes depositary shares, dual listed securities and foreign ordinary shares.

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2016 to March 31, 2017.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

10/1/16 | Ending

Account Value

3/31/17 | Expenses Paid

During Period(1)

10/1/16 - 3/31/17 |

Annualized

Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $1,083.60 | $4.73 | 0.91% |

| Institutional Class | $1,000 | $1,084.60 | $3.69 | 0.71% |

| A Class | $1,000 | $1,082.30 | $6.02 | 1.16% |

| C Class | $1,000 | $1,078.30 | $9.90 | 1.91% |

| R Class | $1,000 | $1,081.20 | $7.32 | 1.41% |

| R6 Class | $1,000 | $1,085.30 | $2.91 | 0.56% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,020.39 | $4.58 | 0.91% |

| Institutional Class | $1,000 | $1,021.39 | $3.58 | 0.71% |

| A Class | $1,000 | $1,019.15 | $5.84 | 1.16% |

| C Class | $1,000 | $1,015.41 | $9.60 | 1.91% |

| R Class | $1,000 | $1,017.90 | $7.09 | 1.41% |

| R6 Class | $1,000 | $1,022.14 | $2.82 | 0.56% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

MARCH 31, 2017

|

| | | | | | |

| | Shares/

Principal Amount | Value |

| COMMON STOCKS — 78.8% | | |

| Air Freight and Logistics — 1.6% | | |

| United Parcel Service, Inc., Class B | 1,879,618 |

| $ | 201,683,011 |

|

| Auto Components — 0.3% | | |

| Delphi Automotive plc | 430,598 |

| 34,658,833 |

|

| Banks — 7.3% | | |

| Comerica, Inc. | 719,500 |

| 49,343,310 |

|

| Commerce Bancshares, Inc. | 1,189,650 |

| 66,810,744 |

|

| JPMorgan Chase & Co. | 2,699,597 |

| 237,132,601 |

|

| PNC Financial Services Group, Inc. (The) | 1,834,552 |

| 220,586,532 |

|

| SunTrust Banks, Inc. | 3,496,630 |

| 193,363,639 |

|

| U.S. Bancorp | 1,298,400 |

| 66,867,600 |

|

| Wells Fargo & Co. | 1,135,500 |

| 63,201,930 |

|

| | | 897,306,356 |

|

| Beverages — 0.5% | | |

| PepsiCo, Inc. | 566,999 |

| 63,424,508 |

|

| Capital Markets — 2.8% | | |

| AllianceBernstein Holding LP | 1,968,278 |

| 44,975,152 |

|

| Bank of New York Mellon Corp. (The) | 1,696,600 |

| 80,130,418 |

|

| BlackRock, Inc. | 141,900 |

| 54,420,069 |

|

| Northern Trust Corp. | 1,950,440 |

| 168,869,095 |

|

| | | 348,394,734 |

|

| Chemicals — 0.5% | | |

| Air Products & Chemicals, Inc. | 499,400 |

| 67,563,826 |

|

| Commercial Services and Supplies — 2.4% | | |

| Republic Services, Inc. | 4,798,661 |

| 301,403,897 |

|

| Communications Equipment — 0.2% | | |

| Cisco Systems, Inc. | 552,791 |

| 18,684,336 |

|

| Containers and Packaging — 1.2% | | |

| Bemis Co., Inc. | 3,078,948 |

| 150,437,399 |

|

| Diversified Telecommunication Services — 1.7% | | |

| AT&T, Inc. | 1,692,800 |

| 70,335,840 |

|

| Verizon Communications, Inc. | 2,848,737 |

| 138,875,929 |

|

| | | 209,211,769 |

|

| Electric Utilities — 2.7% | | |

| Edison International | 398,399 |

| 31,716,544 |

|

| Eversource Energy | 746,700 |

| 43,891,026 |

|

| PG&E Corp. | 2,717,037 |

| 180,302,575 |

|

| Pinnacle West Capital Corp. | 847,917 |

| 70,699,320 |

|

| | | 326,609,465 |

|

| Electrical Equipment — 1.0% | | |

| Emerson Electric Co. | 1,099,100 |

| 65,792,126 |

|

| Rockwell Automation, Inc. | 368,900 |

| 57,441,419 |

|

| | | 123,233,545 |

|

|

| | | | | | |

| | Shares/

Principal Amount | Value |

| Energy Equipment and Services — 2.4% | | |

| Schlumberger Ltd. | 3,714,931 |

| $ | 290,136,111 |

|

| Equity Real Estate Investment Trusts (REITs) — 3.0% | | |

| American Tower Corp. | 999,200 |

| 121,442,768 |

|

| Boston Properties, Inc. | 450,700 |

| 59,677,187 |

|

| Weyerhaeuser Co. | 5,497,000 |

| 186,788,060 |

|

| | | 367,908,015 |

|

| Food and Staples Retailing — 1.9% | | |

| CVS Health Corp. | 797,394 |

| 62,595,429 |

|

| Wal-Mart Stores, Inc. | 2,392,383 |

| 172,442,967 |

|

| | | 235,038,396 |

|

| Food Products — 2.6% | | |

| General Mills, Inc. | 5,418,298 |

| 319,733,765 |

|

| Gas Utilities — 2.7% | | |

| Atmos Energy Corp. | 1,219,420 |

| 96,321,986 |

|

ONE Gas, Inc.(1) | 3,489,338 |

| 235,879,249 |

|

| | | 332,201,235 |

|

| Health Care Equipment and Supplies — 1.1% | | |

| Medtronic plc | 1,658,536 |

| 133,611,660 |

|

| Health Care Providers and Services — 0.5% | | |

| Cardinal Health, Inc. | 147,553 |

| 12,032,947 |

|

| Quest Diagnostics, Inc. | 498,758 |

| 48,973,048 |

|

| | | 61,005,995 |

|

| Household Products — 5.4% | | |

| Kimberly-Clark Corp. | 779,126 |

| 102,556,356 |

|

| Procter & Gamble Co. (The) | 6,298,459 |

| 565,916,541 |

|

| | | 668,472,897 |

|

| Industrial Conglomerates — 2.4% | | |

| 3M Co. | 1,329,500 |

| 254,373,235 |

|

| General Electric Co. | 1,298,695 |

| 38,701,111 |

|

| | | 293,074,346 |

|

| Insurance — 4.3% | | |

| Allstate Corp. (The) | 858,800 |

| 69,983,612 |

|

| Chubb Ltd. | 1,597,328 |

| 217,635,940 |

|

| Marsh & McLennan Cos., Inc. | 2,798,905 |

| 206,811,090 |

|

| MetLife, Inc. | 597,323 |

| 31,550,601 |

|

| | | 525,981,243 |

|

| IT Services — 1.8% | | |

| Automatic Data Processing, Inc. | 2,216,387 |

| 226,935,865 |

|

| Machinery — 0.6% | | |

| Stanley Black & Decker, Inc. | 588,981 |

| 78,257,905 |

|

| Media — 0.3% | | |

| Time Warner, Inc. | 318,800 |

| 31,149,948 |

|

| Oil, Gas and Consumable Fuels — 12.7% | | |

| Chevron Corp. | 2,472,016 |

| 265,420,358 |

|

| Enterprise Products Partners LP | 5,995,300 |

| 165,530,233 |

|

| EQT Midstream Partners LP | 571,318 |

| 43,934,354 |

|

|

| | | | | | |

| | Shares/

Principal Amount | Value |

| Exxon Mobil Corp. | 3,498,615 |

| $ | 286,921,416 |

|

| Occidental Petroleum Corp. | 3,028,677 |

| 191,896,975 |

|

| Phillips 66 Partners LP | 808,930 |

| 41,538,555 |

|

| Shell Midstream Partners LP | 2,023,736 |

| 65,225,011 |

|

| Spectra Energy Partners LP | 2,498,069 |

| 109,065,693 |

|

| TOTAL SA | 7,661,509 |

| 387,536,844 |

|

| | | 1,557,069,439 |

|

| Personal Products — 0.9% | | |

| Unilever NV CVA | 2,220,800 |

| 110,331,269 |

|

| Pharmaceuticals — 8.1% | | |

| Bristol-Myers Squibb Co. | 489,000 |

| 26,591,820 |

|

| Eli Lilly & Co. | 1,262,400 |

| 106,180,464 |

|

| Johnson & Johnson | 4,698,941 |

| 585,253,101 |

|

| Merck & Co., Inc. | 850,222 |

| 54,023,106 |

|

| Pfizer, Inc. | 2,759,822 |

| 94,413,511 |

|

| Roche Holding AG | 499,900 |

| 127,663,775 |

|

| | | 994,125,777 |

|

| Road and Rail — 0.4% | | |

| Norfolk Southern Corp. | 402,500 |

| 45,067,925 |

|

| Semiconductors and Semiconductor Equipment — 2.1% | | |

| Applied Materials, Inc. | 2,187,103 |

| 85,078,307 |

|

| Maxim Integrated Products, Inc. | 3,862,100 |

| 173,640,016 |

|

| | | 258,718,323 |

|

| Software — 1.9% | | |

| Microsoft Corp. | 1,787,336 |

| 117,713,949 |

|

| Oracle Corp. (New York) | 2,599,652 |

| 115,970,476 |

|

| | | 233,684,425 |

|

| Technology Hardware, Storage and Peripherals — 0.3% | | |

| Apple, Inc. | 269,700 |

| 38,745,102 |

|

| Thrifts and Mortgage Finance — 1.2% | | |

Capitol Federal Financial, Inc.(1) | 10,179,179 |

| 148,921,389 |

|

TOTAL COMMON STOCKS

(Cost $7,970,548,624) | | 9,692,782,709 |

|

| CONVERTIBLE BONDS — 6.0% | | |

| Air Freight and Logistics — 0.2% | | |

UBS AG, (convertible into United Parcel Service, Inc., Class B), 2.80%, 8/3/17(2)(3) | $ | 220,800 |

| 23,935,042 |

|

| Auto Components — 0.2% | | |

Credit Suisse AG, (convertible into Delphi Automotive plc), 5.93%, 6/1/17(2)(3) | 390,300 |

| 26,857,627 |

|

| Biotechnology — 0.2% | | |

UBS AG, (convertible into Gilead Science, Inc.), 3.15%, 8/14/17(2)(3) | 332,400 |

| 22,330,464 |

|

| Food Products — 0.1% | | |

Citigroup Global Markets Holdings, Inc., (convertible into Mondelez International, Inc., Class A), 6.82%, 7/14/17(2)(3) | 275,300 |

| 12,122,898 |

|

| Health Care Providers and Services — 0.2% | | |

Merrill Lynch International & Co. C.V., (convertible into Patterson Cos., Inc.), 5.30%, 6/1/17(2)(3) | 169,900 |

| 7,302,400 |

|

| | | |

|

| | | | | | |

| | Shares/

Principal Amount | Value |

Morgan Stanley B.V., (convertible into Cigna Corp.), 4.90%, 4/19/17(2)(3) | $ | 165,300 |

| $ | 21,935,980 |

|

| | | 29,238,380 |

|

| IT Services — 0.2% | | |

UBS AG, (convertible into International Business Machines Corp.), 4.50%, 9/14/17(2)(3) | 155,000 |

| 27,087,264 |

|

| Multiline Retail — 0.4% | | |

Merrill Lynch International & Co. C.V., (convertible into Target Corp.), 3.10%, 8/31/17(2)(3) | 371,100 |

| 21,055,773 |

|

Wells Fargo Bank N.A., (convertible into Target Corp.), 1.72%, 7/21/17(2)(3) | 547,900 |

| 31,751,435 |

|

| | | 52,807,208 |

|

| Oil, Gas and Consumable Fuels — 0.2% | | |

Goldman Sachs International, (convertible into EQT Corp.), 5.50%, 6/15/17(2)(3) | 320,000 |

| 21,523,704 |

|

| Semiconductors and Semiconductor Equipment — 4.1% | | |

Citigroup Global Markets Holdings, Inc., (convertible into QUALCOMM, Inc.), 4.26%, 8/18/17(2)(3) | 742,700 |

| 42,201,093 |

|

| Intel Corp., 3.48%, 12/15/35 | 95,444,000 |

| 130,161,755 |

|

| Microchip Technology, Inc., 1.625%, 2/15/25 | 57,964,000 |

| 83,395,705 |

|

Microchip Technology, Inc., 1.625%, 2/15/27(3) | 162,803,000 |

| 165,753,804 |

|

Teradyne, Inc., 1.25%, 12/15/23(3) | 71,911,000 |

| 84,090,926 |

|

| | | 505,603,283 |

|

| Specialty Retail — 0.2% | | |

Merrill Lynch International & Co. C.V., (convertible into L Brands, Inc.), 8.40%, 8/29/17(2)(3) | 375,100 |

| 17,808,702 |

|

TOTAL CONVERTIBLE BONDS

(Cost $681,770,487) | | 739,314,572 |

|

| PREFERRED STOCKS — 5.4% | | |

| Banks — 2.2% | | |

| Citigroup, Inc., 5.95% | 142,836,000 |

| 149,263,620 |

|

| U.S. Bancorp, 5.30% | 30,618,000 |

| 31,268,633 |

|

| U.S. Bancorp, 6.00% | 3,531,282 |

| 88,282,050 |

|

| | | 268,814,303 |

|

| Capital Markets — 0.7% | | |

| Goldman Sachs Group, Inc. (The), 5.30% | 85,130,000 |

| 86,939,012 |

|

| Industrial Conglomerates — 2.5% | | |

| General Electric Co., 5.00% | 293,503,000 |

| 309,645,665 |

|

TOTAL PREFERRED STOCKS

(Cost $638,448,447) | | 665,398,980 |

|

| CONVERTIBLE PREFERRED STOCKS — 4.1% | | |

| Banks — 3.1% | | |

| Bank of America Corp., 7.25% | 202,969 |

| 242,560,133 |

|

| Wells Fargo & Co., 7.50% | 115,978 |

| 143,812,720 |

|

| | | 386,372,853 |

|

| Equity Real Estate Investment Trusts (REITs) — 0.2% | | |

| Welltower Inc., 6.50% | 381,700 |

| 24,092,904 |

|

| Gas Utilities — 0.8% | | |

| Spire, Inc., 6.75%, 4/1/17 | 1,629,457 |

| 96,007,607 |

|

TOTAL CONVERTIBLE PREFERRED STOCKS

(Cost $443,934,652) | | 506,473,364 |

|

|

| | | | | | |

| | Shares/

Principal Amount | Value |

| EXCHANGE-TRADED FUNDS — 2.5% | | |

| iShares Russell 1000 Value ETF | 2,092,194 |

| $ | 240,476,778 |

|

| SPDR S&P 500 ETF Trust | 247,100 |

| 58,251,354 |

|

TOTAL EXCHANGE-TRADED FUNDS

(Cost $242,709,724) | | 298,728,132 |

|

| TEMPORARY CASH INVESTMENTS — 2.4% | | |

Federal Home Loan Bank Discount Notes, 0.46%, 4/3/17(4) | $ | 132,666,000 |

| 132,666,000 |

|

| Repurchase Agreement, BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 0.75% - 2.75%, 7/31/17 - 2/15/24, valued at $59,212,112), in a joint trading account at 0.67%, dated 3/31/17, due 4/3/17 (Delivery value $58,008,570) | | 58,005,331 |

|

| Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 2.50% - 3.00%, 11/15/45 - 2/15/46, valued at $107,373,137), at 0.22%, dated 3/31/17, due 4/3/17 (Delivery value $105,259,930) | | 105,258,000 |

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 77,915 |

| 77,915 |

|

TOTAL TEMPORARY CASH INVESTMENTS

(Cost $296,003,930) | | 296,007,246 |

|

TOTAL INVESTMENT SECURITIES — 99.2%

(Cost $10,273,415,864) | | 12,198,705,003 |

|

| OTHER ASSETS AND LIABILITIES — 0.8% | | 102,471,068 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 12,301,176,071 |

|

|

| | | | | | | | | | |

| FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS |

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) |

| USD | 80,628,095 |

| CHF | 78,924,020 |

| Credit Suisse AG | 6/30/17 | $ | 1,421,526 |

|

| USD | 10,720,362 |

| CHF | 10,632,884 |

| Credit Suisse AG | 6/30/17 | 49,412 |

|

| USD | 12,237,783 |

| CHF | 12,174,024 |

| Credit Suisse AG | 6/30/17 | 20,176 |

|

| USD | 397,308,160 |

| EUR | 364,616,633 |

| UBS AG | 6/30/17 | 6,714,016 |

|

| | | | | | | $ | 8,205,130 |

|

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| CHF | - | Swiss Franc |

| CVA | - | Certificaten Van Aandelen |

| EUR | - | Euro |

| USD | - | United States Dollar |

| |

| (1) | Affiliated Company: the fund’s holding represents ownership of 5% or more of the voting securities of the company; therefore, the company is affiliated as defined in the Investment Company Act of 1940. |

| |

| (2) | Equity-linked debt security. The aggregated value of these securities at the period end was $275,912,382, which represented 2.2% of total net assets. |

| |

| (3) | Security was purchased pursuant to Rule 144A under the Securities Act of 1933 and may be sold in transactions exempt from registration, normally to qualified institutional investors. The aggregate value of these securities at the period end was $525,757,112, which represented 4.3% of total net assets. |

| |

| (4) | The rate indicated is the yield to maturity at purchase. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| MARCH 31, 2017 | |

| Assets | |

| Investment securities - unaffiliated, at value (cost of $10,030,249,447) | $ | 11,813,904,365 |

|

| Investment securities - affiliated, at value (cost of $243,166,417) | 384,800,638 |

|

| Total investment securities, at value (cost of $10,273,415,864) | 12,198,705,003 |

|

| Foreign currency holdings, at value (cost of $612,148) | 595,431 |

|

| Receivable for investments sold | 212,033,049 |

|

| Receivable for capital shares sold | 13,503,311 |

|

| Unrealized appreciation on forward foreign currency exchange contracts | 8,205,130 |

|

| Dividends and interest receivable | 38,214,752 |

|

| | 12,471,256,676 |

|

| | |

| Liabilities | |

| Payable for investments purchased | 146,350,229 |

|

| Payable for capital shares redeemed | 13,522,866 |

|

| Accrued management fees | 9,081,762 |

|

| Distribution and service fees payable | 1,125,748 |

|

| | 170,080,605 |

|

| | |

| Net Assets | $ | 12,301,176,071 |

|

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 9,890,519,401 |

|

| Distributions in excess of net investment income | (13,618,723 | ) |

| Undistributed net realized gain | 490,853,267 |

|

| Net unrealized appreciation | 1,933,422,126 |

|

| | $ | 12,301,176,071 |

|

|

| | | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class, $0.01 Par Value |

| $7,327,473,453 |

| 802,379,094 |

| $9.13 |

| Institutional Class, $0.01 Par Value |

| $1,515,757,583 |

| 165,870,575 |

| $9.14 |

| A Class, $0.01 Par Value |

| $2,139,411,396 |

| 234,294,484 |

| $9.13* |

| C Class, $0.01 Par Value |

| $711,149,308 |

| 77,882,114 |

| $9.13 |

| R Class, $0.01 Par Value |

| $114,761,871 |

| 12,607,835 |

| $9.10 |

| R6 Class, $0.01 Par Value |

| $492,622,460 |

| 53,856,715 |

| $9.15 |

*Maximum offering price $9.69 (net asset value divided by 0.9425).

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED MARCH 31, 2017 |

| Investment Income (Loss) | |

| Income: | |

| Dividends (including $15,599,114 from affiliates and net of foreign taxes withheld of $2,896,447) | $ | 286,098,843 |

|

| Interest | 33,766,915 |

|

| | 319,865,758 |

|

| | |

| Expenses: | |

| Management fees | 99,061,401 |

|

| Distribution and service fees: | |

| A Class | 5,230,165 |

|

| C Class | 6,630,764 |

|

| R Class | 569,286 |

|

| Directors' fees and expenses | 345,763 |

|

| Other expenses | 21,424 |

|

| | 111,858,803 |

|

| | |

| Net investment income (loss) | 208,006,955 |

|

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions (including $12,772,063 from affiliates) | 1,099,897,272 |

|

| Foreign currency transactions | 7,071,821 |

|

| | 1,106,969,093 |

|

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | 439,721,836 |

|

| Translation of assets and liabilities in foreign currencies | 11,391,840 |

|

| | 451,113,676 |

|

| | |

| Net realized and unrealized gain (loss) | 1,558,082,769 |

|

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 1,766,089,724 |

|

See Notes to Financial Statements.

|

|

| Statement of Changes in Net Assets |

|

| | | | | | |

| YEARS ENDED MARCH 31, 2017 AND MARCH 31, 2016 |

| Increase (Decrease) in Net Assets | March 31, 2017 | March 31, 2016 |

| Operations | | |

| Net investment income (loss) | $ | 208,006,955 |

| $ | 213,315,706 |

|

| Net realized gain (loss) | 1,106,969,093 |

| 491,680,139 |

|

| Change in net unrealized appreciation (depreciation) | 451,113,676 |

| (126,597,246 | ) |

| Net increase (decrease) in net assets resulting from operations | 1,766,089,724 |

| 578,398,599 |

|

| | | |

| Distributions to Shareholders | | |

| From net investment income: | | |

| Investor Class | (129,563,399 | ) | (123,019,058 | ) |

| Institutional Class | (30,618,392 | ) | (30,526,067 | ) |

| A Class | (34,939,594 | ) | (42,382,590 | ) |

| B Class | — |

| (37,483 | ) |

| C Class | (5,979,666 | ) | (7,534,907 | ) |

| R Class | (1,626,120 | ) | (2,144,133 | ) |

| R6 Class | (8,068,622 | ) | (4,870,941 | ) |

| From net realized gains: | | |

| Investor Class | (400,934,887 | ) | (363,605,047 | ) |

| Institutional Class | (85,575,588 | ) | (77,411,532 | ) |

| A Class | (122,509,721 | ) | (139,778,814 | ) |

| C Class | (39,374,591 | ) | (38,422,267 | ) |

| R Class | (6,728,931 | ) | (7,738,439 | ) |

| R6 Class | (22,997,300 | ) | (15,271,252 | ) |

| Decrease in net assets from distributions | (888,916,811 | ) | (852,742,530 | ) |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | 1,945,344,324 |

| (995,331 | ) |

| | | |

| Net increase (decrease) in net assets | 2,822,517,237 |

| (275,339,262 | ) |

| | | |

| Net Assets | | |

| Beginning of period | 9,478,658,834 |

| 9,753,998,096 |

|

| End of period | $ | 12,301,176,071 |

| $ | 9,478,658,834 |

|

| | | |

| Undistributed (distributions in excess of) net investment income | $ | (13,618,723 | ) | $ | 4,293,572 |

|

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

MARCH 31, 2017

1. Organization

American Century Capital Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Equity Income Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek current income. Capital appreciation is a secondary objective.

The fund offers the Investor Class, the Institutional Class, the A Class, the C Class, the R Class and the R6 Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. On October 16, 2015, all outstanding B Class shares were converted to A Class shares and the fund discontinued offering the B Class.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Fixed income securities are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Corporate bonds, U.S. Treasury and Government Agency securities and convertible bonds are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value. Forward foreign currency exchange contracts are valued at the mean of the appropriate forward exchange rate at the close of the NYSE as provided by an independent pricing service.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been

declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. If significant fluctuations in foreign markets are identified, the fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Equity-Linked Debt and Linked-Equity Securities — The fund may invest in hybrid equity securities, which usually convert into common stock at a date predetermined by the issuer. These securities generally offer a higher dividend yield than that of the common stock to which the security is linked. These instruments are issued by a company other than the one to which the security is linked and carry the credit of the issuer, not that of the underlying common stock. The securities’ appreciation is limited based on a predetermined final cap price at the date of the conversion. Risks of investing in these securities include, but are not limited to, a set time to capture the yield advantage, limited appreciation potential, decline in value of the underlying stock, and failure of the issuer to pay dividends or to deliver common stock at maturity.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there

are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually. The fund may elect to treat a portion of its payment to a redeeming shareholder, which represents the pro rata share of undistributed net investment income and net realized gains, as a distribution for federal income tax purposes (tax equalization).

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class. The rate of the fee is determined by applying a fee rate calculation formula. This formula takes into account the fund’s assets as well as certain assets, if any, of other clients of the investment advisor outside the American Century Investments family of funds (such as subadvised funds and separate accounts) that have very similar investment teams and investment strategies (strategy assets). The annual management fee schedule ranges from 0.80% to 1.00% for the Investor Class, A Class, C Class and R Class. The annual management fee schedule ranges from 0.60% to 0.80% for the Institutional Class and 0.45% to 0.65% for the R6 Class. The effective annual management fee for each class for the year ended March 31, 2017 was 0.91% for the Investor Class, A Class, C Class and R Class, 0.71% for the Institutional Class and 0.56% for the R6 Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended March 31, 2017 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Acquired Fund Fees and Expenses — The fund may invest in mutual funds, exchange-traded funds, and business development companies (the acquired funds). The fund will indirectly realize its pro rata share of the

fees and expenses of the acquired funds in which it invests. These indirect fees and expenses are not paid out of the fund's assets but are reflected in the return realized by the fund on its investment in the acquired funds.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund purchases and sales were $127,864,719 and $63,351,257, respectively. The effect of interfund transactions on the Statement of Operations was $9,517,964 in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended March 31, 2017 were $11,114,206,308 and $9,993,930,725, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

|

| | | | | | | | | | |

| | Year ended

March 31, 2017 | Year ended

March 31, 2016 |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 3,690,000,000 |

| | 3,690,000,000 |

| |

| Sold | 293,507,890 |

| $ | 2,609,195,025 |

| 114,466,871 |

| $ | 941,691,955 |

|

| Issued in reinvestment of distributions | 56,671,757 |

| 504,632,303 |

| 56,859,660 |

| 457,471,867 |

|

| Redeemed | (189,696,984 | ) | (1,695,503,573 | ) | (156,737,452 | ) | (1,310,805,748 | ) |

| | 160,482,663 |

| 1,418,323,755 |

| 14,589,079 |

| 88,358,074 |

|

| Institutional Class/Shares Authorized | 900,000,000 |

| | 900,000,000 |

| |

| Sold | 56,832,314 |

| 505,772,022 |

| 43,236,265 |

| 355,337,764 |

|

| Issued in reinvestment of distributions | 12,014,795 |

| 107,079,509 |

| 12,080,239 |

| 97,419,785 |

|

| Redeemed | (49,101,577 | ) | (441,160,610 | ) | (60,463,997 | ) | (509,934,591 | ) |

| | 19,745,532 |

| 171,690,921 |

| (5,147,493 | ) | (57,177,042 | ) |

| A Class/Shares Authorized | 1,450,000,000 |

| | 1,450,000,000 |

| |

| Sold | 67,317,393 |

| 599,764,310 |

| 33,772,941 |

| 281,467,687 |

|

| Issued in reinvestment of distributions | 17,235,247 |

| 153,324,817 |

| 22,158,796 |

| 178,188,273 |

|

| Redeemed | (80,261,080 | ) | (716,879,699 | ) | (75,339,830 | ) | (629,711,265 | ) |

| | 4,291,560 |

| 36,209,428 |

| (19,408,093 | ) | (170,055,305 | ) |

| B Class/Shares Authorized | N/A |

| | N/A |

| |

| Sold | | | 1,773 |

| 15,470 |

|

| Issued in reinvestment of distributions | | | 4,126 |

| 34,715 |

|

| Redeemed | | | (640,096 | ) | (5,462,542 | ) |

| | | | (634,197 | ) | (5,412,357 | ) |

| C Class/Shares Authorized | 380,000,000 |

| | 380,000,000 |

| |

| Sold | 23,508,729 |

| 208,356,587 |

| 10,920,834 |

| 90,266,957 |

|

| Issued in reinvestment of distributions | 4,410,142 |

| 39,190,445 |

| 4,821,802 |

| 38,594,526 |

|

| Redeemed | (16,945,928 | ) | (151,129,533 | ) | (11,886,580 | ) | (99,349,090 | ) |

| | 10,972,943 |

| 96,417,499 |

| 3,856,056 |

| 29,512,393 |

|

| R Class/Shares Authorized | 70,000,000 |

| | 70,000,000 |

| |

| Sold | 3,878,786 |

| 34,434,508 |

| 1,999,195 |

| 16,610,134 |

|

| Issued in reinvestment of distributions | 926,459 |

| 8,213,953 |

| 1,206,549 |

| 9,662,979 |

|

| Redeemed | (4,772,983 | ) | (42,240,369 | ) | (5,355,482 | ) | (44,926,763 | ) |

| | 32,262 |

| 408,092 |

| (2,149,738 | ) | (18,653,650 | ) |

| R6 Class/Shares Authorized | 180,000,000 |

| | 180,000,000 |

| |

| Sold | 37,017,253 |

| 333,067,159 |

| 19,314,185 |

| 162,369,985 |

|

| Issued in reinvestment of distributions | 3,426,134 |

| 30,585,564 |

| 2,424,776 |

| 19,519,689 |

|

| Redeemed | (15,805,023 | ) | (141,358,094 | ) | (6,008,060 | ) | (49,457,118 | ) |

| | 24,638,364 |

| 222,294,629 |

| 15,730,901 |

| 132,432,556 |

|

| Net increase (decrease) | 220,163,324 |

| $ | 1,945,344,324 |

| 6,836,515 |

| $ | (995,331 | ) |

6. Affiliated Company Transactions

If a fund's holding represents ownership of 5% or more of the voting securities of a company, the company is affiliated as defined in the 1940 Act. A summary of transactions for each company which is or was an affiliate at or during the year ended March 31, 2017 follows:

|

| | | | | | | | | | | | | | | | | | |

| Company | Beginning Value | Purchase

Cost | Sales Cost | Realized

Gain (Loss) | Dividend

Income | Ending Value |

| Capitol Federal Financial, Inc. | $ | 160,106,266 |

| $ | 337,094 |

| $ | 24,251,267 |

| $ | 6,032,068 |

| $ | 10,522,159 |

| $ | 148,921,389 |

|

| ONE Gas, Inc. | 218,755,902 |

| 12,998,040 |

| 13,033,788 |

| 6,739,995 |

| 5,076,955 |

| 235,879,249 |

|

| | $ | 378,862,168 |

| $ | 13,335,134 |

| $ | 37,285,055 |

| $ | 12,772,063 |

| $ | 15,599,114 |

| $ | 384,800,638 |

|

7. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| |

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars. |

| |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments. There were no significant transfers between levels during the period.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

|

| | | | | | | | |

| | Level 1 | Level 2 | Level 3 |

| Assets | | | |

| Investment Securities | | | |

| Common Stocks | | | |

| Oil, Gas and Consumable Fuels | $ | 1,169,532,595 |

| $ | 387,536,844 |

| — |

|

| Personal Products | — |

| 110,331,269 |

| — |

|

| Pharmaceuticals | 866,462,002 |

| 127,663,775 |

| — |

|

| Other Industries | 7,031,256,224 |

| — |

| — |

|

| Convertible Bonds | — |

| 739,314,572 |

| — |

|

| Preferred Stocks | 88,282,050 |

| 577,116,930 |

| — |

|

| Convertible Preferred Stocks | — |

| 506,473,364 |

| — |

|

| Exchange-Traded Funds | 298,728,132 |

| — |

| — |

|

| Temporary Cash Investments | 77,915 |

| 295,929,331 |

| — |

|

| | $ | 9,454,338,918 |

| $ | 2,744,366,085 |

| — |

|

| Other Financial Instruments | | | |

| Forward Foreign Currency Exchange Contracts | — |

| $ | 8,205,130 |

| — |

|

8. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund's exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The fund's average U.S. dollar exposure to foreign currency risk derivative instruments held during the period was $325,073,159.

The value of foreign currency risk derivative instruments as of March 31, 2017, is disclosed on the Statement of Assets and Liabilities as an asset of $8,205,130 in unrealized appreciation on forward foreign currency exchange contracts. For the year ended March 31, 2017, the effect of foreign currency risk derivative instruments on the Statement of Operations was $6,967,545 in net realized gain (loss) on foreign currency transactions and $11,501,781 in change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies.

9. Risk Factors

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

10. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2017 and March 31, 2016 were as follows:

|

| | | | | | |

| | 2017 | 2016 |

| Distributions Paid From | | |

| Ordinary income | $ | 358,935,958 |

| $ | 252,510,096 |

|

| Long-term capital gains | $ | 529,980,853 |

| $ | 600,232,434 |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of March 31, 2017, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

|

| | | |

| Federal tax cost of investments | $ | 10,395,140,067 |

|

| Gross tax appreciation of investments | $ | 1,864,516,876 |

|

| Gross tax depreciation of investments | (60,951,940 | ) |

| Net tax appreciation (depreciation) of investments | 1,803,564,936 |

|

| Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | (72,143 | ) |

| Net tax appreciation (depreciation) | $ | 1,803,492,793 |

|

| Undistributed ordinary income | $ | 178,604,095 |

|

| Accumulated long-term gains | $ | 428,559,782 |

|

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales.

11. Recently Issued Accounting Guidance

In October 2016, the Securities and Exchange Commission adopted new rules and forms as well as amendments to its rules and forms to modernize the reporting and disclosure of information by registered investment companies. The amendments to Regulation S-X will require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other provisions. Compliance with the amendments is effective on August 1, 2017. Management is currently evaluating the impact that adopting the amendments will have on the financial statement disclosures.

12. Corporate Event

The Institutional Class was renamed to the I Class effective April 10, 2017.

|

| | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | | |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses(6) | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| Investor Class | | | | | | | | | | | | |

| 2017 | $8.41 | 0.17 | 1.24 | 1.41 | (0.17) | (0.52) | (0.69) | $9.13 | 17.14% | 0.91% | 1.91% | 93% |

| $7,327,473 |

|

| 2016 | $8.71 | 0.21 | 0.32 | 0.53 | (0.20) | (0.63) | (0.83) | $8.41 | 6.78% | 0.94% | 2.44% | 88% |

| $5,399,702 |

|

| 2015 | $8.84 | 0.21 | 0.54 | 0.75 | (0.22) | (0.66) | (0.88) | $8.71 | 8.54% | 0.93% | 2.30% | 56% |

| $5,463,566 |

|

| 2014 | $8.47 | 0.20 | 0.92 | 1.12 | (0.20) | (0.55) | (0.75) | $8.84 | 13.64% | 0.93% | 2.31% | 57% |

| $5,406,362 |

|

| 2013 | $7.69 | 0.21 | 0.86 | 1.07 | (0.21) | (0.08) | (0.29) | $8.47 | 14.33% | 0.93% | 2.63% | 83% |

| $5,504,359 |

|

| Institutional Class | | | | | | | | | | | | |

| 2017 | $8.42 | 0.19 | 1.24 | 1.43 | (0.19) | (0.52) | (0.71) | $9.14 | 17.36% | 0.71% | 2.11% | 93% |

| $1,515,758 |

|

| 2016 | $8.71 | 0.22 | 0.34 | 0.56 | (0.22) | (0.63) | (0.85) | $8.42 | 7.11% | 0.74% | 2.64% | 88% |

| $1,229,940 |

|

| 2015 | $8.85 | 0.22 | 0.54 | 0.76 | (0.24) | (0.66) | (0.90) | $8.71 | 8.63% | 0.73% | 2.50% | 56% |

| $1,318,193 |

|

| 2014 | $8.47 | 0.22 | 0.92 | 1.14 | (0.21) | (0.55) | (0.76) | $8.85 | 13.85% | 0.73% | 2.51% | 57% |

| $1,422,725 |

|

| 2013 | $7.69 | 0.22 | 0.87 | 1.09 | (0.23) | (0.08) | (0.31) | $8.47 | 14.69% | 0.73% | 2.83% | 83% |

| $1,527,723 |

|

| A Class | | | | | | | | | | | | | |

| 2017 | $8.41 | 0.15 | 1.24 | 1.39 | (0.15) | (0.52) | (0.67) | $9.13 | 16.85% | 1.16% | 1.66% | 93% |

| $2,139,411 |

|

| 2016 | $8.71 | 0.18 | 0.33 | 0.51 | (0.18) | (0.63) | (0.81) | $8.41 | 6.51% | 1.19% | 2.19% | 88% |

| $1,934,681 |

|

| 2015 | $8.84 | 0.18 | 0.55 | 0.73 | (0.20) | (0.66) | (0.86) | $8.71 | 8.27% | 1.18% | 2.05% | 56% |

| $2,172,105 |

|

| 2014 | $8.47 | 0.18 | 0.91 | 1.09 | (0.17) | (0.55) | (0.72) | $8.84 | 13.36% | 1.18% | 2.06% | 57% |

| $2,722,731 |

|

| 2013 | $7.69 | 0.19 | 0.86 | 1.05 | (0.19) | (0.08) | (0.27) | $8.47 | 14.05% | 1.18% | 2.38% | 83% |

| $2,631,737 |

|

|

| | | | | | | | | | | | | | | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | | | | |

| Per-Share Data | | | | | | | Ratios and Supplemental Data |

| | | Income From Investment Operations: | Distributions From: | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Net

Investment

Income | Net

Realized

Gains | Total

Distributions | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses(6) | Net

Investment

Income

(Loss) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| C Class | | | | | | | | | | | | | |

| 2017 | $8.41 | 0.08 | 1.24 | 1.32 | (0.08) | (0.52) | (0.60) | $9.13 | 15.97% | 1.91% | 0.91% | 93% |

| $711,149 |

|

| 2016 | $8.71 | 0.12 | 0.33 | 0.45 | (0.12) | (0.63) | (0.75) | $8.41 | 5.72% | 1.94% | 1.44% | 88% |

| $562,723 |

|

| 2015 | $8.84 | 0.12 | 0.54 | 0.66 | (0.13) | (0.66) | (0.79) | $8.71 | 7.47% | 1.93% | 1.30% | 56% |

| $549,088 |

|

| 2014 | $8.47 | 0.12 | 0.91 | 1.03 | (0.11) | (0.55) | (0.66) | $8.84 | 12.53% | 1.93% | 1.31% | 57% |

| $521,688 |

|

| 2013 | $7.69 | 0.13 | 0.86 | 0.99 | (0.13) | (0.08) | (0.21) | $8.47 | 13.21% | 1.93% | 1.63% | 83% |

| $467,913 |

|

| R Class | | | | | | | | | | | | | |

| 2017 | $8.39 | 0.13 | 1.22 | 1.35 | (0.12) | (0.52) | (0.64) | $9.10 | 16.48% | 1.41% | 1.41% | 93% |

| $114,762 |

|

| 2016 | $8.69 | 0.16 | 0.33 | 0.49 | (0.16) | (0.63) | (0.79) | $8.39 | 6.27% | 1.44% | 1.94% | 88% |

| $105,462 |

|

| 2015 | $8.82 | 0.16 | 0.54 | 0.70 | (0.17) | (0.66) | (0.83) | $8.69 | 8.03% | 1.43% | 1.80% | 56% |

| $127,897 |

|

| 2014 | $8.45 | 0.16 | 0.91 | 1.07 | (0.15) | (0.55) | (0.70) | $8.82 | 13.12% | 1.43% | 1.81% | 57% |

| $169,852 |

|

| 2013 | $7.67 | 0.17 | 0.86 | 1.03 | (0.17) | (0.08) | (0.25) | $8.45 | 13.81% | 1.43% | 2.13% | 83% |

| $179,855 |

|

| R6 Class | | | | | | | | | | | | | |

| 2017 | $8.42 | 0.20 | 1.25 | 1.45 | (0.20) | (0.52) | (0.72) | $9.15 | 17.66% | 0.56% | 2.26% | 93% |

| $492,622 |

|

| 2016 | $8.72 | 0.24 | 0.32 | 0.56 | (0.23) | (0.63) | (0.86) | $8.42 | 7.14% | 0.59% | 2.79% | 88% |

| $246,151 |

|

| 2015 | $8.85 | 0.25 | 0.53 | 0.78 | (0.25) | (0.66) | (0.91) | $8.72 | 8.90% | 0.58% | 2.65% | 56% |

| $117,620 |

|

2014(3) | $8.94 | 0.17 | 0.46 | 0.63 | (0.17) | (0.55) | (0.72) | $8.85 | 7.41% | 0.58%(4) | 2.93%(4) | 57%(5) |

| $26,550 |

|

|

| | | | |

| Notes to Financial Highlights | | |

| |

| (1) | Computed using average shares outstanding throughout the period. |

| |

| (2) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges, if any. Total returns for periods less than one year are not annualized. |

| |

| (3) | July 26, 2013 (commencement of sale) through March 31, 2014. |

| |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended March 31, 2014. |

| |

| (6) | Ratio of operating expenses to average net assets does not include any fees and expenses of the acquired funds. |

See Notes to Financial Statements.

|

|

| Report of Independent Registered Public Accounting Firm |

To the Board of Directors and Shareholders of American Century Capital Portfolios, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Equity Income Fund (the “Fund”), one of the funds constituting American Century Capital Portfolios, Inc., as of March 31, 2017, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods presented. These financial statements and financial highlights are the responsibility of the Fund's management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.