OMB APPROVAL

OMB Number: 3235-0570

Expires: October 31, 2006

Estimated average burden hours per response: 19.3

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-7978

ING Mayflower Trust

(Exact name of registrant as specified in charter)

7337 E. Doubletree Ranch Rd., Scottsdale, AZ | | 85258 |

(Address of principal executive offices) | | (Zip code) |

CT Corporation System, 101 Federal Street, Boston, MA 02110

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-800-992-0180

Date of fiscal year end: | October 31 |

| |

Date of reporting period: | November 1, 2005 to October 31, 2006 |

Item 1. Reports to Stockholders.

The following is a copy of the report transmitted to stockholders pursuant to Rule 30e-1 under the Act (17 CFR 270.30e-1):

Funds

Annual Report

October 31, 2006

Classes A, B, C, I, M, O, Q and R

Global Equity Funds

n ING Global Equity Dividend Fund

n ING Global Natural Resources Fund (formerly, ING Precious Metals Fund)

n ING Global Real Estate Fund

n ING Global Value Choice Fund

International Equity Funds

n ING Emerging Countries Fund

n ING Foreign Fund

n ING Greater China Fund

n ING Index Plus International Equity Fund

n ING International Fund

n ING International Capital Appreciation Fund

n ING International Real Estate Fund

n ING International SmallCap Fund

n ING International Value Fund

n ING International Value Choice Fund

n ING Russia Fund

Global and International Fixed-Income Funds

n ING Emerging Markets Fixed Income Fund

n ING Global Bond Fund

International Fund-of-Funds

n ING Diversified International Fund

E-Delivery Sign-up – details inside

E-Delivery Sign-up – details inside

This report is submitted for general information to shareholders of the ING Funds. It is not authorized for distribution to prospective shareholders unless accompanied or preceded by a prospectus which includes details regarding the funds' investment objectives, risks, charges, expenses and other information. This information should be read carefully.

TABLE OF CONTENTS

| President's Letter | | | 1 | | |

|

| Market Perspective | | | 2 | | |

|

| Portfolio Managers' Reports | | | 4 | | |

|

| Shareholder Expense Examples | | | 40 | | |

|

| Report of Independent Registered Public Accounting Firm | | | 46 | | |

|

| Statements of Assets and Liabilities | | | 47 | | |

|

| Statements of Operations | | | 57 | | |

|

| Statements of Changes in Net Assets | | | 62 | | |

|

| Financial Highlights | | | 71 | | |

|

| Notes to Financial Statements | | | 103 | | |

|

| Portfolios of Investments | | | 127 | | |

|

| Tax Information | | | 176 | | |

|

| Trustee and Officer Information | | | 182 | | |

|

| Advisory Contract Approval Discussion | | | 186 | | |

|

Go Paperless with E-Delivery!

Go Paperless with E-Delivery!

Sign up now for on-line prospectuses, fund reports, and proxy statements. In less than five minutes, you can help reduce paper mail and lower fund costs.

Just go to www.ingfunds.com, click on the E-Delivery icon from the home page, follow the directions and complete the quick 5 Steps to Enroll.

You will be notified by e-mail when these communications become available on the internet. Documents that are not available on the internet will continue to be sent by mail.

(THIS PAGE INTENTIONALLY LEFT BLANK)

PRESIDENT'S LETTER

JAMES M. HENNESSY

Dear Shareholder,

In its recent meetings, the Federal Reserve Board (the "Fed") has ceased its two-year trend of raising interest rates. That trend – a string of 17 consecutive rate hikes — was seen by many analysts as a sign that the Fed was concerned about containing inflation.

Its latest actions, or perhaps inactions is a better word, since the Fed has neither raised nor lowered interest rates, put us in a climate that economists refer to as a "plateau." Historically, there have been six similar plateaus since 1982 and during those periods the Standard & Poors 500® Composite Stock Price Index ("S&P 500® Index") experienced significant growth in the three months following the decrease of interest rates by the Fed.

Of course, the Fed's actions have also impacted economies and market performance around the world. For instance, the current interest rate climate has been cited as one reason for a recent decline in the value of the dollar. That drop in the dollar has meant that international stocks — which deal in foreign currencies — have generally experienced strong performance in recent months as their currencies have climbed. Meanwhile other factors have triggered robust international stock performance as well: business confidence overseas is up, foreign merger and acquisition activity has been positive and Japan, England and the Eurozone have all reported impressive earnings in 2006.

Whatever the future holds — here or abroad — we at ING Funds continue to work hard to provide you, the investor, with an array of investment choices that enable you build a smart and diversified portfolio. We also continue to expand and improve our customer service department to ensure that your needs are met promptly and that we indeed continue to make attaining your future goals easier.

On behalf of everyone here at ING Funds, I thank you for your continued support.

Sincerely,

James M. Hennessy1

President

ING Funds

November 1, 2006

The views expressed in the President's Letter reflect those of the President as of the date of the letter. Any such views are subject to change at any time based upon market or other conditions and ING Funds disclaims any responsibility to update such views. These views may not be relied on as investment advice and because investment decisions for an ING Fund are based on numerous factors, may not be relied on as an indication of investment intent on behalf of any ING Fund. Reference to specific company securities should not be construed as recommendations or investment advice.

International investing does pose special risks including currency fluctuation, economic and political risks not found in investments that are solely domestic.

For more complete information, or to obtain a prospectus on any ING fund, please call your Investment Professional or ING Fund Distributor, LLC at (800) 992-0180 or log on to www.ingfunds.com. The prospectus should be read carefully before investing. Consider the fund's investment objectives, risks, charges and expenses. The prospectus contains this information and other information about the fund. Check with your Investment Professional to determine which funds are available for sale within their firm. Not all funds are available for sale at all firms.

1 Effective November 9, 2006, Mr. James M. Hennessy has retired as the president and chief executive officer to the Funds and is replaced with Mr. Shaun P. Mathews.

1

MARKET PERSPECTIVE: YEAR ENDED OCTOBER 31, 2006

In our semi-annual report we described the half-year to dream for as global equities, led by foreign markets surged 16.0%, according to the Morgan Stanley Capital International ("MSCI") World IndexSM(1) calculated in dollars, including net reinvested dividends. The dream still seemed alive into early May but then investors suddenly woke up to fears that zealous, inflation fighting central bankers would raise interest rates by more than enough to choke off global growth. After a sharp, month-long correction, recovery set in, but it was not until nearly mid-October that the May 9 high was regained. For the second six months the inde x rose a more modest 4.6%. In currencies the dollar was mixed, gaining 2.7% against the yen, losing 1.0% against the euro and 4.3% to the surprising pound sterling, which recently displaced the yen as the third most favored reserve currency.

U.S. equities in the form of the Standard & Poor's 500® Composite Stock Price Index ("S&P 500® Index")(2), returned 6.1% including dividends in the second half of our fiscal year. Stocks had actually become cheaper in the last 12 months as corporate profits had been rising faster than prices. But investors seemed only to have eyes for interest rates. Initial hopes of an imminent end to the tightening cycle after fifteen consecutive increases since June 2004 propelled the S&P 500® Index to a five-year high on May 5. But these were soon dashed by the sixteenth increase on May 10, followed by a barrage of hawkish rhetoric from the Federal Open Market Committe e ("FOMC"), even as the economy was already cooling, evidenced especially by a slumping housing market that had driven much of the consumer spending in the last few years, spending that was now also under threat from record oil prices. By June 13 the market had fallen by 7.7% from its best level. But the seventeenth interest rate increase on June 29 was accompanied by balanced language, reviving hopes that the FOMC might at last be finished raising rates. A tentative recovery was interrupted when renewed conflict in the Middle East sent the price of a barrel of oil to another all-time peak on July 14. But peace of sorts ultimately returned and as summer driving demand and the hurricane damage threat subsided, the oil price fell nearly 24% from its peak. The FOMC did indeed refrain from raising rates on August 8 and again took no action in September and October. Housing data continued to deteriorate and by the end of October, new and existing home prices were falling at the fastest rate in decades. Gross Dome stic Product ("GDP") growth was reported at just 1.6%. So in the face of this, why were stocks in a clear up-trend to a near six-year high by the last week in October? For one thing the pull back in oil prices promised to leave more money in the pockets of consumers. Interest rates were now falling fast at the long end, which made stocks look more attractive as the present value of future corporate profits improved. Speaking of which, corporate profits stood at over 12% of GDP, the highest share in 40 years, all set to register their thirteenth straight quarter of double-digit year-over-year growth. In short, for the equity investor, this was a glass that looked distinctly half-full.

In international markets the pattern of results resembled that of the U.S. The scale was larger in some cases, based on MSCI indices in local currencies including net dividends. Sustained growth and an end to inflation had pushed Japan to almost a 15-year high in April. After slipping, the market was by May 8 again approaching that peak, but over the next month stocks dropped 15.3% as U.S. interest rate fears combined with signals from the Bank of Japan, followed by the reality on July 14, that local interest rates would rise for the first time in six years. The economic data were still mostly positive, but getting past their prime. By the end of October, household spending was falling at its fastest pace in five years and second quarter GDP growth was reported at only 0.8% annualized. For the six months the market fell 3.9%. European ex UK markets were initially supported by broadly based mergers and acquisitions amid clear signs of improving growth and falling unemployment. But from their May 9 top, events in the U.S. and a 25bp increase in euro interest rates as inflation remained stubbornly above 2%, sent stocks down 6.9% over the next five weeks. From there however, markets turned around smartly, even as the European Central Bank raised rates twice more. Business confidence was strong and the evidently range-bound euro posed little threat to exports. Merger and acquisition activity rolled on, heartening investors while suggesting that stocks were not particularly expensive. For the half-year, markets ended up 5.8%, making a 51/2-year high. UK equities had been boosted in the first half by the large acquisition-prone Financial, the sizeable Energy and the vibrant Materials sectors. The reversal in the latter two sectors exacerbated the global retrenchment brought on by interest rate worries after May 9 and UK stocks were dragged down 9.3% by mid June. As in Japan and the Eurozone, the Bank of England raised rates by 1/4% as GDP growth returned to trend,

2

MARKET PERSPECTIVE: YEAR ENDED OCTOBER 31, 2006

inflation climbed above target and house prices, an important demand generator, continued their recovery. This cheered investors and led by Financials, the market reclaimed its best levels of the year and more, reaching levels near the end of October not seen in 69 months.

(1) The MSCI World IndexSM is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East.

(2) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 of the largest companies in the United States.

All indices are unmanaged and investors cannot invest directly in an index.

Past performance does not guarantee future results. The performance quoted represents past performance. Investment return and principal value of an investment will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. The Funds' performance is subject to change since the period's end and may be lower or higher than the performance data shown. Please call (800) 992-0180 or log on to www.ingfunds.com to obtain performance data current to the most recent month end.

Market Perspective reflects the views of ING's Chief Investment Risk Officer only through the end of the period, and is subject to change based on market and other conditions.

3

ING GLOBAL EQUITY DIVIDEND FUND

PORTFOLIO MANAGERS' REPORT

The ING Global Equity Dividend Fund (the "Fund") seeks growth of capital with dividend income as a secondary consideration. The Fund is managed by Nicolas Simar, Head of Value/High Dividend and Moudy El Khodr, Senior Investment Manager Equities, ING Investment Management Advisors B.V.(1) — the Sub-Adviser.

Performance: For the year ended October 31, 2006, the Fund's Class A shares, excluding sales charges, provided a total return of 26.56% compared to the Morgan Stanley Capital International World IndexSM ("MSCI World IndexSM"), which returned 21.32% for the same period.

Portfolio Specifics: Most of the market gains came during the first half of the reporting period. Regionally, Europe (up 32.3%) and emerging markets (up 35.4%) performed best, and emerging markets would have been far higher if not for the mini-market correction of May-June. Meanwhile Japan rose 16.6% and the U.S. appreciated 16.3%, both in U.S. dollar terms. On a sector basis, materials appreciated 35.9%, while utilities appreciated 31.2%, information technology 13.7%, and health care 14.0%. The first half of 2006 also witnessed substantial volatility.

During the first quarter, the markets were positive based on good earnings results and future growth prospects for the global economy. By comparison, the markets during the second quarter were crippled by inflation fears which led to the expectation that the U.S. Federal Reserve ("Fed") would raise interest rates to keep these fears in check. This reaction also stoked concerns that the Fed could overshoot by raising interest rates too much, stifling economic growth in the process.

Energy and materials performed well on the back of substantial gains during the first quarter due to higher commodity prices. Utilities companies, a defensive investment by its nature, were in favor throughout the period.

The third quarter was defined by further uncertainty surrounding the direction of the next interest rate movement by the Fed. Despite good second-quarter earnings, there were few upward earnings revisions forecasts for 2007. Several indices around the world reached record levels, stimulated by sharply falling oil prices, a low interest rate environment and stronger-than-expected U.S. consumer confidence numbers. Europe and Japan experienced economic data that pointed to an end in the acceleration of growth and that economic activity would stabilize at a high level.

During the period, the Fund benefited from an overweight position in financials, utilities, and real estate. The Fund had a large position in utilities, which generated significant cash-flows and dividend increases. Financials benefited from positive earnings and was further bolstered by increased merger and acquisition activities. One noticeable M&A transaction saw Italian banking group, UniCredito take over German banking operation Hypovereinsbank. Having zero exposure to technology helped the Fund as the sector underperformed. This was especially helpful in the May-June period.

By comparison, an underweight position in materials hurt the Fund as the sector outperformed for much of the period. However, the sector was rattled by the May-June correction, especially in emerging markets. The telecom sector also helped the Fund in the second half of the year as the sector only started to outperform after March. The sector had been stuck in limbo for some time following the large payments many European-based companies made for third-generation mobile phone licenses some years ago.

On an individual stock basis, a position in Volvo, which has historically performed well for the Fund as the company has consistently raised its dividends, helped the Fund during the period. Additionally, there was speculation that the company might be a leveraged buyout target. DSG International, a UK consumer electronics retailer, had a great run following an increase in its profits, which beat analysts' expectations on the back of strong World Cup television sales. The company also increased dividend payments throughout the year (both interim and final dividends). Reynolds American, the tobacco company, increased its quarterly profits dividend levels throughout the year. The company's share price rallied despite notable court cases pending against the tobacco industry. Scania, the Swedish truck and car company, also became a take-over candidate as MAN group, the German truck manufacturer, made an offer for the company. The Fund sold its p osition in the company as the market digested the news.

By contrast, a position in Precision Drilling, an oilfield drilling and oil and gas services company, acted as a drag as a lack of supply side shocks like Hurricane Katrina in 2005 caused gas prices to fall. Public Services Enterprise Group, a generator, transmitter and distributor of electricity in the U.S., declined after performing well for most of the year on the back of M&A bid rumors. However, talks with a potential suitor, Exelon, were abandoned in September, resulting in both parties seeing a sharp fall in their share price. Pending regulatory changes in New Zealand also hurt Telecom Corp of NZ, a domestic telecommunications operator as it was announced that the country was opening up its telecommunications market to competition. This announcement resulted in a sharp decline in the company's share price, from which it did not fully recover.

A position in Brazilian telecommunications operator Tele Norte Leste also acted as a drag as higher costs hit the operator's profits, despite a significant increase in the company's customer base. Fording Canadian Coal Trust, a Canadian coal miner, also negatively impacted the Fund as the company reported a drop in profits in both the first and second quarter as a result of higher production costs and higher-than-anticipated taxes on minerals. The higher production costs were primarily due to an increase in input costs, lower coal production, and a one-off cost related to a change in labor agreements. This led to a decline in the company's shares.

Currently there is no exposure to Japan due to the dividend yield criterion requiring that all securities in the portfolio provide a yield above 3.3%. Since Japanese companies do not have a high dividend yield (most don't pay dividends), the Japanese names are filtered out in the quantitative stages of screening.

Current Strategy and Outlook: The outlook for the Fund remains positive. We believe investments in defensive sectors including utilities, real estate, telecommunication services and consumer staples give the Fund downside protection. These sectors are relatively cheap, less dependent on the economic environment and offer stable, high-dividend yields. In our opinion, this may result in outperformance versus global equities if they fall significantly. If the equity markets move sideways, stock selection and our consistent, disciplined strategy may add value. In this scenario, dividends will provide an important part of the Fund's total return. This may result in positive absolute returns and outperformance of global equities. Only in the case of a strong rally will it be difficult for us to outperform global equities. If the rally is broadly driven, investmen ts in financials and more cyclical sectors such as industrials, consumer cyclicals and basic materials are expected to perform well. A rally driven by growth stocks (especially information technology or health care) will be the most difficult environment for the strategy. However, we do expect that returns will still be positive in that scenario. Regardless of the market scenario, our strategy continually looks for countries, sectors or individual stocks that will allow us to seek to exploit temporary undervaluations.

(1) Effective January 19, 2006, Nicolas Simar and Moudy El Khodr replaced Jorik van den Bos, Joris Fronssen, and Joost de Graaf as Portfolio Managers to the Fund.

Top Ten Industries*

as of October 31, 2006

(as a percent of net assets)

| Banks | | | 22.4 | % | |

| Telecommunications | | | 13.0 | % | |

| Electric | | | 9.1 | % | |

| Oil & Gas | | | 7.0 | % | |

| Agriculture | | | 5.0 | % | |

| Pharmaceuticals | | | 3.9 | % | |

| Real Estate Investment Trust | | | 3.4 | % | |

| Pipelines | | | 2.8 | % | |

| Beverages | | | 2.5 | % | |

| Insurance | | | 2.5 | % | |

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

4

ING GLOBAL EQUITY DIVIDEND FUND

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended October 31, 2006 | |

| | | 1 Year | | Since Inception

of Class A

September 17, 2003 | | Since Inception

of Class B

October 24, 2003 | | Since Inception

of Class C

October 29, 2003 | |

| Including Sales Charge: | |

| Class A(1) | | | 19.25 | % | | | 18.73 | % | | | — | | | | — | | |

| Class B(2) | | | 20.55 | % | | | — | | | | 19.04 | % | | | — | | |

| Class C(3) | | | 24.62 | % | | | — | | | | — | | | | 19.29 | % | |

| Excluding Sales Charge: | |

| Class A | | | 26.56 | % | | | 21.00 | % | | | — | | | | — | | |

| Class B | | | 25.55 | % | | | — | | | | 19.73 | % | | | — | | |

| Class C | | | 25.62 | % | | | — | | | | — | | | | 19.29 | % | |

| MSCI World IndexSM(4) | | | 21.32 | % | | | 17.60 | %(5) | | | 15.89 | %(6) | | | 15.89 | %(6) | |

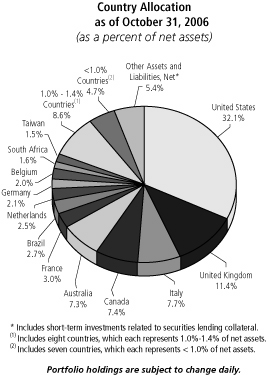

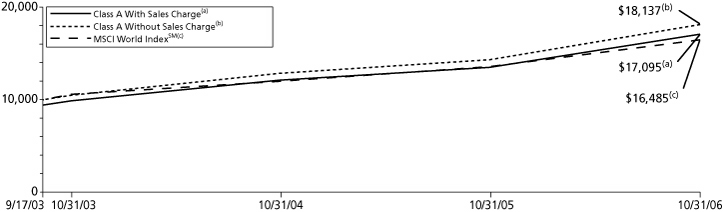

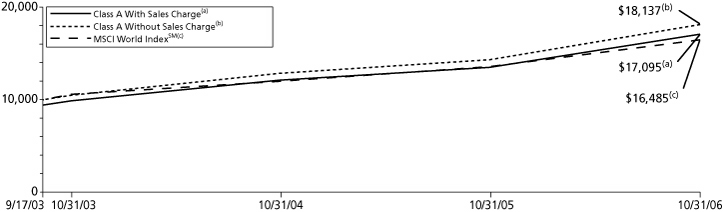

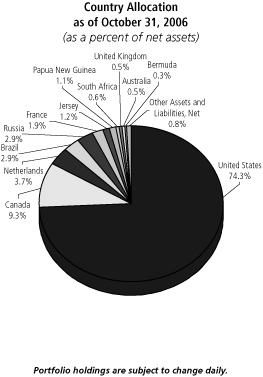

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Equity Dividend Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charges and incurs no operating expenses. An investor cannot invest directly in the index. The Fund's performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund's current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 3%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI World IndexSM is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. It includes the reinvestment of dividends net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing.

(5) Since inception performance for the index is shown from October 1, 2003.

(6) Since inception performance for the index is shown from November 1, 2003.

5

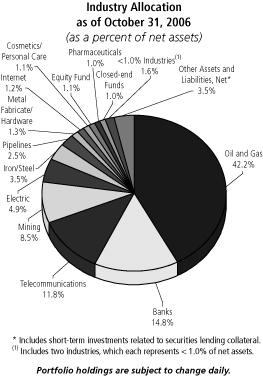

ING GLOBAL NATURAL RESOURCES FUND

PORTFOLIO MANAGERS' REPORT

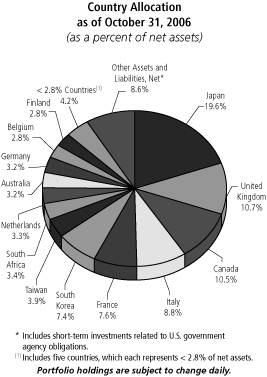

The ING Global Natural Resources Fund (the "Fund") seeks to attain long-term capital appreciation.(1) The Fund is managed by James A. Vail, CFA, Portfolio Manager and Anthony Socci, Portfolio Manager, ING Investment Management Co. — the Sub-Adviser.

Performance: For the year ended October 31, 2006, the Fund's Class A shares, excluding sales charges, provided a total return of 42.76% compared to the Standard & Poor's 500® Composite Stock Price Index ("S&P 500® Index") and the Goldman Sachs Natural Resources Index which returned 16.34% and 18.16%, respectively, for the same period.

Portfolio Specifics: Driven by strong economic activity in much of the world, geopolitical tensions and supply disruptions, prices of most commodities from aluminum to zinc appreciated, with some reaching record highs. Prices generally peaked in the May-to-August time period, but then retreated as fears subsided that severe weather would impact energy supplies. Slower global economic growth also cooled investor speculation in many precious and base metals. By the end of the period, most commodity valuations appeared to have bottomed out, but the outlook is unclear given the uncertainty over future global economic growth.

The Fund outperformed the FTSE Gold Mines Index by a wide margin reflecting its positive stock selection in the gold sector. The Fund was also helped by its overweight position in diversified metals and mining, which is not represented in the index.

By contrast, an underweight position in precious metals and minerals was the biggest drag on performance during the period. This group includes producers of silver, platinum and other precious materials.

While many individual holdings added to the Fund's performance, Agnico-Eagle, Yamana Gold, Gammon Lake Resources, and Newmont Mining were the most notable contributors. Agnico-Eagle possesses an attractive production growth profile in addition to a polymetallic product mix. Yamana Gold has also grown rapidly, both organically and through acquisition, while Gammon Lake Resources has amended its business model from a developer to an expanding producer. Newmont Mining performed poorly during the period, but a significant underweight position helped the Fund.

By comparison, a position in Shore Gold, a misnamed Canadian diamond explorer, acted as the Fund's biggest drag during the period. However, the company possesses one of the most prolific kimberlite diamond deposits in Canada and exploration and development activity continually point to a growing resource. Despite the recent underperformance, we are confident in the potential value of the company. Our decision to not to own Zijin Mining Group detracted from performance as this company has performed extremely well during this period. We were also hurt by our underweight in Harmony Gold, a South African producer.

Current Strategy and Outlook: On October 9, 2006, this Fund changed its name from ING Precious Metals to ING Global Natural Resources Fund, and its benchmark from FTSE Gold Mines Index to the Goldman Sachs Natural Resources Index. The Fund also changed its principal investment objective and strategy and now has a focus in energy rather than materials, which was formerly the case. By investing in natural resources companies, the Fund should benefit from the current commodity cycle which we believe is still in its early stages. This cycle should be driven by consumption trends in China, India, Brazil, and Russia. In these countries populations are moving from rural areas creating the need for raw materials as new cities are built and all the associated amenities are deployed. History suggests commodity cycles can last up to 20 years, and the current one is on ly five years old. As a sector fund addressing the broad commodity universe, we believe our Fund could be a beneficiary of the ongoing global demand for all commodities.

(1) Formally known as the ING Precious Metals Fund, the Fund changed its name to ING Global Natural Resources Fund and its benchmark in October, 2006. The Fund also changed it investment objective and principal investment strategies and now has a focus in energy rather than materials, which was formerly the case.

Top Five Industries

as of October 31, 2006

(as a percent of net assets)

| Oil & Gas | | | 57.2 | % | |

| Mining | | | 18.4 | % | |

| Oil & Gas Services | | | 14.5 | % | |

| Electric | | | 2.6 | % | |

| Coal | | | 1.9 | % | |

Portfolio holdings are subject to change daily.

6

ING GLOBAL NATURAL RESOURCES FUND

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended October 31, 2006 | |

| | | 1 Year | | 5 Year | | 10 Year | |

| Including Sales Charge: | |

| Class A(1) | | | 34.51 | % | | | 27.37 | % | | | 5.56 | % | |

| Excluding Sales Charge: | |

| Class A | | | 42.76 | % | | | 28.92 | % | | | 6.19 | % | |

| S&P 500® Index(2) | | | 16.34 | % | | | 7.26 | % | | | 8.64 | % | |

| Goldman Sachs Natural Resources Index(3) | | | 18.16 | % | | | 17.69 | % | | | 10.29 | % | |

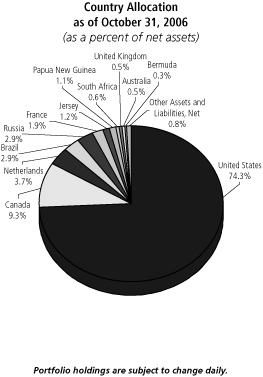

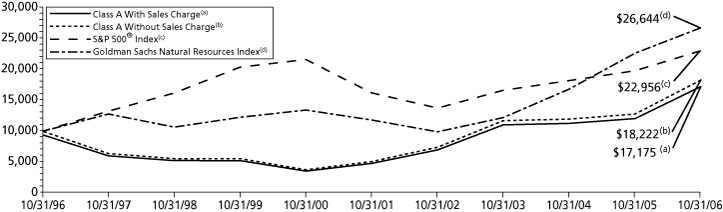

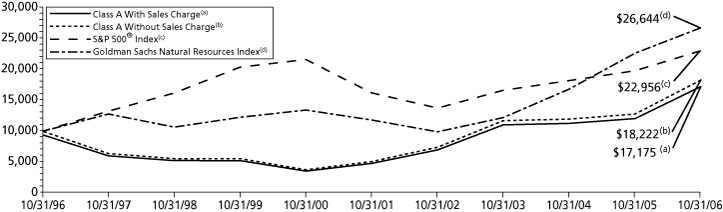

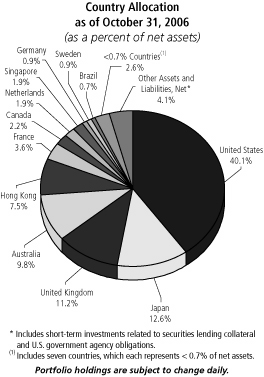

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Natural Resources Fund against the indices indicated. Each index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in an index. The Fund's performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund's current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) The S&P 500® Index is an unmanaged index that measures the performance of securities of approximately 500 large-capitalization U.S. companies whose securities are traded on major U.S. stock markets.

(3) The Goldman Sachs Natural Resources Index is an unmanaged index and a market-capitalization-weighted index of 112 stocks designed to measure the performance of companies in the natural resources sector, which includes energy, precious metals, timber and other sub-sectors.

7

ING GLOBAL REAL ESTATE FUND

PORTFOLIO MANAGERS' REPORT

The ING Global Real Estate Fund (the "Fund") seeks to provide investors with high total return. The Fund is managed by T. Ritson Ferguson, Chief Investment Officer, CFA and Steven D. Burton, Managing Director, CFA, Portfolio Managers, ING Clarion Real Estate Securities L.P. — the Sub-Adviser.

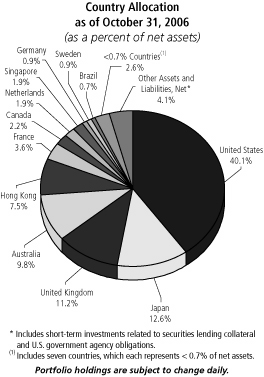

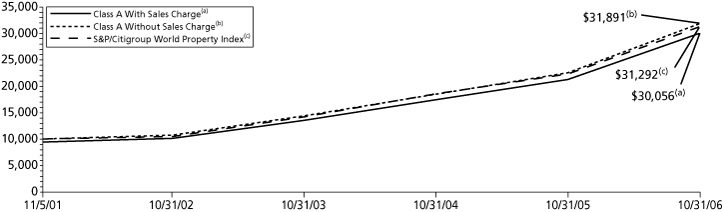

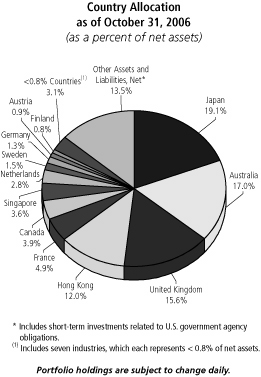

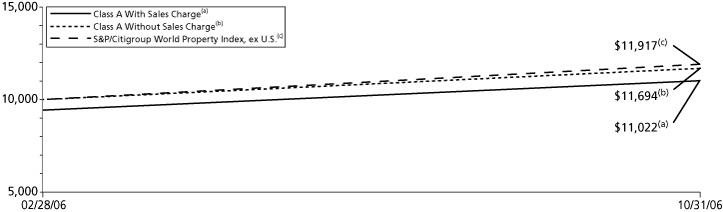

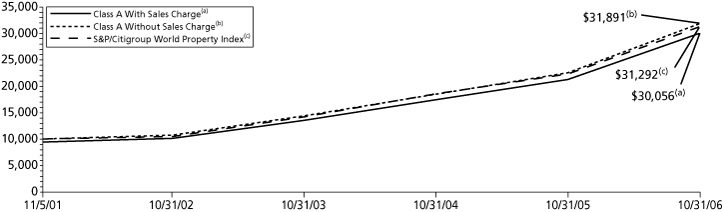

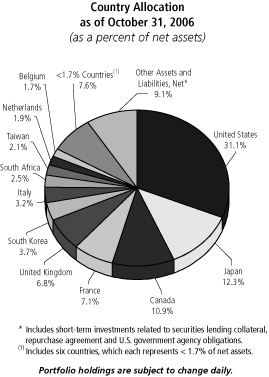

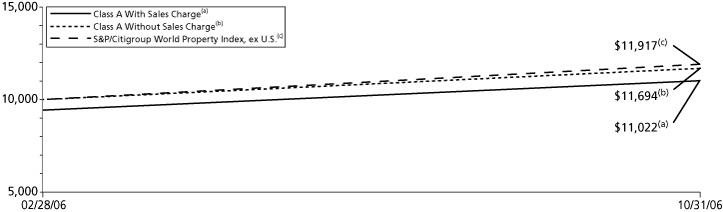

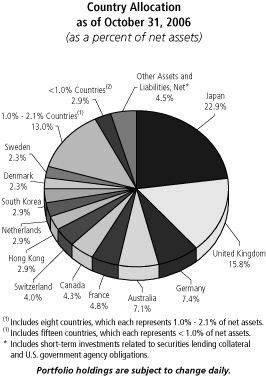

Performance: For the year ended October 31, 2006, the Fund's Class A shares, excluding sales charges, provided a total return of 41.09% compared to the Standard & Poor's/Citigroup World Property Index ("S&P/Citigroup World Property Index"), which returned 39.83% for the same period.

Portfolio Specifics: By region, Europe was the strongest performer with up 55.3% total return followed by North America up 36.7% and the Asia-Pacific region up 36.5%. Within Europe, the United Kingdom property stocks were up 67.9% versus property stocks in continental Europe which were up 45.9%. Out-performance versus the benchmark was generated primarily by stock picking in Japan, the United States, Hong Kong, Canada and Australia. In Japan, an overweight position in Tokyo-based development companies contributed to relative out-performance, including Sumitomo Realty which is primarily a developer and landlord of office and condominium properties. Tokyo office fundamentals continue to improve with rents increasing and vacancy levels below 3.0%. Top picks elsewhere included SL Green Realty Corp (a U.S. Real Estate Investment Trust ("REIT") which specializes in the mid-town Manhattan sub-market), Agile Property Holdings (a residential developer in China which is listed in Hong Kong), Centro Properties (an Australian shopping center company) and Summit REIT (a Canadian warehouse company). Global themes for the year included continued yield compression, mergers and acquisitions activity, syndicate activity (new companies being formed or existing companies raising new equity) and improving property fundamentals. By major country, the strongest performers for the year were Singapore up 80.8%, the United Kingdom up 67.9% and France up 64.4%, all of which are seeing improvements in property fundamentals, especially in the office sector which is showing a combination of higher rents and lower vacancies. Property stocks in the United Kingdom are additionally benefiting from the anticipation of the introduction of the REIT structure beginning January 1, 2007. Many of the major U.K. listed property companies have announced an intention to convert to a REIT structure next year which should generally cause dividend levels to be increased by those companies that are converting.

Current Strategy and Outlook: Global property companies continue to benefit from a combination of improving property fundamentals, yield compression and M&A activity, all of which have underpinned strong performance over the past year and which we believe should continue to serve as positive factors looking forward. Investment themes include investing in higher growth regions of the world, including the Asia-Pacific rim, and looking for opportunities in select markets which are currently under-represented in the listed markets but which show strong property fundamentals. By property type, the Fund strategy will attempt to benefit from generally improving property conditions globally, including the office sector which is generally firming in the major markets around the world. Through an average 3% - 4% dividend yield plus 6% to 9% prospective annual ear nings growth, we believe global property stocks continue to be well-positioned to conservatively deliver attractive total returns over the next several years.

Top Ten Industries*

as of October 31, 2006

(as a percent of net assets)

| Real Estate Operation/Development | | | 25.6 | % | |

| Offices | | | 11.1 | % | |

| Residential: Apartments | | | 10.0 | % | |

| Property Trust | | | 9.8 | % | |

| Diversified Property Holdings | | | 8.1 | % | |

| Real Estate Management/Services | | | 7.4 | % | |

| Retail: Shopping Centers | | | 6.8 | % | |

| Retail: Regional Malls | | | 5.3 | % | |

| Warehouse/Industrial | | | 3.3 | % | |

| Residential: Hotels | | | 2.9 | % | |

* Excludes short-term investments related to U.S. government agency obligations and securities lending collateral.

Portfolio holdings are subject to change daily.

8

ING GLOBAL REAL ESTATE FUND

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended October 31, 2006 | |

| | | 1 Year | | Since Inception

of Class A

November 5, 2001 | | Since Inception

of Class B

March 15, 2002 | | Since Inception

of Class C

January 8, 2002 | | Since Inception

of Class I

June 3, 2005 | |

| Including Sales Charge: | |

| Class A(1) | | | 32.95 | % | | | 24.68 | % | | | — | | | | — | | | | — | | |

| Class B(2) | | | 35.04 | % | | | — | | | | 24.26 | % | | | — | | | | — | | |

| Class C(3) | | | 39.06 | % | | | — | | | | — | | | | 24.29 | % | | | — | | |

| Class I | | | 41.49 | % | | | — | | | | — | | | | — | | | | 33.41 | % | |

| Excluding Sales Charge: | |

| Class A | | | 41.09 | % | | | 26.17 | % | | | — | | | | — | | | | — | | |

| Class B | | | 40.04 | % | | | — | | | | 24.46 | % | | | — | | | | — | | |

| Class C | | | 40.06 | % | | | — | | | | — | | | | 24.29 | % | | | — | | |

| Class I | | | 41.49 | % | | | — | | | | — | | | | — | | | | 33.41 | % | |

| S&P/Citigroup World Property Index(4) | | | 39.83 | % | | | 25.61 | %(5) | | | 26.13 | %(6) | | | 25.17 | %(7) | | | 32.91 | %(8) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Real Estate Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in the index. The Fund's performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund's current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The S&P/Citigroup World Property Index is an unmanaged market-weighted total return index which consists of many companies from developed markets whose floats are larger than $100 million and derive more than half of their revenue from property-related activities.

(5) Since inception performance for index is shown from November 1, 2001.

(6) Since inception performance for index is shown from March 1, 2002.

(7) Since inception performance for index is shown from January 1, 2002.

(8) Since inception performance for index is shown from June 1, 2005.

9

ING GLOBAL VALUE CHOICE FUND

PORTFOLIO MANAGERS' REPORT

The ING Global Value Choice Fund (the "Fund") seeks long-term capital appreciation. The Fund is managed by David Iben, CFA, and Paul J. Hechmer, Portfolio Managers, Tradewinds NWQ Global Investors, LLC(1) — the Sub-Adviser.

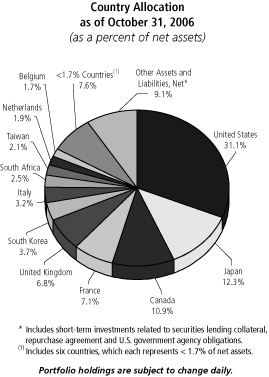

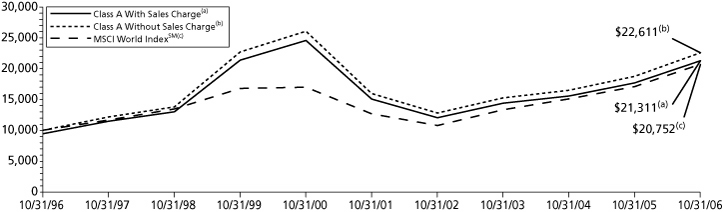

Performance: For the year ended October 31, 2006, the Fund's Class A shares, excluding sales charges, provided a total return of 20.48% compared to the Morgan Stanley Capital International World IndexSM ("MSCI World IndexSM"), which returned 21.32% for the same period.

Portfolio Specifics: In the first six months of the fiscal year, the Fund's high relative exposure to materials stocks contributed most to performance. In particular, Lonmin, a UK-listed platinum producer, was the single largest contributor to performance. Anglo American, Impala Platinum, Lihir Gold, and Placer Dome were also strong performers as gold and platinum prices rose during the period. Within the industrials sector, TNT NV, a Dutch global logistics leader, and Areva, a French multi-national nuclear power conglomerate, were also among the top 5 contributors. Dragging on performance during the first six months of the fiscal year was our significant underweight exposure to the financials sector. Additionally, our large exposure to the telecom sector hampered performance, despite the fact that we found good value in the ample cash generated by these co mpanies. In late April, the Fund reduced its allocation to financial and technology companies and increased its allocation to food, agriculture and utility companies.

Over the second half of the fiscal year, AGCO, a manufacturer and distributor of agricultural equipment, was the Fund's single largest contributor to performance as the agricultural industry started to work its way out of a cyclical bottom. Exposure in the materials sector hindered performance as gold, silver and platinum prices corrected sharply in May and June 2006. The pullback in commodity prices was not unexpected considering the huge run-up earlier in the year. Apex Silver Mines, a base metal mining company that owns the world's largest silver-zinc-lead project, located in Bolivia, was the worst individual performer.

For the entire twelve month period ended October 31, 2006, the Fund's holdings in the materials and industrials sectors were the largest contributors to performance. Despite May-June's correction, commodity prices remained significantly higher during the period; Lonmin and Anglo American were the top two individual performers. In addition, industrials holding Agco was a top performer. The Fund's consumer discretionary holdings hindered performance; Premiere AG, a German pay TV company, declined over 40% in December 2005 alone after it lost the rights to broadcast live soccer in 2006. While the Fund's financials sector weighting was significantly reduced in April, Japanese consumer finance company Takefuji was the Fund's worst individual performer for the fiscal year. The company was mired in an environment of regulatory changes and legal challenges within the country.

Current Strategy and Outlook: Looking ahead, the contrarian side of us worries that "what can't last forever — won't." Corporate profit margins in the world's largest economies are at all-time highs and economic theory dictates that they must retreat. Three years of rising federal fund rates and the current malaise in the housing market suggests that this inevitability may happen sooner rather than later.

Yet, over the longer-term, the economies of China, India, Brazil and other developing countries, should experience robust and sustainable growth, albeit with periodic downturns. We continue to find value in the securities of companies who meet the consumption needs of these growth markets. We believe the Fund is well positioned in food, agriculture, energy, commodities and materials companies worldwide and should benefit from these ongoing global developments.

(1) Effective April 24, 2006, sub-advisory responsibilities were transferred from NWQ Investment Management Company, LLC to Tradewinds NWQ Global Investors, LLC and David Iben replaced Mark A. Morris, Gregg S. Tensen as portfolio managers to the Fund.

Top Ten Industries*

as of October 31, 2006

(as a percent of net assets)

| Mining | | | 24.3 | % | |

| Telecommunications | | | 10.7 | % | |

| Food | | | 6.8 | % | |

| Machinery - Diversified | | | 4.6 | % | |

| Electric | | | 4.4 | % | |

| Oil & Gas | | | 4.3 | % | |

| Transportation | | | 4.2 | % | |

| Forest Products & Paper | | | 3.6 | % | |

| Aerospace/Defense | | | 2.4 | % | |

| Oil & Gas Services | | | 2.2 | % | |

* Excludes short-term investments related to U.S. government agency obligations and securities lending collateral.

Portfolio holdings are subject to change daily.

10

ING GLOBAL VALUE CHOICE FUND

PORTFOLIO MANAGERS' REPORT

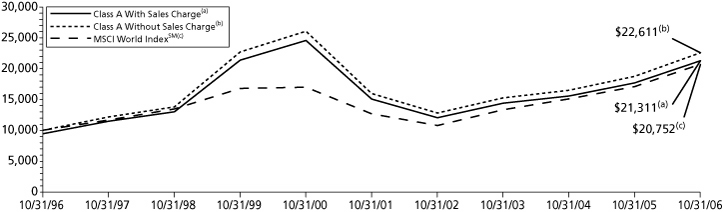

| Average Annual Total Returns for the Periods Ended October 31, 2006 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class I

September 6, 2006 | |

| Including Sales Charge: | |

| Class A(1) | | | 13.54 | % | | | 5.94 | % | | | 7.87 | % | | | — | | |

| Class B(2) | | | 14.67 | % | | | 6.17 | % | | | 7.81 | % | | | — | | |

| Class C(3) | | | 18.73 | % | | | 6.50 | % | | | 7.81 | % | | | — | | |

| Class I | | | — | | | | — | | | | — | | | | 1.97 | % | |

| Class Q | | | 20.75 | % | | | 7.50 | % | | | 8.82 | % | | | — | | |

| Excluding Sales Charge: | |

| Class A | | | 20.48 | % | | | 7.20 | % | | | 8.51 | % | | | — | | |

| Class B | | | 19.67 | % | | | 6.49 | % | | | 7.81 | % | | | — | | |

| Class C | | | 19.73 | % | | | 6.50 | % | | | 7.81 | % | | | — | | |

| Class I | | | — | | | | — | | | | — | | | | 1.97 | % | |

| Class Q | | | 20.75 | % | | | 7.50 | % | | | 8.82 | % | | | — | | |

| MSCI World IndexSM(4) | | | 21.32 | % | | | 10.39 | % | | | 7.57 | % | | | 4.91 | %(5) | |

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Global Value Choice Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in the index. The Fund's performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund's current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI World IndexSM is an unmanaged index that measures the performance of over 1,400 securities listed on exchanges in the U.S., Europe, Canada, Australia, New Zealand and the Far East. It includes the reinvestment of dividends net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing.

(5) Since inception performance for the index is shown from September 1, 2006.

Prior to April 24, 2006, the Fund was advised by a different sub-adviser.

11

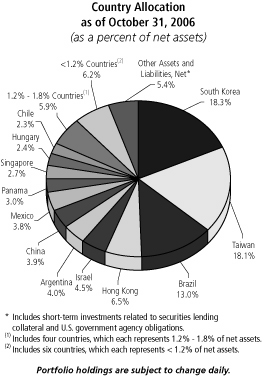

ING EMERGING COUNTRIES FUND

PORTFOLIOS MANAGERS' REPORT

The ING Emerging Countries Fund (the "Fund") seeks maximum long-term capital appreciation. The Fund is managed by Brandes Investment Partners, L.P. ("Brandes"), the Sub-Adviser. Brandes' Emerging Markets Committee, comprised of Alphonse H.L. Chan, Jr., CFA, Portfolio Manager, William Pickering, CFA, Director, Christopher J. Garrett, CFA, Institutional Portfolio Manager/Analyst, Gerardo Zamorano, CFA, Senior Analyst, Greg Rippel, CFA, Senior Analyst, Douglas Edman, CFA, Director, and Steven Leonard, CFA, Senior Analyst, is responsible for making the day-to-day investment decisions for the Fund.

Performance: For the year ended October 31, 2006, the Fund's Class A shares, excluding sales charges, provided a total return of 26.19% compared to the Morgan Stanley Capital International Emerging Markets IndexSM ("MSCI EM IndexSM"), which returned 35.00% for the same period.

Portfolio Specifics: The Fund's positions in the diversified telecom services industry had the most positive impact on performance for the year ended October 31, 2006. Holdings in the commercial banks and wireless telecom services industries also proved favorable to returns. Top performing positions among these industries included Cia Anonima Nacional Telefonos de Venezuela ADR (Venezuela — diversified telecom services), DBS Group Holdings (Singapore — commercial banks), and Partner Communications (Israel — wireless telecom services). Outside of these industries, positions such as Cia de Saneamento Basico do Estado de Sao Paulo (Brazil — water utilities), Sinopec Yizheng Chemical Fibre (China — chemicals), and First Pacific (Hong Kong — diversified financial services) also posted notable advances during the period. Conversely, stock-specific declines, such as Proton Holdings (Malaysia — automobiles), Vivo Participacoes (Brazil — wireless telecom services), and Brasil Telecom Participacoes (Brazil — diversified telecom services), tended to detract from performance.

On a country level, gains for securities domiciled in South Korea and Brazil had the most substantial impact upon performance. Some of the positions from these countries experiencing the greatest share price appreciation included KT Freetel (South Korea — wireless telecom services), Lotte Chilsung Beverage (South Korea — beverages), and Embratel Participacoes (Brazil — diversified telecom services). Fund holdings based in China and Taiwan also tended to advance during the period, while select positions based in Malaysia and South Africa tended to detract from performance.

Relative to the index, the portfolio's underperformance was mostly incurred during the first half of the 12-month period. It can be attributed at the industry level to underexposure to stocks in the oil, gas, & consumable fuels and metals & mining industries, and overexposure to diversified telecom services stocks. Within industries, our holdings in commercial banking, capital markets, and semiconductors & semiconductor equipment underperformed their industries, as represented in the MSCI EM IndexSM.

During the second half of the 12-month period, the Fund slightly outperformed the index as emerging market equities generally experienced negative or nominal returns. The Fund benefited from lack of exposure to the weak energy sector, in particular the oil, gas & consumable fuels industry.

As a reminder, the Fund's industry exposure is a residual of our value-driven investment process, which focuses on company-by-company analysis to identify undervalued securities. It should not be surprising that, as dedicated value managers following a disciplined strategy, we are not finding value in many companies in these commodity-based industries. During this period we held one security in the metals & mining industry, Posco (South Korea), which returned more than 40% for the period. We sold our one holding in the oil, gas & consumable fuels industry, LUKOIL (Russia), as its price approached our estimate of intrinsic value.

Our philosophy remains the same, both during periods of relative outperformance and underperformance. We believe the best opportunities for capital appreciation come from finding securities trading at discounts to our estimate of their true values. Conversely, we firmly believe focusing on short-term relative performance can distract investors from focusing on a disciplined investment strategy.

During the period, our company-specific analysis dictated a number of changes to the Fund composition. We sold positions such as Sinopec Yizheng Chemical Fibre (China — chemicals), PT Indofood Sukses Makmur (Indonesia — food products), and Turkiye Vakiflar Bank (Turkey — commercial banks), as share price appreciation pushed their market prices toward our estimates of their fair values. We also purchased a number of new positions, including Lotte Chilsung Beverage (South Korea — beverages), Taishin Financial Holdings (Taiwan — commercial banks), and Petkim Petrokimya (Turkey — chemicals), at prices we consider attractive.

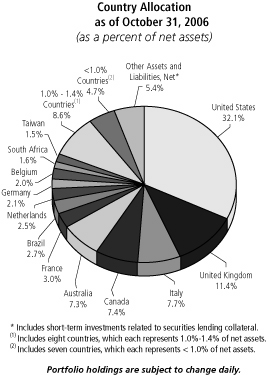

Current Strategy and Outlook: For the year ended October 31, 2006, the Fund's country and industry exposures shifted slightly due to stock-specific buying and selling as well as changes in the prices of holdings. For example, exposure to Taiwan and the industrial conglomerates industry increased, while exposure to Brazil and the commercial banks tended to decline. (Keep in mind that the Fund's weightings for industries and countries are not the product of "top-down" forecasts or opinions, but merely stem from our company-by-company search for compelling investment opportunities in markets around the world.)

Overall, while we offer no predictions regarding the short-term direction of equities in emerging markets, we believe the Fund remains well positioned to deliver favorable long-term results. We believe that all holdings remain undervalued, and we expect them to realize appreciation as the market recognizes their true worth.

Top Ten Industries*

as of October 31, 2006

(as a percent of net assets)

| Telecommunications | | | 34.5 | % | |

| Chemicals | | | 6.0 | % | |

| Banks | | | 5.6 | % | |

| Holding Companies - Diversified | | | 5.3 | % | |

| Auto Manufacturers | | | 5.0 | % | |

| Electric | | | 5.0 | % | |

| Semiconductors | | | 4.5 | % | |

| Electrical Components & Equipment | | | 3.8 | % | |

| Diversified Financial Services | | | 2.7 | % | |

| Textiles | | | 2.6 | % | |

* Excludes short-term investments related to securities lending collateral.

Portfolio holdings are subject to change daily.

12

ING EMERGING COUNTRIES FUND

PORTFOLIO MANAGERS' REPORT

| Average Annual Total Returns for the Periods Ended October 31, 2006 | |

| | | 1 Year | | 5 Year | | 10 Year | | Since Inception

of Class I

December 21, 2005 | | Since Inception

of Class M

August 5, 2002 | |

| Including Sales Charge: | |

| Class A(1) | | | 18.94 | % | | | 18.92 | % | | | 7.25 | % | | | — | | | | — | | |

| Class B(2) | | | 20.33 | % | | | 19.43 | % | | | 7.30 | % | | | — | | | | — | | |

| Class C(3) | | | 24.29 | % | | | 19.32 | % | | | 7.16 | % | | | — | | | | — | | |

| Class I | | | — | | | | — | | | | — | | | | 16.46 | % | | | — | | |

| Class M(4) | | | 21.24 | % | | | — | | | | — | | | | — | | | | 21.38 | % | |

| Class Q | | | 26.37 | % | | | 20.42 | % | | | 8.18 | % | | | — | | | | — | | |

| Excluding Sales Charge: | |

| Class A | | | 26.19 | % | | | 20.33 | % | | | 7.89 | % | | | — | | | | — | | |

| Class B | | | 25.33 | % | | | 19.62 | % | | | 7.30 | % | | | — | | | | — | | |

| Class C | | | 25.29 | % | | | 19.32 | % | | | 7.16 | % | | | — | | | | — | | |

| Class I | | | — | | | | — | | | | — | | | | 16.46 | % | | | — | | |

| Class M | | | 25.63 | % | | | — | | | | — | | | | — | | | | 22.40 | % | |

| Class Q | | | 26.37 | % | | | 20.42 | % | | | 8.18 | % | | | — | | | | — | | |

| MSCI EM IndexSM(5) | | | 35.00 | % | | | 28.11 | %(6) | | | 13.18 | % | | | 17.73 | %(7) | | | 30.26 | %(8) | |

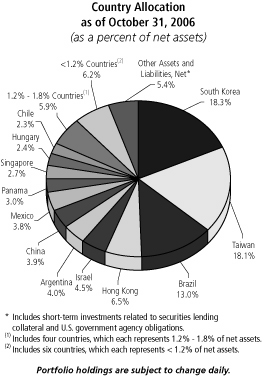

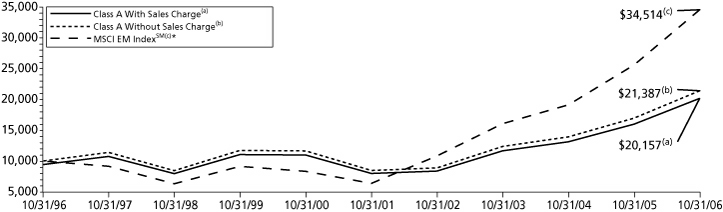

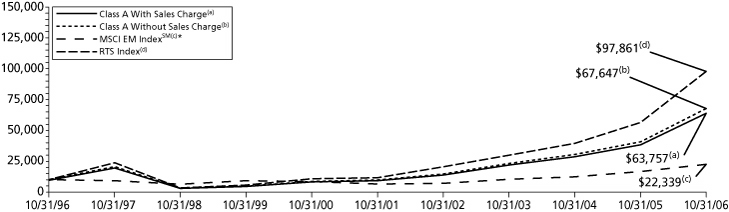

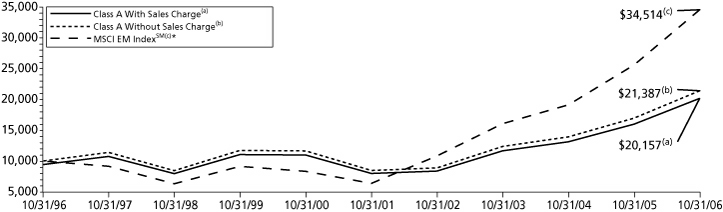

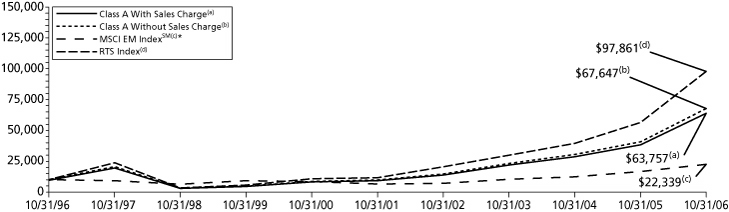

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Emerging Countries Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in the index. The Fund's performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund's current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

* Prior to October 31, 2001, the MSCI EM IndexSM did not include the deduction of withholding taxes.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 2%, respectively, for the 1 year and 5 year returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) Reflects deduction of the maximum Class M sales charge of 3.50%.

(5) The MSCI EM IndexSM is an unmanaged index that measures the performance of securities listed on exchanges in developing nations throughout the world. It includes the reinvestment of dividends and distributions net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing.

(6) Net return for index is shown from November 1, 2001.

(7) Since inception performance for index is shown from January 1, 2006.

(8) Since inception performance for index is shown from August 1, 2002.

Prior to March 1, 2005, the Fund was advised by a different sub-adviser.

13

ING FOREIGN FUND

PORTFOLIO MANAGERS' REPORT

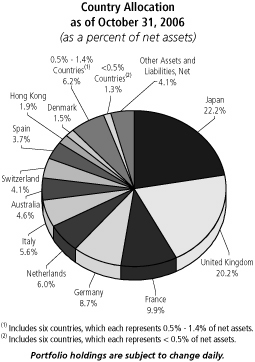

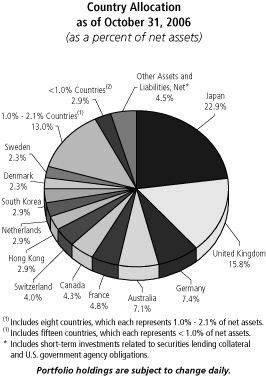

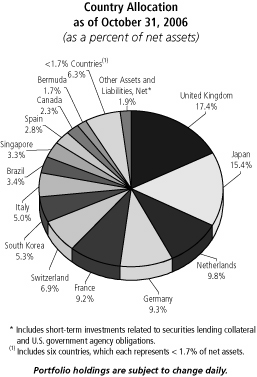

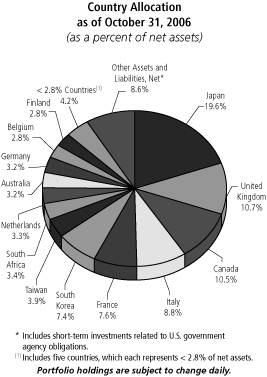

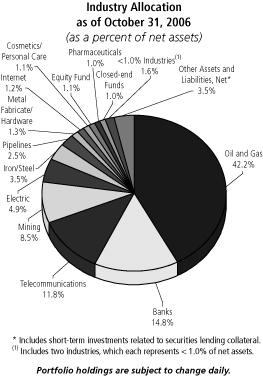

The ING Foreign Fund (the "Fund") seeks long-term growth of capital. The Fund is managed by Rudolph-Riad Younes, CFA, Senior Vice President and Head of International Equity and Richard Pell, Senior Vice President and Chief Investment Officer, Julius Baer Investment Management LLC — the Sub-Adviser.

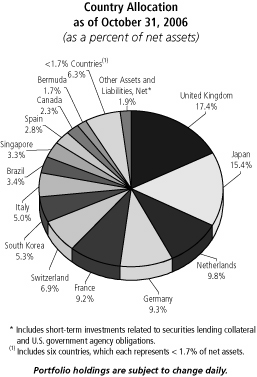

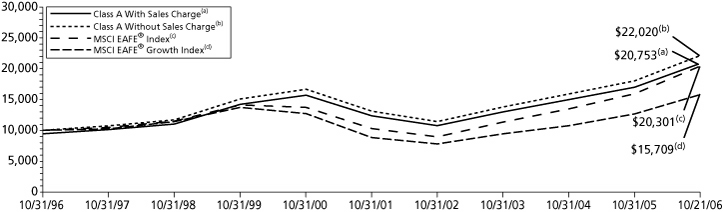

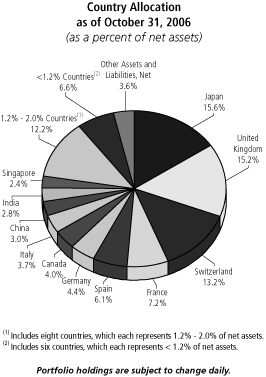

Performance: For the year ended October 31, 2006, the Fund's Class A shares, excluding sales charges, provided a total return of 28.39% compared to the Morgan Stanley Capital International — Europe, Australasia and Far East® Index ("MSCI EAFE® Index"), which returned 27.52% for the same period.

Portfolio Specifics: Positions in Russia, Poland and Turkey positively impacted performance. Within Russia, our position in the nation's largest bank, OAO Sberbank RF was a top contributor to results. Positions in OAO Gazprom and OAO LUKOIL, the country's biggest producers of natural gas and oil, were among top contributors. Additionally, our position in MMC Norilsk Nickel, the world's largest nickel and palladium producer, proved beneficial.

Powszechna Kasa Oszczednosci Bank Polski SA and Bank Pekao, the two largest lenders in Poland, exhibited strong results. Additionally, one of the banking positions held in Turkey, Akbank T.A.S. was a positive contributor. In the Czech Republic, however, shares of Komercni Banka, the third-largest Czech bank which is controlled by Societe Generale of France, underperformed the MSCI EAFE® Index. We have been optimistic about the prospects for emerging markets which have averaged between 15-20% of the strategy. In particular we have focused on the emerging markets of Eastern and Central Europe amid the drive to reunite Europe.

Our underweight to Japan, the weakest performer of the major developed markets, was supportive to results. While we were underweight in Asia overall, we were overweight within Continental Europe, which we believe offers more attractive valuations.

In the UK, stock selection had a positive impact on performance. Within Continental Europe, holdings in cement, airports and banks were positive contributors to results. Our positions in Lafarge (France) and Holcim (Switzerland), the world's #1 and #2 cement makers respectively, exhibited strong results. Our position in Fraport, the operator of the Frankfurt airport, was also a top contributor. Roche Holding (Switzerland), the world's largest maker of cancer medicines, exhibited positive performance over the period, but underperformed the benchmark. Endesa, Spain's largest power company enjoyed very strong performance over the period as a result of takeover bids for the company. Unfortunately, while we held the shares during the earlier part of the reporting period, we had sold our position in February. This negatively impacted relative results versus the benchmark. KKR Private Equity Investors LP is a publicly traded buyout fund that invest s its assets primarily in private equity investments sponsored by Kohlberg Kravis Roberts & Co. The position, which trades on the Amsterdam exchange, was purchased within the Fund in May. These shares have declined since purchase, but given the long-term nature of this investment, we have maintained this position. Also, another factor detracting from results was that the position held in cash equivalents.

Current Strategy and Outlook: Looking forward, we remain enthusiastic toward the long-term opportunities within the emerging markets of Eastern and Central Europe. We view the region as having made significant improvements on many fronts, encouraged by the prospect of European Union membership and possible inclusion into the Eurozone. India is another market which we have recently increased exposure. We see the market as offering long term growth potential, particularly within the banking sector, which should benefit from an increase in loan volumes.

We believe Continental Europe remains relatively strong and our focus continues to be on those industries most prone to a wave of restructuring, mergers and acquisitions taking place. In Germany, we have been focused on companies that will likely benefit from what we expect to be a strengthening domestic economy. We remain underweight the United Kingdom. We continue to be concerned about the UK's growth prospects and the impact this may have on the corporate sector. Much like the United States, the UK has high consumer debt and a declining savings rate which presents potential vulnerability for the UK consumer.

Japan still poses valuation concerns for us. While many companies have undergone structural changes, we've also witnessed this trend in Europe, where individual situations offer more compelling opportunities.

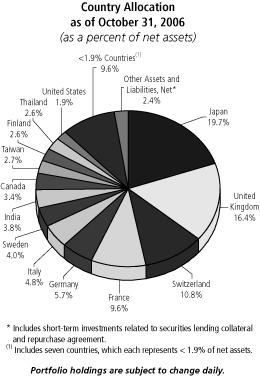

Top Ten Industries*

as of October 31, 2006

(as a percent of net assets)

| Banks | | | 24.5 | % | |

| Telecommunications | | | 7.6 | % | |

| Oil & Gas | | | 4.5 | % | |

| Pharmaceuticals | | | 4.3 | % | |

| Building Materials | | | 4.0 | % | |

| Food | | | 3.5 | % | |

| Mining | | | 3.5 | % | |

| Holding Companies - Diversified | | | 3.0 | % | |

| Engineering & Construction | | | 2.9 | % | |

| Retail | | | 2.6 | % | |

* Excludes short-term investments related to securities lending.

Portfolio holdings are subject to change daily.

14

ING FOREIGN FUND

PORTFOLIO MANAGERS' REPORT

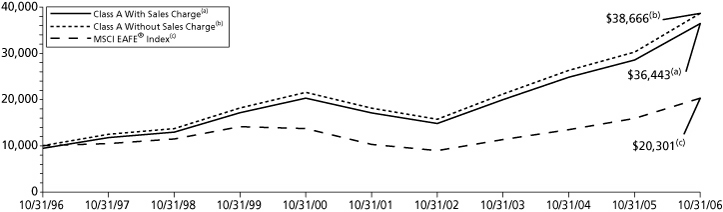

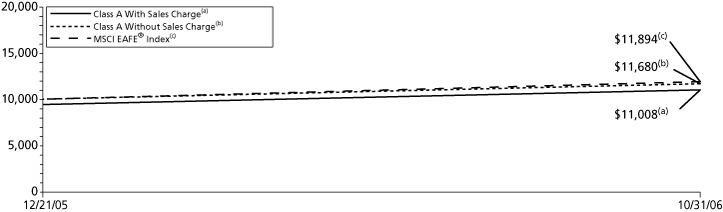

| Average Annual Total Returns for the Periods Ended October 31, 2006 | |

| | | 1 Year | | Since Inception

of Class A

July 1, 2003 | | Since Inception

of Class B

July 8, 2003 | |

| Including Sales Charge: | |

| Class A(1) | | | 21.03 | % | | | 19.63 | % | | | — | | |

| Class B(2) | | | 22.40 | % | | | — | | | | 19.38 | % | |

| Class C(3) | | | 26.43 | % | | | — | | | | — | | |

| Class I | | | 28.67 | % | | | — | | | | — | | |

| Class Q | | | 28.47 | % | | | — | | | | — | | |

| Excluding Sales Charge: | |

| Class A | | | 28.39 | % | | | 21.77 | % | | | — | | |

| Class B | | | 27.40 | % | | | — | | | | 19.98 | % | |

| Class C | | | 27.43 | % | | | — | | | | — | | |

| Class I | | | 28.67 | % | | | — | | | | — | | |

| Class Q | | | 28.47 | % | | | — | | | | — | | |

| MSCI EAFE® Index(4) | | | 27.52 | % | | | 24.13 | % | | | 24.13 | %(5) | |

| Average Annual Total Returns for the Periods Ended October 31, 2006 | |

| | | Since Inception

of Class C

July 7, 2003 | | Since Inception

of Class I

September 8, 2003 | | Since Inception

of Class Q

July 10, 2003 | |

| Including Sales Charge: | |

| Class A(1) | | | — | | | | — | | | | — | | |

| Class B(2) | | | — | | | | — | | | | — | | |

| Class C(3) | | | 20.08 | % | | | — | | | | — | | |

| Class I | | | — | | | | 21.31 | % | | | — | | |

| Class Q | | | — | | | | — | | | | 21.48 | % | |

| Excluding Sales Charge: | |

| Class A | | | — | | | | — | | | | — | | |

| Class B | | | — | | | | — | | | | — | | |

| Class C | | | 20.08 | % | | | — | | | | — | | |

| Class I | | | — | | | | 21.31 | % | | | — | | |

| Class Q | | | — | | | | — | | | | 21.48 | % | |

| MSCI EAFE® Index(4) | | | 24.13 | %(5) | | | 23.67 | %(6) | | | 24.13 | %(5) | |

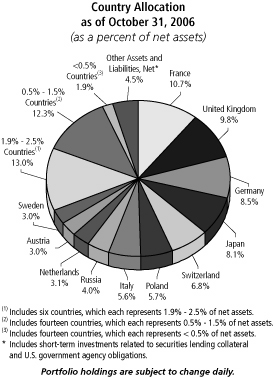

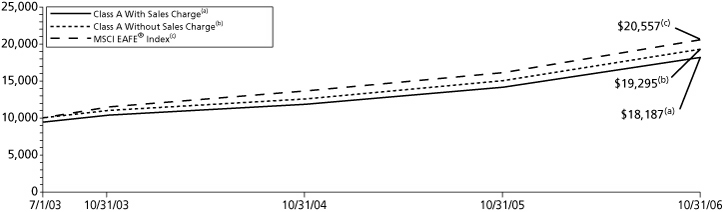

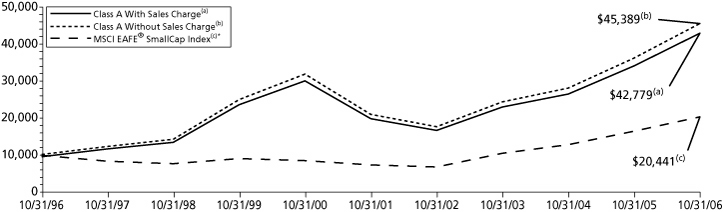

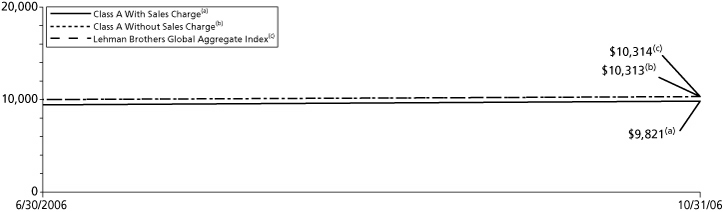

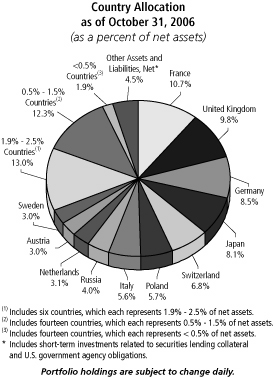

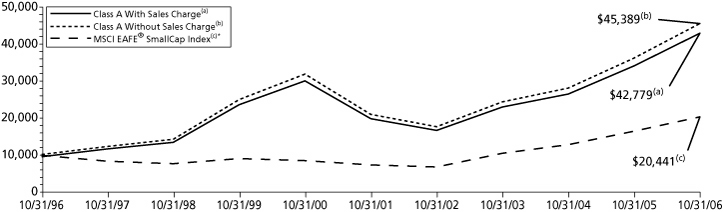

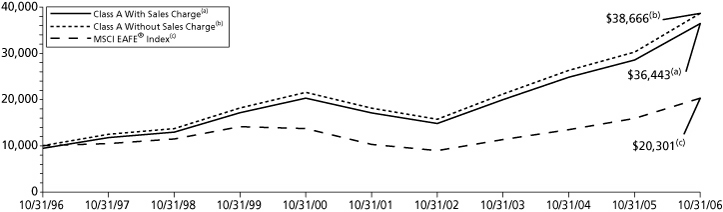

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Foreign Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in the index. The Fund's performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.

Performance data represents past performance and is no assurance of future results. Investment return and principal value of an investment in the Fund will fluctuate. Shares, when sold, may be worth more or less than their original cost. The Fund's current performance may be lower or higher than the performance data shown. Please log on to www.ingfunds.com or call (800) 992-0180 to get performance through the most recent month end.

It is important to note that the Fund has a limited operating history. Performance over a longer period of time may be more meaningful than short-term performance.

This report contains statements that may be "forward-looking" statements. Actual results may differ materially from those projected in the "forward-looking" statements.

The views expressed in this report reflect those of the portfolio managers, only through the end of the period as stated on the cover. The portfolio managers' views are subject to change at any time based on market and other conditions.

Fund holdings are subject to change daily.

(1) Reflects deduction of the maximum Class A sales charge of 5.75%.

(2) Reflects deduction of the Class B deferred sales charge of 5% and 3%, respectively, for the 1 year and since inception returns.

(3) Reflects deduction of the Class C deferred sales charge of 1% for the 1 year return.

(4) The MSCI EAFE® Index is an unmanaged index that measures the performance of securities listed on exchanges in Europe, Australasia and the Far East. It includes the reinvestment of dividends net of withholding taxes, but does not reflect fees, brokerage commissions or other expenses of investing.

(5) Since inception performance for index is shown from July 1, 2003.

(6) Since inception performance for index is shown from September 1, 2003.

15

ING GREATER CHINA FUND

PORTFOLIO MANAGERS' REPORT

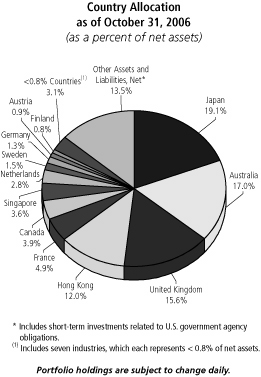

The ING Greater China Fund (the "Fund") seeks long-term capital appreciation. The Fund is managed by Nick Toovey, CFA, Bratin Sanyal, Oscar Leung Kin Fai, CFA and Michael Hon Lung Chiu, CFA, ING Investment Management Asia/Pacific (Hong Kong) Limited — the Sub-Adviser.

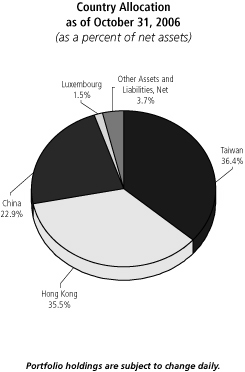

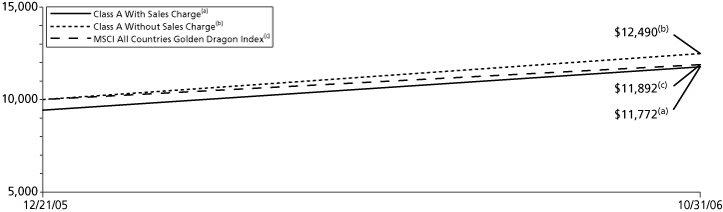

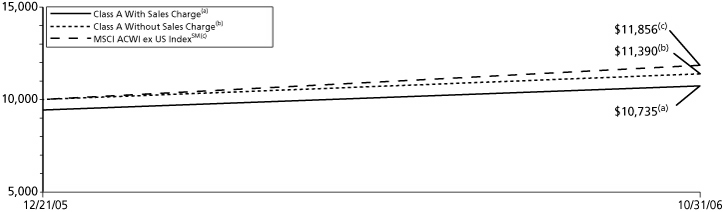

Performance: Since the Fund's inception on December 21, 2005 through October 31, 2006, the Fund's Class A shares, excluding sales charges, provided a total return of 24.90% compared to the Morgan Stanley Capital International ("MSCI") All Countries Golden Dragon Index, which returned 19.34% for the same period. The MSCI All Countries Golden Dragon Index is an aggregate of the MSCI Hong Kong Index, the MSCI China Free Index and the MSCI Taiwan Index.

Portfolio Specifics: The Fund benefited from its overweight in China during the reporting period as China outperformed the region. China this year reported a strong set of macroeconomic figures with its gross domestic product ("GDP") growing more than 10% year over year for 3 prior quarters to September 30, 2006.

To moderate this growth, China's central bank, the People's Bank of China, raised interest rates by 0.27% in August, and also required that commercial banks increase their reserve ratio in order to dampen lending growth. As a result, economic growth in China started to moderate with money supply and fixed asset investment growth slowing down in the second half of 2006. With a rising trade surplus and a resilient export sector the Chinese government also allowed its currency, the renminbi, to appreciate more quickly against the U.S. dollar during the period.

In Hong Kong, GDP growth remained above 5% for the period. Local politics in Taiwan remained deadlocked in the second half of the year after the Pan-Blue Coalition parties failed to recall President Chen Shui-bian. Global headwinds in the technology sector also hurt the island's performance. GDP growth in Taiwan slowed from 6.4% for the year ending December 31, 2005 to 4.6% for the year ending June 30, 2006, due to a decline in consumer confidence.

An overweight position in Chinese real estate and good stock selection within the sector benefited the Fund. In particular, the overweight in China Overseas Land & Investment Ltd. was one of the major contributors to the portfolio. Likewise, an overweight in the Taiwan hardware and equipment sector helped raise the return on the Taiwan section of the portfolio. In particular, the overweight in Foxconn Technology contributed positively to performance. An overweight and good stock selection in the Hong Kong banks industry group including Bank of East Asia also generated outperformance.

The portfolio started to invest in the China A share market through warrants during the reporting period, with a net overweight position in China Merchants Bank 'A' share. The company benefited from the listing of its H share in Hong Kong and the overweight position added value to the portfolio.

By contrast, an underweight position in Chinese telecommunications acted as a drag, as the sector appreciated as companies such as China Mobile reported better-than-expected earnings. An overweight position in some personal computer related technology companies such as Lite-On Technology also hurt the Fund.

Current Strategy and Outlook: Uncertainties regarding the sustainability of China's economic growth remain, although the overall sentiment towards Chinese stocks has improved recently. Macroeconomic numbers such as fixed asset investment and industrial production growth have further moderated recently, which may ease investor's concerns about economic overheating. The continuous appreciation of the renminbi and the increase in quotas are likely to help Hong Kong-listed Chinese shares.

Export growth in both China and Hong Kong remain strong. Domestic consumption confidence in Hong Kong is steady, supported by stable asset prices and improving employment conditions. In Taiwan, the continuous political struggle between the country's President Chen and opposition parties has impacted domestic consumer sentiment. Nevertheless, we believe the long-term outlook for Taiwan is positive, especially if the current political deadlock comes to some form of resolution. We maintain a neutral outlook on Taiwan and await further clarity of the country's political environment.

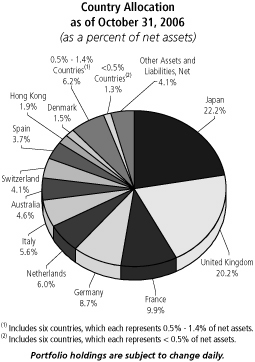

Top Ten Industries

as of October 31, 2006

(as a percent of net assets)

| Real Estate | | | 15.9 | % | |

| Banks | | | 13.2 | % | |

| Semiconductors | | | 11.4 | % | |

| Diversified Financial Services | | | 7.0 | % | |

| Insurance | | | 7.0 | % | |

| Computers | | | 6.6 | % | |

| Telecommunications | | | 6.5 | % | |

| Electronics | | | 5.8 | % | |

| Oil & Gas | | | 4.5 | % | |

| Holding Companies - Diversified | | | 3.6 | % | |

Portfolio holdings are subject to change daily.

16

ING GREATER CHINA FUND

PORTFOLIO MANAGERS' REPORT

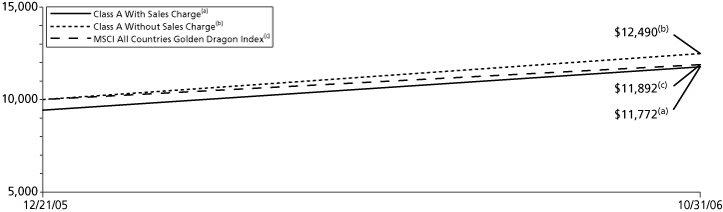

| Cumulative Total Returns for the Periods Ended October 31, 2006 | |

| | | Since Inception

of Class A

December 21, 2005 | | Since Inception

of Class B

January 6, 2006 | | Since Inception

of Class C

January 11, 2006 | | Since Inception

of Class I

May 8, 2006 | |

| Including Sales Charge: | |

| Class A(1) | | | 17.72 | % | | | — | | | | — | | | | — | | |

| Class B(2) | | | — | | | | 12.17 | % | | | — | | | | — | | |

| Class C(3) | | | — | | | | — | | | | 15.49 | % | | | — | | |

| Class I | | | — | | | | — | | | | — | | | | (2.65 | )% | |

| Excluding Sales Charge: | |

| Class A | | | 24.90 | % | | | — | | | | — | | | | — | | |

| Class B | | | — | | | | 17.17 | % | | | — | | | | — | | |

| Class C | | | — | | | | — | | | | 16.49 | % | | | — | | |

| Class I | | | — | | | | — | | | | — | | | | (2.65 | )% | |

| MSCI All Countries Golden Dragon Index(4) | | | 18.92 | %(5) | | | 18.92 | %(5) | | | 18.92 | %(5) | | | 2.07 | %(6) | |

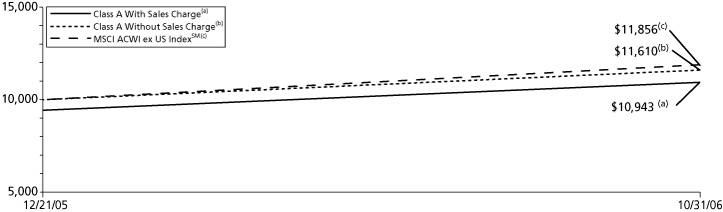

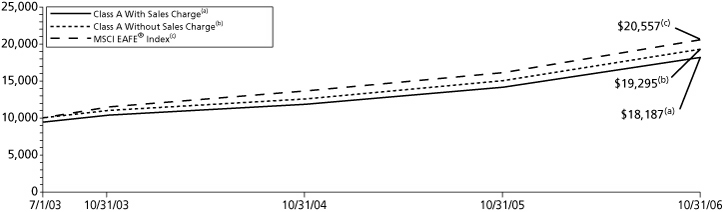

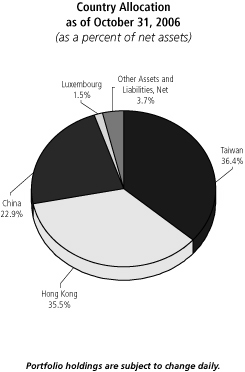

Based on a $10,000 initial investment, the graph and table above illustrate the total return of ING Greater China Fund against the index indicated. The index is unmanaged and has no cash in its portfolio, imposes no sales charge and incurs no operating expenses. An investor cannot invest directly in the index. The Fund's performance is shown both with and without the imposition of sales charges.

The graph and performance table do not reflect the deduction of taxes that a shareholder will pay on Fund distributions or the redemption of Fund shares.

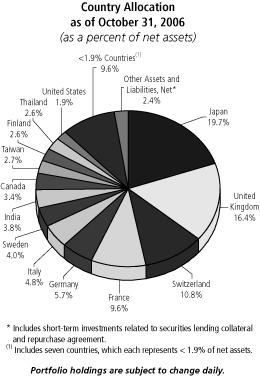

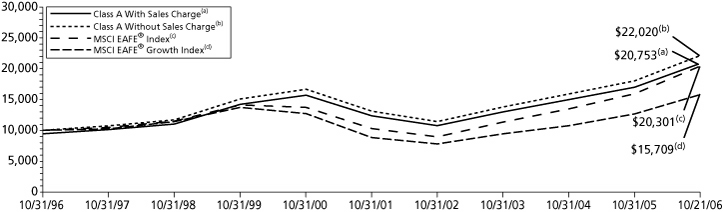

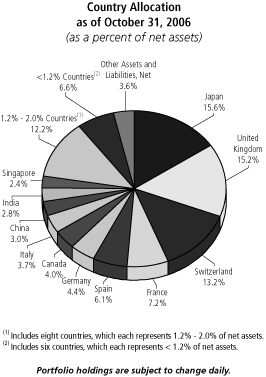

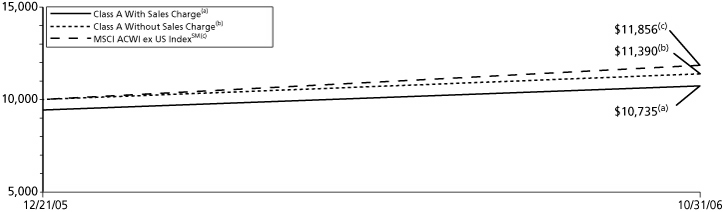

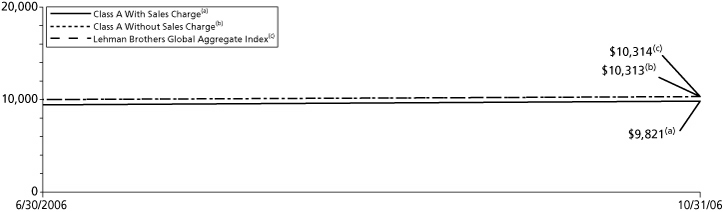

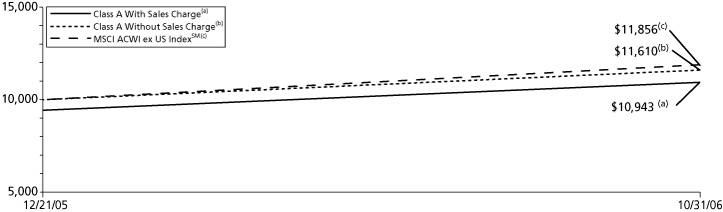

The performance shown may include the effect of fee waivers and/or expense reimbursements by the Investment Adviser and/or other service providers, which have the effect of increasing total return. Had all fees and expenses been considered, the total returns would have been lower.