| | |

| | OMB APPROVAL |

| | OMB Number: 3235-0570 Expires: January 31, 2017 Estimated average burden hours per response: 20.6 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

| | |

Investment Company Act file number | | 811-07890 |

|

| AIM Tax-Exempt Funds (Invesco Tax-Exempt Funds) |

| (Exact name of registrant as specified in charter) |

|

| 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

| (Address of principal executive offices) (Zip code) |

|

| Sheri Morris 11 Greenway Plaza, Suite 1000 Houston, Texas 77046 |

| (Name and address of agent for service) |

Registrant’s telephone number, including area code: (713) 626-1919

| | | | |

Date of fiscal year end: | | 2/28 | | |

| | |

Date of reporting period: | | 2/29/16 | | |

Item 1. Report to Stockholders.

| | | | | | |

| | | | |

| |  | | Annual Report to Shareholders | | February 29, 2016 |

| | | |

| | | Invesco High Yield Municipal Fund |

| | | Nasdaq: |

| | | A: ACTHX n B: ACTGX n C: ACTFX n Y: ACTDX n R5: ACTNX |

Letters to Shareholders

| | |

Philip Taylor | | Dear Shareholders: This annual report includes information about your Fund, including performance data and a complete list of its investments as of the close of the reporting period. Inside is a discussion of how your Fund was managed and the factors that affected its performance during the reporting period. US economic data were generally positive over the reporting period, with the economy expanding modestly and employment numbers improving steadily. Throughout the reporting period, US consumers benefited from declining energy prices and greater credit availability, but a strengthening dollar crimped the profits of many large multi-national companies doing business overseas. Ending years of uncertainty, the US Federal Reserve in December 2015 finally raised |

| finally raised short-term interest rates for the first time since 2006, signaling its confidence that the economy was likely to continue expanding and improving. Overseas, the economic story was less positive. The European Central Bank and central banks in China and Japan – as well as other countries – either instituted or maintained extraordinarily accommodative monetary policies in response to economic weakness. Stocks began 2016 on a weak note due to increased concerns about global economic weakness. |

Short-term market volatility can prompt some investors to abandon their investment plans – and can cause others to settle for average results. The investment professionals at Invesco, in contrast, invest with high conviction and a long-term perspective. At Invesco, investing with high conviction means offering a wide range of strategies designed to go beyond market benchmarks. We trust our research-driven insights, have confidence in our investment processes and build portfolios that reflect our beliefs. Our goal is to look past market noise in an effort to find attractive opportunities at attractive prices – consistent with the investment strategies spelled out in each fund’s prospectus. Of course, investing with high conviction can’t guarantee a profit or ensure investment success; no investment strategy or risk analysis can. To learn more about how we invest with high conviction, visit invesco.com/HighConviction.

You, too, can invest with high conviction by maintaining a long-term investment perspective and by working with your financial adviser on a regular basis. During periods of short-term market volatility or uncertainty, your financial adviser can keep you focused on your long-term investment goals – a new home, a child’s college education, or a secure retirement. He or she also can share research about the economy, the markets and individual investment options.

Visit our website for more information on your investments

Our website, invesco.com/us, offers a wide range of market insights and investment perspectives. On the website, you’ll find detailed information about our funds, including performance, holdings and portfolio manager commentaries. You can access information about your account by completing a simple, secure online registration. Click on the “Need to register” link in the “Account Access” box on our homepage to get started. Invesco’s mobile apps for iPhone® and iPad® (both available free from the App StoreSM) allow you to obtain the same detailed information, monitor your account and create customizable watch lists.

In addition to the resources accessible on our website and through our mobile app, you can obtain timely updates to help you stay informed about the markets, the economy and investing by connecting with Invesco on Twitter, LinkedIn or Facebook. You can access our blog at blog.invesco.us.com. Our goal is to provide you the information you want, when and where you want it.

Have questions?

For questions about your account, contact an Invesco client services representative at 800 959 4246. For Invesco-related questions or comments, please email me directly at phil@invesco.com.

All of us at Invesco look forward to serving your investment management needs. Thank you for investing with us.

Sincerely,

Philip Taylor

Senior Managing Director, Invesco Ltd.

iPhone and iPad are trademarks of Apple Inc., registered in the US and other countries. App Store is a service mark of Apple Inc. Invesco Distributors, Inc. is not affiliated with Apple Inc.

2 Invesco High Yield Municipal Fund

| | |

Bruce Crockett | | Dear Fellow Shareholders: Among the many important lessons I’ve learned in more than 40 years in a variety of business endeavors is the value of a trusted advocate. As independent chair of the Invesco Funds Board, I can assure you that the members of the Board are strong advocates for the interests of investors in Invesco’s mutual funds. We work hard to represent your interests through oversight of the quality of the investment management services your funds receive and other matters important to your investment, including but not limited to: |

| | n Ensuring that Invesco offers a diverse lineup of mutual funds that your financial adviser can use to strive to meet your financial needs as your investment goals change over time. |

| | n Monitoring how the portfolio management teams of the Invesco funds are performing in light of changing economic and market conditions. |

| n | | Assessing each portfolio management team’s investment performance within the context of the investment strategy described in the fund’s prospectus. |

| n | | Monitoring for potential conflicts of interests that may impact the nature of the services that your funds receive. |

We believe one of the most important services we provide our fund shareholders is the annual review of the funds’ advisory and sub-advisory contracts with Invesco Advisers and its affiliates. This review is required by the Investment Company Act of 1940 and focuses on the nature and quality of the services Invesco provides as the adviser to the Invesco funds and the reasonableness of the fees that it charges for those services. Each year, we spend months carefully reviewing information received from Invesco and a variety of independent sources, such as performance and fee data prepared by Lipper Inc., an independent, third-party firm widely recognized as a leader in its field. We also meet with our independent legal counsel and other independent advisers to review and help us assess the information that we have received. Our goal is to assure that you receive quality investment management services for a reasonable fee.

I trust the measures outlined above provide assurance that you have a worthy advocate when it comes to choosing the Invesco Funds.

As always, please contact me at bruce@brucecrockett.com with any questions or concerns you may have. On behalf of the Board, we look forward to continuing to represent your interests and serving your needs.

Sincerely,

Bruce L. Crockett

Independent Chair

Invesco Funds Board of Trustees

3 Invesco High Yield Municipal Fund

Management’s Discussion of Fund Performance

| | | | | |

| Performance summary |

For the fiscal year ended February 29, 2016, Class A shares of Invesco High Yield Municipal Fund (the Fund), at net asset value (NAV), outperformed the Custom Invesco High Yield Municipal Index, the Fund’s style-specific benchmark. Your Fund’s long-term performance appears later in this report. |

| |

| Fund vs. Indexes |

Total returns, 2/28/15 to 2/29/16, at net asset value (NAV). Performance shown does not include applicable contingent deferred sales charges (CDSC) or front-end sales charges, which would have reduced performance. |

| | | | | |

| Class A Shares | | | | 5.62 | % |

| Class B Shares | | | | 5.51 | |

| Class C Shares | | | | 4.79 | |

| Class Y Shares | | | | 5.78 | |

| Class R5 Shares | | | | 5.77 | |

| S&P Municipal Bond High Yield Index▼ (Broad Market Index) | | | | 2.91 | |

| Custom Invesco High Yield Municipal Index¢ (Style-Specific Index) | | | | 3.11 | |

| | | | | |

Source(s): ▼FactSet Research Systems Inc.; ¢Invesco, FactSet Research Systems Inc. |

Market conditions and your Fund

The municipal market benefited from a number of favorable technical factors during the fiscal year ended February 29, 2016, including expectations of a flatter yield curve, strong demand and a lower-than-expected supply of municipal securities. US tax-exempt bonds emerged as the best-performing asset class in 2015, bolstered by constrained supply and high demand, historically low US interest rates and positive US economic conditions.1 For the fiscal year, the S&P Municipal Bond High Yield Index, which represents the performance of high yield municipal bonds, returned 2.91%.2

The US municipal bond market was one of the few sectors that exhibited relative stability in the midst of a global sell-off in equities, commodities and high yield corporate bonds. Although municipal bonds emerged relatively unscathed from energy-related jitters in the second half of 2015, the tax-exempt market was not without its ups and downs during 2015. Dominating municipal headlines were the

budget impasses in Illinois and Pennsylvania, Chicago’s unfunded pension liabilities and the threat of default from Puerto Rico. While worrisome, these concerns were not enough to outweigh the positive impact of US economic performance.

Global economic developments, including concern over China’s economic weakness, accommodative European Central Bank monetary policy and slumping energy prices, supported increased demand for municipals during the reporting period. Municipal bond prices further benefited from low supply during the reporting period. New money issuance in the tax-exempt market totaled just $150 billion in 2015, compared to an annual average of nearly $200 billion over the last 20 years.3 Under normal market conditions, new money tends to comprise the majority of total bond issuance. However, since 2012, refinancings have represented the bulk of total new issuance.3

During the fiscal year, security selection in below-investment-grade and higher-coupon bonds (6.00%+) contributed to

the Fund’s performance relative to its style-specific benchmark. The Fund benefited from its approximately 40% stake in non-rated holdings over the reporting period. At the sector level, the Fund’s security selection in the dedicated tax sector, along with an overweight allocation to life care bonds, contributed to the Fund’s relative performance. Additionally, the Fund’s significant underweight exposure to the Puerto Rico market was a large contributor to the Fund’s relative performance, as Puerto Rico credits were one of the weakest areas in the high yield market over the fiscal year.

An underweight allocation to public power holdings detracted from the Fund’s performance relative to its style-specific index. An underweight allocation to the tobacco sector also detracted from the Fund’s relative performance. At the state level, holdings in Louisiana were detractors from the Fund’s relative performance.

During the reporting period, leverage bolstered Fund performance relative to its style-specific benchmark. The Fund achieved a leveraged position through the use of inverse floating rate securities or tender option bonds (TOBs). Exposure to TOBs aided performance due to the price appreciation in municipal holdings when interest rates declined. The Fund uses leverage because we believe that, over time, leveraging provides opportunities for additional income and total return for shareholders. However, the use of leverage also can expose shareholders to additional volatility. For more information about the Fund’s use of leverage, see the Notes to Financial Statements later in this report.

Final rules implementing section 619 of the Dodd-Frank Wall Street Reform and Consumer Protection Act (commonly known as the “Volcker Rule”) prohibit banking entities from engaging in

| | | | | |

Portfolio Composition | | | | | |

| By credit sector, based on total investments | |

| |

| Revenue Bonds | | | | 87.6 | % |

| Pre-Refunded Bonds | | | | 5.7 | |

| General Obligation Bonds | | | | 5.2 | |

| Other | | | | 1.5 | |

| | | | | |

| Top Five Debt Holdings |

| | | | % of total net assets | |

| | | | | |

| |

1. Los Angeles (City of) Department of Water & Power; Series 2012-B | | | | 1.0 | % |

2. Port Beaumont Navigation District (Jefferson Energy Companies); Series 2016 | | | | 0.9 | |

3. Jefferson (County of); Series 2013 F | | | | 0.9 | |

4. New York (State of) Dormitory Authority (Sales Tax); Series 2015 B-C | | | | 0.8 | |

5. New York Liberty Development Corp. (3 World Trade Center); Series 2014, Class 1 | | | | 0.7 | |

| | | | | |

Total Net Assets | | | | $7.6 billion | |

| |

Total Number of Holdings | | | | 1,257 | |

The Fund’s holdings are subject to change, and there is no assurance that the Fund will continue to hold any particular security.

Data presented here are as of February 29, 2016.

4 Invesco High Yield Municipal Fund

proprietary trading of certain instruments and limit such entities’ investments in, and relationships with, “covered funds,” as defined in the rules. These rules may preclude banking entities and their affiliates from sponsoring and/or providing services for existing TOB Trusts. To ensure compliance with the Volcker Rule, TOB market participants, including the Fund and the Adviser, have developed a new TOB structure. There can be no assurances that the new TOB structure will continue to be a viable option for leverage. For more information, please see the Notes to Financial Statements later in this report.

We wish to remind you that the Fund is subject to interest rate risk, meaning when interest rates rise, the value of fixed income securities tends to fall. This risk may be greater in the current market environment because interest rates are at or near historic lows. The degree to which the value of fixed income securities may decline due to rising interest rates may vary depending on the speed and magnitude of the increase in interest rates, as well as individual security characteristics such as price, maturity, duration and coupon and market forces such as supply and demand for similar securities. We are monitoring interest rates, and the market, economic and geopolitical factors that may impact the direction, speed and magnitude of changes to interest rates across the maturity spectrum, including the potential impact of monetary policy changes by the US Federal Reserve and certain foreign central banks. If interest rates rise, markets may experience increased volatility, which may affect the value and/or liquidity of certain of the Fund’s investments.

Thank you for investing in Invesco High Yield Municipal Fund and for sharing our long-term investment horizon.

| 2 | Source: Standard & Poor’s |

The views and opinions expressed in management’s discussion of Fund performance are those of Invesco Advisers, Inc. These views and opinions are subject to change at any time based on factors such as market and economic conditions. These views and opinions may not be relied upon as investment advice or recommendations, or as an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but Invesco Advisers, Inc. makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

See important Fund and, if applicable, index disclosures later in this report.

| | |

| | Mark Paris Portfolio Manager and Head of Portfolio Management and Trading for the Invesco municipal bond team, is |

| manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010. Mr. Paris earned a BBA in finance from Baruch College, The City University of New York. |

| |

| | Jack Connelly Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2016 and |

| began managing the Fund on April 1, 2016, after the close of the reporting period. Mr. Connelly earned a BA in philosophy from Wheaton College and masters degrees from the University of Rhode Island and Yale University. |

| |

| | Tim O’Reilly Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010 and |

| began managing the Fund on April 1, 2016, after the close of the reporting period. Mr. O’Reilly earned a BS in finance from Eastern Illinois University and an MBA in finance from the University of Illinois at Chicago. |

| |

| | James Phillips Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010. |

| Mr. Phillips earned a BA in American literature from Empire State College and an MBA in finance from University at Albany, The State University of New York. |

| |

| | Robert Stryker Chartered Financial Analyst, Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He |

| joined Invesco in 2010. Mr. Stryker earned a BS in finance from the University of Illinois at Chicago. |

| |

| | Julius Williams Portfolio Manager, is manager of Invesco High Yield Municipal Fund. He joined Invesco in 2010. |

| Mr. Williams earned a BA in economics and sociology and a Master of Education degree in educational psychology from the University of Virginia. |

5 Invesco High Yield Municipal Fund

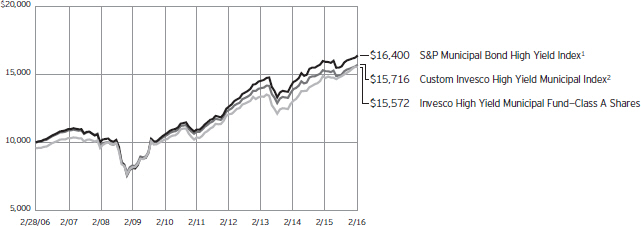

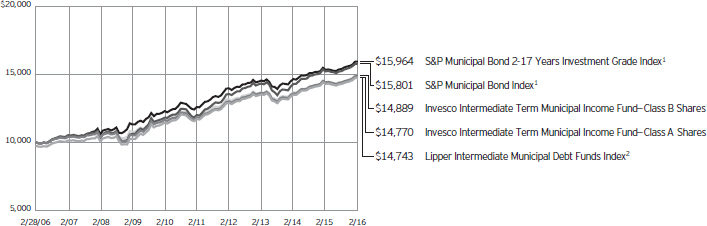

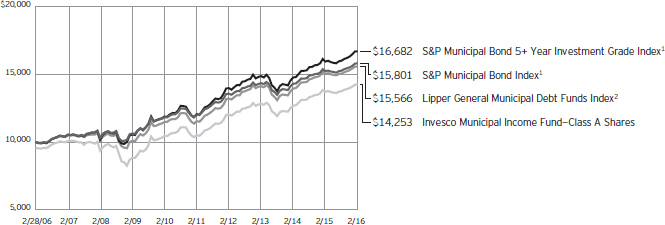

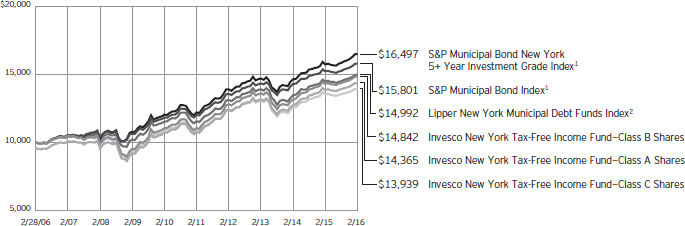

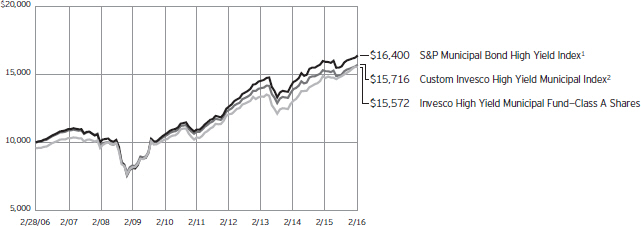

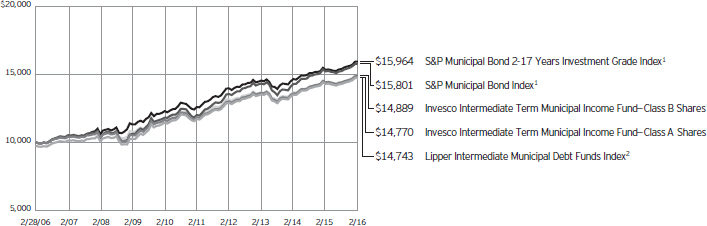

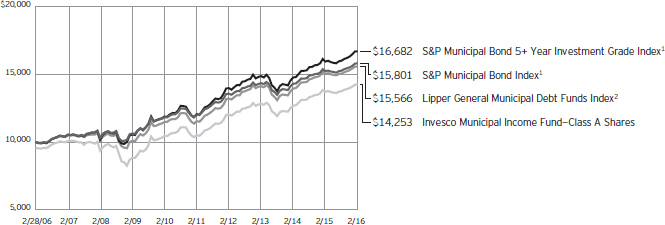

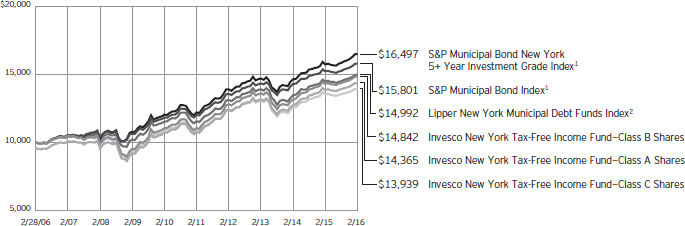

Your Fund’s Long-Term Performance

Results of a $10,000 Investment – Oldest Share Class(es)

Fund and index data from 2/28/06

| 1 | Source: FactSet Research Systems Inc. |

| 2 | Source(s): Invesco, FactSet Research Systems Inc. |

Past performance cannot guarantee comparable future results.

The data shown in the chart include reinvested distributions, applicable sales charges and Fund expenses including

management fees. Index results include reinvested dividends, but they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses and management fees;

performance of a market index does not. Performance shown in the chart and table(s) does not reflect deduction of taxes a shareholder would pay on Fund distributions or sale of Fund shares.

6 Invesco High Yield Municipal Fund

| | | | | |

| Average Annual Total Returns |

| As of 2/29/16, including maximum applicable sales charges |

| | | | | |

| |

| Class A Shares | | | | | |

| Inception (1/2/86) | | | | 6.02 | % |

| 10 Years | | | | 4.53 | |

| 5 Years | | | | 7.55 | |

| 1 Year | | | | 1.09 | |

| |

Class B Shares | | | | | |

| Inception (7/20/92) | | | | 5.57 | % |

| 10 Years | | | | 4.62 | |

| 5 Years | | | | 8.28 | |

| 1 Year | | | | 0.51 | |

| |

Class C Shares | | | | | |

| Inception (12/10/93) | | | | 4.85 | % |

| 10 Years | | | | 4.19 | |

| 5 Years | | | | 7.68 | |

| 1 Year | | | | 3.79 | |

| |

Class Y Shares | | | | | |

| Inception (3/1/06) | | | | 5.25 | % |

| 5 Years | | | | 8.73 | |

| 1 Year | | | | 5.78 | |

| |

Class R5 Shares | | | | | |

| 10 Years | | | | 5.64 | % |

| 5 Years | | | | 8.88 | |

| 1 Year | | | | 5.77 | |

Effective June 1, 2010, Class A, Class B, Class C and Class I shares of the predecessor fund, Van Kampen High Yield Municipal Fund, advised by Van Kampen Asset Management were reorganized into Class A, Class B, Class C and Class Y shares, respectively, of Invesco Van Kampen High Yield Municipal Fund (renamed Invesco High Yield Municipal Fund). Returns shown above for Class A, Class B, Class C and Class Y shares are blended returns of the predecessor fund and Invesco High Yield Municipal Fund. Share class returns will differ from the predecessor fund because of different expenses.

Class R5 shares incepted on April 30, 2012. Performance shown prior to that date is that of the Fund’s and the predecessor fund’s Class A shares and includes the 12b-1 fees applicable to Class A shares.

The performance data quoted represent past performance and cannot guarantee comparable future results; current performance may be lower or higher. Please visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions, changes in net asset value and the

| | | | | |

| Average Annual Total Returns |

| As of 12/31/15, the most recent calendar quarter end, including maximum applicable sales charges |

| | | | | |

| |

| Class A Shares | | | | | |

| Inception (1/2/86) | | | | 6.02 | % |

| 10 Years | | | | 4.57 | |

| 5 Years | | | | 7.26 | |

| 1 Year | | | | 1.77 | |

| |

| Class B Shares | | | | | |

| Inception (7/20/92) | | | | 5.57 | % |

| 10 Years | | | | 4.66 | |

| 5 Years | | | | 7.98 | |

| 1 Year | | | | 1.25 | |

| |

| Class C Shares | | | | | |

| Inception (12/10/93) | | | | 4.85 | % |

| 10 Years | | | | 4.26 | |

| 5 Years | | | | 7.41 | |

| 1 Year | | | | 4.41 | |

| |

| Class Y Shares | | | | | |

| Inception (3/1/06) | | | | 5.25 | % |

| 5 Years | | | | 8.46 | |

| 1 Year | | | | 6.52 | |

| |

Class R5 Shares | | | | | |

| 10 Years | | | | 5.69 | % |

| 5 Years | | | | 8.62 | |

| 1 Year | | | | 6.41 | |

effect of the maximum sales charge unless otherwise stated. Investment return and principal value will fluctuate so that you may have a gain or loss when you sell shares.

The total annual Fund operating expense ratio set forth in the most recent Fund prospectus as of the date of this report for Class A, Class B, Class C, Class Y and Class R5 shares was 0.93%, 0.93%, 1.67%, 0.68%, and 0.68%, respectively. The expense ratios presented above may vary from the expense ratios presented in other sections of this report that are based on expenses incurred during the period covered by this report.

Class A share performance reflects the maximum 4.25% sales charge, and Class B and Class C share performance reflects the applicable contingent deferred sales charge (CDSC) for the period involved. For shares purchased prior to June 1, 2010, the CDSC on Class B shares declines from 4% at the time of purchase to 0% at the beginning of the sixth year. For shares purchased on or after June 1, 2010, the CDSC on Class B shares declines from 5% at the time of purchase to 0% at the beginning of the seventh year. The

CDSC on Class C shares is 1% for the first year after purchase. Class Y and Class R5 shares do not have a front-end sales charge or a CDSC; therefore, performance is at net asset value.

The performance of the Fund’s share classes will differ primarily due to different sales charge structures and class expenses.

Fund performance reflects any applicable fee waivers and/or expense reimbursements. Had fees not been waived and/or expenses reimbursed currently or in the past, returns would have been lower. See current prospectus for more information.

7 Invesco High Yield Municipal Fund

Invesco High Yield Municipal Fund’s investment objective is to seek federal tax exempt current income and taxable capital appreciation.

| n | | Unless otherwise stated, information presented in this report is as of February 29, 2016, and is based on total net assets. |

| n | | Unless otherwise noted, all data provided by Invesco. |

| n | | To access your Fund’s reports/prospectus, visit invesco.com/fundreports. |

About share classes

| n | | Class B shares may not be purchased for new or additional investments. Please see the prospectus for more information. |

| n | | Class Y shares are available only to certain investors. Please see the prospectus for more information. |

| n | | Class R5 shares are primarily intended for employer sponsored retirement and benefit plans that meet certain standards and for institutional investors. Please see the prospectus for more information. |

Principal risks of investing in the Fund

| n | | Alternative minimum tax risk. All or a portion of the Fund’s otherwise tax-exempt income may be taxable to those shareholders subject to the federal alternative minimum tax. |

| n | | Call risk. If interest rates fall, it is possible that issuers of debt securities with high interest rates will prepay or call their securities before their maturity dates. In this event, the proceeds from the called securities would likely be reinvested by the Fund in securities bearing the new, lower interest rates, resulting in a possible decline in the Fund’s income and distributions to shareholders. |

| n | | Changing fixed income market conditions risk. The current low interest rate environment was created in part by the Federal Reserve Board (FRB) and certain foreign central banks keeping the federal funds and equivalent foreign rates at or near zero. Increases in the federal funds and equivalent foreign rates may expose fixed income markets to heightened volatility and reduced liquidity for certain fixed income investments, particularly those with longer maturities. In addition, decreases in fixed income dealer market-making capacity may also potentially lead to heightened volatility and reduced liquidity in the fixed income markets. As a result, the value of the Fund’s investments |

| | | and share price may decline. Changes in central bank policies could also result in higher than normal shareholder redemptions, which could potentially increase portfolio turnover and the Fund’s transaction costs. |

| n | | Credit risk. The issuer of instruments in which the Fund invests may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating. |

| n | | Derivatives risk. The value of a derivative instrument depends largely on (and is derived from) the value of an underlying security, currency, commodity, interest rate, index or other asset (each referred to as an underlying asset). In addition to risks relating to the underlying assets, the use of derivatives may include other, possibly greater, risks, including counterparty, leverage and liquidity risks. |

Counterparty risk is the risk that the counterparty to the derivative contract will default on its obligation to pay the Fund the amount owed or otherwise perform under the derivative contract. Derivatives create leverage risk because they do not require payment up front equal to the economic exposure created by owning the derivative. As a result, an adverse change in the value of the underlying asset could result in the Fund sustaining a loss that is substantially greater than the amount invested in the derivative, which may make the Fund’s returns more volatile and increase the risk of loss. Derivative instruments may also be less liquid than more traditional investments and the Fund may be unable to sell or close out its derivative positions at a desirable time or price. This risk may be more acute under adverse market conditions, during which the Fund may be most in need of liquidating its derivative positions. Derivatives may also be harder to value, less tax efficient and subject to changing government regulation that could impact the Fund’s ability

This report must be accompanied or preceded by a currently effective Fund prospectus, which contains more complete information, including sales charges and expenses. Investors should read it carefully before investing.

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

to use certain derivatives or their cost. Also, derivatives used for hedging or to gain or limit exposure to a particular market segment may not provide the expected benefits, particularly during adverse market conditions.

| n | | High yield (junk bond) risk. Junk bonds involve a greater risk of default or price changes due to changes in the credit quality of the issuer. The values of junk bonds fluctuate more than those of high- quality bonds in response to company, political, regulatory or economic developments. Values of junk bonds can decline significantly over short periods of time. |

| n | | Income risk. The income you receive from the Fund is based primarily on prevailing interest rates, which can vary widely over the short- and long-term. If interest rates drop, your income from the Fund may drop as well. |

| n | | Interest rate risk. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise; conversely, bond prices generally rise as interest rates fall. Specific bonds differ in their sensitivity to changes in interest rates depending on their individual characteristics, including duration. |

| n | | Inverse floating rate obligations risk. Inverse floating rate obligations, including tender option bonds, may be subject to greater price volatility than a fixed income security with similar qualities. When short-term interest rates rise, they may decrease in value and produce less or no income. Additionally, these securities may lose some or all of their principal and. In some cases, the Fund could lose money in excess of its investment. Similar to derivatives, inverse floating rate obligations have the following risks: counterparty, leverage, correlation, liquidity, market, interest rate, and management risks. |

| n | | Liquidity risk. The Fund may hold illiquid securities that it is unable to sell at the preferred time or price and could lose its entire investment in such securities. |

| n | | Management risk. The investment techniques and risk analysis used by the Fund’s portfolio managers may not produce the desired results. |

| n | | Market risk. The prices of and the income generated by the Fund’s securities may decline in response to, among |

8 Invesco High Yield Municipal Fund

| | other things, investor sentiment, general economic and market conditions, regional or global instability, and currency and interest rate fluctuations. |

| n | | Medium- and lower-grade municipal securities risk. Securities which are in the medium- and lower-grade categories generally offer higher yields than are offered by higher-grade securities of similar maturity, but they also generally involve more volatility and greater risks, such as greater credit risk, market risk, liquidity risk, management risk, and regulatory risk. Furthermore, many medium- and lower-grade securities are not listed for trading on any national securities exchange and many issuers of medium- and lower-grade securities choose not to have a rating assigned to their obligations by any nationally recognized statistical rating organization. As a result, the Fund’s portfolio may consist of a higher portion of unlisted or unrated securities as compared with an investment company that invests solely in higher-grade securities. Unrated securities are usually not as attractive to as many buyers as are rated securities, a factor which may make unrated securities less marketable. These factors may have the effect of limiting the availability of the securities for purchase by the Fund and may also limit the ability of the Fund to sell such securities at their fair value either to meet redemption requests or in response to changes in the economy or the financial markets. Investors should carefully consider the risks of owning shares of a Fund which invests in medium- and lower-grade municipal securities before investing in the Fund. |

| n | | Municipal issuer focus risk. The Fund generally considers investments in municipal securities not to be subject to industry concentration policies (issuers of municipal securities as a group is not an industry) and the Fund may invest in municipal securities issued by entities having similar characteristics. The issuers may be located in the same geographic area or may pay their interest obligations from revenue of similar projects, such as hospitals, airports, utility systems and housing finance agencies. This may make the Fund’s investments more susceptible to similar social, economic, political or regulatory occurrences. As the similarity in issuers increases, the potential for fluctuation in the Fund’s net asset value also increases. |

| n | | Municipal securities risk. The Fund may invest in municipal securities. Constitutional |

| | | amendments, legislative enactments, executive orders, administrative regulations, voter initiatives, and the issuer’s regional economic conditions may affect the municipal security’s value, interest payments, repayment of principal and the Fund’s ability to sell it. Failure of a municipal security issuer to comply with applicable tax requirements may make income paid thereon taxable, resulting in a decline in the security’s value. In addition, there could be changes in applicable tax laws or tax treatments that reduce or eliminate the current federal income tax exemption on municipal securities or otherwise adversely affect the current federal or state tax status of municipal securities. |

| n | | Reinvestment risk. Reinvestment risk is the risk that a bond’s cash flows (coupon income and principal repayment) will be reinvested at an interest rate below that on the original bond. |

| n | | Variable-rate demand notes risk. The absence of an active secondary market for certain variable and floating rate notes could make it difficult to dispose of the instruments, and the underlying fund could suffer a loss if the issuer defaults during periods in which the underlying fund is not entitled to exercise its demand rights. |

| n | | When-issued and delayed delivery risks. When-issued and delayed delivery transactions are subject to market risk as the value or yield of a security at delivery may be more or less than the purchase price or the yield generally available on securities when delivery occurs. In addition, the Fund is subject to counterparty risk because it relies on the buyer or seller, as the case may be, to consummate the transaction, and failure by the other party to complete the transaction may result in the Fund missing the opportunity of obtaining a price or yield considered to be advantageous. |

| n | | Zero coupon or pay-in-kind securities risk. The value, interest rates, and liquidity of non-cash paying instruments, such as zero coupon and pay-in-kind securities, are subject to greater fluctuation than other types of securities. The higher yields and interest rates on pay-in-kind securities reflect the payment deferral and increased credit risk associated with such instruments and that such investments may represent a higher credit risk than coupon loans. Pay-in-kind securities may have a potential variability in valuations because their continuing accruals require |

| | | continuing judgments about the collectability of the deferred payments and the value of any associated collateral. |

About indexes used in this report

| n | | The S&P Municipal Bond High Yield Index consists of bonds in the S&P Municipal Bond Index that are not rated or are rated below investment grade. |

| n | | The Custom Invesco High Yield Municipal Index is designed to measure the performance of a hypothetical allocation that consists of an 80% weight in bonds in the S&P Municipal Bond Index that are not rated or are rated below investment grade and a 20% weight in bonds that are rated investment grade by Standard & Poor’s, Moody’s and/or Fitch. |

| n | | The S&P Municipal Bond Index is a broad, market value-weighted index that seeks to measure the performance of the US municipal bond market. |

| n | | The Fund is not managed to track the performance of any particular index, including the index(es) described here, and consequently, the performance of the Fund may deviate significantly from the performance of the index(es). |

| n | | A direct investment cannot be made in an index. Unless otherwise indicated, index results include reinvested dividends, and they do not reflect sales charges. Performance of the peer group, if applicable, reflects fund expenses; performance of a market index does not. |

Other information

| n | | The returns shown in management’s discussion of Fund performance are based on net asset values (NAVs) calculated for shareholder transactions. Generally accepted accounting principles require adjustments to be made to the net assets of the Fund at period end for financial reporting purposes, and as such, the NAVs for shareholder transactions and the returns based on those NAVs may differ from the NAVs and returns reported in the Financial Highlights. |

9 Invesco High Yield Municipal Fund

Schedule of Investments

February 29, 2016

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

Municipal Obligations–109.80% | | | | | | | | | | | | | | | | |

| Alabama–2.90% | | | | | | | | | | | | | | | | |

Birmingham (City of) Special Care Facilities Financing Authority (Methodist Home for the Aging); | | | | | | | | | | | | | | | | |

Series 2016, RB | | | 5.75 | % | | | 06/01/2045 | | | $ | 3,250 | | | $ | 3,298,717 | |

Series 2016, RB | | | 6.00 | % | | | 06/01/2050 | | | | 2,250 | | | | 2,310,435 | |

Birmingham (City of) Water Works Board; Series 2015 A, Ref. Water RB(a) | | | 5.00 | % | | | 01/01/2042 | | | | 12,750 | | | | 14,578,095 | |

Cullman (County of) Health Care Authority (Regional Medical Center); Series 2009 A, RB | | | 7.00 | % | | | 02/01/2036 | | | | 4,400 | | | | 4,785,792 | |

Huntsville (City of) Special Care Facilities Financing Authority (Redstone Village); | | | | | | | | | | | | | | | | |

Series 2007, Retirement Facility RB | | | 5.50 | % | | | 01/01/2043 | | | | 13,170 | | | | 13,217,149 | |

Series 2008 A, Retirement Facility RB | | | 6.88 | % | | | 01/01/2043 | | | | 4,470 | | | | 4,699,445 | |

Series 2011 A, Retirement Facility RB | | | 7.50 | % | | | 01/01/2047 | | | | 2,600 | | | | 2,904,148 | |

Series 2012 A, Retirement Facility RB | | | 5.63 | % | | | 01/01/2042 | | | | 6,825 | | | | 6,976,788 | |

Jefferson (County of); | | | | | | | | | | | | | | | | |

Series 2013 C, Sr. Lien Sewer Revenue Conv. CAB Wts. (INS–AGM)(b)(c) | | | 6.50 | % | | | 10/01/2038 | | | | 7,000 | | | | 5,332,460 | |

Series 2013 C, Sr. Lien Sewer Revenue Conv. CAB Wts. (INS–AGM)(b)(c) | | | 6.60 | % | | | 10/01/2042 | | | | 11,700 | | | | 8,820,747 | |

Series 2013 F, Sr. Sub. Lien Sewer Revenue Conv. CAB Wts.(c) | | | 7.75 | % | | | 10/01/2046 | | | | 96,055 | | | | 70,252,706 | |

Series 2013 F, Sub. Lien Sewer Revenue Conv. CAB Wts.(c) | | | 7.50 | % | | | 10/01/2039 | | | | 27,640 | | | | 20,335,301 | |

Series 2013-F, Sub. Lien Sewer Revenue Conv. CAB Wts.(c) | | | 7.90 | % | | | 10/01/2050 | | | | 64,400 | | | | 46,478,124 | |

Lower Alabama Gas District (The); Series 2016 A, Gas Project RB | | | 5.00 | % | | | 09/01/2046 | | | | 15,000 | | | | 17,570,550 | |

Mobile (City of) Industrial Development Board (Mobile Energy Services Co.); Series 1995, Ref. Solid Waste Disposal RB(d) | | | 6.95 | % | | | 01/01/2020 | | | | 3 | | | | 0 | |

| | | | | | | | | | | | | | | | 221,560,457 | |

| | | | |

| Alaska–0.02% | | | | | | | | | | | | | | | | |

Northern Tobacco Securitization Corp.; | | | | | | | | | | | | | | | | |

Series 2006 B, First Sub. Asset-Backed CAB RB(e) | | | 0.00 | % | | | 06/01/2046 | | | | 27,225 | | | | 880,184 | |

Series 2006 C, Second Sub. Asset-Backed CAB RB(e) | | | 0.00 | % | | | 06/01/2046 | | | | 20,860 | | | | 642,488 | |

| | | | | | | | | | | | | | | | 1,522,672 | |

| | | | |

| American Samoa–0.13% | | | | | | | | | | | | | | | | |

American Samoa (Territory of) Economic Development Authority; Series 2015 A, Ref. RB | | | 6.63 | % | | | 09/01/2035 | | | | 9,845 | | | | 10,011,381 | |

| | | | |

| Arizona–2.57% | | | | | | | | | | | | | | | | |

Peoria (City of) Industrial Development Authority (Sierra Winds Life Care Community); | | | | | | | | | | | | | | | | |

Series 2014, Ref. RB | | | 5.50 | % | | | 11/15/2034 | | | | 3,695 | | | | 3,771,560 | |

Series 2014, Ref. RB | | | 5.75 | % | | | 11/15/2040 | | | | 6,015 | | | | 6,199,239 | |

Phoenix (City of) Industrial Development Authority (Basis Schools); | | | | | | | | | | | | | | | | |

Series 2016 A, Ref. Education RB(f) | | | 5.00 | % | | | 07/01/2035 | | | | 2,400 | | | | 2,528,352 | |

Series 2016 A, Ref. Education RB(f) | | | 5.00 | % | | | 07/01/2046 | | | | 4,125 | | | | 4,258,031 | |

Phoenix (City of) Industrial Development Authority (Choice Academies); Series 2012, Education RB | | | 5.63 | % | | | 09/01/2042 | | | | 2,850 | | | | 3,019,204 | |

Phoenix (City of) Industrial Development Authority (Legacy Traditional Schools); Series 2014 A, Education Facility RB(f) | | | 6.75 | % | | | 07/01/2044 | | | | 5,250 | | | | 5,932,815 | |

Phoenix (City of) Industrial Development Authority (Phoenix Collegiate Academy); Series 2012, Education RB | | | 5.63 | % | | | 07/01/2042 | | | | 2,770 | | | | 2,922,849 | |

Phoenix Civic Improvement Corp.; | | | | | | | | | | | | | | | | |

Series 2008 A, Sr. Lien Airport RB(a) | | | 5.00 | % | | | 07/01/2022 | | | | 3,500 | | | | 3,849,370 | |

Series 2008 A, Sr. Lien Airport RB(a) | | | 5.00 | % | | | 07/01/2024 | | | | 5,000 | | | | 5,490,500 | |

Series 2008 A, Sr. Lien Airport RB(a) | | | 5.00 | % | | | 07/01/2026 | | | | 5,000 | | | | 5,479,500 | |

Series 2009 A, Jr. Lien Water System RB(a) | | | 5.00 | % | | | 07/01/2027 | | | | 8,935 | | | | 10,145,156 | |

Series 2009 A, Jr. Lien Water System RB(a) | | | 5.00 | % | | | 07/01/2028 | | | | 6,785 | | | | 7,691,951 | |

Series 2009 A, Jr. Lien Water System RB(a) | | | 5.00 | % | | | 07/01/2029 | | | | 5,500 | | | | 6,229,355 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

10 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Arizona–(continued) | | | | | | | | | | | | | | | | |

Pima (County of) Industrial Development Authority (Acclaim Charter School); | | | | | | | | | | | | | | | | |

Series 2006, Education Facility RB | | | 5.70 | % | | | 12/01/2026 | | | $ | 2,200 | | | $ | 2,198,020 | |

Series 2006, Education Facility RB | | | 5.80 | % | | | 12/01/2036 | | | | 4,385 | | | | 4,271,078 | |

Pima (County of) Industrial Development Authority (Americal Leadership); | | | | | | | | | | | | | | | | |

Series 2015, Ref. Education Facility RB(f) | | | 5.38 | % | | | 06/15/2035 | | | | 2,370 | | | | 2,381,850 | |

Series 2015, Ref. Education Facility RB(f) | | | 5.63 | % | | | 06/15/2045 | | | | 3,500 | | | | 3,505,950 | |

Pima (County of) Industrial Development Authority (Choice Education & Development Corp.); Series 2006, Education Facility RB | | | 6.25 | % | | | 06/01/2026 | | | | 4,225 | | | | 4,254,195 | |

Pima (County of) Industrial Development Authority (Coral Academy Science); | | | | | | | | | | | | | | | | |

Series 2008 A, Education Facilities RB | | | 7.13 | % | | | 12/01/2028 | | | | 2,120 | | | | 2,231,894 | |

Series 2008 A, Education Facilities RB | | | 7.25 | % | | | 12/01/2038 | | | | 3,285 | | | | 3,439,986 | |

Pima (County of) Industrial Development Authority (Desert Heights Charter School); Series 2014, Ref. Education Facility RB | | | 7.25 | % | | | 05/01/2044 | | | | 3,000 | | | | 3,258,360 | |

Pima (County of) Industrial Development Authority (Edkey Charter Schools); | | | | | | | | | | | | | | | | |

Series 2013, Ref. Education Facility RB | | | 6.00 | % | | | 07/01/2043 | | | | 250 | | | | 249,330 | |

Series 2013, Ref. Education Facility RB | | | 6.00 | % | | | 07/01/2048 | | | | 2,975 | | | | 2,945,518 | |

Pima (County of) Industrial Development Authority (Excalibur Charter School); Series 2003, Education RB | | | 7.75 | % | | | 08/01/2033 | | | | 2,905 | | | | 2,906,511 | |

Pima (County of) Industrial Development Authority (Global Water Resources, LLC); | | | | | | | | | | | | | | | | |

Series 2006, Water & Wastewater RB(f)(g) | | | 5.60 | % | | | 12/01/2022 | | | | 2,000 | | | | 2,033,580 | |

Series 2006, Water & Wastewater RB(f)(g) | | | 5.75 | % | | | 12/01/2032 | | | | 7,120 | | | | 7,227,583 | |

Series 2007, Water & Wastewater RB(g) | | | 6.55 | % | | | 12/01/2037 | | | | 975 | | | | 991,556 | |

Series 2008, Water & Wastewater RB(g) | | | 7.50 | % | | | 12/01/2038 | | | | 13,235 | | | | 13,846,986 | |

Pima (County of) Industrial Development Authority (Legacy Traditional School); Series 2009, Education RB(h)(i) | | | 8.50 | % | | | 07/01/2019 | | | | 1,685 | | | | 2,055,043 | |

Pima (County of) Industrial Development Authority (Milestones Charter School District); | | | | | | | | | | | | | | | | |

Series 2003, Education Facility RB | | | 7.50 | % | | | 11/01/2033 | | | | 3,030 | | | | 3,029,697 | |

Series 2005, Education Facility RB | | | 6.75 | % | | | 11/01/2033 | | | | 2,865 | | | | 2,682,614 | |

Pima (County of) Industrial Development Authority (P.L.C. Charter Schools); | | | | | | | | | | | | | | | | |

Series 2006, Education Facility RB | | | 6.50 | % | | | 04/01/2026 | | | | 2,690 | | | | 2,694,008 | |

Series 2006, Education Facility RB | | | 6.75 | % | | | 04/01/2036 | | | | 3,805 | | | | 3,810,099 | |

Pima (County of) Industrial Development Authority (Paradise Education Center); | | | | | | | | | | | | | | | | |

Series 2006, Ref. Education RB | | | 5.88 | % | | | 06/01/2022 | | | | 535 | | | | 537,894 | |

Series 2006, Ref. Education RB | | | 6.00 | % | | | 06/01/2036 | | | | 830 | | | | 832,756 | |

Series 2010, Education RB | | | 6.10 | % | | | 06/01/2045 | | | | 1,400 | | | | 1,459,262 | |

Pima (County of) Industrial Development Authority (Premier & Air Co.); Series 2005, Education Facility RB(d) | | | 7.00 | % | | | 09/01/2035 | | | | 5,092 | | | | 3,818,949 | |

Pima (County of) Industrial Development Authority (Riverbend Prep); Series 2010, Education RB | | | 7.00 | % | | | 09/01/2037 | | | | 3,358 | | | | 3,224,956 | |

Quechan Indian Tribe of Fort Yuma (California & Arizona Governmental); Series 2008, RB | | | 7.00 | % | | | 12/01/2027 | | | | 5,310 | | | | 5,134,186 | |

Salt Verde Financial Corp.; Series 2007, Sr. Gas RB | | | 5.00 | % | | | 12/01/2037 | | | | 8,000 | | | | 9,477,840 | |

Sundance Community Facilities District (Assessment District No. 2); Series 2003, Special Assessment RB(f) | | | 7.13 | % | | | 07/01/2027 | | | | 1,771 | | | | 1,774,825 | |

Sundance Community Facilities District (Assessment District No. 3); Series 2004, Special Assessment RB | | | 6.50 | % | | | 07/01/2029 | | | | 298 | | | | 298,444 | |

Tempe (City of) Industrial Development Authority (Friendship Village); | | | | | | | | | | | | | | | | |

Series 2012 A, Ref. RB | | | 6.25 | % | | | 12/01/2042 | | | | 2,700 | | | | 2,944,161 | |

Series 2012 A, Ref. RB | | | 6.25 | % | | | 12/01/2046 | | | | 4,100 | | | | 4,463,752 | |

Town of Florence, Inc. (The) Industrial Development Authority (Legacy Traditional School — Queen Creek and Casa Grande Campuses); | | | | | | | | | | | | | | | | |

Series 2013, Education RB | | | 5.75 | % | | | 07/01/2033 | | | | 3,000 | | | | 3,269,130 | |

Series 2013, Education RB | | | 6.00 | % | | | 07/01/2043 | | | | 3,625 | | | | 3,959,044 | |

Tucson (City of) (Catalina Village Assisted Living Apartments); Series 2013 A, MFH RB | | | 2.00 | % | | | 11/01/2045 | | | | 1,700 | | | | 1,039,314 | |

Tucson (City of) Industrial Development Authority (Catalina Assisted Living Apartments); Series 2013 B, Ref. MFH RB | | | 6.00 | % | | | 11/01/2045 | | | | 4,435 | | | | 3,012,651 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

11 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Arizona–(continued) | | | | | | | | | | | | | | | | |

University Medical Center Corp.; | | | | | | | | | | | | | | | | |

Series 2009, Hospital RB(h)(i) | | | 6.25 | % | | | 07/01/2019 | | | $ | 1,650 | | | $ | 1,939,988 | |

Series 2009, Hospital RB(h)(i) | | | 6.50 | % | | | 07/01/2019 | | | | 2,100 | | | | 2,486,316 | |

Series 2011, Hospital RB(h)(i) | | | 6.00 | % | | | 07/01/2021 | | | | 2,600 | | | | 3,253,406 | |

Verrado Community Facilities District No. 1; Series 2006, Unlimited Tax GO Bonds | | | 5.35 | % | | | 07/15/2031 | | | | 5,915 | | | | 5,945,521 | |

| | | | | | | | | | | | | | | | 196,404,135 | |

| | | | |

| California–13.80% | | | | | | | | | | | | | | | | |

ABAG Finance Authority for Non-profit Corps. (Episcopal Senior Communities); Series 2012 A, Ref. RB | | | 5.00 | % | | | 07/01/2047 | | | | 6,000 | | | | 6,556,140 | |

Alhambra (City of) (Atherton Baptist Homes); Series 2010 A, RB | | | 7.63 | % | | | 01/01/2040 | | | | 4,340 | | | | 4,741,754 | |

Bakersfield (City of); Series 2007 A, Wastewater RB(a)(h)(i) | | | 5.00 | % | | | 09/15/2017 | | | | 14,990 | | | | 16,036,752 | |

Bay Area Toll Authority (San Francisco Bay Area); Series 2009 F-1, Toll Bridge RB(a)(h)(i) | | | 5.13 | % | | | 04/01/2019 | | | | 22,295 | | | | 25,289,664 | |

California (County of) Tobacco Securitization Agency (Stanislaus County Tobacco Funding Corp.); Series 2006 A, Tobacco Settlement CAB Sub. RB(e) | | | 0.00 | % | | | 06/01/2046 | | | | 25,000 | | | | 2,911,250 | |

California (State of) Educational Facilities Authority (Stanford University); | | | | | | | | | | | | | | | | |

Series 2010, RB(a) | | | 5.25 | % | | | 04/01/2040 | | | | 6,255 | | | | 8,603,627 | |

Series 2012 U-2, Ref. RB(a) | | | 5.00 | % | | | 10/01/2032 | | | | 8,745 | | | | 11,572,259 | |

Series 2014 U-6, RB(a) | | | 5.00 | % | | | 05/01/2045 | | | | 15,000 | | | | 20,339,400 | |

California (State of) Health Facilities Financing Authority (Children’s Hospital of Orange County); Series 2009, RB | | | 6.50 | % | | | 11/01/2038 | | | | 3,000 | | | | 3,540,390 | |

California (State of) Municipal Finance Authority (American Heritage Education Foundation); Series 2006 A, Education RB | | | 5.25 | % | | | 06/01/2026 | | | | 2,000 | | | | 2,007,860 | |

California (State of) Municipal Finance Authority (Goodwill Industries of Sacramento & Nevada); | | | | | | | | | | | | | | | | |

Series 2012, RB(f) | | | 6.63 | % | | | 01/01/2032 | | | | 1,000 | | | | 1,105,270 | |

Series 2012, RB(f) | | | 6.88 | % | | | 01/01/2042 | | | | 1,500 | | | | 1,679,400 | |

California (State of) Municipal Finance Authority (High Tech High-Chula Vista); | | | | | | | | | | | | | | | | |

Series 2008 B, Educational Facility RB(f) | | | 6.13 | % | | | 07/01/2038 | | | | 2,860 | | | | 2,969,595 | |

Series 2008 B, Educational Facility RB(f) | | | 6.13 | % | | | 07/01/2043 | | | | 2,000 | | | | 2,073,040 | |

Series 2008 B, Educational Facility RB(f) | | | 6.13 | % | | | 07/01/2048 | | | | 3,840 | | | | 3,971,520 | |

California (State of) Municipal Finance Authority (High Tech High-Media Arts); | | | | | | | | | | | | | | | | |

Series 2008 A, Educational Facility RB(f) | | | 6.00 | % | | | 07/01/2038 | | | | 1,170 | | | | 1,214,261 | |

Series 2008 A, Educational Facility RB(f) | | | 6.13 | % | | | 07/01/2048 | | | | 2,415 | | | | 2,503,123 | |

California (State of) Municipal Finance Authority (King/Chavez); Series 2009 A, Educational Facilities RB | | | 8.50 | % | | | 10/01/2029 | | | | 1,000 | | | | 1,124,790 | |

California (State of) Municipal Finance Authority (Santa Rosa Academy); | | | | | | | | | | | | | | | | |

Series 2012 A, Charter School Lease RB | | | 5.75 | % | | | 07/01/2030 | | | | 7,250 | | | | 7,869,295 | |

Series 2012 A, Charter School Lease RB | | | 6.00 | % | | | 07/01/2042 | | | | 5,355 | | | | 5,747,575 | |

California (State of) Pollution Control Finance Authority; | | | | | | | | | | | | | | | | |

Series 2012, Water Furnishing RB(f)(g) | | | 5.00 | % | | | 07/01/2037 | | | | 13,500 | | | | 14,802,480 | |

Series 2012, Water Furnishing RB(f)(g) | | | 5.00 | % | | | 11/21/2045 | | | | 32,210 | | | | 35,184,593 | |

California (State of) Pollution Control Financing Authority (Aemerge Redpack Services LLC); Series 2016, Solid Waste Disposal RB(f)(g) | | | 7.00 | % | | | 12/01/2027 | | | | 2,750 | | | | 2,754,593 | |

California (State of) School Finance Authority (Alliance for College-Ready Public Schools); Series 2013 A, School Facility RB | | | 6.40 | % | | | 07/01/2048 | | | | 3,000 | | | | 3,426,750 | |

California (State of) School Finance Authority (New Designs Charter School); Series 2012, Educational Facilities RB | | | 5.50 | % | | | 06/01/2042 | | | | 5,000 | | | | 5,197,750 | |

California (State of) Statewide Communities Development Authority (American Baptist Homes of the West); Series 2010, RB | | | 6.25 | % | | | 10/01/2039 | | | | 2,000 | | | | 2,214,860 | |

California (State of) Statewide Communities Development Authority (California Baptist University); | | | | | | | | | | | | | | | | |

Series 2007 A, RB | | | 5.50 | % | | | 11/01/2038 | | | | 8,000 | | | | 8,175,120 | |

Series 2011, RB | | | 7.25 | % | | | 11/01/2031 | | | | 1,500 | | | | 1,755,045 | |

Series 2011, RB | | | 7.50 | % | | | 11/01/2041 | | | | 5,500 | | | | 6,473,940 | |

Series 2014 A, RB | | | 6.13 | % | | | 11/01/2033 | | | | 1,560 | | | | 1,722,817 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

12 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| California–(continued) | | | | | | | | | | | | | | | | |

California (State of) Statewide Communities Development Authority (Collegiate Housing Foundation — Irvine, L.L.C. — University of California-Irvine East Campus Apartments, Phase II); Series 2008, Student Housing RB | | | 6.00 | % | | | 05/15/2040 | | | $ | 5,000 | | | $ | 5,416,350 | |

California (State of) Statewide Communities Development Authority (Creative Child Care & Team); Series 2015, School Facilities RB (Acquired 11/03/2015; Cost $6,700,000)(f) | | | 6.75 | % | | | 06/01/2045 | | | | 6,700 | | | | 6,831,320 | |

California (State of) Statewide Communities Development Authority (Eskaton Properties, Inc.); Series 2012, RB | | | 5.25 | % | | | 11/15/2034 | | | | 4,350 | | | | 4,753,984 | |

California (State of) Statewide Communities Development Authority (Huntington Park Charter School); Series 2007 A, Educational Facilities RB | | | 5.25 | % | | | 07/01/2042 | | | | 3,500 | | | | 3,521,315 | |

California (State of) Statewide Communities Development Authority (Lancer Educational Student Housing); | | | | | | | | | | | | | | | | |

Series 2007, RB | | | 5.40 | % | | | 06/01/2017 | | | | 1,285 | | | | 1,312,525 | |

Series 2007, RB | | | 5.63 | % | | | 06/01/2033 | | | | 4,940 | | | | 5,074,566 | |

Series 2010, RB | | | 7.50 | % | | | 06/01/2042 | | | | 1,680 | | | | 1,845,816 | |

California (State of) Statewide Communities Development Authority (Southern California Presbyterian Homes); | | | | | | | | | | | | | | | | |

Series 2009, Senior Living RB(f) | | | 7.00 | % | | | 11/15/2029 | | | | 1,745 | | | | 2,042,872 | |

Series 2009, Senior Living RB(f) | | | 7.25 | % | | | 11/15/2041 | | | | 3,500 | | | | 4,068,645 | |

California (State of) Statewide Communities Development Authority (Terraces at San Joaquin Garden); | | | | | | | | | | | | | | | | |

Series 2012, RB | | | 6.00 | % | | | 10/01/2042 | | | | 2,895 | | | | 3,138,383 | |

Series 2012, RB | | | 6.00 | % | | | 10/01/2047 | | | | 1,785 | | | | 1,931,441 | |

California (State of) Statewide Finance Authority (Pooled Tobacco Securitization); | | | | | | | | | | | | | | | | |

Series 2002, Tobacco Settlement Asset-Backed RB | | | 6.00 | % | | | 05/01/2043 | | | | 15,000 | | | | 15,251,400 | |

Series 2006 A, Tobacco Settlement CAB Turbo RB(e) | | | 0.00 | % | | | 06/01/2046 | | | | 181,950 | | | | 19,696,087 | |

California County Tobacco Securitization Agency (Gold Country Settlement Funding Corp.); Series 2006, Tobacco Settlement Asset-Backed CAB RB(e) | | | 0.00 | % | | | 06/01/2033 | | | | 17,475 | | | | 5,952,160 | |

California County Tobacco Securitization Agency (The) (Sonoma County Securitization Corp.); | | | | | | | | | | | | | | | | |

Series 2005, Ref. Tobacco Settlement Asset-Backed RB | | | 5.13 | % | | | 06/01/2038 | | | | 9,380 | | | | 9,239,675 | |

Series 2005, Ref. Tobacco Settlement Asset-Backed RB | | | 5.25 | % | | | 06/01/2045 | | | | 3,675 | | | | 3,609,989 | |

Carlsbad (City of) Community Facilities District 3 (Improvement Area 2); | | | | | | | | | | | | | | | | |

Series 2008, Special Tax RB | | | 6.10 | % | | | 09/01/2028 | | | | 2,615 | | | | 2,764,500 | |

Series 2008, Special Tax RB | | | 6.20 | % | | | 09/01/2038 | | | | 5,960 | | | | 6,237,796 | |

Desert Community College District (Election of 2004); Series 2007 C, Unlimited Tax CAB GO Bonds (INS–AGM)(b)(e) | | | 0.00 | % | | | 08/01/2046 | | | | 227,175 | | | | 46,111,981 | |

Eden (Township of) Healthcare District; Series 2010, COP | | | 6.13 | % | | | 06/01/2034 | | | | 2,510 | | | | 2,858,162 | |

Fairfield (City of) Community Facilities District No. 2007-1 (Fairfield Commons); | | | | | | | | | | | | | | | | |

Series 2008, Special Tax RB | | | 6.50 | % | | | 09/01/2023 | | | | 1,235 | | | | 1,336,406 | |

Series 2008, Special Tax RB | | | 6.75 | % | | | 09/01/2028 | | | | 2,550 | | | | 2,744,591 | |

Series 2008, Special Tax RB | | | 6.88 | % | | | 09/01/2038 | | | | 4,440 | | | | 4,785,388 | |

Foothill-Eastern Transportation Corridor Agency; | | | | | | | | | | | | | | | | |

Series 2013 C, Ref. Jr. Lien Toll Road RB | | | 6.50 | % | | | 01/15/2043 | | | | 10,750 | | | | 12,826,577 | |

Series 2014 A, Ref. Conv. Toll Road CAB RB(c) | | | 6.85 | % | | | 01/15/2042 | | | | 5,000 | | | | 4,005,100 | |

Series 2014 A, Ref. Toll Road CAB RB (INS–AGM)(b)(e) | | | 0.00 | % | | | 01/15/2036 | | | | 65,000 | | | | 30,192,500 | |

Series 2014 A, Ref. Toll Road CAB RB (INS–AGM)(b)(e) | | | 0.00 | % | | | 01/15/2037 | | | | 20,000 | | | | 8,901,800 | |

Series 2014 A, Ref. Toll Road RB | | | 6.00 | % | | | 01/15/2049 | | | | 20,000 | | | | 23,687,800 | |

Golden State Tobacco Securitization Corp.; | | | | | | | | | | | | | | | | |

Series 2007 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 4.50 | % | | | 06/01/2027 | | | | 28,110 | | | | 28,214,007 | |

Series 2007 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.00 | % | | | 06/01/2033 | | | | 28,870 | | | | 27,401,672 | |

Series 2007 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.13 | % | | | 06/01/2047 | | | | 44,490 | | | | 39,940,008 | |

Series 2007 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.75 | % | | | 06/01/2047 | | | | 22,400 | | | | 21,657,440 | |

Series 2007 A-2, Sr. Tobacco Settlement Asset-Backed RB | | | 5.30 | % | | | 06/01/2037 | | | | 47,000 | | | | 44,364,710 | |

Hawthorne (City of) Community Facilities District No. 2006-1; Series 2006, Special Tax RB | | | 5.00 | % | | | 09/01/2030 | | | | 3,000 | | | | 3,088,620 | |

Hesperia (City of) Public Financing Authority (Redevelopment & Housing); Series 2007 A, Tax Allocation RB (INS–SGI)(b) | | | 5.00 | % | | | 09/01/2037 | | | | 3,395 | | | | 3,456,721 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

13 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| California–(continued) | | | | | | | | | | | | | | | | |

Inland Empire Tobacco Securitization Authority; | | | | | | | | | | | | | | | | |

Series 2007 A, Tobacco Settlement RB | | | 5.00 | % | | | 06/01/2021 | | | $ | 4,020 | | | $ | 4,049,065 | |

Series 2007 C-1, Asset-Backed Tobacco Settlement CAB RB(e) | | | 0.00 | % | | | 06/01/2036 | | | | 158,815 | | | | 34,408,858 | |

Series 2007 D, Asset-Backed Tobacco Settlement CAB RB(e) | | | 0.00 | % | | | 06/01/2057 | | | | 32,090 | | | | 400,162 | |

Los Alamitos Unified School District (Capital); Series 2012, Conv. CAB COP(c) | | | 6.05 | % | | | 08/01/2042 | | | | 9,000 | | | | 7,098,840 | |

Los Angeles (City of) Community Facilities District No. 3 (Cascades Business Park); Series 1997, Special Tax RB | | | 6.40 | % | | | 09/01/2022 | | | | 495 | | | | 505,341 | |

Los Angeles (City of) Department of Water & Power; Series 2012-B, Waterworks RB(a) | | | 5.00 | % | | | 07/01/2043 | | | | 66,530 | | | | 77,734,318 | |

Morongo Band of Mission Indians (The) (Enterprise Casino); Series 2008 B, RB(f) | | | 6.50 | % | | | 03/01/2028 | | | | 5,515 | | | | 6,027,233 | |

National City (City of) Community Development Commission (National City Redevelopment); Series 2011, Tax Allocation RB | | | 7.00 | % | | | 08/01/2032 | | | | 4,750 | | | | 5,956,927 | |

Placentia (City of) Public Financing Authority (Working Capital Financing); Series 2009, Lease RB | | | 7.50 | % | | | 06/01/2019 | | | | 3,615 | | | | 3,620,314 | |

Rancho Cordova (City of) Community Facilities District No. 2003-1 (Sunridge Anatolia); Series 2005, Special Tax RB | | | 5.50 | % | | | 09/01/2037 | | | | 2,000 | | | | 2,032,460 | |

Riverside (County of) Redevelopment Agency (Mid-County Redevelopment Project Area); Series 2010 C, Tax Allocation RB | | | 6.25 | % | | | 10/01/2040 | | | | 1,780 | | | | 1,962,414 | |

Riverside (County of) Transportation Commission; Series 2013 A, Sr. Lien Toll RB | | | 5.75 | % | | | 06/01/2048 | | | | 7,000 | | | | 8,064,000 | |

Roseville (City of) (Fountains Community Facilities District No. 1); Series 2008, Special Tax RB | | | 6.13 | % | | | 09/01/2038 | | | | 1,000 | | | | 1,059,980 | |

Sacramento (County of) Community Facilities District No. 2005-2 (North Vineyard Station No. 1); Series 2007 A, Special Tax RB | | | 6.00 | % | | | 09/01/2037 | | | | 11,110 | | | | 11,405,859 | |

San Bernardino City Unified School District; | | | | | | | | | | | | | | | | |

Series 2011 D, Unlimited Tax CAB GO Bonds (INS–AGM)(b)(e) | | | 0.00 | % | | | 08/01/2036 | | | | 7,650 | | | | 3,489,700 | |

Series 2011 D, Unlimited Tax CAB GO Bonds (INS–AGM)(b)(e) | | | 0.00 | % | | | 08/01/2037 | | | | 13,130 | | | | 5,751,859 | |

Series 2011 D, Unlimited Tax CAB GO Bonds (INS–AGM)(b)(e) | | | 0.00 | % | | | 08/01/2038 | | | | 13,515 | | | | 5,684,274 | |

Series 2011 D, Unlimited Tax CAB GO Bonds (INS–AGM)(b)(e) | | | 0.00 | % | | | 08/01/2039 | | | | 13,895 | | | | 5,597,045 | |

Series 2011 D, Unlimited Tax CAB GO Bonds (INS–AGM)(b)(e) | | | 0.00 | % | | | 08/01/2040 | | | | 14,280 | | | | 5,493,659 | |

Series 2011 D, Unlimited Tax CAB GO Bonds (INS–AGM)(b)(e) | | | 0.00 | % | | | 08/01/2041 | | | | 14,080 | | | | 5,195,942 | |

San Buenaventura (City of) (Community Memorial Health System); | | | | | | | | | | | | | | | | |

Series 2011, RB | | | 7.50 | % | | | 12/01/2041 | | | | 20,980 | | | | 25,717,284 | |

Series 2011, RB | | | 8.00 | % | | | 12/01/2031 | | | | 9,875 | | | | 12,523,277 | |

San Diego Unified School District (Election of 2008); Series 2012 E, Unlimited Tax Conv. CAB GO Bonds(c) | | | 5.25 | % | | | 07/01/2042 | | | | 10,000 | | | | 5,529,000 | |

San Francisco (City & County of) Redevelopment Financing Authority (Mission Bay South Redevelopment); | | | | | | | | | | | | | | | | |

Series 2009 D, Tax Allocation RB | | | 6.25 | % | | | 08/01/2028 | | | | 1,000 | | | | 1,137,250 | |

Series 2009 D, Tax Allocation RB | | | 6.50 | % | | | 08/01/2030 | | | | 1,000 | | | | 1,142,850 | |

San Francisco (City & County of) Successor Agency to the Redevelopment Agency Community Facilities District No. 6 (Mission Bay South Public Improvements); | | | | | | | | | | | | | | | | |

Series 2013 C, Special Tax CAB RB(e) | | | 0.00 | % | | | 08/01/2036 | | | | 5,710 | | | | 1,996,673 | |

Series 2013 C, Special Tax CAB RB(e) | | | 0.00 | % | | | 08/01/2038 | | | | 2,000 | | | | 611,740 | |

Series 2013 C, Special Tax CAB RB(e) | | | 0.00 | % | | | 08/01/2043 | | | | 17,000 | | | | 3,840,640 | |

San Gorgonio Memorial Health Care District (Election 2006); Series 2009 C, Unlimited Tax GO Bonds(h)(i) | | | 7.20 | % | | | 08/01/2017 | | | | 13,000 | | | | 14,248,390 | |

San Joaquin Hills Transportation Corridor Agency; | | | | | | | | | | | | | | | | |

Series 2014 A, Ref. Sr. Toll Road RB | | | 5.00 | % | | | 01/15/2050 | | | | 18,500 | | | | 20,217,170 | |

Series 2014 B, Ref. Jr. Toll Road RB | | | 5.25 | % | | | 01/15/2044 | | | | 7,000 | | | | 7,648,130 | |

Series 2014 B, Ref. Jr. Toll Road RB | | | 5.25 | % | | | 01/15/2049 | | | | 13,000 | | | | 14,318,980 | |

San Jose (City of) (Helzer Courts Apartments); Series 1999 A, MFH RB(g) | | | 6.40 | % | | | 12/01/2041 | | | | 14,123 | | | | 14,131,050 | |

San Jose (City of) Community Facilities District No. 9 (Bailey/Highway 101); | | | | | | | | | | | | | | | | |

Series 2003, Special Tax RB | | | 6.60 | % | | | 09/01/2027 | | | | 2,000 | | | | 2,004,980 | |

Series 2003, Special Tax RB | | | 6.65 | % | | | 09/01/2032 | | | | 2,630 | | | | 2,635,470 | |

Santa Cruz (County of) Redevelopment Agency (Live Oak/Soquel Community Improvement); Series 2009 A, Tax Allocation RB | | | 7.00 | % | | | 09/01/2036 | | | | 3,500 | | | | 4,120,830 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

14 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| California–(continued) | | | | | | | | | | | | | | | | |

Savanna Elementary School District (Election of 2008); Series 2012 B, Unlimited Tax Conv. CAB GO Bonds (INS–AGM)(b)(c) | | | 6.75 | % | | | 02/01/2052 | | | $ | 7,500 | | | $ | 4,845,375 | |

Silicon Valley Tobacco Securitization Authority (Santa Clara); Series 2007 A, Tobacco Settlement CAB Turbo RB(e) | | | 0.00 | % | | | 06/01/2036 | | | | 10,000 | | | | 2,812,300 | |

Southern California Logistics Airport Authority; | | | | | | | | | | | | | | | | |

Series 2007, Tax Allocation RB(j) | | | 6.15 | % | | | 12/01/2043 | | | | 4,400 | | | | 2,375,912 | |

Series 2008 A, Tax Allocation CAB RB(e) | | | 0.00 | % | | | 12/01/2045 | | | | 18,085 | | | | 543,635 | |

Series 2008 A, Tax Allocation CAB RB(e) | | | 0.00 | % | | | 12/01/2046 | | | | 18,085 | | | | 516,508 | |

Series 2008 A, Tax Allocation CAB RB(e) | | | 0.00 | % | | | 12/01/2047 | | | | 18,085 | | | | 447,785 | |

Series 2008 A, Tax Allocation CAB RB(e) | | | 0.00 | % | | | 12/01/2048 | | | | 18,085 | | | | 417,040 | |

Series 2008 A, Tax Allocation CAB RB(e) | | | 0.00 | % | | | 12/01/2049 | | | | 18,085 | | | | 380,870 | |

Series 2008 A, Tax Allocation CAB RB(e) | | | 0.00 | % | | | 12/01/2050 | | | | 18,085 | | | | 353,743 | |

Series 2008 A, Tax Allocation RB(d) | | | 6.00 | % | | | 12/01/2033 | | | | 1,475 | | | | 796,471 | |

Southern California Tobacco Securitization Authority (San Diego County Tobacco Asset Securitization Corp.); | | | | | | | | | | | | | | | | |

Series 2006, Tobacco Settlement Asset-Backed First Sub. CAB RB(e) | | | 0.00 | % | | | 06/01/2046 | | | | 35,000 | | | | 868,000 | |

Series 2006, Tobacco Settlement Asset-Backed Second Sub. CAB RB(e) | | | 0.00 | % | | | 06/01/2046 | | | | 27,200 | | | | 585,888 | |

Series 2006, Tobacco Settlement Asset-Backed Third Sub. CAB RB(e) | | | 0.00 | % | | | 06/01/2046 | | | | 47,000 | | | | 943,290 | |

Series 2006 A-1, Sr. RB | | | 4.75 | % | | | 06/01/2025 | | | | 5 | | | | 5,001 | |

Series 2006 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.00 | % | | | 06/01/2037 | | | | 21,715 | | | | 20,649,228 | |

Series 2006 A-1, Sr. Tobacco Settlement Asset-Backed RB | | | 5.13 | % | | | 06/01/2046 | | | | 8,205 | | | | 7,832,165 | |

University of California; Series 2014 AM, RB(a) | | | 5.00 | % | | | 05/15/2044 | | | | 34,545 | | | | 39,674,242 | |

Vallejo (City of) Public Financing Authority (Hiddenbrooke Improvement District); Series 2004 A, Local Agency RB | | | 5.80 | % | | | 09/01/2031 | | | | 3,965 | | | | 4,010,875 | |

Victor Valley Union High School District (Election of 2008); | | | | | | | | | | | | | | | | |

Series 2013 B, Unlimited Tax CAB GO Bonds(e) | | | 0.00 | % | | | 08/01/2043 | | | | 11,855 | | | | 2,852,669 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(e) | | | 0.00 | % | | | 08/01/2044 | | | | 12,475 | | | | 2,823,716 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(e) | | | 0.00 | % | | | 08/01/2047 | | | | 14,550 | | | | 2,734,527 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(e) | | | 0.00 | % | | | 08/01/2048 | | | | 7,000 | | | | 1,236,970 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(e) | | | 0.00 | % | | | 08/01/2049 | | | | 15,715 | | | | 2,609,633 | |

Series 2013 B, Unlimited Tax CAB GO Bonds(e) | | | 0.00 | % | | | 08/01/2052 | | | | 37,560 | | | | 5,154,359 | |

| | | | | 1,054,659,386 | |

| | | | |

| Colorado–3.99% | | | | | | | | | | | | | | | | |

Banning Lewis Ranch (Metropolitan District No. 3); Series 2015 A, Limited Tax GO Bonds | | | 6.13 | % | | | 12/01/2045 | | | | 1,025 | | | | 1,034,430 | |

Broomfield Village Metropolitan District No. 2; Series 2003, Ref. & Improvement Limited Tax GO Bonds | | | 6.25 | % | | | 12/01/2032 | | | | 3,770 | | | | 3,674,167 | |

Buckhorn Valley Metropolitan District No. 2; Series 2003, Limited Tax GO Bonds(d) | | | 7.00 | % | | | 12/01/2023 | | | | 60 | | | | 49,064 | |

Central Platte Valley Metropolitan District; Series 2014, Ref. Unlimited Tax GO Bonds | | | 5.00 | % | | | 12/01/2043 | | | | 1,250 | | | | 1,314,413 | |

Colorado (State of) Educational & Cultural Facilities Authority (Banning Lewis Ranch Academy); Series 2006, Charter School RB(f) | | | 6.13 | % | | | 12/15/2035 | | | | 2,590 | | | | 2,602,251 | |

Colorado (State of) Educational & Cultural Facilities Authority (Brighton Charter School); Series 2006, Charter School RB | | | 6.00 | % | | | 11/01/2036 | | | | 3,130 | | | | 3,162,990 | |

Colorado (State of) Educational & Cultural Facilities Authority (Community Leadership Academy); | | | | | | | | | | | | | | | | |

Series 2008, Charter School RB | | | 6.25 | % | | | 07/01/2028 | | | | 1,650 | | | | 1,705,159 | |

Series 2008, Charter School RB | | | 6.50 | % | | | 07/01/2038 | | | | 1,000 | | | | 1,032,640 | |

Series 2013, Charter School RB | | | 7.45 | % | | | 08/01/2048 | �� | | | 2,245 | | | | 2,678,195 | |

Colorado (State of) Educational & Cultural Facilities Authority (Flagstaff Academy);

Series 2008 A, Charter School RB | | | 7.00 | % | | | 08/01/2038 | | | | 1,500 | | | | 1,574,895 | |

Colorado (State of) Educational & Cultural Facilities Authority (Monument Academy); | | | | | | | | | | | | | | | | |

Series 2007, Charter School RB(h)(i) | | | 5.88 | % | | | 10/01/2017 | | | | 2,500 | | | | 2,708,000 | |

Series 2007, Charter School RB(h)(i) | | | 6.00 | % | | | 10/01/2017 | | | | 1,635 | | | | 1,774,253 | |

Series 2008 A, Charter School RB(h)(i) | | | 7.25 | % | | | 10/01/2018 | | | | 500 | | | | 582,885 | |

See accompanying Notes to Financial Statements which are an integral part of the financial statements.

15 Invesco High Yield Municipal Fund

| | | | | | | | | | | | | | | | |

| | | Interest

Rate | | | Maturity

Date | | | Principal

Amount

(000) | | | Value | |

| Colorado–(continued) | | | | | | | | | | | | | | | | |

Colorado (State of) Educational & Cultural Facilities Authority (New Vision Charter School); Series 2008, RB(f) | | | 6.75 | % | | | 04/01/2040 | | | $ | 1,760 | | | $ | 1,814,806 | |

Colorado (State of) Educational & Cultural Facilities Authority (North Star Academy);

Series 2008 A, Ref. & Improvement RB(f) | | | 8.25 | % | | | 11/01/2039 | | | | 2,820 | | | | 3,109,417 | |

Colorado (State of) Educational & Cultural Facilities Authority (Northeast Academy); Series 2007, Charter School RB (Acquired 07/27/2007-03/31/2008;

Cost $2,287,635)(f)(h)(i) | | | 5.75 | % | | | 05/15/2017 | | | | 2,380 | | | | 2,519,992 | |

Colorado (State of) Educational & Cultural Facilities Authority (The Classical Academy); Series 2008 A, Charter School RB(h)(i) | | | 7.40 | % | | | 12/01/2018 | | | | 2,000 | | | | 2,360,200 | |

Colorado (State of) Educational and Cultural Facilities Authority (Skyview Academy); | | | | | | | | | | | | | | | | |

Series 2014, Ref. & Improvement Charter School RB(f) | | | 5.38 | % | | | 07/01/2044 | | | | 1,350 | | | | 1,442,421 | |

Series 2014, Ref. & Improvement Charter School RB(f) | | | 5.50 | % | | | 07/01/2049 | | | | 1,600 | | | | 1,712,000 | |

Colorado (State of) Health Facilities Authority (American Baptist Homes); Series 2009 A, RB | | | 7.75 | % | | | 08/01/2039 | | | | 4,000 | | | | 4,400,560 | |

Colorado (State of) Health Facilities Authority (Christian Living Communities); | | | | | | | | | | | | | | | | |

Series 2006 A, RB | | | 5.75 | % | | | 01/01/2037 | | | | 9,355 | | | | 9,477,363 | |

Series 2011, RB | | | 6.38 | % | | | 01/01/2041 | | | | 1,615 | | | | 1,756,587 | |

Colorado (State of) Health Facilities Authority (SCL Health System); Series 2013 A, RB(a) | | | 5.00 | % | | | 01/01/2044 | | | | 21,000 | | | | 23,694,720 | |

Colorado (State of) Health Facilities Authority (Sunny Vista Living Center); | | | | | | | | | | | | | | | | |

Series 2015 A, Ref. RB | | | 5.75 | % | | | 12/01/2035 | | | | 1,150 | | | | 1,160,132 | |

Series 2015 A, Ref. RB | | | 6.13 | % | | | 12/01/2045 | | | | 1,300 | | | | 1,331,005 | |

Series 2015 A, Ref. RB | | | 6.25 | % | | | 12/01/2050 | | | | 1,000 | | | | 1,024,080 | |

Colorado (State of) Health Facilities Authority (Total Longterm Care National Obligated Group); | | | | | | | | | | | | | | | | |

Series 2010 A, RB | | | 6.00 | % | | | 11/15/2030 | | | | 1,600 | | | | 1,827,840 | |

Series 2010 A, RB | | | 6.25 | % | | | 11/15/2040 | | | | 4,750 | | | | 5,399,752 | |

Series 2011, RB | | | 5.75 | % | | | 11/15/2031 | | | | 1,000 | | | | 1,127,360 | |

Series 2011, RB | | | 6.00 | % | | | 11/15/2040 | | | | 1,195 | | | | 1,350,015 | |

Colorado (State of) Health Facilities Authority (Volunteers of America Care); | | | | | | | | | | | | | | | | |

Series 2007 A, Health & Residential Care Facilities RB | | | 5.20 | % | | | 07/01/2022 | | | | 800 | | | | 800,280 | |

Series 2007 A, Health & Residential Care Facilities RB | | | 5.25 | % | | | 07/01/2027 | | | | 3,260 | | | | 3,260,228 | |

Series 2007 A, Health & Residential Care Facilities RB | | | 5.30 | % | | | 07/01/2037 | | | | 5,815 | | | | 5,814,535 | |

Colorado (State of) Regional Transportation District (Denver Transit Partners Eagle P3); Series 2010, Private Activity RB | | | 6.00 | % | | | 01/15/2041 | | | | 13,935 | | | | 15,681,334 | |

Colorado Springs (City of) Urban Renewal Authority (University Village Colorado); Series 2008 A, Tax Increment Allocation RB(d) | | | 7.00 | % | | | 12/01/2029 | | | | 18,050 | | | | 15,870,643 | |

Copperleaf Metropolitan District No. 2; | | | | | | | | | |

Series 2006, Limited Tax GO Bonds | | | 5.85 | % | | | 12/01/2026 | | | | 1,000 | | | | 1,040,160 | |

Series 2006, Limited Tax GO Bonds(h)(i) | | | 5.95 | % | | | 12/01/2016 | | | | 9,000 | | | | 9,368,280 | |

Series 2015, Ref. Unlimited Tax GO Bonds | | | 5.75 | % | | | 12/01/2045 | | | | 2,000 | | | | 2,104,960 | |

Cross Creek Metropolitan District No. 2; Series 2006, Ref. Limited Tax GO Bonds | | | 5.00 | % | | | 12/01/2037 | | | | 2,630 | | | | 2,310,823 | |

Denver (City & County of) (United Airlines); | | | | | | | | | |

Series 2007 A, Ref. Special Facilities Airport RB(g) | | | 5.25 | % | | | 10/01/2032 | | | | 17,110 | | | | 17,811,339 | |

Series 2007 A, Ref. Special Facilities Airport RB(g) | | | 5.75 | % | | | 10/01/2032 | | | | 16,400 | | | | 17,157,188 | |

Elbert (County of) & Highway 86 Commercial Metropolitan District; Series 2008 A, Public Improvement Fee RB(l) | | | 3.38 | % | | | 12/01/2032 | | | | 4,500 | | | | 2,249,685 | |