UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549 |

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES |

| Investment Company Act file number | | 811- 7123 |

Advantage Funds, Inc.

(Exact name of Registrant as specified in charter) |

c/o The Dreyfus Corporation

200 Park Avenue

New York, New York 10166

(Address of principal executive offices) (Zip code) |

Michael A. Rosenberg, Esq.

200 Park Avenue

New York, New York 10166

(Name and address of agent for service) |

| Registrant's telephone number, including area code: | | (212) 922-6000 |

| Date of fiscal year end: | | 8/31 |

| Date of reporting period: | | 8/31/09 |

The following N-CSR relates only to the Registrant's series listed below and does not affect the other series of the Registrant, which have a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate Form N-CSR will be filed for these series as appropriate.

| | Dreyfus Emerging Leaders Fund

Dreyfus International Value Fund

Dreyfus Midcap Value Fund

Dreyfus Small Company Value Fund

Dreyfus Strategic Value Fund

Dreyfus Structured Midcap Fund

Dreyfus Technology Growth Fund

|

| Item 1. | | Reports to Stockholders. |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | Contents |

| |

| | THE FUND |

| |

| 2 | A Letter from the Chairman and CEO |

| |

| 3 | Discussion of Fund Performance |

| |

| 6 | Fund Performance |

| |

| 7 | Understanding Your Fund’s Expenses |

| |

| 7 | Comparing Your Fund’s Expenses With Those of Other Funds |

| |

| 8 | Statement of Investments |

| |

| 16 | Statement of Assets and Liabilities |

| |

| 17 | Statement of Operations |

| |

| 18 | Statement of Changes in Net Assets |

| |

| 19 | Financial Highlights |

| |

| 20 | Notes to Financial Statements |

| |

| 28 | Report of Independent Registered Public Accounting Firm |

| |

| 29 | Important Tax Information |

| |

| 30 | Information About the Review and Approval of the Fund’s Management Agreement |

| |

| 34 | Board Members Information |

| |

| 36 | Officers of the Fund |

| |

| | FOR MORE INFORMATION |

| |

| | Back Cover |

| |

Dreyfus

Emerging Leaders Fund |

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Emerging Leaders Fund, covering the 12-month period from September 1, 2008, through August 31, 2009.

At long last, the current recession cycle appears to be winding down. After generally slumping since December 2007, we expect U.S. economic growth to pick up during the third quarter of 2009. Highly stimulative monetary and fiscal policies domestically and throughout the world, combined with the low cost of debt and equity capital compared to historical norms, already have sparked a rebound in industrial production as manufacturers replenish their depleted inventories. However, we continue to anticipate a slower-than-average recovery, with the unemployment rate likely to remain elevated over the next several quarters.

The U.S. stock market anticipated the economic upturn with a sustained market rally that began in early March 2009. Although the rebound initially was concentrated primarily among lower-quality stocks that had been severely punished in the downturn, it later broadened to include virtually all economic sectors and capitalization ranges. While we are encouraged by the market’s recent strength, we remain concerned that improving investor sentiment may have exceeded the revival of business fundamentals.Accordingly, we continue to believe that careful selectivity and risk management will be keys to success in the financial markets over the foreseeable future.As always, we urge you to speak with your financial adviser about the potential opportunities and obstacles in today’s investment environment.

For information about how the fund performed during the reporting period, as well as market perspectives, we have provided a Discussion of Fund Performance given by the Portfolio Managers.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

September 15, 2009 |

2

DISCUSSION OF FUND PERFORMANCE

For the period of September 1, 2008, through August 31, 2009, as provided by Oliver Buckley, Langton C. Garvin and Kristin Crawford, Portfolio Managers

Fund and Market Performance Overview

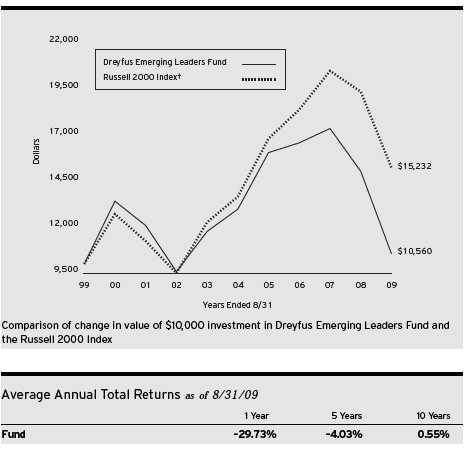

For the 12-month period ended August 31, 2009, Dreyfus Emerging Leaders Fund produced a total return of –29.73%.1 In comparison, the fund’s benchmark, the Russell 2000 Index (the “Index”), achieved a –21.29% total return for the same period.2

A severe recession and global banking crisis fueled steep declines in small-cap stock prices over the reporting period’s first half, but a sustained market rally over the spring and summer of 2009 offset a significant portion of earlier losses.The fund produced lower returns than its benchmark, primarily due to the ineffectiveness of the momentum and value factors considered by our investment process under extremely volatile market conditions.

The Fund’s Investment Approach

The fund seeks capital growth by investing at least 80% of its assets in companies we believe are emerging leaders: small companies characterized by new or innovative products, services or processes having the potential to enhance earnings growth. Our investment process is driven by computer models that identify and rank stocks based on fundamental momentum, relative value, future value, long-term growth and additional factors, such as technical factors. We attempt to maintain a neutral exposure to industry groups relative to the Index.Within each sector, we overweight the stocks ranked most attractive and underweight or avoid those ranked least attractive.

Equity Markets Plunged, Then Rebounded Sharply

Like other capitalization ranges, the small-cap stock market endured a year of extreme volatility. Just weeks after the start of the reporting period, massive losses among mortgage- and asset-backed securities led to the failure of several major financial institutions and for a time it

The Fund 3

| DISCUSSION OF FUND PERFORMANCE (continued) |

seemed as if a collapse of the worldwide banking system was not out of the question. Meanwhile, rising unemployment, plunging housing prices and depressed consumer confidence characterized what will likely be the longest and most severe economic downturn in the postwar period. These influences sparked a bear market that drove many stock market averages, including the fund’s benchmark, to multi-year lows. The decline was broad-based, affecting industry groups and individual stocks seemingly regardless of their underlying business fundamentals.

However, market sentiment suddenly began to improve in early March, as aggressive remedial measures adopted by government and monetary authorities seemed to gain traction. Additional evidence of economic stabilization later appeared, supporting a sustained market rally that lasted through the reporting period’s end. Lower-quality stocks that had been severely punished in the downturn led the market’s 2009 advance.

Stock Selection Process Produced Mixed Results

Our stock selection process is designed to select stocks with favorable earnings and price momentum and attractive valuations. Unfortunately, the momentum factors considered by our investment process proved relatively ineffective in the highly turbulent market environment.Valuation and other considerations of attractiveness (such as quality/sustainability metrics) helped to add value, as did a decision to establish a modest tilt away from highly leveraged companies during the credit crisis.However, the inconsistency of momentum variables caused the fund’s returns to lag its benchmark for the reporting period overall.

The fund’s relative performance was particularly weak in the energy resources and biotechnology industry groups. Some of the fund’s greater disappointments for the reporting period included Myriad Genetics, where lower revenue growth in the company’s molecular diagnostics business hurt its stock price. Medical devices research company Parexel International reported disappointing earnings as its large corporate customers cut spending in the recession. Callon Petroleum Co. also posted poor earnings, largely due to the effects of stubbornly low natural gas prices. In other market sectors, Puerto Rico bank Oriental Financial Group was hurt by nonperforming loans during the

4

financial crisis. Metals fabricator NCI Building Systems was burdened by a heavy debt load in a slumping construction market.

The fund also held its share of better performers, particularly in the consumer durables, electronic equipment and commercial services industry groups. Relatively strong performers during the reporting period included wireless equipment and software provider Starent Networks, which benefited from the rapid growth in demand for multimedia content over mobile phones. Construction equipment maker Astec Industries and heavy equipment seller Rush Enterprises held up better than market averages due to investors’ hopes that the U.S. government’s economic stimulus program would revive public works projects. In the financial services sector, asset manager Knight Capital Group and investment bank Greenhill & Co. won more business while their larger rivals suffered in the credit crisis.

Positioned for an Improved Environment

We have maintained our disciplined investment process, which seeks attractively valued small-cap companies with favorable momentum characteristics. Although market volatility has remained elevated, we have seen recent evidence that investors are focusing more closely on underlying fundamentals.We believe that our process will work more effectively if, as we expect, investors continue to return to rational decision-making under less onerous economic and market conditions.

September 15, 2009

| | | Please note, the position in any security highlighted with italicized typeface was sold during the |

| | | reporting period. |

| 1 | | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | | fund shares may be worth more or less than their original cost.The Dreyfus Corporation has |

| | | undertaken to absorb certain fund expenses pursuant to an agreement in effect through March 31, |

| | | 2010, at which time it may be extended, terminated or modified. |

| 2 | | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | | gain distributions.The Russell 2000 Index is an unmanaged index of small-cap stock performance |

| | | and is composed of the 2,000 smallest companies in the Russell 3000 Index.The Russell 3000 |

| | | Index is composed of the 3,000 largest U.S. companies based on total market capitalization. |

The Fund 5

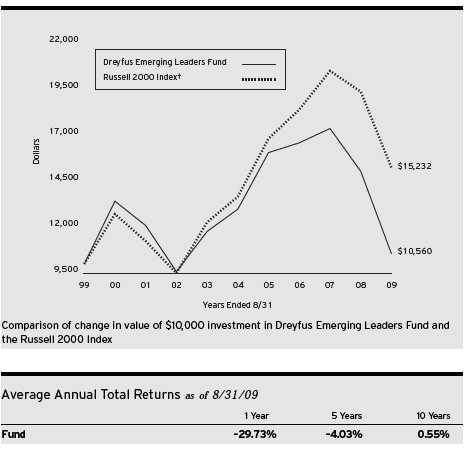

FUND PERFORMANCE

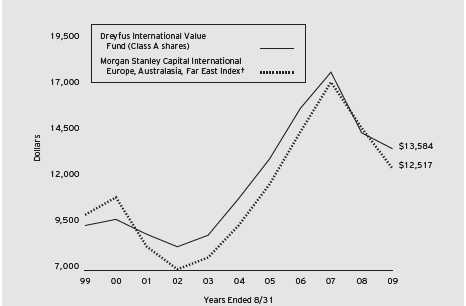

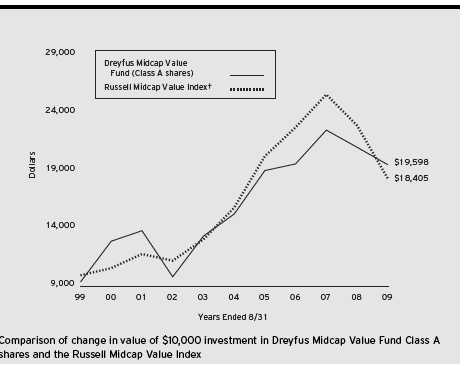

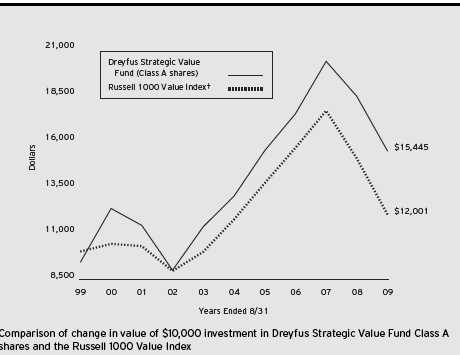

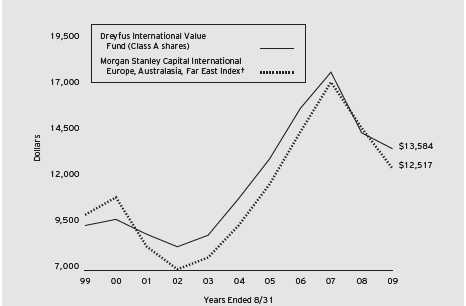

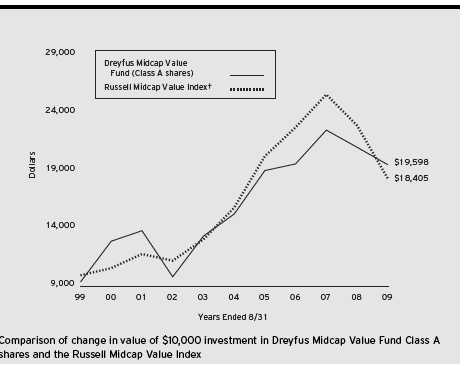

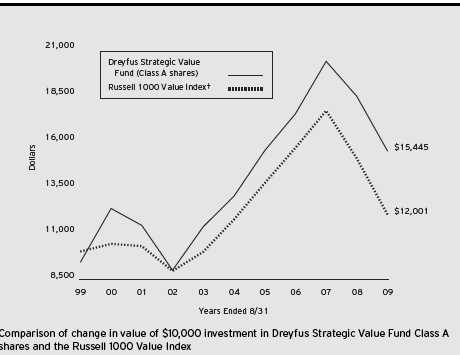

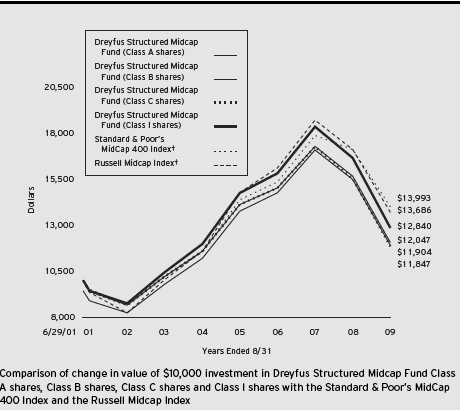

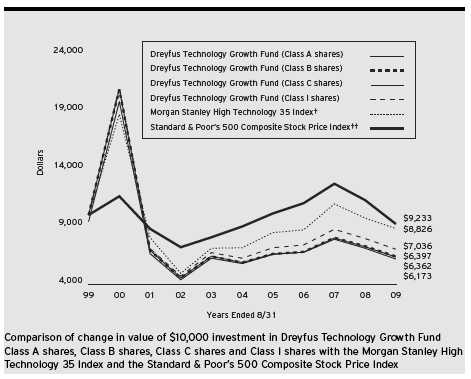

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The above graph compares a $10,000 investment made in Dreyfus Emerging Leaders Fund on 8/31/99 to a |

| $10,000 investment made in the Russell 2000 Index (the “Index”) on that date. All dividends and capital gain |

| distributions are reinvested. |

| The fund’s performance shown in the line graph takes into account all applicable fees and expenses.The Russell 2000 |

| Index is an unmanaged index and is composed of the 2,000 smallest companies in the Russell 3000 Index.The |

| Russell 3000 Index is composed of 3,000 of the largest U.S. companies by market capitalization. Unlike a mutual |

| fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further |

| information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial |

| Highlights section of the prospectus and elsewhere in this report. |

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Emerging Leaders Fund from March 1, 2009 to August 31, 2009. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| Expenses and Value of a $1,000 Investment |

| assuming actual returns for the six months ended August 31, 2009 |

|

| |

| Expenses paid per $1,000† | | $8.87 |

| Ending value (after expenses) | | $1,395.10 |

| COMPARING YOUR FUND’S EXPENSES |

| WITH THOSE OF OTHER FUNDS (Unaudited) |

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| Expenses and Value of a $1,000 Investment |

| assuming a hypothetical 5% annualized return for the six months ended August 31, 2009 |

|

| |

| Expenses paid per $1,000† | | $7.48 |

| Ending value (after expenses) | | $1,017.80 |

† Expenses are equal to the fund’s annualized expense ratio of 1.47%, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half year period).

The Fund 7

| STATEMENT OF INVESTMENTS |

| August 31, 2009 |

| Common Stocks—99.5% | | Shares | | Value ($) |

| |

| |

|

| Commercial & Professional Services—8.3% | | | | |

| Advent Software | | 4,900 a,b | | 189,581 |

| Anixter International | | 26,600 a,b | | 933,128 |

| ATC Technology | | 30,900 b | | 646,428 |

| Ennis | | 109,200 | | 1,488,396 |

| Kforce | | 23,500 b | | 263,200 |

| M & F Worldwide | | 26,900 b | | 527,778 |

| Nash Finch | | 24,100 a | | 654,074 |

| Rush Enterprises, Cl. A | | 61,199 b | | 857,398 |

| ScanSource | | 24,500 b | | 685,755 |

| School Specialty | | 57,500 a,b | | 1,310,425 |

| Stamps.com | | 26,700 b | | 230,154 |

| TeleTech Holdings | | 63,200 b | | 1,078,192 |

| VistaPrint | | 2,300 a,b | | 95,312 |

| World Fuel Services | | 18,600 a | | 835,884 |

| Wright Express | | 47,500 b | | 1,497,200 |

| | | | | 11,292,905 |

| Communications—3.0% | | | | |

| Cogent Communications Group | | 49,000 a,b | | 472,850 |

| iPCS | | 46,600 b | | 735,814 |

| NTELOS Holdings | | 26,300 | | 426,323 |

| Starent Networks | | 70,000 a,b | | 1,416,800 |

| USA Mobility | | 86,100 | | 1,096,053 |

| | | | | 4,147,840 |

| Consumer Durables—3.6% | | | | |

| Briggs & Stratton | | 27,700 a | | 488,628 |

| Cooper Tire & Rubber | | 9,600 a | | 137,088 |

| Fossil | | 43,500 b | | 1,104,030 |

| Fuel Systems Solutions | | 24,900 a,b | | 834,648 |

| M/I Homes | | 20,900 b | | 330,638 |

| Matthews International, Cl. A | | 13,500 | | 470,340 |

| Meritage Homes | | 18,700 a,b | | 419,067 |

| Polaris Industries | | 32,000 a | | 1,206,720 |

| | | | | 4,991,159 |

| Consumer Non-Durables—3.5% | | | | |

| Cal-Maine Foods | | 18,600 a | | 531,030 |

| Carter’s | | 13,900 b | | 349,724 |

8

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Consumer Non-Durables (continued) | | | | |

| Central Garden & Pet, Cl. A | | 126,400 b | | 1,390,400 |

| Elizabeth Arden | | 105,200 b | | 1,083,560 |

| J & J Snack Foods | | 8,700 | | 380,190 |

| Jones Apparel Group | | 14,900 | | 232,291 |

| Oxford Industries | | 33,100 | | 463,400 |

| Steven Madden | | 12,100 b | | 389,983 |

| | | | | 4,820,578 |

| Consumer Services—3.9% | | | | |

| California Pizza Kitchen | | 25,300 b | | 355,718 |

| Cheesecake Factory | | 37,400 b | | 687,038 |

| Corinthian Colleges | | 16,600 a,b | | 318,222 |

| DineEquity | | 14,500 a | | 305,660 |

| Isle of Capri Casinos | | 20,100 a,b | | 205,623 |

| Marcus | | 20,300 | | 254,156 |

| P.F. Chang’s China Bistro | | 30,500 a,b | | 973,255 |

| Pinnacle Entertainment | | 48,700 b | | 456,806 |

| Pre-Paid Legal Services | | 34,100 b | | 1,563,144 |

| Ruby Tuesday | | 38,700 b | | 282,510 |

| | | | | 5,402,132 |

| Electronic Technology—10.2% | | | | |

| Acme Packet | | 89,800 b | | 732,768 |

| Arris Group | | 67,600 b | | 896,376 |

| Avocent | | 18,600 b | | 303,552 |

| Benchmark Electronics | | 66,500 b | | 1,090,600 |

| Cray | | 37,400 b | | 273,394 |

| Cubic | | 12,200 | | 433,344 |

| EMS Technologies | | 15,300 b | | 286,722 |

| Hexcel | | 65,100 b | | 708,288 |

| Imation | | 55,700 | | 479,020 |

| Intevac | | 76,800 b | | 897,024 |

| Loral Space and Communications | | 18,600 a,b | | 383,904 |

| Microsemi | | 45,600 b | | 643,416 |

| Novatel Wireless | | 20,700 a,b | | 199,755 |

| OmniVision Technologies | | 12,600 b | | 184,338 |

| Oplink Communications | | 29,500 b | | 409,460 |

| Silicon Graphics International | | 37,100 b | | 203,679 |

The Fund 9

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Electronic Technology (continued) | | | | |

| Skyworks Solutions | | 70,700 b | | 823,655 |

| Standard Microsystems | | 24,800 b | | 577,344 |

| Tessera Technologies | | 46,800 b | | 1,176,084 |

| TTM Technologies | | 66,600 a,b | | 673,992 |

| Volterra Semiconductor | | 106,500 b | | 1,886,115 |

| Zoran | | 62,000 b | | 685,100 |

| | | | | 13,947,930 |

| Energy Minerals—2.3% | | | | |

| Arena Resources | | 15,200 b | | 464,816 |

| Carrizo Oil & Gas | | 17,200 a,b | | 332,476 |

| Clayton Williams Energy | | 8,400 a,b | | 166,320 |

| GMX Resources | | 31,200 a,b | | 330,408 |

| Goodrich Petroleum | | 12,600 a,b | | 301,644 |

| McMoRan Exploration | | 41,700 a,b | | 347,778 |

| Stone Energy | | 95,900 b | | 1,223,684 |

| | | | | 3,167,126 |

| Finance—21.1% | | | | |

| American Physicians Capital | | 41,333 | | 1,233,377 |

| AmTrust Financial Services | | 99,600 | | 1,257,948 |

| Bank Mutual | | 110,400 | | 970,416 |

| BioMed Realty Trust | | 115,800 | | 1,560,984 |

| Calamos Asset Management, Cl. A | | 73,900 | | 833,592 |

| City Holding | | 44,100 | | 1,404,144 |

| Compass Diversified Holdings | | 90,900 | | 920,817 |

| CorVel | | 17,300 b | | 520,038 |

| Delphi Financial Group, Cl. A | | 49,200 | | 1,149,804 |

| Dollar Thrifty Automotive Group | | 28,700 a,b | | 569,408 |

| Extra Space Storage | | 185,300 a | | 1,834,470 |

| EZCORP, Cl. A | | 44,400 b | | 593,628 |

| First Midwest Bancorp | | 59,500 | | 610,470 |

| First Potomac Realty Trust | | 69,100 | | 738,679 |

| FirstMerit | | 24,666 | | 443,248 |

| Getty Realty | | 53,600 | | 1,264,424 |

| Horace Mann Educators | | 62,200 | | 761,950 |

| Inland Real Estate | | 60,800 a | | 509,504 |

10

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Finance (continued) | | | | |

| Knight Capital Group, Cl. A | | 69,000 b | | 1,388,280 |

| National Health Investors | | 13,800 | | 456,780 |

| Nelnet, Cl. A | | 77,700 b | | 1,146,852 |

| Old National Bancorp | | 22,100 a | | 235,144 |

| Parkway Properties | | 18,600 | | 336,660 |

| Penson Worldwide | | 90,000 a,b | | 912,600 |

| PICO Holdings | | 10,200 b | | 337,926 |

| Platinum Underwriters Holdings | | 5,100 | | 184,875 |

| PMA Capital, Cl. A | | 59,100 b | | 325,641 |

| PS Business Parks | | 6,300 | | 333,459 |

| Signature Bank | | 48,000 b | | 1,457,280 |

| Sterling Bancshares | | 53,600 | | 426,120 |

| Stewart Information Services | | 25,000 | | 354,250 |

| Susquehanna Bancshares | | 108,200 a | | 631,888 |

| UMB Financial | | 17,200 | | 688,516 |

| Universal American | | 86,500 b | | 794,070 |

| Westamerica Bancorporation | | 23,300 a | | 1,198,319 |

| World Acceptance | | 21,600 a | | 562,248 |

| | | | | 28,947,809 |

| Health Care Technology—10.6% | | | | |

| Abaxis | | 33,800 a,b | | 899,080 |

| Align Technology | | 82,100 b | | 1,100,140 |

| Alkermes | | 43,900 b | | 397,295 |

| Alnylam Pharmaceuticals | | 34,200 a,b | | 763,344 |

| Cantel Medical | | 21,300 b | | 286,272 |

| Cynosure, Cl. A | | 26,000 b | | 284,700 |

| Immucor | | 26,000 b | | 470,340 |

| Invacare | | 46,000 | | 996,360 |

| Isis Pharmaceuticals | | 64,000 a,b | | 1,032,960 |

| Martek Biosciences | | 55,500 a,b | | 1,362,525 |

| Maxygen | | 39,400 b | | 278,952 |

| Medicis Pharmaceutical, Cl. A | | 27,800 | | 513,466 |

| Medivation | | 20,000 a | | 506,400 |

| Merit Medical Systems | | 43,900 b | | 792,395 |

| Momenta Pharmaceuticals | | 63,600 a,b | | 629,640 |

The Fund 11

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Health Care Technology (continued) | | | | |

| Myriad Genetics | | 24,500 b | | 748,965 |

| PDL BioPharma | | 31,500 | | 285,075 |

| Progenics Pharmaceuticals | | 47,400 a,b | | 249,798 |

| SonoSite | | 14,200 b | | 330,434 |

| STERIS | | 60,000 | | 1,741,200 |

| ViroPharma | | 107,900 a,b | | 863,200 |

| | | | | 14,532,541 |

| Industrial Services—2.2% | | | | |

| Bolt Technology | | 34,900 a,b | | 412,169 |

| Bristow Group | | 6,700 b | | 195,640 |

| Comfort Systems USA | | 50,100 | | 594,687 |

| EMCOR Group | | 25,000 b | | 579,250 |

| Gulf Island Fabrication | | 21,400 | | 320,358 |

| Michael Baker | | 16,200 b | | 542,376 |

| Tutor Perini | | 15,900 b | | 311,958 |

| | | | | 2,956,438 |

| Non-Energy Minerals—.5% | | | | |

| Haynes International | | 23,400 b | | 634,374 |

| Process Industries—3.4% | | | | |

| Darling International | | 26,600 b | | 186,466 |

| Glatfelter | | 115,900 | | 1,208,837 |

| Landec | | 106,400 b | | 650,104 |

| Minerals Technologies | | 34,900 | | 1,564,916 |

| OM Group | | 23,600 b | | 642,156 |

| Terra Industries | | 11,700 | | 363,987 |

| | | | | 4,616,466 |

| Producer Manufacturing—9.1% | | | | |

| AAON | | 18,800 a | | 392,544 |

| American Superconductor | | 26,700 a,b | | 862,677 |

| Ampco-Pittsburgh | | 10,500 | | 250,740 |

| Apogee Enterprises | | 53,100 | | 700,920 |

| Brady, Cl. A | | 15,700 | | 465,191 |

| Cascade | | 44,800 | | 1,141,504 |

| Chart Industries | | 49,500 b | | 923,670 |

| CIRCOR International | | 22,500 | | 580,725 |

| Columbus McKinnon | | 16,900 b | | 207,870 |

12

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Producer Manufacturing (continued) | | | | |

| Comverge | | 48,600 b | | 541,404 |

| DXP Enterprises | | 30,400 b | | 322,544 |

| Encore Wire | | 11,000 a | | 260,480 |

| Energy Conversion Devices | | 42,600 a,b | | 476,694 |

| Graham | | 18,900 | | 257,418 |

| Insteel Industries | | 27,600 | | 315,192 |

| Kadant | | 13,900 b | | 161,657 |

| Knoll | | 161,100 | | 1,551,393 |

| L.B. Foster, Cl. A | | 20,200 b | | 602,364 |

| Powell Industries | | 19,100 b | | 722,362 |

| Tecumseh Products, Cl. A | | 72,300 b | | 654,315 |

| Tredegar | | 21,000 | | 314,580 |

| Woodward Governor | | 35,100 | | 736,749 |

| | | | | 12,442,993 |

| Retail Trade—5.1% | | | | |

| Cabela’s | | 13,300 a,b | | 213,465 |

| Collective Brands | | 20,500 a,b | | 324,720 |

| Dress Barn | | 65,400 a,b | | 1,061,442 |

| Genesco | | 29,600 a,b | | 648,240 |

| Insight Enterprises | | 23,200 b | | 266,104 |

| Jo-Ann Stores | | 26,300 b | | 718,516 |

| JoS. A. Bank Clothiers | | 36,100 a,b | | 1,588,761 |

| Lithia Motors, Cl. A | | 14,500 | | 185,745 |

| Pantry | | 70,400 b | | 1,066,560 |

| PriceSmart | | 18,600 a | | 330,150 |

| Regis | | 19,900 a | | 321,982 |

| Titan Machinery | | 23,600 a,b | | 284,380 |

| | | | | 7,010,065 |

| Technology Services—9.4% | | | | |

| CACI International, Cl. A | | 25,800 b | | 1,185,768 |

| Centene | | 29,900 b | | 517,569 |

| Chemed | | 35,500 a | | 1,545,670 |

| Earthlink | | 125,700 a | | 1,045,824 |

| Fair Isaac | | 34,600 | | 771,580 |

| HEALTHSOUTH | | 25,200 b | | 393,372 |

| j2 Global Communications | | 11,200 b | | 239,344 |

The Fund 13

| STATEMENT OF INVESTMENTS (continued) |

| Common Stocks (continued) | | Shares | | Value ($) |

| |

| |

|

| Technology Services (continued) | | | | |

| Jack Henry & Associates | | 21,700 | | 505,827 |

| Manhattan Associates | | 84,400 b | | 1,504,852 |

| NetScout Systems | | 67,400 b | | 772,404 |

| PAREXEL International | | 63,900 b | | 819,837 |

| PharMerica | | 48,900 a,b | | 980,445 |

| Shutterfly | | 16,500 b | | 238,590 |

| SRA International, Cl. A | | 52,100 b | | 1,035,227 |

| Sybase | | 20,100 a,b | | 700,485 |

| Vital Images | | 49,100 b | | 624,061 |

| | | | | 12,880,855 |

| Transportation—1.3% | | | | |

| Heartland Express | | 19,200 a | | 271,872 |

| Knightsbridge Tankers | | 42,600 | | 552,096 |

| Nordic American Tanker Shipping | | 21,400 a | | 637,078 |

| SkyWest | | 22,200 | | 342,990 |

| | | | | 1,804,036 |

| Utilities—2.0% | | | | |

| El Paso Electric | | 72,100 | | 1,221,374 |

| New Jersey Resources | | 6,000 | | 220,500 |

| Piedmont Natural Gas | | 25,800 a | | 619,716 |

| PNM Resources | | 51,800 | | 605,024 |

| | | | | 2,666,614 |

| Total Common Stocks | | | | |

| (cost $148,663,064) | | | | 136,261,861 |

| |

| Other Investment—.7% | | | | |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Preferred | | | | |

| Plus Money Market Fund | | | | |

| (cost $970,000) | | 970,000 c | | 970,000 |

14

| Investment of Cash Collateral | | | | |

| for Securities Loaned—19.7% | | Shares | | Value ($) |

| |

| |

|

| Registered Investment Company; | | | | |

| Dreyfus Institutional Cash Advantage Fund | | | | |

| (cost $26,966,404) | | 26,966,404 c | | 26,966,404 |

| Total Investments (cost $176,599,468) | | 119.9% | | 164,198,265 |

| Liabilities, Less Cash and Receivables | | (19.9%) | | (27,244,025) |

| Net Assets | | 100.0% | | 136,954,240 |

a All or a portion of these securities are on loan. At August 31, 2009, the total market value of the fund’s securities on loan is $25,759,615 and the total market value of the collateral held by the fund is $26,966,404.

b Non-income producing security.

c Investment in affiliated money market mutual fund.

| Portfolio Summary (Unaudited)† | | | | |

| |

| | | Value (%) | | | | Value (%) |

| |

| |

| |

|

| Finance | | 21.1 | | Consumer Non-Durables | | 3.5 |

| Money Market Investments | | 20.4 | | Process Industries | | 3.4 |

| Health Care Technology | | 10.6 | | Communications | | 3.0 |

| Electronic Technology | | 10.2 | | Energy Minerals | | 2.3 |

| Technology Services | | 9.4 | | Industrial Services | | 2.2 |

| Producer Manufacturing | | 9.1 | | Utilities | | 2.0 |

| Commercial & Professional Services | | 8.3 | | Transportation | | 1.3 |

| Retail Trade | | 5.1 | | Non-Energy Minerals | | .5 |

| Consumer Services | | 3.9 | | | | |

| Consumer Durables | | 3.6 | | | | 119.9 |

| |

| † Based on net assets. | | | | | | |

| See notes to financial statements. | | | | | | |

The Fund 15

| STATEMENT OF ASSETS AND LIABILITIES |

| August 31, 2009 |

| | | Cost | | Value |

| |

| |

|

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments (including | | | | |

| securities on loan, valued at $25,759,615)—Note 1(b): | | | | |

| Unaffiliated issuers | | 148,663,064 | | 136,261,861 |

| Affiliated issuers | | 27,936,404 | | 27,936,404 |

| Cash | | | | 50,096 |

| Dividends and interest receivable | | | | 94,190 |

| Receivable for shares of Common Stock subscribed | | | | 12,054 |

| Prepaid expenses | | | | 8,317 |

| | | | | 164,362,922 |

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | | | 183,831 |

| Liability for securities on loan—Note 1(b) | | | | 26,966,404 |

| Payable for shares of Common Stock redeemed | | | | 134,245 |

| Accrued expenses | | | | 124,202 |

| | | | | 27,408,682 |

| Net Assets ($) | | | | 136,954,240 |

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | | 218,831,720 |

| Accumulated undistributed investment income—net | | | | 387,991 |

| Accumulated net realized gain (loss) on investments | | | | (69,864,268) |

| Accumulated net unrealized appreciation | | | | |

| (depreciation) on investments | | | | (12,401,203) |

| Net Assets ($) | | | | 136,954,240 |

| Shares Outstanding | | | | |

| (100 million shares of $.001par value Common Stock authorized) | | | | 9,279,067 |

| Net Asset Value, offering and redemption price per share ($) | | | | 14.76 |

| |

| See notes to financial statements. | | | | |

16

| STATEMENT OF OPERATIONS |

| Year Ended August 31, 2009 |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $2,808 foreign taxes withheld at source): | | |

| Unaffiliated issuers | | 2,034,367 |

| Affiliated issuers | | 14,148 |

| Income from securities lending | | 437,587 |

| Total Income | | 2,486,102 |

| Expenses: | | |

| Management fee—Note 3(a) | | 1,268,837 |

| Shareholder servicing costs—Note 3(b) | | 610,451 |

| Prospectus and shareholders’ reports | | 164,632 |

| Professional fees | | 62,216 |

| Registration fees | | 21,316 |

| Custodian fees—Note 3(b) | | 16,862 |

| Directors’ fees and expenses—Note 3(c) | | 14,274 |

| Loan commitment fees—Note 2 | | 6,490 |

| Interest expense—Note 2 | | 539 |

| Miscellaneous | | 20,560 |

| Total Expenses | | 2,186,177 |

| Less—reduction in management fee | | |

| due to undertaking—Note 3(a) | | (148,069) |

| Less—reduction in fees due to earnings credits—Note 1(b) | | (17,036) |

| Net Expenses | | 2,021,072 |

| Investment Income—Net | | 465,030 |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments | | (69,962,208) |

| Net unrealized appreciation (depreciation) on investments | | (12,884,210) |

| Net Realized and Unrealized Gain (Loss) on Investments | | (82,846,418) |

| Net (Decrease) in Net Assets Resulting from Operations | | (82,381,388) |

| |

| See notes to financial statements. | | |

The Fund 17

STATEMENT OF CHANGES IN NET ASSETS

| | | Year Ended August 31, |

| | |

|

| | | 2009 | | 2008 |

| |

| |

|

| Operations ($): | | | | |

| Investment income—net | | 465,030 | | 997,589 |

| Net realized gain (loss) on investments | | (69,962,208) | | 35,381,617 |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | | (12,884,210) | | (87,097,027) |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | | (82,381,388) | | (50,717,821) |

| Dividends to Shareholders from ($): | | | | |

| Investment income—net | | (612,041) | | (11,349) |

| Net realized gain on investments | | (15,842,112) | | (62,419,183) |

| Total Dividends | | (16,454,153) | | (62,430,532) |

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold | | 12,489,327 | | 21,691,521 |

| Dividends reinvested | | 16,218,155 | | 61,671,999 |

| Cost of shares redeemed | | (54,297,061) | | (155,037,205) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | | (25,589,579) | | (71,673,685) |

| Total Increase (Decrease) in Net Assets | | (124,425,120) | | (184,822,038) |

| Net Assets ($): | | | | |

| Beginning of Period | | 261,379,360 | | 446,201,398 |

| End of Period | | 136,954,240 | | 261,379,360 |

| Undistributed investment income—net | | 387,991 | | 898,512 |

| Capital Share Transactions (Shares): | | | | |

| Shares sold | | 870,738 | | 806,489 |

| Shares issued for dividends reinvested | | 1,326,097 | | 2,388,516 |

| Shares redeemed | | (3,722,956) | | (5,559,519) |

| Net Increase (Decrease) in Shares Outstanding | | (1,526,121) | | (2,364,514) |

| |

| See notes to financial statements. | | | | |

18

FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | Year Ended August 31, | | |

| | |

| |

| |

|

| | | 2009 | | 2008 | | 2007 | | 2006 | | 2005 |

| |

| |

| |

| |

| |

|

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | | 24.19 | | 33.88 | | 41.32 | | 46.64 | | 37.71 |

| Investment Operations: | | | | | | | | | | |

| Investment income (loss)—neta | | .05 | | .08 | | .04 | | (.07) | | (.05) |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | | (7.62) | | (4.27) | | 2.28 | | 1.71 | | 8.98 |

| Total from Investment Operations | | (7.57) | | (4.19) | | 2.32 | | 1.64 | | 8.93 |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | | (.07) | | (.00)b | | — | | — | | — |

| Dividends from net realized | | | | | | | | | | |

| gain on investments | | (1.79) | | (5.50) | | (9.76) | | (6.96) | | — |

| Total Distributions | | (1.86) | | (5.50) | | (9.76) | | (6.96) | | — |

| Net asset value, end of period | | 14.76 | | 24.19 | | 33.88 | | 41.32 | | 46.64 |

| Total Return (%) | | (29.73) | | (13.39) | | 4.68 | | 3.31 | | 23.68 |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | | 1.55 | | 1.38 | | 1.33 | | 1.33 | | 1.33 |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | | 1.43 | | 1.37 | | 1.33 | | 1.15 | | 1.26 |

| Ratio of net investment income | | | | | | | | | | |

| (loss) to average net assets | | .33 | | .31 | | .11 | | (.15) | | (.12) |

| Portfolio Turnover Rate | | 54.47 | | 65.98 | | 67.66 | | 65.29 | | 42.07 |

| Net Assets, end of period ($ x 1,000) | | 136,954 | | 261,379 | | 446,201 | | 589,889 | | 772,010 |

| a | | Based on average shares outstanding at each month end. |

| b | | Amount represents less than $.01 per share. |

| See notes to financial statements. |

The Fund 19

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Emerging Leaders Fund (the “fund”) is a separate diversified series of Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company that offers ten series, including the fund. The fund’s investment objective is capital growth.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares, which are sold to the public without a sales charge.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The fund’s financial statements are prepared in accordance with U.S. generally accepted accounting principles, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used

20

for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value.When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and futures contracts. For other securities that are fair valued by the Board of Directors, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Financial futures are valued at the last sales price.

The fund adopted Statement of Financial Accounting Standards No. 157 “FairValue Measurements” (“FAS 157”). FAS 157 establishes an authoritative definition of fair value, sets out a framework for measuring fair value, and requires additional disclosures about fair value measurements.

Various inputs are used in determining the value of the fund’s investments relating to FAS 157.These inputs are summarized in the three broad levels listed below.

Level 1—quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The Fund 21

| NOTES TO FINANCIAL STATEMENTS (continued) |

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of August 31, 2009 in valuing the fund’s investments:

| | | | | Level 2—Other | | Level 3— | | |

| | | Level 1— | | Significant | | Significant | | |

| | | Quoted | | Observable | | Unobservable | | |

| | | Prices | | Inputs | | Inputs | | Total |

| |

| |

| |

| |

|

| Assets ($) | | | | | | | | |

| Investments in Securities: | | | | | | |

| Equity Securities— | | | | | | | | |

| Domestic | | 136,261,861 | | — | | — | | 136,261,861 |

| Mutual Funds | | 27,936,404 | | — | | — | | 27,936,404 |

| Other Financial | | | | | | | | |

| Instruments† | | — | | — | | — | | — |

| Liabilities ($) | | | | | | | | |

| Other Financial | | | | | | | | |

| Instruments† | | — | | — | | — | | — |

| † Other financial instruments include derivative instruments, such as futures, forward foreign currency |

| exchange contracts, swap contracts and options contracts. Amounts shown represent unrealized |

| appreciation (depreciation), or in the case of options, market value at period end. |

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments is recognized on the accrual basis.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least

22

102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S Government and Agency securities or letters of credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended August 31, 2009,The Bank of New York Mellon earned $145,862 from lending fund portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by the Manager are defined as “affiliated” in the Act.

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from U.S. generally accepted accounting principles.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended August 31, 2009, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as

The Fund 23

| NOTES TO FINANCIAL STATEMENTS (continued) |

income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended August 31, 2009, remains subject to examination by the Internal Revenue Service and state taxing authorities.

At August 31, 2009, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $250,356, accumulated capital losses $10,634,185 and unrealized depreciation $12,487,251. In addition, the fund had $59,006,400 of capital losses realized after October 31, 2008, which were deferred for tax purposes to the first day of the following fiscal year.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to August 31, 2009. If not applied, the carryover expires in fiscal 2017.

The tax character of distributions paid to shareholders during the fiscal periods ended August 31, 2009 and August 31, 2008 were as follows: ordinary income $634,630 and $11,349 and long-term capital gains $15,819,523 and $62,419,183, respectively.

During the period ended August 31, 2009, as a result of permanent book to tax differences, primarily due to the tax treatment for real estate investment trusts, dividend reclassification and treating a portion of the proceeds from redemptions as a distribution for tax purposes, the fund decreased accumulated undistributed investment income-net by $363,510, decreased accumulated net realized gain (loss) on investments by $6,064,705 and increased paid-in-capital by $6,428,215. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

Prior to October 15, 2008, the fund participated with other Dreyfus-managed funds in a $350 million redemption credit facility. Effective October 15, 2008, the fund participates with other Dreyfus-managed

24

funds in a $145 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of Facility fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of the borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended August 31, 2009 was approximately $38,600 with a related weighted average annualized interest rate of 1.40%.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of .90% of the value of the fund’s average daily net assets and is payable monthly.

The Manager had undertaken until March 31, 2009 that, if the aggregate expenses of the fund (exclusive of shareholder servicing fees, taxes, brokerage commissions, interest on borrowings, commitment fees and extraordinary expenses) exceed 1.20% of the value of the fund’s average daily net assets, the fund may deduct from the payment to be made to the Manager under the management agreement, or the Manager will bear, such excess expense.The Manager has currently undertaken from April 1, 2009 until March 31, 2010 that, if the aggregate expenses of the fund, exclusive of certain expenses as described above exceed 1.15% of the value of the funds average daily net assets, the fund may deduct from the payments to be made to the Manager under the management agreement, or the Manager will bear such excess expense.The reduction in management fee, pursuant to the undertakings, amounted to $148,069 during the period ended August 31, 2009.

The Fund 25

| NOTES TO FINANCIAL STATEMENTS (continued) |

(b) Under the Shareholder Services Plan, the fund pays the Distributor at an annual rate of .25% of the value of the fund’s average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services.The Distributor determines the amounts to be paid to Service Agents. During the period ended August 31, 2009, the fund was charged $352,455 pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended August 31, 2009, the fund was charged $79,686 pursuant to the transfer agency agreement.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended August 31, 2009, the fund was charged $13,543 pursuant to the cash management agreement.These fees were offset by earnings credits pursuant to the cash management agreement.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended August 31, 2009, the fund was charged $16,862 pursuant to the custody agreement.

During the period ended August 31, 2009, the fund was charged $6,097 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $126,697, shareholder services plan fees $29,380, custody fees $4,502, chief compliance officer fees $2,784 and transfer agency per account fees $20,468.

26

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended August 31, 2009, amounted to $79,966,397 and $116,815,725, respectively.

The fund adopted Statement of Financial Accounting Standards No. 161 “Disclosures about Derivative Instruments and Hedging Activities” (“FAS 161”). FAS 161 requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. Since the fund held no derivatives during the period ended August 31, 2009, FAS 161 disclosures did not impact the notes to the financial statements.

At August 31, 2009, the cost of investments for federal income tax purposes was $176,685,516; accordingly, accumulated net unrealized depreciation on investments was $12,487,251, consisting of $15,858,271 gross unrealized appreciation and $28,345,522 gross unrealized depreciation.

NOTE 5—Subsequent Events Evaluation:

Dreyfus has evaluated the need for disclosures and/or adjustments resulting from subsequent events through October 26, 2009, the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments, other than the renewal by the Board of the management agreement with the Manager on September 22, 2009 for a six-month period ending March 30, 2010.

The Fund 27

| REPORT OF INDEPENDENT REGISTERED |

| PUBLIC ACCOUNTING FIRM |

| | Shareholders and Board of Directors

Dreyfus Emerging Leaders Fund |

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Emerging Leaders Fund (one of the series comprising Advantage Funds, Inc.) as of August 31, 2009, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2009 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Emerging Leaders Fund at August 31, 2009, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U.S. generally accepted accounting principles.

| | New York, New York

October 26, 2009 |

28

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates $1.7860 per share as a long-term capital gain distribution of the $1.8550 per share paid on December 15, 2008. Also the fund hereby designates 100% of the ordinary dividends paid during the fiscal year ended August 31, 2009 as qualifying for the corporate dividends received deduction.Also certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $418,977 represents the maximum amount that may be considered qualified dividend income. Shareholders will receive notification in early 2010 of the percentage applicable to the preparation of their 2009 income tax returns.

The Fund 29

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF |

| THE FUND’S MANAGEMENT AGREEMENT (Unaudited) |

At a meeting of the fund’s Board held on March 3, 2009, the Board unanimously approved the continuation of the fund’s Management Agreement with Dreyfus for a six-month term ending September 30, 2009.The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus. In approving the continuance of the Management Agreement, the Board considered all factors that they believed to be relevant, including, among other things, the factors discussed below.

Analysis of Nature, Extent and Quality of Services Provided to the Fund. The Board members received a presentation from representatives of Dreyfus regarding services provided to the fund and other funds in the Dreyfus fund complex, and discussed the nature, extent and quality of the services provided to the fund pursuant to its Management Agreement. Dreyfus’ representatives reviewed the fund’s distribution of accounts and the relationships Dreyfus has with various intermediaries and the different needs of each. Dreyfus’ representatives noted the various distribution channels for the fund as well as the diverse methods of distribution among other funds in the Dreyfus fund complex, and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each distribution channel, including those of the fund. Dreyfus also provided the number of accounts investing in the fund, as well as the fund’s asset size.

The Board members also considered Dreyfus’ research and portfolio management capabilities and Dreyfus’ oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board members also considered Dreyfus’ extensive administrative, accounting and compliance infrastructure.The Board also considered Dreyfus’ brokerage policies and practices, the standards applied in seeking best execution and Dreyfus’ policies and practices regarding soft dollars.

30

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board members reviewed the fund’s performance and comparisons to a group of retail no-load small-cap core funds that are benchmarked against the Russell 2000 Index (the “Performance Group”) and to a larger universe of funds consisting of all retail and institutional small-cap core funds (the “Performance Universe”) selected and provided by Lipper, Inc., an independent provider of investment company data.The Board was provided with a description of the methodology Lipper used to select the Performance Group and Performance Universe, as well as the Expense Group and Expense Universe (discussed below). The Board members discussed the results of the comparisons and noted the fund’s average annual total return ranked in the fourth quartile of the Performance Group and Performance Universe for the various periods ended December 31, 2008. Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index.

The Board members also discussed the fund’s contractual and actual management fees and expense ratio and reviewed the range of management fees and expense ratios as compared to a comparable group of funds (the “Expense Group”) and a broader group of funds (the “Expense Universe”), each selected and provided by Lipper.The fund’s contractual and actual management fees were lower than the Expense Group medians and the fund’s actual management fee was equal to the Expense Universe median.The fund’s expense ratio was higher than the Expense Group and Expense Universe medians.After discussions with the Board members, representatives of Dreyfus agreed, until March 31, 2010, that if the aggregate expenses of a fund’s share class, exclusive of shareholder servicing fees and Rule 12b-1 fees, but including the management fee, exceed 1.15 of 1% of the value of the fund’s average daily net assets, the fund may deduct from the payment to be made to Dreyfus under the Management Agreement, or Dreyfus will bear, such excess expense.

The Fund 31

| INFORMATION ABOUT THE REVIEW AND APPROVAL OF THE |

| FUND’S MANAGEMENT AGREEMENT (Unaudited) (continued) |

Representatives of Dreyfus reviewed with the Board members the fees paid to Dreyfus or its affiliates by mutual funds and/or separate accounts managed by Dreyfus with similar investment objectives, policies and strategies as the fund (the “Similar Accounts”), and explained the nature of the Similar Accounts and the differences, from Dreyfus’ perspective, as applicable, in providing services to the Similar Accounts as compared to the fund. Dreyfus’ representatives also reviewed the costs associated with distribution through intermediaries.The Board analyzed differences in fees paid to Dreyfus and discussed the relationship of the advisory fees paid in light of the services provided. The Board members considered the relevance of the fee information provided for the Similar Accounts to evaluate the appropriateness and reasonableness of the fund’s management fees.The Board acknowledged that differences in fees paid by the Similar Accounts seemed to be consistent with the services provided.

Analysis of Profitability and Economies of Scale. Dreyfus’ representatives reviewed the dollar amount of expenses allocated and profit received by Dreyfus and the method used to determine such expenses and profit. The Board previously had been provided with information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus mutual fund complex.The Board also was informed that the methodology had also been reviewed by an independent registered public accounting firm which, like the consultant, found the methodology to be reasonable.The consulting firm also analyzed where any economies of scale might emerge in connection with the management of the fund. The Board members evaluated the profitability analysis in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund investors. The Board members also considered potential benefits to Dreyfus from acting as investment adviser and noted the soft dollar arrangements with respect to trading the fund’s investments.

It was noted that the Board members should consider Dreyfus’ profitability with respect to the fund as part of their evaluation of whether the fees under the Management Agreement bear a reasonable relation-

32

ship to the mix of services provided by Dreyfus, including the nature, extent and quality of such services, and that a discussion of economies of scale is predicated on a fund having achieved a substantial size with increasing assets and that, if a fund’s assets had been static or decreasing, the possibility that Dreyfus may have realized any economies of scale would be less. It also was noted that the profitability percentage for managing the fund was within the range determined by appropriate court cases to be reasonable given the services rendered and generally superior service levels provided.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to continuation of the fund’s Management Agreement. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

- The Board concluded that the nature, extent and quality of the ser- vices provided by Dreyfus are adequate and appropriate.

- The Board was concerned about the fund’s relative performance but was encouraged by the steps Dreyfus has taken to improve fund per- formance, including the continuation of the fund’s expense cap.

- The Board concluded that the fee paid by the fund to Dreyfus was reasonable in light of the considerations described above.

- The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the management of the fund had been adequately considered by Dreyfus in connection with the management fee rate charged to the fund and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

The Board members considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year, and, without any one factor being dispositive, the Board determined that continuation of the fund’s Management Agreement was in the best interests of the fund and its shareholders.

The Fund 33

| BOARD MEMBERS INFORMATION (Unaudited) |

| |

| |

| |

| Joseph S. DiMartino (65) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • The Muscular Dystrophy Association, Director |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director |

| No. of Portfolios for which Board Member Serves: 166 |

| ——————— |

| Peggy C. Davis (66) |

| Board Member (2006) |

| Principal Occupation During Past 5Years: |

| • Shad Professor of Law, New York University School of Law (1983-present) |

| • Writer and teacher in the fields of evidence, constitutional theory, family law, social sciences |

| and the law, legal process and professional methodology and training |

| No. of Portfolios for which Board Member Serves: 53 |

| ——————— |

| David P. Feldman (69) |

| Board Member (1996) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Board Memberships and Affiliations: |

| • BBH Mutual Funds Group (11 funds), Director |

| • The Jeffrey Company, a private investment company, Director |

| No. of Portfolios for which Board Member Serves: 46 |

| ——————— |

| James F. Henry (78) |

| Board Member (2006) |

| Principal Occupation During Past 5Years: |

| • Advisor to The Elaw Forum, a consultant on managing corporate legal costs |

| • Advisor to John Jay Homestead (the restored home of the first U.S. Chief Justice) |

| • Individual Trustee of several trusts |

| Other Board Memberships and Affiliations: |

| • Director, advisor and mediator involved in several non-profit organizations, primarily engaged |

| in domestic and international dispute resolution, and historic preservation |

| No. of Portfolios for which Board Member Serves: 31 |

34

| Ehud Houminer (69) |

| Board Member (1993) |

| Principal Occupation During Past 5Years: |

| • Executive-in-Residence at the Columbia Business School, Columbia University |

| |

| Other Board Memberships and Affiliations: |

| • Avnet Inc., an electronics distributor, Director |

| • International Advisory Board to the MBA Program School of Management, Ben Gurion |

| University, Chairman |

| |

| No. of Portfolios for which Board Member Serves: 58 |

| ——————— |

| Gloria Messinger (79) |

| Board Member (1993) |

| Principal Occupation During Past 5Years: |

| • Arbitrator for American Arbitration Association |

| • Arbitrator for FINRA (formerly, National Association of Securities Dealers, Inc.) |

| • Consultant in Intellectual Property |

| |

| Other Board Memberships and Affiliations: |

| • Theater for a New Audience, Inc., Director |

| • Brooklyn Philharmonic, Director |

| |

| No. of Portfolios for which Board Member Serves: 31 |

| ——————— |

| Dr. Martin Peretz (70) |

| Board Member (2006) |

| Principal Occupation During Past 5Years: |

| • Editor-in-Chief of The New Republic Magazine |

| • Director of TheStreet.com, a financial information service on the web |

| |

| Other Board Memberships and Affiliations: |

| • American Council of Trustees and Alumni, Director |

| • Pershing Square Capital Management, Advisor |

| • Montefiore Ventures, General Partner |

| • Harvard Center for Blood Research,Trustee |

| • Bard College,Trustee |

| • Board of Overseers of YIVO Institute for Jewish Research, Chairman |

| |

| No. of Portfolios for which Board Member Serves: 31 |

| ——————— |

| Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The |

| address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, NewYork, NewYork |

| 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information |

| which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-554-4611. |

| John M. Fraser, Jr., Emeritus Board Member |

| Rosalind G. Jacobs, Emeritus Board Member |

| Dr. Paul A. Marks, Emeritus Board Member |

The Fund 35

OFFICERS OF THE FUND (Unaudited)

J. DAVID OFFICER, President since December 2006.

Chairman, President and Chief Executive Officer of Founders Asset Management LLC, an affiliate of the Manager, and an officer of 75 investment companies (comprised of 166 portfolios) managed by the Manager. Prior to June 2009, Mr. Officer was Chief Operating Officer,Vice Chairman and a director of the Manager, where he had been employed since April 1998. He is 61 years old.

PHILLIP N. MAISANO, Executive Vice President since July 2007.

Chief Investment Officer,Vice Chair and a director of the Manager, and an officer of 75 investment companies (comprised of 166 portfolios) managed by the Manager. Mr. Maisano also is an officer and/or Board member of certain other investment management subsidiaries of The Bank of New York Mellon Corporation, each of which is an affiliate of the Manager. He is 62 years old and has been an employee of the Manager since November 2006. Prior to joining the Manager, Mr. Maisano served as Chairman and Chief Executive Officer of EACM Advisors, an affiliate of the Manager, since August 2004, and served as Chief Executive Officer of Evaluation Associates, a leading institutional investment consulting firm, from 1988 until 2004.

MICHAEL A. ROSENBERG, Vice President and Secretary since August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since October 1991.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon and Secretary of the Manager, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. She is 53 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since June 2000.

JANETTE E. FARRAGHER, Vice President and Assistant Secretary since August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. She is 46 years old and has been an employee of the Manager since February 1984.

JOHN B. HAMMALIAN, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since February 1991.

ROBERT R. MULLERY, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Manager since May 1986.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since October 1990.

36

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 41 years old and has been an employee of the Manager since April 1991.

ROBERT ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 42 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 187 portfolios) managed by the Manager. He is 42 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (76 investment companies, comprised of 187 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon’s Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 52 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.