UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORMN-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07896

GAMCO Global Series Funds, Inc.

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

Bruce N. Alpert

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: December 31

Date of reporting period: December 31, 2019

FormN-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule30e-1 under the Investment Company Act of 1940 (17 CFR270.30e-1). The Commission may use the information provided on FormN-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by FormN-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in FormN-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

The Gabelli Global Content & Connectivity Fund

Annual Report — December 31, 2019

(Y)our Portfolio Management Team

| | | | | | |

| |  | |  | |  |

Mario J. Gabelli, CFA Chief Investment Officer | | Evan D. Miller, CFA Portfolio Manager BA, Northwestern UniversityMBA, Booth School of Business,University of Chicago | | Sergey Dluzhevskiy, CFA, CPA Portfolio Manager BS, Case Western Reserve University MBA, The Wharton School, University of Pennsylvania | | Brett Harriss Portfolio Manager BA, Columbia University MBA, Columbia BusinessSchool, ColumbiaUniversity |

To Our Shareholders,

For the year ended December 31, 2019, the net asset value (NAV) per Class AAA Share of The Gabelli Global Content & Connectivity Fund increased 15.6% compared with an increase of 25.1% for the Morgan Stanley Capital International (MSCI) All Country (AC) World Communication Services Index. Other classes of shares are available. See page 3 for performance information for all classes.

Enclosed are the financial statements, including the schedule of investments, as of December 31, 2019.

Performance Discussion (Unaudited)

The Fund’s objective is to provide investors with appreciation of capital. Current income is a secondary objective of the Fund.

The Fund’s investment strategy is to invest its net assets in common stocks of companies in the telecommunications, media, and information technology industries which Gabelli Funds, LLC, the Adviser believes are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. In accordance with its concentration policy, the Fund will invest at least 25% of the value of its total assets in the telecommunications related industry, and not invest more than 25% of the value of its total assets in any other particular industry.

|

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s annual and semiannual shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports. Instead, the reports will be made available on the Fund’s website (www.gabelli.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. To elect to receive all future reports on paper free of charge, please contact your financial intermediary, or, if you invest directly with the Fund, you may call800-422-3554 or send an email request to info@gabelli.com. |

Global equities rebounded from a challenging fourth quarter, with the MSCI AC World Index up 12.3% in the first quarter of 2019. The stock market rally was largely driven by indications from central banks in the U.S. and Europe that monetary tightening was unlikely in the near-term as well as signs of progress in the U.S. - China trade negotiations. Information Technology was the best performing sector, up 18.9%, followed by real estate (+16.2%), helped by expectations that interest rates may remain at levels lower than previously anticipated, and energy (+14.3%), driven by higher oil prices. The communications sector (up 11.2% in the quarter) held its own, with North America (+13.9%) leading all geographic regions.

Global equities rose in the second quarter, with MSCI AC World Index up 3.8%, on continued dovishness from major central banks as well as renewed hopes for the U.S. – China trade deal after Presidents Donald Trump and Xi Jinping agreed to restart negotiations (with no near-term escalation in tariffs) at the G20 meeting in Osaka. Financials (led by JP Morgan Chase and Citigroup) was the best performing sector in the quarter, up 6.1%, followed by Information Technology (+5.3%), and Consumer Discretionary (+4.6%). Communication Services sector was in the “middle of the pack,” up 3.4% in the second quarter.

MSCI AC World Index was essentially flat for the third quarter, reflecting a mixed quarter for global equities (with developed markets registering modest gains and emerging markets declining), amidst continued concerns over the U.S. - China trade dispute and global growth, while central banks in the U.S. and Europe remained largely accommodative. Utilities was the best performing sector in the quarter, up 5.6%, followed by Consumer Staples (+3.7%), Real Estate (+3.0%), and Information Technology (+2.7%). Communication Services sector was in the “middle of the pack,” up 0.4% in the third quarter.

MSCI AC World Index recorded a robust fourth quarter, with strong gains across all major geographies. Although much of the focus has been on the U.S. market reaching record highs, the 9.0% gain in the MSCI AC World Index was achieved with reasonably consistent contributions from North America (+8.9%), Europe (+8.9%), Latin America (+10.5%), Japan (+7.5%), and Asia,ex-Japan (+10.4%). The first phase of the trade deal between the U.S. and China was certainly a contributor to the global equities rally in the quarter, as was the perceived lower risk of global recession heading into 2020. Information Technology was the best performing sector in the quarter, up 14.6%, followed by Health Care (+13.8%), Materials (+9.4%), and Financials (9.0%). Communication Services, up 8.3%, closed out the Top 5.

Selected holdings that contributed positively to performance in 2019 were:

Facebook Inc. (4.2% of net assets as of December 31, 2019) is an online social networking and social media service with over 2.4 billion monthly active users. Revenues were up 29% year over year to $17.6 billion, while operating margin was at 41%. Daily active users were up 9% (to 2.45 billion); Comcast Corp. (4.6%) is a television and broadband provider in the U.S., UK, Italy and Germany. The introduction of the industry leading X1 platform has helped Comcast gain video subscribers in the US while a reinvestment in content and more focused leadership have improved NBC’s viewership and profitability; and Alphabet Inc. (5.1%) is an umbrella company whose subsidiaries include the core Google business (the Google search engine and related ad revenue, Android, YouTube) as well as multiple independent companies, such as Google Ventures, Waymo, and Verily. Total revenue was up 20%. At Google (core business), website revenue was up 19% (to $29 billion), led by an 18% improvement in paid clicks, with the cost per click falling by 2% due to the mix shift towards mobile search.

Some of our weaker performing stocks during the year:

Telephone and Data Systems (2.0%) provides wireless, cable and wireline broadband, TV, voice, and hosted and managed services in the United States. Down largely due to investor disappointment that USM is

2

not planning to sell its wireless towers in the near term and weaker than expected postpaid wireless net additions were a contributing factor as well; U.S. Cellular Corp. (1.6%) is a mobile network operator which owns and operates the fifth largest wireless telecommunications network in the U.S. Share weakness was largely driven by wide 2019 EBITDA guidance range; and Uniti Group Inc. (no longer held) an internally managed real estate investment trust, and is a leading provider of wireless infrastructure solutions for the communications industry. The company was impacted by its largest tenant, Windstream, filing for bankruptcy in early 2019 as well as by the ongoing dispute about the nature of Windstream’s lease and risk that related master lease payments might be reduced.

Thank you for your investment in The Gabelli Global Content and Connectivity Fund.

We appreciate your confidence and trust.

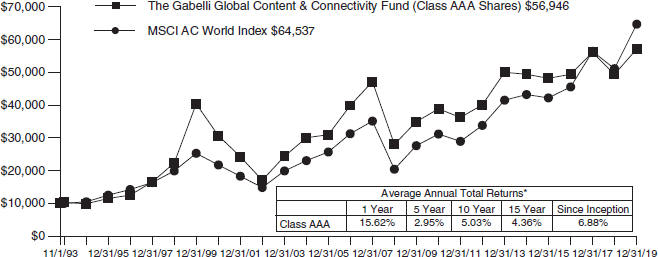

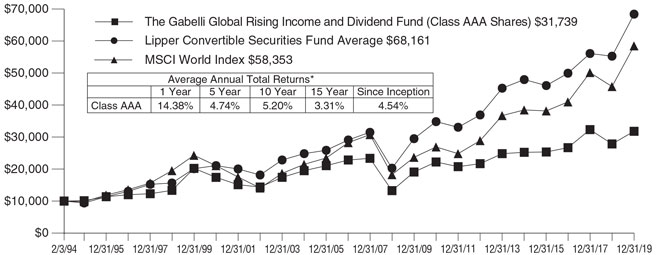

Comparative Results

Average Annual Returns through December 31, 2019 (a) (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | | 1 Year | | | 5 Year | | | 10 Year | | | 15 Year | | | Since

Inception

(11/1/93) | |

Class AAA (GABTX) | | | 15.62 | % | | | 2.95 | % | | | 5.03 | % | | | 4.36 | % | | | 6.88 | % |

MSCI AC World Telecommunication Services Index (b) | | | 25.09 | | | | 4.97 | | | | 6.72 | | | | 5.97 | | | | N/A | |

MSCI AC World Index | | | 26.60 | | | | 8.41 | | | | 8.79 | | | | 6.86 | | | | 7.20 | (c) |

Class A (GTCAX) | | | 15.64 | | | | 2.92 | | | | 5.01 | | | | 4.35 | | | | 6.87 | |

With sales charge (d) | | | 8.99 | | | | 1.71 | | | | 4.39 | | | | 3.94 | | | | 6.63 | |

Class C (GTCCX) | | | 14.81 | | | | 2.19 | | | | 4.25 | | | | 3.58 | | | | 6.28 | |

With contingent deferred sales charge (e) | | | 13.81 | | | | 2.19 | | | | 4.25 | | | | 3.58 | | | | 6.28 | |

Class I (GTTIX) | | | 16.42 | | | | 3.50 | | | | 5.44 | | | | 4.67 | | | | 7.06 | |

In the current prospectuses dated April 30, 2019, as amended by the supplement dated December 3, 2019, the gross expense ratios for Class AAA, A, C, and I Shares are 1.73%, 1.73%, 2.48%, and 1.48%, respectively, and the net expense ratio for all share classes after contractual reimbursements by Gabelli Funds, LLC, (the Adviser) is 0.91%. See page 13 for the expense ratios for the year ended December 31, 2019. The contractual reimbursements are in effect through April 30, 2021. Class AAA and Class I Shares do not have a sales charge. The maximum sales charge for Class A Shares, and Class C Shares is 5.75%, and 1.00%, respectively.

| | (a) | Returns represent past performance and do not guarantee future results. Total returns and average annual returns reflect changes in share price, reinvestment of distributions, and are net of expenses. Investment returns and the principal value of an investment will fluctuate. When shares are redeemed, they may be worth more or less than their original cost. Current performance may be lower or higher than the performance data presented. Visit www.gabelli.com for performance information as of the most recent month end. Returns for Class I Shares would have been lower had the Adviser not reimbursed certain expenses. The Fund imposes a 2% redemption fee on shares sold or exchanged within seven days of purchase. Investors should carefully consider the investment objectives, risks, charges, and expenses of the Fund before investing. The prospectuses contain information about these and other matters and should be read carefully before investing. To obtain a prospectus, please visit our website at www.gabelli.com.Investing in foreign securities involves risks not ordinarily associated with investments in domestic issues, including currency fluctuation, economic, and political risks. The Class AAA Share NAVs are used to calculate performance for the periods prior to the issuance of Class A Shares, Class C Shares, and Class I Shares on March 12, 2000, June 2, 2000, and January 11, 2008, respectively. The actual performance for the Class A Shares and Class C Shares would have been lower due to the additional fees and expenses associated with these classes of shares. The actual performance of the Class I Shares would have been higher due to lower expenses related to this class of shares. The MSCI AC World Telecommunication Services Index is an unmanaged index that measures the performance of the global telecommunication securities from around the world. The MSCI AC World Index is an unmanaged market capitalization weighted index that is designed to measure the equity market performance of developed and emerging markets. The MSCI AC World Index consists of 45 country indices comprising 24 developed and 21 emerging market country indices. Dividends are considered reinvested. You cannot invest directly in an index. | |

| | (b) | MSCI AC World Telecommunication Services Index name changed to MSCI AC World Communication Services Index. | |

| | (c) | The MSCI AC World Index since inception performance is as of October 31, 1993. | |

| | (d) | Performance results include the effect of the maximum 5.75% sales charge at the beginning of the period. | |

| | (e) | Assuming payment of the 1% maximum contingent deferred sales charge imposed on redemptions made within one year of purchase. | |

3

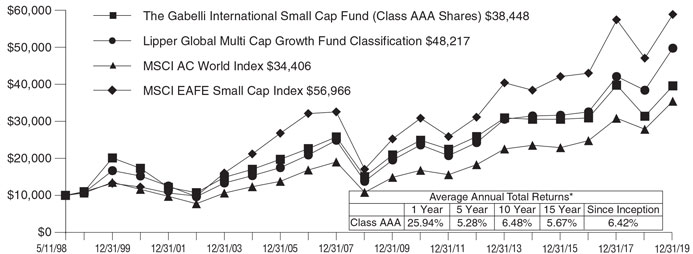

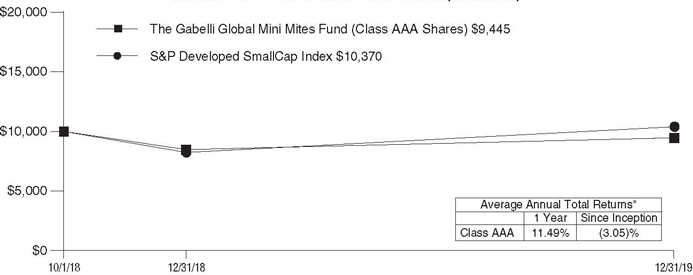

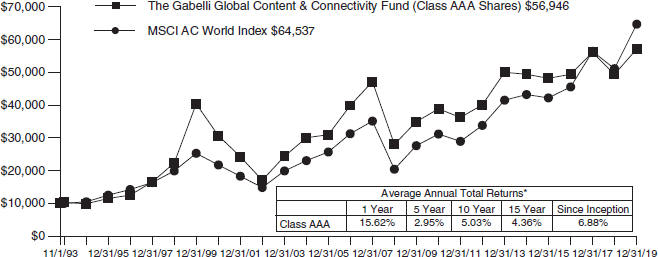

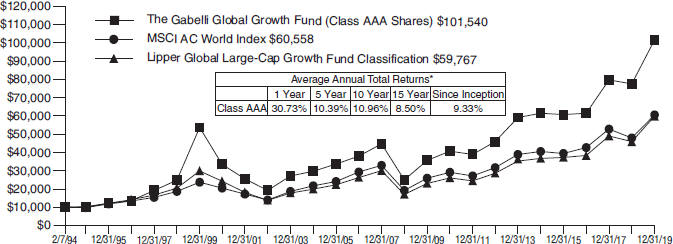

COMPARISON OF CHANGE IN VALUE OF A $10,000 INVESTMENT IN

THE GABELLI GLOBAL CONTENT & CONECTIVITY FUND (CLASS AAA SHARES)

AND MSCI AC WORLD INDEX (Unaudited)

| * | Past performance is not predictive of future results. The performance tables and graph do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. |

4

The Gabelli Global Content & Connectivity Fund

| | | | |

| Disclosure of Fund Expenses (Unaudited) | | |

| For the Six Month Period from July 1, 2019 through December 31, 2019 | | Expense Table |

We believe it is important for you to understand the impact of fees and expenses regarding your investment. All mutual funds have operating expenses. As a shareholder of a fund, you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross income, directly reduce the investment return of a fund. When a fund’s expenses are expressed as a percentage of its average net assets, this figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your Fund and to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The Expense Table below illustrates your Fund’s costs in two ways:

Actual Fund Return:This section provides information about actual account values and actual expenses. You may use this section to help you to estimate the actual expenses that you paid over the period after any fee waivers and expense reimbursements. The “Ending Account Value” shown is derived from the Fund’sactualreturn during the past six months, and the “Expenses Paid During Period” shows the dollar amount that would have been paid by an investor who started with $1,000 in the Fund. You may use this information, together with the amount you invested, to estimate the expenses that you paid over the period.

To do so, simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your Fund under the heading “Expenses Paid During Period” to estimate the expenses you paid during this period.

Hypothetical 5% Return:This section provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense

ratio. It assumes a hypothetical annualized return of 5% before expenses during the period shown. In this case – because the hypothetical return used isnotthe Fund’s actual return – the results do not apply to your investment and you cannot use the hypothetical account value and expense to estimate the actual ending account balance or expenses you paid for the period. This example is useful in making comparisons of the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs such as sales charges (loads), redemption fees, or exchange fees, if any, which are described in the Prospectus. If these costs were applied to your account, your costs would be higher. Therefore, the 5% hypothetical return is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. The “Annualized Expense Ratio” represents the actual expenses for the last six months and may be different from the expense ratio in the Financial Highlights which is for the year ended December 31, 2019.

| | | | | | | | | | | | |

| | | Beginning

Account Value

07/01/19 | | Ending

Account Value

12/31/19 | | Annualized

Expense

Ratio | | | Expenses

Paid During

Period* | |

| The Gabelli Global Content & Connectivity Fund | |

Actual Fund Return | | | | | | | | |

Class AAA | | $1,000.00 | | $1,041.60 | | | 1.63% | | | | $ 8.39 | |

Class A | | $1,000.00 | | $1,041.10 | | | 1.62% | | | | $ 8.33 | |

Class C | | $1,000.00 | | $1,038.00 | | | 2.31% | | | | $ 11.87 | |

Class I | | $1,000.00 | | $1,044.80 | | | 0.98% | | | | $ 5.05 | |

Hypothetical 5% Return | | | | | | | | |

Class AAA | | $1,000.00 | | $1,016.99 | | | 1.63% | | | | $ 8.29 | |

Class A | | $1,000.00 | | $1,017.04 | | | 1.62% | | | | $ 8.24 | |

Class C | | $1,000.00 | | $1,013.56 | | | 2.31% | | | | $ 11.72 | |

Class I | | $1,000.00 | | $1,020.27 | | | 0.98% | | | | $ 4.99 | |

| * | Expenses are equal to the Fund’s annualized expense ratio for the last six months multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half year (184 days), then divided by 365. |

5

Summary of Portfolio Holdings (Unaudited)

The following table presents portfolio holdings as a percent of net assets as of December 31, 2019:

The Gabelli Global Content & Connectivity Fund

| | | | |

Communication Services | | | 81.0 | % |

Information Technology | | | 6.0 | % |

Consumer Discretionary | | | 3.9 | % |

Financials | | | 3.9 | % |

Real Estate | | | 2.3 | % |

U.S. Government Obligations | | | 1.2 | % |

Industrials | | | 0.8 | % |

| | | | |

Health Care | | | 0.8 | % |

Consumer Staples | | | 0.2 | % |

Utilities | | | 0.0 | %* |

Other Assets and Liabilities (Net) | | | (0.1 | )% |

| | | | |

| | | 100.0 | % |

| | | | |

| * | Amount represents less than 0.05%. |

The Fund files a complete schedule of portfolio holdings with the Securities and Exchange Commission (the SEC) for the first and third quarters of each fiscal year on FormN-PORT. Shareholders may obtain this information at www.gabelli.com or by calling the Fund at800-GABELLI(800-422-3554). The Fund’s FormN-PORT is available on the SEC’s website at www.sec.gov and may also be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling800-SEC-0330.

Proxy Voting

The Fund files FormN-PX with its complete proxy voting record for the twelve months ended June 30, no later than August 31 of each year. A description of the Fund’s proxy voting policies, procedures, and how the Fund voted proxies relating to portfolio securities is available without charge, upon request, by (i) calling800-GABELLI(800-422-3554); (ii) writing to The Gabelli Funds at One Corporate Center, Rye, NY 10580-1422; or (iii) visiting the SEC’s website at www.sec.gov.

6

The Gabelli Global Content & Connectivity Fund

Schedule of Investments — December 31, 2019

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market

Value | |

| | | | COMMON STOCKS — 98.1% | |

| | | | COMMUNICATION SERVICES — 80.3% | |

| | | | Telecommunication Services — 41.8% | |

| | | | Wireless Telecommunication Services — 18.7% | |

| | | | Wireless Telecommunication Services — 18.7% | |

| | 62,500 | | | America Movil SAB de CV, Cl. L, ADR | | $ | 210,700 | | | $ | 1,000,000 | |

| | 4,500 | | | Anterix Inc.† | | | 166,779 | | | | 194,445 | |

| | 10,000 | | | Axiata Group Berhad | | | 7,116 | | | | 10,121 | |

| | 9,500 | | | China Mobile Ltd., ADR | | | 113,184 | | | | 401,565 | |

| | 72,808 | | | Econet Wireless Zimbabwe Ltd.† | | | 21,788 | | | | 6,373 | |

| | 17,500 | | | Gogo Inc.† | | | 93,514 | | | | 112,000 | |

| | 666 | | | Hutchison Telecommunications Hong Kong Holdings Ltd. | | | 63 | | | | 134 | |

| | 49,000 | | | KDDI Corp. | | | 386,824 | | | | 1,467,001 | |

| | 23,292 | | | Millicom International Cellular SA, SDR | | | 1,232,638 | | | | 1,115,567 | |

| | 16,200 | | | NTT DOCOMO Inc. | | | 251,251 | | | | 452,953 | |

| | 18,000 | | | PLDT Inc., ADR | | | 242,214 | | | | 359,820 | |

| | 240,000 | | | PT Indosat Tbk† | | | 38,553 | | | | 50,308 | |

| | 11,500 | | | Rogers Communications Inc., Cl. B | | | 37,946 | | | | 571,205 | |

| | 3,500 | | | Shenandoah Telecommunications Co. | | | 7,917 | | | | 145,635 | |

| | 45,000 | | | Sistema PJSC FC, GDR | | | 228,379 | | | | 219,330 | |

| | 14,000 | | | SK Telecom Co. Ltd., ADR | | | 213,315 | | | | 323,540 | |

| | 20,000 | | | SoftBank Group Corp. | | | 721,385 | | | | 875,431 | |

| | 40,000 | | | Sprint Corp.† | | | 202,752 | | | | 208,400 | |

| | 60,000 | | | TIM Participacoes SA | | | 123,340 | | | | 233,724 | |

| | 55,500 | | | T-Mobile US Inc.† | | | 1,546,591 | | | | 4,352,310 | |

| | 56,000 | | | Turkcell Iletisim Hizmetleri A/S, ADR | | | 277,945 | | | | 324,800 | |

| | 33,800 | | | United States Cellular Corp.† | | | 1,126,509 | | | | 1,224,574 | |

| | 140,000 | | | VEON Ltd., ADR | | | 223,340 | | | | 354,200 | |

| | 31,000 | | | Vodafone Group plc, ADR | | | 654,169 | | | | 599,230 | |

| | | | | | | | | | | | |

| | | | | | | 8,128,212 | | | | 14,602,666 | |

| | | | | | | | | | | | |

| | | | Diversified Telecommunication Services — 23.1% | |

| | | | Integrated Telecommunication Services — 19.9% | |

| | 9,500 | | | AT&T Inc. | | | 193,967 | | | | 371,260 | |

| | 1,900 | | | ATN International Inc. | | | 5,893 | | | | 105,241 | |

| | 37,415,054 | | | Cable & Wireless Jamaica Ltd.†(a) | | | 499,070 | | | | 409,347 | |

| | 16,400 | | | China Unicom Hong Kong Ltd., ADR | | | 104,722 | | | | 153,504 | |

| | 44,000 | | | Cincinnati Bell Inc.† | | | 289,030 | | | | 460,680 | |

| | 101,000 | | | Deutsche Telekom AG, ADR | | | 1,836,835 | | | | 1,645,290 | |

| | 3,107 | | | Hellenic Telecommunications Organization SA | | | 43,544 | | | | 49,698 | |

| | 2,000 | | | Hellenic Telecommunications Organization SA, ADR | | | 16,157 | | | | 16,140 | |

| | 15,000 | | | Koninklijke KPN NV | | | 39,437 | | | | 44,268 | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market

Value | |

| | 26,000 | | | Maroc Telecom | | $ | 426,215 | | | $ | 417,050 | |

| | 18,000 | | | Nippon Telegraph & Telephone Corp. | | | 165,752 | | | | 456,730 | |

| | 2,000 | | | Nippon Telegraph & Telephone Corp., ADR | | | 38,489 | | | | 101,000 | |

| | 20,500 | | | Nuvera Communications Inc. | | | 227,926 | | | | 389,500 | |

| | 453 | | | Oi SA, Cl. C, ADR† | | | 1,724 | | | | 422 | |

| | 2,000 | | | Orange SA, ADR | | | 28,867 | | | | 29,180 | |

| | 200,000 | | | Pakistan Telecommunication Co. Ltd. | | | 29,365 | | | | 12,088 | |

| | 90,000 | | | PCCW Ltd. | | | 74,681 | | | | 53,245 | |

| | 6,400 | | | Proximus SA | | | 185,008 | | | | 183,206 | |

| | 9,700 | | | PT Telekomunikasi Indonesia Persero Tbk, ADR | | | 21,613 | | | | 276,450 | |

| | 3,000 | | | Rostelecom PJSC, ADR | | | 20,044 | | | | 22,515 | |

| | 180,000 | | | Singapore Telecommunications Ltd. | | | 136,646 | | | | 451,020 | |

| | 9,800 | | | Swisscom AG, ADR | | | 235,828 | | | | 517,979 | |

| | 18,000 | | | Telecom Argentina SA, ADR | | | 66,803 | | | | 204,300 | |

| | 11,500 | | | Telecom Italia SpA, ADR† | | | 86,914 | | | | 71,070 | |

| | 5,021 | | | Telefonica Brasil SA, ADR | | | 27,844 | | | | 71,901 | |

| | 3,935 | | | Telefonica SA | | | 58,513 | | | | 27,485 | |

| | 77,000 | | | Telefonica SA, ADR | | | 246,054 | | | | 536,690 | |

| | 70,000 | | | Telekom Austria AG | | | 498,397 | | | | 571,621 | |

| | 123,000 | | | Telekom Malaysia Berhad | | | 114,886 | | | | 114,866 | |

| | 36,300 | | | Telenor ASA | | | 515,432 | | | | 651,013 | |

| | 60,000 | | | Telephone & Data Systems Inc. | | | 1,141,189 | | | | 1,525,800 | |

| | 128,000 | | | Telesites SAB de CV† | | | 97,176 | | | | 94,777 | |

| | 259,000 | | | Telia Co. AB | | | 556,485 | | | | 1,113,000 | |

| | 26,000 | | | TELUS Corp. | | | 284,822 | | | | 1,006,980 | |

| | 405,000 | | | True Corp. Public Co. Ltd. | | | 61,287 | | | | 62,196 | |

| | 53,300 | | | Verizon Communications Inc. | | | 1,673,375 | | | | 3,272,620 | |

| | | | | | | | | | | | |

| | | | | | | 10,049,990 | | | | 15,490,132 | |

| | | | | | | | | | | | |

| | | | Alternative Carriers — 3.2% | |

| | 106,000 | | | CenturyLink Inc. | | | 1,695,738 | | | | 1,400,260 | |

| | 300 | | | Iliad SA | | | 29,953 | | | | 38,884 | |

| | 22,500 | | | Intelsat SA† | | | 360,317 | | | | 158,175 | |

| | 28,000 | | | TIME dotCom Berhad | | | 56,823 | | | | 63,112 | |

| | 25,000 | | | Zayo Group Holdings Inc.† | | | 716,486 | | | | 866,250 | |

| | | | | | | | | | | | |

| | | | | | | 2,859,317 | | | | 2,526,681 | |

| | | | | | | | | | | | |

| | | | Media & Entertainment — 38.5% | |

| | | | Media — 25.9% | |

| | | | Cable & Satellite — 13.9% | | | | | |

| | 6,200 | | | Cogeco Inc. | | | 120,942 | | | | 496,983 | |

| | 79,800 | | | Comcast Corp., Cl. A | | | 2,430,616 | | | | 3,588,606 | |

| | 28,461 | | | DISH Network Corp., Cl. A† | | | 553,488 | | | | 1,009,512 | |

| | 280,000 | | | Dish TV India Ltd., GDR† | | | 271,241 | | | | 28,000 | |

| | 3,500 | | | GCI Liberty Inc., Cl. A† | | | 19,375 | | | | 247,975 | |

| | 184,000 | | | Grupo Televisa SAB, ADR | | | 2,266,000 | | | | 2,158,320 | |

| | 1,025 | | | Liberty Broadband Corp., Cl. A† | | | 1,876 | | | | 127,674 | |

See accompanying notes to financial statements.

7

The Gabelli Global Content & Connectivity Fund

Schedule of Investments (Continued) — December 31, 2019

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market

Value | |

| | | | COMMON STOCKS (Continued) | |

| | | | COMMUNICATION SERVICES (Continued) | |

| | | | Media & Entertainment (Continued) | |

| | | | Media (Continued) | | | | | | | | |

| | | | Cable & Satellite (Continued) | |

| | 1,000 | | | Liberty Broadband Corp.,

Cl. C† | | $ | 3,616 | | | $ | 125,750 | |

| | 14,840 | | | Liberty Global plc, Cl. A† | | | 181,787 | | | | 337,462 | |

| | 58,600 | | | Liberty Global plc, Cl. C† | | | 706,948 | | | | 1,277,187 | |

| | 1,000 | | | Liberty Latin America Ltd.,

Cl. A† | | | 13,803 | | | | 19,300 | |

| | 3,444 | | | Liberty Latin America Ltd.,

Cl. C† | | | 36,730 | | | | 67,020 | |

| | 15,500 | | | Liberty Media Corp. - Liberty | | | | | | | | |

| | | | SiriusXM, Cl. A† | | | 537,457 | | | | 749,270 | |

| | 12,000 | | | Liberty Media Corp. - Liberty | | | | | | | | |

| | | | SiriusXM, Cl. C† | | | 474,012 | | | | 577,680 | |

| | 2,000 | | | MultiChoice Group† | | | 13,807 | | | | 16,636 | |

| | | | | | | | | | | | |

| | | | | | | 7,631,698 | | | | 10,827,375 | |

| | | | | | | �� | | | | | |

| | | | Broadcasting — 12.0% | | | | | |

| | 1,400 | | | AMC Networks Inc., Cl. A† | | | 28,458 | | | | 55,300 | |

| | 300,000 | | | Corus Entertainment Inc., Cl. B | | | 1,099,064 | | | | 1,229,063 | |

| | 18,000 | | | Discovery Inc., Cl. A† | | | 337,965 | | | | 589,320 | |

| | 85,000 | | | Discovery Inc., Cl. C† | | | 1,672,913 | | | | 2,591,650 | |

| | 55,666 | | | Fox Corp., Cl. B. | | | 2,078,388 | | | | 2,026,242 | |

| | 11,000 | | | MSG Networks Inc., Cl. A† | | | 67,634 | | | | 191,400 | |

| | 3,000 | | | Nordic Entertainment Group AB, Cl. B | | | 63,636 | | | | 96,985 | |

| | 6,000 | | | Sinclair Broadcast Group Inc., Cl. A | | | 175,753 | | | | 200,040 | |

| | 9,000 | | | Tokyo Broadcasting System Holdings Inc. | | | 114,490 | | | | 154,563 | |

| | 54,070 | | | ViacomCBS Inc., Cl. B | | | 2,494,517 | | | | 2,269,318 | |

| | | | | | | | | | | | |

| | | | | | | 8,132,818 | | | | 9,403,881 | |

| | | | | | | | | | | | |

| | | | Interactive Media & Services — 9.4% | |

| | | | Interactive Media & Services — 9.4% | |

| | 3,000 | | | Alphabet Inc., Cl. C† | | | 3,121,332 | | | | 4,011,060 | |

| | 16,000 | | | Facebook Inc., Cl. A† | | | 2,638,926 | | | | 3,284,000 | |

| | | | | | | | | | | | |

| | | | | | | 5,760,258 | | | | 7,295,060 | |

| | | | | | | | | | | | |

| | | | Entertainment — 3.2% | | | | | |

| | | | Movies & Entertainment — 2.7% | | | | | |

| | 1,600 | | | Liberty Media Corp.- Liberty Braves, Cl. A† | | | 39,285 | | | | 47,440 | |

| | 10,500 | | | Liberty Media Corp.- Liberty Braves, Cl. C† | | | 206,736 | | | | 310,170 | |

| | 950 | | | Liberty Media Corp.- Liberty Formula One, Cl. A† | | | 1,143 | | | | 41,591 | |

| | 2,000 | | | Liberty Media Corp.- Liberty Formula One, Cl. C† | | | 4,491 | | | | 91,930 | |

| | 100 | | | Netflix Inc.† | | | 28,468 | | | | 32,357 | |

| | 4,000 | | | The Madison Square Garden Co., Cl. A† | | | 514,978 | | | | 1,176,760 | |

| | 2,674 | | | The Walt Disney Co. | | | 138,858 | | | | 386,741 | |

| | | | | | | | | | | | |

| | | | | | | 933,959 | | | | 2,086,989 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market

Value | |

| | | | Interactive Home Entertainment — 0.5% | |

| | 3,000 | | | Modern Times Group MTG AB, Cl. B† | | $ | 45,669 | | | $ | 35,761 | |

| | 3,000 | | | Take-Two Interactive Software Inc.† | | | 293,129 | | | | 367,290 | |

| | | | | | | | | | | | |

| | | | | | 338,798 | | | 403,051 | |

| | | | | | | | | | | | |

| | | | TOTAL COMMUNICATION SERVICES | | | 43,835,050 | | | | 62,635,835 | |

| | | | | | | | | | | | |

| | | | INFORMATION TECHNOLOGY — 6.0% | |

| | | | Technology Hardware & Equipment — 1.7% | |

| | | | Technology Hardware, Storage & Peripherals — 1.3% | |

| | | | Technology hardware, Storage & Peripherals — 1.3% | |

| | 3,500 | | | Apple Inc. | | | 559,163 | | | | 1,027,775 | |

| | | | | | | | | | | | |

| | | | Electronic Equipment, Instruments & Components — 0.1% | |

| | | | Electronic Equipment & Instruments — 0.1% | |

| | 1,000 | | | Sony Corp., ADR | | | 52,638 | | | | 68,000 | |

| | | | | | | | | | | | |

| | | | Communications Equipment — 0.3% | |

| | | | Communications Equipment — 0.3% | |

| | 5,000 | | | EchoStar Corp., Cl. A† | | | 109,544 | | | | 216,550 | |

| | | | | | | | | | | | |

| | | | Software & Services — 3.6% | |

| | | | Software — 1.0% | | | | | | | | |

| | | | Systems Software — 0.4% | |

| | 2,000 | | | Microsoft Corp. | | | 152,364 | | | | 315,400 | |

| | | | | | | | | | | | |

| | | | Application Software — 0.6% | |

| | 35,000 | | | MiX Telematics Ltd., ADR | | | 593,390 | | | | 453,950 | |

| | | | | | | | | | | | |

| | | | IT Services — 2.6% | | | | | | | | |

| | | | IT Consulting & Other Services — 1.3% | |

| | 56,062 | | | Cassava SmarTech Zimbabwe Ltd.† | | | 85,775 | | | | 4,678 | |

| | 12,000 | | | InterXion Holding NV† | | | 145,827 | | | | 1,005,720 | |

| | | | | | | | | | | | |

| | | | | | | 231,602 | | | | 1,010,398 | |

| | | | | | | | | | | | |

| | | | Data Processing & Outsourced Services — 1.3% | |

| | 2,000 | | | Mastercard Inc., Cl. A | | | 292,729 | | | | 597,180 | |

| | 2,000 | | | Visa Inc., Cl. A | | | 218,924 | | | | 375,800 | |

| | | | | | | | | | | | |

| | | | | | | 511,653 | | | | 972,980 | |

| | | | | | | | | | | | |

| | | | Semiconductors & Semiconductor Equipment — 0.7% | |

| | | | Semiconductors & Semiconductor Equipment — 0.7% | |

| | | | Semiconductors — 0.7% | |

| | 15,000 | | | SMART Global Holdings Inc.† | | | 401,880 | | | | 569,100 | |

| | | | | | | | | | | | |

| | | | TOTAL INFORMATION TECHNOLOGY | | | 2,612,234 | | | | 4,634,153 | |

| | | | | | | | | | | | |

| | | | FINANCIALS — 3.9% | | | | | | | | |

| | | | Diversified Financials — 3.9% | |

| | | | Diversified Financial Services — 3.1% | |

| | | | Multi-Sector Holdings — 3.1% | |

| | 97,500 | | | First Pacific Co. Ltd. | | | 48,559 | | | | 33,158 | |

See accompanying notes to financial statements.

8

The Gabelli Global Content & Connectivity Fund

Schedule of Investments (Continued) — December 31, 2019

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market

Value | |

| | | | COMMON STOCKS (Continued) | | | | | | | | |

| | | | FINANCIALS (Continued) | | | | | | | | |

| | | | Diversified Financials (Continued) | | | | | |

| | | | Diversified Financial Services (Continued) | | | | | |

| | | | Multi-Sector Holdings (Continued) | | | | | |

| | 4,100 | | | First Pacific Co. Ltd., ADR | | $ | 3,337 | | | $ | 6,806 | |

| | 1,000 | | | Kinnevik AB, Cl. A | | | 33,558 | | | | 25,463 | |

| | 96,000 | | | Kinnevik AB, Cl. B | | | 2,341,640 | | | | 2,347,126 | |

| | 12,000 | | | Waterloo Investment Holdings Ltd.†(a) | | | 1,432 | | | | 2,520 | |

| | | | | | | | | | | | |

| | | | | | | 2,428,526 | | | | 2,415,073 | |

| | | | | | | | | | | | |

| | | | Consumer Finance — 0.8% | | | | | |

| | | | Consumer Finance — 0.8% | | | | | |

| | 5,000 | | | American Express Co. | | | 471,162 | | | | 622,450 | |

| | | | | | | | | | | | |

| | | | TOTAL FINANCIALS | | | 2,899,688 | | | | 3,037,523 | |

| | | | | | | | | | | | |

| | | | CONSUMER DISCRETIONARY —3.8% | | | | | |

| | | | Retailing — 2.6% | | | | | | | | |

| | | | Internet & Direct Marketing Retail — 2.6% | | | | | |

| | | | Internet & Direct Marketing Retail — 2.6% | | | | | |

| | 72 | | | Expedia Group Inc. | | | 6,881 | | | | 7,786 | |

| | 8,600 | | | Naspers Ltd., Cl. N | | | 1,883,150 | | | | 1,406,597 | |

| | 8,600 | | | Prosus NV† | | | 721,572 | | | | 641,792 | |

| | 2,000 | | | Qurate Retail Inc., Cl. A† | | | 15,202 | | | | 16,860 | |

| | | | | | | | | | | | |

| | | | | | | 2,626,805 | | | | 2,073,035 | |

| | | | | | | | | | | | |

| | | | Automobiles & Components — 1.2% | | | | | |

| | | | Automobiles — 1.2% | | | | | | | | |

| | | | Automobile Manufacturers — 1.2% | | | | | |

| | 25,000 | | | General Motors Co. | | | 862,082 | | | | 915,000 | |

| | | | | | | | | | | | |

| | | | TOTAL CONSUMER DISCRETIONARY | | | 3,488,887 | | | | 2,988,035 | |

| | | | | | | | | | | | |

| | | | REAL ESTATE — 2.3% | | | | | | | | |

| | | | Real Estate — 2.3% | | | | | | | | |

| | | | Real Estate Management & Development — 0.3% | |

| | | | Real Estate Development — 0.3% | | | | | |

| | 27,360 | | | CK Asset Holdings Ltd. | | | 150,629 | | | | 197,503 | |

| | | | | | | | | | | | |

| | | | Equity Real Estate Investment Trusts — 2.0% | |

| | | | Specialized REITs — 2.0% | | | | | | | | |

| | 2,000 | | | CyrusOne Inc., REIT | | | 24,800 | | | | 130,860 | |

| | 2,500 | | | Equinix Inc., REIT | | | 227,567 | | | | 1,459,250 | |

| | | | | | | | | | | | |

| | | | | | | 252,367 | | | | 1,590,110 | |

| | | | | | | | | | | | |

| | | | TOTAL REAL ESTATE | | | 402,996 | | | | 1,787,613 | |

| | | | | | | | | | | | |

| | | | INDUSTRIALS — 0.8% | | | | | | | | |

| | | | Commercial & Professional Services — 0.1% | |

| | | | Commercial Services & Supplies — 0.1% | |

| | | | Security & Alarm Services — 0.1% | | | | | |

| | 30,000 | | | G4S plc | | | 0 | | | | 86,629 | |

| | 900 | | | Marlowe plc† | | | 521 | | | | 6,050 | |

| | | | | | | | | | | | |

| | | | | | | 521 | | | | 92,679 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market

Value | |

| | | | Capital Goods — 0.7% | | | | | |

| | | | Industrial Conglomerates — 0.3% | | | | | |

| | | | Industrial Conglomerates — 0.3% | | | | | |

| | 27,360 | | | CK Hutchison Holdings Ltd. | | $ | 245,763 | | | $ | 260,879 | |

| | | | | | | | | | | | |

| | | | Electrical Equipment — 0.1% | | | | | |

| | | | Electrical Components & Equipment — 0.1% | |

| | 1,800 | | | Furukawa Electric Co. Ltd. | | | 53,735 | | | | 46,717 | |

| | | | | | | | | | | | |

| | | | Construction & Engineering — 0.3% | | | | | |

| | | | Construction & Engineering — 0.3% | | | | | |

| | 6,000 | | | Bouygues SA | | | 167,997 | | | | 254,941 | |

| | | | | | | | | | | | |

| | | | TOTAL INDUSTRIALS | | | 468,016 | | | | 655,216 | |

| | | | | | | | | | | | |

| | | | HEALTH CARE — 0.8% | | | | | | | | |

| | | | Health Care Equipment & Services — 0.8% | | | | | |

| | | | Health Care Equipment & Supplies — 0.8% | | | | | |

| | | | Health Care Equipment — 0.8% | | | | | |

| | 13,000 | | | GN Store Nord A/S | | | 76,744 | | | | 611,377 | |

| | | | | | | | | | | | |

| | | | CONSUMER STAPLES — 0.2% | | | | | |

| | | | Food, Beverage & Tobacco — 0.2% | | | | | |

| | | | Food Products — 0.2% | | | | | | | | |

| | | | Agricultural Products — 0.2% | | | | | |

| | 68,000 | | | C.P. Pokphand Co. Ltd., ADR | | | 52,895 | | | | 136,680 | |

| | | | | | | | | | | | |

| | | | Beverages — 0.0% | | | | | | | | |

| | | | Distillers & Vintners — 0.0% | | | | | |

| | 1,768 | | | Gusbourne plc† | | | 1,486 | | | | 1,991 | |

| | | | | | | | | | | | |

| | | | Food & Staples Retailing — 0.0% | | | | | |

| | | | Food & Staples Retailing — 0.0% | | | | | |

| | | | Food Retail — 0.0% | | | | | | | | |

| | 504 | | | Meikles Ltd. | | | 203 | | | | 75 | |

| | | | | | | | | | | | |

| | | | TOTAL CONSUMER STAPLES | | | 54,584 | | | | 138,746 | |

| | | | | | | | | | | | |

| | | | UTILITIES — 0.0% | | | | | | | | |

| | | | Utilities — 0.0% | | | | | | | | |

| | | | Multi-Utilities — 0.0% | | | | | | | | |

| | | | Multi-Utilities — 0.0% | | | | | | | | |

| | 200 | | | National Grid plc, ADR | | | 10,528 | | | | 12,534 | |

| | | | | | | | | | | | |

| | | | TOTAL COMMON STOCKS | | | 53,848,727 | | | | 76,501,032 | |

| | | | | | | | | | | | |

| | | | CLOSED-END FUNDS — 0.1% | | | | | |

| | | | CONSUMER DISCRETIONARY — 0.1% | | | | | |

| | | | Retailing — 0.1% | | | | | | | | |

| | | | Internet & Direct Marketing Retail — 0.1% | | | | | |

| | | | Internet & Direct Marketing Retail — 0.1% | | | | | |

| | 5,800 | | | Altaba Inc., Escrow† | | | 0 | | | | 120,350 | |

| | | | | | | | | | | | |

See accompanying notes to financial statements.

9

The Gabelli Global Content & Connectivity Fund

Schedule of Investments (Continued) — December 31, 2019

| | | | | | | | | | | | |

Shares | | | | | Cost | | | Market Value | |

| | | | WARRANTS — 0.7% | |

| | | | COMMUNICATION SERVICES — 0.7% | |

| | | | Telecommunication Services — 0.7% | |

| | | | Wireless Telecommunication Services — 0.7% | |

| | | | Wireless Telecommunication Services — 0.7% | |

| | 81,000 | | | Bharti Airtel Ltd., expire

11/30/20†(b) | | $ | 443,540 | | | $ | 517,590 | |

| | | | | | | | | | | | |

| | | |

Principal

Amount | | | | | | | | | |

| | | | CORPORATE BONDS — 0.0% | |

| | | | COMMUNICATION SERVICES — 0.0% | |

| | | | Telecommunication Services — 0.0% | |

| | | | Wireless Telecommunication Services — 0.0% | |

| | | | Wireless Telecommunication Services — 0.0% | |

| | $ 32,808 | | | Econet Wireless Zimbabwe Ltd.,

5.000%, 03/17/23(a) | | | 1,768 | | | | 1,532 | |

| | | | | | | | | | | | |

| |

| | | | U.S. GOVERNMENT OBLIGATIONS — 1.2% | |

| | 939,000 | | | U.S. Treasury Bills,

1.531% to 1.557%††,

02/13/20 to 02/27/20 | | | 937,045 | | | | 937,129 | |

| | | | | | | | | | | | |

| | | |

| | | | TOTAL INVESTMENTS —100.1% | | $ | 55,231,080 | | | | 78,077,633 | |

| | | | | | | | | | | | |

| | | | Other Assets and Liabilities (Net) — (0.1)% | | | | (100,290 | ) |

| | | | | | | | | | | | |

| | | | NET ASSETS — 100.0% | | | | | | $ | 77,977,343 | |

| | | | | | | | | | | | |

| (a) | Security is valued using significant unobservable inputs and is classified as Level 3 in the fair value hierarchy. |

| (b) | Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| † | Non-income producing security. |

| †† | Represents annualized yields at dates of purchase. |

| ADR | American Depositary Receipt |

| GDR | Global Depositary Receipt |

| REIT | Real Estate Investment Trust |

| SDR | Swedish Depositary Receipt |

| | | | | | | | |

Geographic Diversification | | %of

Market

Value | | | Market

Value | |

North America | | | 63.3 | % | | $ | 49,431,624 | |

Europe | | | 19.9 | | | | 15,547,950 | |

Latin America | | | 5.4 | | | | 4,175,311 | |

Japan | | | 4.6 | | | | 3,622,395 | |

Asia/Pacific | | | 3.8 | | | | 2,994,995 | |

Africa/Middle East | | | 3.0 | | | | 2,305,358 | |

| | | | | | | | |

| | | 100.0 | % | | $ | 78,077,633 | |

| | | | | | | | |

See accompanying notes to financial statements.

10

The Gabelli Global Content & Connectivity Fund

| | | | |

Statement of Assets and Liabilities December 31, 2019 | |

Assets: | | | | |

Investments, at value (cost $55,231,080) | | | $78,077,633 | |

Foreign currency, at value (cost $1,911) | | | 1,264 | |

Receivable for Fund shares sold | | | 7,575 | |

Receivable from Adviser | | | 30,943 | |

Dividends receivable | | | 90,797 | |

Prepaid expenses | | | 28,843 | |

| | | | |

Total Assets | | | 78,237,055 | |

| | | | |

Liabilities: | | | | |

Payable to custodian | | | 20,919 | |

Payable for Fund shares redeemed | | | 19,817 | |

Payable for investment advisory fees | | | 65,784 | |

Payable for distribution fees | | | 13,857 | |

Payable for accounting fees | | | 11,250 | |

Payable for legal and audit fees | | | 54,427 | |

Payable for shareholder communications expenses | | | 42,568 | |

Payable for shareholder services fees | | | 19,896 | |

Other accrued expenses | | | 11,194 | |

| | | | |

Total Liabilities | | | 259,712 | |

| | | | |

Net Assets

(applicable to 3,972,680 shares outstanding) | | | $77,977,343 | |

| | | | |

Net Assets Consist of: | | | | |

Paid-in capital | | | $56,067,590 | |

Total distributable earnings | | | 21,909,753 | |

| | | | |

Net Assets | | | $77,977,343 | |

| | | | |

| | | | |

Shares of Capital Stock, each at $0.001 par value: | | | | |

Class AAA: | | | | |

Net Asset Value, offering, and redemption price per share ($65,024,198 ÷ 3,311,189 shares outstanding; 150,000,000 shares authorized) | | | $19.64 | |

| | | | |

Class A: | | | | |

Net Asset Value and redemption price per share ($373,605 ÷ 18,860 shares outstanding; 50,000,000 shares authorized) | | | $19.81 | |

| | | | |

Maximum offering price per share (NAV ÷ 0.9425, based on maximum sales charge of 5.75% of the offering price) | | | $21.02 | |

| | | | |

Class C: | | | | |

Net Asset Value and offering price per share ($84,556 ÷ 4,420 shares outstanding; 50,000,000 shares authorized) | | | $19.13 | (a) |

| | | | |

Class I: | | | | |

Net Asset Value, offering, and redemption price per share ($12,494,984 ÷ 638,211 shares outstanding; 50,000,000 shares authorized) | | | $19.58 | |

| | | | |

| | | | |

Statement of Operations For the Year Ended December 31, 2019 | |

Investment Income: | | | | |

Dividends (net of foreign withholding taxes of $115,353) | | $ | 1,340,940 | |

Income fromnon-cash dividends | | | 1,268,866 | |

Interest | | | 23,302 | |

| | | | |

Total Investment Income | | | 2,633,108 | |

| | | | |

Expenses: | | | | |

Investment advisory fees | | | 791,487 | |

Distribution fees - Class AAA | | | 164,815 | |

Distribution fees - Class A | | | 796 | |

Distribution fees - Class C | | | 1,800 | |

Shareholder services fees | | | 84,635 | |

Shareholder communications expenses | | | 80,773 | |

Legal and audit fees | | | 56,973 | |

Registration expenses | | | 48,037 | |

Accounting fees | | | 45,000 | |

Custodian fees | | | 32,377 | |

Directors’ fees | | | 18,724 | |

Interest expense | | | 1,335 | |

Miscellaneous expenses | | | 17,357 | |

| | | | |

Total Expenses | | | 1,344,109 | |

| | | | |

Less: | | | | |

Expenses paid indirectly by broker

(See Note 6) | | | (689 | ) |

Expense reimbursements (See Note 3) | | | (91,150 | ) |

| | | | |

Total Credits and Reimbursements | | | (91,839 | ) |

| | | | |

Net Expenses | | | 1,252,270 | |

| | | | |

Net Investment Income | | | 1,380,838 | |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency: | | | | |

Net realized gain on investments | | | 3,393,353 | |

Net realized loss on foreign currency transactions | | | (6,130 | ) |

| | | | |

Net realized gain on investments and foreign currency transactions | | | 3,387,223 | |

| | | | |

Net change in unrealized appreciation/depreciation: | | | | |

on investments | | | 6,765,388 | |

on foreign currency translations | | | (263 | ) |

| | | | |

Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | 6,765,125 | |

| | | | |

Net Realized and Unrealized Gain/(Loss) on Investments and Foreign Currency | | | 10,152,348 | |

| | | | |

Net Increase in Net Assets Resulting from Operations | | $ | 11,533,186 | |

| | | | |

| (a) | Redemption price varies based on the length of time held. |

See accompanying notes to financial statements.

11

The Gabelli Global Content & Connectivity Fund

Statement of Changes in Net Assets

| | | | | | | | | | |

| | | Year Ended

December 31, 2019 | | Year Ended

December 31, 2018 |

Operations: | | | | | | | | | | |

Net investment income | | | $ | 1,380,838 | | | | $ | 800,143 | |

Net realized gain on investments and foreign currency transactions | | | | 3,387,223 | | | | | 3,939,456 | |

Net change in unrealized appreciation/depreciation on investments and foreign currency translations | | | | 6,765,125 | | | | | (15,398,677 | ) |

| | | | | | | | | | |

Net Increase/(Decrease) in Net Assets Resulting from Operations | | | | 11,533,186 | | | | | (10,659,078 | ) |

| | | | | | | | | | |

Distributions to Shareholders: | | | | | | | | | | |

Accumulated earnings | | | | | | | | | | |

Class AAA | | | | (3,972,615 | ) | | | | (3,588,419 | ) |

Class A | | | | (22,666 | ) | | | | (12,799 | ) |

Class C | | | | (3,829 | ) | | | | (14,569 | ) |

Class I | | | | (855,412 | ) | | | | (802,477 | ) |

| | | | | | | | | | |

| | | | (4,854,522 | ) | | | | (4,418,264 | ) |

| | | | | | | | | | |

Return of capital | | | | | | | | | | |

Class AAA | | | | — | | | | | (33,667 | ) |

Class A | | | | — | | | | | (120 | ) |

Class C | | | | — | | | | | (137 | ) |

Class I | | | | — | | | | | (7,529 | ) |

| | | | | | | | | | |

| | | | — | | | | | (41,453 | ) |

| | | | | | | | | | |

Total Distributions to Shareholders | | | | (4,854,522 | ) | | | | (4,459,717 | ) |

| | | | | | | | | | |

| | |

Capital Share Transactions: | | | | | | | | | | |

Class AAA | | | | (3,728,999 | ) | | | | (6,132,278 | ) |

Class A | | | | 127,427 | | | | | (294,869 | ) |

Class C | | | | (221,139 | ) | | | | 63,433 | |

Class I | | | | (979,121 | ) | | | | 533,982 | |

Class T* | | | | — | | | | | (1,038 | ) |

| | | | | | | | | | |

Net Decrease in Net Assets from Capital Share Transactions | | | | (4,801,832 | ) | | | | (5,830,770 | ) |

| | | | | | | | | | |

| | |

Redemption Fees | | | | 25 | | | | | 113 | |

| | | | | | | | | | |

Net Increase/(Decrease) in Net Assets | | | | 1,876,857 | | | | | (20,949,452 | ) |

Net Assets: | | | | | | | | | | |

Beginning of year | | | | 76,100,486 | | | | | 97,049,938 | |

| | | | | | | | | | |

End of year | | | $ | 77,977,343 | | | | $ | 76,100,486 | |

| | | | | | | | | | |

| * | Class T Shares were liquidated on September 21, 2018. |

See accompanying notes to financial statements.

12

The Gabelli Global Content & Connectivity Fund

Financial Highlights

Selected data for a share of capital stock outstanding throughout each year:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Income (Loss)

from Investment Operations | | | Distributions | | | | | | | | | | | Ratios to Average Net Assets/

Supplemental Data | |

Year Ended

December 31 | | Net Asset

Value,

Beginning

of Year | | Net

Investment

Income

(Loss)(a) | | Net

Realized

and

Unrealized

Gain (Loss)

on Investments | | | Total from

Investment

Operations | | | Net

Investment

Income | | | Net

Realized

Gain | | | Return of

Capital | | | Total

Distributions | | | Redemption

Fees(a)(b) | | | Net Asset

Value,

End of

Year | | | Total

Return† | | Net Assets

End of Year

(in 000’s) | | | Net Investment

Income

(Loss) | | | Operating

Expenses

Before

Reimbursement | | | Operating Expenses Net of Reimbursement(c) | | | Portfolio

Turnover

Rate | |

Class AAA | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019 | | $18.08 | | $0.32(d) | | | $ 2.51 | | | | $ 2.83 | | | | $(0.37) | | | | $(0.90) | | | | — | | | | $(1.27) | | | | $0.00 | | | | $19.64 | | | 15.6% | | $ | 65,024 | | | | 1.63 | %(d) | | | 1.74% | | | | 1.69%(e) | | | | 14% | |

2018 | | 21.77 | | 0.16 | | | (2.76 | ) | | | (2.60 | ) | | | (0.15) | | | | (0.93) | | | | $(0.01) | | | | (1.09) | | | | 0.00 | | | | 18.08 | | | (11.9) | | | 63,196 | | | | 0.78 | | | | 1.72 | | | | 1.72 | | | | 19 | |

2017 | | 20.43 | | 0.11 | | | 2.63 | | | | 2.74 | | | | (0.14) | | | | (1.26) | | | | — | | | | (1.40) | | | | — | | | | 21.77 | | | 13.4 | | | 81,832 | | | | 0.48 | | | | 1.73 | | | | 1.73 | | | | 22 | |

2016 | | 21.30 | | 0.27 | | | 0.29 | | | | 0.56 | | | | (0.28) | | | | (1.13) | | | | (0.02) | | | | (1.43) | | | | 0.00 | | | | 20.43 | | | 2.7 | | | 87,893 | | | | 1.23 | | | | 1.65 | | | | 1.65(f) | | | | 9 | |

2015 | | 23.63 | | 0.26 | | | (0.82 | ) | | | (0.56 | ) | | | (0.27) | | | | (1.49) | | | | (0.01) | | | | (1.77) | | | | 0.00 | | | | 21.30 | | | (2.5) | | | 101,187 | | | | 1.08 | | | | 1.63 | | | | 1.63 | | | | 5 | |

Class A | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019 | | $18.23 | | $0.36(d) | | | $ 2.50 | | | | $ 2.86 | | | | $(0.38) | | | | $(0.90) | | | | — | | | | $(1.28) | | | | $0.00 | | | | $19.81 | | | 15.6% | | $ | 374 | | | | 1.80 | %(d) | | | 1.74% | | | | 1.68%(e) | | | | 14% | |

2018 | | 21.94 | | 0.16 | | | (2.79 | ) | | | (2.63 | ) | | | (0.14) | | | | (0.93) | | | | $(0.01) | | | | (1.08) | | | | 0.00 | | | | 18.23 | | | (11.9) | | | 231 | | | | 0.76 | | | | 1.72 | | | | 1.72 | | | | 19 | |

2017 | | 20.58 | | 0.10 | | | 2.66 | | | | 2.76 | | | | (0.14) | | | | (1.26) | | | | — | | | | (1.40) | | | | — | | | | 21.94 | | | 13.4 | | | 576 | | | | 0.43 | | | | 1.73 | | | | 1.73 | | | | 22 | |

2016 | | 21.29 | | 0.15 | | | 0.38 | | | | 0.53 | | | | (0.09) | | | | (1.13) | | | | (0.02) | | | | (1.24) | | | | 0.00 | | | | 20.58 | | | 2.5 | | | 661 | | | | 0.68 | | | | 1.65 | | | | 1.65(f) | | | | 9 | |

2015 | | 23.61 | | 0.26 | | | (0.81 | ) | | | (0.55 | ) | | | (0.27) | | | | (1.49) | | | | (0.01) | | | | (1.77) | | | | 0.00 | | | | 21.29 | | | (2.5) | | | 846 | | | | 1.08 | | | | 1.63 | | | | 1.63 | | | | 5 | |

Class C | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019 | | $17.45 | | $0.04(d) | | | $ 2.55 | | | | $ 2.59 | | | | $(0.01) | | | | $(0.90) | | | | — | | | | $(0.91) | | | | $0.00 | | | | $19.13 | | | 14.8% | | $ | 84 | | | | 0.19 | %(d) | | | 2.49% | | | | 2.45%(e) | | | | 14% | |

2018 | | 21.08 | | 0.02 | | | (2.68 | ) | | | (2.66 | ) | | | (0.03) | | | | (0.93) | | | | $(0.01) | | | | (0.97) | | | | 0.00 | | | | 17.45 | | | (12.6) | | | 279 | | | | 0.08 | | | | 2.47 | | | | 2.47 | | | | 19 | |

2017 | | 19.85 | | (0.06) | | | 2.55 | | | | 2.49 | | | | — | | | | (1.26) | | | | — | | | | (1.26) | | | | — | | | | 21.08 | | | 12.5 | | | 267 | | | | (0.28 | ) | | | 2.48 | | | | 2.48 | | | | 22 | |

2016 | | 20.71 | | 0.09 | | | 0.30 | | | | 0.39 | | | | (0.10) | | | | (1.13) | | | | (0.02) | | | | (1.25) | | | | 0.00 | | | | 19.85 | | | 1.9 | | | 328 | | | | 0.42 | | | | 2.40 | | | | 2.40(f) | | | | 9 | |

2015 | | 22.98 | | 0.08 | | | (0.79 | ) | | | (0.71 | ) | | | (0.06) | | | | (1.49) | | | | (0.01) | | | | (1.56) | | | | 0.00 | | | | 20.71 | | | (3.2) | | | 441 | | | | 0.36 | | | | 2.38 | | | | 2.38 | | | | 5 | |

Class I | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2019 | | $18.03 | | $0.46(d) | | | $ 2.51 | | | | $ 2.97 | | | | $(0.52) | | | | $(0.90) | | | | — | | | | $(1.42) | | | | $0.00 | | | | $19.58 | | | 16.4% | | $ | 12,495 | | | | 2.33 | %(d) | | | 1.49% | | | | 0.99%(e) | | | | 14% | |

2018 | | 21.75 | | 0.32 | | | (2.79 | ) | | | (2.47 | ) | | | (0.31) | | | | (0.93) | | | | $(0.01) | | | | (1.25) | | | | 0.00 | | | | 18.03 | | | (11.3) | | | 12,394 | | | | 1.52 | | | | 1.47 | | | | 1.00(e) | | | | 19 | |

2017 | | 20.40 | | 0.28 | | | 2.62 | | | | 2.90 | | | | (0.29) | | | | (1.26) | | | | — | | | | (1.55) | | | | — | | | | 21.75 | | | 14.2 | | | 14,374 | | | | 1.26 | | | | 1.48 | | | | 1.00(e) | | | | 22 | |

2016 | | 21.27 | | 0.30 | | | 0.33 | | | | 0.63 | | | | (0.35) | | | | (1.13) | | | | (0.02) | | | | (1.50) | | | | 0.00 | | | | 20.40 | | | 3.0 | | | 6,361 | | | | 1.41 | | | | 1.40 | | | | 1.35(e)(f) | | | | 9 | |

2015 | | 23.60 | | 0.30 | | | (0.79 | ) | | | (0.49 | ) | | | (0.34) | | | | (1.49) | | | | (0.01) | | | | (1.84) | | | | 0.00 | | | | 21.27 | | | (2.2) | | | 1,842 | | | | 1.26 | | | | 1.38 | | | | 1.38 | | | | 5 | |

| † | Total return represents aggregate total return of a hypothetical $1,000 investment at the beginning of the year and sold at the end of the year including reinvestment of distributions and does not reflect the applicable sales charges. |

| (a) | Per share amounts have been calculated using the average shares outstanding method. |

| (b) | Amount represents less than $0.005 per share. |

| (c) | The Fund received credits from a designated broker who agreed to pay certain Fund operating expenses. For the years ended December 31, 2019, 2018, 2017, 2016, and 2015, there was no impact to the expense ratios. |

| (d) | Includes income resulting from special dividends. Without these dividends, the per share income amounts would have been 0.01 (Class AAA), 0.04 (Class A), (0.27) (Class C), and 0.15 (Class I), and the net investment income ratio would have been 0.03% (Class AAA), 0.19% (Class A), (1.41%) (Class C), and 0.73% (Class I), respectively. |

| (e) | Under an expense reimbursement agreement with the Adviser, the Adviser reimbursed expenses of $91,150 for the year ended December 31, 2019 and certain Class I expenses to the Fund of $70,600, $56,231, and $899 for the years ended December 31, 2018, 2017, and 2016, respectively. |

| (f) | During the year ended December 31, 2016, the Fund received reimbursements of custody expenses paid in prior years. Had such reimbursement (allocated by relative net asset values of the Fund’s share classes) been included in that period, the expense ratios would have been 1.22% (Class AAA), 1.54% (Class A), 1.99% (Class C), and 0.95% (Class I). |

See accompanying notes to financial statements.

13

The Gabelli Global Content & Connectivity Fund

Notes to Financial Statements

1. Organization.The Gabelli Global Content & Connectivity Fund, a series of GAMCO Global Series Funds, Inc. (the Corporation), was incorporated on July 16, 1993 in Maryland. The Fund is anon-diversifiedopen-end management investment company registered under the Investment Company Act of 1940, as amended (the 1940 Act), and is one of five separately managed portfolios (collectively, the Portfolios) of the Corporation. The Fund’s primary objective is capital appreciation. The Fund commenced investment operations on November 1, 1993.

The Fund may invest a high percentage of its assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Fund may be more susceptible to economic, political, and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility to the Fund’s NAV and a magnified effect in its total return.

2. Significant Accounting Policies.As an investment company, the Fund follows the investment company accounting and reporting guidance, which is part of U.S. generally accepted accounting principles (GAAP) that may require the use of management estimates and assumptions in the preparation of its financial statements. Actual results could differ from those estimates. The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements.

New Accounting Pronouncements.To improve the effectiveness of fair value disclosure requirements, the Financial Accounting Standards Board recently issued Accounting Standard Update (ASU)2018-13, Fair Value Measurement Disclosure Framework – Changes to the Disclosure Requirements for Fair Value Measurement (ASU2018-13), which adds, removes, and modifies certain aspects relating to fair value disclosure. ASU2018-13 is effective for interim and annual reporting periods beginning after December 15, 2019; early adoption of the additions relating to ASU2018-13 is not required, even if early adoption is elected for the removals and modifications under ASU2018-13. Management has early adopted the removals and modifications set forth in ASU2018-13 in these financial statements and has not early adopted the additions set forth in ASU2018-13.

Security Valuation.Portfolio securities listed or traded on a nationally recognized securities exchange or traded in the U.S.over-the-counter market for which market quotations are readily available are valued at the last quoted sale price or a market’s official closing price as of the close of business on the day the securities are being valued. If there were no sales that day, the security is valued at the average of the closing bid and asked prices or, if there were no asked prices quoted on that day, then the security is valued at the closing bid price on that day. If no bid or asked prices are quoted on such day, the security is valued at the most recently available price or, if the Board of Directors (the Board) so determines, by such other method as the Board shall determine in good faith to reflect its fair market value. Portfolio securities traded on more than one national securities exchange or market are valued according to the broadest and most representative market, as determined by Gabelli Funds, LLC (the Adviser).

Portfolio securities primarily traded on a foreign market are generally valued at the preceding closing values of such securities on the relevant market, but may be fair valued pursuant to procedures established by the Board if market conditions change significantly after the close of the foreign market, but prior to the close of business on the day the securities are being valued. Debt obligations for which market quotations are readily available are valued at the average of the latest bid and asked prices. If there were no asked prices quoted

14

The Gabelli Global Content & Connectivity Fund

Notes to Financial Statements (Continued)

on such day, the security is valued using the closing bid price. Such debt obligations are valued through prices provided by a pricing service approved by the Board. Certain securities are valued principally using dealer quotations.

Securities and assets for which market quotations are not readily available are fair valued as determined by the Board. Fair valuation methodologies and procedures may include, but are not limited to: analysis and review of available financial andnon-financial information about the company; comparisons with the valuation and changes in valuation of similar securities, including a comparison of foreign securities with the equivalent U.S. dollar value American Depositary Receipt securities at the close of the U.S. exchange; and evaluation of any other information that could be indicative of the value of the security.

The inputs and valuation techniques used to measure fair value of the Fund’s investments are summarized into three levels as described in the hierarchy below:

| | ● | | Level 1 — quoted prices in active markets for identical securities; |

| | ● | | Level 2 — other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.); and |

| | ● | | Level 3 — significant unobservable inputs (including the Board’s determinations as to the fair value of investments). |

A financial instrument’s level within the fair value hierarchy is based on the lowest level of any input both individually and in the aggregate that is significant to the fair value measurement. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities. The summary of the Fund’s investments in securities by inputs used to value the Fund’s investments as of December 31, 2019 is as follows:

| | | | | | | | | | | | | | | | |

| | | Valuation Inputs | | | | |

| | | Level 1

Quoted Prices | | | Level 2 Other Significant

Observable Inputs | | | Level 3 Significant

Unobservable Inputs | | | Total Market Value

at 12/31/19 | |

INVESTMENTS IN SECURITIES: | | | | | | | | | | | | | | | | |

ASSETS (Market Value): | | | | | | | | | | | | | | | | |

Common Stocks | | | | | | | | | | | | | | | | |

Communication Services | | | $62,141,777 | | | | $ 84,711 | | | | $409,347 | | | | $62,635,835 | |

Consumer Staples | | | 138,671 | | | | 75 | | | | — | | | | 138,746 | |

Financials | | | 3,035,003 | | | | — | | | | 2,520 | | | | 3,037,523 | |

Other (a) | | | 10,688,928 | | | | — | | | | — | | | | 10,688,928 | |

Total Common Stocks | | | 76,004,379 | | | | 84,786 | | | | 411,867 | | | | 76,501,032 | |

Closed-End Funds (a) | | | — | | | | 120,350 | | | | — | | | | 120,350 | |

Warrants (a) | | | — | | | | 517,590 | | | | — | | | | 517,590 | |

Corporate Bonds (a) | | | — | | | | — | | | | 1,532 | | | | 1,532 | |

U.S. Government Obligations | | | — | | | | 937,129 | | | | — | | | | 937,129 | |

TOTAL INVESTMENTS IN

SECURITIES – ASSETS | | | $76,004,379 | | | | $1,659,855 | | | | $413,399 | | | | $78,077,633 | |

| (a) | Please refer to the Schedule of Investments for the industry classifications of these portfolio holdings. |

The Fund did not have any transfers into or out of Level 3 during the year ended December 31, 2019.

15

The Gabelli Global Content & Connectivity Fund

Notes to Financial Statements (Continued)

Additional Information to Evaluate Qualitative Information.

General.The Fund uses recognized industry pricing services – approved by the Board and unaffiliated with the Adviser – to value most of its securities, and uses broker quotes provided by market makers of securities not valued by these and other recognized pricing sources. Several different pricing feeds are received to value domestic equity securities, international equity securities, preferred equity securities, and fixed income securities. The data within these feeds are ultimately sourced from major stock exchanges and trading systems where these securities trade. The prices supplied by external sources are checked by obtaining quotations or actual transaction prices from market participants. If a price obtained from the pricing source is deemed unreliable, prices will be sought from another pricing service or from a broker/dealer that trades that security or similar securities.

Fair Valuation.Fair valued securities may be common or preferred equities, warrants, options, rights, or fixed income obligations. Where appropriate, Level 3 securities are those for which market quotations are not available, such as securities not traded for several days, or for which current bids are not available, or which are restricted as to transfer. When fair valuing a security, factors to consider include recent prices of comparable securities that are publicly traded, reliable prices of securities not publicly traded, the use of valuation models, current analyst reports, valuing the income or cash flow of the issuer, or cost if the preceding factors do not apply. A significant change in the unobservable inputs could result in a lower or higher value in Level 3 securities. The circumstances of Level 3 securities are frequently monitored to determine if fair valuation measures continue to apply.

The Adviser reports quarterly to the Board the results of the application of fair valuation policies and procedures. These may include backtesting the prices realized in subsequent trades of these fair valued securities to fair values previously recognized.

Foreign Currency Translations.The books and records of the Fund are maintained in U.S. dollars. Foreign currencies, investments, and other assets and liabilities are translated into U.S. dollars at current exchange rates. Purchases and sales of investment securities, income, and expenses are translated at the exchange rate prevailing on the respective dates of such transactions. Unrealized gains and losses that result from changes in foreign exchange rates and/or changes in market prices of securities have been included in unrealized appreciation/depreciation on investments and foreign currency translations. Net realized foreign currency gains and losses resulting from changes in exchange rates include foreign currency gains and losses between trade date and settlement date on investment securities transactions, foreign currency transactions, and the difference between the amounts of interest and dividends recorded on the books of the Fund and the amounts actually received. The portion of foreign currency gains and losses related to fluctuation in exchange rates between the initial purchase trade date and subsequent sale trade date is included in realized gain/(loss) on investments.

Foreign Securities.The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the inability to repatriate funds, less complete financial information about companies, and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

16

The Gabelli Global Content & Connectivity Fund

Notes to Financial Statements (Continued)

Foreign Taxes.The Fund may be subject to foreign taxes on income, gains on investments, or currency repatriation, a portion of which may be recoverable. The Fund will accrue such taxes and recoveries as applicable, based upon its current interpretation of tax rules and regulations that exist in the markets in which it invests.

Restricted Securities.The Fund may invest up to 15% of its net assets in securities for which the markets are restricted. Restricted securities include securities whose disposition is subject to substantial legal or contractual restrictions. The sale of restricted securities often requires more time and results in higher brokerage charges or dealer discounts and other selling expenses than does the sale of securities eligible for trading on national securities exchanges or in theover-the-counter markets. Restricted securities may sell at a price lower than similar securities that are not subject to restrictions on resale. Securities freely saleable among qualified institutional investors under special rules adopted by the SEC may be treated as liquid if they satisfy liquidity standards established by the Board. The continued liquidity of such securities is not as well assured as that of publicly traded securities, and accordingly the Board will monitor their liquidity.

Investments in other Investment Companies.The Fund may invest, from time to time, in shares of other investment companies (or entities that would be considered investment companies but are excluded from the definition pursuant to certain exceptions under the 1940 Act) (the Acquired Funds) in accordance with the 1940 Act and related rules. Shareholders in the Fund would bear the pro rata portion on of the periodic expenses of the Acquired Funds in addition to the Fund’s expenses. For the year ended December 31, 2019, the Fund’s pro rata portion of the periodic expenses charged by the Acquired Funds was approximately two basis points.

Securities Transactions and Investment Income.Securities transactions are accounted for on the trade date with realized gain or loss on investments determined by using the identified cost method. Interest income (including amortization of premium and accretion of discount) is recorded on an accrual basis. Premiums and discounts on debt securities are amortized using the effective yield to maturity method. Dividend income is recorded on theex-dividend date, except for certain dividends from foreign securities that are recorded as soon after theex-dividend date as the Fund becomes aware of such dividends.

Determination of Net Asset Value and Calculation of Expenses.Certain administrative expenses are common to, and allocated among, various affiliated funds. Such allocations are made on the basis of each fund’s average net assets or other criteria directly affecting the expenses as determined by the Adviser pursuant to procedures established by the Board.

In calculating the NAV per share of each class, investment income, realized and unrealized gains and losses, redemption fees, and expenses other than class specific expenses are allocated daily to each class of shares based upon the proportion of net assets of each class at the beginning of each day. Distribution expenses are borne solely by the class incurring the expense.

Distributions to Shareholders.Distributions to shareholders are recorded on theex-dividend date. Distributions to shareholders are based on income and capital gains as determined in accordance with federal income tax regulations, which may differ from income and capital gains as determined under GAAP. These differences are primarily due to differing treatments of income and gains on various investment securities and foreign currency transactions, timing differences, and differing characterizations of distributions made by the Fund. Distributions from net investment income for federal income tax purposes include net realized gains on foreign currency transactions. These book/tax differences are either temporary or permanent in nature. To the extent

17

The Gabelli Global Content & Connectivity Fund

Notes to Financial Statements (Continued)

these differences are permanent, adjustments are made to the appropriate capital accounts in the period when the differences arise. Permanent differences were primarily due to the tax treatment of currency gains and losses, sales relating to investments considered no longer to be passive foreign investments, capital gain adjustment on sale of real estate investment trusts and redesignation of dividends paid. These reclassifications have no impact on the NAV of the Fund. For the year ended December 31, 2019, reclassifications were made to decreasepaid-in capital by $84,346, with an offsetting adjustment to total distributable earnings.

The tax character of distributions paid during the year ended December 31, 2019 and 2018 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, 2019 | | | Year Ended December 31, 2018 | |

Distributions paid from: | | | | | | | | | | | | | | | | | | | | | | | | |

Ordinary income (inclusive of short term capital gains) | | | | | | | $1,903,819 | | | | | | | | | | | | $1,045,421 | | | | | |

Net long term capital gains | | | | | | | 2,950,703 | | | | | | | | | | | | 3,372,843 | | | | | |

Return of Capital | | | | | | | — | | | | | | | | | | | | 41,453 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total distributions paid | | | | | | | $4,854,522 | | | | | | | | | | | | $4,459,717 | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Provision for Income Taxes.The Fund intends to continue to qualify as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended (the Code). It is the policy of the Fund to comply with the requirements of the Code applicable to regulated investment companies and to distribute substantially all of its net investment company taxable income and net capital gains. Therefore, no provision for federal income taxes is required.

At December 31, 2019, the components of accumulated earnings/losses on a tax basis were as follows:

| | | | |

Undistributed ordinary income | | $ | 19,774 | |

Net unrealized appreciation on investments and foreign currency translations | | | 21,889,979 | |

| | | | |

Total | | $ | 21,909,753 | |

| | | | |

The Fund is permitted to carry capital losses forward for an unlimited period. Capital losses that are carried forward will retain their character as either short term or long term capital losses.

At December 31, 2019, the temporary differences between book basis and tax basis unrealized appreciation were primarily due to deferral of losses from wash sales for tax purposes andmark-to-market adjustments on investments previously considered to be a passive foreign investment company, and no longer considered a passive foreign investment company.

The following summarizes the tax cost of investments and the related net unrealized appreciation at December 31, 2019.

| | | | | | | | |

| | | Cost | | Gross

Unrealized

Appreciation | | Gross

Unrealized

Depreciation | | Net Unrealized

Appreciation |

| Investments | | $56,187,116 | | $26,400,369 | | $(4,509,852) | | $21,890,517 |