UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08004

AMG Funds IV

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300,

Greenwich, Connecticut 06830

(Address of principal executive offices) (Zip code)

AMG Funds LLC

600 Steamboat Road, Suite 300,

Greenwich, Connecticut 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: October 31

Date of reporting period: November 1, 2017 - October 31, 2018

(Annual Shareholder Report)

Item 1. Reports to Stockholders.

| | |

| | ANNUAL REPORT |

AMG Funds

October 31, 2018

AMG Funds

Class N, I, R & Z Shares

Equity

Fixed Income

Alternative

International

| | | | | | | | |

amgfunds.com | | | 103118 | | | | AR082 | |

AMG Funds

Annual Report — October 31, 2018

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

| | |

| | Letter to Shareholders |

Dear Shareholder:

The fiscal year ended October 31, 2018, was a period of mixed results for global financial markets. The global economic expansion supported strong investor sentiment early in the year before giving way to higher volatility amid a backdrop of tightening monetary policy and uncertainty around global trade policy. U.S. equities were resilient despite the volatility as the S&P 500® Index, a broad gauge of U.S. equity performance, returned 7.35% over the full fiscal year. The U.S. bull market continued into its 10th year having gained 390% since the market bottom on March 9, 2009.

Economic conditions outside the U.S. have been mixed. At the European Central Bank’s (ECB) most recent monetary policy meeting, the governing council confirmed that the European economy showed signs of continued, though slightly slower, growth and inflation progressing toward its target level. After nine months of strength, global economic growth began to show signs of deceleration in the third quarter of 2018. Although the Purchasing Managers Index, a leading economic indicator, remained slightly above the all-important level of 50 for the five largest global economies, only the United States increased from one year prior. Global interest rate policies remain accommodative, but the ECB has continued on its path to conclude its bond buying program at the end of 2018 and the Bank of England increased its target rate.

Nine of eleven economic sectors of the S&P 500® Index were positive during the 12-month reporting period, but there was significant dispersion in performance across sectors. Information technology, consumer discretionary, and healthcare all ended the period with positive double-digit returns of 16.70%, 15.69%, and 11.32%, respectively. Financials, industrials, and materials significantly lagged the broader benchmark with returns of 0.66%, (1.09)%, and (9.53)%, respectively. Overall, corporate earnings in the third quarter were better than expected with 78% of the companies in the S&P 500® Index beating the consensus earnings per share estimate.1 Growth stocks continued to outperform value with returns of 10.71% and 3.03% for the Russell 1000® Growth and Russell 1000® Value Indexes, respectively. International equities and emerging markets demonstrated significantly weaker returns, with the MSCI All Country World Index ex-USA and MSCI Emerging Markets Index returning (8.24)% and (12.52)%, respectively, in the 12 months ending October 31, 2018. Two rounds of new U.S. tariffs for Chinese imports and signs of a slowing economy acted as a drag on the largest economy within the MSCI Emerging Markets Index. Concurrently, the U.S. Dollar strengthened against most major global currencies, particularly in emerging markets, where those with large current account deficits faced significant pressure adding to the drag on performance for emerging markets.

Tightening U.S. Federal Reserve policy and higher interest rates eroded the performance of bonds. The Bloomberg Barclays U.S. Aggregate Bond Index, a broad measure of U.S. bond market performance, turned negative with (2.05)% return for the 12 months ending October 31, 2018. The yield on the 10-year U.S. Treasury note crossed above 3% at the end of September despite market speculation that the December rate hike may not materialize. During the past year, the short end of the yield curve has risen faster than the longer end, resulting in the 2–10 year Treasury spread falling (0.5)%. Bond investors willing to accept more credit risk were rewarded with higher returns as high yield bonds performed strongly and credit spreads tightened over most of the fiscal year. The Bloomberg Barclays U.S. Corporate High Yield Bond Index ended the period with a 0.97% return.

| 1 | Source: FactSet, Based on the 74% of S&P 500® companies which had reported third quarter earnings as of November 2, 2018. |

AMG Funds appreciates the privilege of providing investment tools to you and your clients. Our foremost goal is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. AMG Funds provides access to a distinctive array of actively managed return-oriented investment strategies. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended

October 31, 2018* | |

| | | | | 1 Year | | | 3 Years | | | 5 Years | |

Stocks: | | | | | | | | | | | | | | |

Large Caps | | (S&P 500® Index) | | | 7.35% | | | | 11.52% | | | | 11.34% | |

Small Caps | | (Russell 2000® Index) | | | 1.85% | | | | 10.68% | | | | 8.01% | |

International | | (MSCI All Country World Index ex USA) | | | (8.24 | )% | | | 4.37% | | | | 1.63% | |

Bonds: | | | | | | | | | | | | | | |

Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | (2.05 | )% | | | 1.04% | | | | 1.83% | |

High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Bond Index) | | | 0.97% | | | | 6.60% | | | | 4.68% | |

Tax-exempt | | (Bloomberg Barclays Municipal Bond Index) | | | (0.51 | )% | | | 1.90% | | | | 3.25% | |

Treasury Bills | | (BofA Merrill Lynch 6-Month U.S. Treasury Bill) | | | 1.68% | | | | 1.05% | | | | 0.70% | |

| * | Source: FactSet. Past performance is no guarantee of future results. |

2

About Your Fund’s Expenses

As a shareholder of a Fund, you may incur two types of costs: (1) transaction costs, which may include sales charges (loads) on purchase payments; redemption fees; and exchange fees; and (2) ongoing costs, including management fees; distribution (12b-1) fees; and other Fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund and to compare these costs with the ongoing costs of investing in other mutual funds. The example is based on $1,000 invested at the beginning of the period and held for the entire period as indicated below.

ACTUAL EXPENSES

The first line of the following table provides information about the actual account values and

actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

HYPOTHETICAL EXAMPLE FOR COMPARISON PURPOSES

The second line of the following table provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense ratio and an assumed annual rate of return of 5% before expenses, which is not the Fund’s

actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds by comparing this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds.

Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees, or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds.

| | | | | | | | | | | | |

Six Months Ended

October 31, 2018 | | Expense

Ratio for

the Period | | Beginning

Account

Value

05/01/18 | | | Ending

Account

Value

10/31/18 | | | Expenses

Paid

During

the Period* |

AMG Managers Fairpointe ESG Equity Fund |

Based on Actual Fund Return | | | | | | | |

Class N | | 1.10% | | $ | 1,000 | | | $ | 952 | | | $5.41 |

Class I | | 0.90% | | $ | 1,000 | | | $ | 953 | | | $4.43 |

Based on Hypothetical 5% Annual Return |

Class N | | 1.10% | | $ | 1,000 | | | $ | 1,020 | | | $5.60 |

Class I | | 0.90% | | $ | 1,000 | | | $ | 1,021 | | | $4.58 |

| | | | | | | | | | | | | | | | |

Six Months Ended

October 31, 2018 | | Expense

Ratio for

the Period | | | Beginning

Account

Value

05/01/18 | | | Ending

Account

Value

10/31/18 | | | Expenses

Paid

During

the Period* | |

AMG River Road Focused Absolute Value Fund | |

Based on Actual Fund Return | | | | | | | | | |

Class N | | | 1.00 | % | | $ | 1,000 | | | $ | 1,062 | | | $ | 5.20 | |

Class I | | | 0.75 | % | | $ | 1,000 | | | $ | 1,063 | | | $ | 3.90 | |

Class Z | | | 0.71 | % | | $ | 1,000 | | | $ | 1,063 | | | $ | 3.69 | |

Based on Hypothetical 5% Annual Return | |

Class N | | | 1.00 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.09 | |

Class I | | | 0.75 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 3.82 | |

Class Z | | | 0.71 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 3.62 | |

3

About Your Fund’s Expenses (continued)

| | | | | | | | | | | | | | | | |

Six Months Ended

October 31, 2018 | | Expense Ratio for

the Period | | | Beginning

Account

Value

05/01/18 | | | Ending

Account

Value

10/31/18 | | | Expenses

Paid

During

the Period* | |

AMG Managers Montag & Caldwell Growth Fund | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.12 | % | | $ | 1,000 | | | $ | 1,033 | | | $ | 5.74 | |

Class I | | | 0.96 | % | | $ | 1,000 | | | $ | 1,034 | | | $ | 4.92 | |

Class R | | | 1.46 | % | | $ | 1,000 | | | $ | 1,032 | | | $ | 7.48 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.12 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.70 | |

Class I | | | 0.96 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.89 | |

Class R | | | 1.46 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.43 | |

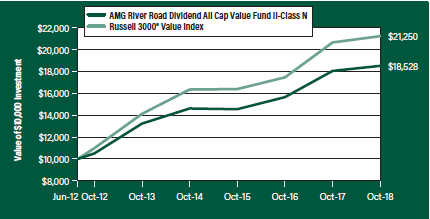

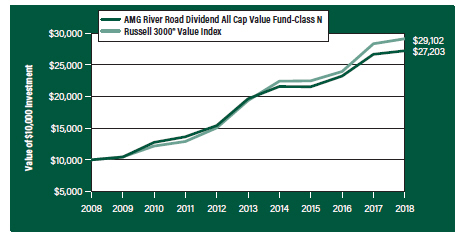

AMG River Road Dividend All Cap Value Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.11 | % | | $ | 1,000 | | | $ | 1,017 | | | $ | 5.64 | |

Class I | | | 0.83 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 4.22 | |

Class Z | | | 0.79 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 4.02 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.11 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.65 | |

Class I | | | 0.83 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.23 | |

Class Z | | | 0.79 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.02 | |

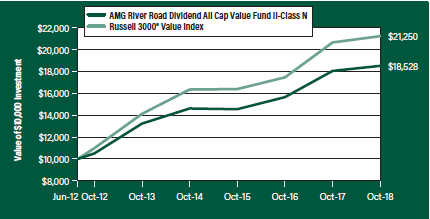

AMG River Road Dividend All Cap Value Fund II | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.22 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 6.22 | |

Class I | | | 0.93 | % | | $ | 1,000 | | | $ | 1,024 | | | $ | 4.74 | |

Class Z | | | 0.86 | % | | $ | 1,000 | | | $ | 1,023 | | | $ | 4.39 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.22 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.21 | |

Class I | | | 0.93 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.74 | |

Class Z | | | 0.86 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.38 | |

| | | | | | | | | | | | | | | | |

Six Months Ended

October 31, 2018 | | Expense Ratio for

the Period | | | Beginning

Account

Value

05/01/18 | | | Ending

Account

Value

10/31/18 | | | Expenses

Paid

During

the Period* | |

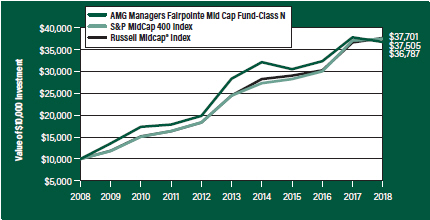

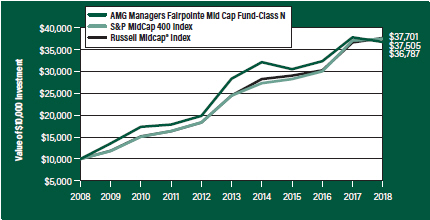

AMG Managers Fairpointe Mid Cap Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.13 | % | | $ | 1,000 | | | $ | 951 | | | $ | 5.56 | |

Class I | | | 0.88 | % | | $ | 1,000 | | | $ | 952 | | | $ | 4.33 | |

Class Z | | | 0.80 | % | | $ | 1,000 | | | $ | 953 | | | $ | 3.94 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.13 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.75 | |

Class I | | | 0.88 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.48 | |

Class Z | | | 0.80 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.08 | |

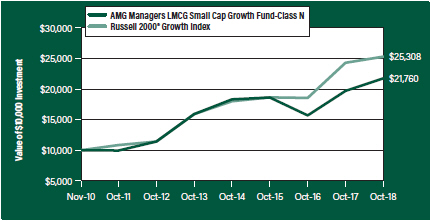

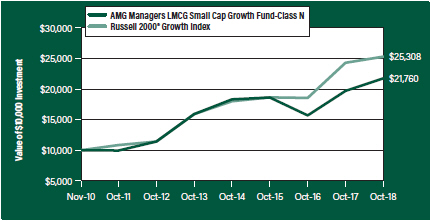

AMG Managers LMCG Small Cap Growth Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.30 | % | | $ | 1,000 | | | $ | 1,036 | | | $ | 6.67 | |

Class I | | | 1.13 | % | | $ | 1,000 | | | $ | 1,037 | | | $ | 5.80 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.30 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.61 | |

Class I | | | 1.13 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.75 | |

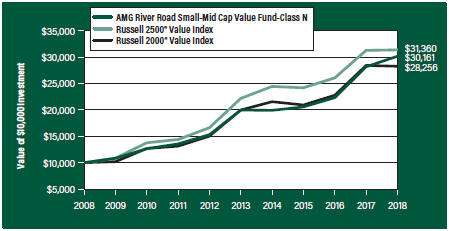

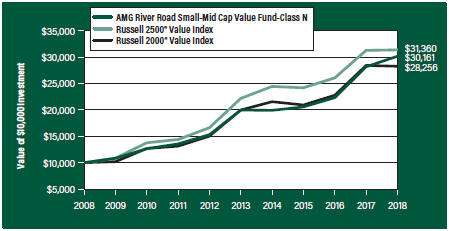

AMG River Road Small-Mid Cap Value Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.32 | % | | $ | 1,000 | | | $ | 1,033 | | | $ | 6.76 | |

Class I | | | 1.09 | % | | $ | 1,000 | | | $ | 1,035 | | | $ | 5.59 | |

Class Z | | | 1.04 | % | | $ | 1,000 | | | $ | 1,033 | | | $ | 5.33 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.32 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.72 | |

Class I | | | 1.09 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.55 | |

Class Z | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

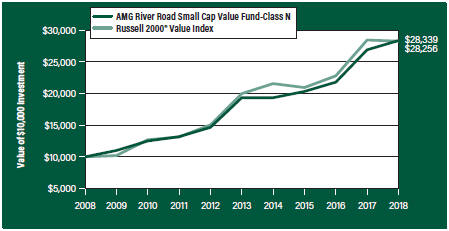

AMG River Road Small Cap Value Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.36 | % | | $ | 1,000 | | | $ | 1,012 | | | $ | 6.90 | |

Class I | | | 1.11 | % | | $ | 1,000 | | | $ | 1,013 | | | $ | 5.63 | |

Class Z | | | 1.01 | % | | $ | 1,000 | | | $ | 1,013 | | | $ | 5.12 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.36 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 6.92 | |

Class I | | | 1.11 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.65 | |

Class Z | | | 1.01 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.14 | |

4

About Your Fund’s Expenses (continued)

| | | | | | | | | | | | | | | | |

| | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Account | | | Account | | | Paid | |

| Six Months Ended | | Ratio for | | | Value | | | Value | | | During | |

| October 31, 2018 | | the Period | | | 05/01/18 | | | 10/31/18 | | | the Period* | |

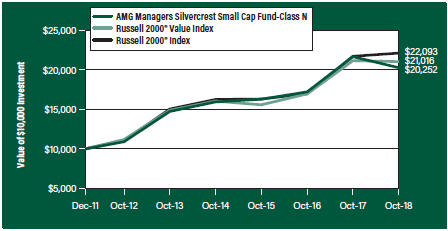

AMG Managers Silvercrest Small Cap Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.38 | % | | $ | 1,000 | | | $ | 969 | | | $ | 6.85 | |

Class I | | | 1.15 | % | | $ | 1,000 | | | $ | 970 | | | $ | 5.71 | |

Class Z | | | 1.08 | % | | $ | 1,000 | | | $ | 970 | | | $ | 5.36 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.38 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.02 | |

Class I | | | 1.15 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.85 | |

Class Z | | | 1.08 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.50 | |

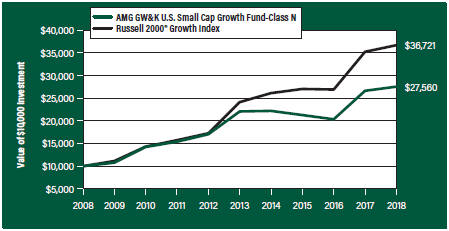

AMG GW&K U.S. Small Cap Growth Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.20 | % | | $ | 1,000 | | | $ | 993 | | | $ | 6.03 | |

Class I | | | 1.00 | % | | $ | 1,000 | | | $ | 996 | | | $ | 5.03 | |

Class Z | | | 0.90 | % | | $ | 1,000 | | | $ | 996 | | | $ | 4.53 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.20 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.11 | |

Class I | | | 1.00 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.09 | |

Class Z | | | 0.90 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.58 | |

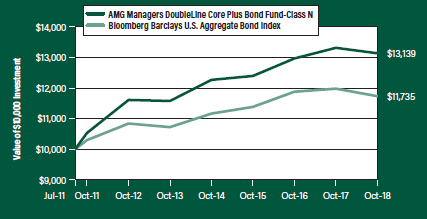

AMG Managers DoubleLine Core Plus Bond Fund | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 0.94 | % | | $ | 1,000 | | | $ | 1,000 | | | $ | 4.74 | |

Class I | | | 0.69 | % | | $ | 1,000 | | | $ | 1,002 | | | $ | 3.48 | |

Class Z | | | 0.61 | % | | $ | 1,000 | | | $ | 1,003 | | | $ | 3.08 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 0.94 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 4.79 | |

Class I | | | 0.69 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 3.52 | |

Class Z | | | 0.61 | % | | $ | 1,000 | | | $ | 1,022 | | | $ | 3.11 | |

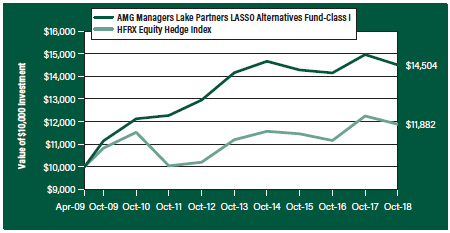

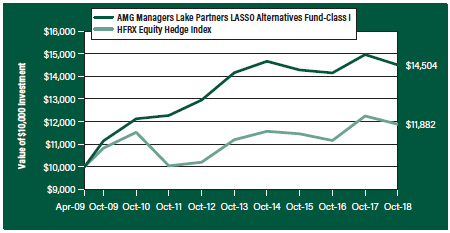

AMG Managers Lake Partners LASSO Alternatives Fund | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.40 | % | | $ | 1,000 | | | $ | 971 | | | $ | 6.96 | |

Class I | | | 1.15 | % | | $ | 1,000 | | | $ | 972 | | | $ | 5.72 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.40 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.12 | |

Class I | | | 1.15 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.85 | |

| | | | | | | | | | | | | | | | |

| | | | | | Beginning | | | Ending | | | Expenses | |

| | | Expense | | | Account | | | Account | | | Paid | |

| Six Months Ended | | Ratio for | | | Value | | | Value | | | During | |

| October 31, 2018 | | the Period | | | 05/01/18 | | | 10/31/18 | | | the Period* | |

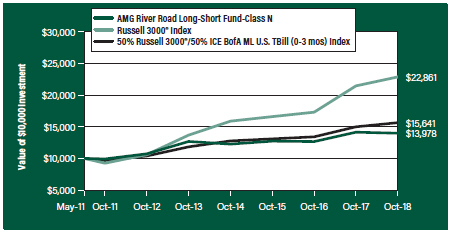

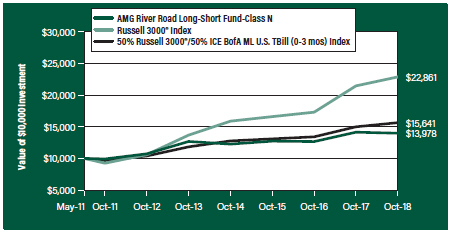

AMG River Road Long-Short Fund** | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.45 | % | | $ | 1,000 | | | $ | 992 | | | $ | 7.28 | |

Class I | | | 1.20 | % | | $ | 1,000 | | | $ | 993 | | | $ | 6.03 | |

Class Z | | | 1.12 | % | | $ | 1,000 | | | $ | 993 | | | $ | 5.63 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.45 | % | | $ | 1,000 | | | $ | 1,018 | | | $ | 7.37 | |

Class I | | | 1.20 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.11 | |

Class Z | | | 1.12 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.70 | |

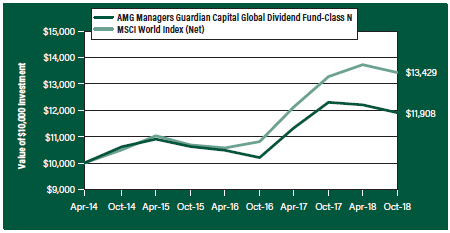

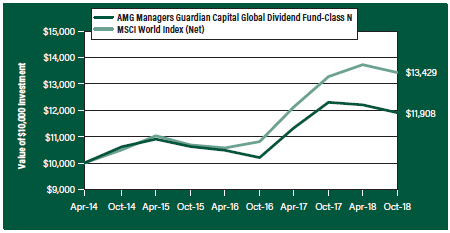

AMG Managers Guardian Capital Global Dividend Fund | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.10 | % | | $ | 1,000 | | | $ | 976 | | | $ | 5.48 | |

Class I | | | 1.05 | % | | $ | 1,000 | | | $ | 976 | | | $ | 5.23 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.10 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.60 | |

Class I | | | 1.05 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.35 | |

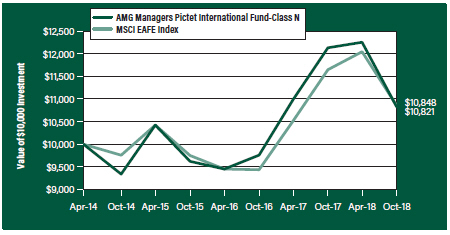

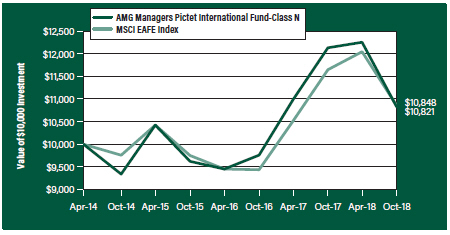

AMG Managers Pictet International Fund | | | | | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.30 | % | | $ | 1,000 | | | $ | 883 | | | $ | 6.17 | |

Class I | | | 1.04 | % | | $ | 1,000 | | | $ | 883 | | | $ | 4.94 | |

Class Z | | | 0.93 | % | | $ | 1,000 | | | $ | 884 | | | $ | 4.42 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.30 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 6.61 | |

Class I | | | 1.04 | % | | $ | 1,000 | | | $ | 1,020 | | | $ | 5.30 | |

Class Z | | | 0.93 | % | | $ | 1,000 | | | $ | 1,021 | | | $ | 4.74 | |

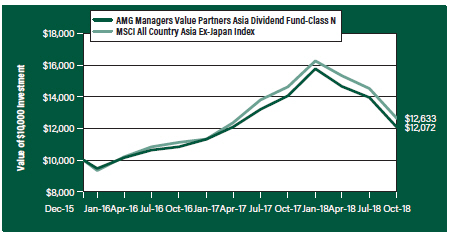

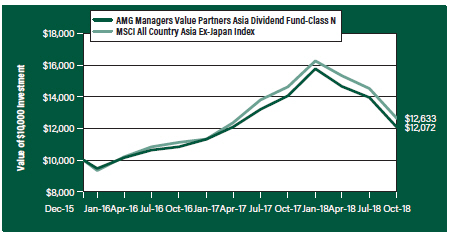

AMG Managers Value Partners Asia Dividend Fund | | | | | |

Based on Actual Fund Return | | | | | | | | | | | | | |

Class N | | | 1.17 | % | | $ | 1,000 | | | $ | 824 | | | $ | 5.38 | |

Class I | | | 1.15 | % | | $ | 1,000 | | | $ | 824 | | | $ | 5.29 | |

Based on Hypothetical 5% Annual Return | | | | | | | | | |

Class N | | | 1.17 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.96 | |

Class I | | | 1.15 | % | | $ | 1,000 | | | $ | 1,019 | | | $ | 5.85 | |

| * | Expenses are equal to the Fund’s annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent fiscal half-year (184), then divided by 365. |

| ** | Excludes interest expense and dividends on short positions. If included, your annualized expense ratios would be 2.88%, 2.63% and 2.55% for Class N, Class I and Class Z, respectively, and your actual and hypothetical expenses paid during the period would be $14.46, $13.21 and $12.81, and $14.60, $13.34 and 12.93 for Class N, Class I and Class Z, respectively. |

5

AMG Managers Fairpointe ESG Equity Fund

Portfolio Manager’s Comments (unaudited)

OVERVIEW

The AMG Managers Fairpointe ESG Equity Fund (the “Fund”) Class N shares returned (2.73)% for the fiscal year ended October 31, 2018, underperforming the Russell 1000® Index, which returned 6.98%. The Fund’s strategy is characterized by a long-term view, a portfolio of high-conviction investments, a focus on purchasing securities at a significant discount to fair value, and a willingness to hold (and add to) positions through volatile markets.

As of September, Fairpointe Capital LLC is proud to be a signatory of the Principles for Responsible Investment (PRI). By signing this agreement, we formally acknowledge our commitment to incorporating ESG factors into our investment analysis and decision-making process. This commitment is an extension of our long-established active ownership and engagement with our portfolio companies.

The United Nations climate report published in October highlights the impending risks of increased greenhouse gases and temperatures around the world. The concern is very real, and we are already seeing the impact globally and in the U.S. with greater destruction from hurricanes, wild fires, and floods. These changes have already exacted significant costs and over time will lead to food shortages, health issues, and changes in migration patterns. A small set of fossil fuel producers are responsible for 71%1 of global emissions. None of these companies are held, and the Fund has a very low carbon footprint as measured by MSCI ESG Research LLC.

In terms of governance, there is an increasing emphasis on the diversity of corporate boards. As an example, in October California enacted a law requiring publicly traded companies that are headquartered in the state to have at least one woman on their boards by the end of 2019 (with higher numbers required over time). We believe goal setting will help encourage accountability by pushing companies to measure and report their progress. Research indicates that board diversity is highly correlated with improved shareholder value and company performance. Diversity on key committees, such as nominating and compensation, also contributes to improved governance. Of course, we scrutinize all board members for their qualifications. Of our 42 current holdings, all have at least one female director, and ten have surpassed the 30% target espoused by The Thirty Percent Coalition (founded in 2011 as a pioneer advocacy organization working for diversity in the corporate boardroom).

As portfolio managers of an ESG Fund, our objective is to find companies that have strong ESG characteristics and that will outperform the market over the long term. We work actively with management teams in order to assess their awareness of environmental, social, and corporate governance issues. For over ten years we have served as active shareholders who use proxy voting processes, as well as regular engagement with management, to support positive changes. Corporate diversity (both at the board level and management) is a key focus, along with our attention to environmental impact policies and demonstrated commitment to employee welfare.

FISCAL YEAR REVIEW

Market volatility continued in the fiscal year, as concerns about trade wars and the global economic outlook persisted. Overall, however, U.S. equities had a strong year, driven by robust earnings reports, tax cuts, and share buybacks. For the year, the Fund returned (2.73)%, lagging the Russell 1000® Index up 6.98%.

Our largest contributors were Hormel Foods Corporation (HRL), Akamai Technologies, Inc. (AKAM), Scholastic Corporation (SCHL), Cisco Systems, Inc. (CSCO), and Tractor Supply Company (TSCO).

Hormel produces meat and other food products, including brands Skippy, SPAM, Applegate, Justin’s nut butters, Wholly Guacamole, and Jennie-O turkeys. Despite headwinds in the markets for pork and turkey, Hormel has recorded increased earnings per share in 2018. For the fiscal year ending in October 2018 earnings per share are expected to be up more than 16% from fiscal 2017. The company is committed to increasing revenues and earnings through organic growth and acquisitions while maintaining a strong balance sheet. The stock moved up during the year as the company executed this plan. We believe corporate governance has improved dramatically with board changes, adoption of majority voting, and proxy access. The community and employee marks are high. Furthermore, the company has diversified its product line to include healthier food items.

Akamai Technologies has a network of internet servers located worldwide to provide content delivery and cloud infrastructure services to its customers. After an activist acquired the stock and the company conducted an internal strategic review resulting in a 5% headcount reduction, profitability improved throughout 2018. Although the legacy content delivery business has experienced a

slowdown in revenue growth as some of the company’s largest customers have developed internal delivery networks, revenue from other clients continues to grow. Cloud security products have shown strong growth and now account for more than 20% of overall revenues. We rate Akamai highly on all three pillars of ESG with its strong corporate governance plus its usage of energy offsets with wind investments.

Scholastic performed well due to strong children’s books and education revenue gains in the quarter. A new series Dog Man has been on the New York Times Best Seller list. They have a strong franchise that generates stable recurring revenues. The company has a robust sustainable paper sourcing policy and has been proactive in addressing environmental concerns around deforestation. We believe management takes a long-term view and has very high stock ownership, which aligns interests with shareholders, although voting power is controlled by the Robinson family.

Detractors for the fiscal year were McDermott International, Inc. (MDR), General Electric Company (GE), Patterson Companies, Inc. (PDCO), International Business Machines Corporation (IBM), and Lions Gate Entertainment Corporation (LGF.B).

McDermott, an oil services provider, has declined due to persistent cost overruns on three large construction projects inherited as part of its acquisition of Chicago Bridge & Iron. The additional expenses have put pressure on McDermott’s balance sheet and delayed the paying down of debt related to the acquisition. It is our view that McDermott’s strong management team has taken the necessary steps to ensure the long-term successful integration of Chicago Bridge & Iron. We believe the combination creates a powerful, worldwide competitor with industry-leading onshore-offshore integration capabilities. McDermott scores well in our book for governance, employee treatment, and environmental impact. However, they are at risk for exposure to corruption in foreign operations due to their geographic footprint. The fund exited its position in McDermott during the period.

Our second greatest detractor for the period was General Electric. After disappointing results in the company’s power segment, a new CEO was named, Larry Culp, formerly a star performer at Danaher. We like the fact that his compensation is heavily weighted to stock appreciation. The other two core divisions of aviation and healthcare are performing

6

AMG Managers Fairpointe ESG Equity Fund

Portfolio Manager’s Comments (continued)

in line with expectations and are producing sustainable energy systems like digital wind farms, oxide fuel cells, and new locomotive engines with significantly reduced emissions. The ongoing restructuring does raise the potential for employee satisfaction.

Patterson Companies is the second largest dental products distributor and the largest animal health distributor in the U.S. Revenue has been pressured by a recent IT system implementation, which caused the sales force to divert efforts to customer service. The new CEO is conducting a strategic review of the company and has hired additional sales representatives. We believe he has a good grasp of

the issues and has a plan to improve the lagging dental results. Patterson has a top score from us for its product safety and quality, strong corporate governance with good diversity on the board.

POSITIONING AND OUTLOOK- ATTRACTIVE FUNDAMENTALS

The valuation of the Fund continues to have a significant discount to that of the market—with a P/E of 13.6x 2019 projected earnings, compared to 15.1x for the Russell 1000® Index2.

Our stock purchases and sales remain guided by a fundamental bottom-up approach with a careful eye on valuation and long-term perspective. We

integrate this fundamental investment analysis with our ESG evaluation with a focus on the carbon footprint and diversity within the company and board. We continue to believe that companies that behave responsibly with attractive valuations and sustained earnings will be recognized by the market over time.

The views expressed represent the opinions of Fairpointe Capital LLC, as of October 31, 2018, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

7

AMG Managers Fairpointe ESG Equity Fund

Portfolio Manager’s Comments (continued)

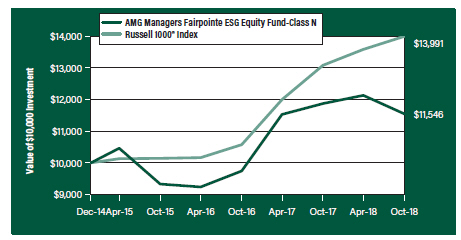

CUMULATIVE TOTAL RETURN PERFORMANCE

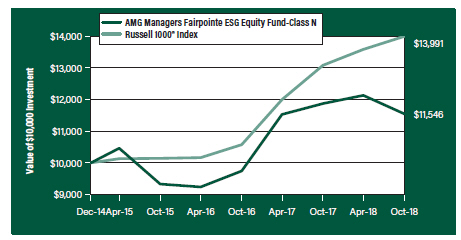

AMG Managers Fairpointe ESG Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Managers Fairpointe ESG Equity Fund’s Class N shares on December 24, 2014, to a $10,000 investment made in the Russell 1000® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses.

Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Managers Fairpointe ESG Equity Fund, the Russell 1000® Index for the same time periods ended October 31, 2018.

| | | | | | | | | | | | |

| | | One | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Inception | | | Date | |

AMG Managers Fairpointe ESG Equity

Fund2, 3, 4, 5, 6, 7, 8 | | | | | | | | | | | | |

Class N | | | (2.73 | %) | | | 3.80 | % | | | 12/24/14 | |

Class I | | | (2.54 | %) | | | 4.02 | % | | | 12/24/14 | |

Russell 1000® Index9 | | | 6.98 | % | | | 9.10 | % | | | 12/24/14 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.835.3879 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2018. All returns are in U.S. dollars ($). |

| 2 | Applying the Fund’s ESG investment criteria may result in the selection or exclusion of securities of certain issuers for reasons other than performance, and the Fund may underperform funds that do not utilize an ESG investment strategy. The application of this strategy may affect the Fund’s exposure to certain companies, sectors, regions, countries or types of investments, which could negatively impact the Fund’s performance depending on whether such investments are in or out of favor. Applying ESG criteria to investment decisions is qualitative and subjective by nature, and there is no guarantee that the criteria utilized by the Subadviser or any judgment exercised by the Subadviser will reflect the beliefs or values of any particular investor. |

| 3 | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| 4 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 5 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, and lower trading volume, less liquidity than the stocks of larger, more established companies. Growth stocks may underperform value stocks during given periods. |

| 6 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| 7 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. |

| 8 | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| 9 | The Russell 1000® Index measures the performance of approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000® represents approximately 92% of the U.S. market. Unlike the Fund, the Russell 1000® Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell Indices are a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value.

8

|

AMG Managers Fairpointe ESG Equity Fund Fund Snapshots (unaudited) October 31, 2018 |

PORTFOLIO BREAKDOWN

| | | | |

| | | % of | |

Sector | | Net Assets | |

Information Technology | | | 24.0 | |

Consumer Discretionary | | | 23.7 | |

Industrials | | | 14.8 | |

Consumer Staples | | | 14.5 | |

Health Care | | | 13.5 | |

Financials | | | 3.4 | |

Short-Term Investments | | | 2.5 | |

Other Assets Less Liabilities | | | 3.6 | |

TOP TEN HOLDINGS

| | | | |

| | | % of | |

Security Name | | Net Assets | |

Meredith Corp. | | | 4.2 | |

Juniper Networks, Inc. | | | 4.1 | |

Scholastic Corp. | | | 4.0 | |

Hormel Foods Corp. | | | 3.9 | |

TEGNA, Inc. | | | 3.9 | |

International Business Machines Corp. | | | 3.5 | |

Mattel, Inc. | | | 3.3 | |

Wabtec Corp. | | | 3.3 | |

Molson Coors Brewing Co., Class B | | | 3.1 | |

QUALCOMM, Inc. | | | 3.1 | |

| | | | |

Top Ten as a Group | | | 36.4 | |

| | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

9

AMG Managers Fairpointe ESG Equity Fund

Schedule of Portfolio Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 93.9% | | | | | | | | |

Consumer Discretionary - 23.7% | | | | | | | | |

Lions Gate Entertainment Corp., Class B | | | 16,100 | | | $ | 286,419 | |

Magna International, Inc. (Canada) | | | 4,600 | | | | 226,504 | |

Mattel, Inc.* | | | 26,700 | | | | 362,586 | |

Meredith Corp. | | | 8,850 | | | | 456,306 | |

The New York Times Co., Class A | | | 7,900 | | | | 208,560 | |

Scholastic Corp. | | | 9,900 | | | | 429,462 | |

TEGNA, Inc. | | | 37,000 | | | | 426,980 | |

Tractor Supply Co. | | | 1,800 | | | | 165,402 | |

Total Consumer Discretionary | | | | | | | 2,562,219 | |

Consumer Staples - 14.5% | | | | | | | | |

Bunge, Ltd. | | | 4,300 | | | | 265,740 | |

Dean Foods Co. | | | 38,300 | | | | 306,017 | |

Hormel Foods Corp. | | | 9,800 | | | | 427,672 | |

Molson Coors Brewing Co., Class B | | | 5,200 | | | | 332,800 | |

Unilever PLC, Sponsored ADR (United Kingdom) | | | 4,500 | | | | 238,410 | |

Total Consumer Staples | | | | | | | 1,570,639 | |

Financials - 3.4% | | | | | | | | |

The Bank of New York Mellon Corp. | | | 2,200 | | | | 104,126 | |

Northern Trust Corp. | | | 2,800 | | | | 263,396 | |

Total Financials | | | | | | | 367,522 | |

Health Care - 13.5% | | | | | | | | |

Bristol-Myers Squibb Co. | | | 5,990 | | | | 302,735 | |

Hologic, Inc.* | | | 3,900 | | | | 152,061 | |

Patterson Cos., Inc. | | | 5,900 | | | | 133,222 | |

Quest Diagnostics, Inc. | | | 2,500 | | | | 235,275 | |

Smith & Nephew PLC, ADR (United Kingdom) | | | 7,200 | | | | 236,736 | |

Varex Imaging Corp.* | | | 6,200 | | | | 160,952 | |

Varian Medical Systems, Inc.* | | | 2,000 | | | | 238,740 | |

Total Health Care | | | | | | | 1,459,721 | |

Industrials - 14.8% | | | | | | | | |

AGCO Corp. | | | 2,900 | | | | 162,516 | |

General Electric Co. | | | 29,800 | | | | 300,980 | |

| * | Non-income producing security. |

| 1 | Yield shown represents the October 31, 2018, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| | | | | | | | |

| | | Shares | | | Value | |

Kennametal, Inc. | | | 2,100 | | | $ | 74,445 | |

ManpowerGroup, Inc. | | | 3,200 | | | | 244,128 | |

Owens Corning | | | 5,700 | | | | 269,439 | |

Quanta Services, Inc.* | | | 5,900 | | | | 184,080 | |

Wabtec Corp. | | | 4,400 | | | | 360,888 | |

Total Industrials | | | | | | | 1,596,476 | |

Information Technology - 24.0% | | | | | | | | |

Akamai Technologies, Inc.* | | | 3,800 | | | | 274,550 | |

Cars.com, Inc.* | | | 4,900 | | | | 127,939 | |

Cisco Systems, Inc. | | | 3,200 | | | | 146,400 | |

Cree, Inc.* | | | 6,800 | | | | 263,976 | |

Hewlett Packard Enterprise Co. | | | 9,200 | | | | 140,300 | |

HP, Inc. | | | 6,700 | | | | 161,738 | |

International Business Machines Corp. | | | 3,250 | | | | 375,147 | |

Juniper Networks, Inc. | | | 15,000 | | | | 439,050 | |

QUALCOMM, Inc. | | | 5,290 | | | | 332,688 | |

Teradata Corp.* | | | 6,200 | | | | 225,680 | |

VMware, Inc., Class A* | | | 800 | | | | 113,112 | |

Total Information Technology | | | | | | | 2,600,580 | |

Total Common Stocks

(Cost $9,396,382) | | | | | | | 10,157,157 | |

Short-Term Investments - 2.5% | | | | | | | | |

Other Investment Companies - 2.5% | | | | | | | | |

Dreyfus Government Cash Management Fund, Institutional Class Shares, 2.05%1 | | | 89,290 | | | | 89,290 | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Class Shares, 2.12%1 | | | 89,290 | | | | 89,290 | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 2.09%1 | | | 91,995 | | | | 91,995 | |

Total Short-Term Investments

(Cost $270,575) | | | | | | | 270,575 | |

Total Investments - 96.4%

(Cost $9,666,957) | | | | | | | 10,427,732 | |

Other Assets, less Liabilities - 3.6% | | | | | | | 394,112 | |

Net Assets - 100.0% | | | | | | $ | 10,821,844 | |

| ADR | American Depositary Receipt |

The accompanying notes are an integral part of these financial statements.

10

| | |

| AMG Managers Fairpointe ESG Equity Fund | | |

| Schedule of Portfolio Investments (continued) | | |

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2018:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 10,157,157 | | | | — | | | | — | | | $ | 10,157,157 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Other Investment Companies | | | 270,575 | | | | — | | | | — | | | | 270,575 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 10,427,732 | | | | — | | | | — | | | $ | 10,427,732 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

As of October 31, 2018, the Fund had no transfers between levels from the beginning of the reporting period.

The accompanying notes are an integral part of these financial statements.

11

AMG River Road Focused Absolute Value Fund

Portfolio Manager’s Comments (unaudited)

OVERVIEW

For the fiscal year ended October 31, 2018, the AMG River Road Focused Absolute Value Fund (the “Fund”) Class N shares returned 8.69%, outperforming the 2.78% return for the Russell 3000® Value Index.

PERFORMANCE REVIEW

The sector with the largest positive contribution to relative return was consumer discretionary, driven by strong stock selection and an overweight allocation. Stock selection within information technology and energy also benefited relative return. This was partially offset by negative stock selection and an overweight allocation in consumer staples. From a market cap perspective, the Fund’s mid cap holdings significantly outperformed, returning +10.84% versus +0.66% for the index. Stock selection was positive across market capitalizations.

The top contributing holdings in the Fund were Advance Auto Parts Inc. (AAP) and Premier Inc. (Cl A) (PINC). Advance Auto is a retailer of aftermarket replacement parts, accessories, batteries, and maintenance items. AAP was initially purchased when many automotive parts industry stocks were out of favor following two consecutive mild winters and renewed fears of Amazon entering the space. AAP was punished further in August 2017 when the company reported poor Q2 2017 earnings results, causing investors to lose patience with its multi-year turnaround effort. Shares continued to decline after the initial purchase in September 2017, until management began showing signs of progress on its inventory management, sales team realignment, and supply chain initiatives. Shares rebounded on these fundamental improvements, then surged higher as AAP and its industry peers posted strong same-store sales numbers following a harsh winter and a return to more normal consumer demand levels. The Fund exited the position in late August 2018 at 100% of the River Road’s assessed value.

Premier is a healthcare group purchasing organization (GPO) and data analytics provider. In mid-April, reports surfaced that Amazon was abandoning its bid to win business from large health systems and instead was focusing on small physician practices, dental offices, and ambulatory surgery centers. This decision suggested GPOs such as PINC offer as much or more value than Amazon can provide, and switching costs are high. For example, if a large health system decided to leave its GPO, it would be faced with the prospect of potentially unwinding thousands of contracts

managed by the GPO. In August, the company reported strong revenue and EBITDA growth, and provided fiscal 2019 guidance above River Road estimates. Administrative fees grew at a mid-single digit pace, and EBITDA margin expanded +130 bps with an improvement of +370 bps within the Performance Services segment, the result of aggressive cost cuts as well as a larger contribution from performance-based contracts, which are high margin. We trimmed the position as shares approached our assessed value.

The bottom contributing holdings in the Fund were Nielsen Holdings PLC (NLSN) and GCI Liberty Inc. (GLIBA). Nielsen is a provider of critical independent third-party media & marketing measurement and analytics about what consumers buy (Buy segment) and what consumers read, watch, and listen to across TV, radio, digital, and mobile platforms (Watch segment). NLSN was purchased in the Fund in January 2018, well into a period of stock price weakness caused by several quarters of poor results from the company’s U.S. Buy business as large fast moving consumer goods (FMCG) companies cut costs amid challenging market conditions. Our investment thesis for Nielsen was based on the eventual stabilization of the U.S. Buy business through product innovation and FMCG companies’ need to return to more robust advertising spending to compete with rapidly growing smaller rivals. Such a stabilization would then turn investor focus to the larger, higher margin Watch business, which was continuing to generate strong organic revenue growth. While quarterly results released in February and April revealed that mixed business trends persisted—weak domestic Buy results, strong Watch results—shares plunged 25% on the release of Q2 results in July. Not only did weaknesses in the U.S. Buy business persist, but the stronger emerging markets Buy business also showed surprising weakness as multinational FMCG companies reduced spending on tertiary products in non-core growth markets. Furthermore, new European privacy laws contributed to a surprise decline in growth for the crown-jewel Watch business. On the day of the Q2 release, CEO Mitch Barns announced he would retire at year end and the company would review strategic alternatives for the Buy business. The stock partially rebounded in August when Elliott Management disclosed an 8.4% stake in a 13D filing, which included language urging management to sell part or all of the company. In September, NLSN announced it expanded its review of strategic alternatives to include the sale of the entire company, not just the Buy business. The Fund

maintained the position, believing the exploration of selling the Buy business would allow the stock to better reflect the Watch business value, which we assessed as worth well above NLSN’s stock price.

GCI Liberty Inc. (GLIBA) owns a 6.8% economic interest in Charter Communications (CHTR) and is the largest cable provider and the second-largest wireless provider in Alaska. In March 2018, GLIBA was formed through the merger of Liberty Interactive Corp. (LVNTA) and General Communications (GCI). The merger simplified LVNTA’s corporate structure as it was no longer a tracking stock, and longer term, we believed the new GLIBA could be a logical acquisition target for Charter. Two primary factors drove the poor performance for Charter, and thus GLIBA, over the last 12 months. First was the company’s declining video subscribers as Charter’s integration of Time Warner Cable created some business disruption, including elevated churn. Second was the potential threat to Charter’s high margin internet service from the coming deployment of 5G service by wireless carriers. However, we believe Charter’s internet service is superior to its competitors, which will allow it to continue growing its base of high margin internet service subscribers. Additionally, through the company’s Mobile Virtual Network Operator (MVNO) agreement with Verizon, we believe Charter will be able to provide competitive wireless service further improving customer retention. We continued to own the position as of October 31, 2018.

POSITIONING AND OUTLOOK

The Fund invests in companies we believe represent the most attractive combination of risk (conviction) and reward (discount) available across the River Road universe of portfolio holdings. As of October 31, 2018, more than 55% of the Fund’s holdings were concentrated in the highest conviction stocks in the River Road universe and were trading at compelling discounts to assessed values.

We believe this positions the Fund attractively relative to the benchmark from the perspective of valuation, quality, and long-term earnings growth. Further, if returns do moderate in the coming year, we expect the Fund’s holdings and low volatility approach to be well positioned.

The views expressed represent the opinions of River Road Asset Management LLC , as of October 31, 2018, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

12

AMG River Road Focused Absolute Value Fund

Portfolio Manager’s Comments (continued)

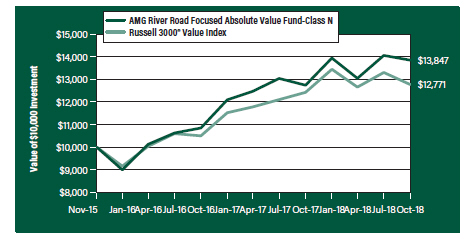

CUMULATIVE TOTAL RETURN PERFORMANCE

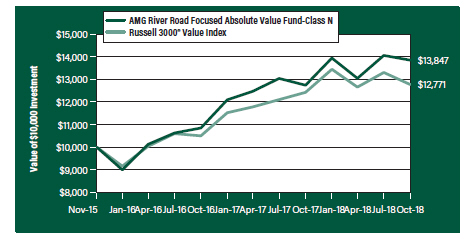

AMG River Road Focused Absolute Value Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG River Road Focused Absolute Value Fund’s Class N shares on November 3, 2015, to a $10,000 investment made in the Russell 3000® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG River Road Focused Absolute Value Fund, the Russell 3000® Value Index for the same time periods ended October 31, 2018.

| | | | | | | | | | | | |

| | | One | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Inception | | | Date | |

AMG River Road Focused Absolute Value

Fund2, 3, 4, 5, 6, 7, 8, 9 | | | | | | | | | | | | |

Class N | | | 8.69 | % | | | 11.47 | % | | | 11/03/15 | |

Class I | | | 8.91 | % | | | 11.74 | % | | | 11/03/15 | |

Class Z | | | 8.96 | % | | | 6.08 | % | | | 09/29/17 | |

Russell 3000® Value Index10 | | | 2.78 | % | | | 8.51 | % | | | 11/03/15 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.835.3879 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and |

| | capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2018. All returns are in U.S. dollars ($). |

| 2 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| 3 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. Growth stocks may underperform value stocks during given periods. |

| 4 | Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. |

| 5 | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| 6 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 7 | The Fund is subject to the risks associated with investments in emerging markets, such as erratic earnings patterns, economic and political instability, changing exchange controls, limitations on repatriation of foreign capital and changes in local governmental attitudes toward private investment, possibly leading to nationalization or confiscation of investor assets. |

| 8 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. |

| 9 | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| 10 | The Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity universe. It includes those Russell 3000® companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 3000® Value Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell Indices are a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value.

13

| | |

| AMG River Road Focused Absolute Value Fund | | |

Fund Snapshots (unaudited) October 31, 2018 | | |

PORTFOLIO BREAKDOWN

| | | | |

| | | % of | |

| Sector | | Net Assets | |

Consumer Discretionary | | | 35.1 | |

Financials | | | 26.5 | |

Information Technology | | | 12.8 | |

Health Care | | | 8.7 | |

Consumer Staples | | | 7.3 | |

Energy | | | 4.4 | |

Real Estate | | | 2.1 | |

Industrials | | | 1.8 | |

Short-Term Investments1 | | | 1.3 | |

Other Assets Less Liabilities2, 3 | | | 0.0 | |

| 1 | Includes reinvestment of cash collateral into joint repurchase agreements on security lending transactions. |

| 3 | Includes repayment of cash collateral on security lending transactions. |

TOP TEN HOLDINGS

| | | | |

| | | % of | |

Security Name | | Net Assets | |

Berkshire Hathaway, Inc., Class B | | | 7.0 | |

Comcast Corp., Class A | | | 5.0 | |

Sabre Corp. | | | 4.6 | |

Brookfield Asset Management, Inc., Class A (Canada) | | | 4.6 | |

GCI Liberty Inc., Class A | | | 4.6 | |

Discovery, Inc., Class C | | | 4.5 | |

World Fuel Services Corp. | | | 4.4 | |

Starbucks Corp. | | | 3.9 | |

Hostess Brands, Inc. | | | 3.7 | |

The Kraft Heinz Co. | | | 3.6 | |

| | | | |

Top Ten as a Group | | | 45.9 | |

| | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

14

AMG River Road Focused Absolute Value Fund

Schedule of Portfolio Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 98.7% | | | | | | | | |

Consumer Discretionary - 35.1% | | | | | | | | |

Comcast Corp., Class A | | | 39,860 | | | $ | 1,520,260 | |

Discovery, Inc., Class C* | | | 46,529 | | | | 1,363,765 | |

Expedia, Inc. | | | 5,019 | | | | 629,533 | |

GCI Liberty Inc., Class A*,1 | | | 29,215 | | | | 1,382,746 | |

General Motors Co. | | | 24,110 | | | | 882,185 | |

Liberty Broadband Corp., Class C* | | | 12,380 | | | | 1,026,673 | |

Liberty Latin America, Ltd., Class C* | | | 49,927 | | | | 899,185 | |

Liberty Media Corp.-Liberty SiriusXM, Class C* | | | 20,036 | | | | 826,886 | |

LKQ Corp.* | | | 32,986 | | | | 899,528 | |

Starbucks Corp. | | | 19,965 | | | | 1,163,361 | |

Total Consumer Discretionary | | | | | | | 10,594,122 | |

Consumer Staples - 7.3% | | | | | | | | |

Hostess Brands, Inc.*,1 | | | 106,255 | | | | 1,105,052 | |

The Kraft Heinz Co. | | | 20,064 | | | | 1,102,918 | |

Total Consumer Staples | | | | | | | 2,207,970 | |

Energy - 4.4% | | | | | | | | |

World Fuel Services Corp. | | | 41,115 | | | | 1,315,680 | |

Financials - 26.5% | | | | | | | | |

Axis Capital Holdings, Ltd. (Bermuda) | | | 19,260 | | | | 1,074,515 | |

Berkshire Hathaway, Inc., Class B* | | | 10,363 | | | | 2,127,317 | |

Brookfield Asset Management, Inc., Class A (Canada) | | | 33,966 | | | | 1,384,114 | |

FGL Holdings (Bermuda)* | | | 90,590 | | | | 715,661 | |

Oaktree Capital Group LLC, (MLP) 1 | | | 20,289 | | | | 848,689 | |

U.S. Bancorp | | | 19,077 | | | | 997,155 | |

Wells Fargo & Co. | | | 16,172 | | | | 860,836 | |

Total Financials | | | | | | | 8,008,287 | |

Health Care - 8.7% | | | | | | | | |

Allergan PLC | | | 5,809 | | | | 917,880 | |

McKesson Corp. | | | 8,305 | | | | 1,036,132 | |

Premier, Inc., Class A* | | | 14,681 | | | | 660,645 | |

Total Health Care | | | | | | | 2,614,657 | |

| | | | | | | | |

| | | Shares | | | Value | |

Industrials - 1.8% | | | | | | | | |

Nielsen Holdings PLC | | | 20,473 | | | $ | 531,888 | |

Information Technology - 12.8% | | | | | | | | |

Avaya Holdings Corp.* | | | 45,020 | | | | 739,228 | |

CDK Global, Inc. | | | 11,371 | | | | 650,876 | |

Sabre Corp. | | | 56,695 | | | | 1,397,532 | |

Tech Data Corp.* | | | 15,425 | | | | 1,089,931 | |

Total Information Technology | | | | | | | 3,877,567 | |

Real Estate - 2.1% | | | | | | | | |

Iron Mountain, Inc., REIT | | | 20,515 | | | | 627,964 | |

Total Common Stocks

(Cost $28,668,218) | | | | | | | 29,778,135 | |

| | |

| | | Principal | | | | |

| | | Amount | | | | |

Short-Term Investments - 1.3% | | | | | | | | |

Joint Repurchase Agreements - 0.6%2 | | | | | | | | |

Citibank N.A., dated 10/31/18, due 11/01/18, 2.200% total to be received $185,230 (collateralized by various U.S. Treasuries, 0.000% - 8.750%, 03/07/19 - 09/09/49, totaling $188,923) | | $ | 185,219 | | | | 185,219 | |

| | |

| | | Shares | | | | |

Other Investment Companies - 0.7% | | | | | | | | |

Dreyfus Government Cash Management Fund, Institutional Class Shares, 2.05%3 | | | 67,971 | | | | 67,971 | |

Dreyfus Institutional Preferred Government Money Market Fund, Institutional Class Shares, 2.12%3 | | | 67,971 | | | | 67,971 | |

JPMorgan U.S. Government Money Market Fund, IM Shares, 2.09%3 | | | 70,031 | | | | 70,031 | |

Total Other Investment Companies | | | | | | | 205,973 | |

Total Short-Term Investments (Cost $391,192) | | | | | | | 391,192 | |

Total Investments - 100.0% (Cost $29,059,410) | | | | | | | 30,169,327 | |

Other Assets, less Liabilities - 0.0%# | | | | | | | 9,084 | |

Net Assets - 100.0% | | | | | | $ | 30,178,411 | |

| * | Non-income producing security. |

| 1 | Some or all of these securities, amounting to $1,590,837 or 5.3% of net assets, were out on loan to various brokers and are collateralized by cash and various U.S. Treasury Obligations. See Note 4 of Notes to Financial Statements. |

| 2 | Cash collateral received from brokers for securities lending was invested in these joint repurchase agreements. |

| 3 | Yield shown represents the October 31, 2018, seven day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| MLP | Master Limited Partnership |

| REIT | Real Estate Investment Trust |

The accompanying notes are an integral part of these financial statements.

15

AMG River Road Focused Absolute Value Fund

Schedule of Portfolio Investments (continued)

The following table summarizes the inputs used to value the Fund’s investments by the fair value hierarchy levels as of October 31, 2018:

| | | | | | | | | | | | | | | | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Investments in Securities | | | | | | | | | | | | | | | | |

Common Stocks† | | $ | 29,778,135 | | | | — | | | | — | | | $ | 29,778,135 | |

Short-Term Investments | | | | | | | | | | | | | | | | |

Joint Repurchase Agreements | | | — | | | $ | 185,219 | | | | — | | | | 185,219 | |

Other Investment Companies | | | 205,973 | | | | — | | | | — | | | | 205,973 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | $ | 29,984,108 | | | $ | 185,219 | | | | — | | | $ | 30,169,327 | |

| | | | | | | | | | | | | | | | |

| † | All common stocks held in the Fund are Level 1 securities. For a detailed breakout of common stocks by major industry classification, please refer to the Fund’s Schedule of Portfolio Investments. |

As of October 31, 2018, the Fund had no transfers between levels from the beginning of the reporting period.

The accompanying notes are an integral part of these financial statements.

16

AMG Managers Montag & Caldwell Growth Fund

Portfolio Manager’s Comments (unaudited)

THE YEAR IN REVIEW

For the fiscal year ended October 31, 2018, the AMG Managers Montag & Caldwell Growth Fund (the “Fund”) Class N shares returned 8.58%, compared to the 10.71% return for its benchmark, the Russell 1000® Growth Index. The Fund is managed using fundamental valuation techniques that focus on a company’s future earnings and dividend growth rates. The process is primarily bottom up and utilizes a present valuation model in which the current price of the stock is related to the risk-adjusted present value of the company’s estimated future earnings stream. The Fund seeks to invest in growth stocks selling at a discount to estimates of fair value and at a time when relative earnings per share growth is visible for the intermediate term.

MARKET ENVIRONMENT

U.S. stock indices experienced positive returns for the 12 months ended October 31, 2018, with a bias toward large cap stocks. The Russell 1000® Index (large cap) was up 6.98%, the Russell Midcap® Index (mid cap) was up 2.80%, and the Russell 2000® Index (small cap) was up 1.85% for the 12 months ended October 31, 2018. Among all capitalization categories, growth was the dominant theme. Within growth, technology and internet-related consumer discretionary stocks led the way, resulting in unprecedented concentrations for the large cap growth index. For the full 12 months, growth outperformed value in each size segment, with the widest spread in returns between large cap growth and large cap value (10.71% vs. 3.04%). The performance advantage of growth over value in both the mid cap and small cap areas was also meaningful, though less pronounced than in large cap.

PERFORMANCE REVIEW

The reporting period began with strong performance from small cap and more cyclically oriented stocks as investors began to discount corporate tax reform,

which was eventually signed into law late in 2017. The Fund’s portfolio of larger companies, the under-allocation to technology and internet-related consumer discretionary stocks, and its over-allocation to less economically sensitive stocks detracted from relative returns during this period. This theme persisted until the end of January 2018 when the market reacted to rising interest rates due to increased wage and inflation data. The volatility was further exacerbated by the unwinding of the crowded short volatility trade. As one might expect, the Fund held up better than the index during this long-overdue correction period for many of the same reasons it had previously underperformed. This was one of the fastest corrections since the 1920s. While the market recovered rather quickly, the broad market then settled into a trading range on concerns over tariffs and a potential trade war with China. Technology and internet discretionary stocks, however, were not constrained by these overhangs and broke away from the pack in the second quarter. Again, the Fund’s underweight allocation to these stocks was a drag on the Fund’s relative performance. While these stocks fared better given their strong fundamentals and the belief that they would be largely insulated from the increasing trade tensions, valuations became increasingly stretched as they became over-owned and heavily concentrated in the index. The Fund’s risk controls around valuation and position size limits were the primary driver of the underweight positions. We entered the third quarter with a strong economic backdrop, which fueled robust corporate profit growth. This strong fundamental backdrop, in turn, produced some of the strongest quarterly results for the market since 2013 and led the market higher to a new bull market record, which was achieved on August 22. The biggest detractors to performance during this period versus the Russell 1000® Growth Index were an above-benchmark weight in financial services and a below-benchmark weight in both technology and industrials. Stock selection in the discretionary sector (primarily not owning Amazon)

was also an impediment to relative returns. On a positive note, the Fund benefited from solid stock selection in the communication services and materials sectors. The market sold off in October with Federal Reserve Chairman Powell’s more hawkish comments and the realization that a more normal monetary environment would be a headwind to price-to-earnings ratios. While equity fundamentals are still strong, the market is also discounting peak earnings growth and higher interest rates, leading to a re-pricing of risk. The Fund held up better than the index during the month, as the more fully valued momentum names sold off.

OUTLOOK

We continue to expect a choppy and range bound stock market. On the positive side, the U.S. is experiencing ongoing economic growth. However, economic activity and earnings growth appear to be peaking and the Federal Reserve seems committed to continued tightening until the unemployment rate stabilizes to prevent inflation pressures. We believe the Fed will no longer have the market’s back, earnings growth will slow, volatility will stay elevated, and, accordingly, investors will adjust risk tolerances.

We believe the balance in the Fund between less economically sensitive companies and those enjoying both cyclical and/or secular tailwinds positions our clients well for the period ahead. We expect the Fund’s holdings to generate profit growth that exceeds overall U.S. corporate profit growth this year. At the same time our holdings remain more attractively valued than the broader market, and the strength of their balance sheets should provide a buffer for the inevitable bouts of volatility that we expect.

The views expressed represent the opinions of Montag & Caldwell LLC, as of October 31, 2018, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

17

AMG Managers Montag & Caldwell Growth Fund

Portfolio Manager’s Comments (continued)

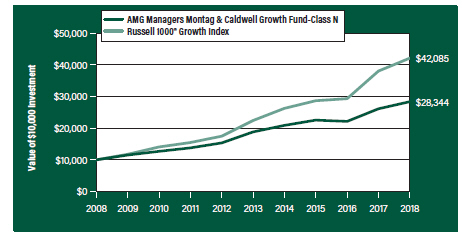

CUMULATIVE TOTAL RETURN PERFORMANCE

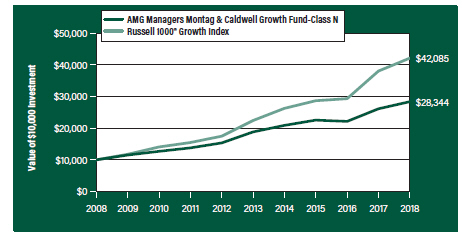

AMG Managers Montag & Caldwell Growth Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The graph compares a hypothetical $10,000 investment made in the AMG Managers Montag & Caldwell Growth Fund’s Class N shares on October 31, 2008, to a $10,000 investment made in the Russell 1000® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for the AMG Managers Montag & Caldwell Growth Fund, the Russell 1000® Growth Index for the same time periods ended October 31, 2018.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One Year | | | Five Years | | | Ten Years | |

AMG Managers Montag & Caldwell Growth Fund2, 3 | | | | | | | | | | | | |

Class N | | | 8.58 | % | | | 8.55 | % | | | 10.98 | % |

Class I | | | 8.75 | % | | | 8.79 | % | | | 11.24 | % |

Class R | | | 8.20 | % | | | 8.28 | % | | | 10.70 | % |

Russell 1000® Growth Index4 | | | 10.71 | % | | | 13.43 | % | | | 15.45 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call 800.835.3879 or visit our website at amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2018. All returns are in U.S. dollars ($). |

| 2 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices |

| | tend to reflect future investor expectations rather than just current profits. Growth stocks may underperform value stocks during given periods. |

| 3 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 4 | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell Indices are a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value.

18

AMG Managers Montag & Caldwell Growth Fund

Fund Snapshots (unaudited)

October 31, 2018

PORTFOLIO BREAKDOWN

| | | | |

| | | % of | |

Sector | | Net Assets | |

Information Technology | | | 28.2 | |

Health Care | | | 21.0 | |

Consumer Discretionary | | | 13.1 | |

Financials | | | 9.6 | |

Communication Services | | | 6.9 | |

Consumer Staples | | | 6.0 | |

Materials | | | 4.4 | |

Industrials | | | 4.4 | |

Real Estate | | | 1.8 | |

Short-Term Investments | | | 4.8 | |

Other Assets Less Liabilities | | | (0.2 | ) |

TOP TEN HOLDINGS

| | | | |

| | | % of | |

Security Name | | Net Assets | |

UnitedHealth Group, Inc. | | | 4.9 | |

Microsoft Corp. | | | 4.9 | |

Visa, Inc., Class A | | | 4.7 | |

Thermo Fisher Scientific, Inc. | | | 4.5 | |

Becton Dickinson & Co. | | | 4.5 | |

Alphabet, Inc., Class A | | | 4.3 | |

Abbott Laboratories | | | 4.3 | |

Apple, Inc. | | | 4.2 | |

S&P Global, Inc. | | | 3.6 | |

Intercontinental Exchange, Inc. | | | 3.3 | |

| | | | |

Top Ten as a Group | | | 43.2 | |

| | | | |

Because a fund’s strategy may result in multiple investments in particular sectors of the economy, its performance may depend on the performance of those sectors and may fluctuate more widely than investments diversified across more sectors. For additional information on these and other risk considerations, please see the Fund’s prospectus.

Any sectors, industries, or securities discussed should not be perceived as investment recommendations. Mention of a specific security should not be considered a recommendation to buy or solicitation to sell that security. Specific securities mentioned in this report may have been sold from the Fund’s portfolio of investments by the time you receive this report.

19

AMG Managers Montag & Caldwell Growth Fund

Schedule of Portfolio Investments

October 31, 2018

| | | | | | | | |

| | | Shares | | | Value | |

Common Stocks - 95.4% | | | | | | | | |

Communication Services - 6.9% | | | | | | | | |

Activision Blizzard, Inc. | | | 223,200 | | | $ | 15,411,960 | |

Alphabet, Inc., Class A* | | | 23,557 | | | | 25,690,793 | |

Total Communication Services | | | | | | | 41,102,753 | |

Consumer Discretionary - 13.1% | | | | | | | | |

Aramark | | | 237,100 | | | | 8,516,632 | |

Booking Holdings, Inc.* | | | 8,280 | | | | 15,521,522 | |

Dollar Tree, Inc.* | | | 160,880 | | | | 13,562,184 | |

Lowe’s Cos., Inc. | | | 162,900 | | | | 15,511,338 | |

Starbucks Corp. | | | 117,900 | | | | 6,870,033 | |

Ulta Beauty, Inc.* | | | 65,838 | | | | 18,073,848 | |

Total Consumer Discretionary | | | | | | | 78,055,557 | |

Consumer Staples - 6.0% | | | | | | | | |

Mondelez International, Inc., Class A | | | 408,600 | | | | 17,153,028 | |

Monster Beverage Corp.* | | | 352,500 | | | | 18,629,625 | |

Total Consumer Staples | | | | | | | 35,782,653 | |

Financials - 9.6% | | | | | | | | |

The Charles Schwab Corp. | | | 355,400 | | | | 16,433,696 | |

Intercontinental Exchange, Inc. | | | 255,350 | | | | 19,672,164 | |

S&P Global, Inc. | | | 116,997 | | | | 21,330,893 | |

Total Financials | | | | | | | 57,436,753 | |

Health Care - 21.0% | | | | | | | | |

Abbott Laboratories | | | 372,000 | | | | 25,645,680 | |