Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08004

AMG Funds IV

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300, Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: October 31

Date of reporting period: November 1, 2019 - October 31, 2020

(Annual Shareholder Report)

Table of Contents

| Item 1. | Reports to Stockholders. |

Table of Contents

| ANNUAL REPORT |

AMG Funds

October 31, 2020

AMG Funds IV | ||||||||

| Class N, I, & Z Shares | ||||||||

| Equity

Fixed Income

International | |||||||

| ||||||||

Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Funds’ shareholder reports like this one will no longer be sent by mail, unless you specifically request paper copies of the reports from the Funds or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Funds’ website (https://www.amgfunds.com/resources/order_literature.html), and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive shareholder reports and other communications from the Funds electronically at any time by contacting your financial intermediary or, if you invest directly with the Funds, by logging into your account at www.amgfunds.com.

You may elect to receive all future reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Funds, you can call 1.800.548.4539 to inform the Funds that you wish to continue receiving paper copies of your shareholder reports. Your election to receive reports in paper will apply to all funds in the AMG Funds Family of Funds held in your account if you invest through your financial intermediary or all funds in the AMG Funds Family of Funds held with the fund complex if you invest directly with the Funds.

amgfunds.com

|

103120 AR082

|

Table of Contents

Table of Contents

AMG Funds Annual Report — October 31, 2020 |

| TABLE OF CONTENTS | PAGE | |||||||||||||||

| ||||||||||||||||

| LETTER TO SHAREHOLDERS | 2 | |||||||||||||||

| ABOUT YOUR FUND’S EXPENSES | 3 | |||||||||||||||

| PORTFOLIO MANAGER’S COMMENTS, FUND SNAPSHOTS AND SCHEDULES OF PORTFOLIO INVESTMENTS |

| |||||||||||||||

| 5 | AMG River Road Small Cap Value Fund | 42 | ||||||||||||||

| 11 | AMG Managers Silvercrest Small Cap Fund | 47 | ||||||||||||||

| 16 | AMG Managers DoubleLine Core Plus Bond Fund | 52 | ||||||||||||||

| 24 | AMG River Road Long-Short Fund | 81 | ||||||||||||||

| 30 | AMG Managers Pictet International Fund | 88 | ||||||||||||||

AMG River Road Small-Mid Cap Value Fund

|

| 36

|

|

| ||||||||||||

| FINANCIAL STATEMENTS | ||||||||||||||||

| 96 | ||||||||||||||||

Balance sheets, net asset value (NAV) per share computations and cumulative distributable earnings (loss) | ||||||||||||||||

| 102 | ||||||||||||||||

Detail of sources of income, expenses, and realized and unrealized gains (losses) during the fiscal year | ||||||||||||||||

| 105 | ||||||||||||||||

Detail of changes in assets for the past two fiscal years | ||||||||||||||||

| 109 | ||||||||||||||||

Historical net asset values per share, distributions, total returns, income and expense ratios, turnover ratios and net assets | ||||||||||||||||

| 140 | ||||||||||||||||

Accounting and distribution policies, details of agreements and transactions with Fund management and affiliates, and descriptions of certain investment risks | ||||||||||||||||

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 156 | |||||||||||||||

| OTHER INFORMATION | 157 | |||||||||||||||

| TRUSTEES AND OFFICERS | 158 | |||||||||||||||

| ANNUAL RENEWAL OF INVESTMENT MANAGEMENT AND SUBADVISORY AGREEMENTS | 160 | |||||||||||||||

| Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds Family of Funds. Such offering is made only by prospectus, which includes details as to offering price and other material information. |

| |||||||||||||||

Table of Contents

Dear Shareholder:

The fiscal year ending October 31, 2020, was a volatile period for financial markets marked by a dramatic selloff and extraordinary rebound amid the unprecedented global effort to stop the COVID-19 pandemic. During the first half of the fiscal year, equities achieved new record highs against the backdrop of a healthy economy and strong investor sentiment. However, a broad-based selloff occurred amid a global flight to quality as investors assessed the scope of the unfolding COVID-19 health care crisis, a deteriorating economy, and skyrocketing unemployment. An oil price war initiated between Saudi Arabia and Russia only made matters worse. From its peak in mid-February 2020, the S&P 500® Index declined (33.79)% over the span of a few weeks, bringing the eleven-year bull market to an abrupt end. In response to the crisis, global central banks and governments were quick to flood the market with massive fiscal and monetary stimulus which helped to stabilize the market and led to an impressive recovery in risk assets, albeit a very uneven one. So despite the volatility, the S&P 500® Index still achieved a 9.71% return for the fiscal year.

During the year there was very wide dispersion in performance across sectors, with information technology and consumer discretionary sectors leading the market with returns of 34.47% and 24.69%, respectively. On the other hand, companies in the energy sector fell (45.24)%, and financials, real estate, and industrials also produced negative returns. Growth stocks significantly outperformed value stocks for the period with returns of 29.22% and (7.57)% for the Russell 1000® Growth and Russell 1000® Value Indexes, respectively. Large caps also outperformed small caps as measured by the 9.71% return for the S&P 500® Index compared to (0.14)% for the Russell 2000® Index. Outside the U.S., emerging markets outperformed developed markets with the 8.25% return for the MSCI Emerging Markets Index compared to the (6.86)% return for the MSCI EAFE Index.

Interest rates fell dramatically and led to strong returns for bond investors as the U.S. Federal Reserve slashed short-term rates in response to the slowing economy. The 10-year Treasury yield ended the year near a historic low yield of 0.88%. The Bloomberg Barclays U.S. Aggregate Bond Index®, a broad measure of U.S. bond market performance, returned 6.19% over the period. Riskier high yield bonds lagged the broader bond market with a 3.49% return as measured by the return of the Bloomberg Barclays U.S. Corporate High Yield Bond Index®.

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds

provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Keitha Kinne

President

AMG Funds

| Average Annual Total Returns | Periods ended October 31, 2020* | |||||||||||||||||

| Stocks: | 1 Year | 3 Years | 5 Years | |||||||||||||||

Large Cap | (S&P 500® Index) | 9.71 | % | 10.42% | 11.71% | |||||||||||||

Small Cap | (Russell 2000® Index) | (0.14 | )% | 2.19% | 7.27% | |||||||||||||

International | (MSCI All Country World Index ex USA) | (2.61 | )% | (0.19)% | 4.26% | |||||||||||||

| Bonds: | ||||||||||||||||||

Investment Grade | (Bloomberg Barclays U.S. Aggregate Bond Index) | 6.19 | % | 5.06% | 4.08% | |||||||||||||

High Yield | (Bloomberg Barclays U.S. Corporate High Yield Bond Index) | 3.49 | % | 4.24% | 6.32% | |||||||||||||

Tax-exempt | (Bloomberg Barclays Municipal Bond Index) | 3.59 | % | 4.09% | 3.70% | |||||||||||||

Treasury Bills | (ICE BofAML U.S. 6-Month Treasury Bill Index) | 1.30 | % | 1.89% | 1.43% | |||||||||||||

*Source: FactSet. Past performance is no guarantee of future results.

2

Table of Contents

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and | actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s | actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. | ||||||

Six Months Ended October 31, 2020 | Expense Ratio for the Period | Beginning Account Value 05/01/20 | Ending Account Value 10/31/20 | Expenses Paid During the Period* | ||||||||||||||||

AMG River Road Focused Absolute Value Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.05 | % | $1,000 | $1,100 | $5.54 | |||||||||||||||

Class I | 0.78 | % | $1,000 | $1,101 | $4.12 | |||||||||||||||

Class Z | 0.77 | % | $1,000 | $1,101 | $4.07 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.05 | % | $1,000 | $1,020 | $5.33 | |||||||||||||||

Class I | 0.78 | % | $1,000 | $1,021 | $3.96 | |||||||||||||||

Class Z | 0.77 | % | $1,000 | $1,021 | $3.91 | |||||||||||||||

AMG Managers Montag & Caldwell Growth Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.15 | % | $1,000 | $1,184 | $6.31 | |||||||||||||||

Class I | 0.99 | % | $1,000 | $1,185 | $5.44 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.15 | % | $1,000 | $1,019 | $5.84 | |||||||||||||||

Class I | 0.99 | % | $1,000 | $1,020 | $5.03 | |||||||||||||||

AMG River Road Dividend All Cap Value Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.13 | % | $1,000 | $1,101 | $5.97 | |||||||||||||||

Class I | 0.86 | % | $1,000 | $1,103 | $4.55 | |||||||||||||||

Class Z | 0.81 | % | $1,000 | $1,103 | $4.28 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.13 | % | $1,000 | $1,019 | $5.74 | |||||||||||||||

Class I | 0.86 | % | $1,000 | $1,021 | $4.37 | |||||||||||||||

Class Z | 0.81 | % | $1,000 | $1,021 | $4.12 | |||||||||||||||

Six Months Ended October 31, 2020 | Expense Ratio for the Period | Beginning Account Value 05/01/20 | Ending Account Value 10/31/20 | Expenses Paid During the Period* | ||||||||||||||||

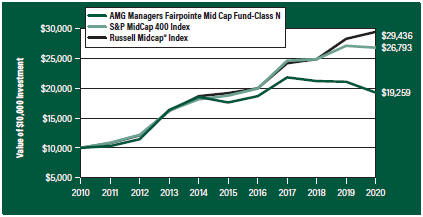

AMG Managers Fairpointe Mid Cap Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.14 | % | $1,000 | $1,113 | $6.05 | |||||||||||||||

Class I | 0.90 | % | $1,000 | $1,114 | $4.78 | |||||||||||||||

Class Z | 0.82 | % | $1,000 | $1,115 | $4.36 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.14 | % | $1,000 | $1,019 | $5.79 | |||||||||||||||

Class I | 0.90 | % | $1,000 | $1,021 | $4.57 | |||||||||||||||

Class Z | 0.82 | % | $1,000 | $1,021 | $4.17 | |||||||||||||||

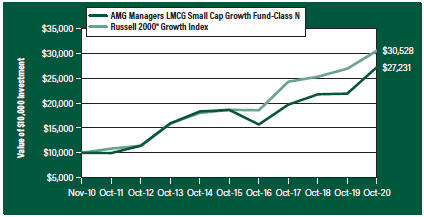

AMG Managers LMCG Small Cap Growth Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.29 | % | $1,000 | $1,287 | $7.42 | |||||||||||||||

Class I | 1.10 | % | $1,000 | $1,289 | $6.33 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.29 | % | $1,000 | $1,019 | $6.55 | |||||||||||||||

Class I | 1.10 | % | $1,000 | $1,020 | $5.58 | |||||||||||||||

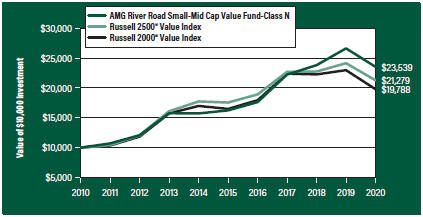

AMG River Road Small-Mid Cap Value Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.32 | % | $1,000 | $1,131 | $7.07 | |||||||||||||||

Class I | 1.07 | % | $1,000 | $1,131 | $5.73 | |||||||||||||||

Class Z | 1.02 | % | $1,000 | $1,133 | $5.47 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.32 | % | $1,000 | $1,019 | $6.70 | |||||||||||||||

Class I | 1.07 | % | $1,000 | $1,020 | $5.43 | |||||||||||||||

Class Z | 1.02 | % | $1,000 | $1,020 | $5.18 | |||||||||||||||

3

Table of Contents

About Your Fund’s Expenses (continued) |

Six Months Ended October 31, 2020 | Expense Ratio for the Period | Beginning Account Value 05/01/20 | Ending Account Value 10/31/20 | Expenses Paid During the Period* | ||||||||||||||||

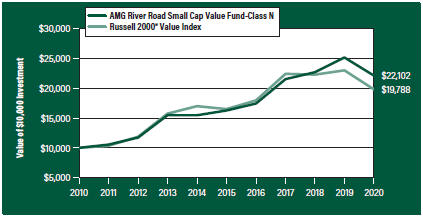

AMG River Road Small Cap Value Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.37 | % | $1,000 | $1,115 | $7.28 | |||||||||||||||

Class I | 1.10 | % | $1,000 | $1,117 | $5.85 | |||||||||||||||

Class Z | 1.02 | % | $1,000 | $1,117 | $5.43 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.37 | % | $1,000 | $1,018 | $6.95 | |||||||||||||||

Class I | 1.10 | % | $1,000 | $1,020 | $5.58 | |||||||||||||||

Class Z | 1.02 | % | $1,000 | $1,020 | $5.18 | |||||||||||||||

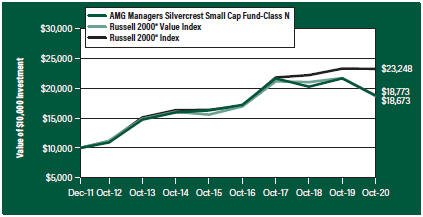

AMG Managers Silvercrest Small Cap Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.39 | % | $1,000 | $1,104 | $7.35 | |||||||||||||||

Class I | 1.15 | % | $1,000 | $1,106 | $6.09 | |||||||||||||||

Class Z | 1.08 | % | $1,000 | $1,106 | $5.72 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.39 | % | $1,000 | $1,018 | $7.05 | |||||||||||||||

Class I | 1.15 | % | $1,000 | $1,019 | $5.84 | |||||||||||||||

Class Z | 1.08 | % | $1,000 | $1,020 | $5.48 | |||||||||||||||

AMG Managers DoubleLine Core Plus Bond Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 0.94 | % | $1,000 | $1,059 | $4.86 | |||||||||||||||

Class I | 0.69 | % | $1,000 | $1,060 | $3.57 | |||||||||||||||

Class Z | 0.61 | % | $1,000 | $1,060 | $3.16 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 0.94 | % | $1,000 | $1,020 | $4.77 | |||||||||||||||

Class I | 0.69 | % | $1,000 | $1,022 | $3.51 | |||||||||||||||

Class Z | 0.61 | % | $1,000 | $1,022 | $3.10 | |||||||||||||||

Six Months Ended October 31, 2020 | Expense Ratio for the Period | Beginning Account Value 05/01/20 | Ending Account Value 10/31/20 | Expenses Paid During the Period* | ||||||||||||||||

AMG River Road Long-Short Fund** |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.45 | % | $1,000 | $1,003 | $7.30 | |||||||||||||||

Class I | 1.20 | % | $1,000 | $1,004 | $6.04 | |||||||||||||||

Class Z | 1.12 | % | $1,000 | $1,004 | $5.64 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.45 | % | $1,000 | $1,018 | $7.35 | |||||||||||||||

Class I | 1.20 | % | $1,000 | $1,019 | $6.09 | |||||||||||||||

Class Z | 1.12 | % | $1,000 | $1,020 | $5.69 | |||||||||||||||

AMG Managers Pictet International Fund |

| |||||||||||||||||||

Based on Actual Fund Return |

| |||||||||||||||||||

Class N | 1.31 | % | $1,000 | $1,109 | $6.95 | |||||||||||||||

Class I | 1.00 | % | $1,000 | $1,112 | $5.31 | |||||||||||||||

Class Z | 0.92 | % | $1,000 | $1,112 | $4.88 | |||||||||||||||

Based on Hypothetical 5% Annual Return |

| |||||||||||||||||||

Class N | 1.31 | % | $1,000 | $1,019 | $6.65 | |||||||||||||||

Class I | 1.00 | % | $1,000 | $1,020 | $5.08 | |||||||||||||||

Class Z | 0.92 | % | $1,000 | $1,021 | $4.67 | |||||||||||||||

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 366. |

| ** | Excludes interest expense and dividends on short positions. If included, your annualized expense ratios would be 2.82%, 2.57% and 2.49% for Class N, Class I and Class Z, respectively, and your actual and hypothetical expenses paid during the period would be $14.20, $12.94 and $12.54, and $14.25, $13.00 and $12.60 for Class N, Class I and Class Z, respectively. |

4

Table of Contents

OVERVIEW

For the fiscal year ended October 31, 2020, the AMG River Road Focused Absolute Value Fund (the “Fund”) Class N shares returned (11.03%), trailing the (8.00%) return for the Russell 3000® Value Index.

PERFORMANCE REVIEW

The sectors with the largest negative contribution to relative return were consumer discretionary, industrials, and information technology, with each underperforming primarily due to poor stock selection. A material portion of poor stock selection within these sectors, as well as others, can be characterized by industries adversely affected by the COVID-19 pandemic, particularly stocks with exposure to travel and hospitality markets. These factors were partially offset by strong stock selection in financials, which was the largest positive contributing sector during the period. Relative return also benefited from our lack of exposure in the real estate sector.

The top contributing holdings in the Fund were Alphabet Inc. (Cl C) (“Alphabet”) and Progressive Corp. (“Progressive”). Progressive is an insurance holding company that primarily focuses on personal and commercial auto insurance. In mid-July, Progressive reported quarterly results that were better than expected as top-line growth (net premium written +11%, net premium earned +9%) accelerated throughout the quarter with June’s results reflecting growth above pre-COVID-19 levels. These results represented a reacceleration of growth after net premiums written growth softened in April as COVID-19 disrupted renewal/new customer activity. This performance continued in Q3 2020 aligned with our thesis that Progressive would grow policies in force at an above market rate. However, Progressive’s underwriting profitability was strong throughout the year as stay-at-home orders and a shift to work from home (WFH) resulted in a lower frequency of accidents across the country. We believe Progressive’s dual sales channel approach of using the direct and agency model will continue to | drive market share gains, while its differentiated data and underwriting practices will support superior underwriting profitability versus the industry moving forward.

Alphabet owns the largest internet search engine in the world, Google.com, which dominates global search with ~90% market share. In October, Alphabet reported results significantly above consensus as Search revenue recovered from Q2 2020 lows as digital advertising budgets were reinstated and operating margins improved year over year. Search should continue to grow as more individuals access the internet (roughly half the world has access to the internet), and digital advertising continues to steal market share from traditional advertising markets. The Search business generates significant free cash flow, which is added to the firm’s fortress-like balance sheet (~10% of the market cap is in cash). Management has proven to be excellent capital allocators with eye-popping returns in businesses such as Android, YouTube, and Waymo and the potential to further increase shareholder returns through larger buybacks.

The bottom contributing holdings in the Fund were Expedia Group Inc. (“Expedia”) and Marathon Petroleum Corp. (“Marathon”). Expedia is an online travel agency (OTA) that helps consumers book flights, hotel rooms, and attractions. In the beginning of March, Expedia’s assessed valuation and conviction were lowered as we incorporated the potential impact of the COVID-19 pandemic. Shortly thereafter, airlines began reducing capacity and hotels reported significantly lower year-over-year occupancy rates, providing tangible data points to the direct impact COVID-19 was having on the travel industry and Expedia. In mid-March, the Fund exited Expedia because of liquidity concerns emanating from the working capital headwinds the company would face in the short term given the high rate of refunded flights and hotel rooms associated with cancellations.

Marathon is the largest independent petroleum refining, retail, and transportation business in the United States. Marathon’s stock price began a violent | downward spiral early in the year as demand and margins for gasoline and jet fuel fell precipitously due to the COVID-19 pandemic, which was worsened by a feud between Russia and Saudi Arabia earlier in the year. The team debated the potential impacts of various factors across Marathon’s operating segments, but decided the likely depth and duration of losses in refining would overwhelm other potential positive developments, including M&A. Given the wide range of possible outcomes and significant unrealized loss, the position was eliminated from the Fund for better risk-to-reward opportunities.

POSITIONING AND OUTLOOK

As always, the Fund invests in companies we believe represent the most attractive combination of risk (conviction) and reward (discount) available across the River Road universe of U.S. equity portfolio holdings. Trying to forecast market trends in 2020 has proven exceptionally challenging, and history provides limited precedent for the current environment. At this stage, we are seeking to maintain balance between more defensive, stable companies and those with greater risk but more upside potential as the economy recovers. As of October 31, 2020, more than 75% of the Fund’s holdings were concentrated in higher conviction stocks within the River Road universe and were trading at compelling discounts to assessed values, while the remaining positions maintain relatively attractive convictions but far deeper discounts, providing significantly more upside. We believe the Fund’s opportunistic benchmark independent style is positioned to take advantage of even fleeting price dislocations created by rising volatility, a likely factor in the year ahead.

This commentary reflects the viewpoints of River Road Asset Management as of November 24, 2020, and is not intended as a forecast or guarantee of future results. |

5

Table of Contents

AMG River Road Focused Absolute Value Fund Portfolio Manager’s Comments (continued) |

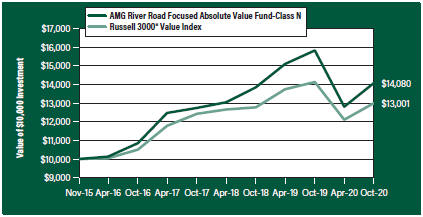

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG River Road Focused Absolute Value Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG River Road Focused Absolute Value Fund’s Class N shares on November 3, 2015, to a $10,000 investment made in the Russell 3000® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG River Road Focused Absolute Value Fund and the Russell 3000® Value Index for the same time periods ended October 31, 2020.

| Average Annual Total Returns1 | One Year | Since Inception | Inception Date | |||||||||

AMG River Road Focused Absolute Value Fund2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12 |

| |||||||||||

Class N | (11.03 | %) | 7.09 | % | 11/03/15 | |||||||

Class I | (10.81 | %) | 7.35 | % | 11/03/15 | |||||||

Class Z | (10.86 | %) | 2.83 | % | 09/29/17 | |||||||

Russell 3000® Value Index13 | (8.00 | %) | 5.39 | % | 11/03/15 | † | ||||||

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2020. All returns are in U.S. dollars ($).

2 Investing in Publicly Traded Partnerships (PTPs) (including master limited partnerships) involves risks in addition to those typically associated with publicly traded companies. PTPs are exposed to the risks of their underlying assets, which in many cases includes the same types of risks as energy and natural resources companies. PTPs are also subject to capital market risk. PTPs may lose their partnership status for tax purposes. The Fund’s status as a regulated investment company may be jeopardized if it does not appropriately limit such investments in PTPs or if such investments are recharacterized for tax purposes.

3 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products.

4 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies.

5 Active and frequent trading of a fund may result in higher transaction costs and increased tax liability.

6 A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. | ||

7 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets.

8 The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets.

9 The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions.

10 The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. | ||

6

Table of Contents

AMG River Road Focused Absolute Value Fund Portfolio Manager’s Comments (continued) |

11 Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase.

12 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. | 13 The Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 3000® Value Index is unmanaged, is not available for investment and does not incur expenses. | The Russell Indices are a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value. | ||||||

|

7

Table of Contents

AMG River Road Focused Absolute Value Fund Fund Snapshots (unaudited) October 31, 2020 |

PORTFOLIO BREAKDOWN

| Sector | % of Net Assets | |

Communication Services | 27.2 | |

Financials | 25.5 | |

Health Care | 15.3 | |

Industrials | 11.2 | |

Consumer Discretionary | 9.3 | |

Information Technology | 6.2 | |

Utilities | 4.1 | |

Short-Term Investments | 1.1 | |

Other Assets Less Liabilities | 0.1 | |

TOP TEN HOLDINGS

| Security Name | % of Net Assets | |

Berkshire Hathaway, Inc., Class B | 9.4 | |

Comcast Corp., Class A | 6.5 | |

GCI Liberty, Inc., Class A | 6.2 | |

Chubb, Ltd. (Switzerland) | 5.0 | |

LKQ Corp. | 5.0 | |

Fidelity National Financial, Inc. | 4.8 | |

Premier, Inc., Class A | 4.8 | |

Liberty Broadband Corp., Class C | 4.7 | |

Bristol-Myers Squibb Co. | 4.4 | |

Alphabet, Inc., Class C | 4.3 | |

| ||

Top Ten as a Group | 55.1 | |

| ||

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

8

Table of Contents

AMG River Road Focused Absolute Value Fund Schedule of Portfolio Investments October 31, 2020 |

| Shares | Value | |||||||

Common Stocks - 98.8% | ||||||||

Communication Services - 27.2% |

| |||||||

Alphabet, Inc., Class C* | 3,856 | $6,250,614 | ||||||

Comcast Corp., Class A | 222,658 | 9,405,074 | ||||||

Discovery, Inc., Class C* | 189,455 | 3,470,816 | ||||||

GCI Liberty, Inc., Class A* | 110,432 | 8,970,391 | ||||||

Liberty Broadband Corp., Class C* | 48,767 | 6,910,772 | ||||||

Liberty Media Corp.-Liberty SiriusXM, Class C* | 133,311 | 4,612,561 | ||||||

Total Communication Services | 39,620,228 | |||||||

Consumer Discretionary - 9.3% | ||||||||

Advance Auto Parts, Inc. | 42,312 | 6,231,711 | ||||||

LKQ Corp.* | 227,052 | 7,263,394 | ||||||

Total Consumer Discretionary | 13,495,105 | |||||||

Financials - 25.5% | ||||||||

Axis Capital Holdings, Ltd. (Bermuda) | 93,476 | 3,990,490 | ||||||

Berkshire Hathaway, Inc., Class B* | 67,713 | 13,671,255 | ||||||

Chubb, Ltd. (Switzerland) | 56,211 | 7,302,371 | ||||||

Fidelity National Financial, Inc. | 224,961 | 7,039,030 | ||||||

The Progressive Corp. | 55,803 | 5,128,296 | ||||||

Total Financials | 37,131,442 | |||||||

Health Care - 15.3% | ||||||||

Bristol-Myers Squibb Co. | 110,422 | 6,454,166 | ||||||

McKesson Corp. | 33,021 | 4,870,267 | ||||||

Premier, Inc., Class A | 214,738 | 7,028,375 | ||||||

UnitedHealth Group, Inc. | 12,882 | 3,930,813 | ||||||

Total Health Care | 22,283,621 | |||||||

Industrials - 11.2% | ||||||||

Armstrong World Industries, Inc.

|

| 89,039

|

|

| 5,333,436

|

| ||

| Shares | Value | |||||||

Huntington Ingalls Industries, Inc. | 35,975 | $ | 5,305,593 | |||||

UniFirst Corp. | 35,046 | 5,740,885 | ||||||

Total Industrials | 16,379,914 | |||||||

Information Technology - 6.2% |

| |||||||

Cisco Systems, Inc. | 158,827 | 5,701,889 | ||||||

NCR Corp.* | 166,723 | 3,387,812 | ||||||

Total Information Technology | 9,089,701 | |||||||

Utilities - 4.1% | ||||||||

The AES Corp. | 305,206 | 5,951,517 | ||||||

Total Common Stocks | 143,951,528 | |||||||

Short-Term Investments - 1.1% | ||||||||

Other Investment Companies - 1.1% |

| |||||||

Dreyfus Government Cash Management Fund, Institutional Shares, 0.02%1 | 542,657 | 542,657 | ||||||

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.04%1 | 542,657 | 542,657 | ||||||

JPMorgan U.S. Government Money Market Fund, IM Shares, 0.04%1 | 559,102 | 559,102 | ||||||

Total Short-Term Investments | 1,644,416 | |||||||

Total Investments - 99.9% | 145,595,944 | |||||||

Other Assets, less Liabilities - 0.1% |

| 89,881 | ||||||

Net Assets - 100.0%

| $

| 145,685,825

|

| |||||

| * | Non-income producing security. |

| 1 | Yield shown represents the October 31, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The accompanying notes are an integral part of these financial statements.

9

Table of Contents

AMG River Road Focused Absolute Value Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2020:

Level 1

| Level 2

| Level 3

| Total

| |||||||||||||

Investments in Securities | ||||||||||||||||

Common Stocks† | $ | 143,951,528 | — | — | $ | 143,951,528 | ||||||||||

Short-Term Investments | ||||||||||||||||

Other Investment Companies | 1,644,416 | — | — | 1,644,416 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $ | 145,595,944 | — | — | $ | 145,595,944 | ||||||||||

|

|

|

|

|

|

|

| |||||||||

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended October 31, 2020, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

10

Table of Contents

For the fiscal year ended October 31, 2020, the AMG Managers Montag & Caldwell Growth Fund (the “Fund”) Class N shares returned 21.36%, compared to the 29.22% return for its benchmark, the Russell 1000® Growth Index, but well ahead of the broader S&P 500® Index’s return of 9.71%. The Fund is managed using fundamental valuation techniques that focus on a company’s future earnings and dividend growth rates. The process is primarily bottom up and utilizes a present valuation model in which the current price of the stock is related to the risk adjusted present value of the company’s estimated future earnings stream. The Fund seeks to invest in growth stocks selling at a discount to our estimate of fair value and at a time when relative earnings per share growth is above median and/or accelerating.

MARKET ENVIRONMENT

U.S. stocks were mixed during the highly volatile fiscal year ended October 31, 2020. Growth stocks experienced strong absolute returns while value stocks were in negative territory. The Russell 1000® Index (large cap stocks) was up 10.87%, the Russell Midcap® Index (mid cap stocks) returned 4.12%, and the Russell 2000® Index (small cap stocks) was down -0.14% for the 12 months ended October 31, 2020. Among all capitalization categories, growth was the dominant theme with an unprecedented concentration of position size and sector allocation for technology stocks in the Russell 1000® Growth Index. For the full 12 months, growth significantly outperformed value in each size segment, with the widest (and historically largest) spread in returns between large cap growth and large cap value (29.22% vs. -7.57%). The performance advantage of growth over value in the mid and small cap areas was similar, though less pronounced than in large cap.

PERFORMANCE REVIEW

The reporting period began with an optimistic growth outlook. The probability of a trade deal with China improved the prospects for manufacturing activity and capital expenditures. Consumer spending was on solid footing and the housing market was strong thanks to lower interest rates. Inflation measures remained below the U.S. Federal

| Reserve’s (the Fed’s) 2% target, allowing monetary policy to remain accommodative. Altogether, this suggested that the economy could accelerate in 2020, perhaps closer to a 2.5% growth rate. The market responded accordingly with strong returns from October 31, 2019, until the pre-COVID-19 peak on February 19, 2020. Momentum growth stocks led the way during this period, and as a result the Fund’s underweight to the technology sector coupled with smaller position sizes in the largest growth names detracted from relative performance. The momentum in the market was interrupted by the spread of the COVID-19 virus, which registered the quickest contraction on record and the worst day of losses in the market since the 1987 crash. The S&P 500 fell more than -30% from its all-time high on February 19, 2020, to its closing low on March 23. This was the first official bear market since the global financial crisis. The Fund held up much better than the benchmark during this period, in part due to the high quality portfolio of cash-rich secular and cyclical growth stocks, despite the rapid pace of decline which led to highly correlated and indiscriminate selling. The Fund also benefited from an underweight in the industrial sector combined with strong stock selection in communication services and financials. Policy makers responded quickly to buffer the economy. The Fed committed to doing “whatever it takes” and immediately slashed the federal funds rate to 0%. This was in addition to unlimited quantitative easing and emergency lending facilities. Congress passed a $2 trillion stimulus package known as the CARES (Coronavirus Aid, Relief, and Economic Security) Act to support workers and businesses. The financial markets responded with a “V”-shaped recovery fueled by this unprecedented fiscal and monetary stimulus in addition to staged re-openings. However, for the most part the positive returns were driven by growth stocks, whose earnings proved to be more resilient this year in the face of COVID-19, and in particular many of the big technology companies viewed as long-term winners due to their strong balance sheets, dominant market positions, and disproportionate exposure to secular trends that the pandemic further accelerated. While the Fund includes many of these growth stocks, underweight positions for some of the largest tech companies relative to the benchmark due to our strict | risk-control measures that limit individual position sizes constituted a headwind to relative performance, as did a modest cash position. Large cap technology and other secular growers propelled the S&P 500 past its pre-COVID-19 market highs by late summer, which set the stage for a market correction in early September. The S&P 500 declined -10%, which allowed the market to work off some of the valuation and sentiment excesses that had built up in growth stocks. Market volatility continued through the end of October as an uptick in virus infections along with election and fiscal stimulus uncertainties remained prevalent in investors’ minds. The Fund outperformed during this period with strong stock selection in discretionary, health care, and technology stocks.

OUTLOOK

Investors continue to look for indications that support a move toward more normalized activity in 2021. Profit forecasts for next year are optimistic, with the 2021 consensus S&P 500 EPS (earnings per share) estimates exceeding the prior 2019 profit peak. Even so, the market will likely be choppier, and possibly range-bound, as investors grapple with uncertainties surrounding COVID-19, the election, questions surrounding additional fiscal stimulus measures, and elevated market valuations. September’s market correction worked off much of the aforementioned excessive enthusiasm that had built up, particularly among market leaders, which should allow growth stocks to resume their market leadership in what we believe will continue to be a low-inflation environment. These secular growers have been rewarded for their more certain earnings outlook and superior financial strength. We don’t see that changing until we see a durable rise in inflation expectations and long-term bond yields. Importantly, however, as we are in the early stages of a new economic cycle, one that is supported by ample liquidity and fiscal stimulus, we believe market setbacks, much like September’s, are likely to be limited for the time being.

This commentary reflects the viewpoints of Montag & Caldwell, LLC as of November 19, 2020, and is not intended as a forecast or guarantee of future results. | ||||||

11

Table of Contents

AMG Managers Montag & Caldwell Growth Fund Portfolio Manager’s Comments (continued) |

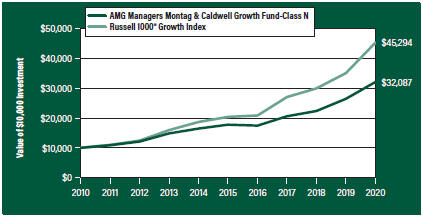

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG Managers Montag & Caldwell Growth Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Managers Montag & Caldwell Growth Fund’s Class N shares on October 31, 2010, to a $10,000 investment made in the Russell 1000® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Managers Montag & Caldwell Growth Fund and the Russell 1000® Growth Index for the same time periods ended October 31, 2020.

| Average Annual Total Returns1 | One Year | Five Years | Ten Years | |||||||||

AMG Managers Montag & Caldwell Growth Fund2, 3, 4, 5, 6 |

| |||||||||||

Class N | 21.36 | % | 12.55 | % | 12.37 | % | ||||||

Class I | 21.60 | % | 12.78 | % | 12.62 | % | ||||||

Russell 1000® Growth Index7 | 29.22 | % | 17.32 | % | 16.31 | % | ||||||

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2020. All returns are in U.S. dollars ($). |

| 2 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. | |

| 3 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. | |

| 4 | Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. | |

| 5 | The Fund invests in large-capitalization companies that may underperform other stock funds (such as funds that focus on small- and medium-capitalization companies) when stocks of large-capitalization companies are out of favor. | |

| 6 | Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase. | |

| 7 | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment and does not incur expenses. | |

| The Russell Indices are a trademark of the London Stock Exchange Group companies. | ||

Not FDIC insured, nor bank guaranteed. May lose value.

| ||

12

Table of Contents

AMG Managers Montag & Caldwell Growth Fund Fund Snapshots (unaudited) October 31, 2020 |

PORTFOLIO BREAKDOWN

| Sector | % of Net Assets | |

Information Technology | 39.3 | |

Health Care | 18.2 | |

Consumer Discretionary | 16.6 | |

Communication Services | 13.5 | |

Financials | 3.2 | |

Materials | 2.7 | |

Consumer Staples | 2.6 | |

Industrials | 2.5 | |

Short-Term Investments | 1.5 | |

Other Assets Less Liabilities

| (0.1)

| |

TOP TEN HOLDINGS

| Security Name | % of Net Assets | |

Microsoft Corp. | 5.7 | |

Alphabet, Inc., Class A | 5.5 | |

Facebook, Inc., Class A | 5.2 | |

Thermo Fisher Scientific, Inc. | 4.9 | |

Visa, Inc., Class A | 4.1 | |

Abbott Laboratories | 4.1 | |

Apple, Inc. | 3.9 | |

Amazon.com, Inc. | 3.9 | |

salesforce.com, Inc. | 3.8 | |

UnitedHealth Group, Inc. | 3.7 | |

| ||

Top Ten as a Group | 44.8 | |

| ||

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

13

Table of Contents

AMG Managers Montag & Caldwell Growth Fund Schedule of Portfolio Investments October 31, 2020 |

| Shares | Value | |||||||

Common Stocks - 98.6% | ||||||||

Communication Services - 13.5% |

| |||||||

Activision Blizzard, Inc. | 173,734 | $13,156,876 | ||||||

Alphabet, Inc., Class A* | 16,199 | 26,179,366 | ||||||

Facebook, Inc., Class A* | 94,403 | 24,838,373 | ||||||

Total Communication Services | 64,174,615 | |||||||

Consumer Discretionary - 16.6% |

| |||||||

Amazon.com, Inc.* | 6,125 | 18,596,419 | ||||||

Aptiv PLC (Ireland) | 86,900 | 8,384,981 | ||||||

Lowe’s Cos., Inc. | 109,483 | 17,309,262 | ||||||

NIKE, Inc., Class B | 87,243 | 10,476,139 | ||||||

Ross Stores, Inc. | 116,100 | 9,888,237 | ||||||

Starbucks Corp. | 166,153 | 14,448,665 | ||||||

Total Consumer Discretionary | 79,103,703 | |||||||

Consumer Staples - 2.6% | ||||||||

Monster Beverage Corp.* | 162,861 | 12,470,267 | ||||||

Financials - 3.2% | ||||||||

Intercontinental Exchange, Inc. | 99,900 | 9,430,560 | ||||||

S&P Global, Inc. | 17,556 | 5,665,848 | ||||||

Total Financials | 15,096,408 | |||||||

Health Care - 18.2% | ||||||||

Abbott Laboratories | 182,753 | 19,209,168 | ||||||

Edwards Lifesciences Corp.* | 125,277 | 8,981,108 | ||||||

Stryker Corp. | 34,700 | 7,009,747 | ||||||

Teleflex, Inc. | 32,149 | 10,230,776 | ||||||

Thermo Fisher Scientific, Inc. | 49,438 | 23,390,107 | ||||||

UnitedHealth Group, Inc. | 57,327 | 17,492,761 | ||||||

Total Health Care | 86,313,667 | |||||||

Industrials - 2.5% | ||||||||

IHS Markit, Ltd. (United Kingdom) | 149,317 | 12,075,266 | ||||||

Information Technology - 39.3% | ||||||||

Accenture PLC, Class A (Ireland)

|

| 53,992

|

|

| 11,711,405

|

| ||

| Shares | Value | |||||||

Amphenol Corp., Class A | 133,312 | $15,042,926 | ||||||

Analog Devices, Inc. | 93,600 | 11,094,408 | ||||||

Apple, Inc. | 170,896 | 18,603,739 | ||||||

Arista Networks, Inc.* | 16,700 | 3,488,630 | ||||||

Fidelity National Information Services, Inc. | 102,929 | 12,823,924 | ||||||

FleetCor Technologies, Inc.* | 48,933 | 10,809,789 | ||||||

Mastercard, Inc., Class A | 31,774 | 9,171,247 | ||||||

Microsoft Corp. | 133,271 | 26,983,379 | ||||||

PayPal Holdings, Inc.* | 75,702 | 14,090,413 | ||||||

QUALCOMM, Inc. | 124,443 | 15,351,288 | ||||||

salesforce.com, Inc.* | 78,021 | 18,121,938 | ||||||

Visa, Inc., Class A | 107,197 | 19,478,767 | ||||||

Total Information Technology | 186,771,853 | |||||||

Materials - 2.7% |

| |||||||

Air Products & Chemicals, Inc. | 46,262 | 12,779,415 | ||||||

Total Common Stocks | ||||||||

(Cost $276,637,034) | 468,785,194 | |||||||

Short-Term Investments - 1.5% | ||||||||

Other Investment Companies - 1.5% |

| |||||||

Dreyfus Government Cash Management Fund, Institutional Shares, 0.02%1 | 2,682,798 | 2,682,798 | ||||||

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Shares, 0.04%1 | 2,294,867 | 2,294,867 | ||||||

JPMorgan U.S. Government Money Market Fund, IM Shares, 0.04%1 | 2,364,408 | 2,364,408 | ||||||

Total Short-Term Investments | 7,342,073 | |||||||

Total Investments - 100.1% | 476,127,267 | |||||||

Other Assets, less Liabilities - (0.1)% | (438,864 | ) | ||||||

Net Assets - 100.0%

|

| $475,688,403

|

| |||||

| * | Non-income producing security. |

| 1 | Yield shown represents the October 31, 2020, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

The accompanying notes are an integral part of these financial statements.

14

Table of Contents

AMG Managers Montag & Caldwell Growth Fund Schedule of Portfolio Investments (continued) |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2020:

Level 1

| Level 2

| Level 3

| Total

| |||||||||||||

Investments in Securities | ||||||||||||||||

Common Stocks† | $ | 468,785,194 | — | — | $ | 468,785,194 | ||||||||||

Short-Term Investments | ||||||||||||||||

Other Investment Companies |

| 7,342,073

|

|

| —

|

|

| —

|

|

| 7,342,073

|

| ||||

|

|

|

|

|

|

|

| |||||||||

Total Investments in Securities | $

| 476,127,267

|

|

| —

|

|

| —

|

| $

| 476,127,267

|

| ||||

|

|

|

|

|

|

|

| |||||||||

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

For the fiscal year ended October 31, 2020, there were no transfers in or out of Level 3.

The accompanying notes are an integral part of these financial statements.

15

Table of Contents

OVERVIEW

For the fiscal year ended October 31, 2020, the AMG River Road Dividend All Cap Value Fund (the “Fund”) Class N shares returned (10.96%), while the Russell 3000® Value Index returned (8.00%).

MARKET AND PERFORMANCE REVIEW

The disruption of the U.S. economy and corporate earnings had a significant impact on the Fund performance in the period. Relative to the benchmark, the Fund’s yield objective was a notable headwind as stocks with high dividend yields underperformed. Additionally, the Fund’s all-cap structure had an adverse impact on relative results as small cap stocks have generally lagged in the period. The information technology sector had the most significant positive impact on relative results in the period, due to strong stock selection and an overweight allocation. The energy sector had the most significant negative impact as the overweight allocation was only offset in part by the strong stock selection.

The two holdings with the largest positive contribution to the Fund’s total return were discount retailer Target Corp. (“Target”) and package delivery company United Parcel Service Inc. (Cl B) (“UPS”). In May Target reported Q1 results, which highlighted the success of management’s omni-channel strategy during the quarantine with comparable sales up 10.8%, driven by 140% growth in digital sales. The company leveraged its store base to fulfill approximately 80% of the growth in digital sales, which reduced costs and improved customer service. In Q3, Target reported comparable sales up 24%, the strongest ever reported, as the company capitalized on its omni-channel strategy and digital sales grew a staggering 195%. In addition, the firm was able to grow its same-day fulfillment services by 273%, highlighting the value of the firm’s existing store base in this key area. Most importantly, despite this rapid shift in the business mix, operating profit grew 73% driven by strength in higher margin discretionary categories and strong fixed cost leverage. This appears to be the culmination of our investment thesis, as Target demonstrated the wherewithal to profitably compete, gather market share, and reward shareholders as e-commerce demand accelerates. In the wake of the strong results, the stock began trading at a significant premium to our assessed value, the yield slipped below 2%, and the position was nearing our 5% maximum limit, so we elected to trim the position.

In July, UPS reported very strong results as the pandemic accelerated the secular shift in consumer behavior toward e-commerce. This behavioral shift | led to 65% growth in business-to-consumer shipments for UPS, which improved route density and drove a 2.7% reduction in the cost per piece shipped. The firm’s new CEO, Carol B. Tomé, articulated a shift in strategy centered on driving proper value for UPS’s infrastructure that should result in higher margins and returns on invested capital (ROIC) moving forward. The team obviously intends to capitalize on the firm’s renewed pricing power following the surge in shipping demand and will focus on imposing surcharges on high volume, low margin customers like Amazon, especially in times of peak volume while reserving capacity for higher margin, smaller and medium-sized customers. While management tempered the expectation for near-term margin expansion, the expected recovery of business-to-business and freight volumes will likely provide additional pricing power and fuel optimism for UPS’s earnings power in the coming quarters. The firm increased the dividend 5% in February 2020 and both free cash flow and liquidity should support the continued growth of the dividend in 2021. Our assessed value for the position increased 38% over the span of the quarter as the dramatic acceleration in volume prompted upward revisions in both margin assumptions and the multiple employed. We remain holders of this position.

The two holdings with the lowest contribution to the Fund’s total return during the period were Kinder Morgan Inc. (Cl P) (“Kinder”), an energy infrastructure that transports approximately 40% of natural gas consumed in the United States, and Ventas Inc. (“Ventas”), a real estate investment trust (REIT) focused on owning healthcare real estate such as senior housing, medical office, and life science centers. In Q3, Kinder reported weak results following the disruption in oil markets that started in March with the collapse in demand for gasoline and the surge in supply from OPEC nations. Management now expects full year EBITDA (earnings before interest, taxes, depreciation, and amortization) and distributable cash flow will decline by a manageable 8% and 10%, respectively. While we suspect that the company’s oil producing business will remain depressed for an extended period of time, this division is responsible for only 10% of profits. More important is the firm’s natural gas business which is benefiting from a surge in pricing as the flood of associated gas coming out of the Permian recedes. We believe that investors are overlooking the underlying stability of this firm and have lost sight of the fact that Kinder’s business has limited commodity price risk with 90% of overall profits | being fee based and 66% of profits from take-or-pay contracts. Given the accumulated unrealized losses, we will continue to monitor the position, but to date we have elected to trim/eliminate other, riskier holdings in the sector.

In March as COVID-19 headlines gained steam, Ventas’s Senior Housing segment became at risk and the stock price fell sharply. Although very little is firewalled from COVID-19 risk, rent from Medical Office and Life Science Centers typically holds up well throughout most bearish pandemic scenarios. However, Senior Housing, which accounts for about one-third of EBITDA, faced near- and intermediate-term risk due to the prospect of lower occupancy at its properties driven by increased tenant mortality and reduced tenant move-ins. Management reacted quickly to the pandemic, increasing liquidity by drawing $2.8 billion on its credit facility in mid-March and issuing $500 million in 10-year notes in late March. Ventas is now incredibly liquid with limited debt maturities, which should make it well positioned to weather the storm. However, as the duration of the lockdown was drawn out and the impact spread deeper into the health care sector, the Board elected to move aggressively and cut the dividend substantially. Given the reduction and the unrealized losses, we elected to eliminate the position in the period.

POSITIONING AND OUTLOOK

As of October 31, 2020, the Fund is significantly overweight in information technology, utilities, and energy and significantly underweight in industrials, financials, and materials. The health care sector had the largest change in the past 12 months, going from substantially underweight in October 2019 to modestly overweight at the end of the period as we seek to capitalize on the expected recovery of discretionary healthcare spending in the post-COVID-19 environment. In contrast, the industrials sector went from a modest overweight to a substantial underweight as the valuations of several holdings surged over the summer and we elected to reposition into cheaper securities.

Despite the sharp rally in the wake of the 2020 election, significant headwinds could arise in the weeks and months to come. Not only is there a threat of renewed COVID-19-related lockdowns, both in the U.S. and abroad, but there is less political consensus surrounding stimulus. The potential of a split in leadership in Washington D.C. is considered a positive by many market prognosticators due to | ||||||

16

Table of Contents

AMG River Road Dividend All Cap Value Fund Portfolio Manager’s Comments (continued) |

reduced uncertainty surrounding policy changes. However, that logic also points toward a reduced outlook for stimulus in 2021. We expect that U.S. Treasury rates will remain low over the next couple years, and assuming the economy continues to rebound, it is unlikely that broader interest rates | will expand significantly either. We believe persistently low rates and a recovering economy are a recipe for increased demand for dividends, especially rising dividends, and we feel the outlook for dividend stocks, and the Fund, is increasingly positive in the period ahead.

| This commentary reflects the viewpoints of River Road Asset Management as of November 24, 2020, and is not intended as a forecast or guarantee of future results. |

17

Table of Contents

AMG River Road Dividend All Cap Value Fund Portfolio Manager’s Comments (continued) |

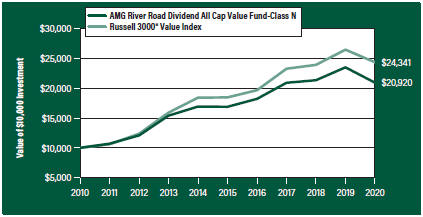

CUMULATIVE TOTAL RETURN PERFORMANCE

AMG River Road Dividend All Cap Value Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG River Road Dividend All Cap Value Fund’s Class N shares on October 31, 2010, to a $10,000 investment made in the Russell 3000® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG River Road Dividend All Cap Value Fund and the Russell 3000® Value Index for the same time periods ended October 31, 2020.

| Average Annual Total Returns1 | One Year | Five Years | Ten Years | Since Inception | Inception Date | ||||||||||||||||||||

AMG River Road Dividend All Cap Value Fund2, 3, 4, 5, 6, 7, 8, 9, 10 |

| ||||||||||||||||||||||||

Class N | (10.96 | %) | 4.38 | % | 7.66 | % | 6.65 | % | 06/28/05 | ||||||||||||||||

Class I | (10.69 | %) | 4.65 | % | 7.94 | % | 5.28 | % | 06/28/07 | ||||||||||||||||

Class Z | (10.65 | %) | — | — | 0.52 | % | 09/29/17 | ||||||||||||||||||

Russell 3000® Value Index11 | (8.00 | %) | 5.69 | % | 9.30 | % | 6.25 | % | 06/28/05 | † | |||||||||||||||

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.548.4539 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2020. All returns are in U.S. dollars ($).

2 Investing in Publicly Traded Partnerships (PTPs) (including master limited partnerships) involves risks in addition to those typically associated with publicly traded companies. PTPs are exposed to the risks of their underlying assets, which in many cases includes the same types of risks as energy and natural resources companies. PTPs are also subject to capital market risk. PTPs may lose their partnership status for tax purposes. The Fund’s status as a regulated investment company may be jeopardized if it does not appropriately limit such investments in PTPs or if such investments are recharacterized for tax purposes.

3 An issuer of a security may be unwilling or unable to pay income on a security. Common stocks do not assure dividend payments and are paid only when declared by an issuer’s board of directors.

4 Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets.

5 The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies.

| ||

6 The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions.

| ||

7 The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products.

| ||

8 The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time.

| ||

9 Market prices of investments held by the Fund may fall rapidly or unpredictably due to a variety of economic or political factors, market conditions, disasters or public health issues, or in response to events that affect particular industries or companies. |

18

Table of Contents

AMG River Road Dividend All Cap Value Fund Portfolio Manager’s Comments (continued) |

10 Companies that are in similar businesses may be similarly affected by particular economic or market events; to the extent the Fund has substantial holdings within a particular sector, the risks associated with that sector increase.

11 The Russell 3000® Value Index measures the performance of the broad value segment of the U.S.

|

| equity universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 3000® Value Index is unmanaged, is not available for investment and does not incur expenses. | The Russell Indices are a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value. |

19

Table of Contents

AMG River Road Dividend All Cap Value Fund Fund Snapshots (unaudited) October 31, 2020 |

PORTFOLIO BREAKDOWN

| Sector | % of Net Assets | |

Financials | 15.3 | |

Health Care | 15.1 | |

Information Technology | 13.6 | |

Utilities | 10.3 | |

Consumer Staples | 8.7 | |

Communication Services | 8.5 | |

Industrials | 8.2 | |

Consumer Discretionary | 7.7 | |

Energy | 7.5 | |

Real Estate | 2.2 | |

Materials | 1.4 | |

Short-Term Investments | 4.1 | |

Other Assets Less Liabilities | (2.6) | |

TOP TEN HOLDINGS

| Security Name | % of Net Assets | |

United Parcel Service, Inc., Class B | 4.3 | |

Corning, Inc. | 4.2 | |

Target Corp. | 3.8 | |

Verizon Communications, Inc. | 3.7 | |

The AES Corp. | 3.6 | |

Comcast Corp., Class A | 3.5 | |

Bristol-Myers Squibb Co. | 3.3 | |

Unilever PLC, Sponsored ADR (United Kingdom) | 3.1 | |

Truist Financial Corp. | 3.0 | |

Kimberly-Clark Corp. | 2.6 | |

| ||

Top Ten as a Group | 35.1 | |

| ||

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

20

Table of Contents

AMG River Road Dividend All Cap Value Fund Schedule of Portfolio Investments October 31, 2020 |

| Shares | Value | |||||||

Common Stocks - 98.5% | ||||||||

Communication Services - 8.5% | ||||||||

Comcast Corp., Class A | 375,630 | $15,866,611 | ||||||

The Interpublic Group of Cos., Inc. | 324,748 | 5,874,691 | ||||||

Verizon Communications, Inc. | 296,038 | 16,871,206 | ||||||

Total Communication Services | 38,612,508 | |||||||

Consumer Discretionary - 7.7% |

| |||||||

Genuine Parts Co. | 74,415 | 6,729,348 | ||||||

The Home Depot, Inc. | 21,576 | 5,754,535 | ||||||

Magna International, Inc. (Canada) | 99,061 | 5,063,008 | ||||||

Target Corp. | 113,393 | 17,260,683 | ||||||

Total Consumer Discretionary | 34,807,574 | |||||||

Consumer Staples - 8.7% |

| |||||||

Kimberly-Clark Corp. | 89,299 | 11,840,155 | ||||||

PepsiCo, Inc. | 75,663 | 10,085,121 | ||||||

Unilever PLC, Sponsored ADR (United Kingdom)1 | 242,524 | 13,782,639 | ||||||

Walgreens Boots Alliance, Inc. | 100,975 | 3,437,189 | ||||||

Total Consumer Staples | 39,145,104 | |||||||

Energy - 7.5% |

| |||||||

Enterprise Products Partners LP, MLP | 527,064 | 8,733,450 | ||||||

Kinder Morgan, Inc. | 847,093 | 10,080,407 | ||||||

Magellan Midstream Partners LP, MLP | 80,284 | 2,853,293 | ||||||

Marathon Petroleum Corp. | 147,345 | 4,346,678 | ||||||

The Williams Cos., Inc. | 407,390 | 7,817,814 | ||||||

Total Energy | 33,831,642 | |||||||

Financials - 15.3% |

| |||||||

Axis Capital Holdings, Ltd. (Bermuda) | 143,598 | 6,130,199 | ||||||

Chubb, Ltd. (Switzerland) | 62,558 | 8,126,910 | ||||||

CNA Financial Corp.1 | 205,850 | �� | 6,132,272 | |||||

Fidelity National Financial, Inc. | 264,672 | 8,281,587 | ||||||

Lazard, Ltd., Class A | 107,544 | 3,621,006 | ||||||

The PNC Financial Services Group, Inc. | 77,190 | 8,636,017 | ||||||

Stock Yards Bancorp, Inc. | 88,324 | 3,375,743 | ||||||

Truist Financial Corp. | 324,237 | 13,656,862 | ||||||

U.S. Bancorp | 289,770 | 11,286,542 | ||||||

Total Financials | 69,247,138 | |||||||

Health Care - 15.1% |

| |||||||

AbbVie, Inc. | 119,321 | 10,154,217 | ||||||

Amgen, Inc. | 48,668 | 10,558,036 | ||||||

Bristol-Myers Squibb Co. | 256,380 | 14,985,411 | ||||||

Medtronic PLC (Ireland) | 57,909 | 5,823,908 | ||||||

Merck & Co., Inc. | 69,659 | 5,239,053 | ||||||

Pfizer, Inc.

|

| 284,794

|

|

| 10,104,491

|

| ||

| Shares | Value | |||||||

Premier, Inc., Class A | 184,591 | $6,041,664 | ||||||

Quest Diagnostics, Inc. | 44,395 | 5,422,405 | ||||||

Total Health Care | 68,329,185 | |||||||

Industrials - 8.2% |

| |||||||

3M Co. | 50,641 | 8,100,535 | ||||||

General Dynamics Corp. | 48,601 | 6,382,769 | ||||||

Insperity, Inc. | 44,464 | 3,405,053 | ||||||

United Parcel Service, Inc., Class B | 122,229 | 19,203,398 | ||||||

Total Industrials | 37,091,755 | |||||||

Information Technology - 13.6% |

| |||||||

Cass Information Systems, Inc. | 92,497 | 3,627,732 | ||||||

Cisco Systems, Inc. | 315,422 | 11,323,650 | ||||||

Corning, Inc. | 595,645 | 19,042,771 | ||||||

CSG Systems International, Inc. | 79,820 | 3,023,582 | ||||||

The Hackett Group, Inc. | 158,401 | 2,046,541 | ||||||

NortonLifeLock, Inc. | 267,443 | 5,501,302 | ||||||

Oracle Corp. | 129,448 | 7,263,327 | ||||||

QUALCOMM, Inc. | 76,525 | 9,440,124 | ||||||

Total Information Technology | 61,269,029 | |||||||

Materials - 1.4% |

| |||||||

Sensient Technologies Corp. | 95,741 | 6,264,334 | ||||||

Real Estate - 2.2% |

| |||||||

Iron Mountain, Inc., REIT 1 | 383,638 | 9,997,606 | ||||||

Utilities - 10.3% |

| |||||||

The AES Corp. | 841,195 | 16,403,303 | ||||||

Atlantica Sustainable Infrastructure PLC (United Kingdom) | 320,703 | 9,457,531 | ||||||

Black Hills Corp. | 106,549 | 6,037,066 | ||||||

Dominion Resources, Inc. | 84,284 | 6,771,377 | ||||||

IDACORP, Inc. | 90,480 | 7,937,810 | ||||||

Total Utilities | 46,607,087 | |||||||

Total Common Stocks | ||||||||

(Cost $380,159,002) | 445,202,962 | |||||||

| ||||||||

| Principal Amount | ||||||||

Short-Term Investments - 4.1% | ||||||||

Joint Repurchase Agreements - 2.6%2 |

| |||||||

Cantor Fitzgerald Securities, Inc., dated 10/30/20,due 11/02/20, 0.120% total to be received $2,805,728 (collateralized by various U.S. Government Agency Obligations, 0.160% - 9.500%, 12/01/20 - 09/20/70, totaling $2,861,814)

|

| $2,805,700

|

|

| 2,805,700

|

| ||

The accompanying notes are an integral part of these financial statements.

21

Table of Contents

AMG River Road Dividend All Cap Value Fund Schedule of Portfolio Investments (continued) |

| Principal Amount | Value | |||||||

Joint Repurchase Agreements - 2.6%2 (continued) |

| |||||||

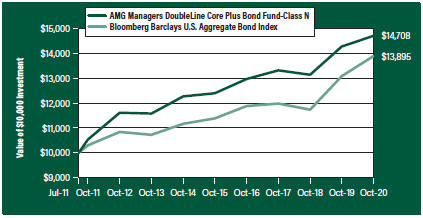

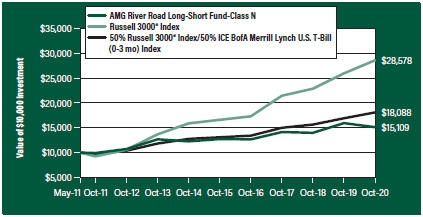

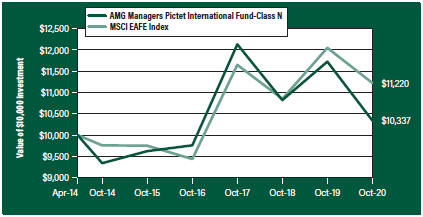

Citadel Securities LLC, dated 10/30/20, due 11/02/20, 0.150% total to be received $2,439,365 (collateralized by various U.S. Treasuries, 0.000% - 8.125%, 10/31/20 - 02/15/50, totaling $2,489,227) | $ | 2,439,335 | $2,439,335 | |||||