0000912036 afiv:C000194568Member afiv:OtherAssetsLessLiabilitiesMember 2024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant's telephone number, including area code:

Date of reporting period:

November 01, 2023 - October 31, 2024

(Annual Shareholder Report)

Item 1. Reports to Shareholders

(a)

AMG Beutel Goodman Core Plus Bond Fund

Class N/ADBLX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG Beutel Goodman Core Plus Bond Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG Beutel Goodman Core Plus Bond Fund

(Class N/ADBLX) | $72 | 0.68% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class N shares advanced by 10.97% for the fiscal year that ended October 31, 2024, led by strong performance in corporate bonds and the portfolio’s duration positioning.

• The Fund outperformed the Bloomberg U.S. Aggregate Bond Index, which returned 10.55% during the period.

Top Contributors and Detractors

• At the beginning of the reporting period, interest rates were at their highest levels since the 1980s, but as inflation began to normalize, the U.S. Federal Reserve followed many of its global peers by reducing its policy rate.

• Amid this backdrop, corporate security selection was the main contributor to performance for the Fund, while duration and curve positioning added value. Government security selection was also positive for performance.

• In contrast, securitized security selection was the main detractor over the period.

Positioning Update

• Given the uncertain investment landscape, we remain defensively positioned in the Fund. The Fund is overweight credit, but is focused on higher-rated securities in less cyclical sectors; we are ready to pivot if the economy slows and spreads move wider.

• The higher-beta investment grade and high-yield credits in the Fund are concentrated in the front end of the curve in shorter maturities (one-to five-year terms to maturity). This has the effect of increasing the average yield of the Fund, while not materially increasing the credit risk due to the lower credit duration.

• We expect interest rates will continue to fall, so we are watching for potential opportunities to increase our duration position. We also believe that the yield curve will continue to steepen.

• The Fund is therefore positioned with an overweight in the mid part of the curve, which tends to perform best during steepening environments.

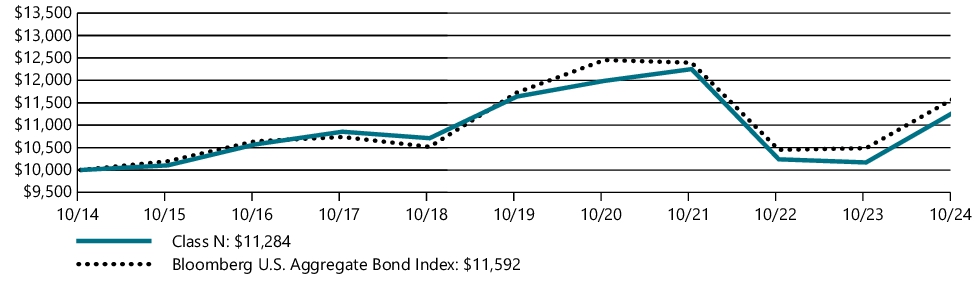

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of a broad based index. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of a broad based index over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class N | 10.97% | (0.62%) | 1.22% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | (0.23%) | 1.49% |

As of March 24, 2021, the Fund's Subadviser was changed to Beutel, Goodman & Company Ltd. Prior to March 24, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 24, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

"Bloomberg®" and any Bloomberg index described herein are service marks of Bloomberg Finance L. P. and its affiliates, including Bloomberg Index Services Limited ("BISL"), the administrator of the index (collectively, "Bloomberg") and have been licensed for use for certain purposes by AMG Funds LLC. Bloomberg is not affiliated with AMG Funds LLC, and Bloomberg does not approve, endorse, review, or recommend the fund described herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to such fund.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $121,038,761 |

| Total number of portfolio holdings | 110 |

| Net advisory fees paid | $141,598 |

| Portfolio turnover rate as of the end of the reporting period | 83% |

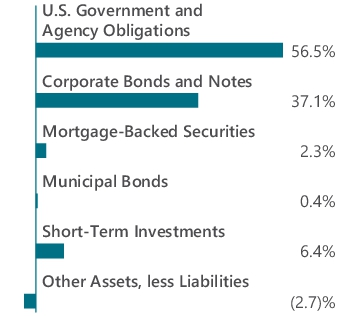

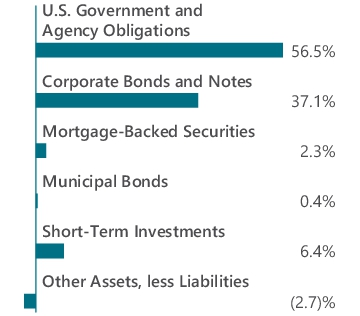

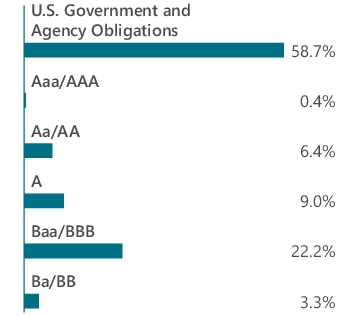

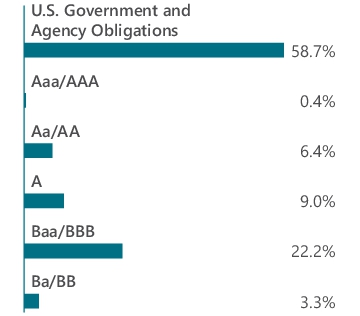

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund.

| U.S. Treasury Notes, 4.500%, 11/15/33 | 9.4% |

| U.S. Treasury Bonds, 4.250%, 02/15/54 | 4.4% |

| U.S. Treasury Notes, 3.500%, 09/30/29 | 3.5% |

| FNMA, 2.140%, 10/01/29 | 3.5% |

| FNMA, 3.000%, 06/01/52 | 3.5% |

| U.S. Treasury Bonds, 3.000%, 08/15/52 | 2.8% |

| U.S. Treasury Bonds, 1.875%, 02/15/41 | 2.8% |

| Bank of America Corp., 4.376%, 04/27/28 | 2.5% |

| FNMA, 2.260%, 01/01/30 | 2.4% |

| U.S. Treasury Notes, 3.500%, 02/15/33 | 2.2% |

| Top Ten as a Group | 37.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG Beutel Goodman Core Plus Bond Fund

Class I/ADLIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG Beutel Goodman Core Plus Bond Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG Beutel Goodman Core Plus Bond Fund

(Class I/ADLIX) | $51 | 0.48% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class I shares advanced by 11.21% for the fiscal year that ended October 31, 2024, led by strong performance in corporate bonds and the portfolio’s duration positioning.

• The Fund outperformed the Bloomberg U.S. Aggregate Bond Index, which returned 10.55% during the period.

Top Contributors and Detractors

• At the beginning of the reporting period, interest rates were at their highest levels since the 1980s, but as inflation began to normalize, the U.S. Federal Reserve followed many of its global peers by reducing its policy rate.

• Amid this backdrop, corporate security selection was the main contributor to performance for the Fund, while duration and curve positioning added value. Government security selection was also positive for performance.

• In contrast, securitized security selection was the main detractor over the period.

Positioning Update

• Given the uncertain investment landscape, we remain defensively positioned in the Fund. The Fund is overweight credit, but is focused on higher-rated securities in less cyclical sectors; we are ready to pivot if the economy slows and spreads move wider.

• The higher-beta investment grade and high-yield credits in the Fund are concentrated in the front end of the curve in shorter maturities (one-to five-year terms to maturity). This has the effect of increasing the average yield of the Fund, while not materially increasing the credit risk due to the lower credit duration.

• We expect interest rates will continue to fall, so we are watching for potential opportunities to increase our duration position. We also believe that the yield curve will continue to steepen.

• The Fund is therefore positioned with an overweight in the mid part of the curve, which tends to perform best during steepening environments.

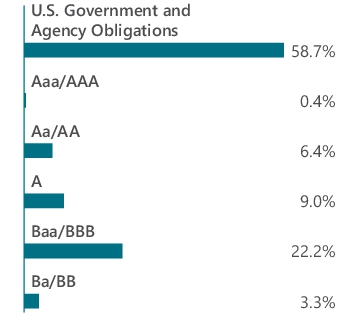

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of a broad based index. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of a broad based index over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class I | 11.21% | (0.42%) | 1.45% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | (0.23%) | 1.49% |

As of March 24, 2021, the Fund's Subadviser was changed to Beutel, Goodman & Company Ltd. Prior to March 24, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 24, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

"Bloomberg®" and any Bloomberg index described herein are service marks of Bloomberg Finance L. P. and its affiliates, including Bloomberg Index Services Limited ("BISL"), the administrator of the index (collectively, "Bloomberg") and have been licensed for use for certain purposes by AMG Funds LLC. Bloomberg is not affiliated with AMG Funds LLC, and Bloomberg does not approve, endorse, review, or recommend the fund described herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to such fund.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $121,038,761 |

| Total number of portfolio holdings | 110 |

| Net advisory fees paid | $141,598 |

| Portfolio turnover rate as of the end of the reporting period | 83% |

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund.

| U.S. Treasury Notes, 4.500%, 11/15/33 | 9.4% |

| U.S. Treasury Bonds, 4.250%, 02/15/54 | 4.4% |

| U.S. Treasury Notes, 3.500%, 09/30/29 | 3.5% |

| FNMA, 2.140%, 10/01/29 | 3.5% |

| FNMA, 3.000%, 06/01/52 | 3.5% |

| U.S. Treasury Bonds, 3.000%, 08/15/52 | 2.8% |

| U.S. Treasury Bonds, 1.875%, 02/15/41 | 2.8% |

| Bank of America Corp., 4.376%, 04/27/28 | 2.5% |

| FNMA, 2.260%, 01/01/30 | 2.4% |

| U.S. Treasury Notes, 3.500%, 02/15/33 | 2.2% |

| Top Ten as a Group | 37.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG Beutel Goodman Core Plus Bond Fund

Class Z/ADZIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG Beutel Goodman Core Plus Bond Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG Beutel Goodman Core Plus Bond Fund

(Class Z/ADZIX) | $45 | 0.43% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class Z shares advanced by 11.25% for the fiscal year that ended October 31, 2024, led by strong performance in corporate bonds and the portfolio’s duration positioning.

• The Fund outperformed the Bloomberg U.S. Aggregate Bond Index, which returned 10.55% during the period.

Top Contributors and Detractors

• At the beginning of the reporting period, interest rates were at their highest levels since the 1980s, but as inflation began to normalize, the U.S. Federal Reserve followed many of its global peers by reducing its policy rate.

• Amid this backdrop, corporate security selection was the main contributor to performance for the Fund, while duration and curve positioning added value. Government security selection was also positive for performance.

• In contrast, securitized security selection was the main detractor over the period.

Positioning Update

• Given the uncertain investment landscape, we remain defensively positioned in the Fund. The Fund is overweight credit, but is focused on higher-rated securities in less cyclical sectors; we are ready to pivot if the economy slows and spreads move wider.

• The higher-beta investment grade and high-yield credits in the Fund are concentrated in the front end of the curve in shorter maturities (one-to five-year terms to maturity). This has the effect of increasing the average yield of the Fund, while not materially increasing the credit risk due to the lower credit duration.

• We expect interest rates will continue to fall, so we are watching for potential opportunities to increase our duration position. We also believe that the yield curve will continue to steepen.

• The Fund is therefore positioned with an overweight in the mid part of the curve, which tends to perform best during steepening environments.

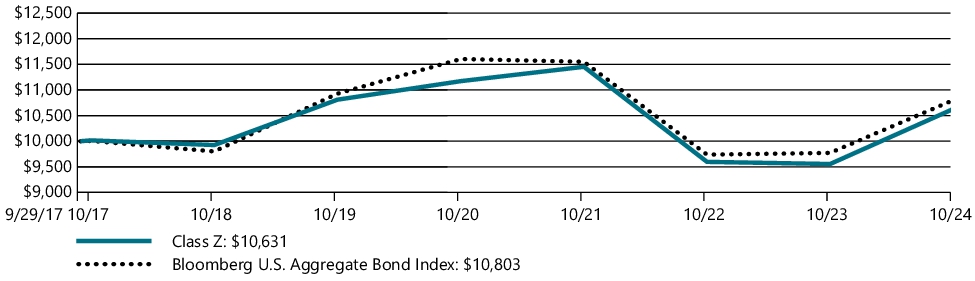

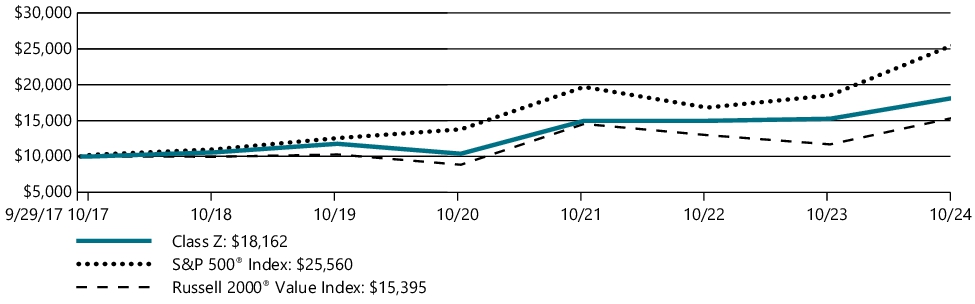

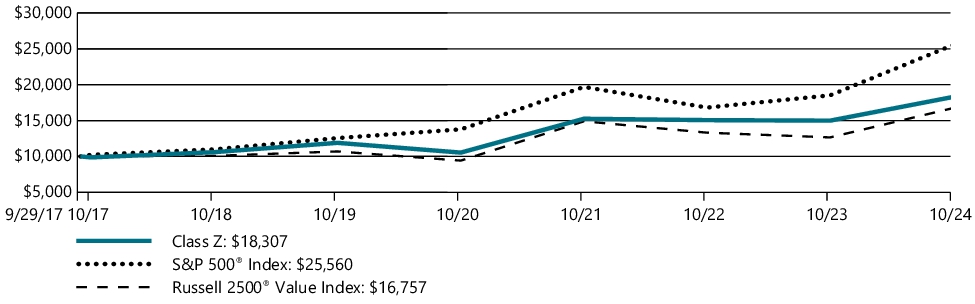

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted since the class's inception on September 29, 2017, as compared to the performance of a broad based index. The performance table below shows the average annual total returns of the class of shares noted for the past one-year and five-year periods and the period from the class's inception through October 31, 2024. It also shows the average total returns of a broad based index over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since Inception |

| Class Z | 11.25% | (0.34%) | 0.87% |

| Bloomberg U.S. Aggregate Bond Index | 10.55% | (0.23%) | 1.10% |

As of March 24, 2021, the Fund's Subadviser was changed to Beutel, Goodman & Company Ltd. Prior to March 24, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 24, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

"Bloomberg®" and any Bloomberg index described herein are service marks of Bloomberg Finance L. P. and its affiliates, including Bloomberg Index Services Limited ("BISL"), the administrator of the index (collectively, "Bloomberg") and have been licensed for use for certain purposes by AMG Funds LLC. Bloomberg is not affiliated with AMG Funds LLC, and Bloomberg does not approve, endorse, review, or recommend the fund described herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to such fund.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $121,038,761 |

| Total number of portfolio holdings | 110 |

| Net advisory fees paid | $141,598 |

| Portfolio turnover rate as of the end of the reporting period | 83% |

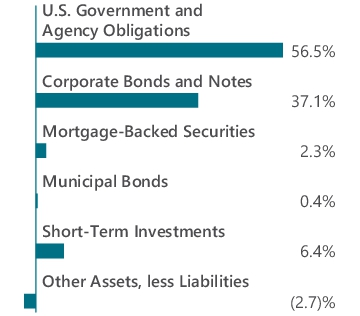

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and ratings are shown as a percentage of total long-term investments of the Fund.

| U.S. Treasury Notes, 4.500%, 11/15/33 | 9.4% |

| U.S. Treasury Bonds, 4.250%, 02/15/54 | 4.4% |

| U.S. Treasury Notes, 3.500%, 09/30/29 | 3.5% |

| FNMA, 2.140%, 10/01/29 | 3.5% |

| FNMA, 3.000%, 06/01/52 | 3.5% |

| U.S. Treasury Bonds, 3.000%, 08/15/52 | 2.8% |

| U.S. Treasury Bonds, 1.875%, 02/15/41 | 2.8% |

| Bank of America Corp., 4.376%, 04/27/28 | 2.5% |

| FNMA, 2.260%, 01/01/30 | 2.4% |

| U.S. Treasury Notes, 3.500%, 02/15/33 | 2.2% |

| Top Ten as a Group | 37.0% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG GW&K Small/Mid Cap Growth Fund

Class N/ACWDX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG GW&K Small/Mid Cap Growth Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small/Mid Cap Growth Fund

(Class N/ACWDX) | $115 | 1.01% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class N shares returned 28.36% for the fiscal year that ended October 31, 2024, underperforming the Russell 2500® Growth Index, which returned 34.21% for the period. The S&P 500® Index returned 38.02% for the period.

• The economic backdrop was favorable for U.S. equities as economic growth remained resilient, inflation declined, the job market stayed healthy, and the U.S. Federal Reserve Board (the Fed) initiated a rate cutting cycle. Areas of concern centered on the weakness in manufacturing activity, the shift in consumer spending to value-driven purchasing, market concentration in a handful of mega-cap companies, and escalating global geopolitical tensions.

Top Contributors and Detractors

• The health care sector was a leading contributor, led by biopharma holdings that announced favorable drug trials and excellent sales results.

• Financials benefited from rising capital markets activity that lifted investment banking positions.

• In materials, each of the Fund’s holdings delivered strong operating results in difficult market conditions.

• Industrials was a detractor from relative performance, where soft-end market demand restrained the Fund’s holdings in the industrial machinery and distributors segments.

• Consumer discretionary experienced a detraction from a position in specialty retail, which announced results that fell short of expectations.

• In energy, the Fund’s holdings were pressured by a weak price environment for natural gas and oil.

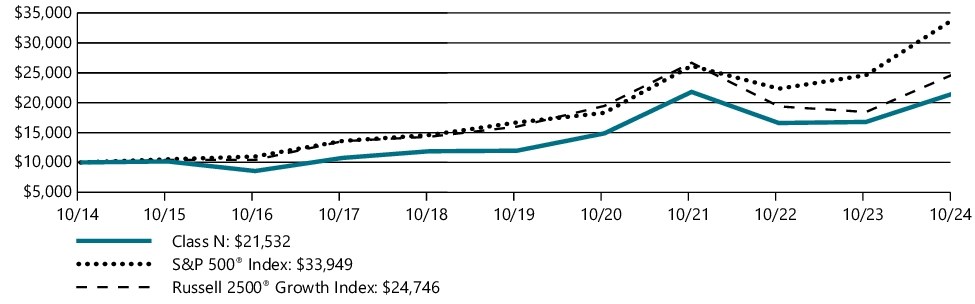

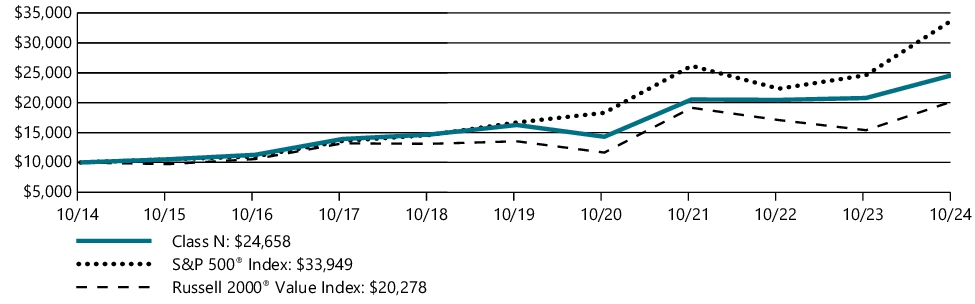

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class N | 28.36% | 12.48% | 7.97% |

| S&P 500® Index | 38.02% | 15.27% | 13.00% |

| Russell 2500® Growth Index | 34.21% | 9.14% | 9.48% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the Russell 2500® Growth Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

As of March 19, 2021, the Fund's Subadviser was changed to GW&K Investment Management, LLC. Prior to March 19, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 19, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

The Russell Index is a trademark of the London Stock Exchange Group companies.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $41,834,206 |

| Total number of portfolio holdings | 77 |

| Net advisory fees paid | $157,451 |

| Portfolio turnover rate as of the end of the reporting period | 19% |

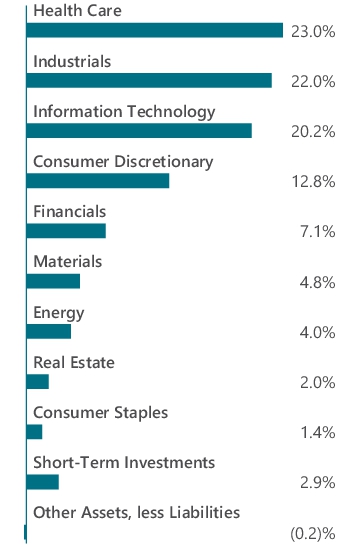

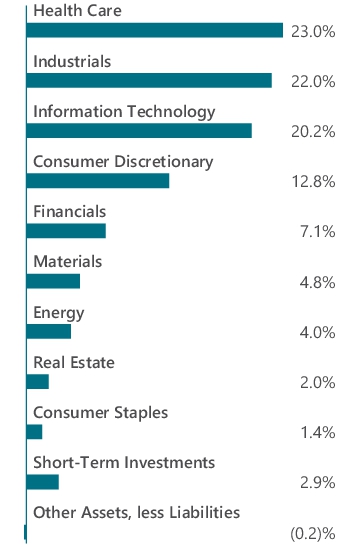

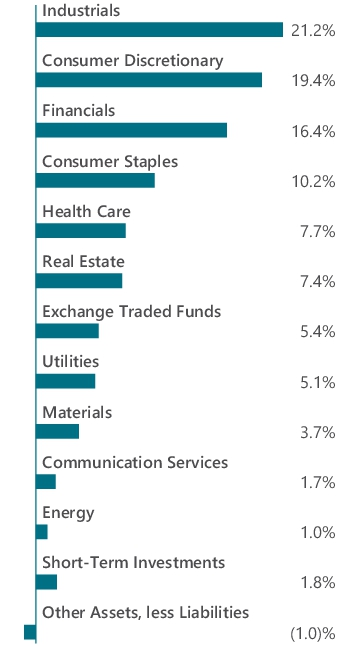

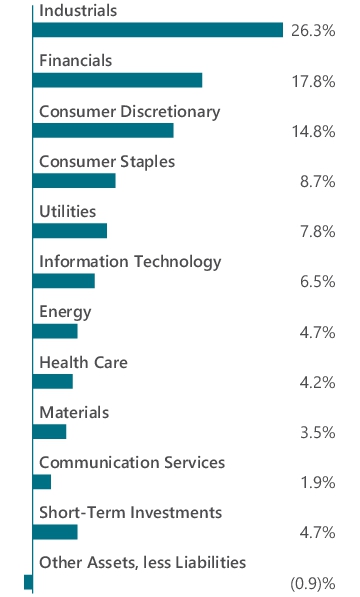

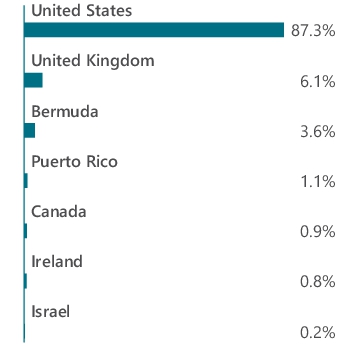

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| CyberArk Software, Ltd. (Israel) | 2.5% |

| Texas Roadhouse, Inc. | 2.2% |

| Tyler Technologies, Inc. | 2.1% |

| Houlihan Lokey, Inc. | 2.1% |

| ITT, Inc. | 1.9% |

| CACI International, Inc., Class A | 1.9% |

| Burlington Stores, Inc. | 1.9% |

| Entegris, Inc. | 1.9% |

| Globant SA (Uruguay) | 1.9% |

| Manhattan Associates, Inc. | 1.8% |

| Top Ten as a Group | 20.2% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG GW&K Small/Mid Cap Growth Fund

Class I/ACWIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG GW&K Small/Mid Cap Growth Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small/Mid Cap Growth Fund

(Class I/ACWIX) | $99 | 0.87% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class I shares returned 28.43% for the fiscal year that ended October 31, 2024, underperforming the Russell 2500® Growth Index, which returned 34.21% for the period. The S&P 500® Index returned 38.02% for the period.

• The economic backdrop was favorable for U.S. equities as economic growth remained resilient, inflation declined, the job market stayed healthy, and the U.S. Federal Reserve Board (the Fed) initiated a rate cutting cycle. Areas of concern centered on the weakness in manufacturing activity, the shift in consumer spending to value-driven purchasing, market concentration in a handful of mega-cap companies, and escalating global geopolitical tensions.

Top Contributors and Detractors

• The health care sector was a leading contributor, led by biopharma holdings that announced favorable drug trials and excellent sales results.

• Financials benefited from rising capital markets activity that lifted investment banking positions.

• In materials, each of the Fund’s holdings delivered strong operating results in difficult market conditions.

• Industrials was a detractor from relative performance, where soft-end market demand restrained the Fund’s holdings in the industrial machinery and distributors segments.

• Consumer discretionary experienced a detraction from a position in specialty retail, which announced results that fell short of expectations.

• In energy, the Fund’s holdings were pressured by a weak price environment for natural gas and oil.

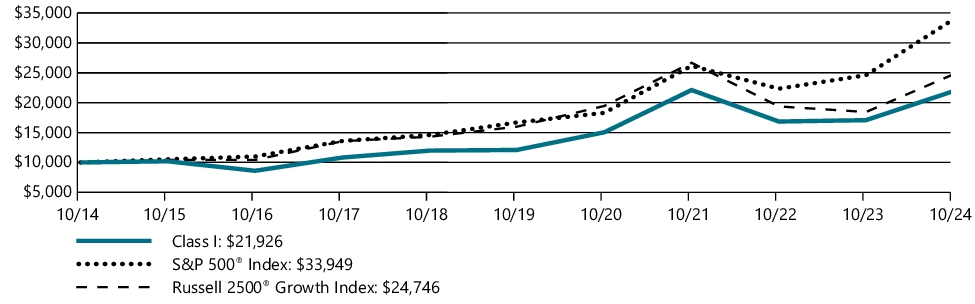

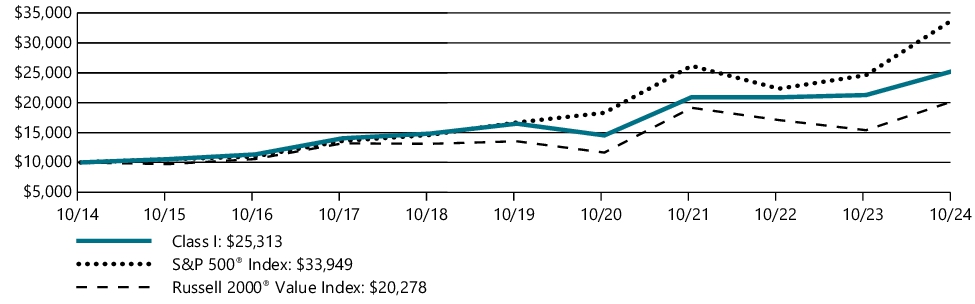

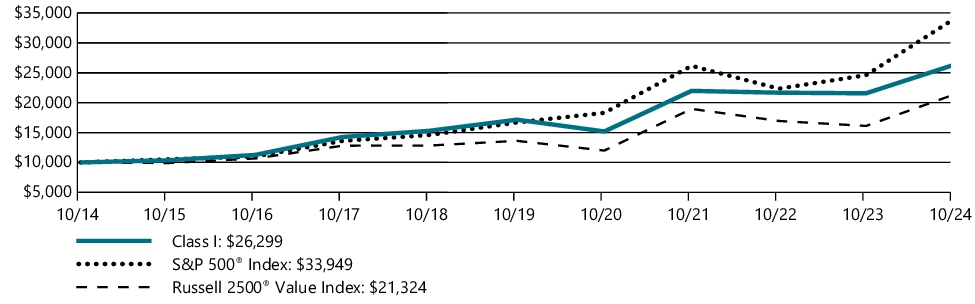

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class I | 28.43% | 12.65% | 8.17% |

| S&P 500® Index | 38.02% | 15.27% | 13.00% |

| Russell 2500® Growth Index | 34.21% | 9.14% | 9.48% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the Russell 2500® Growth Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

As of March 19, 2021, the Fund's Subadviser was changed to GW&K Investment Management, LLC. Prior to March 19, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 19, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

The Russell Index is a trademark of the London Stock Exchange Group companies.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $41,834,206 |

| Total number of portfolio holdings | 77 |

| Net advisory fees paid | $157,451 |

| Portfolio turnover rate as of the end of the reporting period | 19% |

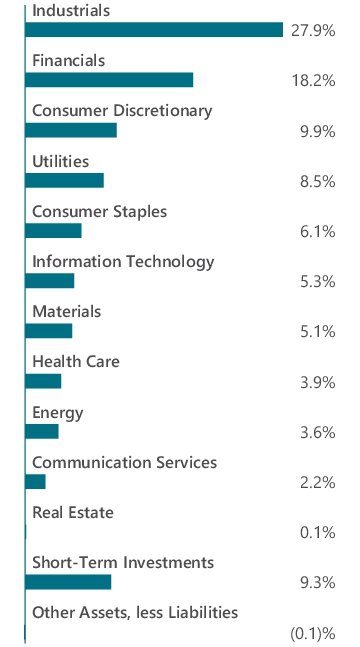

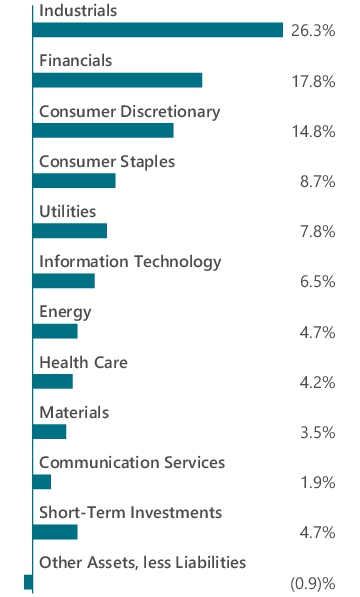

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| CyberArk Software, Ltd. (Israel) | 2.5% |

| Texas Roadhouse, Inc. | 2.2% |

| Tyler Technologies, Inc. | 2.1% |

| Houlihan Lokey, Inc. | 2.1% |

| ITT, Inc. | 1.9% |

| CACI International, Inc., Class A | 1.9% |

| Burlington Stores, Inc. | 1.9% |

| Entegris, Inc. | 1.9% |

| Globant SA (Uruguay) | 1.9% |

| Manhattan Associates, Inc. | 1.8% |

| Top Ten as a Group | 20.2% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG GW&K Small/Mid Cap Growth Fund

Class Z/ACWZX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG GW&K Small/Mid Cap Growth Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG GW&K Small/Mid Cap Growth Fund

(Class Z/ACWZX) | $94 | 0.82% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class Z shares returned 28.53% for the fiscal year that ended October 31, 2024, underperforming the Russell 2500® Growth Index, which returned 34.21% for the period. The S&P 500® Index returned 38.02% for the period.

• The economic backdrop was favorable for U.S. equities as economic growth remained resilient, inflation declined, the job market stayed healthy, and the U.S. Federal Reserve Board (the Fed) initiated a rate cutting cycle. Areas of concern centered on the weakness in manufacturing activity, the shift in consumer spending to value-driven purchasing, market concentration in a handful of mega-cap companies, and escalating global geopolitical tensions.

Top Contributors and Detractors

• The health care sector was a leading contributor, led by biopharma holdings that announced favorable drug trials and excellent sales results.

• Financials benefited from rising capital markets activity that lifted investment banking positions.

• In materials, each of the Fund’s holdings delivered strong operating results in difficult market conditions.

• Industrials was a detractor from relative performance, where soft-end market demand restrained the Fund’s holdings in the industrial machinery and distributors segments.

• Consumer discretionary experienced a detraction from a position in specialty retail, which announced results that fell short of expectations.

• In energy, the Fund’s holdings were pressured by a weak price environment for natural gas and oil.

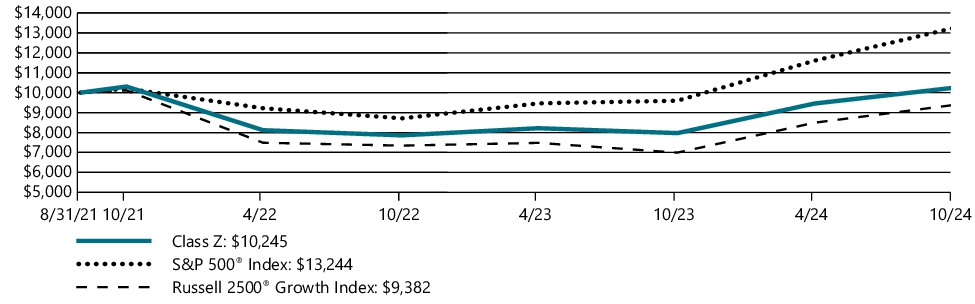

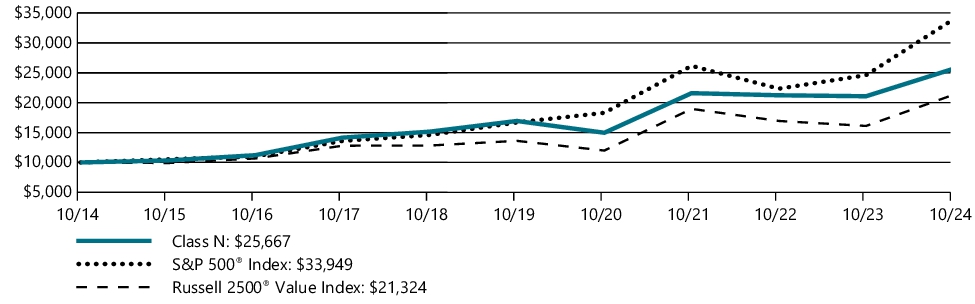

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted since the class's inception on August 31, 2021, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-year period and the period from the class's inception through October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | Since Inception |

| Class Z | 28.53% | 0.77% |

| S&P 500® Index | 38.02% | 9.28% |

| Russell 2500® Growth Index | 34.21% | (1.99%) |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the Russell 2500® Growth Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

As of March 19, 2021, the Fund's Subadviser was changed to GW&K Investment Management, LLC. Prior to March 19, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 19, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

The Russell Index is a trademark of the London Stock Exchange Group companies.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $41,834,206 |

| Total number of portfolio holdings | 77 |

| Net advisory fees paid | $157,451 |

| Portfolio turnover rate as of the end of the reporting period | 19% |

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| CyberArk Software, Ltd. (Israel) | 2.5% |

| Texas Roadhouse, Inc. | 2.2% |

| Tyler Technologies, Inc. | 2.1% |

| Houlihan Lokey, Inc. | 2.1% |

| ITT, Inc. | 1.9% |

| CACI International, Inc., Class A | 1.9% |

| Burlington Stores, Inc. | 1.9% |

| Entegris, Inc. | 1.9% |

| Globant SA (Uruguay) | 1.9% |

| Manhattan Associates, Inc. | 1.8% |

| Top Ten as a Group | 20.2% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG Montrusco Bolton Large Cap Growth Fund

Class N/MCGFX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG Montrusco Bolton Large Cap Growth Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG Montrusco Bolton Large Cap Growth Fund

(Class N/MCGFX) | $104 | 0.91% |

Management's Discussion of Fund Performance

Market Overview

• U.S. stocks performed well during an election year amidst strong job growth and moderating inflation. This occurred despite a tense geopolitical environment and a relatively tight U.S. Federal Reserve monetary policy stance which slightly shifted to an easing monetary policy with a 0.50% interest rate cut in the third quarter.

Performance review

• For the 12 months ended October 31, 2024, the Fund’s Class N shares generated a return of 29.13%, compared to the S&P 500® Index which generated a return of 38.02%. The underperformance came predominantly from stock selection.

Top Contributors and Detractors

• The top contributing sectors to the Fund’s relative performance included health care and communication services.

• The top detracting sectors included consumer discretionary, financials, and information technology.

• The top three contributors to the Fund’s return were NVIDIA, Meta, and Charles River Laboratories. NVIDIA continued its dominance in the artificial intelligence (AI) and GPU (graphics processing unit) markets while Meta’s success can be attributed to its significant investments in AI, its pivot towards the metaverse and augmented reality technologies. Charles River delivered strong performance due to its central role in the biotech and pharmaceutical industries. The Fund exited its position in Charles River Laboratories during the period.

• The top three detractors were Five Below, Adobe, and Lululemon®. Five Below faced numerous challenges that included: rising inflation, which put pressure on consumer spending and increased supply chain and labor costs, which impacted profitability. The Fund exited its position in Five Below. Adobe struggled because of shifts in demand and increasing competition in the creative software and digital marketing space while Lululemon faced a mix of economic pressures and changing consumer behaviors, which impacted demand for its premium athletic apparel.

Positioning

• The Fund’s top ten holdings at the end of October 2024 represented 67.3% of the Fund’s net assets.

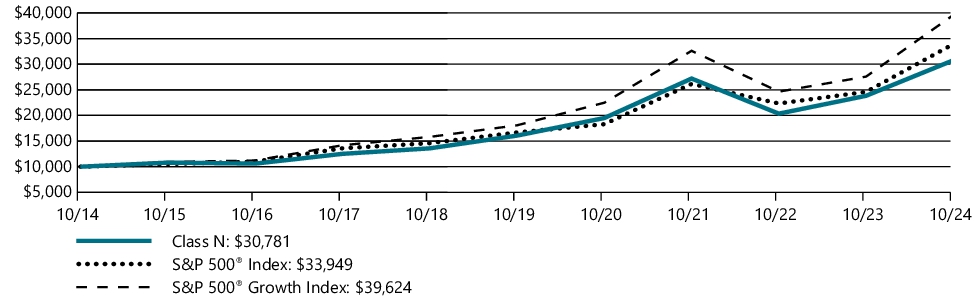

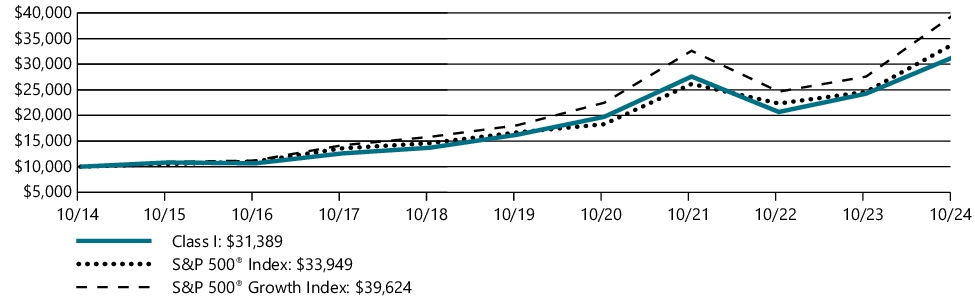

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class N | 29.13% | 13.89% | 11.90% |

| S&P 500® Index | 38.02% | 15.27% | 13.00% |

| S&P 500® Growth Index | 43.67% | 17.01% | 14.76% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the S&P 500® Growth Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

As of March 19, 2021, the Fund's Subadviser was changed to Montrusco Bolton Investments, Inc. Prior to March 19, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 19, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $208,325,570 |

| Total number of portfolio holdings | 27 |

| Net advisory fees paid | $899,126 |

| Portfolio turnover rate as of the end of the reporting period | 83% |

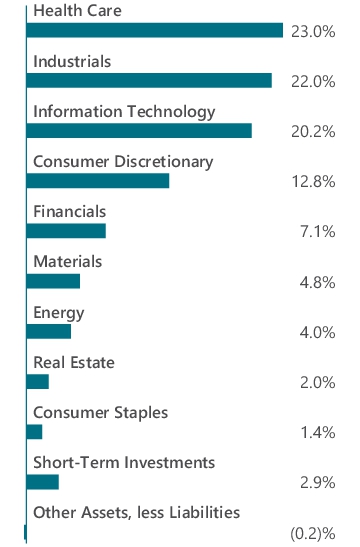

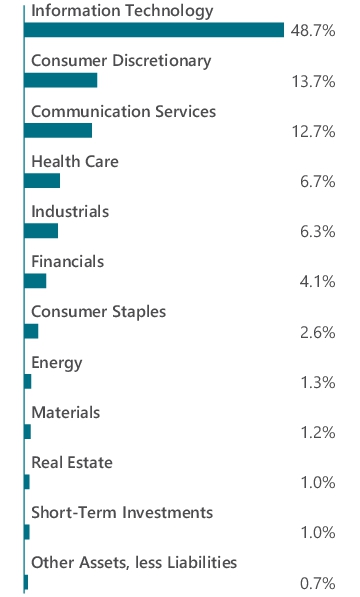

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Apple, Inc. | 9.6% |

| NVIDIA Corp. | 9.3% |

| Microsoft Corp. | 9.2% |

| Adobe, Inc. | 8.9% |

| Alphabet, Inc., Class A | 8.3% |

| Amazon.com, Inc. | 4.8% |

| Texas Instruments, Inc. | 4.8% |

| Meta Platforms, Inc., Class A | 4.4% |

| Workday, Inc., Class A | 4.4% |

| Mastercard, Inc., Class A | 3.6% |

| Top Ten as a Group | 67.3% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG Montrusco Bolton Large Cap Growth Fund

Class I/MCGIX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG Montrusco Bolton Large Cap Growth Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG Montrusco Bolton Large Cap Growth Fund

(Class I/MCGIX) | $84 | 0.73% |

Management's Discussion of Fund Performance

Market Overview

• U.S. stocks performed well during an election year amidst strong job growth and moderating inflation. This occurred despite a tense geopolitical environment and a relatively tight U.S. Federal Reserve monetary policy stance which slightly shifted to an easing monetary policy with a 0.50% interest rate cut in the third quarter.

Performance review

• For the 12 months ended October 31, 2024, the Fund’s Class I shares generated a return of 29.43%, compared to the S&P 500® Index which generated a return of 38.02%. The underperformance came predominantly from stock selection.

Top Contributors and Detractors

• The top contributing sectors to the Fund’s relative performance included health care and communication services.

• The top detracting sectors included consumer discretionary, financials, and information technology.

• The top three contributors to the Fund’s return were NVIDIA, Meta, and Charles River Laboratories. NVIDIA continued its dominance in the artificial intelligence (AI) and GPU (graphics processing unit) markets while Meta’s success can be attributed to its significant investments in AI, its pivot towards the metaverse and augmented reality technologies. Charles River delivered strong performance due to its central role in the biotech and pharmaceutical industries. The Fund exited its position in Charles River Laboratories during the period.

• The top three detractors were Five Below, Adobe, and Lululemon®. Five Below faced numerous challenges that included: rising inflation, which put pressure on consumer spending and increased supply chain and labor costs, which impacted profitability. The Fund exited its position in Five Below. Adobe struggled because of shifts in demand and increasing competition in the creative software and digital marketing space while Lululemon faced a mix of economic pressures and changing consumer behaviors, which impacted demand for its premium athletic apparel.

Positioning

• The Fund’s top ten holdings at the end of October 2024 represented 67.3% of the Fund’s net assets.

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class I | 29.43% | 14.10% | 12.12% |

| S&P 500® Index | 38.02% | 15.27% | 13.00% |

| S&P 500® Growth Index | 43.67% | 17.01% | 14.76% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the S&P 500® Growth Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

As of March 19, 2021, the Fund's Subadviser was changed to Montrusco Bolton Investments, Inc. Prior to March 19, 2021, the Fund had different principal investment strategies and corresponding risks. The Fund's performance before March 19, 2021, might be less pertinent for investors considering whether to purchase shares of the Fund.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $208,325,570 |

| Total number of portfolio holdings | 27 |

| Net advisory fees paid | $899,126 |

| Portfolio turnover rate as of the end of the reporting period | 83% |

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Apple, Inc. | 9.6% |

| NVIDIA Corp. | 9.3% |

| Microsoft Corp. | 9.2% |

| Adobe, Inc. | 8.9% |

| Alphabet, Inc., Class A | 8.3% |

| Amazon.com, Inc. | 4.8% |

| Texas Instruments, Inc. | 4.8% |

| Meta Platforms, Inc., Class A | 4.4% |

| Workday, Inc., Class A | 4.4% |

| Mastercard, Inc., Class A | 3.6% |

| Top Ten as a Group | 67.3% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG River Road Dividend All Cap Value Fund

Class N/ARDEX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG River Road Dividend All Cap Value Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG River Road Dividend All Cap Value Fund

(Class N/ARDEX) | $112 | 0.97% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class N shares returned 31.94% for the fiscal year ended October 31, 2024.

• As of October 31, 2024, the dividend yield of the Fund was 3.01%, which is more than double the 1.31% yield of the S&P 500® Index.

Relative Performance

• The Fund underperformed the S&P 500® Index, which returned 38.02% for the period due to the Fund’s focus on value and high yielding stocks. The benchmark is heavily weighted to growth stocks, which have outperformed value during the year.

Top Contributors and Detractors

• Both sector allocation and stock selection had a negative impact on relative results.

• Utilities and energy were the top performing sectors in the Fund on a relative basis whereas communications services and industrials were the largest relative detractors.

• The positions with the highest contribution to relative return were Vistra, Corning, and Oracle.

• The positions with the lowest contribution to relative return were United Parcel Service, Comcast, and AES.

Positioning

• As of October 31, 2024, the Fund is meaningfully overweight (greater than 5%) in three sectors (energy, consumer staples, and utilities) and meaningfully underweight (greater than -5%) in two: information technology and consumer discretionary. The Fund also has no exposure to the materials sector.

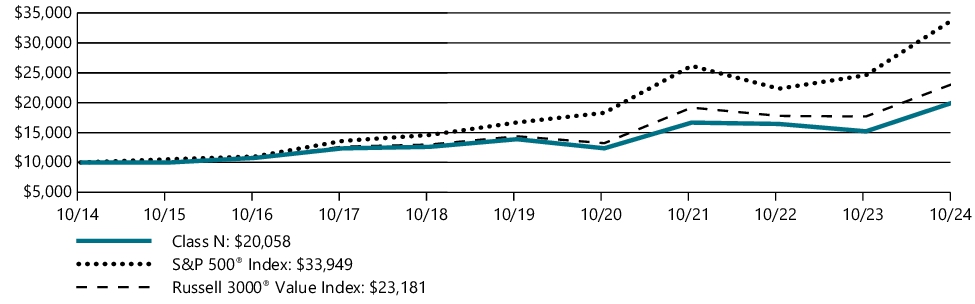

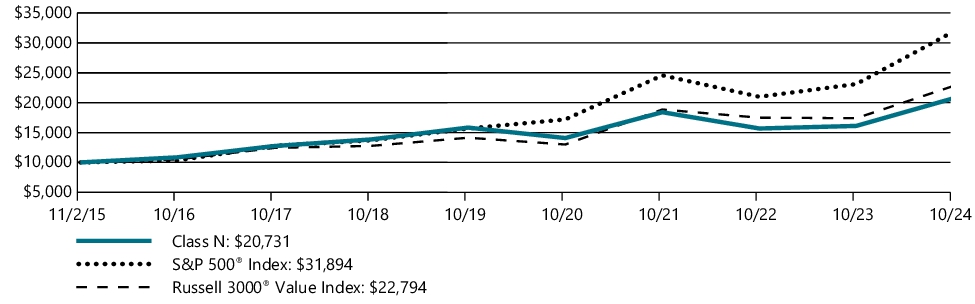

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class N | 31.94% | 7.64% | 7.21% |

| S&P 500® Index | 38.02% | 15.27% | 13.00% |

| Russell 3000® Value Index | 31.02% | 10.04% | 8.77% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the Russell 3000® Value Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

The Russell Index is a trademark of the London Stock Exchange Group companies.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $85,304,165 |

| Total number of portfolio holdings | 57 |

| Net advisory fees paid | $519,687 |

| Portfolio turnover rate as of the end of the reporting period | 26% |

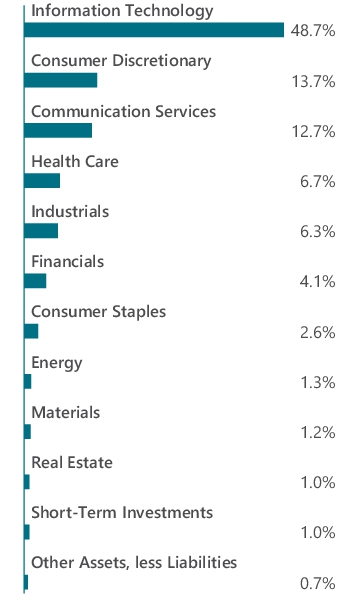

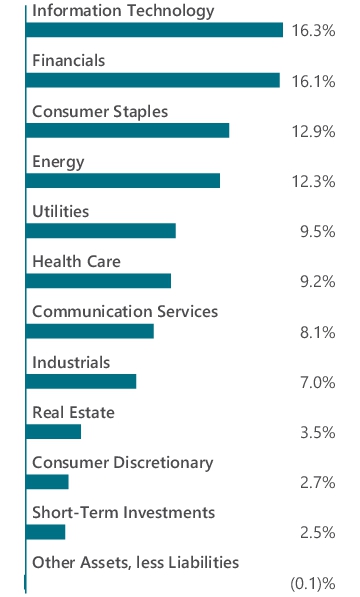

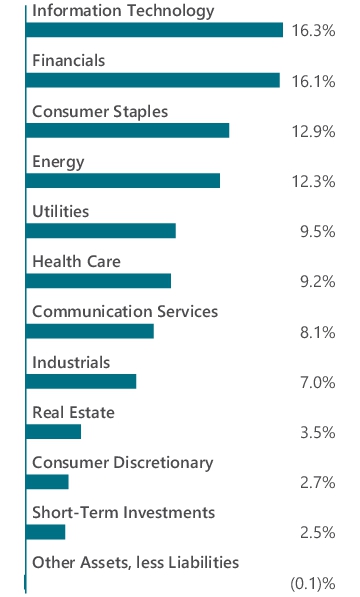

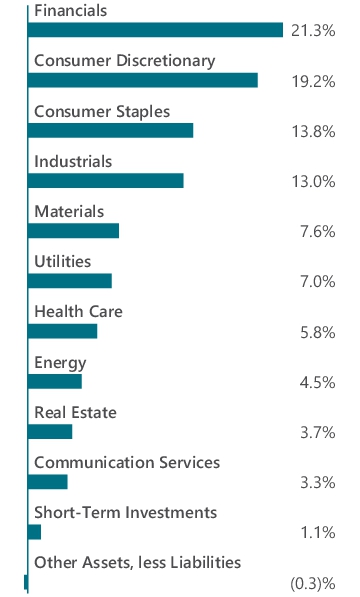

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Oracle Corp. | 4.6% |

| The Williams Cos., Inc. | 4.3% |

| Kinder Morgan, Inc. | 3.8% |

| The Progressive Corp. | 3.6% |

| The PNC Financial Services Group, Inc. | 3.2% |

| Comcast Corp., Class A | 3.2% |

| Unilever PLC, Sponsored ADR (United Kingdom) | 3.1% |

| Corning, Inc. | 3.1% |

| Cogent Communications Holdings, Inc. | 3.1% |

| American Tower Corp., REIT | 2.7% |

| Top Ten as a Group | 34.7% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG River Road Dividend All Cap Value Fund

Class I/ARIDX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG River Road Dividend All Cap Value Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG River Road Dividend All Cap Value Fund

(Class I/ARIDX) | $84 | 0.72% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class I shares returned 32.19% for the fiscal year ended October 31, 2024.

• As of October 31, 2024, the dividend yield of the Fund was 3.01%, which is more than double the 1.31% yield of the S&P 500® Index.

Relative Performance

• The Fund underperformed the S&P 500® Index, which returned 38.02% for the period due to the Fund’s focus on value and high yielding stocks. The benchmark is heavily weighted to growth stocks, which have outperformed value during the year.

Top Contributors and Detractors

• Both sector allocation and stock selection had a negative impact on relative results.

• Utilities and energy were the top performing sectors in the Fund on a relative basis whereas communications services and industrials were the largest relative detractors.

• The positions with the highest contribution to relative return were Vistra, Corning, and Oracle.

• The positions with the lowest contribution to relative return were United Parcel Service, Comcast, and AES.

Positioning

• As of October 31, 2024, the Fund is meaningfully overweight (greater than 5%) in three sectors (energy, consumer staples, and utilities) and meaningfully underweight (greater than -5%) in two: information technology and consumer discretionary. The Fund also has no exposure to the materials sector.

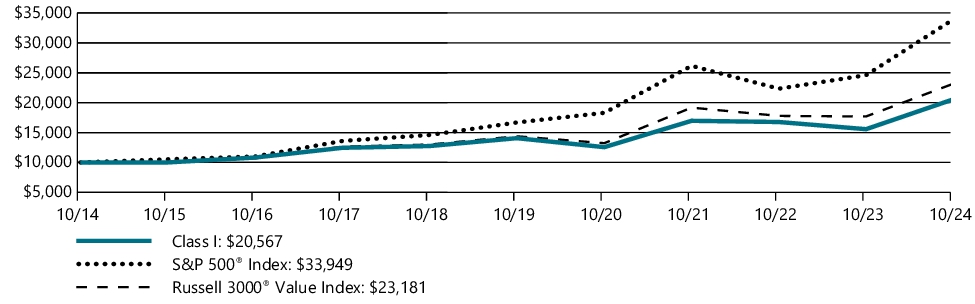

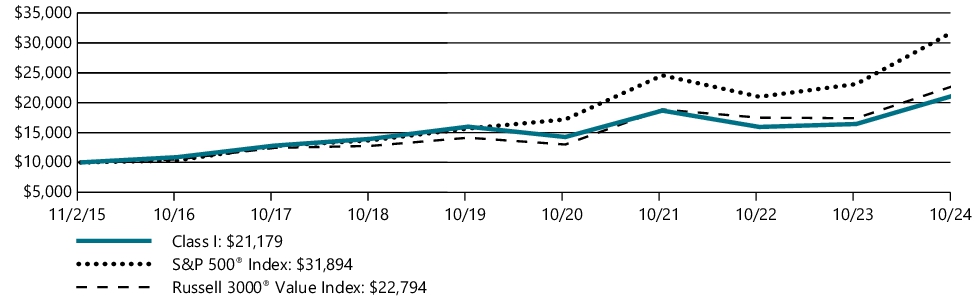

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted over a ten year period, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-, five-, and ten-year periods ended as of October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | 10 Years |

| Class I | 32.19% | 7.91% | 7.48% |

| S&P 500® Index | 38.02% | 15.27% | 13.00% |

| Russell 3000® Value Index | 31.02% | 10.04% | 8.77% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the Russell 3000® Value Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

The Russell Index is a trademark of the London Stock Exchange Group companies.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $85,304,165 |

| Total number of portfolio holdings | 57 |

| Net advisory fees paid | $519,687 |

| Portfolio turnover rate as of the end of the reporting period | 26% |

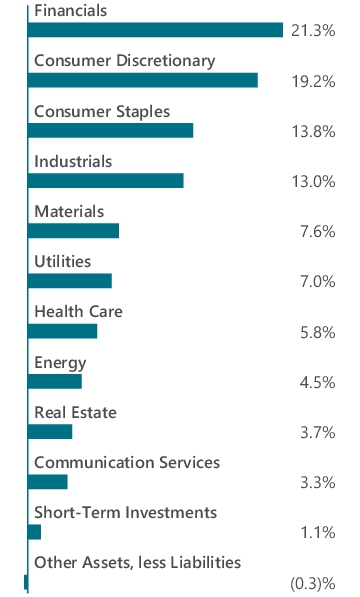

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Oracle Corp. | 4.6% |

| The Williams Cos., Inc. | 4.3% |

| Kinder Morgan, Inc. | 3.8% |

| The Progressive Corp. | 3.6% |

| The PNC Financial Services Group, Inc. | 3.2% |

| Comcast Corp., Class A | 3.2% |

| Unilever PLC, Sponsored ADR (United Kingdom) | 3.1% |

| Corning, Inc. | 3.1% |

| Cogent Communications Holdings, Inc. | 3.1% |

| American Tower Corp., REIT | 2.7% |

| Top Ten as a Group | 34.7% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG River Road Dividend All Cap Value Fund

Class Z/ARZDX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG River Road Dividend All Cap Value Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG River Road Dividend All Cap Value Fund

(Class Z/ARZDX) | $79 | 0.68% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class Z shares returned 32.37% for the fiscal year ended October 31, 2024.

• As of October 31, 2024, the dividend yield of the Fund was 3.01%, which is more than double the 1.31% yield of the S&P 500® Index.

Relative Performance

• The Fund underperformed the S&P 500® Index, which returned 38.02% for the period due to the Fund’s focus on value and high yielding stocks. The benchmark is heavily weighted to growth stocks, which have outperformed value during the year.

Top Contributors and Detractors

• Both sector allocation and stock selection had a negative impact on relative results.

• Utilities and energy were the top performing sectors in the Fund on a relative basis whereas communications services and industrials were the largest relative detractors.

• The positions with the highest contribution to relative return were Vistra, Corning, and Oracle.

• The positions with the lowest contribution to relative return were United Parcel Service, Comcast, and AES.

Positioning

• As of October 31, 2024, the Fund is meaningfully overweight (greater than 5%) in three sectors (energy, consumer staples, and utilities) and meaningfully underweight (greater than -5%) in two: information technology and consumer discretionary. The Fund also has no exposure to the materials sector.

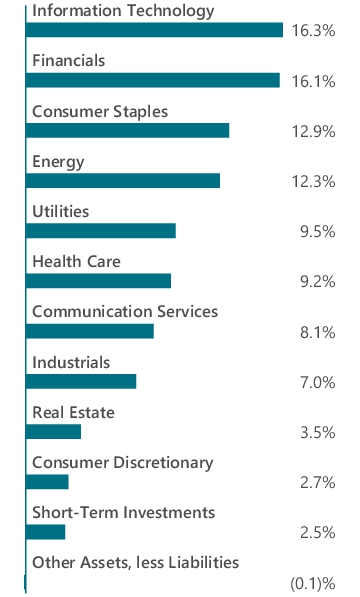

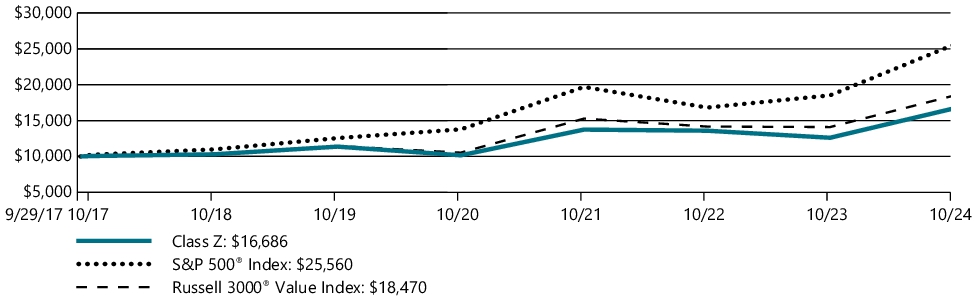

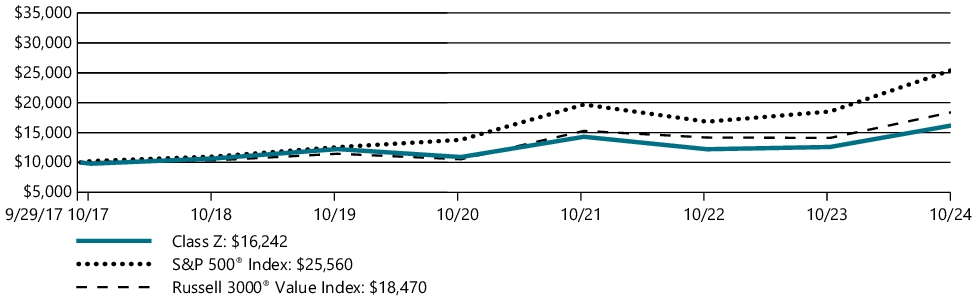

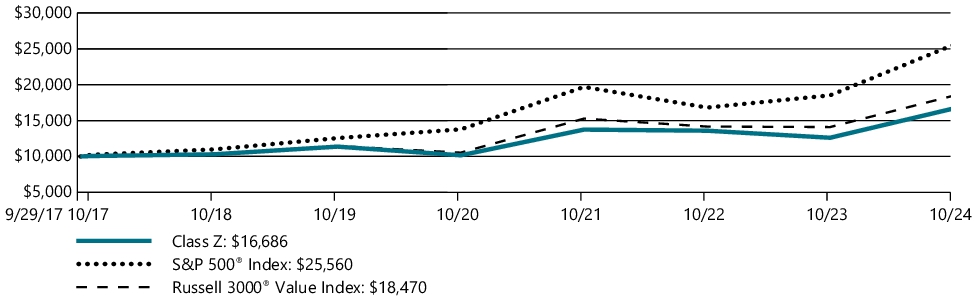

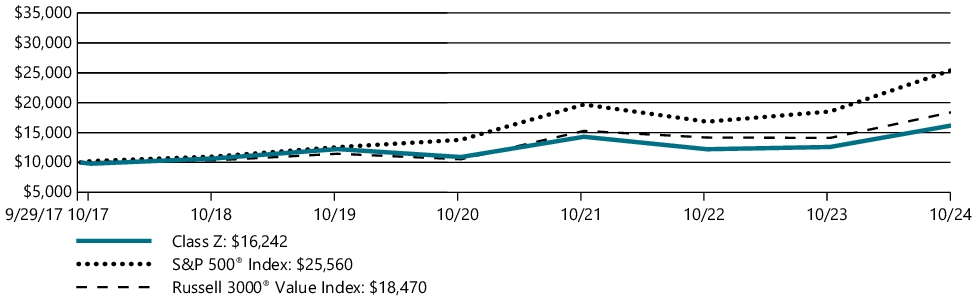

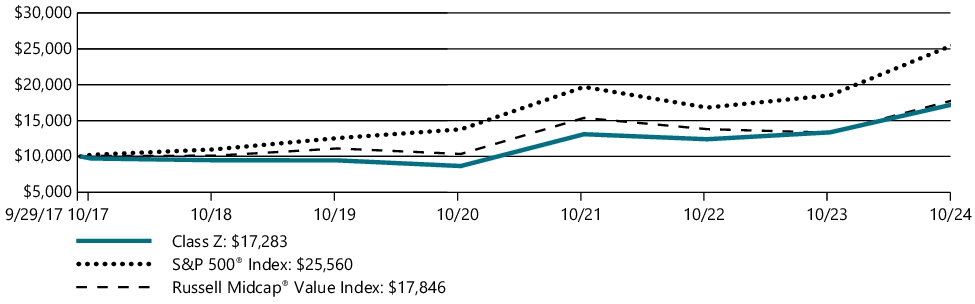

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted since the class's inception on September 29, 2017, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-year and five-year periods and the period from the class's inception through October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since Inception |

| Class Z | 32.37% | 7.98% | 7.49% |

| S&P 500® Index | 38.02% | 15.27% | 14.16% |

| Russell 3000® Value Index | 31.02% | 10.04% | 9.05% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the Russell 3000® Value Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

The Russell Index is a trademark of the London Stock Exchange Group companies.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $85,304,165 |

| Total number of portfolio holdings | 57 |

| Net advisory fees paid | $519,687 |

| Portfolio turnover rate as of the end of the reporting period | 26% |

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Oracle Corp. | 4.6% |

| The Williams Cos., Inc. | 4.3% |

| Kinder Morgan, Inc. | 3.8% |

| The Progressive Corp. | 3.6% |

| The PNC Financial Services Group, Inc. | 3.2% |

| Comcast Corp., Class A | 3.2% |

| Unilever PLC, Sponsored ADR (United Kingdom) | 3.1% |

| Corning, Inc. | 3.1% |

| Cogent Communications Holdings, Inc. | 3.1% |

| American Tower Corp., REIT | 2.7% |

| Top Ten as a Group | 34.7% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.

For additional information, please navigate to the additional material at https://wealth.amg.com/resources/order-literature.

AMG River Road Focused Absolute Value Fund

Class N/ARRFX

ANNUAL SHAREHOLDER REPORT | October 31, 2024

This annual shareholder report contains important information about AMG River Road Focused Absolute Value Fund (the “Fund”) for the period of November 1, 2023 to October 31, 2024. You can find additional information about the Fund at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Fund Expenses

What were the Fund costs for the last year?

(Based on a hypothetical $10,000 investment)

| Fund (Class) | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

AMG River Road Focused Absolute Value Fund

(Class N/ARRFX) | $121 | 1.06% |

Management's Discussion of Fund Performance

Performance Overview

• The Fund’s Class N shares returned 28.70% for the fiscal year ended October 31, 2024, underperforming the S&P 500® Index, which returned 38.02% for the period.

• As an all-cap portfolio, the relative performance was impacted by the Fund’s positioning in mid-cap and small-cap stocks, which underperformed large-cap stocks. The benchmark is heavily weighted in large-cap stocks, which outperformed small- and mid-cap stocks during the year.

Top Contributors and Detractors

• Both stock selection and sector allocation had a negative impact on relative results.

• The sectors with the highest contribution to relative return were utilities and materials. Utilities benefited from positive stock selection and an overweight allocation. Materials benefited from positive stock selection, partially offset by an overweight allocation.

• The holdings with the highest contribution to relative return were Talen Energy, CRH, and Expedia Group.

• The sectors with the lowest contribution to relative return were financials and information technology. Financials suffered from negative stock selection, partially offset by an overweight allocation. Information technology suffered from an underweight allocation, partially offset by positive stock selection.

• The holdings with the lowest contribution to relative return were LKQ, Delek, and Patterson Companies. The Fund exited its position in Patterson Companies during the period.

Positioning

• As of October 31, 2024, the Fund is meaningfully overweight (greater than 5%) in four sectors and meaningfully underweight (greater than -5%) in three. The largest overweight allocations were consumer discretionary and consumer staples. The largest underweight allocations were information technology and communication services.

• From a market cap perspective, the Fund remains significantly underweight larger cap stocks (greater than $45B) and overweight smaller cap stocks (less than $10B) and mid cap stocks ($10B-$45B).

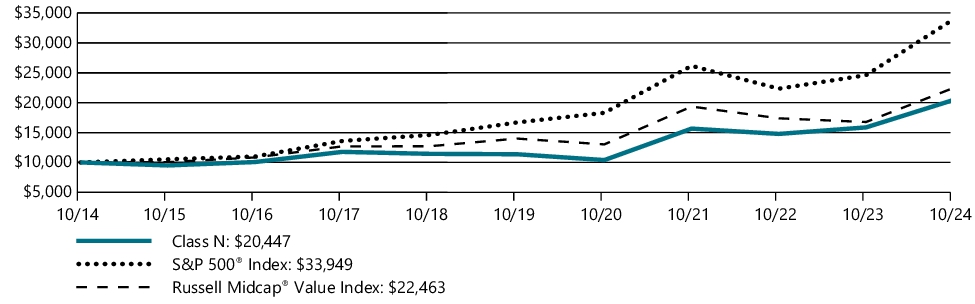

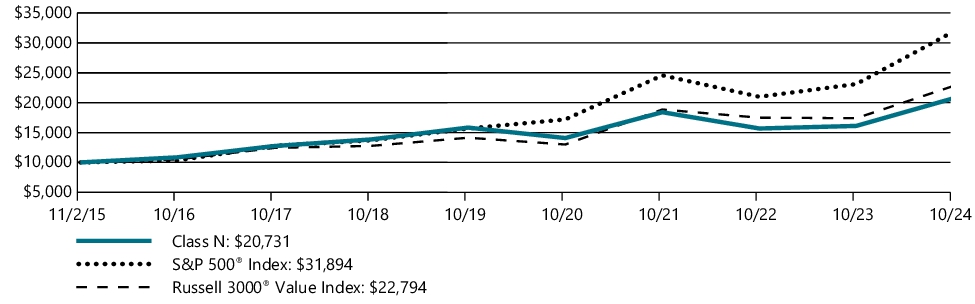

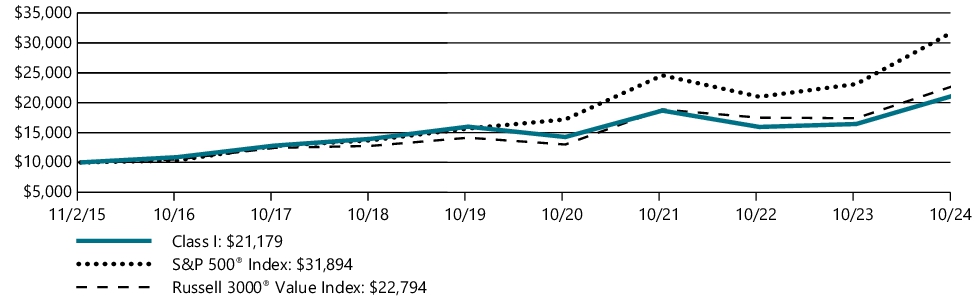

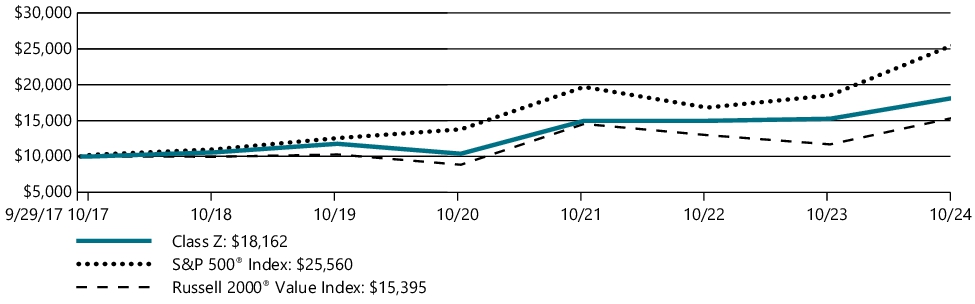

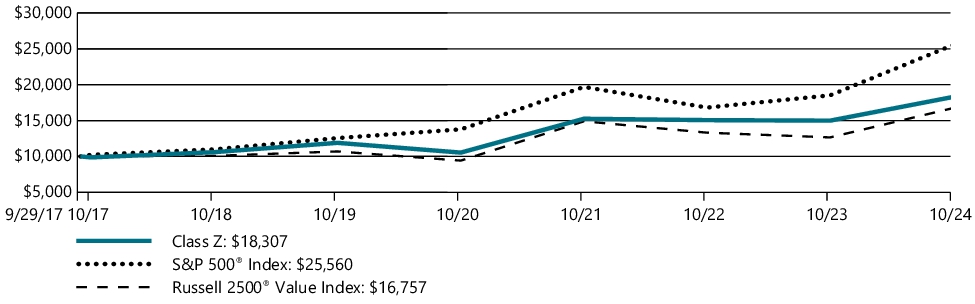

Fund Performance

The performance line graph below shows the performance of a hypothetical $10,000 investment in the class of shares noted since the class's inception on November 02, 2015, as compared to the performance of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests. The performance table below shows the average annual total returns of the class of shares noted for the past one-year and five-year periods and the period from the class's inception through October 31, 2024. It also shows the average total returns of (i) a broad based index and (ii) an additional index reflecting the market segment(s) in which the Fund invests over the same periods.

Performance for other share classes will vary. The Fund’s past performance is not a good predictor of the Fund’s future performance.

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

GROWTH OF $10,000

| AVERAGE ANNUAL TOTAL RETURNS | 1 Year | 5 Years | Since Inception |

| Class N | 28.70% | 5.55% | 8.44% |

| S&P 500® Index | 38.02% | 15.27% | 13.75% |

| Russell 3000® Value Index | 31.02% | 10.04% | 9.59% |

Effective October 31, 2024, the S&P 500® Index was added as a broad measure of market performance in accordance with recent changes to regulatory disclosure requirements. The Fund continues to use the Russell 3000® Value Index as an additional benchmark that reflects the market segment(s) in which the Fund invests.

The S&P Index is proprietary data of Standard & Poor’s, a division of McGraw-Hill Companies, Inc. All rights reserved.

The Russell Index is a trademark of the London Stock Exchange Group companies.

For updated Fund performance information, please visit: https://wealth.amg.com/.

Key Fund Statistics (as of October 31, 2024)

| Fund net assets | $49,054,320 |

| Total number of portfolio holdings | 33 |

| Net advisory fees paid | $192,000 |

| Portfolio turnover rate as of the end of the reporting period | 86% |

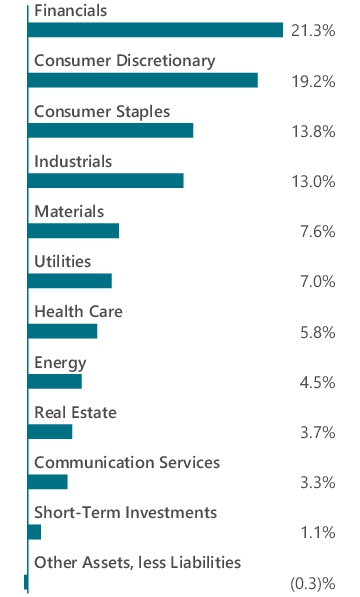

Graphical Representation of Holdings (as of October 31, 2024)

Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund.

| Fairfax Financial Holdings, Ltd. (Canada) | 6.6% |

| Berkshire Hathaway, Inc., Class B | 6.0% |

| BJ's Wholesale Club Holdings, Inc. | 5.0% |

| The Kroger Co. | 4.9% |

| CRH PLC | 4.5% |

| Papa John's International, Inc. | 3.7% |

| Mid-America Apartment Communities, Inc., REIT | 3.7% |

| Talen Energy Corp. | 3.6% |

| Northwestern Energy Group, Inc. | 3.4% |

| SS&C Technologies Holdings, Inc. | 3.4% |

| Top Ten as a Group | 44.8% |

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information, fund holdings and proxy voting information at https://wealth.amg.com/resources/order-literature. You can also request this information by contacting us at 800.548.4539.

Householding

In order to reduce expenses, we will deliver a single copy of prospectuses, proxies, financial reports and other communication to shareholders with the same residential address, provided they have the same last name or we reasonably believe them to be members of the same family. Unless we are notified otherwise, we will continue to send recipients only one copy of these materials for as long as they remain a shareholder of the Fund. If you would like to receive individual mailings, please call 800.548.4539 and we will begin sending you separate copies of these materials within 30 days after receiving your request.