UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07890

AIM Tax-Exempt Funds (Invesco Tax-Exempt Funds)

(Exact name of registrant as specified in charter)

11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Address of principal executive offices) (Zip code)

Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046

(Name and address of agent for service)

Registrant’s telephone number, including area code: (713) 626-1919

Date of fiscal year end: 2/28

Date of reporting period: 2/28/18

Item 1. Report to Stockholders.

| | | | | | |

| | | |

| | Annual Report to Shareholders | | | February 28, 2018 | |

| | | |

| | Invesco High Yield Municipal Fund Nasdaq: A: ACTHX ∎ C: ACTFX ∎ Y: ACTDX ∎ R5: ACTNX ∎ R6: ACTSX | |

Letters to Shareholders

| | |

| | Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. For much of the reporting period, major US stock market indexes rose to record highs – but in early 2018, volatility returned to the US stock and bond markets. Investors worried about how rising interest rates might affect economic growth; those concerns caused the US stock market, which many investors believed had risen too far, too fast, to pull back. Throughout the reporting period, economic data remained generally positive, corporate earnings remained strong and consumer sentiment remained positive, particularly after passage of legislation cutting personal and corporate tax rates in December. The US economy expanded throughout the reporting period, and the first |

signs of rising inflation appeared. In response, the US Federal Reserve raised interest rates three times, and the tone of its statements grew more hawkish regarding potential rate increases in 2018. Overseas, economic data were mixed, prompting the European Central Bank and central banks in China and Japan, among other countries, to maintain extraordinarily accommodative monetary policies.

Short-term market volatility can prompt some investors to abandon their investment plans – and can cause others to settle for whatever returns the market has to offer. The investment professionals at Invesco, in contrast, invest with high conviction. This means that, no matter the asset class or the strategy, each investment team has a passion to exceed. We want to help investors achieve better outcomes, such as seeking higher returns, helping mitigate risk and generating income. Of course, investing with high conviction can’t guarantee a profit or ensure success; no investment strategy can. To learn more about how we invest with high conviction, visit invesco.com/HighConviction.

You, too, can invest with high conviction by maintaining a long-term investment perspective and by working with your financial adviser on a regular basis. During periods of short-term market volatility or uncertainty, your financial adviser can keep you focused on your long-term investment goals – a new home, a child’s college education or a secure retirement. He or she also can share research about the economy, the markets and individual investment options.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. To do so, select “Log In” on the right side of the homepage, and then select “Register for Individual Account Access.”

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets and the economy by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Finally, I’m pleased to share with you Invesco’s commitment to both the Principles for Responsible Investment and to considering environmental, social and governance issues in our robust investment process. I invite you to learn more at invesco.com/esg.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

|

| 2 Invesco High Yield Municipal Fund |

| | |

| | Dear Fellow Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: ∎ Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. ∎ Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

∎ Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus.

∎ Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive.

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper, Inc. (a subsidiary of Broadridge Financial Solutions, Inc.), an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

|

| 3 Invesco High Yield Municipal Fund |

Management’s Discussion of Fund Performance

| | |

Performance summary | | |

For the fiscal year ended February 28, 2018, Class A shares of Invesco High Yield Municipal Fund (the Fund), at net asset value (NAV), outerperformed the Custom Invesco High Yield Municipal Index, the Fund’s style-specific benchmark. Your Fund’s long-term performance appears later in this report. |

Fund vs. Indexes |

Total returns, 2/28/17 to 2/28/18, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. |

Class A Shares | | 5.46% |

Class C Shares | | 4.57 |

Class Y Shares | | 5.61 |

Class R5 Shares | | 5.70 |

Class R6 Shares* | | 5.66 |

S&P Municipal Bond High Yield Index▼ (Broad Market Index) | | 2.25 |

Custom Invesco High Yield Municipal Index⬛ (Style-Specific Index) | | 2.27 |

Lipper High Yield Municipal Debt Funds Index◆ (Peer Group Index) | | 4.92 |

Source(s): ▼FactSet Research Systems Inc.; ⬛Invesco, FactSet Research Systems Inc.; ◆Lipper Inc.*Class R6 shares incepted on April 4, 2017. See page 7 for more information. | | |

Market conditions and your Fund

Although shifting expectations about potential federal tax reform unsettled fixed income investors during the fourth quarter of 2017, municipal bonds enjoyed another year of positive performance in calendar year 2017, with investment grade municipals returning 5.45% and high yield municipals returning 9.69%.1 For the first two months of 2018 however, performance weakened, with investment grade municipals returning -1.47% and high yield municipals returning -0.87%.1

Flows into the municipal bond asset class were positive for 10 of the 12 months covered in this report. The first negative month of flows was in December 2017. Flows were positive in January 2018, but turned negative again in February 2018.2

The broad municipal bond market held up well in the aftermath of hurricanes Harvey, Irma and Maria –

which caused Texas, Florida, the commonwealth of Puerto Rico and the US Virgin Islands to suffer staggering financial losses. The credit quality of each issuer before the storms was the most significant factor in the performance of its municipal debt. Puerto Rico and the US Virgin Islands have been struggling with deteriorating economic conditions for some time. In contrast, Texas and Florida are in relatively stronger economic and financial positions.

Long standing budget standoffs in Illinois and New Jersey ended in 2017, with both states passing budgets within days of each other. This served to stabilize the states’ fiscal conditions and, therefore, their credit ratings, which in turn enhanced the performance of their municipal bonds.

The most significant event impacting the municipal bond market during the fiscal year was passage of the Tax Cuts and Jobs Act (TCJA), which President Donald Trump signed into law in December 2017. As of January 1, 2018, individual tax rates are lower and the corporate tax rate was cut from 35% to 21%.3 In our opinion, the changes in individual income tax rates are not sufficient

to negatively impact individual investors’ demand for municipal securities. Historically, lowering individual tax rates has had minimal impact on individual demand for municipal bonds but may reduce corporate demand. The TCJA eliminated the tax exemption for advance refunding bonds; we believe this may decrease municipal supply by 10% to 20% per year going forward.

Municipal supply was strong through 2017, with $436 billion in new issuance – just 2% less than seen in 2016.4 Many issuers rushed to market with advance refundings previously planned for 2018. There was also a surge in private activity bond issuance until it became clear that the tax exemption for such securities would be preserved. New issuance totaled $62.5 billion in December 2017, making it a record month for issuance.4 This rush to market explains the extremely low volume in new issuance seen in January and February 2018.

During the fiscal year, overweight exposure to non-rated bonds contributed to the Fund’s performance relative to its style-specific benchmark. At the end of the fiscal year, approximately 30% of the Fund’s holdings were non-rated by national credit rating agencies, but they were assigned internal proprietary ratings that allowed us to take advantage of pricing anomalies in the high-yield municipal market. The Fund’s preference for revenue bonds over general obligation bonds benefited relative performance. The Fund’s security selection in and underweight allocation to dedicated tax issues also contributed to relative performance. Continued underexposure to beleaguered Puerto Rico bonds significantly contributed to relative return during the fiscal year.

Security selection in and underweight exposure to the tobacco sector detracted from the Fund’s performance relative to its style-specific benchmark during the

| | | | | |

Portfolio Composition | | | | | |

By credit sector, based on total investments | | | | | |

| |

Revenue Bonds | | | | 84.3 | % |

| Pre-refunded Bonds | | | | 8.3 | |

| General Obligation Bonds | | | | 7.2 | |

| Other | | | | 0.2 | |

| | | | |

Top Five Debt Holdings |

| | % of total net assets |

| 1. | | Jefferson (County of); | | |

| | | Series 2013 F | | 0.8% |

| 2. | | Buckeye Tobacco Settlement Financing Authority; Series 2007 A-2 | | 0.8 |

| 3. | | Port Beaumont Navigation District (Jefferson Energy Companies); Series 2016 | | 0.8 |

| 4. | | Chicago (City of); Series 2017 A | | 0.8 |

| 5. | | Los Angeles (City of) Department of Water & Power; Series 2012 B | | 0.8 |

| | | | |

| | |

Total Net Assets | | $ | 9.4 billion | |

| |

Total Number of Holdings | | | 1,334 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

Data presented here are as of February 28, 2018.

|

| 4 Invesco High Yield Municipal Fund |

fiscal year. Security selection among longer-duration bonds (30 years and greater) was also a detractor from relative performance. On a state level, security selection in Ohio and Michigan holdings marginally detracted from relative performance.

During the fiscal year, leverage contributed to the Fund’s performance relative to its style-specific benchmark. The Fund achieved a leveraged position through the use of inverse floating rate securities or tender option bonds (TOBs). Exposure to TOBs aided performance due to the price appreciation in municipal holdings when interest rates declined. The Fund uses leverage because we believe that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, the use of leverage also can expose shareholders to additional volatility. For more information about the Fund’s use of leverage, see the Notes to Financial Statements later in this report.

We wish to remind you that the Fund is subject to interest rate risk, meaning when interest rates rise, the value of fixed income securities tends to fall. This risk may be greater in the current market environment because interest rates are at or near historic lows. The degree to which the value of fixed income securities may decline due to rising interest rates may vary depending on the speed and magnitude of the increase in interest rates, as well as individual security characteristics such as price, maturity, duration and coupon and market forces such as supply and demand for similar securities. We are monitoring interest rates, and the market, economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the US Federal Reserve and certain foreign central banks. If interest rates rise faster than expected, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Fund’s investments.

Thank you for investing in Invesco High Yield Municipal Fund and for sharing our long-term investment horizon.

| 1 | Source: FactSet Research Systems Inc. |

| 2 | Source: Strategic Insight |

| 3 | Source: Internal Revenue Service |

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| |

| | Mark Paris Portfolio Manager and Chief Investment Officer and Head of Municipal Strategies for Invesco Fixed Income, is |

| manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010. Mr. Paris earned a BBA in finance from Baruch College – The City University of New York. |

| |

| | Jack Connelly Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2016. |

| Mr. Connelly earned a BA in philosophy from Wheaton College and masters degrees from the University of Rhode Island and Yale University. |

| |

| | Tim O’Reilly Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010. Mr. O’Reilly |

| earned a BS in finance from Eastern Illinois University and an MBA in finance from the University of Illinois at Chicago. |

| | |

| |

| | James Phillips Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010. Mr. Phillips |

| earned a BA in American literature from Empire State College, the independent study division of the State University of New York, and an MBA in finance from the University at Albany, State University of New York. |

| | |

| |

| | Robert Stryker Chartered Financial Analyst, Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He |

| joined Invesco in 2010. Mr.Stryker earned a BS in finance from the University of Illinois, Chicago. |

| |

| | Julius Williams Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010. Mr. Williams |

| earned a BA in economics and sociology and a Master of Education degree in educational psychology from the University of Virginia. |

|

| 5 Invesco High Yield Municipal Fund |

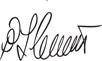

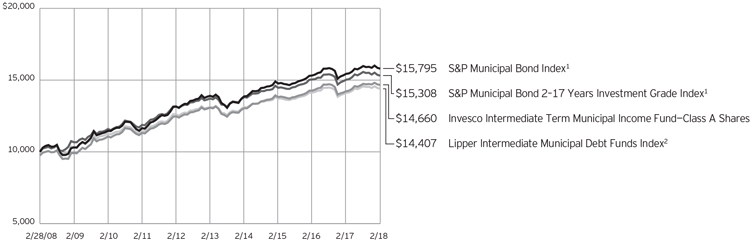

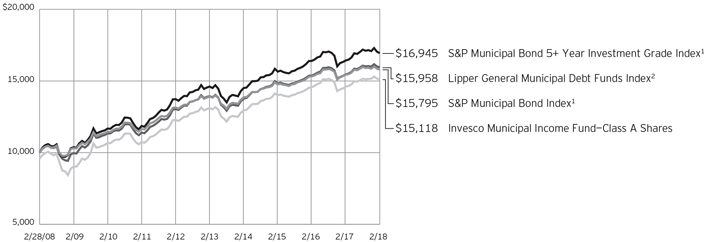

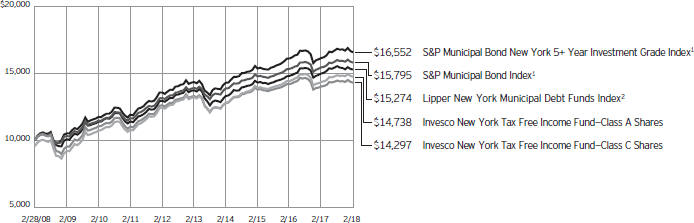

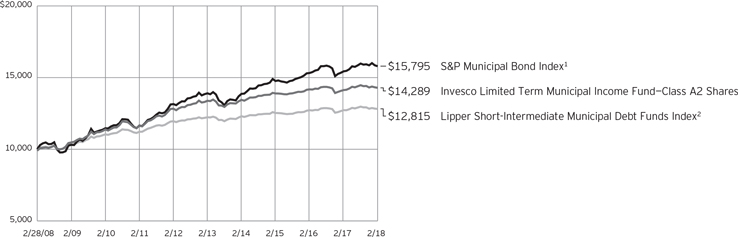

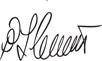

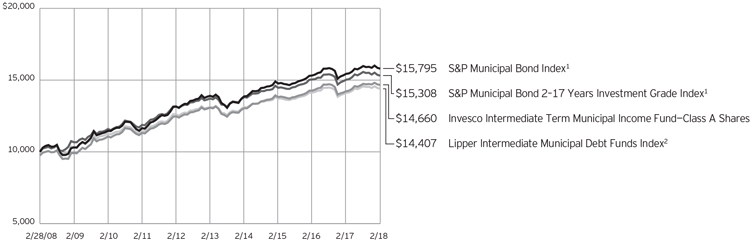

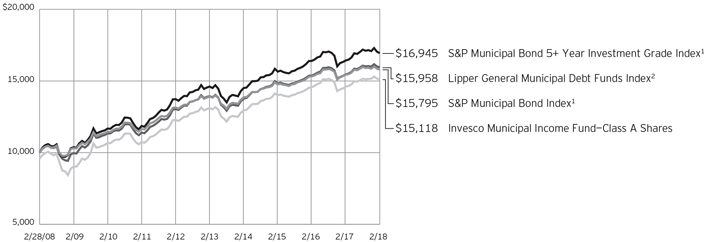

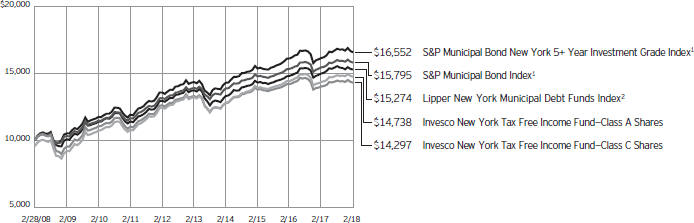

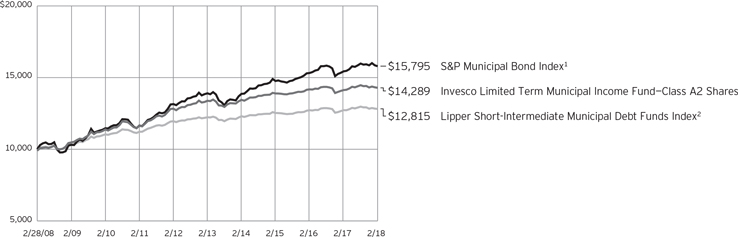

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 2/28/08

1 Source: FactSet Research Systems Inc.

2 Source(s): Invesco, FactSet Research Systems Inc.

3 Source: Lipper Inc.

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including

management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees; performance

of a market index does not. Performance shown in the chart and table(s) does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

|

| 6 Invesco High Yield Municipal Fund |

| | | | | |

| Average Annual Total Returns | |

As of 2/28/18, including maximum applicable sales charges | |

| |

| Class A Shares | | | | | |

| Inception (1/2/86) | | | | 5.89% | |

| 10 Years | | | | 5.33 | |

| 5 Years | | | | 3.80 | |

| 1 Year | | | | 0.95 | |

| |

| Class C Shares | | | | | |

| Inception (12/10/93) | | | | 4.71% | |

| 10 Years | | | | 4.99 | |

| 5 Years | | | | 3.91 | |

| 1 Year | | | | 3.57 | |

| |

| Class Y Shares | | | | | |

| Inception (3/1/06) | | | | 5.08% | |

| 10 Years | | | | 6.02 | |

| 5 Years | | | | 4.94 | |

| 1 Year | | | | 5.61 | |

| |

| Class R5 Shares | | | | | |

| 10 Years | | | | 6.31% | |

| 5 Years | | | | 4.91 | |

| 1 Year | | | | 5.70 | |

| |

| Class R6 Shares | | | | | |

| 10 Years | | | | 5.82% | |

| 5 Years | | | | 4.74 | |

| 1 Year | | | | 5.66 | |

Effective June 1, 2010, Class A, Class B, Class C and Class I shares of the predecessor fund, Van Kampen High Yield Municipal Fund, advised by Van Kampen Asset Management were reorganized into Class A, Class B, Class C and Class Y shares, respectively, of Invesco Van Kampen High Yield Municipal Fund (renamed Invesco High Yield Municipal Fund). Returns shown above, prior to June 1, 2010, for Class A, Class B, Class C and Class Y shares are blended returns of the predecessor fund and Invesco High Yield Municipal Fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R5 shares incepted on April 30, 2012. Performance shown prior to that date is that of the Fund’s and the predecessor fund’s Class A shares and includes the 12b-1 fees applicable to Class A shares. Class R6 shares incepted on April 4, 2017. Performance shown prior to that date is that of Class A shares and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee comparable future results;

| | | | | |

| Average Annual Total Returns | |

| As of 12/31/17, the most recent calendar quarter end, including maximum applicable sales charges | |

| |

| Class A Shares | | | | | |

| Inception (1/2/86) | | | | 5.97% | |

| 10 Years | | | | 4.98 | |

| 5 Years | | | | 4.36 | |

| 1 Year | | | | 4.47 | |

| |

| Class B Shares* | | | | | |

| Inception (7/20/92) | | | | 5.53% | |

| 10 Years | | | | 5.21 | |

| 5 Years | | | | 4.97 | |

| 1 Year | | | | 4.05 | |

| |

| Class C Shares | | | | | |

| Inception (12/10/93) | | | | 4.81% | |

| 10 Years | | | | 4.65 | |

| 5 Years | | | | 4.50 | |

| 1 Year | | | | 7.28 | |

| |

| Class Y Shares | | | | | |

| Inception (3/1/06) | | | | 5.28% | |

| 10 Years | | | | 5.68 | |

| 5 Years | | | | 5.55 | |

| 1 Year | | | | 9.33 | |

| |

| Class R5 Shares | | | | | |

| 10 Years | | | | 5.95% | |

| 5 Years | | | | 5.49 | |

| 1 Year | | | | 9.22 | |

| |

| Class R6 Shares | | | | | |

| 10 Years | | | | 5.45% | |

| 5 Years | | | | 5.32 | |

| 1 Year | | | | 9.35 | |

* Effective January 26, 2018, Class B shares were converted to Class A shares. | |

current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the effect of the maximum sales charge unless otherwise stated. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class B, Class C, Class Y, Class R5 and Class R6 shares was 1.01%, 1.01%, 1.76%, 0.76%, 0.80% and 0.75%, respectively. The expense ratios presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Class A share performance reflects the maximum 4.25% sales charge, and Class B and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. For shares purchased prior to June 1, 2010, the CDSC on Class B shares declines from 4% at the time of purchase to 0% at the beginning of the sixth year. For shares purchased on or after June 1, 2010, the CDSC on Class B shares declines from 5% at the time of purchase to 0% at the beginning of the seventh year. Note: Effective January 26, 2018, Class B shares were converted to Class A shares. No CDSC was paid in connection with this early conversion. The CDSC on Class C shares is 1% for the first year after purchase. Class Y, Class R5 and Class R6 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had fees not been waived and/or expenses reimbursed currently or in the past, returns would have been lower. See current prospectus for more information.

|

| 7 Invesco High Yield Municipal Fund |

Invesco High Yield Municipal Fund’s investment objective is to seek federal tax-exempt current income and taxable capital appreciation.

| ∎ | | Unless otherwise stated, information presented in this report is as of February 28, 2018, and is based on total net assets. |

| ∎ | | Unless otherwise noted, all data provided by Invesco. |

| ∎ | | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About share classes

| ∎ | | Effective January 26, 2018, all outstanding Class B shares were converted to Class A shares, in advance of their normally scheduled conversion. No CDSC was paid in connection with this early conversion. |

| ∎ | | Class Y shares are available only to certain investors. Please see the prospectus for more information. |

| ∎ | | Class R5 shares and Class R6 shares are available for use by retirement plans that meet certain standards and for institutional investors. Class R6 shares are also available through intermediaries that have established an agreement with Invesco Distributors, Inc. to make such shares available for use in retail omnibus accounts. See the prospectus for more information. |

Principal risks of investing in the Fund

| ∎ | | Alternative minimum tax risk. All or a portion of the Fund’s otherwise tax-exempt income may be taxable to those shareholders subject to the federal alternative minimum tax. |

| ∎ | | Changing fixed income market conditions risk. The current low interest rate environment was created in part by the Federal Reserve Board (FRB) and certain foreign central banks keeping the federal funds and equivalent foreign rates near, at or below zero. Increases in the federal funds and equivalent foreign rates may expose fixed income markets to heightened volatility and reduced liquidity for certain fixed income investments, particularly those with longer maturities. In addition, decreases in fixed income dealer market-making capacity may also potentially lead to heightened volatility and reduced liquidity in the fixed income markets. As a result, the value of the Fund’s investments and share price may decline. Changes in central bank policies could also result in higher than normal shareholder redemptions, which could potentially increase portfolio turnover |

| | and the Fund’s transaction costs. |

| ∎ | | Debt securities risk. The prices of debt securities held by the Fund will be affected by changes in interest rates, the creditworthiness of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing debt securities to fall and often has a greater impact on longer-duration debt securities and higher quality debt securities. Falling interest rates will cause the Fund to reinvest the proceeds of debt securities that have been repaid by the issuer at lower interest rates. Falling interest rates may also reduce the Fund’s distributable income because interest payments on floating rate debt instruments held by the Fund will decline. The Fund could lose money on investments in debt securities if the issuer or borrower fails to meet its obligations to make interest payments and/or to repay principal in a timely manner. Changes in an issuer’s financial strength, the market’s perception of such strength or in the credit rating of the issuer or the security may affect the value of debt securities. The Adviser’s credit analysis may fail to anticipate such changes, which could result in buying a debt security at an inopportune time or failing to sell a debt security in advance of a price decline or other credit event. |

| ∎ | | Derivatives risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset (each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise perform under the derivative contract. Derivatives create leverage risk because they |

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing.

| | do not require payment up front equal to the economic exposure created by owning the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in the derivative, which may make the Fund’s returns more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability to use certain derivatives or their cost. Also, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions. |

| ∎ | | High yield debt securities (junk bond) risk. Investments in high yield debt securities (“junk bonds”) and other lower-rated securities will subject the Fund to substantial risk of loss. These securities are considered to be speculative with respect to the issuer’s ability to pay interest and principal when due, are more susceptible to default or decline in market value and are less liquid than investment grade debt securities. Prices of high yield debt securities tend to be very volatile. |

| ∎ | | Inverse floating rate obligations risk. The price of inverse floating rate obligations (inverse floaters) is expected to decline when interest rates rise, and generally will decline further than the price of a bond with a similar maturity. The price of inverse floaters is typically more volatile than the price of bonds with similar maturities. These risks can be particularly high if leverage is used in the formula that determines the interest payable by the inverse floater, which may make the Fund’s returns more volatile and increase the risk of loss. Additionally, these securities may lose some or all of their principal and, in some cases, the Fund could lose |

|

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE 8 Invesco High Yield Municipal Fund |

money in excess of its investment.

| ∎ | | Liquidity risk. The Fund may be unable to sell illiquid investments at the time or price it desires and, as a result, could lose its entire investment in such investments. Liquid securities can become illiquid during periods of market stress. If a significant amount of the Fund’s securities become illiquid, the Fund may not be able to timely pay redemption proceeds and may need to sell securities at significantly reduced prices. |

| ∎ | | Management risk. The Fund is actively managed and depends heavily on the Adviser’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund’s portfolio. The Fund could experience losses if these judgments prove to be incorrect. Additionally, legislative, regulatory, or tax developments may adversely affect management of the Fund and, therefore, the ability of the Fund to achieve its investment objective. |

| ∎ | | Market risk. The market values of the Fund’s investments, and therefore the value of the Fund’s shares, will go up and down, sometimes rapidly or unpredictably. Market risk may affect a single issuer, industry or section of the economy, or it may affect the market as a whole. Individual stock prices tend to go up and down more dramatically than those of certain other types of investments, such as bonds. During a general downturn in the financial markets, multiple asset classes may decline in value. When markets perform well, there can be no assurance that specific investments held by the Fund will rise in value. |

| ∎ | | Medium- and lower-grade municipal securities risk. Medium- and lower-grade municipal securities generally involve more volatility and greater risks, including credit, market, liquidity and management risks, than higher-grade securities. Furthermore, many issuers of medium- and lower-grade securities choose not to have a rating assigned to their obligations. As such, the Fund’s portfolio may consist of a higher portion of unrated securities than an investment company investing solely in higher-grade securities. Unrated securities may not be as attractive to as many buyers as are rated securities, which may have the effect of limiting the Fund’s ability to sell such securities at their fair value. |

| ∎ | | Municipal issuer focus risk. The municipal issuers in which the Fund invests may be located in the same geographic |

| | area or may pay their interest obligations from revenue of similar projects, such as hospitals, airports, utility systems and housing finance agencies. This may make the Fund’s investments more susceptible to similar social, economic, political or regulatory occurrences, making the Fund more susceptible to experience a drop in its share price than if the Fund had been more diversified across issuers that did not have similar characteristics. |

| ∎ | | Municipal securities risk. The risk of a municipal obligation generally depends on the financial and credit status of the issuer. Constitutional amendments, legislative enactments, executive orders, administrative regulations, voter initiatives, and the issuer’s regional economic conditions may affect the municipal security’s value, interest payments, repayment of principal and the Fund’s ability to sell the security. Failure of a municipal security issuer to comply with applicable tax requirements may make income paid thereon taxable, resulting in a decline in the security’s value. In addition, there could be changes in applicable tax laws or tax treatments that reduce or eliminate the current federal income tax exemption on municipal securities or otherwise adversely affect the current federal or state tax status of municipal securities. |

| ∎ | | Variable-rate demand notes risk. The absence of an active secondary market for certain variable and floating rate notes could make it difficult to dispose of these instruments, which could result in a loss. |

| ∎ | | When-issued, delayed delivery and forward commitment risks. When-issued and delayed delivery transactions subject the Fund to market risk because the value or yield of a security at delivery may be more or less than the purchase price or yield generally available when delivery occurs, and counter-party risk because the Fund relies on the buyer or seller, as the case may be, to consummate the transaction. These transactions also have a leveraging effect on the Fund because the Fund commits to purchase securities that it does not have to pay for until a later date, which increases the Fund’s overall investment exposure and, as a result, its volatility. |

| ∎ | | Zero coupon or pay-in-kind securities risk. The value, interest rates, and liquidity of non-cash paying instruments, such as zero coupon and pay-in-kind securities, are subject to greater fluctuation than other types of securities. |

| | | The higher yields and interest rates on pay-in-kind securities reflect the payment deferral and increased credit risk associated with such instruments and that such investments may represent a higher credit risk than loans that periodically pay interest. |

About indexes used in this report

| ∎ | | The S&P Municipal Bond High Yield Index is an unmanaged index considered representative of municipal bonds that are not rated or are rated below investment grade. |

| ∎ | | The Custom Invesco High Yield Municipal Index is designed to measure the performance of a hypothetical allocation that consists of an 80% weight in bonds in the S&P Municipal Bond High Yield Index and a 20% weight in bonds that are rated investment grade by Standard & Poor’s, Moody’s and/or Fitch. |

| ∎ | | The Lipper High Yield Municipal Debt Funds Index is an unmanaged index considered representative of high-yield municipal debt funds tracked by Lipper. |

| ∎ | | The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the US municipal bond market. |

| ∎ | | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| ∎ | | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| ∎ | | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

|

| 9 Invesco High Yield Municipal Fund |

Schedule of Investments

February 28, 2018

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | |

Value | |

Municipal Obligations–110.36%(a) | | | | | | | | | | | | | | | | |

| Alabama–3.21% | | | | | | | | | | | | | | | | |

Birmingham (City of) Special Care Facilities Financing Authority (Methodist Home for the Aging); | | | | | | | | | | | | | | | | |

Series 2016, RB | | | 5.75 | % | | | 06/01/2045 | | | $ | 3,250 | | | $ | 3,564,600 | |

Series 2016, RB | | | 6.00 | % | | | 06/01/2050 | | | | 5,400 | | | | 5,995,727 | |

Birmingham (City of) Water Works Board; Series 2015 A, Ref. Water RB(b) | | | 5.00 | % | | | 01/01/2042 | | | | 12,750 | | | | 14,188,965 | |

Cullman (County of) Health Care Authority (Regional Medical Center); Series 2009 A, RB | | | 7.00 | % | | | 02/01/2036 | | | | 4,400 | | | | 4,520,692 | |

Huntsville (City of) Special Care Facilities Financing Authority (Redstone Village); | | | | | | | | | | | | | | | | |

Series 2007, Retirement Facility RB | | | 5.50 | % | | | 01/01/2043 | | | | 12,670 | | | | 10,059,093 | |

Series 2008 A, Retirement Facility RB | | | 6.88 | % | | | 01/01/2043 | | | | 4,470 | | | | 4,272,694 | |

Series 2011 A, Retirement Facility RB | | | 7.50 | % | | | 01/01/2047 | | | | 2,600 | | | | 2,621,866 | |

Series 2012 A, Retirement Facility RB | | | 5.63 | % | | | 01/01/2042 | | | | 6,575 | | | | 6,328,372 | |

Jefferson (County of); | | | | | | | | | | | | | | | | |

Series 2013 C, Sr. Lien Sewer Revenue Conv. CAB Wts.(INS–AGM)(c)(d) | | | 6.50 | % | | | 10/01/2038 | | | | 7,000 | | | | 6,029,590 | |

Series 2013 C, Sr. Lien Sewer Revenue Conv. CAB Wts.(INS–AGM)(c)(d) | | | 6.60 | % | | | 10/01/2042 | | | | 11,700 | | | | 10,028,538 | |

Series 2013 F, Sub. Lien Sewer Revenue Conv. CAB Wts.(d) | | | 7.50 | % | | | 10/01/2039 | | | | 27,640 | | | | 22,988,741 | |

Series 2013 F, Sub. Lien Sewer Revenue Conv. CAB Wts.(d) | | | 7.75 | % | | | 10/01/2046 | | | | 96,055 | | | | 79,542,185 | |

Series 2013-F, Sub. Lien Sewer Revenue Conv. CAB Wts.(d) | | | 7.90 | % | | | 10/01/2050 | | | | 64,400 | | | | 53,212,432 | |

Lower Alabama Gas District (The); | | | | | | | | | | | | | | | | |

Series 2016 A, Gas Project RB(b) | | | 5.00 | % | | | 09/01/2046 | | | | 24,000 | | | | 28,891,680 | |

Series 2016 A, Gas Project RB | | | 5.00 | % | | | 09/01/2046 | | | | 39,935 | | | | 48,074,552 | |

Mobile (City of) Industrial Development Board (Mobile Energy Services Co.); Series 1995, Ref. Solid Waste Disposal RB(e) | | | 6.95 | % | | | 01/01/2020 | | | | 3 | | | | 0 | |

Mobile (County of) Industrial Development Authority (SSAB Alabama Inc.); Series 2010 A, VRD Recovery Zone Facility RB (LOC–Swedbank AB)(f)(g) | | | 1.09 | % | | | 07/01/2040 | | | | 1,800 | | | | 1,800,000 | |

| | | | | | | | | | | | | | | | 302,119,727 | |

|

| Alaska–0.32% | |

Alaska (State of) Municipal Bond Bank Authority (Master Resolution); | | | | | | | | | | | | | | | | |

Series 2017 A, RB(b) | | | 5.50 | % | | | 10/01/2046 | | | | 22,000 | | | | 25,477,100 | |

Series 2017 A, RB | | | 5.50 | % | | | 10/01/2046 | | | | 505 | | | | 584,815 | |

Northern Tobacco Securitization Corp.; | | | | | | | | | | | | | | | | |

Series 2006 B, First Sub. Asset-Backed CAB RB(h) | | | 0.00 | % | | | 06/01/2046 | | | | 27,225 | | | | 2,544,176 | |

Series 2006 C, Second Sub. Asset-Backed CAB RB(h) | | | 0.00 | % | | | 06/01/2046 | | | | 20,860 | | | | 1,657,536 | |

| | | | | | | | | | | | | | | | 30,263,627 | |

|

| American Samoa–0.14% | |

American Samoa (Territory of) Economic Development Authority; Series 2015 A, Ref. RB | | | 6.63 | % | | | 09/01/2035 | | | | 13,345 | | | | 12,788,113 | |

| | | | |

| Arizona–2.30% | | | | | | | | | | | | | | | | |

Arizona (State of) Industrial Development Authority (American Charter Schools Foundation); | | | | | | | | | | | | | | | | |

Series 2017, Ref. Education RB(i) | | | 6.00 | % | | | 07/01/2037 | | | | 13,845 | | | | 14,643,995 | |

Series 2017, Ref. Education RB(i) | | | 6.00 | % | | | 07/01/2047 | | | | 15,000 | | | | 15,752,550 | |

Arizona (State of) Industrial Development Authority (Basis Schools); | | | | | | | | | | | | | | | | |

Series 2017 A, Ref. Education RB(i) | | | 5.13 | % | | | 07/01/2037 | | | | 1,180 | | | | 1,224,875 | |

Series 2017 D, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2047 | | | | 1,035 | | | | 1,061,320 | |

Series 2017 D, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2051 | | | | 2,300 | | | | 2,341,055 | |

Series 2017 G, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2037 | | | | 1,105 | | | | 1,140,703 | |

Series 2017 G, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2047 | | | | 3,260 | | | | 3,342,902 | |

Series 2017 G, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2051 | | | | 1,000 | | | | 1,017,850 | |

Series 2017-A, Ref. Education RB(i) | | | 5.38 | % | | | 07/01/2050 | | | | 6,000 | | | | 6,255,120 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | |

Value | |

| Arizona–(continued) | | | | | | | | | | | | | | | | |

Arizona (State of) Industrial Development Authority (Kaizen Education Foundation); | | | | | | | | | | | | | | | | |

Series 2016, Education RB(i) | | | 5.70 | % | | | 07/01/2047 | | | $ | 10,730 | | | $ | 11,139,564 | |

Series 2016, Education RB(i) | | | 5.80 | % | | | 07/01/2052 | | | | 4,920 | | | | 5,107,009 | |

Arizona (State of) Industrial Development Authority (Leman Academy of Excellence); Series 2017 A, Ref. Education RB(i) | | | 5.25 | % | | | 07/01/2052 | | | | 500 | | | | 468,710 | |

Glendale (City of) Industrial Development Authority (The Beatitudes Campus); | | | | | | | | | | | | | | | | |

Series 2017, Ref. RB | | | 4.00 | % | | | 11/15/2027 | | | | 1,935 | | | | 1,904,330 | |

Series 2017, Ref. RB | | | 5.00 | % | | | 11/15/2040 | | | | 1,485 | | | | 1,526,283 | |

Series 2017, Ref. RB | | | 5.00 | % | | | 11/15/2045 | | | | 4,410 | | | | 4,515,267 | |

Maricopa (County of) Industrial Development Authority (Paradise Schools); Series 2016, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2047 | | | | 4,000 | | | | 4,078,920 | |

Peoria (City of) Industrial Development Authority (Sierra Winds Life Care Community); | | | | | | | | | | | | | | | | |

Series 2014, Ref. RB | | | 5.50 | % | | | 11/15/2034 | | | | 3,695 | | | | 3,725,558 | |

Series 2014, Ref. RB | | | 5.75 | % | | | 11/15/2040 | | | | 6,015 | | | | 6,094,458 | |

Phoenix (City of) Industrial Development Authority (Basis Schools); | | | | | | | | | | | | | | | | |

Series 2016 A, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2046 | | | | 2,000 | | | | 2,042,940 | |

Series 2016 A, Ref. Education RB(i) | | | 5.00 | % | | | 07/01/2046 | | | | 2,125 | | | | 2,170,624 | |

Phoenix (City of) Industrial Development Authority (Choice Academies); Series 2012, Education RB | | | 5.63 | % | | | 09/01/2042 | | | | 2,850 | | | | 2,916,348 | |

Phoenix (City of) Industrial Development Authority (Legacy Traditional Schools); Series 2014 A, Education Facility RB(i) | | | 6.75 | % | | | 07/01/2044 | | | | 5,250 | | | | 5,796,735 | |

Phoenix (City of) Industrial Development Authority (Phoenix Collegiate Academy); Series 2012, Education RB | | | 5.63 | % | | | 07/01/2042 | | | | 2,770 | | | | 2,873,543 | |

Phoenix Civic Improvement Corp.; | | | | | | | | | | | | | | | | |

Series 2008 A, Sr. Lien Airport RB(b)(j)(k) | | | 5.00 | % | | | 07/01/2018 | | | | 5,000 | | | | 5,061,550 | |

Series 2008 A, Sr. Lien Airport RB(b)(j)(k) | | | 5.00 | % | | | 07/01/2018 | | | | 5,000 | | | | 5,061,550 | |

Series 2008 A, Sr. Lien Airport RB(b)(j)(k) | | | 5.00 | % | | | 07/01/2018 | | | | 3,500 | | | | 3,543,085 | |

Series 2009 A, Jr. Lien Water System RB(b)(j)(k) | | | 5.00 | % | | | 07/01/2019 | | | | 5,500 | | | | 5,755,530 | |

Series 2009 A, Jr. Lien Water System RB(b)(j)(k) | | | 5.00 | % | | | 07/01/2019 | | | | 8,935 | | | | 9,350,120 | |

Series 2009 A, Jr. Lien Water System RB(b)(j)(k) | | | 5.00 | % | | | 07/01/2019 | | | | 6,785 | | | | 7,100,231 | |

Pima (County of) Industrial Development Authority (Acclaim Charter School); | | | | | | | | | | | | | | | | |

Series 2006, Education Facility RB | | | 5.70 | % | | | 12/01/2026 | | | | 2,030 | | | | 2,009,172 | |

Series 2006, Education Facility RB | | | 5.80 | % | | | 12/01/2036 | | | | 4,385 | | | | 4,136,107 | |

Pima (County of) Industrial Development Authority (American Leadership Academy); | | | | | | | | | | | | | | | | |

Series 2017, Education Facility RB(i) | | | 4.13 | % | | | 06/15/2029 | | | | 1,500 | | | | 1,480,605 | |

Series 2017, Education Facility RB(i) | | | 5.00 | % | | | 06/15/2047 | | | | 9,300 | | | | 9,177,612 | |

Series 2017, Education Facility RB(i) | | | 5.00 | % | | | 06/15/2052 | | | | 6,380 | | | | 6,190,195 | |

Pima (County of) Industrial Development Authority (American Leadership); | | | | | | | | | | | | | | | | |

Series 2015, Ref. Education Facility RB(i) | | | 5.38 | % | | | 06/15/2035 | | | | 2,370 | | | | 2,439,560 | |

Series 2015, Ref. Education Facility RB(i) | | | 5.63 | % | | | 06/15/2045 | | | | 3,500 | | | | 3,634,085 | |

Pima (County of) Industrial Development Authority (Coral Academy Science); | | | | | | | | | | | | | | | | |

Series 2008 A, Education Facilities RB | | | 7.13 | % | | | 12/01/2028 | | | | 2,120 | | | | 2,137,511 | |

Series 2008 A, Education Facilities RB | | | 7.25 | % | | | 12/01/2038 | | | | 3,285 | | | | 3,309,112 | |

Pima (County of) Industrial Development Authority (Desert Heights Charter School); Series 2014, Ref. Education Facility RB | | | 7.25 | % | | | 05/01/2044 | | | | 3,000 | | | | 3,240,120 | |

Pima (County of) Industrial Development Authority (Edkey Charter Schools); | | | | | | | | | | | | | | | | |

Series 2013, Ref. Education Facility RB | | | 6.00 | % | | | 07/01/2043 | | | | 250 | | | | 225,587 | |

Series 2013, Ref. Education Facility RB | | | 6.00 | % | | | 07/01/2048 | | | | 2,975 | | | | 2,648,880 | |

Pima (County of) Industrial Development Authority (Legacy Traditional School); Series 2009, Education RB(j)(k) | | | 8.50 | % | | | 07/01/2019 | | | | 1,645 | | | | 1,789,513 | |

Pima (County of) Industrial Development Authority (Paradise Education Center); Series 2010, Education RB(j)(k) | | | 6.10 | % | | | 06/01/2019 | | | | 1,400 | | | | 1,478,708 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | |

Value | |

| Arizona–(continued) | | | | | | | | | | | | | | | | |

Pima (County of) Industrial Development Authority (Premier Charter High School); | | | | | | | | | | | | | | | | |

Series 2016 A, Ref. Education Facility RB(i) | | | 7.00 | % | | | 07/01/2045 | | | $ | 3,315 | | | $ | 2,936,858 | |

Series 2016 B, Ref. Sub. Education Facility RB | | | 2.07 | % | | | 07/01/2045 | | | | 1,735 | | | | 523,869 | |

Series 2016 C, Ref. Jr. Sub. Education Facility RB | | | 2.07 | % | | | 07/01/2045 | | | | 1,036 | | | | 10,355 | |

Pima (County of) Industrial Development Authority (Riverbend Prep); Series 2010, Education RB | | | 7.00 | % | | | 09/01/2037 | | | | 3,358 | | | | 3,358,437 | |

Sundance Community Facilities District (Assessment District No. 2); Series 2003, Special Assessment RB(i) | | | 7.13 | % | | | 07/01/2027 | | | | 1,134 | | | | 1,134,249 | |

Sundance Community Facilities District (Assessment District No. 3); Series 2004, Special Assessment RB | | | 6.50 | % | | | 07/01/2029 | | | | 186 | | | | 186,035 | |

Tempe (City of) Industrial Development Authority (Friendship Village); | | | | | | | | | | | | | | | | |

Series 2012 A, Ref. RB | | | 6.25 | % | | | 12/01/2042 | | | | 2,700 | | | | 2,869,641 | |

Series 2012 A, Ref. RB | | | 6.25 | % | | | 12/01/2046 | | | | 4,100 | | | | 4,348,911 | |

Tempe (City of) Industrial Development Authority (Mirabella at ASU); | | | | | | | | | | | | | | | | |

Series 2017 A, RB(i) | | | 6.13 | % | | | 10/01/2047 | | | | 1,400 | | | | 1,436,106 | |

Series 2017 A, RB(i) | | | 6.13 | % | | | 10/01/2052 | | | | 1,400 | | | | 1,430,940 | |

Town of Florence, Inc. (The) Industrial Development Authority (Legacy Traditional School — Queen Creek and Casa Grande Campuses); | | | | | | | | | | | | | | | | |

Series 2013, Education RB | | | 5.75 | % | | | 07/01/2033 | | | | 3,000 | | | | 3,213,900 | |

Series 2013, Education RB | | | 6.00 | % | | | 07/01/2043 | | | | 3,625 | | | | 3,835,902 | |

Tucson (City of) Industrial Development Authority (Catalina Village Assisted Living Apartments); | | | | | | | | | | | | | | | | |

Series 2017 A, Multifamily Housing RB(l) | | | 5.50 | % | | | 05/01/2051 | | | | 4,435 | | | | 3,237,994 | |

Series 2017 B, Multifamily Housing RB(l) | | | 2.50 | % | | | 05/01/2051 | | | | 1,700 | | | | 487,730 | |

University Medical Center Corp.; | | | | | | | | | | | | | | | | |

Series 2009, Hospital RB(j)(k) | | | 6.25 | % | | | 07/01/2019 | | | | 1,650 | | | | 1,750,337 | |

Series 2009, Hospital RB(j)(k) | | | 6.50 | % | | | 07/01/2019 | | | | 2,100 | | | | 2,233,140 | |

Series 2011, Hospital RB(j)(k) | | | 6.00 | % | | | 07/01/2021 | | | | 2,600 | | | | 2,945,982 | |

| | | | | | | | | | | | | | | | 216,849,878 | |

|

| California–13.25% | |

ABAG Finance Authority for Non-profit Corps. (Episcopal Senior Communities); Series 2012 A, Ref. RB | | | 5.00 | % | | | 07/01/2047 | | | | 6,000 | | | | 6,380,760 | |

Alhambra (City of) (Atherton Baptist Homes); Series 2010 A, RB(j)(k) | | | 7.63 | % | | | 01/01/2020 | | | | 4,340 | | | | 4,812,235 | |

Bay Area Toll Authority (San Francisco Bay Area); | | | | | | | | | | | | | | | | |

Series 2009 F-1, Toll Bridge RB(b)(j)(k) | | | 5.13 | % | | | 04/01/2019 | | | | 22,295 | | | | 23,204,413 | |

Series 2017, Ref. Sub. Toll Bridge RB | | | 4.00 | % | | | 04/01/2047 | | | | 50,640 | | | | 52,634,203 | |

Series 2017, Ref. Sub. Toll Bridge RB | | | 4.00 | % | | | 04/01/2049 | | | | 5,000 | | | | 5,181,100 | |

Series 2017 F-1, Toll Bridge RB(b) | | | 5.00 | % | | | 04/01/2056 | | | | 21,000 | | | | 23,553,180 | |

California (County of) Tobacco Securitization Agency (Gold Country Settlement Funding Corp.); Series 2006, Tobacco Settlement Asset-Backed CAB RB(h) | | | 0.00 | % | | | 06/01/2033 | | | | 16,125 | | | | 6,318,581 | |

California (County of) Tobacco Securitization Agency (Stanislaus County Tobacco Funding Corp.); Series 2006 A, Tobacco Settlement CAB Sub. RB(h) | | | 0.00 | % | | | 06/01/2046 | | | | 25,000 | | | | 3,854,000 | |

California (State of) Educational Facilities Authority (Stanford University); | | | | | | | | | | | | | | | | |

Series 2010, RB(b) | | | 5.25 | % | | | 04/01/2040 | | | | 6,255 | | | | 8,156,708 | |

Series 2012 U-2, Ref. RB(b) | | | 5.00 | % | | | 10/01/2032 | | | | 8,745 | | | | 10,963,257 | |

Series 2014 U-6, RB(b) | | | 5.00 | % | | | 05/01/2045 | | | | 15,000 | | | | 19,359,300 | |

California (State of) Health Facilities Financing Authority (Children’s Hospital of Orange County); Series 2009, RB | | | 6.50 | % | | | 11/01/2038 | | | | 3,000 | | | | 3,245,520 | |

California (State of) Health Facilities Financing Authority (Kaiser Permanente); Subseries 2017 A-2, RB(b) | | | 5.00 | % | | | 11/01/2047 | | | | 10,000 | | | | 12,732,300 | |

California (State of) Municipal Finance Authority (California Baptist University); | | | | | | | | | | | | | | | | |

Series 2016 A, RB(i) | | | 5.00 | % | | | 11/01/2036 | | | | 1,500 | | | | 1,621,395 | |

Series 2016 A, RB(i) | | | 5.00 | % | | | 11/01/2046 | | | | 3,000 | | | | 3,206,250 | |

California (State of) Municipal Finance Authority (Goodwill Industries of Sacramento & Nevada); | | | | | | | | | | | | | | | | |

Series 2012, RB(i) | | | 6.63 | % | | | 01/01/2032 | | | | 1,000 | | | | 1,074,290 | |

Series 2012, RB(i) | | | 6.88 | % | | | 01/01/2042 | | | | 1,500 | | | | 1,616,295 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | �� | Principal

Amount

(000) | | |

Value | |

| California–(continued) | | | | | | | | | | | | | | | | |

California (State of) Municipal Finance Authority (High Tech High-Chula Vista); | | | | | | | | | | | | | | | | |

Series 2008 B, Educational Facility RB(i)(j)(k) | | | 6.13 | % | | | 07/02/2018 | | | $ | 2,860 | | | $ | 2,906,160 | |

Series 2008 B, Educational Facility RB(i)(j)(k) | | | 6.13 | % | | | 07/02/2018 | | | | 2,000 | | | | 2,032,280 | |

Series 2008 B, Educational Facility RB(i)(j)(k) | | | 6.13 | % | | | 07/02/2018 | | | | 3,840 | | | | 3,901,978 | |

California (State of) Municipal Finance Authority (High Tech High-Media Arts); | | | | | | | | | | | | | | | | |

Series 2008 A, Educational Facility RB(i)(j)(k) | | | 6.00 | % | | | 07/02/2018 | | | | 1,170 | | | | 1,188,404 | |

Series 2008 A, Educational Facility RB(i)(j)(k) | | | 6.13 | % | | | 07/02/2018 | | | | 2,415 | | | | 2,453,978 | |

California (State of) Municipal Finance Authority (King/Chavez); Series 2009 A, Educational Facilities RB(j)(k) | | | 8.50 | % | | | 10/01/2019 | | | | 1,000 | | | | 1,107,580 | |

California (State of) Municipal Finance Authority (Santa Rosa Academy); | | | | | | | | | | | | | | | | |

Series 2012 A, Charter School Lease RB | | | 5.75 | % | | | 07/01/2030 | | | | 6,750 | | | | 7,218,450 | |

Series 2012 A, Charter School Lease RB | | | 6.00 | % | | | 07/01/2042 | | | | 5,355 | | | | 5,721,764 | |

California (State of) Pollution Control Finance Authority; | | | | | | | | | | | | | | | | |

Series 2012, Water Furnishing RB(i)(m) | | | 5.00 | % | | | 07/01/2037 | | | | 13,500 | | | | 14,424,075 | |

Series 2012, Water Furnishing RB(i)(m) | | | 5.00 | % | | | 11/21/2045 | | | | 29,210 | | | | 31,100,179 | |

California (State of) Pollution Control Financing Authority (Aemerge Redpack Services LLC); Series 2016, Solid Waste Disposal RB(i)(m) | | | 7.00 | % | | | 12/01/2027 | | | | 10,500 | | | | 10,274,250 | |

California (State of) School Finance Authority (Alliance for College-Ready Public Schools); Series 2013 A, School Facility RB | | | 6.40 | % | | | 07/01/2048 | | | | 3,000 | | | | 3,371,460 | |

California (State of) School Finance Authority (New Designs Charter School); Series 2012, Educational Facilities RB | | | 5.50 | % | | | 06/01/2042 | | | | 5,000 | | | | 5,153,950 | |

California (State of) Statewide Communities Development Authority (American Baptist Homes of the West); Series 2010, RB | | | 6.25 | % | | | 10/01/2039 | | | | 2,000 | | | | 2,114,200 | |

California (State of) Statewide Communities Development Authority (California Baptist University); | | | | | | | | | | | | | | | | |

Series 2011, RB(j)(k) | | | 7.25 | % | | | 11/01/2021 | | | | 1,500 | | | | 1,789,140 | |

Series 2011, RB(j)(k) | | | 7.50 | % | | | 11/01/2021 | | | | 5,500 | | | | 6,608,745 | |

Series 2014 A, RB | | | 6.13 | % | | | 11/01/2033 | | | | 1,560 | | | | 1,795,451 | |

California (State of) Statewide Communities Development Authority (Collegiate Housing Foundation — Irvine, L.L.C. — University of California-Irvine East Campus Apartments, Phase II); Series 2008, Student Housing RB(j)(k) | | | 6.00 | % | | | 05/15/2018 | | | | 5,000 | | | | 5,049,500 | |

California (State of) Statewide Communities Development Authority (Creative Child Care & Team); Series 2015, School Facilities RB (Acquired 11/03/2015; Cost $6,700,000)(i) | | | 6.75 | % | | | 06/01/2045 | | | | 6,700 | | | | 6,837,484 | |

California (State of) Statewide Communities Development Authority (Eskaton Properties, Inc.); Series 2012, RB | | | 5.25 | % | | | 11/15/2034 | | | | 4,350 | | | | 4,722,403 | |

California (State of) Statewide Communities Development Authority (Lancer Educational Student Housing); | | | | | | | | | | | | | | | | |

Series 2010, RB(j)(k) | | | 7.50 | % | | | 06/01/2019 | | | | 1,640 | | | | 1,758,474 | |

Series 2016, Ref. RB(i) | | | 5.00 | % | | | 06/01/2036 | | | | 4,250 | | | | 4,493,780 | |

California (State of) Statewide Communities Development Authority (Loma Linda University Medical Center); | | | | | | | | | | | | | | | | |

Series 2014, RB | | | 5.50 | % | | | 12/01/2054 | | | | 5,000 | | | | 5,411,700 | |

Series 2016 A, RB(i) | | | 5.00 | % | | | 12/01/2036 | | | | 1,500 | | | | 1,604,385 | |

Series 2016 A, RB(i) | | | 5.00 | % | | | 12/01/2041 | | | | 1,370 | | | | 1,451,529 | |

Series 2016 A, RB(i) | | | 5.25 | % | | | 12/01/2056 | | | | 39,000 | | | | 41,686,710 | |

California (State of) Statewide Communities Development Authority (Southern California Presbyterian Homes); | | | | | | | | | | | | | | | | |

Series 2009, Senior Living RB(i) | | | 7.00 | % | | | 11/15/2029 | | | | 1,745 | | | | 1,881,721 | |

Series 2009, Senior Living RB(i) | | | 7.25 | % | | | 11/15/2041 | | | | 3,500 | | | | 3,784,445 | |

California (State of) Statewide Communities Development Authority (Terraces at San Joaquin Garden); | | | | | | | | | | | | | | | | |

Series 2012, RB | | | 6.00 | % | | | 10/01/2042 | | | | 2,895 | | | | 3,148,920 | |

Series 2012, RB | | | 6.00 | % | | | 10/01/2047 | | | | 1,785 | | | | 1,936,886 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | |

Value | |

| California–(continued) | | | | | | | | | | | | | | | | |

California (State of) Statewide Finance Authority (Pooled Tobacco Securitization); | | | | | | | | | | | | | | | | |

Series 2002, Tobacco Settlement Asset-Backed RB | | | 6.00 | % | | | 05/01/2043 | | | $ | 15,000 | | | $ | 15,003,300 | |

Series 2006 A, Tobacco Settlement CAB Turbo RB(h) | | | 0.00 | % | | | 06/01/2046 | | | | 181,950 | | | | 28,280,488 | |

California (State of); | | | | | | | | | | | | | | | | |

Series 2016, Ref. Various Purpose Unlimited Tax GO Bonds | | | 5.00 | % | | | 09/01/2034 | | | | 12,440 | | | | 14,324,162 | |

Series 2016, Ref. Various Purpose Unlimited Tax GO Bonds | | | 5.00 | % | | | 09/01/2035 | | | | 6,605 | | | | 7,583,993 | |

Series 2017, Various Purpose Unlimited Tax GO Bonds | | | 4.00 | % | | | 11/01/2047 | | | | 9,000 | | | | 9,313,650 | |

Series 2017, Various Purpose Unlimited Tax GO Bonds | | | 5.00 | % | | | 08/01/2046 | | | | 24,000 | | | | 27,201,840 | |

Series 2017, Various Purpose Unlimited Tax GO Bonds(b) | | | 5.00 | % | | | 11/01/2047 | | | | 15,000 | | | | 17,242,050 | |

California County Tobacco Securitization Agency (The) (Sonoma County Securitization Corp.); | | | | | | | | | | | | | | | | |

Series 2005, Ref. Tobacco Settlement Asset-Backed RB | | | 5.13 | % | | | 06/01/2038 | | | | 9,380 | | | | 9,380,188 | |

Series 2005, Ref. Tobacco Settlement Asset-Backed RB | | | 5.25 | % | | | 06/01/2045 | | | | 3,730 | | | | 3,729,925 | |

California Public Finance Authority (Henry Mayo Newhall Hospital); | | | | | | | | | | | | | | | | |

Series 2017, Ref. RB | | | 5.00 | % | | | 10/15/2037 | | | | 3,430 | | | | 3,756,399 | |

Series 2017, Ref. RB | | | 5.00 | % | | | 10/15/2047 | | | | 10,170 | | | | 11,005,059 | |

Carlsbad (City of) Community Facilities District 3 (Improvement Area 2); | | | | | | | | | | | | | | | | |

Series 2008, Special Tax RB(j)(k) | | | 6.10 | % | | | 09/01/2018 | | | | 2,615 | | | | 2,677,682 | |

Series 2008, Special Tax RB(j)(k) | | | 6.20 | % | | | 09/01/2018 | | | | 5,960 | | | | 6,105,782 | |

Eden (Township of) Healthcare District; Series 2010, COP(j)(k) | | | 6.13 | % | | | 06/01/2020 | | | | 2,510 | | | | 2,763,159 | |

Fairfield (City of) Community Facilities District No. 2007-1 (Fairfield Commons); | | | | | | | | | | | | | | | | |

Series 2008, Special Tax RB | | | 6.50 | % | | | 09/01/2023 | | | | 1,235 | | | | 1,264,603 | |

Series 2008, Special Tax RB | | | 6.75 | % | | | 09/01/2028 | | | | 2,550 | | | | 2,614,260 | |

Series 2008, Special Tax RB | | | 6.88 | % | | | 09/01/2038 | | | | 4,440 | | | | 4,552,376 | |

Foothill-Eastern Transportation Corridor Agency; | | | | | | | | | | | | | | | | |

Series 2014 A, Ref. Toll Road CAB RB(INS–AGM)(c)(h) | | | 0.00 | % | | | 01/15/2036 | | | | 65,000 | | | | 30,927,650 | |

Series 2014 A, Ref. Toll Road CAB RB(INS–AGM)(c)(h) | | | 0.00 | % | | | 01/15/2037 | | | | 20,000 | | | | 9,078,200 | |

Series 2014 A, Ref. Toll Road RB | | | 6.00 | % | | | 01/15/2049 | | | | 20,000 | | | | 23,405,600 | |

Series 2014 A, Toll Road Conv. CAB RB(d) | | | 6.85 | % | | | 01/15/2042 | | | | 5,000 | | | | 4,418,950 | |

Series 2014 C, Ref. Jr. Lien Toll Road RB | | | 6.50 | % | | | 01/15/2043 | | | | 10,750 | | | | 12,665,650 | |

Golden State Tobacco Securitization Corp.; | | | | | | | | | | | | | | | | |

Series 2007, Sr. Tobacco Settlement Asset-Backed RB | | | 5.75 | % | | | 06/01/2047 | | | | 19,205 | | | | 19,349,037 | |

Series 2007 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.00 | % | | | 06/01/2033 | | | | 28,360 | | | | 28,395,166 | |

Series 2007 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.13 | % | | | 06/01/2047 | | | | 46,490 | | | | 46,373,775 | |

Series 2007 A-2, Sr. Tobacco Settlement Asset-Backed RB | | | 5.30 | % | | | 06/01/2037 | | | | 47,000 | | | | 47,934,830 | |

Series 2007 B, First Sub. Tobacco Settlement Asset-Backed CAB RB(h) | | | 0.00 | % | | | 06/01/2047 | | | | 185,000 | | | | 25,276,550 | |

Hesperia (City of) Public Financing Authority (Redevelopment & Housing); Series 2007 A, Tax Allocation RB (INS–SGI)(c) | | | 5.00 | % | | | 09/01/2037 | | | | 3,395 | | | | 3,398,293 | |

Inland Empire Tobacco Securitization Authority; | | | | | | | | | | | | | | | | |

Series 2007 A, Tobacco Settlement RB | | | 5.00 | % | | | 06/01/2021 | | | | 3,625 | | | | 3,626,486 | |

Series 2007 C-1, Asset-Backed Tobacco Settlement CAB Turbo RB(h) | | | 0.00 | % | | | 06/01/2036 | | | | 158,815 | | | | 48,136,826 | |

Series 2007 D, Asset-Backed Tobacco Settlement CAB RB(h) | | | 0.00 | % | | | 06/01/2057 | | | | 46,635 | | | | 2,572,853 | |

Los Angeles (City of) Community Facilities District No. 3 (Cascades Business Park); Series 1997, Special Tax RB | | | 6.40 | % | | | 09/01/2022 | | | | 375 | | | | 377,272 | |

Los Angeles (City of) Department of Water & Power; Series 2012 B, Waterworks RB (b) | | | 5.00 | % | | | 07/01/2043 | | | | 66,530 | | | | 73,429,162 | |

M-S-R Energy Authority; Series 2009 A, Gas RB | | | 6.50 | % | | | 11/01/2039 | | | | 4,490 | | | | 6,252,011 | |

National City (City of) Community Development Commission (National City Redevelopment); Series 2011, Tax Allocation RB(j)(k) | | | 7.00 | % | | | 08/01/2021 | | | | 4,750 | | | | 5,578,637 | |

Placentia (City of) Public Financing Authority (Working Capital Financing); Series 2009, Lease RB | | | 7.50 | % | | | 06/01/2019 | | | | 2,260 | | | | 2,243,660 | |

Poway Unified School District (Election of 2008 — School Facilities Improvement District No. 2007-1); Series 2011 B, Unlimited Tax CAB GO Bonds(h) | | | 0.00 | % | | | 08/01/2046 | | | | 36,605 | | | | 11,022,864 | |

Regents of the University of California; Series 2014 AM, RB(b) | | | 5.00 | % | | | 05/15/2044 | | | | 34,545 | | | | 38,655,510 | |

Riverside (County of) Redevelopment Agency (Mid-County Redevelopment Project Area); Series 2010 C, Tax Allocation RB(j)(k) | | | 6.25 | % | | | 10/01/2018 | | | | 1,780 | | | | 1,831,300 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | |

Value | |

| California–(continued) | | | | | | | | | | | | | | | | |

Riverside (County of) Transportation Commission; Series 2013 A, Sr. Lien Toll RB | | | 5.75 | % | | | 06/01/2048 | | | $ | 7,000 | | | $ | 7,780,500 | |

Roseville (City of) (Fountains Community Facilities District No. 1); Series 2008, Special Tax

RB(j)(k) | | | 6.13 | % | | | 09/01/2018 | | | | 1,000 | | | | 1,023,580 | |

San Bernardino City Unified School District; | | | | | | | | | | | | | | | | |

Series 2011 D, Unlimited Tax CAB GO Bonds(INS–AGM)(c)(h) | | | 0.00 | % | | | 08/01/2036 | | | | 7,650 | | | | 3,736,183 | |

Series 2011 D, Unlimited Tax CAB GO Bonds(INS–AGM)(c)(h) | | | 0.00 | % | | | 08/01/2037 | | | | 13,130 | | | | 6,109,258 | |

Series 2011 D, Unlimited Tax CAB GO Bonds(INS–AGM)(c)(h) | | | 0.00 | % | | | 08/01/2038 | | | | 13,515 | | | | 5,997,281 | |

Series 2011 D, Unlimited Tax CAB GO Bonds(INS–AGM)(c)(h) | | | 0.00 | % | | | 08/01/2039 | | | | 13,895 | | | | 5,875,779 | |

Series 2011 D, Unlimited Tax CAB GO Bonds(INS–AGM)(c)(h) | | | 0.00 | % | | | 08/01/2040 | | | | 14,280 | | | | 5,762,551 | |

Series 2011 D, Unlimited Tax CAB GO Bonds(INS–AGM)(c)(h) | | | 0.00 | % | | | 08/01/2041 | | | | 14,080 | | | | 5,418,970 | |

San Buenaventura (City of) (Community Memorial Health System); | | | | | | | | | | | | | | | | |

Series 2011, RB | | | 7.50 | % | | | 12/01/2041 | | | | 21,980 | | | | 24,614,083 | |

Series 2011, RB | | | 8.00 | % | | | 12/01/2031 | | | | 9,875 | | | | 11,328,402 | |

San Diego Unified School District (Election of 2008); Series 2012 E, Unlimited Tax Conv. CAB GO Bonds(d) | | | 5.25 | % | | | 07/01/2042 | | | | 10,000 | | | | 6,460,900 | |

San Diego Unified School District; Series 2012 R-2, Ref. Unlimited Tax Conv. CAB GO Bonds(d) | | | 6.63 | % | | | 07/01/2041 | | | | 20,000 | | | | 16,225,400 | |

San Francisco (City & County of) Redevelopment Financing Authority (Mission Bay South Redevelopment); | | | | | | | | | | | | | | | | |

Series 2009 D, Tax Allocation RB(j)(k) | | | 6.25 | % | | | 08/01/2019 | | | | 1,000 | | | | 1,066,630 | |

Series 2009 D, Tax Allocation RB(j)(k) | | | 6.50 | % | | | 08/01/2019 | | | | 1,000 | | | | 1,069,380 | |

San Francisco (City & County of) Successor Agency to the Redevelopment Agency Community Facilities District No. 6 (Mission Bay South Public Improvements); | | | | | | | | | | | | | | | | |

Series 2013 C, Special Tax CAB RB(h) | | | 0.00 | % | | | 08/01/2036 | | | | 5,710 | | | | 2,202,804 | |

Series 2013 C, Special Tax CAB RB(h) | | | 0.00 | % | | | 08/01/2038 | | | | 2,000 | | | | 674,820 | |

Series 2013 C, Special Tax CAB RB(h) | | | 0.00 | % | | | 08/01/2043 | | | | 17,000 | | | | 4,238,440 | |

San Joaquin Hills Transportation Corridor Agency; | | | | | | | | | | | | | | | | |

Series 2014 B, Ref. Jr. Lien Toll Road RB | | | 5.25 | % | | | 01/15/2044 | | | | 7,000 | | | | 7,643,650 | |

Series 2014 B, Ref. Jr. Toll Road RB | | | 5.25 | % | | | 01/15/2049 | | | | 12,000 | | | | 13,065,480 | |

San Jose (City of) (Helzer Courts Apartments); Series 1999 A, MFH RB(m) | | | 6.40 | % | | | 12/01/2041 | | | | 14,123 | | | | 14,129,073 | |

San Jose (City of) Community Facilities District No. 9 (Bailey/Highway 101); | | | | | | | | | | | | | | | | |

Series 2003, Special Tax RB | | | 6.60 | % | | | 09/01/2027 | | | | 2,000 | | | | 2,001,420 | |

Series 2003, Special Tax RB | | | 6.65 | % | | | 09/01/2032 | | | | 2,630 | | | | 2,642,703 | |

San Jose (City of) Norman Y Minesta International Airport; Series 2017 A, Ref. Airport RB(b)(m) | | | 5.00 | % | | | 03/01/2047 | | | | 20,000 | | | | 22,380,200 | |

San Jose (City of) Norman Y Minesta International Airport; Series 2017 A, Ref. Airport RB(m) | | | 5.00 | % | | | 03/01/2047 | | | | 7,815 | | | | 8,745,063 | |

San Jose (City of); Series 2017 A, Ref. Airport RB(b)(m) | | | 5.00 | % | | | 03/01/2041 | | | | 10,000 | | | | 11,239,500 | |

San Mateo (City of) Foster School District (Election 2008); Series 2010, Unlimited Tax Conv. CAB GO Bonds(d) | | | 6.63 | % | | | 08/01/2042 | | | | 4,080 | | | | 3,467,184 | |

Santa Cruz (County of) Redevelopment Agency (Live Oak/Soquel Community Improvement); Series 2009 A, Tax Allocation RB(j)(k) | | | 7.00 | % | | | 09/01/2019 | | | | 3,500 | | | | 3,782,310 | |

Savanna Elementary School District (Election of 2008); Series 2012 B, Unlimited Tax Conv. CAB GO Bonds (INS–AGM)(c)(d) | | | 6.75 | % | | | 02/01/2052 | | | | 7,500 | | | | 4,832,625 | |

Silicon Valley Tobacco Securitization Authority (Santa Clara); | | | | | | | | | | | | | | | | |

Series 2007 A, Tobacco Settlement Asset-Backed CAB Turbo RB(h) | | | 0.00 | % | | | 06/01/2047 | | | | 20,000 | | | | 3,159,400 | |

Series 2007 A, Tobacco Settlement CAB Turbo RB(h) | | | 0.00 | % | | | 06/01/2036 | | | | 10,000 | | | | 3,554,300 | |

Southern California Logistics Airport Authority; | | | | | | | | | | | | | | | | |

Series 2007, Tax Allocation RB(n) | | | 6.15 | % | | | 12/01/2043 | | | | 4,400 | | | | 4,162,400 | |

Series 2008 A, Tax Allocation CAB RB(h) | | | 0.00 | % | | | 12/01/2045 | | | | 18,085 | | | | 468,221 | |

Series 2008 A, Tax Allocation CAB RB(h) | | | 0.00 | % | | | 12/01/2046 | | | | 18,085 | | | | 414,147 | |

Series 2008 A, Tax Allocation CAB RB(h) | | | 0.00 | % | | | 12/01/2047 | | | | 18,085 | | | | 366,402 | |

Series 2008 A, Tax Allocation CAB RB(h) | | | 0.00 | % | | | 12/01/2048 | | | | 18,085 | | | | 324,264 | |

Series 2008 A, Tax Allocation CAB RB(h) | | | 0.00 | % | | | 12/01/2049 | | | | 18,085 | | | | 286,828 | |

Series 2008 A, Tax Allocation CAB RB(h) | | | 0.00 | % | | | 12/01/2050 | | | | 18,085 | | | | 253,913 | |

Series 2008 A, Tax Allocation RB(e) | | | 6.00 | % | | | 12/01/2033 | | | | 1,475 | | | | 1,462,890 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | |

Value | |

| California–(continued) | | | | | | | | | | | | | | | | |

Southern California Tobacco Securitization Authority (San Diego County Tobacco Asset Securitization Corp.); | | | | | | | | | | | | | | | | |

Series 2006, Tobacco Settlement Asset-Backed First Sub. CAB RB(h) | | | 0.00 | % | | | 06/01/2046 | | | $ | 30,000 | | | $ | 4,650,300 | |

Series 2006, Tobacco Settlement Asset-Backed Third Sub. CAB RB(h) | | | 0.00 | % | | | 06/01/2046 | | | | 47,000 | | | | 5,699,690 | |

Series 2006 A-1, Sr. RB | | | 4.75 | % | | | 06/01/2025 | | | | 5 | | | | 5,011 | |

Series 2006 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.00 | % | | | 06/01/2037 | | | | 6,850 | | | | 6,869,728 | |

Series 2006 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.13 | % | | | 06/01/2046 | | | | 8,205 | | | | 8,219,113 | |

Vallejo (City of) Public Financing Authority (Hiddenbrooke Improvement District); Series 2004 A, Local Agency RB | | | 5.80 | % | | | 09/01/2031 | | | | 3,770 | | | | 3,784,062 | |

Victor Valley Union High School District (Election of 2008); | | | | | | | | | | | | | | | | |

Series 2013 B, Unlimited Tax CAB GO Bonds(h)(j)(k) | | | 0.00 | % | | | 08/01/2023 | | | | 37,560 | | | | 6,123,407 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(h)(j)(k) | | | 0.00 | % | | | 08/01/2023 | | | | 14,550 | | | | 3,247,415 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(h)(j)(k) | | | 0.00 | % | | | 08/01/2023 | | | | 7,000 | | | | 1,468,320 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(h)(j)(k) | | | 0.00 | % | | | 08/01/2023 | | | | 15,715 | | | | 3,096,955 | |

| | | | | | | | | | | | | | | | 1,247,723,901 | |

|

| Colorado–3.27% | |

Amber Creak Metropolitan District; Series 2017 B, Sub. Limited Tax GO Bonds | | | 7.75 | % | | | 12/15/2047 | | | | 515 | | | | 510,180 | |

Banning Lewis Ranch Metropolitan District No. 3; Series 2015 A, Limited Tax GO Bonds | | | 6.13 | % | | | 12/01/2045 | | | | 1,025 | | | | 984,656 | |

Brighton Crossing Metropolitan District No. 4; | | | | | | | | | | | | | | | | |

Series 2017 A, Limited Tax GO Bonds | | | 5.00 | % | | | 12/01/2047 | | | | 725 | | | | 738,456 | |

Series 2017 B, Sub. Limited Tax GO Bonds | | | 7.00 | % | | | 12/15/2047 | | | | 670 | | | | 655,059 | |

Broomfield Village Metropolitan District No. 2; Series 2003, Ref. & Improvement Limited Tax GO Bonds | | | 6.25 | % | | | 12/01/2032 | | | | 3,500 | | | | 3,197,460 | |

Canyons Metropolitan District No. 5; | | | | | | | | | | | | | | | | |

Series 2017 A, Ref. Limited Tax GO Bonds | | | 6.00 | % | | | 12/01/2037 | | | | 1,750 | | | | 1,761,655 | |

Series 2017 A, Ref. Limited Tax GO Bonds | | | 6.13 | % | | | 12/01/2047 | | | | 4,735 | | | | 4,767,814 | |

Series 2017 B, Sub. Limited Tax GO Bonds | | | 8.00 | % | | | 12/15/2047 | | | | 3,000 | | | | 3,023,970 | |

Castle Oaks Metropolitan District No. 3; | | | | | | | | | | | | | | | | |

Series 2017, Ref. Limited Tax GO Bonds | | | 5.00 | % | | | 12/01/2037 | | | | 3,275 | | | | 3,287,707 | |

Series 2017, Ref. Limited Tax GO Bonds | | | 5.00 | % | | | 12/01/2047 | | | | 9,265 | | | | 9,221,454 | |

Centerra Metropolitan District No. 1 (In the City of Loveland); Series 2017, Ref. Special Tax Allocation RB(i) | | | 5.00 | % | | | 12/01/2047 | | | | 7,000 | | | | 7,157,360 | |

Clear Creek Station Metropolitan District No. 2; | | | | | | | | | | | | | | | | |

Series 2017 A, Ref. Limited Tax GO Bonds | | | 5.00 | % | | | 12/01/2047 | | | | 1,000 | | | | 1,010,160 | |

Series 2017 B, Sub. Limited Tax GO Bonds | | | 7.38 | % | | | 12/15/2047 | | | | 500 | | | | 501,370 | |

Colorado (State of) Educational & Cultural Facilities Authority (Community Leadership Academy); | | | | | | | | | | | | | | | | |

Series 2008, Charter School RB | | | 6.25 | % | | | 07/01/2028 | | | | 1,650 | | | | 1,660,412 | |

Series 2008, Charter School RB | | | 6.50 | % | | | 07/01/2038 | | | | 1,000 | | | | 1,006,290 | |

Series 2013, Charter School RB | | | 7.45 | % | | | 08/01/2048 | | | | 2,245 | | | | 2,546,144 | |

Colorado (State of) Educational & Cultural Facilities Authority (Flagstaff Academy); Series 2008 A, Charter School RB(j)(k) | | | 7.00 | % | | | 08/01/2018 | | | | 1,500 | | | | 1,535,145 | |

Colorado (State of) Educational & Cultural Facilities Authority (Monument Academy); Series 2008 A, Charter School RB(j)(k) | | | 7.25 | % | | | 10/01/2018 | | | | 500 | | | | 516,845 | |