Suite 1710, 650 West Georgia Street

Vancouver, British Columbia V6B 4N9

AND

INFORMATION CIRCULAR

For

Annual General Meeting of Shareholders

To be Held on

Tuesday, June 16, 2009

at

30th Floor, 650 West Georgia Street

Vancouver, British Columbia V6B 4N9

CANADIAN ZINC CORPORATION

NOTICE OF MEETING

Suite 1710, 650 West Georgia Street

Vancouver, British Columbia V6B 4N9

TO: The Shareholders of Canadian Zinc Corporation

NOTICE IS HEREBY GIVEN THAT an annual general meeting (the "Meeting") of the shareholders of Canadian Zinc Corporation (the "Company") will be held at 30th Floor, 650 West Georgia Street, Vancouver, British Columbia on Tuesday, June 16, 2009, at the hour of 10:00 a.m., Vancouver time, for the following purposes:

| 1. | To receive and consider the report of the directors and the financial statements of the Company together with the auditor's report thereon for the financial year ended December 31, 2008; |

| 2. | To determine the number of directors at five (5); |

| 3. | To elect directors for the ensuing year; |

| 4. | To appoint Ernst & Young LLP as the auditors for the ensuing year and to authorize the directors to fix the remuneration to be paid to the auditors; and |

| 5. | To transact such further or other business as may properly come before the Meeting and any adjournments thereof. |

The accompanying information circular provides additional information relating to the matters to be dealt with at the Meeting and is deemed to form part of this notice. Also accompanying this notice is a form of proxy and a supplemental mailing return card. Any adjournment of the Meeting will be held at a time and place to be specified at the Meeting.

Only holders of common shares of record at the close of business on May 12, 2009 will be entitled to receive notice of and vote at the Meeting. If you are unable to attend the Meeting in person, please complete, sign and date the enclosed form of proxy and return the same in the enclosed return envelope provided for that purpose within the time and to the location set out in the form of proxy accompanying this notice.

DATED this 12th day of May, 2009

| BY ORDER OF THE BOARD OF DIRECTORS |

| |

| (Signed) |

John F. Kearney Chairman |

If you are a non-registered shareholder of the Company and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or by the other intermediary. Failure to do so may result in your shares not being eligible to be voted by proxy at the Meeting.

CANADIAN ZINC CORPORATION

Suite 1710, 650 West Georgia Street

Vancouver, BC V6B 4N9

INFORMATION CIRCULAR

(As at May 12, 2009 except as otherwise indicated)

This information circular is furnished in connection with the solicitation of proxies by the management of Canadian Zinc Corporation (the “Company”) for use at the annual general meeting of the Company to be held on June 16, 2009 and at any adjournments thereof (the “Meeting”). The solicitation will be conducted by mail and may be supplemented by telephone or other personal contact to be made without special compensation by officers and employees of the Company. The cost of solicitation will be borne by the Company.

APPOINTMENT OF PROXYHOLDER

The purpose of a proxy is to designate persons who will vote the proxy on a shareholder's behalf in accordance with the instructions given by the shareholder in the proxy. The persons whose names are printed in the enclosed form of proxy for the Meeting are officers or directors of the Company (the “Management Proxyholders”).

A shareholder has the right to appoint a person other than a Management Proxyholder to represent the shareholder at the Meeting by striking out the names of the Management Proxyholders and by inserting the desired person's name in the blank space provided or by executing a proxy in a form similar to the enclosed form. A proxyholder need not be a shareholder.

REVOCABILITY OF PROXY

Any registered shareholder who has returned a proxy may revoke it at any time before it has been exercised. In addition to revocation in any other manner permitted by law, a proxy may be revoked by instrument in writing, including a proxy bearing a later date, executed by the registered shareholder or by his attorney authorized in writing or, if the registered shareholder is a corporation, under its corporate seal or by an officer or attorney thereof duly authorized. The instrument revoking the proxy must be deposited at the registered office of the Company, at any time up to and including the last business day preceding the date of the Meeting, or any adjournment thereof, or with the chairman of the Meeting on the day of the Meeting. Only registered shareholders have the right to revoke a proxy. Non-Registered Holders who wish to change their vote must, at least seven days before the Meeting, arrange for their respective nominees or intermediaries to revoke the proxy on their behalf.

VOTING BY PROXY

Only registered shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Shares represented by a properly executed proxy will be voted or be withheld from voting on each matter referred to in the Notice of Meeting in accordance with the instructions of the shareholder on any ballot that may be called for and if the shareholder specifies a choice with respect to any matter to be acted upon, the shares will be voted accordingly.

If no choice is specified and one of the Management Proxyholders is appointed by a shareholder as proxyholder, such person will vote in favour of the matters specified in the notice of meeting for this Meeting and in favour of all other matters proposed by management at the Meeting.

The enclosed form of proxy also confers discretionary authority upon the person named therein as proxyholder with respect to amendments or variations to matters identified in the Notice of the Meeting and with respect to other matters which may properly come before the Meeting. At the date of this information circular, management of the Company knows of no such amendments, variations or other matters to come before the Meeting.

COMPLETION AND RETURN OF PROXY

Completed forms of proxy must be deposited at the office of the Company's registrar and transfer agent, Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario, M5J 2Y1, not later than forty-eight (48) hours, excluding Saturdays, Sundays and holidays, prior to the time of the Meeting, unless the chairman of the Meeting elects to exercise his discretion to accept proxies received subsequently.

NON-REGISTERED HOLDERS

Only shareholders whose names appear on the records of the Company as the registered holders of common shares or duly appointed proxyholders are permitted to vote at the Meeting. Most shareholders of the Company are "non-registered" shareholders because the common shares they own are not registered in their names but are instead registered in the name of a nominee such as a brokerage firm, bank or trust company through which they purchased the common shares. More particularly, a person is not a registered shareholder in respect of common shares which are held on behalf of that person (the “Non-Registered Holder”) but which are registered either: (a) in the name of an intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the common shares (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSP's, RRIFs, RESPs and similar plans); or (b) in the name of a clearing agency (such as CDS Clearing and Depository Services Inc. (“CDS”)) of which the Intermediary is a participant. In accordance with the requirements of National Instrument 54-101 of the Canadian Securities Administrators, the Company has distributed copies of the notice of meeting, this information circular and the proxy (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Very often, Intermediaries will use service companies to forward the Meeting Materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive Meeting Materials will either:

| (a) | be given a form of proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Holder when submitting the proxy. In this case, the Non-Registered Holder who wishes to submit a proxy should otherwise properly complete the form of proxy and deliver it to Computershare as provided above; or |

| (b) | more typically, be given a voting instruction form which is not signed by the Intermediary, and which, when properly completed and signed by the Non-Registered Holder and returned to the Intermediary or its service company, will constitute voting instructions (often called a “proxy authorization form”) which the Intermediary must follow. Typically, the proxy authorization form will consist of a one page pre-printed form. Sometimes, instead of the one page pre-printed form, the proxy authorization form will consist of a regular printed proxy form accompanied by a page of instructions which contains a removable label containing a bar-code and other information. In order for the form of proxy to validly constitute a proxy authorization form, the Non-Registered Holder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and return it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. |

| (c) | In either case, the purpose of this procedure is to permit Non-Registered Holders to direct the voting of the common shares which they beneficially own. Should a Non-Registered Holder who receives one of the above forms wish to vote at the Meeting in person, the Non-Registered Holder should strike out the names of the Management Proxyholders and insert the Non-Registered Holder's name in the blank space provided. In either case, Non-Registered Holders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or proxy authorization form is to be delivered. In addition, Canadian securities legislation now permits the Company to forward meeting materials directly to Non-Objecting Beneficial Owners (“NOBOs”). As a result NOBOs can expect to receive a scannable Voting Instruction Form (“VIF”) from Computershare. These VIFs are to be completed and returned to Computershare in the envelope provided or by facsimile. In addition, Computershare provides both telephone voting and internet voting as described on the VIF itself which contain complete instructions. Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the shares represented by the VIFs they receive. If the Company or its agent has sent these materials directly to you (instead of through a nominee), your name and address and information about your holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the nominee holding on your behalf. By choosing to send these materials to you directly, the Company (and not the nominee holding on your behalf) has assumed responsibility for (i) delivering these materials to you and (ii) executing your proper voting instructions. |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as set out herein, to the knowledge of the management of the Company, no person who has been a director or executive officer of the Company since the beginning of the Company's last financial year, no proposed nominee of management for election as a director of the Company and no associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting other than the election of directors and the appointment of auditors.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

To the knowledge of management of the Company, no person beneficially owns, controls or directs, directly or indirectly, shares carrying more than 10% of the voting rights attached to the common shares of the Company, except as disclosed in the table below:

| Name of Owner | Number of Common Shares | Percentage |

Sprott Asset Management Inc.(1) | 17,837,833(1) | 15% |

(1) Based upon information contained in the most recent Schedule 13G/A form filed with the United States Securities and Exchange Commission dated February 14, 2009 as filed on IDEA (formerly EDGAR), adjusted for warrants which have not been exercised.

ELECTION OF DIRECTORS

At the meeting, shareholders will be asked to elect five (5) directors proposed by management (the “Proposed Directors”). The following table provides the names of the directors proposed by management and information concerning them, as furnished by the individual Proposed Directors. The specified persons in the enclosed form of proxy intend to vote for the election of the Proposed Directors. Management does not contemplate that any of the Proposed Directors will be unable to serve as a director. Each director of the Company holds office until the next annual general meeting of shareholders or until his successor is elected or appointed.

| Name, Jurisdiction of Residence and Position Held with the Company | Principal Occupation During Preceding Five Years | Date First Became Director of the Company | Common Shares beneficially owned, controlled or directed, directly or indirectly (1) |

Brian A. Atkins British Columbia, Canada Director | Chartered Accountant; Partner at KPMG LLP, Chartered Accountants, from 1978 to 2005; Director of North Shore Credit Union; Member of Independent Review Committee of Inhance Investment Management Inc. | June 2008 | Nil |

John F. Kearney(2) Ontario, Canada Chairman, President, Chief Executive Officer and Director | Chairman, President and Chief Executive Officer of Canadian Zinc Corporation since 2003; Chairman of Labrador Iron Mines Limited since May 2007; Chairman of Conquest Resources Limited since 2001; Chairman of Anglesey Mining plc since 1994 | November 2001 | 1,923,909 common shares |

John A. MacPherson British Columbia, Canada Director | Director and Chairman of Tower Energy Ltd. until 2007; Private Businessman. | May 1999 | Nil |

Dave Nickerson Northwest Territories, Canada Director | Professional Engineer, Mining consultant, Director, Tyhee Development Corp.; previously Chairman of Northwest Territories Water Board; Member of Parliament, Member of NWT Legislative Assembly; Government Minister | March 2004 | 17,500 common shares |

Alan B. Taylor British Columbia, Canada Vice President, Exploration, Chief Operating Officer and Director | Vice President, Exploration of Canadian Zinc Corporation since 1999 and Chief Operating Officer of Canadian Zinc Corporation since March 2004. | March 2004 | Nil |

| (1) | The information as to common shares beneficially owned or over which the above-named directors exercise control or direction, not being within the knowledge of the Company, has been furnished by the respective directors individually. |

| (2) | Mr. Kearney served as a non-executive director of McCarthy Corporation plc from July 2000 to March 2003. In June 2003, McCarthy Corporation plc proposed a voluntary arrangement with its creditors pursuant to the legislation of the United Kingdom. |

IF ANY OF THE ABOVE PROPOSED DIRECTORS IS FOR ANY REASON UNAVAILABLE TO SERVE AS A DIRECTOR, PROXIES IN FAVOUR OF MANAGEMENT WILL BE VOTED FOR ANOTHER PROPOSED DIRECTOR IN THEIR DISCRETION UNLESS THE SHAREHOLDER HAS SPECIFIED IN THE PROXY THAT HIS SHARES ARE TO BE WITHHELD FROM VOTING IN THE ELECTION OF DIRECTORS.

EXECUTIVE COMPENSATION

Compensation Committee

In 2008, the Compensation Committee of the Board (the “Committee”) consisted of John MacPherson, and Alan Savage (both considered independent directors). Alan Savage resigned from the Board on January 29, 2009. Following the resignation of Alan Savage, the Board considered that it would be appropriate to revisit the membership of the Committee following the re-election of directors at the next Annual General Meeting of the Company.

The Compensation Committee of the Board (the “Committee”) has, among others, the following responsibilities:

| - | Review and make recommendations to the Board regarding the Company’s compensation plans, including with respect to incentive-compensation plans and equity-based plans, policies and programs. |

| - | Review the level and form of Director’s compensation and recommend changes to the Board for consideration and approval. |

| - | Review and monitor the Company’s employee and management compensation and benefit plans and policies, provide oversight of any employee benefit plan, and review and approve the compensation of the Company’s executive officers. |

| - | Annually review and approve corporate goals and objectives relevant to Chief Executive Officer (“CEO”) compensation, evaluate the CEO’s performance in light of those goals and objectives and establish the individual elements of the CEO’s total compensation based on this evaluation. |

| - | Review and make recommendations to the Board with regard to grants and/or awards of restricted stock, stock options and other forms of equity-based compensation under the Company’s stock option, incentive-compensation and equity-based plans (as applicable). |

| - | Review and make recommendations for the Board, when and if appropriate, of employment agreements, severance agreements and change in control provisions / agreements for the CEO and other executive officers. |

The Committee relies on the knowledge and experience of its members and recommendations from senior management in reviewing appropriate levels of compensation for senior officers and the implementation of, or amendment to, any other aspects of compensation that the Committee may review from time to time. Neither the Company nor the Committee currently has any contractual arrangement with any compensation consultant.

Compensation Discussion and Analysis

Objectives of Executive Compensation

The Company is primarily engaged in the exploration, development and re-permitting of its Prairie Creek property located in the Northwest Territories, Canada. The Company is considered to be in the exploration and development stage given that its Prairie Creek property is not in production and, to date, has not earned any significant revenues. Accordingly, the Company is reliant upon funding from capital raising activities. As a result, the Board of Directors has to consider the financial situation of the Company in a wider context involving the ongoing status of the Prairie Creek project, when setting its executive compensation levels.

The general compensation philosophy of the Company for executive officers, including for the CEO, is to provide a level of compensation that is competitive within the North American marketplace and that will attract and retain individuals with the experience and qualifications necessary for the Company to be successful, and to provide long-term incentive compensation which aligns the interest of executives with those of shareholders and provides long-term incentives to members of senior management whose actions have a direct and identifiable impact on the performance of the Company and who have material responsibility for long-range strategy development and implementation.

Structure of Executive Compensation

The Company does not have a formal compensation plan in place for its Executive Officers. The Company is in the exploration and development stage and does not generate revenues from operations. Accordingly, the use of traditional performance standards, such as corporate profitability, is not considered by the Committee to be appropriate in the evaluation of corporate or executive performance.

Historically, the compensation of executive officers of the Company has been comprised primarily of cash compensation and the allocation of incentive stock options. In establishing levels of remuneration and in granting stock options, an executive's performance, level of expertise, responsibilities, length of service to the Company and comparable levels of remuneration paid to executives of other companies of comparable size and development within the industry are taken into consideration. Interested executives do not participate in reviews, discussions or decisions of the Compensation Committee or the board of directors regarding this remuneration.

While the Company does not actively benchmark its compensation programs for executive officers, and the individual components thereof, it does review the compensation practices of comparable companies to ensure the compensation that it is paying its executive officers is competitive. This has primarily been done through the use of externally prepared “Compensation Reports, ” which are available through certain consulting firms. These reports typically include information for larger mining companies but do assist the Committee and the Company in determining approximately what salary levels and other benefits are in place across the industry.

Base Salary

The Company provides executive officers with base salaries which represent their minimum compensation for services rendered during the fiscal year. Salary levels are based upon the executive’s experience, responsibilities, performance and time commitment. Base salaries are reviewed annually by the Committee.

Stock Options

The grant of stock options to purchase common shares of the Company, pursuant to the Company’s Stock Option Plan is an integral component of executive officer compensation packages. The Company's stock option plan is administered by the board of directors of the Company, with option grants being recommended by the Committee to the Board. The stock option plan is designed to give each option holder an interest in preserving and maximizing shareholder value in the longer term, to enable the Company to attract and retain individuals with experience and ability, and to reward individuals for current performance and expected future performance. Stock option grants are considered when reviewing executive officer compensation packages as a whole.

Other incentives

The Company does not have a formal annual incentive bonus plan in place. Any award of a bonus to executive officers is entirely at the discretion of the Board of Directors based upon recommendation by the Committee. In considering the payment of a discretionary bonus to executive officers, the Committee takes into account the individual performance and efforts of the executive during the year, the progress made by the Company in furthering its business plan and the overall economic climate.

The Company has a health benefit plan that is available to all full-time employees. The benefit plan is designed to protect employees’ health and that of their dependents, and cover them in the event of disability or death.

Perquisites and personal benefits provided to executive officers reflect competitive practices and particular business needs. They are not considered a material component of the executive compensation program.

Defined Benefit or Actuarial Plan

The Company does not have a defined benefit or actuarial plan.

Summary Compensation Table

The following table (presented in accordance with National Instrument 51-102F6) sets out total compensation for the year ended December 31, 2008 in respect of John F. Kearney, the CEO of the Company, Alan Taylor, the Chief Operating Officer (“COO”) of the Company and Martin Rip, the Chief Financial Officer (“CFO”) of the Company (the “Named Executive Officers”).

Name And Principal Position | Year | Salary ($) | Share-based awards ($) | Option-based awards ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation (2) ($) | Total Compensation ($) |

| Annual incentive plans | Long-term incentive plans |

John F. Kearney Chairman, President and CEO (1) | 2008 | 155,000 (2) | Nil | Nil | Nil | Nil | Nil | Nil | 155,000 |

Alan B. Taylor COO (1) | 2008 | 168,000 | Nil | Nil | Nil | Nil | Nil | Nil | 168,000 |

Martin Rip CFO | 2008 | 144,000 | Nil | Nil | Nil | Nil | Nil | Nil | 144,000 |

| (1) | John Kearney and Alan Taylor are directors of the Company but were not compensated for services in this capacity. |

| (2) | $30,000 of the total salary was paid to a private company controlled by John Kearney. |

| (3) | Perquisites have not been included, as they do not exceed 10% of total salary for the financial year ended December 31, 2008. |

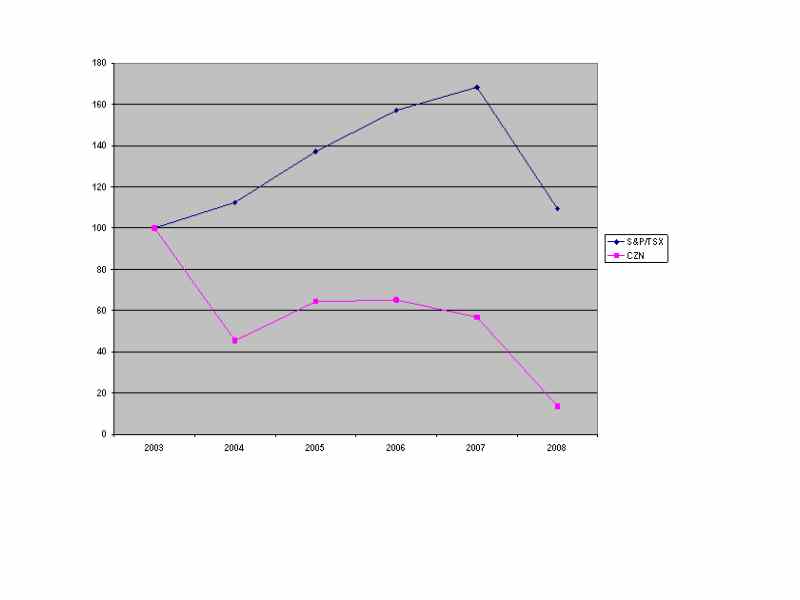

The following graph compares the yearly percentage change in the cumulative total shareholder return over the last five financial years of the common shares of the Company, assuming a $100 investment in the common shares of the Company on December 31, 2003, with the S&P/TSX Composite Index during such period, assuming dividend reinvestment.

CUMULATIVE VALUE OF A $100 INVESTMENT AS OF DECEMBER 31

| DATA | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 |

| CZN | 100 | 45 | 64 | 65 | 57 | 14 |

| S&P/TSX | 100 | 112 | 137 | 157 | 168 | 109 |

The Company has seen a recent decline in its share price which reflects the current market conditions and, in particular, pricing for junior mineral exploration and development companies. While the Company believes it made significant progress in 2008 with regards to, among others, permitting, the chart does reflect the current economic climate. The Company responded to the current global situation by cutting back certain activities in order to preserve cash, and determined that it would not be appropriate, for example, to pay any management bonuses for the year ended December 31, 2008.

Incentive plan awards

The following table shows all awards outstanding to each Named Executive Officer as at December 31, 2008.

| | Option-based Awards | Share-based Awards |

Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) |

| John F. Kearney | 1,000,000 200,000 | 0.60 0.90 | Jan 14, 2010 Dec 13, 2011 | Nil Nil | N/a | N/a |

| Alan B. Taylor | 700,000 200,000 | 0.60 0.90 | Jan 14, 2010 Dec 13, 2011 | Nil Nil | N/a | N/a |

| Martin Rip | 300,000 | 0.94 | Oct 15, 2012 | Nil | N/a | N/a |

Incentive plan awards – value vested or earned during the year

The following table shows all awards outstanding to each Named Executive Officers as at December 31, 2008.

Name | Option-based awards – Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) |

John F. Kearney (1) | Nil | N/a | Nil |

Alan B. Taylor (1) | Nil | N/a | Nil |

Martin Rip (2) | Nil | N/a | Nil |

| (1) | No awards vested for John Kearney or Alan Taylor during the year ended December 31, 2008. |

| (2) | Options that vested for Martin Rip during the year ended December 31, 2008 were all “out-of-the-money” on the vesting date and throughout the year. |

Stock Option Plan

Under the stock option plan of the Company (the “Stock Option Plan”), options to purchase common shares of the Company may be granted to employees, officers and directors of the Company or subsidiaries of the Company and other persons or companies engaged to provide ongoing management or consulting services (“Service Providers”) for the Company or any entity controlled by the Company. In determining the number of common shares of the Company subject to each option granted under the Stock Option Plan, consideration is given to the present and potential contribution by such person or company to the success of the Company.

Following amendments made by the Toronto Stock Exchange to its Company Manual effective January 1, 2005, the Company implemented amendments to its Stock Option Plan to change the maximum number of common shares which may be made subject to option from time to time from a fixed number to a rolling maximum of 10% of the Company's issued and outstanding share capital at the time of grant.

Pension Plan Benefits

The Company does not provide any form of group pension plan benefits to employees, officers or directors.

Termination and Change of Control Benefits

Except as otherwise disclosed herein, the Company and its subsidiaries have no compensatory plan or arrangement in respect of compensation received or that may be received by an executive officer of the Company in the Company's most recently completed or current financial year to compensate such executive officer in the event of the termination of employment (resignation, retirement, change of control) or in the event of a change in responsibilities following a change in control.

The Company entered into an Employment Agreement dated effective October 15, 2007 (the “Rip Agreement”) with Mr. Martin Rip for his continuing services as an officer of the Company commencing on October 15, 2007 in consideration of an annual salary of $144,000. Certain provisions in the Rip Agreement deal with events around termination of employment and change in responsibilities following a change of control. Should Mr. Rip’s employment with the Company be terminated without cause prior to October 15, 2011, Mr. Rip is entitled to receive six months termination pay at his then current salary. If his employment is terminated without cause on or after October 15, 2011 this amount increases to one year of termination pay. In the event of a change of control and subsequent termination or constructive dismissal within 12 months of the change of control, Mr. Rip is entitled to receive, in addition to termination pay, a further amount equal to six months of his then current annual salary.

A summary of the potential payments to Mr. Rip, based on his current salary, are illustrated below:

Termination without cause prior to October 15, 2011 - $72,000.

Termination without cause following a change of control prior to October 15, 2011 - $144,000.

Termination without cause subsequent to October 14, 2011 - $144,000.

Termination without cause following a change of control subsequent to October 15, 2011 - $216,000.

Director Compensation

The following table shows director compensation for each director, other than directors that are also Named Executive Officers, for the year ended December 31, 2008.

| Name | Fees earned ($) | Share-based awards ($) | Option-based awards (4) ($) | Non-equity incentive plan compensation ($) | Pension value ($) | All other compensation ($) | Total ($) |

Brian A. Atkins (1) | 10,397 | N/a | Nil | Nil | N/a | Nil | 10,397 |

Robert Gayton (2) | 10,500 | N/a | Nil | Nil | N/a | Nil | 10,500 |

| John MacPherson | 16,500 | N/a | Nil | Nil | N/a | Nil | 16,500 |

| Dave Nickerson | 18,500 | N/a | Nil | Nil | N/a | Nil | 18,500 |

Alan Savage (3) | 18,500 | N/a | Nil | Nil | N/a | Nil | 18,500 |

| (1) | Mr. Atkins was appointed as a director of the Company on June 17, 2008. |

| (2) | Mr. Gayton served as a director of the Company until June 17, 2008. |

| (3) | Mr. Savage resigned from the board on January 29, 2009, subsequent to the year reported in the table above. |

| (4) | No stock options were granted to directors during the year ended December 31, 2008. |

The Company pays each director, other than directors that are also executive officers, an annual fee of $10,000 (payable quarterly and pro-rated for partial months served) plus $500 for each meeting or committee meeting

attended. The Chair of a committee (i.e. audit or compensation committee) receives an additional $500 per meeting attended. An aggregate of $74,397 was paid to directors for their services as directors during 2008.

From time to time, directors may be retained to provide specific services to the Company and will be compensated on a basis to be negotiated. There were no such arrangements in 2008.

Share-based awards, option-based awards and non-equity incentive plan compensation

The following table shows all option-based and share-based awards outstanding to each director, other than those that are also Named Executive Officers, as at December 31, 2008.

| | Option-based Awards | Share-based Awards |

Name | Number of securities underlying unexercised options (#) | Option exercise price ($) | Option expiration date | Value of unexercised in-the-money options ($) | Number of shares or units of shares that have not vested (#) | Market or payout value of share-based awards that have not vested ($) |

| Brian A. Atkins | Nil | N/a | N/a | N/a | N/a | N/a |

| John MacPherson | 400,000 200,000 | 0.60 0.90 | Jan 14, 2010 Dec 13, 2011 | Nil Nil | N/a | N/a |

| Dave Nickerson | 300,000 200,000 | 0.60 0.90 | Jan 14, 2010 Dec 13, 2011 | Nil Nil | N/a | N/a |

Alan Savage (1) | 200,000 | 0.90 | Dec 13, 2011 | Nil | N/a | N/a |

| (1) | Options granted to Mr. Savage expired unexercised on April 29, 2009 following his resignation as a director on January 29, 2009. |

Incentive plan awards – value vested or earned during the year

The following table shows all incentive plan awards values vested or earned for each director, other than those that are Named Executive Officers, during the year ended December 31, 2008.

Name | Option-based awards – Value vested during the year ($) | Share-based awards – Value vested during the year ($) | Non-equity incentive plan compensation – Value earned during the year ($) |

Brian A. Atkins (1) | N/a | N/a | N/a |

John MacPherson (2) | Nil | N/a | Nil |

Dave Nickerson (2) | Nil | N/a | Nil |

Alan Savage (2) | Nil | N/a | Nil |

| (1) | No awards were granted (or vested) to Mr. Atkins during the year ended December 31, 2008. |

| (2) | No awards vested during the year ended December 31, 2008. |

The Company has no plans other than the Company's stock option plan previously referred to herein pursuant to which cash or non-cash compensation was paid or distributed to directors during the most recently completed financial year or is proposed to be paid or distributed in a subsequent year. Directors are eligible to participate in the stock option plan. During the financial year ended December 31, 2008, no stock options were granted to directors of the Company.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

No director or executive officer, proposed management nominee for election as a director of the Company or associate or affiliate of any such director or executive officer, is or, at any time since the beginning of the most recently completed financial year of the Company, was indebted to or guaranteed or supported by the Company.

DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE

Section 21 of the Articles of the Company provides for mandatory indemnification of directors and former directors against all costs, charges and expenses in respect of any proceeding to which they are made a party by reason of being a director or officer of the Company, subject any limitations contained in the Articles and in the Business Corporations Act (British Columbia).

The Company maintains insurance for the benefit of the Company’s directors and officers against liability incurred by them in their capacity as directors and officers. The policy provides coverage in respect of a maximum total liability of $5 million, subject to a deductible of $25,000 per event (or $75,000 deductible for U.S. Securities Claim). The premium for 2008 was $24,000. The policy was renewed in 2009 for a premium of $22,000. The policy contains standard industry exclusions and no claims have been made to date.

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

No informed person or proposed director of the Company, or any associate or affiliate of any informed person or proposed director, has had a material interest, direct or indirect, in any transaction of the Company since the commencement of the Company's last fiscal year or in any proposed transaction which has materially affected or would materially affect the Company.

MANAGEMENT CONTRACTS

Except as otherwise disclosed herein, no management functions of the Company are performed to any substantial degree by a person other than the directors or executive officers of the Company.

DISCLOSURE OF CORPORATE GOVERNANCE PRACTICES

The following discloses the Company’s corporate governance practices as required by National Instrument 58-101.

Independence of Members of Board

The Company’s board of directors currently consists of five directors. Three of the directors, Brian Atkins, Dave Nickerson and John MacPherson, being a majority, are considered independent of management and of any significant shareholder and are considered competent to exercise independent judgment in carrying out their responsibilities as directors. None of these directors have any direct or indirect material relationship with the Company or have any relationship pursuant to which they may accept directly or indirectly any consulting, advisory or other compensatory fees, other than as remuneration for acting in his capacity as a member of the Board of Directors or any committee thereof.

The Chairman of the Board, John F. Kearney, is not independent in that he is also President and Chief Executive Officer of the Company. Alan B. Taylor is not independent as he is the Vice-President Exploration and Chief Operating Officer of the Company.

Until January 29, 2009, Alan Savage acted as lead director. No lead director has been appointed since his resignation from the Board. However, three of the five board members of the Company are independent and this is considered sufficient at the current time to enable the Board to carry out its duties and responsibilities.

The Chairman of each of the Audit Committee and the Compensation Committee is an independent director, who provides leadership to those committees, and the Chairman of the Board does not sit on either committee.

Management Supervision by the Board

The Chief Executive Officer and Chief Operating Officer report upon the operations of the Company directly to the Board on a regular basis. The independent directors are able to meet at any time they consider necessary without any members of management, including non-independent directors, being present. The Audit Committee is composed of independent directors who meet with the Company’s auditors, and without management in attendance if considered necessary or desirable. The independent directors have regular and full access to management and are able to meet at any time without the non-independent directors being present if considered necessary or desirable.

Participation of Directors in Other Reporting Issuers

The participation of the Directors in other reporting issuers is described in the following table:

| Name of Director | Name of Other Reporting Issuer |

| John F. Kearney | Anglesey Mining plc Avnel Gold Mining Limited Blackwater Capital Corp. Conquest Resources Limited Labrador Iron Mines Holdings Limited Minco plc Sulliden Exploration Inc. Xtierra Inc. |

| Dave Nickerson | Tyhee Development Corp. |

Participation of Directors in Board Meetings

In the year ended December 31, 2008, thirteen board meetings were held. In addition, there were four meetings of the audit committee, one of the compensation committee and three of the Health & Safety Committee. The attendance record of each director for the board and applicable committee meetings held is as follows:

| Name of Director | Board Meetings Attended | Committee Meetings Attended |

| Brian Atkins | 6 of 7 | 2 of 2 |

| Robert Gayton | 4 of 6 | 2 of 2 |

| John F. Kearney | 13 of 13 | N/a |

| John A. MacPherson | 12 of 13 | 1 of 1 |

| Dave Nickerson | 11 of 13 | 7 of 7 |

| Alan C. Savage | 10 of 13 | 4 of 5 |

| Alan B. Taylor | 13 of 13 | 3 of 3 |

Board Mandate

The Board does not have a written mandate. The mandate of the Board is to supervise the management of the business and affairs of the Company. As part of its overall stewardship the Board of Directors assumes responsibility for strategic planning, identification of the principal risks associated with the Company’s business and ensuring appropriate management of these risks and making all senior officer appointments, including responsibility for evaluating performance, management development and succession planning.

Position Descriptions

The Board has not developed written position descriptions for the Chair of the Board or the Chairs of each of the Committees. The Board is of the view that the role and responsibilities of the Chair and of the Chairs of the respective Committees are sufficiently specific that no separate written position descriptions would be helpful.

The Company does not have an employment contract, or a written position description, in place with its President and Chief Executive Officer. The Chief Executive Officer is responsible for the day to day operations of the Company and reports directly to the Board of Directors on a regular basis. The Board responds to, and if it considers appropriate, approves with such revisions as it may require, recommendations which have been brought forward by the Chief Executive Officer. In addition to those matters which by law must be approved by the Board, all significant activities and actions proposed to be taken by the Company including in particular capital budgets, financing, property acquisitions or dispositions, senior appointments and compensation are subject to approval by the Board of Directors.

Orientation and Continuing Education

The Company does not have a formal orientation or education program for directors. New Board members are provided with information respecting the functioning of the Board of Directors and its Committees. In addition, directors receive copies of Board materials, corporate policies and procedures, and other information regarding the business and operations of the Company. Board members are expected to keep themselves current with industry trends and developments and are encouraged to communicate with management and, where applicable, auditors and technical consultants of the Company, and visit the Company’s offices on a regular basis. Board members have access to legal counsel to the Company in the event of any questions or matters relating to the Board members’ corporate and director responsibilities and to keep themselves current with changes in legislation. Board members have full access to the Company’s records and general industry information and material of interest is circulated to directors on a regular basis.

Ethical Business Conduct

The Board assumes responsibility for the Company’s approach to corporate governance matters. The Board views good corporate governance and ethical business conduct as an integral and essential component to the supervision and management of the Company and to meet responsibilities to shareholders, employees and other stakeholders.

The Board has adopted a written code for directors, officers and employees – a copy of this Code can be found on the Company’s website at www.canadianzinc.com. The Code is intended to define the ethical and regulatory standards applicable to all directors, officers and employees (including contractors) of the Company, and their family members, and provides guidance as to the following matters (being a summary and not exhaustive list): Honest and ethical conduct; avoidance of conflicts of interest, whether actual or potential; full, fair, accurate, timely and understandable disclosures; compliance with legislation and regulations; prompt internal disclosure of any violation of the Code; and accountability for any failure to respect the Code.

The Code is not considered a comprehensive guide to all the Company’s policies or to individuals’ responsibilities under applicable laws and regulations. The Code is intended to provide general parameters and expectations of the Company and is provided to all directors, officers, employees and key contractors when they commence their services with the Company.

The Board requires an annual review of the Code, conducted by the CFO. This review consists of interviews and queries within the Company, the results of which are then reported by the CFO at a full meeting of the Board of Directors. The form of the review is intended to determine whether there are any violations of the Code that have not been previously reported and also to ensure that the Code has been understood by

recipients. Should any matters come to the attention of the Company during this review, or at any other time, they are discussed by the Board.

The Board conducts periodic reviews of the Company’s corporate governance practices and procedures in the light of applicable rules and guidelines and the current status and stage of development of the Company.

Directors are expected to adhere to all corporate law requirements in respect of any transaction or agreement in which they may have a material interest. It is a requirement of applicable corporate law that directors who have an interest in a transaction or agreement with the Company promptly disclose that interest at any meeting of the Board at which the transaction or agreement will be discussed and abstain from discussions and voting in respect to same if the interest is material. Where appropriate any director having a material conflict of interest will be expected to withdraw from the meeting and not participate in the meeting where such matter is being considered so that the remaining directors may properly exercise independent judgment.

Nomination of Directors

The Board has not appointed an independent Nominating Committee. Nominations, if and when they arise, are generally the result of formal or informal discussions with members of the Board or recommendations by members of the Board. Nominations to the Board are determined, after appropriate review and investigation, by the Board of Directors, of which a majority are independent directors, as a whole.

Compensation

The Board has appointed a Compensation Committee which has responsibility for determining compensation for the directors and senior management. See the “Executive Compensation -- Compensation Committee” section above.

During 2008, the Compensation Committee was comprised of John MacPherson and Alan Savage. On January 29, 2009, Alan Savage resigned from the Board of Directors. The Board determined that, as the Compensation Committee has already provided input to year end matters during November and December 2008, it would seek to revisit the membership of the Compensation Committee at the board meeting to be held immediately following the upcoming annual general meeting of shareholders of the Company.

All members of the Compensation Committee are considered independent. The Committee makes recommendations to the Board with respect to the compensation of the President and Chief Executive Officer. The Compensation Committee meets as requested by the Board or the Chief Executive Officer, or as considered desirable by the Committee. The Compensation Committee has the authority to retain independent advisors as it may deem necessary or appropriate to allow it to discharge its responsibilities. The Compensation Committee has not retained a compensation consultant or advisor since the beginning of the 2006 financial year, except that a recruitment consultant was retained to assist in the search for a Chief Financial Officer during 2007.

Other Committees

In addition to the Audit Committee and the Compensation Committee, the Board also has a Health & Safety Committee comprised of Alan Taylor, Dave Nickerson and the Prairie Creek Site Managers.

Assessment

The Board of Directors continuously reviews on an ongoing informal basis the effectiveness of the Board as a whole and the effectiveness, contribution and performance of the Board, its committees and individual directors. Each year, when it determines the number of directors to be elected at the annual meeting of shareholders, the Board considers its appropriate size and composition to properly administer the affairs of the Company and to effectively carry out the duties of the Board, given the Company’s current status and stage of development.

AUDIT COMMITTEE DISCLOSURE

The Company's audit committee is governed by a written charter that sets out its mandate and responsibilities. A copy of this charter and the disclosure on the Audit Committee required by National Instrument 52-110 is contained under the heading “Audit Committee Information” in the Company's Annual Information Form for the year ended December 31, 2008 which may be viewed under the Company's profile on SEDAR at www.sedar.com.

EQUITY COMPENSATION PLAN INFORMATION

The following table sets out certain details as at December 31, 2008 with respect to compensation plans pursuant to which equity securities of the Company are authorized for issuance:

Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) | Weighted-average exercise price of outstanding options, warrants and rights (b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

| Equity compensation plans approved by securityholders | 4,205,000 | $0.73 | 7,691,906 |

| Equity compensation plans not approved by securityholders | Nil | Nil | Nil |

| Total | 4,205,000 | | 7,691,906 |

Under the stock option plan of the Company (the “Stock Option Plan”), options to purchase common shares of the Company may be granted to employees, officers and directors of the Company or subsidiaries of the Company and other persons or companies engaged to provide ongoing management or consulting services (“service providers”) for the Company or any entity controlled by the Company. In determining the number of common shares of the Company subject to each option granted under the Stock Option Plan, consideration is given to the present and potential contribution by such person or company to the success of the Company.

The Company currently has a 10% rolling stock option plan, approved by shareholders in 2007 (the “10% Rolling Plan”). The 10% Rolling Plan provides that the number of common shares which may be issued pursuant to options granted under the 10% Rolling Plan or otherwise is a maximum of 10% of the issued and outstanding common shares at the time of the grant. The TSX requires the 10% Rolling Plan to be approved and ratified by shareholders every three years.

The effect of the 10% Rolling Plan is that at any point in time, the Company may have stock options outstanding for the purchase of up to 10% of issued capital of the Company. Based upon the issued capital of the Company and the number of outstanding stock options at May 12, 2009, the Company can issue an additional 5,150,056 stock options.

There were 4,205,000 stock options issued and outstanding under the Stock Option Plan, representing 3.53% of the Company’s issued and outstanding share capital as at December 31, 2008. Subsequent to December 31, 2008, a further 2,905,000 stock options were granted.

The purpose of the 10% Rolling Plan is to attract and motivate directors, officers, employees of and service providers to the Company (collectively the “Optionees”) and thereby advance the Company’s interests by affording such persons with an opportunity to acquire an equity interest in the Company through the stock options. The 10% Rolling Plan authorizes the board of directors (or compensation committee) to grant stock options to the Optionees on the following terms:

| 1. | The number of shares subject to each stock option is determined by the board of directors (or compensation committee) provided that the 10% Rolling Plan, together with all other previously established or proposed share compensation arrangements, may not result in: |

| a. | the number of common shares of the Company reserved for issuance pursuant to stock options granted to insiders exceeding 10% of the outstanding issue; |

| b. | the issuance, to insiders of the Company of a number of common shares of the Company exceeding, within a one year period, 10% of the outstanding issue; or |

| c. | the issuance, to any one insider of the Company and such insider’s associates, of a number of common shares of the Company exceeding, within a one year period, 5% of the outstanding issue. |

The outstanding issue is determined on the basis of the number of common shares of the Company outstanding immediately prior to any share issuance, excluding shares issued pursuant to share compensation arrangements over the preceding one-year period.

| 2. | The maximum number of common shares of the Company which may be issued pursuant to stock options granted under the 10% Rolling Plan, unless otherwise approved by shareholders, is 10% of the issued and outstanding common shares at the time of the grant. Any increase in the issued and outstanding common shares will result in an increase in the available number of common shares issuable under the 10% Rolling Plan, and any exercises of stock options will make new grants available under the Stock Option Plan. |

| 3. | The 10% Rolling Plan must be approved and ratified by shareholders every three years. |

| 4. | The exercise price of an option may not be set at less than the closing price of the common shares of the Company on the TSX on the trading day immediately preceding the date of grant of the option. |

| 5. | The options may be exercisable for a period of up to ten years, such period and any vesting schedule to be determined by the board of directors (or compensation committee) of the Company, and are non-assignable, except in certain circumstances. |

| 6. | The options can be exercised by the Optionee as long as the Optionee is a director, officer, employee or service provider to the Company or within a period of not more than 90 days after ceasing to be a director, officer, employee or service provider (or such longer period as may be approved by the board of directors of the Company and, if required, the TSX) or, if the Optionee dies, within one year from the date of the Optionee’s death. |

| 7. | On the receipt of a takeover bid or change of control, any unvested options shall be immediately exercisable. |

| 8. | The directors may from time to time in the absolute discretion of the Directors amend, modify and change the provisions of an option or the 10% Rolling Plan without obtaining approval of shareholders to: |

| a. | make amendments of a “housekeeping” nature; |

| b. | change vesting provisions; |

| c. | change termination provisions for an insider provided that the expiry date does not extend beyond the original expiry date; |

| d. | change termination provisions which does not extend beyond the original expiry date for an optionee who is not an insider; |

| e. | reduce the exercise price of an option for an optionee who is not an insider; |

| f. | implement a cashless exercise feature, payable in cash or securities, provided that such feature provides for a full deduction of the number of shares from the number of shares reserved under the 10% Rolling Plan; and |

| g. | make any other amendments of a non-material nature which are approved by the TSX. |

All other amendments will require approval of shareholders and the TSX.

APPOINTMENT OF AUDITORS

Unless such authority is withheld, the persons named in the accompanying proxy intend to vote for the re-appointment of Ernst & Young LLP, as auditors of the Company for the 2009 fiscal year, and to authorize the directors to fix their remuneration.

PARTICULARS OF OTHER MATTERS TO BE ACTED UPON

There are no other matters to be acted upon.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Except as set out herein, no person who has been a Director or executive officer of the Company at any time since the beginning of the Company’s last financial year, no proposed nominee of management of the Company for election as a Director of the Company and no associate or affiliate of the foregoing persons, has any material interest, direct or indirect, by way of beneficial ownership or otherwise, in matters to be acted upon at the Meeting other than the election of Directors or the appointment of auditors.

NORMAL COURSE ISSUER BID

The Company conducted a normal course issuer bid (the “Bid”) from May 13, 2008 to May 12, 2009. During this one year period, the Company acquired 1,784,500 common shares under the Bid for a total cost of $390,000. All shares purchased under the Company’s normal course issuer were cancelled and returned to treasury as soon as practical after the purchase date. No insiders of the Company participated in the Bid.

ADDITIONAL INFORMATION

Additional information relating to the Company is available under the Company's profile on SEDAR at www.sedar.com and on the Company's website at www.canadianzinc.com. Financial information is provided in the Company’s Financial Statements and Management’s Discussion and Analysis (“MD&A”) for the year ended December 31, 2008.

Shareholders may request copies of the Company’s Financial Statements, MD&A and Annual Information Form by contacting the Company at:

Suite 1710, 650 West Georgia Street

Vancouver, BC V6B 4N9

Tel: (604) 688-2001 Fax: (604) 688-2043

Email: invest@canadianzinc.com

* * * * * * * *

OTHER MATTERS

Management of the Company is not aware of any other matter to come before the Meeting other than as set forth in the notice of Meeting. If any other matter properly comes before the Meeting, it is the intention of the persons named in the enclosed form of proxy to vote the shares represented thereby in accordance with their best judgment on such matter.

The contents and sending of this Information Circular have been approved by the directors of the Company.

DATED at Vancouver, British Columbia as of the 12th day of May, 2009.

BY ORDER OF THE BOARD OF DIRECTORS

(Signed)

John F. Kearney

Chairman