UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-07912

| | Old Westbury Funds, Inc. | |

| | (Exact name of registrant as specified in charter) | |

| | | |

| | 103 Bellevue Parkway

Wilmington, DE 19809 | |

| | (Address of principal executive offices) (Zip code) | |

| | | |

| | Jordan Hedge

BNY Mellon Investment Servicing (US) Inc.

103 Bellevue Parkway

Wilmington, DE 19809 | |

| | (Name and address of agent for service) | |

Registrant’s telephone number, including area code: 800-607-2200

Date of fiscal year end: October 31

Date of reporting period: October 31, 2023

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Old Westbury Funds, Inc.

Annual Report

October 31, 2023

BESSEMER INVESTMENT MANAGEMENT LLC

Investment Adviser

Old Westbury Funds, Inc.

| Old Westbury Funds, Inc. | |

| A Letter from the President (Unaudited) | |

| | October 31, 2023

|

Dear Shareholders:

Fiscal 2023 was marked by ongoing geopolitical tensions, easing inflation, a slowing in the pace of interest rate hikes, resilient consumer spending despite diminishing excess savings, and economic strength that surprised to the upside. Equity markets had a strong year overall, though there has been some volatility, particularly given the sharp rise in yields. A “bad news is good news” narrative drove markets in recent months as they welcomed weaker economic data and sold off at the sight of strong data, recognizing that softening data would alleviate pressure on the Federal Reserve to keep interest rates elevated.

The primary economic question throughout the fiscal year has been whether higher interest rates would gently produce a “soft landing” or, not so gently, tip the economy into a recession. Throughout the period, economic growth in the U.S. continued to surpass expectations. In addition, labor market dynamics reflected a jobs market that has cooled but remained on solid ground. Inflation continued its decline, though the pace of disinflation slowed in recent months as components such as shelter and services remain elevated. Thus far, the Federal Reserve has been able to ease inflation and slow economic growth while avoiding a recession. Still, there is evidence that growth is set to slow further as the effects of elevated interest rates continue to permeate the economy.

The Adviser maintained an out-of-consensus positive economic outlook at the start of the fiscal year. With the economy on more stable footing, a soft landing has since become a more consensus view. The expected impact of still-elevated rates on future economic growth continues to be the market’s primary focus. Over time, the Adviser expects slower economic growth to place downward pressure on interest rates and believes investors are likely to pay a premium for companies that can maintain solid levels of earnings growth in this environment.

The Old Westbury All Cap Core Fund outperformed its primary benchmark, the MSCI ACWI Investable Market Index (Net), due to an overweight position in the U.S. and stock selection within consumer staples, communication services, and information technology, while investments in sector and exchange-traded funds and stock selection in the healthcare and energy sectors detracted from relative performance. The Old Westbury Large Cap Strategies Fund underperformed its benchmark, the MSCI All Country World Large Cap Index (Net), as stock selection in financials, energy, and healthcare detracted from relative performance. The Old Westbury Small & Mid Cap Strategies Fund underperformed its benchmark, MSCI All Country World Small Mid Cap Index (Net), as a result of stock selection in healthcare, technology, and financials.

The Old Westbury Credit Income Fund underperformed its benchmark, the ICE Bank of America 1-10 Year U.S. Corporate Index due to its Treasury curve positioning, while floating rate and credit allocations aided performance at the margin. The Old Westbury Fixed Income Fund underperformed its benchmark, the ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index; the Fund’s longer duration and barbelled yield-curve exposure were a drag on performance, while its overweight to credit aided performance. The Old Westbury Municipal Bond Fund underperformed its primary benchmark, the ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index; duration and some credit selection were detractors while credit spread management, curve positioning, and roll-down were additive. The Old Westbury California Municipal Bond Fund outperformed its primary benchmark, the ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index. The Old Westbury New York Municipal Bond Fund performed in line with its primary benchmark, the ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index. Duration and some credit selection detracted while credit spread management, curve positioning, and roll-down contributed to performance.

At fiscal year-end, the Adviser remains committed to its longstanding investment approach, characterized by rigorous research and analysis, a centralized approach, and long-term perspective. These disciplines will likely continue to provide competitive long-term results for shareholders and position the Adviser to fulfill the central mandate of participating in strong market environments, while preserving capital during difficult times.

Sincerely,

David W. Rossmiller

President

Old Westbury Funds, Inc.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) | |

The return of the Old Westbury All Cap Core Fund (the “Fund”) for the fiscal year ended October 31, 2023, was 10.67%. In comparison, the return of its primary benchmark, the MSCI ACWI Investable Market Index (Net)a, was 9.43%. The Fund’s secondary benchmark, a blend of 90% MSCI USA Index (Gross) and 10% MSCI ACWI ex USA Index (Net)a, returned 10.33%.

The most significant detractor to the Fund’s results relative to its primary benchmark was the Fund’s investments in certain sector and exchange-traded funds such as SDIT Government II Fund, Health Care Select Sector SPDR Fund, and iShares China Large-Cap ETF as well as stock selection in the healthcare and energy sectors. Stocks within underperforming sectors with the highest negative relative contributions included UnitedHealth Group Incorporated and Pioneer Energy Resources Company. UnitedHealth Group failed to keep up with the move in cyclical assets that drove the market given its less economically sensitive healthcare business. Pioneer Energy Resources Company appreciated less than the sector and industry as it has less sensitivity to oil price movements and due to concerns that its oil wells were becoming less productive.

The most significant contributors to the Fund’s results relative to its primary benchmark were an overweight position in the U.S. and stock selection within consumer staples, communication services, and information technology. Stocks in these sectors with the greatest relative positive contribution included US Food Holdings Corp., Meta Platforms, and NVIDIA Corporation. US Food Holdings Corp. benefited from the return to restaurant dining post pandemic. Meta Platforms appreciated significantly on the recovery in earnings. NVIDIA Corporation more than doubled on the back of high demand for its artificial intelligence chips.

At fiscal year-end, versus its primary benchmark, the Fund maintained relative overweight positions in the industrials, financials, and energy sectors and underweight positions in healthcare, consumer staples, and consumer discretionary. Relative to the primary benchmark, the Fund continued to be significantly overweight U.S. stocks (94%) versus non-U.S. stocks (6%).

| a | The Net version of each index reflects no deductions for fees, expenses or income taxes. |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

PORTFOLIO DIVERSIFICATION BY SECTOR

| Sector: | | Percentage

of Net Assets |

| Banks | | | 3.3 | % |

| Communication Services | | | 6.8 | |

| Consumer Discretionary | | | 10.0 | |

| Consumer Staples | | | 6.1 | |

| Energy | | | 4.6 | |

| Exchange-Traded Funds | | | 3.6 | |

| Financial Services | | | 9.5 | |

| Health Care | | | 9.6 | |

| Industrials | | | 13.3 | |

| Information Technology | | | 24.3 | |

| Insurance | | | 1.0 | |

| Materials | | | 1.9 | |

| Real Estate | | | 1.2 | |

| Utilities | | | 2.1 | |

| Other* | | | 2.7 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

All Cap Core Fund | | | |

| One Year | | | 10.67 | % |

| Five Year | | | 10.54 | % |

| Ten Year | | | 8.69 | % |

| | | | | |

| MSCI ACWI IMI Index (Net) | | | | |

| One Year | | | 9.43 | % |

| Five Year | | | 7.11 | % |

| Ten Year | | | 6.61 | % |

| | | | | |

| Blended Index (Net) | | | | |

| One Year | | | 10.33 | % |

| Five Year | | | 10.21 | % |

| Ten Year | | | 10.22 | % |

On December 30, 2016, the Fund changed its name to All Cap Core Fund (formerly Large Cap Core Fund) as part of a series of changes to the overall investment focus and strategies of the Fund. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy. The index performance is not illustrative of the Fund’s performance and performance of the fund will differ; the use of the index performance is not intended to mask negative performance.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus dated March 1, 2023 as 0.97%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

The chart shown on the previous page illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The Fund compares its performance to a blended benchmark, as a secondary benchmark, consisting of a 90% weighting in the MSCI USA Index (Gross) and a 10% weighting in the MSCI ACWI ex USA Index (Net) (the“Blended Index”). The MSCI ACWI IMI (Net) and the Blended Index (Net) also include the reinvestment of distributions but do not include fees, expenses and income taxes associated with an investment in the Fund. The MSCI ACWI IMI (Net) and the Blended Index (Net) are unmanaged. Investments cannot be made directly in an index.

The value of an investment in the Fund will fluctuate, which means that an investor could lose the principal amount invested. Investments made in foreign and emerging country securities may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) |

|

The return of the Old Westbury Large Cap Strategies Fund (the “Fund”) for the fiscal year ended October 31, 2023, was 7.40%. In comparison, the return of the MSCI All Country World Large Cap Index (Net)a (“the Index”) was 11.86%.

Stock selection in the financials, energy, and healthcare sectors detracted from performance relative to the benchmark. Top relative detractors for the period included Chevron, NextEra Energy, and Bank of America. Shares in Chevron have underperformed as project slippage in key acreage and weak price realization have weighed on free cash flows and profitability. NextEra Energy shares fell due to the negative effect of higher interest rates on financing for renewables projects. Bank of America underperformed bank stocks due to the perception of its marginally higher mark-to-market risk, especially in relation to its treasury holdings. In addition, most banks underperformed the financials sector due to their greater interest rate sensitivity.

Stock selection within communications services and technology contributed to relative performance. Mega-capitalization U.S. companies such as Microsoft, NVIDIA, Meta, and Alphabet all experienced strong share price appreciation, particularly through the first half of 2023 due in part to strong results and growing excitement around artificial intelligence (AI). The Fund’s overweight positions in Microsoft and Alphabet helped drive the outperformance in these sectors. In addition, aerospace and defense company Rolls Royce was the Fund’s top positive contributor. Rolls Royce appreciated following management’s new and aggressive restructuring strategy, bolstered by the continued post-pandemic air traffic recovery.

At fiscal year-end, versus its benchmark, the Fund was relatively overweight the materials, technology, and utilities sectors and underweight the consumer staples, financials, and healthcare sectors. Relative to the benchmark, the Fund maintained its overweight to the U.S. and its underweight to developed Europe and Japan.

| a | The Net version of each index reflects no deductions for fees, expenses or income taxes. |

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

PORTFOLIO DIVERSIFICATION BY COUNTRY

| Country: | | Percentage

of Net Assets |

| Australia | | | 1.5 | % |

| Belgium | | | 0.0 | * |

| Brazil | | | 0.5 | |

| Canada | | | 1.4 | |

| Chile | | | 0.0 | * |

| China | | | 4.0 | |

| Czech Republic | | | 0.0 | * |

| Denmark | | | 0.0 | * |

| Egypt | | | 0.0 | * |

| Faeroe Islands | | | 0.0 | * |

| Finland | | | 0.0 | * |

| France | | | 1.3 | |

| Germany | | | 0.7 | |

| Hong Kong | | | 0.2 | |

| India | | | 2.7 | |

| Indonesia | | | 0.1 | |

| Ireland | | | 0.4 | |

| Israel | | | 0.0 | * |

| Italy | | | 0.0 | * |

| Japan | | | 0.6 | |

| Jersey Channel Islands | | | 0.0 | * |

| Kazakhstan | | | 0.1 | |

| Malaysia | | | 0.0 | * |

| Mexico | | | 0.0 | * |

| Netherlands | | | 2.1 | |

| Norway | | | 0.1 | |

| Peru | | | 0.0 | * |

| Philippines | | | 0.0 | * |

| Poland | | | 0.1 | |

| Portugal | | | 0.0 | * |

| Qatar | | | 0.0 | * |

| Singapore | | | 0.4 | |

| South Africa | | | 0.1 | |

| South Korea | | | 0.1 | |

| Spain | | | 0.0 | * |

| Sweden | | | 0.0 | * |

| Switzerland | | | 0.4 | |

| Taiwan | | | 0.3 | |

| Turkey | | | 0.0 | * |

| United Arab Emirates | | | 0.0 | * |

| United Kingdom | | | 3.4 | |

| United States | | | 74.1 | |

| Uruguay | | | 0.8 | |

| Other** | | | 4.6 | |

| | | | 100.0 | % |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, exchange-traded funds, rights/warrants, U.S. Government Securities, investment company, forward foreign currency exchange contracts, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

Large Cap Strategies Fund | | | |

| One Year | | | 7.40 | % |

| Five Year | | | 5.74 | % |

| Ten Year | | | 5.72 | % |

| | | | | |

| MSCI ACWI Large Cap Index (Net) | | | | |

| One Year | | | 11.86 | % |

| Five Year | | | 7.97 | % |

| Ten Year | | | 7.13 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would be lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2026, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding, Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 1.10%. The expense ratio including acquired fund fees and expenses (if any), is stated in the prospectus dated March 1, 2023 as 1.11%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The MSCI ACWI Large Cap Index (Net) also includes the reinvestment of distributions but not fees, expenses and income taxes associated with an investment in the Fund. The MSCI ACWI Large Cap Index (Net) is unmanaged. Investments cannot be made directly in an index.

The value of an investment in the Fund will fluctuate, which means that an investor could lose the principal amount invested. Investments made in foreign and emerging country securities may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) |

|

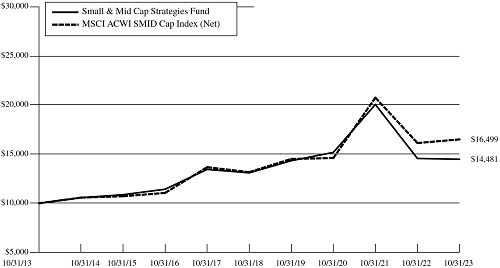

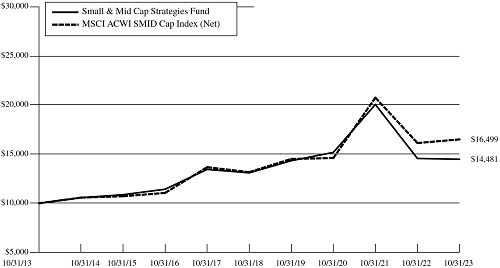

The return of the Old Westbury Small & Mid Cap Strategies Fund (the “Fund”) for the fiscal year ended October 31, 2023, was -0.53%. In comparison, the return of the MSCI All Country World Small Mid Cap Index (Net)a (the “Index”) was 2.28%.

Stock selection in healthcare, technology, and financials detracted from relative performance. The top three relative detractors were all in the healthcare sector and included Novocure, Alnylam Pharmaceuticals, and STAAR Surgical. Novocure faced setbacks in its clinical trials for Tumor Treating Fields (TTF) devices as a recent lung cancer trial failed to provide clear commercial viability and its ovarian cancer trial showed no meaningful benefit, although the team believes that the combination of TTFs with checkpoint inhibitors still holds promise. Alnylam’s shares faced pressure from below-market guidance and the Food and Drug Administration’s (FDA’s) rejection of Onpattro for Cardiomyopathy, but the team believes that the setback does not significantly diminish its potential as the company focuses on other therapies and larger patient groups. STAAR Surgical has been facing challenges gaining traction in the U.S. market due to limited surgery suite access and lack of control over the patient experience while experiencing strong global growth driven by China, Japan, and South Korea.

Stock selection within the real estate and consumer staples sectors contributed to relative performance. Real estate was a bottom performing sector in the index and the Fund’s underweight to the sector was a net benefit. Stocks with the greatest relative positive contribution include transportation and logistics company SAIA, healthcare technology company Exact Sciences, and software company Synopsis. SAIA outperformed due to consistent market share gains and resilient pricing power within the Less-Than-Truckload (LTL) freight industry, which led to leading to better-than-expected earnings along with valuation expansion. Exact Science’s share price has responded positively to the strong revenue growth of 33% year-over-year, and the expectation that it will turn free cash flow positive this year. Synopsys outperformed due to strong demand for semiconductor design software and increased investor enthusiasm around artificial intelligence (AI) adoption which could accelerate Synopsis growth rate over the medium-term.

At fiscal year-end, versus its benchmark, the Fund was relatively overweight the healthcare, technology, and energy sectors and underweight the real estate, financials, and consumer discretionary sectors. On a regional basis, the Fund was underweight the U.S. and Emerging Asia Pacific and overweight Developed Europe.

| a | The Net version of each index reflects no deductions for fees, expenses or income taxes. |

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

PORTFOLIO DIVERSIFICATION BY COUNTRY

| Country: | | Percentage

of Net Assets |

| Australia | | | 2.1 | % |

| Austria | | | 0.2 | |

| Belgium | | | 0.2 | |

| Bermuda | | | 0.1 | |

| Brazil | | | 0.7 | |

| Canada | | | 3.4 | |

| Chile | | | 0.1 | |

| China | | | 4.0 | |

| Costa Rica | | | 0.0 | * |

| Denmark | | | 1.4 | |

| Finland | | | 0.5 | |

| France | | | 1.3 | |

| Germany | | | 1.6 | |

| Greece | | | 0.4 | |

| Hong Kong | | | 0.5 | |

| Iceland | | | 0.1 | |

| India | | | 1.0 | |

| Indonesia | | | 0.1 | |

| Ireland | | | 0.2 | |

| Israel | | | 2.1 | |

| Italy | | | 1.5 | |

| Japan | | | 8.6 | |

| Jersey Channel Islands | | | 0.1 | |

| Luxembourg | | | 0.0 | * |

| Malaysia | | | 0.0 | * |

| Mexico | | | 0.1 | |

| Netherlands | | | 0.8 | |

| New Zealand | | | 0.2 | |

| Norway | | | 0.6 | |

| Peru | | | 0.1 | |

| Poland | | | 0.4 | |

| Portugal | | | 0.1 | |

| Russia | | | 0.0 | * |

| Singapore | | | 0.4 | |

| South Africa | | | 0.3 | |

| South Korea | | | 1.1 | |

| Spain | | | 0.5 | |

| Sweden | | | 1.2 | |

| Switzerland | | | 1.9 | |

| Taiwan | | | 0.8 | |

| Thailand | | | 0.4 | |

| Turkey | | | 0.2 | |

| United Kingdom | | | 5.8 | |

| United States | | | 39.1 | |

| Uruguay | | | 0.2 | |

| Vietnam | | | 0.0 | * |

| Other** | | | 15.6 | |

| | | | 100.0 | % |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, exchange-traded funds, rights/warrants, U.S. Government Securities, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

Small & Mid Cap Strategies Fund | | | |

| One Year | | | -0.53 | % |

| Five Year | | | 2.03 | % |

| Ten Year | | | 3.77 | % |

| | | | | |

| MSCI ACWI SMID Cap Index (Net) | | | | |

| One Year | | | 2.28 | % |

| Five Year | | | 4.62 | % |

| Ten Year | | | 5.13 | % |

On December 30, 2016, the Fund changed its name to Small & Mid Cap Strategies Fund (formerly Small & Mid Cap Fund) as part of a series of changes to the overall investment focus and strategies of the Fund. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy. The index performance is not illustrative of the Fund’s performance and performance of the fund will differ; the use of the index performance is not intended to mask negative performance.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2026, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any), at 1.10%, as disclosed in the Funds’ prospectus dated March 1, 2023. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 1.17% and after fee waivers as 1.13%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The MSCI ACWI SMID Cap Index (Net) also includes the reinvestment of distributions but not fees, expenses and income taxes associated with an investment in the Fund. The MSCI ACWI SMID Cap Index (Net) is unmanaged. Investments cannot be made directly in an index.

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Investments made in small-capitalization and mid-capitalization companies are subject to greater volatility and less liquidity compared to investments made in larger and more established companies. The value of an investment in the Fund will fluctuate, which means that an investor could lose the principal amount invested. Investments made in securities of companies in foreign and emerging countries may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. | |

| Credit Income Fund | |

| Investment Adviser’s Report (Unaudited) |

|

The Old Westbury Credit Income Fund (the “Fund”) returned -1.05% for the fiscal year ended October 31, 2023. In comparison, the return of the ICE Bank of America 1-10 Year U.S. Corporate Index (the “Index”) was 4.20%.

The Fund’s credit allocation generally has a tilt toward risk-on assets; namely convertible bonds, preferred securities, and emerging market debt. Global equity strength and credit spread compression were tailwinds for these asset classes, especially considering their lower duration risk profiles. Despite these tailwinds, bank failures early in the year created idiosyncratic volatility in preferred securities, which marginally detracted from performance relative to the benchmark through the end of the fiscal year.

Non-agency mortgage-backed securities overall high coupon rates delivered strong returns despite still elevated fixed income volatility and mortgage rates. While these dynamics continued to slow the overall housing market, underlying fundamentals remained strong and the overweight to mortgages remained a high conviction allocation as the floating rate component of the securities helped insulate performance. High-yield fixed income also participated in the general risk-on environment, especially considering higher yields have helped the asset class remain relatively stable. To note, high yield securities held by the Fund are managed with a conservative bent via rating and sector positioning. The government security allocation consists of long-duration U.S. Treasuries and agency mortgage-backed securities, which are quasi-government backed. The Fund’s long-duration Treasuries have the highest sensitivity to interest rates. With the continued pronounced shift toward tighter monetary policy, performance remained challenged in U.S. Treasuries. The allocation has been slightly underweight long-duration Treasuries relative to a target weight of 25% for the Fund but still contributed negatively relative to the Index.

At fiscal year end, the Fund allocated 28.1% to emerging market debt, convertible securities, and preferred securities, 40.5% to non-agency mortgage-backed securities and high yield debt, and 31.4% to government securities, which include agency mortgage-backed securities and long-duration Treasuries. Overall, diversification is of critical importance to the Fund’s construction.

PORTFOLIO DIVERSIFICATION BY SECTOR

| Sector: | | Percentage

of Net Assets |

| Asset-Backed Securities | | | 18.3 | % |

| Bank Loans | | | 0.1 | |

| Corporate Bonds | | | 7.9 | |

| Exchange-Traded Funds | | | 13.6 | |

| Non-Agency Mortgage-Backed Securities | | | 22.2 | |

| Preferred Stocks | | | 0.2 | |

| U.S. Government Agencies and Securities | | | 31.4 | |

| Other* | | | 6.3 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, swap agreements, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Credit Income Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

Credit Income Fund | | | |

| One Year | | | -1.05 | % |

| Since Inception date of October 1, 2020 | | | -4.75 | % |

| | | | | |

| ICE Bank of America 1-10 Year U.S. Corporate Index | | | | |

| One Year | | | 4.20 | % |

| Since Inception date of October 1, 2020 | | | -2.64 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2026, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any), at 0.85%, as disclosed in the Funds’ prospectus dated March 1, 2023. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 0.94% and after fee waivers as 0.93%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 3 Years and 1 Month, with distributions reinvested. The ICE Bank of America 1-10 Year U.S. Corporate Index also includes the reinvestment of distributions but does not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 1-10 Year U.S. Corporate Index is unmanaged. Investments cannot be made directly in an index.

Securities representing interests in “pools” of mortgages or other assets are subject to various risks, including prepayment and contraction risk, risk of default of the underlying mortgage or assets, and delinquencies and losses of the underlying mortgage or assets. Investments made in securities of companies in foreign and emerging countries may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility. The Fund may invest in instruments that are volatile, speculative or otherwise risky. The Fund is non-diversified, meaning it may focus its assets in a smaller number of issuers and may be subject to more risk than a more diversified fund.

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) |

|

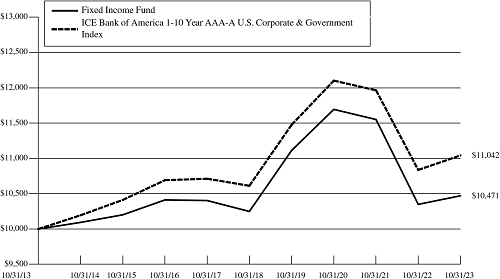

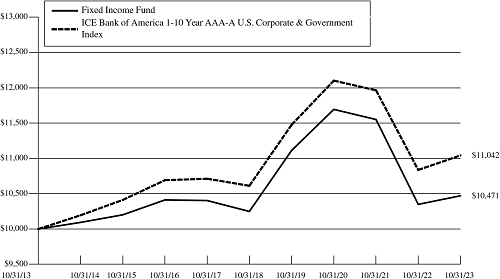

The Old Westbury Fixed Income Fund (the “Fund”) returned 1.18% for the fiscal year ended October 31, 2023. In comparison, the return of the ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index (the “Index”) was 1.90%.

During the first half of the fiscal year, the team began to extend the duration of the Fund by lowering exposure at the front of the yield curve and increasing exposure in longer-dated bonds, primarily at the 5-year point. The team believed that the Federal Reserve was quickly approaching the end of its rate hiking cycle. Higher interest rates and the resulting tightening of credit conditions were expected to slow the economy during the course of the 2023. The team believes that longer-maturity bonds generally outperform shorter-maturity bonds in this environment. At the same time, the team also gradually extended the maturity of its credit holdings. The high overall yield and strong credit fundamentals of the investment grade credit market provided an opportunity for the team to begin to lock in higher yields for longer.

Although the economy proved to be more resilient than the team had anticipated, the team believes there is evidence that the economy is beginning to slow and inflation is moderating. The team expects the economy to continue to slow over the course of the next several quarters as higher interest rates weigh on growth. The team maintains the Fund’s longer-than-benchmark duration position and has gradually increased high quality credit exposure. Exposure to asset-backed securities and collateralized loan obligations have been maintained for their high quality, high yield attributes.

PORTFOLIO DIVERSIFICATION BY SECTOR

| Sector: | | Percentage

of Net Assets |

| Asset-Backed Securities | | | 7.2 | % |

| Corporate Bonds | | | 25.9 | |

| Municipal Bonds | | | 0.6 | |

| Non-Agency Mortgage-Backed Securities | | | 0.0 | * |

| U.S. Government Agencies and Securities | | | 64.8 | |

| Other** | | | 1.5 | |

| | | | 100.0 | % |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

Fixed Income Fund | | | |

| One Year | | | 1.18 | % |

| Five Year | | | 0.43 | % |

| Ten Year | | | 0.46 | % |

| | | | | |

| ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index | | | | |

| One Year | | | 1.90 | % |

| Five Year | | | 0.80 | % |

| Ten Year | | | 1.00 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2026, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus dated March 1, 2023 as 0.69% and after fee waivers as 0.57%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index also includes the reinvestment of distributions but does not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index is unmanaged. Investments cannot be made directly in an index.

The Fund is subject to risks such as credit, prepayment and interest rate risk associated with the underlying bond holdings in the Fund. The value of the Fund can decline as interest rates rise and an investor can lose principal.

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) |

|

The return of the Old Westbury Municipal Bond Fund (the “Fund”) for the fiscal year ended October 31, 2023, was 1.34%. In comparison, the return of the primary benchmark, the ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index (the “Index”), was 1.85%. The Fund’s secondary benchmark, the Lipper Short-Intermediate Municipal Debt Funds Index, returned 2.11%.

Throughout the year, the Fund maintained a longer duration posture compared to its primary benchmark, reflective of strong municipal fundamentals, favorable supply trends, relatively high yields, and a high-tax environment conducive to elevated demand for the asset class. Throughout the fiscal year, the team’s investment thesis remained unchanged, specifically that the Federal Reserve’s aggressive hiking campaign would ultimately lead to slower growth, in turn driving a flight-to-quality trade into fixed income. In the interim, the team believes that absolute and tax-adjusted municipal yields provided a compelling opportunity for investors. In light of that outlook, the team maintained the Fund’s longer duration posture throughout the year, utilizing the selloff in rates to opportunistically capture wider spreads and reset book yields higher.

The Fund’s performance fluctuated in line with broader market volatility. Positive contributors to performance during the period included credit spread management (as the flight to quality commenced, high-grade spreads tightened rather dramatically), curve positioning (barbell with overweights in the front end and back end of the curve to take advantage of the inversion), and roll-down (capturing the steepness of the yield curve in longer-dated maturities), while detractors included duration (the long duration posture proved to be particularly challenging in the third quarter) and some credit selection.

At fiscal year end, the Fund was positioned with a long duration posture relative to its primary benchmark and an up-in-quality focus. Exposures were spread across a number of municipal sectors, and the Fund maintained an opportunistic allocation to taxable municipals and U.S. Treasuries.

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

PORTFOLIO DIVERSIFICATION BY STATE

| State: | | Percentage

of Net Assets |

| Alabama | | | 0.4 | % |

| Arizona | | | 1.5 | |

| California | | | 5.8 | |

| Colorado | | | 1.2 | |

| Connecticut | | | 1.9 | |

| Delaware | | | 1.6 | |

| District of Columbia | | | 2.3 | |

| Florida | | | 1.0 | |

| Georgia | | | 1.9 | |

| Hawaii | | | 3.2 | |

| Idaho | | | 0.0 | * |

| Illinois | | | 0.3 | |

| Iowa | | | 0.4 | |

| Maryland | | | 6.6 | |

| Massachusetts | | | 5.1 | |

| Michigan | | | 0.5 | |

| Minnesota | | | 1.1 | |

| Mississippi | | | 0.3 | |

| Missouri | | | 0.3 | |

| Nebraska | | | 0.2 | |

| Nevada | | | 1.1 | |

| New Jersey | | | 4.2 | |

| New York | | | 15.0 | |

| North Carolina | | | 3.1 | |

| Ohio | | | 2.7 | |

| Oklahoma | | | 0.2 | |

| Oregon | | | 1.4 | |

| Pennsylvania | | | 1.0 | |

| South Carolina | | | 0.1 | |

| Tennessee | | | 0.5 | |

| Texas | | | 15.7 | |

| Utah | | | 0.8 | |

| Virginia | | | 3.5 | |

| Washington | | | 6.9 | |

| Wisconsin | | | 1.6 | |

| Other** | | | 6.6 | |

| | | | 100.0 | % |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, Corporate Bonds, U.S. Government Securities, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

Municipal Bond Fund | | | |

| One Year | | | 1.34 | % |

| Five Year | | | 0.58 | % |

| Ten Year | | | 0.75 | % |

| | | | | |

| ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index | | | | |

| One Year | | | 1.85 | % |

| Five Year | | | 1.05 | % |

| Ten Year | | | 1.28 | % |

| | | | | |

| Lipper Short-Intermediate Municipal Debt Funds Index | | | | |

| One Year | | | 2.11 | % |

| Five Year | | | 0.97 | % |

| Ten Year | | | 1.08 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2026, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus dated March 1, 2023 as 0.66% and after fee waivers as 0.58%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index and the Lipper Short-Intermediate Municipal Debt Funds Index also include the reinvestment of distributions but do not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

of America 1-12 Year AAA-AA Municipal Securities Index and the Lipper Short-Intermediate Municipal Debt Funds Index are unmanaged. Investments cannot be made directly in an index.

Municipal securities held by the Fund may be adversely affected by local political and economic factors. Income from the Fund may be subject to federal alternative minimum tax, state and local taxes.

| Old Westbury Funds, Inc. | |

| California Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) |

|

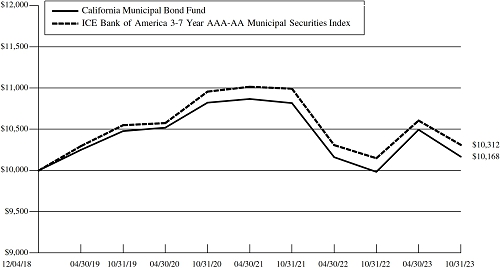

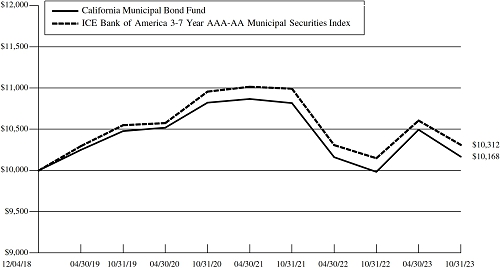

The return of the Old Westbury California Municipal Bond Fund (the “Fund”) for the fiscal year ended October 31, 2023, was 1.85%. In comparison, the return of its benchmark, the ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index (the “Index”), was 1.60%.

Throughout the year, the Fund maintained a longer duration posture compared to its benchmark, reflective of strong municipal fundamentals, favorable supply trends, relatively high yields, and a high-tax environment conducive to elevated demand for the asset class. Throughout the fiscal year, the team’s investment thesis remained unchanged, specifically that the Federal Reserve’s aggressive hiking campaign would ultimately lead to slower growth, in turn driving a flight-to-quality trade into fixed income. The team believes that in the interim, absolute and tax-adjusted municipal yields provided a compelling opportunity for investors. In light of that outlook, the Fund maintained its longer duration posture throughout the year, utilizing the selloff in rates to opportunistically capture wider spreads and reset book yields higher.

Through the fiscal year, the Fund’s performance fluctuated in line with the broader market volatility. Positive contributors to performance during the period included credit spread management (as the flight to quality commenced, high-grade spreads tightened rather dramatically), curve positioning (barbell with overweights in the front end and back end of the curve to take advantage of the inversion), and roll-down (capturing the steepness of the yield curve in longer-dated maturities), while detractors included duration (the long duration posture proved to be particularly challenging in the third quarter) and some credit selection. Notably, state-specific debt issuances for high-tax states such as New York, California, and Connecticut outperformed the broader municipal market as investors in those states sought to shelter their income from onerous in-state tax rates. California, for example, experienced very strong demand for the deals that came to market given the 13.3% top tax rate, resulting in significantly oversubscribed new issues and trading activity thereafter that drove prices higher than more generic counterparts.

At fiscal year end, the Fund was positioned with a long duration posture relative to its benchmark and an up-in-quality focus. Exposures were spread across a number of municipal sectors, and the Fund maintained an opportunistic allocation to taxable municipals and U.S. Treasuries. Furthermore, given the particularly onerous tax profile of the state of California, the tax-exempt portion of the Fund was funded solely with high-coupon California municipal bonds.

PORTFOLIO DIVERSIFICATION BY STATE

| State: | | Percentage

of Net Assets |

| California | | | 82.8 | % |

| Other* | | | 17.2 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, Corporate Bonds, U.S. Government Securities, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| California Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

California Municipal Bond Fund | | | |

| One Year | | | 1.85 | % |

| Since Inception date of December 4, 2018 | | | 0.34 | % |

| | | | | |

| ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index | | | | |

| One Year | | | 1.60 | % |

| Since Inception date of December 4, 2018 | | | 0.63 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2026, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus dated March 1, 2023 as 0.78% and after fee waivers as 0.58%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 4 Years and 11 Months, with distributions reinvested. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index also includes the reinvestment of distributions but does not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index is unmanaged. Investments cannot be made directly in an index.

Municipal securities held by the Fund may be adversely affected by local political and economic factors. Income from the Fund may be subject to federal alternative minimum tax, state and local taxes. The Fund is non-diversified, meaning it may focus its assets in a smaller number of issuers and may be subject to more risk than a more diversified fund.

| Old Westbury Funds, Inc. | |

| New York Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) |

|

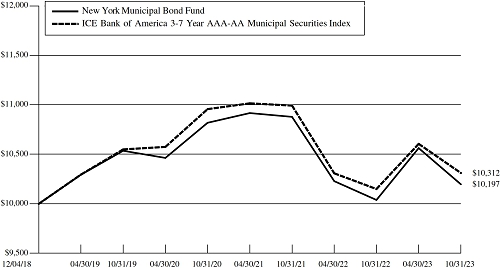

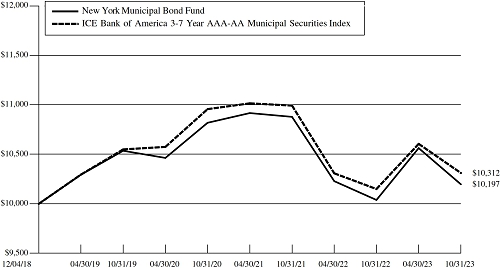

The return of the Old Westbury New York Municipal Bond Fund (the “Fund”) for the fiscal year ended October 31, 2023, was 1.58%. In comparison, the return of its benchmark, the ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index (the “Index”), was 1.60%.

Throughout the fiscal year, the Fund maintained a longer duration posture compared to its benchmark, reflective of strong municipal fundamentals, favorable supply trends, relatively high yields, and a high-tax environment conducive to elevated demand for the asset class. Throughout the fiscal year, the team’s investment thesis remained unchanged, specifically that the Fed’s aggressive hiking campaign would ultimately lead to slower growth, in turn driving a flight-to-quality trade into fixed income. The team believes that in the interim, absolute and tax-adjusted municipal yields provided a compelling opportunity for investors. In light of that outlook, the Fund maintained its longer duration posture throughout the year, utilizing the selloff in rates to opportunistically capture wider spreads and reset book yields higher.

Through the fiscal year, the Fund’s performance fluctuated in line with the broader market volatility and ultimately ended the year in line with the benchmark. Positive contributors to performance during the period included credit spread management (as the flight to quality commenced, high-grade spreads tightened rather dramatically), curve positioning (barbell with overweights in the front end and back end of the curve to take advantage of the inversion), and roll-down (capturing the steepness of the yield curve in longer-dated maturities), while detractors included duration (the long duration posture proved to be particularly challenging in the third quarter) and some credit selection. Notably, state-specific debt issuances for high-tax states such as New York, California, and Connecticut outperformed the broader municipal market as investors in those states sought to shelter their income from onerous in-state tax rates. New York, for example, experienced very strong demand for the deals that came to market given the 10.9% top tax rate, resulting in oversubscribed new issues and trading activity thereafter that drove prices higher than more generic counterparts.

At fiscal year end, the Fund was positioned with a long duration posture relative to its primary benchmark and an up-in-quality focus. Exposures were spread across a number of municipal sectors, and the Fund maintained an opportunistic allocation to taxable municipals and U.S. Treasuries. Furthermore, given the particularly onerous tax profile of the state of New York, the tax-exempt portion of the Fund was funded solely with high-coupon New York municipal bonds.

PORTFOLIO DIVERSIFICATION BY STATE

| State: | | Percentage

of Net Assets |

| New York | | | 88.4 | % |

| Other* | | | 11.6 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, Corporate Bonds, U.S. Government Securities, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| New York Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) |

|

Average Annual Total Returns

For the Year Ended October 31, 2023

New York Municipal Bond Fund | | | |

| One Year | | | 1.58 | % |

| Since Inception date of December 4, 2018 | | | 0.40 | % |

| | | | | |

| ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index | | | | |

| One Year | | | 1.60 | % |

| Since Inception date of December 4, 2018 | | | 0.63 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2026, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus dated March 1, 2023 as 0.75% and after fee waivers as 0.58%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2023 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 4 Years and 11 Months, with distributions reinvested. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index also includes the reinvestment of distributions but does not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index is unmanaged. Investments cannot be made directly in an index.

Municipal securities held by the Fund may be adversely affected by local political and economic factors. Income from the Fund may be subject to federal alternative minimum tax, state and local taxes The Fund is non-diversified, meaning it may focus its assets in a smaller number of issuers and may be subject to more risk than a more diversified fund.

| Old Westbury Funds, Inc. | |

| Disclosure of Fund Expenses (Unaudited) | |

| | For the Period Ended October 31, 2023 |

As a shareholder of Old Westbury Funds, Inc., you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2023 through October 31, 2023.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | Actual

Beginning

Account Value

05/01/2023 | | Actual

Ending

Account Value

10/31/2023 | | Actual

Expenses Paid

During Period*

05/01/2023

- 10/31/2023 | | Actual

Expense Ratio

During Period**

05/01/2023

- 10/31/2023 |

| All Cap Core Fund | | $1,000.00 | | $1,014.90 | | $4.88 | | 0.96% |

| Large Cap Strategies Fund | | 1,000.00 | | 976.40 | | 5.48 | | 1.10% |

| Small & Mid Cap Strategies Fund | | 1,000.00 | | 921.60 | | 5.33 | | 1.10% |

| Credit Income Fund | | 1,000.00 | | 935.20 | | 4.15 | | 0.85% |

| Fixed Income Fund | | 1,000.00 | | 962.30 | | 2.82 | | 0.57% |

| Municipal Bond Fund | | 1,000.00 | | 964.20 | | 2.82 | | 0.57% |

| California Municipal Bond Fund | | 1,000.00 | | 968.80 | | 2.83 | | 0.57% |

| New York Municipal Bond Fund | | 1,000.00 | | 965.40 | | 2.82 | | 0.57% |

| * | Expenses are equal to the average account value times each Fund’s annualized expense ratio multiplied by 184/365 to reflect the one-half year period. |

| ** | Expense ratios are annualized and reflect existing expense waivers/reimbursements. |

| Old Westbury Funds, Inc. | |

| Disclosure of Fund Expenses (Unaudited) - (Continued) | |

| | For the Period Ended October 31, 2023

|

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | Hypothetical

Beginning

Account Value

05/01/2023 | | Hypothetical

Ending

Account Value

10/31/2023 | | Hypothetical

Expenses Paid

During Period*

05/01/2023

- 10/31/2023 | | Hypothetical

Expense Ratio

During Period**

05/01/2023

- 10/31/2023 |

| All Cap Core Fund | | $1,000.00 | | $1,020.37 | | $4.89 | | 0.96% |

| Large Cap Strategies Fund | | 1,000.00 | | 1,019.66 | | 5.60 | | 1.10% |

| Small & Mid Cap Strategies Fund | | 1,000.00 | | 1,019.66 | | 5.60 | | 1.10% |

| Credit Income Fund | | 1,000.00 | | 1,020.92 | | 4.33 | | 0.85% |

| Fixed Income Fund | | 1,000.00 | | 1,022.33 | | 2.91 | | 0.57% |

| Municipal Bond Fund | | 1,000.00 | | 1,022.33 | | 2.91 | | 0.57% |

| California Municipal Bond Fund | | 1,000.00 | | 1,022.33 | | 2.91 | | 0.57% |

| New York Municipal Bond Fund | | 1,000.00 | | 1,022.33 | | 2.91 | | 0.57% |

| * | Expenses are equal to the average account value times each Fund’s annualized expense ratio multiplied by 184/365 to reflect the one-half year period. |

| ** | Expense ratios are annualized and reflect existing expense waivers/reimbursements. |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, these tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Portfolio of Investments | October 31, 2023

|

| Shares | | | | | Value |

| COMMON STOCKS — 93.7% |

| Banks — 3.3% |

| | 217,851 | | | Bank of America Corp. | | $ | 5,738,195 | |

| | 649,714 | | | JPMorgan Chase & Co. | | | 90,349,229 | |

| | | | | | | | 96,087,424 | |

| Communication Services — 6.8% |

| | 748,214 | | | Alphabet, Inc. - Class C(a) | | | 93,751,214 | |

| | 97,065 | | | Live Nation Entertainment, Inc.(a) | | | 7,767,142 | |

| | 189,008 | | | Meta Platforms, Inc. - Class A(a) | | | 56,942,440 | |

| | 288,348 | | | Take-Two Interactive Software, Inc.(a) | | | 38,566,545 | |

| | | | | | | | 197,027,341 | |

| Consumer Discretionary — 10.0% |

| | 745,995 | | | Amazon.com, Inc.(a) | | | 99,284,475 | |

| | 7,128 | | | AutoZone, Inc.(a) | | | 17,656,983 | |

| | 234,965 | | | Bath & Body Works, Inc. | | | 6,966,712 | |

| | 47,312 | | | Burlington Stores, Inc.(a) | | | 5,726,171 | |

| | 429,142 | | | Dollarama, Inc. | | | 29,305,749 | |

| | 185,061 | | | Expedia Group, Inc.(a) | | | 17,634,463 | |

| | 214,767 | | | Hilton Worldwide Holdings, Inc. | | | 32,543,644 | |

| | 59,005 | | | Home Depot, Inc. (The) | | | 16,798,133 | |

| | 360 | | | Lowe’s Cos., Inc. | | | 68,605 | |

| | 35,935 | | | LVMH Moet Hennessy Louis Vuitton SE | | | 25,726,965 | |

| | 19,633 | | | MercadoLibre, Inc.(a) | | | 24,359,448 | |

| | 26,540 | | | Pool Corp. | | | 8,380,536 | |

| | 14,613 | | | Ulta Beauty, Inc.(a) | | | 5,572,083 | |

| | | | | | | | 290,023,967 | |

| Consumer Staples — 6.1% |

| | 1,025,899 | | | Alimentation Couche-Tard, Inc. | | | 55,846,487 | |

| | 375,955 | | | BJ’s Wholesale Club Holdings, Inc.(a) | | | 25,610,055 | |

| | 48,716 | | | Costco Wholesale Corp. | | | 26,912,667 | |

| | 610,808 | | | US Foods Holding Corp.(a) | | | 23,784,863 | |

| | 269,703 | | | Walmart, Inc. | | | 44,072,167 | |

| | | | | | | | 176,226,239 | |

| Energy — 4.6% |

| | 377,008 | | | ChampionX Corp. | | | 11,611,846 | |

| | 333,835 | | | ConocoPhillips | | | 39,659,598 | |

| | 101,166 | | | Pioneer Natural Resources Co. | | | 24,178,674 | |

| | 1,022,890 | | | Schlumberger NV | | | 56,934,058 | |

| | | | | | | | 132,384,176 | |

| Financial Services — 9.5% |

| | 310,032 | | | Blackstone, Inc. | | | 28,631,455 | |

| | 210,901 | | | Brookfield Corp. | | | 6,147,764 | |

| | 381,562 | | | Intercontinental Exchange, Inc. | | | 40,995,021 | |

| | 290,733 | | | Nasdaq, Inc. | | | 14,420,357 | |

| | 118,318 | | | S&P Global, Inc. | | | 41,329,661 | |

| | 249,978 | | | Tradeweb Markets, Inc. - Class A | | | 22,500,520 | |

| | 440,472 | | | Visa, Inc. - Class A | | | 103,554,967 | |

| | 93,905 | | | WEX, Inc.(a) | | | 15,633,304 | |

| | | | | | | | 273,213,049 | |

| Shares | | | | | Value |

| Health Care — 9.6% | | |

| | 195,329 | | | Avantor, Inc.(a) | | $ | 3,404,584 | |

| | 288,348 | | | Cencora, Inc. | | | 53,387,632 | |

| | 63,693 | | | Cooper Cos., Inc. (The) | | | 19,856,293 | |

| | 95,147 | | | Danaher Corp. | | | 18,270,127 | |

| | 56,055 | | | IQVIA Holdings, Inc.(a) | | | 10,136,426 | |

| | 37,035 | | | Medpace Holdings, Inc.(a) | | | 8,987,283 | |

| | 100,102 | | | STERIS Plc | | | 21,019,418 | |

| | 56,249 | | | Teleflex, Inc. | | | 10,392,003 | |

| | 113,097 | | | Thermo Fisher Scientific, Inc. | | | 50,302,153 | |

| | 154,815 | | | UnitedHealth Group, Inc. | | | 82,912,721 | |

| | | | | | | | 278,668,640 | |

| Industrials — 13.3% | | |

| | 163,702 | | | A.O. Smith Corp. | | | 11,419,852 | |

| | 163,725 | | | Ashtead Group Plc | | | 9,390,039 | |

| | 150,325 | | | Booz Allen Hamilton Holding Corp. | | | 18,028,477 | |

| | 489,996 | | | Canadian Pacific Kansas City Ltd. | | | 34,789,981 | |

| | 89,073 | | | Carlisle Cos., Inc. | | | 22,632,559 | |

| | 129,215 | | | Clean Harbors, Inc.(a) | | | 19,856,469 | |

| | 1,024,133 | | | Copart, Inc.(a) | | | 44,570,268 | |

| | 127,013 | | | Eaton Corp. Plc | | | 26,407,273 | |

| | 125,669 | | | Equifax, Inc. | | | 21,309,693 | |

| | 201,150 | | | Fortive Corp. | | | 13,131,072 | |

| | 59,400 | | | Herc Holdings, Inc. | | | 6,343,326 | |

| | 922,213 | | | Howmet Aerospace, Inc. | | | 40,669,593 | |

| | 81,814 | | | Lincoln Electric Holdings, Inc. | | | 14,301,087 | |

| | 75,475 | | | Northrop Grumman Corp. | | | 35,581,179 | |

| | 37,335 | | | Saia, Inc.(a) | | | 13,384,224 | |

| | 741,523 | | | TransUnion | | | 32,538,029 | |

| | 70,211 | | | Veralto Corp.(a) | | | 4,844,559 | |

| | 353,603 | | | WillScot Mobile Mini Holdings Corp.(a) | | | 13,935,494 | |

| | | | | | | | 383,133,174 | |

| Information Technology — 24.3% | | |

| | 889,401 | | | Apple, Inc. | | | 151,883,009 | |

| | 30,904 | | | ASM International NV | | | 12,753,462 | |

| | 58,552 | | | ASML Holding NV | | | 35,196,803 | |

| | 103,355 | | | CDW Corp. | | | 20,712,342 | |

| | 98,100 | | | Five9, Inc.(a) | | | 5,677,047 | |

| | 77,985 | | | Gartner, Inc.(a) | | | 25,894,139 | |

| | 37,366 | | | Keysight Technologies, Inc.(a) | | | 4,560,520 | |

| | 57,890 | | | Manhattan Associates, Inc.(a) | | | 11,287,392 | |

| | 463,652 | | | Marvell Technology, Inc. | | | 21,893,647 | |

| | 560,538 | | | Microsoft Corp. | | | 189,523,503 | |

| | 178,474 | | | Motorola Solutions, Inc. | | | 49,697,870 | |

| | 88,525 | | | Nice Ltd. - ADR(a) | | | 13,663,834 | |

| | 146,907 | | | NVIDIA Corp. | | | 59,908,675 | |

| | 528,220 | | | Oracle Corp. | | | 54,617,948 | |

| | 45,985 | | | ServiceNow, Inc.(a) | | | 26,756,372 | |

| | 35,406 | | | Synopsys, Inc.(a) | | | 16,620,993 | |

| | | | | | | | 700,647,556 | |

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Portfolio of Investments - (Continued) | October 31, 2023

|

| Shares | | | | Value |

| Insurance — 1.0% |

| | 89,235 | | | Aon Plc - Class A | | $ | 27,609,309 | |

| Materials — 1.9% |

| | 128,012 | | | Sherwin-Williams Co. (The) | | | 30,493,739 | |

| | 131,741 | | | Vulcan Materials Co. | | | 25,885,789 | |

| | | | | | | | 56,379,528 | |

| Real Estate — 1.2% | | |

| | 334,313 | | | Prologis, Inc. REIT | | | 33,682,035 | |

| Utilities — 2.1% | | |

| | 458,372 | | | Ameren Corp. | | | 34,703,344 | |

| | 431,510 | | | NextEra Energy, Inc. | | | 25,157,033 | |

| | | | | | | | 59,860,377 | |

Total Common Stocks

(Cost $1,840,148,782) | | | 2,704,942,815 | |

| | | | | | | | | |

| EXCHANGE-TRADED FUNDS — 3.6% |

| | 603,004 | | | Health Care Select Sector SPDR Fund | | | 75,098,118 | |

| | 737,700 | | | iShares China Large-Cap ETF | | | 18,826,104 | |

| | 50,325 | | | VanEck Retail ETF(a) | | | 8,449,064 | |

| | | | | | | | | |

Total Exchange-Traded Funds

(Cost $104,655,256) | | | 102,373,286 | |

| | | | | | | | | |

| INVESTMENT COMPANY — 2.8% |

| | 82,215,409 | | | Federated Hermes Government Obligations Fund, 5.26%(b) | | | 82,215,409 | |

Total Investment Company

(Cost $82,215,409) | | | 82,215,409 | |

| | | | | | | |

TOTAL INVESTMENTS — 100.1%

(Cost $2,027,019,447) | | $ | 2,889,531,510 | |

| LIABILITIES IN EXCESS OF OTHER ASSETS — (0.1)% | | | (1,780,479 | ) |

| NET ASSETS — 100.0% | | $ | 2,887,751,031 | |

| (a) | Non-income producing security. |

| (b) | The rate shown represents the current yield as of October 31, 2023. |

The following abbreviations are used in the report:

ADR — American Depositary Receipt

ETF — Exchange-Traded Fund

REIT — Real Estate Investment Trust

SPDR — Standard & Poor’s Depositary Receipt

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Portfolio of Investments | October 31, 2023

|

| Shares | | | | | Value |

| COMMON STOCKS — 95.4% | | |

| AUSTRALIA — 1.5% | | |

| | 39,390 | | | ANZ Group Holdings Ltd. | | $ | 621,140 | |

| | 268,018 | | | Atlassian Corp. - Class A(a) | | | 48,414,772 | |

| | 3,311,979 | | | BHP Group Ltd. | | | 93,753,768 | |

| | 63,459 | | | BlueScope Steel Ltd. | | | 760,712 | |

| | 417,530 | | | Capricorn Metals Ltd.(a) | | | 1,242,313 | |

| | 21,219 | | | Commonwealth Bank of Australia | | | 1,305,306 | |

| | 57,241 | | | Computershare Ltd. | | | 903,375 | |

| | 769,998 | | | CSL Ltd. | | | 113,799,642 | |

| | 2,077,935 | | | Evolution Mining Ltd. | | | 4,647,544 | |

| | 276,330 | | | Fortescue Metals Group Ltd. | | | 3,931,024 | |

| | 1,234,270 | | | Gold Road Resources Ltd. | | | 1,467,170 | |

| | 23,566 | | | National Australia Bank Ltd. | | | 422,167 | |

| | 78,727 | | | Nick Scali Ltd. | | | 540,000 | |

| | 265,632 | | | Nine Entertainment Co. Holdings Ltd. | | | 313,018 | |

| | 1,304,450 | | | Northern Star Resources Ltd. | | | 9,552,206 | |

| | 817,390 | | | OceanaGold Corp. | | | 1,367,474 | |

| | 1,530,745 | | | Perseus Mining Ltd. | | | 1,635,540 | |

| | 427,295 | | | Pilbara Minerals Ltd. | | | 1,003,715 | |

| | 6,007 | | | REA Group Ltd. | | | 551,471 | |

| | 845,060 | | | Regis Resources Ltd.(a) | | | 914,824 | |

| | 405,299 | | | Santos Ltd. | | | 1,977,640 | |

| | 1,040,245 | | | Silver Lake Resources Ltd.(a) | | | 684,226 | |

| | 89,940 | | | SmartGroup Corp. Ltd. | | | 491,722 | |

| | 791,820 | | | South32 Ltd. | | | 1,694,007 | |

| | 209,670 | | | Woodside Energy Group Ltd. | | | 4,566,571 | |

| | 39,726 | | | Woolworths Group Ltd. | | | 889,257 | |

| | | | | | | | 297,450,604 | |

| BELGIUM — 0.0% |

| | 18,862 | | | Proximus SADP | | | 156,338 | |

| | 5,063 | | | UCB SA | | | 370,308 | |

| | | | | | | | 526,646 | |

| BRAZIL — 0.5% |

| | 177,748 | | | Ambev SA | | | 452,677 | |

| | 153,321 | | | B3 SA - Brasil Bolsa Balcao | | | 339,075 | |

| | 108,815 | | | Cia de Saneamento Basico do Estado de Sao Paulo SABESP | | | 1,259,355 | |

| | 65,990 | | | Cia de Saneamento de Minas Gerais Copasa MG | | | 209,812 | |

| | 1,327,600 | | | Localiza Rent a Car SA | | | 13,426,751 | |

| | 3,405,483 | | | NU Holdings Ltd. - Class A(a) | | | 27,924,961 | |

| | 124,132 | | | Petroleo Brasileiro SA | | | 930,667 | |

| | 396,380 | | | Petroleo Brasileiro SA - Preference Shares | | | 2,730,456 | |

| | 3,128,540 | | | Raia Drogasil SA | | | 16,015,792 | |

| | 183,590 | | | Suzano SA | | | 1,880,416 | |

| | 615,615 | | | Vale SA | | | 8,428,800 | |

| | 1,640,500 | | | WEG SA | | | 10,714,864 | |

| | 949,080 | | | XP, Inc. - Class A | | | 18,981,600 | |

| | | | | | | | 103,295,226 | |

| Shares | | | | | Value |

| CANADA — 1.4% | |

| | 365,715 | | | Agnico Eagle Mines Ltd. | | $ | 17,152,409 | |

| | 441,560 | | | Alamos Gold, Inc. - Class A | | | 5,467,161 | |

| | 18,292 | | | Alimentation Couche-Tard, Inc. | | | 995,755 | |

| | 1,221,765 | | | B2Gold Corp. | | | 3,911,763 | |

| | 10,593 | | | Bank of Nova Scotia (The) | | | 428,914 | |

| | 1,273,120 | | | Barrick Gold Corp. | | | 20,335,034 | |

| | 5,187 | | | Canadian National Railway Co. | | | 548,829 | |

| | 126,973 | | | Canadian Natural Resources Ltd. | | | 8,062,911 | |

| | 1,059,702 | | | Canadian Pacific Kansas City Ltd. | | | 75,239,415 | |

| | 115,880 | | | Cenovus Energy, Inc. | | | 2,207,716 | |

| | 253,410 | | | Centerra Gold, Inc. | | | 1,288,293 | |

| | 449 | | | Constellation Software, Inc. | | | 900,108 | |

| | 13,540 | | | Dollarama, Inc. | | | 924,635 | |

| | 217,550 | | | Dundee Precious Metals, Inc. | | | 1,426,017 | |

| | 17,628 | | | Enbridge, Inc. | | | 564,910 | |

| | 87,860 | | | First Quantum Minerals Ltd. | | | 1,018,143 | |

| | 396,415 | | | Franco-Nevada Corp. | | | 48,224,417 | |

| | 84,462 | | | Frontera Energy Corp.(a) | | | 716,260 | |

| | 14,240 | | | Interfor Corp.(a) | | | 175,696 | |

| | 14,649 | | | Metro, Inc. | | | 744,096 | |

| | 245,575 | | | Nutrien Ltd. | | | 13,189,419 | |

| | 208,610 | | | Osisko Gold Royalties Ltd. | | | 2,549,803 | |

| | 46,594 | | | Pason Systems, Inc. | | | 446,536 | |

| | 10,675 | | | Rogers Communications, Inc. - Class B | | | 395,516 | |

| | 12,979 | | | Royal Bank of Canada | | | 1,036,635 | |

| | 896,980 | | | Shopify, Inc. - Class A(a) | | | 42,328,486 | |

| | 15,525 | | | Stella-Jones, Inc. | | | 813,222 | |

| | 114,090 | | | Suncor Energy, Inc. | | | 3,694,813 | |

| | 9,866 | | | TC Energy Corp. | | | 339,787 | |

| | 75,500 | | | Teck Resources Ltd. - Class B | | | 2,667,748 | |

| | 94,950 | | | Torex Gold Resources, Inc.(a) | | | 915,437 | |

| | 10,456 | | | Toronto-Dominion Bank (The) | | | 584,043 | |

| | 25,505 | | | Tourmaline Oil Corp. | | | 1,348,680 | |

| | 15,825 | �� | | West Fraser Timber Co. Ltd. | | | 1,068,009 | |

| | 324,035 | | | Wheaton Precious Metals Corp. | | | 13,685,762 | |

| | | | | | | | 275,396,378 | |

| CHILE — 0.0% |

| | 40,805 | | | Antofagasta Plc | | | 667,224 | |

| CHINA — 4.0% |

| | 1,194,656 | | | Agricultural Bank of China Ltd. - H Shares | | | 441,254 | |

| | 16,885,468 | | | Alibaba Group Holding Ltd.(a) | | | 173,837,229 | |

| | 162,600 | | | Anker Innovations Technology Co. Ltd. - A Shares | | | 2,075,788 | |