UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-08004

AMG Funds IV

(Exact name of registrant as specified in charter)

600 Steamboat Road, Suite 300

Greenwich, CT 06830

(Address of principal executive offices) (Zip code)

Jeffrey T. Cerutti, President, Chief Executive Officer and Principal Executive Officer

AMG Funds IV

600 Steamboat Road, Suite 300

Greenwich, CT 06830

(Name and address of agent for service)

Registrant’s telephone number, including area code: (203) 299-3500

Date of fiscal year end: October 31

Date of reporting period: November 1, 2015 - October 31, 2016

Item 1. Reports to Stockholders.

| | | | |

| | Annual Report 2016 | | October 31, 2016 |

| | |

| | AMG Funds (formerly Aston Funds) Class N, I & R Shares Equity Fixed Income Alternative International Balanced |

Dear Shareholder:

While the period got off to a rocky start, overall U.S. equity investors enjoyed modest returns for the 12-months ended October 31, 2016. The S&P 500 Index, a widely followed barometer of the U.S. equity market, returned 4.5% during the prior twelve months, with most of the gains coming in the middle of the period. The year was also marked by the three major U.S. indices, the Dow Jones Industrial Average, NASDAQ and the S&P 500, all closing at all-time highs on the same day in August; the first time this has occurred since 1999. Small-cap investors were equally fortunate, with a 4.1% return for the small-cap Russell 2000® Index for the fiscal year. Investors had to balance the first rate increase from the U.S. Federal Reserve (+0.25%) in nearly six years, a contentious U.S. presidential election season, continued slowing of growth in China and the implications for global economic growth along with the impact of commodity prices falling to lows not seen since 2009. Oil prices have since recovered, lending some support to the beleaguered energy industry. During the year, most sectors of the S&P 500 were positive. However, there was some dispersion in performance across sectors, with utilities, information technology and telecommunication services returning 17%, 11% and 11%, respectively, while companies within the consumer discretionary and health care sectors returned (2.0)% and (4.0)%, respectively. Meanwhile, international stocks lagged the U.S., returning 0.2%, as measured by the MSCI ACWI ex USA (in U.S. Dollar terms).

The Bloomberg Barclays U.S. Aggregate Bond Index, a broad U.S. bond market benchmark, returned 4.4% for the year ended October 31, 2016. Interest rates and credit spreads gyrated during 2015 and 2016, at times putting some pressure on bond prices. Investors’ appetite for risk declined sharply during the latter part of 2015 and early 2016, before rebounding significantly as oil prices recovered, reflected in the 10.1% return for the Bloomberg Barclays U.S. Corporate High Yield Index.

We are excited to announce as of October 1, the AMG Funds family of mutual funds fully integrated the former Aston Funds. AMG Funds and Aston Funds shareholders will now have access to the differentiated solutions of AMG Funds, which represents a single point of access to one of the largest line-ups of boutique managers and products in the world.

AMG Funds appreciates the privilege of providing investment solutions to you and your clients. Our foremost goal at AMG Funds is to provide investment solutions that help our shareholders successfully reach their long-term investment goals. By partnering with AMG’s affiliated investment boutiques, AMG Funds provides access to a distinctive array of actively-managed return-oriented investment strategies. Additionally, we oversee and distribute a number of complementary open-architecture mutual funds subadvised by unaffiliated investment managers. We thank you for your continued confidence and investment in AMG Funds. You can rest assured that under all market conditions our team is focused on delivering excellent investment management services for your benefit.

Respectfully,

Jeffrey Cerutti

President

AMG Funds

| | | | | | | | | | | | | | |

Average Annual Total Returns | | Periods ended October 31, 2016* | |

| | | | | 1 Year | | | 3 Years | | | 5 Years | |

Stocks: | | | | | | | | | | | | | | |

Large Caps | | (S&P 500 Index) | | | 4.51 | % | | | 8.84 | % | | | 13.57 | % |

Small Caps | | (Russell 2000® Index) | | | 4.11 | % | | | 4.12 | % | | | 11.51 | % |

International | | (MSCI All Country World Index ex USA) | | | 0.22 | % | | | (1.49 | )% | | | 3.64 | % |

Bonds: | | | | | | | | | | | | | | |

Investment Grade | | (Bloomberg Barclays U.S. Aggregate Bond Index) | | | 4.37 | % | | | 3.48 | % | | | 2.90 | % |

High Yield | | (Bloomberg Barclays U.S. Corporate High Yield Index) | | | 10.14 | % | | | 4.55 | % | | | 7.17 | % |

Tax-exempt | | (Bloomberg Barclays Municipal Bond Index) | | | 4.06 | % | | | 4.89 | % | | | 4.34 | % |

Treasury Bills | | (BofA Merrill Lynch 6 Month U.S. Treasury Bill) | | | 0.64 | % | | | 0.32 | % | | | 0.26 | % |

| * | Source: FactSet. Past performance is no guarantee of future results. |

Large Cap Funds

AMG Managers Fairpointe Focused Equity Fund

AMG River Road Focused Absolute Value Fund

AMG Managers Montag & Caldwell Growth Fund

Equity Income Funds

AMG River Road Dividend All Cap Value Fund

AMG River Road Dividend All Cap Value Fund II

Mid Cap Funds

AMG Managers Fairpointe Mid Cap Fund

AMG Managers Montag & Caldwell Mid Cap Growth Fund

Small Cap Funds

AMG Managers LMCG Small Cap Growth Fund

AMG River Road Select Value Fund

AMG River Road Small Cap Value Fund

AMG Managers Silvercrest Small Cap Fund

AMG GW&K U.S. Small Cap Growth Fund

Fixed Income Fund

AMG Managers DoubleLine Core Plus Bond Fund

Alternative Funds

AMG Managers Anchor Capital Enhanced Equity Fund

AMG Managers Lake Partners LASSO Alternatives Fund

AMG River Road Long-Short Fund

International Funds

AMG Managers Guardian Capital Global Dividend Fund

AMG Managers Pictet International Fund

AMG Managers Value Partners Asia Dividend Fund

Balanced Fund

AMG Managers Montag & Caldwell Balanced Fund

Table of Contents

Nothing contained herein is to be considered an offer, sale or solicitation of an offer to buy shares of any series of the AMG Funds family of mutual funds. Such offering is made only by prospectus, which includes details as to offering price and other material information.

AMG Funds are distributed by AMG Distributors, Inc., member FINRA/SIPC, 600 Steamboat Road, Suite 300, Greenwich, CT 06830

Shareholder Services 800-835-3879 • www.amgfunds.com

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

AMG Managers Fairpointe Focused Equity Fund

Portfolio Manager’s Comments (unaudited)

THE YEAR IN REVIEW

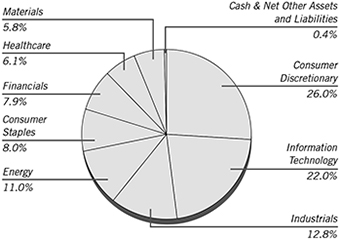

U.S. equity markets posted modest positive performance for the fiscal year ending October 31, 2016. The AMG Managers Fairpointe Focused Equity Fund1 (the “Fund”) Class N shares returned 4.4% for the fiscal year, slightly outperforming the benchmark returns of 4.3% for the Russell 1000® Index, 4.2% for the Russell Midcap® Index, and in-line with the return of 4.5% for the S&P 500 Index. Good stock selection in technology, health care, industrials and materials, partially offset by under-performance in consumer discretionary, contributed to our positive absolute returns and relative outperformance during the year. The Fund is characterized by a long-term view, a high-conviction concentrated portfolio, a focus on purchasing securities at a significant discount to fair value and a willingness to hold (and add to) positions through volatile markets.

FISCAL 2016 REVIEW

The performance contribution for the fiscal year was positive, with fourteen stocks up more than 10% and seven stocks down more than 10%. Our largest contributors were Hewlett Packard Enterprise, Greif, WalMart, Apache and HP Inc. Hewlett Packard Enterprise, in separate transactions, announced that it would spin off its enterprise services business and merge it into Computer Sciences and spin off its software business and merge it into Micro Focus. Hewlett Packard Enterprise shareholders will own a majority of outstanding shares of Computer Sciences and Micro Focus, respectively, upon the completion of each of those transactions. The remaining Hewlett Packard Enterprise will include servers, storage, networking and tech services. We believe Hewlett Packard Enterprise will be more focused and possess a very strong balance sheet with solid and improving cash flow generation

from its core technology infrastructure units. Industrial packaging producer Greif expanded year-over-year margins in its most recent reported financial results despite a sluggish industrial economy. Management remains focused on the business levers within its control – customer service excellence, disciplined commercial and operational execution and greater financial discipline. Energy exploration and production company Apache rebounded with the increase in oil prices. Printing and computer maker HP Inc. rounded out our top five contributors for the year. We reduced our positions in Greif and Apache during the fiscal year as our estimates of the gap between price and fair value narrowed.

Our largest detractors for the fiscal year were Legg Mason, Transocean, Staples, News Corp. and Liberty Interactive. Asset manager Legg Mason declined as investors remain concerned regarding global equity markets and the potential for increased volatility in the profitability and cash flows generated by Legg Mason. We were pleased to see multiple insiders (including the CEO, CFO and several board members) purchase shares during the year. Along with Legg Mason’s significant share repurchase activity, these actions signal management’s belief that Legg Mason shares are undervalued, a view with which we concur. Offshore driller Transocean declined on continued fears of oversupply of offshore drilling rigs and lower current demand for such rigs due to low oil prices. Transocean has highlighted that it expects to have cash and bank revolver capacity resulting in liquidity exceeding $3 billion at the end of calendar year 2018. This should provide sufficient time for oil markets to recover and allow Transocean to begin its economic recovery. Office supply retailer Staples declined after the federal court decision granting the U.S. Federal Trade

Commission’s preliminary injunction against Staples acquisition of Office Depot. While we were disappointed with the court’s logic and decision, we view Staples’ stock as undervalued at its current quote, which provides a 6.5% dividend yield and even greater annual free cash flow yield. Media company News Corp.’s stock price declined during the year as uncertainty regarding future secular changes in its media properties, particularly print advertising, has weighed on the stock and industry. News Corp. also suffered from the negative impact of foreign currency fluctuations during the year. Liberty Interactive declined as the company experienced weak sales in QVC’s U.S. business in its most recent quarter, which sales decline we believe is temporary in nature. We added to our positions in Legg Mason, Staples and Liberty Interactive during the year as our estimates of the gap between price and fair value widened.

ADDITIONS AND ELIMINATIONS

We added five new stocks to the Fund during the fiscal year—Hewlett Packard Enterprise, EMC Corp., Baker Hughes, VMware and Quanta Services. Hewlett Packard Enterprise currently encompasses the enterprise group, enterprise services, software and financial services units of the former Hewlett-Packard. The markets in which Hewlett Packard Enterprise operate are large and offer significant growth potential. Margins should improve through the implementation of further cost cuts. The company generates strong free cash flow and trades at an attractive 11x forward earnings, a substantial discount to the market multiple. EMC, a global leader in data storage, management, protection and analysis, was bought and sold during the fiscal year, resulting in an attractive gain. Oilfield services provider Baker Hughes was added to the Fund after its stock price declined in connection with its terminated merger

2

AMG Managers Fairpointe Focused Equity Fund

Portfolio Manager’s Comments (continued)

deal with Halliburton, due to significant regulatory opposition. Subsequent to the Fund’s investment, GE’s energy services unit and Baker Hughes agreed to combine, which should allow the combined company to cut costs and improve its operating margin profile. VMware, a global leader in cloud infrastructure and business mobility, delivers information technology solutions that are fluid, instant and more secure. We capitalized on an opportunity to invest in VMware, as the stock significantly declined earlier this year over concerns relating to EMC’s pending acquisition by Dell. EMC had owned 80% of VMware prior to EMC’s acquisition by Dell. Quanta Services provides engineering, procurement and construction services for comprehensive infrastructure needs in the electric power and oil and natural gas industries. Its stock significantly underperformed the market in the year prior to the Fund’s investment, primarily resulting from weakened activity in several of the largest end markets that it serves, as well as a self-inflicted wound from cost over-runs at an Alaska power plant project. Quanta Services repurchased $1.7 billion of its stock in the 18 months preceding the Fund’s investment, reducing its shares outstanding by 32%. We view these repurchases positively, evidencing management’s confidence in its own business.

The Fund remains overweighted relative to its benchmarks in consumer discretionary, technology, industrials, materials and energy. This outcome is driven by our fundamental, bottom up valuation-based approach to stock selection. As our holding period is generally three to five years, we advocate patience to allow the discount between current prices of these securities and our estimates of fair value to narrow.

We eliminated six holdings during the fiscal year—Boston Scientific, EMC, Interpublic Group, Itron, Quest Diagnostics and VCA. We sold our remaining position in Boston Scientific as it reached our price target. Management provided strong stewardship and unlocked significant shareholder value at Boston Scientific during the last few years. Dell completed its acquisition of EMC in the third quarter. As shareholders of EMC, we received $24.05 in cash per share, plus additional shares of a tracking stock of VMware, which we also sold during the quarter. While the investment in the Fund was short-lived, we took advantage of an opportunistic mispricing of EMC shares in early 2016 and realized a strong gain on our investment. Itron was sold to provide a source of funds for other opportunities, while Quest and VCA were sold as they reached or approached our sell targets. Quest and VCA provided attractive returns for the portfolio and were replaced with securities we believe to be more undervalued.

OUTLOOK

While near-term macroeconomic issues (e.g., U.S. elections, interest rates, Brexit, European banks) exist, the U.S. economy continues its recovery (e.g. further job growth, increases in consumer spending, strengthening housing market). It would not surprise us to see increased volatility in global equity markets due to the greater perceived near-term uncertainties and higher equity valuations, yet we would seek to capitalize on opportunities that may emerge due to any near-term disruptions.

We believe the Fund remains attractively positioned relative to its equity benchmarks and other asset classes (e.g. fixed income). As of October 31, 2016, the Fund’s holdings on average trade at

15.3x 2017 consensus earnings estimates, while the Russell 1000®, the S&P 500 and the Russell Midcap® indices trade at 16.3, 16.0 and 17.2x 2017 consensus earnings estimates, respectively2. Moreover, the Fund trades at 1.0x enterprise value/trailing 12 months’ revenue, which is a substantial discount to the Russell 1000®, the S&P 500 and the Russell Midcap® indices of 2.3, 2.4 and 2.1x enterprise value/trailing 12 months’ revenue, respectively2.

The views expressed represent the opinions of Fairpointe Capital LLC, as of October 31, 2016, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

| 1 | Prior to October 1, 2016, the Fund was known as ASTON/Fairpointe Focused Equity Fund. |

| 2 | FactSet, Standard & Poors, Russell Investments |

3

AMG Managers Fairpointe Focused Equity Fund

Portfolio Manager’s Comments (continued)

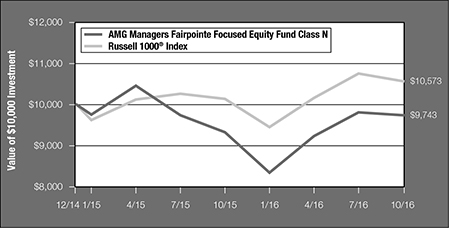

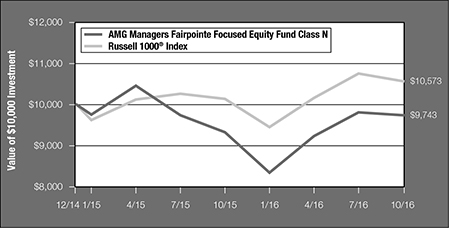

CUMULATIVE TOTAL RETURN PERFORMANCE

The AMG Managers Fairpointe Focused Equity Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The chart compares a hypothetical $10,000 investment made in AMG Managers Fairpointe Focused Equity Fund’s Class N on December 24, 2014, to a $10,000 investment made in the Russell 1000® Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for AMG Managers Fairpointe Focused Equity Fund and the Russell 1000® Index for the same time periods ended October 31, 2016.

| | | | | | | | | | | | |

| Average Annual Total Returns1 | | One

Year | | | Since

Inception | | | Inception

Date | |

AMG Managers Fairpointe Focused Equity Fund2,3,4,5 | | | | | | | | | | | | |

Class N | | | 4.43 | % | | | (1.39 | )% | | | 12/24/14 | |

Class I | | | 4.65 | % | | | (1.16 | )% | | | 12/24/14 | |

Russell 1000® Index6 | | | 4.26 | % | | | 3.06 | % | | | 12/24/14 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2016. All returns are in U.S. dollars ($). |

| 2 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. |

| 3 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| 4 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| 5 | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| 6 | The Russell 1000® Index measures the performance of approximately 1,000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market. Unlike the Fund, the Russell 1000® Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell Indices are a trademark of the London Stock Exchange Group Companies.

Not FDIC insured, nor bank guaranteed. May lose value.

4

AMG Funds

| | |

| AMG Managers Fairpointe Focused Equity Fund | | October 31, 2016 |

| |

| Schedule of Investments | | |

% of Net Assets

| | | | | | | | |

Shares | | | | | Market

Value | |

| COMMON STOCKS – 99.6% | | | | |

| | | | Consumer Discretionary – 26.0% | | | | |

| | 6,400 | | | Carnival Corp. (Panama) | | $ | 314,240 | |

| | 12,000 | | | Discovery Communications, Inc., Class C * | | | 301,320 | |

| | 12,700 | | | Liberty Interactive Corp. QVC Group, Class A * | | | 234,823 | |

| | 17,900 | | | News Corp., Class A | | | 216,948 | |

| | 5,700 | | | Scholastic Corp. | | | 218,025 | |

| | 27,800 | | | Staples, Inc. | | | 205,720 | |

| | 12,700 | | | Twenty-First Century Fox, Inc., Class A | | | 333,629 | |

| | | | | | | | |

| | | | | | | 1,824,705 | |

| | | | | | | | |

| | | | Consumer Staples – 8.0% | | | | |

| | 1,400 | | | PepsiCo, Inc. | | | 150,080 | |

| | 2,800 | | | Unilever PLC, Sponsored ADR (United Kingdom) | | | 116,676 | |

| | 4,200 | | | Wal-Mart Stores, Inc. | | | 294,084 | |

| | | | | | | | |

| | | | | | | 560,840 | |

| | | | | | | | |

| | | | Energy – 11.0% | | | | |

| | 2,000 | | | Apache Corp. | | | 118,960 | |

| | 4,400 | | | Baker Hughes, Inc. | | | 243,760 | |

| | 8,000 | | | BP PLC, Sponsored ADR (United Kingdom) | | | 284,400 | |

| | 13,400 | | | Transocean, Ltd. (Switzerland) * | | | 128,774 | |

| | | | | | | | |

| | | | | | | 775,894 | |

| | | | | | | | |

| | | | Financials – 7.9% | | | | |

| | 9,500 | | | Legg Mason, Inc. | | | 272,840 | |

| | 3,900 | | | Northern Trust Corp. | | | 282,438 | |

| | | | | | | | |

| | | | | | | 555,278 | |

| | | | | | | | |

| | | | Healthcare – 6.1% | | | | |

| | 4,900 | | | Hologic, Inc. * | | | 176,449 | |

| | 2,800 | | | Varian Medical Systems, Inc. * | | | 254,044 | |

| | | | | | | | |

| | | | | | | 430,493 | |

| | | | | | | | |

| | | | | | |

Shares | | | | Market

Value | |

| | Industrials – 12.8% | | | | |

3,200 | | AGCO Corp. | | $ | 163,456 | |

3,800 | | Fluor Corp. | | | 197,562 | |

11,100 | | Kennametal, Inc. | | | 314,241 | |

7,800 | | Quanta Services, Inc. * | | | 224,250 | |

| | | | | | |

| | | | | 899,509 | |

| | | | | | |

| | Information Technology – 22.0% | | | | |

6,900 | | Cisco Systems, Inc. | | | 211,692 | |

12,700 | | Cree, Inc. * | | | 283,210 | |

15,300 | | Hewlett Packard Enterprise Co. | | | 343,791 | |

15,500 | | HP, Inc. | | | 224,595 | |

10,700 | | Teradata Corp. * | | | 288,472 | |

2,500 | | VMware, Inc., Class A * | | | 196,500 | |

| | | | | | |

| | | | | 1,548,260 | |

| | | | | | |

| | Materials – 5.8% | | | | |

5,800 | | FMC Corp. | | | 271,962 | |

2,900 | | Greif, Inc., Class A | | | 135,894 | |

| | | | | | |

| | | | | 407,856 | |

| | | | | | |

| | Total Common Stocks

(Cost $7,025,556) | | | 7,002,835 | |

| | | | | | |

INVESTMENT COMPANY – 2.1% | | | | |

149,437 | | Dreyfus Government Cash Management Fund, Institutional Class Shares, 0.28%** | | | 149,437 | |

| | | | | | |

| | Total Investment Company

(Cost $149,437) | | | 149,437 | |

| | | | | | |

Total Investments – 101.7%

(Cost $7,174,993)*** | | | 7,152,272 | |

| | | | | | |

Net Other Assets and Liabilities – (1.7)% | | | (117,532 | ) |

| | | | | | |

Net Assets – 100.0% | | $ | 7,034,740 | |

| | | | | | |

| * | Non-income producing security. |

| ** | Yield shown represents the October 31, 2016, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| *** | At October 31, 2016, the aggregate cost for Federal income tax purposes is $7,179,714. |

| | | | |

Gross unrealized appreciation | | $ | 629,557 | |

Gross unrealized depreciation | | | (656,999 | ) |

| | | | |

Net unrealized depreciation | | $ | (27,442 | ) |

| | | | |

ADR American Depositary Receipt

The accompanying notes are an integral part of these financial statements.

5

AMG River Road Focused Absolute Value Fund

Portfolio Manager’s Comments (unaudited)

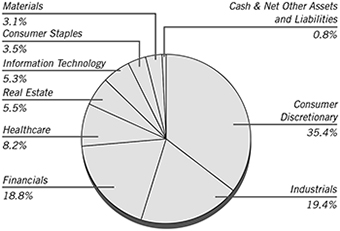

The AMG River Road Focused Absolute Value Fund1 (the “Fund”) Class N shares outperformed the Russell 3000® Value Index benchmark over the period since inception (November 3, 2015) and ending October 31, 2016, with a return of +8.50% versus +5.03% for the Index. The largest positive contribution to relative return was from the financials sector, which benefited primarily from strong stock selection. This was partially offset by negative stock selection in energy and a lack of exposure to the utilities sector. From a market cap perspective, the Fund outperformed across the spectrum with small- and mid-cap holdings delivering the largest contributions to relative return.

The two holdings with the largest positive contribution to the Fund’s return were Rackspace Hosting Inc. (RAX) and Communications Sales & Leasing Inc. (CSAL). Rackspace is a global provider of managed cloud and related IT services. We initiated our position earlier this year as RAX was transitioning its business model from only providing services and raw cloud computing capacity to support customized cloud and software applications. By leveraging other cloud platforms, former competitors such as Amazon Web Services and Microsoft Azure were transformed into Rackspace partners. In August, private-equity firm Apollo Global signed a deal to acquire Rackspace for $32 per share, which was a +38% premium to the unaffected stock price. The Fund exited the position near the deal price.

CSAL is a real estate investment trust (REIT) focused on telecom network infrastructure (the pipes). CSAL was founded last year as a tax-free spin-off from Windstream Holdings. Concurrent with the spinoff, Windstream executed a 15-year triple net lease for the entirety of CSAL’s network assets and retained a 19.6% ownership stake in CSAL. As the first and only REIT of its kind, CSAL initially suffered from skepticism around the concentration and quality of Windstream as its only tenant. During Q2, CSAL rallied on several transactions that

supported our thesis—including reducing revenue dependence on Windstream. The Fund exited the position as the stock approached our assessed valuation.

The two holdings with the largest negative contribution to return were American Express Co. (AXP) and Rolls-Royce Holdings PLC Sponsored ADR (RYCEY). American Express is a global provider of charge and credit card products. We introduced AXP following the announcement of the loss of its Costco relationship, based on the belief that the non-renewal as Costco’s sole credit card provider was priced into the stock. Our investment thesis relied on AXP’s ability to leverage its brand strength and global network to take advantage of the secular growth tailwinds in electronic payments. However, we underestimated the impact the loss of Costco would have on the business, which led to margin pressure from heavier investment to replace the lost Costco business and disappointing guidance for 2016 and 2017. As such, our thesis was weakened and the Fund exited the position.

Rolls-Royce makes and maintains engines primarily for wide-body (more than one aisle) aircraft. Aftermarket services account for half of the company’s revenue. Our investment thesis relied on Rolls-Royce’s ability to increase its installed base of engines in coming years, which would provide a long runway of growth in the highly-profitable after-market services. Last November, Rolls-Royce lowered profit and free cash flow guidance, citing weakness in after-market services for regional jets and wide-body aircraft. The weakness in aftermarket services threatened our investment thesis; thus, the Fund exited the position.

The Fund invests in companies that we believe represent the most attractive combination of risk (conviction) and reward (discount) available. The largest change to positioning in the Fund over the last year was the shift away from larger-cap securities to smaller-cap. The allocation to smaller-cap securities was driven by bottom-up opportunities

throughout our universe as we found more attractive combinations of risk/reward within the smaller-cap space. From a sector perspective, exposure to Information technology decreased, as several names were sold as they approached assessed valuation. The largest increases in sector exposure were within consumer discretionary and health care.

The views expressed represent the opinions of River Road Asset Management LLC , as of October 31, 2016, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

| 1 | Prior to October 1, 2016, the Fund was known as ASTON/River Road Focused Absolute Value Fund. |

6

AMG River Road Focused Absolute Value Fund

Portfolio Manager’s Comments (continued)

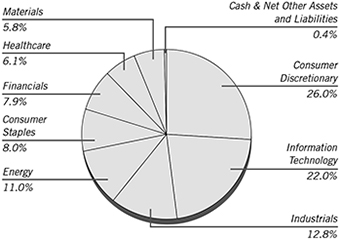

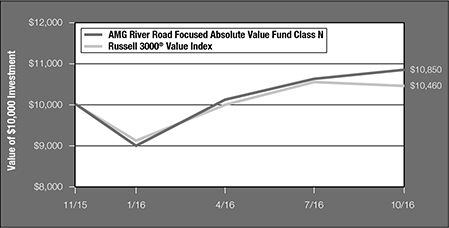

CUMULATIVE TOTAL RETURN PERFORMANCE

The AMG River Road Focused Absolute Value Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The chart compares a hypothetical $10,000 investment made in AMG River Road Focused Absolute Value Fund’s Class N on November 3, 2015, to a $10,000 investment made in the Russell 3000® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for AMG River Road Focused Absolute Value Fund and the Russell 3000® Value Index for the same time periods ended October 31, 2016.

| | | | | | | | |

| | | Since | | | Inception | |

| Average Annual Total Returns1 | | Inception | | | Date | |

AMG River Road Focused Absolute Value Fund2,3,4,5,6,7,8 | | | | | | | | |

Class N | | | 8.50 | % | | | 11/03/15 | |

Class I | | | 8.80 | % | | | 11/03/15 | |

Russell 3000® Value Index9 | | | 5.03 | % | | | 11/03/15 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2016. All returns are in U.S. dollars ($). |

| 2 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| 3 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| 4 | Active and frequent trading of a fund may result in higher transaction costs and increased tax liability. |

| 5 | A greater percentage of the Fund’s holdings may be focused in a smaller number of securities which may place the Fund at greater risk than a more diversified fund. |

| 6 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 7 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. |

| 8 | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| 9 | The Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 3000® Value Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell Indices are a trademark of the London Stock Exchange Group Companies.

Not FDIC insured, nor bank guaranteed. May lose value.

7

AMG Funds

| | |

| AMG River Road Focused Absolute Value Fund | | October 31, 2016 |

| |

| Schedule of Investments | | |

% of Net Assets

| | | | | | | | |

Shares | | | | | Market

Value | |

| COMMON STOCKS – 99.2% | | | | |

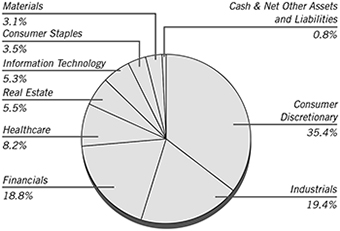

| | | | Consumer Discretionary – 35.4% | | | | |

| | 8,193 | | | Comcast Corp., Class A | | $ | 506,491 | |

| | 11,291 | | | General Motors Co. | | | 356,796 | |

| | 11,097 | | | International Speedway Corp., Class A | | | 365,091 | |

| | 6,126 | | | L Brands, Inc. | | | 442,236 | |

| | 5,031 | | | Liberty Broadband Corp., Class C * | | | 335,316 | |

| | 14,396 | | | Liberty Media Corp-Liberty SiriusXM, Class C * | | | 477,803 | |

| | 13,787 | | | Liberty Ventures, Class A * | | | 550,101 | |

| | 3,929 | | | Polaris Industries, Inc. | | | 301,001 | |

| | 3,851 | | | Ralph Lauren Corp. | | | 377,783 | |

| | 5,295 | | | Time Warner, Inc. | | | 471,202 | |

| | | | | | | | |

| | | | | | | 4,183,820 | |

| | | | | | | | |

| | | | Consumer Staples – 3.5% | | | | |

| | 10,417 | | | Ingles Markets, Inc., Class A | | | 411,471 | |

| | | | | | | | |

| | | | Financials – 18.8% | | | | |

| | 12,803 | | | CNA Financial Corp. | | | 468,206 | |

| | 37,836 | | | FNFV Group * | | | 455,924 | |

| | 8,997 | | | Oaktree Capital Group LLC, MLP | | | 374,275 | |

| | 10,929 | | | U.S. Bancorp | | | 489,182 | |

| | 9,361 | | | Wells Fargo & Co. | | | 430,700 | |

| | | | | | | | |

| | | | | | | 2,218,287 | |

| | | | | | | | |

| | | | Healthcare – 8.2% | | | | |

| | 6,683 | | | DaVita, Inc. * | | | 391,757 | |

| | 18,195 | | | Premier, Inc., Class A * | | | 579,329 | |

| | | | | | | | |

| | | | | | | 971,086 | |

| | | | | | | | |

| | | | Industrials – 19.4% | | | | |

| | 21,943 | | | Air Transport Services Group, Inc. * | | | 290,306 | |

| | 10,878 | | | Cubic Corp. | | | 464,491 | |

| | 21,319 | | | Resources Connection, Inc. | | | 316,587 | |

| | | | | | |

Shares | | | | Market

Value | |

| | Industrials (continued) | | | | |

12,426 | | SP Plus Corp. * | | $ | 313,135 | |

9,063 | | Spirit AeroSystems Holdings, Inc., Class A * | | | 456,413 | |

3,644 | | UniFirst Corp./MA | | | 446,390 | |

| | | | | | |

| | | | | 2,287,322 | |

| | | | | | |

| | Information Technology – 5.3% | | | | |

9,134 | | Blackhawk Network Holdings, Inc. * | | | 314,666 | |

20,114 | | VeriFone Systems, Inc. * | | | 311,365 | |

| | | | | | |

| | | | | 626,031 | |

| | | | | | |

| | Materials – 3.1% | | | | |

3,106 | | Praxair, Inc. | | | 363,588 | |

| | | | | | |

| | Real Estate – 5.5% | | | | |

12,226 | | The GEO Group, Inc. | | | 292,935 | |

15,349 | | Realogy Holdings Corp. | | | 351,339 | |

| | | | | | |

| | | | | 644,274 | |

| | | | | | |

| | Total Common Stocks

(Cost $11,197,685) | | | 11,705,879 | |

| | | | | | |

Total Investments – 99.2%

(Cost $11,197,685)** | | | 11,705,879 | |

Net Other Assets and Liabilities – 0.8% | | | 95,090 | |

| | | | | | |

Net Assets – 100.0% | | $ | 11,800,969 | |

| | | | | | |

| * | Non-income producing security. |

| ** | At October 31, 2016, the aggregate cost for Federal income tax purposes is $11,280,866. |

| | | | |

Gross unrealized appreciation | | $ | 783,510 | |

Gross unrealized depreciation | | | (358,497 | ) |

| | | | |

Net unrealized appreciation | | $ | 425,013 | |

| | | | |

| MLP | Master Limited Partnership |

The accompanying notes are an integral part of these financial statements.

8

AMG Managers Montag & Caldwell Growth Fund

Portfolio Manager’s Comments (unaudited)

THE YEAR IN REVIEW

For the fiscal year ended October 31, 2016, the AMG Managers Montag & Caldwell Growth Fund1 (the “Fund”) Class N shares returned (1.77)%, compared to the 2.28% return for its benchmark, the Russell 1000® Growth Index. The Fund is managed using fundamental valuation techniques that focus on a company’s future earnings and dividend growth rates. The process is primarily bottom up and utilizes a present valuation model in which the current price of the stock is related to the risk-adjusted present value of the company’s estimated future earnings stream. The Fund seeks to invest in growth stocks selling at a discount to estimates of fair value and at a time when relative earnings-per-share growth is visible for the intermediate term.

MARKET ENVIRONMENT

Stocks were generally positive for the year ended October 31, 2016, without a significant bias in market capitalization. The Russell 1000® (large-cap) Index was up 4.26%, the Russell Midcap® Index (mid cap) was up 4.17% and the Russell 2000® Index (small-cap) was up 4.11%. There was, however, a significant head-wind to growth, as value outperformed growth in each size segment, but particularly in the small-cap space. The Russell 2000® Value Index (small-cap value) was up 8.81% vs. a -0.49% return for the Russell 2000® Growth Index (small-cap growth). The spread of value over growth was similar in the mid-cap space and, although not as pronounced, in the large-cap space where the Russell 1000® Value Index (large-cap value) was up 6.37% vs. a 2.28% return for the Russell 1000® Growth Index (large-cap growth).

PERFORMANCE REVIEW

The Fund declined 1.77% vs. a 2.28% increase for the Russell 1000® Growth Index for the year ended October 31, 2016. The markets ended the last quarter of 2015 with increased levels of volatility that accomplished very little in terms of improving overall market valuations. The volatility continued into the start of the year with a big draw down. During this

market decline, the Fund held up much better than the benchmark and peer group. However, this was short lived as the market bounced back during the second half of the first quarter. This was one of the largest intra-quarter reversals in market history. Unfortunately, while the market recovered, fundamentals continued to deteriorate (S&P 500 Index rallied while earnings estimates for 2016 declined—causing market price-to-earnings multiples to expand further). Again, market volatility failed to make progress on valuation and the Fund underperformed.

From the February lows through the end of the second quarter, bond yields fell in anticipation of further economic weakness and the now-predictable response of central banks extending support to the market by injecting additional liquidity and suppressing interest rates. The leg down in bond yields contributed to significant outperformance in the equity markets by the bond proxies (utilities, telecom and REITs) as investors sought out high and stable dividend yields as a substitute for bonds in an income-starved world. As a result, investors rotated into high-quality large-cap value stocks that offered above-average yields. Furthermore, given that the Fund’s consumer staples exposure, generally speaking, is oriented toward higher growth rather than higher yield names, its exposure didn’t participate to the degree that the Russell 1000® Growth Index did.

The stock market continued its post-Brexit rally in July, hitting new all-time highs, before settling into a mostly calm, sideways trading pattern through August, after central bankers promised additional support in response to any dislocations caused by the decision of U.K. voters to leave the European Union. September ushered in a minor bout of volatility, with stocks dipping about 3% on fears that central banks might begin to withdraw monetary stimulus, before rebounding into quarter-end when those fears proved premature. Generally speaking, the Fund has been disadvantaged in this environment by a mix of high beta, lower-quality, and smaller-cap cyclical bias in the

market. Most of the names that benefited from this theme did not fit within our investment discipline.

The Fund held up better than the benchmark and peer group as the markets sold off in October. Investors grappled with high valuations, a volatile political environment, mixed economic data and an uncertain earnings outlook.

OUTLOOK

After moderate gains in the third quarter, the stock market advance may pause as investors discount various economic and political uncertainties, particularly with stock market median valuations near or at all-time highs. The median price-to-earnings valuation ratio for the S&P 500 is higher than 90% of all historical periods going back to 1984, while the price-to-sales ratio is at a record high for the same time period. With economic data clearly turning mixed, national election uncertainties on the horizon and the U.S. Federal Reserve signaling a desire to raise interest rates in December into what appears to be slowing growth, investors may hesitate at these unusually high valuation levels. Unprecedented Central Bank policies and historically-low interest rates will likely continue to support these unusually high valuations and, with recession risk still low, downside market risk should also be limited.

In the low growth, low inflation and low interest-rate world that is likely to persist longer term, we believe the Fund’s holdings are well positioned to provide attractive investment returns. These holdings are, in our opinion, attractively valued and, due to their financial strength and global diversification, their earnings growth is more assured in what is likely to be a slow and uneven global economy.

The views expressed represent the opinions of Montag & Caldwell LLC, as of October 31, 2016, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

| 1 | Prior to October 1, 2016, the Fund was known as ASTON/Montag & Caldwell Growth Fund. |

9

AMG Managers Montag & Caldwell Growth Fund

Portfolio Manager’s Comments (continued)

CUMULATIVE TOTAL RETURN PERFORMANCE

The AMG Managers Montag & Caldwell Growth Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The chart compares a hypothetical $10,000 investment made in the AMG Managers Montag & Caldwell Growth Fund’s Class N on October 31, 2006, to a $10,000 investment made in the Russell 1000® Growth Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for AMG Managers Montag and Caldwell Growth Fund and the Russell 1000® Growth Index for the same time periods ended October 31, 2016.

| | | | | | | | | | | | |

| | | One | | | Five | | | Ten | |

| Average Annual Total Returns1 | | Year | | | Years | | | Years | |

AMG Managers Montag and Caldwell Growth Fund2,3 | | | | | | | | | | | | |

Class N | | | (1.77 | )% | | | 9.95 | % | | | 6.77 | % |

Class I | | | (1.51 | )% | | | 10.24 | % | | | 7.04 | % |

Class R | | | (2.02 | )% | | | 9.68 | % | | | 6.51 | % |

Russell 1000® Growth Index4 | | | 2.28 | % | | | 13.65 | % | | | 8.22 | % |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are the average annual returns. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2016. All returns are in U.S. dollars ($). |

| 2 | The Fund invests in growth stocks, which may be more sensitive to market movements because their prices tend to reflect future investor expectations rather than just current profits. |

| 3 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 4 | The Russell 1000® Growth Index is a market capitalization weighted index that measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. Unlike the Fund, the Russell 1000® Growth Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell Indices are a trademark of the London Stock Exchange Group companies.

Not FDIC insured, nor bank guaranteed. May lose value.

10

AMG Funds

| | |

| AMG Managers Montag & Caldwell Growth Fund | | October 31, 2016 |

| |

| Schedule of Investments | | |

| | | | | | |

% of Net Assets | | | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| COMMON STOCKS – 93.1% | | | | |

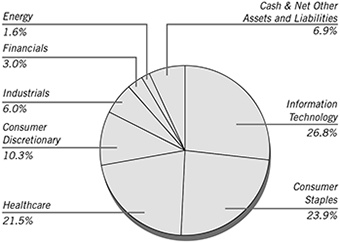

| | | | Consumer Discretionary – 10.3% | | | | |

| | 651,500 | | | Dollar Tree, Inc. * | | $ | 49,220,825 | |

| | 24,979 | | | The Priceline Group, Inc. * | | | 36,824,791 | |

| | 557,800 | | | Starbucks Corp. | | | 29,602,446 | |

| | 317,500 | | | The TJX Cos, Inc. | | | 23,415,625 | |

| | | | | | | | |

| | | | | | | 139,063,687 | |

| | | | | | | | |

| | | | Consumer Staples – 23.9% | | | | |

| | 238,200 | | | Colgate-Palmolive Co. | | | 16,997,953 | |

| | 139,289 | | | Costco Wholesale Corp. | | | 20,596,664 | |

| | 235,700 | | | The Estee Lauder Cos, Inc., Class A | | | 20,536,541 | |

| | 618,300 | | | The Kraft Heinz Co. | | | 54,997,785 | |

| | 1,217,000 | | | Mondelez International, Inc., Class A | | | 54,691,980 | |

| | 224,300 | | | Monster Beverage Corp. * | | | 32,375,462 | |

| | 579,200 | | | PepsiCo, Inc. | | | 62,090,240 | |

| | 713,100 | | | Walgreens Boots Alliance, Inc. | | | 58,994,763 | |

| | | | | | | | |

| | | | | | | 321,281,388 | |

| | | | | | | | |

| | | | Energy – 1.6% | | | | |

| | 295,800 | | | Occidental Petroleum Corp. | | | 21,566,778 | |

| | | | | | | | |

| | | | Financials – 3.0% | | | | |

| | 149,216 | | | Intercontinental Exchange, Inc. | | | 40,346,514 | |

| | | | | | | | |

| | | | Healthcare – 21.5% | | | | |

| | 116,982 | | | Allergan PLC (Ireland) * | | | 24,442,219 | |

| | 195,472 | | | Amgen, Inc. | | | 27,592,828 | |

| | 337,900 | | | Bristol-Myers Squibb Co. | | | 17,202,489 | |

| | 428,200 | | | Celgene Corp. * | | | 43,753,476 | |

| | 594,600 | | | Danaher Corp. | | | 46,705,830 | |

| | 676,700 | | | Medtronic PLC (Ireland) | | | 55,502,934 | |

| | 307,730 | | | Thermo Fisher Scientific, Inc. | | | 45,245,542 | |

| | | | | | |

Shares | | | | Market

Value | |

| | Healthcare (continued) | | | | |

202,800 | | UnitedHealth Group, Inc. | | $ | 28,661,724 | |

| | | | | | |

| | | | | 289,107,042 | |

| | | | | | |

| | Industrials – 6.0% | | | | |

426,100 | | Honeywell International, Inc. | | | 46,734,648 | |

314,600 | | United Parcel Service, Inc., Class B | | | 33,901,296 | |

| | | | | | |

| | | | | 80,635,944 | |

| | | | | | |

| | Information Technology – 26.8% | | | | |

243,200 | | Accenture PLC, Class A (Ireland) | | | 28,269,568 | |

75,357 | | Alphabet, Inc., Class A * | | | 61,031,634 | |

470,000 | | Apple, Inc. | | | 53,363,800 | |

438,900 | | Facebook, Inc., Class A * | | | 57,491,511 | |

215,000 | | Fidelity National Information Services, Inc. | | | 15,892,800 | |

288,300 | | MasterCard, Inc., Class A | | | 30,853,866 | |

762,500 | | QUALCOMM, Inc. | | | 52,399,000 | |

738,200 | | Visa, Inc., Class A | | | 60,908,882 | |

| | | | | | |

| | | | | 360,211,061 | |

| | | | | | |

| | Total Common Stocks

(Cost $1,115,717,490) | | | 1,252,212,414 | |

| | | | | | |

INVESTMENT COMPANY – 6.7% | | | | |

89,795,475 | | Dreyfus Government Cash Management Fund, Institutional Class Shares, 0.28%** | | | 89,795,475 | |

| | | | | | |

| | Total Investment Company

(Cost $89,795,475) | | | 89,795,475 | |

| | | | | | |

Total Investments – 99.8%

(Cost $1,205,512,965)*** | | | 1,342,007,889 | |

| | | | | | |

Net Other Assets and Liabilities – 0.2% | | | 2,776,697 | |

| | | | | | |

Net Assets – 100.0% | | $ | 1,344,784,586 | |

| | | | | | |

| * | Non-income producing security. |

| ** | Yield shown represents the October 31, 2016, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| *** | At October 31, 2016, the aggregate cost for Federal income tax purposes is $1,207,637,272. |

| | | | |

Gross unrealized appreciation | | $ | 165,935,605 | |

Gross unrealized depreciation | | | (31,564,988 | ) |

| | | | |

Net unrealized appreciation | | $ | 134,370,617 | |

| | | | |

| PLC | Public Limited Company |

The accompanying notes are an integral part of these financial statements.

11

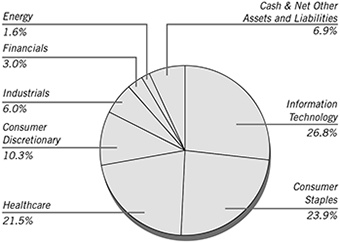

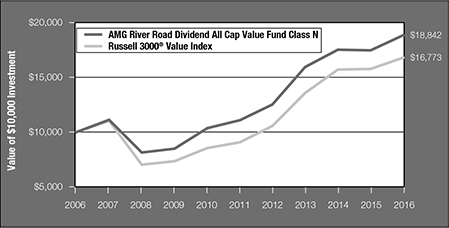

AMG River Road Dividend All Cap Value Fund

Portfolio Manager’s Comments (unaudited)

Over the 12-month period ending October 31, 2016, the AMG River Road Dividend All Cap Value Fund1 (the “Fund”) Class N shares returned 7.88%, outperforming the Russell 3000® Value Index, which returned 6.55%.

The most significant market factors affecting absolute returns were the steady improvement in corporate earnings growth and uncertainty about the timing of monetary tightening by the U.S. Federal Reserve (the Fed). Additionally, according to Ned Davis Research, among S&P 500 companies, those with below average yields significantly outperformed those with above average yields, creating a significant relative headwind for a dividend-oriented fund. Despite these challenges, the Fund outperformed significantly during the period due to both sector allocation and stock selection. The financials sector had the most significant positive impact on relative results in the period, primarily due to the strong performance of numerous real estate investment trust (REIT) holdings. The materials sector had the most significant negative impact on relative results due to weak stock selection.

The two holdings with the largest positive contribution to the Fund’s total return were ADT Corp. (ADT), the number one provider of electronic security and monitoring services in North America, and Microsoft Corp. (MSFT), the multinational technology company behind the Windows operating software. In February, ADT agreed to be acquired by funds affiliated with Apollo Global Management for $42/share in cash, or a +56% premium to the previous closing price. The acquisition price represented a discount to our $50 assessed value. The position was reduced and eventually eliminated due to the acquisition. In October 2015, MSFT announced strong fiscal Q1 2016 results driven by robust cloud revenue growth and much better-than-expected margins. The company also reported strong quarterly results in Q3 2016 with +5% constant currency growth driven by the cloud. In September, MSFT raised its dividend

+8% and announced a new $40B share repurchase program. We reduced the position during the period as it reached its assessed value, but it remained the largest position in the Fund.

The two holdings with the lowest contribution to the Fund’s total return during the period were Martin Midstream Partners LP (MMLP), a diversified master limited partnership with operations focused primarily in the United States Gulf Coast region, and Wells Fargo & Co. (WFC), the third-largest commercial bank in the United States. Shares of MMLP were down at the end of 2015 after the company reported a mixed quarter in which total revenue declined -40% due to lower product sales revenue and operating income decreased -9%. We eliminated the position in Q1 2016 due to unrealized losses. WFC underperformed in light of the macro environment for banks in the beginning of 2016. Economic uncertainty increased around expectations that the Fed could raise interest rates, which caused the banking industry to broadly underperform the market. We trimmed the position on two occasions during the period due to unrealized losses.

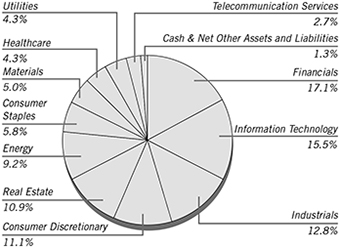

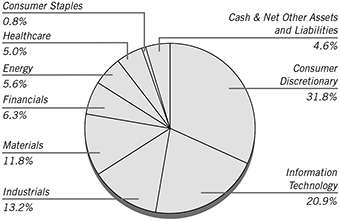

The Fund is significantly overweighted in consumer discretionary, real estate and information technology, and is significantly underweighted in financials, health care, energy and consumer staples. Consumer staples went from +438 bps overweight to -330 bps underweight versus the Russell 3000® Value benchmark, driven by the elimination of two holdings from the Fund in this sector. Real estate was broken out from financials as a separate sector during the year and it ended the period at +523 bps overweight versus the benchmark. Telecommunication services went from +234 bps overweight to -97 bps underweight versus the benchmark, also due to the elimination of two positions from the Fund in this sector. Turnover remained elevated as we dealt with both overvalued positions and accumulated losses, and the average yield of Fund holdings increased modestly. We were pleased to

see that the valuation-driven shift from more defensive sectors toward cyclicals was positive as interest rates moved higher in the later part of the period.

The views expressed represent the opinions of River Road Asset Management LLC, as of October 31, 2016, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

| 1 | Prior to October 1, 2016, the Fund was known as ASTON/River Road Dividend All Cap Value Fund. |

12

AMG River Road Dividend All Cap Value Fund

Portfolio Manager’s Comments (continued)

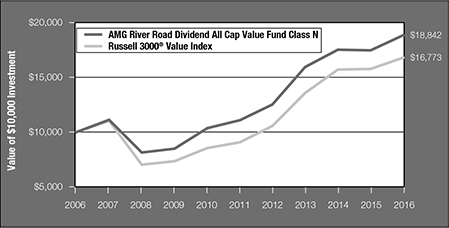

CUMULATIVE TOTAL RETURN PERFORMANCE

The AMG River Road Dividend All Cap Value Fund’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The chart compares a hypothetical $10,000 investment made in AMG River Road Dividend All Cap Value Fund’s Class N on October 31, 2006, to a $10,000 investment made in the Russell 3000® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for AMG River Road Dividend All Cap Value Fund and the Russell 3000® Value Index for the same time periods ended October 31, 2016.

| | | | | | | | | | | | | | | | | | | | |

| | | One | | | Five | | | Ten | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Years | | | Years | | | Inception | | | Date | |

AMG River Road Dividend All Cap Value Fund2,3,4,5,6 | | | | | | | | | | | | | | | | | |

Class N | | | 7.88 | % | | | 11.24 | % | | | 6.54 | % | | | 7.78 | % | | | 06/28/05 | |

Class I | | | 8.15 | % | | | 11.52 | % | | | — | | | | 5.92 | % | | | 06/28/07 | |

Russell 3000® Value Index7 | | | 6.55 | % | | | 13.17 | % | | | 5.31 | % | | | 6.53 | % | | | 06/28/05 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2016. All returns are in U.S. dollars ($). |

| 2 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |

| 3 | The Fund is subject to risks associated with investments in mid-capitalization companies such as greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. |

| 4 | The Fund is subject to special risk considerations similar to those associated with the direct ownership of real estate. Real estate valuations may be subject to factors such as changing general and local economic, financial, competitive, and environmental conditions. |

| 5 | The Fund is subject to risks associated with investments in small-capitalization companies, such as erratic earnings patterns, competitive conditions, limited earnings history and a reliance on one or a limited number of products. |

| 6 | The Fund invests in value stocks, which may perform differently from the market as a whole and may be undervalued by the market for a long period of time. |

| 7 | The Russell 3000® Value Index measures the performance of the broad value segment of the U.S. equity universe. It includes those Russell 3000 companies with lower price-to-book ratios and lower forecasted growth values. Unlike the Fund, the Russell 3000® Value Index is unmanaged, is not available for investment and does not incur expenses. |

The Russell Indices are a trademark of the London Stock Exchange Group Companies.

Not FDIC insured, nor bank guaranteed. May lose value.

13

AMG Funds

| | |

| AMG River Road Dividend All Cap Value Fund | | October 31, 2016 |

| |

| Schedule of Investments | | |

% of Net Assets

| | | | | | | | |

Shares | | | | | Market

Value | |

| COMMON STOCKS – 96.4% | | | | |

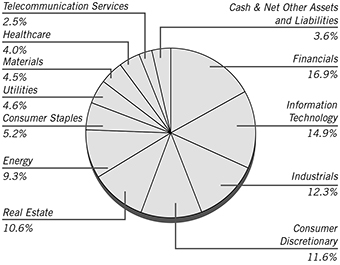

| | | | Consumer Discretionary – 11.6% | | | | |

| | 28,023 | | | Adient PLC (Ireland) * | | $ | 1,275,313 | |

| | 222,586 | | | Cedar Fair LP | | | 12,654,014 | |

| | 468,364 | | | Cinemark Holdings, Inc. | | | 18,640,887 | |

| | 109,830 | | | DineEquity, Inc. | | | 8,687,553 | |

| | 420,308 | | | National CineMedia, Inc. | | | 5,829,672 | |

| | 257,014 | | | Omnicom Group, Inc. | | | 20,514,857 | |

| | 89,783 | | | Polaris Industries, Inc. | | | 6,878,276 | |

| | 224,196 | | | Target Corp. | | | 15,408,991 | |

| | 98,328 | | | Time Warner, Inc. | | | 8,750,209 | |

| | | | | | | | |

| | | | | | | 98,639,772 | |

| | | | | | | | |

| | | | Consumer Staples – 5.2% | | | | |

| | 54,805 | | | Kimberly-Clark Corp. | | | 6,270,240 | |

| | 93,735 | | | PepsiCo, Inc. | | | 10,048,392 | |

| | 282,559 | | | Unilever PLC, Sponsored ADR

(United Kingdom) | | | 11,774,234 | |

| | 227,012 | | | Wal-Mart Stores, Inc. | | | 15,895,380 | |

| | | | | | | | |

| | | | | | | 43,988,246 | |

| | | | | | | | |

| | | | Energy – 9.3% | | | | |

| | 94,031 | | | Chevron Corp. | | | 9,849,747 | |

| | 157,433 | | | Exxon Mobil Corp. | | | 13,117,318 | |

| | 161,647 | | | Magellan Midstream Partners LP | | | 10,867,528 | |

| | 223,037 | | | Occidental Petroleum Corp. | | | 16,261,628 | |

| | 270,051 | | | Spectra Energy Partners LP | | | 11,514,975 | |

| | 212,298 | | | TransMontaigne Partners LP | | | 8,283,868 | |

| | 157,935 | | | Valero Energy Corp. | | | 9,356,069 | |

| | | | | | | | |

| | | | | | | 79,251,133 | |

| | | | | | | | |

| | | | Financials – 16.9% | | | | |

| | 233,163 | | | Allied World Assurance Co. Holdings AG (Switzerland) | | | 10,021,346 | |

| | 545,938 | | | BB&T Corp. | | | 21,400,770 | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| | | | Financials (continued) | | | | |

| | 84,894 | | | CME Group, Inc. | | $ | 8,497,889 | |

| | 160,883 | | | CNA Financial Corp. | | | 5,883,491 | |

| | 256,571 | | | MetLife, Inc. | | | 12,048,574 | |

| | 262,852 | | | The PNC Financial Services Group, Inc. | | | 25,128,651 | |

| | 347,382 | | | Thomson Reuters Corp. (Canada) | | | 13,690,325 | |

| | 492,088 | | | U.S. BanCorp. | | | 22,025,859 | |

| | 73,578 | | | Washington Trust Bancorp, Inc. | | | 3,377,230 | |

| | 355,224 | | | Wells Fargo & Co. | | | 16,343,856 | |

| | 166,991 | | | WesBanco, Inc. | | | 5,495,674 | |

| | | | | | | | |

| | | | | | | 143,913,665 | |

| | | | | | | | |

| | | | Healthcare – 4.0% | | | | |

| | 90,900 | | | Amgen, Inc. | | | 12,831,444 | |

| | 160,116 | | | Cardinal Health, Inc. | | | 10,998,368 | |

| | 320,474 | | | Owens & Minor, Inc. | | | 10,399,381 | |

| | | | | | | | |

| | | | | | | 34,229,193 | |

| | | | | | | | |

| | | | Industrials – 12.3% | | | | |

| | 634,731 | | | Aircastle, Ltd. (Bermuda) | | | 13,043,723 | |

| | 244,359 | | | Emerson Electric Co. | | | 12,384,114 | |

| | 436,800 | | | Fastenal Co. | | | 17,026,464 | |

| | 280,227 | | | Johnson Controls International PLC (Ireland) | | | 11,298,753 | |

| | 131,283 | | | MSC Industrial Direct Co., Inc., Class A | | | 9,557,402 | |

| | 85,708 | | | Parker-Hannifin Corp. | | | 10,520,657 | |

| | 155,412 | | | Union Pacific Corp. | | | 13,704,230 | |

| | 159,235 | | | United Parcel Service, Inc., Class B | | | 17,159,164 | |

| | | | | | | | |

| | | | | | | 104,694,507 | |

| | | | | | | | |

| | | | Information Technology – 14.9% | | | | |

| | 785,385 | | | Corning, Inc. | | | 17,836,093 | |

| | 168,044 | | | CSG Systems International, Inc. | | | 6,390,713 | |

| | 375,693 | | | Intel Corp. | | | 13,100,415 | |

| | 509,164 | | | Microsoft Corp. | | | 30,509,107 | |

| | 263,991 | | | Motorola Solutions, Inc. | | | 19,160,467 | |

| | 163,495 | | | QUALCOMM, Inc. | | | 11,235,376 | |

| | 206,672 | | | TE Connectivity, Ltd. (Switzerland) | | | 12,993,469 | |

| | 793,346 | | | The Western Union Co. | | | 15,922,454 | |

| | | | | | | | |

| | | | | | | 127,148,094 | |

| | | | | | | | |

| | | | Materials – 4.5% | | | | |

| | 174,496 | | | Compass Minerals International, Inc. | | | 12,537,538 | |

| | 104,085 | | | LyondellBasell Industries NV, Class A (Netherlands) | | | 8,279,962 | |

| | 146,323 | | | Praxair, Inc. | | | 17,128,570 | |

| | | | | | | | |

| | | | | | | 37,946,070 | |

| | | | | | | | |

| | | | Real Estate – 10.6% | | | | |

| | 397,417 | | | Communications Sales & Leasing, Inc. | | | 11,298,565 | |

| | 327,950 | | | The GEO Group, Inc. | | | 7,857,682 | |

| | 773,419 | | | Iron Mountain, Inc. | | | 26,087,410 | |

| | 176,635 | | | Ryman Hospitality Properties, Inc. | | | 8,905,937 | |

| | 505,761 | | | Sabra Health Care REIT, Inc. | | | 11,784,231 | |

The accompanying notes are an integral part of these financial statements.

14

AMG Funds

| | |

| AMG River Road Dividend All Cap Value Fund | | October 31, 2016 |

| |

| Schedule of Investments – continued | | |

| | | | | | |

Shares | | | | Market

Value | |

| | Real Estate (continued) | | | | |

191,323 | | Ventas, Inc. | | $ | 12,962,133 | |

371,613 | | Weyerhaeuser Co. | | | 11,122,377 | |

| | | | | | |

| | | | | 90,018,335 | |

| | | | | | |

| | Telecommunication Services – 2.5% | | | | |

442,714 | | Verizon Communications, Inc. | | | 21,294,543 | |

| | | | | | |

| | Utilities – 4.6% | | | | |

334,548 | | AmeriGas Partners LP | | | 15,974,667 | |

306,447 | | National Fuel Gas Co. | | | 16,051,694 | |

144,815 | | Vectren Corp. | | | 7,285,643 | |

| | | | | | |

| | | | | 39,312,004 | |

| | | | | | |

| | Total Common Stocks

(Cost $708,121,484) | | | 820,435,562 | |

| | | | | | |

| INVESTMENT COMPANY – 3.7% | | | | |

31,615,358 | | Dreyfus Government Cash Management Fund, Institutional Class Shares, 0.28%** | | | 31,615,358 | |

| | | | | | |

| | Total Investment Company

(Cost $31,615,358) | | | 31,615,358 | |

| | | | | | |

Total Investments – 100.1%

(Cost $739,736,842)*** | | | 852,050,920 | |

| | | | | | |

Net Other Assets and Liabilities – (0.1)% | | | (1,189,683 | ) |

| | | | | | |

Net Assets – 100.0% | | $ | 850,861,237 | |

| | | | | | |

| * | Non-income producing security. |

| ** | Yield shown represents the October 31, 2016, seven-day average yield, which refers to the sum of the previous seven days’ dividends paid, expressed as an annual percentage. |

| *** | At October 31, 2016, the aggregate cost for Federal income tax purposes is $743,643,159. |

| | | | |

Gross unrealized appreciation | | $ | 128,209,924 | |

Gross unrealized depreciation | | | (19,802,163 | ) |

| | | | |

Net unrealized appreciation | | $ | 108,407,671 | |

| | | | |

| | |

| ADR | | American Depositary Receipt |

| LP | | Limited Partnership |

| PLC | | Public Limited Company |

| REIT | | Real Estate Investment Trust |

The accompanying notes are an integral part of these financial statements.

15

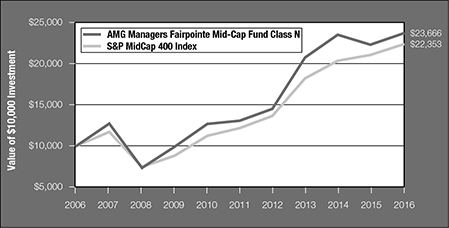

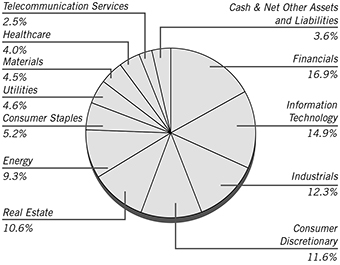

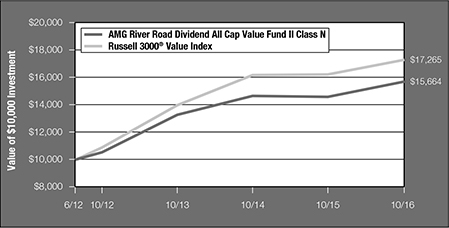

AMG River Road Dividend All Cap Value Fund II

Portfolio Manager’s Comments (unaudited)

Over 12-month period ending October 31, 2016, the AMG River Road Dividend All Cap Value Fund II1 (the “Fund”) Class N shares returned 7.61%, outperforming the Russell 3000® Value Index, which returned 6.55%.

The most significant market factors affecting absolute returns were the steady improvement in corporate earnings growth and uncertainty about the timing of monetary tightening by the U.S. Federal Reserve (the Fed). Additionally, according to Ned Davis Research, among S&P 500 companies, those with below average yields significantly outperformed those with above average yields, creating a significant relative headwind for a dividend-oriented fund. Despite these challenges, the Fund outperformed significantly during the period due to both sector allocation and stock selection. The financials sector had the most significant positive impact on relative results in the period, primarily due to the strong performance of certain real estate investment trust (REIT) holdings. The utilities sector had the most significant negative impact on relative results due to both relatively weak stock selection and an underweight allocation.

The two holdings with the largest positive contribution to the Fund’s total return were ADT Corp. (ADT), the number one provider of electronic security and monitoring services in North America, and Microsoft Corp. (MSFT), the multinational technology company behind the Windows operating software. In February, ADT agreed to be acquired by funds affiliated with Apollo Global Management for $42/share in cash, or a +56% premium to the previous closing price. The acquisition price represented a discount to our $50 assessed value. The position was reduced and eventually eliminated due to the acquisition. In October 2015, MSFT

announced strong fiscal Q1 2016 results driven by robust cloud revenue growth and much better-than-expected margins. The company also reported strong quarterly results in Q3 2016 with +5% constant currency growth driven by the cloud. In September, MSFT raised its dividend +8% and announced a new $40B share repurchase program. We reduced the position during the period as it reached it assessed value, but it remained the largest position in the Fund.

The two holdings with the lowest contribution to the Fund’s total return during the period were Wells Fargo & Co. (WFC), the third-largest commercial bank in the United States, and Kohl’s Corp. (KSS). WFC underperformed in light of the macro environment for banks in the beginning of 2016. Economic uncertainty increased around expectations that the Fed could raise interest rates, which caused the banking industry to broadly underperform the market. We trimmed the position on two occasions during the period due to unrealized losses. In Q2 2016, KSS reported a weak quarter with comparable sales down -4%. The sales decline was steeper than expected and put an abrupt end to Kohl’s six quarters of positive sales growth. Management comments indicated that Kohl’s free cash flow generation, central to our thesis, could be in a very slow decline. We exited the position due to accumulated losses and a decreased conviction.

The Fund is significantly overweight in consumer discretionary, real estate and information technology, and is significantly underweight in financials, health care, energy and consumer staples. Consumer staples went from +520 bps overweight to -266 bps underweight versus the Russell 3000® Value benchmark, driven by the elimination of two holdings from the Fund in this sector. Real estate was broken out from financials as a

separate sector during the year, and it ended the period at +557 bps overweight versus the benchmark. The underweight in energy went from -643 bps to -348 bps versus the benchmark due to three new holdings and one elimination from the Fund in this sector. Turnover remained elevated as we dealt with both overvalued positions and accumulated losses, and the average yield of Fund holdings increased modestly. We were pleased to see that the valuation-driven shift from more defensive sectors toward cyclicals was positive as interest rates moved higher in the later part of the period.

The views expressed represent the opinions of River Road Asset Management LLC , as of October 31, 2016, and are not intended as a forecast or guarantee of future results and are subject to change without notice.

| 1 | Prior to October 1, 2016, the Fund was known as ASTON/River Road Dividend All Cap Value Fund II. |

16

AMG River Road Dividend All Cap Value Fund II

Portfolio Manager’s Comments (continued)

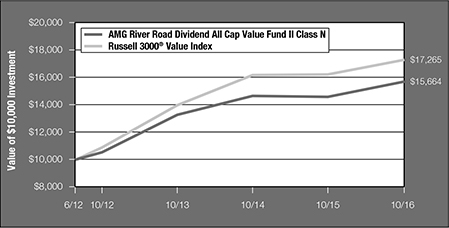

CUMULATIVE TOTAL RETURN PERFORMANCE

The AMG River Road Dividend All Cap Value Fund II’s cumulative total return is based on the daily change in net asset value (NAV), and assumes that all dividends and distributions were reinvested. The chart compares a hypothetical $10,000 investment made in AMG River Road Dividend All Cap Value Fund II’s Class N on June 27, 2012, to a $10,000 investment made in the Russell 3000® Value Index for the same time period. The graph and table do not reflect the deduction of taxes that a shareholder would pay on a Fund distribution or redemption of shares. The listed returns for the Fund are net of expenses and the returns for the index exclude expenses. Total returns would have been lower had certain expenses not been reduced.

The table below shows the average annual total returns for AMG River Road Dividend All Cap Value Fund II and the Russell 3000® Value Index for the same time periods ended October 31, 2016.

| | | | | | | | | | | | |

| | | One | | | Since | | | Inception | |

| Average Annual Total Returns1 | | Year | | | Inception | | | Date | |

AMG River Road Dividend All Cap Value Fund II2,3,4,5,6 | | | | | | | | | | | | |

Class N | | | 7.61 | % | | | 10.87 | % | | | 06/27/12 | |

Class I | | | 7.87 | % | | | 11.16 | % | | | 06/27/12 | |

Russell 3000® Value Index7 | | | 6.55 | % | | | 13.70 | % | | | 06/27/12 | † |

The performance data shown represents past performance. Past performance is not a guarantee of future results. Current performance may be lower or higher than the performance data quoted. The investment return and the principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost.

Investors should carefully consider the Fund’s investment objectives, risks, charges and expenses before investing. For performance information through the most recent month end, current net asset values per share for the Fund and other information, please call (800) 835-3879 or visit our website at www.amgfunds.com for a free prospectus. Read it carefully before investing or sending money.

Distributed by AMG Distributors, Inc., member FINRA/SIPC.

| † | Date reflects the inception date of the Fund, not the index. |

| 1 | Total return equals income yield plus share price change and assumes reinvestment of all dividends and capital gain distributions. Returns are net of fees and may reflect offsets of Fund expenses as described in the prospectus. No adjustment has been made for taxes payable by shareholders on their reinvested dividends and capital gain distributions. Returns for periods greater than one year are annualized. The listed returns on the Fund are net of expenses and based on the published NAV as of October 31, 2016. All returns are in U.S. dollars ($). |

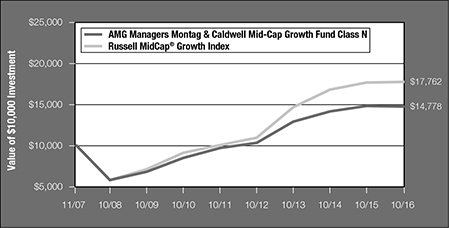

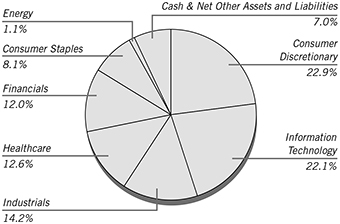

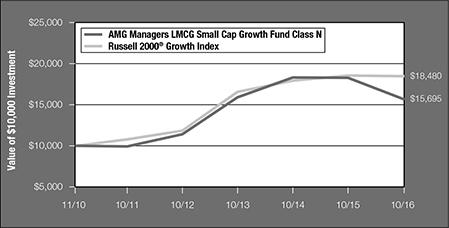

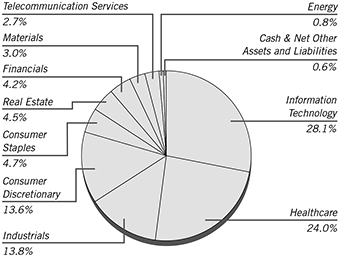

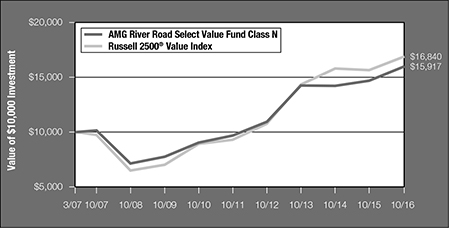

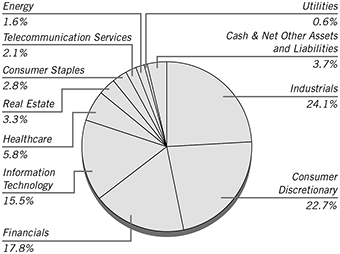

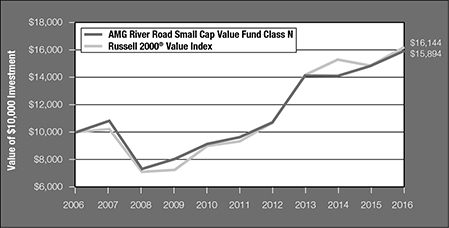

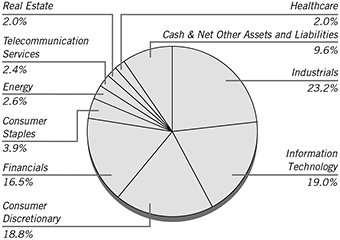

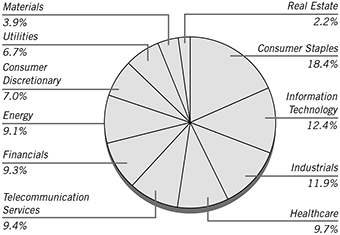

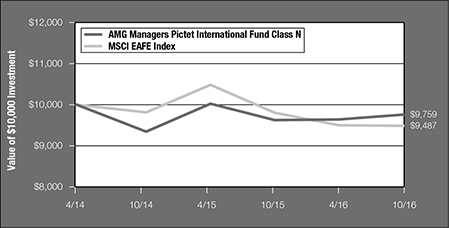

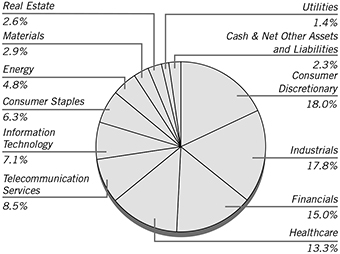

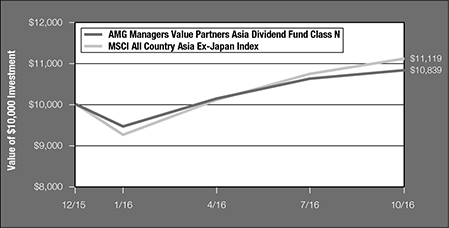

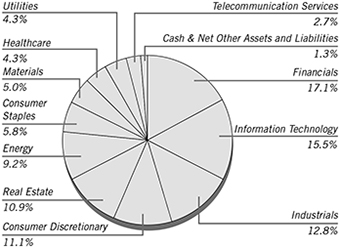

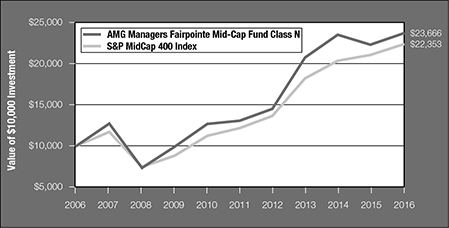

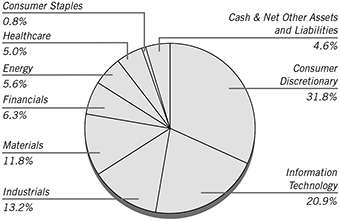

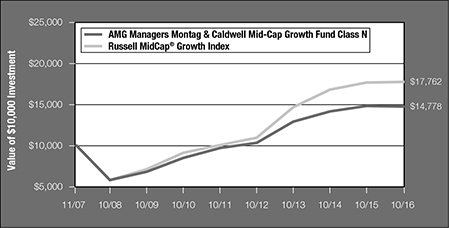

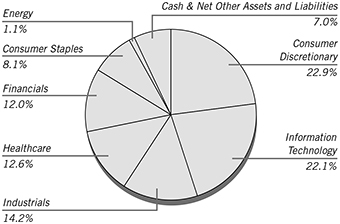

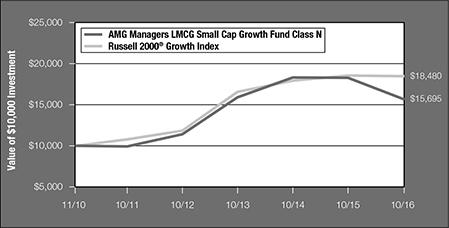

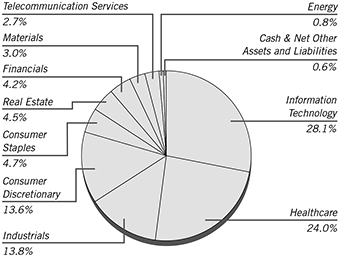

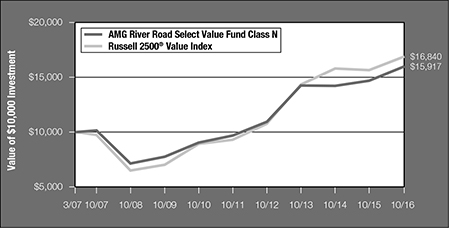

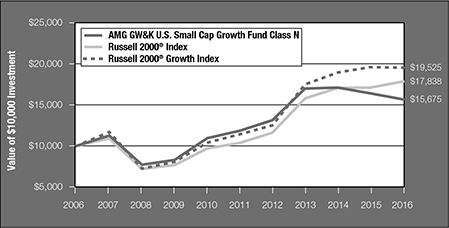

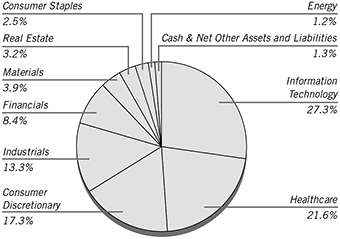

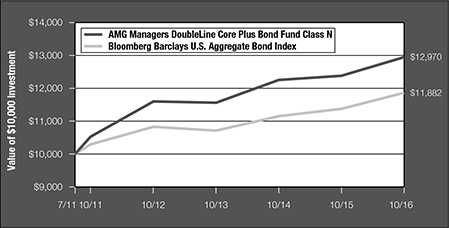

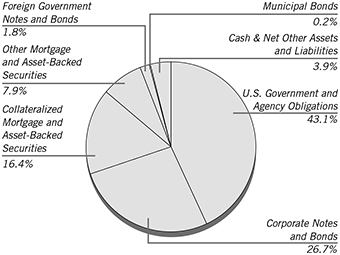

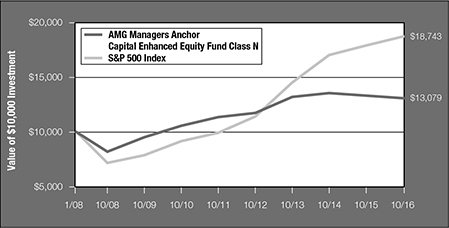

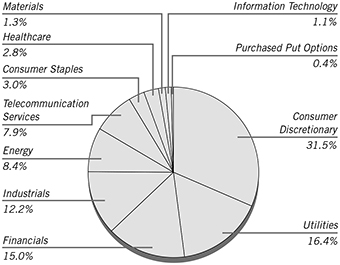

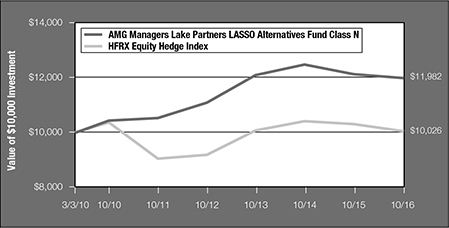

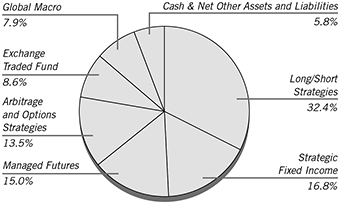

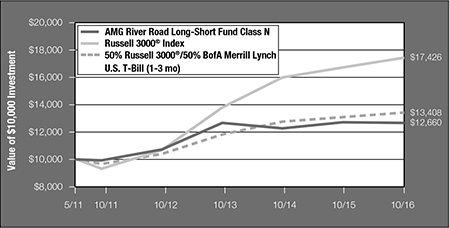

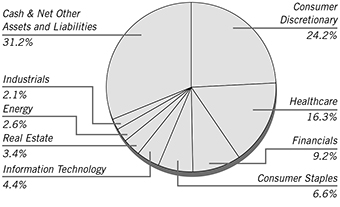

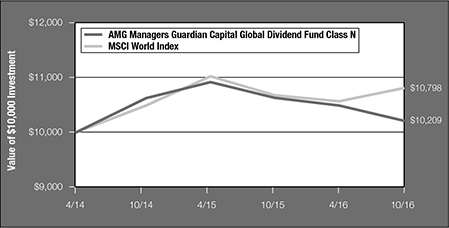

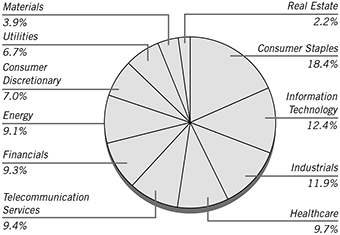

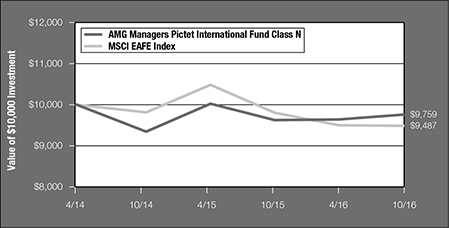

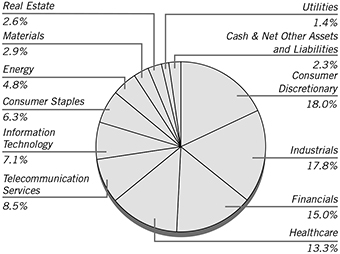

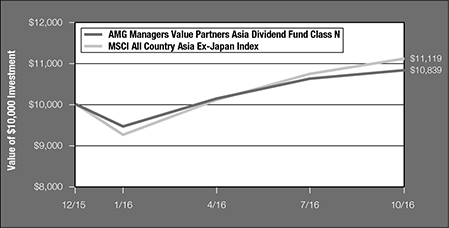

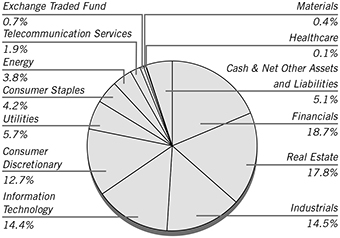

| 2 | Investments in international securities are subject to certain risks of overseas investing including currency fluctuations and changes in political and economic conditions, which could result in significant market fluctuations. These risks are magnified in emerging markets. |