UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-07852 | |||||||

| ||||||||

USAA Mutual Funds Trust | ||||||||

(Exact name of registrant as specified in charter) | ||||||||

| ||||||||

15935 La Cantera Pkwy, Building Two, San Antonio, Texas |

| 78256 | ||||||

(Address of principal executive offices) |

| (Zip code) | ||||||

| ||||||||

Citi Fund Services Ohio, Inc., 4400 Easton Commons, Suite 200, Columbus, Ohio 43219 | ||||||||

(Name and address of agent for service) | ||||||||

| ||||||||

Registrant’s telephone number, including area code: | 800-235-8396 |

| ||||||

| ||||||||

Date of fiscal year end: | December 31 |

| ||||||

| ||||||||

Date of reporting period: | December 31, 2019 |

| ||||||

Item 1. Reports to Stockholders.

DECEMBER 31, 2019

Annual Report

USAA Extended Market Index Fund

Beginning January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund's shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Fund or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on usaa.com, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Fund or your financial intermediary electronically by notifying your financial intermediary directly, or if you are a direct investor, by calling (800) 235-8396 or logging on to usaa.com.

You may elect to receive all future reports in paper free of charge. You can inform the Fund or your financial intermediary that you wish to continue receiving paper copies of your shareholder reports by notifying your financial intermediary directly, or if you are a direct investor, by calling (800) 235-8396 or logging on to usaa.com. Your election to receive reports in paper will apply to all funds held with the USAA family of funds or your financial intermediary.

Victory Capital means Victory Capital Management Inc., the investment manager of the USAA Mutual Funds. USAA Mutual Funds are distributed by Victory Capital Advisers, Inc., a broker dealer registered with FINRA and an affiliate of Victory Capital. Victory Capital and its affiliates are not affiliated with United Services Automobile Association or its affiliates. USAA and the USAA logos are registered trademarks and the USAA Mutual Funds and USAA Investments logos are trademarks of United Services Automobile Association and are being used by Victory Capital and its affiliates under license.

TABLE OF CONTENTS

Managers' Commentary on the Fund (Unaudited) | 4 | ||||||

Investment Overview (Unaudited) | 5 | ||||||

| Investment Objective & Portfolio Holdings (Unaudited) | 7 | ||||||

| Report of Independent Registered Public Accounting Firm | 9 | ||||||

Financial Statements | |||||||

Schedule of Portfolio Investments | 10 | ||||||

Statement of Assets and Liabilities | 46 | ||||||

Statement of Operations | 47 | ||||||

Statements of Changes in Net Assets | 48 | ||||||

Financial Highlights | 50 | ||||||

Notes to Financial Statements | 52 | ||||||

Supplemental Information (Unaudited) | 61 | ||||||

Expense Example | 61 | ||||||

Proxy Voting and Portfolio Holdings Information | 61 | ||||||

Trustees' and Officers' Information | 62 | ||||||

Additional Federal Income Tax Information | 68 | ||||||

Privacy Policy (inside back cover) | |||||||

This report is for the information of the shareholders and others who have received a copy of the currently effective prospectus of the Fund, managed by Victory Capital Management Inc. It may be used as sales literature only when preceded or accompanied by a current prospectus, which provides further details about the Fund.

IRA DISTRIBUTION WITHHOLDING DISCLOSURE

We generally must withhold federal income tax at a rate of 10% of the taxable portion of your distribution and, if you live in a state that requires state income tax withholding, at your state's tax rate. However, you may elect not to have withholding apply or to have income tax withheld at a higher rate. Any withholding election that you make will apply to any subsequent distribution unless and until you change or revoke the election. If you wish to make a withholding election, or change or revoke a prior withholding election, call (800) 235-8396.

If you do not have a withholding election in place by the date of a distribution, federal income tax will be withheld from the taxable portion of your distribution at a rate of 10%. If you must pay estimated taxes, you may be subject to estimated tax penalties if your estimated tax payments are not sufficient and sufficient tax is not withheld from your distribution.

For more specific information, please consult your tax adviser.

USAA Mutual Funds Trust

1

(Unaudited)

Dear Shareholder,

As we turn the page into a new decade, it's hard not to reflect on the fact that we have been enjoying the longest-ever bull market in U.S. equities. The run has been impressive, and despite periods of tumult and plenty of negative news, the bull market endured throughout 2019.

For the annual reporting period ended December 31, 2019, the S&P 500® Index ("S&P 500") posted impressive gains of almost 29%. This represents the greatest one-year gain since 2013 and also illustrates a swift bounce-back after a precipitous drop late in 2018. The move higher supports the notion that underlying fundamentals of U.S. companies drive performance, rather than the political news and headline fears that often capture the attention of investors.

Perhaps we shouldn't be surprised at the impressive performance of equities. The U.S. economy—the world's largest—remains on solid footing and has been a key driver of both domestic and international stocks. Robust job creation, near-record low unemployment, and steady consumer spending continue and offer reasons for further optimism. Meanwhile, inflation remains muted, and the U.S. Federal Reserve (the "Fed") and other major global central banks have taken an accommodative stance. In fact, the Fed has cut interest rates by a total of 0.75% over three meetings last July, September, and October.

The risk-on attitudes of investors, coupled with the accommodative monetary policy, had an expected impact on U.S. Treasury yields. The 10-year Treasury yield declined significantly over the course of 2019, falling from 2.66% to 1.92% at year-end. More interesting, however, was that the yield on 10-year Treasurys fell below shorter-term yields for the first time since before the 2007-2008 Global Financial Crisis. This inverted yield curve spooked investors for a spell, only to revert back to a traditional upward sloping yield curve by the end of 2019.

The robust domestic economy, low interest rates, and ample liquidity from central banks provided a potent tonic for the stock market in 2019. In fact, at year-end 2019, the S&P 500 was approaching its highest valuation level since 1999. This reminds all of us to retain some historical context on the bull market. Many of us remember the Global Financial Crisis and, before that, the collapse of the dot-com bubble. Although those are now but a distant memory (and we are not forecasting such tumult), we should not forget that stocks don't always go up and cycles don't last forever. In other words, valuations still matter.

The key point is not to discount the risks. In addition to lofty valuations, investors need to keep apprised of trade disputes, geopolitical hotspots, a contentious U.S. election, and a host of other potential headwinds. Yet it is these very risks—these cross-currents—that may create pricing dislocations. This is an environment in which we believe our Victory Capital independent investment franchises can thrive.

On the following pages, you will find information relating to your USAA Funds investment. If you have any questions, we encourage you to contact your financial adviser. Or, if you invest with us directly, you may call (800) 235-8396, or visit our website at www.usaa.com.

2

My colleagues and I sincerely appreciate the confidence you have placed in the USAA Funds, and we value the opportunity to help meet your investment goals.

Christopher K. Dyer, CFA

President,

USAA Funds

3

USAA Mutual Funds Trust (Unaudited)

USAA Extended Market Index Fund

Manager's Commentary

Victory Solutions

Mannik S. Dhillon, CFA, CAIA

Wasif A. Latif

• What where the market conditions during the reporting period?

The broad U.S. equity market as measured by the S&P 500® Index registered a very strong return for 2019, outpacing the return of the Wilshire 4500 Completion IndexSM (the "Benchmark Index") despite a few trade war related scares in the middle of the year. The market staged a strong fourth quarter to end the year and continued the longest bull market on record. U.S. equity securities surged during the year, aided by clear messaging from the U.S. Federal Reserve (the "Fed") of a continued accommodative stance along with additional liquidity in the overnight interbank lending market. Indications of continued U.S. economic growth led by the consumer, as well as improvement in economic activity overseas, boosted investor confidence. This confluence of a stable economic environment, an accommodative Fed, and a resolution in sight for the trade war helped push stocks higher throughout the year.

• How did the USAA Extended Market Index Fund (the "Fund") perform during the reporting period?

Against this backdrop, the Fund posted a strong total return of 27.94% for the reporting period ended December 31, 2019, while its Benchmark Index posted a return of 28.05%.

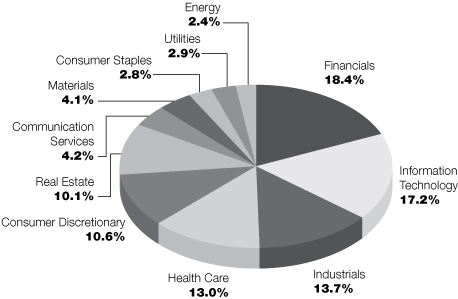

• Please describe sector performance during the reporting period

During the year, in terms of sector returns within the Benchmark Index, information technology stocks were the highlight performers, while communications services and consumer discretionary also were strong contributors. Energy stocks trailed the rest of the market through this period.

Thank you for the opportunity to help you with your investment needs.

Effective July 1, 2019, the Wilshire 4500 Completion Index replaced the Dow Jones U.S. Completion Total Stock Market Index as the Fund's primary broad-based securities market index in connection with a change in the Fund's investment objective.

4

USAA Mutual Funds Trust (Unaudited)

USAA Extended Market Index Fund

Investment Overview

Average Annual Total Return

Year Ended December 31, 2019

INCEPTION DATE | 10/27/00 | ||||||||||||||

Net Asset Value | Wilshire 4500 Completion Index1 | Dow Jones U.S. Completion Total Stock Market Index2 | |||||||||||||

One Year | 27.94 | % | 28.05 | % | 27.94 | % | |||||||||

Five Year | 8.61 | % | 9.51 | % | 8.84 | % | |||||||||

Ten Year | 12.37 | % | 13.08 | % | 12.72 | % | |||||||||

High double-digit returns are attributable, in part, to unusually favorable market conditions and may not be repeated or consistently achieved in the future.

Past performance is not indicative of future results. The performance data quoted represents past performance and current returns may be lower or higher. The investment return and principal value will fluctuate so that an investor's shares, when redeemed, may be worth more or less than the original cost. To obtain performance information current to the most recent month's end, please visit www.usaa.com.

Total return measures the price change in a share assuming the reinvestment of all net investment income and realized capital gain distributions, if any. The total returns quoted do not reflect adjustments made to the enclosed financial statements in accordance with U.S. generally accepted accounting principles or the deduction of taxes that a shareholder would pay on net investment income and realized capital gain distributions, including reinvested distributions, or redemptions of shares.

The total return figures set forth above include all waivers of fees for various periods since inception. Without such fee waivers, the total returns would have been lower.

5

USAA Mutual Funds Trust (Unaudited)

USAA Extended Market Index Fund

Investment Overview (continued)

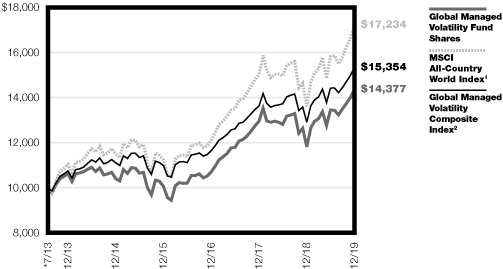

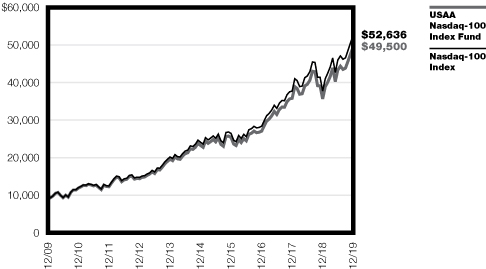

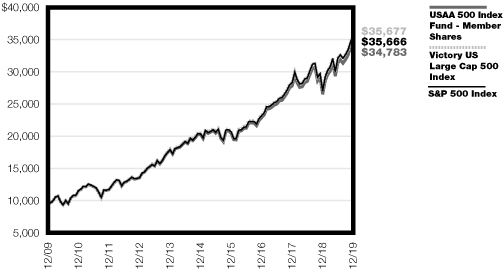

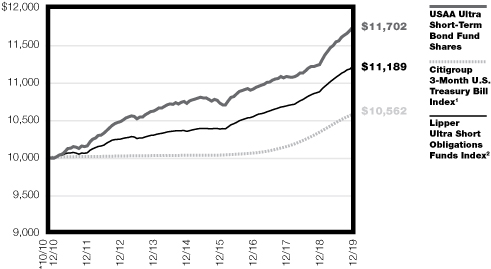

USAA Extended Market Index Fund — Growth of $10,000

1The Wilshire 4500 Completion Index is a market cap-weighted index consisting of the small and mid-cap companies in the U.S. equity market. The Index consists of securities within the Wilshire 5000 Total Market Index (Parent Index) after eliminating the companies included in the S&P 500 Index. The Parent Index measures performance of all U.S. equity securities with readily available price data. There are no expenses associated with the index, while there are expenses associated with the Fund. It is not possible to invest directly in an index.

2The Dow Jones U.S. Completion Total Stock Market Index is a subset of the Dow Jones U.S. Total Stock Market Index that excludes components of the S&P 500 Index. The Dow Jones U.S. Total Stock Market Index is an all-inclusive measure composed of all U.S. equity securities with readily available prices. This broad index is divided according to stock-size segment, style, and sector to create distinct sub-indexes that track every major segment of the market. There are no expenses associated with the index, while there are expenses associated with the Fund. It is not possible to invest directly in an index.

The graph reflects investment of growth of a hypothetical $10,000 investment in the Fund. Past performance is no guarantee of future results.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

Dow Jones U.S. Completion Total Stock Market Index is a service mark of Dow Jones & Company, Inc. Dow Jones does not have any relationship to the Fund other than the licensing and sublicensing of the Dow Jones U.S. Completion Total Stock Market Index and its service marks for use in connection with the Fund.

•Dow Jones does not sponsor, endorse, sell, or promote the Fund; recommend that any person invest in the Fund or any other securities; have any responsibility or liability for or make any decisions about the timing, amount, or pricing of the Fund; have any responsibility or liability for the administration, management, or marketing of the Fund; consider the needs of the Fund or the owners of the Fund in determining, composing, or calculating the Dow Jones U.S. Completion Total Stock Market Index, or have any obligation to do so.

Dow Jones will have no liability in connection with the Fund. Specifically, Dow Jones makes no warranty, express or implied, and Dow Jones disclaims any warranty about: the results to be obtained by the Fund, the owner of the Fund, or any other person in connection with the use of the Dow Jones U.S. Completion Total Stock Market Index and the data included in the Dow Jones U.S. Completion Total Stock Market Index; the accuracy or completeness of the Dow Jones U.S. Completion Total Stock Market Index and any related data; the merchantability and the fitness for a particular purpose or use of the Dow Jones U.S. Completion Total Stock Market Index and/or its related data; Dow Jones will have no liability for any errors, omissions, or interruptions in the Dow Jones U.S. Completion Total Stock Market Index or related data; under no circumstances will Dow Jones be liable for any lost profits or indirect, punitive, special, or consequential damages or losses, even if Dow Jones knows that they might occur.

6

| USAA Mutual Funds Trust USAA Extended Market Index Fund | December 31, 2019 | ||||||

(Unaudited)

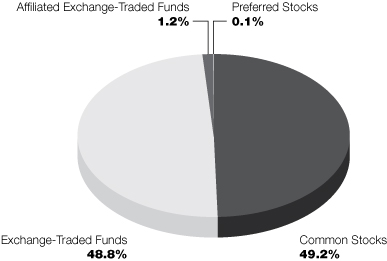

Investment Objective & Portfolio Holdings:

The Fund's investment objective seeks to match, before fees and expenses, the performance of all small- and mid-cap stocks as measured by the Wilshire 4500 Completion IndexSM.

Top 10 Holdings*

12/31/19

(% of Net Assets)

Tesla, Inc. | 1.2 | % | |||||

The Blackstone Group, Inc., Class A | 0.8 | % | |||||

Uber Technologies, Inc. | 0.6 | % | |||||

Palo Alto Networks, Inc. | 0.5 | % | |||||

Liberty Broadband Corp., Class A | 0.5 | % | |||||

CoStar Group, Inc. | 0.4 | % | |||||

Splunk, Inc. | 0.4 | % | |||||

Dexcom, Inc. | 0.4 | % | |||||

Seattle Genetics, Inc. | 0.4 | % | |||||

Markel Corp. | 0.3 | % | |||||

*Does not include futures, money market instruments and short-term investments purchased with cash collateral from securities loaned.

Refer to the Schedule of Portfolio Investments for a complete list of securities.

7

| USAA Mutual Funds Trust USAA Extended Market Index Fund (continued) | December 31, 2019 | ||||||

(Unaudited)

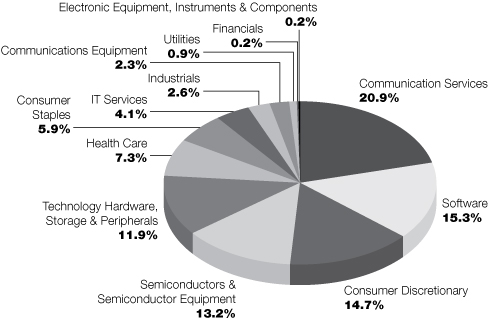

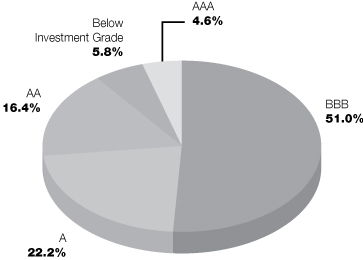

Sector Allocation*:

12/31/19

(% of Net Assets)

*Does not include futures, money market instruments and short-term investments purchased with cash collateral from securities loaned.

Percentages are of the net assets of the Fund and may not equal 100%.

8

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Shareholders and the Board of Trustees of USAA Extended Market Index Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities of USAA Extended Market Index Fund (the "Fund") (one of the funds constituting the USAA Mutual Funds Trust (the "Trust")), including the schedule of portfolio investments, as of December 31, 2019, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights for each of the five years in the period then ended and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund at December 31, 2019, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

Basis for Opinion

These financial statements are the responsibility of the Trust's management. Our responsibility is to express an opinion on the Fund's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Trust in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Trust is not required to have, nor were we engaged to perform, an audit of the Trust's internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting, but not for the purpose of expressing an opinion on the effectiveness of the Trust's internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of December 31, 2019, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

| |||||||||||||||||||||||

We have served as the auditor of one or more Victory Capital investment companies since 1995.

San Antonio, Texas

February 28, 2020

9

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Common Stocks (99.4%) | |||||||||||

Communication Services (4.2%): | |||||||||||

Altice USA, Inc., Class A (a) | 11,546 | $ | 316 | ||||||||

AMC Networks, Inc., Class A (a) | 7,037 | 278 | |||||||||

ANGI Homeservices, Inc., Class A (a) (b) | 14,592 | 124 | |||||||||

Atn International, Inc. | 2,528 | 140 | |||||||||

Boingo Wireless, Inc. (a) | 8,659 | 95 | |||||||||

Cable One, Inc. | 684 | 1,018 | |||||||||

Cardlytics, Inc. (a) | 3,488 | 219 | |||||||||

Care.com, Inc. (a) | 7,677 | 115 | |||||||||

Cargurus, Inc. (a) | 2,070 | 73 | |||||||||

Cars.com, Inc. (a) | 12,931 | 158 | |||||||||

Cinemark Holdings, Inc. | 17,553 | 594 | |||||||||

Clear Channel Outdoor Holdings, Inc. (a) | 33,406 | 96 | |||||||||

Cogent Communications Holdings, Inc. | 7,193 | 473 | |||||||||

Entercom Communications Corp., Class A | 31,277 | 145 | |||||||||

Gannett Co., Inc. (b) | 17,758 | 113 | |||||||||

GCI Liberty, Inc., Class A (a) | 14,715 | 1,043 | |||||||||

Glu Mobile, Inc. (a) | 26,936 | 163 | |||||||||

Gray Television, Inc. (a) | 13,312 | 285 | |||||||||

InterActive Corp. (a) | 10,805 | 2,692 | |||||||||

Iridium Communications, Inc. (a) | 19,432 | 479 | |||||||||

John Wiley & Sons, Inc., Class A | 5,940 | 288 | |||||||||

Liberty Broadband Corp., Class A (a) | 28,518 | 3,551 | |||||||||

Liberty Media Corp.-Liberty Formula One (a) | 33,105 | 1,449 | |||||||||

Liberty Media Corp-Liberty Braves, Class A (a) | 9,866 | 293 | |||||||||

Liberty Media Corp-Liberty SiriusXM, Class A (a) | 46,495 | 2,248 | |||||||||

Liberty TripAdvisor Holdings, Inc. (a) | 12,802 | 94 | |||||||||

Lions Gate Entertainment (a) | 23,061 | 229 | |||||||||

Live Nation Entertainment, Inc. (a) | 24,094 | 1,721 | |||||||||

Loral Space & Communications, Inc. (a) | 5,431 | 176 | |||||||||

Match Group, Inc. (a) (b) | 5,272 | 433 | |||||||||

Meredith Corp. | 5,910 | 192 | |||||||||

MSG Networks, Inc., Class A (a) | 9,573 | 167 | |||||||||

National CineMedia, Inc. | 16,381 | 119 | |||||||||

Nexstar Media Group, Inc., Class A | 7,588 | 890 | |||||||||

Pinterest, Inc. (a) | 13,753 | 256 | |||||||||

QuinStreet, Inc. (a) | 7,981 | 122 | |||||||||

Scholastic Corp. | 5,887 | 226 | |||||||||

Shenandoah Telecommunications Co. | 9,855 | 410 | |||||||||

Sinclair Broadcast Group, Inc., Class A | 9,916 | 331 | |||||||||

Sirius XM Holdings, Inc. (b) | 229,107 | 1,638 | |||||||||

Snap, Inc. (a) | 141,955 | 2,318 | |||||||||

Sprint Corp. (a) | 120,452 | 628 | |||||||||

TechTarget, Inc. (a) | 4,265 | 111 | |||||||||

TEGNA, Inc. | 34,553 | 577 | |||||||||

Telephone & Data Systems, Inc. | 16,686 | 424 | |||||||||

The E.W. Scripps Co., Class A | 11,271 | 177 | |||||||||

The Madison Square Garden Co. (a) | 3,282 | 966 | |||||||||

The Marcus Corp. | 3,703 | 118 | |||||||||

See notes to financial statements.

10

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

The New York Times Co. | 18,750 | $ | 603 | ||||||||

United States Cellular Corp. (a) | 4,280 | 155 | |||||||||

Vonage Holdings Corp. (a) | 40,621 | 301 | |||||||||

World Wrestling Entertainment, Inc., Class A (b) | 5,842 | 379 | |||||||||

Yelp, Inc. (a) | 10,967 | 382 | |||||||||

Zayo Group Holdings, Inc. (a) | 36,958 | 1,281 | |||||||||

Zillow Group, Inc. (a) (b) | 15,583 | 716 | |||||||||

Zynga, Inc., Class A (a) | 143,276 | 877 | |||||||||

33,465 | |||||||||||

Consumer Discretionary (10.6%): | |||||||||||

1-800-Flowers.com, Inc., Class A (a) | 7,014 | 102 | |||||||||

Aaron's, Inc. | 9,836 | 562 | |||||||||

Abercrombie & Fitch Co. | 10,654 | 184 | |||||||||

Acushnet Holdings Corp. | 7,781 | 253 | |||||||||

Adtalem Global Education, Inc. (a) | 9,002 | 315 | |||||||||

American Axle & Manufacturing Holdings, Inc. (a) | 19,085 | 205 | |||||||||

American Eagle Outfitters, Inc. | 27,225 | 400 | |||||||||

America's Car-Mart, Inc. (a) | 1,131 | 124 | |||||||||

Aramark | 32,712 | 1,420 | |||||||||

Asbury Automotive Group, Inc. (a) | 2,721 | 304 | |||||||||

At Home Group, Inc. (a) | 10,197 | 56 | |||||||||

Autoliv, Inc. (b) | 14,455 | 1,220 | |||||||||

AutoNation, Inc. (a) | 9,253 | 450 | |||||||||

Bed Bath & Beyond, Inc. | 17,105 | 296 | |||||||||

Big Lots, Inc. | 6,070 | 174 | |||||||||

BJ's Restaurants, Inc. | 3,404 | 129 | |||||||||

Bloomin' Brands, Inc. | 13,025 | 287 | |||||||||

Boot Barn Holdings, Inc. (a) | 4,303 | 192 | |||||||||

Boyd Gaming Corp. | 13,297 | 398 | |||||||||

Bright Horizons Family Solutions, Inc. (a) | 9,098 | 1,368 | |||||||||

Brinker International, Inc. | 4,859 | 204 | |||||||||

Brunswick Corp. | 14,457 | 866 | |||||||||

Burlington Stores, Inc. (a) | 9,379 | 2,138 | |||||||||

Caesars Entertainment Corp. (a) | 113,186 | 1,539 | |||||||||

Caleres, Inc. | 7,935 | 188 | |||||||||

Callaway Golf Co. | 15,414 | 327 | |||||||||

Career Education Corp. (a) | 12,368 | 227 | |||||||||

Carter's, Inc. | 6,694 | 733 | |||||||||

Carvana Co. (a) (b) | 2,044 | 188 | |||||||||

Cavco Industries, Inc. (a) (b) | 1,333 | 260 | |||||||||

Century Communities, Inc. (a) | 4,486 | 123 | |||||||||

Chegg, Inc. (a) | 16,990 | 644 | |||||||||

Chewy, Inc. (a) (b) | 9,984 | 290 | |||||||||

Chico's FAS, Inc. | 21,697 | 83 | |||||||||

Choice Hotels International, Inc. | 7,372 | 762 | |||||||||

Churchill Downs, Inc. | 6,219 | 853 | |||||||||

Chuy's Holdings, Inc. (a) | 3,267 | 85 | |||||||||

Columbia Sportswear Co. | 6,485 | 650 | |||||||||

Cooper Tire & Rubber Co. | 7,791 | 224 | |||||||||

Core-Mark Holding Co., Inc. | 7,852 | 213 | |||||||||

See notes to financial statements.

11

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Cracker Barrel Old Country Store, Inc. (b) | 3,673 | $ | 565 | ||||||||

Crocs, Inc. (a) | 11,157 | 467 | |||||||||

Dana, Inc. | 23,388 | 426 | |||||||||

Dave & Buster's Entertainment, Inc. | 4,722 | 190 | |||||||||

Deckers Outdoor Corp. (a) | 4,214 | 712 | |||||||||

Denny's Corp. (a) | 9,200 | 183 | |||||||||

Designer Brands, Inc. (b) | 10,396 | 164 | |||||||||

Dick's Sporting Goods, Inc. | 10,825 | 536 | |||||||||

Dillard's, Inc., Class A (b) | 3,640 | 267 | |||||||||

Dine Brands Global, Inc. | 2,475 | 207 | |||||||||

Domino's Pizza, Inc. (b) | 6,669 | 1,959 | |||||||||

Dorman Products, Inc. (a) | 4,400 | 333 | |||||||||

Dunkin' Brands Group, Inc. | 12,096 | 914 | |||||||||

Ethan Allen Interiors, Inc. | 4,996 | 95 | |||||||||

Etsy, Inc. (a) | 20,573 | 911 | |||||||||

Extended Stay America, Inc. | 32,733 | 486 | |||||||||

Five Below, Inc. (a) | 9,096 | 1,163 | |||||||||

Floor & Decor Holdings, Inc., Class A (a) | 14,453 | 734 | |||||||||

Foot Locker, Inc. | 18,841 | 735 | |||||||||

Fox Factory Holding Corp. (a) | 5,490 | 382 | |||||||||

Frontdoor, Inc. (a) | 13,371 | 634 | |||||||||

GameStop Corp., Class A (b) | 15,088 | 92 | |||||||||

Genesco, Inc. (a) | 2,955 | 142 | |||||||||

Gentex Corp. | 40,580 | 1,176 | |||||||||

Gentherm, Inc. (a) | 4,463 | 198 | |||||||||

G-III Apparel Group Ltd. (a) | 7,966 | 267 | |||||||||

GoPro, Inc., Class A (a) (b) | 24,346 | 106 | |||||||||

Graham Holdings Co., Class B | 684 | 437 | |||||||||

Grand Canyon Education, Inc. (a) | 7,704 | 738 | |||||||||

Green Brick Partners, Inc. (a) | 11,378 | 131 | |||||||||

Group 1 Automotive, Inc. | 2,988 | 299 | |||||||||

Groupon, Inc. (a) | 96,404 | 230 | |||||||||

GrubHub, Inc. (a) (b) | 12,809 | 623 | |||||||||

Guess?, Inc. | 5,948 | 133 | |||||||||

Helen of Troy Ltd. (a) | 3,529 | 634 | |||||||||

Hilton Grand Vacations, Inc. (a) | 12,840 | 442 | |||||||||

Houghton Mifflin Harcourt Co. (a) | 26,943 | 168 | |||||||||

Hudson Ltd., Class A (a) | 10,593 | 162 | |||||||||

Hyatt Hotels Corp., Class A | 3,521 | 316 | |||||||||

Installed Building Products, Inc. (a) | 3,607 | 248 | |||||||||

iRobot Corp. (a) (b) | 3,579 | 181 | |||||||||

Jack in the Box, Inc. | 4,074 | 318 | |||||||||

Johnson Outdoors, Inc., Class A | 1,812 | 139 | |||||||||

K12, Inc. (a) | 7,684 | 156 | |||||||||

KB Home | 11,275 | 386 | |||||||||

Kontoor Brands, Inc. | 9,276 | 389 | |||||||||

Laureate Education, Inc. (a) | 8,073 | 142 | |||||||||

La-Z-Boy, Inc. | 7,832 | 247 | |||||||||

LCI Industries | 4,136 | 443 | |||||||||

Lear Corp. | 9,763 | 1,340 | |||||||||

See notes to financial statements.

12

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Levi Strauss & Co., Class A (b) | 7,540 | $ | 145 | ||||||||

Lithia Motors, Inc. | 3,498 | 514 | |||||||||

M/I Homes, Inc. (a) | 4,068 | 160 | |||||||||

Malibu Boats, Inc., Class A (a) | 3,755 | 154 | |||||||||

MarineMax, Inc. (a) | 5,811 | 97 | |||||||||

Marriott Vacations Worldwide Corp. | 7,279 | 937 | |||||||||

Mattel, Inc. (a) (b) | 37,950 | 514 | |||||||||

MDC Holdings, Inc. | 9,156 | 349 | |||||||||

Meritage Homes Corp. (a) | 5,743 | 351 | |||||||||

Modine Manufacturing Co. (a) | 11,856 | 91 | |||||||||

Monarch Casino & Resort, Inc. (a) | 2,906 | 141 | |||||||||

Monro, Inc | 4,722 | 369 | |||||||||

Murphy USA, Inc. (a) | 4,927 | 576 | |||||||||

National Vision Holdings, Inc. (a) | 10,837 | 351 | |||||||||

Office Depot, Inc. | 91,700 | 251 | |||||||||

Ollie's Bargain Outlet Holdings, Inc. (a) | 8,332 | 545 | |||||||||

Oxford Industries, Inc. | 3,115 | 235 | |||||||||

Papa John's International, Inc. | 3,442 | 217 | |||||||||

Peloton Interactive, Inc., Class A (a) (b) | 6,581 | 187 | |||||||||

Penn National Gaming, Inc. (a) (b) | 18,278 | 467 | |||||||||

Penske Automotive Group, Inc. | 6,847 | 344 | |||||||||

Planet Fitness, Inc., Class A (a) | 13,556 | 1,012 | |||||||||

Polaris, Inc. | 7,951 | 809 | |||||||||

Pool Corp. | 6,697 | 1,423 | |||||||||

Quotient Technology, Inc. (a) | 13,823 | 136 | |||||||||

Qurate Retail, Inc., Class A (a) | 74,168 | 625 | |||||||||

Red Rock Resorts, Inc., Class A | 11,370 | 272 | |||||||||

Regis Corp. (a) | 7,288 | 130 | |||||||||

Rent-A-Center, Inc. | 7,821 | 226 | |||||||||

RH Corp. (a) (b) | 1,994 | 426 | |||||||||

Roku, Inc. (a) (b) | 3,178 | 426 | |||||||||

Ruth's Hospitality Group, Inc. | 6,390 | 139 | |||||||||

Sally Beauty Holdings, Inc. (a) | 13,845 | 253 | |||||||||

Scientific Games Corp. (a) | 8,149 | 218 | |||||||||

Seaworld Entertainment, Inc. (a) (b) | 9,005 | 286 | |||||||||

Service Corp. International | 27,048 | 1,246 | |||||||||

Servicemaster Global Holdings, Inc. (a) | 18,491 | 715 | |||||||||

Shake Shack, Inc., Class A (a) (b) | 2,886 | 172 | |||||||||

Shutterstock, Inc. (a) | 3,610 | 155 | |||||||||

Signet Jewelers Ltd. | 8,522 | 185 | |||||||||

Six Flags Entertainment Corp. | 12,008 | 542 | |||||||||

Skechers USA, Inc., Class A (a) | 16,558 | 715 | |||||||||

Skyline Champion Corp. (a) | 8,309 | 263 | |||||||||

Sleep Number Corp. (a) | 3,648 | 180 | |||||||||

Sonic Automotive, Inc., Class A | 3,237 | 100 | |||||||||

Sonos, Inc. (a) | 11,843 | 185 | |||||||||

Stamps.com, Inc. (a) | 2,559 | 214 | |||||||||

Standard Motor Products, Inc. | 3,347 | 178 | |||||||||

Steven Madden Ltd. | 12,641 | 544 | |||||||||

Stoneridge, Inc. (a) | 4,836 | 142 | |||||||||

See notes to financial statements.

13

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Strategic Education, Inc. | 3,059 | $ | 486 | ||||||||

Sturm Ruger & Co., Inc. | 3,252 | 153 | |||||||||

Taylor Morrison Home Corp., Class A (a) | 13,701 | 300 | |||||||||

Tempur Sealy International, Inc. (a) (b) | 6,660 | 580 | |||||||||

Tenneco, Inc., Class A | 11,050 | 145 | |||||||||

Tesla, Inc. (a) | 21,791 | 9,116 | |||||||||

Texas Roadhouse, Inc. | 9,992 | 563 | |||||||||

The Buckle, Inc. (b) | 4,242 | 115 | |||||||||

The Cheesecake Factory, Inc. | 5,986 | 233 | |||||||||

The Children's Place, Inc. (b) | 2,285 | 143 | |||||||||

The Goodyear Tire & Rubber Co. | 38,315 | 596 | |||||||||

The Michaels Cos., Inc. (a) | 16,960 | 137 | |||||||||

The RealReal, Inc. (a) (b) | 6,466 | 122 | |||||||||

The Wendy's Co. | 37,645 | 836 | |||||||||

Thor Industries, Inc. | 9,268 | 689 | |||||||||

Toll Brothers, Inc. | 19,168 | 758 | |||||||||

TopBuild Corp. (a) | 5,150 | 531 | |||||||||

TRI Pointe Group, Inc. (a) | 19,344 | 301 | |||||||||

Tupperware Brands Corp. | 11,178 | 96 | |||||||||

Unifi, Inc. (a) | 4,562 | 115 | |||||||||

Universal Electronics, Inc. (a) | 2,506 | 131 | |||||||||

Urban Outfitters, Inc. (a) | 9,421 | 262 | |||||||||

Vail Resorts, Inc. | 6,276 | 1,505 | |||||||||

Veoneer, Inc. (a) | 22,123 | 346 | |||||||||

Vista Outdoor, Inc. (a) | 11,192 | 84 | |||||||||

Visteon Corp. (a) | 3,427 | 297 | |||||||||

Wayfair, Inc. (a) (b) | 8,231 | 744 | |||||||||

William Lyon Homes, Class A (a) | 6,016 | 120 | |||||||||

Williams-Sonoma, Inc. | 8,620 | 633 | |||||||||

Wingstop, Inc. | 4,661 | 402 | |||||||||

Winmark Corp. | 713 | 141 | |||||||||

Winnebago Industries, Inc. | 4,326 | 229 | |||||||||

Wolverine World Wide, Inc. | 14,409 | 486 | |||||||||

WW International, Inc. (a) | 7,732 | 295 | |||||||||

Wyndham Destinations, Inc. | 15,468 | 800 | |||||||||

Wyndham Hotels & Resorts, Inc. | 16,016 | 1,006 | |||||||||

YETI Holdings, Inc. (a) (b) | 6,032 | 210 | |||||||||

Zumiez, Inc. (a) | 3,534 | 122 | |||||||||

84,122 | |||||||||||

Consumer Staples (2.8%): | |||||||||||

Avon Products, Inc. | 63,933 | 360 | |||||||||

B&G Foods, Inc. (b) | 10,053 | 180 | |||||||||

BellRing Brands, Inc., Class A (a) | 6,947 | 148 | |||||||||

Beyond Meat, Inc. (a) (b) | 7,973 | 603 | |||||||||

BJ's Wholesale Club Holdings, Inc. (a) (b) | 14,036 | 319 | |||||||||

Bunge Ltd. | 23,525 | 1,354 | |||||||||

Calavo Growers, Inc. | 2,932 | 266 | |||||||||

Cal-Maine Foods, Inc. | 4,539 | 194 | |||||||||

Casey's General Stores, Inc. | 5,057 | 803 | |||||||||

Central Garden & Pet Co., Class A (a) | 5,659 | 166 | |||||||||

See notes to financial statements.

14

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Coca-Cola Consolidated, Inc. | 708 | $ | 201 | ||||||||

Darling Ingredients, Inc. (a) | 22,687 | 637 | |||||||||

Edgewell Personal Care Co. (a) | 8,743 | 271 | |||||||||

elf Beauty, Inc. (a) | 5,582 | 90 | |||||||||

Energizer Holdings, Inc. | 8,286 | 416 | |||||||||

Flowers Foods, Inc. | 31,111 | 676 | |||||||||

Fresh Del Monte Produce, Inc. | 5,567 | 195 | |||||||||

Freshpet, Inc. (a) | 5,965 | 352 | |||||||||

Grocery Outlet Holding Corp. (a) | 5,849 | 190 | |||||||||

Herbalife Ltd. (a) | 22,124 | 1,055 | |||||||||

HF Foods Group, Inc., Class A (a) (b) | 7,431 | 145 | |||||||||

Hostess Brands, Inc. (a) | 10,990 | 160 | |||||||||

Ingles Markets, Inc., Class A | 2,422 | 115 | |||||||||

Ingredion, Inc. | 10,868 | 1,010 | |||||||||

Inter Parfums, Inc. | 2,759 | 201 | |||||||||

J&J Snack Foods Corp. | 2,418 | 446 | |||||||||

John B Sanfilippo & Son, Inc. | 1,392 | 127 | |||||||||

Keurig Dr Pepper, Inc. | 47,467 | 1,374 | |||||||||

Lancaster Colony Corp. | 3,249 | 520 | |||||||||

Medifast, Inc. (b) | 1,894 | 208 | |||||||||

MGP Ingredients, Inc. (b) | 2,582 | 125 | |||||||||

National Beverage Corp. (a) (b) | 3,206 | 164 | |||||||||

Nu Skin Enterprises, Inc., Class A | 9,489 | 388 | |||||||||

Performance Food Group Co. (a) | 14,592 | 751 | |||||||||

Pilgrim's Pride Corp. (a) | 10,411 | 341 | |||||||||

Post Holdings, Inc. (a) | 10,951 | 1,194 | |||||||||

PriceSmart, Inc. | 3,153 | 224 | |||||||||

Primo Water Corp. (a) | 7,928 | 89 | |||||||||

Rite AID Corp. (a) (b) | 9,807 | 152 | |||||||||

Sanderson Farms, Inc. | 2,990 | 527 | |||||||||

Seaboard Corp. | 46 | 196 | |||||||||

SpartanNash Co. | 7,837 | 112 | |||||||||

Spectrum Brands Holdings, Inc. | 7,205 | 464 | |||||||||

Sprouts Farmers Markets, Inc. (a) | 16,336 | 316 | |||||||||

The Andersons, Inc. | 6,709 | 170 | |||||||||

The Boston Beer Co., Inc., Class A (a) | 1,080 | 408 | |||||||||

The Chefs' Warehouse, Inc. (a) | 4,055 | 155 | |||||||||

The Hain Celestial Group, Inc. (a) | 17,295 | 449 | |||||||||

The Simply Good Foods Co. (a) | 12,110 | 346 | |||||||||

Tootsie Roll Industries, Inc. (b) | 3,643 | 124 | |||||||||

TreeHouse Foods, Inc. (a) | 6,580 | 319 | |||||||||

Universal Corp. | 4,204 | 240 | |||||||||

US Foods Holding Corp. (a) | 35,139 | 1,471 | |||||||||

USANA Health Sciences, Inc. (a) | 2,224 | 175 | |||||||||

Vector Group Ltd. | 20,357 | 272 | |||||||||

WD-40 Co. | 1,805 | 350 | |||||||||

Weis Markets, Inc. | 3,701 | 150 | |||||||||

22,454 | |||||||||||

See notes to financial statements.

15

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Energy (2.4%): | |||||||||||

Antero Midstream Corp. (b) | 51,480 | $ | 391 | ||||||||

Antero Resources Corp. (a) | 56,664 | 161 | |||||||||

Apergy Corp. (a) | 14,865 | 503 | |||||||||

Arch Coal, Inc., Class A | 2,292 | 164 | |||||||||

Archrock, Inc. | 22,002 | 221 | |||||||||

Cactus, Inc. | 4,356 | 149 | |||||||||

California Resources Corp. (a) (b) | 11,434 | 103 | |||||||||

Callon Petroleum Co. (a) | 76,231 | 368 | |||||||||

Centennial Resource Development, Inc., Class A (a) | 56,644 | 262 | |||||||||

Cheniere Energy, Inc. (a) | 43,044 | 2,628 | |||||||||

Chesapeake Energy Corp. (a) (b) | 279,091 | 230 | |||||||||

CNX Resources Corp. (a) | 33,523 | 297 | |||||||||

Comstock Resources, Inc. (a) (b) | 14,622 | 120 | |||||||||

Continental Resources, Inc. | 17,805 | 611 | |||||||||

Delek US Holdings, Inc. | 11,340 | 380 | |||||||||

Denbury Resources, Inc. (a) | 86,415 | 122 | |||||||||

Dorian LPG Ltd. (a) | 9,466 | 147 | |||||||||

Dril-Quip, Inc. (a) | 5,681 | 266 | |||||||||

Energy Transfer LP | 7,108 | 91 | |||||||||

EQT Corp. | 42,371 | 462 | |||||||||

Equitrans Midstream Corp. (b) | 28,032 | 375 | |||||||||

Green Plains, Inc. | 7,227 | 112 | |||||||||

Helix Energy Solutions Group, Inc. (a) | 26,974 | 260 | |||||||||

Jagged Peak Energy, Inc. (a) | 17,606 | 149 | |||||||||

Magnolia Oil & Gas Corp. (a) | 22,276 | 280 | |||||||||

Matador Resources Co. (a) | 21,064 | 379 | |||||||||

Murphy Oil Corp. | 19,778 | 530 | |||||||||

Nabors Industries Ltd. | 70,094 | 202 | |||||||||

Newpark Resources, Inc. (a) | 17,897 | 112 | |||||||||

Nextdecade Corp. (a) | 23,274 | 143 | |||||||||

Nextier Oilfield Solutions, Inc. (a) | 32,580 | 218 | |||||||||

Northern Oil And Gas, Inc. (a) | 61,640 | 144 | |||||||||

Oasis Petroleum, Inc. (a) | 54,176 | 177 | |||||||||

Oceaneering International, Inc. (a) | 17,873 | 266 | |||||||||

Oil States International, Inc. (a) | 10,723 | 175 | |||||||||

Parker Drilling Co. (a) | 4,135 | 93 | |||||||||

Parsley Energy, Inc., Class A | 49,341 | 933 | |||||||||

Patterson-UTI Energy, Inc. | 37,880 | 398 | |||||||||

PBF Energy, Inc., Class A | 16,290 | 511 | |||||||||

PDC Energy, Inc. (a) | 10,601 | 277 | |||||||||

Peabody Energy Corp. (b) | 16,624 | 152 | |||||||||

Penn Virginia Corp. (a) | 3,683 | 112 | |||||||||

Propetro Holding Corp. (a) (b) | 15,642 | 176 | |||||||||

QEP Resources, Inc. | 45,615 | 205 | |||||||||

Range Resources Corp. (b) | 45,523 | 221 | |||||||||

Renewable Energy Group, Inc. (a) | 6,976 | 188 | |||||||||

SEACOR Holdings, Inc. (a) | 3,670 | 158 | |||||||||

Select Energy Services, Inc. (a) | 14,080 | 131 | |||||||||

SFL Corp., Ltd. | 15,033 | 219 | |||||||||

See notes to financial statements.

16

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

SM Energy Co. | 18,772 | $ | 211 | ||||||||

Southwestern Energy Co. (a) | 89,121 | 216 | |||||||||

SRC Energy, Inc. (a) | 40,240 | 166 | |||||||||

Talos Energy, Inc. (a) | 5,917 | 178 | |||||||||

Targa Resources Corp. | 39,290 | 1,604 | |||||||||

Tellurian, Inc. (a) | 24,500 | 178 | |||||||||

Tidewater, Inc. (a) | 9,260 | 179 | |||||||||

W&T Offshore, Inc. (a) | 21,590 | 120 | |||||||||

Whiting Petroleum Corp. (a) (b) | 15,191 | 112 | |||||||||

World Fuel Services Corp. (c) | 9,939 | 432 | |||||||||

WPX Energy, Inc. (a) | 73,102 | 1,004 | |||||||||

19,372 | |||||||||||

Financials (18.4%): | |||||||||||

1st Source Corp. | 4,509 | 234 | |||||||||

AG Mortgage Investment Trust, Inc. | 6,786 | 105 | |||||||||

Agnc Investment Corp. | 84,796 | 1,500 | |||||||||

Alleghany Corp. (a) | 2,279 | 1,822 | |||||||||

Allegiance Bancshares, Inc. (a) (b) | 4,874 | 183 | |||||||||

Ally Financial, Inc. | 61,634 | 1,885 | |||||||||

American Equity Investment Life Holding Co. | 15,779 | 472 | |||||||||

American Financial Group, Inc. | 12,441 | 1,364 | |||||||||

American National Bankshares, Inc. | 3,218 | 127 | |||||||||

American National Insurance Co. | 4,036 | 475 | |||||||||

Ameris Bancorp | 11,561 | 492 | |||||||||

AMERISAFE, Inc. | 3,469 | 229 | |||||||||

Annaly Capital Management, Inc. | 238,471 | 2,247 | |||||||||

Anworth Mortgage Asset Corp. | 29,321 | 103 | |||||||||

Apollo Commercial Real Estate Finance, Inc. | 21,068 | 385 | |||||||||

Apollo Investment Corp. | 15,134 | 264 | |||||||||

Arbor Realty Trust, Inc. | 15,704 | 225 | |||||||||

Arch Capital Group Ltd. (a) | 52,164 | 2,237 | |||||||||

Ares Capital Corp. | 73,890 | 1,378 | |||||||||

Ares Commercial Real Estate Corp. | 6,763 | 107 | |||||||||

Ares Management Corp., Class A | 16,463 | 588 | |||||||||

Argo Group International Holdings Ltd. | 6,041 | 397 | |||||||||

Armour Residential REIT, Inc. | 9,842 | 176 | |||||||||

Arrow Financial Corp. | 3,863 | 146 | |||||||||

Artisan Partners Asset Management, Inc., Class A | 7,501 | 242 | |||||||||

Assetmark Financial Holdings, Inc. (a) | 5,224 | 152 | |||||||||

Associated Bancorp, Class A | 26,305 | 580 | |||||||||

Assured Guaranty Ltd. | 16,302 | 799 | |||||||||

Atlantic Union Bankshares Corp. | 14,843 | 557 | |||||||||

AXA Equitable Holdings, Inc. | 52,694 | 1,306 | |||||||||

Axis Capital Holdings Ltd. | 13,282 | 789 | |||||||||

Axos Financial, Inc. (a) | 9,527 | 288 | |||||||||

Banc of California, Inc. | 9,642 | 166 | |||||||||

BancFirst Corp. | 4,207 | 263 | |||||||||

BancorpSouth Bank | 16,899 | 531 | |||||||||

Bank of Hawaii Corp. | 5,839 | 556 | |||||||||

Bank of Marin Bancorp | 2,844 | 128 | |||||||||

See notes to financial statements.

17

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Bank OZK, Class A | 21,918 | $ | 669 | ||||||||

BankUnited, Inc. | 15,308 | 560 | |||||||||

Banner Corp. | 5,761 | 326 | |||||||||

Bar Harbor Bankshares | 4,265 | 108 | |||||||||

Barings BDC, Inc. (b) | 14,775 | 152 | |||||||||

Berkshire Hills Bancorp, Inc. | 8,514 | 280 | |||||||||

BGC Partners, Inc., Class A | 46,807 | 278 | |||||||||

BlackRock Capital Investment Corp. | 17,752 | 88 | |||||||||

BlackRock TCP Capital Corp. | 10,327 | 145 | |||||||||

Blackstone Mortgage Trust, Inc., Class A | 21,860 | 814 | |||||||||

Blucora, Inc. (a) | 8,499 | 222 | |||||||||

BOK Financial Corp. | 6,595 | 576 | |||||||||

Boston Private Financial Holdings, Inc. | 15,544 | 187 | |||||||||

Bridge Bancorp, Inc. | 5,308 | 178 | |||||||||

Brighthouse Financial, Inc. (a) | 17,973 | 705 | |||||||||

Brookline Bancorp, Inc., Class A | 14,257 | 235 | |||||||||

Brown & Brown, Inc. | 38,415 | 1,517 | |||||||||

Bryn Mawr Bank Corp. | 5,103 | 210 | |||||||||

Byline Bancorp, Inc., Class A | 6,991 | 137 | |||||||||

Cadence Bancorp | 22,307 | 404 | |||||||||

Cambridge Bancorp, Class A (b) | 1,126 | 90 | |||||||||

Camden National Corp. | 3,711 | 171 | |||||||||

Capital City Bank Group, Inc. | 3,438 | 105 | |||||||||

Capitol Federal Financial, Inc. | 18,864 | 259 | |||||||||

Capstead Mortgage Corp. | 17,851 | 141 | |||||||||

Cathay General Bancorp | 12,825 | 488 | |||||||||

CBTX, Inc., Class A | 5,544 | 173 | |||||||||

Centerstate Banks, Inc. | 21,134 | 528 | |||||||||

Central Pacific Financial Corp. | 4,668 | 138 | |||||||||

Chimera Investment Corp. | 30,443 | 626 | |||||||||

CIT Group, Inc. | 15,696 | 716 | |||||||||

Citizens & Northern Corp. | 3,546 | 100 | |||||||||

City Holding Co. | 3,079 | 252 | |||||||||

Civista Bancshares, Inc. | 4,196 | 101 | |||||||||

CNA Financial Corp. | 5,537 | 248 | |||||||||

CNB Financial Corp., Class A | 4,524 | 148 | |||||||||

CNO Financial Group, Inc. | 27,067 | 491 | |||||||||

Cohen & Steers, Inc. | 4,487 | 282 | |||||||||

Colony Credit Real Estate, Inc. | 19,530 | 257 | |||||||||

Columbia Banking System, Inc. | 11,337 | 461 | |||||||||

Columbia Financial, Inc. (a) | 9,786 | 166 | |||||||||

Commerce Bancshares, Inc., Class C | 16,612 | 1,128 | |||||||||

Community Bank System, Inc. | 8,072 | 573 | |||||||||

Community Trust Bancorp, Inc., Class A | 4,328 | 202 | |||||||||

Connectone Bancorp, Inc., Class A | 6,748 | 174 | |||||||||

Cowen, Inc., Class A (a) | 5,232 | 82 | |||||||||

Credit Acceptance Corp. (a) | 2,544 | 1,126 | |||||||||

Cullen/Frost Bankers, Inc. | 9,352 | 914 | |||||||||

Customers Bancorp, Inc., Class A (a) | 6,138 | 146 | |||||||||

CVB Financial Corp. | 22,284 | 481 | |||||||||

See notes to financial statements.

18

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Dime Community Bancshares, Inc. | 5,125 | $ | 107 | ||||||||

Eagle Bancorp, Inc. | 6,290 | 306 | |||||||||

East West Bancorp, Inc. | 24,538 | 1,194 | |||||||||

Eaton Vance Corp. | 18,340 | 856 | |||||||||

eHealth, Inc. (a) | 3,283 | 315 | |||||||||

Ellington Financial, Inc. | 4,711 | 86 | |||||||||

Employers Holdings, Inc. | 5,803 | 242 | |||||||||

Encore Capital Group, Inc. (a) | 2,696 | 95 | |||||||||

Enova International, Inc. (a) | 6,351 | 153 | |||||||||

Enstar Group Ltd. (a) | 2,458 | 508 | |||||||||

Enterprise Financial Services Corp. | 5,521 | 266 | |||||||||

Equus Total Return, Inc. (a) | 1,196 | 2 | |||||||||

Erie Indemnity Co., Class A | 3,675 | 610 | |||||||||

Evercore, Inc. | 6,466 | 483 | |||||||||

FactSet Research Systems, Inc. | 6,124 | 1,643 | |||||||||

FB Financial Corp. | 3,403 | 135 | |||||||||

FBL Financial Group, Inc., Class A | 5,727 | 337 | |||||||||

Federal Agricultural Mortgage Corp. | 1,887 | 158 | |||||||||

Federal Home Loan Mortgage Corp. (a) | 120,046 | 361 | |||||||||

Federal National Mortgage Association (a) (b) | 217,440 | 678 | |||||||||

Federated Investors, Inc., Class B | 12,337 | 402 | |||||||||

Fidelity National Financial, Inc., Class A | 42,772 | 1,940 | |||||||||

Financial Institutions, Inc. | 3,998 | 128 | |||||||||

First American Financial Corp. | 17,213 | 1,004 | |||||||||

First Bancorp, Inc. | 32,215 | 341 | |||||||||

First Bancorp, Inc., Class A | 5,826 | 233 | |||||||||

First Busey Corp. | 11,287 | 310 | |||||||||

First Citizens BancShares, Inc., Class A | 1,330 | 708 | |||||||||

First Commonwealth Financial Corp. | 19,976 | 290 | |||||||||

First Defiance Financial Corp. | 3,625 | 114 | |||||||||

First Financial Bancorp | 16,138 | 411 | |||||||||

First Financial Bankshares, Inc. (b) | 20,768 | 729 | |||||||||

First Financial Corp., Class A | 3,019 | 138 | |||||||||

First Hawaiian, Inc. | 19,314 | 557 | |||||||||

First Horizon National Corp. | 41,651 | 690 | |||||||||

First Internet Bancorp | 3,579 | 85 | |||||||||

First Interstate BancSystem, Inc., Class A | 5,209 | 218 | |||||||||

First Merchants Corp. | 10,281 | 428 | |||||||||

First Midwest Bancorp, Inc. | 18,644 | 430 | |||||||||

FirstCash, Inc., Class A | 6,777 | 546 | |||||||||

Flagstar Bancorp, Inc., Class A | 6,039 | 231 | |||||||||

Flushing Financial Corp. | 6,100 | 132 | |||||||||

FNB Corp. | 50,569 | 642 | |||||||||

Focus Financial Partners, Inc. (a) | 4,379 | 129 | |||||||||

Franklin Financial Network, Inc. | 3,252 | 112 | |||||||||

FS KKR Capital Corp. | 90,529 | 555 | |||||||||

Fulton Financial Corp. | 24,523 | 427 | |||||||||

Genworth Financial, Inc., A (a) | 80,720 | 355 | |||||||||

German American Bancorp, Inc., Class A | 5,864 | 209 | |||||||||

Glacier Bancorp, Inc. | 13,807 | 635 | |||||||||

See notes to financial statements.

19

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Goldman Sachs BDC, Inc. | 9,544 | $ | 203 | ||||||||

Golub Capital BDC, Inc. | 25,239 | 466 | |||||||||

Granite Point Mortgage Trust, Inc. | 7,647 | 141 | |||||||||

Great Southern Bancorp, Inc., Class A | 3,015 | 191 | |||||||||

Great Western Bancorp, Inc. | 9,010 | 313 | |||||||||

Green Dot Corp. (a) | 9,291 | 216 | |||||||||

Hamilton Lane, Inc. | 2,734 | 163 | |||||||||

Hancock Whitney Corp., Class B | 15,194 | 667 | |||||||||

Hanmi Financial Corp. | 6,428 | 129 | |||||||||

Hannon Armstrong Sustainable Infrastructure Capital, Inc. | 11,241 | 362 | |||||||||

HarborOne Bancorp, Inc. (a) | 9,352 | 103 | |||||||||

Heartland Financial USA, Inc. | 7,166 | 356 | |||||||||

Hercules Capital, Inc. | 18,892 | 265 | |||||||||

Heritage Commerce Corp. | 10,652 | 137 | |||||||||

Heritage Financial Corp. | 6,062 | 172 | |||||||||

Heritage Insurance Holdings, Inc. | 6,313 | 84 | |||||||||

Hilltop Holdings, Inc. | 13,754 | 343 | |||||||||

Home BancShares, Inc. | 25,734 | 506 | |||||||||

Homestreet, Inc. (a) | 4,516 | 154 | |||||||||

Hope Bancorp, Inc. | 20,707 | 308 | |||||||||

Horace Mann Educators Corp. | 7,014 | 306 | |||||||||

Horizon Bancorp, Inc., Class A | 9,306 | 177 | |||||||||

Houlihan Lokey, Inc. | 3,316 | 162 | |||||||||

IBERIABANK Corp. | 8,324 | 623 | |||||||||

Independent Bank Corp. | 4,592 | 104 | |||||||||

Independent Bank Corp. | 5,773 | 481 | |||||||||

Independent Bank Group, Inc. (b) | 6,626 | 367 | |||||||||

Interactive Brokers Group, Inc. | 8,476 | 395 | |||||||||

International Bancshares Corp. | 10,578 | 456 | |||||||||

International Fcstone, Inc., Class A (a) | 3,168 | 155 | |||||||||

Invesco Mortgage Capital, Inc. | 19,192 | 320 | |||||||||

Investors Bancorp, Inc., Class A | 43,471 | 518 | |||||||||

Jefferies Financial Group, Inc. | 46,853 | 1,001 | |||||||||

Kearny Financial Corp. | 11,607 | 161 | |||||||||

Kemper Corp. | 11,286 | 875 | |||||||||

Kinsale Capital Group, Inc. | 3,773 | 384 | |||||||||

KKR Real Estate Finance Trust, Inc. | 7,853 | 160 | |||||||||

Ladder Capital Corp. | 11,386 | 205 | |||||||||

Lakeland Bancorp, Inc., Class A | 10,974 | 191 | |||||||||

Lakeland Financial Corp. | 5,712 | 279 | |||||||||

Legg Mason, Inc. | 13,427 | 482 | |||||||||

LendingTree, Inc. (a) | 1,080 | 328 | |||||||||

Live Oak Bancshares, Inc. | 7,661 | 146 | |||||||||

LPL Financial Holdings, Inc. | 13,058 | 1,205 | |||||||||

Macatawa Bank Corp. | 8,522 | 95 | |||||||||

Main Street Capital Corp. (b) | 11,578 | 499 | |||||||||

Markel Corp. (a) | 2,358 | 2,697 | |||||||||

MBIA, Inc. (a) | 17,204 | 160 | |||||||||

Mercantile Bank Corp. | 4,021 | 147 | |||||||||

Mercury General Corp. | 5,377 | 262 | |||||||||

See notes to financial statements.

20

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Meridian Bancorp, Inc. | 7,486 | $ | 150 | ||||||||

Meta Financial Group, Inc. | 6,519 | 238 | |||||||||

MFA Financial, Inc. | 60,188 | 460 | |||||||||

MGIC Investment Corp. | 61,414 | 869 | |||||||||

Midland States BanCorp, Inc. | 5,796 | 168 | |||||||||

MidWestOne Financial Group, Inc. | 4,280 | 155 | |||||||||

Moelis & Co., Class A | 5,316 | 170 | |||||||||

Morningstar, Inc. | 3,877 | 587 | |||||||||

Mutualfirst Financial, Inc. | 2,886 | 114 | |||||||||

National Bank Holdings Corp. | 4,859 | 171 | |||||||||

National General Holdings Corp. | 13,723 | 303 | |||||||||

National Western Life Group, Inc., Class A | 396 | 115 | |||||||||

Navient Corp. | 35,391 | 484 | |||||||||

NBT Bancorp, Inc. | 8,118 | 329 | |||||||||

Nelnet, Inc., Class A | 3,727 | 217 | |||||||||

New Mountain Finance Corp. | 15,159 | 208 | |||||||||

New Residential Investment Corp. | 66,731 | 1,075 | |||||||||

New York Community Bancorp, Inc. | 65,587 | 788 | |||||||||

New York Mortgage Trust, Inc. | 31,179 | 194 | |||||||||

Newtek Business Services Corp. | 4,844 | 110 | |||||||||

NMI Holdings, Inc., Class A (a) (b) | 11,226 | 372 | |||||||||

Northfield Bancorp, Inc. | 8,933 | 152 | |||||||||

Northrim Bancorp, Inc. | 2,193 | 84 | |||||||||

Northwest Bancshares, Inc. | 14,820 | 246 | |||||||||

Oaktree Specialty Lending Corp. | 23,243 | 127 | |||||||||

Oceanfirst Financial Corp. | 8,880 | 227 | |||||||||

OFG Bancorp | 7,593 | 179 | |||||||||

Old National Bancorp (b) | 28,232 | 516 | |||||||||

Old Republic International Corp. | 47,964 | 1,073 | |||||||||

Old Second Bancorp, Inc. | 7,730 | 104 | |||||||||

Onemain Holdings, Inc. | 15,384 | 648 | |||||||||

Origin Bancorp, Inc. | 4,417 | 167 | |||||||||

Oxford Square Capital Corp. | 21,842 | 119 | |||||||||

Pacific Premier Bancorp, Inc. | 9,619 | 314 | |||||||||

PacWest Bancorp | 19,215 | 735 | |||||||||

Park National Corp. | 3,403 | 348 | |||||||||

Peapack-Gladstone Financial Corp. | 3,442 | 106 | |||||||||

PennantPark Floating Rate Capital Ltd. | 9,322 | 114 | |||||||||

Pennantpark Investment Corp. | 19,793 | 129 | |||||||||

Pennymac Financial Services | 8,990 | 306 | |||||||||

Pennymac Mortgage Investment Trust | 14,331 | 319 | |||||||||

Peoples Bancorp, Inc. | 4,790 | 166 | |||||||||

People's Utah Bancorp | 4,150 | 125 | |||||||||

Pinnacle Financial Partners, Inc. | 12,520 | 801 | |||||||||

Piper Jaffray Co. | 2,457 | 196 | |||||||||

Popular, Inc. | 13,931 | 818 | |||||||||

PRA Group, Inc. (a) | 6,260 | 227 | |||||||||

Preferred Bank | 2,277 | 137 | |||||||||

Primerica, Inc. | 5,691 | 743 | |||||||||

ProAssurance Corp. | 9,253 | 334 | |||||||||

See notes to financial statements.

21

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Prosight Global, Inc. (a) | 6,252 | $ | 101 | ||||||||

Prospect Capital Corp. (b) | 55,699 | 359 | |||||||||

Prosperity Bancshares, Inc. | 14,333 | 1,030 | |||||||||

Provident Financial Services, Inc. | 10,426 | 257 | |||||||||

QCR Holdings, Inc. | 3,359 | 147 | |||||||||

Radian Group, Inc. | 31,423 | 790 | |||||||||

Ready Capital Corp. | 11,041 | 170 | |||||||||

Redwood Trust, Inc. | 16,541 | 274 | |||||||||

Reinsurance Group of America, Inc. | 9,809 | 1,599 | |||||||||

RenaissanceRe Holdings Ltd. | 6,644 | 1,303 | |||||||||

Renasant Corp. | 11,241 | 398 | |||||||||

Republic Bancorp, Inc. | 2,902 | 136 | |||||||||

RLI Corp. | 7,505 | 676 | |||||||||

S&T Bancorp, Inc. | 5,940 | 239 | |||||||||

Safety Insurance Group, Inc. | 2,475 | 229 | |||||||||

Sandy Spring Bancorp, Inc. | 5,986 | 227 | |||||||||

Santander Consumer USA Holdings, Inc. | 18,879 | 441 | |||||||||

Seacoast Banking Corp. of Florida (a) | 8,537 | 261 | |||||||||

SEI Investments Co. | 25,382 | 1,662 | |||||||||

Selective Insurance Group, Inc. | 9,393 | 612 | |||||||||

ServisFirst Bancshares, Inc. (b) | 9,535 | 359 | |||||||||

Sierra Bancorp | 3,808 | 111 | |||||||||

Signature Bank | 8,087 | 1,104 | |||||||||

Simmons First National Corp., Class A (b) | 15,696 | 420 | |||||||||

SLM Corp. | 65,549 | 584 | |||||||||

Solar Capital Ltd. | 7,166 | 148 | |||||||||

South State Corp. | 5,910 | 513 | |||||||||

Southern First Bancshares, Inc. (a) | 2,064 | 88 | |||||||||

Southern National Bancorp of Virginia, Inc. | 4,905 | 80 | |||||||||

Southside Bancshares, Inc. | 6,428 | 239 | |||||||||

Starwood Property Trust, Inc. | 46,669 | 1,160 | |||||||||

State Auto Financial Corp. | 3,724 | 116 | |||||||||

Sterling Bancorp | 31,842 | 671 | |||||||||

Stewart Information Services Corp. | 4,250 | 173 | |||||||||

Stifel Financial Corp. | 11,217 | 680 | |||||||||

Stock Yards Bancorp, Inc. | 4,608 | 189 | |||||||||

Synovus Financial Corp. | 24,416 | 957 | |||||||||

TCF Financial Corp. | 26,244 | 1,227 | |||||||||

TCG BDC, Inc. | 12,778 | 171 | |||||||||

TD Ameritrade Holding Corp. | 39,441 | 1,960 | |||||||||

Texas Capital Bancshares, Inc. (a) | 8,240 | 468 | |||||||||

TFS Financial Corp. | 10,358 | 204 | |||||||||

The Bancorp, Inc. (a) | 12,094 | 157 | |||||||||

The Blackstone Group, Inc., Class A | 117,039 | 6,548 | |||||||||

The First of Long Island Corp. | 4,958 | 124 | |||||||||

The Hanover Insurance Group, Inc. | 6,039 | 825 | |||||||||

Tompkins Financial Corp. | 2,765 | 253 | |||||||||

Towne Bank | 12,947 | 360 | |||||||||

TPG RE Finance Trust, Inc. | 9,917 | 201 | |||||||||

TPG Specialty Lending, Inc. | 10,118 | 217 | |||||||||

See notes to financial statements.

22

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Tradeweb Markets, Inc., Class A | 7,279 | $ | 337 | ||||||||

Trico Bancshares | 5,090 | 208 | |||||||||

Tristate Capital Holdings, Inc. (a) | 5,308 | 139 | |||||||||

Triumph Bancorp, Inc. (a) | 4,874 | 185 | |||||||||

Trupanion, Inc. (a) (b) | 6,123 | 229 | |||||||||

TrustCo Bank Corp. | 19,230 | 167 | |||||||||

Trustmark Corp. | 8,621 | 298 | |||||||||

Two Harbors Investment Corp. | 45,535 | 666 | |||||||||

UMB Financial Corp. | 6,016 | 413 | |||||||||

Umpqua Holdings Corp. | 32,816 | 581 | |||||||||

United Bankshares, Inc. (b) | 16,495 | 638 | |||||||||

United Community Banks, Inc. | 13,465 | 416 | |||||||||

United Community Financial Corp. | 9,124 | 106 | |||||||||

United Fire Group, Inc. | 4,364 | 191 | |||||||||

United Insurance Holdings Corp. | 7,127 | 90 | |||||||||

Universal Insurance Holdings, Inc. | 6,427 | 180 | |||||||||

Univest Financial Corp. | 6,298 | 169 | |||||||||

Valley National Bancorp | 57,492 | 658 | |||||||||

Veritex Holdings, Inc. | 8,301 | 242 | |||||||||

Virtu Financial, Inc. | 5,909 | 94 | |||||||||

Virtus Investment Partners, Inc. | 1,211 | 147 | |||||||||

Voya Financial, Inc. | 20,738 | 1,265 | |||||||||

Waddell & Reed Financial, Inc., Class A (b) | 11,622 | 194 | |||||||||

Walker & Dunlop, Inc. | 5,620 | 364 | |||||||||

Washington Federal, Inc. | 12,376 | 454 | |||||||||

Washington Trust Bancorp, Inc. | 3,397 | 183 | |||||||||

Webster Financial Corp. | 14,576 | 778 | |||||||||

WesBanco, Inc. | 9,779 | 370 | |||||||||

West Bancorp, Inc. | 4,103 | 105 | |||||||||

Westamerica Bancorporation | 4,104 | 278 | |||||||||

Western Alliance Bancorp | 17,204 | 981 | |||||||||

Western Asset Mortgage Capital Corp. | 11,553 | 119 | |||||||||

Westwood Holdings Group, Inc. | 3,472 | 103 | |||||||||

White Mountains Insurance Group Ltd. | 525 | 586 | |||||||||

Wintrust Financial Corp. | 9,230 | 654 | |||||||||

WisdomTree Investments, Inc. | 25,734 | 125 | |||||||||

World Acceptance Corp. (a) | 1,531 | 132 | |||||||||

WSFS Financial Corp. | 7,951 | 350 | |||||||||

143,590 | |||||||||||

Health Care (13.0%): | |||||||||||

10x Genomics, Inc., Class A (a) | 2,550 | 194 | |||||||||

Acadia Healthcare Co., Inc. (a) | 11,294 | 375 | |||||||||

ACADIA Pharmaceuticals, Inc. (a) | 20,022 | 857 | |||||||||

Accelerate Diagnostics, Inc. (a) (b) | 7,639 | 129 | |||||||||

Acceleron Pharma, Inc. (a) | 7,364 | 390 | |||||||||

Achillion Pharmaceuticals, Inc. (a) | 25,879 | 156 | |||||||||

Adaptive Biotechnologies Corp. (a) (b) | 11,416 | 342 | |||||||||

Addus HomeCare Corp. (a) | 2,385 | 232 | |||||||||

Adverum Biotechnologies, Inc. (a) | 9,715 | 112 | |||||||||

Aerie Pharmaceuticals, Inc. (a) (b) | 8,370 | 202 | |||||||||

See notes to financial statements.

23

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Agenus, Inc. (a) | 23,624 | $ | 96 | ||||||||

Agios Pharmaceuticals, Inc. (a) (b) | 9,548 | 456 | |||||||||

Aimmune Therapeutics, Inc. (a) | 7,718 | 258 | |||||||||

Akebia Therapeutics, Inc. (a) | 30,111 | 190 | |||||||||

Alector, Inc. (a) | 7,494 | 129 | |||||||||

Alkermes PLC (a) | 22,184 | 452 | |||||||||

Allakos, Inc. (a) (b) | 3,379 | 322 | |||||||||

Allogene Therapeutics, Inc. (a) | 12,364 | 321 | |||||||||

Allscripts Healthcare Solutions, Inc. (a) | 26,700 | 262 | |||||||||

Alnylam Pharmaceuticals, Inc. (a) | 16,473 | 1,897 | |||||||||

Amedisys, Inc. (a) | 5,222 | 872 | |||||||||

Amicus Therapeutics, Inc. (a) | 47,416 | 462 | |||||||||

AMN Healthcare Services, Inc. (a) | 7,365 | 459 | |||||||||

Amneal Pharmaceuticals, Inc. (a) | 55,108 | 266 | |||||||||

Amphastar Pharmaceuticals, Inc. (a) | 7,489 | 144 | |||||||||

AngioDynamics, Inc. (a) | 7,470 | 120 | |||||||||

ANI Pharmaceuticals, Inc. (a) | 2,038 | 126 | |||||||||

Anika Therapeutics, Inc. (a) | 2,014 | 104 | |||||||||

Antares Pharma, Inc. (a) | 33,510 | 157 | |||||||||

Apellis Pharmaceuticals, Inc. (a) | 9,192 | 281 | |||||||||

Apollo Medical Holdings, Inc. (a) | 5,213 | 96 | |||||||||

Arena Pharmaceuticals, Inc. (a) | 8,804 | 400 | |||||||||

ArQule, Inc. (a) | 21,834 | 436 | |||||||||

Arrowhead Pharmaceuticals, Inc. (a) | 14,763 | 936 | |||||||||

Arvinas, Inc. (a) | 4,146 | 170 | |||||||||

Atara Biotherapeutics, Inc. (a) | 10,384 | 171 | |||||||||

Athenex, Inc. (a) | 13,168 | 201 | |||||||||

AtriCure, Inc. (a) | 6,740 | 219 | |||||||||

Atrion Corp. | 206 | 155 | |||||||||

Audentes Therapeutics, Inc. (a) | 9,512 | 569 | |||||||||

Avanos Medical, Inc., Class I (a) | 7,265 | 245 | |||||||||

Avantor, Inc. (a) | 60,833 | 1,104 | |||||||||

Axogen, Inc. (a) | 7,829 | 140 | |||||||||

Axsome Therapeutics, Inc. (a) (b) | 4,760 | 492 | |||||||||

Baudax Bio, Inc. (a) | 2,136 | 15 | |||||||||

Biodelivery Sciences International, Inc. (a) | 20,700 | 131 | |||||||||

BioMarin Pharmaceutical, Inc. (a) | 26,655 | 2,255 | |||||||||

Bio-Rad Laboratories, Inc., Class A (a) | 3,194 | 1,182 | |||||||||

Bio-Techne Corp. | 6,301 | 1,384 | |||||||||

BioTelemetry, Inc. (a) | 5,963 | 276 | |||||||||

Bluebird Bio, Inc. (a) | 5,302 | 465 | |||||||||

Blueprint Medicines Corp. (a) | 7,274 | 583 | |||||||||

Bridgebio Pharma, Inc. (a) | 7,290 | 256 | |||||||||

Brookdale Senior Living, Inc. (a) | 34,081 | 248 | |||||||||

Bruker Corp. | 12,993 | 662 | |||||||||

Cantel Medical Corp. (b) | 5,902 | 418 | |||||||||

Cara Therapeutics, Inc. (a) (b) | 8,301 | 134 | |||||||||

Cardiovascular Systems, Inc. (a) | 4,866 | 236 | |||||||||

CareDx, Inc. (a) | 7,614 | 164 | |||||||||

Catalent, Inc. (a) | 20,188 | 1,137 | |||||||||

See notes to financial statements.

24

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Catalyst Pharmaceuticals, Inc. (a) | 19,169 | $ | 72 | ||||||||

Cerus Corp. (a) | 25,139 | 106 | |||||||||

Change Healthcare, Inc. (a) (b) | 12,588 | 206 | |||||||||

Charles River Laboratories International, Inc. (a) | 8,073 | 1,234 | |||||||||

Chemed Corp. | 2,514 | 1,104 | |||||||||

Chemocentryx, Inc. (a) | 9,914 | 392 | |||||||||

Codexis, Inc. (a) | 11,126 | 178 | |||||||||

Coherus Biosciences, Inc. (a) | 11,404 | 205 | |||||||||

CONMED Corp. | 3,721 | 416 | |||||||||

Constellation Pharmaceuticals, Inc. (a) (b) | 2,249 | 106 | |||||||||

Corcept Therapeutics, Inc. (a) | 19,535 | 236 | |||||||||

CorVel Corp. (a) | 1,922 | 168 | |||||||||

Covetrus, Inc. (a) (b) | 19,191 | 253 | |||||||||

Crinetics Pharmaceuticals, Inc. (a) (b) | 4,968 | 125 | |||||||||

CryoLife, Inc. (a) | 7,341 | 199 | |||||||||

Cryoport, Inc. (a) | 7,562 | 124 | |||||||||

Cutera, Inc. (a) | 2,803 | 100 | |||||||||

Cytokinetics, Inc. (a) (b) | 11,371 | 121 | |||||||||

Deciphera Pharmaceuticals, Inc. (a) | 5,911 | 368 | |||||||||

Denali Therapeutics, Inc. (a) | 13,587 | 237 | |||||||||

Dexcom, Inc. (a) | 13,438 | 2,940 | |||||||||

Dicerna Pharmaceuticals, Inc. (a) | 10,501 | 231 | |||||||||

Dynavax Technologies Corp. (a) (b) | 14,595 | 83 | |||||||||

Eagle Pharmaceuticals, Inc. (a) | 2,456 | 148 | |||||||||

Editas Medicine, Inc. (a) | 8,651 | 256 | |||||||||

Eidos Therapeutics, Inc. (a) | 2,527 | 145 | |||||||||

Eiger Biopharmaceuticals, Inc. (a) | 7,221 | 108 | |||||||||

Elanco Animal Health, Inc. (a) | 54,574 | 1,607 | |||||||||

Emergent BioSolutions, Inc. (a) | 7,937 | 428 | |||||||||

Enanta Pharmaceuticals, Inc. (a) | 3,048 | 188 | |||||||||

Encompass Health Corp. | 16,101 | 1,115 | |||||||||

Endo International PLC (a) | 36,190 | 170 | |||||||||

Epizyme, Inc. (a) | 15,308 | 377 | |||||||||

Esperion Therapeutics, Inc. (a) (b) | 4,536 | 270 | |||||||||

Establishment Labs Holdings, Inc. (a) | 3,493 | 97 | |||||||||

Evolent Health, Inc. (a) | 15,026 | 136 | |||||||||

Exact Sciences Corp. (a) | 24,764 | 2,291 | |||||||||

Exelixis, Inc. (a) | 47,766 | 842 | |||||||||

Fate Therapeutics, Inc. (a) | 13,007 | 255 | |||||||||

Fibrogen, Inc. (a) | 12,947 | 555 | |||||||||

Flexion Therapeutics, Inc. (a) (b) | 6,061 | 125 | |||||||||

G1 Therapeutics, Inc. (a) | 4,646 | 123 | |||||||||

Glaukos Corp. (a) (b) | 5,986 | 326 | |||||||||

Global Blood Therapeutics, Inc. (a) | 8,903 | 708 | |||||||||

Globus Medical, Inc. (a) | 10,715 | 631 | |||||||||

Gossamer Bio, Inc. (a) | 7,753 | 121 | |||||||||

Guardant Health, Inc. (a) | 8,401 | 656 | |||||||||

Haemonetics Corp. (a) | 7,745 | 890 | |||||||||

Halozyme Therapeutics, Inc. (a) | 24,271 | 430 | |||||||||

Hanger, Inc. (a) | 5,857 | 162 | |||||||||

See notes to financial statements.

25

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

HealthEquity, Inc. (a) | 12,132 | $ | 899 | ||||||||

HealthStream, Inc. (a) | 5,240 | 143 | |||||||||

Heska Corp. (a) | 1,445 | 139 | |||||||||

Hill-Rom Holdings, Inc. | 10,531 | 1,196 | |||||||||

HMS Holdings Corp. (a) | 14,113 | 418 | |||||||||

Homology Medicines, Inc. (a) | 7,250 | 150 | |||||||||

Horizon Therapeutics PLC (a) | 32,429 | 1,174 | |||||||||

ICU Medical, Inc. (a) | 2,704 | 506 | |||||||||

IGM Biosciences, Inc. (a) (b) | 3,689 | 141 | |||||||||

ImmunoGen, Inc. (a) | 36,129 | 184 | |||||||||

Immunomedics, Inc. (a) | 31,890 | 675 | |||||||||

Innoviva, Inc. (a) | 13,975 | 198 | |||||||||

Inogen, Inc. (a) | 2,635 | 180 | |||||||||

Inovalon Holdings, Inc., Class A (a) | 7,966 | 150 | |||||||||

Inovio Pharmaceuticals, Inc. (a) (b) | 37,149 | 123 | |||||||||

Insmed, Inc. (a) | 13,990 | 334 | |||||||||

Inspire Medical System, Inc. (a) | 3,876 | 288 | |||||||||

Insulet Corp. (a) (b) | 7,506 | 1,285 | |||||||||

Integer Holdings Corp. (a) | 5,072 | 408 | |||||||||

Integra LifeSciences Holdings Corp. (a) | 9,771 | 569 | |||||||||

Intellia Therapeutics, Inc. (a) (b) | 8,514 | 125 | |||||||||

Intercept Pharmaceuticals, Inc. (a) | 3,895 | 483 | |||||||||

Intersect ENT, Inc. (a) | 6,778 | 169 | |||||||||

Intrexon Corp. (a) (b) | 16,960 | 93 | |||||||||

Invitae Corp. (a) (b) | 15,635 | 252 | |||||||||

Ionis Pharmaceuticals, Inc. (a) | 15,871 | 959 | |||||||||

Irhythm Technologies, Inc. (a) | 3,755 | 256 | |||||||||

Ironwood Pharmaceuticals, Inc. (a) | 26,092 | 347 | |||||||||

Kodiak Sciences, Inc. (a) | 3,559 | 256 | |||||||||

Krystal Biotech, Inc. (a) (b) | 2,104 | 117 | |||||||||

Kura Oncology, Inc. (a) | 9,725 | 134 | |||||||||

Lantheus Holdings, Inc. (a) | 6,428 | 132 | |||||||||

LeMaitre Vascular, Inc. | 2,886 | 104 | |||||||||

LHC Group, Inc. (a) | 4,973 | 685 | |||||||||

Ligand Pharmaceuticals, Inc. (a) (b) | 3,229 | 337 | |||||||||

Livongo Health, Inc. (a) (b) | 8,256 | 207 | |||||||||

Luminex Corp. | 9,252 | 214 | |||||||||

MacroGenics, Inc. (a) | 10,478 | 114 | |||||||||

Madrigal Pharmaceuticals, Inc. (a) | 1,825 | 166 | |||||||||

Magellan Health, Inc. (a) | 3,844 | 301 | |||||||||

Masimo Corp. (a) | 7,340 | 1,160 | |||||||||

MEDNAX, Inc. (a) | 15,185 | 422 | |||||||||

Medpace Holdings, Inc. (a) | 4,371 | 367 | |||||||||

MeiraGTx Holdings PLC (a) | 7,021 | 141 | |||||||||

Meridian Bioscience, Inc. | 9,192 | 90 | |||||||||

Merit Medical Systems, Inc. (a) | 9,550 | 298 | |||||||||

Moderna, Inc. (a) (b) | 41,305 | 808 | |||||||||

Molina Healthcare, Inc. (a) | 7,611 | 1,033 | |||||||||

Momenta Pharmaceuticals, Inc. (a) | 15,148 | 299 | |||||||||

MyoKardia, Inc. (a) | 6,892 | 502 | |||||||||

See notes to financial statements.

26

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Myriad Genetics, Inc. (a) | 9,916 | $ | 270 | ||||||||

NanoString Technologies, Inc. (a) | 6,801 | 189 | |||||||||

Natera, Inc. (a) | 11,299 | 381 | |||||||||

National Healthcare Corp. | 2,869 | 248 | |||||||||

National Research Corp. | 1,969 | 130 | |||||||||

Natus Medical, Inc. (a) | 5,765 | 190 | |||||||||

Nektar Therapeutics (a) (b) | 22,349 | 482 | |||||||||

Neogen Corp. (a) | 7,463 | 487 | |||||||||

NeoGenomics, Inc. (a) | 17,037 | 498 | |||||||||

Neurocrine Biosciences, Inc. (a) | 14,278 | 1,535 | |||||||||

Nevro Corp. (a) | 4,440 | 522 | |||||||||

NextCure, Inc. (a) | 3,480 | 196 | |||||||||

Nextgen Healthcare, Inc. (a) | 7,943 | 128 | |||||||||

NGM Biopharmaceuticals, Inc. (a) (b) | 6,039 | 112 | |||||||||

NuVasive, Inc. (a) | 8,400 | 650 | |||||||||

Odonate Therapeutics, Inc. (a) | 3,530 | 115 | |||||||||

Omeros Corp. (a) (b) | 10,245 | 144 | |||||||||

Omnicell, Inc. (a) | 6,862 | 561 | |||||||||

OPKO Health, Inc. (a) (b) | 87,300 | 128 | |||||||||

Option Care Health, Inc. (a) | 30,348 | 113 | |||||||||

OraSure Technologies, Inc. (a) | 13,114 | 105 | |||||||||

Orthofix Medical, Inc. (a) | 3,838 | 177 | |||||||||

Orthopediatrics Corp. (a) | 2,513 | 118 | |||||||||

Pacific Biosciences of California, Inc. (a) | 31,781 | 163 | |||||||||

Pacira BioSciences, Inc. (a) | 7,242 | 328 | |||||||||

Patterson Cos., Inc. | 11,204 | 229 | |||||||||

Penumbra, Inc. (a) (b) | 5,319 | 874 | |||||||||

Phreesia, Inc. (a) | 3,968 | 106 | |||||||||

Portola Pharmaceuticals, Inc. (a) | 13,072 | 312 | |||||||||

PRA Health Sciences, Inc. (a) | 8,042 | 894 | |||||||||

Precision BioSciences, Inc. (a) | 9,428 | 131 | |||||||||

Premier, Inc., Class A (a) | 7,524 | 285 | |||||||||

Prestige Consumer Healthcare, Inc. (a) | 8,842 | 358 | |||||||||

Principia Biopharma, Inc. (a) | 5,096 | 279 | |||||||||

PTC Therapeutics, Inc. (a) | 10,049 | 483 | |||||||||

Quanterix Corp. (a) | 4,741 | 112 | |||||||||

Quidel Corp. (a) | 4,623 | 347 | |||||||||

R1 Rcm, Inc. (a) | 20,083 | 261 | |||||||||

Ra Pharmaceuticals, Inc. (a) | 7,294 | 342 | |||||||||

RadNet, Inc. (a) | 8,910 | 181 | |||||||||

Reata Pharmaceuticals, Inc., Class A (a) | 3,440 | 703 | |||||||||

Recro Pharma, Inc. | 5,526 | 101 | |||||||||

REGENXBIO, Inc. (a) | 5,569 | 228 | |||||||||

Repligen Corp. (a) | 6,973 | 645 | |||||||||

Revance Therapeutics, Inc. (a) | 9,847 | 160 | |||||||||

Rhythm Pharmaceuticals, Inc. (a) | 6,067 | 139 | |||||||||

Rigel Pharmaceuticals, Inc. (a) | 45,175 | 97 | |||||||||

Rocket Pharmaceuticals, Inc. (a) | 10,822 | 246 | |||||||||

Sage Therapeutics, Inc. (a) | 6,321 | 456 | |||||||||

Sangamo Therapeutics, Inc. (a) | 22,604 | 189 | |||||||||

See notes to financial statements.

27

| USAA Mutual Funds Trust USAA Extended Market Index Fund | Schedule of Portfolio Investments — continued December 31, 2019 | ||||||

(Amounts in Thousands, Except for Shares)

Security Description | Shares | Value | |||||||||

Sarepta Therapeutics, Inc. (a) | 11,464 | $ | 1,479 | ||||||||

Seattle Genetics, Inc. (a) | 25,384 | 2,901 | |||||||||

Select Medical Holdings Corp. (a) | 14,988 | 350 | |||||||||

SI-BONE, Inc. (a) | 5,128 | 110 | |||||||||

Sientra, Inc. (a) | 10,401 | 93 | |||||||||