UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07896

GAMCO Global Series Funds, Inc.

(Exact name of registrant as specified in charter)

One Corporate Center

Rye, New York 10580-1422

(Address of principal executive offices) (Zip code)

John C. Ball

Gabelli Funds, LLC

One Corporate Center

Rye, New York 10580-1422

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-422-3554

Date of fiscal year end: December 31

Date of reporting period: December 31, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

| (a) | Include a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1). |

| | | |

| | | The Report to Shareholders is attached herewith. |

0000909504gabelli:MSCIEAFESmallCapIndex40586AdditionalIndexMember2021-12-31

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Growth Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund’s investment objective primarily seeks to provide investors with appreciation of capital. Current income is a secondary objective of the Fund. The Fund’s investment strategy is to invest at least 65% of its total assets in common stocks of companies which the portfolio managers believe are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. The Global Growth Fund invests primarily in common stocks of foreign and domestic small-capitalization, mid-capitalization, and large-capitalization issuers. As a “global” fund, the Fund invests in securities of issuers, or related investments thereof, located in at least three countries, and at least 40% of the Fund’s total net assets are invested in securities of non-U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Growth Fund - Class AAA | $103 | 0.90% |

|---|

How did the Fund perform?

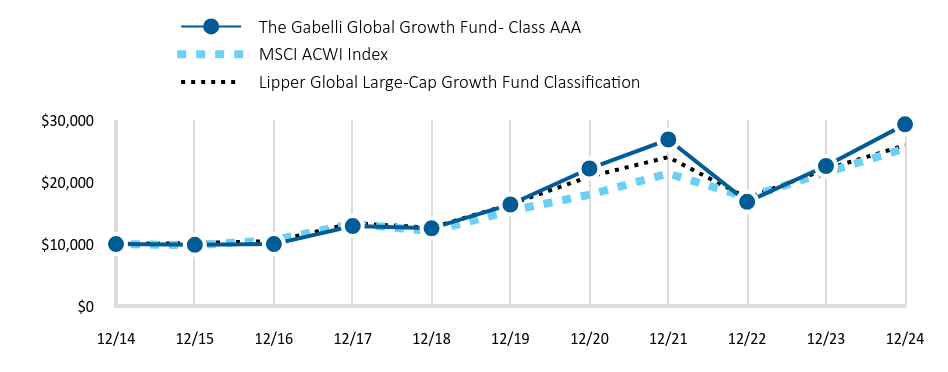

In 2024, The Gabelli Global Growth Fund outperformed its broad-based benchmark, the MSCI AC World Index and its comparative benchmark, the Lipper Global Large-Cap Growth Fund Classification. Economic data generally came in stronger than anticipated during the year, and the Federal Reserve saw enough progress in inflation to support 100bps of policy rate cuts starting in September. Separately, the artificial intelligence space continued to mature this year, and early winners have emerged in the semiconductor and data center infrastructure sectors. Against this backdrop, many of our large technology holdings performed well.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Growth Fund - Class AAA | MSCI ACWI Index | Lipper Global Large-Cap Growth Fund Classification |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,879 | 9,816 | 10,176 |

|---|

| 12/16 | 9,998 | 10,648 | 10,472 |

|---|

| 12/17 | 12,899 | 13,270 | 13,359 |

|---|

| 12/18 | 12,538 | 12,085 | 12,646 |

|---|

| 12/19 | 16,390 | 15,384 | 16,422 |

|---|

| 12/20 | 22,198 | 17,972 | 20,895 |

|---|

| 12/21 | 26,881 | 21,394 | 24,042 |

|---|

| 12/22 | 16,814 | 17,551 | 17,452 |

|---|

| 12/23 | 22,610 | 21,555 | 22,079 |

|---|

| 12/24 | 29,328 | 25,439 | 25,951 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Growth Fund - Class AAA | 29.71% | 12.34% | 11.36% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| Lipper Global Large-Cap Growth Fund Classification | 17.54% | 9.58% | 10.00% |

|---|

- Total Net Assets$190,324,373

- Number of Portfolio Holdings47

- Portfolio Turnover Rate26%

- Management Fees$923,769

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

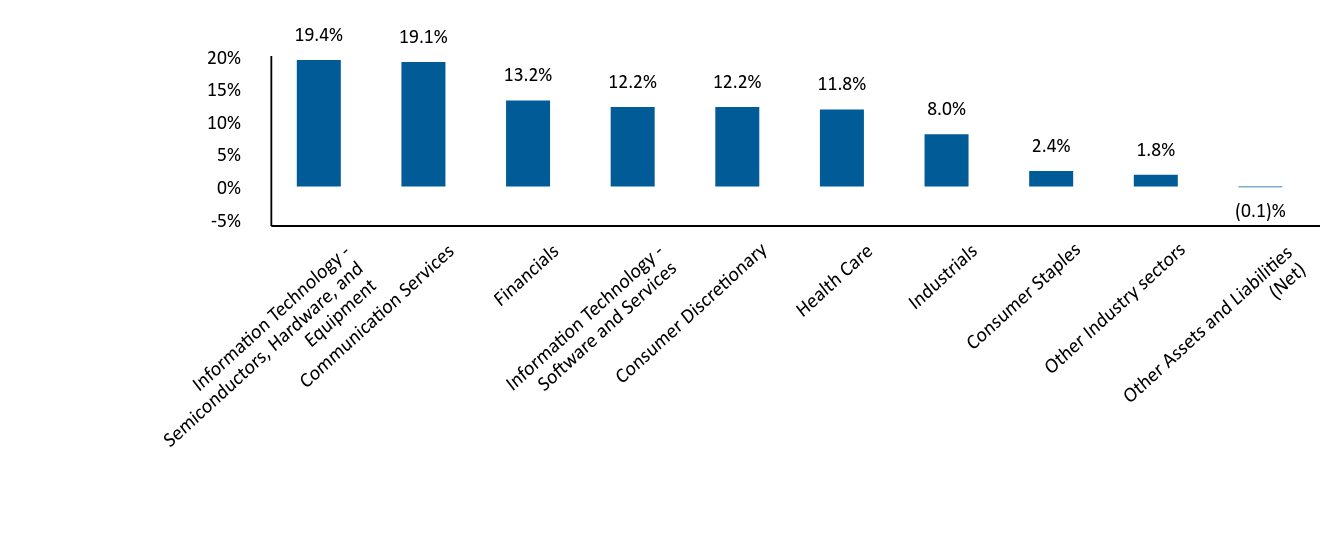

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| NVIDIA Corp. | 7.5% |

| Amazon.com Inc. | 6.5% |

| Meta Platforms Inc. | 5.5% |

| Microsoft Corp. | 5.4% |

| Netflix Inc. | 5.4% |

| Alphabet Inc. | 5.0% |

| Eli Lilly & Co. | 3.8% |

| Apple Inc. | 3.2% |

| Spotify Technology SA | 3.2% |

| Trane Technologies plc | 3.1% |

Portfolio Weighting (% of net assets)

| Common Stocks | 99.2% |

| U.S. Government Obligations | 0.9% |

| Other Assets and Liabilities (Net) | (0.1)% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Information Technology - Semiconductors, Hardware, and Equipment | 19.4% |

| Communication Services | 19.1% |

| Financials | 13.2% |

| Information Technology - Software and Services | 12.2% |

| Consumer Discretionary | 12.2% |

| Health Care | 11.8% |

| Industrials | 8.0% |

| Consumer Staples | 2.4% |

| Other Industry sectors | 1.8% |

| Other Assets and Liabilities (Net) | (0.1)% |

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Growth Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund’s investment objective primarily seeks to provide investors with appreciation of capital. Current income is a secondary objective of the Fund. The Fund’s investment strategy is to invest at least 65% of its total assets in common stocks of companies which the portfolio managers believe are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. The Global Growth Fund invests primarily in common stocks of foreign and domestic small-capitalization, mid-capitalization, and large-capitalization issuers. As a “global” fund, the Fund invests in securities of issuers, or related investments thereof, located in at least three countries, and at least 40% of the Fund’s total net assets are invested in securities of non-U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Growth Fund - Class C | $103 | 0.90% |

|---|

How did the Fund perform?

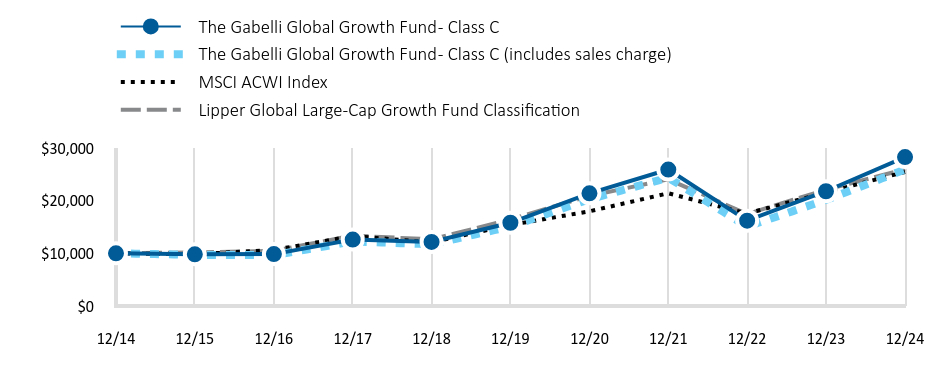

In 2024, The Gabelli Global Growth Fund outperformed its broad-based benchmark, the MSCI AC World Index and its comparative benchmark, the Lipper Global Large-Cap Growth Fund Classification. Economic data generally came in stronger than anticipated during the year, and the Federal Reserve saw enough progress in inflation to support 100bps of policy rate cuts starting in September. Separately, the artificial intelligence space continued to mature this year, and early winners have emerged in the semiconductor and data center infrastructure sectors. Against this backdrop, many of our large technology holdings performed well.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Growth Fund - Class C | The Gabelli Global Growth Fund - Class C (includes sales charge) | MSCI ACWI Index | Lipper Global Large-Cap Growth Fund Classification |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,806 | 9,708 | 9,816 | 10,176 |

|---|

| 12/16 | 9,848 | 9,653 | 10,648 | 10,472 |

|---|

| 12/17 | 12,610 | 12,263 | 13,270 | 13,359 |

|---|

| 12/18 | 12,168 | 11,716 | 12,085 | 12,646 |

|---|

| 12/19 | 15,797 | 15,092 | 15,384 | 16,422 |

|---|

| 12/20 | 21,390 | 20,286 | 17,972 | 20,895 |

|---|

| 12/21 | 25,900 | 24,359 | 21,394 | 24,042 |

|---|

| 12/22 | 16,200 | 15,085 | 17,551 | 17,452 |

|---|

| 12/23 | 21,783 | 20,133 | 21,555 | 22,079 |

|---|

| 12/24 | 28,257 | 25,915 | 25,439 | 25,951 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Growth Fund - Class C | 29.72% | 12.34% | 10.95% |

|---|

| The Gabelli Global Growth Fund - Class C (includes sales charge) | 28.72% | 12.34% | 10.95% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| Lipper Global Large-Cap Growth Fund Classification | 17.54% | 9.58% | 10.00% |

|---|

- Total Net Assets$190,324,373

- Number of Portfolio Holdings47

- Portfolio Turnover Rate26%

- Management Fees$923,769

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

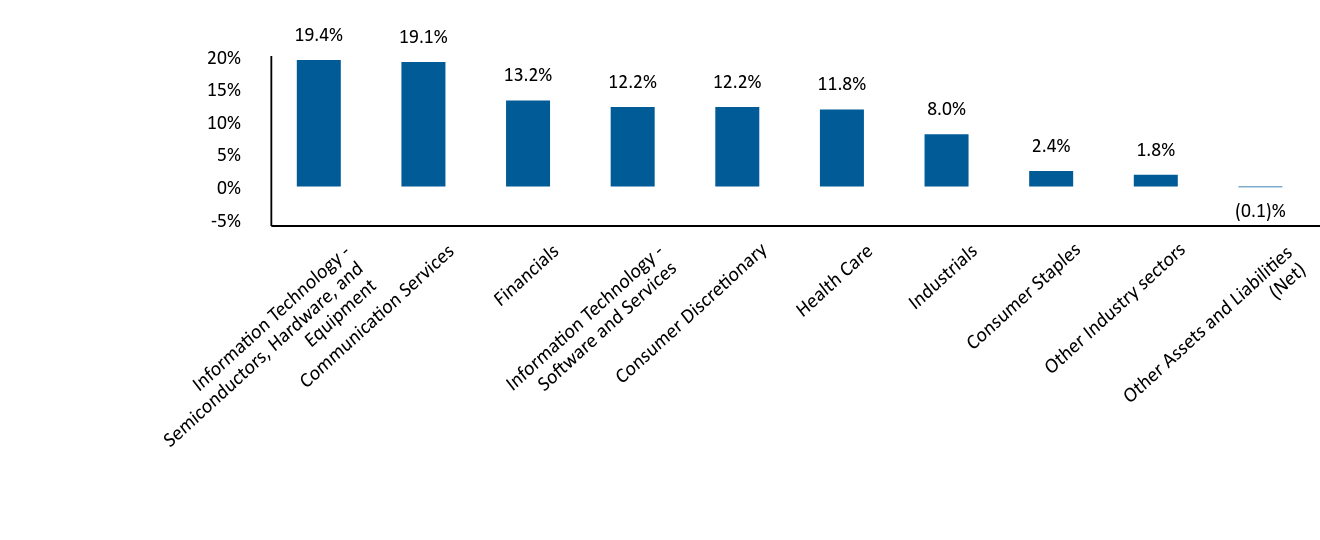

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| NVIDIA Corp. | 7.5% |

| Amazon.com Inc. | 6.5% |

| Meta Platforms Inc. | 5.5% |

| Microsoft Corp. | 5.4% |

| Netflix Inc. | 5.4% |

| Alphabet Inc. | 5.0% |

| Eli Lilly & Co. | 3.8% |

| Apple Inc. | 3.2% |

| Spotify Technology SA | 3.2% |

| Trane Technologies plc | 3.1% |

Portfolio Weighting (% of net assets)

| Common Stocks | 99.2% |

| U.S. Government Obligations | 0.9% |

| Other Assets and Liabilities (Net) | (0.1)% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Information Technology - Semiconductors, Hardware, and Equipment | 19.4% |

| Communication Services | 19.1% |

| Financials | 13.2% |

| Information Technology - Software and Services | 12.2% |

| Consumer Discretionary | 12.2% |

| Health Care | 11.8% |

| Industrials | 8.0% |

| Consumer Staples | 2.4% |

| Other Industry sectors | 1.8% |

| Other Assets and Liabilities (Net) | (0.1)% |

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Growth Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund’s investment objective primarily seeks to provide investors with appreciation of capital. Current income is a secondary objective of the Fund. The Fund’s investment strategy is to invest at least 65% of its total assets in common stocks of companies which the portfolio managers believe are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. The Global Growth Fund invests primarily in common stocks of foreign and domestic small-capitalization, mid-capitalization, and large-capitalization issuers. As a “global” fund, the Fund invests in securities of issuers, or related investments thereof, located in at least three countries, and at least 40% of the Fund’s total net assets are invested in securities of non-U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Growth Fund - Class I | $103 | 0.90% |

|---|

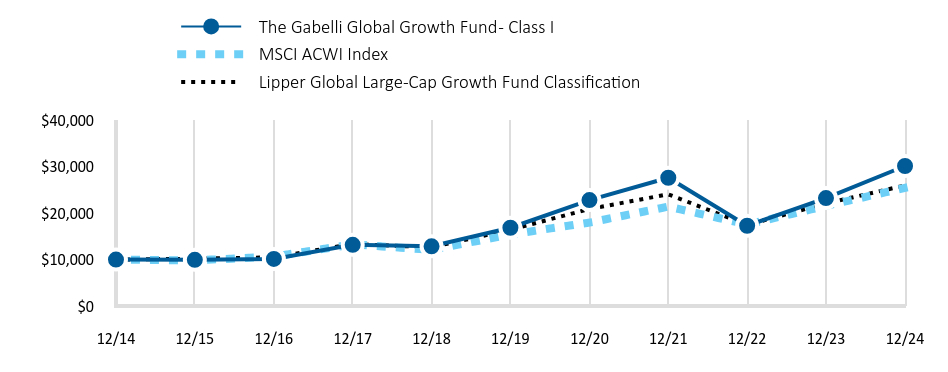

How did the Fund perform?

In 2024, The Gabelli Global Growth Fund outperformed its broad-based benchmark, the MSCI AC World Index and its comparative benchmark, the Lipper Global Large-Cap Growth Fund Classification. Economic data generally came in stronger than anticipated during the year, and the Federal Reserve saw enough progress in inflation to support 100bps of policy rate cuts starting in September. Separately, the artificial intelligence space continued to mature this year, and early winners have emerged in the semiconductor and data center infrastructure sectors. Against this backdrop, many of our large technology holdings performed well.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Growth Fund - Class I | MSCI ACWI Index | Lipper Global Large-Cap Growth Fund Classification |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,947 | 9,816 | 10,176 |

|---|

| 12/16 | 10,141 | 10,648 | 10,472 |

|---|

| 12/17 | 13,167 | 13,270 | 13,359 |

|---|

| 12/18 | 12,855 | 12,085 | 12,646 |

|---|

| 12/19 | 16,844 | 15,384 | 16,422 |

|---|

| 12/20 | 22,805 | 17,972 | 20,895 |

|---|

| 12/21 | 27,617 | 21,394 | 24,042 |

|---|

| 12/22 | 17,280 | 17,551 | 17,452 |

|---|

| 12/23 | 23,238 | 21,555 | 22,079 |

|---|

| 12/24 | 30,142 | 25,439 | 25,951 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Growth Fund - Class I | 29.71% | 12.34% | 11.66% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| Lipper Global Large-Cap Growth Fund Classification | 17.54% | 9.58% | 10.00% |

|---|

- Total Net Assets$190,324,373

- Number of Portfolio Holdings47

- Portfolio Turnover Rate26%

- Management Fees$923,769

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

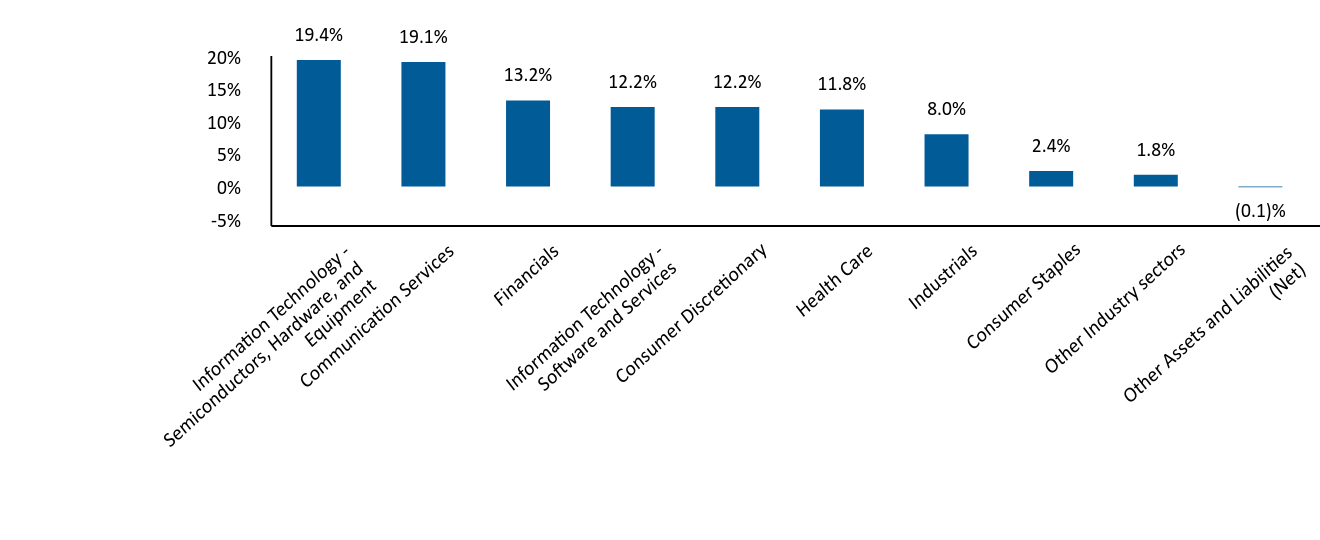

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| NVIDIA Corp. | 7.5% |

| Amazon.com Inc. | 6.5% |

| Meta Platforms Inc. | 5.5% |

| Microsoft Corp. | 5.4% |

| Netflix Inc. | 5.4% |

| Alphabet Inc. | 5.0% |

| Eli Lilly & Co. | 3.8% |

| Apple Inc. | 3.2% |

| Spotify Technology SA | 3.2% |

| Trane Technologies plc | 3.1% |

Portfolio Weighting (% of net assets)

| Common Stocks | 99.2% |

| U.S. Government Obligations | 0.9% |

| Other Assets and Liabilities (Net) | (0.1)% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Information Technology - Semiconductors, Hardware, and Equipment | 19.4% |

| Communication Services | 19.1% |

| Financials | 13.2% |

| Information Technology - Software and Services | 12.2% |

| Consumer Discretionary | 12.2% |

| Health Care | 11.8% |

| Industrials | 8.0% |

| Consumer Staples | 2.4% |

| Other Industry sectors | 1.8% |

| Other Assets and Liabilities (Net) | (0.1)% |

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Growth Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund’s investment objective primarily seeks to provide investors with appreciation of capital. Current income is a secondary objective of the Fund. The Fund’s investment strategy is to invest at least 65% of its total assets in common stocks of companies which the portfolio managers believe are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. The Global Growth Fund invests primarily in common stocks of foreign and domestic small-capitalization, mid-capitalization, and large-capitalization issuers. As a “global” fund, the Fund invests in securities of issuers, or related investments thereof, located in at least three countries, and at least 40% of the Fund’s total net assets are invested in securities of non-U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Growth Fund - Class A | $103 | 0.90% |

|---|

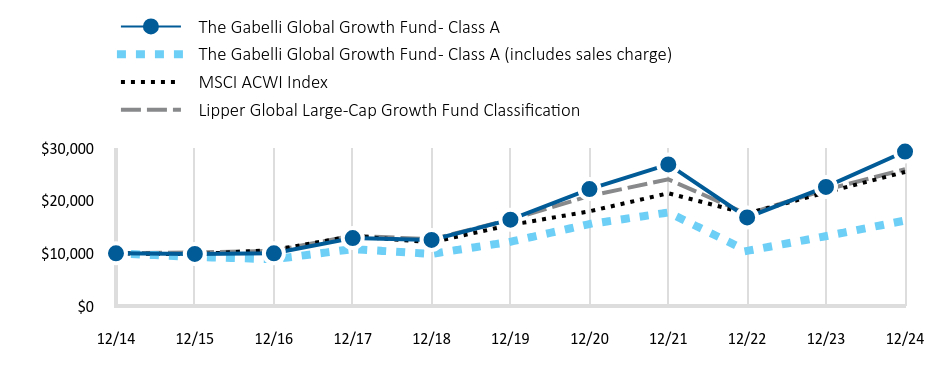

How did the Fund perform?

In 2024, The Gabelli Global Growth Fund outperformed its broad-based benchmark, the MSCI AC World Index and its comparative benchmark, the Lipper Global Large-Cap Growth Fund Classification. Economic data generally came in stronger than anticipated during the year, and the Federal Reserve saw enough progress in inflation to support 100bps of policy rate cuts starting in September. Separately, the artificial intelligence space continued to mature this year, and early winners have emerged in the semiconductor and data center infrastructure sectors. Against this backdrop, many of our large technology holdings performed well.

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Growth Fund - Class A | The Gabelli Global Growth Fund - Class A (includes sales charge) | MSCI ACWI Index | Lipper Global Large-Cap Growth Fund Classification |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,877 | 9,309 | 9,816 | 10,176 |

|---|

| 12/16 | 10,000 | 8,884 | 10,648 | 10,472 |

|---|

| 12/17 | 12,899 | 10,799 | 13,270 | 13,359 |

|---|

| 12/18 | 12,537 | 9,893 | 12,085 | 12,646 |

|---|

| 12/19 | 16,391 | 12,190 | 15,384 | 16,422 |

|---|

| 12/20 | 22,191 | 15,554 | 17,972 | 20,895 |

|---|

| 12/21 | 26,871 | 17,752 | 21,394 | 24,042 |

|---|

| 12/22 | 16,805 | 10,463 | 17,551 | 17,452 |

|---|

| 12/23 | 22,603 | 13,263 | 21,555 | 22,079 |

|---|

| 12/24 | 29,318 | 16,214 | 25,439 | 25,951 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Growth Fund - Class A | 29.71% | 12.33% | 11.36% |

|---|

| The Gabelli Global Growth Fund - Class A (includes sales charge) | 22.25% | 11.01% | 10.70% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| Lipper Global Large-Cap Growth Fund Classification | 17.54% | 9.58% | 10.00% |

|---|

- Total Net Assets$190,324,373

- Number of Portfolio Holdings47

- Portfolio Turnover Rate26%

- Management Fees$923,769

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

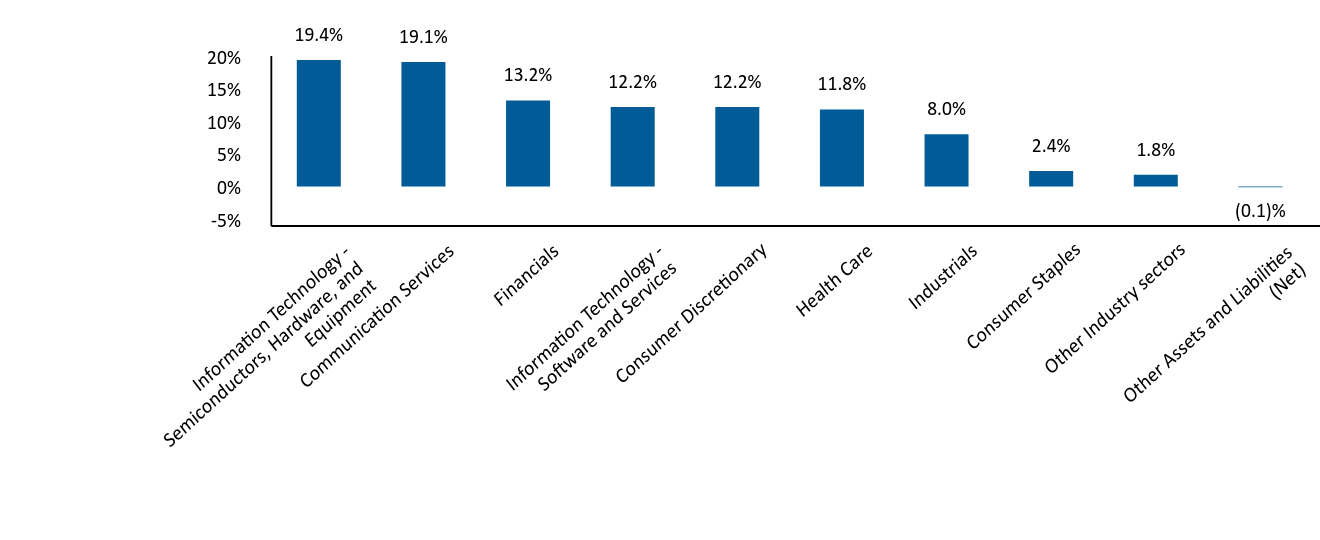

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| NVIDIA Corp. | 7.5% |

| Amazon.com Inc. | 6.5% |

| Meta Platforms Inc. | 5.5% |

| Microsoft Corp. | 5.4% |

| Netflix Inc. | 5.4% |

| Alphabet Inc. | 5.0% |

| Eli Lilly & Co. | 3.8% |

| Apple Inc. | 3.2% |

| Spotify Technology SA | 3.2% |

| Trane Technologies plc | 3.1% |

Portfolio Weighting (% of net assets)

| Common Stocks | 99.2% |

| U.S. Government Obligations | 0.9% |

| Other Assets and Liabilities (Net) | (0.1)% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Information Technology - Semiconductors, Hardware, and Equipment | 19.4% |

| Communication Services | 19.1% |

| Financials | 13.2% |

| Information Technology - Software and Services | 12.2% |

| Consumer Discretionary | 12.2% |

| Health Care | 11.8% |

| Industrials | 8.0% |

| Consumer Staples | 2.4% |

| Other Industry sectors | 1.8% |

| Other Assets and Liabilities (Net) | (0.1)% |

The Gabelli Global Growth Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Content & Connectivity Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The primary investment objective of The Gabelli Global Content & Connectivity Fund is capital appreciation. The Fund’s secondary investment objective is current income. The Fund’s investment strategy is to invest its net assets in common stocks of companies in the telecommunications, media, and information technology industries which Gabelli Funds, LLC (the Adviser), believes are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. In accordance with its concentration policy, the Fund will invest at least 25% of the value of its total assets in the telecommunications related industry, and not invest more than 25% of the value of its total assets in any other particular industry. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Content & Connectivity Fund - Class AAA | $100 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, The Gabelli Global Content & Connectivity Fund outperformed its broad-based benchmark, MSCI AC World Index but underperformed its comparative benchmark, MSCI AC World Communication Services Index. The difference in performance was largely driven by the Fund’s lower weights in technology- and online-related mega-cap stocks, to avoid excessive concentration. Top contributors to our Fund included firms benefiting from strength and scale in digital advertising, continued optimism around artificial intelligence platforms and rising demand for AI chips, solid wireless operating performance, or announced merger and acquisition transactions.

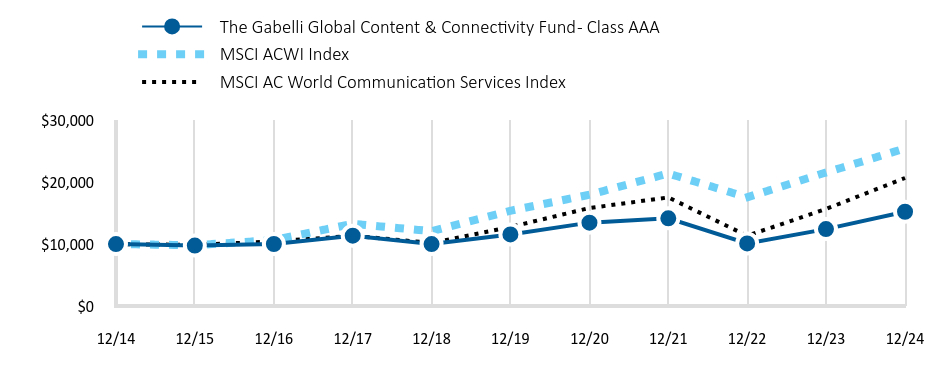

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Content & Connectivity Fund - Class AAA | MSCI ACWI Index | MSCI AC World Communication Services Index |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,752 | 9,816 | 9,860 |

|---|

| 12/16 | 10,010 | 10,648 | 10,437 |

|---|

| 12/17 | 11,350 | 13,270 | 11,335 |

|---|

| 12/18 | 10,000 | 12,085 | 10,191 |

|---|

| 12/19 | 11,562 | 15,384 | 12,750 |

|---|

| 12/20 | 13,461 | 17,972 | 15,823 |

|---|

| 12/21 | 14,157 | 21,394 | 17,535 |

|---|

| 12/22 | 10,105 | 17,551 | 11,340 |

|---|

| 12/23 | 12,418 | 21,555 | 15,664 |

|---|

| 12/24 | 15,221 | 25,439 | 20,669 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Content & Connectivity Fund - Class AAA | 22.57% | 5.65% | 4.29% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| MSCI AC World Communication Services Index | 31.95% | 10.14% | 7.53% |

|---|

- Total Net Assets$65,443,369

- Number of Portfolio Holdings48

- Portfolio Turnover Rate11%

- Management Fees$137,060

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| T-Mobile US Inc. | 9.1% |

| Meta Platforms Inc. | 8.5% |

| Alphabet Inc. | 7.8% |

| SoftBank Group Corp. | 6.6% |

| Deutsche Telekom AG | 5.0% |

| Prosus NV | 4.8% |

| Telephone and Data Systems Inc. | 3.9% |

| Microsoft Corp. | 3.9% |

| United States Cellular Corp. | 3.8% |

| Frontier Communications Parent Inc. | 3.5% |

Portfolio Weighting (% of net assets)

| Common Stocks | 101.0% |

| Preferred Stocks | 0.2% |

| Other Assets and Liabilities (Net) | (1.2)% |

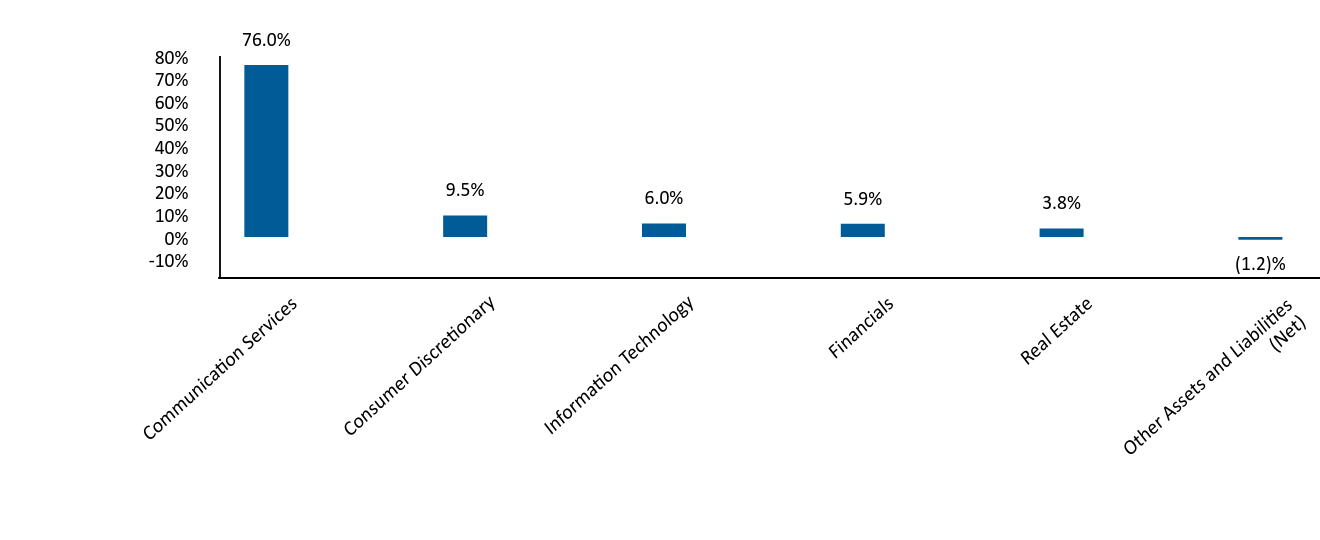

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Communication Services | 76.0% |

| Consumer Discretionary | 9.5% |

| Information Technology | 6.0% |

| Financials | 5.9% |

| Real Estate | 3.8% |

| Other Assets and Liabilities (Net) | (1.2)% |

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Content & Connectivity Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The primary investment objective of The Gabelli Global Content & Connectivity Fund is capital appreciation. The Fund’s secondary investment objective is current income. The Fund’s investment strategy is to invest its net assets in common stocks of companies in the telecommunications, media, and information technology industries which Gabelli Funds, LLC (the Adviser), believes are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. In accordance with its concentration policy, the Fund will invest at least 25% of the value of its total assets in the telecommunications related industry, and not invest more than 25% of the value of its total assets in any other particular industry. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Content & Connectivity Fund - Class C | $101 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, The Gabelli Global Content & Connectivity Fund outperformed its broad-based benchmark, MSCI AC World Index but underperformed its comparative benchmark, MSCI AC World Communication Services Index. The difference in performance was largely driven by the Fund’s lower weights in technology- and online-related mega-cap stocks, to avoid excessive concentration. Top contributors to our Fund included firms benefiting from strength and scale in digital advertising, continued optimism around artificial intelligence platforms and rising demand for AI chips, solid wireless operating performance, or announced merger and acquisition transactions.

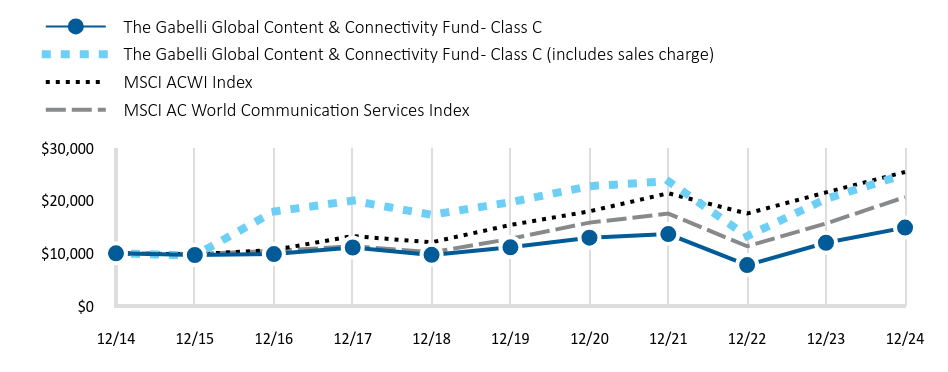

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Content & Connectivity Fund - Class C | The Gabelli Global Content & Connectivity Fund - Class C (includes sales charge) | MSCI ACWI Index | MSCI AC World Communication Services Index |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,682 | 9,585 | 9,816 | 9,860 |

|---|

| 12/16 | 9,863 | 17,924 | 10,648 | 10,437 |

|---|

| 12/17 | 11,099 | 19,991 | 13,270 | 11,335 |

|---|

| 12/18 | 9,705 | 17,306 | 12,085 | 10,191 |

|---|

| 12/19 | 11,142 | 19,696 | 15,384 | 12,750 |

|---|

| 12/20 | 12,974 | 22,737 | 17,972 | 15,823 |

|---|

| 12/21 | 13,645 | 23,685 | 21,394 | 17,535 |

|---|

| 12/22 | 7,771 | 13,247 | 17,551 | 11,340 |

|---|

| 12/23 | 11,999 | 20,324 | 21,555 | 15,664 |

|---|

| 12/24 | 14,876 | 24,992 | 25,439 | 20,669 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Content & Connectivity Fund - Class C | 22.57% | 5.54% | 3.85% |

|---|

| The Gabelli Global Content & Connectivity Fund - Class C (includes sales charge) | 21.57% | 5.54% | 3.85% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| MSCI AC World Communication Services Index | 31.95% | 10.14% | 7.53% |

|---|

- Total Net Assets$65,443,369

- Number of Portfolio Holdings48

- Portfolio Turnover Rate11%

- Management Fees$137,060

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| T-Mobile US Inc. | 9.1% |

| Meta Platforms Inc. | 8.5% |

| Alphabet Inc. | 7.8% |

| SoftBank Group Corp. | 6.6% |

| Deutsche Telekom AG | 5.0% |

| Prosus NV | 4.8% |

| Telephone and Data Systems Inc. | 3.9% |

| Microsoft Corp. | 3.9% |

| United States Cellular Corp. | 3.8% |

| Frontier Communications Parent Inc. | 3.5% |

Portfolio Weighting (% of net assets)

| Common Stocks | 101.0% |

| Preferred Stocks | 0.2% |

| Other Assets and Liabilities (Net) | (1.2)% |

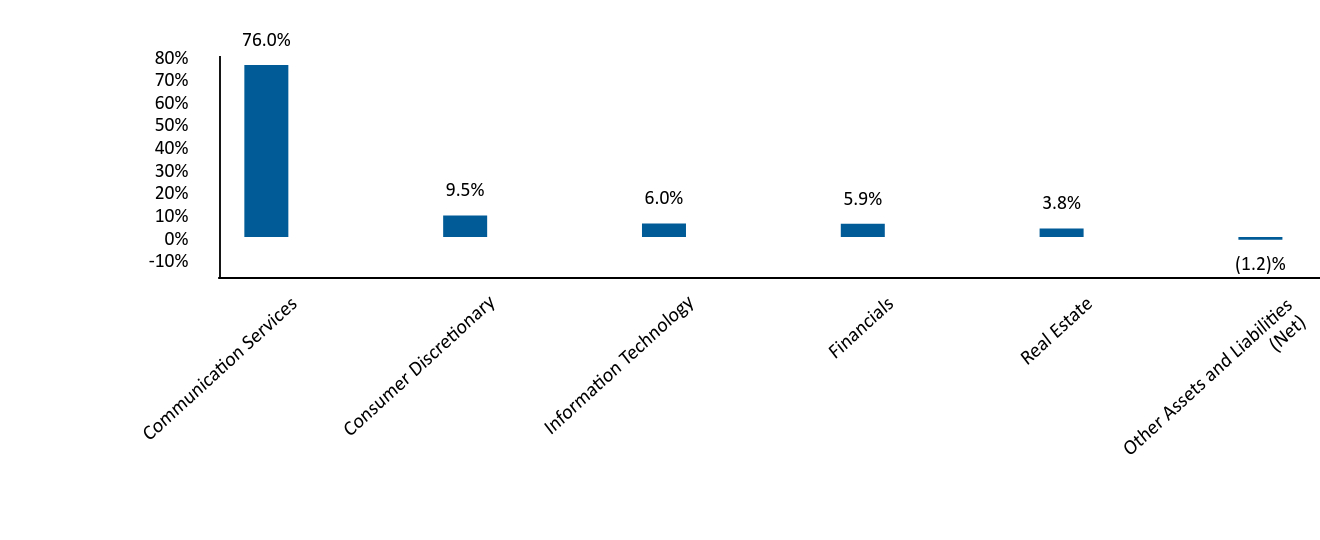

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Communication Services | 76.0% |

| Consumer Discretionary | 9.5% |

| Information Technology | 6.0% |

| Financials | 5.9% |

| Real Estate | 3.8% |

| Other Assets and Liabilities (Net) | (1.2)% |

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Content & Connectivity Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The primary investment objective of The Gabelli Global Content & Connectivity Fund is capital appreciation. The Fund’s secondary investment objective is current income. The Fund’s investment strategy is to invest its net assets in common stocks of companies in the telecommunications, media, and information technology industries which Gabelli Funds, LLC (the Adviser), believes are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. In accordance with its concentration policy, the Fund will invest at least 25% of the value of its total assets in the telecommunications related industry, and not invest more than 25% of the value of its total assets in any other particular industry. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Content & Connectivity Fund - Class I | $100 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, The Gabelli Global Content & Connectivity Fund outperformed its broad-based benchmark, MSCI AC World Index but underperformed its comparative benchmark, MSCI AC World Communication Services Index. The difference in performance was largely driven by the Fund’s lower weights in technology- and online-related mega-cap stocks, to avoid excessive concentration. Top contributors to our Fund included firms benefiting from strength and scale in digital advertising, continued optimism around artificial intelligence platforms and rising demand for AI chips, solid wireless operating performance, or announced merger and acquisition transactions.

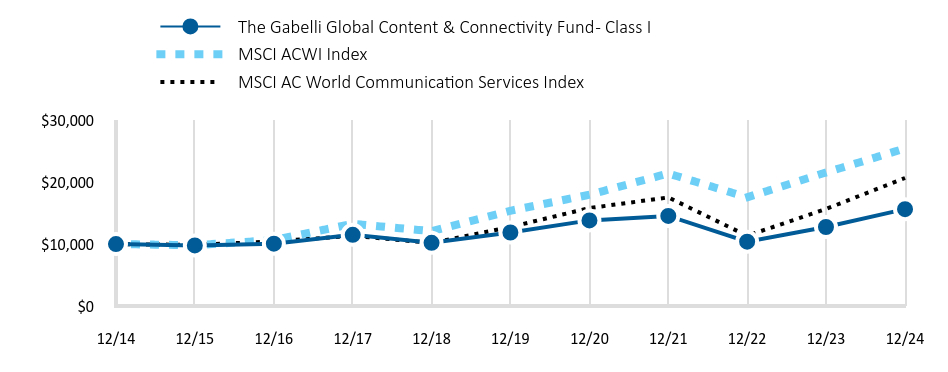

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Content & Connectivity Fund - Class I | MSCI ACWI Index | MSCI AC World Communication Services Index |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,778 | 9,816 | 9,860 |

|---|

| 12/16 | 10,066 | 10,648 | 10,437 |

|---|

| 12/17 | 11,496 | 13,270 | 11,335 |

|---|

| 12/18 | 10,200 | 12,085 | 10,191 |

|---|

| 12/19 | 11,875 | 15,384 | 12,750 |

|---|

| 12/20 | 13,825 | 17,972 | 15,823 |

|---|

| 12/21 | 14,541 | 21,394 | 17,535 |

|---|

| 12/22 | 10,380 | 17,551 | 11,340 |

|---|

| 12/23 | 12,756 | 21,555 | 15,664 |

|---|

| 12/24 | 15,637 | 25,439 | 20,669 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Content & Connectivity Fund - Class I | 22.58% | 5.66% | 4.57% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| MSCI AC World Communication Services Index | 31.95% | 10.14% | 7.53% |

|---|

- Total Net Assets$65,443,369

- Number of Portfolio Holdings48

- Portfolio Turnover Rate11%

- Management Fees$137,060

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| T-Mobile US Inc. | 9.1% |

| Meta Platforms Inc. | 8.5% |

| Alphabet Inc. | 7.8% |

| SoftBank Group Corp. | 6.6% |

| Deutsche Telekom AG | 5.0% |

| Prosus NV | 4.8% |

| Telephone and Data Systems Inc. | 3.9% |

| Microsoft Corp. | 3.9% |

| United States Cellular Corp. | 3.8% |

| Frontier Communications Parent Inc. | 3.5% |

Portfolio Weighting (% of net assets)

| Common Stocks | 101.0% |

| Preferred Stocks | 0.2% |

| Other Assets and Liabilities (Net) | (1.2)% |

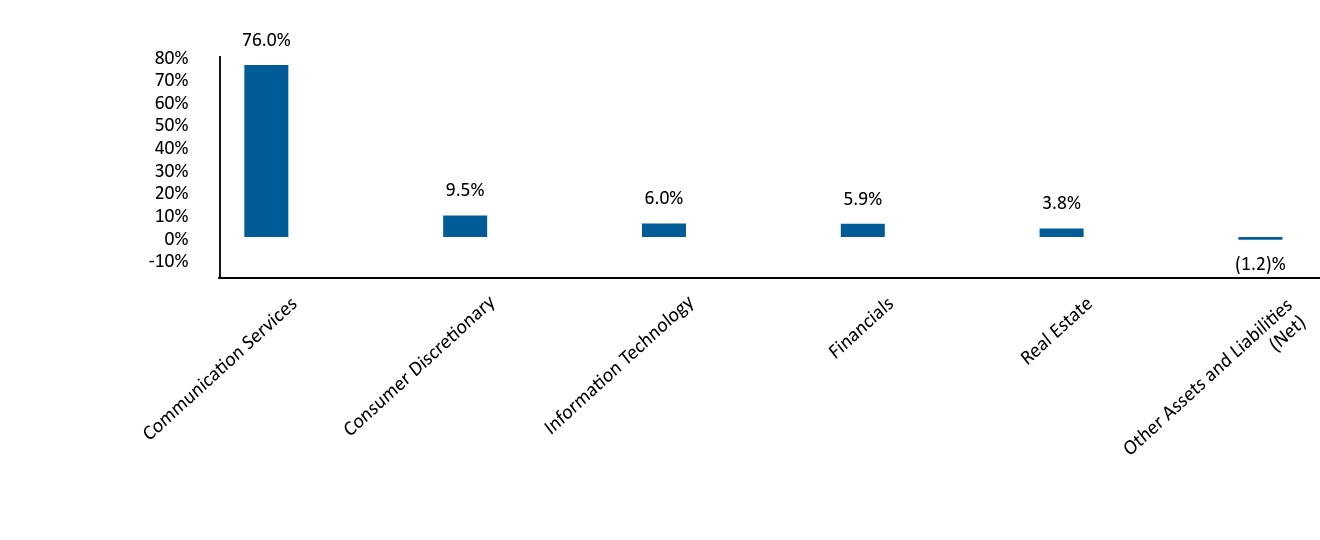

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Communication Services | 76.0% |

| Consumer Discretionary | 9.5% |

| Information Technology | 6.0% |

| Financials | 5.9% |

| Real Estate | 3.8% |

| Other Assets and Liabilities (Net) | (1.2)% |

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Content & Connectivity Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The primary investment objective of The Gabelli Global Content & Connectivity Fund is capital appreciation. The Fund’s secondary investment objective is current income. The Fund’s investment strategy is to invest its net assets in common stocks of companies in the telecommunications, media, and information technology industries which Gabelli Funds, LLC (the Adviser), believes are likely to have rapid growth in revenues and earnings and potential for above average capital appreciation or are undervalued. In accordance with its concentration policy, the Fund will invest at least 25% of the value of its total assets in the telecommunications related industry, and not invest more than 25% of the value of its total assets in any other particular industry. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Content & Connectivity Fund - Class A | $100 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, The Gabelli Global Content & Connectivity Fund outperformed its broad-based benchmark, MSCI AC World Index but underperformed its comparative benchmark, MSCI AC World Communication Services Index. The difference in performance was largely driven by the Fund’s lower weights in technology- and online-related mega-cap stocks, to avoid excessive concentration. Top contributors to our Fund included firms benefiting from strength and scale in digital advertising, continued optimism around artificial intelligence platforms and rising demand for AI chips, solid wireless operating performance, or announced merger and acquisition transactions.

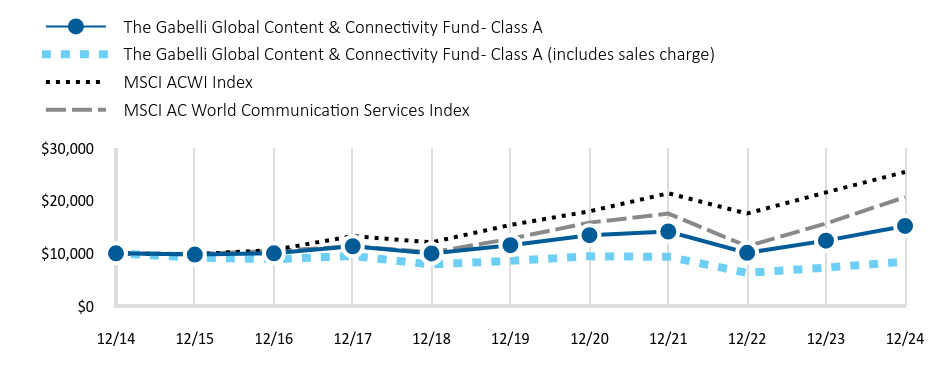

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Content & Connectivity Fund - Class A | The Gabelli Global Content & Connectivity Fund - Class A (includes sales charge) | MSCI ACWI Index | MSCI AC World Communication Services Index |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 9,754 | 9,194 | 9,816 | 9,860 |

|---|

| 12/16 | 9,999 | 8,883 | 10,648 | 10,437 |

|---|

| 12/17 | 11,338 | 9,494 | 13,270 | 11,335 |

|---|

| 12/18 | 9,984 | 7,880 | 12,085 | 10,191 |

|---|

| 12/19 | 11,545 | 8,588 | 15,384 | 12,750 |

|---|

| 12/20 | 13,442 | 9,424 | 17,972 | 15,823 |

|---|

| 12/21 | 14,136 | 9,342 | 21,394 | 17,535 |

|---|

| 12/22 | 10,090 | 6,285 | 17,551 | 11,340 |

|---|

| 12/23 | 12,403 | 7,281 | 21,555 | 15,664 |

|---|

| 12/24 | 15,200 | 8,410 | 25,439 | 20,669 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Content & Connectivity Fund - Class A | 22.55% | 5.66% | 4.28% |

|---|

| The Gabelli Global Content & Connectivity Fund - Class A (includes sales charge) | 15.51% | 4.41% | 3.66% |

|---|

| MSCI ACWI Index | 18.02% | 10.58% | 9.79% |

|---|

| MSCI AC World Communication Services Index | 31.95% | 10.14% | 7.53% |

|---|

- Total Net Assets$65,443,369

- Number of Portfolio Holdings48

- Portfolio Turnover Rate11%

- Management Fees$137,060

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| T-Mobile US Inc. | 9.1% |

| Meta Platforms Inc. | 8.5% |

| Alphabet Inc. | 7.8% |

| SoftBank Group Corp. | 6.6% |

| Deutsche Telekom AG | 5.0% |

| Prosus NV | 4.8% |

| Telephone and Data Systems Inc. | 3.9% |

| Microsoft Corp. | 3.9% |

| United States Cellular Corp. | 3.8% |

| Frontier Communications Parent Inc. | 3.5% |

Portfolio Weighting (% of net assets)

| Common Stocks | 101.0% |

| Preferred Stocks | 0.2% |

| Other Assets and Liabilities (Net) | (1.2)% |

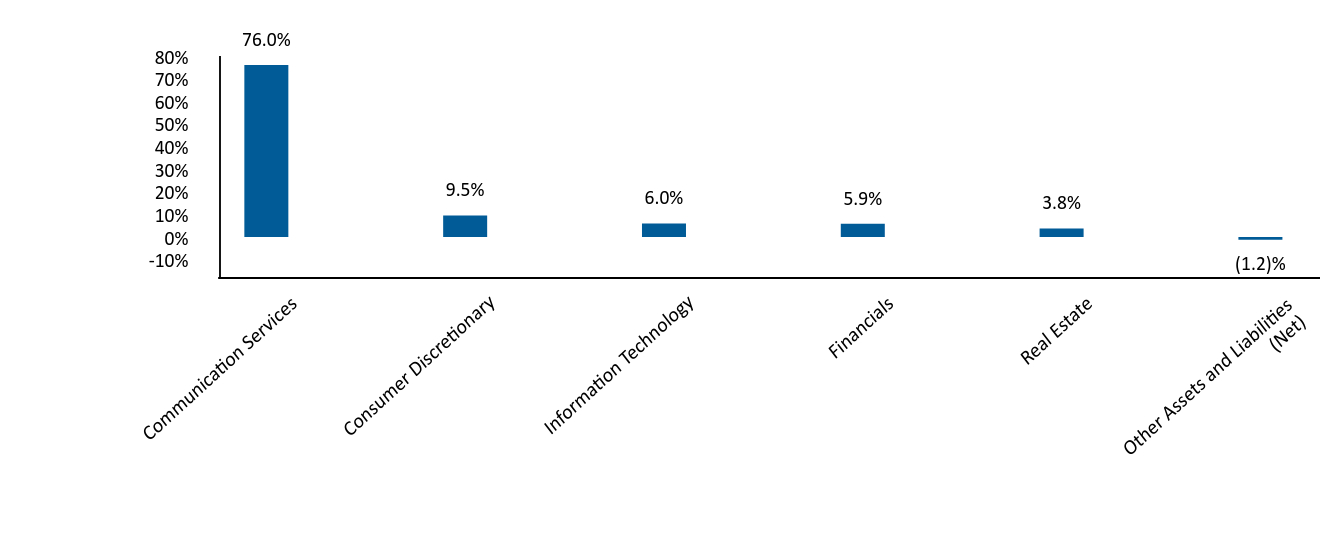

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Communication Services | 76.0% |

| Consumer Discretionary | 9.5% |

| Information Technology | 6.0% |

| Financials | 5.9% |

| Real Estate | 3.8% |

| Other Assets and Liabilities (Net) | (1.2)% |

The Gabelli Global Content & Connectivity Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Mini Mites Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund is a non-diversified open end management investment company whose investment objective is to provide investors with long term capital appreciation by investing primarily in micro-capitalization equity securities. The Fund’s investment strategy is to invest in common stocks of smaller companies that have a market capitalization (defined as shares outstanding times current market price) of $250 million or less at the time of the Fund's initial investment. These companies are called micro-cap companies. As a "global" fund, the Fund invests in securities of issuers located in at least three countries and at least 40% of its net assets are invested in securities of non U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Mini Mites Fund - Class A | $95 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, the Gabelli Global Mini Mites Fund underperformed its broad-based benchmark, the Russell 2000 Index, while outperforming its comparative benchmarks, the MSCI World Micro-Cap and the S&P Developed Small Cap Indices. The year's second half performance accelerated in anticipation of a more favorable environment under a Trump administration. The new administration may fuel increased deal activity, higher domestic economic activity, and increased expectations of lower interest rates. The fund seeks to invest in companies that have market capitalizations of $250 million or less which are sensitive to these macro indicators.

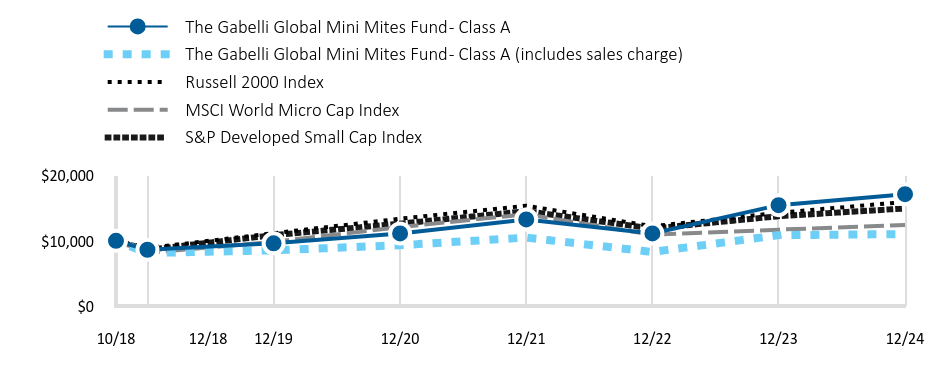

How has the Fund performed since inception?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Mini Mites Fund - Class A | The Gabelli Global Mini Mites Fund - Class A (includes sales charge) | Russell 2000 Index | MSCI World Micro Cap Index | S&P Developed Small Cap Index |

|---|

| 10/18 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/18 | 8,628 | 8,132 | 8,899 | 8,157 | 8,620 |

|---|

| 12/19 | 9,618 | 8,543 | 11,170 | 9,844 | 10,873 |

|---|

| 12/20 | 11,133 | 9,330 | 13,400 | 12,120 | 12,635 |

|---|

| 12/21 | 13,291 | 10,498 | 15,385 | 14,080 | 14,553 |

|---|

| 12/22 | 11,142 | 8,295 | 12,241 | 10,938 | 11,888 |

|---|

| 12/23 | 15,479 | 10,861 | 14,313 | 11,718 | 13,778 |

|---|

| 12/24 | 17,164 | 11,040 | 15,965 | 12,436 | 14,969 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception (10/1/2018) |

|---|

| The Gabelli Global Mini Mites Fund - Class A | 10.98% | 12.30% | 9.04% |

|---|

| The Gabelli Global Mini Mites Fund - Class A (includes sales charge) | 4.60% | 10.98% | 8.01% |

|---|

| Russell 2000 Index | 11.54% | 7.40% | 6.15% |

|---|

| MSCI World Micro Cap Index | 6.13% | 4.88% | 3.67% |

|---|

| S&P Developed Small Cap Index | 8.64% | 6.60% | 5.97% |

|---|

- Total Net Assets$12,664,636

- Number of Portfolio Holdings143

- Portfolio Turnover Rate26%

- Management Fees$(54,045)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

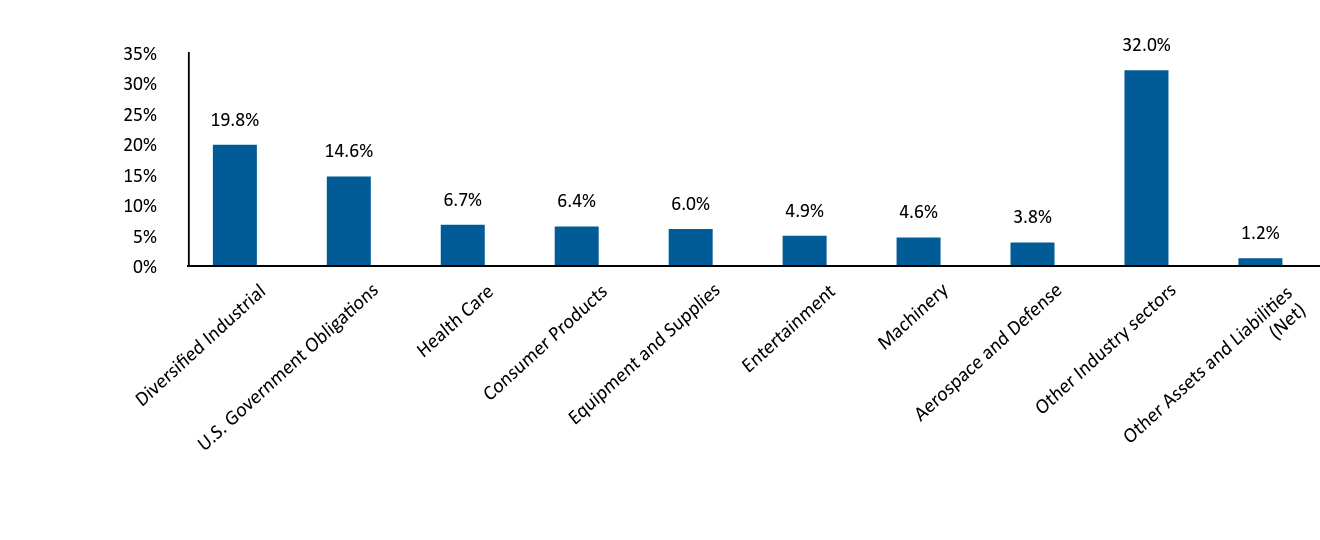

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Tredegar Corp. | 7.0% |

| Applied Optoelectronics Inc. | 4.4% |

| L.B. Foster Co. | 2.6% |

| Park-Ohio Holdings Corp. | 2.4% |

| Electromed Inc. | 2.1% |

| Ampco-Pittsburgh Corp. | 2.0% |

| Lee Enterprises Inc. | 2.0% |

| Clarus Corp. | 2.0% |

| Inspired Entertainment Inc. | 1.8% |

| Velan Inc. | 1.8% |

Portfolio Weighting (% of net assets)

| Common Stocks | 84.2% |

| U.S. Government Obligations | 14.6% |

| Other Assets and Liabilities (Net) | 1.2% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Diversified Industrial | 19.8% |

| U.S. Government Obligations | 14.6% |

| Health Care | 6.7% |

| Consumer Products | 6.4% |

| Equipment and Supplies | 6.0% |

| Entertainment | 4.9% |

| Machinery | 4.6% |

| Aerospace and Defense | 3.8% |

| Other Industry sectors | 32.0% |

| Other Assets and Liabilities (Net) | 1.2% |

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Mini Mites Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund is a non-diversified open end management investment company whose investment objective is to provide investors with long term capital appreciation by investing primarily in micro-capitalization equity securities. The Fund’s investment strategy is to invest in common stocks of smaller companies that have a market capitalization (defined as shares outstanding times current market price) of $250 million or less at the time of the Fund's initial investment. These companies are called micro-cap companies. As a "global" fund, the Fund invests in securities of issuers located in at least three countries and at least 40% of its net assets are invested in securities of non U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Mini Mites Fund - Class C | $95 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, the Gabelli Global Mini Mites Fund underperformed its broad-based benchmark, the Russell 2000 Index, while outperforming its comparative benchmarks, the MSCI World Micro-Cap and the S&P Developed Small Cap Indices. The year's second half performance accelerated in anticipation of a more favorable environment under a Trump administration. The new administration may fuel increased deal activity, higher domestic economic activity, and increased expectations of lower interest rates. The fund seeks to invest in companies that have market capitalizations of $250 million or less which are sensitive to these macro indicators.

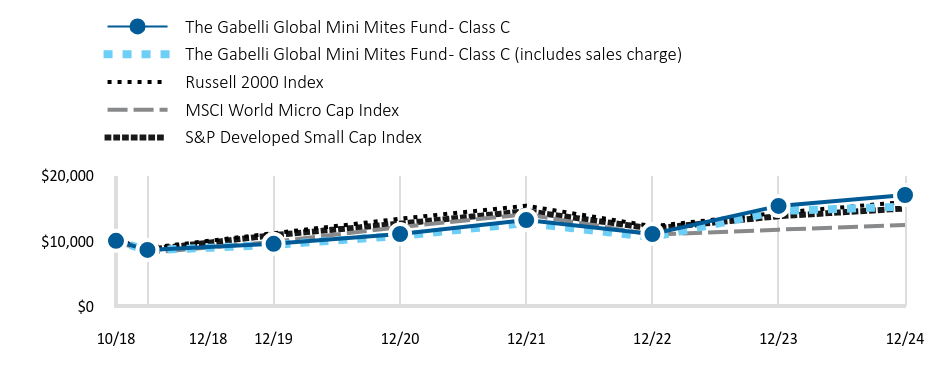

How has the Fund performed since inception?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Mini Mites Fund - Class C | The Gabelli Global Mini Mites Fund - Class C (includes sales charge) | Russell 2000 Index | MSCI World Micro Cap Index | S&P Developed Small Cap Index |

|---|

| 10/18 | 10,000 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/18 | 8,612 | 8,538 | 8,899 | 8,157 | 8,620 |

|---|

| 12/19 | 9,545 | 9,377 | 11,170 | 9,844 | 10,873 |

|---|

| 12/20 | 11,054 | 10,766 | 13,400 | 12,120 | 12,635 |

|---|

| 12/21 | 13,191 | 12,741 | 15,385 | 14,080 | 14,553 |

|---|

| 12/22 | 11,048 | 10,564 | 12,241 | 10,938 | 11,888 |

|---|

| 12/23 | 15,363 | 14,585 | 14,313 | 11,718 | 13,778 |

|---|

| 12/24 | 17,035 | 15,242 | 15,965 | 12,436 | 14,969 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception (10/1/2018) |

|---|

| The Gabelli Global Mini Mites Fund - Class C | 10.89% | 12.29% | 8.90% |

|---|

| The Gabelli Global Mini Mites Fund - Class C (includes sales charge) | 9.89% | 12.29% | 8.90% |

|---|

| Russell 2000 Index | 11.54% | 7.40% | 6.15% |

|---|

| MSCI World Micro Cap Index | 6.13% | 4.88% | 3.67% |

|---|

| S&P Developed Small Cap Index | 8.64% | 6.60% | 5.97% |

|---|

- Total Net Assets$12,664,636

- Number of Portfolio Holdings143

- Portfolio Turnover Rate26%

- Management Fees$(54,045)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

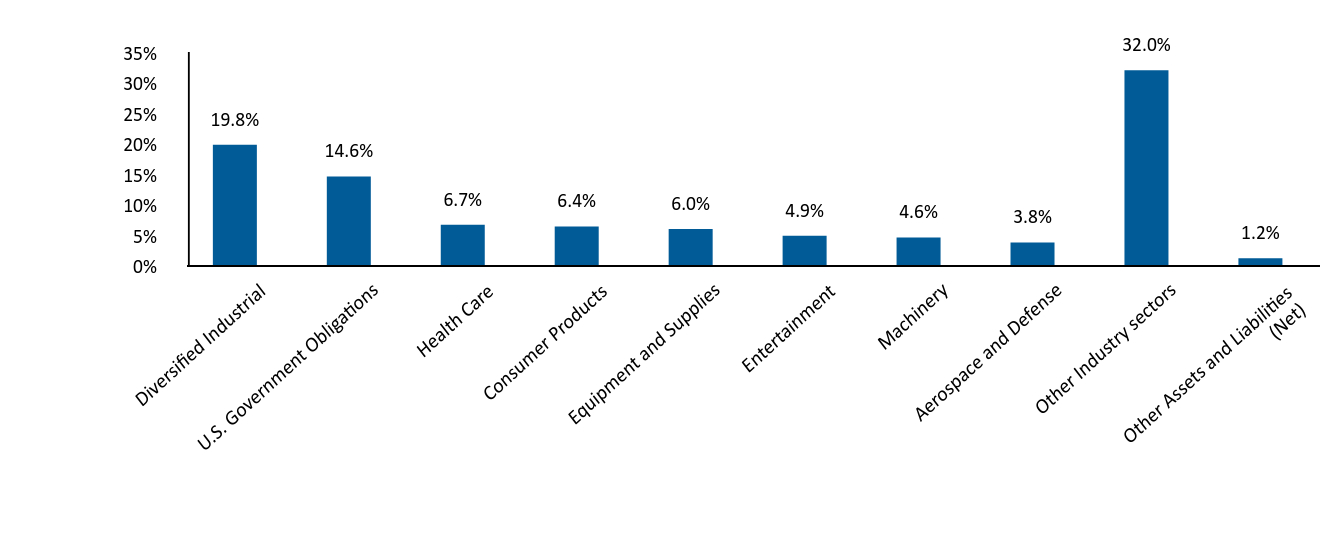

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Tredegar Corp. | 7.0% |

| Applied Optoelectronics Inc. | 4.4% |

| L.B. Foster Co. | 2.6% |

| Park-Ohio Holdings Corp. | 2.4% |

| Electromed Inc. | 2.1% |

| Ampco-Pittsburgh Corp. | 2.0% |

| Lee Enterprises Inc. | 2.0% |

| Clarus Corp. | 2.0% |

| Inspired Entertainment Inc. | 1.8% |

| Velan Inc. | 1.8% |

Portfolio Weighting (% of net assets)

| Common Stocks | 84.2% |

| U.S. Government Obligations | 14.6% |

| Other Assets and Liabilities (Net) | 1.2% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Diversified Industrial | 19.8% |

| U.S. Government Obligations | 14.6% |

| Health Care | 6.7% |

| Consumer Products | 6.4% |

| Equipment and Supplies | 6.0% |

| Entertainment | 4.9% |

| Machinery | 4.6% |

| Aerospace and Defense | 3.8% |

| Other Industry sectors | 32.0% |

| Other Assets and Liabilities (Net) | 1.2% |

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

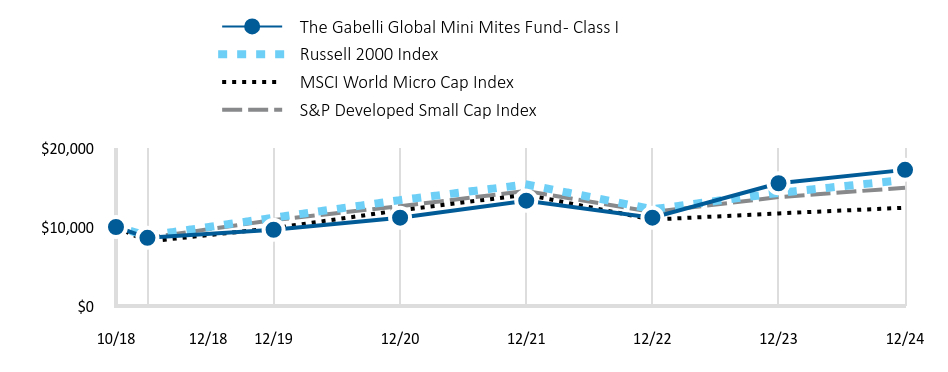

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Mini Mites Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund is a non-diversified open end management investment company whose investment objective is to provide investors with long term capital appreciation by investing primarily in micro-capitalization equity securities. The Fund’s investment strategy is to invest in common stocks of smaller companies that have a market capitalization (defined as shares outstanding times current market price) of $250 million or less at the time of the Fund's initial investment. These companies are called micro-cap companies. As a "global" fund, the Fund invests in securities of issuers located in at least three countries and at least 40% of its net assets are invested in securities of non U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Mini Mites Fund - Class I | $95 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, the Gabelli Global Mini Mites Fund underperformed its broad-based benchmark, the Russell 2000 Index, while outperforming its comparative benchmarks, the MSCI World Micro-Cap and the S&P Developed Small Cap Indices. The year's second half performance accelerated in anticipation of a more favorable environment under a Trump administration. The new administration may fuel increased deal activity, higher domestic economic activity, and increased expectations of lower interest rates. The fund seeks to invest in companies that have market capitalizations of $250 million or less which are sensitive to these macro indicators.

How has the Fund performed since inception?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Mini Mites Fund - Class I | Russell 2000 Index | MSCI World Micro Cap Index | S&P Developed Small Cap Index |

|---|

| 10/18 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/18 | 8,624 | 8,899 | 8,157 | 8,620 |

|---|

| 12/19 | 9,645 | 11,170 | 9,844 | 10,873 |

|---|

| 12/20 | 11,176 | 13,400 | 12,120 | 12,635 |

|---|

| 12/21 | 13,327 | 15,385 | 14,080 | 14,553 |

|---|

| 12/22 | 11,172 | 12,241 | 10,938 | 11,888 |

|---|

| 12/23 | 15,535 | 14,313 | 11,718 | 13,778 |

|---|

| 12/24 | 17,225 | 15,965 | 12,436 | 14,969 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception (10/1/2018) |

|---|

| The Gabelli Global Mini Mites Fund - Class I | 10.88% | 12.30% | 9.09% |

|---|

| Russell 2000 Index | 11.54% | 7.40% | 6.15% |

|---|

| MSCI World Micro Cap Index | 6.13% | 4.88% | 3.67% |

|---|

| S&P Developed Small Cap Index | 8.64% | 6.60% | 5.97% |

|---|

- Total Net Assets$12,664,636

- Number of Portfolio Holdings143

- Portfolio Turnover Rate26%

- Management Fees$(54,045)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

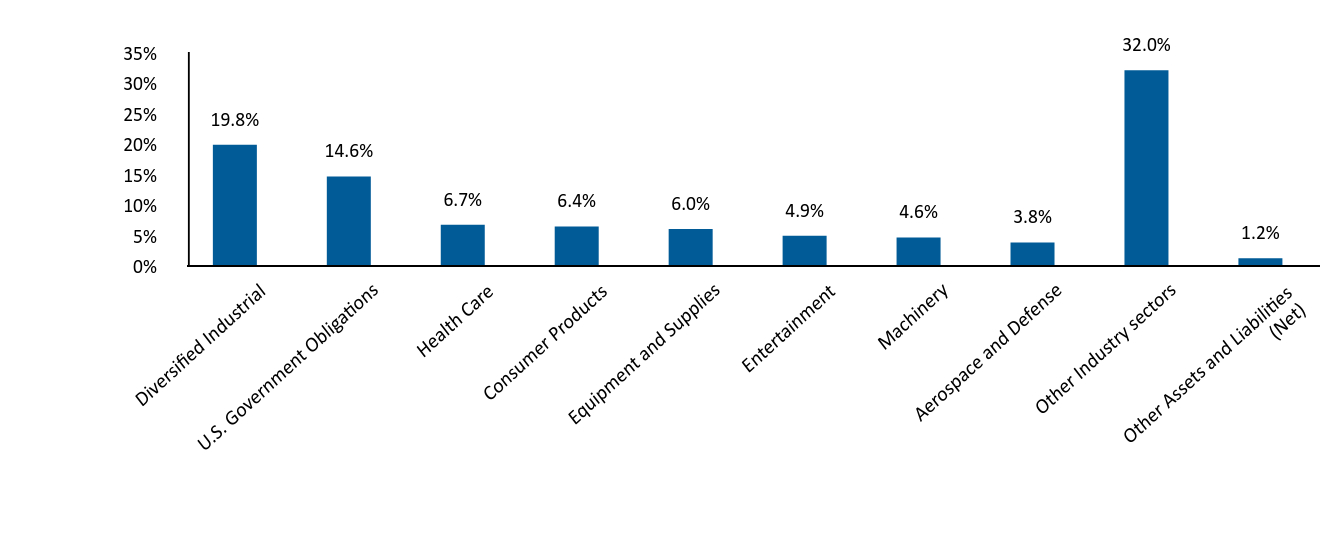

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Tredegar Corp. | 7.0% |

| Applied Optoelectronics Inc. | 4.4% |

| L.B. Foster Co. | 2.6% |

| Park-Ohio Holdings Corp. | 2.4% |

| Electromed Inc. | 2.1% |

| Ampco-Pittsburgh Corp. | 2.0% |

| Lee Enterprises Inc. | 2.0% |

| Clarus Corp. | 2.0% |

| Inspired Entertainment Inc. | 1.8% |

| Velan Inc. | 1.8% |

Portfolio Weighting (% of net assets)

| Common Stocks | 84.2% |

| U.S. Government Obligations | 14.6% |

| Other Assets and Liabilities (Net) | 1.2% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Diversified Industrial | 19.8% |

| U.S. Government Obligations | 14.6% |

| Health Care | 6.7% |

| Consumer Products | 6.4% |

| Equipment and Supplies | 6.0% |

| Entertainment | 4.9% |

| Machinery | 4.6% |

| Aerospace and Defense | 3.8% |

| Other Industry sectors | 32.0% |

| Other Assets and Liabilities (Net) | 1.2% |

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

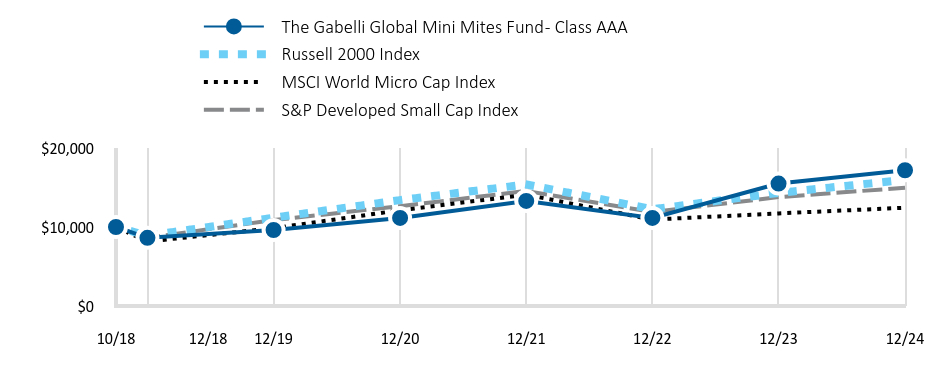

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Mini Mites Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund is a non-diversified open end management investment company whose investment objective is to provide investors with long term capital appreciation by investing primarily in micro-capitalization equity securities. The Fund’s investment strategy is to invest in common stocks of smaller companies that have a market capitalization (defined as shares outstanding times current market price) of $250 million or less at the time of the Fund's initial investment. These companies are called micro-cap companies. As a "global" fund, the Fund invests in securities of issuers located in at least three countries and at least 40% of its net assets are invested in securities of non U.S. issuers. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Mini Mites Fund - Class AAA | $95 | 0.90% |

|---|

How did the Fund perform?

For the fiscal year ended December 31, 2024, the Gabelli Global Mini Mites Fund underperformed its broad-based benchmark, the Russell 2000 Index, while outperforming its comparative benchmarks, the MSCI World Micro-Cap and the S&P Developed Small Cap Indices. The year's second half performance accelerated in anticipation of a more favorable environment under a Trump administration. The new administration may fuel increased deal activity, higher domestic economic activity, and increased expectations of lower interest rates. The fund seeks to invest in companies that have market capitalizations of $250 million or less which are sensitive to these macro indicators.

How has the Fund performed since inception?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Mini Mites Fund - Class AAA | Russell 2000 Index | MSCI World Micro Cap Index | S&P Developed Small Cap Index |

|---|

| 10/18 | 10,000 | 10,000 | 10,000 | 10,000 |

|---|

| 12/18 | 8,629 | 8,899 | 8,157 | 8,620 |

|---|

| 12/19 | 9,620 | 11,170 | 9,844 | 10,873 |

|---|

| 12/20 | 11,147 | 13,400 | 12,120 | 12,635 |

|---|

| 12/21 | 13,293 | 15,385 | 14,080 | 14,553 |

|---|

| 12/22 | 11,144 | 12,241 | 10,938 | 11,888 |

|---|

| 12/23 | 15,495 | 14,313 | 11,718 | 13,778 |

|---|

| 12/24 | 17,181 | 15,965 | 12,436 | 14,969 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | Since Inception (10/1/2018) |

|---|

| The Gabelli Global Mini Mites Fund - Class AAA | 10.88% | 12.30% | 9.05% |

|---|

| Russell 2000 Index | 11.54% | 7.40% | 6.15% |

|---|

| MSCI World Micro Cap Index | 6.13% | 4.88% | 3.67% |

|---|

| S&P Developed Small Cap Index | 8.64% | 6.60% | 5.97% |

|---|

- Total Net Assets$12,664,636

- Number of Portfolio Holdings143

- Portfolio Turnover Rate26%

- Management Fees$(54,045)

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

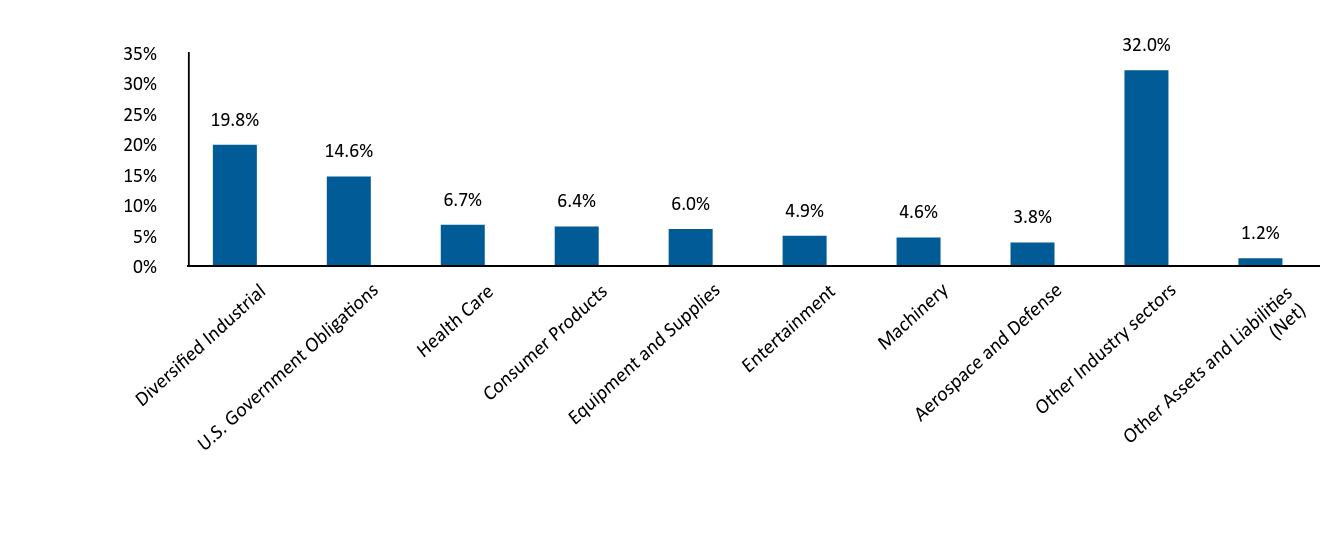

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Tredegar Corp. | 7.0% |

| Applied Optoelectronics Inc. | 4.4% |

| L.B. Foster Co. | 2.6% |

| Park-Ohio Holdings Corp. | 2.4% |

| Electromed Inc. | 2.1% |

| Ampco-Pittsburgh Corp. | 2.0% |

| Lee Enterprises Inc. | 2.0% |

| Clarus Corp. | 2.0% |

| Inspired Entertainment Inc. | 1.8% |

| Velan Inc. | 1.8% |

Portfolio Weighting (% of net assets)

| Common Stocks | 84.2% |

| U.S. Government Obligations | 14.6% |

| Other Assets and Liabilities (Net) | 1.2% |

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| Diversified Industrial | 19.8% |

| U.S. Government Obligations | 14.6% |

| Health Care | 6.7% |

| Consumer Products | 6.4% |

| Equipment and Supplies | 6.0% |

| Entertainment | 4.9% |

| Machinery | 4.6% |

| Aerospace and Defense | 3.8% |

| Other Industry sectors | 32.0% |

| Other Assets and Liabilities (Net) | 1.2% |

The Gabelli Global Mini Mites Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

Contact Us

Phone: 800-GABELLI (800-422-3554)

Email: info@gabelli.com

If you wish to receive a copy of this document at a new address, contact 800-GABELLI (800-422-3554)

The Gabelli Global Rising Income and Dividend Fund

Annual Shareholder Report - December 31, 2024

This annual shareholder report contains important information about The Gabelli Global Rising Income and Dividend Fund (the Fund) for the period of January 1, 2024 to December 31, 2024. The Fund’s investment objective is to provide investors with a high level of total return through a combination of current income and appreciation of capital. The Fund’s investment strategy is to invest 80% of its net assets in dividend paying securities (such as common and preferred stock) or other income producing securities (such as fixed income securities and securities that are convertible into common stock). The Fund will primarily invest in common stocks of foreign and domestic issuers that the Gabelli Funds, LLC (the Adviser) believes are likely to pay dividends and income and have the potential for above average capital appreciation and dividend increases. You may find additional information about the Fund at www.gabelli.com/funds/open_ends. You may also request information by contacting us at 800-GABELLI (800-422-3554).

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Class Name | Costs of a $10k Investment | Costs Paid as a % of a $10k Investment |

|---|

| The Gabelli Global Rising Income and Dividend Fund - Class AAA | $91 | 0.90% |

|---|

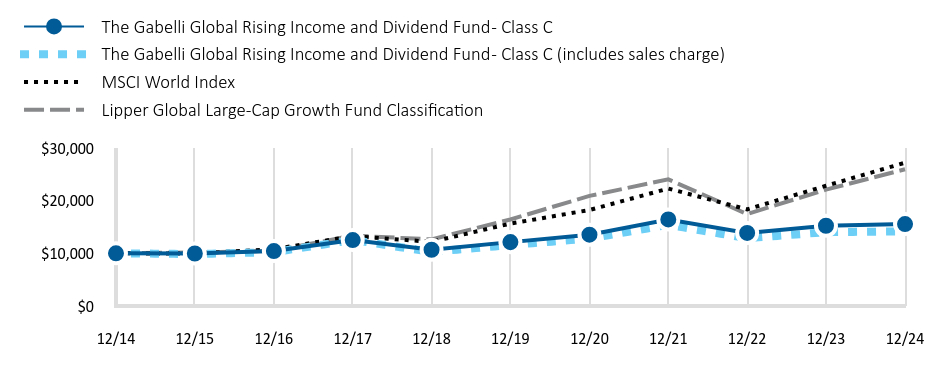

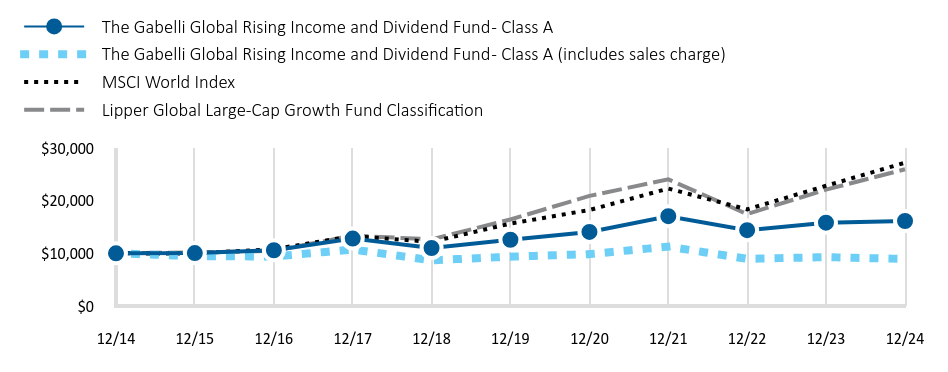

How did the Fund perform?

For the fiscal year ended December 31, 2024, The Gabelli Global Rising Income & Dividend Fund underperformed its broad-based benchmark, the MSCI World Index, and its comparative benchmark, the Lipper Global Large-Cap Growth Fund Classification. In 2024, US inflation improved substantially, running around 3%, close to the Federal Reserve’s long term target rate of 2% annually. Also in 2024, the Fed lowered short-term interest rates by 100 basis points and rates now stand at 4.5%. Although geopolitical risks in the Ukraine and the Middle East have remained high all year, inflation rates are generally coming down across the globe as supply chains get back to normal.

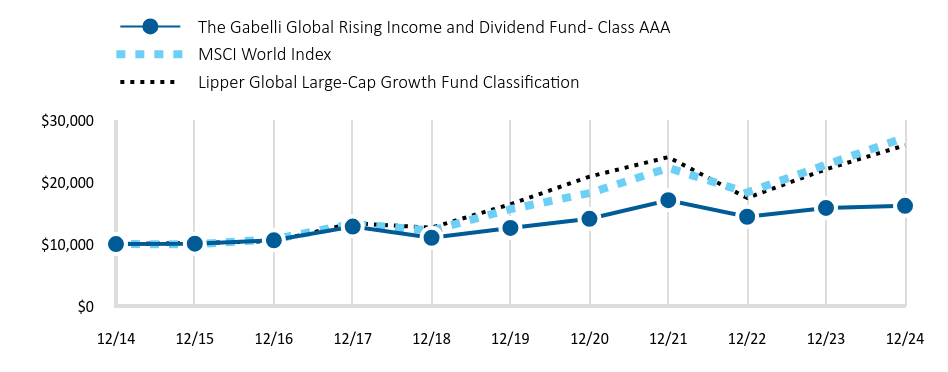

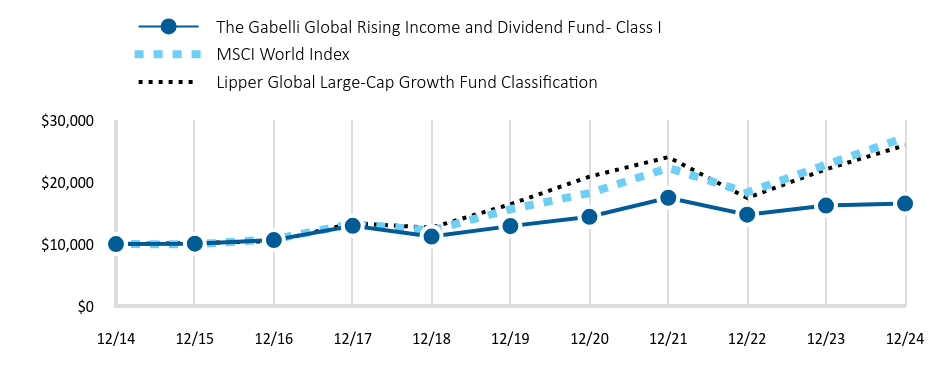

How has the Fund performed over the past 10 years?

The performance chart of the fund class presented reflects a hypothetical $10,000 investment, assuming the maximum sales charge, compared to a broad-based securities market index and more narrowly based indices reflecting market sectors in which the Fund invests over a 10-year period. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains distribution. Fund expenses were deducted.

Total Return Based on a $10,000 Investment

| The Gabelli Global Rising Income and Dividend Fund - Class AAA | MSCI World Index | Lipper Global Large-Cap Growth Fund Classification |

|---|

| 12/14 | 10,000 | 10,000 | 10,000 |

|---|

| 12/15 | 10,059 | 9,968 | 10,176 |

|---|

| 12/16 | 10,603 | 10,780 | 10,472 |

|---|

| 12/17 | 12,820 | 13,267 | 13,359 |

|---|

| 12/18 | 11,023 | 12,179 | 12,646 |

|---|

| 12/19 | 12,608 | 15,638 | 16,422 |

|---|

| 12/20 | 14,081 | 18,219 | 20,895 |

|---|

| 12/21 | 17,083 | 22,291 | 24,042 |

|---|

| 12/22 | 14,413 | 18,339 | 17,452 |

|---|

| 12/23 | 15,842 | 22,817 | 22,079 |

|---|

| 12/24 | 16,170 | 27,195 | 25,951 |

|---|

Average Annual Total Returns

| 1 Year | 5 Year | 10 Year |

|---|

| The Gabelli Global Rising Income and Dividend Fund - Class AAA | 2.07% | 5.10% | 4.92% |

|---|

| MSCI World Index | 19.19% | 11.70% | 10.52% |

|---|

| Lipper Global Large-Cap Growth Fund Classification | 17.54% | 9.58% | 10.00% |

|---|

- Total Net Assets$64,704,417

- Number of Portfolio Holdings183

- Portfolio Turnover Rate7%

- Management Fees$305,937

Past performance does not guarantee future results. Call 800-GABELLI (800-422-3554) or visit www.gabelli.com/funds/open_ends for current month-end performance. The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on fund distributions or the redemption of fund shares.

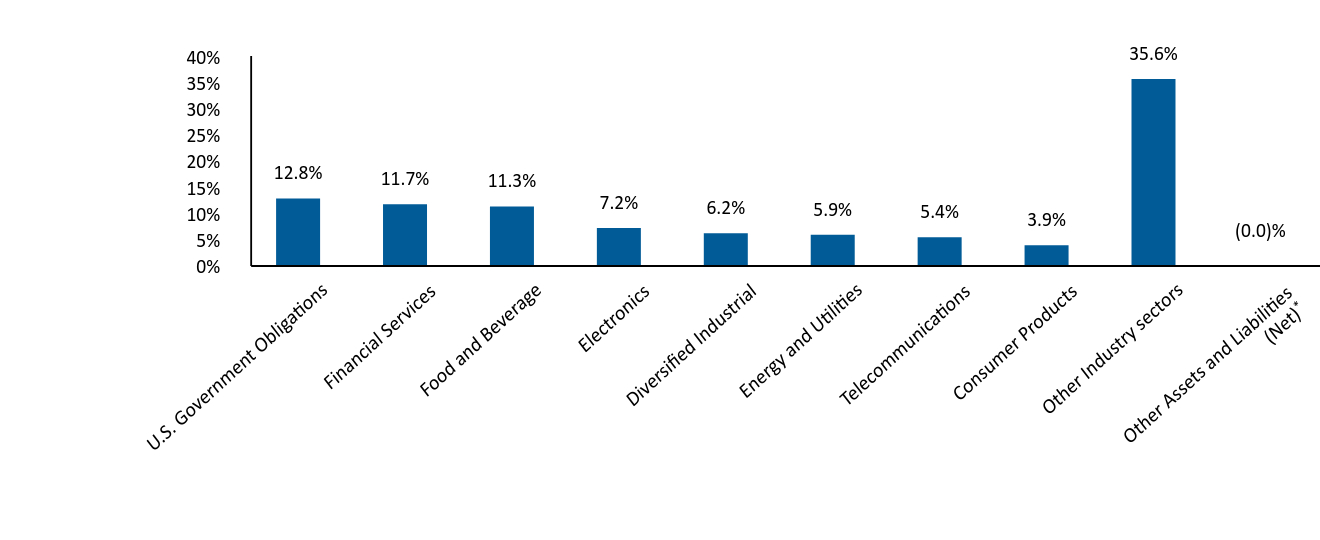

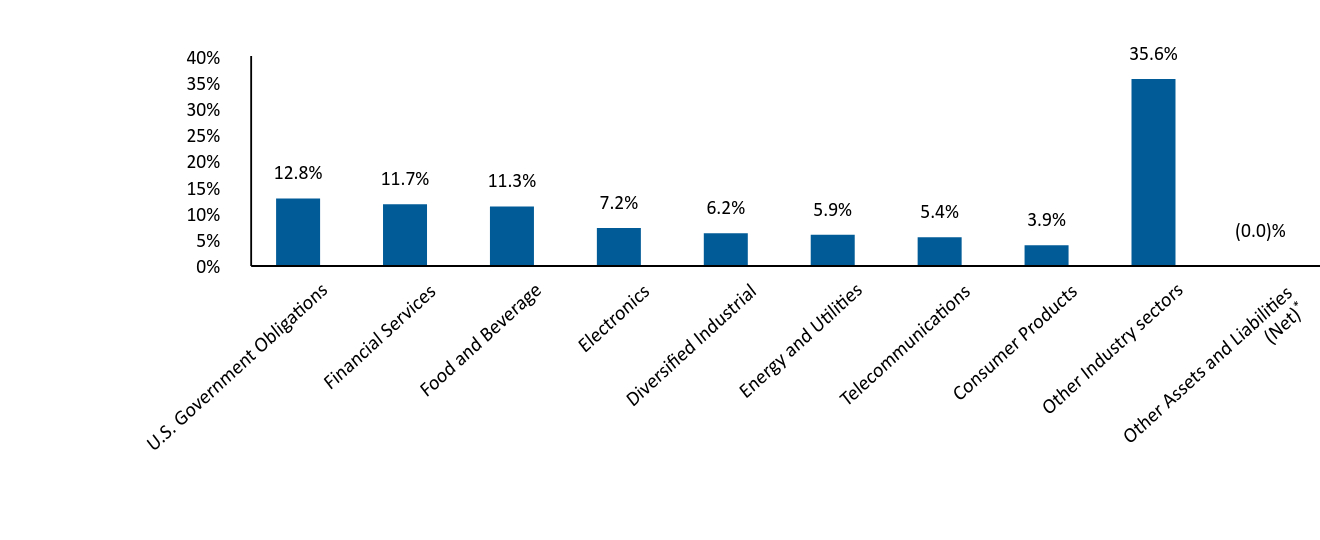

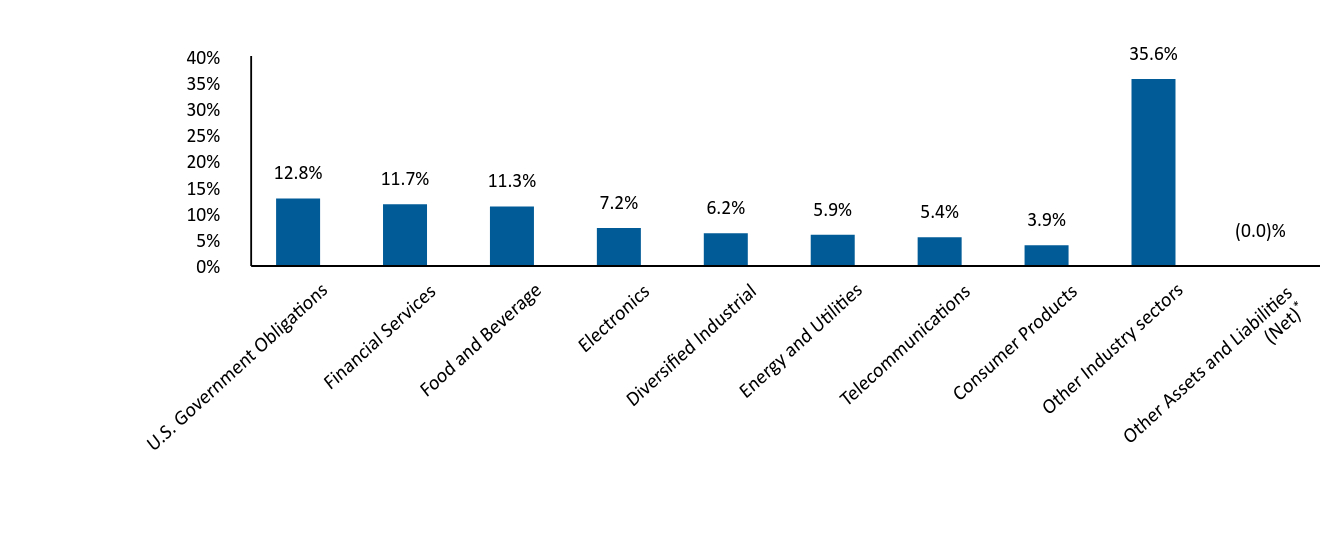

What did the Fund invest in?

Top 10 Holdings (% of net assets)

| Sony Group Corp. | 7.2% |

| Berkshire Hathaway Inc. | 3.2% |

| CNH Industrial NV, New York | 2.4% |

| Herc Holdings Inc. | 2.1% |

| Nestlé SA | 1.8% |

| Mueller Industries Inc. | 1.8% |

| T-Mobile US Inc. | 1.8% |

| Traton SE | 1.6% |

| Deutsche Telekom AG | 1.5% |

| Enpro Inc. | 1.4% |

Portfolio Weighting (% of net assets)

| Common Stocks | 87.2% |

| U.S. Government Obligations | 12.8% |

Other Assets and Liabilities (Net)Footnote Reference* | (0.0)% |

| Footnote | Description |

Footnote* | Amount represents greater than (0.05)%. |

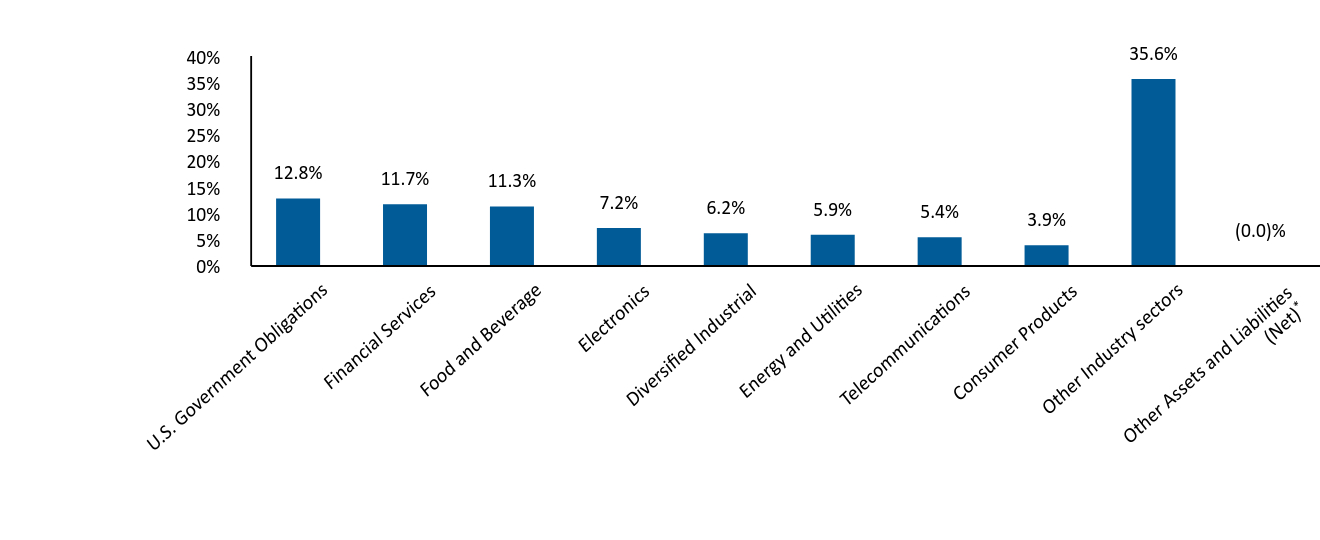

Industry Allocation (% of net assets)

| Industry Weighting | . |

|---|

| U.S. Government Obligations | 12.8% |

| Financial Services | 11.7% |

| Food and Beverage | 11.3% |

| Electronics | 7.2% |

| Diversified Industrial | 6.2% |

| Energy and Utilities | 5.9% |

| Telecommunications | 5.4% |

| Consumer Products | 3.9% |

| Other Industry sectors | 35.6% |

Other Assets and Liabilities (Net)Footnote Reference* | (0.0)% |

| Footnote | Description |

Footnote* | Amount represents greater than (0.05)%. |

The Gabelli Global Rising Income and Dividend Fund

Annual Shareholder Report - December 31, 2024

Where can I find additional information about the Fund?

If you wish to view additional information about the Fund; including but not limited to financial statements or holdings, please visit www.gabelli.com/funds/open_ends.

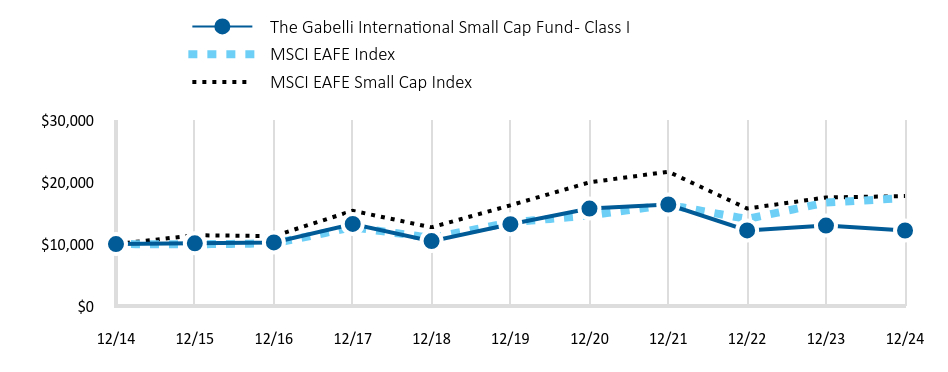

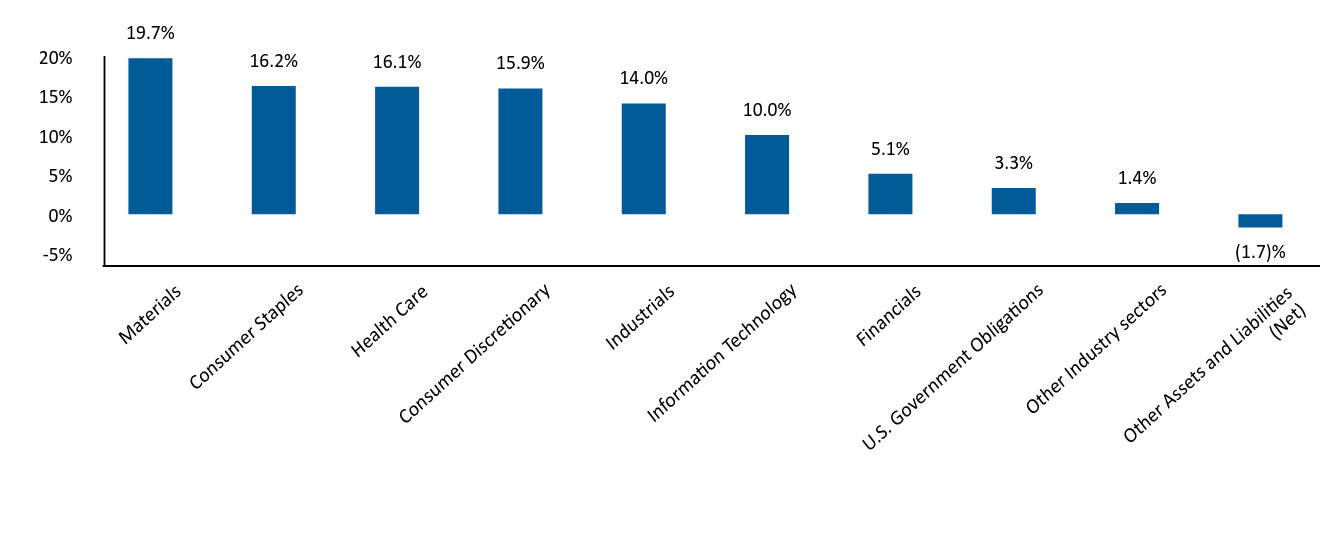

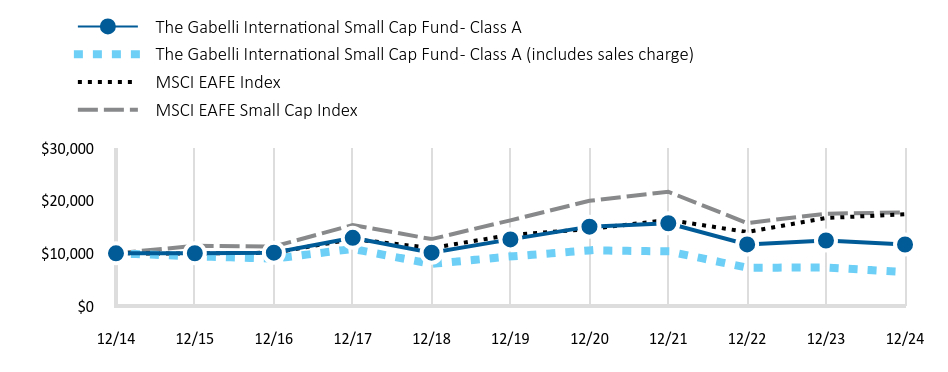

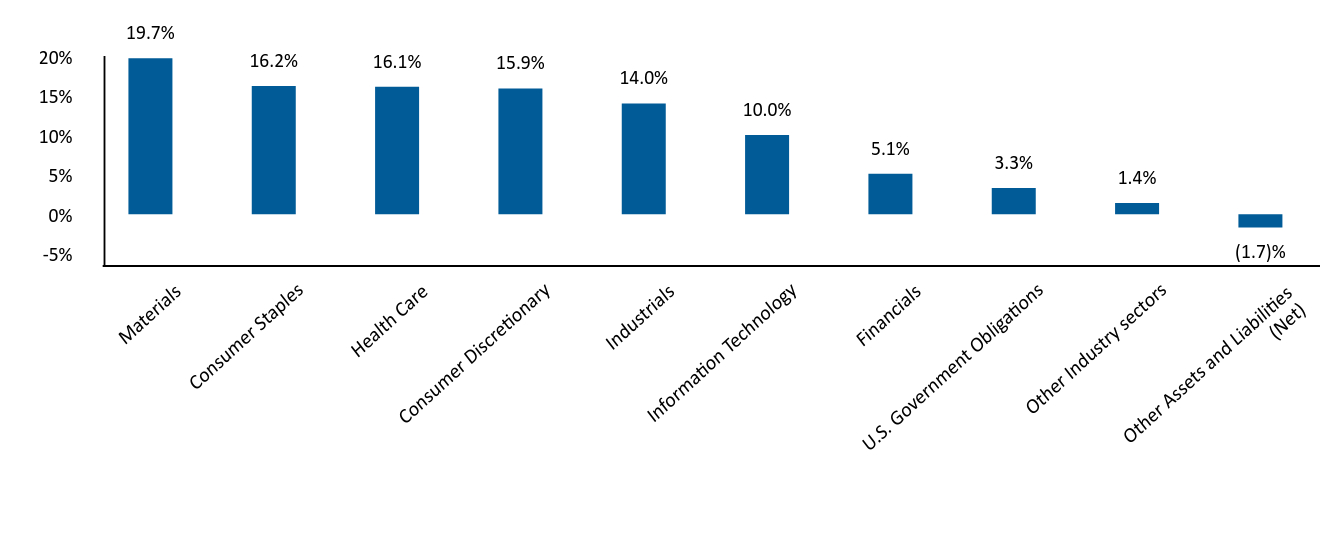

Contact Us