UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811- 7123 |

| |

| Advantage Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 10/31 | |

Date of reporting period: | 10/31/2010 | |

| | | | | | |

ADVANTAGE FUNDS, INC.

- Dreyfus Global Absolute Return Fund

- Dreyfus Global Real Return Fund

- Dreyfus Total Return Advantage Fund

- Global Alpha Fund

FORM N-CSR

Item 1. Reports to Stockholders.

|

| Dreyfus |

| Global Absolute |

| Return Fund |

ANNUAL REPORT October 31, 2010

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 10 | Statement of Financial Futures |

| 11 | Statement of Assets and Liabilities |

| 12 | Statement of Operations |

| 13 | Statement of Changes in Net Assets |

| 15 | Financial Highlights |

| 18 | Notes to Financial Statements |

| 36 | Report of Independent Registered Public Accounting Firm |

| 37 | Board Members Information |

| 39 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

|

| Dreyfus |

| Global Absolute |

| Return Fund |

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Global Absolute Return Fund, covering the 12-month period from November 1, 2009, through October 31, 2010.

Although a double-dip recession has recently become an increasingly unlikely scenario in our view, persistent uncertainty regarding the breadth and strength of the U.S. and global economic recoveries led to bouts of heightened volatility for U.S. stocks during most of 2010.The spending power of the U.S. consumer, long an important catalyst for economic growth, has been diminished by concerns over job security and an inability to generate cash from home equity.The second major driver of sustainable growth, corporate investment, has been stunted to a similar extent by tight credit conditions. However, the recent announcement of additional quantitative easing (QE2) measures by the Federal Reserve Board, as well as improved fundamentals across many developing nations, have helped support moderate global economic growth.

Uncertainty will probably remain in the broader financial markets until we see more evidence of robust economic growth, but we remain optimistic regarding the prospects for equities. Many stocks of quality companies with healthy balance sheets, higher credit ratings and strong cash flows appear to be currently priced at a discount.With that, we strongly suggest that you meet with your financial advisor to discuss the potential opportunities which may exist in the global markets, as well as to evaluate your portfolio to help meet your individual investment needs and your future goals relative to your risk-tolerance level.

For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

November 15, 2010

2

DISCUSSION OF FUND PERFORMANCE

For the period of November 1, 2009, through October 31, 2010, as provided by Vassilis Dagioglu, James Stavena, Torrey Zaches and Joseph Miletich, Portfolio Managers

Fund and Market Performance Overview

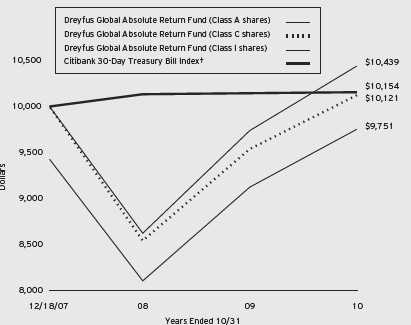

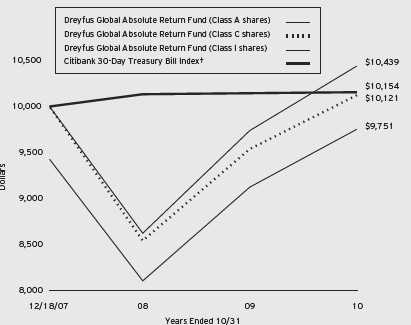

For the 12-month period ended October 31, 2010, Dreyfus Global Absolute Return Fund’s Class A shares produced a total return of 6.89%, Class C shares returned 6.11% and Class I shares returned 7.20%.1 In comparison, the fund’s benchmark, the Citibank 30-Day Treasury Bill Index, produced a total return of 0.11% for the same period.2

Relative mispricing across global markets converged during the reporting period as a result of improved market liquidity and a recovering global economy.The fund produced higher returns than its benchmark, as it successfully adopted various equity, bond and currency positions that were designed to take fuller advantage of the global economic recovery and changes in relative valuations across asset classes and geographic regions.

The Fund’s Investment Approach

The fund seeks total return through investments in securities and instruments that provide exposure to global stock, bond and currency markets. For allocation among equity markets, the portfolio managers employ a bottom-up valuation approach using proprietary models to derive market level expected returns. For allocation among bond markets, the portfolio managers use proprietary models to identify temporary mispricings among the long-term government bond markets. The most relevant long-term bond yield within each country serves as the expected return for each bond market. Our quantitative investment approach is designed to identify and exploit relative misvaluations across and within major developed capital markets such as the United States, Japan and the larger Western European countries.

Global Economic Concerns Sparked Market Volatility

Although the reporting period began in the midst of an economic recovery that propelled many financial markets higher through the first quarter

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

of 2010, investor confidence was shaken in the spring by a sovereign debt crisis in Europe. Greece found itself unable to refinance a heavy debt load, leading to devaluation of the euro against most other major currencies. Meanwhile, inflation-fighting measures in China caused investors to worry that a major engine of global growth might be derailed. In the United States, mixed housing and employment data and a catastrophic oil spill in the Gulf of Mexico added to global and domestic economic uncertainty. As investor sentiment deteriorated during the spring and summer, global financial markets generally declined sharply.

However, investors’ fears at the time may have been overblown. Earnings among multinational companies generally continued to improve, and the U.S. and global economies remained on mildly upward trajectories through the fall. In addition, anticipation of a second round of quantitative easing of U.S. monetary policy helped support certain stocks, bonds and currencies in September and October, helping to erase the reporting period’s previous losses.

Stock, Bond and Currency Strategies Supported Fund Results

The fund proved to be well positioned in advance of the European sovereign debt crisis, enabling it to participate fully in the devaluation of the euro and rally in U.S. bonds as global investors sought traditional safe havens in the face of market instability and a potential economic downturn in Europe. Later in the reporting period, when the Federal Reserve Board announced the second round of quantitative easing in the United States, the fund further benefited from a short position in the U.S. dollar, which shed some of its value relative to other currencies, such as the Australian dollar. However, the fund received its strongest contributions to performance during the reporting period from global equity markets, where a bearish position in Japanese equities and a bullish position in the United Kingdom produced above-average results with below-average levels of volatility.

Although the fund encountered relatively few disappointments during the reporting period, its relative performance was undermined to a mild degree by short positions in the British pound and European equities. In particular, the fund suffered from its long exposure to the stock market of France.

4

Seeking Opportunities in Currency and Equity Markets

Despite the financial markets’ recent positive responses to signs of potential improvement in the global economy, we expect uncertainty to persist into 2011 as investors “wait and see” regarding the efficacy of current monetary stimulus efforts in the face of persistent headwinds.Therefore, the fund has adopted a generally market-neutral investment posture, without taking directional bets regarding the overall performance of global stock and bond markets.We see more opportunity for returns in the currency markets, where we anticipate further devaluation of the U.S. dollar against other major currencies. We also have identified valuation disparities across regional equity markets, as stock prices in the United Kingdom appear more attractive to us than they do in North American markets. In our judgment, these strategies position the fund to participate in global financial markets while effectively man aging the risks of heightened market volatility as economic conditions change.

November 15, 2010

| |

| | Investing in foreign companies involves special risks, including changes in currency rates, political, |

| | economic and social instability, a lack of comprehensive company information, differing auditing |

| | and legal standards, and less market liquidity. |

| | Equity securities are subject generally to market, market sector, market liquidity, issuer and |

| | investment style risks, among other factors, to varying degrees, all of which are more fully |

| | described in the fund’s prospectus. Bond securities are subject generally to interest rate, credit, |

| | liquidity, call, sector and market risks, to varying degrees, all of which are more fully described in |

| | the fund’s prospectus. |

| | Investments in foreign currencies are subject to the risk that those currencies will decline in value |

| | relative to the U.S. dollar, or, in the case of hedged positions, that the U.S. dollar will decline |

| | relative to the currency being hedged. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid, and does not take |

| | into consideration the maximum initial sales charge in the case of Class A shares, or the |

| | applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. |

| | Had these charges been reflected, returns would have been lower. Past performance is no guarantee |

| | of future results. Share price, yield and investment return fluctuate such that upon redemption, |

| | fund shares may be worth more or less than their original cost. Return figures provided reflect |

| | the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement |

| | in effect until March 1, 2012. Had these expenses not been absorbed, the fund’s returns would |

| | have been lower. |

| 2 | SOURCE: FactSet – Citigroup 30-Day Treasury Bill Index is a market value-weighted index |

| | of public obligations of the U.S.Treasury with maturities of 30 days. Investors cannot invest |

| | directly in any index. |

The Fund 5

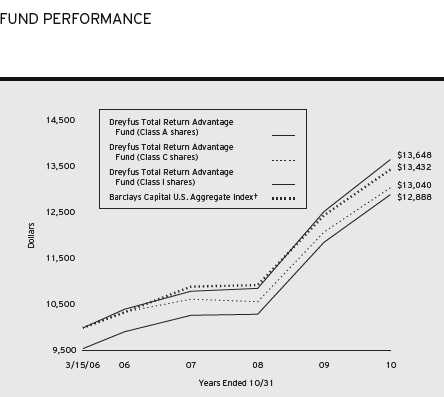

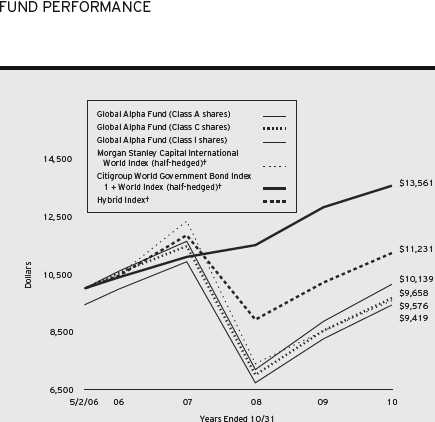

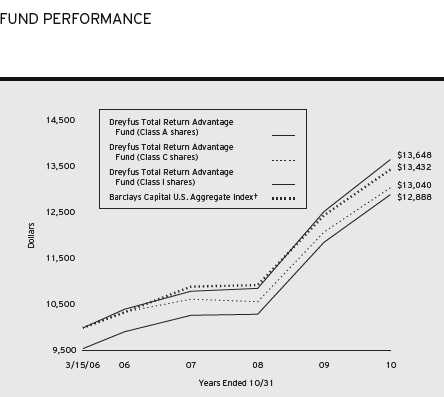

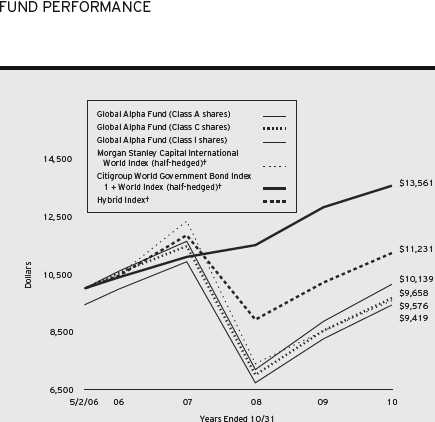

FUND PERFORMANCE

Comparison of change in value of $10,000 investment in Dreyfus Global Absolute Return Fund Class A shares, Class C shares and Class I shares and the Citibank 30-Day Treasury Bill Index

† Source: Bloomberg L.P.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in Class A, Class C and Class I shares of Dreyfus Global Absolute Return Fund on 12/18/07 (inception date) to a $10,000 investment made in the Citibank 30-Day Treasury Bill Index (the “Index”) on that date.All dividends and capital gain distributions are reinvested. For comparative purposes, the value of the Index on 12/31/07 is used as the beginning value on 12/18/07.

The fund’s performance shown in the line graph takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes.The Index is a market value-weighted index of public obligations of the U.S.Treasury with maturities of 30 days. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | |

| Average Annual Total Returns as of 10/31/10 | | | |

| |

| | Inception | | From |

| | Date | 1 Year | Inception |

| Class A shares | | | |

| with maximum sales charge (5.75%) | 12/18/07 | 0.71% | –0.88% |

| without sales charge | 12/18/07 | 6.89% | 1.18% |

| Class C shares | | | |

| with applicable redemption charge † | 12/18/07 | 5.11% | 0.42% |

| without redemption | 12/18/07 | 6.11% | 0.42% |

| Class I shares | 12/18/07 | 7.20% | 1.51% |

| Citibank 30-Day Treasury Bill Index†† | 12/31/07 | 0.11% | 0.54% |

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

| |

| † | The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| | date of purchase. |

| †† | For comparative purposes, the value of the Index as of 12/31/07 is used as the beginning value on 12/18/07. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Global Absolute Return Fund from May 1, 2010 to October 31, 2010. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended October 31, 2010

| | | |

| | Class A | Class C | Class I |

| Expenses paid per $1,000† | $ 7.79 | $ 11.66 | $ 6.50 |

| Ending value (after expenses) | $1,060.80 | $1,056.60 | $1,062.30 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended October 31, 2010

| | | |

| | Class A | Class C | Class I |

| Expenses paid per $1,000† | $ 7.63 | $ 11.42 | $ 6.36 |

| Ending value (after expenses) | $1,017.64 | $1,013.86 | $1,018.90 |

|

| † Expenses are equal to the fund’s annualized expense ratio of 1.50% for Class A, 2.25% for Class C and 1.25% |

| for Class I , multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half |

| year period). |

8

STATEMENT OF INVESTMENTS

October 31, 2010

| | | |

| | Principal | | |

| Short-Term Investments—71.0% | Amount ($) | | Value ($) |

| U.S. Treasury Bills: | | | |

| 0.12%, 11/26/10 | 660,000 | | 659,945 |

| 0.13%, 12/23/10 | 635,000 | a | 634,872 |

| 0.13%, 1/27/11 | 1,030,000 | | 1,029,733 |

| 0.14%, 12/16/10 | 2,100,000 | | 2,099,672 |

| 0.14%, 1/13/11 | 1,638,000 | | 1,637,667 |

| 0.15%, 11/4/10 | 400,000 | | 399,995 |

| 0.15%, 11/12/10 | 2,590,000 | | 2,589,920 |

| 0.15%, 11/18/10 | 600,000 | | 599,971 |

| Total Short-Term Investments | | | |

| (cost $9,651,505) | | | 9,651,775 |

| |

| | Face Amount | | |

| | Covered by | | |

| Options Purchased—3.8% | Contracts ($) | | Value ($) |

| Call Options; | | | |

| U.S. Treasury 10 Year Notes | | | |

| November 2010 @ $114 | | | |

| (cost $471,276) | 4,200,000 | b | 515,813 |

| |

| Other Investment—23.7% | Shares | | Value ($) |

| Registered Investment Company; | | | |

| Dreyfus Institutional Preferred | | | |

| Plus Money Market Fund | | | |

| (cost $3,225,000) | 3,225,000 | c | 3,225,000 |

| |

| Total Investments (cost $13,347,781) | 98.5% | | 13,392,588 |

| Cash and Receivables (Net) | 1.5% | | 198,920 |

| Net Assets | 100.0% | | 13,591,508 |

| |

| a | Held by a broker as collateral for open financial futures positions. |

| b | Non-income producing security. |

| c | Investment in affiliated money market mutual fund. |

| | | |

| Portfolio Summary (Unaudited)† | | |

| | Value (%) | | Value (%) |

| Short-Term/ | | Options Purchased | 3.8 |

| Money Market Investments | 94.7 | | 98.5 |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

The Fund 9

STATEMENT OF FINANCIAL FUTURES

October 31, 2010

| | | | |

| | | | | Unrealized |

| | | Market Value | | Appreciation |

| | | Covered by | | (Depreciation) |

| Contracts | Contracts ($) | Expiration | at 10/31/2010 ($) |

| Financial Futures Long | | | | |

| CAC 40 10 Euro | 12 | 636,209 | November 2010 | 2,720 |

| DAX | 1 | 230,010 | December 2010 | 12,923 |

| Euro-Bond | 12 | 2,155,390 | December 2010 | (11,409) |

| Euro-Bond Options | 23 | 472,160 | November 2010 | 99,904 |

| FTSE 100 | 29 | 2,624,730 | December 2010 | 55,842 |

| Japanese 10 Year Mini Bond | 9 | 1,600,335 | December 2010 | 4,346 |

| U.S. Treasury 10 Year Notes | 12 | 1,515,375 | December 2010 | (1,353) |

| Financial Futures Short | | | | |

| Long Gilt | 19 | (3,747,326) | December 2010 | 45,756 |

| Japanese 10 Year Bond | 1 | (1,777,778) | December 2010 | (26,453) |

| S & P 500 Emini | 34 | (2,005,490) | December 2010 | (109,881) |

| Gross Unrealized Appreciation | | | | 221,491 |

| Gross Unrealized Depreciation | | | | (149,096) |

| |

| See notes to financial statements. | | | | |

10

STATEMENT OF ASSETS AND LIABILITIES

October 31, 2010

| | | |

| | | Cost | Value |

| Assets ($): | | | |

| Investments in securities—See Statement of Investments: | | |

| Unaffiliated issuers | | 10,122,781 | 10,167,588 |

| Affiliated issuers | | 3,225,000 | 3,225,000 |

| Cash | | | 74,866 |

| Unrealized appreciation on forward foreign | | | |

| currency exchange contracts—Note 4 | | | 231,481 |

| Receivable for investment securities sold | | | 141,895 |

| Receivable for shares of Common Stock subscribed | | | 58,302 |

| Dividends and interest receivable | | | 444 |

| Prepaid expenses | | | 9,407 |

| | | | 13,908,983 |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 12,778 |

| Payable for investment securities purchased | | | 129,586 |

| Unrealized depreciation on forward foreign | | | |

| currency exchange contracts—Note 4 | | | 109,705 |

| Payable for futures variation margin—Note 4 | | | 25,888 |

| Accrued expenses | | | 39,518 |

| | | | 317,475 |

| Net Assets ($) | | | 13,591,508 |

| Composition of Net Assets ($): | | | |

| Paid-in capital | | | 12,686,852 |

| Accumulated net realized gain (loss) on investments | | | 668,697 |

| Accumulated net unrealized appreciation (depreciation) on investments, | |

| options transactions and foreign currency transactions (including | | |

| $72,395 net unrealized appreciation on financial futures) | | 235,959 |

| Net Assets ($) | | | 13,591,508 |

| |

| |

| Net Asset Value Per Share | | | |

| | Class A | Class C | Class I |

| Net Assets ($) | 7,995,129 | 1,242,719 | 4,353,660 |

| Shares Outstanding | 628,084 | 99,316 | 340,164 |

| Net Asset Value Per Share ($) | 12.73 | 12.51 | 12.80 |

| |

| See notes to financial statements. | | | |

The Fund 11

| |

| STATEMENT OF OPERATIONS | |

| Year Ended October 31, 2010 | |

| |

| |

| |

| |

| Investment Income ($): | |

| Income: | |

| Interest | 12,273 |

| Cash dividends; | |

| Affiliated issuers | 4,498 |

| Total Income | 16,771 |

| Expenses: | |

| Management fee—Note 3(a) | 148,181 |

| Auditing fees | 37,331 |

| Registration fees | 37,249 |

| Shareholder servicing costs—Note 3(c) | 35,304 |

| Distribution fees—Note 3(b) | 10,851 |

| Prospectus and shareholders’ reports | 9,846 |

| Custodian fees—Note 3(c) | 2,352 |

| Legal fees | 1,122 |

| Directors’ fees and expenses—Note 3(d) | 813 |

| Loan commitment fees—Note 2 | 313 |

| Miscellaneous | 10,570 |

| Total Expenses | 293,932 |

| Less—reduction in management fee due to undertaking—Note 3(a) | (88,267) |

| Less—reduction in fees due to earnings credits—Note 3(c) | (14) |

| Net Expenses | 205,651 |

| Investment (Loss)—Net | (188,880) |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments and foreign currency transactions | (53,499) |

| Net realized gain (loss) on options transactions | 364,511 |

| Net realized gain (loss) on financial futures | 218,250 |

| Net realized gain (loss) on forward foreign currency exchange contracts | 552,542 |

| Net Realized Gain (Loss) | 1,081,804 |

| Net unrealized appreciation (depreciation) on | |

| investments and foreign currency transactions | (3,599) |

| Net unrealized appreciation (depreciation) on options transactions | 44,537 |

| Net unrealized appreciation (depreciation) on financial futures | 12,362 |

| Net unrealized appreciation (depreciation) on | |

| forward foreign currency exchange contracts | (2,214) |

| Net Unrealized Appreciation (Depreciation) | 51,086 |

| Net Realized and Unrealized Gain (Loss) on Investments | 1,132,890 |

| Net Increase in Net Assets Resulting from Operations | 944,010 |

| |

| See notes to financial statements. | |

12

STATEMENT OF CHANGES IN NET ASSETS

| | |

| | Year Ended October 31, |

| | 2010 | 2009a |

| Operations ($): | | |

| Investment (loss)—net | (188,880) | (152,401) |

| Net realized gain (loss) on investments | 1,081,804 | 1,027,496 |

| Net unrealized appreciation | | |

| (depreciation) on investments | 51,086 | 432,432 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 944,010 | 1,307,527 |

| Dividends to Shareholders from ($): | | |

| Investment income—net: | | |

| Class A Shares | — | (84,905) |

| Class C Shares | — | (11,770) |

| Class I Shares | — | (59,541) |

| Class T Shares | — | (8,028) |

| Total Dividends | — | (164,244) |

| Capital Stock Transactions ($): | | |

| Net proceeds from shares sold: | | |

| Class A Shares | 3,509,994 | 6,479,947 |

| Class C Shares | 293,608 | 407,275 |

| Class I Shares | 3,588,104 | 1,402,557 |

| Class T Shares | — | 119 |

| Dividends reinvested: | | |

| Class A Shares | — | 16,538 |

| Class C Shares | — | 3,853 |

| Class I Shares | — | 11,442 |

| Class T Shares | — | 412 |

| Cost of shares redeemed: | | |

| Class A Shares | (5,059,714) | (3,024,381) |

| Class C Shares | (575,688) | (92,410) |

| Class I Shares | (1,168,350) | (3,753,216) |

| Class T Shares | — | (648,088) |

| Increase (Decrease) in Net Assets | | |

| from Capital Stock Transactions | 587,954 | 804,048 |

| Total Increase (Decrease) in Net Assets | 1,531,964 | 1,947,331 |

| Net Assets ($): | | |

| Beginning of Period | 12,059,544 | 10,112,213 |

| End of Period | 13,591,508 | 12,059,544 |

The Fund 13

STATEMENT OF CHANGES IN NET ASSETS (continued)

| | |

| | Year Ended October 31, |

| | 2010 | 2009a |

| Capital Share Transactions: | | |

| Class Ab | | |

| Shares sold | 289,548 | 588,765 |

| Shares issued for dividends reinvested | — | 1,523 |

| Shares redeemed | (409,873) | (272,603) |

| Net Increase (Decrease) in Shares Outstanding | (120,325) | 317,685 |

| Class C | | |

| Shares sold | 24,481 | 36,918 |

| Shares issued for dividends reinvested | — | 356 |

| Shares redeemed | (47,291) | (8,506) |

| Net Increase (Decrease) in Shares Outstanding | (22,810) | 28,768 |

| Class I | | |

| Shares sold | 292,013 | 126,472 |

| Shares issued for dividends reinvested | — | 1,055 |

| Shares redeemed | (94,870) | (341,811) |

| Net Increase (Decrease) in Shares Outstanding | 197,143 | (214,284) |

| Class Tb | | |

| Shares sold | — | 11 |

| Shares issued for dividends reinvested | — | 38 |

| Shares redeemed | — | (59,078) |

| Net Increase (Decrease) in Shares Outstanding | — | (59,029) |

|

| a Effective as of the close of business on February 4, 2009, the fund no longer offers Class T shares. |

| b On the close of business on February 4, 2009, 59,078 Class T shares representing $648,088 were converted to |

| 59,132 Class A shares. |

See notes to financial statements.

14

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | |

| | | Year Ended October 31, |

| Class A Shares | 2010 | 2009 | 2008a |

| Per Share Data ($): | | | |

| Net asset value, beginning of period | 11.91 | 10.75 | 12.50 |

| Investment Operations: | | | |

| Investment income (loss)—netb | (.17) | (.15) | .12 |

| Net realized and unrealized | | | |

| gain (loss) on investments | .99 | 1.48 | (1.87) |

| Total from Investment Operations | .82 | 1.33 | (1.75) |

| Distributions: | | | |

| Dividends from investment income—net | — | (.17) | — |

| Net asset value, end of period | 12.73 | 11.91 | 10.75 |

| Total Return (%)c | 6.89 | 12.52 | (14.00)d |

| Ratios/Supplemental Data (%): | | | |

| Ratio of total expenses to average net assets | 2.15 | 2.65 | 3.04e |

| Ratio of net expenses to average net assets | 1.50 | 1.50 | 1.48e |

| Ratio of net investment income | | | |

| (loss) to average net assets | (1.37) | (1.29) | 1.14e |

| Portfolio Turnover Rate | — | — | — |

| Net Assets, end of period ($ x 1,000) | 7,995 | 8,911 | 4,630 |

| |

| a | From December 18, 2007 (commencement of operations) to October 31, 2008. |

| b | Based on average shares outstanding at each month end. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

See notes to financial statements.

The Fund 15

FINANCIAL HIGHLIGHTS (continued)

| | | |

| | | Year Ended October 31, |

| Class C Shares | 2010 | 2009 | 2008a |

| Per Share Data ($): | | | |

| Net asset value, beginning of period | 11.79 | 10.68 | 12.50 |

| Investment Operations: | | | |

| Investment income (loss)—netb | (.26) | (.22) | .03 |

| Net realized and unrealized | | | |

| gain (loss) on investments | .98 | 1.45 | (1.85) |

| Total from Investment Operations | .72 | 1.23 | (1.82) |

| Distributions: | | | |

| Dividends from investment income—net | — | (.12) | — |

| Net asset value, end of period | 12.51 | 11.79 | 10.68 |

| Total Return (%)c | 6.11 | 11.64 | (14.56)d |

| Ratios/Supplemental Data (%): | | | |

| Ratio of total expenses to average net assets | 2.96 | 3.32 | 4.00e |

| Ratio of net expenses to average net assets | 2.25 | 2.25 | 2.23e |

| Ratio of net investment income | | | |

| (loss) to average net assets | (2.13) | (2.03) | .35e |

| Portfolio Turnover Rate | — | — | — |

| Net Assets, end of period ($ x 1,000) | 1,243 | 1,440 | 997 |

| |

| a | From December 18, 2007 (commencement of operations) to October 31, 2008. |

| b | Based on average shares outstanding at each month end. |

| c | Exclusive of sales charge. |

| d | Not annualized. |

| e | Annualized. |

See notes to financial statements.

16

| | | |

| | | Year Ended October 31, |

| Class I Shares | 2010 | 2009 | 2008a |

| Per Share Data ($): | | | |

| Net asset value, beginning of period | 11.94 | 10.78 | 12.50 |

| Investment Operations: | | | |

| Investment income (loss)—netb | (.14) | (.11) | .09 |

| Net realized and unrealized | | | |

| gain (loss) on investments | 1.00 | 1.48 | (1.81) |

| Total from Investment Operations | .86 | 1.37 | (1.72) |

| Distributions: | | | |

| Dividends from investment income—net | — | (.21) | — |

| Net asset value, end of period | 12.80 | 11.94 | 10.78 |

| Total Return (%) | 7.20 | 12.91 | (13.76)c |

| Ratios/Supplemental Data (%): | | | |

| Ratio of total expenses to average net assets | 1.89 | 2.57 | 3.12d |

| Ratio of net expenses to average net assets | 1.25 | 1.25 | 1.23d |

| Ratio of net investment income | | | |

| (loss) to average net assets | (1.12) | (1.07) | 1.03d |

| Portfolio Turnover Rate | — | — | — |

| Net Assets, end of period ($ x 1,000) | 4,354 | 1,708 | 3,851 |

| |

| a | From December 18, 2007 (commencement of operations) to October 31, 2008. |

| b | Based on average shares outstanding at each month end. |

| c | Not annualized. |

| d | Annualized. |

See notes to financial statements.

The Fund 17

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

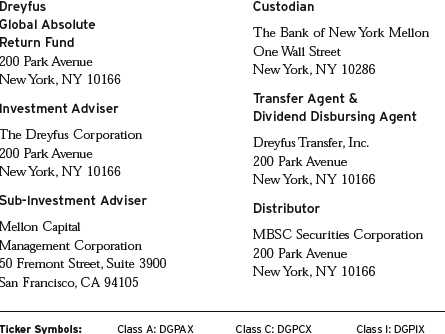

Dreyfus Global Absolute Return Fund (the “fund”) is a separate diversified series of Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company that offers eleven series, including the fund. The fund’s investment objective is to seek total return by investing in instruments that provide investment exposure to global equity, bond and currency markets, and in fixed-income securities. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Mellon Capital Management Corporation (“Mellon Capital”), a subsidiary of BNY Mellon, serves as the fund’s sub-investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares.The fund is authorized to issue 100 million shares of $.001 par value Common Stock in each of the following classes of shares: Class A, Class C and Class I. Class A shares are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments a re allocated to each class of shares based on its relative net assets.

As of October 31, 2010, MBC Investments Corp., an indirect subsidiary of BNY Mellon, held 224,025 Class A, 28,000 Class C and 28,000 Class I shares of the fund.

18

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications.The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: Investments in equity securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset valu e.When market quotations or official closing prices are not readily available, or are determined not to reflect accu-

The Fund 19

NOTES TO FINANCIAL STATEMENTS (continued)

rately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures contracts. For other securities that are fair valued by the Board of Directors, certain factors may be considered such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.

Investments in debt securities excluding short-term investments (other than U.S.Treasury Bills), financial futures, options and forward foreign currency exchange contracts (“forward contracts”) are valued each business day by an independent pricing service (the “Service”) approved by the Board of Directors. Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments are valued as determined by the Service, based on methods which include consideration of: yields or prices of securities of comparable quality, coupon, maturity and type; indications as to values from dealers; a nd general market conditions. Restricted securities, as well as securities or other assets for which recent market quotations are not readily available, that are not valued by a pricing service approved by the Board of

20

Directors, or are determined by the fund not to reflect accurately fair value, are valued at fair value as determined in good faith under the direction of the Board of Directors.The factors that may be considered when fair valuing a security include fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold and public trading in similar securities of the issuer or comparable issuers. Short-term investments, excluding U.S.Treasury Bills, are carried at amortized cost, which approximates value. Financial futures and options, which are traded on an exchange, are valued at the last sales price on the securities exchange on which such securities are primarily traded or at the last sales price on the national securities market on each business day. Options traded over-the-counter are valued at t he mean between the bid and asked price. Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange. Forward contracts are valued at the forward rate.

The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

The Fund 21

NOTES TO FINANCIAL STATEMENTS (continued)

Various inputs are used in determining the value of the fund’s invest ments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for

identical investments.

Level 2—other significant observable inputs (including quoted

prices for similar investments, interest rates, prepayment speeds,

credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s

own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following is a summary of the inputs used as of October 31, 2010 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Mutual Funds | 3,225,000 | — | — | 3,225,000 |

| Options Purchased | 515,813 | — | — | 515,813 |

| U.S. Treasury | — | 9,651,775 | — | 9,651,775 |

| Other Financial | | | | |

| Instruments: | | | | |

| Forward Foreign | | | | |

| Exchange Contracts† | — | 231,481 | — | 231,481 |

| Futures† | 221,491 | — | — | 221,491 |

| Liabilities ($) | | | | |

| Other Financial | | | | |

| Instruments: | | | | |

| Forward Foreign | | | | |

| Exchange Contracts† | — | (109,705) | — | (109,705) |

| Futures† | (149,096) | — | — | (149,096) |

| |

| † | Amount shown represents unrealized appreciation (depreciation) at period end. |

22

In January 2010, FASB issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about Fair Value Measurements”. The portions of ASU No. 2010-06 which require reporting entities to prepare new disclosures surrounding amounts and reasons for significant transfers in and out of Level 1 and Level 2 fair value measurements as well as inputs and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements that fall in either Level 2 or Level 3 have been adopted by the fund. No significant transfers between Level 1 or Level 2 fair value measurements occurred at October 31, 2010. The remaining portion of ASU No. 2010-06 requires reporting entities to make new disclosures about information on purchases, sales, issuances and settlements on a gross basis in the reconciliation of activity in Level 3 fair value measurements.These new and rev ised disclosures are required to be implemented for fiscal years beginning after December 15, 2010. Management is currently evaluating the impact that the adoption of this remaining portion of ASU No. 2010-06 may have on the fund’s financial statement disclosures.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on investments are included with net realized and unrealized gain or loss on investments.

The Fund 23

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

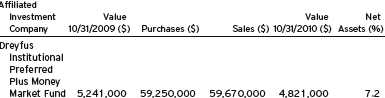

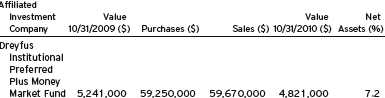

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended October 31, 2010 were as follows:

| | | | | |

| Affiliated | | | | | |

| Investment | Value | | | Value | Net |

| Company | 10/31/2009 ($) | Purchases ($) | Sales ($) | 10/31/2010 ($) | Assets (%) |

| Dreyfus | | | | | |

| Institutional | | | | | |

| Preferred | | | | | |

| Plus Money | | | | | |

| Market Fund | 2,434,000 | 10,713,000 | 9,922,000 | 3,225,000 | 23.7 |

(e) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(f) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

24

As of and during the period ended October 31, 2010, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the three-year period ended October 31, 2010 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At October 31, 2010, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $91,843, undistributed capital gains $731,240 and unrealized appreciation $81,573.

The tax character of distributions paid to shareholders during the fiscal periods ended October 31, 2010 and October 31, 2009 were as follows: ordinary income $0 and $164,244, respectively.

During the period ended October 31, 2010, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign currency gains and losses and net operating losses, the fund increased accumulated undistributed investment income-net by $188,880 and decreased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

determined pursuant to the terms of the respective Facility at the time of borrowing. During the period ended October 31, 2010, the fund did not borrow under the Facilities.

NOTE 3—Management Fee, Sub-Investment Advisory Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with Dreyfus, the management fee is computed at the annual rate of 1.10% of the value of the fund’s average daily net assets and is payable monthly. Dreyfus has agreed, to waive receipt of its fees and/or assume the expenses of the fund, until March 1, 2012, so that the expenses of none of the classes, (exclusive of taxes, brokerage fees, Rule 12b-1 distribution plan fees, interest on borrowings, shareholder services plan fees, commitment fees and extraordinary expenses) exceed an annual rate of 1.25% of the value of the average daily net assets of their class. The reduction in management fee, pursuant to the undertaking, amounted to $88,267 during the period ended October 31, 2010.

Pursuant to a Sub-Investment Advisory Agreement between Dreyfus and Mellon Capital, Dreyfus pays Mellon Capital an annual fee of .65% of the value of the fund’s average daily net assets, payable monthly.

During the period ended October 31, 2010, the Distributor retained $1,613 from commissions earned on sales of the fund’s Class A shares.

(b) Under the Distribution Plan (the “Plan”) adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of the average daily net assets of Class C shares. During the period ended October 31, 2010, Class C shares were charged $10,851 pursuant to the Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as

26

answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended October 31, 2010, Class A and Class C shares were charged $23,083 and $3,617, respectively, pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended October 31, 2010, the fund was charged $1,459 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended October 31, 2010, the fund was charged $220 pursuant to the cash management agreement which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $14.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended October 31, 2010, the fund was charged $2,352 pursuant to the custody agreement.

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

During the period ended October 31, 2010, the fund was charged $6,114 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $12,132, Rule 12b-1 distribution plan fees $785, shareholder services plan fees $1,958, custodian fees $527, chief compliance officer fees $2,248 and transfer agency per account fees $351, which are offset against an expense reimbursement currently in effect in the amount of $5,223.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

During the period ended October 31, 2010, there were no purchases and sales of investment securities, excluding short-term securities, financial futures, options transactions and forward contracts.

The provisions of ASC Topic 815 “Derivatives and Hedging” require qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures about fair value amounts of gains and losses on derivative instruments and disclosures about credit-risk-related contingent features in derivative agreements. The disclosure requirements distinguish between derivatives, which are accounted for as “hedges” and those that do not qualify for hedge accounting. Because investment companies value their derivatives at fair value and recognize changes in fair value through the Statement of Operations, they do not qualify for such accounting. Accordingly, even though a fund’s investments in derivatives may represent economic hedges, they are considered to be non-hedge transactions for purposes of this disclosure. The following tables show the fund’s exposure to different types of market risk as it relates to the Statement of Assets and Liabilities and the Statement of Operations, respectively.

28

Fair value of derivative instruments as of October 31, 2010 is shown below:

| | | |

| | Derivative | | Derivative |

| | Assets ($) | | Liabilities ($) |

| Equity risk1 | 71,485 | Equity risk1 | (109,881) |

| Interest rate risk1,2 | 194,543 | Interest rate risk1 | (39,215) |

| Foreign exchange risk3 | 231,481 | Foreign exchange risk4 | (109,705) |

| Gross fair value of | | | |

| derivative contracts | 497,509 | | (258,801) |

| |

| Statement of Assets and Liabilities location: |

| 1 | Includes cumulative appreciation (depreciation) on futures contracts as reported in the Statement of |

| | Financial Futures, but only the unpaid variation margin is reported in the Statement of Assets |

| | and Liabilities. |

| 2 | Options purchased are included in investments in securities of unaffiliated issuers. |

| 3 | Unrealized appreciation on forward foreign currency exchange contracts. |

| 4 | Unrealized depreciation on forward foreign currency exchange contracts. |

The effect of derivative instruments in the Statement of Operations during the period ended October 31, 2010 is shown below:

| | | | |

| | Amount of realized gain or (loss) on derivatives recognized in income ($) |

| | | | Forward | |

| Underlying risk | Futures5 | Options6 | Contracts7 | Total |

| Equity | 364,882 | — | — | 364,882 |

| Interest rate | (146,632) | 364,511 | — | 217,879 |

| Foreign exchange | — | — | 552,542 | 552,542 |

| Total | 218,250 | 364,511 | 552,542 | 1,135,303 |

| | | | |

| Change in unrealized appreciation or (depreciation) on derivatives recognized in income ($) |

| | | | Forward | |

| Underlying risk | Futures8 | Options9 | Contracts10 | Total |

| Equity | (10,958) | — | — | (10,958) |

| Interest rate | 23,320 | 44,537 | — | 67,857 |

| Foreign exchange | — | — | (2,214) | (2,214) |

| Total | 12,362 | 44,537 | (2,214) | 54,685 |

| |

| Statement of Operations location: |

| 5 | Net realized gain (loss) on financial futures. |

| 6 | Net realized gain (loss) on options transactions. |

| 7 | Net realized gain (loss) on forward foreign currency exchange contracts. |

| 8 | Net unrealized appreciation (depreciation) on financial futures. |

| 9 | Net unrealized appreciation (depreciation) on options transactions. |

| 10 | Net unrealized appreciation (depreciation) on forward foreign currency exchange contracts. |

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

The following summarizes the average market value of derivatives outstanding during the period ended October 31, 2010:

| |

| | Value ($) |

| Equity futures contracts | 5,555,083 |

| Interest rate futures contracts | 15,303,236 |

| Interest rate options contracts | 250,974 |

| Forward contracts | 10,744,332 |

Futures Contracts: In the normal course of pursuing its investment objective, the fund is exposed to market risk, including equity price risk and interest rate risk as a result of changes in value of underlying financial instruments.The fund invests in financial futures contracts in order to manage its exposure to or protect against changes in the market. A futures contract represents a commitment for the future purchase or a sale of an asset at a specified date. Upon entering into such contracts, these investments require initial margin deposits with a broker, which consist of cash or cash equivalents. The amount of these deposits is determined by the exchange or Board of Trade on which the contract is traded and is subject to change. Accordingly, variation margin payments are received or made to reflect daily unrealized ga ins or losses which are recorded in the Statement of Operations. Futures contracts are valued daily at the last sales price established by the Board of Trade or exchange upon which they are traded.When the contracts are closed, the fund recognizes a realized gain or loss.There is minimal counterparty credit risk to the fund with futures since futures are exchange traded, and the exchange’s clearinghouse guarantees the futures against default. Contracts open at October 31, 2010 are set forth in the Statement of Financial Futures.

Options: The fund purchases and writes (sells) put and call options to hedge against changes in interest rates or as a substitute for an invest-ment.The fund is subject to interest rate risk in the course of pursuing its investment objectives through its investments in options contracts.A call option gives the purchaser of the option the right (but not the obligation) to buy, and obligates the writer to sell, the underlying secu-

30

rity or securities at the exercise price at any time during the option period, or at a specified date. Conversely, a put option gives the purchaser of the option the right (but not the obligation) to sell, and obligates the writer to buy the underlying security or securities at the exercise price at any time during the option period, or at a specified date.

As a writer of call options, the fund receives a premium at the outset and then bears the market risk of unfavorable changes in the price of the financial instrument underlying the option. Generally, the fund realizes a gain, to the extent of the premium, if the price of the underlying financial instrument decreases between the date the option is written and the date on which the option is terminated. Generally, the fund incurs a loss, if the price of the financial instrument increases between those dates.

As a writer of put options, the fund receives a premium at the outset and then bears the market risk of unfavorable changes in the price of the financial instrument underlying the option. Generally, the fund realizes a gain, to the extent of the premium, if the price of the underlying financial instrument increases between the date the option is written and the date on which the option is terminated. Generally, the fund incurs a loss, if the price of the financial instrument decreases between those dates.

As a writer of an option, the fund has no control over whether the underlying securities may be sold (called) or purchased (put) and as a result bears the market risk of an unfavorable change in the price of the security underlying the written option.There is a risk of loss from a change in value of such options which may exceed the related premiums received. One risk of holding a put or a call option is that if the option is not sold or exercised prior to its expiration, it becomes worthless. However, this risk is limited to the premium paid by the fund. Upon the expiration or closing of the option transaction, a gain or loss is reported in the Statement of Operations.

The Fund 31

NOTES TO FINANCIAL STATEMENTS (continued)

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates.With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the for ward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. Any realized gain or loss which occurred during the period is reflected in the Statement of Operations.The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is typically limited to the unrealized gain on each open contract.The following summarizes open forward contracts at October 31, 2010:

| | | | |

| | Foreign | | | Unrealized |

| Forward Foreign Currency | Currency | | | Appreciation |

| Exchange Contracts | Amounts | Cost ($) | Value ($) (Depreciation) ($) |

| Purchases: | | | | |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 1,035,989 | 941,227 | 1,008,885 | 67,658 |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 420,875 | 389,667 | 409,864 | 20,197 |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 197,862 | 187,983 | 192,686 | 4,703 |

| British Pound, | | | | |

| Expiring 12/15/2010 | 46,831 | 73,393 | 75,011 | 1,618 |

| British Pound, | | | | |

| Expiring 12/15/2010 | 145,400 | 230,023 | 232,895 | 2,872 |

| British Pound, | | | | |

| Expiring 12/15/2010 | 17,600 | 27,847 | 28,191 | 344 |

| British Pound, | | | | |

| Expiring 12/15/2010 | 70,400 | 111,358 | 112,763 | 1,405 |

32

| | | | |

| | Foreign | | | Unrealized |

| Forward Foreign Currency | Currency | | | Appreciation |

| Exchange Contracts | Amounts | Cost ($) | Value ($) (Depreciation) ($) |

| Purchases (continued): | | | | |

| Canadian Dollar, | | | | |

| Expiring 12/15/2010 | 37,263 | 36,135 | 36,494 | 359 |

| Canadian Dollar, | | | | |

| Expiring 12/15/2010 | 120,625 | 117,184 | 118,135 | 951 |

| Canadian Dollar, | | | | |

| Expiring 12/15/2010 | 113,689 | 110,546 | 111,342 | 796 |

| Canadian Dollar, | | | | |

| Expiring 12/15/2010 | 10,296 | 10,011 | 10,083 | 72 |

| Canadian Dollar, | | | | |

| Expiring 12/15/2010 | 110,015 | 106,973 | 107,744 | 771 |

| Euro, | | | | |

| Expiring 12/15/2010 | 152,753 | 208,298 | 212,475 | 4,177 |

| Euro, | | | | |

| Expiring 12/15/2010 | 37,600 | 51,262 | 52,301 | 1,039 |

| Euro, | | | | |

| Expiring 12/15/2010 | 94,000 | 128,190 | 130,751 | 2,561 |

| Euro, | | | | |

| Expiring 12/15/2010 | 95,800 | 131,634 | 133,255 | 1,621 |

| Euro, | | | | |

| Expiring 12/15/2010 | 383,200 | 526,538 | 533,020 | 6,482 |

| Euro, | | | | |

| Expiring 12/15/2010 | 26,900 | 37,191 | 37,417 | 226 |

| Euro, | | | | |

| Expiring 12/15/2010 | 4,000 | 5,582 | 5,564 | (18) |

| Euro, | | | | |

| Expiring 12/15/2010 | 347,594 | 485,234 | 483,494 | (1,740) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 129,019,539 | 1,539,456 | 1,604,051 | 64,595 |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 6,705,100 | 81,988 | 83,362 | 1,374 |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 1,512,158 | 1,498,536 | 1,537,273 | 38,737 |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 21,300 | 21,132 | 21,653 | 521 |

| Sales: | | Proceeds ($) | | |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 142,049 | 138,261 | 138,332 | (71) |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 99,000 | 96,768 | 96,410 | 358 |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 246,000 | 238,055 | 239,564 | (1,509) |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 98,400 | 95,149 | 95,826 | (677) |

The Fund 33

NOTES TO FINANCIAL STATEMENTS (continued)

| | | | |

| | Foreign | | | Unrealized |

| Forward Foreign Currency | Currency | | | Appreciation |

| Exchange Contracts | Amounts | Proceeds ($) | Value ($) (Depreciation) ($) |

| Sales (continued): | | | | |

| Australian Dollar, | | | | |

| Expiring 12/15/2010 | 49,200 | 47,467 | 47,913 | (446) |

| British Pound, | | | | |

| Expiring 12/15/2010 | 584 | 905 | 935 | (30) |

| British Pound, | | | | |

| Expiring 12/15/2010 | 991,600 | 1,529,364 | 1,588,297 | (58,933) |

| British Pound, | | | | |

| Expiring 12/15/2010 | 134,000 | 209,224 | 214,634 | (5,410) |

| British Pound, | | | | |

| Expiring 12/15/2010 | 84,350 | 133,144 | 135,107 | (1,963) |

| British Pound, | | | | |

| Expiring 12/15/2010 | 24,600 | 38,622 | 39,403 | (781) |

| British Pound, | | | | |

| Expiring 12/15/2010 | 339,150 | 537,039 | 543,234 | (6,195) |

| Euro, | | | | |

| Expiring 12/15/2010 | 80,922 | 112,299 | 112,560 | (261) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 2,421,950 | 28,920 | 30,111 | (1,191) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 22,810,338 | 267,131 | 283,592 | (16,461) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 630,201 | 7,473 | 7,835 | (362) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 6,733,832 | 79,904 | 83,719 | (3,815) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 20,564,000 | 251,526 | 255,665 | (4,139) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 2,478,000 | 30,348 | 30,818 | (470) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 4,957,600 | 60,673 | 61,636 | (963) |

| Japanese Yen, | | | | |

| Expiring 12/15/2010 | 12,394,000 | 151,795 | 154,090 | (2,295) |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 475,300 | 481,219 | 483,194 | (1,975) |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 110,773 | 112,748 | 112,613 | 135 |

34

| | | | |

| | Foreign | | | Unrealized |

| Forward Foreign Currency | Currency | | | Appreciation |

| Exchange Contracts | Amounts | Proceeds ($) | Value ($) (Depreciation) ($) |

| Sales (continued): | | | | |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 52,150 | 53,439 | 53,016 | 423 |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 36,900 | 37,642 | 37,513 | 129 |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 162,450 | 169,263 | 165,148 | 4,115 |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 101,844 | 106,446 | 103,535 | 2,911 |

| Swiss Franc, | | | | |

| Expiring 12/15/2010 | 312,000 | 317,513 | 317,182 | 331 |

| Gross Unrealized Appreciation | | | 231,481 |

| Gross Unrealized Depreciation | | | (109,705) |

At October 31, 2010, the cost of investments for federal income tax purposes was $13,347,781; accordingly, accumulated net unrealized appreciation on investments was $44,807, consisting of $44,818 gross unrealized appreciation and $11 gross unrealized depreciation.

The Fund 35

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Directors

Dreyfus Global Absolute Return Fund

We have audited the accompanying statement of assets and liabilities, including the statements of investments and financial futures, of Dreyfus Global Absolute Return Fund (one of the series comprising Advantage Funds, Inc.) as of October 31, 2010, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended and financial highlights for each of the periods indicated therein.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting p rinciples used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of October 31, 2010 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Global Absolute Return Fund at October 31, 2010, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended and the financial highlights for each of the indicated periods, in conformity with U.S. generally accepted accounting principles.

New York, New York

December 28, 2010

36

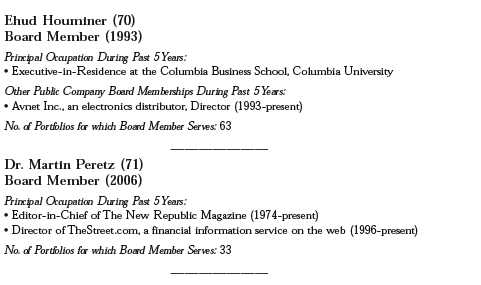

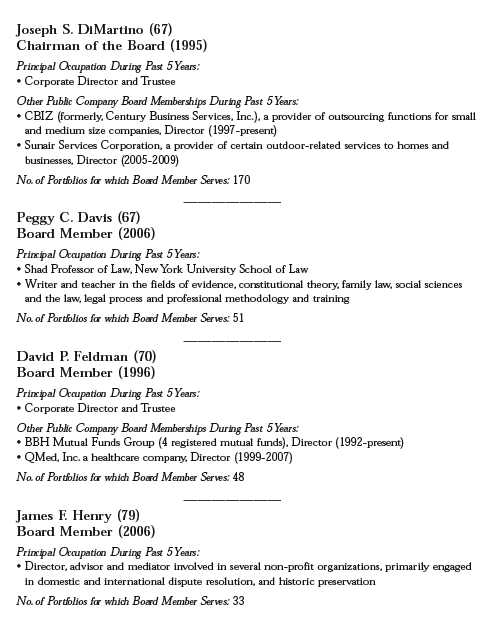

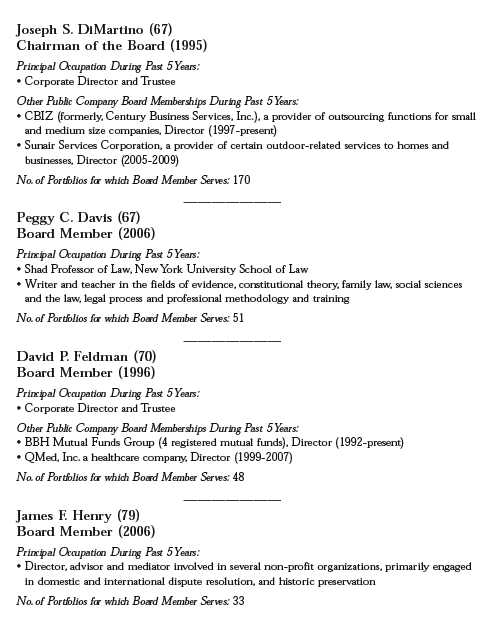

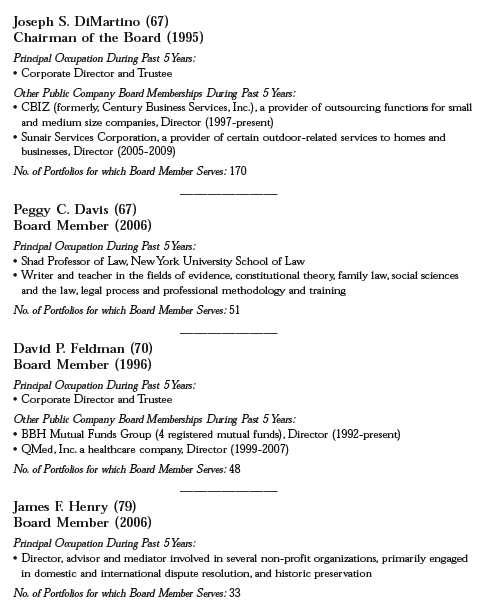

BOARD MEMBERS INFORMATION (Unaudited)

The Fund 37

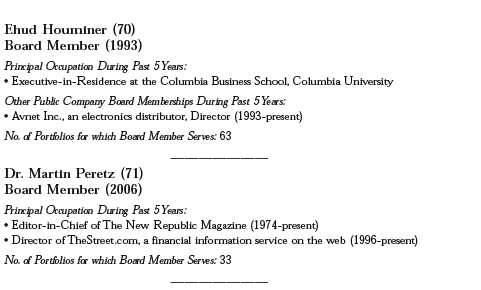

BOARD MEMBERS INFORMATION (Unaudited) (continued)

38

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since

January 2010.

Chief Operating Officer and a director of the Manager since June 2009. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 76 investment companies (comprised of 170 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since February 1988.

PHILLIP N. MAISANO, Executive Vice

President since July 2007.

Chief Investment Officer,Vice Chair and a director of the Manager, and an officer of 76 investment companies (comprised of 170 portfolios) managed by the Manager.

Mr. Maisano also is an officer and/or Board member of certain other investment management subsidiaries of The Bank of New York Mellon Corporation, each of which is an affiliate of the Manager. He is 63 years old and has been an employee of the Manager since November 2006. Prior to joining the Manager, Mr. Maisano served as Chairman and Chief Executive Officer of EACM Advisors, an affiliate of the Manager, since August 2004.

MICHAEL A. ROSENBERG, Vice President

and Secretary since August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since October 1991.

KIESHA ASTWOOD, Vice President and

Assistant Secretary since January 2010.

Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 37 years old and has been an employee of the Manager since July 1995.

JAMES BITETTO, Vice President and

Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon and Secretary of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President

and Assistant Secretary since

August 2005.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 54 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and

Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since June 2000.

KATHLEEN DENICHOLAS, Vice President

and Assistant Secretary since

January 2010.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 36 years old and has been an employee of the Manager since February 2001.

JANETTE E. FARRAGHER, Vice President

and Assistant Secretary since

August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 47 years old and has been an employee of the Manager since February 1984.

The Fund 39

OFFICERS OF THE FUND (Unaudited) (continued)

JOHN B. HAMMALIAN, Vice President and

Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since February 1991.

M. CRISTINA MEISER, Vice President and

Assistant Secretary since January 2010.

Senior Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. She is 40 years old and has been an employee of the Manager since August 2001.

ROBERT R. MULLERY, Vice President and

Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 58 years old and has been an employee of the Manager since May 1986.

JEFF PRUSNOFSKY, Vice President and

Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since

November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer

since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer

since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 42 years old and has been an employee of the Manager since April 1991.

ROBERT ROBOL, Assistant Treasurer

since August 2005.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer

since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 77 investment companies (comprised of 195 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since June 1989.