OMB APPROVAL

OMB Number: 3235-0570

Expires: October 31, 2006

Estimated average burden hours per response: 19.3

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-7978

ING Mayflower Trust

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

CT Corporation System, 101 Federal Street, Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | November 1, 2004 to October 31, 2005 |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

| Funds |

| Annual Report |

| |

| October 31, 2005 |

| |

| Classes A, B, C and M |

| |

| |

| Global Equity Funds |

| |

| § ING Global Equity Dividend Fund |

| § ING Global Real Estate Fund |

| § ING Global Value Choice Fund |

| |

| International Equity Funds |

| |

| § ING Emerging Countries Fund |

| § ING Foreign Fund |

| § ING International Fund |

| § ING International SmallCap Fund |

| § ING International Value Fund |

| § ING International Value Choice Fund |

| § ING Precious Metals Fund |

| § ING Russia Fund |

E-Delivery Sign-up – details inside E-Delivery Sign-up – details inside

|

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds’ investment objectives, risks, charges, expenses and other information. This information should be read carefully. |

|

TABLE OF CONTENTS

| President’s Letter | 1 | |

| | | |

| Market Perspective | 2 | |

| | | |

| Portfolio Managers’ Reports | 4 | |

| | | |

| Shareholder Expense Examples | 26 | |

| | | |

| Report of Independent Registered Public Accounting Firm | 30 | |

| | | |

| Statements of Assets and Liabilities | 31 | |

| | | |

| Statements of Operations | 37 | |

| | | |

| Statements of Changes in Net Assets | 40 | |

| | | |

| Financial Highlights | 45 | |

| | | |

| Notes to Financial Statements | 61 | |

| | | |

| Portfolios of Investments | 79 | |

| | | |

| Shareholder Meeting Information | 108 | |

| | | |

| Tax Information | 110 | |

| | | |

| Trustee and Officer Information | 111 | |

| | | |

| Advisory Contract Approval Discussion | 115 | |

| | | | | | |

| |

| Go Paperless with E-Delivery! |

| | |

| | Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs. | | |

| | | | |

| | Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll. | | |

| | | | |

| | You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail. | | |

| | | | | | |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| Dear Shareholder, |

|

We are in the midst of an exciting time here at ING Funds. We began the year by introducing the ING Global Equity Dividend and Premium Opportunity Fund that gave investors an opportunity to invest in global companies with a history of attractive dividend yields. |

|

When the Fund’s initial offering period closed, it proved to be one of the five largest unleveraged closed-end funds in history. |

|

The success of the Fund offering illustrates what ING Funds is really all about: fresh thinking in financial services. The Fund’s offering success also confirmed something else that we have long believed; namely, that investors are excited about opportunities beyond our shores. |

|

As globalization grows, investment opportunities grow as well. In 1970, only about one-third of equity market capitalization was located abroad; by 2004, that number had jumped to 50 percent(1). It is often said that the world is becoming ever more complicated. This is undoubtedly true in the world of investments where the range of asset classes and investment techniques has never been wider. To take advantage of the opportunities that are now available, it is essential to seek investment partners who have the required breadth and depth of experience — on a global basis. |

|

Our goal at ING Funds is to deliver innovative investment products that help you, the investor, to achieve your financial dreams. We have also long been committed to uncovering opportunities worldwide. |

|

We will continue to bring you opportunities — wherever they occur. With access to more than 700 ING investment management professionals who are located around the world and who, in our consideration, deliver exceptional insight into markets in Europe, the Americas and the Asia-Pacific region, we believe we are in a unique position to help you take advantage of the opportunities that the world has to offer. |

|

On behalf of everyone here at ING Funds, I thank you for your continued support and loyalty. We look forward to serving you in the future. |

Sincerely,

James M. Hennessy

President

ING Funds

December 5, 2005

The views expressed in the President’s Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

(1) Morgan Stanley Capital International

1

MARKET PERSPECTIVE: YEAR ENDED OCTOBER 31, 2005

Investors in global equities gained 7.2% in the second half of our 12-month review period (13.3% for the twelve months as a whole), after 5.7% in the first half, according to the Morgan Stanley Capital International (“MSCI”) World Index(1) in dollars, including net reinvested dividends. Little of the 7.2% however, was made after July 2005, with July 2005 being the best month since 2003. In currencies, the dollar built on early strength in 2004, reflecting faster U.S. growth and rising short-term interest rates. The euro was further buffeted by the defeat of a proposal for a European constitution, acrimonious stalemate on a European budget and German electoral indecision. For the second six months the U.S. dollar rose 7.4% (6.7% for the twelve months as a whole), against the euro 7.8% (3.8% for the twelve months as a whole), against the pound and 11.1% (10.0% for the twelve months as a whole), against the oil price sensitive yen.

Trends in investment grade U.S. fixed income securities had been dominated since the middle of 2004 by the flattening of the U.S. Treasury yield curve as ten-year U.S. Treasury yields fell, even as the Federal Open Market Committee (“FOMC”) raised short-term interest rates seven times to the end of March 2005. The curve-flattening trend was further sustained by three more increases in May 2005, June 2005 and August 2005. August 2005 ended with second quarter gross domestic product (“GDP”) growth being revised down and a final new record oil price of almost $70 a barrel as Hurricane Katrina’s devastation became known. But any hopes that the FOMC might now relent vanished in September 2005 when factory prices were reported to have risen by the most in decades. The FOMC duly struck for the 11th time. Inflationary clouds continued to gather in October 2005, pulling both short- and long-term rates higher. For the half-year, the yield on the ten-year U.S. Treasury Note rose by 36 basis points to 4.56% (53 basis points for the twelve months as a whole), while that on 13-week U.S Treasury Bills rose 99 basis points, to 3.88% (198 basis points for the twelve months as a whole). The return on the broader Lehman Aggregate Bond Index(2) was 0.15% for the six months.

The U.S. equities market in the form of the Standard & Poor’s 500 Composite Stock Price (“S&P 500”) Index(3), gained 5.00%, including dividends in the six months through October 2005 (8.72% for the twelve months as a whole). Investors warily watched interest rates as they ultimately rose at the long end as well as the short. Falling mortgage interest rates have encouraged refinancing on a massive scale and the funds raised have tended not to stay long in the wallets of American consumers, keeping expansion strong. Still, stocks benefited from July 2005’s positive economic data, especially robust second quarter company earnings figures. The S&P 500 Index reached its best level, a four-year high on August 3, 2005, but then fell back. Little headway was made after Hurricane Katrina and Hurricane Rita. High prices at the gas pump were already here and an expensive winter for heating fuel was expected. Continual and pervasive reports of sharply rising prices persisted through October, and with consumer confidence slumping, stocks pulled back. However, in the last two days of October 2005, stocks slashed their losses amid reports that evidenced recovery from the Hurricanes. Perhaps we could look forward to a year-end rally after all.

Japan equities soared 16.6%, based on the MSCI Japan Index(4) (“Index”) in dollars plus net dividends, for the six months ended October 31, 2005 (22.3% for the twelve months as a whole). The Index actually rose a remarkable 29.3% in yen, which weakened as money increasingly abandoned low yielding yen-denominated securities in favor of ever-higher dollar interest rates. The market did little until August 2005, but thereafter, a new sense of optimism took hold, based on an encouraging improvement in domestic demand suggesting a return to a balanced economy after years of export dependency. In addition, it was the prospect of a new reformist beginning under Prime Minister Koizumi, who won a landslide election victory in support of his proposal to privatize Japan Post, the savings vehicle of choice among the Japanese public and, improbably, the world’s largest financial institution. By October 31, 2005, the Bank of Japan was even predicting a swift end to deflation, propelling local currency indices toward five-year records.

European ex UK markets added 7.5% in the six months ended October 31, 2005, according to the MSCI Europe ex UK Index(5) including net dividends (17.40% for the twelve months as a whole). Such bullish performance belied bearish economic conditions. High unemployment and restrictive employment practices continued to depress domestic demand, while European ministerial bickering and political deadlock in Germany disappointed reformers, which resulted in the depressing of the euro. Stock markets cheered the weaker currency and corporate profits held up, allowing stocks to advance in the face of record low bond yields. Markets drifted down 3.2% in October 2005 however, despite improved business

2

MARKET PERSPECTIVE: YEAR ENDED OCTOBER 31, 2005

confidence and strong purchasing managers’ reports. The loss would have been worse had a surge of merger and acquisition activity on the last day not lifted markets by approximately 2%. The problem was the combination of the highest inflation in over four years: 2.6% and increasingly tough talk from the European Central Bank, which seemed to be preparing markets for an unwelcome rate increase.

The UK market gained 3.6% in dollars in the second six months, based on the MSCI UK Index(6) including net dividends (14.2% for the twelve months as a whole). The UK’s interest rate cycle is ahead of those in other economies. The tightening to restrain over-stretched consumers and soaring real estate prices is long since complete and has taken effect. GDP growth is set to fall in 2005 to about 11/2%, the lowest since 1992. Manufacturing is in decline. The Bank of England has even started to reverse the process with one rate reduction. Nonetheless, company earnings held up and despite terrorist attacks, investors supported an inexpensive market that paid over 3% in dividends. As in Europe, UK equities slumped 3.1% in October 2005, again relieved from an even bigger loss by the late merger and acquisition action. The scope for further rate reductions seemed to evaporate as consumer price inflation was reported at a multi-year high.

(1) The MSCI World Index is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The Lehman Brothers Aggregate Bond Index is a widely recognized, unmanaged index of publicly issued investment grade U.S. Government, mortgage-backed, asset-backed and corporate debt securities.

(3) The Standard & Poor’s 500 Composite Stock Price Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the United States.

(4) The MSCI Japan Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Japan.

(5) The MSCI Europe ex UK Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in Europe, excluding the UK.

(6) The MSCI UK Index is a free float-adjusted market capitalization index that is designed to measure developed market equity performance in the UK.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Funds’ performance is subject to change since the period’s end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of the Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

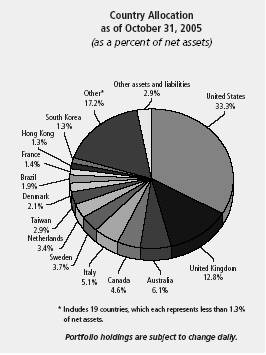

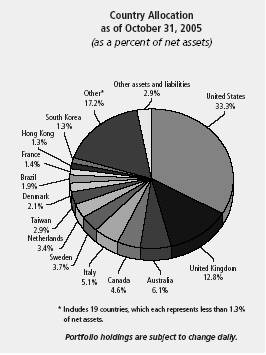

ING Global Equity Dividend Fund | | PORTFOLIO MANAGERS’ REPORT |

The ING Global Equity Dividend Fund (the “Fund”) seeks growth of capital with dividend income as a secondary consideration through investment primarily in equity securities of dividend paying companies. The Portfolio is managed by Jorik van den Bos, Director, Global Equities, Joris Franssen and Joost de Graaf, Portfolio Managers, ING Investment Management Advisors B.V. — the Sub-Adviser.

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charge, provided a total return of 11.45% compared to the MSCI World Index, which returned 13.82% for the same period.

Portfolio Specifics: The world financial markets have struggled to keep pace with last year’s strong performance. Markets have continued to face pressures on account of further increases in oil prices, inflation fears and a continued increase of Federal Fund rates. On the other hand, markets have been supported by lower long- term yields, low inflation, positive economic data from the U.S. and Europe and restructuring in Japan, strengthening U.S. dollar and positive earnings surprises.

Backed by rising oil prices, the energy and utilities sectors outperformed the market. The low interest rate environment continued to support the real estate sector. Cyclical sectors, such as industrials lagged as they were impacted by rising input costs. Materials performed strongly as demand and economic data out of China were strong and commodity prices have seen further increases this year. Telecoms underperformed the market on the back of concerns on growth prospects. Regionally, emerging markets performed best. Japan also outperformed as investors were positive on the country’s restructuring prospects. Europe slightly outperformed the world markets and the U.S. lagged.

The Fund benefited from its overweight positions in utilities, real estate and energy as these sectors performed strongly. The Fund also has exposure to the materials sector. The overweight position in the high dividend sectors of banks and telecoms was a drag on the performance. Banks lagged as there were concerns on margin compression as the yield curve flattened. Telecoms lagged on the lack luster prospects of future growth for the sector. However, the two sectors had very strong cash generation and dividend pay outs. The Fund’s regional allocation worked positively in our overweight positions of Emerging Markets and Europe and underweight position in the U.S. The Fund was negatively affected by the strong performance of the Japanese market, as the Fund did not have any exposure to Japan attributable to no Japanese companies satisfying the Fund’s dividend yield criteria of 3%.

Petroleo Brasilero and Altria Group were among the top performers. Petroleo Brasilero, the Brazilian oil company, performed strongly amidst rising oil prices and strong performance from emerging markets. Altria Group, the parent company of Kraft Foods and Philip Morris, performed strongly as it entered the last phase of the legal procedures that would allow the company to split its organization structure, if needed. The bottom performer was Sara Lee Corporation, a U.S. based consumer products (food, clothing and hosiery) manufacturer. Sara Lee underperformed on low growth prospects and an announcement that it would restructure its operations. The market is skeptical on the success of the Sara Lee restructuring.

Current Strategy and Outlook: We expect the global equity dividend strategy to remain successful. Investments in defensive sectors like utilities, telecommunication services, real estate and consumer staples should give the strategy downside protection. We believe these sectors are relatively inexpensive, less dependent on the economic environment and offer stable, high dividend yields. If markets fall significantly, we think that defensive sectors are likely to outperform.

If the equity markets move sideways, stock selection and the consistent, disciplined strategy are expected to add value. In this scenario, we believe that dividends will make up for an important part of the total return. In the case of a strong rally, we believe the strategy is expected to generate an absolute positive return, but less than the benchmark due to its defensive positioning.

Top Ten Industries

as of October 31, 2005

(as a percent of net assets)

Banks | | 20.6 | % |

| | | |

Telecommunications | | 9.5 | % |

| | | |

Oil and Gas | | 7.1 | % |

| | | |

Electric | | 7.4 | % |

| | | |

Agriculture | | 5.5 | % |

| | | |

Real Estate Investment Trusts | | 5.1 | % |

| | | |

Pharmaceuticals | | 3.9 | % |

| | | |

Chemicals | | 3.6 | % |

| | | |

Diversified Financial Services | | 2.6 | % |

| | | |

Gas | | 2.4 | % |

Portfolio holdings are subject to change daily.

4

Portfolio Managers’ Report | | ING Global Equity Dividend Fund |

| | |

| Average Annual Total Returns for the Periods Ended October 31, 2005 | |

| | | | | | | | | | |

| | | | | Since Inception | | Since Inception | | Since Inception | |

| | | | | of Class A | | of Class B | | of Class C | |

| | | | 1 Year | | | September 17, 2003 | | October 24, 2003 | | October 29, 2003 | |

| | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | |

| Class A(1) | | 5.04 | % | | 15.22 | % | | — | | | — | | |

| Class B(2) | | 5.65 | % | | — | | | 15.68 | % | | — | | |

| Class C(3) | | 9.51 | % | | — | | | — | | | 16.26 | % | |

| Excluding Sales Charge: | | | | | | | | | | | | | |

| Class A | | 11.45 | % | | 18.47 | % | | — | | | — | | |

| Class B | | 10.65 | % | | — | | | 16.95 | % | | — | | |

| Class C | | 10.51 | % | | — | | | — | | | 16.26 | % | |

| MSCI World Index(4) | | 13.82 | % | | 16.39 | %(5) | | 16.05 | %(6) | | 16.05 | %(6) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Equity Dividend Fund against the index indicated. An Index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 3%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI World Index is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(5) Since inception performance for the index is shown from October 1, 2003.

(6) Since inception performance for the index is shown from November 1, 2003.

5

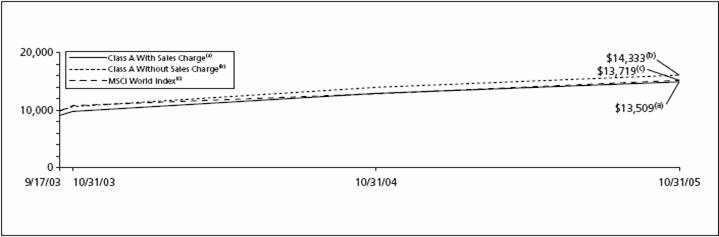

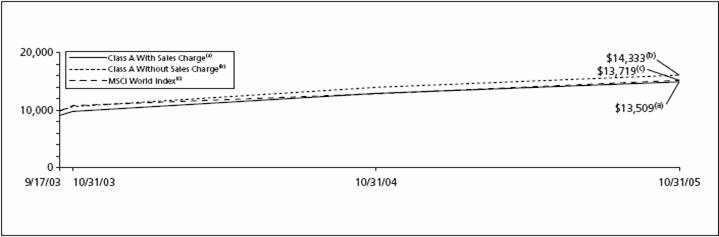

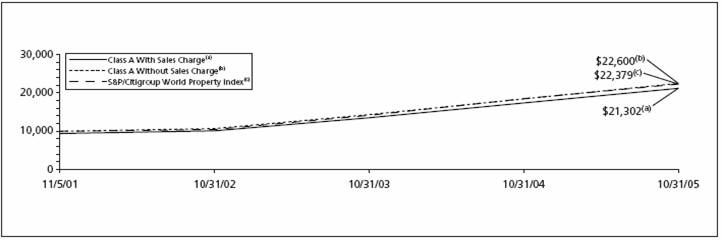

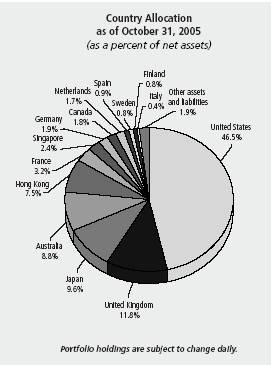

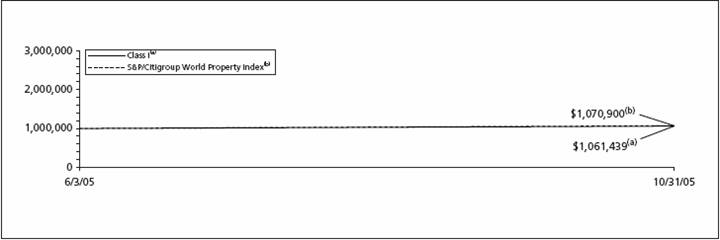

ING GLOBAL REAL ESTATE FUND | | Portfolio Managers’ Report |

The ING Global Real Estate Fund seeks to provide investors with high total return. The Fund is managed by a team led by T. Ritson Ferguson, Chief Investment Officer, ING Clarion Real Estate Securities L.P. — the Sub-Adviser.

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charge, provided a total return of 21.95% compared to the Standard and Poor’s (“S&P”)/Citigroup World Property Index, which returned 20.39% for the same period.

Portfolio Specifics: Property stocks around the world have benefited from strong performance relative to other equities over the past several years as a result of the desire for predictable cash flows as generated by real estate. Investment characteristics include high free cash flow from long lease terms, dividend yield, stable earnings growth, and low to moderate correlation to broad equities. The Fund, while maintaining a core of higher dividend yielding, defensively positioned stocks, has shifted over the past several months into higher growth sectors which will likely respond better to economic recovery (for example the office, industrial and lodging sectors, and the Asia-Pacific ex-Australia region).

Global property stocks were up 20.4% (S&P/Citigroup World Property Index) for the year ended October 31, 2005, propelled by strong returns in all major regions of the world. By region, continental Europe (up 30.0%) was the strongest performer followed by the Asia-Pacific region (+22.2%) and North America (up 18.3%).

Performance for the Fund over the twelve months was 21.95% which outperformed the benchmark return by 156 basis points driven exclusively by stock selection. Two-thirds of the superior stock selection was generated within the U.S., including a number of office and apartment companies. Approximately one-quarter of the stock selection outperformance was from continental Europe, driven by selections in France, including Nexity a homebuilder with a focus on the provinces. Global themes for the year included continued yield compression, mergers and acquisitions activity, the prospect of rising interest rates, syndicate activity (companies raising new equity) and, more recently, increasing evidence of a sustained economic recovery in Japan.

The strongest performer for the year among major countries was Japan (up 34.4%) where property stocks continue to climb on increasing evidence that an economic recovery in Japan is underway. This evidence has been seen in the property markets via many data points, including the September report by the Japan Land Ministry reported that land prices in Tokyo (23 wards) increased for both residential and commercial properties for the first time in 15 years (for the year ended July 1, 2005). Residential prices were up 50 basis points, commercial up 60 basis points. Land prices have decreased, until recently, every year since 1991.

The U.S. dollar generally continued to strengthen during the year versus other major currencies, particularly versus the Japanese yen, increasing by 10.1%. The U.S. dollar also strengthened by 6.1% versus the Euro, 3.5% versus the British pound and 3.1% versus the Canadian dollar.

Current Strategy and Outlook: Global property companies have provided strong absolute and relative returns when compared to broad equities over the past several years. Valuation disparities continue to provide investment opportunities to an investor with a global scope. Through an average 3%-4% dividend yield plus 5%-8% prospective annual earnings growth, we believe global property stocks continue to be well-positioned to conservatively deliver attractive total returns over the next several years.

Top Ten Industries

as of October 31, 2005

(as a percent of net assets)

Office Buildings | 29.1 | % |

| | |

Diversified Property Holdings | 15.5 | % |

| | |

Retail: Enclosed Malls | 13.7 | % |

| | |

Retail: Shopping Center | 10.4 | % |

| | |

Residential Apartments | 8.9 | % |

| | |

Industrial Properties | 6.3 | % |

| | |

Residential: Hotels | 3.0 | % |

| | |

Real Estate Services | 2.7 | % |

| | |

Self Storage Property | 2.5 | % |

| | |

Closed End Investment Companies | 1.5 | % |

Portfolio holdings are subject to change daily.

6

Portfolio Managers’ Report | | Ing Global Real Estate Fund |

| | |

| Average Annual Total Returns for the Periods Ended October 31, 2005 | |

| | | | | | | | | | |

| | | | | Since Inception | | Since Inception | | Since Inception | |

| | | | | of Class A | | of Class B | | of Class C | |

| | | | 1 Year | | | November 5, 2001 | | March 15, 2002 | | January 8, 2002 | |

| | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | |

| Class A(1) | | 14.94 | % | | 20.87 | % | | — | | | — | | |

| Class B(2) | | 16.05 | % | | — | | | 19.98 | % | | — | | |

| Class C(3) | | 20.11 | % | | — | | | — | | | 20.46 | % | |

| Excluding Sales Charge: | | | | | | | | | | | | | |

| Class A | | 21.95 | % | | 22.68 | % | | — | | | — | | |

| Class B | | 21.05 | % | | — | | | 20.49 | % | | — | | |

| Class C | | 21.11 | % | | — | | | — | | | 20.46 | % | |

| S&P/Citigroup World Property Index(4) | | 20.39 | % | | 22.31 | %(5) | | 22.65 | %(6) | | 21.62 | %(7) | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | |

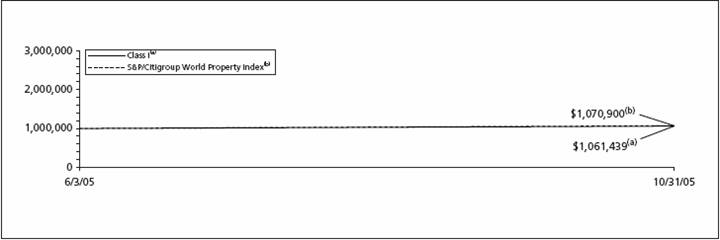

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Real Estate Fund against the index indicated. An Index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 3%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The S&P/Citigroup World Property Index is an unmanaged market-weighted total return index which consists of many companies from developed markets whose floats are larger than $100 million and derive more than half of their revenue from property-related activities.

(5) Since inception performance for index is shown from November 1, 2001.

(6) Since inception performance for index is shown from March 1, 2002.

(7) Since inception performance for index is shown from January 1, 2002.

7

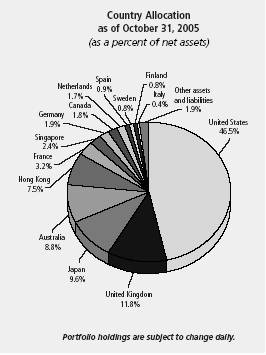

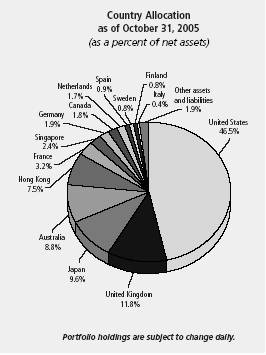

ING GLOBAL VALUE CHOICE FUND | | Portfolio Managers’ Report |

The ING Global Value Choice Fund (the “Fund”) seeks long-term capital appreciation. The Fund is managed by Paul Hechmer, Gregg Tenser, CFA, Mark Morris, CFA and Jon Bosse, CFA, Portfolio Managers, NWQ Investment Management Company, LLC — the Sub-Adviser.

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charge, provided a total return of 13.78% compared to the Morgan Stanley Capital International (“MSCI”) World Index 13.82% for the same period.

Portfolio Specifics: Since assuming sub-advisory management of the Fund, the ING Global Value Choice Fund has outperformed the benchmark, the MSCI World Index. From an absolute return perspective, the Fund generated positive returns in both the U.S. and in the rest of the world, although returns from overseas were mitigated somewhat by a stronger U.S. dollar. With that being said, the non-U.S. portion of the Fund outperformed the U.S. portion, as international markets continued their strong run, which started in 2003.

On both an absolute and relative basis, companies within the energy sector contributed most to performance as the oil price reached close to $70 a barrel. Individual names, including Suncor Energy, the Canadian oil sands company, and Noble Energy and Kerr McGee in the U.S., performed well. Exposure to the materials sector and exposure to select companies in the industrials sector, including Metso Corp. in Finland, also aided returns. On the negative side, overweight exposure to the telecommunications sector, primarily through international companies including Chunghwa Telecom and Belgacom, detracted from returns, with both weaker currencies and negative absolute company performance hurting Fund returns. However, we continue to believe that the telecommunications sector continues to offer dominant companies with very attractive valuation characteristics. Holdings in the financials sector, including Federal National Mortgage Association (“Fannie Mae”) and Countrywide Financial, also hurt performance.

Current Strategy and Outlook: Value opportunities continue to be found in global markets and those opportunities are finely balanced between both U.S. and international companies. In the U.S., corporate earnings and cash flows have been growing at a double-digit pace for the last several years, with many companies experiencing record profit margins and profitability. This has resulted in corporations having record amounts of cash on their balance sheets, which they are increasingly using for acquisitions and share repurchases, and has provided strong support for equity markets. While stock market valuations appear reasonable on current record profits, it is unclear the impact that anticipated Federal Reserve rate hikes, aimed to deflate inflation pressures, will have on the economy and the outlook for corporate profits.

In the rest of the world, markets have rallied strongly now since March 2003, and as a result, value opportunities in the international space are proving harder to find. However, on a relative basis, overseas markets continue to trade at lower multiples than the U.S., and as bottom-up value managers on an opportunistic basis, we continue to find selective opportunities. Regionally, we maintain a modest underweight to the U.S. and outside of the U.S., we continue to find more opportunities in Japan and Asia ex Japan rather than Europe. From a sector perspective we continue to find more value in the basic materials and telecommunications sectors.

Top Ten Industries

as of October 31, 2005

(as a percent of net assets)

Mining | | 10.4 | % |

| | | |

Oil and Gas | | 10.2 | % |

| | | |

Telecommunications | | 10.2 | % |

| | | |

Diversified Financial Services | | 8.8 | % |

| | | |

Aeorspace/Defense | | 5.2 | % |

| | | |

Software | | 4.9 | % |

| | | |

Insurance | | 3.4 | % |

| | | |

Media | | 3.4 | % |

| | | |

Agriculture | | 3.0 | % |

| | | |

Electric | | 2.7 | % |

Portfolio holdings are subject to change daily.

Effective February 1, 2005 NWQ Investment Management Company, LLC became Sub-Adviser to ING Global Value Choice Fund. Prior to February 1, 2005, the Fund was sub-advised by ING Investment Management Co. (formerly, Aeltus Investment Management, Inc.)

8

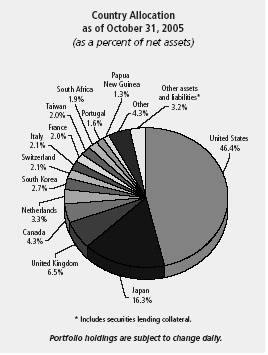

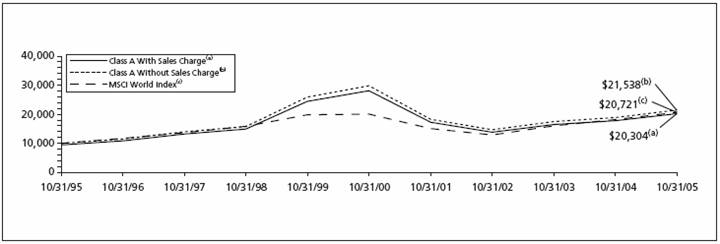

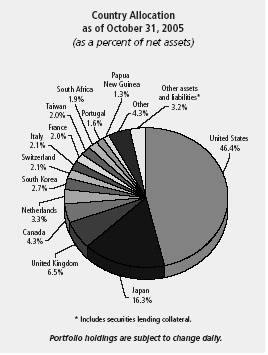

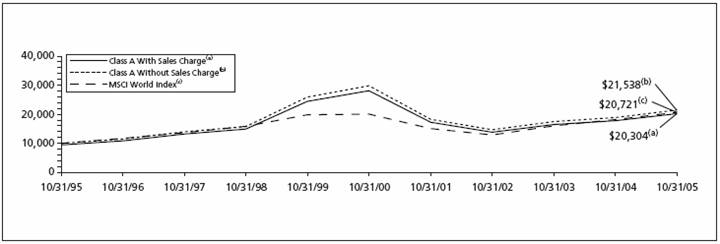

PORTFOLIO MANAGERS’ REPORT | | ING GLOBAL VALUE CHOICE FUND |

| Average Annual Total Returns for the Periods Ended October 31, 2005 | |

| | | | | | | | |

| | | | 1 Year | | | | 5 Year | | | | 10 Year | | |

| Including Sales Charge: | | | | | | | |

| Class A(1) | | 7.24 | % | | (7.47 | )% | | 7.33 | % | |

| Class B(2) | | 8.11 | % | | (7.36 | )% | | 7.29 | % | |

| Class C(3) | | 12.05 | % | | (6.99 | )% | | 7.28 | % | |

| Excluding Sales Charge: | | | | | | | | | | |

| Class A | | 13.78 | % | | (6.37 | )% | | 7.97 | % | |

| Class B | | 13.11 | % | | (7.00 | )% | | 7.29 | % | |

| Class C | | 13.05 | % | | (6.99 | )% | | 7.28 | % | |

| MSCI World Index(4) | | 13.82 | % | | 0.57 | % | | 7.56 | % | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Value Choice Fund against the index indicated. An Index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance table does not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI World Index is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

Prior to February 1, 2005, the Fund was advised by a different sub-adviser.

9

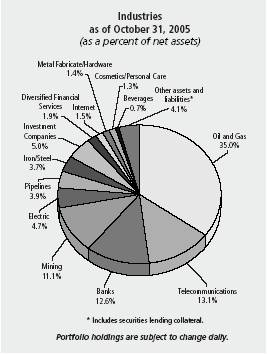

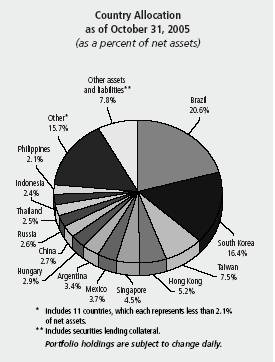

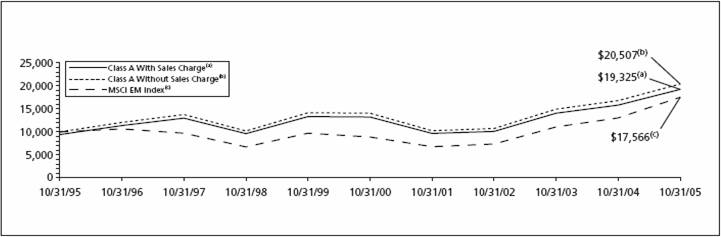

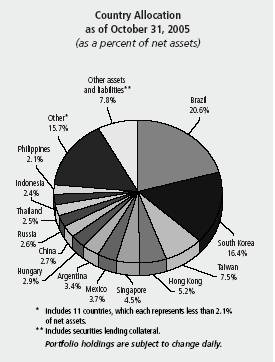

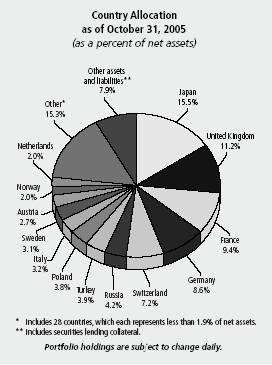

Ing Emerging Countries Fund | | Portfolio Managers’ Report |

The ING Emerging Countries Fund (the “Fund”) seeks maximum long-term capital appreciation. The Fund is managed by Brandes Investment Partners, L.P. — the Sub-Adviser.* Brandes’ Emerging Markets Investment Committee is responsible for making the day-to-day investment decisions for the Fund.

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charge, provided a total return of 21.76% compared to the Morgan Stanley Capital International (“MSCI”) Emerging Markets (“EM”) Index, which returned 34.34% for the same period.

Portfolio Specifics: During the first four months of the reporting period, the Fund slightly underperformed its benchmark (22.5% versus 24.8%). The main elements of underperformance over the four-month period were stock selection among financials and in Turkish stocks, as well as the opportunity loss from maintaining a cash balance in a strong market.

From March 1, 2005 through October 31, 2005, on a country and industry level, advances for holdings in Brazil and South Korea contributed to the Fund’s performance. Such holdings included Uniao de Bancos Brasil (Brazil — commercial banking), CIA Paranaense de Energia (Brazil — utilities), and Korea Electric Power (South Korea — electric utilities). Other positions posting gains included Lukoil (Russia — oil, gas & consumable fuels) and Quilmes (Argentina beverages).

The Fund’s holdings in China and Indonesia tended to weigh on performance. Positions in these countries declining in the period included PT Gudang Garam (Indonesia — tobacco), Brilliance Auto Holdings (China — automobiles), and Sinopec Yizheng Chemical Fibres (China — chemicals).

From an industry perspective, gains for holdings in beverages, oil, gas & consumable fuels, and commercial banking made the most substantial contribution to performance. Top performers in these industries included Quilmes (Argentina — beverages), Lukoil (Russia — oil, gas & consumable fuels), and Uniao de Bancos Brasil (Brazil — commercial banking). Positions in the wireless telecom services industry, such as Telesp Celular Participacoes (Brazil) and Telecentro Oeste Celular (Brazil), tended to decline.

The main reasons for the underperformance against the benchmark in the eight-month period ended October 31, 2005, were stock selection, especially in the wireless telecommunications industry, and an underweighting in the top performing oil, gas & consumable fuels industry. The Fund’s industry exposure is a residual of our investment process, which focuses on company-by-company analysis to identify undervalued securities.

After the Fund’s portfolio management change on March 1, 2005, we established a wide range of positions at prices that we considered attractive. During the subsequent period, the Fund sold positions such as Hite Brewing (South Korea — beverages), and Fraser & Neave Limited (Singapore — beverages) as appreciation pushed their market prices toward our estimates of their long-term values.

Current Strategy and Outlook: For the four months ended March 1, 2005, India, Turkey and Brazil were the largest overweight countries in their respective regions (Asia, EMEA and Latin America). The Fund was also underweight in China, South Korea, Hungary and Chile, which were among the strongest performing countries. In terms of sectors, the Fund was overweight financials and telecommunications, and underweight consumer staples and industrials.

During the eight-month period from March 1, 2005 through October 31, 2005, the Fund’s country and industry exposures shifted slightly due to stock-specific buying and selling as well as changes in the prices of holdings. For example, exposure to Brazil increased, while exposure to South Korea and the commercial banking industry tended to decline. The Fund’s weightings for industries and countries are not the product of “top-down” forecasts or opinions, but merely stem from our company-by-company search for compelling investment opportunities in markets around the world. As of October 31, 2005, the Fund’s largest positions were in Brazil and South Korea, and in the diversified telecom services and commercial banking industries.

Keep in mind that the Fund’s weightings for industries and countries are not the product of “top-down” forecasts or opinions, but merely stem from our company-by-company search for compelling investment opportunities in markets around the world.

Overall, while we offer no predictions regarding the short-term direction of equities in emerging markets, we believe the Fund remains well positioned to deliver favorable long-term results. We believe that all holdings remain undervalued, and we expect to realize significant profit as the market recognizes their true worth.

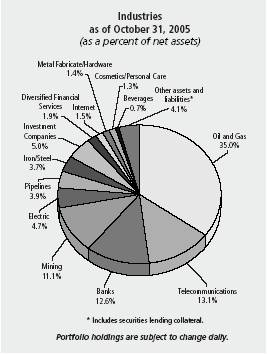

Top Ten Industries

as of October 31, 2005

(as a percent of net assets)

Telecommunications | | 31.2 | % |

| | | |

Banks | | 10.7 | % |

| | | |

Electric | | 10.6 | % |

| | | |

Chemicals | | 4.6 | % |

| | | |

Semiconductors | | 3.8 | % |

| | | |

Auto Manufacturers | | 3.1 | % |

| | | |

Food | | 3.0 | % |

| | | |

Electrical Components and Equipment | | 2.6 | % |

| | | |

Oil and Gas | | 2.6 | % |

| | | |

Retail | | 2.6 | % |

Portfolio holdings are subject to change daily.

* Effective March 1, 2005 Brandes Investment Partners L.P. became sub-adviser to ING Emerging Countries Fund. Prior to March 1, 2005, the Fund was sub-advised by ING Investment Management B.V.

10

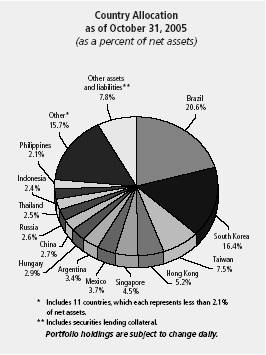

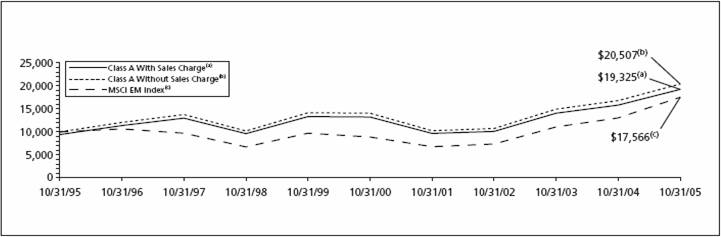

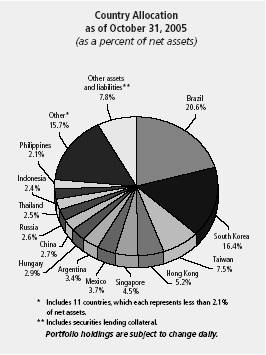

Portfolio Managers’ Report | | Ing Emerging Countries Fund |

| | | | | | | | | | |

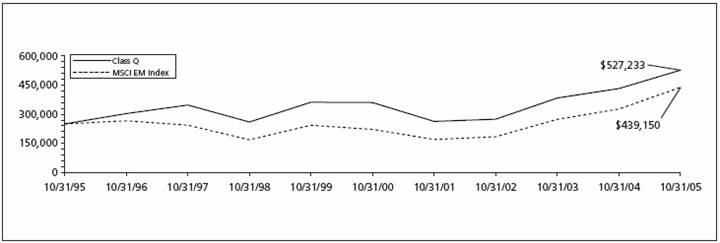

| Average Annual Total Returns for the Periods Ended October 31, 2005 | |

| | | | | | | | | | |

| | | | | | | | | Since Inception | |

| | | | | | | | | of Class M | |

| | | 1 Year | | 5 Year | | 10 Year | | August 5, 2002 | |

| | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | |

| Class A(1) | | 14.75 | % | | 6.52 | % | | 6.81 | % | | — | | |

| Class B(2) | | 15.87 | % | | 6.85 | % | | 6.86 | % | | — | | |

| Class C(3) | | 19.83 | % | | 6.88 | % | | 6.72 | % | | — | | |

| Class M(4) | | 16.91 | % | | — | | | — | | | 20.10 | % | |

| | | | | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | | | | |

| Class A | | 21.76 | % | | 7.79 | % | | 7.44 | % | | — | | |

| Class B | | 20.87 | % | | 7.15 | % | | 6.86 | % | | — | | |

| Class C | | 20.83 | % | | 6.88 | % | | 6.72 | % | | — | | |

| Class M | | 21.15 | % | | — | | | — | | | 21.42 | % | |

| MSCI EM Index(5) | | 34.34 | % | | 14.64 | % | | 5.80 | % | | 29.24 | %(6) | |

| | | | | | | | | | | | | | |

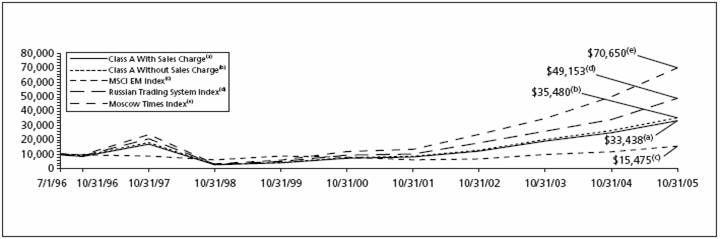

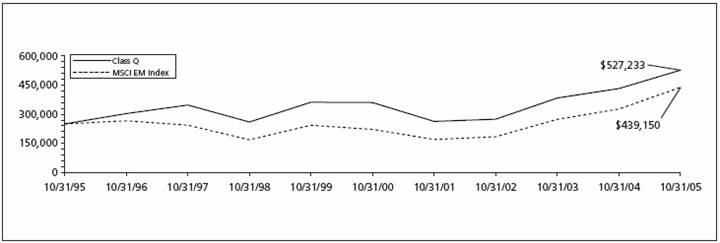

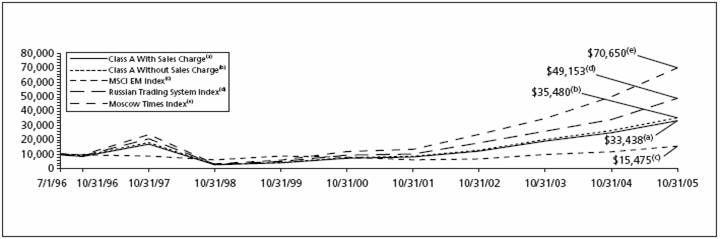

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Emerging Countries Fund against the index indicated. An Index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) Reflects deduction of the maximum Class M sales charge of 3.50%.

(5) The MSCI EM Index is an unmanaged index that measures the performance of securities listed on exchanges in developing nations throughout the world.

(6) Since inception performance for index is shown from August 1, 2002.

Prior to March 1, 2005, the Fund was advised by a different sub-adviser.

11

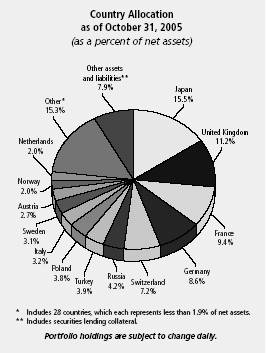

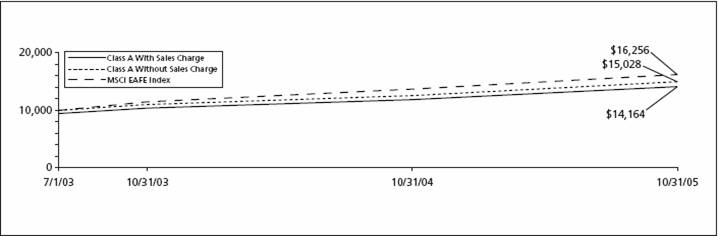

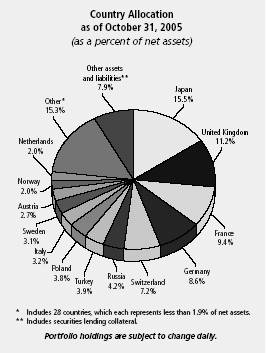

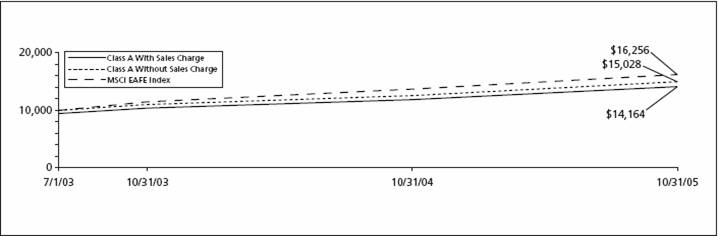

Ing Foreign Fund | | Portfolio Managers’ Report |

The ING Foreign Fund (the “Fund”) seeks long-term growth of capital. The Fund is managed by Rudolph-Riad Younes, CFA, Senior Vice President and Head of International Equity and Richard Pell, Senior Vice President and Chief Investment Officer, Julius Baer Investment Management, LLC — the Sub-Adviser.

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charges, provided a total return of 19.47% compared to the Morgan Stanley Capital International Europe, Austrasia and Far East (“MSCI EAFE”) Index, which returned 18.59% for the same period.

Portfolio Specifics: Over the period ended October 31, 2005, international equities provided strong returns for investors, and the Fund outperformed the Index due to several factors. Within Europe, the overweight position to Austria was a positive contributor. Many Austrian holdings, including Bank Austria Creditanstalt AG, benefited from the strong Eastern European market. The underweight position to the United Kingdom, an underperforming market over the period, also supported results.

The allocation to Eastern and Central Europe proved favorable as positions in Russia, Turkey, Hungary and Poland outperformed the Index by a wide margin. The Fund held many banks in the region that posted strong returns including Sberbank (Russia), Turkiye Garanti Bankasi A.S., Turkiye Is Bankasi A.S. and Akbank T.A.S. (Turkey). Elsewhere in emerging markets, holdings in Grupo Financiero Banorte S.A. (Mexico) helped performance while CANTV (Venezuela) detracted. Within China, a market we have largely avoided, shares of Weiqiao Textile Co. underperformed.

The underweight position to Japanese equities, as well as individual stock selection, were a drag on results. Shares of Uni-Charm Corp, a producer of personal hygiene products, underperformed over the period ended October 31, 2005. The Fund’s cash equivalents position also had a negative impact due to the strong environment for equities.

Both stock selection and an overweight position to the energy sector were also important contributors to performance. Companies such as Lukoil and Gazprom (Russia), OMV AG (Austria), EnCana and Canadian Natural Resources (Canada), Statoil (Norway) and Dragon Oil (Ireland) were particularly strong. Stock selection in the telecommunications and health care sectors also supported results. In the materials sector, the underweight position as well as stock selection, including companies such as LaFarge (France) the world’s largest cement producer, negatively impacted performance. Finally, stock selection in the industrials sector detracted from performance.

Current Strategy and Outlook: During the month of October 2005, equity markets fell amid concerns over rising inflation and slower global growth. Early in October 2005’s retrenchment, we took profits and reduced exposure to certain sectors, including energy, which had exhibited solid performance for the Fund. At the end of October 2005, we were underweight the energy sector relative to the Index and holdings were more defensively positioned. We believe energy stocks are likely to be negatively impacted by any global slowdown. We believe that signs of demand destruction, rather than the commodity price itself will hold the key to sector performance.

October 2005 also witnessed a rollback in returns in many emerging markets, but we took profits from select holdings. Emerging markets are susceptible to a slowdown in global growth, and in the current climate, volatility is likely to remain high. However, we believe that emerging markets will reassert themselves based on their strong fundamentals and attractive risk/reward opportunities, particularly Eastern and Central Europe.

Since Japan’s September 2005 elections, the Fund’s exposure to the country has increased through more domestically-focused companies such as regional banks. While we are still concerned about the state of national reforms, hence our overall underweight position to Japan, we see many individual companies showing a greater interest in enhancing shareholder value. Japan does remain vulnerable to any slowdown in Chinese growth and to a certain extent growth in the U.S.; therefore we believe this domestic focus is warranted.

Top Ten Industries

as of October 31, 2005

(as a percent of net assets)

Banks | | 22.7 | % |

| | | |

Investment Companies | | 7.5 | % |

| | | |

Pharmaceuticals | | 6.5 | % |

| | | |

Oil and Gas | | 5.8 | % |

| | | |

Telecommunications | | 5.7 | % |

| | | |

Food | | 4.1 | % |

| | | |

Engineering and Construction | | 3.6 | % |

| | | |

Beverages | | 2.8 | % |

| | | |

Building Materials | | 2.2 | % |

| | | |

Holding Companies - Diversified | | 2.2 | % |

Portfolio holdings are subject to change daily.

12

Portfolio Managers’ Report | | Ing Foreign Fund |

| | | | | | | | | | |

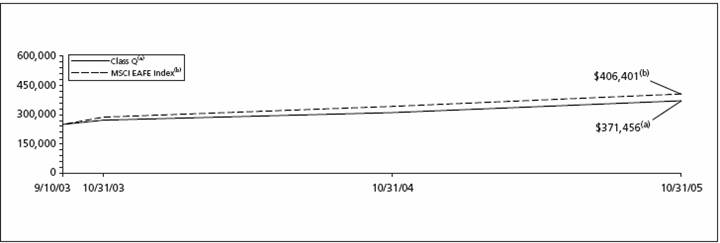

| Average Annual Total Returns for the Periods Ended October 31, 2005 | |

| | | | | | | | | | |

| | | | | Since Inception | | Since Inception | | Since Inception | |

| | | | | of Class A | | of Class B | | of Class C | |

| | | 1 Year | | July 1, 2003 | | July 8, 2003 | | July 7, 2003 | |

| | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | |

| Class A(1) | | 12.60 | % | | 16.06 | % | | — | | | — | | |

| Class B(2) | | 13.68 | % | | — | | | 15.85 | % | | — | | |

| Class C(3) | | 17.65 | % | | — | | | — | | | 17.05 | % | |

| | | | | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | | | | |

| Class A | | 19.47 | % | | 19.04 | % | | — | | | — | | |

| Class B | | 18.68 | % | | — | | | 16.91 | % | | — | | |

| Class C | | 18.65 | % | | — | | | — | | | 17.05 | % | |

| MSCI EAFE Index(4) | | 18.59 | % | | 23.15 | %(5) | | 23.15 | %(5) | | 23.15 | %(5) | |

| | | | | | | | | | | | | | |

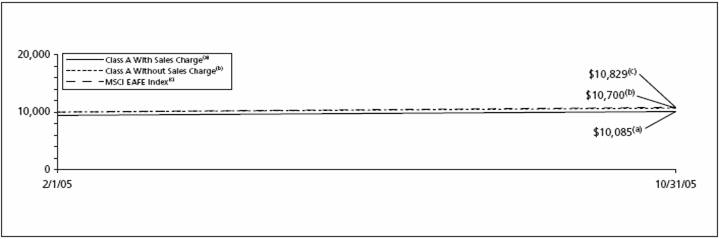

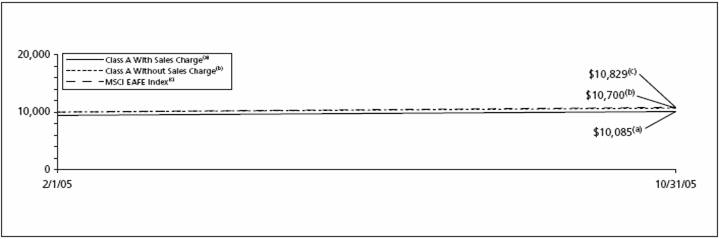

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Foreign Fund against the index indicated. An Index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 3%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI EAFE Index is an unmanaged index that measures the performance of securities listed on exchanges in Europe, Australasia and the Far East.

(5) Since inception performance for index is shown from July 1, 2003.

13

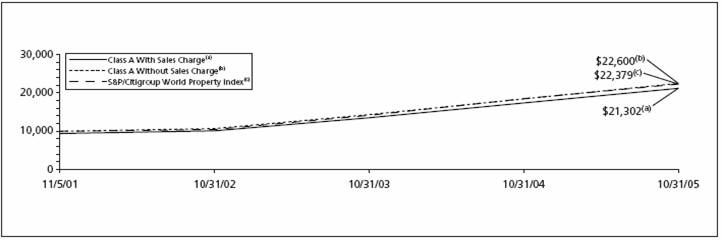

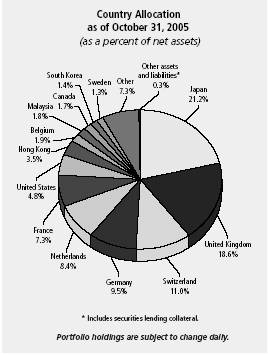

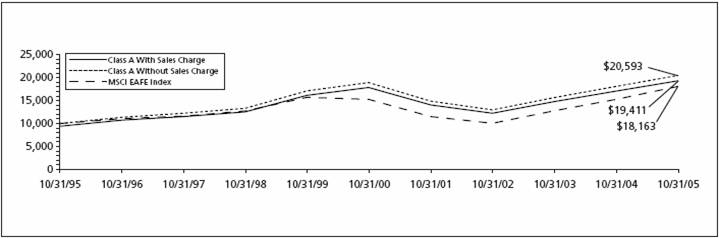

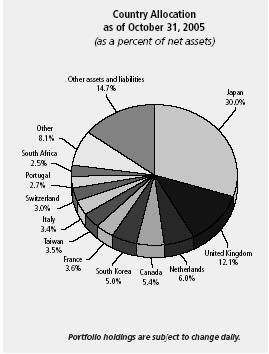

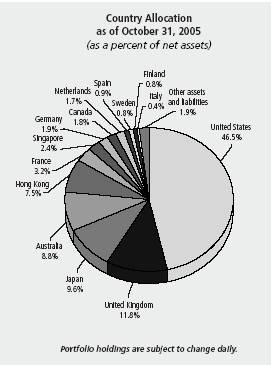

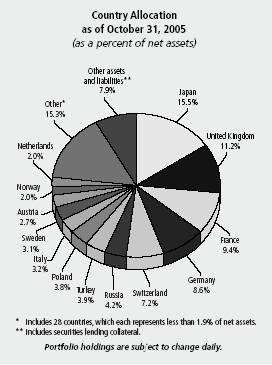

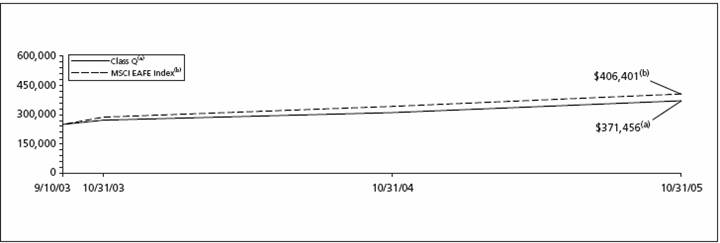

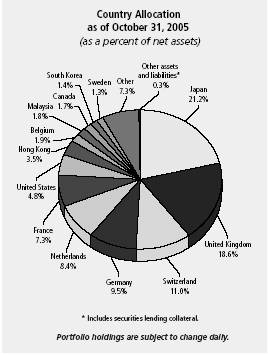

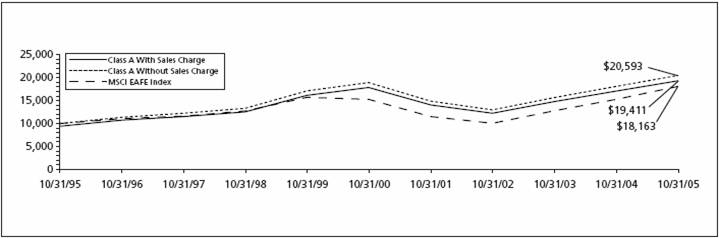

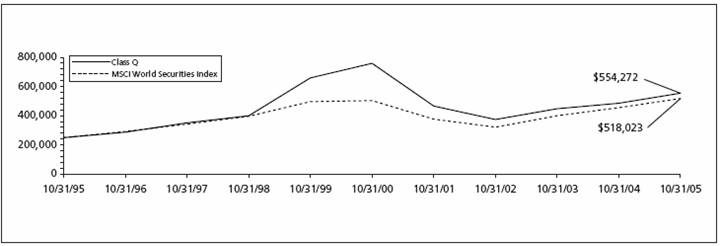

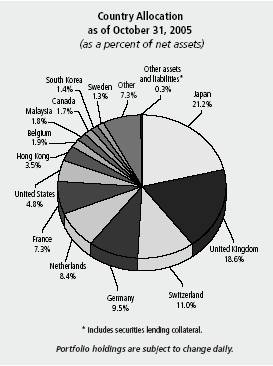

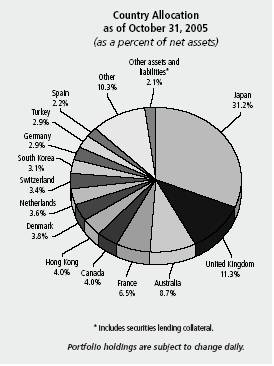

Ing International Fund | | Portfolio Managers’ Report |

The ING International Fund (the “Fund”) seeks long-term growth of capital through investment in equity securities and equity equivalents of companies outside the United States. The Fund is a managed by a team of investment professionals led by Richard T. Saler and Philip A. Schwartz, CFA, each a Senior Vice President and Director of International Investment Strategy, ING Investment Manager Co. — the Sub-Adviser.

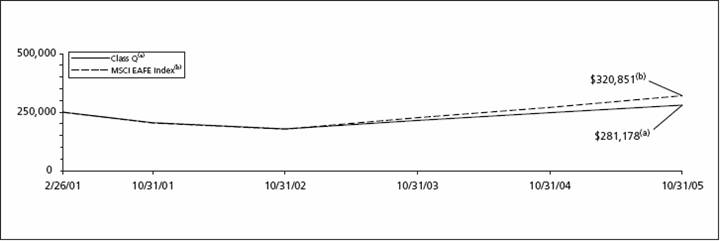

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charges, provided a total return of 13.30% compared to the Morgan Stanley Capital International Europe, Austrasia and Far East (“MSCI EAFE”) Index, which returned 18.59% for the same period.

Portfolio Specifics: The Fund’s defensive positioning in the earlier part of the year ended October 2005 at first proved disappointing. Later in the 2005 year, however, many defensive names regained strength as the market grew concerned about high energy prices and economic growth. Newer positions in a broader array of sectors also helped performance. Much of the first half’s losses of 2005 were made up in the second half of the 2005 year.

Overall, stock selection was positive in Europe and developed Asia-ex Japan, while our holdings in Japan were disappointing. Our underweight of the U.K., which had relatively weak performance in the second half of the fiscal year ended October 2005 proved beneficial, but was not enough to make up for weak stock selection. emerging market stocks detracted from relative return. On a sector basis, our underweight positions in consumer discretionary and information technology stocks added to performance. This result was partially offset by a negative selection outcome in the financials and materials sectors. Energy and telecom stock selection added materially to results.

On an individual stock level, significant value was added by TDC A/S, the main Danish telecom services provider, after it increased on reports of takeover bids. Amano Corp., a Japanese industrial firm, added materially to performance during the second half of the fiscal year due to high product demand and the resulting higher price targets by analysts. A material positive contribution was made by our holding of SolarWorld AG, a German energy company, mainly due to an increase in capacity and expanded production, higher demand, and a secure supply base. The largest detractor was Canadian gold producer Placer Dome in a weak gold market; most of the loss occurred during the first half of the reporting 2005 period. Other negative contributors included Barco N.V, a Belgian maker of electronic visual displays, which fell after a lower profit forecast due to the decline in the dollar, and Tenaga Nasional Bhd, a Malaysian electric utility, which declined following decreased profits.

Current Strategy and Outlook: Despite signs that economic growth may be slowing and some nagging inflation concerns, our models continue to point towards a variety of solid investment opportunities. Japan’s election results were encouraging and appear to promise more financial reform. China’s growth continues to offer opportunity among global commodities companies, including oil. We have increased the Fund’s weightings in financial stocks since valuations appear attractive, and a peak in bond yields is likely in the year ahead. The Fund is maintaining an overweight position in energy stocks due to their strong cash generation and positive outlook. The Fund is underweight Europe and the U.K., and maintaining a modest exposure to emerging market stocks. At the sector level, the Fund continues to be underweight in the consumer discretionary and industrial sectors, and overweight positions on consumer staples, health care and utility stocks.

Top Ten Industries

as of October 31, 2005

(as a percent of net assets)

Banks | | 19.2 | % |

| | | |

Oil and Gas | | 10.2 | % |

| | | |

Pharmaceuticals | | 8.4 | % |

| | | |

Food | | 8.1 | % |

| | | |

Telecommunications | | 7.9 | % |

| | | |

Diversified Financial Services | | 5.3 | % |

| | | |

Insurance | | 4.6 | % |

| | | |

Mining | | 3.5 | % |

| | | |

Electric | | 3.3 | % |

| | | |

Agriculture | | 3.1 | % |

Portfolio holdings are subject to change daily.

14

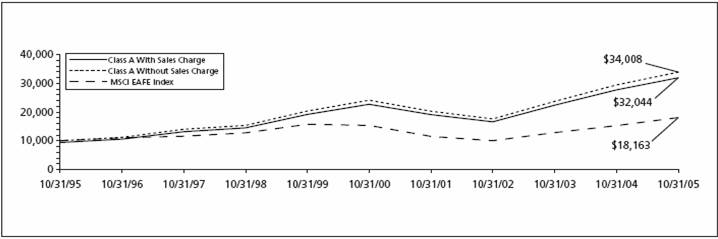

Portfolio Managers’ Report | | Ing International Fund |

| | |

| Average Annual Total Returns for the Periods Ended October 31, 2005 | |

| | | | | | | | | | | | |

| | | | | | | | | Since Inception | | Since Inception | |

| | | | | | | | | of Class B | | of Class C | |

| | | 1 Year | | 5 Year | | 10 Year | | August 22, 2000 | | September 15, 2000 | |

| | | | | | | | | | | | |

| Including Sales Charge: | | | | | | | | | | | |

| Class A(1) | | 6.79 | % | | 0.40 | % | | 6.85 | % | | — | | | — | | |

| Class B(2) | | 7.41 | % | | 0.28 | % | | — | | | (1.33 | )% | | — | | |

| Class C(3) | | 11.46 | % | | 0.61 | % | | — | | | — | | | (0.19 | )% | |

| | | | | | | | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | | | | | | | |

| Class A | | 13.30 | % | | 1.59 | % | | 7.48 | % | | — | | | — | | |

| Class B | | 12.41 | % | | 0.65 | % | | — | | | (1.16 | )% | | — | | |

| Class C | | 12.46 | % | | 0.61 | % | | — | | | — | | | (0.19 | )% | |

| MSCI EAFE Index(4) | | 18.59 | % | | 3.42 | % | | 6.15 | % | | 1.85 | %(5) | | 1.85 | %(5) | |

| | | | | | | | | | | | |

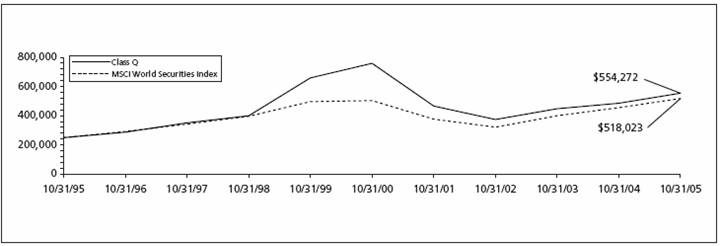

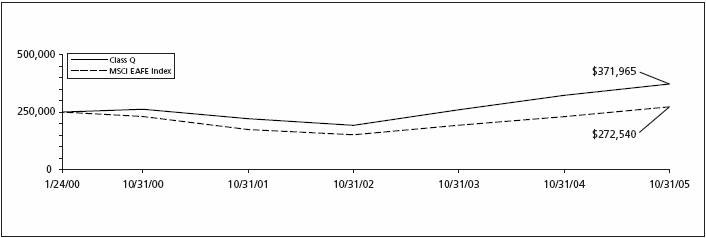

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING International Fund against the index indicated. An Index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 1%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI EAFE Index is an unmanaged index that measures the performance of securities listed on exchanges in markets in Europe, Australasia and the Far East.

(5) Since inception performance for the index is shown from September 1, 2000.

Effective November 1, 2001, Class A shares liquidated within 30 days of purchase are subject to a 2% redemption fee.

Prior to July 26, 2000, the Fund was advised by a different sub-adviser.

15

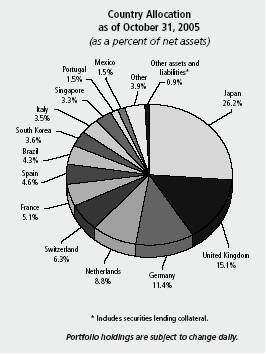

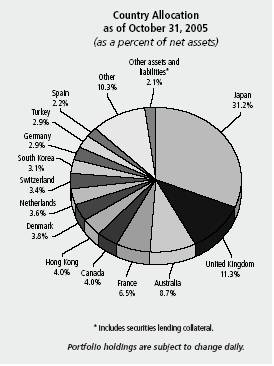

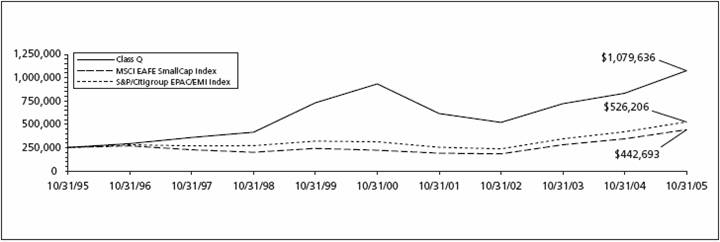

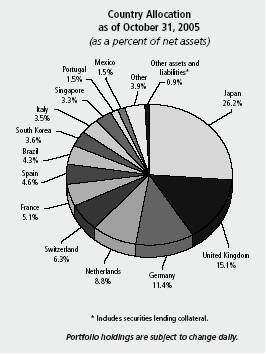

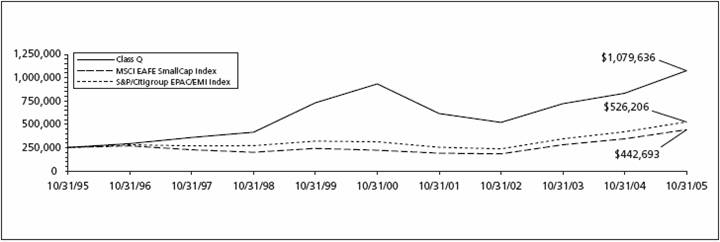

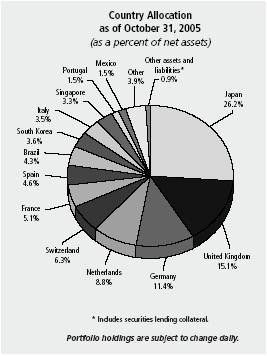

Ing International Smallcap Fund | | Portfolio Managers’ Report |

The ING International SmallCap Fund (the “Fund”) seeks maximum long-term capital appreciation. The Fund is managed by John Chisholm, CFA, Executive Vice President and Matthew J. Cohen, CFA, Senior Vice President, Acadian Asset Management, Inc. — the Sub-Adviser.

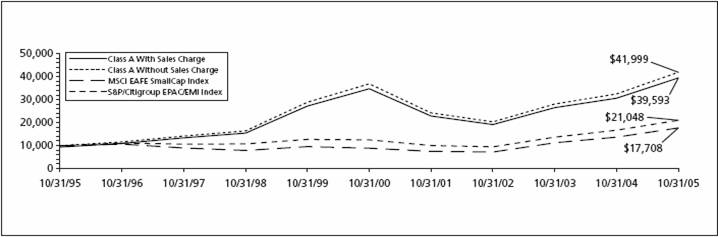

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charges, provided a total return of 28.97% compared to the Morgan Stanley Capital International Europe, Austrasia and Far East (“MSCI EAFE”) SmallCap Index and the Standard & Poor’s/Citigroup Europe, Pacific, Asia Composite/Extended Market Index (“S&P/Citigroup EPAC/EMI”) which returned 29.05% and 25.41%, respectively, for the same period.

Portfolio Specifics: The MSCI EAFE SmallCap Index posted solid gains in the four months ended February 28, 2005, up 20.2%. International equity markets extended November’s gains into December and capped 2004 with robust performance across the board, despite an uncertain environment characterized by rising interest rates, higher oil prices and the ongoing war in Iraq. In the final weeks of 2004, trading volume was thin as investors geared up for the holidays, but the markets reacted favorably to easing oil prices, increased merger activity and rosy outlooks from such industry leaders as Intel Corp. and General Electric Co. The Fund benefited from overweightings in Europe and Canada, but an overweighting in Korea detracted from performance. Stock selection was strong in Europe, but was weak in the UK and Japan. For the period from March 1, 2005, through April 30, 2005, the Fund underperformed the MSCI EAFE SmallCap Index by approximately 2.6%. This was mostly the result of country allocations, though stock selection also detracted slightly from return.

The following investments helped the Fund’s performance for the subsequent eight months ended October 31, 2005. In Australia, stock-level performance, particularly in the materials sector, more than offset value lost to an overweighted country allocation. Energy sector holding Oil Search was also a significant contributor to active return. Strong global demand and elevated commodity prices over the period helped holdings in these sectors. In Spain, successful stock selection combined with an overweighting to deliver value added in this market. Homebuilder Fadesa Inmobiliar led the Fund’s Spanish holdings as construction activity was strong. In the United Kingdom, an underweighted allocation, which showed lackluster growth over the eight months ended October 31, 2005, helped return. Also contributing to active return was stock-level performance in the U.K., particularly in the capital equipment sector. Defense holding Cobham and building materials manufacturer BPB were the top performers among the Fund’s U.K. holdings. In Germany, stock selection generated additional active return. Selections in the materials sector were especially successful. Specifically, a position in German steel producer Salzgitter was a key driver of value added. In France, stock selection combined with the country overweighting to contribute excess return. A position in technology firm Neopost was the top contributor to active return among the Fund’s French holdings.

The following investments have detracted from the Fund’s inception performance for the eight months ended October, 31, 2005. In Japan, stock selection, combined with an underweighting, detracted from the Fund’s active return, as this market has had a particularly robust year, up approximately 11% over the eight month period ended October 31, 2005. Holdings that detracted from performance included services stocks Kyoei Tanker and Tonichi Carlife. In Greece, stock selection and an overweighted allocation, resulted in a negative impact to the Fund’s return. Specifically, an overweighting to the Greek services sector detracted from return. In emerging markets, stock selection in China offset value added from overweighting in this market, as selections in the materials and services sectors trailed the index. The active allocations to Turkey and Taiwan also lost value.

Current Strategy and Outlook: Country weightings are driven by bottom-up stock selection. The Fund is currently overweighted in Spain and France and actively allocated to Canada, Korea and Turkey. Significant underweightings include Japan and the U.K. Our bottom-up process led the Fund to focus on materials, energy and durables stocks.

The outlooks for Spain and France are positive based on our forecast factors. There are signs of particular strength in the banking and energy sectors, which are also expected to outperform in Canada, where the local currency remains quite strong. Turkey is the highest-ranked country in our emerging markets framework, driven primarily by longer-term cash flow factors and perceived lower risk as the country continues to bring its economic policy in line with that of the European Union.

Our forecast for Japan continues to show it as one of our lowest-ranked markets. This short-term outlook is based on the fact that the economic rehabilitation is still in the early stages, relative valuations are still high and deflation remains in place. We are most negative on technology and staples, though even within a sector that we view negatively overall, we often find individual holdings that are highly attractive. We are long-term positive on Japan given Koizumi’s reform-minded economic policy, strong and improving economic fundamentals and the expectation that earnings will catch up with valuations.

Top Ten Industries

as of October 31, 2005

(as a percent of net assets)

Iron/Steel | | 7.7 | % |

| | | |

Diversified Financial Services | | 6.9 | % |

| | | |

Transportation | | 6.7 | % |

| | | |

Retail | | 6.6 | % |

| | | |

Oil and Gas | | 5.0 | % |

| | | |

Food | | 4.5 | % |

| | | |

Distribution/Wholesale | | 4.1 | % |

| | | |

Real Estate | | 3.9 | % |

| | | |

Insurance | | 3.5 | % |

| | | |

Building Materials | | 3.4 | % |

Portfolio holdings are subject to change daily.

Effective March 1, 2005 Acadian Asset Management became sub-adviser to ING International SmallCap Fund. Prior to March 1, 2005, the Fund was sub-advised by Nicholas-Applegate Capital Management. The views expressed are those of the specific sub-adviser with respect to the period of time discussed.

16

Portfolio Managers’ Report | | Ing International Smallcap Fund |

| | | | | | | | |

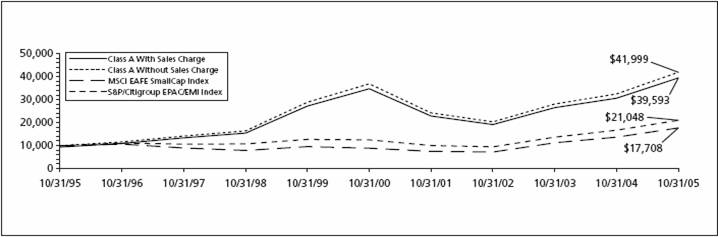

| Average Annual Total Returns for the Periods Ended October 31, 2005 | |

| | | | | | | | |

| | | | 1 Year | | | | 5 Year | | | | 10 Year | | |

| | | | | | | | |

| Including Sales Charge: | | | | | | | |

| Class A(1) | | 21.56 | % | | 1.37 | % | | 14.74 | % | |

| Class B(2) | | 23.15 | % | | 1.58 | % | | 14.72 | % | |

| Class C(3) | | 27.16 | % | | 1.94 | % | | 14.70 | % | |

| | | | | | | | | | | |

| Excluding Sales Charge: | | | | | | | | | | |

| Class A | | 28.97 | % | | 2.58 | % | | 15.42 | % | |

| Class B | | 28.15 | % | | 1.95 | % | | 14.72 | % | |

| Class C | | 28.16 | % | | 1.94 | % | | 14.70 | % | |

| MSCI EAFE SmallCap Index(4) | | 29.05 | % | | 15.10 | % | | 6.00 | % | |

| S&P/Citigroup EPAC/EMI Index(5) | | 25.41 | % | | 11.01 | % | | 7.73 | % | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING International SmallCap Fund against the Indicies indicated. An Index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund’s performance is shown both with and without the imposition of sales charges.

The performance graph and table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Manager and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund’s current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be “forward-looking” statements. Actual results may differ materially from those projected in the “forward-looking” statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers’ views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI EAFE SmallCap Index is an unmanaged, market-weighted index that represents the smallcap segments in 21 developed equity markets outside of North America, which more closely tracks the types of securities in which the Fund invests than the S&P/Citigroup EPAC/EMI Index.

(5) The S&P/Citigroup EPAC/EMI Index is an unmanaged index that measures the performance of securities of smaller-capitalization companies in 22 countries excluding the U.S. and Canada.

Prior to March 1, 2005, the Fund was advised by a different sub-adviser.

17

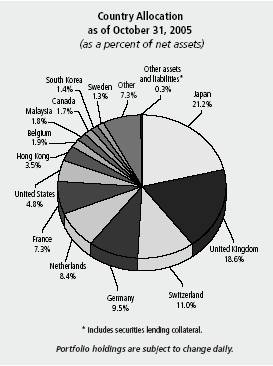

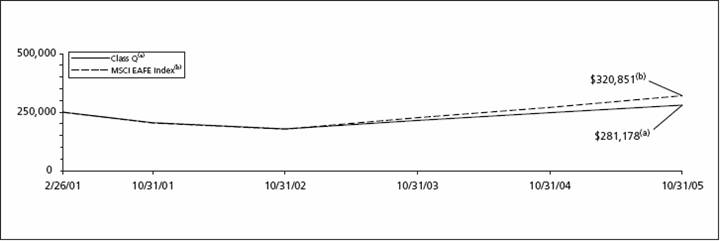

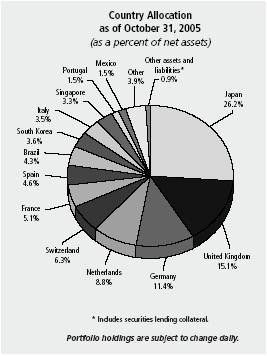

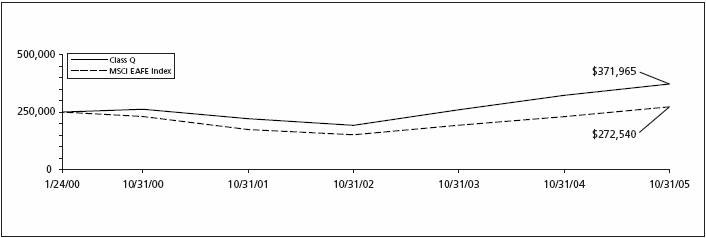

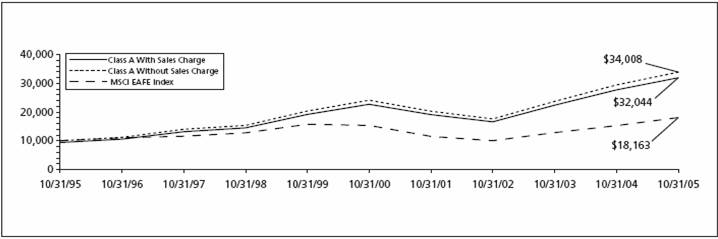

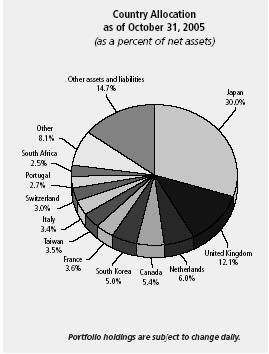

Ing International Value Fund | | Portfolio Managers’ Report |

The ING International Value Fund (the “Fund”) seeks long-term capital appreciation. The Fund is managed by Brandes Investment Partners, L.P. — the Sub-Adviser. Brandes’ Large Cap Investment Committee is responsible for making the day-to-day investment decisions for the Fund.

Performance: For the year ended October 31, 2005, the Fund’s Class A shares, excluding sales charges, provided a total return of 15.06% compared to the Morgan Stanley Capital International Europe, Australasia and Far East (“MSCI EAFE”) Index, which returned 18.59% for the same period.

Portfolio Specifics: The Fund’s advance during the fiscal year of 2005 was broad based, with positions in a wide range of countries and industries registering gains. On a country basis, advances for holdings in Japan made the most substantial contribution to returns. Top Japan-based performers included Japan Tobacco (tobacco), Mitsubishi Tokyo Financial (commercial banking), and Sumitomo Mitsui Financial Group (commercial banking)

In addition, advances for holdings in the United Kingdom and Germany also contributed to favorable absolute performance. Top performers in these countries included Volkswagen (Germany — automobiles) and Imperial Chemical (United Kingdom — chemicals).

From an industry perspective, advances for holdings in commercial banking and insurance helped drive performance. Among the stronger-performing holdings in these industries were Commerzbank (Germany — Commercial Banks) and Millea Holdings Inc. Tokyo (Japan — insurance). Gains for positions in the food products and the tobacco industries also tended to advance.

The main reason for the underperformance against the benchmark during the year was an overweight position in the diversified telecommunications industry, one of the weakest industry performers. The Fund was also underweight in the metals & mining and in the oil, gas, & consumable fuels industries, two of the strongest performing industries. The Fund’s industry exposure is a residual of our investment process, which focuses on company-by-company analysis to identify undervalued securities.

During the period, we sold positions such as BAE Systems (United Kingdom — aerospace & defense), Lukoil (Russia — oil gas & consumable fuels), and E.ON AG (Germany — electric utilities) as appreciation pushed their market prices toward our estimates of their long-term values. We also sold portions of other holdings to reduce their Fund weightings and to pursue other investment opportunities.

New purchases for the year included DaimlerChrysler (Germany — automobiles), Aegon (Netherlands — insurance), and Fuji Photo Film (Japan — leisure equipment & products), among others. We also added to select existing holdings at prices that we consider attractive.