UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-07820 |

| | |

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 10-31 |

| | |

| Date of reporting period: | 10-31-2018 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| ANNUAL REPORT | |

| OCTOBER 31, 2018 |

| |

|

|

AC Alternatives® Income Fund |

| Investor Class (ALNNX) |

| I Class (ALNIX) |

| Y Class (ALYNX) |

| A Class (ALNAX) |

| C Class (ALNHX) |

| R Class (ALNRX) |

| R6 Class (ALNDX) |

|

| | |

| President’s Letter | 2 |

|

| Performance | 3 |

|

| Portfolio Commentary | |

|

| Fund Characteristics | |

|

| Shareholder Fee Example | |

|

| Schedule of Investments | |

|

| Statement of Assets and Liabilities | |

|

| Statement of Operations | |

|

| Statement of Changes in Net Assets | |

|

| Notes to Financial Statements | |

|

| Financial Highlights | |

|

| Report of Independent Registered Public Accounting Firm | |

|

| Management | |

|

| Approval of Management and Subadvisory Agreements | |

|

| Additional Information | |

|

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the 12 months ended October 31, 2018. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional investment and market insights, we encourage you to visit our website, americancentury.com.

Rising Rates, Heightened Volatility Challenge Investors

U.S. stocks generally delivered gains for the period, but returns were considerably weaker than the robust, double-digit results of the previous fiscal year. Early on, a backdrop of robust corporate earnings results, improving global economic growth, and growth-oriented U.S. tax reform helped drive stock prices higher. The S&P 500 Index returned more than 10% just in the first three months of the reporting period.

Investor sentiment shifted dramatically in early February, as volatility resurfaced after an extended period of relative dormancy. Better-than-expected U.S. economic data triggered expectations for rising inflation, higher interest rates, and a more-hawkish Federal Reserve (Fed). In response, U.S. Treasury yields soared, and stock prices plunged. Although this bout of market unrest quickly subsided, volatility remained a formidable force throughout the rest of the period. Stocks remained resilient, though, and the S&P 500 Index advanced 7.35% for the 12-month period. Growth stocks outpaced value stocks, and large-cap stocks outperformed small-cap stocks. Meanwhile, rising U.S. Treasury yields and Fed rate hikes weighed on interest-rate sensitive assets, including investment-grade bonds and real estate investment trusts.

Outside the U.S., economic growth moderated as the period unfolded, and global bond yields were flat to modestly higher. The U.S. dollar continued to gain ground versus other currencies, which drove down non-U.S. bond returns for unhedged investors. The strong dollar, combined with rising U.S. interest rates, geopolitical tensions, and fiscal challenges in several developing countries, led to negative results for emerging markets bonds.

With global economic growth diverging, Treasury yields rising, and volatility lingering, investors likely will face opportunities and challenges in the months ahead. We believe this scenario underscores the importance of using professionally managed portfolios in pursuit of investment goals. We appreciate your continued trust and confidence in us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | |

| Total Returns as of October 31, 2018 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | Since Inception | Inception

Date |

| Investor Class | ALNNX | 1.66% | 2.32% | 7/31/15 |

| HFRX Fixed Income - Credit Index | — | -0.19% | 0.82% | — |

| Bloomberg Barclays U.S. Universal Bond Index | — | -1.95% | 1.59% | — |

| I Class | ALNIX | 1.87% | 2.53% | 7/31/15 |

| Y Class | ALYNX | 1.92% | 2.91% | 4/10/17 |

| A Class | ALNAX | | | 7/31/15 |

| No sales charge | | 1.41% | 2.09% | |

| With sales charge | | -4.44% | 0.25% | |

| C Class | ALNHX | 0.55% | 1.30% | 7/31/15 |

| R Class | ALNRX | 1.16% | 1.82% | 7/31/15 |

| R6 Class | ALNDX | 2.02% | 2.72% | 7/31/15 |

Although the fund commenced operations on May 29, 2015, the performance inception date (for all classes except Y Class) reflects the date the fund began investing in accordance with its investment strategy.

Fund returns would have been lower if a portion of the fees had not been waived.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

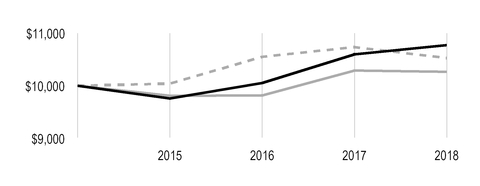

| Growth of $10,000 Over Life of Class |

| $10,000 investment made July 31, 2015 |

| Performance for other share classes will vary due to differences in fee structure. |

|

| |

| Value on October 31, 2018 |

| | Investor Class — $10,776 |

| |

| | HFRX Fixed Income - Credit Index — $10,268 |

| |

| | Bloomberg Barclays U.S. Universal Bond Index — $10,527 |

| |

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

|

| | | | | | |

| Total Annual Fund Operating Expenses |

| Investor Class | I Class | Y Class | A Class | C Class | R Class | R6 Class |

| 2.10% | 1.90% | 1.75% | 2.35% | 3.10% | 2.60% | 1.75% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Advisor: American Century Investment Management, Inc.

Portfolio Managers: Cleo Chang and Hitesh Patel

Subadvisor: Perella Weinberg Partners Capital Management LP

Portfolio Managers: Chris Bittman, Kent Muckel, and Darren Myers

Hitesh Patel joined American Century Investments and began managing the fund in 2018.

Performance Summary

For the fiscal year ended October 31, 2018, the AC Alternatives Income Fund generated a return of 1.66%.* This compares favorably with the loss of -0.19% for the HFRX Fixed Income - Credit Index and the -1.95% decline for the Bloomberg Barclays U.S. Universal Bond Index during the same period. Fund returns reflect operating expenses, while index returns do not.

Performance Review

The global capital markets produced mixed results during the 12-month period. U.S. equities (S&P 500 Index) fared well, buoyed by strong earnings growth and corporate tax cuts. U.S. stocks gained 7.35% for the period. Meanwhile, non-U.S. equity markets experienced more headwinds than tailwinds. Concerns about growth in Europe, continued Brexit negotiations, and China’s weakening economy weighed on non-U.S. equity returns. Developed markets, as measured by the MSCI EAFE Index, lost -6.85%, while the MSCI Emerging Markets Index fell -12.52%.

The fixed-income markets also experienced some dispersion in returns. Interest rates rose across the U.S. yield curve, and the yield on the 10-year U.S. Treasury note increased 76 basis points (one basis point equals 0.01%) to 3.14%. The rise in rates led to losses in core fixed-income investments, as measured by the Bloomberg Barclays U.S. Aggregate Bond Index, which lost -2.05%. The Bloomberg Barclays U.S. Corporate High Yield Bond Index managed a gain of 0.97%, as coupon income offset the price losses stemming from rising rates. Credit spreads (the difference in yields between Treasuries and corporate bonds of similar maturity) spent most of the period in a tight range. However, in October, high-yield spreads spiked sharply wider.

Given the positive backdrop for equity markets, the portfolio's high-dividend equity sleeve managed by Perella Weinberg Partners Capital Management (PWP) aided performance, as the strategy outpaced the returns in the broader equity markets. Structured and opportunistic credit strategies managed by Good Hill Partners and ArrowMark Colorado Holdings, respectively, also posted positive returns despite the rising-rate environment. The BCSF Advisors** strategy, which benefited from bank loan exposure, generated better returns than the broad corporate high-yield bond market. The portfolio also benefited from select hedging activity, especially during a spike in market volatility in August. Finally, master limited partnerships were modestly negative for the period but experienced significant price volatility throughout the 12 months.

Outlook

Our outlook for global growth has become a bit more mixed. While the U.S. continues to press ahead, propelled by fiscal stimulus and still-supportive overall domestic financial conditions,

* All fund returns referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund's benchmarks, other share classes may not. See page 3 for returns for all share classes.

** Effective August 1, 2018, BCSF Advisors, LP replaced Bain Capital Credit, LP as subadvisor of the portfolio's corporate credit strategy. BCSF Advisors is a subsidiary of Bain Capital Credit.

Europe and Japan are following at a clearly decelerated pace. China’s economy has also lost steam and faces rising trade tensions with the U.S.

Given this backdrop, adopting late-cycle positioning seems to be appropriate, as the shift from monetary stimulus to fiscal stimulus requires a rethinking of portfolio exposures. Furthermore, markets are transitioning from a long-term trend of deflationary pressures to one of heightened inflationary influences. For nearly a generation, fixed-income markets represented a diversifier to equity market weakness, and falling interest rates helped support lofty equity valuations. Recent asset class behavior suggests this trend is ending. Thus, traditional portfolio construction relying on a 60/40 stock and bond mix likely will not yield the same results as it did in the past. We continue to believe a diversified portfolio of income-generating assets along with relative value positions and portfolio hedges remains appropriate.

When the fiscal year closed on October 31, 2018, the portfolio’s capital allocation was as follows: 26% BCSF Advisors, 20% ArrowMark Colorado Holdings, 20% Good Hill Partners, and 8% Timbercreek Investment Management. Allocations to cash and specific sleeves PWP manages accounted for the remaining balances.

|

| |

| OCTOBER 31, 2018 | |

| Types of Investments in Portfolio | % of net assets |

| Common Stocks | 15.5% |

| Asset-Backed Securities | 15.3% |

| Bank Loan Obligations | 14.3% |

| Exchange-Traded Funds | 11.3% |

| Corporate Bonds | 11.0% |

| Collateralized Loan Obligations | 10.8% |

| Commercial Mortgage-Backed Securities | 8.4% |

| Collateralized Mortgage Obligations | 2.5% |

| Preferred Stocks | 2.0% |

| U.S. Treasury Securities | 1.4% |

| Convertible Bonds | 0.1% |

| Convertible Preferred Stocks | 0.1% |

| Corporate Bonds Sold Short | (0.1)% |

| Temporary Cash Investments | 6.3% |

| Other Assets and Liabilities | 1.1% |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from May 1, 2018 to October 31, 2018.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| Beginning

Account Value

5/1/18 | Ending

Account Value

10/31/18 | Expenses Paid

During Period(1)

5/1/18 - 10/31/18 | Annualized

Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $1,008.50 | $9.67 | 1.91% |

| I Class | $1,000 | $1,008.40 | $8.66 | 1.71% |

| Y Class | $1,000 | $1,009.20 | $7.90 | 1.56% |

| A Class | $1,000 | $1,007.20 | $10.93 | 2.16% |

| C Class | $1,000 | $1,002.40 | $14.69 | 2.91% |

| R Class | $1,000 | $1,004.90 | $12.18 | 2.41% |

| R6 Class | $1,000 | $1,010.30 | $7.90 | 1.56% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,015.58 | $9.70 | 1.91% |

| I Class | $1,000 | $1,016.59 | $8.69 | 1.71% |

| Y Class | $1,000 | $1,017.34 | $7.93 | 1.56% |

| A Class | $1,000 | $1,014.32 | $10.97 | 2.16% |

| C Class | $1,000 | $1,010.54 | $14.75 | 2.91% |

| R Class | $1,000 | $1,013.06 | $12.23 | 2.41% |

| R6 Class | $1,000 | $1,017.34 | $7.93 | 1.56% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 184, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

OCTOBER 31, 2018

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| COMMON STOCKS — 15.5% | | | |

| Airlines — 0.2% | | | |

| American Airlines Group, Inc. | | 894 |

| $ | 31,362 |

|

| Copa Holdings SA, Class A | | 7,880 |

| 570,748 |

|

| | | | 602,110 |

|

| Automobiles — 0.5% | | | |

| General Motors Co. | | 40,840 |

| 1,494,336 |

|

| Beverages — 0.2% | | | |

| Coca-Cola European Partners plc | | 9,680 |

| 440,343 |

|

| Biotechnology — 0.4% | | | |

| AbbVie, Inc. | | 5,240 |

| 407,934 |

|

| Amgen, Inc. | | 2,170 |

| 418,354 |

|

| Gilead Sciences, Inc. | | 6,090 |

| 415,216 |

|

| | | | 1,241,504 |

|

| Chemicals — 0.6% | | | |

| Eastman Chemical Co. | | 5,450 |

| 427,007 |

|

| Olin Corp. | | 58,960 |

| 1,190,992 |

|

| | | | 1,617,999 |

|

| Commercial Services and Supplies — 0.2% | | | |

| KAR Auction Services, Inc. | | 7,580 |

| 431,605 |

|

| Communications Equipment — 0.2% | | | |

| Cisco Systems, Inc. | | 9,310 |

| 425,933 |

|

| Containers and Packaging — 0.6% | | | |

| Packaging Corp. of America | | 15,060 |

| 1,382,658 |

|

| Sonoco Products Co. | | 7,860 |

| 428,999 |

|

| | | | 1,811,657 |

|

| Distributors — 0.1% | | | |

| Genuine Parts Co. | | 4,260 |

| 417,139 |

|

| Electric Utilities — 0.1% | | | |

| Alliant Energy Corp. | | 9,730 |

| 418,195 |

|

| Electrical Equipment — 0.4% | | | |

| Hubbell, Inc. | | 10,680 |

| 1,086,156 |

|

| Equity Real Estate Investment Trusts (REITs) — 4.5% | | | |

| AIMS AMP Capital Industrial REIT | | 369,569 |

| 357,523 |

|

| American Campus Communities, Inc. | | 7,450 |

| 294,350 |

|

| Automotive Properties Real Estate Investment Trust | | 33,218 |

| 259,900 |

|

| CapitaLand Commercial Trust | | 165,900 |

| 207,203 |

|

| CapitaLand Retail China Trust | | 469,593 |

| 464,457 |

|

| Centuria Industrial REIT | | 111,854 |

| 219,410 |

|

| Charter Hall Retail REIT | | 101,801 |

| 306,384 |

|

| Chesapeake Lodging Trust | | 8,603 |

| 252,842 |

|

| Colony Capital, Inc. | | 74,288 |

| 436,071 |

|

| Dream Industrial Real Estate Investment Trust | | 44,849 |

| 333,186 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Fortune Real Estate Investment Trust | | 349,000 |

| $ | 381,846 |

|

| Frasers Logistics & Industrial Trust | | 354,139 |

| 260,782 |

|

| GLP J-Reit | | 310 |

| 306,882 |

|

| HCP, Inc. | | 19,000 |

| 523,450 |

|

| Intervest Offices & Warehouses NV | | 15,797 |

| 410,632 |

|

| Invesco Office J-Reit, Inc. | | 3,387 |

| 478,776 |

|

| Keppel DC REIT | | 276,600 |

| 265,587 |

|

| Kimco Realty Corp. | | 27,996 |

| 450,456 |

|

| Kite Realty Group Trust | | 31,967 |

| 506,357 |

|

| Kiwi Property Group Ltd. | | 373,435 |

| 320,446 |

|

| Klepierre SA | | 14,228 |

| 483,460 |

|

| Mercialys SA | | 28,783 |

| 422,184 |

|

| Merlin Properties Socimi SA | | 20,883 |

| 262,077 |

|

| MGM Growth Properties LLC, Class A | | 15,200 |

| 430,008 |

|

New South Resources Ltd.(1) | | 366,758 |

| 442,822 |

|

| Northview Apartment Real Estate Investment Trust | | 17,386 |

| 334,262 |

|

| NSI NV | | 8,563 |

| 338,006 |

|

| QTS Realty Trust, Inc., Class A | | 10,065 |

| 385,691 |

|

| Sabra Health Care REIT, Inc. | | 3,696 |

| 80,018 |

|

Slate Retail REIT(1) | | 38,249 |

| 367,541 |

|

| STAG Industrial, Inc. | | 15,557 |

| 411,638 |

|

| Star Asia Investment Corp. | | 471 |

| 439,130 |

|

| Sunlight Real Estate Investment Trust | | 456,500 |

| 274,763 |

|

| Ventas, Inc. | | 7,800 |

| 452,712 |

|

| VEREIT, Inc. | | 67,502 |

| 494,790 |

|

| Vicinity Centres | | 235,885 |

| 442,661 |

|

| | | | 13,098,303 |

|

| Food Products — 0.9% | | | |

| Hershey Co. (The) | | 11,930 |

| 1,278,300 |

|

| J.M. Smucker Co. (The) | | 12,170 |

| 1,318,254 |

|

| | | | 2,596,554 |

|

| Gas Utilities — 0.4% | | | |

| New Jersey Resources Corp. | | 27,640 |

| 1,246,564 |

|

| Hotels, Restaurants and Leisure — 0.9% | | | |

| Carnival Corp. | | 22,920 |

| 1,284,437 |

|

| Las Vegas Sands Corp. | | 23,910 |

| 1,220,127 |

|

| | | | 2,504,564 |

|

| Household Durables — 0.6% | | | |

| Garmin Ltd. | | 20,280 |

| 1,341,725 |

|

| Whirlpool Corp. | | 4,120 |

| 452,211 |

|

| | | | 1,793,936 |

|

| Industrial Conglomerates — 0.1% | | | |

Toshiba Corp.(1) | | 9,460 |

| 283,377 |

|

IT Services† | | | |

| Travelport Worldwide Ltd. | | 5,667 |

| 84,778 |

|

| Machinery — 0.1% | | | |

| Cummins, Inc. | | 3,110 |

| 425,106 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

Media† | | | |

MDC Partners, Inc., Class A(1) | | 34,004 |

| $ | 83,990 |

|

| Metals and Mining — 0.2% | | | |

| Southern Copper Corp. | | 11,110 |

| 425,957 |

|

| Mortgage Real Estate Investment Trusts (REITs) — 0.8% | | | |

| Apollo Commercial Real Estate Finance, Inc. | | 18,200 |

| 340,522 |

|

| Granite Point Mortgage Trust, Inc. | | 27,667 |

| 514,883 |

|

| MFA Financial, Inc. | | 47,100 |

| 326,403 |

|

| Starwood Property Trust, Inc. | | 26,791 |

| 581,901 |

|

| TPG RE Finance Trust, Inc. | | 25,949 |

| 514,309 |

|

| | | | 2,278,018 |

|

| Multi-Utilities — 0.9% | | | |

| DTE Energy Co. | | 11,350 |

| 1,275,740 |

|

| Public Service Enterprise Group, Inc. | | 23,310 |

| 1,245,453 |

|

| | | | 2,521,193 |

|

| Oil, Gas and Consumable Fuels — 1.1% | | | |

CHC Group LLC (Ordinary Membership Interest)(1) | | 1,954 |

| 15,632 |

|

| Chevron Corp. | | 3,650 |

| 407,523 |

|

| Occidental Petroleum Corp. | | 13,870 |

| 930,261 |

|

| Phillips 66 | | 12,500 |

| 1,285,250 |

|

| Valero Energy Corp. | | 4,580 |

| 417,192 |

|

| | | | 3,055,858 |

|

| Personal Products — 0.2% | | | |

Coty, Inc., Class A(1) | | 40,710 |

| 429,491 |

|

| Pharmaceuticals — 0.6% | | | |

| Bristol-Myers Squibb Co. | | 8,430 |

| 426,052 |

|

| Johnson & Johnson | | 9,330 |

| 1,306,107 |

|

| | | | 1,732,159 |

|

| Real Estate Management and Development — 0.1% | | | |

| VICI Properties, Inc. | | 19,167 |

| 413,816 |

|

| Semiconductors and Semiconductor Equipment — 0.4% | | | |

| Maxim Integrated Products, Inc. | | 25,750 |

| 1,288,015 |

|

| Specialty Retail — 0.2% | | | |

| Penske Automotive Group, Inc. | | 9,860 |

| 437,587 |

|

Trading Companies and Distributors† | | | |

| Aircastle Ltd. | | 5,838 |

| 113,432 |

|

TOTAL COMMON STOCKS

(Cost $45,199,560) | | | 44,799,675 |

|

ASSET-BACKED SECURITIES(2) — 15.3% | | | |

| AmeriCredit Automobile Receivables, Series 2015-4, Class D, 3.72%, 12/8/21 | | $ | 80,000 |

| 80,412 |

|

Avant Loans Funding Trust, Series 2017-B, Class C, 4.99%, 11/15/23(3) | | 500,000 |

| 502,162 |

|

Avant Loans Funding Trust, Series 2018-B, Class A SEQ, 3.42%, 1/18/22(3) | | 1,000,000 |

| 999,492 |

|

| Bear Stearns Asset Backed Securities Trust, Series 2007-2, Class A2, VRN, 2.60%, 11/25/18, resets monthly off the 1-month LIBOR plus 0.32% | | 158,116 |

| 158,078 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

CAL Funding II Ltd., Series 2012-1A, Class A SEQ, 3.47%, 10/25/27(3) | | $ | 706,000 |

| $ | 696,658 |

|

CAL Funding II Ltd., Series 2013-1A, Class A SEQ, 3.35%, 3/27/28(3) | | 203,167 |

| 200,460 |

|

| CarMax Auto Owner Trust, Series 2018-3, Class D, 3.91%, 1/15/25 | | 315,000 |

| 313,261 |

|

| Carmax Auto Owner Trust, Series 2018-4, Class D, 4.15%, 4/15/25 | | 1,000,000 |

| 1,001,358 |

|

CFG Investments Ltd., Series 2017-1, Class A SEQ, 7.87%, 11/15/26(3) | | 1,000,000 |

| 1,022,967 |

|

CFG Investments Ltd., Series 2017-1, Class B, 9.42%, 11/15/26(3) | | 1,000,000 |

| 1,025,778 |

|

CLI Funding V LLC, Series 2013-2A, SEQ, 3.22%, 6/18/28(3) | | 257,885 |

| 252,711 |

|

CLI Funding V LLC, Series 2014-1A, Class A SEQ, 3.29%, 6/18/29(3) | | 776,801 |

| 762,543 |

|

CLI Funding V LLC, Series 2014-2A, Class A SEQ, 3.38%, 10/18/29(3) | | 347,058 |

| 339,980 |

|

Coinstar Funding LLC Series, Series 2017-1A, Class A2 SEQ, 5.22%, 4/25/47(3) | | 492,500 |

| 496,455 |

|

Conn's Receivables Funding LLC, Series 2018-A, Class A SEQ, 3.25%, 1/15/23(3) | | 353,347 |

| 353,364 |

|

Conn's Receivables Funding LLC, Series 2018-A, Class B, 4.65%, 1/15/23(3) | | 800,000 |

| 800,216 |

|

CPS Auto Receivables Trust, Series 2014-C, Class D, 4.83%, 8/17/20(3) | | 250,000 |

| 252,668 |

|

CPS Auto Receivables Trust, Series 2015-C, Class C SEQ, 3.42%, 8/16/21(3) | | 313,815 |

| 314,348 |

|

CPS Auto Receivables Trust, Series 2015-C, Class D SEQ, 4.63%, 8/16/21(3) | | 207,000 |

| 209,650 |

|

CPS Auto Trust, Series 2016-D, Class D SEQ, 4.53%, 1/17/23(3) | | 750,000 |

| 759,323 |

|

Credit Suisse ABS Trust, Series 2018-LD1, Class A SEQ, 3.42%, 7/25/24(3) | | 588,644 |

| 588,443 |

|

Credit Suisse ABS Trust, Series 2018-LD1, Class B, 4.28%, 7/25/24(3) | | 750,000 |

| 749,230 |

|

Cronos Containers Program I Ltd., Series 2013-1A, Class A SEQ, 3.08%, 4/18/28(3) | | 569,250 |

| 559,137 |

|

Drive Auto Receivables Trust, Series 2015-AA, Class D, 4.12%, 7/15/22(3) | | 250,000 |

| 251,429 |

|

| Drive Auto Receivables Trust, Series 2017-2, Class D, 3.49%, 9/15/23 | | 1,000,000 |

| 998,240 |

|

DT Auto Owner Trust, Series 2014-3A, Class D, 4.47%, 11/15/21(3) | | 408,252 |

| 408,484 |

|

DT Auto Owner Trust, Series 2015-2A, Class D, 4.25%, 2/15/22(3) | | 295,415 |

| 296,897 |

|

DT Auto Owner Trust, Series 2016-1A, Class D, 4.66%, 12/15/22(3) | | 1,000,000 |

| 1,008,441 |

|

DT Auto Owner Trust, Series 2016-3A, Class D, 4.52%, 6/15/23(3) | | 400,000 |

| 404,088 |

|

Element Rail Leasing II LLC, Series 2015-1A, Class A2 SEQ, 3.59%, 2/19/45(3) | | 1,225,000 |

| 1,209,016 |

|

Exeter Automobile Receivables Trust, Series 2015-1A, Class C, 4.10%, 12/15/20(3) | | 738,897 |

| 741,683 |

|

Exeter Automobile Receivables Trust, Series 2015-1A, Class D, 5.83%, 12/15/21(3) | | 1,000,000 |

| 1,018,268 |

|

Exeter Automobile Receivables Trust, Series 2016-2A, Class D, 8.25%, 4/17/23(3) | | 1,000,000 |

| 1,060,875 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

Exeter Automobile Receivables Trust, Series 2016-3A, Class D, 6.40%, 7/17/23(3) | | $ | 350,000 |

| $ | 361,364 |

|

Freed Abs Trust, Series 2018-2, Class A SEQ, 3.99%, 10/20/25(3) | | 650,000 |

| 649,213 |

|

Global SC Finance II SRL, Series 2013-1A, Class A SEQ, 2.98%, 4/17/28(3) | | 157,500 |

| 154,500 |

|

Global SC Finance II SRL, Series 2014-1A, Class A2 SEQ, 3.09%, 7/17/29(3) | | 802,125 |

| 782,063 |

|

HERO Funding Trust, Series 2016-4A, Class A2 SEQ, 4.29%, 9/20/47(3) | | 586,792 |

| 593,438 |

|

HERO Funding Trust, Series 2017-2A, Class A2 SEQ, 4.07%, 9/20/48(3) | | 381,525 |

| 383,065 |

|

Hertz Vehicle Financing II LP, Series 2016-1A, Class B, 3.72%, 3/25/20(3) | | 166,000 |

| 166,179 |

|

Hertz Vehicle Financing II LP, Series 2016-2A, Class B, 3.94%, 3/25/22(3) | | 262,800 |

| 261,499 |

|

Hertz Vehicle Financing II LP, Series 2016-2A, Class C, 4.99%, 3/25/22(3) | | 370,000 |

| 371,963 |

|

Hertz Vehicle Financing II LP, Series 2017-2A, Class B, 4.20%, 10/25/23(3) | | 1,475,000 |

| 1,466,444 |

|

Hertz Vehicle Financing II LP, Series 2017-2A, Class C, 5.31%, 10/25/23(3) | | 148,000 |

| 149,776 |

|

Invitation Homes Trust, Series 2018-SFR2, Class D, VRN, 3.73%, 11/17/18, resets monthly off the 1-month LIBOR plus 1.45%(3) | | 1,000,000 |

| 1,000,474 |

|

Invitation Homes Trust, Series 2018-SFR3, Class B, VRN, 3.44%, 11/17/18, resets monthly off the 1-month LIBOR plus 1.15%(3) | | 185,000 |

| 185,897 |

|

Invitation Homes Trust, Series 2018-SFR3, Class C, VRN, 3.59%, 11/17/18, resets monthly off the 1-month LIBOR plus 1.30%(3) | | 370,000 |

| 369,609 |

|

Kabbage Asset Securitization LLC, Series 2017-1, Class A SEQ, 4.57%, 3/15/22(3) | | 1,500,000 |

| 1,508,561 |

|

Kabbage Asset Securitization LLC, Series 2017-1, Class B, 5.79%, 3/15/22(3) | | 800,000 |

| 809,654 |

|

Mariner Finance Issuance Trust, Series 2017-AA, Class C, 6.73%, 2/20/29(3) | | 800,000 |

| 822,220 |

|

Marlette Funding Trust, Series 2017-1A, Class A SEQ, 2.83%, 3/15/24(3) | | 214,925 |

| 214,857 |

|

Marlette Funding Trust, Series 2017-2A, Class C, 4.58%, 7/15/24(3) | | 1,000,000 |

| 1,005,748 |

|

Marlette Funding Trust, Series 2017-3A, Class B, 3.01%, 12/15/24(3) | | 1,000,000 |

| 992,081 |

|

Marlette Funding Trust, Series 2017-3A, Class C, 4.01%, 12/15/24(3) | | 500,000 |

| 498,320 |

|

Marlette Funding Trust, Series 2018-2A, Class C, 4.37%, 7/17/28(3) | | 850,000 |

| 846,760 |

|

OneMain Financial Issuance Trust, Series 2015-1A, Class C, 5.12%, 3/18/26(3) | | 981,000 |

| 991,064 |

|

OneMain Financial Issuance Trust, Series 2016-2A, Class A SEQ, 4.10%, 3/20/28(3) | | 266,074 |

| 267,414 |

|

OneMain Financial Issuance Trust, Series 2016-2A, Class B, 5.94%, 3/20/28(3) | | 1,000,000 |

| 1,018,012 |

|

OneMain Financial Issuance Trust, Series 2016-3A, Class A SEQ, 3.83%, 6/18/31(3) | | 475,000 |

| 472,836 |

|

OneMain Financial Issuance Trust, Series 2017-1A, Class D, 4.52%, 9/14/32(3) | | 2,500,000 |

| 2,450,888 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

Sierra Timeshare Receivables Funding LLC, Series 2014-2A, Class B, 2.40%, 6/20/31(3) | | $ | 52,471 |

| $ | 52,427 |

|

Skopos Auto Receivables Trust, Series 2015-2A, Class B, 5.71%, 2/15/21(3) | | 320,004 |

| 321,617 |

|

Springleaf Funding Trust, Series 2015-AA, Class A SEQ, 3.16%, 11/15/24(3) | | 221,960 |

| 221,938 |

|

Springleaf Funding Trust, Series 2015-AA, Class B, 3.62%, 11/15/24(3) | | 130,000 |

| 129,561 |

|

TAL Advantage V LLC, Series 2014-1A, Class A SEQ, 3.51%, 2/22/39(3) | | 418,667 |

| 413,335 |

|

TAL Advantage V LLC, Series 2014-3A, Class A SEQ, 3.27%, 11/21/39(3) | | 182,500 |

| 178,326 |

|

Triton Container Finance IV LLC, Series 2017-2A, Class A SEQ, 3.62%, 8/20/42(3) | | 894,432 |

| 873,200 |

|

United Auto Credit Securitization Trust, Series 2018-2, Class D, 4.26%, 5/10/23(3) | | 1,000,000 |

| 1,001,518 |

|

Vantage Data Centers Issuer LLC, Series 2018-1A, Class A2 SEQ, 4.07%, 2/16/43(3) | | 1,490,000 |

| 1,487,439 |

|

Vertical Bridge CC LLC, Series 2016-2A, Class A SEQ, 5.19%, 10/15/46(3) | | 978,436 |

| 982,198 |

|

TOTAL ASSET-BACKED SECURITIES

(Cost $44,414,456) | | | 44,291,573 |

|

BANK LOAN OBLIGATIONS(4) — 14.3% | | | |

| Aerospace and Defense — 0.4% | | | |

| Accudyne Industries, LLC, 2017 Term Loan, 5.30%, 8/18/24, resets monthly off the 1-month LIBOR plus 3.00% | | 106,114 |

| 105,868 |

|

| DAE Aviation Holdings, Inc., 1st Lien Term Loan, 6.05%, 7/7/22, resets monthly off the 1-month LIBOR plus 3.75% | | 456,931 |

| 459,152 |

|

| Jazz Acquisition, Inc., 1st Lien Term Loan, 5.89%, 6/19/21, resets quarterly off the 3-month LIBOR plus 3.50% | | 243,545 |

| 237,457 |

|

| Sequa Mezzanine Holdings LLC, 1st Lien Term Loan, 7.41%, 11/28/21, resets quarterly off the 3-month LIBOR plus 5.00% | | 240,898 |

| 238,338 |

|

| Sequa Mezzanine Holdings LLC, 1st Lien Term Loan, 7.39%, 11/28/21, resets quarterly off the 3-month LIBOR plus 5.00% | | 611 |

| 605 |

|

| | | | 1,041,420 |

|

| Air Freight and Logistics — 0.1% | | | |

| EXC Holdings III Corp., EUR 2017 1st Lien Term Loan, 3.50%, 12/2/24, resets quarterly off the 3-month Euribor plus 3.50% | EUR | 19,822 |

| 22,536 |

|

| EXC Holdings III Corp., USD 2017 1st Lien Term Loan, 5.89%, 12/2/24, resets quarterly off the 3-month LIBOR plus 3.50% | | $ | 386,037 |

| 387,967 |

|

| | | | 410,503 |

|

| Chemicals — 0.2% | | | |

| Ascend Performance Materials Operations LLC, Term Loan B, 7.64%, 8/12/22, resets quarterly off the 3-month LIBOR plus 5.25% | | 364,301 |

| 365,895 |

|

| Solenis International, LP, 2018 2nd Lien Term Loan, 10.81%, 6/26/24, resets quarterly off the 3-month LIBOR plus 8.50% | | 250,000 |

| 247,500 |

|

| | | | 613,395 |

|

| Commercial Services and Supplies — 0.6% | | | |

| Asurion LLC, 2017 Term Loan B4, 5.30%, 8/4/22, resets monthly off the 1-month LIBOR plus 3.00% | | 239,641 |

| 240,347 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Asurion LLC, 2018 Term Loan B6, 5.30%, 11/3/23, resets monthly off the 1-month LIBOR plus 3.00% | | $ | 238,695 |

| $ | 239,243 |

|

| Midas Intermediate Holdco II, LLC, Incremental Term Loan B, 5.14%, 8/18/21, resets quarterly off the 3-month LIBOR plus 2.75% | | 173,627 |

| 167,659 |

|

| Prime Security Services Borrower, LLC, 2016 1st Lien Term Loan, 5.05%, 5/2/22, resets monthly off the 1-month LIBOR plus 2.75% | | 125,887 |

| 126,116 |

|

| Sedgwick Claims Management Services, Inc., 1st Lien Term Loan, 5.05%, 3/1/21, resets monthly off the 1-month LIBOR plus 2.75% | | 463,207 |

| 463,679 |

|

| Stiphout Finance LLC, USD 1st Lien Term Loan, 5.30%, 10/26/22, resets monthly off the 1-month LIBOR plus 3.00% | | 74,711 |

| 74,991 |

|

| Syniverse Holdings, Inc., 2018 1st Lien Term Loan, 7.28%, 3/9/23, resets monthly off the 1-month LIBOR plus 5.00% | | 64,406 |

| 64,876 |

|

| TNS, Inc., 2013 Term Loan B, 6.32%, 8/14/22, resets quarterly off the 3-month LIBOR plus 4.00% | | 247,212 |

| 248,655 |

|

| TRC Companies, Inc., Term Loan, 5.80%, 6/21/24, resets monthly off the 1-month LIBOR plus 3.50% | | 94,284 |

| 94,668 |

|

| | | | 1,720,234 |

|

| Communications Equipment — 0.8% | | | |

| AppLovin Corporation, 2018 Term Loan B, 6.06%, 8/15/25, resets quarterly off the 3-month LIBOR plus 3.75% | | 347,553 |

| 351,681 |

|

| Masergy Communications, 2017 1st Lien Term Loan, 5.64%, 12/15/23, resets quarterly off the 3-month LIBOR plus 3.25% | | 404,065 |

| 405,075 |

|

| MH Sub I, LLC, 2017 1st Lien Term Loan, 6.03%, 9/13/24, resets monthly off the 1-month LIBOR plus 3.75% | | 762,786 |

| 766,394 |

|

| Radiate Holdco, LLC, 1st Lien Term Loan, 5.30%, 2/1/24, resets monthly off the 1-month LIBOR plus 3.00% | | 484,144 |

| 481,118 |

|

Tyco Electronics Subsea Communications, Term Loan B, 10/26/25(5) | | 180,297 |

| 179,847 |

|

| | | | 2,184,115 |

|

| Construction and Engineering — 0.1% | | | |

| KBR, Inc., Term Loan B, 6.04%, 4/25/25, resets monthly off the 1-month LIBOR plus 3.75% | | 374,063 |

| 375,465 |

|

| Construction Materials — 0.3% | | | |

| Caelus Energy Alaska O3, LLC, 2nd Lien Term Loan, 9.84%, 4/15/20, resets quarterly off the 3-month LIBOR plus 7.50% | | 176,969 |

| 164,433 |

|

| CPG International Inc., 2017 Term Loan, 6.25%, 5/5/24, resets semi-annually off the 6-month LIBOR plus 3.75% | | 228,668 |

| 229,622 |

|

| Pisces Midco, Inc., 2018 Term Loan, 6.18%, 4/12/25, resets quarterly off the 3-month LIBOR plus 3.75% | | 243,381 |

| 242,900 |

|

U.S. Lumber Group, LLC, 2018 Term Loan B, 9/18/25(5) | | 173,601 |

| 173,384 |

|

| | | | 810,339 |

|

Consumer Finance† | | | |

| ASP MCS Acquisition Corp., Term Loan B, 7.14%, 5/18/24, resets quarterly off the 3-month LIBOR plus 4.75% | | 55,025 |

| 45,809 |

|

| Containers and Packaging — 0.5% | | | |

| BWAY Holding Company, 2017 Term Loan B, 5.66%, 4/3/24, resets quarterly off the 3-month LIBOR plus 3.25% | | 486,493 |

| 484,365 |

|

| BWAY Holding Company, 2017 Term Loan B, 5.66%, 4/3/24, resets quarterly off the 3-month LIBOR plus 3.25% | | 1,235 |

| 1,229 |

|

| Flex Acquisition Company, Inc., 1st Lien Term Loan, 5.26%, 12/29/23, resets quarterly off the 3-month LIBOR plus 3.00% | | 511,739 |

| 511,420 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Verallia Packaging S.A.S., 2018 EUR Term Loan C, 3.25%, 8/29/25, resets monthly off the 1-month Euribor plus 3.25% | EUR | 106,667 |

| $ | 121,317 |

|

| Verallia Packaging S.A.S., EUR Term Loan B4, 2.75%, 10/29/22, resets monthly off the 1-month Euribor plus 2.75% | EUR | 41,842 |

| 47,493 |

|

| Verallia Packaging S.A.S., EUR Term Loan B4, 2.75%, 10/29/22, resets monthly off the 1-month Euribor plus 2.75% | EUR | 120,334 |

| 136,588 |

|

| Verallia Packaging S.A.S., EUR Term Loan B4, 2.75%, 10/29/22, resets monthly off the 1-month Euribor plus 2.75% | EUR | 82,111 |

| 93,202 |

|

| | | | 1,395,614 |

|

| Distributors — 0.3% | | | |

| GOBP Holdings, Inc., 1st Lien Term Loan, 6.03%, 10/18/25, resets quarterly off the 3-month LIBOR plus 3.75% | | $ | 163,246 |

| 163,246 |

|

| IRB Holding Corp, 1st Lien Term Loan, 5.46%, 2/5/25, resets bi-monthly off the 2-month LIBOR plus 3.25% | | 160,627 |

| 160,493 |

|

IRB Holding Corp, 1st Lien Term Loan, 2/5/25(5) | | 286,725 |

| 286,485 |

|

| Polyconcept Investments B.V., USD 2016 Term Loan B, 6.05%, 8/16/23, resets monthly off the 1-month LIBOR plus 3.75% | | 298,019 |

| 299,509 |

|

| | | | 909,733 |

|

| Diversified Consumer Services — 0.1% | | | |

| Financiere Dry Mix Solutions S.A.S., EUR 1st Lien Term Loan, 3.50%, 3/8/24, resets quarterly off the 3-month Euribor plus 3.50% | EUR | 32,595 |

| 37,106 |

|

| Financiere Dry Mix Solutions S.A.S., EUR 1st Lien Term Loan, 3.50%, 3/8/24, resets quarterly off the 3-month Euribor plus 3.50% | EUR | 28,521 |

| 32,467 |

|

| Financiere Dry Mix Solutions S.A.S., EUR 1st Lien Term Loan, 3.50%, 3/8/24, resets quarterly off the 3-month Euribor plus 3.50% | EUR | 79,857 |

| 90,909 |

|

| Moran Foods LLC, Term Loan, 8.30%, 12/5/23, resets monthly off the 1-month LIBOR plus 6.00% | | $ | 130,276 |

| 93,753 |

|

| | | | 254,235 |

|

| Diversified Financial Services — 0.5% | | | |

| AqGen Ascensus, Inc., 2017 Repriced Term Loan, 5.89%, 12/3/22, resets quarterly off the 3-month LIBOR plus 3.50% | | 135,088 |

| 135,341 |

|

| Camelot UK Holdco Limited, 2017 Repriced Term Loan, 5.55%, 10/3/23, resets monthly off the 1-month LIBOR plus 3.25% | | 5,777 |

| 5,784 |

|

| Camelot UK Holdco Limited, 2017 Repriced Term Loan, 5.55%, 10/3/23, resets monthly off the 1-month LIBOR plus 3.25% | | 144,272 |

| 144,453 |

|

| Camelot UK Holdco Limited, 2017 Repriced Term Loan, 5.55%, 10/3/23, resets monthly off the 1-month LIBOR plus 3.25% | | 82,165 |

| 82,268 |

|

| Camelot UK Holdco Limited, 2017 Repriced Term Loan, 5.55%, 10/3/23, resets monthly off the 1-month LIBOR plus 3.25% | | 11,394 |

| 11,408 |

|

| Genuine Financial Holdings, LLC, 2018 1st Lien Term Loan, 6.14%, 7/12/25, resets quarterly off the 3-month LIBOR plus 3.75% | | 500,000 |

| 502,033 |

|

| Hub International Limited, 2018 Term Loan B, 5.49%, 4/25/25, resets quarterly off the 3-month LIBOR plus 3.00% | | 497,500 |

| 496,721 |

|

| Hub International Limited, 2018 Term Loan B, 5.36%, 4/25/25, resets quarterly off the 3-month LIBOR plus 3.00% | | 1,250 |

| 1,248 |

|

| | | | 1,379,256 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Diversified Telecommunication Services — 1.2% | | | |

| CenturyLink, Inc., 2017 Term Loan B, 5.05%, 1/31/25, resets monthly off the 1-month LIBOR plus 2.75% | | $ | 468,342 |

| $ | 463,951 |

|

| Frontier Communications Corp., 2017 Term Loan B1, 6.06%, 6/15/24, resets monthly off the 1-month LIBOR plus 3.75% | | 480,277 |

| 466,348 |

|

| Hargray Communications Group, Inc., 2017 Term Loan B, 5.30%, 5/16/24, resets monthly off the 1-month LIBOR plus 3.00% | | 458,798 |

| 458,970 |

|

| Intelsat Jackson Holdings S.A., 2017 Term Loan B4, 6.79%, 1/2/24, resets monthly off the 1-month LIBOR plus 4.50% | | 99,619 |

| 103,853 |

|

| Intelsat Jackson Holdings S.A., 2017 Term Loan B5, 6.625%, 1/2/24 | | 326,455 |

| 335,897 |

|

| Sprint Communications, Inc., 1st Lien Term Loan B, 4.81%, 2/2/24, resets monthly off the 1-month LIBOR plus 2.50% | | 266,739 |

| 266,947 |

|

| TDC A/S, EUR Term Loan, 3.50%, 5/31/25, resets monthly off the 1-month Euribor plus 3.50% | EUR | 498,125 |

| 567,976 |

|

| Telesat Canada, Term Loan B4, 4.89%, 11/17/23, resets quarterly off the 3-month LIBOR plus 2.50% | | $ | 196,809 |

| 197,252 |

|

| Windstream Services, LLC, Repriced Term Loan B6, 6.29%, 3/29/21, resets monthly off the 1-month LIBOR plus 4.00% | | 576,908 |

| 542,911 |

|

| Windstream Services, LLC, Term Loan B7, 5.54%, 2/17/24, resets monthly off the 1-month LIBOR plus 3.25% | | 52,388 |

| 45,785 |

|

| | | | 3,449,890 |

|

| Electric Utilities — 0.2% | | | |

| Compass Power Generation LLC, 2018 Term Loan B, 5.80%, 12/20/24, resets monthly off the 1-month LIBOR plus 3.50% | | 127,580 |

| 128,633 |

|

| Gamma Infrastructure III B.V., EUR 1st Lien Term Loan B, 3.50%, 1/9/25, resets quarterly off the 3-month Euribor plus 3.50% | EUR | 163,587 |

| 186,137 |

|

| Research Now Group, Inc., 2017 1st Lien Term Loan, 7.80%, 12/20/24, resets monthly off the 1-month LIBOR plus 5.50% | | $ | 293,330 |

| 294,920 |

|

Resideo Funding Inc., Term Loan B, 10/24/25(5) | | 58,955 |

| 59,213 |

|

| | | | 668,903 |

|

| Energy Equipment and Services — 0.1% | | | |

Grizzly Acquisitions Inc., 2018 Term Loan B, 10/1/25(5) | | 242,809 |

| 244,302 |

|

| Entertainment — 0.4% | | | |

| CSC Holdings, LLC, 2017 1st Lien Term Loan, 4.53%, 7/17/25, resets monthly off the 1-month LIBOR plus 2.25% | | 193,613 |

| 193,440 |

|

| Technicolor SA, EUR Term Loan B, 3.50%, 12/6/23, resets quarterly off the 3-month Euribor plus 3.50% | EUR | 486,161 |

| 524,151 |

|

| William Morris Endeavor Entertainment, LLC, 2018 1st Lien Term Loan, 5.28%, 5/18/25, resets quarterly off the 3-month LIBOR plus 2.75% | | $ | 465,253 |

| 465,253 |

|

| William Morris Endeavor Entertainment, LLC, 2018 1st Lien Term Loan, 5.15%, 5/18/25, resets bi-monthly off the 2-month LIBOR plus 2.75% | | 107 |

| 107 |

|

| William Morris Endeavor Entertainment, LLC, 2018 1st Lien Term Loan, 5.15%, 5/18/25, resets bi-monthly off the 2-month LIBOR plus 2.75% | | 1,169 |

| 1,169 |

|

| William Morris Endeavor Entertainment, LLC, 2018 1st Lien Term Loan, 5.28%, 5/18/25, resets quarterly off the 3-month LIBOR plus 2.75% | | 42,472 |

| 42,472 |

|

| | | | 1,226,592 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Equity Real Estate Investment Trusts (REITs) — 0.1% | | | |

| Communications Sales & Leasing, Inc., 2017 Term Loan B, 5.30%, 10/24/22, resets monthly off the 1-month LIBOR plus 3.00% | | $ | 218,667 |

| $ | 207,351 |

|

| Food and Staples Retailing — 0.1% | | | |

Albertsons, LLC, Term Loan B7, 10/29/25(5) | | 200,496 |

| 199,202 |

|

| Hearthside Food Solutions, LLC, 2018 Term Loan B, 5.30%, 5/23/25, resets monthly off the 1-month LIBOR plus 3.00% | | 177,851 |

| 175,072 |

|

| | | | 374,274 |

|

| Health Care Providers and Services — 0.9% | | | |

Auris Luxembourg III S.a.r.l., 2018 EUR Term Loan B, 7/20/25(5) | EUR | 464,170 |

| 531,494 |

|

| BioClinica, Inc., 1st Lien Term Loan, 6.75%, 10/20/23, resets quarterly off the 3-month LIBOR plus 4.25% | | $ | 62,033 |

| 59,086 |

|

| BioClinica, Inc., 1st Lien Term Loan, 6.625%, 10/20/23, resets quarterly off the 3-month LIBOR plus 4.25% | | 316 |

| 301 |

|

| BioClinica, Inc., 1st Lien Term Loan, 6.625%, 10/20/23, resets quarterly off the 3-month LIBOR plus 4.25% | | 475 |

| 452 |

|

| BioClinica, Inc., 1st Lien Term Loan, 6.75%, 10/20/23, resets quarterly off the 3-month LIBOR plus 4.25% | | 31,017 |

| 29,543 |

|

| BioClinica, Inc., 1st Lien Term Loan, 6.75%, 10/20/23, resets quarterly off the 3-month LIBOR plus 4.25% | | 201,607 |

| 192,031 |

|

| BioClinica, Inc., 1st Lien Term Loan, 6.75%, 10/20/23, resets quarterly off the 3-month LIBOR plus 4.25% | | 15,508 |

| 14,772 |

|

| Concentra Inc., 2018 1st Lien Term Loan, 5.03%, 6/1/22, resets monthly off the 1-month LIBOR plus 2.75% | | 131,746 |

| 132,212 |

|

| Jaguar Holding Company II, 2018 Term Loan, 4.80%, 8/18/22, resets monthly off the 1-month LIBOR plus 2.50% | | 667,865 |

| 666,697 |

|

| nThrive, Inc., 2016 1st Lien Term Loan, 6.80%, 10/20/22, resets monthly off the 1-month LIBOR plus 4.50% | | 241,933 |

| 243,294 |

|

| Team Health Holdings, Inc., 1st Lien Term Loan, 5.05%, 2/6/24, resets monthly off the 1-month LIBOR plus 2.75% | | 93,815 |

| 89,007 |

|

| Tecomet Inc., 2017 Repriced Term Loan, 5.78%, 5/1/24, resets monthly off the 1-month LIBOR plus 3.50% | | 95,982 |

| 96,202 |

|

| Wink Holdco, Inc., 1st Lien Term Loan B, 5.30%, 12/2/24, resets monthly off the 1-month LIBOR plus 3.00% | | 498,119 |

| 497,372 |

|

| | | | 2,552,463 |

|

| Hotels, Restaurants and Leisure — 0.2% | | | |

| 1011778 B.C. Unlimited Liability Company, Term Loan B3, 4.55%, 2/16/24, resets monthly off the 1-month LIBOR plus 2.25% | | 81,507 |

| 81,293 |

|

| 1011778 B.C. Unlimited Liability Company, Term Loan B3, 4.55%, 2/16/24, resets monthly off the 1-month LIBOR plus 2.25% | | 100,437 |

| 100,173 |

|

| NPC International, Inc., 1st Lien Term Loan, 5.80%, 4/19/24, resets monthly off the 1-month LIBOR plus 3.50% | | 108,017 |

| 108,571 |

|

| Scientific Games International, Inc., 2018 Term Loan B5, 5.04%, 8/14/24, resets bi-monthly off the 2-month LIBOR plus 2.75% | | 130,850 |

| 129,764 |

|

| Scientific Games International, Inc., 2018 Term Loan B5, 5.05%, 8/14/24, resets monthly off the 1-month LIBOR plus 2.75% | | 31,213 |

| 30,954 |

|

| | | | 450,755 |

|

| Household Durables — 0.2% | | | |

| Wilsonart LLC, 2017 Term Loan B, 5.64%, 12/19/23, resets quarterly off the 3-month LIBOR plus 3.25% | | 498,737 |

| 499,049 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Industrial Conglomerates — 0.1% | | | |

Ammeraal Beltech Holding B.V., 2018 EUR 1st Lien Term Loan B, 9/26/25(5) | EUR | 142,683 |

| $ | 163,327 |

|

| Gates Global LLC, 2017 USD Repriced Term Loan B, 5.05%, 4/1/24, resets monthly off the 1-month LIBOR plus 2.75% | | $ | 243,142 |

| 243,805 |

|

| | | | 407,132 |

|

| Insurance — 0.2% | | | |

| Alliant Holdings I, Inc., 2018 Term Loan B, 5.28%, 5/9/25, resets monthly off the 1-month LIBOR plus 3.00% | | 498,750 |

| 499,062 |

|

| Genworth Holdings, Inc., Term Loan, 6.83%, 3/7/23, resets bi-monthly off the 2-month LIBOR plus 4.50% | | 43,258 |

| 44,231 |

|

| | | | 543,293 |

|

| IT Services — 0.9% | | | |

| Ancestry.com Operations Inc., 2017 1st Lien Term Loan, 5.55%, 10/19/23, resets monthly off the 1-month LIBOR plus 3.25% | | 438,967 |

| 441,271 |

|

| Everest Bidco S.A.S., 2018 EUR Term Loan, 4.00%, 7/4/25, resets quarterly off the 3-month Euribor plus 4.00% | EUR | 265,332 |

| 302,407 |

|

| First Data Corporation, 2017 USD Term Loan, 4.29%, 7/8/22, resets monthly off the 1-month LIBOR plus 2.00% | | $ | 383,365 |

| 382,528 |

|

| First Data Corporation, 2024 USD Term Loan, 4.29%, 4/26/24, resets monthly off the 1-month LIBOR plus 2.00% | | 322,908 |

| 321,529 |

|

| GTT Communications, Inc., 2018 EUR Term Loan, 3.25%, 5/31/25, resets monthly off the 1-month Euribor plus 3.25% | EUR | 371,253 |

| 418,749 |

|

| Netsmart Technologies, Inc., Term Loan D1, 6.05%, 4/19/23, resets monthly off the 1-month LIBOR plus 3.75% | | $ | 348,984 |

| 351,389 |

|

| Rackspace Hosting, Inc., 2017 Incremental 1st Lien Term Loan, 5.35%, 11/3/23, resets quarterly off the 3-month LIBOR plus 3.00% | | 288,380 |

| 280,510 |

|

| Travelport Finance (Luxembourg) S.a.r.l., 2018 Term Loan B, 4.81%, 3/17/25, resets quarterly off the 3-month LIBOR plus 2.50% | | 182,984 |

| 183,003 |

|

| | | | 2,681,386 |

|

| Life Sciences Tools and Services — 0.2% | | | |

| Parexel International Corporation, Term Loan B, 5.05%, 9/27/24, resets monthly off the 1-month LIBOR plus 2.75% | | 542,444 |

| 535,751 |

|

| Syneos Health, Inc., 2018 Term Loan B, 4.30%, 8/1/24, resets monthly off the 1-month LIBOR plus 2.00% | | 66,317 |

| 66,244 |

|

| Syneos Health, Inc., 2018 Term Loan B, 4.30%, 8/1/24, resets monthly off the 1-month LIBOR plus 2.00% | | 15,245 |

| 15,228 |

|

| Syneos Health, Inc., 2018 Term Loan B, 4.30%, 8/1/24, resets monthly off the 1-month LIBOR plus 2.00% | | 78,395 |

| 78,308 |

|

| | | | 695,531 |

|

| Machinery — 0.7% | | | |

AL Alpine AT Bidco GmbH, 2018 EUR Term Loan B, 9/30/25(5) | EUR | 210,729 |

| 240,109 |

|

AL Alpine AT Bidco GmbH, 2018 Term Loan B, 9/30/25(5) | | $ | 47,621 |

| 47,740 |

|

| Altra Industrial Motion Corp., 2018 Term Loan B, 4.30%, 10/1/25, resets monthly off the 1-month LIBOR plus 2.00% | | 93,367 |

| 93,464 |

|

| DXP Enterprises, Inc., 2017 Term Loan B, 7.05%, 8/29/23, resets monthly off the 1-month LIBOR plus 4.75% | | 66,483 |

| 67,107 |

|

| Filtration Group Corporation, 2018 EUR Term Loan, 3.50%, 3/29/25, resets quarterly off the 3-month Euribor plus 3.50% | EUR | 208,857 |

| 238,890 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Hayward Industries, Inc., 1st Lien Term Loan, 5.79%, 8/5/24, resets monthly off the 1-month LIBOR plus 3.50% | | $ | 498,741 |

| $ | 500,145 |

|

| Pro Mach Group, Inc., 2018 Term Loan B, 5.28%, 3/7/25, resets quarterly off the 3-month LIBOR plus 3.00% | | 498,747 |

| 497,936 |

|

| Titan Acquisition Limited, 2018 Term Loan B, 5.30%, 3/28/25, resets monthly off the 1-month LIBOR plus 3.00% | | 351,313 |

| 332,116 |

|

| | | | 2,017,507 |

|

| Media — 0.7% | | | |

| Acosta Holdco, Inc., 2015 Term Loan, 5.55%, 9/26/21, resets monthly off the 1-month LIBOR plus 3.25% | | 128,682 |

| 95,926 |

|

| Advantage Sales & Marketing, Inc., 2014 1st Lien Term Loan, 5.55%, 7/23/21, resets monthly off the 1-month LIBOR plus 3.25% | | 707 |

| 646 |

|

| Advantage Sales & Marketing, Inc., 2014 1st Lien Term Loan, 5.55%, 7/23/21, resets monthly off the 1-month LIBOR plus 3.25% | | 270,758 |

| 247,406 |

|

| Checkout Holding Corp., 1st Lien Term Loan, 5.81%, 4/9/21, resets quarterly off the 3-month LIBOR plus 3.50% | | 350,549 |

| 133,209 |

|

| Getty Images, Inc., Term Loan B, 5.80%, 10/18/19, resets monthly off the 1-month LIBOR plus 3.50% | | 425,701 |

| 421,599 |

|

| National CineMedia, LLC, 2018 Term Loan B, 5.31%, 6/20/25, resets monthly off the 1-month LIBOR plus 3.00% | | 41,278 |

| 41,343 |

|

| Recorded Books Inc., 2018 Term Loan B, 6.89%, 8/9/25, resets quarterly off the 3-month LIBOR plus 4.50% | | 92,690 |

| 93,732 |

|

| Unitymedia Finance LLC, Term Loan B, 4.53%, 9/30/25, resets monthly off the 1-month LIBOR plus 2.25% | | 189,923 |

| 189,936 |

|

| Unitymedia Hessen GmbH & Co. KG, EUR Term Loan C, 2.75%, 1/15/27, resets semi-annually off the 6-month Euribor plus 2.75% | EUR | 98,508 |

| 112,278 |

|

| Virgin Media Bristol LLC, Term Loan K, 4.78%, 1/15/26, resets monthly off the 1-month LIBOR plus 2.50% | | $ | 193,885 |

| 193,945 |

|

| Ziggo Secured Finance BV, EUR Term Loan F, 3.00%, 4/15/25, resets semi-annually off the 6-month Euribor plus 3.00% | EUR | 370,632 |

| 419,897 |

|

| | | | 1,949,917 |

|

| Metals and Mining — 0.4% | | | |

| LTI Holdings, Inc., 2018 2nd Lien Term Loan, 9.05%, 9/6/26, resets monthly off the 1-month LIBOR plus 6.75% | | $ | 16,985 |

| 16,953 |

|

| LTI Holdings, Inc., 2018 Add On 1st Lien Term Loan, 5.80%, 9/6/25, resets monthly off the 1-month LIBOR plus 3.50% | | 233,463 |

| 233,536 |

|

| TurboCombustor Technology, Inc., New Term Loan B, 6.80%, 12/2/20, resets monthly off the 1-month LIBOR plus 4.50% | | 432,644 |

| 420,747 |

|

| WireCo WorldGroup, Inc., 1st Lien Term Loan, 7.30%, 9/30/23, resets monthly off the 1-month LIBOR plus 5.00% | | 254,719 |

| 257,266 |

|

| WireCo WorldGroup, Inc., 2016 2nd Lien Term Loan, 11.30%, 9/30/24, resets monthly off the 1-month LIBOR plus 9.00% | | 250,000 |

| 252,500 |

|

| | | | 1,181,002 |

|

| Oil, Gas and Consumable Fuels — 0.4% | | | |

| BCP Renaissance Parent LLC, 2017 Term Loan B, 6.03%, 10/31/24, resets quarterly off the 3-month LIBOR plus 3.50% | | 72,392 |

| 72,754 |

|

| Keane Group Holdings, LLC, 2018 1st Lien Term Loan, 6.06%, 5/25/25, resets monthly off the 1-month LIBOR plus 3.75% | | 94,419 |

| 92,531 |

|

| Murray Energy Corporation, 2018 Term Loan B2, 9.78%, 10/17/22, resets quarterly off the 3-month LIBOR plus 7.25% | | 874,640 |

| 788,453 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Traverse Midstream Partners LLC, 2017 Term Loan, 6.60%, 9/27/24, resets semi-annually off the 6-month LIBOR plus 4.00% | | $ | 44,603 |

| $ | 44,958 |

|

| Ultra Resources, Inc., 1st Lien Term Loan, 5.47%, 4/12/24, resets quarterly off the 3-month LIBOR plus 3.00% | | 218,750 |

| 205,703 |

|

| | | | 1,204,399 |

|

| Personal Products — 0.1% | | | |

| KIK Custom Products, Inc., 2015 Term Loan B, 6.30%, 5/15/23, resets monthly off the 1-month LIBOR plus 4.00% | | 80,238 |

| 79,285 |

|

| KIK Custom Products, Inc., 2015 Term Loan B, 6.30%, 5/15/23, resets monthly off the 1-month LIBOR plus 4.00% | | 142,978 |

| 141,280 |

|

| KIK Custom Products, Inc., 2015 Term Loan B, 6.30%, 5/15/23, resets monthly off the 1-month LIBOR plus 4.00% | | 99,491 |

| 98,310 |

|

| KIK Custom Products, Inc., 2015 Term Loan B, 6.30%, 5/15/23, resets monthly off the 1-month LIBOR plus 4.00% | | 46,137 |

| 45,589 |

|

| | | | 364,464 |

|

| Pharmaceuticals — 0.4% | | | |

| Packaging Coordinators Midco, Inc., 1st Lien Term Loan, 6.39%, 6/30/23, resets quarterly off the 3-month LIBOR plus 4.00% | | 471,977 |

| 473,306 |

|

| U.S. Anesthesia Partners, Inc., 2017 Term Loan, 5.30%, 6/23/24, resets monthly off the 1-month LIBOR plus 3.00% | | 658,684 |

| 659,711 |

|

| | | | 1,133,017 |

|

| Real Estate Management and Development — 0.1% | | | |

| Brookfield WEC Holdings Inc., 2018 1st Lien Term Loan, 6.05%, 8/1/25, resets monthly off the 1-month LIBOR plus 3.75% | | 238,092 |

| 239,895 |

|

| Brookfield WEC Holdings Inc., 2018 2nd Lien Term Loan, 9.05%, 8/3/26, resets monthly off the 1-month LIBOR plus 6.75% | | 66,166 |

| 67,373 |

|

| Capital Automotive L.P., 2017 2nd Lien Term Loan, 8.31%, 3/24/25, resets monthly off the 1-month LIBOR plus 6.00% | | 44,238 |

| 45,068 |

|

| | | | 352,336 |

|

| Semiconductors and Semiconductor Equipment — 0.1% | | | |

| Microchip Technology Incorporated, 2018 Term Loan B, 4.31%, 5/29/25, resets monthly off the 1-month LIBOR plus 2.00% | | 178,655 |

| 178,253 |

|

| Software — 1.7% | | | |

| Autodata, Inc., 1st Lien Term Loan, 5.55%, 12/13/24, resets monthly off the 1-month LIBOR plus 3.25% | | 360,999 |

| 360,999 |

|

| Compuware Corporation, 2018 Term Loan B, 5.79%, 8/22/25, resets monthly off the 1-month LIBOR plus 3.50% | | 52,509 |

| 53,012 |

|

| Epicor Software Corporation, 1st Lien Term Loan, 5.56%, 6/1/22, resets monthly off the 1-month LIBOR plus 3.25% | | 508,209 |

| 510,155 |

|

| Kronos, Incorporated, 2017 Term Loan B, 5.34%, 11/1/23, resets quarterly off the 3-month LIBOR plus 3.00% | | 497,500 |

| 498,938 |

|

| Mavenir Systems, Inc., 2018 Term Loan B, 8.28%, 5/8/25, resets monthly off the 1-month LIBOR plus 6.00% | | 212,644 |

| 213,973 |

|

| Press Ganey Holdings, Inc., 2018 1st Lien Term Loan, 5.05%, 10/23/23, resets monthly off the 1-month LIBOR plus 2.75% | | 405,252 |

| 406,265 |

|

| Project Alpha Intermediate Holding, Inc., 2017 Term Loan B, 5.94%, 4/26/24, resets quarterly off the 3-month LIBOR plus 3.50% | | 273,661 |

| 272,977 |

|

| Quest Software US Holdings Inc., 2018 1st Lien Term Loan, 6.78%, 5/16/25, resets quarterly off the 3-month LIBOR plus 4.25% | | 28,609 |

| 28,779 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| Quest Software US Holdings Inc., 2018 1st Lien Term Loan, 6.78%, 5/16/25, resets quarterly off the 3-month LIBOR plus 4.25% | | $ | 82,250 |

| $ | 82,738 |

|

| Quest Software US Holdings Inc., 2018 1st Lien Term Loan, 6.78%, 5/16/25, resets quarterly off the 3-month LIBOR plus 4.25% | | 87,176 |

| 87,694 |

|

| RP Crown Parent, LLC, 2016 Term Loan B, 5.05%, 10/12/23, resets monthly off the 1-month LIBOR plus 2.75% | | 245,781 |

| 245,719 |

|

| Salient CRGT, Inc., 2017 Term Loan, 8.05%, 2/25/22, resets monthly off the 1-month LIBOR plus 5.75% | | 104,011 |

| 104,791 |

|

| SolarWinds Holdings, Inc., 2018 Term Loan B, 5.30%, 2/5/24, resets monthly off the 1-month LIBOR plus 3.00% | | 843,074 |

| 846,003 |

|

| Sophia, L.P., 2017 Term Loan B, 5.64%, 9/30/22, resets quarterly off the 3-month LIBOR plus 3.25% | | 739,601 |

| 742,067 |

|

| STG-Fairway Acquisitions, Inc., 2015 1st Lien Term Loan, 7.78%, 6/30/22, resets quarterly off the 3-month LIBOR plus 5.25% | | 491,348 |

| 491,756 |

|

| Weld North Education, LLC, Term Loan B, 6.64%, 2/7/25, resets quarterly off the 3-month LIBOR plus 4.25% | | 107,746 |

| 108,150 |

|

| | | | 5,054,016 |

|

| Specialty Retail — 0.4% | | | |

| Eyemart Express LLC, 2017 Term Loan B, 5.31%, 8/4/24, resets monthly off the 1-month LIBOR plus 3.00% | | 248,744 |

| 249,417 |

|

| Harbor Freight Tools USA, Inc., 2018 Term Loan B, 4.80%, 8/18/23, resets monthly off the 1-month LIBOR plus 2.50% | | 509,502 |

| 502,114 |

|

| National Vision, Inc., 2017 Repriced Term Loan, 4.80%, 11/20/24, resets monthly off the 1-month LIBOR plus 2.50% | | 267,589 |

| 269,052 |

|

| | | | 1,020,583 |

|

| Technology Hardware, Storage and Peripherals — 0.3% | | | |

| Dell International LLC, 2017 Term Loan A2, 4.06%, 9/7/21, resets monthly off the 1-month LIBOR plus 1.75% | | 92,595 |

| 92,576 |

|

| Dynatrace LLC, 2018 1st Lien Term Loan, 5.55%, 8/22/25, resets monthly off the 1-month LIBOR plus 3.25% | | 89,074 |

| 89,760 |

|

| Optiv Security, Inc., 1st Lien Term Loan, 5.55%, 2/1/24, resets monthly off the 1-month LIBOR plus 3.25% | | 142,286 |

| 138,507 |

|

| Tempo Acquisition LLC, Term Loan, 5.30%, 5/1/24, resets monthly off the 1-month LIBOR plus 3.00% | | 535,075 |

| 536,145 |

|

| | | | 856,988 |

|

| Textiles, Apparel and Luxury Goods — 0.1% | | | |

| Ascena Retail Group, Inc., 2015 Term Loan B, 6.81%, 8/21/22, resets monthly off the 1-month LIBOR plus 4.50% | | 277,454 |

| 269,894 |

|

Trading Companies and Distributors† | | | |

| Oxbow Carbon LLC, 2017 1st Lien Term Loan B, 5.80%, 1/4/23, resets monthly off the 1-month LIBOR plus 3.50% | | 42,830 |

| 43,223 |

|

| Transportation Infrastructure — 0.1% | | | |

| Savage Enterprises LLC, 2018 1st Lien Term Loan B, 6.77%, 8/1/25, resets monthly off the 1-month LIBOR plus 4.50% | | 344,974 |

| 348,423 |

|

| Wireless Telecommunication Services — 0.1% | | | |

| WP CPP Holdings, LLC, 2018 Term Loan, 6.28%, 4/30/25, resets quarterly off the 3-month LIBOR plus 3.75% | | 275,339 |

| 276,773 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

| WP CPP Holdings, LLC, 2018 Term Loan, 6.05%, 4/30/25, resets monthly off the 1-month LIBOR plus 3.75% | | $ | 690 |

| $ | 694 |

|

| | | | 277,467 |

|

TOTAL BANK LOAN OBLIGATIONS

(Cost $41,750,281) | | | 41,392,528 |

|

| EXCHANGE-TRADED FUNDS — 11.3% | | | |

| Energy Select Sector SPDR Fund | | 110,395 |

| 7,414,128 |

|

| iShares Global Financials ETF | | 101,976 |

| 6,328,631 |

|

| iShares Global Infrastructure ETF | | 118,740 |

| 4,816,095 |

|

| iShares International Select Dividend ETF | | 156,118 |

| 4,797,506 |

|

| iShares Mortgage Real Estate ETF | | 60,738 |

| 2,592,905 |

|

| SPDR Bloomberg Barclays Emerging Markets Local Bond ETF | | 110,447 |

| 2,870,517 |

|

| VanEck Vectors J.P. Morgan EM Local Currency Bond ETF | | 116,312 |

| 3,752,225 |

|

TOTAL EXCHANGE-TRADED FUNDS

(Cost $32,121,372) | | | 32,572,007 |

|

| CORPORATE BONDS — 11.0% | | | |

| Aerospace and Defense — 0.3% | | | |

BBA US Holdings, Inc., 5.375%, 5/1/26(3) | | $ | 49,000 |

| 48,571 |

|

BWX Technologies, Inc., 5.375%, 7/15/26(3) | | 189,000 |

| 189,945 |

|

Pioneer Holdings LLC / Pioneer Finance Corp., 9.00%, 11/1/22(3) | | 327,000 |

| 335,175 |

|

Pisces Midco, Inc., 8.00%, 4/15/26(3) | | 66,000 |

| 64,350 |

|

| TransDigm, Inc., 6.50%, 7/15/24 | | 77,000 |

| 78,027 |

|

| TransDigm, Inc., 6.50%, 5/15/25 | | 72,000 |

| 71,910 |

|

| TransDigm, Inc., 6.375%, 6/15/26 | | 82,000 |

| 80,565 |

|

| | | | 868,543 |

|

| Air Freight and Logistics — 0.3% | | | |

Avolon Holdings Funding Ltd., 5.50%, 1/15/23(3) | | 66,000 |

| 65,835 |

|

Avolon Holdings Funding Ltd., 5.125%, 10/1/23(3) | | 165,000 |

| 162,319 |

|

Wabash National Corp., 5.50%, 10/1/25(3) | | 219,000 |

| 197,647 |

|

XPO Logistics, Inc., 6.50%, 6/15/22(3) | | 563,000 |

| 579,186 |

|

| | | | 1,004,987 |

|

| Airlines — 0.2% | | | |

| United Continental Holdings, Inc., 5.00%, 2/1/24 | | 522,000 |

| 514,170 |

|

| Commercial Services and Supplies — 0.6% | | | |

APTIM Corp., 7.75%, 6/15/25(3) | | 315,000 |

| 260,662 |

|

Iron Mountain, Inc., 5.25%, 3/15/28(3) | | 240,000 |

| 216,600 |

|

KAR Auction Services, Inc., 5.125%, 6/1/25(3) | | 440,000 |

| 418,000 |

|

Midas Intermediate Holdco II LLC / Midas Intermediate Holdco II Finance, Inc., 7.875%, 10/1/22(3) | | 344,000 |

| 305,300 |

|

Prime Security Services Borrower LLC / Prime Finance, Inc., 9.25%, 5/15/23(3) | | 443,000 |

| 469,226 |

|

Ritchie Bros Auctioneers, Inc., 5.375%, 1/15/25(3) | | 114,000 |

| 112,860 |

|

ServiceMaster Co. LLC (The), 5.125%, 11/15/24(3) | | 120,000 |

| 115,800 |

|

| | | | 1,898,448 |

|

| Communications Equipment — 0.3% | | | |

ViaSat, Inc., 5.625%, 9/15/25(3) | | 212,000 |

| 197,425 |

|

| Zayo Group LLC / Zayo Capital, Inc., 6.375%, 5/15/25 | | 573,000 |

| 588,041 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

Zayo Group LLC / Zayo Capital, Inc., 5.75%, 1/15/27(3) | | $ | 32,000 |

| $ | 31,447 |

|

| | | | 816,913 |

|

| Construction and Engineering — 0.4% | | | |

| AECOM, 5.125%, 3/15/27 | | 760,000 |

| 710,600 |

|

New Enterprise Stone & Lime Co., Inc., 6.25%, 3/15/26(3) | | 212,000 |

| 207,230 |

|

| SBA Communications Corp., 4.875%, 7/15/22 | | 126,000 |

| 125,685 |

|

| | | | 1,043,515 |

|

| Construction Materials — 0.3% | | | |

CPG Merger Sub LLC, 8.00%, 10/1/21(3) | | 518,000 |

| 520,590 |

|

Summit Materials LLC / Summit Materials Finance Corp., 5.125%, 6/1/25(3) | | 556,000 |

| 499,010 |

|

| | | | 1,019,600 |

|

| Consumer Finance — 0.1% | | | |

Park Aerospace Holdings Ltd., 5.25%, 8/15/22(3) | | 102,000 |

| 101,617 |

|

Park Aerospace Holdings Ltd., 5.50%, 2/15/24(3) | | 69,000 |

| 68,500 |

|

| | | | 170,117 |

|

| Containers and Packaging — 0.6% | | | |

Ardagh Packaging Finance plc / Ardagh Holdings USA, Inc., 6.00%, 2/15/25(3) | | 750,000 |

| 705,000 |

|

BWAY Holding Co., 7.25%, 4/15/25(3) | | 270,000 |

| 256,500 |

|

Multi-Color Corp., 4.875%, 11/1/25(3) | | 450,000 |

| 412,875 |

|

| Silgan Holdings, Inc., 3.25%, 3/15/25 | EUR | 105,000 |

| 121,862 |

|

W/S Packaging Holdings, Inc., 9.00%, 4/15/23(3) | | $ | 250,000 |

| 255,625 |

|

| | | | 1,751,862 |

|

Diversified Consumer Services† | | | |

frontdoor, Inc., 6.75%, 8/15/26(3) | | 105,000 |

| 107,363 |

|

| Diversified Financial Services — 0.1% | | | |

Travelport Corporate Finance plc, 6.00%, 3/15/26(3) | | 277,000 |

| 278,385 |

|

| Diversified Telecommunication Services — 0.4% | | | |

Cincinnati Bell, Inc., 7.00%, 7/15/24(3) | | 80,000 |

| 72,400 |

|

Cincinnati Bell, Inc., 8.00%, 10/15/25(3) | | 99,000 |

| 90,585 |

|

Intelsat Jackson Holdings SA, 9.50%, 9/30/22(3) | | 100,000 |

| 116,500 |

|

Intelsat Jackson Holdings SA, 8.50%, 10/15/24(3) | | 298,000 |

| 293,157 |

|

| Level 3 Financing, Inc., 5.625%, 2/1/23 | | 600,000 |

| 603,618 |

|

| | | | 1,176,260 |

|

| Electronic Equipment, Instruments and Components — 0.1% |

| WESCO Distribution, Inc., 5.375%, 6/15/24 | | 263,000 |

| 255,767 |

|

| Entertainment — 0.7% | | | |

Altice Finco SA, 7.625%, 2/15/25(3) | | 250,000 |

| 223,125 |

|

Altice Luxembourg SA, 7.75%, 5/15/22(3) | | 250,000 |

| 232,188 |

|

Altice Luxembourg SA, 7.625%, 2/15/25(3) | | 250,000 |

| 214,063 |

|

| CCO Holdings LLC / CCO Holdings Capital Corp., 5.75%, 1/15/24 | | 387,000 |

| 391,837 |

|

CCO Holdings LLC / CCO Holdings Capital Corp., 5.75%, 2/15/26(3) | | 476,000 |

| 472,430 |

|

CCO Holdings LLC / CCO Holdings Capital Corp., 5.125%, 5/1/27(3) | | 111,000 |

| 104,756 |

|

CCO Holdings LLC / CCO Holdings Capital Corp., 5.00%, 2/1/28(3) | | 119,000 |

| 111,414 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

Netflix, Inc., 5.875%, 11/15/28(3) | | $ | 407,000 |

| $ | 401,912 |

|

| | | | 2,151,725 |

|

| Equity Real Estate Investment Trusts (REITs) — 0.1% | | | |

| SBA Communications Corp., 4.875%, 9/1/24 | | 212,000 |

| 205,375 |

|

| Food and Staples Retailing — 0.3% | | | |

Kronos Acquisition Holdings, Inc., 9.00%, 8/15/23(3) | | 323,000 |

| 283,433 |

|

Sabre GLBL, Inc., 5.375%, 4/15/23(3) | | 292,000 |

| 293,460 |

|

Sabre GLBL, Inc., 5.25%, 11/15/23(3) | | 303,000 |

| 300,691 |

|

| | | | 877,584 |

|

| Food Products — 0.3% | | | |

Matterhorn Merger Sub LLC / Matterhorn Finance Sub, Inc., 8.50%, 6/1/26(3) | | 500,000 |

| 462,500 |

|

Post Holdings, Inc., 5.00%, 8/15/26(3) | | 485,000 |

| 449,231 |

|

| | | | 911,731 |

|

| Health Care Equipment and Supplies — 0.2% | | | |

MEDNAX, Inc., 5.25%, 12/1/23(3) | | 492,000 |

| 493,230 |

|

| Health Care Providers and Services — 0.3% | | | |

| HCA, Inc., 5.375%, 2/1/25 | | 644,000 |

| 649,635 |

|

| HCA, Inc., 5.375%, 9/1/26 | | 103,000 |

| 102,485 |

|

| HCA, Inc., 4.50%, 2/15/27 | | 175,000 |

| 170,625 |

|

| | | | 922,745 |

|

| Hotels, Restaurants and Leisure — 0.5% | | | |

1011778 BC ULC / New Red Finance, Inc., 5.00%, 10/15/25(3) | | 228,000 |

| 214,320 |

|

Delta Merger Sub, Inc., 6.00%, 9/15/26(3) | | 285,000 |

| 280,369 |

|

International Game Technology plc, 6.25%, 1/15/27(3) | | 250,000 |

| 247,344 |

|

IRB Holding Corp., 6.75%, 2/15/26(3) | | 183,000 |

| 175,680 |

|

| Radisson Hotel Holdings AB, 6.875%, 7/15/23 | EUR | 362,000 |

| 444,405 |

|

Scientific Games International, Inc., 5.00%, 10/15/25(3) | | $ | 61,000 |

| 56,882 |

|

Scientific Games International, Inc., 3.375%, 2/15/26(3) | EUR | 111,000 |

| 116,943 |

|

| | | | 1,535,943 |

|

| Industrial Conglomerates — 0.2% | | | |

Core & Main LP, 6.125%, 8/15/25(3) | | $ | 219,000 |

| 206,407 |

|

EnPro Industries, Inc., 5.75%, 10/15/26(3) | | 162,000 |

| 160,429 |

|

RBS Global, Inc. / Rexnord LLC, 4.875%, 12/15/25(3) | | 194,000 |

| 182,845 |

|

| | | | 549,681 |

|

| Insurance — 0.1% | | | |

| Genworth Holdings, Inc., 4.90%, 8/15/23 | | 239,000 |

| 211,515 |

|

| Genworth Holdings, Inc., 4.80%, 2/15/24 | | 67,000 |

| 58,290 |

|

| | | | 269,805 |

|

| IT Services — 0.2% | | | |

GTT Communications, Inc., 7.875%, 12/31/24(3) | | 480,000 |

| 453,600 |

|

| Leisure Products — 0.1% | | | |

Mattel, Inc., 6.75%, 12/31/25(3) | | 250,000 |

| 239,298 |

|

| Machinery — 0.4% | | | |

SPX FLOW, Inc., 5.875%, 8/15/26(3) | | 219,000 |

| 211,335 |

|

Stevens Holding Co., Inc., 6.125%, 10/1/26(3) | | 39,000 |

| 38,956 |

|

|

| | | | | | | |

| | | Principal Amount/Shares | Value |

Titan Acquisition Ltd. / Titan Co-Borrower LLC, 7.75%, 4/15/26(3) | | $ | 719,000 |

| $ | 600,365 |

|

TriMas Corp., 4.875%, 10/15/25(3) | | 156,000 |

| 147,764 |

|

| Welbilt, Inc., 9.50%, 2/15/24 | | 40,000 |

| 43,300 |

|

| | | | 1,041,720 |

|