UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-07820 |

| | |

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 03-31 |

| | |

| Date of reporting period: | 03-31-2018 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| ANNUAL REPORT | |

| MARCH 31, 2018 |

| |

|

| |

| | AC Alternatives® Market Neutral Value Fund |

| | Investor Class (ACVVX) |

| | I Class (ACVKX) |

| | A Class (ACVQX) |

| | C Class (ACVHX) |

| | R Class (ACVWX) |

|

| | |

| President’s Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Proxy Voting Results | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2018. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional, updated investment and market insights, we encourage you to visit our website, americancentury.com.

Rally Rolled On, Until Volatility Resurfaced

For most of the 12-month period, broad U.S. stock and bond indices generated positive returns. Stocks generally rallied against a backdrop of robust corporate earnings results, steady economic growth, relatively low interest rates, and U.S. tax reform. For bonds, modest economic gains, relatively muted inflation, and gradual—and well telegraphed—tightening from the Federal Reserve (the Fed) continued to support positive performance.

Then, in early February, a force that was largely dormant during 2017—volatility—re-emerged. Robust U.S. wage growth triggered expectations for rising inflation, higher interest rates, and a more-hawkish Fed. Treasury yields climbed to their highest levels in several years, and stock prices plunged into correction territory. Economic data released in March helped calm the unrest, while the Fed's March rate hike, which investors had expected, had little impact. Markets recovered much of the previous weeks’ losses, until a fresh round of worries emerged. President Trump announced the U.S. would implement tariffs on certain imports from China, sparking fears of a global trade war and triggering a flight to quality in the financial markets.

Despite the resurgence of volatility late in the period, U.S. stocks (S&P 500 Index) delivered a total return of 13.99% for the 12 months. Continuing a long-standing trend, growth stocks significantly outperformed their value counterparts across the capitalization spectrum. Meanwhile, the March flight to quality helped bonds hang onto the modest gains generated ahead of the market turbulence, and investment-grade bonds (Bloomberg Barclays U.S. Aggregate Bond Index) returned 1.20% for the 12-month period.

With inflationary pressures mounting, Treasury yields rising, volatility resurfacing, and the implications of tax reform still unfolding, investors likely will face new opportunities and challenges in the months ahead. We believe this scenario warrants a disciplined, diversified, and risk-aware approach, using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust and confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | |

| Total Returns as of March 31, 2018 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | Since Inception | Inception Date |

| Investor Class | ACVVX | -2.36% | 2.13% | 2.57% | 10/31/11 |

| Bloomberg Barclays U.S. 1-3 Month Treasury Bill Index | — | 1.05% | 0.30% | 0.25% | — |

| I Class | ACVKX | -2.15% | 2.35% | 2.79% | 10/31/11 |

| A Class | ACVQX | | | | 10/31/11 |

| No sales charge | | -2.58% | 1.90% | 2.32% | |

| With sales charge | | -8.21% | 0.70% | 1.38% | |

| C Class | ACVHX | -3.39% | 1.12% | 1.55% | 10/31/11 |

| R Class | ACVWX | -2.91% | 1.62% | 2.06% | 10/31/11 |

Fund returns would have been lower if a portion of the fees had not been waived. Prior to April 10, 2017, the

I Class was referred to as the Institutional Class.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

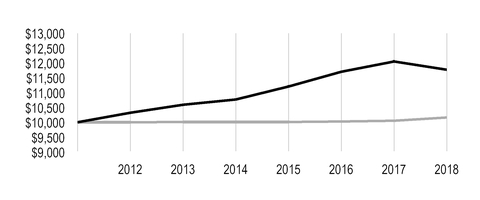

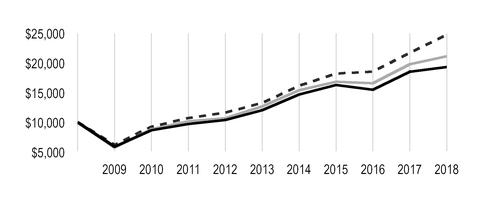

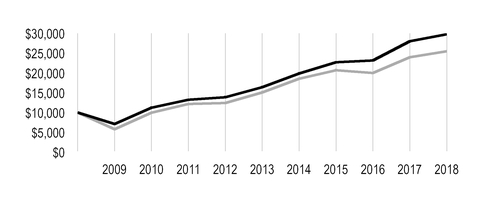

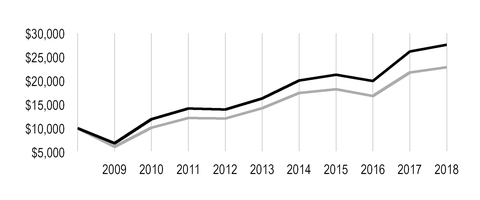

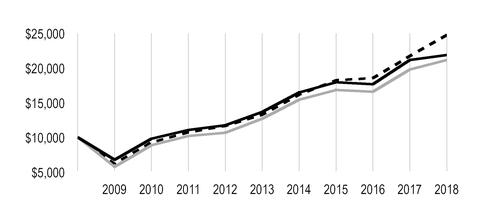

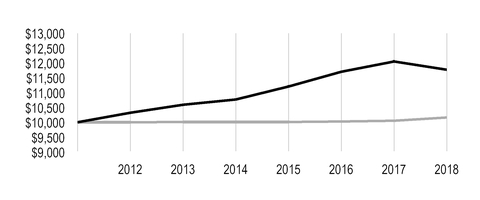

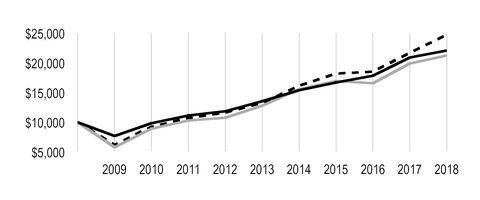

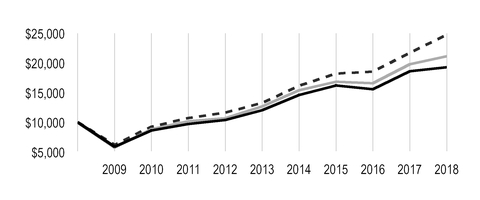

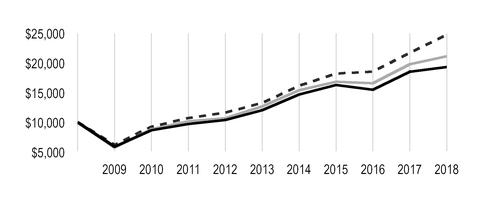

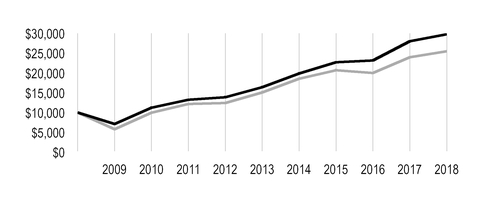

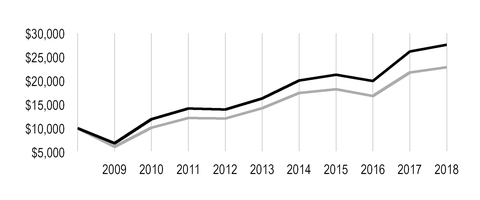

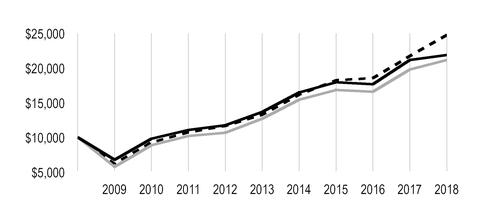

| Growth of $10,000 Over Life of Class |

$10,000 investment made October 31, 2011 |

Performance for other share classes will vary due to differences in fee structure.

|

|

| |

| Value on March 31, 2018 |

| | Investor Class — $11,770 |

| |

| | Bloomberg Barclays U.S. 1-3 Month Treasury Bill Index — $10,160 |

| |

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

|

| | | | |

| Total Annual Fund Operating Expenses |

| Investor Class | I Class | A Class | C Class | R Class |

| 3.96% | 3.76% | 4.21% | 4.96% | 4.46% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Phil Davidson, Michael Liss, Kevin Toney, Brian Woglom, and Dan Gruemmer

Performance Summary

AC Alternatives Market Neutral Value declined -2.36%* for the fiscal year ended March 31, 2018, compared with the 1.05% return of its benchmark, the Bloomberg Barclays U.S. 1-3 Month Treasury Bill Index. The fund's return reflects operating expenses, while the index's return does not.

The foundation of the strategy is to pair long positions in more undervalued companies with short positions in overvalued companies. We believe this helps reduce the risk inherent in long/short strategies. Over the past 12-month period, however, our portfolio produced negative returns as investors’ preference for growth and momentum pressured many of our pairs.

Key Detractors

Among the top detractors from performance was a pair consisting of a long position in the Consumer Discretionary Select Sector SPDR Fund and a short position in Avis Budget Group. The short position in Avis negatively affected the portfolio’s performance as investors rewarded the stock on news of an opportunity to manage a growing fleet of autonomous vehicles. Additionally, following the hurricanes that hit in the fall of 2017, the stock benefited from diminished concerns regarding the supply/demand gap in the used car market. We continued to hold a short position in Avis because we believe the company’s high level of debt will exacerbate its overextended capacity issues, which will only be compounded by increasing threats to the rental car industry.

Our Alaska Air Group (long) and American Airlines Group (short) pair also weighed on returns. When Alaska Air Group reported its fiscal fourth-quarter results, the company provided disappointing revenue per available seat mile guidance as it worked to integrate its acquisition of Virgin America and optimize its route structure. On the other hand, American Airlines Group’s stock rose after it provided guidance above expectations.

Zimmer Biomet Holdings (long) and Stryker (short) comprise a pair of medical device companies that detracted from performance. Zimmer’s stock declined due to weak guidance, while Stryker’s stock rose due to positive earnings and guidance. We increased the weight in this pair based on the greater valuation gap between these two stocks and on our belief that the valuation gap will close.

Key Contributors

Some of the portfolio’s top-performing pairs were in the industrials sector. This included a pair consisting of a long position in W.W. Grainger, a supplier of industrial supplies and equipment, and a short position in Fastenal Company, a fastener distributor. Our long position in W.W. Grainger drove this pair’s strong performance. In January of 2018, W.W. Grainger reported fiscal fourth-quarter results that showed a stronger-than-expected gain in volumes and a smaller-than-expected decline in margins as a result of the company lowering its prices in the U.S. The company also provided 2018 guidance that exceeded expectations.

A long position in Hubbell, an electrical equipment company, paired with a short position in industrial conglomerate General Electric (GE), also buoyed returns. Hubbell’s stock outperformed

*All fund returns referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund's benchmark, other share classes may not. See page 3 for returns for all share classes.

as its management team continued to drive stable, above-average growth. Additionally, the market expects Hubbell’s recent acquisition of Aclara Technologies to be cash accretive in 2018. The short position in GE also positively impacted performance as its stock declined. GE’s stock was pressured by various headwinds, including fundamental challenges in its power division, a change in CEO, a 50% dividend cut, and lowered earnings expectations for 2018. Due to GE’s significant underperformance and the narrowing of the valuation spread between Hubbell and GE, we swapped into a long GE position in December of 2017.

Our Walmart (long) and Costco Wholesale (short) pairing was beneficial as well. These companies have similar business models and are subject to similar secular trends and competition. We held the pair because a meaningful valuation discrepancy existed between the two stocks. The driver behind this pair’s strong performance was our long position in Walmart. Its stock rose substantially during the fourth quarter of 2017 as it announced strong quarterly results, reiterated guidance to grow earnings by 5% in 2018, and showcased its technology enhancements to validate its e-commerce platform.

Portfolio Positioning

AC Alternatives Market Neutral Value is designed to address several secular financial planning trends, including the need for an alternative to cash in a low interest rate environment, diversification resulting from not being correlated to equity markets, low volatility exposure, and a hedge against a rise in inflation and/or interest rates.

We continue to follow our disciplined, bottom-up process, selecting securities one at a time for the portfolio. We look for securities of companies that we believe are misvalued on both the long and short side of the market with consideration for both upside potential and downside risk. The portfolio’s current positioning reflects the individual opportunities identified by our team.

|

| |

| MARCH 31, 2018 | |

| Top Ten Long Holdings | % of net assets |

| Consumer Discretionary Select Sector SPDR Fund | 4.22% |

| iShares U.S. Real Estate ETF | 2.75% |

| Microchip Technology, Inc. (Convertible) | 2.50% |

| Ralph Lauren Corp. | 2.45% |

| Royal Dutch Shell plc, Class A ADR | 2.39% |

| HEICO Corp., Class A | 2.21% |

| Michael Kors Holdings Ltd. | 2.17% |

| Cummins, Inc. | 2.14% |

| Discover Financial Services | 2.11% |

| Medtronic plc | 2.06% |

| | |

| Top Ten Short Holdings | % of net assets |

| Stryker Corp. | (3.57)% |

| Costco Wholesale Corp. | (3.44)% |

| Fastenal Co. | (2.58)% |

| Avis Budget Group, Inc. | (2.55)% |

| American Airlines Group, Inc. | (2.44)% |

| Microchip Technology, Inc. | (2.42)% |

| NIKE, Inc., Class B | (2.37)% |

| HEICO Corp. | (2.19)% |

| Deere & Co. | (2.05)% |

| Lululemon Athletica, Inc. | (1.89)% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Domestic Common Stocks | 72.8% |

| Foreign Common Stocks* | 7.6% |

| Exchange-Traded Funds | 9.2% |

| Convertible Bonds | 2.5% |

| Domestic Common Stocks Sold Short | (76.0)% |

| Foreign Common Stocks Sold Short* | (8.3)% |

| Exchange-Traded Funds Sold Short | (7.6)% |

| Temporary Cash Investments | 6.6% |

| Other Assets and Liabilities | 93.2%** |

*Includes depositary shares, dual listed securities and foreign ordinary shares.

**Amount relates primarily to deposits for securities sold short at period end.

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2017 to March 31, 2018.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| Beginning

Account Value

10/1/17 | Ending

Account Value

3/31/18 | Expenses Paid

During Period(1)

10/1/17 - 3/31/18 |

Annualized

Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $989.30 | $18.10 | 3.65% |

| I Class | $1,000 | $990.40 | $17.12 | 3.45% |

| A Class | $1,000 | $988.10 | $19.33 | 3.90% |

| C Class | $1,000 | $983.50 | $23.00 | 4.65% |

| R Class | $1,000 | $986.00 | $20.55 | 4.15% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,006.73 | $18.26 | 3.65% |

| I Class | $1,000 | $1,007.73 | $17.27 | 3.45% |

| A Class | $1,000 | $1,005.49 | $19.50 | 3.90% |

| C Class | $1,000 | $1,001.75 | $23.21 | 4.65% |

| R Class | $1,000 | $1,004.24 | $20.74 | 4.15% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

MARCH 31, 2018

|

| | | | | | |

| | Shares/ Principal Amount | Value |

| COMMON STOCKS — 80.4% | | |

| Aerospace and Defense — 5.2% | | |

| BAE Systems plc | 810,760 |

| $ | 6,622,658 |

|

HEICO Corp., Class A(1) | 165,063 |

| 11,711,220 |

|

L3 Technologies, Inc.(1) | 44,610 |

| 9,278,880 |

|

| | | 27,612,758 |

|

| Air Freight and Logistics — 0.2% | | |

| United Parcel Service, Inc., Class B | 12,990 |

| 1,359,533 |

|

| Airlines — 2.9% | | |

Alaska Air Group, Inc.(1) | 115,300 |

| 7,143,988 |

|

Southwest Airlines Co.(1) | 142,870 |

| 8,183,593 |

|

| | | 15,327,581 |

|

| Auto Components — 1.0% | | |

Lear Corp.(1) | 29,010 |

| 5,398,471 |

|

| Automobiles — 1.9% | | |

| Ford Motor Co. | 196,120 |

| 2,173,010 |

|

| Harley-Davidson, Inc. | 88,470 |

| 3,793,593 |

|

| Honda Motor Co. Ltd. ADR | 119,630 |

| 4,154,750 |

|

| | | 10,121,353 |

|

| Banks — 5.7% | | |

| Bank of Hawaii Corp. | 26,260 |

| 2,182,206 |

|

| Bank of the Ozarks, Inc. | 100,020 |

| 4,827,965 |

|

BB&T Corp.(1) | 147,700 |

| 7,686,308 |

|

| PNC Financial Services Group, Inc. (The) | 39,110 |

| 5,914,997 |

|

| U.S. Bancorp | 148,510 |

| 7,499,755 |

|

| Wells Fargo & Co. | 40,140 |

| 2,103,737 |

|

| | | 30,214,968 |

|

| Beverages — 1.6% | | |

Boston Beer Co., Inc. (The), Class A(2) | 28,410 |

| 5,370,910 |

|

| PepsiCo, Inc. | 30,800 |

| 3,361,820 |

|

| | | 8,732,730 |

|

| Biotechnology — 0.5% | | |

| Gilead Sciences, Inc. | 34,740 |

| 2,619,049 |

|

| Capital Markets — 1.0% | | |

| AllianceBernstein Holding LP | 199,406 |

| 5,354,051 |

|

| Commercial Services and Supplies — 0.4% | | |

| Republic Services, Inc. | 30,160 |

| 1,997,497 |

|

| Communications Equipment — 1.3% | | |

F5 Networks, Inc.(2) | 24,910 |

| 3,602,235 |

|

| Juniper Networks, Inc. | 145,900 |

| 3,549,747 |

|

| | | 7,151,982 |

|

| Consumer Finance — 2.1% | | |

Discover Financial Services(1) | 154,990 |

| 11,148,431 |

|

| Containers and Packaging — 0.8% | | |

| Bemis Co., Inc. | 49,440 |

| 2,151,629 |

|

|

| | | | | | |

| | Shares/ Principal Amount | Value |

| Graphic Packaging Holding Co. | 139,697 |

| $ | 2,144,349 |

|

| | | 4,295,978 |

|

| Electric Utilities — 1.2% | | |

| Edison International | 49,628 |

| 3,159,318 |

|

| Eversource Energy | 50,480 |

| 2,974,282 |

|

| | | 6,133,600 |

|

| Electrical Equipment — 2.7% | | |

Eaton Corp. plc(1) | 133,160 |

| 10,640,816 |

|

| Hubbell, Inc. | 29,445 |

| 3,585,812 |

|

| | | 14,226,628 |

|

| Electronic Equipment, Instruments and Components — 0.7% | | |

| TE Connectivity Ltd. | 34,830 |

| 3,479,517 |

|

| Energy Equipment and Services — 0.8% | | |

| National Oilwell Varco, Inc. | 45,380 |

| 1,670,438 |

|

| Schlumberger Ltd. | 42,157 |

| 2,730,930 |

|

| | | 4,401,368 |

|

| Equity Real Estate Investment Trusts (REITs) — 1.3% | | |

| American Tower Corp. | 48,340 |

| 7,025,736 |

|

| Food and Staples Retailing — 2.7% | | |

| Kroger Co. (The) | 147,130 |

| 3,522,292 |

|

| Walmart, Inc. | 119,760 |

| 10,655,047 |

|

| | | 14,177,339 |

|

| Food Products — 2.0% | | |

| Conagra Brands, Inc. | 74,190 |

| 2,736,127 |

|

| General Mills, Inc. | 96,040 |

| 4,327,563 |

|

| J.M. Smucker Co. (The) | 28,340 |

| 3,514,443 |

|

| | | 10,578,133 |

|

| Gas Utilities — 0.5% | | |

| Atmos Energy Corp. | 29,230 |

| 2,462,335 |

|

| Health Care Equipment and Supplies — 4.5% | | |

| Medtronic plc | 135,810 |

| 10,894,678 |

|

Siemens Healthineers AG(2) | 73,290 |

| 3,012,001 |

|

Zimmer Biomet Holdings, Inc.(1) | 90,157 |

| 9,830,719 |

|

| | | 23,737,398 |

|

| Health Care Providers and Services — 0.7% | | |

| Cigna Corp. | 21,640 |

| 3,629,894 |

|

| Hotels, Restaurants and Leisure — 1.3% | | |

| Cheesecake Factory, Inc. (The) | 109,230 |

| 5,267,071 |

|

| McDonald's Corp. | 10,350 |

| 1,618,533 |

|

| | | 6,885,604 |

|

| Household Durables — 0.3% | | |

| PulteGroup, Inc. | 56,233 |

| 1,658,311 |

|

| Industrial Conglomerates — 0.7% | | |

| General Electric Co. | 265,820 |

| 3,583,254 |

|

| Insurance — 3.0% | | |

| Chubb Ltd. | 71,582 |

| 9,790,270 |

|

| EMC Insurance Group, Inc. | 42,636 |

| 1,154,583 |

|

| MetLife, Inc. | 83,283 |

| 3,821,857 |

|

| ProAssurance Corp. | 22,030 |

| 1,069,556 |

|

| | | 15,836,266 |

|

|

| | | | | | |

| | Shares/ Principal Amount | Value |

| Internet Software and Services — 0.4% | | |

Alphabet, Inc., Class C(2) | 1,840 |

| $ | 1,898,494 |

|

| IT Services — 0.6% | | |

| International Business Machines Corp. | 19,270 |

| 2,956,596 |

|

| Machinery — 7.9% | | |

| Allison Transmission Holdings, Inc. | 105,320 |

| 4,113,799 |

|

Crane Co.(1) | 94,780 |

| 8,789,897 |

|

| Cummins, Inc. | 69,820 |

| 11,317,124 |

|

| Dover Corp. | 32,069 |

| 3,149,817 |

|

| IMI plc | 369,770 |

| 5,612,543 |

|

| Ingersoll-Rand plc | 35,540 |

| 3,039,025 |

|

Rexnord Corp.(2) | 199,463 |

| 5,920,062 |

|

| | | 41,942,267 |

|

| Multiline Retail — 0.7% | | |

| Target Corp. | 53,810 |

| 3,736,028 |

|

| Oil, Gas and Consumable Fuels — 4.9% | | |

| Anadarko Petroleum Corp. | 23,120 |

| 1,396,679 |

|

| BP Midstream Partners LP | 284,918 |

| 5,082,937 |

|

| Enterprise Products Partners LP | 84,450 |

| 2,067,336 |

|

| EQT Corp. | 53,810 |

| 2,556,513 |

|

| EQT Midstream Partners LP | 33,630 |

| 1,985,179 |

|

| Royal Dutch Shell plc, Class A ADR | 198,335 |

| 12,655,757 |

|

| | | 25,744,401 |

|

| Pharmaceuticals — 1.7% | | |

Pfizer, Inc.(1) | 252,279 |

| 8,953,382 |

|

| Road and Rail — 1.4% | | |

| Norfolk Southern Corp. | 15,490 |

| 2,103,232 |

|

| Union Pacific Corp. | 38,470 |

| 5,171,522 |

|

| | | 7,274,754 |

|

| Semiconductors and Semiconductor Equipment — 3.0% | | |

Cirrus Logic, Inc.(2) | 104,559 |

| 4,248,232 |

|

| KLA-Tencor Corp. | 43,970 |

| 4,793,170 |

|

| Lam Research Corp. | 21,839 |

| 4,436,811 |

|

| Maxim Integrated Products, Inc. | 43,070 |

| 2,593,675 |

|

| | | 16,071,888 |

|

| Software — 1.3% | | |

| Microsoft Corp. | 29,246 |

| 2,669,282 |

|

| Oracle Corp. (New York) | 96,930 |

| 4,434,548 |

|

| | | 7,103,830 |

|

| Specialty Retail — 2.0% | | |

| L Brands, Inc. | 282,360 |

| 10,788,976 |

|

| Textiles, Apparel and Luxury Goods — 6.9% | | |

| Burberry Group plc | 247,370 |

| 5,890,910 |

|

| Gildan Activewear, Inc. | 90,630 |

| 2,617,567 |

|

| Hanesbrands, Inc. | 109,920 |

| 2,024,726 |

|

Michael Kors Holdings Ltd.(2) | 185,250 |

| 11,500,320 |

|

Ralph Lauren Corp.(1) | 116,190 |

| 12,990,042 |

|

| Wolverine World Wide, Inc. | 52,145 |

| 1,506,991 |

|

| | | 36,530,556 |

|

|

| | | | | | |

| | Shares/ Principal Amount | Value |

| Trading Companies and Distributors — 2.6% | | |

| MSC Industrial Direct Co., Inc., Class A | 74,650 |

| $ | 6,846,152 |

|

| W.W. Grainger, Inc. | 24,320 |

| 6,864,806 |

|

| | | 13,710,958 |

|

TOTAL COMMON STOCKS

(Cost $382,105,404) | | 425,861,895 |

|

| EXCHANGE-TRADED FUNDS — 9.2% | | |

| Consumer Discretionary Select Sector SPDR Fund | 220,304 |

| 22,314,592 |

|

| iShares Russell 1000 Value ETF | 69,213 |

| 8,302,791 |

|

| iShares TIPS Bond ETF | 29,480 |

| 3,332,714 |

|

| iShares U.S. Real Estate ETF | 192,550 |

| 14,531,749 |

|

TOTAL EXCHANGE-TRADED FUNDS

(Cost $45,051,413) | | 48,481,846 |

|

| CONVERTIBLE BONDS — 2.5% | | |

| Semiconductors and Semiconductor Equipment — 2.5% | | |

Microchip Technology, Inc., 1.625%, 2/15/25

(Cost $7,475,345) | $ | 7,464,000 |

| 13,252,220 |

|

| TEMPORARY CASH INVESTMENTS — 6.6% | | |

| Repurchase Agreement, BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 1.375% - 3.625%, 2/15/23 - 5/15/47, valued at $19,519,045), in a joint trading account at 1.45%, dated 3/29/18, due 4/2/18 (Delivery value $19,096,032) | | 19,092,956 |

|

| Repurchase Agreement, Fixed Income Clearing Corp., (collateralized by various U.S. Treasury obligations, 2.25%, 11/15/24, valued at $16,236,219), at 0.74%, dated 3/29/18, due 4/2/18 (Delivery value $15,918,309) | | 15,917,000 |

|

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 19,106 |

| 19,106 |

|

TOTAL TEMPORARY CASH INVESTMENTS

(Cost $35,029,062) | | 35,029,062 |

|

TOTAL INVESTMENT SECURITIES BEFORE SECURITIES SOLD SHORT — 98.7%

(Cost $469,661,224) | 522,625,023 |

|

| SECURITIES SOLD SHORT — (91.9)% | | |

| COMMON STOCKS SOLD SHORT — (84.3)% | | |

| Aerospace and Defense — (5.5)% | | |

| HEICO Corp. | (133,697 | ) | (11,606,237 | ) |

| Northrop Grumman Corp. | (22,800 | ) | (7,959,936 | ) |

| Raytheon Co. | (19,790 | ) | (4,271,078 | ) |

| Rolls-Royce Holdings plc | (438,780 | ) | (5,374,326 | ) |

| | | (29,211,577 | ) |

| Air Freight and Logistics — (0.3)% | | |

| FedEx Corp. | (5,790 | ) | (1,390,237 | ) |

| Airlines — (2.9)% | | |

| American Airlines Group, Inc. | (248,500 | ) | (12,912,060 | ) |

| Spirit Airlines, Inc. | (63,880 | ) | (2,413,386 | ) |

| | | (15,325,446 | ) |

| Automobiles — (2.2)% | | |

| General Motors Co. | (118,357 | ) | (4,301,093 | ) |

| Tesla, Inc. | (28,590 | ) | (7,608,657 | ) |

| | | (11,909,750 | ) |

| Banks — (5.8)% | | |

| Citizens Financial Group, Inc. | (61,760 | ) | (2,592,685 | ) |

| Comerica, Inc. | (44,150 | ) | (4,235,309 | ) |

|

| | | | | | |

| | Shares/ Principal Amount | Value |

| KeyCorp | (372,338 | ) | $ | (7,279,208 | ) |

| M&T Bank Corp. | (18,840 | ) | (3,473,342 | ) |

| Regions Financial Corp. | (273,550 | ) | (5,082,559 | ) |

| Zions BanCorp. | (148,820 | ) | (7,847,279 | ) |

| | | (30,510,382 | ) |

| Beverages — (1.0)% | | |

| Constellation Brands, Inc., Class A | (24,340 | ) | (5,547,573 | ) |

| Capital Markets — (1.6)% | | |

| Eaton Vance Corp. | (95,000 | ) | (5,288,650 | ) |

| FactSet Research Systems, Inc. | (16,890 | ) | (3,368,204 | ) |

| | | (8,656,854 | ) |

| Commercial Services and Supplies — (0.4)% | | |

| Waste Management, Inc. | (23,500 | ) | (1,976,820 | ) |

| Consumer Finance — (2.3)% | | |

| American Express Co. | (31,960 | ) | (2,981,229 | ) |

| Capital One Financial Corp. | (94,510 | ) | (9,055,948 | ) |

| | | (12,037,177 | ) |

| Containers and Packaging — (0.4)% | | |

| Ball Corp. | (53,850 | ) | (2,138,384 | ) |

| Distributors — (0.9)% | | |

| Pool Corp. | (32,940 | ) | (4,816,487 | ) |

| Diversified Financial Services — (0.2)% | | |

| Berkshire Hathaway, Inc., Class B | (4,900 | ) | (977,452 | ) |

| Electric Utilities — (0.4)% | | |

| Southern Co. (The) | (45,383 | ) | (2,026,805 | ) |

| Electronic Equipment, Instruments and Components — (0.6)% | | |

| Amphenol Corp., Class A | (39,180 | ) | (3,374,573 | ) |

| Energy Equipment and Services — (0.8)% | | |

| Halliburton Co. | (93,785 | ) | (4,402,268 | ) |

| Equity Real Estate Investment Trusts (REITs) — (3.5)% | | |

| AvalonBay Communities, Inc. | (19,360 | ) | (3,183,945 | ) |

| Crown Castle International Corp. | (63,638 | ) | (6,975,361 | ) |

| Equity Residential | (54,840 | ) | (3,379,241 | ) |

| Essex Property Trust, Inc. | (14,210 | ) | (3,420,063 | ) |

| Simon Property Group, Inc. | (10,280 | ) | (1,586,718 | ) |

| | | (18,545,328 | ) |

| Food and Staples Retailing — (3.4)% | | |

| Costco Wholesale Corp. | (96,530 | ) | (18,189,148 | ) |

| Food Products — (2.6)% | | |

| Kraft Heinz Co. (The) | (153,933 | ) | (9,588,487 | ) |

| Nestle SA | (54,280 | ) | (4,297,151 | ) |

| | | (13,885,638 | ) |

| Health Care Equipment and Supplies — (5.4)% | | |

| Align Technology, Inc. | (19,200 | ) | (4,821,696 | ) |

| Becton Dickinson and Co. | (8,640 | ) | (1,872,288 | ) |

| Koninklijke Philips NV | (73,900 | ) | (2,839,979 | ) |

| Stryker Corp. | (117,280 | ) | (18,872,697 | ) |

| | | (28,406,660 | ) |

| Health Care Providers and Services — (0.7)% | | |

| Anthem, Inc. | (6,930 | ) | (1,522,521 | ) |

|

| | | | | | |

| | Shares/ Principal Amount | Value |

| UnitedHealth Group, Inc. | (9,110 | ) | $ | (1,949,540 | ) |

| | | (3,472,061 | ) |

| Hotels, Restaurants and Leisure — (2.1)% | | |

| Chipotle Mexican Grill, Inc. | (21,450 | ) | (6,930,710 | ) |

| MGM Resorts International | (114,600 | ) | (4,013,292 | ) |

| | | (10,944,002 | ) |

| Household Durables — (0.3)% | | |

| Toll Brothers, Inc. | (37,520 | ) | (1,622,740 | ) |

| Insurance — (3.0)% | | |

| Hartford Financial Services Group, Inc. (The) | (46,470 | ) | (2,394,134 | ) |

| Prudential Financial, Inc. | (36,203 | ) | (3,748,821 | ) |

| Travelers Cos., Inc. (The) | (36,610 | ) | (5,083,665 | ) |

| Unum Group | (27,440 | ) | (1,306,418 | ) |

| Zurich Insurance Group AG | (10,920 | ) | (3,583,231 | ) |

| | | (16,116,269 | ) |

| Internet and Direct Marketing Retail — (0.9)% | | |

| Amazon.com, Inc. | (3,220 | ) | (4,660,435 | ) |

| IT Services — (1.4)% | | |

| Gartner, Inc. | (62,160 | ) | (7,311,259 | ) |

| Leisure Products — (0.6)% | | |

| Polaris Industries, Inc. | (25,650 | ) | (2,937,438 | ) |

| Machinery — (10.0)% | | |

| Caterpillar, Inc. | (47,830 | ) | (7,049,186 | ) |

| CNH Industrial NV | (485,910 | ) | (6,025,284 | ) |

| Deere & Co. | (69,930 | ) | (10,861,528 | ) |

| ESCO Technologies, Inc. | (43,240 | ) | (2,531,702 | ) |

| Illinois Tool Works, Inc. | (20,520 | ) | (3,214,663 | ) |

| Parker-Hannifin Corp. | (33,010 | ) | (5,645,700 | ) |

| RBC Bearings, Inc. | (48,244 | ) | (5,991,905 | ) |

| Weir Group plc (The) | (198,930 | ) | (5,575,540 | ) |

| Xylem, Inc. | (79,960 | ) | (6,150,523 | ) |

| | | (53,046,031 | ) |

| Oil, Gas and Consumable Fuels — (2.4)% | | |

| Exxon Mobil Corp. | (82,850 | ) | (6,181,439 | ) |

| Royal Dutch Shell plc, Class B ADR | (36,810 | ) | (2,412,159 | ) |

| Valero Energy Corp. | (45,590 | ) | (4,229,384 | ) |

| | | (12,822,982 | ) |

| Paper and Forest Products — (0.4)% | | |

| International Paper Co. | (40,930 | ) | (2,186,890 | ) |

| Pharmaceuticals — (2.2)% | | |

| AstraZeneca plc ADR | (166,402 | ) | (5,819,078 | ) |

| Bristol-Myers Squibb Co. | (46,500 | ) | (2,941,125 | ) |

| Sanofi | (33,460 | ) | (2,688,685 | ) |

| | | (11,448,888 | ) |

| Real Estate Investment Trusts (REITs) — (0.6)% | | |

| Host Hotels & Resorts, Inc. | (167,090 | ) | (3,114,558 | ) |

| Road and Rail — (3.9)% | | |

| Avis Budget Group, Inc. | (288,264 | ) | (13,502,286 | ) |

| CSX Corp. | (129,880 | ) | (7,235,615 | ) |

| | | (20,737,901 | ) |

|

| | | | | | |

| | Shares/ Principal Amount | Value |

| Semiconductors and Semiconductor Equipment — (4.0)% | | |

| Analog Devices, Inc. | (91,510 | ) | $ | (8,339,306 | ) |

| Microchip Technology, Inc. | (139,960 | ) | (12,786,746 | ) |

| | | (21,126,052 | ) |

| Specialty Retail — (0.7)% | | |

| Tiffany & Co. | (36,279 | ) | (3,543,007 | ) |

| Textiles, Apparel and Luxury Goods — (8.3)% | | |

| Lululemon Athletica, Inc. | (112,192 | ) | (9,998,551 | ) |

| LVMH Moet Hennessy Louis Vuitton SE | (19,380 | ) | (5,976,578 | ) |

| NIKE, Inc., Class B | (188,896 | ) | (12,550,250 | ) |

| PVH Corp. | (40,160 | ) | (6,081,429 | ) |

| Under Armour, Inc., Class C | (230,840 | ) | (3,312,554 | ) |

| VF Corp. | (83,670 | ) | (6,201,620 | ) |

| | | (44,120,982 | ) |

| Trading Companies and Distributors — (2.6)% | | |

| Fastenal Co. | (249,860 | ) | (13,639,857 | ) |

TOTAL COMMON STOCKS SOLD SHORT

(Proceeds $407,279,882) | | (446,179,911 | ) |

| EXCHANGE-TRADED FUNDS SOLD SHORT — (7.6)% | | |

| Alerian MLP ETF | (956,981 | ) | (8,966,912 | ) |

| Industrial Select Sector SPDR Fund | (40,550 | ) | (3,012,459 | ) |

| iShares US Preferred Stock ETF | (89,110 | ) | (3,346,972 | ) |

| PowerShares QQQ Trust Series 1 | (44,560 | ) | (7,135,393 | ) |

| SPDR S&P Oil & Gas Exploration & Production ETF | (116,050 | ) | (4,087,281 | ) |

| Technology Select Sector SPDR Fund | (111,314 | ) | (7,282,162 | ) |

| Utilities Select Sector SPDR Fund | (127,816 | ) | (6,458,542 | ) |

TOTAL EXCHANGE-TRADED FUNDS SOLD SHORT

(Proceeds $42,398,313) | | (40,289,721 | ) |

TOTAL SECURITIES SOLD SHORT — (91.9)%

(Proceeds $449,678,195) | | (486,469,632 | ) |

OTHER ASSETS AND LIABILITIES(3) — 93.2% | | 493,142,179 |

|

| TOTAL NET ASSETS — 100.0% | | $ | 529,297,570 |

|

|

| | |

| NOTES TO SCHEDULE OF INVESTMENTS |

| ADR | - | American Depositary Receipt |

| |

| (1) | Security, or a portion thereof, has been pledged at the custodian bank or with a broker for collateral requirements on securities sold short. At the period end, the aggregate value of securities pledged was $108,448,886. |

| |

| (3) | Amount relates primarily to deposits for securities sold short at period end. |

See Notes to Financial Statements.

|

|

| Statement of Assets and Liabilities |

|

| | | |

| MARCH 31, 2018 | |

| Assets | |

| Investment securities, at value (cost of $469,661,224) | $ | 522,625,023 |

|

| Deposits for securities sold short | 493,639,363 |

|

| Receivable for investments sold | 25,581,376 |

|

| Receivable for capital shares sold | 410,725 |

|

| Dividends and interest receivable | 919,158 |

|

| | 1,043,175,645 |

|

| | |

| Liabilities | |

| Securities sold short, at value (proceeds of $449,678,195) | 486,469,632 |

|

| Disbursements in excess of demand deposit cash | 15,460 |

|

| Payable for investments purchased | 25,327,264 |

|

| Payable for capital shares redeemed | 981,428 |

|

| Accrued management fees | 699,283 |

|

| Distribution and service fees payable | 22,189 |

|

| Dividend expense payable on securities sold short | 362,819 |

|

| | 513,878,075 |

|

| | |

| Net Assets | $ | 529,297,570 |

|

| | |

| Net Assets Consist of: | |

| Capital (par value and paid-in surplus) | $ | 545,738,891 |

|

| Accumulated net investment loss | (1,177,928 | ) |

| Accumulated net realized loss | (31,436,041 | ) |

| Net unrealized appreciation | 16,172,648 |

|

| | $ | 529,297,570 |

|

|

| | | | | | |

| | Net Assets | Shares Outstanding | Net Asset Value Per Share |

| Investor Class, $0.01 Par Value |

| $232,629,154 |

| 22,657,907 |

| $10.27 |

| I Class, $0.01 Par Value |

| $261,905,634 |

| 25,141,317 |

| $10.42 |

| A Class, $0.01 Par Value |

| $12,055,274 |

| 1,193,856 |

| $10.10* |

| C Class, $0.01 Par Value |

| $22,628,526 |

| 2,361,901 |

| $9.58 |

| R Class, $0.01 Par Value |

| $78,982 |

| 7,959 |

| $9.92 |

*Maximum offering price $10.72 (net asset value divided by 0.9425).

See Notes to Financial Statements.

|

| | | |

| YEAR ENDED MARCH 31, 2018 | |

| Investment Income (Loss) | |

| Income: | |

| Dividends (net of foreign taxes withheld of $272,768) | $ | 12,794,123 |

|

| Interest | 4,519,518 |

|

| | 17,313,641 |

|

| | |

| Expenses: | |

| Dividend expense on securities sold short | 13,754,932 |

|

| Management fees | 11,578,871 |

|

| Distribution and service fees: | |

| A Class | 59,601 |

|

| C Class | 292,155 |

|

| R Class | 391 |

|

| Directors' fees and expenses | 19,326 |

|

| Other expenses | 17,934 |

|

| | 25,723,210 |

|

Fees waived(1) | (1,589,647 | ) |

| | 24,133,563 |

|

| | |

| Net investment income (loss) | (6,819,922 | ) |

| | |

| Realized and Unrealized Gain (Loss) | |

| Net realized gain (loss) on: | |

| Investment transactions | 101,768,911 |

|

| Securities sold short transactions | (93,626,882 | ) |

| Forward foreign currency exchange contract transactions | (67,115 | ) |

| Foreign currency translation transactions | 2,425 |

|

| | 8,077,339 |

|

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | (17,129,583 | ) |

| Securities sold short | 39,822 |

|

| Forward foreign currency exchange contracts | (129,692 | ) |

| Translation of assets and liabilities in foreign currencies | 785 |

|

| | (17,218,668 | ) |

| | |

| Net realized and unrealized gain (loss) | (9,141,329 | ) |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | (15,961,251 | ) |

| |

| (1) | Amount consists of $828,756, $628,055, $59,601, $73,039 and $196 for Investor Class, I Class, A Class, C Class and R Class, respectively. |

See Notes to Financial Statements.

|

|

| Statement of Changes in Net Assets |

|

| | | | | | |

| YEARS ENDED MARCH 31, 2018 AND MARCH 31, 2017 |

| Increase (Decrease) in Net Assets | March 31, 2018 | March 31, 2017 |

| Operations | | |

| Net investment income (loss) | $ | (6,819,922 | ) | $ | (11,700,373 | ) |

| Net realized gain (loss) | 8,077,339 |

| 12,486,197 |

|

| Change in net unrealized appreciation (depreciation) | (17,218,668 | ) | 18,412,884 |

|

| Net increase (decrease) in net assets resulting from operations | (15,961,251 | ) | 19,198,708 |

|

| | | |

| Distributions to Shareholders | | |

| From net realized gains: | | |

| Investor Class | (6,698,830 | ) | (10,130,104 | ) |

| I Class | (5,587,919 | ) | (4,651,007 | ) |

| A Class | (365,770 | ) | (3,199,654 | ) |

| C Class | (638,486 | ) | (920,441 | ) |

| R Class | (1,837 | ) | (3,174 | ) |

| Decrease in net assets from distributions | (13,292,842 | ) | (18,904,380 | ) |

| | | |

| Capital Share Transactions | | |

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (187,833,645 | ) | 270,349,369 |

|

| | | |

| Net increase (decrease) in net assets | (217,087,738 | ) | 270,643,697 |

|

| | | |

| Net Assets | | |

| Beginning of period | 746,385,308 |

| 475,741,611 |

|

| End of period | $ | 529,297,570 |

| $ | 746,385,308 |

|

| | | |

| Accumulated net investment loss | $ | (1,177,928 | ) | $ | (206,639 | ) |

See Notes to Financial Statements.

|

|

| Notes to Financial Statements |

MARCH 31, 2018

1. Organization

American Century Capital Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. AC Alternatives Market Neutral Value Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek long-term capital growth, independent of equity market conditions.

The fund offers the Investor Class, I Class (formerly Institutional Class), A Class, C Class and R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Fixed income securities are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Corporate and convertible bonds are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value. Forward foreign currency exchange contracts are valued at the mean of the appropriate forward exchange rate at the close of the NYSE as provided by an independent pricing service.

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a

security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. If significant fluctuations in foreign markets are identified, the fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Securities Sold Short — The fund enters into short sales, which is selling securities it does not own, as part of its normal investment activities. Upon selling a security short, the fund will segregate cash, cash equivalents or other appropriate liquid securities in at least an amount equal to the current market value of the securities sold short until the fund replaces the borrowed security. Interest earned on segregated cash for securities sold short is reflected as interest income. The fund is required to pay any dividends or interest due on securities sold short. Such dividends and interest are recorded as an expense. The fund may pay fees or charges on the assets borrowed for securities sold short. These fees are calculated daily based upon the value of each security sold short and a rate that is dependent on the availability of such security. Liabilities for securities sold short are valued daily and changes in value are recorded as change in net unrealized appreciation (depreciation) on securities sold short. The fund records realized gain (loss) on a security sold short when it is terminated by the fund and includes as a component of net realized gain (loss) on securities sold short transactions.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively. Net realized and unrealized foreign currency exchange gains or losses related to securities sold short are a component of net realized gain (loss) on securities sold short transactions and change in net unrealized appreciation (depreciation) on securities sold short, respectively.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investments, including, but not limited to, futures contracts and short sales. American Century Investment Management, Inc. (ACIM) (the investment advisor) monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for collateral requirements on futures contracts and short sales.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that ACIM has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, expenses on securities sold short, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class's daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class. During the period ended March 31, 2018, the investment advisor agreed to waive 0.25% of the fund's management fee. The investment advisor expects this waiver to continue until July 31, 2018 and cannot terminate it prior to such date without the approval of the Board of Directors.

The annual management fee and the effective annual management fee after waiver for each class for the period ended March 31, 2018 are as follows:

|

| | |

| | Annual Management Fee | Effective Annual Management Fee After Waiver |

| Investor Class | 1.90% | 1.65% |

| I Class | 1.70% | 1.45% |

| A Class | 1.90% | 1.65% |

| C Class | 1.90% | 1.65% |

| R Class | 1.90% | 1.65% |

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the period ended March 31, 2018 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund purchases and sales were $21,877,579 and $21,562,301, respectively. The effect of interfund transactions on the Statement of Operations was $1,217,266 in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities and securities sold short, excluding short-term investments, for the period ended March 31, 2018 were $1,892,066,641 and $1,883,534,584, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

|

| | | | | | | | | | |

| | Year ended

March 31, 2018 | Year ended

March 31, 2017 |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 240,000,000 |

| | 160,000,000 |

| |

| Sold | 14,653,809 |

| $ | 155,378,996 |

| 38,163,480 |

| $ | 409,848,107 |

|

| Issued in reinvestment of distributions | 640,969 |

| 6,627,618 |

| 953,814 |

| 10,053,201 |

|

| Redeemed | (31,655,638 | ) | (333,048,836 | ) | (23,759,846 | ) | (254,452,883 | ) |

| | (16,360,860 | ) | (171,042,222 | ) | 15,357,448 |

| 165,448,425 |

|

| I Class/Shares Authorized | 150,000,000 |

| | 60,000,000 |

| |

| Sold | 22,670,745 |

| 241,153,307 |

| 12,817,012 |

| 139,407,265 |

|

| Issued in reinvestment of distributions | 515,071 |

| 5,403,092 |

| 369,477 |

| 3,938,624 |

|

| Redeemed | (15,002,218 | ) | (159,752,059 | ) | (7,696,378 | ) | (83,354,520 | ) |

| | 8,183,598 |

| 86,804,340 |

| 5,490,111 |

| 59,991,369 |

|

| A Class/Shares Authorized | 70,000,000 |

| | 50,000,000 |

| |

| Sold | 864,634 |

| 9,018,952 |

| 7,205,999 |

| 76,907,509 |

|

| Issued in reinvestment of distributions | 35,896 |

| 365,419 |

| 307,598 |

| 3,199,016 |

|

| Redeemed | (9,756,785 | ) | (102,303,722 | ) | (4,685,220 | ) | (49,611,414 | ) |

| | (8,856,255 | ) | (92,919,351 | ) | 2,828,377 |

| 30,495,111 |

|

| C Class/Shares Authorized | 25,000,000 |

| | 15,000,000 |

| |

| Sold | 282,807 |

| 2,814,310 |

| 2,091,153 |

| 21,387,959 |

|

| Issued in reinvestment of distributions | 65,910 |

| 638,013 |

| 91,952 |

| 917,682 |

|

| Redeemed | (1,427,910 | ) | (14,089,402 | ) | (782,225 | ) | (7,938,502 | ) |

| | (1,079,193 | ) | (10,637,079 | ) | 1,400,880 |

| 14,367,139 |

|

| R Class/Shares Authorized | 10,000,000 |

| | 10,000,000 |

| |

| Sold | 4,087 |

| 41,696 |

| 6,544 |

| 68,556 |

|

| Issued in reinvestment of distributions | 184 |

| 1,837 |

| 309 |

| 3,174 |

|

| Redeemed | (8,063 | ) | (82,866 | ) | (2,337 | ) | (24,405 | ) |

| | (3,792 | ) | (39,333 | ) | 4,516 |

| 47,325 |

|

| Net increase (decrease) | (18,116,502 | ) | $ | (187,833,645 | ) | 25,081,332 |

| $ | 270,349,369 |

|

6. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| |

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars. |

| |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments. There were no significant transfers between levels during the period.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

|

| | | | | | | | |

| | Level 1 | Level 2 | Level 3 |

| Assets | | | |

| Investment Securities | | | |

| Common Stocks | | | |

| Aerospace and Defense | $ | 20,990,100 |

| $ | 6,622,658 |

| — |

|

| Health Care Equipment and Supplies | 20,725,397 |

| 3,012,001 |

| — |

|

| Machinery | 36,329,724 |

| 5,612,543 |

| — |

|

| Textiles, Apparel and Luxury Goods | 28,022,079 |

| 8,508,477 |

| — |

|

| Other Industries | 296,038,916 |

| — |

| — |

|

| Exchange-Traded Funds | 48,481,846 |

| — |

| — |

|

| Convertible Bonds | — |

| 13,252,220 |

| — |

|

| Temporary Cash Investments | 19,106 |

| 35,009,956 |

| — |

|

| | $ | 450,607,168 |

| $ | 72,017,855 |

| — |

|

| | | | |

| Liabilities | | | |

| Securities Sold Short | | | |

| Common Stocks | | | |

| Aerospace and Defense | $ | 23,837,251 |

| $ | 5,374,326 |

| — |

|

| Food Products | 9,588,487 |

| 4,297,151 |

| — |

|

| Health Care Equipment and Supplies | 25,566,681 |

| 2,839,979 |

| — |

|

| Insurance | 12,533,038 |

| 3,583,231 |

| — |

|

| Machinery | 47,470,491 |

| 5,575,540 |

| — |

|

| Pharmaceuticals | 8,760,203 |

| 2,688,685 |

| — |

|

| Textiles, Apparel and Luxury Goods | 38,144,404 |

| 5,976,578 |

| — |

|

| Other Industries | 249,943,866 |

| — |

| — |

|

| Exchange-Traded Funds | 40,289,721 |

| — |

| — |

|

| | $ | 456,134,142 |

| $ | 30,335,490 |

| — |

|

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund's exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on forward foreign currency exchange contract transactions and change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms.The fund's average U.S. dollar exposure to foreign currency risk derivative instruments held during the period was $31,568,943.

At period end, the fund did not have any derivative instruments disclosed on the Statement of Assets and Liabilities. For the year ended March 31, 2018, the effect of foreign currency risk derivative instruments on the Statement of Operations was $(67,115) in net realized gain (loss) on forward foreign currency exchange contract transactions and $(129,692) in change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts.

8. Risk Factors

The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

The fund is subject to short sales risk. If the market price of a security increases after the fund borrows the security, the fund may suffer a loss when it replaces the borrowed security at the higher price. Any loss will be increased by the amount of compensation, interest or dividends, and transaction costs the fund must pay to the lender of the borrowed security.

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

9. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2018 and March 31, 2017 were as follows:

|

| | | | | | |

| | 2018 | 2017 |

| Distributions Paid From | | |

| Ordinary income | $ | 6,768,945 |

| $ | 14,225,012 |

|

| Long-term capital gains | $ | 6,523,897 |

| $ | 4,679,368 |

|

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

The reclassifications, which are primarily due to net operating losses, were made to capital $(4,647,061), accumulated net investment loss $5,848,633, and accumulated net realized loss $(1,201,572).

As of period end, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

|

| | | |

| Federal tax cost of investments | $ | 477,988,864 |

|

| Gross tax appreciation of investments | $ | 54,523,735 |

|

| Gross tax depreciation of investments | (9,887,576 | ) |

| Net tax appreciation (depreciation) of investments | 44,636,159 |

|

| Gross tax appreciation on securities sold short | — |

|

| Gross tax depreciation on securities sold short | (54,384,004 | ) |

| Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | $ | (1,351 | ) |

| Net tax appreciation (depreciation) | $ | (9,749,196 | ) |

| Other book-to-tax adjustments | $ | (10,427,033 | ) |

Undistributed ordinary income

| — |

|

| Accumulated long-term gains | $ | 4,237,502 |

|

| Late-year ordinary loss deferral | $ | (502,594 | ) |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales. Other book-to-tax adjustments are attributable primarily to the tax deferral of losses on straddle positions.

Loss deferrals represent certain qualified losses that the fund has elected to treat as having been incurred in the following fiscal year for federal income tax purposes.

10. Recently Issued Accounting Standards

In March 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update No.2017-08, “Receivables - Nonrefundable Fees and Other Costs (Subtopic 310-20), Premium Amortization on Purchased Callable Debt Securities” (ASU 2017-08). ASU 2017-08 amends the amortization period for certain purchased callable debt securities held at a premium, shortening such period to the earliest call date. The amendments are effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2018. Management is currently evaluating the impact that adopting ASU 2017-08 will have on the financial statements.

|

| | | | | | | | | | | | | | | | |

For a Share Outstanding Throughout the Years Ended March 31 (except as noted)

|

| Per-Share Data | | | | | | Ratios and Supplemental Data | | |

| | | Income From Investment Operations: | | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning

of Period | Net

Investment

Income

(Loss)(1) | Net

Realized

and

Unrealized

Gain (Loss) | Total From

Investment

Operations | Distributions From Net

Realized

Gains | Net Asset

Value,

End

of Period | Total

Return(2) | Operating

Expenses | Operating

Expenses

(before

expense

waiver) | Operating

Expenses

(excluding

expenses on

securities

sold short) | Net

Investment

Income

(Loss) | Net

Investment

Income

(Loss)

(before

expense

waiver) | Portfolio

Turnover

Rate | Net

Assets,

End of

Period

(in thousands) |

| Investor Class | | | | | | | | | | | | | |

| 2018 | $10.76 | (0.12) | (0.13) | (0.25) | (0.24) | $10.27 | (2.36)% | 3.82% | 4.07% | 1.66% | (1.10)% | (1.35)% | 307% |

| $232,629 |

|

| 2017 | $10.73 | (0.18) | 0.49 | 0.31 | (0.28) | $10.76 | 2.97% | 3.68% | 3.94% | 1.64% | (1.65)% | (1.91)% | 374% |

| $419,925 |

|

| 2016 | $10.44 | (0.19) | 0.65 | 0.46 | (0.17) | $10.73 | 4.42% | 3.78% | 4.08% | 1.61% | (1.82)% | (2.12)% | 679% |

| $253,885 |

|

| 2015 | $10.22 | (0.20) | 0.62 | 0.42 | (0.20) | $10.44 | 4.10% | 3.88% | 4.18% | 1.60% | (1.95)% | (2.25)% | 447% |

| $49,465 |

|

| 2014 | $10.25 | (0.04) | 0.21 | 0.17 | (0.20) | $10.22 | 1.69% | 4.09% | 4.39% | 1.60% | (0.35)% | (0.65)% | 521% |

| $49,665 |

|

I Class(3) | | | | | | | | | | | | | |

| 2018 | $10.89 | (0.09) | (0.14) | (0.23) | (0.24) | $10.42 | (2.15)% | 3.62% | 3.87% | 1.46% | (0.90)% | (1.15)% | 307% |

| $261,906 |

|

| 2017 | $10.83 | (0.16) | 0.50 | 0.34 | (0.28) | $10.89 | 3.23% | 3.48% | 3.74% | 1.44% | (1.45)% | (1.71)% | 374% |

| $184,717 |

|

| 2016 | $10.52 | (0.16) | 0.64 | 0.48 | (0.17) | $10.83 | 4.58% | 3.58% | 3.88% | 1.41% | (1.62)% | (1.92)% | 679% |

| $124,249 |

|

| 2015 | $10.28 | (0.18) | 0.62 | 0.44 | (0.20) | $10.52 | 4.28% | 3.68% | 3.98% | 1.40% | (1.75)% | (2.05)% | 447% |

| $6,013 |

|

| 2014 | $10.28 | 0.11 | 0.09 | 0.20 | (0.20) | $10.28 | 1.98% | 3.89% | 4.19% | 1.40% | (0.15)% | (0.45)% | 521% |

| $5,714 |

|

|

| | | | | | | | | | | | | | | | |

For a Share Outstanding Throughout the Years Ended March 31 (except as noted)

|

| Per-Share Data | | | | | | Ratios and Supplemental Data | | |

| | | Income From Investment Operations: | | | | Ratio to Average Net Assets of: | | |

| | Net Asset

Value,

Beginning