The individuals listed below serve as directors of the fund. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors), is 72. However, the mandatory retirement age for an individual director may be extended with the approval of the remaining independent directors.

Mr. Thomas is the only director who is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor).

The other directors (more than three-fourths of the total number) are independent; that is, they have never been employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS). The directors serve in this capacity for seven (in the case of Mr. Thomas, 15) registered investment companies in the American Century Investments family of funds.

The following presents additional information about the directors. The mailing address for each director is 4500 Main Street, Kansas City, Missouri 64111.

ANNUAL REPORT MARCH 31, 2011

| President’s Letter | 2 |

| Independent Chairman’s Letter | 3 |

| Market Perspective | 4 |

| Performance | 5 |

| Portfolio Commentary | 7 |

| Fund Characteristics | 9 |

| Shareholder Fee Example | 10 |

| Schedule of Investments | 12 |

| Statement of Assets and Liabilities | 15 |

| Statement of Operations | 16 |

| Statement of Changes in Net Assets | 17 |

| Notes to Financial Statements | 18 |

| Financial Highlights | 24 |

| Report of Independent Registered Public Accounting Firm | 29 |

| Proxy Results | 30 |

| Management | 31 |

| Additional Information | 34 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2011. Our report offers investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional, updated information on fund performance, portfolio strategy, and the investment markets, we encourage you to visit our website, americancentury.com. Click on the “Fund Performance” and “Insights & News” headings at the top of our Individual Investors site.

Investment Performance and Macroeconomic Update

Investment performance tables turned dramatically since our semiannual report for the six months ended September 30, 2010. That report chronicled an uneven period for economic growth and financial market performance that produced generally higher returns for U.S. bonds than for U.S. stocks. For the subsequent six months ended March 31, 2011, broad U.S. stock indices significantly outperformed their bond counterparts as monetary and fiscal intervention in 2010 fueled investor optimism about economic and financial market conditions in 2011 and 2012. The S&P 500 Index (representing U.S. stocks) and the Barclays Capital U.S. Aggregate Bond Index returned 17.31% and -0.88%, respectively, during those final six months.

In the second half of 2010, the U.S. Federal Reserve launched its second round of quantitative easing (QE2), a form of monetary intervention involving the purchase of U.S. government securities to increase the money supply and encourage investors to purchase potentially higher-risk/higher-return assets, such as stocks. Small-cap growth stocks benefited most from the resulting rally. But besides boosting stock prices, QE2 also helped fuel inflation fears. The benchmark 10-year U.S. Treasury note suffered a -5.92% total return from September 30, 2010, to March 31, 2011, as its yield jumped from 2.51% to 3.47%.

These developments over the more-recent six months are incorporated in the broader, enclosed 12-month Market Perspective and Portfolio Commentary from the portfolio management team. Our experts will continue to diligently apply their knowledge and skills as they make daily investment decisions for you.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

Independent Chairman’s Letter |

Don Pratt

Dear Fellow Shareholders,

With an existing vacancy and several directors approaching retirement age over the next few years, your American Century Investments Kansas City-based mutual fund board of directors recently addressed board succession planning. The board developed a succession plan and conducted an extensive search that yielded two new members who will join the board in 2011.

As part of the planning process, the board referred to the criteria for potential new directors set forth in its director nomination policy adopted in 2009. A nomination process generated more than 20 candidates whose credentials were reviewed by the board’s Governance Committee. Six candidates were selected by the committee for telephone interviews. Three were then chosen for in person interviews.

The committee recommended, and the full board approved, the addition of Jan Lewis, currently the President and Chief Executive Officer of Catholic Charities of Northeast Kansas, to fill the vacant board seat and the addition as an advisory director of Stephen E. Yates, who recently retired as Executive Vice President, Technology and Operations at Keycorp of Cleveland, Ohio. Mr. Yates will serve in an advisory capacity for 12-18 months before becoming an active director. Both of these additions bring operating management experience and unique perspectives to our various tasks.

We look forward to the contributions of our new directors to our efforts as shareholder representatives and thank the Governance Committee for their thorough search process.

If you have comments, suggestions or questions send them to me at dhpratt@fundboardchair.com.

Best regards,

Don Pratt

By Phil Davidson, Chief Investment Officer, U.S. Value Equity

U.S. Stocks Enjoyed Double-Digit Gains

Thanks to a sharp rally during the last six months, the U.S. stock market enjoyed solid gains for the one-year period ended March 31, 2011. The market’s upward trajectory was fueled by renewed investor confidence in a sustainable economic recovery.

The period started on a down note as the U.S. economic expansion that began in mid-2009 started to lose momentum. Signs of slowing economic growth in the second and third quarters of 2010, along with intensifying sovereign debt problems in Europe, raised the possibility of a “double-dip” recession (a recession followed by a brief recovery and then another recession). Uncertain economic expectations led to a broad stock decline and increased market volatility during the first half of the 12-month period.

However, stocks rebounded during the last six months of the period as the clouded economic outlook came into sharper focus. As the Federal Reserve implemented a second round of quantitative easing measures, economic data steadily improved, most notably in the labor market, which produced six straight months of positive job growth. Furthermore, corporate profit growth remained robust as cost-cutting efforts at many companies during the 2008–09 recession translated into substantial operating leverage as economic activity increased. As a result, the equity market rallied sharply throughout the last half of the 12-month period, overcoming some challenges in early 2011, including growing unrest in the Middle East and an earthquake and tsunami in Japan.

Value Stocks Underperformed

Although stocks rallied across the board, smaller-company issues and growth-oriented companies were the best performers (see the table below). Growth shares outpaced value amid increased demand for economically sensitive stocks, which tend to be congregated in growth-oriented sectors of the market. In addition, investors’ higher appetite for risk during the latter half of the period favored growth stocks.

Another factor contributing to the underperformance of value stocks was the financials sector (the largest weighting in most value indices), which posted the lowest return of any sector in the market. Continued weakness in the housing market and regulatory uncertainty weighed on the shares of financial companies.

| U.S. Stock Index Returns |

| For the 12 months ended March 31, 2011 |

| Russell 1000 Index (Large-Cap) | 16.69% | | Russell 2000 Index (Small-Cap) | 25.79% |

| Russell 1000 Growth Index | 18.26% | | Russell 2000 Growth Index | 31.04% |

| Russell 1000 Value Index | 15.15% | | Russell 2000 Value Index | 20.63% |

| Russell Midcap Index | 24.27% | | |

| Russell Midcap Growth Index | 26.60% | | | |

| Russell Midcap Value Index | 22.26% | | | |

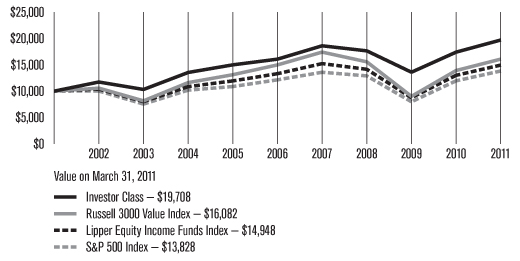

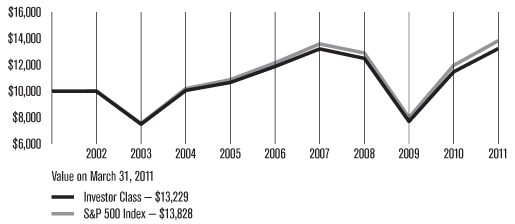

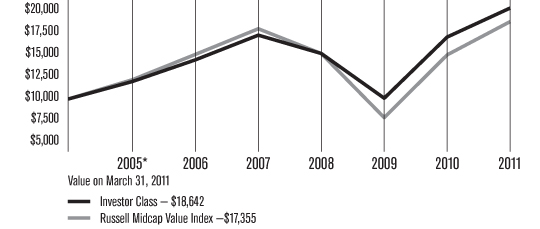

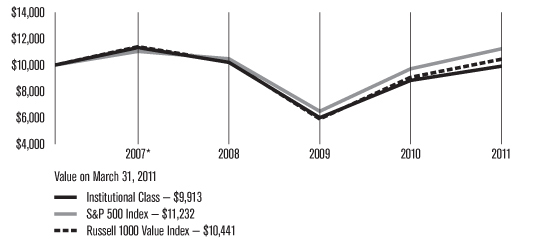

| Total Returns as of March 31, 2011 |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | Sinc Inception | Inception Date |

| Investor Class | ACMVX | 17.34% | 6.32% | 9.30% | 3/31/04 |

| Russell Midcap Value Index | — | 22.26% | 4.04% | 8.19% | — |

| Institutional Class | AVUAX | 17.66% | 6.55% | 9.88% | 8/2/04 |

A Class(1) No sales charge* With sales charge* | ACLAX | 17.05% 10.28% | 6.06% 4.81% | 8.10% 7.08% | 1/13/05 |

| C Class | ACCLX | 16.24% | — | 19.27% | 3/1/10 |

| R Class | AMVRX | 16.85% | 5.83% | 6.48% | 7/29/05 |

| * | Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| (1) | Prior to March 1, 2010, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that date has been adjusted to reflect this charge. |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index does not.

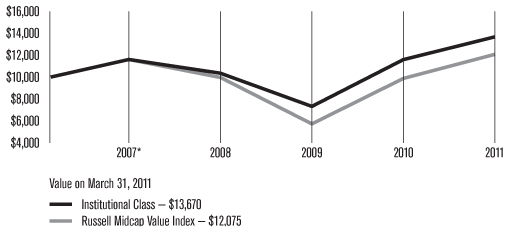

| Growth of $10,000 Over Life of Class |

| $10,000 investment made March 31, 2004 |

*From 3/31/04, the Investor Class’s inception date. Not annualized.

| Total Annual Fund Operating Expenses |

| Investor Class | Institutional Class | A Class | C Class | R Class |

| 1.01% | 0.81% | 1.26% | 2.01% | 1.51% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the index are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the index does not.

Portfolio Managers: Kevin Toney, Michael Liss, and Phil Davidson

Performance Summary

Mid Cap Value returned 17.34%* for the 12 months ended March 31, 2011. By comparison, the average return for Morningstar’s Mid Cap Value category (its performance, like Mid Cap Value’s, reflects operating expenses) was 20.45%.** The fund’s benchmark, the Russell Midcap Value Index, was up 22.26%. Its returns do not include operating expenses.

As the U.S. economy continued its slow recovery, investors digested the implications of several dramatic events, including the sovereign debt crisis in Europe, the oil spill in the Gulf of Mexico, turmoil in the Middle East, and the earthquake, tsunami, and nuclear disaster in Japan. Higher-risk stocks were in favor as fears of a double-dip recession eased. At the same time, investors continued to favor higher-yielding securities because of very low interest rates. Growth stocks outperformed their value counterparts across the capitalization spectrum. In this environment, Mid Cap Value’s investment approach, which emphasizes higher-quality businesses with sound balance sheets, provided positive absolute results in all ten of the sectors in which it was invested. On a relative basis, performance was dampened by investments in the energy, financials, and consumer discretionary sectors. Its positions in the utilities, information technology, and industrials sectors enhanced results.

We carefully manage this portfolio for long-term results. Since its inception on March 31, 2004, Mid Cap Value has produced an average annual return of 9.30%, topping the returns for that period for Morningstar’s Mid Cap Value category average and the Russell Midcap Value Index (see the performance information on pages 5 and 6 or in footnotes below).

Energy Slowed Performance

Mid Cap Value was hampered by an underweight in energy, which was by far the strongest-performing sector in the benchmark. Our bias toward stable companies with low-risk business models also detracted from relative results. Because of valuations, the portfolio did not own the riskier exploration and production names, many of which appreciated as oil prices surged during the period.

Financials Hampered Progress

In financials, security selection and the portfolio’s conservative positioning dampened relative performance. Specifically, Mid Cap Value was hindered by its overweight in thrifts and mortgage finance stocks. A top detractor was Hudson City Bank, a regional bank operating primarily in New Jersey and New York. As its share price declined, the management team took advantage of weakness to add to the portfolio’s position. Hudson has restructured its balance sheet to reduce its higher-cost borrowings in order to mitigate interest rate risk and to compete more effectively in the residential mortgage marketplace.

| * | All fund returns referenced in this commentary are for Investor Class shares. |

| ** | The average returns for Morningstar’s Mid Cap Value category were 3.87% for the five-year period ended March 31, 2011, and 6.95% since March 31, 2004, the Investor Class’s inception. © Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. |

The capital markets segment supplied top detractor Northern Trust Corp. The company was negatively impacted by expectations of a prolonged period of historically low interest rates and concerns about the diminished profitability of its securities lending and foreign exchange businesses.

Consumer Discretionary Detracted

In consumer discretionary, an overweight in specialty retailers was a drag on relative performance. A key detractor was Staples. The largest U.S. office supply retailer reported disappointing earnings in the first quarter of 2011 as a result of winter storm disruptions and the promotional efforts of its competitors. In addition, the chain’s profits were hurt by weakness in white-collar employment.

Utilities and Information Technology Boosted Performance

Mid Cap Value’s mix of utilities stocks enhanced relative results. The portfolio benefited from our preference for higher-quality utilities, such as regulated utilities like Wisconsin Energy Corp. and Westar Energy, which have stable business models.

An underweight and security selection in the information technology sector contributed to relative performance. Holdings among IT services companies and semiconductor names were particularly advantageous. A notable contributor was Teradyne, a semiconductor test equipment maker that is not represented in the benchmark. The company reported improved earnings and stands to make market gains if its rival Verigy is acquired by Advantest, a supplier of automatic test equipment for the semiconductor industry.

Industrials Contributed Positively

In industrials, Mid Cap Value benefited from its overweight to companies with exposure to the late stage of the industrial cycle and which had not yet benefited from the global economic recovery. Top contributors were Hubbell and Thomas & Betts Corp., which both of which manufacture electrical components. The share prices of these companies climbed as demand in their end markets began to normalize.

Outlook

We continue to follow our disciplined, bottom-up process, selecting companies one at a time for the portfolio. As of March 31, 2011, we see opportunities in consumer staples, industrials, telecommunication services, and health care reflected by overweight positions in these sectors, relative to the benchmark. Our fundamental analysis and valuation work are also directing us toward smaller relative weightings in energy, utilities, information technology, and

financials stocks.

| MARCH 31, 2011 | |

| Top Ten Holdings | % of net assets |

| Republic Services, Inc. | 3.1% |

| Northern Trust Corp. | 2.5% |

| Kimberly-Clark Corp. | 2.3% |

| Imperial Oil Ltd. | 2.2% |

| Lowe’s Cos., Inc. | 2.2% |

| PG&E Corp. | 1.9% |

| ConAgra Foods, Inc. | 1.8% |

| Koninklijke Philips Electronics NV | 1.7% |

| Hudson City Bancorp., Inc. | 1.7% |

| Murphy Oil Corp. | 1.7% |

| | |

| Top Five Industries | % of net assets |

| Insurance | 10.8% |

| Oil, Gas & Consumable Fuels | 8.1% |

| Food Products | 5.9% |

| Real Estate Investment Trusts (REITs) | 4.8% |

| Electric Utilities | 4.8% |

| | |

| Types of Investments in Portfolio | % of net assets |

| Domestic Common Stocks | 89.5% |

| Foreign Common Stocks* | 7.7% |

| Total Common Stocks | 97.2% |

| Temporary Cash Investments | 3.2% |

| Other Assets and Liabilities | (0.4)% |

*Includes depositary shares, dual listed securities and foreign ordinary shares.

Shareholder Fee Example (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2010 to March 31, 2011.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | | |

| | Beginning Account Value 10/1/10 | Ending Account Value 3/31/11 | Expenses Paid During Period* 10/1/10 - 3/31/11 | Annualized Expense Ratio* |

| Actual |

| Investor Class | $1,000 | $1,160.80 | $5.39 | 1.00% |

| Institutional Class | $1,000 | $1,161.80 | $4.31 | 0.80% |

| A Class | $1,000 | $1,159.30 | $6.73 | 1.25% |

| C Class | $1,000 | $1,154.60 | $10.74 | 2.00% |

| R Class | $1,000 | $1,158.80 | $8.07 | 1.50% |

| Hypothetical |

| Investor Class | $1,000 | $1,019.95 | $5.04 | 1.00% |

| Institutional Class | $1,000 | $1,020.94 | $4.03 | 0.80% |

| A Class | $1,000 | $1,018.70 | $6.29 | 1.25% |

| C Class | $1,000 | $1,014.96 | $10.05 | 2.00% |

| R Class | $1,000 | $1,017.45 | $7.54 | 1.50% |

| * | Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

| | | |

| | Shares | Value |

| Common Stocks — 97.2% |

| AEROSPACE & DEFENSE — 1.2% |

Huntington Ingalls Industries, Inc.(1) | 205,600 | $8,532,400 |

| ITT Corp. | 221,300 | 13,289,065 |

| | | 21,821,465 |

| AIRLINES — 0.7% |

| Southwest Airlines Co. | 1,014,100 | 12,808,083 |

| CAPITAL MARKETS — 3.8% |

| Franklin Resources, Inc. | 113,400 | 14,184,072 |

| Northern Trust Corp. | 874,800 | 44,396,100 |

| State Street Corp. | 192,700 | 8,659,938 |

| | | 67,240,110 |

| CHEMICALS — 0.6% |

| Minerals Technologies, Inc. | 166,501 | 11,408,648 |

| COMMERCIAL BANKS — 3.6% |

| BOK Financial Corp. | 87,200 | 4,506,496 |

| Comerica, Inc. | 692,528 | 25,429,628 |

| Commerce Bancshares, Inc. | 488,221 | 19,743,657 |

| Cullen/Frost Bankers, Inc. | 59,600 | 3,517,592 |

| SunTrust Banks, Inc. | 357,300 | 10,304,532 |

| | | 63,501,905 |

| COMMERCIAL SERVICES & SUPPLIES — 4.6% |

| Cintas Corp. | 420,500 | 12,728,535 |

| Pitney Bowes, Inc. | 264,400 | 6,792,436 |

| Republic Services, Inc. | 1,818,698 | 54,633,688 |

| Waste Management, Inc. | 187,044 | 6,984,223 |

| | | 81,138,882 |

| COMMUNICATIONS EQUIPMENT — 0.6% |

Emulex Corp.(1) | 1,005,800 | 10,731,886 |

| CONTAINERS & PACKAGING — 1.5% |

| Bemis Co., Inc. | 786,006 | 25,788,857 |

| DISTRIBUTORS — 0.3% |

| Genuine Parts Co. | 84,294 | 4,521,530 |

| DIVERSIFIED — 1.2% |

| iShares Russell Midcap Value Index Fund | 453,445 | 21,837,911 |

| DIVERSIFIED TELECOMMUNICATION SERVICES — 2.4% |

| Consolidated Communications Holdings, Inc. | 322,600 | 6,042,298 |

| Qwest Communications International, Inc. | 2,874,100 | 19,630,103 |

| TELUS Corp. | 223,600 | 11,432,545 |

| Windstream Corp. | 409,100 | 5,265,117 |

| | | 42,370,063 |

| ELECTRIC UTILITIES — 4.8% |

| American Electric Power Co., Inc. | 296,455 | 10,417,428 |

| IDACORP, Inc. | 83,768 | 3,191,561 |

| Northeast Utilities | 407,083 | 14,085,072 |

| NV Energy, Inc. | 1,541,400 | 22,951,446 |

| Portland General Electric Co. | 354,536 | 8,427,321 |

| Westar Energy, Inc. | 951,010 | 25,125,684 |

| | | 84,198,512 |

| ELECTRICAL EQUIPMENT — 2.7% |

| Hubbell, Inc., Class B | 261,935 | 18,605,243 |

Thomas & Betts Corp.(1) | 474,600 | 28,224,462 |

| | | 46,829,705 |

| ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS — 0.5% |

| Molex, Inc., Class A | 454,100 | 9,395,329 |

| FOOD & STAPLES RETAILING — 2.8% |

| CVS Caremark Corp. | 813,400 | 27,915,888 |

| SYSCO Corp. | 802,600 | 22,232,020 |

| | | 50,147,908 |

| FOOD PRODUCTS — 5.9% |

| ConAgra Foods, Inc. | 1,356,190 | 32,209,513 |

| General Mills, Inc. | 594,600 | 21,732,630 |

| H.J. Heinz Co. | 506,725 | 24,738,314 |

| Kellogg Co. | 463,700 | 25,030,526 |

| | | 103,710,983 |

| GAS UTILITIES — 0.7% |

| AGL Resources, Inc. | 326,800 | 13,019,712 |

| HEALTH CARE EQUIPMENT & SUPPLIES — 3.5% |

Boston Scientific Corp.(1) | 1,220,200 | 8,773,238 |

CareFusion Corp.(1) | 566,861 | 15,985,480 |

| Covidien plc | 153,300 | 7,962,402 |

Symmetry Medical, Inc.(1) | 232,871 | 2,282,136 |

Zimmer Holdings, Inc.(1) | 439,000 | 26,572,670 |

| | | 61,575,926 |

| HEALTH CARE PROVIDERS & SERVICES — 2.9% |

LifePoint Hospitals, Inc.(1) | 576,700 | 23,171,806 |

| Patterson Cos., Inc. | 636,400 | 20,485,716 |

| Quest Diagnostics, Inc. | 76,600 | 4,421,352 |

Select Medical Holdings Corp.(1) | 460,178 | 3,709,035 |

| | | 51,787,909 |

| HOTELS, RESTAURANTS & LEISURE — 2.1% |

| CEC Entertainment, Inc. | 638,800 | $24,101,924 |

| International Speedway Corp., Class A | 264,907 | 7,894,229 |

| Speedway Motorsports, Inc. | 267,543 | 4,275,337 |

| | | 36,271,490 |

| HOUSEHOLD DURABLES — 1.5% |

| Stanley Black & Decker, Inc. | 112,000 | 8,579,200 |

| Whirlpool Corp. | 213,200 | 18,198,752 |

| | | 26,777,952 |

| HOUSEHOLD PRODUCTS — 3.5% |

| Clorox Co. | 220,600 | 15,457,442 |

Energizer Holdings, Inc.(1) | 99,000 | 7,044,840 |

| Kimberly-Clark Corp. | 614,123 | 40,083,808 |

| | | 62,586,090 |

| INDUSTRIAL CONGLOMERATES — 2.4% |

Koninklijke Philips Electronics NV(1) | 957,900 | 30,619,222 |

| Tyco International Ltd. | 265,600 | 11,890,912 |

| | | 42,510,134 |

| INSURANCE — 10.8% |

| ACE Ltd. | 320,500 | 20,736,350 |

| Allstate Corp. (The) | 558,800 | 17,758,664 |

| Aon Corp. | 420,900 | 22,290,864 |

| Chubb Corp. (The) | 254,100 | 15,578,871 |

| HCC Insurance Holdings, Inc. | 688,160 | 21,546,289 |

| Marsh & McLennan Cos., Inc. | 638,227 | 19,025,547 |

| Symetra Financial Corp. | 602,878 | 8,199,141 |

| Torchmark Corp. | 86,900 | 5,777,112 |

| Transatlantic Holdings, Inc. | 480,558 | 23,388,758 |

| Travelers Cos., Inc. (The) | 379,400 | 22,566,712 |

| Unum Group | 496,400 | 13,030,500 |

| | | 189,898,808 |

| IT SERVICES — 0.8% |

| Automatic Data Processing, Inc. | 86,700 | 4,448,577 |

Booz Allen Hamilton Holding Corp.(1) | 486,164 | 8,755,814 |

| | | 13,204,391 |

| LEISURE EQUIPMENT & PRODUCTS — 0.5% |

| Mattel, Inc. | 321,400 | 8,012,502 |

| MACHINERY — 1.6% |

| Harsco Corp. | 166,200 | 5,865,198 |

| Kaydon Corp. | 580,356 | 22,744,152 |

| | | 28,609,350 |

| METALS & MINING — 1.0% |

| Newmont Mining Corp. | 318,138 | 17,363,972 |

| MULTILINE RETAIL — 0.7% |

| Target Corp. | 262,000 | 13,102,620 |

| MULTI-UTILITIES — 3.3% |

| Consolidated Edison, Inc. | 117,800 | 5,974,816 |

| PG&E Corp. | 774,700 | 34,226,246 |

| Wisconsin Energy Corp. | 139,200 | 4,245,600 |

| Xcel Energy, Inc. | 597,768 | 14,280,678 |

| | | 58,727,340 |

| OIL, GAS & CONSUMABLE FUELS — 8.1% |

| Devon Energy Corp. | 99,000 | 9,085,230 |

| EQT Corp. | 576,657 | 28,775,184 |

| Imperial Oil Ltd. | 771,500 | 39,422,496 |

| Murphy Oil Corp. | 397,800 | 29,206,476 |

| Noble Energy, Inc. | 53,900 | 5,209,435 |

Southwestern Energy Co.(1) | 193,500 | 8,314,695 |

| Spectra Energy Partners LP | 291,800 | 9,591,466 |

Ultra Petroleum Corp.(1) | 66,700 | 3,284,975 |

| Williams Partners LP | 197,300 | 10,220,140 |

| | | 143,110,097 |

| PAPER & FOREST PRODUCTS — 0.6% |

| MeadWestvaco Corp. | 352,600 | 10,694,358 |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 4.8% |

| Annaly Capital Management, Inc. | 748,316 | 13,058,114 |

| Capstead Mortgage Corp. | 483,500 | 6,179,130 |

| Government Properties Income Trust | 959,098 | 25,761,372 |

| Host Hotels & Resorts, Inc. | 117,869 | 2,075,673 |

| National Health Investors, Inc. | 105,400 | 5,050,768 |

| Piedmont Office Realty Trust, Inc., Class A | 1,218,762 | 23,656,171 |

| Weyerhaeuser Co. | 394,371 | 9,701,527 |

| | | 85,482,755 |

| SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT — 1.8% |

| Applied Materials, Inc. | 1,508,200 | 23,558,084 |

Teradyne, Inc.(1) | 463,600 | 8,256,716 |

| | | 31,814,800 |

| SOFTWARE — 0.5% |

Cadence Design Systems, Inc.(1) | 848,200 | 8,269,950 |

| SPECIALTY RETAIL — 4.3% |

| Best Buy Co., Inc. | 395,300 | 11,353,016 |

| Lowe’s Cos., Inc. | 1,470,300 | 38,860,029 |

| Staples, Inc. | 1,297,100 | 25,189,682 |

| | | 75,402,727 |

| THRIFTS & MORTGAGE FINANCE — 3.4% |

| Capitol Federal Financial, Inc. | 595,687 | $6,713,392 |

| Hudson City Bancorp., Inc. | 3,093,900 | 29,948,952 |

| People’s United Financial, Inc. | 1,868,289 | 23,503,076 |

| | | 60,165,420 |

| TRADING COMPANIES & DISTRIBUTORS — 0.4% |

Beacon Roofing Supply, Inc.(1) | 370,300 | 7,580,041 |

| WIRELESS TELECOMMUNICATION SERVICES — 0.8% |

| Rogers Communications, Inc., Class B | 384,600 | 13,979,684 |

TOTAL COMMON STOCKS(Cost $1,545,659,867) | 1,717,399,805 |

| Temporary Cash Investments — 3.2% |

| JPMorgan U.S. Treasury Plus Money Market Fund Agency Shares | 23,268 | $23,268 |

Repurchase Agreement, Credit Suisse First Boston, Inc., (collateralized by various U.S. Treasury obligations, 1.50%, 1/31/14, valued at $57,221,544), in a joint trading account at 0.07%, dated 3/31/11, due 4/1/11 (Delivery value $56,100,109) | 56,100,000 |

TOTAL TEMPORARY CASH INVESTMENTS(Cost $56,123,268) | 56,123,268 |

TOTAL INVESTMENT SECURITIES — 100.4%(Cost $1,601,783,135) | 1,773,523,073 |

| OTHER ASSETS AND LIABILITIES — (0.4)% | (6,376,385) |

| TOTAL NET ASSETS — 100.0% | $1,767,146,688 |

| Forward Foreign Currency Exchange Contracts |

| Contracts to Sell | Counterparty | Settlement Date | Value | Unrealized Gain (Loss) |

| 50,373,716 | CAD for USD | Bank of America | 4/29/11 | $51,931,669 | $(295,182) |

| 17,410,790 | EUR for USD | UBS AG | 4/29/11 | 24,664,416 | (110,302) |

| | | | | $76,596,085 | $(405,484) |

(Value on Settlement Date $76,190,601)

Notes to Schedule of Investments

EUR = Euro

USD = United States Dollar

See Notes to Financial Statements.

Statement of Assets and Liabilities |

| MARCH 31, 2011 |

| Assets |

| Investment securities, at value (cost of $1,601,783,135) | $1,773,523,073 |

| Receivable for investments sold | 3,043,259 |

| Receivable for capital shares sold | 22,055,949 |

| Dividends and interest receivable | 4,613,754 |

| | 1,803,236,035 |

| Liabilities |

| Payable for investments purchased | 32,754,039 |

| Payable for capital shares redeemed | 1,502,530 |

| Unrealized loss on forward foreign currency exchange contracts | 405,484 |

| Accrued management fees | 1,362,616 |

| Distribution and service fees payable | 64,678 |

| | 36,089,347 |

| | |

| Net Assets | $1,767,146,688 |

| | |

| Net Assets Consist of: |

| Capital (par value and paid-in surplus) | $1,571,921,967 |

| Undistributed net investment income | 2,804,020 |

| Undistributed net realized gain | 21,082,873 |

| Net unrealized appreciation | 171,337,828 |

| | $1,767,146,688 |

| | Net assets | Shares outstanding | Net asset value per share |

| Investor Class, $0.01 Par Value | $1,334,229,790 | | 101,585,727 | | $13.13 | |

| Institutional Class, $0.01 Par Value | $170,181,879 | | 12,954,381 | | $13.14 | |

| A Class, $0.01 Par Value | $215,812,824 | | 16,430,613 | | $13.13 | * |

| C Class, $0.01 Par Value | $5,989,447 | | 455,847 | | $13.14 | |

| R Class, $0.01 Par Value | $40,932,748 | | 3,116,021 | | $13.14 | |

*Maximum offering price $13.93 (net asset value divided by 0.9425)

See Notes to Financial Statements.

| YEAR ENDED MARCH 31, 2011 |

| Investment Income (Loss) |

| Income: | |

| Dividends (net of foreign taxes withheld of $80,453) | $31,180,973 |

| Interest | 34,741 |

| | 31,215,714 |

| Expenses: | |

| | |

| Management fees | 9,891,262 |

| Distribution and service fees: | |

| A Class | 311,808 |

| C Class | 18,162 |

| R Class | 121,293 |

| Directors’ fees and expenses | 39,514 |

| Other expenses | 43,973 |

| | 10,426,012 |

| | |

| Net investment income (loss) | 20,789,702 |

| | |

| Realized and Unrealized Gain (Loss) |

| Net realized gain (loss) on: | |

| Investment transactions | 91,366,774 |

| Foreign currency transactions | (1,587,912) |

| | 89,778,862 |

| | |

| Change in net unrealized appreciation (depreciation) on: | |

| Investments | 87,796,941 |

| Translation of assets and liabilities in foreign currencies | (361,007) |

| | 87,435,934 |

| | |

| Net realized and unrealized gain (loss) | 177,214,796 |

| | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | $198,004,498 |

See Notes to Financial Statements.

Statement of Changes in Net Assets |

| YEARS ENDED MARCH 31, 2011 AND MARCH 31, 2010 |

| Increase (Decrease) in Net Assets | 2011 | 2010 |

| Operations |

| Net investment income (loss) | $20,789,702 | $7,479,824 |

| Net realized gain (loss) | 89,778,862 | 46,250,158 |

| Change in net unrealized appreciation (depreciation) | 87,435,934 | 121,366,633 |

| Net increase (decrease) in net assets resulting from operations | 198,004,498 | 175,096,615 |

| | | |

| Distributions to Shareholders |

| From net investment income: | | |

| Investor Class | (13,839,031) | (4,964,361) |

| Institutional Class | (2,589,110) | (603,466) |

| A Class | (2,017,571) | (619,938) |

| C Class | (11,585) | — |

| R Class | (327,247) | (93,212) |

| Decrease in net assets from distributions | (18,784,544) | (6,280,977) |

| | | |

| Capital Share Transactions |

| Net increase (decrease) in net assets from capital share transactions | 948,545,915 | 211,781,652 |

| | | |

| | | |

| Net increase (decrease) in net assets | 1,127,765,869 | 380,597,290 |

| | | |

| Net Assets |

| Beginning of period | 639,380,819 | 258,783,529 |

| End of period | $1,767,146,688 | $639,380,819 |

| | | |

| Undistributed net investment income | $2,804,020 | $900,994 |

See Notes to Financial Statements.

Notes to Financial Statements |

MARCH 31, 2011

1. Organization

American Century Capital Portfolios, Inc. (the corporation) is registered under the Investment Company Act of 1940, as amended (the 1940 Act), as an open-end management investment company and is organized as a Maryland corporation. Mid Cap Value Fund (the fund) is one fund in a series issued by the corporation. The fund is diversified as defined under the 1940 Act. The fund’s investment objective is to seek long-term capital growth. Income is a secondary objective. The fund pursues its objectives by investing primary in stocks of medium size companies that management believes to be undervalued at the time of purchase.

The fund is authorized to issue the Investor Class, the Institutional Class, the A Class (formerly Advisor Class), the C Class and the R Class. The A Class may incur an initial sales charge. The A Class and C Class may be subject to a contingent deferred sales charge. The share classes differ principally in their respective sales charges and distribution and shareholder servicing expenses and arrangements. The Institutional Class is made available to institutional shareholders or through financial intermediaries whose clients do not require the same level of shareholder and administrative services as shareholders of other classes. As a result, the Institutional Class is charged a lower unified management fee. Sale of the C Class commenced on March 1, 2010.

2. Significant Accounting Policies

The following is a summary of significant accounting policies consistently followed by the fund in preparation of its financial statements. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America, which may require management to make certain estimates and assumptions at the date of the financial statements. Actual results could differ from these estimates.

Investment Valuations — The fund determines the fair value of its investments and computes its net asset value per share as of the close of regular trading (usually 4 p.m. Eastern time) on the New York Stock Exchange (NYSE) on each day the NYSE is open.

Equity securities that are listed or traded on a domestic securities exchange are valued at the last reported sales price or at the official closing price as provided by the exchange. Equity securities traded on foreign securities exchanges are typically valued at the closing price on the exchange where primarily traded or as of the close of the NYSE, if that is earlier. If no last sales price is reported, or if local convention or regulation so provides, the mean of the latest bid and asked prices is used. Depending on local convention or regulation, securities traded over-the-counter are valued at the mean of the latest bid and asked prices, the last sales price, or the official closing price. In its determination of fair value, the fund may review several factors including: market information specific to a security; news developments in U.S. and foreign markets; the performance of particular U.S. and foreign securities, indices, comparable securities, American Depositary Receipts, Exchange-Traded Funds, and other relevant market indicators.

Debt securities maturing within 60 days at the time of purchase may be valued at cost, plus or minus any amortized discount or premium or at the evaluated mean as provided by an independent pricing service. Evaluated mean prices are commonly derived through utilization of market models, which may consider, among other factors, trade data, quotations from dealers and active market makers, relevant yield curve and spread data, related sector levels, creditworthiness, and other relevant market information on the same or comparable securities.

Investments in open-end management investment companies are valued at the reported net asset value per share. Repurchase agreements are valued at cost. Forward foreign currency exchange contracts are valued at the mean of the latest bid and asked prices of the forward currency rates as provided by an independent pricing service.

The value of investments initially expressed in foreign currencies is translated into U.S. dollars at prevailing exchange rates.

If the fund determines that the market price for a portfolio security is not readily available or the valuation methods mentioned above do not reflect a security’s fair value, such security is valued as determined in good faith by the Board of Directors or its designee, in accordance with procedures adopted by the Board of Directors. Circumstances that may cause the fund to use these procedures to value a security include, but are not limited to: a security has been declared in default; trading in a security has been halted during the trading day; there is a foreign market holiday and no trading occurred; or an event occurred between the close of a foreign exchange and the NYSE that may affect the value of a security.

Security Transactions — Security transactions are accounted for as of the trade date. Net realized gains and losses are determined on the identified cost basis, which is also used for federal income tax purposes.

Investment Income — Dividend income less foreign taxes withheld, if any, is recorded as of the ex-dividend date. Distributions received on securities that represent a return of capital or capital gain are recorded as a reduction of cost of investments and/or as a realized gain. The fund estimates the components of distributions received that may be considered nontaxable distributions or capital gain distributions for income tax purposes. Interest income is recorded on the accrual basis and includes accretion of discounts and amortization of premiums.

Foreign Currency Translations — All assets and liabilities initially expressed in foreign currencies are translated into U.S. dollars at prevailing exchange rates at period end. The fund may enter into spot foreign currency exchange contracts to facilitate transactions denominated in a foreign currency. Purchases and sales of investment securities, dividend and interest income, spot foreign currency exchange contracts, and expenses are translated at the rates of exchange prevailing on the respective dates of such transactions. Net realized and unrealized foreign currency exchange gains or losses related to investment securities are a component of net realized gain (loss) on investment transactions and change in net unrealized appreciation (depreciation) on investments, respectively.

Repurchase Agreements — The fund may enter into repurchase agreements with institutions that American Century Investment Management, Inc. (ACIM) (the investment advisor) has determined are creditworthy pursuant to criteria adopted by the Board of Directors. The fund requires that the collateral, represented by securities, received in a repurchase transaction be transferred to the custodian in a manner sufficient to enable the fund to obtain those securities in the event of a default under the repurchase agreement. ACIM monitors, on a daily basis, the securities transferred to ensure the value, including accrued interest, of the securities under each repurchase agreement is equal to or greater than amounts owed to the fund under each repurchase agreement.

Joint Trading Account — Pursuant to an Exemptive Order issued by the Securities and Exchange Commission, the fund, along with certain other funds in the American Century Investments family of funds, may transfer uninvested cash balances into a joint trading account. These balances are invested in one or more repurchase agreements that are collateralized by U.S. Treasury or Agency obligations.

Exchange-Traded Funds — The fund may invest in exchange-traded funds (ETFs). ETFs are a type of index fund bought and sold on a securities exchange. An ETF trades like common stock and represents a fixed portfolio of securities designed to track the performance and dividend yield of a particular domestic or foreign market index. A fund may purchase an ETF to temporarily gain exposure to a portion of the U.S. or a foreign market while awaiting purchase of underlying securities. The risks of owning an ETF generally reflect the risks of owning the underlying securities they are designed to track, although a lack of liquidity on an ETF could result in it being more volatile. Additionally, ETFs have fees and expenses that reduce their value.

Income Tax Status — It is the fund’s policy to distribute substantially all net investment income and net realized gains to shareholders and to otherwise qualify as a regulated investment company under provisions of the Internal Revenue Code. The fund is no longer subject to examination by tax authorities for years prior to 2008. At this time, management believes there are no uncertain tax positions which, based on their technical merit, would not be sustained upon examination and for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. Accordingly, no provision has been made for federal or state income taxes.

Multiple Class — All shares of the fund represent an equal pro rata interest in the net assets of the class to which such shares belong, and have identical voting, dividend, liquidation and other rights and the same terms and conditions, except for class specific expenses and exclusive rights to vote on matters affecting only individual classes. Income, non-class specific expenses, and realized and unrealized capital gains and losses of the fund are allocated to each class of shares based on their relative net assets.

Distributions to Shareholders — Distributions from net investment income, if any, are generally declared and paid quarterly. Distributions from net realized gains, if any, are generally declared and paid annually.

Indemnifications — Under the corporation’s organizational documents, its officers and directors are indemnified against certain liabilities arising out of the performance of their duties to the fund. In addition, in the normal course of business, the fund enters into contracts that provide general indemnifications. The maximum exposure under these arrangements is unknown as this would involve future claims that may be made against a fund. The risk of material loss from such claims is considered by management to be remote.

3. Fees and Transactions with Related Parties

Management Fees — The corporation has entered into a management agreement with ACIM, under which ACIM provides the fund with investment advisory and management services in exchange for a single, unified management fee (the fee) per class. The agreement provides that all expenses of managing and operating the fund, except distribution and service fees, brokerage expenses, taxes, interest, fees and expenses of the independent directors (including legal counsel fees), and extraordinary expenses, will be paid by ACIM. The fee is computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The annual management fee is 1.00% for the Investor Class, A Class, C Class and R Class and 0.80% for the Institutional Class.

Distribution and Service Fees — The Board of Directors has adopted a separate Master Distribution and Individual Shareholder Services Plan for each of the A Class, C Class and R Class (collectively the plans), pursuant to Rule 12b-1 of the 1940 Act. The plans provide that the A Class will pay American Century Investment Services, Inc. (ACIS) an annual distribution and service fee of 0.25%. The plans provide that the C Class will pay ACIS an annual distribution and service fee of 1.00%, of which 0.25% is paid for individual shareholder services and 0.75% is paid for distribution services. The plans provide that the R Class will pay ACIS an annual distribution and service fee of 0.50%.The fees are computed and accrued daily based on each class’s daily net assets and paid monthly in arrears. The fees are used to pay financial intermediaries for distribution and individual shareholder services. Fees incurred under the plans during the year ended March 31, 2011 are detailed in the Statement of Operations.

Related Parties — Certain officers and directors of the corporation are also officers and/or directors of American Century Companies, Inc. (ACC), the parent of the corporation’s investment advisor, ACIM, the distributor of the corporation, ACIS, and the corporation’s transfer agent, American Century Services, LLC. Various funds in a series issued by American Century Asset Allocation Portfolios, Inc. (ACAAP) own, in aggregate, 6% of the shares of the fund. ACAAP does not invest in the fund for the purpose of exercising management or control.

The fund is eligible to invest in a money market fund for temporary purposes, which is managed by J.P. Morgan Investment Management, Inc. (JPMIM). The fund has a securities lending agreement with JPMorgan Chase Bank (JPMCB) and a mutual funds services agreement with J.P. Morgan Investor Services Co. (JPMIS). JPMCB is a custodian of the fund. JPMIM, JPMIS and JPMCB are wholly owned subsidiaries of JPMorgan Chase & Co. (JPM). JPM is an equity investor in ACC.

4. Investment Transactions

Purchases and sales of investment securities, excluding short-term investments, for the year ended March 31, 2011, were $1,624,806,688 and $709,880,796, respectively.

5. Capital Share Transactions

Transactions in shares of the fund were as follows:

| | | |

| | Year ended March 31, 2011 | Year ended March 31, 2010(1) |

| | Shares | Amount | Shares | Amount |

| Investor Class/Shares Authorized | 250,000,000 | | 120,000,000 | |

| Sold | 72,679,735 | $882,067,136 | 21,306,808 | $213,695,479 |

| Issued in reinvestment of distributions | 1,048,319 | 12,365,504 | 417,792 | 4,255,315 |

| Redeemed | (14,116,783) | (168,457,048) | (8,496,534) | (82,980,087) |

| | 59,611,271 | 725,975,592 | 13,228,066 | 134,970,707 |

| Institutional Class/Shares Authorized | 40,000,000 | | 20,000,000 | |

| Sold | 8,642,241 | 99,291,094 | 4,462,654 | 46,178,288 |

| Issued in reinvestment of distributions | 151,992 | 1,786,456 | 46,510 | 483,302 |

| Redeemed | (1,842,986) | (22,136,228) | (939,061) | (9,386,542) |

| | 6,951,247 | 78,941,322 | 3,570,103 | 37,275,048 |

| A Class/Shares Authorized | 50,000,000 | | 20,000,000 | |

| Sold | 12,326,960 | 147,472,567 | 4,642,922 | 46,461,341 |

| Issued in reinvestment of distributions | 170,784 | 2,000,933 | 60,409 | 617,612 |

| Redeemed | (2,680,188) | (31,630,079) | (1,638,412) | (16,714,115) |

| | 9,817,556 | 117,843,421 | 3,064,919 | 30,364,838 |

| C Class/Shares Authorized | 10,000,000 | | 20,000,000 | |

| Sold | 457,926 | 5,640,665 | 4,468 | 50,000 |

| Issued in reinvestment of distributions | 948 | 10,937 | — | — |

| Redeemed | (7,495) | (95,061) | — | — |

| | 451,379 | 5,556,541 | 4,468 | 50,000 |

| R Class/Shares Authorized | 10,000,000 | | 10,000,000 | |

| Sold | 2,347,333 | 28,450,865 | 1,132,811 | 11,223,557 |

| Issued in reinvestment of distributions | 28,213 | 327,105 | 9,042 | 93,171 |

| Redeemed | (715,651) | (8,548,931) | (220,730) | (2,195,669) |

| | 1,659,895 | 20,229,039 | 921,123 | 9,121,059 |

| Net increase (decrease) | 78,491,348 | $948,545,915 | 20,788,679 | $211,781,652 |

| (1) | March 1, 2010 (commencement of sale) through March 31, 2010 for the C Class. |

6. Fair Value Measurements

The fund’s securities valuation process is based on several considerations and may use multiple inputs to determine the fair value of the positions held by the fund. In conformity with accounting principles generally accepted in the United States of America, the inputs used to determine a valuation are classified into three broad levels as follows:

| • | Level 1 valuation inputs consist of unadjusted quoted prices in an active market for identical securities; |

| • | Level 2 valuation inputs consist of direct or indirect observable market data (including quoted prices for similar securities, evaluations of subsequent market events, interest rates, prepayment speeds, credit risk, etc.); or |

| • | Level 3 valuation inputs consist of unobservable data (including a fund’s own assumptions). |

The level classification is based on the lowest level input that is significant to the fair valuation measurement. The valuation inputs are not necessarily an indication of the risks associated with investing in these securities or other financial instruments.

The following is a summary of the level classifications as of period end. The Schedule of Investments provides additional information on the fund’s portfolio holdings.

| | | | |

| | Level 1 | Level 2 | Level 3 |

| Investment Securities | | | |

| Domestic Common Stocks | $1,581,356,194 | — | — |

| Foreign Common Stocks | 40,589,664 | $95,453,947 | — |

| Temporary Cash Investments | 23,268 | 56,100,000 | — |

| Total Value of Investment Securities | $1,621,969,126 | $151,553,947 | — |

| | | | |

| Other Financial Instruments | | | |

| Total Unrealized Gain (Loss) on Forward Foreign Currency Exchange Contracts | — | $(405,484) | — |

7. Derivative Instruments

Foreign Currency Risk — The fund is subject to foreign currency exchange rate risk in the normal course of pursuing its investment objectives. The value of foreign investments held by a fund may be significantly affected by changes in foreign currency exchange rates. The dollar value of a foreign security generally decreases when the value of the dollar rises against the foreign currency in which the security is denominated and tends to increase when the value of the dollar declines against such foreign currency. A fund may enter into forward foreign currency exchange contracts to reduce a fund’s exposure to foreign currency exchange rate fluctuations. The net U.S. dollar value of foreign currency underlying all contractual commitments held by a fund and the resulting unrealized appreciation or depreciation are determined daily. Realized gain or loss is recorded upon the termination of the contract. Net realized and unrealized gains or losses occurring during the holding period of forward foreign currency exchange contracts are a component of net realized gain (loss) on foreign currency transactions and change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies, respectively. A fund bears the risk of an unfavorable change in the foreign currency exchange rate underlying the forward contract. Additionally, losses, up to the fair value, may arise if the counterparties do not perform under the contract terms. The risk of loss from non-performance by the counterparty may be reduced by the use of master netting agreements. The foreign currency risk derivative instruments held at period end as disclosed on the Schedule of Investments are indicative of the fund’s typical volume during the period.

The value of foreign currency risk derivative instruments as of March 31, 2011, is disclosed on the Statement of Assets and Liabilities as a liability of $405,484 in unrealized loss on forward foreign currency exchange contracts. For the year ended March 31, 2011, the effect of foreign currency risk derivative instruments on the Statement of Operations was $(1,618,526) in net realized gain (loss) on foreign currency transactions and $(362,359) in change in net unrealized appreciation (depreciation) on translation of assets and liabilities in foreign currencies.

8. Risk Factors

There are certain risks involved in investing in foreign securities. These risks include those resulting from future adverse political, social, and economic developments, fluctuations in currency exchange rates, the possible imposition of exchange controls, and other foreign laws or restrictions.

9. Federal Tax Information

The tax character of distributions paid during the years ended March 31, 2011 and

March 31, 2010 were as follows:

| | | |

| | 2011 | 2010 |

| Distributions Paid From | | |

| Ordinary income | $18,784,544 | $6,280,977 |

| Long-term capital gains | — | — |

The book-basis character of distributions made during the year from net investment income or net realized gains may differ from their ultimate characterization for federal income tax purposes. These differences reflect the differing character of certain income items and net realized gains and losses for financial statement and tax purposes, and may result in reclassification among certain capital accounts on the financial statements.

As of March 31, 2011, the federal tax cost of investments and the components of distributable earnings on a tax-basis were as follows:

| | |

| Federal tax cost of investments | $1,619,909,178 |

| Gross tax appreciation of investments | $174,979,058 |

| Gross tax depreciation of investments | (21,365,163) |

| Net tax appreciation (depreciation) of investments | $153,613,895 |

Net tax appreciation (depreciation) on derivatives and translation of assets and liabilities in foreign currencies | $5,011 |

| Net tax appreciation (depreciation) | $153,618,906 |

| Undistributed ordinary income | $5,394,859 |

| Accumulated long-term gains | $36,210,956. |

The difference between book-basis and tax-basis cost and unrealized appreciation (depreciation) is attributable primarily to the tax deferral of losses on wash sales and the realization for tax purposes of unrealized gains (losses) on certain forward foreign currency exchange contracts.

On December 22, 2010, the Regulated Investment Company Modernization Act of 2010 (the “Act”) was enacted, which changed various technical rules governing the tax treatment of regulated investment companies. The changes are generally effective for taxable years beginning after the date of enactment. Under the Act, the fund will be permitted to carry forward capital losses incurred in taxable years beginning after the

date of enactment for an unlimited period.

| Investor Class | |

| For a Share Outstanding Throughout the Years Ended March 31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $11.41 | | | | $7.34 | | | | $10.66 | | | | $13.33 | | | | $12.10 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(1) | | | 0.25 | | | | 0.18 | | | | 0.19 | | | | 0.16 | | | | 0.16 | |

| Net Realized and Unrealized Gain (Loss) | | | 1.70 | | | | 4.03 | | | | (3.32 | ) | | | (1.51 | ) | | | 1.87 | |

| Total From Investment Operations | | | 1.95 | | | | 4.21 | | | | (3.13 | ) | | | (1.35 | ) | | | 2.03 | |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.23 | ) | | | (0.14 | ) | | | (0.19 | ) | | | (0.16 | ) | | | (0.14 | ) |

| From Net Realized Gains | | | — | | | | — | | | | — | | | | (1.16 | ) | | | (0.66 | ) |

| Total Distributions | | | (0.23 | ) | | | (0.14 | ) | | | (0.19 | ) | | | (1.32 | ) | | | (0.80 | ) |

| Net Asset Value, End of Period | | | $13.13 | | | | $11.41 | | | | $7.34 | | | | $10.66 | | | | $13.33 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(2) | | | 17.34 | % | | | 57.68 | % | | | (29.66 | )% | | | (10.84 | )% | | | 17.12 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Ratio of Operating Expenses to Average Net Assets | | | 1.01 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % | | | 1.00 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 2.07 | % | | | 1.79 | % | | | 2.10 | % | | | 1.25 | % | | | 1.30 | % |

| Portfolio Turnover Rate | | | 71 | % | | | 126 | % | | | 173 | % | | | 206 | % | | | 187 | % |

| Net Assets, End of Period (in thousands) | | | $1,334,230 | | | | $478,796 | | | | $210,960 | | | | $274,918 | | | | $301,642 | |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

| Institutional Class | |

| For a Share Outstanding Throughout the Years Ended March 31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $11.41 | | | | $7.34 | | | | $10.66 | | | | $13.33 | | | | $12.10 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(1) | | | 0.28 | | | | 0.20 | | | | 0.21 | | | | 0.18 | | | | 0.19 | |

| Net Realized and Unrealized Gain (Loss) | | | 1.70 | | | | 4.03 | | | | (3.32 | ) | | | (1.51 | ) | | | 1.87 | |

| Total From Investment Operations | | | 1.98 | | | | 4.23 | | | | (3.11 | ) | | | (1.33 | ) | | | 2.06 | |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.25 | ) | | | (0.16 | ) | | | (0.21 | ) | | | (0.18 | ) | | | (0.17 | ) |

| From Net Realized Gains | | | — | | | | — | | | | — | | | | (1.16 | ) | | | (0.66 | ) |

| Total Distributions | | | (0.25 | ) | | | (0.16 | ) | | | (0.21 | ) | | | (1.34 | ) | | | (0.83 | ) |

| Net Asset Value, End of Period | | | $13.14 | | | | $11.41 | | | | $7.34 | | | | $10.66 | | | | $13.33 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(2) | | | 17.66 | % | | | 58.00 | % | | | (29.52 | )% | | | (10.67 | )% | | | 17.36 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Ratio of Operating Expenses to Average Net Assets | | | 0.81 | % | | | 0.80 | % | | | 0.80 | % | | | 0.80 | % | | | 0.80 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 2.27 | % | | | 1.99 | % | | | 2.30 | % | | | 1.45 | % | | | 1.50 | % |

| Portfolio Turnover Rate | | | 71 | % | | | 126 | % | | | 173 | % | | | 206 | % | | | 187 | % |

| Net Assets, End of Period (in thousands) | | | $170,182 | | | | $68,487 | | | | $17,859 | | | | $17,378 | | | | $20,623 | |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

A Class(1) | |

| For a Share Outstanding Throughout the Years Ended March 31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $11.41 | | | | $7.34 | | | | $10.66 | | | | $13.33 | | | | $12.10 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(2) | | | 0.21 | | | | 0.15 | | | | 0.17 | | | | 0.13 | | | | 0.14 | |

| Net Realized and Unrealized Gain (Loss) | | | 1.71 | | | | 4.04 | | | | (3.32 | ) | | | (1.51 | ) | | | 1.86 | |

| Total From Investment Operations | | | 1.92 | | | | 4.19 | | | | (3.15 | ) | | | (1.38 | ) | | | 2.00 | |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.20 | ) | | | (0.12 | ) | | | (0.17 | ) | | | (0.13 | ) | | | (0.11 | ) |

| From Net Realized Gains | | | — | | | | — | | | | — | | | | (1.16 | ) | | | (0.66 | ) |

| Total Distributions | | | (0.20 | ) | | | (0.12 | ) | | | (0.17 | ) | | | (1.29 | ) | | | (0.77 | ) |

| Net Asset Value, End of Period | | | $13.13 | | | | $11.41 | | | | $7.34 | | | | $10.66 | | | | $13.33 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(3) | | | 17.05 | % | | | 57.28 | % | | | (29.84 | )% | | | (11.07 | )% | | | 16.83 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

Ratio of Operating Expenses to Average Net Assets | | | 1.26 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % | | | 1.25 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 1.82 | % | | | 1.54 | % | | | 1.85 | % | | | 1.00 | % | | | 1.05 | % |

| Portfolio Turnover Rate | | | 71 | % | | | 126 | % | | | 173 | % | | | 206 | % | | | 187 | % |

| Net Assets, End of Period (in thousands) | | | $215,813 | | | | $75,435 | | | | $26,039 | | | | $25,932 | | | | $21,412 | |

| (1) | Prior to March 1, 2010, the A Class was referred to as the Advisor Class. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

| C Class | |

| For a Share Outstanding Throughout the Years Ended March 31 (except as noted) | |

| | | 2011 | | | 2010(1) | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $11.42 | | | | $10.97 | |

| Income From Investment Operations | | | | | | | | |

Net Investment Income (Loss)(2) | | | 0.13 | | | | 0.02 | |

| Net Realized and Unrealized Gain (Loss) | | | 1.71 | | | | 0.43 | |

| Total From Investment Operations | | | 1.84 | | | | 0.45 | |

| Distributions | | | | | | | | |

| From Net Investment Income | | | (0.12 | ) | | | — | |

| Net Asset Value, End of Period | | | $13.14 | | | | $11.42 | |

| | | | | | | | | |

Total Return(3) | | | 16.24 | % | | | 4.10 | % |

| | | | | | | | | |

| Ratios/Supplemental Data | |

| Ratio of Operating Expenses to Average Net Assets | | | 2.01 | % | | | 2.00 | %(4) |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | | 1.07 | % | | | 2.07 | %(4) |

| Portfolio Turnover Rate | | | 71 | % | | | 126 | %(5) |

| Net Assets, End of Period (in thousands) | | | $5,989 | | | | $51 | |

| (1) | March 1, 2010 (commencement of sale) through March 31, 2010. |

| (2) | Computed using average shares outstanding throughout the period. |

| (3) | Total returns are calculated based on the net asset value of the last business day and do not reflect applicable sales charges. Total returns for periods less than one year are not annualized. |

| (5) | Portfolio turnover is calculated at the fund level. Percentage indicated was calculated for the year ended March 31, 2010. |

See Notes to Financial Statements.

| R Class | |

| For a Share Outstanding Throughout the Years Ended March 31 | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

| Per-Share Data | |

| Net Asset Value, Beginning of Period | | | $11.41 | | | | $7.34 | | | | $10.65 | | | | $13.32 | | | | $12.09 | |

| Income From Investment Operations | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss)(1) | | | 0.19 | | | | 0.13 | | | | 0.15 | | | | 0.10 | | | | 0.13 | |

| Net Realized and Unrealized Gain (Loss) | | | 1.71 | | | | 4.03 | | | | (3.32 | ) | | | (1.51 | ) | | | 1.84 | |

| Total From Investment Operations | | | 1.90 | | | | 4.16 | | | | (3.17 | ) | | | (1.41 | ) | | | 1.97 | |

| Distributions | | | | | | | | | | | | | | | | | | | | |

| From Net Investment Income | | | (0.17 | ) | | | (0.09 | ) | | | (0.14 | ) | | | (0.10 | ) | | | (0.08 | ) |

| From Net Realized Gains | | | — | | | | — | | | | — | | | | (1.16 | ) | | | (0.66 | ) |

| Total Distributions | | | (0.17 | ) | | | (0.09 | ) | | | (0.14 | ) | | | (1.26 | ) | | | (0.74 | ) |

| Net Asset Value, End of Period | | | $13.14 | | | | $11.41 | | | | $7.34 | | | | $10.65 | | | | $13.32 | |

| | | | | | | | | | | | | | | | | | | | | |

Total Return(2) | | | 16.85 | % | | | 56.88 | % | | | (29.95 | )% | | | (11.30 | )% | | | (16.55 | )% |

| | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data | |

| Ratio of Operating Expenses to Average Net Assets | | | 1.51 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % | | | 1.50 | % |

Ratio of Net Investment Income (Loss) to Average Net Assets | | | 1.57 | % | | | 1.29 | % | | | 1.60 | % | | | 0.75 | % | | | 0.80 | % |

| Portfolio Turnover Rate | | | 71 | % | | | 126 | % | | | 173 | % | | | 206 | % | | | 187 | % |

| Net Assets, End of Period (in thousands) | | | $40,933 | | | | $16,611 | | | | $3,926 | | | | $3,172 | | | | $820 | |

| (1) | Computed using average shares outstanding throughout the period. |

| (2) | Total returns are calculated based on the net asset value of the last business day. Total returns for periods less than one year are not annualized. |

See Notes to Financial Statements.

Report of Independent Registered Public Accounting Firm |

The Board of Directors and Shareholders of

American Century Capital Portfolios, Inc.:

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Mid Cap Value Fund, one of the funds constituting American Century Capital Portfolios, Inc. (the “Corporation”), as of March 31, 2011, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Corporation’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Corporation is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Corporation’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of March 31, 2011, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Mid Cap Value Fund of American Century Capital Portfolios, Inc. as of March 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

Deloitte & Touche LLP

Kansas City, Missouri

May 18, 2011

A special meeting of shareholders was held on June 16, 2010, to vote on the following proposals. Each proposal received the required number of votes and was adopted. A summary of voting results is listed below each proposal.

Proposal 1:

To elect one Director to the Board of Directors of American Century Capital Portfolios, Inc. (the proposal was voted on by all shareholders of funds issued by American Century Capital Portfolios, Inc.):

| | | |

| John R. Whitten | For: | 8,909,100,602 |

| | Withhold: | 464,054,213 |

| | Abstain: | 0 |

| | Broker Non-Vote: | 0 |

The other directors whose term of office continued after the meeting include Jonathan S. Thomas, Thomas A. Brown, Andrea C. Hall, James A. Olson, Donald H. Pratt, and M. Jeannine Strandjord.

Proposal 2:

To approve a management agreement between the fund and American Century Investment Management, Inc.:

| | | |

| Investor, A and R Classes | For: | 326,212,222 |

| | Against: | 5,269,357 |

| | Abstain: | 8,487,828 |

| | Broker Non-Vote: | 85,816,071 |

| |

| Institutional Class | For: | 34,327,103 |

| | Against: | 27,804 |

| | Abstain: | 298,999 |

| | Broker Non-Vote: | 8,442,681 |

Proposal 3:

To approve an amendment to the Articles of Incorporation to limit certain director liability to the extent permitted by Maryland law (the proposal was voted on by all shareholders of funds issued by American Century Capital

Portfolios, Inc.):

| | | |

| | For: | 7,171,505,354 |

| | Against: | 434,482,700 |

| | Abstain: | 468,352,741 |

| | Broker Non-Vote: | 1,298,814,021 |

The individuals listed below serve as directors of the fund. Each director will continue to serve in this capacity until death, retirement, resignation or removal from office. The mandatory retirement age for directors who are not “interested persons,” as that term is defined in the Investment Company Act (independent directors), is 72. However, the mandatory retirement age for an individual director may be extended with the approval of the remaining independent directors.

Mr. Thomas is the only director who is an “interested person” because he currently serves as President and Chief Executive Officer of American Century Companies, Inc. (ACC), the parent company of American Century Investment Management, Inc. (ACIM or the advisor).

The other directors (more than three-fourths of the total number) are independent; that is, they have never been employees, directors or officers of, and have no financial interest in, ACC or any of its wholly owned, direct or indirect, subsidiaries, including ACIM, American Century Investment Services, Inc. (ACIS) and American Century Services, LLC (ACS). The directors serve in this capacity for seven (in the case of Mr. Thomas, 15) registered investment companies in the American Century Investments family of funds.