UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-7123 |

| |

| ADVANTAGE FUNDS, INC. | |

| | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| | |

| | |

| Michael A. Rosenberg, Esq. 200 Park Avenue New York, New York 10166 | |

| | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 8/31 | |

Date of reporting period: | 8/31/11 | |

| | | | | | | |

Advantage Funds, Inc.

-Dreyfus Emerging Leaders Fund

-Dreyfus International Value Fund

-Dreyfus Opportunistic Midcap Value Fund

-Dreyfus Opportunistic Small Cap Fund

-Dreyfus Strategic Value Fund

-Dreyfus Structured Midcap Fund

-Dreyfus Technology Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

|

| Dreyfus |

| Emerging Leaders Fund |

ANNUAL REPORT August 31, 2011

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 7 | Understanding Your Fund’s Expenses |

| 7 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 8 | Statement of Investments |

| 12 | Statement of Assets and Liabilities |

| 13 | Statement of Operations |

| 14 | Statement of Changes in Net Assets |

| 15 | Financial Highlights |

| 16 | Notes to Financial Statements |

| 26 | Report of Independent Registered Public Accounting Firm |

| 27 | Important Tax Information |

| 28 | Information About the Renewal of the Fund’s Management Agreement |

| 33 | Board Members Information |

| 35 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

Emerging Leaders Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Emerging Leaders Fund, covering the 12-month period from September 1, 2010, through August 31, 2011. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Although stocks rallied strongly through the first quarter of 2011 due to expectations of a more robust economic recovery, the reporting period ended amid sharply deteriorating investor sentiment due to disappointing economic data, an escalating sovereign debt crisis in Europe and a contentious debate regarding taxes, spending and borrowing in the United States. In the final month of the reporting period, a major credit rating agency downgraded U.S. long-term debt, marking the first time in history that U.S.Treasury securities were not assigned the highest possible credit rating. Stocks proved volatile in this tumultuous environment, as the stalled economy caused most market sectors to give back many of the reporting period’s previous gains.

The economic outlook currently is clouded by heightened market volatility and political infighting, but we believe that a sustained, moderate global expansion is more likely than a double-dip recession. Inflationary pressures appear to be waning in most countries, including the United States, as energy prices have retreated from their highs.The Federal Reserve Board has signaled its intention to maintain an aggressively accommodative monetary policy, which may help offset the financial stresses caused by recent fiscal policy choices in the United States and Europe. To assess how these and other developments may affect your investments, we encourage you, as always, to speak with your financial advisor.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

September 15, 2011

2

DISCUSSION OF FUND PERFORMANCE

For the period of September 1, 2010, through August 31, 2011, as provided by David A. Daglio, Primary Portfolio Manager

Fund and Market Performance Overview

For the 12-month period ended August 31, 2011, Dreyfus Emerging Leaders Fund produced a total return of 12.28%.1 In comparison, the Russell 2000 Index (the “Index”) produced a total return of 22.19%.2

The changes in the investment environment over the last year were dra-matic.The period began with renewed optimism as the Federal Reserve launched its second round of quantitative easing and a resumption of stronger domestic economic growth occurred. By its end, world economic growth had slowed, a U.S. government default had been narrowly averted and the European financial system was under siege.

Investor sentiment shifted quickly with the changing environment. Rational longer-term perspectives gave way to a complete focus on only the very short term.As a result, the fund’s focus on future earnings, cash flow, and relative performance, combined with a soft patch of stock selection, detracted from the fund’s performance relative to the benchmark.

The Fund’s Investment Approach

The fund seeks capital growth. Stocks are selected for the fund’s portfolio based primarily on bottom-up fundamental analysis. The fund’s portfolio managers use a disciplined investment process that relies, in general, on proprietary fundamental research and valuation. Generally, elements of the process include analysis of mid-cycle business prospects, estimation of the intrinsic value of the company and the identification of a revaluation trigger. Intrinsic value is based on the combination of the valuation assessment of the company’s operating divisions with the firm’s economic balance sheet. Mid-cycle estimates, growth prospects and competitive advantages are some of the factors used in the valuation assessment. A company’s stated and hidden liabilities and assets are included in the portfolio managers’ economic balance sheet calculation. Sector overweights and underweights are a function of the relative attractiveness of securities within the fund’s investable universe. The fund’s portfolio managers invest in stocks that they believe have attractive reward to risk opportunities and may actively adjust the fund’s portfolio to reflect new developments.

DISCUSSION OF FUND PERFORMANCE (continued)

Economic Concerns Sparked Heightened Market Volatility

Investors’ economic outlooks improved markedly amid expectations of a stronger economic recovery early in the reporting period, sending stock prices higher. However, the rally was interrupted in February 2011 when political unrest in the Middle East led to sharply rising energy prices, and again in March when natural and nuclear disasters in Japan threatened one of the world’s largest economies. Nonetheless, investors proved resilient and U.S. stocks rebounded quickly from these unexpected shocks.

In late April, investor sentiment began to deteriorate in earnest when Greece appeared headed for default on its sovereign debt, economic data proved disappointing and a contentious debate regarding U.S. government spending and borrowing intensified. Stocks suffered heightened volatility over the summer of 2011 as newly risk-averse investors generally disregarded the long-term strengths of individual companies in favor of reacting to near-term macroeconomic develop-ments.The reporting period ended on a pessimistic note after a major credit-rating agency downgraded U.S.Treasury bonds.

Deteriorating Investor Sentiment Dampened Fund Results

The fund’s investment approach focuses on companies that we believe to be priced below their real worth and that have strong earnings and cash flow prospects over the next one to three years. The approach fell out of favor during the May to August time period when investors proved unwilling to look beyond the next several months for their investment horizon. Relative performance was negatively impacted by this development.

The fund’s investment team also hit a soft patch of weak stock selection. A few holdings and industry overweights hampered our returns. Meritor, a leading manufacturer of axles and drivetrains for trucks, experienced higher than expected raw materials costs and announced a delay in its earnings recovery. Lennox International, one of the oldest and most established names in heating and air conditioning systems, suffered from a lack of new orders.Velti, one of the most interesting prospects in the nascent market of advertising on cellular phones, struggled in a market environment that demanded short-term earnings results. An overweighted position in machinery stocks based on the belief that U.S. manufacturing is in the middle of a multi-year renaissance gave back earlier gains. Positions in building products struggled as limited evidence of a turn in residential construction appeared during the reporting period.

4

Weakness in these areas was offset to a degree by better results in other market sectors. In the energy sector, natural gas producers Gulfport Energy, SandRidge Energy and Cabot Oil & Gas benefited from increased production activity when commodity prices moved higher. In the health care sector, drug developer King Pharmaceuticals advanced when it accepted an acquisition offer, while takeover speculation also lifted the stocks of Pain Therapeutics and Onyx Pharmaceuticals. Several industrials holdings fared well, including wire-and-cables producer WESCO International and mechanical transmissions maker Altra Holdings.

Uncertainty Creates Opportunity

We remain committed to finding companies priced below their real worth that are positioned to deliver strong earnings and cash flow over the next few years.While there are a number of concerns dominating the current investment landscape, we believe that investors’ current focus on short-term results is likely to shift to a long-term perspective in time. As in the past, when a greater level of clarity returns to the market, we would expect our approach to regain favor and more competitive returns to be delivered in that more traditional environment. In the meantime, we have found what we believe are a number of exciting investment opportunities in the industrials, consumer discretionary and information technology sectors.We have found fewer opportunities in the materials sector, where moderating commodity prices could put pressure on earnings, and in the utilities sector, where few companies meet our valuation standards.

September 15, 2011

| |

| | Please note, the position in any security highlighted with italicized typeface was sold during the |

| | reporting period. |

| | Equity funds are subject generally to market, market sector, market liquidity, issuer and investment |

| | style risks, among other factors, to varying degrees, all of which are more fully described in the |

| | fund’s prospectus. |

| | Stocks of small- and/or midcap companies often experience sharper price fluctuations than stocks |

| | of large-cap companies. |

| 1 | Total return includes reinvestment of dividends and any capital gains paid. Past performance is no |

| | guarantee of future results. Share price and investment return fluctuate such that upon redemption, |

| | fund shares may be worth more or less than their original cost. |

| 2 | SOURCE: LIPPER INC. — Reflects reinvestment of dividends and, where applicable, capital |

| | gain distributions.The Russell 2000 Index is an unmanaged index of small-cap stock |

| | performance and is composed of the 2,000 smallest companies in the Russell 3000 Index.The |

| | Russell 3000 Index is composed of the 3,000 largest U.S. companies based on total market |

| | capitalization. Investors cannot invest directly in any index. |

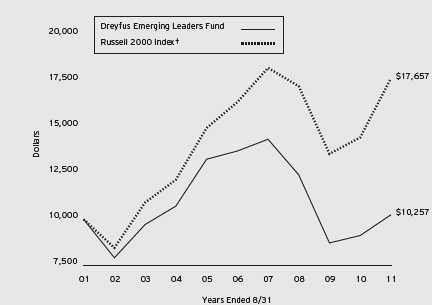

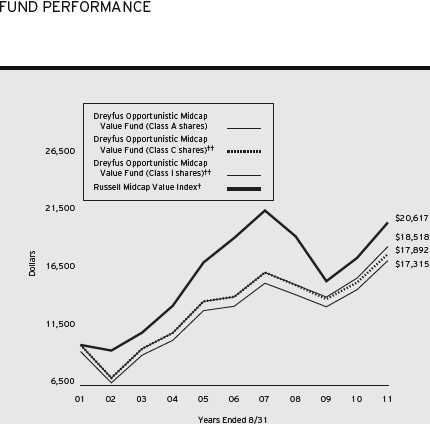

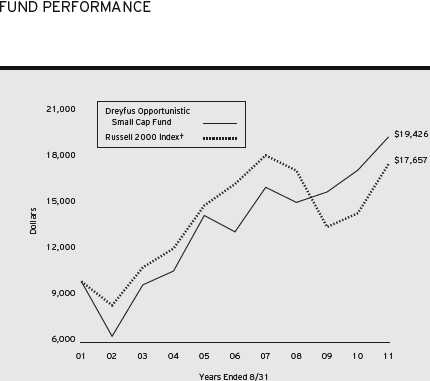

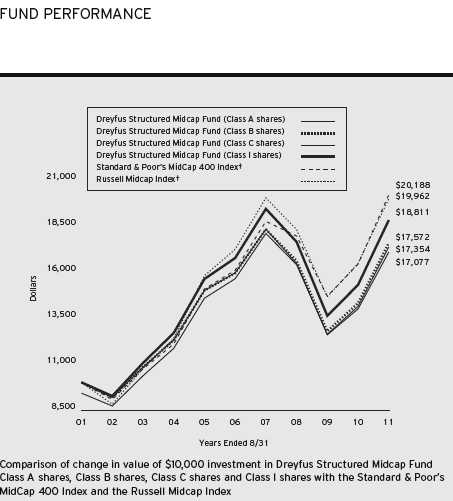

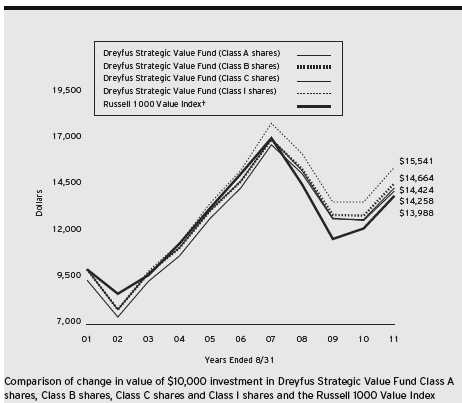

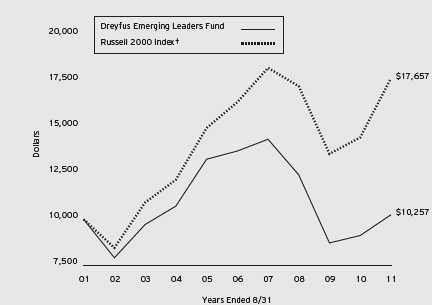

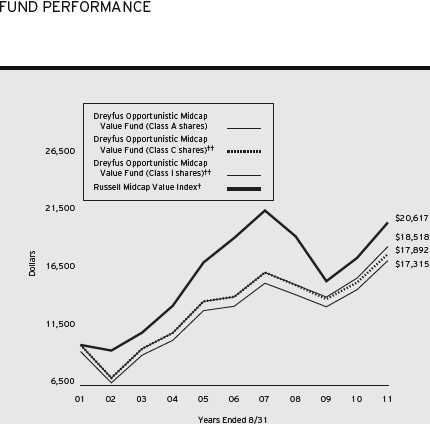

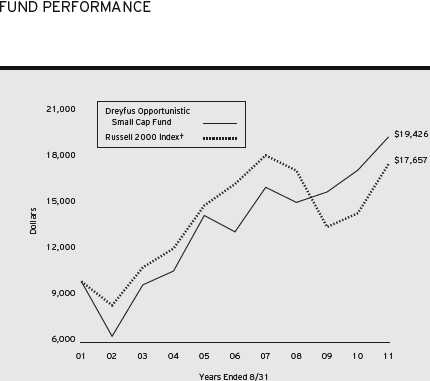

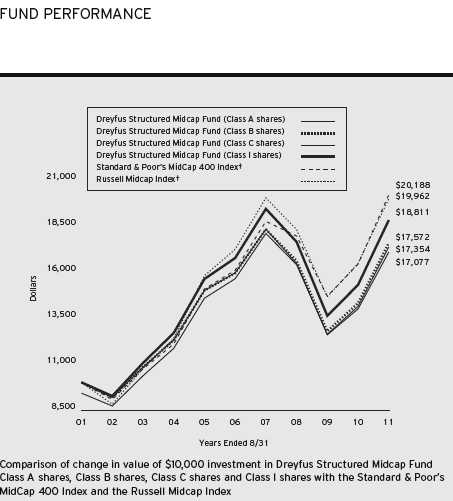

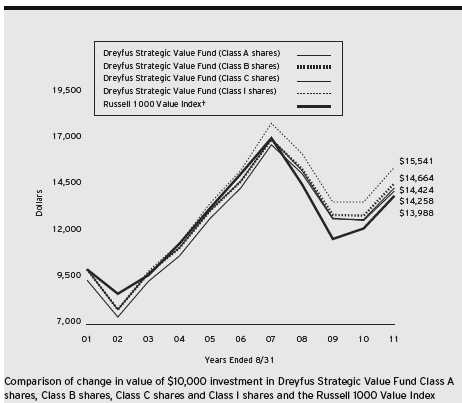

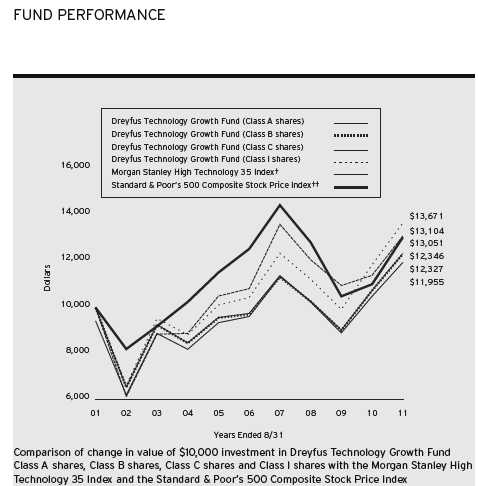

FUND PERFORMANCE

| | | | | | |

| Average Annual Total Returns as of 8/31/11 | | |

| | 1Year | 5 Years | 10 Years |

| Fund | 12.28% | –5.63% | 0.25% |

| Russell 2000 Index | 22.19% | 1.53% | 5.85% |

|

| † Source: Lipper Inc. |

| Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not |

| reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. |

| The above graph compares a $10,000 investment made in Dreyfus Emerging Leaders Fund on 8/31/01 to a |

| $10,000 investment made in the Russell 2000 Index (the “Index”) on that date. All dividends and capital gain |

| distributions are reinvested. |

| The fund’s performance shown in the line graph above takes into account all applicable fees and expenses.The Russell |

| 2000 Index is an unmanaged index and is composed of the 2,000 smallest companies in the Russell 3000 Index.The |

| Russell 3000 Index is composed of 3,000 of the largest U.S. companies by market capitalization. Unlike a mutual |

| fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further |

| information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial |

| Highlights section of the prospectus and elsewhere in this report. |

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Emerging Leaders Fund from March 1, 2011 to August 31, 2011. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended August 31, 2011

| | |

| Expenses paid per $1,000† | $ | 7.12 |

| Ending value (after expenses) | $ | 788.30 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds.All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended August 31, 2011

| | |

| Expenses paid per $1,000† | $ | 8.03 |

| Ending value (after expenses) | $ | 1,017.24 |

|

| † Expenses are equal to the fund’s annualized expense ratio of 1.58%, multiplied by the average account value over |

| the period, multiplied by 184/365 (to reflect the one-half year period). |

|

| STATEMENT OF INVESTMENTS |

| August 31, 2011 |

| | |

| Common Stocks—115.0% | Shares | Value ($) |

| Consumer Discretionary—40.0% | | |

| Accuride | 58,390a | 492,228 |

| American Axle & Manufacturing Holdings | 52,284a | 488,855 |

| Dana Holding | 154,600a | 1,971,150 |

| DFC Global | 109,230a,b | 2,410,706 |

| Equifax | 48,650 | 1,572,854 |

| Express | 101,870 | 1,944,698 |

| Group 1 Automotive | 63,610 | 2,655,718 |

| Guess? | 23,910 | 815,570 |

| Herman Miller | 56,250 | 1,117,688 |

| ICF International | 83,550a | 1,894,078 |

| Kelly Services, Cl. A | 165,550 | 2,516,360 |

| Liz Claiborne | 601,450a,b | 3,139,569 |

| Meritage Homes | 139,630a,b | 2,615,270 |

| Meritor | 287,870a,b | 2,432,502 |

| Oshkosh | 83,350a | 1,643,662 |

| Saks | 296,060a,b | 2,865,861 |

| Standard-Pacific | 335,180a,b | 861,413 |

| Steelcase, Cl. A | 133,250 | 1,103,310 |

| Tower International | 75,620a | 1,054,143 |

| TrueBlue | 33,650a | 472,782 |

| Williams-Sonoma | 76,470 | 2,531,922 |

| Wright Express | 65,870a | 2,775,762 |

| | | 39,376,101 |

| Consumer Staples—1.2% | | |

| Dole Food | 61,290a,b | 690,738 |

| Primo Water | 74,210b | 524,665 |

| | | 1,215,403 |

| Energy—8.2% | | |

| Endeavour International | 109,600a,b | 1,080,656 |

| Forest Oil | 61,110a | 1,189,812 |

| Gulfport Energy | 83,480a | 2,412,572 |

| Resolute Energy | 112,270a | 1,514,522 |

| SandRidge Energy | 263,320a,b | 1,932,769 |

| | | 8,130,331 |

8

| | |

| Common Stocks (continued) | Shares | Value ($) |

| Financial—10.9% | | |

| Brown & Brown | 81,380 | 1,709,794 |

| Employers Holdings | 91,760 | 1,122,225 |

| Jones Lang LaSalle | 39,630 | 2,651,643 |

| Nelnet, Cl. A | 24,360 | 467,712 |

| Och-Ziff Capital | | |

| Management Group, Cl. A | 98,450 | 1,117,407 |

| Popular | 207,050 a | 430,664 |

| Portfolio Recovery Associates | 25,060 a,b | 1,832,638 |

| PrivateBancorp | 86,910 | 771,761 |

| Starwood Property Trust | 33,100 c | 612,350 |

| | | 10,716,194 |

| Health Care—10.4% | | |

| Align Technology | 69,580 a,b | 1,328,978 |

| Durect | 171,500 a | 286,405 |

| Emergent BioSolutions | 158,740 a | 2,868,432 |

| Hanger Orthopedic Group | 167,940 a | 3,153,913 |

| Onyx Pharmaceuticals | 20,930 a | 712,248 |

| Sagent Pharmaceuticals | 33,210 | 763,498 |

| Salix Pharmaceuticals | 18,880 a | 574,896 |

| United Therapeutics | 13,020 a | 561,813 |

| | | 10,250,183 |

| Industrial—12.6% | | |

| Columbus McKinnon | 100,700 a | 1,452,094 |

| Con-way | 29,770 | 761,814 |

| Granite Construction | 84,710 b | 1,756,038 |

| Griffon | 60,350 a | 527,459 |

| Landstar System | 44,640 | 1,807,474 |

| Lennox International | 31,900 | 995,918 |

| Orion Marine Group | 91,980 a,b | 591,431 |

| Saia | 35,290 a | 422,421 |

| Sterling Construction | 45,800 a | 584,408 |

| Trinity Industries | 44,670 b | 1,231,105 |

| UTi Worldwide | 168,700 | 2,285,042 |

| | | 12,415,204 |

STATEMENT OF INVESTMENTS (continued)

| | |

| Common Stocks (continued) | Shares | Value ($) |

| Information Technology—21.1% | | |

| Brocade Communications Systems | 158,940a | 615,098 |

| CSG Systems International | 102,250a,b | 1,366,060 |

| DealerTrack Holdings | 176,960a | 3,312,691 |

| Encore Wire | 60,310 | 1,351,547 |

| Hubbell, Cl. B | 12,460 | 736,760 |

| MICROS Systems | 58,340a | 2,780,484 |

| Microsemi | 122,270a,b | 1,898,853 |

| ScanSource | 99,460a,b | 3,078,287 |

| SYKES Enterprises | 53,080a | 830,702 |

| Take-Two Interactive Software | 77,020a | 1,018,204 |

| Velti | 220,620a | 2,087,065 |

| Vishay Intertechnology | 47,750a,b | 544,350 |

| Watts Water Technologies, Cl. A | 40,810 | 1,155,739 |

| | | 20,775,840 |

| Materials—4.7% | | |

| Cytec Industries | 4,660 | 211,564 |

| Georgia Gulf | 56,250a,b | 1,191,937 |

| Mohawk Industries | 26,650a | 1,320,508 |

| Omnova Solutions | 98,520a | 434,473 |

| Zoltek | 162,250a,b | 1,427,800 |

| | | 4,586,282 |

| Telecommunications—5.9% | | |

| Cbeyond | 73,220a | 680,214 |

| GeoEye | 94,500a | 3,418,065 |

| JDS Uniphase | 134,680a | 1,746,800 |

| | | 5,845,079 |

| Total Common Stocks | | |

| (cost $124,868,784) | | 113,310,617 |

10

| | | | |

| Other Investment—.1% | Shares | Value ($) |

| Registered Investment Company; | | |

| Dreyfus Institutional Preferred | | |

| Plus Money Market Fund | | |

| (cost $46,000) | 46,000d | 46,000 |

| |

| Investment of Cash Collateral | | |

| for Securities Loaned—15.9% | | |

| Registered Investment Company; | | |

| Dreyfus Institutional Cash Advantage Fund | | |

| (cost $15,699,771) | 15,699,771d | 15,699,771 |

| |

| Total Investments (cost $140,614,555) | 131.0% | 129,056,388 |

| Liabilities, Less Cash and Receivables | (31.0%) | (30,526,025) |

| Net Assets | 100.0% | 98,530,363 |

|

| a Non-income producing security. |

| b Security, or portion thereof, on loan.At August 31, 2011, the value of the fund’s securities on loan was |

| $15,043,900 and the value of the collateral held by the fund was $15,699,771. |

| c Investment in real estate investment trust. |

| d Investment in affiliated money market mutual fund. |

| | | |

| Portfolio Summary (Unaudited)† | | |

| |

| | Value (%) | | Value (%) |

| |

| Consumer Discretionary | 40.0 | Energy | 8.2 |

| Information Technology | 21.1 | Telecommunications | 5.9 |

| Money Market Investments | 16.0 | Materials | 4.7 |

| Industrial | 12.6 | Consumer Staples | 1.2 |

| Financial | 10.9 | | |

| Health Care | 10.4 | | 131.0 |

| |

| † Based on net assets. | | | |

| See notes to financial statements. | | | |

|

| STATEMENT OF ASSETS AND LIABILITIES |

| August 31, 2011 |

| | | |

| | Cost | Value |

| Assets ($): | | |

| Investments in securities—See Statement of Investments (including | | |

| securities on loan, valued at $15,043,900)—Note 1(b): | | |

| Unaffiliated issuers | 124,868,784 | 113,310,617 |

| Affiliated issuers | 15,745,771 | 15,745,771 |

| Cash | | 3,928 |

| Receivable for investment securities sold | | 2,353,641 |

| Dividends and securities lending income receivable | | 39,996 |

| Receivable for shares of Common Stock subscribed | | 833 |

| Prepaid expenses | | 20,802 |

| | | 131,475,588 |

| Liabilities ($): | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(b) | | 134,045 |

| Liability for securities on loan—Note 1(b) | | 15,699,771 |

| Payable for shares of Common Stock redeemed | | 14,706,544 |

| Payable for investment securities purchased | | 2,227,604 |

| Accrued expenses | | 177,261 |

| | | 32,945,225 |

| Net Assets ($) | | 98,530,363 |

| Composition of Net Assets ($): | | |

| Paid-in capital | | 151,727,851 |

| Accumulated net realized gain (loss) on investments | | (41,639,321) |

| Accumulated net unrealized appreciation | | |

| (depreciation) on investments | | (11,558,167) |

| Net Assets ($) | | 98,530,363 |

| Shares Outstanding | | |

| (100 million shares of $.001 par value shares of Common Stock authorized) | 5,696,751 |

| Net Asset Value, offering and redemption price per share ($) | | 17.30 |

| |

| See notes to financial statements. | | |

12

|

| STATEMENT OF OPERATIONS |

| Year Ended August 31, 2011 |

| | |

| Investment Income ($): | |

| Income: | |

| Cash dividends: | |

| Unaffiliated issuers | 1,395,196 |

| Affiliated issuers | 2,146 |

| Income from securities lending—Note 1 (b) | 83,992 |

| Total Income | 1,481,334 |

| Expenses: | |

| Management fee—Note 3(a) | 1,332,732 |

| Shareholder servicing costs—Note 3(b) | 612,098 |

| Professional fees | 112,322 |

| Prospectus and shareholders’ reports | 64,799 |

| Custodian fees—Note 3(b) | 30,706 |

| Registration fees | 16,924 |

| Directors’ fees and expenses—Note 3(c) | 9,747 |

| Loan commitment fees—Note 2 | 2,048 |

| Miscellaneous | 9,744 |

| Total Expenses | 2,191,120 |

| Less—reduction in fees due to earnings credits—Note 3(b) | (569) |

| Net Expenses | 2,190,551 |

| Investment (Loss)—Net | (709,217) |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | |

| Net realized gain (loss) on investments | 23,782,308 |

| Net unrealized appreciation (depreciation) on investments | (2,153,626) |

| Net Realized and Unrealized Gain (Loss) on Investments | 21,628,682 |

| Net Increase in Net Assets Resulting from Operations | 20,919,465 |

| |

| See notes to financial statements. | |

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Year Ended August 31, |

| | 2011 | 2010 |

| Operations ($): | | |

| Investment (loss)—net | (709,217) | (77,479) |

| Net realized gain (loss) on investments | 23,782,308 | 4,443,160 |

| Net unrealized appreciation | | |

| (depreciation) on investments | (2,153,626) | 2,996,662 |

| Net Increase (Decrease) in Net Assets | | |

| Resulting from Operations | 20,919,465 | 7,362,343 |

| Dividends to Shareholders from ($): | | |

| Investment income—net | (22,307) | (289,551) |

| Capital Stock Transactions ($): | | |

| Net proceeds from shares sold | 7,120,073 | 6,198,985 |

| Dividends reinvested | 21,930 | 285,155 |

| Cost of shares redeemed | (54,238,609) | (25,781,361) |

| Increase (Decrease) in Net Assets | | |

| from Capital Stock Transactions | (47,096,606) | (19,297,221) |

| Total Increase (Decrease) in Net Assets | (26,199,448) | (12,224,429) |

| Net Assets ($): | | |

| Beginning of Period | 124,729,811 | 136,954,240 |

| End of Period | 98,530,363 | 124,729,811 |

| Undistributed investment income—net | — | 20,961 |

| Capital Share Transactions (Shares): | | |

| Shares sold | 352,602 | 375,478 |

| Shares issued for dividends reinvested | 1,001 | 17,583 |

| Shares redeemed | (2,750,320) | (1,578,660) |

| Net Increase (Decrease) in Shares Outstanding | (2,396,717) | (1,185,599) |

| |

| See notes to financial statements. | | |

14

FINANCIAL HIGHLIGHTS

The following table describes the performance for the fiscal periods indicated. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | Year Ended August 31, | |

| | 2011 | 2010 | 2009 | 2008 | 2007 |

| Per Share Data ($): | | | | | |

| Net asset value, beginning of period | 15.41 | 14.76 | 24.19 | 33.88 | 41.32 |

| Investment Operations: | | | | | |

| Investment income (loss)—neta | (.10) | (.01) | .05 | .08 | .04 |

| Net realized and unrealized | | | | | |

| gain (loss) on investments | 1.99 | .69b | (7.62) | (4.27) | 2.28 |

| Total from Investment Operations | 1.89 | .68 | (7.57) | (4.19) | 2.32 |

| Distributions: | | | | | |

| Dividends from | | | | | |

| investment income—net | (.00)c | (.03) | (.07) | (.00)c | — |

| Dividends from net realized | | | | | |

| gain on investments | — | — | (1.79) | (5.50) | (9.76) |

| Total Distributions | (.00)c | (.03) | (1.86) | (5.50) | (9.76) |

| Net asset value, end of period | 17.30 | 15.41 | 14.76 | 24.19 | 33.88 |

| Total Return (%) | 12.28 | 4.62 | (29.73) | (13.39) | 4.68 |

| Ratios/Supplemental Data (%): | | | | | |

| Ratio of total expenses | | | | | |

| to average net assets | 1.48 | 1.45 | 1.55 | 1.38 | 1.33 |

| Ratio of net expenses | | | | | |

| to average net assets | 1.48 | 1.40 | 1.43 | 1.37 | 1.33 |

| Ratio of net investment income | | | | | |

| (loss) to average net assets | (.48) | (.05) | .33 | .31 | .11 |

| Portfolio Turnover Rate | 98.84 | 181.65 | 54.47 | 65.98 | 67.66 |

| Net Assets, end of period ($ x 1,000) | 98,530 | 124,730 | 136,954 | 261,379 | 446,201 |

|

| a Based on average shares outstanding at each month end. |

| b Amount includes litigation proceeds received by the fund amounting to $.15 per share for the year ended |

| August 31, 2010. |

| c Amount represents less than $.01 per share. |

See notes to financial statements.

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Emerging Leaders Fund (the “fund”) is a separate diversified series of Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company that offers thirteen series, including the fund.The fund’s investment objective is to seek capital growth.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of NewYork Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares, which are sold to the public without a sales charge.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications.The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the

16

measurement date (i.e. the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price.

NOTES TO FINANCIAL STATEMENTS (continued)

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All preceding securities are categorized as Level 1 in the hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant American Depository Receipts and futures contracts. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board of Directors. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized as Level 2 or 3 depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized as Level 3 in the hierarchy.

18

The following is a summary of the inputs used as of August 31, 2011 in valuing the fund’s investments:

| | | | |

| | | Level 2—Other | Level 3— | |

| | Level 1— | Significant | Significant | |

| | Unadjusted | Observable | Unobservable | |

| | Quoted Prices | Inputs | Inputs | Total |

| Assets ($) | | | | |

| Investments in Securities: | | | |

| Equity Securities— | | | | |

| Domestic† | 108,938,510 | — | — | 108,938,510 |

| Equity Securities— | | | | |

| Foreign† | 4,372,107 | — | — | 4,372,107 |

| Mutual Funds | 15,745,771 | — | — | 15,745,771 |

| † See Statement of Investments for additional detailed categorizations. | |

In January 2010, FASB issued Accounting Standards Update (“ASU”) No. 2010-06 “Improving Disclosures about FairValue Measurements” (“ASU 2010-06”). The portions of ASU 2010-06 which require reporting entities to prepare new disclosures surrounding amounts and reasons for significant transfers in and out of Level 1 and Level 2 fair value measurements as well as inputs and valuation techniques used to measure fair value for both recurring and nonrecurring fair value measurements that fall in either Level 2 or Level 3 have been adopted by the fund. No significant transfers between Level 1 or Level 2 fair value measurements occurred at August 31, 2011.

In May 2011, FASB issued ASU No. 2011-04 “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in GAAP and International Financial Reporting Standards (“IFRS”)” (“ASU 2011-04”). ASU 2011-04 includes common requirements for measurement of and disclosure about fair value between GAAP and IFRS. ASU 2011-04 will require reporting entities to disclose the following information for fair value measurements categorized within

NOTES TO FINANCIAL STATEMENTS (continued)

Level 3 of the fair value hierarchy: quantitative information about the unobservable inputs used in the fair value measurement, the valuation processes used by the reporting entity and a narrative description of the sensitivity of the fair value measurement to changes in unobservable inputs and the interrelationships between those unobservable inputs. In addition, ASU 2011-04 will require reporting entities to make disclosures about amounts and reasons for all transfers in and out of Level 1 and Level 2 fair value measurements.The new and revised disclosures are effective for interim and annual reporting periods beginning after December 15, 2011. At this time, management is evaluating the implications of ASU 2011-04 and its impact on the financial statements.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by the Manager, U.S. Government and Agency securities or letters of credit.The fund is entitled to receive all income on securities loaned, in addition to income earned as a result of the lending transaction. Although each security loaned is fully collateralized, the fund bears the risk of delay in recovery of, or loss of rights in, the securities loaned should a borrower fail to return the securities in a timely manner. During the period ended August 31, 2011, The Bank of New York Mellon earned $27,997 from lending portfolio securities, pursuant to the securities lending agreement.

20

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” in the Act.

The fund may invest in shares of certain affiliated investment companies also advised or managed by Dreyfus. Investments in affiliated investment companies for the period ended August 31, 2011 were as follows:

| | | | | | | |

| Affiliated | | | | | | | |

| Investment | Value | | | | Value | | Net |

| Company | 8/31/2010 | ($) | Purchases ($) | Sales ($) | 8/31/2011 | ($) | Assets (%) |

| Dreyfus | | | | | | | |

| Institutional | | | | | | | |

| Preferred | | | | | | | |

| Plus Money | | | | | | | |

| Market Fund | 1,597,000 | | 57,155,000 | 58,706,000 | 46,000 | | .1 |

| Dreyfus | | | | | | | |

| Institutional | | | | | | | |

| Cash | | | | | | | |

| Advantage | | | | | | | |

| Fund | 10,922,389 | | 161,642,696 | 156,865,314 | 15,699,771 | | 15.9 |

| Total | 12,519,389 | | 218,797,696 | 215,571,314 | 15,745,771 | | 16.0 |

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended August 31, 2011, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes

NOTES TO FINANCIAL STATEMENTS (continued)

interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each of the tax years in the four-year period ended August 31, 2011 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At August 31, 2011, the components of accumulated earnings on a tax basis were as follows: accumulated capital losses $41,631,021 and unrealized depreciation $11,566,467.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net securities profits, if any, realized subsequent to August 31, 2011. If not applied, the carryover expires in fiscal 2018.

The tax character of distributions paid to shareholders during the fiscal periods ended August 31, 2011 and August 31, 2010 were as follows: ordinary income $22,307 and $289,551, respectively.

During the period ended August 31, 2011, as a result of permanent book to tax differences, primarily due to the tax treatment for net operating losses and real estate investment trusts, the fund increased accumulated undistributed investment income-net by $710,563, decreased accumulated net realized gain (loss) on investments by $521 and decreased paid-in capital by $710,042. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $225 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective

22

Facility at the time of borrowing. During the period ended August 31, 2011, the fund did not borrow under the Facilities.

NOTE 3—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of .90% of the value of the fund’s average daily net assets and is payable monthly.The Manager had agreed from September 1, 2010 through March 31, 2011, to waive receipt of its fees and/or assume the expenses of the fund so that the total annual fund operating expenses (excluding shareholder services fees, taxes, brokerage commissions, interest on borrowings and extraordinary expenses) did not exceed 1.15% of the value of the funds average daily net assets. At August 31, 2011, there were no reductions in management fee, pursuant to the undertakings.

(b) Under the Shareholder Services Plan, the fund pays the Distributor at an annual rate of .25% of the value of the fund’s average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (a securities dealer, financial institution or other industry professional) in respect of these services.The Distributor determines the amounts to be paid to Service Agents. During the period ended August 31, 2011, the fund was charged $370,203 pursuant to the Shareholder Services Plan.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing personnel and facilities to perform transfer agency services for the fund. During the period ended August 31, 2011, the fund was charged $76,431 pursuant to the transfer agency agreement, which is included in Shareholder servicing costs in the Statement of Operations.

NOTES TO FINANCIAL STATEMENTS (continued)

The fund has arrangements with the custodian and cash management bank whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody and cash management fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing cash management services related to fund subscriptions and redemptions. During the period ended August 31, 2011, the fund was charged $12,412 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $569.

The fund also compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. During the period ended August 31, 2011, the fund was charged $30,706 pursuant to the custody agreement.

During the period ended August 31, 2011, the fund was charged $7,225 for services performed by the Chief Compliance Officer.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $85,285, shareholder services plan fees $23,690, custodian fees $10,000, chief compliance officer fees $3,253 and transfer agency per account fees $11,817.

(c) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

24

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended August 31, 2011 amounted to $142,850,598 and $173,595,860, respectively.

At August 31, 2011, the cost of investments for federal income tax purposes was $140,622,855; accordingly, accumulated net unrealized depreciation on investments was $11,566,467, consisting of $5,083,863 gross unrealized appreciation and $16,650,330 gross unrealized depreciation.

NOTE 5—Plan of Reorganization:

On April 7, 2011, the fund’s Board of Directors approved the merger of the fund and Dreyfus Opportunistic Small Cap Fund (the “Acquiring Fund”). On September 15, 2011, the shareholders of the fund approved a Plan of Reorganization to allow the fund to transfer all of its assets in a tax-free reorganization to the Acquiring Fund, in exchange solely for shares of the Acquiring Fund having an aggregate net asset value equal to the value of the fund’s net assets and the assumption by the Acquiring Fund of the fund’s stated liabilities (the “Reorganization”).The shares of the Acquiring Fund received by the fund in the Reorganization will be distributed by the fund to its shareholders in liquidation of the fund, after which the fund will cease operations and will be terminated as a series of the Company.The Reorganization is anticipated to occur on or about November 28, 2011.

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Directors

Dreyfus Emerging Leaders Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Emerging Leaders Fund (one of the series comprising Advantage Funds, Inc.) as of August 31, 2011, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and financial highlights for each of the years indicated therein.These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting.Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2011 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Emerging Leaders Fund at August 31, 2011, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated years, in conformity with U.S. generally accepted accounting principles.

|

| New York, New York |

| October 27, 2011 |

26

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby designates 100% of the ordinary dividends paid during the fiscal year ended August 31, 2011 as qualifying for the corporate dividends received deduction.Also certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $22,307 represents the maximum amount that may be considered qualified dividend income. Shareholders will receive notification in early 2012 of the percentage applicable to the preparation of their 2011 income tax returns.

|

| INFORMATION ABOUT THE RENEWAL OF THE |

| FUND’S MANAGEMENT AGREEMENT (Unaudited) |

At a meeting of the fund’s Board of Directors held on March 1, 2011, the Board considered the renewal of the fund’s Management Agreement pursuant to which Dreyfus provides the fund with investment advisory and administrative services (the “Agreement”). The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus. In considering the renewal of the Agreement, the Board considered all factors that it believed to be relevant, including those discussed below.The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund.The Board members considered information previously provided to them in presentations from representatives of Dreyfus regarding the nature, extent, and quality of the services provided to funds in the Dreyfus fund complex, and representatives of Dreyfus confirmed that there had been no material changes in this information. Dreyfus provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. Dreyfus also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the Dreyfus fund complex and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each distribution channel, including the distribution channel(s) for the fund.

The Board members also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements.The Board members also

28

considered Dreyfus’ extensive administrative, accounting, and compliance infrastructures.The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio.The Board members reviewed reports prepared by Lipper, Inc. (“Lipper”), an independent provider of investment company data, which included information comparing (1) the fund’s performance with the performance of a group of comparable funds (the “Performance Group”) and with a broader group of funds (the “Performance Universe”), all for various periods ended December 31, 2010 and (2) the fund’s actual and contractual management fees and total expenses with those of a group of comparable funds (the “Expense Group”) and with a broader group of funds (the “Expense Universe”), the information for which was derived in part from fund financial statements available to Lipper as of December 31, 2010. Dreyfus previously had furnished the Board with a description of the methodology Lipper used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Dreyfus representatives stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations that may be applicable to the fund and comparison funds. The Board members discussed the results of the comparisons and noted that the fund’s total return performance was below the Performance Group and Performance Universe medians for the various periods, except for the one-year period when the fund’s performance was above the Performance Group and Performance Universe medians and ranked in the first quartile. Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index.

|

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S |

| MANAGEMENT AGREEMENT (Unaudited) (continued) |

The Board members also reviewed the range of actual and contractual management fees and total expenses of the Expense Group and Expense Universe funds and discussed the results of the comparisons. They noted that the fund’s contractual management fee was below the Expense Group median, the fund’s actual management fee was below the Expense Group and Expense Universe medians and the fund’s total expenses were above the Expense Group and the Expense Universe medians.The Board also considered the current fee waiver and expense reimbursement arrangement undertaken by Dreyfus.

Representatives of Dreyfus reviewed with the Board members the management or investment advisory fees (1) paid by funds advised or administered by Dreyfus that are in the same Lipper category as the fund and (2) paid to Dreyfus or the Dreyfus-affiliated primary employer of the fund’s primary portfolio manager for advising any separate accounts and/or other types of client portfolios that are considered to have similar investment strategies and policies as the fund (the “Similar Clients”), and explained the nature of the Similar Clients.They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors.The Board members considered the relevance of the fee information provided for the Similar Clients to evaluate the appropriateness and reasonableness of the fund’s management fee.

Analysis of Profitability and Economies of Scale. Dreyfus’ representatives reviewed the expenses allocated and profit received by Dreyfus and the resulting profitability percentage for managing the fund, and the method used to determine the expenses and profit. The Board concluded that the profitability results were not unreasonable, given the services rendered and service levels provided by Dreyfus. The Board also noted the expense limitation arrangement and its effect on Dreyfus’ profitability. The Board previously had been provided with information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the prof-

30

itability of, individual funds and the entire Dreyfus fund complex.The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board’s counsel stated that the Board members should consider the profitability analysis (1) as part of their evaluation of whether the fees under the Agreement bear a reasonable relationship to the mix of services provided by Dreyfus, including the nature, extent and quality of such services, and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Dreyfus representatives noted that, as a result of shared and allocated costs among funds in the Dreyfus funds complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from, changes in the fund’s asset level. The Board members also considered potential benefits to Dreyfus from acting as investment adviser and noted the soft dollar arrangements in effect for trading the fund’s investments.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreement. Based on the discussions and considerations as described above, the Board concluded and determined as follows.

The Board concluded that the nature, extent and quality of the services provided by Dreyfus are adequate and appropriate.

The Board was concerned with the fund’s relative performance and agreed to closely monitor performance.

The Board concluded that the fee paid to Dreyfus was reasonable in light of the considerations described above.

|

| INFORMATION ABOUT THE RENEWAL OF THE FUND’S |

| MANAGEMENT AGREEMENT (Unaudited) (continued) |

The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the management of the fund had been adequately considered by Dreyfus in connection with the fee rate charged to the fund pursuant to the Agreement and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

The Board members considered these conclusions and determinations, along with information received on a routine and regular basis throughout the year. In addition, it should be noted that the Board’s consideration of the contractual fee arrangements for this fund had the benefit of a number of years of reviews of prior or similar agreements during which lengthy discussions took place between the Board members and Dreyfus representatives. Certain aspects of the arrangements may receive greater scrutiny in some years than in others, and the Board members’ conclusions may be based, in part, on their consideration of the same or similar arrangements in prior years. The Board members determined that renewal of the Agreement was in the best interests of the fund and its shareholders.

32

BOARD MEMBERS INFORMATION (Unaudited)

|

| Joseph S. DiMartino (67) |

| Chairman of the Board (1995) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small |

| and medium size companies, Director (1997-present) |

| • Sunair Services Corporation, a provider of certain outdoor-related services to homes and |

| businesses, Director (2005-2009) |

| • The Newark Group, a provider of a national market of paper recovery facilities, paperboard |

| mills and paperboard converting plants, Director (2000-2010) |

| No. of Portfolios for which Board Member Serves: 167 |

| ——————— |

| Peggy C. Davis (68) |

| Board Member (2006) |

| Principal Occupation During Past 5Years: |

| • Shad Professor of Law, New York University School of Law |

| • Writer and teacher in the fields of evidence, constitutional theory, family law, social sciences |

| and the law, legal process and professional methodology and training |

| No. of Portfolios for which Board Member Serves: 53 |

| ——————— |

| David P. Feldman (71) |

| Board Member (1996) |

| Principal Occupation During Past 5Years: |

| • Corporate Director and Trustee |

| Other Public Company Board Memberships During Past 5Years: |

| • BBH Mutual Funds Group (4 registered mutual funds), Director (1992-present) |

| • QMed, Inc. a healthcare company, Director (1999-2007) |

| No. of Portfolios for which Board Member Serves: 50 |

BOARD MEMBERS INFORMATION (Unaudited) (continued)

|

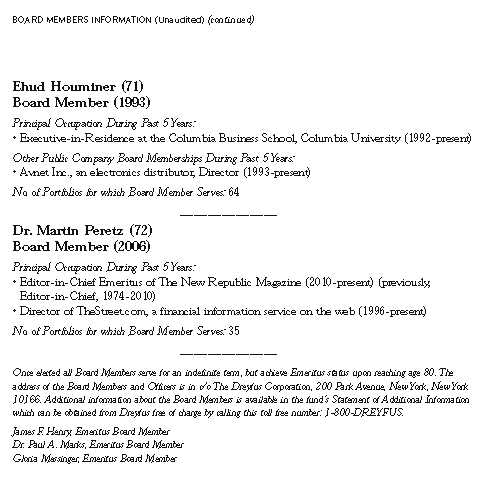

| Ehud Houminer (71) |

| Board Member (1993) |

| Principal Occupation During Past 5Years: |

| • Executive-in-Residence at the Columbia Business School, Columbia University (1992-present) |

| Other Public Company Board Memberships During Past 5Years: |

| • Avnet Inc., an electronics distributor, Director (1993-present) |

| No. of Portfolios for which Board Member Serves: 64 |

| ——————— |

| Dr. Martin Peretz (72) |

| Board Member (2006) |

| Principal Occupation During Past 5Years: |

| • Editor-in-Chief Emeritus of The New Republic Magazine (2010-present) (previously, |

| Editor-in-Chief, 1974-2010) |

| • Director of TheStreet.com, a financial information service on the web (1996-present) |

| No. of Portfolios for which Board Member Serves: 35 |

| ——————— |

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80.The address of the Board Members and Officers is in c/o The Dreyfus Corporation, 200 Park Avenue, NewYork, NewYork 10166.Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James F. Henry, Emeritus Board Member

Dr. Paul A. Marks, Emeritus Board Member

Gloria Messinger, Emeritus Board Member

34

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 75 investment companies (comprised of 167 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since February 1988.

MICHAEL A. ROSENBERG, Vice President and Secretary since August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since October 1991.

KIESHA ASTWOOD, Vice President and Assistant Secretary since January 2010.

Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 38 years old and has been an employee of the Manager since July 1995.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon and Secretary of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 45 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 55 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since June 2000.

KATHLEEN DENICHOLAS, Vice President and Assistant Secretary since January 2010.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 36 years old and has been an employee of the Manager since February 2001.

JANETTE E. FARRAGHER, Vice President and Assistant Secretary since August 2005.

Assistant General Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 48 years old and has been an employee of the Manager since February 1984.

JOHN B. HAMMALIAN, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since February 1991.

M. CRISTINA MEISER, Vice President and Assistant Secretary since January 2010.

Senior Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. She is 41 years old and has been an employee of the Manager since August 2001.

OFFICERS OF THE FUND (Unaudited) (continued)

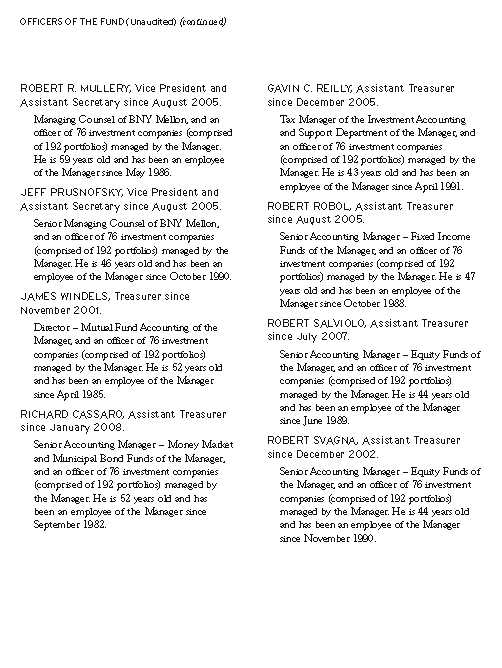

ROBERT R. MULLERY, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 59 years old and has been an employee of the Manager since May 1986.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 46 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market and Municipal Bond Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since September 1982.

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 43 years old and has been an employee of the Manager since April 1991.

ROBERT ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager – Fixed Income Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 47 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 76 investment companies (comprised of 192 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since November 1990.

36

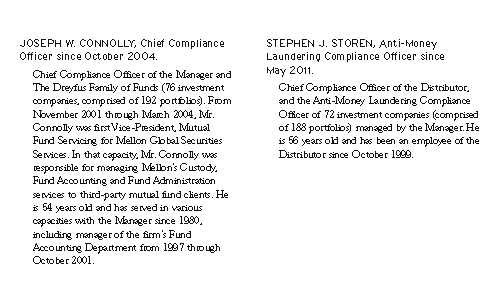

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (76 investment companies, comprised of 192 portfolios). From November 2001 through March 2004, Mr. Connolly was first Vice-President, Mutual Fund Servicing for Mellon Global Securities Services. In that capacity, Mr. Connolly was responsible for managing Mellon’s Custody, Fund Accounting and Fund Administration services to third-party mutual fund clients. He is 54 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

STEPHEN J. STOREN, Anti-Money Laundering Compliance Officer since May 2011.

Chief Compliance Officer of the Distributor, and the Anti-Money Laundering Compliance Officer of 72 investment companies (comprised of 188 portfolios) managed by the Manager. He is 56 years old and has been an employee of the Distributor since October 1999.

Ticker Symbol: DRELX

Telephone 1-800-DREYFUS

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144 E-mail Send your request to info@dreyfus.com Internet Information can be viewed online or downloaded at: http://www.dreyfus.com

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities, and information regarding how the fund voted these proxies for the the most recent 12-month period ended June 30 is available at http://www.dreyfus.com and on the SEC’s website at http://www.sec.gov. The description of the policies and procedures is also available without charge, upon request, by calling 1-800-DREYFUS.

|

| Dreyfus |

| International |

| Value Fund |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value

| | Contents |

| | THE FUND |

| 2 | A Letter from the Chairman and CEO |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 15 | Statement of Assets and Liabilities |

| 16 | Statement of Operations |

| 17 | Statement of Changes in Net Assets |

| 19 | Financial Highlights |

| 23 | Notes to Financial Statements |

| 35 | Report of Independent Registered Public Accounting Firm |

| 36 | Important Tax Information |

| 37 | Information About the Renewal of the Fund’s Management Agreement |

| 42 | Board Members Information |

| 44 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

International Value Fund

The Fund

A LETTER FROM THE CHAIRMAN AND CEO

Dear Shareholder:

We are pleased to present this annual report for Dreyfus International Value Fund, covering the 12-month period from September 1, 2010, through August 31, 2011. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Although stocks in some markets rallied strongly through the end of 2010 due to expectations of a more robust economic recovery, the reporting period ended amid broadly deteriorating investor sentiment due to disappointing global economic data, an escalating sovereign debt crisis in Europe and a contentious debate regarding taxes, spending and borrowing in the United States. In the final month of the reporting period, a major credit rating agency downgraded U.S. long-term debt, marking the first time in history that U.S.Treasury securities were not assigned the highest possible credit rating. Stocks in markets throughout the world proved volatile in this tumultuous environment, as the stalled U.S. and global economies caused many market sectors to give back a portion of the reporting period’s previous gains.

The global economic outlook currently is clouded by heightened market volatility and geopolitical instability, but we believe that a sustained, moderate global expansion is more likely than a double-dip recession. Inflationary pressures appear to be waning in most countries, including the United States, as energy prices have retreated from their highs.Various central banks have signaled their intention to maintain accommodative monetary policies, which may help offset the financial stresses expected from recent fiscal policy choices in the United States and Europe. To assess how these and other developments may affect your investments, we encourage you, as always, to speak with your financial advisor.

Thank you for your continued confidence and support.

Jonathan R. Baum

Chairman and Chief Executive Officer

The Dreyfus Corporation

September 15, 2011

2

DISCUSSION OF FUND PERFORMANCE

For the period of September 1, 2010, through August 31, 2011, as provided by D. Kirk Henry, Senior Portfolio Manager

Fund and Market Performance Overview

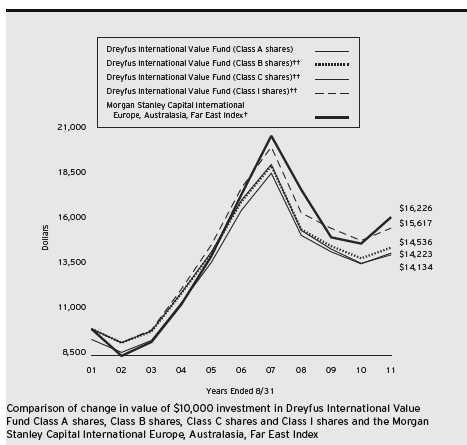

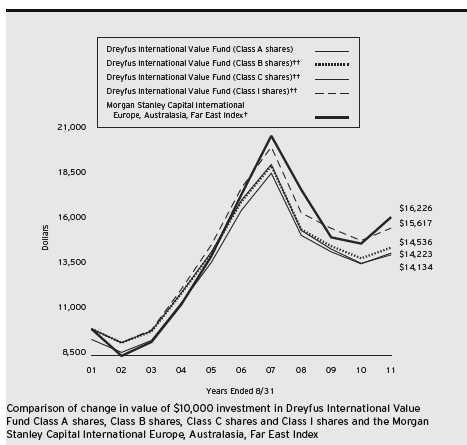

For the 12-month period ended August 31, 2011, Dreyfus International Value Fund’s Class A shares produced a total return of 4.32%, Class B shares returned 3.14%, Class C shares returned 3.48% and Class I shares returned 4.67%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Europe,Australasia, Far East Index (“MSCI EAFE Index”), produced a total return of 10.01% for the same period.2

Strong corporate earnings buoyed international stocks over the reporting period’s first half, but macroeconomic challenges later erased many of those gains.The fund produced lower returns than its benchmark, as the valuation factors considered by our investment process fell out of favor among investors.

The Fund’s Investment Approach

The fund seeks long-term capital growth.The fund ordinarily invests most of its assets in securities of foreign companies which Dreyfus considers to be value companies.