UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-07123 |

| |

| Advantage Funds, Inc. | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| Bennett MacDougall, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6400 |

| |

Date of fiscal year end: | 08/31 | |

Date of reporting period: | 08/31/2016 | |

| | | | | | | |

The following N-CSR relates only to the Registrant's series listed below and does not affect the other series of the Registrant, which have a different fiscal year end and, therefore, different N-CSR reporting requirements. A separate N-CSR Form will be filed for those series, as appropriate.

Dreyfus Opportunistic Midcap Value Fund

Dreyfus Opportunistic Small Cap Fund

Dreyfus Opportunistic U.S. Stock Fund

Dreyfus Strategic Value Fund

Dreyfus Structured Midcap Fund

Dreyfus Technology Growth Fund

FORM N-CSR

Item 1. Reports to Stockholders.

Dreyfus Opportunistic Midcap Value Fund

| | | |

| | ANNUAL REPORT August 31, 2016 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Opportunistic Midcap Value Fund

| | The Fund |

A LETTER FROM THE CHIEF EXECUTIVE OFFICER

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Opportunistic Midcap Value Fund, covering the 12-month period from September 1, 2015 through August 31, 2016. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Despite tumultuous swings in market sentiment stemming from global economic developments, stocks and bonds generally produced strong returns over the reporting period. During the fall of 2015, investors reacted cautiously to sluggish global economic growth, plummeting commodity prices, and the first increase in short-term U.S. interest rates in nearly a decade. These worries sparked particularly sharp declines in equities in January 2016, but investor sentiment soon improved when U.S. monetary policymakers refrained from additional rate hikes, other central banks eased their monetary policies further, and commodity prices rebounded. Stocks mostly rallied over the ensuing months, driving several broad measures of stock market performance to new record highs. In the bond market, aggressively accommodative monetary policies and robust investor demand for current income sent yields of high-quality sovereign bonds lower and their prices higher.

Recently we have seen evidence that investors may be shifting their focus away from macroeconomic influences and toward underlying company and industry fundamentals. This development—along with wide differences in underlying fundamental and technical influences across various asset classes, economic sectors, and regional markets—suggests that selectivity may be a more important determinant of investment success over the months ahead. As always, we encourage you to discuss the implications of our observations with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Mark D. Santero

Chief Executive Officer

The Dreyfus Corporation

September 15, 2016

2

DISCUSSION OF FUND PERFORMANCE

For the period from September 1, 2015 through August 31, 2016, as provided by David A. Daglio, James Boyd, and Dale Dutile, Primary Portfolio Managers

Market and Fund Performance Overview

For the 12-month period ended August 31, 2016, Dreyfus Opportunistic Midcap Value Fund’s Class A shares produced a total return of 3.95%, Class C shares returned 3.19%, Class I shares returned 4.23%, and Class Y shares returned 4.40%.1 In comparison, the fund’s benchmark, the Russell Midcap® Value Index (the “Index”), produced a 12.88% total return for the same period.2

Mid-cap value stocks achieved double-digit returns as a rally over the reporting period’s second half more than erased losses from the first half. The fund lagged its benchmark, mainly due to shortfalls in the financials, health care, and consumer discretionary sectors.

The Fund’s Investment Approach

The fund seeks to surpass the performance of the Index by investing in mid-cap companies with market capitalizations between $1 billion and $25 billion at the time of purchase. The fund’s portfolio managers identify potential investments through extensive fundamental and macro research conducted by the team’s dedicated sector specialists and primary portfolio managers.

The fund focuses on individual stock selection to position the fund in stocks priced at a large discount to the portfolio managers’ view of their intrinsic value and a capital allocation discipline guided by market dislocations.

The portfolio managers use an opportunistic value style in selecting stocks in an attempt to benefit from valuation inefficiencies and underappreciated fundamental prospects present in the marketplace. To do this, the portfolio managers use mid-cycle estimates, growth prospects, the identification of a revaluation catalyst, and competitive advantages as some of the factors in the valuation assessment.

Stocks Advanced Strongly Despite Headwinds

Stocks across all capitalization ranges proved volatile over the final months of 2015 as investors grew more averse to risks in light of persistently sluggish global growth. In January 2016, equity markets suffered particularly severe declines due to disappointing economic data in China, plunging commodity prices, and worries that higher short-term U.S. interest rates might weigh on the domestic economic recovery. The markets changed direction in mid-February, as investors responded positively to relatively strong U.S. economic data and better-than-expected corporate earnings. The market rally continued through the spring when monetary policymakers refrained from implementing additional rate hikes, commodity prices rebounded, and foreign currencies strengthened against the U.S. dollar. Although a referendum in the United Kingdom to leave the European Union introduced renewed market turmoil in late June, equity markets bounced back quickly, enabling the Index to post solidly positive returns for the reporting period overall.

Income-Oriented Stocks Led Market’s Advance

In a market environment motivated mainly by changing investor sentiment, companies exhibiting attractive fundamental characteristics were not rewarded to the extent they have been in the past. Investors seeking higher levels of income than were available from high-quality sovereign bonds turned instead to dividend-paying stocks generally in traditionally defensive market sectors, such as utilities and real estate investment trusts (REITs). Consequently, the fund’s security selections lagged market averages.

3

DISCUSSION OF FUND PERFORMANCE (continued)

Results in the financials sector were particularly undermined by low interest rates, which investors worried might weigh on lenders’ profit margins. Consequently, fund holdings E*TRADE Financial and TD Ameritrade Holding underperformed. Meanwhile, residential real estate agency franchisor Realogy Holdings did not benefit as expected from a recovering housing market. In the health care sector, biopharmaceutical developer Vertex Pharmaceuticals was hurt by insurance reimbursement issues surrounding a new product, which dampened demand. Among consumer discretionary companies, office supplies retailer Staples struggled after a proposed merger was not approved by regulators, and kitchenware seller Williams-Sonoma languished when investors disregarded the company’s e-commerce growth opportunities.

The fund produced better relative results in the materials sector, where rebounding commodity prices benefited Newmont Mining and Yamana Gold. In addition, paint manufacturer Valspar was acquired by a former rival, and the fund benefited from favorable timing in the trading of agricultural commodities producer Mosaic. Finally, underweighted exposure to the energy sector enabled the fund to cushion the impact of industry-wide weakness, and a new position in natural gas distributor Cheniere Energy rallied strongly when commodity prices bounced back during the spring. In the industrials sector, water infrastructure components supplier Xylem was rewarded during the market rally for strong fundamentals, and Ingersoll-Rand was bolstered by generally improved investor sentiment.

Maintaining a Focus on Fundamentals

In our analysis, investors are likely to return their focus to underlying company fundamentals as global economic and political conditions stabilize. We have maintained the fund’s research-driven investment approach, which favors mid-cap companies we have identified as having attractive valuations and underappreciated cash flow potential. As of the reporting period’s end, we have identified an ample number of stocks meeting our criteria in the financials, information technology, and industrials sectors, but relatively few in the more richly valued utilities, REITs, and consumer staples sectors.

September 15, 2016

Please note, the position in any security highlighted with italicized typeface was sold during the reporting period.

Equities are subject generally to market, market sector, market liquidity, issuer, and investment style risks, among other factors, to varying degrees, all of which are more fully described in the fund’s prospectus.

Stocks of small- and/or mid-cap companies often experience sharper price fluctuations than stocks of large-cap companies.

1 Total return includes reinvestment of dividends and any capital gains paid and does not take into consideration the maximum initial sales charge in the case of Class A shares, or the applicable contingent deferred sales charge imposed on redemptions in the case of Class C shares. Had these charges been reflected, returns would have been lower. Past performance is no guarantee of future results. Share price and investment return fluctuate such that upon redemption, fund shares may be worth more or less than their original cost.

2 Source: Lipper Inc. — Reflects reinvestment of dividends and, where applicable, capital gain distributions. The Russell Midcap® Value Index is a widely accepted, unmanaged index of medium-cap stock market performance and measures the performance of those Russell mid-cap companies with lower price-to-book ratios and lower forecasted growth values. Investors cannot invest directly in any index.

4

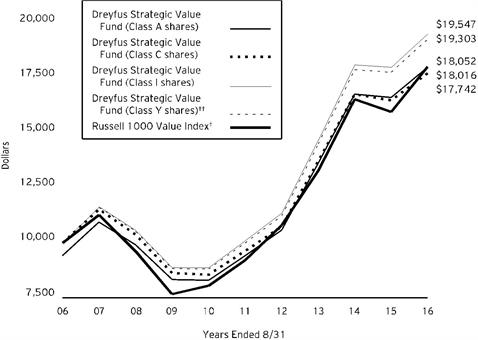

FUND PERFORMANCE

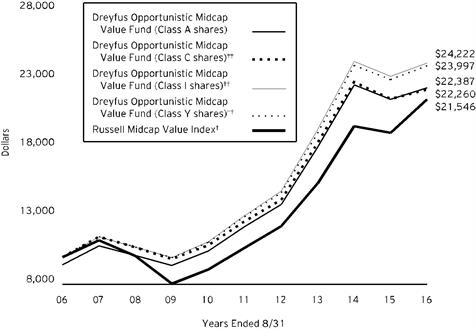

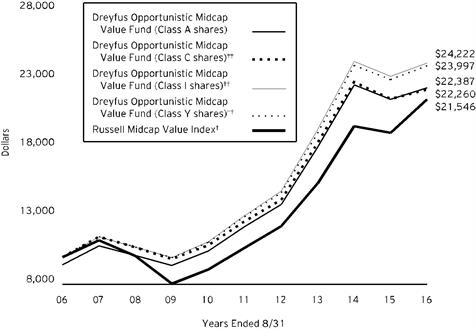

Comparison of change in value of $10,000 investment in Dreyfus Opportunistic Midcap Value Fund Class A shares, Class C shares, Class I shares and Class Y shares and the Russell Midcap Value Index

† Source: Lipper Inc.

†† The total return figures presented for Class C shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 5/30/08 (the inception date for Class C shares), not reflecting the applicable sales charges for Class A shares.

The total return figures presented for Class I shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 5/30/08 (the inception date for Class I shares), not reflecting the applicable sales charges for Class A shares.

The total return figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

Past performance is not predictive of future performance.

The above graph compares a $10,000 investment made in each of the Class A, Class C, Class I and Class Y shares of Dreyfus Opportunistic Midcap Value Fund on 8/31/06 to a $10,000 investment made in the Russell Midcap Value Index (the “Index”) on that date. All dividends and capital gain distributions are reinvested.

The fund’s performance shown in the line graph above takes into account the maximum initial sales charge on Class A shares and all other applicable fees and expenses on all classes. The Index is a widely accepted, unmanaged index of medium-cap stock market performance and measures the performance of those Russell Midcap companies with lower price-to-book ratios and lower forecasted growth values. Unlike a mutual fund, the Index is not subject to charges, fees and other expenses. Investors cannot invest directly in any index. Further information relating to fund performance, including expense reimbursements, if applicable, is contained in the Financial Highlights section of the prospectus and elsewhere in this report.

5

FUND PERFORMANCE (continued)

| | | | | | | | |

Average Annual Total Returns as of 8/31/16 | | | |

| | Inception

Date | 1 Year | 5 Years | | 10 Years | |

Class A shares | | | | | | |

with maximum sales charge (5.75%) | 9/29/95 | -2.04% | 11.54% | | 8.39% | |

without sales charge | 9/29/95 | 3.95% | 12.87% | | 9.04% | |

Class C shares | | | | | | |

with applicable redemption charge † | 5/30/08 | 2.36% | 12.01% | | 8.33% | †† |

without redemption | 5/30/08 | 3.19% | 12.01% | | 8.33% | †† |

Class I shares | | 5/30/08 | 4.23% | 13.14% | | 9.25% | †† |

Class Y shares | | 7/1/13 | 4.40% | 13.10% | †† | 9.15% | †† |

Russell Midcap Value Index | 12.88% | 15.03% | | 7.98% | |

Past performance is not predictive of future performance. The fund’s performance shown in the graph and table does not reflect the deduction of taxes that a shareholder would pay on fund distributions or the redemption of fund shares. In addition to the performance of Class A shares shown with and without a maximum sales charge, the fund’s performance shown in the table takes into account all other applicable fees and expenses on all classes.

† The maximum contingent deferred sales charge for Class C shares is 1% for shares redeemed within one year of the date of purchase.

†† The total return performance figures presented for Class C shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 5/30/08 (the inception date for Class C shares), not reflecting the applicable sales charges for Class A shares.

The total return performance figures presented for Class I shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 5/30/08 (the inception date for Class I shares), not reflecting the applicable sales charges for Class A shares.

The total return performance figures presented for Class Y shares of the fund reflect the performance of the fund’s Class A shares for the period prior to 7/1/13 (the inception date for Class Y shares), not reflecting the applicable sales charges for Class A shares.

6

UNDERSTANDING YOUR FUND’S EXPENSES (Unaudited)

As a mutual fund investor, you pay ongoing expenses, such as management fees and other expenses. Using the information below, you can estimate how these expenses affect your investment and compare them with the expenses of other funds. You also may pay one-time transaction expenses, including sales charges (loads) and redemption fees, which are not shown in this section and would have resulted in higher total expenses. For more information, see your fund’s prospectus or talk to your financial adviser.

Review your fund’s expenses

The table below shows the expenses you would have paid on a $1,000 investment in Dreyfus Opportunistic Midcap Value Fund from March 1, 2016 to August 31, 2016. It also shows how much a $1,000 investment would be worth at the close of the period, assuming actual returns and expenses.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming actual returns for the six months ended August 31, 2016 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $6.57 | | $10.52 | | $5.00 | | $4.35 |

Ending value (after expenses) | | $1,160.60 | | $1,156.50 | | $1,162.00 | | $1,162.80 |

COMPARING YOUR FUND’S EXPENSES

WITH THOSE OF OTHER FUNDS (Unaudited)

Using the SEC’s method to compare expenses

The Securities and Exchange Commission (SEC) has established guidelines to help investors assess fund expenses. Per these guidelines, the table below shows your fund’s expenses based on a $1,000 investment, assuming a hypothetical 5% annualized return. You can use this information to compare the ongoing expenses (but not transaction expenses or total cost) of investing in the fund with those of other funds. All mutual fund shareholder reports will provide this information to help you make this comparison. Please note that you cannot use this information to estimate your actual ending account balance and expenses paid during the period.

| | | | | | | | | | | | |

Expenses and Value of a $1,000 Investment | | |

assuming a hypothetical 5% annualized return for the six months ended August 31, 2016 |

| | | | | | | | |

| | | | Class A | Class C | Class I | Class Y |

Expenses paid per $1,000† | | $6.14 | | $9.83 | | $4.67 | | $4.06 |

Ending value (after expenses) | | $1,019.05 | | $1,015.38 | | $1,020.51 | | $1,021.11 |

† Expenses are equal to the fund’s annualized expense ratio of 1.21% for Class A, 1.94% for Class C, .92% for Class I and .80% for Class Y, multiplied by the average account value over the period, multiplied by 184/366 (to reflect the one-half year period).

7

STATEMENT OF INVESTMENTS

August 31, 2016

| | | | | | |

| |

Common Stocks - 98.8% | | Shares | | Value ($) | |

Banks - 3.9% | | | | | |

Capital One Financial | | 469,451 | | 33,612,692 | |

First Republic Bank | | 266,446 | | 20,505,684 | |

| | | | | 54,118,376 | |

Capital Goods - 10.4% | | | | | |

HD Supply Holdings | | 1,200,686 | a | 43,356,771 | |

Hubbell | | 364,683 | | 39,498,816 | |

Ingersoll-Rand | | 101,903 | | 6,928,385 | |

Regal Beloit | | 71,400 | | 4,378,962 | |

Snap-on | | 138,639 | | 21,251,972 | |

Textron | | 708,497 | | 28,942,102 | |

| | | | | 144,357,008 | |

Consumer Durables & Apparel - 2.0% | | | | | |

PVH | | 260,455 | | 28,066,631 | |

Consumer Services - 1.7% | | | | | |

Houghton Mifflin Harcourt | | 539,651 | a | 8,607,433 | |

Royal Caribbean Cruises | | 202,377 | | 14,391,028 | |

| | | | | 22,998,461 | |

Diversified Financials - 24.0% | | | | | |

E*TRADE Financial | | 2,214,318 | a | 58,413,709 | |

Intercontinental Exchange | | 149,763 | | 42,236,161 | |

Leucadia National | | 2,711,105 | | 51,917,661 | |

Raymond James Financial | | 710,195 | | 41,312,043 | |

SLM | | 6,196,142 | a | 45,944,393 | |

Synchrony Financial | | 2,273,508 | | 63,271,728 | |

TD Ameritrade Holding | | 867,436 | | 28,508,284 | |

| | | | | 331,603,979 | |

Energy - 2.0% | | | | | |

Cheniere Energy | | 643,468 | a | 27,604,777 | |

Food, Beverage & Tobacco - 2.6% | | | | | |

Archer-Daniels-Midland | | 829,012 | | 36,277,565 | |

Insurance - 4.6% | | | | | |

Assurant | | 310,688 | | 27,822,110 | |

FNF Group | | 959,327 | | 36,157,035 | |

| | | | | 63,979,145 | |

Materials - 5.3% | | | | | |

Mosaic | | 1,634,933 | b | 49,162,435 | |

Newmont Mining | | 262,687 | | 10,045,151 | |

8

| | | | | | |

| |

Common Stocks - 98.8% (continued) | | Shares | | Value ($) | |

Materials - 5.3% (continued) | | | | | |

Potash Corp of Saskatchewan | | 740,411 | | 13,401,439 | |

| | | | | 72,609,025 | |

Media - 3.2% | | | | | |

CBS, Cl. B | | 777,191 | | 39,660,057 | |

Sinclair Broadcast Group, Cl. A | | 179,551 | | 5,113,613 | |

| | | | | 44,773,670 | |

Pharmaceuticals, Biotechnology & Life Sciences - 8.2% | | | | | |

Agilent Technologies | | 347,175 | | 16,310,282 | |

Akorn | | 1,061,852 | a | 28,585,056 | |

Jazz Pharmaceuticals | | 248,645 | a | 30,789,710 | |

Mylan | | 882,419 | a | 37,379,269 | |

| | | | | 113,064,317 | |

Retailing - 6.7% | | | | | |

Bed Bath & Beyond | | 123,437 | | 5,723,774 | |

LKQ | | 574,785 | a | 20,743,991 | |

Staples | | 4,562,931 | | 39,058,689 | |

Tiffany & Co. | | 88,072 | b | 6,285,699 | |

Williams-Sonoma | | 392,799 | b | 20,676,939 | |

| | | | | 92,489,092 | |

Semiconductors & Semiconductor Equipment - 2.8% | | | | | |

Maxim Integrated Products | | 553,810 | | 22,551,143 | |

United Microelectronics, ADR | | 9,051,076 | | 16,835,001 | |

| | | | | 39,386,144 | |

Software & Services - 5.5% | | | | | |

Broadridge Financial Solutions | | 207,223 | | 14,360,554 | |

CommVault Systems | | 161,815 | a | 8,339,945 | |

eBay | | 538,055 | a | 17,303,849 | |

First Data, Cl. A | | 1,067,844 | a | 14,864,389 | |

Fortinet | | 216,155 | a | 7,811,842 | |

Intuit | | 115,157 | | 12,834,248 | |

| | | | | 75,514,827 | |

Technology Hardware & Equipment - 10.4% | | | | | |

Amphenol, Cl. A | | 377,784 | | 23,539,721 | |

Ciena | | 1,147,071 | a | 24,604,673 | |

Corning | | 1,133,565 | | 25,720,590 | |

FEI | | 74,374 | | 7,918,600 | |

FLIR Systems | | 470,439 | | 14,503,634 | |

Hewlett Packard Enterprise | | 356,986 | | 7,668,059 | |

Keysight Technologies | | 867,671 | a | 26,403,229 | |

9

STATEMENT OF INVESTMENTS (continued)

| | | | | | |

| |

Common Stocks - 98.8% (continued) | | Shares | | Value ($) | |

Technology Hardware & Equipment - 10.4% (continued) | | | | | |

Viavi Solutions | | 1,749,503 | a | 13,611,133 | |

| | | | | 143,969,639 | |

Transportation - 3.8% | | | | | |

Hertz Global Holdings | | 465,089 | a | 22,910,284 | |

Norfolk Southern | | 311,570 | | 29,256,423 | |

| | | | | 52,166,707 | |

Utilities - 1.7% | | | | | |

Calpine | | 1,888,355 | a | 23,566,670 | |

Total Common Stocks (cost $1,234,686,670) | | | | 1,366,546,033 | |

Master Limited Partnership - .8% | | | | | |

Diversified Financials - .8% | | | | | |

Blackstone Group LP

(cost $8,242,659) | | 403,456 | | 11,062,764 | |

Other Investment - .2% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Preferred Government Plus Money Market Fund

(cost $3,006,949) | | 3,006,949 | c | 3,006,949 | |

Investment of Cash Collateral for Securities Loaned - 1.3% | | | | | |

Registered Investment Company; | | | | | |

Dreyfus Institutional Cash Advantage Fund, Institutional Shares

(cost $18,406,000) | | 18,406,000 | c | 18,406,000 | |

Total Investments (cost $1,264,342,278) | | 101.1% | | 1,399,021,746 | |

Liabilities, Less Cash and Receivables | | (1.1%) | | (15,446,762) | |

Net Assets | | 100.0% | | 1,383,574,984 | |

ADR—American Depository Receipt

LP—Limited Partnership

a Non-income producing security.

b Security, or portion thereof, on loan. At August 31, 2016, the value of the fund’s securities on loan was $75,059,390 and the value of the collateral held by the fund was $77,660,493, consisting of cash collateral of $18,406,000 and U.S. Government & Agency securities valued at $59,254,493.

c Investment in affiliated money market mutual fund.

10

| | |

Portfolio Summary (Unaudited) † | Value (%) |

Diversified Financials | 24.8 |

Capital Goods | 10.4 |

Technology Hardware & Equipment | 10.4 |

Pharmaceuticals, Biotechnology & Life Sciences | 8.2 |

Retailing | 6.7 |

Software & Services | 5.5 |

Materials | 5.3 |

Insurance | 4.6 |

Banks | 3.9 |

Transportation | 3.8 |

Media | 3.2 |

Semiconductors & Semiconductor Equipment | 2.8 |

Food, Beverage & Tobacco | 2.6 |

Consumer Durables & Apparel | 2.0 |

Energy | 2.0 |

Consumer Services | 1.7 |

Utilities | 1.7 |

Money Market Investments | 1.5 |

| | 101.1 |

† Based on net assets.

See notes to financial statements.

11

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2016

| | | | | | | |

| | | | | | |

| | | Cost | | Value | |

Assets ($): | | | | |

Investments in securities—See Statement of Investments

(including securities on loan, valued at $75,059,390)—Note 1(b): | | | | |

Unaffiliated issuers | | 1,242,929,329 | | 1,377,608,797 | |

Affiliated issuers | | 21,412,949 | | 21,412,949 | |

Cash | | | | | 176,378 | |

Receivable for investment securities sold | | | | | 14,477,199 | |

Dividends and securities lending income receivable | | | | | 1,349,385 | |

Receivable for shares of Common Stock subscribed | | | | | 318,490 | |

Prepaid expenses | | | | | 73,411 | |

| | | | | 1,415,416,609 | |

Liabilities ($): | | | | |

Due to The Dreyfus Corporation and affiliates—Note 3(c) | | | | | 1,201,323 | |

Liability for securities on loan—Note 1(b) | | | | | 18,406,000 | |

Payable for investment securities purchased | | | | | 9,939,865 | |

Payable for shares of Common Stock redeemed | | | | | 1,863,118 | |

Interest payable—Note 2 | | | | | 3,447 | |

Accrued expenses | | | | | 427,872 | |

| | | | | 31,841,625 | |

Net Assets ($) | | | 1,383,574,984 | |

Composition of Net Assets ($): | | | | |

Paid-in capital | | | | | 1,232,798,901 | |

Accumulated undistributed investment income—net | | | | | 1,905,676 | |

Accumulated net realized gain (loss) on investments | | | | | 14,190,939 | |

Accumulated net unrealized appreciation (depreciation)

on investments | | | | | 134,679,468 | |

Net Assets ($) | | | 1,383,574,984 | |

| | | | | | |

Net Asset Value Per Share | Class A | Class C | Class I | Class Y | |

Net Assets ($) | 796,685,948 | 76,886,464 | 492,694,132 | 17,308,440 | |

Shares Outstanding | 25,118,651 | 2,681,261 | 15,569,904 | 545,740 | |

Net Asset Value Per Share ($) | 31.72 | 28.68 | 31.64 | 31.72 | |

See notes to financial statements.

12

STATEMENT OF OPERATIONS

Year Ended August 31, 2016

| | | | | | | |

| | | | | | |

| | | | | | |

Investment Income ($): | | | | |

Income: | | | | |

Cash dividends (net of $249,173 foreign taxes withheld at source): | | | | |

Unaffiliated issuers | | | 20,632,206 | |

Affiliated issuers | | | 25,482 | |

Income from securities lending—Note 1(b) | | | 101,886 | |

Total Income | | | 20,759,574 | |

Expenses: | | | | |

Management fee—Note 3(a) | | | 11,932,283 | |

Shareholder servicing costs—Note 3(c) | | | 4,692,469 | |

Distribution fees—Note 3(b) | | | 668,265 | |

Prospectus and shareholders’ reports | | | 137,909 | |

Custodian fees—Note 3(c) | | | 120,828 | |

Directors’ fees and expenses—Note 3(d) | | | 113,603 | |

Registration fees | | | 94,827 | |

Professional fees | | | 75,565 | |

Loan commitment fees—Note 2 | | | 24,609 | |

Interest expense—Note 2 | | | 12,574 | |

Miscellaneous | | | 43,518 | |

Total Expenses | | | 17,916,450 | |

Less—reduction in fees due to earnings credits—Note 3(c) | | | (2,968) | |

Net Expenses | | | 17,913,482 | |

Investment Income—Net | | | 2,846,092 | |

Realized and Unrealized Gain (Loss) on Investments—Note 4 ($): | | |

Net realized gain (loss) on investments | 33,387,974 | a |

Net unrealized appreciation (depreciation) on investments | | | (9,528,738) | |

Net Realized and Unrealized Gain (Loss) on Investments | | | 23,859,236 | |

Net Increase in Net Assets Resulting from Operations | | 26,705,328 | |

| | | | | | | |

a Includes net realized gain of $10,278,766 for securities redeemed-in-kind. |

See notes to financial statements.

13

STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2016 | | | | 2015 | |

Operations ($): | | | | | | | | |

Investment income—net | | | 2,846,092 | | | | 1,009,372 | |

Net realized gain (loss) on investments | | 33,387,974 | | | | 364,285,092 | |

Net unrealized appreciation (depreciation)

on investments | | (9,528,738) | | | | (490,058,264) | |

Net Increase (Decrease) in Net Assets

Resulting from Operations | 26,705,328 | | | | (124,763,800) | |

Dividends to Shareholders from ($): | | | | | | | | |

Investment income—net: | | | | | | | | |

Class A | | | - | | | | (1,486,128) | |

Class I | | | (378,487) | | | | (3,415,093) | |

Class Y | | | (201,480) | | | | (95,271) | |

Net realized gain on investments: | | | | | | | | |

Class A | | | (163,514,213) | | | | (134,482,192) | |

Class C | | | (18,133,204) | | | | (12,676,901) | |

Class I | | | (95,819,995) | | | | (101,601,362) | |

Class Y | | | (12,858,708) | | | | (2,100,596) | |

Total Dividends | | | (290,906,087) | | | | (255,857,543) | |

Capital Stock Transactions ($): | | | | | | | | |

Net proceeds from shares sold: | | | | | | | | |

Class A | | | 144,471,285 | | | | 325,561,801 | |

Class C | | | 9,703,250 | | | | 32,333,148 | |

Class I | | | 141,009,615 | | | | 491,709,342 | |

Class Y | | | 9,901,433 | | | | 74,744,792 | |

Dividends reinvested: | | | | | | | | |

Class A | | | 148,969,232 | | | | 125,099,846 | |

Class C | | | 14,641,322 | | | | 9,693,034 | |

Class I | | | 88,032,264 | | | | 96,450,364 | |

Class Y | | | 12,714,335 | | | | 1,960,207 | |

Cost of shares redeemed: | | | | | | | | |

Class A | | | (424,844,330) | | | | (610,472,279) | |

Class C | | | (46,692,551) | | | | (20,205,410) | |

Class I | | | (562,111,303) | | | | (788,832,838) | |

Class Y | | | (69,663,961) | | | | (15,214,634) | |

Increase (Decrease) in Net Assets

from Capital Stock Transactions | (533,869,409) | | | | (277,172,627) | |

Total Increase (Decrease) in Net Assets | (798,070,168) | | | | (657,793,970) | |

Net Assets ($): | | | | | | | | |

Beginning of Period | | | 2,181,645,152 | | | | 2,839,439,122 | |

End of Period | | | 1,383,574,984 | | | | 2,181,645,152 | |

Undistributed investment income—net | 1,905,676 | | | | 576,363 | |

14

| | | | | | | | | | |

| | | | Year Ended August 31, |

| | | | 2016 | | | | 2015 | |

Capital Share Transactions (Shares): | | | | | | | | |

Class A | | | | | | | | |

Shares sold | | | 4,722,794 | | | | 8,137,340 | |

Shares issued for dividends reinvested | | | 5,163,578 | | | | 3,215,108 | |

Shares redeemed | | | (13,754,633) | | | | (15,199,740) | |

Net Increase (Decrease) in Shares Outstanding | (3,868,261) | | | | (3,847,292) | |

Class Ca | | | | | | | | |

Shares sold | | | 346,788 | | | | 866,037 | |

Shares issued for dividends reinvested | | | 558,402 | | | | 267,394 | |

Shares redeemed | | | (1,629,615) | | | | (543,447) | |

Net Increase (Decrease) in Shares Outstanding | (724,425) | | | | 589,984 | |

Class Ia | | | | | | | | |

Shares sold | | | 4,618,348 | | | | 12,271,844 | |

Shares issued for dividends reinvested | | | 3,065,191 | | | | 2,493,547 | |

Shares redeemedb | | | (16,927,149) | | | | (19,773,668) | |

Net Increase (Decrease) in Shares Outstanding | (9,243,610) | | | | (5,008,277) | |

Class Y | | | | | | | | |

Shares sold | | | 335,763 | | | | 1,897,175 | |

Shares issued for dividends reinvested | | | 442,084 | | | | 50,573 | |

Shares redeemed | | | (2,381,985) | | | | (380,984) | |

Net Increase (Decrease) in Shares Outstanding | (1,604,138) | | | | 1,566,764 | |

| | | | | | | | | | |

a | During the period ended August 31, 2016, 164 Class C shares representing $5,387 were exchanged for 152 Class I shares. | |

b | During the period ended August 31, 2016, 6,020,293 shares amounting to $216,790,748 were redeemed-in-kind resulting in a net realized gain on investments of $10,278,766. | |

See notes to financial statements.

15

FINANCIAL HIGHLIGHTS

The following tables describe the performance for each share class for the fiscal periods indicated. All information (except portfolio turnover rate) reflects financial results for a single fund share. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements.

| | | | | | | | | | |

| | | | | | |

| | |

| | Year Ended August 31, |

Class A Shares | | | 2016 | 2015 | 2014 | 2013 | 2012 |

Per Share Data ($): | | | | | | | |

Net asset value, beginning of period | | | 36.97 | 43.17 | 38.27 | 29.47 | 31.19 |

Investment Operations: | | | | | | | |

Investment income (loss)—net a | | | .03 | (.02) | .05 | .03 | .07 |

Net realized and unrealized gain (loss)

on investments | | | .82 | (1.79) | 9.10 | 8.83 | 3.34 |

Total from Investment Operations | | | .85 | (1.81) | 9.15 | 8.86 | 3.41 |

Distributions: | | | | | | | |

Dividends from investment income—net | | | - | (.05) | - | (.06) | (.23) |

Dividends from net realized gain

on investments | | | (6.10) | (4.34) | (4.25) | - | (4.90) |

Total Distributions | | | (6.10) | (4.39) | (4.25) | (.06) | (5.13) |

Net asset value, end of period | | | 31.72 | 36.97 | 43.17 | 38.27 | 29.47 |

Total Return (%)b | | | 3.95 | (4.72) | 25.32 | 30.11 | 13.44 |

Ratios/Supplemental Data (%): | | | | | | | |

Ratio of total expenses to

average net assets | | | 1.21 | 1.18 | 1.15 | 1.18 | 1.22 |

Ratio of net expenses to

average net assets | | | 1.21 | 1.18 | 1.15 | 1.18 | 1.22 |

Ratio of net investment income (loss) to

average net assets | | | .11 | (.05) | .12 | .08 | .25 |

Portfolio Turnover Rate | | | 101.68 | 74.05 | 67.49 | 91.31 | 71.25 |

Net Assets, end of period ($ x 1,000) | | | 796,686 | 1,071,713 | 1,417,535 | 1,079,346 | 979,628 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

16

| | | | | | | | | | |

| | | | | | |

| | | | |

| | | | Year Ended August 31, |

Class C Shares | | | 2016 | 2015 | 2014 | 2013 | 2012 |

Per Share Data ($): | | | | | | | |

Net asset value, beginning of period | | | 34.26 | 40.55 | 36.44 | 28.22 | 30.24 |

Investment Operations: | | | | | | | |

Investment (loss)—net a | | | (.18) | (.29) | (.26) | (.24) | (.16) |

Net realized and unrealized gain (loss)

on investments | | | .70 | (1.66) | 8.62 | 8.46 | 3.20 |

Total from Investment Operations | | | .52 | (1.95) | 8.36 | 8.22 | 3.04 |

Distributions: | | | | | | | |

Dividends from investment income—net | | | - | - | - | - | (.16) |

Dividends from net realized gain

on investments | | | (6.10) | (4.34) | (4.25) | - | (4.90) |

Total Distributions | | | (6.10) | (4.34) | (4.25) | - | (5.06) |

Net asset value, end of period | | | 28.68 | 34.26 | 40.55 | 36.44 | 28.22 |

Total Return (%)b | | | 3.19 | (5.41) | 24.35 | 29.13 | 12.48 |

Ratios/Supplemental Data (%): | | | | | | | |

Ratio of total expenses to

average net assets | | | 1.94 | 1.90 | 1.92 | 1.97 | 2.03 |

Ratio of net expenses to

average net assets | | | 1.94 | 1.90 | 1.92 | 1.97 | 2.03 |

Ratio of net investment (loss) to

average net assets | | | (.62) | (.77) | (.66) | (.72) | (.56) |

Portfolio Turnover Rate | | | 101.68 | 74.05 | 67.49 | 91.31 | 71.25 |

Net Assets, end of period ($ x 1,000) | | | 76,886 | 116,683 | 114,179 | 46,708 | 22,538 |

a Based on average shares outstanding.

b Exclusive of sales charge.

See notes to financial statements.

17

FINANCIAL HIGHLIGHTS (continued)

| | | | | | | | | |

| | | | | | |

| | | | |

| | | | Year Ended August 31, |

Class I Shares | | | 2016 | 2015 | 2014 | 2013 | 2012 |

Per Share Data ($): | | | | | | | |

Net asset value, beginning of period | | | 36.83 | 43.01 | 38.12 | 29.38 | 31.21 |

Investment Operations: | | | | | | | |

Investment income—neta | | | .12 | .09 | .15 | .10 | .14 |

Net realized and unrealized gain (loss)

on investments | | | .81 | (1.78) | 9.07 | 8.77 | 3.32 |

Total from Investment Operations | | | .93 | (1.69) | 9.22 | 8.87 | 3.46 |

Distributions: | | | | | | | |

Dividends from investment income—net | | | (.02) | (.15) | (.08) | (.13) | (.39) |

Dividends from net realized gain

on investments | | | (6.10) | (4.34) | (4.25) | - | (4.90) |

Total Distributions | | | (6.12) | (4.49) | (4.33) | (.13) | (5.29) |

Net asset value, end of period | | | 31.64 | 36.83 | 43.01 | 38.12 | 29.38 |

Total Return (%) | | | 4.23 | (4.43) | 25.62 | 30.26 | 13.71 |

Ratios/Supplemental Data (%): | | | | | | | |

Ratio of total expenses to

average net assets | | | .90 | .89 | .90 | .97 | 1.00 |

Ratio of net expenses to

average net assets | | | .90 | .89 | .90 | .97 | 1.00 |

Ratio of net investment income to

average net assets | | | .39 | .22 | .37 | .27 | .48 |

Portfolio Turnover Rate | | | 101.68 | 74.05 | 67.49 | 91.31 | 71.25 |

Net Assets, end of period ($ x 1,000) | | | 492,694 | 913,852 | 1,282,578 | 856,830 | 155,210 |

a Based on average shares outstanding.

See notes to financial statements.

18

| | | | | | | | |

| | | | | | |

| | | | |

| | | | Year Ended August 31, |

Class Y Shares | | 2016 | 2015 | 2014 | 2013a |

Per Share Data ($): | | | | | |

Net asset value, beginning of period | | 36.93 | 43.12 | 38.12 | 37.48 |

Investment Operations: | | | | | |

Investment income—netb | | .16 | .13 | .19 | .02 |

Net realized and unrealized gain (loss) on investments | | .83 | (1.78) | 9.17 | .62 |

Total from Investment Operations | | .99 | (1.65) | 9.36 | .64 |

Distributions: | | | | | |

Dividends from investment income—net | | (.10) | (.20) | (.11) | - |

Dividends from net realized gain on investments | | (6.10) | (4.34) | (4.25) | - |

Total Distributions | | (6.20) | (4.54) | (4.36) | - |

Net asset value, end of period | | 31.72 | 36.93 | 43.12 | 38.12 |

Total Return (%) | | 4.40 | (4.34) | 26.02 | 1.74c |

Ratios/Supplemental Data (%): | | | | | |

Ratio of total expenses to average net assets | | .78 | .80 | .83 | .80d |

Ratio of net expenses to average net assets | | .78 | .80 | .83 | .80d |

Ratio of net investment income to average net assets | | .53 | .30 | .50 | .33d |

Portfolio Turnover Rate | | 101.68 | 74.05 | 67.49 | 91.31 |

Net Assets, end of period ($ x 1,000) | | 17,308 | 79,397 | 25,147 | 1 |

a From July 1, 2013 (commencement of initial offering) to August 31, 2013.

b Based on average shares outstanding.

c Not annualized.

d Annualized.

See notes to financial statements.

19

NOTES TO FINANCIAL STATEMENTS

NOTE 1—Significant Accounting Policies:

Dreyfus Opportunistic Midcap Value Fund (the “fund”) is a separate diversified series of Advantage Funds, Inc. (the “Company”), which is registered under the Investment Company Act of 1940, as amended (the “Act”), as an open-end management investment company and operates as a series company currently offering ten series, including the fund. The fund’s investment objective is to seek to surpass the performance of the Russell Midcap® Value Index. The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser.

MBSC Securities Corporation (the “Distributor”), a wholly-owned subsidiary of Dreyfus, is the distributor of the fund’s shares. The fund is authorized to issue 700 million shares of $.001 par value Common Stock. The fund currently offers four classes of shares: Class A (350 million shares authorized), Class C (125 million shares authorized), Class I (125 million shares authorized) and Class Y (100 million shares authorized). Class A shares generally are subject to a sales charge imposed at the time of purchase. Class C shares are subject to a contingent deferred sales charge (“CDSC”) imposed on Class C shares redeemed within one year of purchase. Class I and Class Y shares are sold at net asset value per share generally to institutional investors. Other differences between the classes include the services offered to and the expenses borne by each class, the allocation of certain transfer agency costs, and certain voting rights. Income, expenses (other than expenses attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based on its relative net assets.

The Company accounts separately for the assets, liabilities and operations of each series. Expenses directly attributable to each series are charged to that series’ operations; expenses which are applicable to all series are allocated among them on a pro rata basis.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions. Actual results could differ from those estimates.

20

The Company enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued at the last sales price on the securities exchange or national securities market on which such securities are primarily traded. Securities listed on the National Market System for which market quotations are available are valued at the official closing price or, if there is no official closing price that day, at the last sales price. For open short positions, asked prices are used for valuation purposes. Bid price is

21

NOTES TO FINANCIAL STATEMENTS (continued)

used when no asked price is available. Registered investment companies that are not traded on an exchange are valued at their net asset value. All of the preceding securities are generally categorized within Level 1 of the fair value hierarchy.

Securities not listed on an exchange or the national securities market, or securities for which there were no transactions, are valued at the average of the most recent bid and asked prices. These securities are generally categorized within Level 2 of the fair value hierarchy.

Fair valuing of securities may be determined with the assistance of a pricing service using calculations based on indices of domestic securities and other appropriate indicators, such as prices of relevant ADRs and financial futures. Utilizing these techniques may result in transfers between Level 1 and Level 2 of the fair value hierarchy.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded (for example, a foreign exchange or market), but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Company’s Board of Directors (the “Board”). Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers. These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are generally categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of August 31, 2016 in valuing the fund’s investments:

22

| | | | | | |

| | Level 1 -

Unadjusted

Quoted Prices | Level 2 - Other

Significant

Observable

Inputs | Level 3

-Significant

Unobservable

Inputs | Total |

Assets ($) | | | | |

Investments in Securities: | | | |

Equity Securities - Domestic Common Stocks† | 1,336,309,593 | - | - | 1,336,309,593 |

Equity Securities - Foreign Common Stocks† | 30,236,440 | - | - | 30,236,440 |

Master Limited Partnership† | 11,062,764 | - | - | 11,062,764 |

Mutual Funds | 21,412,949 | - | - | 21,412,949 |

† See Statement of Investments for additional detailed categorizations.

At August 31, 2016, there were no transfers between levels of the fair value hierarchy.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income, including, where applicable, accretion of discount and amortization of premium on investments, is recognized on the accrual basis.

Pursuant to a securities lending agreement with The Bank of New York Mellon, a subsidiary of BNY Mellon and an affiliate of Dreyfus, the fund may lend securities to qualified institutions. It is the fund’s policy that, at origination, all loans are secured by collateral of at least 102% of the value of U.S. securities loaned and 105% of the value of foreign securities loaned. Collateral equivalent to at least 100% of the market value of securities on loan is maintained at all times. Collateral is either in the form of cash, which can be invested in certain money market mutual funds managed by Dreyfus, or U.S. Government and Agency securities. The fund is entitled to receive all dividends, interest and distributions on securities loaned, in addition to income earned as a result of the lending transaction. Should a borrower fail to return the securities in a timely manner, The Bank of New York Mellon is required to replace the securities for the benefit of the fund or credit the fund with the market value of the unreturned securities and is subrogated to the fund’s rights against the borrower and the collateral. Additionally, the contractual maturity of security lending transactions are on an overnight and continuous basis. During the period ended August 31, 2016, The Bank of New York Mellon

23

NOTES TO FINANCIAL STATEMENTS (continued)

earned $26,161 from lending portfolio securities, pursuant to the securities lending agreement.

(c) Affiliated issuers: Investments in other investment companies advised by Dreyfus are defined as “affiliated” under the Act. Investments in affiliated investment companies during the period ended August 31, 2016 were as follows:

| | | | | | |

Affiliated Investment Company | Value 8/31/2015 ($) | Purchases ($) | Sales ($) | Value 8/31/2016 ($) | Net

Assets (%) |

Dreyfus Institutional Cash Advantage Fund, Institutional Shares | - | 318,655,347 | 300,249,347 | 18,406,000 | 1.3 |

Dreyfus Institutional Preferred Government Plus Money Market Fund† | 18,497,781 | 607,535,248 | 623,026,080 | 3,006,949 | .2 |

Total | 18,497,781 | 926,190,595 | 923,275,427 | 21,412,949 | 1.5 |

† Formerly Dreyfus Institutional Preferred Plus Money Market Fund.

(d) Dividends to shareholders: Dividends are recorded on the ex-dividend date. Dividends from investment income-net and dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

(e) Federal income taxes: It is the policy of the fund to continue to qualify as a regulated investment company, if such qualification is in the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable income sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended August 31, 2016, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period ended August 31, 2016, the fund did not incur any interest or penalties.

24

Each tax year in the four–year period ended August 31, 2016 remains subject to examination by the Internal Revenue Service and state taxing authorities.

At August 31, 2016, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $1,905,676, undistributed capital gains $43,085,187 and unrealized appreciation $105,785,220.

The tax character of distributions paid to shareholders during the fiscal periods ended August 31, 2016 and August 31, 2015 were as follows: ordinary income $27,165,334 and $68,462,559, and long-term capital gains $263,740,753 and $187,394,984, respectively.

During the period ended August 31, 2016, as a result of permanent book to tax differences, primarily due to the tax treatment for gains from redemptions-in-kind, dividend reclassification and limited partnerships, the fund decreased accumulated undistributed investment income-net by $936,812, decreased accumulated net realized gain (loss) on investments by $9,341,954 and increased paid-in-capital by $10,278,766. Net assets and net asset value per share were not affected by this reclassification.

NOTE 2—Bank Lines of Credit:

The fund participates with other Dreyfus-managed funds in a $555 million unsecured credit facility led by Citibank, N.A. and a $300 million unsecured credit facility provided by The Bank of New York Mellon (each, a “Facility”), each to be utilized primarily for temporary or emergency purposes, including the financing of redemptions. Prior to January 11, 2016, the unsecured credit facility with Citibank, N.A. was $480 million and prior to October 7, 2015, the unsecured credit facility with Citibank, N.A. was $430 million. In connection therewith, the fund has agreed to pay its pro rata portion of commitment fees for each Facility. Interest is charged to the fund based on rates determined pursuant to the terms of the respective Facility at the time of borrowing.

The average amount of borrowings outstanding under the Facilities during the period ended August 31, 2016, was approximately $938,500 with a related weighted average annualized interest rate of 1.34%.

NOTE 3—Management Fee and Other Transactions with Affiliates:

(a) Pursuant to a management agreement with Dreyfus, the management fee is computed at the annual rate of .75% of the value of the fund's average daily net assets and is payable monthly.

25

NOTES TO FINANCIAL STATEMENTS (continued)

During the period ended August 31, 2016, the Distributor retained $12,621 from commissions earned on sales of the fund’s Class A shares and $16,608 from CDSCs on redemptions of the fund’s Class C shares.

(b) Under the Distribution Plan adopted pursuant to Rule 12b-1 under the Act, Class C shares pay the Distributor for distributing its shares at an annual rate of .75% of the value of its average daily net assets. During the period ended August 31, 2016, Class C shares were charged $668,265 pursuant to the Distribution Plan.

(c) Under the Shareholder Services Plan, Class A and Class C shares pay the Distributor at an annual rate of .25% of the value of their average daily net assets for the provision of certain services. The services provided may include personal services relating to shareholder accounts, such as answering shareholder inquiries regarding the fund and providing reports and other information, and services related to the maintenance of shareholder accounts. The Distributor may make payments to Service Agents (securities dealers, financial institutions or other industry professionals) with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the period ended August 31, 2016, Class A and Class C shares were charged $2,213,375 and $222,755, respectively, pursuant to the Shareholder Services Plan.

The fund has arrangements with the transfer agent and the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset transfer agency and custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

The fund compensates Dreyfus Transfer, Inc., a wholly-owned subsidiary of Dreyfus, under a transfer agency agreement for providing transfer agency and cash management services for the fund. The majority of transfer agency fees are comprised of amounts paid on a per account basis, while cash management fees are related to fund subscriptions and redemptions. During the period ended August 31, 2016, the fund was charged $113,500 for transfer agency services and $8,667 for cash management services. These fees are included in Shareholder servicing costs in the Statement of Operations. Cash management fees were partially offset by earnings credits of $2,968.

The fund compensates The Bank of New York Mellon under a custody agreement for providing custodial services for the fund. These fees are determined based on net assets, geographic region and transaction activity. During the period ended August 31, 2016, the fund was charged $120,828 pursuant to the custody agreement.

26

During the period ended August 31, 2016, the fund was charged $9,967 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $881,059, Distribution Plan fees $49,277, Shareholder Services Plan fees $185,931, custodian fees $56,761, Chief Compliance Officer fees $6,416 and transfer agency fees $21,879.

(d) Each Board member also serves as a Board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 4—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended August 31, 2016, amounted to $1,622,742,543 and $2,433,874,350, respectively.

At August 31, 2016, the cost of investments for federal income tax purposes was $1,293,236,526; accordingly, accumulated net unrealized appreciation on investments was $105,785,220, consisting of $186,612,278 gross unrealized appreciation and $80,827,058 gross unrealized depreciation.

27

REPORT OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

Shareholders and Board of Directors

Dreyfus Opportunistic Midcap Value Fund

We have audited the accompanying statement of assets and liabilities, including the statement of investments, of Dreyfus Opportunistic Midcap Value Fund (one of the series comprising Advantage Funds, Inc.) as of August 31, 2016, and the related statement of operations for the year then ended, the statement of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the periods indicated therein. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of August 31, 2016 by correspondence with the custodian and others. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Dreyfus Opportunistic Midcap Value Fund at August 31, 2016, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the indicated periods, in conformity with U.S. generally accepted accounting principles.

New York, New York

October 27, 2016

28

IMPORTANT TAX INFORMATION (Unaudited)

For federal tax purposes, the fund hereby reports 84.80% of the ordinary dividends paid during the fiscal year ended August 31, 2016 as qualifying for the corporate dividends received deduction. Also, certain dividends paid by the fund may be subject to a maximum tax rate of 15%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. Of the distributions paid during the fiscal year, $27,165,335 represents the maximum amount that may be considered qualified dividend income. The fund also hereby reports $.5587 per share as a short-term capital gain distribution and $5.5426 per share as a long-term capital gain distribution paid on December 15, 2015. Shareholders will receive notification in early 2017 of the percentage applicable to the preparation of their 2016 income tax returns.

29

BOARD MEMBERS INFORMATION (Unaudited)

INDEPENDENT BOARD MEMBERS

Joseph S. DiMartino (72)

Chairman of the Board (1995)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1995-present)

Other Public Company Board Memberships During Past 5 Years:

· CBIZ (formerly, Century Business Services, Inc.), a provider of outsourcing functions for small and medium size companies, Director (1997-present)

No. of Portfolios for which Board Member Serves: 136

———————

Peggy C. Davis (73)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Shad Professor of Law, New York University School of Law (1983-present)

No. of Portfolios for which Board Member Serves: 49

———————

David P. Feldman (76)

Board Member (1996)

Principal Occupation During Past 5 Years:

· Corporate Director and Trustee (1985-present)

Other Public Company Board Memberships During Past 5 Years:

· BBH Mutual Funds Group (5 registered mutual funds), Director (1992-2014)

No. of Portfolios for which Board Member Serves: 35

———————

Ehud Houminer (76)

Board Member (1993)

Principal Occupation During Past 5 Years:

· Executive-in-Residence at the Columbia Business School, Columbia

University (1992-present)

Other Public Company Board Memberships During Past 5 Years:

· Avnet, Inc., an electronics distributor, Director (1993-2012)

No. of Portfolios for which Board Member Serves: 59

———————

30

Lynn Martin (76)

Board Member (2012)

Principal Occupation During Past 5 Years:

· President of The Martin Hall Group LLC, a human resources consulting firm (2005-2012)

Other Public Company Board Memberships During Past 5 Years:

· AT&T, Inc., a telecommunications company, Director (1999-2012)

· Ryder System, Inc., a supply chain and transportation management company, Director (1993-2012)

No. of Portfolios for which Board Member Serves: 35

———————

Robin A. Melvin (52)

Board Member (2012)

Principal Occupation During Past 5 Years:

· Co-chairman, Illinois Mentoring Partnership, non-profit organization dedicated to increasing the quantity and quality of mentoring services in Illinois; (2014-present; served as a board member since 2013)

· Director, Boisi Family Foundation, a private family foundation that supports youth-serving organizations that promote the self sufficiency of youth from disadvantaged circumstances (1995-2012)

No. of Portfolios for which Board Member Serves: 108

———————

Dr. Martin Peretz (77)

Board Member (2006)

Principal Occupation During Past 5 Years:

· Editor-in-Chief Emeritus of The New Republic Magazine (2011-2012) (previously,

Editor-in-Chief, 1974-2011)

· Director of TheStreet.com, a financial information service on the web (1996-2010)

· Lecturer at Harvard University (1969-2012)

No. of Portfolios for which Board Member Serves: 35

———————

Once elected all Board Members serve for an indefinite term, but achieve Emeritus status upon reaching age 80. The address of the Board Members and Officers is c/o The Dreyfus Corporation, 200 Park Avenue, New York, New York 10166. Additional information about the Board Members is available in the fund’s Statement of Additional Information which can be obtained from Dreyfus free of charge by calling this toll free number: 1-800-DREYFUS.

James F. Henry, Emeritus Board Member

Dr. Paul A. Marks, Emeritus Board Member

Philip L. Toia, Emeritus Board Member

31

OFFICERS OF THE FUND (Unaudited)

BRADLEY J. SKAPYAK, President since January 2010.

Chief Operating Officer and a director of the Manager since June 2009, Chairman of Dreyfus Transfer, Inc., an affiliate of the Manager and the transfer agent of the funds, since May 2011 and Executive Vice President of the Distributor since June 2007. From April 2003 to June 2009, Mr. Skapyak was the head of the Investment Accounting and Support Department of the Manager. He is an officer of 65 investment companies (comprised of 136 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Manager since February 1988.

BENNETT A. MACDOUGALL, Chief Legal Officer since October 2015.

Chief Legal Officer of the Manager since June 2015; from June 2005 to June 2015, he served in various capacities with Deutsche Bank – Asset & Wealth Management Division, including as Director and Associate General Counsel, and Chief Legal Officer of Deutsche Investment Management Americas Inc. from June 2012 to May 2015. He is an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 44 years old and has been an employee of the Manager since June 2015.

JANETTE E. FARRAGHER, Vice President and Secretary since December 2011.

Assistant General Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. She is 53 years old and has been an employee of the Manager since February 1984.

JAMES BITETTO, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon and Secretary of the Manager, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 50 years old and has been an employee of the Manager since December 1996.

JONI LACKS CHARATAN, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. She is 60 years old and has been an employee of the Manager since October 1988.

JOSEPH M. CHIOFFI, Vice President and Assistant Secretary since August 2005.

Managing Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 54 years old and has been an employee of the Manager since June 2000.

MAUREEN E. KANE, Vice President and Assistant Secretary since April 2015.

Managing Counsel of BNY Mellon since July 2014; from October 2004 until July 2014, General Counsel, and from May 2009 until July 2014, Chief Compliance Officer of Century Capital Management. She is an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. She is 54 years old and has been an employee of the Manager since July 2014.

SARAH S. KELLEHER, Vice President and Assistant Secretary since April 2014.

Senior Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager; from August 2005 to March 2013, Associate General Counsel of Third Avenue Management. She is 40 years old and has been an employee of the Manager since March 2013.

JEFF PRUSNOFSKY, Vice President and Assistant Secretary since August 2005.

Senior Managing Counsel of BNY Mellon, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 51 years old and has been an employee of the Manager since October 1990.

JAMES WINDELS, Treasurer since November 2001.

Director – Mutual Fund Accounting of the Manager, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Manager since April 1985.

RICHARD CASSARO, Assistant Treasurer since January 2008.

Senior Accounting Manager – Money Market, Municipal Bond and Equity Funds of the Manager, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 57 years old and has been an employee of the Manager since September 1982.

32

GAVIN C. REILLY, Assistant Treasurer since December 2005.

Tax Manager of the Investment Accounting and Support Department of the Manager, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 48 years old and has been an employee of the Manager since April 1991.

ROBERT S. ROBOL, Assistant Treasurer since August 2005.

Senior Accounting Manager of the Manager, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 52 years old and has been an employee of the Manager since October 1988.

ROBERT SALVIOLO, Assistant Treasurer since July 2007.

Senior Accounting Manager – Equity Funds of the Manager, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since June 1989.

ROBERT SVAGNA, Assistant Treasurer since December 2002.

Senior Accounting Manager – Fixed Income and Equity Funds of the Manager, and an officer of 66 investment companies (comprised of 161 portfolios) managed by the Manager. He is 49 years old and has been an employee of the Manager since November 1990.

JOSEPH W. CONNOLLY, Chief Compliance Officer since October 2004.

Chief Compliance Officer of the Manager and The Dreyfus Family of Funds (66 investment companies, comprised of 161 portfolios). He is 59 years old and has served in various capacities with the Manager since 1980, including manager of the firm’s Fund Accounting Department from 1997 through October 2001.

CARIDAD M. CAROSELLA, Anti-Money Laundering Compliance Officer since January 2016

Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust since January 2016; from May 2015 to December 2015, Interim Anti-Money Laundering Compliance Officer of the Dreyfus Family of Funds and BNY Mellon Funds Trust and the Distributor; from January 2012 to May 2015, AML Surveillance Officer of the Distributor and from 2007 to December 2011, Financial Processing Manager of the Distributor. She is an officer of 61 investment companies (comprised of 156 portfolios) managed by the Manager. She is 48 years old and has been an employee of the Distributor since 1997.

33

Dreyfus Opportunistic Midcap Value Fund

200 Park Avenue

New York, NY 10166

Manager

The Dreyfus Corporation

200 Park Avenue

New York, NY 10166

Custodian

The Bank of New York Mellon

225 Liberty Street

New York, NY 10286

Transfer Agent &

Dividend Disbursing Agent

Dreyfus Transfer, Inc.

200 Park Avenue

New York, NY 10166

Distributor

MBSC Securities Corporation

200 Park Avenue

New York, NY 10166

| | |

Ticker Symbol: | Class A: DMCVX Class C: DVLCX Class I: DVLIX Class Y: DMCYX |

Telephone Call your financial representative or 1-800-DREYFUS

Mail The Dreyfus Family of Funds, 144 Glenn Curtiss Boulevard, Uniondale, NY 11556-0144

E-mail Send your request to info@dreyfus.com

Internet Information can be viewed online or downloaded at www.dreyfus.com

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year on Form N-Q. The fund’s Forms N-Q are available on the SEC’s website at www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, DC. (phone 1-800-SEC-0330 for information).

A description of the policies and procedures that the fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the fund voted these proxies for the most recent 12-month period ended June 30 is available at www.dreyfus.com and on the SEC’s website at www.sec.gov and without charge, upon request, by calling 1-800-DREYFUS.

| | |

© 2016 MBSC Securities Corporation

0258AR0816 |

|

Dreyfus Opportunistic Small Cap Fund

| | | |

| | ANNUAL REPORT August 31, 2016 |

| |

Save time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.dreyfus.com and sign up for Dreyfus eCommunications. It’s simple and only takes a few minutes. |

| |

The views expressed in this report reflect those of the portfolio manager only through the end of the period covered and do not necessarily represent the views of Dreyfus or any other person in the Dreyfus organization. Any such views are subject to change at any time based upon market or other conditions and Dreyfus disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Dreyfus fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Dreyfus fund. |

| |

Not FDIC-Insured • Not Bank-Guaranteed • May Lose Value |

Contents

T H E F U N D

F O R M O R E I N F O R M AT I O N

Back Cover

| | | | |

| |

Dreyfus Opportunistic Small Cap Fund

| | The Fund |

A LETTER FROM THE CHIEF EXECUTIVE OFFICER

Dear Shareholder:

We are pleased to present this annual report for Dreyfus Opportunistic Small Cap Fund, covering the 12-month period from September 1, 2015 through August 31, 2016. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

Despite tumultuous swings in market sentiment stemming from global economic developments, stocks and bonds generally produced strong returns over the reporting period. During the fall of 2015, investors reacted cautiously to sluggish global economic growth, plummeting commodity prices, and the first increase in short-term U.S. interest rates in nearly a decade. These worries sparked particularly sharp declines in equities in January 2016, but investor sentiment soon improved when U.S. monetary policymakers refrained from additional rate hikes, other central banks eased their monetary policies further, and commodity prices rebounded. Stocks mostly rallied over the ensuing months, driving several broad measures of stock market performance to new record highs. In the bond market, aggressively accommodative monetary policies and robust investor demand for current income sent yields of high-quality sovereign bonds lower and their prices higher.

Recently we have seen evidence that investors may be shifting their focus away from macroeconomic influences and toward underlying company and industry fundamentals. This development—along with wide differences in underlying fundamental and technical influences across various asset classes, economic sectors, and regional markets—suggests that selectivity may be a more important determinant of investment success over the months ahead. As always, we encourage you to discuss the implications of our observations with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

Mark D. Santero

Chief Executive Officer

The Dreyfus Corporation

September 15, 2016

2

DISCUSSION OF FUND PERFORMANCE

For the period from September 1, 2015 through August 31, 2016, as provided by David A. Daglio, James Boyd, and Dale Dutile, Primary Portfolio Managers

Market and Fund Performance Overview

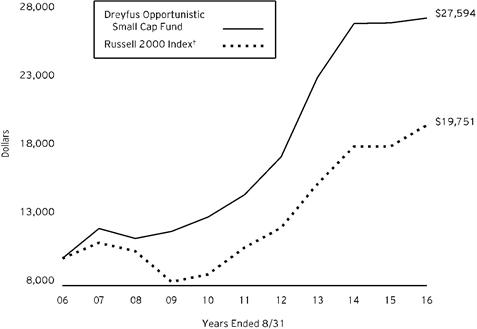

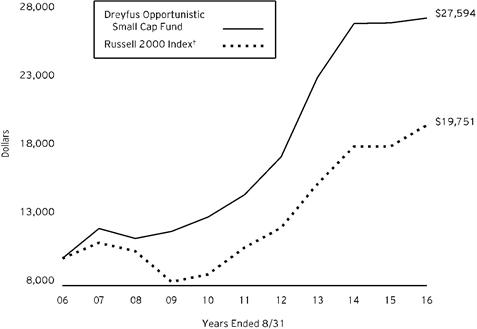

For the 12-month period ended August 31, 2016, Dreyfus Opportunistic Small Cap Fund produced a total return of 1.34%.1 In comparison, the fund’s benchmark, the Russell 2000® Index (the “Index”), produced a total return of 8.59%.2

Small-cap stocks achieved relatively strong returns as a rally over the reporting period’s second half more than erased losses from the first half. The fund lagged its benchmark, mainly due to shortfalls in the financials, industrials, and health care sectors.

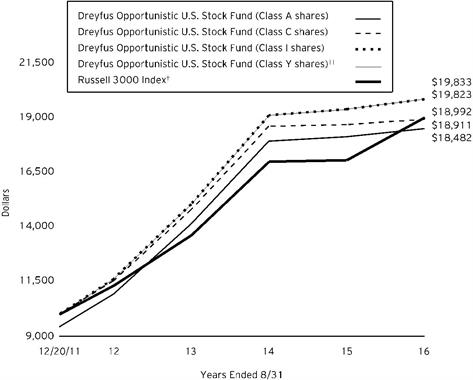

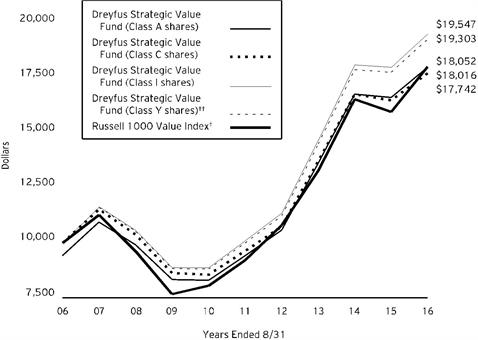

The Fund’s Investment Approach