UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| Investment Company Act file number | 811-07820 | |||||

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. | ||||||

| (Exact name of registrant as specified in charter) | ||||||

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 | |||||

| (Address of principal executive offices) | (Zip Code) | |||||

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 | ||||||

| (Name and address of agent for service) | ||||||

| Registrant’s telephone number, including area code: | 816-531-5575 | |||||

| Date of fiscal year end: | 03-31 | |||||

| Date of reporting period: | 03-31-2020 | |||||

ITEM 1. REPORTS TO STOCKHOLDERS.

| ANNUAL REPORT |  |

| MARCH 31, 2020 | |

AC Alternatives® Market Neutral Value Fund | |

| Investor Class (ACVVX) | |

| I Class (ACVKX) | |

| A Class (ACVQX) | |

| C Class (ACVHX) | |

| R Class (ACVWX) | |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the fund or your financial intermediary electronically by calling or sending an email request to your appropriate contacts as listed on the back cover of this report.

You may elect to receive all future reports in paper free of charge. You can inform the fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an email request to your appropriate contacts as listed on the back cover of this report. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

| Table of Contents |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Liquidity Risk Management Program | |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

| President’s Letter |

Jonathan Thomas

Jonathan ThomasDear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2020. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional insights, please visit americancentury.com.

Virus Outbreak Abruptly Altered Economic, Market Backdrops

Through most of the period, market sentiment was upbeat, partly due to accommodative Federal Reserve (Fed) policy and modest inflation. Improving economic and corporate earnings data and a phase 1 U.S.-China trade deal also helped boost growth outlooks. Against this backdrop, key U.S. stock benchmarks rose to record highs by mid-February, and U.S. bonds continued to advance.

However, beginning in late February, unprecedented social and economic turmoil emerged and reversed the positive trajectory. The COVID-19 epidemic originating in China rapidly spread throughout the world, forcing stay-at-home orders and industry-wide shutdowns. U.S. stocks, corporate bonds and other riskier assets sold off sharply, while U.S. Treasuries rallied in the global flight to quality. The Fed stepped in quickly and aggressively, slashing interest rates to near 0% and enacting massive lending and asset-purchase programs to stabilize the financial system.

The swift and severe sell-off erased the strong stock market gains realized earlier in the period and left key benchmarks with losses for the 12 months. Reflecting their defensive characteristics, high-quality U.S. bonds withstood the turmoil and delivered solid returns for the 12-month period.

Promoting Health and Safety Remains Our Focus

While the market impact of COVID-19 has been severe, reducing the human toll is most important. We are monitoring the situation closely and following guidelines and protocols from all relevant authorities. Our firm has activated a comprehensive Pandemic Response Plan, which includes social distancing and work-from-home mandates, travel restrictions and escalated cleaning regimens at all our facilities. We’ve also launched a Business Continuity Plan to maintain regular business operations and ensure delivery of outstanding service.

We appreciate your confidence in us during these extraordinary times. We have a long history of helping clients weather volatile markets, and we are confident we will meet today’s challenges. In the meantime, the health and safety of you, your family and our employees remain a top priority.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

| Performance |

| Total Returns as of March 31, 2020 | |||||

| Average Annual Returns | |||||

Ticker Symbol | 1 year | 5 years | Since Inception | Inception Date | |

| Investor Class | ACVVX | 1.52% | 0.66% | 1.76% | 10/31/11 |

| Bloomberg Barclays U.S. 1-3 Month Treasury Bill Index | — | 2.08% | 1.12% | 0.68% | — |

| I Class | ACVKX | 1.80% | 0.87% | 1.98% | 10/31/11 |

| A Class | ACVQX | 10/31/11 | |||

| No sales charge | 1.29% | 0.40% | 1.52% | ||

| With sales charge | -4.48% | -0.78% | 0.81% | ||

| C Class | ACVHX | 0.58% | -0.34% | 0.76% | 10/31/11 |

| R Class | ACVWX | 1.06% | 0.17% | 1.27% | 10/31/11 |

Fund returns would have been lower if a portion of the fees had not been waived.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

3

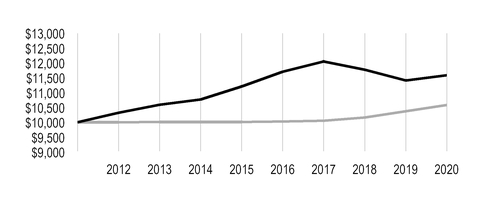

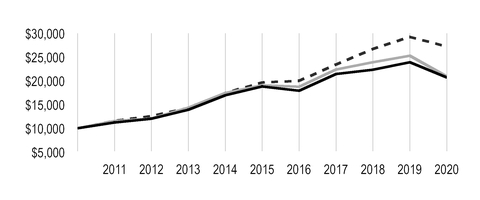

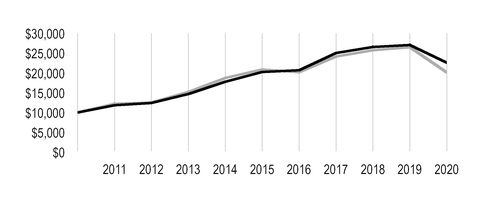

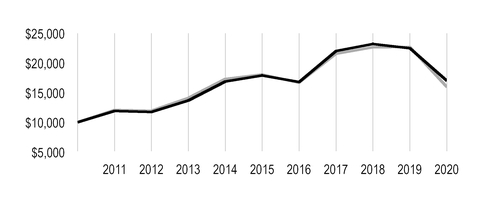

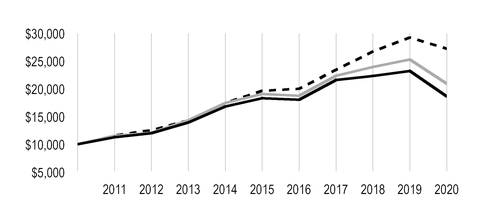

| Growth of $10,000 Over Life of Class |

$10,000 investment made October 31, 2011 |

Performance for other share classes will vary due to differences in fee structure. |

| Value on March 31, 2020 | |

| Investor Class — $11,586 | |

| Bloomberg Barclays U.S. 1-3 Month Treasury Bill Index — $10,588 | |

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

| Total Annual Fund Operating Expenses | ||||

| Investor Class | I Class | A Class | C Class | R Class |

| 3.50% | 3.30% | 3.75% | 4.50% | 4.00% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

4

| Portfolio Commentary |

Portfolio Managers: Phil Davidson, Kevin Toney, Michael Liss, Brian Woglom, Phil Sundell and David Byrns

Effective February 2020, David Byrns joined the fund’s management team.

Performance Summary

AC Alternatives Market Neutral Value returned 1.52%* for the fiscal year ended March 31, 2020, compared with the 2.08% return for its benchmark, the Bloomberg Barclays U.S. 1-3 Month Treasury Bill Index. The fund’s return reflects operating expenses, while the index’s return does not.

The foundation of the strategy is to pair long positions in more undervalued companies with short positions in overvalued companies. We believe this helps reduce the risk inherent in long/short strategies. Over the trailing 12-month period, the fund provided positive absolute returns, while maintaining limited correlation with stocks and bonds.

Key Detractors

A short position in the iShares Russell 1000 Growth ETF and a long position in the iShares Russell 1000 Value ETF negatively impacted performance. This pair represented a relatively large position within the portfolio. Due to the sustained and notable outperformance of growth relative to value stocks, we view value stocks as more attractively valued. However, value continued to underperform growth by a notable margin, particularly in the first quarter of 2020. During the coronavirus-driven market downturn that began in February of 2020, the energy and financials sectors were hit particularly hard. Energy stocks were pressured by a sharp decline in oil prices, caused by waning global demand and a price war between Saudi Arabia and Russia. Financials were pressured by lower interest rates and deteriorating economic conditions, which may negatively impact future earnings. These two sectors represent meaningful portions of value indices, contributing to the continued underperformance of value versus growth stocks.

A pair consisting of a long position in a Tesla convertible bond and a short position in Tesla common stock also detracted. Tesla’s common stock appreciated more than the convertible bond as Tesla reported better-than-expected operating results. Investors have also been attracted to the growth prospects for electric vehicles. Given the significant appreciation in Tesla’s stock, we believe it remained overvalued, and we continued to hold our position in the pair.

Key Contributors

Among the top contributors to performance was a pair consisting of a long position in Janus Henderson Group and a short position in Franklin Resources. While the stocks of both of these asset management companies declined, Franklin underperformed by a considerable margin as it experienced significant outflows. The stock was also pressured by news of its all-cash acquisition of Legg Mason.

Another top contributor was a pair consisting of a long position in HEICO Class A shares and a short position in HEICO common stock. We believe both securities possess the same economic value, and we monitor the valuation spread (the difference in valuation) between the two securities.

*All fund returns referenced in this commentary are for Investor Class shares. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the fund’s benchmark, other share classes may not. See page 3 for returns for all share classes.

5

The valuation spread was wider than it had been historically, with the Class A shares trading at a discount relative to the common stock. The pair positively impacted performance as the valuation spread between the two securities narrowed.

Portfolio Positioning

AC Alternatives Market Neutral Value is designed to address several secular financial planning trends, including the need for an alternative to cash in a low interest rate environment, diversification resulting from not being correlated to equity markets, low volatility exposure and a hedge against a rise in inflation and/or interest rates.

We continue to follow our disciplined, bottom-up process, selecting securities one at a time for the portfolio. We look for securities of companies that we believe are misvalued on both the long and short side of the market with consideration for both upside potential and downside risk. The portfolio’s current positioning reflects the individual opportunities identified by our team.

6

| Fund Characteristics |

| MARCH 31, 2020 | |

| Top Ten Long Holdings | % of net assets |

| iShares Russell 1000 Value ETF | 4.91% |

| Royal Dutch Shell plc, Class B ADR | 4.44% |

| Fox Corp., Class B | 3.30% |

| Teradyne, Inc. (Convertible) | 3.05% |

| HEICO Corp., Class A | 2.80% |

| Atlas Copco AB, B Shares | 2.56% |

| Tesla, Inc. (Convertible) | 2.36% |

| Microchip Technology, Inc. (Convertible) | 1.97% |

| Emerson Electric Co. | 1.77% |

| Chubb Ltd. | 1.61% |

| Top Ten Short Holdings | % of net assets |

| iShares Russell 1000 Growth ETF | (4.52)% |

| Royal Dutch Shell plc, Class A ADR | (4.46)% |

| Utilities Select Sector SPDR Fund | (4.36)% |

| Fox Corp., Class A | (3.05)% |

| Teradyne, Inc. | (2.99)% |

| HEICO Corp. | (2.76)% |

| Atlas Copco AB, A Shares | (2.36)% |

| Tesla, Inc. | (2.26)% |

| Caterpillar, Inc. | (1.76)% |

| Microchip Technology, Inc. | (1.74)% |

| Types of Investments in Portfolio | % of net assets |

| Domestic Common Stocks | 42.6% |

| Foreign Common Stocks* | 12.3% |

| Convertible Bonds | 7.4% |

| Exchange-Traded Funds | 5.3% |

| Domestic Common Stocks Sold Short | (46.3)% |

| Foreign Common Stocks Sold Short* | (10.5)% |

| Exchange-Traded Funds Sold Short | (10.4)% |

| Temporary Cash Investments | 17.1% |

| Other Assets and Liabilities | 82.5%** |

*Includes depositary shares, dual listed securities and foreign ordinary shares.

**Amount relates primarily to deposits for securities sold short at period end.

7

| Shareholder Fee Example |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2019 to March 31, 2020.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

8

| Beginning Account Value 10/1/19 | Ending Account Value 3/31/20 | Expenses Paid During Period(1) 10/1/19 - 3/31/20 | Annualized Expense Ratio(1) | |

| Actual | ||||

| Investor Class | $1,000 | $999.30 | $17.39 | 3.48% |

| I Class | $1,000 | $1,000.30 | $16.40 | 3.28% |

| A Class | $1,000 | $997.80 | $18.63 | 3.73% |

| C Class | $1,000 | $994.30 | $22.34 | 4.48% |

| R Class | $1,000 | $997.40 | $19.87 | 3.98% |

| Hypothetical | ||||

| Investor Class | $1,000 | $1,007.60 | $17.47 | 3.48% |

| I Class | $1,000 | $1,008.60 | $16.47 | 3.28% |

| A Class | $1,000 | $1,006.35 | $18.71 | 3.73% |

| C Class | $1,000 | $1,002.60 | $22.43 | 4.48% |

| R Class | $1,000 | $1,005.10 | $19.95 | 3.98% |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

9

| Schedule of Investments |

MARCH 31, 2020

Shares/ Principal Amount | Value | |||||

| COMMON STOCKS — 54.9% | ||||||

| Aerospace and Defense — 3.9% | ||||||

| Airbus SE ADR | 9,538 | $ | 154,039 | |||

HEICO Corp., Class A(1) | 33,156 | 2,118,668 | ||||

| Raytheon Co. | 5,390 | 706,899 | ||||

| 2,979,606 | ||||||

| Air Freight and Logistics — 0.5% | ||||||

| United Parcel Service, Inc., Class B | 4,136 | 386,385 | ||||

| Airlines — 0.2% | ||||||

| Southwest Airlines Co. | 4,949 | 176,234 | ||||

| Automobiles — 1.0% | ||||||

| General Motors Co. | 17,643 | 366,622 | ||||

| Honda Motor Co. Ltd. ADR | 9,333 | 209,619 | ||||

| Thor Industries, Inc. | 3,294 | 138,941 | ||||

| 715,182 | ||||||

| Banks — 1.6% | ||||||

Comerica, Inc.(1) | 12,131 | 355,923 | ||||

First Hawaiian, Inc.(1) | 15,251 | 252,099 | ||||

PNC Financial Services Group, Inc. (The)(1) | 1,257 | 120,320 | ||||

| Toronto-Dominion Bank (The) | 3,789 | 161,086 | ||||

Wells Fargo & Co.(1) | 11,846 | 339,980 | ||||

| 1,229,408 | ||||||

| Beverages — 0.9% | ||||||

| Heineken Holding NV | 2,884 | 221,341 | ||||

PepsiCo, Inc.(1) | 3,523 | 423,113 | ||||

| 644,454 | ||||||

| Building Products — 1.3% | ||||||

| Johnson Controls International plc | 15,207 | 409,981 | ||||

| Masco Corp. | 7,330 | 253,398 | ||||

| Trane Technologies plc | 3,775 | 311,777 | ||||

| 975,156 | ||||||

| Capital Markets — 0.7% | ||||||

| Bank of New York Mellon Corp. (The) | 11,094 | 373,646 | ||||

| Janus Henderson Group plc | 8,219 | 125,915 | ||||

| 499,561 | ||||||

| Chemicals — 0.7% | ||||||

| Akzo Nobel NV | 3,421 | 225,534 | ||||

| DuPont de Nemours, Inc. | 7,704 | 262,706 | ||||

| 488,240 | ||||||

| Commercial Services and Supplies — 0.9% | ||||||

Republic Services, Inc.(1) | 8,673 | 650,995 | ||||

| Communications Equipment — 0.2% | ||||||

F5 Networks, Inc.(2) | 1,649 | 175,833 | ||||

10

Shares/ Principal Amount | Value | |||||

| Construction Materials — 0.5% | ||||||

| Martin Marietta Materials, Inc. | 2,161 | $ | 408,926 | |||

| Containers and Packaging — 0.6% | ||||||

| Packaging Corp. of America | 3,040 | 263,963 | ||||

| WestRock Co. | 7,675 | 216,896 | ||||

| 480,859 | ||||||

| Diversified Financial Services — 0.2% | ||||||

| Equitable Holdings, Inc. | 9,013 | 130,238 | ||||

| Diversified Telecommunication Services — 1.1% | ||||||

Verizon Communications, Inc.(1) | 15,975 | 858,337 | ||||

| Electric Utilities — 3.2% | ||||||

| Duke Energy Corp. | 3,921 | 317,131 | ||||

| Edison International | 6,665 | 365,175 | ||||

| Eversource Energy | 6,889 | 538,789 | ||||

Pinnacle West Capital Corp.(1) | 6,874 | 520,980 | ||||

Xcel Energy, Inc.(1) | 11,290 | 680,787 | ||||

| 2,422,862 | ||||||

| Electrical Equipment — 2.0% | ||||||

| Emerson Electric Co. | 28,071 | 1,337,583 | ||||

| nVent Electric plc | 11,851 | 199,927 | ||||

| 1,537,510 | ||||||

| Energy Equipment and Services — 0.8% | ||||||

| Schlumberger Ltd. | 41,739 | 563,059 | ||||

| Equity Real Estate Investment Trusts (REITs) — 0.7% | ||||||

| American Tower Corp. | 960 | 209,040 | ||||

| Camden Property Trust | 2,189 | 173,456 | ||||

| Welltower, Inc. | 3,506 | 160,505 | ||||

| 543,001 | ||||||

| Food and Staples Retailing — 1.7% | ||||||

| Koninklijke Ahold Delhaize NV | 17,151 | 401,390 | ||||

| Sysco Corp. | 7,856 | 358,469 | ||||

Walmart, Inc.(1) | 4,704 | 534,468 | ||||

| 1,294,327 | ||||||

| Food Products — 0.9% | ||||||

| Nestle SA ADR | 6,683 | 688,282 | ||||

| Gas Utilities — 2.5% | ||||||

Atmos Energy Corp.(1) | 7,346 | 728,944 | ||||

| ONE Gas, Inc. | 4,851 | 405,641 | ||||

Spire, Inc.(1) | 10,409 | 775,262 | ||||

| 1,909,847 | ||||||

| Health Care Equipment and Supplies — 1.2% | ||||||

Hologic, Inc.(2) | 6,647 | 233,310 | ||||

| Medtronic plc | 7,276 | 656,149 | ||||

| 889,459 | ||||||

| Health Care Providers and Services — 1.3% | ||||||

McKesson Corp.(1) | 2,202 | 297,842 | ||||

| Quest Diagnostics, Inc. | 6,204 | 498,181 | ||||

11

Shares/ Principal Amount | Value | |||||

| Universal Health Services, Inc., Class B | 1,845 | $ | 182,803 | |||

| 978,826 | ||||||

| Health Care Technology — 0.5% | ||||||

| Cerner Corp. | 6,365 | 400,931 | ||||

| Household Durables — 0.2% | ||||||

| Electrolux AB, Series B | 9,410 | 117,180 | ||||

| Household Products — 0.6% | ||||||

| Kimberly-Clark Corp. | 3,658 | 467,748 | ||||

| Industrial Conglomerates — 0.7% | ||||||

| Siemens AG ADR | 12,873 | 540,666 | ||||

| Insurance — 3.5% | ||||||

| Aflac, Inc. | 9,260 | 317,062 | ||||

| Chubb Ltd. | 10,940 | 1,221,889 | ||||

Marsh & McLennan Cos., Inc.(1) | 9,159 | 791,887 | ||||

MetLife, Inc.(1) | 11,106 | 339,511 | ||||

| 2,670,349 | ||||||

| IT Services — 1.5% | ||||||

| Automatic Data Processing, Inc. | 2,946 | 402,659 | ||||

Visa, Inc., Class A(1) | 4,494 | 724,074 | ||||

| 1,126,733 | ||||||

| Machinery — 4.1% | ||||||

Atlas Copco AB, B Shares(1) | 65,600 | 1,934,437 | ||||

| Deere & Co. | 2,859 | 394,999 | ||||

Electrolux Professional AB, B Shares(2) | 17,777 | 51,215 | ||||

| IMI plc | 31,428 | 290,695 | ||||

Ingersoll Rand, Inc.(2) | 3,617 | 89,702 | ||||

| PACCAR, Inc. | 5,410 | 330,713 | ||||

| 3,091,761 | ||||||

| Media — 3.3% | ||||||

Fox Corp., Class B(1)(2) | 109,098 | 2,496,162 | ||||

| Multi-Utilities — 1.0% | ||||||

| CMS Energy Corp. | 8,423 | 494,851 | ||||

| WEC Energy Group, Inc. | 3,055 | 269,237 | ||||

| 764,088 | ||||||

| Oil, Gas and Consumable Fuels — 5.4% | ||||||

| Chevron Corp. | 3,338 | 241,871 | ||||

| Enterprise Products Partners LP | 22,243 | 318,075 | ||||

| Noble Energy, Inc. | 25,818 | 155,941 | ||||

| Royal Dutch Shell plc, Class B ADR | 102,892 | 3,360,453 | ||||

| 4,076,340 | ||||||

| Paper and Forest Products — 0.5% | ||||||

| Mondi plc | 22,782 | 388,595 | ||||

| Pharmaceuticals — 2.1% | ||||||

Johnson & Johnson(1) | 3,603 | 472,461 | ||||

| Novartis AG | 1,310 | 108,265 | ||||

Pfizer, Inc.(1) | 20,051 | 654,465 | ||||

| Roche Holding AG ADR | 9,516 | 386,064 | ||||

| 1,621,255 | ||||||

12

Shares/ Principal Amount | Value | |||||

| Road and Rail — 1.1% | ||||||

| Norfolk Southern Corp. | 2,879 | $ | 420,334 | |||

| Union Pacific Corp. | 2,895 | 408,311 | ||||

| 828,645 | ||||||

| Semiconductors and Semiconductor Equipment — 0.7% | ||||||

| Texas Instruments, Inc. | 5,162 | 515,839 | ||||

| Software — 0.7% | ||||||

Microsoft Corp.(1) | 3,440 | 542,522 | ||||

| Textiles, Apparel and Luxury Goods — 0.1% | ||||||

Under Armour, Inc., Class C(2) | 10,741 | 86,572 | ||||

| Thrifts and Mortgage Finance — 0.3% | ||||||

| Capitol Federal Financial, Inc. | 17,408 | 202,107 | ||||

TOTAL COMMON STOCKS (Cost $41,404,593) | 41,564,080 | |||||

| CONVERTIBLE BONDS — 7.4% | ||||||

| Automobiles — 2.4% | ||||||

| Tesla, Inc., 2.00%, 5/15/24 | $ | 978,000 | 1,786,499 | |||

| Semiconductors and Semiconductor Equipment — 5.0% | ||||||

| Microchip Technology, Inc., 1.625%, 2/15/27 | 1,447,000 | 1,488,737 | ||||

| Teradyne, Inc., 1.25%, 12/15/23 | 1,286,000 | 2,305,155 | ||||

| 3,793,892 | ||||||

TOTAL CONVERTIBLE BONDS (Cost $4,934,782) | 5,580,391 | |||||

| EXCHANGE-TRADED FUNDS — 5.3% | ||||||

| Consumer Discretionary Select Sector SPDR Fund | 1,770 | 173,601 | ||||

| iShares Russell 1000 Value ETF | 37,467 | 3,715,977 | ||||

| SPDR S&P Insurance ETF | 5,229 | 130,359 | ||||

TOTAL EXCHANGE-TRADED FUNDS (Cost $4,471,631) | 4,019,937 | |||||

| TEMPORARY CASH INVESTMENTS — 17.1% | ||||||

| Repurchase Agreement, BMO Capital Markets Corp., (collateralized by various U.S. Treasury obligations, 1.875% - 3.00%, 11/30/21 - 5/15/45, valued at $4,266,906), in a joint trading account at 0.01%, dated 3/31/20, due 4/1/20 (Delivery value $4,183,944) | 4,183,943 | |||||

| State Street Institutional U.S. Government Money Market Fund, Premier Class | 8,788,096 | 8,788,096 | ||||

TOTAL TEMPORARY CASH INVESTMENTS (Cost $12,972,039) | 12,972,039 | |||||

TOTAL INVESTMENT SECURITIES BEFORE SECURITIES SOLD SHORT — 84.7% (Cost $63,783,045) | 64,136,447 | |||||

| SECURITIES SOLD SHORT — (67.2)% | ||||||

| COMMON STOCKS SOLD SHORT — (56.8)% | ||||||

| Aerospace and Defense — (3.9)% | ||||||

| Boeing Co. (The) | (994 | ) | (148,245 | ) | ||

| HEICO Corp. | (27,997 | ) | (2,088,856 | ) | ||

| United Technologies Corp. | (7,594 | ) | (716,342 | ) | ||

| (2,953,443 | ) | |||||

| Air Freight and Logistics — (0.5)% | ||||||

| FedEx Corp. | (3,297 | ) | (399,794 | ) | ||

13

Shares/ Principal Amount | Value | |||||

| Airlines — (0.2)% | ||||||

| American Airlines Group, Inc. | (14,611 | ) | $ | (178,108 | ) | |

| Automobiles — (3.0)% | ||||||

| Ford Motor Co. | (76,567 | ) | (369,818 | ) | ||

| Tesla, Inc. | (3,265 | ) | (1,710,860 | ) | ||

| Toyota Motor Corp. ADR | (1,747 | ) | (209,553 | ) | ||

| (2,290,231 | ) | |||||

| Banks — (1.9)% | ||||||

| Bank of America Corp. | (15,583 | ) | (330,827 | ) | ||

| Bank of Hawaii Corp. | (4,657 | ) | (257,253 | ) | ||

| Bank OZK | (11,975 | ) | (199,982 | ) | ||

| National Bank of Canada | (4,257 | ) | (164,527 | ) | ||

| Regions Financial Corp. | (39,569 | ) | (354,934 | ) | ||

| US Bancorp | (3,569 | ) | (122,952 | ) | ||

| (1,430,475 | ) | |||||

| Beverages — (0.9)% | ||||||

| Coca-Cola Co. (The) | (9,755 | ) | (431,659 | ) | ||

| Heineken NV | (2,587 | ) | (216,527 | ) | ||

| (648,186 | ) | |||||

| Building Products — (1.3)% | ||||||

| Daikin Industries Ltd. | (3,300 | ) | (402,422 | ) | ||

| Fortune Brands Home & Security, Inc. | (5,990 | ) | (259,067 | ) | ||

| Lennox International, Inc. | (1,590 | ) | (289,046 | ) | ||

| (950,535 | ) | |||||

| Capital Markets — (1.0)% | ||||||

| FactSet Research Systems, Inc. | (857 | ) | (223,403 | ) | ||

| Franklin Resources, Inc. | (7,914 | ) | (132,084 | ) | ||

| State Street Corp. | (7,221 | ) | (384,663 | ) | ||

| (740,150 | ) | |||||

| Chemicals — (0.4)% | ||||||

| Corteva, Inc. | (3,324 | ) | (78,114 | ) | ||

| PPG Industries, Inc. | (2,590 | ) | (216,524 | ) | ||

| (294,638 | ) | |||||

| Commercial Services and Supplies — (0.9)% | ||||||

| Waste Management, Inc. | (7,057 | ) | (653,196 | ) | ||

| Construction Materials — (0.6)% | ||||||

| Vulcan Materials Co. | (3,890 | ) | (420,392 | ) | ||

| Containers and Packaging — (0.6)% | ||||||

| International Paper Co. | (14,424 | ) | (449,019 | ) | ||

| Diversified Telecommunication Services — (1.1)% | ||||||

| AT&T, Inc. | (29,431 | ) | (857,914 | ) | ||

| Electric Utilities — (1.3)% | ||||||

| American Electric Power Co., Inc. | (8,592 | ) | (687,188 | ) | ||

| Southern Co. (The) | (5,867 | ) | (317,639 | ) | ||

| (1,004,827 | ) | |||||

| Energy Equipment and Services — (0.7)% | ||||||

| Baker Hughes Co. | (52,748 | ) | (553,854 | ) | ||

14

Shares/ Principal Amount | Value | |||||

| Entertainment — (0.2)% | ||||||

| Walt Disney Co. (The) | (1,692 | ) | $ | (163,447 | ) | |

| Equity Real Estate Investment Trusts (REITs) — (0.7)% | ||||||

| Apartment Investment & Management Co., Class A | (5,066 | ) | (178,070 | ) | ||

| Crown Castle International Corp. | (1,505 | ) | (217,322 | ) | ||

| Ventas, Inc. | (5,665 | ) | (151,822 | ) | ||

| (547,214 | ) | |||||

| Food and Staples Retailing — (1.0)% | ||||||

| Kroger Co. (The) | (13,627 | ) | (410,445 | ) | ||

| US Foods Holding Corp. | (20,736 | ) | (367,235 | ) | ||

| (777,680 | ) | |||||

| Food Products — (0.9)% | ||||||

| General Mills, Inc. | (12,880 | ) | (679,678 | ) | ||

| Health Care Equipment and Supplies — (1.1)% | ||||||

| Alcon, Inc. | (2,466 | ) | (125,322 | ) | ||

| Align Technology, Inc. | (385 | ) | (66,971 | ) | ||

| Baxter International, Inc. | (854 | ) | (69,336 | ) | ||

| STERIS plc | (770 | ) | (107,777 | ) | ||

| Stryker Corp. | (2,563 | ) | (426,714 | ) | ||

| (796,120 | ) | |||||

| Health Care Providers and Services — (2.0)% | ||||||

| Cardinal Health, Inc. | (6,270 | ) | (300,584 | ) | ||

| HCA Healthcare, Inc. | (8,213 | ) | (737,938 | ) | ||

| Laboratory Corp. of America Holdings | (3,905 | ) | (493,553 | ) | ||

| (1,532,075 | ) | |||||

| Household Durables — (0.2)% | ||||||

| Whirlpool Corp. | (1,824 | ) | (156,499 | ) | ||

| Industrial Conglomerates — (1.3)% | ||||||

| 3M Co. | (1,399 | ) | (190,977 | ) | ||

| General Electric Co. | (104,023 | ) | (825,943 | ) | ||

| (1,016,920 | ) | |||||

| Insurance — (3.5)% | ||||||

| Allstate Corp. (The) | (1,458 | ) | (133,742 | ) | ||

| Aon plc | (4,778 | ) | (788,561 | ) | ||

| Prudential Financial, Inc. | (6,612 | ) | (344,750 | ) | ||

| Travelers Cos., Inc. (The) | (12,298 | ) | (1,221,806 | ) | ||

| Unum Group | (8,846 | ) | (132,779 | ) | ||

| (2,621,638 | ) | |||||

| Internet and Direct Marketing Retail — (0.7)% | ||||||

| Amazon.com, Inc. | (280 | ) | (545,922 | ) | ||

| IT Services — (1.5)% | ||||||

| MasterCard, Inc., Class A | (2,952 | ) | (713,085 | ) | ||

| Paychex, Inc. | (6,364 | ) | (400,423 | ) | ||

| (1,113,508 | ) | |||||

| Leisure Products — (0.2)% | ||||||

| Polaris, Inc. | (2,890 | ) | (139,153 | ) | ||

15

Shares/ Principal Amount | Value | |||||

| Machinery — (5.5)% | ||||||

| AGCO Corp. | (8,656 | ) | $ | (408,996 | ) | |

| Atlas Copco AB, A Shares | (53,194 | ) | (1,787,735 | ) | ||

| Caterpillar, Inc. | (11,493 | ) | (1,333,648 | ) | ||

| Ingersoll Rand, Inc. | (9,610 | ) | (238,328 | ) | ||

| Volvo AB, B Shares | (29,435 | ) | (353,948 | ) | ||

| (4,122,655 | ) | |||||

| Media — (3.3)% | ||||||

| Discovery, Inc., Class A | (11,049 | ) | (214,793 | ) | ||

| Fox Corp., Class A | (97,556 | ) | (2,305,248 | ) | ||

| (2,520,041 | ) | |||||

| Multi-Utilities — (1.0)% | ||||||

| Consolidated Edison, Inc. | (3,402 | ) | (265,356 | ) | ||

| DTE Energy Co. | (5,097 | ) | (484,062 | ) | ||

| (749,418 | ) | |||||

| Oil, Gas and Consumable Fuels — (4.8)% | ||||||

| Exxon Mobil Corp. | (6,441 | ) | (244,565 | ) | ||

| Royal Dutch Shell plc, Class A ADR | (96,806 | ) | (3,377,561 | ) | ||

| (3,622,126 | ) | |||||

| Paper and Forest Products — (0.5)% | ||||||

| UPM-Kymmene Oyj | (14,309 | ) | (394,391 | ) | ||

| Personal Products — (0.6)% | ||||||

| Unilever NV (New York) | (9,835 | ) | (479,850 | ) | ||

| Pharmaceuticals — (2.2)% | ||||||

| AstraZeneca plc ADR | (2,932 | ) | (130,943 | ) | ||

| Bristol-Myers Squibb Co. | (9,540 | ) | (531,759 | ) | ||

| Merck & Co., Inc. | (10,216 | ) | (786,019 | ) | ||

| Sanofi | (2,420 | ) | (213,059 | ) | ||

| (1,661,780 | ) | |||||

| Road and Rail — (1.1)% | ||||||

| CSX Corp. | (14,536 | ) | (832,913 | ) | ||

| Semiconductors and Semiconductor Equipment — (5.4)% | ||||||

| Microchip Technology, Inc. | (19,480 | ) | (1,320,744 | ) | ||

| Micron Technology, Inc. | (11,845 | ) | (498,201 | ) | ||

| Teradyne, Inc. | (41,790 | ) | (2,263,764 | ) | ||

| (4,082,709 | ) | |||||

| Specialty Retail — (0.7)% | ||||||

| Tractor Supply Co. | (6,329 | ) | (535,117 | ) | ||

| Textiles, Apparel and Luxury Goods — (0.1)% | ||||||

| Under Armour, Inc., Class A | (9,480 | ) | (87,311 | ) | ||

TOTAL COMMON STOCKS SOLD SHORT (Proceeds $44,374,459) | (43,002,927 | ) | ||||

| EXCHANGE-TRADED FUNDS SOLD SHORT — (10.4)% | ||||||

| Alerian MLP ETF | (93,248 | ) | (320,773 | ) | ||

| Financial Select Sector SPDR Fund | (15,237 | ) | (317,234 | ) | ||

| Industrial Select Sector SPDR Fund | (3,378 | ) | (199,336 | ) | ||

| iShares Russell 1000 Growth ETF | (22,688 | ) | (3,417,947 | ) | ||

16

Shares/ Principal Amount | Value | |||||

| SPDR S&P Oil & Gas Exploration & Production ETF | (4,572 | ) | $ | (150,411 | ) | |

| Technology Select Sector SPDR Fund | (2,183 | ) | (175,448 | ) | ||

| Utilities Select Sector SPDR Fund | (59,624 | ) | (3,303,766 | ) | ||

TOTAL EXCHANGE-TRADED FUNDS SOLD SHORT (Proceeds $8,437,769) | (7,884,915 | ) | ||||

TOTAL SECURITIES SOLD SHORT — (67.2)% (Proceeds $52,812,228) | (50,887,842 | ) | ||||

OTHER ASSETS AND LIABILITIES(3) — 82.5% | 62,442,930 | |||||

| TOTAL NET ASSETS — 100.0% | $ | 75,691,535 | ||||

| FORWARD FOREIGN CURRENCY EXCHANGE CONTRACTS | ||||||||

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) | ||||

| CAD | 581 | USD | 408 | Morgan Stanley | 6/30/20 | $ | 5 | |

| CAD | 1,873 | USD | 1,285 | Morgan Stanley | 6/30/20 | 47 | ||

| CAD | 3,261 | USD | 2,234 | Morgan Stanley | 6/30/20 | 85 | ||

| CAD | 9,573 | USD | 6,669 | Morgan Stanley | 6/30/20 | 140 | ||

| CAD | 8,938 | USD | 6,325 | Morgan Stanley | 6/30/20 | 32 | ||

| CAD | 8,492 | USD | 6,033 | Morgan Stanley | 6/30/20 | 6 | ||

| USD | 218 | CAD | 313 | Morgan Stanley | 6/30/20 | (5 | ) | |

| USD | 667 | CAD | 958 | Morgan Stanley | 6/30/20 | (15 | ) | |

| USD | 3,370 | CAD | 4,887 | Morgan Stanley | 6/30/20 | (106 | ) | |

| USD | 2,441 | CAD | 3,450 | Morgan Stanley | 6/30/20 | (13 | ) | |

| USD | 10,085 | CAD | 14,277 | Morgan Stanley | 6/30/20 | (68 | ) | |

| USD | 6,235 | CAD | 8,845 | Morgan Stanley | 6/30/20 | (56 | ) | |

| CHF | 72,838 | USD | 74,231 | UBS AG | 6/30/20 | 1,761 | ||

| CHF | 29,783 | USD | 30,466 | UBS AG | 6/30/20 | 607 | ||

| USD | 902,751 | CHF | 872,554 | UBS AG | 6/30/20 | (7,582 | ) | |

| USD | 194 | CHF | 191 | UBS AG | 6/30/20 | (5 | ) | |

| USD | 27,055 | CHF | 25,965 | UBS AG | 6/30/20 | (34 | ) | |

| USD | 67,607 | CHF | 65,054 | UBS AG | 6/30/20 | (264 | ) | |

| EUR | 22,066 | USD | 24,436 | Credit Suisse AG | 6/30/20 | (18 | ) | |

| EUR | 16,241 | USD | 17,444 | Credit Suisse AG | 6/30/20 | 529 | ||

| EUR | 185,821 | USD | 199,012 | Credit Suisse AG | 6/30/20 | 6,622 | ||

| EUR | 347,985 | USD | 375,249 | Credit Suisse AG | 6/30/20 | 9,841 | ||

| EUR | 92,740 | USD | 101,277 | Credit Suisse AG | 6/30/20 | 1,352 | ||

| USD | 665,425 | EUR | 612,003 | Credit Suisse AG | 6/30/20 | (11,835 | ) | |

| USD | 11,807 | EUR | 10,913 | Credit Suisse AG | 6/30/20 | (270 | ) | |

| USD | 21,656 | EUR | 19,871 | Credit Suisse AG | 6/30/20 | (333 | ) | |

| USD | 120,927 | EUR | 109,271 | Credit Suisse AG | 6/30/20 | 4 | ||

| USD | 31,884 | EUR | 28,698 | Credit Suisse AG | 6/30/20 | 126 | ||

| USD | 710 | EUR | 643 | Credit Suisse AG | 6/30/20 | (2 | ) | |

| GBP | 30,980 | USD | 38,405 | JPMorgan Chase Bank N.A. | 6/30/20 | 133 | ||

| GBP | 30,262 | USD | 37,565 | JPMorgan Chase Bank N.A. | 6/30/20 | 79 | ||

| GBP | 104,734 | USD | 121,068 | JPMorgan Chase Bank N.A. | 6/30/20 | 9,217 | ||

| GBP | 77,008 | USD | 90,601 | JPMorgan Chase Bank N.A. | 6/30/20 | 5,193 | ||

17

| Currency Purchased | Currency Sold | Counterparty | Settlement Date | Unrealized Appreciation (Depreciation) | ||||

| GBP | 8,943 | USD | 11,107 | JPMorgan Chase Bank N.A. | 6/30/20 | $ | 19 | |

| USD | 102,119 | GBP | 87,648 | JPMorgan Chase Bank N.A. | 6/30/20 | (6,911 | ) | |

| USD | 95,676 | GBP | 82,472 | JPMorgan Chase Bank N.A. | 6/30/20 | (6,915 | ) | |

| USD | 77,187 | GBP | 66,837 | JPMorgan Chase Bank N.A. | 6/30/20 | (5,956 | ) | |

| USD | 21,579 | GBP | 18,120 | JPMorgan Chase Bank N.A. | 6/30/20 | (962 | ) | |

| USD | 79,497 | GBP | 65,317 | JPMorgan Chase Bank N.A. | 6/30/20 | (1,754 | ) | |

| JPY | 28,901,913 | USD | 271,739 | Bank of America N.A. | 6/30/20 | (1,937 | ) | |

| JPY | 1,708,951 | USD | 15,670 | Bank of America N.A. | 6/30/20 | 283 | ||

| JPY | 1,861,308 | USD | 16,980 | Bank of America N.A. | 6/30/20 | 395 | ||

| JPY | 4,596,694 | USD | 41,896 | Bank of America N.A. | 6/30/20 | 1,014 | ||

| JPY | 1,193,190 | USD | 10,779 | Bank of America N.A. | 6/30/20 | 360 | ||

| JPY | 883,767 | USD | 7,985 | Bank of America N.A. | 6/30/20 | 265 | ||

| JPY | 2,296,468 | USD | 21,000 | Bank of America N.A. | 6/30/20 | 438 | ||

| JPY | 1,392,728 | USD | 12,926 | Bank of America N.A. | 6/30/20 | 75 | ||

| USD | 172 | JPY | 18,607 | Bank of America N.A. | 6/30/20 | (1 | ) | |

| USD | 19,071 | JPY | 2,108,784 | Bank of America N.A. | 6/30/20 | (615 | ) | |

| USD | 12,851 | JPY | 1,390,173 | Bank of America N.A. | 6/30/20 | (126 | ) | |

| USD | 24,331 | JPY | 2,631,021 | Bank of America N.A. | 6/30/20 | (230 | ) | |

| SEK | 82,606 | USD | 8,265 | Goldman Sachs & Co. | 6/30/20 | 102 | ||

| SEK | 46,218 | USD | 4,642 | Goldman Sachs & Co. | 6/30/20 | 39 | ||

| SEK | 407,626 | USD | 39,262 | Goldman Sachs & Co. | 6/30/20 | 2,024 | ||

| SEK | 67,333 | USD | 6,592 | Goldman Sachs & Co. | 6/30/20 | 228 | ||

| SEK | 513,688 | USD | 50,913 | Goldman Sachs & Co. | 6/30/20 | 1,116 | ||

| SEK | 187,437 | USD | 18,909 | Goldman Sachs & Co. | 6/30/20 | 76 | ||

| USD | 19,755 | SEK | 202,627 | Goldman Sachs & Co. | 6/30/20 | (768 | ) | |

| USD | 14,300 | SEK | 146,807 | Goldman Sachs & Co. | 6/30/20 | (569 | ) | |

| USD | 2,332 | SEK | 23,828 | Goldman Sachs & Co. | 6/30/20 | (82 | ) | |

| USD | 26,551 | SEK | 263,277 | Goldman Sachs & Co. | 6/30/20 | (115 | ) | |

| $ | (5,334 | ) | ||||||

| NOTES TO SCHEDULE OF INVESTMENTS | ||

| ADR | - | American Depositary Receipt |

| CAD | - | Canadian Dollar |

| CHF | - | Swiss Franc |

| EUR | - | Euro |

| GBP | - | British Pound |

| JPY | - | Japanese Yen |

| SEK | - | Swedish Krona |

| USD | - | United States Dollar |

| (1) | Security, or a portion thereof, has been pledged at the custodian bank or with a broker for collateral requirements on securities sold short. At the period end, the aggregate value of securities pledged was $11,592,005. |

| (2) | Non-income producing. |

| (3) | Amount relates primarily to deposits for securities sold short at period end. |

See Notes to Financial Statements.

18

| Statement of Assets and Liabilities |

| MARCH 31, 2020 | |||

| Assets | |||

| Investment securities, at value (cost of $63,783,045) | $ | 64,136,447 | |

| Deposits for securities sold short | 54,105,820 | ||

| Foreign currency holdings, at value (cost of $32) | 32 | ||

| Receivable for investments sold | 2,546,062 | ||

| Receivable for capital shares sold | 8,381,564 | ||

| Unrealized appreciation on forward foreign currency exchange contracts | 42,213 | ||

| Dividends and interest receivable | 114,336 | ||

| 129,326,474 | |||

| Liabilities | |||

| Securities sold short, at value (proceeds of $52,812,228) | 50,887,842 | ||

| Disbursements in excess of demand deposit cash | 1,872 | ||

| Payable for investments purchased | 2,408,381 | ||

| Payable for capital shares redeemed | 131,852 | ||

| Unrealized depreciation on forward foreign currency exchange contracts | 47,547 | ||

| Accrued management fees | 85,114 | ||

| Distribution and service fees payable | 4,128 | ||

| Dividend expense payable on securities sold short | 68,203 | ||

| 53,634,939 | |||

| Net Assets | $ | 75,691,535 | |

| Net Assets Consist of: | |||

| Capital (par value and paid-in surplus) | $ | 119,473,776 | |

| Distributable earnings | (43,782,241 | ) | |

| $ | 75,691,535 | ||

| Net Assets | Shares Outstanding | Net Asset Value Per Share | ||||

| Investor Class, $0.01 Par Value | $11,753,113 | 1,233,118 | $9.53 | |||

| I Class, $0.01 Par Value | $57,261,307 | 5,903,705 | $9.70 | |||

| A Class, $0.01 Par Value | $2,325,172 | 248,894 | $9.34* | |||

| C Class, $0.01 Par Value | $4,206,211 | 481,492 | $8.74 | |||

| R Class, $0.01 Par Value | $145,732 | 15,933 | $9.15 | |||

*Maximum offering price $9.91 (net asset value divided by 0.9425).

See Notes to Financial Statements.

19

| Statement of Operations |

| YEAR ENDED MARCH 31, 2020 | |||

| Investment Income (Loss) | |||

| Income: | |||

| Dividends (net of foreign taxes withheld of $83,765) | $ | 2,713,356 | |

| Interest | 2,661,666 | ||

| 5,375,022 | |||

| Expenses: | |||

| Dividend expense on securities sold short | 2,776,068 | ||

| Management fees | 2,304,492 | ||

| Distribution and service fees: | |||

| A Class | 6,837 | ||

| C Class | 72,490 | ||

| R Class | 271 | ||

| Directors' fees and expenses | 5,312 | ||

| Other expenses | 4,243 | ||

| 5,169,713 | |||

| Net investment income (loss) | 205,309 | ||

| Realized and Unrealized Gain (Loss) | |||

| Net realized gain (loss) on: | |||

| Investment transactions | 32,045,467 | ||

| Securities sold short transactions | (48,531,965 | ) | |

| Forward foreign currency exchange contract transactions | 3,262 | ||

| Foreign currency translation transactions | (7,917 | ) | |

| (16,491,153 | ) | ||

| Change in net unrealized appreciation (depreciation) on: | |||

| Investments | (26,759,435 | ) | |

| Securities sold short | 46,389,247 | ||

| Forward foreign currency exchange contracts | (5,334 | ) | |

| Translation of assets and liabilities in foreign currencies | 303 | ||

| 19,624,781 | |||

| Net realized and unrealized gain (loss) | 3,133,628 | ||

| Net Increase (Decrease) in Net Assets Resulting from Operations | $ | 3,338,937 | |

See Notes to Financial Statements.

20

| Statement of Changes in Net Assets |

| YEARS ENDED MARCH 31, 2020 AND MARCH 31, 2019 | ||||||

| Increase (Decrease) in Net Assets | March 31, 2020 | March 31, 2019 | ||||

| Operations | ||||||

| Net investment income (loss) | $ | 205,309 | $ | 1,382,333 | ||

| Net realized gain (loss) | (16,491,153 | ) | 20,545,037 | |||

| Change in net unrealized appreciation (depreciation) | 19,624,781 | (33,525,329 | ) | |||

| Net increase (decrease) in net assets resulting from operations | 3,338,937 | (11,597,959 | ) | |||

| Distributions to Shareholders | ||||||

| From earnings: | ||||||

| Investor Class | (130,637 | ) | (6,907,961 | ) | ||

| I Class | (443,124 | ) | (10,706,558 | ) | ||

| A Class | (10,199 | ) | (252,366 | ) | ||

| C Class | — | (802,869 | ) | |||

| R Class | (102 | ) | (2,255 | ) | ||

| Decrease in net assets from distributions | (584,062 | ) | (18,672,009 | ) | ||

| Capital Share Transactions | ||||||

| Net increase (decrease) in net assets from capital share transactions (Note 5) | (204,267,713 | ) | (221,823,229 | ) | ||

| Net increase (decrease) in net assets | (201,512,838 | ) | (252,093,197 | ) | ||

| Net Assets | ||||||

| Beginning of period | 277,204,373 | 529,297,570 | ||||

| End of period | $ | 75,691,535 | $ | 277,204,373 | ||

See Notes to Financial Statements.

21

| Notes to Financial Statements |

MARCH 31, 2020

1. Organization

American Century Capital Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. AC Alternatives Market Neutral Value Fund (the fund) is one fund in a series issued by the corporation. The fund’s investment objective is to seek long-term capital growth, independent of equity market conditions.

The fund offers the Investor Class, I Class, A Class, C Class and R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The fund is an investment company and follows accounting and reporting guidance in accordance with accounting principles generally accepted in the United States of America. This may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates. Management evaluated the impact of events or transactions occurring through the date the financial statements were issued that would merit recognition or disclosure.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share at the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open. The Board of Directors has adopted valuation policies and procedures to guide the investment advisor in the fund’s investment valuation process and to provide methodologies for the oversight of the fund’s pricing function.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are generally valued at the closing price of such securities on the exchange where primarily traded or at the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices may be used. Securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. Equity securities initially expressed in local currencies are translated into U.S. dollars at the mean of the appropriate currency exchange rate at the close of the NYSE as provided by an independent pricing service.

Fixed income securities are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Corporate and convertible bonds are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Hybrid securities are valued at the evaluated mean as provided by independent pricing services or at the mean of the most recent bid and asked prices as provided by investment dealers. Preferred stocks and convertible preferred stocks with perpetual maturities are valued using market models that consider trade data, quotations from dealers and active market makers, relevant yield curve and spread data, creditworthiness, trade data or market information on comparable securities, and other relevant security specific information.

Open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost, which approximates fair value. Forward foreign currency exchange contracts are valued at the mean of the appropriate forward exchange rate at the close of the NYSE as provided by an independent pricing service.

22

If the fund determines that the market price for an investment is not readily available or the valuation methods mentioned above do not reflect an investment’s fair value, such investment is valued as determined in good faith by the Board of Directors or its delegate, in accordance with policies and procedures adopted by the Board of Directors. In its determination of fair value, the fund may review several factors including, but not limited to, market information regarding the specific investment or comparable investments and correlation with other investment types, futures indices or general market indicators. Circumstances that may cause the fund to use these procedures to value an investment include, but are not limited to: an investment has been declared in default or is distressed; trading in a security has been suspended during the trading day or a security is not actively trading on its principal exchange; prices received from a regular pricing source are deemed unreliable; or there is a foreign market holiday and no trading occurred.

The fund monitors for significant events occurring after the close of an investment’s primary exchange but before the fund’s net asset value per share is determined. Significant events may include, but are not limited to: corporate announcements and transactions; governmental action and political unrest that could impact a specific investment or an investment sector; or armed conflicts, natural disasters and similar events that could affect investments in a specific country or region. The fund also monitors for significant fluctuations between domestic and foreign markets, as evidenced by the U.S. market or such other indicators that the Board of Directors, or its delegate, deems appropriate. The fund may apply a model-derived factor to the closing price of equity securities traded on foreign securities exchanges. The factor is based on observable market data as provided by an independent pricing service.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or long-term capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund may estimate the components of distributions received that may be considered nontaxable distributions or long-term capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Securities Sold Short — The fund enters into short sales, which is selling securities it does not own, as part of its normal investment activities. Upon selling a security short, the fund will segregate cash, cash equivalents or other appropriate liquid securities in at least an amount equal to the current market value of the securities sold short until the fund replaces the borrowed security. Interest earned on segregated cash for securities sold short, if any, is reflected as interest income. The fund is required to pay any dividends or interest due on securities sold short. Such dividends and interest are recorded as an expense. The fund may pay fees or charges on the assets borrowed for securities sold short. These fees are calculated daily based upon the value of each security sold short and a rate that is dependent on the availability of such security. Liabilities for securities sold short are valued daily and changes in value are recorded as change in net unrealized appreciation (depreciation) on securities sold short. The fund records realized gain (loss) on a security sold short when it is terminated by the fund and includes as a component of net realized gain (loss) on securities sold short transactions.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively. Net realized and unrealized foreign currency exchange gains or losses related to securities sold short are a component of net realized gain (loss) on securities sold short transactions and change in net unrealized appreciation (depreciation) on securities sold short, respectively.

Segregated Assets — In accordance with the 1940 Act, the fund segregates assets on its books and records to cover certain types of investment securities and other financial instruments. American Century Investment Management, Inc. (ACIM) (the investment advisor) monitors, on a daily basis, the securities segregated to ensure the fund designates a sufficient amount of liquid assets, marked-to-market daily. The fund may also receive assets or be required to pledge assets at the custodian bank or with a broker for collateral requirements.

23

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that ACIM has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. Accordingly, no provision has been made for income taxes. The fund files U.S. federal, state, local and non-U.S. tax returns as applicable. The fund's tax returns are subject to examination by the relevant taxing authority until expiration of the applicable statute of limitations, which is generally three years from the date of filing but can be longer in certain jurisdictions. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC). The corporation’s investment advisor, ACIM, the corporation's distributor, American Century Investment Services, Inc. (ACIS), and the corporation’s transfer agent, American Century Services, LLC, are wholly owned, directly or indirectly, by ACC.

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, expenses on securities sold short, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class's daily net assets and paid monthly in arrears. The difference in the fee among the classes is a result of their separate arrangements for non-Rule 12b-1 shareholder services. It is not the result of any difference in advisory or custodial fees or other expenses related to the management of the fund’s assets, which do not vary by class.

The annual management fee for each class is as follows:

| Investor Class | I Class | A Class | C Class | R Class |

| 1.65% | 1.45% | 1.65% | 1.65% | 1.65% |

24

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay ACIS an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%. The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the period ended March 31, 2020 are detailed in the Statement of Operations.

Directors' Fees and Expenses — The Board of Directors is responsible for overseeing the investment advisor’s management and operations of the fund. The directors receive detailed information about the fund and its investment advisor regularly throughout the year, and meet at least quarterly with management of the investment advisor to review reports about fund operations. The fund’s officers do not receive compensation from the fund.

Interfund Transactions — The fund may enter into security transactions with other American Century Investments funds and other client accounts of the investment advisor, in accordance with the 1940 Act rules and procedures adopted by the Board of Directors. The rules and procedures require, among other things, that these transactions be effected at the independent current market price of the security. During the period, the interfund purchases and sales were $1,880,505 and $8,206,165, respectively. The effect of interfund transactions on the Statement of Operations was $124,874 in net realized gain (loss) on investment transactions.

4. Investment Transactions

Purchases and sales of investment securities and securities sold short, excluding short-term investments, for the period ended March 31, 2020 were $733,336,412 and $735,640,978, respectively.

25

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

Year ended March 31, 2020 | Year ended March 31, 2019 | |||||||||

| Shares | Amount | Shares | Amount | |||||||

| Investor Class/Shares Authorized | 100,000,000 | 170,000,000 | ||||||||

| Sold | 321,330 | $ | 3,047,343 | 3,286,629 | $ | 33,034,441 | ||||

| Issued in reinvestment of distributions | 13,739 | 130,105 | 722,917 | 6,903,858 | ||||||

| Redeemed | (6,921,253 | ) | (65,546,953 | ) | (18,848,151 | ) | (187,412,531 | ) | ||

| (6,586,184 | ) | (62,369,505 | ) | (14,838,605 | ) | (147,474,232 | ) | |||

| I Class/Shares Authorized | 120,000,000 | 220,000,000 | ||||||||

| Sold | 7,043,479 | 68,117,462 | 15,751,101 | 161,495,339 | ||||||

| Issued in reinvestment of distributions | 43,691 | 420,744 | 1,062,405 | 10,315,952 | ||||||

| Redeemed | (20,814,474 | ) | (202,447,815 | ) | (22,323,814 | ) | (227,846,287 | ) | ||

| (13,727,304 | ) | (133,909,609 | ) | (5,510,308 | ) | (56,034,996 | ) | |||

| A Class/Shares Authorized | 30,000,000 | 25,000,000 | ||||||||

| Sold | 53,781 | 499,901 | 129,158 | 1,287,385 | ||||||

| Issued in reinvestment of distributions | 1,097 | 10,191 | 26,852 | 251,608 | ||||||

| Redeemed | (229,997 | ) | (2,138,082 | ) | (925,853 | ) | (9,237,455 | ) | ||

| (175,119 | ) | (1,627,990 | ) | (769,843 | ) | (7,698,462 | ) | |||

| C Class/Shares Authorized | 30,000,000 | 25,000,000 | ||||||||

| Sold | 58,928 | 512,711 | 60,650 | 567,849 | ||||||

| Issued in reinvestment of distributions | — | — | 91,016 | 801,847 | ||||||

| Redeemed | (802,602 | ) | (6,978,211 | ) | (1,288,401 | ) | (11,950,802 | ) | ||

| (743,674 | ) | (6,465,500 | ) | (1,136,735 | ) | (10,581,106 | ) | |||

| R Class/Shares Authorized | 20,000,000 | 10,000,000 | ||||||||

| Sold | 14,041 | 128,307 | 2,617 | 25,325 | ||||||

| Issued in reinvestment of distributions | 11 | 102 | 245 | 2,255 | ||||||

| Redeemed | (2,571 | ) | (23,518 | ) | (6,369 | ) | (62,013 | ) | ||

| 11,481 | 104,891 | (3,507 | ) | (34,433 | ) | |||||

| Net increase (decrease) | (21,220,800 | ) | $ | (204,267,713 | ) | (22,258,998 | ) | $ | (221,823,229 | ) |

6. Fair Value Measurements

The fund’s investments valuation process is based on several considerations and may use multiple inputs to determine the fair value of the investments held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels.

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical investments. |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for comparable investments, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.). These inputs also consist of quoted prices for identical investments initially expressed in local currencies that are adjusted through translation into U.S. dollars. |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

26

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| Level 1 | Level 2 | Level 3 | ||||||

| Assets | ||||||||

| Investment Securities | ||||||||

| Common Stocks | ||||||||

| Banks | $ | 1,068,322 | $ | 161,086 | — | |||

| Beverages | 423,113 | 221,341 | — | |||||

| Chemicals | 262,706 | 225,534 | — | |||||

| Food and Staples Retailing | 892,937 | 401,390 | — | |||||

| Household Durables | — | 117,180 | — | |||||

| Machinery | 815,414 | 2,276,347 | — | |||||

| Paper and Forest Products | — | 388,595 | — | |||||

| Pharmaceuticals | 1,512,990 | 108,265 | — | |||||

| Other Industries | 32,688,860 | — | — | |||||

| Convertible Bonds | — | 5,580,391 | — | |||||

| Exchange-Traded Funds | 4,019,937 | — | — | |||||

| Temporary Cash Investments | 8,788,096 | 4,183,943 | — | |||||

| $ | 50,472,375 | $ | 13,664,072 | — | ||||

| Other Financial Instruments | ||||||||

| Forward Foreign Currency Exchange Contracts | — | $ | 42,213 | — | ||||

| Liabilities | ||||||||

| Securities Sold Short | ||||||||

| Common Stocks | ||||||||

| Banks | $ | 1,265,948 | $ | 164,527 | — | |||

| Beverages | 431,659 | 216,527 | — | |||||

| Building Products | 548,113 | 402,422 | — | |||||

| Machinery | 1,980,972 | 2,141,683 | — | |||||

| Paper and Forest Products | — | 394,391 | — | |||||

| Pharmaceuticals | 1,448,721 | 213,059 | — | |||||

| Other Industries | 33,794,905 | — | — | |||||

| Exchange-Traded Funds | 7,884,915 | — | — | |||||

| $ | 47,355,233 | $ | 3,532,609 | — | ||||

| Other Financial Instruments | ||||||||

| Forward Foreign Currency Exchange Contracts | — | $ | 47,547 | — | ||||

27

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund's exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on forward foreign currency exchange contract transactions and change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The fund's average U.S. dollar exposure to foreign currency risk derivative instruments held during the period was $14,577,276.

The value of foreign currency risk derivative instruments as of March 31, 2020, is disclosed on the Statement of Assets and Liabilities as an asset of $42,213 in unrealized appreciation on forward foreign currency exchange contracts and a liability of $47,547 in unrealized depreciation on forward foreign currency exchange contracts. For the year ended March 31, 2020, the effect of foreign currency risk derivative instruments on the Statement of Operations was $3,262 in net realized gain (loss) on forward foreign currency exchange contract transactions and $(5,334) in change in net unrealized appreciation (depreciation) on forward foreign currency exchange contracts.

8. Risk Factors

The value of the fund’s shares will go up and down, sometimes rapidly or unpredictably, based on the performance of the companies whose securities it owns in its long portfolio, or in which the fund has taken a short position as well as other factors generally affecting the securities market. Market risks, including political, regulatory, economic and social developments, can affect the value of the fund’s investments. Natural disasters, public health emergencies, terrorism and other unforeseeable events may lead to increased market volatility and may have adverse long-term effects on world economies and markets generally.

The fund’s investment process may result in high portfolio turnover, which could mean high transaction costs, affecting both performance and capital gains tax liabilities to investors.

The fund is subject to short sales risk. If the market price of a security increases after the fund borrows the security, the fund may suffer a loss when it replaces the borrowed security at the higher price. Any loss will be increased by the amount of compensation, interest or dividends, and transaction costs the fund must pay to the lender of the borrowed security.

There are certain risks involved in investing in foreign securities. These risks include those resulting from political events (such as civil unrest, national elections and imposition of exchange controls), social and economic events (such as labor strikes and rising inflation), and natural disasters. Securities of foreign issuers may be less liquid and more volatile. Investing a significant portion of assets in one country or region may accentuate these risks.

9. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2020 and March 31, 2019 were as follows:

| 2020 | 2019 | |||||

| Distributions Paid From | ||||||

| Ordinary income | $ | 584,062 | $ | 3,983,846 | ||

| Long-term capital gains | — | $ | 14,688,163 | |||

28

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of period end, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| Federal tax cost of investments | $ | 68,768,707 | |

| Gross tax appreciation of investments | $ | 1,928,468 | |

| Gross tax depreciation of investments | (6,560,728 | ) | |

| Net tax appreciation (depreciation) of investments | (4,632,260 | ) | |

| Gross tax appreciation on securities sold short | 5,182,980 | ||

| Gross tax depreciation on securities sold short | (4,048,426 | ) | |

| Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | (354 | ) | |

| Net tax appreciation (depreciation) | $ | (3,498,060 | ) |

| Other book-to-tax adjustments | $ | (1,533,971 | ) |

| Undistributed ordinary income | — | ||

Accumulated short-term capital losses | $ | (38,675,059 | ) |

Late-year ordinary loss deferral | $ | (75,151 | ) |

The difference between book-basis and tax-basis unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales. Other book-to-tax adjustments are attributable primarily to the tax deferral of losses on straddle positions.

Accumulated capital losses represent net capital loss carryovers that may be used to offset future realized capital gains for federal income tax purposes. The capital loss carryovers may be carried forward for an unlimited period. Future capital loss carryover utilization in any given year may be subject to Internal Revenue Code limitations.

Loss deferrals represent certain qualified losses that the fund has elected to treat as having been incurred in

the following fiscal year for federal income tax purposes.

10. Recently Issued Accounting Standards