UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

|

| | | | | | |

| Investment Company Act file number | 811-07822 |

| | |

| AMERICAN CENTURY INVESTMENT TRUST |

| (Exact name of registrant as specified in charter) |

| | |

| 4500 MAIN STREET, KANSAS CITY, MISSOURI | 64111 |

| (Address of principal executive offices) | (Zip Code) |

| | |

CHARLES A. ETHERINGTON 4500 MAIN STREET, KANSAS CITY, MISSOURI 64111 |

| (Name and address of agent for service) |

| | |

| Registrant’s telephone number, including area code: | 816-531-5575 |

| | |

| Date of fiscal year end: | 03-31 |

| | |

| Date of reporting period: | 03-31-2020 |

ITEM 1. REPORTS TO STOCKHOLDERS.

|

| |

| | |

| | Annual Report |

| | |

| | March 31, 2020 |

| | |

| | Core Plus Fund |

| | Investor Class (ACCNX) |

| | I Class (ACCTX) |

| | A Class (ACCQX) |

| | C Class (ACCKX) |

| | R Class (ACCPX) |

| | R5 Class (ACCUX) |

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the fund’s shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the fund or your financial intermediary electronically by calling or sending an email request to your appropriate contacts as listed on the back cover of this report.

You may elect to receive all future reports in paper free of charge. You can inform the fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by calling or sending an email request to your appropriate contacts as listed on the back cover of this report. Your election to receive reports in paper will apply to all funds held with the fund complex/your financial intermediary.

|

| |

| President’s Letter | |

| Performance | |

| Portfolio Commentary | |

| Fund Characteristics | |

| Shareholder Fee Example | |

| Schedule of Investments | |

| Statement of Assets and Liabilities | |

| Statement of Operations | |

| Statement of Changes in Net Assets | |

| Notes to Financial Statements | |

| Financial Highlights | |

| Report of Independent Registered Public Accounting Firm | |

| Management | |

| Liquidity Risk Management Program | |

| Additional Information | |

Any opinions expressed in this report reflect those of the author as of the date of the report, and do not necessarily represent the opinions of American Century Investments® or any other person in the American Century Investments organization. Any such opinions are subject to change at any time based upon market or other conditions and American Century Investments disclaims any responsibility to update such opinions. These opinions may not be relied upon as investment advice and, because investment decisions made by American Century Investments funds are based on numerous factors, may not be relied upon as an indication of trading intent on behalf of any American Century Investments fund. Security examples are used for representational purposes only and are not intended as recommendations to purchase or sell securities. Performance information for comparative indices and securities is provided to American Century Investments by third party vendors. To the best of American Century Investments’ knowledge, such information is accurate at the time of printing.

Jonathan Thomas

Jonathan Thomas

Dear Investor:

Thank you for reviewing this annual report for the period ended March 31, 2020. Annual reports help convey important information about fund returns, including market factors that affected performance during the reporting period. For additional insights, please visit americancentury.com.

Virus Outbreak Abruptly Altered Economic, Market Backdrops

Through most of the period, market sentiment was upbeat, partly due to accommodative Federal Reserve (Fed) policy and modest inflation. Improving economic and corporate earnings data and a phase 1 U.S.-China trade deal also helped boost growth outlooks. Against this backdrop, key U.S. stock benchmarks rose to record highs by mid-February, and U.S. bonds continued to advance.

However, beginning in late February, unprecedented social and economic turmoil emerged and reversed the positive trajectory. The COVID-19 epidemic originating in China rapidly spread throughout the world, forcing stay-at-home orders and industry-wide shutdowns. U.S. stocks, corporate bonds and other riskier assets sold off sharply, while U.S. Treasuries rallied in the global flight to quality. The Fed stepped in quickly and aggressively, slashing interest rates to near 0% and enacting massive lending and asset-purchase programs to stabilize the financial system.

The swift and severe sell-off erased the strong stock market gains realized earlier in the period and left key benchmarks with losses for the 12 months. Reflecting their defensive characteristics, high-quality U.S. bonds withstood the turmoil and delivered solid returns for the 12-month period.

Promoting Health and Safety Remains Our Focus

While the market impact of COVID-19 has been severe, reducing the human toll is most important. We are monitoring the situation closely and following guidelines and protocols from all relevant authorities. Our firm has activated a comprehensive Pandemic Response Plan, which includes social distancing and work-from-home mandates, travel restrictions and escalated cleaning regimens at all our facilities. We’ve also launched a Business Continuity Plan to maintain regular business operations and ensure delivery of outstanding service.

We appreciate your confidence in us during these extraordinary times. We have a long history of helping clients weather volatile markets, and we are confident we will meet today’s challenges. In the meantime, the health and safety of you, your family and our employees remain a top priority.

Sincerely,

Jonathan Thomas

President and Chief Executive Officer

American Century Investments

|

| | | | | | |

| Total Returns as of March 31, 2020 | | |

| | | | Average Annual Returns | |

| | Ticker Symbol | 1 year | 5 years | 10 years | Since Inception | Inception Date |

| Investor Class | ACCNX | 4.57% | 2.56% | 3.56% | — | 11/30/06 |

| Bloomberg Barclays U.S. Aggregate Bond Index | — | 8.93% | 3.35% | 3.88% | — | — |

| I Class | ACCTX | 4.67% | — | — | 3.38% | 4/10/17 |

| A Class | ACCQX | | | | | 11/30/06 |

| No sales charge | | 4.31% | 2.30% | 3.30% | — | |

| With sales charge | | -0.41% | 1.36% | 2.83% | — | |

| C Class | ACCKX | 3.45% | 1.54% | 2.53% | — | 11/30/06 |

| R Class | ACCPX | 4.05% | 2.06% | 3.05% | — | 11/30/06 |

| R5 Class | ACCUX | 4.68% | 2.74% | 3.76% | — | 11/30/06 |

Average annual returns since inception are presented when ten years of performance history is not available.

Fund returns would have been lower if a portion of the fees had not been waived.

Sales charges include initial sales charges and contingent deferred sales charges (CDSCs), as applicable. A Class shares have a 4.50% maximum initial sales charge and may be subject to a maximum CDSC of 1.00%. C Class shares redeemed within 12 months of purchase are subject to a maximum CDSC of 1.00%. The SEC requires that mutual funds provide performance information net of maximum sales charges in all cases where charges could be applied.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

|

|

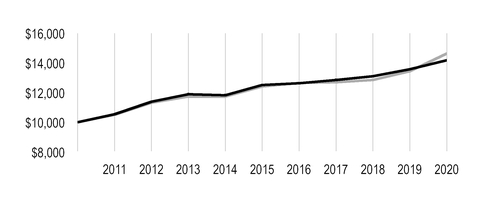

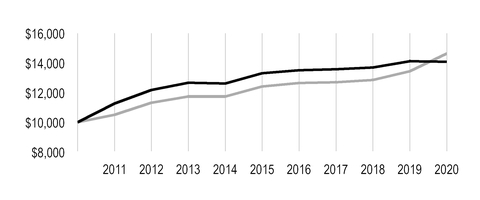

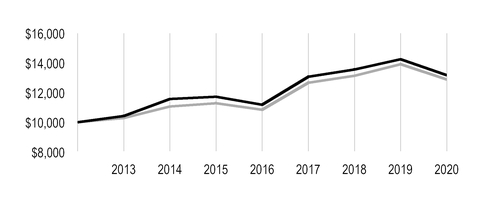

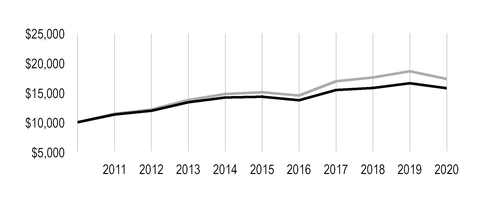

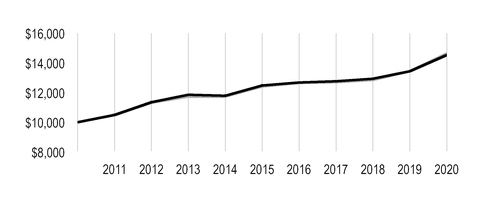

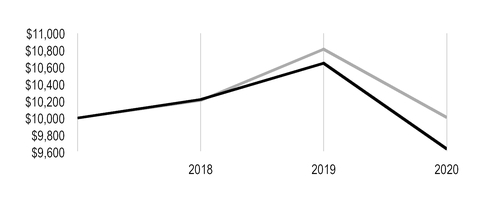

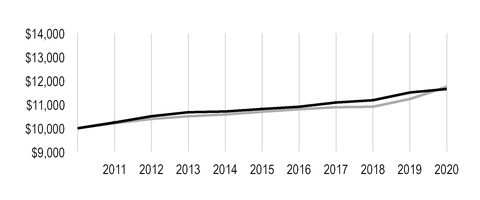

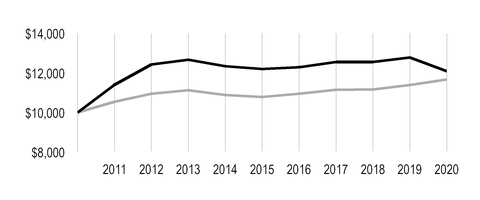

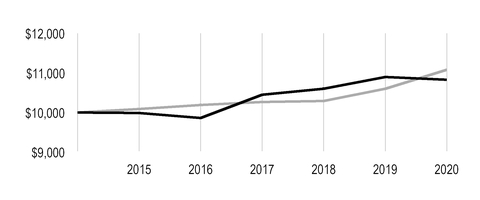

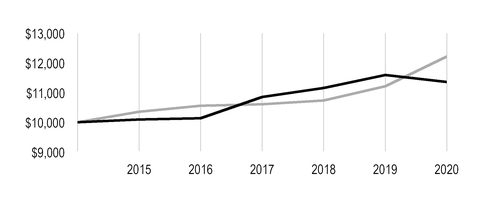

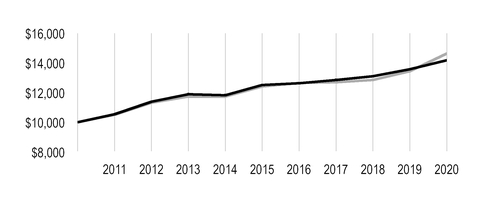

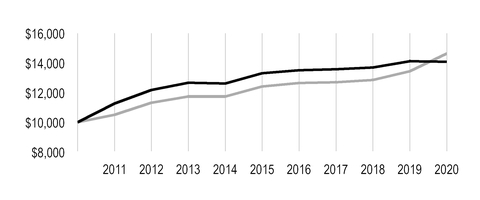

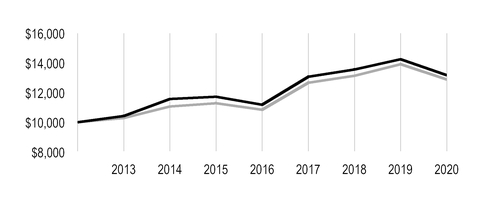

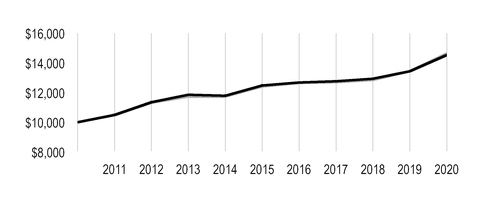

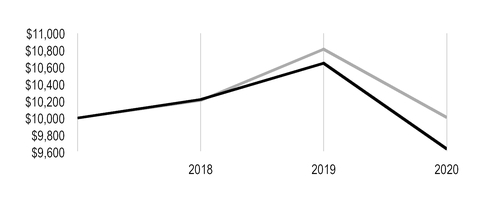

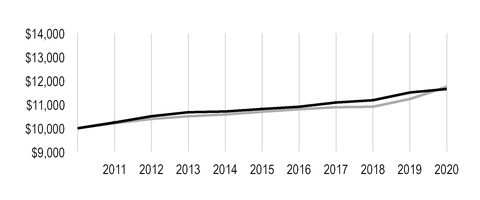

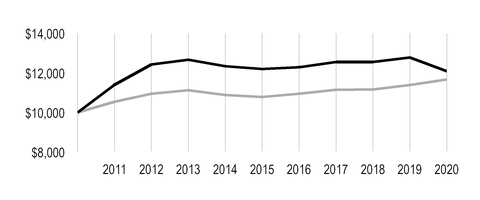

| Growth of $10,000 Over 10 Years |

| $10,000 investment made March 31, 2010 |

Performance for other share classes will vary due to differences in fee structure.

|

|

| |

| Value on March 31, 2020 |

| | Investor Class — $14,193 |

| |

| | Bloomberg Barclays U.S. Aggregate Bond Index — $14,639 |

| |

Ending value of Investor Class would have been lower if a portion of the fees had not been waived.

|

| | | | | |

| Total Annual Fund Operating Expenses |

| Investor Class | I Class | A Class | C Class | R Class | R5 Class |

| 0.65% | 0.55% | 0.90% | 1.65% | 1.15% | 0.45% |

The total annual fund operating expenses shown is as stated in the fund’s prospectus current as of the date of this report. The prospectus may vary from the expense ratio shown elsewhere in this report because it is based on a different time period, includes acquired fund fees and expenses, and, if applicable, does not include fee waivers or expense reimbursements.

Data presented reflect past performance. Past performance is no guarantee of future results. Current performance may be higher or lower than the performance shown. Total returns for periods less than one year are not annualized. Investment return and principal value will fluctuate, and redemption value may be more or less than original cost. Data assumes reinvestment of dividends and capital gains, and none of the charts reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. To obtain performance data current to the most recent month end, please call 1-800-345-2021 or visit americancentury.com. For additional information about the fund, please consult the prospectus.

Portfolio Managers: Bob Gahagan, Hando Aguilar, Jeff Houston, Brian Howell and Charles Tan

Performance Summary

Core Plus returned 4.57%* for the 12 months ended March 31, 2020. By comparison, the Bloomberg Barclays U.S. Aggregate Bond Index gained 8.93%. Fund returns reflect operating expenses, while index returns do not. Returns for the fund and the index during the period largely reflected the defensive characteristics of the broad U.S. investment-grade bond market in the face of unprecedented market unrest in early 2020.

The reporting period began on an upbeat note for bond investors. The Federal Reserve’s (Fed’s) early 2019 pivot toward dovish policy set the stage for rate cuts in July, September and October. This action, along with modest economic and earnings growth and low inflation, generally supported solid gains for U.S. bonds. By year-end 2019, global economic data improved, the U.S. and China signed a phase 1 trade deal, and the Fed suggested it would hold rates steady through 2020.

Conditions deteriorated rapidly within the first quarter of 2020. As the COVID-19 epidemic originating in China expanded into a pandemic, nervous fixed-income investors scrambled to shed credit risk and seek shelter in cash. Market volatility soared and liquidity sank. In response, the Fed slashed short-term rates to near 0% and launched a series of initiatives to stabilize the financial markets. Separately, Congress passed a $2 trillion fiscal relief package. Reflecting market sentiment, the 10-year Treasury yield started the period at 2.41% and closed at 0.68% after touching a record-low 0.54% in early March. The two-year Treasury yield followed a similar path during the 12-month period, dropping from 2.27% to 0.22%, including a 135-basis-point decline in the first quarter of 2020.

Amid a global flight to quality, riskier investments, including corporate and securitized bonds, suffered significant losses. The Fed’s rescue programs helped stabilize credit-sensitive sectors of the fixed-income universe, including mortgage-backed securities, municipal bonds (munis) and investment-grade corporate bonds. Against this backdrop, an underweight position in Treasuries, relative to the benchmark, accounted for much of Core Plus’ underperformance.

Securitized Exposure Hindered Performance

We continued to underweight Treasuries and government agencies relative to the index in favor of spread (non-Treasury) sectors, including securitized bonds and corporate issues. This strategy diminished returns amid the late-period rush for stability and liquidity.

Throughout the period, we maintained an overweight position in securitized bonds, believing the sector offered better relative value and less volatility than corporate credit issues. The strategy generally aided performance during risk-on periods, but it proved detrimental amid the coronavirus sell-off. Forced selling created havoc for the sector, as the credit-sensitive holdings we favored, including non-agency commercial mortgage-backed securities, collateralized mortgage obligations and collateralized loan obligations, were hardest hit. Agency-backed mortgages recovered slightly after the Fed announced its asset-purchase plan, which included agency mortgages.

*All fund returns referenced in this commentary are for Investor Class shares. Fund returns would have been lower if a portion of the fees had not been waived. Performance for other share classes will vary due to differences in fee structure; when Investor Class performance exceeds that of the index, other share classes may not. See page 3 for returns for all share classes.

Corporate, Non-Index Securities Weighed on Results

As sentiment on the economy started to soften during 2019, we reduced our allocation to the corporate bond sector. Combined with our view that the credit cycle had entered its final stage, we believed that valuations among corporate bonds had advanced to levels in line with fundamentals. In addition to trimming exposure, we maintained a higher-quality bias, given the then uncertainties surrounding the effects of tariffs on corporate earnings. We also reduced our out-of-index stake in high-yield bonds. Although our corporate exposure suffered with all risk assets in the early 2020 decline, investment-grade securities recovered slightly late in the period on news the Fed would purchase corporate bonds.

Meanwhile, our out-of-index foreign currency exposure dragged down relative performance as the U.S. dollar soared.

Portfolio Positioning

The economic downturn during the first quarter was swift and severe, but we do not expect an equally swift, or V-shaped, recovery. The consumer is the main driver of the U.S. economy, and we believe the effects of the COVID-19 pandemic will weigh on consumer sentiment—and job and economic growth—for several months. Ultimately, this crisis requires a medical solution.

With its massive financial rescue package, the Fed has demonstrated it will take extraordinary steps to maintain broad market liquidity and assure credit market stability. However, we don’t expect the Fed to ease further, as policymakers previously noted an unwillingness to push rates below zero. Additionally, the effects of significant fiscal stimulus should allow the Fed to keep rates steady.

Heightened volatility often creates market disruptions that lead to attractive buying opportunities. In the first quarter’s flight to quality, we identified such opportunities in the securitized, corporate credit and muni sectors. We’re remaining cautious and defensive in our positioning, focusing on high-quality securities and positioning our portfolio to weather a U-shaped recovery. We’re emphasizing securities the Fed is buying—high-quality corporate, mortgage and muni securities and Treasury inflation-protected securities.

At the same time, we’re reviewing each portfolio holding, eliminating securities we’re uncomfortable holding in the current environment. In particular, we’ve reduced exposure to securitized securities. We believe rising unemployment and the broad economic shutdown created by the pandemic will create challenges for certain segments of the mortgage market. We’ve also hedged overall risk in the portfolio via credit default swaps. As always, we favor a bottom-up approach to portfolio management, emphasizing careful security selection.

|

| |

| MARCH 31, 2020 | |

| Portfolio at a Glance | |

| Average Duration (effective) | 5.9 years |

| Weighted Average Life to Maturity | 7.9 years |

| | |

| Types of Investments in Portfolio | % of net assets |

| Corporate Bonds | 31.6% |

| U.S. Treasury Securities | 28.2% |

| U.S. Government Agency Mortgage-Backed Securities | 12.8% |

| Asset-Backed Securities | 6.8% |

| Collateralized Mortgage Obligations | 4.5% |

| Collateralized Loan Obligations | 3.9% |

| Municipal Securities | 2.1% |

| Commercial Mortgage-Backed Securities | 1.9% |

| Sovereign Governments and Agencies | 1.8% |

| Preferred Stocks | 0.2% |

| Bank Loan Obligations | 0.2% |

| Temporary Cash Investments | 6.0% |

| Other Assets and Liabilities | —* |

*Category is less than 0.05% of total net assets.

Fund shareholders may incur two types of costs: (1) transaction costs, including sales charges (loads) on purchase payments and redemption/exchange fees; and (2) ongoing costs, including management fees; distribution and service (12b-1) fees; and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in your fund and to compare these costs with the ongoing cost of investing in other mutual funds.

The example is based on an investment of $1,000 made at the beginning of the period and held for the entire period from October 1, 2019 to March 31, 2020.

Actual Expenses

The table provides information about actual account values and actual expenses for each class. You may use the information, together with the amount you invested, to estimate the expenses that you paid over the period. First, identify the share class you own. Then simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number under the heading “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

If you hold Investor Class shares of any American Century Investments fund, or I Class shares of the American Century Diversified Bond Fund, in an American Century Investments account (i.e., not through a financial intermediary or employer-sponsored retirement plan account), American Century Investments may charge you a $25.00 annual account maintenance fee if the value of those shares is less than $10,000. We will redeem shares automatically in one of your accounts to pay the $25.00 fee. In determining your total eligible investment amount, we will include your investments in all personal accounts (including American Century Investments brokerage accounts) registered under your Social Security number. Personal accounts include individual accounts, joint accounts, UGMA/UTMA accounts, personal trusts, Coverdell Education Savings Accounts and IRAs (including traditional, Roth, Rollover, SEP-, SARSEP- and SIMPLE-IRAs), and certain other retirement accounts. If you have only business, business retirement, employer-sponsored or American Century Investments brokerage accounts, you are currently not subject to this fee. If you are subject to the account maintenance fee, your account value could be reduced by the fee amount.

Hypothetical Example for Comparison Purposes

The table also provides information about hypothetical account values and hypothetical expenses based on the actual expense ratio of each class of your fund and an assumed rate of return of 5% per year before expenses, which is not the actual return of a fund’s share class. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in your fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads) or redemption/exchange fees. Therefore, the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

|

| | | | |

| | Beginning

Account Value

10/1/19 | Ending

Account Value

3/31/20 | Expenses Paid

During Period(1)

10/1/19 - 3/31/20 | Annualized

Expense Ratio(1) |

| Actual | | | | |

| Investor Class | $1,000 | $994.80 | $2.74 | 0.55% |

| I Class | $1,000 | $995.30 | $2.24 | 0.45% |

| A Class | $1,000 | $993.60 | $3.99 | 0.80% |

| C Class | $1,000 | $989.10 | $7.71 | 1.55% |

| R Class | $1,000 | $992.40 | $5.23 | 1.05% |

| R5 Class | $1,000 | $994.90 | $1.75 | 0.35% |

| Hypothetical | | | | |

| Investor Class | $1,000 | $1,022.25 | $2.78 | 0.55% |

| I Class | $1,000 | $1,022.75 | $2.28 | 0.45% |

| A Class | $1,000 | $1,021.00 | $4.04 | 0.80% |

| C Class | $1,000 | $1,017.25 | $7.82 | 1.55% |

| R Class | $1,000 | $1,019.75 | $5.30 | 1.05% |

| R5 Class | $1,000 | $1,023.25 | $1.77 | 0.35% |

| |

| (1) | Expenses are equal to the class's annualized expense ratio listed in the table above, multiplied by the average account value over the period, multiplied by 183, the number of days in the most recent fiscal half-year, divided by 366, to reflect the one-half year period. Annualized expense ratio reflects actual expenses, including any applicable fee waivers or expense reimbursements and excluding any acquired fund fees and expenses. |

MARCH 31, 2020

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| CORPORATE BONDS — 31.6% | | |

| Aerospace and Defense — 0.2% | | |

| Lockheed Martin Corp., 3.80%, 3/1/45 | $ | 90,000 |

| $ | 98,308 |

|

| United Technologies Corp., 6.05%, 6/1/36 | 95,000 |

| 127,174 |

|

| | | 225,482 |

|

| Auto Components — 0.1% | | |

ZF North America Capital, Inc., 4.00%, 4/29/20(1) | 150,000 |

| 149,252 |

|

| Automobiles — 0.7% | | |

| Ford Motor Credit Co. LLC, 5.875%, 8/2/21 | 270,000 |

| 265,950 |

|

| Ford Motor Credit Co. LLC, 2.98%, 8/3/22 | 200,000 |

| 187,000 |

|

| Ford Motor Credit Co. LLC, 3.35%, 11/1/22 | 200,000 |

| 185,000 |

|

| General Motors Co., 5.15%, 4/1/38 | 100,000 |

| 72,646 |

|

| General Motors Financial Co., Inc., 3.20%, 7/6/21 | 210,000 |

| 200,688 |

|

| General Motors Financial Co., Inc., 5.25%, 3/1/26 | 75,000 |

| 66,329 |

|

| | | 977,613 |

|

| Banks — 4.8% | | |

| Banco Santander SA, 3.50%, 4/11/22 | 200,000 |

| 197,978 |

|

| Bank of America Corp., MTN, 4.00%, 1/22/25 | 250,000 |

| 264,460 |

|

| Bank of America Corp., MTN, VRN, 3.82%, 1/20/28 | 150,000 |

| 155,906 |

|

| Bank of America Corp., VRN, 3.00%, 12/20/23 | 325,000 |

| 331,548 |

|

| Bank of America Corp., VRN, 3.42%, 12/20/28 | 60,000 |

| 62,077 |

|

| Bank of Montreal, MTN, 3.30%, 2/5/24 | 30,000 |

| 31,389 |

|

BNP Paribas SA, VRN, 2.82%, 11/19/25(1) | 150,000 |

| 148,446 |

|

BPCE SA, 5.15%, 7/21/24(1) | 200,000 |

| 211,235 |

|

| Canadian Imperial Bank of Commerce, 2.25%, 1/28/25 | 260,000 |

| 257,842 |

|

| Citigroup, Inc., 2.90%, 12/8/21 | 592,000 |

| 597,844 |

|

| Citigroup, Inc., 2.75%, 4/25/22 | 12,000 |

| 12,072 |

|

| Citigroup, Inc., 4.05%, 7/30/22 | 80,000 |

| 81,537 |

|

| Citigroup, Inc., VRN, 3.52%, 10/27/28 | 180,000 |

| 180,592 |

|

| Cooperatieve Rabobank UA, 3.95%, 11/9/22 | 250,000 |

| 251,797 |

|

| Fifth Third BanCorp., 4.30%, 1/16/24 | 80,000 |

| 86,029 |

|

| Fifth Third BanCorp., 2.375%, 1/28/25 | 270,000 |

| 263,499 |

|

| FNB Corp., 2.20%, 2/24/23 | 180,000 |

| 176,922 |

|

| HSBC Holdings plc, 2.95%, 5/25/21 | 200,000 |

| 201,330 |

|

| HSBC Holdings plc, 4.30%, 3/8/26 | 200,000 |

| 213,950 |

|

| HSBC Holdings plc, 4.375%, 11/23/26 | 200,000 |

| 212,851 |

|

| HSBC Holdings plc, VRN, 3.26%, 3/13/23 | 200,000 |

| 200,479 |

|

| HSBC Holdings plc, VRN, 2.63%, 11/7/25 | 200,000 |

| 194,384 |

|

| Huntington Bancshares, Inc., 2.55%, 2/4/30 | 330,000 |

| 300,696 |

|

| JPMorgan Chase & Co., VRN, 3.70%, 5/6/30 | 135,000 |

| 145,277 |

|

| Lloyds Banking Group plc, VRN, 2.44%, 2/5/26 | 200,000 |

| 189,272 |

|

| PNC Bank N.A., 2.70%, 10/22/29 | 250,000 |

| 243,079 |

|

| Regions Financial Corp., 3.80%, 8/14/23 | 100,000 |

| 101,427 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| Royal Bank of Canada, 2.15%, 10/26/20 | $ | 210,000 |

| $ | 209,915 |

|

| Sumitomo Mitsui Financial Group, Inc., 2.35%, 1/15/25 | 300,000 |

| 298,540 |

|

| Truist Bank, 3.30%, 5/15/26 | 200,000 |

| 205,627 |

|

| U.S. Bancorp, MTN, 3.60%, 9/11/24 | 70,000 |

| 71,994 |

|

| U.S. Bank N.A., 2.80%, 1/27/25 | 250,000 |

| 258,416 |

|

UniCredit SpA, VRN, 5.86%, 6/19/32(1) | 200,000 |

| 184,417 |

|

| Wells Fargo & Co., 4.125%, 8/15/23 | 10,000 |

| 10,329 |

|

| Wells Fargo & Co., 3.00%, 10/23/26 | 250,000 |

| 256,712 |

|

| Wells Fargo & Co., MTN, 4.65%, 11/4/44 | 150,000 |

| 173,558 |

|

| | | 6,983,426 |

|

| Beverages — 0.4% | | |

| Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide, Inc., 4.90%, 2/1/46 | 240,000 |

| 263,138 |

|

| Anheuser-Busch InBev Worldwide, Inc., 4.75%, 1/23/29 | 190,000 |

| 209,331 |

|

| Constellation Brands, Inc., 4.75%, 12/1/25 | 140,000 |

| 146,757 |

|

| | | 619,226 |

|

| Biotechnology — 0.9% | | |

| AbbVie, Inc., 3.60%, 5/14/25 | 280,000 |

| 295,527 |

|

AbbVie, Inc., 3.20%, 11/21/29(1) | 180,000 |

| 184,748 |

|

AbbVie, Inc., 4.25%, 11/21/49(1) | 140,000 |

| 152,970 |

|

| Amgen, Inc., 4.66%, 6/15/51 | 108,000 |

| 136,615 |

|

| Biogen, Inc., 3.625%, 9/15/22 | 210,000 |

| 215,905 |

|

| Gilead Sciences, Inc., 3.65%, 3/1/26 | 230,000 |

| 251,193 |

|

| Gilead Sciences, Inc., 4.15%, 3/1/47 | 50,000 |

| 61,431 |

|

| | | 1,298,389 |

|

| Building Products — 0.5% | | |

Builders FirstSource, Inc., 5.00%, 3/1/30(1) | 260,000 |

| 235,462 |

|

Carrier Global Corp., 2.72%, 2/15/30(1) | 131,000 |

| 121,304 |

|

| Masco Corp., 4.45%, 4/1/25 | 100,000 |

| 102,318 |

|

Standard Industries, Inc., 4.75%, 1/15/28(1) | 224,000 |

| 207,854 |

|

| | | 666,938 |

|

| Capital Markets — 2.3% | | |

| Ares Capital Corp., 3.25%, 7/15/25 | 325,000 |

| 258,888 |

|

| Goldman Sachs BDC, Inc., 3.75%, 2/10/25 | 103,000 |

| 95,677 |

|

| Goldman Sachs Group, Inc. (The), 3.50%, 4/1/25 | 204,000 |

| 207,236 |

|

| Goldman Sachs Group, Inc. (The), 3.50%, 11/16/26 | 380,000 |

| 389,203 |

|

| Goldman Sachs Group, Inc. (The), VRN, 2.88%, 10/31/22 | 70,000 |

| 70,416 |

|

| Icahn Enterprises LP / Icahn Enterprises Finance Corp., 5.25%, 5/15/27 | 391,000 |

| 364,119 |

|

KKR Group Finance Co. VII LLC, 3.625%, 2/25/50(1) | 310,000 |

| 257,233 |

|

LPL Holdings, Inc., 4.625%, 11/15/27(1) | 250,000 |

| 230,530 |

|

| Morgan Stanley, MTN, 3.70%, 10/23/24 | 60,000 |

| 63,511 |

|

| Morgan Stanley, MTN, 4.00%, 7/23/25 | 440,000 |

| 471,810 |

|

| Morgan Stanley, MTN, VRN, 2.70%, 1/22/31 | 240,000 |

| 235,760 |

|

MSCI, Inc., 4.00%, 11/15/29(1) | 330,000 |

| 329,647 |

|

| Oaktree Specialty Lending Corp., 3.50%, 2/25/25 | 155,000 |

| 139,508 |

|

State Street Corp., VRN, 2.83%, 3/30/23(1) | 40,000 |

| 40,392 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

UBS Group AG, 3.49%, 5/23/23(1) | $ | 200,000 |

| $ | 202,334 |

|

| | | 3,356,264 |

|

| Chemicals — 0.2% | | |

CF Industries, Inc., 4.50%, 12/1/26(1) | 130,000 |

| 137,286 |

|

| CF Industries, Inc., 5.15%, 3/15/34 | 110,000 |

| 112,288 |

|

| | | 249,574 |

|

| Commercial Services and Supplies — 0.7% | | |

Nielsen Finance LLC / Nielsen Finance Co., 5.00%, 4/15/22(1) | 80,000 |

| 74,173 |

|

| Republic Services, Inc., 3.55%, 6/1/22 | 190,000 |

| 195,064 |

|

| Republic Services, Inc., 2.30%, 3/1/30 | 341,000 |

| 327,752 |

|

| Waste Connections, Inc., 3.50%, 5/1/29 | 130,000 |

| 131,966 |

|

| Waste Connections, Inc., 2.60%, 2/1/30 | 230,000 |

| 215,789 |

|

| Waste Management, Inc., 4.75%, 6/30/20 | 70,000 |

| 70,453 |

|

| | | 1,015,197 |

|

| Communications Equipment — 0.2% | | |

CommScope, Inc., 5.50%, 3/1/24(1) | 140,000 |

| 142,556 |

|

| Motorola Solutions, Inc., 4.60%, 5/23/29 | 190,000 |

| 199,981 |

|

| | | 342,537 |

|

| Construction Materials — 0.2% | | |

| Martin Marietta Materials, Inc., 2.50%, 3/15/30 | 227,000 |

| 208,011 |

|

| Consumer Finance — 1.2% | | |

| AerCap Ireland Capital DAC / AerCap Global Aviation Trust, 5.00%, 10/1/21 | 150,000 |

| 134,658 |

|

| Ally Financial, Inc., 4.625%, 3/30/25 | 278,000 |

| 267,432 |

|

| Ally Financial, Inc., 5.75%, 11/20/25 | 36,000 |

| 35,485 |

|

| Capital One Bank USA N.A., 3.375%, 2/15/23 | 250,000 |

| 244,918 |

|

| Capital One Bank USA N.A., VRN, 2.28%, 1/28/26 | 300,000 |

| 272,222 |

|

| Capital One Financial Corp., 3.80%, 1/31/28 | 130,000 |

| 128,785 |

|

| Discover Financial Services, 3.75%, 3/4/25 | 200,000 |

| 197,926 |

|

| Navient Corp., 5.00%, 3/15/27 | 100,000 |

| 86,720 |

|

Park Aerospace Holdings Ltd., 5.50%, 2/15/24(1) | 225,000 |

| 194,124 |

|

| Synchrony Financial, 2.85%, 7/25/22 | 140,000 |

| 133,544 |

|

| Synchrony Financial, 3.95%, 12/1/27 | 100,000 |

| 89,138 |

|

| | | 1,784,952 |

|

| Containers and Packaging — 0.4% | | |

Ardagh Packaging Finance plc / Ardagh Holdings USA, Inc., 5.25%, 8/15/27(1) | 200,000 |

| 206,110 |

|

Berry Global, Inc., 4.875%, 7/15/26(1) | 150,000 |

| 152,343 |

|

| Crown Americas LLC / Crown Americas Capital Corp. V, 4.25%, 9/30/26 | 65,000 |

| 64,580 |

|

Reynolds Group Issuer, Inc. / Reynolds Group Issuer LLC / Reynolds Group Issuer Lu, 5.125%, 7/15/23(1) | 130,000 |

| 129,837 |

|

| | | 552,870 |

|

| Diversified Financial Services — 0.2% | | |

| Berkshire Hathaway, Inc., 2.75%, 3/15/23 | 10,000 |

| 10,421 |

|

| Credit Suisse Group Funding Guernsey Ltd., 3.45%, 4/16/21 | 250,000 |

| 251,658 |

|

| | | 262,079 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| Diversified Telecommunication Services — 1.4% | | |

| AT&T, Inc., 3.875%, 8/15/21 | $ | 180,000 |

| $ | 184,427 |

|

| AT&T, Inc., 3.80%, 2/15/27 | 100,000 |

| 104,143 |

|

| AT&T, Inc., 4.10%, 2/15/28 | 160,000 |

| 168,420 |

|

| AT&T, Inc., 4.30%, 2/15/30 | 200,000 |

| 215,691 |

|

| AT&T, Inc., 5.15%, 11/15/46 | 55,000 |

| 64,976 |

|

Deutsche Telekom AG, 3.625%, 1/21/50(1) | 200,000 |

| 199,952 |

|

| Telefonica Emisiones SA, 5.46%, 2/16/21 | 110,000 |

| 112,376 |

|

| Verizon Communications, Inc., 2.95%, 3/15/22 | 182,000 |

| 185,794 |

|

| Verizon Communications, Inc., 2.45%, 11/1/22 | 111,000 |

| 112,928 |

|

| Verizon Communications, Inc., 4.40%, 11/1/34 | 300,000 |

| 352,363 |

|

| Verizon Communications, Inc., 4.75%, 11/1/41 | 100,000 |

| 116,927 |

|

| Verizon Communications, Inc., 5.01%, 8/21/54 | 130,000 |

| 178,518 |

|

| | | 1,996,515 |

|

| Electric Utilities — 1.3% | | |

| AEP Transmission Co. LLC, 3.75%, 12/1/47 | 60,000 |

| 62,215 |

|

| Berkshire Hathaway Energy Co., 3.80%, 7/15/48 | 90,000 |

| 94,774 |

|

| Commonwealth Edison Co., 3.20%, 11/15/49 | 40,000 |

| 40,442 |

|

| DTE Electric Co., 2.25%, 3/1/30 | 130,000 |

| 126,261 |

|

| Duke Energy Corp., 3.55%, 9/15/21 | 80,000 |

| 81,130 |

|

| Duke Energy Corp., 2.65%, 9/1/26 | 50,000 |

| 49,736 |

|

| Duke Energy Florida LLC, 6.35%, 9/15/37 | 70,000 |

| 96,842 |

|

| Duke Energy Florida LLC, 3.85%, 11/15/42 | 10,000 |

| 11,055 |

|

| Duke Energy Progress LLC, 4.15%, 12/1/44 | 20,000 |

| 22,665 |

|

| Duke Energy Progress LLC, 3.70%, 10/15/46 | 50,000 |

| 54,177 |

|

| Exelon Corp., 5.15%, 12/1/20 | 130,000 |

| 131,278 |

|

| Exelon Corp., 4.45%, 4/15/46 | 60,000 |

| 61,006 |

|

FirstEnergy Transmission LLC, 4.55%, 4/1/49(1) | 80,000 |

| 80,278 |

|

| Florida Power & Light Co., 4.125%, 2/1/42 | 70,000 |

| 76,161 |

|

| Florida Power & Light Co., 3.15%, 10/1/49 | 70,000 |

| 72,967 |

|

| Georgia Power Co., 4.30%, 3/15/42 | 70,000 |

| 76,425 |

|

| MidAmerican Energy Co., 4.40%, 10/15/44 | 140,000 |

| 160,243 |

|

| Nevada Power Co., 2.40%, 5/1/30 | 91,000 |

| 87,231 |

|

NextEra Energy Operating Partners LP, 4.50%, 9/15/27(1) | 100,000 |

| 98,197 |

|

| Oncor Electric Delivery Co. LLC, 3.10%, 9/15/49 | 80,000 |

| 78,084 |

|

| Progress Energy, Inc., 3.15%, 4/1/22 | 80,000 |

| 80,967 |

|

| Southern Co. Gas Capital Corp., 3.95%, 10/1/46 | 10,000 |

| 8,989 |

|

| Xcel Energy, Inc., 3.35%, 12/1/26 | 30,000 |

| 29,701 |

|

Xcel Energy, Inc., 3.40%, 6/1/30(2) | 140,000 |

| 142,198 |

|

| | | 1,823,022 |

|

| Electronic Equipment, Instruments and Components — 0.1% | | |

| Amphenol Corp., 2.05%, 3/1/25 | 200,000 |

| 189,792 |

|

| Energy Equipment and Services — 0.1% | | |

| Baker Hughes a GE Co. LLC / Baker Hughes Co-Obligor, Inc., 3.14%, 11/7/29 | 115,000 |

| 99,974 |

|

| Equity Real Estate Investment Trusts (REITs) — 1.6% | | |

| Alexandria Real Estate Equities, Inc., 4.90%, 12/15/30 | 40,000 |

| 43,635 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| American Tower Corp., 3.375%, 10/15/26 | $ | 70,000 |

| $ | 70,175 |

|

| American Tower Corp., 2.90%, 1/15/30 | 178,000 |

| 174,315 |

|

| AvalonBay Communities, Inc., MTN, 3.20%, 1/15/28 | 110,000 |

| 109,649 |

|

| Boston Properties LP, 3.65%, 2/1/26 | 200,000 |

| 213,262 |

|

| Crown Castle International Corp., 5.25%, 1/15/23 | 240,000 |

| 254,866 |

|

Crown Castle International Corp., 3.30%, 7/1/30(2) | 14,000 |

| 14,026 |

|

| Duke Realty LP, 2.875%, 11/15/29 | 194,000 |

| 187,032 |

|

| Duke Realty LP, 3.05%, 3/1/50 | 50,000 |

| 40,616 |

|

| Essex Portfolio LP, 3.625%, 8/15/22 | 170,000 |

| 168,657 |

|

| Essex Portfolio LP, 3.25%, 5/1/23 | 50,000 |

| 49,103 |

|

| Healthcare Realty Trust, Inc., 2.40%, 3/15/30 | 100,000 |

| 89,132 |

|

| Kilroy Realty LP, 3.80%, 1/15/23 | 44,000 |

| 44,838 |

|

| Kimco Realty Corp., 2.80%, 10/1/26 | 150,000 |

| 146,682 |

|

| MPT Operating Partnership LP / MPT Finance Corp., 5.00%, 10/15/27 | 160,000 |

| 156,412 |

|

| MPT Operating Partnership LP / MPT Finance Corp., 4.625%, 8/1/29 | 120,000 |

| 111,075 |

|

| National Retail Properties, Inc., 2.50%, 4/15/30 | 100,000 |

| 89,423 |

|

| Prologis LP, 2.125%, 4/15/27 | 50,000 |

| 47,721 |

|

| Prologis LP, 3.00%, 4/15/50 | 146,000 |

| 127,228 |

|

| Public Storage, 3.39%, 5/1/29 | 100,000 |

| 100,576 |

|

SBA Communications Corp., 3.875%, 2/15/27(1) | 20,000 |

| 20,200 |

|

| Service Properties Trust, 4.65%, 3/15/24 | 80,000 |

| 58,694 |

|

| Ventas Realty LP, 4.125%, 1/15/26 | 10,000 |

| 10,006 |

|

Ventas Realty LP, 4.75%, 11/15/30(2) | 33,000 |

| 32,479 |

|

| | | 2,359,802 |

|

| Food and Staples Retailing — 0.4% | | |

Albertsons Cos., Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC, 4.875%, 2/15/30(1) | 260,000 |

| 259,350 |

|

| Kroger Co. (The), 3.875%, 10/15/46 | 130,000 |

| 128,185 |

|

Sysco Corp., 5.95%, 4/1/30(2) | 42,000 |

| 44,307 |

|

| Walmart, Inc., 4.05%, 6/29/48 | 100,000 |

| 129,175 |

|

| | | 561,017 |

|

| Food Products — 0.4% | | |

| Conagra Brands, Inc., 4.60%, 11/1/25 | 130,000 |

| 137,872 |

|

Kraft Heinz Foods Co., 3.75%, 4/1/30(1) | 120,000 |

| 114,733 |

|

Lamb Weston Holdings, Inc., 4.625%, 11/1/24(1) | 170,000 |

| 168,513 |

|

Post Holdings, Inc., 4.625%, 4/15/30(1) | 180,000 |

| 173,700 |

|

| | | 594,818 |

|

| Health Care Equipment and Supplies — 0.3% | | |

Baxter International, Inc., 3.95%, 4/1/30(1) | 30,000 |

| 32,505 |

|

| Becton Dickinson and Co., 3.73%, 12/15/24 | 200,000 |

| 205,428 |

|

| DH Europe Finance II Sarl, 3.40%, 11/15/49 | 50,000 |

| 49,393 |

|

| Medtronic, Inc., 3.50%, 3/15/25 | 67,000 |

| 72,298 |

|

| Medtronic, Inc., 4.375%, 3/15/35 | 72,000 |

| 89,969 |

|

| | | 449,593 |

|

| Health Care Providers and Services — 1.4% | | |

| Acadia Healthcare Co., Inc., 5.125%, 7/1/22 | 100,000 |

| 96,156 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| Aetna, Inc., 2.75%, 11/15/22 | $ | 60,000 |

| $ | 60,436 |

|

| Anthem, Inc., 3.65%, 12/1/27 | 80,000 |

| 82,801 |

|

Catalent Pharma Solutions, Inc., 5.00%, 7/15/27(1) | 200,000 |

| 195,110 |

|

| Centene Corp., 4.75%, 1/15/25 | 70,000 |

| 71,313 |

|

Centene Corp., 4.625%, 12/15/29(1) | 150,000 |

| 151,583 |

|

| Cigna Corp., 2.40%, 3/15/30 | 130,000 |

| 123,780 |

|

| CommonSpirit Health, 2.95%, 11/1/22 | 100,000 |

| 97,758 |

|

| CVS Health Corp., 3.50%, 7/20/22 | 70,000 |

| 71,883 |

|

| CVS Health Corp., 2.75%, 12/1/22 | 20,000 |

| 20,160 |

|

| CVS Health Corp., 4.30%, 3/25/28 | 110,000 |

| 117,052 |

|

| CVS Health Corp., 4.78%, 3/25/38 | 80,000 |

| 88,180 |

|

| HCA, Inc., 5.00%, 3/15/24 | 30,000 |

| 31,116 |

|

| HCA, Inc., 3.50%, 9/1/30 | 195,000 |

| 177,717 |

|

IQVIA, Inc., 5.00%, 5/15/27(1) | 200,000 |

| 205,894 |

|

| Partners Healthcare System, Inc., 3.19%, 7/1/49 | 85,000 |

| 85,476 |

|

Tenet Healthcare Corp., 4.875%, 1/1/26(1) | 75,000 |

| 71,719 |

|

| UnitedHealth Group, Inc., 2.875%, 3/15/22 | 10,000 |

| 10,282 |

|

| UnitedHealth Group, Inc., 3.75%, 7/15/25 | 170,000 |

| 184,765 |

|

| UnitedHealth Group, Inc., 4.75%, 7/15/45 | 70,000 |

| 89,610 |

|

| | | 2,032,791 |

|

| Hotels, Restaurants and Leisure — 0.1% | | |

| McDonald's Corp., MTN, 3.375%, 5/26/25 | 160,000 |

| 167,048 |

|

| Household Durables — 0.8% | | |

| D.R. Horton, Inc., 2.50%, 10/15/24 | 160,000 |

| 149,768 |

|

| Lennar Corp., 4.75%, 11/29/27 | 100,000 |

| 100,305 |

|

Mattamy Group Corp., 4.625%, 3/1/30(1) | 225,000 |

| 194,766 |

|

| MDC Holdings, Inc., 3.85%, 1/15/30 | 410,000 |

| 371,306 |

|

| Toll Brothers Finance Corp., 4.35%, 2/15/28 | 100,000 |

| 91,854 |

|

| Toll Brothers Finance Corp., 3.80%, 11/1/29 | 220,000 |

| 194,167 |

|

| | | 1,102,166 |

|

Household Products† | | |

| Kimberly-Clark Corp., 3.10%, 3/26/30 | 28,000 |

| 30,105 |

|

| Independent Power and Renewable Electricity Producers — 0.2% | |

Cometa Energia SA de CV, 6.375%, 4/24/35(1) | 290,700 |

| 266,079 |

|

| Industrial Conglomerates — 0.2% | | |

| Carlisle Cos., Inc., 2.75%, 3/1/30 | 335,000 |

| 294,618 |

|

| Insurance — 1.4% | | |

Aflac, Inc., 3.60%, 4/1/30(2) | 58,000 |

| 58,834 |

|

| American International Group, Inc., 4.125%, 2/15/24 | 420,000 |

| 441,544 |

|

| American International Group, Inc., 4.50%, 7/16/44 | 157,000 |

| 161,184 |

|

Athene Holding Ltd., 6.15%, 4/3/30(2) | 100,000 |

| 100,022 |

|

| Berkshire Hathaway Finance Corp., 4.20%, 8/15/48 | 60,000 |

| 70,850 |

|

| Chubb INA Holdings, Inc., 3.15%, 3/15/25 | 80,000 |

| 83,570 |

|

| Hartford Financial Services Group, Inc. (The), 3.60%, 8/19/49 | 184,000 |

| 174,942 |

|

Liberty Mutual Group, Inc., 4.50%, 6/15/49(1) | 60,000 |

| 59,115 |

|

| Markel Corp., 4.90%, 7/1/22 | 212,000 |

| 213,202 |

|

| MetLife, Inc., 4.125%, 8/13/42 | 120,000 |

| 126,880 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| Prudential Financial, Inc., MTN, 1.50%, 3/10/26 | $ | 300,000 |

| $ | 282,760 |

|

| Prudential Financial, Inc., VRN, 5.875%, 9/15/42 | 100,000 |

| 97,170 |

|

| WR Berkley Corp., 4.625%, 3/15/22 | 110,000 |

| 94,556 |

|

| | | 1,964,629 |

|

| IT Services — 0.3% | | |

| Fiserv, Inc., 3.50%, 7/1/29 | 90,000 |

| 95,789 |

|

| Global Payments, Inc., 3.20%, 8/15/29 | 160,000 |

| 157,252 |

|

| Mastercard, Inc., 3.65%, 6/1/49 | 80,000 |

| 93,684 |

|

Visa, Inc., 1.90%, 4/15/27(2) | 70,000 |

| 70,004 |

|

| Western Union Co. (The), 2.85%, 1/10/25 | 54,000 |

| 53,855 |

|

| | | 470,584 |

|

| Machinery — 0.1% | | |

Otis Worldwide Corp., VRN, 2.09%, 4/5/23(1) | 60,000 |

| 57,131 |

|

| Media — 1.0% | | |

Cable Onda SA, 4.50%, 1/30/30(1) | 200,000 |

| 177,110 |

|

| Charter Communications Operating LLC / Charter Communications Operating Capital, 4.91%, 7/23/25 | 160,000 |

| 172,675 |

|

| Charter Communications Operating LLC / Charter Communications Operating Capital, 4.20%, 3/15/28 | 10,000 |

| 10,288 |

|

| Charter Communications Operating LLC / Charter Communications Operating Capital, 4.80%, 3/1/50 | 60,000 |

| 62,816 |

|

| Comcast Corp., 4.40%, 8/15/35 | 30,000 |

| 36,461 |

|

| Comcast Corp., 6.40%, 5/15/38 | 80,000 |

| 117,041 |

|

| Comcast Corp., 4.75%, 3/1/44 | 154,000 |

| 195,539 |

|

| Comcast Corp., 3.97%, 11/1/47 | 102,000 |

| 118,400 |

|

Fox Corp., 3.05%, 4/7/25(2) | 40,000 |

| 40,430 |

|

TEGNA, Inc., 4.625%, 3/15/28(1) | 125,000 |

| 110,547 |

|

TEGNA, Inc., 5.00%, 9/15/29(1) | 140,000 |

| 126,525 |

|

| ViacomCBS, Inc., 3.125%, 6/15/22 | 50,000 |

| 49,389 |

|

| ViacomCBS, Inc., 4.25%, 9/1/23 | 140,000 |

| 142,988 |

|

| ViacomCBS, Inc., 3.70%, 8/15/24 | 100,000 |

| 102,162 |

|

| | | 1,462,371 |

|

| Metals and Mining — 0.4% | | |

Minera Mexico SA de CV, 4.50%, 1/26/50(1) | 300,000 |

| 255,091 |

|

Novelis Corp., 4.75%, 1/30/30(1) | 235,000 |

| 210,472 |

|

| Steel Dynamics, Inc., 3.45%, 4/15/30 | 90,000 |

| 82,048 |

|

| | | 547,611 |

|

| Multi-Utilities — 0.5% | | |

Ameren Corp., 3.50%, 1/15/31(2) | 42,000 |

| 42,291 |

|

| CenterPoint Energy, Inc., 4.25%, 11/1/28 | 120,000 |

| 123,340 |

|

| Consolidated Edison Co. of New York, Inc., 3.95%, 3/1/43 | 110,000 |

| 103,259 |

|

| Dominion Energy, Inc., 4.90%, 8/1/41 | 100,000 |

| 104,739 |

|

| NiSource, Inc., 5.65%, 2/1/45 | 110,000 |

| 126,885 |

|

| Sempra Energy, 2.875%, 10/1/22 | 130,000 |

| 130,590 |

|

| Sempra Energy, 3.25%, 6/15/27 | 100,000 |

| 97,412 |

|

| Sempra Energy, 4.00%, 2/1/48 | 50,000 |

| 48,165 |

|

| | | 776,681 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| Oil, Gas and Consumable Fuels — 3.3% | | |

Aker BP ASA, 3.75%, 1/15/30(1) | $ | 150,000 |

| $ | 112,923 |

|

| CNOOC Nexen Finance 2014 ULC, 4.25%, 4/30/24 | 70,000 |

| 74,901 |

|

| Concho Resources, Inc., 4.375%, 1/15/25 | 110,000 |

| 94,018 |

|

| Continental Resources, Inc., 4.375%, 1/15/28 | 140,000 |

| 65,314 |

|

| Diamondback Energy, Inc., 5.375%, 5/31/25 | 100,000 |

| 73,975 |

|

| Diamondback Energy, Inc., 3.50%, 12/1/29 | 260,000 |

| 184,411 |

|

| Enbridge, Inc., 4.00%, 10/1/23 | 10,000 |

| 9,533 |

|

| Energy Transfer Operating LP, 4.25%, 3/15/23 | 70,000 |

| 62,820 |

|

| Energy Transfer Operating LP, 3.75%, 5/15/30 | 140,000 |

| 110,313 |

|

| Energy Transfer Operating LP, 6.50%, 2/1/42 | 140,000 |

| 126,701 |

|

| EnLink Midstream Partners LP, 4.85%, 7/15/26 | 110,000 |

| 54,853 |

|

| Enterprise Products Operating LLC, 4.85%, 3/15/44 | 200,000 |

| 209,299 |

|

| Equinor ASA, 3.25%, 11/18/49 | 100,000 |

| 98,939 |

|

Gazprom PJSC via Gaz Finance plc, 3.25%, 2/25/30(1) | 400,000 |

| 371,329 |

|

| Hess Corp., 6.00%, 1/15/40 | 70,000 |

| 50,626 |

|

Holly Energy Partners LP / Holly Energy Finance Corp., 5.00%, 2/1/28(1) | 120,000 |

| 101,175 |

|

| Kinder Morgan Energy Partners LP, 5.30%, 9/15/20 | 60,000 |

| 59,823 |

|

| Kinder Morgan Energy Partners LP, 6.50%, 9/1/39 | 161,000 |

| 158,308 |

|

| MPLX LP, 4.875%, 6/1/25 | 190,000 |

| 156,740 |

|

MPLX LP, 4.25%, 12/1/27(1) | 60,000 |

| 52,022 |

|

| MPLX LP, 4.50%, 4/15/38 | 50,000 |

| 39,234 |

|

| MPLX LP, 5.20%, 3/1/47 | 70,000 |

| 56,107 |

|

| Newfield Exploration Co., 5.375%, 1/1/26 | 110,000 |

| 57,651 |

|

| Ovintiv, Inc., 6.50%, 2/1/38 | 30,000 |

| 13,065 |

|

| Petroleos Mexicanos, 6.375%, 2/4/21 | 600,000 |

| 570,720 |

|

| Petroleos Mexicanos, 4.875%, 1/24/22 | 350,000 |

| 302,955 |

|

| Petroleos Mexicanos, 6.50%, 3/13/27 | 600,000 |

| 449,185 |

|

| Petroleos Mexicanos, 6.625%, 6/15/35 | 50,000 |

| 34,138 |

|

| Petroleos Mexicanos, 5.50%, 6/27/44 | 80,000 |

| 50,136 |

|

| Phillips 66, 4.30%, 4/1/22 | 60,000 |

| 60,263 |

|

| Sabine Pass Liquefaction LLC, 5.625%, 3/1/25 | 315,000 |

| 289,667 |

|

| Sunoco Logistics Partners Operations LP, 4.00%, 10/1/27 | 50,000 |

| 39,660 |

|

| Williams Cos., Inc. (The), 4.125%, 11/15/20 | 280,000 |

| 276,836 |

|

| Williams Cos., Inc. (The), 4.55%, 6/24/24 | 135,000 |

| 123,249 |

|

| Williams Cos., Inc. (The), 5.10%, 9/15/45 | 80,000 |

| 76,311 |

|

| WPX Energy, Inc., 4.50%, 1/15/30 | 120,000 |

| 65,610 |

|

| | | 4,732,810 |

|

| Pharmaceuticals — 0.8% | | |

| Allergan Finance LLC, 3.25%, 10/1/22 | 60,000 |

| 60,224 |

|

| Allergan Funding SCS, 3.85%, 6/15/24 | 100,000 |

| 104,926 |

|

| Allergan Funding SCS, 4.55%, 3/15/35 | 100,000 |

| 110,539 |

|

Bausch Health Cos., Inc., 7.00%, 3/15/24(1) | 150,000 |

| 154,688 |

|

Bausch Health Cos., Inc., 5.00%, 1/30/28(1) | 220,000 |

| 209,924 |

|

Bristol-Myers Squibb Co., 3.25%, 8/15/22(1) | 200,000 |

| 207,874 |

|

| Elanco Animal Health, Inc., 5.65%, 8/28/28 | 270,000 |

| 285,491 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| Zoetis, Inc., 3.00%, 9/12/27 | $ | 70,000 |

| $ | 70,732 |

|

| | | 1,204,398 |

|

| Road and Rail — 0.7% | | |

Ashtead Capital, Inc., 4.125%, 8/15/25(1) | 200,000 |

| 184,000 |

|

| Burlington Northern Santa Fe LLC, 4.95%, 9/15/41 | 100,000 |

| 125,993 |

|

| Burlington Northern Santa Fe LLC, 4.45%, 3/15/43 | 120,000 |

| 142,592 |

|

| Burlington Northern Santa Fe LLC, 4.15%, 4/1/45 | 90,000 |

| 105,810 |

|

| CSX Corp., 3.25%, 6/1/27 | 170,000 |

| 174,992 |

|

| CSX Corp., 3.80%, 4/15/50 | 70,000 |

| 73,860 |

|

| Union Pacific Corp., 2.40%, 2/5/30 | 90,000 |

| 88,160 |

|

| Union Pacific Corp., 3.60%, 9/15/37 | 50,000 |

| 51,956 |

|

Union Pacific Corp., 3.84%, 3/20/60(1) | 10,000 |

| 10,872 |

|

| Union Pacific Corp., MTN, 3.55%, 8/15/39 | 80,000 |

| 80,932 |

|

| | | 1,039,167 |

|

| Semiconductors and Semiconductor Equipment — 0.1% | | |

NXP BV / NXP Funding LLC, 3.875%, 9/1/22(1) | 200,000 |

| 200,967 |

|

| Software — 0.4% | | |

| Adobe, Inc., 2.30%, 2/1/30 | 200,000 |

| 200,719 |

|

| Oracle Corp., 2.50%, 10/15/22 | 105,000 |

| 107,527 |

|

Oracle Corp., 2.50%, 4/1/25(2) | 150,000 |

| 153,307 |

|

| Oracle Corp., 2.65%, 7/15/26 | 20,000 |

| 20,557 |

|

Oracle Corp., 2.95%, 4/1/30(2) | 100,000 |

| 100,813 |

|

| | | 582,923 |

|

| Specialty Retail — 0.4% | | |

| Home Depot, Inc. (The), 3.75%, 2/15/24 | 20,000 |

| 21,155 |

|

| Home Depot, Inc. (The), 3.00%, 4/1/26 | 150,000 |

| 158,619 |

|

| Home Depot, Inc. (The), 5.95%, 4/1/41 | 170,000 |

| 238,952 |

|

| Home Depot, Inc. (The), 3.90%, 6/15/47 | 20,000 |

| 22,589 |

|

| Home Depot, Inc. (The), 3.35%, 4/15/50 | 98,000 |

| 106,868 |

|

| | | 548,183 |

|

| Technology Hardware, Storage and Peripherals — 0.4% | | |

Dell International LLC / EMC Corp., 5.45%, 6/15/23(1) | 230,000 |

| 236,313 |

|

Dell International LLC / EMC Corp., 6.02%, 6/15/26(1) | 320,000 |

| 341,175 |

|

| | | 577,488 |

|

| Textiles, Apparel and Luxury Goods — 0.1% | | |

| NIKE, Inc., 3.375%, 3/27/50 | 70,000 |

| 76,935 |

|

| Trading Companies and Distributors — 0.2% | | |

| Air Lease Corp., MTN, 3.00%, 2/1/30 | 332,000 |

| 241,490 |

|

| International Lease Finance Corp., 5.875%, 8/15/22 | 110,000 |

| 98,452 |

|

| | | 339,942 |

|

| Wireless Telecommunication Services — 0.2% | | |

| Vodafone Group plc, 2.95%, 2/19/23 | 321,000 |

| 328,144 |

|

TOTAL CORPORATE BONDS

(Cost $47,174,430) | | 45,569,114 |

|

| U.S. TREASURY SECURITIES — 28.2% | | |

| U.S. Treasury Bonds, 3.50%, 2/15/39 | 300,000 |

| 427,195 |

|

U.S. Treasury Bonds, 4.375%, 11/15/39(3) | 600,000 |

| 949,547 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| U.S. Treasury Bonds, 3.125%, 11/15/41 | $ | 200,000 |

| $ | 273,187 |

|

| U.S. Treasury Bonds, 3.125%, 2/15/42 | 300,000 |

| 410,156 |

|

| U.S. Treasury Bonds, 3.00%, 5/15/42 | 1,600,000 |

| 2,148,500 |

|

| U.S. Treasury Bonds, 2.875%, 5/15/43 | 400,000 |

| 527,219 |

|

U.S. Treasury Bonds, 3.125%, 8/15/44(3) | 200,000 |

| 275,773 |

|

| U.S. Treasury Bonds, 3.00%, 11/15/44 | 200,000 |

| 270,828 |

|

| U.S. Treasury Bonds, 2.50%, 2/15/45 | 700,000 |

| 874,426 |

|

| U.S. Treasury Bonds, 3.00%, 5/15/45 | 1,100,000 |

| 1,496,602 |

|

| U.S. Treasury Bonds, 3.00%, 11/15/45 | 200,000 |

| 273,703 |

|

| U.S. Treasury Bonds, 3.375%, 11/15/48 | 800,000 |

| 1,188,000 |

|

| U.S. Treasury Bonds, 2.25%, 8/15/49 | 2,700,000 |

| 3,285,773 |

|

| U.S. Treasury Bonds, 2.00%, 2/15/50 | 400,000 |

| 464,805 |

|

| U.S. Treasury Inflation Indexed Notes, 0.25%, 7/15/29 | 2,521,275 |

| 2,621,076 |

|

| U.S. Treasury Notes, 1.625%, 12/31/21 | 1,700,000 |

| 1,741,736 |

|

| U.S. Treasury Notes, 0.375%, 3/31/22 | 700,000 |

| 701,928 |

|

| U.S. Treasury Notes, 1.75%, 6/15/22 | 2,500,000 |

| 2,584,229 |

|

| U.S. Treasury Notes, 1.50%, 9/15/22 | 4,000,000 |

| 4,122,109 |

|

| U.S. Treasury Notes, 1.875%, 9/30/22 | 2,500,000 |

| 2,601,660 |

|

| U.S. Treasury Notes, 1.625%, 12/15/22 | 3,500,000 |

| 3,629,131 |

|

| U.S. Treasury Notes, 0.50%, 3/15/23 | 3,100,000 |

| 3,119,738 |

|

| U.S. Treasury Notes, 1.50%, 11/30/24 | 3,000,000 |

| 3,159,961 |

|

| U.S. Treasury Notes, 1.125%, 2/28/25 | 1,500,000 |

| 1,556,250 |

|

| U.S. Treasury Notes, 0.50%, 3/31/25 | 300,000 |

| 301,928 |

|

| U.S. Treasury Notes, 1.375%, 8/31/26 | 500,000 |

| 526,934 |

|

| U.S. Treasury Notes, 1.625%, 9/30/26 | 100,000 |

| 107,055 |

|

| U.S. Treasury Notes, 0.625%, 3/31/27 | 1,000,000 |

| 1,005,684 |

|

TOTAL U.S. TREASURY SECURITIES

(Cost $37,197,826) | | 40,645,133 |

|

| U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES — 12.8% |

| Adjustable-Rate U.S. Government Agency Mortgage-Backed Securities — 0.4% | |

| FHLMC, VRN, 4.28%, (12-month LIBOR plus 1.80%), 2/1/38 | 50,645 |

| 51,286 |

|

| FHLMC, VRN, 4.29%, (12-month LIBOR plus 1.84%), 6/1/38 | 40,868 |

| 41,510 |

|

| FHLMC, VRN, 3.90%, (12-month LIBOR plus 1.78%), 9/1/40 | 43,730 |

| 44,642 |

|

| FHLMC, VRN, 4.77%, (12-month LIBOR plus 1.88%), 5/1/41 | 21,247 |

| 21,734 |

|

| FHLMC, VRN, 3.64%, (12-month LIBOR plus 1.64%), 2/1/43 | 21,219 |

| 21,607 |

|

| FHLMC, VRN, 4.43%, (12-month LIBOR plus 1.65%), 6/1/43 | 11,150 |

| 11,221 |

|

| FHLMC, VRN, 4.50%, (12-month LIBOR plus 1.62%), 6/1/43 | 325 |

| 328 |

|

| FHLMC, VRN, 3.06%, (12-month LIBOR plus 1.64%), 9/1/47 | 204,272 |

| 211,145 |

|

| FNMA, VRN, 3.49%, (6-month LIBOR plus 1.57%), 6/1/35 | 20,703 |

| 21,087 |

|

| FNMA, VRN, 3.69%, (12-month LIBOR plus 1.69%), 1/1/40 | 11,107 |

| 11,331 |

|

| FNMA, VRN, 3.81%, (12-month LIBOR plus 1.77%), 10/1/40 | 68,706 |

| 70,135 |

|

| FNMA, VRN, 3.17%, (12-month LIBOR plus 1.61%), 3/1/47 | 88,042 |

| 91,087 |

|

| | | 597,113 |

|

| Fixed-Rate U.S. Government Agency Mortgage-Backed Securities — 12.4% | |

| FHLMC, 4.50%, 6/1/21 | 660 |

| 690 |

|

| FHLMC, 5.50%, 1/1/38 | 4,993 |

| 5,647 |

|

| FHLMC, 5.50%, 4/1/38 | 31,913 |

| 36,249 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| FNMA, 5.00%, 7/1/20 | $ | 1,127 |

| $ | 1,187 |

|

| FNMA, 5.00%, 7/1/31 | 262,511 |

| 286,328 |

|

| FNMA, 4.50%, 10/1/33 | 136,214 |

| 149,516 |

|

| FNMA, 5.00%, 11/1/33 | 298,823 |

| 331,938 |

|

| FNMA, 6.00%, 12/1/33 | 173,083 |

| 196,290 |

|

| FNMA, 3.50%, 3/1/34 | 687,215 |

| 724,379 |

|

| FNMA, 5.50%, 4/1/34 | 231,068 |

| 261,675 |

|

| FNMA, 5.50%, 4/1/34 | 77,475 |

| 87,530 |

|

| FNMA, 5.00%, 8/1/34 | 37,679 |

| 41,857 |

|

| FNMA, 5.50%, 8/1/34 | 73,575 |

| 83,324 |

|

| FNMA, 5.00%, 4/1/35 | 181,024 |

| 201,421 |

|

| FNMA, 5.00%, 8/1/35 | 12,433 |

| 13,850 |

|

| FNMA, 4.50%, 9/1/35 | 14,543 |

| 15,932 |

|

| FNMA, 5.50%, 7/1/36 | 11,785 |

| 13,197 |

|

| FNMA, 5.50%, 12/1/36 | 19,351 |

| 21,976 |

|

| FNMA, 6.00%, 7/1/37 | 43,984 |

| 49,886 |

|

| FNMA, 6.00%, 8/1/37 | 30,098 |

| 34,209 |

|

| FNMA, 6.50%, 8/1/37 | 2,122 |

| 2,453 |

|

| FNMA, 6.00%, 9/1/37 | 37,479 |

| 42,900 |

|

| FNMA, 6.00%, 11/1/37 | 41,438 |

| 47,743 |

|

| FNMA, 5.00%, 3/1/38 | 65,012 |

| 72,359 |

|

| FNMA, 6.50%, 9/1/38 | 117,601 |

| 135,892 |

|

| FNMA, 5.50%, 1/1/39 | 79,422 |

| 90,224 |

|

| FNMA, 5.00%, 2/1/39 | 179,222 |

| 199,703 |

|

| FNMA, 4.50%, 4/1/39 | 64,520 |

| 71,137 |

|

| FNMA, 4.50%, 5/1/39 | 161,638 |

| 178,043 |

|

| FNMA, 6.50%, 5/1/39 | 2,502 |

| 2,977 |

|

| FNMA, 4.50%, 10/1/39 | 280,936 |

| 310,640 |

|

| FNMA, 4.00%, 10/1/40 | 291,071 |

| 319,054 |

|

| FNMA, 4.50%, 11/1/40 | 267,390 |

| 293,561 |

|

| FNMA, 4.00%, 8/1/41 | 422,032 |

| 460,736 |

|

| FNMA, 4.50%, 9/1/41 | 244,158 |

| 267,975 |

|

| FNMA, 3.50%, 5/1/42 | 362,723 |

| 390,219 |

|

| FNMA, 3.50%, 6/1/42 | 420,123 |

| 451,982 |

|

| FNMA, 3.50%, 9/1/42 | 319,498 |

| 343,744 |

|

| FNMA, 3.50%, 5/1/45 | 827,485 |

| 885,821 |

|

| FNMA, 3.50%, 2/1/47 | 2,083,556 |

| 2,222,833 |

|

| FNMA, 3.50%, 7/1/47 | 1,729,925 |

| 1,837,500 |

|

| FNMA, 6.50%, 8/1/47 | 761 |

| 817 |

|

| FNMA, 6.50%, 9/1/47 | 1,541 |

| 1,650 |

|

| FNMA, 6.50%, 9/1/47 | 74 |

| 79 |

|

| FNMA, 6.50%, 9/1/47 | 810 |

| 867 |

|

| FNMA, 4.00%, 6/1/48 | 2,030,697 |

| 2,170,271 |

|

| FNMA, 4.00%, 10/1/48 | 994,300 |

| 1,060,798 |

|

| FNMA, 3.50%, 5/1/49 | 445,883 |

| 471,742 |

|

| GNMA, 5.50%, 12/15/32 | 79,345 |

| 90,035 |

|

| GNMA, 6.00%, 9/20/38 | 23,660 |

| 27,035 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| GNMA, 5.50%, 12/20/38 | $ | 55,897 |

| $ | 62,709 |

|

| GNMA, 4.50%, 6/15/39 | 360,269 |

| 403,958 |

|

| GNMA, 4.50%, 1/15/40 | 147,178 |

| 163,259 |

|

| GNMA, 4.50%, 4/15/40 | 229,796 |

| 257,638 |

|

| GNMA, 4.00%, 11/20/40 | 467,968 |

| 511,057 |

|

| GNMA, 3.50%, 6/20/42 | 504,433 |

| 540,251 |

|

| GNMA, 2.50%, 7/20/46 | 440,206 |

| 463,014 |

|

| GNMA, 2.50%, 2/20/47 | 523,155 |

| 550,179 |

|

| | | 17,959,936 |

|

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES

(Cost $17,739,142) | 18,557,049 |

|

| ASSET-BACKED SECURITIES — 6.8% | | |

Avis Budget Rental Car Funding AESOP LLC, Series 2015-2A, Class B, 3.42%, 12/20/21(1) | 250,000 |

| 246,543 |

|

BRE Grand Islander Timeshare Issuer LLC, Series 2017-1A, Class A SEQ, 2.94%, 5/25/29(1) | 94,431 |

| 92,643 |

|

Goodgreen, Series 2018-1A, Class A, VRN, 3.93%, 10/15/53(1) | 264,878 |

| 272,039 |

|

Hilton Grand Vacations Trust, Series 2014-AA, Class A SEQ, 1.77%, 11/25/26(1) | 54,360 |

| 53,952 |

|

Hilton Grand Vacations Trust, Series 2017-AA, Class A SEQ, 2.66%, 12/26/28(1) | 85,700 |

| 84,470 |

|

Hilton Grand Vacations Trust, Series 2017-AA, Class B, 2.96%, 12/26/28(1) | 140,236 |

| 138,195 |

|

Invitation Homes Trust, Series 2018-SFR1, Class B, VRN, 1.75%, (1-month LIBOR plus 0.95%), 3/17/37(1) | 725,000 |

| 654,831 |

|

Invitation Homes Trust, Series 2018-SFR2, Class C, VRN, 1.98%, (1-month LIBOR plus 1.28%), 6/17/37(1) | 575,000 |

| 519,901 |

|

Invitation Homes Trust, Series 2018-SFR3, Class B, VRN, 1.95%, (1-month LIBOR plus 1.15%), 7/17/37(1) | 550,000 |

| 498,673 |

|

MVW Owner Trust, Series 2013-1A, Class A SEQ, 2.15%, 4/22/30(1) | 41,758 |

| 41,733 |

|

MVW Owner Trust, Series 2015-1A, Class A SEQ, 2.52%, 12/20/32(1) | 43,454 |

| 42,891 |

|

MVW Owner Trust, Series 2017-1A, Class B, 2.75%, 12/20/34(1) | 602,748 |

| 588,277 |

|

MVW Owner Trust, Series 2018-1A, Class B, 3.60%, 1/21/36(1) | 270,592 |

| 257,257 |

|

Progress Residential Trust, Series 2017-SFR1, Class A SEQ, 2.77%, 8/17/34(1) | 373,427 |

| 372,580 |

|

Progress Residential Trust, Series 2017-SFR2, Class A SEQ, 2.90%, 12/17/34(1) | 848,421 |

| 853,405 |

|

Progress Residential Trust, Series 2018-SFR1, Class B, 3.48%, 3/17/35(1) | 325,000 |

| 321,619 |

|

Progress Residential Trust, Series 2018-SFR2, Class C, 4.04%, 8/17/35(1) | 675,000 |

| 673,632 |

|

Progress Residential Trust, Series 2018-SFR3, Class B, 4.08%, 10/17/35(1) | 1,000,000 |

| 1,009,913 |

|

Progress Residential Trust, Series 2018-SFR3, Class C, 4.18%, 10/17/35(1) | 675,000 |

| 676,614 |

|

Sierra Timeshare Conduit Receivables Funding LLC, Series 2017-1A, Class A SEQ, 2.91%, 3/20/34(1) | 68,347 |

| 67,516 |

|

Sierra Timeshare Receivables Funding LLC, Series 2016-1A, Class A SEQ, 3.08%, 3/21/33(1) | 62,274 |

| 61,994 |

|

Sierra Timeshare Receivables Funding LLC, Series 2016-2A, Class A SEQ, 2.33%, 7/20/33(1) | 62,213 |

| 61,489 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

Sierra Timeshare Receivables Funding LLC, Series 2018-2A, Class B, 3.65%, 6/20/35(1) | $ | 267,760 |

| $ | 255,995 |

|

Sierra Timeshare Receivables Funding LLC, Series 2019-2A, Class C, 3.12%, 5/20/36(1) | 364,359 |

| 359,863 |

|

Towd Point Mortgage Trust, Series 2017-3, Class M1, VRN, 3.50%, 7/25/57(1) | 300,000 |

| 270,509 |

|

Towd Point Mortgage Trust, Series 2017-6, Class A1, VRN, 2.75%, 10/25/57(1) | 501,505 |

| 502,180 |

|

Towd Point Mortgage Trust, Series 2018-4, Class A1, VRN, 3.00%, 6/25/58(1) | 207,663 |

| 205,408 |

|

| US Airways Pass-Through Trust, Series 2013-1, Class A, 3.95%, 5/15/27 | 65,236 |

| 65,283 |

|

VSE VOI Mortgage LLC, Series 2016-A, Class A SEQ, 2.54%, 7/20/33(1) | 139,774 |

| 137,453 |

|

VSE VOI Mortgage LLC, Series 2017-A, Class B, 2.63%, 3/20/35(1) | 196,721 |

| 192,084 |

|

VSE VOI Mortgage LLC, Series 2018-A, Class B, 3.72%, 2/20/36(1) | 228,312 |

| 225,880 |

|

TOTAL ASSET-BACKED SECURITIES

(Cost $10,055,436) | | 9,804,822 |

|

| COLLATERALIZED MORTGAGE OBLIGATIONS — 4.5% | | |

| Private Sponsor Collateralized Mortgage Obligations — 2.5% | | |

| Bear Stearns Adjustable Rate Mortgage Trust, Series 2004-12, Class 2A1, VRN, 3.74%, 2/25/35 | 52,511 |

| 47,774 |

|

| Bear Stearns Adjustable Rate Mortgage Trust, Series 2006-1, Class A1, VRN, 3.84%, (1-year H15T1Y plus 2.25%), 2/25/36 | 89,198 |

| 84,083 |

|

| Citigroup Mortgage Loan Trust, Inc., Series 2004-UST1, Class A4, VRN, 3.74%, 8/25/34 | 23,517 |

| 20,850 |

|

| Citigroup Mortgage Loan Trust, Inc., Series 2005-4, Class A, VRN, 4.59%, 8/25/35 | 90,631 |

| 84,446 |

|

| Countrywide Home Loan Mortgage Pass-Through Trust, Series 2004-4, Class A19, 5.25%, 5/25/34 | 73,472 |

| 75,324 |

|

| Countrywide Home Loan Mortgage Pass-Through Trust, Series 2005-17, Class 1A11, 5.50%, 9/25/35 | 964 |

| 888 |

|

| Credit Suisse First Boston Mortgage-Backed Pass-Through Certificates, Series 2005-3, Class 1A1, VRN, 5.50%, 7/25/35 | 124,880 |

| 123,722 |

|

Credit Suisse Mortgage Trust, Series 2017-HL2, Class A3 SEQ, VRN, 3.50%, 10/25/47(1) | 122,915 |

| 122,465 |

|

| First Horizon Alternative Mortgage Securities Trust, Series 2004-AA4, Class A1, VRN, 3.80%, 10/25/34 | 42,382 |

| 38,955 |

|

| First Horizon Mortgage Pass-Through Trust, Series 2005-AR3, Class 4A1, VRN, 5.01%, 8/25/35 | 54,675 |

| 52,828 |

|

| First Horizon Mortgage Pass-Through Trust, Series 2006-AR4, Class 1A2, VRN, 3.99%, 1/25/37 | 70,324 |

| 54,862 |

|

Flagstar Mortgage Trust, Series 2017-1, Class 1A5 SEQ, VRN, 3.50%, 3/25/47(1) | 155,077 |

| 157,135 |

|

| GSR Mortgage Loan Trust, Series 2005-AR6, Class 2A1, VRN, 4.10%, 9/25/35 | 74,420 |

| 70,453 |

|

| JPMorgan Mortgage Trust, Series 2005-A4, Class 2A1, VRN, 4.12%, 7/25/35 | 35,529 |

| 32,716 |

|

| JPMorgan Mortgage Trust, Series 2005-A6, Class 7A1, VRN, 4.19%, 8/25/35 | 166,688 |

| 153,258 |

|

| JPMorgan Mortgage Trust, Series 2005-S2, Class 3A1, VRN, 7.16%, 2/25/32 | 13,631 |

| 13,784 |

|

| MASTR Adjustable Rate Mortgages Trust, Series 2004-13, Class 3A7, VRN, 4.68%, 11/21/34 | 44,522 |

| 42,477 |

|

| Merrill Lynch Mortgage Investors Trust, Series 2005-3, Class 2A, VRN, 3.80%, 11/25/35 | 86,563 |

| 75,864 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

New Residential Mortgage Loan Trust, Series 2017-2A, Class A3, VRN, 4.00%, 3/25/57(1) | $ | 127,051 |

| $ | 132,828 |

|

New Residential Mortgage Loan Trust, Series 2017-5A, Class A1, VRN, 2.45%, (1-month LIBOR plus 1.50%), 6/25/57(1) | 225,427 |

| 215,982 |

|

Sequoia Mortgage Trust, Series 2017-CH1, Class A1, VRN, 4.00%, 8/25/47(1) | 240,913 |

| 245,000 |

|

Sequoia Mortgage Trust, Series 2017-CH2, Class A10 SEQ, VRN, 4.00%, 12/25/47(1) | 270,256 |

| 271,705 |

|

Sequoia Mortgage Trust, Series 2018-CH2, Class A12 SEQ, VRN, 4.00%, 6/25/48(1) | 68,012 |

| 68,509 |

|

| Structured Adjustable Rate Mortgage Loan Trust, Series 2004-8, Class 2A1, VRN, 3.78%, 7/25/34 | 54,067 |

| 50,273 |

|

| Thornburg Mortgage Securities Trust, Series 2006-4, Class A2B, VRN, 4.43%, 7/25/36 | 105,211 |

| 90,330 |

|

Verus Securitization Trust, Series 2019-3, Class A1, 2.78%, 7/25/59(1) | 7,623 |

| 7,483 |

|

| WaMu Mortgage Pass-Through Certificates, Series 2005-AR7, Class A3, VRN, 4.26%, 8/25/35 | 68,093 |

| 61,083 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-7, Class 3A1 SEQ, 6.00%, 6/25/36 | 251,956 |

| 240,155 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR12, Class 1A1, VRN, 4.71%, 9/25/36 | 95,668 |

| 85,476 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR15, Class A1, VRN, 4.61%, 10/25/36 | 33,629 |

| 29,515 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR16, Class A1, VRN, 4.49%, 10/25/36 | 73,512 |

| 65,094 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR19, Class A1, VRN, 4.35%, 12/25/36 | 53,704 |

| 47,641 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2006-AR5, Class 2A1, VRN, 4.14%, 4/25/36 | 84,973 |

| 80,255 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-AR10, Class 1A1, VRN, 4.26%, 1/25/38 | 51,834 |

| 44,002 |

|

| Wells Fargo Mortgage-Backed Securities Trust, Series 2007-AR7, Class A1, VRN, 4.35%, 12/28/37 | 345,274 |

| 302,733 |

|

Wells Fargo Mortgage-Backed Securities Trust, Series 2018-1, Class A3, VRN, 3.50%, 7/25/47(1) | 356,710 |

| 357,242 |

|

| | | 3,647,190 |

|

| U.S. Government Agency Collateralized Mortgage Obligations — 2.0% | |

| FHLMC, Series 2013-DN2, Class M2, VRN, 5.20%, (1-month LIBOR plus 4.25%), 11/25/23 | 151,428 |

| 146,990 |

|

| FHLMC, Series 2015-DNA1, Class M3, VRN, 4.25%, (1-month LIBOR plus 3.30%), 10/25/27 | 175,000 |

| 169,956 |

|

| FHLMC, Series 2015-HQ2, Class M3, VRN, 4.20%, (1-month LIBOR plus 3.25%), 5/25/25 | 175,000 |

| 156,001 |

|

| FHLMC, Series 2018-DNA1, Class M2, VRN, 2.75%, (1-month LIBOR plus 1.80%), 7/25/30 | 100,000 |

| 83,227 |

|

FHLMC, Series 2020-DNA2, Class M2, VRN, 2.80%, (1-month LIBOR plus 1.85%), 2/25/50(1) | 250,000 |

| 162,639 |

|

| FHLMC, Series 3397, Class GF, VRN, 1.20%, (1-month LIBOR plus 0.50%), 12/15/37 | 77,724 |

| 77,761 |

|

| FNMA, Series 2014-C02, Class 1M2, VRN, 3.55%, (1-month LIBOR plus 2.60%), 5/25/24 | 309,465 |

| 280,937 |

|

| FNMA, Series 2014-C02, Class 2M2, VRN, 3.55%, (1-month LIBOR plus 2.60%), 5/25/24 | 323,335 |

| 297,166 |

|

| FNMA, Series 2016-C01, Class 2M2, VRN, 7.90%, (1-month LIBOR plus 6.95%), 8/25/28 | 156,665 |

| 158,093 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| FNMA, Series 2016-C03, Class 2M2, VRN, 6.85%, (1-month LIBOR plus 5.90%), 10/25/28 | $ | 139,878 |

| $ | 137,888 |

|

| FNMA, Series 2017-C03, Class 1M2, VRN, 3.95%, (1-month LIBOR plus 3.00%), 10/25/29 | 225,000 |

| 202,218 |

|

| FNMA, Series 2017-C05, Class 1M2, VRN, 3.15%, (1-month LIBOR plus 2.20%), 1/25/30 | 283,377 |

| 253,502 |

|

| FNMA, Series 2017-C06, Class 2M2, VRN, 3.75%, (1-month LIBOR plus 2.80%), 2/25/30 | 641,635 |

| 542,341 |

|

| FNMA, Series 2017-C07, Class 1M2, VRN, 3.35%, (1-month LIBOR plus 2.40%), 5/25/30 | 150,000 |

| 135,287 |

|

| | | 2,804,006 |

|

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $6,988,365) | | 6,451,196 |

|

| COLLATERALIZED LOAN OBLIGATIONS — 3.9% | | |

Allegany Park CLO Ltd., Series 2019-1A, Class C, VRN, 4.38%, (3-month LIBOR plus 2.55%), 1/20/33(1) | 475,000 |

| 411,183 |

|

Ares XLI CLO Ltd., Series 2016-41A, Class AR, VRN, 3.03%, (3-month LIBOR plus 1.20%), 1/15/29(1) | 375,000 |

| 360,679 |

|

Bean Creek CLO Ltd., Series 2015-1A, Class BR, VRN, 3.27%, (3-month LIBOR plus 1.45%), 4/20/31(1) | 250,000 |

| 222,400 |

|

CBAM Ltd., Series 2018-5A, Class B1, VRN, 3.24%, (3-month LIBOR plus 1.40%), 4/17/31(1) | 200,000 |

| 177,309 |

|

CIFC Funding Ltd., Series 2013-2A, Class A2LR, VRN, 3.43%, (3-month LIBOR plus 1.60%), 10/18/30(1) | 400,000 |

| 370,816 |

|

CIFC Funding Ltd., Series 2016-1A, Class BR, VRN, 3.77%, (3-month LIBOR plus 1.95%), 10/21/31(1) | 125,000 |

| 115,043 |

|

Elmwood CLO IV Ltd., Series 2020-1A, Class B, VRN, 3.07%, (3-month LIBOR plus 1.70%), 4/15/33(1) | 500,000 |

| 460,000 |

|

Goldentree Loan Management US CLO 3 Ltd., Series 2018-3A, Class B1, VRN, 3.37%, (3-month LIBOR plus 1.55%), 4/20/30(1) | 300,000 |

| 276,496 |

|

Goldentree Loan Management US CLO 5 Ltd., Series 2019-5A, Class A, VRN, 3.12%, (3-month LIBOR plus 1.30%), 10/20/32(1) | 300,000 |

| 283,412 |

|

KKR CLO Ltd., Series 2022A, Class B, VRN, 3.42%, (3-month LIBOR plus 1.60%), 7/20/31(1) | 150,000 |

| 137,894 |

|

LCM XIV LP, Series 2014A, Class BR, VRN, 3.40%, (3-month LIBOR plus 1.58%), 7/20/31(1) | 500,000 |

| 453,717 |

|

Madison Park Funding XXII Ltd., Series 2016-22A, Class BR, VRN, 3.26%, (3-month LIBOR plus 1.60%), 1/15/33(1) | 100,000 |

| 87,243 |

|

Magnetite VIII Ltd., Series 2014-8A, Class BR2, VRN, 3.33%, (3-month LIBOR plus 1.50%), 4/15/31(1) | 100,000 |

| 92,335 |

|

Magnetite XXIV Ltd., Series 2019-24A, Class B, VRN, 3.76%, (3-month LIBOR plus 1.85%), 1/15/33(1) | 500,000 |

| 446,743 |

|

Magnetite XXIV Ltd., Series 2019-24A, Class C, VRN, 4.46%, (3-month LIBOR plus 2.55%), 1/15/33(1) | 700,000 |

| 604,738 |

|

Octagon Investment Partners 45 Ltd., Series 2019-1A, Class B1, VRN, 3.68%, (3-month LIBOR plus 1.85%), 10/15/32(1) | 450,000 |

| 417,405 |

|

Sounds Point CLO IV-R Ltd., Series 2013-3RA, Class A, VRN, 2.97%, (3-month LIBOR plus 1.15%), 4/18/31(1) | 150,000 |

| 139,780 |

|

Sounds Point CLO IV-R Ltd., Series 2013-3RA, Class B, VRN, 3.57%, (3-month LIBOR plus 1.75%), 4/18/31(1) | 200,000 |

| 178,063 |

|

Voya CLO Ltd., Series 2013-2A, Class A2AR, VRN, 3.19%, (3-month LIBOR plus 1.40%), 4/25/31(1) | 350,000 |

| 316,169 |

|

Voya CLO Ltd., Series 2013-3A, Class A2RR, VRN, 3.52%, (3-month LIBOR plus 1.70%), 10/18/31(1) | 150,000 |

| 137,656 |

|

TOTAL COLLATERALIZED LOAN OBLIGATIONS

(Cost $6,263,833) | | 5,689,081 |

|

|

| | | | | | |

| | Principal Amount/ Shares | Value |

| MUNICIPAL SECURITIES — 2.1% | | |

| Bay Area Toll Authority Rev., 6.92%, 4/1/40 | $ | 180,000 |

| $ | 265,918 |

|

| California State University Rev., 2.98%, 11/1/51 | 225,000 |

| 224,975 |

|

| Chicago GO, 7.05%, 1/1/29 | 50,000 |

| 57,499 |

|

| Escambia County Health Facilities Authority Rev., (Baptist Health Care Corp. Obligated Group), 3.61%, 8/15/40 (AGM) | 105,000 |

| 101,692 |

|

| Foothill-Eastern Transportation Corridor Agency Rev., 4.09%, 1/15/49 | 95,000 |

| 96,358 |

|

| Grand Parkway Transportation Corp. Rev., 3.24%, 10/1/52 | 135,000 |

| 131,613 |

|

| Houston GO, 3.96%, 3/1/47 | 50,000 |

| 56,287 |

|

| Metropolitan Transportation Authority Rev., 6.69%, 11/15/40 | 80,000 |

| 104,109 |

|

| Metropolitan Transportation Authority Rev., 6.81%, 11/15/40 | 50,000 |

| 65,500 |

|

| Missouri Highway & Transportation Commission Rev., 5.45%, 5/1/33 | 50,000 |

| 64,059 |

|

| New Jersey Turnpike Authority Rev., 7.10%, 1/1/41 | 40,000 |

| 57,112 |

|

| New York State Dormitory Authority Rev., (State of New York Personal Income Tax Rev.), 3.19%, 2/15/43 | 85,000 |

| 84,373 |

|

| Ohio Turnpike & Infrastructure Commission Rev., 3.22%, 2/15/48 | 130,000 |

| 130,900 |

|

| Ohio Water Development Authority Water Pollution Control Loan Fund Rev., 4.88%, 12/1/34 | 80,000 |

| 89,539 |

|

| Pennsylvania Turnpike Commission Rev., 5.56%, 12/1/49 | 65,000 |

| 88,668 |

|

| Port Authority of New York & New Jersey Rev., 4.93%, 10/1/51 | 75,000 |

| 93,370 |

|

| Regents of the University of California Medical Center Pooled Rev., 3.26%, 5/15/60 | 155,000 |

| 145,748 |

|

| Rutgers The State University of New Jersey Rev., 5.67%, 5/1/40 | 175,000 |

| 231,794 |

|

| Sacramento Municipal Utility District Rev., 6.16%, 5/15/36 | 150,000 |

| 204,709 |

|

| San Antonio Electric & Gas Systems Rev., 5.99%, 2/1/39 | 50,000 |

| 70,167 |