UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-7123 |

| |

| Advantage Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| John Pak, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 8/31 | |

Date of reporting period: | 8/31/2013 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not affect the other series of the Registrant, which have a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR Form will be filed for the remaining series as appropriate.

-DREYFUS INTERNATIONAL VALUE FUND

-DREYFUS OPPORTUNISTIC MIDCAP VALUE FUND

-DREYFUS OPPORTUNISTIC SMALL CAP FUND

-DREYFUS OPPORTUNISTIC U.S. STOCK FUND

-DREYFUS STRATEGIC VALUE FUND

-DREYFUS STRUCTURED MIDCAP FUND

-DREYFUS TECHNOLOGY GROWTH FUND

FORM N-CSR

Item 1. Reports to Stockholders.

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 14 | Statement of Assets and Liabilities |

| 15 | Statement of Operations |

| 16 | Statement of Changes in Net Assets |

| 18 | Financial Highlights |

| 21 | Notes to Financial Statements |

| 34 | Report of Independent Registered Public Accounting Firm |

| 35 | Important Tax Information |

| 36 | Information About the Renewal of the Fund’s Management Agreement |

| 42 | Board Members Information |

| 44 | Officers of the Fund |

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

International Value Fund

The Fund

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus International Value Fund, covering the 12-month period from September 1, 2012, through August 31, 2013. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

U.S. equities fared quite well over the reporting period. Low interest rates, muted inflationary pressures, and a strong U.S. dollar helped fuel the market’s gains, as did a declining unemployment rate, rebounding housing markets, and increased production of domestic oil and natural gas. International equities produced widely divergent returns over the past year, as stocks in developed markets advanced more strongly than their counterparts in emerging markets. Developed markets in Europe and Japan benefited from a rebound from depressed levels of economic activity in response to the aggressively accommodative monetary policies adopted by their central banks. In contrast, some of the major emerging markets, most notably China, have seen their growth rates moderate to more sustainable levels after years of torrid expansion, making it more difficult for monetary policymakers to stimulate their economies without risking an unwanted acceleration of inflation.

We expect a broad pattern of economic growth to persist in both developed and emerging countries, with emerging markets exhibiting higher long-term growth trends. However, developed markets appear to have better prospects over the near term, as they remain supported by more stimulative monetary policies. For information on how these developments may affect your investments, we urge you to discuss these matters with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

September 16, 2013

2

DISCUSSION OF FUND PERFORMANCE

For the period of September 1, 2012, through August 31, 2013, as provided by D. Kirk Henry, Portfolio Manager

Fund and Market Performance Overview

For the 12-month period ended August 31, 2013, Dreyfus International Value Fund’s Class A shares produced a total return of 20.76%, Class C shares returned 19.82%, and Class I shares returned 21.27%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East Index (“MSCI EAFE Index”), produced a total return of 18.66% for the same period.2

International stock markets rallied over the reporting period as economic conditions improved in developed countries. The fund outperformed its benchmark on the strength of successful stock selections in Japan, Switzerland, and Australia.

The Fund’s Investment Approach

The fund seeks long-term capital growth.The fund ordinarily invests most of its assets in securities of foreign companies which Dreyfus considers to be value companies.

The fund’s investment approach is value-oriented and research-driven. In selecting stocks, we attempt to identify potential investments through extensive quantitative and fundamental research. Emphasizing individual stock selection over economic or industry trends, the fund focuses on three key factors: value, or how a stock is valued relative to its intrinsic worth based on traditional value measures; business health, or overall efficiency and profitability as measured by return on assets and return on equity; and business momentum, or the presence of a catalyst (such as corporate restructuring, change in management, or spin-off) that will trigger a price increase near term to midterm.

The fund typically sells a stock when it is no longer considered a value company, appears less likely to benefit from the current market and economic environment, shows deteriorating fundamentals or declining momentum, or falls short of our expectations.

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

Recovering Global Economy Fueled Equity Markets’ Gains

The reporting period began near the outset of stock market rallies driven by improved global economic trends in developed nations. Investors were particularly encouraged by the European Central Bank’s efforts to shore up the region’s banking system, newly stimulative fiscal and monetary policies in Japan, and a new quantitative easing program in the United States.

Global economic data continued to show signs of improvement, and stocks generally continued to rally, through the spring of 2013. In late May, remarks by Federal Reserve Board Chairman Ben Bernanke were widely interpreted as a signal that U.S. monetary policymakers would begin to back away from their quantitative easing program sooner than expected. Consequently, global stock markets encountered heightened volatility in June, and a strengthening U.S. dollar further eroded returns from international investments for U.S. residents. Global equity markets generally stabilized in July and August when investors realized that the end of the quantitative easing program did not necessarily portend higher short-term interest rates, and they returned their focus to company and market fundamentals.

Strong Stock Selections in Developed Markets

In this environment, the fund’s strong relative performance was driven by our stock selection strategy in several of the world’s more developed markets. Japanese holdings provided a strong boost to relative results, led by consumer discretionary companies such as carmaker Toyota Motor and auto parts manufacturer Denso, and technology firms, such as automation equipment producer Omron, robotics specialist Yaskawa Electric, and office equipment maker Ricoh. Japanese financial services firms also advanced, including banks Nomura Holdings and Sumitomo Mitsui Trust Holdings.

Winners in Switzerland included banking giant UBS, pharmaceuticals developer Roche Holding, and specialty chemicals producer Clariant, while lack of participation in Nestle helped the fund avoid relative weakness in the global food company. Underweighted exposure to Australia also bolstered relative performance, as did strong stock selections such as medical professional services provider Primary Health Care. The fund particularly benefited from lack of exposure to Australian materials producers, which suffered due to economic slowdowns in nearby emerging markets. Finally, the fund was helped by grocery and convenience stores in France, Belgium, and Japan.

4

Disappointments during the reporting period were concentrated in the traditionally defensive utilities and telecommunications services sectors, where French telephony provider Orange and German electricity producer E.ON weighed on relative results. Investments in the emerging markets also trailed market averages, with particular weakness in Brazilian oil producer Petroleo Brasileiro, Brazilian bank Banco Santander Brasil, and Indian energy and materials conglomerate Reliance Industries.

Finding Opportunities in Most Markets

We have been encouraged by positive economic data in Europe, Japan, and the United States. Despite richer valuations in some regions and industry groups, our value-oriented investment process has continued to identify opportunities in a variety of markets.We recently have found an ample number of opportunities in France and certain emerging markets, but fewer in Australia, Japan, and the United Kingdom. From a market sector perspective, the fund ended the reporting period with overweighted positions in the energy and information technology sectors and underweighted exposure to the consumer discretionary, consumer staples, and materials sectors.

September 16, 2013

Please note, the position in any security highlighted with italicized typeface was sold during the reporting period. Equity funds are subject generally to market, market sector, market liquidity, issuer and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund’s performance will be influenced by political, social and economic factors affecting investments in foreign companies. Special risks associated with investments in foreign companies include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability and differing auditing and legal standards.These risks are enhanced in emerging market countries. Please read the prospectus for further discussion of these risks.

|

| 1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the |

| maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed |

| on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past |

| performance is no guarantee of future results. Share price, yield and investment return fluctuate such that upon |

| redemption fund shares may be worth more or less than their original cost.The fund’s returns reflect the absorption of |

| certain fund expenses by The Dreyfus Corporation pursuant to an agreement in effect through March 31, 2014. Had |

| these expenses not been absorbed, the fund’s returns would have been lower. |

| 2 SOURCE: LIPPER INC. — Reflects reinvestment of net dividends and, where applicable, capital gain |

| distributions.The Morgan Stanley Capital International Europe,Australasia, Far East (MSCI EAFE) Index is an |

| unmanaged index composed of a sample of companies representative of the market structure of European and Pacific |

| Basin countries.The Index does not take into account fees and expenses to which the fund is subject. Investors cannot |

| invest directly in any index. |

The Fund 5

6

| | | | | | |

| Average Annual Total Returns as of 8/31/13 | | | | | | |

| | 1 Year | | 5 Years | | 10 Years | |

| Class A shares | | | | | | |

| with maximum sales charge (5.75%) | 13.77 | % | 0.04 | % | 4.99 | % |

| without sales charge | 20.76 | % | 1.23 | % | 5.61 | % |

| Class C shares | | | | | | |

| with applicable redemption charge † | 18.82 | % | 0.43 | % | 4.81 | % |

| without redemption | 19.82 | % | 0.43 | % | 4.81 | % |

| Class I shares | 21.27 | % | 1.71 | % | 6.06 | % |

| Morgan Stanley Capital | | | | | | |

| International Europe, | | | | | | |

| Australasia, Far East Index | 18.66 | % | 1.62 | % | 7.57 | % |

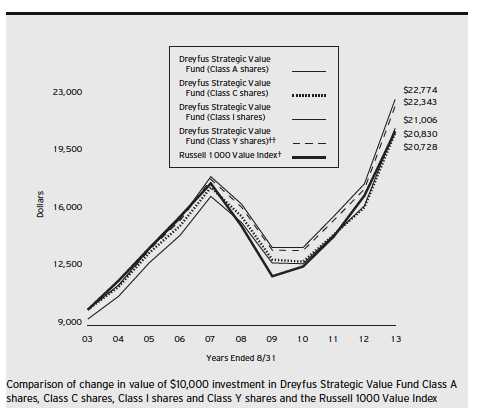

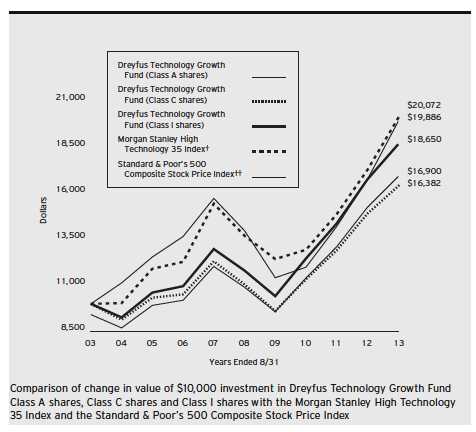

Past performance is not predictive of future performance.The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares.

|

| † The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the |

| date of purchase. |

The Fund 7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds.You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus International Value Fund from March 1, 2013 to August 31, 2013. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

Expenses and Value of a $1,000 Investment

assuming actual returns for the six months ended August 31, 2013

| | | | | | |

| | | Class A | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 7.98 | $ | 11.92 | $ | 5.85 |

| Ending value (after expenses) | $ | 1,068.50 | $ | 1,065.40 | $ | 1,071.70 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help

investors assess fund expenses. Per these guidelines, the table below shows your fund’s

expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return.

You can use this information to compare the ongoing expenses (but not transaction

expenses or total cost) of investing in the fund with those of other funds.All mutual fund

shareholder reports will provide this information to help you make this comparison.

Please note that you cannot use this information to estimate your actual ending account

balance and expenses paid during the period.

Expenses and Value of a $1,000 Investment

assuming a hypothetical 5% annualized return for the six months ended August 31, 2013

| | | | | | |

| | | Class A | | Class C | | Class I |

| Expenses paid per $1,000† | $ | 7.78 | $ | 11.62 | $ | 5.70 |

| Ending value (after expenses) | $ | 1,017.49 | $ | 1,013.66 | $ | 1,019.56 |

|

| † Expenses are equal to the fund’s annualized expense ratio of 1.53% for Class A, 2.29% for Class C and 1.12% |

| for Class I, multiplied by the average account value over the period, multiplied by 184/365 (to reflect the one-half |

| year period). |

8

STATEMENT OF INVESTMENTS

August 31, 2013

| | | |

| Common Stocks—98.0% | Shares | | Value ($) |

| Australia—2.9% | | | |

| Australia & New Zealand Banking Group | 43,141 | | 1,140,029 |

| Metcash | 265,300 | | 767,425 |

| Primary Health Care | 55,830 | | 255,912 |

| QBE Insurance Group | 127,962 | | 1,731,171 |

| | | | 3,894,537 |

| Belgium—.4% | | | |

| Delhaize Group | 8,090 | | 516,163 |

| Brazil—1.4% | | | |

| Banco Santander Brasil, ADS | 181,250 | | 1,045,813 |

| Petroleo Brasileiro, ADR | 62,260 | | 841,755 |

| | | | 1,887,568 |

| China—2.4% | | | |

| Beijing Capital International Airport, Cl. H | 1,186,000 | | 776,958 |

| CNOOC | 469,000 | | 931,414 |

| FIH Mobile | 1,281,000 | a | 832,585 |

| Guangzhou Automobile Group, Cl. H | 650,194 | | 663,237 |

| | | | 3,204,194 |

| Denmark—.8% | | | |

| Carlsberg, Cl. B | 11,600 | | 1,125,216 |

| France—12.0% | | | |

| Alstom | 41,820 | | 1,471,601 |

| BNP Paribas | 20,310 | | 1,272,747 |

| Bouygues | 22,430 | | 701,540 |

| Carrefour | 78,701 | | 2,463,599 |

| Cie de St-Gobain | 29,677 | | 1,386,127 |

| Danone | 15,020 | | 1,118,416 |

| Electricite de France | 29,229 | | 818,967 |

| GDF Suez | 76,604 | | 1,660,396 |

| Sanofi | 20,871 | | 2,005,092 |

| Total | 60,670 | | 3,360,933 |

| | | | 16,259,418 |

| Germany—8.4% | | | |

| Aixtron | 82,520 | a | 1,290,755 |

| Celesio | 63,060 | | 1,314,323 |

| Daimler | 26,786 | | 1,838,057 |

The Fund 9

STATEMENT OF INVESTMENTS (continued)

| | | | |

| Common Stocks (continued) | Shares | | | Value ($) |

| Germany (continued) | | | | |

| Deutsche Bank | 51,390 | | | 2,225,046 |

| Deutsche Telekom | 72,820 | | | 932,783 |

| E.ON | 29,040 | | | 459,801 |

| Muenchener Rueckversicherungs | 5,440 | | | 991,470 |

| Siemens | 22,360 | | | 2,366,827 |

| | | | | 11,419,062 |

| Hong Kong—3.7% | | | | |

| COSCO Pacific | 662,392 | | | 973,798 |

| Esprit Holdings | 875,239 | | | 1,494,389 |

| Hang Seng Bank | 72,800 | | | 1,131,273 |

| Pacific Basin Shipping | 518,000 | | | 324,650 |

| Yue Yuen Industrial Holdings | 344,000 | | | 1,060,243 |

| | | | | 4,984,353 |

| India—1.2% | | | | |

| Reliance Industries, GDR | 41,974 | b | | 1,056,066 |

| State Bank of India, GDR | 11,470 | | | 525,326 |

| | | | | 1,581,392 |

| Ireland—.8% | | | | |

| CRH | 53,040 | | | 1,126,080 |

| Israel—1.5% | | | | |

| Teva Pharmaceutical Industries, ADR | 53,540 | | | 2,046,299 |

| Italy—2.6% | | | | |

| Assicurazioni Generali | 38,170 | | | 731,487 |

| Eni | 37,005 | | | 845,124 |

| Finmeccanica | 136,916 | a | | 700,296 |

| Saras | 994,610 | a | 1,202,792 |

| | | | | 3,479,699 |

| Japan—20.4% | | | | |

| East Japan Railway | 11,600 | | | 890,808 |

| Fujitsu | 199,000 | | | 735,723 |

| INPEX | 313 | | | 1,420,191 |

| Kao | 42,600 | | | 1,245,221 |

| Matsumotokiyoshi Holdings | 21,300 | | | 720,232 |

| Mitsubishi UFJ Financial Group | 527,200 | | | 3,092,806 |

| Nippon Express | 306,000 | | | 1,433,620 |

| Nippon Shokubai | 117,000 | | | 1,190,436 |

10

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| Japan (continued) | | | |

| Nippon Telegraph & Telephone | 18,600 | | 946,244 |

| Nomura Holdings | 49,800 | | 347,943 |

| Nomura Real Estate Holdings | 36,700 | | 841,014 |

| Ricoh | 128,800 | | 1,399,701 |

| Shimamura | 9,500 | | 971,432 |

| Shin-Etsu Chemical | 10,220 | | 617,249 |

| Sumitomo Electric Industries | 104,200 | | 1,406,172 |

| Sumitomo Mitsui Financial Group | 33,800 | | 1,497,479 |

| Sumitomo Mitsui Trust Holdings | 174,560 | | 760,928 |

| Taiyo Nippon Sanso | 227,000 | | 1,491,216 |

| Tokyo Electron | 32,500 | | 1,355,477 |

| Toyota Motor | 60,600 | | 3,666,181 |

| Yamada Denki | 28,270 | | 895,449 |

| Yamaha Motor | 52,600 | | 684,119 |

| | | | 27,609,641 |

| Netherlands—2.1% | | | |

| Aegon | 111,523 | | 795,340 |

| Koninklijke Philips | 68,038 | | 2,103,285 |

| | | | 2,898,625 |

| Norway—1.2% | | | |

| Norsk Hydro | 178,348 | | 718,072 |

| Orkla | 126,010 | | 909,271 |

| | | | 1,627,343 |

| Russia—.5% | | | |

| Gazprom, ADR | 88,460 | | 695,296 |

| Singapore—2.1% | | | |

| Avago Technologies | 21,860 | | 841,829 |

| DBS Group Holdings | 77,782 | | 963,433 |

| United Overseas Bank | 65,000 | | 1,013,523 |

| | | | 2,818,785 |

| South Africa—.2% | | | |

| Murray & Roberts Holdings | 126,343 | a | 318,269 |

| South Korea—3.3% | | | |

| Hyundai Mobis | 1,803 | | 453,166 |

| KB Financial Group | 6,000 | | 192,964 |

| KB Financial Group, ADR | 33,244 | | 1,050,843 |

The Fund 11

STATEMENT OF INVESTMENTS (continued)

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| South Korea (continued) | | | |

| Korea Electric Power | 25,400 | a | 702,473 |

| Korea Electric Power, ADR | 43,714 | | 599,756 |

| Samsung Electronics | 604 | | 744,356 |

| Samsung Fire & Marine Insurance | 3,394 | | 764,380 |

| | | | 4,507,938 |

| Spain—.5% | | | |

| Banco Bilbao Vizcaya Argentaria | 66,520 | | 634,755 |

| Sweden—2.2% | | | |

| Ericsson, Cl. B | 187,820 | | 2,207,697 |

| Svenska Cellulosa, Cl. B | 33,450 | | 817,152 |

| | | | 3,024,849 |

| Switzerland—8.5% | | | |

| Adecco | 14,950 | a | 941,555 |

| Clariant | 65,080 | a | 1,055,465 |

| Credit Suisse Group | 20,470 | a | 590,043 |

| Novartis | 59,566 | | 4,343,654 |

| Roche Holding | 11,280 | | 2,813,787 |

| UBS | 95,388 | a | 1,847,377 |

| | | | 11,591,881 |

| Taiwan—1.2% | | | |

| Advanced Semiconductor Engineering | 795,000 | | 702,693 |

| Hon Hai Precision Industry | 344,400 | a | 934,528 |

| | | | 1,637,221 |

| United Kingdom—17.7% | | | |

| Anglo American | 59,043 | | 1,352,804 |

| AZ Electronic Materials | 82,920 | | 392,826 |

| Barclays | 220,929 | | 970,110 |

| BHP Billiton | 48,580 | | 1,413,833 |

| BP | 338,184 | | 2,338,448 |

| Direct Line Insurance Group | 208,527 | | 700,594 |

| eSure Group | 285,630 | a | 1,071,184 |

| Home Retail Group | 409,565 | | 904,446 |

| HSBC Holdings | 396,858 | | 4,157,449 |

| Resolution | 176,067 | | 869,571 |

| Royal Dutch Shell, Cl. A | 106,621 | | 3,449,168 |

| Shire | 29,160 | | 1,074,142 |

12

| | | |

| Common Stocks (continued) | Shares | | Value ($) |

| United Kingdom (continued) | | | |

| Standard Chartered | 37,630 | | 840,317 |

| Tesco | 187,694 | | 1,066,175 |

| Unilever | 25,795 | | 982,967 |

| Vodafone Group | 756,317 | | 2,417,369 |

| | | | 24,001,403 |

| Total Common Stocks | | | |

| (cost $153,720,884) | | | 132,889,987 |

| |

| Other Investment—1.4% | | | |

| Registered Investment Company; | | | |

| Dreyfus Institutional Preferred | | | |

| Plus Money Market Fund | | | |

| (cost $1,870,000) | 1,870,000 | c | 1,870,000 |

| Total Investments (cost $155,590,884) | 99.4 | % | 134,759,987 |

| Cash and Receivables (Net) | .6 | % | 840,017 |

| Net Assets | 100.0 | % | 135,600,004 |

ADR—American Depository Receipts

ADS—American Depository Shares

GDR—Global Depository Receipts

|

| a Non-income producing security. |

| b Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933.This security may be |

| resold in transactions exempt from registration, normally to qualified institutional buyers.At August 31, 2013, this |

| security was valued at $1,056,066 or .8% of net assets. |

| c Investment in affiliated money market mutual fund. |

Portfolio Summary (Unaudited)†

| | | |

| | Value (%) | | Value (%) |

| Financial | 24.9 | Consumer Staples | 8.7 |

| Energy | 11.9 | Materials | 6.9 |

| Health Care | 10.2 | Telecommunication Services | 3.2 |

| Industrial | 10.1 | Utilities | 3.1 |

| Information Technology | 9.7 | Money Market Investment | 1.4 |

| Consumer Discretionary | 9.3 | | 99.4 |

|

| † Based on net assets. |

| See notes to financial statements. |

The Fund 13

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2013

| | | | |

| | | Cost | Value | |

| Assets ($): | | | | |

| Investments in securities—See Statement of Investments: | | | |

| Unaffiliated issuers | | 153,720,884 | 132,889,987 | |

| Affiliated issuers | | 1,870,000 | 1,870,000 | |

| Cash | | | 44,070 | |

| Cash denominated in foreign currencies | | 527,235 | 524,279 | |

| Dividends receivable | | | 626,532 | |

| Receivable for investment securities sold | | | 528,096 | |

| Receivable for shares of Common Stock subscribed | | | 1,376 | |

| Prepaid expenses | | | 18,429 | |

| | | | 136,502,769 | |

| Liabilities ($): | | | | |

| Due to The Dreyfus Corporation and affiliates—Note 3(c) | | 177,385 | |

| Payable for investment securities purchased | | | 495,166 | |

| Payable for shares of Common Stock redeemed | | | 130,545 | |

| Unrealized depreciation on forward foreign | | | | |

| currency exchange contracts—Note 4 | | | 145 | |

| Accrued expenses | | | 99,524 | |

| | | | 902,765 | |

| Net Assets ($) | | | 135,600,004 | |

| Composition of Net Assets ($): | | | | |

| Paid-in capital | | | 246,435,156 | |

| Accumulated undistributed investment income—net | | | 2,259,459 | |

| Accumulated net realized gain (loss) on investments | | | (92,262,796 | ) |

| Accumulated net unrealized appreciation (depreciation) | | | |

| on investments and foreign currency transactions | | | (20,831,815 | ) |

| Net Assets ($) | | | 135,600,004 | |

| |

| |

| Net Asset Value Per Share | | | | |

| | Class A | Class C | Class I | |

| Net Assets ($) | 68,771,181 | 7,667,435 | 59,161,388 | |

| Shares Outstanding | 5,960,080 | 672,123 | 5,141,724 | |

| Net Asset Value Per Share ($) | 11.54 | 11.41 | 11.51 | |

| |

| See notes to financial statements. | | | | |

14

STATEMENT OF OPERATIONS

Year Ended August 31, 2013

| | |

| Investment Income ($): | | |

| Income: | | |

| Cash dividends (net of $407,226 foreign taxes withheld at source): | | |

| Unaffiliated issuers | 4,383,112 | |

| Affiliated issuers | 2,040 | |

| Interest | 1,002 | |

| Total Income | 4,386,154 | |

| Expenses: | | |

| Management fee—Note 3(a) | 1,515,719 | |

| Shareholder servicing costs—Note 3(c) | 397,567 | |

| Custodian fees—Note 3(c) | 93,842 | |

| Professional fees | 64,858 | |

| Distribution fees—Note 3(b) | 60,716 | |

| Registration fees | 44,669 | |

| Prospectus and shareholders’ reports | 22,852 | |

| Directors’ fees and expenses—Note 3(d) | 14,583 | |

| Interest expense—Note 2 | 5,265 | |

| Loan commitment fees—Note 2 | 905 | |

| Miscellaneous | 40,381 | |

| Total Expenses | 2,261,357 | |

| Less—reduction in expenses due to undertaking—Note 3(a) | (151,575 | ) |

| Less—reduction in fees due to earnings credits—Note 3(c) | (137 | ) |

| Net Expenses | 2,109,645 | |

| Investment Income—Net | 2,276,509 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

| Net realized gain (loss) on investments and foreign currency transactions | 3,109,679 | |

| Net realized gain (loss) on forward foreign currency exchange contracts | 7,784 | |

| Net Realized Gain (Loss) | 3,117,463 | |

| Net unrealized appreciation (depreciation) on | | |

| investments and foreign currency transactions | 25,122,131 | |

| Net unrealized appreciation (depreciation) on | | |

| forward foreign currency exchange contracts | 1,818 | |

| Net Unrealized Appreciation (Depreciation) | 25,123,949 | |

| Net Realized and Unrealized Gain (Loss) on Investments | 28,241,412 | |

| Net Increase in Net Assets Resulting from Operations | 30,517,921 | |

| |

| See notes to financial statements. | | |

The Fund 15

STATEMENT OF CHANGES IN NET ASSETS

| | | | |

| | Year Ended August 31, | |

| | 2013 | | 2012 | a |

| Operations ($): | | | | |

| Investment income—net | 2,276,509 | | 3,460,352 | |

| Net realized gain (loss) on investments | 3,117,463 | | (24,426,152 | ) |

| Net unrealized appreciation | | | | |

| (depreciation) on investments | 25,123,949 | | 5,562,944 | |

| Net Increase (Decrease) in Net Assets | | | | |

| Resulting from Operations | 30,517,921 | | (15,402,856 | ) |

| Dividends to Shareholders from ($): | | | | |

| Investment income—net: | | | | |

| Class A | (1,779,844 | ) | (2,772,443 | ) |

| Class C | (98,693 | ) | (186,447 | ) |

| Class I | (1,603,998 | ) | (2,975,318 | ) |

| Total Dividends | (3,482,535 | ) | (5,934,208 | ) |

| Capital Stock Transactions ($): | | | | |

| Net proceeds from shares sold: | | | | |

| Class A | 12,719,514 | | 20,878,977 | |

| Class B | — | | 13,986 | |

| Class C | 146,329 | | 255,905 | |

| Class I | 3,686,507 | | 16,118,621 | |

| Dividends reinvested: | | | | |

| Class A | 1,718,394 | | 2,666,058 | |

| Class C | 54,020 | | 98,544 | |

| Class I | 1,424,443 | | 2,622,324 | |

| Cost of shares redeemed: | | | | |

| Class A | (54,174,851 | ) | (23,471,434 | ) |

| Class B | — | | (476,981 | ) |

| Class C | (1,916,922 | ) | (2,885,040 | ) |

| Class I | (19,133,866 | ) | (37,097,091 | ) |

| Increase (Decrease) in Net Assets | | | | |

| from Capital Stock Transactions | (55,476,432 | ) | (21,276,131 | ) |

| Total Increase (Decrease) in Net Assets | (28,441,046 | ) | (42,613,195 | ) |

| Net Assets ($): | | | | |

| Beginning of Period | 164,041,050 | | 206,654,245 | |

| End of Period | 135,600,004 | | 164,041,050 | |

| Undistributed investment income—net | 2,259,459 | | 3,417,397 | |

16

| | | | |

| | Year Ended August 31, | |

| | 2013 | | 2012 | a |

| Capital Share Transactions: | | | | |

| Class Ab,c | | | | |

| Shares sold | 1,206,880 | | 2,047,935 | |

| Shares issued for dividends reinvested | 169,634 | | 274,286 | |

| Shares redeemed | (4,951,509 | ) | (2,387,133 | ) |

| Net Increase (Decrease) in Shares Outstanding | (3,574,995 | ) | (64,912 | ) |

| Class Bb | | | | |

| Shares sold | — | | 1,369 | |

| Shares redeemed | — | | (46,819 | ) |

| Net Increase (Decrease) in Shares Outstanding | — | | (45,450 | ) |

| Class Cc | | | | |

| Shares sold | 13,612 | | 18,196 | |

| Shares issued for dividends reinvested | 5,364 | | 10,212 | |

| Shares redeemed | (176,471 | ) | (299,702 | ) |

| Net Increase (Decrease) in Shares Outstanding | (157,495 | ) | (271,294 | ) |

| Class I | | | | |

| Shares sold | 332,712 | | 1,535,195 | |

| Shares issued for dividends reinvested | 141,454 | | 271,462 | |

| Shares redeemed | (1,796,033 | ) | (3,962,000 | ) |

| Net Increase (Decrease) in Shares Outstanding | (1,321,867 | ) | (2,155,343 | ) |

| a | Effective as of the close of business on March 13, 2012, the fund no longer offers Class B shares. |

| b | During the period ended August 31, 2012, 27,053 Class B shares representing $272,804 were automatically converted to 26,973 Class A shares. |

| c | During the period ended August 31, 2013, 12,494 Class C shares representing $147,433 were exchanged for 12,389 Class A shares. |

See notes to financial statements.

The Fund 17

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated.All information (except portfolio turnover rate) reflects financial results for a single fund share.Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions.These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | Year Ended August 31, | | | |

| Class A Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 9.76 | | 10.69 | | 10.37 | | 11.02 | | 12.30 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .15 | | .17 | | .20 | | .15 | | .15 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 1.85 | | (.80 | ) | .26 | | (.65 | ) | (1.01 | ) |

| Total from Investment Operations | 2.00 | | (.63 | ) | .46 | | (.50 | ) | (.86 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.22 | ) | (.30 | ) | (.14 | ) | (.15 | ) | (.42 | ) |

| Net asset value, end of period | 11.54 | | 9.76 | | 10.69 | | 10.37 | | 11.02 | |

| Total Return (%)b | 20.76 | | (5.89 | ) | 4.32 | | (4.66 | ) | (5.97 | ) |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 1.61 | | 1.63 | | 1.54 | | 1.54 | | 1.84 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 1.51 | | 1.53 | | 1.49 | | 1.54 | | 1.84 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 1.40 | | 1.74 | | 1.70 | | 1.29 | | 1.66 | |

| Portfolio Turnover Rate | 43.35 | | 40.93 | | 60.72 | | 55.35 | | 69.63 | |

| Net Assets, end of period ($ x 1,000) | 68,771 | | 93,078 | | 102,606 | | 112,716 | | 159,260 | |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

18

| | | | | | | | | | |

| | | | Year Ended August 31, | | | |

| Class C Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 9.64 | | 10.51 | | 10.19 | | 10.84 | | 11.98 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .06 | | .10 | | .11 | | .06 | | .08 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 1.83 | | (.79 | ) | .25 | | (.65 | ) | (.96 | ) |

| Total from Investment Operations | 1.89 | | (.69 | ) | .36 | | (.59 | ) | (.88 | ) |

| Distributions: | | | | | | | | | | |

| Dividends from investment income—net | (.12 | ) | (.18 | ) | (.04 | ) | (.06 | ) | (.26 | ) |

| Net asset value, end of period | 11.41 | | 9.64 | | 10.51 | | 10.19 | | 10.84 | |

| Total Return (%)b | 19.82 | | (6.55 | ) | 3.48 | | (5.49 | ) | (6.71 | ) |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 2.39 | | 2.38 | | 2.31 | | 2.33 | | 2.63 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 2.29 | | 2.28 | | 2.26 | | 2.33 | | 2.63 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | .60 | | .99 | | .91 | | .56 | | .87 | |

| Portfolio Turnover Rate | 43.35 | | 40.93 | | 60.72 | | 55.35 | | 69.63 | |

| Net Assets, end of period ($ x 1,000) | 7,667 | | 7,998 | | 11,573 | | 14,604 | | 18,607 | |

| a | Based on average shares outstanding at each month end. |

| b | Exclusive of sales charge. |

See notes to financial statements.

The Fund 19

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | | |

| | | | Year Ended August 31, | | | |

| Class I Shares | 2013 | | 2012 | | 2011 | | 2010 | | 2009 | |

| Per Share Data ($): | | | | | | | | | | |

| Net asset value, beginning of period | 9.74 | | 10.67 | | 10.36 | | 11.02 | | 12.31 | |

| Investment Operations: | | | | | | | | | | |

| Investment income—neta | .19 | | .23 | | .28 | | .22 | | .19 | |

| Net realized and unrealized | | | | | | | | | | |

| gain (loss) on investments | 1.84 | | (.81 | ) | .22 | | (.68 | ) | (.98 | ) |

| Total from Investment Operations | 2.03 | | (.58 | ) | .50 | | (.46 | ) | (.79 | ) |

| Distributions: | | | | | | | | | �� | |

| Dividends from investment income—net | (.26 | ) | (.35 | ) | (.19 | ) | (.20 | ) | (.50 | ) |

| Net asset value, end of period | 11.51 | | 9.74 | | 10.67 | | 10.36 | | 11.02 | |

| Total Return (%) | 21.27 | | (5.41 | ) | 4.67 | | (4.37 | ) | (5.21 | ) |

| Ratios/Supplemental Data (%): | | | | | | | | | | |

| Ratio of total expenses | | | | | | | | | | |

| to average net assets | 1.21 | | 1.19 | | 1.15 | | 1.22 | | 1.37 | |

| Ratio of net expenses | | | | | | | | | | |

| to average net assets | 1.11 | | 1.09 | | 1.09 | | 1.22 | | 1.36 | |

| Ratio of net investment income | | | | | | | | | | |

| to average net assets | 1.76 | | 2.29 | | 2.29 | | 1.93 | | 2.09 | |

| Portfolio Turnover Rate | 43.35 | | 40.93 | | 60.72 | | 55.35 | | 69.63 | |

| Net Assets, end of period ($ x 1,000) | 59,161 | | 62,965 | | 91,998 | | 97,429 | | 41,460 | |

| |

| a Based on average shares outstanding at each month end. | | | | | | | | | |

| See notes to financial statements. | | | | | | | | | | |

20

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus International Value Fund (the “fund”) is a separate diversified series of Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering twelve series, including the fund. The fund’s investment objective is to seek long-term capital growth. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Manager, is the distributor of the fund’s shares. The fund is authorized to issue 500 million shares of $.001 par value Common Stock. The fund currently offers three classes of shares: Class A (200 million shares authorized), Class C (100 million shares authorized) and Class I (200 million shares authorized). Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share only to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The sales charge may be reduced or waived for certain purchases of Class A shares. Effective April 1, 2013, pursuant to new/modified front-end sales charge waivers, Class A shares of the fund may be purchased at net asset value without payment of a sales charge by (a) investors who participate in a self-directed investment brokerage account program offered by financial intermediaries that have entered into an agreement

The Fund 21

NOTES TO FINANCIAL STATEMENTS (continued)

with the fund’s Distributor (financial intermediaries offering self-directed investment brokerage accounts may or may not charge their customers a transaction fee) and (b) investors who purchase Class A shares directly through the fund’s Distributor, and either (i) have, or whose spouse or minor children have, beneficially owned shares and continuously maintained an open account with the Distributor in a Dreyfus-managed fund since on or before February 28, 2006, or (ii) such purchase is for a self-directed investment account that may or may not be subject to a transaction fee.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications.The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

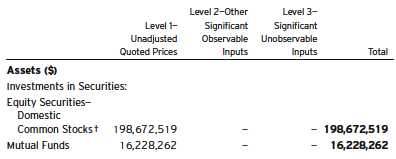

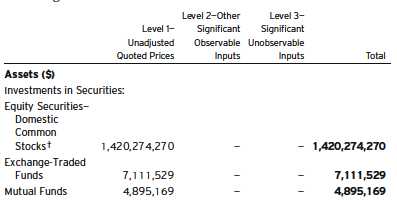

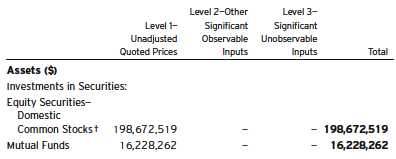

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to

22

measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

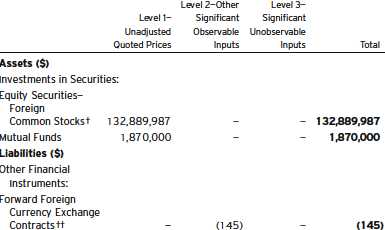

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales

The Fund 23

NOTES TO FINANCIAL STATEMENTS (continued)

price. Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices, except for open short positions, where the asked price is used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are categorized within Level 1 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and financial futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Directors (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

24

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

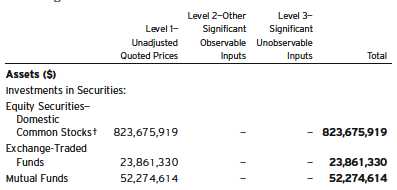

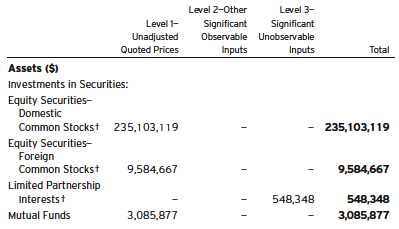

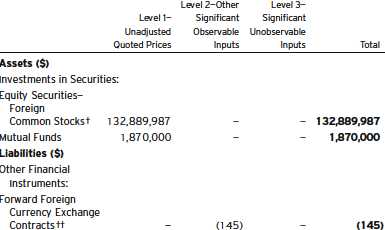

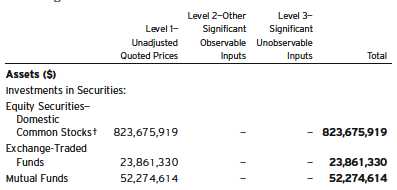

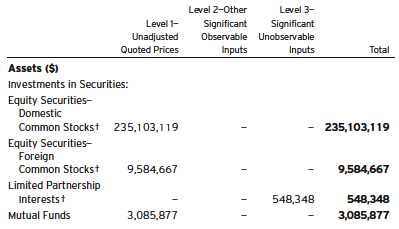

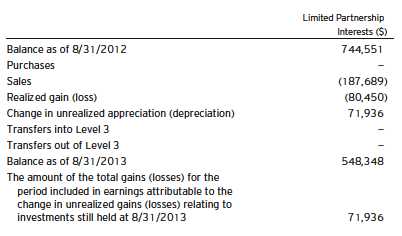

The following is a summary of the inputs used as of August 31, 2013 in valuing the fund's investments:

| |

| † | See Statement of Investments for additional detailed categorizations. |

| †† | Amount shown represents unrealized (depreciation) at period end. |

At August 31, 2013, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

The Fund 25

NOTES TO FINANCIAL STATEMENTS (continued)

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

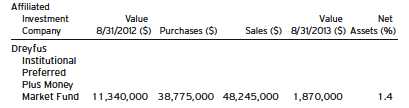

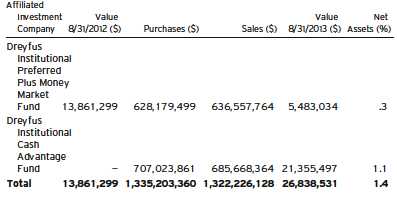

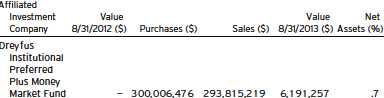

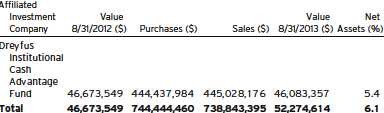

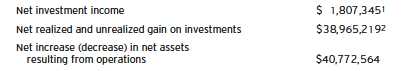

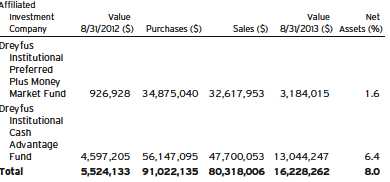

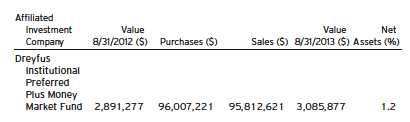

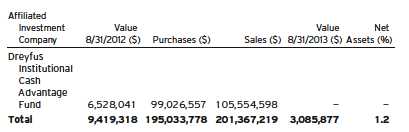

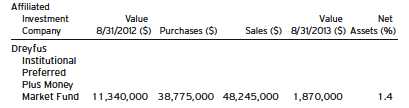

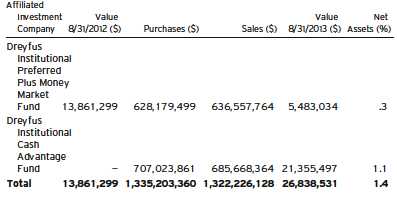

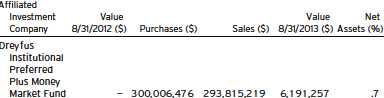

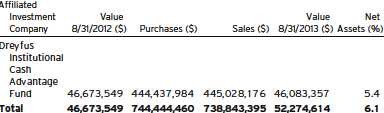

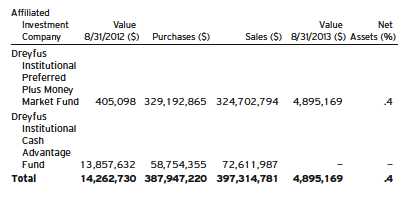

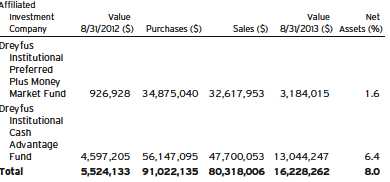

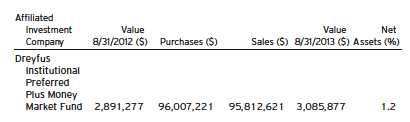

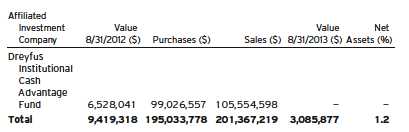

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended August 31, 2013 were as follows:

(e) Risk: Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S.These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less

26

liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(f) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended August 31, 2013, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended August 31, 2013 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At August 31, 2013, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $2,259,459, accumulated capital losses $90,459,306 and unrealized depreciation $22,635,305.

The Fund 27

NOTES TO FINANCIAL STATEMENTS (continued)

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Furthermore, post-enactment capital loss carryovers retain their character as either short-term or long-term capital losses rather than short-term as they were under previous statute. The 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act (“pre-enactment losses”).As a result of this ordering rule, pre-enactment losses may be more likely to expire unused.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to August 31, 2013. If not applied, $24,770,979 of the carryover expires in fiscal year 2017 and $41,505,181 expires in fiscal year 2018.The fund has $24,183,146 of post-enactment long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended August 31, 2013 and August 31, 2012 were as follows: ordinary income $3,482,535 and $5,934,208, respectively.

During the period ended August 31, 2013, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign exchange gains and losses and passive foreign investment companies, the fund increased accumulated undistributed investment income-net by $48,088 and decreased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

(h) Accounting Pronouncement: In January 2013, FASB issued Accounting Standards Update No. 2013-01 (“ASU 2013-01”), “Clarifying the Scope of Disclosures about Offsetting Assets and Liabilities”, which replaced Accounting Standards Update No. 2011-11 (“ASU 2011-11”), “Disclosures about Offsetting Assets and Liabilities”.

28

ASU 2013-01 is effective for fiscal years beginning on or after January 1, 2013, and interim periods within those annual periods. ASU 2011-11 was intended to enhance disclosure requirements on the offsetting of financial assets and liabilities.ASU 2013-01 limits the scope of the new balance sheet offsetting disclosures to derivatives, repurchase agreements, and securities lending transactions to the extent that they are (1) offset in the financial statements or (2) subject to enforceable master netting arrangements (“MNA”) or similar agreements. Management is currently evaluating the application of ASU 2013-01 and its impact on the fund’s financial statements.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $210 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 10, 2012, the unsecured credit facility with Citibank, N.A. was $225 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended August 31, 2013 was approximately $463,600 with a related weighted average annualized interest rate of 1.14%.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of 1% of the value of the fund’s average daily net assets and is payable monthly.The Manager has agreed to waive receipt of a portion of the fund’s management fee, in

The Fund 29

NOTES TO FINANCIAL STATEMENTS (continued)

the amount of .10% of the value of the fund’s average daily net assets from September 1, 2012 through March 31, 2014. The reduction in expenses, pursuant to the undertaking, amounted to $151,575 during the period ended August 31, 2013.

During the period ended August 31, 2013, the Distributor retained $1,399 from commissions earned on sales of the fund’s Class A shares and $295 from CDSCs on redemptions of the fund’s Class C shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended August 31, 2013, Class C shares were charged $60,716 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services.The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts.The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended August 31, 2013, Class A and Class C shares were charged $207,798 and $20,239, respectively, pursuant to the Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates DreyfusTransfer, Inc., a wholly-owned subsidiary of the Manager, under a transfer agency agreement for providing transfer agency services for the fund and cash management services related to fund subscriptions and redemptions. During the period ended August

30

31, 2013, the fund was charged $25,053 for transfer agency services and $1,052 for cash management services. These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $133.

The fund compensatesThe Bank of NewYork Mellon under a custody agreement for providing custodial services for the fund. During the period ended August 31, 2013, the fund was charged $93,842 pursuant to the custody agreement.

The fund compensates The Bank of New York Mellon under a cash management agreement for performing certain cash management services related to fund subscriptions and redemptions. During the period ended August 31, 2013, the fund was charged $588 pursuant to the cash management agreement, which is included in Shareholder servicing costs in the Statement of Operations.These fees were partially offset by earnings credits of $4.

During the period ended August 31, 2013, the fund was charged $8,973 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $118,478, Distribution Plan fees $5,051, Shareholder Services Plan fees $16,753, custodian fees $34,744, Chief Compliance Officer fees $6,172 and transfer agency fees $7,856, which are offset against an expense reimbursement currently in effect in the amount of $11,669.

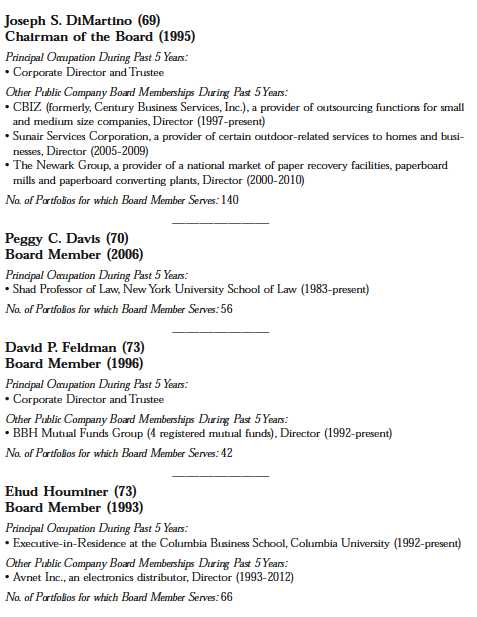

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended August 31, 2013 amounted to $63,832,856 and $116,874,003, respectively.

The Fund 31

NOTES TO FINANCIAL STATEMENTS (continued)

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. Each type of derivative instrument that was held by the fund during the period ended August 31, 2013 is discussed below.

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract decreases between those dates.With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed.The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments.The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is typically limited to the unrealized gain on each open contract.The following summarizes open forward contracts at August 31, 2013:

| | | | | |

| | Foreign | | | | |

| Forward Foreign Currency | Currency | | | Unrealized | |

| Exchange Contracts | Amounts | Cost ($) | Value ($) | (Depreciation) ($) | |

| Purchases: | | | | | |

| Australian Dollar, | | | | | |

| Expiring 9/3/2013a | 69,928 | 62,385 | 62,240 | (145 | ) |

| |

| Counterparty: | | | | | |

| a Barclays Bank | | | | | |

32

The following summarizes the average market value of derivatives outstanding during the period ended August 31, 2013:

At August 31, 2013, the cost of investments for federal income tax purposes was $157,394,374; accordingly, accumulated net unrealized depreciation on investments was $22,634,387, consisting of $7,359,629 gross unrealized appreciation and $29,994,016 gross unrealized depreciation.

The Fund 33

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Directors

Dreyfus International Value Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus International Value Fund (one of the series comprising Advantage Funds, Inc.) as of August 31, 2013, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States).Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement.We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion.An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2013 by correspondence with the custodian and others.We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus International Value Fund at August 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

October 28, 2013

34

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund elects to provide each shareholder with their portion of the fund’s foreign taxes paid and the income sourced from foreign countries.Accordingly, the fund hereby reports the following information regarding its fiscal year ended August 31, 2013:

—the total amount of taxes paid to foreign countries was $269,633

—the total amount of income sourced from foreign countries was $4,790,337.

Where required by federal tax law rules, shareholders will receive notification of their proportionate share of foreign taxes paid and foreign sourced income for the 2013 calendar year with Form 1099-DIV which will be mailed in early 2014.Also certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $3,482,535 represents the maximum amount that may be considered qualified dividend income.

The Fund 35

INFORMATION ABOUT THE RENEWAL OF THE

FUND’S MANAGEMENT AGREEMENT (Unaudited)

At a meeting of the fund’s Board of Directors held on March 4-5, 2013, the Board considered the renewal of the fund’s Management Agreement pursuant to which Dreyfus provides the fund with investment advisory and administrative services (the “Agreement”). The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from Dreyfus representatives. In considering the renewal of the Agreement, the Board considered all factors that it believed to be relevant, including those discussed below.The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund. The Board considered information provided to them at the meeting and in previous presentations from Dreyfus representatives regarding the nature, extent, and quality of the services provided to funds in the Dreyfus fund complex. Dreyfus provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. Dreyfus also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the Dreyfus fund complex (such as retail direct or intermediary, in which intermediaries typically are paid by the fund and/or Dreyfus) and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements.The Board also considered Dreyfus’

36

extensive administrative, accounting, and compliance infrastructures. The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board reviewed reports prepared by Lipper, Inc. (“Lipper”), an independent provider of investment company data, which included information comparing (1) the fund’s performance with the performance of a group of comparable funds (the “Performance Group”) and with a broader group of funds (the “Performance Universe”), all for various periods ended December 31, 2012, and (2) the fund’s actual and contractual management fees and total expenses with those of a group of comparable funds (the “Expense Group”) and with a broader group of funds (the “Expense Universe”), the information for which was derived in part from fund financial statements available to Lipper as of the date of its analysis. Dreyfus previously had furnished the Board with a description of the methodology Lipper used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Dreyfus representatives stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations that may be applicable to the fund and comparison funds.The Board discussed the results of the comparisons and noted that the fund’s total return performance was below the Performance Group and Performance Universe medians in all periods and ranked in the fourth quartile of the Performance Group and Performance Universe in most of the periods. Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index. Dreyfus representatives discussed with the Board the reasons for the fund’s underperformance and the addi-

The Fund 37

INFORMATION ABOUT THE RENEWAL OF THE FUND’S

MANAGEMENT AGREEMENT (Unaudited) (continued)

tional steps taken to improve performance, including appointing one of the fund’s portfolio managers as lead portfolio manager in early 2013.The Board stated its expectations for improvements in the fund’s performance results in the future.

The Board also reviewed the range of actual and contractual management fees and total expenses of the Expense Group and Expense Universe funds and discussed the results of the comparisons.The Board noted that the fund’s contractual management fee was above the Expense Group median and the fund’s actual management fee and the fund’s total expense ratio were above the Expense Group and Expense Universe medians.

Dreyfus representatives noted that Dreyfus has contractually agreed to waive receipt of a portion of the fund’s management fee in the amount of .10% of the value of the fund’s average daily net assets until March 31, 2014.

Dreyfus representatives reviewed with the Board the management or investment advisory fees (1) paid by funds advised or administered by Dreyfus that are in the same Lipper category as the fund and (2) paid to Dreyfus or the Dreyfus-affiliated primary employer of the fund’s primary portfolio manager(s) for advising any separate accounts and/or other types of client portfolios that are considered to have similar investment strategies and policies as the fund (the “Similar Clients”), and explained the nature of the Similar Clients.They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors. The Board considered the relevance of the fee information provided for the Similar Clients to evaluate the appropriateness and reasonableness of the fund’s management fee.

Analysis of Profitability and Economies of Scale. Dreyfus representatives reviewed the expenses allocated and profit received by Dreyfus and the resulting profitability percentage for managing the fund and the aggre-

38

gate profitability percentage to Dreyfus of managing the funds in the Dreyfus fund complex, and the method used to determine the expenses and profit.The Board concluded that the profitability results were not unreasonable, given the services rendered and service levels provided by Dreyfus.The Board also noted the fee waiver arrangement and its effect on Dreyfus’ profitability.The Board also had been provided with information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex.The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board’s counsel stated that the Board should consider the profitability analysis (1) as part of the evaluation of whether the fees under the Agreement bear a reasonable relationship to the mix of services provided by Dreyfus, including the nature, extent and quality of such services, and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Dreyfus representatives noted that a discussion of economies of scale is predicated on a fund having achieved a substantial size with increasing assets and that, if a fund’s assets had been stable or decreasing, the possibility that Dreyfus may have realized any economies of scale would be less. Dreyfus representatives also noted that, as a result of shared and allocated costs among funds in the Dreyfus fund complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from, changes in the fund’s asset level. The Board also considered potential benefits to Dreyfus from acting as investment adviser and noted the soft dollar arrangements in effect for trading the fund’s investments.

The Fund 39

INFORMATION ABOUT THE RENEWAL OF THE FUND’S

MANAGEMENT AGREEMENT (Unaudited) (continued)

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreement. Based on the discussions and considerations as described above, the Board concluded and determined as follows.

The Board concluded that the nature, extent and quality of the services provided by Dreyfus are adequate and appropriate.

The Board agreed to closely monitor performance and determined to approve renewal of the Agreement only through September 30, 2013.

The Board concluded that the fee paid to Dreyfus was reasonable in light of the considerations described above.

The Board determined that the economies of scale which may accrue to Dreyfus and its affiliates in connection with the management of the fund had been adequately considered by Dreyfus in connection with the fee rate charged to the fund pursuant to the Agreement and that, to the extent in the future it were determined that material economies of scale had not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

In evaluating the Agreement, the Board considered these conclusions and determinations and also relied on its previous knowledge, gained through meetings and other interactions with Dreyfus and its affiliates, of the fund and the services provided to the fund by Dreyfus. The Board also relied on information received on a routine and regular basis throughout the year relating to the operations of the fund and the investment management and other services provided under the Agreement, including information on the investment performance of the fund in comparison to similar mutual funds and benchmark performance indices; general market outlook as applicable to the fund;

40

and compliance reports. In addition, it should be noted that the Board’s consideration of the contractual fee arrangements for this fund had the benefit of a number of years of reviews of prior or similar agreements during which lengthy discussions took place between the Board and Dreyfus representatives. Certain aspects of the arrangements may receive greater scrutiny in some years than in others, and the Board’s conclusions may be based, in part, on their consideration of the same or similar arrangements in prior years.The Board determined that renewal of the Agreement through September 30, 2013 was in the best interests of the fund and its shareholders.

The Fund 41

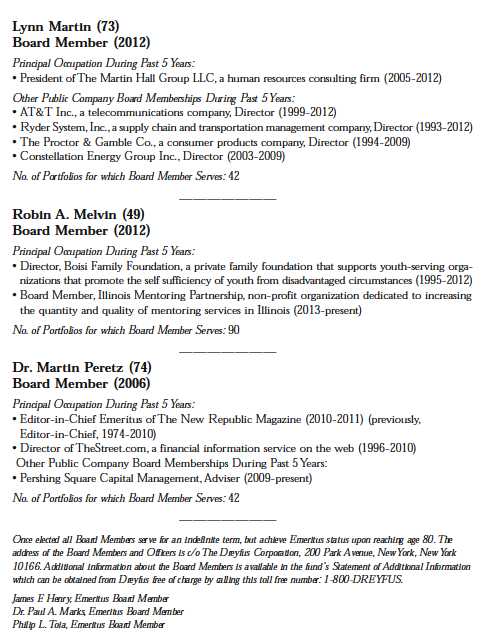

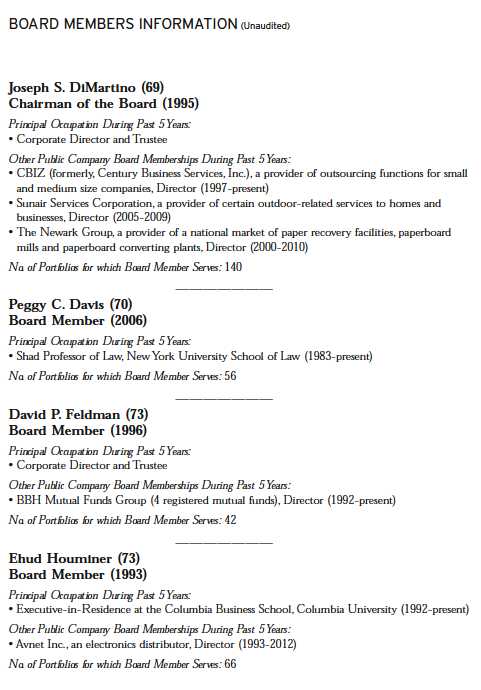

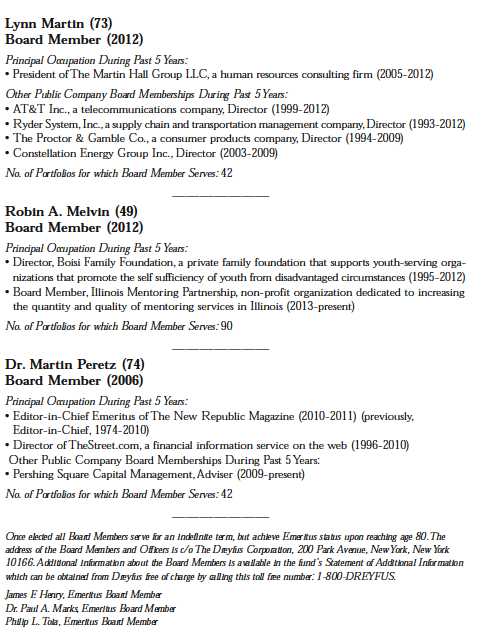

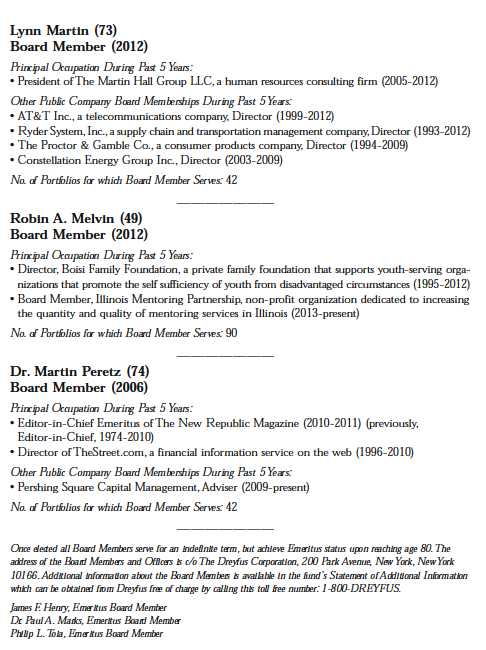

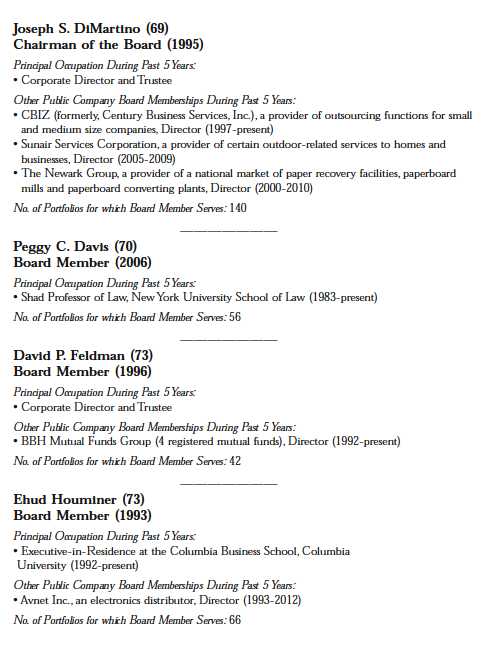

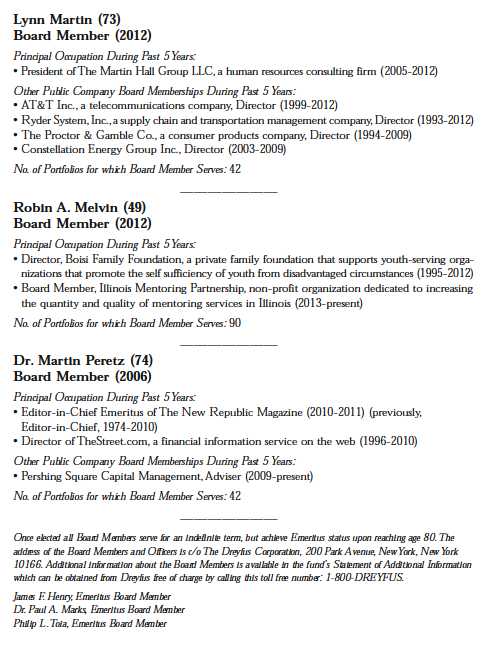

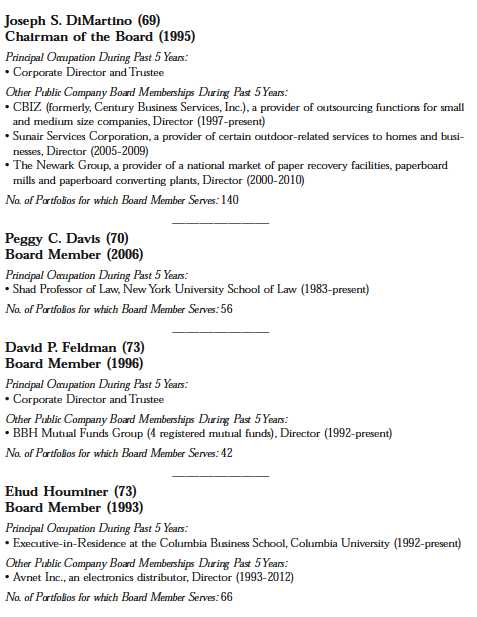

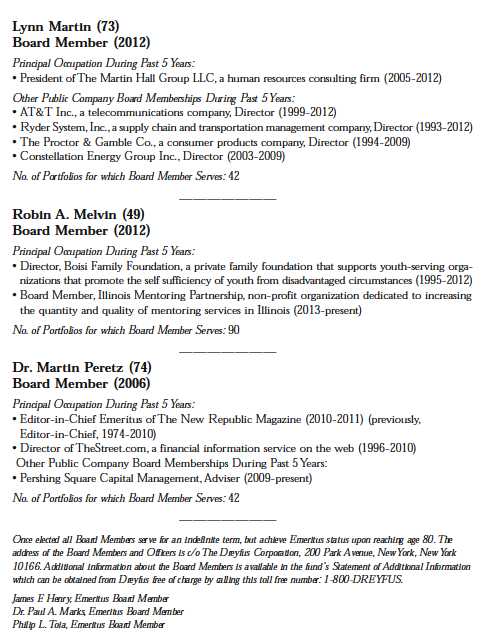

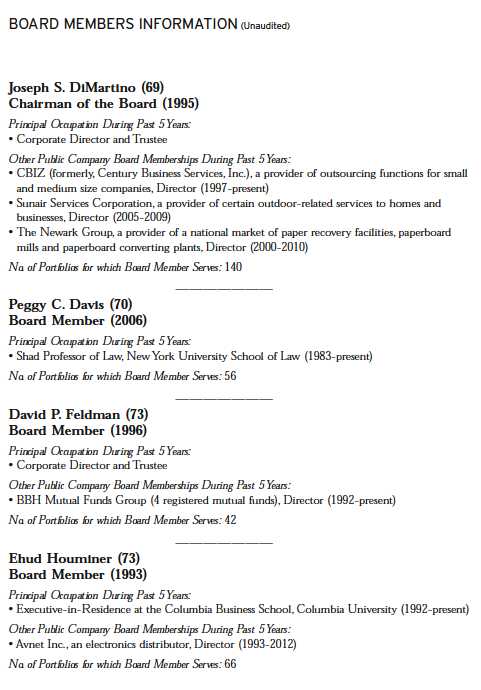

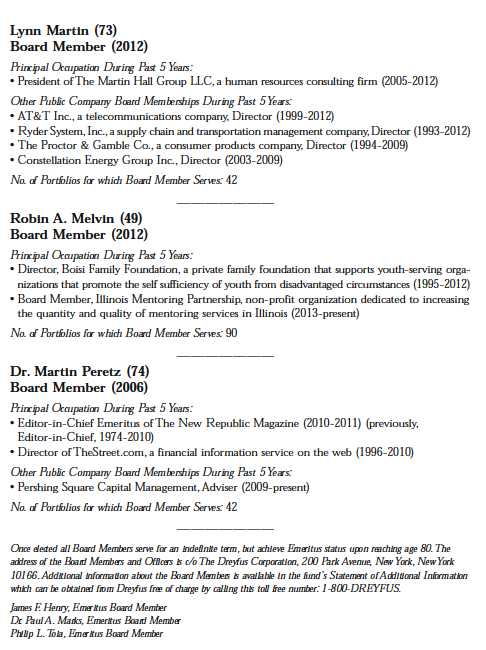

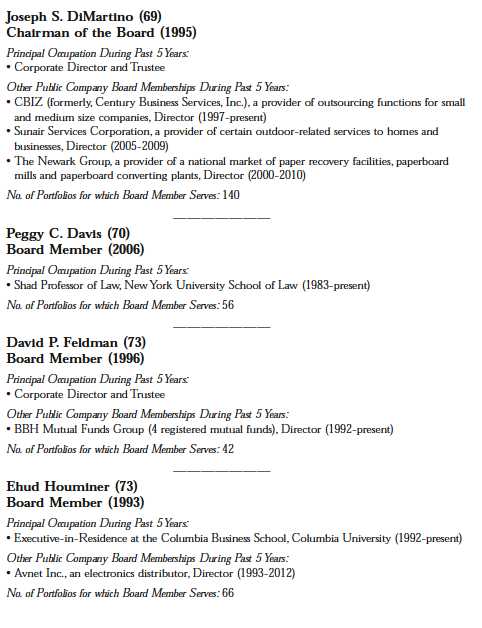

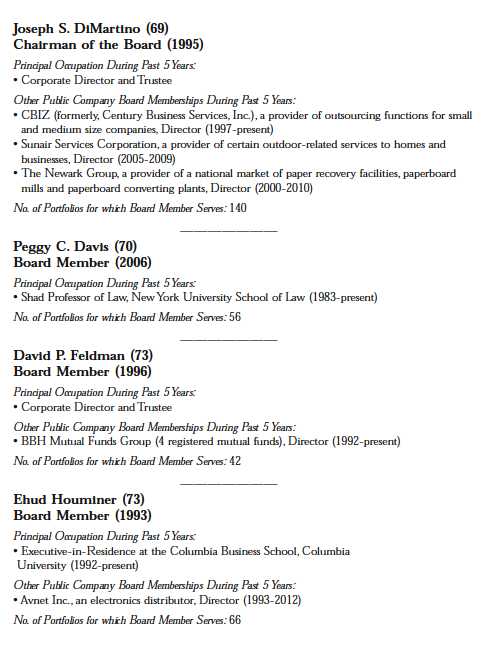

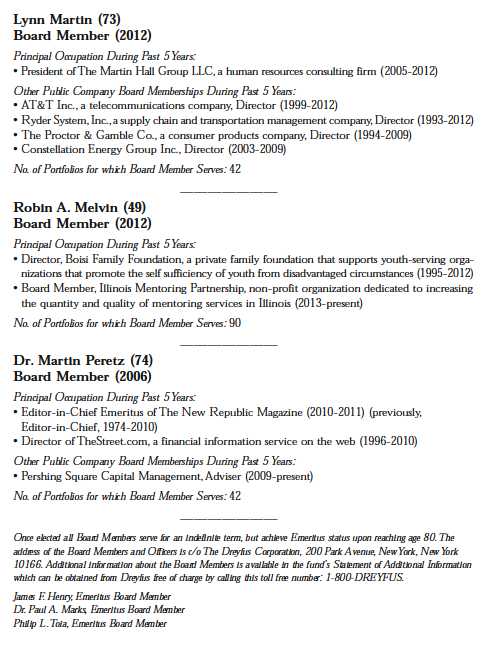

BOARD MEMBERS INFORMATION (Unaudited)

42

The Fund 43

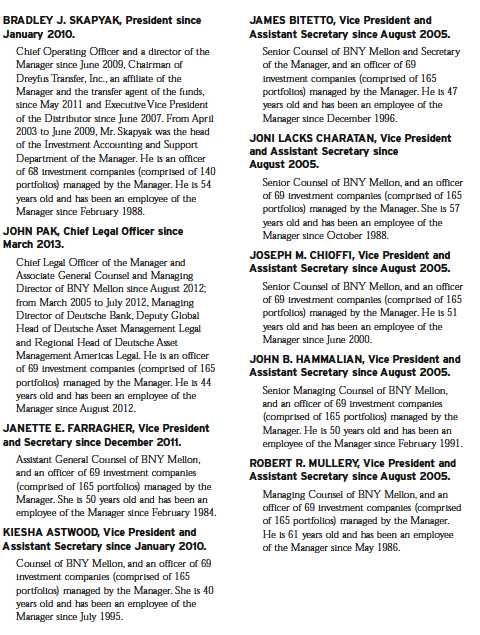

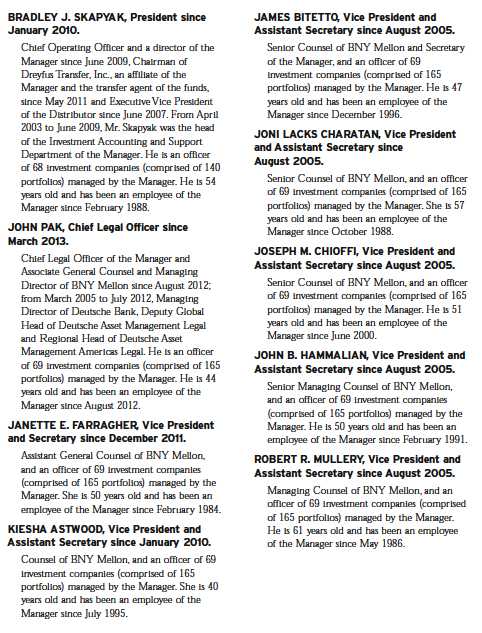

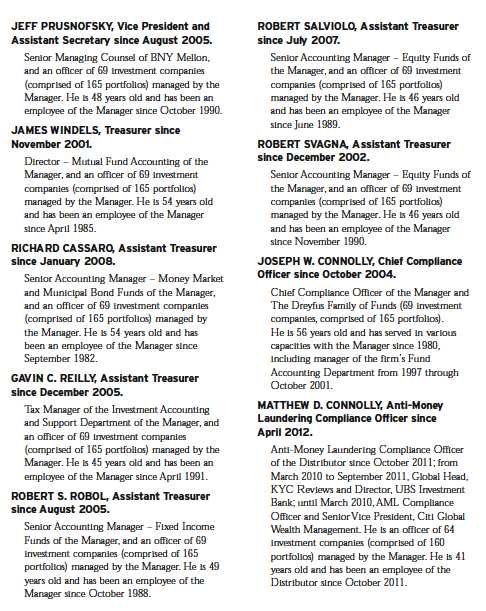

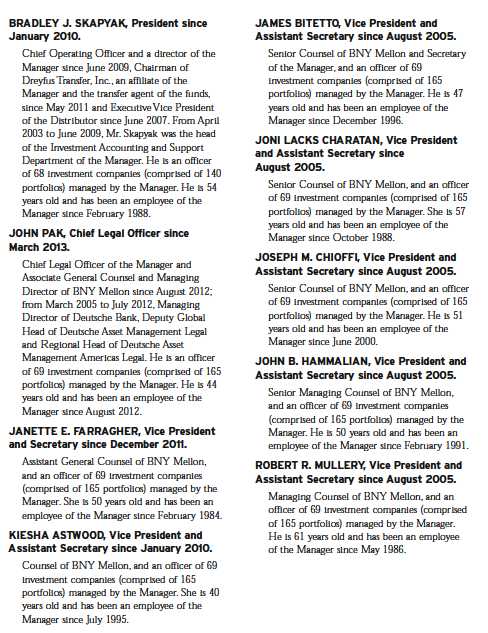

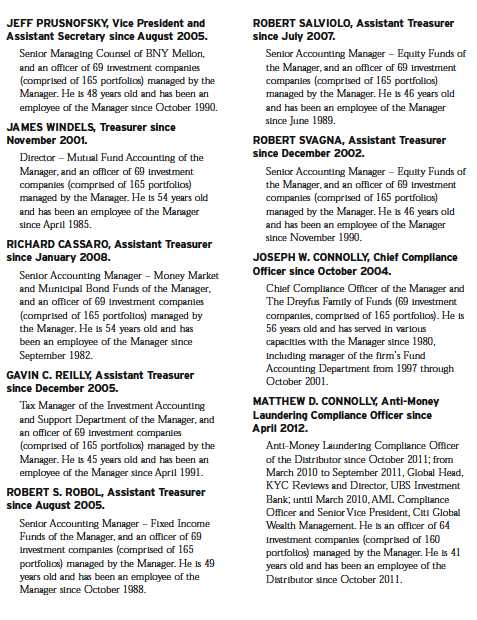

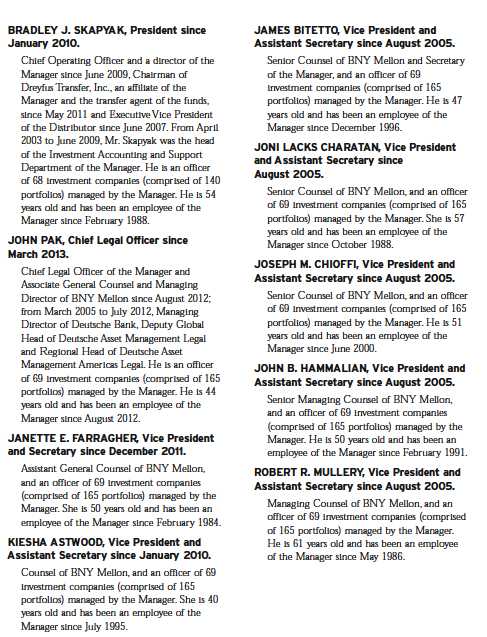

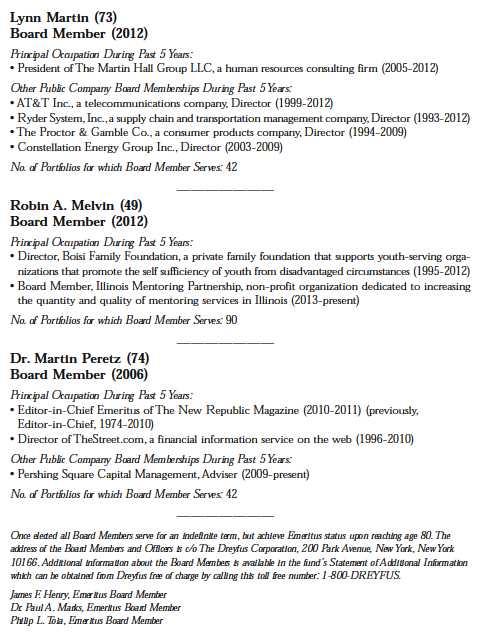

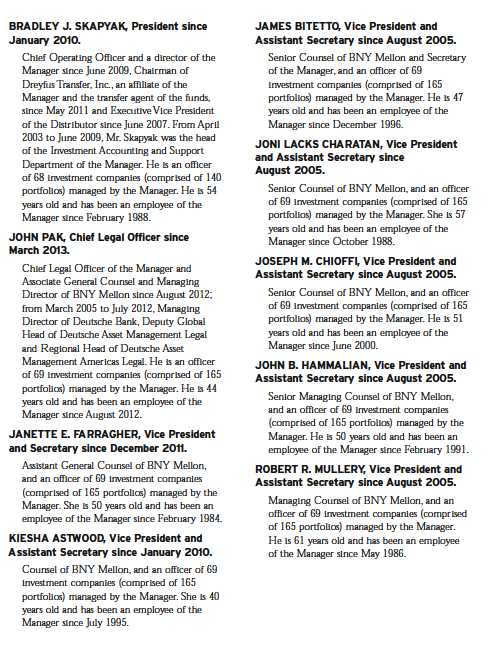

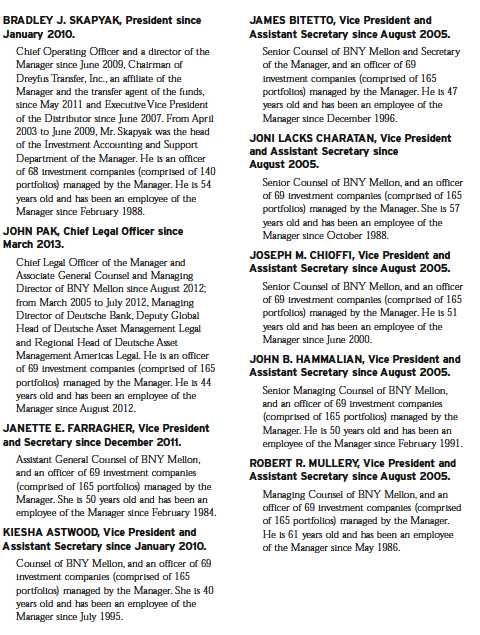

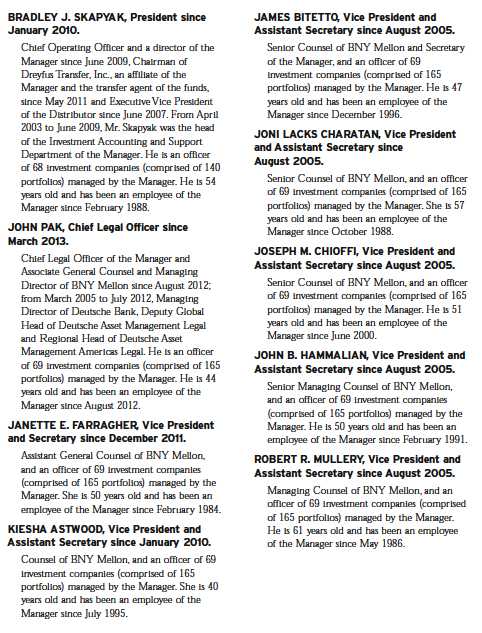

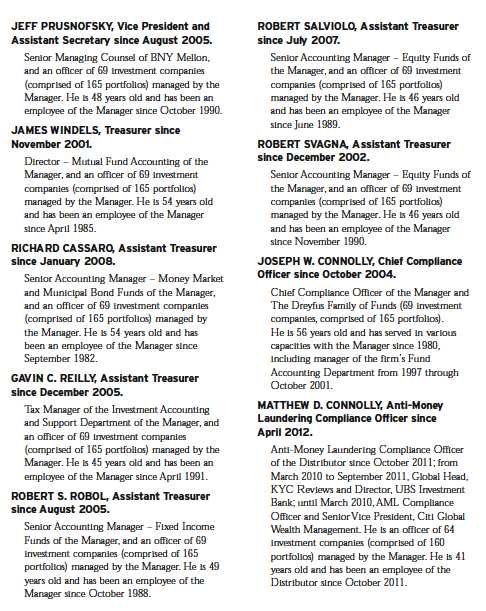

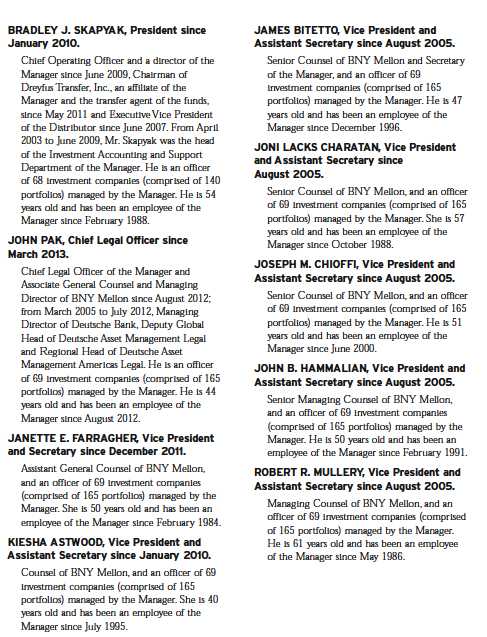

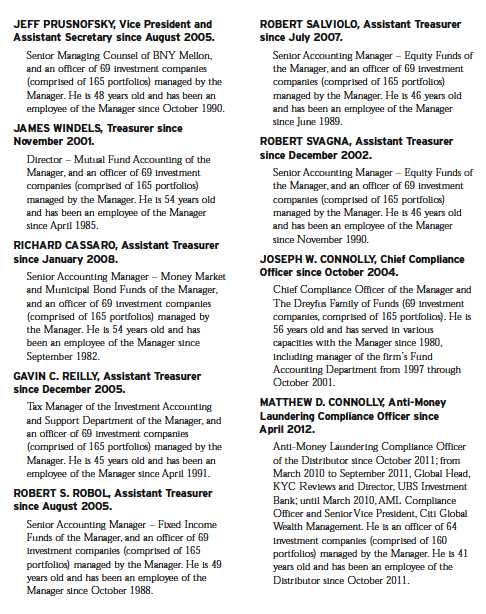

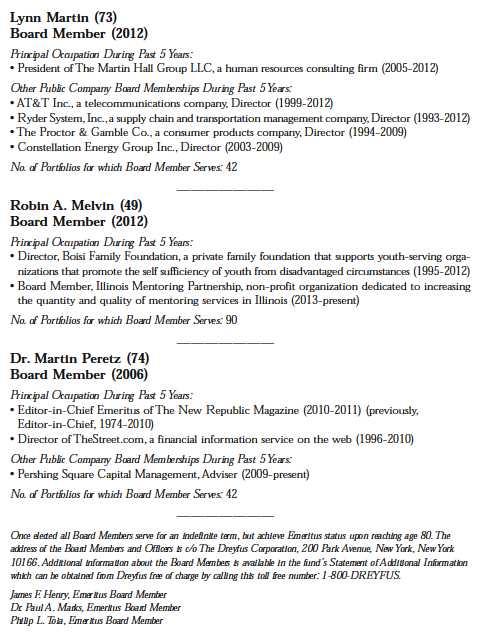

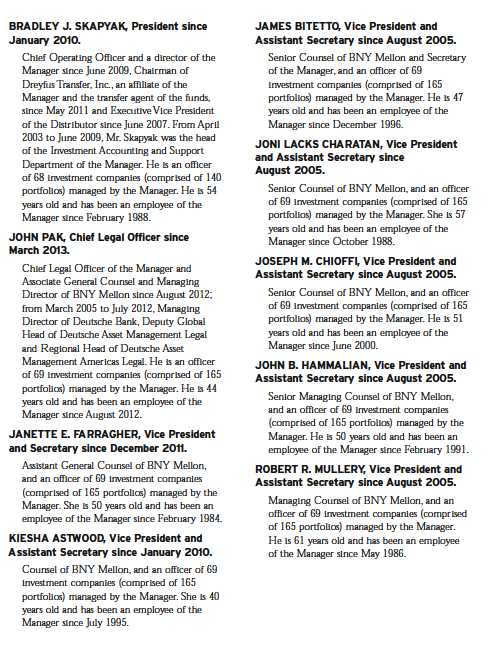

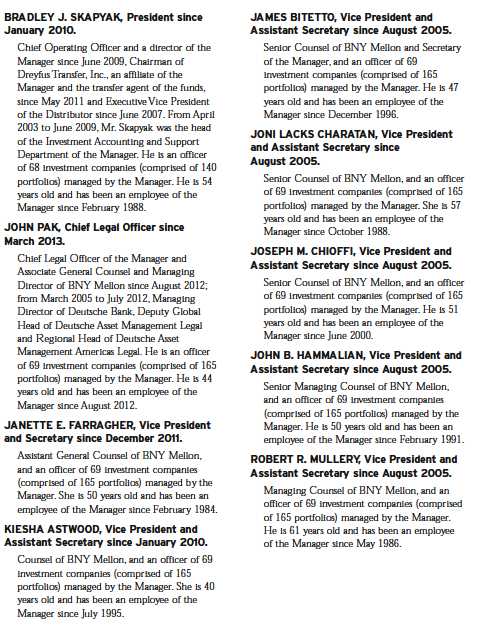

OFFICERS OF THE FUND (Unaudited)

44

The Fund 45

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes.

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views.These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund.

| | Contents |

| | THE FUND |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Fund Performance |

| 8 | Understanding Your Fund’s Expenses |

| 8 | Comparing Your Fund’s Expenses With Those of Other Funds |

| 9 | Statement of Investments |

| 13 | Statement of Assets and Liabilities |

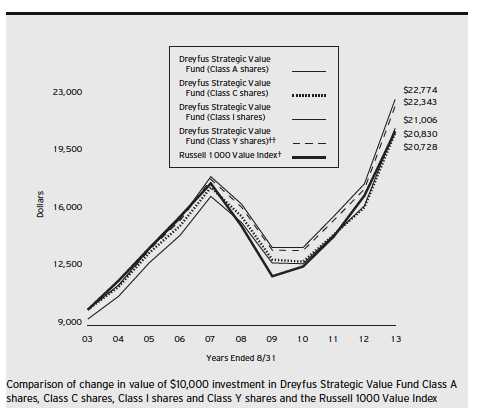

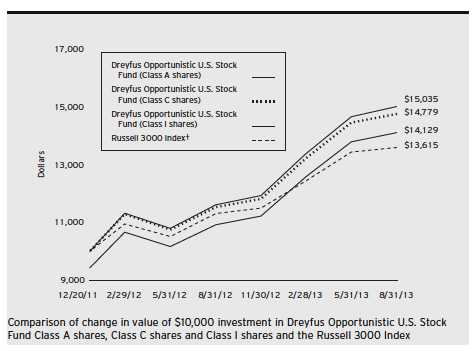

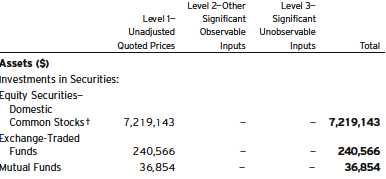

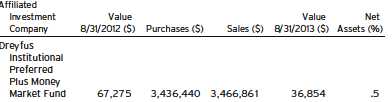

| 14 | Statement of Operations |