| | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

| Washington, D.C. 20549 |

|

| FORM N-CSR |

|

| CERTIFIED SHAREHOLDER REPORT OF REGISTERED |

| MANAGEMENT INVESTMENT COMPANIES |

|

| Investment Company Act file number | 811-07820 |

| |

| AMERICAN CENTURY CAPITAL PORTFOLIOS, INC. |

| (Exact name of registrant as specified in charter) |

| |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| |

| CHARLES A. ETHERINGTON |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| |

| Date of fiscal year end: | 03-31 |

| |

| Date of reporting period: | 03-31-2010 |

| |

| ITEM 1. REPORTS TO STOCKHOLDERS |

|

| Annual Report | |

| March 31, 2010 | |

|

| American Century Investments® |

Equity Income Fund

Value Fund

Large Company Value Fund

| |

| President’s Letter | 2 |

| Independent Chairman’s Letter | 3 |

| Market Perspective | 4 |

| U.S. Stock Index Returns | 4 |

| |

| Equity Income | |

| |

| Performance | 5 |

| Portfolio Commentary | 7 |

| Top Ten Holdings, Top Five Industries and | |

| Types of Investments in Portfolio | 9 |

| |

| Value | |

| |

| Performance | 10 |

| Portfolio Commentary | 12 |

| Top Ten Holdings, Top Five Industries and | |

| Types of Investments in Portfolio | 14 |

| |

| Large Company Value | |

| |

| Performance | 15 |

| Portfolio Commentary | 17 |

| Top Ten Holdings, Top Five Industries and | |

| Types of Investments in Portfolio | 19 |

| |

| Shareholder Fee Examples | 20 |

| |

| Financial Statements | |

| |

| Schedule of Investments | 23 |

| Statement of Assets and Liabilities | 33 |

| Statement of Operations | 35 |

| Statement of Changes in Net Assets | 36 |

| Notes to Financial Statements | 38 |

| Financial Highlights | 51 |

| Report of Independent Registered Public Accounting Firm | 69 |

| |

| Other Information | |

| |

| Management | 70 |

| Board Approval of Management Agreements | 74 |

| Additional Information | 80 |

| Index Definitions | 81 |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Dear Investor:

To learn more about the capital markets, your investment, and the portfolio management strategies American Century Investments provides, we encourage you to review this shareholder report for the financial reporting period ended March 31, 2010.

On the following pages, you will find investment performance and portfolio information, presented with the expert perspective and commentary of our portfolio management team. This report remains one of our most important vehicles for conveying the information you need about your investment performance, and about the market factors and strategies that affect fund returns. For additional information on the markets, we encourage you to visit the “Insights & News” tab at our Web site, americancentury.com, for updates and further expert commentary.

The top of our Web site’s home page also provides a link to “Our Story,” which, first and foremost, outlines our commitment—since 1958—to helping clients reach their financial goals. We believe strongly that we will only be successful when our clients are successful. That’s who we are.

Another important, unique facet of our story and who we are is “Profits with a Purpose,” which describes our bond with the Stowers Institute for Medical Research (SIMR). SIMR is a world-class biomedical organization—founded by our company founder James E. Stowers, Jr. and his wife Virginia—that is dedicated to researching the causes, treatment, and prevention of gene-based diseases, including cancer. Through American Century Investments’ private ownership structure, more than 40% of our profits support SIMR.

Mr. Stowers’ example of achieving financial success and using that platform to help humanity motivates our entire American Century Investments team. His story inspires us to help each of our clients achieve success. Thank you for sharing your financial journey with us.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

2

|

| Independent Chairman’s Letter |

Fellow Shareholders,

The principal event at a recent board meeting was the retirement of Jim Stowers, Jr. from the American Century Mutual Funds Kansas City board. This was one of those times when you felt like you were living a historical moment. Jim founded what was known as Twentieth Century Mutual Funds over 50 years ago. Through the years, his number one priority has been to “Put Investors First!” The board presented Jim with a resolution acknowledging that, by building a successful investment company, he has impacted the lives of many by helping them on the path to financial success.

We respect Jim’s decision to focus his energy on the Stowers Institute for Medical Research and American Century Companies, Inc. (ACC), the parent company of the funds’ investment advisors. The pioneering medical research that Jim and his wife Virginia have made possible through the Institute should enrich the lives of millions in the future.

Shortly after his retirement from the board, we received word that Jim—who celebrated his 86th birthday in January—was hospitalized after experiencing a fall during his regular exercise regimen. While Jim has made steady progress toward recovery, this potentially serious incident resulted in the activation of his long-standing estate and business succession plan. Under the terms of the plan, ACC’s co-chairman Richard W. Brown succeeded Jim as trustee of a trust that holds a significant interest in ACC stock. While less than a majority interest, the trust is presumed to control the funds’ investment advisors under the Investment Company Act of 1940. This change triggered the need for a shareholder proxy to approve new management and subadvisory agreements for the funds. If you have not already responded, I encourage you to take the time to read the proxy materials and send your vote as soon as p ossible.

On behalf of the board, I want to once again thank Jim for his mutual fund board service and wish him a speedy recovery. More than three years ago, Jim and Richard Brown installed a strong and effective leadership team at American Century Investments and I look forward to continuing to work with them on behalf of fund shareholders. And while Jim no longer sits on the fund board, the inherent optimism captured by his favorite catch phrase—“The best is yet to be”—still resonates with all of us who have the privilege of serving you. I invite you to send your comments, questions or concerns to me at dhpratt@fundboardchair.com.

3

By Phil Davidson, Chief Investment Officer, U.S. Value Equity

Stocks Enjoyed Bountiful Recovery

The U.S. stock market gained approximately 50% for the year ended March 31, 2010—one of its best 12-month returns in the last three decades. The key factor behind the remarkable rally in stocks was increasing confidence in a potential economic recovery.

The period began as the U.S. economy was beginning to emerge from its worst downturn since the Great Depression. Signs of economic improvement—including a pickup in industrial production, rising retail sales, and signals that the housing sector was starting to stabilize—gained momentum throughout the 12-month period, helping the U.S. economy post positive growth in the third and fourth quarters of 2009. The exception was job growth—the unemployment rate rose to its highest level since 1983 before falling back slightly toward the end of the reporting period.

Better-than-expected corporate profits also provided a boost to stocks despite sluggish revenue growth. Aggressive cost-cutting strategies across much of corporate America helped profits remain on an upward trajectory.

Value Stocks Led the Rally

Value stocks led the market’s advance, outperforming growth shares across all market capitalizations (see the table below). Many of the best-performing stocks were financially stressed companies that were able to stabilize their businesses and strengthen their balance sheets—characteristics that apply to value-oriented issues. In addition, the financial sector—a sizable component of the value universe—was one of the top-performing sectors in the equity market as many troubled financial firms were able to issue equity and deleverage.

Another recent development that has been favorable for value stocks is a resurgence of dividends. 2009 was the worst year on record for dividends in the U.S., where more than 800 companies reduced their dividend payouts by a total of $58 billion. However, in the first three months of 2010, income-oriented investors were rewarded with growing dividend payouts. In February alone, 47 companies in the S&P 500 increased their dividends or began paying them. Dividends play a central role in our efforts to reduce risk and increase total returns, and they also confirm the strength of a company’s earnings and cash flow.

| | | | |

| U.S. Stock Index Returns | | | | |

| For the 12 months ended March 31, 2010 | | | | |

| Russell 1000 Index (Large-Cap) | 51.60% | | Russell 2000 Index (Small-Cap) | 62.76% |

| Russell 1000 Growth Index | 49.75% | | Russell 2000 Growth Index | 60.32% |

| Russell 1000 Value Index | 53.56% | | Russell 2000 Value Index | 65.07% |

| Russell Midcap Index | 67.71% | | | |

| Russell Midcap Growth Index | 63.00% | | | |

| Russell Midcap Value Index | 72.41% | | | |

4

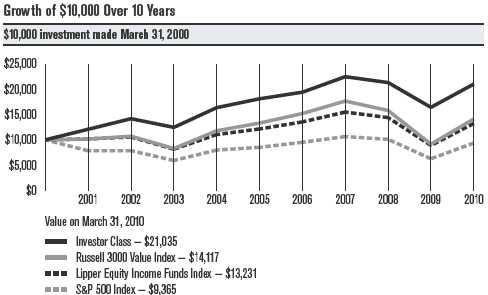

| | | | | | | |

| Equity Income | | | | | | |

| |

| Total Returns as of March 31, 2010 | | | | | |

| | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 1 year | 5 years | 10 years | Inception | Date |

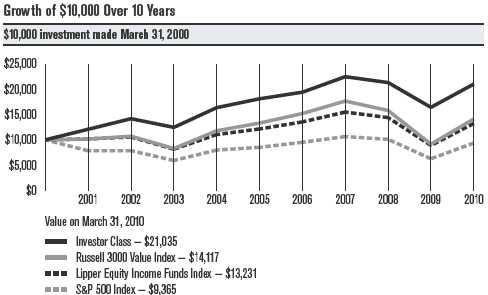

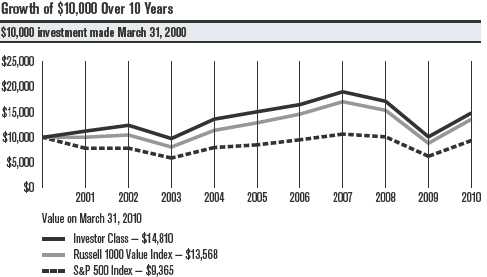

| Investor Class | TWEIX | 28.04% | 3.03% | 7.72% | 10.59% | 8/1/94 |

| Russell 3000 Value Index(1) | — | 54.46% | 1.18% | 3.51% | 8.88%(2) | — |

| S&P 500 Index(1) | — | 49.77% | 1.92% | -0.65% | 8.16%(2) | — |

| Lipper Equity Income | | | | | | |

| Funds Index(1) | — | 48.54% | 1.72% | 2.84% | 7.13%(2) | — |

| Institutional Class | ACIIX | 28.30% | 3.21% | 7.93% | 7.23% | 7/8/98 |

| A Class(3) | TWEAX | | | | | 3/7/97 |

| No sales charge* | | 27.71% | 2.77% | 7.45% | 8.26% | |

| With sales charge* | | 20.38% | 1.56% | 6.81% | 7.77% | |

| B Class | AEKBX | | | | | 9/28/07 |

| No sales charge* | | 26.92% | — | — | -5.48% | |

| With sales charge* | | 22.92% | — | — | -6.79% | |

| C Class | AEYIX | 26.74% | 1.98% | — | 4.65% | 7/13/01 |

| R Class | AEURX | 27.44% | 2.52% | — | 5.22% | 8/29/03 |

| * Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% |

| maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six |

| years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after |

| purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that |

| mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| |

| (1) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | Lipper Fund Performance — Performance data is total return, and is preliminary and subject to revision. | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (2) | Since 7/31/94, the date nearest the Investor Class’s inception for which data are available. | | | |

| (3) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that |

| | date has been adjusted to reflect this charge. | | | | | |

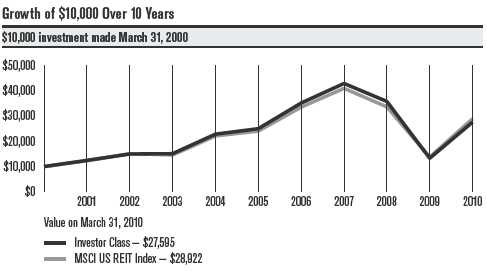

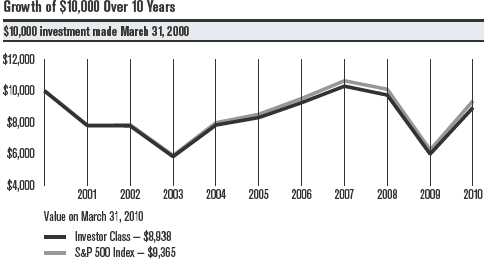

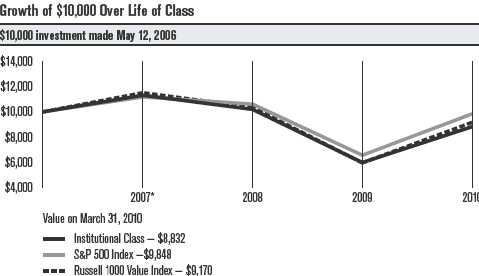

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

5

Equity Income

| | | | | |

| Total Annual Fund Operating Expenses | | | |

| | Institutional | | | | |

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 0.99% | 0.79% | 1.24% | 1.99% | 1.99% | 1.49% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

6

Equity Income

Portfolio Managers: Phil Davidson, Kevin Toney, and Michael Liss

Performance Summary

Equity Income returned 28.04%* for the 12 months ended March 31, 2010. By comparison, the Lipper Equity Income Funds Index returned 48.54%, and the average return for Morningstar’s Large Cap Value category** (its performance, like Equity Income’s, reflects operating expenses) was 50.25%. Two market indices—the Russell 3000 Value Index and the S&P 500 Index—returned 54.46% and 49.77%, respectively. The portfolio’s return reflects operating expenses, while the indices’ returns do not.

As the performance figures above indicate, the stock market staged a remarkable comeback during the reporting period. Economic conditions improved (partly in response to government stimulus programs), corporate earnings were better than expected, and improving conditions in the capital markets helped the more highly leveraged and financially strapped companies. These factors led many investors to shift into riskier assets, and many of the period’s largest gains were made by securities of lower-quality businesses that had fared the worst during the financial crisis. That situation was at odds with Equity Income’s conservative investment approach, which emphasizes higher-quality, income-producing securities. Many of the companies held by the portfolio have contained costs and gained market share, allowing them to raise their dividends, but a large number were left behind in the low-quality rally. Against t his backdrop, Equity Income’s relative performance for the annual period was more a result of what it didn’t own rather than what it did.

Equity Income is carefully managed to provide solid long-term performance. Since its inception on August 1, 1994, Equity Income has produced an average annual return of 10.59%, topping the returns for the Lipper Equity Income Funds Index, Morningstar’s Large Cap Value category average, the Russell 3000 Value Index, and the S&P 500 Index for the same period (see performance information on page 5 and in footnotes below).

Financials Slowed Progress

Although financials contributed significantly to the portfolio’s return, the sector was the largest source of underperformance against the benchmark. Equity Income’s mix of higher-quality companies and its underweight position restrained performance during the market rally when companies with stressed balance sheets outperformed stronger, higher-quality businesses. For example, in commercial banks, the portfolio held Commerce Bancshares, a high-quality regional bank serving customers in Midwestern states. Commerce did not take federal bailout money and raised its dividend, but its shares did not keep pace with the sector during the low-quality rally.

| |

| * | All fund returns referenced in this commentary are for Investor Class shares. |

| **The average returns for Morningstar’s Large Cap Value category were 1.21% and 3.12% for the five- and ten-year periods ended March 31, 2010, |

| | respectively, and 7.46% since the fund’s inception. © Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to |

| | Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither |

| | Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. |

7

Equity Income

For some time, we have approached financials with caution and conservatism as evidenced by an investment in a convertible security issued by U.S. Bancorp. Although the position provided the portfolio with a positive return, it underperformed many other financials names.

Elsewhere in the sector, our investments were concentrated in the less-volatile names in insurance, thrifts, and capital markets companies. In the insurance industry, Equity Income was overweight shares of Marsh & McLennan. A global insurance broker, Marsh does not have a credit-sensitive business model and we believe it is well-positioned to benefit from new management and improving operating conditions.

The capital markets segment provided top contributor T. Rowe Price Group. As the environment improves for asset managers, the company stands to benefit from consolidation within the segment and appears positioned to gain market share.

Industrials Detracted

In industrials, Equity Income was hindered by the combination of an underweight position and stock selection. Many industrials stocks, which suffered steep declines as the recession took hold, posted strong results during the annual period. The sector was up more than 80% in the benchmark. The portfolio’s investments were concentrated in commercial services and supplies, specifically among waste management companies. In keeping with our conservative stance, Equity Income held a less risky convertible security issued by Waste Connections, which did not keep up with other securities in the sector.

Consumer Discretionary Hampered Results

An underweight in the consumer discretionary sector dampened relative progress. Equity Income did not own any media companies, which outperformed as the economy strengthened and advertising revenues improved. Similarly, the portfolio was slowed by an underweight in automakers, which turned in strong results during the period.

Outlook

We will continue to follow our disciplined, bottom-up investment process, selecting companies one at a time for the portfolio. As of March 31, 2010, we see attractive opportunities in consumer staples, utilities, and information technology, reflected by our overweight positions in these sectors. We continue to be selective in holdings of consumer discretionary, industrials, materials, and financials companies, relying on fundamental analysis to identify strong, financially sound businesses whose securities provide attractive yields.

8

| |

| Equity Income | |

| |

| Top Ten Holdings | |

| | % of net assets |

| | as of 3/31/10 |

| Exxon Mobil Corp. | 6.4% |

| Bank of America Corp. | 3.9% |

| AT&T, Inc. | 3.7% |

| Johnson & Johnson | 3.2% |

| Kimberly-Clark Corp. | 3.1% |

| United Parcel Service, Inc., Class B | 3.1% |

| Wal-Mart Stores, Inc. | 3.0% |

| U.S. Bancorp. (Convertible Bonds) | 3.0% |

| Total SA | 2.9% |

| Chevron Corp. | 2.9% |

| |

| Top Five Industries | |

| | % of net assets |

| | as of 3/31/10 |

| Oil, Gas & Consumable Fuels | 14.4% |

| Insurance | 7.5% |

| Real Estate Investment Trusts (REITs) | 6.5% |

| Pharmaceuticals | 6.0% |

| Household Products | 5.8% |

| |

| Types of Investments in Portfolio | |

| | % of net assets |

| | as of 3/31/10 |

| Common Stocks | 72.5% |

| Convertible Bonds | 21.3% |

| Convertible Preferred Stocks | 3.9% |

| Preferred Stocks | 0.1% |

| Total Equity Exposure | 97.8% |

| Temporary Cash Investments | 0.4% |

| Other Assets and Liabilities | 1.8% |

9

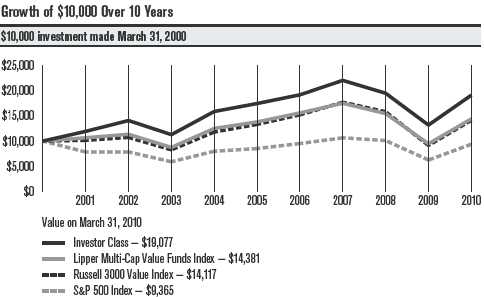

| | | | | | | |

| Value | | | | | | |

| |

| Total Returns as of March 31, 2010 | | | | | |

| | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 1 year | 5 years | 10 years | Inception | Date |

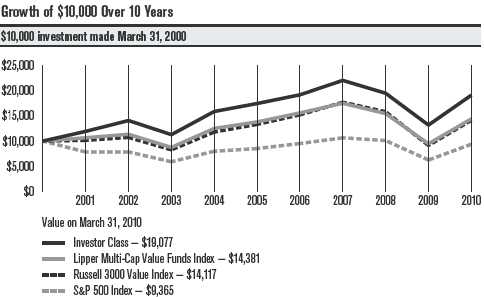

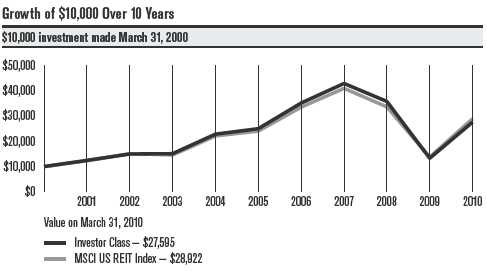

| Investor Class | TWVLX | 44.84% | 1.82% | 6.67% | 9.24% | 9/1/93 |

| Russell 3000 Value Index(1) | — | 54.46% | 1.18% | 3.51% | 8.39%(2) | — |

| S&P 500 Index(1) | — | 49.77% | 1.92% | -0.65% | 7.77%(2) | — |

| Lipper Multi-Cap Value | | | | | | |

| Funds Index(1) | — | 51.98% | 0.85% | 3.70% | 7.55%(2) | — |

| Institutional Class | AVLIX | 45.01% | 2.02% | 6.87% | 6.01% | 7/31/97 |

| A Class(3) | TWADX | | | | | 10/2/96 |

| No sales charge* | | 44.47% | 1.57% | 6.39% | 7.19% | |

| With sales charge* | | 36.23% | 0.36% | 5.76% | 6.72% | |

| B Class | ACBVX | | | | | 1/31/03 |

| No sales charge* | | 43.21% | 0.80% | — | 6.21% | |

| With sales charge* | | 39.21% | 0.60% | — | 6.21% | |

| C Class | ACLCX | 43.29% | 0.80% | — | 3.29% | 6/4/01 |

| R Class | AVURX | 44.10% | — | — | 0.53% | 7/29/05 |

| * Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% |

| maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six |

| years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after |

| purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that |

| mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| |

| (1) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | Lipper Fund Performance — Performance data is total return, and is preliminary and subject to revision. | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (2) | Since 8/31/93, the date nearest the Investor Class’s inception for which data are available. | | | |

| (3) | Prior to September 4, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that |

| | date has been adjusted to reflect this charge. | | | | | |

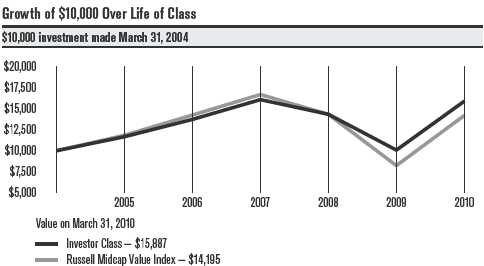

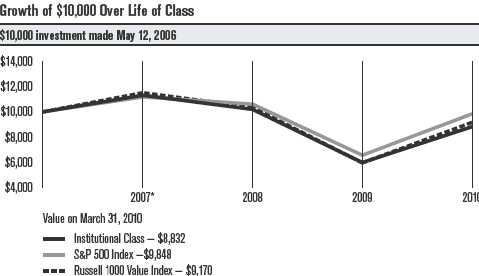

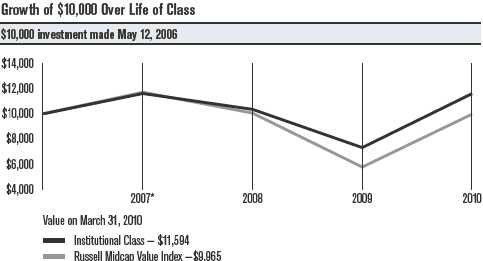

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

10

Value

| | | | | |

| Total Annual Fund Operating Expenses | | | |

| | Institutional | | | | |

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 1.01% | 0.81% | 1.26% | 2.01% | 2.01% | 1.51% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. International investing involves special risks, such as political instability and currency fluctuations.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

11

Value

Portfolio Managers: Michael Liss, Kevin Toney, and Phil Davidson

Performance Summary

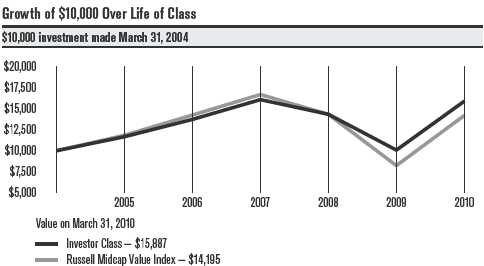

Value returned 44.84%* for the 12 months ended March 31, 2010. By comparison, the Lipper Multi-Cap Value Funds Index returned 51.98%, while the average return for Morningstar’s Large Cap Value category** (its performance, like Value’s, reflects operating expenses) was 50.25%. Two market indices—the Russell 3000 Value Index and the S&P 500 Index—returned 54.46% and 49.77%, respectively. The portfolio’s return reflects operating expenses, while the indices’ returns do not.

As the performance figures above indicate, the stock market staged a remarkable comeback during the reporting period. Economic conditions improved (partly in response to government stimulus programs), corporate earnings were better than expected, and improving conditions in the capital markets helped the more highly leveraged or financially strapped companies. These factors led many investors to shift into riskier assets, and many of the period’s largest gains were made by the lower-quality businesses that fared the worst during the financial crisis. That situation was at odds with Value’s investment approach, which emphasizes higher-quality businesses with sound balance sheets. Nonetheless, the portfolio received positive contributions in absolute terms from all 10 of the sectors in which it was invested. On a relative basis, Value’s underperformance was more a result of what it didn’t own rat her than what it did.

Value is carefully managed for long-term results. Since its inception on September 1, 1993, Value has produced an average annual return of 9.24%, topping the returns for the Lipper Multi-Cap Value Funds Index, Morning-star’s Large Cap Value category average, the Russell 3000 Value Index, and the S&P 500 Index for the same period (see performance information on page 10 and in footnotes below).

Financials Slowed Results

Value’s position in the financials sector was its largest source of underperfor-mance versus the benchmark. Although financials contributed the most to the portfolio’s return, an underweight restrained relative progress as companies with stressed balance sheets, some of which had appeared to be on the brink of bankruptcy only months earlier, outperformed stronger, higher-quality businesses. The portfolio was underweight commercial banks, a segment that returned more than 82% to the Russell 3000 Value Index.

During the reporting period, the portfolio’s investments were concentrated in the less-volatile insurance names. Many of these companies, however, underperformed during the low-quality rally. Value benefited from holdings among asset management firms, including notable contributor

| |

| * | All fund returns referenced in this commentary are for Investor Class shares. |

| **The average returns for Morningstar’s Large Cap Value category were 1.21% and 3.12% for the five- and ten-year periods ended March 31, 2010, |

| | respectively, and 7.47% since the fund’s inception. © Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to |

| | Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither |

| | Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. |

12

Value

AllianceBernstein Holding LP which performed well as the environment for asset managers improved.

Value’s underweight in real estate investment trusts (REITs) detracted from relative performance. For some time, the management team has been concerned about this segment’s operating trends, financial leverage, access to funding, and valuation. However, in spite of deterioration in the commercial real estate market, REIT stocks posted gains of more than 214% in the benchmark, as investors moved into riskier assets during the period.

Consumer Discretionary Detracted

Relative performance was slowed by the combination of an underweight position and security selection in the consumer discretionary sector. Many of these stocks, which suffered steep declines as the recession took hold, rallied on optimism about a possible economic recovery and improving consumer sentiment. Value was hindered by its lack of exposure to media stocks, which outperformed as advertising revenues improved. It also did not own Ford Motor, which rose nearly 378% during the period.

Utilities Contributed

Security selection in utilities—the second-weakest sector in the benchmark—benefited relative performance. Because of valuations and higher-risk business models, Value did not hold any independent power producers; the segment declined more than 23% in the Russell 3000 Value Index. The portfolio’s mix of electric utilities was particularly advantageous.

Information Technology Added Value

The portfolio’s position in the information technology sector enhanced relative performance. The portfolio held Tyco Electronics, a global provider of engineered electronic components, network solutions, wireless systems, and undersea telecommunication systems. Tyco, which derives a significant percentage of its revenue from the manufacturing of automotive products, performed well as conditions improved in the automobiles segment and the global economy strengthened.

Outlook

We will continue to follow our disciplined, bottom-up process, selecting securities one at a time for the portfolio. As of March 31, 2010, we see opportunities in consumer staples, health care, information technology, and energy, reflected by overweight positions in these sectors relative to the benchmark. Our fundamental analysis and valuation work are also directing us toward relative underweights in financials, consumer discretionary, and materials energy stocks.

13

| |

| Value | |

| |

| Top Ten Holdings | |

| | % of net assets |

| | as of 3/31/10 |

| Exxon Mobil Corp. | 5.2% |

| AT&T, Inc. | 3.4% |

| JPMorgan Chase & Co. | 3.2% |

| Chevron Corp. | 3.2% |

| General Electric Co. | 3.1% |

| Total SA | 2.7% |

| Marsh & McLennan Cos., Inc. | 2.7% |

| Pfizer, Inc. | 2.7% |

| Lowe’s Cos., Inc. | 2.1% |

| Berkshire Hathaway, Inc., Class A | 2.0% |

| |

| Top Five Industries | |

| | % of net assets |

| | as of 3/31/10 |

| Oil, Gas & Consumable Fuels | 16.4% |

| Insurance | 8.2% |

| Pharmaceuticals | 6.7% |

| Capital Markets | 5.5% |

| Food Products | 4.6% |

| |

| Types of Investments in Portfolio | |

| | % of net assets |

| | as of 3/31/10 |

| Domestic Common Stocks | 92.2% |

| Foreign Common Stocks* | 6.8% |

| Total Common Stocks | 99.0% |

| Temporary Cash Investments | 1.2% |

| Other Assets and Liabilities | (0.2)% |

| * Includes depositary shares, dual listed securities and foreign ordinary shares. | |

14

| | | | | | | |

| Large Company Value | | | | | |

| |

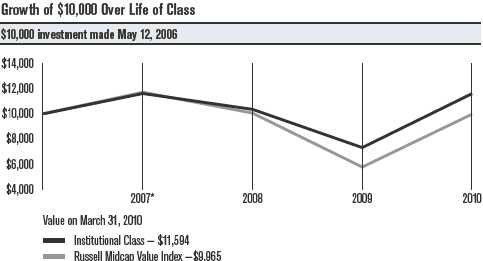

| Total Returns as of March 31, 2010 | | | | | |

| | | | | Average Annual Returns | |

| | | Ticker | | | | Since | Inception |

| | | Symbol | 1 year | 5 years | 10 years | Inception | Date |

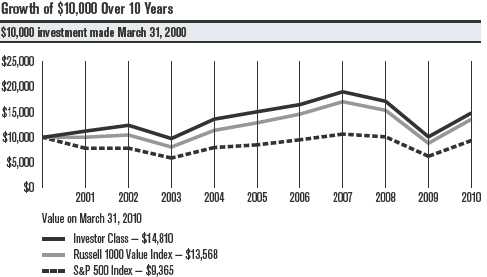

| Investor Class | ALVIX | 46.68% | -0.33% | 4.00% | 3.02% | 7/30/99 |

| Russell 1000 Value Index(1) | — | 53.56% | 1.05% | 3.10% | 2.75% | — |

| S&P 500 Index(1) | — | 49.77% | 1.92% | -0.65% | 0.59% | — |

| Institutional Class | ALVSX | 46.97% | -0.13% | — | 2.59% | 8/10/01 |

| A Class(2) | ALPAX | | | | | 10/26/00 |

| No sales charge* | | 46.31% | -0.58% | — | 3.66% | |

| With sales charge* | | 37.97% | -1.75% | — | 3.01% | |

| B Class | ALBVX | | | | | 1/31/03 |

| No sales charge* | | 45.34% | -1.32% | — | 4.48% | |

| With sales charge* | | 41.34% | -1.53% | — | 4.48% | |

| C Class | ALPCX | 45.19% | -1.32% | — | 2.09% | 11/7/01 |

| R Class | ALVRX | 45.93% | -0.83% | — | 2.95% | 8/29/03 |

| * Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 5.75% |

| maximum initial sales charge for equity funds and may be subject to a maximum CDSC of 1.00%. B Class shares redeemed within six |

| years of purchase are subject to a CDSC that declines from 5.00% during the first year after purchase to 0.00% the sixth year after |

| purchase. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that |

| mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied. |

| |

| (1) | Data provided by Lipper Inc. — A Reuters Company. © 2010 Reuters. All rights reserved. Any copying, republication or redistribution of Lipper |

| | content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be |

| | liable for any errors or delays in the content, or for any actions taken in reliance thereon. | | | |

| | The data contained herein has been obtained from company reports, financial reporting services, periodicals and other resources believed to be |

| | reliable. Although carefully verified, data on compilations is not guaranteed by Lipper and may be incomplete. No offer or solicitations to buy or |

| | sell any of the securities herein is being made by Lipper. | | | | | |

| (2) | Prior to December 3, 2007, the A Class was referred to as the Advisor Class and did not have a front-end sales charge. Performance prior to that |

| | date has been adjusted to reflect this charge. | | | | | |

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

15

Large Company Value

| | | | | |

| Total Annual Fund Operating Expenses | | | |

| | Institutional | | | | |

| Investor Class | Class | A Class | B Class | C Class | R Class |

| 0.83% | 0.63% | 1.08% | 1.83% | 1.83% | 1.33% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com.

Unless otherwise indicated, performance reflects Investor Class shares; performance for other share classes will vary due to differences in fee structure. For information about other share classes available, please consult the prospectus. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. Returns for the indices are provided for comparison. The fund’s total returns include operating expenses (such as transaction costs and management fees) that reduce returns, while the total returns of the indices do not.

16

Large Company Value

Portfolio Managers: Chuck Ritter and Brendan Healy

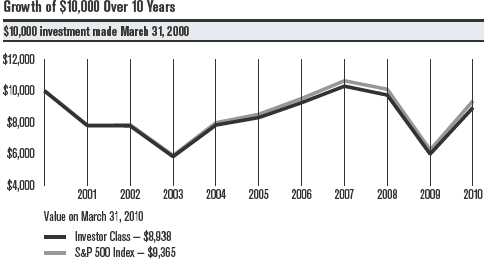

Performance Summary

Large Company Value returned 46.68%* for the 12 months ended March 31, 2010. By comparison, its benchmark, the Russell 1000 Value Index, returned 53.56%. The broader market, as measured by the S&P 500 Index, returned 49.77%. The portfolio’s return reflects operating expenses, while the indices’ returns do not. The average return for Morningstar’s Large Cap Value category** (its performance, like Large Company Value’s, reflects operating expenses) was 50.25%.

As the performance figures above indicate, the stock market staged a remarkable comeback during the reporting period. Economic conditions improved in response to government stimulus, corporate earnings were better than expected, and improving conditions in the capital markets helped the more highly leveraged or financially strapped companies. These factors led many investors to shift into riskier assets, and many of the period’s largest gains were made by the lower-quality businesses that fared the worst during the financial crisis. Furthermore, the names that lagged the rally tended to be the stable, less risky businesses favored by Large Company Value. In this environment, the portfolio received positive results in absolute terms from all 10 of the sectors in which it was invested. On a relative basis, holdings in the consumer discretionary and health care sectors detracted. The portfolio’s position in utilities contributed positively.

Large Company Value is carefully managed for long-term results. Since its inception on July 30, 1999, Large Company Value has produced an average annual return of 3.02%, topping the returns for Morningstar’s Large Cap Value category average, the Russell 1000 Value Index, and the S&P 500 Index for the same period (see performance information on page 15 and in footnotes below).

Consumer Discretionary Detracted

Within the consumer discretionary sector, security selection was a drag on relative performance. Although the portfolio benefited from its investments in the media industry, these results were offset by a lack of exposure to car maker Ford Motor and auto component companies. Ford, which was up significantly in the benchmark, has restructured its business and steadily gained market share. Among diversified consumer services stocks, a notable detractor was H&R Block, which experienced a decline in its tax-preparation business.

Health Care Hampered Results

The portfolio’s overweight in health care dampened relative progress. Health care stocks gained, but their progress was constrained as investors

| |

| * | All fund returns referenced in this commentary are for Investor Class shares. |

| **The average returns for Morningstar’s Large Cap Value category were 1.21% and 3.12% for the five- and ten-year periods ended March 31, 2010, |

| | respectively, and 2.69% since the fund’s inception. © Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to |

| | Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither |

| | Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. |

17

Large Company Value

priced in worst-case scenarios for health care reform. As fears abated, the sector’s performance strengthened.

Security selection also slowed relative results. A notable detractor was Abbott Laboratories, which develops and manufactures laboratory diagnostics, medical devices, and pharmaceutical therapies. Earlier in the reporting period, Abbott reported a deceleration in prescription growth for Humira, its blockbuster drug for the treatment of rheumatoid arthritis. Eventually, sales of Humira rebounded strongly, but the drugmaker’s shares underper-formed other pharmaceutical names.

A Defensive Bias Also Slowed Progress

A factor influencing Large Company Value’s relative underperformance was the annual reconstitution of the portfolio’s benchmark index, the Russell 1000 Value Index. The reconstitution, which occurred during June 2009, gave greater weighting to cyclical sectors and stocks—in other words, those that tend to rise during good economic times. Because of our investment approach, we did not respond to this shift in weightings by increasing the portfolio’s cyclical sensitivity, which hampered relative performance.

Utilities Provided a Boost

Large Company Value continued to benefit from a significant underweight in the utilities sector, reflecting our belief that many of these stocks have been overvalued for some time. The stance added value during the market rally when utilities underperformed all but one other benchmark sector.

Consumer Staples Provided Notable Contributor

The consumer staples sector was the source of key contributor Pepsi Bottling Group. Its share price surged on news that PepsiCo, which already owned one third of the bottling company, had launched a takeover bid. We sold the position after the announcement.

Outlook

We continue to be bottom-up investment managers, evaluating each company individually and building the portfolio one stock at a time. As of March 31, 2010, Large Company Value is broadly diversified, with ongoing overweight positions in the health care, information technology, and consumer staples sectors. Our valuation work is also directing us toward smaller relative weightings in financials, utilities, and materials stocks.

18

| |

| Large Company Value | |

| |

| Top Ten Holdings | |

| | % of net assets |

| | as of 3/31/10 |

| Exxon Mobil Corp. | 4.9% |

| General Electric Co. | 3.9% |

| JPMorgan Chase & Co. | 3.8% |

| Bank of America Corp. | 3.5% |

| Pfizer, Inc. | 3.5% |

| Chevron Corp. | 3.5% |

| AT&T, Inc. | 3.5% |

| ConocoPhillips | 2.7% |

| Verizon Communications, Inc. | 2.2% |

| Wells Fargo & Co. | 2.2% |

| |

| Top Five Industries | |

| | % of net assets |

| | as of 3/31/10 |

| Oil, Gas & Consumable Fuels | 15.8% |

| Pharmaceuticals | 8.8% |

| Diversified Financial Services | 7.8% |

| Diversified Telecommunication Services | 6.0% |

| Insurance | 4.8% |

| |

| Types of Investments in Portfolio | |

| | % of net assets |

| | as of 3/31/10 |

| Common Stocks & Futures | 99.0% |

| Temporary Cash Investments | 0.7% |

| Other Assets and Liabilities | 0.3% |

19

|

| Shareholder Fee Examples (Unaudited) |

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/ exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2009 to March 31, 2010.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or Institutional Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not a financial intermediary or retirement plan account), American Century Investments may charge you a $12.50 semiannual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $12.50 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments Brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments Brokerage accounts, you are currently not subject to this fee. We will not charge the fee as long as you choose to manage your accounts exclusively online. If you are subject to the Account Maintenance Fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

20

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 10/1/09 | 3/31/10 | 10/1/09 – 3/31/10 | Expense Ratio* |

| Equity Income | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,091.50 | $5.06 | 0.97% |

| Institutional Class | $1,000 | $1,091.00 | $4.01 | 0.77% |

| A Class | $1,000 | $1,090.10 | $6.36 | 1.22% |

| B Class | $1,000 | $1,085.80 | $10.24 | 1.97% |

| C Class | $1,000 | $1,085.90 | $10.24 | 1.97% |

| R Class | $1,000 | $1,088.90 | $7.66 | 1.47% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,020.09 | $4.89 | 0.97% |

| Institutional Class | $1,000 | $1,021.09 | $3.88 | 0.77% |

| A Class | $1,000 | $1,018.85 | $6.14 | 1.22% |

| B Class | $1,000 | $1,015.11 | $9.90 | 1.97% |

| C Class | $1,000 | $1,015.11 | $9.90 | 1.97% |

| R Class | $1,000 | $1,017.60 | $7.39 | 1.47% |

| Value | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,110.90 | $5.26 | 1.00% |

| Institutional Class | $1,000 | $1,114.10 | $4.22 | 0.80% |

| A Class | $1,000 | $1,111.80 | $6.58 | 1.25% |

| B Class | $1,000 | $1,104.00 | $10.49 | 2.00% |

| C Class | $1,000 | $1,104.80 | $10.50 | 2.00% |

| R Class | $1,000 | $1,108.10 | $7.88 | 1.50% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,019.95 | $5.04 | 1.00% |

| Institutional Class | $1,000 | $1,020.94 | $4.03 | 0.80% |

| A Class | $1,000 | $1,018.70 | $6.29 | 1.25% |

| B Class | $1,000 | $1,014.96 | $10.05 | 2.00% |

| C Class | $1,000 | $1,014.96 | $10.05 | 2.00% |

| R Class | $1,000 | $1,017.45 | $7.54 | 1.50% |

|

| * Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

21

| | | | |

| | Beginning | Ending | Expenses Paid | |

| | Account Value | Account Value | During Period* | Annualized |

| | 10/1/09 | 3/31/10 | 10/1/09 – 3/31/10 | Expense Ratio* |

| Large Company Value | | | | |

| Actual | | | | |

| Investor Class | $1,000 | $1,087.90 | $4.37 | 0.84% |

| Institutional Class | $1,000 | $1,089.00 | $3.33 | 0.64% |

| A Class | $1,000 | $1,086.50 | $5.67 | 1.09% |

| B Class | $1,000 | $1,082.00 | $9.55 | 1.84% |

| C Class | $1,000 | $1,082.30 | $9.55 | 1.84% |

| R Class | $1,000 | $1,085.10 | $6.97 | 1.34% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,020.74 | $4.23 | 0.84% |

| Institutional Class | $1,000 | $1,021.74 | $3.23 | 0.64% |

| A Class | $1,000 | $1,019.50 | $5.49 | 1.09% |

| B Class | $1,000 | $1,015.76 | $9.25 | 1.84% |

| C Class | $1,000 | $1,015.76 | $9.25 | 1.84% |

| R Class | $1,000 | $1,018.25 | $6.74 | 1.34% |

| * Expenses are equal to the class’s annualized expense ratio listed in the table above, multiplied by the average account value over the period, |

| multiplied by 182, the number of days in the most recent fiscal half-year, divided by 365, to reflect the one-half year period. |

22

| | | | | | |

| Equity Income | | | | | | |

| |

| MARCH 31, 2010 | | | | | | |

| |

| | Shares/ | | | | Shares/ | |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| Common Stocks — 72.5% | | | ELECTRONIC EQUIPMENT, | | |

| | | | | INSTRUMENTS & COMPONENTS — 0.5% | |

| AEROSPACE & DEFENSE — 1.3% | | | Molex, Inc., Class A | 1,800,000 | $ 31,770,000 |

| Honeywell International, Inc. | 353,800 | $ 16,016,526 | | FOOD & STAPLES RETAILING — 3.0% | |

| Northrop Grumman Corp. | 407,127 | 26,695,317 | | Wal-Mart Stores, Inc. | 3,450,016 | 191,820,890 |

| Raytheon Co. | 740,500 | 42,297,360 | | FOOD PRODUCTS — 2.6% | | |

| | | 85,009,203 | | Campbell Soup Co. | 1,400,821 | 49,519,023 |

| AIR FREIGHT & LOGISTICS — 3.1% | | | H.J. Heinz Co. | 1,325,400 | 60,451,494 |

| United Parcel Service, Inc., | | | | Hershey Co. (The) | 700,030 | 29,968,284 |

| Class B | 3,020,921 | 194,577,522 | | | | |

| AUTOMOBILES — 0.3% | | | | Unilever NV CVA | 765,000 | 23,139,572 |

| Honda Motor Co. Ltd. | 448,800 | 15,841,694 | | | | 163,078,373 |

| CAPITAL MARKETS — 2.8% | | | | GAS UTILITIES — 4.8% | | |

| AllianceBernstein Holding LP | 890,173 | 27,292,704 | | AGL Resources, Inc. | 2,463,700 | 95,222,005 |

| Northern Trust Corp. | 2,244,500 | 124,031,070 | | Nicor, Inc. | 1,000,000 | 41,920,000 |

| | | | | Piedmont Natural | | |

| T. Rowe Price Group, Inc. | 500,000 | 27,465,000 | | Gas Co., Inc. | 1,900,030 | 52,402,827 |

| | | 178,788,774 | | Spectra Energy Partners LP | 850,062 | 25,841,885 |

| CHEMICALS — 0.7% | | | | WGL Holdings, Inc.(1) | 2,505,688 | 86,822,089 |

| E.I. du Pont | | | | | | |

| de Nemours & Co. | 1,144,800 | 42,632,352 | | | | 302,208,806 |

| COMMERCIAL BANKS — 0.7% | | | HOTELS, RESTAURANTS & LEISURE — 0.6% | |

| Commerce Bancshares, Inc. | 1,110,049 | 45,667,416 | | McDonald’s Corp. | 608,500 | 40,599,120 |

| COMMERCIAL SERVICES & SUPPLIES — 1.7% | | HOUSEHOLD PRODUCTS — 5.8% | |

| Pitney Bowes, Inc. | 800,000 | 19,560,000 | | Clorox Co. | 582,000 | 37,329,480 |

| Waste Management, Inc. | 2,449,945 | 84,351,606 | | Kimberly-Clark Corp. | 3,130,300 | 196,833,264 |

| | | 103,911,606 | | Procter & Gamble Co. (The) | 2,081,930 | 131,723,711 |

| CONSTRUCTION MATERIALS — 0.5% | | | | | 365,886,455 |

| Martin Marietta | | | | INSURANCE — 6.8% | | |

| Materials, Inc. | 377,500 | 31,540,125 | | ACE Ltd. | 534,700 | 27,964,810 |

| DISTRIBUTORS — 0.8% | | | | Allstate Corp. (The) | 3,480,000 | 112,438,800 |

| Genuine Parts Co. | 1,180,400 | 49,860,096 | | Chubb Corp. (The) | 1,590,200 | 82,451,870 |

| DIVERSIFIED TELECOMMUNICATION | | | Marsh & McLennan | | |

| SERVICES — 4.1% | | | | Cos., Inc. | 7,000,089 | 170,942,173 |

| AT&T, Inc. | 9,000,000 | 232,560,000 | | MetLife, Inc. | 145,000 | 6,284,300 |

| BCE, Inc. | 236,200 | 6,941,929 | | Transatlantic Holdings, Inc. | 533,204 | 28,153,171 |

| CenturyTel, Inc. | 478,100 | 16,953,426 | | | | 428,235,124 |

| | | 256,455,355 | | IT SERVICES — 1.1% | | |

| ELECTRIC UTILITIES — 1.6% | | | | Automatic Data | | |

| Northeast Utilities | 1,500,000 | 41,460,000 | | Processing, Inc. | 1,535,500 | 68,283,685 |

| Portland General Electric Co. | 1,107,133 | 21,378,738 | | MACHINERY — 0.5% | | |

| Southern Co. | 1,065,200 | 35,322,032 | | Caterpillar, Inc. | 513,600 | 32,279,760 |

| | | 98,160,770 | | METALS & MINING — 0.3% | | |

| ELECTRICAL EQUIPMENT — 1.3% | | | Nucor Corp. | 470,800 | 21,364,904 |

| Emerson Electric Co. | 1,131,400 | 56,954,676 | | | | |

| Rockwell Automation, Inc. | 470,019 | 26,490,271 | | | | |

| | | 83,444,947 | | | | |

23

| | | | | | |

| Equity Income | | | | | | |

| |

| | Shares/ | | | | Shares/ | |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| MULTI-UTILITIES — 3.7% | | | | Convertible Bonds — 21.3% | |

| Consolidated Edison, Inc. | 2,615,168 | $ 116,479,583 | | AUTO COMPONENTS — 1.1% | |

| PG&E Corp. | 2,300,000 | 97,566,000 | | BorgWarner, Inc., | | |

| Wisconsin Energy Corp. | 390,000 | 19,269,900 | | 3.50%, 4/15/12 | $ 52,000,000 | $ 68,250,000 |

| | | 233,315,483 | | CAPITAL MARKETS — 0.6% | | |

| OIL, GAS & CONSUMABLE FUELS — 13.3% | | Janus Capital Group, Inc., | | |

| BP plc | 4,549,300 | 43,036,810 | | 3.25%, 7/15/14 | 17,500,000 | 22,181,250 |

| Chevron Corp. | 2,381,500 | 180,589,145 | | Morgan Stanley, (convertible | | |

| Enterprise Products | | | | into Charles Schwab Corp. | | |

| Partners LP | 537,500 | 18,586,750 | | (The)), 6.10%, 8/10/10(2)(3) | 888,200 | 16,640,427 |

| Exxon Mobil Corp. | 6,000,029 | 401,881,943 | | | | 38,821,677 |

| Total SA | 3,146,400 | 182,651,468 | | COMMERCIAL BANKS — 3.0% | |

| XTO Energy, Inc. | 196,400 | 9,266,152 | | U.S. Bancorp., VRN, | | |

| | | 836,012,268 | | 0.00%, 6/11/10 | 190,130,000 | 188,466,362 |

| PHARMACEUTICALS — 6.0% | | | | COMMUNICATIONS EQUIPMENT — 0.1% | |

| | | | | Ciena Corp., | | |

| Bristol-Myers Squibb Co. | 3,825,740 | 102,147,258 | | 4.00%, 3/15/15(2) | 6,500,000 | 6,760,000 |

| Eli Lilly & Co. | 1,273,000 | 46,108,060 | | ENERGY EQUIPMENT & SERVICES — 1.0% | |

| Johnson & Johnson | 3,040,835 | 198,262,442 | | Cameron International Corp., | | |

| Pfizer, Inc. | 1,974,524 | 33,863,087 | | 2.50%, 6/15/26 | 47,511,000 | 63,070,853 |

| | | 380,380,847 | | HEALTH CARE EQUIPMENT & SUPPLIES — 0.3% |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.9% | | Beckman Coulter, Inc., | | |

| Annaly Capital | | | | 2.50%, 12/15/36 | 16,697,000 | 18,784,125 |

| Management, Inc. | 3,150,200 | 54,120,436 | | HEALTH CARE PROVIDERS & SERVICES — 1.1% |

| SEMICONDUCTORS & SEMICONDUCTOR | | | Lincare Holdings, Inc., | | |

| EQUIPMENT — 1.1% | | | | 2.75%, 11/1/37 | 59,000,000 | 68,292,500 |

| Applied Materials, Inc. | 3,045,246 | 41,049,916 | | HOUSEHOLD DURABLES — 0.4% | |

| Microchip Technology, Inc. | 1,000,000 | 28,160,000 | | Deutsche Bank AG, | | |

| | | 69,209,916 | | (convertible into Toll | | |

| SPECIALTY RETAIL — 1.8% | | | | Brothers, Inc.), | | |

| | | | | 15.67%, 6/11/10(2)(3) | 655,000 | 12,825,883 |

| Lowe’s Cos., Inc. | 3,322,300 | 80,532,552 | | Deutsche Bank AG, | | |

| Sherwin-Williams Co. (The) | 469,400 | 31,768,992 | | (convertible into Toll | | |

| | | 112,301,544 | | Brothers, Inc.), | | |

| THRIFTS & MORTGAGE FINANCE — 0.8% | | | 12.05%, 7/29/10(2)(3) | 600,000 | 11,968,500 |

| Hudson City Bancorp., Inc. | 1,800,000 | 25,488,000 | | | | 24,794,383 |

| People’s United | | | | INSURANCE — 0.7% | | |

| Financial, Inc. | 1,610,000 | 25,180,400 | | BNP Paribas, | | |

| | | 50,668,400 | | (convertible into Aon Corp.), | | |

| | | | | 4.55%, 5/4/10(2)(3) | 640,000 | 26,928,000 |

| TOTAL COMMON STOCKS | | | | | | |

| (Cost $3,963,429,430) | | 4,567,425,871 | | Morgan Stanley, | | |

| | | | | (convertible into Marsh | | |

| | | | | & McLennan Cos., Inc.), | | |

| | | | | 8.20%, 6/10/10(2)(3) | 725,000 | 17,200,625 |

| | | | | | | 44,128,625 |

24

| | | | | | |

| Equity Income | | | | | |

| |

| | Shares/ | | | | Shares/ | |

| | Principal | | | | Principal | |

| | Amount | Value | | | Amount | Value |

| IT SERVICES — 1.3% | | | | SPECIALTY RETAIL — 0.6% | | |

| DST Systems, Inc., VRN, | | | | Best Buy Co., Inc., | | |

| 3.625%, 8/15/23 | $ 77,000,000 | $ 79,887,500 | | 2.25%, 1/15/22 | $ 22,497,000 | $ 25,196,640 |

| METALS & MINING — 1.0% | | | | BNP Paribas, (convertible | | |

| Newmont Mining Corp., | | | | into Gap, Inc. (The)), 6.79%, | | |

| 3.00%, 2/15/12 | 50,000,000 | 63,562,500 | | 8/10/10(2)(3) | 530,000 | 11,389,700 |

| OIL, GAS & CONSUMABLE FUELS — 1.1% | | | | | 36,586,340 |

| Peabody Energy Corp., | | | | TOTAL CONVERTIBLE BONDS | |

| 4.75%, 12/15/41 | 67,000,000 | 72,862,500 | | (Cost $1,214,656,240) | | 1,342,621,712 |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 5.6% | | Convertible Preferred Stocks — 3.9% |

| Annaly Capital Management, | | | | DIVERSIFIED FINANCIAL SERVICES — 3.9% |

| Inc., 4.00%, 2/15/15 | 55,012,000 | 56,043,475 | | Bank of America Corp., | | |

| Host Hotels & Resorts LP, | | | | 7.25%, 12/31/49(4) | | |

| 3.25%, 4/15/24(2) | 105,600,000 | 108,504,000 | | (Cost $185,303,843) | 252,200 | 245,895,000 |

| Host Hotels & Resorts LP, | | | | | | |

| 2.50%, 10/15/29(2) | 47,000,000 | 57,222,500 | | Preferred Stocks — 0.1% | |

| Rayonier TRS Holdings, Inc., | | | | REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.1% |

| 3.75%, 10/15/12 | 55,028,000 | 60,324,445 | | Public Storage, | | |

| Rayonier TRS Holdings, Inc., | | | | 7.50%, 5/7/10(4) | | |

| 4.50%, 8/15/15(2) | 38,975,000 | 46,282,812 | | (Cost $7,223,942) | 330,522 | 8,329,155 |

| Reckson Operating | | | | Temporary Cash Investments — 0.4% |

| Partnership LP, 4.00%, | | | | | | |

| 6/15/25 | 24,000,000 | 23,940,000 | | FHLB Discount Notes, | | |

| | | | | 0.001%, 4/1/10(5) | $ 24,500,000 | 24,500,000 |

| | | 352,317,232 | | JPMorgan U.S. Treasury | | |

| SEMICONDUCTORS & SEMICONDUCTOR | | | Plus Money Market Fund | | |

| EQUIPMENT — 3.0% | | | | Agency Shares | 31,029 | 31,029 |

| Intel Corp., 2.95%, 12/15/35 | 138,004,000 | 136,106,445 | | TOTAL TEMPORARY | | |

| Linear Technology Corp., | | | | CASH INVESTMENTS | | |

| 3.125%, 5/1/27 | 34,970,000 | 35,232,275 | | (Cost $24,531,029) | | 24,531,029 |

| Verigy Ltd., | | | | TOTAL INVESTMENT | | |

| 5.25%, 7/15/14(2) | 18,000,000 | 20,070,000 | | SECURITIES — 98.2% | | |

| | | 191,408,720 | | (Cost $5,395,144,484) | | 6,188,802,767 |

| SOFTWARE — 0.4% | | | | OTHER ASSETS | | |

| Sybase, Inc., | | | | AND LIABILITIES — 1.8% | | 111,547,780 |

| 3.50%, 8/15/29(2) | 20,588,000 | 24,628,395 | | TOTAL NET ASSETS — 100.0% | $6,300,350,547 |

25

| | | | | |

| Equity Income | | | |

| |

| Forward Foreign Currency Exchange Contracts | | |

| | Contracts to Sell | Settlement Date | Value | Unrealized Gain (Loss) |

| | 6,726,600 | CAD for USD | 4/30/10 | $ 6,622,951 | $ (15,591) |

| | 112,957,802 | EUR for USD | 4/30/10 | 152,566,455 | (490,237) |

| | 21,666,041 | GBP for USD | 4/30/10 | 32,874,606 | (433,176) |

| | 1,102,365,000 | JPY for USD | 4/30/10 | 11,792,890 | 110,928 |

| | | | | $203,856,902 | $(828,076) |

| (Value on Settlement Date $203,028,826) | | | |

| |

| Notes to Schedule of Investments | | |

| CAD = Canadian Dollar | | | |

| CVA = Certificaten Van Aandelen | | | |

| EUR = Euro | | | | |

| FHLB = Federal Home Loan Bank | | | |

| GBP = British Pound | | | |

| JPY = Japanese Yen | | | |

| USD = United States Dollar | | | |

| VRN = Variable Rate Note. Interest reset date is indicated. Rate shown is effective at the period end. | |

| |

| (1) | Affiliated Company: the fund’s holding represents ownership of 5% or more of the voting securities of the company; therefore, the company is |

| | affiliated as defined in the Investment Company Act of 1940. | | |

| (2) | Security was purchased under Rule 144A of the Securities Act of 1933 or is a private placement and, unless registered under the Act or |

| | exempted from registration, may only be sold to qualified institutional investors. The aggregate value of these securities at the period end was |

| | $360,420,842, which represented 5.7% of total net assets. | | |

| (3) | Equity-linked debt security. The aggregated value of these securities at the period end, was $96,953,135, which represented 1.5% of total |

| | net assets. | | | | |

| (4) | Perpetual security. These securities do not have a predetermined maturity date. The coupon rates are fixed for a period of time and may be |

| | structured to adjust thereafter. Interest reset or next call date is indicated, as applicable. | |

| (5) | The rate indicated is the yield to maturity at purchase. | | |

Industry classifications are unaudited.

See Notes to Financial Statements.

26

| | | | | | |

| Value | | | | | | |

| |

| MARCH 31, 2010 | | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| Common Stocks — 99.0% | | | COMPUTERS & PERIPHERALS — 1.6% | |

| AEROSPACE & DEFENSE — 0.6% | | | Diebold, Inc. | 359,120 | $ 11,405,651 |

| Boeing Co. (The) | 34,190 | $ 2,482,536 | | Hewlett-Packard Co. | 287,460 | 15,278,499 |

| Northrop Grumman Corp. | 118,840 | 7,792,339 | | | | 26,684,150 |

| | | 10,274,875 | | CONSTRUCTION MATERIALS — 0.3% | |

| AIR FREIGHT & LOGISTICS — 1.4% | | | Vulcan Materials Co. | 110,720 | 5,230,413 |

| United Parcel Service, Inc., | | | | CONTAINERS & PACKAGING — 0.5% | |

| Class B | 360,900 | 23,245,569 | | Bemis Co., Inc. | 265,010 | 7,611,087 |

| AIRLINES — 0.1% | | | | DISTRIBUTORS — 1.3% | | |

| Southwest Airlines Co. | 125,210 | 1,655,276 | | Genuine Parts Co. | 489,340 | 20,669,722 |

| AUTOMOBILES — 1.4% | | | | DIVERSIFIED — 0.6% | | |

| Honda Motor Co. Ltd. | 175,900 | 6,208,899 | | iShares Russell 3000 | | |

| Toyota Motor Corp. | 408,300 | 16,355,584 | | Value Index Fund | 127,110 | 10,177,698 |

| | | 22,564,483 | | DIVERSIFIED FINANCIAL SERVICES — 4.4% | |

| BEVERAGES — 0.8% | | | | Bank of America Corp. | 870,360 | 15,535,926 |

| PepsiCo, Inc. | 195,470 | 12,932,295 | | JPMorgan Chase & Co. | 1,157,280 | 51,788,280 |

| CAPITAL MARKETS — 5.5% | | | | McGraw-Hill Cos., Inc. (The) | 133,150 | 4,746,797 |

| AllianceBernstein Holding LP | 419,130 | 12,850,526 | | | | 72,071,003 |

| | | | | DIVERSIFIED TELECOMMUNICATION | |

| Ameriprise Financial, Inc. | 137,350 | 6,230,196 | | SERVICES — 4.5% | | |

| Bank of New York | | | | AT&T, Inc. | 2,127,990 | 54,987,262 |

| Mellon Corp. (The) | 307,040 | 9,481,395 | | | | |

| Goldman Sachs | | | | BCE, Inc. | 162,180 | 4,766,478 |

| Group, Inc. (The) | 85,230 | 14,542,795 | | Verizon | | |

| Invesco Ltd. | 224,080 | 4,909,593 | | Communications, Inc. | 435,880 | 13,520,997 |

| Morgan Stanley | 326,020 | 9,549,126 | | | | 73,274,737 |

| Northern Trust Corp. | 342,610 | 18,932,629 | | ELECTRIC UTILITIES — 3.7% | | |

| | | | | American Electric | | |

| State Street Corp. | 265,490 | 11,984,218 | | Power Co., Inc. | 244,080 | 8,342,654 |

| | | 88,480,478 | | IDACORP, Inc. | 467,540 | 16,186,235 |

| CHEMICALS — 1.0% | | | | Southern Co. | 250,270 | 8,298,953 |

| E.I. du Pont | | | | Westar Energy, Inc. | 1,197,600 | 26,706,480 |

| de Nemours & Co. | 426,590 | 15,886,212 | | | | |

| COMMERCIAL BANKS — 2.2% | | | | | | 59,534,322 |

| Commerce Bancshares, Inc. | 134,870 | 5,548,552 | | ELECTRICAL EQUIPMENT — 1.8% | |

| PNC Financial Services | | | | Emerson Electric Co. | 91,140 | 4,587,988 |

| Group, Inc. | 80,610 | 4,812,417 | | Hubbell, Inc., Class B | 474,250 | 23,916,427 |

| U.S. Bancorp. | 956,820 | 24,762,501 | | | | 28,504,415 |

| | | 35,123,470 | | ELECTRONIC EQUIPMENT, | | |

| COMMERCIAL SERVICES & SUPPLIES — 2.5% | | INSTRUMENTS & COMPONENTS — 1.5% | |

| Avery Dennison Corp. | 163,270 | 5,944,661 | | Molex, Inc. | 734,050 | 15,312,283 |

| Pitney Bowes, Inc. | 165,170 | 4,038,406 | | Tyco Electronics Ltd. | 318,470 | 8,751,556 |

| Republic Services, Inc. | 645,190 | 18,723,414 | | | | 24,063,839 |

| Waste Management, Inc. | 335,740 | 11,559,528 | | ENERGY EQUIPMENT & SERVICES — 1.0% | |

| | | 40,266,009 | | Baker Hughes, Inc. | 85,900 | 4,023,556 |

| COMMUNICATIONS EQUIPMENT — 0.3% | | | BJ Services Co. | 168,690 | 3,609,966 |

| Nokia Oyj ADR | 106,250 | 1,651,125 | | Schlumberger Ltd. | 136,410 | 8,656,579 |

| QUALCOMM, Inc. | 97,150 | 4,079,328 | | | | 16,290,101 |

| | | 5,730,453 | | | | |

27

| | | | | | |

| Value | | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| FOOD & STAPLES RETAILING — 1.7% | | | INSURANCE — 8.2% | | |

| Casey’s General Stores, Inc. | 89,150 | $ 2,799,310 | | Allstate Corp. (The) | 367,430 | $ 11,871,663 |

| CVS Caremark Corp. | 272,980 | 9,980,149 | | Aon Corp. | 240,050 | 10,252,535 |

| Wal-Mart Stores, Inc. | 280,750 | 15,609,700 | | Berkshire Hathaway, Inc., | | |

| | | 28,389,159 | | Class A(1) | 260 | 31,668,000 |

| FOOD PRODUCTS — 4.6% | | | | Chubb Corp. (The) | 245,870 | 12,748,360 |

| Campbell Soup Co. | 404,890 | 14,312,862 | | Marsh & McLennan | | |

| ConAgra Foods, Inc. | 393,020 | 9,853,011 | | Cos., Inc. | 1,767,290 | 43,157,222 |

| H.J. Heinz Co. | 278,360 | 12,696,000 | | Transatlantic Holdings, Inc. | 133,310 | 7,038,768 |

| Kraft Foods, Inc., Class A | 852,350 | 25,775,064 | | Travelers Cos., Inc. (The) | 295,070 | 15,916,076 |

| Unilever NV CVA | 392,570 | 11,874,381 | | | | 132,652,624 |

| | | 74,511,318 | | IT SERVICES — 0.6% | | |

| | | | | Automatic Data | | |

| HEALTH CARE EQUIPMENT & SUPPLIES — 2.4% | | Processing, Inc. | 220,380 | 9,800,299 |

| Beckman Coulter, Inc. | 271,270 | 17,035,756 | | MEDIA — 0.4% | | |

| Boston Scientific Corp.(1) | 1,436,220 | 10,369,508 | | Walt Disney Co. (The) | 191,020 | 6,668,508 |

| CareFusion Corp.(1) | 43,650 | 1,153,670 | | METALS & MINING — 0.7% | | |

| Zimmer Holdings, Inc.(1) | 182,060 | 10,777,952 | | Barrick Gold Corp. | 131,610 | 5,045,927 |

| | | 39,336,886 | | Newmont Mining Corp. | 124,860 | 6,359,120 |

| HEALTH CARE PROVIDERS & SERVICES — 1.6% | | | | 11,405,047 |

| Aetna, Inc. | 178,340 | 6,261,517 | | MULTILINE RETAIL — 0.7% | | |

| Cardinal Health, Inc. | 67,330 | 2,425,900 | | Target Corp. | 201,750 | 10,612,050 |

| CIGNA Corp. | 74,110 | 2,710,944 | | MULTI-UTILITIES — 2.3% | | |

| LifePoint Hospitals, Inc.(1) | 230,860 | 8,491,031 | | PG&E Corp. | 215,160 | 9,127,087 |

| UnitedHealth Group, Inc. | 183,210 | 5,985,471 | | Wisconsin Energy Corp. | 377,190 | 18,636,958 |

| | | 25,874,863 | | Xcel Energy, Inc. | 465,040 | 9,858,848 |

| HOTELS, RESTAURANTS & LEISURE — 1.7% | | | | | 37,622,893 |

| Hyatt Hotels Corp., | | | | OIL, GAS & CONSUMABLE FUELS — 16.4% | |

| Class A(1) | 73,950 | 2,881,092 | | | | |

| | | | | Apache Corp. | 47,790 | 4,850,685 |

| International Speedway | | | | Chevron Corp. | 679,870 | 51,554,542 |

| Corp., Class A | 549,040 | 14,148,761 | | | | |

| Speedway Motorsports, Inc. | 644,162 | 10,055,369 | | ConocoPhillips | 270,510 | 13,841,997 |

| | | 27,085,222 | | Devon Energy Corp. | 296,720 | 19,117,670 |

| HOUSEHOLD DURABLES — 0.7% | | | EQT Corp. | 424,700 | 17,412,700 |

| | | | | Exxon Mobil Corp. | 1,257,880 | 84,252,802 |

| Toll Brothers, Inc.(1) | 259,880 | 5,405,504 | | | | |

| | | | | Imperial Oil Ltd. | 321,070 | 12,401,493 |

| Whirlpool Corp. | 62,570 | 5,459,232 | | | | |

| | | | | Total SA | 754,360 | 43,791,305 |

| | | 10,864,736 | | | | |

| | | | | Valero Energy Corp. | 141,680 | 2,791,096 |

| HOUSEHOLD PRODUCTS — 2.2% | | | | | |

| | | | | XTO Energy, Inc. | 333,090 | 15,715,186 |

| Kimberly-Clark Corp. | 435,470 | 27,382,354 | | | | |

| | | | | | | 265,729,476 |

| Procter & Gamble Co. (The) | 139,530 | 8,828,063 | | | | |

| | | | | PAPER & FOREST PRODUCTS — 0.3% | |

| | | 36,210,417 | | | | |

| | | | | Weyerhaeuser Co. | 96,020 | 4,346,825 |

| INDUSTRIAL CONGLOMERATES — 3.4% | | | | | |

| | | | | PHARMACEUTICALS — 6.7% | | |

| 3M Co. | 59,220 | 4,949,015 | | | | |

| | | | | Bristol-Myers Squibb Co. | 292,610 | 7,812,687 |

| General Electric Co. | 2,756,910 | 50,175,762 | | | | |

| | | | | Eli Lilly & Co. | 383,230 | 13,880,591 |

| | | 55,124,777 | | | | |

| | | | | Johnson & Johnson | 419,350 | 27,341,620 |

| | | | | Merck & Co., Inc. | 443,160 | 16,552,026 |

| | | | | Pfizer, Inc. | 2,513,550 | 43,107,382 |

| | | | | | | 108,694,306 |

28

| | | | | | |

| Value | | | | | | |

| |

| | Shares | Value | | | Shares | Value |

| REAL ESTATE INVESTMENT TRUSTS (REITs) — 0.9% | | Temporary Cash Investments — 1.2% |

| Boston Properties, Inc. | 51,970 | $ 3,920,617 | | JPMorgan U.S. Treasury | | |

| Host Hotels & Resorts, Inc. | 530,000 | 7,764,500 | | Plus Money Market Fund | | |

| Public Storage | 40,600 | 3,734,794 | | Agency Shares | 58,100 | $ 58,100 |

| | | 15,419,911 | | Repurchase Agreement, Bank of America | |

| ROAD & RAIL — 0.9% | | | | Securities, LLC, (collateralized by various | |

| | | | | U.S. Treasury obligations, 3.125%, 1/31/17, | |

| Heartland Express, Inc. | 400,090 | 6,601,485 | | valued at $19,757,579), in a joint trading | |

| Union Pacific Corp. | 110,940 | 8,131,902 | | account at 0.01%, dated 3/31/10, due | |

| | | 14,733,387 | | 4/1/10 (Delivery value $19,300,005) | 19,300,000 |

| SEMICONDUCTORS & SEMICONDUCTOR | | | TOTAL TEMPORARY | | |

| EQUIPMENT — 2.5% | | | | CASH INVESTMENTS | | |

| Applied Materials, Inc. | 1,206,040 | 16,257,419 | | (Cost $19,358,100) | | 19,358,100 |

| Intel Corp. | 758,150 | 16,876,419 | | TOTAL INVESTMENT | | |

| | | | | SECURITIES — 100.2% | | |

| KLA-Tencor Corp. | 126,980 | 3,926,222 | | (Cost $1,505,602,382) | | 1,626,000,563 |

| Texas Instruments, Inc. | 167,080 | 4,088,447 | | OTHER ASSETS | | |

| | | 41,148,507 | | AND LIABILITIES — (0.2)% | | (3,459,260) |

| SPECIALTY RETAIL — 2.5% | | | | TOTAL NET ASSETS — 100.0% | | $1,622,541,303 |

| Lowe’s Cos., Inc. | 1,384,490 | 33,560,037 | | | | |

| PetSmart, Inc. | 222,580 | 7,113,657 | | | | |

| | | 40,673,694 | | | | |

| THRIFTS & MORTGAGE FINANCE — 0.6% | | | | | |