UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-07123 |

| |

| Advantage Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 8/31 | |

Date of reporting period: | 8/31/2015 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus International Value Fund

| | | |

| | ANNUAL REPORT

August 31, 2015 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus International Value Fund

| | The Fund |

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this annual report for Dreyfus International Value Fund, covering the 12-month period from September 1, 2014, through August 31, 2015. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Financial markets proved volatile over the reporting period. For much of the year, a recovering U.S. economy enabled stocks to advance, but those gains were more than erased in August when economic concerns in China, falling commodity prices and a stronger U.S. dollar sparked sharp corrections in equity markets throughout the world. The emerging markets were especially hard hit in this environment. U.S. bonds generally fared better, rallying in late 2014 due to robust investor demand before reversing course in the spring as the domestic economy strengthened. Global economic instability in August hurt corporate-backed and inflation-linked bonds, but U.S. government securities held up relatively well.

We expect market uncertainty and volatility to persist over the near term as investors vacillate between hopes that current market turmoil represents a healthy correction and fears that further disappointments could trigger a full-blown bear market. Our investment strategists and portfolio managers are monitoring developments carefully, keeping a close watch on Chinese fiscal and monetary policy, liquidity factors affecting various asset classes, and other developments that could influence investor sentiment. Over the longer term, we remain confident that financial markets are likely to stabilize as the world adjusts to slower Chinese economic growth, abundant energy resources, and the anticipated eventual normalization of monetary policy. In our view, investors will continue to be well served under these circumstances by a long-term perspective and a disciplined investment approach.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

September 15, 2015

2

DISCUSSION OF FUND PERFORMANCE

For the period of September 1, 2014, through August 31, 2015, as provided by D. Kirk Henry, Portfolio Manager

Fund and Market Performance Overview

For the 12-month period ended August 31, 2015, Dreyfus International Value Fund’s Class A shares produced a total return of -9.68%, Class C shares returned -10.31%, and Class I shares returned -9.52%.1 In comparison, the fund’s benchmark, the Morgan Stanley Capital International Europe, Australasia, Far East Index (“MSCI EAFE Index”), produced a total return of -7.47% for the same period.2

Developed equity markets lost ground during the reporting period amid heightened volatility stemming from various global economic developments. The fund produced lower returns than its benchmark, primarily due to stock selection shortfalls in the United Kingdom, France, and Germany.

The Fund’s Investment Approach

The fund seeks long-term capital growth. The fund ordinarily invests most of its assets in securities of foreign companies which Dreyfus considers to be value companies.

The fund’s investment approach is value-oriented and research driven. In selecting stocks, we attempt to identify potential investments through extensive quantitative and fundamental research. Emphasizing individual stock selection over economic or industry trends, the fund focuses on three key factors: value, or how a stock is valued relative to its intrinsic worth based on traditional value measures; business health, or overall efficiency and profitability as measured by return on assets and return on equity; and business momentum, or the presence of a catalyst (such as corporate restructuring, change in management, or spin-off) that will trigger a price increase near term to midterm.

The fund typically sells a stock when it is no longer considered a value company, appears less likely to benefit from the current market and economic environment, shows deteriorating fundamentals or declining momentum, or falls short of our expectations.

International Equities Declined Amid Volatility

International equity markets experienced a series of sharp turns during the reporting period, rising and falling in response to shifting economic trends. The MSCI EAFE Index dropped more than 10% between early September and mid-October 2014. Markets recovered much of that ground in November, then dropped again in December 2014 and early January 2015 amid a steep decline in oil prices. A subsequent recovery through the spring of 2015 was supported by interest rate cuts from several central banks and a short-term agreement with the European Union to extend Greece’s bailout.

At the beginning of June 2015, the MSCI EAFE Index stood at virtually the same level at which it began the reporting period. In late June and early July, share prices fell again after a plunge in the Chinese stock market sparked renewed concerns regarding slowing Chinese economic growth, an important driver of global economic activity. Those concerns were exacerbated when the Chinese central bank devalued the country’s currency in August,

3

DISCUSSION OF FUND PERFORMANCE (continued)

precipitating a further decline in international stocks and energy and commodity prices. Value-oriented stocks significantly underperformed their growth-oriented counterparts in this tumultuous environment.

Stock Selections Hampered Relative Performance

While the fund’s value-oriented tilt detracted from returns relative to the benchmark, disappointing U.K. holdings proved responsible for the greatest share of the fund’s relative underperformance. Banking institutions Standard Chartered and HSBC Holdings lost ground due to their emerging markets exposure, while grocery chain Tesco struggled with declining earnings and margins, and electronics retailer Home Retail Group was hurt by the slow pace of its expansion into Internet sales. In France, utilities Electricite de France and ENGIE (formerly GDF Suez) saw rising costs and increasing debt loads, while energy producer Total fell in sympathy with declining oil prices. A few German holdings also detracted mildly from relative returns, including specialty chemical company LANXESS and machine tool maker Aixtron.

On a more positive note, several holdings in other markets delivered relatively strong returns. In Italy, oil refiner Saras benefited from lower input costs, while aerospace manufacturer Finmeccanica saw shares rise in the wake of the company’s restructuring. In Japan, top performers included East Japan Railway, freight delivery company Nippon Express, Mitsubishi UFJ Financial Group and Nomura Real Estate Holdings. The fund’s performance compared to the benchmark further benefited from our decision to avoid investments in the materials-focused Australian market at a time of declining commodity prices.

Fundamental Outlook Remains Positive

In light of quantitative easing programs implemented by a growing number of central banks around the world and improving economic trends in some areas, many international markets appear poised for growth. If, as we believe likely, the recent market pullback proves temporary, lower equity prices offer attractive entry points. Therefore, the fund has emphasized investments in value-oriented stocks in markets with good recovery prospects. As of the end of the reporting period, we have increased the fund’s exposure to investments in Italy, Singapore, and Spain, and we have trimmed holdings in Germany, China, Brazil, and France.

September 15, 2015

Please note, the position in any security highlighted with italicized typeface was sold during the reporting period.

Equity funds are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

The fund’s performance will be influenced by political, social, and economic factors affecting investments in foreign companies. Special risks associated with investments in foreign companies include exposure to currency fluctuations, less liquidity, less developed or less efficient trading markets, lack of comprehensive company information, political instability, and differing auditing and legal standards. These risks are enhanced in emerging market countries. Please read the prospectus for further discussion of these risks.

1 Total return includes reinvestment of dividends and any capital gains paid, and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price, yield, and investment return fluctuate such that upon redemption fund shares may be worth more or less than their original cost. The fund’s returns reflect the absorption of certain fund expenses by The Dreyfus Corporation pursuant to an agreement in effect through January 1, 2016. Had these expenses not been absorbed, the fund’s returns would have been lower.

4

2 SOURCE: LIPPER INC. — Reflects reinvestment of net dividends and, where applicable, capital gain distributions. The Morgan Stanley Capital International Europe, Australasia, Far East (MSCI EAFE) Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries. The Index does not take into account fees and expenses to which the fund is subject. Investors cannot invest directly in any index.

5

FUND PERFORMANCE

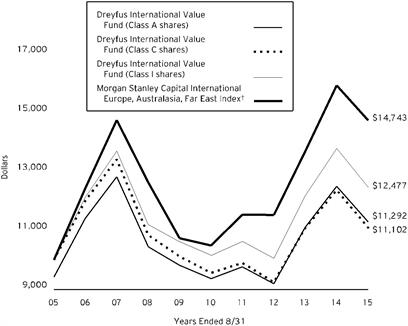

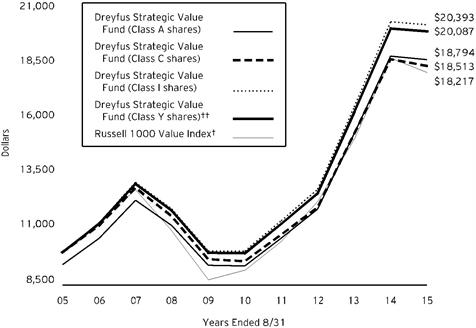

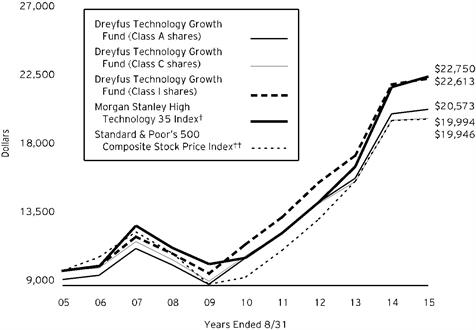

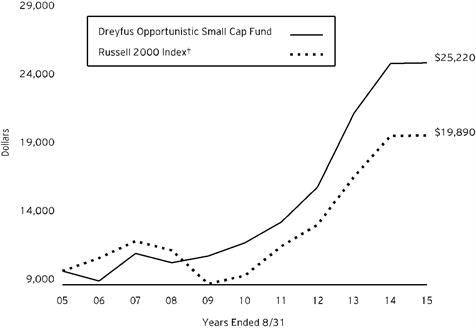

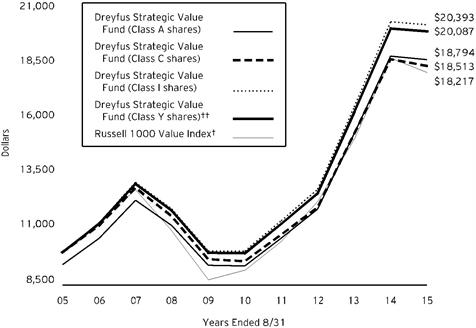

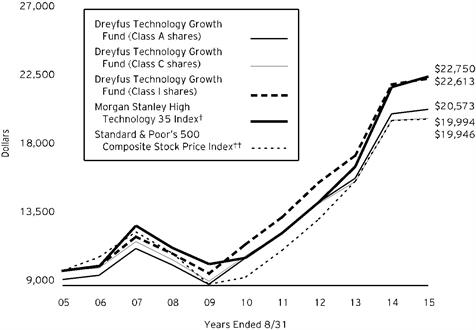

Comparison of change in value of $10,000 investment in Dreyfus International Value Fund Class A shares, Class C shares and Class I shares and the Morgan Stanley Capital International Europe, Australasia, Far East Index

† Source: Lipper Inc.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C and Class I shares of Dreyfus International Value Fund on 8/31/05 to a $10,000 investment made in the Morgan Stanley Capital International Europe, Australasia, Far East Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index is an unmanaged index composed of a sample of companies representative of the market structure of European and Pacific Basin countries. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

6

| | | | | |

Average Annual Total Returns as of 8/31/15 | | | |

| 1 Year | 5 Years | 10 Years |

Class A shares | | | |

with maximum sales charge (5.75%) | -14.87% | 2.59% | 1.22% |

without sales charge | -9.68% | 3.81% | 1.83% |

Class C shares | | | |

with applicable redemption charge † | -11.20% | 3.02% | 1.05% |

without redemption | -10.31% | 3.02% | 1.05% |

Class I shares | -9.52% | 4.19% | 2.24% |

Morgan Stanley Capital International Europe, Australasia, Far East Index | -7.47% | 7.05% | 3.96% |

Past performance is not predictive of future performance. The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

7

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus International Value Fund from March 1, 2015 to August 31, 2015. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended August 31, 2015 |

| | | | Class A | | Class C | | Class I | |

Expenses paid per $1,000† | | $ 8.68 | | $ 12.36 | | $ 6.43 | |

Ending value (after expenses) | | $ 933.80 | | $ 930.80 | | $ 934.00 | |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | | |

assuming a hypothetical 5% annualized return for the six months ended August 31, 2015 |

| | | | | Class A | | Class C | | Class I | |

Expenses paid per $1,000† | | | $ 9.05 | | $ 12.88 | | $ 6.72 | |

Ending value (after expenses) | | | $ 1,016.23 | | $ 1,012.40 | | $ 1,018.55 | |

† Expenses are equal to the fund’s annualized expense ratio of 1.78% for Class A, 2.54% for Class C and 1.32% for Class I, multiplied by the average account value over the period, multiplied by 184/365 ( to reflect the one-half year period).

8

STATEMENT OF INVESTMENTS

August 31, 2015

| | | | | | | | | |

Common Stocks - 97.9% | | Shares | | Value ($) | |

Australia - 2.5% | | | | | |

Australia & New Zealand Banking Group | | 21,127 | | 419,492 | |

Primary Health Care | | 107,622 | | 315,917 | |

QBE Insurance Group | | 47,697 | | 446,859 | |

| | | | | 1,182,268 | |

Austria - .7% | | | | | |

Erste Group Bank | | 11,246 | a | 333,490 | |

Brazil - .4% | | | | | |

Petroleo Brasileiro, ADR | | 29,858 | a | 174,968 | |

China - 1.6% | | | | | |

CNOOC | | 275,000 | | 345,191 | |

FIH Mobile | | 392,000 | | 173,801 | |

Guangzhou Automobile Group, Cl. H | | 328,000 | | 231,551 | |

| | | | | 750,543 | |

Denmark - .8% | | | | | |

Carlsberg, Cl. B | | 5,300 | | 398,778 | |

France - 8.4% | | | | | |

BNP Paribas | | 10,619 | | 665,679 | |

Casino Guichard Perrachon | | 5,317 | | 335,285 | |

Danone | | 6,355 | | 393,254 | |

Electricite de France | | 27,705 | | 598,773 | |

ENGIE | | 22,537 | | 403,328 | |

Publicis Groupe | | 2,391 | | 169,783 | |

Sanofi | | 8,079 | | 794,447 | |

Total | | 15,141 | | 688,840 | |

| | | | | 4,049,389 | |

Germany - 5.8% | | | | | |

Aixtron | | 41,764 | a | 267,371 | |

Deutsche Bank | | 27,730 | | 818,004 | |

E.ON | | 22,059 | | 250,047 | |

LANXESS | | 8,356 | | 424,766 | |

METRO | | 13,233 | | 386,543 | |

Talanx | | 12,475 | | 375,674 | |

Wacker Chemie | | 3,169 | | 273,546 | |

| | | | | 2,795,951 | |

Hong Kong - 4.7% | | | | | |

CITIC | | 190,000 | | 347,080 | |

COSCO Pacific | | 346,557 | b | 456,111 | |

Esprit Holdings | | 235,074 | | 195,939 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | | |

Common Stocks - 97.9% (continued) | | Shares | | Value ($) | |

Hong Kong - 4.7% (continued) | | | | | |

Lifestyle International Holdings | | 187,000 | | 288,928 | |

Pacific Basin Shipping | | 440,000 | | 137,911 | |

WH Group | | 641,000 | c | 335,415 | |

Yue Yuen Industrial Holdings | | 131,000 | | 467,179 | |

| | | | | 2,228,563 | |

India - 1.5% | | | | | |

Reliance Industries, GDR | | 15,382 | c | 397,767 | |

State Bank of India, GDR | | 9,139 | | 341,622 | |

| | | | | 739,389 | |

Ireland - .8% | | | | | |

CRH | | 12,190 | | 358,060 | |

Israel - 1.4% | | | | | |

Teva Pharmaceutical Industries, ADR | | 10,700 | | 689,187 | |

Italy - 5.6% | | | | | |

Assicurazioni Generali | | 38,313 | | 698,521 | |

Azimut Holding SpA | | 16,348 | | 358,490 | |

Finmeccanica | | 24,491 | a | 329,823 | |

Saras | | 157,429 | a | 397,885 | |

Telecom Italia | | 444,788 | a | 540,874 | |

UniCredit | | 57,550 | | 376,040 | |

| | | | | 2,701,633 | |

Japan - 21.0% | | | | | |

Aiful Corp | | 98,900 | a | 382,478 | |

Asahi Kasei | | 36,000 | | 286,671 | |

Credit Saison | | 23,700 | | 474,540 | |

Denso | | 8,300 | | 370,204 | |

East Japan Railway | | 5,900 | | 543,522 | |

Ebara | | 107,000 | | 426,179 | |

Fujitsu | | 116,000 | | 573,699 | |

Honda Motor | | 32,300 | | 1,016,233 | |

INPEX | | 33,400 | | 341,171 | |

LIXIL Group | | 29,800 | | 613,758 | |

Mitsubishi UFJ Financial Group | | 99,100 | | 651,462 | |

Nippon Shokubai | | 37,000 | | 568,706 | |

Nippon Telegraph & Telephone | | 15,800 | | 603,472 | |

Nomura Real Estate Holdings | | 26,800 | | 501,364 | |

Ricoh | | 39,700 | | 387,437 | |

Shimamura | | 3,900 | | 359,766 | |

Sumitomo Electric Industries | | 25,600 | | 350,673 | |

10

| | | | | | | | | | | |

Common Stocks - 97.9% (continued) | | Shares | | Value ($) | |

Japan - 21.0% (continued) | | | | | |

Sumitomo Mitsui Financial Group | | 22,600 | | 921,677 | |

Sumitomo Mitsui Trust Holdings | | 66,560 | | 274,131 | |

Yamada Denki | | 108,100 | | 415,496 | |

| | | | | 10,062,639 | |

Netherlands - 5.1% | | | | | |

Aegon | | 54,100 | | 332,196 | |

ING Groep | | 39,371 | | 598,998 | |

Koninklijke Philips | | 44,625 | | 1,145,163 | |

Randstad Holding | | 5,751 | | 362,613 | |

| | | | | 2,438,970 | |

Russia - .3% | | | | | |

Gazprom, ADR | | 33,030 | | 145,662 | |

Singapore - 1.7% | | | | | |

United Overseas Bank | | 40,300 | | 549,481 | |

Wilmar International | | 133,300 | | 269,296 | |

| | | | | 818,777 | |

South Korea - 2.8% | | | | | |

Hyundai Mobis | | 1,622 | | 282,259 | |

KB Financial Group, ADR | | 19,429 | | 581,121 | |

Korea Electric Power | | 5,101 | | 206,125 | |

Samsung Electronics | | 303 | | 278,789 | |

| | | | | 1,348,294 | |

Spain - 2.0% | | | | | |

Banco Popular Espanol | | 71,004 | | 304,057 | |

Banco Santander | | 47,538 | | 289,229 | |

Ebro Foods | | 18,991 | | 382,477 | |

| | | | | 975,763 | |

Sweden - 2.0% | | | | | |

Ericsson, Cl. B | | 51,692 | | 503,525 | |

Getinge, Cl. B | | 21,033 | | 465,634 | |

| | | | | 969,159 | |

Switzerland - 7.4% | | | | | |

ABB | | 30,054 | a | 579,371 | |

Aryzta | | 6,827 | a | 349,619 | |

Credit Suisse Group | | 35,241 | a | 946,584 | |

LafargeHolcim | | 9,315 | a | 589,964 | |

Roche Holding | | 3,899 | | 1,057,711 | |

| | | | | 3,523,249 | |

United Kingdom - 21.4% | | | | | |

Anglo American | | 17,961 | | 201,561 | |

11

STATEMENT OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Common Stocks - 97.9% (continued) | | Shares | | Value ($) | |

United Kingdom - 21.4% (continued) | | | | | |

ArcelorMittal | | 36,297 | | 281,021 | |

AstraZeneca | | 8,194 | | 512,031 | |

Aviva | | 54,335 | | 399,450 | |

Barclays | | 109,012 | | 435,627 | |

BHP Billiton | | 18,701 | | 321,052 | |

BP | | 155,451 | | 852,455 | |

esure Group | | 133,500 | | 501,225 | |

GlaxoSmithKline | | 54,585 | | 1,118,228 | |

Home Retail Group | | 183,283 | | 427,034 | |

HSBC Holdings | | 114,018 | | 898,952 | |

Royal Bank of Scotland Group | | 75,724 | a | 387,065 | |

Royal Dutch Shell, Cl. A | | 42,366 | | 1,098,067 | |

Serco Group | | 193,872 | | 335,011 | |

Spire Healthcare Group | | 69,153 | c | 376,665 | |

Standard Chartered | | 75,969 | | 881,542 | |

Tesco | | 245,471 | | 715,231 | |

Unilever | | 13,635 | | 545,597 | |

| | | | | 10,287,814 | |

Total Common Stocks (cost $67,283,823) | | | | 46,972,546 | |

Preferred Stocks - 1.2% | | | | | |

Germany - 1.2% | | | | | |

Volkswagen | | 2,975 | | 565,855 | |

Total Preferred Stocks (cost $740,380) | | | | | |

Other Investments - .9% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Preferred Plus Money Market Fund | | 449,157 | d | 449,157 | |

(cost $449,157) | | | | | |

Total Investments (cost $68,473,360) | | 100.0% | | 47,987,558 | |

Cash and Receivables (Net) | | .0% | | 5,923 | |

Net Assets | | 100.0% | | 47,993,481 | |

ADR—American Depository Receipt

GDR—Global Depository Receipt

aNon-income producing security.

bThe valuation of this security has been determined in good faith by management under the direction of the Board of Directors. At August 31, 2015, the value of this security amounted to $456,111, or 1.0% of net assets.

cSecurities exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. At August 31, 2015, these securities were valued at $1,109,847, or 2.3% of net assets.

dInvestment in affiliated money market mutual fund.

12

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Financials | 32.3 |

Industrials | 11.6 |

Health Care | 11.1 |

Consumer Discretionary | 10.7 |

Energy | 9.3 |

Consumer Staples | 8.6 |

Materials | 4.9 |

Information Technology | 3.8 |

Telecommunications | 3.8 |

Utilities | 3.0 |

Money Market Investment | .9 |

| | 100.0 |

†Based on net assets.

See notes to financial statements.

13

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2015

| | | | | | |

| | | Cost | | Value |

Assets ($): | | | |

Investments in securities—See Statement of Investments: | | | | |

Unaffiliated issuers | | 68,024,203 | | 47,538,401 |

Affiliated issuers | | 449,157 | | 449,157 |

Cash | | | | | 76,939 |

Cash denominated in foreign currency | | | 228,457 | | 219,404 |

Dividends and interest receivable | | | | | 291,587 |

Receivable for shares of Common Stock subscribed | | | | | 587 |

Unrealized appreciation on forward foreign

currency exchange contracts—Note 4 | | | | | 2 |

Deferred reorganization costs—Note 5 | | | | | 104,348 |

Prepaid expenses | | | | | 15,261 |

| | | | | 48,695,686 |

Liabilities ($): | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | | 82,073 |

Payable for shares of Common Stock redeemed | | | | | 201,330 |

Payable for investment securities purchased | | | | | 190,123 |

Unrealized depreciation on forward foreign

currency exchange contracts—Note 4 | | | | | 227 |

Accrued expenses | | | | | 228,452 |

| | | | | 702,205 |

Net Assets ($) | | | 47,993,481 |

Composition of Net Assets ($): | | | |

Paid-in capital | | | | | 157,015,773 |

Accumulated undistributed investment income—net | | | | | 817,197 |

Accumulated net realized gain (loss) on investments | | | | | (89,325,080) |

Accumulated net unrealized appreciation (depreciation)

on investments and foreign currency transactions | | | | | (20,514,409) |

Net Assets ($) | | | 47,993,481 |

| | | | |

Net Asset Value Per Share | Class A | Class C | Class I |

Net Assets ($) | 35,592,999 | 5,740,852 | 6,659,630 |

Shares Outstanding | 3,112,797 | 508,077 | 587,535 |

Net Asset Value Per Share ($) | 11.43 | 11.30 | 11.33 |

See notes to financial statements.

14

STATEMENT OF OPERATIONS

Year Ended August 31, 2015

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Interest | | | 2,124 | |

Cash dividends (net of $197,511 foreign taxes withheld at source): | | | | |

Unaffliated issuers | | | 2,505,605 | |

Affliated issuers | | | 1,161 | |

Total Income | | | 2,508,890 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 1,005,944 | |

Shareholder servicing costs—Note 3(c) | | | 210,125 | |

Custodian fees—Note 3(c) | | | 80,479 | |

Professional fees | | | 76,588 | |

Distribution fees—Note 3(b) | | | 47,723 | |

Reorganization expense—Note 5 | | | 45,652 | |

Registration fees | | | 41,928 | |

Prospectus and shareholders’ reports | | | 15,570 | |

Directors' fees and expenses—Note 3(d) | | | 14,853 | |

Loan commitment fees—Note 2 | | | 1,539 | |

Interest expense—Note 2 | | | 60 | |

Miscellaneous | | | 30,288 | |

Total Expenses | | | 1,570,749 | |

Less—reduction in expenses due to undertaking—Note 3(a) | | | (130,678) | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (35) | |

Net Expenses | | | 1,440,036 | |

Investment Income—Net | | | 1,068,854 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments and foreign currency transactions | | | (7,267,711) | |

Net realized gain (loss) on forward foreign currency exchange contracts | | | 204,601 | |

Net Realized Gain (Loss) | | | (7,063,110) | |

Net unrealized appreciation (depreciation) on investments

and foreign currency transactions | | | (4,024,467) | |

Net unrealized appreciation (depreciation) on

forward foreign currency exchange contracts | | | (62) | |

Net Unrealized Appreciation (Depreciation) | | | (4,024,529) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | (11,087,639) | |

Net (Decrease) in Net Assets Resulting from Operations | | (10,018,785) | |

See notes to financial statements.

15

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2015 | | | | 2014 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 1,068,854 | | | | 1,878,741 | |

Net realized gain (loss) on investments | | (7,063,110) | | | | 9,786,947 | |

Net unrealized appreciation (depreciation)

on investments | | (4,024,529) | | | | 4,341,935 | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | (10,018,785) | | | | 16,007,623 | |

Dividends to Shareholders from ($): | | | | | | | | |

Investment income—net: | | | | | | | | |

Class A | | | (473,489) | | | | (877,464) | |

Class C | | | (15,507) | | | | (70,871) | |

Class I | | | (1,418,077) | | | | (1,320,570) | |

Total Dividends | | | (1,907,073) | | | | (2,268,905) | |

Capital Stock Transactions ($): | | | | | | | | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 4,559,236 | | | | 23,744,575 | |

Class C | | | 495,450 | | | | 459,266 | |

Class I | | | 9,570,555 | | | | 24,670,716 | |

Dividends reinvested: | | | | | | | | |

Class A | | | 444,674 | | | | 833,178 | |

Class C | | | 8,879 | | | | 40,444 | |

Class I | | | 1,345,534 | | | | 1,184,689 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (12,765,623) | | | | (51,790,279) | |

Class C | | | (1,305,533) | | | | (1,711,841) | |

Class I | | | (83,144,346) | | | | (6,058,957) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (80,791,174) | | | | (8,628,209) | |

Total Increase (Decrease) in Net Assets | (92,717,032) | | | | 5,110,509 | |

Net Assets ($): | | | | | | | | |

Beginning of Period | | | 140,710,513 | | | | 135,600,004 | |

End of Period | | | 47,993,481 | | | | 140,710,513 | |

Undistributed investment income—net | 817,197 | | | | 1,898,353 | |

16

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2015 | | | | 2014 | |

Capital Share Transactions: | | | | | | | | |

Class A | | | | | | | | |

Shares sold | | | 375,323 | | | | 1,865,718 | |

Shares issued for dividends reinvested | | | 37,653 | | | | 67,464 | |

Shares redeemed | | | (1,054,404) | | | | (4,139,037) | |

Net Increase (Decrease) in Shares Outstanding | (641,428) | | | | (2,205,855) | |

Class C | | | | | | | | |

Shares sold | | | 42,284 | | | | 36,863 | |

Shares issued for dividends reinvested | | | 756 | | | | 3,299 | |

Shares redeemed | | | (111,877) | | | | (135,371) | |

Net Increase (Decrease) in Shares Outstanding | (68,837) | | | | (95,209) | |

Class I | | | | | | | | |

Shares sold | | | 805,180 | | | | 1,948,730 | |

Shares issued for dividends reinvested | | | 115,003 | | | | 96,710 | |

Shares redeemed | | | (7,034,233) | | | | (485,579) | |

Net Increase (Decrease) in Shares Outstanding | (6,114,050) | | | | 1,559,861 | |

See notes to financial statements.

17

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | |

| | |

| | Year Ended August 31, |

Class A Shares | | 2015 | 2014 | 2013 | 2012 | 2011 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.80 | 11.54 | 9.76 | 10.69 | 10.37 |

Investment Operations: | | | | | | |

Investment income—neta | | .12 | .15 | .15 | .17 | .20 |

Net realized and unrealized gain (loss) on investments | | (1.35) | 1.30 | 1.85 | (.80) | .26 |

Total from Investment Operations | | (1.23) | 1.45 | 2.00 | (.63) | .46 |

Distributions: | | | | | | |

Dividends from investment income—net | | (.14) | (.19) | (.22) | (.30) | (.14) |

Net asset value, end of period | | 11.43 | 12.80 | 11.54 | 9.76 | 10.69 |

Total Return (%)b | | (9.68) | 12.58 | 20.76 | (5.89) | 4.32 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | 1.80 | 1.59 | 1.61 | 1.63 | 1.54 |

Ratio of net expenses to average net assets | | 1.64 | 1.49 | 1.51 | 1.53 | 1.49 |

Ratio of net investment income to average net assets | | 1.00 | 1.17 | 1.40 | 1.74 | 1.70 |

Portfolio Turnover Rate | | 52.37 | 65.25 | 43.35 | 40.93 | 60.72 |

Net Assets, end of period ($ x 1,000) | | 35,593 | 48,052 | 68,771 | 93,078 | 102,606 |

aBased on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

18

| | | | | | | |

| | | | |

Class C Shares | Year Ended August 31, |

| | 2015 | 2014 | 2013 | 2012 | 2011 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.63 | 11.41 | 9.64 | 10.51 | 10.19 |

Investment Operations: | | | | | | |

Investment income —neta | | .03 | .04 | .06 | .10 | .11 |

Net realized and unrealized gain (loss) on investments | | (1.33) | 1.29 | 1.83 | (.79) | .25 |

Total from Investment Operations | | (1.30) | 1.33 | 1.89 | (.69) | .36 |

Distributions: | | | | | | |

Dividends from investment income—net | | (.03) | (.11) | (.12) | (.18) | (.04) |

Net asset value, end of period | | 11.30 | 12.63 | 11.41 | 9.64 | 10.51 |

Total Return (%)b | | (10.31) | 11.68 | 19.82 | (6.55) | 3.48 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | 2.57 | 2.37 | 2.39 | 2.38 | 2.31 |

Ratio of net expenses to average net assets | | 2.41 | 2.27 | 2.29 | 2.28 | 2.26 |

Ratio of net investment income to average net assets | | .22 | .35 | .60 | .99 | .91 |

Portfolio Turnover Rate | | 52.37 | 65.25 | 43.35 | 40.93 | 60.72 |

Net Assets, end of period ($ x 1,000) | | 5,741 | 7,288 | 7,667 | 7,998 | 11,573 |

aBased on average shares outstanding.

bExclusive of sales charge.

See notes to financial statements.

19

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | |

| | | |

| | | Year Ended August 31, |

Class I Shares | | 2015 | 2014 | 2013 | 2012 | 2011 |

Per Share Data ($): | | | | | | |

Net asset value, beginning of period | | 12.74 | 11.51 | 9.74 | 10.67 | 10.36 |

Investment Operations: | | | | | | |

Investment income—neta | | .15 | .20 | .19 | .23 | .28 |

Net realized and unrealized gain (loss) on investments | | (1.36) | 1.29 | 1.84 | (.81) | .22 |

Total from Investment Operations | | (1.21) | 1.49 | 2.03 | (.58) | .50 |

Distributions: | | | | | | |

Dividends from investment income—net | | (.20) | (.26) | (.26) | (.35) | (.19) |

Net asset value, end of period | | 11.33 | 12.74 | 11.51 | 9.74 | 10.67 |

Total Return (%) | | (9.52) | 13.01 | 21.27 | (5.41) | 4.67 |

Ratios/Supplemental Data (%): | | | | | | |

Ratio of total expenses to average net assets | | 1.25 | 1.20 | 1.21 | 1.19 | 1.15 |

Ratio of net expenses to average net assets | | 1.15 | 1.10 | 1.11 | 1.09 | 1.09 |

Ratio of net investment income to average net assets | | 1.21 | 1.56 | 1.76 | 2.29 | 2.29 |

Portfolio Turnover Rate | | 52.37 | 65.25 | 43.35 | 40.93 | 60.72 |

Net Assets, end of period ($ x 1,000) | | 6,660 | 85,370 | 59,161 | 62,965 | 91,998 |

aBased on average shares outstanding.

See notes to financial statements.

20

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus International Value Fund (the “fund”) is a separate diversified series of Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering eleven series, including the fund. The fund’s investment objective is to seek long-term capital growth. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue 500 million shares of $.001 par value Common Stock. The fund currently offers three classes of shares: Class A (200 million shares authorized), Class C (100 million shares authorized) and Class I (200 million shares authorized). Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I shares are sold at net asset value per share generally to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these

21

NOTES TO FINANCIAL STATEMENTS (continued)

arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of

22

the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and financial futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company's Board of Directors (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

Investments denominated in foreign currencies are translated to U.S. dollars at the prevailing rates of exchange.

Forward foreign currency exchange contracts (“forward contracts”) are valued at the forward rate and are generally categorized within Level 2 of the fair value hierarchy.

The following is a summary of the inputs used as of August 31, 2015 in valuing the fund’s investments:

23

NOTES TO FINANCIAL STATEMENTS (continued)

| | | | | | |

| | Level 1 - Unadjusted Quoted Prices | Level 2 - Other Significant Observable Inputs | | Level 3 -Significant Unobservable Inputs | Total |

Assets ($) | | | | | |

Investments in Securities: | | | | | |

Equity Securities - Foreign Common Stocks† | 1,590,939 | 45,381,607 | †† | - | 46,972,546 |

Equity Securities - Foreign Preferred Stocks† | - | 565,855 | †† | - | 565,855 |

Mutual Funds | 449,157 | - | | - | 449,157 |

Other Financial Instruments: | | | | | |

Forward Foreign Currency Exchange Contracts††† | - | 2 | | - | 2 |

Liabilities ($) | | | | | |

Other Financial Instruments: | | | | | |

Forward Foreign Currency Exchange Contracts††† | - | (227) | | - | (227) |

† See Statement of Investments for additional detailed categorizations.

†† Securities classified within Level 2 at period end as the values were determined pursuant to the fund's fair valuation procedures. See note above for additional information.

††† Amount shown represents unrealized appreciation (depreciation) at period end.

At August 31, 2014, no exchange traded foreign equity securities were classified within Level 2 of the fair value hierarchy pursuant to the fund’s fair valuation procedures.

(b) Foreign currency transactions: The fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in the market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized on securities transactions between trade and settlement date, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the value of assets and liabilities other than investments resulting from changes in exchange rates. Foreign currency gains and losses on foreign currency transactions are also included with net realized and unrealized gain or loss on investments.

24

(c) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

(d) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended August 31, 2015 were as follows:

| | | | | | |

Affiliated Investment Company | Value 8/31/2014 ($) | Purchases ($) | Sales ($) | Value 8/31/2015 ($) | Net Assets (%) |

Dreyfus Institutional Preferred Plus Money Market Fund | 4,790,000 | 26,957,803 | 31,298,646 | 449,157 | .9 |

(e) Risk: Investing in foreign markets may involve special risks and considerations not typically associated with investing in the U.S. These risks include revaluation of currencies, high rates of inflation, repatriation restrictions on income and capital, and adverse political and economic developments. Moreover, securities issued in these markets may be less liquid, subject to government ownership controls and delayed settlements, and their prices may be more volatile than those of comparable securities in the U.S.

(f) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(g) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

25

NOTES TO FINANCIAL STATEMENTS (continued)

As of and during the period ended August 31, 2015, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended August 31, 2015, the fund did not incur any interest or penalties.

Each tax year in the four-year period ended August 31, 2015 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At August 31, 2015, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $817,197, accumulated capital losses $88,976,827 and unrealized depreciation $20,862,662.

Under the Regulated Investment Company Modernization Act of 2010 (the “2010 Act”), the fund is permitted to carry forward capital losses incurred in taxable years beginning after December 22, 2010 (“post-enactment losses”) for an unlimited period. Furthermore, post-enactment capital loss carryovers retain their character as either short-term or long-term capital losses rather than short-term as they were under previous statute. The 2010 Act requires post-enactment losses to be utilized before the utilization of losses incurred in taxable years prior to the effective date of the 2010 Act (“pre-enactment losses”). As a result of this ordering rule, pre-enactment losses may be more likely to expire unused.

The accumulated capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if any, realized subsequent to August 31, 2015. If not applied, $24,770,979 of the carryover expires in fiscal year 2017 and $41,505,182 expires in fiscal year 2018. The fund has $238,747 of post-enactment short-term capital losses and $22,461,919 of post-enactment long-term capital losses which can be carried forward for an unlimited period.

The tax character of distributions paid to shareholders during the fiscal periods ended August 31, 2015 and August 31, 2014 were as follows: ordinary income $1,907,073 and $2,268,905.

During the period ended August 31, 2015, as a result of permanent book to tax differences, primarily due to the tax treatment for foreign exchange gains and losses and passive foreign investment companies, the fund decreased accumulated undistributed investment income-net by $242,937 and increased accumulated net realized gain (loss) on investments by the same amount. Net assets and net asset value per share were not affected by this reclassification.

26

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $430 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to October 8, 2014, the unsecured credit facility with Citibank, N.A. was $265 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended August 31, 2015, was approximately $5,500 with a related weighted average annualized interest rate of 1.09%.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with Dreyfus, the management fee is computed at the annual rate of 1% of the value of the fund’s average daily net assets and is payable monthly. Dreyfus has agreed, from September 1, 2014 through January 1, 2016, to waive receipt of a portion of the fund’s management fee in the amount of .10% of the value of the fund’s average daily net assets. Dreyfus has also contractually agreed, from March 20, 2015 through January 1, 2016, to waive receipt of its fees and/or assume the direct expenses of the fund, so that the expenses of none of its classes (excluding Rule 12b-1 Distribution Plan fees, Shareholder Services plan fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed 1.37% of the value of the fund’s average daily net assets. The reduction in expenses, pursuant to the undertakings, amounted to $130,678 during the period ended August 31, 2015.

During the period ended August 31, 2015, the Distributor retained $624 from commissions earned on sales of the fund's Class A shares and $18 from CDSCs on redemptions of the fund's Class C shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended August 31, 2015, Class C shares were charged $47,723 pursuant to the Distribution Plan.

27

NOTES TO FINANCIAL STATEMENTS (continued)

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended August 31, 2015, Class A and Class C shares were charged $103,788 and $15,908, respectively, pursuant to the Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended August 31, 2015, the fund was charged $16,318 for transfer agency services and $878 for cash management services. These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $35.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended August 31, 2015, the fund was charged $80,479 pursuant to the custody agreement.

During the period ended August 31, 2015, the fund was charged $10,965 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $43,127, Distribution Plan fees $3,888, Shareholder Services Plan fees $9,301, custodian fees $46,722, Chief Compliance Officer fees $1,737 and transfer agency fees $4,249, which are offset against an expense reimbursement currently in effect in the amount of $26,951.

28

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities and forward contracts, during the period ended August 31, 2015, amounted to $51,709,446 and $129,372,695, respectively.

Derivatives: A derivative is a financial instrument whose performance is derived from the performance of another asset. The fund enters into International Swaps and Derivatives Association, Inc. Master Agreements or similar agreements (collectively, “Master Agreements”) with its over-the counter ("OTC") derivative contract counterparties in order to, among other things, reduce its credit risk to counterparties. Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under a Master Agreement, the fund may offset with the counterparty certain derivative financial instrument’s payables and/or receivables with collateral held and/or posted and create one single net payment in the event of default or termination.

Each type of derivative instrument that was held by the fund during the period ended August 31, 2015 is discussed below.

Forward Foreign Currency Exchange Contracts: The fund enters into forward contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to settle foreign currency transactions or as a part of its investment strategy. When executing forward contracts, the fund is obligated to buy or sell a foreign currency at a specified rate on a certain date in the future. With respect to sales of forward contracts, the fund incurs a loss if the value of the contract increases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract decreases between those dates. With respect to purchases of forward contracts, the fund incurs a loss if the value of the contract decreases between the date the forward contract is opened and the date the forward contract is closed. The fund realizes a gain if the value of the contract increases between those dates. Any realized or unrealized gains or losses which occurred during the period are reflected in the Statement of Operations. The fund is exposed to foreign currency risk as a result of changes in value of underlying financial instruments. The fund is also exposed to credit risk associated with counterparty nonperformance on these forward contracts, which is generally limited to the unrealized gain

29

NOTES TO FINANCIAL STATEMENTS (continued)

on each open contract. This risk is mitigated by Master Agreements between the fund and the counterparty and the posting of collateral, if any, by the counterparty to the fund to cover the fund’s exposure to the counterparty. The following summarizes open forward contracts at August 31, 2015:

| | | | | |

Forward Foreign Currency Exchange Contracts | Foreign Currency Amounts | Cost ($) | Value ($) | Unrealized Appreciation (Depreciation) ($) |

Purchases: | | | | |

Barclays Bank | | | | |

Euro, | | | | |

Expiring | | | | |

9/1/2015 | 151,272 | 169,976 | 169,749 | (227) |

Morgan Stanley Capital Services | | | | |

Hong Kong Dollar, | | | | |

Expiring | | | | |

9/1/2015 | 157,904 | 20,373 | 20,375 | 2 |

| | | | | |

Gross Unrealized Appreciation | | | | 2 |

| | | | | |

Gross Unrealized Depreciation | | | | (227) |

The provisions of ASC Topic 210 “Disclosures about Offsetting Assets and Liabilities” require disclosure on the offsetting of financial assets and liabilities. These disclosures are required for certain investments, including derivative financial instruments subject to Master Agreements which are eligible for offsetting in the Statement of Assets and Liabilities and require the fund to disclose both gross and net information with respect to such investments. For financial reporting purposes, the fund does not offset derivative assets and derivative liabilities that are subject to Master Agreements in the Statement of Assets and Liabilities.

At August 31, 2015, derivative assets and liabilities (by type) on a gross basis are as follows:

30

| | | | | | |

Derivative Financial Instruments: | | Assets ($) | | Liabilities ($) | |

Forward contracts | | 2 | | (227) | |

Total gross amount of derivative | | | | | |

assets and liabilities in the | | | | | |

Statement of Assets and Liabilities | | 2 | | (227) | |

Derivatives not subject to | | | | | |

Master Agreements | | - | | - | |

Total gross amount of assets | | | | | |

and liabilities subject to | | | | | |

Master Agreements | | 2 | | (227) | |

The following tables present derivative assets and liabilities net of amounts available for offsetting under Master Agreements and net of related collateral received or pledged, if any, as of August 31, 2015:

| | | | | | | |

| | | | Financial | | | |

| | | | Instruments | | | |

| | | | and Derivatives | | | |

| | Gross Amount of | | Available | Collateral | | Net Amount of |

Counterparty | Assets ($) | 1 | for Offset ($) | Received ($) | | Assets ($) |

Morgan Stanley

Capital Services | 2 | | - | - | | 2 |

| | | | | | | |

| | | | Financial | | | |

| | | | Instruments | | | |

| | | | and Derivatives | | | |

| | Gross Amount of | | Available | Collateral | | Net Amount of |

Counterparty | Liabilities ($) | 1 | for Offset ($) | Pledged ($) | | Liabilities ($) |

Barclays Bank | (227) | | - | - | | (227) |

| | | | | | | |

1 Absent a default event or early termination, OTC derivative assets and liabilities are

presented at gross amounts and are not offset in the Statement of Assets and Liabilities. |

The following summarizes the average market value of derivatives outstanding during the period ended August 31, 2015:

| | | | | | |

| | | | | Average Market Value ($) |

Forward contracts | | | | 453,558 |

At August 31, 2015, the cost of investments for federal income tax purposes was $68,821,613; accordingly, accumulated net unrealized depreciation on investments was $20,834,055, consisting of $753,192 gross unrealized appreciation and $21,587,247 gross unrealized depreciation.

NOTE 5—Plan of Reorganization:

At a meeting held on July 27, 2015, the Board of Trustees of Dreyfus Stock Funds, on behalf of Dreyfus International Equity Fund (the “Acquiring Fund”) and at a special meeting held on July 27, 2015, the

31

NOTES TO FINANCIAL STATEMENTS (continued)

Board of Directors of Advantage Funds, Inc. (the “Company”), on behalf of Dreyfus International Value Fund (the “fund”), each approved an Agreement and Plan of Reorganization.

The merger is subject to the approval of the fund shareholders on or about November 19, 2015. If approved, the merger is anticipated to occur on or about January 22, 2016. The merger provides for the fund to transfer all of its assets, subject to its liabilities, to the Acquiring Fund, in exchange for a number of Class A, Class C and Class I shares of the Acquiring Fund equal in value to the assets less liabilities of the fund (the “Exchange”). The Acquiring Fund’s Class A, Class C and Class I shares will then be distributed to the fund’s shareholders on a pro rata basis in liquidation of the fund and subsequent termination as a series of the Company. Shareholders of the fund will receive Class A, Class C and Class I shares of the Acquiring Fund in the Exchange. The fund was closed to new investors on September 2, 2015. Reorganization costs estimated at $150,000 will be paid by the fund and are being amortized from July 27, 2015 through November 19, 2015. During the period ended August 31, 2015, the fund amortized $45,652 of reorganization costs.

32

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Directors

Dreyfus International Value Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus International Value Fund (one of the series comprising Advantage Funds, Inc.) as of August 31, 2015, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2015 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus International Value Fund at August 31, 2015, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting principles.

New York, New York

October 28, 2015

33

IMPORTANT TAX INFORMATION (Unaudited)

In accordance with federal tax law, the fund elects to provide each shareholder with their portion of the fund’s foreign taxes paid and the income sourced from foreign countries.

Accordingly, the fund hereby reports the following information regarding its fiscal year ended August 31, 2015:

- the total amount of taxes paid to foreign countries was $197,511.

- the total amount of income sourced from foreign countries was $2,684,649.

Where required by federal tax law rules, shareholders will receive notification of their proportionate share of foreign taxes paid and foreign sourced income for the 2015 calendar year with Form 1099-DIV which will be mailed in early 2016. Also, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $1,907,073 represents the maximum amount that may be considered qualified dividend income.

34

INFORMATION ABOUT THE RENEWAL OF THE FUND'S MANAGEMENT AGREEMENT (Unaudited)

At a meeting of the fund’s Board of Directors held on March 11-12, 2015, the Board considered the renewal of the fund’s Management Agreement pursuant to which Dreyfus provides the fund with investment advisory and administrative services (the “Agreement”). The Board members, none of whom are “interested persons” (as defined in the Investment Company Act of 1940, as amended) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from Dreyfus representatives. In considering the renewal of the Agreement, the Board considered all factors that it believed to be relevant, including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

Analysis of Nature, Extent, and Quality of Services Provided to the Fund. The Board considered information provided to them at the meeting and in previous presentations from Dreyfus representatives regarding the nature, extent, and quality of the services provided to funds in the Dreyfus fund complex. Dreyfus provided the number of open accounts in the fund, the fund’s asset size and the allocation of fund assets among distribution channels. Dreyfus also had previously provided information regarding the diverse intermediary relationships and distribution channels of funds in the Dreyfus fund complex (such as retail direct or intermediary, in which intermediaries typically are paid by the fund and/or Dreyfus) and Dreyfus’ corresponding need for broad, deep, and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to the fund.

The Board also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board also considered Dreyfus’ extensive administrative, accounting and compliance infrastructures. The Board also considered portfolio management’s brokerage policies and practices (including policies and practices regarding soft dollars) and the standards applied in seeking best execution.

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio. The Board reviewed reports prepared by Lipper, Inc. (“Lipper”), an independent provider of investment company data, which included information comparing (1) the fund’s performance with the performance of a group of comparable funds (the “Performance Group”) and with a broader group of funds (the “Performance Universe”), all for various periods ended December 31, 2014, and (2) the fund’s actual and contractual management fees and total expenses with those of a group of comparable funds (the “Expense Group”) and with a broader group of funds (the “Expense Universe”), the information for which was derived in part from fund financial statements available to Lipper as of the date of its analysis. Dreyfus previously had furnished the Board with a description of the methodology Lipper used to select the

35

INFORMATION ABOUT THE RENEWAL OF THE FUND'S MANAGEMENT AGREEMENT (Unaudited) (continued)

Performance Group and Performance Universe and the Expense Group and Expense Universe.

Dreyfus representatives stated that the usefulness of performance comparisons may be affected by a number of factors, including different investment limitations that may be applicable to the fund and comparison funds. The Board discussed with representatives of Dreyfus and its affiliates the results of the comparisons and noted that the fund’s total return performance was below the Performance Group and Performance Universe medians for all periods, ranking in the fourth quartile of the Performance Group and Performance Universe for all periods (ranking lowest in the Performance Group in the five- and ten- year periods). Dreyfus also provided a comparison of the fund’s calendar year total returns to the returns of the fund’s benchmark index. The representatives of Dreyfus and its affiliates discussed reasons for the fund’s relative underperformance, including specific securities selection issues affecting performance in the most recent one-year period. They also noted the addition of a new lead portfolio manager in 2013.

The Board also reviewed the range of actual and contractual management fees and total expenses of the Expense Group and Expense Universe funds and discussed the results of the comparisons. The Board noted that the fund’s contractual management fee was above the Expense Group median and the fund’s actual management fee and total expenses were above the Expense Group and Expense Universe medians.

Dreyfus representatives noted that Dreyfus has agreed to waive receipt of a portion of the fund’s management fee in the amount of .10% of the value of the fund’s average daily net assets until September 30, 2015.

Dreyfus representatives reviewed with the Board the management or investment advisory fees (1) paid by funds advised or administered by Dreyfus that are in the same Lipper category as the fund and (2) paid to Dreyfus or the Dreyfus-affiliated primary employer of the fund’s primary portfolio manager(s) for advising any separate accounts and/or other types of client portfolios that are considered to have similar investment strategies and policies as the fund (the “Similar Clients”), and explained the nature of the Similar Clients. They discussed differences in fees paid and the relationship of the fees paid in light of any differences in the services provided and other relevant factors. The Board considered the relevance of the fee information provided for the Similar Clients to evaluate the appropriateness and reasonableness of the fund’s management fee.

Analysis of Profitability and Economies of Scale. Dreyfus representatives reviewed the expenses allocated and profit received by Dreyfus and its affiliates and the resulting profitability percentage for managing the fund and the aggregate profitability percentage to Dreyfus and its affiliates for managing the funds in the Dreyfus fund complex, and the method used to determine the expenses and profit. The Board concluded that the profitability results were not unreasonable, given the services rendered and service levels provided by Dreyfus. The Board also noted the fee waiver arrangement and its effect on the profitability of Dreyfus and its affiliates. The Board also had been provided with

36

information prepared by an independent consulting firm regarding Dreyfus’ approach to allocating costs to, and determining the profitability of, individual funds and the entire Dreyfus fund complex. The consulting firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board considered, on the advice of its counsel, the profitability analysis (1) as part of its evaluation of whether the fees under the Agreement bear a reasonable relationship to the mix of services provided by Dreyfus, including the nature, extent and quality of such services, and (2) in light of the relevant circumstances for the fund and the extent to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit of fund shareholders. Dreyfus representatives noted that a discussion of economies of scale is predicated on a fund having achieved a substantial size with increasing assets and that, if a fund’s assets had been stable or decreasing, the possibility that Dreyfus may have realized any economies of scale would be less. Dreyfus representatives also noted that, as a result of shared and allocated costs among funds in the Dreyfus fund complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the opposite direction from, changes in the fund’s asset level. The Board also considered potential benefits to Dreyfus from acting as investment adviser and noted the soft dollar arrangements in effect for trading the fund’s investments.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to the renewal of the Agreement. Based on the discussions and considerations as described above, the Board concluded and determined as follows:

· The Board concluded that the nature, extent and quality of the services provided by Dreyfus are adequate and appropriate.

· The Board agreed to closely monitor performance and determined to approve renewal of the Agreement only through September 30, 2015.

· The Board concluded that the fee paid to Dreyfus was reasonable in light of the considerations described above.