UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT

COMPANIES

Investment Company Act file number 811-08034

Franklin Real Estate Securities Trust

(Exact name of registrant as specified in charter)

_One Franklin Parkway, San Mateo, CA 94403-1906

(Address of principal executive offices) (Zip code)

_Craig S. Tyle, One Franklin Parkway, San Mateo, CA 94403-1906

(Name and address of agent for service)

Registrant's telephone number, including area code: 650 312-2000

Date of fiscal year end: _4/30

Date of reporting period: _4/30/15

Item 1. Reports to Stockholders.

Franklin Templeton Investments

Gain From Our Perspective®

At Franklin Templeton Investments, we’re dedicated to one goal: delivering exceptional asset management for our clients. By bringing together multiple, world-class investment teams in a single firm, we’re able to offer specialized expertise across styles and asset classes, all supported by the strength and resources of one of the world’s largest asset managers. This has helped us to become a trusted partner to individual and institutional investors across the globe.

Focus on Investment Excellence

At the core of our firm, you’ll find multiple independent investment teams—each with a focused area of expertise—from traditional to alternative strategies and multi-asset solutions. And because our portfolio groups operate autonomously, their strategies can be combined to deliver true style and asset class diversification.

All of our investment teams share a common commitment to excellence grounded in rigorous, fundamental research and robust, disciplined risk management. Decade after decade, our consistent, research-driven processes have helped Franklin Templeton earn an impressive record of strong, long-term results.

Global Perspective Shaped by Local Expertise

In today’s complex and interconnected world, smart investing demands a global perspective. Franklin Templeton pioneered international investing over 60 years ago, and our expertise in emerging markets spans more than a quarter of a century. Today, our investment professionals are on the ground across the globe, spotting investment ideas and potential risks firsthand. These locally based teams bring in-depth understanding of local companies, economies and cultural nuances, and share their best thinking across our global research network.

Strength and Experience

Franklin Templeton is a global leader in asset management serving clients in over 150 countries.1 We run our business with the same prudence we apply to asset management, staying focused on delivering relevant investment solutions, strong long-term results and reliable, personal service. This approach, focused on putting clients first, has helped us to become one of the most trusted names in financial services.

1. As of 12/31/14. Clients are represented by the total number of shareholder accounts.

Not FDIC Insured | May Lose Value | No Bank Guarantee

| |

| Contents | |

| |

| Shareholder Letter | 1 |

| Annual Report | |

| Franklin Real Estate | |

| Securities Fund | 3 |

| Performance Summary | 6 |

| Your Fund’s Expenses | 11 |

| Financial Highlights and | |

| Statement of Investments | 13 |

| Financial Statements | 19 |

| Notes to Financial Statements | 22 |

| Report of Independent Registered | |

| Public Accounting Firm | 29 |

| Tax Information | 30 |

| Board Members and Officers | 31 |

| Shareholder Information | 36 |

| |

| |

| |

| |

| franklintempleton.com | |

Annual Report

Franklin Real Estate Securities Fund

We are pleased to bring you Franklin Real Estate Securities Fund’s annual report for the fiscal year ended April 30, 2015.

Your Fund’s Goal and Main Investments

The Fund seeks to maximize total return by investing at least 80% of its net assets in equity securities of companies operating in the real estate industry predominantly in the U.S., including real estate investment trusts (REITs) and companies that derive at least half of their assets or revenues from the ownership, construction, management, development or sale of residential or commercial real estate.1

Performance Overview

For the 12 months under review, the Fund’s Class A shares delivered a +12.95% cumulative total return. In comparison, the Standard & Poor’s (S&P®) U.S. Property Index, which tracks the investable universe of publicly traded U.S. property companies, produced a +12.92% total return.2 You can find the Fund’s long-term performance data in the Performance Summary beginning on page 6.

Performance data represent past performance, which does not guarantee future results. Investment return and principal value will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown. Please visit franklintempleton.com or call (800) 342-5236 for most recent month-end performance.

Economic and Market Overview

U.S. economic growth moderated during the 12 months ended April 30, 2015, especially in the second half of the review period. The economy grew for most of 2014, supported in some quarters by greater spending by consumers, businesses, and state and local governments, partially offset by the negative impacts of a wider trade deficit and lower federal defense spending. In the first quarter of 2015, factors including low energy prices and U.S. dollar strength led exports to decline.

In addition, harsh weather and labor disruptions weighed on business spending. Manufacturing and non-manufacturing activities increased, and the unemployment rate declined to 5.4% at period-end from 6.2% in April 2014.3 Housing market data were positive for most of the period as home sales and prices rose while mortgage rates declined. After a brief slump during the period, retail sales rebounded toward period-end as auto sales surged. Inflation, as measured by the Consumer Price Index, remained subdued during the past 12 months but rose late in the period amid higher energy prices bouncing from recent lows.

1. A REIT is a type of real estate company that is dedicated to owning and usually operating income-producing real estate properties such as apartments, hotels, industrial

properties, office buildings or shopping centers. Equity REITs generally receive income from rents received, are generally operated by experienced property management

teams and typically concentrate on a specific geographic region or property type.

2. Source: Morningstar.

The index is unmanaged and includes reinvested dividends. One cannot invest directly in an index, and an index is not representative of the Fund’s portfolio.

3. Source: Bureau of Labor Statistics.

The dollar value, number of shares or principal amount, and names of all portfolio holdings are listed in the Fund’s Statement of Investments (SOI).

The SOI begins on page 17.

franklintempleton.com

Annual Report

| 3

FRANKLIN REAL ESTATE SECURITIES FUND

The Federal Reserve Board (Fed) ended its bond buying program in October 2014, based on its view that underlying economic strength could support ongoing progress in labor market conditions. Although the Fed had repeatedly stated that it could be patient with regard to raising interest rates, in March 2015, the Fed removed the word “patient” from its monetary policy guidance. It added, however, that it might keep interest rates lower than what it viewed as normal. In its April 2015 meeting, the Fed attributed the economy’s first-quarter slowdown to transitory factors. The Fed reiterated that it would raise interest rates when it saw further improvement in the labor market and was reasonably confident that inflation would move back to its 2% objective over the medium term.

Investor confidence grew during the period as corporate profits remained healthy, the Fed maintained its cautious tone on raising interest rates and China introduced more stimulus measures. The stock markets endured some sell-offs when many investors reacted to political instability in certain emerging markets, Greece’s debt negotiations and relatively weak economic growth in Europe and Japan, as well as less robust growth in China. U.S. stocks rose overall for the 12 months under review as the S&P 500® and the Dow Jones Industrial Average reached all-time highs.

Investment Strategy

We are research-driven, fundamental investors with an active investment strategy. We use a bottom-up security selection process that incorporates macro-level views in our evaluation process. We analyze individual stock and real estate market fundamentals to provide regional, property type and company-size perspectives in identifying local cyclical and thematic trends that highlight investment opportunities.

Manager’s Discussion

During the 12 months under review, security selection and an underweighting in triple net leasing companies contributed to the Fund’s performance relative to the benchmark S&P U.S. Property Index, with most of the positive effects coming from a lack of exposure to certain companies in the benchmark that performed poorly over the period.

Security selection in the office space and apartments sectors also contributed to the Fund’s performance, with an overweighting in Essex Property Trust, a West Coast apartment owner and operator, proving especially beneficial. Essex continued to deliver superior revenue growth compared to many of its peers, largely due to its exposure to the strong northern California apartment market, which benefited from significant job creation in the technology sector. In addition, Essex’s

| | |

| Top 10 Holdings | | |

| 4/30/15 | | |

| Company | % of Total | |

| Sector/Industry | Net Assets | |

| Simon Property Group Inc. | 9.0 | % |

| Retail REITs | | |

| Equity Residential | 4.7 | % |

| Residential REITs | | |

| Boston Properties Inc. | 4.1 | % |

| Office REITs | | |

| General Growth Properties Inc. | 3.9 | % |

| Retail REITs | | |

| Vornado Realty Trust | 3.9 | % |

| Office REITs | | |

| Health Care REIT Inc. | 3.8 | % |

| Health Care REITs | | |

| Prologis Inc. | 3.7 | % |

| Industrial REITs | | |

| Ventas Inc. | 3.5 | % |

| Health Care REITs | | |

| Public Storage | 3.1 | % |

| Specialized REITs | | |

| Essex Property Trust Inc. | 3.1 | % |

| Residential REITs | | |

recent acquisition of West Coast peer BRE Properties achieved greater-than-expected synergies and operating improvements. Our investment in Essex outperformed the benchmark index and the apartment peer group over the reporting period.

The Fund’s relative performance was also supported by an overweighted investment in storage property REIT Extra Space Storage, whose shares outperformed the benchmark index for the reporting period. Strong storage operating fundamentals with healthy customer demand for storage units and limited supply benefited the company, as it generated robust operating results with accelerating revenue growth. The company’s occupancy level improved significantly, allowing the company to raise existing and new customers’ monthly rates.

Our position in data center company CoreSite Realty also aided relative performance. Shares of CoreSite rose significantly during the 12-month period, outperforming its peers and the benchmark index. In our view, performance was likely the result of a number of fundamental factors. In 2014, per-share funds from operations, a key profit measure for REITs, increased 22%, and the company’s dividend distribution rose 20%. The company made progress in leasing its properties, raising occupancy more than 5 percentage points in 2014. Increasing occupancy led to strong growth in revenues and EBITDA (earnings before interest, taxes, depreciation and amortization, an indicator of a company’s financial performance) during the period. In addition, the company maintained what we viewed as a conservative financial leverage profile.

4 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES FUND

In contrast, security selection in the health care property sector hampered the Fund’s performance relative to the benchmark. Shares of Ventas, a large-capitalization health care REIT, underperformed the index during the reporting period, and our overweighted position detracted from performance. Despite the company’s positive core results, strong balance sheet and high-quality management, investors became concerned about the company’s recent initiatives for external growth. Similar to the performance of other health care REITs with above-average dividend yields, the stock’s underperformance also reflected market expectations for a higher interest rate environment.

Stock selection in the diversified and hotel/resort sectors also weighed on results. Although shares of Starwood Hotels & Resorts Worldwide performed well for the reporting period, the increase largely reflected the stock’s price surge near period-end, following the company’s announcement of a new strategic review, which increased investors’ expectations for potential merger and acquisition activity.4 The stock was quite volatile during the period, especially after the departure of Starwood’s chief executive officer. We liquidated our position early in 2015 mainly due to our concerns about the company’s growth outlook at the time, which we expected to stay below that of its peers. Thus, we decided to invest in another hotel stock that we believed had a better earnings growth outlook.

The Fund’s overweighted position in STAG Industrial, a small-capitalization industrial REIT that focuses on owning single-tenant class B industrial properties in secondary markets, also detracted from the Fund’s performance as its shares under-performed during the reporting period. STAG had successfully expanded its portfolio since its initial public offering by acquiring assets at accretive capitalization rates (yields) above its cost of capital, which benefited the stock in 2014. The stock was under increased pressure during the reporting period, reflecting investors’ concerns about the sustainability of the company’s strategy to acquire assets above its cost of capital in a rising interest rate environment.

Thank you for your continued participation in Franklin Real Estate Securities Fund. We look forward to serving your future investment needs.

The foregoing information reflects our analysis, opinions and portfolio holdings as of April 30, 2015, the end of the reporting period. The way we implement our main investment strategies and the resulting portfolio holdings may change depending on factors such as market and economic conditions. These opinions may not be relied upon as investment advice or an offer for a particular security. The information is not a complete analysis of every aspect of any market, country, industry, security or the Fund. Statements of fact are from sources considered reliable, but the investment manager makes no representation or warranty as to their completeness or accuracy. Although historical performance is no guarantee of future results, these insights may help you understand our investment management philosophy.

CFA® is a trademark owned by CFA Institute.

4. Not part of the index.

See www.franklintempletondatasources.com for additional data provider information.

franklintempleton.com

Annual Report

| 5

FRANKLIN REAL ESTATE SECURITIES FUND

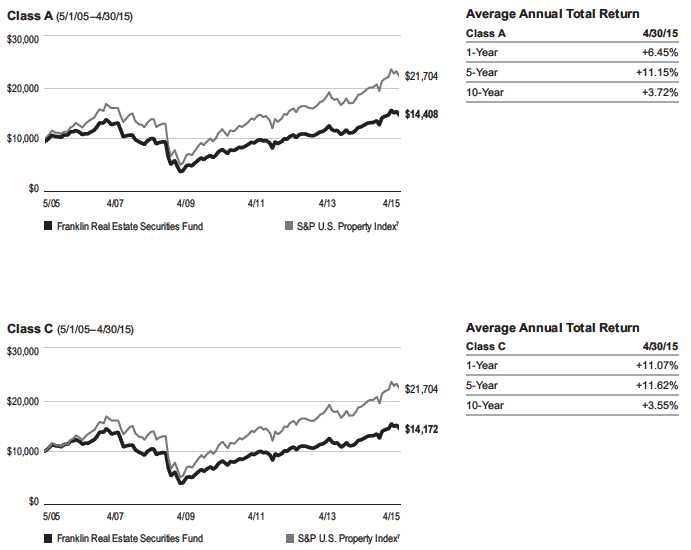

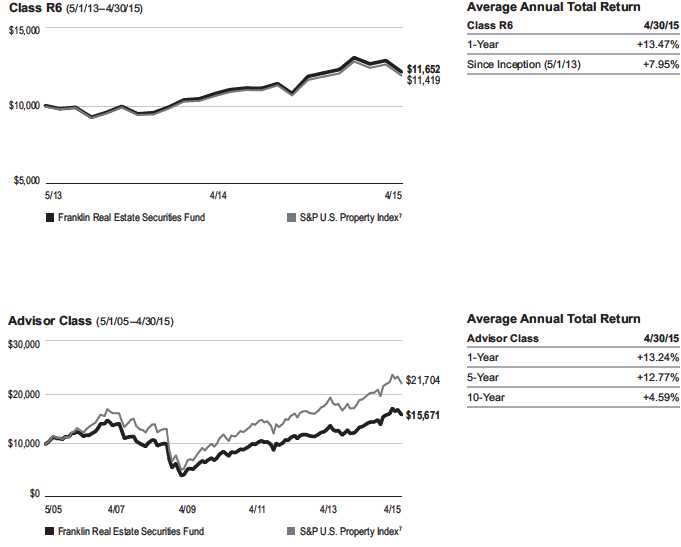

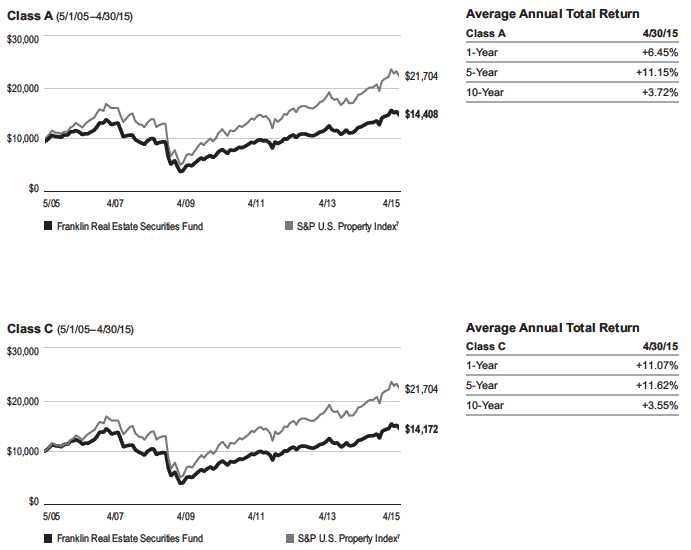

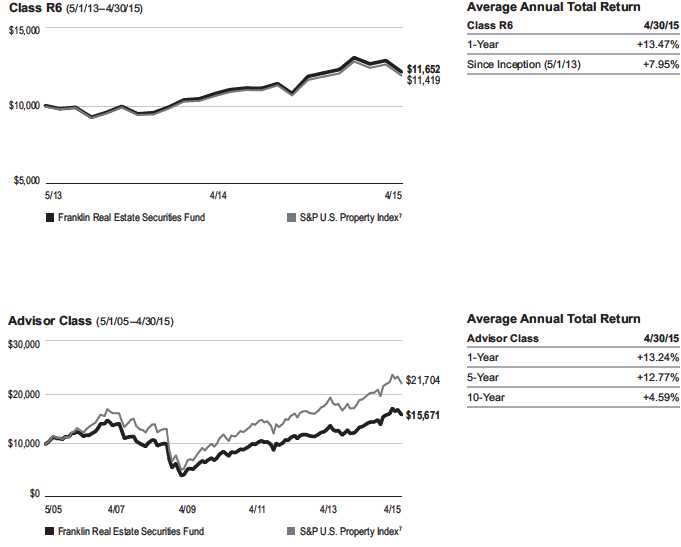

Performance Summary as of April 30, 2015

Your dividend income will vary depending on dividends or interest paid by securities in the Fund’s portfolio, adjusted for operating expenses of each class. Capital gain distributions are net profits realized from the sale of portfolio securities. The performance table and graphs do not reflect any taxes that a shareholder would pay on Fund dividends, capital gain distributions, if any, or any realized gains on the sale of Fund shares. Total return reflects reinvestment of the Fund’s dividends and capital gain distributions, if any, and any unrealized gains or losses.

| | | | | | |

| Net Asset Value | | | | | | |

| Share Class (Symbol) | | 4/30/15 | | 4/30/14 | | Change |

| A (FREEX) | $ | 21.49 | $ | 19.31 | +$ | 2.18 |

| C (FRRSX) | $ | 20.75 | $ | 18.66 | +$ | 2.09 |

| R6 (FSERX) | $ | 21.67 | $ | 19.46 | +$ | 2.21 |

| Advisor (FRLAX) | $ | 21.67 | $ | 19.46 | +$ | 2.21 |

| |

| |

| Distributions (5/1/14–4/30/15) | | | | | | |

| Dividend |

| Share Class | | Income | | | | |

| A | $ | 0.2947 | | | | |

| C | $ | 0.1540 | | | | |

| R6 | $ | 0.3883 | | | | |

| Advisor | $ | 0.3464 | | | | |

6 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES FUND

PERFORMANCE SUMMARY

Performance as of 4/30/151

Cumulative total return excludes sales charges. Average annual total returns and value of $10,000 investment include maximum sales charges. Class A: 5.75% maximum initial sales charge; Class C: 1% contingent deferred sales charge in first year only;

Class R6/Advisor Class: no sales charges.

| | | | | | | | | | | | | |

| | | Cumulative | | | Average Annual | | | Value of | | Average Annual | | Total Annual Operating | |

| Share Class | | Total Return2 | | | Total Return3 | | $ | 10,000 Investment4 | | Total Return (3/31/15)5 | | Operating Expenses6 | |

| A | | | | | | | | | | | | 1.05 | % |

| 1-Year | + | 12.95 | % | + | 6.45 | % | $ | 10,645 | + | 17.01 | % | | |

| 5-Year | + | 80.02 | % | + | 11.15 | % | $ | 16,963 | + | 13.94 | % | | |

| 10-Year | + | 52.85 | % | + | 3.72 | % | $ | 14,408 | + | 4.75 | % | | |

| C | | | | | | | | | | | | 1.80 | % |

| 1-Year | + | 12.07 | % | + | 11.07 | % | $ | 11,107 | + | 22.22 | % | | |

| 5-Year | + | 73.28 | % | + | 11.62 | % | $ | 17,328 | + | 14.44 | % | | |

| 10-Year | + | 41.72 | % | + | 3.55 | % | $ | 14,172 | + | 4.59 | % | | |

| R6 | | | | | | | | | | | | 0.58 | % |

| 1-Year | + | 13.47 | % | + | 13.47 | % | $ | 11,347 | + | 24.74 | % | | |

| Since Inception (5/1/13) | + | 16.52 | % | + | 7.95 | % | $ | 11,652 | + | 11.83 | % | | |

| Advisor | | | | | | | | | | | | 0.80 | % |

| 1-Year | + | 13.24 | % | + | 13.24 | % | $ | 11,324 | + | 24.49 | % | | |

| 5-Year | + | 82.34 | % | + | 12.77 | % | $ | 18,234 | + | 15.60 | % | | |

| 10-Year | + | 56.71 | % | + | 4.59 | % | $ | 15,671 | + | 5.64 | % | | |

Performance data represent past performance, which does not guarantee future results. Investment return and principal value

will fluctuate, and you may have a gain or loss when you sell your shares. Current performance may differ from figures shown.

For most recent month-end performance, go to franklintempleton.com or call (800) 342-5236.

franklintempleton.com

Annual Report

| 7

FRANKLIN REAL ESTATE SECURITIES FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1

Total return represents the change in value of an investment over the periods shown. It includes any applicable maximum sales charge, Fund expenses, account fees and reinvested distributions. The unmanaged index includes reinvestment of any income or distributions. It differs from the Fund in composition and does not pay management fees or expenses. One cannot invest directly in an index.

8 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES FUND

PERFORMANCE SUMMARY

Total Return Index Comparison for a Hypothetical $10,000 Investment1 (continued)

franklintempleton.com

Annual Report

| 9

FRANKLIN REAL ESTATE SECURITIES FUND

PERFORMANCE SUMMARY

All investments involve risks, including possible loss of principal. The Fund concentrates in real estate securities, which involve special risks, such as declines in the value of real estate and increased susceptibility to adverse economic or regulatory developments affecting the sector. The Fund’s investments in REITs involve additional risks; since REITs typically are invested in a limited number of projects or in a particular market segment, they are more susceptible to adverse developments affecting a single project or market segment than more broadly diversified investments. Also, the Fund is a nondiversified fund and investing in a nondiversified fund involves the risk of greater price fluctuation than a more diversified portfolio. The Fund is actively managed but there is no guarantee that the manager’s investment decisions will produce the desired results. The Fund’s prospectus also includes a description of the main investment risks.

| |

| Class C: | These shares have higher annual fees and expenses than Class A shares. |

| Class R6: | Shares are available to certain eligible investors as described in the prospectus. |

| Advisor Class: | Shares are available to certain eligible investors as described in the prospectus. |

1. The Fund has a fee waiver associated with its investments in a Franklin Templeton money fund, contractually guaranteed through at least its current fiscal year-end.

Class R6 has a fee waiver contractually guaranteed through at least the Fund’s current fiscal year-end. Fund investment results reflect the fee waivers, to the extent

applicable; without these reductions, the results would have been lower.

2. Cumulative total return represents the change in value of an investment over the periods indicated.

3. Average annual total return represents the average annual change in value of an investment over the periods indicated.

4. These figures represent the value of a hypothetical $10,000 investment in the Fund over the periods indicated.

5. In accordance with SEC rules, we provide standardized average annual total return information through the latest calendar quarter.

6. Figures are as stated in the Fund’s current prospectus. In periods of market volatility, assets may decline significantly, causing total annual Fund operating expenses to

become higher than the figures shown.

7. Source: Morningstar. The S&P U.S. Property Index measures the investable universe of publicly traded property companies in the U.S.

See www.franklintempletondatasources.com for additional data provider information.

10 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES FUND

Your Fund’s Expenses

As a Fund shareholder, you can incur two types of costs:

- Transaction costs, including sales charges (loads) on Fund purchases; and

- Ongoing Fund costs, including management fees, distribu- tion and service (12b-1) fees, and other Fund expenses. All mutual funds have ongoing costs, sometimes referred to as operating expenses.

The following table shows ongoing costs of investing in the Fund and can help you understand these costs and compare them with those of other mutual funds. The table assumes a $1,000 investment held for the six months indicated.

Actual Fund Expenses

The first line (Actual) for each share class listed in the table provides actual account values and expenses. The “Ending Account Value” is derived from the Fund’s actual return, which includes the effect of Fund expenses.

You can estimate the expenses you paid during the period by following these steps. Of course, your account value and expenses will differ from those in this illustration:

| 1. | Divide your account value by $1,000. |

| | If an account had an $8,600 value, then $8,600 ÷ $1,000 = 8.6. |

| 2. | Multiply the result by the number under the heading “Expenses Paid During Period.” |

| | If Expenses Paid During Period were $7.50, then 8.6 x $7.50 = $64.50. |

In this illustration, the estimated expenses paid this period are $64.50.

Hypothetical Example for Comparison with Other Funds

Information in the second line (Hypothetical) for each class in the table can help you compare ongoing costs of investing in the Fund with those of other mutual funds. This information may not be used to estimate the actual ending account balance or expenses you paid during the period. The hypothetical “Ending Account Value” is based on the actual expense ratio for each class and an assumed 5% annual rate of return before expenses, which does not represent the Fund’s actual return. The figure under the heading “Expenses Paid During Period” shows the hypothetical expenses your account would have incurred under this scenario. You can compare this figure with the 5% hypothetical examples that appear in shareholder reports of other funds.

Please note that expenses shown in the table are meant to highlight ongoing costs and do not reflect any transaction costs, such as sales charges. Therefore, the second line for each class is useful in comparing ongoing costs only, and will not help you compare total costs of owning different funds. In addition, if transaction costs were included, your total costs would have been higher. Please refer to the Fund prospectus for additional information on operating expenses.

franklintempleton.com

Annual Report

| 11

| | | | | | |

| FRANKLIN REAL ESTATE SECURITIES FUND | | | | |

| YOUR FUND’S EXPENSES | | | | | | |

| |

| |

| |

| | | Beginning Account | | Ending Account | | Expenses Paid During |

| Share Class | | Value 11/1/14 | | Value 4/30/15 | | Period* 11/1/14–4/30/15 |

| A | | | | | | |

| Actual | $ | 1,000 | $ | 1,022.70 | $ | 4.86 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,019.98 | $ | 4.86 |

| C | | | | | | |

| Actual | $ | 1,000 | $ | 1,018.50 | $ | 8.61 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,016.27 | $ | 8.60 |

| R6 | | | | | | |

| Actual | $ | 1,000 | $ | 1,025.20 | $ | 2.66 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,022.17 | $ | 2.66 |

| Advisor | | | | | | |

| Actual | $ | 1,000 | $ | 1,024.20 | $ | 3.61 |

| Hypothetical (5% return before expenses) | $ | 1,000 | $ | 1,021.22 | $ | 3.61 |

*Expenses are calculated using the most recent six-month expense ratio, net of expense waivers, annualized for each class (A: 0.97%;

C: 1.72%; R6: 0.53%; and Advisor: 0.72%), multiplied by the average account value over the period, multiplied by 181/365 to reflect the

one-half year period.

12 | Annual Report

franklintempleton.com

| | | | | | | | | | | | | | | |

| | | FRANKLIN REAL ESTATE SECURITIES TRUST | |

| |

| |

| Financial Highlights | | | | | | | | | | | | | | | |

| Franklin Real Estate Securities Fund | | | | | | | | | | | | | | | |

| | | | | | | | | Year Ended April 30, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Class A | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 19.31 | | $ | 19.29 | | $ | 16.78 | | $ | 15.26 | | $ | 12.57 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.30 | | | 0.26 | | | 0.23 | | | 0.14 | | | 0.09 | |

| Net realized and unrealized gains (losses) | | 2.17 | | | —c | | | 2.49 | | | 1.46 | | | 2.66 | |

| Total from investment operations | | 2.47 | | | 0.26 | | | 2.72 | | | 1.60 | | | 2.75 | |

| Less distributions from net investment income | | (0.29 | ) | | (0.24 | ) | | (0.21 | ) | | (0.08 | ) | | (0.06 | ) |

| Net asset value, end of year | $ | 21.49 | | $ | 19.31 | | $ | 19.29 | | $ | 16.78 | | $ | 15.26 | |

| |

| Total returnd | | 12.95 | % | | 1.49 | % | | 16.38 | % | | 10.59 | % | | 22.00 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.99 | % | | 1.05 | % | | 1.03 | % | | 1.14 | % | | 1.18 | % |

| Expenses net of waiver and payments by affiliates | | 0.99 | %e | | 1.04 | % | | 1.03 | % | | 1.14 | % | | 1.18 | % |

| Net investment income | | 1.41 | % | | 1.43 | % | | 1.33 | % | | 0.92 | % | | 0.67 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 381,925 | | $ | 303,815 | | $ | 347,101 | | $ | 262,991 | | $ | 228,472 | |

| Portfolio turnover rate | | 24.12 | % | | 17.04 | % | | 22.69 | % | | 23.43 | % | | 40.15 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of waiver and payments by affiliates rounds to less than 0.01%.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 13

FRANKLIN REAL ESTATE SECURITIES TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | |

| Franklin Real Estate Securities Fund (continued) | | | | | | | | | | | | | | | |

| | | | | | | | | Year Ended April 30, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Class C | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 18.66 | | $ | 18.65 | | $ | 16.20 | | $ | 14.77 | | $ | 12.23 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment income (loss)b | | 0.13 | | | 0.12 | | | 0.10 | | | 0.02 | | | (0.01 | ) |

| Net realized and unrealized gains (losses) | | 2.11 | | | —c | | | 2.40 | | | 1.42 | | | 2.58 | |

| Total from investment operations | | 2.24 | | | 0.12 | | | 2.50 | | | 1.44 | | | 2.57 | |

| Less distributions from net investment income | | (0.15 | ) | | (0.11 | ) | | (0.05 | ) | | (0.01 | ) | | (0.03 | ) |

| Net asset value, end of year | $ | 20.75 | | $ | 18.66 | | $ | 18.65 | | $ | 16.20 | | $ | 14.77 | |

| |

| Total returnd | | 12.07 | % | | 0.73 | % | | 15.47 | % | | 9.77 | % | | 21.10 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 1.74 | % | | 1.80 | % | | 1.78 | % | | 1.89 | % | | 1.93 | % |

| Expenses net of waiver and payments by affiliates | | 1.74 | %e | | 1.79 | % | | 1.78 | % | | 1.89 | % | | 1.93 | % |

| Net investment income (loss) | | 0.66 | % | | 0.68 | % | | 0.58 | % | | 0.17 | % | | (0.08 | )% |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 89,328 | | $ | 68,914 | | $ | 77,324 | | $ | 58,296 | | $ | 54,089 | |

| Portfolio turnover rate | | 24.12 | % | | 17.04 | % | | 22.69 | % | | 23.43 | % | | 40.15 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cAmount rounds to less than $0.01 per share.

dTotal return does not reflect sales commissions or contingent deferred sales charges, if applicable.

eBenefit of waiver and payments by affiliates rounds to less than 0.01%.

14 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

FINANCIAL HIGHLIGHTS

| | | | | | |

| Franklin Real Estate Securities Fund (continued) | | | | | | |

| | | Year Ended | |

| | | April 30, | |

| | | 2015 | | | 2014 | a |

| Class R6 | | | | | | |

| Per share operating performance | | | | | | |

| (for a share outstanding throughout the year) | | | | | | |

| Net asset value, beginning of year | $ | 19.46 | | $ | 19.30 | |

| Income from investment operationsb: | | | | | | |

| Net investment incomec | | 0.41 | | | 0.34 | |

| Net realized and unrealized gains (losses) | | 2.19 | | | 0.14 | |

| Total from investment operations | | 2.60 | | | 0.48 | |

| Less distributions from net investment income | | (0.39 | ) | | (0.32 | ) |

| Net asset value, end of year | $ | 21.67 | | $ | 19.46 | |

| |

| Total return | | 13.47 | % | | 2.69 | % |

| |

| Ratios to average net assets | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.54 | % | | 0.57 | % |

| Expenses net of waiver and payments by affiliates | | 0.54 | %d | | 0.56 | % |

| Net investment income | | 1.86 | % | | 1.91 | % |

| |

| Supplemental data | | | | | | |

| Net assets, end of year (000’s) | $ | 106,725 | | $ | 97,224 | |

| Portfolio turnover rate | | 24.12 | % | | 17.04 | % |

aFor the year May 1, 2013 (effective date) to April 30, 2014.

bThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

cBased on average daily shares outstanding.

dBenefit of waiver and payments by affiliates rounds to less than 0.01%.

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 15

FRANKLIN REAL ESTATE SECURITIES TRUST

FINANCIAL HIGHLIGHTS

| | | | | | | | | | | | | | | |

| Franklin Real Estate Securities Fund (continued) | | | | | | | | | | | | | | | |

| | | | | | | | | Year Ended April 30, | | | | |

| | | 2015 | | | 2014 | | | 2013 | | | 2012 | | | 2011 | |

| Advisor Class | | | | | | | | | | | | | | | |

| Per share operating performance | | | | | | | | | | | | | | | |

| (for a share outstanding throughout the year) | | | | | | | | | | | | | | | |

| Net asset value, beginning of year | $ | 19.46 | | $ | 19.43 | | $ | 16.92 | | $ | 15.38 | | $ | 12.65 | |

| Income from investment operationsa: | | | | | | | | | | | | | | | |

| Net investment incomeb | | 0.33 | | | 0.29 | | | 0.27 | | | 0.16 | | | 0.13 | |

| Net realized and unrealized gains (losses) | | 2.23 | | | 0.03 | | | 2.51 | | | 1.50 | | | 2.67 | |

| Total from investment operations | | 2.56 | | | 0.32 | | | 2.78 | | | 1.66 | | | 2.80 | |

| Less distributions from net investment income | | (0.35 | ) | | (0.29 | ) | | (0.27 | ) | | (0.12 | ) | | (0.07 | ) |

| Net asset value, end of year | $ | 21.67 | | $ | 19.46 | | $ | 19.43 | | $ | 16.92 | | $ | 15.38 | |

| |

| Total return | | 13.24 | % | | 1.79 | % | | 16.64 | % | | 10.91 | % | | 22.28 | % |

| |

| Ratios to average net assets | | | | | | | | | | | | | | | |

| Expenses before waiver and payments by affiliates | | 0.74 | % | | 0.80 | % | | 0.78 | % | | 0.89 | % | | 0.93 | % |

| Expenses net of waiver and payments by affiliates | | 0.74 | %c | | 0.79 | % | | 0.78 | % | | 0.89 | % | | 0.93 | % |

| Net investment income | | 1.66 | % | | 1.68 | % | | 1.58 | % | | 1.17 | % | | 0.92 | % |

| |

| Supplemental data | | | | | | | | | | | | | | | |

| Net assets, end of year (000’s) | $ | 17,644 | | $ | 12,402 | | $ | 108,076 | | $ | 10,542 | | $ | 7,833 | |

| Portfolio turnover rate | | 24.12 | % | | 17.04 | % | | 22.69 | % | | 23.43 | % | | 40.15 | % |

aThe amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and

repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

bBased on average daily shares outstanding.

cBenefit of waiver and payments by affiliates rounds to less than 0.01%.

16 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

| | | |

| | FRANKLIN REAL ESTATE SECURITIES TRUST |

| |

| |

| |

| |

| Statement of Investments, April 30, 2015 | | | |

| |

| Franklin Real Estate Securities Fund | | | |

| | Shares | | Value |

| Common Stocks 99.1% | | | |

| Diversified REITs 3.0% | | | |

| American Assets Trust Inc. | 211,500 | $ | 8,417,700 |

| Spirit Realty Capital Inc. | 229,500 | | 2,591,055 |

| WP Carey Inc. | 110,600 | | 7,020,888 |

| | | | 18,029,643 |

| Health Care REITs 12.0% | | | |

| HCP Inc. | 390,200 | | 15,721,158 |

| Health Care REIT Inc. | 316,700 | | 22,808,734 |

| OMEGA Healthcare Investors Inc. | 131,200 | | 4,735,008 |

| Sabra Health Care REIT Inc. | 247,400 | | 7,392,312 |

| Ventas Inc. | 300,550 | | 20,707,895 |

| | | | 71,365,107 |

| Hotel & Resort REITs 6.6% | | | |

| Host Hotels & Resorts Inc. | 792,650 | | 15,963,971 |

| Pebblebrook Hotel Trust | 309,900 | | 13,307,106 |

| Summit Hotel Properties Inc. | 78,469 | | 1,033,437 |

| Sunstone Hotel Investors Inc. | 563,211 | | 8,774,827 |

| | | | 39,079,341 |

| Hotels, Resorts & Cruise Lines 0.6% | | | |

| aHilton Worldwide Holdings Inc. | 126,300 | | 3,657,648 |

| Industrial REITs 5.8% | | | |

| First Industrial Realty Trust Inc. | 303,000 | | 5,978,190 |

| Prologis Inc. | 548,961 | | 22,068,232 |

| STAG Industrial Inc. | 308,800 | | 6,710,224 |

| | | | 34,756,646 |

| Office REITs 20.8% | | | |

| Alexandria Real Estate Equities Inc. | 158,200 | | 14,614,516 |

| Boston Properties Inc. | 182,800 | | 24,186,268 |

| Brandywine Realty Trust | 345,400 | | 5,035,932 |

| Coresite Realty Corp. | 120,800 | | 5,808,064 |

| CyrusOne Inc. | 148,300 | | 4,816,784 |

| Digital Realty Trust Inc. | 63,900 | | 4,051,899 |

| Highwoods Properties Inc. | 187,200 | | 8,057,088 |

| Kilroy Realty Corp. | 198,100 | | 14,063,119 |

| Paramount Group Inc. | 228,400 | | 4,184,288 |

| SL Green Realty Corp. | 130,600 | | 15,980,216 |

| Vornado Realty Trust | 222,745 | | 23,051,880 |

| | | | 123,850,054 |

| Residential REITs 17.2% | | | |

| Apartment Investment & Management Co., A | 326,300 | | 12,311,299 |

| AvalonBay Communities Inc. | 98,772 | | 16,232,190 |

| Camden Property Trust | 35,100 | | 2,635,308 |

| Equity Lifestyle Properties Inc. | 189,800 | | 10,025,236 |

| Equity Residential | 378,644 | | 27,966,646 |

| Essex Property Trust Inc. | 83,163 | | 18,458,028 |

| Post Properties Inc. | 47,300 | | 2,704,141 |

| UDR Inc. | 371,762 | | 12,182,641 |

| | | | 102,515,489 |

| |

| |

| franklintempleton.com | Annual Report | 17 |

FRANKLIN REAL ESTATE SECURITIES TRUST

STATEMENT OF INVESTMENTS

| | | | |

| Franklin Real Estate Securities Fund (continued) | | | | |

| | Shares | | Value | |

| Common Stocks (continued) | | | | |

| Retail REITs 26.2% | | | | |

| DDR Corp. | 198,107 | $ | 3,377,724 | |

| Federal Realty Investment Trust | 78,000 | | 10,426,260 | |

| General Growth Properties Inc. | 852,100 | | 23,347,540 | |

| Kimco Realty Corp. | 259,700 | | 6,258,770 | |

| The Macerich Co. | 154,921 | | 12,666,341 | |

| National Retail Properties Inc. | 92,500 | | 3,552,000 | |

| Realty Income Corp. | 256,300 | | 12,038,411 | |

| Regency Centers Corp. | 178,700 | | 11,218,786 | |

| Simon Property Group Inc. | 295,500 | | 53,630,295 | |

| Taubman Centers Inc. | 102,300 | | 7,366,623 | |

| Urban Edge Properties | 191,822 | | 4,340,932 | |

| Weingarten Realty Investors | 238,300 | | 7,806,708 | |

| | | | 156,030,390 | |

| Specialized REITs 6.9% | | | | |

| CubeSmart | 359,600 | | 8,295,972 | |

| Extra Space Storage Inc. | 210,900 | | 13,904,637 | |

| Public Storage | 99,000 | | 18,603,090 | |

| | | | 40,803,699 | |

| Total Common Stocks (Cost $374,541,702) | | | 590,088,017 | |

| Short Term Investments (Cost $6,059,485) 1.0% | | | | |

| Money Market Funds 1.0% | | | | |

| a,bInstitutional Fiduciary Trust Money Market Portfolio | 6,059,485 | | 6,059,485 | |

| Total Investments (Cost $380,601,187) 100.1% | | | 596,147,502 | |

| Other Assets, less Liabilities (0.1)% | | | (526,339 | ) |

| Net Assets 100.0% | | $ | 595,621,163 | |

See Abbreviations on page 28.

aNon-income producing.

bSee Note 3(f) regarding investments in Institutional Fiduciary Trust Money Market Portfolio.

18 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

Financial Statements

Statement of Assets and Liabilities

April 30, 2015

| | | | |

| Franklin Real Estate Securities Fund | | | |

| |

| Assets: | | | | |

| Investments in securities: | | | | |

| Cost - Unaffiliated issuers | | $ | 374,541,702 | |

| Cost - Sweep Money Fund (Note 3f) | | 6,059,485 | |

| Total cost of investments | | $ | 380,601,187 | |

| Value - Unaffiliated issuers | | $ | 590,088,017 | |

| Value - Sweep Money Fund (Note 3f) | | 6,059,485 | |

| Total value of investments | | | 596,147,502 | |

| Receivables: | | | | |

| Investment securities sold | | | 702,418 | |

| Capital shares sold | | | 884,764 | |

| Dividends | | | 145,775 | |

| Other assets | | | 343 | |

| Total assets | | | 597,880,802 | |

| Liabilities: | | | | |

| Payables: | | | | |

| Investment securities purchased | | 722,269 | |

| Capital shares redeemed | | | 970,836 | |

| Management fees | | | 251,498 | |

| Distribution fees | | | 159,436 | |

| Transfer agent fees | | | 116,724 | |

| Accrued expenses and other liabilities | | 38,876 | |

| Total liabilities | | | 2,259,639 | |

| Net assets, at value | | $ | 595,621,163 | |

| Net assets consist of: | | | | |

| Paid-in capital | | $ | 444,292,609 | |

| Undistributed net investment income | | 2,434,942 | |

| Net unrealized appreciation (depreciation) | | 215,546,315 | |

| Accumulated net realized gain (loss) | | (66,652,703 | ) |

| Net assets, at value | | $ | 595,621,163 | |

| Class A: | | | | |

| Net assets, at value | | $ | 381,924,932 | |

| Shares outstanding | | | 17,768,174 | |

| Net asset value per sharea | | $ | 21.49 | |

| Maximum offering price per share (net asset value per share ÷ 94.25%) | $ | 22.80 | |

| Class C: | | | | |

| Net assets, at value | | $ | 89,327,584 | |

| Shares outstanding | | | 4,304,407 | |

| Net asset value and maximum offering price per sharea | $ | 20.75 | |

| Class R6: | | | | |

| Net assets, at value | | $ | 106,724,845 | |

| Shares outstanding | | | 4,925,934 | |

| Net asset value and maximum offering price per share | $ | 21.67 | |

| Advisor Class: | | | | |

| Net assets, at value | | $ | 17,643,802 | |

| Shares outstanding | | | 814,387 | |

| Net asset value and maximum offering price per share | $ | 21.67 | |

| aRedemption price is equal to net asset value less contingent deferred sales charges, if applicable. | | | |

| |

| franklintempleton.com | The accompanying notes are an integral part of these financial statements. | Annual Report | 19 | |

FRANKLIN REAL ESTATE SECURITIES TRUST

FINANCIAL STATEMENTS

Statement of Operations

for the year ended April 30, 2015

| | | |

| Franklin Real Estate Securities Fund | | | |

| |

| Investment income: | | | |

| Dividends | $ | 13,325,309 | |

| Income from securities loaned | | 6,137 | |

| Total investment income | | 13,331,446 | |

| Expenses: | | | |

| Management fees (Note 3a) | | 2,741,836 | |

| Distribution fees: (Note 3c) | | | |

| Class A | | 874,256 | |

| Class C | | 815,084 | |

| Transfer agent fees: (Note 3e) | | | |

| Class A | | 698,651 | |

| Class C | | 162,799 | |

| Class R6 | | 170 | |

| Advisor Class | | 34,873 | |

| Custodian fees (Note 4) | | 4,967 | |

| Reports to shareholders | | 82,158 | |

| Registration and filing fees | | 92,423 | |

| Professional fees | | 51,860 | |

| Trustees’ fees and expenses | | 32,688 | |

| Other | | 3,991 | |

| Total expenses | | 5,595,756 | |

| Expenses waived/paid by affiliates (Note 3f) | | (7,068 | ) |

| Net expenses | | 5,588,688 | |

| Net investment income | | 7,742,758 | |

| Realized and unrealized gains (losses): | | | |

| Net realized gain (loss) from: | | | |

| Investments | | 19,407,209 | |

| Realized gain distributions from REITs | | 3,831,329 | |

| Net realized gain (loss) | | 23,238,538 | |

| Net change in unrealized appreciation (depreciation) on investments | | 29,138,076 | |

| Net realized and unrealized gain (loss) | | 52,376,614 | |

| Net increase (decrease) in net assets resulting from operations | $ | 60,119,372 | |

20 | Annual Report | The accompanying notes are an integral part of these financial statements.

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

FINANCIAL STATEMENTS

| | | | | | |

| Statements of Changes in Net Assets | | | | | | |

| |

| |

| Franklin Real Estate Securities Fund | | | | | | |

| |

| | | Year Ended April 30, | |

| | | 2015 | | | 2014 | |

| Increase (decrease) in net assets: | | | | | | |

| Operations: | | | | | | |

| Net investment income | $ | 7,742,758 | | $ | 6,533,718 | |

| Net realized gain (loss) from investments and realized gain distributions from REITs | | 23,238,538 | | | 8,327,014 | |

| Net change in unrealized appreciation (depreciation) on investments | | 29,138,076 | | | (12,848,903 | ) |

| Net increase (decrease) in net assets resulting from operations | | 60,119,372 | | | 2,011,829 | |

| Distributions to shareholders from: | | | | | | |

| Net investment income: | | | | | | |

| Class A | | (4,821,385 | ) | | (3,928,585 | ) |

| Class C | | (605,677 | ) | | (462,692 | ) |

| Class R6 | | (1,923,476 | ) | | (1,583,196 | ) |

| Advisor Class | | (276,200 | ) | | (175,212 | ) |

| Total distributions to shareholders | | (7,626,738 | ) | | (6,149,685 | ) |

| Capital share transactions: (Note 2) | | | | | | |

| Class A | | 45,395,649 | | | (39,939,742 | ) |

| Class C | | 12,902,054 | | | (7,467,839 | ) |

| Class R6 | | (1,177,228 | ) | | 96,281,912 | |

| Advisor Class | | 3,654,047 | | | (94,884,555 | ) |

| Total capital share transactions | | 60,774,522 | | | (46,010,224 | ) |

| Net increase (decrease) in net assets | | 113,267,156 | | | (50,148,080 | ) |

| Net assets: | | | | | | |

| Beginning of year | | 482,354,007 | | | 532,502,087 | |

| End of year | $ | 595,621,163 | | $ | 482,354,007 | |

| Undistributed net investment income included in net assets: | | | | | | |

| End of year | $ | 2,434,942 | | $ | 2,318,922 | |

franklintempleton.com

The accompanying notes are an integral part of these financial statements. | Annual Report | 21

FRANKLIN REAL ESTATE SECURITIES TRUST

Notes to Financial Statements

Franklin Real Estate Securities Fund

1. Organization and Significant Accounting Policies

Franklin Real Estate Securities Trust (Trust) is registered under the Investment Company Act of 1940, as amended, (1940 Act) as an open-end management investment company, consisting of one fund, Franklin Real Estate Securities Fund (Fund) and applies the specialized accounting and reporting guidance in U.S. Generally Accepted Accounting Principles (U.S. GAAP). The Fund offers four classes of shares: Class A, Class C, Class R6, and Advisor Class. Each class of shares differs by its initial sales load, contingent deferred sales charges, voting rights on matters affecting a single class, its exchange privilege and fees primarily due to differing arrangements for distribution and transfer agent fees.

The following summarizes the Fund’s significant accounting policies.

a. Financial Instrument Valuation

The Fund’s investments in financial instruments are carried at fair value daily. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants on the measurement date. The Fund calculates the net asset value (NAV) per share at the close of the New York Stock Exchange (NYSE), generally at 4 p.m. Eastern time (NYSE close) on each day the NYSE is open for trading. Under compliance policies and procedures approved by the Fund’s Board of Trustees (the Board), the Fund’s administrator has responsibility for oversight of valuation, including leading the cross-functional Valuation and Liquidity Oversight Committee (VLOC). The VLOC provides administration and oversight of the Fund’s valuation policies and procedures, which are approved annually by the Board. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers, and other market sources to determine fair value.

Equity securities listed on an exchange or on the NASDAQ National Market System are valued at the last quoted sale price or the official closing price of the day, respectively. Over-the-counter securities are valued within the range of the most recent quoted bid and ask prices. Securities that trade in multiple markets or on multiple exchanges are valued according to the broadest and most representative market. Certain equity securities are valued based upon fundamental characteristics

or relationships to similar securities. Investments in open-end mutual funds are valued at the closing NAV.

The Fund has procedures to determine the fair value of financial instruments for which market prices are not reliable or readily available. Under these procedures, the VLOC convenes on a regular basis to review such financial instruments and considers a number of factors, including significant unobservable valuation inputs, when arriving at fair value. The VLOC primarily employs a market-based approach which may use related or comparable assets or liabilities, recent transactions, market multiples, book values, and other relevant information for the investment to determine the fair value of the investment. An income-based valuation approach may also be used in which the anticipated future cash flows of the investment are discounted to calculate fair value. Discounts may also be applied due to the nature or duration of any restrictions on the disposition of the investments. Due to the inherent uncertainty of valuations of such investments, the fair values may differ significantly from the values that would have been used had an active market existed. The VLOC employs various methods for calibrating these valuation approaches including a regular review of key inputs and assumptions, transactional back-testing or disposition analysis, and reviews of any related market activity.

b. Securities Lending

The Fund participates in an agency based securities lending program to earn additional income. The Fund receives cash collateral against the loaned securities in an amount equal to at least 102% of the fair value of the loaned securities. Collateral is maintained over the life of the loan in an amount not less than 100% of the fair value of loaned securities, as determined at the close of fund business each day; any additional collateral required due to changes in security values is delivered to the Fund on the next business day. The collateral is deposited into a joint cash account with other funds and is used to invest in a money market fund managed by Franklin Advisers, Inc., an affiliate of the Fund, and/or a joint repurchase agreement. The Fund may receive income from the investment of cash collateral, in addition to lending fees and rebates paid by the borrower. Income from securities loaned is reported separately in the Statement of Operations. The Fund bears the market risk with respect to the collateral investment, securities loaned, and the risk that the agent may default on its obligations to the Fund. If the borrower defaults on its obligation to return the securities loaned, the Fund has the right to repurchase the securities in the open market using the collateral received.

22 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Real Estate Securities Fund (continued)

The securities lending agent has agreed to indemnify the Fund in the event of default by a third party borrower. At April 30, 2015, the Fund had no securities on loan.

c. Income Taxes

It is the Fund’s policy to qualify as a regulated investment company under the Internal Revenue Code. The Fund intends to distribute to shareholders substantially all of its taxable income and net realized gains to relieve it from federal income and excise taxes. As a result, no provision for U.S. federal income taxes is required.

The Fund recognizes the tax benefits of uncertain tax positions only when the position is “more likely than not” to be sustained upon examination by the tax authorities based on the technical merits of the tax position. As of April 30, 2015, and for all open tax years, the Fund has determined that no liability for unrecognized tax benefits is required in the Fund’s financial statements related to uncertain tax positions taken on a tax return (or expected to be taken on future tax returns). Open tax years are those that remain subject to examination and are based on each tax jurisdiction’s statute of limitation.

d. Security Transactions, Investment Income, Expenses and Distributions

Security transactions are accounted for on trade date. Realized gains and losses on security transactions are determined on a specific identification basis. Estimated expenses are accrued daily. Dividend income is recorded on the ex-dividend date. Distributions to shareholders are recorded on the ex-dividend date and are determined according to income tax regulations (tax basis). Distributable earnings determined on a tax basis may differ from earnings recorded in accordance with U.S. GAAP. These differences may be permanent or temporary. Permanent differences are reclassified among capital accounts to reflect their tax character. These reclassifications have no impact on net assets or the results of operations. Temporary

differences are not reclassified, as they may reverse in subsequent periods.

Realized and unrealized gains and losses and net investment income, not including class specific expenses, are allocated daily to each class of shares based upon the relative proportion of net assets of each class. Differences in per share distributions, by class, are generally due to differences in class specific expenses.

Distributions received by the Fund from certain securities may be a return of capital (ROC). Such distributions reduce the cost basis of the securities, and any distributions in excess of the cost basis are recognized as capital gains. For Real Estate Investment Trust (REIT) securities, the Fund records ROC estimates, if any, on the ex-dividend date and are adjusted once actual tax designations are known.

e. Accounting Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

f. Guarantees and Indemnifications

Under the Trust’s organizational documents, its officers and trustees are indemnified by the Trust against certain liabilities arising out of the performance of their duties to the Trust. Additionally, in the normal course of business, the Trust, on behalf of the Fund, enters into contracts with service providers that contain general indemnification clauses. The Trust’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Trust that have not yet occurred. Currently, the Trust expects the risk of loss to be remote.

franklintempleton.com

Annual Report

| 23

FRANKLIN REAL ESTATE SECURITIES TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Real Estate Securities Fund (continued)

2. Shares of Beneficial Interest

At April 30, 2015, there were an unlimited number of shares authorized ($0.01 par value). Transactions in the Fund’s shares were as follows:

| | | | | | | | | | | |

| | | | | Year Ended April 30, | | | | | |

| | | | | 2015 | | | | | 2014 | | |

| | Shares | | | Amount | | Shares | | | | Amount | |

| Class A Shares: | | | | | | | | | | | |

| Shares sold | 5,397,559 | | $ | 117,086,369 | | 3,385,983 | | | $ | 61,575,547 | |

| Shares issued in reinvestment of distributions | 224,169 | | | 4,596,250 | | 214,128 | | | | 3,743,256 | |

| Shares redeemed | (3,587,998 | ) | | (76,286,970 | ) | (5,859,641 | ) | | (105,258,545 | ) |

| Net increase (decrease) | 2,033,730 | | $ | 45,395,649 | | (2,259,530 | ) | $ | (39,939,742 | ) |

| Class C Shares: | | | | | | | | | | | |

| Shares sold | 1,454,556 | | $ | 30,447,174 | | 868,474 | | | $ | 15,261,187 | |

| Shares issued in reinvestment of distributions | 29,496 | | | 583,390 | | 26,180 | | | | 444,938 | |

| Shares redeemed | (872,763 | ) | | (18,128,510 | ) | (1,347,793 | ) | | | (23,173,964 | ) |

| Net increase (decrease) | 611,289 | | $ | 12,902,054 | | (453,139 | ) | | $ | (7,467,839 | ) |

| Class R6 Sharesa: | | | | | | | | | | | |

| Shares soldb | 314,578 | | $ | 6,879,683 | | 5,157,127 | | | $ | 99,223,996 | |

| Shares issued in reinvestment of distributions | 93,382 | | | 1,923,476 | | 90,094 | | | | 1,583,174 | |

| Shares redeemed | (478,049 | ) | | (9,980,387 | ) | (251,198 | ) | | | (4,525,258 | ) |

| Net increase (decrease) | (70,089 | ) | $ | (1,177,228 | ) | 4,996,023 | | | $ | 96,281,912 | |

| Advisor Class Shares: | | | | | | | | | | | |

| Shares sold | 622,016 | | $ | 13,399,905 | | 219,998 | | | $ | 4,007,322 | |

| Shares issued in reinvestment of distributions | 11,465 | | | 237,490 | | 8,689 | | | | 153,084 | |

| Shares redeemedb | (456,386 | ) | | (9,983,348 | ) | (5,152,361 | ) | | | (99,044,961 | ) |

| Net increase (decrease) | 177,095 | | $ | 3,654,047 | | (4,923,674 | ) | $ | (94,884,555 | ) |

| aFor the year May 1, 2013 (effective date) to April 30, 2014. | | | | | | | | | | | |

| bEffective May 1, 2013, a portion of Advisor Class shares were exchanged into Class R6. | | | | | | | | | | | |

3. Transactions with Affiliates

Franklin Resources, Inc. is the holding company for various subsidiaries that together are referred to as Franklin Templeton Investments. Certain officers and trustees of the Trust are also officers and/or directors of the following subsidiaries:

| |

| Subsidiary | Affiliation |

| Franklin Templeton Institutional, LLC (FT Institutional) | Investment manager |

| Franklin Templeton Services, LLC (FT Services) | Administrative manager |

| Franklin Templeton Distributors, Inc. (Distributors) | Principal underwriter |

| Franklin Templeton Investor Services, LLC (Investor Services) | Transfer agent |

24 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Real Estate Securities Fund (continued)

a. Management Fees

The Fund pays an investment management fee to FT Institutional based on the month-end net assets of the Fund as follows:

| | |

| Annualized Fee Rate | | Net Assets |

| 0.625 | % | Up to and including $100 million |

| 0.500 | % | Over $100 million, up to and including $250 million |

| 0.450 | % | Over $250 million, up to and including $7.5 billion |

| 0.440 | % | Over $7.5 billion, up to and including $10 billion |

| 0.430 | % | Over $10 billion, up to and including $12.5 billion |

| 0.420 | % | Over $12.5 billion, up to and including $15 billion |

| 0.400 | % | In excess of $15 billion |

b. Administrative Fees

Under an agreement with FT Institutional, FT Services provides administrative services to the Fund. The fee is paid by FT Institutional based on the Fund’s average daily net assets, and is not an additional expense of the Fund.

c. Distribution Fees

The Board has adopted distribution plans for each share class, with the exception of Class R6 and Advisor Class shares, pursuant to Rule 12b-1 under the 1940 Act. Distribution fees are not charged on shares held by affiliates. Under the Fund’s Class A reimbursement distribution plan, the Fund reimburses Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. Under the Class A reimbursement distribution plan, costs exceeding the maximum for the current plan year cannot be reimbursed in subsequent periods. In addition, under the Fund’s Class C compensation distribution plan, the Fund pays Distributors for costs incurred in connection with the servicing, sale and distribution of the Fund’s shares up to the maximum annual plan rate. The plan year, for purposes of monitoring compliance with the maximum annual plan rates, is February 1 through January 31.

The maximum annual plan rates, based on the average daily net assets, for each class, are as follows:

d. Sales Charges/Underwriting Agreements

Front-end sales charges and contingent deferred sales charges (CDSC) do not represent expenses of the Fund. These charges are deducted from the proceeds of sales of Fund shares prior to investment or from redemption proceeds prior to remittance, as applicable. Distributors has advised the Fund of the following commission transactions related to the sales and redemptions of the Fund’s shares for the year:

| | |

| Sales charges retained net of commissions paid to unaffiliated | | |

| broker/dealers | $ | 234,830 |

| CDSC retained | $ | 9,417 |

franklintempleton.com

Annual Report

| 25

FRANKLIN REAL ESTATE SECURITIES TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Real Estate Securities Fund (continued)

3. Transactions with Affiliates (continued)

e. Transfer Agent Fees

Each class of shares, except for Class R6, pays transfer agent fees to Investor Services for its performance of shareholder servicing obligations and reimburses Investor Services for out of pocket expenses incurred, including shareholding servicing fees paid to third parties. These fees are allocated daily based upon their relative proportion of such classes’ aggregate net assets. Class R6 pays Investor Services transfer agent fees specific to that class.

For the year ended April 30, 2015, the Fund paid transfer agent fees of $896,493, of which $475,607 was retained by Investor Services.

f. Investments in Institutional Fiduciary Trust Money Market Portfolio

The Fund invests in Institutional Fiduciary Trust Money Market Portfolio (Sweep Money Fund), an affiliated open-end management investment company. Management fees paid by the Fund are waived on assets invested in the Sweep Money Fund, in an amount not to exceed the management and administrative fees paid directly or indirectly by the Sweep Money Fund. Prior to May 1, 2013, the waiver was accounted for as a reduction to management fees.

g. Waiver and Expense Reimbursements

Investor Services has contractually agreed in advance to waive or limit its fees so that the Class R6 transfer agent fees do not exceed 0.01% until August 31, 2015. There were no Class R6 transfer agent fees waived during the year ended April 30, 2015.

h. Other Affiliated Transactions

At April 30, 2015, one or more of the funds in Franklin Fund Allocator Series owned 17.54 % of the Fund’s outstanding shares.

4. Expense Offset Arrangement

The Fund has entered into an arrangement with its custodian whereby credits realized as a result of uninvested cash balances are used to reduce a portion of the Fund’s custodian expenses. During the year ended April 30, 2015, there were no credits earned.

5. Income Taxes

For tax purposes, capital losses may be carried over to offset future capital gains. Capital loss carryforwards with no expiration, if any, must be fully utilized before those losses with expiration dates.

At April 30, 2015, the Fund had capital loss carryforwards of $35,957,662 expiring in 2018. During the year ended April 30, 2015, the Fund utilized $22,709,755 of capital loss carryforwards. The tax character of distributions paid during the years ended April 30, 2015 and 2014, was as follows:

| | | | |

| | | 2015 | | 2014 |

| Distributions paid from ordinary income | $ | 7,626,738 | $ | 6,149,685 |

26 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Real Estate Securities Fund (continued)

At April 30, 2015, the cost of investments, net unrealized appreciation (depreciation) and undistributed ordinary income for income tax purposes were as follows:

| | |

| Cost of investments | $ | 411,296,237 |

| |

| Unrealized appreciation | $ | 186,339,049 |

| Unrealized depreciation | | 1,487,784 |

| | $ | 184,851,265 |

| |

| Distributable earnings - undistributed ordinary income | $ | 2,434,942 |

Differences between income and/or capital gains as determined on a book basis and a tax basis are primarily due to differing treatment of wash sales.

6. Investment Transactions

Purchases and sales of investments (excluding short term securities) for the year ended April 30, 2015, aggregated $198,432,049 and $131,073,313, respectively.

7. Concentration of Risk

The Fund invests a large percentage of its total assets in REIT securities. Such concentration may subject the Fund to special risks associated with real estate securities. These securities may be more sensitive to economic or regulatory developments due to a variety of factors such as local, regional, national and global economic conditions, interest rates and tax considerations.

8. Credit facility

The Fund, together with other U.S. registered and foreign investment funds (collectively, Borrowers), managed by Franklin Templeton Investments, are borrowers in a joint syndicated senior unsecured credit facility totaling $2 billion (Global Credit Facility) which, matures on February 12, 2016. This Global Credit Facility provides a source of funds to the Borrowers for temporary and emergency purposes, including the ability to meet future unanticipated or unusually large redemption requests.

Under the terms of the Global Credit Facility, the Fund shall, in addition to interest charged on any borrowings made by the Fund and other costs incurred by the Fund, pay its share of fees and expenses incurred in connection with the implementation and maintenance of the Global Credit Facility, based upon its relative share of the aggregate net assets of all of the Borrowers, including an annual commitment fee of 0.07% based upon the unused portion of the Global Credit Facility. These fees are reflected in other expenses in the Statement of Operations. During the year ended April 30, 2015, the Fund did not use the Global Credit Facility.

franklintempleton.com

Annual Report

| 27

FRANKLIN REAL ESTATE SECURITIES TRUST

NOTES TO FINANCIAL STATEMENTS

Franklin Real Estate Securities Fund (continued)

9. Fair Value Measurements

The Fund follows a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s financial instruments and are summarized in the following fair value hierarchy:

- Level 1 – quoted prices in active markets for identical financial instruments

- Level 2 – other significant observable inputs (including quoted prices for similar financial instruments, interest rates, prepayment speed, credit risk, etc.)

- Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of financial instruments)

The input levels are not necessarily an indication of the risk or liquidity associated with financial instruments at that level.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfers as of the date of the underlying event which caused the movement.

At April 30, 2015, all of the Fund’s investments in financial instruments carried at fair value were valued using Level 1 inputs.

For detailed categories, see the accompanying Statement of Investments.

10. New Accounting Pronouncements

In June 2014, The Financial Accounting Standards Board issued Accounting Standards Update (ASU) No. 2014-11, Transfers and Servicing (Topic 860), Repurchase-to-Maturity Transactions, Repurchase Financings, and Disclosures. The ASU changes the accounting for certain repurchase agreements and expands disclosure requirements related to repurchase agreements, securities lending, repurchase-to-maturity and similar transactions. The ASU is effective for interim and annual reporting periods beginning after December 15, 2014. Management has reviewed the requirements and believes the adoption of this ASU will not have a material impact on the financial statements.

11. Subsequent Events

The Fund has evaluated subsequent events through the issuance of the financial statements and determined that no events have occurred that require disclosure.

Abbreviations

Selected Portfolio

REIT Real Estate Investment Trust

28 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

Report of Independent Registered Public Accounting Firm

To the Board of Trustees and Shareholders of Franklin Real Estate Securities Fund

In our opinion, the accompanying statement of assets and liabilities, including the statement of investments, and the related statements of operations and of changes in net assets and the financial highlights present fairly, in all material respects, the financial position of Franklin Real Estate Securities Fund (the “Fund”) at April 30, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the periods presented, in conformity with accounting principles generally accepted in the United States of America. These financial statements and financial highlights (hereafter referred to as “financial statements”) are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements based on our audits. We conducted our audits of these financial statements in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits, which included confirmation of securities at April 30, 2015 by correspondence with the custodian, transfer agent and brokers, provide a reasonable basis for our opinion.

PricewaterhouseCoopers LLP

San Francisco, California

June 15, 2015

franklintempleton.com

Annual Report

| 29

FRANKLIN REAL ESTATE SECURITIES TRUST

Tax Information (unaudited)

Franklin Real Estate Securities Fund

Under Section 854(b)(1)(B) of the Internal Revenue Code (Code), the Fund hereby reports the maximum amount allowable but no less than $180,900 as qualified dividends for purposes of the maximum rate under Section 1(h)(11) of the Code for the fiscal year ended April 30, 2015. Distributions, including qualified dividend income, paid during calendar year 2015 will be reported to shareholders on Form 1099-DIV by mid-February 2016. Shareholders are advised to check with their tax advisors for information on the treatment of these amounts on their individual income tax returns.

30 | Annual Report

franklintempleton.com

FRANKLIN REAL ESTATE SECURITIES TRUST

| | | | |

| Board Members and Officers | | |

| |

| The name, year of birth and address of the officers and board members, as well as their affiliations, positions held with the Trust, |

| principal occupations during at least the past five years and number of portfolios overseen in the Franklin Templeton Investments |

| fund complex are shown below. Generally, each board member serves until that person’s successor is elected and qualified. |

| |

| |

| Independent Board Members | | | |

| |

| | | | Number of Portfolios in | |

| Name, Year of Birth | | Length of | Fund Complex Overseen | Other Directorships Held |

| and Address | Position | Time Served | by Board Member* | During at Least the Past 5 Years |

| |

| Harris J. Ashton (1932) | Trustee | Since 1993 | 145 | Bar-S Foods (meat packing company) |

| One Franklin Parkway | | | | (1981-2010). |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director of various companies; and formerly, Director, RBC Holdings, Inc. (bank holding company) (until 2002); and President, Chief Executive |

| Officer and Chairman of the Board, General Host Corporation (nursery and craft centers) (until 1998). | |

| |

| Mary C. Choksi (1950) | Trustee | Since | 119 | Avis Budget Group Inc. (car rental) |

| One Franklin Parkway | | October 2014 | | (2007-present), Omnicom Group Inc. |

| San Mateo, CA 94403-1906 | | | | (advertising and marketing communi- |

| | | | | cations services) (2011-present) and |

| | | | | H.J. Heinz Company (processed foods |

| | | | | and allied products) (1998-2006). |

| |

| Principal Occupation During at Least the Past 5 Years: | | |

| Founding Partner and Senior Managing Director, Strategic Investment Group (investment management group) (1987-present); director of |

| various companies; and formerly, Founding Partner and Managing Director, Emerging Markets Management LLC (investment management |

| firm) (1987-2011); and Loan Officer/Senior Loan Officer/Senior Pension Investment Officer, World Bank Group (international financial |

| institution) (1977-1987). | | | | |

| |

| Edith E. Holiday (1952) | Trustee | Since 2005 | 145 | Hess Corporation (exploration and |

| One Franklin Parkway | | | | refining of oil and gas) (1993-present), |

| San Mateo, CA 94403-1906 | | | | RTI International Metals, Inc. (manu- |

| | | | | facture and distribution of titanium) |

| | | | | (1999-present), Canadian National |

| | | | | Railway (railroad) (2001-present), |

| | | | | White Mountains Insurance Group, Ltd. |

| | | | | (holding company) (2004-present) and |

| | | | | H.J. Heinz Company (processed foods |

| | | | | and allied products) (1994-2013). |

| Principal Occupation During at Least the Past 5 Years: | | |

| Director or Trustee of various companies and trusts; and formerly, Assistant to the President of the United States and Secretary of the |

| Cabinet (1990-1993); General Counsel to the United States Treasury Department (1989-1990); and Counselor to the Secretary and Assistant |

| Secretary for Public Affairs and Public Liaison – United States Treasury Department (1988-1989). | |

| |

| J. Michael Luttig (1954) | Trustee | Since 2009 | 145 | Boeing Capital Corporation |

| One Franklin Parkway | | | | (aircraft financing) (2006-2013). |

| San Mateo, CA 94403-1906 | | | | |

| Principal Occupation During at Least the Past 5 Years: | | |

| Executive Vice President, General Counsel and member of the Executive Council, The Boeing Company (aerospace company); and formerly, |

| Federal Appeals Court Judge, U.S. Court of Appeals for the Fourth Circuit (1991-2006). | |

franklintempleton.com

Annual Report

| 31

FRANKLIN REAL ESTATE SECURITIES TRUST

| | | | |

| Independent Board Members (continued) | | |

| |

| | | | Number of Portfolios in | |

| Name, Year of Birth | | Length of | Fund Complex Overseen | Other Directorships Held |

| and Address | Position | Time Served | by Board Member* | During at Least the Past 5 Years |

| |

| Frank A. Olson (1932) | Trustee | Since 2007 | 145 | Hess Corporation (exploration and |

| One Franklin Parkway | | | | refining of oil and gas) (1998-2013). |