UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-07912

Old Westbury Funds, Inc.

(Exact name of registrant as specified in charter)

760 Moore Rd.

King of Prussia, PA 19406

(Address of principal executive offices) (Zip code)

Marianna DiBenedetto

BNY Mellon Investment Servicing (US) Inc.

760 Moore Rd.

King of Prussia, PA 19406

(Name and address of agent for service)

Registrant’s telephone number, including area code: 800-607-2200

Date of fiscal year end: October 31

Date of reporting period: October 31, 2020

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Old Westbury Funds, Inc.

Annual Report

October 31, 2020

BESSEMER INVESTMENT MANAGEMENT LLC

Investment Adviser

Old Westbury Funds, Inc.

| Old Westbury Funds, Inc. | |

| A Letter from the President (Unaudited) | |

| | October 31, 2020 |

| | |

Dear Shareholders:

Fiscal 2020 was marked by the outbreak of a global pandemic which upended financial markets around the world. Despite the tremendous uncertainty created by the virus, global equity markets still generated positive returns of about 5% for the fiscal year. U.S. investment-grade bonds slightly outperformed global equities, posting returns just over 5%. Overall, large-cap stocks outperformed small cap names, while U.S. stocks bested their non-U.S. developed-market counterparts.

The year began on a positive note, with global equities rallying nicely in November and December 2019. Economic data were strong, and progress was occurring on a U.S.-China trade deal. In January, news of the outbreak hit, and governments around the world worked to contain the spread, blocking travel and imposing quarantines. Investors sought to quantify the impact on growth as companies closed factories and supply chains were disrupted. By March, most of the world was sheltering in place, which led to a sharp drop in economic activity.

Global policymakers took swift and bold action, seeking to cushion the impact on citizens, financial markets, and the overall economy with aggressive monetary policy measures and expansive fiscal stimulus packages. In the U.S., the Federal Reserve introduced an unprecedented series of measures at record speed, including massive bond purchases, emergency facilities to bolster credit markets, actions with foreign central banks to ease the supply of dollars worldwide, and programs for lending directly to American businesses. Other world governments and central banks enacted similar measures. After improvement throughout the summer, a resurgence of the virus is occurring around the world as we write this. However, significant progress has been made toward developing both vaccines and treatments.

The Adviser, Bessemer Investment Management, LLC, maintained a modestly defensive stance, with U.S. election and virus-related uncertainty posing the threat of increased volatility. The uneven recovery, with some sectors benefiting from the virus while others are impaired, creates opportunity via active security selection across equity and bond markets – specifically, healthcare equities and higher-yielding credit.

The Old Westbury All Cap Core Fund significantly outperformed its primary benchmark due to its overweight position in the U.S. and stock selection within communication services, healthcare, and financials. The Old Westbury Large Cap Strategies Fund outperformed its benchmark as its stock selection in the communication services sector, underweight position to developed Europe, and stock selection in that region benefited relative performance. The Old Westbury Small & Mid Cap Strategies Fund experienced strong outperformance, benefiting from strong stock selection in the U.S. and specifically, the consumer discretionary sector. The Old Westbury All Cap ESG Fund underperformed, held back by negative stock selection in the technology, consumer discretionary, and communication services sectors; stock selection in the U.S., Japan, and emerging Asia Pacific also detracted from results.

The Old Westbury Fixed Income Fund was fairly even with the benchmark; the Fund maintains a portfolio duration slightly higher than the benchmark and an overweight position in credit-related assets, including investment-grade corporate bonds, high-quality asset-backed securities (ABS), collateralized loan obligations (CLOs), and taxable-municipal bonds. The Old Westbury Municipal Bond Fund was also even with the benchmark; duration, yield curve, and credit positioning were additive while bond selection detracted as several names have yet to recover to pre-COVID levels given ongoing macroeconomic headwinds. The Old Westbury California Municipal Bond Fund and the Old Westbury New York Municipal Bond Fund both slightly underperformed their benchmark; credit positioning posed a headwind as certain AA and A credit spreads* widened during the March / April volatility and have yet to fully recover.

At year-end, we remain committed to the Adviser’s longstanding investment approach, characterized by independent research, a global orientation, and long-term perspective. We believe these disciplines should continue to reap competitive long-term results for shareholders and position the Adviser to fulfill the central mandate of participating in strong market environments, while preserving capital during difficult times.

Sincerely,

David W. Rossmiller

President

Old Westbury Funds, Inc.

*Credit quality ratings are based on converting the available Moody’s and Standard & Poor’s ratings to a common numerical standard, and averaging that result. If neither of these agencies has assigned a rating, the Fund will determine the holding to be “Not Rated.” The ratings, expressed in Standard & Poor’s nomenclature, range from AAA (extremely strong capacity to meet its financial commitments; highest rating) to D (payment default on financial commitments). The ratings, expressed in Moody’s nomenclature, range from Aaa (highest) to C (lowest). The ratings represent the rating agencies’ opinions of the quality of the securities they rate, not of the Fund itself. Ratings are relative and subjective, and are not absolute standards of quality.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

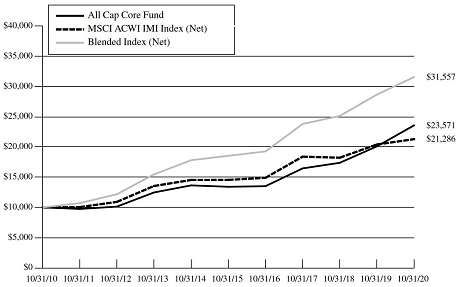

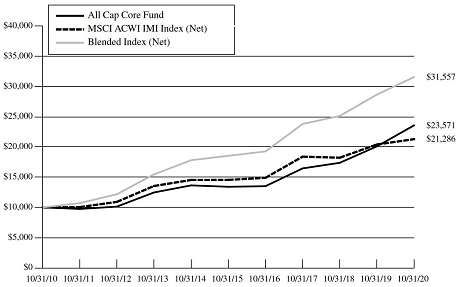

The return of the Old Westbury All Cap Core Fund (the “Fund”) for the fiscal year ended October 31, 2020 was 17.32%. In comparison, the return of its primary benchmark, the MSCI ACWI Investable Market Index (Net)a, was 4.32%. The Fund’s secondary benchmark, a blend of 90% MSCI USA Index (Gross) and 10% MSCI ACWI ex USA Index (Net)a, returned 10.11%.

The most significant positive contributors to the Fund’s relative performance during the year were an overweight position in the U.S. and stock selection within communication services, healthcare, and financials. Stocks in these sectors with the greatest relative contribution included Sea Ltd., Danaher, and BlackRock. Sea Ltd. appreciated significantly, driven by the company’s strong revenue growth in its gaming business and a successful foray into e-commerce. Danaher benefited from continued investment in life science and tools by the healthcare industry as well as a surge in demand for COVID-19 testing and prevention-related product. BlackRock benefited from strong fund flows and the market appreciation of assets under management. The Fund also benefited from an overweight position in the information technology sector (32.3% of the Fund during the fiscal year) as well as an underweight position in energy (-41.8% versus the benchmark).

The Fund’s results were modestly held back by an underweight to the materials sector which outperformed the benchmark as well as negative stock selection within the sector. Stocks within this sector with the highest negative relative contributions included Vulcan Materials and Aptargroup. The Fund was also held back by holding cash in a rising market.

At fiscal year-end, versus the primary benchmark, the Fund maintained overweight positions in the technology, communication services, consumer discretionary, and healthcare sectors and underweight positions in consumer staples, financials, materials, real estate, energy, and utilities. Relative to the primary benchmark, the Fund continued to be significantly overweight U.S. stocks (90%) versus non-U.S. stocks (9%); the remainder was cash.

a The Net version of each index reflects no deductions for fees, expenses or income taxes.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY SECTOR

| Sector: | | Percentage

of Net Assets |

| Banks | | | 0.7 | % |

| Communication Services | | | 13.6 | |

| Consumer Discretionary | | | 14.8 | |

| Consumer Staples | | | 2.0 | |

| Diversified Financials | | | 4.0 | |

| Energy | | | 0.4 | |

| Health Care | | | 14.0 | |

| Industrials | | | 10.0 | |

| Information Technology | | | 28.2 | |

| Insurance | | | 1.6 | |

| Materials | | | 1.7 | |

| Real Estate | | | 1.3 | |

| Utilities | | | 2.2 | |

| Other* | | | 5.5 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, exchange traded funds, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Average Annual Total Returns

For the Period Ended October 31, 2020

| All Cap Core Fund | | | |

| One Year | | | 17.32 | % |

| Five Year | | | 11.94 | % |

| Ten Year | | | 8.95 | % |

| | | | | |

| MSCI ACWI IMI Index (Net) | | | | |

| One Year | | | 4.32 | % |

| Five Year | | | 7.91 | % |

| Ten Year | | | 7.85 | % |

| | | | | |

| Blended Index (Net) | | | | |

| One Year | | | 10.11 | % |

| Five Year | | | 11.24 | % |

| Ten Year | | | 12.18 | % |

On December 30, 2016, the Fund changed its name to All Cap Core Fund (formerly Large Cap Core Fund) as part of a series of changes to the overall investment focus and strategies of the Fund. Prior to November 16, 2011, the Fund was named the U.S. Large Cap Fund and operated under a different investment strategy. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy. The index performance is not illustrative of the Fund’s performance and performance of the fund will differ; the use of the index performance is not intended to mask negative performance.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus dated February 28, 2020 as 0.99%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

The chart shown on the previous page illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The Fund compares its performance to a blended benchmark, as a secondary benchmark, consisting of a 90% weighting in the MSCI USA Index (Gross) and a 10% weighting in the MSCI ACWI ex USA Index (Net) (the “Blended Index”). The MSCI ACWI IMI (Net) and the Blended Index (Net) also include the reinvestment of distributions but do not include fees, expenses and income taxes associated with an investment in the Fund. The MSCI ACWI IMI (Net) and the Blended Index (Net) are unmanaged. Investments cannot be made directly in an index.

Investments made in foreign and emerging country securities may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. |

| All Cap ESG Fund |

| Investment Adviser’s Report (Unaudited) |

| |

The Old Westbury All Cap ESG Fund (the “Fund”) returned -2.48% for the fiscal year ended October 31, 2020. In comparison, the return of its benchmark, the MSCI All Country World Index (Net)a, was 4.89% for the year.

The Fund’s results were held back by negative stock selection in the technology, consumer discretionary, and communication services sectors. ESG criteria prevented the portfolio from holding top performing names (ex. Amazon, Tesla, Alibaba) in the last fiscal year. Furthermore, size of individual names constraint designed to limit single stock risk exposure detracted from relative performance in a more concentrated market environment. By region, stock selection in the U.S., Japan, and emerging Asia Pacific detracted from results. The overall overweight position to developed Europe and underweight position to emerging Asia Pacific also detracted.

The most significant positive contributors to the Fund’s relative performance for the year were stock selection in financials, an underweight position to the energy sector, and an overweight position to the technology sector. On a regional basis, stock selection in Asia Pacific ex-Japan and developed Europe helped.

At fiscal-year end, versus the benchmark, the Fund maintained the largest overweight positions in the healthcare, financials, and technology sectors and the largest underweight positions in the consumer discretionary, communication services, and utilities sectors. Relative to the benchmark, the Fund was overweight stocks in developed Europe, underweight emerging markets stocks, and close to neutral in the U.S., Japan, and other developed markets.

a The Net version of each index reflects no deductions for fees, expenses or income taxes.

| Old Westbury Funds, Inc. |

| All Cap ESG Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

PORTFOLIO DIVERSIFICATION BY SECTOR

| Sector: | | Percentage

of Net Assets |

| Banks | | | 2.0 | % |

| Communication Services | | | 7.7 | |

| Consumer Discretionary | | | 6.3 | |

| Consumer Staples | | | 7.8 | |

| Diversified Financials | | | 11.4 | |

| Energy | | | 1.7 | |

| Health Care | | | 17.5 | |

| Industrials | | | 10.6 | |

| Information Technology | | | 21.7 | |

| Insurance | | | 2.8 | |

| Materials | | | 4.3 | |

| Real Estate | | | 3.2 | |

| Utilities | | | 1.8 | |

| Other* | | | 1.2 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. |

| All Cap ESG Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

| Average Annual Total Returns | | | |

| For the Period Ended October 31, 2020 | | | |

| All Cap ESG Fund | | | | |

| One Year | | | -2.48 | % |

| Since Inception date of March 1, 2018 | | | 1.04 | % |

| | | | | |

| MSCI ACWI USD (Net) | | | | |

| One Year | | | 4.89 | % |

| Since Inception date of March 1, 2018 | | | 4.84 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding, Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 1.00%, as disclosed in the Funds’ prospectus dated February 28, 2020. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus dated February 28, 2020 as 1.43%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

The chart shown illustrates the total value of a $10,000 investment for 1 year and 8 months, with distributions reinvested. The MSCI ACWI USD Index (Net) also includes the reinvestment of distributions but not fees, expenses and income taxes associated with an investment in the Fund. The MSCI ACWI USD Index (Net) is unmanaged. Investments cannot be made directly in an index.

Investing in emerging and foreign markets may involve additional risks such as economic and political instability, market illiquidity, and currency volatility.

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The return of the Old Westbury Small & Mid Cap Strategies Fund (the “Fund”) for the fiscal year ended October 31, 2020, was 5.91%. In comparison, the return of the MSCI All Country World Small Mid Cap Index (Net)a (the “Index”) was 0.61%.

The Fund benefitted from strong stock selection in the U.S. and specifically, the consumer discretionary sector. Individual stocks that contributed to performance included U.S. electric vehicle manufacturer Tesla (+516.1%), U.S. tele-healthcare provider Teladoc Health (+156.5%), and U.S. electronic design automation company Synopsys (+57.5%). Tesla’s share price movements have predominantly been driven by the company’s strong operational performance. Historically, the market had concerns about Tesla’s execution ability, doubting it could scale up production and become a mass-market auto manufacturer. Its progress this year, most noticeably opening a new plant in Shanghai within 10 months and completing approximately 500,000 vehicle deliveries, have largely allayed these concerns and this has driven the share price appreciation. Teladoc Health performed well as the pandemic-related quarantines drove doctors, hospitals, and patients to embrace the use of telemedicine. Synopsys is well positioned to participate in several secular trends (i.e. Internet of Things, 5G, autonomous), and constant improvement in the semiconductor chips. In addition, the company has a resilient business model, which has led to largely uninterrupted growth, all while improving margins and returns.

On the negative side, stock selection in the healthcare and technology sectors were drags to performance. Individual stocks detracted included Hong Kong luggage manufacturer Samsonite (-43.6%) and U.S. foodservice equipment manufacturer Welbilt (-67.9%). Samsonite and Welbilt were both victims of the COVID-19 pandemic. Samsonite faced challenges as a result of severe disruptions within the global travel industry, which resulted in extreme stress on the company’s financial profile and significant uncertainty over the company’s medium-term growth prospects. Welbilt struggled following the unprecedented shutdown of restaurants due to COVID-19, which had a material, short-term impact on demand for kitchen equipment.

At fiscal year-end, the Fund was overweight the healthcare, technology, and consumer discretionary sectors, and underweight real estate, financials, materials, utilities, energy, industrials, and communication services.

The Fund was regionally overweight the U.S. market. Conversely, the Fund was underweight developed Europe and Japan.

a The Net version of each index reflects no deductions for fees, expenses or income taxes.

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY COUNTRY

| | | Percentage |

| Country: | | of Net Assets |

| Argentina | | | 0.4 | % |

| Australia | | | 2.2 | |

| Austria | | | 0.0 | * |

| Belgium | | | 0.4 | |

| Bermuda | | | 0.4 | |

| Brazil | | | 0.3 | |

| Canada | | | 2.3 | |

| China | | | 3.7 | |

| Denmark | | | 1.4 | |

| Finland | | | 0.7 | |

| France | | | 0.6 | |

| Germany | | | 1.8 | |

| Greece | | | 0.1 | |

| Hong Kong | | | 0.5 | |

| Hungary | | | 0.0 | * |

| Iceland | | | 0.1 | |

| India | | | 0.4 | |

| Indonesia | | | 0.0 | * |

| Ireland | | | 0.1 | |

| Israel | | | 2.0 | |

| Italy | | | 0.7 | |

| Japan | | | 7.1 | |

| Jersey Channel Islands | | | 0.5 | |

| Malaysia | | | 0.0 | * |

| Netherlands | | | 1.0 | |

| New Zealand | | | 0.5 | |

| Norway | | | 0.1 | |

| Peru | | | 0.1 | |

| Philippines | | | 0.0 | * |

| Poland | | | 0.2 | |

| Portugal | | | 0.0 | * |

| Qatar | | | 0.0 | * |

| Russia | | | 0.5 | |

| Singapore | | | 0.2 | |

| South Africa | | | 0.0 | * |

| South Korea | | | 1.0 | |

| Spain | | | 0.4 | |

| Sweden | | | 1.6 | |

| Switzerland | | | 1.4 | |

| Taiwan | | | 1.3 | |

| Thailand | | | 0.2 | |

| Turkey | | | 0.3 | |

| United Arab Emirates | | | 0.0 | * |

| United Kingdom | | | 6.1 | |

| United States | | | 46.2 | |

| Vietnam | | | 0.0 | * |

| Other** | | | 13.2 | |

| | | | 100.0 | % |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, exchange traded funds, rights/warrants, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

| Average Annual Total Returns | | |

| For the Period Ended October 31, 2020 | | |

| Small & Mid Cap Strategies Fund | | |

| One Year | | | 5.91 | % |

| Five Year | | | 6.90 | % |

| Ten Year | | | 7.73 | % |

| | | | | |

| MSCI ACWI SMID Cap Index (Net) | | | | |

| One Year | | | 0.61 | % |

| Five Year | | | 6.39 | % |

| Ten Year | | | 7.33 | % |

On December 30, 2016, the Fund changed its name to Small & Mid Cap Strategies Fund (formerly Small & Mid Cap Fund) as part of a series of changes to the overall investment focus and strategies of the Fund. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy. The index performance is not illustrative of the Fund’s performance and performance of the fund will differ; the use of the index performance is not intended to mask negative performance.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any), at 1.11%, as disclosed in the Funds’ prospectus dated February 28, 2020. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 1.17%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The MSCI ACWI SMID Cap Index (Net) also includes the reinvestment of distributions but not fees, expenses and income taxes associated with an investment in the Fund. The MSCI ACWI SMID Cap Index (Net) is unmanaged. Investments cannot be made directly in an index.

| Old Westbury Funds, Inc. | |

| Small & Mid Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Investments made in small-capitalization and mid-capitalization companies are subject to greater volatility and less liquidity compared to investments made in larger and more established companies. Investments made in securities of companies in foreign and emerging countries may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The return of the Old Westbury Large Cap Strategies Fund (the “Fund”) for the fiscal year ended October 31, 2020, was 6.98%. In comparison, the return of the MSCI All Country World Large Cap Index (Net)a (“the Index”) was 5.67%.

The largest contributor to the Fund’s overall performance came from stock selection in the communication services sector. In addition, an underweight to developed Europe and stock selection in the region also benefited the Fund. Individual stocks that contributed included Singapore-based online gaming platform Sea Limited (+328.5%), Chinese internet company Tencent (+86.2%), Chinese online marketplace provider Alibaba (+72.5%), and Canadian e-commerce operator Shopify (+195.1%). All of these stocks are enablers of a more digital world, and have benefited as people around the globe have engaged in more activities from home amid the pandemic. Sea Ltd. delivered strong results across its core businesses in gaming and e-commerce, with COVID-19 further accelerating its traffic growth amid the lockdown. Tencent is the world’s largest social media operator, engaging over a billion monthly users and accounting for over 50 percent of all mobile-internet time spent in China. Meanwhile, Tencent’s cloud computing, fin-tech, and video game units have continued to generate strong growth, for the period. Alibaba is the world’s leading e-commerce business by gross merchandise volume, and has benefited broadly from the pandemic-induced spike in e-commerce adoption. Additionally, COVID-19 has accelerated online penetration and digitization of several strategic areas where Alibaba has the leading market share, including grocery delivery, cloud computing, and work collaboration. Shopify has become the operating system for small to medium enterprises seeking to do business on the internet, and is a key beneficiary of the generational shift from physical to digital commerce.

Stock selection in the U.S. and the consumer discretionary sector were the largest detractors overall. Individual stocks that detracted included U.S. aerospace and defense systems company Raytheon Technologies (-59.8%) and U.S. bank JPMorgan Chase (-21.5%). The COVID-19 pandemic negatively impacted Raytheon Technologies’ commercial aerospace business, as global air travel, related aftermarket parts and services, and plunging production rates at Boeing and Airbus drove revenues significantly lower. Further, fears of future defense spending reductions, principally driven by higher federal debt levels, also negatively impacted aerospace-defense sector sentiment and valuations. JP Morgan, like many U.S. and international banks, trailed the broader markets in fiscal 2020, reflecting the pandemic-driven broad-based global economic shutdown as unemployment surged, interest rates declined, and fears of loan losses grew. This drove a tightening of credit standards, and banks meaningfully boosted loss provisions, which negatively impacted earnings for the year.

At fiscal year-end, the Fund was overweight the consumer discretionary, healthcare, and technology sectors. The Fund was underweight financials, consumer staples, energy, financials, materials, real estate, and utilities.

On a regional basis, as of fiscal year-end, the Fund was overweight the U.S. and emerging markets, while being underweight developed Europe, Japan, and other developed markets.

a The Net version of each index reflects no deductions for fees, expenses or income taxes.

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY COUNTRY

| Country: | | Percentage

of Net Assets |

| Argentina | | | 0.4 | % |

| Australia | | | 0.4 | |

| Belgium | | | 0.2 | |

| Brazil | | | 0.6 | |

| Canada | | | 1.4 | |

| Chile | | | 0.0 | * |

| China | | | 8.5 | |

| Colombia | | | 0.0 | * |

| Czech Republic | | | 0.0 | * |

| Denmark | | | 0.1 | |

| Egypt | | | 0.0 | * |

| Finland | | | 0.1 | |

| France | | | 1.7 | |

| Georgia | | | 0.0 | * |

| Germany | | | 0.8 | |

| Hong Kong | | | 1.4 | |

| India | | | 3.0 | |

| Indonesia | | | 0.2 | |

| Ireland | | | 0.8 | |

| Isle of Man | | | 0.4 | |

| Israel | | | 0.1 | |

| Italy | | | 0.0 | * |

| Japan | | | 2.5 | |

| Kazakhstan | | | 0.0 | * |

| Kenya | | | 0.1 | |

| Luxembourg | | | 0.0 | * |

| Macau | | | 0.1 | |

| Malaysia | | | 0.1 | |

| Mexico | | | 0.2 | |

| Netherlands | | | 2.1 | |

| Norway | | | 0.0 | * |

| Panama | | | 0.0 | * |

| Peru | | | 0.0 | * |

| Poland | | | 0.1 | |

| Portugal | | | 0.0 | * |

| Puerto Rico | | | 0.0 | * |

| Qatar | | | 0.0 | * |

| Russia | | | 0.5 | |

| Singapore | | | 1.5 | |

| South Africa | | | 0.1 | |

| South Korea | | | 0.6 | |

| Spain | | | 0.0 | * |

| Sweden | | | 0.4 | |

| Switzerland | | | 2.1 | |

| Taiwan | | | 0.8 | |

| Thailand | | | 0.4 | |

| Turkey | | | 0.0 | * |

| United Arab Emirates | | | 0.0 | * |

| United Kingdom | | | 1.2 | |

| United States | | | 61.0 | |

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

| | | |

| Country: | | Percentage

of Net Assets |

| Vietnam | | | 0.0 | %* |

| Other** | | | 6.1 | |

| | | | 100.0 | % |

| | |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, exchange traded funds, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Large Cap Strategies Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Average Annual Total Returns

For the Period Ended October 31, 2020

| Large Cap Strategies Fund | | | |

| One Year | | | 6.98 | % |

| Five Year | | | 7.30 | % |

| Ten Year | | | 7.01 | % |

| | | | | |

| MSCI ACWI Large Cap Index (Net) | | | | |

| One Year | | | 5.67 | % |

| Five Year | | | 8.46 | % |

| Ten Year | | | 8.03 | % |

On November 16, 2011, the Fund changed its name to Large Cap Strategies Fund (formerly Non-U.S. Large Cap Fund) as part of a series of changes to the overall investment focus and strategies of the Fund. The performance information shown above may not be representative of performance the Fund will achieve under its current investment strategy. The index performance is not illustrative of the Fund’s performance and performance of the fund will differ; the use of the index performance is not intended to mask negative performance.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would be lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding, Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 1.15%, (current net operating expense is 1.10%). The expense ratio including acquired fund fees and expenses (if any), is stated in the prospectus dated February 28, 2020 as 1.12%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

The chart shown illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The MSCI ACWI Large Cap Index (Net) also includes the reinvestment of distributions but not fees, expenses and income taxes associated with an investment in the Fund. The MSCI ACWI Large Cap Index (Net) is unmanaged. Investments cannot be made directly in an index.

Investments made in foreign and emerging country securities may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility.

| Old Westbury Funds, Inc. |

| Credit Income Fund |

| Investment Adviser’s Report (Unaudited) |

| |

The Credit Income Fund was launched at the beginning of October 2020. Its investment approach provides the flexibility to invest across a wide variety of global credit instruments without constraints to particular benchmarks, asset classes, or sectors. The management of the Fund utilizes a combination of internally and externally managed strategies, and these are allocated in a complementary fashion in aiming to achieve the portfolio’s primary objective of income and secondary objective of capital appreciation.

At fiscal year-end, the Fund was allocated 15.6% to internally managed credit, 58.0% to externally managed credit, and 26.4% to government securities. The external-manager allocation included 1) Blackrock, which primarily invests in non-agency mortgage-backed securities, via both fixed and floating-rate securities, and 2) Muzinich, which mostly invests in U.S. high-yield bonds with credit ratings BB and lower. The internal-credit strategy employs quantitative tools and/or fundamental analysis in order to provide overall portfolio balance across actively and passively managed credit sectors, including asset-backed securities, preferred securities, and others.

| Old Westbury Funds, Inc. |

| Credit Income Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

PORTFOLIO DIVERSIFICATION BY SECTOR

| Sector: | | Percentage

of Net Assets |

| Asset-Backed Securities | | | 28.2 | % |

| Bank Loans | | | 0.1 | |

| Collateralized Mortgage Obligations | | | 16.8 | |

| Commercial Mortgage-Backed Securities | | | 2.4 | |

| Corporate Bonds | | | 7.8 | |

| U.S. Government Agencies and Securities | | | 17.2 | |

| Other* | | | 27.5 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, exchange traded funds, swap agreements, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. |

| Credit Income Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

| Average Annual Total Returns | | | |

| For the Period Ended October 31, 2020 | | | |

| Credit Income Fund | | | |

| Since Inception date of October 1, 2020 | | | -0.10 | % |

| | | | | |

| ICE Bank of America 1-10 Year U.S. Corporate Index | | | | |

| Since Inception date of October 1, 2020 | | | 0.06 | % |

The index performance is not illustrative of the Fund’s performance and performance of the fund will differ; the use of the index performance is not intended to mask negative performance.

The Fund has been in existence for less than one year; cumulative performance may not be indicative of the Fund’s long-term potential. The Fund returns will fluctuate over long and short-term periods.

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any), at 0.85%, as disclosed in the Funds’ prospectus dated September 28, 2020. The expense ratio, prior to fee waivers and including acquired fund fees and expenses (if any), is stated in the prospectus as 0.95%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

Investments made in securities of companies in foreign and emerging countries may involve additional risks, such as political and social instability, less liquidity and currency exchange rate volatility. The Fund may invest in instruments that are volatile, speculative or otherwise risky. The Fund is non-diversified, meaning it may focus its assets in a smaller number of issuers and may be subject to more risk than a more diversified fund.

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The Old Westbury Fixed Income Fund (the “Fund”) returned 5.23% for the fiscal year ended October 31, 2020. In comparison, the return of the ICE Bank of America U.S. Corporate & Government 1-10 Year AAA-A US Corporate & Government Index (the “Index”) was 5.45%.

The Fund’s 2020 fiscal year began on a generally positive note in November 2019. Although economic data appeared to be slowing, progress on trade deals and recent interest rate cuts combined with supportive statements by the Federal Reserve buoyed market sentiment. As the calendar year turned however, news of the highly contagious virus that would define 2020 began to emerge. By the end of the first calendar quarter, it became clear that COVID-19, as the virus came to be known, would dominate every aspect of life during 2020. In March, broad stay-at-home orders were issued globally, shutting down significant parts of the economy and resulting in record-breaking job losses. Equities sold off sharply and liquidity dried up in fixed income markets. Governments around the world responded quickly and aggressively to this crisis. In the U.S., the Federal Reserve (Fed) lowered the Federal Funds rate to zero and began a very large-scale bond-buying program. In conjunction with the Treasury Department, the Fed introduced a number of lending programs intended in aiming to stabilize markets, provide liquidity and restore confidence. Congress passed the CARES Act which provided support to individuals and businesses financially impacted by COVID-19. On several measures, these actions were successful in supporting markets and the economy: equities have rebounded, credit is broadly available and as the initial wave of the virus subsided, many businesses were able to reopen and many unemployed workers were reemployed. Nonetheless, as the fiscal year came to a close, the virus continued to be both a health and economic threat to the U.S.

During the Fund’s fiscal year, Treasury yields declined across the yield curve, most significantly for shorter maturities where the Fed’s zero-rate policy and bond-buying program have the most impact. Longer-term rates have fluctuated within a relatively tight range throughout the year, drifting slightly higher as expectations for a vaccine that would end the health crisis gained traction, but remain near historic lows. Investment-grade corporate bonds underperformed Treasury securities during the fiscal year as a result of the sharp spread widening at the beginning of the pandemic. During the second half of the fiscal year, investment-grade bonds outperformed Treasury securities.

The Fund began the fiscal year with higher-than-benchmark duration (price sensitivity to interest rate moves), on the expectation that the economy would continue to slow and the Fed would take more aggressive action. Typically, as the economy weakens, the bond market rallies, with most benefit accruing to the intermediate part of the curve. Longer-dated securities may also benefit as yields respond to lower expected growth and inflation. The Fund was also underweight corporate bonds relative to the benchmark. Corporate spreads were near all-time lows at the beginning of the year. Given the team’s conviction that the economy would continue to weaken, investment grade bonds did not appear compelling. The Fund benefited from this positioning at the onset of the pandemic when Treasury yields declined and corporate spreads widened. The team maintained a long-duration bias during the second half of the year but shifted to target an overweight in corporate bonds to take advantage of wider credit spreads.

The outlook for the U.S. economy remains uncertain. Economic recovery is closely tied to the path of the pandemic. While there is encouraging news with respect to development of an effective vaccine, infection rates are increasing across the globe and the threat of the virus will remain a concern until a large portion of the population is vaccinated. Meanwhile, the recovery has been spotty. The goods-producing sector has rebounded from the worst of the crisis, but the services sector, which accounts for the greater part of the U.S. economy, has lagged. Inflation, both domestically and globally, remains muted. While the Federal Reserve has indicated its intention to support the economy through accommodative monetary policy, the prospect of divided government in the U.S. puts in question the extent of additional fiscal support.

The team’s current strategy is to maintain the portfolio duration slightly higher than the benchmark and an overweight position in credit-related assets, including investment-grade corporate bonds, high-quality asset-backed securities (ABS), collateralized loan obligations (CLOs), and taxable-municipal bonds. A small exposure will be maintained in U.S. Treasury Inflation-Protected Securities (TIPS), which helps protect against a possible increase in inflation. At fiscal year-end, credit represented approximately 35% of market value of the Fund, of which ABS and CLOs accounted for under 5%.

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY SECTOR

| Sector: | | Percentage

of Net Assets |

| Asset-Backed Securities | | | 3.6 | % |

| Collateralized Mortgage Obligations | | | 0.0 | * |

| Corporate Bonds | | | 29.8 | |

| Municipal Bonds | | | 0.9 | |

| U.S. Government Agencies and Securities | | | 64.9 | |

| Other** | | | 0.8 | |

| | | | 100.0 | % |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Fixed Income Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Average Annual Total Returns

For the Period Ended October 31, 2020

| Fixed Income Fund | | | | |

| One Year | | | 5.23 | % |

| Five Year | | | 2.77 | % |

| Ten Year | | | 2.08 | % |

| | | | | |

| ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index | | | | |

| One Year | | | 5.45 | % |

| Five Year | | | 3.05 | % |

| Ten Year | | | 2.60 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees (if any), is stated in the prospectus dated February 28, 2020 as 0.70%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index also includes the reinvestment of distributions but does not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 1-10 Year AAA-A U.S. Corporate & Government Index is unmanaged. Investments cannot be made directly in an index.

The Fund is subject to risks such as credit, prepayment and interest rate risk associated with the underlying bond holdings in the Fund. The value of the Fund can decline as interest rates rise and an investor can lose principal.

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The return of the Old Westbury Municipal Bond Fund (the “Fund”) for the fiscal year ended October 31, 2020, was 3.38%. In comparison, the return of the primary benchmark, the ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index (the “Index”), was 3.58%.

The municipal bond market’s momentum in 2019 continued in 2020 with one notable exception, the spike in volatility experienced in March / April. As in the prior year, the momentum in municipals was primarily attributable to several key tenets of the tax package that disproportionately affected the supply / demand backdrop for the asset class (the cap on the state/local tax deduction, the removal of the advanced refunding option, etc.). On the supply side of the equation, tax exempt supply was significantly lower than historical levels due to the removal of the advanced refunding option and a related shift to taxable muni issuance (given favorable economics of that transaction and a broader buyer base). The lower-supply tailwind was bolstered by continued strong demand from investors given an increasingly onerous tax regime on the state / local level. Despite the constructive backdrop, 2020 was not without trials for municipals; the asset class saw a significant sell-off in March given a funding squeeze for some levered mutual funds, and the onset of COVID-related shutdowns created significant investor trepidation in related sectors (airports, toll roads, hospitals, etc.). The swift and significant action taken by the Fed, in particular the Municipal Liquidity Facility, helped to assuage investor concerns, and the market normalized over the balance of the year.

Over the course of the year, the Fund was positioned with a long-duration posture relative to the benchmark in order to take advantage of the momentum within the asset class, which ultimately contributed to performance. Curve positioning was also additive as the curve flattened and the fund held an underweight front-end and overweight long-end stance. Credit positioning also worked well over the course of the year as the Fund’s credit barbell around AA insulated the Fund against volatility while managing to capture spread compression after the tumultuous March / April period. The most significant performance detractor was bond selection as several names have yet to recover to pre-COVID levels given ongoing macroeconomic headwinds.

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY STATE

| State: | | Percentage

of Net Assets |

| Alabama | | | 1.0 | % |

| Arizona | | | 1.7 | |

| Arkansas | | | 0.2 | |

| California | | | 3.2 | |

| Colorado | | | 1.4 | |

| Connecticut | | | 2.6 | |

| Delaware | | | 2.6 | |

| District of Columbia | | | 1.8 | |

| Florida | | | 2.0 | |

| Georgia | | | 4.4 | |

| Hawaii | | | 1.8 | |

| Idaho | | | 0.1 | |

| Illinois | | | 0.2 | |

| Indiana | | | 0.1 | |

| Iowa | | | 0.6 | |

| Kansas | | | 0.0 | * |

| Maine | | | 0.1 | |

| Maryland | | | 5.8 | |

| Massachusetts | | | 4.0 | |

| Michigan | | | 0.3 | |

| Minnesota | | | 1.1 | |

| Mississippi | | | 0.4 | |

| Missouri | | | 0.1 | |

| Montana | | | 0.1 | |

| New Hampshire | | | 0.2 | |

| New Jersey | | | 2.1 | |

| New York | | | 16.5 | |

| North Carolina | | | 2.4 | |

| Ohio | | | 3.4 | |

| Oklahoma | | | 1.0 | |

| Oregon | | | 1.1 | |

| Pennsylvania | | | 1.1 | |

| Rhode Island | | | 0.3 | |

| South Carolina | | | 0.6 | |

| South Dakota | | | 0.9 | |

| Tennessee | | | 0.3 | |

| Texas | | | 17.2 | |

| Utah | | | 0.5 | |

| Virginia | | | 4.9 | |

| Washington | | | 2.6 | |

| Wisconsin | | | 1.7 | |

| Other** | | | 7.6 | |

| | | | 100.0 | % |

| | |

| * | Represents less than 0.01% of net assets. |

| ** | Includes cash and equivalents, Corporate Bonds, U.S. Government Securities, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Average Annual Total Returns

For the Period Ended October 31, 2020

| Municipal Bond Fund | | | |

| One Year | | | 3.38 | % |

| Five Year | | | 2.26 | % |

| Ten Year | | | 1.95 | % |

| | | | | |

| ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index | | | | |

| One Year | | | 3.58 | % |

| Five Year | | | 2.54 | % |

| Ten Year | | | 2.61 | % |

| | | | | |

| Lipper Short-Intermediate Municipal Debt Funds Index | | | | |

| One Year | | | 3.37 | % |

| Five Year | | | 2.21 | % |

| Ten Year | | | 2.10 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees (if any), is stated in the prospectus dated February 28, 2020 as 0.68%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 10 years, with distributions reinvested. The ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index and the Lipper Short-Intermediate Municipal Debt Funds Index also include the reinvestment of distributions but do not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 1-12 Year AAA-AA Municipal Securities Index and the Lipper Short-Intermediate Municipal Debt Funds Index are unmanaged. Investments cannot be made directly in an index.

| Old Westbury Funds, Inc. | |

| Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

Municipal securities held by the Fund may be adversely affected by local political and economic factors. Income from the Fund may be subject to federal alternative minimum tax, state and local taxes.

| Old Westbury Funds, Inc. | |

| California Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) | |

| | |

The return of the Old Westbury California Municipal Bond Fund (the “Fund”) for the fiscal year ended October 31, 2020, was 3.30%. In comparison, the return of the primary benchmark, the ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index (the “Index”), was 3.86%.

Over the course of the year, the Fund was positioned with a long-duration posture relative to the benchmark in order to take advantage of the momentum within the asset class, which ultimately contributed to performance. Curve positioning was also additive as the curve flattened and the fund held an underweight front-end and overweight long-end stance, though significant underweights in the belly of the curve dampened that somewhat. Credit positioning posed a headwind to performance over the year as certain AA and A credit spreads widened during the March / April volatility and have yet to fully recover. As a reminder, the Fund is compared to a national index of municipal securities, which can cause deviation over time based on the performance of California municipals relative to the rest of the market.

| Old Westbury Funds, Inc. | |

| California Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

PORTFOLIO DIVERSIFICATION BY STATE

| | | Percentage |

| State: | | of Net Assets |

| California | | | 88.2 | % |

| Other* | | | 11.8 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, Corporate Bonds, U.S. Government Securities, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. | |

| California Municipal Bond Fund | |

| Investment Adviser’s Report (Unaudited) - (Continued) | |

| | |

| Average Annual Total Returns | | | |

| For the Period Ended October 31, 2020 | | | |

| California Municipal Bond Fund | | | |

| One Year | | | 3.30 | % |

| Since Inception date of December 4, 2018 | | | 4.23 | % |

| | | | | |

| ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index | | | | |

| One Year | | | 3.86 | % |

| Since Inception date of December 4, 2018 | | | 4.90 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees (if any), is stated in the prospectus dated February 28, 2020 as 0.78%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

The chart shown illustrates the total value of a $10,000 investment for 1 Year and 11 Months, with distributions reinvested. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index also includes the reinvestment of distributions but does not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index is unmanaged. Investments cannot be made directly in an index.

Municipal securities held by the Fund may be adversely affected by local political and economic factors. Income from the Fund may be subject to federal alternative minimum tax, state and local taxes. The Fund is non-diversified, meaning it may focus its assets in a smaller number of issuers and may be subject to more risk than a more diversified fund.

| Old Westbury Funds, Inc. |

| New York Municipal Bond Fund |

| Investment Adviser’s Report (Unaudited) |

| |

The return of the Old Westbury New York Municipal Bond Fund (the “Fund”) for the fiscal year ended October 31, 2020, was 2.69%. In comparison, the return of the primary benchmark, the ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index (the “Index”), was 3.86%.

Over the course of the year, the Fund was positioned with a long-duration posture relative to the benchmark in order to take advantage of the momentum within the asset class, which ultimately contributed to performance. Curve positioning was also additive as the curve flattened and the fund held an underweight front-end and overweight long-end stance, though significant underweights in the belly of the curve dampened that somewhat. Credit positioning posed a headwind to performance over the year as certain AA and A credit spreads widened during the March / April volatility and have yet to fully recover (NY was certainly hit disproportionately hard during the spike in COVID-19 over the winter/spring months). As a reminder, the Fund is compared to a national index of municipal securities, which can cause deviation over time based on the performance of New York municipals relative to the rest of the market.

| Old Westbury Funds, Inc. |

| New York Municipal Bond Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

PORTFOLIO DIVERSIFICATION BY STATE

| State: | | Percentage

of Net Assets |

| New York | | | 88.9 | % |

| Other* | | | 11.1 | |

| | | | 100.0 | % |

| * | Includes cash and equivalents, Corporate Bonds, U.S. Government Securities, investment company, pending trades and Fund share transactions, interest and dividends receivable, prepaids and accrued expenses payable. |

| Old Westbury Funds, Inc. |

| New York Municipal Bond Fund |

| Investment Adviser’s Report (Unaudited) - (Continued) |

| |

| Average Annual Total Returns | | | |

| For the Period Ended October 31, 2020 | | | |

| New York Municipal Bond Fund | | | |

| One Year | | | 2.69 | % |

| Since Inception date of December 4, 2018 | | | 4.21 | % |

| | | | | |

| ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index | | | | |

| One Year | | | 3.86 | % |

| Since Inception date of December 4, 2018 | | | 4.90 | % |

The performance data quoted represents past performance. Past performance does not guarantee future results and does not reflect the deduction of taxes that a shareholder may pay on Fund distributions or the redemption of Fund shares. Fund performance reflects fee waivers and/or expense reimbursements and reinvestments of distributions, if any. Without waivers/reimbursements, performance would have been lower. The investment return and principal value of an investment will fluctuate. Consequently, an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. To obtain performance information current to the most recent month end, please call 1-800-607-2200.

The Adviser has contractually committed through October 31, 2021, to waive its advisory fees to the extent necessary to maintain the net operating expense ratio of the Fund, excluding Fund transaction costs, investment interest expense, dividend expenses associated with securities sold short and acquired fund fees and expenses (if any) at 0.57%. The expense ratio, prior to fee waivers and including acquired fund fees (if any), is stated in the prospectus dated February 28, 2020 as 0.78%. Additional information pertaining to the Fund’s expense ratio for the year ended October 31, 2020 can be found in the Financial Highlights.

The chart shown above illustrates the total value of a $10,000 investment for 1 Year and 11 Months, with distributions reinvested. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index also includes the reinvestment of distributions but does not include fees, expenses and income taxes associated with an investment in the Fund. The ICE Bank of America 3-7 Year AAA-AA Municipal Securities Index is unmanaged. Investments cannot be made directly in an index.

Municipal securities held by the Fund may be adversely affected by local political and economic factors. Income from the Fund may be subject to federal alternative minimum tax, state and local taxes The Fund is non-diversified, meaning it may focus its assets in a smaller number of issuers and may be subject to more risk than a more diversified fund.

| Old Westbury Funds, Inc. | |

| Disclosure of Fund Expenses (Unaudited) | |

| | For the Period Ended October 31, 2020 |

| | |

As a shareholder of Old Westbury Funds, Inc., you incur ongoing costs, including management fees and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other mutual funds.

The example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from May 1, 2020 through October 31, 2020.

Actual Expenses

The table below provides information about actual account values and actual expenses. You may use the information below, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the table under the heading entitled “Actual Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

| | | | | | | Actual | | Actual |

| | | Actual | | Actual | | Expenses Paid | | Expense Ratio |

| | | Beginning | | ending | | During Period* | | During Period** |

| | | Account Value | | Account value | | 05/01/2020 | | 05/01/2020 |

| | | 05/01/2020 | | 10/31/2020 | | - 10/31/2020 | | - 10/31/2020 |

| All Cap Core Fund | | $ | 1,000.00 | | | $ | 1,174.60 | | | $ | 5.30 | | | | 0.97 | % |

| All Cap ESG Fund | | | 1,000.00 | | | | 1,073.70 | | | | 5.21 | | | | 1.00 | % |

| Small & Mid Cap Strategies Fund | | | 1,000.00 | | | | 1,177.80 | | | | 6.08 | | | | 1.11 | % |

| Large Cap Strategies Fund | | | 1,000.00 | | | | 1,152.60 | | | | 5.95 | | | | 1.10 | % |

| Credit Income Fund*** | | | 1,000.00 | | | | 999.00 | | | | 0.70 | | | | 0.85 | % |

| Fixed Income Fund | | | 1,000.00 | | | | 1,006.70 | | | | 2.88 | | | | 0.57 | % |

| Municipal Bond Fund | | | 1,000.00 | | | | 1,030.50 | | | | 2.91 | | | | 0.57 | % |

| California Municipal Bond Fund | | | 1,000.00 | | | | 1,028.80 | | | | 2.91 | | | | 0.57 | % |

| New York Municipal Bond Fund | | | 1,000.00 | | | | 1,033.90 | | | | 2.91 | | | | 0.57 | % |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 184/366 to reflect the one-half year period. |

| ** | Expense ratios are annualized and reflect existing expense waivers/reimbursements. |

| *** | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 30/366 to reflect the period of the Fund’s operations. |

| Old Westbury Funds, Inc. | |

| Disclosure of Fund Expenses (Unaudited) - (Continued) | |

| | For the Period Ended October 31, 2020 |

| | |

Hypothetical Example for Comparison Purposes

The table below provides information about hypothetical account values and hypothetical expenses based on each Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

| | | | | | | Hypothetical | | Hypothetical |

| | | Hypothetical | | Hypothetical | | Expenses Paid | | Expense Ratio |

| | | Beginning | | Ending | | During Period* | | During Period** |

| | | Account Value | | Account Value | | 05/01/2020 | | 05/01/2020 |

| | | 05/01/2020 | | 10/31/2020 | | - 10/31/2020 | | - 10/31/2020 |

| All Cap Core Fund | | $ | 1,000.00 | | | $ | 1,020.26 | | | $ | 4.93 | | | | 0.97 | % |

| All Cap ESG Fund | | | 1,000.00 | | | | 1,020.11 | | | | 5.08 | | | | 1.00 | % |

| Small & Mid Cap Strategies Fund | | | 1,000.00 | | | | 1,019.56 | | | | 5.63 | | | | 1.11 | % |

| Large Cap Strategies Fund | | | 1,000.00 | | | | 1,019.61 | | | | 5.58 | | | | 1.10 | % |

| Credit Income Fund*** | | | 1,000.00 | | | | 1,003.40 | | | | 0.70 | | | | 0.85 | % |

| Fixed Income Fund | | | 1,000.00 | | | | 1,022.27 | | | | 2.90 | | | | 0.57 | % |

| Municipal Bond Fund | | | 1,000.00 | | | | 1,022.27 | | | | 2.90 | | | | 0.57 | % |

| California Municipal Bond Fund | | | 1,000.00 | | | | 1,022.27 | | | | 2.90 | | | | 0.57 | % |

| New York Municipal Bond Fund | | | 1,000.00 | | | | 1,022.27 | | | | 2.90 | | | | 0.57 | % |

| * | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 184/366 to reflect the one-half year period. |

| ** | Expense ratios are annualized and reflect existing expense waivers/reimbursements. |

| *** | Expenses are equal to the average account value times the Fund’s annualized expense ratio multiplied by 30/366 to reflect the period of the Fund’s operations. |

Please note that the expenses shown in the tables are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, these tables are useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| Old Westbury Funds, Inc. | |

| All Cap Core Fund | |

| Portfolio of Investments | October 31, 2020 |

| Shares | | | | | Value | |

| COMMON STOCKS — 94.5% |

| Banks — 0.7% |

| | 207,856 | | | Bank of America Corp. | | $ | 4,926,187 | |

| | 265,812 | | | Citigroup, Inc. | | | 11,009,933 | |

| | | | | | | | 15,936,120 | |

| Communication Services — 13.6% |

| | 59,865 | | | Alphabet, Inc. - Class C(a) | | | 97,041,764 | |

| | 87,609 | | | Charter Communications, Inc. - Class A(a) | | | 52,900,067 | |

| | 297,229 | | | Facebook, Inc. - Class A(a) | | | 78,203,922 | |

| | 135,426 | | | Match Group, Inc.(a) | | | 15,815,048 | |

| | 158,620 | | | Sea Ltd. - ADR(a) | | | 25,014,374 | |

| | 539,039 | | | Tencent Holdings Ltd. - Class H | | | 41,092,815 | |

| | | | | | | | 310,067,990 | |

| Consumer Discretionary — 14.8% |

| | 126,590 | | | Advance Auto Parts, Inc. | | | 18,644,175 | |

| | 133,174 | | | Alibaba Group Holding Ltd. - ADR(a) | | | 40,576,786 | |

| | 30,809 | | | Amazon.com, Inc.(a) | | | 93,540,745 | |

| | 82,564 | | | Burlington Stores, Inc.(a) | | | 15,982,739 | |

| | 508,899 | | | Dollarama, Inc. | | | 17,524,796 | |

| | 254,450 | | | Hilton Worldwide Holdings, Inc. | | | 22,343,255 | |

| | 107,769 | | | Home Depot, Inc. (The) | | | 28,743,070 | |

| | 52,235 | | | LVMH Moet Hennessy Louis Vuitton SE | | | 24,474,035 | |

| | 410,112 | | | NIKE, Inc. - Class B | | | 49,246,249 | |

| | 214,055 | | | Ross Stores, Inc. | | | 18,231,064 | |

| | 183,680 | | | Wyndham Hotels & Resorts, Inc. | | | 8,542,957 | |

| | | | | | | | 337,849,871 | |

| Consumer Staples — 2.0% |

| | 299,865 | | | PepsiCo, Inc. | | | 39,969,006 | |

| | 300,200 | | | US Foods Holding Corp.(a) | | | 6,274,180 | |

| | | | | | | | 46,243,186 | |

| Diversified Financials — 4.0% |

| | 38,447 | | | BlackRock, Inc. | | | 23,037,827 | |

| | 619,085 | | | Blackstone Group, Inc. (The) - Class A | | | 31,214,266 | |

| | 146,774 | | | Nasdaq, Inc. | | | 17,758,186 | |

| | 59,222 | | | S&P Global, Inc. | | | 19,112,716 | |

| | | | | | | | 91,122,995 | |

| Energy — 0.4% |

| | 114,979 | | | Pioneer Natural Resources Co. | | | 9,147,729 | |

| Health Care — 14.0% |

| | 68,757 | | | Cooper Cos, Inc. (The) | | | 21,936,921 | |

| | 265,219 | | | Danaher Corp. | | | 60,878,369 | |

| | 274,371 | | | IQVIA Holdings, Inc.(a) | | | 42,250,390 | |

| | 89,294 | | | Laboratory Corp. of America Holdings(a) | | | 17,838,262 | |

| | 101,293 | | | STERIS Plc | | | 17,948,107 | |

| | 40,380 | | | Teleflex, Inc. | | | 12,850,127 | |

| | 128,829 | | | Thermo Fisher Scientific, Inc. | | | 60,951,577 | |

| | 139,698 | | | UnitedHealth Group, Inc. | | | 42,627,448 | |

| Shares | | | | | Value | |

| Health Care (continued) |

| | 19,384 | | | West Pharmaceutical Services, Inc. | | $ | 5,273,805 | |

| | 232,107 | | | Zoetis, Inc. | | | 36,800,565 | |

| | | | | | | | 319,355,571 | |

| Industrials — 10.0% |

| | 272,051 | | | A.O. Smith Corp. | | | 14,062,316 | |

| | 73,648 | | | Cintas Corp. | | | 23,165,978 | |

| | 146,224 | | | Dover Corp. | | | 16,188,459 | |

| | 105,523 | | | Equifax, Inc. | | | 14,414,442 | |

| | 385,144 | | | Fortive Corp. | | | 23,724,870 | |

| | 394,859 | | | IAA, Inc.(a) | | | 22,345,071 | |

| | 41,152 | | | IDEX Corp. | | | 7,011,889 | |

| | 45,115 | | | L3Harris Technologies, Inc. | | | 7,268,478 | |

| | 2,205,642 | | | Rentokil Initial Plc(a) | | | 15,030,026 | |

| | 190,756 | | | Safran SA(a) | | | 20,110,214 | |

| | 307,122 | | | Union Pacific Corp. | | | 54,418,947 | |

| | 58,344 | | | Verisk Analytics, Inc. | | | 10,383,482 | |

| | | | | | | | 228,124,172 | |

| Information Technology — 28.2% |

| | 44,250 | | | Adobe, Inc.(a) | | | 19,784,175 | |

| | 214,872 | | | Amphenol Corp. - Class A | | | 24,246,157 | |

| | 48,761 | | | ANSYS, Inc.(a) | | | 14,841,386 | |

| | 950,903 | | | Apple, Inc. | | | 103,515,301 | |

| | 113,839 | | | CDW Corp. | | | 13,956,661 | |

| | 122,575 | | | CMC Materials, Inc. | | | 17,428,939 | |

| | 351,668 | | | Fidelity National Information Services, Inc. | | | 43,814,316 | |

| | 706,801 | | | Microsoft Corp. | | | 143,105,998 | |

| | 61,640 | | | Nice Ltd. - ADR(a) | | | 14,069,946 | |

| | 23,673 | | | Paycom Software, Inc.(a) | | | 8,619,103 | |

| | 134,008 | | | salesforce.com, Inc.(a) | | | 31,126,038 | |

| | 52,049 | | | ServiceNow, Inc.(a) | | | 25,898,021 | |

| | 140,300 | | | SS&C Technologies Holdings, Inc. | | | 8,308,566 | |

| | 119,139 | | | Synopsys, Inc.(a) | | | 25,479,067 | |

| | 343,854 | | | Texas Instruments, Inc. | | | 49,717,850 | |

| | 468,513 | | | Visa, Inc. - Class A | | | 85,133,497 | |

| | 154,057 | | | Vontier Corp.(a) | | | 4,427,598 | |

| | 93,935 | | | WEX, Inc.(a) | | | 11,887,474 | |

| | | | | | | | 645,360,093 | |

| Insurance — 1.6% |

| | 95,445 | | | Aon Plc - Class A | | | 17,562,835 | |

| | 144,431 | | | Chubb Ltd. | | | 18,763,031 | |

| | | | | | | | 36,325,866 | |

| Materials — 1.7% |

| | 93,575 | | | Air Products & Chemicals, Inc. | | | 25,849,158 | |

| | 110,598 | | | AptarGroup, Inc. | | | 12,618,126 | |