UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07912

Old Westbury Funds, Inc.

(Exact name of registrant as specified in charter)

760 Moore Rd.

King of Prussia, PA 19406

(Address of principal executive offices) (Zip code)

Andrew J. McNally

BNY Mellon Investment Servicing (US) Inc.

760 Moore Rd.

King of Prussia, PA 19406

(Name and address of agent for service)

Registrant's telephone number, including area code: 800-607-2200

Date of fiscal year end: October 31

Date of reporting period: October 31, 2016

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget ("OMB") control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Old Westbury Funds, Inc.

Annual Report

October 31, 2016

BESSEMER INVESTMENT MANAGEMENT LLC

Investment Adviser

Old Westbury Funds, Inc.

This Page Intentionally Left Blank

| Old Westbury Funds, Inc. |

| A Letter From the President (Unaudited) |

| |

| |

Dear Shareholders:

The fiscal year ended October 31, 2016 was marked by two pronounced rotations within financial markets away from risk assets. The first came at the turn of the calendar year. Global equities sold off as oil prices declined precipitously and investors worried about economic growth in China and the future path of its currency, the renminbi. Another concern feeding into the sell-off was the impact that negative European and Japanese interest rates may have on banks and the effectiveness of monetary policy. Equities recovered as oil prices stabilized, only to be whipsawed once again in June after the U.K.’s surprise referendum mandate to leave the European Union (called “Brexit”). Again, recovery was relatively quick, as central banks pledged to maintain liquidity, valuations became more attractive, and investors questioned whether the U.K. would in fact ultimately leave the European Union.

After the Brexit vote in June, equity markets enjoyed a respite from volatility until uncertainty escalated over the outcome of the U.S. presidential and congressional elections. For the fiscal year, global equities posted gains of about 2%. The U.S. outperformed other developed markets and emerging markets, while small-cap stocks generally outperformed large-cap names. By sector, the global leaders were materials, information technology, and utilities, while financials, consumer discretionary, and healthcare lagged.

Global central banks were more active earlier in the fiscal year. The Fed delivered one rate increase in December 2015 – its first in nine years, but kept its policy intact thereafter in the face of heightened uncertainty over Brexit and the U.S. elections. Other notable actions included the Bank of Japan’s implementation of negative interest rates and expanded asset purchases as well as the European Central Bank’s reduction of its deposit-facility rate further below zero. Later in the year, the Bank of England announced monetary stimulus measures and reduced interest rates in the wake of the Brexit vote, while the Bank of Japan announced new fiscal stimulus and yield-curve targeting measures that aim to keep its 10-year government bond yield near 0%.

During the year, bonds slightly outperformed global equities, benefitting from the intra-year rotations out of risk assets. For most of the year, bond yields declined across the globe, with certain global non-U.S. 10-year bond yields entering negative territory. During the summer, the 10-year U.S. Treasury yield fell to a record low of 1.32% as lackluster economic growth and low inflation pushed yields downward. The U.S. yield curve flattened, with short-term rates rising and long-term rates declining. Global bond yields moved higher later in the year, driven by a view that central banks may dial back their accommodative policies. In the U.S., inflation began to tick higher, and economic prospects began to improve as markets began to expect some form of stimulative fiscal spending from the new U.S. administration.

The oil-price slump early in the year was driven by fears of a slowdown in China, and reports of a supply build-up. U.S. drillers idled rigs, which helped prices to stabilize. Later in the year, OPEC members appeared to reach an agreement to cut production by up to one million barrels per day, though details have yet to be finalized. The drop in oil prices had a negative impact on the energy sector — both in equities and high yield bonds.

Global economic growth continued to be muted. In the U.S., growth was lackluster through the first three quarters of the fiscal year, with growth rates under 1.5%. However, the economy accelerated in the calendar third quarter, rising around 3% with employment and consumer spending holding up relatively well. Europe and Japan remained mired in low inflation, and extraordinarily easy monetary policy has reduced the urgency for policymakers to tackle structural reforms. To date, Europe has weathered the immediate aftermath of Brexit surprisingly well; a bright spot is an acceleration in European loan growth.

In this environment, our portfolio results varied. On a total-return basis, the Small & Mid Cap Fund posted solid outperformance due to strong stock selection. The Old Westbury Large Cap Core Fund underperformed as a result of sector allocation and stock selection within the technology sector, and the Old Westbury Large Cap Strategies Fund slightly underperformed. Elevated cash holdings early in the year detracted slightly from the performance of each of the equity funds. The Old Westbury Strategic Opportunities Fund’s return was short of its primary and secondary benchmarks. Most components outperformed, but de-risking measures taken early in the year detracted. The Old Westbury Fixed Income Fund underperformed, mainly due to its conservative underweight position in interest-rate exposure. The Old Westbury Municipal Bond Fund’s return was essentially in-line with its benchmark.

During the fiscal year, the adviser, Bessemer Investment Management, LLC (the “Adviser” or “BIM”), made several key changes. It added Bessemer-managed quantitative low-volatility equity sleeves to the Old Westbury Large Cap Strategies and Small & Mid Cap Funds. BIM also added an external manager with a low-volatility U.S. small-cap strategy to the Old Westbury Small & Mid Cap Fund. In the Old Westbury Strategic Opportunities Fund, positions were eliminated in master limited partnerships (MLPs) and global government bonds.

| Old Westbury Funds, Inc. |

| A Letter From the President (Unaudited) - (Continued) |

| |

| |

At year-end, we remain committed to the Adviser’s longstanding investment approach, characterized by independent research, a global orientation, and long-term perspective. We believe these disciplines will continue to reap competitive long-term results for shareholders and position the Adviser to fulfill the central mandate of participating in strong market environments while preserving capital during difficult ones.

Sincerely,

David W. Rossmiller

President

Old Westbury Funds, Inc.

| Old Westbury Funds, Inc. |

| Large Cap Core Fund |

| Investment Adviser’s Report (Unaudited) |

| |

The return of the Old Westbury Large Cap Core Fund (the “Fund”) for the fiscal year ended October 31, 2016 was 0.73%. In comparison, the return of the MSCI ACWI Large Cap Index (Net) was 2.01%. The MSCI All Country World Large Cap Index (Net)is comprised of large-capitalization stocks in 23 developed and 23 emerging market countries. With close to 1,200 constituents, the index covers approximately 70% of the free float-adjusted market capitalization in each country. Net means that the return calculation for the index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The most significant positive contributors to the Fund’s relative performance during the year were an overweight position in the utilities sector (4.7% of the Fund as of October 31, 2016) and an underweight position in consumer staples (6.7%). Stock selection overall was a positive contributor. By sector, healthcare and financials stock selection contributed positively. Stocks that contributed the most included American Water Works Company, Broadcom Limited, and Raytheon. American Water Works shares appreciated as the market rewarded a higher valuation to its steady and growing earnings power. Broadcom benefited from its continued strategy of consolidating the semiconductor industry via acquisition. Raytheon’s shares outperformed as the market came to appreciate the improving outlook for defense spending and the durable nature of the company’s long-term prospects.

The Fund’s results were held back by an overweight position in the consumer discretionary sector (23.8%), an underweight position in materials (1.3%), and an allocation to cash (4.8%). Stock selection within the information technology sector also detracted from returns. Stocks with the highest negative contributions included Nokia Oyi, Nike, and ConocoPhillips. Nokia shares have fallen as the outlook networking equipment sales has declined due to a slowdown in customer spending on wireless networks. Nike shares have pulled back after having a strong run in the previous year, as the market worried that growth and market-share gains were slowing. Oil and gas company ConocoPhillips saw its share price fall with the price of crude oil.

At fiscal year-end, the Fund maintained overweight positions in consumer discretionary and utilities; these overweights were largely the result of Comcast, Aramark, Dollar General, PVH Corp., and Lowe’s. The Fund maintained underweight positions in consumer staples, telecoms, financials, materials, and energy, due to a general caution over commodity prices and the high valuations among consumer staples. The Fund continues to be overweight U.S. stocks (66.6%) versus non-U.S. stocks (28.4%); the remainder was cash. Within non-U.S. stocks, the Fund is underweight Europe, Japan, and emerging markets.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/ reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

| Old Westbury Funds, Inc. | |

| Large Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY SECTOR*

| Sector: | | | | |

| Banks | | | 9.6 | % |

| Consumer Discretionary | | | 23.8 | |

| Consumer Staples | | | 6.7 | |

| Diversified Financials | | | 5.1 | |

| Energy | | | 4.9 | |

| Health Care | | | 11.2 | |

| Industrials | | | 7.1 | |

| Information Technology | | | 16.1 | |

| Insurance | | | 2.5 | |

| Materials | | | 1.3 | |

| Real Estate | | | 1.0 | |

| Telecommunication Services | | | 1.1 | |

| Utilities | | | 4.7 | |

| Other** | | | 4.9 | |

| | | | 100.0 | % |

| * | Stated as a percentage of net assets. |

| ** | Includes cash and equivalents, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Large Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Average Annual Total Returns

For the Period Ended October 31, 2016

| Large Cap Core Fund | | | | |

| One Year | | | 0.73 | % |

| Five Year | | | 6.76 | % |

| Ten Year | | | 1.82 | % |

| | | | | |

| MSCI ACWI Large Cap Index (Net) | | | | |

| One Year | | | 2.01 | % |

| Five Year | | | 7.95 | % |

| Ten Year | | | 3.66 | % |

| | | | | |

| S&P Global LargeCap Index (Net) | | | | |

| One Year | | | 1.96 | % |

| Five Year | | | 7.84 | % |

| Ten Year | | | 3.64 | % |

On November 16, 2011, the Fund changed its name to Large Cap Core Fund (formerly U.S. Large Cap Fund) as part of a series of changes to the overall investment focus and strategies of the Fund. Prior to October 2, 2008, the Fund was named the Large Cap Equity Fund and operated under a different investment strategy. Prior to February 16, 2004, the Fund was named the Core Equities Fund and operated under a different investment strategy. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2017, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any), at 1.00%, as disclosed in the Funds’ prospectus dated March 1, 2016. The Board has approved, the termination of this fee waiver agreement (subject to shareholder approval, which was given at a shareholder meeting held on December 22, 2016, of a proposed fee change in connection with a modification of the Fund’s investment strategy). The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 1.01%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2016 can be found in the Financial Highlights.

| Old Westbury Funds, Inc. | |

| Large Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Concluded) | |

| | |

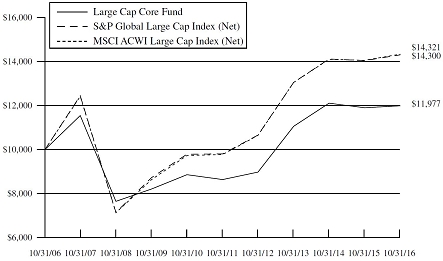

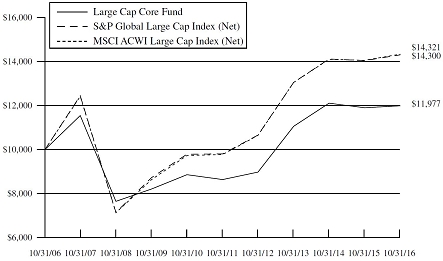

The chart shown on the previous page illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. On January 1, 2016, the Fund changed its primary benchmark from the S&P Global LargeCap Index (Net) to the MSCI ACWI Large Cap Index (Net) to more closely reflect the Fund’s current investment strategy. The S&P Global LargeCap Index (Net) and MSCI ACWI Large Cap Index (Net) also include the reinvestment of distributions but not fees and expenses associated with an investment in the Fund. The S&P Global LargeCap Index (Net) and the MSCI ACWI Large Cap Index (Net) are unmanaged. Investments cannot be made directly in an index. The Board has approved a change in the Fund’s primary benchmark to MSCI ACWI Investible Market Index (Net) in conjunction with a modification of the Fund’s investment strategy, all of which will become effective on or about December 30, 2016.

Investments made in foreign and emerging country securities may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. |

| Large Cap Strategies Fund |

| Investment Adviser’s Report (Unaudited) |

| |

The return of the Old Westbury Large Cap Strategies Fund (the “Fund”) for the fiscal year ended October 31, 2016, was 1.93%. In comparison, the return of the MSCI ACWI Large Cap Index (Net) (“the Index”) was 2.01%. The Index is comprised of large-capitalization stocks in 23 developed and 23 emerging market countries. With close to 1,200 constituents, the index covers approximately 70% of the free float-adjusted market capitalization in each country. Net means that the return calculation for the index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

During the fiscal year, each of the Fund’s main components outperformed the Index, while holdings of cash, exchange-traded funds, and currency hedges detracted from performance.

Stocks that contributed the most to relative performance were Hewlett Packard Enterprise (1.24%), Texas Instruments (1.90%), and Tencent Holdings (1.21%). Hewlett Packard Enterprise posted resilient earnings and announced two well-received divestitures. U.S. semiconductor company Texas Instruments continued to benefit from the stable growth of its analog business. Tencent Holdings, the largest internet company in Asia, saw significant appreciation as it found new ways to monetize its dominant position in Chinese social media.

Stocks that detracted from relative performance were Gilead Sciences (0.90%), Apple (1.19%), and Regeneron Pharmaceuticals (0.33%). Gilead and Regeneron, two biotechnology firms, suffered from a broad sell-off across the health care sector caused by worries around the sustainability of high drug prices in the U.S. under a new president. An underweight position in Apple detracted from performance as excitement around a new product launch supported the shares.

At fiscal year-end, the Fund was overweight the following sectors: consumer discretionary (14.7% versus the Index’s 11.4%), consumer staples (14.1% versus 11.1%), industrials (9.7% versus 9.1%), and information technology (22.4% versus 16.8%).The Fund was underweight the following sectors: energy (2.6% versus the Index’s 7.4%), financials (14.9% versus 21.0%), materials (1.4% versus 4.1%), telecommunications (1.7% versus 4.1%), and utilities (0.4% versus 2.9%). The health care sector weighting was relatively neutral (11.7% versus the Index’s 12.1%).

The Fund held a significant overweight to the U.S. (+5.5% as of 10/31/16), given the country’s improving economy and strengthening currency, combined with U.S. companies’ greater focus on economic value creation than companies in other global regions. At fiscal year-end, the Fund was underweight developed Europe and Japan, and slightly overweight emerging markets.

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY COUNTRY*

| Country: | | | | |

| Argentina | | | 0.0 | %*** |

| Belgium | | | 0.2 | |

| Bermuda | | | 0.4 | |

| Brazil | | | 1.6 | |

| Canada | | | 1.8 | |

| Chile | | | 0.0 | *** |

| China | | | 4.2 | |

| Columbia | | | 0.0 | *** |

| Czech Republic | | | 0.1 | |

| Egypt | | | 0.0 | *** |

| Finland | | | 2.2 | |

| France | | | 1.4 | |

| Germany | | | 0.8 | |

| Guernsey | | | 0.1 | |

| Hong Kong | | | 2.0 | |

| Hungary | | | 0.1 | |

| India | | | 2.3 | |

| Indonesia | | | 0.2 | |

| Japan | | | 5.9 | |

| Kenya | | | 0.0 | *** |

| Luxembourg | | | 0.1 | |

| Mexico | | | 0.3 | |

| Netherlands | | | 3.1 | |

| Peru | | | 0.0 | *** |

| Philippines | | | 0.0 | *** |

| Poland | | | 0.1 | |

| Russia | | | 0.3 | |

| Singapore | | | 0.7 | |

| South Africa | | | 0.8 | |

| South Korea | | | 0.9 | |

| Sweden | | | 1.8 | |

| Switzerland | | | 1.5 | |

| Taiwan | | | 0.8 | |

| Thailand | | | 0.7 | |

| Turkey | | | 0.0 | *** |

| United Arab Emirates | | | 0.1 | |

| United Kingdom | | | 2.6 | |

| United States | | | 56.7 | |

| Other** | | | 6.2 | |

| | | | 100.0 | % |

| * | Stated as a percentage of net assets. |

| ** | Includes cash and equivalents, participation notes, exchange traded funds, U.S. government agencies, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| *** | Represents less than 0.1% of net assets. |

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

| Average Annual Total Returns | | | | |

| For the Period Ended October 31, 2016 | | | | |

| | | | | |

| Large Cap Strategies Fund | | | | |

| One Year | | | 1.93 | % |

| Five Year | | | 9.18 | % |

| Ten Year | | | 2.78 | % |

| | | | | |

| MSCI ACWI Large Cap Index (Net) | | | | |

| One Year | | | 2.01 | % |

| Five Year | | | 7.95 | % |

| Ten Year | | | 3.66 | % |

| | | | | |

| S&P Global LargeCap Index (Net) | | | | |

| One Year | | | 1.96 | % |

| Five Year | | | 7.84 | % |

| Ten Year | | | 3.64 | % |

On November 16, 2011, the Fund changed its name to Large Cap Strategies Fund (formerly Non-U.S. Large Cap Fund) as part of a series of changes to the overall investment focus and strategies of the Fund. Prior to July 28, 2008, the Fund was named the International Fund and operated under a different investment strategy. The prior performance shown represents performance of the Fund’s prior strategy to invest in a diversified portfolio of foreign companies located outside of the U.S., at least 85% of which were listed on recognized foreign securities exchanges. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would be lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Concluded) | |

| | |

The Adviser has contractually committed through October 31, 2017, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding, Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 1.15% (current net operating expense is 1.11%), as disclosed in the Funds’ prospectus dated March 1, 2016. The Board has approved the termination of this fee waiver agreement. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 1.15%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2016 can be found in the Financial Highlights.

The chart shown on the previous page illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. On January 1, 2016, the Fund changed its primary benchmark from the S&P Global LargeCap Index (Net) to the MSCI ACWI Large Cap Index (Net) to more closely reflect the Fund’s current investment strategy. The S&P Global LargeCap Index (Net) and MSCI ACWI Large Cap Index (Net) also include the reinvestment of distributions but not fees and expenses associated with an investment in the Fund. The S&P Global LargeCap Index (Net) and the MSCI ACWI Large Cap Index (Net) are unmanaged. Investments cannot be made directly in an index.

Investments made in foreign and emerging country securities may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The return of the Old Westbury Small & Mid Cap Fund (the “Fund”) for the fiscal year ended October 31, 2016, was 5.13%. In comparison, the return of the MSCI All Country World Small Mid Cap Index (Net) (the “Index”) was 3.17%. The Index is comprised of mid- and small-cap stocks in 23 developed and 23 emerging market countries. With around 7,500 constituents, the index covers approximately 28% of the free float-adjusted market capitalization in each country. Net means that the return calculation for the index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

Relative to the Index, strong outperformance came from the Bessemer Investment Management LLC’s mid-cap segment (18.18%) of the Fund as of October 31, 2016), non-U.S. developed-market small-cap stocks managed by London-based Mondrian Investment Partners (10.1%), and small- and mid-cap stocks managed by Vermont-based Champlain Investment Partners LLC (16.4%). Global small-cap stocks managed by Texas-based Dimensional Fund Advisors LP (15.5%) slightly outperformed. Small-cap stocks in emerging markets managed by Mondrian (13.7%) modestly underperformed. Elevated cash holdings early in 2016 also detracted from performance.

The Fund benefited from excellent stock selection in the healthcare and consumer staples sectors. In healthcare, strong performers included C.R. Bard (1.82%), a medical technologies company that benefitted from a sustained and meaningful increase in organic growth partially attributable to a successful launch of a drug-coated balloon for treatment of vascular diseases. Cooper Companies (1.71%), a medical devices company, performed well thanks to the continued patient trade-up to higher-priced daily contact lenses. In the consumer staples sector, Spectrum Brands (2.13%), a diversified consumer products company, benefitted from increased confidence in the sustainability of organic revenue growth and robust free cash flow generation. Ingredion (0.25%), a global ingredients company, benefitted from lower input costs, higher capacity utilization, and the success of many new value-added and higher-margin products. J.M. Smucker (1.26%), a food products company, benefitted from a significant rebound in branded coffee profitability and better synergies and cash-flow generation from a recent acquisition. From a sector-allocation perspective, the Fund benefited from an overweight position in consumer staples and an underweight position in financials.

Sectors that detracted from performance included materials and utilities; the Fund was underweight both of these sectors. Stocks that were challenged included auto parts retailer Advance Auto Parts (1.16%), which faced significant integration challenges from a recent acquisition that negatively impacted sales and profits. Wyndham Worldwide (1.97%), a global hospitality company that specializes in vacation ownership, managed home rentals, and hotel management, struggled to contain an increase in vacation ownership defaults, which modestly weighed on revenue and profit growth. Tupperware Brands, a relationship-based seller of consumer products, disappointed investors with continued sales growth challenges in both developed and emerging markets.

At fiscal year-end, the Fund was overweight the consumer staples, healthcare, and industrials sectors. The Fund was underweight energy, financials, materials, and utilities.

The Fund was regionally overweight the U.S. market (63.3%) thanks to the country’s low interest rates, reasonable valuations, and promising earnings outlook. Conversely, the Fund was underweight developed Europe (11.4%), Japan (6.2%), and emerging markets (7.9%).

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY COUNTRY*

| Country: | | | | |

| Australia | | | 1.7 | % |

| Austria | | | 0.2 | |

| Belgium | | | 0.2 | |

| Bermuda | | | 1.2 | |

| Brazil | | | 0.3 | |

| Cambodia | | | 0.0 | *** |

| Canada | | | 2.3 | |

| Cayman Islands | | | 0.0 | *** |

| Chile | | | 0.1 | |

| China | | | 1.2 | |

| Curacao | | | 0.1 | |

| Denmark | | | 0.5 | |

| Faeroe Islands | | | 0.0 | *** |

| Finland | | | 0.4 | |

| France | | | 1.4 | |

| Germany | | | 1.6 | |

| Gibraltar | | | 0.0 | *** |

| Greece | | | 0.0 | *** |

| Guernsey | | | 0.0 | *** |

| Hong Kong | | | 1.1 | |

| Hungary | | | 0.0 | *** |

| India | | | 1.3 | |

| Indonesia | | | 0.5 | |

| Ireland | | | 0.3 | |

| Isle of Man | | | 0.0 | *** |

| Israel | | | 1.5 | |

| Italy | | | 0.3 | |

| Japan | | | 6.1 | |

| Jersey Channel Islands | | | 0.1 | |

| Luxembourg | | | 0.2 | |

| Malaysia | | | 0.4 | |

| Malta | | | 0.0 | *** |

| Martinique | | | 0.0 | *** |

| Mexico | | | 0.4 | |

| Monaco | | | 0.0 | *** |

| Netherlands | | | 0.5 | |

| New Zealand | | | 0.7 | |

| Norway | | | 0.1 | |

| Peru | | | 0.1 | |

| Philippines | | | 0.2 | |

| Poland | | | 0.1 | |

| Portugal | | | 0.0 | *** |

| Puerto Rico | | | 0.0 | *** |

| Romania | | | 0.0 | *** |

| Singapore | | | 1.0 | |

| South Africa | | | 0.4 | |

| South Korea | | | 1.0 | |

| Spain | | | 0.3 | |

| Sweden | | | 0.8 | |

| Switzerland | | | 1.5 | |

| Taiwan | | | 0.8 | |

| Thailand | | | 0.3 | |

| Turkey | | | 0.0 | *** |

| Ukraine | | | 0.0 | *** |

| United Arab Emirates | | | 0.0 | *** |

| United Kingdom | | | 3.6 | |

| United States | | | 59.0 | |

| Other** | | | 6.2 | |

| | | | 100.0 | % |

| * | Stated as a percentage of net assets. |

| ** | Includes cash and equivalents, exchange traded funds, rights/warrants, U.S. Government agencies, investment companies, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| *** | Represents less than 0.1% of net assets. |

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

| Average Annual Total Returns | | | | |

| For the Period Ended October 31, 2016 | | | | |

| | | | | |

| Small & Mid Cap Fund | | | | |

| One Year | | | 5.13 | % |

| Five Year | | | 9.37 | % |

| Ten Year | | | 7.61 | % |

| | | | | |

| MSCI ACWI SMID Cap Index (Net) | | | | |

| One Year | | | 3.17 | % |

| Five Year | | | 8.82 | % |

| Ten Year | | | 4.99 | % |

| | | | | |

| S&P Global MidSmallCap Index (Net) | | | | |

| One Year | | | 3.30 | % |

| Five Year | | | 8.94 | % |

| Ten Year | | | 4.94 | % |

Prior to October 2, 2008, the Fund was named Global Small Cap Fund and operated under a different investment strategy. The prior performance shown represents performance of the Fund’s prior strategy to invest at least 80% of its net assets plus any borrowings for investment purposes in securities of small-capitalization companies. Effective January 1, 2014, the Board approved changes to the Fund’s name (formerly Global Small & Mid Cap Fund), and investment strategies. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would be lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Fund | |

| Investment Adviser’s Report (Unaudited) - (Concluded) | |

| | |

The Adviser has contractually committed through October 31, 2017, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any), at 1.11%, as disclosed in the Funds’ prospectus dated March 1, 2016. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 1.18%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2016 can be found in the Financial Highlights.

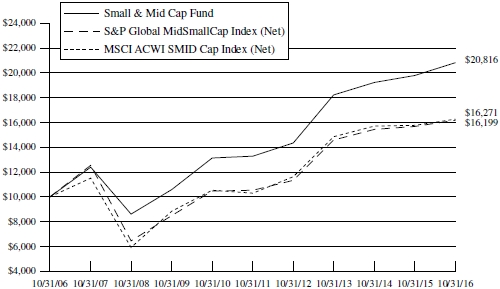

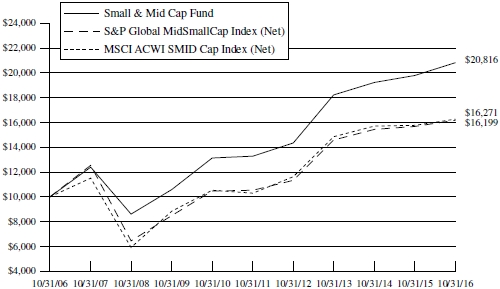

The chart shown on the previous page illustrates the total value of a $10,000 investment from the Fund’s inception, with distributions reinvested. On January 1, 2016, the Fund changed its primary benchmark from the S&P Global MidSmallCap Index (Net) to the MSCI ACWI SMID Cap Index (Net) to more closely reflect the Fund’s current investment strategy. The S&P Global MidSmallCap Index (Net) and the MSCI ACWI SMID Cap Index (Net) also include the reinvestment of distributions but not fees and expenses associated with an investment in the Fund. The S&P Global MidSmallCap Index (Net) and the MSCI ACWI SMID Cap Index (Net) are unmanaged. Investments cannot be made directly in an index.

Investments made in small-capitalization and mid-capitalization companies are subject to greater volatility and less liquidity compared to investments made in larger and more established companies. Investments made in securities of companies in foreign and emerging countries may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. | |

| Strategic Opportunities Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The return of the Old Westbury Strategic Opportunities Fund (the “Fund”) for the fiscal year ended October 31, 2016, was 0.17%. In comparison, the return of the Fund’s primary benchmark, the MSCI All Country World Investable Market Index (IMI) (Net), was 2.34%. The MSCI All Country World IMI (Net) is comprised of large-, mid- and small-capitalization stocks in 23 developed market and 23 emerging market countries. With around 8,600 constituents, the index covers approximately 99% of the global investable equity opportunity set. Net means that the return calculation for the index reflects the reinvestment of dividends after the deduction of withholding taxes, using a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties. The return for the Fund’s secondary benchmark, the BofA Merrill Lynch 1-10 Year AAA-A U.S. Corporate & Government Index (40%) and the MSCI All Country World (IMI) (Net) (60%), was 2.65%. The BofA Merrill Lynch 1-10 Year AAA-A U.S. Corporate & Government Index tracks the performance of U.S. dollar denominated investment grade debt publicly issued in the U.S. market, including U.S. Treasury, U.S. agency, foreign government, supranational and corporate securities, with a remaining term to final maturity less than 10 years and rated AAA through A3, inclusive.

During the fiscal year, segments of the Fund that outperformed the primary benchmark included Bessemer Investment Management LLC’s (“Bessemer”) quantitative equities (8% of the Fund as of October 31, 2016), global high yield (4%, managed by sub-advisor Muzinich & Co., Inc.), non-agency mortgage-backed securities (16%, managed by sub-advisor BlackRock Financial Management, Inc.), collateralized loan obligations (5%, managed by Bessemer and BlackRock), closed-end funds (7%, managed by Bessemer), and convertible bonds (5%, managed by Bessemer). Non-agency mortgage-backed securities were boosted by an improving housing market. In quantitative equities, results were driven by strong stock selection in Japan, overweight positions in consumer staples and utilities, and outperformance in the volatile January-February 2016 period. Global high yield benefitted from a narrowing of credit spreads due to the oil rally that began earlier in the year. Also, the Fund’s derivative strategies (41%) contributed positive absolute return as many of the seasoned options positions, primarily sold puts, earned option premium throughout the year.

Earlier in the calendar year, de-risking measures undertaken by the Fund detracted from performance. Despite the U.S. dollar overweight, exposure to other currencies was a detractor in absolute terms. Other segments of the Fund that underperformed included Bessemer’s commodity alpha (1%), global government bonds (now exited, previously managed by sub-advisor Franklin Advisers, Inc.) and master limited partnerships, or MLPs (now exited, previously managed by sub-advisor TPH Asset Management LLC). Commodity alpha’s results were hurt by a soybean swap trade in the second quarter. Global government bonds fell as bond yields dropped in line with negative interest rates becoming a global theme. The volatility in the energy sector negatively impacted MLPs.

The Fund’s primary benchmark consists of global equities, and the Fund’s secondary benchmark consists of equities and U.S. Treasuries. Relative to the benchmarks, therefore, at year-end, the Fund was overweight convertible bonds, collateralized loan obligations, non-agency mortgage-backed securities, global high yield, and closed-end credit funds. The investment team views each of these asset classes as having a better risk-adjusted return profile than U.S. Treasuries. The Fund has limited interest rate risk — despite U.S. Treasuries comprising 40% of the secondary benchmark — as this asset class does not currently fit the Fund’s criteria established for all investments: equity-like returns, facing a market dislocation, and upside potential greater than downside risk (positive asymmetry).

At year-end, based on notional exposures for derivatives and underlying regional exposures with exchange traded funds, the Fund had 75.2% of its assets in the U.S., 13.8% in developed Europe, 5.1% in Japan, 5.4% in emerging markets, and 0.5% in other developed markets. The Fund maintains significant exposure to the U.S. dollar, representing 77.8% of the Fund compared to 53.7% for the primary benchmark and 72.2% for the secondary benchmark.

| Old Westbury Funds, Inc. | |

| Strategic Opportunities Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY COUNTRY*

| Country: | | | | |

| Belgium | | | 0.1 | |

| Bermuda | | | 0.5 | |

| Bulgaria | | | 0.0 | *** |

| Canada | | | 0.1 | |

| Cayman Islands | | | 4.8 | |

| China | | | 0.3 | |

| Cyprus | | | 0.0 | *** |

| Czech Republic | | | 0.0 | *** |

| Dominican Republic | | | 0.0 | *** |

| Finland | | | 0.0 | *** |

| France | | | 0.1 | |

| Germany | | | 0.1 | |

| Hong Kong | | | 0.4 | |

| Hungary | | | 0.0 | *** |

| Indonesia | | | 0.0 | *** |

| Ireland | | | 0.3 | |

| Italy | | | 0.1 | |

| Japan | | | 1.0 | |

| Jersey Channel Islands | | | 0.1 | |

| Luxembourg | | | 0.4 | |

| Malaysia | | | 0.1 | |

| Mexico | | | 0.0 | *** |

| Morocco and Antilles | | | 0.1 | |

| Netherlands | | | 0.3 | |

| New Zealand | | | 0.0 | *** |

| Norway | | | 0.0 | *** |

| Pakistan | | | 0.1 | |

| Peru | | | 0.0 | *** |

| Poland | | | 0.0 | *** |

| Qatar | | | 0.0 | *** |

| Singapore | | | 0.1 | |

| South Africa | | | 0.0 | *** |

| South Korea | | | 0.1 | |

| Spain | | | 0.0 | *** |

| Sweden | | | 0.1 | |

| Switzerland | | | 0.2 | |

| Taiwan | | | 0.1 | |

| Thailand | | | 0.0 | *** |

| Turkey | | | 0.1 | |

| United Arab Emirates | | | 0.1 | |

| United Kingdom | | | 0.4 | |

| United States | | | 71.8 | |

| Other** | | | 18.1 | |

| | | | 100.0 | % |

| * | Value of Investments in Portfolio as a percentage of net assets. |

| ** | Includes cash and equivalents, closed-end funds, exchange traded funds, purchased or written options, futures, swap agreements, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| *** | Represents less than 0.1% of net assets. |

| Old Westbury Funds, Inc. | |

| Strategic Opportunities Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Average Annual Total Returns

For the Period Ended October 31, 2016

| Strategic Opportunities Fund | | | | |

| One Year | | | 0.17 | % |

| Five Year | | | 5.61 | % |

| Since Inception (November 28, 2007) | | | 1.61 | % |

| | | | | |

| S&P Global Broad Market Index (Net) | | | | |

| One Year | | | 2.36 | % |

| Five Year | | | 8.18 | % |

| November 28, 2007 to October 31, 2016 | | | 2.71 | % |

| | | | | |

| Prior Blended Index (Net) | | | | |

| One Year | | | 2.67 | % |

| Five Year | | | 5.86 | % |

| November 28, 2007 to October 31, 2016 | | | 3.41 | % |

| | | | | |

| MSCI ACWI Investable Market Index (IMI) (Net) | | | | |

| One Year | | | 2.34 | % |

| Five Year | | | 8.19 | % |

| November 28, 2007 to October 31, 2016 | | | 2.74 | % |

| | | | | |

| Blended Index (Net) | | | | |

| One Year | | | 2.65 | % |

| Five Year | | | 5.86 | % |

| November 28, 2007 to October 31, 2016 | | | 3.41 | % |

Effective January 1, 2014, the Board approved changes to the Fund’s name (formerly Global Opportunities Fund), investment strategies and primary benchmark. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy.

| Old Westbury Funds, Inc. | |

| Strategic Opportunities Fund | |

| Investment Adviser’s Report (Unaudited) - (Concluded) | |

| | |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would be lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2017, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any), at 1.20%, as disclosed in the Funds’ prospectus dated March 1, 2016. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 1.45%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2016 can be found in the Financial Highlights.

The chart shown on the previous page illustrates the total value of a $10,000 investment from the Fund’s inception, with distributions reinvested. On January 1, 2016, the Fund changed its primary benchmark from the S&P Global Broad Market Index (Net) to the MSCI All Country World Investable Market Index (ACWI IMI) (Net) to more closely reflect the Fund’s current investment strategy. In addition, effective January 1, 2016, the Fund also compares its performance to a blended benchmark, as a secondary benchmark, consisting of a 60% weighting in the MSCI All Country World Investable Market Index (ACWI IMI) (Net) and a 40% weighting in the Bank of America Merrill Lynch 1-10 Year AAA-A US Corporate & Government Index (the “Blended Index”). The Fund previously compared its performance to a blended benchmark, as a secondary benchmark, consisting of a 60% weighting in the S&P Global Broad Market Index (Net) and a 40% weighting in the Bank of America Merrill Lynch 1-10 Year AAA-A US Corporate & Government Index (the “Prior Blended Index”). The ACWI IMI (Net), the Blended Index (Net), the S&P Global Broad Market Index (Net) and the Prior Blended Index (Net) also include the reinvestment of distributions but do not include fees and expenses associated with an investment in the Fund. The ACWI IMI (Net), the Blended Index (Net), the S&P Global Broad Market Index (Net) and the Prior Blended Index (Net) are unmanaged. Investments cannot be made directly in an index.

Investments made in securities of companies in foreign and emerging countries may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility. The Fund may invest in instruments that are volatile, speculative or otherwise risky. The Fund is non-diversified, meaning it may focus its assets in a smaller number of issuers and may be subject to more risk than a more diversified fund.

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The Old Westbury Fixed Income Fund (the “Fund”) returned 2.08% for the fiscal year ended October 31, 2016. In comparison, the return of the Bank of America Merrill Lynch U.S. Corporate & Government 1-10 Year AAA-A US Corporate & Government Index (the “Index”) was 2.69%.

Short-term interest rates rose slightly during the fiscal year, while longer-term rates dipped in a flattening of the yield curve. Weaker-than-expected growth and inflation prospects in the U.S. economy during the end of 2015 and the first quarter of 2016 pushed yields lower in a move that ran until midyear. As economic prospects improved, other risks kept yields low and prevented the Fed from raising its policy rates further. These risks included Brexit in June, and the U.S. election in November. Finally, as the election approached, long-term yields began to rise, anticipating stimulative fiscal spending from whichever candidate might win the presidency. During the year, credit spreads contracted, and corporate bonds outperformed treasuries and U.S. agency bonds.

The Fund maintained a barbell structure throughout the year, meaning it was underweight bonds with intermediate maturities, and overweight bonds with shorter- and longer-term maturities. A barbell positioning is typically advantageous in a rising-rate environment. For the year, this structure had a slightly negative influence on performance. The Fund also had a lower duration (price sensitivity to interest-rate moves) than the benchmark, and since yields fell sharply in the first quarter, this was a drag on performance. The market does not believe the Fed will raise rates as quickly as its statements have suggested, and long-term yields have been slow to react.

Corporate credit significantly outperformed treasuries and agencies, so the Fund’s large portfolio overweight in corporate bonds, as well as the addition of even more corporate exposure toward year-end, had a positive effect on relative performance. Corporate bonds have benefitted from a slowdown in the pace of new issuance, continued strong investor demand, and a decline in global interest rates.

Further improving U.S. economic strength and a slowly moving Fed are expected as 2017 approaches, and these factors, combined with weak non-U.S. growth, low inflation, and strong demand for bonds will likely keep yields from breaking out significantly to the upside. That said, if the new U.S. administration implements strong fiscal spending measures, yields could rise further.

At fiscal year-end, the Fund maintained its barbell positioning. Credit represented approximately 42% of the market value of the Fund, including an allocation to high-quality asset-backed securities and collateralized loan obligations. Credit exposure is limited to investment-grade securities, with an emphasis on liquid, shorter-duration bonds. In the coming months, the team will closely watch developments in the U.S. and global economy that may drive changes in interest rates and the yield curve.

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO ASSET ALLOCATION*

| U.S. Government Agencies and Securities | | | 55.3 | % |

| Corporate Bonds | | | 34.7 | |

| Municipal Bonds | | | 1.7 | |

| Government Bonds | | | 0.2 | |

| Asset Backed Securities | | | 7.4 | |

| Collateralized Mortgage Obligations | | | 0.2 | |

| Other** | | | 0.5 | |

| | | | 100.0 | % |

| * | Stated as a percentage of net assets. |

| ** | Includes cash and equivalents, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Average Annual Total Returns

For the Period Ended October 31, 2016

| Fixed Income Fund | | | | |

| One Year | | | 2.08 | % |

| Five Year | | | 1.43 | % |

| Ten Year | | | 3.79 | % |

| | | | | |

| Bank of America Merrill Lynch 1-10 Year AAA-A US Corporate & Government Index | | | | |

| One Year | | | 2.69 | % |

| Five Year | | | 2.04 | % |

| Ten Year | | | 3.79 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursement and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2017, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.70% (current net operating expense ratio is 0.64%), as disclosed in the Funds’ prospectus dated March 1, 2016. The expense ratio, prior to fee waivers and including acquired fund fees (if any), is stated in the prospectus as 0.74%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2016 can be found in the Financial Highlights.

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) - (Concluded) | |

| | |

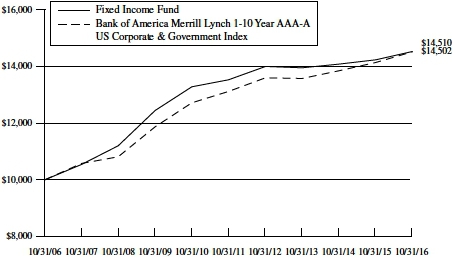

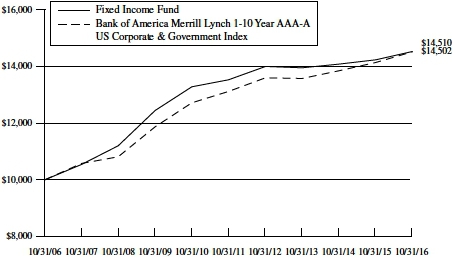

The chart shown on the previous page illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The Bank of America Merrill Lynch 1-10 Year AAA-A US Corporate & Government Index also includes the reinvestment of distributions but does not include fees and expenses associated with an investment in the Fund. The Bank of America Merrill Lynch 1-10 Year AAA-A US Corporate & Government Index is unmanaged. Investments cannot be made directly in an index.

The Fund is subject to risks such as credit, prepayment and interest rate risk associated with the underlying bond holdings in the Fund. The value of the Fund can decline as interest rates rise and an investor can lose principal.

| Old Westbury Funds, Inc. |

| Municipal Bond Fund |

| Investment Adviser’s Report (Unaudited) |

| |

The return of the Old Westbury Municipal Bond Fund (the “Fund”) for the fiscal year ended October 31, 2016, was 2.05%. In comparison, the return of the Bank of America Merrill Lynch 1-12 Year AAA-AA Municipal Securities Index (the “Index”) was 2.09%, and the return of the Fund’s other index, the Lipper Short-Intermediate Municipal Debt Funds Index, was 1.72%.

Throughout the year, the Fund used a barbell maturity structure with a lower concentration in the three- to six-year maturity range. This proved beneficial as the yield curve flattened through October of this year. The Fund maintains this type of structure given the view that the yield curve will flatten further as the Federal Reserve (the “Fed”) increases the federal funds rate. The Fund’s duration is slightly lower than the Index in anticipation of some pressure on interest rates to rise.

While rates ranged widely over the course of the year, the general path of long-maturity municipal yields was lower. The Fund was positioned for an increase in short-term yields, given the expectation that the Fed would move rates higher; the Fed only moved once, in December 2015. This positioning resulted in a slight drag on performance.

Municipal credit spreads were virtually unchanged for the year. The Fund has a greater weighting in A-rated bonds and benefits when the difference between lower- and higher-quality securities narrows. The Fund’s advisor expects that the yield spread between higher- and A-rated municipal bonds will remain somewhat constant.

| Old Westbury Funds, Inc. |

| Municipal Bond Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

PORTFOLIO DIVERSIFICATION BY STATE*

| States: | | | |

| Alabama | | 1.0 | % |

| Arizona | | 0.8 | |

| Arkansas | | 0.1 | |

| California | | 6.0 | |

| Colorado | | 1.4 | |

| Connecticut | | 3.8 | |

| District of Columbia | | 1.1 | |

| Florida | | 1.8 | |

| Georgia | | 4.2 | |

| Hawaii | | 0.4 | |

| Idaho | | 0.6 | |

| Illinois | | 1.1 | |

| Indiana | | 1.9 | |

| Iowa | | 0.2 | |

| Kansas | | 0.2 | |

| Kentucky | | 0.5 | |

| Louisiana | | 0.1 | |

| Maine | | 0.2 | |

| Maryland | | 1.2 | |

| Massachusetts | | 9.3 | |

| Michigan | | 0.8 | |

| Minnesota | | 1.4 | |

| Mississippi | | 0.2 | |

| Missouri | | 0.9 | |

| Montana | | 0.1 | |

| Nevada | | 0.1 | |

| New Hampshire | | 0.4 | |

| New Jersey | | 2.7 | |

| New Mexico | | 0.5 | |

| New York | | 21.5 | |

| North Carolina | | 1.9 | |

| Ohio | | 2.6 | |

| Oklahoma | | 0.2 | |

| Oregon | | 0.6 | |

| Pennsylvania | | 1.9 | |

| Rhode Island | | 0.6 | |

| South Carolina | | 2.6 | |

| Tennessee | | 0.4 | |

| Texas | | 14.3 | |

| Utah | | 1.9 | |

| Virginia | | 3.6 | |

| Washington | | 2.5 | |

| West Virginia | | 0.0 | *** |

| Other** | | 2.4 | |

| | | 100.0 | % |

| * | Stated as a percentage of net assets. |

| ** | Includes cash and equivalents, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| *** | Represents less than 0.1% of net assets. |

| Old Westbury Funds, Inc. |

| Municipal Bond Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

Average Annual Total Returns

For the Period Ended October 31, 2016

| Municipal Bond Fund | | | | |

| One Year | | | 2.05 | % |

| Five Year | | | 1.95 | % |

| Ten Year | | | 3.15 | % |

| | | | | |

Bank of America Merrill Lynch

1-12 Year AAA-AA Municipal

Securities Index | | | | |

| One Year | | | 2.09 | % |

| Five Year | | | 2.49 | % |

| Ten Year | | | 3.69 | % |

| | | | | |

Bank of America Merrill Lynch

1-12 Year Municipal Bond Index | | | | |

| One Year | | | 2.49 | % |

| Five Year | | | 2.83 | % |

| Ten Year | | | 3.95 | % |

| | | | | |

|

Lipper Short-Intermediate

Municipal Debt Funds Index | | | | |

| One Year | | | 1.72 | % |

| Five Year | | | 1.92 | % |

| Ten Year | | | 2.84 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestment of distributions, if any. Without waivers/reimbursements performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

| Old Westbury Funds, Inc. |

| Municipal Bond Fund |

| Investment Adviser’s Report (Unaudited) - (Concluded) |

| |

The Adviser has contractually committed through October 31, 2017, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.70% (current net operating expense ratio is 0.59%), as disclosed in the Fund’s prospectus dated March 1, 2016. The expense ratio, prior to fee waivers and including acquired fund fees (if any), is stated in the prospectus as 0.70%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2016 can be found in the Financial Highlights.

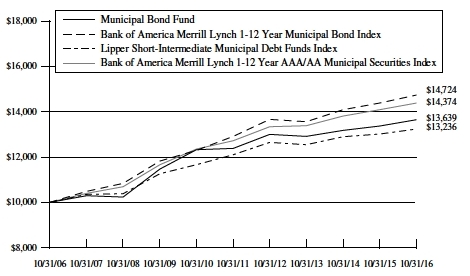

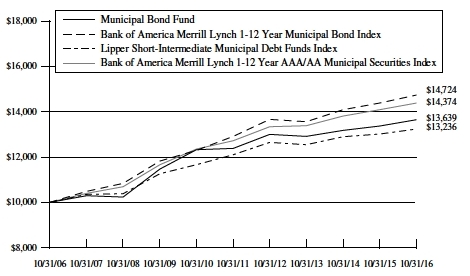

The chart shown on the previous page illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. On January 1, 2016, the Fund changed its primary benchmark from the Bank of America Merrill Lynch 1-12 Year Municipal Bond Index to the Bank of America Merrill Lynch 1-12 Year AAA-AA Municipal Securities Index to more closely reflect the Fund’s current investment strategy. The Fund also compares its performance to the Lipper Short-Intermediate Municipal Debt Funds Index. The Bank of America Merrill Lynch 1-12 Year AAA-AA Municipal Securities Index, Bank of America Merrill Lynch 1-12 Year Municipal Bond Index and Lipper Short-Intermediate Municipal Debt Funds Index also include the reinvestment of distributions but do not include fees and expenses associated with an investment in the Fund. The Bank of America Merrill Lynch 1-12 Year AAA-AA Municipal Securities Index, Bank of America Merrill Lynch 1-12 Year Municipal Bond Index and the Lipper Short-Intermediate Municipal Debt Funds Index are unmanaged. Investments cannot be made directly in an index.

Municipal securities held by the Fund may be adversely affected by local political and economic factors. Income from the Fund may be subject to federal alternative minimum tax, state and local taxes.

| Old Westbury Funds, Inc. |

| Disclosure of Fund Expenses (Unaudited) |

| For the Period Ended October 31, 2016 |

| |

As a shareholder of Old Westbury Funds, Inc., you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2016 through October 31, 2016.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | Actual

Beginning

Account Value

5/1/16 | | Actual

Ending

Account Value

10/31/16 | | Actual

Expenses Paid

During Period*

5/1/16-10/31/16 | | Actual

Expense Ratio

During Period

5/1/16-10/31/16** |

| Large Cap Core Fund | | | $1,000.00 | | | | $1,021.60 | | | | $5.05 | | | | 1.00 | % |

| Large Cap Strategies Fund | | | 1,000.00 | | | | 1,031.10 | | | | 5.69 | | | | 1.12 | % |

| Small & Mid Cap Fund | | | 1,000.00 | | | | 1,044.30 | | | | 5.67 | | | | 1.11 | % |

| Strategic Opportunities Fund | | | 1,000.00 | | | | 1,032.00 | | | | 6.10 | | | | 1.20 | % |

| Fixed Income Fund | | | 1,000.00 | | | | 1,004.00 | | | | 3.16 | | | | 0.63 | % |

| Municipal Bond Fund | | | 1,000.00 | | | | 1,000.30 | | | | 2.90 | | | | 0.58 | % |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 183/366 to reflect the one-half year period. |

| ** | Expense ratios are annualized and reflect existing expense waivers/reimbursements. |

| Old Westbury Funds, Inc. |

| Disclosure of Fund Expenses (Unaudited) - (Continued) |

| For the Period Ended October 31, 2016 |

| |

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | Hypothetical

Beginning

Account Value

5/1/16 | | Hypothetical

Ending

Account Value

10/31/16 | | Hypothetical

Expenses Paid

During Period*

5/1/16-10/31/16 | | Hypothetical

Expense Ratio

During Period

5/1/16-10/31/16** |

| Large Cap Core Fund | | | $1,000.00 | | | | $1,020.00 | | | | $5.05 | | | | 1.00 | % |

| Large Cap Strategies Fund | | | 1,000.00 | | | | 1,019.40 | | | | 5.65 | | | | 1.12 | % |

| Small & Mid Cap Fund | | | 1,000.00 | | | | 1,019.45 | | | | 5.60 | | | | 1.11 | % |

| Strategic Opportunities Fund | | | 1,000.00 | | | | 1,019.00 | | | | 6.06 | | | | 1.20 | % |

| Fixed Income Fund | | | 1,000.00 | | | | 1,021.85 | | | | 3.18 | | | | 0.63 | % |

| Municipal Bond Fund | | | 1,000.00 | | | | 1,022.10 | | | | 2.93 | | | | 0.58 | % |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 183/366 to reflect the one-half year period. |

| ** | Expense ratios are annualized and reflect existing expense waivers/reimbursements. |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, these tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Old Westbury Funds, Inc. | |

| Large Cap Core Fund | |

| Portfolio of Investments | October 31, 2016 |

| | |

| Shares | | | | | Value | |

| COMMON STOCKS — 95.1% | | | | |

| Banks — 9.6% | | | | |

| | 485,020 | | | BNP Paribas SA - ADR | | $ | 14,075,280 | |

| | 401,070 | | | Citigroup, Inc. | | | 19,712,591 | |

| | 363,160 | | | DBS Group Holdings Ltd. - ADR | | | 15,681,249 | |

| | 169,175 | | | HSBC Holdings Plc - ADR | | | 6,366,055 | |

| | 1,607,445 | | | KeyCorp | | | 22,697,123 | |

| | 696,970 | | | Morgan Stanley | | | 23,397,283 | |

| | 969,100 | | | Nordea Bank AB | | | 10,187,613 | |

| | 1,919,810 | | | Siam Commercial Bank Public Co. Ltd.(b)(c) | | | 7,871,783 | |

| | | | | | | | 119,988,977 | |

| Consumer Discretionary — 23.8% | | | | |

| | 200,880 | | | Accor SA | | | 7,626,582 | |

| | 28,171 | | | Amazon.com, Inc.(b) | | | 22,250,019 | |

| | 721,200 | | | Aramark | | | 26,850,276 | |

| | 388,240 | | | CBS Corp. - Class B | | | 21,982,149 | |

| | 484,405 | | | Comcast Corp. - Class A | | | 29,945,917 | |

| | 322,290 | | | Dollar General Corp. | | | 22,267,016 | |

| | 2,451,450 | | | Kingfisher Plc | | | 10,841,121 | |

| | 326,910 | | | Lowe’s Cos, Inc. | | | 21,788,552 | |

| | 116,920 | | | Mohawk Industries, Inc.(b) | | | 21,548,356 | |

| | 277,520 | | | Nielsen Holdings Plc | | | 12,493,950 | |

| | 343,460 | | | NIKE, Inc. - Class B | | | 17,234,823 | |

| | 1,422,780 | | | Nissan Motor Co. Ltd. | | | 14,496,428 | |

| | 272,875 | | | Pandora A/S - ADR | | | 8,827,506 | |

| | 243,225 | | | PVH Corp. | | | 26,020,211 | |

| | 245,495 | | | Royal Caribbean Cruises Ltd. | | | 18,871,201 | |

| | 334,860 | | | Tata Motors Ltd. - ADR | | | 13,196,833 | |

| | | | | | | | 296,240,940 | |

| Consumer Staples — 6.7% | | | | |

| | 240,000 | | | Coca-Cola European Partners Plc | | | 9,254,075 | |

| | 322,310 | | | CVS Health Corp. | | | 27,106,271 | |

| | 240,860 | | | PepsiCo, Inc. | | | 25,820,192 | |

| | 325,440 | | | Unilever NV | | | 13,639,935 | |

| | 326,055 | | | Wilmar International Ltd. - ADR | | | 7,669,792 | |

| | | | | | | | 83,490,265 | |

| Diversified Financials — 5.1% | | | | |

| | 588,010 | | | Discover Financial Services | | | 33,122,603 | |

| | 860,210 | | | ING Groep NV | | | 11,326,877 | |

| | 578,550 | | | Mediobanca SpA | | | 4,239,335 | |

| | 915,170 | | | ORIX Corp. | | | 14,534,334 | |

| | | | | | | | 63,223,149 | |

| Energy — 4.9% | | | | |

| | 140,805 | | | China Petroleum & Chemical Corp. - ADR | | | 10,197,098 | |

| | 720,705 | | | ConocoPhillips | | | 31,314,632 | |

| | 372,190 | | | Encana Corp. | | | 3,549,027 | |

| | 1,072,340 | | | ENI SpA | | | 15,550,372 | |

| | | | | | | | 60,611,129 | |

| Shares | | | | | Value | |

| Health Care — 11.2% | | | | |

| | 148,615 | | | Aetna, Inc. | | $ | 15,953,820 | |

| | 197,415 | | | AstraZeneca Plc | | | 11,086,303 | |

| | 405,660 | | | DENTSPLY Sirona, Inc. | | | 23,353,846 | |

| | 143,210 | | | Otsuka Holdings Co. Ltd. | | | 6,277,643 | |

| | 589,890 | | | Pfizer, Inc. | | | 18,705,412 | |

| | 236,400 | | | Shionogi & Co. Ltd. | | | 11,672,349 | |

| | 159,260 | | | Shire Plc | | | 9,064,479 | |

| | 204,905 | | | Thermo Fisher Scientific, Inc. | | | 30,127,182 | |

| | 122,915 | | | Zimmer Holdings, Inc. | | | 12,955,241 | |

| | | | | | | | 139,196,275 | |

| Industrials — 7.1% | | | | |

| | 275,500 | | | J.B. Hunt Transport Services, Inc. | | | 22,483,555 | |

| | 664,600 | | | Obayashi Corp. | | | 6,419,756 | |

| | 250,885 | | | Raytheon Co. | | | 34,273,400 | |

| | 148,460 | | | Union Pacific Corp. | | | 13,091,203 | |

| | 262,480 | | | Xylem, Inc. | | | 12,685,658 | |

| | | | | | | | 88,953,572 | |

| Information Technology — 16.1% | | | | |

| | 139,000 | | | Alibaba Group Holding Ltd. - ADR(b) | | | 14,134,910 | |

| | 52,900 | | | Alphabet, Inc. - Class C(b) | | | 41,502,166 | |

| | 449,870 | | | Apple, Inc. | | | 51,078,240 | |

| | 126,440 | | | Atos SE | | | 13,133,271 | |

| | 113,345 | | | Broadcom Ltd. | | | 19,300,387 | |

| | 373,800 | | | CDW Corp. | | | 16,787,358 | |

| | 2,212,160 | | | Nokia Oyj | | | 9,878,771 | |

| | 198,840 | | | NXP Semiconductors NV(b) | | | 19,884,000 | |

| | 564,000 | | | Sabre Corp. | | | 14,568,120 | |

| | | | | | | | 200,267,223 | |

| Insurance — 2.5% | | | | |

| | 176,555 | | | American International Group, Inc. | | | 10,893,444 | |

| | 113,085 | | | CHUBB Ltd. | | | 14,361,795 | |

| | 972,349 | | | RSA Insurance Group Plc - ADR | | | 6,508,904 | |

| | | | | | | | 31,764,143 | |

| Materials — 1.3% | | | | |

| | 386,690 | | | Rio Tinto Ltd. | | | 15,937,301 | |

| Real Estate — 1.0% | | | | |

| | 809,910 | | | Wharf Holdings Ltd. - ADR | | | 12,096,006 | |

| Telecommunication Services — 1.1% | | | | |

| | 281,015 | | | China Telecom Corp. Ltd. - ADR | | | 14,486,323 | |

| Utilities — 4.7% | | | | |

| | 154,740 | | | American Water Works Co., Inc. | | | 11,456,950 | |

| | 302,905 | | | Edison International | | | 22,257,459 | |

| | 407,310 | | | Electric Power Development Co. Ltd. | | | 9,504,029 | |

| Old Westbury Funds, Inc. | |

| Large Cap Core Fund | |

| Portfolio of Investments - (Continued) | October 31, 2016 |

| | |

| Shares | | | | | Value | |

| Utilities (continued) | | | | |

| | 549,460 | | | Enagas SA | | $ | 15,772,961 | |

| | | | | | | | 58,991,399 | |

Total Common Stocks

(Cost $1,081,748,771) | | | 1,185,246,702 | |

| | | | | | | | | |

| INVESTMENT COMPANY — 4.8% | | | | |

| | 60,170,000 | | | SEI Daily Income Trust Government II Fund, Class A, 0.01%,(d) | | | 60,170,000 | |

Total Investment Company

(Cost $60,170,000) | | | 60,170,000 | |

TOTAL INVESTMENTS — 99.9%

(Cost $1,141,918,771)(a) | | | 1,245,416,702 | |

| OTHER ASSETS IN EXCESS OF LIABILITIES — 0.1% | | | 780,305 | |

| NET ASSETS — 100.0% | | $ | 1,246,197,007 | |

| (a) | Cost for federal income tax purposes is $1,145,177,115 and net unrealized appreciation of investments is as follows: |

| Unrealized appreciation | | $ | 185,879,755 | |

| Unrealized depreciation | | | (85,640,168 | ) |

| Net unrealized appreciation | | $ | 100,239,587 | |

| (b) | Non-income producing security. |

| (c) | This security is considered either fully or partially illiquid. These securities or portions thereof have a value of $7,785,194 or 0.62% of net assets. |

| (d) | Rate shown represents current yield at October 31, 2016. |

ADR-American Depositary Receipt

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Portfolio of Investments | October 31, 2016 |

| | |

| Shares | | | | | Value | |

| COMMON STOCKS — 93.6% | | | | |

| ARGENTINA — 0.0% | | | | |

| | 36,000 | | | MercadoLibre, Inc. | | $ | 6,048,360 | |

| BELGIUM — 0.2% | | | | |

| | 387,000 | | | UCB SA | | | 26,207,838 | |

| BERMUDA — 0.4% | | | | |

| | 99,976 | | | RenaissanceRe Holdings Ltd. | | | 12,426,017 | |

| | 784,117 | | | Validus Holdings Ltd. | | | 40,068,379 | |

| | | | | | | | 52,494,396 | |

| BRAZIL — 1.6% | | | | |

| | 28,950,000 | | | Ambev SA(e) | | | 170,779,605 | |

| | 1,563,900 | | | Ambev SA - ADR | | | 9,227,010 | |

| | 1,170,952 | | | Banco Bradesco SA - ADR | | | 12,189,610 | |

| | 1,150,600 | | | BM&FBovespa SA - Bolsa de Valores Mercadorias e Futuros | | | 6,758,694 | |

| | 331,800 | | | Cia Brasileira de Distribuicao - ADR | | | 6,320,790 | |

| | 715,368 | | | Cielo SA | | | 7,272,460 | |

| | 1,231,662 | | | Itau Unibanco Holding SA - ADR | | | 14,693,731 | |

| | | | | | | | 227,241,900 | |

| CANADA — 1.8% | | | | |

| | 1,557,000 | | | Canadian Pacific Railway Ltd. | | | 222,574,502 | |

| | 394,979 | | | Peyto Exploration & Development Corp.(e) | | | 10,147,600 | |

| | 360,609 | | | Waste Connections, Inc. | | | 27,121,403 | |

| | | | | | | | 259,843,505 | |

| CHILE — 0.0% | | | | |

| | 341,100 | | | Banco Santander Chile - ADR | | | 7,794,135 | |

| CHINA — 4.2% | | | | |

| | 289,500 | | | 51Job, Inc. - ADR(b) | | | 9,843,000 | |

| | 1,515,000 | | | AAC Technologies Holdings, Inc. | | | 14,455,454 | |

| | 895,000 | | | Alibaba Group Holding Ltd. - ADR(b) | | | 91,012,550 | |

| | 352,700 | | | Baidu, Inc. - ADR(b) | | | 62,378,522 | |

| | 15,369,500 | | | China Shenhua Energy Co. Ltd. - H Shares | | | 31,985,318 | |

| | 122,362 | | | CNOOC Ltd. - ADR | | | 15,353,984 | |

| | 253,800 | | | Ctrip.com International Ltd. - ADR(b) | | | 11,205,270 | |

| | 1,854,000 | | | ENN Energy Holdings Ltd. | | | 8,725,493 | |

| | 273,100 | | | JD.Com, Inc. -ADR(b) | | | 7,086,945 | |

| | 3,404,000 | | | Jiangsu Expressway Co. Ltd. - H Shares | | | 4,634,905 | |

| | 1,239,000 | | | Shenzhou International Group Holdings Ltd. | | | 8,219,475 | |

| | 35,300,000 | | | Sinopharm Group Co. Ltd. - H Shares(e) | | | 171,822,114 | |

| | 6,683,000 | | | Tencent Holdings Ltd. | | | 177,338,989 | |

| | | | | | | | 614,062,019 | |

| Shares | | | | | Value | |

| COLUMBIA — 0.0% | | | | |

| | 208,300 | | | Bancolombia SA - ADR | | $ | 7,973,724 | |

| CZECH REPUBLIC — 0.1% | | | | |

| | 254,740 | | | Komercni Banka AS | | | 9,331,018 | |

| EGYPT — 0.0% | | | | |

| | 666,500 | | | Commercial International Bank Egypt SAE - GDR | | | 2,945,929 | |

| FINLAND — 2.2% | | | | |

| | 1,650,000 | | | Kone Oyj - Class B(e) | | | 75,947,637 | |

| | 5,320,000 | | | Sampo Oyj - A Shares(e) | | | 243,939,184 | |

| | | | | | | | 319,886,821 | |

| FRANCE — 1.4% | | | | |

| | 1,125,000 | | | L’Oreal SA(e) | | | 201,362,589 | |

| GERMANY — 0.8% | | | | |

| | 1,372,000 | | | Bayerische Motoren Werke AG | | | 119,540,743 | |

| GUERNSEY — 0.1% | | | | |

| | 304,290 | | | Amdocs Ltd. | | | 17,785,751 | |

| HONG KONG — 2.0% | | | | |

| | 3,224,000 | | | AIA Group Ltd. | | | 20,348,628 | |

| | 707,709 | | | ASM Pacific Technology Ltd. | | | 6,830,208 | |

| | 3,178,570 | | | China Merchants Holdings International Co. Ltd. | | | 8,237,876 | |

| | 1,582,781 | | | China Mobile Ltd. | | | 18,132,833 | |

| | 238,700 | | | China Mobile Ltd. - ADR | | | 13,708,541 | |

| | 13,244,000 | | | China Unicom Hong Kong Ltd. | | | 15,522,814 | |

| | 214,419 | | | Hong Kong Exchanges and Clearing Ltd. | | | 5,678,728 | |

| | 2,875,718 | | | Jardine Matheson Holdings Ltd.(e) | | | 175,159,983 | |

| | 3,844,400 | | | Sands China Ltd. | | | 16,729,761 | |

| | 8,173,162 | | | Sino Biopharmaceutical Ltd. | | | 5,722,388 | |

| | 2,605,500 | | | Yue Yuen Industrial Holdings Ltd. | | | 9,927,410 | |

| | | | | | | | 295,999,170 | |

| HUNGARY — 0.1% | | | | |

| | 501,217 | | | Richter Gedeon | | | 10,772,899 | |

| INDIA — 2.3% | | | | |

| | 1,734,071 | | | Ambuja Cements Ltd. | | | 6,236,647 | |

| | 2,329,000 | | | Asian Paints Ltd.(e) | | | 37,513,895 | |

| | 1,942,300 | | | Axis Bank Ltd. | | | 14,183,401 | |

| | 1,249,421 | | | Bharti Airtel Ltd.(b) | | | 5,962,140 | |

| | 1,155,700 | | | Bharti Infratel Ltd. | | | 6,013,277 | |

| | 1,367,134 | | | Dabur India Ltd. | | | 5,978,326 | |

| | 113,233 | | | Eicher Motors Ltd.(e) | | | 40,719,476 | |

| | 4,581,700 | | | Housing Development Finance Corp. | | | 94,499,513 | |

| | 842,800 | | | Maruti Suzuki India Ltd. | | | 74,405,385 | |