UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08004

AMG Funds IV

(Exact name of registrant as specified in charter)

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Address of principal executive offices) (Zip code)

AMG Funds LLC

680 Washington Boulevard, Suite 500, Stamford, Connecticut 06901

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: October 31

Date of reporting period: November 1, 2022 - October 31, 2023

(Annual Shareholder Report)

Item 1. Reports to Stockholders.

| | |

| | ANNUAL REPORT |

| | | | | | | | | | | | |

| | | | AMG Funds October 31, 2023 | | |

| | | |

| | |

| | | | AMG GW&K Core Bond ESG Fund |

| | | | Class N: MBGVX | | | | Class I: MBDFX | | | | Class Z: MBDLX |

| | |

| | | | AMG GW&K Emerging Markets Equity Fund |

| | | | Class N: TLEVX | | | | Class I: TLESX | | | | Class Z: TLEIX |

| | |

| | | | AMG GW&K Emerging Wealth Equity Fund |

| | | | Class N: TYWVX | | | | Class I: TYWSX | | | | Class Z: TYWIX |

| | |

| | | | AMG GW&K Small/Mid Cap Growth Fund |

| | | | Class N: ACWDX | | | | Class I: ACWIX | | | | Class Z: ACWZX |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | |

| | | |

| wealth.amg.com | | | | 103123 AR069 |

| | |

| | | AMG Funds Annual Report — October 31, 2023 |

| | | | | | |

| | | |

| | | | | | | |

| | | TABLE OF CONTENTS | | PAGE | |

| | | | |

| | | |

| | | LETTER TO SHAREHOLDERS | | | 2 | |

| | | |

| | | ABOUT YOUR FUND’S EXPENSES | | | 3 | |

| | | |

| | | PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS | | | | |

| | | |

| | | AMG GW&K Core Bond ESG Fund | | | 4 | |

| | | |

| | | AMG GW&K Emerging Markets Equity Fund | | | 12 | |

| | | |

| | | AMG GW&K Emerging Wealth Equity Fund | | | 19 | |

| | | |

| | | AMG GW&K Small/Mid Cap Growth Fund | | | 25 | |

| | | |

| | | FINANCIAL STATEMENTS | | | | |

| | | |

| | | Statement of Assets and Liabilities | | | 32 | |

| | | |

| | | Balance sheets, net asset value (NAV) per share computations

and cumulative distributable earnings (loss) | | | | |

| | | |

| | | Statement of Operations | | | 34 | |

| | | |

| | | Detail of sources of income, expenses, and realized and

unrealized gains (losses) during the fiscal year | | | | |

| | | |

| | | Statements of Changes in Net Assets | | | 35 | |

| | | |

| | | Detail of changes in assets for the past two fiscal years | | | | |

| | | |

| | | Financial Highlights | | | 37 | |

| | | |

| | | Historical net asset values per share, distributions, total returns, income

and expense ratios, turnover ratios and net assets | | | | |

| | | |

| | | Notes to Financial Statements | | | 49 | |

| | | |

| | | Accounting and distribution policies, details of agreements and

transactions with Fund management and affiliates, and descriptions of

certain investment risks | | | | |

| | | |

| | | REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | | | 58 | |

| | | |

| | | OTHER INFORMATION | | | 59 | |

| | | |

| | | TRUSTEES AND OFFICERS | | | 61 | |

| | | |

| | | ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | | | 64 | |

| | | | | | | |

|

| |

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | Letter to Shareholders |

Dear Shareholder:

We are pleased to provide this annual report for your investment with AMG Funds. Our foremost goal is to provide investment solutions that help our shareholders successfully achieve their long-term investment goals. We appreciate the privilege of providing you with investment tools.

The most recent fiscal year ended October 31, 2023, resulted in mixed returns for risk assets as global equity markets wrestled with tighter monetary policy, increased geopolitical tension, instability in the regional banking sector, and political handwringing over the U.S. debt ceiling. Bonds struggled to move higher as global central banks raised interest rates to cool the economy and bring down inflation. Relative to the prior year, 2023 brought a more favorable environment based on the optimism that easing inflation would allow the U.S. Federal Reserve (the “Fed”) to pause the interest rate hiking cycle and deliver an economic soft landing.

The S&P 500® Index gained 10.14% for the fiscal year, despite experiencing a pullback in the final three months of the period. Large-cap stocks diverged meaningfully from small-cap stocks, particularly driven by a handful of mega-cap technology and consumer discretionary stocks. The Russell 1000® Index gained 9.48% compared to the -8.56% return for the Russell 2000® Index. Only five of eleven sectors posted positive returns, with communications services (+36.06%), information technology (+33.15%), and consumer discretionary (+8.87%) leading the way. The weakest sectors were utilities (-7.72%), real estate (-6.57%), and health care (-4.64%). The strength in information technology drove Growth stocks to strongly outperform Value stocks with the Russell 1000® Growth Index gaining 18.95% compared to a 0.13% return for the Russell 1000® Value Index. Outside the U.S., foreign equity markets outperformed domestic equities, delivering a 12.07% return, as measured by the MSCI All Country World Index (ACWI) ex USA benchmark.

The Bloomberg U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, managed to generate a modest 0.36% return over the period as the Fed raised interest rates and the 10-year Treasury yield reached its highest point since 2008, resulting in longer-duration bonds underperforming. Investment-grade corporate bonds gained 2.77% for the year, while agency mortgage-backed securities fell -0.82%. High yield bonds were the best performing sector with a 6.23% return as measured by the return of the Bloomberg U.S. Corporate High Yield Bond Index. Municipal bonds outperformed the broader market with a 2.64% gain for the Bloomberg Municipal Bond Index.

AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit. For more information about AMG Funds’ wide range of products and resources, please visit wealth.amg.com. We thank you for your investment and continued trust in AMG Funds.

|

Respectfully, |

|

| Keitha Kinne |

| President |

| AMG Funds |

| | | | | | | | | | | | | | |

| | | | | Periods ended | |

| Average Annual Total Returns | | October 31, 2023* | |

| | | | |

| Stocks: | | | | 1 Year | | | 3 Years | | | 5 Years | |

| | | | |

Large Cap | | (S&P 500® Index) | | | 10.14 | % | | | 10.36 | % | | | 11.01 | % |

| | | | |

Small Cap | | (Russell 2000® Index) | | | (8.56 | )% | | | 3.95 | % | | | 3.31 | % |

| | | | |

International | | (MSCI ACWI ex USA) | | | 12.07 | % | | | 3.03 | % | | | 3.46 | % |

| | | | |

Bonds: | | | | | | | | | | | | | | |

| | | | |

Investment Grade | | (Bloomberg U.S. Aggregate Bond Index) | | | 0.36 | % | | | (5.57 | )% | | | (0.06 | )% |

| | | | |

High Yield | | (Bloomberg U.S. Corporate High Yield Bond Index) | | | 6.23 | % | | | 1.19 | % | | | 3.05 | % |

| | | | |

Tax-exempt | | (Bloomberg Municipal Bond Index) | | | 2.64 | % | | | (2.48 | )% | | | 1.00 | % |

| | | | |

Treasury Bills | | (ICE BofAML U.S. 6-Month Treasury Bill Index) | | | 4.88 | % | | | 1.83 | % | | | 1.90 | % |

*Source: FactSet. Past performance is no guarantee of future results.

2

| | |

| | | About Your Fund’s Expenses |

| | | |

| | | |

| | | | | | | | |

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below. ACTUAL EXPENSES The first section of the following table provides information about the actual account values and | | | | actual expenses. You may use the information in this section, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first section under the heading entitled “Expenses Paid During the Period” to estimate the expenses you paid on your account during this period. HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES The second section of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | | | | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second section of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. |

| | | | | | | | |

| | | | | | | | |

Six Months Ended October 31, 2023 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/23 | | Ending

Account

Value

10/31/23 | | Expenses

Paid

During

the Period* |

AMG GW&K Core Bond ESG Fund |

Based on Actual Fund Return |

| | | | |

Class N | | 0.88% | | $1,000 | | $930 | | $4.28 |

| | | | |

Class I | | 0.56% | | $1,000 | | $933 | | $2.73 |

| | | | |

Class Z | | 0.48% | | $1,000 | | $932 | | $2.34 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 0.88% | | $1,000 | | $1,021 | | $4.48 |

| | | | |

Class I | | 0.56% | | $1,000 | | $1,022 | | $2.85 |

| | | | |

Class Z | | 0.48% | | $1,000 | | $1,023 | | $2.45 |

| | | | |

| | | | | | | | |

AMG GW&K Emerging Markets Equity Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.27% | | $1,000 | | $932 | | $6.18 |

| | | | |

Class I | | 0.96% | | $1,000 | | $932 | | $4.68 |

| | | | |

Class Z | | 0.87% | | $1,000 | | $934 | | $4.24 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.27% | | $1,000 | | $1,019 | | $6.46 |

| | | | |

Class I | | 0.96% | | $1,000 | | $1,020 | | $4.89 |

| | | | |

Class Z | | 0.87% | | $1,000 | | $1,021 | | $4.43 |

| | | | |

| | | | | | | | |

AMG GW&K Emerging Wealth Equity Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.30% | | $1,000 | | $874 | | $6.14 |

| | | | |

Class I | | 0.99% | | $1,000 | | $875 | | $4.68 |

| | | | |

Class Z | | 0.90% | | $1,000 | | $875 | | $4.25 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.30% | | $1,000 | | $1,019 | | $6.61 |

| | | | |

Class I | | 0.99% | | $1,000 | | $1,020 | | $5.04 |

| | | | |

Class Z | | 0.90% | | $1,000 | | $1,021 | | $4.58 |

| | | | | | | | |

Six Months Ended October 31, 2023 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/23 | | Ending

Account

Value

10/31/23 | | Expenses

Paid

During

the Period* |

AMG GW&K Small/Mid Cap Growth Fund |

|

Based on Actual Fund Return |

| | | | |

Class N | | 1.02% | | $1,000 | | $968 | | $5.06 |

| | | | |

Class I | | 0.87% | | $1,000 | | $969 | | $4.32 |

| | | | |

Class Z | | 0.82% | | $1,000 | | $970 | | $4.07 |

|

Based on Hypothetical 5% Annual Return |

| | | | |

Class N | | 1.02% | | $1,000 | | $1,020 | | $5.19 |

| | | | |

Class I | | 0.87% | | $1,000 | | $1,021 | | $4.43 |

| | | | |

Class Z | | 0.82% | | $1,000 | | $1,021 | | $4.18 |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

3

| | |

| | | AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (unaudited) |

| | | |

| | | |

| | | | | | | | |

THE YEAR IN REVIEW For the 12 months ended October 31, 2023, AMG GW&K Core Bond ESG Fund’s (the “Fund”) Class I shares returned 0.30%, compared to the return of 0.36% for the Bloomberg U.S. Aggregate Bond Index. MARKET OVERVIEW Fixed income markets rose in the fourth quarter of 2022 amid growing confidence that central banks succeeded in slowing inflation and would be able to pursue less restrictive policy. This modest rally nevertheless ended up being too little, too late to help the bond market avoid its worst annual performance on record and an unprecedented second consecutive year of losses. Sentiment among both investors and consumers may have reached an inflection point, but data continued to justify some measure of caution: inflation was still stubbornly above the U.S. Federal Reserve (the “Fed”) target, the labor market showed few signs of loosening, and corporations had yet to see a meaningful deterioration in earnings. Only the rate-sensitive housing market really stood out as a casualty of the Fed’s tightening campaign to this point. Whether the end of the cycle is imminent remained an open question, especially as investors awaited the realization of the “long and variable lag” that had yet to be fully reflected across so many segments of the economy. Fixed income experienced a solid rally in the first quarter of 2023 as it rebounded from its worst year on record. Much of the period saw a continuation of the tension that drove trading in 2022: inflation continued to slow, but at a glacial pace; a moribund housing market and downbeat consumer had yet to manifest as a slowdown in spending; and a record pace of rate hikes was unable to cool a stubbornly hot labor market. Investors also struggled to anticipate the Fed’s reaction function amid the various crosscurrents, while Chair Powell’s commentary offered few concrete insights beyond a firm resolve and data dependence. But the narrative shifted abruptly in the final weeks, as signs of systemic instability flared up amid a flurry of bank failures. The implications of this turmoil for financial conditions were not evident at the time, but the stress in the banking sector was clearly a complicating factor for both the Fed and the bond market. | | | | The fixed income market posted a small loss in the second quarter of 2023 as it gave back a portion of the banking crisis-inspired rally that occurred in the closing days of March. Sentiment was cautious at the outset and investors sought haven assets on the possibility of contagion in the financial sector. But as it became clear that fallout from the failure of several regional lenders was likely to be contained, attention returned to the underlying strength of the economy and the stubborn persistence of inflation. The labor market gave only the slightest indications of softening, the buoyant housing sector continued to defy higher mortgage rates, and consumer spending once again proved irrepressible. Inflation showed limited progress on its path lower, plateauing at a level solidly above the Fed’s 2% target. Against this backdrop, the Federal Open Market Committee (FOMC) endeavored to maintain restrictive financial conditions by raising rates and providing hawkish guidance. There had nevertheless been scant evidence of the Fed’s success in curbing aggregate demand away from some narrow segments of the commercial real estate and consumer finance markets. The fixed income market posted a significant loss in the third quarter of 2023 that more than offset the gains achieved in the first half of the year. The higher-for-longer Fed narrative increasingly took center stage, driven by a surprisingly resilient economy, surging oil prices, and inflation that persisted well above the Fed’s 2% target. While there were subtle signs that the labor market and consumer credit metrics might be softening, the unemployment rate remained near cycle lows and the consumer continued to spend robustly. The undeniably strong cadence of the economy left economists upgrading their third-quarter Gross Domestic Product (GDP) growth estimates and recharging optimism for a soft landing. Fed officials held rates steady at the September FOMC meeting, but thwarted hopes for a pivot by signaling the possibility of one more hike during the year and projecting less easing in 2024/2025. Markets assimilated a great deal in October—the news out of the Middle East, rising rates, and third quarter earnings. The spike in yields drove the bond market to its sixth consecutive month of negative returns. The economy remained stronger than expected, inflation stayed above the Fed’s target, the government sold a hefty amount of bonds into the market to fund large deficits, and the central bank’s | | | | theme of higher for longer remained in place. By mid-month yields had advanced to multi-year highs, with the 10-year’s 5% handle the most elevated since 2007. Rates staged a rally during the back half of the month, however. FUND REVIEW The Fund modestly underperformed the Bloomberg U.S. Aggregate Bond Index for the year ended October 31, 2023. The Fund’s overweight to spread product was the main positive driver, particularly our overweight to Corporates. The overweight to Taxable Municipals also contributed along with sector allocation within BBB-rated Corporates, particularly the underweights to the banking and energy sectors. The out-of-benchmark allocation to Preferreds was a beneficial factor. The Fund’s overweight to Agency MBS detracted but was entirely offset by our higher coupon and specified pool bias which were pluses. Security selection was a detractor, mostly from within the BBB-rated communications, consumer non-cyclical, and consumer cyclical sectors. Duration and yield curve positioning were contributors, mostly from our modest overweight to duration and overweight to the 10-year part of the curve. The corporate bond market remains in a transition period with respect to environmental, social, and governance (ESG) and sustainability. Many companies have set sustainability targets and are now shifting into the implementation phase, at times supported by public funds and incentives. However, higher inflation and increased regulatory costs of reporting have kept progress slow. Still, despite a sometimes-downbeat portrayal in media, investors continue to show a strong interest in ESG and sustainability, with fund flows and ESG bond issuance remaining roughly steady from last year. 2024 promises to be another important year for global ESG topics with many important regions poised for elections that could have a meaningful impact on the direction of ESG initiatives globally. Overall, we believe ESG and sustainability concerns will remain key issues for both companies and investors in the coming year. We continue to integrate ESG as a core part of our fundamental investment process and will closely monitor regulatory and policy actions that could influence the ESG investing landscape. |

4

| | |

| | | AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | | | | | |

We conducted the following trades based on ESG factors over the period: • We purchased a Comcast green bond; focus on renewable energy projects, energy efficiency improvements to offices and operations and clean transportation. • We bought a Jacobs Engineering sustainability bond; gender diversity and greenhouse gas emissions targets in place with coupon steps if both are not met. • We added an Eastman Chemical green bond; proceeds used to refinance current and future green projects determined by the Green Finance Committee (the bond was subsequently sold in October). • We purchased an Air Products & Chemicals green bond; proceeds to fund large scale green and blue hydrogen and sustainable aviation fuel projects to support energy transition. • We bought an auto asset-backed green bond; finances hybrid autos. • We added Campbell Soup: strong credit with well-established brands and leading market share; leads peers in sustainable agricultural practices, specifically water conservation efforts. | | | | OUTLOOK We witnessed a mind-numbing period where the market’s expectations for multiple interest rate cuts this year were in complete opposition to the Fed’s well telegraphed guidance for rate hikes. But inflation is the Fed’s predominant concern. The higher-for-longer message drove 10-year yields to within striking distance of 5% and the bond market toward a potential third straight annual loss. It is uncertain whether this higher level of yields represents the new normal or a rate move gone too far. While the economy continues to exhibit surprising strength, formidable headwinds lie ahead, including tighter credit conditions, dwindling excess consumer savings, slowing global growth, and rising energy prices. These economic challenges could shift the narrative from an economy that is impervious to rapid rate hikes to one that is susceptible to below-trend growth next year. The torrid rise in rates to multi-year highs makes the value proposition for bonds more compelling. These higher levels of yields can provide a significant cushion should rates continue to rise and are often a good indicator of forward returns. We continue to favor higher quality intermediate-duration bonds. Locking in these maturities diminishes reinvestment risk while still offering the potential for significant | | | | price appreciation when the Fed finally signals a pivot. We remain underweight the long end of the yield curve, which is most vulnerable to losses in this higher-for-longer regime. We are overweight corporates but cautiously positioned in higher quality investment grade issuers. Strong fundamentals and higher yields continue to anchor the sector, driving inflows. However, spreads appear fully valued and may face heightened volatility as issuers confront higher borrowing costs and an elevated number of upcoming maturities. This stress could be compounded by the prospect of slower economic growth and potentially lead to de-risking and an uptick in defaults. We are finding value in blue chip companies and stay particularly selective in the consumer space, especially as post-pandemic savings dwindle. We continue to be overweight Agency MBS, which is far less cyclically exposed and offers the widest spread differential relative to investment grade corporate bonds since 2003. The views expressed represent the opinions of GW&K Investment Management, LLC as of October 31, 2023, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

| | | | | | | | |

| | | | | | | | |

5

| | |

| | | AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

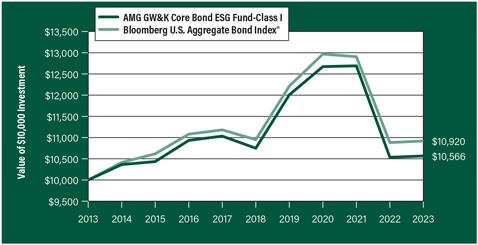

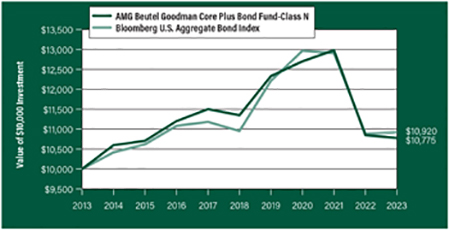

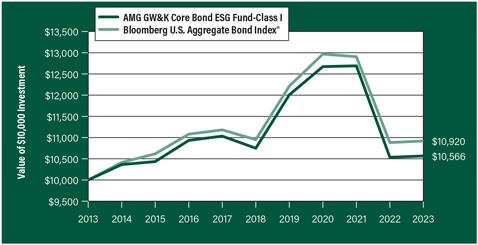

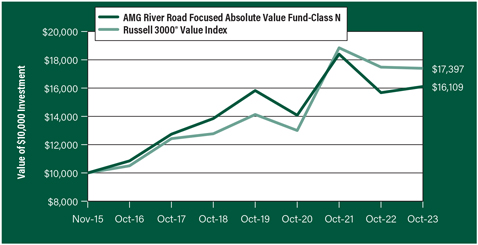

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG GW&K Core Bond ESG Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG GW&K Core Bond ESG Fund’s Class I shares on October 31, 2013, to a $10,000 investment made in the Bloomberg U.S. Aggregate Bond Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Core Bond ESG Fund and the Bloomberg U.S. Aggregate Bond Index for the same time periods ended October 31, 2023.

| | | | | | | | | | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Five

Years | | | Ten

Years | | | Since

Inception | | | Inception

Date | |

| |

AMG GW&K Core Bond ESG Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16 | | | | | |

| | | | | |

Class N | | | (0.15%) | | | | (0.69%) | | | | — | | | | (0.25%) | | | | 05/08/15 | |

Class I | | | 0.30% | | | | (0.34%) | | | | 0.55% | | | | 4.63% | | | | 04/30/93 | |

Class Z | | | 0.25% | | | | (0.29%) | | | | — | | | | 0.15% | | | | 05/08/15 | |

| | | | | |

Bloomberg U.S. Aggregate Bond Index17 | | | 0.36% | | | | (0.06%) | | | | 0.88% | | | | 4.21% | | | | 04/30/93 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at wealth.amg.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

|

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2023. All returns are in U.S. Dollars($). 2 From time to time, the Fund’s adviser has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of factors, including economic, political, or market conditions, or other factors including terrorism, war, natural disasters and the spread of infectious illness or other public health issues, including epidemics or pandemics, or in response to events that affect particular industries or companies. 4 Because the Fund is an actively managed investment portfolio, security selection or focus on securities in a particular style, market sector or group of companies may cause the Fund to incur losses or underperform relative to its benchmark or other funds with a similar investment objective. There can be no guarantee that the Subadviser’s investment techniques and risk analysis will produce the desired result. 5 The value of a debt security changes in response to various factors, including, for example, market-related factors, such as changes in interest rates or changes in the actual or perceived ability of an issuer to meet its obligations. Investments in debt securities are subject to, among other risks, credit risk, interest rate risk, extension risk, prepayment risk and liquidity risk. 6 Because applying the Fund’s ESG investment criteria may result in the selection or exclusion of securities of certain issuers for reasons other than financial performance, the Fund’s investment returns may underperform funds that do not incorporate ESG factors into their investment process. The incorporation of ESG criteria into the investment process may affect the Fund’s investment exposure to certain companies, sectors, regions, countries or types of investments, which could negatively impact the Fund’s performance depending on whether such investments are in or out of favor. Applying ESG criteria to investment decisions is qualitative and subjective by nature, and there is no guarantee that the criteria utilized by the Subadviser or any judgment exercised by the Subadviser will improve the financial performance of the Fund or reflect the beliefs or values of any particular investor. ESG standards differ by region and industry, and a company’s ESG practices or the Subadviser’s assessment of a company’s ESG practices may change over time. 7 Fixed coupon payments (cash flows) of bonds and debt securities may become less competitive with |

6

| | |

| | | AMG GW&K Core Bond ESG Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | | | | | |

the market in periods of rising interest rates and cause bond prices to decline. 8 The issuer of bonds or other debt securities may be unable or unwilling, or may be perceived as unable or unwilling, to make timely interest or principal payments or otherwise honor its obligations. 9 Investments in asset-backed and mortgage-backed securities involve risk of severe credit downgrades, loss due to prepayments that occur earlier or later than expected, illiquidity and default. 10 During periods of rising interest rates, a debtor may pay back a bond or other fixed income security slower than expected or required, and the value of such security may fall. 11 Inflation risk is the risk that the value of assets or income from investments will be worth less in the future. Inflation rates may change frequently and drastically as a result of various factors and the Fund’s investments may not keep pace with inflation, which may result in losses to Fund investors or adversely affect the real value of shareholders’ investments in the Fund. Recently, inflation levels have been at their highest point in nearly 40 years, and the U.S. Federal Reserve has begun an aggressive campaign to raise certain benchmark interest rates in an effort to combat inflation. As such, fixed income securities markets may experience heightened levels of interest rate volatility and liquidity risk. Deflation risk is the risk that the prices throughout the economy decline | | | | over time – the opposite of inflation. Deflation may have an adverse effect on the creditworthiness of issuers and may make issuer default more likely, which may result in a decline in the value of the Fund’s portfolio. 12 Factors unique to the municipal bond market may negatively affect the value of municipal bonds. 13 A debtor may exercise its right to pay back a bond or other debt security earlier than expected or required during periods of decreasing interest rates. 14 The Fund may have difficulty reinvesting payments from debtors and may receive lower rates than from its original investments. 15 Obligations issued by some U.S. Government agencies, authorities, instrumentalities, or sponsored enterprises such as Government National Mortgage Association (“GNMA”) are backed by the full faith and credit of the U.S. Government, while obligations issued by others, such as Federal National Mortgage Association (“FNMA”), Federal Home Loan Mortgage Corporation (“FHLMC”), and Federal Home Loan Banks (“FHLBs”), are not backed by the full faith and credit of the U.S. Government and are backed solely by the entity’s own resources or by the ability of the entity to borrow from the U.S. Treasury. If one of these agencies defaults on a loan, there is no guarantee that the U.S. Government will provide financial support. | | | | 16 The Fund may not be able to dispose of particular investments, such as illiquid securities, readily at favorable times or prices or the Fund may have to sell them at a loss. 17 The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds. Unlike the Fund, the Bloomberg U.S. Aggregate Bond Index is unmanaged, is not available for investment and does not incur expenses. “Bloomberg®” and any Bloomberg index described herein are service marks of Bloomberg Finance L.P. and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by AMG Funds LLC. Bloomberg is not affiliated with AMG Funds LLC, and Bloomberg does not approve, endorse, review, or recommend the fund described herein. Bloomberg does not guarantee the timeliness, accurateness, or completeness of any data or information relating to such fund. Not FDIC insured, nor bank guaranteed. May lose value. |

| | | | | | | | |

7

| | |

| | | AMG GW&K Core Bond ESG Fund Fund Snapshots (unaudited) |

| | | October 31, 2023 |

| | | |

| | | |

PORTFOLIO BREAKDOWN

| | | | |

| Category | | % of

Net Assets |

| | |

U.S. Government and Agency Obligations | | | 50.9 | |

| | |

Corporate Bonds and Notes | | | 36.6 | |

| | |

Municipal Bonds | | | 8.3 | |

| | |

Asset-Backed Securities | | | 0.7 | |

| | |

Short-Term Investments | | | 4.4 | |

| | |

Other Assets, less Liabilities | | | (0.9) | |

| | | | |

| Rating | | % of Market Value1 |

| | |

U.S. Government and Agency Obligations | | | 52.7 | |

| | |

Aaa/AAA | | | 4.8 | |

| | |

Aa/AA | | | 10.0 | |

| | |

A | | | 13.9 | |

| | |

Baa/BBB | | | 18.6 | |

| 1 | Includes market value of long-term fixed-income securities only. |

TOP TEN HOLDINGS

| | | | |

| Security Name | | % of

Net Assets | |

| | |

U.S. Treasury Bonds, 2.250%, 05/15/41 | | | 3.8 | |

| | |

U.S. Treasury Bonds, 3.500%, 02/15/39 | | | 2.6 | |

| | |

FHLMC, 3.500%, 10/01/45 | | | 2.4 | |

| | |

Verizon Communications, Inc., 3.875%, 02/08/29 | | | 2.2 | |

| | |

California State General Obligation, School Improvements, Build America Bonds, 7.550%, 04/01/39 | | | 2.2 | |

| | |

FNMA, 3.500%, 02/01/47 | | | 2.1 | |

| | |

FHLMC, 5.500%, 06/01/53 | | | 2.0 | |

| | |

Freddie Mac Multifamily Structured Pass Through Certificates, Series K134, Class A2, 2.243%, 10/25/31 | | | 2.0 | |

| | |

FHLMC, 3.000%, 11/01/49 | | | 2.0 | |

| | |

The Goldman Sachs Group, Inc. , 3.500%, 11/16/26 | | | 1.9 | |

| | | | | |

| | |

Top Ten as a Group | | | 23.2 | |

| | | | |

Credit quality ratings shown above reflect the highest rating assigned by either Standard & Poor’s (“S&P”) or Moody’s Investors Service, Inc. (“Moody’s”). These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB- or higher. Below investment grade ratings are credit ratings of BB+ or lower. Investments designated N/R are not rated by any of the rating agencies. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

| | |

| | | AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments |

| | | October 31, 2023 |

| | | |

| | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| |

Corporate Bonds and Notes - 36.6% | | | | | |

| | |

Financials - 16.3% | | | | | | | | |

| | |

AerCap Ireland Capital DAC/AerCap Global Aviation Trust (Ireland) 1.650%, 10/29/24 | | | $1,650,000 | | | | $1,573,352 | |

| | |

Aircastle, Ltd. (Bermuda)

4.250%, 06/15/26 | | | 1,562,000 | | | | 1,464,749 | |

| | |

American Tower Corp.

3.600%, 01/15/28 | | | 1,680,000 | | | | 1,510,241 | |

| | |

Bank of America Corp.

| | | | | | | | |

MTN, (4.330% to 03/15/49 then 3 month SOFR + 1.782%), 4.330%, 03/15/501,2 | | | 1,300,000 | | | | 954,409 | |

Series X, (6.250% to 09/05/24 then 3 month SOFR + 3.967%), 6.250%, 09/05/241,2,3 | | | 265,000 | | | | 260,450 | |

| | |

The Bank of New York Mellon Corp.

MTN, 2.450%, 08/17/26 | | | 937,000 | | | | 860,177 | |

Series G, (4.700% to 09/20/25 then U.S. Treasury Yield Curve CMT 5 year + 4.358%), 4.700%, 09/20/251,2,3 | | | 795,000 | | | | 752,444 | |

| | |

Citigroup, Inc.

| | | | | | | | |

(3.980% to 03/20/29 then 3 month SOFR + 1.600%), 3.980%, 03/20/301,2 | | | 1,677,000 | | | | 1,483,674 | |

| | |

Crown Castle, Inc.

4.000%, 03/01/27 | | | 1,800,000 | | | | 1,676,359 | |

| | |

The Goldman Sachs Group, Inc.

3.500%, 11/16/26 | | | 2,526,000 | | | | 2,342,637 | |

| | |

JPMorgan Chase & Co.

| | | | | | | | |

(1.470% to 09/22/26 then SOFR + 0.765%), 1.470%, 09/22/271,2 | | | 1,877,000 | | | | 1,635,121 | |

Series X, (6.100% to 10/01/24 then 3 month SOFR + 3.592%), 6.100%, 10/01/241,2,3 | | | 275,000 | | | | 271,253 | |

| | |

MetLife, Inc.

| | | | | | | | |

Series G, (3.850% to 09/15/25 then U.S. Treasury Yield Curve CMT 5 year + 3.576%), 3.850%, 09/15/251,2,3 | | | 1,409,000 | | | | 1,281,060 | |

| | |

Morgan Stanley

| | | | | | | | |

(4.431% to 01/23/29 then 3 month SOFR + 1.890%), 4.431%, 01/23/301,2 | | | 1,624,000 | | | | 1,478,691 | |

| | |

The PNC Financial Services Group, Inc.

| | | | | | | | |

(5.068% to 01/24/33 then SOFR + 1.933%), 5.068%, 01/24/341,2 | | | 1,426,000 | | | | 1,254,799 | |

| | |

Wells Fargo & Co.

| | | | | | | | |

MTN, (5.013% to 04/04/50 then 3 month SOFR + 4.502%), 5.013%, 04/04/511,2 | | | 1,411,000 | | | | 1,119,009 | |

| | |

Total Financials | | | | | | | 19,918,425 | |

| | |

Industrials - 18.8% | | | | | | | | |

| | |

Air Products and Chemicals, Inc.

4.800%, 03/03/334 | | | 1,030,000 | | | | 963,295 | |

| | |

Alcoa Nederland Holding, B.V. (Netherlands)

4.125%, 03/31/295 | | | 1,275,000 | | | | 1,110,439 | |

| | |

Ashtead Capital, Inc.

1.500%, 08/12/265 | | | 1,786,000 | | | | 1,569,632 | |

| | |

| | | | | | | | |

| | | | | | | | |

| | | Principal

Amount | | | Value | |

| | |

AT&T, Inc.

4.300%, 02/15/30 | | | $700,000 | | | | $627,770 | |

| | |

Broadcom, Inc.

4.150%, 11/15/30 | | | 717,000 | | | | 624,108 | |

| | |

Campbell Soup Co.

2.375%, 04/24/30 | | | 1,578,000 | | | | 1,250,949 | |

| | |

Comcast Corp.

4.650%, 02/15/334 | | | 1,115,000 | | | | 1,009,014 | |

| | |

CommonSpirit Health

3.347%, 10/01/29 | | | 1,737,000 | | | | 1,490,627 | |

| | |

Dell International LLC/EMC Corp.

6.200%, 07/15/30 | | | 1,512,000 | | | | 1,498,790 | |

| | |

The Ford Foundation

Series 2020, 2.415%, 06/01/50 | | | 2,207,000 | | | | 1,205,644 | |

| | |

Jacobs Engineering Group, Inc.

5.900%, 03/01/33 | | | 1,291,000 | | | | 1,195,703 | |

| | |

Kraft Heinz Foods Co.

3.875%, 05/15/27 | | | 1,518,000 | | | | 1,423,067 | |

| | |

Merck & Co., Inc.

1.900%, 12/10/28 | | | 1,547,000 | | | | 1,308,931 | |

| | |

Microsoft Corp.

2.525%, 06/01/50 | | | 2,090,000 | | | | 1,196,361 | |

| | |

Parker-Hannifin Corp.

3.250%, 06/14/29 | | | 1,573,000 | | | | 1,381,994 | |

| | |

Smith & Nephew PLC (United Kingdom)

2.032%, 10/14/30 | | | 1,010,000 | | | | 759,815 | |

| | |

Sysco Corp.

2.400%, 02/15/30 | | | 2,209,000 | | | | 1,778,735 | |

| | |

Verizon Communications, Inc.

3.875%, 02/08/29 | | | 2,953,000 | | | | 2,680,979 | |

| | |

Total Industrials | | | | | | | 23,075,853 | |

| | |

Utilities - 1.5% | | | | | | | | |

| | |

National Rural Utilities Cooperative Finance Corp.

1.350%, 03/15/31 | | | 1,749,000 | | | | 1,252,057 | |

| | |

Northern States Power Co.

2.900%, 03/01/50 | | | 1,000,000 | | | | 575,124 | |

| | |

Total Utilities | | | | | | | 1,827,181 | |

| | |

Total Corporate Bonds and Notes

(Cost $52,648,806) | | | | | | | 44,821,459 | |

| |

Asset-Backed Securities - 0.7% | | | | | |

| | |

American Express Credit Account Master Trust

Series 2022-4, Class A

4.950%, 10/15/27 | | | 630,000 | | | | 621,924 | |

| | |

Toyota Auto Receivables Owner Trust

Series 2021-B, Class A4

0.530%, 10/15/26 | | | 297,000 | | | | 276,139 | |

| | |

Total Asset-Backed Securities

(Cost $900,471) | | | | | | | 898,063 | |

| | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

9

| | |

| | | AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

| |

Municipal Bonds - 8.3% | | | | | |

| | |

California Health Facilities Financing Authority 4.190%, 06/01/37 | | | $775,000 | | | | $654,842 | |

| | |

California State General Obligation, School Improvements, Build America Bonds 7.550%, 04/01/39 | | | 2,310,000 | | | | 2,635,916 | |

| | |

Commonwealth of Massachusetts, Series B 4.110%, 07/15/31 | | | 783,520 | | | | 752,492 | |

| | |

JobsOhio Beverage System, Series B Build America Bonds, 4.532%, 01/01/35 | | | 1,705,000 | | | | 1,565,873 | |

| | |

Los Angeles Unified School District, School Improvements, Build America Bonds 5.750%, 07/01/34 | | | 1,775,000 | | | | 1,758,448 | |

| | |

Massachusetts School Building Authority, Series B, 1.753%, 08/15/30 | | | 2,017,000 | | | | 1,631,725 | |

| | |

University of California, University & College Improvements, Series BD 3.349%, 07/01/29 | | | 1,310,000 | | | | 1,171,861 | |

| | |

Total Municipal Bonds

(Cost $12,086,738) | | | | | | | 10,171,157 | |

| |

| U.S. Government and Agency Obligations - 50.9% | | | | | |

| | |

Fannie Mae - 22.9% | | | | | | | | |

| | |

FNMA | | | | | | | | |

2.000%, 02/01/36 | | | 776,450 | | | | 665,616 | |

3.000%, 06/01/38 to 12/01/50 | | | 1,376,082 | | | | 1,212,041 | |

3.500%, 03/01/30 to 07/01/50 | | | 10,903,631 | | | | 9,549,900 | |

4.000%, 03/01/44 to 01/01/51 | | | 7,634,324 | | | | 6,741,196 | |

4.500%, 04/01/39 to 08/01/52 | | | 7,875,335 | | | | 7,249,100 | |

5.000%, 07/01/47 to 02/01/49 | | | 1,806,468 | | | | 1,722,524 | |

5.500%, 11/01/52 | | | 949,082 | | | | 908,911 | |

| | |

Total Fannie Mae | | | | | | | 28,049,288 | |

| | |

Freddie Mac - 14.8% | | | | | | | | |

| | |

FHLMC | | | | | | | | |

2.500%, 10/01/34 | | | 2,353,969 | | | | 2,099,127 | |

3.000%, 11/01/49 to 03/01/50 | | | 3,943,676 | | | | 3,221,923 | |

3.500%, 10/01/45 | | | 3,470,060 | | | | 2,995,109 | |

4.000%, 07/01/48 to 09/01/50 | | | 2,104,942 | | | | 1,851,508 | |

4.500%, 05/01/48 | | | 265,192 | | | | 244,698 | |

5.000%, 07/01/44 | | | 1,084,484 | | | | 1,040,186 | |

5.500%, 06/01/53 | | | 2,624,014 | | | | 2,496,542 | |

| | |

FHLMC Gold Pool

3.500%, 07/01/32 to 05/01/44 | | | 1,108,106 | | | | 1,012,314 | |

| | |

Freddie Mac Multifamily Structured Pass Through Certificates | | | | | | | | |

Series K134, Class A2

2.243%, 10/25/312 | | | 3,175,000 | | | | 2,490,062 | |

| | |

Freddie Mac REMICS | | | | | | | | |

Series 5297, Class DA

5.000%, 12/25/52 | | | 656,524 | | | | 623,926 | |

| | |

Total Freddie Mac | | | | | | | 18,075,395 | |

| | |

| | | | | | | | |

| | | | | | | | |

| | |

| | | Principal

Amount | | | Value | |

| | |

Ginnie Mae - 0.5% | | | | | | | | |

| | |

GNMA | | | | | | | | |

Series 2023-111, Class FD

(1-month SOFR + 1.000%, Cap 7.000%, Floor 1.000%), 6.321%, 08/20/532 | | | $645,580 | | | | $627,087 | |

| | |

U.S. Treasury Obligations - 12.7% | | | | | | | | |

| | |

U.S. Treasury Bonds | | | | | | | | |

1.875%, 02/15/51 | | | 3,558,000 | | | | 1,867,533 | |

2.250%, 05/15/41 | | | 7,080,000 | | | | 4,642,655 | |

3.125%, 05/15/48 | | | 3,234,000 | | | | 2,285,529 | |

3.500%, 02/15/39 | | | 3,777,000 | | | | 3,122,664 | |

3.625%, 02/15/53 | | | 500,000 | | | | 389,609 | |

5.000%, 05/15/37 | | | 328,000 | | | | 328,448 | |

6.750%, 08/15/26 | | | 1,339,000 | | | | 1,402,080 | |

| | |

U.S. Treasury Notes

2.375%, 05/15/27 | | | 1,641,000 | | | | 1,507,925 | |

| | |

Total U.S. Treasury Obligations | | | | | | | 15,546,443 | |

| | |

Total U.S. Government and Agency Obligations

(Cost $75,519,144) | | | | | | | 62,298,213 | |

| |

Short-Term Investments - 4.4% | | | | | |

| | |

Joint Repurchase

Agreements - 1.7%6 | | | | | | | | |

| | |

Bank of America Securities, Inc., dated 10/31/23, due 11/01/23, 5.310% total to be received $1,000,148 (collateralized by various U.S. Government Agency Obligations, 2.000% - 6.500%, 04/01/48 - 10/01/53, totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

| | |

Industrial and Commercial Bank of China Financial Services LLC, dated 10/31/23, due 11/01/23, 5.340% total to be received $1,000,148 (collateralized by various U.S. Treasuries, 0.000% - 7.625%, 11/02/23 - 08/15/53, totaling $1,020,000) | | | 1,000,000 | | | | 1,000,000 | |

| | |

RBC Capital Markets LLC, dated 10/31/23, due 11/01/23, 5.310% total to be received $21,231 (collateralized by various U.S. Government Agency Obligations and U.S. Treasuries, 0.000% - 6.500%, 11/07/23 - 08/20/53, totaling $21,653) | | | 21,228 | | | | 21,228 | |

| | |

Total Joint Repurchase Agreements | | | | | | | 2,021,228 | |

| |

Repurchase Agreements - 2.7% | | | | | |

| | |

Fixed Income Clearing Corp., dated 10/31/23, due 11/01/23, 5.150% total to be received $1,679,240 (collateralized by a U.S. Treasury, 4.125%, 06/15/26, totaling $1,712,635) | | | 1,679,000 | | | | 1,679,000 | |

| | |

Fixed Income Clearing Corp., dated 10/31/23, due 11/01/23, 5.150% total to be received $1,640,235 (collateralized by a U.S. Treasury, 3.500%, 04/30/30, totaling $1,672,883) | | | 1,640,000 | | | | 1,640,000 | |

| | |

Total Repurchase Agreements | | | | | | | 3,319,000 | |

| | |

Total Short-Term Investments

(Cost $5,340,228) | | | | | | | 5,340,228 | |

| | |

| | | | | | | | |

The accompanying notes are an integral part of these financial statements.

10

| | |

| | | AMG GW&K Core Bond ESG Fund Schedule of Portfolio Investments (continued) |

| | | |

| | | |

| | | | | | | | |

| | | | | | Value | |

| | |

Total Investments - 100.9%

(Cost $146,495,387) | | | | | | | $123,529,120 | |

| | |

Other Assets, less Liabilities - (0.9)% | | | | | | | (1,122,215 | ) |

| | |

Net Assets - 100.0% | | | | | | | $122,406,905 | |

| 1 | Fixed to variable rate investment. The rate shown reflects the fixed rate in effect at October 31, 2023. Rate will reset at a future date. |

| 2 | Variable rate security. The rate shown is based on the latest available information as of October 31, 2023. Certain variable rate securities are not based on a published reference rate and spread but are determined by the issuer or agent and are based on current market conditions. These securities do not indicate a reference rate and spread in their description above. |

| 3 | Perpetuity Bond. The date shown represents the next call date. |

| 4 | Some of these securities, amounting to $1,952,586 or 1.6% of net assets, were out on loan to various borrowers and are collateralized by cash. See Note 4 of Notes to Financial Statements. |

| 5 | Security exempt from registration under Rule 144A of the Securities Act of 1933. This security may be resold in transactions exempt from registration, normally to qualified institutional buyers. At October 31, 2023, the value of these securities amounted to $2,680,071 or 2.2% of net assets. |

| 6 | Cash collateral received for securities lending activity was invested in these joint repurchase agreements. |

| | |

CMT | | Constant Maturity Treasury |

FHLMC | | Freddie Mac |

FNMA | | Fannie Mae |

GNMA | | Ginnie Mae |

MTN | | Medium-Term Note |

REMICS | | Real Estate Mortgage Investment Conduit |

SOFR | | Secured Overnight Financing Rate |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2023:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

| | | | |

Corporate Bonds and Notes† | | | — | | | | $44,821,459 | | | | — | | | | $44,821,459 | |

| | | | |

Asset-Backed Securities | | | — | | | | 898,063 | | | | — | | | | 898,063 | |

| | | | |

Municipal Bonds† | | | — | | | | 10,171,157 | | | | — | | | | 10,171,157 | |

| | | | |

U.S. Government and Agency Obligations† | | | — | | | | 62,298,213 | | | | — | | | | 62,298,213 | |

| | | | |

Short-Term Investments | | | | | | | | | | | | | | | | |

| | | | |

Joint Repurchase Agreements | | | — | | | | 2,021,228 | | | | — | | | | 2,021,228 | |

| | | | |

Repurchase Agreements | | | — | | | | 3,319,000 | | | | — | | | | 3,319,000 | |

| | | | | | | | | | | | | | | | |

| | | | |

Total Investments in Securities | | | — | | | | $123,529,120 | | | | — | | | | $123,529,120 | |

| | | | | | | | | | | | | | | | |

| | † | All corporate bonds and notes, municipal bonds, U.S. government and agency obligations held in the Fund are Level 2 securities. For a detailed breakout of corporate bonds and notes, municipal bonds, U.S. government and agency obligations by major industry or agency classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended October 31, 2023, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

11

| | |

| | | AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (unaudited) |

| | | |

| | | |

| | | | | | | | |

MARKET OVERVIEW Emerging markets advanced in choppy trading during the fiscal year ended October 31, 2023. The period started on a positive note, as China abandoned its restrictive zero-COVID policy and Eastern Europe rallied on the Continent’s improving energy security situation despite sanctions on Russian gas imports. Sentiment shifted later in the fiscal year, however, due to mounting problems in China’s property market, elevated U.S. yields, and volatile energy prices. The MSCI Emerging Markets Index gained 10.80%, slightly ahead of the MSCI World Index of developed markets, which was up 10.50%. Asia was the standout performer regionally led by tech heavy Taiwan, which rose sharply on an artificially intelligence (AI) hype-driven rally in semiconductors and hardware. China surged early in the period as the abrupt end to its zero-COVID policy drove investment flows back into the market, and the government softened its regulatory offensive targeting several industries. But the country’s macro challenges were deeper than expected and the rally faded as the year progressed. A short seller report on Indian conglomerate Adani Enterprises Ltd. (not held in the Fund), which forced the company to abandon a follow-on public share offering, capped gains in the country’s equity indexes. Mexico delivered surprisingly good Gross Domestic Product (GDP) and earnings growth throughout the period, driven by local consumption and US exports. Brazilian equities were volatile as investors weighed the impact of policy changes under President Lula against the potential for aggressive interest rate cuts. The Europe, Middle East and Africa (EMEA) region declined modestly due to weakness across the Persian Gulf oil and gas producers, though Eastern Europe remained well bid as the threat of an energy shortage eased considerably. Turkey gained substantially on easing geopolitical tensions with its NATO allies and a marked shift to more orthodox economic policies following President Erdogan’s reelection. The sector leaders were information technology, with semiconductors a key contributor, | | | | communication services and consumer discretionary, which gained on China reopening optimism. Utilities declined due to steep losses in Adani Enterprises’ listed subsidiaries in India. Materials and industrials were also notable underperformers. FUND REVIEW For the fiscal year ending October 31, 2023, the AMG GW&K Emerging Markets Equity Fund’s (the “Fund”) Class N shares returned 15.96%, outperforming the Fund’s benchmark, MSCI Emerging Markets Index, which returned 10.80%. Strong stock selection in Asia and no exposure to either materials or utilities were key contributors to the Fund’s relative performance. Individual stock highlights included Taiwan Semiconductor Manufacturing Co., Ltd., the world’s leading semiconductor foundry, which rose on better-than-expected second quarter and third quarter 2023 earnings. China’s Tencent Holdings, Ltd. finished the period higher on easing regulatory scrutiny and the surprise approval of several new video games. Online travel platform Trip.com Group, Ltd. rallied on the resumption of leisure activity following elimination of COVID-related restrictions in China. AI enthusiasm and a potential trough in memory chip prices drove gains in SK Hynix, Inc. Conversely, sporting goods specialist Li Ning Co., Ltd. reported disappointing third-quarter sales and reduced full-year guidance. European discount retailer Pepco Group, N.V. also lowered fiscal year guidance due to weakening demand for key clothing and merchandising categories. Following its recent merger with consumer finance subsidiary HDFC, India’s HDFC Bank, Ltd. provided proforma financial guidance, which will initially result in slightly lower returns and net interest margins. MultiChoice Group, a South African video entertainment platform, lowered guidance due to the negative impact of power rationing on consumer engagement. OUTLOOK We remain optimistic about the extended outlook for emerging markets but are mindful of the near-term risks facing capital markets globally, including the | | | | impact of aggressive interest rate hikes across developed markets, economic challenges facing China, and geopolitical tension. This is balanced against several factors that support our positive view of the longer-term growth and performance potential of emerging markets. China’s compelling valuation combined with the government’s renewed focus on domestically driven growth make it one of the more attractive markets globally. Additionally, many emerging markets have relatively high real interest rates and have already begun to pivot policy to support credit expansion. Other structural tailwinds include intraregional trade and diversification of supply chains, which should benefit countries like India and Mexico. At the end of October, the MSCI Emerging Markets Index traded at 11.0 times forward earnings, which represented a notable 37% discount relative to the MSCI USA Index. Although further bouts of volatility are possible, we believe emerging markets will reward investors willing to take the long-term view. With respect to the Fund’s structure, trading and market activity during the fiscal year resulted in increased exposure to communication services, energy, and consumer staples, while our weights in health care, industrials, and consumer discretionary decreased. At the close of the period, the Fund had overweight positions in the financials, consumer discretionary, consumer staples, communication services, and information technology sectors and underweight positions in the materials, industrials, utilities, health care, real estate, and energy sectors relative to the benchmark. Geographically, the portfolio finished the fiscal year with 82% in Asia, 13% in Latin America, and 5% in the EMEA region. The views expressed represent the opinions of GW&K Investment Management, LLC as of October 31, 2023, and are not intended as a forecast or guarantee of future results, and are subject to change without notice. |

12

| | |

| | | AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

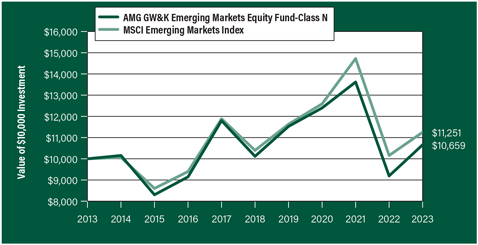

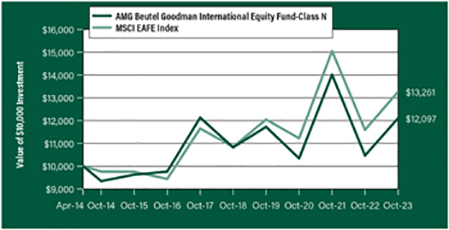

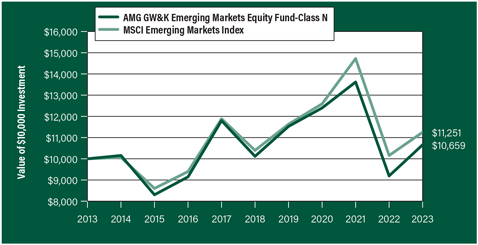

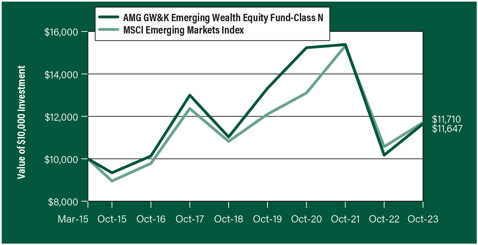

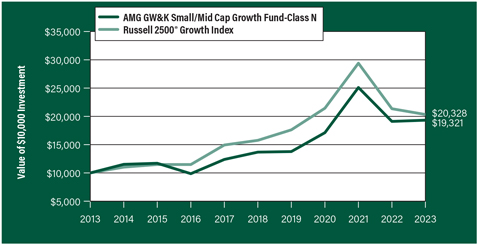

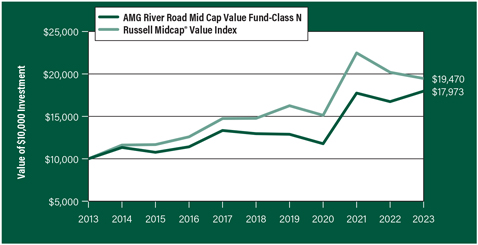

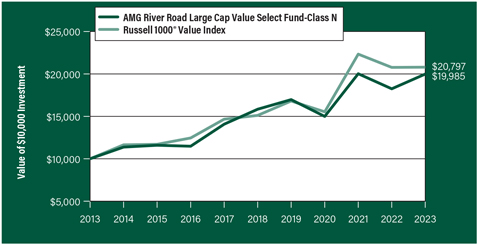

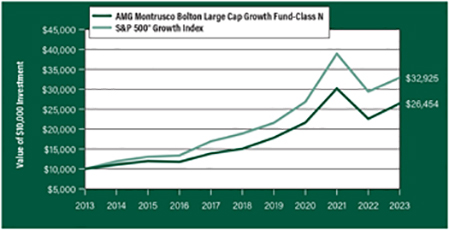

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG GW&K Emerging Markets Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. This graph compares a hypothetical $10,000 investment made in the AMG GW&K Emerging Markets Equity Fund’s Class N shares on October 31, 2013, to a $10,000 investment made in the MSCI Emerging Markets Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG GW&K Emerging Markets Equity Fund and the MSCI Emerging Markets Index for the same time periods ended October 31, 2023.

| | | | | | |

| | | One | | Five | | Ten |

| Average Annual Total Returns1 | | Year | | Years | | Years |

|

AMG GW&K Emerging Markets Equity Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20 |

| | | |

Class N | | 15.96% | | 1.05% | | 0.64% |

| | | |

Class I | | 16.28% | | 1.36% | | 0.97% |

| | | |

Class Z | | 16.56% | | 1.47% | | 1.08% |

| | | |

MSCI Emerging Markets Index21 | | 10.80% | | 1.59% | | 1.19% |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at wealth.amg.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2023. All returns are in U.S. Dollars ($). |

|

2 From time to time, the Fund’s adviser has waived its fees and/or absorbed Fund expenses, which has resulted in higher returns. 3 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of factors, including economic, political, or market conditions, or other factors including terrorism, war, natural disasters and the spread of infectious illness or other public health issues, including epidemics or pandemics, or in response to events that affect particular industries or companies. 4 Because the Fund is an actively managed investment portfolio, security selection or focus on securities in a particular style, market sector or group of companies may cause the Fund to incur losses or underperform relative to its benchmark or other funds with a similar investment objective. There can be no guarantee that the Subadviser’s investment techniques and risk analysis will produce the desired result. 5 Investments in foreign issuers involve additional risks (such as risks arising from less frequent trading, changes in political or social conditions, and less publicly available information about non-U.S. issuers) that differ from those associated with investments in U.S. issuers and may result in greater price volatility. 6 Investments in emerging markets are subject to the general risks of foreign investments, as well as additional risks which can result in greater price volatility. Such additional risks include the risk that markets in emerging market countries are typically less developed and less liquid than markets in developed countries and such markets are subjected to increased economic, political, or regulatory uncertainties. 7 Changes in the general political and social environment of a country can have substantial effects on the value of investments exposed to that country. 8 To the extent the Fund focuses its investments in a particular country, group of countries or geographic region, the Fund is particularly susceptible to economic, political, regulatory or other events or conditions affecting such countries or region, and the Fund’s NAV may be more volatile than the NAV of a more geographically diversified fund and may result in losses. The Fund is particularly susceptible to risks in the Greater China region, which consists of Hong Kong, The People’s Republic of China and Taiwan, among other countries. Economies in the Greater China region are dependent on the economies of other countries and can be significantly affected by currency fluctuations and increasing competition from other emerging economies in Asia with lower costs. Adverse events in any one country within the |

13

| | |

| | | AMG GW&K Emerging Markets Equity Fund Portfolio Manager’s Comments (continued) |

| | | |

| | | |

| | | | | | | | |

region may impact the other countries in the region or Asia as a whole. Markets in the Greater China region can experience significant volatility due to social, economic, regulatory and political uncertainties. Significant portions of the Chinese securities markets may become rapidly illiquid, as Chinese issuers have the ability to suspend the trading of their equity securities, and have shown a willingness to exercise that option in response to market volatility and other events. U.S. or foreign government restrictions or intervention could negatively affect the implementation of the Fund’s investment strategies, for example by precluding the Fund from making certain investments or causing the Fund to sell investments at disadvantageous times. China has yet to develop comprehensive securities, corporate, or commercial laws, its market is relatively new and less developed, and its economy may be adversely impacted by a slowdown in export growth. 9 The Fund may gain investment exposure to certain Chinese companies through variable interest entity (“VIE”) structures. A VIE structure enables foreign investors, such as the Fund, to obtain investment exposure to a Chinese company in situations in which the Chinese government has limited or prohibited non-Chinese ownership of such company. A VIE does not have equity ownership in its corresponding China-based company but has claims to the China-based company’s profits and control of its assets through contractual arrangements. VIEs are a common industry practice and well known to officials and regulators in China; however, VIEs are not formally recognized under Chinese law. If the Chinese government takes action adversely affecting VIEs, the market value of the Fund’s associated portfolio holdings would likely suffer significant, detrimental, and possibly permanent consequences, which could result in substantial investment losses. 10 Fluctuations in exchange rates may affect the total | | | | loss or gain on a non-U.S. dollar investment when converted back to U.S. dollars and exposure to non-U.S. currencies may subject the Fund to the risk that those currencies will decline in value relative to the U.S. dollar. 11 The use of derivatives involves costs, the risk that the value of derivatives may not correlate perfectly with their underlying assets, rates or indices, liquidity risk, and the risk of mispricing or improper valuation. The use of derivatives may not succeed for various reasons, and the complexity and rapidly changing structure of derivatives markets may increase the possibility of market losses. 12 The counterparty to a derivatives contract may be unable or unwilling, or may be perceived as unable or unwilling, to make timely interest, principal or settlement payments or otherwise honor its obligations. 13 Borrowing and some derivative investments such as futures, forward commitment transactions and swaps may magnify smaller adverse market movements into relatively larger losses. 14 The prices of equity securities of companies that are expected to experience relatively rapid earnings growth, or “growth stocks,” may be more sensitive to market movements because the prices tend to reflect future investor expectations rather than just current profits. 15 The prices of stocks purchased in initial public offerings (“IPOs”) can be very volatile and tend to fluctuate more widely than stocks of companies that have been publicly traded for a longer period of time. The effect of IPOs on the Fund’s performance depends on a variety of factors. 16 The stocks of large-capitalization companies are generally more mature and may not be able to reach the same levels of growth as the stocks of small- or mid-capitalization companies. 17 The stocks of small-and mid-capitalization | | | | companies often have greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. 18 An investment in participatory notes is subject to market risk. The performance results of participatory notes may not exactly replicate the performance of the underlying securities. An investment in participatory notes is also subject to counterparty risk, relating to the non-U.S. bank or broker-dealer that issues the participatory notes, and may be subject to liquidity risk. 19 Issuers and companies that are in similar industry sectors may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. 20 The Fund may not be able to dispose of particular investments, such as illiquid securities, readily at favorable times or prices or the Fund may have to sell them at a loss. 21 The MSCI Emerging Markets Index is a free float-adjusted market capitalization index that is designed to measure equity market performance of emerging markets. Please go to msci.com for most current list of countries represented by the index. Unlike the Fund, the MSCI Emerging Markets Index is unmanaged, is not available for investment and does not incur expenses. All MSCI data is provided “as is.” The products described herein are not sponsored or endorsed and have not been reviewed or passed on by MSCI. In no event shall MSCI, its affiliates or any MSCI data provider have any liability of any kind in connection with the MSCI data or the products described herein. Copying or redistributing the MSCI data is strictly prohibited. Not FDIC insured, nor bank guaranteed. May lose value. |

14

| | |

| | | AMG GW&K Emerging Markets Equity Fund Fund Snapshots (unaudited) |

| | | October 31, 2023 |

| | | |

| | | |

PORTFOLIO BREAKDOWN

| | | | |

| Sector | | % of Net Assets |

| | |

Financials | | | 27.4 | |

| | |

Information Technology | | | 22.4 | |

| | |

Consumer Discretionary | | | 17.6 | |

| | |

Communication Services | | | 11.6 | |

| | |

Consumer Staples | | | 9.1 | |

| | |

Energy | | | 4.7 | |

| | |

Industrials | | | 3.7 | |

| | |

Health Care | | | 1.8 | |

| | |

Short-Term Investments | | | 1.8 | |

| | |

Other Assets, less Liabilities | | | (0.1 | ) |

TOP TEN HOLDINGS

| | | | |

| Security Name | | % of

Net Assets | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. (Taiwan) | | | 8.8 | |

| | |

HDFC Bank, Ltd. (India) | | | 6.8 | |

| | |

Samsung Electronics Co., Ltd. (South Korea) | | | 5.5 | |

| | |

Tencent Holdings, Ltd. (China) | | | 3.6 | |

| | |

Reliance Industries, Ltd. (India) | | | 2.9 | |

| | |

Baidu, Inc., Class A (China) | | | 2.8 | |

| | |

Yum China Holdings, Inc. (China) | | | 2.7 | |

| | |

Bank Mandiri Persero Tbk PT (Indonesia) | | | 2.6 | |

| | |

Trip.com Group, Ltd., ADR (China) | | | 2.6 | |

| | |

SK Hynix, Inc. (South Korea) | | | 2.6 | |

| | | | | |

| | |

Top Ten as a Group | | | 40.9 | |

| | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

15

| | |

| | | AMG GW&K Emerging Markets Equity Fund Schedule of Portfolio Investments October 31, 2023 |

| | | |

| | | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Common Stocks - 98.3% | | | | | | | | |

| | |

Communication Services - 11.6% | | | | | | | | |

| | |

Baidu, Inc., Class A (China)* | | | 42,316 | | | | $555,559 | |

| | |

Kanzhun, Ltd., ADR (China)* | | | 18,600 | | | | 275,280 | |

| | |

Kingsoft Corp., Ltd. (China) | | | 55,800 | | | | 194,713 | |

| | |

Kuaishou Technology (China)*,1 | | | 29,500 | | | | 189,975 | |

| | |

MultiChoice Group (South Africa)* | | | 13,958 | | | | 52,282 | |

| | |

NetEase, Inc. (China) | | | 10,425 | | | | 223,111 | |

| | |

Tencent Holdings, Ltd. (China) | | | 19,106 | | | | 707,089 | |

| | |

Tencent Music Entertainment Group, ADR (China)* | | | 14,772 | | | | 107,245 | |

| | |

Total Communication Services | | | | | | | 2,305,254 | |

| | |

Consumer Discretionary - 17.6% | | | | | | | | |

| | |

Alibaba Group Holding, Ltd. (China)* | | | 48,928 | | | | 503,718 | |

| | |

Americana Restaurants International PLC (United Arab Emirates) | | | 91,300 | | | | 92,234 | |

| | |

Feng TAY Enterprise Co., Ltd. (Taiwan) | | | 47,437 | | | | 261,939 | |

| | |

H World Group Ltd., ADR (China)* | | | 5,150 | | | | 193,949 | |

| | |

Haidilao International Holding, Ltd. (China)1 | | | 47,000 | | | | 117,679 | |

| | |

Li Ning Co., Ltd. (China) | | | 63,000 | | | | 193,057 | |

| | |

MakeMyTrip, Ltd. (India)* | | | 11,748 | | | | 455,000 | |

| | |

Mitra Adiperkasa Tbk PT (Indonesia) | | | 947,099 | | | | 103,445 | |

| | |

Pepco Group, N.V. (United Kingdom)* | | | 13,230 | | | | 53,623 | |

| | |

Sands China, Ltd. (Macau)* | | | 128,750 | | | | 346,601 | |

| | |

Shenzhou International Group Holdings, Ltd. (China) | | | 10,460 | | | | 102,743 | |

| | |

Trip.com Group, Ltd., ADR (China)* | | | 15,177 | | | | 516,018 | |

| | |

Yum China Holdings, Inc. (China) | | | 10,367 | | | | 544,889 | |

| | |

Total Consumer Discretionary | | | | | | | 3,484,895 | |

| | |

Consumer Staples - 9.1% | | | | | | | | |

| | |

Angel Yeast Co., Ltd., Class A (China) | | | 14,100 | | | | 67,416 | |

| | |

Bid Corp., Ltd. (South Africa) | | | 10,593 | | | | 224,728 | |

| | |

By-health Co., Ltd., Class A (China) | | | 55,400 | | | | 138,705 | |

| | |

CP All PCL (Thailand) | | | 48,168 | | | | 74,028 | |

| | |

CP All PCL, Foreign Shares (Thailand) | | | 4,900 | | | | 7,486 | |

| | |

Dino Polska, S.A. (Poland)*,1,2 | | | 926 | | | | 87,743 | |

| | |

Fomento Economico Mexicano, S.A.B de CV (Mexico) | | | 35,096 | | | | 396,803 | |

| | |

Orion Corp. (South Korea) | | | 1,735 | | | | 153,556 | |

| | |

Proya Cosmetics Co., Ltd., Class A (China) | | | 10,800 | | | | 153,346 | |

| | |

Sumber Alfaria Trijaya Tbk PT (Indonesia) | | | 568,600 | | | | 103,447 | |

| | |

Vietnam Dairy Products JSC (Vietnam) | | | 23,700 | | | | 65,640 | |

| | |

Wal-Mart de Mexico, S.A.B. de CV (Mexico) | | | 72,973 | | | | 261,471 | |

| | |

| | | | | | | | |

| | | | | | | | |

| | | Shares | | | Value | |

| | |

Wuliangye Yibin Co., Ltd., Class A (China) | | | 3,100 | | | | $66,081 | |

| | |

Total Consumer Staples | | | | | | | 1,800,450 | |

| | |

Energy - 4.7% | | | | | | | | |

| | |

ADNOC Drilling Co. PJSC (United Arab Emirates) | | | 163,900 | | | | 162,427 | |

| | |

Arabian Drilling Co. (Saudi Arabia)* | | | 4,000 | | | | 187,014 | |

| | |

Reliance Industries, Ltd. (India) | | | 20,988 | | | | 577,124 | |

| | |

Total Energy | | | | | | | 926,565 | |

| | |

Financials - 27.4% | | | | | | | | |

| | |

AIA Group, Ltd. (Hong Kong) | | | 47,368 | | | | 411,335 | |

| | |

Al Rajhi Bank (Saudi Arabia) | | | 4,350 | | | | 77,868 | |

| | |

B3, S.A. - Brasil Bolsa Balcao (Brazil) | | | 32,600 | | | | 72,096 | |

| | |

Banco Bradesco, S.A., ADR (Brazil) | | | 72,583 | | | | 202,507 | |

| | |

Bank Mandiri Persero Tbk PT (Indonesia) | | | 1,463,432 | | | | 522,814 | |

| | |

Bank Rakyat Indonesia Persero Tbk PT (Indonesia) | | | 777,236 | | | | 243,029 | |

| | |

BDO Unibank, Inc. (Philippines) | | | 158,488 | | | | 356,752 | |

| | |

China International Capital Corp., Ltd., Class H (China)1 | | | 204,800 | | | | 326,197 | |

| | |

Cholamandalam Investment and Finance Co., Ltd. (India) | | | 9,450 | | | | 129,141 | |

| | |

Grupo Financiero Banorte, S.A.B de CV, Class O (Mexico) | | | 41,842 | | | | 338,955 | |

| | |

HDFC Asset Management Co., Ltd. (India)1 | | | 8,809 | | | | 289,351 | |

| | |

HDFC Bank, Ltd. (India) | | | 75,879 | | | | 1,346,438 | |

| | |

HDFC Life Insurance Co., Ltd. (India)1 | | | 20,200 | | | | 150,059 | |

| | |

Hong Kong Exchanges & Clearing, Ltd. (Hong Kong) | | | 5,000 | | | | 174,913 | |

| | |

Jio Financial Services, Ltd. (India)* | | | 21,588 | | | | 56,784 | |

| | |

NU Holdings, Ltd., Class A (Brazil)* | | | 16,800 | | | | 137,760 | |

| | |

One 97 Communications, Ltd. (India)* | | | 12,500 | | | | 138,339 | |

| | |

Pagseguro Digital, Ltd., Class A (Brazil)* | | | 4,288 | | | | 30,273 | |

| | |

Ping An Insurance Group Co. of China, Ltd., Class H (China) | | | 32,000 | | | | 162,319 | |

| | |

XP, Inc., Class A (Brazil) | | | 13,206 | | | | 264,120 | |

| | |

Total Financials | | | | | | | 5,431,050 | |

| | |

Health Care - 1.8% | | | | | | | | |

| | |

China Resources Sanjiu Medical & Pharmaceutical Co., Ltd., Class A (China) | | | 16,500 | | | | 97,267 | |

| | |