UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-08004

Aston Funds

(Exact name of registrant as specified in charter)

120 North LaSalle Street, 25th Floor

Chicago, IL 60602

(Address of principal executive offices) (Zip code)

Kenneth C. Anderson, President

Aston Funds

120 North LaSalle Street, 25th Floor

Chicago, IL 60602

(Name and address of agent for service)

Registrant’s telephone number, including area code: (312) 268-1400

Date of fiscal year end: October 31

Date of reporting period: October 31, 2013

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

Item 1. Reports to Stockholders.

The Report to Shareholders is attached herewith.

Annual Report 2013

October 31, 2013

Class N, I & R Shares

Equity

Fixed Income

Alternative

International

Sector

Balanced

Aston Funds

Dear Fellow Shareholder:

As I reflect on the past 12 months, ending October 31, 2013, I am reminded of one of the most memorable quotes by the great Russian author Leo Tolstoy: “The strongest of all warriors are these two—Time and Patience.”

About a year ago, it was beginning to dawn on much of the investment community that the world was not coming to an end. Although bearish sentiment and uncertainty still ran high, there were reasons to be hopeful that with time and patience, the global economy and world financial markets could continue healing from the deep wounds sustained during the Great Recession. In the summer, this optimism was further bolstered by evidence that the global economy—led by growth in developed nations such as the United States—was accelerating and corporate earnings were improving. Against this backdrop, the Standard & Poor’s 500 Index, a broad gauge of the U.S. stock market, was up 27% for the period, finishing at a new high and marking one of the index’s best 12-month periods since 2003. Small stocks soared even higher, with the Russell 2000 Index up 36%. Developed market equities tended to fare best, while foreign equity markets produced significantly divergent results for the year, and emerging markets securities lagged amid worries about growth in those nations.

Bonds, meanwhile, charted a more volatile course. After a multi-year period of outperformance of equities, the improving global economy significantly dampened investors’ aversion to risk and their appetite for “risk-free” government securities. The growing likelihood that the Federal Reserve would begin to taper its purchases of Treasury and agency mortgage-backed securities was another chief concern. Since these accommodative policies were largely credited with keeping interest rates low, the prospects of a higher interest rates weighed heavily on U.S. investment-grade bonds, as measured by the -1.1% return of the Barclays U.S. Aggregate Bond Index.

Although the future is inherently uncertain, we believe that our talented investment managers have proven their ability to persevere across multiple market cycles. They may, at times, be overshadowed in the short term by those who are temporarily lifted by prevailing market trends. But in our view, our investors are best served by Aston’s skilled, active managers who have exhibited the patience to survive and thrive over time.

We are pleased to present you with the Aston Funds annual report and appreciate your continued support of the Aston Funds family.

Sincerely,

Kenneth C. Anderson

President

Aston Funds

|

| The views expressed in this report reflect those of the portfolio managers only, through the end of the period covered and do not necessarily represent the views of Aston Funds or Aston Asset Management, LP. Any such views are subject to change at any time based upon market or other conditions and Aston Funds and Aston Asset Management, LP disclaim any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for an Aston Fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Aston Fund. |

Aston Funds

Large Cap Funds

ASTON/Montag & Caldwell Growth Fund

ASTON/TAMRO Diversified Equity Fund

ASTON/Herndon Large Cap Value Fund

ASTON/Cornerstone Large Cap Value Fund

Equity Income Funds

ASTON/River Road Dividend All Cap Value Fund

ASTON/River Road Dividend All Cap Value Fund II

Mid Cap Funds

ASTON/Fairpointe Mid Cap Fund

ASTON/Montag & Caldwell Mid Cap Growth Fund

Table of Contents

Small Cap Funds

ASTON/LMCG Small Cap Growth Fund

(formerly, ASTON Small Cap Growth Fund)

ASTON/Silvercrest Small Cap Fund

ASTON/TAMRO Small Cap Fund

ASTON/River Road Select Value Fund

ASTON/River Road Small Cap Value Fund

ASTON/River Road Independent Value Fund

Fixed Income Funds

ASTON/DoubleLine Core Plus Fixed Income Fund ASTON/TCH Fixed Income Fund

Alternative Funds

ASTON/Lake Partners LASSO Alternatives Fund

ASTON/Anchor Capital Enhanced Equity Fund

ASTON/River Road Long-Short Fund

International Funds

ASTON/Barings International Fund

ASTON/LMCG Emerging Markets Fund

Sector Fund

ASTON/Harrison Street Real Estate Fund

Balanced Fund

ASTON/Montag & Caldwell Balanced Fund

This report is submitted for general information to the shareholders of the funds. It is not authorized for distribution to prospective investors in the funds unless preceded or accompanied by an effective prospectus which includes details regarding the funds’ objectives, policies, expenses and other information.

Aston Funds are distributed by Foreside Funds Distributors LLC, 400 Berwyn Park, 899 Cassatt Road, Berwyn, PA 19312

Shareholder Services 800-992-8151 • www.astonfunds.com

NOT FDIC INSURED • NO BANK GUARANTEE • MAY LOSE VALUE

ASTON/Montag & Caldwell Growth Fund

| | |

| |

| Portfolio Manager Commentary (unaudited) | | October 31, 2013 |

| | Ronald E. Canakaris, CFA, CIC |

| Q. | What were the most significant market factors affecting Fund performance and returns relative to the benchmark during the past 12 months? |

| A. | The Class N Shares of the Fund gained 22.61% during the past year, trailing the Russell 1000 Growth Index gain of 28.30% and the S&P 500 Index, which rose 27.16%. The Fund benefited from good stock selection in the Consumer Discretionary, Information Technology and Financial sectors, as well as an underweight position to the Information Technology sector. The Fund lagged the benchmark due to an overweight position to the Consumer Staples sector, an underweight position to the Consumer Discretionary sector and its cash reserve. Adverse stock section in the Healthcare, Industrials and Energy sectors also detracted from performance relative to the benchmark. |

| Q. | What were the best performing holdings for the Fund during the period? |

| A. | Biogen was the Fund’s top performing stock, as the company enjoyed stable demand in its major franchises and the company launched Tecfidera, an oral therapy for the treatment of multiple sclerosis. Starbucks rose strongly during the period, as the company delivered top- and bottom-line results that far surpassed peers within the restaurant industry, as well as investor expectations. Johnson Controls surged, as the company reported better than expected results driven by ongoing improvement in the global automotive business and benefits from cost restructuring actions taken by management earlier this year. Amerisource Bergen gained, as the company is benefiting from increased scale and purchasing power as a result of its agreement with Walgreen/Alliance Boots. Nike was a top performer as the company is benefiting from growing enthusiasm around its innovative new product cycle, which should allow double digit earnings growth in fiscal year 2014, as well as improvement in gross margins and robust growth in direct consumer sales. |

| Q. | What were the weakest performing holdings? |

| A. | Express Scripts fell in the fourth quarter of 2012 and the position was eliminated in the first quarter of 2013 as benefits from the company’s merger with Medco were waning and earnings growth was expected to decelerate sharply, reflecting the roll-off of additional United Health claims and the fully consolidated post-merger comparisons. EMC was slightly negative during the period as investors became concerned that capital spending will be reduced on storage as it is shifted from on-premise capacity to infrastructure as a service by cloud providers, negatively impacting demand for EMC’s products. Allergan was unchanged during the period, which significantly lagged the gains in the Healthcare sector. The company experienced a delay in the clinical trials of an age-related macular degeneration product and the stock declined following the release of draft guidance from the FDA for generic Restasis bioequivalence. Coca-Cola and Philip Morris were up single digits during the period, lagging the market. Both companies have had their earnings impacted by a slow-down in emerging markets and adverse currency movements. |

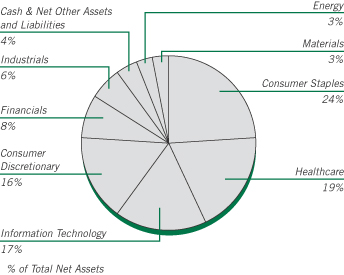

| Q. | How was the Fund positioned as of October 31, 2013? |

| A. | We believe the high quality growth stocks held in the Fund are well positioned for the period ahead. They are reasonably valued, and in our opinion offer more assured earnings growth due to their global diversification and financial strength. In addition, many of the Fund’s holdings have above average dividend yields and dividend growth prospects. We expect economic growth to continue to be more moderate than generally assumed as the developed world deleverages, and for the Federal Reserve to keep short term interest rates low for a long time. |

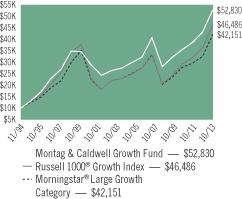

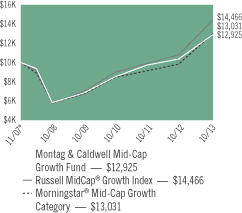

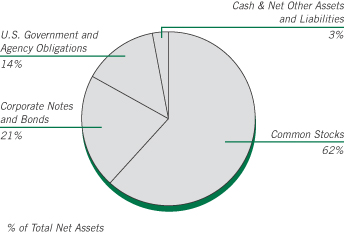

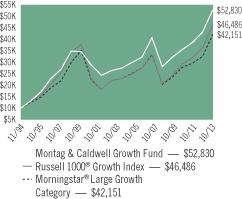

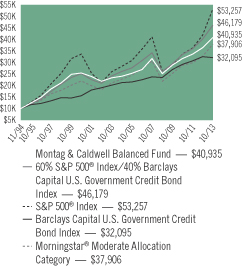

Growth of a Hypothetical

$10,000 Investment—Class N

All dividends and capital gains are reinvested. Indexes are unmanaged and do not take into account fees, expenses or other costs.

Returns shown in the chart and table do not reflect taxes that a shareholder would pay on Fund distributions or on the sale of the Fund shares.

RETURNSFOR PERIOD ENDED 10/31/13

Average Annual Total Returns - Class N

| | | | |

One Year | | | 22.61 | % |

Five Year | | | 13.46 | % |

Ten Year | | | 7.16 | % |

Since Inception | | | 9.16 | % |

Inception Date 11/02/94

Average Annual Total Returns - Class I

| | | | |

One Year | | | 22.95 | % |

Five Year | | | 13.75 | % |

Ten Year | | | 7.44 | % |

Since Inception | | | 7.57 | % |

Inception Date 06/28/96

Average Annual Total Returns - Class R

| | | | |

One Year | | | 22.30 | % |

Five Year | | | 13.18 | % |

Ten Year | | | 6.91 | % |

Since Inception | | | 7.42 | % |

Inception Date 12/31/02

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, upon redemption, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit our website at www.astonfunds.com.

The total expense ratios for Class N, Class I and Class R Shares are 1.06%, 0.81% and 1.31% respectively, as disclosed in the prospectus dated February 28, 2013. Please refer to the Financial Highlights section in this report for more information.

| | |

| |

| ASTON/Montag & Caldwell Growth Fund | | October 31, 2013 |

| |

| Schedule of Investments | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

|

| | COMMON STOCKS – 95.83% | |

| |

| | | | Consumer Discretionary – 16.00% | |

| | 1,189,030 | | | Bed Bath & Beyond * | | $ | 91,935,800 | |

| | 3,119,700 | | | Johnson Controls | | | 143,974,155 | |

| | 2,416,400 | | | NIKE, Class B | | | 183,066,464 | |

| | 91,046 | | | Priceline.com * | | | 95,947,006 | |

| | 318,063 | | | Ralph Lauren | | | 52,683,955 | |

| | 1,633,300 | | | Starbucks | | | 132,378,965 | |

| | 2,264,600 | | | TJX | | | 137,665,034 | |

| | | | | | | | |

| | | | | | | 837,651,379 | |

| | | | | | | | |

| | |

| | | | Consumer Staples – 23.99% | | | | |

| | 4,229,400 | | | Coca-Cola | | | 167,357,358 | |

| | 2,510,000 | | | Colgate-Palmolive | | | 162,472,300 | |

| | 659,900 | | | Costco Wholesale | | | 77,868,200 | |

| | 2,435,200 | | | Estee Lauder, Class A | | | 172,801,792 | |

| | 5,133,700 | | | Mondelez International, Class A | | | 172,697,668 | |

| | 2,004,500 | | | PepsiCo | | | 168,558,405 | |

| | 1,867,000 | | | Philip Morris International | | | 166,387,040 | |

| | 2,079,800 | | | Procter & Gamble | | | 167,943,850 | |

| | | | | | | | |

| | | | | | | 1,256,086,613 | |

| | | | | | | | |

| | |

| | | | Energy – 3.36% | | | | |

| | 1,833,100 | | | Occidental Petroleum | | | 176,124,248 | |

| | | | | | | | |

| | |

| | | | Financials – 7.69% | | | | |

| | 1,160,000 | | | American Express | | | 94,888,000 | |

| | 798,000 | | | Franklin Resources | | | 42,980,280 | |

| | 1,572,200 | | | State Street | | | 110,164,054 | |

| | 3,619,600 | | | Wells Fargo | | | 154,520,724 | |

| | | | | | | | |

| | | | | | | 402,553,058 | |

| | | | | | | | |

| | |

| | | | Healthcare – 18.50% | | | | |

| | 4,807,700 | | | Abbott Laboratories | | | 175,721,435 | |

| | 1,840,000 | | | Allergan | | | 166,722,400 | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| | |

| | | | Healthcare (continued) | | | | |

| | 1,879,800 | | | AmerisourceBergen | | $ | 122,807,334 | |

| | 662,967 | | | Biogen Idec * | | | 161,889,912 | |

| | 1,811,100 | | | Gilead Sciences * | | | 128,569,989 | |

| | 2,033,900 | | | Sanofi, ADR | | | 108,772,972 | |

| | 1,411,800 | | | Stryker | | | 104,275,548 | |

| | | | | | | | |

| | | | | | | 968,759,590 | |

| | | | | | | | |

| | |

| | | | Industrials – 6.35% | | | | |

| | 7,072,800 | | | General Electric | | | 184,882,992 | |

| | 1,499,800 | | | United Parcel Service, Class B | | | 147,340,352 | |

| | | | | | | | |

| | | | | | | 332,223,344 | |

| | | | | | | | |

| |

| | | | Information Technology – 16.84% | |

| | 544,500 | | | Accenture, Class A (Ireland) | | | 40,020,750 | |

| | 2,561,800 | | | eBay * | | | 135,032,478 | |

| | 1,496,500 | | | EMC | | | 36,020,755 | |

| | 415,200 | | | F5 Networks * | | | 33,842,952 | |

| | 256,662 | | | Google, Class A * | | | 264,510,724 | |

| | 4,851,000 | | | Juniper Networks * | | | 90,422,640 | |

| | 2,258,000 | | | QUALCOMM | | | 156,863,260 | |

| | 634,900 | | | Visa, Class A | | | 124,865,783 | |

| | | | | | | | |

| | | | | | | 881,579,342 | |

| | | | | | | | |

| | |

| | | | Materials – 3.10% | | | | |

| | 1,549,800 | | | Monsanto | | | 162,543,024 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Cost $3,987,546,489) | | | 5,017,520,598 | |

| | | | | | | | |

|

| INVESTMENT COMPANY – 4.19%

|

|

| | |

| | 219,503,319 | | | BlackRock Liquidity Funds

TempCash Portfolio | | | 219,503,319 | |

| | | | | | | | |

| | |

| | | | Total Investment Company

(Cost $219,503,319) | | | 219,503,319 | |

| | | | | | | | |

| Total Investments – 100.02%

(Cost $4,207,049,808)** | | | 5,237,023,917 | |

| | | | | | | | |

| Net Other Assets and Liabilities – (0.02)% | | | (1,227,241 | ) |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 5,235,796,676 | |

| | | | | | | | |

| * | | Non-income producing security. |

| ** | | Aggregate cost for Federal income tax purposes is $4,213,183,141. |

| | | | |

Gross unrealized appreciation | | $ | 1,043,014,106 | |

Gross unrealized depreciation | | | (19,173,330 | ) |

| | | | |

Net unrealized appreciation | | $ | 1,023,840,776 | |

| | | | |

| ADR | | American Depositary Receipt |

See accompanying Notes to Financial Statements.

ASTON/TAMRO Diversified Equity Fund

| | |

| |

| Portfolio Manager Commentary (unaudited) | | October 31, 2013 |

Philip D. Tasho, CFA & Timothy A. Holland, CFA

| Q. | What were the most significant market factors affecting Fund performance and returns relative to the benchmark during the past 12 months? |

| A. | The fiscal year ended October 31, 2013 was a robust year for equities across the market cap spectrum due to slow, but steady economic growth, an ongoing housing rebound that boosted consumer sentiment and spending, little to no inflation and accommodative monetary policy. While providing a healthy return of 24.29% for Class N Shares on an absolute basis, the Fund trailed its benchmark, the Russell 1000 Index for two primary reasons. First, many of the year’s big winners — stocks with 100%+ returns — were at the extremes of the growth/value spectrum. These companies typically did not dovetail with our investment philosophy, either because of fundamentals or valuation, and we could not justify owning them. The second reason was stock selection. We owned a number of companies that simply did not execute in line with our expectations. In some cases, we sold the positions to fund higher-confidence opportunities. In other cases, where we believe the long-term opportunity remains, we added to those positions on weakness. |

| Q. | What were the best performing holdings for the Fund during the period? |

| A. | The three holdings that contributed the most to performance were Chicago Bridge & Iron, Amazon.com and Boeing. Chicago Bridge & Iron reported better-than-expected revenues and earnings and an improving backlog from energy-related infrastructure projects globally. The significant investments Amazon.com made in technology, digital content and fulfillment centers to support future growth began to bear fruit, resulting in improving sales and gross margins. Shares of Boeing moved higher due to strengthening operating margins and an increased backlog for its aircraft that now represents nearly six years of production. |

| Q. | What were the weakest performing holdings? |

| A. | Increased competition weighed on Apple shares, as revenue and earnings came in |

| | below consensus estimates and the company’s new guidance range was lower than anticipated. Royal Gold corrected in sympathy with the price of gold. Carnival, the largest global cruise company, experienced several cruise mishaps that caused significant negative publicity and resulted in lowered guidance to reflect weaker ticket pricing and costs for ship repair. |

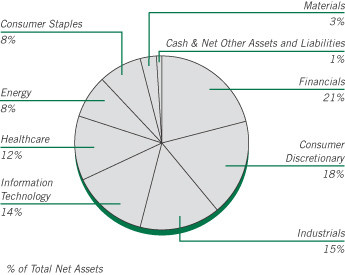

| Q. | How was the Fund positioned as of October 31, 2013? |

| A. | The Fund’s investment process focuses on individual, bottom-up stock selection to identify companies that we believe possess a sustainable competitive advantage and are attractively valued. Our approach to portfolio management is opportunistic and broadly diversified, with sector weights determined by where we see opportunities at the stock level. |

While we remain positive toward the equity markets, we believe this is not an average economic recovery where a rising tide will lift all boats. In this environment, valuations for companies that are executing may go higher than in recent years —i.e. multiples will expand. We need to differentiate between speculative stocks and those that are truly out-executing their peers and should resonate long term. We are closely looking at historical valuations and are ever watchful for opportunities as they dovetail with our three investment categories: Leaders, Laggards, and Innovators.

We continue to orient the portfolio toward better-capitalized, better-run companies that participate in more domestic facing industries such as Consumer Discretionary and Financial Services. As the U.S. consumer, U.S. housing and the U.S. economy continue to come back, these companies should be well positioned. As of October 31, 2013, Financials, Consumer Discretionary and Industrials were the largest sectors in the Fund. Among our investment categories, Leaders and Innovators, which tend to be higher quality companies with leading market share and tenured management teams, comprised 80% of the portfolio. Laggards, or companies undergoing restructuring, made up 20%.

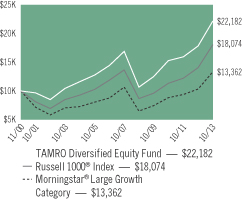

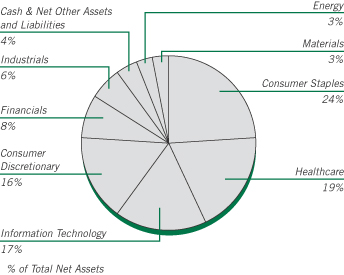

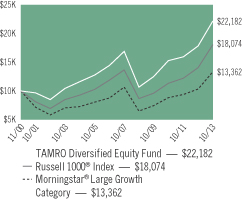

Growth of a Hypothetical

$10,000 Investment—Class N

All dividends and capital gains are reinvested. Indexes are unmanaged and do not take into account fees, expenses or other costs.

Returns shown in the chart and table do not reflect taxes that a shareholder would pay on Fund distributions or on the sale of the Fund shares.

RETURNSFOR PERIOD ENDED 10/31/13

Average Annual Total Returns - Class N

| | | | |

One Year | | | 24.29 | % |

Five Year | | | 15.70 | % |

Ten Year | | | 7.81 | % |

Since Inception | | | 6.36 | % |

Inception Date 11/30/00

Average Annual Total Returns - Class I

| | | | |

One Year | | | 24.64 | % |

Since Inception | | | 15.50 | % |

Inception date 03/02/12

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, upon redemption, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit our website at www.astonfunds.com.

The performance quoted would have been lower if fee waivers and/or expense reimbursements had not been in effect.

The total expense ratios for Class N and Class I Shares are 1.68% and 1.43% respectively, as disclosed in the prospectus dated February 28, 2013. Please refer to the Financial Highlights section in this report for more information.

| | |

| |

| ASTON/TAMRO Diversified Equity Fund | | October 31, 2013 |

| |

| Schedule of Investments | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

|

| | COMMON STOCKS – 99.82% | |

| | |

| | | | Consumer Discretionary – 17.78% | | | | |

| | 4,979 | | | Amazon.com * | | $ | 1,812,505 | |

| | 22,655 | | | Arcos Dorados Holdings, Class A

(Argentina) | | | 272,766 | |

| | 15,100 | | | Bed Bath & Beyond * | | | 1,167,532 | |

| | 39,493 | | | Best Buy | | | 1,690,300 | |

| | 21,493 | | | CarMax * | | | 1,009,956 | |

| | 14,455 | | | Coach | | | 732,579 | |

| | 12,209 | | | GNC Holdings, Class A | | | 718,133 | |

| | 10,730 | | | Home Depot | | | 835,760 | |

| | 17,667 | | | Macy’s | | | 814,625 | |

| | 11,076 | | | Red Robin Gourmet Burgers * | | | 843,770 | |

| | | | | | | | |

| | | | | | | 9,897,926 | |

| | | | | | | | |

| | | | Consumer Staples – 7.74% | | | | |

| | 25,148 | | | Mondelez International, Class A | | | 845,979 | |

| | 22,947 | | | Safeway | | | 800,850 | |

| | 19,340 | | | United Natural Foods * | | | 1,381,843 | |

| | 21,647 | | | Walgreen | | | 1,282,368 | |

| | | | | | | | |

| | | | | | | 4,311,040 | |

| | | | | | | | |

| | | | Energy – 8.17% | | | | |

| | 11,118 | | | Continental Resources * | | | 1,266,340 | |

| | 22,143 | | | Kinder Morgan | | | 781,869 | |

| | 6,039 | | | Occidental Petroleum | | | 580,227 | |

| | 8,635 | | | Phillips 66 | | | 556,353 | |

| | 14,491 | | | Range Resources | | | 1,097,114 | |

| | 14,572 | | | Ultra Petroleum (Canada) * | | | 267,542 | |

| | | | | | | | |

| | | | | | | 4,549,445 | |

| | | | | | | | |

| | | | Financials – 20.91% | | | | |

| | 14,337 | | | American Express | | | 1,172,767 | |

| | 27,228 | | | American International Group | | | 1,406,326 | |

| | 16,733 | | | American Tower, REIT | | | 1,327,764 | |

| | 16,229 | | | Bank of the Ozarks | | | 803,011 | |

| | 9,073 | | | Berkshire Hathaway, Class B * | | | 1,044,121 | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| | |

| | | | Financials (continued) | | | | |

| | 29,063 | | | Citigroup | | $ | 1,417,693 | |

| | 49,923 | | | FirstMerit | | | 1,121,271 | |

| | 78,004 | | | Itau Unibanco Holding SA (Brazil), ADR | | | 1,202,042 | |

| | 12,006 | | | Ocwen Financial Corp * | | | 675,097 | |

| | 13,562 | | | Portfolio Recovery Associates * | | | 806,261 | |

| | 38,019 | | | Redwood Trust, REIT | | | 666,093 | |

| | | | | | | | |

| | | | | | | 11,642,446 | |

| | | | | | | | |

| | |

| | | | Healthcare – 12.01% | | | | |

| | 10,600 | | | Allergan | | | 960,466 | |

| | 5,101 | | | Athenahealth * | | | 681,035 | |

| | 19,170 | | | Catamaran (Canada) * | | | 900,223 | |

| | 19,056 | | | DaVita HealthCare Partners * | | | 1,071,138 | |

| | 15,303 | | | Edwards Lifesciences * | | | 997,603 | |

| | 16,717 | | | Express Scripts * | | | 1,045,147 | |

| | 11,153 | | | Johnson & Johnson | | | 1,032,879 | |

| | | | | | | | |

| | | | | | | 6,688,491 | |

| | | | | | | | |

| | |

| | | | Industrials – 15.73% | | | | |

| | 8,180 | | | Boeing | | | 1,067,490 | |

| | 13,703 | | | C.H. Robinson Worldwide | | | 818,617 | |

| | 21,136 | | | Chicago Bridge & Iron (Netherlands) | | | 1,565,966 | |

| | 15,458 | | | Cintas | | | 831,177 | |

| | 21,542 | | | Colfax * | | | 1,205,490 | |

| | 13,703 | | | Danaher | | | 987,849 | |

| | 3,860 | | | Middleby * | | | 878,729 | |

| | 63,883 | | | US Airways Group * | | | 1,403,510 | |

| | | | | | | | |

| | | | | | | 8,758,828 | |

| | | | | | | | |

| | |

| | | | Information Technology – 13.93% | | | | |

| | 6,768 | | | Baidu, SP ADR * | | | 1,088,971 | |

| | 27,306 | | | Facebook, Class A * | | | 1,372,400 | |

| | 1,200 | | | Google, Class A * | | | 1,236,696 | |

| | 25,530 | | | Hewlett-Packard | | | 622,166 | |

| | 10,730 | | | MICROS Systems * | | | 582,103 | |

| | 16,186 | | | QUALCOMM | | | 1,124,441 | |

| | 23,597 | | | Seagate Technology (Ireland) | | | 1,148,702 | |

| | 22,395 | | | Skyworks Solutions * | | | 577,343 | |

| | | | | | | | |

| | | | | | | 7,752,822 | |

| | | | | | | | |

| | |

| | | | Materials – 3.55% | | | | |

| | 4,616 | | | CF Industries Holdings | | | 995,210 | |

| | 9,341 | | | Monsanto | | | 979,684 | |

| | | | | | | | |

| | | | | | | 1,974,894 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Cost $45,528,595) | | | 55,575,892 | |

| | | | | | | | |

|

| | INVESTMENT COMPANY – 0.83% | |

| | |

| | 461,680 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 461,680 | |

| | | | | | | | |

| | |

| | | | Total Investment Company

(Cost $461,680) | | | 461,680 | |

| | | | | | | | |

| Total Investments – 100.65%

(Cost $45,990,275)** | | | 56,037,572 | |

| | | | | | | | |

| Net Other Assets and Liabilities – (0.65)% | | | (360,545 | ) |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 55,677,027 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

| | |

| |

| ASTON/TAMRO Diversified Equity Fund | | October 31, 2013 |

| |

| Schedule of Investments – continued | | |

| * | | Non-income producing security. |

| ** | | Aggregate cost for Federal income tax purposes is $46,032,483. |

| | | | |

Gross unrealized appreciation | | $ | 10,512,559 | |

Gross unrealized depreciation | | | (507,470 | ) |

| | | | |

Net unrealized appreciation | | $ | 10,005,089 | |

| | | | |

| ADR | | American Depositary Receipt |

| REIT | | Real Estate Investment Trust |

| SP ADR | | Sponsored American Depositary Receipt |

See accompanying Notes to Financial Statements.

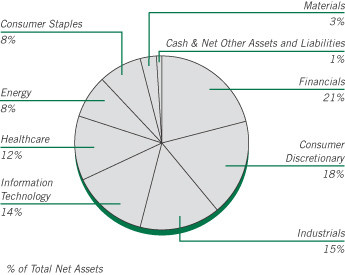

ASTON/Herndon Large Cap Value Fund

| | |

| |

| Portfolio Manager Commentary (unaudited) | | October 31, 2013 |

| | Randell A. Cain, Jr., CFA |

| Q. | What were the most significant market factors affecting Fund performance and returns relative to the benchmark during the past 12 months? |

| A. | Over the past 12 months, the Russell 1000 Value Index increased nearly 30%. The key drivers of this uptrend have been increased share buybacks, corporate dividends and merger activity. These positives have outweighed market headwinds brought on by political wrangling in Washington D.C. and increased concern about market volatility and potentially decelerating earnings growth. |

The Fund underperformed the Russell 1000 Value Index by more than 500 basis points during the period. While allocation effect was slightly negative, stock selection was the primary driver of the relative underperformance for the period. The portfolio’s top performing sectors were Healthcare, Energy and Financials, which all benefitted from positive stock selection. The sectors with the greatest negative contribution to relative performance were Consumer Discretionary, Consumer Staples and Materials. The portfolio was overweight each of these sectors, which only compounded their negative contribution, as each sector suffered from poor stock selection.

| Q. | What were the best performing holdings for the Fund during the period? |

| A. | The greatest individual stock performers during the period were Western Digital Corp. (+107% return), Waddell & Reed Financial Inc. (+96%) and CBOE Holdings Inc. (+71%). Western Digital is a holding from the Information Technology sector, while Waddell & Reed and CBOE are holdings from the Financials sector. |

| Q. | What were the weakest performing holdings? |

| A. | The weakest individual stock performers over the period were Cliffs Natural Resources (-50% return), Herbalife Ltd. (-26%) and American Capital Agency (-23%). These securities represent holdings from the Materials, Consumer Staples and Financials sectors, respectively. |

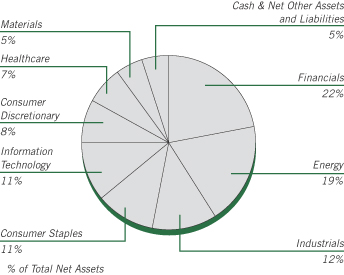

| Q. | How was the Fund positioned as of October 31, 2013? |

| A. | As of October 31, 2013, the Fund was overweight in the Energy, Consumer Staples, Materials, Industrials and Information Technology sectors. The underweight sectors were Financials, Utilities, Telecommunications and Healthcare. |

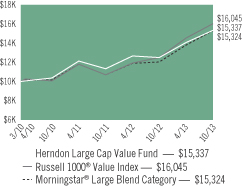

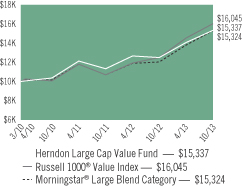

Growth of a Hypothetical

$10,000 Investment—Class N

All dividends and capital gains are reinvested. Indexes are unmanaged and do not take into account fees, expenses or other costs.

Returns shown in the chart and table do not reflect taxes that a shareholder would pay on Fund distributions or on the sale of the Fund shares.

Value investing involves the risk that a Fund’s investments in companies believed to be undervalued will not appreciate as anticipated.

RETURNSFOR PERIOD ENDED 10/31/13

Average Annual Total Returns - Class N

| | | | |

1 Year | | | 22.58 | % |

Since Inception | | | 12.66 | % |

Inception Date 03/31/10

Average Annual Total Returns - Class I

| | | | |

1 Year | | | 22.94 | % |

Since Inception | | | 11.68 | % |

Inception Date 03/02/11

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, upon redemption, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit our website at www.astonfunds.com.

The performance quoted would have been lower if fee waivers and/or expense reimbursements had not been in effect.

| | |

| |

| ASTON/Herndon Large Cap Value Fund | | October 31, 2013 |

| |

| Schedule of Investments | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

|

| | COMMON STOCKS – 95.10% | |

| | |

| | | | Consumer Discretionary – 7.81% | | | | |

| | 41,849 | | | Coach | | $ | 2,120,907 | |

| | 16,149 | | | Ross Stores | | | 1,249,125 | |

| | 65,010 | | | TJX | | | 3,951,958 | |

| | 33,046 | | | Yum! Brands | | | 2,234,571 | |

| | | | | | | | |

| | | | | | | 9,556,561 | |

| | | | | | | | |

| | | | Consumer Staples – 10.83% | | | | |

| | 78,097 | | | Altria Group | | | 2,907,551 | |

| | 52,111 | | | Campbell Soup | | | 2,218,365 | |

| | 47,686 | | | Colgate-Palmolive | | | 3,086,715 | |

| | 39,349 | | | Kellogg | | | 2,488,824 | |

| | 28,668 | | | Philip Morris International | | | 2,554,892 | |

| | | | | | | | |

| | | | | | | 13,256,347 | |

| | | | | | | | |

| | | | Energy – 19.37% | | | | |

| | 29,139 | | | Apache | | | 2,587,543 | |

| | 17,841 | | | Chevron | | | 2,140,206 | |

| | 22,642 | | | Continental Resources * | | | 2,578,924 | |

| | 28,150 | | | Exxon Mobil | | | 2,522,803 | |

| | 57,572 | | | HollyFrontier | | | 2,651,766 | |

| | 42,273 | | | Marathon Petroleum | | | 3,029,283 | |

| | 18,453 | | | Murphy Oil | | | 1,113,085 | |

| | 118,063 | | | Patterson-UTI Energy | | | 2,864,208 | |

| | 171,634 | | | RPC | | | 3,147,768 | |

| | 58,722 | | | Ultra Petroleum (Canada) * | | | 1,078,136 | |

| | | | | | | | |

| | | | | | | 23,713,722 | |

| | | | | | | | |

| | | | Financials – 21.67% | | | | |

| | 57,619 | | | Aflac | | | 3,744,083 | |

| | 74,848 | | | American Capital Agency, REIT | | | 1,625,699 | |

| | 88,171 | | | Apartment Investment & Management, Class A, REIT | | | 2,467,025 | |

| | 70,282 | | | CBOE Holdings | | | 3,408,677 | |

| | 58,466 | | | Discover Financial Services | | | 3,033,216 | |

| | 63,645 | | | Eaton Vance | | | 2,660,997 | |

| | 86,899 | | | Federated Investors, Class B | | | 2,356,701 | |

| | 35,258 | | | McGraw-Hill | | | 2,456,777 | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| | |

| | | | Financials (continued) | | | | |

| | 53,241 | | | SLM | | $ | 1,350,724 | |

| | 55,359 | | | Waddell & Reed Financial, Class A | | | 3,418,418 | |

| | | | | | | | |

| | | | | | | 26,522,317 | |

| | | | | | | | |

| | |

| | | | Healthcare – 7.21% | | | | |

| | 15,063 | | | Baxter International | | | 992,200 | |

| | 69,858 | | | Endo Health Solutions * | | | 3,054,890 | |

| | 68,493 | | | Mylan * | | | 2,593,830 | |

| | 24,733 | | | United Therapeutics * | | | 2,189,365 | |

| | | | | | | | |

| | | | | | | 8,830,285 | |

| | | | | | | | |

| | |

| | | | Industrials – 12.18% | | | | |

| | 18,359 | | | Caterpillar | | | 1,530,407 | |

| | 8,506 | | | Copa Holdings SA, Class A (Panama) | | | 1,271,987 | |

| | 54,277 | | | Joy Global | | | 3,080,220 | |

| | 41,684 | | | Landstar System | | | 2,304,708 | |

| | 23,537 | | | Lockheed Martin | | | 3,138,424 | |

| | 15,487 | | | Rockwell Collins | | | 1,081,457 | |

| | 25,420 | | | United Parcel Service, Class B | | | 2,497,261 | |

| | | | | | | | |

| | | | | | | 14,904,464 | |

| | | | | | | | |

| |

| | | | Information Technology – 10.75% | |

| | 6,637 | | | Apple | | | 3,466,837 | |

| | 11,015 | | | International Business Machines | | | 1,973,998 | |

| | 77,390 | | | Microsoft | | | 2,735,737 | |

| | 55,218 | | | Western Digital | | | 3,844,829 | |

| | 66,502 | | | Western Union | | | 1,131,864 | |

| | | | | | | | |

| | | | | | | 13,153,265 | |

| | | | | | | | |

| | |

| | | | Materials – 5.28% | | | | |

| | 10,403 | | | CF Industries Holdings | | | 2,242,888 | |

| | 18,453 | | | Lyondellbasell Industries NV Class A (Netherlands) | | | 1,376,594 | |

| | 7,579 | | | Newmarket | | | 2,359,797 | |

| | 17,276 | | | Southern Copper | | | 482,864 | |

| | | | | | | | |

| | | | | | | 6,462,143 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Cost $100,757,829) | | | 116,399,104 | |

| | | | | | | | |

|

| | INVESTMENT COMPANY – 5.51% | |

| | |

| | 6,740,441 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 6,740,441 | |

| | | | | | | | |

| | |

| | | | Total Investment Company

(Cost $6,740,441) | | | 6,740,441 | |

| | | | | | | | |

| Total Investments – 100.61%

(Cost $107,498,270)** | | | 123,139,545 | |

| | | | | | | | |

| Net Other Assets and Liabilities – (0.61)% | | | (744,464 | ) |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 122,395,081 | |

| | | | | | | | |

| * | | Non-income producing security. |

| ** | | Aggregate cost for Federal income tax purposes is $108,309,361. |

| | | | |

Gross unrealized appreciation | | $ | 17,389,154 | |

Gross unrealized depreciation | | | (2,558,970 | ) |

| | | | |

Net unrealized appreciation | | $ | 14,830,184 | |

| | | | |

| REIT | | Real Estate Investment Trust |

See accompanying Notes to Financial Statements.

ASTON/Cornerstone Large Cap Value Fund

| | |

| |

| Portfolio Manager Commentary (unaudited) | | October 31, 2013 |

John Campbell, CFA; Rick van Nostrand, CFA; Cameron Clement, CFA; & Dean Morris, CFA

| Q. | What were the most significant market factors affecting Fund performance and returns relative to the benchmark during the past 12 months? |

| A. | Despite an increasing barrage of negative news, the past 12 months saw the continuation of strong equity returns experienced since the beginning of 2012. Continued Federal Reserve intervention, turmoil in the Middle East, concerns over the most recent political standoff, the initial rollout of the Affordable Care Act and a myriad of other headline news have dominated the press. Given this backdrop, the Russell 1000 Value Index posted a 28.29% return. Despite the negative headlines, we continue to see positives in the underlying corporate fundamentals that determine value and drive stock prices over the long-term, and this is where we continue to direct our focus. |

| Q. | What were the best performing holdings for the Fund during the period? |

| A. | Western Digital (+107.5%) was a strong contributor in the Information Technology space. The stock delivered strong quarterly results with margins holding steady despite weakness in overall global PC demand. Investors rewarded the stock as inventory levels continue to decline quarter-over-quarter. |

Hess (+50.3%) was also a strong contributor to performance. The company announced plans to sell its U.S. oil storage terminal network as well as its refining business. The market viewed this positively, as the company intends to focus on its core strength, Exploration and Production, going forward. Additionally, an activist investor, Elliott Management, proposed a number of initiatives which should spur management to continue to streamline the company which could be viewed favorably by the market.

Eaton (+40.9%) was the best performer within the Industrials sector and our third best stock in the portfolio. Following the completed acquisition of Cooper Industries, Eaton’s revenue mix is more diversified and will primarily be derived from its electrical business, which is viewed as being less cyclical. As a result, the market has begun re-rating Eaton’s

prospects and has begun rewarding the company with a higher Price/Earnings multiple.

| Q. | What were the weakest performing holdings? |

| A. | Royal Dutch Shell (+1.9%) was the biggest detractor to performance. Management reported disappointing quarterly results and the market penalized the stock accordingly. Specifically, results were consistently below consensus expectations, as capital expenditures continue to weigh on near-term results and the outlook into 2013 and beyond was muted. |

Wal-Mart (+4.8%), a stock that traded at an all-time high in early October 2012, was a laggard during the period. The market remains concerned that overall consumer spending remains constrained and, as a result, that Wal-Mart will have trouble achieving near-term sales targets.

Teva Pharmaceuticals (-6.2%) was a weak overall performer. At Teva’s annual Investor Day in December 2012, new CEO Jeremy Levin laid out Teva’s strategy going forward. While the plan seemed reasonable, it could take some time to bear fruit. As a result, investors seemed disappointed overall with the firm’s outlook and penalized the firm.

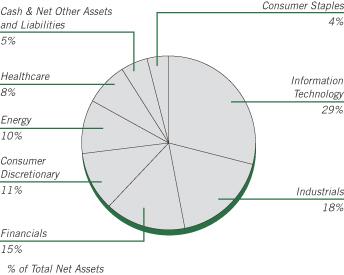

| Q. | How was the Fund positioned as of October 31, 2013? |

| A. | Cornerstone’s actively constructed 800 stock universe is trading at 82% of fair value based on our proprietary Fair Value Model. Despite strong market returns, the Fair Value Model still indicates that 442 of the 800 stocks in the universe are undervalued. Should markets continue to appreciate and the number of under-valued businesses shrinks, we believe active management becomes increasingly important, as investors need to be discerning when looking for attractive opportunities. We will not be swayed by the “noise” in the market, which appears to be changing quarter to quarter, and we continue to focus on finding companies with strong and improving fundamentals that trade at attractive valuations. |

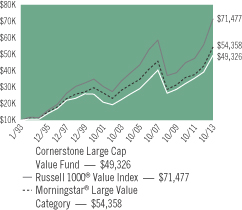

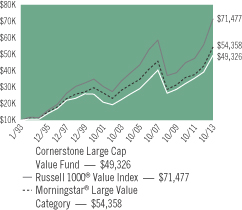

Growth of a Hypothetical

$10,000 Investment—Class N

All dividends and capital gains are reinvested. Indexes are unmanaged and do not take into account fees, expenses or other costs.

Returns shown in the chart and table do not reflect taxes that a shareholder would pay on Fund distributions or on the sale of the Fund shares.

Value investing involves the risk that a Fund’s investments in companies believed to be undervalued will not appreciate as anticipated.

RETURNSFOR PERIOD ENDED 10/31/13

Average Annual Total Returns - Class N

| | | | |

One Year | | | 25.72 | % |

Five Year | | | 13.35 | % |

Ten Year | | | 8.18 | % |

Since Inception | | | 7.97 | % |

Inception Date 01/04/93

Average Annual Total Returns - Class I

| | | | |

One Year | | | 26.08 | % |

Five Year | | | 13.69 | % |

Since Inception | | | 6.81 | % |

Inception Date 09/20/05

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, upon redemption, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit our website at www.astonfunds.com.

The performance quoted would have been lower if fee waivers and/or expense reimbursements had not been in effect.

The total expense ratios for Class N and Class I Shares are 1.59% and 1.34%, respectively, as disclosed in the prospectus dated February 28, 2013. Please refer to the Financial Highlights section in this report for more information.

| | |

| |

| ASTON/Cornerstone Large Cap Value Fund | | October 31, 2013 |

| |

| Schedule of Investments | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| |

| | COMMON STOCKS – 95.15% | | | | |

| | |

| | | | Consumer Discretionary – 10.64% | | | | |

| | 28,510 | | | Bed Bath & Beyond * | | $ | 2,204,393 | |

| | 36,850 | | | Hasbro | | | 1,903,303 | |

| | 57,675 | | | Mattel | | | 2,559,040 | |

| | | | | | | | |

| | | | | | | 6,666,736 | |

| | | | | | | | |

| | |

| | | | Consumer Staples – 3.75% | | | | |

| | 30,600 | | | Wal-Mart Stores | | | 2,348,550 | |

| | | | | | | | |

| | |

| | | | Energy – 9.90% | | | | |

| | 17,150 | | | Chevron | | | 2,057,314 | |

| | 19,725 | | | Exxon Mobil | | | 1,767,755 | |

| | 35,625 | | | Royal Dutch Shell PLC, ADR | | | 2,374,762 | |

| | | | | | | | |

| | | | | | | 6,199,831 | |

| | | | | | | | |

| | |

| | | | Financials – 15.49% | | | | |

| | 20,025 | | | ACE (Switzerland) | | | 1,911,186 | |

| | 29,300 | | | Capital One Financial | | | 2,012,031 | |

| | 45,525 | | | Citigroup | | | 2,220,709 | |

| | 37,225 | | | JPMorgan Chase | | | 1,918,577 | |

| | 51,800 | | | Unum Group | | | 1,644,132 | |

| | | | | | | | |

| | | | | | | 9,706,635 | |

| | | | | | | | |

| | |

| | | | Healthcare – 7.67% | | | | |

| | 18,350 | | | Baxter International | | | 1,208,714 | |

| | 20,825 | | | Johnson & Johnson | | | 1,928,603 | |

| | 22,600 | | | Stryker | | | 1,669,236 | |

| | | | | | | | |

| | | | | | | 4,806,553 | |

| | | | | | | | |

| | |

| | | | Industrials – 18.23% | | | | |

| | 17,700 | | | 3M | | | 2,227,545 | |

| | 16,575 | | | Cummins | | | 2,105,356 | |

| | 28,575 | | | Emerson Electric | | | 1,913,668 | |

| | 11,800 | | | General Dynamics | | | 1,022,234 | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| | |

| | | | Industrials (continued) | | | | |

| | 23,225 | | | Norfolk Southern | | $ | 1,997,815 | |

| | 18,425 | | | Parker Hannifin | | | 2,150,566 | |

| | | | | | | | |

| | | | | | | 11,417,184 | |

| | | | | | | | |

| |

| | | | Information Technology – 29.47% | |

| | 3,780 | | | Apple | | | 1,974,483 | |

| | 44,600 | | | EMC | | | 1,073,522 | |

| | 2,385 | | | Google, Class A * | | | 2,457,933 | |

| | 86,700 | | | Intel | | | 2,118,081 | |

| | 6,910 | | | International Business Machines | | | 1,238,341 | |

| | 70,950 | | | Microsoft | | | 2,508,083 | |

| | 75,100 | | | Oracle | | | 2,515,850 | |

| | 33,900 | | | QUALCOMM | | | 2,355,033 | |

| | 31,925 | | | Western Digital | | | 2,222,938 | |

| | | | | | | | |

| | | | | | | 18,464,264 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Cost $52,766,899) | | | 59,609,753 | |

| | | | | | | | |

| |

| | INVESTMENT COMPANY – 4.49% | | | | |

| | |

| | 2,811,444 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 2,811,444 | |

| | | | | | | | |

| | |

| | | | Total Investment Company

(Cost $2,811,444) | | | 2,811,444 | |

| | | | | | | | |

| Total Investments – 99.64%

(Cost $55,578,343)** | | | 62,421,197 | |

| | | | | | | | |

| Net Other Assets and Liabilities – 0.36% | | | 227,181 | |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 62,648,378 | |

| | | | | | | | |

| * | | Non-income producing security. |

| ** | | Aggregate cost for Federal income tax purposes is $55,677,959. |

| | | | |

Gross unrealized appreciation | | $ | 7,101,610 | |

Gross unrealized depreciation | | | (358,372 | ) |

| | | | |

Net unrealized appreciation | | $ | 6,743,238 | |

| | | | |

| ADR | | American Depositary Receipt |

See accompanying Notes to Financial Statements.

ASTON/River Road Dividend All Cap Value Fund

| | |

| |

| Portfolio Manager Commentary (unaudited) | | October 31, 2013 |

Henry W. Sanders, III, CFA; Thomas S. Forsha, CFA & James C. Shircliff, CFA

| Q. | What were the most significant market factors affecting Fund performance and returns relative to the benchmark during the past 12 months? |

| A. | Over the last 12 months, the most significant market factor affecting absolute performance was the ongoing extraordinary monetary policy (quantitative easing). Additionally, according to Ned Davis Research*, among S&P 500 companies, performance declined as dividend yield increased, creating a significant relative headwind for a dividend-oriented strategy. The Energy sector had the highest impact on relative results, due to an underweight allocation in that sector. The Consumer Discretionary sector had the most negative impact on relative results, as weak stock selection offset the positive impact of the significant overweight in the sector. |

| Q. | What were the best performing holdings for the Fund during the period? |

| A. | The two holdings with the largest positive contribution to the Fund’s total return were Walgreen Co., the drugstore chain, and BlackRock Inc., a leading investment management company. In the summer of 2012, Walgreen settled its dispute with Express Scripts and launched a joint venture with a leading drugstore chain in Europe, Alliance Boots. These actions, combined with the March announcement of a new distribution agreement with, and investment in, AmerisourceBergen, provided significant momentum to the firm over the period. |

BlackRock benefitted substantially from the strong market returns and continued inflows into its retail and exchange-traded fund (ETF) businesses. The firm increased the dividend payment in March, and has increased its annual rate over the last five years.

| Q. | What were the weakest performing holdings? |

| A. | The two holdings with the lowest contribution to the Fund’s total return during |

| | the period were Iron Mountain Inc., a document storage company, and Entergy Corp., an integrated utility. Iron Mountain’s plans to convert to a real estate investment trust (REIT) on January 1, 2014, were put at risk when the firm received a “tentatively adverse” preliminary finding on the proposal from the IRS. The firm appears to have a strong case, but if allowed, the conversion is now likely to be delayed to January 2015. |

In November 2012, Entergy released poor Q3 results and announced its intention to conduct a tax-free spin-off of its transmission assets. In addition, the company softened its support for the dividend going forward. Coupled with concerns surrounding the contentious relicensing of the Indian Point nuclear plant, our conviction in the position declined and we exited the position in the period.

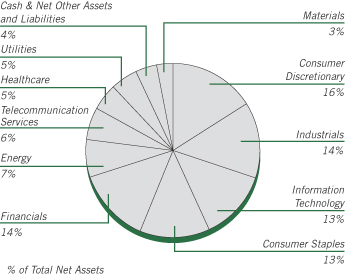

| Q. | How was the Fund positioned as of October 31, 2013? |

| A. | The overall positioning of the Fund has changed modestly over the period. The Fund is significantly overweight in Consumer stocks, both Staples and Cyclicals, and is significantly underweight in Financials, Healthcare, and Energy. Turnover increased in the period as we dealt with numerous overvalued positions as stocks have surged despite anemic revenue and earnings growth. The average yield of the Fund holdings has declined over the last twelve months as continued low interest rates increased valuation pressure on higher yielding stocks. While providing an attractive yield is a key goal, we must also maintain the potential for attractive capital gains, otherwise the potential total return for investors will suffer. We will continue to focus on stocks with high and growing dividends and healthy balance sheets but we are very mindful of the valuations of individual securities in the Fund. |

*Ned Davis Research, Inc., examined S&P 500 Stock Constituents ranked by quartiles (Dividend Yield) for the twelve months ended October 31, 2013.

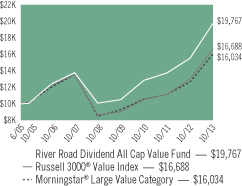

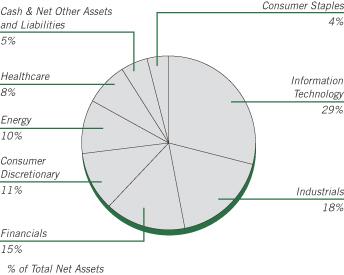

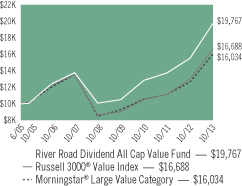

Growth of a Hypothetical

$10,000 Investment—Class N

All dividends and capital gains are reinvested. Indexes are unmanaged and do not take into account fees, expenses or other costs.

Returns shown in the chart and table do not reflect taxes that a shareholder would pay on Fund distributions or on the sale of the Fund shares.

Value investing involves the risk that a Fund’s investments in companies believed to be undervalued will not appreciate as anticipated.

Small-cap and mid-cap stocks may be subject to a higher degree of market risk than the securities of more established companies because they tend to be more volatile and less liquid.

RETURNSFOR PERIOD ENDED 10/31/13

Average Annual Total Returns - Class N

| | | | |

One Year | | | 27.47 | % |

Five Year | | | 14.44 | % |

Since Inception | | | 8.51 | % |

Inception Date 06/28/05

Average Annual Total Returns - Class I

| | | | |

One Year | | | 27.81 | % |

Five Year | | | 14.74 | % |

Since Inception | | | 5.86 | % |

Inception Date 06/28/07

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, upon redemption, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit our website at www.astonfunds.com.

| | |

| |

| ASTON/River Road Dividend All Cap Value Fund | | October 31, 2013 |

| |

| Schedule of Investments | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| |

| | COMMON STOCKS – 96.45% | | | | |

| |

| | | | Consumer Discretionary – 16.03% | |

| | 441,680 | | | Bob Evans Farms | | $ | 25,215,511 | |

| | 348,650 | | | Coach | | | 17,669,582 | |

| | 331,595 | | | Darden Restaurants | | | 17,087,090 | |

| | 484,515 | | | Hasbro | | | 25,025,200 | |

| | 329,775 | | | Hillenbrand | | | 9,306,250 | |

| | 459,900 | | | Kohl’s | | | 26,122,320 | |

| | 677,690 | | | National CineMedia | | | 11,873,129 | |

| | 1,263,035 | | | Staples | | | 20,360,124 | |

| | 350,345 | | | Target | | | 22,698,853 | |

| | 576,665 | | | Thomson Reuters (Canada) | | | 21,665,304 | |

| | | | | | | | |

| | | | | | | 197,023,363 | |

| | | | | | | | |

| | |

| | | | Consumer Staples – 13.10% | | | | |

| | 565,575 | | | Dr Pepper Snapple Group | | | 26,779,976 | |

| | 135,955 | | | General Mills | | | 6,854,851 | |

| | 219,905 | | | Kimberly-Clark | | | 23,749,740 | |

| | 294,235 | | | Molson Coors Brewing, Class B | | | 15,888,690 | |

| | 261,075 | | | PepsiCo | | | 21,953,797 | |

| | 190,730 | | | Procter & Gamble | | | 15,401,448 | |

| | 616,655 | | | Sysco | | | 19,942,623 | |

| | 238,930 | | | Wal-Mart Stores | | | 18,337,878 | |

| | 204,290 | | | Walgreen | | | 12,102,140 | |

| | | | | | | | |

| | | | | | | 161,011,143 | |

| | | | | | | | |

| | |

| | | | Energy – 7.25% | | | | |

| | 169,985 | | | Chevron | | | 20,391,401 | |

| | 587,150 | | | Memorial Production Partners LP | | | 12,218,591 | |

| | 317,940 | | | Occidental Petroleum | | | 30,547,675 | |

| | 149,990 | | | Transmontaigne Partners LP | | | 6,328,078 | |

| | 381,005 | | | Williams Partners LP | | | 19,591,277 | |

| | | | | | | | |

| | | | | | | 89,077,022 | |

| | | | | | | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| | |

| | | | Financials – 13.84% | | | | |

| | 64,485 | | | BlackRock | | $ | 19,397,733 | |

| | 310,545 | | | CME Group | | | 23,045,544 | |

| | 411,905 | | | Compass Diversified Holdings | | | 7,900,338 | |

| | 529,675 | | | Geo Group, REIT | | | 18,681,637 | |

| | 359,905 | | | OneBeacon Insurance Group, Class A (Bermuda) | | | 5,744,084 | |

| | 196,425 | | | PartnerRe (Bermuda) | | | 19,683,749 | |

| | 305,990 | | | PNC Financial Services Group | | | 22,499,445 | |

| | 808,559 | | | Sabra Health Care, REIT | | | 21,750,237 | |

| | 203,200 | | | Safety Insurance Group (a) | | | 11,113,008 | |

| | 542,055 | | | U.S. Bancorp | | | 20,251,175 | |

| | | | | | | | |

| | | | | | | 170,066,950 | |

| | | | | | | | |

| | |

| | | | Healthcare – 4.79% | | | | |

| | 151,360 | | | Becton, Dickinson | | | 15,912,477 | |

| | 127,995 | | | Medtronic | | | 7,346,913 | |

| | 516,827 | | | Owens & Minor | | | 19,339,666 | |

| | 530,585 | | | Pfizer | | | 16,278,348 | |

| | | | | | | | |

| | | | | | | 58,877,404 | |

| | | | | | | | |

| | |

| | | | Industrials – 14.02% | | | | |

| | 257,071 | | | ABM Industries | | | 7,072,023 | |

| | 668,470 | | | Aircastle (Bermuda) | | | 12,614,029 | |

| | 299,605 | | | Emerson Electric | | | 20,064,547 | |

| | 234,825 | | | General Dynamics | | | 20,342,890 | |

| | 486,369 | | | Iron Mountain | | | 12,908,233 | |

| | 118,290 | | | Lockheed Martin | | | 15,772,789 | |

| | 291,230 | | | Norfolk Southern | | | 25,051,605 | |

| | 226,915 | | | Raytheon | | | 18,690,989 | |

| | 431,775 | | | Republic Services | | | 14,451,509 | |

| | 257,705 | | | United Parcel Service, Class B | | | 25,316,939 | |

| | | | | | | | |

| | | | | | | 172,285,553 | |

| | | | | | | | |

| |

| | | | Information Technology – 13.27% | |

| | 578,105 | | | CA | | | 18,360,615 | |

| | 1,380,075 | | | Corning | | | 23,585,482 | |

| | 1,344,185 | �� | | Intel | | | 32,838,439 | |

| | 353,695 | | | j2 Global | | | 19,446,151 | |

| | 527,795 | | | Microsoft | | | 18,657,553 | |

| | 299,085 | | | Paychex | | | 12,639,332 | |

| | 227,200 | | | QUALCOMM | | | 15,783,584 | |

| | 1,280,020 | | | Western Union | | | 21,785,940 | |

| | | | | | | | |

| | | | | | | 163,097,096 | |

| | | | | | | | |

| | |

| | | | Materials – 3.13% | | | | |

| | 344,480 | | | Bemis | | | 13,744,752 | |

| | 167,925 | | | Innophos Holdings | | | 8,416,401 | |

| | 315,230 | | | Nucor | | | 16,319,457 | |

| | | | | | | | |

| | | | | | | 38,480,610 | |

| | | | | | | | |

| |

| | | | Telecommunication Services – 6.29% | |

| | 134,800 | | | Atlantic Tele-Network | | | 7,470,616 | |

| | 598,995 | | | Rogers Communications, Class B (Canada) | | | 27,200,363 | |

| | 444,125 | | | Verizon Communications | | | 22,432,754 | |

See accompanying Notes to Financial Statements.

| | |

| |

| ASTON/River Road Dividend All Cap Value Fund | | October 31, 2013 |

| |

| Schedule of Investments – continued | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| |

| | | | Telecommunication Services (continued) | |

| | 549,260 | | | Vodafone Group, SP ADR (United Kingdom) | | $ | 20,223,753 | |

| | | | | | | | |

| | | | | | | 77,327,486 | |

| | | | | | | | |

| | |

| | | | Utilities – 4.73% | | | | |

| | 357,895 | | | AmeriGas Partners LP | | | 16,130,328 | |

| | 448,645 | | | Avista | | | 12,467,844 | |

| | 413,175 | | | National Fuel Gas | | | 29,562,671 | |

| | | | | | | | |

| | | | | | | 58,160,843 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Cost $933,224,911) | | | 1,185,407,470 | |

| | | | | | | | |

|

| | INVESTMENT COMPANY – 3.40% | |

| | |

| | 41,773,450 | | | BlackRock Liquidity Funds TempCash Portfolio | | | 41,773,450 | |

| | | | | | | | |

| | |

| | | | Total Investment Company

(Cost $41,773,450) | | | 41,773,450 | |

| | | | | | | | |

| Total Investments – 99.85%

(Cost $974,998,361)* | | | 1,227,180,920 | |

| | | | | | | | |

| Net Other Assets and Liabilities – 0.15% | | | 1,807,605 | |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 1,228,988,525 | |

| | | | | | | | |

| (a) | | This security has been determined by the Subadviser to be an illiquid security. At October 31, 2013, this security amounted to $11,113,008 or 0.90% of net assets. |

| * | | Aggregate cost for Federal income tax purposes is $974,039,641. |

| | | | |

Gross unrealized appreciation | | $ | 259,236,122 | |

Gross unrealized depreciation | | | (6,094,843 | ) |

| | | | |

Net unrealized appreciation | | $ | 253,141,279 | |

| | | | |

| REIT | | Real Estate Investment Trust |

| SP ADR | | Sponsored American Depositary Receipt |

See accompanying Notes to Financial Statements.

ASTON/River Road Dividend All Cap Value Fund II

| | |

| |

| Portfolio Manager Commentary (unaudited) | | October 31, 2013 |

Henry W. Sanders, III, CFA; Thomas S. Forsha, CFA & James C. Shircliff, CFA

| Q. | What were the most significant market factors affecting Fund performance and returns relative to the benchmark during the past 12 months? |

| A. | Over the last 12 months, the most significant market factor affecting absolute performance was the ongoing extraordinary monetary policy (quantitative easing). Additionally, according to Ned Davis Research*, among S&P 500 companies, performance declined as dividend yield increased, creating a significant relative headwind for a dividend-oriented strategy. The Utilities sector had the highest impact on relative results, due to both strong stock selection and the modest underweight allocation in that sector. The Consumer Discretionary sector had the most negative impact on relative results, as weak stock selection offset the positive impact of the significant overweight in the sector. |

| Q. | What were the best performing holdings for the Fund during the period? |

| A. | The two holdings with the largest positive contribution to the Fund’s total return were Walgreen Co., the drugstore chain, and BlackRock Inc., a leading investment management company. In the summer of 2012, Walgreen settled its dispute with Express Scripts and launched a joint venture with a leading drugstore chain in Europe, Alliance Boots. These actions, combined with the March announcement of a new distribution agreement with, and investment in, AmerisourceBergen, provided significant momentum to the firm over the period. |

BlackRock benefitted substantially from the strong market returns and continued inflows into its retail and exchange-traded funds (ETF) businesses. The firm increased the dividend payment in March, and has increased its annual rate over the last five years.

| Q. | What were the weakest performing holdings? |

| A. | The two holdings with the lowest contribution to the Fund’s total return during |

| | the period were Iron Mountain Inc., a document storage company, and Entergy Corp., an integrated utility. Iron Mountain’s plan to convert to a real estate investment trust (REIT) on January 1, 2014 was put at risk when the firm received a “tentatively adverse” preliminary finding on the proposal from the IRS. The firm appears to have a strong case, but if allowed, the conversion is now likely to be delayed to January 2015. |

In November 2012, Entergy released poor Q3 results and announced its intention to conduct a tax-free spin-off of its transmission assets. In addition, the company softened its support for the dividend going forward. Coupled with concerns surrounding the contentious relicensing of the Indian Point nuclear plant, our conviction in the position declined and we exited the position.

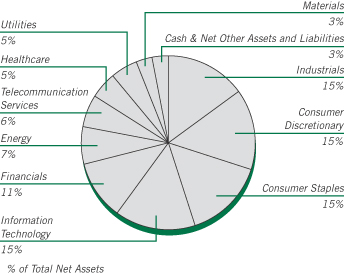

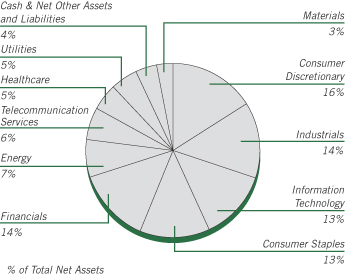

| Q. | How was the Fund positioned as of October 31, 2013? |

| A. | The overall positioning of the Fund has changed modestly over the period. The Fund is significantly overweight in Consumer stocks, both Staples and Cyclicals, and is significantly underweight in Financials, Healthcare, and Energy. Turnover increased in the period as we dealt with numerous overvalued positions as stocks have surged despite anemic revenue and earnings growth. The average yield of the Fund holdings has declined over the last twelve months as continued low interest rates increased valuation pressure on higher yielding stocks. While providing an attractive yield is a key goal, we must also maintain the potential for attractive capital gains, otherwise the potential total return for investors will suffer. We will continue to focus on stocks with high and growing dividends and healthy balance sheets but we are very mindful of the valuations of individual securities in the Fund. |

*Ned Davis Research, Inc., examined S&P 500 Stock Constituents ranked by quartiles (Dividend Yield) for the twelve months ended October 31, 2013.

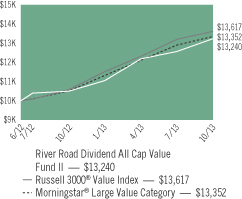

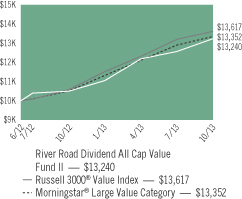

Growth of a Hypothetical

$10,000 Investment—Class N

All dividends and capital gains are reinvested. Indexes are unmanaged and do not take into account fees, expenses or other costs.

Returns shown in the chart and table do not reflect taxes that a shareholder would pay on Fund distributions or on the sale of the Fund shares.

Value investing involves the risk that a Fund’s investments in companies believed to be undervalued will not appreciate as anticipated.

Small-cap and mid-cap stocks may be subject to a higher degree of market risk than the securities of more established companies because they tend to be more volatile and less liquid.

RETURNSFOR PERIOD ENDED 10/31/13

Average Annual Total Returns - Class N

| | | | |

One-Year | | | 25.99 | % |

Since Inception | | | 23.15 | % |

Inception Date 06/27/12

Average Annual Total Returns - Class I

| | | | |

One Year | | | 26.30 | % |

Since Inception | | | 23.44 | % |

Inception Date 06/27/12

The performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate so that an investor’s shares, upon redemption, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. For performance data current to the most recent month-end, please visit our website at www.astonfunds.com.

The performance quoted would have been lower if fee waivers and/or expense reimbursements had not been in effect.

| | |

| |

| ASTON/River Road Dividend All Cap Value Fund II | | October 31, 2013 |

| |

| Schedule of Investments | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

|

| | COMMON STOCKS – 97.03% | |

| | |

| | | | Consumer Discretionary – 15.21% | | | | |

| | 16,720 | | | Bob Evans Farms | | $ | 954,545 | |

| | 28,770 | | | Coach | | | 1,458,064 | |

| | 28,135 | | | Darden Restaurants | | | 1,449,797 | |

| | 39,575 | | | Hasbro | | | 2,044,049 | |

| | 10,635 | | | Hillenbrand | | | 300,120 | |

| | 37,830 | | | Kohl’s | | | 2,148,744 | |

| | 102,625 | | | Staples | | | 1,654,315 | |

| | 28,865 | | | Target | | | 1,870,163 | |

| | 47,620 | | | Thomson Reuters (Canada) | | | 1,789,083 | |

| | | | | | | | |

| | | | | | | 13,668,880 | |

| | | | | | | | |

| | | | Consumer Staples – 14.67% | | | | |

| | 45,980 | | | Dr Pepper Snapple Group | | | 2,177,153 | |

| | 11,225 | | | General Mills | | | 565,965 | |

| | 18,005 | | | Kimberly-Clark | | | 1,944,540 | |

| | 24,440 | | | Molson Coors Brewing, Class B | | | 1,319,760 | |

| | 21,580 | | | PepsiCo | | | 1,814,662 | |

| | 15,595 | | | Procter & Gamble | | | 1,259,296 | |

| | 50,705 | | | Sysco | | | 1,639,800 | |

| | 19,510 | | | Wal-Mart Stores | | | 1,497,393 | |

| | 16,330 | | | Walgreen | | | 967,389 | |

| | | | | | | | |

| | | | | | | 13,185,958 | |

| | | | | | | | |

| | | | Energy – 6.95% | | | | |

| | 14,180 | | | Chevron | | | 1,701,033 | |

| | 21,695 | | | Memorial Production Partners LP | | | 451,473 | |

| | 25,820 | | | Occidental Petroleum | | | 2,480,786 | |

| | 31,305 | | | Williams Partners LP | | | 1,609,703 | |

| | | | | | | | |

| | | | | | | 6,242,995 | |

| | | | | | | | |

| | | | Financials – 11.14% | | | | |

| | 5,225 | | | BlackRock | | | 1,571,732 | |

| | 25,320 | | | CME Group | | | 1,878,997 | |

| | 43,074 | | | Geo Group, REIT | | | 1,519,220 | |

| | 15,795 | | | PartnerRe (Bermuda) | | | 1,582,817 | |

| | | | | | | | |

Shares | | | | | Market

Value | |

| | |

| | | | Financials (continued) | | | | |

| | 24,815 | | | PNC Financial Services Group | | $ | 1,824,647 | |

| | 43,820 | | | U.S. Bancorp | | | 1,637,115 | |

| | | | | | | | |

| | | | | | | 10,014,528 | |

| | | | | | | | |

| | |

| | | | Healthcare – 4.93% | | | | |

| | 12,350 | | | Becton, Dickinson | | | 1,298,355 | |

| | 10,160 | | | Medtronic | | | 583,184 | |

| | 33,510 | | | Owens & Minor | | | 1,253,944 | |

| | 42,055 | | | Pfizer | | | 1,290,247 | |

| | | | | | | | |

| | | | | | | 4,425,730 | |

| | | | | | | | |

| | |

| | | | Industrials – 15.41% | | | | |

| | 18,725 | | | ABM Industries | | | 515,124 | |

| | 49,145 | | | Aircastle (Bermuda) | | | 927,366 | |

| | 24,405 | | | Emerson Electric | | | 1,634,403 | |

| | 19,355 | | | General Dynamics | | | 1,676,724 | |

| | 40,115 | | | Iron Mountain | | | 1,064,652 | |

| | 9,165 | | | Lockheed Martin | | | 1,222,061 | |

| | 23,375 | | | Norfolk Southern | | | 2,010,718 | |

| | 18,930 | | | Raytheon | | | 1,559,264 | |

| | 35,335 | | | Republic Services | | | 1,182,662 | |

| | 20,965 | | | United Parcel Service, Class B | | | 2,059,602 | |

| | | | | | | | |

| | | | | | | 13,852,576 | |

| | | | | | | | |

| | |

| | | | Information Technology – 14.57% | | | | |

| | 46,710 | | | CA | | | 1,483,510 | |

| | 113,555 | | | Corning | | | 1,940,655 | |

| | 109,335 | | | Intel | | | 2,671,054 | |

| | 25,950 | | | j2 Global | | | 1,426,731 | |

| | 44,220 | | | Microsoft | | | 1,563,177 | |

| | 21,830 | | | Paychex | | | 922,536 | |

| | 18,585 | | | QUALCOMM | | | 1,291,100 | |

| | 105,700 | | | Western Union | | | 1,799,014 | |

| | | | | | | | |

| | | | | | | 13,097,777 | |

| | | | | | | | |

| | |

| | | | Materials – 3.16% | | | | |

| | 27,390 | | | Bemis | | | 1,092,861 | |

| | 8,140 | | | Innophos Holdings | | | 407,977 | |

| | 25,870 | | | Nucor | | | 1,339,290 | |

| | | | | | | | |

| | | | | | | 2,840,128 | |

| | | | | | | | |

| |

| | | | Telecommunication Services – 6.36% | |

| | 48,855 | | | Rogers Communications, Class B (Canada) | | | 2,218,506 | |

| | 36,940 | | | Verizon Communications | | | 1,865,839 | |

| | 44,390 | | | Vodafone Group, SP ADR (United Kingdom) | | | 1,634,440 | |

| | | | | | | | |

| | | | | | | 5,718,785 | |

| | | | | | | | |

| | |

| | | | Utilities – 4.63% | | | | |

| | 21,860 | | | AmeriGas Partners LP | | | 985,230 | |

| | 27,715 | | | Avista | | | 770,199 | |

| | 33,565 | | | National Fuel Gas | | | 2,401,576 | |

| | | | | | | | |

| | | | | | | 4,157,005 | |

| | | | | | | | |

| | |

| | | | Total Common Stocks

(Cost $77,979,133) | | | 87,204,362 | |

| | | | | | | | |

See accompanying Notes to Financial Statements.

| | |

| |

| ASTON/River Road Dividend All Cap Value Fund II | | October 31, 2013 |

| |

| Schedule of Investments – continued | | |

| | | | | | | | |

Shares | | | | | Market

Value | |

|

| | INVESTMENT COMPANY – 2.82% | |

| | |

| | 2,537,440 | | | BlackRock Liquidity Funds TempCash Portfolio | | $ | 2,537,440 | |

| | | | | | | | |

| | |

| | | | Total Investment Company

(Cost $2,537,440) | | | 2,537,440 | |

| | | | | | | | |

| Total Investments – 99.85%

(Cost $80,516,573)* | | | 89,741,802 | |

| | | | | | | | |

| Net Other Assets and Liabilities – 0.15% | | | 131,860 | |

| | | | | | | | |

| Net Assets – 100.00% | | $ | 89,873,662 | |

| | | | | | | | |

| * | | Aggregate cost for Federal income tax purposes is $80,608,747. |

| | | | |

Gross unrealized appreciation | | $ | 9,655,649 | |

Gross unrealized depreciation | | | (522,594 | ) |

| | | | |

Net unrealized appreciation | | $ | 9,133,055 | |

| | | | |

| REIT | | Real Estate Investment Trust |

| SP ADR | | Sponsored American Depositary Receipt |

See accompanying Notes to Financial Statements.

ASTON/Fairpointe Mid Cap Fund

| | |

| |

| Portfolio Manager Commentary (unaudited) | | October 31, 2013 |

Thyra E. Zerhusen, Marie L. Lorden & Mary L. Pierson

| Q. | What were the most significant market factors affecting Fund performance and returns relative to the benchmark during the past 12 months? |

| A. | This past year was filled with market moving headlines both on the global front and out of Washington. Each new headline can cause a significant move in stocks either up or down. Operating in this environment of volatility creates opportunities as stocks overreact to short-term concerns. We strive to take advantage of these opportunities by buying stocks when short-term concerns cause companies with strong long-term fundamentals to become temporarily undervalued and by selling or trimming stocks that achieve our valuation targets. |

Within the context of this market volatility, our stock selection was the most significant contributor to our performance during the past 12 months, with 90% of our holdings increasing in value during the period. Also contributing to performance were two acquisitions. Gannett Company agreed to buy Belo Corporation in June 2013. Both media stocks were held in the portfolio and both jumped on the acquisition announcement. Molex, another portfolio holding, agreed to be acquired at a significant premium by Koch Industries.

Class N Shares of the Fund gained 42.88% during the past year, outperforming the S&P 400 Index, up 33.48% and the broader market, S&P 500 Index, up 27.16%.

| Q. | What were the best performing holdings for the Fund during the period? |

| A. | The Fund’s top contributors to performance for the past twelve months included Boston Scientific, a medical device company specializing in cardiovascular, endosurgery, neurovascular, and neuro modulation markets. After a couple of difficult years, Boston Scientific’s revenues have stabilized and we expect modest revenue growth with increasing operating margins going forward. Another top contributor was Cree, Inc., a producer of semiconductors and LED (light-emitting diode) components, LED chips and LED lighting products. We expect |

| | Cree to grow significantly over the next several years as LED lighting is adopted more widely. |

| Q. | What were the weakest performing holdings? |

| A. | Our weakest performing stocks included McDermott International, a global engineering and construction company serving offshore oil and gas markets, which was down from our initial purchase in the first quarter 2013. We believe that the company will rebound as it addresses recent execution issues. The stock of Nuance Communications, the leader in speech recognition technology (speech-to-text) also declined. We believe Nuance’s scale and competitive position remain attractive, especially in the healthcare vertical where the company participates in electronic health record management. |

| Q. | How was the Fund positioned as of October 31, 2013? |

| A. | While equity valuations have moved up and no longer trade at depressed levels, the Fund remains attractively valued. The Fund’s P/E of 15.1x and P/S of 0.9x compare favorably with the S&P 400 Index P/E of 16.4x and P/S of 1.2x. |

U.S. equities have performed well and continue to be supported by a stronger and relatively stable U.S. economy. We are also seeing a resurgence of manufacturing in North America due to lower energy costs, more competitive labor rates and available capital. We continually re-balance the portfolio to keep the overall valuation attractive relative to our own history and to the mid-cap benchmarks. Our mid-cap holdings are well-diversified, have the ability to grow market share, and in many cases represent “must have” products or services that make their clients more efficient.

Note: Price/Earnings (P/E) and Price/Sales (P/S) of a fund are the weighted averages of the P/E and P/S ratios of all the companies in the portfolio. P/E is determined by the price of the company’s stock divided by its estimated earnings. P/S is the price of the company divided by estimated sales.

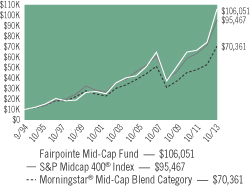

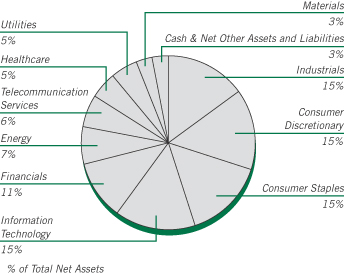

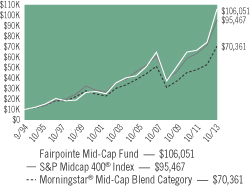

Growth of a Hypothetical

$10,000 Investment—Class N

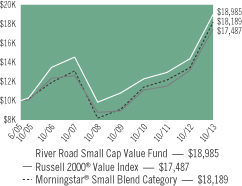

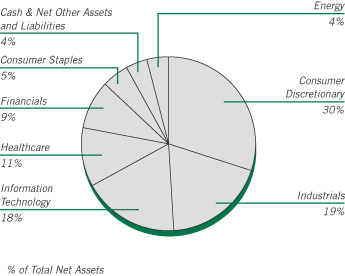

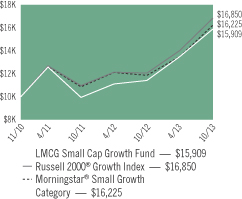

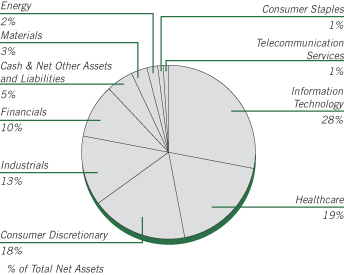

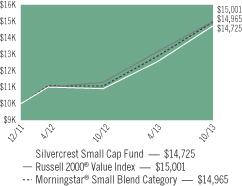

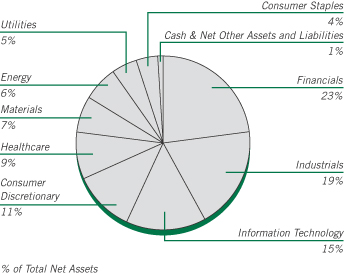

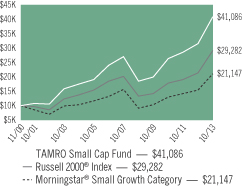

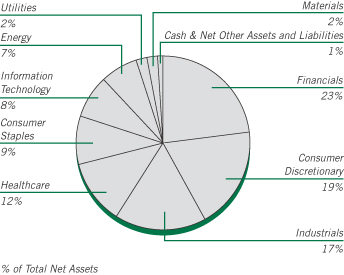

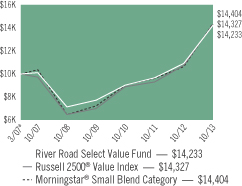

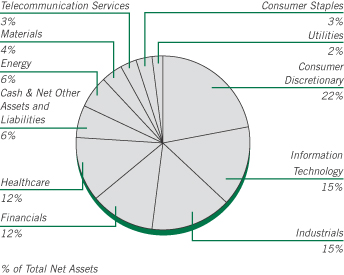

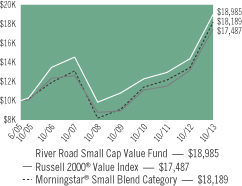

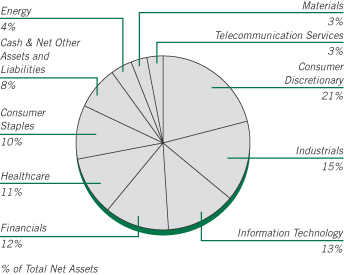

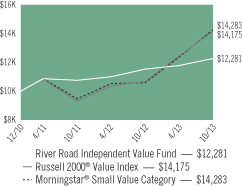

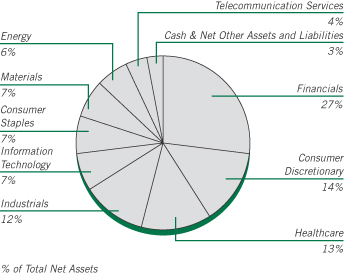

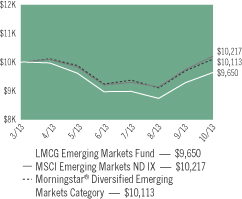

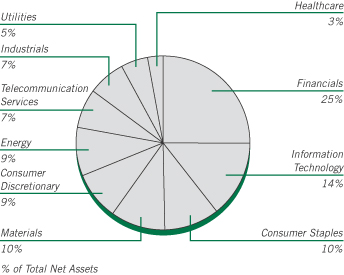

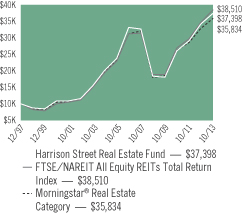

All dividends and capital gains are reinvested. Indexes are unmanaged and do not take into account fees, expenses or other costs.